UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-06243

Franklin Strategic Series

(Exact name of registrant as specified in charter)

One Franklin Parkway, San Mateo, CA 94403-1906

(Address of principal executive offices) (Zip code)

Craig S. Tyle , One Franklin Parkway, San Mateo, CA 94403-1906

(Name and address of agent for service)

Registrant’s telephone number, including area code: 650 312-2000

Date of fiscal year end: 4/30

Date of reporting period: 10/31/18

| Item 1. | Reports to Stockholders. |

| | |

| | Semiannual Report and Shareholder Letter October 31, 2018 |

Franklin Growth Opportunities Fund

Franklin Select U.S. Equity Fund

Formerly, Franklin Focused Core Equity Fund

Franklin Small Cap Growth Fund

Franklin Small-Mid Cap Growth Fund

Sign up for electronic delivery at franklintempleton.com/edelivery

Franklin Templeton Investments

Successful investing begins with ambition. And achievement only comes when you reach for it. That’s why we continually strive to deliver better outcomes for investors. No matter what your goals are, our deep, global investment expertise allows us to offer solutions that can help.

During our more than 70 years of experience, we’ve managed through all kinds of markets—up, down and those in between. We’re always preparing for what may come next. It’s because of this, combined with our strength as one of the world’s largest asset managers that we’ve earned the trust of millions of investors around the world.

Dear Shareholder:

The six months ended October 31, 2018, benefited from mostly upbeat economic data as the U.S. job market continued to improve and the unemployment rate declined. During the second and third quarters, U.S. corporate profits rose, supported by healthy economic growth and tax cuts.

In September 2018, the Standard & Poor’s 500® Index (S&P 500®) reached an all-time high, but experienced heightened volatility near period-end due to investor concerns about U.S. Federal Reserve interest-rate policies, higher U.S. Treasury yields, trade tensions, a potentially slower economy and some weaker-than-expected fourth-quarter 2018 revenue guidance. Within this environment, U.S. stocks, as measured by the S&P 500, generated a modest positive total return for the six-month period.

We are committed to our long-term perspective and disciplined investment approach as we conduct a rigorous, fundamental analysis of securities with a regular emphasis on investment risk management.

We believe active, professional investment management serves investors well. We also recognize the important role of financial advisors in today’s markets and encourage investors to continue to seek their advice. Amid changing markets and economic conditions, we are confident investors with a well-diversified portfolio and a patient, long-term outlook should be well positioned for the years ahead.

In addition, Franklin Strategic Series’ semiannual report includes more detail about prevailing conditions and a discussion about investment decisions during the period. Please remember all securities markets fluctuate, as do mutual fund share prices.

We thank you for investing with Franklin Templeton, welcome your questions and comments, and look forward to serving your future investment needs.

Sincerely,

Edward B. Jamieson

President and Chief Executive Officer –

Investment Management

Franklin Strategic Series

This letter reflects our analysis and opinions as of October 31, 2018, unless otherwise indicated. The information is not a complete analysis of every aspect of any market, country, industry, security or fund. Statements of fact are from sources considered reliable.

|

| Not FDIC Insured | May Lose Value | No Bank Guarantee |

| | | | |

| | | |

| franklintempleton.com | | Not part of the semiannual report | | 1 |

Contents

Semiannual Report

Visit franklintempleton.com for fund updates, to access your account, or to find helpful financial planning tools.

| | | | |

| | | |

2 | | Semiannual Report | | franklintempleton.com |

Semiannual Report

Economic and Market Overview

The U.S. economy grew during the six months under review. The economy grew faster in 2018’s second quarter, driven by consumer spending, business investment, exports and government spending, but moderated in the third quarter due to declines in exports and housing investment. The manufacturing and services sectors expanded during the period. The unemployment rate declined from 3.9% in April 2018, as reported at the beginning of the six-month period, to a nearly 49-year low of 3.7% at period-end.1 Annual inflation, as measured by the Consumer Price Index, was 2.5% in April 2018, as reported at the beginning of the period, and while it varied during the six months under review, it ended the period at 2.5%.1

The U.S. Federal Reserve (Fed) raised its target range for the federal funds rate 0.25% at its June 2018 meeting and continued to reduce its balance sheet as part of its ongoing plan to normalize monetary policy. In his congressional testimony in July 2018 and at the Fed symposium in August, Fed Chair Jerome Powell reiterated the Fed’s intention to gradually raise interest rates. At its September 2018 meeting, the Fed raised its target range for the federal funds rate 0.25% to 2.00%–2.25%, as widely expected. Furthermore, the Fed raised its forecast for U.S. economic growth in 2018 and 2019 and projected one more rate increase in 2018. Minutes from the Fed’s September meeting (released in October) indicated that a few officials expected monetary policy to become modestly restrictive of economic growth, while some officials seemed to favor increasing the federal funds rate temporarily above what they consider to be its longer-term level to reduce the risk of overshooting the Fed’s inflation objective. In contrast, some officials indicated they would not favor a restrictive policy unless they see clear signs of an overheating economy and rising inflation.

U.S. equity markets rose overall during the period, benefiting from mostly upbeat economic data and better U.S. corporate earnings. However, markets were pressured at certain times during the period by fears of tighter regulation of information technology and technology-related companies, as well as concerns that strong economic growth and rising inflation would lead the Fed to increase its target rate faster than expected. Other factors that curbed investor sentiment were tensions between the U.S. and North Korea earlier in the

period, political uncertainties in the U.S., the Trump administration’s protectionist policies, and the potential impact of escalating U.S.-China trade tensions on global growth and corporate earnings. Partially offsetting these concerns were an overall easing of tensions in the Korean peninsula in the latter part of the period, intermittent U.S.-China trade negotiations, an agreement between the U.S. and the European Union to try to reduce trade barriers, and a trade deal between the U.S., Mexico and Canada. After reaching a new all-time high in September 2018, the broad U.S. stock market, as measured by the Standard & Poor’s 500 Index (S&P 500), experienced heightened volatility in October amid investor concerns about the Fed’s interest-rate path, rising U.S. Treasury yields, trade, a potentially moderating economy and several big companies’ weaker-than-expected fourth-quarter 2018 revenue guidance. In this environment, the S&P 500 generated a +3.40% total return for the six-month period.2

The foregoing information reflects our analysis and opinions as of October 31, 2018. The information is not a complete analysis of every aspect of any market, country, industry, security or fund. Statements of fact are from sources considered reliable.

