| 1

Semiannual Report

Economic and Market Overview

The U.S. economy, as measured by gross domestic product (GDP), grew at a modest rate during the six-month period ended October 31, 2012. Unemployment declined from 8.1% to 7.9%, and data at period-end revealed a healthy increase in U.S. industrial production and durable goods orders for September.1 Consumer spending and personal income levels also climbed, and inflation was generally mild with the exception of energy and food prices. Consumer sentiment rose to its highest level in five years. The federal budget deficit for fiscal year 2012 fell to its lowest level since 2008. U.S. home prices increased in most regions, as mortgage rates near record lows, affordable housing prices and low new-home inventories contributed to the improvement. The U.S. home foreclosure level dropped to a five-year low, further enhancing confidence in the housing market.

For the six-month period, U.S. stocks, as measured by the Standard & Poor’s® 500 Index (S&P 500®), fluctuated as investors apparently reacted to news headlines and shifted between risk taking and risk aversion.2 Toward period-end uncertainty surrounding the closely contested U.S. presidential election, the European fiscal crisis, slowing growth in China and the potential U.S. tax hikes and spending cuts known as the “fiscal cliff” weighed on stock market returns. In addition, U.S. companies generally reported modest third-quarter revenues, suggesting a drop in global demand. The International Monetary Fund announced that fiscal consolidation efforts had weighed on global growth, including the U.S., and described the risk of a steep global slowdown as “alarmingly high.” Reduced third-quarter profit levels and lowered revenue guidance for some companies also overshadowed optimism earlier in the period surrounding new stimulus measures and improvements in certain economic reports. In its October meeting, the Federal Open Market Committee reaffirmed its decision to keep interest rates low until at least mid-2015. Superstorm Sandy’s devastating impact on the east coast at the end of the six-month period also contributed to uncertainty. Despite these factors, the S&P 500 generated a modest six-month gain. Not all investors favored stocks, however, and many sought perceived safe havens such as gold bullion, the Japanese yen, the U.S. dollar and U.S. Treasuries. By period-end, the nominal yield on the 10-year U.S. Treasury note declined to 1.72%.

The foregoing information reflects our analysis and opinions as of October 31, 2012. The information is not a complete analysis of every aspect of any market, country, industry, security or fund. Statements of fact are from sources considered reliable.

1. Source: Bureau of Labor Statistics.

2. STANDARD & POOR’S®, S&P® and S&P 500® are registered trademarks of Standard & Poor’s Financial Services LLC.

Semiannual Report | 3

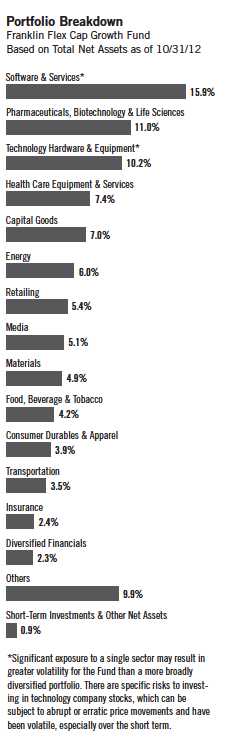

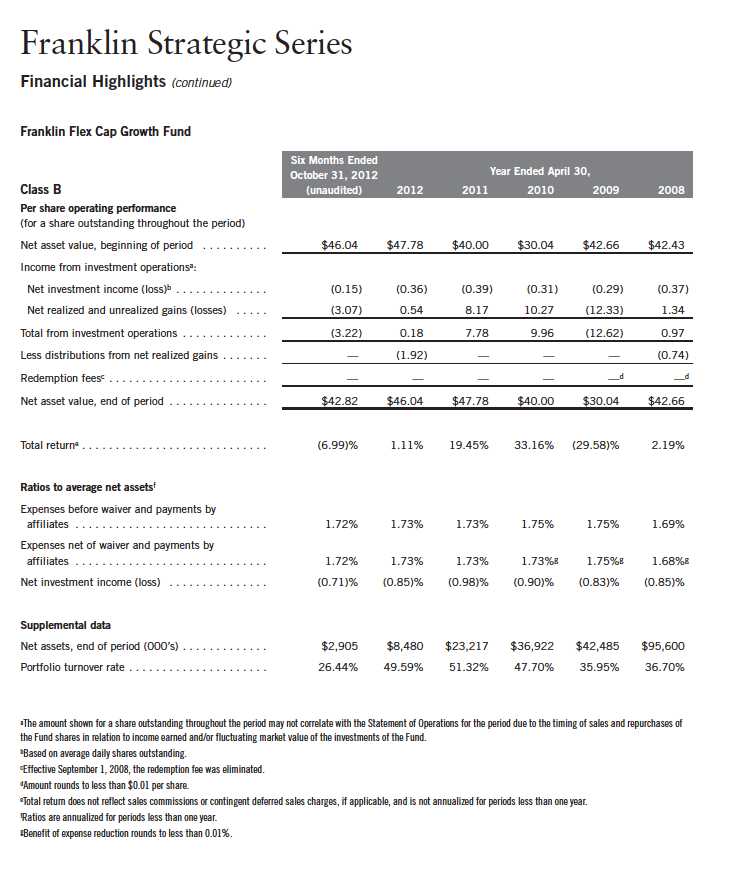

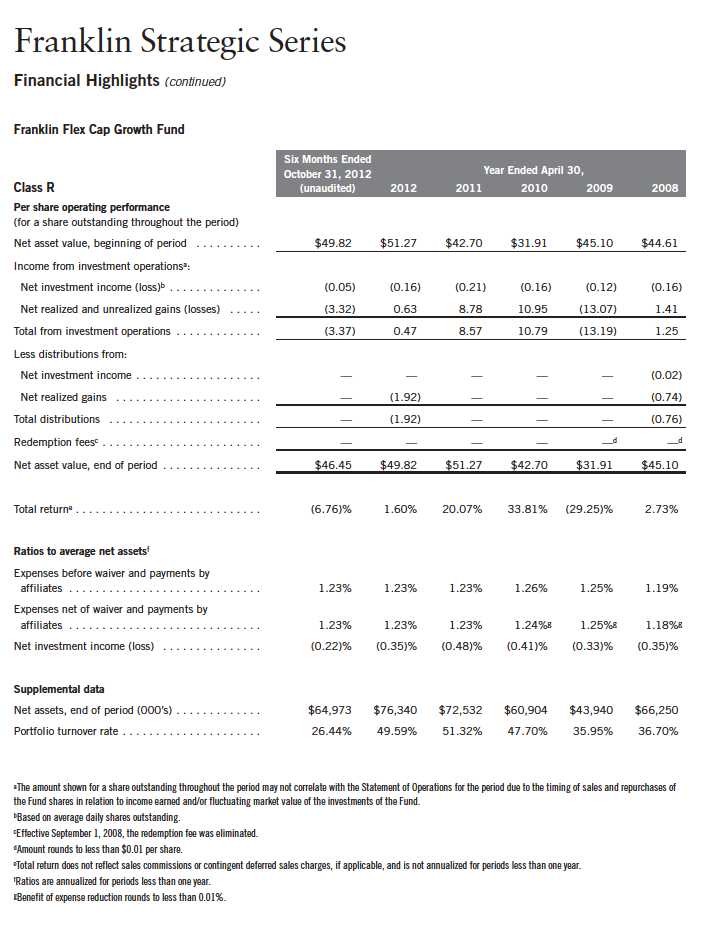

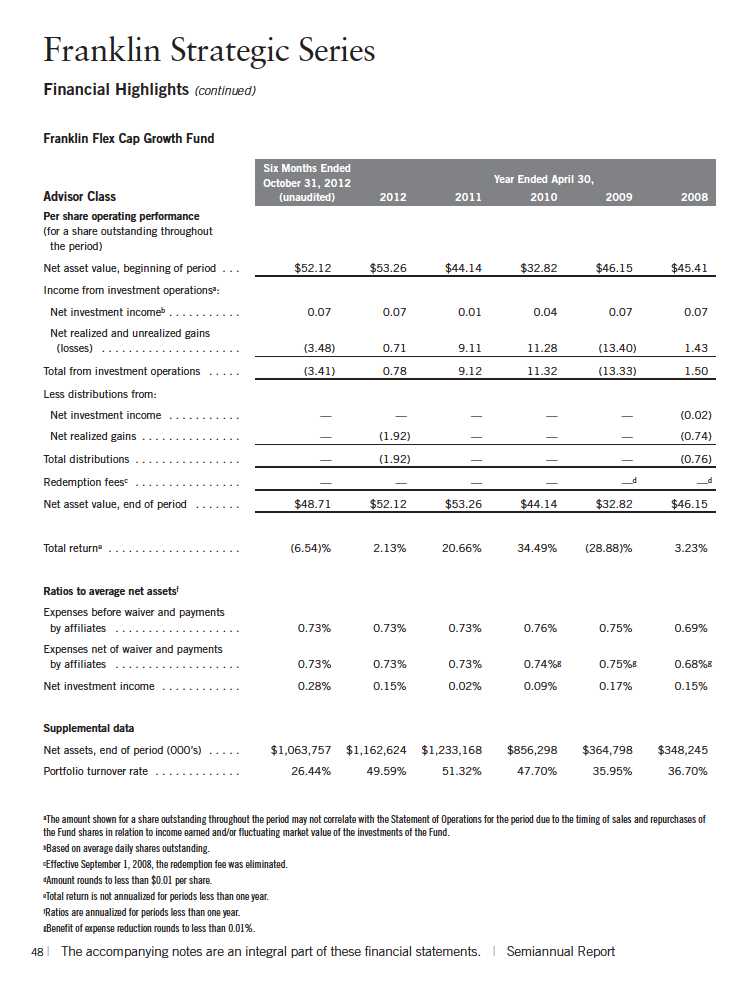

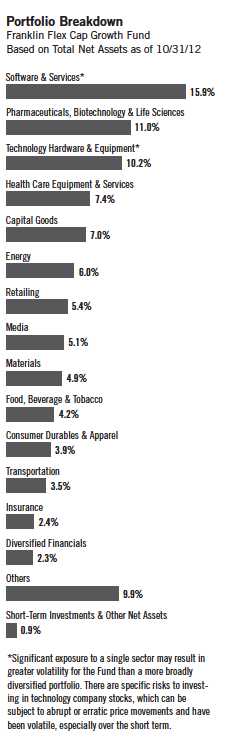

Franklin Flex Cap Growth Fund

Your Fund’s Goal and Main Investments: Franklin Flex Cap Growth Fund seeks capital appreciation. The Fund normally invests predominantly in equity securities of companies that the manager believes have the potential for capital appreciation. The Fund has flexibility to invest in companies located, headquartered or operating inside and outside the U.S., across the entire market capitalization spectrum from small, emerging growth companies to well-established, large cap companies.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. Please visit franklintempleton.com or call (800) 342-5236 for most recent month-end performance.

This semiannual report for Franklin Flex Cap Growth Fund covers the period ended October 31, 2012.

Performance Overview

For the six months under review, Franklin Flex Cap Growth Fund – Class A had a -6.65% cumulative total return. Compared with its narrow benchmarks, the Fund underperformed the -0.96% total return of the Russell 3000® Growth Index, which measures performance of Russell 3000® Index companies with higher price-to-book ratios and higher forecasted growth values, and the -0.98% total return of the Russell 1000® Growth Index, which tracks performance of the largest companies in the Russell 3000® Index with higher price-to-book ratios and higher forecasted growth values.1 Additionally, the Fund underperformed the +2.16% total return of its broad benchmark, the Standard & Poor’s 500 Index, which tracks the broad U.S. stock market.1 You can find the Fund’s long-term performance data in the Performance Summary beginning on page 7.

Investment Strategy

We use fundamental, bottom-up research to seek companies meeting our criteria of growth potential, quality and valuation. In seeking sustainable growth characteristics, we look for companies we believe can produce sustainable earnings and cash flow growth, evaluating the long-term market opportunity and competitive structure of an industry to target leaders and emerging leaders. We

1. Source: © 2012 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. RUSSELL® is a trademark of the Frank Russell Company. The indexes are unmanaged and include reinvested dividends. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI). The SOI begins on page 49.

4 | Semiannual Report

define quality companies as those with strong and improving competitive positions in attractive markets. We also believe important attributes of quality are experienced and talented management teams as well as financial strength reflected in the capital structure, gross and operating margins, free cash flow generation and returns on capital employed. Our valuation analysis includes a range of potential outcomes based on an assessment of multiple scenarios. In assessing value, we consider whether security prices fully reflect the balance of the sustainable growth opportunities relative to business and financial risks.

Manager’s Discussion

Although the Fund trailed its benchmark for the six-month period, Fund holdings in the financials sector contributed to performance relative to the Russell 3000® Growth Index.2 Life insurer Aflac represented one of the Fund’s top performers as it reported double-digit revenue growth and raised its per-share operating earnings estimate for the year.3 The firm’s Japan operations, representing Aflac’s largest revenue source, provided higher sales. The company also raised its quarterly dividend payment during the period and reported investment gains. Cell-tower real estate investment trust American Tower also enjoyed double-digit revenue growth amid robust demand for broadband service, attributable mostly to growing smartphone and tablet use. American Tower’s stock price was also aided by a foreign currency gain and by Sprint Nextel’s deal to sell a majority stake to a rival, which was viewed as positive for wireless tower companies.

During the reporting period, stock selection in the information technology (IT), energy and consumer staples sectors detracted from the Fund’s performance relative to the benchmark.4 In the IT sector, the Fund’s position in data integration software and services firm Informatica weighed on relative performance as the company reported lower revenues and higher operating expenses.5 The firm’s chief executive conceded Informatica did not adapt in a timely fashion to the changing macroeconomic environment, but he pledged to bolster growth efforts. Acme Packet, a communications equipment holding, also hurt relative results as the company lowered its outlook for its fiscal year, citing a spending slowdown by North American service providers. In our assessment, the phone and data network equipment maker is well positioned for future growth with

2. The financials sector comprises banks, diversified financials, insurance and real estate in the SOI. 3. This holding is not an index component.

4. The IT sector comprises semiconductors and semiconductor equipment; software and services; and technology hardware and equipment in the SOI. The consumer staples sector comprises food and staples retailing; and food, beverage and tobacco in the SOI.

5. Sold by period-end.

Semiannual Report | 5

products that improve voice quality and optimize networks. In the energy sector, despite Whiting Petroleum’s production and revenue growth amid higher oil prices, the company could not offset unrealized derivative losses. The share price for beverage maker Monster Beverage also declined as the U.S. Food and Drug Administration confirmed it was examining the potential for adverse reactions to the company’s beverage products. In the consumer staples sector, baby formula manufacturer Mead Johnson Nutrition reduced its earnings forecast for the year because of fewer births in the U.S. and lower product sales.

Thank you for your continued participation in Franklin Flex Cap Growth Fund. We look forward to serving your future investment needs.

CFA® is a trademark owned by CFA Institute.

The foregoing information reflects our analysis, opinions and portfolio holdings as of October 31, 2012, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

6 | Semiannual Report

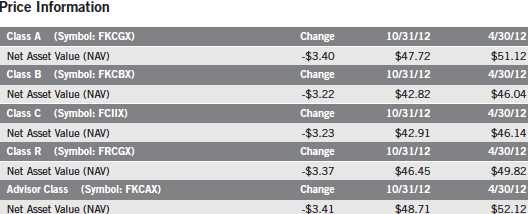

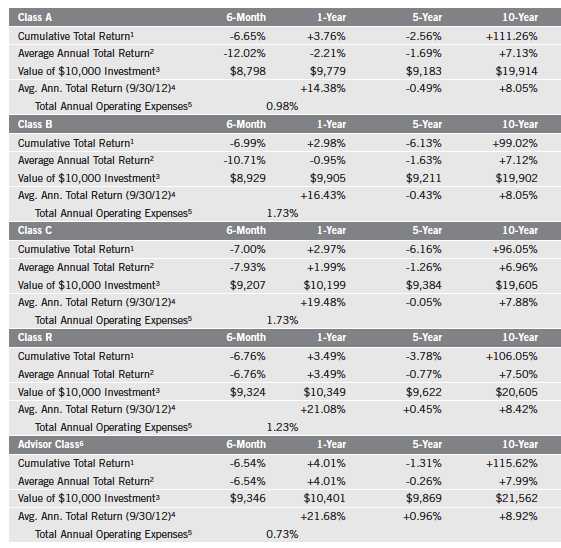

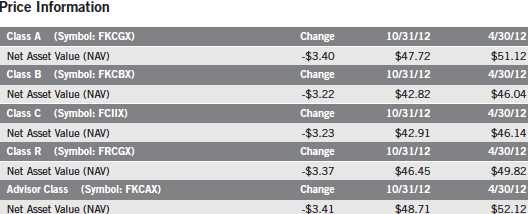

Performance Summary as of 10/31/12

Franklin Flex Cap Growth Fund

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

Semiannual Report | 7

Performance Summary (continued)

Performance

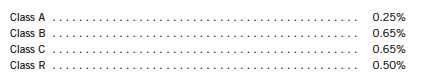

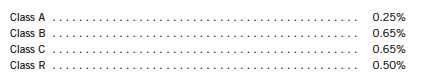

Cumulative total return excludes sales charges. Average annual total returns and value of $10,000 investment include maximum sales charges. Class A: 5.75% maximum initial sales charge; Class B: contingent deferred sales charge (CDSC) declining from 4% to 1% over six years, and eliminated thereafter; Class C: 1% CDSC in first year only;

Class R/Advisor Class: no sales charges.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

8 | Semiannual Report

Performance Summary (continued)

Endnotes

All investments involve risks, including possible loss of principal. Investors should be comfortable with fluctuations in the value of their investments, as small and midsized company stocks can be volatile, especially over the short term. Smaller, midsized and relatively new or unseasoned companies can be particularly sensitive to changing economic conditions, and their prospects for growth are less certain than those of larger, more established companies. The Fund includes investments in technology securities, which can be highly volatile and involves special risks. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

| |

Class B: Class C: | These shares have higher annual fees and expenses than Class A shares. Prior to 1/1/04, these shares were offered with an initial sales charge; thus actual total returns would have differed. These shares have higher annual fees and expenses than Class A shares. |

Class R: | Shares are available to certain eligible investors as described in the prospectus. These shares have higher annual fees and expenses than Class A shares. |

Advisor Class: | Shares are available to certain eligible investors as described in the prospectus. |

1. Cumulative total return represents the change in value of an investment over the periods indicated.

2. Average annual total return represents the average annual change in value of an investment over the periods indicated. Six-month return has not been annualized.

3. These figures represent the value of a hypothetical $10,000 investment in the Fund over the periods indicated.

4. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

5. Figures are as stated in the Fund’s prospectus current as of the date of this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

6. Effective 8/2/04, the Fund began offering Advisor Class shares, which do not have sales charges or a Rule 12b-1 plan. Performance quotations for this class reflect the following methods of calculation: (a) For periods prior to 8/2/04, a restated figure is used based upon the Fund’s Class A performance, excluding the effect of Class A’s maximum initial sales charge, but reflecting the effect of the Class A Rule 12b-1 fees; and (b) for periods after 8/2/04, actual Advisor Class performance is used reflecting all charges and fees applicable to that class. Since 8/2/04 (commencement of sales), the cumulative and average annual total returns of Advisor Class shares were +55.17% and +5.47%.

Semiannual Report | 9

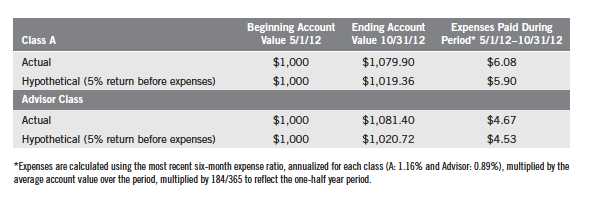

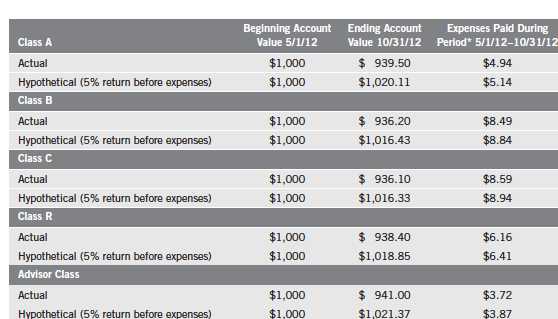

Your Fund’s Expenses

Franklin Flex Cap Growth Fund

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

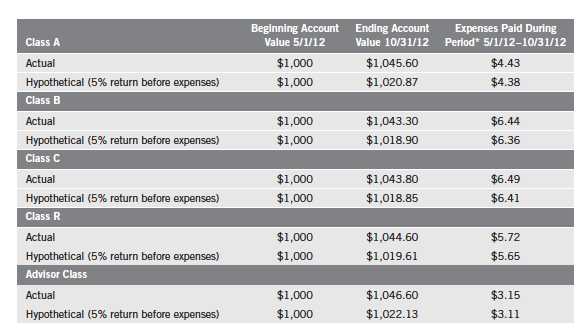

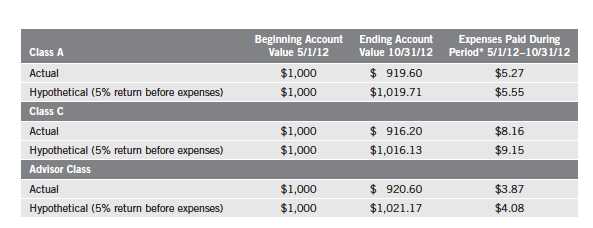

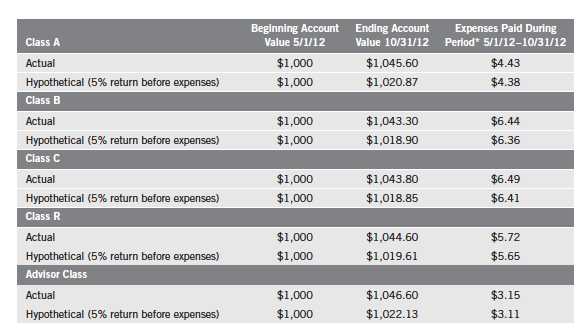

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

10 | Semiannual Report

Your Fund’s Expenses (continued)

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

*Expenses are calculated using the most recent six-month expense ratio, annualized for each class (A: 0.98%; B: 1.72%; C: 1.73%; R: 1.23%; and Advisor: 0.73%), multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period.

