UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-06279 |

|

Harris Associates Investment Trust |

(Exact name of registrant as specified in charter) |

|

111 South Wacker Drive, Suite 4600

Chicago, Illinois | | 60606-4319 |

(Address of principal executive offices) | | (Zip code) |

|

Kristi L. Rowsell Harris Associates L.P. 111 South Wacker Drive, #4600 Chicago, Illinois 60606 | Alan Goldberg K&L Gates LLP 70 West Madison Street, Suite 3100 Chicago, Illinois 60602 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (312) 646-3600 | |

|

Date of fiscal year end: | 09/30/15 | |

|

Date of reporting period: | 09/30/15 | |

| | | | | | | | | |

Item 1. Reports to Shareholders.

OAKMARK FUNDS

ANNUAL REPORT | SEPTEMBER 30, 2015

OAKMARK FUND

OAKMARK SELECT FUND

OAKMARK EQUITY AND INCOME FUND

OAKMARK GLOBAL FUND

OAKMARK GLOBAL SELECT FUND

OAKMARK INTERNATIONAL FUND

OAKMARK INTERNATIONAL SMALL CAP FUND

Oakmark Funds

2015 Annual Report

TABLE OF CONTENTS

Fund Expenses | | | 1 | | |

Commentary on Oakmark and Oakmark Select Funds | | | 2 | | |

Oakmark Fund (OAKMX) | |

Summary Information | | | 4 | | |

Portfolio Manager Commentary | | | 5 | | |

Schedule of Investments | | | 6 | | |

Oakmark Select Fund (OAKLX) | |

Summary Information | | | 8 | | |

Portfolio Manager Commentary | | | 9 | | |

Schedule of Investments | | | 10 | | |

Oakmark Equity and Income Fund (OAKBX) | |

Summary Information | | | 12 | | |

Portfolio Manager Commentary | | | 13 | | |

Schedule of Investments | | | 15 | | |

Oakmark Global Fund (OAKGX) | |

Summary Information | | | 20 | | |

Portfolio Manager Commentary | | | 21 | | |

Schedule of Investments | | | 23 | | |

Oakmark Global Select Fund (OAKWX) | |

Summary Information | | | 26 | | |

Portfolio Manager Commentary | | | 27 | | |

Schedule of Investments | | | 28 | | |

Oakmark International Fund (OAKIX) | |

Summary Information | | | 30 | | |

Portfolio Manager Commentary | | | 31 | | |

Schedule of Investments | | | 33 | | |

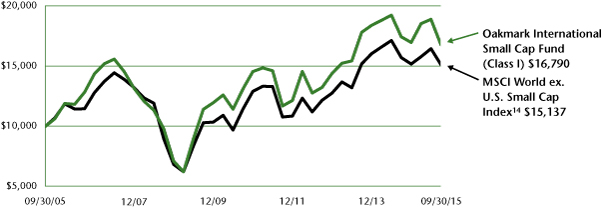

Oakmark International Small Cap Fund (OAKEX) | |

Summary Information | | | 36 | | |

Portfolio Manager Commentary | | | 37 | | |

Schedule of Investments | | | 38 | | |

Financial Statements | |

Statements of Assets and Liabilities | | | 40 | | |

Statements of Operations | | | 42 | | |

Statements of Changes in Net Assets | | | 44 | | |

Notes to Financial Statements | | | 51 | | |

Financial Highlights | | | 63 | | |

Report of Independent Registered Public Accounting Firm | | | 70 | | |

Federal Tax Information | | | 71 | | |

Disclosures and Endnotes | | | 71 | | |

Trustees and Officers | | | 73 | | |

FORWARD-LOOKING STATEMENT DISCLOSURE

One of our most important responsibilities as mutual fund managers is to communicate with shareholders in an open and direct manner. Some of our comments in our letters to shareholders are based on current management expectations and are considered "forward-looking statements". Actual future results, however, may prove to be different from our expectations. You can identify forward-looking statements by words such as "estimate", "may", "will", "expect", "believe", "plan" and other similar terms. We cannot promise future returns. Our opinions are a reflection of our best judgment at the time this report is compiled, and we disclaim any obligation to update or alter forward-looking statements as a result of new information, future events, or otherwise.

OAKMARK FUNDS

Oakmark and Oakmark Select Funds September 30, 2015

Portfolio Manager Commentary

William C. Nygren, CFA

Portfolio Manager

oakmx@oakmark.com

oaklx@oakmark.com

At Oakmark, we are long-term investors. We attempt to identify growing businesses that are managed to benefit their shareholders. We will purchase stock in those businesses only when priced substantially below our estimate of intrinsic value. After purchase, we patiently wait for the gap between stock price and intrinsic value to close.

"If you don't know where you are going, you might wind up someplace else."

-Yogi Berra

(May 12, 1925 – September 22, 2015) RIP

Party Like It's 1908

As I write this, something wonderful is happening in Chicago: There is excitement about winning an October baseball game for the first time in twelve years.1 The Chicago Cubs are finally back in the playoffs. As every Chicago Cubs fan knows, it has been a long road back from our last World Series win in 1908. In 2003, we were one game from going to the World Series, leading the Florida Marlins three games to one, but went on to lose three consecutive games to the eventual champions. Since then, the Cubs compiled a cumulative regular season record of 90 games below .500 and lost all six of their playoff games, bringing their post-season losing streak to nine games. Until this year.

Twelve years ago, in our June 2003 report, I wrote about the Michael Lewis book Moneyball. It tells the story of how Oakland A's general manager Billy Beane built a team that made the post-season, even though it had one of the lowest payrolls in Major League Baseball. Beane used advanced statistics to identify valuable players whom other teams had given up on. (I liked how Beane's approach resembled Oakmark's approach to buying stocks.) In 2002, after taking the A's to the playoffs for three consecutive years, Beane turned down an offer from the Boston Red Sox to become baseball's highest paid general manager.

Spurned by Beane, the Red Sox instead hired another young statistical guru, Theo Epstein. The Red Sox had just missed the 2002 playoffs despite having one of baseball's highest payrolls, and the owners had lost patience with the team's direction. By 2004, Epstein had overhauled the roster, hired a new manager and won the World Series. From 2003 through 2011—while the Cubs struggled—the Epstein-led Red Sox won two World Series, went to the playoffs six times and ended each season an average of 25 games over .500.

In 2011, the Cubs' record was 71-91. The Cubs' owners lost patience with the team's direction, so they hired Theo Epstein away from Boston. With a starting point of 20 games under .500, the Cubs were more of a teardown than the Red Sox had been. But by 2015, the roster had been overhauled and a new manager was put in place. The team's record improved to 32 games over .500, they earned a spot in the playoffs and they are now widely considered the most promising young team in baseball.

Baseball and Business Aren't That Different

Though I enjoy writing about baseball and the Cubs, the purpose of these reports is to share how we think about investing. Baseball is just a convenient analogy for examining businesses. An owner of a baseball team gets frustrated, hires a new GM and watches for signs of a turnaround. The shareholders of a poorly performing business get frustrated, the board of directors hires a new CEO and everyone watches for signs of a turnaround.

In both baseball and business, a turnaround isn't always immediately apparent in the numbers. In Epstein's first year with the Cubs, the team lost 40 more games than they won, 20 worse than the prior season. The next two seasons weren't much better, totaling 46 games under .500. But beneath the surface, the culture was improving as toxic veterans were replaced by highly talented, motivated rookies. Strategic trades took advantage of teams that were focused on the short term. (Can you believe we got Jake Arrieta for a three-month rental of Scott Feldman? Or Addison Russell for three months of Jeff Samardzija?) A new manager was hired, Joe Maddon, who had a proven track record of getting the most from young players. Individual goals finally took a back seat to team goals. But it still took three painfully long years before that progress was visible in the number of wins.

I remember many years ago talking to Warren Batts, then-CEO of Premark, which he headed after it was spun out from Kraft. (We owned it in the Oakmark Fund.) Batts said that a new CEO needs about two years to complete strategic acquisitions or divestitures and to build a new team of top managers. Then it takes those managers a year to build their teams. So three years in, the turnaround is finally in gear, yet investors have often already given up. If Theo Epstein's tenure with the Cubs was judged by the one-, two- or three-year win-loss record, it would have been deemed a failure. In year four, he looks like baseball executive of the year. Similarly, we've often used Oakmark's long investment horizon to try to gain an advantage over shorter term investors. Patience is generally a virtue in management of a baseball team, a business or an investment portfolio.

What Is the W-L Record of a Business?

In baseball it is generally agreed upon that the number of wins defines success. (Some might say success should be measured by World Series Championships, but I agree with the purists who argue that luck plays too big a factor in an individual series whereas it tends to even out over the course of a 162-game season.) In business, however, there isn't a generally agreed-upon metric to grade the success of a CEO. In a recent political debate, a particular candidate's tenure as CEO of a public company became a topic of discussion. Various statistics were cited, including changes in sales, earnings, stock price, number of

2 OAKMARK FUNDS

Oakmark and Oakmark Select Funds September 30, 2015

Portfolio Manager Commentary (continued)

people employed and dollars spent on R&D. Depending on which statistic was used, the resulting conclusion ranged from miserable failure to huge success.

Of those metrics, the one that interests us most is the change over time in stock price. Stock price presumably takes into account all of the other metrics and weights them appropriately. If markets were perfectly efficient, we'd say that change in stock price is the best measure of a CEO. But since we have seen markets sometimes overwhelmed by irrational exuberance or pessimism, we believe that an individual CEO can be unfairly blamed or credited for what is in fact a broad shift in valuation of many similar companies. When Jack Welch retired as CEO of General Electric in 2000, he was replaced by current CEO Jeff Immelt. Say what you will about Immelt's tenure as CEO, but it wasn't his fault that it started just as the large-cap bull market of 2000 was ending, when GE traded at 40 times earnings, a multiple at which almost no large company sells today. So, we need a better metric than stock price.

At Oakmark, we believe CEOs should have one goal: to maximize the long-term value of the business (including dividends), adjusted for net-debt and measured on a per-share basis. Interestingly, during the political debate, not one person mentioned any metric that included changes in the balance sheet or the number of shares outstanding. I don't know any business owners that would judge success or failure based on how their businesses grew without also considering how the balance sheets or their equity ownership percentage had changed. If a company doubles its size by doubling its share count, it is effectively just running in place. Many acquisitions that increase a company's sales and earnings fail to add value when considering the cash or stock that was paid to the seller.