1. Source: U.S. Bureau of Labor Statistics.

2. Source: Morningstar.

See www.franklintempletondatasources.com for additional data provider information.

| | | | |

| | | |

| franklintempleton.com | | Semiannual Report | | 3 |

Franklin Growth Opportunities Fund

| | |

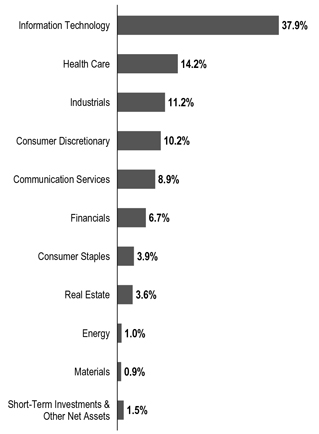

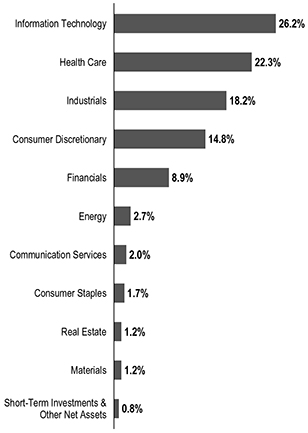

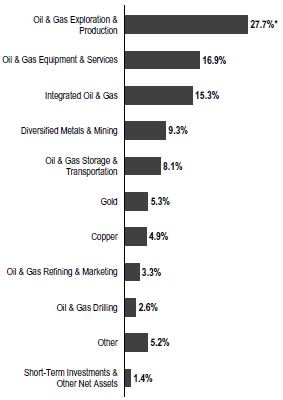

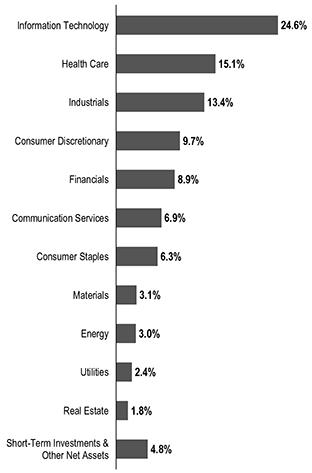

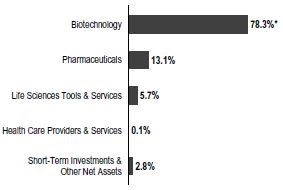

| This semiannual report for Franklin Growth Opportunities Fund covers the period ended October 31, 2018. | | Portfolio Composition |

| | Based on Total Net Assets as of 10/31/18 |

Your Fund’s Goal and Main Investments

The Fund seeks capital appreciation by investing, under normal conditions, predominantly in equity securities of companies demonstrating accelerating growth, increasing profitability, or above-average growth or growth potential as compared with the overall economy.

Performance Overview

The Fund’s Class A shares delivered a +0.96% cumulative total return for the six months under review. In comparison, the Fund’s narrow benchmark, the Russell 3000® Growth Index, which measures performance of Russell 3000® Index companies with relatively higher price-to-book ratios and higher forecasted growth values, generated a +4.29% total return.1 The Fund’s broad benchmark, the Standard & Poor’s 500 Index (S&P 500), which tracks the broad U.S. stock market, produced a +3.40% total return.1 You can find the Fund’s long-term performance data in the Performance Summary beginning on page 7.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

Investment Strategy

We use fundamental, bottom-up research to seek companies meeting our criteria of growth potential, quality and valuation. In seeking sustainable growth characteristics, we look for companies we believe can produce sustainable earnings and cash flow growth, evaluating the long-term market opportunity and competitive structure of an industry to target leaders and emerging leaders. We define quality companies as those with strong and improving competitive positions in attractive markets. We also believe important attributes of quality are experienced and talented management teams as well as financial strength reflected in the capital structure, gross and

operating margins, free cash flow generation and returns on capital employed. Our valuation analysis includes a range of potential outcomes based on an assessment of multiple scenarios. In assessing value, we consider whether security prices fully reflect the balance of the sustainable growth opportunities relative to business and financial risks.

Manager’s Discussion

During the six months under review, several sectors represented in the Fund’s portfolio posted positive returns and contributed to absolute performance. Relative to the Russell 3000® Growth Index, key contributors to the Fund’s performance included stock selection and an underweighting in materials. Within the sector, our position in Ingevity, a

1. Source: Morningstar.

Frank Russell Company is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of Frank Russell Company.

The indexes are unmanaged and include reinvestment of any income or distributions. They do not reflect any fees, expenses or sales charges. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI).

The SOI begins on page 33.

| | | | |

| | | |

4 | | Semiannual Report | | franklintempleton.com |

FRANKLIN GROWTH OPPORTUNITIES FUND

manufacturer of specialty chemicals and carbon materials, benefited relative results.

Other key individual contributors to relative performance included our investments in payment solutions provider Mastercard, biopharmaceutical firm AbbVie,2 programmable devices company Xilinx and frozen potato products manufacturer Lamb Weston Holdings. Mastercard continues to perform very well, exceeding expectations and announcing several growth initiatives and partnerships. The company has shown an ability to both invest for the long term while delivering solid quarter-to-quarter execution, which we believe is supported by a strong organic growth profile, specifically in Europe and total cross-border flows. Our underweighted position in Abbvie, which declined during the period due to investor concerns about rebates and biosimilar adoptions, contributed to relative results. Xilinx benefited from the adoption of complex programmable logic devices into additional end markets and its introduction of new products. In addition to delivering solid results for the September 2018 quarter, the company also provided strong forward guidance.

In contrast, key detractors from the Fund’s relative performance included stock selection in the consumer discretionary, financials and consumer staples sectors, as well as an overweighting in the financials sector and an underweighting in the consumer staples sector.

Within consumer discretionary, casino resorts operator Wynn Resorts’ shares fell amid slowing VIP trends in Macau, concerns about new competition and trade war risks, and a weak third-quarter convention calendar in Las Vegas with relatively weak leisure visitation.2

In the financials sector, our positions in financial and banking holding company SVB Financial Group and financial services firm Charles Schwab hindered relative returns.

In consumer staples, Constellation Brands, which produces, markets and distributes beverage alcohol products, detracted from relative results.

Other key individual detractors included our positions in medical devices company Nevro and defense and security solutions manufacturer Raytheon. Nevro’s shares declined due to weaker-than-expected earnings reports and a reduction in 2018 sales guidance. Although Nevro’s market growth and share capture assumptions have been lowered, we believe

Top 10 Holdings

10/31/18

| | | | |

Company

Sector/Industry | | % of Total

Net Assets | |

| |

Amazon.com Inc. Consumer Discretionary | | | 7.4% | |

| |

Apple Inc. Information Technology | | | 6.0% | |

| |

Mastercard Inc. Information Technology | | | 5.0% | |

| |

Microsoft Corp. Information Technology | | | 4.7% | |

| |

Alphabet Inc. Communication Services | | | 4.0% | |

| |

Visa Inc. Information Technology | | | 4.0% | |

| |

UnitedHealth Group Inc. Health Care | | | 2.7% | |

| |

SBA Communications Corp. Real Estate | | | 2.3% | |

| |

ServiceNow Inc. Information Technology | | | 2.2% | |

| |

Adobe Inc. Information Technology | | | 2.0% | |

Nevro’s growth profile is still attractive, with new applications and product enhancements driving its strong growth going forward. Raytheon’s shares declined along with many defense stocks, despite the company’s better-than-expected earnings reports and a relatively solid 2019 guidance.

2. Not held at period-end.

See www.franklintempletondatasources.com for additional data provider information.

| | | | |

| | | |

| franklintempleton.com | | Semiannual Report | | 5 |

FRANKLIN GROWTH OPPORTUNITIES FUND

Thank you for your continued participation in Franklin Growth Opportunities Fund. We look forward to serving your future investment needs.

| | |

| |

Grant Bowers Lead Portfolio Manager |

| |

| |

Sara Araghi, CFA |

| | Portfolio Management Team |

The foregoing information reflects our analysis, opinions and portfolio holdings as of October 31, 2018, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

CFA® is a trademark owned by CFA Institute.

| | | | |

| | | |

6 | | Semiannual Report | | franklintempleton.com |

FRANKLIN GROWTH OPPORTUNITIES FUND

Performance Summary as of October 31, 2018

The performance table does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses. Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities.

