UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-06243

Franklin Strategic Series

(Exact name of registrant as specified in charter)

_One Franklin Parkway, San Mateo, CA 94403-1906

(Address of principal executive offices) (Zip code)

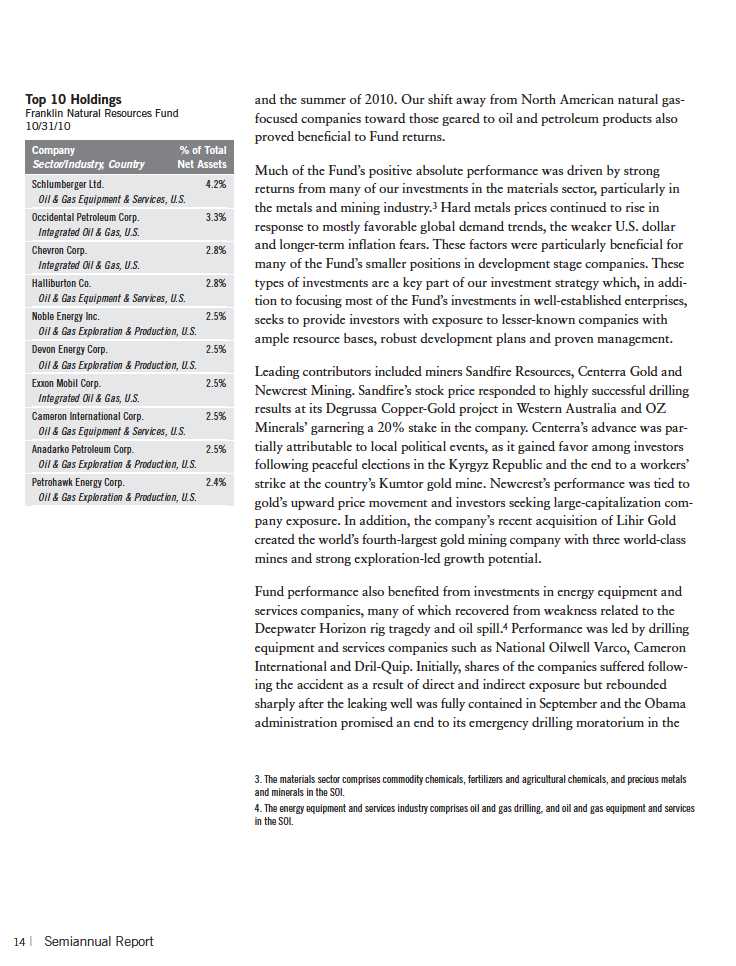

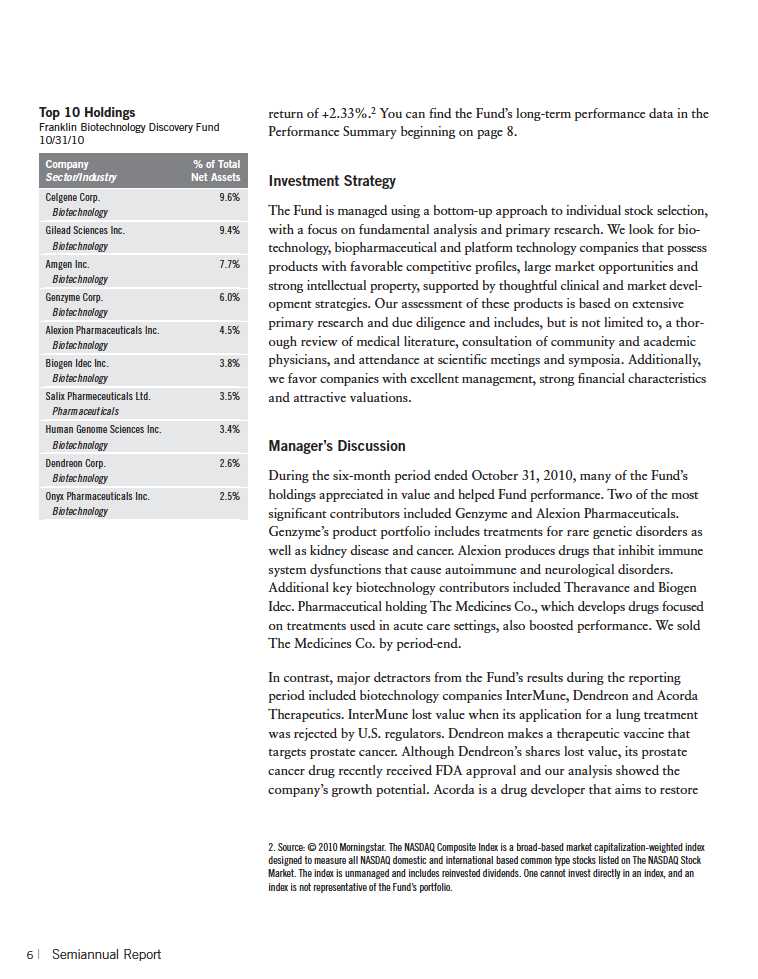

_Craig S. Tyle, One Franklin Parkway, San Mateo, CA 94403-1906

(Name and address of agent for service)

Registrant's telephone number, including area code: 650 312-2000

Date of fiscal year end:_4/30

Date of reporting period:_10/31/10

Item 1. Reports to Stockholders.

FRANKLIN STRATEGIC SERIES

SPECIALIZED EXPERTISE

TRUE DIVERSIFICATION

RELIABILITY YOU CAN TRUST

MUTUAL FUNDS |

Franklin Templeton Investments

Gain From Our Perspective®

Franklin Templeton’s distinct multi-manager structure combines the specialized expertise of three world-class investment management groups—Franklin, Templeton and Mutual Series.

Each of our portfolio management groups operates autonomously, relying on its own research and staying true to the unique investment disciplines that underlie its success.

Franklin. Founded in 1947, Franklin is a recognized leader in fixed income investing and also brings expertise in growth- and value-style U.S. equity investing.

Templeton. Founded in 1940, Templeton pioneered international investing and, in 1954, launched what has become the industry’s oldest global fund. Today, with offices in over 25 countries, Templeton offers investors a truly global perspective.

Mutual Series. Founded in 1949, Mutual Series is dedicated to a unique style of value investing, searching aggressively for opportunity among what it believes are undervalued stocks, as well as arbitrage situations and distressed securities.

Because our management groups work independently and adhere to different investment approaches, Franklin, Templeton and Mutual Series funds typically have distinct portfolios. That’s why our funds can be used to build truly diversified allocation plans covering every major asset class.

At Franklin Templeton Investments, we seek to consistently provide investors with exceptional risk-adjusted returns over the long term, as well as the reliable, accurate and personal service that has helped us become one of the most trusted names in financial services.

RETIREMENT PLANS | 529 COLLEGE SAVINGS PLANS | SEPARATE ACCOUNTS

| Not part of the semiannual report |

Not part of the semiannual report | 1

Economic and Market Overview

During the six-month period ended October 31, 2010, the U.S. economic recovery showed signs of deceleration from earlier in 2010 as manufacturing and exports cooled somewhat. Consumer spending picked up likely due to pent-up, post-recession demand. In 2010’s second and third quarters, U.S. gross domestic product growth eased from the first quarter’s pace, recording modest annualized rates of 1.7% and 2.5% as trade dynamics turned negative and government spending waned. Corporate profits largely surpassed consensus estimates during the period, and businesses restocked their depleted inventories. Challenges remained as mixed economic data, elevated debt concerns surrounding the U.S. budget deficit and a lack of job prospects for the unemployed reflected considerable slack in the economy. The housing market overall remained weak as home sales and housing starts failed to gain traction despite an earlier, first-time homebuyer t ax credit program that had helped lift the housing market in early 2010.

As signs emerged of a demand-led global recovery, oil prices began the period at $86 per barrel at the end of April, just off their 17-month high price of $87 early that month. As doubts surfaced about the recovery’s sustainability, oil prices dipped to $66 in late May. Despite an abundant oil supply, prices rebounded to $81 per barrel by the end of October largely due to a falling U.S. dollar and speculative buying. The October 2010 inflation rate was an annualized 1.2%.1 Core inflation, which excludes volatile food and energy costs, rose at a 0.6% annualized rate, the smallest 12-month increase in more than 50 years.1 Job gains were disappointing until October when businesses added more jobs than expected. The unemployment rate fell from 9.9% in April to 9.6% at period-end with some of the decline attributable to a shrinking labor force as some unemployed workers stopped looking for jobs.1

Given few inflationary pressures and uncertainty surrounding the economic recovery, The Federal Open Market Committee (FOMC) made no major changes to its monetary policy for most of the period. It repeatedly stated it will keep the federal funds target rate in the exceptionally low 0% to 0.25% range “for an extended period” while shifting its focus to its outlook and the status of its current holdings. In September, the FOMC revealed concerns about the subdued recovery and said inflation was below the pace “consistent with

| | 1. Source: Bureau of Labor Statistics. |

Semiannual Report | 3

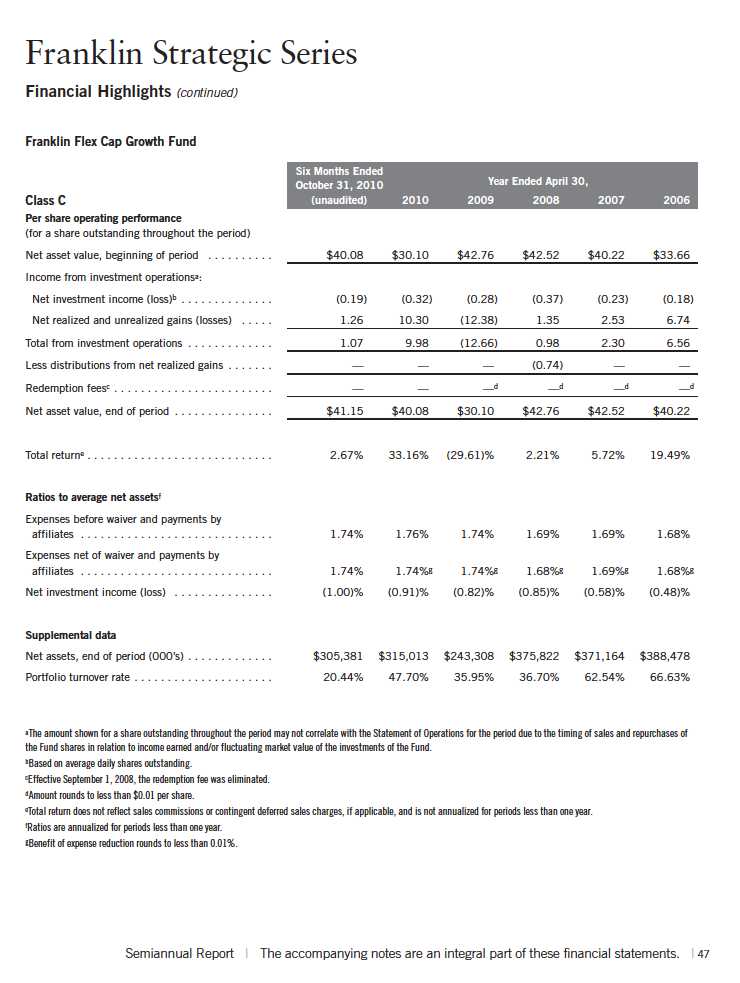

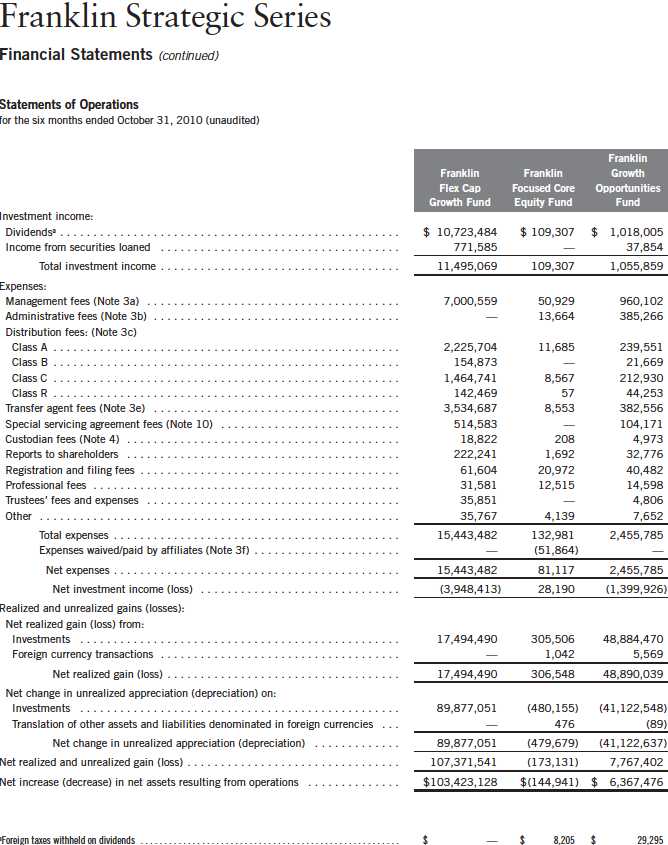

Franklin Flex Cap Growth Fund

Your Fund’s Goal and Main Investments: Franklin Flex Cap Growth Fund seeks capital appreciation. The Fund normally invests predominantly in equity securities of companies that the manager believes have the potential for capital appreciation. The Fund has flexibility to invest in companies located, headquartered or operating inside and outside the U.S., across the entire market capitalization spectrum from small, emerging growth companies to well-established, large cap companies.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. Please visit franklintempleton.com or call (800) 342-5236 for most recent month-end performance.

This semiannual report for Franklin Flex Cap Growth Fund covers the period ended October 31, 2010.

Performance Overview

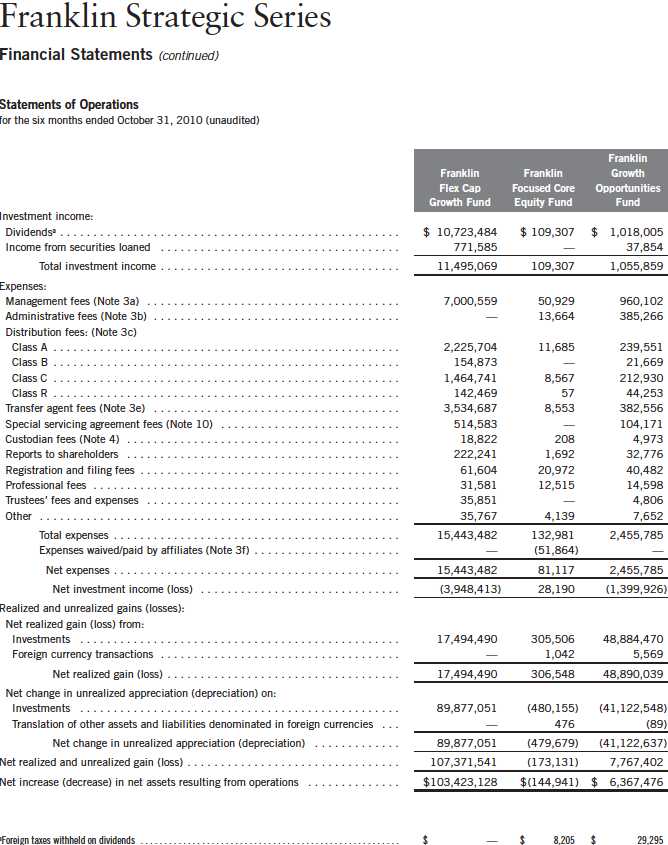

For the six months under review, Franklin Flex Cap Growth Fund – Class A delivered a +3.05% cumulative total return. The Fund underperformed its narrow benchmarks, the Russell 3000® Growth Index, which posted a +3.27% total return, and the Russell 1000® Growth Index, which generated a +3.34% total return.1 However, the Fund outperformed its broad benchmark, the Standard & Poor’s 500 Index (S&P 500), which posted a +0.74% total return for the same period.1 In addition, the Fund underperformed the +3.41% total return of its peers in the Lipper Multi-Cap Growth Funds Classification Average.2 You can find the Fund’s long-term performance data in the Performance Summary beginning on page 8.

1. Source: © 2010 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. The Russell 3000 Growth Index is market capitalization weighted and measures performance of those Russell 3000 Index companies with higher price-to-book ratios and higher forecasted growth values. The Russell 1000 Growth Index is market capitalization weighted and measures performance of those Russell 1000 Index companies with higher price-to-book ratios and higher forecasted growth values. The S&P 500 is a market capitalization-weighted index of 500 stocks designed to measure total U.S. equity performance.

2. Source: Lipper Inc. The Lipper Multi-Cap Growth Funds Classification Average is calculated by averaging the total returns of all funds within the Lipper Multi-Cap Growth Funds classification in the Lipper Open-End underlying funds universe for the period indicated. Lipper Multi-Cap Growth Funds are defined as funds that normally invest in companies, of any size, with long-term earnings expected to grow significantly faster than the earnings of the stocks represented in the major unmanaged stock indexes. For the six-month period ended 10/31/10, there were 443 funds in this category. Lipper calculations do not include sales charges or subsidization by a Fund’s manager. The Fund’s performance relative to the average may have differed if these or other factors had been considered.

The indexes are unmanaged and include reinvested dividends. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI). The SOI begins on page 50.