Today it seems unpopular, especially in the political arena, to say that a CEO's goal should be to maximize value for the owners of a business. When you hear that view being challenged, remember that a company can only maximize long-term value by treating its employees fairly (or they will work elsewhere), by treating its customers fairly (or they will buy elsewhere) and by allocating its capital to the highest return projects. When a company doesn't have high return projects to invest in, returning excess capital to shareholders either through dividends or stock repurchase frees that capital to be invested in other businesses that do have growth opportunities. A no-growth company building new plants doesn't help anyone in the long run. For example, think of the societal gain that occurred when declining mainframe computer companies returned capital to shareholders and that money was invested in Internet startups. Capital returned to shareholders doesn't just get stuffed into mattresses.

At Oakmark, we believe the win-loss record of a CEO is the change in value per-share over his or her tenure. A good CEO will build a team to help maximize that change, just as a good baseball GM will build a team to maximize the number of wins. I hope by the time you read this the Cubs have passed their first playoff challenge and are on their way to the World Series. But if not, we fans will take comfort that the foundation appears to be in place for long-term success. It's a lot like our investment portfolios: When Oakmark invests in undervalued businesses run by CEOs with good win-loss records, our portfolios might not perform well next quarter or even next year, but we believe the foundation is in place for long-term success.

Oakmark.com 3

Oakmark Fund September 30, 2015

Summary Information

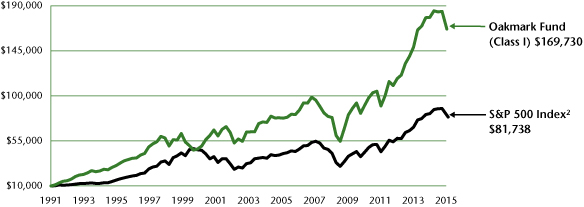

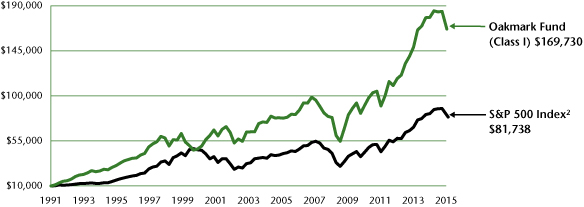

VALUE OF A $10,000 INVESTMENT

Since Inception - 08/05/91 (Unaudited)

PERFORMANCE

| | | | | Average Annual Total Returns (as of 09/30/15) | | | |

(Unaudited) | | Total Return

Last 3 Months | | 1-year | | 3-year | | 5-year | | 10-year | | Since

Inception | | Inception

Date | |

Oakmark Fund (Class I) | | | -7.93 | % | | | -4.87 | % | | | 13.11 | % | | | 13.39 | % | | | 8.12 | % | | | 12.44 | % | | 08/05/91 | |

S&P 500 Index | | | -6.44 | % | | | -0.61 | % | | | 12.40 | % | | | 13.34 | % | | | 6.80 | % | | | 9.09 | % | | | |

Dow Jones Industrial Average3 | | | -6.98 | % | | | -2.11 | % | | | 9.26 | % | | | 11.38 | % | | | 7.17 | % | | | 9.84 | % | | | |

Lipper Large Cap Value Funds Index4 | | | -8.91 | % | | | -5.34 | % | | | 11.02 | % | | | 11.03 | % | | | 5.32 | % | | | 8.34 | % | | | |

Oakmark Fund (Class II) | | | -8.02 | % | | | -5.19 | % | | | 12.76 | % | | | 13.04 | % | | | 7.79 | % | | | 7.10 | % | | 04/05/01 | |

The graph and table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Past performance is no guarantee of future results. The performance data quoted represents past performance. Current performance may be lower or higher than the performance data quoted. Total return includes change in share prices and, in each case, includes reinvestment of dividends and capital gain distributions. The investment return and principal value vary so that an investor's shares when redeemed may be worth more or less than the original cost. To obtain the most recent month-end performance, please visit Oakmark.com.

TOP TEN EQUITY HOLDINGS5 | | % of Net Assets | |

Bank of America Corp. | | | 3.3 | | |

Citigroup, Inc. | | | 2.7 | | |

MasterCard, Inc., Class A | | | 2.6 | | |

American International Group, Inc. | | | 2.5 | | |

JPMorgan Chase & Co. | | | 2.5 | | |

General Electric Co. | | | 2.3 | | |

Google, Inc., Class A | | | 2.3 | | |

Visa, Inc., Class A | | | 2.2 | | |

Intel Corp. | | | 2.1 | | |

Automatic Data Processing, Inc. | | | 2.1 | | |

FUND STATISTICS | |

Ticker - Class I | | OAKMX | |

Inception - Class I | | 08/05/1991 | |

Number of Equity Holdings | | 57 | |

Net Assets | | $16.6 billion | |

Benchmark | | S&P 500 Index | |

Weighted Average Market Cap | | $112.7 billion | |

Median Market Cap | | $47.6 billion | |

Portfolio Turnover (for the 12-months ended 09/30/15) | | 33% | |

Expense Ratio - Class I (as of 09/30/14) | | 0.87% | |

Expense Ratio - Class I (as of 09/30/15) | | 0.85% | |

SECTOR ALLOCATION | | % of Net Assets | |

Financials | | | 28.9 | | |

Information Technology | | | 25.2 | | |

Consumer Discretionary | | | 11.8 | | |

Industrials | | | 9.6 | | |

Consumer Staples | | | 6.4 | | |

Energy | | | 5.7 | | |

Health Care | | | 5.1 | | |

Materials | | | 2.0 | | |

Short-Term Investments and Other | | | 5.3 | | |

4 OAKMARK FUNDS

Oakmark Fund September 30, 2015

Portfolio Manager Commentary

William C. Nygren, CFA

Portfolio Manager

oakmx@oakmark.com

Kevin Grant, CFA

Portfolio Manager

oakmx@oakmark.com

The Oakmark Fund declined 8% during the past quarter, bringing the decline to 5% for the fiscal year ended September 30. The S&P 5002 declined 6% for the quarter and declined 1% for the fiscal year. Market volatility increased dramatically during the third quarter, driven by global economic softness, interest rate uncertainty and commodity weakness. We are certainly not pleased with near-term underperformance, but we remain confident that our focus on business value and our extended investment time horizon will position the Fund for favorable results over longer periods of time. We typically view heightened volatility as an opportunity to buy undervalued companies at attractive prices.

For the quarter and the fiscal year, energy and financials were our weakest sectors. We think these are among the most attractive areas in the market, and over one-third of the Fund's equities are invested in these two sectors. Our best performing sectors for the quarter were consumer staples and health care. The best performing sectors for the year were consumer discretionary and information technology. For the fiscal year, our best performing securities were Amazon and UnitedHealth Group, and the worst performers were Chesapeake Energy and Apache. We added two new names to the portfolio during the quarter (see below). We eliminated positions in Baker Hughes Incorporated, Glencore PLC, Las Vegas Sands Corp. and Precision Castparts Corp. We sold Precision Castparts following Berkshire Hathaway's acquisition offer. The other sales were part of our ongoing tax-trading strategy, and in these instances, we elected to invest funds elsewhere after we had completed the front-end tax-trade sales.

Anadarko Petroleum Corp. (APC-$60)

Anadarko Petroleum is a large oil and gas exploration and production company with operations in the United States and abroad. We believe the company has an excellent track record of discovering and developing profitable oil and gas reserves, and management has a reputation for being best-in-class operators. Anadarko has been able to consistently increase its proved reserves at costs that are well below industry averages, adding value in the process. Most importantly, management seeks to maximize per-share asset value with its capital allocation decisions and has shunned the "growth at all costs" mentality prevalent at many peers. This approach has encouraged low-cost development and intelligent asset monetization, which we believe is creating significant value. Like many oil and gas stocks, however, Anadarko shares have been affected by falling oil and gas prices, driving them down from a high of $110 last year to a low of $59 last quarter. We believe this substantially undervalues Anadarko's asset base. After adjusting for the company's stakes in public midstream equities and in large non-producing oil and gas assets, which are not needed to support future production growth, we believe Anadarko is attractively valued on multiples of earnings and cash flow. In our view, this

is a best-in-class company that is trading at a discount to lower quality peers in an already depressed industry, making Anadarko an attractive addition to our portfolio.

Cummins Inc. (CMI-$109)

The Oakmark Fund previously held shares in Cummins from the third quarter of 2012 through the second quarter of 2014. Cummins is the world's largest non-affiliated engine manufacturer, and it has a strong global distribution network. North America remains its largest market, but faster growing emerging markets account for almost one-third of the company's revenues. Cummins is also a leader in emissions control technology, which should lead to favorable revenue growth as more countries mandate tougher emissions standards. Global economic weakness has hurt the company's results, but we are encouraged by management's ability to innovate, cut costs and allocate capital wisely. The share price has fallen considerably from when we eliminated the position in the second quarter of 2014 when the business was valued at over 15x 2014 earnings, and we believe the business is now attractively valued at a below-average multiple of 11x expected 2015 earnings.

Oakmark.com 5

Oakmark Fund September 30, 2015

Schedule of Investments (in thousands)

| | | Shares | | Value | |

COMMON STOCKS - 94.7% | |

FINANCIALS - 28.9% | |

DIVERSIFIED FINANCIALS - 11.3% | |

American Express Co.

Consumer Finance | | | 4,600 | | | $ | 340,998 | | |

State Street Corp.

Asset Management & Custody Banks | | | 4,880 | | | | 327,985 | | |

The Goldman Sachs Group, Inc.

Investment Banking & Brokerage | | | 1,740 | | | | 302,342 | | |

Capital One Financial Corp.

Consumer Finance | | | 4,113 | | | | 298,260 | | |

Bank of New York Mellon Corp.

Asset Management & Custody Banks | | | 6,450 | | | | 252,503 | | |

Franklin Resources, Inc.

Asset Management & Custody Banks | | | 5,339 | | | | 198,913 | | |

T Rowe Price Group, Inc.

Asset Management & Custody Banks | | | 2,349 | | | | 163,235 | | |

| | | | | | 1,884,236 | | |

BANKS - 10.1% | |

Bank of America Corp.

Diversified Banks | | | 35,500 | | | | 553,090 | | |

Citigroup, Inc.

Diversified Banks | | | 9,030 | | | | 447,978 | | |

JPMorgan Chase & Co.

Diversified Banks | | | 6,740 | | | | 410,938 | | |

Wells Fargo & Co.

Diversified Banks | | | 5,290 | | | | 271,642 | | |

| | | | | | 1,683,648 | | |

INSURANCE - 7.5% | |

American International Group, Inc.

Multi-line Insurance | | | 7,305 | | | | 415,070 | | |

Aflac, Inc.

Life & Health Insurance | | | 5,670 | | | | 329,597 | | |

Aon PLC

Insurance Brokers | | | 3,080 | | | | 272,919 | | |

Principal Financial Group, Inc.