Performance as of 10/31/181

Cumulative total return excludes sales charges. Average annual total return includes maximum sales charges. Sales charges will vary depending on the size of the investment and the class of share purchased. The maximum is 5.50% and the minimum is 0%. Class A: 5.50% maximum initial sales charge; Advisor Class: no sales charges. For other share classes, visit franklintempleton.com.

| | | | |

Share Class | | Cumulative

Total Return2 | | Average Annual

Total Return3 |

A4 | | | | |

| | |

6-Month | | +0.96% | | -4.60% |

| | |

1-Year | | +8.89% | | +2.90% |

| | |

5-Year | | +63.11% | | +9.04% |

| | |

10-Year | | +271.21% | | +13.37% |

| | |

Advisor | | | | |

| | |

6-Month | | +1.09% | | +1.09% |

| | |

1-Year | | +9.16% | | +9.16% |

| | |

5-Year | | +65.35% | | +10.58% |

| | |

10-Year | | +281.74% | | +14.33% |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

See page 8 for Performance Summary footnotes.

| | | | |

| | | |

| franklintempleton.com | | Semiannual Report | | 7 |

FRANKLIN GROWTH OPPORTUNITIES FUND

PERFORMANCE SUMMARY

Total Annual Operating Expenses5

| | |

Share Class | | |

A | | 0.99% |

Advisor | | 0.74% |

Each class of shares is available to certain eligible investors and has different annual fees and expenses, as described in the prospectus.

All investments involve risks, including possible loss of principal. Growth stock prices reflect projections of future earnings or revenues, and can, therefore, fall dramatically if the company fails to meet those projections. To the extent the Fund focuses on particular countries, regions, industries, sectors or types of investment from time to time, it may be subject to greater risks of adverse developments in such areas of focus than a fund that invests in a wider variety of countries, regions, industries, sectors or investments. Smaller, midsized and relatively new or unseasoned companies can be particularly sensitive to changing economic conditions, and their prospects for growth are less certain than those of larger, more established companies. Historically, these securities have experienced more price volatility than larger-company stocks, especially over the short term. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

1. The Fund has a fee waiver associated with any investment it makes in a Franklin Templeton money fund and/or other Franklin Templeton fund, contractually guaranteed through 8/31/19. Fund investment results reflect the fee waiver; without this waiver, the results would have been lower.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated. Return for less than one year, if any, has not been annualized.

4. Prior to 9/10/18, these shares were offered at a higher initial sales charge of 5.75%, thus actual returns would have differed. Total returns with sales charges have been restated to reflect the current maximum initial sales charge of 5.50%.

5. Figures are as stated in the Fund’s current prospectus and may differ from the expense ratios disclosed in the Your Fund’s Expenses and Financial Highlights sections in this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

| | | | |

| | | |

8 | | Semiannual Report | | franklintempleton.com |

FRANKLIN GROWTH OPPORTUNITIES FUND

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs: (1) transaction costs, including sales charges (loads) on Fund purchases and redemptions; and (2) ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses. The table below shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The table below provides information about actual account values and actual expenses in the columns under the heading “Actual.” In these columns the Fund’s actual return, which includes the effect of Fund expenses, is used to calculate the “Ending Account Value” for each class of shares. You can estimate the expenses you paid during the period by following these steps (of course, your account value and expenses will differ from those in this illustration): Divide your account value by $1,000 (if your account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6). Then multiply the result by the number in the row for your class of shares under the headings “Actual” and “Expenses Paid During Period” (if Actual Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50). In this illustration, the actual expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Under the heading “Hypothetical” in the table, information is provided about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. This information may not be used to estimate the actual ending account balance or expenses you paid for the period, but it can help you compare ongoing costs of investing in the Fund with those of other funds. To do so, compare this 5% hypothetical example for the class of shares you hold with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transactional costs. Therefore, information under the heading “Hypothetical” is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transactional costs were included, your total costs would have been higher.

| | | | | | | | | | | | | | | | | | |

| | | | | | | Actual | | | | Hypothetical | | | | |

| | | | | | | (actual return after expenses) | | | | (5% annual return before expenses) | | | | |

Share

Class | | Beginning

Account

Value 5/1/18 | | | | Ending

Account

Value 10/31/18 | | Expenses

Paid During

Period

5/1/18–10/31/181,2 | | | | Ending

Account

Value 10/31/18 | | Expenses

Paid During

Period

5/1/18–10/31/181,2 | | | | Net

Annualized

Expense

Ratio2 |

| A | | $1,000 | | | | $1,009.60 | | $4.76 | | | | $1,020.47 | | $4.79 | | | | 0.94% |

| C | | $1,000 | | | | $1,005.80 | | $8.54 | | | | $1,016.69 | | $8.59 | | | | 1.69% |

| R | | $1,000 | | | | $1,008.40 | | $6.02 | | | | $1,019.21 | | $6.06 | | | | 1.19% |

| R6 | | $1,000 | | | | $1,011.50 | | $2.94 | | | | $1,022.28 | | $2.96 | | | | 0.58% |

| Advisor | | $1,000 | | | | $1,010.90 | | $3.50 | | | | $1,021.73 | | $3.52 | | | | 0.69% |

1. Expenses are equal to the annualized expense ratio for the six-month period as indicated above—in the far right column—multiplied by the simple average account value over the period indicated, and then multiplied by 184/365 to reflect the one-half year period.

2. Reflects expenses after fee waivers and expense reimbursements. Does not include acquired fund fees and expenses.

| | | | |

| | | |

| franklintempleton.com | | Semiannual Report | | 9 |

Franklin Select U.S. Equity Fund

Formerly, Franklin Focused Core Equity Fund

This semiannual report for Franklin Select U.S. Equity Fund covers the period ended October 31, 2018. As previously communicated, effective June 1, 2018, the Fund changed its investment strategy, but its goal remained the same.

Your Fund’s Goal and Main Investments

The Fund seeks capital appreciation by investing, under normal market conditions, at least 80% of its net assets in U.S. equity securities. The Fund invests primarily to predominantly in equity securities of large capitalization companies, which are similar in size to those in the Standard & Poor’s 500 Index (S&P 500).

Performance Overview

The Fund’s Class A shares delivered a +0.06% cumulative total return for the six months under review. In comparison, the S&P 500, which tracks the broad U.S. stock market, generated a +3.40% total return.1 You can find the Fund’s long-term performance data in the Performance Summary beginning on page 13.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

Investment Strategy

We are research-driven, bottom-up fundamental investors seeking companies that exhibit a combination of growth potential, quality and reasonable valuation. We assess growth potential by considering companies that we believe are positioned for growth in revenue, earnings or assets. In assessing valuation, we consider whether security prices fully reflect the balance of the long-term growth prospects relative to business and financial risks. We place a particular emphasis on quality and assessing downside risk, believing that important attributes of quality include experienced and talented management teams, favorable competitive positioning, and financial strength reflected in metrics including profitability, free cash flow generation and returns on capital employed. This quality analysis generally includes our assessment of the