Semiannual Report | 5

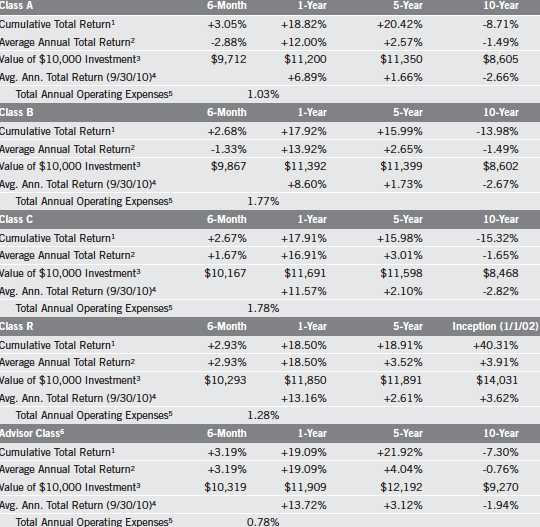

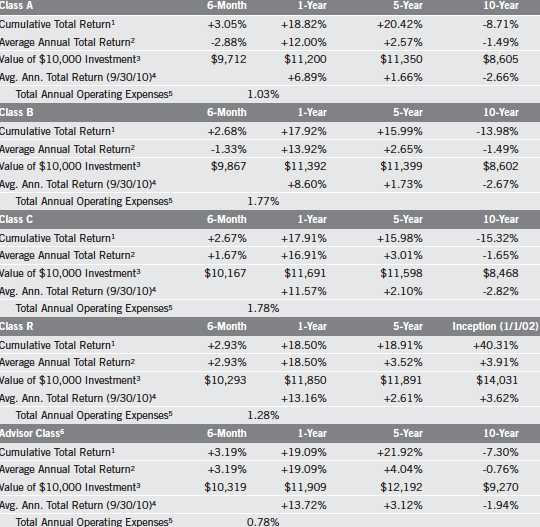

Performance Summary as of 10/31/10

Franklin Flex Cap Growth Fund

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

8 | Semiannual Report

Performance Summary (continued)

Performance

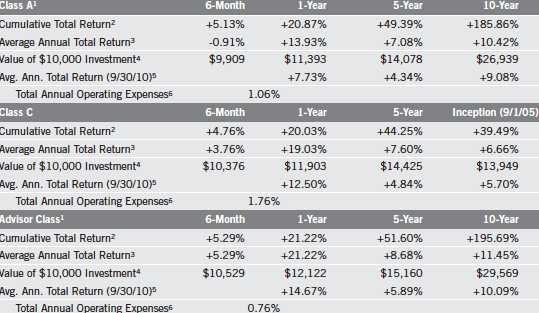

Cumulative total return excludes sales charges. Average annual total returns and value of $10,000 investment include maximum sales charges. Class A: 5.75% maximum initial sales charge; Class B: contingent deferred sales charge (CDSC) declining from 4% to 1% over six years, and eliminated thereafter; Class C: 1% CDSC in first year only;

Class R/Advisor Class: no sales charges.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ f rom figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

Semiannual Report | 9

Performance Summary (continued)

Endnotes

Investors should be comfortable with fluctuations in the value of their investments, as small and midsized company stocks can be volatile, especially over the short term. Smaller, midsized and relatively new or unseasoned companies can be particularly sensitive to changing economic conditions, and their prospects for growth are less certain than those of larger, more established companies. The Fund also invests in technology stocks, which can be highly volatile and involves special risks. The Fund’s prospectus also includes a description of the main investment risks.

| |

Class B: Class C: | These shares have higher annual fees and expenses than Class A shares. Prior to 1/1/04, these shares were offered with an initial sales charge; thus actual total returns would have differed. These shares have higher annual fees and expenses than Class A shares. |

Class R: | Shares are available to certain eligible investors as described in the prospectus. These shares have higher annual fees and expenses than Class A shares. |

Advisor Class: | Shares are available to certain eligible investors as described in the prospectus. |

1. Cumulative total return represents the change in value of an investment over the periods indicated.

2. Average annual total return represents the average annual change in value of an investment over the periods indicated. Six-month return has not been annualized.

3. These figures represent the value of a hypothetical $10,000 investment in the Fund over the periods indicated.

4. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

5. Figures are as stated in the Fund’s prospectus current as of the date of this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

6. Effective 8/2/04, the Fund began offering Advisor Class shares, which do not have sales charges or a Rule 12b-1 plan. Performance quotations for this class reflect the following methods of calculation: (a) For periods prior to 8/2/04, a restated figure is used based upon the Fund’s Class A performance, excluding the effect of Class A’s maximum initial sales charge, but reflecting the effect of the Class A Rule 12b-1 fees; and (b) for periods after 8/1/04, actual Advisor Class performance is used reflecting all charges and fees applicable to that class. Since 8/2/04 (commencement of sales), the cumulative and average annual total returns of Advisor Class shares were +39.03% and +5.42%.

10 | Semiannual Report

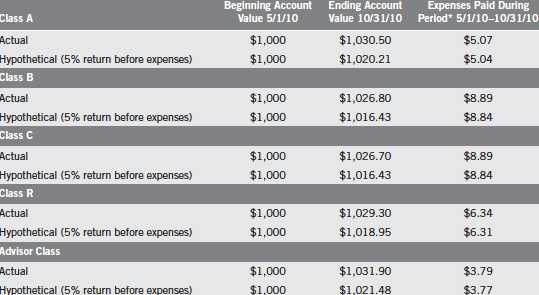

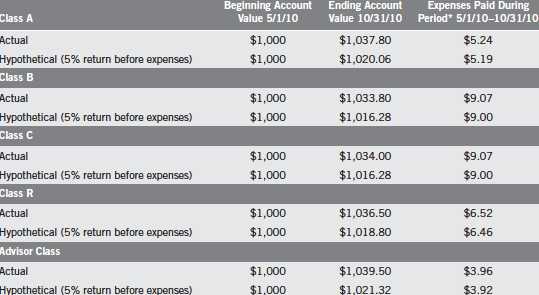

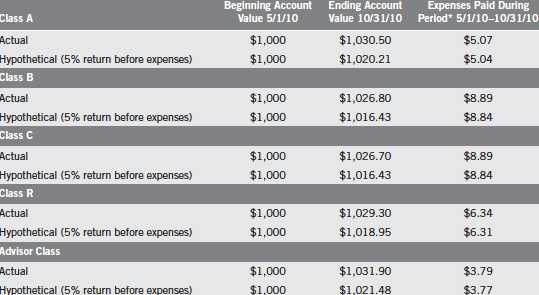

Your Fund’s Expenses

Franklin Flex Cap Growth Fund

As a Fund shareholder, you can incur two types of costs:

Transaction costs, including sales charges (loads) on Fund purchases; and

Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

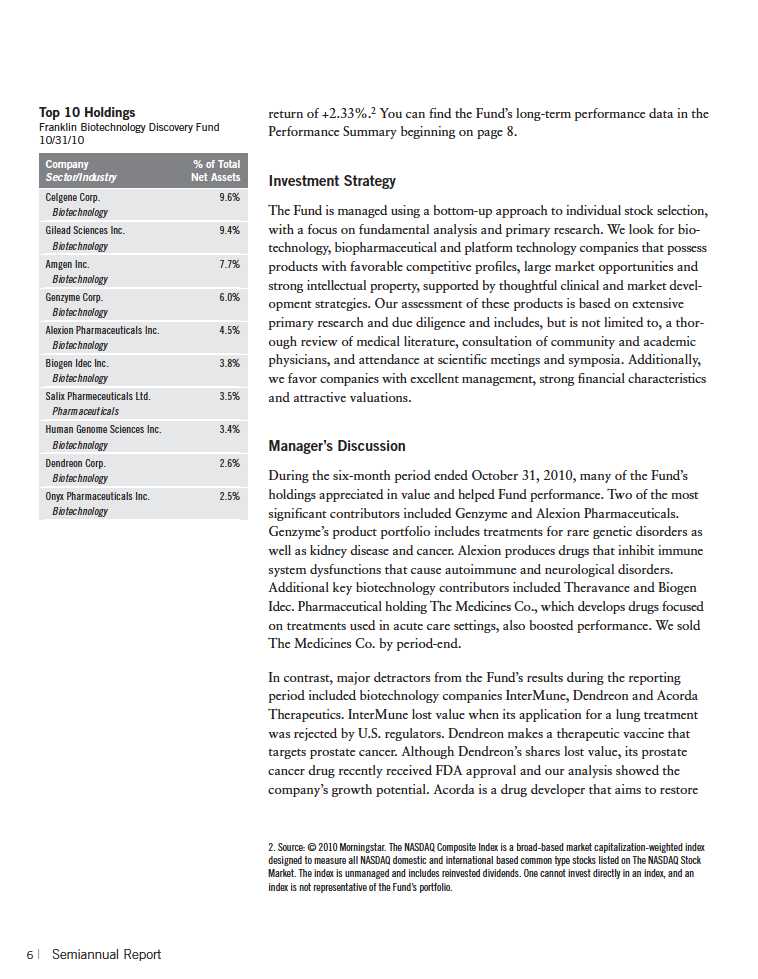

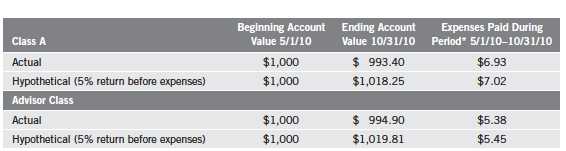

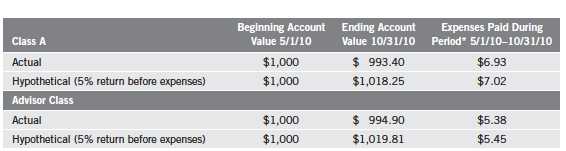

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

Semiannual Report | 11

Your Fund’s Expenses (continued)

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

*Expenses are calculated using the most recent six-month expense ratio, annualized for each class (A: 0.99%; B: 1.74%; C: 1.74%; R: 1.24%; and Advisor: 0.74%), multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period.

12 | Semiannual Report

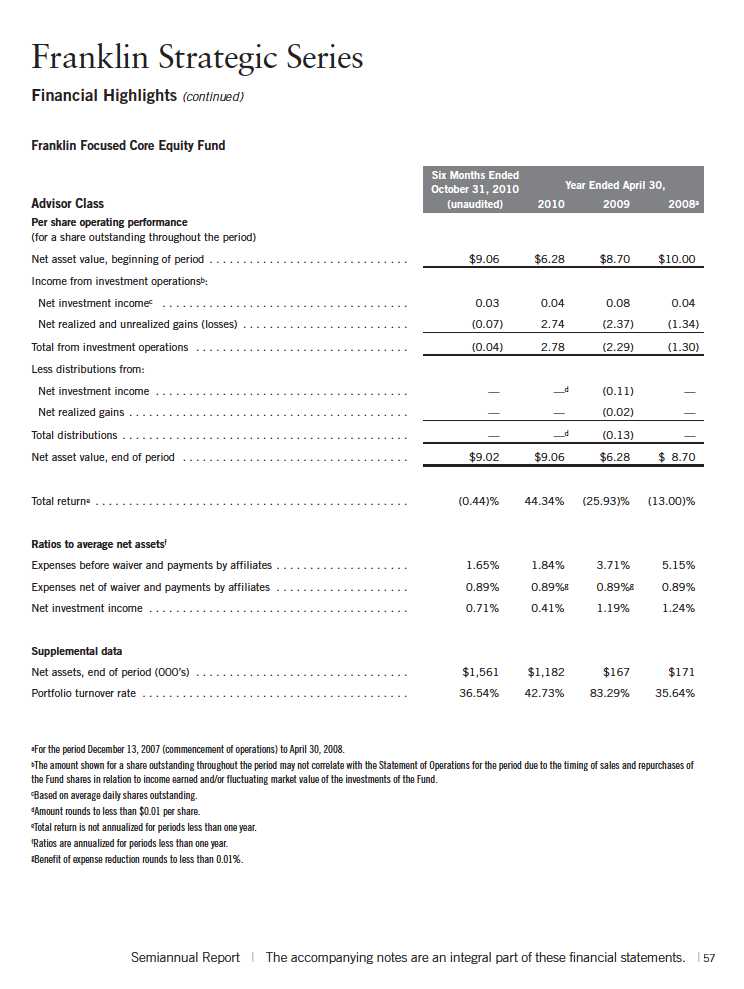

Franklin Focused Core Equity Fund

Your Fund’s Goal and Main Investments: Franklin Focused Core Equity Fund seeks capital appreciation by normally investing at least 80% of its net assets in equity securities. The Fund will invest primarily in equity securities of large capitalization companies, which are similar in size to those in the Standard & Poor’s 500 Index (S&P 500).1

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. Please visit franklintempleton.com or call (800) 342-5236 for most recent month-end performance.

This semiannual report for Franklin Focused Core Equity Fund covers the period ended October 31, 2010.

Performance Overview

For the six months under review, Franklin Focused Core Equity Fund – Class A had a -0.55% cumulative total return. The Fund underperformed its benchmark, the S&P 500, which posted a +0.74% total return for the same period.2 You can find more of the Fund’s performance data in the Performance Summary beginning on page 16.

Investment Strategy

We are research-driven, bottom-up, fundamental investors. Our investment approach is opportunistic and contrarian, and we seek to identify mispriced companies using fundamental analysis. We seek to take advantage of price dislocations that result from the market’s short-term focus. Our analysis includes the investigation of the valuation for each investment based upon the view that the price paid for the security is a critical factor determining long-term success. We rely on a team of analysts to help provide in-depth industry expertise and use both qualitative and quantitative analysis to evaluate companies. Our analysts identify each company’s market opportunity, competitive position, management and financial strength, business and financial risks, and valuation. We choose to invest in those companies that, in our opinion, offer the best trade-off between growth opportunity, business and financial risk, and valuation.

1. The S&P 500 is a market capitalization-weighted index of 500 stocks designed to measure total U.S. equity market performance.

2. Source: © 2010 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. See footnote 1 for a description of the S&P 500. The index is unmanaged and includes reinvested dividends. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI). The SOI begins on page 58.

Semiannual Report | 13

Performance Summary as of 10/31/10

Franklin Focused Core Equity Fund

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

16 | Semiannual Report

Performance Summary (continued)

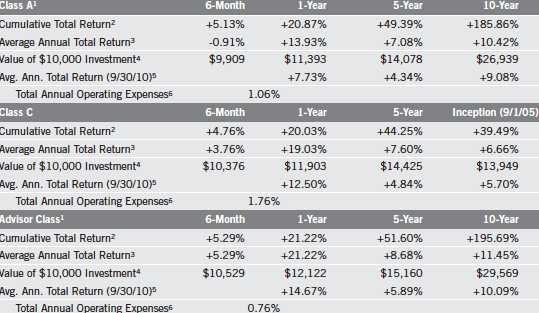

Performance1

Cumulative total return excludes sales charges. Average annual total returns and value of $10,000 investment include maximum sales charges. Class A: 5.75% maximum initial sales charge; Class C: 1% contingent deferred sales charge in first year only; Class R/Advisor Class: no sales charges.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ f rom figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

The investment manager and administrator have co ntractually agreed to waive or assume certain expenses so that common expenses (excluding the Rule 12b-1 fees and acquired fund fees and expenses) for each class of the Fund do not exceed 0.89% (other than certain nonroutine expenses) until 8/31/11.

Semiannual Report | 17

Performance Summary (continued)

Endnotes

While stocks have historically outperformed other asset classes over the long term, they tend to fluctuate more dramatically over the short term. Special risks are involved with significant exposure to a particular sector, including increased susceptibility related to economic, business or other developments affecting that sector, which may result in increased volatility. The Fund also has the potential to invest in foreign company stocks, which involve exposure to currency volatility and political uncertainty. The Fund’s prospectus also includes a description of the main investment risks.

| |

Class C: Class R: | These shares have higher annual fees and expenses than Class A shares. Shares are available to certain eligible investors as described in the prospectus. These shares have higher annual fees and expenses than Class A shares. |

Advisor Class: | Shares are available to certain eligible investors as described in the prospectus. |

1. If the manager and administrator had not waived fees, the Fund’s total returns would have been lower. 2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated. Six-month return has not been annualized.

4. These figures represent the value of a hypothetical $10,000 investment in the Fund over the periods indicated.

5. In accordance with SEC rules, we provide standardized total return information through the latest calendar quarter.

6. Figures are as stated in the Fund’s prospectus current as of the date of this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

18 | Semiannual Report

Your Fund’s Expenses

Franklin Focused Core Equity Fund

As a Fund shareholder, you can incur two types of costs:

Transaction costs, including sales charges (loads) on Fund purchases; and

Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

Semiannual Report | 19

Your Fund’s Expenses (continued)

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

*Expenses are calculated using the most recent six-month expense ratio, net of expense waivers, annualized for each class (A: 1.11%; C: 1.89%; R: 1.39%; and Advisor: 0.89%), multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period.