Life & Health Insurance | | | 4,609 | | | | 218,205 | | |

| | | | | | 1,235,791 | | |

| | | | | | 4,803,675 | | |

INFORMATION TECHNOLOGY - 25.2% | |

SOFTWARE & SERVICES - 15.1% | |

MasterCard, Inc., Class A

Data Processing & Outsourced Services | | | 4,850 | | | | 437,082 | | |

Google, Inc., Class A (a)

Internet Software & Services | | | 612 | | | | 390,426 | | |

Visa, Inc., Class A

Data Processing & Outsourced Services | | | 5,280 | | | | 367,805 | | |

Automatic Data Processing, Inc.

Data Processing & Outsourced Services | | | 4,320 | | | | 347,155 | | |

Oracle Corp.

Systems Software | | | 9,445 | | | | 341,154 | | |

Microsoft Corp.

Systems Software | | | 6,650 | | | | 294,329 | | |

| | | Shares | | Value | |

Accenture PLC, Class A

IT Consulting & Other Services | | | 2,100 | | | $ | 206,346 | | |

Google, Inc., Class C (a)

Internet Software & Services | | | 210 | | | | 127,768 | | |

| | | | | | 2,512,065 | | |

TECHNOLOGY HARDWARE & EQUIPMENT - 5.5% | |

Apple, Inc.

Technology Hardware, Storage & Peripherals | | | 3,107 | | | | 342,702 | | |

TE Connectivity, Ltd.

Electronic Manufacturing Services | | | 5,036 | | | | 301,585 | | |

QUALCOMM, Inc.

Communications Equipment | | | 4,845 | | | | 260,322 | | |

| | | | | | 904,609 | | |

SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT - 4.6% | |

Intel Corp.

Semiconductors | | | 11,580 | | | | 349,021 | | |

Texas Instruments, Inc.

Semiconductors | | | 6,365 | | | | 315,195 | | |

Applied Materials, Inc.

Semiconductor Equipment | | | 7,260 | | | | 106,649 | | |

| | | | | | 770,865 | | |

| | | | | | 4,187,539 | | |

CONSUMER DISCRETIONARY - 11.8% | |

RETAILING - 3.7% | |

Liberty Interactive Corp. QVC Group, Class A (a)

Catalog Retail | | | 11,891 | | | | 311,898 | | |

Amazon.com, Inc. (a)

Internet Retail | | | 599 | | | | 306,622 | | |

| | | | | | 618,520 | | |

AUTOMOBILES & COMPONENTS - 3.7% | |

General Motors Co.

Automobile Manufacturers | | | 7,850 | | | | 235,657 | | |

Fiat Chrysler Automobiles N.V. (a)

Automobile Manufacturers | | | 16,000 | | | | 211,360 | | |

Harley-Davidson, Inc.

Motorcycle Manufacturers | | | 3,102 | | | | 170,300 | | |

| | | | | | 617,317 | | |

MEDIA - 3.1% | |

News Corp., Class A

Publishing | | | 19,704 | | | | 248,665 | | |

Comcast Corp., Class A

Cable & Satellite | | | 2,940 | | | | 168,286 | | |

Omnicom Group, Inc.

Advertising | | | 1,559 | | | | 102,758 | | |

| | | | | | 519,709 | | |

CONSUMER DURABLES & APPAREL - 1.3% | |

Whirlpool Corp.

Household Appliances | | | 1,400 | | | | 206,164 | | |

| | | | | | 1,961,710 | | |

See accompanying Notes to Financial Statements.

6 OAKMARK FUNDS

Oakmark Fund September 30, 2015

Schedule of Investments (in thousands) (continued)

| | | Shares | | Value | |

COMMON STOCKS - 94.7% (continued) | |

INDUSTRIALS - 9.6% | |

CAPITAL GOODS - 6.6% | |

General Electric Co.

Industrial Conglomerates | | | 15,500 | | | $ | 390,910 | | |

Caterpillar, Inc.

Construction Machinery & Heavy Trucks | | | 4,400 | | | | 287,584 | | |

Parker-Hannifin Corp.

Industrial Machinery | | | 2,225 | | | | 216,492 | | |

Cummins, Inc.

Construction Machinery & Heavy Trucks | | | 1,900 | | | | 206,302 | | |

| | | | | | 1,101,288 | | |

TRANSPORTATION - 3.0% | |

FedEx Corp.

Air Freight & Logistics | | | 2,200 | | | | 316,756 | | |

Union Pacific Corp.

Railroads | | | 1,950 | | | | 172,400 | | |

| | | | | | 489,156 | | |

| | | | | | 1,590,444 | | |

CONSUMER STAPLES - 6.4% | |

FOOD, BEVERAGE & TOBACCO - 5.0% | |

General Mills, Inc.

Packaged Foods & Meats | | | 5,820 | | | | 326,677 | | |

Nestle SA (b)

Packaged Foods & Meats | | | 3,540 | | | | 266,350 | | |

Diageo PLC (b)

Distillers & Vintners | | | 2,250 | | | | 242,527 | | |

| | | | | | 835,554 | | |

HOUSEHOLD & PERSONAL PRODUCTS - 1.4% | |

Unilever PLC (b)

Personal Products | | | 5,613 | | | | 228,898 | | |

| | | | | | 1,064,452 | | |

ENERGY - 5.7% | |

Apache Corp.

Oil & Gas Exploration & Production | | | 8,274 | | | | 324,005 | | |

Halliburton Co.

Oil & Gas Equipment & Services | | | 6,801 | | | | 240,415 | | |

Anadarko Petroleum Corp.

Oil & Gas Exploration & Production | | | 2,700 | | | | 163,053 | | |

National Oilwell Varco, Inc.

Oil & Gas Equipment & Services | | | 3,580 | | | | 134,787 | | |

Chesapeake Energy Corp.

Oil & Gas Exploration & Production | | | 12,000 | | | | 87,960 | | |

| | | | | | 950,220 | | |

HEALTH CARE - 5.1% | |

HEALTH CARE EQUIPMENT & SERVICES - 3.5% | |

UnitedHealth Group, Inc.

Managed Health Care | | | 2,590 | | | | 300,466 | | |

Medtronic PLC

Health Care Equipment | | | 4,190 | | | | 280,478 | | |

| | | | | | 580,944 | | |

| | | Shares | | Value | |

PHARMACEUTICALS, BIOTECHNOLOGY & LIFE SCIENCES - 1.6% | |

Sanofi (b)

Pharmaceuticals | | | 5,670 | | | $ | 269,155 | | |

| | | | | | 850,099 | | |

MATERIALS - 2.0% | |

Monsanto Co.

Fertilizers & Agricultural Chemicals | | | 3,950 | | | | 337,093 | | |

TOTAL COMMON STOCKS - 94.7%

(COST $12,596,938) | | | | | 15,745,232 | | |

| | | Par Value | | Value | |

SHORT TERM INVESTMENTS - 5.7% | |

REPURCHASE AGREEMENT - 2.1% | |

Fixed Income Clearing Corp. Repurchase

Agreement, 0.01% dated 09/30/15 due

10/01/15, repurchase price $352,651,

collateralized by a Federal National

Mortgage Association Corp. Bond,

1.500%, due 06/22/20, value plus

accrued interest of $691, by United

States Treasury Notes, 0.625% - 3.500%,

due 09/30/17 - 07/31/20, aggregate

value plus accrued interest of $359,016

(Cost: $352,651) | | $ | 352,651 | | | | 352,651 | | |

U.S. GOVERNMENT BILLS - 2.1% | |

United States Treasury Bills, 0.13% - 0.26%,

due 01/14/16 - 03/10/16 (c)

(Cost $349,788) | | | 350,000 | | | | 349,980 | | |

GOVERNMENT AND AGENCY SECURITIES - 1.5% | |

United States Treasury Floating Rate Note,

0.084%, due 04/30/16 (d)

(Cost $250,000) | | | 250,000 | | | | 250,024 | | |

TOTAL SHORT TERM INVESTMENTS - 5.7%

(Cost $952,439) | | | | | 952,655 | | |

TOTAL INVESTMENTS - 100.4%

(COST $13,549,377) | | | | | 16,697,887 | | |

Foreign Currencies (Cost $0) - 0.0% (e) | | | | | 0 | (f) | |

Liabilities In Excess of Other Assets - (0.4)% | | | | | (58,499 | ) | |

TOTAL NET ASSETS - 100.0% | | | | $ | 16,639,388 | | |

(a) Non-income producing security

(b) Sponsored American Depositary Receipt

(c) The rate shown represents the annualized yield at the time of purchase; not a coupon rate.

(d) Floating Rate Note. Rate shown is as of September 30, 2015.

(e) Amount rounds to less than 0.1%.

(f) Amount rounds to less than $1,000.

See accompanying Notes to Financial Statements.

Oakmark.com 7

Oakmark Select Fund September 30, 2015

Summary Information

VALUE OF A $10,000 INVESTMENT

Since Inception - 11/01/96 (Unaudited)

PERFORMANCE

| | | | | Average Annual Total Returns (as of 09/30/15) | | | |

(Unaudited) | | Total Return

Last 3 Months | | 1-year | | 3-year | | 5-year | | 10-year | | Since

Inception | | Inception

Date | |

Oakmark Select Fund (Class I) | | | -8.80 | % | | | -6.75 | % | | | 14.40 | % | | | 13.64 | % | | | 7.11 | % | | | 12.46 | % | | 11/01/96 | |

S&P 500 Index | | | -6.44 | % | | | -0.61 | % | | | 12.40 | % | | | 13.34 | % | | | 6.80 | % | | | 7.42 | % | | | |

Lipper Multi-Cap Value Funds Index6 | | | -9.11 | % | | | -4.05 | % | | | 11.70 | % | | | 11.17 | % | | | 5.03 | % | | | 7.05 | % | | | |

Oakmark Select Fund (Class II) | | | -8.91 | % | | | -7.04 | % | | | 14.04 | % | | | 13.30 | % | | | 6.80 | % | | | 8.74 | % | | 12/31/99 | |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Past performance is no guarantee of future results. The performance data quoted represents past performance. Current performance may be lower or higher than the performance data quoted. Total return includes change in share prices and, in each case, includes reinvestment of dividends and capital gain distributions. The investment return and principal value vary so that an investor's shares when redeemed may be worth more or less than the original cost. To obtain the most recent month-end performance, please visit Oakmark.com.

