UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-06279 |

|

Harris Associates Investment Trust |

(Exact name of registrant as specified in charter) |

|

111 South Wacker Drive, Suite 4600 Chicago, Illinois | | 60606-4319 |

(Address of principal executive offices) | | (Zip code) |

|

Kristi L. Rowsell Harris Associates L.P. 111 South Wacker Drive, Suite 4600 Chicago, Illinois 60606-4319 | Ndenisarya M. Bregasi, Esq. K&L Gates LLP 1601 K Street, N.W. Washington, D.C. 20006-1600 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (312) 646-3600 | |

|

Date of fiscal year end: | 09/30/16 | |

|

Date of reporting period: | 09/30/16 | |

| | | | | | | | | |

Item 1. Reports to Shareholders.

OAKMARK FUNDS

ANNUAL REPORT | SEPTEMBER 30, 2016

OAKMARK FUND

OAKMARK SELECT FUND

OAKMARK EQUITY AND INCOME FUND

OAKMARK GLOBAL FUND

OAKMARK GLOBAL SELECT FUND

OAKMARK INTERNATIONAL FUND

OAKMARK INTERNATIONAL SMALL CAP FUND

Oakmark Funds

2016 Annual Report

TABLE OF CONTENTS

Fund Expenses | | | 2 | | |

Commentary on Oakmark and Oakmark Select Funds | | | 3 | | |

Oakmark Fund | |

Summary Information | | | 6 | | |

Portfolio Manager Commentary | | | 7 | | |

Schedule of Investments | | | 8 | | |

Oakmark Select Fund | |

Summary Information | | | 10 | | |

Portfolio Manager Commentary | | | 11 | | |

Schedule of Investments | | | 12 | | |

Oakmark Equity and Income Fund | |

Summary Information | | | 14 | | |

Portfolio Manager Commentary | | | 15 | | |

Schedule of Investments | | | 17 | | |

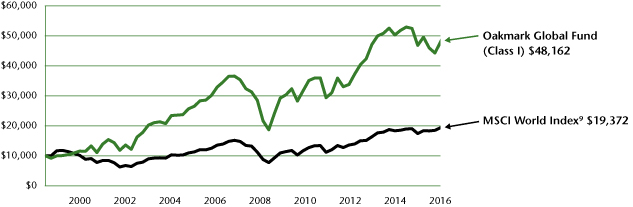

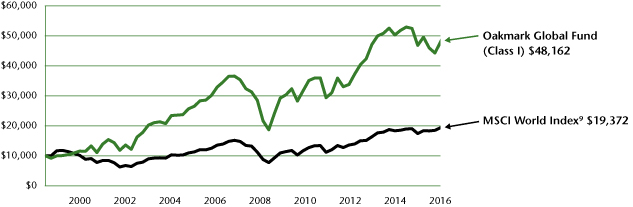

Oakmark Global Fund | |

Summary Information | | | 24 | | |

Portfolio Manager Commentary | | | 25 | | |

Schedule of Investments | | | 27 | | |

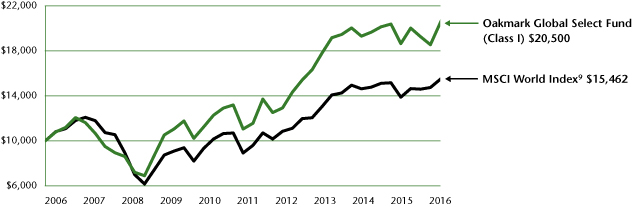

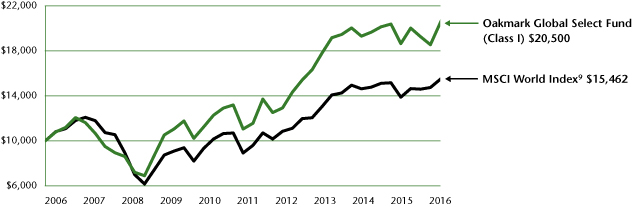

Oakmark Global Select Fund | |

Summary Information | | | 30 | | |

Portfolio Manager Commentary | | | 31 | | |

Schedule of Investments | | | 32 | | |

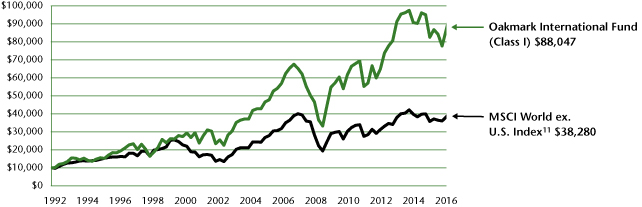

Oakmark International Fund | |

Summary Information | | | 34 | | |

Portfolio Manager Commentary | | | 35 | | |

Schedule of Investments | | | 36 | | |

Oakmark International Small Cap Fund | |

Summary Information | | | 40 | | |

Portfolio Manager Commentary | | | 41 | | |

Schedule of Investments | | | 43 | | |

Financial Statements | |

Statements of Assets and Liabilities | | | 46 | | |

Statements of Operations | | | 48 | | |

Statements of Changes in Net Assets | | | 50 | | |

Notes to Financial Statements | | | 57 | | |

Financial Highlights | | | 68 | | |

Report of Independent Registered Public Accounting Firm | | | 75 | | |

Report of Votes of Shareholders | | | 76 | | |

Federal Tax Information | | | 78 | | |

Disclosures and Endnotes | | | 78 | | |

Trustees and Officers | | | 80 | | |

FORWARD-LOOKING STATEMENT DISCLOSURE

One of our most important responsibilities as mutual fund managers is to communicate with shareholders in an open and direct manner. Some of our comments in our letters to shareholders are based on current management expectations and are considered "forward-looking statements." Actual future results, however, may prove to be different from our expectations. You can identify forward-looking statements by words such as "estimate", "may", "will", "expect", "believe",

"plan" and other similar terms. We cannot promise future returns. Our opinions are a reflection of our best judgment at the time this report is compiled, and we disclaim any obligation to update or alter forward-looking statements as a result of new information, future events, or otherwise.

oakmark.com

This page intentionally left blank.

OAKMARK FUNDS

Oakmark Funds September 30, 2016

President's Letter

Kristi L. Rowsell

President of Oakmark Funds

President of Harris Associates

We are pleased to announce that the Oakmark Funds have initiated the registration process to add two new share classes to our lineup: an Advisor share class and an Institutional share class. The Advisor and Institutional share classes will have higher investment minimums than our current share classes and are expected to have lower expense ratios. As part of the launch of these new share classes, our Class I will be renamed Investor class and our Class II will be renamed Service class. The features of our Investor and Service classes will be unchanged from today. The launch of the new share classes and the Class I and Class II name changes are expected to occur on November 30, 2016.

What are the new share classes?

We are adding two new share classes that will allow shareholders more flexibility in how they incur and pay fees for financial advice and shareholder services. A newly created Advisor share class, as its name suggests, will be primarily available through financial advisors and on the major intermediary platforms. We expect the Advisor share class to have a lower expense structure than our current share classes. Shareholders registered directly with the Oakmark Funds with balances of $100,000 or more in a single Fund will be eligible to purchase the Advisor shares of that Fund.

The newly created Institutional share class is targeted to retirement plans and large institutions seeking a minimal amount of shareholder services. We expect the Institutional share class to have an even lower expense structure than the Advisor share class. Shareholders registered directly with the Oakmark Funds with balances of $1,000,000 or more in a single Fund will be eligible to purchase the Institutional shares of that Fund.

Additional details may be found on the Securities and Exchange Commission's Edgar database1.

How do I buy the new share classes?

Subject to satisfying the eligibility requirement of a class, shareholders will be able to exchange their shares within

the same Fund from one class to another without recognizing taxable gains or losses on the exchange. We plan to notify certain qualifying shareholders registered directly with the Funds about their eligibility status and, shortly thereafter, convert their Class I (Investor) shares to the class for which they are newly eligible.

We believe that adding share classes with a range of shareholder service fees helps provide shareholders with better options to meet their investment needs. Please contact us directly at 1-800-OAKMARK or at Oakmark.com with any questions you may have on how our new share classes may be beneficial to you.

Early year-end distribution

In order to facilitate the launch of our new share classes, the Oakmark Funds will pay their annual distributions in the last week of November. We will post distribution estimates to our Oakmark.com site in mid-November to assist in your year-end tax planning.

We hope that you will find our new share classes beneficial in meeting your financial needs. We appreciate your confidence and partnership, and remain committed to improving your Oakmark experience.

Kristi Rowsell

President of Oakmark Funds

President of Harris Associates

We may not sell shares of the Advisor class or Institutional class until the registration statement filed with the Securities and Exchange Commission is effective. This is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state in which the offer or sale is not permitted.

Oakmark.com 1

Fund Expenses (Unaudited)

A shareholder of each Fund incurs ongoing costs, including investment advisory fees, transfer agent fees and other fund expenses. The examples below are intended to help shareholders understand the ongoing costs (in dollars) of investing in each Fund and to compare these costs with the ongoing costs of investing in other funds.

The following table provides information about actual account values and actual fund expenses as well as hypothetical account values and hypothetical fund expenses for shares of each Fund.

ACTUAL EXPENSES

The following table shows the expenses a shareholder would have paid on a $1,000 investment in each Fund from April 1, 2016 to September 30, 2016, as well as how much a $1,000 investment would be worth at the close of the period, assuming actual fund returns and expenses. A shareholder can estimate expenses incurred for the period by dividing the account value at September 30, 2016, by $1,000 and multiplying the result by the number in the Actual Expenses Paid During Period column shown below.