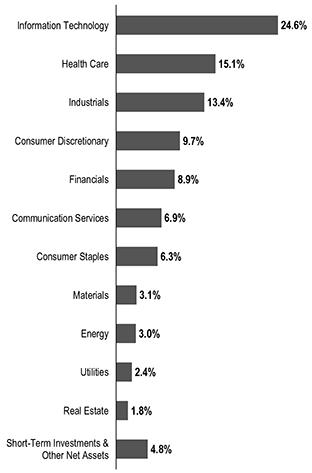

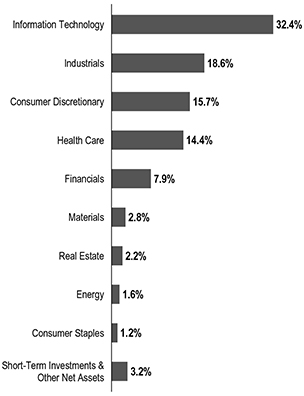

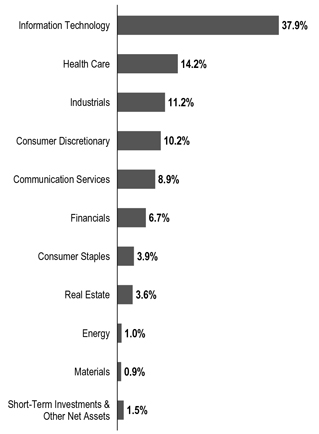

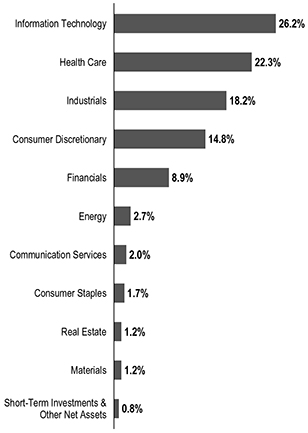

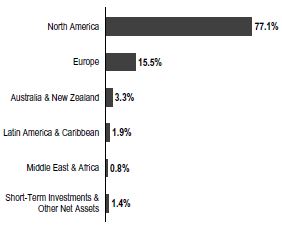

Portfolio Composition

Based on Total Net Assets as of 10/31/18

potential impacts of any material environmental, social and governance (ESG) factors on the long-term risk and return profile of a company. We generally use a team of analysts to help provide in-depth industry expertise and use both qualitative and quantitative analysis to evaluate companies.

Manager’s Discussion

During the six months under review, key sector contributors to the Fund’s absolute performance included information technology (IT), health care and materials.

Within the IT sector, our investments in software and electronics equipment company Apple, software and services

1. Source: Morningstar.

The index is unmanaged and includes reinvestment of any income or distributions. It does not reflect any fees, expenses or sales charges. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

See www.franklintempletondatasources.com for additional data provider information.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI).

The SOI begins on page 41.

| | | | |

| | | |

10 | | Semiannual Report | | franklintempleton.com |

FRANKLIN SELECT U.S. EQUITY FUND

firm Microsoft and payment technology company Mastercard benefited absolute performance. Apple reported solid results for its fiscal second and third quarters (ended March and June, respectively), supported by strong growth in services and higher average selling price for iPhones, and issued strong guidance for its fiscal fourth quarter (ended September). Near period-end, the company revealed its latest lineup of products, which included new Apple Watch and iPhone models. Microsoft reported robust quarterly results during the period, supported by solid demand for its suite of office and cloud-based products and services. The company is a beneficiary of strong sales execution, a positive enterprise IT spending environment, its status as a critical partner to IT departments in this time of digital transformation, and a large installed base that it is successfully moving to higher-value cloud and Service-as-a-Software (SaaS) deployments. In the consumer market, the company continued to deliver new value into the declining personal computer market, while generating growth in gaming.

In health care, life sciences tools and services company Illumina and health care provider UnitedHealth Group contributed to absolute results. Illumina benefited from strong second- and third-quarter earnings, with revenue and a raise in guidance coming in above expectations. Results were helped by high customer utilization rates of the company’s genome sequencing system NovaSeq.

In the materials sector, Ecolab, which provides products and services in the field of water, hygiene and energy, aided absolute results.

Other key individual contributors to absolute performance included frozen potato products manufacturer Lamb Weston Holdings.

In contrast, key sector detractors from the Fund’s absolute performance included financials, consumer discretionary and industrials.

Within financials, our positions in asset manager BlackRock and financial services firm Charles Schwab hurt absolute results. Although BlackRock reported better-than-expected earnings for the second and third quarters of 2018, its shares declined due to investor concerns about slower investment inflows. Charles Schwab reported second-quarter 2018 earnings that were slightly better than market expectations and third-quarter earnings that were in line with expectations. However, its shares declined due to investor concerns about pricing pressures coming from new no-fee products introduced by competitors.

Top 10 Holdings

10/31/18

| | | | |

Company

Sector/Industry | | % of Total

Net Assets | |

| |

Amazon.com Inc. Consumer Discretionary | | | 4.3% | |

| |

Microsoft Corp. Information Technology | | | 3.5% | |

| |

Alphabet Inc. Communication Services | | | 3.2% | |

| |

Mastercard Inc. Information Technology | | | 2.8% | |

| |

Analog Devices Inc. Information Technology | | | 2.7% | |

| |

UnitedHealth Group Inc. Health Care | | | 2.7% | |

| |

The Charles Schwab Corp. Financials | | | 2.6% | |

| |

NextEra Energy Inc. Utilities | | | 2.4% | |

| |

Apple Inc. Information Technology | | | 2.4% | |

| |

Fortive Corp. Industrials | | | 2.3% | |

In consumer discretionary, Alibaba Group Holding, China’s largest e-commerce company, hindered absolute results.

In the industrials sector, defense and security solutions manufacturer Raytheon and nuclear components and products company BWX Technologies hurt performance.

Other key individual detractors included semiconductor equipment company Applied Materials. Its shares fell after the company reported mixed results for fiscal third-quarter 2018 (ended July), with earnings exceeding market expectations and revenue missing expectations. Furthermore, the company provided a weaker-than-expected guidance for its fiscal fourth quarter, due in part to weakness at a foundry customer that reduced capital expenditures resulting from weaker cryptocurrency (a digital or virtual currency that uses cryptography for security) demand.

| | | | |

| | | |

| franklintempleton.com | | Semiannual Report | | 11 |

FRANKLIN SELECT U.S. EQUITY FUND

Thank you for your continued participation in Franklin Select U.S. Equity Fund.

| | |

| |  |

| | Serena Perin Vinton, CFA Lead Portfolio Manager |

| | |

| | |

| |

|

| | Chris Anderson |

| |

| | Portfolio Management Team |

The foregoing information reflects our analysis, opinions and portfolio holdings as of October 31, 2018, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

| | | | |

| | | |

12 | | Semiannual Report | | franklintempleton.com |

FRANKLIN SELECT U.S. EQUITY FUND

Performance Summary as of October 31, 2018

The performance table does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses. Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities.