Semiannual Report | 11

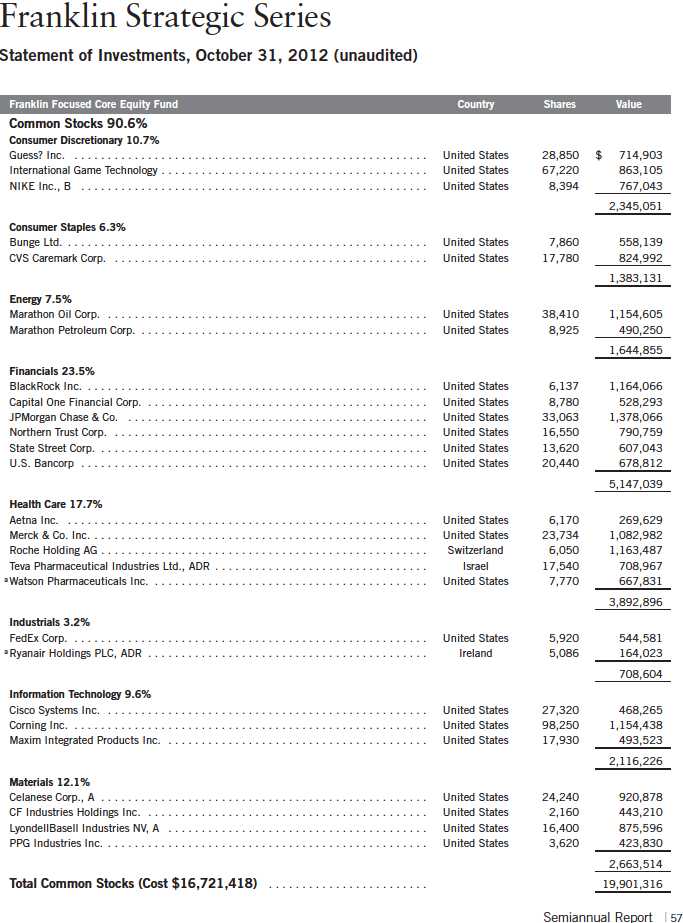

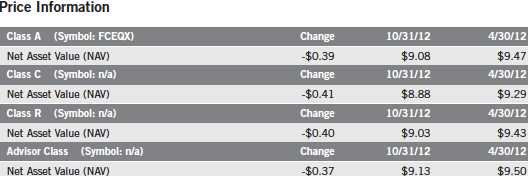

Franklin Focused Core Equity Fund

Your Fund’s Goal and Main Investments: Franklin Focused Core Equity Fund seeks capital appreciation by normally investing at least 80% of its net assets in equity securities. The Fund will invest primarily to predominantly in equity securities of large capitalization companies, which are similar in size to those in the Standard & Poor’s 500 Index (S&P 500).

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. Please visit franklintempleton.com or call (800) 342-5236 for most recent month-end performance.

This semiannual report for Franklin Focused Core Equity Fund covers the period ended October 31, 2012.

Performance Overview

For the six months under review, Franklin Focused Core Equity Fund – Class A had a -4.12% cumulative total return. The Fund underperformed the +2.16% total return of its benchmark, the S&P 500, which tracks the broad U.S. stock market.1 You can find more of the Fund’s performance data in the Performance Summary beginning on page 15.

Investment Strategy

We are research-driven, bottom-up, fundamental investors. Our investment approach is opportunistic and contrarian, and we seek to identify mispriced companies using fundamental analysis. We seek to take advantage of price dislocations that result from the market’s short-term focus. Our analysis includes the investigation of the valuation for each investment based upon the view that the price paid for the security is a critical factor determining long-term success. We rely on a team of analysts to help provide in-depth industry expertise and use both qualitative and quantitative analysis to evaluate companies. Our analysts identify each company’s market opportunity, competitive position, management and financial strength, business and financial risks, and valuation. We choose to invest in those companies that, in our opinion, offer the best trade-off between growth opportunity, business and financial risk, and valuation.

1. Source: © 2012 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. The index is unmanaged and includes reinvested dividends. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI). The SOI begins on page 57.

12 | Semiannual Report

Manager’s Discussion

During the six months under review, most sectors represented in the Fund’s portfolio benefited absolute performance. Key contributors included our investments in the health care, energy and materials sectors. Within health care, pharmaceuticals were particularly strong, and top contributors included Merck & Co., Watson Pharmaceuticals and Roche Holding. Merck & Co.’s share price reached a multi-year high in October as the company continued to deliver better-than-expected earnings results. In the third quarter, the company reported strong profits as a lower tax rate and robust sales of its diabetes treatments helped offset losses from the patent expiration of its asthma treatment Singulair. Watson Pharmaceuticals’ share price reached an all-time high near period-end as the generic drug company continued to generate better-than-expected earnings and made significant progress in its global expansion strategy. On October 31, Watson Pharmaceuticals completed its acquisition of Swiss competitor Actavis Group, making it the world’s third-largest generic pharmaceutical company, and announced it will change its name to Actavis in 2013 and initiate a multi-year global rebranding campaign. Swiss pharmaceutical giant Roche delivered strong first-half 2012 earnings and confirmed its full-year 2012 outlook for high single-digit core earnings per share growth, driven by the solid performance of its existing portfolio and newly launched products. Low U.S. natural gas prices helped the profit margins of plastics and chemicals company LyondellBasell Industries in the materials sector. Despite lower volumes, the company managed to improve margins in its European division as it continued to cut costs. In energy, a significant contributor was refiner Marathon Petroleum, which became an independent company in 2011 through the spin-off from oil and gas explorer and producer Marathon Oil, also a Fund holding. Marathon Petroleum’s share price rallied after the company announced that it signed an agreement to purchase a Texas City refinery and infrastructure assets from BP. Marathon Petroleum expected the acquisition to close in early 2013 and contribute to earnings in the first year of operation.

In contrast, key detractors from absolute performance included our investments in the consumer discretionary, information technology (IT) and telecommunication services sectors. In consumer discretionary, for-profit education company Apollo Group, which we sold during the period, and International Game Technology (IGT) hurt relative results. IGT’s share price fell in late July after the electronic gaming company reported weaker-than-expected fiscal third-quarter earnings largely as a result of higher expenses in its interactive business. In August, IGT launched a partnership program with land-based casinos to feature its DoubleDown Casino application on their websites. In IT, wireless

Semiannual Report | 13

devices and software manufacturer Research in Motion, which we sold during the period, and leading specialty glass and ceramics manufacturer Corning hurt relative results. Corning delivered better-than-expected third-quarter earnings, but its share price fell largely after the company announced a cautious outlook for 2013. Wireless telecommunication service provider NII Holdings, which we sold during the period, hampered relative returns in the telecommunication services sector. Although our overall materials holdings contributed strongly to relative results, a notable detractor was Celanese. The technology and specialty materials company’s third-quarter revenue was negatively affected by lower pricing in some of its business segments and the generally strong U.S. dollar. Expecting economic uncertainties to persist in 2013, Celanese continued to focus on cost control and innovative technology, such as turning natural gas and coal to ethanol, in an effort to maintain long-term growth.

Thank you for your continued participation in Franklin Focused Core Equity Fund. We look forward to serving your future investment needs.

Effective November 1, 2012, Brent Loder assumed portfolio manager responsibilities for the Fund. He is a member of the business and financial services team of Franklin Equity Group. Prior to joining Franklin Templeton Investments in 2006, Mr. Loder worked as an associate at Blum Capital Partners where he helped evaluate, execute and monitor investments in public and private companies. Previously, Mr. Loder worked at Morgan Stanley as an analyst in corporate finance and mergers and acquisitions.

14 | Semiannual Report

Performance Summary as of 10/31/12

Franklin Focused Core Equity Fund

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

Semiannual Report | 15

Performance Summary (continued)

Performance1

Cumulative total return excludes sales charges. Average annual total returns and value of $10,000 investment include maximum sales charges. Class A: 5.75% maximum initial sales charge; Class C: 1% contingent deferred sales charge in first year only; Class R/Advisor Class: no sales charges.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

The investment manager and administrator have contractually agreed to waive or assume certain expenses so that common expenses (excluding the Rule 12b-1 fees and acquired fund fees and expenses) for each class of the Fund do not exceed 0.89% (other than certain non-routine expenses) until 8/31/13.

16 | Semiannual Report

Performance Summary (continued)

Endnotes

All investments involve risks, including possible loss of principal. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Since the Fund invests in a relatively small number of companies, the Fund is subject to the risk that poor performance by several companies could adversely affect Fund performance more so than a more broadly diversified fund. Special risks are involved with significant exposure to a particular sector, including increased susceptibility related to economic, business or other developments affecting that sector, which may result in increased volatility. The Fund also has the potential to invest in foreign company stocks, which involve exposure to currency volatility and political uncertainty. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

| |

Class C: Class R: | These shares have higher annual fees and expenses than Class A shares. Shares are available to certain eligible investors as described in the prospectus. These shares have higher annual fees and expenses than Class A shares. |

Advisor Class: | Shares are available to certain eligible investors as described in the prospectus. |

1. Fund investment results reflect the expense reduction, without which the results would have been lower.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated. Six-month return has not

been annualized.

4. These figures represent the value of a hypothetical $10,000 investment in the Fund over the periods indicated.

5. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

6. Figures are as stated in the Fund’s prospectus current as of the date of this report. In periods of market volatility, assets may decline significantly,

causing total annual Fund operating expenses to become higher than the figures shown.

Semiannual Report | 17

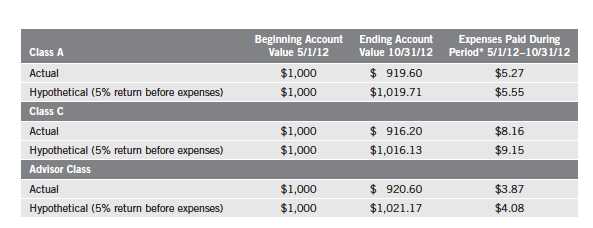

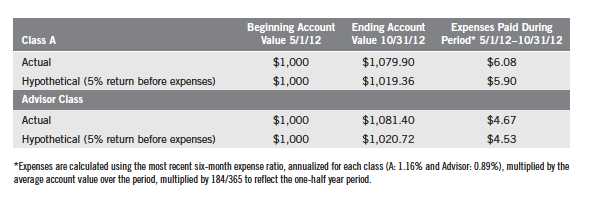

Your Fund’s Expenses

Franklin Focused Core Equity Fund

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

18 | Semiannual Report

Your Fund’s Expenses (continued)