TOP TEN EQUITY HOLDINGS5 | | % of Net Assets | |

Google, Inc., Class C | | | 7.5 | | |

General Electric Co. | | | 6.6 | | |

American International Group, Inc. | | | 6.3 | | |

Bank of America Corp. | | | 5.9 | | |

Citigroup, Inc. | | | 5.9 | | |

TE Connectivity, Ltd. | | | 5.8 | | |

JPMorgan Chase & Co. | | | 5.8 | | |

CBRE Group, Inc. Class A | | | 5.2 | | |

FNF Group | | | 5.0 | | |

MasterCard, Inc., Class A | | | 5.0 | | |

FUND STATISTICS | |

Ticker - Class I | | OAKLX | |

Inception - Class I | | 11/01/96 | |

Number of Equity Holdings | | 20 | |

Net Assets | | $5.5 billion | |

Benchmark | | S&P 500 Index | |

Weighted Average Market Cap | | $127.1 billion | |

Median Market Cap | | $56.7 billion | |

Portfolio Turnover (for the 12-months ended 09/30/15) | | 46% | |

Expense Ratio - Class I (as of 09/30/14) | | 0.95% | |

Expense Ratio - Class I (as of 09/30/15) | | 0.95% | |

SECTOR ALLOCATION | | % of Net Assets | |

Financials | | | 38.0 | | |

Information Technology | | | 26.2 | | |

Consumer Discretionary | | | 11.5 | | |

Industrials | | | 6.6 | | |

Energy | | | 4.5 | | |

Materials | | | 3.1 | | |

Utilities | | | 2.6 | | |

Short-Term Investments and Other | | | 7.5 | | |

8 OAKMARK FUNDS

Oakmark Select Fund September 30, 2015

Portfolio Manager Commentary

William C. Nygren, CFA

Portfolio Manager

oaklx@oakmark.com

Anthony P. Coniaris, CFA

Portfolio Manager

oaklx@oakmark.com

Win Murray

Portfolio Manager

oaklx@oakmark.com

For the quarter, the Oakmark Select Fund declined 9%, compared to a 6% decline for the S&P 5002. This brings the Fund's return for the fiscal year that ended on September 30 to a decline of 7%, compared to a decline of 1% for the S&P 500 over the same period. Although we are disappointed with these outcomes, we have been through difficult periods before and remain thoroughly committed to the same investment process that has delivered success since the Fund's inception.

During the quarter, Apache (–32%) and Chesapeake (–32%) were our largest detractors, as commodity prices declined broadly. Our largest contributors were Google Cl A (+19%) and Amazon (+18%). For the fiscal year, Apache (–58%) and Chesapeake (–65%) were our largest detractors by a significant margin, and Amazon (+59%) and MasterCard (+23%) were our largest contributors. We wrote fairly extensively about Chesapeake last quarter, but an update seems warranted given the stock price's continued weakness. In short, it wasn't all bad news—lower oil and gas prices notwithstanding. Chesapeake renegotiated a meaningful component of its legacy high-cost transportation contracts (see last quarter's letter for details), and this has reduced the company's sensitivity to lower gas prices. Importantly, many of the company's fundamentals, including production volume as well as drilling and operating costs, have been consistent with our expectations. Furthermore, one of Chesapeake's competitors recently sold assets in the Haynesville Shale that were quite similar to those of Chesapeake; the sale price was consistent with our estimated value. At Oakmark, we always closely monitor private market transactions, which we believe are important indicators of business value.

We sold Franklin Resources in the quarter and allocated the proceeds across several existing holdings in the Fund. We established no new positions in the quarter. You may notice the cash balance was higher than normal at quarter end. The elevated cash position supports a tax trade on Apache, whereby we sold puts and a portion of our shares to maintain some exposure to the company while harvesting a tax loss. We expect the cash position will normalize when we complete the tax trade. While it's too early to make promises, as of September 30, we do not expect to be making a capital gain distribution this year.

Thank you for your continued investment in the Fund.

Oakmark.com 9

Oakmark Select Fund September 30, 2015

Schedule of Investments (in thousands)

| | | Shares | | Value | |

COMMON STOCKS - 92.0% | |

FINANCIALS - 38.0% | |

BANKS - 17.5% | |

Bank of America Corp.

Diversified Banks | | | 20,979 | | | $ | 326,847 | | |

Citigroup, Inc.

Diversified Banks | | | 6,577 | | | | 326,285 | | |

JPMorgan Chase & Co.

Diversified Banks | | | 5,230 | | | | 318,873 | | |

| | | | | | 972,005 | | |

INSURANCE - 11.3% | |

American International Group, Inc.

Multi-line Insurance | | | 6,145 | | | | 349,170 | | |

FNF Group

Property & Casualty Insurance | | | 7,821 | | | | 277,418 | | |

| | | | | | 626,588 | | |

REAL ESTATE - 5.2% | |

CBRE Group, Inc., Class A (a)

Real Estate Services | | | 8,964 | | | | 286,848 | | |

DIVERSIFIED FINANCIALS - 4.0% | |

Capital One Financial Corp.

Consumer Finance | | | 3,050 | | | | 221,186 | | |

| | | | | | 2,106,627 | | |

INFORMATION TECHNOLOGY - 26.2% | |

SOFTWARE & SERVICES - 16.8% | |

Google, Inc., Class C (a)

Internet Software & Services | | | 686 | | | | 417,163 | | |

MasterCard, Inc., Class A

Data Processing & Outsourced Services | | | 3,075 | | | | 277,119 | | |

Oracle Corp.

Systems Software | | | 6,540 | | | | 236,225 | | |

| | | | | | 930,507 | | |

TECHNOLOGY HARDWARE & EQUIPMENT - 5.9% | |

TE Connectivity, Ltd.

Electronic Manufacturing Services | | | 5,394 | | | | 323,043 | | |

SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT - 3.5% | |

Intel Corp.

Semiconductors | | | 6,447 | | | | 194,312 | | |

| | | | | | 1,447,862 | | |

CONSUMER DISCRETIONARY - 11.0% | |

RETAILING - 8.1% | |

Liberty Interactive Corp. QVC Group, Class A (a)

Catalog Retail | | | 9,214 | | | | 241,680 | | |

Amazon.com, Inc. (a)

Internet Retail | | | 407 | | | | 208,340 | | |

| | | | | | 450,020 | | |

| | | Shares | | Value | |

AUTOMOBILES & COMPONENTS - 2.9% | |

Fiat Chrysler Automobiles N.V. (a)

Automobile Manufacturers | | | 11,870 | | | $ | 156,809 | | |

| | | | | | 606,829 | | |

INDUSTRIALS - 6.6% | |

CAPITAL GOODS - 6.6% | |

General Electric Co. (b)

Industrial Conglomerates | | | 14,500 | | | | 365,690 | | |

ENERGY - 4.5% | |

Chesapeake Energy Corp.

Oil & Gas Exploration & Production | | | 25,700 | | | | 188,381 | | |

Apache Corp.

Oil & Gas Exploration & Production | | | 1,500 | | | | 58,740 | | |

| | | | | | 247,121 | | |

MATERIALS - 3.1% | |

Monsanto Co.

Fertilizers & Agricultural Chemicals | | | 2,000 | | | | 170,680 | | |

UTILITIES - 2.6% | |

Calpine Corp. (a)

Independent Power Producers & Energy Traders | | | 10,004 | | | | 146,064 | | |

TOTAL COMMON STOCKS - 92.0%

(COST $3,830,678) | | | | | 5,090,873 | | |

| | | Par Value | | Value | |

FIXED INCOME - 0.5% | |

CONVERTIBLE BOND - 0.5% | |

Fiat Chrysler Automobiles N.V.,

7.875%, due 12/15/16

(Cost $34,575) | | $ | 25,779 | | | | 30,032 | | |

TOTAL FIXED INCOME - 0.5%

(COST $34,575) | | | | | 30,032 | | |

See accompanying Notes to Financial Statements.

10 OAKMARK FUNDS

Oakmark Select Fund September 30, 2015

Schedule of Investments (in thousands) (continued)

| | | Par Value | | Value | |

SHORT TERM INVESTMENTS - 7.1% | |

REPURCHASE AGREEMENT - 7.1% | |

Fixed Income Clearing Corp. Repurchase

Agreement, 0.01% dated 09/30/15 due

10/01/15, repurchase price $394,629,

collateralized by a Federal Home Loan

Bank Bond, 1.000%, due 06/21/17, value

plus accrued interest of $27,908, by

Federal Home Loan Mortgage Corp.

Bonds, 0.875% - 2.120%, due 02/22/17 -

06/02/21, aggregate value plus accrued

interest of $165,194, by Federal National

Mortgage Association Bonds, 1.250% -

5.000%, due 11/15/16 - 02/13/17,

aggregate value plus accrued interest of

$135,558, by a United States Treasury

Floating Rate Note, 0.089%, due 04/30/17,

value plus accrued interest of $50,000, by

United States Treasury Notes, 2.750% -

3.500%, due 05/31/17 - 05/15/20,

aggregate value plus accrued interest of

$23,865 (Cost: $394,629) | | $ | 394,629 | | | $ | 394,629 | | |

TOTAL SHORT TERM INVESTMENTS - 7.1%

(COST $394,629) | | | | | 394,629 | | |

TOTAL INVESTMENTS - 99.6%

(COST $4,259,882) | | | | | 5,515,534 | | |

Other Assets In Excess of Liabilities - 0.4% | | | | | 20,526 | | |

TOTAL NET ASSETS - 100.0% | | | | $ | 5,536,060 | | |

| | Contracts | | Value | |

PUT OPTIONS WRITTEN - (0.1)% | |

ENERGY - (0.1)% | |

Apache Corp., Strike Price $36.50,

Expires 11/6/2015 (c) | | | 51 | | | | (7,391 | ) | |

TOTAL PUT OPTIONS WRITTEN

(PREMIUMS RECEIVED

$(12,393)) - (0.1%) | | | | | (7,391 | ) | |

(a) Non-income producing security

(b) All or a portion of this security is held for open written options collateral.

(c) Fair value is determined in good faith in accordance with procedures established by the Board of Trustees.

See accompanying Notes to Financial Statements.

Oakmark.com 11

Oakmark Equity and Income Fund September 30, 2015

Summary Information

VALUE OF A $10,000 INVESTMENT

Since Inception - 11/01/95 (Unaudited)

PERFORMANCE

| | | | | Average Annual Total Returns (as of 09/30/15) | | | |

(Unaudited) | | Total Return

Last 3 Months | | 1-year | | 3-year | | 5-year | | 10-year | | Since

Inception | | Inception

Date | |

Oakmark Equity and Income Fund (Class I) | | | -6.95 | % | | | -2.53 | % | | | 8.17 | % | | | 8.04 | % | | | 6.50 | % | | | 10.21 | % | | 11/01/95 | |

Lipper Balanced Funds Index | | | -4.59 | % | | | -1.06 | % | | | 6.89 | % | | | 7.61 | % | | | 5.30 | % | | | 6.62 | % | | | |

S&P 500 Index | | | -6.44 | % | | | -0.61 | % | | | 12.40 | % | | | 13.34 | % | | | 6.80 | % | | | 8.17 | % | | | |

Barclays U.S. Govt./Credit Index | | | 1.20 | % | | | 2.73 | % | | | 1.59 | % | | | 3.09 | % | | | 4.61 | % | | | 5.53 | % | | | |

Oakmark Equity and Income Fund (Class II) | | | -7.03 | % | | | -2.84 | % | | | 7.82 | % | | | 7.70 | % | | | 6.16 | % | | | 8.36 | % | | 07/12/00 | |

The graph and table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Past performance is no guarantee of future results. The performance data quoted represents past performance. Current performance may be lower or higher than the performance data quoted. Total return includes change in share prices and, in each case, includes reinvestment of dividends and capital gain distributions. The investment return and principal value vary so that an investor's shares when redeemed may be worth more or less than the original cost. To obtain the most recent month-end performance, please visit Oakmark.com.

