UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-06243

Franklin Strategic Series

(Exact name of registrant as specified in charter)

_One Franklin Parkway, San Mateo, CA 94403-1906

(Address of principal executive offices) (Zip code)

_Craig S. Tyle, One Franklin Parkway, San Mateo, CA 94403-1906

(Name and address of agent for service)

Registrant's telephone number, including area code: 650 312-2000

Date of fiscal year end: 4/30

Date of reporting period: 10/31/15

Item 1. Reports to Stockholders.

| |

| Contents | |

| Semiannual Report | |

| Economic and Market Overview | 3 |

| Franklin Flex Cap Growth Fund | 4 |

| Franklin Focused Core Equity Fund | 12 |

| Franklin Growth Opportunities Fund | 20 |

| Franklin Small Cap Growth Fund | 28 |

| Franklin Small-Mid Cap Growth Fund | 36 |

| Financial Highlights and Statements of Investments | 44 |

| Financial Statements | 85 |

| Notes to Financial Statements | 94 |

| Shareholder Information | 110 |

Visit franklintempleton.com for fund updates, to access your account, or to find helpful financial planning tools.

|

2 Semiannual Report

franklintempleton.com

Semiannual Report

Economic and Market Overview

The U.S. economy improved during the six months under review. Growth strengthened in the second quarter but moderated in the third quarter despite healthy consumer spending. Businesses cut back on inventories, exports slowed, and state and local governments reduced their spending. In contrast, non-manufacturing activities strengthened. The unemployment rate declined to 5.0% at period-end, the lowest level in more than seven years.1 Housing market data were mixed as existing home sales and prices rose, while new home sales slowed and mortgage rates edged higher. Retail sales grew modestly, driven by automobile and auto component sales. After two consecutive declines, monthly inflation, as measured by the Consumer Price Index, rose in October as prices for energy and other goods increased.

During the six-month period, the Federal Reserve (Fed) kept its target interest rate at 0%–0.25% while considering when an increase might be appropriate. Although global financial markets anticipated an increase, in September and October the Fed kept interest rates unchanged and said it expected moderate economic expansion, but it would continue to monitor developments domestically and abroad.

Although U.S. stock markets experienced sell-offs at times during the period, investor confidence generally grew as corporate profits remained healthy, the Fed kept its target interest rate low, the eurozone economy improved, China implemented more stimulus measures and Greece reached an agreement with its creditors. Toward period-end, U.S. stocks rallied amid easing concerns about China’s economy and increased optimism that certain central banks might introduce additional stimulus measures. In this environment, the broad U.S. stock market, as measured by the Standard & Poor’s 500 Index, generated a small, positive total return. Large capitalization growth stocks, as measured by the Russell 1000® Growth Index, made a gain, while small capitalization growth stocks, as measured by the Russell 2000® Growth Index, registered a loss.

The foregoing information reflects our analysis and opinions as of October 31, 2015. The information is not a complete analysis of every aspect of any market, country, industry, security or fund. Statements of fact are from sources considered reliable.

1. Source: Bureau of Labor Statistics.

Russell Investment Group is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of Russell

Investment Group.

|

franklintempleton.com Semiannual Report 3

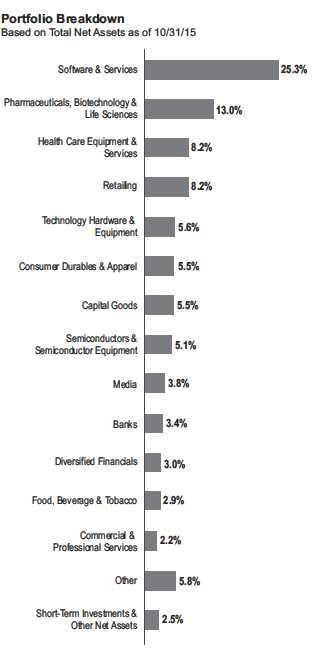

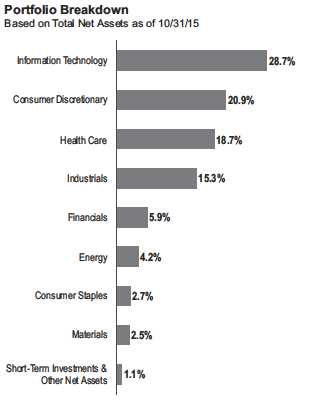

Franklin Flex Cap Growth Fund

This semiannual report for Franklin Flex Cap Growth Fund covers the period ended October 31, 2015.

Your Fund’s Goal and Main Investments

The Fund seeks capital appreciation. The Fund normally invests predominantly in equity securities of companies that the manager believes have the potential for capital appreciation. The Fund has flexibility to invest in companies located, headquartered or operating inside and outside the U.S., across the entire market capitalization spectrum from small, emerging growth companies to well-established, large cap companies.

Performance Overview

For the six months under review, the Fund’s Class A shares delivered a +0.78% cumulative total return. In comparison, the Fund’s narrow benchmark, the Russell 3000® Growth Index, which measures performance of Russell 3000® Index companies with higher price-to-book ratios and higher forecasted growth values, generated a +1.99% total return.1 Also in comparison, the Russell 1000® Growth Index, which tracks performance of the largest companies in the Russell 3000® Index with higher price-to-book ratios and higher forecasted growth values, produced a +2.48% total return.1 Additionally, the Fund’s broad benchmark, the Standard & Poor’s 500 Index, which tracks the broad U.S. stock market, posted a +0.77% total return.1 You can find the Fund’s long-term performance data in the Performance Summary beginning on page 7.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. Please visit franklintempleton.com or call (800) 342-5236 for most recent month-end performance.

Investment Strategy

We use fundamental, bottom-up research to seek companies meeting our criteria of growth potential, quality and valuation. In seeking sustainable growth characteristics, we look for companies we believe can produce sustainable earnings and cash flow growth, evaluating the long-term market opportunity and competitive structure of an industry to target leaders and emerging leaders. We define quality companies as those with

strong and improving competitive positions in attractive markets. We also believe important attributes of quality are experienced and talented management teams as well as financial strength reflected in the capital structure, gross and operating margins, free cash flow generation and returns on capital employed. Our valuation analysis includes a range of

1. Source: Morningstar.

The indexes are unmanaged and include reinvested dividends. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI).

The SOI begins on page 49.

|

4 Semiannual Report franklintempleton.com

FRANKLIN FLEX CAP GROWTH FUND

| | |

| Top 10 Holdings | | |

| 10/31/15 | | |

| Company | % of Total | |

| Sector/Industry | Net Assets | |

| Apple Inc. | 3.7 | % |

| Technology Hardware & Equipment | | |

| Alphabet Inc., C | 3.6 | % |

| Software & Services | | |

| Facebook Inc., A | 3.6 | % |

| Software & Services | | |

| MasterCard Inc., A | 3.5 | % |

| Software & Services | | |

| Allergan PLC | 3.2 | % |

| Pharmaceuticals, Biotechnology & Life Sciences | | |

| Amazon.com Inc. | 3.2 | % |

| Retailing | | |

| Celgene Corp. | 3.0 | % |

| Pharmaceuticals, Biotechnology & Life Sciences | | |

| NXP Semiconductors NV (Netherlands) | 2.7 | % |

| Semiconductors & Semiconductor Equipment | | |

| Visa Inc., A | 2.7 | % |

| Software & Services | | |

| NIKE Inc., B | 2.6 | % |

| Consumer Durables & Apparel | | |

potential outcomes based on an assessment of multiple scenarios. In assessing value, we consider whether security prices fully reflect the balance of the sustainable growth opportunities relative to business and financial risks.