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

Semiannual Report | 19

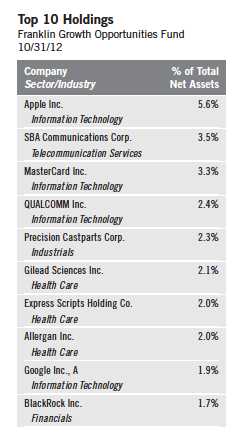

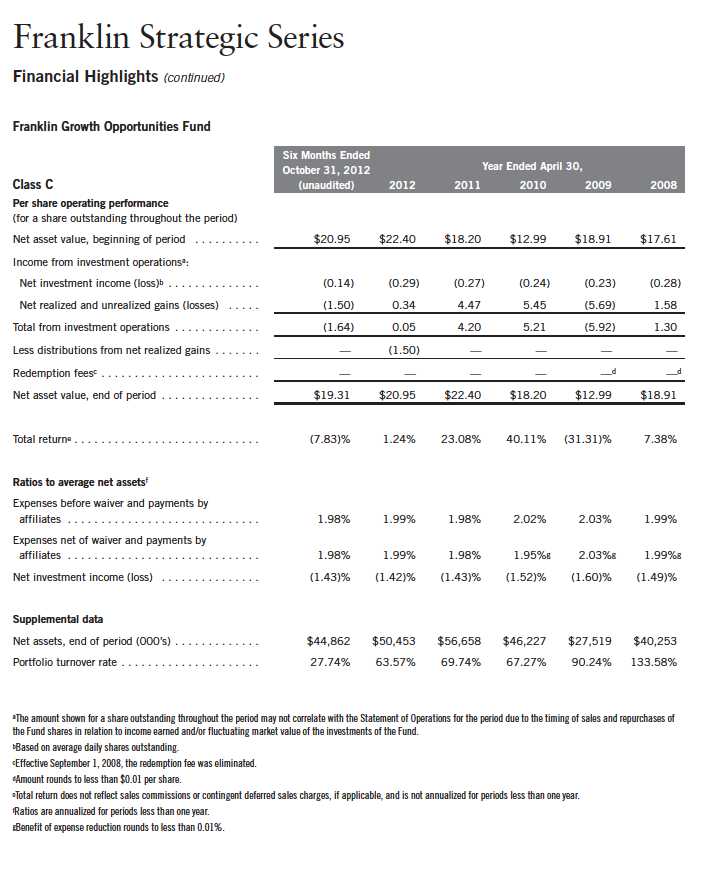

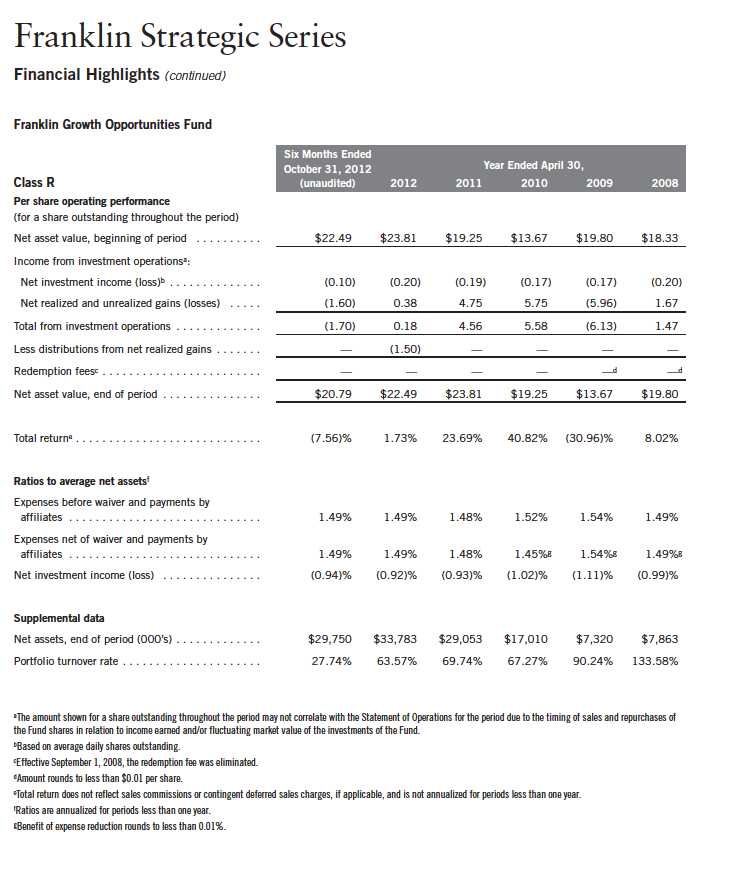

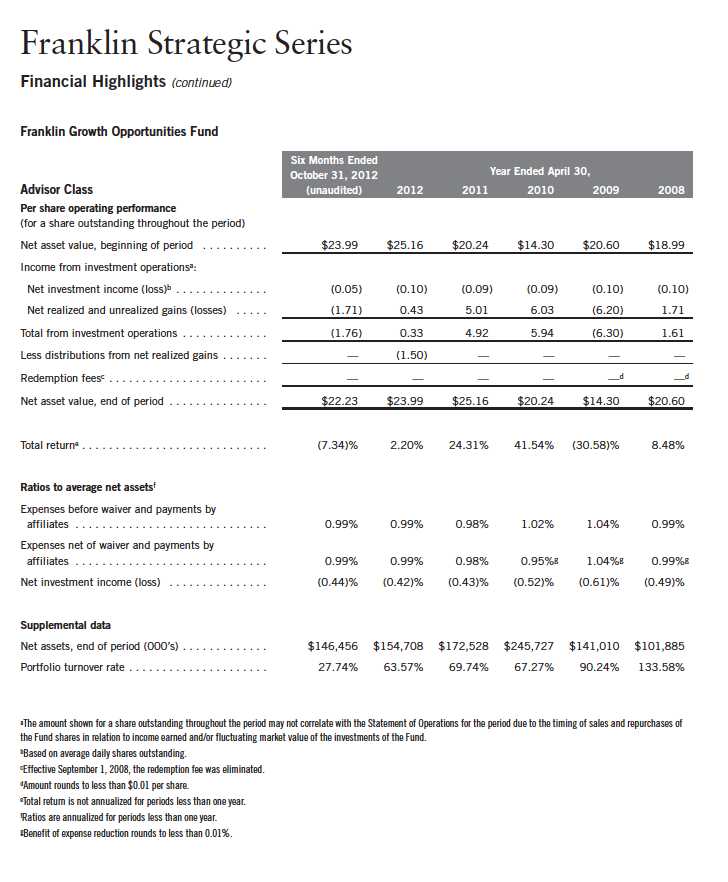

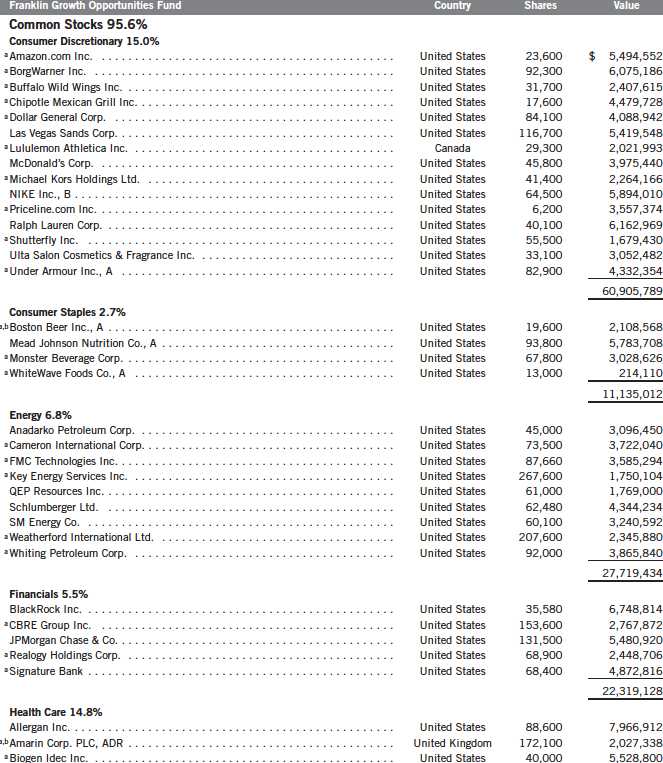

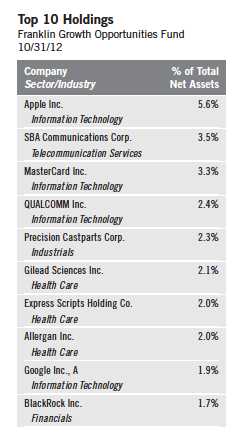

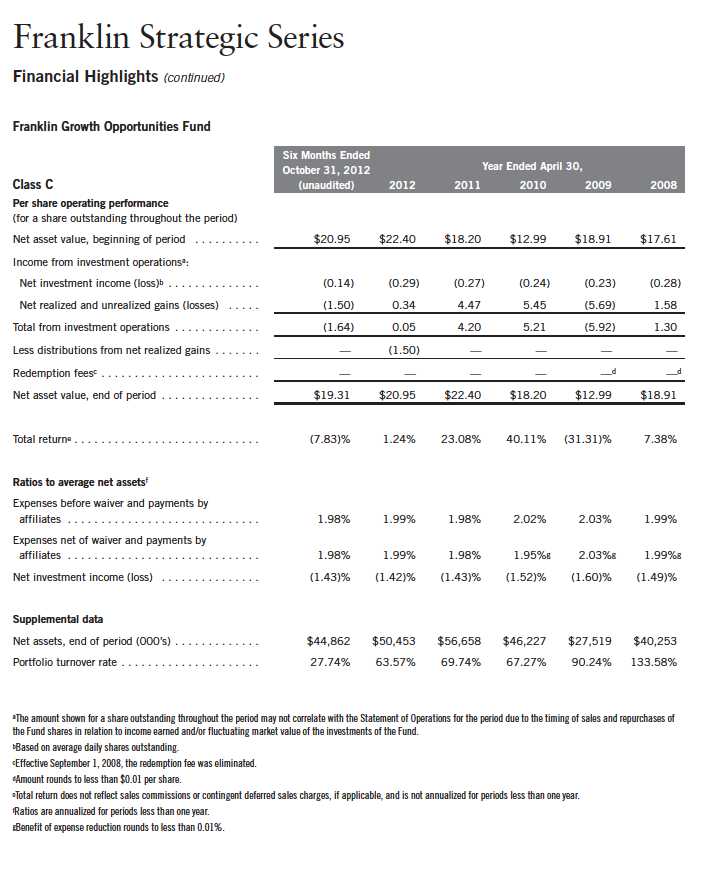

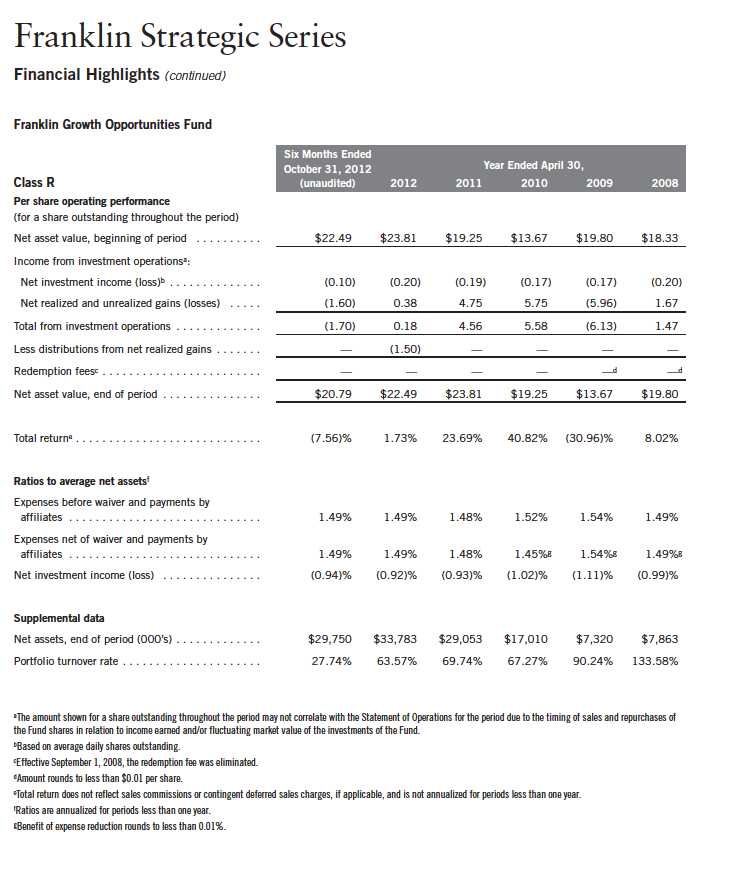

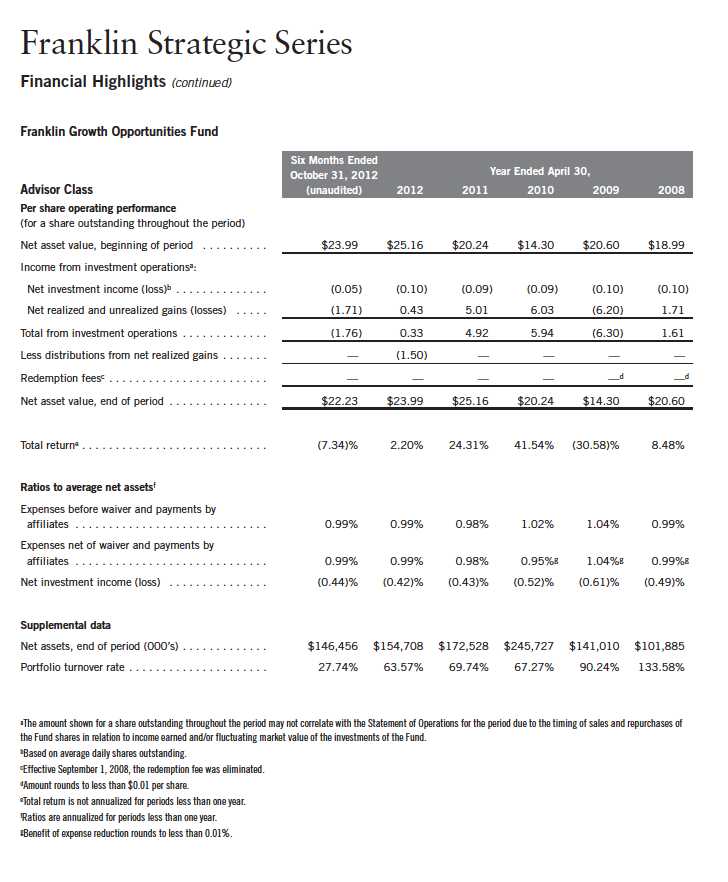

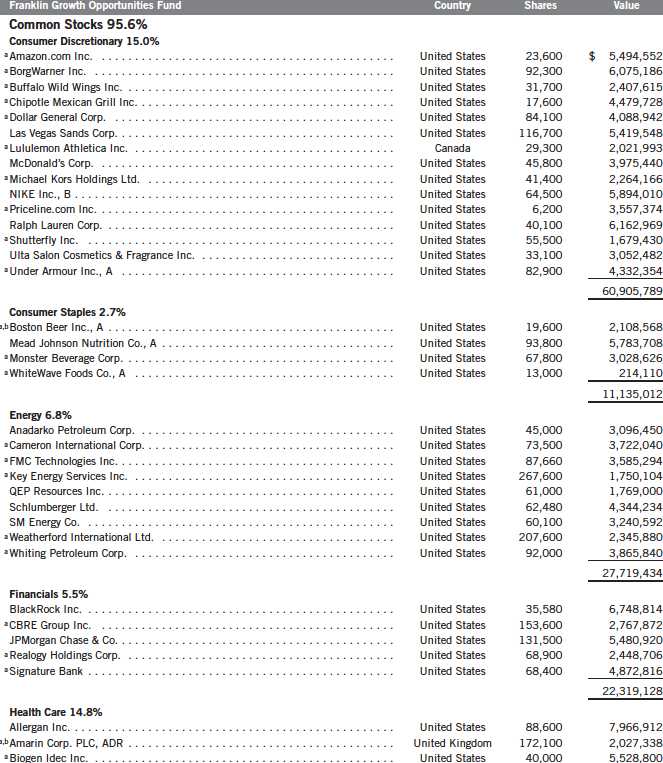

Franklin Growth Opportunities Fund

Your Fund’s Goal and Main Investments: Franklin Growth Opportunities Fund seeks capital appreciation by investing substantially in equity securities of companies demonstrating accelerat ing growth, increasing profitability, or above-average growth or growth potential, when compared with the overall economy.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. Please visit franklintempleton.com or call (800) 342-5236 for most recent month-end performance.

This semiannual report for Franklin Growth Opportunities Fund covers the period ended October 31, 2012.

Performance Overview

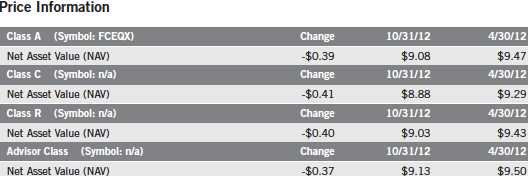

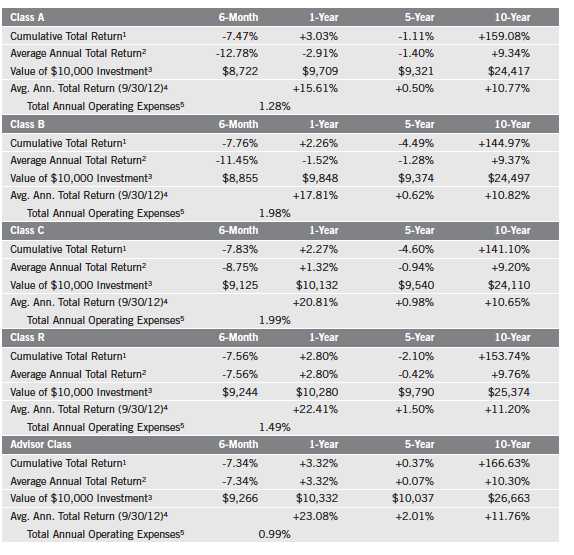

For the six months under review, Franklin Growth Opportunities Fund –Class A had a -7.47% cumulative total return. The Fund underperformed the -0.96% total return of its narrow benchmark, the Russell 3000® Growth Index, which measures performance of Russell 3000® Index companies with higher price-to-book ratios and higher forecasted growth values.1 The Fund also underperformed the +2.16% total return of its broad benchmark, the Standard & Poor’s 500 Index (S&P 500), which tracks the broad U.S. stock market.1 You can find the Fund’s long-term performance data in the Performance Summary beginning on page 23.

Investment Strategy

We use fundamental, bottom-up research to seek companies meeting our criteria of growth potential, quality and valuation. In seeking sustainable growth characteristics, we look for companies we believe can produce sustainable earnings and cash flow growth, evaluating the long-term market opportunity and competitive structure of an industry to target leaders and emerging leaders. We define quality companies as those with strong and improving competitive positions in attractive markets. We also believe important attributes of quality are experienced and talented management teams as well as financial strength reflected in the capital structure, gross and operating margins, free cash flow

1. Source: © 2012 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. The index is unmanaged and includes reinvested interest. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI). The SOI begins on page 64.

20 | Semiannual Report

generation and returns on capital employed. Our valuation analysis includes a range of potential outcomes based on an assessment of multiple scenarios. In assessing value, we consider whether security prices fully reflect the balance of the sustainable growth opportunities relative to business and financial risks.

Manager’s Discussion

Although the Fund trailed its benchmark, the Russell 3000® Growth Index, for the period, the Fund’s stock selection in the health care and telecommunication services sectors contributed to relative performance. Onyx Pharmaceuticals led gains in the health care sector as the global biopharmaceutical firm, whose products treat cancer, announced the Food and Drug Administration (FDA) granted accelerated approval of its drug Kyprolis. Gilead Sciences, another holding in the biotechnology industry, reported strong adjusted income and revenue totals and raised its sales forecast. Sales rose for the firm’s HIV drug Atripla. Wireless communications infrastructure firm SBA Communications’ stock price rose as it completed its TowerCo II Holdings acquisition, which includes more than 3,000 tower sites across the U.S. and Puerto Rico. SBA Communications’ share price also benefited from the increased usage of mobile phones for voice and data in the U.S., as this should help raise demand for their services.

During the reporting period, stock selection detracted from the Fund’s performance relative to the benchmark, particularly in the information technology (IT), consumer discretionary, consumer staples and energy sectors. In the IT sector, the Fund’s position in computing network optimizing products manufacturer F5 Networks weighed on relative performance as the firm’s fourth-quarter earnings per share fell short of expectations. Another communications equipment holding also hurt relative results as Acme Packet lowered its outlook for its fiscal year, citing a spending slowdown by North American service providers. In our assessment, the phone and data network equipment maker is well positioned for future growth with products that improve voice quality and optimize networks. Revenue also fell short of expectations for Chipotle Mexican Grill as the casual restaurant chain reported reduced customer traffic growth. In addition, the company experienced higher costs associated with food and labor. In the consumer staples sector, baby formula manufacturer Mead Johnson Nutrition reduced its earnings forecast for the year due to slowing sales growth in emerging markets, particularly China. The share price for beverage maker Monster Beverage also declined as the FDA confirmed it was examining the potential for adverse reactions to the company’s beverage products.

Semiannual Report | 21

Thank you for your continued participation in Franklin Growth Opportunities Fund. We look forward to serving your future investment needs.

The foregoing information reflects our analysis, opinions and portfolio holdings as of October 31, 2012, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

22 | Semiannual Report

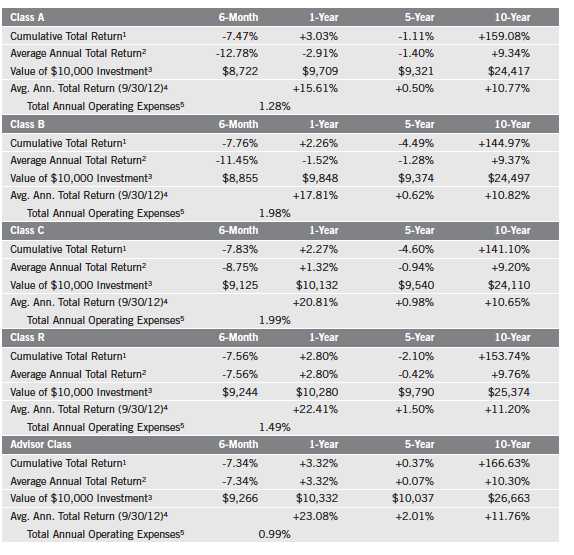

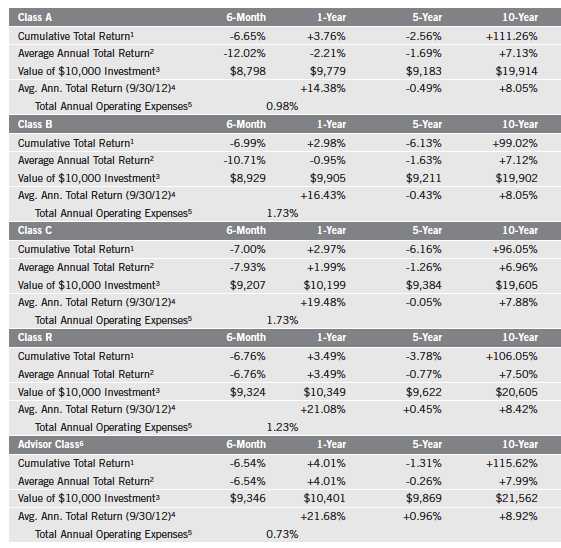

Performance Summary as of 10/31/12

Franklin Growth Opportunities Fund

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

Semiannual Report | 23

Performance Summary (continued)

Performance

Cumulative total return excludes sales charges. Average annual total returns and value of $10,000 investment include maximum sales charges. Class A: 5.75% maximum initial sales charge; Class B: contingent deferred sales charge (CDSC) declining from 4% to 1% over six years, and eliminated thereafter; Class C: 1% CDSC in first year only; Class R/Advisor Class: no sales charges.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

24 | Semiannual Report

Performance Summary (continued)

Endnotes

All investments involve risks, including possible loss of principal. The Fund may be more volatile than a more conservative equity fund and may be best suited for long-term investors. The Fund’s investments in smaller and midsized company stocks involve special risks such as relatively smaller revenues, limited product lines and smaller market share. Smaller and midsized company stocks historically have exhibited greater price volatility than larger company stocks, particularly over the short term. The Fund may focus on particular sectors of the market from time to time, which can carry greater risks of adverse developments in such sectors. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

| |

Class B: Class C: | These shares have higher annual fees and expenses than Class A shares. Prior to 1/1/04, these shares were offered with an initial sales charge; thus actual total returns would have differed. These shares have higher annual fees and expenses than Class A shares. |

Class R: | Shares are available to certain eligible investors as described in the prospectus. These shares have higher annual fees and expenses than Class A shares. |

Advisor Class: | Shares are available to certain eligible investors as described in the prospectus. |

1. Cumulative total return represents the change in value of an investment over the periods indicated.

2. Average annual total return represents the average annual change in value of an investment over the periods indicated. Six-month return has not been annualized.

3. These figures represent the value of a hypothetical $10,000 investment in the Fund over the periods indicated.

4. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

5. Figures are as stated in the Fund’s prospectus current as of the date of this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

Semiannual Report | 25

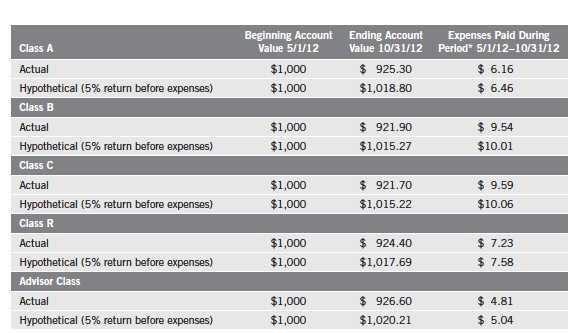

Your Fund’s Expenses

Franklin Growth Opportunities Fund

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

26 | Semiannual Report

Your Fund’s Expenses (continued)

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

*Expenses are calculated using the most recent six-month expense ratio, annualized for each class (A: 1.27%; B: 1.97%; C: 1.98%; R: 1.49%; and Advisor: 0.99%), multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period.