TOP TEN EQUITY HOLDINGS5 | | % of Net Assets | |

Bank of America Corp. | | | 3.8 | | |

General Motors Co. | | | 3.6 | | |

Oracle Corp. | | | 3.5 | | |

Nestle ADR | | | 3.3 | | |

Foot Locker, Inc. | | | 2.9 | | |

TE Connectivity, Ltd. | | | 2.7 | | |

CVS Health Corp. | | | 2.6 | | |

Dover Corp. | | | 2.2 | | |

TD Ameritrade Holding Corp. | | | 2.1 | | |

MasterCard, Inc., Class A | | | 2.1 | | |

FUND STATISTICS | |

Ticker - Class I | | OAKBX | |

Inception - Class I | | 11/01/95 | |

Number of Equity Holdings | | 47 | |

Net Assets | | $18.2 billion | |

Benchmark | | Lipper Balanced Funds Index | |

Weighted Average Market Cap | | $70.7 billion | |

Median Market Cap | | $14.0 billion | |

Portfolio Turnover (for the 12-months ended 09/30/15) | | 25% | |

Expense Ratio - Class I (as of 09/30/14) | | 0.74% | |

Expense Ratio - Class I (as of 09/30/15) | | 0.75% | |

SECTOR ALLOCATION | | % of Net Assets | |

Equity Investments | |

Financials | | | 15.4 | | |

Consumer Discretionary | | | 11.3 | | |

Industrials | | | 9.9 | | |

Information Technology | | | 9.5 | | |

Consumer Staples | | | 9.2 | | |

Energy | | | 2.9 | | |

Health Care | | | 2.2 | | |

Materials | | | 0.4 | | |

Total Equity Investments | | | 60.8 | | |

Fixed Income Investments | |

Corporate Bonds | | | 8.5 | | |

Government and Agency Securities | | | 8.2 | | |

Asset Backed Securities | | | 0.1 | | |

Total Fixed Income Investments | | | 16.8 | | |

Short-Term Investments and Other | | | 22.4 | | |

12 OAKMARK FUNDS

Oakmark Equity and Income Fund September 30, 2015

Portfolio Manager Commentary

Clyde S. McGregor, CFA

Portfolio Manager

oakbx@oakmark.com

M. Colin Hudson, CFA

Portfolio Manager

oakbx@oakmark.com

Matthew A. Logan, CFA

Portfolio Manager

oakbx@oakmark.com

Edward J. Wojciechowski, CFA

Portfolio Manager

oakbx@oakmark.com

Voilà! Volatility is Back

"In the history of the stock market this is the first year to have made it to July without breaching the 3.5% barrier in either direction...A newly awakened Rip van Winkle might think that this lack of directional volatility implied a very calm economy and world political environment, to which we would reply 'Greece, Islamic State, negative first quarter GDP...'"

Just one quarter ago we commented on the unusual lack of volatility in the stock market. How quickly things change! Within seven weeks of writing our last quarterly letter, the market fell by 11% in just six trading days, and on two of those days it fell by more than 3%. While the market has recovered some of those losses, it was still down 6% in the quarter.

So what has changed? As we alluded to in our commentary last quarter, despite the subdued movement in the market through the first half of the year, the world remained a volatile place. It seems as if the market became more cognizant of this in the third quarter, after China surprised investors with weak economic indicators and equally surprising government responses. And, so, market volatility reappeared, reminding investors it was merely in hibernation and not extinct.

As if the sudden reappearance of volatility wasn't enough to rattle investors, technical issues further compounded the problem. On Monday, August 24, some exchange traded funds (ETFs) opened down as much as 40% while the underlying net asset values were down a fraction of that. Even the shares of enormous, widely owned companies like GE, JPMorgan and CVS fell 20% in the early minutes of trading, before recovering to end the day down "just" low- to mid-single digit percentages.

Such wild moves lend credence to the concerns that many have expressed about potential volatility in another asset class: bonds. With bonds having been in a 30-year bull market, some are concerned that investors aren't prepared for the repercussions that may follow the Federal Reserve's rate hikes. Making matters potentially worse, a greater percentage of the bond market is now controlled by flightier open-end mutual funds and exchange-traded funds; at the same time, large banks are playing a smaller role intermediating bond trading, as a result of post-financial crisis regulations. The combined effect of all of this is that the bond market could be in for a period of unusual price swings. Even plain vanilla Treasuries—long viewed as one of the most liquid markets in the world—could be "violently volatile," according to JPMorgan Chairman and CEO Jamie Dimon.

While orderly capital markets are essential to a resilient and growing economy, we wonder if too much has been made of this issue. Yes, extreme volatility can cost investors who sell out during times of stress. But that only exacerbates the real problem: panicking and selling during times of stress. Certainly there are investors who need to sell merely out of unfortunate coincidence on days the market is under unusual strain. But it seems many of the sellers on such days are reacting to nothing more than the decline in the market. Indeed, the volume on Monday, August 24, was nearly twice the average experienced throughout the summer. Investors would be well served on such days (and extended periods) simply to tune out the market and adhere to their long-term investment plans. It's the deviation from those investment plans in times of stress—and not the resultant trading costs—that is the real problem.

While we may not think the issues of liquidity and volatility are quite as deleterious as some have claimed, we still have taken great care to protect shareholders of the Oakmark Equity and Income Fund. In general, we take a holistic approach to managing the Fund's liquidity. In addition to holding considerable levels of cash, commercial paper, and other short-term instruments—conventional sources of liquidity—the Fund also invests in numerous other securities that we believe can be at least partially liquidated with relative ease, such as government bonds and large capitalization equities. While the composition of the portfolio will likely change over time to capitalize on the opportunity set, we seek to manage the Fund with a goal of maintaining ample total liquidity.

Regarding a rise in interest rates and any related dislocations in the fixed income markets, the Equity and Income Fund is intentionally positioned to mitigate the associated risks and ultimately, we believe, to take advantage of potential opportunities that may arise. With cash and short-term investments amounting to 20% of assets, we believe the Fund has substantial liquidity to weather such an environment without being a seller of any bond holdings that may be under temporary pressure. In fact, the Fund is positioned to be a net buyer of bonds in an environment where the risk-adjusted returns become compelling.

Although it is impossible to foresee all of the knock-on effects from a potential sharp increase in rates, we believe the direct impact on the Fund from bond market turmoil related to a rise in rates should be relatively muted given the short duration of the fixed income holdings and the substantial liquidity.

Oakmark.com 13

Oakmark Equity and Income Fund September 30, 2015

Portfolio Manager Commentary (continued)

Quarter Review

The Fund has not come out of this period of volatility unscathed. For the quarter, the Fund declined 7% while the Lipper Balanced Index7, the Fund's performance benchmark, declined 5%. For the fiscal year ended September 30, the Fund declined 3% compared to the Lipper Balanced Index, which was down 1%. Top contributors for the quarter were Foot Locker, Precision Castparts, Broadridge Financial Solutions, Omnicare and Nestle. The largest detractors were Glencore, BorgWarner, Dover, Flowserve and Oracle. For the fiscal year, UnitedHealth Group, Foot Locker, Omnicare, CVS Health and Lear contributed the most, while Glencore, National Oilwell Varco, Dover, Flowserve and Ultra Petroleum were the largest detractors. Much like in previous quarters, the consumer and health care names did well while weak commodity prices hurt the shares of some of the largest detractors. We are glad to note that Precision Castparts, as well as Remy International, accepted acquisition offers during the quarter.

The stock prices of many of our equity holdings have fallen, in some cases substantially. In most instances, we believe the stock price declines have been much greater than the changes in business values. In these situations, we have often added to the holding, as we expect, over time, that stock prices and business value will converge when this current period of increased volatility subsides. In our view, the Fund's strong liquidity position enables us to be patient, long-term equity and fixed income investors. The Fund's overall asset allocation was slightly more skewed toward fixed income and cash than last quarter, with 61% of assets in equities and 39% in fixed income and cash.

Transaction Activity

During the quarter, we initiated a new position in Oceaneering International, as well as a small position in Howard Hughes Corporation, and we eliminated three holdings: Aflac, Omnicare and Remy. Omnicare left the portfolio as the result of an acquisition by fellow Fund holding CVS. Omnicare was a long-term, successful holding, and we would like to thank CEO Nitin Sahney and his team for doing a fantastic job.

As for the addition of Oceaneering International to the portfolio, this company offers various niche products and services used in deepwater oil and gas exploration and production. In our view, management has done a terrific job of growing market share and profitability through strong execution and wise capital allocation. Although the large decline in oil prices will affect near-term demand for deepwater services, we still believe that deepwater production will be necessary to meet future oil demand. Given Oceaneering's strong balance sheet, we can wait for demand to recover, and we believe that Oceaneering trades at a low teens multiple of normalized earnings.

As always, we thank our shareholders for entrusting their assets to the Fund and welcome your questions and comments.

14 OAKMARK FUNDS

Oakmark Equity and Income Fund September 30, 2015

Schedule of Investments (in thousands)

| | | Shares | | Value | |

COMMON STOCKS - 60.8% | |

FINANCIALS - 15.4% | |

BANKS - 6.1% | |

Bank of America Corp.

Diversified Banks | | | 44,733 | | | $ | 696,937 | | |

Wells Fargo & Co.

Diversified Banks | | | 4,326 | | | | 222,140 | | |

U.S. Bancorp

Diversified Banks | | | 4,461 | | | | 182,939 | | |

| | | | | | 1,102,016 | | |

DIVERSIFIED FINANCIALS - 5.0% | |

TD Ameritrade Holding Corp.

Investment Banking & Brokerage | | | 12,006 | | | | 382,284 | | |

The Goldman Sachs Group, Inc.

Investment Banking & Brokerage | | | 1,361 | | | | 236,539 | | |

Bank of New York Mellon Corp.