Shares of Oakmark International Small Cap Fund, held for 90 days or less, may be charged a 2% redemption fee upon redemption. Please consult the Funds' prospectus at Oakmark.com for more information.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The following table provides information about hypothetical account values and hypothetical expenses for shares of each Fund based on actual expense ratios and an assumed rate of return of 5% per year before expenses, which are not the Funds' actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balances or actual expenses shareholders paid for the period. Shareholders may use this information to compare the ongoing costs of investing in a Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the Hypothetical Expenses Paid During Period column of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. If transaction costs were included, the total costs would have been higher.

| | | | | ACTUAL | | HYPOTHETICAL

(5% annual return before expenses) | | | |

| | | Beginning

Account Value

(4/1/16) | | Ending

Account Value

(9/30/16) | | Expenses

Paid During

Period* | | Ending

Account Value

(9/30/16) | | Expenses

Paid During

Period* | | Annualized

Expense

Ratio | |

Oakmark Fund | |

Class I | | $ | 1,000.00 | | | $ | 1,099.70 | | | $ | 4.72 | | | $ | 1,020.50 | | | $ | 4.55 | | | | 0.90 | % | |

Class II | | $ | 1,000.00 | | | $ | 1,098.20 | | | $ | 6.29 | | | $ | 1,019.00 | | | $ | 6.06 | | | | 1.20 | % | |

Oakmark Select Fund | |

Class I | | $ | 1,000.00 | | | $ | 1,106.90 | | | $ | 5.27 | | | $ | 1,020.00 | | | $ | 5.05 | | | | 1.00 | % | |

Class II | | $ | 1,000.00 | | | $ | 1,105.20 | | | $ | 6.95 | | | $ | 1,018.40 | | | $ | 6.66 | | | | 1.32 | % | |

Oakmark Equity and Income Fund | |

Class I | | $ | 1,000.00 | | | $ | 1,049.00 | | | $ | 4.10 | | | $ | 1,021.00 | | | $ | 4.04 | | | | 0.80 | % | |

Class II | | $ | 1,000.00 | | | $ | 1,047.90 | | | $ | 5.43 | | | $ | 1,019.70 | | | $ | 5.35 | | | | 1.06 | % | |

Oakmark Global Fund | |

Class I | | $ | 1,000.00 | | | $ | 1,048.50 | | | $ | 6.04 | | | $ | 1,019.10 | | | $ | 5.96 | | | | 1.18 | % | |

Class II | | $ | 1,000.00 | | | $ | 1,046.90 | | | $ | 7.73 | | | $ | 1,017.45 | | | $ | 7.62 | | | | 1.51 | % | |

Oakmark Global Select Fund | |

Class I | | $ | 1,000.00 | | | $ | 1,063.90 | | | $ | 5.93 | | | $ | 1,019.25 | | | $ | 5.81 | | | | 1.15 | % | |

Oakmark International Fund | |

Class I | | $ | 1,000.00 | | | $ | 1,044.90 | | | $ | 5.16 | | | $ | 1,019.95 | | | $ | 5.10 | | | | 1.01 | % | |

Class II | | $ | 1,000.00 | | | $ | 1,043.20 | | | $ | 6.79 | | | $ | 1,018.35 | | | $ | 6.71 | | | | 1.33 | % | |

Oakmark International Small Cap Fund | |

Class I | | $ | 1,000.00 | | | $ | 1,059.20 | | | $ | 7.10 | | | $ | 1,018.10 | | | $ | 6.96 | | | | 1.38 | % | |

Class II | | $ | 1,000.00 | | | $ | 1,057.30 | | | $ | 8.59 | | | $ | 1,016.65 | | | $ | 8.42 | | | | 1.67 | % | |

* Expenses for each share class is equal to the Annualized Expense Ratio, multiplied by the average account value over the period, multiplied by the number of days in the most recent half-year divided by 366 (to reflect the one-half year period).

2 OAKMARK FUNDS

Oakmark and Oakmark Select Funds September 30, 2016

Portfolio Manager Commentary

William C. Nygren, CFA

Portfolio Manager

oakmx@oakmark.com

oaklx@oakmark.com

At Oakmark, we are long-term investors. We attempt to identify growing businesses that are managed to benefit their shareholders. We will purchase stock in those businesses only when priced substantially below our estimate of intrinsic value. After purchase, we patiently wait for the gap between stock price and intrinsic value to close.

"The years say what the days cannot tell."

-Ancient Chinese proverb

The calendar has flipped to October, and again this year, the city of Chicago is focused on its Cubs. After just concluding a 103-win, best-in-the-MLB season, the Cubs enter the playoffs as the World Series favorite. The prospect of a Cubs' World Series win is especially exciting because it hasn't happened since 1908. Into this highly charged atmosphere, along came Joe Sheehan, a writer for Sports Illustrated, who unwelcomingly inserted some math into the discussion. To win a World Series, a team must win a five-game series followed by two seven-game series. If all the teams were equal, each would have a one-in-eight chance of winning. Joe did some homework and found that teams that won over 100 games in the regular season were crowned World Series champions only 23% of the time. That means 77% of the time they weren't. So despite starting the playoffs as the overwhelming favorite, the likelihood is that the Cubs will not win the World Series this year. As Joe says, "The differences that separate great teams from good ones in baseball show over 162 games; over five or seven, those differences vanish." Nobody likes the dream killer!

Those of you who are regular readers of Oakmark reports know that we aren't here to write about sports, but as sports fans, we often see analogies that provide useful ways to think about investing. It is with that in mind that I was considering how short the average investor's time frame has become—effectively investing for just the World Series rather than the longer regular season. The financial media, broadcasting 24/7, bombards investors with information and encourages almost constant action. In that environment it is rare to take time to look at the forest instead of each tree. But right now we have the perfect reason to step back and take such an opportunity.

This year marks the 25th anniversary for Oakmark. Our flagship fund started on August 5, 1991. In some ways, 1991 seems a world away: Sixty Minutes was the most watched TV show, newspapers were viewed as one of the safest and most predictable businesses, AOL was just beginning to connect early adopters to the Internet using landlines, and the Minnesota Twins (MLB's worst team in 2016) won the World Series. In other ways—such as Clinton running for President—it seems like just yesterday. In Chicago in 1991, a group of young investment professionals, eager to invest their own capital side-by-side with their clients, convinced the decision makers at Harris Associates to launch a mutual fund using our long-term value approach, and thus Oakmark was born.

As anniversaries are a time for reflection, let's look at some of the things we can learn from a 25-year "season" rather than focusing on just the past quarter or year. Warren Buffett once referred to compound interest as the 8th Wonder of the World, and 25 years is enough time to see that "wonder" working.

Anyone who invested in the S&P 5002 just over 25 years ago, when we started Oakmark, would now have over nine times their original investment. That's what makes market timing almost impossible and why we don't even attempt it at Oakmark. The long-term record for investing in equities is so good that it is very difficult to add value by trying to identify the brief periods when stock market returns are unattractive.

In case you are tempted to think the past 25 years was a positive "perfect storm" for equity prices (the real Perfect Storm with 100 foot waves off the East Coast did occur in 1991), let's remember, chronologically, some of the key events that market-timers cited as reasons to not invest in stocks:

Operation Desert Storm, global recession, Hillarycare, Fed increasing rates, Oklahoma City bombing, U.S. government shutdown, Mad Cow disease, Asian Flu, Clinton impeachment, Y2K, tech bubble, 9/11, Afghan War, recession, Iraq War, SARS, Hurricane Katrina, subprime mortgage crisis, Lehman Brothers, Obamacare, real estate collapse, Global Financial Crisis, Greek bailout, S&P downgrading U.S. debt, oil price collapse, Ebola, Ukraine, Syrian migrant crisis, and Brexit—just to name a few.

Yes, that all happened, and the market still went up more than ninefold. So, next time someone tells you that stocks can't possibly go up because the Fed has to raise interest rates or because Congress is doing something stupid or because we have the worst presidential candidates ever, remember the very high hurdle that exists for altering your long-term asset allocation based on current events.

The second reflection that is equally impressive is the value that was added by consistent application of our disciplined investment approach. The quote at the top of the page, which has led off these commentaries for many years, describes how we invest. We search for fundamental value, making the most of opportunities created by short-term investors, and we very patiently wait for other investors to see the value that we thought was hidden. It is an approach that has led to many disappointing quarters and more disappointing years than we would have liked. But during those times, our faith in the process was unwavering. An investor who purchased Oakmark at its inception 25 years ago would today have over 19 times their original investment or more than twice the capital they would have accumulated by investing in the S&P index.

That's an uncomfortable fact for those who argue that active management can't add value. But just like our investment approach requires the discipline to stay true during periods when the market tells us it "isn't working," it is equally important for the shareholders in our funds to exhibit that same level of patience and discipline. Despite Oakmark's track record, those investors who bought the Fund after periods of strong performance and sold after periods of poor performance did not

Oakmark.com 3

Oakmark and Oakmark Select Funds September 30, 2016

Portfolio Manager Commentary (continued)

generally have a profitable experience. As I highlighted in last quarter's commentary, a full one-third of the five-year holding periods for Oakmark showed returns below the S&P despite a 25-year return that doubled it. Fund investors need to have a reason for investing that goes beyond short-term performance, which is one of the reasons we've put so much effort into shareholder communication that focuses on our investment philosophy.

The third and final reflection I'd like to highlight is the value of concentrating assets into what we consider to be our best investments. As we recognize the 25th anniversary for the Oakmark Fund, we have also reached the 20-year milestone for Oakmark Select. The two Funds invest with the same philosophy and are supported by the same team of investment analysts. The main difference is that Oakmark is much more diversified than Oakmark Select. While the Oakmark Fund typically diversifies its assets across 50 or more stocks, Oakmark Select generally holds only 20. It is almost certain that a 20-stock portfolio will be much more volatile than a 50-stock portfolio, but our expectation is that over time that risk will be rewarded with a higher return. Since the inception of Oakmark Select on November 1, 1996, an Oakmark Fund investment has grown over five times while Oakmark Select has achieved a tenfold increase. Just as Oakmark endured periods when the comparison to the S&P was unfavorable, the results of concentrating in our highest conviction investments has also been a bumpy ride, but one with an equally good outcome.

As we look to the next 25 years, we clearly can't promise that the S&P will again increase ninefold. With interest rates as low as they are now, I'd say it's in fact quite unlikely the S&P replicates that performance. But I'd also say that over that much time, the S&P is likely to continue its historical pattern of meaningfully outperforming both bonds and cash. We also can't promise that Oakmark will double the return of the S&P. Just as there is no guarantee that the MLB-leading Cubs will break the curse this year, there is no guarantee that a sound investment decision will produce great returns. There is always uncertainty as to the output of any investment process. Though I can't promise great returns, I can promise that the important inputs that have worked throughout Oakmark's history will remain unchanged:

-We will continue to apply a high level of effort and talent to this challenge.

-We will continue to invest with a goal of maximizing long-term, after-tax returns.

-We will continue our attempts to make investment writing both entertaining and educational.

-We will continue to invest side-by-side with you in each of our Funds.

Thank you to our shareholders who, by entrusting us with the investment of your hard-earned dollars, have allowed us to celebrate 25 years of Oakmark, 20 years of Oakmark Select and 10 years for our newest Fund, Oakmark Global Select. We are grateful and humbled by the confidence you have expressed in us and endeavor to continue doing the best we can to reward your decision.

4 OAKMARK FUNDS

This page intentionally left blank.