20 | Semiannual Report

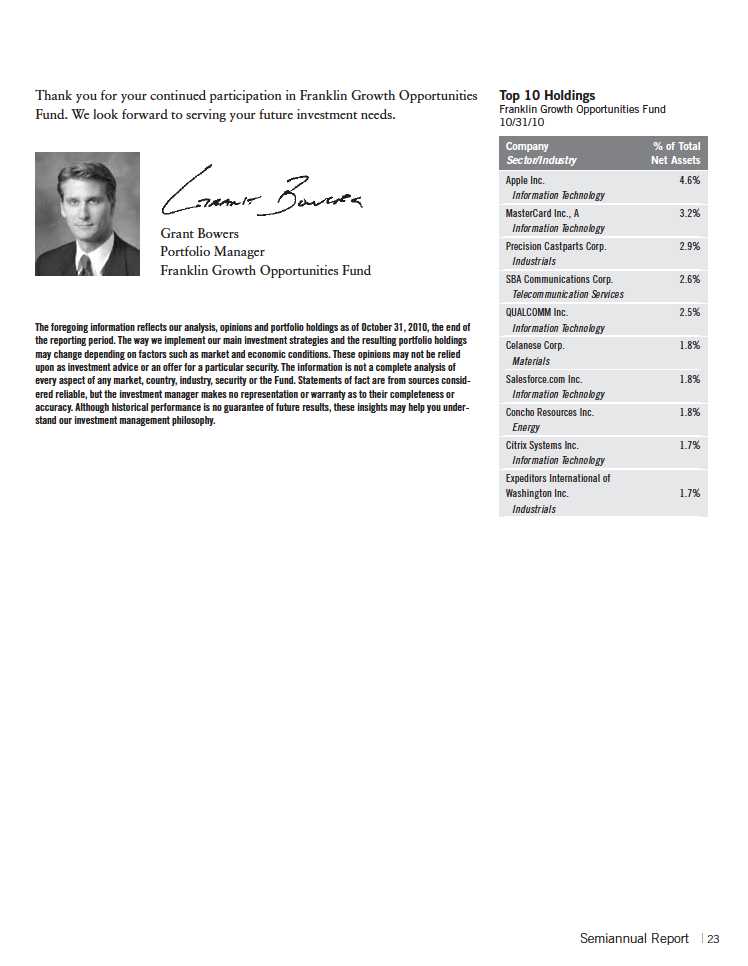

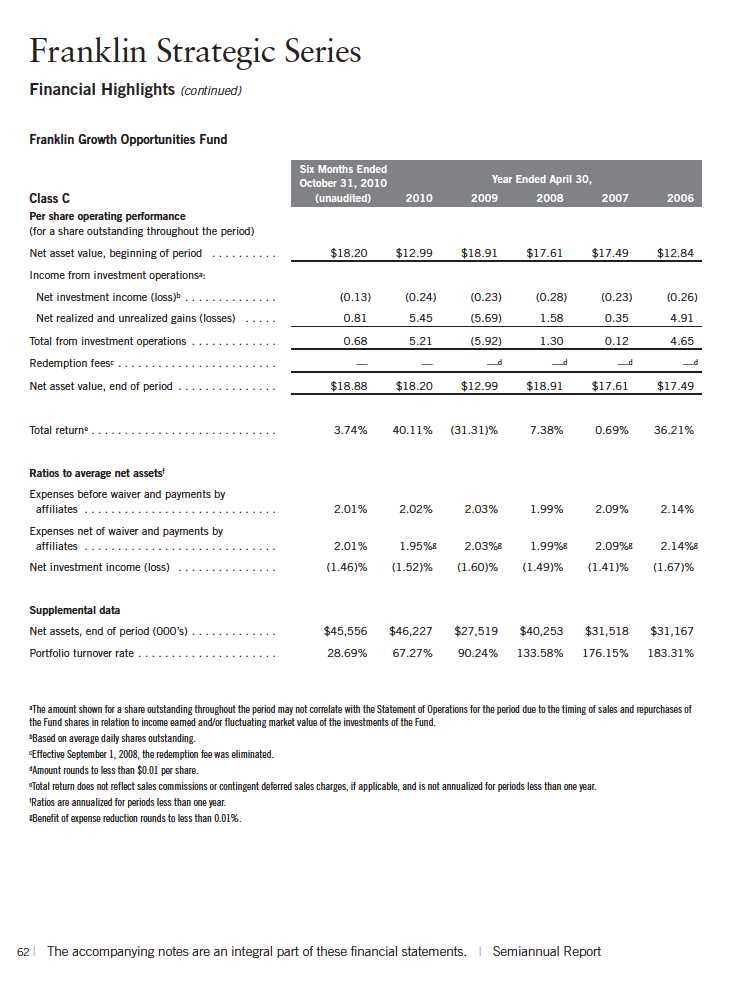

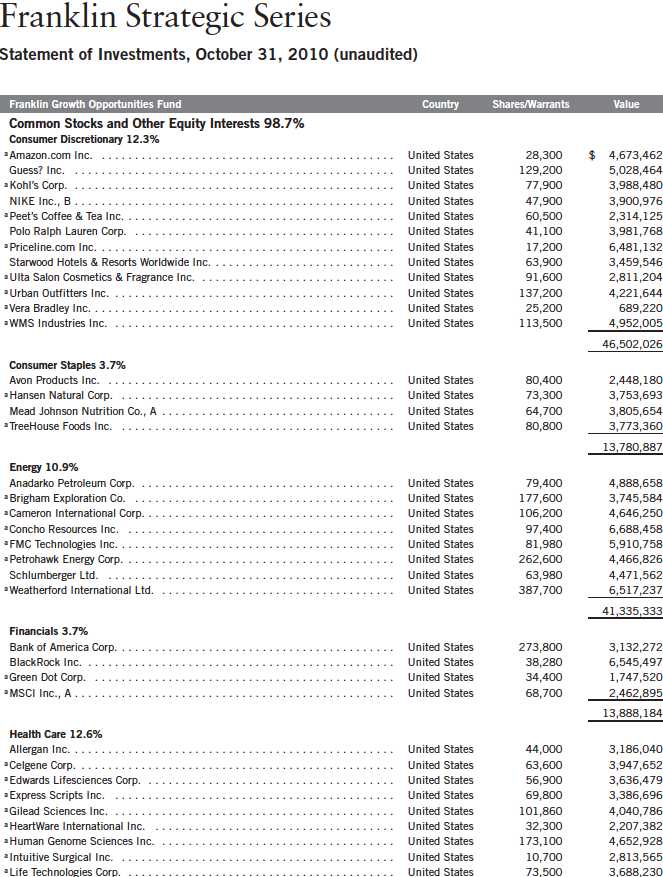

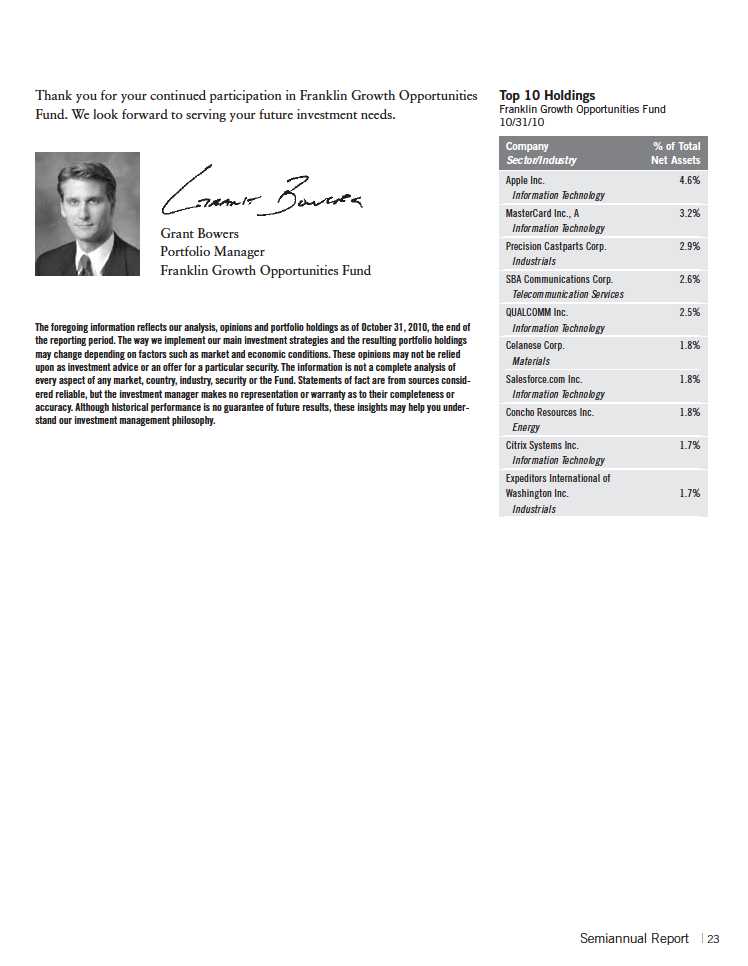

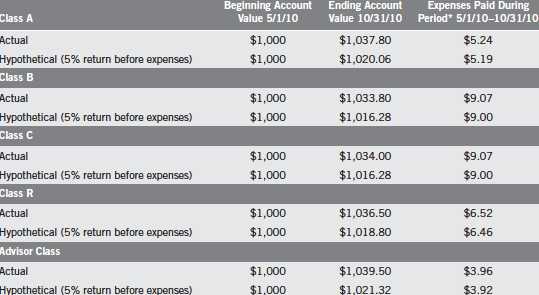

Franklin Growth Opportunities Fund

Your Fund’s Goal and Main Investments: Franklin Growth Opportunities Fund seeks capital appreciation by investing substantially in equity securities of companies demonstrating accelerating growth, increasing profitability, or above-average growth or growth potential, when compared with the

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. Please visit franklintempleton.com or call (800) 342-5236 for most recent month-end performance.

We are pleased to bring you Franklin Growth Opportunities Fund’s semiannual report for the period ended October 31, 2010.

Performance Overview

For the six months under review, Franklin Growth Opportunities Fund –Class A delivered a +4.08% cumulative total return. The Fund outperformed its narrow benchmark, the Russell 3000 Growth Index, which posted a +3.27% total return, and outperformed its broad benchmark, the Standard & Poor’s 500 Index (S&P 500), which generated a +0.74% total return for the same period.1 You can find the Fund’s long-term performance data in the Performance Summary beginning on page 24.

Investment Strategy

We use fundamental, bottom-up research to seek companies meeting our criteria of growth potential, quality and valuation. In seeking sustainable growth characteristics, we look for companies we believe can produce sustainable earnings and cash flow growth, evaluating the long-term market opportunity and competitive structure of an industry to target leaders and emerging leaders. We define quality companies as those with strong and improving competitive positions in attractive markets. We also believe important attributes of quality are experienced and talented management teams as well as financial strength reflected in the capital structure, gross and operating margins, free cash flow generation and returns on capital employed. Our valuation analysis includes a

1. Source: © 2010 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. The Russell 3000 Growth Index is market capitalization weighted and measures performance of those Russell 3000 Index companies with higher price-to-book ratios and higher forecasted growth values. The S&P 500 is a market capitalization-weighted index of 500 stocks designed to measure total U.S. equity market performance. The indexes are unmanaged and include reinvested dividends. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

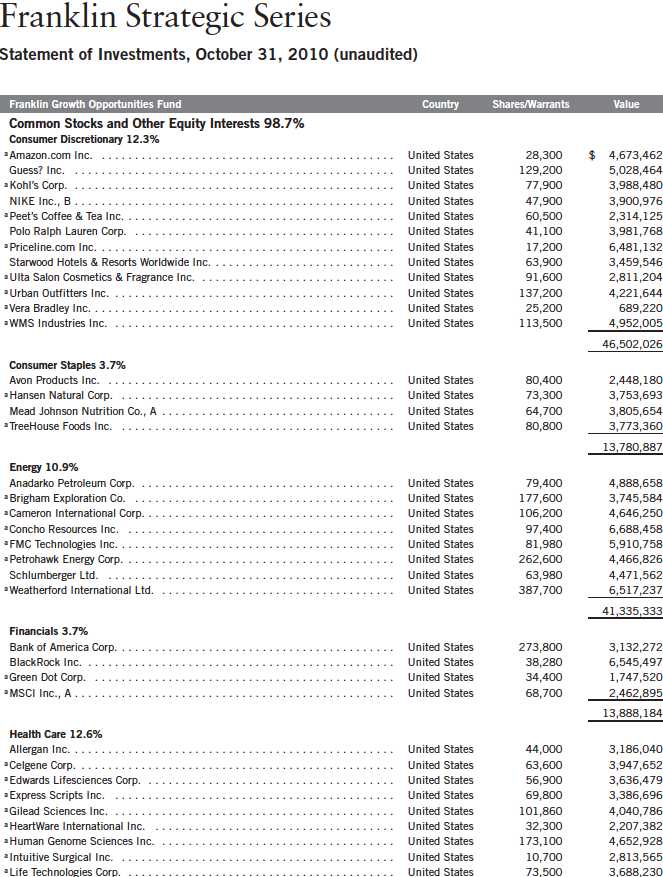

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI). The SOI begins on page 65.

Semiannual Report | 21

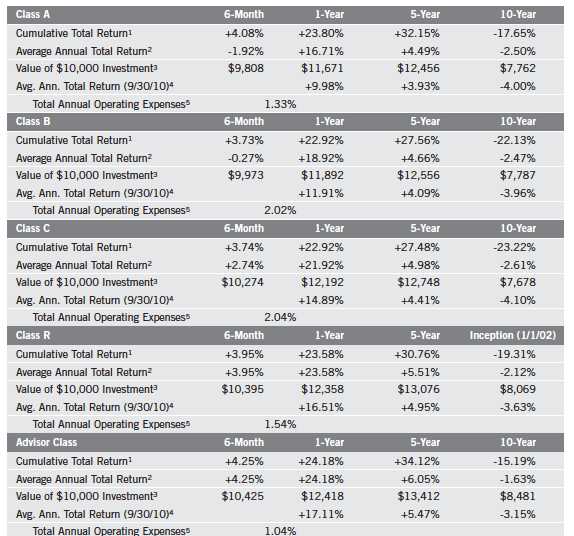

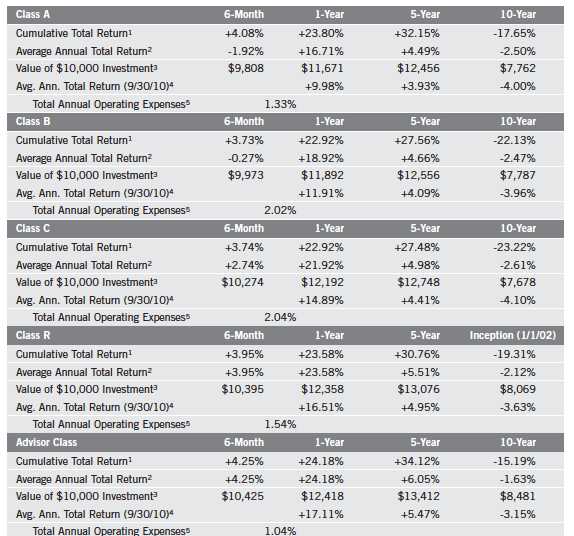

Performance Summary as of 10/31/10

Franklin Growth Opportunities Fund

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

24 | Semiannual Report

Performance Summary (continued)

Performance

Cumulative total return excludes sales charges. Average annual total returns and value of $10,000 investment include maximum sales charges. Class A: 5.75% maximum initial sales charge; Class B: contingent deferred sales charge (CDSC) declining from 4% to 1% over six years, and eliminated thereafter; Class C: 1% CDSC in first year only;

Class R/Advisor Class: no sales charges.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ f rom figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

Semiannual Report | 25

Performance Summary (continued)

Endnotes

The Fund may be more volatile than a more conservative equity fund and may be best suited for long-term investors. The Fund’s investments in smaller and midsized company stocks involve special risks such as relatively smaller revenues, limited product lines and smaller market share. Smaller and midsized company stocks historically have exhibited greater price volatility than larger company stocks, particularly over the short term. The Fund’s portfolio includes technology stocks, a sector which has been one of the most volatile and involves special risks. The Fund’s prospectus also includes a description of the main investment risks.

| |

Class B: Class C: | These shares have higher annual fees and expenses than Class A shares. Prior to 1/1/04, these shares were offered with an initial sales charge; thus actual total returns would have differed. These shares have higher annual fees and expenses than Class A shares. |

Class R: | Shares are available to certain eligible investors as described in the prospectus. These shares have higher annual fees and expenses than Class A shares. |

Advisor Class: | Shares are available to certain eligible investors as described in the prospectus. |

1. Cumulative total return represents the change in value of an investment over the periods indicated.

2. Average annual total return represents the average annual change in value of an investment over the periods indicated. Six-month return has not been annualized.

3. These figures represent the value of a hypothetical $10,000 investment in the Fund over the periods indicated.

4. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

5. Figures are as stated in the Fund’s prospectus current as of the date of this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

26 | Semiannual Report

Your Fund’s Expenses

Franklin Growth Opportunities Fund

As a Fund shareholder, you can incur two types of costs:

Transaction costs, including sales charges (loads) on Fund purchases; and

Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

Semiannual Report | 27

Your Fund’s Expenses (continued)

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

*Expenses are calculated using the most recent six-month expense ratio, annualized for each class (A: 1.32%; B: 2.00%; C: 2.01%; R: 1.51%; and Advisor: 1.01%), multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period.