Asset Management & Custody Banks | | | 5,340 | | | | 209,079 | | |

T Rowe Price Group, Inc.

Asset Management & Custody Banks | | | 1,290 | | | | 89,676 | | |

| | | | | | 917,578 | | |

INSURANCE - 4.0% | |

FNF Group

Property & Casualty Insurance | | | 7,689 | | | | 272,739 | | |

Principal Financial Group, Inc.

Life & Health Insurance | | | 5,061 | | | | 239,602 | | |

Reinsurance Group of America, Inc.

Reinsurance | | | 2,402 | | | | 217,606 | | |

| | | | | | 729,947 | | |

REAL ESTATE - 0.3% | |

The Howard Hughes Corp. (a)

Real Estate Development | | | 401 | | | | 46,030 | | |

| | | | | | 2,795,571 | | |

CONSUMER DISCRETIONARY - 11.3% | |

AUTOMOBILES & COMPONENTS - 6.8% | |

General Motors Co.

Automobile Manufacturers | | | 21,666 | | | | 650,425 | | |

BorgWarner, Inc.

Auto Parts & Equipment | | | 7,138 | | | | 296,853 | | |

Lear Corp.

Auto Parts & Equipment | | | 2,613 | | | | 284,231 | | |

| | | | | | 1,231,509 | | |

RETAILING - 3.6% | |

Foot Locker, Inc. (b)

Apparel Retail | | | 7,206 | | | | 518,644 | | |

HSN, Inc.

Catalog Retail | | | 2,491 | | | | 142,599 | | |

| | | | | | 661,243 | | |

| | | Shares | | Value | |

CONSUMER DURABLES & APPAREL - 0.9% | |

Kate Spade & Co. (a)

Apparel, Accessories & Luxury Goods | | | 4,759 | | | $ | 90,936 | | |

Carter's, Inc.

Apparel, Accessories & Luxury Goods | | | 760 | | | | 68,841 | | |

| | | | | | 159,777 | | |

| | | | | | 2,052,529 | | |

INDUSTRIALS - 9.9% | |

CAPITAL GOODS - 8.2% | |

Dover Corp.

Industrial Machinery | | | 7,011 | | | | 400,882 | | |

Flowserve Corp. (b)

Industrial Machinery | | | 7,338 | | | | 301,877 | | |

Rockwell Automation, Inc.

Electrical Components & Equipment | | | 2,145 | | | | 217,653 | | |

Precision Castparts Corp.

Aerospace & Defense | | | 794 | | | | 182,390 | | |

Parker-Hannifin Corp.

Industrial Machinery | | | 1,638 | | | | 159,373 | | |

General Electric Co.

Industrial Conglomerates | | | 3,834 | | | | 96,696 | | |

The Manitowoc Co., Inc.

Construction Machinery & Heavy Trucks | | | 4,384 | | | | 65,764 | | |

WESCO International, Inc. (a)

Trading Companies & Distributors | | | 1,118 | | | | 51,935 | | |

Blount International, Inc. (a) (b)

Industrial Machinery | | | 2,853 | | | | 15,892 | | |

| | | | | | 1,492,462 | | |

TRANSPORTATION - 1.5% | |

Union Pacific Corp.

Railroads | | | 3,086 | | | | 272,851 | | |

COMMERCIAL & PROFESSIONAL SERVICES - 0.2% | |

Herman Miller, Inc.

Office Services & Supplies | | | 1,402 | | | | 40,422 | | |

| | | | | | 1,805,735 | | |

INFORMATION TECHNOLOGY - 9.5% | |

SOFTWARE & SERVICES - 6.6% | |

Oracle Corp.

Systems Software | | | 17,795 | | | | 642,756 | | |

MasterCard, Inc., Class A

Data Processing & Outsourced Services | | | 4,183 | | | | 376,979 | | |

Broadridge Financial Solutions, Inc.

Data Processing & Outsourced Services | | | 3,189 | | | | 176,522 | | |

| | | | | | 1,196,257 | | |

TECHNOLOGY HARDWARE & EQUIPMENT - 2.9% | |

TE Connectivity, Ltd.

Electronic Manufacturing Services | | | 8,052 | | | | 482,252 | | |

Knowles Corp. (a)

Electronic Components | | | 3,155 | | | | 58,155 | | |

| | | | | | 540,407 | | |

| | | | | | 1,736,664 | | |

See accompanying Notes to Financial Statements.

Oakmark.com 15

Oakmark Equity and Income Fund September 30, 2015

Schedule of Investments (in thousands) (continued)

| | | Shares | | Value | |

COMMON STOCKS - 60.8% (continued) | |

CONSUMER STAPLES - 9.2% | |

FOOD, BEVERAGE & TOBACCO - 6.6% | |

Nestle SA (c)

Packaged Foods & Meats | | | 7,993 | | | $ | 601,393 | | |

Philip Morris International, Inc.

Tobacco | | | 3,806 | | | | 301,954 | | |

Diageo PLC (c)

Distillers & Vintners | | | 2,715 | | | | 292,661 | | |

| | | | | | 1,196,008 | | |

FOOD & STAPLES RETAILING - 2.6% | |

CVS Health Corp.

Drug Retail | | | 4,993 | | | | 481,681 | | |

| | | | | | 1,677,689 | | |

ENERGY - 2.9% | |

Baker Hughes, Inc.

Oil & Gas Equipment & Services | | | 6,736 | | | | 350,517 | | |

Oceaneering International, Inc.

Oil & Gas Equipment & Services | | | 2,312 | | | | 90,803 | | |

National Oilwell Varco, Inc.

Oil & Gas Equipment & Services | | | 1,522 | | | | 57,290 | | |

Rowan Cos. PLC

Oil & Gas Drilling | | | 1,491 | | | | 24,086 | | |

Ultra Petroleum Corp. (a) (d)

Oil & Gas Exploration & Production | | | 521 | | | | 3,331 | | |

| | | | | | 526,027 | | |

HEALTH CARE - 2.2% | |

HEALTH CARE EQUIPMENT & SERVICES - 1.8% | |

UnitedHealth Group, Inc.

Managed Health Care | | | 2,821 | | | | 327,234 | | |

PHARMACEUTICALS, BIOTECHNOLOGY & LIFE SCIENCES - 0.4% | |

Bruker Corp. (a)

Life Sciences Tools & Services | | | 4,814 | | | | 79,089 | | |

| | | | | | 406,323 | | |

MATERIALS - 0.4% | |

Glencore PLC

Diversified Metals & Mining | | | 34,327 | | | | 47,540 | | |

Southern Copper Corp.

Diversified Metals & Mining | | | 693 | | | | 18,520 | | |

| | | | | | 66,060 | | |

TOTAL COMMON STOCKS - 60.8%

(COST $7,851,033) | | | | | 11,066,598 | | |

| | | Par Value | | Value | |

FIXED INCOME - 16.8% | |

CORPORATE BONDS - 8.5% | |

Kinetic Concepts, Inc.,

10.50%, due 11/01/18 | | $ | 47,940 | | | | 50,181 | | |

| | | Par Value | | Value | |

Omega Healthcare Investors, Inc.,

6.75%, due 10/15/22 | | $ | 45,079 | | | $ | 46,733 | | |

JPMorgan Chase & Co.,

3.15%, due 07/05/16 | | | 44,592 | | | | 45,347 | | |

Mondelez International, Inc.,

4.125%, due 02/09/16 | | | 43,567 | | | | 44,048 | | |

General Motors Co.,

4.875%, due 10/02/23 | | | 41,400 | | | | 41,987 | | |

Omega Healthcare Investors, Inc.,

5.875%, due 03/15/24 | | | 39,292 | | | | 40,962 | | |

The Manitowoc Co., Inc.,

8.50%, due 11/01/20 | | | 35,655 | | | | 37,259 | | |

The William Carter Co.,

5.25%, due 08/15/21 | | | 35,137 | | | | 36,191 | | |

Zimmer Biomet Holdings, Inc.,

1.45%, due 04/01/17 | | | 32,180 | | | | 32,115 | | |

Credit Suisse Group AG, 144A,

7.50% (e) (f) (g) | | | 30,000 | | | | 31,237 | | |

CVS Health Corp.,

4.00%, due 12/05/23 | | | 29,325 | | | | 31,069 | | |

Omnicom Group, Inc.,

3.625%, due 05/01/22 | | | 30,425 | | | | 30,785 | | |

Live Nation Entertainment, Inc., 144A,

7.00%, due 09/01/20 (e) | | | 28,930 | | | | 30,232 | | |

1011778 BC ULC / New Red Finance Inc., 144A,

6.00%, due 04/01/22 (e) | | | 29,500 | | | | 29,943 | | |

General Motors Co.,

3.50%, due 10/02/18 | | | 29,525 | | | | 29,763 | | |

Toyota Motor Credit Corp.,

1.45%, due 01/12/18 | | | 29,495 | | | | 29,529 | | |

Ultra Petroleum Corp., 144A,

5.75%, due 12/15/18 (e) | | | 37,809 | | | | 27,222 | | |

Activision Blizzard, Inc., 144A,

5.625%, due 09/15/21 (e) | | | 25,765 | | | | 27,118 | | |

Credit Suisse New York,

1.75%, due 01/29/18 | | | 24,700 | | | | 24,702 | | |

Penn National Gaming, Inc.,

5.875%, due 11/01/21 | | | 23,704 | | | | 23,911 | | |

Whirlpool Corp.,

7.75%, due 07/15/16 | | | 22,256 | | | | 23,399 | | |

Glencore Canada Corp.,

6.00%, due 10/15/15 | | | 21,915 | | | | 21,915 | | |

Anadarko Petroleum Corp.,

5.95%, due 09/15/16 | | | 20,821 | | | | 21,638 | | |

Delphi Corp.,

5.00%, due 02/15/23 | | | 20,277 | | | | 20,987 | | |

Bank of America Corp.,

3.75%, due 07/12/16 | | | 20,295 | | | | 20,699 | | |

Centene Corp.,

4.75%, due 05/15/22 | | | 20,084 | | | | 19,984 | | |

Thermo Fisher Scientific, Inc.,

2.25%, due 08/15/16 | | | 19,554 | | | | 19,723 | | |

JPMorgan Chase Bank NA,

0.736%, due 06/14/17 (f) | | | 19,750 | | | | 19,705 | | |

JPMorgan Chase & Co.,

1.70%, due 03/01/18 | | | 19,665 | | | | 19,620 | | |

CBRE Services, Inc.,

4.875%, due 03/01/26 | | | 19,665 | | | | 19,517 | | |

Lam Research Corp.,

2.75%, due 03/15/20 | | | 19,660 | | | | 19,271 | | |

See accompanying Notes to Financial Statements.