Oakmark.com 5

Oakmark Fund September 30, 2016

Summary Information

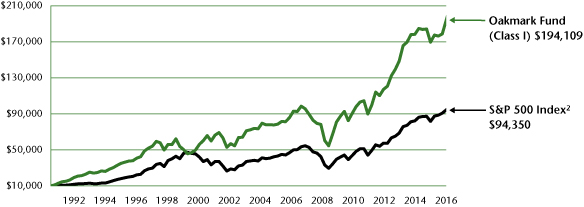

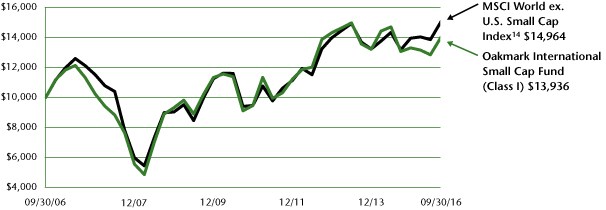

VALUE OF A $10,000 INVESTMENT

Since Inception - 08/05/91 (Unaudited)

PERFORMANCE

| | | | | Average Annual Total Returns (as of 09/30/16) | | | |

(Unaudited) | | Total Return

Last 3 Months | | 1-year | | 3-year | | 5-year | | 10-year | | Since

Inception | | Inception

Date | |

Oakmark Fund (Class I) | | | 8.53 | % | | | 14.36 | % | | | 9.30 | % | | | 16.64 | % | | | 8.50 | % | | | 12.51 | % | | 08/05/91 | |

S&P 500 Index | | | 3.85 | % | | | 15.43 | % | | | 11.16 | % | | | 16.37 | % | | | 7.24 | % | | | 9.33 | % | | | |

Dow Jones Industrial Average3 | | | 2.78 | % | | | 15.46 | % | | | 9.23 | % | | | 13.77 | % | | | 7.39 | % | | | 10.06 | % | | | |

Lipper Large Cap Value Funds Index4 | | | 4.28 | % | | | 14.87 | % | | | 8.45 | % | | | 14.98 | % | | | 5.53 | % | | | 8.60 | % | | | |

Oakmark Fund (Class II) | | | 8.44 | % | | | 14.00 | % | | | 8.95 | % | | | 16.29 | % | | | 8.16 | % | | | 7.54 | % | | 04/05/01 | |

The graph and table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Past performance is no guarantee of future results. The performance data quoted represents past performance. Current performance may be lower or higher than the performance data quoted. Total return includes change in share prices and, in each case, includes reinvestment of dividends and capital gain distributions. The investment return and principal value vary so that an investor's shares when redeemed may be worth more or less than the original cost. To obtain the most recent month-end performance, please visit Oakmark.com.

TOP TEN EQUITY HOLDINGS5 | | % of Net Assets | |

Alphabet Inc., Class C | | | 3.4 | | |

Bank of America Corp. | | | 3.4 | | |

Apache Corp. | | | 3.2 | | |

Citigroup, Inc. | | | 3.1 | | |

General Electric Co. | | | 2.8 | | |

American International Group, Inc. | | | 2.8 | | |

JPMorgan Chase & Co. | | | 2.7 | | |

MasterCard, Inc., Class A | | | 2.7 | | |

Intel Corp. | | | 2.6 | | |

Visa, Inc., Class A | | | 2.5 | | |

FUND STATISTICS | |

Ticker | | OAKMX | |

Inception | | 08/05/1991 | |

Number of Equity Holdings | | 48 | |

Net Assets | | $14.8 billion | |

Benchmark | | S&P 500 Index | |

Weighted Average Market Cap | | $122.7 billion | |

Median Market Cap | | $53.7 billion | |

Portfolio Turnover (for the 12-months ended 09/30/2016) | | 20% | |

Expense Ratio - Class I (as of 09/30/15) | | 0.85% | |

Expense Ratio - Class I (as of 09/30/16) | | 0.89% | |

SECTOR ALLOCATION | | % of Net Assets | |

Equity Investments | |

Financials | | | 30.8 | | |

Information Technology | | | 27.1 | | |

Industrials | | | 12.0 | | |

Consumer Discretionary | | | 10.4 | | |

Energy | | | 7.6 | | |

Health Care | | | 3.6 | | |

Consumer Staples | | | 3.0 | | |

Total Equity Investments | | | 94.5 | | |

Fixed Income Investments | | | |

Convertible Bond | | | 1.1 | | |

Short-Term Investments and Other | | | 4.4 | | |

6 OAKMARK FUNDS

Oakmark Fund September 30, 2016

Portfolio Manager Commentary

William C. Nygren, CFA

Portfolio Manager

oakmx@oakmark.com

Kevin Grant, CFA

Portfolio Manager

oakmx@oakmark.com

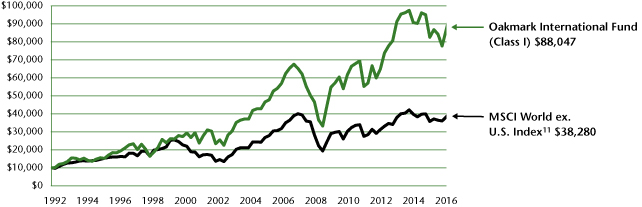

This quarter marks the 25th anniversary of the Oakmark Fund, and we are proud of our long-term results and pleased to mark the occasion with an all-time high adjusted NAV at quarter end. As you can see from the Growth of a $10,000 Investment chart, a $10,000 investment in the Oakmark Fund in August 1991 has appreciated to $194,000 as of the end of this quarter, which is more than twice the appreciation level of the S&P 5002 over the same time period. This represents an average annual total return of 13% for the Oakmark Fund and 9% for the S&P 500.

We're investing the same way today as we did 25 years ago. The Oakmark Fund's first quarterly report in 1991 mentioned the following principles: invest in companies selling below long-term intrinsic value, take advantage of irrational and short-term investor thinking, and invest with companies that have owner-oriented management teams. We have a great team of investment analysts who use these principles to find attractive investment opportunities for the Oakmark portfolio. It is an honor to manage the Oakmark Fund, and we want to thank you for your support and confidence. We look forward to continuing this tradition for the next 25 years and beyond.

The Oakmark Fund increased 9% during the recent quarter, bringing the increase to 14% for the fiscal year ended September 30. The S&P 500 increased 4% for the quarter and increased 15% for the fiscal year. This was a very good quarter for the Oakmark Fund, with strong performance from our highest weighted sectors. For some time we have believed that businesses with a narrower range of outcomes, or stable businesses, have been bid-up as bond substitutes, while businesses with a more cyclical profile have fallen to more attractive valuation levels. In the third quarter, that positioning paid off for the Oakmark Fund. For the quarter, Information Technology and Financials were our highest contributing sectors, and Health Care and Consumer Staples, two of our lowest weighted areas, were our weakest performers.

For the full fiscal year, Information Technology and Industrials were our best performers, and Consumer Staples and Health Care were our weakest. Our highest contributing securities for the year were Apache and Texas Instruments, and our worst performers were American Express and Liberty Interactive QVC. For the recent quarter, Bank of America and Qualcomm were our best contributors, and our weakest were Liberty Interactive QVC and General Electric Company. We added one new name to the portfolio during the quarter (see below), and we eliminated our positions in LinkedIn and Monsanto after they received acquisition offers.

MGM Resorts International (MGM-$26)

We believe there are many ways to achieve strong returns from an investment in MGM Resorts International. MGM is a recovery story, driven by improving supply and demand in Las Vegas where MGM has significant exposure. The company's Profit

Growth Plan, which is a cost-cutting and revenue enhancement program, should lead to higher profitability and allow for significant operating leverage once sales recover. From a longer term perspective, we believe MGM will benefit from its increasing geographic diversity, strong property development pipeline and improving capital structure. We think that valuing MGM on a property-by-property basis using cash flow multiples from recent transactions produces a much higher value than the current stock price indicates.

Oakmark.com 7

Oakmark Fund September 30, 2016

Schedule of Investments (in thousands)

| | | Shares | | Value | |

COMMON STOCKS - 94.5% | |

FINANCIALS - 30.8% | |

DIVERSIFIED FINANCIALS - 10.8% | |

Capital One Financial Corp.

Consumer Finance | | | 4,663 | | | $ | 334,929 | | |

State Street Corp.

Asset Management & Custody Banks | | | 4,700 | | | | 327,261 | | |

Ally Financial, Inc.

Consumer Finance | | | 15,674 | | | | 305,173 | | |

The Goldman Sachs Group, Inc.

Investment Banking & Brokerage | | | 1,705 | | | | 274,965 | | |

Bank of New York Mellon Corp.

Asset Management & Custody Banks | | | 6,320 | | | | 252,027 | | |

T Rowe Price Group, Inc.

Asset Management & Custody Banks | | | 1,597 | | | | 106,186 | | |

| | | | | | 1,600,541 | | |

BANKS - 10.8% | |

Bank of America Corp.

Diversified Banks | | | 32,300 | | | | 505,495 | | |

Citigroup, Inc.

Diversified Banks | | | 9,630 | | | | 454,825 | | |

JPMorgan Chase & Co.

Diversified Banks | | | 6,115 | | | | 407,198 | | |

Wells Fargo & Co.

Diversified Banks | | | 5,110 | | | | 226,270 | | |

| | | | | | 1,593,788 | | |

INSURANCE - 9.2% | |

American International Group, Inc.

Multi-line Insurance | | | 7,080 | | | | 420,127 | | |

Aflac, Inc.

Life & Health Insurance | | | 4,910 | | | | 352,882 | | |

Aon PLC

Insurance Brokers | | | 2,790 | | | | 313,847 | | |

Principal Financial Group, Inc.

Life & Health Insurance | | | 5,489 | | | | 282,755 | | |

| | | | | | 1,369,611 | | |

| | | | | | 4,563,940 | | |

INFORMATION TECHNOLOGY - 27.1% | |

SOFTWARE & SERVICES - 14.9% | |

Alphabet, Inc., Class C (a)

Internet Software & Services | | | 651 | | | | 506,215 | | |

MasterCard, Inc., Class A

Data Processing & Outsourced Services | | | 3,870 | | | | 393,850 | | |

Visa, Inc., Class A

Data Processing & Outsourced Services | | | 4,485 | | | | 370,910 | | |

Oracle Corp.

Systems Software | | | 8,765 | | | | 344,289 | | |

Automatic Data Processing, Inc.

Data Processing & Outsourced Services | | | 3,420 | | | | 301,644 | | |

Microsoft Corp.

Systems Software | | | 5,190 | | | | 298,944 | | |

| | | | | | 2,215,852 | | |

| | | Shares | | Value | |

SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT - 7.6% | |

Intel Corp.

Semiconductors | | | 10,155 | | | $ | 383,351 | | |

Texas Instruments, Inc.

Semiconductors | | | 5,120 | | | | 359,322 | | |

QUALCOMM, Inc.

Semiconductors | | | 4,745 | | | | 325,032 | | |

Applied Materials, Inc.