28 | Semiannual Report

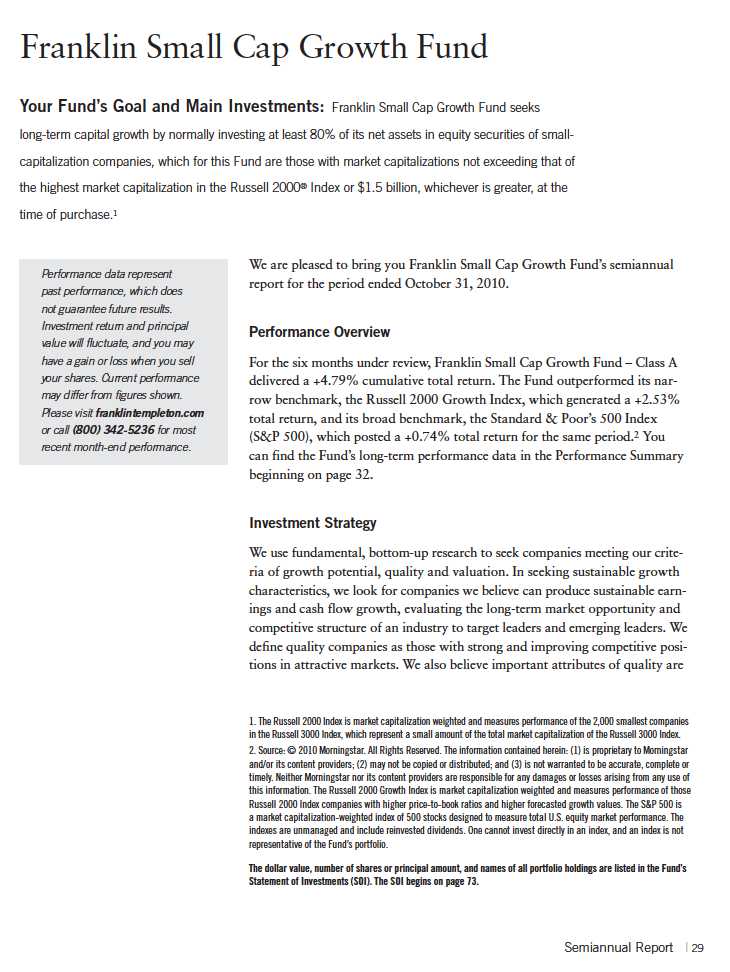

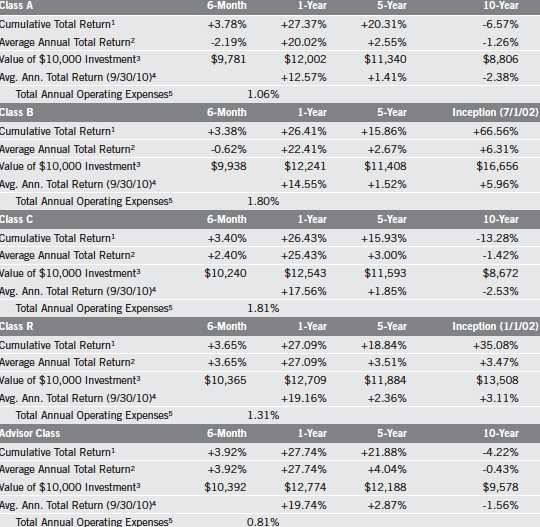

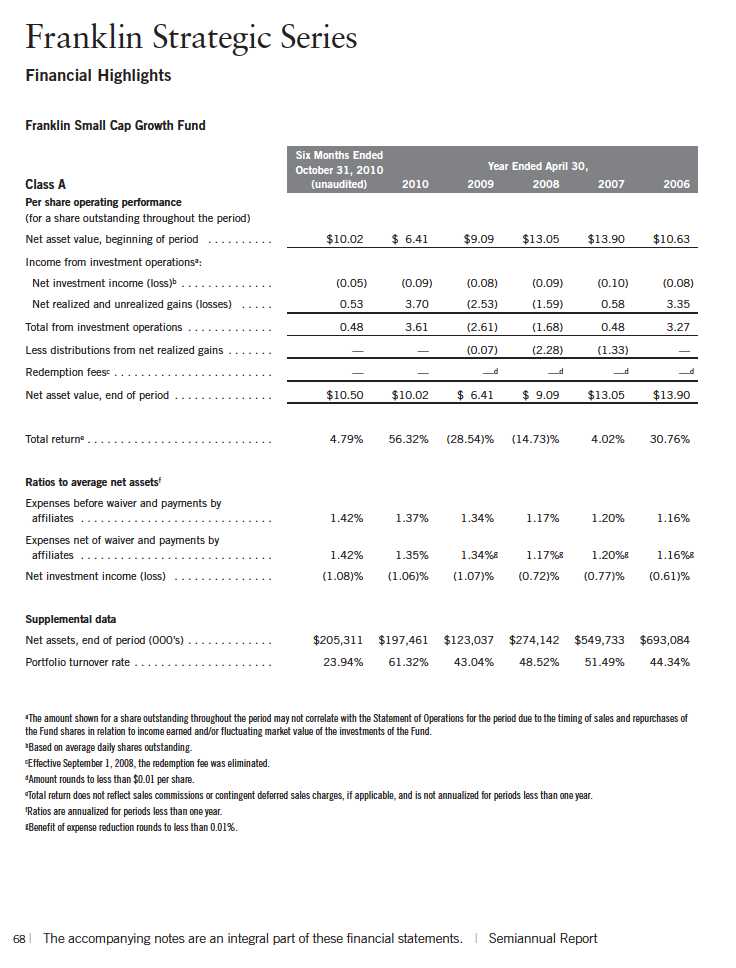

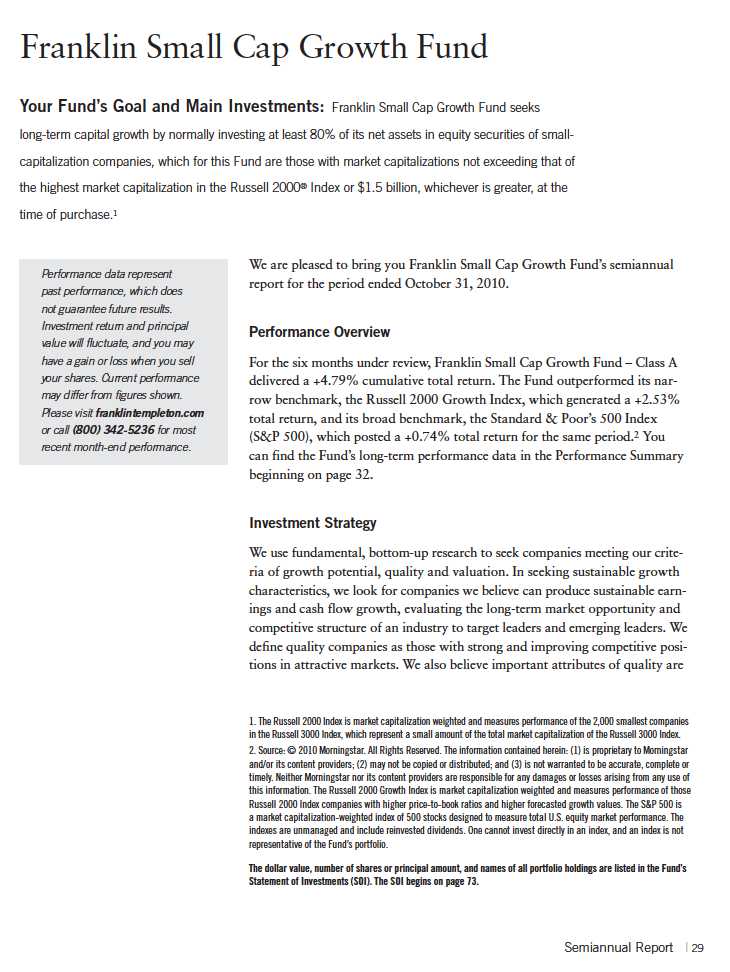

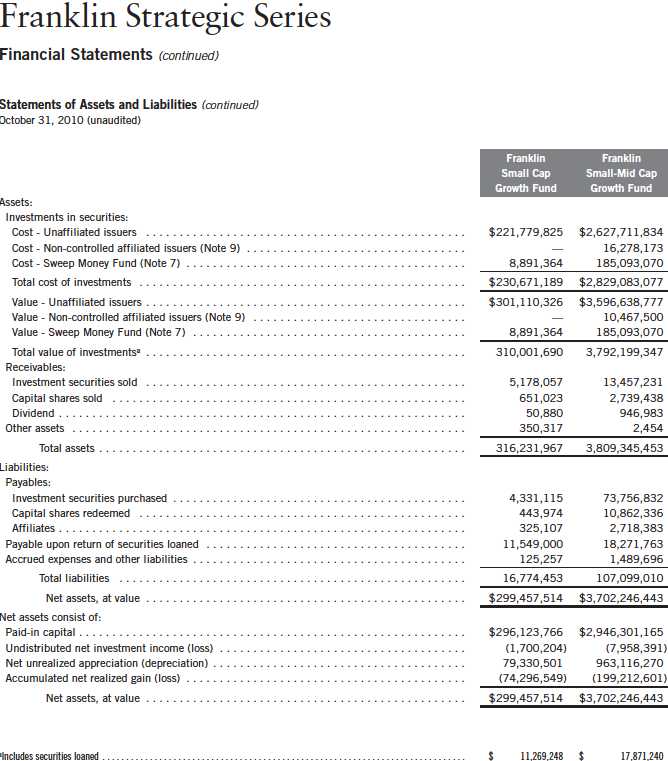

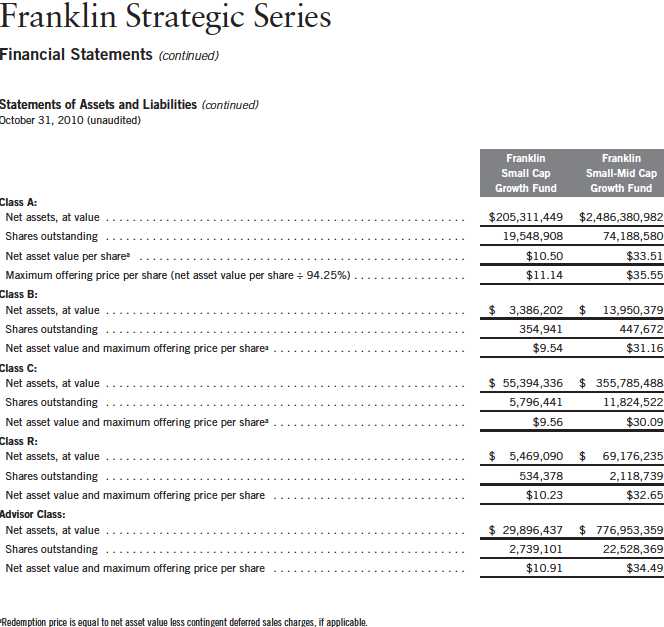

Performance Summary as of 10/31/10

Franklin Small Cap Growth Fund

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

32 | Semiannual Report

Performance Summary (continued)

Performance

Cumulative total return excludes sales charges. Average annual total returns and value of $10,000 investment include maximum sales charges. Class A: 5.75% maximum initial sales charge; Class B: contingent deferred sales charge (CDSC) declining from 4% to 1% over six years, and eliminated thereafter; Class C: 1% CDSC in first year only;

Class R/Advisor Class: no sales charges.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ f rom figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

Semiannual Report | 33

Performance Summary (continued)

Endnotes

Smaller and newer companies can be particularly sensitive to changing economic conditions. Their growth prospects are less certain than those of larger, more established companies, and they can be volatile. The Fund is intended for long-term investors who are comfortable with short-term fluctuations in share price. There are special risks involved with significant exposure to a particular sector, including increased susceptibility related to economic, business or other developments affecting that sector. The Fund includes investments in the technology sector, which has been highly volatile and involves special risks. The Fund’s prospectus also includes a description of the main investment risks.

| |

Class B: Class C: | These shares have higher annual fees and expenses than Class A shares. Prior to 1/1/04, these shares were offered with an initial sales charge; thus actual total returns would have differed. These shares have higher annual fees and expenses than Class A shares. |

Class R: | Shares are available to certain eligible investors as described in the prospectus. These shares have higher annual fees and expenses than Class A shares. |

Advisor Class: | Shares are available to certain eligible investors as described in the prospectus. |

1. Cumulative total return represents the change in value of an investment over the periods indicated.

2. Average annual total return represents the average annual change in value of an investment over the periods indicated. Six-month return has not been annualized.

3. These figures represent the value of a hypothetical $10,000 investment in the Fund over the periods indicated.

4. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

5. Figures are as stated in the Fund’s prospectus current as of the date of this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

34 | Semiannual Report

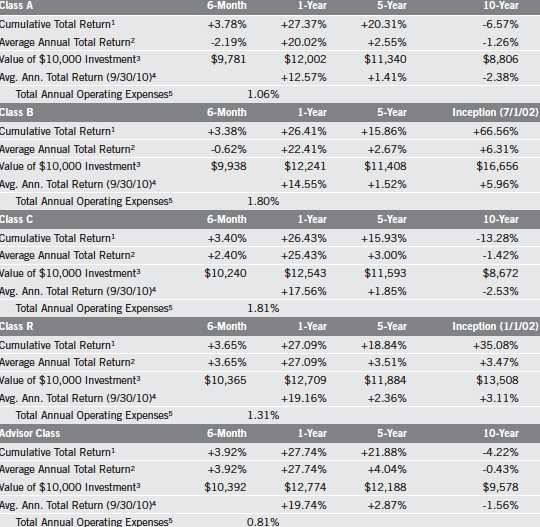

Your Fund’s Expenses

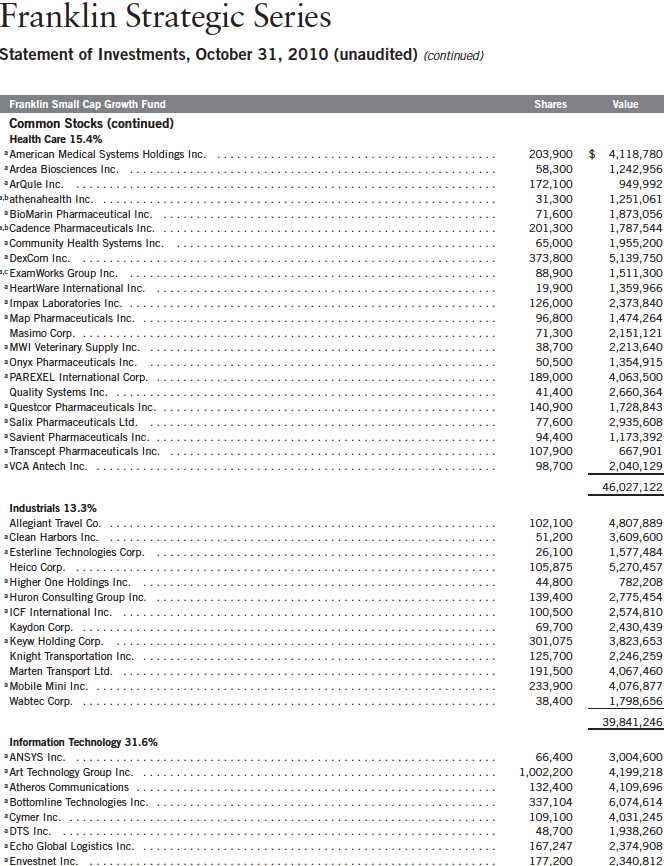

Franklin Small Cap Growth Fund

As a Fund shareholder, you can incur two types of costs:

Transaction costs, including sales charges (loads) on Fund purchases; and

Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

Semiannual Report | 35

Your Fund’s Expenses (continued)

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

*Expenses are calculated using the most recent six-month expense ratio, annualized for each class (A: 1.42%; B: 2.11%; C: 2.11%; R: 1.61%; and Advisor: 1.11%), multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period.

36 | Semiannual Report

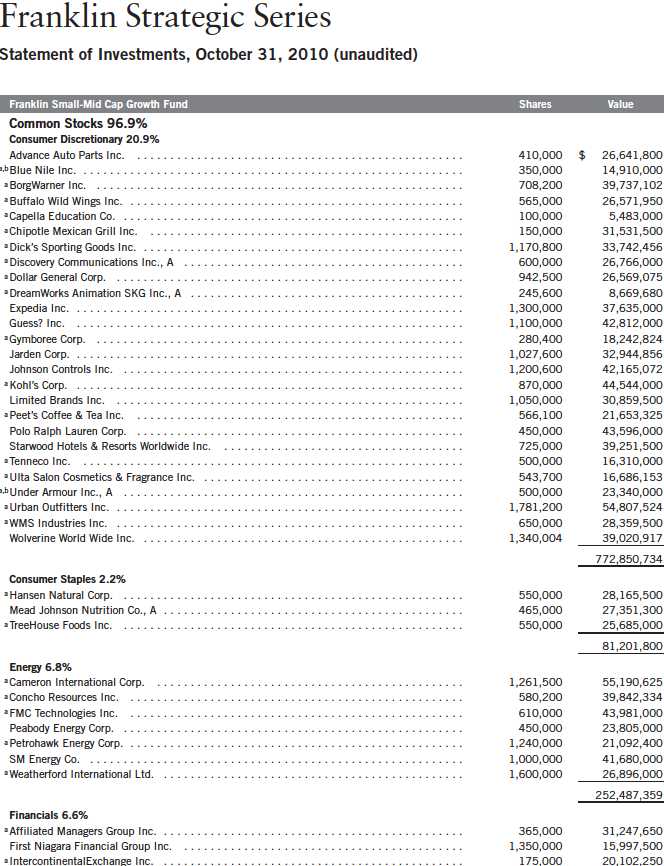

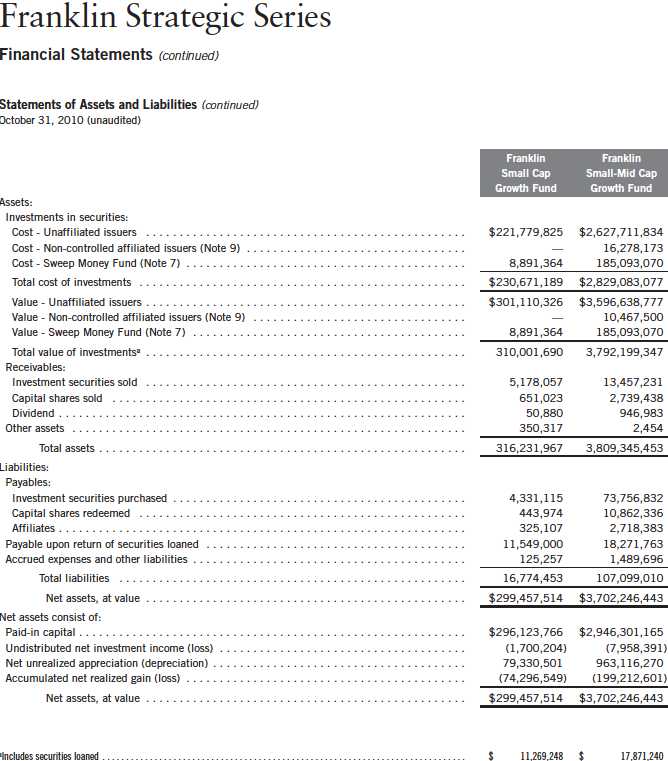

Franklin Small-Mid Cap Growth Fund

Your Fund’s Goal and Main Investments: Franklin Small-Mid Cap Growth Fund seeks long-term capital growth by normally investing at least 80% of its net assets in equity securities of small-cap and mid-cap companies. The Fund defines small-cap companies as those within the market capitalization range of companies in the Russell 2500™ Index at the time of purchase, and mid-cap companies as those within the market capitalization range of the Russell Midcap® Index at the time of purchase.1

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. Please visit franklintempleton.com or call (800) 342-5236 for most recent month-end performance.

We are pleased to bring you Franklin Small-Mid Cap Growth Fund’s semiannual report for the period ended October 31, 2010.

Performance Overview

For the six months under review, Franklin Small-Mid Cap Growth Fund –Class A delivered a +3.78% cumulative total return. The Fund performed comparably to its narrow benchmark, the Russell Midcap Growth Index, which posted a +3.90% total return and outperformed its broad benchmark, the Standard & Poor’s 500 Index (S&P 500) Index, which had +0.74% total return for the same period.2 You can find the Fund’s long-term performance data in the Performance Summary beginning on page 40.

Investment Strategy

We use fundamental, bottom-up research to seek companies meeting our criteria of growth potential, quality and valuation. In seeking sustainable growth characteristics, we look for companies we believe can produce sustainable earnings and cash flow growth, evaluating the long-term market opportunity and competitive structure of an industry to target leaders and emerging leaders. We

1. The Russell 2500 Index is market capitalization weighted and measures performance of the 2,500 smallest companies in the Russell 3000 Index, which represent a modest amount of the Russell 3000 Index’s total market capitalization. The Russell Midcap Index is market capitalization weighted and measures performance of the smallest companies in the Russell 1000 Index, which represent a modest amount of the Russell 1000 Index’s total market capitalization.

2. Source: © 2010 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. The Russell Midcap Growth Index is market capitalization weighted and measures performance of those Russell Midcap Index companies with higher price-to-book ratios and higher forecasted growth values. The S&P 500 is a market capitalization-weighted index of 500 stocks designed to measure total U.S. equity market performance. The indexes are unmanaged and include reinvested dividends. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI). The SOI begins on page 81.