16 OAKMARK FUNDS

Oakmark Equity and Income Fund September 30, 2015

Schedule of Investments (in thousands) (continued)

| | | Par Value | | Value | |

FIXED INCOME - 16.8% (continued) | |

CORPORATE BONDS - 8.5% (continued) | |

Thermo Fisher Scientific, Inc.,

3.20%, due 03/01/16 | | $ | 18,617 | | | $ | 18,789 | | |

DIRECTV Holdings LLC / DIRECTV Financing Co., Inc.,

5.00%, due 03/01/21 | | | 16,710 | | | | 18,213 | | |

Dollar General Corp.,

4.125%, due 07/15/17 | | | 17,095 | | | | 17,627 | | |

Scientific Games International, Inc.,

10.00%, due 12/01/22 | | | 19,665 | | | | 17,158 | | |

Aon Corp.,

5.00%, due 09/30/20 | | | 14,745 | | | | 16,351 | | |

Anthem, Inc.,

5.875%, due 06/15/17 | | | 15,150 | | | | 16,230 | | |

Valeant Pharmaceuticals International, Inc., 144A,

5.625%, due 12/01/21 (e) | | | 16,370 | | | | 15,552 | | |

Kinetic Concepts, Inc.,

12.50%, due 11/01/19 | | | 14,360 | | | | 15,240 | | |

Pentair Finance SA,

2.90%, due 09/15/18 | | | 14,750 | | | | 14,798 | | |

Activision Blizzard, Inc., 144A,

6.125%, due 09/15/23 (e) | | | 13,615 | | | | 14,466 | | |

Zayo Group LLC / Zayo Capital Inc, 144A,

6.00%, due 04/01/23 (e) | | | 14,745 | | | | 14,303 | | |

International Game Technology PLC, 144A,

6.25%, due 02/15/22 (e) | | | 14,800 | | | | 13,764 | | |

CBRE Services, Inc.,

5.00%, due 03/15/23 | | | 13,409 | | | | 13,478 | | |

Royal Caribbean Cruises, Ltd.,

7.25%, due 06/15/16 | | | 13,053 | | | | 13,477 | | |

Medtronic, Inc.,

3.15%, due 03/15/22 | | | 13,228 | | | | 13,417 | | |

International Game Technology PLC, 144A,

6.50%, due 02/15/25 (e) | | | 14,800 | | | | 13,320 | | |

GLP Capital, LP / GLP Financing II, Inc.,

5.375%, due 11/01/23 | | | 12,000 | | | | 12,180 | | |

BorgWarner, Inc.,

4.625%, due 09/15/20 | | | 10,810 | | | | 11,828 | | |

Ultra Petroleum Corp., 144A,

6.125%, due 10/01/24 (e) | | | 19,665 | | | | 11,209 | | |

Bank of America Corp.,

5.25%, due 12/01/15 | | | 10,778 | | | | 10,849 | | |

Valeant Pharmaceuticals International, Inc., 144A,

6.375%, due 10/15/20 (e) | | | 10,540 | | | | 10,481 | | |

Howard Hughes Corp., 144A,

6.875%, due 10/01/21 (e) | | | 10,000 | | | | 10,159 | | |

GLP Capital, LP / GLP Financing II, Inc.,

4.875%, due 11/01/20 | | | 10,000 | | | | 10,125 | | |

Kellogg Co.,

4.45%, due 05/30/16 | | | 9,835 | | | | 10,061 | | |

CNO Financial Group, Inc.,

4.50%, due 05/30/20 | | | 9,830 | | | | 10,027 | | |

Omega Healthcare Investors, Inc., 144A,

5.25%, due 01/15/26 (e) | | | 9,835 | | | | 9,998 | | |

Six Flags Entertainment Corp., 144A,

5.25%, due 01/15/21 (e) | | | 9,970 | | | | 9,970 | | |

Chevron Corp.,

1.365%, due 03/02/18 | | | 9,835 | | | | 9,844 | | |

International Game Technology PLC, 144A,

5.625%, due 02/15/20 (e) | | | 9,800 | | | | 9,506 | | |

| | | Par Value | | Value | |

Tempur Sealy International, Inc.,

6.875%, due 12/15/20 | | $ | 8,819 | | | $ | 9,326 | | |

Sirius XM Radio Inc, 144A,

5.25%, due 08/15/22 (e) | | | 8,895 | | | | 9,229 | | |

Health Net, Inc.,

6.375%, due 06/01/17 | | | 8,680 | | | | 9,040 | | |

E*TRADE Financial Corp.,

4.625%, due 09/15/23 | | | 7,865 | | | | 7,944 | | |

Glencore Funding LLC, 144A,

1.70%, due 05/27/16 (e) | | | 8,060 | | | | 7,657 | | |

Omnicare, Inc.,

5.00%, due 12/01/24 | | | 6,880 | | | | 7,465 | | |

Omnicare, Inc.,

4.75%, due 12/01/22 | | | 6,880 | | | | 7,430 | | |

McGraw Hill Financial, Inc., 144A,

4.00%, due 06/15/25 (e) | | | 7,320 | | | | 7,286 | | |

Omnicom Group, Inc.,

5.90%, due 04/15/16 | | | 6,862 | | | | 7,030 | | |

Whirlpool Corp.,

6.50%, due 06/15/16 | | | 6,610 | | | | 6,872 | | |

Scientific Games International, Inc., 144A,

7.00%, due 01/01/22 (e) | | | 6,885 | | | | 6,782 | | |

Concho Resources, Inc.,

5.50%, due 10/01/22 | | | 6,980 | | | | 6,648 | | |

Level 3 Financing Inc, 144A,

5.125%, due 05/01/23 (e) | | | 6,895 | | | | 6,593 | | |

Credit Suisse Group AG, 144A,

6.25% (e) (f) (g) | | | 7,000 | | | | 6,563 | | |

Level 3 Financing Inc, 144A,

5.375%, due 05/01/25 (e) | | | 6,895 | | | | 6,546 | | |

Reynolds American, Inc.,

6.75%, due 06/15/17 | | | 5,900 | | | | 6,387 | | |

CNO Financial Group, Inc.,

5.25%, due 05/30/25 | | | 5,895 | | | | 5,983 | | |

Quest Diagnostics, Inc.,

4.70%, due 04/01/21 | | | 5,128 | | | | 5,568 | | |

Bank of America Corp.,

5.625%, due 10/14/16 | | | 5,285 | | | | 5,526 | | |

Serta Simmons Bedding LLC, 144A,

8.125%, due 10/01/20 (e) | | | 4,990 | | | | 5,233 | | |

E*TRADE Financial Corp.,

5.375%, due 11/15/22 | | | 4,910 | | | | 5,205 | | |

Glencore Finance Canada, Ltd., 144A,

3.60%, due 01/15/17 (e) | | | 5,590 | | | | 5,196 | | |

Foot Locker, Inc.,

8.50%, due 01/15/22 (b) | | | 4,340 | | | | 5,100 | | |

Penske Truck Leasing Co., LP / PTL Finance Corp., 144A,

3.75%, due 05/11/17 (e) | | | 4,920 | | | | 5,067 | | |

GLP Capital, LP / GLP Financing II, Inc.,

4.375%, due 11/01/18 | | | 5,000 | | | | 5,038 | | |

Capital One NA,

2.35%, due 08/17/18 | | | 5,000 | | | | 5,014 | | |

The Goldman Sachs Group, Inc.,

0.999%, due 05/22/17 (f) | | | 5,000 | | | | 4,997 | | |

CBRE Services, Inc.,

5.25%, due 03/15/25 | | | 4,915 | | | | 4,983 | | |

Zayo Group LLC / Zayo Capital, Inc.,

10.125%, due 07/01/20 | | | 4,030 | | | | 4,373 | | |

USG Corp.,

6.30%, due 11/15/16 | | | 4,100 | | | | 4,233 | | |

See accompanying Notes to Financial Statements.

Oakmark.com 17

Oakmark Equity and Income Fund September 30, 2015

Schedule of Investments (in thousands) (continued)