Semiconductor Equipment | | | 1,760 | | | | 53,064 | | |

| | | | | | 1,120,769 | | |

TECHNOLOGY HARDWARE & EQUIPMENT - 4.6% | |

Apple, Inc.

Technology Hardware, Storage & Peripherals | | | 3,187 | | | | 360,290 | | |

TE Connectivity, Ltd.

Electronic Manufacturing Services | | | 4,936 | | | | 317,757 | | |

| | | | | | 678,047 | | |

| | | | | | 4,014,668 | | |

INDUSTRIALS - 12.0% | |

CAPITAL GOODS - 9.7% | |

General Electric Co.

Industrial Conglomerates | | | 14,250 | | | | 422,085 | | |

Caterpillar, Inc.

Construction Machinery & Heavy Trucks | | | 4,000 | | | | 355,080 | | |

Cummins, Inc.

Construction Machinery & Heavy Trucks | | | 2,720 | | | | 348,568 | | |

Parker-Hannifin Corp.

Industrial Machinery | | | 2,439 | | | | 306,200 | | |

| | | | | | 1,431,933 | | |

TRANSPORTATION - 2.3% | |

FedEx Corp.

Air Freight & Logistics | | | 1,980 | | | | 345,867 | | |

| | | | | | 1,777,800 | | |

CONSUMER DISCRETIONARY - 10.4% | |

MEDIA - 2.9% | |

News Corp., Class A

Publishing | | | 16,691 | | | | 233,336 | | |

Comcast Corp., Class A

Cable & Satellite | | | 2,944 | | | | 195,318 | | |

| | | | | | 428,654 | | |

AUTOMOBILES & COMPONENTS - 2.9% | |

General Motors Co.

Automobile Manufacturers | | | 7,650 | | | | 243,041 | | |

Harley-Davidson, Inc.

Motorcycle Manufacturers | | | 3,502 | | | | 184,170 | | |

| | | | | | 427,211 | | |

CONSUMER DURABLES & APPAREL - 1.9% | |

Whirlpool Corp.

Household Appliances | | | 1,730 | | | | 280,537 | | |

See accompanying Notes to Financial Statements.

8 OAKMARK FUNDS

Oakmark Fund September 30, 2016

Schedule of Investments (in thousands) (continued)

| | | Shares | | Value | |

COMMON STOCKS - 94.5% (continued) | |

CONSUMER DISCRETIONARY - 10.4% (continued) | |

RETAILING - 1.6% | |

Liberty Interactive Corp. QVC Group,

Class A (a)

Internet & Direct Marketing Retail | | | 11,491 | | | $ | 229,933 | | |

CONSUMER SERVICES - 1.1% | |

MGM Resorts International (a)

Casinos & Gaming | | | 6,500 | | | | 169,195 | | |

| | | | | | 1,535,530 | | |

ENERGY - 7.6% | |

Apache Corp.

Oil & Gas Exploration & Production | | | 7,440 | | | | 475,185 | | |

Anadarko Petroleum Corp.

Oil & Gas Exploration & Production | | | 5,100 | | | | 323,136 | | |

National Oilwell Varco, Inc.

Oil & Gas Equipment & Services | | | 4,429 | | | | 162,718 | | |

Halliburton Co.

Oil & Gas Equipment & Services | | | 3,581 | | | | 160,715 | | |

| | | | | | 1,121,754 | | |

HEALTH CARE - 3.6% | |

HEALTH CARE EQUIPMENT & SERVICES - 2.8% | |

UnitedHealth Group, Inc.

Managed Health Care | | | 2,195 | | | | 307,300 | | |

Medtronic PLC

Health Care Equipment | | | 1,140 | | | | 98,496 | | |

| | | | | | 405,796 | | |

PHARMACEUTICALS, BIOTECHNOLOGY & LIFE SCIENCES - 0.8% | |

Sanofi (b)

Pharmaceuticals | | | 3,170 | | | | 121,062 | | |

| | | | | | 526,858 | | |

CONSUMER STAPLES - 3.0% | |

FOOD, BEVERAGE & TOBACCO - 2.3% | |

Diageo PLC (b)

Distillers & Vintners | | | 2,000 | | | | 232,080 | | |

Nestlé SA (b)

Packaged Foods & Meats | | | 1,365 | | | | 107,863 | | |

| | | | | | 339,943 | | |

HOUSEHOLD & PERSONAL PRODUCTS - 0.7% | |

Unilever PLC (b)

Personal Products | | | 2,363 | | | | 112,006 | | |

| | | | | | 451,949 | | |

TOTAL COMMON STOCKS - 94.5%

(COST $9,291,353) | | | | | 13,992,499 | | |

| | | Par Value | | Value | |

FIXED INCOME - 1.1% | |

CONVERTIBLE BOND - 1.1% | |

Fiat Chrysler Automobiles N.V.,

7.875%, due 12/15/16 (c)

(Cost $148,544) | | $ | 278,779 | | | $ | 161,151 | | |

TOTAL FIXED INCOME - 1.1%

(COST $148,544) | | | | | 161,151 | | |

SHORT TERM INVESTMENT - 4.2% | |

REPURCHASE AGREEMENT - 4.2% | |

Fixed Income Clearing Corp. Repurchase

Agreement, 0.15% dated 09/30/16 due

10/03/16, repurchase price $624,984,

collateralized by a United States Treasury

Note, 2.000%, due 08/15/25, value plus

accrued interest of $637,478

(Cost: $624,976) | | | 624,976 | | | | 624,976 | | |

TOTAL SHORT TERM INVESTMENTS - 4.2%

(COST $624,976) | | | | | 624,976 | | |

TOTAL INVESTMENTS - 99.8%

(COST $10,064,873) | | | | | 14,778,626 | | |

Foreign Currencies (Cost $0) - 0.0% (d) | | | | | 0 | (e) | |

Other Assets In Excess of Liabilities - 0.2% | | | | | 34,595 | | |

TOTAL NET ASSETS - 100.0% | | | | $ | 14,813,221 | | |

(a) Non-income producing security

(b) Sponsored American Depositary Receipt

(c) The rate shown represents the annualized yield at the time of purchase; not a coupon rate.

(d) Amount rounds to less than 0.1%.

(e) Amount rounds to less than $1,000.

See accompanying Notes to Financial Statements.

Oakmark.com 9

Oakmark Select Fund September 30, 2016

Summary Information

VALUE OF A $10,000 INVESTMENT

Since Inception - 11/01/96 (Unaudited)

PERFORMANCE

| | | | | Average Annual Total Returns (as of 09/30/16) | | | |

(Unaudited) | | Total Return

Last 3 Months | | 1-year | | 3-year | | 5-year | | 10-year | | Since

Inception | | Inception

Date | |

Oakmark Select Fund (Class I) | | | 7.81 | % | | | 11.76 | % | | | 9.22 | % | | | 16.28 | % | | | 7.32 | % | | | 12.43 | % | | 11/01/96 | |

S&P 500 Index | | | 3.85 | % | | | 15.43 | % | | | 11.16 | % | | | 16.37 | % | | | 7.24 | % | | | 7.81 | % | | | |

Lipper Multi-Cap Value Funds Index6 | | | 4.14 | % | | | 12.23 | % | | | 7.60 | % | | | 14.94 | % | | | 5.15 | % | | | 7.30 | % | | | |

Oakmark Select Fund (Class II) | | | 7.73 | % | | | 11.37 | % | | | 8.88 | % | | | 15.91 | % | | | 7.01 | % | | | 8.90 | % | | 12/31/99 | |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Past performance is no guarantee of future results. The performance data quoted represents past performance. Current performance may be lower or higher than the performance data quoted. Total return includes change in share prices and, in each case, includes reinvestment of dividends and capital gain distributions. The investment return and principal value vary so that an investor's shares when redeemed may be worth more or less than the original cost. To obtain the most recent month-end performance, please visit Oakmark.com.

TOP TEN EQUITY HOLDINGS5 | | % of Net Assets | |

Alphabet Inc., Class C | | | 8.3 | | |

CBRE Group, Inc., Class A | | | 6.5 | | |

General Electric Co. | | | 6.4 | | |

American International Group, Inc. | | | 6.3 | | |

TE Connectivity, Ltd. | | | 6.1 | | |

Apache Corp. | | | 5.8 | | |

Bank of America Corp. | | | 5.4 | | |

MasterCard, Inc., Class A | | | 5.2 | | |

Citigroup, Inc. | | | 5.1 | | |

JPMorgan Chase & Co. | | | 5.1 | | |

FUND STATISTICS | |

Ticker | | OAKLX | |

Inception | | 11/01/96 | |

Number of Equity Holdings | | 19 | |

Net Assets | | $5.0 billion | |

Benchmark | | S&P 500 Index | |

Weighted Average Market Cap | | $124.4 billion | |

Median Market Cap | | $36.8 billion | |

Portfolio Turnover (for the 12-months ended 09/30/2016) | | 38% | |

Expense Ratio - Class I (as of 09/30/15) | | 0.95% | |

Expense Ratio - Class I (as of 09/30/16) | | 0.98% | |

SECTOR ALLOCATION | | % of Net Assets | |

Financials | | | 30.9 | | |

Information Technology | | | 27.1 | | |

Consumer Discretionary | | | 14.6 | | |

Energy | | | 9.9 | | |

Real Estate | | | 6.5 | | |

Industrials | | | 6.4 | | |

Short-Term Investments and Other | | | 4.6 | | |

10 OAKMARK FUNDS

Oakmark Select Fund September 30, 2016

Portfolio Manager Commentary

William C. Nygren, CFA

Portfolio Manager

oaklx@oakmark.com

Anthony P. Coniaris, CFA

Portfolio Manager

oaklx@oakmark.com

Win Murray

Portfolio Manager

oaklx@oakmark.com

The Oakmark Select Fund returned 8% for the quarter, ahead of the S&P 500's2 4% return. This brings the Fund's return for the fiscal year ended September 30, 2016 to 12%, compared to 15% for the S&P 500.

During the quarter, our largest contributors to performance included Alphabet (+12%), Bank of America (+18%), MasterCard (+16%), and AIG (+13%). From a sector standpoint, our stock selection in Energy, as well as our selection and allocation to Financials, had the most positive impact. We also benefitted by what we didn't own in the quarter. For some time now, we have had trouble finding value in the Consumer Staples, Utilities and Telecommunications sectors. In these sectors, we have found that share prices appear to be valued more closely to bonds, which we believe to be unattractive at current yields. Not owning these three sectors added over 1% to our performance relative to the S&P 500.