Manager’s Discussion

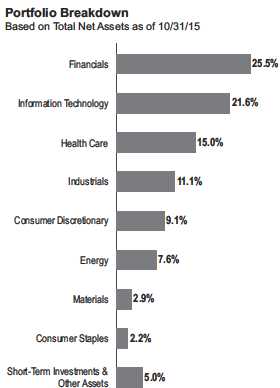

During the six months under review, relative to the Russell 3000® Growth Index, major contributors to performance included stock selection in the consumer discretionary sector and stock selection and an underweighting in the materials sector.2

In consumer discretionary, top performers included footwear, apparel and equipment manufacturer NIKE, aftermarket parts and accessories retailer Advance Auto Parts and online retail shopping service provider Amazon.com. We feel that NIKE is exposed to the best secular growth area in the apparel industry and is a leader in the growing athletic category. In our view, it has a proven category strategy driven by innovation and marketing that has worked tremendously in the U.S. and is now being replicated across the globe. Advance Auto Parts reported solid second-quarter results and positive long-term earnings projections, which could indicate strong earnings acceleration in the coming years, in our opinion. Amazon reported strong, sustained revenue growth in core domestic retail, including Amazon Prime customers, and better-than-expected profits for its new Amazon Web Services cloud computing business. Additionally, the company improved its fixed and variable costs through lower shipping expenses, better utilization of fulfillment centers and growing use of third-party sellers.

Within materials, our holding in specialty materials and chemicals company Cytec Industries contributed to relative returns.3,4 Cytec shares performed well due to an announced acquisition by Belgium-based Solvay at a premium to Cytec’s share price.

Outside these sectors, another notable contributor was global specialty pharmaceutical firm Allergan PLC. Actavis acquired Allergan Inc. and quickly integrated the new company, renamed Allergan, announced a divestiture of its generic business to Teva Pharmaceutical Industries at a favorable price and became an acquisition target for Pfizer.

In contrast, stock selection and an overweighting in the health care sector, and stock selection in the industrials sector, detracted from the Fund’s relative performance.5

In health care, our positions in multinational specialty pharmaceutical company Valeant Pharmaceuticals International3,4 and health care service provider Envision Healthcare Holdings hurt relative performance. Valeant’s aggressive business model has been challenged due to a high debt load from mergers and acquisitions, aggressive price increases and the use of alternative pharmacy distribution programs. Envision’s stock fell when the company missed its third-quarter earnings estimate resulting from underperforming contracts that led to lower revenue and higher labor costs, which pressured margins. We believed these were short-term, transient operational issues that can be fixed and the stock’s sharp decline was unwarranted.

In the industrials sector, Spirit Airlines hampered the Fund when the company’s fares came under pressure as American Airlines and Southwest Airlines added capacity in some of their core markets. In our analysis, this pressure could continue into 2016, but over the long term we expect Spirit’s low-cost advantage could lead to profitable growth for several years.

2. The consumer discretionary sector comprises automobiles and components, consumer durables and apparel, consumer services, media and retailing in the SOI.

3. Not part of the index.

4. No longer held at period-end.

5. The health care sector comprises health care equipment and services; and pharmaceuticals, biotechnology and life sciences in the SOI. The industrials sector comprises

capital goods, commercial and professional services, and transportation in the SOI.

See www.franklintempletondatasources.com for additional data provider information.

|

franklintempleton.com Semiannual Report 5

FRANKLIN FLEX CAP GROWTH FUND

Other key individual detractors included our positions in mixed-signal and standard semiconductor manufacturer NXP Semiconductors3 and asset management company Affiliated Managers Group (AMG). NXP shares declined as the company reported disappointing revenue and earnings guidance for the fourth quarter. Additionally, most semiconductor stocks came under pressure during the period as investors grew increasingly concerned about weakening end-market demand. NXP is expected to close its merger with Freescale Semiconductor before the end of 2015, and we believe the combined entity should have superior growth, profitability and shareholder return prospects over the longer term. AMG shares fell due to a drop in assets under management driven by lower global equity markets, slightly weaker quarterly flows, less optimism for performance fee accruals, and sector-wide price-earnings multiple compression (when stock prices move down despite higher earnings).

Thank you for your continued participation in Franklin Flex Cap Growth Fund. We look forward to serving your future investment needs.

The foregoing information reflects our analysis, opinions and portfolio holdings as of October 31, 2015, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

CFA® is a trademark owned by CFA Institute.

|

6 Semiannual Report franklintempleton.com

FRANKLIN FLEX CAP GROWTH FUND

Performance Summary as of October 31, 2015

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

| | | | | |

| Net Asset Value | | | | | |

| Share Class (Symbol) | | 10/31/15 | | 4/30/15 | Change |

| A (FKCGX) | $ | 51.96 | $ | 51.56 | +$0.40 |

| C (FCIIX) | $ | 43.27 | $ | 43.10 | +$0.17 |

| R (FRCGX) | $ | 49.54 | $ | 49.22 | +$0.32 |

| R6 (FFCRX) | $ | 54.21 | $ | 53.67 | +$0.54 |

| Advisor (FKCAX) | $ | 53.87 | $ | 53.38 | +$0.49 |

franklintempleton.com

|

Semiannual Report 7

FRANKLIN FLEX CAP GROWTH FUND

PERFORMANCE SUMMARY

Performance as of 10/31/151

Cumulative total return excludes sales charges. Average annual total returns and value of $10,000 investment include maximum sales charges. Class A: 5.75% maximum initial sales charge; Class C: 1% contingent deferred sales charge in first year only;

Class R/R6/Advisor Class: no sales charges.

| | | | | | | | | | |

| | Cumulative | | Average Annual | | | Value of | Average Annual | | Total Annual | |

| Share Class | Total Return2 | | Total Return3 | | $ | 10,000 Investment4 | Total Return (9/30/15)5 | | Operating Expenses6 | |

| A | | | | | | | | | 0.94 | % |

| 6-Month | +0.78 | % | -5.03 | % | $ | 9,497 | | | | |

| 1-Year | +5.84 | % | -0.25 | % | $ | 9,975 | -3.16 | % | | |

| 5-Year | +72.70 | % | +10.23 | % | $ | 16,277 | +9.60 | % | | |

| 10-Year | +107.96 | % | +6.96 | % | $ | 19,602 | +6.18 | % | | |

| C | | | | | | | | | 1.69 | % |

| 6-Month | +0.39 | % | -0.61 | % | $ | 9,939 | | | | |

| 1-Year | +5.06 | % | +4.20 | % | $ | 10,420 | +1.18 | % | | |

| 5-Year | +66.41 | % | +10.72 | % | $ | 16,641 | +10.08 | % | | |

| 10-Year | +93.01 | % | +6.80 | % | $ | 19,301 | +6.02 | % | | |

| R | | | | | | | | | 1.19 | % |

| 6-Month | +0.65 | % | +0.65 | % | $ | 10,065 | | | | |

| 1-Year | +5.56 | % | +5.56 | % | $ | 10,556 | +2.49 | % | | |

| 5-Year | +70.59 | % | +11.27 | % | $ | 17,059 | +10.63 | % | | |

| 10-Year | +102.85 | % | +7.33 | % | $ | 20,285 | +6.55 | % | | |

| R6 | | | | | | | | | 0.48 | % |

| 6-Month | +1.01 | % | +1.01 | % | $ | 10,101 | | | | |

| 1-Year | +6.30 | % | +6.30 | % | $ | 10,630 | +3.22 | % | | |

| Since Inception (5/1/13) | +43.30 | % | +15.47 | % | $ | 14,330 | +13.32 | % | | |

| Advisor | | | | | | | | | 0.69 | % |

| 6-Month | +0.92 | % | +0.92 | % | $ | 10,092 | | | | |

| 1-Year | +6.09 | % | +6.09 | % | $ | 10,609 | +2.99 | % | | |

| 5-Year | +74.94 | % | +11.83 | % | $ | 17,494 | +11.19 | % | | |

| 10-Year | +113.28 | % | +7.87 | % | $ | 21,328 | +7.08 | % | | |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

|

8 Semiannual Report

franklintempleton.com

FRANKLIN FLEX CAP GROWTH FUND

PERFORMANCE SUMMARY

All investments involve risks, including possible loss of principal. Growth stock prices reflect projections of future earnings or revenues, and can, therefore, fall dramatically if the company fails to meet those projections. Smaller, midsized and relatively new or unseasoned companies can be particularly sensitive to changing economic conditions, and their prospects for growth are less certain than those of larger, more established companies. Historically, these securities have experienced more price volatility than larger company stocks, especially over the short term. To the extent the Fund focuses on particular countries, regions, industries, sectors or types of investment from time to time, it may be subject to greater risks of adverse developments in such areas of focus than a fund that invests in a wider variety of countries, regions, industries, sectors or investments. Foreign securities involve special risks, including currency fluctuations and economic and political uncertainties. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

Class C: These shares have higher annual fees and expenses than Class A shares.

Class R: Shares are available to certain eligible investors as described in the prospectus. These shares have higher annual fees and expenses than Class A shares.

Class R6: Shares are available to certain eligible investors as described in the prospectus.

Advisor Class: Shares are available to certain eligible investors as described in the prospectus.

1. The Fund has a fee waiver associated with any investment in a Franklin Templeton money fund, contractually guaranteed through at least its current fiscal year-end.

Fund investment results reflect the fee waiver, to the extent applicable; without this reduction, the results would have been lower.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated. Six-month return has not been annualized.

4. These figures represent the value of a hypothetical $10,000 investment in the Fund over the periods indicated.

5. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

6. Figures are as stated in the Fund’s current prospectus. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to

become higher than the figures shown.

franklintempleton.com

|

Semiannual Report 9

FRANKLIN FLEX CAP GROWTH FUND

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribu- tion and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

|

10 Semiannual Report

franklintempleton.com

FRANKLIN FLEX CAP GROWTH FUND

YOUR FUND’S EXPENSES

| | | | | | |

| | | Beginning Account | | Ending Account | | Expenses Paid During |

| Share Class | | Value 5/1/15 | | Value 10/31/15 | | Period* 5/1/15–10/31/15 |

| A | | | | | | |

| Actual | $ | 1,000 | $ | 1,007.80 | $ | 4.74 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,020.41 | $ | 4.77 |

| C | | | | | | |

| Actual | $ | 1,000 | $ | 1,003.90 | $ | 8.51 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,016.64 | $ | 8.57 |

| R | | | | | | |

| Actual | $ | 1,000 | $ | 1,006.50 | $ | 6.00 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,019.15 | $ | 6.04 |

| R6 | | | | | | |

| Actual | $ | 1,000 | $ | 1,010.10 | $ | 2.43 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,022.72 | $ | 2.44 |

| Advisor | | | | | | |

| Actual | $ | 1,000 | $ | 1,009.20 | $ | 3.48 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,021.67 | $ | 3.51 |

*Expenses are calculated using the most recent six-month expense ratio, net of expense waivers, annualized for each class (A: 0.94%;

C: 1.69%; R: 1.19%; R6: 0.48%; and Advisor: 0.69%), multiplied by the average account value over the period, multiplied by 184/366 to

reflect the one-half year period.

franklintempleton.com

|

Semiannual Report 11

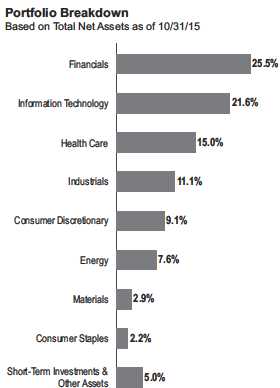

Franklin Focused Core Equity Fund

This semiannual report for Franklin Focused Core Equity Fund covers the period ended October 31, 2015.

Your Fund’s Goal and Main Investments

The Fund seeks capital appreciation by normally investing at least 80% of its net assets in equity securities. The Fund normally invests primarily to predominantly in equity securities of large capitalization companies, which are similar in size to those in the Standard & Poor’s 500 Index (S&P 500®).

Performance Overview

For the six months under review, the Fund’s Class A shares had a -4.64% cumulative total return. In comparison, the S&P 500, which tracks the broad U.S. stock market, posted a +0.77% total return.1 You can find the Fund’s long-term performance data in the Performance Summary beginning on page 15.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. Please visit franklintempleton.com or call (800) 342-5236 for most recent month-end performance.

Investment Strategy

We are research-driven, bottom-up, fundamental investors. Our investment approach is opportunistic and contrarian, and we seek to identify mispriced companies using fundamental analysis. We seek to take advantage of price dislocations that result from the market’s short-term focus. Our analysis includes the investigation of the valuation for each investment based upon the view that the price paid for the security is a critical factor determining long-term success. We rely on a team of analysts to help provide in-depth industry expertise and use both qualitative and quantitative analysis to evaluate companies. Our analysts identify each company’s market opportunity, competitive position, management and financial strength, business and financial risks, and valuation. We choose to invest in those companies that, in our opinion, offer the best trade-off between growth opportunity, business and financial risk, and valuation.

Manager’s Discussion

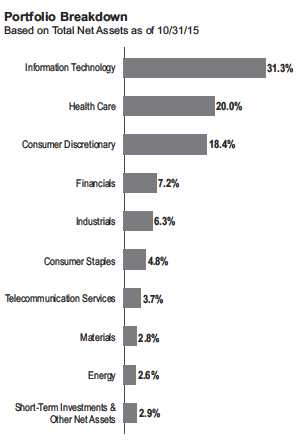

During the six months under review, contributors to the Fund’s absolute performance included holdings in the information technology (IT) and financials sectors.

In the IT sector, top performers included Alphabet (formerly, Google) and Microsoft. Alphabet generated robust third-quarter revenue growth, driven by YouTube and mobile search. Additionally, the company announced a share buyback in each of the last three quarterly reports and delivered, or agreed to deliver, on three key factors that concerned investors: expense management, transparency and capital returns. Thus far, we have seen lower expense growth and stable profit margins. In October, the company completed the previously announced restructuring of what was formerly Google into Alphabet, a holding company for smaller companies, including Google, which would remain focused on Internet products. Alphabet

1. Source: Morningstar.

The index is unmanaged and includes reinvested dividends. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

See www.franklintempletondatasources.com for additional data provider information.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI).

The SOI begins on page 57.

|

12 Semiannual Report franklintempleton.com

FRANKLIN FOCUSED CORE EQUITY FUND

| | |

| Top 10 Holdings | | |

| 10/31/15 | | |

| Company | % of Total | |

| Sector/Industry | Net Assets | |

| |

| Allergan PLC | 7.2 | % |

| Health Care | | |

| Microsoft Corp. | 4.5 | % |

| Information Technology | | |

| QUALCOMM Inc. | 4.5 | % |

| Information Technology | | |

| The Hartford Financial Services Group Inc. | 4.2 | % |

| Financials | | |

| Genesee & Wyoming Inc. | 3.4 | % |

| Industrials | | |

| Adobe Systems Inc. | 3.4 | % |

| Information Technology | | |

| Towers Watson & Co. | 3.3 | % |

| Industrials | | |

| The Charles Schwab Corp. | 3.3 | % |

| Financials | | |

| Equinix Inc. | 3.2 | % |

| Financials | | |

| Sanofi, ADR | 3.2 | % |

| Health Care | | |

also committed to giving investors visibility into the profitability and capital spending of the core advertising businesses as a whole, as well as the investment and capital spending related to earlier stage businesses and longer term research and development products. Microsoft is the world’s largest provider of document productivity software and value-oriented data-center software, as well as a dominant provider of personal computer (PC) software. Over the past six months, investors became increasingly enthusiastic about Microsoft’s shift to the cloud. We believe that Microsoft’s Office and data-center software franchises became more valuable as a result of the cloud transition the company began executing, and we were impressed with the company’s strategy to reignite growth in the mature PC market.

The financials sector’s performance was driven largely by Equinix and The Hartford Financial Services Group. Equinix is a global data-center company that offers colocation and interconnection services to network providers, cloud service providers and enterprises. The company’s growth accelerated as customers took advantage of different cloud infrastructures. As the data-center industry continued to consolidate, new supply buildout became more disciplined, resulting in pricing stability. Equinix’s large global footprint created significant barriers to entry, which we believe allowed the company to benefit from attractive industry trends. The Hartford’s share price appreciated due to increased market speculation about mergers and acquisitions in the property-casualty insurance industry, following the July announcement of a definitive agreement wherein ACE would acquire Chubb. Additionally, many investors seemed to see the strategic value in Hartford’s platform, which is a combination of small-market and middle-market insurance products for businesses and for individuals.

Another key contributor was global specialty pharmaceutical firm Allergan PLC. Actavis acquired Allergan Inc. and quickly integrated the new company, renamed Allergan, announced a divestiture of its generic business to Teva Pharmaceutical Industries at a favorable price and became an acquisition target for Pfizer.

In contrast, key detractors from the Fund’s absolute performance included holdings in the health care, materials and energy sectors.

In health care, the share price decline of multinational specialty pharmaceutical company Valeant Pharmaceuticals International more than offset the solid performance of other holdings. Valeant’s aggressive business model has been challenged due to a high debt load from mergers and acquisitions, aggressive price increases and the use of alternative pharmacy distribution programs.

In the materials sector, chemicals and building products manufacturer Axiall’s share price fell amid continued price weakness in caustic soda, one of the company’s key product lines. North America’s and South America’s caustic soda demand weakened because of excess supply. In addition, the global energy price decline allowed non-U.S.-based producers to become more cost-competitive, further pressuring prices. As a result, caustic soda prices experienced a double-digit percentage annual decline, contributing to Axiall’s negative earnings estimate revisions.

In the energy sector, shares of oil and gas explorer and producer Anadarko Petroleum fell during the period as crude oil prices plunged to multi-year lows after a second-quarter rebound. This decline led to market expectations for lower crude oil prices for a longer period and impacted many investors’ time horizon for a price recovery. Furthermore, weak crude oil prices negatively

franklintempleton.com

|

Semiannual Report 13

FRANKLIN FOCUSED CORE EQUITY FUND

affected liquid natural gas (LNG) prices and the value of Anadarko’s Mozambique LNG project, which is still several years away from production. Further hurting Anadarko’s shares was a sell-off in midstream master limited partnership stocks, including the company’s subsidiary, Western Gas Equity Partners, LP (WGP), resulting from investors’ perception of a lack of capital funding options and fears that interest rate increases would hinder yield-oriented investments. Anadarko had sold some of its interest in WGP and planned to do so again. In our view, Anadarko remains a resource-rich company with strong onshore U.S. shale exposure and reserve, as well as international offshore assets. The company has reduced spending to within its cash flow and has a sizable amount of cash on its balance sheet.

Other key individual detractors included Netherlands-based multinational cable and telecommunications company Altice and global freight railroad operator Genesee & Wyoming. Altice’s announced deal to acquire U.S.-based Cablevision was not well received by investors, who expressed concerns about the purchase price and the deal synergies that Altice used in its financing assumptions. Furthermore, the high yield market’s weakness in the late summer and early fall contributed to share price declines of highly leveraged companies such as Altice. Investors seemed to question the sustainability of Altice’s rollup strategy, which is dependent on debt to fund the transactions. Low natural gas and iron ore prices affected Genesee & Wyoming’s shipment volume. In our analysis, the company’s strategy to reduce resources dedicated to transporting these commodities and redeploying them into business areas that are experiencing better demand could lead to better corporate results in 2016.

Thank you for your continued participation in Franklin Focused Core Equity Fund. We look forward to serving your future investment needs.

The foregoing information reflects our analysis, opinions and portfolio holdings as of October 31, 2015, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

|

14 Semiannual Report

franklintempleton.com

FRANKLIN FOCUSED CORE EQUITY FUND

Performance Summary as of October 31, 2015

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

| | | | | | |

| Net Asset Value | | | | | | |

| Share Class (Symbol) | | 10/31/15 | | 4/30/15 | | Change |

| A (FCEQX) | $ | 14.58 | $ | 15.29 | -$ | 0.71 |

| C (FCEDX) | $ | 14.00 | $ | 14.73 | -$ | 0.73 |

| R (FCERX) | $ | 14.43 | $ | 15.15 | -$ | 0.72 |

| R6 (FEFCX) | $ | 14.77 | $ | 15.46 | -$ | 0.69 |

| Advisor (FCEZX) | $ | 14.75 | $ | 15.44 | -$ | 0.69 |

franklintempleton.com

|

Semiannual Report 15

FRANKLIN FOCUSED CORE EQUITY FUND

PERFORMANCE SUMMARY

Performance as of 10/31/151

Cumulative total return excludes sales charges. Average annual total returns and value of $10,000 investment include maximum sales charges. Class A: 5.75% maximum initial sales charge; Class C: 1% contingent deferred sales charge in first year only;

Class R/R6/Advisor Class: no sales charges.

| | | | | | | | | | | | |

| | | | | | | Value of | Average Annual | | Total Annual | |

| | Cumulative | | Average Annual | | $ | 10,000 | Total Return | | Operating Expenses6 | |

| Share Class | Total Return2 | | Total Return3 | | | Investment4 | (9/30/15 | )5 | (with waiver) | | (without waiver) | |

| A | | | | | | | | | 1.25 | % | 1.50 | % |

| 6-Month | -4.64 | % | -10.11 | % | $ | 8,989 | | | | | | |

| 1-Year | +2.81 | % | -3.08 | % | $ | 9,692 | -6.49 | % | | | | |

| 5-Year | +82.18 | % | +11.41 | % | $ | 17,166 | +10.72 | % | | | | |

| Since Inception (12/13/07) | +67.46 | % | +5.96 | % | $ | 15,783 | +5.30 | % | | | | |

| C | | | | | | | | | 2.00 | % | 2.25 | % |

| 6-Month | -4.96 | % | -5.91 | % | $ | 9,409 | | | | | | |

| 1-Year | +2.18 | % | +1.18 | % | $ | 10,118 | -2.43 | % | | | | |

| 5-Year | +76.30 | % | +12.01 | % | $ | 17,630 | +11.30 | % | | | | |

| Since Inception (12/13/07) | +58.52 | % | +6.02 | % | $ | 15,852 | +5.36 | % | | | | |

| R | | | | | | | | | 1.50 | % | 1.75 | % |

| 6-Month | -4.75 | % | -4.75 | % | $ | 9,525 | | | | | | |

| 1-Year | +2.62 | % | +2.62 | % | $ | 10,262 | -1.00 | % | | | | |

| 5-Year | +80.52 | % | +12.54 | % | $ | 18,052 | +11.83 | % | | | | |

| Since Inception (12/13/07) | +64.47 | % | +6.51 | % | $ | 16,447 | +5.85 | % | | | | |

| R6 | | | | | | | | | 0.85 | % | 1.10 | % |

| 6-Month | -4.46 | % | -4.46 | % | $ | 9,554 | | | | | | |

| 1-Year | +3.25 | % | +3.25 | % | $ | 10,325 | -0.37 | % | | | | |

| Since Inception (5/1/13) | +46.26 | % | +16.42 | % | $ | 14,626 | +14.44 | % | | | | |

| Advisor | | | | | | | | | 1.00 | % | 1.25 | % |

| 6-Month | -4.47 | % | -4.47 | % | $ | 9,553 | | | | | | |

| 1-Year | +3.13 | % | +3.13 | % | $ | 10,313 | -0.49 | % | | | | |

| 5-Year | +84.91 | % | +13.08 | % | $ | 18,491 | +12.39 | % | | | | |

| Since Inception (12/13/07) | +71.23 | % | +7.06 | % | $ | 17,123 | +6.39 | % | | | | |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

|

16 Semiannual Report

franklintempleton.com

FRANKLIN FOCUSED CORE EQUITY FUND

PERFORMANCE SUMMARY

All investments involve risks, including possible loss of principal. To the extent the Fund focuses on particular countries, regions, industries, sectors or types of investment from time to time, it may be subject to greater risks of adverse developments in such areas of focus than a fund that invests in a wider variety of countries, regions, industries, sectors or investments. The Fund may have investments in both growth and value stocks, or in stocks with characteristics of both. Growth stock prices reflect projections of future earnings or revenues, and can, therefore, fall dramatically if the company fails to meet those projections. A value stock may not increase in price as anticipated by the investment manager if other investors fail to recognize the company’s value and bid up the price, the markets favor faster growing companies, or the factors that the investment manager believes will increase the price of the security do not occur. Foreign securities involve special risks, including currency fluctuations and economic and political uncertainties. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

Class C: These shares have higher annual fees and expenses than Class A shares.

Class R: Shares are available to certain eligible investors as described in the prospectus. These shares have higher annual fees and expenses than Class A shares.

Class R6: Shares are available to certain eligible investors as described in the prospectus.

Advisor Class: Shares are available to certain eligible investors as described in the prospectus.

1. The Fund has an expense reduction contractually guaranteed through at least 8/31/16 and a fee waiver associated with any investment in a Franklin Templeton money

fund, contractually guaranteed through at least its current fiscal year-end. Fund investment results reflect the expense reduction and fee waiver, to the extent applicable;

without these reductions, the results would have been lower.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated. Six-month return has not been annualized.

4. These figures represent the value of a hypothetical $10,000 investment in the Fund over the periods indicated.

5. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

6. Figures are as stated in the Fund’s current prospectus. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to

become higher than the figures shown.

franklintempleton.com

|

Semiannual Report 17

FRANKLIN FOCUSED CORE EQUITY FUND

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribu- tion and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

|

18 Semiannual Report

franklintempleton.com

FRANKLIN FOCUSED CORE EQUITY FUND

YOUR FUND’S EXPENSES

| | | | | | |

| | | Beginning Account | | Ending Account | | Expenses Paid During |

| Share Class | | Value 5/1/15 | | Value 10/31/15 | | Period* 5/1/15–10/31/15 |

| A | | | | | | |

| Actual | $ | 1,000 | $ | 953.60 | $ | 6.09 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,018.90 | $ | 6.29 |

| C | | | | | | |

| Actual | $ | 1,000 | $ | 950.40 | $ | 9.66 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,015.23 | $ | 9.98 |

| R | | | | | | |

| Actual | $ | 1,000 | $ | 952.50 | $ | 7.21 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,017.75 | $ | 7.46 |

| R6 | | | | | | |

| Actual | $ | 1,000 | $ | 955.40 | $ | 4.13 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,020.91 | $ | 4.27 |

| Advisor | | | | | | |

| Actual | $ | 1,000 | $ | 955.30 | $ | 4.77 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,020.26 | $ | 4.93 |

*Expenses are calculated using the most recent six-month expense ratio, net of expense waivers, annualized for each class (A: 1.24%;

C: 1.97%; R: 1.47%; R6: 0.84%; and Advisor: 0.97%), multiplied by the average account value over the period, multiplied by 184/366 to

reflect the one-half year period.

franklintempleton.com

|

Semiannual Report 19

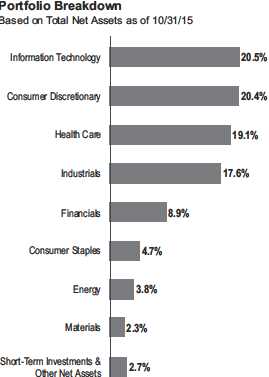

Franklin Growth Opportunities Fund

This semiannual report for Franklin Growth Opportunities Fund covers the period ended October 31, 2015.

Your Fund’s Goal and Main Investments

The Fund seeks capital appreciation by normally investing substantially in equity securities of companies demonstrating accelerating growth, increasing profitability, or above-average growth or growth potential, when compared with the overall economy.

Performance Overview

For the six months under review, the Fund’s Class A shares delivered a +0.45% cumulative total return. In comparison, the Fund’s narrow benchmark, the Russell 3000® Growth Index, which measures performance of Russell 3000® Index companies with higher price-to-book ratios and higher forecasted growth values, generated a +1.99% total return.1 The Fund’s broad benchmark, the Standard & Poor’s 500 Index, which tracks the broad U.S. stock market, produced a +0.77% total return.1 You can find the Fund’s long-term performance data in the Performance Summary beginning on page 23.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. Please visit franklintempleton.com or call (800) 342-5236 for most recent month-end performance.