Performance as of 10/31/181

Cumulative total return excludes sales charges. Average annual total return includes maximum sales charges. Sales charges will vary depending on the size of the investment and the class of share purchased. The maximum is 5.50% and the minimum is 0%. Class A: 5.50% maximum initial sales charge; Advisor Class: no sales charges. For other share classes, visit franklintempleton.com.

| | | | | | | | |

Share Class | | Cumulative Total Return2 | | | Average Annual Total Return3 | |

A4 | | | | | | | | |

| | |

6-Month | | | +0.06% | | | | -5.44% | |

| | |

1-Year | | | +4.61% | | | | -1.15% | |

| | |

5-Year | | | +43.92% | | | | +6.34% | |

| | |

10-Year | | | +226.50% | | | | +11.93% | |

| | |

Advisor | | | | | | | | |

| | |

6-Month | | | +0.18% | | | | +0.18% | |

| | |

1-Year | | | +4.86% | | | | +4.86% | |

| | |

5-Year | | | +45.74% | | | | +7.82% | |

| | |

10-Year | | | +234.98% | | | | +12.85% | |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

See page 14 for Performance Summary footnotes.

| | | | |

| | | |

| franklintempleton.com | | Semiannual Report | | 13 |

FRANKLIN SELECT U.S. EQUITY FUND

PERFORMANCE SUMMARY

Total Annual Operating Expenses5

| | | | |

Share Class | | With Waiver | | Without Waiver |

A | | 1.25% | | 1.49% |

Advisor | | 1.00% | | 1.24% |

Each class of shares is available to certain eligible investors and has different annual fees and expenses, as described in the prospectus.

All investments involve risks, including possible loss of principal. To the extent the Fund focuses on particular countries, regions, industries, sectors or types of investment from time to time, it may be subject to greater risks of adverse developments in such areas of focus than a fund that invests in a wider variety of countries, regions, industries, sectors or investments. The Fund may have investments in both growth and value stocks, or in stocks with characteristics of both. Growth stock prices reflect projections of future earnings or revenues, and can, therefore, fall dramatically if the company fails to meet those projections. A value stock may not increase in price as anticipated by the investment manager if other investors fail to recognize the company’s value and bid up the price, the markets favor faster growing companies, or the factors that the investment manager believes will increase the price of the security do not occur. Foreign securities involve special risks, including currency fluctuations and economic and political uncertainties. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

1.The Fund has an expense reduction contractually guaranteed through 8/31/19. Fund investment results reflect the expense reduction; without this reduction, the results would have been lower.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated. Return for less than one year, if any, has not been annualized.

4. Prior to 9/10/18, these shares were offered at a higher initial sales charge of 5.75%, thus actual returns would have differed. Total returns with sales charges have been restated to reflect the current maximum initial sales charge of 5.50%.

5. Figures are as stated in the Fund’s current prospectus and may differ from the expense ratios disclosed in the Your Fund’s Expenses and Financial Highlights sections in this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

| | | | |

| | | |

14 | | Semiannual Report | | franklintempleton.com |

FRANKLIN SELECT U.S. EQUITY FUND

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs: (1) transaction costs, including sales charges (loads) on Fund purchases and redemptions; and (2) ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses. The table below shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The table below provides information about actual account values and actual expenses in the columns under the heading “Actual.” In these columns the Fund’s actual return, which includes the effect of Fund expenses, is used to calculate the “Ending Account Value” for each class of shares. You can estimate the expenses you paid during the period by following these steps (of course, your account value and expenses will differ from those in this illustration): Divide your account value by $1,000 (if your account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6). Then multiply the result by the number in the row for your class of shares under the headings “Actual” and “Expenses Paid During Period” (if Actual Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50). In this illustration, the actual expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Under the heading “Hypothetical” in the table, information is provided about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. This information may not be used to estimate the actual ending account balance or expenses you paid for the period, but it can help you compare ongoing costs of investing in the Fund with those of other funds. To do so, compare this 5% hypothetical example for the class of shares you hold with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transactional costs. Therefore, information under the heading “Hypothetical” is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transactional costs were included, your total costs would have been higher.

| | | | | | | | | | | | | | | | | | |

| | | | | | | Actual | | | | Hypothetical | | | | |

| | | | | | | (actual return after expenses) | | | | (5% annual return before expenses) | | | | |

| | | | | | | | | Expenses | | | | | | Expenses | | | | Net |

| | | Beginning | | | | Ending | | Paid During | | | | Ending | | Paid During | | | | Annualized |

| Share | | Account | | | | Account | | Period | | | | Account | | Period | | | | Expense |

| Class | | Value 5/1/18 | | | | Value 10/31/18 | | 5/1/18–10/31/181,2 | | | | Value 10/31/18 | | 5/1/18–10/31/181,2 | | | | Ratio2 |

| A | | $1,000 | | | | $1,000.60 | | $6.20 | | | | $1,019.00 | | $ 6.26 | | | | 1.23% |

| C | | $1,000 | | | | $ 996.80 | | $9.97 | | | | $1,015.22 | | $10.06 | | | | 1.98% |

| R | | $1,000 | | | | $ 999.40 | | $7.66 | | | | $1,017.54 | | $ 7.73 | | | | 1.52% |

| R6 | | $1,000 | | | | $1,002.40 | | $4.29 | | | | $1,020.92 | | $ 4.33 | | | | 0.85% |

| Advisor | | $1,000 | | | | $1,001.80 | | $4.94 | | | | $1,020.27 | | $ 4.99 | | | | 0.98% |

1. Expenses are equal to the annualized expense ratio for the six-month period as indicated above—in the far right column—multiplied by the simple average account value over the period indicated, and then multiplied by 184/365 to reflect the one-half year period.

2. Reflects expenses after fee waivers and expense reimbursements. Does not include acquired fund fees and expenses.

| | | | |

| | | |

| franklintempleton.com | | Semiannual Report | | 15 |

Franklin Small Cap Growth Fund

This semiannual report for Franklin Small Cap Growth Fund covers the period ended October 31, 2018. At the market close on February 12, 2015, the Fund closed to new investors with limited exceptions. Existing shareholders may add to their accounts. Effective April 28, 2017, the Fund opened Class R6 shares to new investors who are eligible to purchase Class R6 shares. Effective January 17, 2019, all share classes of the Fund will be re-opened to new investors.

Your Fund’s Goal and Main Investments

The Fund seeks long-term capital growth by investing, under normal market conditions, at least 80% of its net assets in equity securities of small-cap companies, which for this Fund are those with market capitalizations not exceeding $1.5 billion or that of the highest market capitalization in the Russell 2000® Index, whichever is greater, at the time of purchase.1

Performance Overview

The Fund’s Class A shares delivered a +3.09% cumulative total return for the six months under review. In comparison, the Russell 2000® Growth Index, which measures performance of small-cap companies with relatively higher price-to-book ratios and higher forecasted growth values, had a -1.26% total return.2 The Standard & Poor’s 500 Index (S&P 500), which tracks the broad U.S. stock market, produced a +3.40% total return.2 You can find the Fund’s long-term performance data in the Performance Summary beginning on page 19.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

Investment Strategy

We use fundamental, bottom-up research to seek companies meeting our criteria of growth potential, quality and valuation. In seeking sustainable growth characteristics, we look for companies we believe can produce sustainable earnings and cash flow growth, evaluating the long-term market opportunity and competitive structure of an industry. We define quality

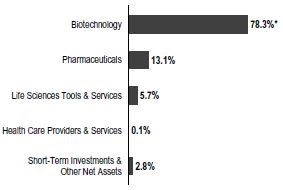

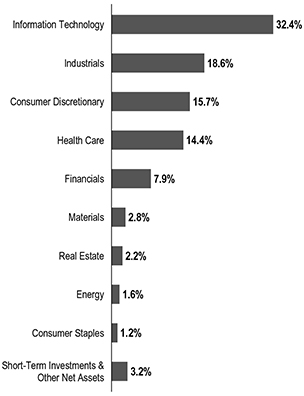

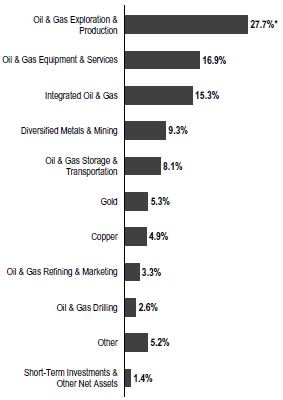

Portfolio Composition

Based on Total Net Assets as of 10/31/18

companies as those with strong and improving competitive positions in attractive markets. We also believe important attributes of quality are experienced and talented management teams as well as financial strength reflected in the capital structure, gross and operating margins, free cash flow generation and returns on capital employed. Our valuation analysis includes a range of potential outcomes based on an assessment of multiple scenarios. In assessing value, we consider whether security prices fully reflect the balance of the sustainable growth opportunities relative to business and financial risks.