Our largest quarterly detractor was Liberty Interactive QVC (-21%). After a long period of rather stable but low single-digit growth, the company announced that sales fell by a mid-to-upper single digit amount in June, and these trends continued through July. The management team cited numerous company-specific reasons for the decline and is taking action accordingly. We continue to hold our position because we believe the company's underlying value has only been modestly affected, relative to the decline in its share price. Only three other investments showed declines during the quarter: General Electric, Oracle and FNF Group.

For the fiscal year, our largest contributors were LinkedIn (+66%), Apache (+67%), and Alphabet (+28%). Our largest detractors were Liberty Interactive QVC (-24%), Citigroup (-4%), and CBRE Group (-13%).

Recall that earlier in 2016, we swapped most of our Chesapeake stock at approximately $4 per share for the company's bonds at $48 per $100 par value, believing the bonds offered similar upside and less downside while capturing a tax loss. Last quarter we reported that the bonds had rallied to $85 per $100 par value, and the stock was trading at $4.28. Given the relative performance of the bonds to the stock and our comfort with the improved liquidity position of the company, we elected to swap back into the stock. Today our position in Chesapeake is exclusively in the form of equity.

We sold our remaining shares of LinkedIn and established a new position in casino operator MGM Resorts International (MGM). We believe the recovery potential in the Las Vegas market and MGM's profit improvement plan are both underappreciated at the current value. Meanwhile, management has been busily working to close the price-value gap on the shares by monetizing latent real estate value and improving the balance sheet. In the short time we've owned MGM, both the

fundamentals and management actions have been consistent with our thesis.

Thank you for your continued investment in the Fund.

Oakmark.com 11

Oakmark Select Fund September 30, 2016

Schedule of Investments (in thousands)

| | | Shares | | Value | |

COMMON STOCKS - 95.4% | |

FINANCIALS - 30.9% | |

BANKS - 15.6% | |

Bank of America Corp.

Diversified Banks | | | 17,101 | | | $ | 267,625 | | |

Citigroup, Inc.

Diversified Banks | | | 5,412 | | | | 255,609 | | |

JPMorgan Chase & Co.

Diversified Banks | | | 3,831 | | | | 255,106 | | |

| | | | | | 778,340 | | |

INSURANCE - 11.0% | |

American International Group, Inc.

Multi-line Insurance | | | 5,295 | | | | 314,217 | | |

FNF Group

Property & Casualty Insurance | | | 6,446 | | | | 237,929 | | |

| | | | | | 552,146 | | |

DIVERSIFIED FINANCIALS - 4.3% | |

Capital One Financial Corp.

Consumer Finance | | | 2,985 | | | | 214,405 | | |

| | | | | | 1,544,891 | | |

INFORMATION TECHNOLOGY - 27.1% | |

SOFTWARE & SERVICES - 17.8% | |

Alphabet, Inc., Class C (a)

Internet Software & Services | | | 532 | | | | 413,246 | | |

MasterCard, Inc., Class A

Data Processing & Outsourced Services | | | 2,559 | | | | 260,429 | | |

Oracle Corp.

Systems Software | | | 5,567 | | | | 218,672 | | |

| | | | | | 892,347 | | |

TECHNOLOGY HARDWARE & EQUIPMENT - 6.1% | |

TE Connectivity, Ltd.

Electronic Manufacturing Services | | | 4,723 | | | | 304,063 | | |

SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT - 3.2% | |

Intel Corp.

Semiconductors | | | 4,237 | | | | 159,947 | | |

| | | | | | 1,356,357 | | |

CONSUMER DISCRETIONARY - 14.6% | |

AUTOMOBILES & COMPONENTS - 7.8% | |

Harley-Davidson, Inc.

Motorcycle Manufacturers | | | 4,300 | | | | 226,137 | | |

Fiat Chrysler Automobiles N.V.

Automobile Manufacturers | | | 26,134 | | | | 167,259 | | |

| | | | | | 393,396 | | |

RETAILING - 3.4% | |

Liberty Interactive Corp. QVC Group, Class A (a)

Internet & Direct Marketing Retail | | | 8,459 | | | | 169,262 | | |

CONSUMER SERVICES - 3.4% | |

MGM Resorts International (a)

Casinos & Gaming | | | 6,500 | | | | 169,195 | | |

| | | | | | 731,853 | | |

| | | Shares | | Value | |

ENERGY - 9.9% | |

Apache Corp.

Oil & Gas Exploration & Production | | | 4,501 | | | $ | 287,479 | | |

Chesapeake Energy Corp. (a)

Oil & Gas Exploration & Production | | | 32,840 | | | | 205,909 | | |

| | | | | | 493,388 | | |

REAL ESTATE - 6.5% | |

CBRE Group, Inc., Class A (a)

Real Estate Services | | | 11,648 | | | | 325,897 | | |

INDUSTRIALS - 6.4% | |

CAPITAL GOODS - 6.4% | |

General Electric Co.

Industrial Conglomerates | | | 10,718 | | | | 317,467 | | |

TOTAL COMMON STOCKS - 95.4%

(COST $3,277,588) | | | | | 4,769,853 | | |

| | | Par Value | | Value | |

SHORT TERM INVESTMENTS - 4.6% | |

REPURCHASE AGREEMENT - 4.6% | |

Fixed Income Clearing Corp. Repurchase

Agreement, 0.15% dated 09/30/16 due

10/03/16, repurchase price $228,233,

collateralized by a United States Treasury

Bond, 3.750%, due 08/15/41, value plus

accrued interest of $232,799

(Cost: $228,230) | | $ | 228,230 | | | | 228,230 | | |

TOTAL SHORT TERM INVESTMENTS - 4.6%

(COST $228,230) | | | | | 228,230 | | |

TOTAL INVESTMENTS - 100.0%

(COST $3,505,818) | | | | | 4,998,083 | | |

Foreign Currencies (Cost $0) - 0.0% (b) | | | | | 0 | (c) | |

Liabilities In Excess of Other Assets - 0.0% (b) | | | | | (738 | ) | |

TOTAL NET ASSETS - 100.0% | | | | $ | 4,997,345 | | |

(a) Non-income producing security

(b) Amount rounds to less than 0.1%.

(c) Amount rounds to less than $1,000.

See accompanying Notes to Financial Statements.

12 OAKMARK FUNDS

This page intentionally left blank.

Oakmark.com 13

Oakmark Equity and Income Fund September 30, 2016

Summary Information

VALUE OF A $10,000 INVESTMENT

Since Inception - 11/01/95 (Unaudited)

PERFORMANCE

| | | | | Average Annual Total Returns (as of 09/30/16) | | | |

(Unaudited) | | Total Return

Last 3 Months | | 1-year | | 3-year | | 5-year | | 10-year | | Since

Inception | | Inception

Date | |

Oakmark Equity and Income Fund (Class I) | | | 5.34 | % | | | 7.34 | % | | | 4.92 | % | | | 9.75 | % | | | 6.59 | % | | | 10.07 | % | | 11/01/95 | |

Lipper Balanced Funds Index | | | 3.07 | % | | | 9.64 | % | | | 6.23 | % | | | 9.54 | % | | | 5.46 | % | | | 6.76 | % | | | |

S&P 500 Index | | | 3.85 | % | | | 15.43 | % | | | 11.16 | % | | | 16.37 | % | | | 7.24 | % | | | 8.50 | % | | | |

Barclays U.S. Govt./Credit Index | | | 0.40 | % | | | 5.86 | % | | | 4.22 | % | | | 3.24 | % | | | 4.86 | % | | | 5.55 | % | | | |

Oakmark Equity and Income Fund (Class II) | | | 5.30 | % | | | 7.02 | % | | | 4.59 | % | | | 9.40 | % | | | 6.24 | % | | | 8.28 | % | | 07/12/00 | |

The graph and table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Past performance is no guarantee of future results. The performance data quoted represents past performance. Current performance may be lower or higher than the performance data quoted. Total return includes change in share prices and, in each case, includes reinvestment of dividends and capital gain distributions. The investment return and principal value vary so that an investor's shares when redeemed may be worth more or less than the original cost. To obtain the most recent month-end performance, please visit Oakmark.com.

TOP TEN EQUITY HOLDINGS5 | | % of Net Assets | |

General Motors Co. | | | 4.2 | | |

Bank of America Corp. | | | 3.8 | | |

Oracle Corp. | | | 3.2 | | |

TE Connectivity, Ltd. | | | 3.1 | | |

Nestlé ADR | | | 3.0 | | |

Dover Corp. | | | 2.8 | | |

CVS Health Corp. | | | 2.7 | | |

Foot Locker, Inc. | | | 2.7 | | |

MasterCard, Inc., Class A | | | 2.3 | | |

UnitedHealth Group, Inc. | | | 2.1 | | |

FUND STATISTICS | |

Ticker | | OAKBX | |

Inception | | 11/01/95 | |

Number of Equity Holdings | | 44 | |

Net Assets | | $16.1 billion | |

Benchmark | | Lipper Balanced Funds Index | |

Weighted Average Market Cap | | $69.4 billion | |

Median Market Cap | | $14.8 billion | |

Portfolio Turnover (for the 12-months ended 09/30/2016) | | 18% | |

Expense Ratio - Class I (as of 09/30/15) | | 0.75% | |

Expense Ratio - Class I (as of 09/30/16) | | 0.79% | |

SECTOR ALLOCATION | | % of Net Assets | |

Equity Investments | |

Financials | | | 17.1 | | |

Consumer Discretionary | | | 11.1 | | |

Consumer Staples | | | 9.4 | | |

Industrials | | | 9.0 | | |

Information Technology | | | 8.6 | | |

Health Care | | | 2.7 | | |

Energy | | | 2.6 | | |

Real Estate | | | 1.3 | | |

Materials | | | 0.6 | | |

Total Equity Investments | | | 62.4 | | |

Fixed Income Investments | | | | | |

Corporate Bonds | | | 12.6 | | |

Government and Agency Securities | | | 8.4 | | |

Asset Backed Securities | | | 0.1 | | |

Convertible Bond | | | 0.1 | | |

Total Fixed Income Investments | | | 21.2 | | |

Short-Term Investments and Other | | | 16.4 | | |

14 OAKMARK FUNDS

Oakmark Equity and Income Fund September 30, 2016

Portfolio Manager Commentary

Clyde S. McGregor, CFA

Portfolio Manager

oakbx@oakmark.com

M. Colin Hudson, CFA

Portfolio Manager

oakbx@oakmark.com

Edward J. Wojciechowski, CFA

Portfolio Manager

oakbx@oakmark.com

Quarter and Fiscal Year Review

After the market's Brexit-related turbulence at the end of the June quarter, comparative calm marked the September quarter. At one point the stock market posted an unusually long streak of days without a 1% price change in the averages. The fact that this torpidity occurred during a time of worldwide political upheaval made it seem even odder.