Investment Strategy

We use fundamental, bottom-up research to seek companies meeting our criteria of growth potential, quality and valuation. In seeking sustainable growth characteristics, we look for companies we believe can produce sustainable earnings and cash flow growth, evaluating the long-term market opportunity and competitive structure of an industry to target leaders and emerging leaders. We define quality companies as those with strong and improving competitive positions in attractive markets. We also believe important attributes of quality are experienced and talented management teams as well as financial strength reflected in the capital structure, gross and operating margins, free cash flow generation and returns on

capital employed. Our valuation analysis includes a range of potential outcomes based on an assessment of multiple scenarios. In assessing value, we consider whether security prices fully reflect the balance of the sustainable growth opportunities relative to business and financial risks.

Manager’s Discussion

During the six months under review, key contributors to the Fund’s performance relative to the Russell 3000® Growth Index included stock selection in the information technology (IT) and consumer discretionary sectors. In IT, our position in Facebook helped relative results. The social networking service and website company continued to surpass analyst expectations as it reported strong second-quarter local currency advertising revenue growth with a solid high profit margin. We believe the company’s rollout of advertisements on Instagram and video on

1. Source: Morningstar.

The indexes are unmanaged and include reinvested dividends. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI).

The SOI begins on page 64.

|

20 Semiannual Report franklintempleton.com

FRANKLIN GROWTH OPPORTUNITIES FUND

its core platform could drive incremental growth. Facebook continued to have a strong and engaged user base, especially on mobile devices, its largest advertisement revenue source. Advertising dollars, especially those related to brand advertising, are shifting from television to Facebook as advertisers follow their audience and are achieving positive measurable returns on the platform.

In the consumer discretionary sector, our positions in online retail shopping service provider Amazon.com, coffee and tea manufacturer and retailer Starbucks, and apparel and footwear manufacturer Under Armour supported the Fund’s relative performance. Amazon reported strong, sustained revenue growth in core domestic retail, including Amazon Prime customers, and better-than-expected profits for its new Amazon Web Services cloud computing business. Additionally, the company improved its fixed and variable costs through lower shipping expenses, better utilization of fulfillment centers and growing use of third-party sellers. Starbucks outperformed the index and the overall restaurant industry as the company reported strong sales growth and modest margin expansion for its fiscal year ended September 27, 2015. The company generated robust sales growth in all regions, particularly in the U.S., where comparative store sales were driven by newly introduced beverages and increased tea and food sales. Starbucks continued to open new stores domestically and internationally, with more than 1,600 net new stores in fiscal year 2015. Under Armour continued to generate strong sales momentum around the world with recent innovations that were well received by consumers. The company gained market share as it drove category growth, while showing improved profitability in international markets. In our view, Under Armour continued to have potential for long-term growth.

Another key individual contributor was our position in Celgene, which discovers, develops and sells therapies for treating cancer and immunological diseases. Its acquisition of Receptos provided Celgene with a new, strong pipeline product, Ozanimod, which is being developed for the treatment of inflammatory bowel disease and multiple sclerosis. An enhanced inflammation and immunology portfolio led Celgene to raise its long-term revenue and earnings guidance.

| | |

| Top 10 Holdings | | |

| 10/31/15 | | |

| Company | % of Total | |

| Sector/Industry | Net Assets | |

| |

| Alphabet Inc., A & C | 4.5 | % |

| Information Technology | | |

| Allergan PLC | 4.1 | % |

| Health Care | | |

| Amazon.com Inc. | 3.9 | % |

| Consumer Discretionary | | |

| Celgene Corp. | 3.8 | % |

| Health Care | | |

| MasterCard Inc., A | 3.8 | % |

| Information Technology | | |

| Apple Inc. | 3.1 | % |

| Information Technology | | |

| Facebook Inc., A | 3.1 | % |

| Information Technology | | |

| SBA Communications Corp. | 3.0 | % |

| Telecommunication Services | | |

| Visa Inc., A | 2.9 | % |

| Information Technology | | |

| Gilead Sciences Inc. | 2.6 | % |

| Health Care | | |

In contrast, key detractors from the Fund’s relative performance included stock selection in the health care and industrials sectors. In health care, our positions in multinational specialty pharmaceutical company Valeant Pharmaceuticals International2,3 and health care services provider Envision Healthcare Holdings hurt relative results. Valeant’s aggressive business model has been challenged due to a high debt load from mergers and acquisitions, aggressive price increases and the use of alternative pharmacy distribution programs. Envision’s stock fell when the company missed its third-quarter earnings estimate resulting from underperforming contracts that led to lower revenue and higher labor costs, which pressured margins. We believed these were short-term, transient operational issues that can be fixed and the stock’s sharp decline was unwarranted.

In the industrials sector, our position in geospatial information product and service provider DigitalGlobe hindered performance.3 The commercial side of DigitalGlobe’s business has been struggling recently, while the defense side has been

2. No longer held at period-end.

3. Not part of the index.

See www.franklintempletondatasources.com for additional data provider information.

franklintempleton.com

|

Semiannual Report 21

FRANKLIN GROWTH OPPORTUNITIES FUND

experiencing stable growth. The commercial side has been trying to expand into the most troubled markets and sectors, such as Russia, energy and agriculture. We remained confident that the company’s new, higher resolution capabilities can drive acceleration in growth later next year.

Other key individual detractors included our positions in Netherlands-based mixed-signal and standard semiconductor manufacturer NXP Semiconductors3 and oil and gas explorer and producer Anadarko Petroleum. NXP shares declined as the company reported disappointing revenue and earnings guidance for the fourth quarter. Additionally, most semiconductor stocks came under pressure during the period as investors grew increasingly concerned about weakening end-market demand. NXP is expected to close its merger with Freescale Semiconductor before the end of 2015, and we believe the combined entity should have superior growth, profitability and shareholder return prospects over the longer term. Anadarko’s shares fell as crude oil prices plunged to multi-year lows after a second-quarter rebound. This decline led to market expectations for lower crude oil prices for a longer period and impacted many investors’ time horizon for a price recovery. Furthermore, weak crude oil prices negatively affected liquid natural gas (LNG) prices and the value of Anadarko’s Mozambique LNG project, which is still several years away from production. Further hurting Anadarko’s shares was a sell-off in midstream master limited partnership stocks, including the company’s subsidiary, Western Gas Equity Partners, LP (WGP), resulting from investors’ perception of a lack of capital funding options and fears that interest rate increases would hinder yield-oriented investments. Anadarko had sold some of its interest in WGP and planned to do so again. In our view, Anadarko remains a resource-rich company with strong onshore U.S. shale exposure and reserve, as well as international offshore assets. The company has reduced spending to within its cash flow and has sizable cash on its balance sheet.

Thank you for your continued participation in Franklin Growth Opportunities Fund. We look forward to serving your future investment needs.

The foregoing information reflects our analysis, opinions and portfolio holdings as of October 31, 2015, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

|

22 Semiannual Report

franklintempleton.com

FRANKLIN GROWTH OPPORTUNITIES FUND

Performance Summary as of October 31, 2015

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

| | | | | |

| Net Asset Value | | | | | |

| Share Class (Symbol) | | 10/31/15 | | 4/30/15 | Change |

| A (FGRAX) | $ | 33.28 | $ | 33.13 | +$0.15 |

| C (FKACX) | $ | 29.30 | $ | 29.27 | +$0.03 |

| R (FKARX) | $ | 32.22 | $ | 32.10 | +$0.12 |

| R6 (FOPPX) | $ | 35.34 | $ | 35.09 | +$0.25 |

| Advisor (FRAAX) | $ | 35.17 | $ | 34.96 | +$0.21 |

franklintempleton.com

|

Semiannual Report 23

FRANKLIN GROWTH OPPORTUNITIES FUND

PERFORMANCE SUMMARY

Performance as of 10/31/151

Cumulative total return excludes sales charges. Average annual total returns and value of $10,000 investment include maximum sales charges. Class A: 5.75% maximum initial sales charge; Class C: 1% contingent deferred sales charge in first year only;

Class R/R6/Advisor Class: no sales charges.

| | | | | | | | | | |

| | Cumulative | | Average Annual | | | Value of | Average Annual | | Total Annual | |

| Share Class | Total Return2 | | Total Return3 | | $ | 10,000 Investment4 | Total Return (9/30/15)5 | | Operating Expenses6 | |

| A | | | | | | | | | 1.13 | % |

| 6-Month | +0.45 | % | -5.32 | % | $ | 9,468 | | | | |

| 1-Year | +8.07 | % | +1.85 | % | $ | 10,185 | -1.90 | % | | |

| 5-Year | +88.70 | % | +12.21 | % | $ | 17,788 | +11.36 | % | | |

| 10-Year | +149.35 | % | +8.92 | % | $ | 23,503 | +8.22 | % | | |

| C | | | | | | | | | 1.88 | % |

| 6-Month | +0.10 | % | -0.90 | % | $ | 9,910 | | | | |

| 1-Year | +7.31 | % | +6.31 | % | $ | 10,631 | +2.37 | % | | |

| 5-Year | +82.15 | % | +12.74 | % | $ | 18,215 | +11.90 | % | | |

| 10-Year | +132.20 | % | +8.79 | % | $ | 23,220 | +8.09 | % | | |

| R | | | | | | | | | 1.38 | % |

| 6-Month | +0.37 | % | +0.37 | % | $ | 10,037 | | | | |

| 1-Year | +7.85 | % | +7.85 | % | $ | 10,785 | +3.87 | % | | |

| 5-Year | +86.68 | % | +13.30 | % | $ | 18,668 | +12.45 | % | | |

| 10-Year | +144.12 | % | +9.34 | % | $ | 24,412 | +8.64 | % | | |

| R6 | | | | | | | | | 0.68 | % |

| 6-Month | +0.71 | % | +0.71 | % | $ | 10,071 | | | | |

| 1-Year | +8.59 | % | +8.59 | % | $ | 10,859 | +4.57 | % | | |

| Since Inception (5/1/13) | +47.83 | % | +16.91 | % | $ | 14,783 | +14.41 | % | | |

| Advisor | | | | | | | | | 0.88 | % |

| 6-Month | +0.60 | % | +0.60 | % | $ | 10,060 | | | | |

| 1-Year | +8.39 | % | +8.39 | % | $ | 10,839 | +4.39 | % | | |

| 5-Year | +91.43 | % | +13.87 | % | $ | 19,143 | +13.02 | % | | |

| 10-Year | +156.74 | % | +9.89 | % | $ | 25,674 | +9.18 | % | | |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

|

24 Semiannual Report

franklintempleton.com

FRANKLIN GROWTH OPPORTUNITIES FUND

PERFORMANCE SUMMARY

All investments involve risks, including possible loss of principal. Growth stock prices reflect projections of future earnings or revenues, and can, therefore, fall dramatically if the company fails to meet those projections. Smaller, midsized and relatively new or unseasoned companies can be particularly sensitive to changing economic conditions, and their prospects for growth are less certain than those of larger, more established companies. Historically, these securities have experienced more price volatility than larger company stocks, especially over the short term. To the extent the Fund focuses on particular countries, regions, industries, sectors or types of investment from time to time, it may be subject to greater risks of adverse developments in such areas of focus than a fund that invests in a wider variety of countries, regions, industries, sectors or investments. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

Class C: These shares have higher annual fees and expenses than Class A shares.

Class R: Shares are available to certain eligible investors as described in the prospectus. These shares have higher annual fees and expenses than Class A shares.

Class R6: Shares are available to certain eligible investors as described in the prospectus.

Advisor Class: Shares are available to certain eligible investors as described in the prospectus.

1. The Fund has a fee waiver associated with any investment in a Franklin Templeton money fund, contractually guaranteed through at least its current fiscal year-end.

Fund investment results reflect the fee waiver, to the extent applicable; without this reduction, the results would have been lower.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated. Six-month return has not been annualized.

4. These figures represent the value of a hypothetical $10,000 investment in the Fund over the periods indicated.

5. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

6. Figures are as stated in the Fund’s current prospectus. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to

become higher than the figures shown.

franklintempleton.com

|

Semiannual Report 25

FRANKLIN GROWTH OPPORTUNITIES FUND

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribu- tion and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

|

26 Semiannual Report

franklintempleton.com

FRANKLIN GROWTH OPPORTUNITIES FUND

YOUR FUND’S EXPENSES

| | | | | | |

| | | Beginning Account | | Ending Account | | Expenses Paid During |

| Share Class | | Value 5/1/15 | | Value 10/31/15 | | Period* 5/1/15–10/31/15 |

| A | | | | | | |

| Actual | $ | 1,000 | $ | 1,004.50 | $ | 5.49 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,019.66 | $ | 5.53 |

| C | | | | | | |

| Actual | $ | 1,000 | $ | 1,001.00 | $ | 9.15 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,015.99 | $ | 9.22 |

| R | | | | | | |

| Actual | $ | 1,000 | $ | 1,003.70 | $ | 6.65 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,018.50 | $ | 6.70 |

| R6 | | | | | | |

| Actual | $ | 1,000 | $ | 1,007.10 | $ | 3.28 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,021.87 | $ | 3.30 |

| Advisor | | | | | | |

| Actual | $ | 1,000 | $ | 1,006.00 | $ | 4.13 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,021.01 | $ | 4.17 |

*Expenses are calculated using the most recent six-month expense ratio, net of expense waivers, annualized for each class (A: 1.09%;

C: 1.82%; R: 1.32%; R6: 0.65%; and Advisor: 0.82%), multiplied by the average account value over the period, multiplied by 184/366 to

reflect the one-half year period.

franklintempleton.com

|

Semiannual Report 27

Franklin Small Cap Growth Fund

This semiannual report for Franklin Small Cap Growth Fund covers the period ended October 31, 2015. At the market close on February 12, 2015, the Fund closed to new investors with limited exceptions. Existing shareholders may add to their accounts. We believe this closure can help us effectively manage our current level of assets.

Your Fund’s Goal and Main Investments

The Fund seeks long-term capital growth by normally investing at least 80% of its net assets in equity securities of small cap companies, which for this Fund are those with market capitalizations not exceeding $1.5 billion or that of the highest market capitalization in the Russell 2000® Index, whichever is greater, at the time of purchase.1

Performance Overview

For the six months under review, the Fund’s Class A shares had a cumulative total return of -8.71%. In comparison, the Russell 2000® Growth Index, which measures performance of small cap companies with higher price-to-book ratios and higher forecasted growth values, had a -3.47% total return.2 The Standard & Poor’s 500 Index, which tracks the broad U.S. stock market, produced a +0.77% total return.2 You can find the Fund’s long-term performance data in the Performance Summary beginning on page 31.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. Please visit franklintempleton.com or call (800) 342-5236 for most recent month-end performance.

Investment Strategy

We use fundamental, bottom-up research to seek companies meeting our criteria of growth potential, quality and valuation. In seeking sustainable growth characteristics, we look for companies we believe can produce sustainable earnings and cash flow growth, evaluating the long-term market opportunity and competitive structure of an industry to target leaders and emerging leaders. We define quality companies as those with

strong and improving competitive positions in attractive markets. We also believe important attributes of quality are experienced and talented management teams as well as financial strength reflected in the capital structure, gross and operating margins, free cash flow generation and returns on capital employed. Our valuation analysis includes a range of potential outcomes based on an assessment of multiple scenarios. In assessing value, we consider whether security prices fully reflect the balance of the sustainable growth opportunities relative to business and financial risks.

Manager’s Discussion

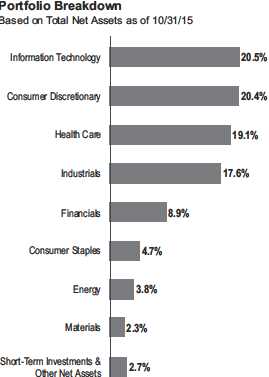

During the six months under review, most sectors represented in the Fund’s portfolio detracted from absolute performance. Relative to the Russell 2000® Growth Index, stock selection and an overweighting in the information technology sector contributed to performance. In this sector, our position in cloud

1. The Russell 2000 Index is market capitalization weighted and measures performance of the 2,000 smallest companies in the Russell 3000 Index, which represent a small

amount of the total market capitalization of the Russell 3000 Index.

2. Source: Morningstar.

The indexes are unmanaged and include reinvested dividends. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

See www.franklintempletondatasources.com for additional data provider information.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI).

The SOI begins on page 72.

|

28 Semiannual Report

franklintempleton.com

FRANKLIN SMALL CAP GROWTH FUND

| | |

| Top 10 Holdings | | |

| 10/31/15 | | |

| Company | % of Total | |

| Sector/Industry | Net Assets | |

| Grand Canyon Education Inc. | 1.7 | % |

| Consumer Discretionary | | |

| Demandware Inc. | 1.7 | % |

| Information Technology | | |

| ViaSat Inc. | 1.6 | % |

| Information Technology | | |

| Callidus Software Inc. | 1.6 | % |

| Information Technology | | |

| 2U Inc. | 1.6 | % |

| Consumer Discretionary | | |

| The Advisory Board Co. | 1.5 | % |

| Industrials | | |

| HomeAway Inc. | 1.5 | % |

| Information Technology | | |

| Revance Therapeutics Inc. | 1.5 | % |

| Health Care | | |

| Bottomline Technologies Inc. | 1.5 | % |

| Information Technology | | |

| Intersil Corp., A | 1.5 | % |

| Information Technology | | |

software provider Callidus Software was a major contributor. Callidus experienced accelerating growth of Software as a Service (SaaS) revenues and profitability due to an efficient salesforce. The company’s “Lead to Money” as a suite approach seemed to gain traction against single-product “best of breed” vendors.

Other key individual contributors included health care holdings such as specialty biopharmaceutical company Revance Therapeutics and polymer pharmaceutical technology firm Heron Therapeutics. Revance announced positive phase II data comparing its injectable botulinum toxin to a placebo and Allergan’s Botox, giving investors a reason to believe its product will have regulatory and commercial success. Heron’s share price made a triple-digit percentage gain as investors perceived a strong potential for future earnings growth, sparked by the company’s innovation in drug delivery technology.

In contrast, several sectors hampered the Fund’s relative performance. Significant detractors included stock selection in health care as well as stock selection and an overweighting in consumer discretionary.

Within health care, medical device manufacturer Spectranetics and biological research equipment provider Fluidigm hurt relative results. Shares of Spectranetics declined as the company faced increased competition from Medtronic and Boston Scientific in the U.S. peripheral artery disease market. Still, we expect Spectranetics to launch a competitive product within 18 months that could lead to sales growth and a stock recovery. Although Fluidigm shares rose in October after the company reported positive third-quarter earnings results, the stock declined for the period due to a large net loss in revenues during the second quarter. We believed key personnel changes and a reorganized sales force should stabilize Fluidigm’s near-term performance and position it for growth in 2016 and beyond.

In consumer discretionary, educational technology company 2U detracted after a short-selling firm published a negative note on the company that adversely impacted its stock. However, third-quarter revenue growth, margins and strategic updates as well as initial 2016 guidance were all positive. In our analysis, 2U is a best-in-class, SaaS-like company with an attractive revenue growth profile compared with its peers.

Another key individual detractor was our position in geospatial information product and service provider DigitalGlobe (not an index component). The commercial side of DigitalGlobe’s business has been struggling recently, while the defense side has been experiencing stable growth. The commercial side has been trying to expand into the most troubled markets and sectors, such as Russia, energy and agriculture. We remained confident that the company’s new, higher resolution capabilities can drive acceleration in growth later next year.

franklintempleton.com

|

Semiannual Report 29

FRANKLIN SMALL CAP GROWTH FUND

Thank you for your continued participation in Franklin Small Cap Growth Fund. We look forward to serving your future investment needs.

The foregoing information reflects our analysis, opinions and portfolio holdings as of October 31, 2015, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

|

30 Semiannual Report

franklintempleton.com

FRANKLIN SMALL CAP GROWTH FUND

Performance Summary as of October 31, 2015

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

| | | | | | |

| Net Asset Value | | | | | | |

| Share Class (Symbol) | | 10/31/15 | | 4/30/15 | | Change |

| A (FSGRX) | $ | 17.19 | $ | 18.83 | -$ | 1.64 |

| C (FCSGX) | $ | 14.88 | $ | 16.36 | -$ | 1.48 |

| R (FSSRX) | $ | 16.52 | $ | 18.11 | -$ | 1.59 |

| R6 (FSMLX) | $ | 18.32 | $ | 20.02 | -$ | 1.70 |

| Advisor (FSSAX) | $ | 18.23 | $ | 19.94 | -$ | 1.71 |

franklintempleton.com

|

Semiannual Report 31

FRANKLIN SMALL CAP GROWTH FUND

PERFORMANCE SUMMARY

Performance as of 10/31/151

Cumulative total return excludes sales charges. Average annual total returns and value of $10,000 investment include maximum sales charges. Class A: 5.75% maximum initial sales charge; Class C: 1% contingent deferred sales charge in first year only;