Semiannual Report | 27

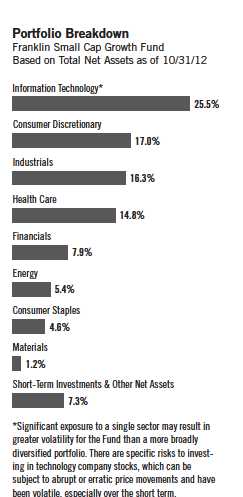

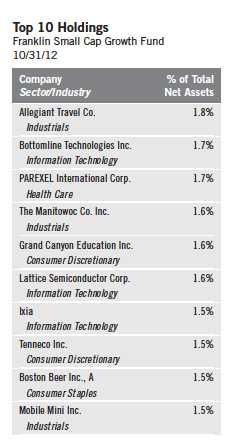

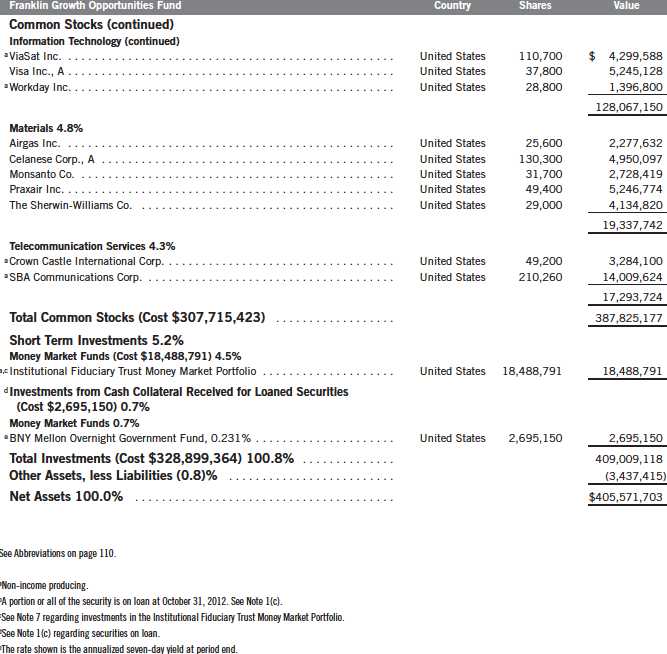

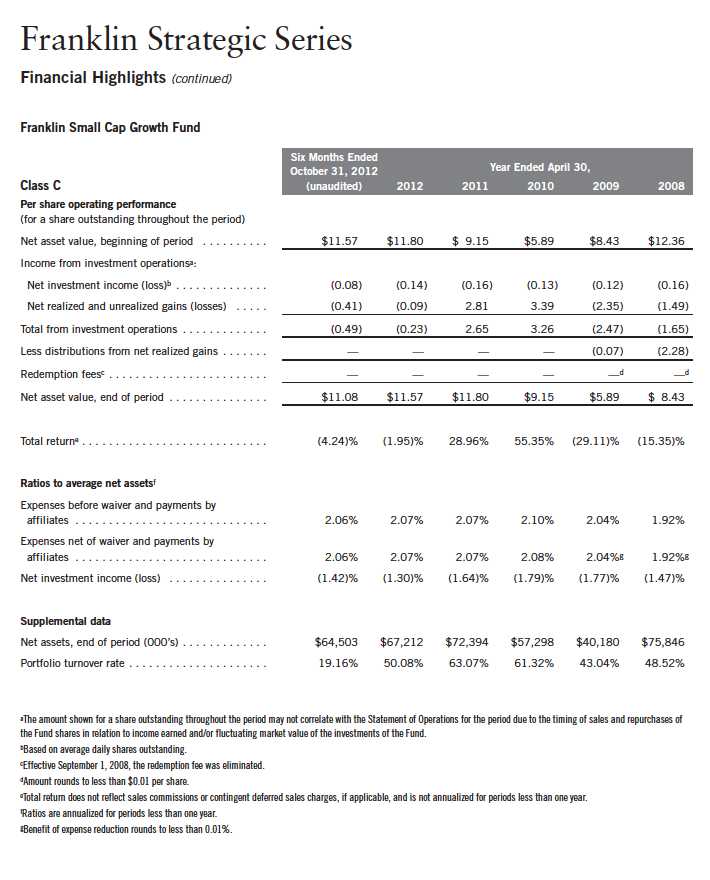

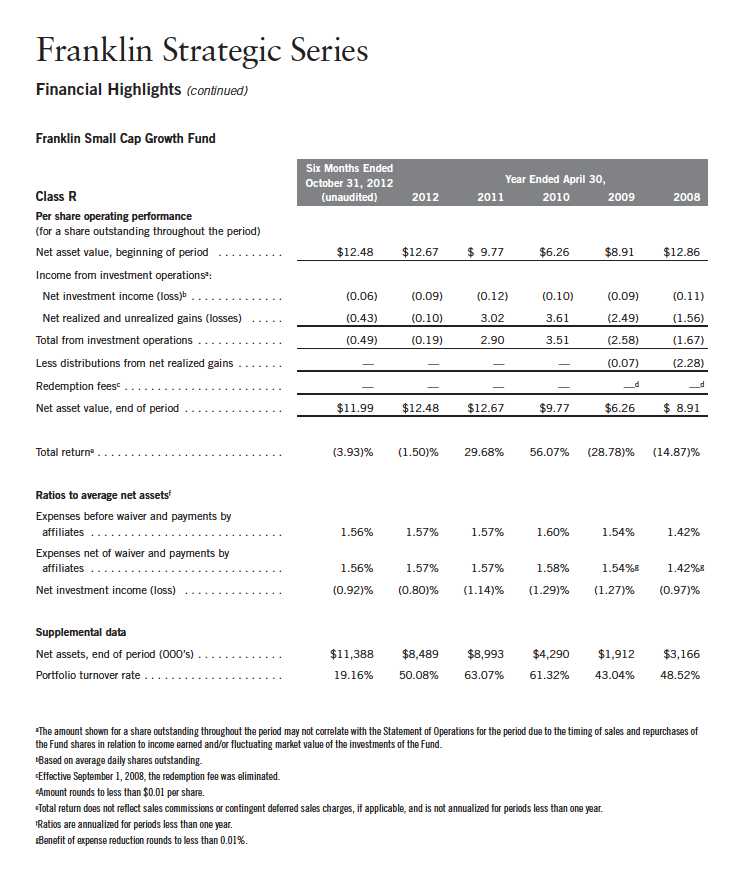

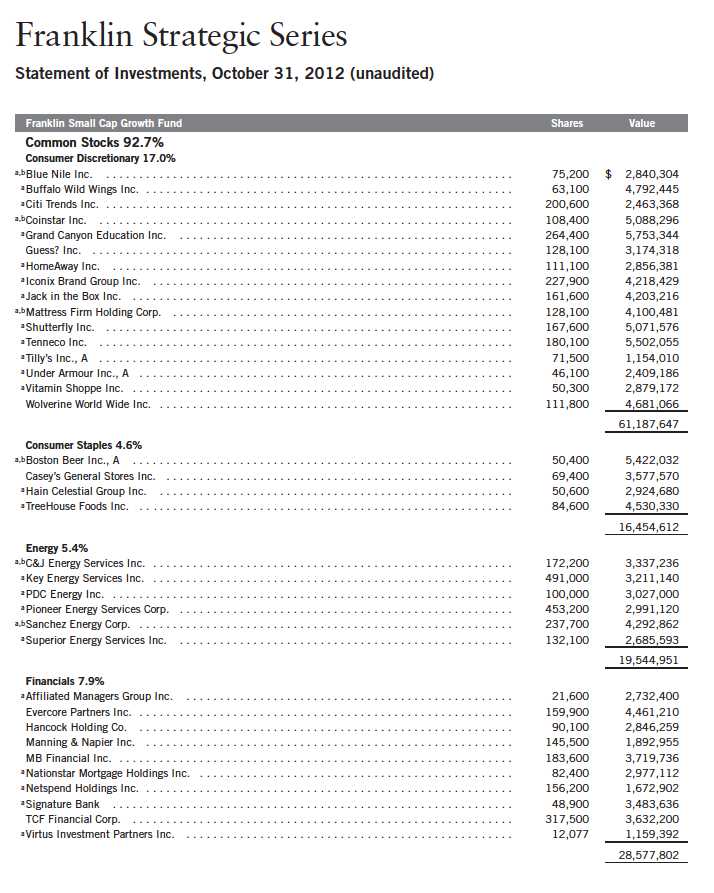

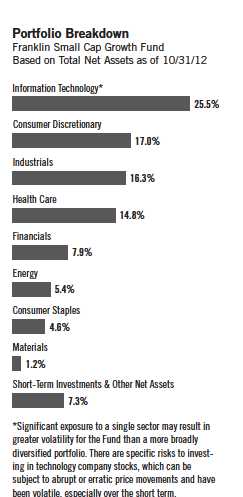

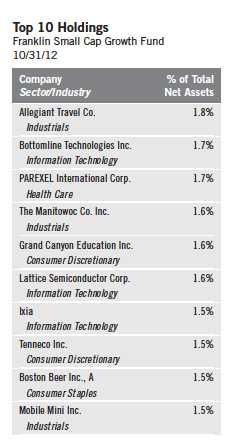

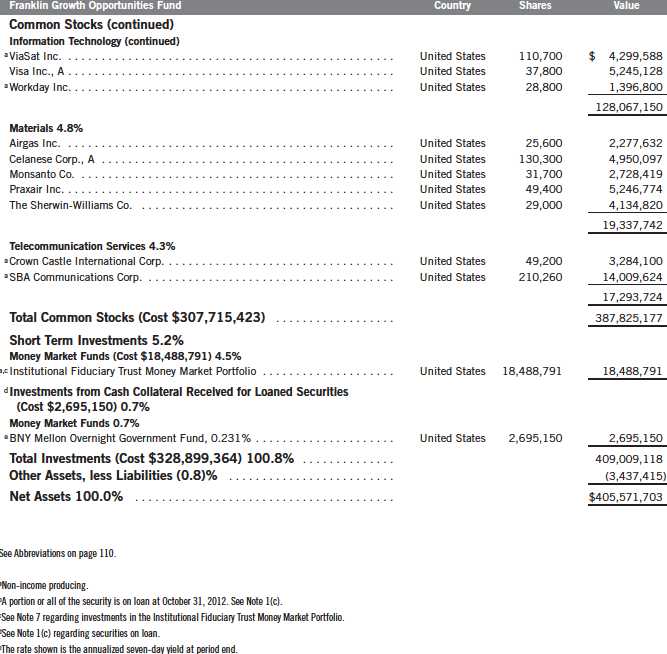

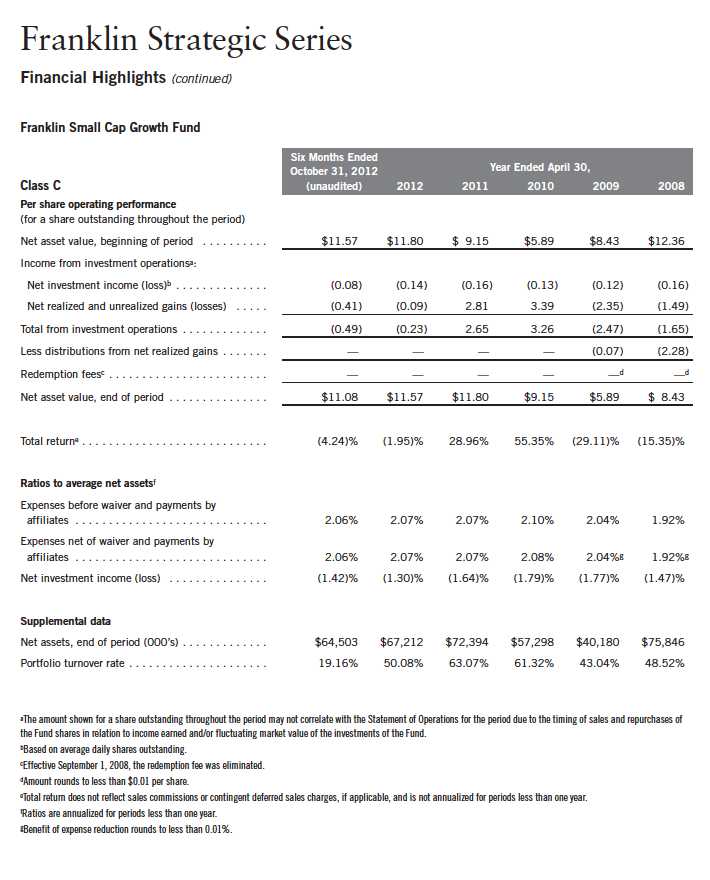

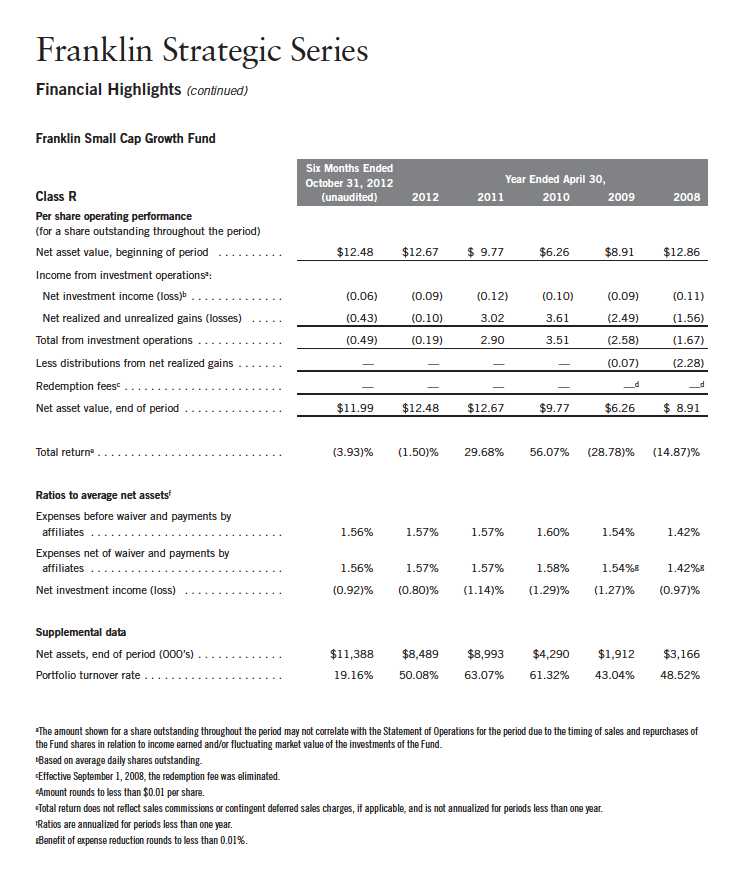

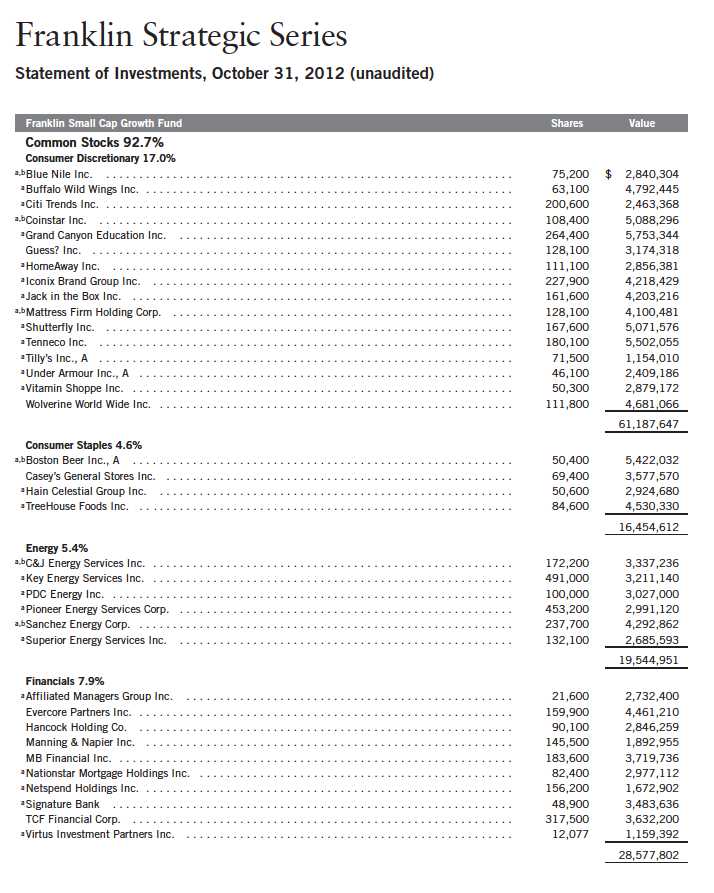

Franklin Small Cap Growth Fund

Your Fund’s Goal and Main Investments: Franklin Small Cap Growth Fund seeks

long-term capital growth by normally investing at least 80% of its net assets in equity securities of small-capitalization companies, which for this Fund are those with market capitalizations not exceeding that of the highest market capitalization in the Russell 2000® Index or $1.5 billion, whichever is greater, at the time of purchase.1

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. Please visit franklintempleton.com or call (800) 342-5236 for most recent month-end performance.

This semiannual report for Franklin Small Cap Growth Fund covers the period ended October 31, 2012.

Performance Overview

For the six months under review, Franklin Small Cap Growth Fund – Class A had a -3.82% cumulative total return. The Fund underperformed the -0.80% total return of its narrow benchmark, the Russell 2000® Growth Index, which measures performance of small companies with higher price-to-book ratios and higher forecasted growth values.2 The Fund also underperformed the +2.16% total return of its broad benchmark, the Standard & Poor’s 500 Index, which tracks the broad U.S. stock market.2 You can find the Fund’s long-term performance data in the Performance Summary beginning on page 31.

Investment Strategy

We use fundamental, bottom-up research to seek companies meeting our criteria of growth potential, quality and valuation. In seeking sustainable growth characteristics, we look for companies we believe can produce sustainable earnings and cash flow growth, evaluating the long-term market opportunity and competitive structure of an industry to target leaders and emerging leaders. We define quality companies as those with strong and improving competitive positions in attractive markets. We also believe important attributes of quality are experienced and talented management teams as well as financial strength

1. The Russell 2000® Index is market capitalization weighted and measures performance of the 2,000 smallest companies in the Russell 3000® Index, which represent a small amount of the total market capitalization of the Russell 3000® Index.

2. Source: © 2012 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. The index is unmanaged and includes reinvested dividends. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI). The SOI begins on page 72.

28 | Semiannual Report

reflected in the capital structure, gross and operating margins, free cash flow generation and returns on capital employed. Our valuation analysis includes a range of potential outcomes based on an assessment of multiple scenarios. In assessing value, we consider whether security prices fully reflect the balance of the sustainable growth opportunities relative to business and financial risks.

Manager’s Discussion

During the six months under review, stock selection in the financials and consumer discretionary sectors was a key contributor to the Fund’s performance relative to the Russell 2000® Growth Index. Nonbank mortgage servicer Nationstar Mortgage Holdings, which had its initial public offering in March, was a top performer in the financials sector as its share price more than doubled during the period. Nationstar has been a beneficiary of many financial institutions’ efforts to reduce their residential mortgage exposure and overall servicing portfolio. In consumer discretionary, postsecondary education services company Grand Canyon Education generated better-than-expected earnings in recent quarters due to solid enrollment growth. Although underweighting and stock selection in the industrials sector generally hurt relative performance, Allegiant Travel was a key contributor. The airline company reported record third-quarter earnings driven by increased passenger capacities, lower costs per passenger as it used more fuel-efficient planes, new Hawaii routes, and higher ancillary revenue and third-party sales. In the health care sector, continuous glucose monitor (CGM) systems provider DexCom and clinical-stage biopharmaceutical company Pharmacyclics were notable contributors, despite the sector’s detractive underweighting. DexCom recently received regulatory approvals in key markets for its new CGM system, which is in the early stages of adoption in the large market of insulin users. Pharmacyclics continued to make progress in its development of therapeutics for the treatment of cancer and immune-related diseases.

In contrast, stock selection and overweighting in the information technology (IT) sector was a major detractor from the Fund’s relative performance, largely resulting from our positions in Volterra Semiconductor, Acme Packet (not an index component) and FARO Technologies. Shares of Volterra, a provider of high-performance analog and mixed-signal power management semiconductors, declined in value largely because of investor concerns about the notebook market segment and the company’s lower-than-expected fourth-quarter revenue and earnings forecast. Communications equipment company Acme Packet was negatively affected by tepid worldwide enterprise sales and soft capital expenditures in North America. FARO Technologies, a 3D measurement and imaging solutions manufacturer, reported weaker-than-expected earnings as economic uncertainties, particularly in Europe, led customers to delay purchase decisions. Stock selection in the industrials sector also hindered

Semiannual Report | 29

relative results, particularly patent risk management solutions provider RPX. In the energy sector, onshore rig-based well servicing contractor Key Energy Services lost value as declining activity in the natural gas markets and pricing pressure in the oil markets hurt demand for the company’s services.

Thank you for your continued participation in Franklin Small Cap Growth Fund. We look forward to serving your future investment needs.

30 | Semiannual Report

Performance Summary as of 10/31/12

Franklin Small Cap Growth Fund

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

Semiannual Report | 31

Performance Summary (continued)

32 | Semiannual Report

Performance Summary (continued)

Endnotes

All investments involve risks, including possible loss of principal. Smaller and newer companies can be particularly sensitive to changing economic conditions. Their growth prospects are less certain than those of larger, more established companies, and they can be volatile. The Fund is intended for long-term investors who are comfortable with short-term fluctuations in share price. There are special risks involved with significant exposure to a particular sector, including increased susceptibility related to economic, business, or other developments affecting that sector. The Fund may focus on particular sectors of the market from time to time, which can carry greater risks of adverse developments in such sectors. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

| |

Class B: Class C: | These shares have higher annual fees and expenses than Class A shares. Prior to 1/1/04, these shares were offered with an initial sales charge; thus actual total returns would have differed. These shares have higher annual fees and expenses than Class A shares. |

Class R: | Shares are available to certain eligible investors as described in the prospectus. These shares have higher annual fees and expenses than Class A shares. |

Advisor Class: | Shares are available to certain eligible investors as described in the prospectus. |

1. Cumulative total return represents the change in value of an investment over the periods indicated.

2. Average annual total return represents the average annual change in value of an investment over the periods indicated. Six-month return has not been annualized.

3. These figures represent the value of a hypothetical $10,000 investment in the Fund over the periods indicated.

4. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

5. Figures are as stated in the Fund’s prospectus current as of the date of this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

Semiannual Report | 33

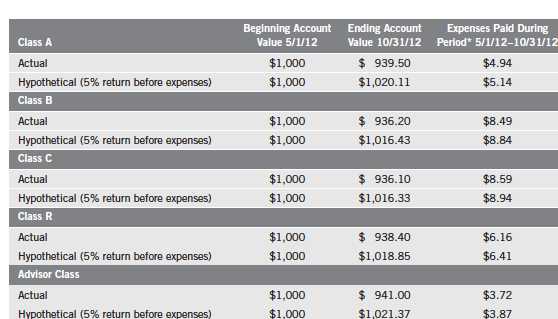

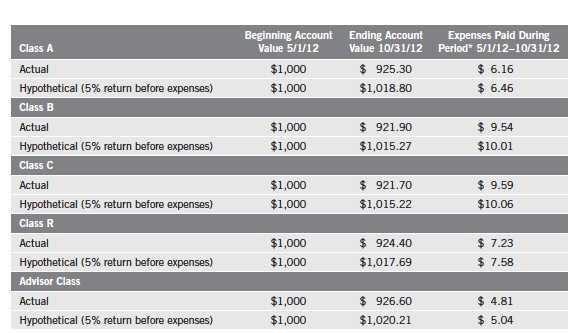

Your Fund’s Expenses

Franklin Small Cap Growth Fund

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

34 | Semiannual Report

Your Fund’s Expenses (continued)

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

*Expenses are calculated using the most recent six-month expense ratio, annualized for each class (A: 1.36%; B: 2.06%; C: 2.06%; R: 1.56%; and Advisor: 1.06%), multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period.

Semiannual Report | 35

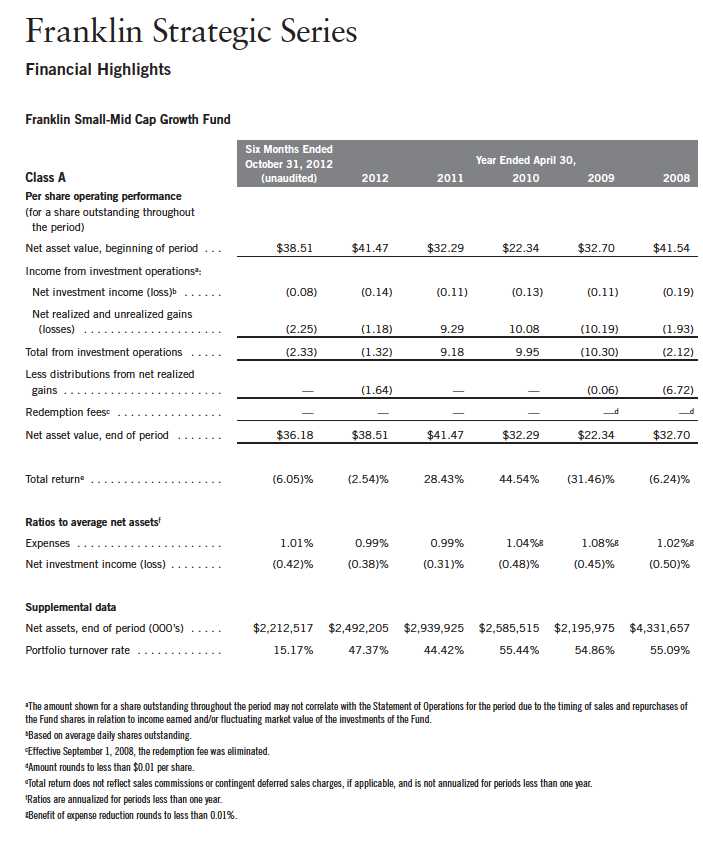

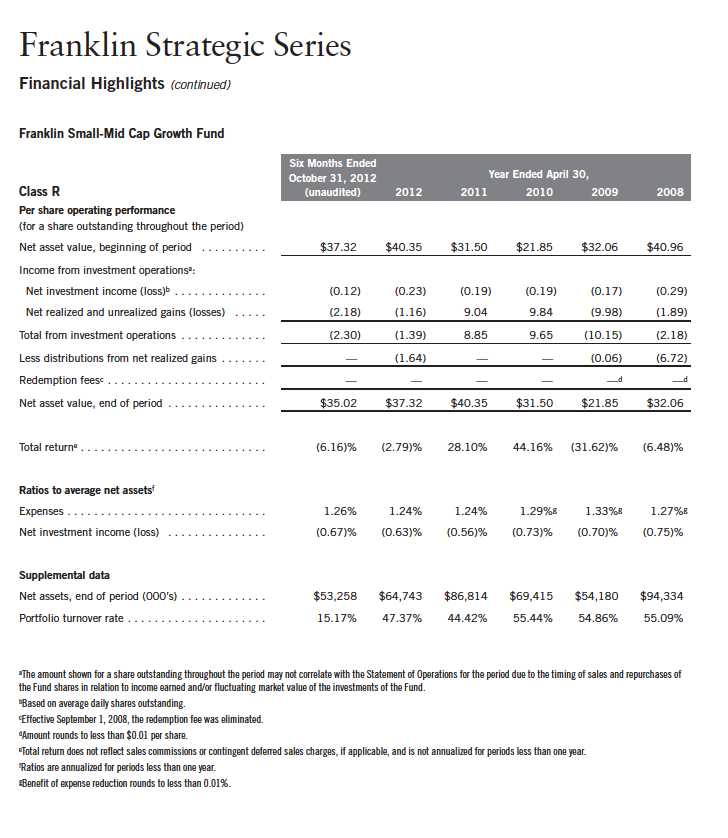

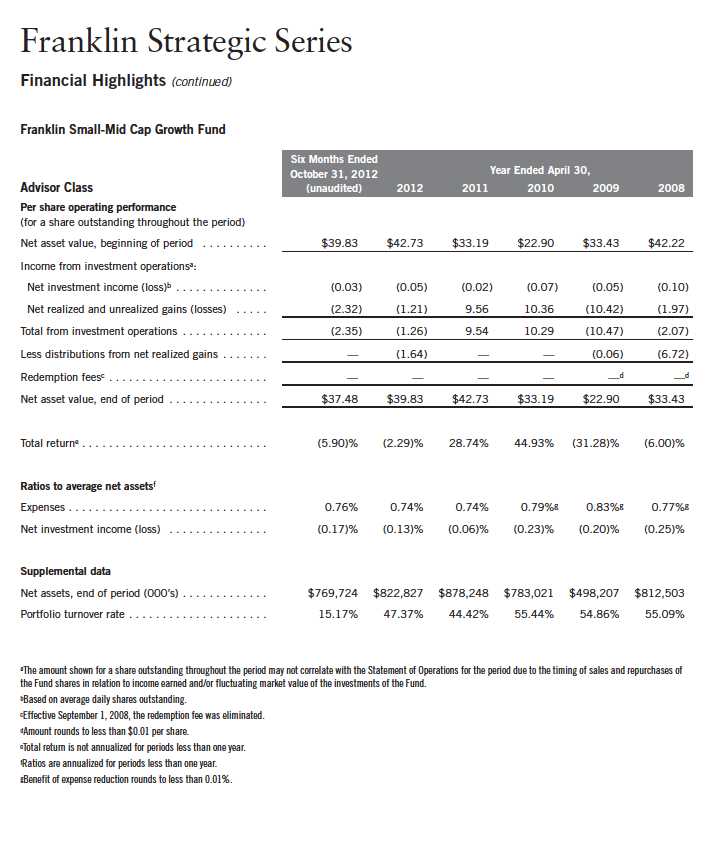

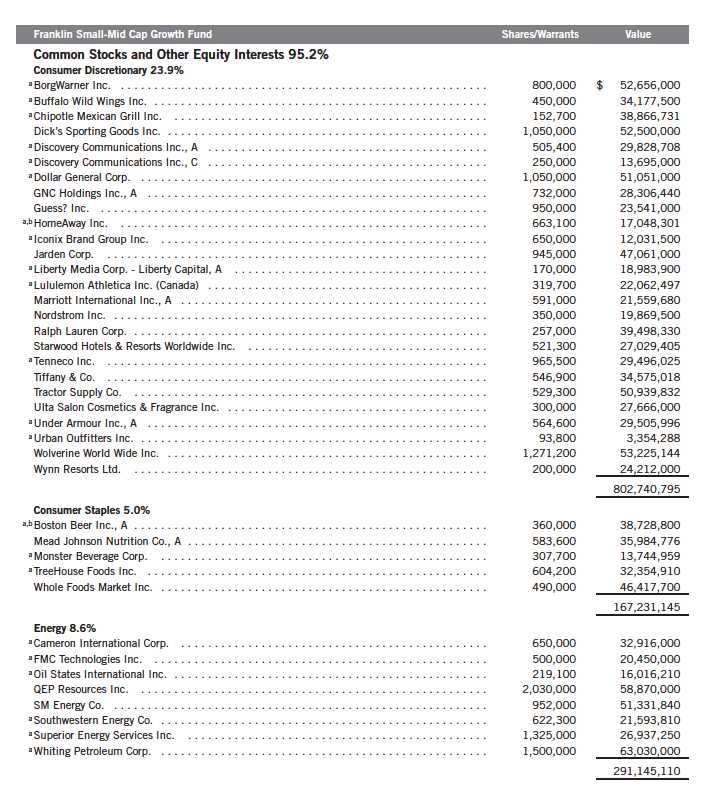

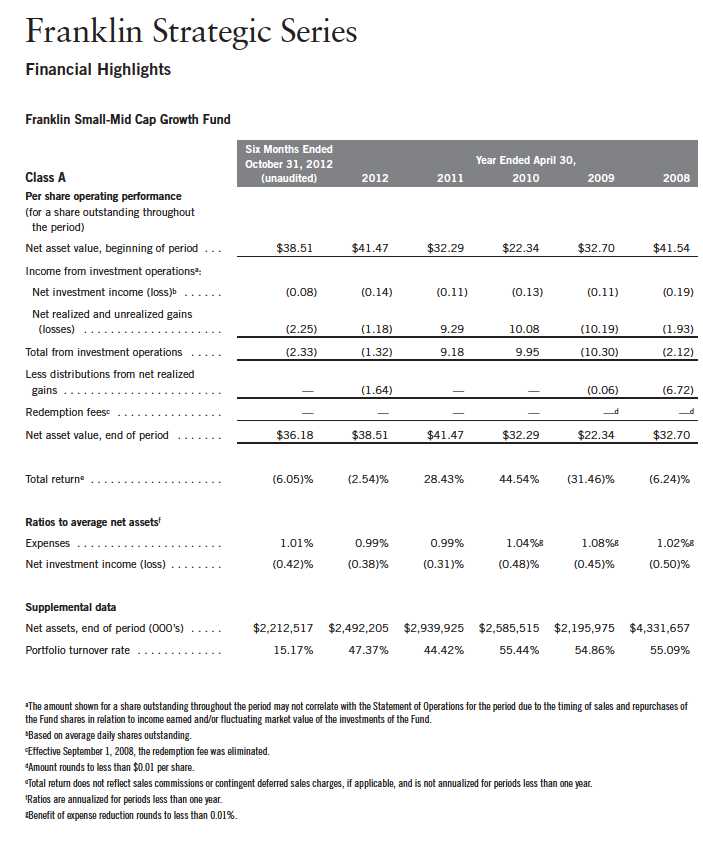

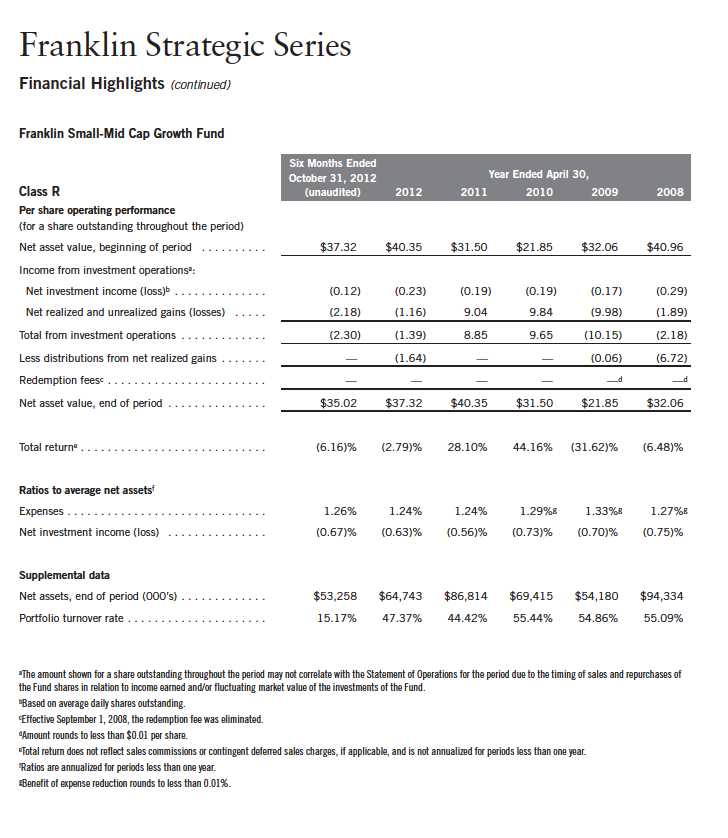

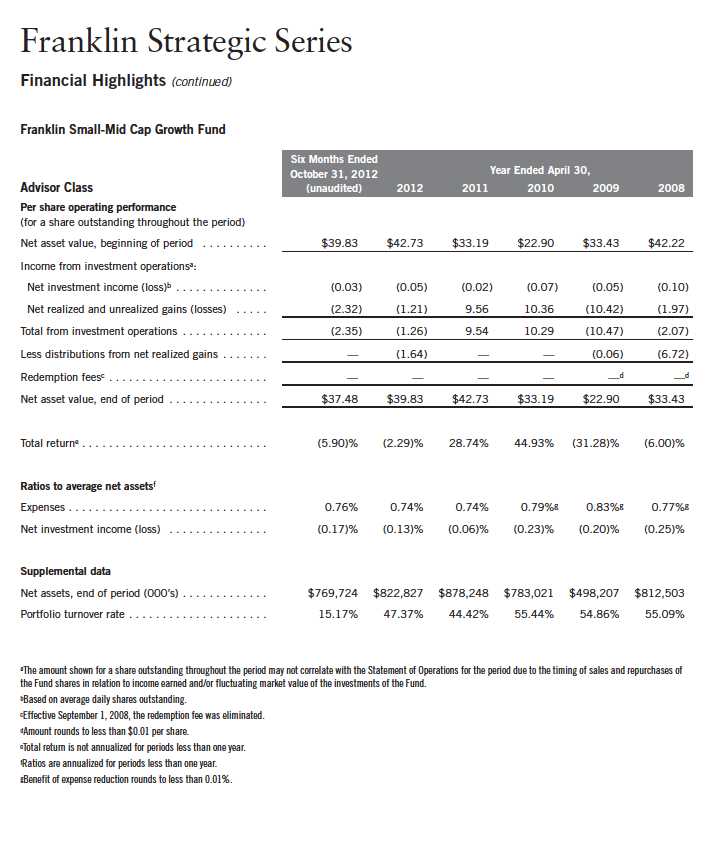

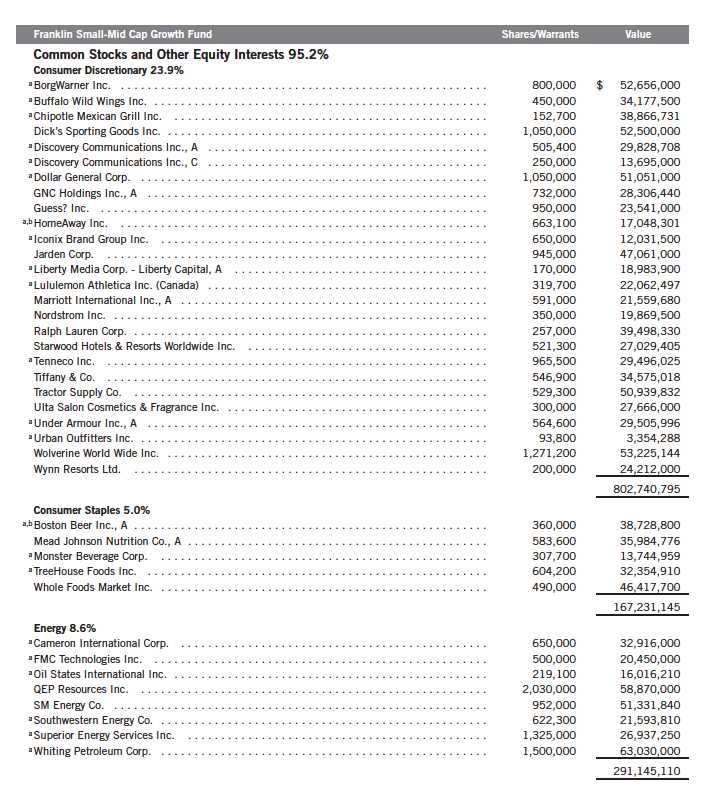

Franklin Small-Mid Cap Growth Fund

Your Fund’s Goal and Main Investments: Franklin Small-Mid Cap Growth Fund seeks long-term capital growth by normally investing at least 80% of its net assets in equity securities of small-cap and mid-cap companies. The Fund defines small-cap companies as those within the market capitalization range of companies in the Russell 2500™ Index at the time of purchase, and mid-cap companies as those within the market capitalization range of the Russell Midcap® Index at the time of purchase.1

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. Please visit franklintempleton.com or call (800) 342-5236 for most recent month-end performance.

This semiannual report for Franklin Small-Mid Cap Growth Fund covers the period ended October 31, 2012.

Performance Overview

For the six months under review, Franklin Small-Mid Cap Growth Fund –Class A had a -6.05% cumulative total return. The Fund underperformed the -2.82% total return of its narrow benchmark, the Russell Midcap® Growth Index, which measures performance of companies in the Russell Midcap® Index with higher price-to-book ratios and higher forecasted growth values.2 The Fund also underperformed the +2.16% total return of its broad benchmark, the Standard & Poor’s 500 Index, which tracks the broad U.S. stock market.2 You can find the Fund’s long-term performance data in the Performance Summary beginning on page 39.

Investment Strategy

We use fundamental, bottom-up research to seek companies meeting our criteria of growth potential, quality and valuation. In seeking sustainable growth characteristics, we look for companies we believe can produce sustainable earnings and cash flow growth, evaluating the long-term market opportunity and competitive structure of an industry to target leaders and emerging leaders. We

1. The Russell 2500™ Index is market capitalization weighted and measures performance of the 2,500 smallest companies in the Russell 3000® Index, which represent a modest amount of the Russell 3000® Index’s total market capitalization. The Russell Midcap® Index is market capitalization weighted and measures performance of the smallest companies in the Russell 1000® Index, which represent a modest amount of the Russell 1000® Index’s total market capitalization.

2. Source: © 2012 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. The index is unmanaged and includes reinvested dividends. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI). The SOI begins on page 80.

36 | Semiannual Report

define quality companies as those with strong and improving competitive positions in attractive markets. We also believe important attributes of quality are experienced and talented management teams as well as financial strength reflected in the capital structure, gross and operating margins, free cash flow generation and returns on capital employed. Our valuation analysis includes a range of potential outcomes based on an assessment of multiple scenarios. In assessing value, we consider whether security prices fully reflect the balance of the sustainable growth opportunities relative to business and financial risks.

Manager’s Discussion

During the six months under review, key contributors to the Fund’s performance relative to the Russell Midcap® Growth Index included stock selection in the industrials and telecommunication services sectors. In the industrials sector, Allegiant Travel’s share price rose as the airline company reported record third-quarter earnings driven by increased passenger capacities, lower costs per passenger as it used more fuel-efficient planes, new Hawaii routes, and higher ancillary revenue and third-party sales. In the telecommunication services sector, SBA Communications’ share price rose to an all-time high as the wireless communications tower owner and operator benefited from strong leasing demand domestically and internationally, especially from the four biggest U.S. wireless carriers. Although our positions in the consumer discretionary and health care sectors generally detracted from relative results, there were some notable contributors. In the consumer discretionary sector, top performers included global diversified consumer products company Jarden and lifestyle specialty retailer Urban Outfitters. Jarden reported strong earnings in recent quarters as the company experienced solid demand for its household products. Urban Outfitters had strong sales growth and better gross margins largely driven by the company’s fashion improvement initiatives, reduction in merchandise markdowns and better marketing efforts. In the health care sector, kidney dialysis services provider DaVita rose in value after an initial dip following the company’s announcement in late May to acquire privately held HealthCare Partners, one of the nation’s largest operators of medical groups and physician networks.

In contrast, key detractors from the Fund’s relative performance included stock selection in the materials and energy sectors, as well as overweighting and stock selection in the information technology (IT) sector. In the materials sector, metallurgical coal producer and exporter Walter Energy was negatively affected by lower coal prices resulting largely from Asia’s slower economic growth. Whiting Petroleum, in the energy sector, declined in value as the oil and gas company’s share price suffered from falling crude oil prices during the period. In the IT sector, communications equipment manufacturer F5 Networks and electronic payment solutions provider VeriFone Systems were

Semiannual Report | 37

among the weakest performers. F5 Networks’ share price fell as the company reported weaker-than-expected third-quarter earnings and issued a downbeat forecast for the remainder of 2012. Although the company’s European revenue had robust growth, its overall revenue suffered as major U.S. customers reduced their most expensive orders largely because of challenging economic conditions and political uncertainty surrounding the November election. VeriFone reported strong fiscal third-quarter income growth, but weaker-than-expected fourth-quarter revenue guidance drove its share price lower. In the consumer staples sector, Monster Beverage detracted from performance as the leading energy drink manufacturer’s share price corrected sharply after it reached an all-time high in June. Further contributing to the price correction were a U.S. Food and Drug Administration examination into the potential adverse reactions to the company’s beverage products and investor concerns about the company’s ability to maintain the stellar growth it had demonstrated in recent years.

Thank you for your continued participation in Franklin Small-Mid Cap Growth Fund. We look forward to serving your future investment needs.

38 | Semiannual Report

Performance Summary as of 10/31/12

Franklin Small-Mid Cap Growth Fund

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

Semiannual Report | 39

Performance Summary (continued)

40 | Semiannual Report

Performance Summary (continued)

Endnotes

All investments involve risks, including possible loss of principal. Investors should be comfortable with fluctuations in the value of their investment, as small and midsized company stocks can be volatile, especially over the short term. Smaller or relatively new or unseasoned companies can be particularly sensitive to changing economic conditions, and their prospects for growth are less certain than those of larger, more established companies. The Fund may focus on particular sectors of the market from time to time, which can carry greater risks of adverse developments in such sectors. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

| |

Class B: Class C: | These shares have higher annual fees and expenses than Class A shares. Prior to 1/1/04, these shares were offered with an initial sales charge; thus actual total returns would have differed. These shares have higher annual fees and expenses than Class A shares. |

Class R: | Shares are available to certain eligible investors as described in the prospectus. These shares have higher annual fees and expenses than Class A shares. |

Advisor Class: | Shares are available to certain eligible investors as described in the prospectus. |

1. Cumulative total return represents the change in value of an investment over the periods indicated.

2. Average annual total return represents the average annual change in value of an investment over the periods indicated. Six-month return has not been annualized.

3. These figures represent the value of a hypothetical $10,000 investment in the Fund over the periods indicated.

4. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

5. Figures are as stated in the Fund’s prospectus current as of the date of this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

Semiannual Report | 41

Your Fund’s Expenses

Franklin Small-Mid Cap Growth Fund

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

42 | Semiannual Report

Your Fund’s Expenses (continued)

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

*Expenses are calculated using the most recent six-month expense ratio, annualized for each class (A: 1.01%; B: 1.74%; C: 1.76%; R: 1.26%; and Advisor: 0.76%), multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period.

Semiannual Report | 43

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 45

46 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 47

Semiannual Report | 49

50 | Semiannual Report

Semiannual Report | 51

52 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 53

54 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 55

56 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

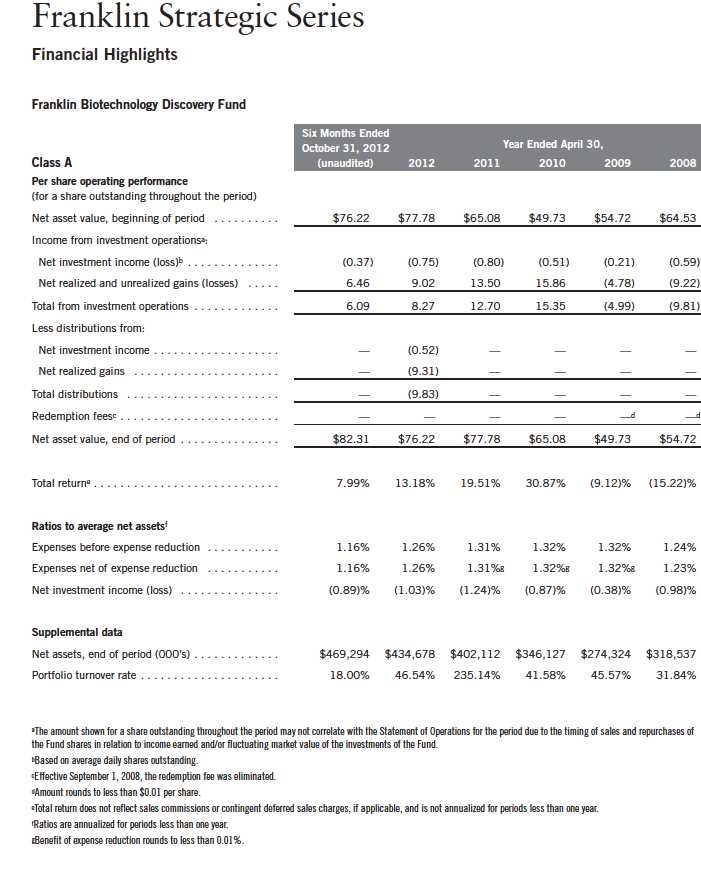

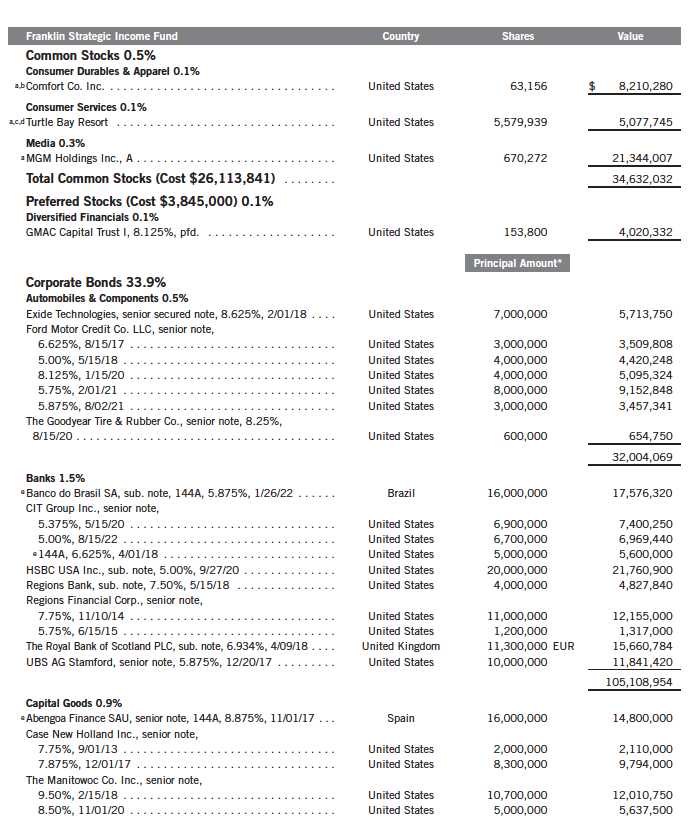

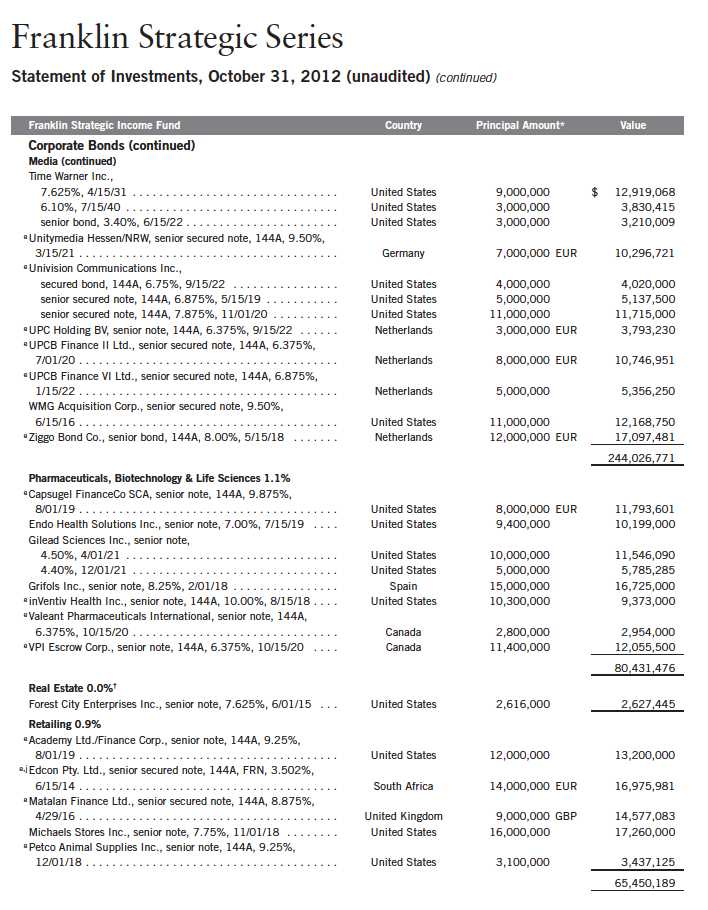

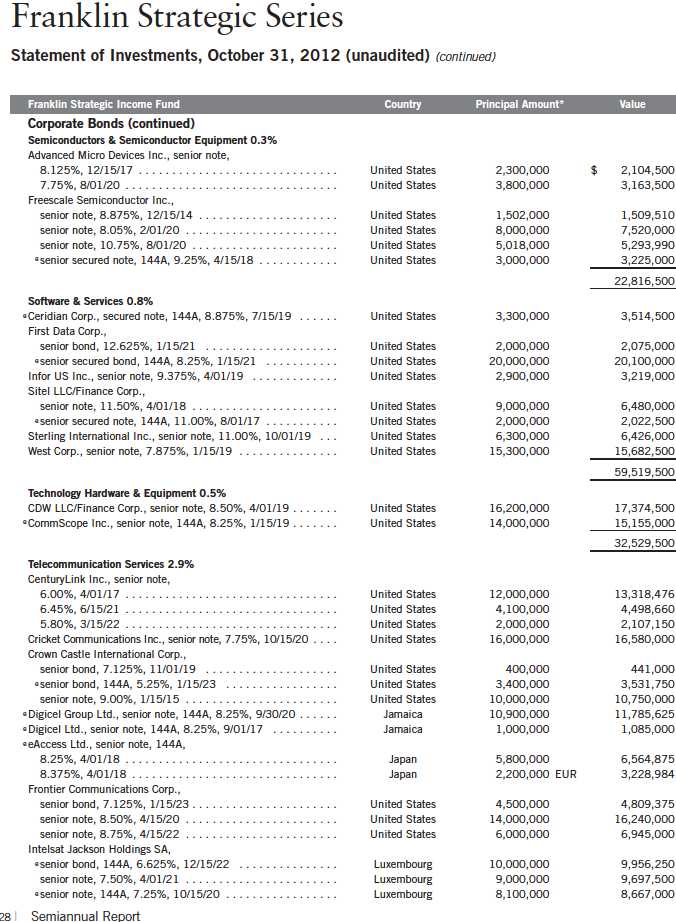

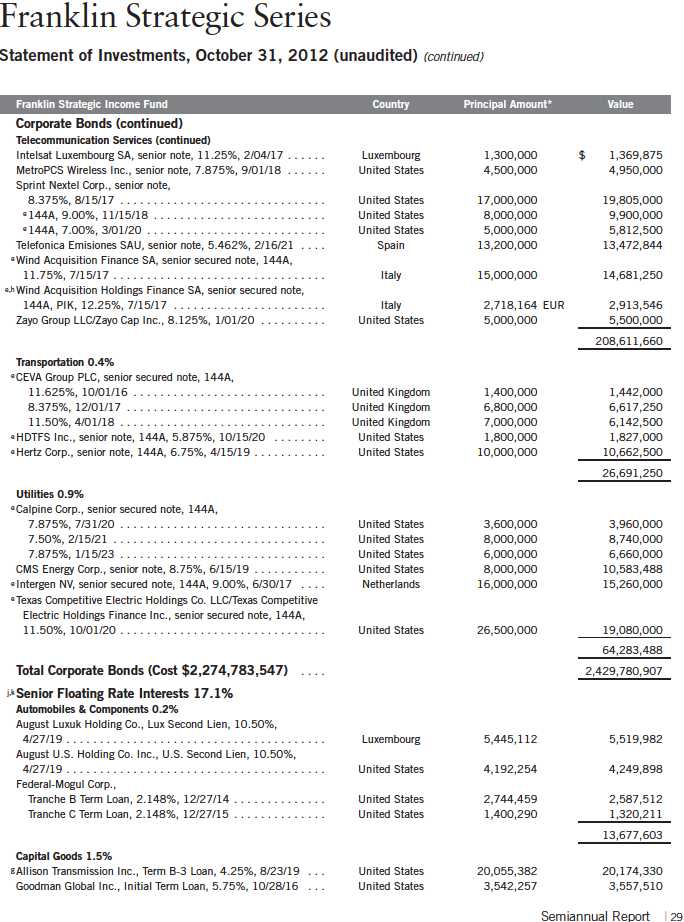

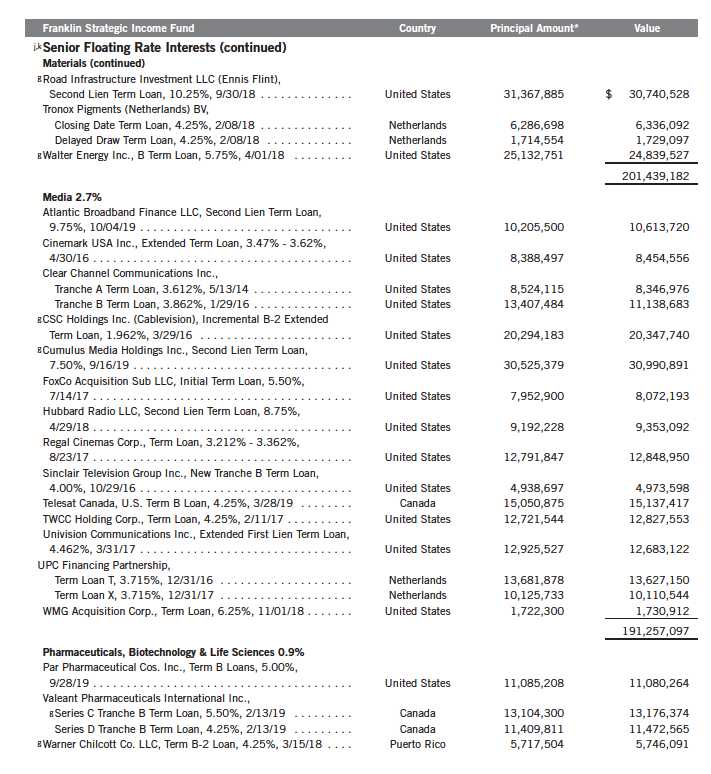

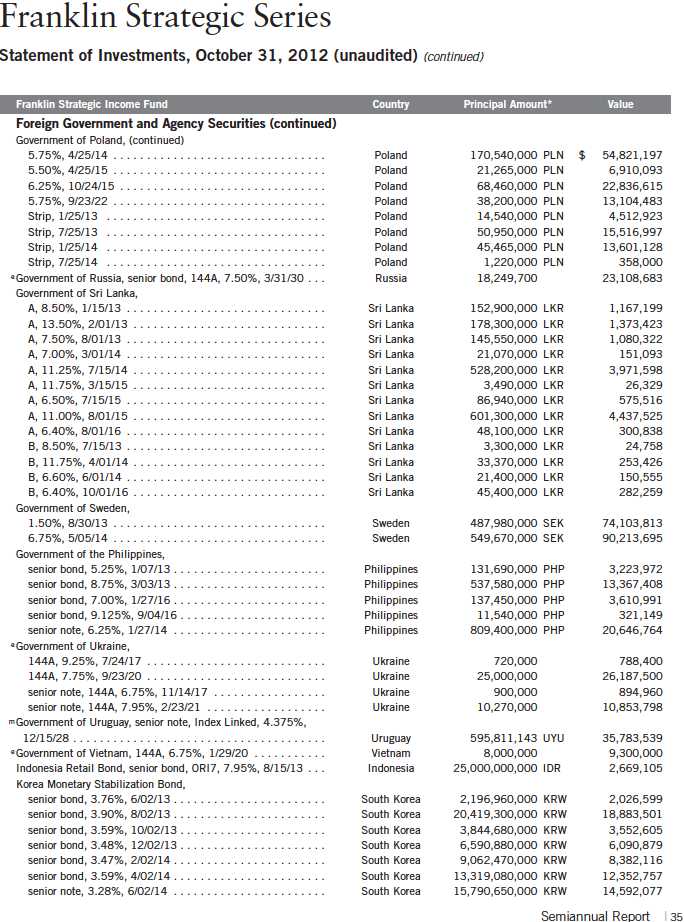

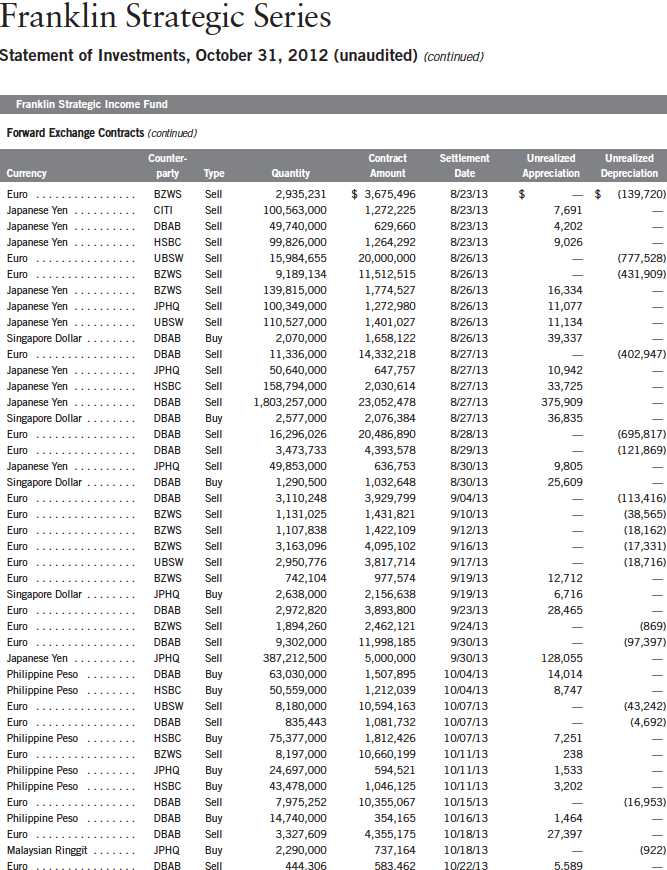

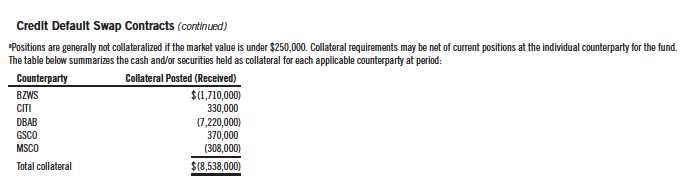

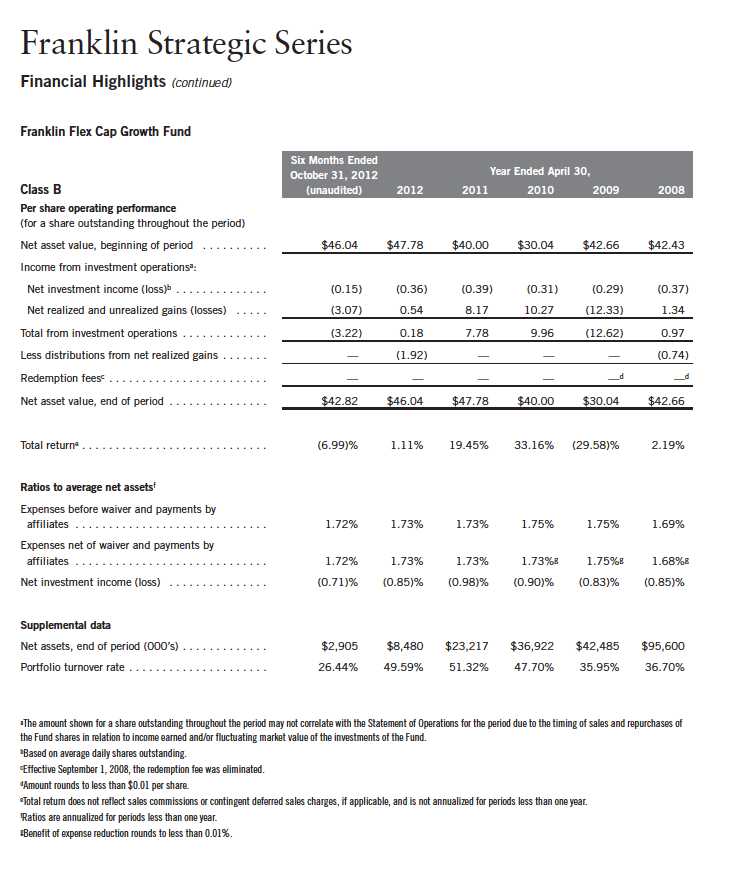

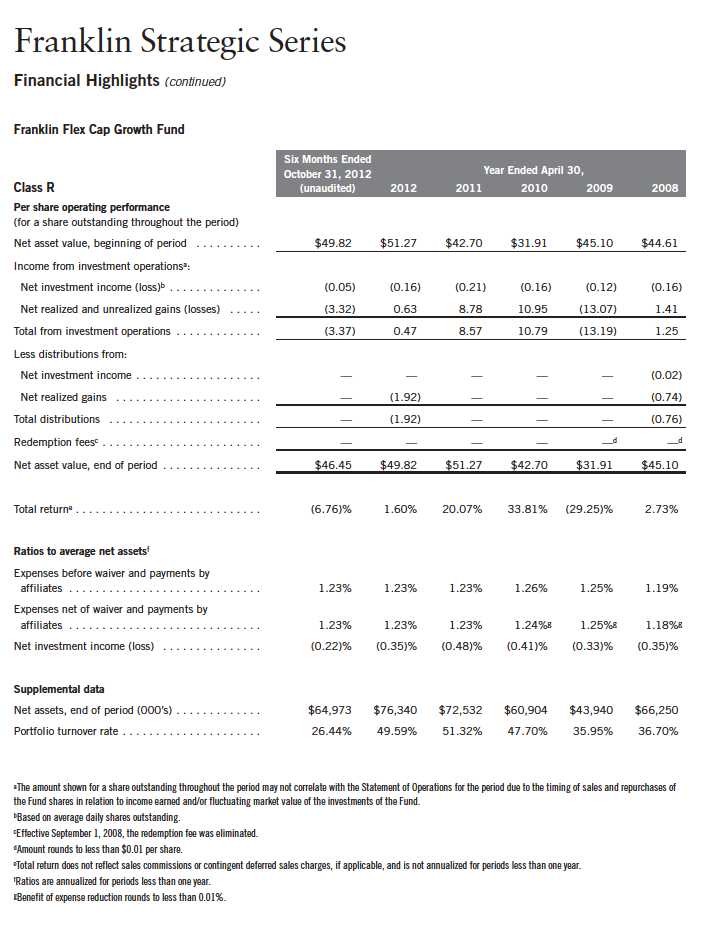

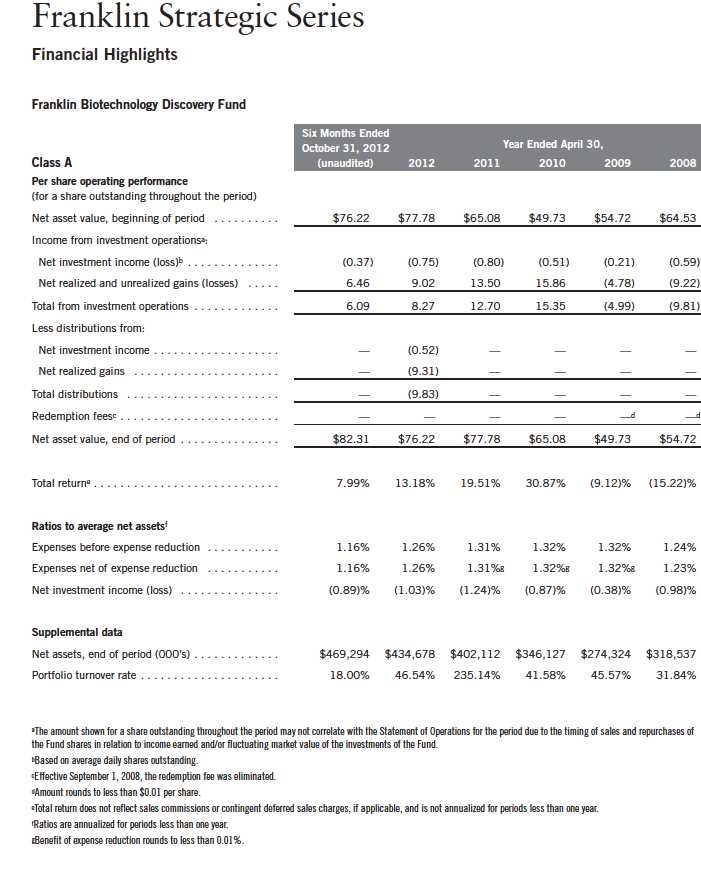

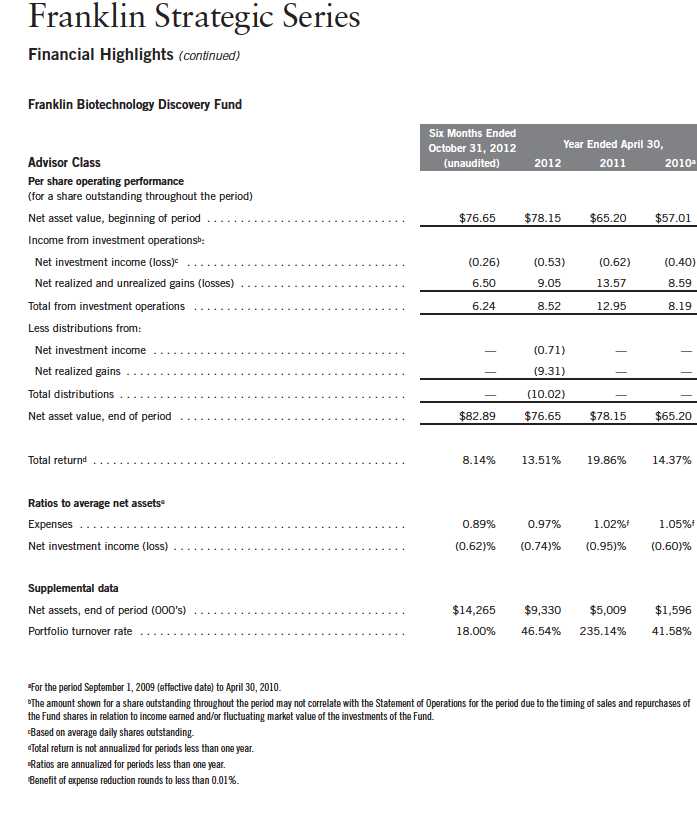

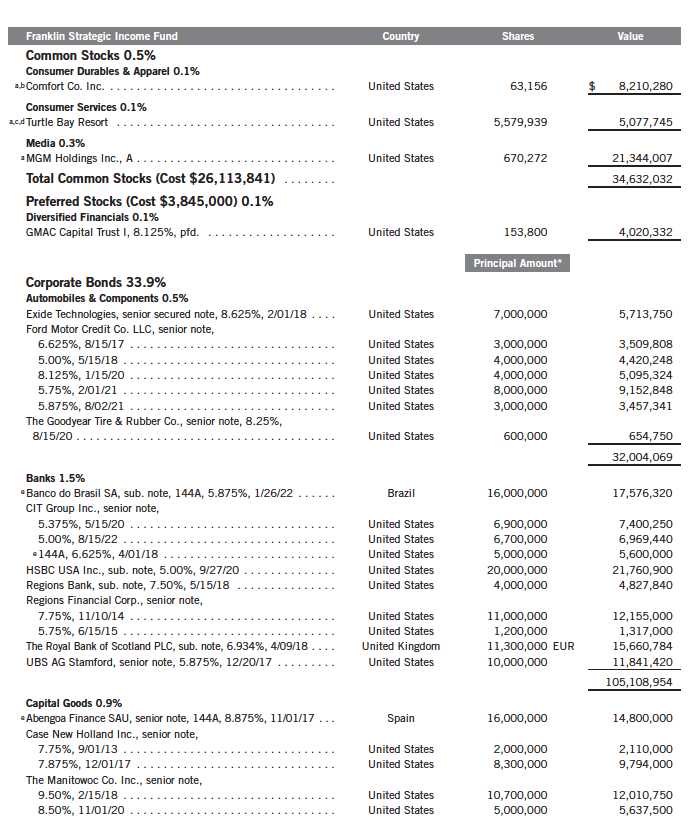

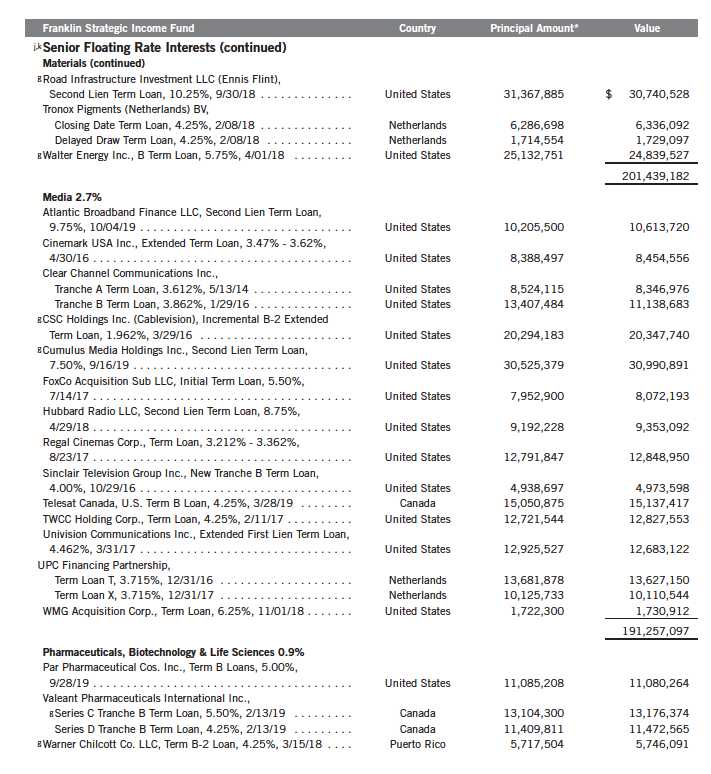

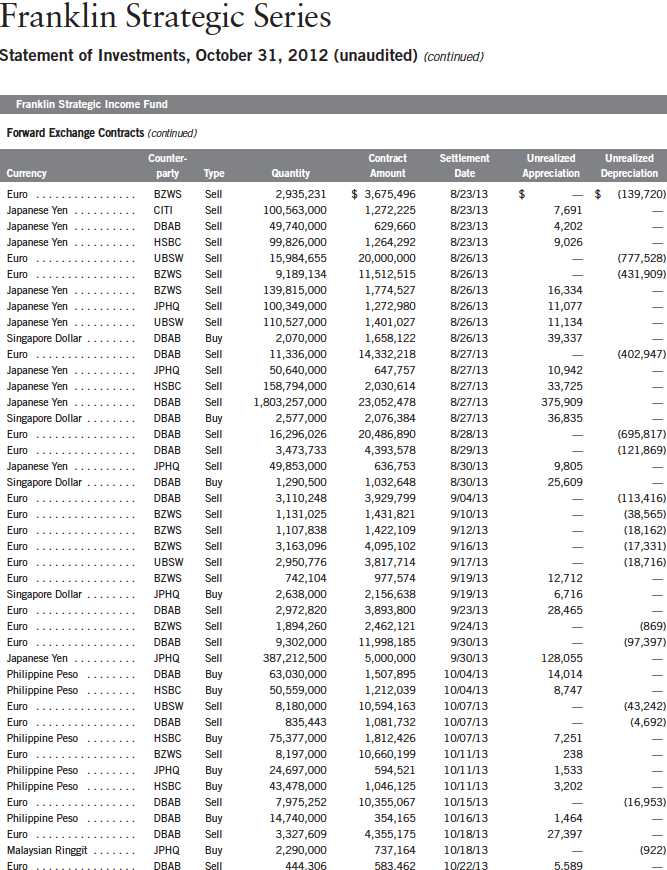

Franklin Strategic Series

Statement of Investments, October 31, 2012 (unaudited) (continued)

58 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 59

60 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 61

62 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 63

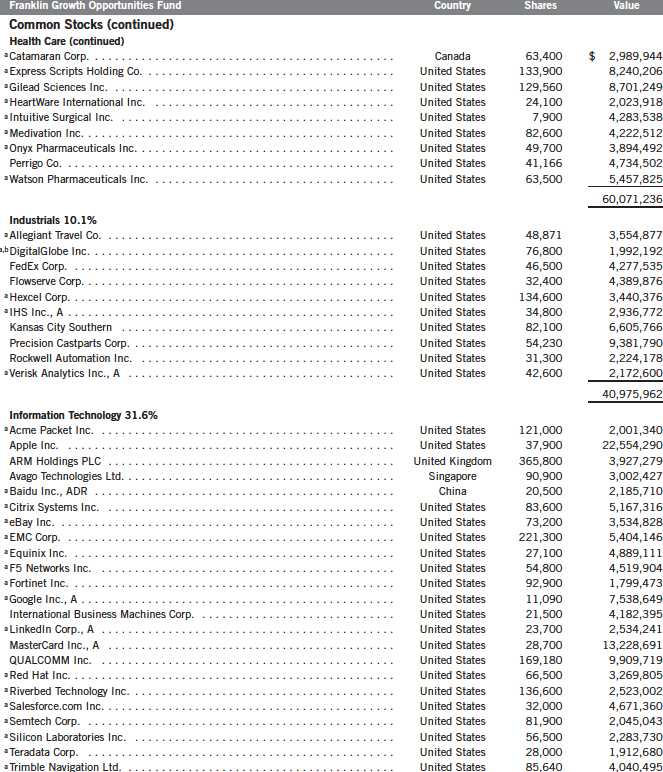

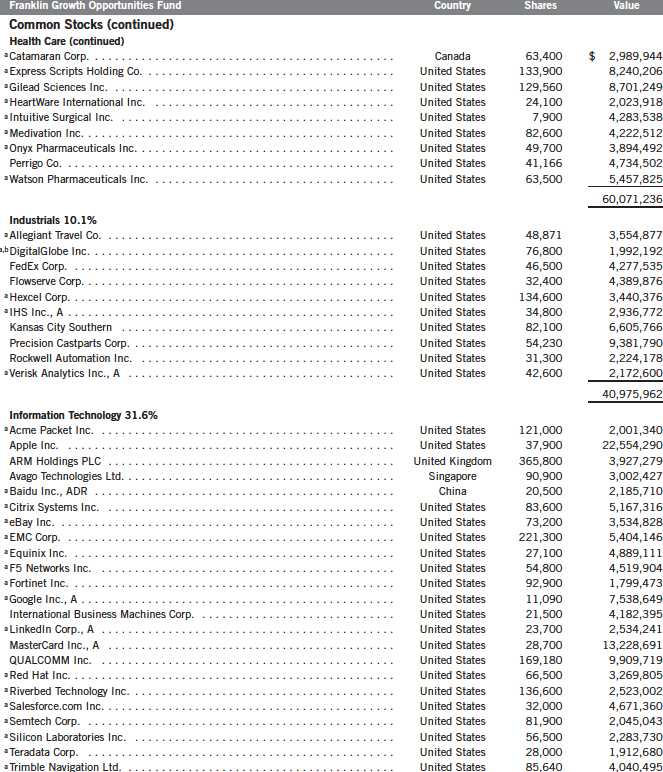

Franklin Strategic Series

Statement of Investments, October 31, 2012 (unaudited)

64 | Semiannual Report

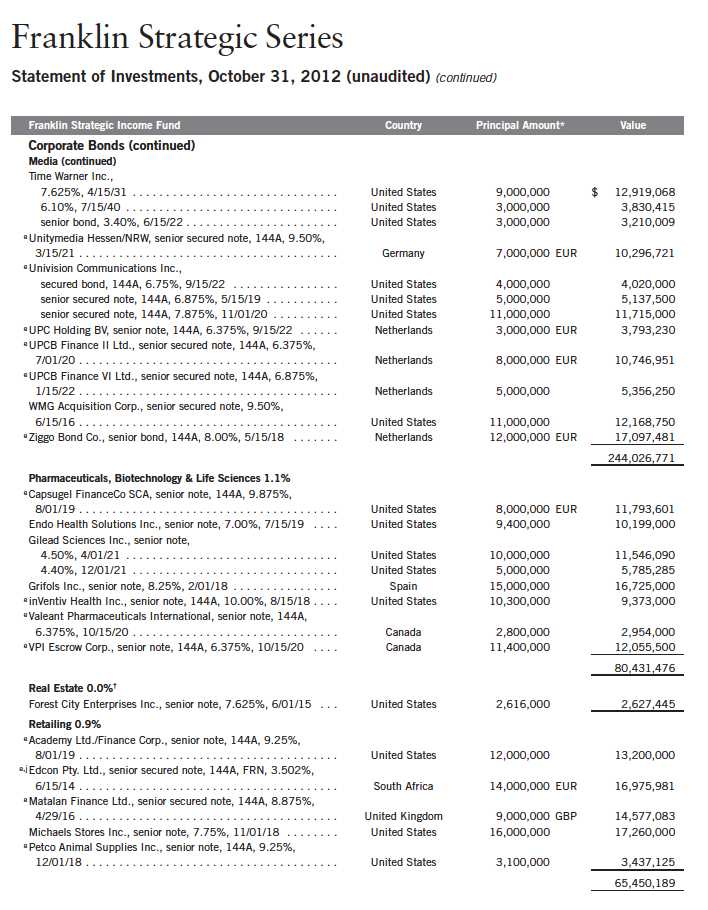

Franklin Strategic Series

Statement of Investments, October 31, 2012 (unaudited) (continued)

Semiannual Report | 65

Franklin Strategic Series

Statement of Investments, October 31, 2012 (unaudited) (continued)

66 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 67

68 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 69

70 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 71

72 | Semiannual Report

Semiannual Report | 73

Franklin Strategic Series

Statement of Investments, October 31, 2012 (unaudited) (continued)

74 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 75

76 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 77

78 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 79

Franklin Strategic Series

Statement of Investments, October 31, 2012 (unaudited)

80 | Semiannual Report

Franklin Strategic Series

Statement of Investments, October 31, 2012 (unaudited) (continued)

Semiannual Report | 81

82 | Semiannual Report

Franklin Strategic Series

Statement of Investments, October 31, 2012 (unaudited) (continued)

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 83

84 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

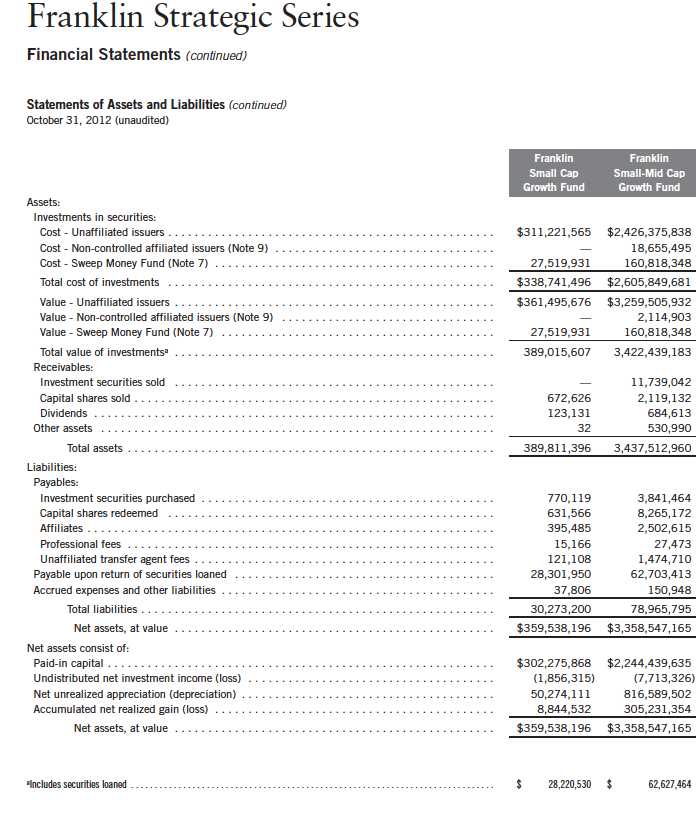

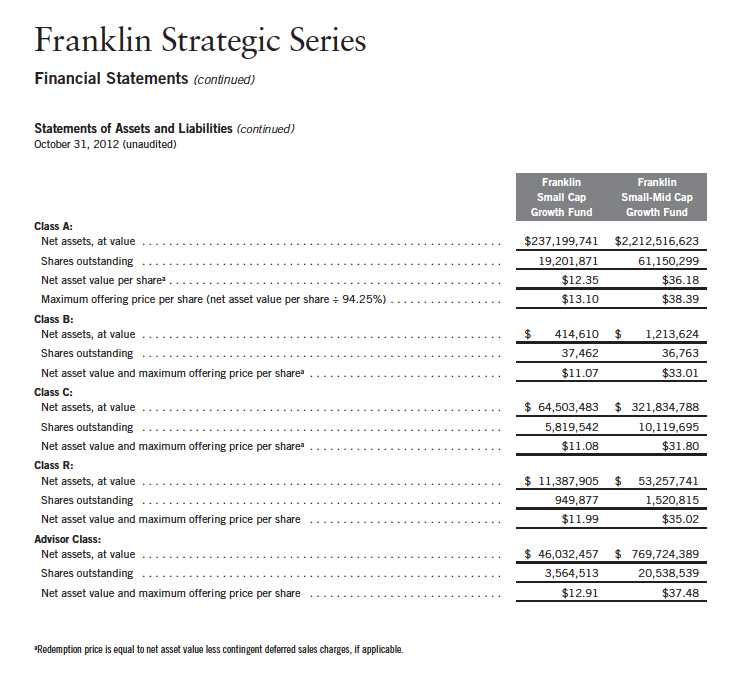

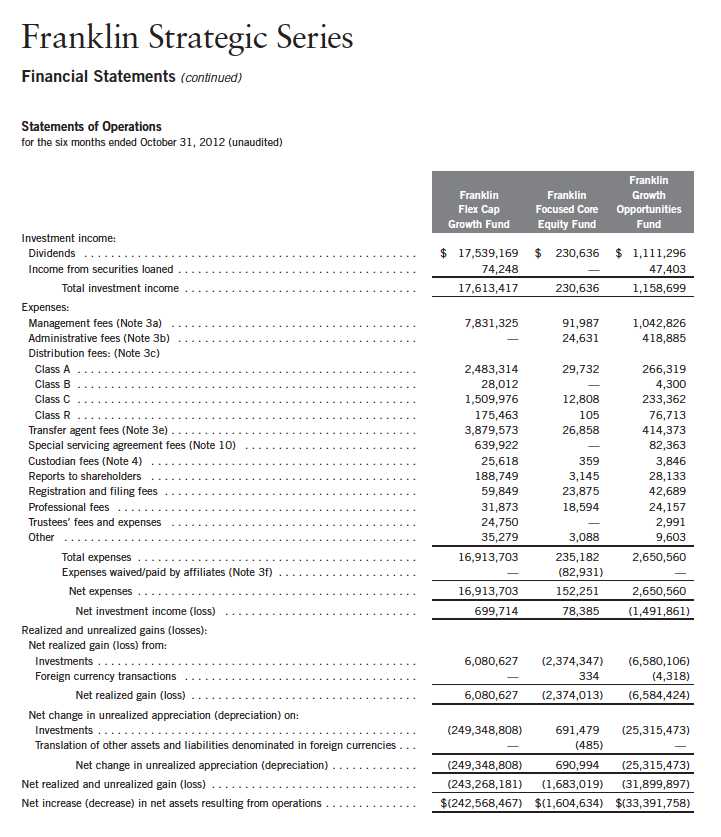

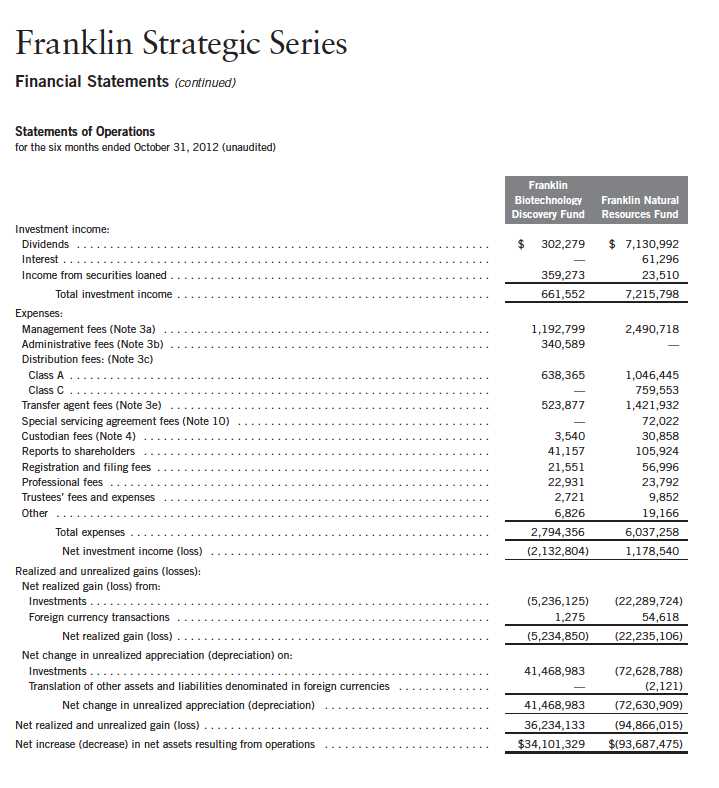

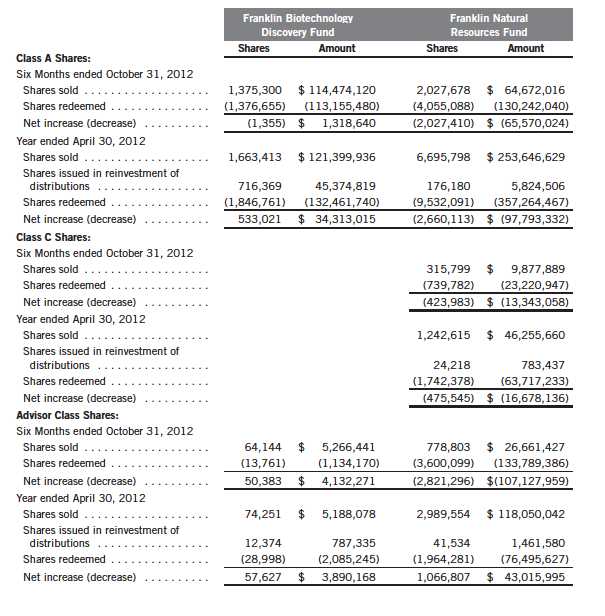

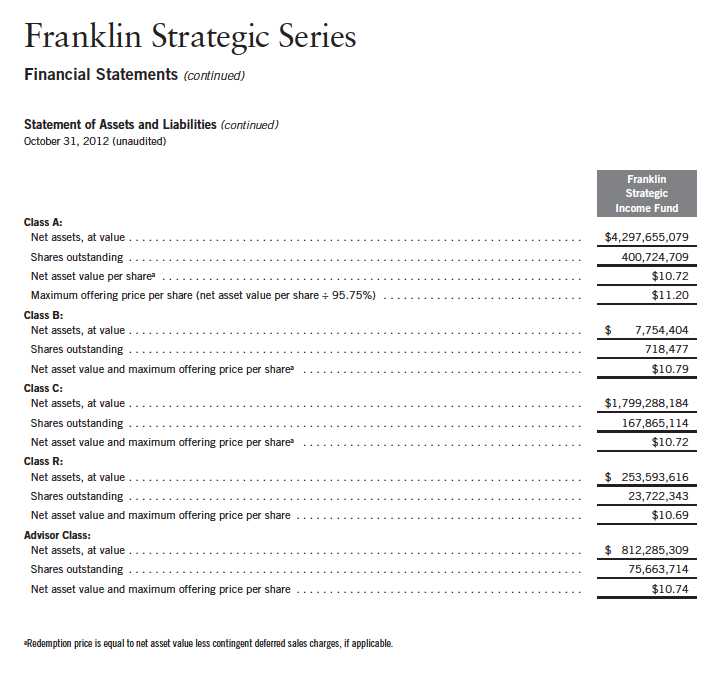

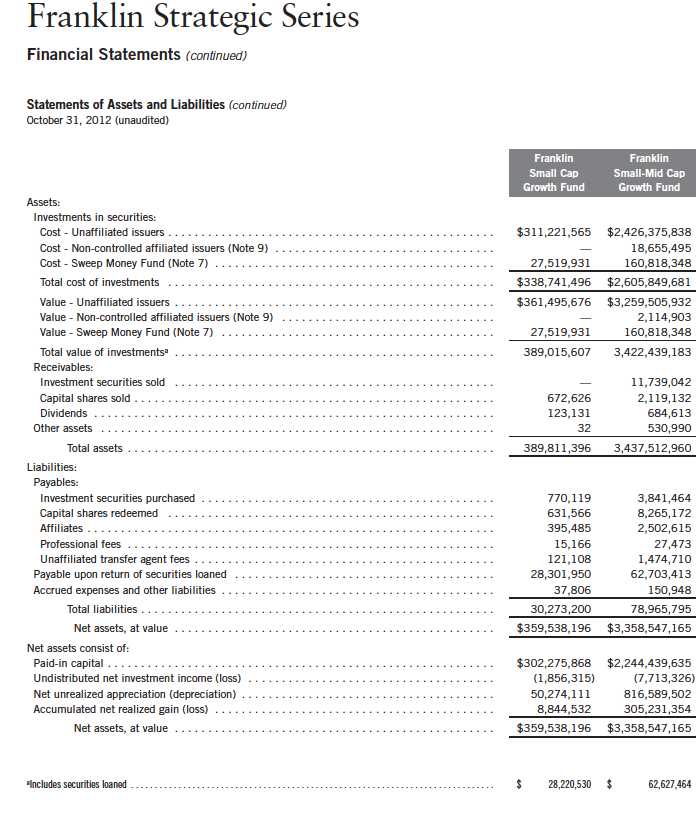

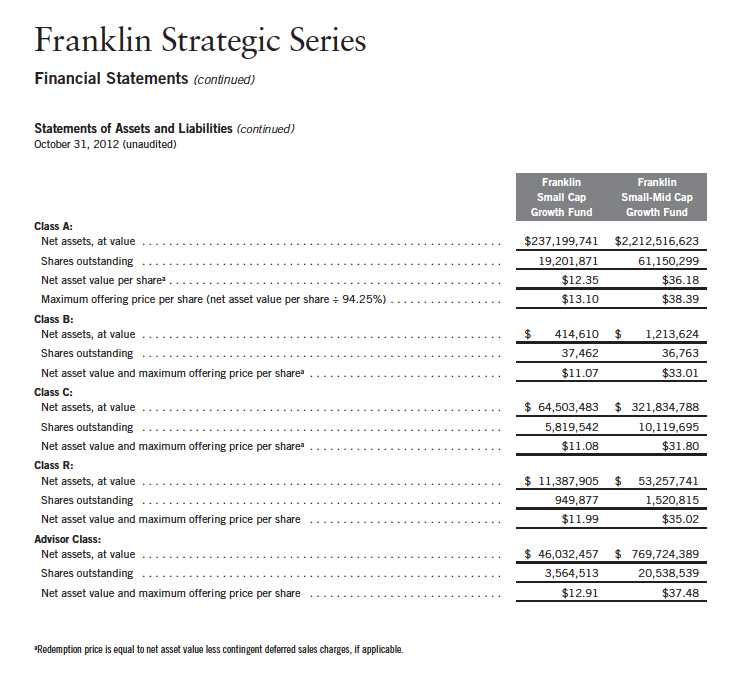

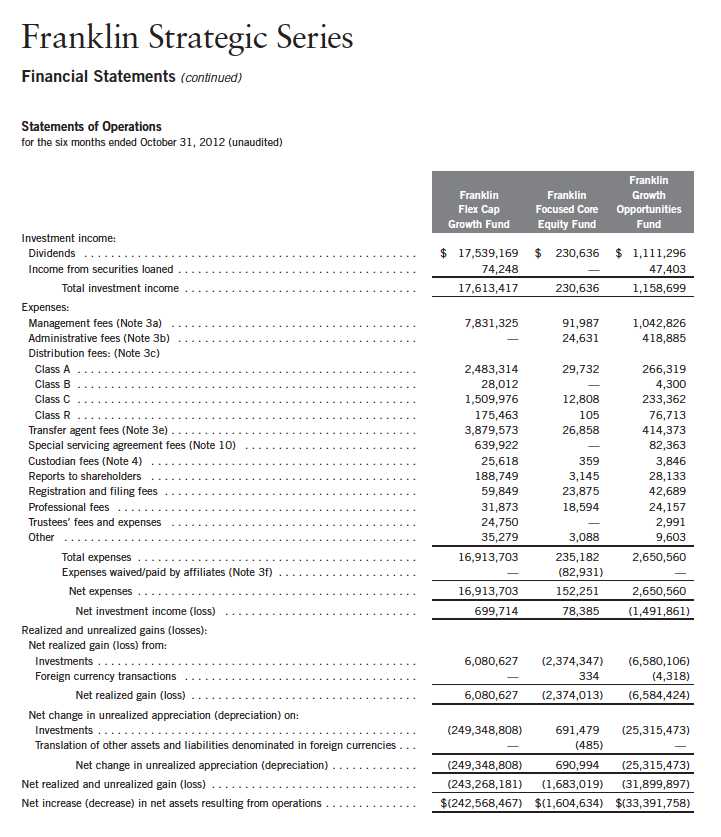

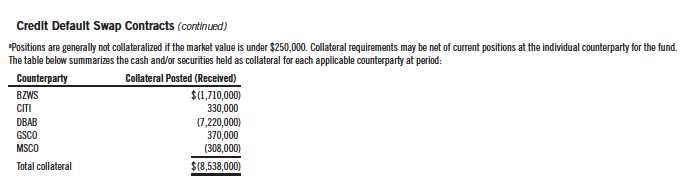

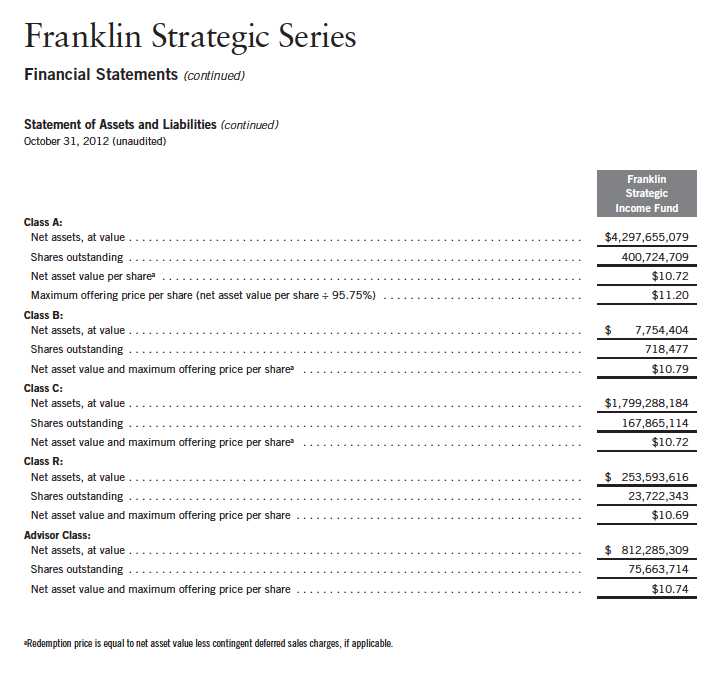

Franklin Strategic Series

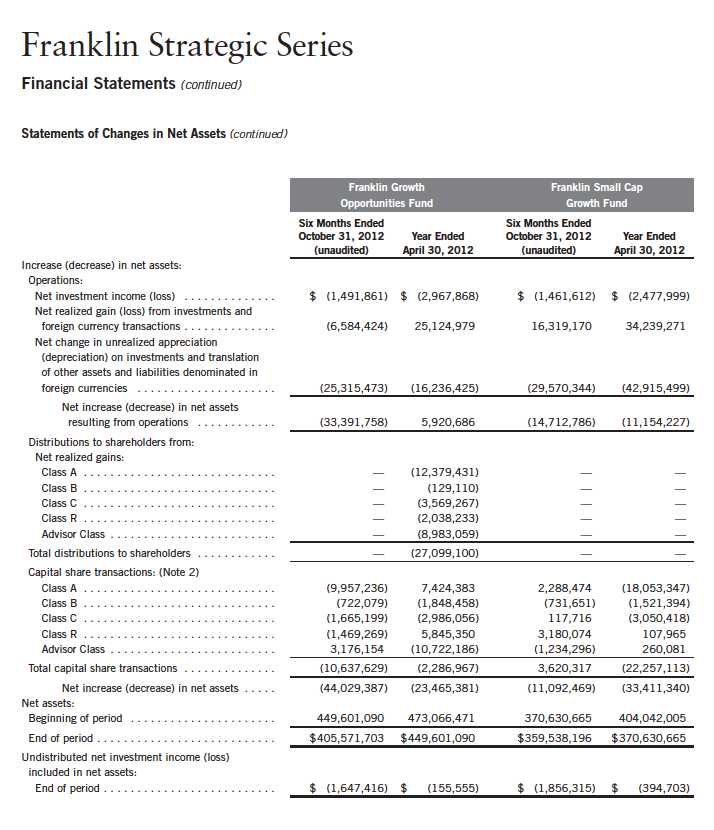

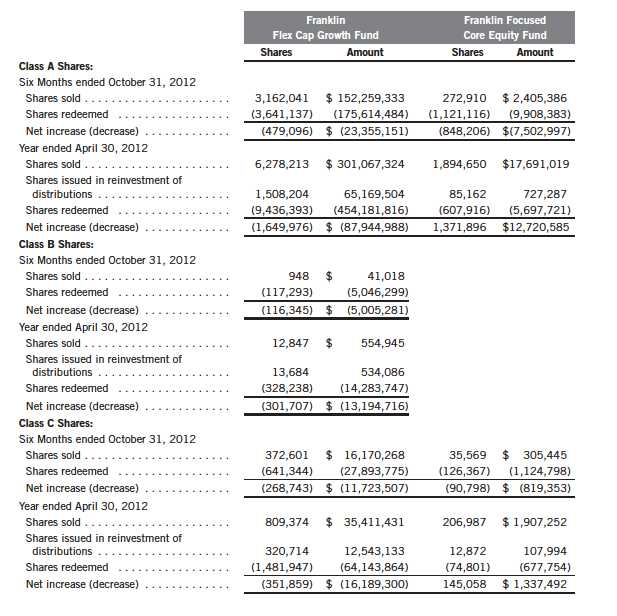

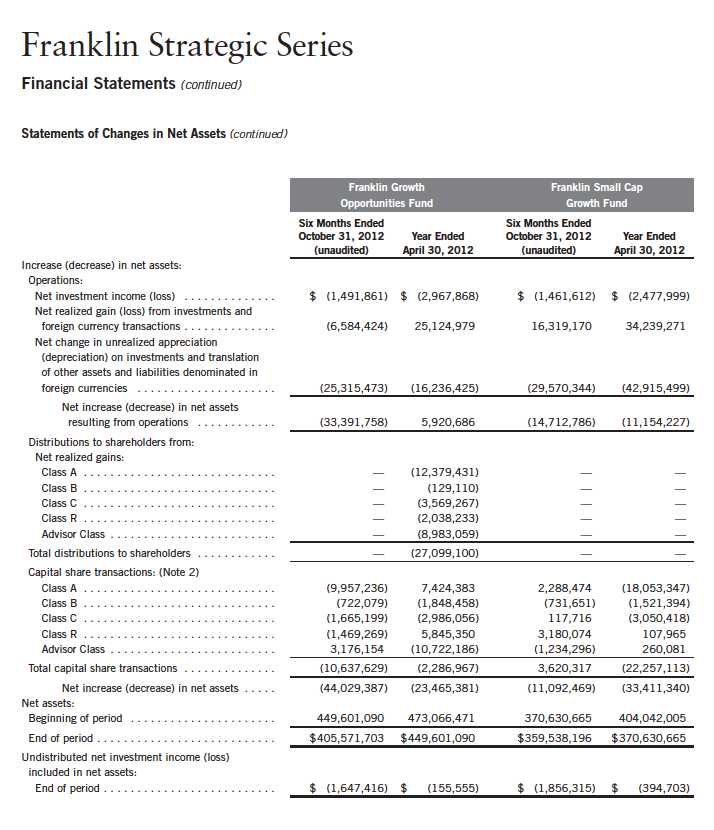

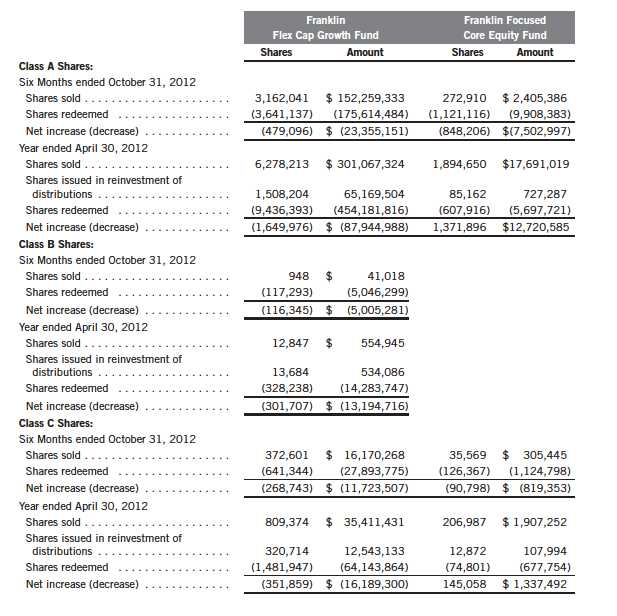

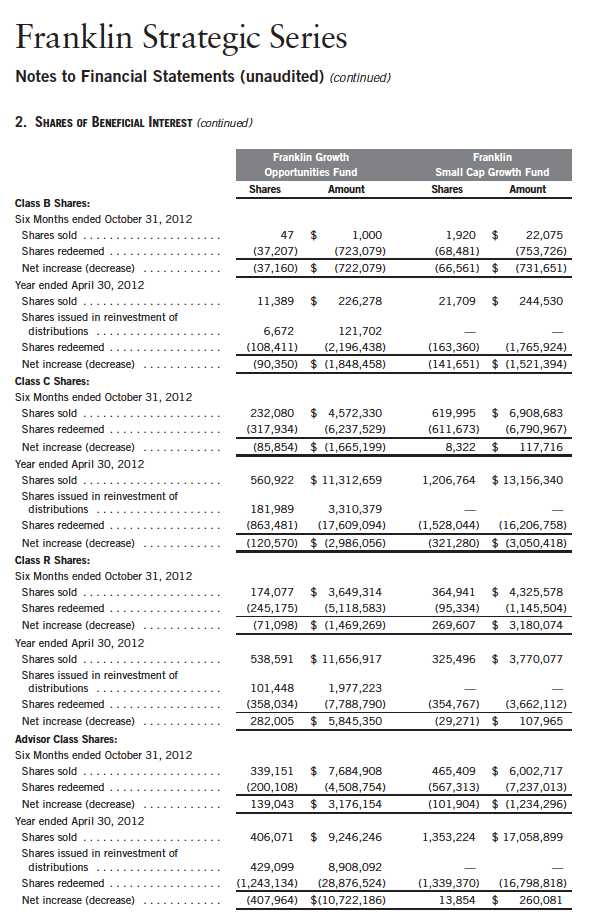

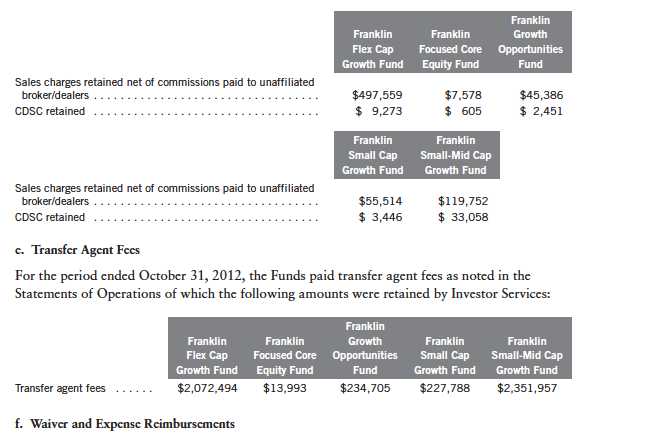

Financial Statements (continued)

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 85

86 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 87

88 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 89

90 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 91

92 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

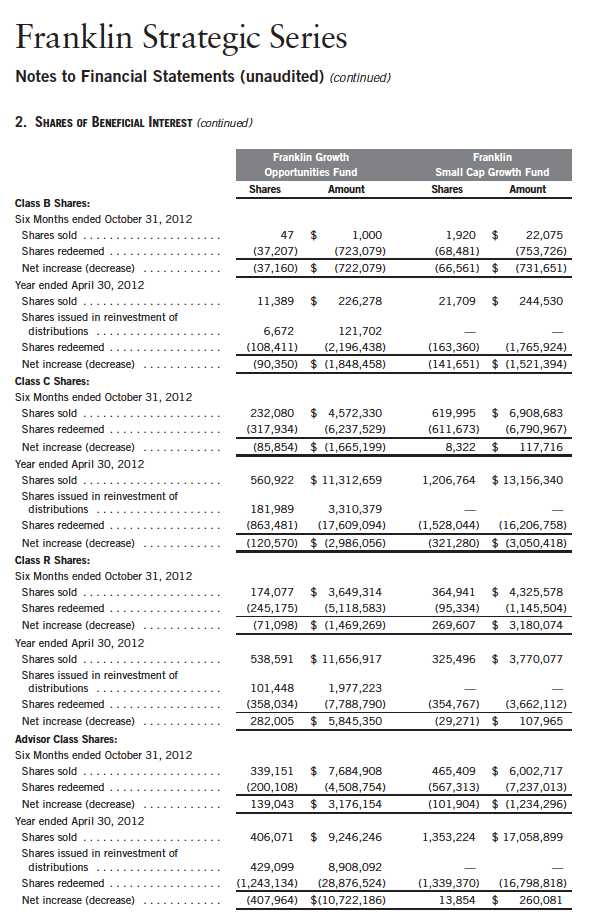

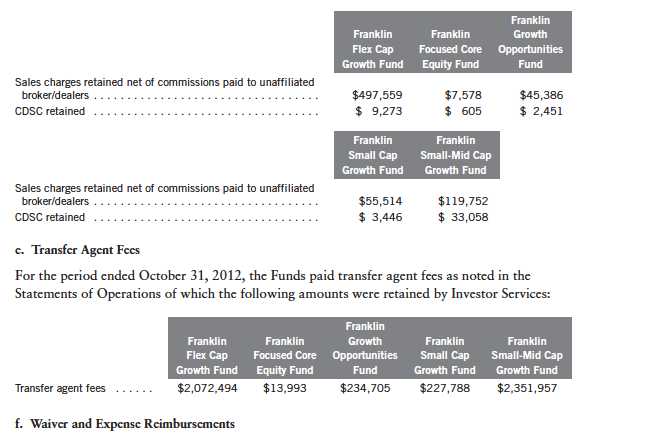

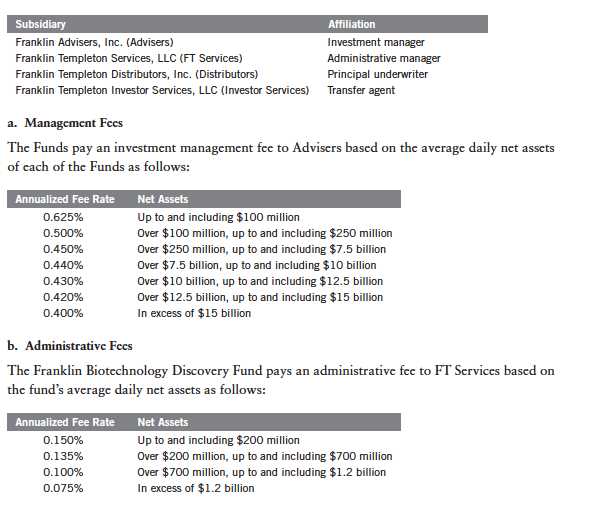

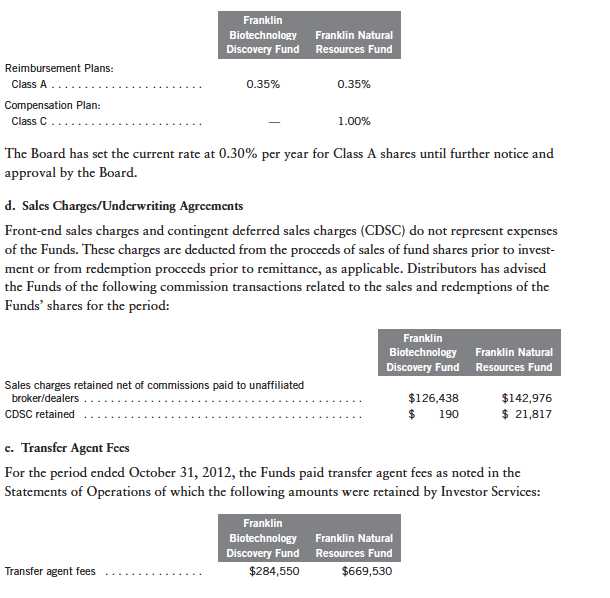

Franklin Strategic Series

Notes to Financial Statements (unaudited)

1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

Franklin Strategic Series (Trust) is registered under the Investment Company Act of 1940, as amended, (1940 Act) as an open-end investment company, consisting of eight separate funds, five of which are included in this report (Funds). The financial statements of the remaining funds in the Trust are presented separately. The classes of shares offered within each of the Funds are indicated below. Each class of shares differs by its initial sales load, contingent deferred sales charges, distribution fees, voting rights on matters affecting a single class and its exchange privilege.

*Effective March 1, 2005, the funds no longer offered Class B shares for purchase. As disclosed in the applicable fund prospectus Class B shares convert to Class A shares after eight years of investment, therefore all Class B shares will convert to Class A by March 2013.

The following summarizes the Funds’ significant accounting policies.

a. Financial Instrument Valuation