The Equity and Income Fund found this investing environment to be favorable as it gained 5% in the quarter. This compares to 3% for the Lipper Balanced Funds Index7, the Fund's performance benchmark. For the nine months of the calendar year, the Fund returned 6%, compared to 6% for the Lipper. And for the twelve months ended September 30 (the Fund's fiscal year), Equity and Income earned 7%, which compares to 10% for the Lipper Balanced Funds Index. The annualized compound rate of return since inception in 1995 is 10% while the corresponding return for the Lipper Index is 7%.

Bank of America, General Motors, Foot Locker, TD Ameritrade and Principal Financial Group provided the largest contribution to portfolio return in the quarter. CVS Health led the largest detractors list, apparently suffering collateral damage from the congressional hearings on pharmaceutical industry price increases. Other detractors included Kate Spade, HSN, Oracle and Carters. The largest contributors for the calendar year to date were Glencore, Dover, Oracle, UnitedHealth Group and Union Pacific. Bank of America, BorgWarner, CVS Health, Wells Fargo and Goldman Sachs were the leading detractors for the nine months. Finally, for the Fund's fiscal year, the largest contributors were Dover, Glencore, Philip Morris International, Oracle and UnitedHealth Group. The stocks that detracted most were BorgWarner, HSN, Bank of America, Oceaneering International (sold) and CVS Health.

Is Value Investing Impaired?

As we all know, 2008 was the start of the Great Recession and a brutal year in the stock market. Less well known is the fact that 2008 also witnessed a significant change in stock market internal dynamics. Before 2008, measures of return for value stocks relative to growth stocks had favored value when measured over long time periods. Short-term, counter-trend moves were frequent, and some were extreme, such as the 1997-99 Internet boom. However, over the very long term, value dominated. Since 2008, though, growth stock indexes have persistently prevailed over value in terms of relative performance.

Many explanations have been given to explain this change in market dynamics, but as is usually the case, the simplest answer appears to be the best. In a period of slow or negative economic growth, those companies that can demonstrate meaningful growth in revenues and profits will generally outperform in the market regardless of valuation. Calendar year 2015 demonstrated this phenomenon to an extreme: the so-called FANG

stocks (Facebook, Amazon, Netflix and Google, aka Alphabet) provided a majority of the S&P 500's investment return. To have such a small number of equities dominate investment return to this degree was an unprecedented outcome.

So as fundamental value investors, what is to be done in such an investing environment? Simply put, we continue as before, knowing that over time price and value will come together often enough to be the basis of an effective investing strategy. We recently read a quote from a portfolio manager in a Financial Times article that stated "You have to believe [when] getting out of bed that you have a chance of outperforming, otherwise you wouldn't bother." This is not the way that we think about it. We would instead say that we believe when we come to work each day, we have the possibility of finding and investing in the next great value opportunity for our clients, and it is that search that energizes us. Value investing is unlike farming, however, in that we do not know when our crops will be ripe for harvesting. This means that periods of relative underperformance are inevitable, but the economic logic underpinning fundamental value investing should ensure satisfactory absolute returns when measured over a suitable time horizon. An unusual economy has favored growth for quite some time, but we believe fundamental value investing itself is not impaired.

Transaction Activity

We initiated two new positions in the September quarter while exiting one. Our one sale was Goldman Sachs, which we sold partly for tax reasons and partly to rebalance the portfolio, which had become somewhat heavy with financial industry issues. We believe Goldman Sachs is a great company with many desirable attributes, but we determined that the portfolio's other financial company investments were more attractive at this time.

Alphabetically, our first new purchase was HCA Holdings, the largest operator of for-profit hospitals and related health care services in the U.S. The company benefits from scale and size advantages, an attractive geographic footprint in higher growth markets, best-in-class management and governance, and an equity-friendly approach to capital allocation. We expect HCA to grow operating income in the mid-single digits and EPS in the low double-digits over time. The company could also benefit from increased adoption of Medicaid expansion and/or increased enrollment on public exchanges. Uncertainty about health care reform and a rotation away from levered companies have caused HCA's share price to sell below our estimate of intrinsic value, offering what we believe is an attractive entry point.

Our second new purchase, MGM Resorts International, offers several paths to being a successful investment. First, MGM Resorts is in the early stage of recovery from an industry downturn. Activity on the Las Vegas strip is strengthening, and this

Oakmark.com 15

Oakmark Equity and Income Fund September 30, 2016

Portfolio Manager Commentary (continued)

should enable MGM to benefit from operating leverage in its significant Las Vegas assets. Augmenting this is the company's Profit Growth Plan, a cost-cutting and revenue-enhancement program that we believe will add substantial profitability. To our surprise, many investors have not yet fully incorporated this plan and its implications in their forecasts. Longer term, the investing story has a transformational element as well, due to the company's geographically diverse and multifaceted development pipeline, its improving capital structure, and the secular trends in Las Vegas. We believe that the stock is not getting enough credit for these and other value creators, so we view it as an attractive opportunity.

The combined effect of our transaction activity and market price movements resulted in a small increase in the portfolio's equity allocation. The Fund's fixed income allocation experienced a significant number of maturities and calls in the quarter causing that allocation to fall and the cash reserve position to rise. We continue to seek out fixed income issues that will provide income and diversification benefits without too much sensitivity to an increase in interest rates. To that end, we have kept the portfolio's fixed income duration relatively short.

As always, we thank you for entrusting us with your assets. Please feel welcome to send us your comments or questions.

16 OAKMARK FUNDS

Oakmark Equity and Income Fund September 30, 2016

Schedule of Investments (in thousands)

| | | Shares | | Value | |

COMMON STOCKS - 62.4% | |

FINANCIALS - 17.1% | |

BANKS - 7.8% | |

Bank of America Corp.

Diversified Banks | | | 39,501 | | | $ | 618,197 | | |

U.S. Bancorp

Diversified Banks | | | 4,936 | | | | 211,722 | | |

Citigroup, Inc.

Diversified Banks | | | 3,514 | | | | 165,976 | | |

Wells Fargo & Co.

Diversified Banks | | | 3,299 | | | | 146,089 | | |

Comerica, Inc.

Diversified Banks | | | 2,460 | | | | 116,407 | | |

| | | | | | 1,258,391 | | |

DIVERSIFIED FINANCIALS - 4.8% | |

TD Ameritrade Holding Corp.

Investment Banking & Brokerage | | | 9,175 | | | | 323,326 | | |

Bank of New York Mellon Corp.

Asset Management & Custody Banks | | | 5,340 | | | | 212,977 | | |

Ally Financial, Inc.

Consumer Finance | | | 6,540 | | | | 127,336 | | |

State Street Corp.

Asset Management & Custody Banks | | | 1,551 | | | | 108,010 | | |

| | | | | | 771,649 | | |

INSURANCE - 4.5% | |

Principal Financial Group, Inc.

Life & Health Insurance | | | 5,946 | | | | 306,294 | | |

FNF Group

Property & Casualty Insurance | | | 6,360 | | | | 234,740 | | |

Reinsurance Group of America, Inc.

Reinsurance | | | 1,683 | | | | 181,706 | | |

| | | | | | 722,740 | | |

| | | | | | 2,752,780 | | |

CONSUMER DISCRETIONARY - 11.1% | |

AUTOMOBILES & COMPONENTS - 6.8% | |

General Motors Co.

Automobile Manufacturers | | | 21,241 | | | | 674,836 | | |

BorgWarner, Inc.

Auto Parts & Equipment | | | 7,250 | | | | 255,059 | | |

Lear Corp.

Auto Parts & Equipment | | | 1,316 | | | | 159,578 | | |

| | | | | | 1,089,473 | | |

RETAILING - 3.1% | |

Foot Locker, Inc. (b)

Apparel Retail | | | 6,369 | | | | 431,309 | | |

HSN, Inc.

Internet Retail | | | 1,794 | | | | 71,383 | | |

| | | | | | 502,692 | | |

| | | Shares | | Value | |

CONSUMER DURABLES & APPAREL - 1.0% | |

Kate Spade & Co. (a)

Apparel, Accessories & Luxury Goods | | | 5,722 | | | $ | 98,018 | | |

Carter's, Inc.

Apparel, Accessories & Luxury Goods | | | 664 | | | | 57,601 | | |

| | | | | | 155,619 | | |

CONSUMER SERVICES - 0.2% | |

MGM Resorts International (a)

Casinos & Gaming | | | 1,424 | | | | 37,073 | | |

| | | | | | 1,784,857 | | |

CONSUMER STAPLES - 9.4% | |

FOOD, BEVERAGE & TOBACCO - 6.7% | |

Nestlé SA (c)

Packaged Foods & Meats | | | 6,207 | | | | 490,438 | | |

Philip Morris International, Inc.

Tobacco | | | 3,092 | | | | 300,575 | | |

Diageo PLC (c)

Distillers & Vintners | | | 2,441 | | | | 283,305 | | |

| | | | | | 1,074,318 | | |

FOOD & STAPLES RETAILING - 2.7% | |

CVS Health Corp.

Drug Retail | | | 4,911 | | | | 437,061 | | |

| | | | | | 1,511,379 | | |

INDUSTRIALS - 9.0% | |

CAPITAL GOODS - 7.2% | |

Dover Corp.

Industrial Machinery | | | 6,030 | | | | 444,075 | | |

Rockwell Automation, Inc.

Electrical Components & Equipment | | | 1,995 | | | | 244,093 | | |

Flowserve Corp. (b)

Industrial Machinery | | | 4,203 | | | | 202,742 | | |

Oshkosh Corp.

Construction Machinery & Heavy Trucks | | | 2,435 | | | | 136,338 | | |

Manitowoc Foodservice, Inc. (a)

Industrial Machinery | | | 3,794 | | | | 61,538 | | |

WESCO International, Inc. (a)

Trading Companies & Distributors | | | 682 | | | | 41,912 | | |

The Manitowoc Co., Inc.

Construction Machinery & Heavy Trucks | | | 6,243 | | | | 29,903 | | |

| | | | | | 1,160,601 | | |

TRANSPORTATION - 1.6% | |

Union Pacific Corp.

Railroads | | | 2,575 | | | | 251,140 | | |

COMMERCIAL & PROFESSIONAL SERVICES - 0.2% | |

Herman Miller, Inc.

Office Services & Supplies | | | 1,350 | | | | 38,606 | | |

| | | | | | 1,450,347 | | |

See accompanying Notes to Financial Statements.

Oakmark.com 17

Oakmark Equity and Income Fund September 30, 2016

Schedule of Investments (in thousands) (continued)

| | | Shares | | Value | |

COMMON STOCKS - 62.4% (continued) | |

INFORMATION TECHNOLOGY - 8.6% | |

SOFTWARE & SERVICES - 5.6% | |

Oracle Corp.

Systems Software | | | 13,327 | | | $ | 523,496 | | |

MasterCard, Inc., Class A

Data Processing & Outsourced Services | | | 3,703 | | | | 376,812 | | |

| | | | | | 900,308 | | |

TECHNOLOGY HARDWARE & EQUIPMENT - 3.0% | |

TE Connectivity, Ltd.

Electronic Manufacturing Services | | | 7,641 | | | | 491,927 | | |

| | | | | | 1,392,235 | | |

HEALTH CARE - 2.7% | |

HEALTH CARE EQUIPMENT & SERVICES - 2.7% | |

UnitedHealth Group, Inc.

Managed Health Care | | | 2,445 | | | | 342,306 | | |

HCA Holdings, Inc. (a)

Health Care Facilities | | | 1,284 | | | | 97,124 | | |

| | | | | | 439,430 | | |

ENERGY - 2.6% | |

Baker Hughes, Inc.

Oil & Gas Equipment & Services | | | 4,436 | | | | 223,874 | | |

National Oilwell Varco, Inc.

Oil & Gas Equipment & Services | | | 5,343 | | | | 196,294 | | |

| | | | | | 420,168 | | |

REAL ESTATE - 1.3% | |

The Howard Hughes Corp. (a)

Real Estate Development | | | 429 | | | | 49,105 | | |

Gaming and Leisure Properties, Inc.

Specialized REIT's | | | 1,833 | | | | 61,300 | | |

Jones Lang LaSalle, Inc.

Real Estate Services | | | 938 | | | | 106,678 | | |

| | | | | | 217,083 | | |

MATERIALS - 0.6% | |

Glencore PLC

Diversified Metals & Mining | | | 35,440 | | | | 97,453 | | |

TOTAL COMMON STOCKS - 62.4%

(COST $6,424,633) | | | | | 10,065,732 | | |

| | | Par Value | | Value | |

FIXED INCOME - 21.2% | |

CORPORATE BONDS - 12.6% | |

Kinetic Concepts, Inc.,

10.50%, due 11/01/18 | | $ | 47,940 | | | | 50,397 | | |

Ecolab, Inc.,

3.00%, due 12/08/16 | | | 48,290 | | | | 48,460 | | |

General Motors Co.,

4.875%, due 10/02/23 | | | 41,400 | | | | 44,854 | | |

| | | Par Value | | Value | |

Omega Healthcare Investors, Inc.,

5.875%, due 03/15/24 | | $ | 39,292 | | | $ | 41,050 | | |

Capital One NA/Mclean VA,

1.85%, due 09/13/19 | | | 39,255 | | | | 39,254 | | |

Zimmer Biomet Holdings, Inc.,

1.45%, due 04/01/17 | | | 37,671 | | | | 37,690 | | |

The William Carter Co.,

5.25%, due 08/15/21 | | | 35,137 | | | | 36,740 | | |

Omnicom Group, Inc.,

3.625%, due 05/01/22 | | | 30,425 | | | | 32,592 | | |

1011778 BC ULC / New Red Finance, Inc., 144A,

6.00%, due 04/01/22 (d) | | | 29,500 | | | | 30,901 | | |

Ultra Petroleum Corp., 144A,

5.75%, due 12/15/18 (d) (j) | | | 37,809 | | | | 30,531 | | |

Credit Suisse Group AG, 144A,

7.50% (d) (e) (f) | | | 30,000 | | | | 30,517 | | |

General Motors Co.,

3.50%, due 10/02/18 | | | 29,525 | | | | 30,436 | | |

Live Nation Entertainment, Inc., 144A,

7.00%, due 09/01/20 (d) | | | 28,930 | | | | 30,015 | | |

Bank of America Corp.,

5.625%, due 10/14/16 | | | 29,855 | | | | 29,889 | | |

Expedia, Inc., 144A,

5.00%, due 02/15/26 (d) | | | 28,360 | | | | 29,849 | | |

Toyota Motor Credit Corp.,

1.45%, due 01/12/18 | | | 29,495 | | | | 29,606 | | |

Activision Blizzard, Inc., 144A,

5.625%, due 09/15/21 (d) | | | 26,745 | | | | 27,906 | | |

CBRE Services, Inc.,

5.00%, due 03/15/23 | | | 25,239 | | | | 26,585 | | |

E*TRADE Financial Corp.,

5.375%, due 11/15/22 | | | 24,308 | | | | 25,911 | | |

Glencore Canada Corp.,

5.50%, due 06/15/17 | | | 25,290 | | | | 25,859 | | |

Credit Suisse Group Funding Guernsey, Ltd.,

3.125%, due 12/10/20 | | | 25,000 | | | | 25,327 | | |

Boston Scientific Corp.,

5.125%, due 01/12/17 | | | 24,913 | | | | 25,173 | | |

Credit Suisse New York,

1.75%, due 01/29/18 | | | 24,700 | | | | 24,704 | | |

Citigroup, Inc.,

1.70%, due 04/27/18 | | | 24,560 | | | | 24,587 | | |

AbbVie, Inc.,

1.75%, due 11/06/17 | | | 24,405 | | | | 24,485 | | |

Penn National Gaming, Inc.,

5.875%, due 11/01/21 | | | 23,704 | | | | 24,474 | | |

Weyerhaeuser Co. REIT,

6.95%, due 08/01/17 | | | 22,722 | | | | 23,677 | | |

Anthem, Inc.,

5.875%, due 06/15/17 | | | 22,388 | | | | 23,090 | | |

Anthem, Inc.,

2.375%, due 02/15/17 | | | 22,690 | | | | 22,769 | | |

Activision Blizzard, Inc., 144A,

6.125%, due 09/15/23 (d) | | | 20,525 | | | | 22,552 | | |

Pentair Finance SA,

2.90%, due 09/15/18 | | | 21,630 | | | | 21,933 | | |

Electronic Arts, Inc.,

4.80%, due 03/01/26 | | | 19,655 | | | | 21,645 | | |

International Game Technology PLC, 144A,

6.50%, due 02/15/25 (d) | | | 19,600 | | | | 21,119 | | |

See accompanying Notes to Financial Statements.

18 OAKMARK FUNDS

Oakmark Equity and Income Fund September 30, 2016

Schedule of Investments (in thousands) (continued)

