UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-06279 |

|

Harris Associates Investment Trust |

(Exact name of registrant as specified in charter) |

|

Two North La Salle Street, Suite 500 Chicago, Illinois | | 60602-3790 |

(Address of principal executive offices) | | (Zip code) |

|

Kristi L. Rowsell Harris Associates L.P. Two North La Salle Street, #500 Chicago, Illinois 60602 | Paulita A. Pike K&L Gates LLP Three First National Plaza, #3100 Chicago, Illinois 60602 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (312) 621-0600 | |

|

Date of fiscal year end: | 09/30/12 | |

|

Date of reporting period: | 09/30/12 | |

| | | | | | | | | |

Item 1. Reports to Shareholders.

THE OAKMARK FUNDS

ANNUAL REPORT | SEPTEMBER 30, 2012

OAKMARK FUND

OAKMARK SELECT FUND

OAKMARK EQUITY AND INCOME FUND

OAKMARK GLOBAL FUND

OAKMARK GLOBAL SELECT FUND

OAKMARK INTERNATIONAL FUND

OAKMARK INTERNATIONAL SMALL CAP FUND

The Oakmark Funds

2012 Annual Report

Introducing Our New Annual Report Format

The report has been redesigned to present Fund information in a more efficient manner. By streamlining the layout, we have significantly reduced the number of pages and cost of printing and mailing the report—a win for both the environment and our shareholders.

We would like to highlight a couple of the report's enhancements. For each Fund's Schedule of Investments, we have changed the format and groupings of the holdings to present this important material in a more clear and concise fashion. We have also added a summary page for each Fund to provide a snapshot of key metrics.

While this report contains a wealth of information, we encourage you to visit Oakmark.com for additional commentary and insight from our portfolio managers. We hope you find these changes useful, and as always, we welcome your thoughts and feedback.

TABLE OF CONTENTS

President's Letter | | | 1 | | |

Fund Expenses | | | 3 | | |

Oakmark Fund | |

Summary Information | | | 4 | | |

Portfolio Manager Commentary | | | 5 | | |

Schedule of Investments | | | 7 | | |

Oakmark Select Fund | |

Summary Information | | | 10 | | |

Portfolio Manager Commentary | | | 11 | | |

Schedule of Investments | | | 12 | | |

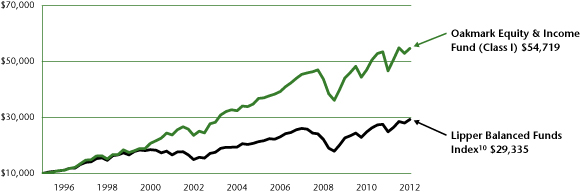

Oakmark Equity and Income Fund | |

Summary Information | | | 14 | | |

Portfolio Manager Commentary | | | 15 | | |

Schedule of Investments | | | 17 | | |

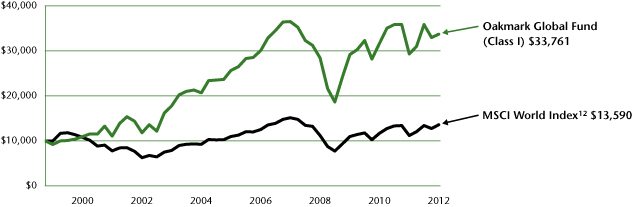

Oakmark Global Fund | |

Summary Information | | | 20 | | |

Portfolio Manager Commentary | | | 21 | | |

Schedule of Investments | | | 23 | | |

Oakmark Global Select Fund | |

Summary Information | | | 26 | | |

Portfolio Manager Commentary | | | 27 | | |

Schedule of Investments | | | 29 | | |

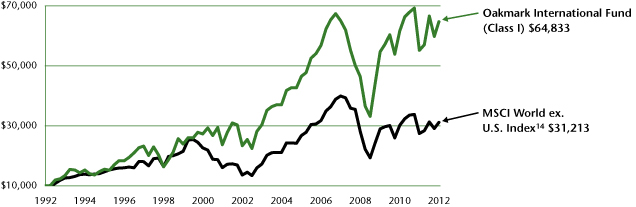

Oakmark International Fund | |

Summary Information | | | 30 | | |

Portfolio Manager Commentary | | | 31 | | |

Schedule of Investments | | | 32 | | |

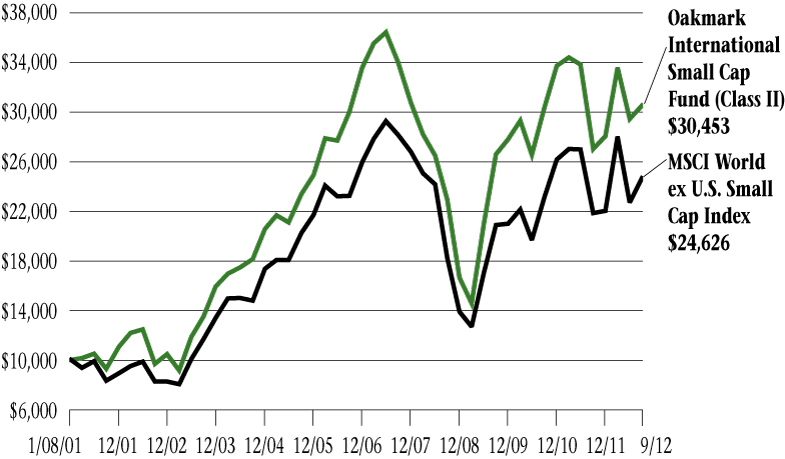

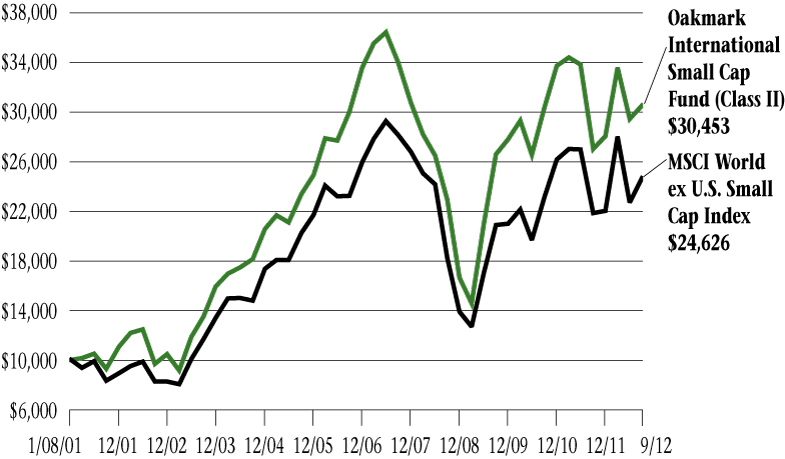

Oakmark International Small Cap Fund | |

Summary Information | | | 34 | | |

Portfolio Manager Commentary | | | 35 | | |

Schedule of Investments | | | 36 | | |

Financial Statements | |

Statements of Assets and Liabilities | | | 38 | | |

Statements of Operations | | | 40 | | |

Statements of Changes in Net Assets | | | 42 | | |

Notes to Financial Statements | | | 49 | | |

Financial Highlights | | | 60 | | |

Report of Independent Registered Public Accounting Firm | | | 67 | | |

Federal Tax Information | | | 68 | | |

Disclosures and Endnotes | | | 68 | | |

Trustees and Officers | | | 70 | | |

FORWARD-LOOKING STATEMENT DISCLOSURE

One of our most important responsibilities as mutual fund managers is to communicate with shareholders in an open and direct manner. Some of our comments in our letters to shareholders are based on current management expectations and are considered "forward-looking statements". Actual future results, however, may prove to be different from our expectations. You can identify forward-looking statements by words such as "estimate", "may", "will", "expect", "believe",

"plan" and other similar terms. We cannot promise future returns. Our opinions are a reflection of our best judgment at the time this report is compiled, and we disclaim any obligation to update or alter forward-looking statements as a result of new information, future events, or otherwise.

THE OAKMARK FUNDS

The Oakmark Funds

President's Letter

September 30, 2012

Dear Fellow Shareholders,

The Oakmark Funds closed their fiscal year on September 30 with strong investment returns, both in the U.S. and overseas. The path has not been smooth, but the results should gratify investors who were able to stay the course over the year.

As we near the end of long election campaigns in the U.S., I can't help but remark about my desires for the upcoming political season and the coming year. Tension about the upcoming fiscal cliff is so intense that it can dominate most financial decisions in households and businesses alike. So much work has been done on a bipartisan basis to try to forge a solution that so far has been elusive. Outside of Washington, most citizens understand that change will be difficult and costly, but they also understand that the country is running out of time to adjust course. My petition to politicians from all philosophical corners is to trust that your constituents will be mature enough to appreciate real problem-solving, focus on the similarities of the proposed plans and formulate a path to long-term fiscal stability. The economy should start to recover when business managements feel confident that the landscape for taxation and monetary policy will stabilize. To allow market participants to suffer another political impasse, like the debt ceiling standoff in 2011, is simply dereliction of duty.

Trading as Long-Term Investors

Congress, regulators at home and abroad, and members of the financial industry are speaking a lot these days about high-frequency trading (HFT) and its impact on financial markets. We believe these inquiries are productive. Events such as the "flash crash" in May 2010, the Knight Capital trading debacle and the technology snafus seen during the Facebook IPO reveal that program-driven trading can go seriously awry, and errant algorithms can greatly drive up volatility in the financial markets. Some say HFT provides

valuable liquidity, serving to narrow the bid-ask spread or provide support in the event of some displacement. As long-term investors, we are less concerned with daily volatility or the efficacy of technology-driven trading platforms than how matters affect the future for individual investors. Investor confidence is already eroding, and a growing belief that unrestrained HFT further stacks the deck against small investors could exacerbate the risk aversion that keeps individuals from allocating more of their portfolios to equities.

We are long-term investors, and as a result, our portfolios consistently exhibit low turnover. When we buy a stock, we are seeking to own a slice of a business that is trading at a substantial discount to our estimate of intrinsic value. We think that Oakmark shareholders should not fear short-term price swings or temporary trading trends because these do not affect the underlying fundamentals of these businesses. Our lower trading volume should benefit our shareholders in the form of lower portfolio transaction costs which, in contrast, usually erode returns for mutual funds that trade frequently.

Nonetheless, Harris traders see themselves as an extension of our long-term intentions. Our traders are willing to aggressively assess all sources of liquidity when establishing portfolio positions at prices attractive to us, and they have found that algorithmic venues can often fill their orders for low commissions at compelling prices. They steadily refine their approach to keep up with changes in trading trends and technology, both to defend against unfavorable pricing and to safeguard sensitive information. Their dedication behind the scenes provides important protections for Oakmark shareholders.

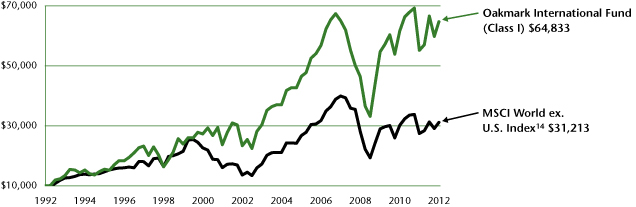

Twenty Years with the Oakmark International Fund

When Harris Associates L.P. opened the Oakmark International Fund (OAKIX) in late September 1992, the

oakmark.com 1

The Oakmark Funds

President's Letter (continued)

September 30, 2012

S&P 5001 was around 400, and gold sold for less than $350 an ounce. The dollar was still quoted against marks and French francs, Japan was entering its "Lost Decade," Eastern Europe was trading central planning for market capitalism, and China's economy was years away from becoming a daily headline. Today, markets are much more integrated, and because information moves instantly, the globe feels much smaller.