Manager’s Discussion

During the six months under review, key contributors to the Fund’s performance relative to the Russell 2000® Growth

1. The Russell 2000 Index is market capitalization weighted and measures performance of the 2,000 smallest companies in the Russell 3000 Index, which represent a small amount of the total market capitalization of the Russell 3000 Index.

2. Source: Morningstar.

The indexes are unmanaged and include reinvested dividends. They do not reflect any fees, expenses or sales charges. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI).

The SOI begins on page 48.

| | | | |

| | | |

16 | | Semiannual Report | | franklintempleton.com |

FRANKLIN SMALL CAP GROWTH FUND

Index included stock selection and an overweighting in the information technology (IT) sector and stock selection in the consumer discretionary and industrials sectors.

Within IT, our positions in cloud communications company Twilio and system-level semiconductor solutions developer Integrated Device Technology (not held at period-end) aided relative results. Twilio reported stronger-than-expected earnings and revenue for the first and second quarters of 2018 and raised its full-year 2018 guidance, aided by a larger customer base, higher average revenue per customer and its core voice and messaging solutions. During the period, the company introduced a new contact center solution, Twilio Flex, and announced its plan to acquire a leading business-to-consumer email messaging company.

In consumer discretionary, Duluth Holdings, which sells men’s and women’s casual wear, work wear and accessories through its own channels, contributed to relative results.

In the industrials sector, notable contributors included Spirit Airlines,3 an ultra low-cost, low-fare airline, and Mercury Systems, a provider of secure sensor and safety critical mission processing subsystems. Spirit Airlines delivered better-than-expected second- and third-quarter earnings, supported by solid growth in ticket and non-ticket revenues, fares and capacity. The airline also benefited from service improvements and cost reductions, as well as a new pilot deal that gave the airline more flexibility, leading to more completed flights.

Other notable contributors included medical device manufacturer DexCom3 and cancer diagnostics and pharmaceutical services company NeoGenomics. DexCom reported better-than-expected sales for the first and second quarters of 2018, driven by strong international sales growth, and company management raised its 2018 sales guidance. Furthermore, management indicated that the early adoption of the recently launched G6 continuous glucose monitoring (CGM) system represented a broadening of its user base into individuals who had been waiting for a CGM system that did not require finger stick calibration measurements.

In contrast, key detractors from the Fund’s relative performance included stock selection and an overweighting in the financials sector and stock selection and underweightings in the communication services and consumer staples sectors.

Top 10 Holdings

10/31/18

| | | | |

Company Sector/Industry | | % of Total

Net Assets | |

| |

2U Inc. Information Technology | | | 2.1% | |

| |

Mercury Systems Inc. Industrials | | | 1.8% | |

| |

Spirit Airlines Inc. Industrials | | | 1.7% | |

| |

Grand Canyon Education Inc. Consumer Discretionary | | | 1.4% | |

| |

Cubic Corp. Industrials | | | 1.4% | |

| |

Integer Holdings Corp. Health Care | | | 1.4% | |

| |

Univar Inc. Industrials | | | 1.4% | |

| |

US Ecology Inc. Industrials | | | 1.3% | |

| |

Kennametal Inc. Industrials | | | 1.3% | |

| |

Twilio Inc. Information Technology | | | 1.3% | |

Within the financials sector, our position in Western Alliance Bancorp, which provides banking products and services for businesses, hampered relative results. Other key detractors included motion pictures technology company IMAX in the communication services sector and baked sweet goods company Hostess Brands in the consumer staples sector.

Other notable individual detractors from the Fund’s relative performance included medical devices company Nevro, roofing materials distributor Beacon Roofing Supply and education technology company 2U. Nevro’s shares declined due to weaker-than-expected earnings reports and a reduction in 2018 sales guidance. Although Nevro’s market growth and share capture assumptions have been lowered, we believe Nevro’s growth profile is still attractive, with new applications and product enhancements driving its strong growth going forward. Beacon Roofing Supply’s share price weakened due to investor concerns about several issues, including rising mortgage rates, an unfavorable price/cost dynamic for roofing shingles and slowing growth in upcoming quarters due to increased storm-related activity last year. 2U’s shares reached an all-time high in mid-May after the company reported better-than-expected first-quarter 2018 results and raised its revenue

3. Not part of the index.

See www.franklintempletondatasources.com for additional data provider information.

| | | | |

| | | |

| franklintempleton.com | | Semiannual Report | | 17 |

FRANKLIN SMALL CAP GROWTH FUND

guidance for full-year 2018. However, its shares were pressured by an analyst report that raised investor concerns about the company’s competition. Nonetheless, the company reported strong second-quarter results and again raised its full-year 2018 guidance.

Thank you for your continued participation in Franklin Small Cap Growth Fund. We look forward to serving your future investment needs.

| | |

| |

Michael P. McCarthy, CFA Lead Portfolio Manager |

| |

| |

Bradley T. Carris, CFA |

| | Portfolio Management Team |

The foregoing information reflects our analysis, opinions and portfolio holdings as of October 31, 2018, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

| | | | |

| | | |

18 | | Semiannual Report | | franklintempleton.com |

FRANKLIN SMALL CAP GROWTH FUND

Performance Summary as of October 31, 2018

The performance table does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses. Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities.

Performance as of 10/31/181

Cumulative total return excludes sales charges. Average annual total return includes maximum sales charges. Sales charges will vary depending on the size of the investment and the class of share purchased. The maximum is 5.50% and the minimum is 0%. Class A: 5.50% maximum initial sales charge; Advisor Class: no sales charges. For other share classes, visit franklintempleton.com.

| | | | |

Share Class | | Cumulative Total Return2 | | Average Annual Total Return3 |

A4 | | | | |

| | |

6-Month | | +3.09% | | -2.59% |

| | |

1-Year | | +13.71% | | +7.44% |

| | |

5-Year | | +50.13% | | +7.24% |

| | |

10-Year | | +328.88% | | +15.02% |

| | |

Advisor | | | | |

| | |

6-Month | | +3.21% | | +3.21% |

| | |

1-Year | | +14.00% | | +14.00% |

| | |

5-Year | | +52.12% | | +8.75% |

| | |

10-Year | | +341.21% | | +16.00% |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

See page 20 for Performance Summary footnotes.

| | | | |

| | | |

franklintempleton.com | | Semiannual Report | | 19 |

FRANKLIN SMALL CAP GROWTH FUND

PERFORMANCE SUMMARY

Total Annual Operating Expenses5

| | | | | | | | |

Share Class | | With Waiver | | | Without Waiver | |

A | | | 1.09% | | | | 1.10% | |

Advisor | | | 0.84% | | | | 0.85% | |

Each class of shares is available to certain eligible investors and has different annual fees and expenses, as described in the prospectus.