| | | Par Value | | Value | |

FIXED INCOME - 21.2% (continued) | |

CORPORATE BONDS - 12.6% (continued) | |

Centene Corp.,

4.75%, due 05/15/22 | | $ | 20,084 | | | $ | 20,737 | | |

American International Group, Inc.,

3.30%, due 03/01/21 | | | 19,650 | | | | 20,617 | | |

CBRE Services, Inc.,

4.875%, due 03/01/26 | | | 19,665 | | | | 20,500 | | |

Lam Research Corp.,

2.75%, due 03/15/20 | | | 19,660 | | | | 20,120 | | |

CVS Health Corp.,

4.00%, due 12/05/23 | | | 18,198 | | | | 20,044 | | |

JPMorgan Chase Bank NA,

1.256%, due 06/14/17 (e) | | | 19,750 | | | | 19,752 | | |

JPMorgan Chase & Co.,

1.70%, due 03/01/18 | | | 19,665 | | | | 19,725 | | |

AT&T, Inc.,

5.00%, due 03/01/21 | | | 16,710 | | | | 18,709 | | |

S&P Global, Inc.,

4.00%, due 06/15/25 | | | 17,150 | | | | 18,579 | | |

Scientific Games International, Inc.,

10.00%, due 12/01/22 | | | 19,665 | | | | 18,141 | | |

Dollar General Corp.,

4.125%, due 07/15/17 | | | 17,095 | | | | 17,481 | | |

Aon Corp.,

5.00%, due 09/30/20 | | | 14,745 | | | | 16,330 | | |

CBRE Services, Inc.,

5.25%, due 03/15/25 | | | 14,975 | | | | 16,050 | | |

Ventas Realty LP / Ventas Capital Corp. REIT,

2.00%, due 02/15/18 | | | 15,876 | | | | 15,971 | | |

Diamond 1 Finance Corp. / Diamond 2 Finance Corp., 144A,

5.45%, due 06/15/23 (d) | | | 14,725 | | | | 15,777 | | |

International Game Technology PLC, 144A,

6.25%, due 02/15/22 (d) | | | 14,800 | | | | 15,688 | | |

Electronic Arts, Inc.,

3.70%, due 03/01/21 | | | 14,740 | | | | 15,662 | | |

Ultra Petroleum Corp., 144A,

6.125%, due 10/01/24 (d) (j) | | | 19,665 | | | | 15,535 | | |

Citigroup, Inc.,

3.40%, due 05/01/26 | | | 15,000 | | | | 15,498 | | |

Zayo Group LLC / Zayo Capital, Inc.,

6.00%, due 04/01/23 | | | 14,745 | | | | 15,482 | | |

The Priceline Group, Inc.,

3.60%, due 06/01/26 | | | 14,730 | | | | 15,444 | | |

Mead Johnson Nutrition Co.,

4.125%, due 11/15/25 | | | 13,955 | | | | 15,130 | | |

Omega Healthcare Investors, Inc.,

4.375%, due 08/01/23 | | | 14,625 | | | | 15,050 | | |

Schlumberger Holdings Corp., 144A,

2.35%, due 12/21/18 (d) | | | 14,740 | | | | 15,015 | | |

Credit Suisse Group Funding Guernsey, Ltd., 144A,

3.80%, due 06/09/23 (d) | | | 14,750 | | | | 14,946 | | |

Kinetic Concepts, Inc.,

12.50%, due 11/01/19 | | | 14,360 | | | | 14,288 | | |

WESCO Distribution, Inc., 144A,

5.375%, due 06/15/24 (d) | | | 13,675 | | | | 13,709 | | |

GLP Capital, LP / GLP Financing II, Inc.,

5.375%, due 11/01/23 | | | 12,000 | | | | 12,930 | | |

Universal Health Services, Inc., 144A,

4.75%, due 08/01/22 (d) | | | 12,350 | | | | 12,751 | | |

| | | Par Value | | Value | |

BorgWarner, Inc.,

4.625%, due 09/15/20 | | $ | 10,810 | | | $ | 11,711 | | |

Moody's Corp.,

4.50%, due 09/01/22 | | | 9,820 | | | | 10,934 | | |

GLP Capital, LP / GLP Financing II, Inc.,

4.875%, due 11/01/20 | | | 10,000 | | | | 10,775 | | |

Citigroup, Inc.,

6.125%, due 11/21/17 | | | 10,180 | | | | 10,703 | | |

Schlumberger Holdings Corp., 144A,

4.00%, due 12/21/25 (d) | | | 9,830 | | | | 10,695 | | |

The Howard Hughes Corp., 144A,

6.875%, due 10/01/21 (d) | | | 10,000 | | | | 10,512 | | |

Tyco Electronics Group SA,

3.70%, due 02/15/26 | | | 9,830 | | | | 10,508 | | |

Omega Healthcare Investors, Inc. REIT,

5.25%, due 01/15/26 | | | 9,835 | | | | 10,486 | | |

MSCI, Inc., 144A,

5.25%, due 11/15/24 (d) | | | 9,905 | | | | 10,486 | | |

International Game Technology PLC, 144A,

5.625%, due 02/15/20 (d) | | | 9,800 | | | | 10,400 | | |

Six Flags Entertainment Corp., 144A,

5.25%, due 01/15/21 (d) | | | 9,970 | | | | 10,294 | | |

Universal Health Services, Inc., 144A,

5.00%, due 06/01/26 (d) | | | 9,820 | | | | 10,225 | | |

CNO Financial Group, Inc.,

4.50%, due 05/30/20 | | | 9,830 | | | | 10,063 | | |

Kraft Heinz Foods Co.,

2.00%, due 07/02/18 | | | 9,830 | | | | 9,921 | | |

S&P Global, Inc., 144A,

2.95%, due 01/22/27 (d) | | | 9,810 | | | | 9,862 | | |

Chevron Corp.,

1.365%, due 03/02/18 | | | 9,835 | | | | 9,852 | | |

National Oilwell Varco, Inc.,

1.35%, due 12/01/17 | | | 9,844 | | | | 9,803 | | |

Ally Financial, Inc.,

5.50%, due 02/15/17 | | | 9,365 | | | | 9,482 | | |

Sirius XM Radio, Inc., 144A,

5.25%, due 08/15/22 (d) | | | 8,895 | | | | 9,406 | | |

USG Corp.,

6.30%, due 11/15/16 | | | 8,871 | | | | 8,911 | | |

Health Net, Inc.,

6.375%, due 06/01/17 | | | 8,680 | | | | 8,897 | | |

E*TRADE Financial Corp.,

4.625%, due 09/15/23 | | | 7,865 | | | | 8,174 | | |

CVS Health Corp.,

5.00%, due 12/01/24 | | | 6,880 | | | | 7,969 | | |

CVS Health Corp.,

4.75%, due 12/01/22 | | | 6,880 | | | | 7,803 | | |

Actavis Funding SCS,

1.30%, due 06/15/17 | | | 7,727 | | | | 7,721 | | |

Scientific Games International, Inc., 144A,

7.00%, due 01/01/22 (d) | | | 6,885 | | | | 7,281 | | |

L-3 Communications Corp.,

1.50%, due 05/28/17 | | | 7,274 | | | | 7,279 | | |

Concho Resources, Inc.,

5.50%, due 10/01/22 | | | 6,980 | | | | 7,242 | | |

Mead Johnson Nutrition Co.,

3.00%, due 11/15/20 | | | 6,885 | | | | 7,171 | | |

Level 3 Financing, Inc.,

5.125%, due 05/01/23 | | | 6,895 | | | | 7,102 | | |

See accompanying Notes to Financial Statements.

Oakmark.com 19

Oakmark Equity and Income Fund September 30, 2016

Schedule of Investments (in thousands) (continued)

| | | Par Value | | Value | |

FIXED INCOME - 21.2% (continued) | |

CORPORATE BONDS - 12.6% (continued) | |

Stanley Black & Decker, Inc.,

2.451%, due 11/17/18 | | $ | 6,875 | | | $ | 7,024 | | |

Wolverine World Wide, Inc., 144A,

5.00%, due 09/01/26 (d) | | | 6,870 | | | | 6,939 | | |

Kraft Heinz Foods Co., 144A,

4.875%, due 02/15/25 (d) | | | 6,260 | | | | 6,903 | | |

Fidelity National Financial, Inc.,

6.60%, due 05/15/17 | | | 6,446 | | | | 6,628 | | |

Credit Suisse Group AG, 144A,

6.25% (d) (e) (f) | | | 7,000 | | | | 6,624 | | |

IMS Health, Inc., 144A,

5.00%, due 10/15/26 (d) | | | 6,000 | | | | 6,240 | | |

Yum! Brands, Inc.,

3.875%, due 11/01/23 | | | 6,329 | | | | 6,234 | | |

Oceaneering International, Inc.,

4.65%, due 11/15/24 | | | 5,895 | | | | 5,934 | | |

CNO Financial Group, Inc.,

5.25%, due 05/30/25 | | | 5,895 | | | | 5,851 | | |

Quest Diagnostics, Inc.,

4.70%, due 04/01/21 | | | 5,128 | | | | 5,682 | | |

Manitowoc Foodservice, Inc.,

9.50%, due 02/15/24 | | | 4,915 | | | | 5,628 | | |

Glencore Finance Canada, Ltd., 144A,

3.60%, due 01/15/17 (d) | | | 5,590 | | | | 5,597 | | |

Ally Financial, Inc.,

2.75%, due 01/30/17 | | | 5,500 | | | | 5,510 | | |

Bank of America Corp.,

4.45%, due 03/03/26 | | | 5,000 | | | | 5,366 | | |

ConocoPhillips Co.,

4.20%, due 03/15/21 | | | 4,915 | | | | 5,320 | | |

EMI Music Publishing Group North America Holdings, Inc., 144A,

7.625%, due 06/15/24 (d) | | | 4,910 | | | | 5,309 | | |

Serta Simmons Bedding LLC, 144A,

8.125%, due 10/01/20 (d) | | | 4,990 | | | | 5,215 | | |

GLP Capital, LP / GLP Financing II, Inc.,

4.375%, due 11/01/18 | | | 5,000 | | | | 5,213 | | |

Express Scripts Holding Co.,

3.30%, due 02/25/21 | | | 4,915 | | | | 5,165 | | |

Reinsurance Group of America, Inc.,

3.95%, due 09/15/26 | | | 4,905 | | | | 5,132 | | |

Foot Locker, Inc.,

8.50%, due 01/15/22 (b) | | | 4,340 | | | | 5,121 | | |

Lam Research Corp.,

3.90%, due 06/15/26 | | | 4,910 | | | | 5,112 | | |

Berkshire Hathaway, Inc.,

2.75%, due 03/15/23 | | | 4,915 | | | | 5,108 | | |

Capital One NA,

2.35%, due 08/17/18 | | | 5,000 | | | | 5,061 | | |

Lam Research Corp.,

2.80%, due 06/15/21 | | | 4,910 | | | | 5,040 | | |

Lam Research Corp.,

3.45%, due 06/15/23 | | | 4,910 | | | | 5,022 | | |

General Motors Financial Co., Inc.,

3.10%, due 01/15/19 | | | 4,915 | | | | 5,010 | | |

The Goldman Sachs Group, Inc.,

1.481%, due 05/22/17 (e) | | | 5,000 | | | | 5,009 | | |

Penske Truck Leasing Co., LP / PTL Finance Corp., 144A,

3.75%, due 05/11/17 (d) | | | 4,920 | | | | 4,987 | | |

| | | Par Value | | Value | |

Bank of America Corp.,

3.875%, due 03/22/17 | | $ | 4,915 | | | $ | 4,972 | | |

American Express Credit Corp.,

1.875%, due 11/05/18 | | | 4,915 | | | | 4,955 | | |

Schlumberger Holdings Corp., 144A,

1.90%, due 12/21/17 (d) | | | 4,915 | | | | 4,946 | | |

GLP Capital, LP / GLP Financing II, Inc.,

5.375%, due 04/15/26 | | | 3,925 | | | | 4,219 | | |

Dana, Inc.,

6.00%, due 09/15/23 | | | 3,925 | | | | 4,082 | | |

Scripps Networks Interactive, Inc.,

2.80%, due 06/15/20 | | | 3,930 | | | | 4,026 | | |

Zimmer Biomet Holdings, Inc.,

3.15%, due 04/01/22 | | | 3,810 | | | | 3,941 | | |

Lear Corp.,

4.75%, due 01/15/23 | | | 3,476 | | | | 3,611 | | |

CHS/Community Health Systems, Inc.,

6.875%, due 02/01/22 | | | 3,920 | | | | 3,371 | | |

Omnicom Group, Inc.,

6.25%, due 07/15/19 | | | 2,950 | | | | 3,313 | | |

MGM Growth Properties Operating Partnership LP / MGP Escrow

Co-Issuer, Inc., 144A,

5.625%, due 05/01/24 (d) | | | 2,945 | | | | 3,194 | | |

Dollar Tree, Inc.,

5.75%, due 03/01/23 | | | 2,950 | | | | 3,175 | | |

The Manitowoc Co., Inc., 144A,

12.75%, due 08/15/21 (d) | | | 2,950 | | | | 3,171 | | |

MSCI, Inc., 144A,

5.75%, due 08/15/25 (d) | | | 2,950 | | | | 3,149 | | |

Diamond 1 Finance Corp. / Diamond 2 Finance Corp., 144A,

4.42%, due 06/15/21 (d) | | | 2,940 | | | | 3,073 | | |

American Express Credit Corp.,

2.60%, due 09/14/20 | | | 2,945 | | | | 3,031 | | |

eBay, Inc.,

2.50%, due 03/09/18 | | | 2,945 | | | | 2,987 | | |

MSCI, Inc., 144A,

4.75%, due 08/01/26 (d) | | | 2,940 | | | | 2,977 | | |

Medtronic, Inc.,

1.50%, due 03/15/18 | | | 2,950 | | | | 2,963 | | |

CVS Health Corp.,

2.25%, due 08/12/19 | | | 2,884 | | | | 2,938 | | |

CHS/Community Health Systems, Inc.,

8.00%, due 11/15/19 | | | 2,940 | | | | 2,881 | | |

S&P Global, Inc.,

4.40%, due 02/15/26 | | | 1,970 | | | | 2,201 | | |

The Gap, Inc.,

5.95%, due 04/12/21 | | | 1,965 | | | | 2,096 | | |

GLP Capital, LP / GLP Financing II, Inc.,

4.375%, due 04/15/21 | | | 1,965 | | | | 2,068 | | |

S&P Global, Inc.,

3.30%, due 08/14/20 | | | 1,970 | | | | 2,068 | | |

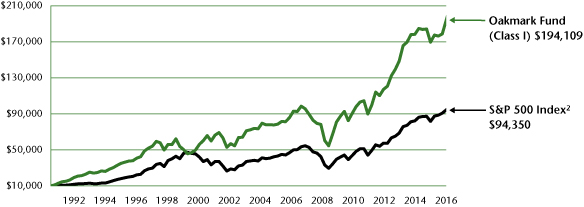

Live Nation Entertainment, Inc., 144A,