Semiannual Report | 37

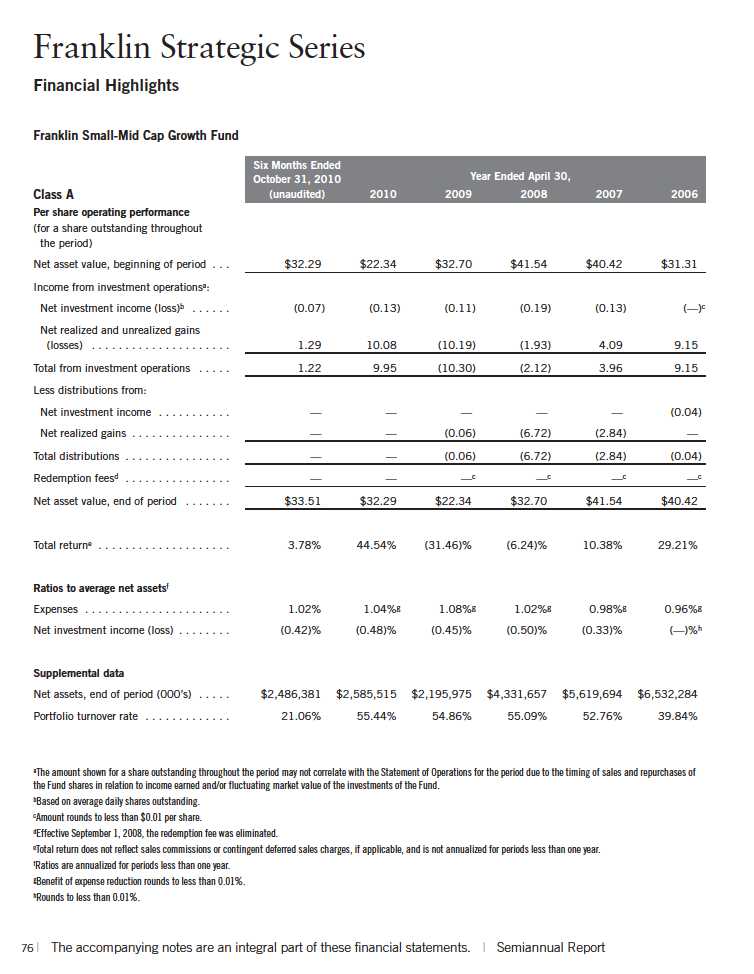

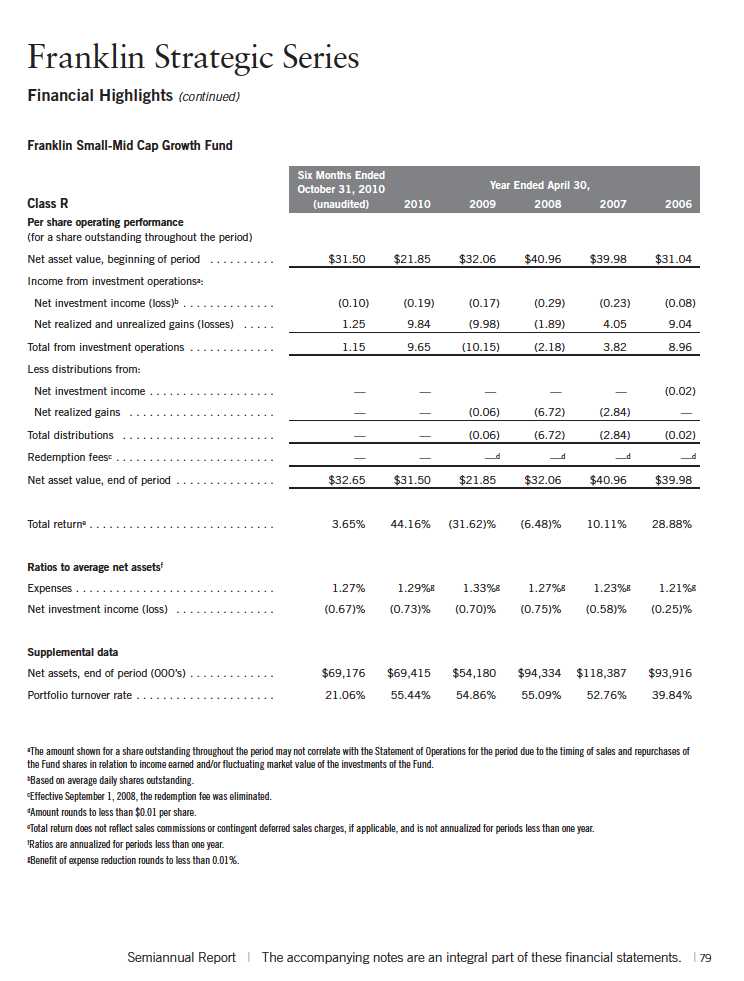

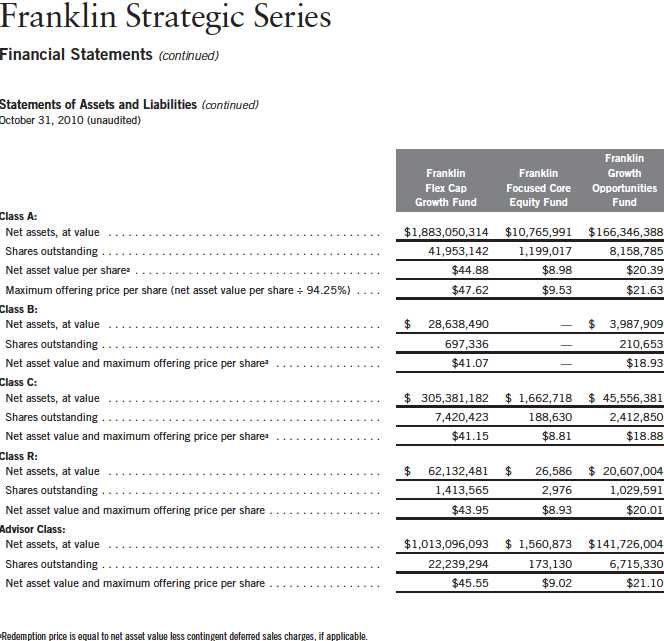

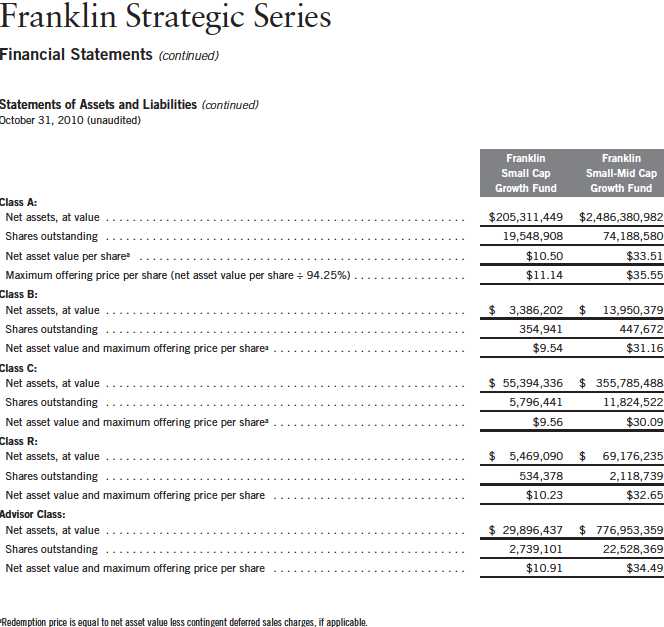

Performance Summary as of 10/31/10

Franklin Small-Mid Cap Growth Fund

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

40 | Semiannual Report

Performance Summary (continued)

Performance

Cumulative total return excludes sales charges. Average annual total returns and value of $10,000 investment include maximum sales charges. Class A: 5.75% maximum initial sales charge; Class B: contingent deferred sales charge (CDSC) declining from 4% to 1% over six years, and eliminated thereafter; Class C: 1% CDSC in first year only;

Class R/Advisor Class: no sales charges.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ f rom figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

Semiannual Report | 41

Performance Summary (continued)

Endnotes

Investors should be comfortable with fluctuations in the value of their investment, as small and midsized company stocks can be volatile, especially over the short term. Smaller or relatively new or unseasoned companies can be particularly sensitive to changing economic conditions, and their prospects for growth are less certain than those of larger, more established companies. The Fund includes investments in the technology sector, which has been highly volatile and involves special risks. The Fund’s prospectus also includes a description of the main investment risks.

| |

Class B: Class C: | These shares have higher annual fees and expenses than Class A shares. Prior to 1/1/04, these shares were offered with an initial sales charge; thus actual total returns would have differed. These shares have higher annual fees and expenses than Class A shares. |

Class R: | Shares are available to certain eligible investors as described in the prospectus. These shares have higher annual fees and expenses than Class A shares. |

Advisor Class: | Shares are available to certain eligible investors as described in the prospectus. |

1. Cumulative total return represents the change in value of an investment over the periods indicated.

2. Average annual total return represents the average annual change in value of an investment over the periods indicated. Six-month return has not been annualized.

3. These figures represent the value of a hypothetical $10,000 investment in the Fund over the periods indicated.

4. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

5. Figures are as stated in the Fund’s prospectus current as of the date of this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

42 | Semiannual Report

Your Fund’s Expenses

Franklin Small-Mid Cap Growth Fund

As a Fund shareholder, you can incur two types of costs:

Transaction costs, including sales charges (loads) on Fund purchases; and

Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

Semiannual Report | 43

Your Fund’s Expenses (continued)

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

*Expenses are calculated using the most recent six-month expense ratio, annualized for each class (A: 1.02%; B: 1.77%; C: 1.77%; R: 1.27%; and Advisor: 0.77%), multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period.