| | | Par Value | | Value | |

FIXED INCOME - 16.8% (continued) | |

CORPORATE BONDS - 8.5% (continued) | |

Valeant Pharmaceuticals International Inc, 144A,

6.75%, due 08/15/18 (e) | | $ | 3,855 | | | $ | 3,922 | | |

Scripps Networks Interactive, Inc.,

2.80%, due 06/15/20 | | | 3,930 | | | | 3,890 | | |

Omnicom Group, Inc.,

6.25%, due 07/15/19 | | | 2,950 | | | | 3,373 | | |

Quiksilver, Inc. / QS Wholesale, Inc., 144A,

7.875%, due 08/01/18 (e) | | | 4,049 | | | | 3,280 | | |

Dollar Tree, Inc., 144A,

5.75%, due 03/01/23 (e) | | | 2,950 | | | | 3,061 | | |

MSCI, Inc., 144A,

5.75%, due 08/15/25 (e) | | | 2,950 | | | | 2,972 | | |

American Express Credit Corp.,

2.60%, due 09/14/20 | | | 2,945 | | | | 2,958 | | |

Medtronic, Inc.,

1.50%, due 03/15/18 | | | 2,950 | | | | 2,938 | | |

CVS Health Corp.,

2.25%, due 08/12/19 | | | 2,884 | | | | 2,915 | | |

Boston Scientific Corp.,

5.125%, due 01/12/17 | | | 2,546 | | | | 2,658 | | |

The Goldman Sachs Group, Inc.,

5.625%, due 01/15/17 | | | 2,095 | | | | 2,200 | | |

Ecolab, Inc.,

3.00%, due 12/08/16 | | | 1,970 | | | | 2,008 | | |

McGraw Hill Financial, Inc., 144A,

3.30%, due 08/14/20 (e) | | | 1,970 | | | | 2,004 | | |

McGraw Hill Financial, Inc., 144A,

4.40%, due 02/15/26 (e) | | | 1,970 | | | | 1,999 | | |

McGraw Hill Financial, Inc., 144A,

2.50%, due 08/15/18 (e) | | | 1,970 | | | | 1,985 | | |

Valeant Pharmaceuticals International, Inc., 144A,

6.75%, due 08/15/21 (e) | | | 1,960 | | | | 1,980 | | |

Live Nation Entertainment, Inc., 144A,

5.375%, due 06/15/22 (e) | | | 2,000 | | | | 1,960 | | |

Tyco Electronics Group SA,

6.55%, due 10/01/17 | | | 1,385 | | | | 1,518 | | |

Dollar Tree, Inc., 144A,

5.25%, due 03/01/20 (e) | | | 1,000 | | | | 1,025 | | |

Post Holdings, Inc.,

7.375%, due 02/15/22 | | | 1,000 | | | | 1,015 | | |

Post Holdings, Inc., 144A,

6.75%, due 12/01/21 (e) | | | 1,000 | | | | 1,000 | | |

The Goldman Sachs Group, Inc.,

2.55%, due 10/23/19 | | | 980 | | | | 986 | | |

Tribune Media Co., 144A,

5.875%, due 07/15/22 (e) | | | 1,000 | | | | 970 | | |

Ventas Realty, LP REIT,

3.50%, due 02/01/25 | | | 1,000 | | | | 966 | | |

Post Holdings, Inc., 144A,

7.75%, due 03/15/24 (e) | | | 500 | | | | 513 | | |

Valeant Pharmaceuticals International, Inc., 144A,

5.875%, due 05/15/23 (e) | | | 500 | | | | 478 | | |

Valeant Pharmaceuticals International, Inc., 144A,

6.125%, due 04/15/25 (e) | | | 250 | | | | 238 | | |

Total Corporate Bonds

(Cost $1,563,927) | | | | | 1,544,338 | | |

| | | Par Value | | Value | |

GOVERNMENT AND AGENCY SECURITIES - 8.2% | |

U.S. GOVERNMENT NOTES - 7.9% | |

1.375%, due 07/15/18, Inflation Indexed | | $ | 469,963 | | | $ | 488,688 | | |

1.25%, due 07/15/20, Inflation Indexed | | | 459,397 | | | | 482,283 | | |

2.125%, due 01/15/19, Inflation Indexed | | | 221,625 | | | | 236,088 | | |

1.00%, due 09/30/16 | | | 199,380 | | | | 200,587 | | |

0.75%, due 06/30/17 | | | 24,585 | | | | 24,653 | | |

| | | | | | 1,432,299 | | |

U.S. GOVERNMENT AGENCIES - 0.3% | |

Federal Home Loan Bank,

1.65%, due 07/18/19 | | | 29,550 | | | | 29,571 | | |

Federal National Mortgage Association,

1.25%, due 09/27/18 | | | 24,680 | | | | 24,853 | | |

Federal National Mortgage Association,

1.25%, due 01/30/20 | | | 9,525 | | | | 9,526 | | |

| | | | | | 63,950 | | |

Total Government and Agency Securities

(Cost $1,446,992) | | | | | 1,496,249 | | |

ASSET BACKED SECURITIES - 0.1% | |

Cabela's Master Credit Card Trust, 144A,

0.757%, due 10/15/19 (e) (f)

(Cost $11,450) | | | 11,450 | | | | 11,473 | | |

TOTAL FIXED INCOME - 16.8%

(COST $3,022,369) | | | | | 3,052,060 | | |

SHORT TERM INVESTMENTS - 21.9% | |

COMMERCIAL PAPER - 15.0% | |

Toyota Motor Credit Corp.,

0.18% - 0.24%,

due 10/02/15 - 12/07/15 (h) | | | 1,075,000 | | | | 1,074,861 | | |

MetLife Short Term Funding LLC, 144A,

0.16% - 0.22%,

due 10/01/15 - 11/17/15 (e) (h) | | | 484,000 | | | | 483,950 | | |

Kellogg Co., 144A,

0.35% - 0.39%,

due 10/01/15 - 10/29/15 (e) (h) | | | 187,375 | | | | 187,346 | | |

General Mills, Inc., 144A,

0.20% - 0.22%,

due 10/01/15 - 10/08/15 (e) (h) | | | 175,000 | | | | 174,996 | | |

BMW US Capital LLC, 144A,

0.13% - 0.21%,

due 10/14/15 - 12/07/15 (e) (h) | | | 156,000 | | | | 155,977 | | |

Chevron Corp., 144A,

0.17% - 0.22%,

due 10/23/15 - 11/16/15 (e) (h) | | | 125,000 | | | | 124,978 | | |

Anthem, Inc., 144A,

0.28% - 0.57%,

due 10/07/15 - 12/07/15 (e) (h) | | | 125,000 | | | | 124,963 | | |

Wal-Mart Stores, Inc., 144A,

0.14%, due 10/29/15 - 10/30/15 (e) (h) | | | 100,000 | | | | 99,989 | | |

J.P. Morgan Securities LLC, 144A,

0.32%, due 11/02/15 - 11/04/15 (e) (h) | | | 100,000 | | | | 99,971 | | |

American Honda Finance Corp,

0.17% - 0.22%,

due 10/22/15 - 11/05/15 (h) | | | 91,100 | | | | 91,088 | | |

John Deere Capital Co., 144A,

0.12% - 0.19%,

due 10/15/15 - 11/04/15 (e) (h) | | | 75,000 | | | | 74,991 | | |

See accompanying Notes to Financial Statements.

18 OAKMARK FUNDS

Oakmark Equity and Income Fund September 30, 2015

Schedule of Investments (in thousands) (continued)

| | | Par Value | | Value | |

SHORT TERM INVESTMENTS - 21.9% (continued) | |

COMMERCIAL PAPER - 15.0% (continued) | |

BP Capital Markets PLC, 144A,

0.60% - 0.63%,

due 10/16/15 - 11/02/15 (e) (h) | | $ | 40,750 | | | $ | 40,736 | | |

Total Commercial Paper

(Cost $2,733,820) | | | | | 2,733,846 | | |

REPURCHASE AGREEMENT - 4.7% | |

Fixed Income Clearing Corp. Repurchase

Agreement, 0.01% dated 09/30/15 due

10/01/15, repurchase price $858,827,

collateralized by a Federal National

Mortgage Association Bond, 2.375%,

due 01/13/22, value plus accrued interest

of $4,805, by United States Treasury

Bonds, 3.125% - 3.375%, due 02/15/42 -

05/15/44, aggregate value plus accrued

interest of $52,906, by United States

Treasury Notes, 0.625% - 1.500%, due

09/30/17 - 01/31/19, aggregate value

plus accrued interest of $818,294

(Cost: $858,826) | | | 858,826 | | | | 858,826 | | |

CORPORATE BONDS - 2.2% | |

AbbVie, Inc.,

1.20%, due 11/06/15 | | | 46,810 | | | | 46,832 | | |

ConAgra Foods, Inc.,

1.30%, due 01/25/16 | | | 38,723 | | | | 38,754 | | |

The Goldman Sachs Group, Inc.,

5.35%, due 01/15/16 | | | 33,875 | | | | 34,308 | | |

Amazon.com, Inc.,

0.65%, due 11/27/15 | | | 30,784 | | | | 30,786 | | |

Bank of America Corp.,

1.50%, due 10/09/15 | | | 27,245 | | | | 27,250 | | |

American International Group, Inc.,

5.05%, due 10/01/15 | | | 25,655 | | | | 25,655 | | |

Mohawk Industries, Inc.,

6.125%, due 01/15/16 | | | 22,336 | | | | 22,634 | | |

Aon Corp.,

3.125%, due 05/27/16 | | | 19,920 | | | | 20,202 | | |

The Goldman Sachs Group, Inc.,

1.60%, due 11/23/15 | | | 19,660 | | | | 19,680 | | |

JPMorgan Chase & Co.,

1.10%, due 10/15/15 | | | 18,438 | | | | 18,441 | | |

Willis Group Holdings PLC,

4.125%, due 03/15/16 | | | 17,433 | | | | 17,647 | | |

Yum! Brands, Inc.,

6.25%, due 04/15/16 | | | 17,105 | | | | 17,544 | | |

Morgan Stanley,

3.45%, due 11/02/15 | | | 17,280 | | | | 17,321 | | |

JPMorgan Chase & Co.,

5.15%, due 10/01/15 | | | 13,323 | | | | 13,323 | | |

Capital One Financial Corp.,

1.00%, due 11/06/15 | | | 12,325 | | | | 12,328 | | |

Morgan Stanley,

1.75%, due 02/25/16 | | | 9,830 | | | | 9,862 | | |

The Bear Stearns Cos. LLC,

5.30%, due 10/30/15 | | | 8,675 | | | | 8,708 | | |

Bank of America Corp.,

6.05%, due 05/16/16 | | | 7,890 | | | | 8,115 | | |

| | | Par Value | | Value | |

Capital One Financial Corp.,

3.15%, due 07/15/16 | | $ | 3,513 | | | $ | 3,570 | | |

Total Corporate Bonds

(Cost $393,060) | | | | | 392,960 | | |

TOTAL SHORT TERM INVESTMENTS - 21.9%

(COST $3,985,706) | | | | | 3,985,632 | | |

TOTAL INVESTMENTS - 99.5%

(COST $14,859,108) | | | | | 18,104,290 | | |

Foreign Currencies (Cost $0) - 0.0% (i) | | | | | 0 | (j) | |

Other Assets In Excess of Liabilities - 0.5% | | | | | 81,970 | | |

NET ASSETS - 100.0% | | | | $ | 18,186,260 | | |

(a) Non-income producing security

(b) See Note 5 in the Notes to Financial Statements regarding investments in affiliated issuers.

(c) Sponsored American Depositary Receipt

(d) A portion of the security out on loan.

(e) See Note 1 in the Notes to Financial Statements regarding restricted securities. These securities may be resold subject to restrictions on resale under federal securities law.

(f) Floating Rate Note. Rate shown is as of September 30, 2015.

(g) Security is perpetual and has no stated maturity date.

(h) The rate shown represents the annualized yield at the time of purchase; not a coupon rate.

(i) Amount rounds to less than 0.1%.

(j) Amount rounds to less than $1,000.

Abbreviations:

REIT: Real Estate Investment Trust

See accompanying Notes to Financial Statements.

Oakmark.com 19

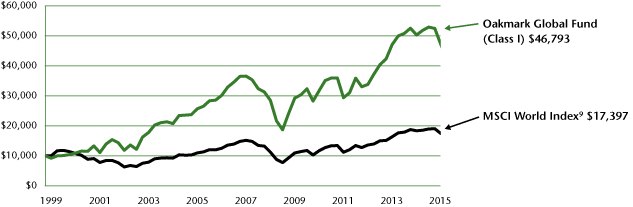

Oakmark Global Fund September 30, 2015

Summary Information

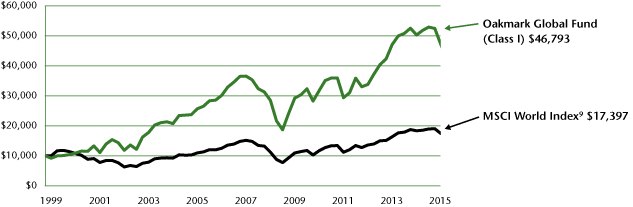

VALUE OF A $10,000 INVESTMENT

Since Inception - 08/04/99 (Unaudited)

PERFORMANCE

| | | | | Average Annual Total Returns (as of 09/30/15) | | | |

(Unaudited) | | Total Return