UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-06247 | |||||||||||||||||||

| AMERICAN CENTURY WORLD MUTUAL FUNDS, INC. | ||||||||||||||||||||

| (Exact name of registrant as specified in charter) | ||||||||||||||||||||

| 4500 MAIN STREET, KANSAS CITY, MISSOURI | 64111 | |||||||||||||||||||

| (Address of principal executive offices) | (Zip Code) | |||||||||||||||||||

| CHARLES A. ETHERINGTON 4500 MAIN STREET, KANSAS CITY, MISSOURI 64111 | ||||||||||||||||||||

| (Name and address of agent for service) | ||||||||||||||||||||

| Registrant’s telephone number, including area code: | 816-531-5575 | |||||||||||||||||||

| Date of fiscal year end: | 11-30 | |||||||||||||||||||

| Date of reporting period: | 11-30-2020 | |||||||||||||||||||

ITEM 1. REPORTS TO STOCKHOLDERS.

(a)

| Annual Report | |||||

| November 30, 2020 | |||||

| Emerging Markets Fund | |||||

| Investor Class (TWMIX) | |||||

| I Class (AMKIX) | |||||

| Y Class (AEYMX) | |||||

| A Class (AEMMX) | |||||

| C Class (ACECX) | |||||

| R Class (AEMRX) | |||||

| R5 Class (AEGMX) | |||||

| R6 Class (AEDMX) | |||||

| Table of Contents | ||

| President’s Letter | |||||

| Performance | |||||

| Portfolio Commentary | |||||

| Fund Characteristics | |||||

| Shareholder Fee Example | |||||

| Schedule of Investments | |||||

| Statement of Assets and Liabilities | |||||

| Statement of Operations | |||||

| Statement of Changes in Net Assets | |||||

| Notes to Financial Statements | |||||

| Financial Highlights | |||||

| Report of Independent Registered Public Accounting Firm | |||||

| Management | |||||

| Approval of Management Agreement | |||||

| Additional Information | |||||

Any opinions expressed in this report reflect those of the author as of the date of the report, and do not necessarily represent the opinions of American Century Investments® or any other person in the American Century Investments organization. Any such opinions are subject to change at any time based upon market or other conditions and American Century Investments disclaims any responsibility to update such opinions. These opinions may not be relied upon as investment advice and, because investment decisions made by American Century Investments funds are based on numerous factors, may not be relied upon as an indication of trading intent on behalf of any American Century Investments fund. Security examples are used for representational purposes only and are not intended as recommendations to purchase or sell securities. Performance information for comparative indices and securities is provided to American Century Investments by third party vendors. To the best of American Century Investments’ knowledge, such information is accurate at the time of printing.

| President’s Letter | ||

Jonathan Thomas

Jonathan ThomasDear Investor:

Thank you for reviewing this annual report for the period ended November 30, 2020. Annual reports help convey important information about fund returns, including market factors that affected performance. For additional investment insights, please visit americancentury.com.

Stocks Recovered from Pandemic-Fueled Sell-Off

In late 2019, broad market sentiment was generally upbeat. Dovish central banks in developed markets, modest inflation, improving economic and corporate earnings data, and progress on U.S.-China trade policy helped boost global growth outlooks. Against this backdrop, riskier assets generally remained in favor.

However, beginning in late February, the COVID-19 outbreak rapidly spread worldwide, halting most economic activity and triggering a deep global recession. Global stocks sold off sharply amid a widespread flight to safety. Quick and aggressive action from the Federal Reserve and other central banks and federal governments helped stabilize and restore confidence in the financial markets. By summer, declining coronavirus infection and death rates in many regions and the reopening of economies were positive influences. By the end of November, most data suggested economies were recovering. But at the same time, COVID-19 infection rates were rising in the U.S. and Europe, prompting new lockdown measures that threatened the economic recovery.

Overall, global stocks overcame the effects of the early 2020 sell-off to deliver solid gains for the 12-month period. Emerging markets stocks rallied and outperformed developed markets stocks, while growth stocks significantly outpaced value stocks worldwide.

Science Helps Steer the Return to Normal

The return to pre-pandemic life will take time and patience, but we are confident we will get there. The first COVID-19 vaccine is now approved and in limited distribution, and medical professionals continue to develop better treatment protocols. Until the vaccine is widely available, investors likely will face periods of outbreak-related disruptions, economic uncertainty and heightened market volatility. These influences can be unsettling, but they tend to be temporary.

We appreciate your confidence in us during these extraordinary times. Our firm has a long history of helping clients weather unpredictable markets, and we’re confident we will continue to meet today’s challenges.

Sincerely,

Jonathan Thomas

President and Chief Executive Officer

American Century Investments

2

| Performance | ||

| Total Returns as of November 30, 2020 | ||||||||||||||||||||

| Average Annual Returns | ||||||||||||||||||||

| Ticker Symbol | 1 year | 5 years | 10 years | Since Inception | Inception Date | |||||||||||||||

| Investor Class | TWMIX | 22.79% | 11.61% | 5.27% | — | 9/30/97 | ||||||||||||||

| MSCI Emerging Markets Index | — | 18.43% | 10.71% | 3.60% | — | — | ||||||||||||||

| I Class | AMKIX | 22.94% | 11.83% | 5.48% | — | 1/28/99 | ||||||||||||||

| Y Class | AEYMX | 23.09% | — | — | 11.42% | 4/10/17 | ||||||||||||||

| A Class | AEMMX | 5/12/99 | ||||||||||||||||||

| No sales charge | 22.50% | 11.32% | 5.02% | — | ||||||||||||||||

| With sales charge | 15.47% | 10.00% | 4.40% | — | ||||||||||||||||

| C Class | ACECX | 21.48% | 10.49% | 4.23% | — | 12/18/01 | ||||||||||||||

| R Class | AEMRX | 22.11% | 11.05% | 4.74% | — | 9/28/07 | ||||||||||||||

| R5 Class | AEGMX | 22.92% | — | — | 11.26% | 4/10/17 | ||||||||||||||

| R6 Class | AEDMX | 23.13% | 11.98% | — | 7.91% | 7/26/13 | ||||||||||||||

Average annual returns since inception are presented when ten years of performance history is not available.

Fund returns would have been lower if a portion of the fees had not been waived.

Sales charges include initial sales charges and contingent deferred sales charges (CDSCs), as applicable. A Class shares have a 5.75% maximum initial sales charge and may be subject to a maximum CDSC of 1.00%. C Class shares redeemed within 12 months of purchase are subject to a maximum CDSC of 1.00%. The SEC requires that mutual funds provide performance information net of maximum sales charges in all cases where charges could be applied.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Total returns for periods less than one year are not annualized. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. For additional information about the fund, please consult the prospectus.

3

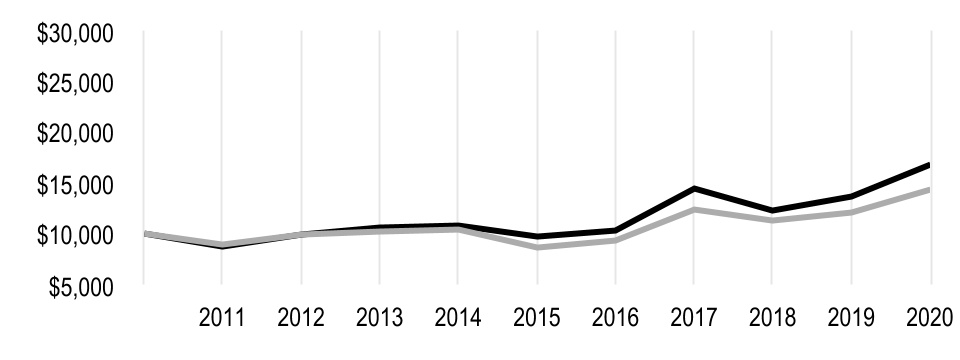

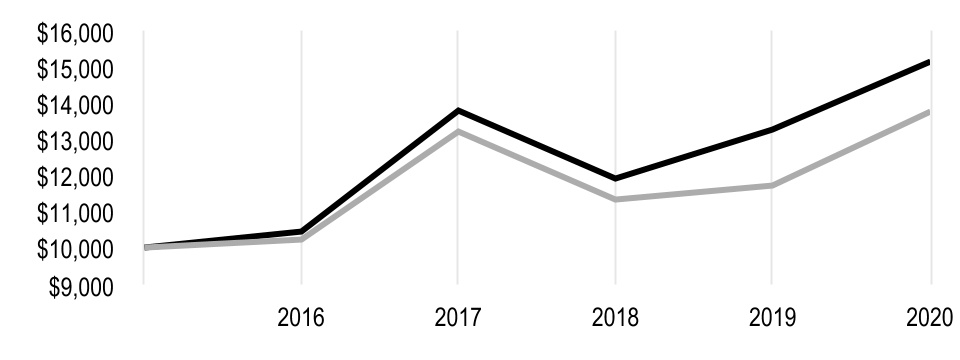

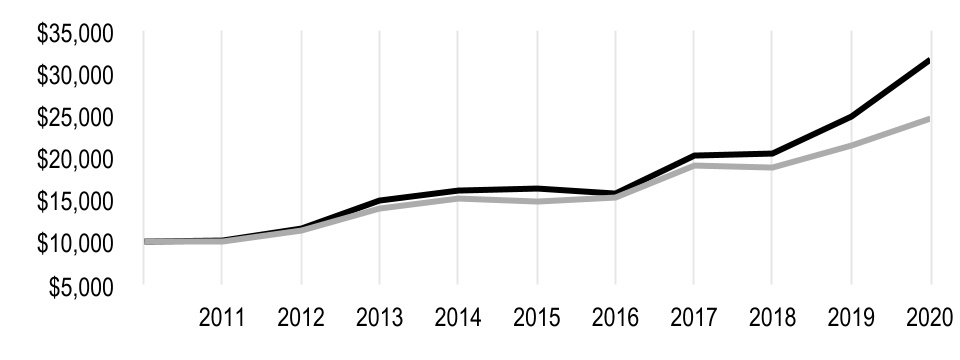

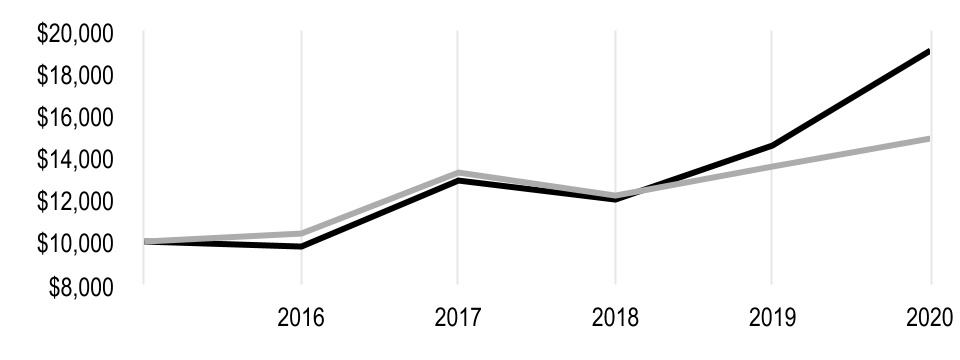

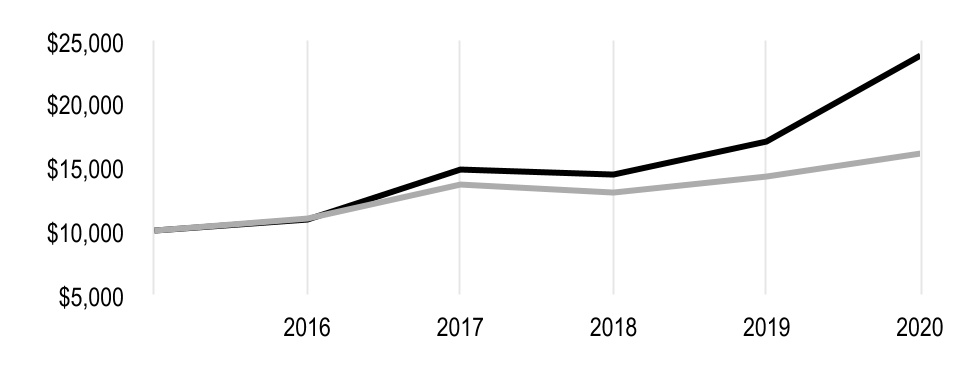

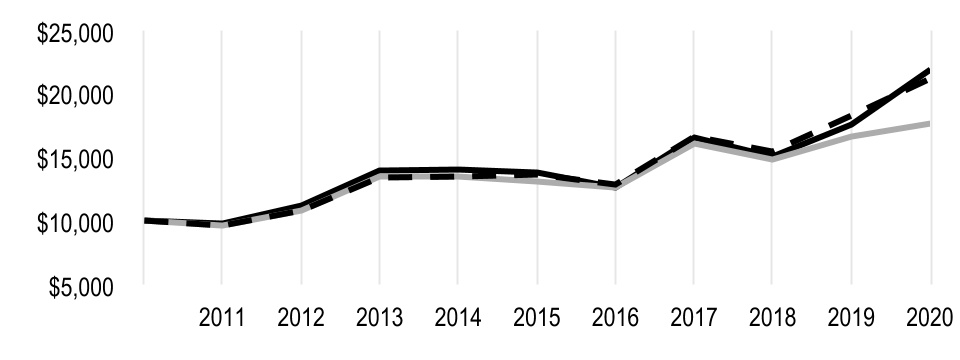

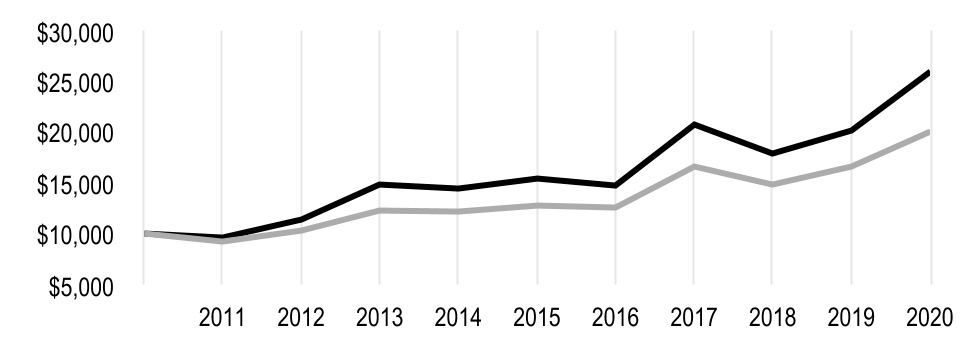

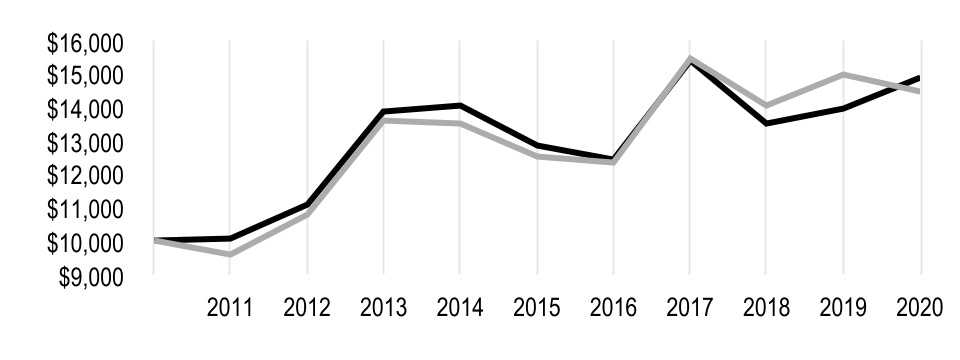

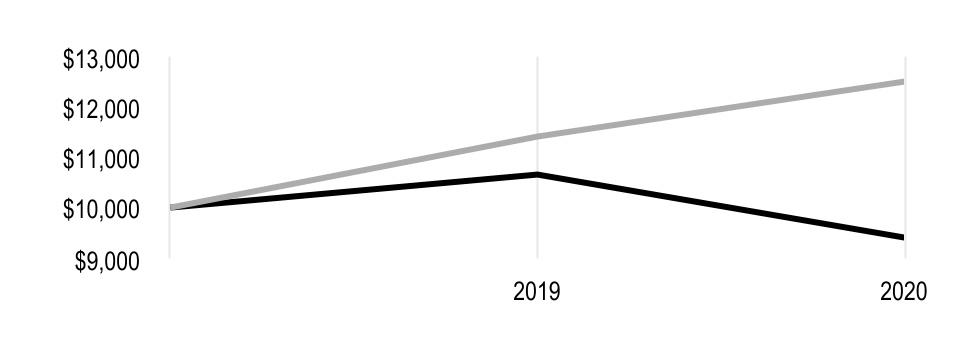

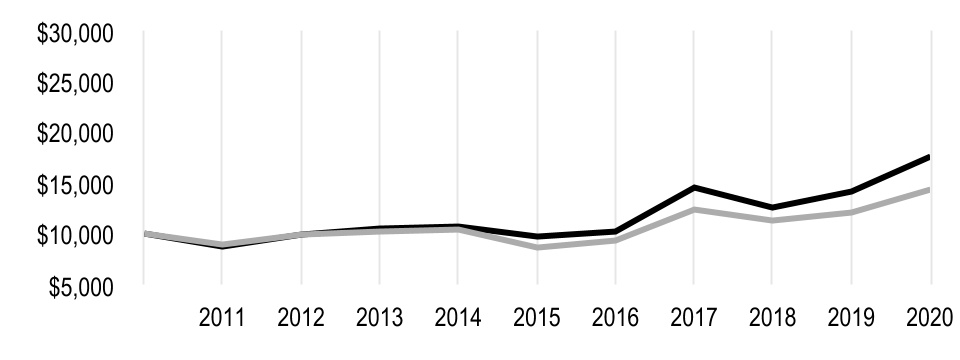

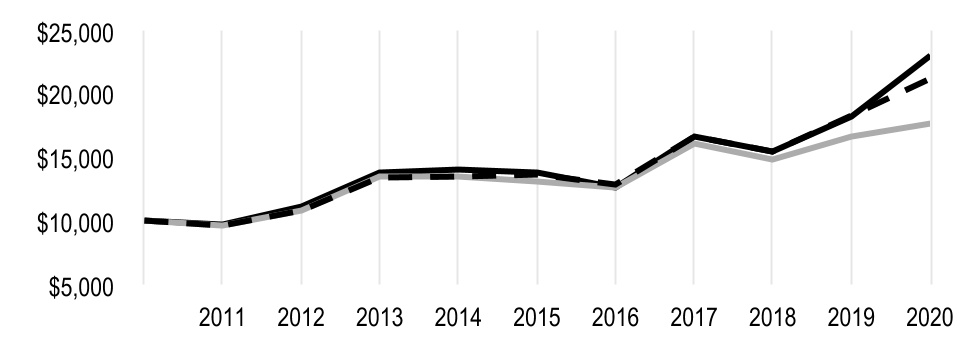

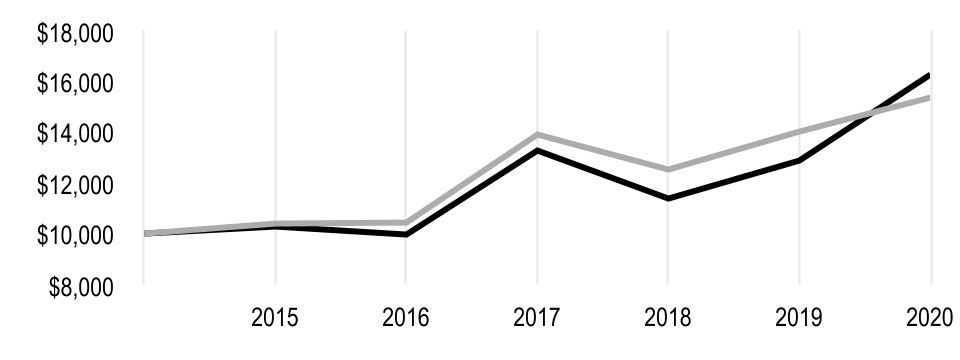

| Growth of $10,000 Over 10 Years | ||

| $10,000 investment made November 30, 2010 | ||

| Performance for other share classes will vary due to differences in fee structure. | ||

| Value on November 30, 2020 | |||||

| Investor Class — $16,722 | |||||

| MSCI Emerging Markets Index — $14,253 | |||||

Ending value of Investor Class would have been lower if a portion of the fees had not been waived.

Total Annual Fund Operating Expenses | |||||||||||||||||||||||

| Investor Class | I Class | Y Class | A Class | C Class | R Class | R5 Class | R6 Class | ||||||||||||||||

| 1.25% | 1.05% | 0.90% | 1.50% | 2.25% | 1.75% | 1.05% | 0.90% | ||||||||||||||||

The total annual fund operating expenses shown is as stated in the fund’s prospectus current as of the date of this report. The prospectus may vary from the expense ratio shown elsewhere in this report because it is based on a different time period, includes acquired fund fees and expenses, and, if applicable, does not include fee waivers or expense reimbursements.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Total returns for periods less than one year are not annualized. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. For additional information about the fund, please consult the prospectus.

4

| Portfolio Commentary | ||

Portfolio Managers: Patricia Ribeiro and Sherwin Soo

Performance Summary

Emerging Markets returned 22.79%* for the 12 months ended November 30, 2020. The fund’s benchmark, the MSCI Emerging Markets Index, returned 18.43% for the same period.

The fund outperformed its benchmark during the period, driven primarily by a combination of an overweight, relative to the benchmark, for most of the year in information technology and positive stock selection in the sector. Stock selection in communication services also added value, along with an underweight to energy. Conversely, stock selection in consumer discretionary had a significant negative relative impact. Regionally, stock selection in China and Malaysia were key drivers of relative outperformance, while stock choices in South Korea weighed on returns.

Information Technology Holdings Contributed

Holdings in the information technology sector were the primary drivers of the fund’s outperformance over the 12-month period. Notable contributors included overweight positions in China-based solar glass manufacturer Xinyi Solar Holdings, China-based data center operator GDS Holdings and Taiwan Semiconductor Manufacturing Co. (TSMC), the world’s largest chipmaker.

Xinyi Solar’s stock price appreciated as the company continued to benefit from rapidly rising prices as supply did not meet a dramatic rise in demand, driving sales volumes higher amid lower costs for raw materials and production. China’s decarbonization efforts to address climate change underpinned Xinyi Solar’s growth. GDS continued to benefit from ongoing digitization efforts by industries in China, supporting strong demand for data centers. The company’s successful capital raise to pursue projects and capacity expansion also bolstered the stock. Shares of TSMC rallied sharply with the expansion of its addressable market. We believe high-performance computing, artificial intelligence and demand for 5G-related technology will likely continue to be key growth drivers for TSMC.

In the communication services sector, another substantial relative contributor, China-based social media and gaming giant Tencent Holdings and Russia-based search engine and online services provider Yandex drove the fund’s outperformance. Tencent’s shares continued to rally amid strong revenue growth and expectations for robust earnings and increased monetization of Tencent’s user base. Reduced social activity bolstered Tencent’s online gaming franchise. We remain constructive on Tencent’s rich game pipeline and multiple revenue streams, including cloud, financial technology and advertisements, amid an ongoing recovery in advertising. Yandex continued to gain market share across multiple businesses, including advertising, ride-sharing, e-commerce and food delivery.

Notable individual contributors included Top Glove, the Malaysia-based rubber glovemaker, and Country Garden Services Holdings, the China-based property service provider. Top Glove’s shares advanced as a surge in demand from COVID-19 drove a severe demand/supply mismatch that supported aggressive price increases. As the pandemic lingers, prices are expected to keep rising as customers continue to scramble for gloves amid the shortage. Country Garden beat earnings estimates, driven by revenue growth in value-added services and improved margins. The company continued to gain market share and enhance efficiencies through cost savings measures.

Consumer Discretionary Sector Detracted

Within consumer discretionary, lack of exposure to several China-based benchmark constituents that performed well during the period weighed on the fund’s relative return. These included food delivery, group buying and consumer review platform Meituan (formerly Meituan Dianping) and

*All fund returns referenced in this commentary are for Investor Class shares. Performance for other share classes will vary due to differences in fee structure; when Investor Class performance exceeds that of the fund’s benchmark, other share classes may not. See page 3 for returns for all share classes.

5

automobile manufacturer NIO. Brazil-based residential real estate firm Cyrela Brazil Realty, a holding classified as a household durables stock, also weighed on returns. Shares declined amid expectations for a prolonged disruption from COVID-19 restrictions, and we exited our position during the first half of 2020.

Health care also weighed on relative results, driven by an underweight to the sector and a position in NMC Health, a U.K.-listed diversified health care and medical services provider in the Middle East, which we exited in May 2020. NMC's shares were impacted by concerns surrounding the company’s financial health, and we exited the position given the lack of visibility.

Outlook

While each of the emerging markets (EM) has responded differently to COVID-19 and may face different challenges, we continue to believe the long-term case for EM stocks remains strong. We believe EM economies will likely benefit from the recovery in global demand and that the extension of highly accommodative monetary policies in prominent global markets will likely continue to push capital flows into EM.

The change in the U.S. administration is likely to reduce uncertainty and lower volatility, given the potential reduction in geopolitical risk that has, at times, weighed on EM equities. In our view, as COVID-19 vaccines roll out, the U.S. is likely to de-escalate tensions with China, which could help improve commodity prices and weaken the U.S. dollar, all positives for EM equities in 2021.

The acceleration of existing trends, aided by the pandemic, continues to drive growth in areas related to information technology. E-commerce and logistics are benefiting amid increasing adoption of online purchasing, including within previously underutilized areas such as groceries. Also, 5G network rollout and the smartphone replacement cycle support growth. We believe COVID-19 may permanently alter consumer behavior, further accelerating these trends.

The information technology (IT) sector remains a prominent overweight for the fund. We are positioned in a variety of businesses, including producers of electric vehicle batteries and solar glass. The consumer discretionary sector also remains an important overweight, particularly education holdings such as China-based TAL Education Group and New Oriental Education & Technology Group.

China continues to be a prominent position in the portfolio. Holdings include positions in IT and the online economy (media, entertainment and e-commerce). We also own names in distance learning and structural growth areas such as the 5G build-out. In our view, IT and communication services will likely continue to benefit from the COVID-19-related structural changes occurring across sectors.

6

| Fund Characteristics | ||

| NOVEMBER 30, 2020 | |||||

Top Ten Holdings | % of net assets | ||||

| Taiwan Semiconductor Manufacturing Co. Ltd. | 8.7% | ||||

| Tencent Holdings Ltd. | 7.4% | ||||

| Alibaba Group Holding Ltd. ADR | 7.0% | ||||

| Samsung Electronics Co. Ltd. | 5.3% | ||||

| Naspers Ltd., N Shares | 2.7% | ||||

| HDFC Bank Ltd. | 2.4% | ||||

| Chailease Holding Co. Ltd. | 1.8% | ||||

| Xinyi Solar Holdings Ltd. | 1.7% | ||||

| Vale SA ADR | 1.7% | ||||

| Yandex NV, A Shares | 1.7% | ||||

Types of Investments in Portfolio | % of net assets | ||||

| Common Stocks | 98.6% | ||||

| Temporary Cash Investments | 1.4% | ||||

| Other Assets and Liabilities | —* | ||||

| *Category is less than 0.05% of total net assets. | |||||

Investments by Country | % of net assets | ||||

| China | 38.5% | ||||

| South Korea | 15.4% | ||||

| Taiwan | 13.7% | ||||

| Brazil | 7.8% | ||||

| India | 7.6% | ||||

| South Africa | 4.0% | ||||

| Russia | 3.2% | ||||

| Mexico | 2.0% | ||||

| Other Countries | 6.4% | ||||

| Cash and Equivalents* | 1.4% | ||||

| *Includes temporary cash investments and other assets and liabilities. | |||||

7

| Shareholder Fee Example | ||

Fund shareholders may incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemption/exchange fees; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in your fund and to compare these costs with the ongoing cost of investing in other mutual funds.

The example is based on an investment of $1,000 made at the beginning of the period and held for the entire period from June 1, 2020 to November 30, 2020.

Actual Expenses

The table provides information about actual account values and actual expenses for each class. You may use the information, together with the amount you invested, to estimate the expenses that you paid over the period. First, identify the share class you own. Then simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

If you hold Investor Class shares of any American Century Investments fund, or I Class shares of the American Century Diversified Bond Fund, in an American Century Investments account (i.e., not through a financial intermediary or employer-sponsored retirement plan account), American Century Investments may charge you a $25.00 annual account maintenance fee if the value of those shares is less than $10,000. We will redeem shares automatically in one of your accounts to pay the $25.00 fee. In determining your total eligible investment amount, we will include your investments in all personal accounts (including American Century Investments brokerage accounts) registered under your Social Security number. Personal accounts include individual accounts, joint accounts, UGMA/UTMA accounts, personal trusts, Coverdell Education Savings Accounts and IRAs (including traditional, Roth, Rollover, SEP-, SARSEP- and SIMPLE-IRAs), and certain other retirement accounts. If you have only business, business retirement, employer-sponsored or American Century Investments brokerage accounts, you are currently not subject to this fee. If you are subject to the account maintenance fee, your account value could be reduced by the fee amount.

Hypothetical Example for Comparison Purposes

The table also provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio of each class of your fund and an assumed rate of return of 5% per year before expenses, which is not the actual return of a fund’s share class. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption/exchange fees. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

8

| Beginning Account Value 6/1/20 | Ending Account Value 11/30/20 | Expenses Paid During Period(1) 6/1/20 - 11/30/20 | Annualized Expense Ratio(1) | |||||||||||

Actual | ||||||||||||||

| Investor Class | $1,000 | $1,340.60 | $7.31 | 1.25% | ||||||||||

| I Class | $1,000 | $1,342.00 | $6.15 | 1.05% | ||||||||||

| Y Class | $1,000 | $1,342.30 | $5.27 | 0.90% | ||||||||||

| A Class | $1,000 | $1,338.40 | $8.77 | 1.50% | ||||||||||

| C Class | $1,000 | $1,333.30 | $13.12 | 2.25% | ||||||||||

| R Class | $1,000 | $1,337.10 | $10.22 | 1.75% | ||||||||||

| R5 Class | $1,000 | $1,341.70 | $6.15 | 1.05% | ||||||||||

| R6 Class | $1,000 | $1,342.90 | $5.27 | 0.90% | ||||||||||

| Hypothetical | ||||||||||||||

| Investor Class | $1,000 | $1,018.75 | $6.31 | 1.25% | ||||||||||

| I Class | $1,000 | $1,019.75 | $5.30 | 1.05% | ||||||||||

| Y Class | $1,000 | $1,020.50 | $4.55 | 0.90% | ||||||||||

| A Class | $1,000 | $1,017.50 | $7.57 | 1.50% | ||||||||||

| C Class | $1,000 | $1,013.75 | $11.33 | 2.25% | ||||||||||

| R Class | $1,000 | $1,016.25 | $8.82 | 1.75% | ||||||||||

| R5 Class | $1,000 | $1,019.75 | $5.30 | 1.05% | ||||||||||

| R6 Class | $1,000 | $1,020.50 | $4.55 | 0.90% | ||||||||||

(1)Expenses are equal to the class's annualized expense ratio listed in the table above, multiplied by the average account value over the period, multiplied by 183, the number of days in the most recent fiscal half-year, divided by 366, to reflect the one-half year period. Annualized expense ratio reflects actual expenses, including any applicable fee waivers or expense reimbursements and excluding any acquired fund fees and expenses.

9

| Schedule of Investments | ||

NOVEMBER 30, 2020

| Shares | Value | |||||||

| COMMON STOCKS — 98.6% | ||||||||

| Argentina — 1.1% | ||||||||

Globant SA(1) | 165,924 | $ | 31,306,540 | |||||

| Brazil — 7.8% | ||||||||

| B3 SA - Brasil Bolsa Balcao | 3,403,200 | 35,655,657 | ||||||

Locaweb Servicos de Internet SA(1) | 1,535,600 | 18,909,085 | ||||||

| Magazine Luiza SA | 7,783,272 | 33,966,644 | ||||||

| Raia Drogasil SA | 4,959,800 | 24,125,954 | ||||||

| TOTVS SA | 3,500,400 | 17,902,520 | ||||||

| Vale SA, ADR | 3,342,195 | 48,662,359 | ||||||

| WEG SA | 3,140,300 | 43,540,054 | ||||||

| 222,762,273 | ||||||||

| China — 38.5% | ||||||||

| A-Living Smart City Services Co., Ltd., H Shares | 4,020,500 | 16,971,976 | ||||||

Alibaba Group Holding Ltd., ADR(1) | 753,185 | 198,358,802 | ||||||

| Anhui Conch Cement Co. Ltd., H Shares | 2,216,000 | 14,129,585 | ||||||

| China Construction Bank Corp., H Shares | 54,801,000 | 42,152,415 | ||||||

| China Education Group Holdings Ltd. | 9,550,000 | 19,062,394 | ||||||

| China Gas Holdings Ltd. | 4,976,000 | 18,142,883 | ||||||

| China Tourism Group Duty Free Corp. Ltd., A Shares | 1,000,917 | 29,427,416 | ||||||

| CIFI Holdings Group Co. Ltd. | 39,800,888 | 34,255,599 | ||||||

| CNOOC Ltd. | 27,739,000 | 27,305,793 | ||||||

| Country Garden Services Holdings Co. Ltd. | 3,568,000 | 20,004,584 | ||||||

GDS Holdings Ltd., ADR(1) | 454,658 | 40,932,860 | ||||||

| Geely Automobile Holdings Ltd. | 9,561,000 | 26,654,849 | ||||||

| Industrial & Commercial Bank of China Ltd., H Shares | 44,372,645 | 27,639,297 | ||||||

JD.com, Inc., ADR(1) | 444,425 | 37,931,674 | ||||||

| Kweichow Moutai Co. Ltd., A Shares | 106,310 | 27,621,047 | ||||||

| Li Ning Co. Ltd. | 3,989,000 | 21,691,719 | ||||||

| Luxshare Precision Industry Co. Ltd., A Shares | 5,157,134 | 40,668,686 | ||||||

New Oriental Education & Technology Group, Inc., ADR(1) | 156,305 | 25,766,879 | ||||||

| Nine Dragons Paper Holdings Ltd. | 12,385,000 | 16,173,733 | ||||||

| Ping An Insurance Group Co. of China Ltd., H Shares | 2,964,500 | 34,724,063 | ||||||

| Sany Heavy Industry Co. Ltd., A Shares | 5,541,380 | 25,839,595 | ||||||

| Shenzhou International Group Holdings Ltd. | 1,057,400 | 17,423,187 | ||||||

TAL Education Group, ADR(1) | 350,808 | 24,577,608 | ||||||

| Tencent Holdings Ltd. | 2,905,400 | 211,486,696 | ||||||

Wuxi Biologics, Inc.(1) | 3,420,000 | 34,006,463 | ||||||

| Xinyi Solar Holdings Ltd. | 27,573,818 | 49,697,628 | ||||||

| Zhongji Innolight Co. Ltd., A Shares | 1,830,938 | 13,642,983 | ||||||

| 1,096,290,414 | ||||||||

| Hungary — 1.2% | ||||||||

OTP Bank Nyrt(1) | 877,810 | 34,715,480 | ||||||

| India — 7.6% | ||||||||

| Asian Paints Ltd. | 876,513 | 26,069,471 | ||||||

| Bajaj Finance Ltd. | 344,554 | 22,607,320 | ||||||

| Bata India Ltd. | 643,473 | 13,656,613 | ||||||

HDFC Bank Ltd.(1) | 3,576,662 | 68,980,383 | ||||||

10

| Shares | Value | |||||||

| Indraprastha Gas Ltd. | 1,844,144 | $ | 12,287,697 | |||||

| Jubilant Foodworks Ltd. | 730,692 | 24,644,384 | ||||||

| Nestle India Ltd. | 94,618 | 22,846,248 | ||||||

| Tata Consultancy Services Ltd. | 684,706 | 24,763,621 | ||||||

| 215,855,737 | ||||||||

| Indonesia — 1.3% | ||||||||

| Bank Rakyat Indonesia Persero Tbk PT | 78,306,200 | 22,593,423 | ||||||

| Telekomunikasi Indonesia Persero Tbk PT | 68,550,900 | 15,687,283 | ||||||

| 38,280,706 | ||||||||

| Malaysia — 0.5% | ||||||||

| Top Glove Corp. Bhd | 8,241,900 | 14,397,363 | ||||||

| Mexico — 2.0% | ||||||||

| Cemex SAB de CV, ADR | 8,697,890 | 40,010,294 | ||||||

| Wal-Mart de Mexico SAB de CV | 6,544,675 | 17,227,729 | ||||||

| 57,238,023 | ||||||||

| Philippines — 0.7% | ||||||||

| Ayala Land, Inc. | 24,231,200 | 19,151,306 | ||||||

| Russia — 3.2% | ||||||||

| Novatek PJSC, GDR | 135,655 | 21,045,055 | ||||||

| Sberbank of Russia PJSC, ADR (London) | 1,761,672 | 23,333,754 | ||||||

Yandex NV, A Shares(1) | 687,615 | 47,417,931 | ||||||

| 91,796,740 | ||||||||

| South Africa — 4.0% | ||||||||

Capitec Bank Holdings Ltd.(1) | 267,034 | 22,299,920 | ||||||

| Kumba Iron Ore Ltd. | 422,312 | 14,309,314 | ||||||

Naspers Ltd., N Shares(2) | 381,741 | 76,870,305 | ||||||

| 113,479,539 | ||||||||

| South Korea — 15.4% | ||||||||

CJ Logistics Corp.(1) | 225,793 | 33,810,263 | ||||||

| Cosmax, Inc. | 130,101 | 11,227,515 | ||||||

| Hotel Shilla Co. Ltd. | 233,909 | 16,954,277 | ||||||

| Hyundai Motor Co. | 229,762 | 37,841,593 | ||||||

| LG Household & Health Care Ltd. | 11,239 | 15,381,676 | ||||||

| Mando Corp. | 661,868 | 29,140,311 | ||||||

| NAVER Corp. | 127,392 | 32,037,739 | ||||||

| Orion Corp./Republic of Korea | 100,714 | 10,862,366 | ||||||

Samsung Biologics Co. Ltd.(1) | 22,476 | 16,098,830 | ||||||

| Samsung Electro-Mechanics Co. Ltd. | 328,476 | 46,449,272 | ||||||

| Samsung Electronics Co. Ltd. | 2,505,813 | 151,377,042 | ||||||

| Samsung SDI Co. Ltd. | 75,726 | 36,600,094 | ||||||

| 437,780,978 | ||||||||

| Taiwan — 13.7% | ||||||||

| ASPEED Technology, Inc. | 324,000 | 16,059,210 | ||||||

| Chailease Holding Co. Ltd. | 9,558,338 | 52,379,605 | ||||||

| Giant Manufacturing Co. Ltd. | 1,372,000 | 13,613,918 | ||||||

| Largan Precision Co. Ltd. | 124,000 | 13,978,478 | ||||||

| Merida Industry Co. Ltd. | 1,979,000 | 17,377,689 | ||||||

| President Chain Store Corp. | 1,338,000 | 12,165,707 | ||||||

| Taiwan Semiconductor Manufacturing Co. Ltd. | 14,708,939 | 248,435,694 | ||||||

| Win Semiconductors Corp. | 1,322,000 | 15,563,402 | ||||||

| 389,573,703 | ||||||||

11

| Shares | Value | |||||||

| Thailand — 0.9% | ||||||||

CP ALL PCL(1) | 6,066,700 | $ | 12,063,269 | |||||

Muangthai Capital PCL(1) | 6,961,000 | 12,329,895 | ||||||

| 24,393,164 | ||||||||

| Turkey — 0.7% | ||||||||

| BIM Birlesik Magazalar AS | 2,106,988 | 18,831,612 | ||||||

TOTAL COMMON STOCKS (Cost $1,872,887,962) | 2,805,853,578 | |||||||

| TEMPORARY CASH INVESTMENTS — 1.4% | ||||||||

| Repurchase Agreement, BMO Capital Markets Corp., (collateralized by various U.S. Treasury obligations, 0.625% - 1.375%, 1/31/25 - 5/15/30, valued at $18,945,160), in a joint trading account at 0.06%, dated 11/30/20, due 12/1/20 (Delivery value $18,556,346) | 18,556,315 | |||||||

| Repurchase Agreement, Fixed Income Clearing Corp., (collateralized by various U.S. Treasury obligations, 0.625%, 4/15/23, valued at $21,282,329), at 0.07%, dated 11/30/20, due 12/1/20 (Delivery value $20,865,041) | 20,865,000 | |||||||

| State Street Institutional U.S. Government Money Market Fund, Premier Class | 980 | 980 | ||||||

TOTAL TEMPORARY CASH INVESTMENTS (Cost $39,422,295) | 39,422,295 | |||||||

TOTAL INVESTMENT SECURITIES — 100.0% (Cost $1,912,310,257) | 2,845,275,873 | |||||||

OTHER ASSETS AND LIABILITIES† | (843,049) | |||||||

| TOTAL NET ASSETS — 100.0% | $ | 2,844,432,824 | ||||||

| MARKET SECTOR DIVERSIFICATION | |||||

(as a % of net assets) | |||||

| Information Technology | 26.9 | % | |||

| Consumer Discretionary | 23.4 | % | |||

| Financials | 14.1 | % | |||

| Communication Services | 10.7 | % | |||

| Consumer Staples | 6.1 | % | |||

| Materials | 5.6 | % | |||

| Industrials | 4.9 | % | |||

| Health Care | 2.3 | % | |||

| Real Estate | 1.9 | % | |||

| Energy | 1.7 | % | |||

| Utilities | 1.0 | % | |||

| Cash and Equivalents* | 1.4 | % | |||

*Includes temporary cash investments and other assets and liabilities.

| NOTES TO SCHEDULE OF INVESTMENTS | ||||||||

| ADR | - | American Depositary Receipt | ||||||

| GDR | - | Global Depositary Receipt | ||||||

†Category is less than 0.05% of total net assets.

(1)Non-income producing.

(2)Security, or a portion thereof, is on loan. At the period end, the aggregate value of securities on loan was $61,496,083. The amount of securities on loan indicated may not correspond with the securities on loan identified because securities with pending sales are in the process of recall from the brokers. At period end, the aggregate value of the collateral held by the fund was $66,868,298, all of which is securities collateral.

See Notes to Financial Statements.

12

| Statement of Assets and Liabilities | ||

| NOVEMBER 30, 2020 | |||||

| Assets | |||||

| Investment securities, at value (cost of $1,912,310,257) — including $61,496,083 of securities on loan | $ | 2,845,275,873 | |||

| Foreign currency holdings, at value (cost of $123,512) | 121,538 | ||||

| Receivable for capital shares sold | 4,135,399 | ||||

| Dividends and interest receivable | 94,085 | ||||

| Securities lending receivable | 1,993 | ||||

| Other assets | 48,544 | ||||

| 2,849,677,432 | |||||

| Liabilities | |||||

| Payable for capital shares redeemed | 1,668,344 | ||||

| Accrued management fees | 2,467,481 | ||||

| Distribution and service fees payable | 43,247 | ||||

| Accrued foreign taxes | 1,065,536 | ||||

| 5,244,608 | |||||

| Net Assets | $ | 2,844,432,824 | |||

| Net Assets Consist of: | |||||

| Capital (par value and paid-in surplus) | $ | 2,286,284,963 | |||

| Distributable earnings | 558,147,861 | ||||

| $ | 2,844,432,824 | ||||

| Net Assets | Shares Outstanding | Net Asset Value Per Share | |||||||||

| Investor Class, $0.01 Par Value | $582,035,803 | 42,736,523 | $13.62 | ||||||||

| I Class, $0.01 Par Value | $1,534,445,154 | 109,823,372 | $13.97 | ||||||||

| Y Class, $0.01 Par Value | $30,169,363 | 2,154,274 | $14.00 | ||||||||

| A Class, $0.01 Par Value | $88,485,440 | 6,740,149 | $13.13* | ||||||||

| C Class, $0.01 Par Value | $27,100,541 | 2,281,467 | $11.88 | ||||||||

| R Class, $0.01 Par Value | $7,465,977 | 566,850 | $13.17 | ||||||||

| R5 Class, $0.01 Par Value | $3,862,952 | 276,274 | $13.98 | ||||||||

| R6 Class, $0.01 Par Value | $570,867,594 | 40,833,321 | $13.98 | ||||||||

*Maximum offering price $13.93 (net asset value divided by 0.9425).

See Notes to Financial Statements.

13

| Statement of Operations | ||

| YEAR ENDED NOVEMBER 30, 2020 | |||||

| Investment Income (Loss) | |||||

| Income: | |||||

| Dividends (net of foreign taxes withheld of $4,675,714) | $ | 38,910,315 | |||

| Securities lending, net | 132,274 | ||||

| Interest | 72,837 | ||||

| 39,115,426 | |||||

| Expenses: | |||||

| Management fees | 26,555,703 | ||||

| Distribution and service fees: | |||||

| A Class | 194,113 | ||||

| C Class | 264,412 | ||||

| R Class | 33,523 | ||||

| Directors' fees and expenses | 77,745 | ||||

| Other expenses | 70,583 | ||||

| 27,196,079 | |||||

| Net investment income (loss) | 11,919,347 | ||||

| Realized and Unrealized Gain (Loss) | |||||

| Net realized gain (loss) on: | |||||

| Investment transactions (net of foreign tax expenses paid (refunded) of $(20,598)) | (74,989,683) | ||||

| Foreign currency translation transactions | (687,389) | ||||

| (75,677,072) | |||||

| Change in net unrealized appreciation (depreciation) on: | |||||

| Investments (includes (increase) decrease in accrued foreign taxes of $(1,065,536)) | 586,986,177 | ||||

| Translation of assets and liabilities in foreign currencies | 49,803 | ||||

| 587,035,980 | |||||

| Net realized and unrealized gain (loss) | 511,358,908 | ||||

| Net Increase (Decrease) in Net Assets Resulting from Operations | $ | 523,278,255 | |||

See Notes to Financial Statements.

14

| Statement of Changes in Net Assets | ||

| YEARS ENDED NOVEMBER 30, 2020 AND NOVEMBER 30, 2019 | ||||||||

| Increase (Decrease) in Net Assets | November 30, 2020 | November 30, 2019 | ||||||

| Operations | ||||||||

| Net investment income (loss) | $ | 11,919,347 | $ | 40,847,232 | ||||

| Net realized gain (loss) | (75,677,072) | (165,576,882) | ||||||

| Change in net unrealized appreciation (depreciation) | 587,035,980 | 371,028,910 | ||||||

| Net increase (decrease) in net assets resulting from operations | 523,278,255 | 246,299,260 | ||||||

| Distributions to Shareholders | ||||||||

| From earnings: | ||||||||

| Investor Class | (8,013,736) | (4,369,482) | ||||||

| I Class | (21,862,436) | (6,026,364) | ||||||

| Y Class | (310,424) | (55,971) | ||||||

| A Class | (874,154) | (149,480) | ||||||

| C Class | (114,160) | — | ||||||

| R Class | (57,761) | — | ||||||

| R5 Class | (44,744) | (18,644) | ||||||

| R6 Class | (8,006,334) | (2,430,490) | ||||||

| Decrease in net assets from distributions | (39,283,749) | (13,050,431) | ||||||

| Capital Share Transactions | ||||||||

| Net increase (decrease) in net assets from capital share transactions (Note 5) | (110,421,098) | 825,809 | ||||||

| Net increase (decrease) in net assets | 373,573,408 | 234,074,638 | ||||||

| Net Assets | ||||||||

| Beginning of period | 2,470,859,416 | 2,236,784,778 | ||||||

| End of period | $ | 2,844,432,824 | $ | 2,470,859,416 | ||||

See Notes to Financial Statements.

15

| Notes to Financial Statements | ||

NOVEMBER 30, 2020

1. Organization

American Century World Mutual Funds, Inc. (the corporation) is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company and is organized as a Maryland corporation. Emerging Markets Fund (the fund) is one fund in a series issued by the corporation. The fund’s investment objective is to seek capital growth.

The fund offers the Investor Class, I Class, Y Class, A Class, C Class, R Class, R5 Class and R6 Class. The A Class may incur an initial sales charge. The A Class and C Class may be subject to a contingent deferred sales charge.

2. Significant Accounting Policies

The following is a summary of significant accounting policies consistently followed by the fund in preparation of its financial statements. The fund is an investment company and follows accounting and reporting guidance in accordance with accounting principles generally accepted in the United States of America. This may require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from these estimates. Management evaluated the impact of events or transactions occurring through the date the financial statements were issued that would merit recognition or disclosure.

Investment Valuations — The fund determines the fair value of its investments and computes its net asset value (NAV) per share at the close of regular trading (usually 4 p.m. Eastern time) on the New York Stock Exchange (NYSE) on each day the NYSE is open. The Board of Directors has adopted valuation policies and procedures to guide the investment advisor in the fund’s investment valuation process and to provide methodologies for the oversight of the fund’s pricing function.

Equity securities that are listed or traded on a domestic securities exchange are valued at the last reported sales price or at the official closing price as provided by the exchange. Equity securities traded on foreign securities exchanges are generally valued at the closing price of such securities on the exchange where primarily traded or at the close of the NYSE, if that is earlier. If no last sales price is reported, or if local convention or regulation so provides, the mean of the latest bid and asked prices may be used. Securities traded over-the-counter are valued at the mean of the latest bid and asked prices, the last sales price, or the official closing price. Equity securities initially expressed in local currencies are translated into U.S. dollars at the mean of the appropriate currency exchange rate at the close of the NYSE as provided by an independent pricing service.

Open-end management investment companies are valued at the reported NAV per share. Repurchase agreements are valued at cost, which approximates fair value.

If the fund determines that the market price for an investment is not readily available or the valuation methods mentioned above do not reflect an investment’s fair value, such investment is valued as determined in good faith by the Board of Directors or its delegate, in accordance with policies and procedures adopted by the Board of Directors. In its determination of fair value, the fund may review several factors including, but not limited to, market information regarding the specific investment or comparable investments and correlation with other investment types, futures indices or general market indicators. Circumstances that may cause the fund to use these procedures to value an investment include, but are not limited to: an investment has been declared in default or is distressed; trading in a security has been suspended during the trading day or a security is not actively trading on its principal exchange; prices received from a regular pricing source are deemed unreliable; or there is a foreign market holiday and no trading occurred.

16

The fund monitors for significant events occurring after the close of an investment’s primary exchange but before the fund’s NAV per share is determined. Significant events may include, but are not limited to: corporate announcements and transactions; governmental action and political unrest that could impact a specific investment or an investment sector; or armed conflicts, natural disasters and similar events that could affect investments in a specific country or region. The fund also monitors for significant fluctuations between domestic and foreign markets, as evidenced by the U.S. market or such other indicators that the Board of Directors, or its delegate, deems appropriate. The fund may apply a model-derived factor to the closing price of equity securities traded on foreign securities exchanges. The factor is based on observable market data as provided by an independent pricing service.

Security Transactions — Security transactions are accounted for as of the trade date. Net realized gains and losses are determined on the identified cost basis, which is also used for federal income tax purposes. Certain countries impose taxes on realized gains on the sale of securities registered in their country. The fund records the foreign tax expense, if any, on an accrual basis. The foreign tax expense on realized gains and unrealized appreciation reduces the net realized gain (loss) on investment transactions and net unrealized appreciation (depreciation) on investments, respectively.

Investment Income — Dividend income less foreign taxes withheld, if any, is recorded as of the ex-dividend date. Distributions received on securities that represent a return of capital or long-term capital gain are recorded as a reduction of cost of investments and/or as a realized gain. The fund may estimate the components of distributions received that may be considered nontaxable distributions or long-term capital gain distributions for income tax purposes. Interest income is recorded on the accrual basis and includes accretion of discounts and amortization of premiums. Securities lending income is net of fees and rebates earned by the lending agent for its services.

Foreign Currency Translations — All assets and liabilities initially expressed in foreign currencies are translated into U.S. dollars at prevailing exchange rates at period end. The fund may enter into spot foreign currency exchange contracts to facilitate transactions denominated in a foreign currency. Purchases and sales of investment securities, dividend and interest income, spot foreign currency exchange contracts, and expenses are translated at the rates of exchange prevailing on the respective dates of such transactions. Net realized and unrealized foreign currency exchange gains or losses related to investment securities are a component of net realized gain (loss) on investment transactions and change in net unrealized appreciation (depreciation) on investments, respectively.

Repurchase Agreements — The fund may enter into repurchase agreements with institutions that American Century Investment Management, Inc. (ACIM) (the investment advisor) has determined are creditworthy pursuant to criteria adopted by the Board of Directors. The fund requires that the collateral, represented by securities, received in a repurchase transaction be transferred to the custodian in a manner sufficient to enable the fund to obtain those securities in the event of a default under the repurchase agreement. ACIM monitors, on a daily basis, the securities transferred to ensure the value, including accrued interest, of the securities under each repurchase agreement is equal to or greater than amounts owed to the fund under each repurchase agreement.

Joint Trading Account — Pursuant to an Exemptive Order issued by the Securities and Exchange Commission, the fund, along with certain other funds in the American Century Investments family of funds, may transfer uninvested cash balances into a joint trading account. These balances are invested in one or more repurchase agreements that are collateralized by U.S. Treasury or Agency obligations.

Segregated Assets — In accordance with the 1940 Act, the fund segregates assets on its books and records to cover certain types of investment securities and other financial instruments. ACIM monitors, on a daily basis, the securities segregated to ensure the fund designates a sufficient amount of liquid assets, marked-to-market daily. The fund may also receive assets or be required to pledge assets at the custodian bank or with a broker for collateral requirements.

Income Tax Status — It is the fund’s policy to distribute substantially all net investment income and net realized gains to shareholders and to otherwise qualify as a regulated investment company under provisions of the Internal Revenue Code. Accordingly, no provision has been made for income taxes. The fund files U.S. federal, state, local and non-U.S. tax returns as applicable. The fund's tax returns are subject to examination by the relevant taxing authority until expiration of the applicable statute of limitations, which is generally three years from the date of filing but can be longer in certain jurisdictions. At this time, management believes there are no uncertain tax positions which, based on their technical merit, would not be sustained upon examination and for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

17

Multiple Class — All shares of the fund represent an equal pro rata interest in the net assets of the class to which such shares belong, and have identical voting, dividend, liquidation and other rights and the same terms and conditions, except for class specific expenses and exclusive rights to vote on matters affecting only individual classes. Income, non-class specific expenses, and realized and unrealized capital gains and losses of the fund are allocated to each class of shares based on their relative net assets.

Distributions to Shareholders — Distributions from net investment income and net realized gains, if any, are generally declared and paid annually. The fund may make distributions on a more frequent basis to comply with the distribution requirements of the Internal Revenue Code, in all events in a manner consistent with provisions of the 1940 Act.

Indemnifications — Under the corporation’s organizational documents, its officers and directors are indemnified against certain liabilities arising out of the performance of their duties to the fund. In addition, in the normal course of business, the fund enters into contracts that provide general indemnifications. The maximum exposure under these arrangements is unknown as this would involve future claims that may be made against a fund. The risk of material loss from such claims is considered by management to be remote.

Securities Lending — Securities are lent to qualified financial institutions and brokers. State Street Bank & Trust Co. serves as securities lending agent to the fund pursuant to a Securities Lending Agreement. The lending of securities exposes the fund to risks such as: the borrowers may fail to return the loaned securities, the borrowers may not be able to provide additional collateral, the fund may experience delays in recovery of the loaned securities or delays in access to collateral, or the fund may experience losses related to the investment collateral. To minimize certain risks, loan counterparties pledge collateral in the form of cash and/or securities. The lending agent has agreed to indemnify the fund in the case of default of any securities borrowed. Cash collateral received is invested in the State Street Navigator Securities Lending Government Money Market Portfolio, a money market mutual fund registered under the 1940 Act. The loans may also be secured by U.S. government securities in an amount at least equal to the market value of the securities loaned, plus accrued interest and dividends, determined on a daily basis and adjusted accordingly. By lending securities, the fund seeks to increase its net investment income through the receipt of interest and fees. Such income is reflected separately within the Statement of Operations. The value of loaned securities and related collateral outstanding at period end, if any, are shown on a gross basis within the Schedule of Investments and Statement of Assets and Liabilities.

3. Fees and Transactions with Related Parties

Certain officers and directors of the corporation are also officers and/or directors of American Century Companies, Inc. (ACC). The corporation’s investment advisor, ACIM, the corporation's distributor, American Century Investment Services, Inc. (ACIS), and the corporation’s transfer agent, American Century Services, LLC, are wholly owned, directly or indirectly, by ACC. Various funds issued by American Century Asset Allocation Portfolios, Inc. own, in aggregate, 6% of the shares of the fund.

Management Fees — The corporation has entered into a management agreement with ACIM, under which ACIM provides the fund with investment advisory and management services in exchange for a single, unified management fee (the fee) per class. The agreement provides that ACIM will pay all expenses of managing and operating the fund, except brokerage expenses, taxes, interest, fees and expenses of the independent directors (including legal counsel fees), extraordinary expenses, and expenses incurred in connection with the provision of shareholder services and distribution services under a plan adopted pursuant to Rule 12b-1 under the 1940 Act. The fee is computed and accrued daily based on each class's daily net assets and paid monthly in arrears. The difference in the fee among the classes is a result of their separate arrangements for non-Rule 12b-1 shareholder services. It is not the result of any difference in advisory or custodial fees or other expenses related to the management of the fund’s assets, which do not vary by class.

The annual management fee for each class is as follows:

| Investor Class | I Class | Y Class | A Class | C Class | R Class | R5 Class | R6 Class | ||||||||||||||||

| 1.25% | 1.05% | 0.90% | 1.25% | 1.25% | 1.25% | 1.05% | 0.90% | ||||||||||||||||

18

Distribution and Service Fees — The Board of Directors has adopted a separate Master Distribution and Individual Shareholder Services Plan for each of the A Class, C Class and R Class (collectively the plans), pursuant to Rule 12b-1 of the 1940 Act. The plans provide that the A Class will pay ACIS an annual distribution and service fee of 0.25%. The plans provide that the C Class will pay ACIS an annual distribution and service fee of 1.00%, of which 0.25% is paid for individual shareholder services and 0.75% is paid for distribution services. The plans provide that the R Class will pay ACIS an annual distribution and service fee of 0.50%. The fees are computed and accrued daily based on each class’s daily net assets and paid monthly in arrears. The fees are used to pay financial intermediaries for distribution and individual shareholder services. Fees incurred under the plans during the period ended November 30, 2020 are detailed in the Statement of Operations.

Directors' Fees and Expenses — The Board of Directors is responsible for overseeing the investment advisor’s management and operations of the fund. The directors receive detailed information about the fund and its investment advisor regularly throughout the year, and meet at least quarterly with management of the investment advisor to review reports about fund operations. The fund’s officers do not receive compensation from the fund.

Interfund Transactions — The fund may enter into security transactions with other American Century Investments funds and other client accounts of the investment advisor, in accordance with the 1940 Act rules and procedures adopted by the Board of Directors. The rules and procedures require, among other things, that these transactions be effected at the independent current market price of the security. During the period, the interfund sales were $175 and there were no interfund purchases. The effect of interfund transactions on the Statement of Operations was $81 in net realized gain (loss) on investment transactions.

4. Investment Transactions

Purchases and sales of investment securities, excluding short-term investments, for the period ended November 30, 2020 were $733,750,339 and $856,530,710, respectively.

19

5. Capital Share Transactions

Transactions in shares of the fund were as follows:

| Year ended November 30, 2020 | Year ended November 30, 2019 | |||||||||||||

| Shares | Amount | Shares | Amount | |||||||||||

| Investor Class/Shares Authorized | 1,100,000,000 | 1,100,000,000 | ||||||||||||

| Sold | 12,495,933 | $ | 134,906,888 | 22,833,790 | $ | 240,540,598 | ||||||||

| Issued in reinvestment of distributions | 722,447 | 7,801,863 | 388,374 | 4,217,739 | ||||||||||

| Redeemed | (24,386,669) | (277,708,979) | (65,606,525) | (711,808,825) | ||||||||||

| (11,168,289) | (135,000,228) | (42,384,361) | (467,050,488) | |||||||||||

| I Class/Shares Authorized | 1,520,000,000 | 1,520,000,000 | ||||||||||||

| Sold | 49,164,195 | 563,271,691 | 78,665,181 | 874,061,540 | ||||||||||

| Issued in reinvestment of distributions | 1,776,798 | 19,811,353 | 474,557 | 5,281,820 | ||||||||||

| Redeemed | (55,821,848) | (622,419,153) | (50,245,387) | (545,284,007) | ||||||||||

| (4,880,855) | (39,336,109) | 28,894,351 | 334,059,353 | |||||||||||

| Y Class/Shares Authorized | 30,000,000 | 30,000,000 | ||||||||||||

| Sold | 1,038,304 | 11,973,089 | 913,667 | 10,139,043 | ||||||||||

| Issued in reinvestment of distributions | 27,351 | 306,119 | 4,968 | 55,447 | ||||||||||

| Redeemed | (173,558) | (1,986,251) | (106,700) | (1,190,387) | ||||||||||

| 892,097 | 10,292,957 | 811,935 | 9,004,103 | |||||||||||

| A Class/Shares Authorized | 100,000,000 | 100,000,000 | ||||||||||||

| Sold | 2,676,295 | 29,022,024 | 3,294,887 | 33,939,545 | ||||||||||

| Issued in reinvestment of distributions | 53,746 | 556,804 | 10,533 | 110,381 | ||||||||||

| Redeemed | (3,247,159) | (34,383,970) | (3,456,550) | (35,675,172) | ||||||||||

| (517,118) | (4,805,142) | (151,130) | (1,625,246) | |||||||||||

| C Class/Shares Authorized | 45,000,000 | 45,000,000 | ||||||||||||

| Sold | 192,283 | 2,004,278 | 716,119 | 6,640,072 | ||||||||||

| Issued in reinvestment of distributions | 10,261 | 96,660 | — | — | ||||||||||

| Redeemed | (977,404) | (9,501,689) | (1,227,066) | (11,446,164) | ||||||||||

| (774,860) | (7,400,751) | (510,947) | (4,806,092) | |||||||||||

| R Class/Shares Authorized | 30,000,000 | 30,000,000 | ||||||||||||

| Sold | 257,538 | 2,908,336 | 220,384 | 2,282,049 | ||||||||||

| Issued in reinvestment of distributions | 5,549 | 57,761 | — | — | ||||||||||

| Redeemed | (323,560) | (3,545,976) | (184,311) | (1,924,685) | ||||||||||

| (60,473) | (579,879) | 36,073 | 357,364 | |||||||||||

| R5 Class/Shares Authorized | 30,000,000 | 30,000,000 | ||||||||||||

| Sold | 181,608 | 2,248,341 | 58,405 | 635,522 | ||||||||||

| Issued in reinvestment of distributions | 4,015 | 44,739 | 1,674 | 18,644 | ||||||||||

| Redeemed | (120,565) | (1,477,816) | (280,786) | (3,093,224) | ||||||||||

| 65,058 | 815,264 | (220,707) | (2,439,058) | |||||||||||

| R6 Class/Shares Authorized | 450,000,000 | 450,000,000 | ||||||||||||

| Sold | 17,846,785 | 207,338,285 | 18,822,132 | 206,418,584 | ||||||||||

| Issued in reinvestment of distributions | 690,876 | 7,733,183 | 212,269 | 2,364,675 | ||||||||||

| Redeemed | (12,752,599) | (149,478,678) | (6,804,815) | (75,457,386) | ||||||||||

| 5,785,062 | 65,592,790 | 12,229,586 | 133,325,873 | |||||||||||

| Net increase (decrease) | (10,659,378) | $ | (110,421,098) | (1,295,200) | $ | 825,809 | ||||||||

20

6. Fair Value Measurements

The fund’s investments valuation process is based on several considerations and may use multiple inputs to determine the fair value of the investments held by the fund. In conformity with accounting principles generally accepted in the United States of America, the inputs used to determine a valuation are classified into three broad levels.

•Level 1 valuation inputs consist of unadjusted quoted prices in an active market for identical investments.

•Level 2 valuation inputs consist of direct or indirect observable market data (including quoted prices for comparable investments, evaluations of subsequent market events, interest rates, prepayment speeds, credit risk, etc.). These inputs also consist of quoted prices for identical investments initially expressed in local currencies that are adjusted through translation into U.S. dollars.

•Level 3 valuation inputs consist of unobservable data (including a fund’s own assumptions).

The level classification is based on the lowest level input that is significant to the fair valuation measurement. The valuation inputs are not necessarily an indication of the risks associated with investing in these securities or other financial instruments.

The following is a summary of the level classifications as of period end. The Schedule of Investments provides additional information on the fund’s portfolio holdings.

| Level 1 | Level 2 | Level 3 | |||||||||

| Assets | |||||||||||

| Investment Securities | |||||||||||

| Common Stocks | |||||||||||

| Argentina | $ | 31,306,540 | — | — | |||||||

| Brazil | 48,662,359 | $ | 174,099,914 | — | |||||||

| China | 327,567,823 | 768,722,591 | — | ||||||||

| Mexico | 40,010,294 | 17,227,729 | — | ||||||||

| Russia | 47,417,931 | 44,378,809 | — | ||||||||

| Other Countries | — | 1,306,459,588 | — | ||||||||

| Temporary Cash Investments | 980 | 39,421,315 | — | ||||||||

| $ | 494,965,927 | $ | 2,350,309,946 | — | |||||||

7. Risk Factors

The value of the fund’s shares will go up and down, sometimes rapidly or unpredictably, based on the performance of the securities owned by the fund and other factors generally affecting the securities market. Market risks, including political, regulatory, economic and social developments, can affect the value of the fund’s investments. Natural disasters, public health emergencies, terrorism and other unforeseeable events may lead to increased market volatility and may have adverse long-term effects on world economies and markets generally.

There are certain risks involved in investing in foreign securities. These risks include those resulting from political events (such as civil unrest, national elections and imposition of exchange controls), social and economic events (such as labor strikes and rising inflation), and natural disasters. Securities of foreign issuers may be less liquid and more volatile. Investing in emerging markets or a significant portion of assets in one country or region may accentuate these risks.

21

8. Federal Tax Information

The tax character of distributions paid during the years ended November 30, 2020 and November 30, 2019 were as follows:

| 2020 | 2019 | |||||||

| Distributions Paid From | ||||||||

| Ordinary income | $ | 39,283,749 | $ | 13,050,431 | ||||

| Long-term capital gains | — | — | ||||||

The book-basis character of distributions made during the year from net investment income or net realized gains may differ from their ultimate characterization for federal income tax purposes. These differences reflect the differing character of certain income items and net realized gains and losses for financial statement and tax purposes, and may result in reclassification among certain capital accounts on the financial statements.

As of period end, the federal tax cost of investments and the components of distributable earnings on a tax-basis were as follows:

| Federal tax cost of investments | $ | 1,924,568,076 | |||

| Gross tax appreciation of investments | $ | 975,234,572 | |||

| Gross tax depreciation of investments | (54,526,775) | ||||

| Net tax appreciation (depreciation) of investments | 920,707,797 | ||||

| Net tax appreciation (depreciation) on translation of assets and liabilities in foreign currencies | (1,068,423) | ||||

| Net tax appreciation (depreciation) | $ | 919,639,374 | |||

| Undistributed ordinary income | $ | 22,712,299 | |||

| Accumulated short-term capital losses | $ | (294,244,851) | |||

| Accumulated long-term capital losses | $ | (89,958,961) | |||

The difference between book-basis and tax-basis unrealized appreciation (depreciation) is attributable primarily to the realization to ordinary income for tax purposes of unrealized gains on investments in passive foreign investment companies.

Accumulated capital losses represent net capital loss carryovers that may be used to offset future realized capital gains for federal income tax purposes. The capital loss carryovers may be carried forward for an unlimited period. Future capital loss carryover utilization in any given year may be subject to Internal Revenue Code limitations.

22

| Financial Highlights | ||

| For a Share Outstanding Throughout the Years Ended November 30 (except as noted) | |||||||||||||||||||||||||||||||||||||||||||||||

| Per-Share Data | Ratios and Supplemental Data | ||||||||||||||||||||||||||||||||||||||||||||||

| Income From Investment Operations: | Distributions From: | Ratio to Average Net Assets of: | |||||||||||||||||||||||||||||||||||||||||||||

| Net Asset Value, Beginning of Period | Net Investment Income (Loss)(1) | Net Realized and Unrealized Gain (Loss) | Total From Investment Operations | Net Investment Income | Net Realized Gains | Total Distributions | Net Asset Value, End of Period | Total Return(2) | Operating Expenses | Operating Expenses (before expense waiver) | Net Investment Income (Loss) | Net Investment Income (Loss) (before expense waiver) | Portfolio Turnover Rate | Net Assets, End of Period (in thousands) | |||||||||||||||||||||||||||||||||

| Investor Class | |||||||||||||||||||||||||||||||||||||||||||||||

| 2020 | $11.25 | 0.04 | 2.48 | 2.52 | (0.15) | — | (0.15) | $13.62 | 22.79% | 1.26% | 1.26% | 0.33% | 0.33% | 30% | $582,036 | ||||||||||||||||||||||||||||||||

| 2019 | $10.19 | 0.17 | 0.94 | 1.11 | (0.05) | — | (0.05) | $11.25 | 10.99% | 1.25% | 1.25% | 1.59% | 1.59% | 39% | $606,668 | ||||||||||||||||||||||||||||||||

| 2018 | $12.00 | 0.08 | (1.80) | (1.72) | (0.03) | (0.06) | (0.09) | $10.19 | (14.57)% | 1.18% | 1.29% | 0.71% | 0.60% | 36% | $980,765 | ||||||||||||||||||||||||||||||||

| 2017 | $8.57 | 0.02 | 3.44 | 3.46 | (0.03) | — | (0.03) | $12.00 | 40.46% | 1.18% | 1.50% | 0.19% | (0.13)% | 47% | $883,436 | ||||||||||||||||||||||||||||||||

| 2016 | $8.10 | 0.02 | 0.46 | 0.48 | (0.01) | — | (0.01) | $8.57 | 5.95% | 1.38% | 1.63% | 0.30% | 0.05% | 59% | $470,280 | ||||||||||||||||||||||||||||||||

| I Class | |||||||||||||||||||||||||||||||||||||||||||||||

| 2020 | $11.56 | 0.06 | 2.54 | 2.60 | (0.19) | — | (0.19) | $13.97 | 22.94% | 1.06% | 1.06% | 0.53% | 0.53% | 30% | $1,534,445 | ||||||||||||||||||||||||||||||||

| 2019 | $10.46 | 0.20 | 0.97 | 1.17 | (0.07) | — | (0.07) | $11.56 | 11.20% | 1.05% | 1.05% | 1.79% | 1.79% | 39% | $1,325,801 | ||||||||||||||||||||||||||||||||

| 2018 | $12.32 | 0.11 | (1.85) | (1.74) | (0.06) | (0.06) | (0.12) | $10.46 | (14.35)% | 0.98% | 1.09% | 0.91% | 0.80% | 36% | $897,336 | ||||||||||||||||||||||||||||||||

| 2017 | $8.79 | 0.04 | 3.54 | 3.58 | (0.05) | — | (0.05) | $12.32 | 40.86% | 0.94% | 1.26% | 0.43% | 0.11% | 47% | $505,000 | ||||||||||||||||||||||||||||||||

| 2016 | $8.31 | 0.04 | 0.47 | 0.51 | (0.03) | — | (0.03) | $8.79 | 6.13% | 1.18% | 1.43% | 0.50% | 0.25% | 59% | $37,036 | ||||||||||||||||||||||||||||||||

| Y Class | |||||||||||||||||||||||||||||||||||||||||||||||

| 2020 | $11.60 | 0.08 | 2.54 | 2.62 | (0.22) | — | (0.22) | $14.00 | 23.09% | 0.91% | 0.91% | 0.68% | 0.68% | 30% | $30,169 | ||||||||||||||||||||||||||||||||

| 2019 | $10.49 | 0.26 | 0.94 | 1.20 | (0.09) | — | (0.09) | $11.60 | 11.43% | 0.90% | 0.90% | 1.94% | 1.94% | 39% | $14,638 | ||||||||||||||||||||||||||||||||

| 2018 | $12.34 | 0.08 | (1.81) | (1.73) | (0.06) | (0.06) | (0.12) | $10.49 | (14.23)% | 0.83% | 0.94% | 1.06% | 0.95% | 36% | $4,724 | ||||||||||||||||||||||||||||||||

2017(3) | $9.79 | 0.07 | 2.48 | 2.55 | — | — | — | $12.34 | 26.05% | 0.77%(4) | 1.12%(4) | 0.91%(4) | 0.56%(4) | 47%(5) | $6 | ||||||||||||||||||||||||||||||||

| For a Share Outstanding Throughout the Years Ended November 30 (except as noted) | |||||||||||||||||||||||||||||||||||||||||||||||

| Per-Share Data | Ratios and Supplemental Data | ||||||||||||||||||||||||||||||||||||||||||||||

| Income From Investment Operations: | Distributions From: | Ratio to Average Net Assets of: | |||||||||||||||||||||||||||||||||||||||||||||

| Net Asset Value, Beginning of Period | Net Investment Income (Loss)(1) | Net Realized and Unrealized Gain (Loss) | Total From Investment Operations | Net Investment Income | Net Realized Gains | Total Distributions | Net Asset Value, End of Period | Total Return(2) | Operating Expenses | Operating Expenses (before expense waiver) | Net Investment Income (Loss) | Net Investment Income (Loss) (before expense waiver) | Portfolio Turnover Rate | Net Assets, End of Period (in thousands) | |||||||||||||||||||||||||||||||||

| A Class | |||||||||||||||||||||||||||||||||||||||||||||||

| 2020 | $10.84 | 0.01 | 2.40 | 2.41 | (0.12) | — | (0.12) | $13.13 | 22.50% | 1.51% | 1.51% | 0.08% | 0.08% | 30% | $88,485 | ||||||||||||||||||||||||||||||||

| 2019 | $9.81 | 0.14 | 0.91 | 1.05 | (0.02) | — | (0.02) | $10.84 | 10.71% | 1.50% | 1.50% | 1.34% | 1.34% | 39% | $78,704 | ||||||||||||||||||||||||||||||||

| 2018 | $11.57 | 0.05 | (1.75) | (1.70) | — | (0.06) | (0.06) | $9.81 | (14.80)% | 1.43% | 1.54% | 0.46% | 0.35% | 36% | $72,711 | ||||||||||||||||||||||||||||||||

| 2017 | $8.26 | —(6) | 3.32 | 3.32 | (0.01) | — | (0.01) | $11.57 | 40.16% | 1.43% | 1.75% | (0.06)% | (0.38)% | 47% | $61,586 | ||||||||||||||||||||||||||||||||

| 2016 | $7.82 | 0.01 | 0.43 | 0.44 | — | — | — | $8.26 | 5.63% | 1.63% | 1.88% | 0.05% | (0.20)% | 59% | $37,743 | ||||||||||||||||||||||||||||||||

| C Class | |||||||||||||||||||||||||||||||||||||||||||||||

| 2020 | $9.82 | (0.07) | 2.17 | 2.10 | (0.04) | — | (0.04) | $11.88 | 21.48% | 2.26% | 2.26% | (0.67)% | (0.67)% | 30% | $27,101 | ||||||||||||||||||||||||||||||||

| 2019 | $8.93 | 0.05 | 0.84 | 0.89 | — | — | — | $9.82 | 9.97% | 2.25% | 2.25% | 0.59% | 0.59% | 39% | $30,004 | ||||||||||||||||||||||||||||||||

| 2018 | $10.61 | (0.03) | (1.59) | (1.62) | — | (0.06) | (0.06) | $8.93 | (15.39)% | 2.18% | 2.29% | (0.29)% | (0.40)% | 36% | $31,871 | ||||||||||||||||||||||||||||||||

| 2017 | $7.63 | (0.08) | 3.06 | 2.98 | — | — | — | $10.61 | 39.06% | 2.16% | 2.48% | (0.79)% | (1.11)% | 47% | $24,972 | ||||||||||||||||||||||||||||||||

| 2016 | $7.28 | (0.05) | 0.40 | 0.35 | — | — | — | $7.63 | 4.81% | 2.38% | 2.63% | (0.70)% | (0.95)% | 59% | $5,840 | ||||||||||||||||||||||||||||||||

| R Class | |||||||||||||||||||||||||||||||||||||||||||||||

| 2020 | $10.88 | (0.02) | 2.40 | 2.38 | (0.09) | — | (0.09) | $13.17 | 22.11% | 1.76% | 1.76% | (0.17)% | (0.17)% | 30% | $7,466 | ||||||||||||||||||||||||||||||||

| 2019 | $9.85 | 0.12 | 0.91 | 1.03 | — | — | — | $10.88 | 10.46% | 1.75% | 1.75% | 1.09% | 1.09% | 39% | $6,825 | ||||||||||||||||||||||||||||||||

| 2018 | $11.64 | 0.02 | (1.75) | (1.73) | — | (0.06) | (0.06) | $9.85 | (14.97)% | 1.68% | 1.79% | 0.21% | 0.10% | 36% | $5,825 | ||||||||||||||||||||||||||||||||

| 2017 | $8.33 | (0.02) | 3.33 | 3.31 | — | — | — | $11.64 | 39.74% | 1.68% | 2.00% | (0.31)% | (0.63)% | 47% | $4,811 | ||||||||||||||||||||||||||||||||

| 2016 | $7.90 | (0.02) | 0.45 | 0.43 | — | — | — | $8.33 | 5.44% | 1.88% | 2.13% | (0.20)% | (0.45)% | 59% | $2,340 | ||||||||||||||||||||||||||||||||

| For a Share Outstanding Throughout the Years Ended November 30 (except as noted) | |||||||||||||||||||||||||||||||||||||||||||||||

| Per-Share Data | Ratios and Supplemental Data | ||||||||||||||||||||||||||||||||||||||||||||||

| Income From Investment Operations: | Distributions From: | Ratio to Average Net Assets of: | |||||||||||||||||||||||||||||||||||||||||||||

| Net Asset Value, Beginning of Period | Net Investment Income (Loss)(1) | Net Realized and Unrealized Gain (Loss) | Total From Investment Operations | Net Investment Income | Net Realized Gains | Total Distributions | Net Asset Value, End of Period | Total Return(2) | Operating Expenses | Operating Expenses (before expense waiver) | Net Investment Income (Loss) | Net Investment Income (Loss) (before expense waiver) | Portfolio Turnover Rate | Net Assets, End of Period (in thousands) | |||||||||||||||||||||||||||||||||

| R5 Class | |||||||||||||||||||||||||||||||||||||||||||||||

| 2020 | $11.57 | 0.06 | 2.54 | 2.60 | (0.19) | — | (0.19) | $13.98 | 22.92% | 1.06% | 1.06% | 0.53% | 0.53% | 30% | $3,863 | ||||||||||||||||||||||||||||||||

| 2019 | $10.47 | 0.20 | 0.97 | 1.17 | (0.07) | — | (0.07) | $11.57 | 11.19% | 1.05% | 1.05% | 1.79% | 1.79% | 39% | $2,444 | ||||||||||||||||||||||||||||||||

| 2018 | $12.32 | 0.12 | (1.86) | (1.74) | (0.05) | (0.06) | (0.11) | $10.47 | (14.33)% | 0.98% | 1.09% | 0.91% | 0.80% | 36% | $4,521 | ||||||||||||||||||||||||||||||||

2017(3) | $9.78 | 0.03 | 2.51 | 2.54 | — | — | — | $12.32 | 25.97% | 0.92%(4) | 1.27%(4) | 0.78%(4) | 0.43%(4) | 47%(5) | $46 | ||||||||||||||||||||||||||||||||

| R6 Class | |||||||||||||||||||||||||||||||||||||||||||||||

| 2020 | $11.58 | 0.08 | 2.54 | 2.62 | (0.22) | — | (0.22) | $13.98 | 23.13% | 0.91% | 0.91% | 0.68% | 0.68% | 30% | $570,868 | ||||||||||||||||||||||||||||||||

| 2019 | $10.48 | 0.23 | 0.96 | 1.19 | (0.09) | — | (0.09) | $11.58 | 11.45% | 0.90% | 0.90% | 1.94% | 1.94% | 39% | $405,776 | ||||||||||||||||||||||||||||||||

| 2018 | $12.34 | 0.12 | (1.84) | (1.72) | (0.08) | (0.06) | (0.14) | $10.48 | (14.28)% | 0.83% | 0.94% | 1.06% | 0.95% | 36% | $239,031 | ||||||||||||||||||||||||||||||||

| 2017 | $8.81 | 0.06 | 3.53 | 3.59 | (0.06) | — | (0.06) | $12.34 | 40.98% | 0.83% | 1.15% | 0.54% | 0.22% | 47% | $92,470 | ||||||||||||||||||||||||||||||||

| 2016 | $8.33 | 0.06 | 0.46 | 0.52 | (0.04) | — | (0.04) | $8.81 | 6.27% | 1.03% | 1.28% | 0.65% | 0.40% | 59% | $34,065 | ||||||||||||||||||||||||||||||||

| Notes to Financial Highlights | |||||

(1)Computed using average shares outstanding throughout the period.

(2)Total returns are calculated based on the net asset value of the last business day and do not reflect applicable sales charges, if any. Total returns for periods less than one year are not annualized.

(3)April 10, 2017 (commencement of sale) through November 30, 2017.

(4)Annualized.

(5)Portfolio turnover is calculated at the fund level. Percentage indicated was calculated for the year ended November 30, 2017.

(6)Per share amount was less than $0.005.

See Notes to Financial Statements.

| Report of Independent Registered Public Accounting Firm | ||

To the Shareholders and the Board of Directors of American Century World Mutual Funds, Inc.:

Opinion on the Financial Statements and Financial Highlights

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Emerging Markets Fund (the “Fund”), one of the funds constituting the American Century World Mutual Funds, Inc., as of November 30, 2020, the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, the financial highlights for each of the five years in the period then ended, and the related notes. In our opinion, the financial statements and financial highlights present fairly, in all material respects, the financial position of Emerging Markets Fund of the American Century World Mutual Funds, Inc. as of November 30, 2020, and the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements and financial highlights are the responsibility of the Fund's management. Our responsibility is to express an opinion on the Fund’s financial statements and financial highlights based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements and financial highlights, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements and financial highlights. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements and financial highlights. Our procedures included confirmation of securities owned as of November 30, 2020, by correspondence with the custodian and brokers; when replies were not received from brokers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

DELOITTE & TOUCHE LLP

Kansas City, Missouri

January 19, 2021

We have served as the auditor of one or more American Century investment companies since 1997.

27

| Management | ||

The Board of Directors

The individuals listed below serve as directors of the funds. Each director will continue to serve in this capacity until death, retirement, resignation or removal from office. The board has adopted a mandatory retirement age for directors who are not “interested persons,” as that term is defined in the Investment Company Act (independent directors). Independent directors shall retire by December 31 of the year in which they reach their 75th birthday.

Mr. Thomas is an “interested person” because he currently serves as President and Chief Executive Officer of American Century Companies, Inc. (ACC), the parent company of American Century Investment Management, Inc. (ACIM or the advisor). The other directors (more than three-fourths of the total number) are independent. They are not employees, directors or officers of, and have no financial interest in, ACC or any of its wholly owned, direct or indirect, subsidiaries, including ACIM, American Century Investment Services, Inc. (ACIS) and American Century Services, LLC (ACS), and they do not have any other affiliations, positions or relationships that would cause them to be considered “interested persons” under the Investment Company Act. The directors serve in this capacity for seven (in the case of Jonathan S. Thomas, 16; and Stephen E. Yates, 8) registered investment companies in the American Century Investments family of funds.

The following table presents additional information about the directors. The mailing address for each director is 4500 Main Street, Kansas City, Missouri 64111.

| Name (Year of Birth) | Position(s) Held with Funds | Length of Time Served | Principal Occupation(s) During Past 5 Years | Number of American Century Portfolios Overseen by Director | Other Directorships Held During Past 5 Years | ||||||||||||

| Independent Directors | |||||||||||||||||

| Thomas W. Bunn (1953) | Director | Since 2017 | Retired | 62 | SquareTwo Financial; Barings (formerly Babson Capital Funds Trust) (2013 to 2016) | ||||||||||||

| Chris H. Cheesman (1962) | Director | Since 2019 | Retired. Senior Vice President & Chief Audit Executive, AllianceBernstein (1999 to 2018) | 62 | None | ||||||||||||

| Barry Fink (1955) | Director | Since 2012 (independent since 2016) | Retired | 62 | None | ||||||||||||