44 | Semiannual Report

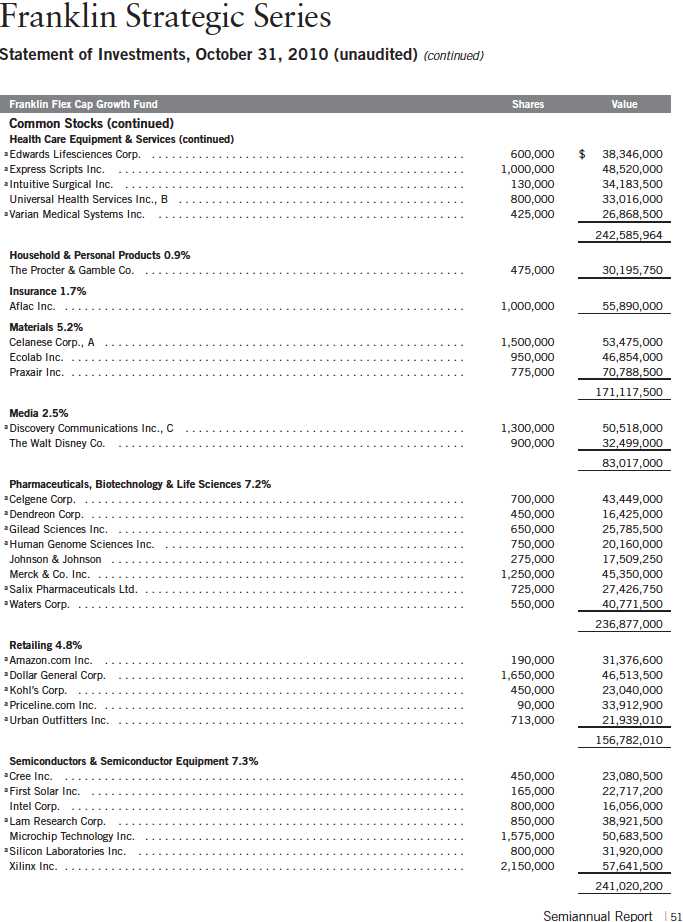

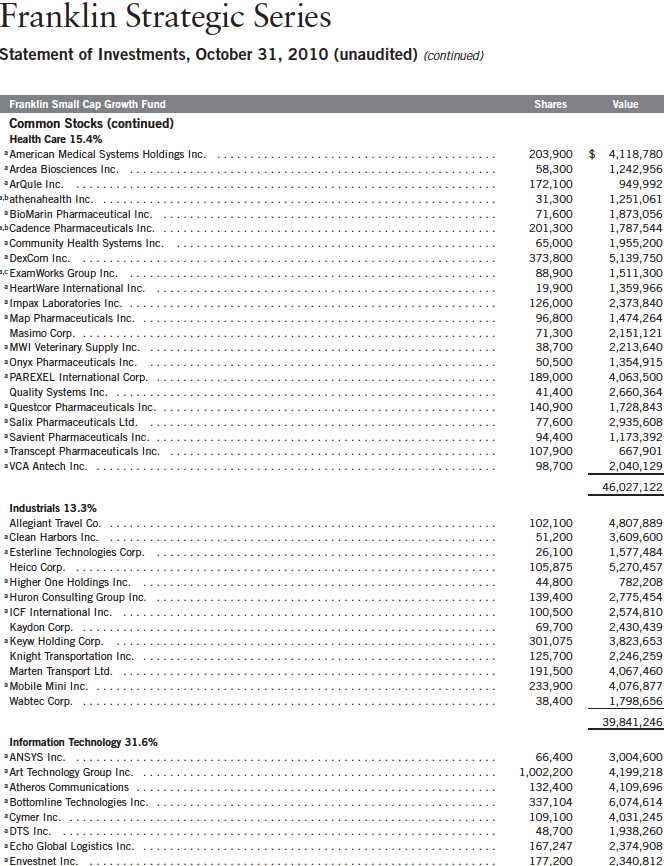

50 | Semiannual Report

52 | Semiannual Report

58 | Semiannual Report

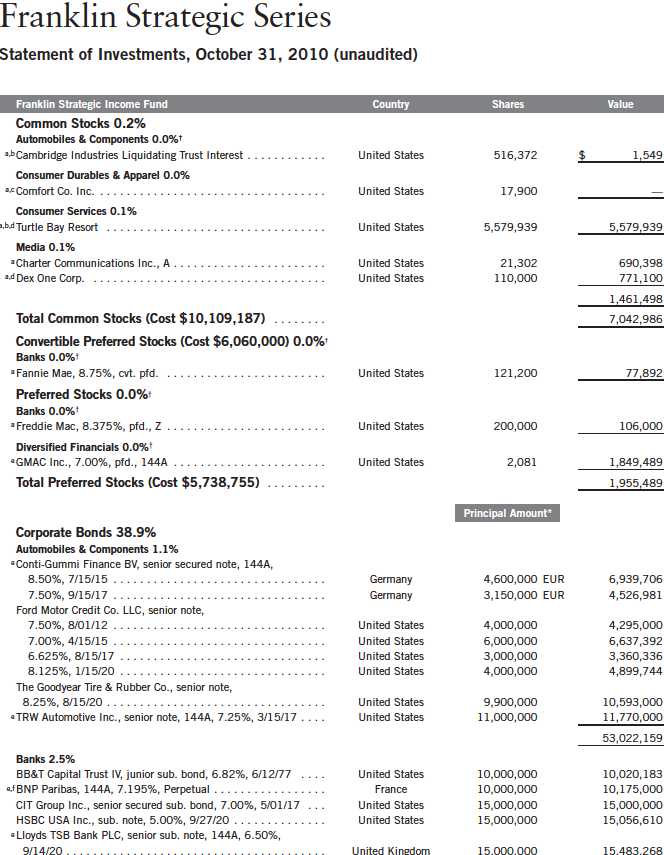

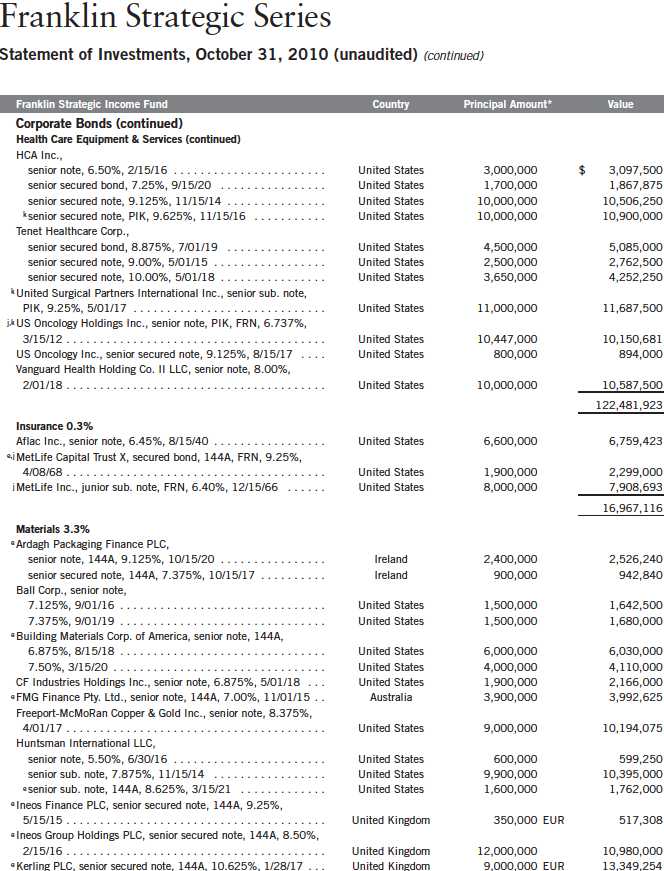

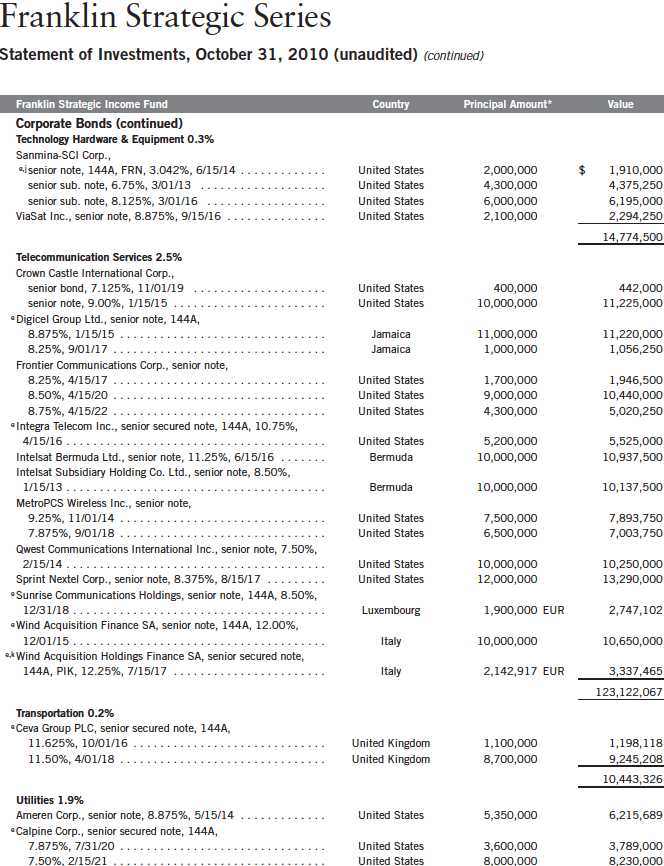

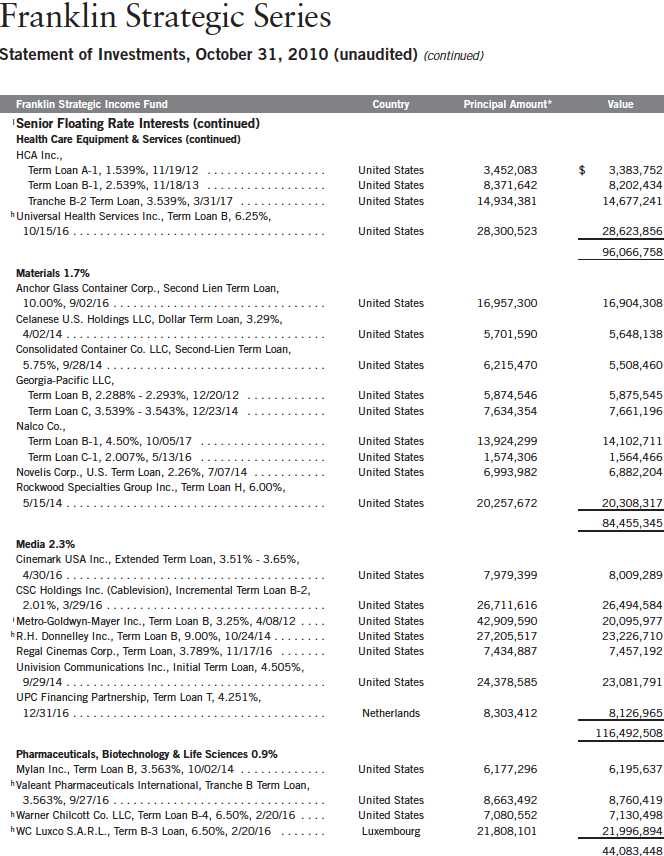

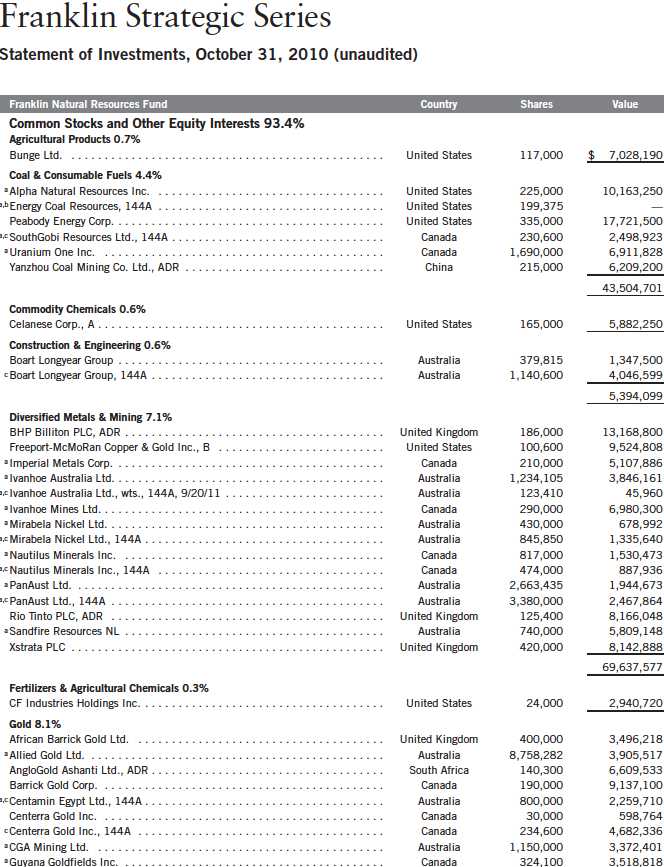

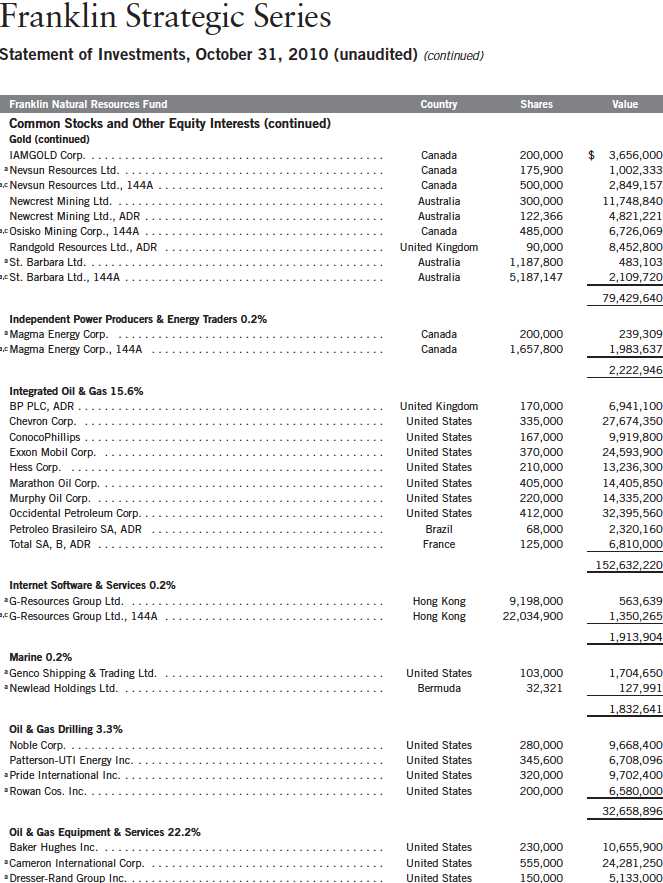

See Abbreviations on page 112.

aNon-income producing.

bSee Note 7 regarding investments in the Institutional Fiduciary Trust Money Market Portfolio. The rate shown is the annualized seven-day yield at period end.

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 59

Semiannual Report | 65

66 | Semiannual Report

See Abbreviations on page 112.

aNon-income producing.

bSee Note 8 regarding restricted securities.

cSee Note 7 regarding investments in the Institutional Fiduciary Trust Money Market Portfolio. The rate shown is the annualized seven-day yield at period end.

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 67

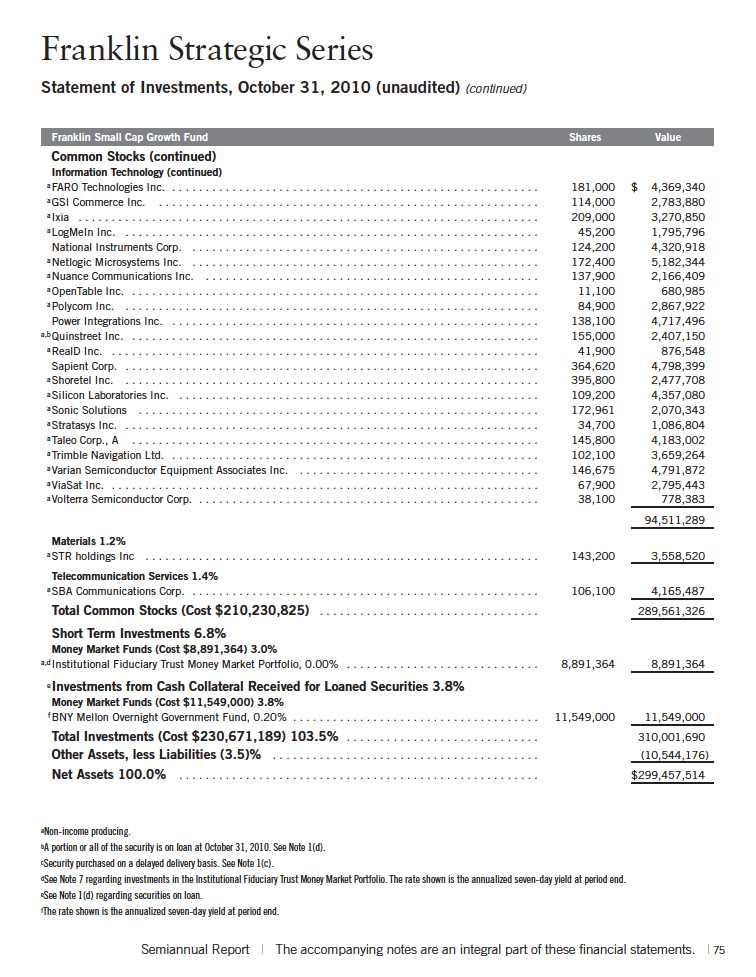

Semiannual Report | 73

74 | Semiannual Report

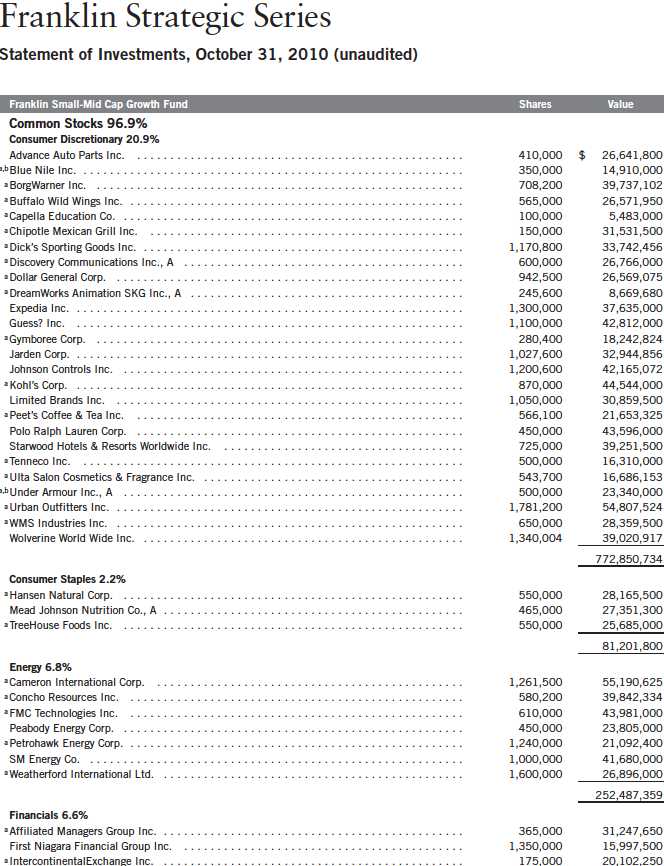

Semiannual Report | 81

82 | Semiannual Report

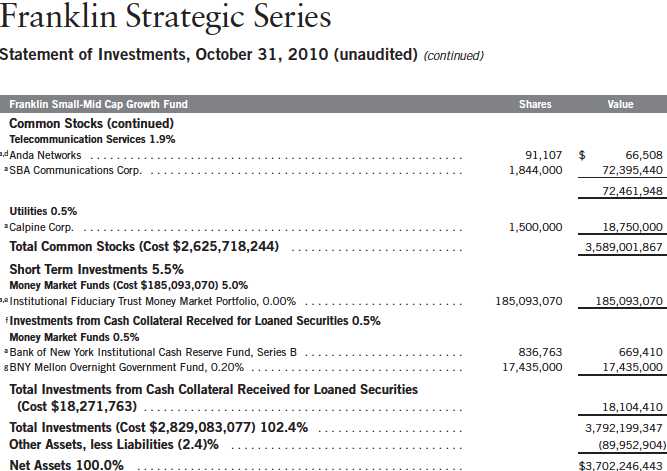

Semiannual Report | 83

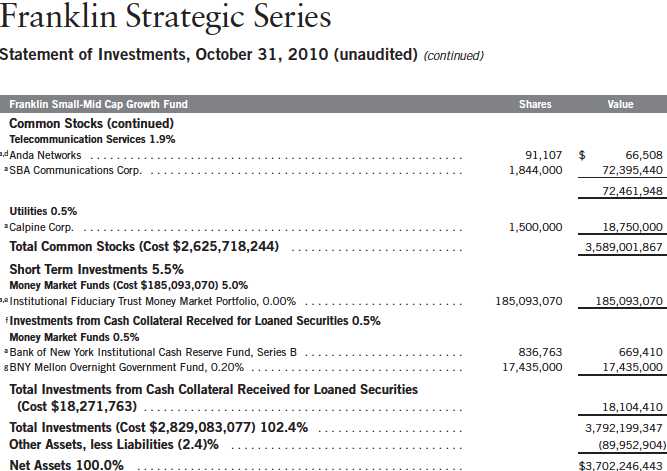

See Abbreviations on page 112.

aNon-income producing.

bA portion or all of the security is on loan at October 31, 2010. See Note 1(d).

cSee Note 9 regarding holdings of 5% voting securities.

dSee Note 8 regarding restricted securities.

eSee Note 7 regarding investments in the Institutional Fiduciary Trust Money Market Portfolio. The rate shown is the annualized seven-day yield at period end.

fSee Note 1(d) regarding securities on loan.

gThe rate shown is the annualized seven-day yield at period end.

84 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

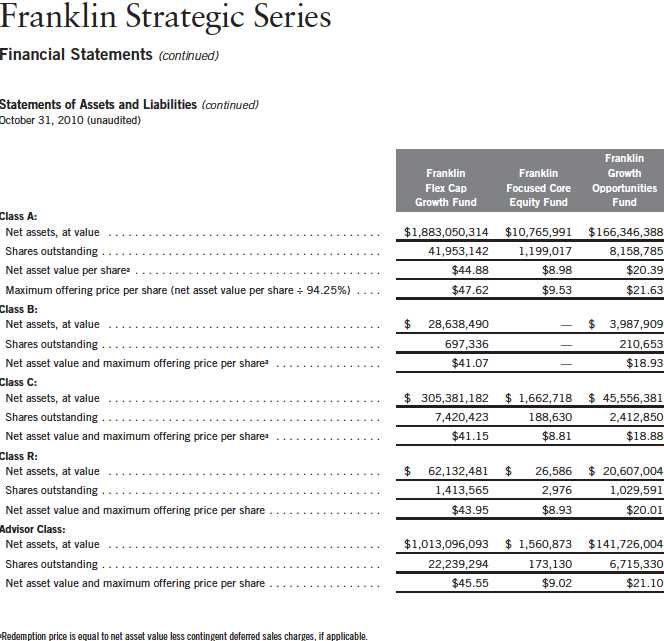

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 85

86 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 87

88 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 89

90 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 91

92 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 93

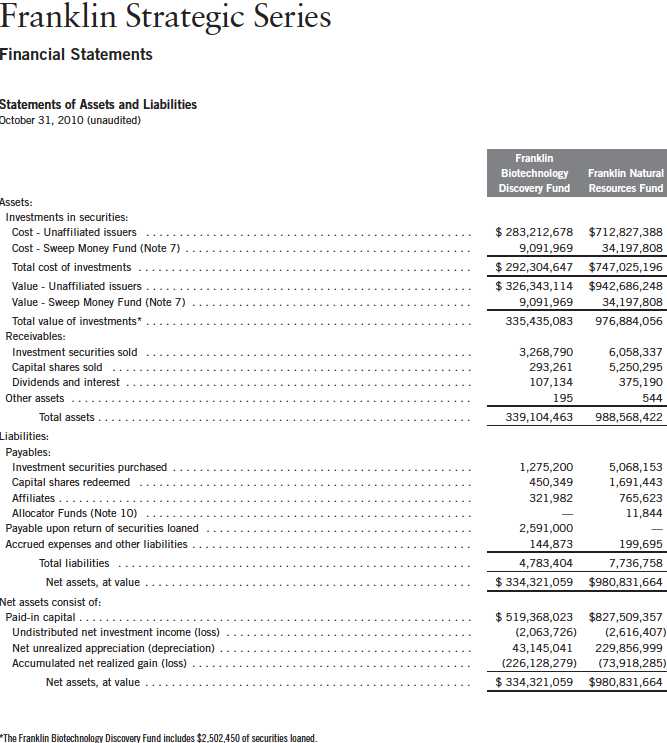

Franklin Strategic Series

Notes to Financial Statements (unaudited) (continued)

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) |

| a. | Financial Instrument Valuation (continued) |

the investment are discounted to calculate fair value. Discounts may also be applied due to the nature or duration of any restrictions on the disposition of the investments. Due to the inherent uncertainty of valuations of such investments, the fair values may differ significantly from the values that would have been used had an active market existed.

Trading in securities on foreign exchanges and over-the-counter markets may be completed before the daily close of business on the NYSE. Occasionally, events occur between the time at which trading in a foreign security is completed and the close of the NYSE that might call into question the reliability of the value of a portfolio security held by the fund. As a result, differences may arise between the value of the Funds’ portfolio securities as determined at the foreign market close and the latest indications of value at the close of the NYSE. In order to minimize the potential for these differences, the investment manager monitors price movements following the close of trading in foreign stock markets through a series of country specific market proxies (such as baskets of American Depository Receipts, futures contracts and exchange traded funds). These price movements are measured against established trigger thresholds for ea ch specific market proxy to assist in determining if an event has occurred that may call into question the reliability of the values of the foreign securities held by the Funds. If such an event occurs, the securities may be valued using fair value procedures, which may include the use of independent pricing services.

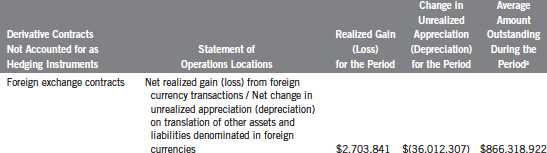

b. Foreign Currency Translation

Portfolio securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars based on the exchange rate of such currencies against U.S. dollars on the date of valuation. The Funds may enter into foreign currency exchange contracts to facilitate transactions denominated in a foreign currency. Purchases and sales of securities, income and expense items denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date. Portfolio securities and assets and liabilities denominated in foreign currencies contain risks that those currencies will decline in value relative to the U.S. dollar. Occasionally, events may impact the availability or reliability of foreign exchange rates used to convert the U.S. dollar equivalent value. If such an event occurs, the foreign exchange rate will be valued at fair value using procedures established and appro ved by the Funds’ Board of Trustees.

The Funds do not separately report the effect of changes in foreign exchange rates from changes in market prices on securities held. Such changes are included in net realized and unrealized gain or loss from investments on the Statement of Operations.

Realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on securities transactions and the difference between the recorded amounts of dividends, interest, and foreign withholding taxes and the

Semiannual Report | 95

Franklin Strategic Series

Notes to Financial Statements (unaudited) (continued)

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) |

| f. | Security Transactions, Investment Income, Expenses and Distributions |

Security transactions are accounted for on trade date. Realized gains and losses on security transactions are determined on a specific identification basis. Interest income and estimated expenses are accrued daily. Dividend income is recorded on the ex-dividend date except that certain dividends from foreign securities are recognized as soon as the Funds are notified of the ex-dividend date. Distributions to shareholders are recorded on the ex-dividend date and are determined according to income tax regulations (tax basis). Distributable earnings determined on a tax basis may differ from earnings recorded in accordance with accounting principles generally accepted in the United States of America. These differences may be permanent or temporary. Permanent differences are reclassified among capital accounts to reflect their tax character. These reclassifications have no impact on net assets or the results of operations. Temporary diffe rences are not reclassified, as they may reverse in subsequent periods.

Common expenses incurred by the Trust are allocated among the Funds based on the ratio of net assets of each fund to the combined net assets of the Trust. Fund specific expenses are charged directly to the fund that incurred the expense.

Realized and unrealized gains and losses and net investment income, not including class specific expenses, are allocated daily to each class of shares based upon the relative proportion of net assets of each class. Differences in per share distributions, by class, are generally due to differences in class specific expenses.

g. Accounting Estimates

The preparation of financial statements in accordance with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

h. Guarantees and Indemnifications

Under the Trust’s organizational documents, its officers and trustees are indemnified by the Trust against certain liabilities arising out of the performance of their duties to the Trust. Additionally, in the normal course of business, the Trust, on behalf of the Funds, enters into contracts with service providers that contain general indemnification clauses. The Trust’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Trust that have not yet occurred. Currently, the Trust expects the risk of loss to be remote.

Semiannual Report | 97

Franklin Strategic Series

Notes to Financial Statements (unaudited) (continued)

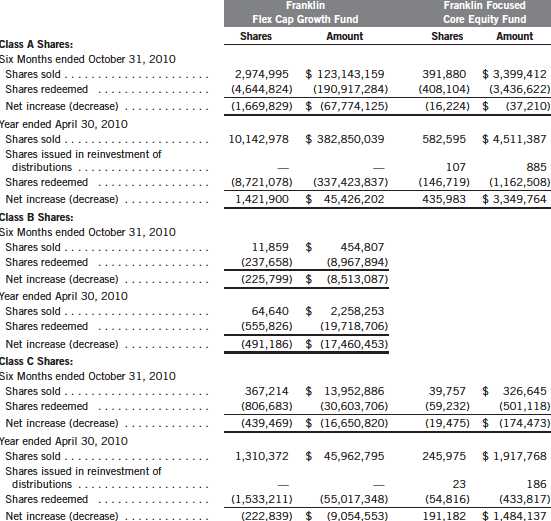

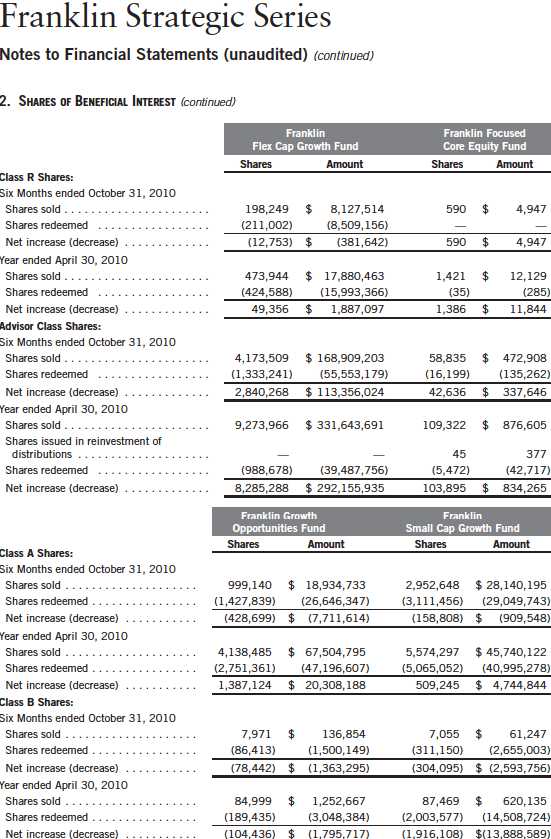

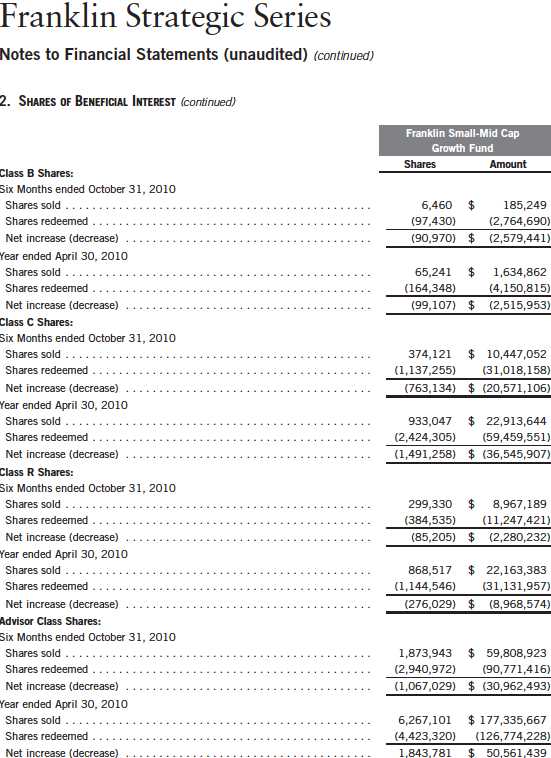

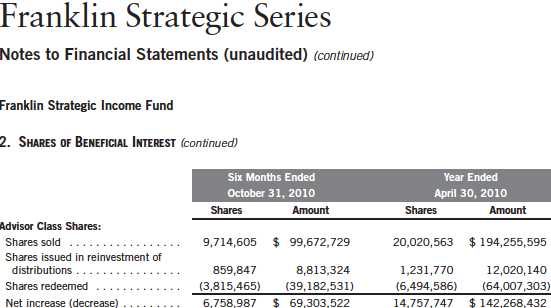

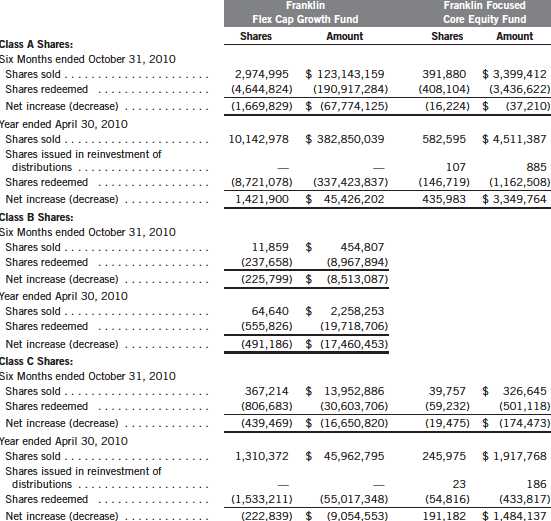

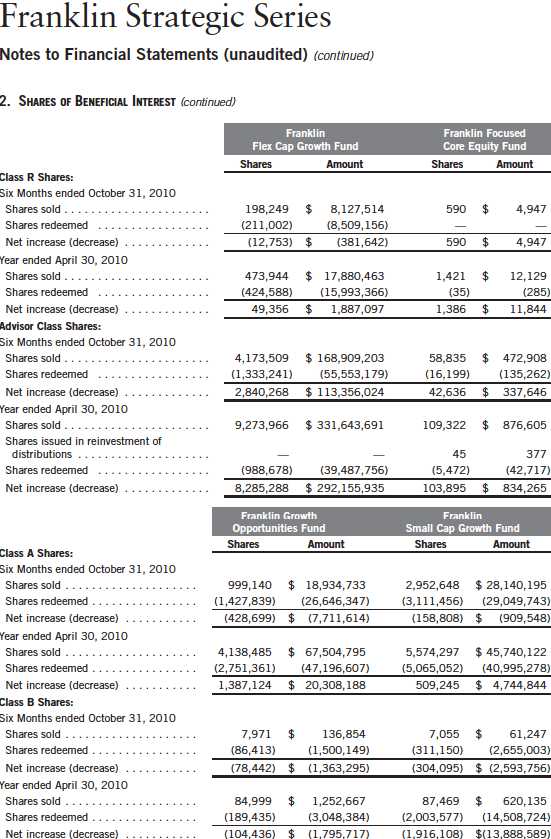

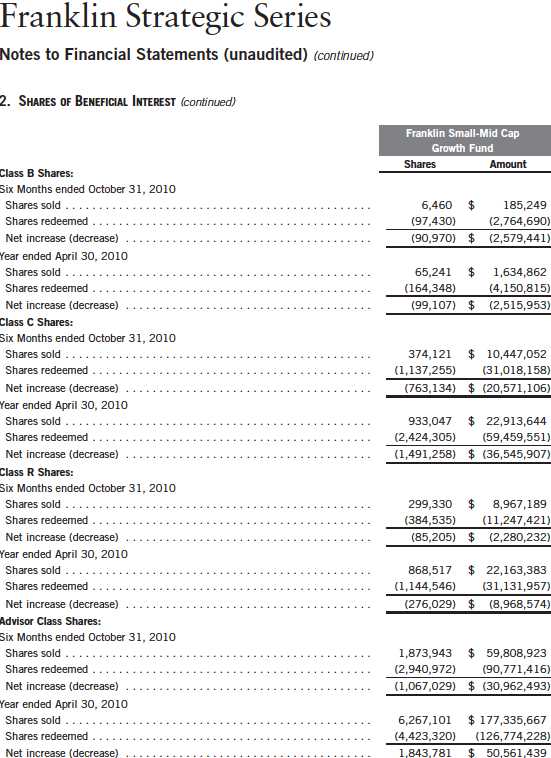

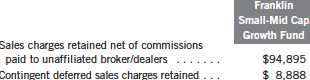

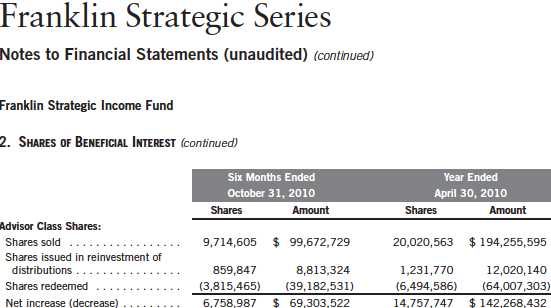

2. SHARES OF BENEFICIAL INTEREST

At October 31, 2010, there were an unlimited number of shares authorized (without par value).

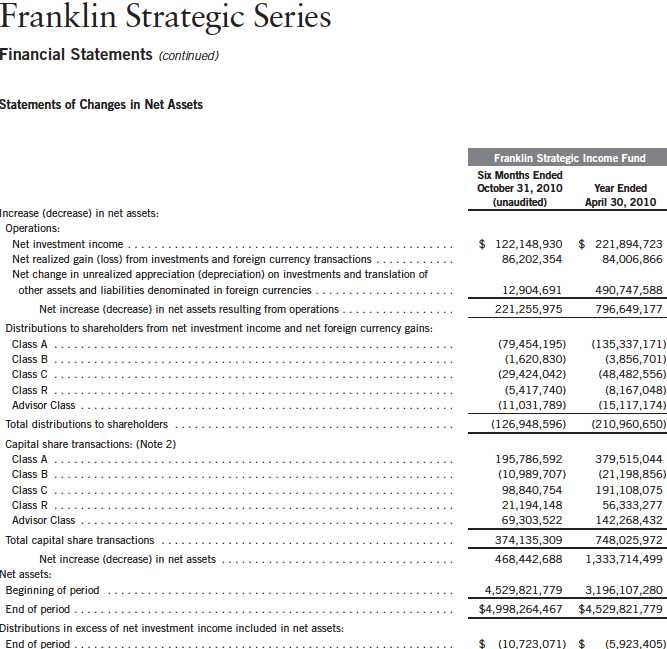

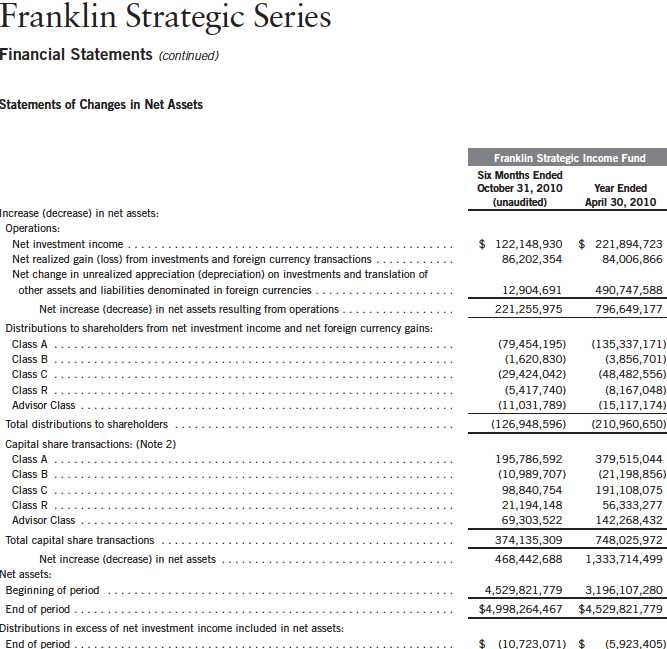

Transactions in the Funds’ shares were as follows:

98 | Semiannual Report

Semiannual Report | 99

100 | Semiannual Report

Semiannual Report | 101

Franklin Strategic Series

Notes to Financial Statements (unaudited) (continued)

| 3. | TRANSACTIONS WITH AFFILIATES (continued) |

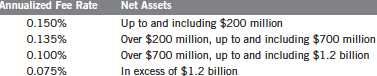

| a. | Management Fees (continued) |

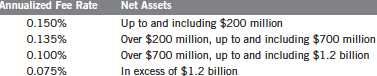

The Franklin Growth Opportunities Fund pays an investment management fee to Advisers based on the average daily net assets of the fund as follows:

The Franklin Small Cap Growth Fund pays an investment management fee to Advisers based on the average daily net assets of the fund as follows:

b. Administrative Fees

The Franklin Focused Core Equity Fund, the Franklin Growth Opportunities Fund, and the Franklin Small Cap Growth Fund pay an administrative fee to FT Services of 0.20% per year of the average daily net assets of each of the funds.

Under an agreement with Advisers, FT Services provides administrative services to the Franklin Flex Cap Growth Fund and the Franklin Small-Mid Cap Growth Fund. The fee is paid by Advisers based on average daily net assets, and is not an additional expense of the funds.

Semiannual Report | 103

Franklin Strategic Series

Notes to Financial Statements (unaudited) (continued)

| 3. | TRANSACTIONS WITH AFFILIATES (continued) |

| c. | Distribution Fees |

The Trust’s Board of Trustees has adopted distribution plans for each share class, with the exception of Advisor Class shares, pursuant to Rule 12b-1 under the 1940 Act. Under the Funds’ Class A reimbursement distribution plans, the Funds reimburse Distributors for costs incurred in connection with the servicing, sale and distribution of each fund’s shares up to the maximum annual plan rate. Under the Class A reimbursement distribution plans, costs exceeding the maximum for the current plan year cannot be reimbursed in subsequent periods.

In addition, under the Funds’ Class B, C and R compensation distribution plans, the Funds pay Distributors for costs incurred in connection with the servicing, sale and distribution of each fund’s shares up to the maximum annual plan rate for each class.

The maximum annual plan rates, based on the average daily net assets, for each class, are as follows:

The Board of Trustees has set the current rate at 0.30% per year for Class A shares for the Franklin Focused Core Equity Fund, the Franklin Growth Opportunities Fund, and the Franklin Small Cap Growth Fund until further notice and approval by the Board.

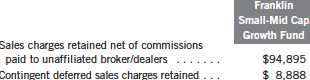

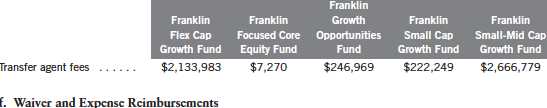

d. Sales Charges/Underwriting Agreements

Distributors has advised the Funds of the following commission transactions related to the sales and redemptions of the Funds’ shares for the period:

104 | Semiannual Report

Franklin Strategic Series

Notes to Financial Statements (unaudited) (continued)

| 3. | TRANSACTIONS WITH AFFILIATES (continued) |

| d. | Sales Charges/Underwriting Agreements (continued) |

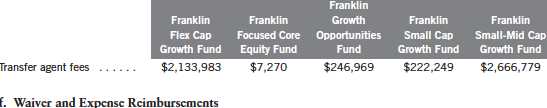

e. Transfer Agent Fees

For the period ended October 31, 2010, the Funds paid transfer agent fees as noted in the Statements of Operations of which the following amounts were retained by Investor Services:

For the Franklin Focused Core Equity Fund, Advisers and FT Services have voluntarily agreed in advance to waive or limit their respective fees and to assume as their own expense certain expenses otherwise payable by the fund so that the common expenses (i.e. a combination of management fees, administrative fees, and other expenses, but excluding distribution fees, and acquired fund fees and expenses) for each class of the Fund do not exceed 0.89% (other than certain non-routine expenses or costs, including those relating to litigation, indemnification, reorganizations, and liquidations) until August 31, 2011.

g. Other Affiliated Transactions

At October 31, 2010, Advisers owned 31.85% of the Franklin Focused Core Equity Fund’s outstanding shares.

4. EXPENSE OFFSET ARRANGEMENT

The Funds have entered into an arrangement with their custodian whereby credits realized as a result of uninvested cash balances are used to reduce a portion of the Funds’ custodian expenses. During the period ended October 31, 2010, there were no credits earned.

Semiannual Report | 105

Franklin Strategic Series

Notes to Financial Statements (unaudited) (continued)

5. INCOME TAXES

For tax purposes, capital losses may be carried over to offset future capital gains, if any. At April 30, 2010, the capital loss carryforwards were as follows:

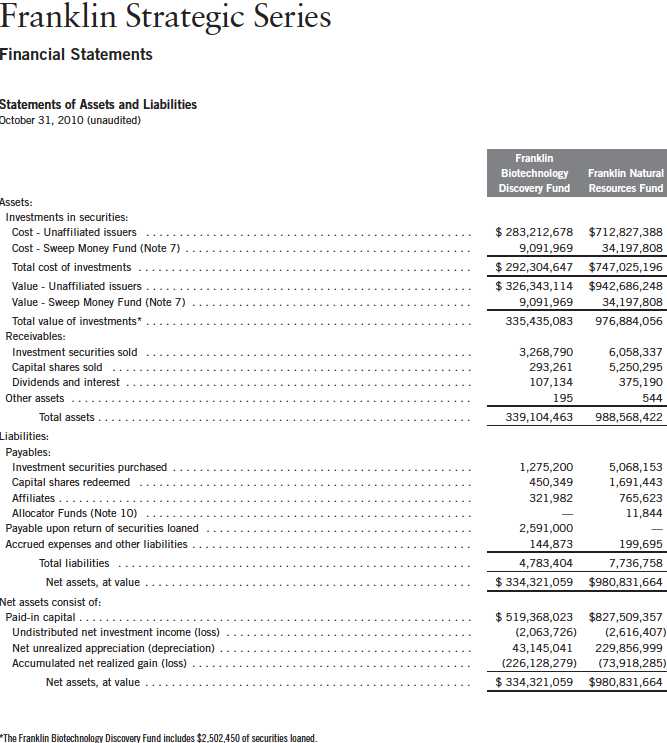

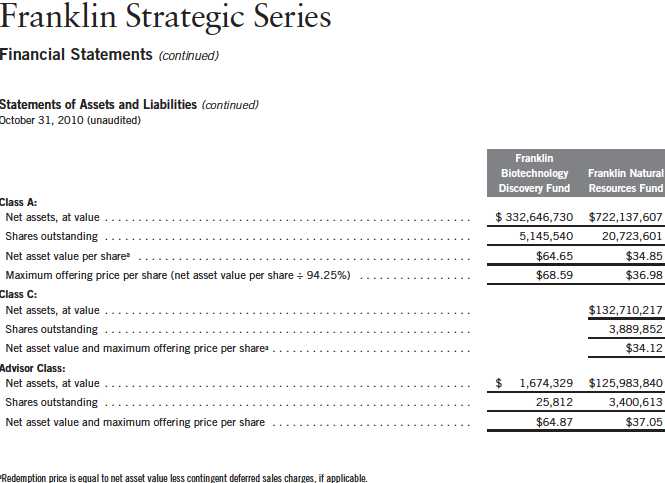

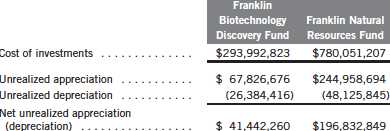

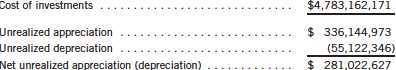

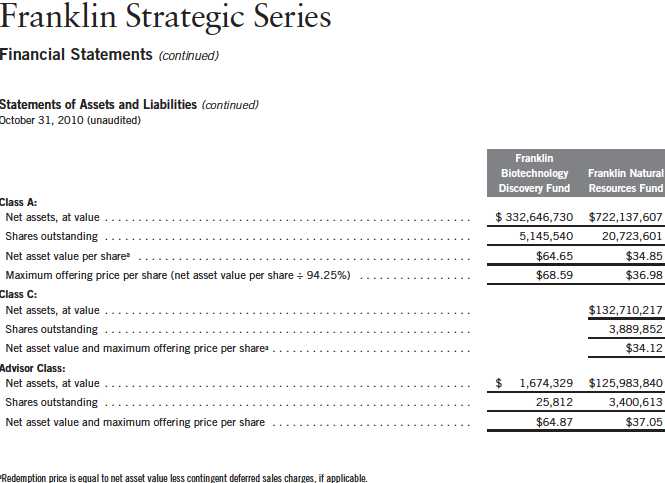

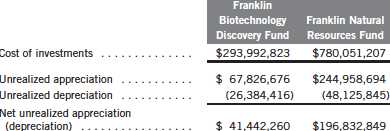

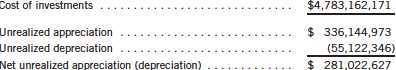

At October 31, 2010, the cost of investments and net unrealized appreciation (depreciation) for income tax purposes were as follows:

106 | Semiannual Report

Franklin Strategic Series

Notes to Financial Statements (unaudited) (continued)

5. INCOME TAXES (continued)

Net investment income (loss) differs for financial statement and tax purposes primarily due to differing treatments of foreign currency transactions, bond discounts and premiums, and regulatory settlements.

Net realized gains (losses) differ for financial statement and tax purposes primarily due to differing treatments of wash sales, foreign currency transactions, and bond discounts and premiums.

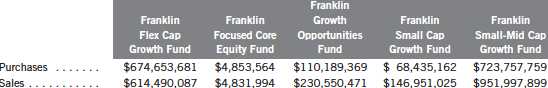

6. INVESTMENT TRANSACTIONS

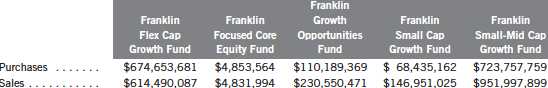

Purchases and sales of investments (excluding short term securities) for the period ended October 31, 2010, were as follows:

7. INVESTMENTS IN INSTITUTIONAL FIDUCIARY TRUST MONEY MARKET PORTFOLIO

The Funds may invest in the Institutional Fiduciary Trust Money Market Portfolio (Sweep Money Fund), an open-end investment company managed by Advisers. Management fees paid by the Funds are reduced on assets invested in the Sweep Money Fund, in an amount not to exceed the management and administrative fees paid by the Sweep Money Fund.

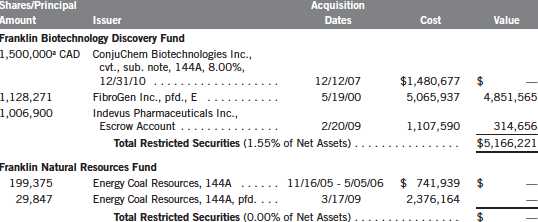

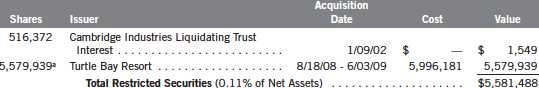

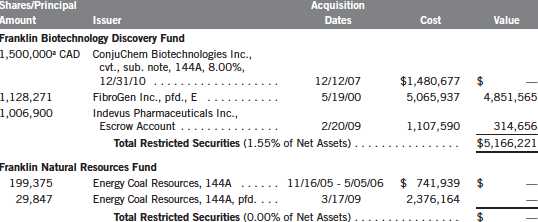

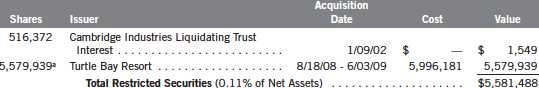

8. RESTRICTED SECURITIES

The Funds may invest in securities that are restricted under the Securities Act of 1933 (1933 Act) or which are subject to legal, contractual, or other agreed upon restrictions on resale. Restricted securities are often purchased in private placement transactions, and cannot be sold without prior registration unless the sale is pursuant to an exemption under the 1933 Act. Disposal of these securities may require greater effort and expense, and prompt sale at an acceptable price may be difficult. The Funds may have registration rights for restricted securities. The issuer generally incurs all registration costs.

Semiannual Report | 107

Franklin Strategic Series

Notes to Financial Statements (unaudited) (continued)

8. RESTRICTED SECURITIES (continued)

At October 31, 2010, the Funds held investments in restricted securities, excluding certain securities exempt from registration under the 1933 Act deemed to be liquid, as follows:

9. HOLDINGS OF 5% VOTING SECURITIES OF PORTFOLIO COMPANIES

The 1940 Act defines “affiliated companies” to include investments in portfolio companies in which a fund owns 5% or more of the outstanding voting securities. Investments in “affiliated companies” for the Franklin Small-Mid Cap Growth Fund for the period ended October 31, 2010, were as shown below.

10. SPECIAL SERVICING AGREEMENT

The Franklin Flex Cap Growth Fund, the Franklin Growth Opportunities Fund, the Franklin Small Cap Growth Fund and the Franklin Small-Mid Cap Growth Fund, which are eligible underlying investments of one or more of the Franklin Templeton Fund Allocator Series

108 | Semiannual Report

Franklin Strategic Series

Notes to Financial Statements (unaudited) (continued)

10. SPECIAL SERVICING AGREEMENT (continued)

Funds (Allocator Funds), participate in a Special Servicing Agreement (SSA) with the Allocator Funds and certain service providers of the funds and the Allocator Funds. Under the SSA, the funds may pay a portion of the Allocator Funds’ expenses (other than any asset allocation, administrative and distribution fees), to the extent such payments are less than the amount of the benefits realized or expected to be realized by the funds (e.g., due to reduced costs associated with servicing accounts) from the investment in the funds by the Allocator Funds. The Allocator Funds are either managed by Advisers or administered by FT Services, affiliates of the funds. For the period ended October 31, 2010, the Franklin Flex Cap Growth Fund and the Franklin Growth Opportunities Fund were held by one or more of the Allocator Funds and were allocated expenses as noted in the Statements of Operations. At October 31, 2010, 19.24% and 24.07%, res pectively of the Franklin Flex Cap Growth Fund and the Franklin Growth Opportunities Fund outstanding shares were held by one or more of the Allocator Funds. At October 31, 2010, the Franklin Small Cap Growth Fund was no longer held by any of the Allocator Funds.

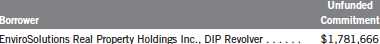

11. CREDIT FACILITY

The Funds, together with other U.S. registered and foreign investment funds (collectively “Borrowers”), managed by Franklin Templeton Investments, are borrowers in a joint syndicated senior unsecured credit facility totaling $750 million (Global Credit Facility) which matures on January 21, 2011. This Global Credit Facility provides a source of funds to the Borrowers for temporary and emergency purposes, including the ability to meet future unanticipated or unusually large redemption requests.

Under the terms of the Global Credit Facility, the Funds shall, in addition to interest charged on any borrowings made by the Funds and other costs incurred by the Funds, pay their share of fees and expenses incurred in connection with the implementation and maintenance of the Global Credit Facility, based upon its relative share of the aggregate net assets of all of the Borrowers, including an annual commitment fee of 0.10% based upon the unused portion of the Global Credit Facility, which is reflected in other expenses on the Statements of Operations. During the period ended October 31, 2010, the Funds did not use the Global Credit Facility.

Semiannual Report | 109

Franklin Strategic Series

Notes to Financial Statements (unaudited) (continued)

12. FAIR VALUE MEASUREMENTS

The Trust follows a fair value hierarchy that distinguishes between market data obtained from independent sources (observable inputs) and the Trust’s own market assumptions (unobservable inputs). These inputs are used in determining the value of the Funds’ investments and are summarized in the following fair value hierarchy:

Level 1 – quoted prices in active markets for identical securities

Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speed, credit risk, etc.)

Level 3 – significant unobservable inputs (including the fund’s own assumptions in determining the fair value of investments)

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities.

For movements between the levels within the fair value hierarchy, the Funds have adopted a policy of recognizing the transfers as of the date of the underlying event which caused the movement.

The following is a summary of the inputs used as of October 31, 2010, in valuing the Funds’ assets carried at fair value:

110 | Semiannual Report

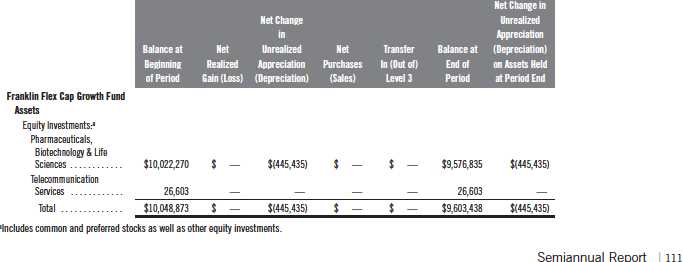

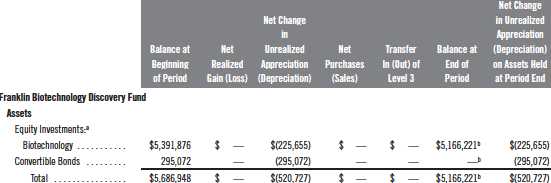

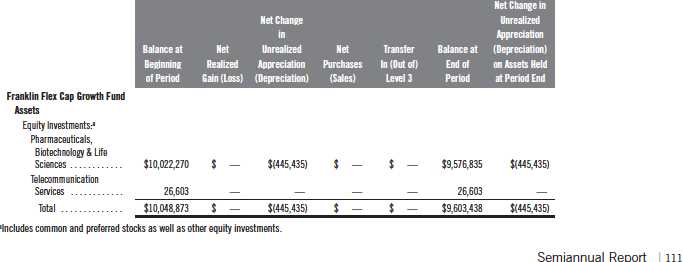

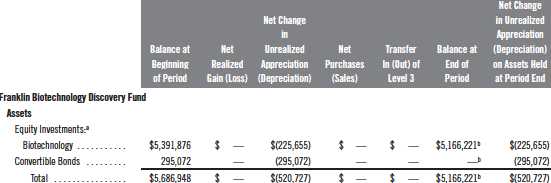

At October 31, 2010, the reconciliation of assets in which significant unobservable inputs (Level 3) were used in determining the Funds’ fair value, was as follows:

Franklin Strategic Series

Notes to Financial Statements (unaudited) (continued)

13. SUBSEQUENT EVENTS

The Funds have evaluated subsequent events through the issuance of the financial statements and determined that no events have occurred that require disclosure.

ABBREVIATIONS

Selected Portfolio |

112 | Semiannual Report

Franklin Strategic Series

Shareholder Information

Proxy Voting Policies and Procedures

The Trust’s investment manager has established Proxy Voting Policies and Procedures (Policies) that the Trust uses to determine how to vote proxies relating to portfolio securities. Shareholders may view the Trust’s complete Policies online at franklintempleton.com. Alternatively, shareholders may request copies of the Policies free of charge by calling the Proxy Group collect at (954) 527-7678 or by sending a written request to: Franklin Templeton Companies, LLC, 500 East Broward Boulevard, Suite 1500, Fort Lauderdale, FL 33394, Attention: Proxy Group. Copies of the Trust’s proxy voting records are also made available online at franklintempleton.com and posted on the U.S. Securities and Exchange Commission’s website at sec.gov and reflect the most recent 12-month period ended June 30.

Quarterly Statement of Investments

The Trust files a complete statement of investments with the U.S. Securities and Exchange Commission for the first and third quarters for each fiscal year on Form N-Q. Shareholders may view the filed Form N-Q by visiting the Commission’s website at sec.gov. The filed form may also be viewed and copied at the Commission’s Public Reference Room in Washington, DC. Information regarding the operations of the Public Reference Room may be obtained by calling (800) SEC-0330.

Semiannual Report | 113

This page intentionally left blank.

This page intentionally left blank.

This page intentionally left blank.

| �� | Sign up for electronic delivery

on franklintempleton. com |

Semiannual Report and Shareholder Letter

FRANKLIN STRATEGIC SERIES

| | Investment Manager

Franklin Advisers, Inc.

Distributor

Franklin Templeton Distributors, Inc.

(800) DIAL BEN®

franklintempleton. com

Shareholder Services

(800) 632-2301 |

Authorized for distribution only when accompanied or preceded by a summary prospectus and/or prospectus. Investors should carefully consider a fund’s investment goals, risks, charges and expenses before investing. A prospectus contains this and other information; please read it carefully before investing.

To ensure the highest quality of service, telephone calls to or from our service departments may be monitored, recorded and accessed. These calls can be identified by the presence of a regular beeping tone.

© 2010 Franklin Templeton Investments. All rights reserved.

FSS1 S 12/10

FRANKLIN STRATEGIC SERIES

SPECIALIZED EXPERTISE

TRUE DIVERSIFICATION

RELIABILITY YOU CAN TRUST

MUTUAL FUNDS |

Franklin Templeton Investments

Gain From Our Perspective®

Franklin Templeton’s distinct multi-manager structure combines the specialized expertise of three world-class investment management groups—Franklin, Templeton and Mutual Series.

Each of our portfolio management groups operates autonomously, relying on its own research and staying true to the unique investment disciplines that underlie its success.

Franklin. Founded in 1947, Franklin is a recognized leader in fixed income investing and also brings expertise in growth- and value-style U.S. equity investing.

Templeton. Founded in 1940, Templeton pioneered international investing and, in 1954, launched what has become the industry’s oldest global fund. Today, with offices in over 25 countries, Templeton offers investors a truly global perspective.

Mutual Series. Founded in 1949, Mutual Series is dedicated to a unique style of value investing, searching aggressively for opportunity among what it believes are undervalued stocks, as well as arbitrage situations and distressed securities.

Because our management groups work independently and adhere to different investment approaches, Franklin, Templeton and Mutual Series funds typically have distinct portfolios. That’s why our funds can be used to build truly diversified allocation plans covering every major asset class.

At Franklin Templeton Investments, we seek to consistently provide investors with exceptional risk-adjusted returns over the long term, as well as the reliable, accurate and personal service that has helped us become one of the most trusted names in financial services.

RETIREMENT PLANS | 529 COLLEGE SAVINGS PLANS | SEPARATE ACCOUNTS

| Not part of the semiannual report |

Not part of the semiannual report | 1

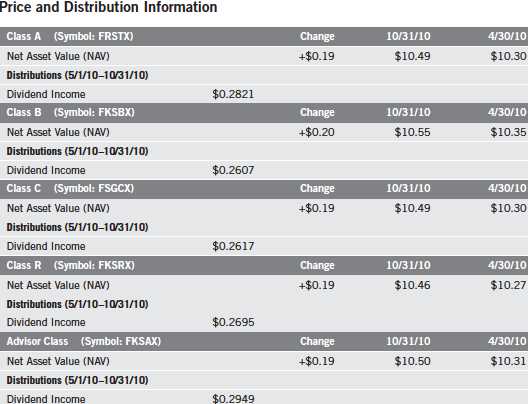

Economic and Market Overview