UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-06279 |

|

Harris Associates Investment Trust |

(Exact name of registrant as specified in charter) |

|

Two North La Salle Street, Suite 500 Chicago, Illinois | | 60602-3790 |

(Address of principal executive offices) | | (Zip code) |

|

Kristi L. Rowsell Harris Associates L.P. Two North La Salle Street, #500 Chicago, Illinois 60602 | Paulita A. Pike K&L Gates LLP Three First National Plaza, #3100 Chicago, Illinois 60602 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (312) 621-0600 | |

|

Date of fiscal year end: | 09/30/13 | |

|

Date of reporting period: | 09/30/13 | |

| | | | | | | | | |

Item 1. Reports to Shareholders.

THE OAKMARK FUNDS

ANNUAL REPORT | SEPTEMBER 30, 2013

OAKMARK FUND

OAKMARK SELECT FUND

OAKMARK EQUITY AND INCOME FUND

OAKMARK GLOBAL FUND

OAKMARK GLOBAL SELECT FUND

OAKMARK INTERNATIONAL FUND

OAKMARK INTERNATIONAL SMALL CAP FUND

The Oakmark Funds

2013 Annual Report

TABLE OF CONTENTS

President's Letter | | | 1 | | |

Fund Expenses | | | 2 | | |

Oakmark Fund | |

Summary Information | | | 4 | | |

Portfolio Manager Commentary | | | 5 | | |

Schedule of Investments | | | 6 | | |

Oakmark Select Fund | |

Summary Information | | | 8 | | |

Portfolio Manager Commentary | | | 9 | | |

Schedule of Investments | | | 10 | | |

Oakmark Equity and Income Fund | |

Summary Information | | | 12 | | |

Portfolio Manager Commentary | | | 13 | | |

Schedule of Investments | | | 15 | | |

Oakmark Global Fund | |

Summary Information | | | 20 | | |

Portfolio Manager Commentary | | | 21 | | |

Schedule of Investments | | | 23 | | |

Oakmark Global Select Fund | |

Summary Information | | | 26 | | |

Portfolio Manager Commentary | | | 27 | | |

Schedule of Investments | | | 28 | | |

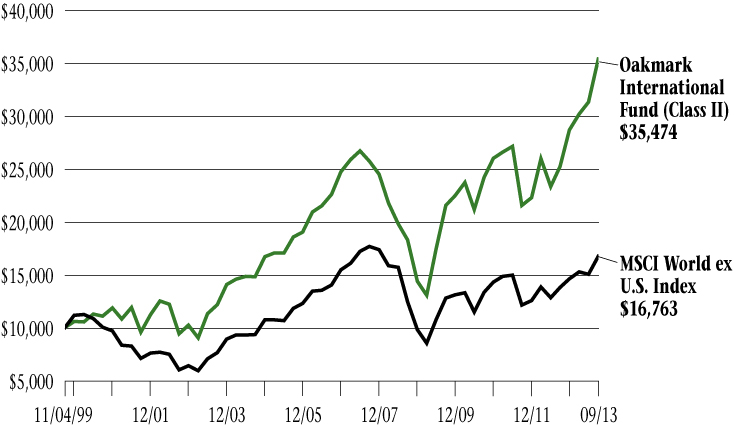

Oakmark International Fund | |

Summary Information | | | 30 | | |

Portfolio Manager Commentary | | | 31 | | |

Schedule of Investments | | | 32 | | |

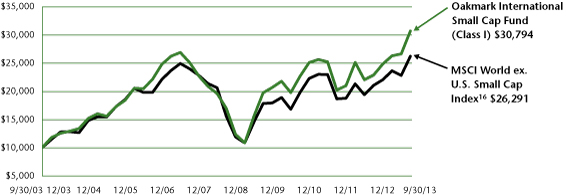

Oakmark International Small Cap Fund | |

Summary Information | | | 36 | | |

Portfolio Manager Commentary | | | 37 | | |

Schedule of Investments | | | 38 | | |

Financial Statements | |

Statements of Assets and Liabilities | | | 40 | | |

Statements of Operations | | | 42 | | |

Statements of Changes in Net Assets | | | 44 | | |

Notes to Financial Statements | | | 51 | | |

Financial Highlights | | | 62 | | |

Report of Independent Registered Public Accounting Firm | | | 69 | | |

Federal Tax Information | | | 70 | | |

Disclosures and Endnotes | | | 70 | | |

Trustees and Officers | | | 72 | | |

FORWARD-LOOKING STATEMENT DISCLOSURE

One of our most important responsibilities as mutual fund managers is to communicate with shareholders in an open and direct manner. Some of our comments in our letters to shareholders are based on current management expectations and are considered "forward-looking statements". Actual future results, however, may prove to be different from our expectations. You can identify forward-looking statements by words such as "estimate", "may", "will", "expect", "believe",

"plan" and other similar terms. We cannot promise future returns. Our opinions are a reflection of our best judgment at the time this report is compiled, and we disclaim any obligation to update or alter forward-looking statements as a result of new information, future events, or otherwise.

THE OAKMARK FUNDS

The Oakmark Funds September 30, 2013

President's Letter

Dear Fellow Shareholders,

The Oakmark Funds posted strong absolute and relative returns during the fiscal year that ended September 30, 2013, with each Fund significantly outperforming its benchmark for the period. While we are gratified by such rewarding results, we always look to our long-term performance to determine whether we are meeting our shareholders' expectations. This quarter, our portfolio managers' letters reflect upon the fiscal year and explain why we still find equity valuations attractive, even after the recent market gains.

Slowing Cash Inflows

Cash flows into the Oakmark International Fund were substantial in 2013. We have chosen to slow inflows beginning in October by closing the Fund to most new investors. Existing shareholders, including retirement plans and advisory platforms, can continue to add to their accounts or platforms. Our prospectus supplement at www.oakmark.com provides more specific details. An essential part of acting as good stewards of shareholder assets is monitoring the size of a fund versus our capacity to invest. Our experience with partial closes is that fund flows tend to level, rather than turn into net redemptions, as often occurs with full closes. This matches our desire for continued orderly investment into new, undervalued companies, while retiring those that have appreciated closer to our estimate of full business value.

Capacity determinations reflect several of our core tenets. We construct our portfolios so that successful ideas can meaningfully contribute to portfolio returns. We do this by limiting the number of stocks we own in a portfolio and by assigning the largest weights to companies that we believe trade at the greatest discount to business value. We determine holding limits for the level of outstanding shares of a company we are willing to own. These holding limits consider factors such as the average daily trading volume of the security, and they reflect our conviction in the company's business model, management team, and level of potential upside relative to business value. To test capacity, we

determine the desired position size in the Fund, and evaluate how the consequent dollar amount fits these criteria and the universe of opportunities reflected on our approved lists. We are committed to closing a fund ahead of any indications of strain, especially while there is plenty of capacity ahead for existing shareholders.

Outlook for Year-End Distributions

Mutual funds are required to distribute their income and realized capital gains annually. Throughout the year Oakmark managers strive to be tax efficient, paying close attention to maximizing after-tax returns without reducing pre-tax returns. Securities are typically held for several years, thus our distributions tend to be long-term and subject to a more favorable tax rate. That said, the Funds have experienced large absolute returns over the past year, and several positions were sold as they approached full valuation. The time period to accrue capital gains for distribution stays open through October, and income distributions continue to accrue through December 31. However, many shareholders appreciate when we share our outlook. At this time, each of the Oakmark Funds expects to pay a distribution, ranging from nominal amounts to a few dollars per share. In all cases they are expected to represent low- or mid-single-digit percentages of the respective Fund's net asset value—which we believe are very reasonable levels given performance over the year. We will release more definitive estimates on our website in mid-November, once the applicable recording periods have closed.

Thank you for your continued investment and confidence in The Oakmark Funds. We welcome your comments and suggestions. You may reach us via email at ContactOakmark@oakmark.com.

Kristi L. Rowsell

President of The Oakmark Funds

President of Harris Associates L.P.

oakmark.com 1

Fund Expenses (Unaudited)

A shareholder of each Fund incurs ongoing costs, including investment advisory fees, transfer agent fees and other fund expenses. The examples below are intended to help shareholders understand the ongoing costs (in dollars) of investing in each Fund and to compare these costs with the ongoing costs of investing in other funds.

The following table provides information about actual account values and actual fund expenses as well as hypothetical account values and hypothetical fund expenses for shares of each Fund.

ACTUAL EXPENSES

The following table shows the expenses a shareholder would have paid on a $1,000 investment in each Fund from April 1, 2013 to September 30, 2013, as well as how much a $1,000 investment would be worth at the close of the period, assuming actual fund returns and expenses. A shareholder can estimate expenses incurred for the period by dividing the account value at September 30, 2013, by $1,000 and multiplying the result by the number in the Actual Expenses Paid During Period column shown below.

Shares of Oakmark International Small Cap Fund, held for 90 days or less, may be charged a 2% redemption fee upon redemption. Please consult the Funds' prospectus at oakmark.com for more information.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The following table provides information about hypothetical account values and hypothetical expenses for shares of each Fund based on actual expense ratios and an assumed rate of return of 5% per year before expenses, which are not the Funds' actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balances or actual expenses shareholders paid for the period. Shareholders may use this information to compare the ongoing costs of investing in a Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the Hypothetical Expenses Paid During Period column of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. If transaction costs were included, the total costs would have been higher.

| | | | ACTUAL | | HYPOTHETICAL

(5% annual return before expenses) | | | |

| | Beginning

Account Value

(4/1/13) | | Ending

Account Value

(9/30/13) | | Expenses

Paid During

Period* | | Ending

Account Value

(9/30/13) | | Expenses

Paid During

Period* | | Annualized

Expense

Ratio | |

Oakmark Fund | |

Class I | | $ | 1,000.00 | | | $ | 1,123.20 | | | $ | 5.00 | | | $ | 1,020.36 | | | $ | 4.76 | | | | 0.94 | % | |

Class II | | $ | 1,000.00 | | | $ | 1,121.40 | | | $ | 6.75 | | | $ | 1,018.70 | | | $ | 6.43 | | | | 1.27 | % | |

Oakmark Select Fund | |

Class I | | $ | 1,000.00 | | | $ | 1,133.30 | | | $ | 5.40 | | | $ | 1,020.00 | | | $ | 5.11 | | | | 1.01 | % | |

Class II | | $ | 1,000.00 | | | $ | 1,131.60 | | | $ | 7.21 | | | $ | 1,018.30 | | | $ | 6.83 | | | | 1.35 | % | |

Oakmark Equity and Income Fund | |

Class I | | $ | 1,000.00 | | | $ | 1,092.50 | | | $ | 3.99 | | | $ | 1,021.26 | | | $ | 3.85 | | | | 0.76 | % | |

Class II | | $ | 1,000.00 | | | $ | 1,090.70 | | | $ | 5.77 | | | $ | 1,019.55 | | | $ | 5.57 | | | | 1.10 | % | |

Oakmark Global Fund | |

Class I | | $ | 1,000.00 | | | $ | 1,166.50 | | | $ | 6.03 | | | $ | 1,019.50 | | | $ | 5.62 | | | | 1.11 | % | |

Class II | | $ | 1,000.00 | | | $ | 1,164.80 | | | $ | 7.87 | | | $ | 1,017.80 | | | $ | 7.33 | | | | 1.45 | % | |

Oakmark Global Select Fund | |

Class I | | $ | 1,000.00 | | | $ | 1,154.30 | | | $ | 6.16 | | | $ | 1,019.35 | | | $ | 5.77 | | | | 1.14 | % | |

Oakmark International Fund | |

Class I | | $ | 1,000.00 | | | $ | 1,174.10 | | | $ | 5.34 | | | $ | 1,020.16 | | | $ | 4.96 | | | | 0.98 | % | |

Class II | | $ | 1,000.00 | | | $ | 1,171.90 | | | $ | 7.46 | | | $ | 1,018.20 | | | $ | 6.93 | | | | 1.37 | % | |

Oakmark International Small Cap Fund | |

Class I | | $ | 1,000.00 | | | $ | 1,168.20 | | | $ | 7.28 | | | $ | 1,018.35 | | | $ | 6.78 | | | | 1.34 | % | |

Class II | | $ | 1,000.00 | | | $ | 1,165.60 | | | $ | 9.07 | | | $ | 1,016.70 | | | $ | 8.44 | | | | 1.67 | % | |

* Expenses for each share class is equal to the annualized expense ratio, multiplied by the average account value over the period, multiplied by the number of days in the most recent half-year divided by 365 (to reflect one-half year period)

2 THE OAKMARK FUNDS

This page intentionally left blank.

oakmark.com 3

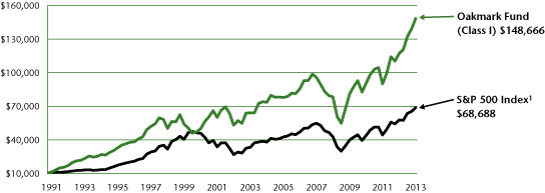

Oakmark Fund September 30, 2013

Summary Information

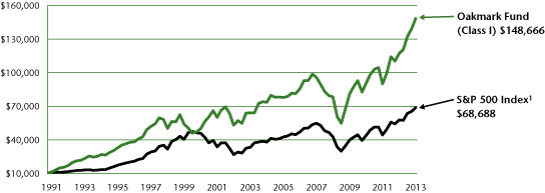

VALUE OF A $10,000 INVESTMENT

Since Inception - 08/05/91 (Unaudited)

PERFORMANCE

| | | | | Average Annual Total Returns (as of 09/30/13)2 | |

(Unaudited) | | Total Return

Last 3 Months | | 1-year | | 3-year | | 5-year | | 10-year | | Since

Inception

(08/05/91) | |

Oakmark Fund (Class I) | | | 6.60 | % | | | 26.75 | % | | | 17.98 | % | | | 13.66 | % | | | 8.79 | % | | | 12.96 | % | |

S&P 500 Index | | | 5.25 | % | | | 19.34 | % | | | 16.27 | % | | | 10.02 | % | | | 7.57 | % | | | 9.09 | % | |

Dow Jones Industrial Average3 | | | 2.12 | % | | | 15.59 | % | | | 14.94 | % | | | 9.93 | % | | | 7.74 | % | | | 10.17 | % | |

Lipper Large Cap Value Funds Index4 | | | 4.99 | % | | | 23.25 | % | | | 14.97 | % | | | 8.95 | % | | | 7.20 | % | | | 8.62 | % | |

The graph and table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Past Performance is no guarantee of future results. Performance data quoted represents past performance. Current performance may be lower or higher than the performance data quoted. The investment return and principal value vary so that an investor's shares when redeemed may be worth more or less than the original cost. To obtain the most recent month-end performance, please visit oakmark.com.

TOP TEN EQUITY HOLDINGS5 | | % of Net Assets | |

Bank of America Corp. | | | 3.0 | | |

Capital One Financial Corp. | | | 2.5 | | |

American International Group, Inc. | | | 2.5 | | |

UnitedHealth Group, Inc. | | | 2.4 | | |

TE Connectivity, Ltd. | | | 2.3 | | |

FedEx Corp. | | | 2.3 | | |

Franklin Resources, Inc. | | | 2.3 | | |

Oracle Corp. | | | 2.2 | | |

Medtronic, Inc. | | | 2.2 | | |

Illinois Tool Works, Inc. | | | 2.2 | | |

FUND STATISTICS | |

Ticker | | OAKMX | |

Inception | | 08/05/91 | |

Number of Equity Holdings | | 53 | |

Net Assets | | $10.5 billion | |

Benchmark | | S&P 500 Index | |

Weighted Average Market Cap | | $84.2 billion | |

Median Market Cap | | $40.2 billion | |

Portfolio Turnover (for the 12-months ended 09/30/13) | | 19% | |

Expense Ratio - Class I (as of 09/30/12) | | 1.03% | |

Expense Ratio - Class I (as of 09/30/13) | | 0.95% | |

SECTOR ALLOCATION | | % of Net Assets | |

Financials | | | 24.6 | | |

Information Technology | | | 19.2 | | |

Consumer Discretionary | | | 16.5 | | |

Energy | | | 10.2 | | |

Industrials | | | 10.1 | | |

Health Care | | | 9.8 | | |

Consumer Staples | | | 3.5 | | |

Short-Term Investments and Other | | | 6.1 | | |

4 THE OAKMARK FUNDS

Oakmark Fund September 30, 2013

Portfolio Manager Commentary

William C. Nygren, CFA

Portfolio Manager

oakmx@oakmark.com

Kevin Grant, CFA

Portfolio Manager

oakmx@oakmark.com

The Oakmark Fund increased 7% during the past quarter, which brings the gain to 27% for the fiscal year ended September 30. The S&P 5001 gained 5% in the quarter and gained 19% for the fiscal year. While we are thrilled with these strong results, we remind shareholders that our style doesn't typically lead to such dramatic outperformance in periods of broad market gains.

Looking back at the fiscal year, we outperformed a very strong 19% return for the S&P 500 with leading performance from the financials and information technology sectors. We still find these two sectors to be attractively valued, and they currently represent a combined 47% of our portfolio. For the fiscal year, 26 of the Oakmark Fund's holdings gained over 30%, and only Apple declined by more than 20%. Despite Apple's poor full fiscal year performance, it was one of the Fund's top two performers for the third quarter, gaining 21%. After a period of skepticism surrounding the company's ability to create compelling new products, Apple is once again experiencing strong demand for its recently introduced iPhones. We remain pleased that the company is allocating more of their $145B cash balance to share repurchases and dividends. Throughout the market, even as equity valuations have increased, we are still finding attractive opportunities in businesses with strong balance sheets, high free cash flow, and a management committed to return a substantial portion of excess capital to shareholders through dividends and share repurchases.

During the quarter, we eliminated positions in Boeing and Northrop Grumman as both approached our sell targets. We started new positions in Nestle and Qualcomm, which are described briefly below:

Nestle S.A. (NSRGY-$70)

Nestle is a global leader in packaged foods with $100 billion of revenue and operations in over 70 countries. The company has more than 25 brands with sales over $1 billion, with leading market share in most of their product categories. With broad exposure to high-growth emerging markets, Nestle has enjoyed strong and consistent revenue growth. Like many of our holdings, Nestle generates more cash than they need to run the business, so the company has used a significant portion of its excess cash to repurchase shares and pay dividends. Over the past four years, Nestle has reduced their share count by over 10%. We think this is a high quality, stable business that deserves to sell at a premium, so we initiated a position when Nestle was priced at a discount to other global consumer products companies due to concerns about Europe.

Qualcomm Inc. (QCOM-$67)

Qualcomm is the global leader in wireless technology licensing and mobile device chipsets. Qualcomm has dominant market share in both businesses, and it uses the strong recurring cash flow from its licensing business to reinvest in its chipset business. The company owns intellectual property that defines many of

the standards used for 3G and 4G wireless communication, which allows it to collect royalties from handset providers that license these ubiquitous standards. Qualcomm's licensing business accounts for only a third of the company's revenue, and it is often underappreciated. However, its licensing business has unusually high profitability and represents close to two-thirds of Qualcomm's profits. The majority of the world's mobile handset users are still using older 2G technology, which is not a focus area for Qualcomm, so when these customers upgrade to 3G and 4G, Qualcomm should be well positioned to enjoy robust incremental revenue. The company is also the leading provider of chipsets, which function as the brains for wireless devices. Qualcomm's industry-leading product breadth and peer-leading R&D investment should drive the company's chipset growth. We expect Qualcomm to earn over $4.50 per share in a couple of years, and after adjusting for $20/share of cash, this high-quality business is priced at a forward P/E6 of just 11x.

oakmark.com 5

Oakmark Fund September 30, 2013

Schedule of Investments (in thousands)

| | | Shares | | Value | |

COMMON STOCKS - 93.9% | |

FINANCIALS - 24.6% | |

DIVERSIFIED FINANCIALS - 15.0% | |

Bank of America Corp.

Other Diversified Financial Services | | | 22,950 | | | $ | 316,710 | | |

Capital One Financial Corp.

Consumer Finance | | | 3,753 | | | | 257,967 | | |

Franklin Resources, Inc.

Asset Management & Custody Banks | | | 4,740 | | | | 239,607 | | |

JPMorgan Chase & Co.

Other Diversified Financial Services | | | 4,495 | | | | 232,347 | | |

The Goldman Sachs Group, Inc.

Investment Banking & Brokerage | | | 1,213 | | | | 191,909 | | |

State Street Corp.

Asset Management & Custody Banks | | | 2,800 | | | | 184,100 | | |

Bank of New York Mellon Corp.

Asset Management & Custody Banks | | | 5,260 | | | | 158,788 | | |

| | | | | | 1,581,428 | | |

INSURANCE - 7.7% | |

American International Group, Inc.

Multi-line Insurance | | | 5,295 | | | | 257,496 | | |

Aflac, Inc.

Life & Health Insurance | | | 3,210 | | | | 198,988 | | |

Principal Financial Group, Inc.

Life & Health Insurance | | | 4,500 | | | | 192,690 | | |

Aon PLC (b)

Insurance Brokers | | | 2,100 | | | | 156,324 | | |

| | | | | | 805,498 | | |

BANKS - 1.9% | |

Wells Fargo & Co.

Diversified Banks | | | 4,820 | | | | 199,162 | | |

| | | | | | 2,586,088 | | |

INFORMATION TECHNOLOGY - 19.2% | |

SOFTWARE & SERVICES - 8.6% | |

Oracle Corp.

Systems Software | | | 7,080 | | | | 234,844 | | |

MasterCard, Inc., Class A

Data Processing & Outsourced Services | | | 313 | | | | 210,580 | | |

Microsoft Corp.

Systems Software | | | 5,920 | | | | 197,195 | | |

Google, Inc., Class A (a)

Internet Software & Services | | | 179 | | | | 156,788 | | |

Automatic Data Processing, Inc.

Data Processing & Outsourced Services | | | 1,430 | | | | 103,503 | | |

| | | | | | 902,910 | | |

| | | Shares | | Value | |

TECHNOLOGY HARDWARE & EQUIPMENT - 5.4% | |

TE Connectivity, Ltd. (b)

Electronic Manufacturing Services | | | 4,686 | | | $ | 242,623 | | |

Apple, Inc.

Computer Hardware | | | 381 | | | | 181,642 | | |

QUALCOMM, Inc.

Communications Equipment | | | 2,100 | | | | 141,456 | | |

| | | | | | 565,721 | | |

SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT - 5.2% | |

Texas Instruments, Inc.

Semiconductors | | | 5,465 | | | | 220,076 | | |

Intel Corp.

Semiconductors | | | 8,800 | | | | 201,696 | | |

Applied Materials, Inc.

Semiconductor Equipment | | | 7,160 | | | | 125,586 | | |

| | | | | | 547,358 | | |

| | | | | | 2,015,989 | | |

CONSUMER DISCRETIONARY - 16.5% | |

MEDIA - 5.6% | |

DIRECTV (a)

Cable & Satellite | | | 3,639 | | | | 217,440 | | |

Omnicom Group, Inc.

Advertising | | | 3,171 | | | | 201,184 | | |

Comcast Corp., Class A

Cable & Satellite | | | 3,940 | | | | 170,878 | | |

| | | | | | 589,502 | | |

AUTOMOBILES & COMPONENTS - 4.7% | |

Delphi Automotive PLC (b)

Auto Parts & Equipment | | | 3,984 | | | | 232,745 | | |

General Motors Co. (a)

Automobile Manufacturers | | | 5,300 | | | | 190,641 | | |

Harley-Davidson, Inc.

Motorcycle Manufacturers | | | 1,102 | | | | 70,793 | | |

| | | | | | 494,179 | | |

RETAILING - 4.3% | |

Liberty Interactive Corp., Class A (a)

Catalog Retail | | | 8,370 | | | | 196,436 | | |

The Home Depot, Inc.

Home Improvement Retail | | | 1,957 | | | | 148,401 | | |

Kohl's Corp.

Department Stores | | | 2,042 | | | | 105,668 | | |

| | | | | | 450,505 | | |

CONSUMER SERVICES - 1.9% | |

McDonald's Corp.

Restaurants | | | 2,059 | | | | 198,096 | | |

| | | | | | 1,732,282 | | |

See accompanying Notes to Financial Statements.

6 THE OAKMARK FUNDS

Oakmark Fund September 30, 2013

Schedule of Investments (in thousands) (continued)

| | | Shares | | Value | |

COMMON STOCKS - 93.9% (continued) | |

ENERGY - 10.2% | |

Apache Corp.

Oil & Gas Exploration & Production | | | 2,600 | | | $ | 221,364 | | |

Halliburton Co.

Oil & Gas Equipment & Services | | | 3,950 | | | | 190,192 | | |

Devon Energy Corp.

Oil & Gas Exploration & Production | | | 3,202 | | | | 184,948 | | |

Exxon Mobil Corp.

Integrated Oil & Gas | | | 2,117 | | | | 182,147 | | |

National Oilwell Varco, Inc.

Oil & Gas Equipment & Services | | | 2,300 | | | | 179,653 | | |

Cenovus Energy, Inc. (b)

Integrated Oil & Gas | | | 3,930 | | | | 117,310 | | |

| | | | | | 1,075,614 | | |

INDUSTRIALS - 10.1% | |

CAPITAL GOODS - 7.8% | |

Illinois Tool Works, Inc.

Industrial Machinery | | | 3,060 | | | | 233,386 | | |

Parker Hannifin Corp.

Industrial Machinery | | | 1,875 | | | | 203,850 | | |

3M Co.

Industrial Conglomerates | | | 1,643 | | | | 196,191 | | |

Cummins, Inc.

Construction & Farm Machinery & Heavy Trucks | | | 1,380 | | | | 183,360 | | |

| | | | | | 816,787 | | |

TRANSPORTATION - 2.3% | |

FedEx Corp.

Air Freight & Logistics | | | 2,100 | | | | 239,631 | | |

| | | | | | 1,056,418 | | |

HEALTH CARE - 9.8% | |

HEALTH CARE EQUIPMENT & SERVICES - 7.1% | |

UnitedHealth Group, Inc.

Managed Health Care | | | 3,460 | | | | 247,771 | | |

Medtronic, Inc.

Health Care Equipment | | | 4,385 | | | | 233,501 | | |

Covidien PLC (b)

Health Care Equipment | | | 2,708 | | | | 165,025 | | |

Baxter International, Inc.

Health Care Equipment | | | 1,523 | | | | 100,046 | | |

| | | | | | 746,343 | | |

PHARMACEUTICALS, BIOTECHNOLOGY & LIFE SCIENCES - 2.7% | |

Forest Laboratories, Inc. (a)

Pharmaceuticals | | | 4,950 | | | | 211,811 | | |

Merck & Co., Inc.

Pharmaceuticals | | | 1,587 | | | | 75,535 | | |

| | | | | | 287,346 | | |

| | | | | | 1,033,689 | | |

| | | Shares | | Value | |

CONSUMER STAPLES - 3.5% | |

FOOD, BEVERAGE & TOBACCO - 2.6% | |

Unilever PLC (c)

Packaged Foods & Meats | | | 3,983 | | | $ | 153,664 | | |

Nestle SA (c)

Packaged Foods & Meats | | | 1,700 | | | | 118,320 | | |

| | | | | | 271,984 | | |

FOOD & STAPLES RETAILING - 0.9% | |

Wal-Mart Stores, Inc.

Hypermarkets & Super Centers | | | 1,265 | | | | 93,560 | | |

| | | | | | 365,544 | | |

TOTAL COMMON STOCKS - 93.9%

(COST $6,645,820) | | | | | 9,865,624 | | |

| | | Par Value | | Value | |

SHORT TERM INVESTMENT - 6.1% | |

REPURCHASE AGREEMENT - 6.1% | |

Fixed Income Clearing Corp. Repurchase

Agreement, 0.00% dated 09/30/13 due

10/01/13, repurchase price $641,852,

collateralized by a Federal Home Loan

Bank Bond, 1.750%, due 06/10/20,

value plus accrued interest of $22,200,

by Federal Home Loan Mortgage

Corp. Bonds, 1.600% - 1.650%, due

11/15/19 - 01/09/20, aggregate value

plus accrued interest of $632,492

(Cost: $641,852) | | | 641,852 | | | | 641,852 | | |

TOTAL SHORT TERM INVESTMENTS - 6.1%

(COST $641,852) | | | | | 641,852 | | |

TOTAL INVESTMENTS - 100.0%

(COST $7,287,672) | | | | | 10,507,476 | | |

Liabilities In Excess of Other Assets - 0.0% (d) | | | | | (4,651 | ) | |

TOTAL NET ASSETS - 100.0% | | | | $ | 10,502,825 | | |

(a) Non-income producing security

(b) Foreign domiciled corporation

(c) Sponsored American Depositary Receipt

(d) Amount rounds to less than 0.1%.

See accompanying Notes to Financial Statements.

oakmark.com 7

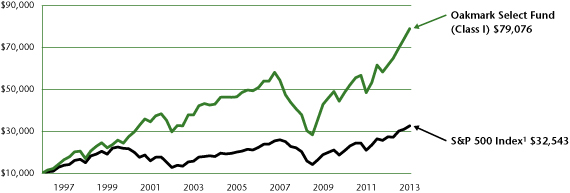

Oakmark Select Fund September 30, 2013

Summary Information

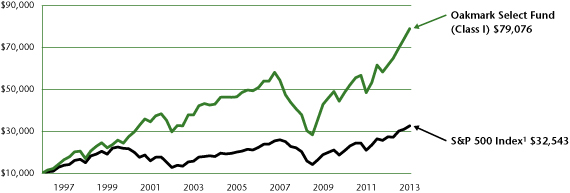

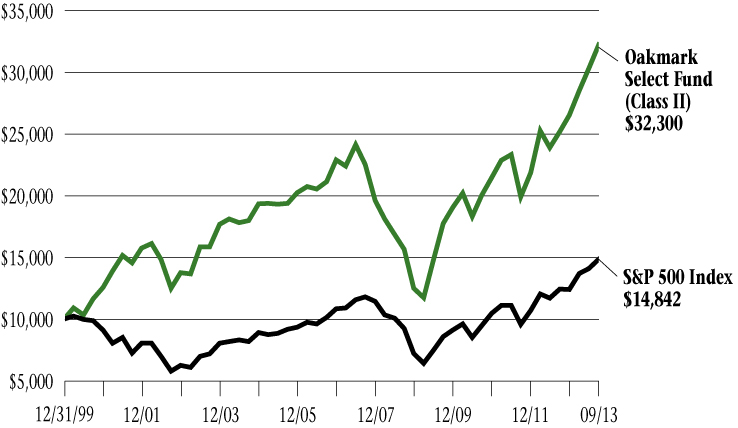

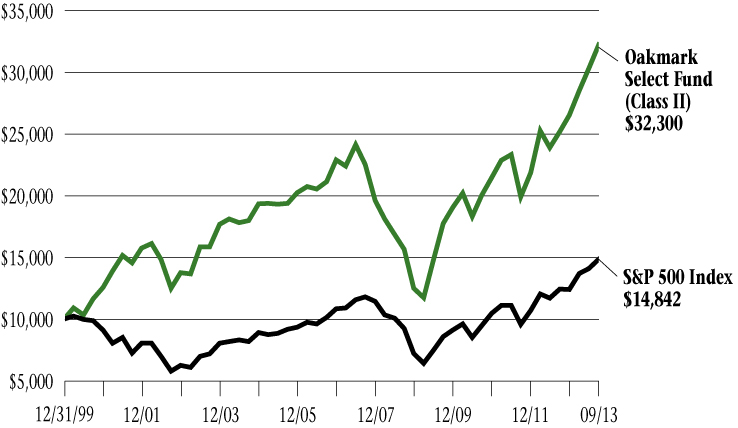

VALUE OF A $10,000 INVESTMENT

Since Inception - 11/01/96 (Unaudited)

PERFORMANCE

| | | | | Average Annual Total Returns (as of 09/30/13)2 | |

(Unaudited) | | Total Return

Last 3 Months | | 1-year | | 3-year | | 5-year | | 10-year | | Since

Inception

(11/01/96) | |

Oakmark Select Fund (Class I) | | | 6.46 | % | | | 28.40 | % | | | 17.59 | % | | | 15.87 | % | | | 7.65 | % | | | 13.01 | % | |

S&P 500 Index | | | 5.25 | % | | | 19.34 | % | | | 16.27 | % | | | 10.02 | % | | | 7.57 | % | | | 7.23 | % | |

Lipper Multi-Cap Value Funds Index7 | | | 5.84 | % | | | 25.58 | % | | | 15.22 | % | | | 9.50 | % | | | 7.16 | % | | | 7.25 | % | |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Past performance is no guarantee of future results. Performance data quoted represents past performance. Current performance may be lower or higher than the performance data quoted. The investment return and principal value vary so that an investor's shares when redeemed may be worth more or less than the original cost. To obtain the most recent month-end performance data, visit oakmark.com.

TOP TEN EQUITY HOLDINGS5 | | % of Net Assets | |

TRW Automotive Holdings Corp. | | | 8.1 | | |

TE Connectivity, Ltd. | | | 6.8 | | |

Capital One Financial Corp. | | | 6.0 | | |

Bank of America Corp. | | | 6.0 | | |

American International Group, Inc. | | | 5.7 | | |

Medtronic, Inc. | | | 5.5 | | |

MasterCard, Inc., Class A | | | 5.4 | | |

JPMorgan Chase & Co. | | | 5.0 | | |

DIRECTV | | | 4.8 | | |

Liberty Interactive Corp., Class A | | | 4.6 | | |

FUND STATISTICS | |

Ticker | | OAKLX | |

Inception | | 11/01/96 | |

Number of Equity Holdings | | 20 | |

Net Assets | | $4.0 billion | |

Benchmark | | S&P 500 Index | |

Weighted Average Market Cap | | $59.1 billion | |

Median Market Cap | | $38.2 billion | |

Portfolio Turnover (for the 12-months ended 09/30/13) | | 24% | |

Expense Ratio - Class I (as of 09/30/12) | | 1.05% | |

Expense Ratio - Class I (as of 09/30/13) | | 1.01% | |

SECTOR ALLOCATION | | % of Net Assets | |

Information Technology | | | 24.3 | | |

Financials | | | 22.6 | | |

Consumer Discretionary | | | 21.0 | | |

Health Care | | | 10.1 | | |

Industrials | | | 7.5 | | |

Energy | | | 6.0 | | |

Utilities | | | 3.7 | | |

Short-Term Investments and Other | | | 4.8 | | |

8 THE OAKMARK FUNDS

Oakmark Select Fund September 30, 2013

Portfolio Manager Commentary

William C. Nygren, CFA

Portfolio Manager

oaklx@oakmark.com

Anthony P. Coniaris, CFA

Portfolio Manager

oaklx@oakmark.com

Win Murray

Portfolio Manager

oaklx@oakmark.com

For the quarter, the Oakmark Select Fund gained 6%, compared to 5% for the S&P 5001. This brings the Fund's fiscal year (September 30) return to a strong absolute and relative return of 28%, compared to 19% for the S&P 500. As we've stated in the past, our investors should not expect this magnitude of absolute and relative performance every quarter or year, but we hope you enjoy them, as we do as fellow investors in the Fund.

These strong fiscal-year results were primarily due to stock selection and our relatively large weighting in more economically sensitive sectors such as consumer discretionary and financials. Our five largest contributors were TRW Automotive Holdings (up 63%), TE Connectivity (56%), Bank of America (57%), AIG (49%) and MasterCard (50%). You may have noticed that many of our top 5 contributors to performance remain among our largest holdings. This is not by accident. We are constantly evaluating the upside of our holdings relative to our estimate of intrinsic value on a risk-adjusted basis. Despite the strong price performance, we believe these investments remain attractive enough to warrant above average weights in the portfolio. Our largest two detractors were both energy related. Newfield Exploration (down 13%) and Cenovus Energy (down 12%) were the only two current holdings that generated negative returns over the past 12 months.

During the past fiscal year, we eliminated three positions in the Fund (Discovery Holdings, Dell, BMC Software) and added three new positions (Forest Laboratories, Kennametal, Oracle). Although this is less change than the Fund normally experiences, we neither wear this with a badge of honor nor manage the portfolio to a non-economic metric such as a turnover ratio. Position changes are simply the result of applying our investment process, which is to buy businesses at substantial discounts to our estimate of intrinsic value, where we see a clear path to that value growing on a per share basis, and management is focused on maximizing per share value. We sell a stock when we believe one or more of these criteria are no longer met.

We have discussed our thoughts on the Discovery and Dell sales in past letters, but we did receive a worthy update on BMC since we sold it in the fourth quarter of 2012. Recall that BMC management conducted a strategic review during the second quarter that we owned the stock and decided to remain an independent company. Given the lack of a compelling purchase offer for BMC during the review, we exited our position because we no longer believed it was selling at a significant discount to private market value. Our opinion has since been validated. On September 10, 2013, BMC management sold the company for $46.25 per share—roughly 12% above our average sale price. During that same time, the Oakmark Select Fund and the S&P 500 returned 25% and 20%, respectively—both well in excess of BMC's modest price increase.

In the past fiscal year, we purchased Forest Laboratories, Kennametal, and Oracle, which were all discussed in prior letters. Forest's many new drug launches remain on track with our original estimates and we look forward to this value being demonstrated in the income statement as sales ramp relative to expenses over the next several years. Kennametal is still operating well below our estimate of mid-cycle earnings though managing expenses consistent with our expectations such that incremental profits from an eventual recovery in demand ought to result in substantial profit improvement. In the quarter we have owned Oracle, it has had more difficulty keeping up with Wall Street's expectations than with ours. We continue to view the shares—selling at approximately 10x free cash flow—as significantly undervalued. Meanwhile, management is doing the right thing by aggressively repurchasing shares at what we believe to be a terrific price.

One year ago in this letter we discussed our view that equities remained the most attractively priced asset class despite having returned 30% in the prior year. One year later, the S&P gained another 19%, and Oakmark Select returned 28%, while the Barclays U.S. Aggregate Bond Index8 experienced a decline of 2%. While it's personally rewarding to see our analysis confirmed, you are likely (and rightly) more concerned about whether our opinion has changed. In short, it has not. While equities may be less undervalued than they were one year ago, we believe they are still reasonably priced, particularly when compared to bonds, which continue to offer historically low yields.

Thank you for your continued investment in the Fund.

oakmark.com 9

Oakmark Select Fund September 30, 2013

Schedule of Investments (in thousands)

| | | Shares | | Value | |

COMMON STOCKS - 95.2% | |

INFORMATION TECHNOLOGY - 24.3% | |

SOFTWARE & SERVICES - 9.5% | |

MasterCard, Inc., Class A

Data Processing & Outsourced Services | | | 315 | | | $ | 211,925 | | |

Oracle Corp.

Systems Software | | | 5,000 | | | | 165,850 | | |

| | | | | | 377,775 | | |

SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT - 8.0% | |

Texas Instruments, Inc.

Semiconductors | | | 4,150 | | | | 167,121 | | |

Intel Corp.

Semiconductors | | | 6,447 | | | | 147,765 | | |

| | | | | | 314,886 | | |

TECHNOLOGY HARDWARE & EQUIPMENT - 6.8% | |

TE Connectivity, Ltd. (b)

Electronic Manufacturing Services | | | 5,194 | | | | 268,942 | | |

| | | | | | 961,603 | | |

FINANCIALS - 22.6% | |

DIVERSIFIED FINANCIALS - 16.9% | |

Capital One Financial Corp.

Consumer Finance | | | 3,450 | | | | 237,153 | | |

Bank of America Corp.

Other Diversified Financial Services | | | 17,100 | | | | 235,980 | | |

JPMorgan Chase & Co.

Other Diversified Financial Services | | | 3,800 | | | | 196,422 | | |

| | | | | | 669,555 | | |

INSURANCE - 5.7% | |

American International Group, Inc.

Multi-line Insurance | | | 4,605 | | | | 223,951 | | |

| | | | | | 893,506 | | |

CONSUMER DISCRETIONARY - 21.0% | |

MEDIA - 8.3% | |

DIRECTV (a)

Cable & Satellite | | | 3,148 | | | | 188,090 | | |

Comcast Corp., Class A

Cable & Satellite | | | 3,250 | | | | 140,952 | | |

| | | | | | 329,042 | | |

AUTOMOBILES & COMPONENTS - 8.1% | |

TRW Automotive Holdings Corp. (a)

Auto Parts & Equipment | | | 4,500 | | | | 320,895 | | |

RETAILING - 4.6% | |

Liberty Interactive Corp., Class A (a)

Catalog Retail | | | 7,800 | | | | 183,066 | | |

| | | | | | 833,003 | | |

| | | Shares | | Value | |

HEALTH CARE - 10.1% | |

HEALTH CARE EQUIPMENT & SERVICES - 5.5% | |

Medtronic, Inc.

Health Care Equipment | | | 4,100 | | | $ | 218,325 | | |

PHARMACEUTICALS, BIOTECHNOLOGY & LIFE SCIENCES - 4.6% | |

Forest Laboratories, Inc. (a)

Pharmaceuticals | | | 4,200 | | | | 179,718 | | |

| | | | | | 398,043 | | |

INDUSTRIALS - 7.5% | |

TRANSPORTATION - 4.2% | |

FedEx Corp.

Air Freight & Logistics | | | 1,450 | | | | 165,460 | | |

CAPITAL GOODS - 3.3% | |

Kennametal, Inc.

Industrial Machinery | | | 2,902 | | | | 132,328 | | |

| | | | | | 297,788 | | |

ENERGY - 6.0% | |

Cenovus Energy, Inc. (b)

Integrated Oil & Gas | | | 4,097 | | | | 122,307 | | |

Newfield Exploration Co. (a)

Oil & Gas Exploration & Production | | | 4,250 | | | | 116,312 | | |

| | | | | | 238,619 | | |

UTILITIES - 3.7% | |

Calpine Corp. (a)

Independent Power Producers & Energy Traders | | | 7,604 | | | | 147,754 | | |

TOTAL COMMON STOCKS - 95.2%

(COST $2,325,602) | | | | | 3,770,316 | | |

| | | Par Value | | Value | |

SHORT TERM INVESTMENTS - 4.2% | |

REPURCHASE AGREEMENT - 4.2% | |

Fixed Income Clearing Corp. Repurchase

Agreement, 0.00% dated 09/30/13 due

10/01/13, repurchase price $165,580,

collateralized by a Federal Home Loan

Bank Bond, 2.470%, due 08/27/24,

value plus accrued interest of $15,246,

by Federal National Mortgage

Association Bonds, 2.210% - 7.125%,

due 12/27/22 - 01/15/30, aggregate

value plus accrued interest of $153,648

(Cost: $165,580) | | | 165,580 | | | | 165,580 | | |

TOTAL SHORT TERM INVESTMENTS - 4.2%

(COST $165,580) | | | | | 165,580 | | |

TOTAL INVESTMENTS - 99.4%

(COST $2,491,182) | | | | | 3,935,896 | | |

Other Assets In Excess of Liabilities - 0.6% | | | | | 23,726 | | |

TOTAL NET ASSETS - 100.0% | | | | $ | 3,959,622 | | |

(a) Non-income producing security

(b) Foreign domiciled corporation

See accompanying Notes to Financial Statements.

10 THE OAKMARK FUNDS

This page intentionally left blank.

oakmark.com 11

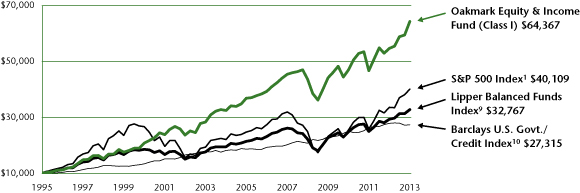

Oakmark Equity and Income Fund September 30, 2013

Summary Information

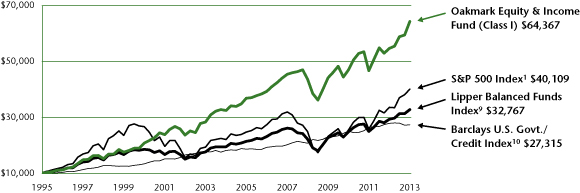

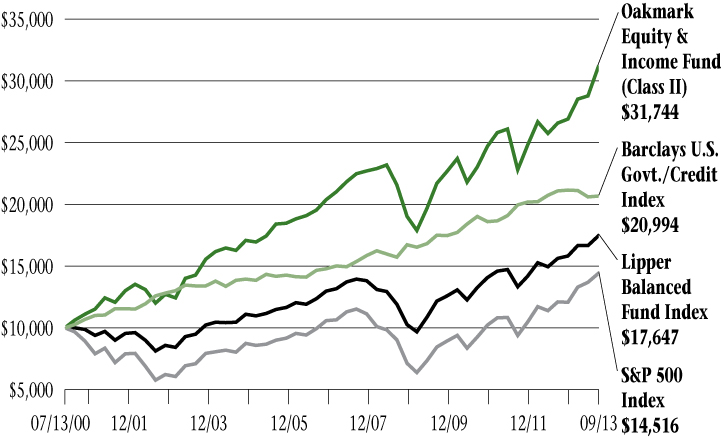

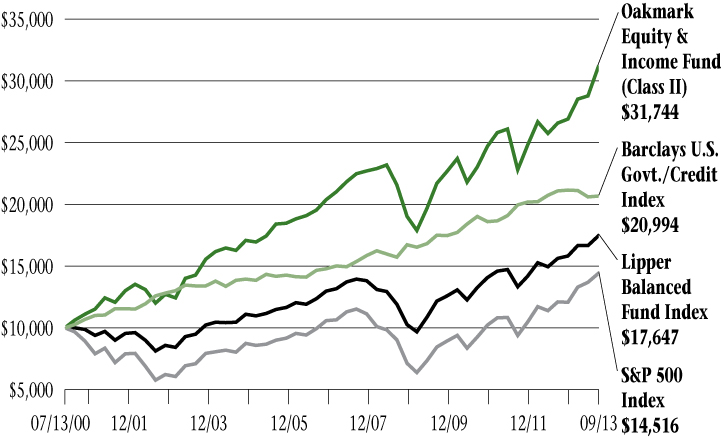

VALUE OF A $10,000 INVESTMENT

Since Inception - 11/01/95 (Unaudited)

PERFORMANCE

| | | | | Average Annual Total Returns (as of 09/30/13)2 | |

(Unaudited) | | Total Return

Last 3 Months | | 1-year | | 3-year | | 5-year | | 10-year | | Since

Inception

(11/01/95) | |

Oakmark Equity & Income Fund (Class I) | | | 8.18 | % | | | 17.63 | % | | | 11.01 | % | | | 8.04 | % | | | 8.56 | % | | | 10.95 | % | |

Lipper Balanced Funds Index | | | 4.58 | % | | | 11.70 | % | | | 9.68 | % | | | 8.11 | % | | | 6.44 | % | | | 6.85 | % | |

S&P 500 Index | | | 5.25 | % | | | 19.34 | % | | | 16.27 | % | | | 10.02 | % | | | 7.57 | % | | | 8.06 | % | |

Barclays U.S. Govt./Credit Index | | | 0.36 | % | | | -1.96 | % | | | 2.89 | % | | | 5.71 | % | | | 4.52 | % | | | 5.77 | % | |

The graph and table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Past Performance is no guarantee of future results. Performance data quoted represents past performance. Current performance may be lower or higher than the performance data quoted. The investment return and principal value vary so that an investor's shares when redeemed may be worth more or less than the original cost. To obtain the most recent month-end performance, please visit oakmark.com.

TOP TEN EQUITY HOLDINGS5 | | % of Net Assets | |

Dover Corp. | | | 3.5 | | |

UnitedHealth Group, Inc. | | | 3.2 | | |

General Dynamics Corp. | | | 3.0 | | |

Oracle Corp. | | | 3.0 | | |

General Motors Co. | | | 2.9 | | |

Rockwell Automation, Inc. | | | 2.9 | | |

FedEx Corp. | | | 2.7 | | |

National Oilwell Varco | | | 2.7 | | |

Philip Morris International, Inc. | | | 2.6 | | |

Bank of America Corp. | | | 2.6 | | |

FUND STATISTICS | |

Ticker | | OAKBX | |

Inception | | 11/01/95 | |

Number of Equity Holdings | | 49 | |

Net Assets | | $19.4 billion | |

Benchmark | | Lipper Balanced Funds Index | |

Weighted Average Market Cap | | $47.5 billion | |

Median Market Cap | | $12.6 billion | |

Portfolio Turnover (for the 12-months ended 09/30/13) | | 25% | |

Expense Ratio - Class I (as of 09/30/12) | | 0.78% | |

Expense Ratio - Class I (as of 09/30/13) | | 0.77% | |

SECTOR ALLOCATION | | % of Net Assets | |

Equity Investments | |

Industrials | | | 16.0 | | |

Consumer Discretionary | | | 11.8 | | |

Energy | | | 11.7 | | |

Health Care | | | 10.2 | | |

Consumer Staples | | | 8.7 | | |

Information Technology | | | 8.0 | | |

Financials | | | 6.8 | | |

Total Equity Investments | | | 73.2 | | |

Government and Agency Securities | | | 9.7 | | |

Corporate Bonds | | | 2.0 | | |

Asset Backed Securities | | | 0.1 | | |

Short-Term Investments and Other | | | 15.0 | | |

12 THE OAKMARK FUNDS

Oakmark Equity and Income Fund September 30, 2013

Portfolio Manager Commentary

Clyde S. McGregor, CFA

Portfolio Manager

oakbx@oakmark.com

M. Colin Hudson, CFA

Portfolio Manager

oakbx@oakmark.com

Matthew A. Logan, CFA

Portfolio Manager

oakbx@oakmark.com

Edward J. Wojciechowski, CFA

Portfolio Manager

oakbx@oakmark.com

A Good September Quarter Surprise

"Sell in May and go away" is a well-known phrase in the investing community. It derives from empirical observations that the summer months are often difficult for the stock market. September has a particularly high propensity to produce losses. Academics spend considerable effort attempting to explain these market tendencies, yet the past two years will only make their job more difficult: in both years the September quarters have been quite rewarding to investors.

The Equity and Income Fund participated in the September quarter's strength, earning 8% in the period, which contrasts to a 5% gain for the Lipper Balanced Fund Index9, the Fund's performance benchmark. For the nine months of the calendar year the returns are 16% for the Fund, and 10% for the Lipper Index. Finally, for the Funds' fiscal year ending September 30, the return to the Fund was 18%, while the Lipper Index returned 12%. The annualized compound rate of return since the Fund's inception in 1995 is 11% while the corresponding return to the Lipper Index is 7%.

Rockwell Automation, Cimarex Energy, Dover, FedEx and General Dynamics contributed most significantly to the past quarter's returns. The largest detractors were Foot Locker, Ultra Petroleum (purchased during the quarter—see below), Laboratory Corporation of America, Range Resources (sold early in the quarter) and Staples. The price declines for the detractors were all quite small. Over the past nine months, detractors included Walter Energy (sold), Cenovus Energy, EnCana, Blount International and Apache (sold). The largest contributors to portfolio return were Dover, United Health, General Dynamics, MasterCard and Cimarex Energy. Finally, for the Fund's fiscal year, the largest contributors were Dover, Rockwell Automation, General Dynamics, MasterCard and Flowserve (sold in the quarter). The largest 12-month detractors were Walter Energy, Cenovus Energy, EnCana, Apache and Devon Energy. The detractors were all energy resource companies, although Walter primarily produces coal used in the production of steel.

We write this letter at a time of unusual macroeconomic uncertainty given the twin possibilities for governmental shutdown and federal debt default. We see little value in ruminating about the various possibilities, especially since this may all be resolved in the time between letter completion and its distribution. We leave it to our friends in the trading community to attempt to profit from the volatility surrounding the political controversy. We will continue to focus on understanding the long-term fundamental values of the Fund's holdings, both current and prospective. We believe that, regardless of the maneuvering in

Washington, the employees of the companies in which we invest will go home at the end of each day knowing that they have helped to increase their employer's value.

Transaction Activity

Our activity in the September quarter favored the sell side as we eliminated five holdings while initiating only one. As noted above, absolute returns have been strong over the past 12 months. To produce this level of return, many stocks within the portfolio have excelled—and several more reached—our sell targets. To review our process, as value managers we establish buy and sell targets for the stock of any company that is voted onto our firm's approved list. Buy targets are normally set at 60% of our estimate of the company's intrinsic value and sell targets at 90%. Of course, our targets are not static. With new information and the passage of time, our targets evolve to reflect a business' current fundamentals better. Generally, when a stock approaches the sell target we begin to reduce the size of the holding because its relative attraction has diminished. Its higher price makes it less able to compete for portfolio space. Sometimes, however, the stock price jumps to the area of its sell target because of a merger offer, which is what happened this past quarter to one of the Fund's smallest companies, Kaydon. Kaydon is a quality manufacturer with strong market shares in specialty industrial products such as bearings and seals. SKF, a Swedish industrial company, recognized Kaydon's attractiveness and agreed to purchase the company during the quarter.

The other four portfolio eliminations also had an industrial orientation. Northrop Grumman is a major defense and aerospace contractor. The company is well-managed and shareholder-friendly with a solid history of dividends and share repurchase. Teledyne Technologies also has products in aerospace and defense electronics as well as digital imaging, although instrumentation is its largest segment. Range Resources is an exploration and production company with major leaseholds in the Marcellus Shale. Natural gas prices have been low for many months, and the outlook is for prices to stay low well into the future. This means that controlling production costs is essential for profitability, and Range's costs are among the industry's lowest. Last, but hardly least, is Flowserve, a leading manufacturer of pumps, valves and seals. Flowserve served the Equity and Income Fund well during its nearly three years in the portfolio, and we wish to thank our recently retired long-time partner John Raitt for this successful idea (as well as many others). We did not enjoy eliminating any of these five holdings from the portfolio as each company had been performing well and meeting or exceeding expectations. Nevertheless, our discipline

oakmark.com 13

Oakmark Equity and Income Fund September 30, 2013

Portfolio Manager Commentary (continued)

demands that we move on whenever price and our estimate of intrinsic value per share come together.

The Fund's one new purchase is actually a return to a previous holding, Ultra Petroleum. During the past year, companies in the energy sector have experienced a wide variety of investment outcomes. A few, such as Cimarex and Range, have enjoyed strong share price increases, but others, such as Ultra, have trailed market returns. We sold the Fund's Ultra holding 17 months ago to realize a tax loss but have watched the company carefully over the intervening period. In our opinion the discount to value in Ultra is simply too great to prevail indefinitely, particularly with its solid management team that is heavily invested in the company.

Fixed Income Management under Rate Suppression

Times remain unusual in the world of fixed income investing. The Federal Reserve continues to suppress interest rates through the purchase of Treasury and Agency securities. Although this policy does not appear to have had the desired effect of increasing business investment, it did produce negative real interest rates on 10-year Treasuries for all of 2012 and much of 2013. Negative real rates make the search for attractive fixed income instruments extremely difficult. Early in the summer interest rates increased fairly dramatically when the Fed suggested that monetary policy would soon become less accommodating (what became known as "the taper"), and we became hopeful that attractive opportunities would develop. In September, however, the Fed elected to maintain its previous policy, and rates have retraced some of their move upward. It is difficult to invest prudently in fixed income investments when rates are being managed to such low levels.

Our basic answer has been to accept credit, but not duration, risk. What this means in practice is that we have kept maturities of our investments very short, particularly for low-risk issuers such as governments and agencies, while we seek out opportunities to increase portfolio yield with what we think is well-priced corporate debt. During much of the past three years this has been difficult to execute when investors were pouring money into fixed income funds. Generally, managers of fixed income funds invest money as it comes in without regard for value considerations. In the most recent quarter, however, the competition was less fierce because investors were pulling money from bond funds.

We have made progress in building the Fund's corporate debt allocation, but this process will take time because of our price and quality requirements, combined with these unusual market conditions. Even with some success to this effort, any increase in portfolio income yield will hardly be stunning. When we opened the Fund to investment in 1995, we naively assumed as our base case that the Fund would average 6% yields on its fixed income allocation. Those days passed very quickly. Although the search for fixed income return is less rewarding than in the past, we continue the search, always guided by our disciplined value philosophy.

Once again we thank our fellow shareholders for investing in the Equity and Income Fund and welcome your comments and questions.

14 THE OAKMARK FUNDS

Oakmark Equity and Income Fund September 30, 2013

Schedule of Investments (in thousands)

| | | Shares | | Value | |

COMMON STOCKS - 73.2% | |

INDUSTRIALS - 16.0% | |

CAPITAL GOODS - 12.9% | |

Dover Corp.

Industrial Machinery | | | 7,563 | | | $ | 679,411 | | |

General Dynamics Corp.

Aerospace & Defense | | | 6,765 | | | | 592,103 | | |

Rockwell Automation Inc.

Electrical Components & Equipment | | | 5,347 | | | | 571,755 | | |

Illinois Tool Works, Inc.

Industrial Machinery | | | 4,239 | | | | 323,339 | | |

Parker Hannifin Corp.

Industrial Machinery | | | 2,718 | | | | 295,496 | | |

Blount International, Inc. (a)

Industrial Machinery | | | 2,263 | | | | 27,410 | | |

Crane Co.

Industrial Machinery | | | 271 | | | | 16,694 | | |

| | | | | | 2,506,208 | | |

TRANSPORTATION - 2.9% | |

FedEx Corp.

Air Freight & Logistics | | | 4,672 | | | | 533,083 | | |

Atlas Air Worldwide Holdings, Inc. (a)

Air Freight & Logistics | | | 800 | | | | 36,888 | | |

| | | | | | 569,971 | | |

COMMERCIAL & PROFESSIONAL SERVICES - 0.2% | |

Herman Miller, Inc.

Office Services & Supplies | | | 1,402 | | | | 40,898 | | |

| | | | | | 3,117,077 | | |

CONSUMER DISCRETIONARY - 11.8% | |

AUTOMOBILES & COMPONENTS - 6.3% | |

General Motors Co. (a)

Automobile Manufacturers | | | 15,938 | | | | 573,272 | | |

BorgWarner, Inc.

Auto Parts & Equipment | | | 3,229 | | | | 327,358 | | |

Lear Corp.

Auto Parts & Equipment | | | 4,424 | | | | 316,601 | | |

| | | | | | 1,217,231 | | |

MEDIA - 2.4% | |

Scripps Networks Interactive, Inc., Class A

Broadcasting | | | 5,895 | | | | 460,474 | | |

RETAILING - 2.2% | |

Foot Locker, Inc. (b)

Apparel Retail | | | 7,711 | | | | 261,705 | | |

Staples, Inc.

Specialty Stores | | | 5,934 | | | | 86,934 | | |

HSN, Inc.

Catalog Retail | | | 1,534 | | | | 82,231 | | |

| | | | | | 430,870 | | |

| | | Shares | | Value | |

CONSUMER DURABLES & APPAREL - 0.9% | |

Carter's, Inc.

Apparel, Accessories & Luxury Goods | | | 1,691 | | | $ | 128,300 | | |

Leggett & Platt, Inc.

Home Furnishings | | | 1,603 | | | | 48,320 | | |

| | | | | | 176,620 | | |

| | | | | | 2,285,195 | | |

ENERGY - 11.7% | |

National Oilwell Varco, Inc.

Oil & Gas Equipment & Services | | | 6,662 | | | | 520,388 | | |

Baker Hughes, Inc.

Oil & Gas Equipment & Services | | | 10,059 | | | | 493,907 | | |

Devon Energy Corp.

Oil & Gas Exploration & Production | | | 5,481 | | | | 316,584 | | |

Encana Corp. (c)

Oil & Gas Exploration & Production | | | 14,713 | | | | 254,983 | | |

Cimarex Energy Co.

Oil & Gas Exploration & Production | | | 2,461 | | | | 237,231 | | |

Cenovus Energy, Inc. (c)

Integrated Oil & Gas | | | 6,675 | | | | 199,246 | | |

Concho Resources, Inc. (a)

Oil & Gas Exploration & Production | | | 1,302 | | | | 141,627 | | |

Ultra Petroleum Corp. (a) (c)

Oil & Gas Exploration & Production | | | 3,575 | | | | 73,527 | | |

Patterson-UTI Energy, Inc.

Oil & Gas Drilling | | | 1,730 | | | | 36,987 | | |

| | | | | | 2,274,480 | | |

HEALTH CARE - 10.2% | |

HEALTH CARE EQUIPMENT & SERVICES - 8.5% | |

UnitedHealth Group, Inc.

Managed Health Care | | | 8,799 | | | | 630,068 | | |

Omnicare, Inc.

Health Care Services | | | 5,138 | | | | 285,181 | | |

Quest Diagnostics, Inc.

Health Care Services | | | 4,115 | | | | 254,241 | | |

Laboratory Corp. of America Holdings (a)

Health Care Services | | | 2,524 | | | | 250,259 | | |

Varian Medical Systems, Inc. (a) (b)

Health Care Equipment | | | 3,148 | | | | 235,280 | | |

| | | | | | 1,655,029 | | |

PHARMACEUTICALS, BIOTECHNOLOGY & LIFE SCIENCES - 1.7% | |

Hospira, Inc. (a)

Pharmaceuticals | | | 6,217 | | | | 243,850 | | |

Bruker Corp. (a)

Life Sciences Tools & Services | | | 3,834 | | | | 79,162 | | |

| | | | | | 323,012 | | |

| | | | | | 1,978,041 | | |

See accompanying Notes to Financial Statements.

oakmark.com 15

Oakmark Equity and Income Fund September 30, 2013

Schedule of Investments (in thousands) (continued)

| | | Shares | | Value | |

COMMON STOCKS - 73.2% (continued) | |

CONSUMER STAPLES - 8.7% | |

FOOD, BEVERAGE & TOBACCO - 7.2% | |

Philip Morris International, Inc.

Tobacco | | | 5,915 | | | $ | 512,171 | | |

Nestle SA (d)

Packaged Foods & Meats | | | 6,956 | | | | 484,145 | | |

Diageo PLC (d)

Distillers & Vintners | | | 3,124 | | | | 397,049 | | |

| | | | | | 1,393,365 | | |

FOOD & STAPLES RETAILING - 1.5% | |

CVS Caremark Corp.

Drug Retail | | | 5,285 | | | | 299,932 | | |

| | | | | | 1,693,297 | | |

INFORMATION TECHNOLOGY - 8.0% | |

SOFTWARE & SERVICES - 5.9% | |

Oracle Corp.

Systems Software | | | 17,795 | | | | 590,260 | | |

MasterCard, Inc., Class A

Data Processing & Outsourced Services | | | 535 | | | | 359,909 | | |

Broadridge Financial Solutions, Inc. (b)

Data Processing & Outsourced Services | | | 5,904 | | | | 187,436 | | |

| | | | | | 1,137,605 | | |

TECHNOLOGY HARDWARE & EQUIPMENT - 2.1% | |

TE Connectivity, Ltd. (c)

Electronic Manufacturing Services | | | 6,797 | | | | 351,928 | | |

ARRIS Group, Inc. (a)

Communications Equipment | | | 3,461 | | | | 59,046 | | |

| | | | | | 410,974 | | |

| | | | | | 1,548,579 | | |

FINANCIALS - 6.8% | |

DIVERSIFIED FINANCIALS - 4.3% | |

Bank of America Corp.

Other Diversified Financial Services | | | 37,109 | | | | 512,103 | | |

TD Ameritrade Holding Corp.

Investment Banking & Brokerage | | | 12,006 | | | | 314,327 | | |

| | | | | | 826,430 | | |

INSURANCE - 1.7% | |

Principal Financial Group, Inc.

Life & Health Insurance | | | 4,727 | | | | 202,393 | | |

Aflac, Inc.

Life & Health Insurance | | | 2,077 | | | | 128,741 | | |

| | | | | | 331,134 | | |

BANKS - 0.8% | |

U.S. Bancorp

Diversified Banks | | | 4,461 | | | | 163,177 | | |

| | | | | | 1,320,741 | | |

TOTAL COMMON STOCKS - 73.2%

(COST $9,452,429) | | | | | 14,217,410 | | |

| | | Par Value | | Value | |

FIXED INCOME - 11.8% | |

GOVERNMENT AND AGENCY SECURITIES - 9.7% | |

U.S. GOVERNMENT NOTES - 8.9% | |

1.375%, due 07/15/18, Inflation Indexed | | $ | 539,946 | | | $ | 592,675 | | |

1.25%, due 07/15/20, Inflation Indexed | | | 533,895 | | | | 584,114 | | |

2.125%, due 01/15/19, Inflation Indexed | | | 216,925 | | | | 246,210 | | |

1.00%, due 09/30/16 | | | 199,380 | | | | 201,436 | | |

1.00%, due 01/15/14 | | | 99,690 | | | | 99,967 | | |

| | | | | | 1,724,402 | | |

U.S. GOVERNMENT AGENCIES - 0.6% | |

Federal Home Loan Bank,

1.65%, due 07/18/19 | | | 29,550 | | | | 28,712 | | |

Federal Home Loan Mortgage Corp.,

2.25%, due 03/13/20 | | | 25,000 | | | | 24,817 | | |

Federal National Mortgage Association,

1.25%, due 09/27/18 | | | 24,680 | | | | 24,213 | | |

Federal Home Loan Bank,

1.00%, due 07/10/18 | | | 10,845 | | | | 10,847 | | |

Federal National Mortgage Association,

1.125%, due 07/18/18 | | | 9,825 | | | | 9,864 | | |

Federal National Mortgage Association,

1.00%, due 01/30/20 | | | 9,525 | | | | 9,182 | | |

| | | | | | 107,635 | | |

CANADIAN GOVERNMENT BONDS - 0.2% | |

4.25%, due 12/01/21, Inflation Indexed | | CAD | 36,939 | | | | 46,343 | | |

Total Government and Agency Securities

(Cost $1,755,525) | | | | | 1,878,380 | | |

CORPORATE BONDS - 2.0% | |

Kinetic Concepts, Inc.,

10.50%, due 11/01/18 | | | 47,940 | | | | 52,914 | | |

General Motors Co., 144A,

4.875%, due 10/02/23 (e) | | | 41,400 | | | | 40,468 | | |

Fifth & Pacific Cos., Inc.,

10.50%, due 04/15/19 | | | 31,603 | | | | 34,447 | | |

Omnicare, Inc.,

7.75%, due 06/01/20 | | | 27,669 | | | | 30,315 | | |

General Motors Co., 144A,

3.50%, due 10/02/18 (e) | | | 29,525 | | | | 29,451 | | |

The William Carter Co., 144A,

5.25%, due 08/15/21 (e) | | | 28,002 | | | | 28,002 | | |

Denbury Resources, Inc.,

8.25%, due 02/15/20 | | | 21,771 | | | | 23,894 | | |

Delphi Corp.,

5.875%, due 05/15/19 | | | 20,943 | | | | 22,226 | | |

Triumph Group, Inc.,

8.625%, due 07/15/18 | | | 20,000 | | | | 21,700 | | |

Kinetic Concepts, Inc.,

12.50%, due 11/01/19 | | | 14,360 | | | | 15,006 | | |

The Manitowoc Co., Inc.,

8.50%, due 11/01/20 | | | 12,825 | | | | 14,268 | | |

Penn National Gaming, Inc.,

8.75%, due 08/15/19 | | | 9,970 | | | | 10,917 | | |

Live Nation Entertainment, Inc., 144A,

7.00%, due 09/01/20 (e) | | | 9,605 | | | | 10,025 | | |

Howard Hughes Corp., 144A,

6.875%, due 10/01/21 (e) | | | 10,000 | | | | 10,025 | | |

See accompanying Notes to Financial Statements.

16 THE OAKMARK FUNDS

Oakmark Equity and Income Fund September 30, 2013

Schedule of Investments (in thousands) (continued)

| | | Par Value | | Value | |

FIXED INCOME - 11.8% (continued) | |

CORPORATE BONDS - 2.0% (continued) | |

Six Flags Entertainment Corp., 144A,

5.25%, due 01/15/21 (e) | | $ | 9,970 | | | $ | 9,496 | | |

Health Net, Inc.,

6.375%, due 06/01/17 | | | 8,680 | | | | 9,223 | | |

Concho Resources, Inc.,

5.50%, due 10/01/22 | | | 6,980 | | | | 6,963 | | |

Serta Simmons Holdings LLC, 144A,

8.125%, due 10/01/20 (e) | | | 4,990 | | | | 5,252 | | |

Scotiabank Peru SA, 144A,

4.50%, due 12/13/27 (e) (f) | | | 6,000 | | | | 5,220 | | |

Walter Energy, Inc., 144A,

9.875%, due 12/15/20 (b) (e) | | | 5,390 | | | | 4,689 | | |

Walter Energy, Inc., 144A,

8.50%, due 04/15/21 (b) (e) | | | 5,000 | | | | 4,175 | | |

Activision Blizzard, Inc., 144A,

6.125%, due 09/15/23 (e) | | | 3,000 | | | | 3,015 | | |

Quiksilver, Inc. / QS Wholesale, Inc., 144A,

7.875%, due 08/01/18 (e) | | | 2,000 | | | | 2,085 | | |

Quiksilver, Inc. / QS Wholesale, Inc., 144A,

10.00%, due 08/01/20 (e) | | | 1,000 | | | | 1,053 | | |

Post Holdings, Inc.,

7.375%, due 02/15/22 | | | 1,000 | | | | 1,051 | | |

Activision Blizzard, Inc., 144A,

5.625%, due 09/15/21 (e) | | | 1,000 | | | | 1,001 | | |

CNO Financial Group, Inc., 144A,

6.375%, due 10/01/20 (e) | | | 250 | | | | 261 | | |

Hologic, Inc.,

6.25%, due 08/01/20 | | | 250 | | | | 260 | | |

Tempur Sealy International, Inc.,

6.875%, due 12/15/20 | | | 100 | | | | 105 | | |

Total Corporate Bonds

(Cost $395,567) | | | | | 397,507 | | |

ASSET BACKED SECURITIES - 0.1% | |

Cabela's Master Credit Card Trust, 144A,

0.732%, due 10/15/19 (e) (f)

(Cost $11,450) | | | 11,450 | | | | 11,501 | | |

CONVERTIBLE BOND - 0.0%(g) | |

Live Nation Entertainment, Inc.,

2.875%, due 07/15/27

(Cost $834) | | | 828 | | | | 845 | | |

TOTAL FIXED INCOME - 11.8%

(COST $2,163,376) | | | | | 2,288,233 | | |

| | | Par Value | | Value | |

SHORT TERM INVESTMENTS - 14.9% | |

COMMERCIAL PAPER - 4.9% | |

Toyota Motor Credit Corp.,

0.05% - 0.10%, due

10/03/13 - 11/26/13 (h) | | $ | 350,000 | | | $ | 349,974 | | |

General Mills Inc., 144A,

0.12% - 0.17%, due

10/02/13 - 11/08/13 (e) (h) | | | 221,500 | | | | 221,482 | | |

BP Capital Markets PLC, 144A,

0.07%, due 10/09/13 - 10/10/13 (e) (h) | | | 100,000 | | | | 99,998 | | |

Kellogg Co., 144A,

0.14% - 0.19%, due

10/01/13 - 12/09/13 (e) (h) | | | 99,475 | | | | 99,458 | | |

American Honda Finance Corp.,

0.09%, due 10/22/13 - 10/23/13 (h) | | | 83,750 | | | | 83,745 | | |

Wellpoint, Inc., 144A,

0.23% - 0.30%, due

10/10/13 - 12/03/13 (e) (h) | | | 52,200 | | | | 52,191 | | |

John Deere Capital Co., 144A,

0.05% - 0.06%, due

10/08/13 - 10/15/13 (e) (h) | | | 50,000 | | | | 49,999 | | |

Total Commercial Paper

(Cost $956,851) | | | | | 956,847 | | |

GOVERNMENT AND AGENCY SECURITIES - 4.4% | |

United States Treasury Bill,

0.05%, due 10/24/13 (h) | | | 350,000 | | | | 349,988 | | |

United States Treasury Note,

0.06%, due 12/31/13 (h) | | | 250,000 | | | | 250,899 | | |

United States Treasury Note,

0.06%, due 12/15/13 (h) | | | 250,000 | | | | 250,361 | | |

Total Government and Agency Securities

(Cost $851,231) | | | | | 851,248 | | |

REPURCHASE AGREEMENT - 3.4% | |

Fixed Income Clearing Corp. Repurchase

Agreement, 0.00% dated 09/30/13 due

10/01/13, repurchase price $659,912,

collateralized by Federal Home Loan

Bank Bonds, 1.750% - 1.770%, due

06/10/20 - 03/18/21, aggregate value

plus accrued interest of $96,644, by

Federal National Mortgage Association

Bonds, 2.220% - 2.230%, due

12/06/22 - 12/27/22, aggregate value

plus accrued interest of $576,466

(Cost: $659,912) | | | 659,912 | | | | 659,912 | | |

See accompanying Notes to Financial Statements.

oakmark.com 17

Oakmark Equity and Income Fund September 30, 2013

Schedule of Investments (in thousands) (continued)

| | Par Value | | Value | |

SHORT TERM INVESTMENTS - 14.9% (continued) | |

CORPORATE BONDS - 1.2% | |

Merrill Lynch & Co., Inc.,

5.45%, due 07/15/14 | | $ | 43,637 | | | $ | 45,237 | | |

Citigroup, Inc.,

5.00%, due 09/15/14 | | | 38,240 | | | | 39,681 | | |

Capital One Financial Corp.,

7.38%, due 05/23/14 | | | 36,712 | | | | 38,275 | | |

MetLife, Inc.,

2.38%, due 02/06/14 | | | 37,151 | | | | 37,417 | | |

Citigroup, Inc.,

6.00%, due 12/13/13 | | | 34,839 | | | | 35,217 | | |

Anheuser-Busch InBev Worldwide, Inc.,

1.50%, due 07/14/14 | | | 18,200 | | | | 18,359 | | |

BP Capital Markets PLC,

3.63%, due 05/08/14 | | | 14,500 | | | | 14,787 | | |

United Parcel Service, Inc.,

3.88%, due 04/01/14 | | | 13,075 | | | | 13,294 | | |

Total Corporate Bonds

(Cost $242,359) | | | | | 242,267 | | |

CANADIAN TREASURY BILLS - 1.0% | |

1.04% - 1.05%, due 10/24/13 - 11/21/13 (h)

(Cost $199,466) | | CAD | 200,000 | | | | 193,961 | | |

TOTAL SHORT TERM INVESTMENTS - 14.9%

(COST $2,909,819) | | | | | 2,904,235 | | |

TOTAL INVESTMENTS - 99.9%

(COST $14,525,624) | | | | | 19,409,878 | | |

Foreign Currencies (Cost $0) - 0.0% (g) | | | | | 0 | (i) | |

Other Assets In Excess of Liabilities - 0.1% | | | | | 24,059 | | |

NET ASSETS - 100.0% | | | | $ | 19,433,937 | | |

(a) Non-income producing security

(b) See Note 5 in the Notes to the Financial Statements regarding investments in affiliated issuers.

(c) Foreign domiciled corporation

(d) Sponsored American Depositary Receipt

(e) See Note 1 in the Notes to Financial Statements regarding restricted securities. These securities may be resold subject to restrictions on resale under federal securities law.

(f) Floating Rate Note. Rate shown is as of September 30, 2013.

(g) Amount rounds to less than 0.1%.

(h) The rate shown represents the annualized yield at the time of purchase; not a coupon rate.

(i) Amount rounds to less than $1,000.

Key to Abbreviations:

CAD Canadian Dollar

See accompanying Notes to Financial Statements.

18 THE OAKMARK FUNDS

This page intentionally left blank.

oakmark.com 19

Oakmark Global Fund September 30, 2013

Summary Information

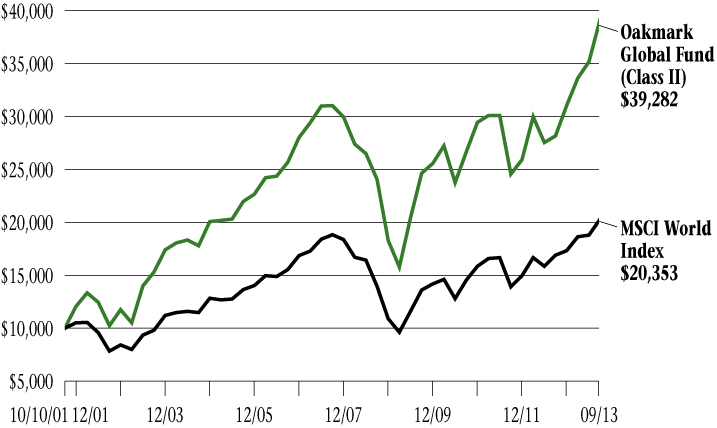

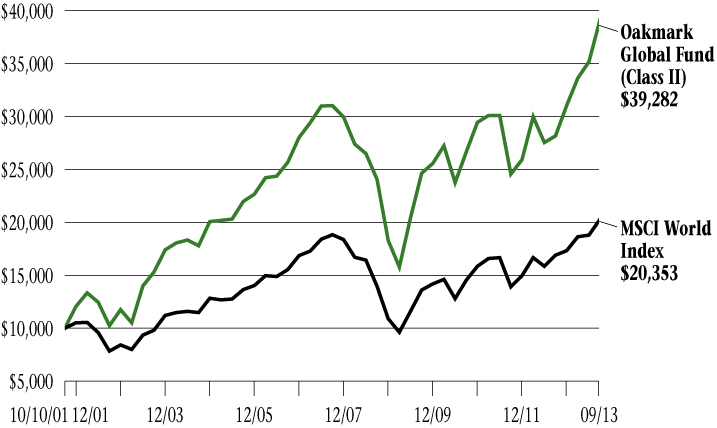

VALUE OF A $10,000 INVESTMENT

Since Inception - 08/04/99 (Unaudited)

PERFORMANCE

| | | | | Average Annual Total Returns (as of 09/30/13)2 | |

(Unaudited) | | Total Return

Last 3 Months | | 1-year | | 3-year | | 5-year | | 10-year | | Since

Inception

(08/04/99) | |

Oakmark Global Fund (Class I) | | | 11.36 | % | | | 39.55 | % | | | 14.12 | % | | | 10.59 | % | | | 10.24 | % | | | 11.57 | % | |

MSCI World Index | | | 8.18 | % | | | 20.21 | % | | | 11.82 | % | | | 7.84 | % | | | 7.58 | % | | | 3.53 | % | |

Lipper Global Funds Index12 | | | 8.01 | % | | | 22.17 | % | | | 10.07 | % | | | 7.70 | % | | | 7.79 | % | | | 4.60 | % | |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Past performance is no guarantee of future results. Performance data quoted represents past performance. Current performance may be lower or higher than the performance data quoted. The investment return and principal value vary so that an investor's shares when redeemed may be worth more or less than the original cost. To obtain the most recent month-end performance data, visit oakmark.com.

TOP TEN EQUITY HOLDINGS5 | | % of Net Assets | |

Julius Baer Group, Ltd. | | | 4.8 | | |

Oracle Corp. | | | 4.5 | | |

Daimler AG | | | 4.0 | | |

MasterCard, Inc., Class A | | | 3.9 | | |

Credit Suisse Group | | | 3.4 | | |

TE Connectivity, Ltd. | | | 3.4 | | |

General Motors Co. | | | 3.2 | | |

FedEx Corp. | | | 3.2 | | |

Incitec Pivot, Ltd. | | | 3.2 | | |

Holcim, Ltd. | | | 3.0 | | |

FUND STATISTICS | |

Ticker | | OAKGX | |

Inception | | 08/04/99 | |

Number of Equity Holdings | | 44 | |

Net Assets | | $2.9 billion | |

Benchmark | | MSCI World Index | |

Weighted Average Market Cap | | $42.9 billion | |

Median Market Cap | | $16.5 billion | |

Portfolio Turnover (for the 12-months ended 09/30/13) | | 45% | |

Expense Ratio - Class I (as of 09/30/12) | | 1.16% | |

Expense Ratio - Class I (as of 09/30/13) | | 1.13% | |

SECTOR ALLOCATION | | % of Net Assets | |

Information Technology | | | 23.1 | | |

Industrials | | | 19.7 | | |

Financials | | | 14.1 | | |

Consumer Discretionary | | | 12.6 | | |

Materials | | | 9.7 | | |

Energy | | | 8.6 | | |

Health Care | | | 7.2 | | |

Consumer Staples | | | 3.5 | | |

Short-Term Investments and Other | | | 1.5 | | |

GEOGRAPHIC ALLOCATION | |

| | | % of Equity | |

North America | | | 44.4 | | |

United States | | | 44.4 | | |

Europe | | | 39.1 | | |

Switzerland | | | 20.9 | | |

Netherlands* | | | 8.4 | | |

Germany* | | | 6.4 | | |

UK | | | 3.4 | | |

| | | % of Equity | |

Asia | | | 13.3 | | |

Japan | | | 13.3 | | |

Australasia | | | 3.2 | | |

Australia | | | 3.2 | | |

* Euro currency countries comprise 14.8% of equity investments

20 THE OAKMARK FUNDS

Oakmark Global Fund September 30, 2013

Portfolio Manager Commentary

Clyde S. McGregor, CFA

Portfolio Manager

oakgx@oakmark.com

Robert A. Taylor, CFA

Portfolio Manager

oakgx@oakmark.com

The September quarter produced strong equity outcomes across most world markets. The Oakmark Global Fund participated in this rally, gaining 11%. The MSCI World Index11 returned 8%, and the Lipper Global Fund Index12 returned 8%. The Fund's return for the calendar nine months is 26%, compared to the 17% return for the MSCI World Index and the Lipper Global Fund Index. For the Global Fund's fiscal year ended September 30 the returns are 40% for the Fund, 20% for the MSCI World Index, and 22% for the Lipper Global Fund Index. As always, we are most pleased to report the Fund's 12% compound annualized rate of return since inception, which compares to 4% for the MSCI World Index and 5% for the Lipper Global Fund Index for the same period.

The countries that contributed most to the Fund's quarter return were the U.S., Switzerland, and Japan. Australia was the only country to have equities that detracted from the Fund's return in the quarter. The five largest contributors to the Fund's return in the quarter were Daimler (Germany), Julius Baer (Switzerland), Cimarex Energy (U.S.), Credit Suisse (Switzerland) and MasterCard (U.S.). The Fund holdings that detracted most were Tenet Healthcare (U.S.), Incitec Pivot (Australia), Intel (U.S.), Bank of America (U.S. new purchase) and Canon (Japan).

For the calendar nine months the highest contributing countries were the U.S., Japan and Switzerland. Holdings in both Spain and Australia detracted from nine-month return. Daiwa Securities Group (Japan), Daimler, Live Nation (U.S.), MasterCard and Julius Baer were the leading contributors. Incitec Pivot, Canon, Banco Santander (Spain), Bank of America and Apache (U.S.) detracted most from the nine-month return. For the Fund's fiscal year the U.S., Japan and Switzerland were again the leading contributors to return while Australia was the only detractor. The five companies that led the contributors list were Daiwa Securities Group, Daimler, Tenet Healthcare, Credit Suisse and MasterCard. Detractors were Incitec Pivot, Square Enix (Japan), Apache, Bank of America and Franklin Resources (U.S. new purchase).

Portfolio Activity

Although equity markets moved higher in the quarter, we found opportunities to make new additions to the Fund, adding three U.S. and two European holdings. The first name alphabetically is Bank of America. For years, Bank of America was the poster child for all that was troubling about banks. But like the industry as a whole, we believe Bank of America has made tremendous progress simplifying and "de-risking" its business. For instance, in just the past few quarters it has gone from being one of the worst capitalized big banks to one of the best. (For perspective, the company's tangible common equity ratio is 64% higher than it was in 2006, which was before the crisis). Management also took advantage of lowered investor expectations as an opportunity to invest heavily in systems technology and rationalization. Investors have rewarded the company for

its progress and brought the stock up from its lows. However, it is still being valued at a sizeable discount to its peers. In our view, the discount derives both from stale perceptions of the relative risk profile, but also because Bank of America's near-term earnings are more depressed than its peers. We expect this discount to close with time, as investors reevaluate the "new" Bank of America and its profitability catches up.

Our second new purchase is Franklin Resources, an investment firm that manages a family of more than 300 mutual funds under the names Franklin, Templeton and Fiduciary Trust, among others. The funds invest internationally and domestically in equities, fixed income and money market instruments. Franklin Resources also offers separately managed accounts and insurance product funds. Franklin Resources has an excellent brand name and a well-established global network, with a presence in over 17 international markets. The company has deliberately built this international presence over decades, and we believe this provides, and will continue to provide, a distinct competitive advantage. In addition, management has historically returned capital to shareholders through stock buybacks and dividends, and we expect Franklin Resources to continue to be good stewards of shareholders' capital.

Next is Fugro, a Netherlands-domiciled geological engineering company that primarily serves the off-shore oil market. Much of Fugro's value—about 85%—comes from businesses that are tied to construction or production related to the off-shore oil market. Investors are attracted to this market because it is growing at nearly a double-digit rate, and Fugro controls very high market shares in many of its businesses. That said, the other 15% of Fugro's value comes from Geoscience, which is not nearly as attractive. Fugro essentially operates ships that take seismic pictures of the ocean floor. This business is capital intensive (ships and cameras), and its returns are erratic, like a commodity's (because it depends on exploration demand). While this "lumpiness" can cause short-term earnings to fluctuate greatly, in our view, it does not affect long-term business value. We have taken advantage of this volatility—and other investors' shortsightedness—and initiated a position during the quarter when Fugro's share price fell after missing Street guidance.

Long-term holders of the Global Fund may remember us buying Holcim (Switzerland) in late 2010. We sold it only one year later, an unusually short holding period relative to our normal three- to five-year holding period. We did not sell because of a change in our investment thesis about Holcim. Instead, our other holdings were not doing as well. Many Japanese names were hurt by the earthquake and tsunami in March 2011 and the Thai floods in the Fall of 2011. In addition, many of our European names also fared poorly in the third and fourth quarters of 2011 as markets feared the break-up of the Euro. We sold Holcim so that we could purchase other positions that offered greater share appreciation potential.

oakmark.com 21

Oakmark Global Fund September 30, 2013

Portfolio Manager Commentary (continued)

Looking back, these trades worked in our favor. Since the sale of Holcim, the Global Fund appreciated almost 50%, while Holcim appreciated less than 30%. During the past quarter we started buying Holcim at a price that was only 7% higher than our previous average cost, while our estimate of intrinsic value increased more than 10%. This makes Holcim absolutely and relatively more attractive now than when we purchased it in 2010.

As a refresher, Switzerland-based Holcim is one of the world's largest cement makers. The company has a broad geographic spread, with more than 70% of its pre-tax profits originating in emerging markets such as India, Indonesia and Africa. We think the company will thrive in these emerging economies and will gain from development in these areas. In addition, recent consolidations in the cement sector have strengthened the company's market position. Holcim's cost-reduction plan, which includes a restructuring plan in India to improve the cost base, is on track for 2014, and we believe its expected benefits have not yet been reflected in the stock price and that demand for cement will increase over the medium term.