Oakmark International extended our quest for value outside the U.S. and offered our shareholders a global investment opportunity. Amid two decades of vast global change, the Fund has stayed the same in its investment approach: Using rigorous bottom-up research and analysis, the Fund seeks out undervalued companies with a clear, long-term growth path and management teams that think and act like owners.

This consistency has paid off for the Fund and its shareholders—$10,000 invested in Oakmark International on its opening day would have grown over 20 years to more than $60,000, roughly double the gains of the Fund's benchmark. The Fund's performance ranks it in the top 10% of its category over the 3-, 5-, 10- and 15-year periods, as measured by the Morningstar U.S. OE Foreign Large Blend Category.2

Congratulations to David Herro, Rob Taylor and our entire International team for this remarkable achievement. We are confident that, in the decades ahead, the time-tested process in place at Oakmark International and all The Oakmark Funds will continue to generate success for the Funds and our fellow shareholders.

Kristi L. Rowsell

President of The Oakmark Funds

President of Harris Associates L.P.

2 THE OAKMARK FUNDS

Fund Expenses (Unaudited)

A shareholder of each Fund incurs ongoing costs, including investment advisory fees, transfer agent fees and other fund expenses. The examples below are intended to help shareholders understand the ongoing costs (in dollars) of investing in each Fund and to compare these costs with the ongoing costs of investing in other funds.

The following table provides information about actual account values and actual fund expenses as well as hypothetical account values and hypothetical fund expenses for shares of each Fund.

ACTUAL EXPENSES

The following table shows the expenses a shareholder would have paid on a $1,000 investment in each Fund from April 1, 2012 to September 30, 2012, as well as how much a $1,000 investment would be worth at the close of the period, assuming actual fund returns and expenses. A shareholder can estimate expenses incurred for the period by dividing the account value at September 30, 2012, by $1,000 and multiplying the result by the number in the Actual Expenses Paid During Period column shown below.

Shares of Oakmark International Small Cap Fund, invested for 90 days or less, may be charged a 2% redemption fee upon redemption. Please consult the Funds' prospectus at oakmark.com for more information.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The following table provides information about hypothetical account values and hypothetical expenses for shares of each Fund based on actual expense ratios and an assumed rate of return of 5% per year before expenses, which are not the Funds' actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balances or actual expenses shareholders paid for the period. Shareholders may use this information to compare the ongoing costs of investing in a Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs, such as redemption fees. Therefore, the Hypothetical Expenses Paid During Period column of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. If these transaction costs were included, the total costs would have been higher.

| | | | | ACTUAL | | HYPOTHETICAL

(assumes 5% annual return

before expenses) | | | |

| | | Beginning

Account Value

(4/1/12) | | Ending

Account Value

(9/30/12) | | Expenses

Paid During

Period* | | Ending

Account Value

(9/30/12) | | Expenses

Paid During

Period* | | Annualized

Expense

Ratio | |

Oakmark Fund | |

Class I | | $ | 1,000.00 | | | $ | 1,026.40 | | | $ | 5.22 | | | $ | 1,019.85 | | | $ | 5.20 | | | | 1.03 | % | |

Class II | | $ | 1,000.00 | | | $ | 1,024.90 | | | $ | 6.63 | | | $ | 1,018.45 | | | $ | 6.61 | | | | 1.31 | % | |

Oakmark Select Fund | |

Class I | | $ | 1,000.00 | | | $ | 999.70 | | | $ | 5.25 | | | $ | 1,019.75 | | | $ | 5.30 | | | | 1.05 | % | |

Class II | | $ | 1,000.00 | | | $ | 997.80 | | | $ | 6.89 | | | $ | 1,018.10 | | | $ | 6.96 | | | | 1.38 | % | |

Oakmark Equity and Income Fund | |

Class I | | $ | 1,000.00 | | | $ | 996.60 | | | $ | 3.89 | | | $ | 1,021.10 | | | $ | 3.94 | | | | 0.78 | % | |

Class II | | $ | 1,000.00 | | | $ | 995.50 | | | $ | 5.34 | | | $ | 1,019.65 | | | $ | 5.40 | | | | 1.07 | % | |

Oakmark Global Fund | |

Class I | | $ | 1,000.00 | | | $ | 940.80 | | | $ | 5.68 | | | $ | 1,019.15 | | | $ | 5.91 | | | | 1.17 | % | |

Class II | | $ | 1,000.00 | | | $ | 939.50 | | | $ | 6.98 | | | $ | 1,017.80 | | | $ | 7.26 | | | | 1.44 | % | |

Oakmark Global Select Fund | |

Class I | | $ | 1,000.00 | | | $ | 942.60 | | | $ | 5.97 | | | $ | 1,018.85 | | | $ | 6.21 | | | | 1.23 | % | |

Oakmark International Fund | |

Class I | | $ | 1,000.00 | | | $ | 972.10 | | | $ | 5.23 | | | $ | 1,019.70 | | | $ | 5.35 | | | | 1.06 | % | |

Class II | | $ | 1,000.00 | | | $ | 970.70 | | | $ | 7.00 | | | $ | 1,017.90 | | | $ | 7.16 | | | | 1.42 | % | |

Oakmark International Small Cap Fund | |

Class I | | $ | 1,000.00 | | | $ | 909.50 | | | $ | 6.73 | | | $ | 1,017.95 | | | $ | 7.11 | | | | 1.41 | % | |

Class II | | $ | 1,000.00 | | | $ | 908.30 | | | $ | 8.01 | | | $ | 1,016.60 | | | $ | 8.47 | | | | 1.68 | % | |

* Expenses for each share class is equal to the annualized expense ratio, multiplied by the average account value over the period, multiplied by the number of days in the most recent half-year divided by 365 (to reflect one-half year period).

oakmark.com 3

Oakmark Fund September 30, 2012

Summary Information

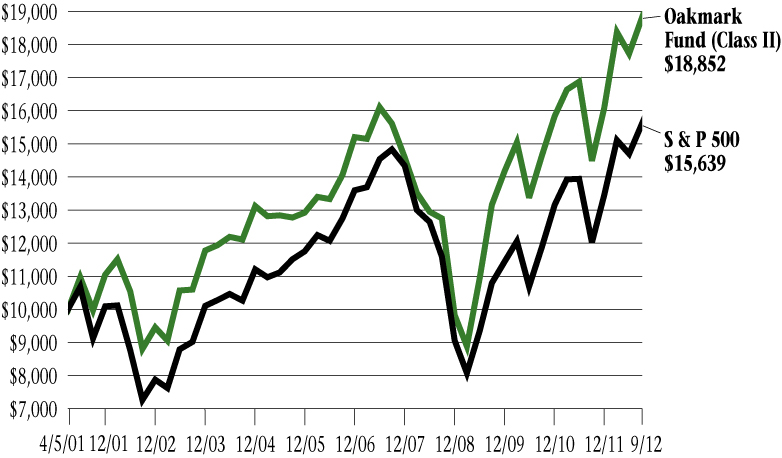

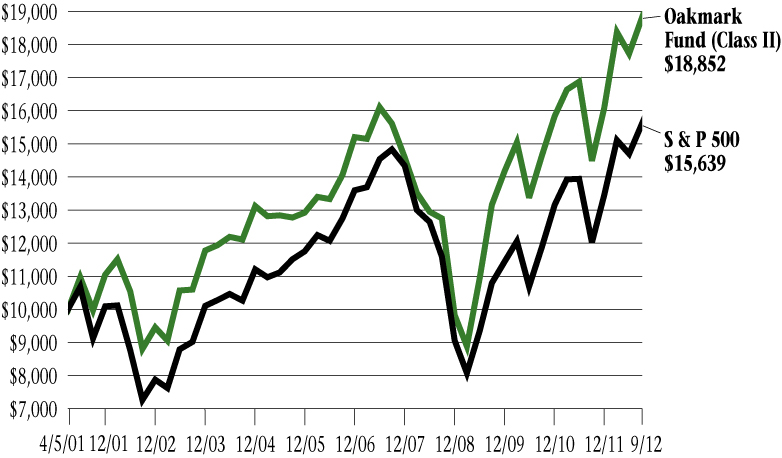

VALUE OF A $10,000 INVESTMENT

Since Inception - 08/05/91 (Unaudited)

PERFORMANCE

| | | | | Average Annual Total Returns (as of 09/30/12)3 | |

| (Unaudited) | | Total Return

Last 3 Months | | 1-year | | 3-year | | 5-year | | 10-year | | Since

Inception

(08/05/91) | |

Oakmark Fund (Class I) | | | 6.32 | % | | | 30.43 | % | | | 13.12 | % | | | 4.14 | % | | | 8.28 | % | | | 12.34 | % | |

S&P 500 Index | | | 6.35 | % | | | 30.20 | % | | | 13.20 | % | | | 1.05 | % | | | 8.01 | % | | | 8.63 | % | |

Dow Jones Industrial Average4 | | | 5.02 | % | | | 26.52 | % | | | 14.45 | % | | | 2.16 | % | | | 8.60 | % | | | 9.92 | % | |

Lipper Large-Cap Value Funds Index5 | | | 6.15 | % | | | 27.85 | % | | | 9.87 | % | | | -1.07 | % | | | 7.14 | % | | | 7.97 | % | |

The graph and table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Past Performance is no guarantee of future results. Performance data quoted represents past performance. Current performance may be lower or higher than the performance data quoted. The investment return and principal value vary so that an investor's shares when redeemed may be worth more or less than the original cost. To obtain the most recent month-end performance, please visit oakmark.com.

TOP TEN EQUITY HOLDINGS6 | | % of Net Assets | |

JPMorgan Chase & Co. | | | 2.5 | | |

Medtronic, Inc. | | | 2.5 | | |

Comcast Corp., Class A | | | 2.4 | | |

Capital One Financial Corp. | | | 2.4 | | |

Bank of America Corp. | | | 2.4 | | |

Oracle Corp. | | | 2.3 | | |

FedEx Corp. | | | 2.3 | | |

Apple, Inc. | | | 2.3 | | |

Discovery Communications, Inc., Class C | | | 2.2 | | |

TE Connectivity, Ltd. | | | 2.2 | | |

FUND STATISTICS | |

Ticker | | OAKMX | |

Inception | | 08/05/91 | |

Number of Equity Holdings | | 55 | |

Net Assets | | $6.8 billion | |

Benchmark | | S&P 500 Index | |

Weighted Average Market Cap | | $84.6 billion | |

Median Market Cap | | $32.9 billion | |

Equity Turnover (as of 9/30/12) | | 27% | |

Expense Ratio - Class I (as of 9/30/11) | | 1.04% | |

Expense Ratio - Class I (as of 9/30/12) | | 1.03% | |

SECTOR ALLOCATION | | % of Net Assets | |

Financials | | | 22.8 | | |

Information Technology | | | 21.4 | | |

Consumer Discretionary | | | 20.8 | | |

Industrials | | | 12.1 | | |

Health Care | | | 7.2 | | |

Energy | | | 5.9 | | |

Consumer Staples | | | 3.6 | | |

Short-Term Investments and Other | | | 6.2 | | |

4 THE OAKMARK FUNDS

Oakmark Fund September 30, 2012

Portfolio Manager Commentary

William C. Nygren, CFA

Portfolio Manager

oakmx@oakmark.com

Kevin Grant, CFA

Portfolio Manager

oakmx@oakmark.com

For the quarter, Oakmark Fund gained 6%, equal to the 6% gain in the S&P 500.1 Strong gains by our most important contributors—Google, Time Warner, and JP Morgan—more than offset the declines in our worst performers—Dell, Intel and FedEx. We continue to hold each of these extreme performers because we believe that the best performers are not yet fully valued and that the worst performers are still achieving the fundamental results we expect.

For the fiscal year, Oakmark Fund achieved a very high absolute return of 30%. Because we focus on value, we rarely outperform during strong markets. Most of our relative gains have historically come from losing less when the market is down. In the preceding commentary in this report, we discuss why this has been an unusual year for risk and volatility and why we believe it is creating opportunities for us to perform very well when the market is rising.

The biggest reason we performed well last year was good stock selection in the consumer discretionary and financial services sectors. Many of our cable companies returned more than 50%—Comcast, Time Warner, Disney and Discovery. They were joined in above-average performance by financial holdings, including Capital One, Wells Fargo, Bank of America, JP Morgan, Allstate and Aflac. Partially offsetting those good results, poor stock selection in technology hurt us. One of our best performing stocks was Apple (up 76%), a stock that few value funds hold. But because it comprised a smaller part of Oakmark (2%) than it did the S&P 500 (5%), it was a drag on our relative results. We want to reiterate that we don't think about portfolio construction that way. We size our positions based on our assessment of risk and return rather than basing that decision on market capitalization. It can create odd outcomes like Apple "hurting" relative performance last year, but we believe our approach leads to better long-term results.

We began the fiscal year with 56 holdings. We eliminated 12 of those positions during the year. Coincidentally, that equates to roughly a 20% turnover of names, which is consistent with the five-year time frame we use. (Note that our turnover ratio most years has exceeded 20% largely due to aggressive tax trading.) We don't manage the Fund with an eye on turnover, but we sell stocks either when we believe they have become fairly priced or when the businesses don't perform the way we expect. On average, that just works out to a five-year holding period. Last year most of our "fair value" sales were stable businesses—like Bristol Myers and Diageo—that benefited from investors paying up for safety. Our purchases, on the other hand, were mostly financials and industrials, which investors had been shunning.

During the quarter, we eliminated our holdings in Best Buy and Diageo. Diageo was sold because the stock performed well; Best Buy was sold because we were disappointed in both its business performance and how the proposed buyout by the founder was handled. The Best Buy board was not as receptive as we had

expected it to be when its founder expressed an interest in purchasing the entire company. Either the board wasn't acting in what we believed was the shareholders' best interest, or the buyout offer wasn't as real as the founder was claiming. Neither would be a good outcome for us, so we sold the stock. We initiated three new holdings which are described below.

Cummins Inc. (CMI-$92)

Cummins is the world's second-largest manufacturer of engines and the largest maker of truck engines. While North America is still its largest market, Cummins has been very successful in building sales and market share in faster-growth emerging markets, which now account for about a quarter of companywide sales. Further, we believe that its undisputed position as the industry leader in emissions controls technology should provide a long-lasting tailwind as countries mandate progressively tighter emissions standards in upcoming years. Cummins earned just over $9 per share last year, so it wasn't surprising to see the stock reach a price of $130 in March. By July, however, as investors became increasingly concerned about the possibility of decreasing global growth, the stock hit a low of $82. We believe the decline was an overreaction. Cummins now sells at about 9x expected current-year earnings. Like many of our holdings, we expect Cummins to achieve mid-single-digit revenue growth over the economic cycle, and expect per-share growth to be higher as excess cash flow is devoted to share repurchase. Our expectation for above-average EPS7 growth, a moderate but growing dividend and a higher P/E8 multiple results in us believing Cummins is likely to produce above-average returns.

Principal Financial Group (PFG-$27)

Principal Financial is a leader in providing administration services and asset management for small to mid-sized corporate retirement plans. Additionally, just over a third of its income comes from various life, annuity and dental insurance operations. Despite the overwhelming majority of income coming from the asset management business, the stock is priced like a less attractive insurer. In 2007, before the financial collapse, Principal stock surpassed $70 when operating earnings were $3.93 and book value was $26.55. So, the P/E ratio was 18x, and the stock sold for about 265% of its book value. Today, the stock sells at about 85% of expected year-end book value and at less than 9x expected 2013 earnings. Assets under management have been growing nicely; inflows alone account for a mid-single-digit growth rate. Because of Principal's strength in asset accumulation in emerging markets, we believe that growth rate is sustainable. Further, the company is repurchasing about 3% of its shares each year, and it recently raised its dividend to a current yield of more than 3%. We believe that investors' distaste for owning financial services stocks has given us a very attractive entry price for this investment.

oakmark.com 5

Oakmark Fund September 30, 2012

Portfolio Manager Commentary (continued)

UnitedHealth Group (UNH-$55)

UnitedHealth is the nation's largest provider of managed-care services. The managed-care business has strong economies of scale, so UNH is also arguably the most efficient provider. In 2005, when UNH earned $2.48 per share, its stock reached a high of $65, for a P/E ratio of 26x. UNH is expected to earn just over $5 per share this year, more than double its earnings from seven years ago, yet the stock price is now lower. The result is that UNH sells at only 10x expected 2013 earnings. Managed-care companies have fallen to below-average multiples because investors fear that health care reform will hurt these businesses significantly. We believe that fear is misplaced. We think the government needs companies like UNH because using the existing managed-care networks is far less expensive than building a new one, and UNH's breadth should allow it to thrive in most scenarios. UNH revenues grow with medical costs, supplemented by market share gains and an aging population that requires more spending on health care. Further, the share base has fallen every year since 2005 as a result of management using excess cash generation for repurchases. Shares outstanding have been reduced by about 4% per year, a trend we expect will continue. We believe that purchasing UNH at a below-average P/E ratio, combined with its moderate revenue growth, its shrinking share base and its moderate dividend, is likely to produce an above-average rate of return.

6 THE OAKMARK FUNDS

Oakmark Fund September 30, 2012

Schedule of Investments (in thousands)

| | | Shares | | Value | |

COMMON STOCKS - 93.8% | |

FINANCIALS - 22.8% | |

DIVERSIFIED FINANCIALS - 14.6% | |

JPMorgan Chase & Co.

Other Diversified Financial Services | | | 4,255 | | | $ | 172,243 | | |

Capital One Financial Corp.

Consumer Finance | | | 2,880 | | | | 164,177 | | |

Bank of America Corp.

Other Diversified Financial Services | | | 18,500 | | | | 163,355 | | |

Franklin Resources, Inc.

Asset Management & Custody Banks | | | 1,100 | | | | 137,577 | | |

The Goldman Sachs Group, Inc.

Investment Banking & Brokerage | | | 1,175 | | | | 133,574 | | |

State Street Corp.

Asset Management & Custody Banks | | | 2,590 | | | | 108,676 | | |

Bank of New York Mellon Corp.

Asset Management & Custody Banks | | | 4,760 | | | | 107,663 | | |

| | | | | | 987,265 | | |

INSURANCE - 6.1% | |

American International Group, Inc. (a)

Multi-line Insurance | | | 4,400 | | | | 144,276 | | |

Aflac, Inc.

Life & Health Insurance | | | 2,700 | | | | 129,276 | | |

Aon PLC (b)

Insurance Brokers | | | 1,400 | | | | 73,206 | | |

Principal Financial Group, Inc.

Life & Health Insurance | | | 2,500 | | | | 67,350 | | |

| | | | | | 414,108 | | |

BANKS - 2.1% | |

Wells Fargo & Co.

Diversified Banks | | | 4,165 | | | | 143,817 | | |

| | | | | | 1,545,190 | | |

INFORMATION TECHNOLOGY - 21.4% | |

SOFTWARE & SERVICES - 10.6% | |

Oracle Corp.

Systems Software | | | 5,000 | | | | 157,450 | | |

MasterCard, Inc., Class A

Data Processing & Outsourced Services | | | 299 | | | | 134,993 | | |

Google, Inc., Class A (a)

Internet Software & Services | | | 170 | | | | 128,265 | | |

Microsoft Corp.

Systems Software | | | 3,970 | | | | 118,227 | | |

eBay, Inc. (a)

Internet Software & Services | | | 2,000 | | | | 96,820 | | |

Automatic Data Processing, Inc.

Data Processing & Outsourced Services | | | 1,375 | | | | 80,657 | | |

| | | | | | 716,412 | | |

| | | Shares | | Value | |

TECHNOLOGY HARDWARE & EQUIPMENT - 5.6% | |

Apple, Inc.

Computer Hardware | | | 230 | | | $ | 153,470 | | |

TE Connectivity, Ltd. (b)

Electronic Manufacturing Services | | | 4,336 | | | | 147,455 | | |

Dell, Inc.

Computer Hardware | | | 7,860 | | | | 77,500 | | |

| | | | | | 378,425 | | |

SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT - 5.2% | |

Texas Instruments, Inc.

Semiconductors | | | 4,995 | | | | 137,612 | | |

Intel Corp.

Semiconductors | | | 5,945 | | | | 134,833 | | |

Applied Materials, Inc.

Semiconductor Equipment | | | 7,160 | | | | 79,941 | | |

| | | | | | 352,386 | | |

| | | | | | 1,447,223 | | |

CONSUMER DISCRETIONARY - 20.8% | |

MEDIA - 13.0% | |

Comcast Corp., Class A

Cable & Satellite | | | 4,740 | | | | 164,952 | | |

Discovery Communications, Inc., Class C (a)

Broadcasting | | | 2,660 | | | | 149,074 | | |

Omnicom Group, Inc.

Advertising | | | 2,676 | | | | 137,988 | | |

DIRECTV (a)

Cable & Satellite | | | 2,264 | | | | 118,778 | | |

The Walt Disney Co.

Movies & Entertainment | | | 2,056 | | | | 107,503 | | |

Viacom, Inc., Class B

Movies & Entertainment | | | 1,930 | | | | 103,415 | | |

Time Warner, Inc.

Movies & Entertainment | | | 2,193 | | | | 99,389 | | |

| | | | | | 881,099 | | |

RETAILING - 4.8% | |

Liberty Interactive Corp., Class A (a)

Catalog Retail | | | 6,405 | | | | 118,492 | | |

The Home Depot, Inc.

Home Improvement Retail | | | 1,957 | | | | 118,114 | | |

Kohl's Corp.

Department Stores | | | 1,742 | | | | 89,220 | | |

| | | | | | 325,826 | | |

AUTOMOBILES & COMPONENTS - 2.1% | |

Delphi Automotive PLC (a) (b)

Auto Parts & Equipment | | | 2,984 | | | | 92,504 | | |

Harley-Davidson, Inc.

Motorcycle Manufacturers | | | 1,102 | | | | 46,692 | | |

| | | | | | 139,196 | | |

CONSUMER SERVICES - 0.9% | |

McDonald's Corp.

Restaurants | | | 699 | | | | 64,133 | | |

| | | | | | 1,410,254 | | |

See accompanying Notes to Financial Statements.

oakmark.com 7

Oakmark Fund September 30, 2012

Schedule of Investments (in thousands) (continued)

| | | Shares | | Value | |

COMMON STOCKS - 93.8% (continued) | |

INDUSTRIALS - 12.1% | |

CAPITAL GOODS - 9.8% | |

Illinois Tool Works, Inc.

Industrial Machinery | | | 2,385 | | | $ | 141,836 | | |

Parker Hannifin Corp.

Industrial Machinery | | | 1,600 | | | | 133,728 | | |

3M Co.

Industrial Conglomerates | | | 1,323 | | | | 122,271 | | |

Cummins, Inc.

Construction & Farm Machinery &

Heavy Trucks | | | 1,300 | | | | 119,873 | | |

Northrop Grumman Corp.

Aerospace & Defense | | | 1,330 | | | | 88,352 | | |

The Boeing Co.

Aerospace & Defense | | | 798 | | | | 55,557 | | |

| | | | | | 661,617 | | |

TRANSPORTATION - 2.3% | |

FedEx Corp.

Air Freight & Logistics | | | 1,855 | | | | 156,970 | | |

| | | | | | 818,587 | | |

HEALTH CARE - 7.2% | |

HEALTH CARE EQUIPMENT & SERVICES - 6.2% | |

Medtronic, Inc.

Health Care Equipment | | | 3,870 | | | | 166,874 | | |

Covidien PLC (b)

Health Care Equipment | | | 1,985 | | | | 117,949 | | |

UnitedHealth Group, Inc.

Managed Health Care | | | 1,200 | | | | 66,492 | | |

Baxter International, Inc.

Health Care Equipment | | | 1,103 | | | | 66,467 | | |

| | | | | | 417,782 | | |

PHARMACEUTICALS, BIOTECHNOLOGY & LIFE SCIENCES - 1.0% | |

Merck & Co., Inc.

Pharmaceuticals | | | 1,587 | | | | 71,553 | | |

| | | | | | 489,335 | | |

ENERGY - 5.9% | |

Exxon Mobil Corp.

Integrated Oil & Gas | | | 1,545 | | | | 141,290 | | |

Devon Energy Corp.

Oil & Gas Exploration & Production | | | 2,200 | | | | 133,100 | | |

Cenovus Energy, Inc. (b)

Integrated Oil & Gas | | | 3,650 | | | | 127,203 | | |

| | | | | | 401,593 | | |

| | | Shares | | Value | |

CONSUMER STAPLES - 3.6% | |

FOOD, BEVERAGE & TOBACCO - 2.4% | |

Unilever PLC (c)

Packaged Foods & Meats | | | 3,530 | | | $ | 128,916 | | |

H.J. Heinz Co.

Packaged Foods & Meats | | | 650 | | | | 36,367 | | |

| | | | | | 165,283 | | |

FOOD & STAPLES RETAILING - 1.2% | |

Wal-Mart Stores, Inc.

Hypermarkets & Super Centers | | | 1,065 | | | | 78,597 | | |

| | | | | | 243,880 | | |

TOTAL COMMON STOCKS - 93.8%

(COST $4,568,511) | | | | | 6,356,062 | | |

| | | Par Value | | Value | |

SHORT TERM INVESTMENT - 6.5% | |

REPURCHASE AGREEMENT - 6.5% | |

Fixed Income Clearing Corp. Repurchase

Agreement, 0.12% dated 09/28/12 due

10/01/12, repurchase price $437,635,

collateralized by a Federal Home Loan

Bank Bond, 0.500%, due 11/20/15,

value plus accrued interest of $90,125,

by a Federal Home Loan Mortgage

Corp. Bond, 4.750%, due 11/17/15,

value plus accrued interest of $69,150,

by Federal National Mortgage

Association Bonds, 0.625% - 5.000%,

due 04/10/15 - 03/15/16, aggregate

value plus accrued interest of

$242,396, by a United States

Treasury Bond, 4.500%, due 11/15/15,

value plus accrued interest of $17,382,

by United States Treasury Notes,

1.50% - 2.50%, due 03/31/15 - 07/31/16,

aggregate value plus accrued

interest of $27,332 (Cost: $437,631) | | | 437,631 | | | | 437,631 | | |

TOTAL SHORT TERM INVESTMENTS - 6.5%

(COST $437,631) | | | | | 437,631 | | |

TOTAL INVESTMENTS - 100.3%

(COST $5,006,142) | | | | | 6,793,693 | | |

Liabilities In Excess of Other Assets - (0.3)% | | | | | (18,892 | ) | |

TOTAL NET ASSETS - 100.0% | | | | $ | 6,774,801 | | |

(a) Non-income producing security

(b) Foreign domiciled corporation

(c) Sponsored American Depositary Receipt

See accompanying Notes to Financial Statements.

8 THE OAKMARK FUNDS

This page intentionally left blank.

oakmark.com 9

Oakmark Select Fund September 30, 2012

Summary Information

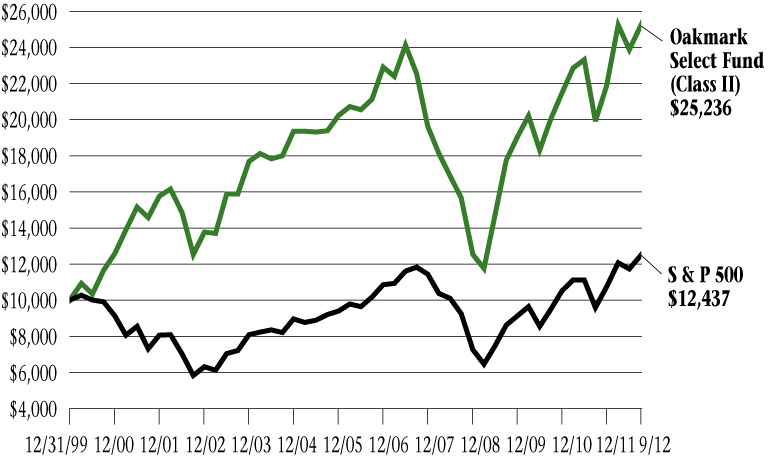

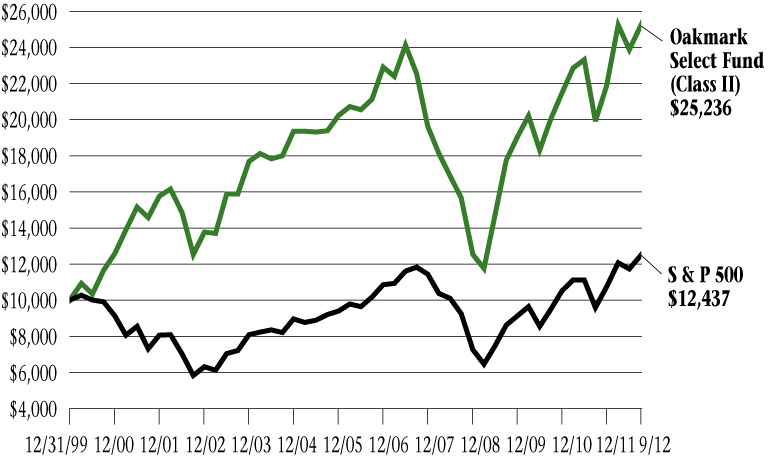

VALUE OF A $10,000 INVESTMENT

Since Inception - 11/01/96 (Unaudited)

PERFORMANCE

| | | | | Average Annual Total Returns (as of 09/30/12)3 | |

(Unaudited) | | Total Return

Last 3 Months | | 1-year | | 3-year | | 5-year | | 10-year | | Since

Inception

(11/01/96) | |

Oakmark Select Fund (Class I) | | | 5.62 | % | | | 27.05 | % | | | 12.81 | % | | | 2.51 | % | | | 7.56 | % | | | 12.10 | % | |

S&P 500 Index | | | 6.35 | % | | | 30.20 | % | | | 13.20 | % | | | 1.05 | % | | | 8.01 | % | | | 6.51 | % | |

Lipper Multi-Cap Value Funds Index9 | | | 6.26 | % | | | 28.23 | % | | | 9.56 | % | | | -1.30 | % | | | 7.29 | % | | | 6.19 | % | |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Past performance is no guarantee of future results. Performance data quoted represents past performance. Current performance may be lower or higher than the performance data quoted. The investment return and principal value vary so that an investor's shares when redeemed may be worth more or less than the original cost. To obtain the most recent month-end performance data, visit oakmark.com.

TOP TEN EQUITY HOLDINGS6 | | % of Net Assets | |

Discovery Communications, Inc., Class C | | | 8.5 | | |

Capital One Financial Corp. | | | 5.7 | | |

TE Connectivity, Ltd. | | | 5.6 | | |

JPMorgan Chase & Co. | | | 5.3 | | |

TRW Automotive Holdings Corp. | | | 5.0 | | |

Bank of America Corp. | | | 5.0 | | |

Comcast Corp., Class A | | | 4.9 | | |

Newfield Exploration Co. | | | 4.9 | | |

Medtronic, Inc. | | | 4.8 | | |

Liberty Interactive Corp., Class A | | | 4.7 | | |

FUND STATISTICS | |

Ticker | | OAKLX | |

Inception | | 11/01/96 | |

Number of Equity Holdings | | 20 | |

Net Assets | | $3.0 billion | |

Benchmark | | S&P 500 Index | |

Weighted Average Market Cap | | $42.2 billion | |

Median Market Cap | | $29.0 billion | |

Equity Turnover (as of 9/30/12) | | 32% | |

Expense Ratio - Class I (as of 9/30/11) | | 1.07% | |

Expense Ratio - Class I (as of 9/30/12) | | 1.05% | |

SECTOR ALLOCATION | | % of Net Assets | |

Consumer Discretionary | | | 27.4 | | |

Information Technology | | | 25.1 | | |

Financials | | | 20.0 | | |

Energy | | | 9.1 | | |

Health Care | | | 4.8 | | |

Utilities | | | 4.1 | | |

Industrials | | | 4.0 | | |

Short-Term Investments and Other | | | 5.5 | | |

10 THE OAKMARK FUNDS

Oakmark Select Fund September 30, 2012

Portfolio Manager Commentary

William C. Nygren, CFA

Portfolio Manager

oaklx@oakmark.com

For the quarter, the Oakmark Select Fund gained 6%, consistent with the 6% gain in the S&P 500.1 Good gains in our media and financial stocks—Liberty Interactive, Discovery, Time Warner, Comcast, JP Morgan and Bank of America, all up more than 10%—helped produce our good return. Two losers—Intel and Dell, off 14% and 21%, respectively—offset some of that gain. Because both businesses are performing close to our expectations, we continue to hold both stocks.

Looking at the fiscal-year results, Oakmark Select achieved a very good absolute return of 27%, just short of the S&P 500's 30% gain. Good stock selection and a heavy weighting in consumer discretionary—primarily media companies—helped our performance. Our top contributors were Discovery (up 59%), Comcast (72%), eBay (63%) Liberty Interactive (40%) and Time Warner (48%). We have trimmed the Discovery and Comcast holdings and, as discussed below, sold eBay and Time Warner.

On the negative side, two stocks suffered meaningful losses: Dell and Newfield Exploration. We've written about their issues before, but in short, Dell is really two businesses—a declining PC business and growing non-PC businesses. We believe the non-PC businesses, which now account for most of Dell's income, should be getting more investor attention. Newfield is an energy company whose main revenue stream is transitioning from natural gas to oil. Investors, however, seem to be more focused on the declining gas production than on the growing oil revenues. When a company has one growing business and one shrinking business, we find investors often behave like the Winnie the Pooh character Eeyore in always seeing the glass as half-empty.

During the fiscal year, we eliminated four positions from the Fund. That should be considered a typical number, given that the Fund holds about 20 stocks and averages about a five-year holding period. The stocks we sold were Bristol Myers, eBay, H&R Block and Time Warner. With the exception of Block, the sales were the result of stocks having performed so well that new opportunities forced them out of the portfolio. As stated in the quarterly report when we sold Block, despite having made money on it, business fundamentals were not unfolding as we had anticipated, and we lost confidence in management's ability to remedy things.

Replacing those positions, we added AIG Corp, Bank of America, BMC Software and TRW. It should come as no surprise that, as investors were paying a larger premium for safety, our purchases were generally riskier businesses than our sales. AIG and Bank of America were both new in the past quarter. Their stories are quite similar: Financial businesses at the eye of the storm in 2008, now selling for less than half of book value, with management targeting a double-digit return on equity within three years and with a commitment to return capital to shareholders through share repurchases and dividends.

Some of the bears on these stocks are concerned that top-line growth might be very difficult to come by. Let's assume they are right and that AIG earns 7% on its equity in 2014 (EPS7 of about $5.25 per share). Further, let's assume that, by the end of next year, AIG is deemed to have sufficient capital such that future earnings are entirely excess capital. That would mean that AIG, selling at half of book value, would generate enough cash to repurchase 14% of its shares annually. If it had flat net income, it would produce a 16% annual growth rate in EPS.

Bank of America has a similar story, except that its dividends are expected to be an important part of its return. Again assuming a 7% ROE in 2014 (EPS of about $1.50 per share) but with a 30% payout ratio, Bank of America would be paying a dividend of 5% on the current stock price and repurchasing about 10% of its shares annually. As with our other financials, we aren't arguing that AIG and Bank of America are the world's greatest businesses, but rather that a price of only 50% of book value is a bargain purchase price.

As we begin our new fiscal year, we continue to believe equities are the most attractively priced asset class and that, within equities, the stocks investors mistakenly view as safe are generally the least attractive. Usually stocks get more popular after they go up and vice-versa. Despite the S&P returning 30% in the past year, we see no signs of investors being more positive on equities or more willing to take on risk. Mutual fund flows continue to strongly favor fixed income, an asset class we believe is overvalued and, at these price levels, mistakenly viewed as safe. In fact, CNBC reported last month that at fund industry giant Fidelity, long known for its equity funds, assets invested in its bond funds now exceed assets in its equity funds. We view investors' lack of interest in equities as another positive.

Thank you for your support.

oakmark.com 11

Oakmark Select Fund September 30, 2012

Schedule of Investments (in thousands)

| | | Shares | | Value | |

COMMON STOCKS - 94.5% | |

CONSUMER DISCRETIONARY - 27.4% | |

MEDIA - 17.6% | |

Discovery Communications, Inc., Class C (a)

Broadcasting | | | 4,610 | | | $ | 258,316 | | |

Comcast Corp., Class A

Cable & Satellite | | | 4,250 | | | | 147,900 | | |

DIRECTV (a)

Cable & Satellite | | | 2,448 | | | | 128,420 | | |

| | | | | | 534,636 | | |

AUTOMOBILES & COMPONENTS - 5.0% | |

TRW Automotive Holdings Corp. (a)

Auto Parts & Equipment | | | 3,500 | | | | 152,985 | | |

RETAILING - 4.8% | |

Liberty Interactive Corp., Class A (a)

Catalog Retail | | | 7,800 | | | | 144,300 | | |

| | | | | | 831,921 | | |

INFORMATION TECHNOLOGY - 25.1% | |

SOFTWARE & SERVICES - 8.8% | |

MasterCard, Inc., Class A

Data Processing & Outsourced Services | | | 315 | | | | 142,216 | | |

BMC Software, Inc. (a)

Systems Software | | | 3,000 | | | | 124,470 | | |

| | | | | | 266,686 | | |

TECHNOLOGY HARDWARE & EQUIPMENT - 8.5% | |

TE Connectivity, Ltd. (b)

Electronic Manufacturing Services | | | 5,044 | | | | 171,544 | | |

Dell, Inc.

Computer Hardware | | | 9,000 | | | | 88,740 | | |

| | | | | | 260,284 | | |

SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT - 7.8% | |

Intel Corp.

Semiconductors | | | 5,497 | | | | 124,672 | | |

Texas Instruments, Inc.

Semiconductors | | | 4,050 | | | | 111,578 | | |

| | | | | | 236,250 | | |

| | | | | | 763,220 | | |

FINANCIALS - 20.0% | |

DIVERSIFIED FINANCIALS - 16.0% | |

Capital One Financial Corp.

Consumer Finance | | | 3,050 | | | | 173,880 | | |

JPMorgan Chase & Co.

Other Diversified Financial Services | | | 4,000 | | | | 161,920 | | |

Bank of America Corp.

Other Diversified Financial Services | | | 17,100 | | | | 150,993 | | |

| | | | | | 486,793 | | |

| | | Shares | | Value | |

INSURANCE - 4.0% | |

American International Group, Inc. (a)

Multi-line Insurance | | | 3,700 | | | $ | 121,323 | | |

| | | | | | 608,116 | | |

ENERGY - 9.1% | |

Newfield Exploration Co. (a)

Oil & Gas Exploration & Production | | | 4,720 | | | | 147,816 | | |

Cenovus Energy, Inc. (b)

Integrated Oil & Gas | | | 3,735 | | | | 130,158 | | |

| | | | | | 277,974 | | |

HEALTH CARE - 4.8% | |

HEALTH CARE EQUIPMENT & SERVICES - 4.8% | |

Medtronic, Inc.

Health Care Equipment | | | 3,400 | | | | 146,608 | | |

UTILITIES - 4.1% | |

Calpine Corp. (a)

Independent Power Producers & Energy Traders | | | 7,104 | | | | 122,906 | | |

INDUSTRIALS - 4.0% | |

TRANSPORTATION - 4.0% | |

FedEx Corp.

Air Freight & Logistics | | | 1,450 | | | | 122,699 | | |

TOTAL COMMON STOCKS - 94.5%

(COST $2,030,560) | | | | | 2,873,444 | | |

| | | Par Value | | Value | |

SHORT TERM INVESTMENTS - 5.8% | |

REPURCHASE AGREEMENT - 5.8% | |

Fixed Income Clearing Corp. Repurchase

Agreement, 0.12% dated 09/28/12 due

10/01/12, repurchase price $177,351,

collateralized by a United States

Treasury Bond, 4.500%, due 11/15/15,

value plus accrued interest of

$84,105, and by a United States

Treasury Note, 1.250%, due 10/31/15,

value plus accrued interest of

$96,794 (Cost: $177,350) | | | 177,350 | | | | 177,350 | | |

TOTAL SHORT TERM INVESTMENTS - 5.8%

(COST $177,350) | | | | | 177,350 | | |

TOTAL INVESTMENTS - 100.3%

(COST $2,207,910) | | | | | 3,050,794 | | |

Liabilities In Excess of Other Assets - (0.3)% | | | | | (9,470 | ) | |

TOTAL NET ASSETS - 100.0% | | | | $ | 3,041,324 | | |

(a) Non-income producing security

(b) Foreign domiciled corporation

See accompanying Notes to Financial Statements.

12 THE OAKMARK FUNDS

This page intentionally left blank.

oakmark.com 13

Oakmark Equity and Income Fund September 30, 2012

Summary Information

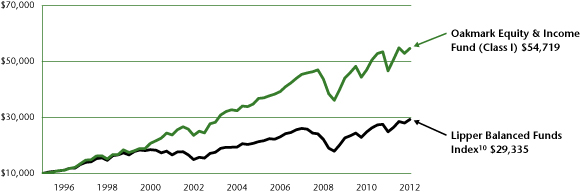

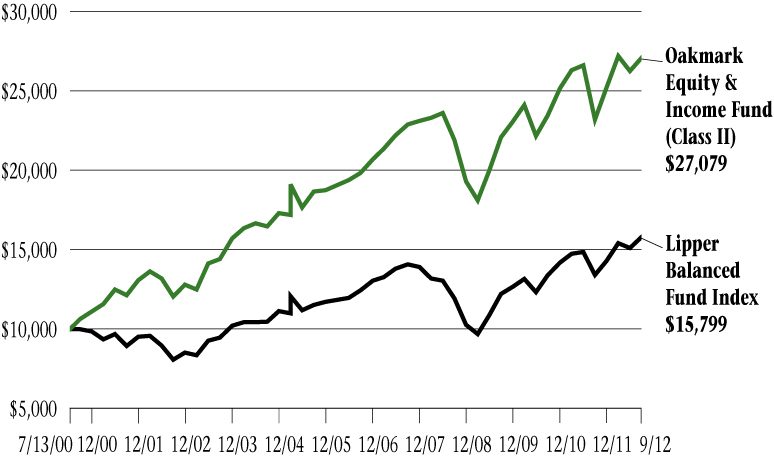

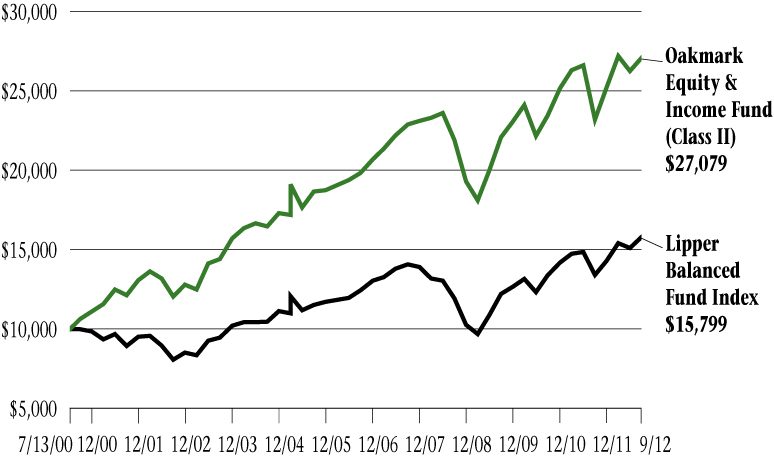

VALUE OF A $10,000 INVESTMENT

Since Inception - 11/01/95 (Unaudited)

PERFORMANCE

| | | | | Average Annual Total Returns (as of 09/30/12)3 | |

(Unaudited) | | Total Return

Last 3 Months | | 1-year | | 3-year | | 5-year | | 10-year | | Since

Inception

(11/01/95) | |

Oakmark Equity & Income Fund (Class I) | | | 3.27 | % | | | 17.19 | % | | | 7.40 | % | | | 3.77 | % | | | 8.75 | % | | | 10.57 | % | |

Lipper Balanced Funds Index | | | 4.59 | % | | | 17.78 | % | | | 8.92 | % | | | 2.34 | % | | | 6.95 | % | | | 6.57 | % | |

S&P 500 Index1 | | | 6.35 | % | | | 30.20 | % | | | 13.20 | % | | | 1.05 | % | | | 8.01 | % | | | 7.43 | % | |

Barclays U.S. Govt./Credit Index11 | | | 1.73 | % | | | 5.66 | % | | | 6.50 | % | | | 6.63 | % | | | 5.39 | % | | | 6.25 | % | |

The graph and table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Past Performance is no guarantee of future results. Performance data quoted represents past performance. Current performance may be lower or higher than the performance data quoted. The investment return and principal value vary so that an investor's shares when redeemed may be worth more or less than the original cost. To obtain the most recent month-end performance, please visit oakmark.com.

TOP TEN EQUITY HOLDINGS6 | | % of Net Assets | |

Nestle SA | | | 3.3 | | |

UnitedHealth Group, Inc. | | | 3.2 | | |

Diageo PLC | | | 3.1 | | |

Cenovus Energy, Inc. | | | 3.1 | | |

Philip Morris International, Inc. | | | 3.1 | | |

General Dynamics Corp. | | | 2.8 | | |

Dover Corp. | | | 2.5 | | |

Flowserve Corp. | | | 2.4 | | |

MasterCard, Inc., Class A | | | 2.3 | | |

Scripps Networks Interactive, Inc., Class A | | | 2.1 | | |

FUND STATISTICS | |

Ticker | | OAKBX | |

Inception | | 11/01/95 | |

Number of Equity Holdings | | 52 | |

Net Assets | | $19.2 billion | |

Benchmark | | Lipper Balanced Fund Index | |

Weighted Average Market Cap | | $36.6 billion | |

Median Market Cap | | $9.0 billion | |

Equity Turnover (as of 9/30/12) | | 32% | |

Expense Ratio - Class I (as of 9/30/11) | | 0.77% | |

Expense Ratio - Class I (as of 9/30/12) | | 0.78% | |

SECTOR ALLOCATION | | % of Net Assets | |

Equity Investments | |

Industrials | | | 16.5 | | |

Energy | | | 14.2 | | |

Health Care | | | 12.9 | | |

Consumer Staples | | | 10.8 | | |

Consumer Discretionary | | | 8.8 | | |

Information Technology | | | 6.0 | | |

Materials | | | 0.5 | | |

Financials | | | 0.4 | | |

Total Equity Investments | | | 70.1 | | |

Government and Agency Securities | | | 20.1 | | |

Corporate Bonds | | | 1.2 | | |

Asset Backed Securities | | | 0.1 | | |

Short-Term Investments and Other | | | 8.5 | | |

14 THE OAKMARK FUNDS

Oakmark Equity and Income Fund September 30, 2012

Portfolio Manager Commentary

Clyde S. McGregor, CFA

Portfolio Manager

oakbx@oakmark.com

Quarter Review

Despite the pervasive tendency for investors to reduce equity exposure while increasing their fixed-income commitments, equity markets rebounded in the September quarter, and fixed-income markets were directionless. For the three months, the Equity and Income Fund earned 3%, which contrasts to a 5% gain for the Lipper Balanced Fund Index,10 the Fund's performance benchmark. For the calendar nine months, the returns are 8% for the Fund and 11% for the Lipper Index. Finally, for the Fund's fiscal year ending September 30, the return to the Fund was 17%, while the Lipper Index returned 18%. The annualized compound rate of return since the Fund's inception in 1995 is 11%, while the corresponding return to the Lipper Index is 7%.

Diageo, Cenovus Energy, Flowserve, Dover and Nestle contributed the most to return in the quarter. The largest detractors were Walter Energy, United Health Group, Staples, FedEx, and CR Bard. During this calendar year, the most significant detractors have been Walter Energy, Staples, Varian Medical Systems, Patterson-UTI Energy and Lear. The largest contributors to portfolio return during the past nine months were Diageo, Scripps Networks Interactive, TJX, Flowserve and Philip Morris International. Finally, for the Fund's fiscal year, the largest contributors were Diageo, Flowserve, Philip Morris International, TJX and Scripps Networks Interactive. The largest 12-month detractors were Walter Energy, Staples, Hospira, Lear and Republic Services (sold).

Transaction Activity

The quarter's trading activity in the Fund was modest, at least in terms of new purchases or eliminations. The two eliminations were Steris and Republic Services. Steris was a successful smaller holding, and I sold it both for valuation reasons and because of the company's exposure to the hospital capital equipment market in a period of rapid change in the health care sector. We believed that the improvement in the U.S. industrial economy would support Republic Services' earnings, but recent trends do not justify that thesis, which dictated the sale of the holding.

The Fund's only new purchase was Bruker, a diversified scientific instrument manufacturer with a strong reputation for innovation and product quality. The company's management team holds large ownership stakes and focuses on growth in intrinsic value per share over the long term. To that end, we think management is willing to make sensible elective investments in the business that promise returns only well into the future, and this factor often discourages investor interest. Earlier this year, the company hired a new chief financial officer who appears to have the necessary skills and experience required to transform the company from one known primarily for its technical excellence to one also known for its financial attributes.

Cape of Good Hope?

In the September 17 edition of the Financial Times, columnist John Authers discussed the evolution of Yale Professor Robert Shiller's "Cape" indicator. "Cape" is an acronym for "cyclically adjusted price earnings" ratio. This indicator compares the price of a stock to its average earnings over the preceding decade. When valuing stocks, most investors use forward-looking price-to-earnings ratios that depend on the ability to make reasonable forecasts of future earnings. Obviously, forecasting errors are frequent, but never more so than when the economy is approaching recession. By using a backward-looking model that covers a long time period, Shiller avoids forecasting error while capturing data that describe a company's performance through a variety of economic environments.

Although Shiller's model has proven to be helpful in identifying market extremes, it has been less valuable in more normal times. Accordingly, he has refined his concept to provide more market-timing guidance as well as industry-relative rankings. For the Equity and Income Fund, it is the industry analysis that is most revealing. Shiller's work looks at the history of the 10 main market sectors of the S&P 500 Index.1 As one would expect, different sectors have different Capes. Shiller's concept is to look at each sector relative to its own history and determine which are trading dear to that history and which are cheap. According to Authers, current industry Capes suggest that industrial, energy and health care stocks offer good value, while industries typically seen as defensive (e.g., consumer staples) are expensive. The three sectors that are most overweight in the Fund versus the S&P 500 are industrials, energy and health care. At Harris Associates, we pay little attention to the industry weights in the S&P 500, and I did not construct the Fund portfolio with the Shiller Cape in mind. Nevertheless, it should not be surprising that our value philosophy would cause the portfolio to end up in the Cape's cheapest neighborhoods.

Why own TIPS today?

For the majority of its existence, the Equity and Income Fund has had an invested position in U.S. Treasury inflation-protected securities, often referred to by their acronym TIPS. In general, this asset type has been good to the Fund, but at today's price levels, investors are beginning to ask why we continue to own any. Before arriving at the answer, we should first review the exact nature of this security.

TIPS represent a loan to the U.S. government at a specified interest rate (the bond's coupon) and a multiplier that amplifies (or diminishes in the event of deflation) the face value of the bond based on a formula containing "chained CPI" (a variant of the Consumer Price Index). Every month, the government provides an index value of a basket of items, which is then used to calculate the "Index Ratio." This ratio incorporates a Reference CPI statistic and an inflation assumption. For example, were you to purchase a TIPS bond for $100 and the Index Ratio

oakmark.com 15

Oakmark Equity and Income Fund September 30, 2012

Portfolio Manager Commentary (continued)

is 1.1, your cost for the bond would be $110 (ignoring any accrued interest). This value, inclusive of the Index Ratio multiplier, is realized at maturity or at time of sale.

Currently, the Equity and Income Fund has approximately $1.5 billion invested in TIPS, plus a small holding of Canadian inflation-indexed securities. This allocation accounts for more than 35% of the Fund's fixed-income assets (ignoring short-term investments). More importantly, the TIPS position comprises the bulk of the portfolio's longer duration assets. Looking at the portfolio today, one sees that the TIPS all show "negative yields," which naturally concerns Fund investors. This yield is somewhat misleading; however, as it is calculated using the current trading price for the bonds and their stated coupons without incorporating the value added by the Index Ratio multiplier. Taking the Index Ratio into account, we calculate TIPS to be yielding roughly the same as their conventional Treasury bond counterparts. It is this added feature, which protects and compensates the investor for inflation that compels us to own these bonds. In our opinion, forecasting future interest rates, especially for more distant maturities, is very difficult. What we do know is that the Federal Reserve is currently employing policies that historically have generated inflationary outcomes. Federal Reserve Chairman Bernanke has stated that he will stave off deflation with massive liquidity injections into the fixed-income markets. The latest such effort was announced on September 13. Since we see future inflation to be the great risk facing the fixed-income investor, we own TIPS to reduce our exposure to that risk. In closing, I wish to thank John Tansey of our firm's fixed-income department for his assistance in writing this section.

Once again, I thank my fellow shareholders for investing in the Equity and Income Fund. I welcome your comments and questions.

16 THE OAKMARK FUNDS

Oakmark Equity and Income Fund September 30, 2012

Schedule of Investments (in thousands)

| | | Shares | | Value | |

COMMON STOCKS - 70.1% | |

INDUSTRIALS - 16.5% | |

CAPITAL GOODS - 14.6% | |

General Dynamics Corp.

Aerospace & Defense | | | 8,235 | | | $ | 544,498 | | |

Dover Corp.

Industrial Machinery | | | 8,076 | | | | 480,412 | | |

Flowserve Corp. (b)

Industrial Machinery | | | 3,639 | | | | 464,869 | | |

Rockwell Automation Inc.

Electrical Components & Equipment | | | 5,363 | | | | 373,011 | | |

Parker Hannifin Corp.

Industrial Machinery | | | 3,600 | | | | 300,901 | | |

Northrop Grumman Corp.

Aerospace & Defense | | | 4,313 | | | | 286,479 | | |

Illinois Tool Works, Inc.

Industrial Machinery | | | 4,253 | | | | 252,902 | | |

Teledyne Technologies, Inc. (a)

Aerospace & Defense | | | 1,097 | | | | 69,559 | | |

Blount International, Inc. (a)

Industrial Machinery | | | 1,534 | | | | 20,192 | | |

| | | | | | 2,792,823 | | |

TRANSPORTATION - 1.9% | |

FedEx Corp.

Air Freight & Logistics | | | 4,243 | | | | 359,068 | | |

COMMERCIAL & PROFESSIONAL SERVICES - 0.0% (c) | |

Mine Safety Appliances Co.

Office Services & Supplies | | | 119 | | | | 4,430 | | |

| | | | | | 3,156,321 | | |

ENERGY - 14.2% | |

Cenovus Energy, Inc. (d)

Integrated Oil & Gas | | | 17,020 | | | | 593,133 | | |

Devon Energy Corp.

Oil & Gas Exploration & Production | | | 6,468 | | | | 391,308 | | |

Apache Corp.

Oil & Gas Exploration & Production | | | 4,450 | | | | 384,791 | | |

Encana Corp. (d)

Oil & Gas Exploration & Production | | | 16,573 | | | | 363,271 | | |

Baker Hughes, Inc.

Oil & Gas Equipment & Services | | | 7,606 | | | | 344,035 | | |

Range Resources Corp.

Oil & Gas Exploration & Production | | | 3,296 | | | | 230,292 | | |

Cimarex Energy Co.

Oil & Gas Exploration & Production | | | 3,186 | | | | 186,539 | | |

Concho Resources, Inc. (a)

Oil & Gas Exploration & Production | | | 1,501 | | | | 142,239 | | |

Patterson-UTI Energy, Inc.

Oil & Gas Drilling | | | 5,200 | | | | 82,371 | | |

| | | | | | 2,717,979 | | |

| | | Shares | | Value | |

HEALTH CARE - 12.9% | |

HEALTH CARE EQUIPMENT & SERVICES - 12.1% | |

UnitedHealth Group, Inc.

Managed Health Care | | | 11,034 | | | $ | 611,366 | | |

Laboratory Corp. of America Holdings (a)

Health Care Services | | | 4,181 | | | | 386,599 | | |

Quest Diagnostics, Inc.

Health Care Services | | | 5,602 | | | | 355,335 | | |

Varian Medical Systems, Inc. (a) (b)

Health Care Equipment | | | 5,700 | | | | 343,824 | | |

CR Bard, Inc.

Health Care Equipment | | | 2,777 | | | | 290,638 | | |

Omnicare, Inc.

Health Care Services | | | 5,155 | | | | 175,098 | | |

Boston Scientific Corp. (a)

Health Care Equipment | | | 22,764 | | | | 130,665 | | |

PharMerica Corp. (a) (b)

Health Care Distributors | | | 1,710 | | | | 21,649 | | |

VCA Antech, Inc. (a)

Health Care Facilities | | | 209 | | | | 4,125 | | |

| | | | | | 2,319,299 | | |

PHARMACEUTICALS, BIOTECHNOLOGY & LIFE SCIENCES - 0.8% | |

Hospira, Inc. (a) (b)

Pharmaceuticals | | | 3,341 | | | | 109,635 | | |

Bruker Corp. (a)

Life Sciences Tools & Services | | | 2,535 | | | | 33,181 | | |

| | | | | | 142,816 | | |

| | | | | | 2,462,115 | | |

CONSUMER STAPLES - 10.8% | |

FOOD, BEVERAGE & TOBACCO - 9.5% | |

Nestle SA (e) (f)

Packaged Foods & Meats | | | 10,000 | | | | 630,520 | | |

Diageo PLC (e)

Distillers & Vintners | | | 5,347 | | | | 602,778 | | |

Philip Morris International, Inc.

Tobacco | | | 6,506 | | | | 585,150 | | |

| | | | | | 1,818,448 | | |

FOOD & STAPLES RETAILING - 1.3% | |

CVS Caremark Corp.

Drug Retail | | | 5,369 | | | | 259,943 | | |

| | | | | | 2,078,391 | | |

CONSUMER DISCRETIONARY - 8.8% | |

RETAILING - 3.5% | |

The TJX Cos., Inc.

Apparel Retail | | | 6,352 | | | | 284,519 | | |

Staples, Inc.

Specialty Stores | | | 20,638 | | | | 237,750 | | |

Foot Locker, Inc.

Apparel Retail | | | 3,000 | | | | 106,500 | | |

HSN, Inc.

Catalog Retail | | | 1,037 | | | | 50,855 | | |

| | | | | | 679,624 | | |

See accompanying Notes to Financial Statements.

oakmark.com 17

Oakmark Equity and Income Fund September 30, 2012

Schedule of Investments (in thousands) (continued)

| | | Shares | | Value | |

COMMON STOCKS - 70.1% (continued) | |

CONSUMER DISCRETIONARY - 8.8% (continued) | |

CONSUMER DURABLES & APPAREL - 2.3% | |

Mohawk Industries, Inc. (a)

Home Furnishings | | | 2,203 | | | $ | 176,284 | | |

Leggett & Platt, Inc.

Home Furnishings | | | 5,862 | | | | 146,837 | | |

Carter's, Inc. (a)

Apparel, Accessories & Luxury Goods | | | 2,324 | | | | 125,124 | | |

| | | | | | 448,245 | | |

MEDIA - 2.1% | |

Scripps Networks Interactive, Inc., Class A

Broadcasting | | | 6,500 | | | | 397,995 | | |

AUTOMOBILES & COMPONENTS - 0.9% | |

Lear Corp.

Auto Parts & Equipment | | | 4,437 | | | | 167,691 | | |

| | | | | | 1,693,555 | | |

INFORMATION TECHNOLOGY - 6.0% | |

SOFTWARE & SERVICES - 4.0% | |

MasterCard, Inc., Class A

Data Processing & Outsourced Services | | | 959 | | | | 433,131 | | |

eBay, Inc. (a)

Internet Software & Services | | | 3,731 | | | | 180,594 | | |

Broadridge Financial Solutions, Inc. (b)

Data Processing & Outsourced Services | | | 6,900 | | | | 160,977 | | |

| | | | | | 774,702 | | |

TECHNOLOGY HARDWARE & EQUIPMENT - 1.5% | |

TE Connectivity, Ltd. (d)

Electronic Manufacturing Services | | | 6,818 | | | | 231,874 | | |

Arris Group, Inc. (a)

Communications Equipment | | | 4,785 | | | | 61,205 | | |

| | | | | | 293,079 | | |

SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT - 0.5% | |

Texas Instruments, Inc.

Semiconductors | | | 3,200 | | | | 88,173 | | |

| | | | | | 1,155,954 | | |

MATERIALS - 0.5% | |

Walter Energy, Inc. (b)

Diversified Metals & Mining | | | 3,000 | | | | 97,380 | | |

FINANCIALS - 0.4% | |

DIVERSIFIED FINANCIALS - 0.4% | |

TD Ameritrade Holding Corp.

Investment Banking & Brokerage | | | 5,461 | | | | 83,928 | | |

TOTAL COMMON STOCKS - 70.1%

(COST $10,040,944) | | | | | 13,445,623 | | |

| | | Par Value | | Value | |

FIXED INCOME - 21.4% | |

GOVERNMENT AND AGENCY SECURITIES - 20.1% | |

U.S. GOVERNMENT NOTES - 18.2% | |

1.25%, due 07/15/20, Inflation Indexed | | | 525,290 | | | $ | 628,009 | | |

1.375%, due 07/15/18, Inflation Indexed | | | 531,250 | | | | 622,725 | | |

2.875%, due 01/31/13 | | | 483,005 | | | | 487,382 | | |

0.125%, due 09/30/13 | | | 300,000 | | | | 299,801 | | |

2.125%, due 01/15/19, Inflation Indexed | | | 213,430 | | | | 261,902 | | |

1.00%, due 09/30/16 | | | 200,000 | | | | 204,250 | | |

0.625%, due 02/28/13 | | | 200,000 | | | | 200,398 | | |

0.125%, due 08/31/13 | | | 200,000 | | | | 199,906 | | |

1.125%, due 06/15/13 | | | 175,000 | | | | 176,162 | | |

1.00%, due 01/15/14 | | | 100,000 | | | | 101,012 | | |

1.125%, due 12/15/12 | | | 100,000 | | | | 100,203 | | |

1.375%, due 11/15/12 | | | 100,000 | | | | 100,152 | | |

1.375%, due 10/15/12 | | | 100,000 | | | | 100,047 | | |

| | | | | | 3,481,949 | | |

U.S. GOVERNMENT AGENCIES - 1.0% | |

Federal National Mortgage Association,

3.97%, due 11/27/19 | | | 32,000 | | | | 32,165 | | |

Federal Home Loan Mortgage Corp.,

2.00%, due 08/08/17 | | | 25,000 | | | | 25,352 | | |

Federal National Mortgage Association,

1.30%, due 05/10/17 | | | 25,000 | | | | 25,149 | | |

Federal Home Loan Mortgage Corp.,

1.30%, due 06/07/17 | | | 25,000 | | | | 25,119 | | |

Federal National Mortgage Association,

1.375%, due 08/28/17 | | | 24,000 | | | | 24,102 | | |

Federal Farm Credit Banks,

1.90%, due 11/15/17 | | | 22,925 | | | | 22,960 | | |

Federal Home Loan Mortgage Corp.,

1.375%, due 09/14/17 | | | 20,875 | | | | 20,966 | | |

Federal Home Loan Mortgage Corp.,

1.55%, due 12/28/16 | | | 5,000 | | | | 5,015 | | |

Federal National Mortgage Association,

1.65%, due 10/23/17 | | | 5,000 | | | | 5,004 | | |

| | | | | | 185,832 | | |

CANADIAN GOVERNMENT BONDS - 0.8% | |

1.50%, due 12/01/12 | | CAD | 100,000 | | | | 101,791 | | |

4.25%, due 12/01/21,

Inflation Indexed | | CAD | 36,564 | | | | 52,997 | | |

| | | | | | 154,788 | | |

NORWEGIAN GOVERNMENT BONDS - 0.1% | |

6.50%, due 05/15/13 | | NOK | 150,000 | | | | 26,943 | | |

Total Government and Agency Securities

(Cost $3,604,815) | | | | | 3,849,512 | | |

CORPORATE BONDS - 1.2% | |

SSIF Nevada, LP, 144A,

1.155%, due 04/14/14 (g) (h) | | | 55,100 | | | | 55,350 | | |

Kinetic Concepts, Inc., 144A,

10.50%, due 11/01/18 (h) | | | 48,080 | | | | 50,845 | | |

Denbury Resources, Inc.,

9.75%, due 03/01/16 | | | 18,101 | | | | 19,459 | | |

Sealed Air Corp., 144A,

5.625%, due 07/15/13 (h) | | | 18,740 | | | | 19,208 | | |

See accompanying Notes to Financial Statements.

18 THE OAKMARK FUNDS

Oakmark Equity and Income Fund September 30, 2012

Schedule of Investments (in thousands) (continued)

| | | Par Value | | Value | |

FIXED INCOME - 21.4% (continued) | |

CORPORATE BONDS - 1.2% (continued) | |

ASML Holding NV,

5.75%, due 06/13/17 | | EUR | 9,660 | | | $ | 14,312 | | |

Kinetic Concepts, Inc., 144A,

12.50%, due 11/01/19 (h) | | | 14,400 | | | | 13,536 | | |

Penn National Gaming, Inc.,

8.75%, due 08/15/19 | | | 10,000 | | | | 11,200 | | |

Live Nation Entertainment, Inc. 144A,

7.00%, due 09/01/20 (h) | | | 9,625 | | | | 10,010 | | |

Concho Resources, Inc.,

5.50%, due 10/01/22 | | | 7,000 | | | | 7,297 | | |

Serta Simmons Holdings LLC, 144A,

8.125%, due 10/01/20 (h) | | | 5,000 | | | | 4,963 | | |

Health Net, Inc.,

6.375%, due 06/01/17 | | | 4,185 | | | | 4,373 | | |

OneBeacon US Holdings, Inc.,

5.875%, due 05/15/13 | | | 3,589 | | | | 3,674 | | |

Range Resources Corp.,

7.25%, due 05/01/18 | | | 3,085 | | | | 3,262 | | |

Encore Acquisition Co.,

9.50%, due 05/01/16 | | | 2,550 | | | | 2,767 | | |

Ameristar Casinos, Inc.,

7.50%, due 04/15/21 | | | 2,000 | | | | 2,150 | | |

Post Holdings, Inc., 144A,

7.375%, due 02/15/22 (h) | | | 1,000 | | | | 1,063 | | |

Hologic, Inc., 144A,

6.25%, due 08/01/20 (h) | | | 250 | | | | 265 | | |

CNO Financial Group, Inc., 144A,

6.375%, due 10/01/20 (h) | | | 250 | | | | 255 | | |

Total Corporate Bonds

(Cost $214,368) | | | | | 223,989 | | |

ASSET BACKED SECURITIES - 0.1% | |

Cabela's Master Credit Card Trust, 144A,

0.771%, due 10/15/19 (g) (h)

(Cost $11,450) | | | 11,450 | | | | 11,497 | | |

TOTAL FIXED INCOME - 21.4%

(COST $3,830,633) | | | | | 4,084,998 | | |

SHORT TERM INVESTMENTS - 9.2% | |

REPURCHASE AGREEMENT - 3.8% | |

Fixed Income Clearing Corp. Repurchase

Agreement, 0.12% dated 09/28/12 due

10/01/12, repurchase price $725,316,

collateralized by a Federal Home Loan

Bank Bond, 2.375%, due 03/14/14,

value plus accrued interest of $51,563,

and by Federal National Mortgage

Association Bonds, 1.250% - 4.625%,

due 02/27/14 - 10/15/14, aggregate

value plus accrued interest of $76,206,

and by United States Treasury Notes,

0.250% - 1.875%, due 02/28/14 - 09/15/14,

aggregate value plus accrued

interest of $612,046 (Cost: $725,308) | | | 725,308 | | | | 725,308 | | |

CANADIAN TREASURY BILLS - 2.6% | |

0.87% - 1.09%, due 10/25/12 - 05/09/13 (i)

(Cost $497,936) | | CAD | 500,000 | | | | 506,755 | | |

| | | Par Value | | Value | |

COMMERCIAL PAPER - 1.9% | |

Toyota Motor Credit, 0.13% - 0.20%,

due 10/09/12 - 11/19/12 (i) | | | 130,500 | | | $ | 130,487 | | |

Wellpoint, Inc., 144A, 0.25% - 0.46%,

due 10/15/12 - 01/04/13 (h) (i) | | | 118,000 | | | | 117,931 | | |

BP Capital Markets PLC, 144A, 0.25% - 0.31%,

due 01/02/13 - 01/18/13 (h) (i) | | | 53,900 | | | | 53,878 | | |

American Honda Finance, 0.14% - 0.16%,

due 10/11/12 - 12/05/12 (i) | | | 50,450 | | | | 50,441 | | |

Medtronic, Inc., 144A, 0.16% - 0.17%,

due 12/20/12 - 01/10/13 (h) (i) | | | 19,850 | | | | 19,839 | | |

Total Commercial Paper (Cost $372,564) | | | | | 372,576 | | |

GOVERNMENT AND AGENCY SECURITIES - 0.5% | |

United States Treasury Note,

0.17%, due 07/15/13 (i)

(Cost $100,642) | | | 100,000 | | | | 100,644 | | |

CORPORATE BONDS - 0.4% | |

Dell, Inc.,

1.40%, due 09/10/13 | | | 17,880 | | | | 18,032 | | |

Comcast Cable Communications Holdings, Inc.,

8.375%, due 03/15/13 | | | 16,007 | | | | 16,576 | | |

Wells Fargo & Co.,

4.375%, due 01/31/13 | | | 13,325 | | | | 13,502 | | |

Kellogg Co.,

4.25%, due 03/06/13 | | | 10,169 | | | | 10,333 | | |

General Mills, Inc.,

5.25%, due 08/15/13 | | | 9,199 | | | | 9,580 | | |

Merrill Lynch & Co., Inc.,

5.45%, due 02/05/13 | | | 830 | | | | 843 | | |

Total Corporate Bonds (Cost $68,909) | | | | | 68,866 | | |

TOTAL SHORT TERM INVESTMENTS - 9.2%

(COST $1,765,359) | | | | | 1,774,149 | | |

TOTAL INVESTMENTS - 100.7%

(COST $15,636,936) | | | | | 19,304,770 | | |

Foreign Currencies (Cost $471) - 0.0% (c) | | | | | 470 | | |

Liabilities In Excess of Other Assets - (0.7)% | | | | | (128,313 | ) | |

NET ASSETS - 100.0% | | | | $ | 19,176,927 | | |

(a) Non-income producing security

(b) See Note 5 in the Notes to the Financial Statements regarding investments in affiliated issuers.

(c) Amount rounds to less than 0.1%.

(d) Foreign domiciled corporation

(e) Sponsored American Depositary Receipt

(f) Fair value is determined in good faith in accordance with procedures established by the Board of Trustees.

(g) Floating Rate Note. Rate shown is as of September 30, 2012.

(h) See Note 1 in the Notes to Financial Statements regarding restricted securities. These securities may be resold subject to restrictions on resale under federal securities laws.

(i) The rate shown represents the annualized yield at the time of purchase; not a coupon rate.

Key to Abbreviations:

CAD Canadian Dollar

EUR Euro

NOK Norwegian Krone

See accompanying Notes to Financial Statements.

oakmark.com 19

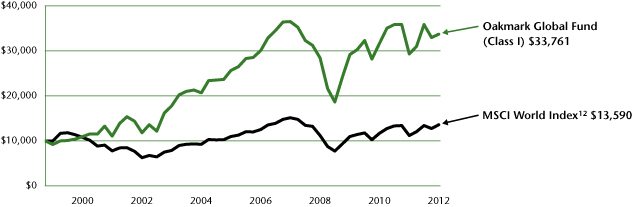

Oakmark Global Fund September 30, 2012

Summary Information

VALUE OF A $10,000 INVESTMENT

Since Inception - 08/04/99 (Unaudited)

PERFORMANCE

| | | | | Average Annual Total Returns (as of 09/30/12)3 | |

| (Unaudited) | | Total Return

Last 3 Months | | 1-year | | 3-year | | 5-year | | 10-year | | Since

Inception

(08/04/99) | |

Oakmark Global Fund (Class I) | | | 2.27 | % | | | 14.99 | % | | | 4.92 | % | | | -1.58 | % | | | 11.06 | % | | | 9.69 | % | |

MSCI World Index | | | 6.71 | % | | | 21.59 | % | | | 7.48 | % | | | -2.15 | % | | | 8.04 | % | | | 2.36 | % | |

Lipper Global Funds Index13 | | | 5.81 | % | | | 19.04 | % | | | 5.82 | % | | | -2.27 | % | | | 7.83 | % | | | 3.37 | % | |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Past performance is no guarantee of future results. Performance data quoted represents past performance. Current performance may be lower or higher than the performance data quoted. The investment return and principal value vary so that an investor's shares when redeemed may be worth more or less than the original cost. To obtain the most recent month-end performance data, visit oakmark.com.

TOP TEN EQUITY HOLDINGS6 | | % of Net Assets | |

Oracle Corp. | | | 4.5 | | |

Snap-on, Inc. | | | 4.5 | | |

Credit Suisse Group* | | | 4.1 | | |

Daiwa Securities Group, Inc. | | | 4.0 | | |

MasterCard, Inc., Class A | | | 3.9 | | |

Toyota Motor Corp. | | | 3.4 | | |

Julius Baer Group, Ltd. | | | 3.4 | | |

Discovery Communications, Inc., Class C | | | 3.3 | | |

Laboratory Corp. of America Holdings | | | 3.3 | | |

Square Enix Holdings Co., Ltd. | | | 3.3 | | |

* Includes Mandatory and Contingent Convertible Securities.

FUND STATISTICS | |

Ticker | | OAKGX | |

Inception | | 08/04/99 | |

Number of Equity Holdings | | 40 | |

Net Assets | | $2.1 billion | |

Benchmark | | MSCI World Index | |

Weighted Average Market Cap | | $33.8 billion | |

Median Market Cap | | $12.7 billion | |

Equity Turnover (as of 9/30/12) | | 26% | |

Expense Ratio - Class I (as of 9/30/11) | | 1.16% | |

Expense Ratio - Class I (as of 9/30/12) | | 1.16% | |

SECTOR ALLOCATION | | % of Net Assets | |

Information Technology | | | 31.1 | | |

Industrials | | | 21.4 | | |

Financials | | | 14.0 | | |

Consumer Discretionary | | | 11.7 | | |

Health Care | | | 7.5 | | |

Materials | | | 6.8 | | |

Energy | | | 4.6 | | |

Consumer Staples | | | 2.1 | | |

Short-Term Investments and Other | | | 0.8 | | |

GEOGRAPHIC ALLOCATION | |

| | | % of Equity | |

North America | | | 48.5 | | |

United States | | | 48.5 | | |

Europe | | | 27.7 | | |

Switzerland | | | 15.2 | | |

Germany* | | | 5.7 | | |

Spain* | | | 2.5 | | |

Italy* | | | 1.8 | | |

UK | | | 1.6 | | |

Netherlands* | | | 0.9 | | |

| | | % of Equity | |

Asia | | | 22.1 | | |

Japan | | | 22.1 | | |

Australasia | | | 1.7 | | |

Australia | | | 1.7 | | |

* Euro currency countries comprise 10.9% of equity investments.

20 THE OAKMARK FUNDS

Oakmark Global Fund September 30, 2012

Portfolio Manager Commentary

Clyde S. McGregor, CFA

Portfolio Manager

oakgx@oakmark.com

Robert A. Taylor, CFA

Portfolio Manager

oakgx@oakmark.com

Quarter Review

The September quarter witnessed a strong rebound in European equity markets while Japan and the U.S. lagged. It remains to be seen whether this rebound is well-founded, as European economic and political circumstances remain challenging. The Oakmark Global Fund gained 2% in the quarter, while the MSCI World Index12 returned 7%, and the Lipper Global Fund Index13 returned 6%. The Fund's return for the calendar nine months is 9%, which contrasts to the 13% return for the MSCI World Index and 11% for the Lipper Global Fund Index. For the fiscal year, ended September 30, the returns are 15% for the Fund, 22% for the MSCI World Index, and 19% for the Lipper Global Fund Index. As always, we are most pleased to report the Fund's 10% compound annualized rate of return since inception, which compares to 2% for the MSCI World Index and 3% for the Lipper Global Fund Index for the same period.

The countries that contributed most to the Fund's quarterly return were the U.S., Switzerland, and Spain, although it should be noted that the U.S. return was weak in relative terms. Japan was the only country to detract from the Fund's return in the quarter. The five largest contributors to the Fund's return in the quarter were Snap-on (U.S.), Credit Suisse (Switzerland), Hirose Electric (Japan), Banco Santander (Spain), and Discovery Communications, Series C (U.S.). The Fund holdings that detracted most were Canon (Japan), Intel (U.S.), FedEx (U.S.), ROHM (Japan) and Omron (Japan).

For the calendar nine months, the highest contributing countries were the U.S., Germany and Switzerland, although it must be noted that none of these three stand out relative to their local markets. Australia and Japan detracted from the nine-month return. Snap-on, Discovery Communications, Oracle (all U.S.-domiciled), Daiwa Securities Group and Hirose Electric (both Japan) were the leading contributors. Square Enix (Japan), Canon, ROHM, Health Net (U.S.), and Julius Baer (Switzerland) detracted most from the nine-month return. For the Fund's fiscal year, the U.S., Switzerland and Germany were the leading contributors to return, while Japan was the only detractor. Although the U.S. return was not exceptional on a relative basis in the period, all five companies that led the contributors list were American: Snap-on, Equifax, Discovery Communications, MasterCard and Union Pacific. Detractors were ROHM, Canon, Square Enix, Health Net and Credit Suisse.