All investments involve risks, including possible loss of principal. Smaller, midsized and relatively new or unseasoned companies can be particularly sensitive to changing economic conditions, and their prospects for growth are less certain than those of larger, more established companies. Historically, these securities have experienced more price volatility than larger-company stocks, especially over the short term. Growth stock prices reflect projections of future earnings or revenues, and can, therefore, fall dramatically if the company fails to meet those projections. To the extent the Fund focuses on particular countries, regions, industries, sectors or types of investment from time to time, it may be subject to greater risks of adverse developments in such areas of focus than a fund that invests in a wider variety of countries, regions, industries, sectors or investments. From time to time, the trading market for a particular security or type of security in which the Fund invests may become less liquid or even illiquid. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

1. The Fund has a fee waiver associated with any investment it makes in a Franklin Templeton money fund and/or other Franklin Templeton fund, contractually guaranteed through 8/31/19. Fund investment results reflect the fee waiver; without this waiver, the results would have been lower.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated. Return for less than one year, if any, has not been annualized.

4. Prior to 9/10/18, these shares were offered at a higher initial sales charge of 5.75%, thus actual returns would have differed. Total returns with sales charges have been restated to reflect the current maximum initial sales charge of 5.50%.

5. Figures are as stated in the Fund’s current prospectus and may differ from the expense ratios disclosed in the Your Fund’s Expenses and Financial Highlights sections in this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

| | | | |

| | | |

20 | | Semiannual Report | | franklintempleton.com |

FRANKLIN SMALL CAP GROWTH FUND

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs: (1) transaction costs, including sales charges (loads) on Fund purchases and redemptions; and (2) ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses. The table below shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The table below provides information about actual account values and actual expenses in the columns under the heading “Actual.” In these columns the Fund’s actual return, which includes the effect of Fund expenses, is used to calculate the “Ending Account Value” for each class of shares. You can estimate the expenses you paid during the period by following these steps (of course, your account value and expenses will differ from those in this illustration): Divide your account value by $1,000 (if your account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6). Then multiply the result by the number in the row for your class of shares under the headings “Actual” and “Expenses Paid During Period” (if Actual Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50). In this illustration, the actual expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Under the heading “Hypothetical” in the table, information is provided about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. This information may not be used to estimate the actual ending account balance or expenses you paid for the period, but it can help you compare ongoing costs of investing in the Fund with those of other funds. To do so, compare this 5% hypothetical example for the class of shares you hold with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transactional costs. Therefore, information under the heading “Hypothetical” is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transactional costs were included, your total costs would have been higher.

| | | | | | | | | | | | | | | | | | |

| | | | | | | Actual (actual return after expenses) | | | | Hypothetical

(5% annual return before expenses) | | | | |

Share

Class | | Beginning

Account

Value 5/1/18 | | | | Ending

Account

Value 10/31/18 | | Expenses

Paid During

Period

5/1/18–10/31/181,2 | | | | Ending

Account

Value 10/31/18 | | Expenses

Paid During

Period

5/1/18–10/31/181,2 | | | | Net

Annualized

Expense

Ratio2 |

| | | | | | | | | | | | |

| A | | $1,000 | | | | $1,030.90 | | $5.37 | | | | $1,019.91 | | $5.35 | | | | 1.05% |

| C | | $1,000 | | | | $1,026.80 | | $9.20 | | | | $1,016.13 | | $9.15 | | | | 1.80% |

| R | | $1,000 | | | | $1,029.60 | | $6.65 | | | | $1,018.65 | | $6.61 | | | | 1.30% |

| R6 | | $1,000 | | | | $1,033.00 | | $3.23 | | | | $1,022.03 | | $3.21 | | | | 0.63% |

| Advisor | | $1,000 | | | | $1,032.10 | | $4.10 | | | | $1,021.17 | | $4.08 | | | | 0.80% |

1. Expenses are equal to the annualized expense ratio for the six-month period as indicated above—in the far right column—multiplied by the simple average account value over the period indicated, and then multiplied by 184/365 to reflect the one-half year period.

2. Reflects expenses after fee waivers and expense reimbursements. Does not include acquired fund fees and expenses.

| | | | |

| | | |

| franklintempleton.com | | Semiannual Report | | 21 |

Franklin Small-Mid Cap Growth Fund

This semiannual report for Franklin Small-Mid Cap Growth Fund covers the period ended October 31, 2018.

Your Fund’s Goal and Main Investments

The Fund seeks long-term capital growth by investing, under normal market conditions, at least 80% of its net assets in equity securities of small-cap and mid-cap companies. The Fund defines small-cap companies as those within the market capitalization range of companies in the Russell 2500™ Index at the time of purchase, and mid-cap companies as those within the market capitalization range of the Russell Midcap® Index, at the time of purchase.1

Performance Overview

The Fund’s Class A shares delivered a +0.19% cumulative total return for the six months under review. In comparison, the Russell Midcap® Growth Index, which measures performance of companies in the Russell Midcap® Index with relatively higher price-to-book ratios and higher forecasted growth values, generated a +0.94% total return.2 Also in comparison, the Standard & Poor’s 500 Index (S&P 500), which tracks the broad U.S. stock market, produced a +3.40% total return.2 You can find the Fund’s long-term performance data in the Performance Summary beginning on page 25.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

Investment Strategy

We use fundamental, bottom-up research to seek companies meeting our criteria of growth potential, quality and valuation. In seeking sustainable growth characteristics, we look for companies we believe can produce sustainable earnings and cash flow growth, evaluating the long-term market opportunity and competitive structure of an industry to target leaders and emerging leaders. We define quality companies as those with strong and improving competitive positions in attractive markets. We also believe important attributes of quality are

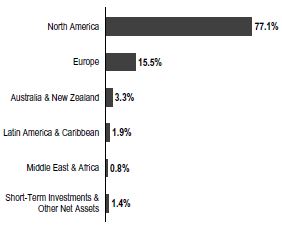

Portfolio Composition

Based on Total Net Assets as of 10/31/18

experienced and talented management teams as well as financial strength reflected in the capital structure, gross and operating margins, free cash flow generation and returns on capital employed. Our valuation analysis includes a range of potential outcomes based on an assessment of multiple scenarios. In assessing value, we consider whether security prices fully reflect the balance of the sustainable growth opportunities relative to business and financial risks.

Manager’s Discussion

During the six months under review, most sectors represented in the Fund’s portfolio posted positive returns and contributed to absolute performance. Relative to the Russell Midcap® Growth Index, key contributors to the Fund’s performance included stock selection and an underweighting in the materials

1. The Russell 2500 Index is market capitalization weighted and measures performance of the 2,500 smallest companies in the Russell 3000 Index, which represent a modest amount of the Russell 3000 Index’s total market capitalization. The Russell Midcap Index is market capitalization weighted and measures performance of the smallest companies in the Russell 1000 Index, which represent a modest amount of the Russell 1000 Index’s total market capitalization.

2. Source: Morningstar.

The indexes are unmanaged and include reinvested dividends. They do not reflect any fees, expenses or sales charges. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI).

The SOI begins on page 57.

| | | | |

| | | |

22 | | Semiannual Report | | franklintempleton.com |

FRANKLIN SMALL-MID CAP GROWTH FUND

sector and stock selection in the financials and consumer discretionary sectors.

In materials, our investment in Ingevity, a manufacturer of specialty chemicals and carbon materials, benefited relative results.3 In financials, MarketAxess Holdings, an electronic trading platform operator, aided relative returns.

In the consumer discretionary sector, notable contributors included apparel and home product retailer Burlington Stores, education services provider Grand Canyon Education and fantasy sports company DraftKings3. Burlington Stores reported better-than-expected earnings for the first and second quarters of 2018 and raised its earnings guidance for full-year 2018. The company continued to show improved productivity, merchandise margin expansion and store growth opportunities.

Other key individual contributors included system-level semiconductor solutions developer Integrated Device Technology4 and medical device manufacturer DexCom. Integrated Device Technology reported better-than-expected second-quarter 2018 earnings results and raised its full-year 2018 guidance. Further boosting its shares was an agreement to be acquired by Japanese semiconductor company Renesas Electronics (not a Fund holding). DexCom reported better-than-expected sales for the first and second quarters of 2018, driven by strong international sales growth, and company management raised its 2018 sales guidance. Furthermore, management indicated that the early adoption of the recently launched G6 continuous glucose monitoring (CGM) system represented a broadening of its user base into individuals who had been waiting for a CGM system that did not require finger stick calibration measurements.

In contrast, key detractors from the Fund’s relative performance included stock selection in the information technology (IT), energy and real estate sectors.

Within IT, notable detractors included education technology company 2U, software solutions firm Red Hat4 and semiconductor products manufacturer Microchip Technology. 2U’s shares reached an all-time high in mid-May after the company reported better-than-expected first-quarter 2018 results and raised its revenue guidance for full-year 2018. However, its shares were pressured by an analyst report that raised investor concerns about the company’s competition. Nonetheless, the company reported strong second-quarter

Top 10 Holdings

10/31/18

| | |

Company

Sector/Industry | | % of Total

Net Assets |

| |

Roper Technologies Inc.

Industrials | | 2.7% |

| |

Edwards Lifesciences Corp.

Health Care | | 2.1% |

| |

ServiceNow Inc.

Information Technology | | 2.1% |

| |

GoDaddy Inc.

Information Technology | | 1.9% |

| |

SBA Communications Corp.

Real Estate | | 1.8% |

| |

Ross Stores Inc.

Consumer Discretionary | | 1.7% |

| |

Verisk Analytics Inc.

Industrials | | 1.7% |

| |

Workday Inc.

Information Technology | | 1.7% |

| |

2U Inc.

Information Technology | | 1.6% |

| |

Worldpay Inc.

Information Technology | | 1.5% |

results and again raised its full-year 2018 guidance. Red Hat reported slightly better-than-expected revenue and earnings for its fiscal first quarter (ended May) and reduced its revenue outlook for fiscal-year 2019 (ending in February), citing unfavorable currency exchange rates. Furthermore, the company reported slightly weaker-than-expected revenue for its fiscal second quarter (ended August), due to various reasons, including unfavorable currency exchange rates and increased competition in its middleware business.

In the energy sector, our position in oil and natural gas company Concho Resources hurt relative results.

Other key individual detractors from relative performance included holdings in medical devices company Nevro and homebuilder NVR. Nevro’s shares declined due to weaker-than-expected earnings reports and a reduction in 2018 sales guidance.

3. Not part of the index.

4. Not held at period-end.

See www.franklintempletondatasources.com for additional data provider information.

| | | | |

| | | |

| franklintempleton.com | | Semiannual Report | | 23 |

FRANKLIN SMALL-MID CAP GROWTH FUND

Thank you for your continued participation in Franklin Small-Mid Cap Growth Fund. We look forward to serving your future investment needs.

| | |

| |

Edward B. Jamieson Lead Portfolio Manager |

| |

| |  |

| | John P. Scandalios Michael P. McCarthy, CFA James Cross, CFA Portfolio Management Team |

The foregoing information reflects our analysis, opinions and portfolio holdings as of October 31, 2018, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

| | | | |

| | | |

24 | | Semiannual Report | | franklintempleton.com |

FRANKLIN SMALL-MID CAP GROWTH FUND

Performance Summary as of October 31, 2018

The performance table does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses. Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities.

Performance as of 10/31/181

Cumulative total return excludes sales charges. Average annual total return includes maximum sales charges. Sales charges will vary depending on the size of the investment and the class of share purchased. The maximum is 5.50% and the minimum is 0%. Class A: 5.50% maximum initial sales charge; Advisor Class: no sales charges. For other share classes, visit franklintempleton.com.

| | | | |

Share Class | | Cumulative Total Return2 | | Average Annual Total Return3 |

A4 | | | | |

| | |

6-Month | | +0.19% | | -5.32% |

| | |

1-Year | | +4.66% | | -1.10% |

| | |

5-Year | | +45.45% | | +6.57% |

| | |

10-Year | | +236.44% | | +12.26% |

| | |

Advisor | | | | |

| | |

6-Month | | +0.33% | | +0.33% |

| | |

1-Year | | +4.94% | | +4.94% |

| | |

5-Year | | +47.30% | | +8.05% |

| | |

10-Year | | +245.20% | | +13.19% |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

See page 26 for Performance Summary footnotes.

| | | | |

| | | |

| franklintempleton.com | | Semiannual Report | | 25 |

FRANKLIN SMALL-MID CAP GROWTH FUND

PERFORMANCE SUMMARY

Total Annual Operating Expenses5

| | | | | | | | |

Share Class | | With Waiver | | | Without Waiver | |

A | | | 0.93% | | | | 0.95% | |

Advisor | | | 0.68% | | | | 0.70% | |

Each class of shares is available to certain eligible investors and has different annual fees and expenses, as described in the prospectus.

All investments involve risks, including possible loss of principal. Growth stock prices reflect projections of future earnings or revenues, and can, therefore, fall dramatically if the company fails to meet those projections. Smaller, midsized and relatively new or unseasoned companies can be particularly sensitive to changing economic conditions, and their prospects for growth are less certain than those of larger, more established companies. Historically, these securities have experienced more price volatility than larger-company stocks, especially over the short term. To the extent the Fund focuses on particular countries, regions, industries, sectors or types of investment from time to time, it may be subject to greater risks of adverse developments in such areas of focus than a fund that invests in a wider variety of countries, regions, industries, sectors or investments. From time to time, the trading market for a particular security or type of security in which the Fund invests may become less liquid or even illiquid. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

1. The Fund has a fee waiver associated with any investment it makes in a Franklin Templeton money fund and/or other Franklin Templeton fund, contractually guaranteed through 8/31/19. Fund investment results reflect the fee waiver; without this waiver, the results would have been lower.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated. Return for less than one year, if any, has not been annualized.

4. Prior to 9/10/18, these shares were offered at a higher initial sales charge of 5.75%, thus actual returns would have differed. Total returns with sales charges have been restated to reflect the current maximum initial sales charge of 5.50%.

5. Figures are as stated in the Fund’s current prospectus and may differ from the expense ratios disclosed in the Your Fund’s Expenses and Financial Highlights sections in this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

| | | | |

| | | |

26 | | Semiannual Report | | franklintempleton.com |

FRANKLIN SMALL-MID CAP GROWTH FUND

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs: (1) transaction costs, including sales charges (loads) on Fund purchases and redemptions; and (2) ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses. The table below shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses