UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | | | | | | | | | | | | | | | | | | | |

| Investment Company Act file number | 811-06247 |

| |

| AMERICAN CENTURY WORLD MUTUAL FUNDS, INC. |

| (Exact name of registrant as specified in charter) |

| |

| 4500 MAIN STREET, KANSAS CITY, MISSOURI | 64111 |

| (Address of principal executive offices) | (Zip Code) |

| |

JOHN PAK

4500 MAIN STREET, KANSAS CITY, MISSOURI 64111 |

| (Name and address of agent for service) |

| |

| Registrant’s telephone number, including area code: | 816-531-5575 |

| |

| Date of fiscal year end: | 11-30 |

| |

| Date of reporting period: | 11-30-2022 |

ITEM 1. REPORTS TO STOCKHOLDERS.

(a) Provided under separate cover.

| | | | | |

| |

| Annual Report |

| |

| November 30, 2022 |

| |

| Emerging Markets Fund |

| Investor Class (TWMIX) |

| I Class (AMKIX) |

| Y Class (AEYMX) |

| A Class (AEMMX) |

| C Class (ACECX) |

| R Class (AEMRX) |

| R5 Class (AEGMX) |

| R6 Class (AEDMX) |

| G Class (ACADX) |

| | | | | |

| President’s Letter | |

| Performance | |

| Portfolio Commentary | |

| Fund Characteristics | |

| Shareholder Fee Example | |

| Schedule of Investments | |

| Statement of Assets and Liabilities | |

| Statement of Operations | |

| Statement of Changes in Net Assets | |

| Notes to Financial Statements | |

| Financial Highlights | |

| Report of Independent Registered Public Accounting Firm | |

| Management | |

| Approval of Management Agreement | |

| Proxy Voting Results | |

| |

| Additional Information | |

Any opinions expressed in this report reflect those of the author as of the date of the report, and do not necessarily represent the opinions of American Century Investments® or any other person in the American Century Investments organization. Any such opinions are subject to change at any time based upon market or other conditions and American Century Investments disclaims any responsibility to update such opinions. These opinions may not be relied upon as investment advice and, because investment decisions made by American Century Investments funds are based on numerous factors, may not be relied upon as an indication of trading intent on behalf of any American Century Investments fund. Security examples are used for representational purposes only and are not intended as recommendations to purchase or sell securities. Performance information for comparative indices and securities is provided to American Century Investments by third party vendors. To the best of American Century Investments’ knowledge, such information is accurate at the time of printing.

Jonathan Thomas

Jonathan Thomas

Dear Investor:

Thank you for reviewing this annual report for the period ending November 30, 2022. Annual reports help convey important information about fund returns, including market factors that affected performance. For additional investment insights, please visit americancentury.com.

High Inflation, Rising Rates Fueled Volatility

The global economic and investment backdrops faced several challenges during the 12-month period. Concerns began to surface early in the fiscal year, as central banks finally admitted inflation was entrenched rather than transitory. Investors grew more cautious amid growing expectations for less accommodative monetary policy in the new year.

By early 2022, inflation soared to levels last seen in the early 1980s. Massive fiscal and monetary support unleashed during the pandemic was partly to blame. In addition, escalating energy prices, supply chain breakdowns, labor market shortages and Russia’s invasion of Ukraine further aggravated the inflation backdrop, particularly in Europe.

The Bank of England responded to surging inflation in late 2021 with a 0.15 percentage point rate hike. Policymakers raised rates another 2.75 percentage points through the end of November. The Federal Reserve waited until March 2022 to launch its inflation-fighting campaign, hiking rates 3.75 percentage points by period-end. Meanwhile, the European Central Bank (ECB) held off until July. Facing record-high inflation, the ECB raised rates 2 percentage points through November.

In addition to advancing recession risk, the combination of elevated inflation and hawkish central banks led to losses for most developed and emerging markets stock indices. A late-period rally, triggered by expectations for central banks to slow their pace of tightening, helped stocks recover some earlier losses. Overall, developed markets stocks generally fared better than emerging markets stocks, and the value style generally outpaced the growth style.

Staying Disciplined in Uncertain Times

We expect market volatility to linger as investors navigate a complex environment of high inflation, rising interest rates and economic uncertainty. In addition, Russia’s invasion of Ukraine complicates an increasingly tense geopolitical backdrop and threatens global energy markets. We will continue to monitor this evolving situation and what it broadly means for investors across asset classes.

We appreciate your confidence in us during these extraordinary times. Our firm has a long history of helping clients weather unpredictable markets, and we’re confident we will continue to meet today’s challenges.

Sincerely,

Jonathan Thomas

President and Chief Executive Officer

American Century Investments

| | | | | | | | | | | | | | | | | | | | |

| Total Returns as of November 30, 2022 | | | |

| | | | Average Annual Returns | |

| | Ticker

Symbol | 1 year | 5 years | 10 years | Since

Inception | Inception

Date |

| Investor Class | TWMIX | -25.84% | -2.72% | 2.39% | — | 9/30/97 |

| MSCI Emerging Markets Index | — | -17.43% | -0.42% | 2.06% | — | — |

| I Class | AMKIX | -25.69% | -2.53% | 2.60% | — | 1/28/99 |

| Y Class | AEYMX | -25.60% | -2.39% | — | 1.98% | 4/10/17 |

| A Class | AEMMX | | | | | 5/12/99 |

| No sales charge | | -26.03% | -2.97% | 2.14% | — | |

| With sales charge | | -30.28% | -4.12% | 1.54% | — | |

| C Class | ACECX | -26.56% | -3.69% | 1.38% | — | 12/18/01 |

| R Class | AEMRX | -26.20% | -3.20% | 1.88% | — | 9/28/07 |

| R5 Class | AEGMX | -25.67% | -2.53% | — | 1.84% | 4/10/17 |

| R6 Class | AEDMX | -25.56% | -2.38% | — | 3.00% | 7/26/13 |

| G Class | ACADX | — | — | — | -15.56% | 4/1/22 |

Average annual returns since inception are presented when ten years of performance history is not available. Fund returns would have been lower if a portion of the fees had not been waived.

C Class shares will automatically convert to A Class shares after being held for approximately eight years. C Class average annual returns do not reflect this conversion.

Sales charges include initial sales charges and contingent deferred sales charges (CDSCs), as applicable. A Class shares have a 5.75% maximum initial sales charge and may be subject to a maximum CDSC of 1.00%. C Class shares redeemed within 12 months of purchase are subject to a maximum CDSC of 1.00%. The SEC requires that mutual funds provide performance information net of maximum sales charges in all cases where charges could be applied.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Total returns for periods less than one year are not annualized. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. For additional information about the fund, please consult the prospectus.

| | |

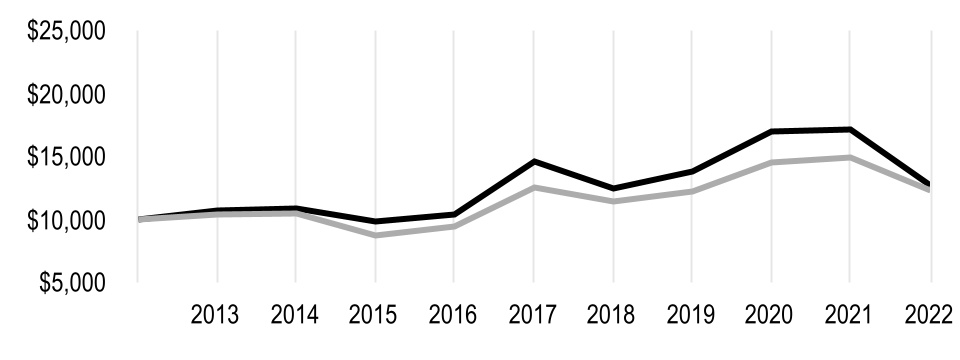

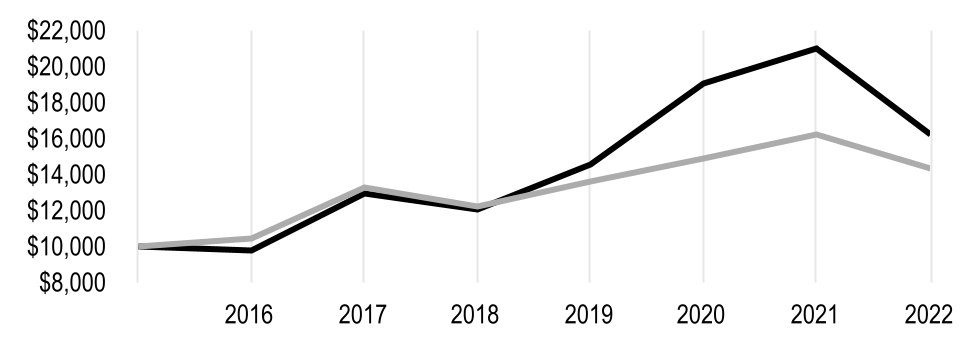

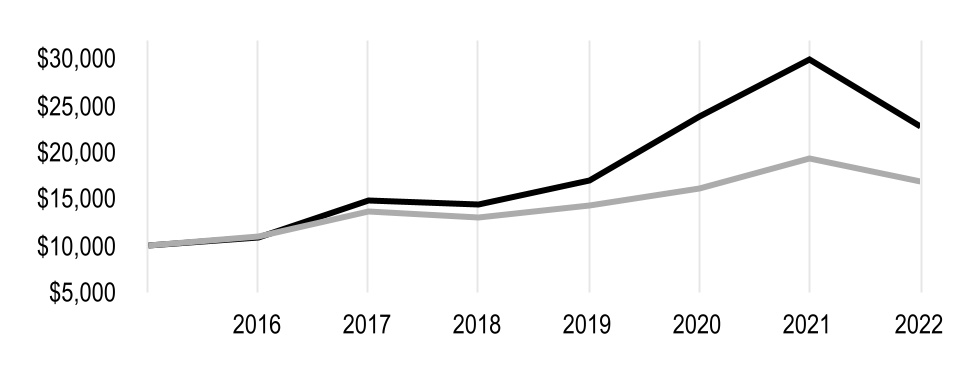

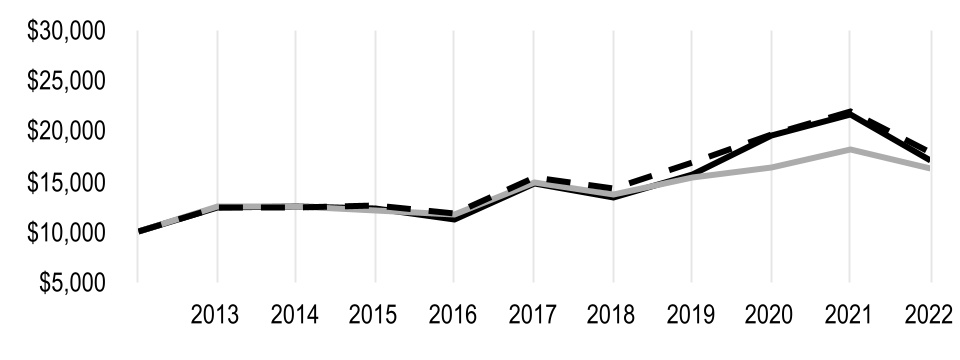

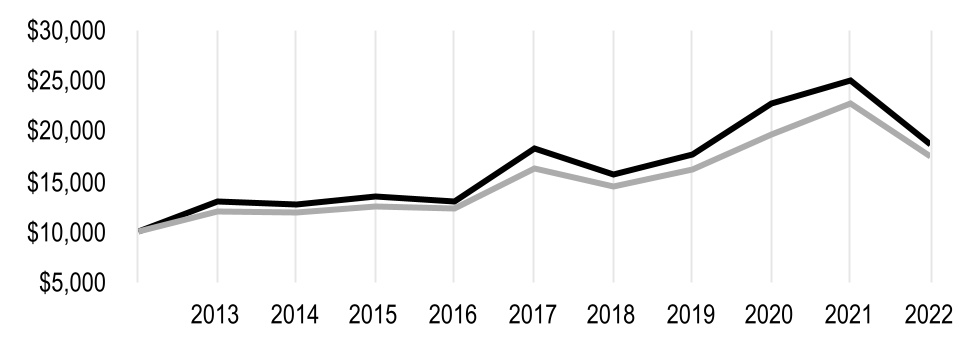

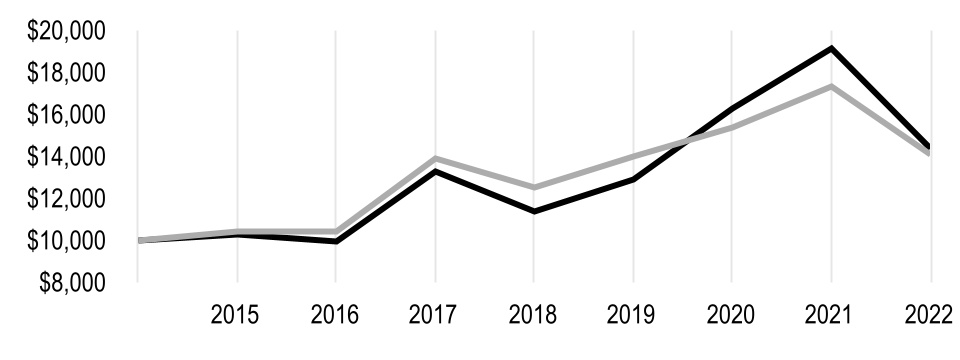

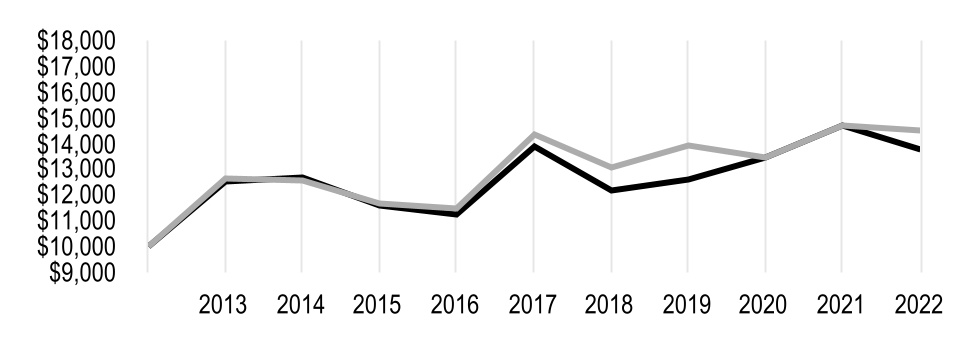

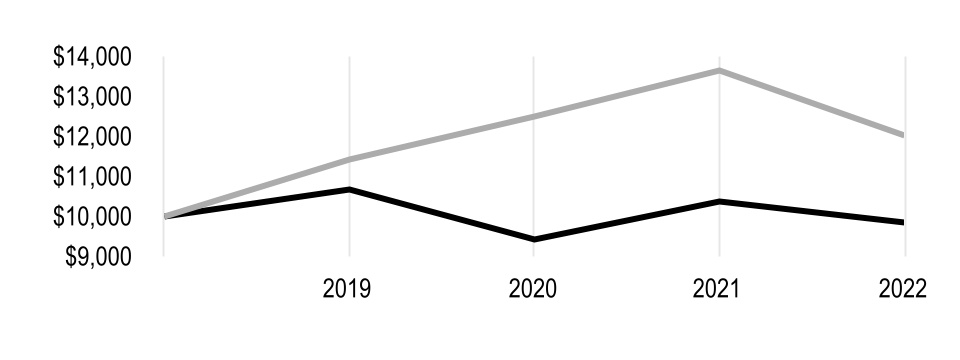

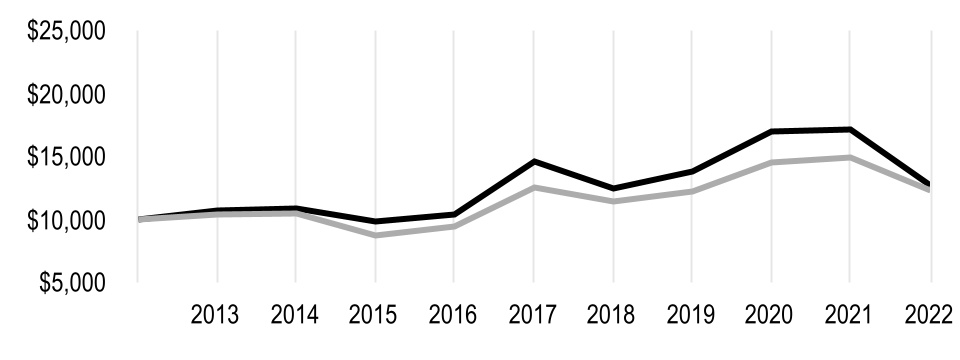

| Growth of $10,000 Over 10 Years |

| $10,000 investment made November 30, 2012 |

| Performance for other share classes will vary due to differences in fee structure. |

| | | | | |

| Value on November 30, 2022 |

| Investor Class — $12,664 |

|

| MSCI Emerging Markets Index — $12,269 |

|

| |

|

Ending value of Investor Class would have been lower if a portion of the fees had not been waived.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Annual Fund Operating Expenses | | | | | |

| Investor Class | I Class | Y Class | A Class | C Class | R Class | R5 Class | R6 Class | G Class |

| 1.25% | 1.05% | 0.90% | 1.50% | 2.25% | 1.75% | 1.05% | 0.90% | 0.90% |

The total annual fund operating expenses shown is as stated in the fund’s prospectus current as of the date of this report. The prospectus may vary from the expense ratio shown elsewhere in this report because it is based on a different time period, includes acquired fund fees and expenses, and, if applicable, does not include fee waivers or expense reimbursements.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Total returns for periods less than one year are not annualized. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. For additional information about the fund, please consult the prospectus.

Portfolio Managers: Patricia Ribeiro and Sherwin Soo

Performance Summary

Emerging Markets returned -25.84%* for the 12 months ended November 30, 2022. The fund’s benchmark, the MSCI Emerging Markets Index, returned -17.43% for the same period.

The fund underperformed its benchmark during the period as investors rotated toward value stocks, which sharply outperformed growth names. Factor returns were dominated by rising interest rates, and the rise in yields weighed on relative performance as value stocks outperformed growth names. Soaring inflation and tighter central bank policy ignited recession fears in many countries, roiling global assets. Macroeconomic and geopolitical uncertainty weighed on emerging markets (EM) stocks as the Russia-Ukraine conflict pressured supply chains and drove high energy and commodities prices. In China, regulatory pressures and COVID-19-induced restrictions weighed on corporate earnings and snarled supply chains.

The continuing rise in value was challenging for our investment approach as a growth manager. From a sector perspective, materials was the largest detractor from relative performance, owing largely to stock selection. Stock selection and an overweight in consumer discretionary also weighed on relative returns, as did stock choices in industrials. Conversely, stock selection in energy added value, aided by currency effect. Regionally, China, India and Taiwan were the key drivers of relative underperformance, owing primarily to stock selection, while Thailand was a notable contributor, due to an overweight allocation and stock choices. An overweight to Mexico and security selection in Malaysia also aided relative performance.

Materials, Consumer Discretionary and Industrials Drove Relative Underperformance

Metals and mining stocks, along with chemicals names, drove detraction within the materials sector. An underweight to mining company Vale, whose shares rose during a period of strong prices for iron ore and other metals, weighed on returns. Ganfeng Lithium Group’s shares declined despite high lithium prices, amid concerns that prices could drop, as well as higher input costs for materials such as spodumene, a mineral source of lithium. In chemicals, shares of the electric vehicle (EV) battery component maker Yunnan Energy New Material declined amid growing concerns over an EV demand slowdown in Europe.

Within consumer discretionary, an overweight to clothing manufacturer Shenzhou International Group Holdings was a notable detractor, weighed down by macroeconomic uncertainty, rising costs and production issues relating to COVID-19 outbreaks and restrictions. Turning to industrials, EV battery maker Contemporary Amperex Technology Co. was a key source of relative weakness, with shares declining amid concerns around potentially slowing demand and the impact of elevated raw materials cost on margins.

Several of the largest individual detractors were based in or heavily exposed to Russia, including natural gas producer and distributor Novatek, search engine/internet services provider Yandex and online banking firm TCS Group Holding. We exited our position in TCS Group Holding. Russian stocks declined sharply as diplomacy weakened, Russia invaded Ukraine and touched off the ongoing war and sanctions from the U.S., European Union and others grew harsher. Lack of exposure to Brazil-based Petroleo Brasileiro also weighed on relative results.

Energy Sector Led Contributors

Stock choices in energy helped relative performance, led by two holdings, petroleum exploration and production company PTT Exploration & Production (PTTEP) and independent oil and gas company Petro Rio. Lack of exposure to Russia-based energy companies Gazprom and LUKOIL

*All fund returns referenced in this commentary are for Investor Class shares. Performance for other share classes will vary due to differences in fee structure; when Investor Class performance exceeds that of the fund’s benchmark, other share classes may not. See page 3 for returns for all share classes.

also contributed as share prices declined sharply. PTTEP benefited from higher global crude oil prices, sanctions on Russia, relatively low inventory levels and post-COVID-19 demand. Petro Rio’s shares advanced sharply amid strong results on the back of higher production, sales growth and lower costs.

Elsewhere, key individual contributors included multiple holdings in the financials sector, particularly overweights to Grupo Financiero Banorte, Bank Rakyat Indonesia Persero and ICICI Bank. Analysts raised earnings estimates and reiterated positive views toward Mexico-based Banorte, whose earnings growth is supported by net interest margin expansion and an improving efficiency ratio. New guidance for 2022, as well as an improved growth outlook for 2023, bolstered by tailwinds from higher interest rates, also supported the stock. Shares of Indonesia-based Bank Rakyat advanced as net interest margins, a key measure of profitability, improved, supported by resilient asset yields, lower funding costs and better asset quality, leading to lower credit costs. India-based ICICI’s earnings were strong amid continued acceleration in loan growth and continued market share gains in retail and small to medium-size business banking. Management said rising interest rates are cyclically beneficial for margins and that they expect higher rates to support margin expansion.

Outlook

After a challenging 2022, EM equities appear ready to turn the corner toward recovery, in our view. Key macroeconomic conditions that weighed heavily on the asset class in 2022 are evolving. The U.S. dollar and U.S. bond yields may have rolled over from cyclical peaks. Also, inflation is at or near peaks in many EM economies. Finally, global supply chain disruptions continue to improve.

Interest rate increases, driven by central banks’ response to surging inflation, weighed heavily on EM stocks in 2022. Led by inflation fears and a determinedly hawkish Federal Reserve (Fed) (with global central banks following suit), elevated yields drove a rotation to value at the expense of growth-oriented, long-duration equities.

On the earnings side, EM earnings-per-share expectations have been cut significantly. It appears much of the recession worries have been priced in. After a sharp cut to consensus estimates, 2022 could mark a bottom for EM earnings, setting the stage for recovery in 2023. This is particularly likely as China reopens. A rebound in Chinese equities, which has already begun due to reopening optimism, is a large driver of the headline EM index upside expected in 2023.

In our view, China’s reopening may occur in fits and starts. China has taken a decisive step toward reopening. The economic and social impact of reopening will likely be volatile over the next few months, but we believe it will likely support a risk recovery over the course of 2023.

Likewise, China’s pro-growth policies align with our expectations. We believe policy will likely support stronger economic growth in 2023. Near-term growth may face some headwinds, but we expect consumption to become a key driver, along with continued support from infrastructure growth and further property market stabilization.

In this environment, we continue to favor stocks that benefit from government policy focus (such as names tied to the green economy and electric vehicles), reopening of the economy and an improving consumer. As COVID-19 restrictions ease—combined with a further uptick of booster vaccinations—we believe services activity and consumption will likely rebound. This should be driven by pent-up consumer demand, employment and income growth and increasing consumer and business confidence.

As we look ahead to 2023, macroeconomic headwinds should begin to fade, in our view. We believe much of the Fed’s heavy lifting is likely done, while China’s recovery will likely continue.

| | | | | |

| NOVEMBER 30, 2022 | |

| Types of Investments in Portfolio | % of net assets |

| Common Stocks | 100.4% |

| Short-Term Investments | 1.2% |

| Other Assets and Liabilities | (1.6)% |

| |

| Top Five Countries | % of net assets |

| China | 30.3% |

| Taiwan | 13.5% |

| India | 11.4% |

| South Korea | 9.2% |

| Brazil | 7.6% |

Fund shareholders may incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemption/exchange fees; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in your fund and to compare these costs with the ongoing cost of investing in other mutual funds.

The example is based on an investment of $1,000 made at the beginning of the period and held for the entire period from June 1, 2022 to November 30, 2022.

Actual Expenses

The table provides information about actual account values and actual expenses for each class. You may use the information, together with the amount you invested, to estimate the expenses that you paid over the period. First, identify the share class you own. Then simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

If you hold Investor Class shares of any American Century Investments mutual fund, or I Class shares of the American Century Diversified Bond Fund, in an American Century Investments account (i.e., not through a financial intermediary or employer-sponsored retirement plan account), American Century Investments may charge you a $25 annual account maintenance fee if the value of those shares is less than $10,000. We will redeem shares automatically in one of your accounts to pay the $25 fee. In determining your total eligible investment amount, we will include your investments in all personal accounts (including American Century Investments brokerage accounts) registered under your Social Security number. Personal accounts include individual accounts, joint accounts, UGMA/UTMA accounts, personal trusts, Coverdell Education Savings Accounts and IRAs (including traditional, Roth, Rollover, SEP-, SARSEP- and SIMPLE-IRAs), and certain other retirement accounts. If you have only business, business retirement, employer-sponsored or American Century Investments brokerage accounts, you are currently not subject to this fee. If you are subject to the account maintenance fee, your account value could be reduced by the fee amount.

Hypothetical Example for Comparison Purposes

The table also provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio of each class of your fund and an assumed rate of return of 5% per year before expenses, which is not the actual return of a fund’s share class. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption/exchange fees. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | |

| Beginning Account Value 6/1/22 | Ending Account Value 11/30/22 | Expenses Paid During Period(1) 6/1/22 - 11/30/22 | Annualized Expense Ratio(1) |

| Actual | | | | |

| Investor Class | $1,000 | $920.30 | $6.07 | 1.26% |

| I Class | $1,000 | $920.50 | $5.10 | 1.06% |

| Y Class | $1,000 | $920.60 | $4.38 | 0.91% |

| A Class | $1,000 | $918.30 | $7.26 | 1.51% |

| C Class | $1,000 | $914.90 | $10.85 | 2.26% |

| R Class | $1,000 | $917.80 | $8.46 | 1.76% |

| R5 Class | $1,000 | $920.50 | $5.10 | 1.06% |

| R6 Class | $1,000 | $921.40 | $4.38 | 0.91% |

| G Class | $1,000 | $926.10 | $0.05 | 0.01% |

| Hypothetical | | | | |

| Investor Class | $1,000 | $1,018.75 | $6.38 | 1.26% |

| I Class | $1,000 | $1,019.75 | $5.37 | 1.06% |

| Y Class | $1,000 | $1,020.51 | $4.61 | 0.91% |

| A Class | $1,000 | $1,017.50 | $7.64 | 1.51% |

| C Class | $1,000 | $1,013.74 | $11.41 | 2.26% |

| R Class | $1,000 | $1,016.24 | $8.90 | 1.76% |

| R5 Class | $1,000 | $1,019.75 | $5.37 | 1.06% |

| R6 Class | $1,000 | $1,020.51 | $4.61 | 0.91% |

| G Class | $1,000 | $1,025.02 | $0.05 | 0.01% |

(1)Expenses are equal to the class's annualized expense ratio listed in the table above, multiplied by the average account value over the period, multiplied by 183, the number of days in the most recent fiscal half-year, divided by 365, to reflect the one-half year period. Annualized expense ratio reflects actual expenses, including any applicable fee waivers or expense reimbursements and excluding any acquired fund fees and expenses.

NOVEMBER 30, 2022

| | | | | | | | |

| Shares | Value |

| COMMON STOCKS — 100.4% | | |

| Brazil — 7.6% | | |

| Banco BTG Pactual SA | 5,580,400 | | $ | 26,991,442 | |

Embraer SA, ADR(1) | 1,545,562 | | 16,413,868 | |

| Hapvida Participacoes e Investimentos SA | 22,565,700 | | 22,394,588 | |

| Itau Unibanco Holding SA, ADR | 3,339,087 | | 16,628,653 | |

Petro Rio SA(1) | 7,518,100 | | 51,937,889 | |

| Sendas Distribuidora SA | 3,810,300 | | 14,457,458 | |

| Suzano SA | 1,619,200 | | 16,487,330 | |

| Vale SA, ADR | 830,073 | | 13,696,205 | |

| WEG SA | 3,737,500 | | 28,009,553 | |

| | 207,016,986 | |

| China — 30.3% | | |

Alibaba Group Holding Ltd., ADR(1) | 947,889 | | 82,997,161 | |

| BYD Co. Ltd., H Shares | 992,500 | | 25,268,834 | |

| China Construction Bank Corp., H Shares | 70,629,000 | | 42,744,662 | |

| China Education Group Holdings Ltd. | 22,865,000 | | 24,460,537 | |

| China State Construction International Holdings Ltd. | 21,134,000 | | 25,519,978 | |

Chinasoft International Ltd.(1) | 22,036,000 | | 19,039,708 | |

| Contemporary Amperex Technology Co. Ltd., A Shares | 215,013 | | 11,940,424 | |

| Country Garden Services Holdings Co. Ltd. | 4,131,000 | | 10,329,449 | |

| ENN Energy Holdings Ltd. | 2,046,800 | | 29,005,312 | |

Ganfeng Lithium Group Co. Ltd., H Shares(2) | 1,967,839 | | 17,413,378 | |

| H World Group Ltd., ADR | 409,415 | | 15,672,406 | |

| Industrial & Commercial Bank of China Ltd., H Shares | 33,521,740 | | 16,801,044 | |

| JD.com, Inc., Class A | 1,889,892 | | 53,952,203 | |

| Kweichow Moutai Co. Ltd., A Shares | 193,110 | | 44,114,878 | |

| Li Ning Co. Ltd. | 2,037,500 | | 16,374,362 | |

Meituan, Class B(1) | 3,508,400 | | 75,630,757 | |

NIO, Inc., ADR(1) | 982,228 | | 12,552,874 | |

| Ping An Insurance Group Co. of China Ltd., H Shares | 3,155,000 | | 19,478,978 | |

Shanghai International Airport Co. Ltd., Class A(1) | 941,400 | | 7,481,586 | |

| Shenzhou International Group Holdings Ltd. | 1,365,600 | | 12,328,787 | |

| Sungrow Power Supply Co. Ltd., A Shares | 1,774,699 | | 29,511,508 | |

| Tencent Holdings Ltd. | 3,658,800 | | 138,362,255 | |

Trip.com Group Ltd.(1) | 881,300 | | 27,891,489 | |

Wuxi Biologics Cayman, Inc.(1) | 5,500,500 | | 36,048,796 | |

| Yantai Jereh Oilfield Services Group Co. Ltd., A Shares | 5,172,929 | | 23,154,463 | |

| Yunnan Energy New Material Co. Ltd., A Shares | 568,434 | | 10,160,491 | |

| | 828,236,320 | |

| India — 11.4% | | |

| Bata India Ltd. | 864,794 | | 18,313,796 | |

| HDFC Bank Ltd. | 3,465,493 | | 68,731,188 | |

| Hindalco Industries Ltd. | 2,844,614 | | 15,958,493 | |

| ICICI Bank Ltd., ADR | 2,492,524 | | 59,122,669 | |

Infosys Ltd., ADR(2) | 1,302,082 | | 26,497,369 | |

| Reliance Industries Ltd. | 2,093,229 | | 70,410,991 | |

| Sun Pharmaceutical Industries Ltd. | 3,164,837 | | 40,810,848 | |

| | | | | | | | |

| Shares | Value |

| Tata Consultancy Services Ltd. | 292,382 | | $ | 12,278,721 | |

| | 312,124,075 | |

| Indonesia — 2.7% | | |

| Bank Rakyat Indonesia Persero Tbk PT | 152,825,200 | | 48,615,657 | |

| Telkom Indonesia Persero Tbk PT | 103,053,400 | | 26,585,173 | |

| | 75,200,830 | |

| Malaysia — 2.0% | | |

| CIMB Group Holdings Bhd | 42,081,909 | | 55,042,863 | |

| Mexico — 5.1% | | |

| America Movil SAB de CV, Class L, ADR | 1,835,069 | | 35,710,443 | |

| Arca Continental SAB de CV | 1,980,354 | | 16,484,132 | |

| Grupo Financiero Banorte SAB de CV, Class O | 6,484,983 | | 52,047,249 | |

Sitios Latinoamerica SAB de CV(1) | 1,835,069 | | 817,953 | |

| Wal-Mart de Mexico SAB de CV | 8,378,293 | | 33,111,063 | |

| | 138,170,840 | |

| Peru — 1.0% | | |

| Credicorp Ltd. | 177,378 | | 27,236,392 | |

| Philippines — 0.6% | | |

| Ayala Land, Inc. | 31,019,980 | | 17,542,962 | |

Russia(3)† | | |

| Magnit PJSC | 267,484 | | — | |

| Novatek PJSC, GDR | 1,100,400 | | 2 | |

Yandex NV, A Shares(1) | 456,739 | | 46 | |

| | 48 | |

| Saudi Arabia — 3.7% | | |

Al Rajhi Bank(1) | 2,726,031 | | 58,698,262 | |

| Alinma Bank | 4,664,138 | | 43,174,830 | |

| | 101,873,092 | |

| South Africa — 5.2% | | |

| Capitec Bank Holdings Ltd. | 415,554 | | 49,336,672 | |

| Exxaro Resources Ltd. | 2,140,170 | | 27,993,594 | |

| Naspers Ltd., N Shares | 236,082 | | 36,182,897 | |

| Shoprite Holdings Ltd. | 1,962,927 | | 28,893,454 | |

| | 142,406,617 | |

| South Korea — 9.2% | | |

Ecopro BM Co. Ltd.(2) | 490,604 | | 43,472,028 | |

| Hyundai Motor Co. | 138,029 | | 17,982,523 | |

| Iljin Materials Co. Ltd. | 36,796 | | 1,764,660 | |

Samsung Biologics Co. Ltd.(1) | 93,707 | | 63,733,694 | |

| Samsung Electronics Co. Ltd. | 1,536,349 | | 73,819,959 | |

| Samsung SDI Co. Ltd. | 88,988 | | 50,236,214 | |

| | 251,009,078 | |

| Taiwan — 13.5% | | |

| Chailease Holding Co. Ltd. | 8,449,836 | | 55,772,150 | |

| Delta Electronics, Inc. | 2,771,000 | | 27,401,617 | |

| E Ink Holdings, Inc. | 5,435,000 | | 32,588,937 | |

| E.Sun Financial Holding Co. Ltd. | 17,662,617 | | 14,269,777 | |

| Far EasTone Telecommunications Co. Ltd. | 7,120,000 | | 15,721,512 | |

| Taiwan Semiconductor Manufacturing Co. Ltd. | 13,928,713 | | 223,693,026 | |

| | 369,447,019 | |

| Thailand — 5.1% | | |

| Central Pattana PCL | 8,316,900 | | 17,205,492 | |

| | | | | | | | |

| Shares | Value |

| CP ALL PCL | 22,424,200 | | $ | 41,517,044 | |

| Kasikornbank PCL | 7,382,900 | | 30,403,463 | |

| PTT Exploration & Production PCL | 9,499,900 | | 49,749,859 | |

| | 138,875,858 | |

| Turkey — 0.9% | | |

| BIM Birlesik Magazalar AS | 3,408,403 | | 24,715,803 | |

| United Arab Emirates — 1.3% | | |

| Emaar Properties PJSC | 21,311,883 | | 35,433,322 | |

| United States — 0.8% | | |

MercadoLibre, Inc.(1) | 24,130 | | 22,464,668 | |

TOTAL COMMON STOCKS (Cost $2,625,753,160) | | 2,746,796,773 | |

| SHORT-TERM INVESTMENTS — 1.2% | | |

| Money Market Funds — 1.2% | | |

State Street Navigator Securities Lending Government Money Market Portfolio(4) | 33,975,400 | | 33,975,400 | |

Repurchase Agreements† | | |

| BMO Capital Markets Corp., (collateralized by various U.S. Treasury obligations, 2.00% - 3.375%, 2/15/25 - 5/15/51, valued at $39,852), in a joint trading account at 3.74%, dated 11/30/22, due 12/1/22 (Delivery value $39,111) | | 39,107 | |

| Fixed Income Clearing Corp., (collateralized by various U.S. Treasury obligations, 1.125%, 2/15/31, valued at $114,272), at 3.77%, dated 11/30/22, due 12/1/22 (Delivery value $112,012) | | 112,000 | |

| | 151,107 | |

TOTAL SHORT-TERM INVESTMENTS (Cost $34,126,507) | | 34,126,507 | |

TOTAL INVESTMENT SECURITIES—101.6% (Cost $2,659,879,667) | | 2,780,923,280 | |

| OTHER ASSETS AND LIABILITIES — (1.6)% | | (44,720,776) | |

| TOTAL NET ASSETS — 100.0% | | $ | 2,736,202,504 | |

| | | | | |

| MARKET SECTOR DIVERSIFICATION |

| (as a % of net assets) | |

| Financials | 24.9% |

| Information Technology | 17.1% |

| Consumer Discretionary | 16.2% |

| Energy | 8.1% |

| Communication Services | 8.0% |

| Consumer Staples | 7.5% |

| Industrials | 5.9% |

| Health Care | 5.9% |

| Real Estate | 3.0% |

| Materials | 2.7% |

| Utilities | 1.1% |

| Short-Term Investments | 1.2% |

| Other Assets and Liabilities | (1.6)% |

| | | | | | | | |

| NOTES TO SCHEDULE OF INVESTMENTS |

| ADR | - | American Depositary Receipt |

| GDR | - | Global Depositary Receipt |

†Category is less than 0.05% of total net assets.

(1)Non-income producing.

(2)Security, or a portion thereof, is on loan. At the period end, the aggregate value of securities on loan was $42,844,492. The amount of securities on loan indicated may not correspond with the securities on loan identified because securities with pending sales are in the process of recall from the brokers.

(3)Securities may be subject to resale, redemption or transferability restrictions.

(4)Investment of cash collateral from securities on loan. At the period end, the aggregate value of the collateral held by the fund was $44,105,978, which includes security collateral of $10,130,578.

See Notes to Financial Statements.

| | |

| Statement of Assets and Liabilities |

| | | | | |

| NOVEMBER 30, 2022 | |

| Assets | |

| Investment securities, at value (cost of $2,625,904,267) — including $42,844,492 of securities on loan | $ | 2,746,947,880 | |

| Investment made with cash collateral received for securities on loan, at value (cost of $33,975,400) | 33,975,400 | |

| Total investment securities, at value (cost of $2,659,879,667) | 2,780,923,280 | |

| Foreign currency holdings, at value (cost of $429,010) | 428,132 | |

| Receivable for investments sold | 2,979,901 | |

| Receivable for capital shares sold | 1,126,160 | |

| Dividends and interest receivable | 92,650 | |

| Securities lending receivable | 36,555 | |

| Other assets | 55,986 | |

| 2,785,642,664 | |

| |

| Liabilities | |

| Disbursements in excess of demand deposit cash | 838 | |

| Payable for collateral received for securities on loan | 33,975,400 | |

| Payable for capital shares redeemed | 10,507,317 | |

| Accrued management fees | 1,630,672 | |

| Distribution and service fees payable | 23,490 | |

| Accrued foreign taxes | 3,284,383 | |

| Accrued other expenses | 18,060 | |

| 49,440,160 | |

| |

| Net Assets | $ | 2,736,202,504 | |

| |

| Net Assets Consist of: | |

| Capital (par value and paid-in surplus) | $ | 3,166,315,902 | |

| Distributable earnings | (430,113,398) | |

| $ | 2,736,202,504 | |

| | | | | | | | | | | |

| Net Assets | Shares Outstanding | Net Asset Value Per Share* |

| Investor Class, $0.01 Par Value | $368,506,244 | 36,712,475 | $10.04 |

| I Class, $0.01 Par Value | $828,882,907 | 80,453,566 | $10.30 |

| Y Class, $0.01 Par Value | $37,908,710 | 3,671,649 | $10.32 |

| A Class, $0.01 Par Value | $51,434,366 | 5,317,530 | $9.67 |

| C Class, $0.01 Par Value | $13,231,484 | 1,518,756 | $8.71 |

| R Class, $0.01 Par Value | $6,074,587 | 625,782 | $9.71 |

| R5 Class, $0.01 Par Value | $10,725,190 | 1,040,118 | $10.31 |

| R6 Class, $0.01 Par Value | $687,720,305 | 66,713,719 | $10.31 |

| G Class, $0.01 Par Value | $731,718,711 | 70,378,479 | $10.40 |

*Maximum offering price per share was equal to the net asset value per share for all share classes, except Class A, for which the maximum offering price per share was $10.26 (net asset value divided by 0.9425). A contingent deferred sales charge may be imposed on redemptions of Class A and Class C.

See Notes to Financial Statements.

| | | | | |

| YEAR ENDED NOVEMBER 30, 2022 | |

| Investment Income (Loss) | |

| Income: | |

| Dividends (net of foreign taxes withheld of $7,355,806) | $ | 61,758,048 | |

| Securities lending, net | 475,902 | |

| Interest | 181,706 | |

| 62,415,656 | |

| |

| Expenses: | |

| Management fees | 30,515,648 | |

| Distribution and service fees: | |

| A Class | 175,255 | |

| C Class | 179,137 | |

| R Class | 32,001 | |

| Directors' fees and expenses | 81,818 | |

| Other expenses | 107,625 | |

| 31,091,484 | |

| Fees waived - G Class | (3,923,100) | |

| 27,168,384 | |

| |

| Net investment income (loss) | 35,247,272 | |

| |

| Realized and Unrealized Gain (Loss) | |

| Net realized gain (loss) on: | |

| Investment transactions (net of foreign tax expenses paid (refunded) of $45,875) | (306,233,330) | |

| Foreign currency translation transactions | (3,718,077) | |

| (309,951,407) | |

| |

| Change in net unrealized appreciation (depreciation) on: | |

| Investments (includes (increase) decrease in accrued foreign taxes of $2,226,687) | (625,389,031) | |

| Translation of assets and liabilities in foreign currencies | 108,869 | |

| (625,280,162) | |

| |

| Net realized and unrealized gain (loss) | (935,231,569) | |

| |

| Net Increase (Decrease) in Net Assets Resulting from Operations | $ | (899,984,297) | |

See Notes to Financial Statements.

| | |

| Statement of Changes in Net Assets |

| | | | | | | | |

| YEARS ENDED NOVEMBER 30, 2022 AND NOVEMBER 30, 2021 |

| Increase (Decrease) in Net Assets | November 30, 2022 | November 30, 2021 |

| Operations | | |

| Net investment income (loss) | $ | 35,247,272 | | $ | 17,543,192 | |

| Net realized gain (loss) | (309,951,407) | | 143,688,790 | |

| Change in net unrealized appreciation (depreciation) | (625,280,162) | | (167,631,110) | |

| Net increase (decrease) in net assets resulting from operations | (899,984,297) | | (6,399,128) | |

| | |

| Distributions to Shareholders | | |

| From earnings: | | |

| Investor Class | (4,433,245) | | (3,436,076) | |

| I Class | (15,057,238) | | (12,395,337) | |

| Y Class | (535,793) | | (317,596) | |

| A Class | (538,424) | | (298,238) | |

| R Class | (31,292) | | (3,177) | |

| R5 Class | (121,944) | | (30,070) | |

| R6 Class | (9,852,306) | | (6,236,864) | |

| G Class | (24) | | — | |

| Decrease in net assets from distributions | (30,570,266) | | (22,717,358) | |

| | |

| Capital Share Transactions | | |

| Net increase (decrease) in net assets from capital share transactions (Note 5) | 420,922,848 | | 430,517,881 | |

| | |

| Net increase (decrease) in net assets | (509,631,715) | | 401,401,395 | |

| | |

| Net Assets | | |

| Beginning of period | 3,245,834,219 | | 2,844,432,824 | |

| End of period | $ | 2,736,202,504 | | $ | 3,245,834,219 | |

See Notes to Financial Statements.

| | |

| Notes to Financial Statements |

NOVEMBER 30, 2022

1. Organization

American Century World Mutual Funds, Inc. (the corporation) is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company and is organized as a Maryland corporation. Emerging Markets Fund (the fund) is one fund in a series issued by the corporation. The fund’s investment objective is to seek capital growth.

The fund offers the Investor Class, I Class, Y Class, A Class, C Class, R Class, R5 Class, R6 Class and G Class. The A Class may incur an initial sales charge. The A Class and C Class may be subject to a contingent deferred sales charge. Sale of the G Class commenced on April 1, 2022.

2. Significant Accounting Policies

The following is a summary of significant accounting policies consistently followed by the fund in preparation of its financial statements. The fund is an investment company and follows accounting and reporting guidance in accordance with accounting principles generally accepted in the United States of America. This may require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from these estimates. Management evaluated the impact of events or transactions occurring through the date the financial statements were issued that would merit recognition or disclosure.

Investment Valuations — The fund determines the fair value of its investments and computes its net asset value (NAV) per share at the close of regular trading (usually 4 p.m. Eastern time) on the New York Stock Exchange (NYSE) on each day the NYSE is open. The value of investments of the fund is determined by American Century Investment Management, Inc. (ACIM) (the investment advisor), as the valuation designee, pursuant to its valuation policies and procedures. The Board of Directors oversees the valuation designee and reviews its valuation policies and procedures at least annually.

Equity securities that are listed or traded on a domestic securities exchange are valued at the last reported sales price or at the official closing price as provided by the exchange. Equity securities traded on foreign securities exchanges are generally valued at the closing price of such securities on the exchange where primarily traded or at the close of the NYSE, if that is earlier. If no last sales price is reported, or if local convention or regulation so provides, the mean of the latest bid and asked prices may be used. Securities traded over-the-counter are valued at the mean of the latest bid and asked prices, the last sales price, or the official closing price. Equity securities initially expressed in local currencies are translated into U.S. dollars at the mean of the appropriate currency exchange rate at the close of the NYSE as provided by an independent pricing service.

Open-end management investment companies are valued at the reported NAV per share. Repurchase agreements are valued at cost, which approximates fair value.

If the valuation designee determines that the market price for a portfolio security is not readily available or is believed by the valuation designee to be unreliable, such security is valued at fair value as determined in good faith by the valuation designee, in accordance with its policies and procedures. Circumstances that may cause the fund to determine that market quotations are not available or reliable include, but are not limited to: when there is a significant event subsequent to the market quotation; trading in a security has been halted during the trading day; or trading in a security is insufficient or did not take place due to a closure or holiday.

The valuation designee monitors for significant events occurring after the close of an investment’s primary exchange but before the fund’s NAV per share is determined. Significant events may include, but are not limited to: corporate announcements and transactions; regulatory news, governmental action and political unrest that could impact a specific investment or an investment sector; or armed conflicts, natural disasters and similar events that could affect investments in a specific country or region. The valuation designee also monitors for significant fluctuations between domestic and foreign markets, as evidenced by the U.S. market or such other indicators that it deems appropriate. The valuation designee may apply a model-derived factor to the closing price of equity securities traded on foreign securities exchanges. The factor is based on observable market data as provided by an independent pricing service.

Security Transactions — Security transactions are accounted for as of the trade date. Net realized gains and losses are determined on the identified cost basis, which is also used for federal income tax purposes. Certain countries impose taxes on realized gains on the sale of securities registered in their country. The fund records the foreign tax expense, if any, on an accrual basis. The foreign tax expense on realized gains and unrealized appreciation reduces the net realized gain (loss) on investment transactions and net unrealized appreciation (depreciation) on investments, respectively.

Investment Income — Dividend income less foreign taxes withheld, if any, is recorded as of the ex-dividend date. Distributions received on securities that represent a return of capital or long-term capital gain are recorded as a reduction of cost of investments and/or as a realized gain. The fund may estimate the components of distributions received that may be considered nontaxable distributions or long-term capital gain distributions for income tax purposes. Interest income is recorded on the accrual basis and includes accretion of discounts and amortization of premiums. Securities lending income is net of fees and rebates earned by the lending agent for its services.

Foreign Currency Translations — All assets and liabilities initially expressed in foreign currencies are translated into U.S. dollars at prevailing exchange rates at period end. The fund may enter into spot foreign currency exchange contracts to facilitate transactions denominated in a foreign currency. Purchases and sales of investment securities, dividend and interest income, spot foreign currency exchange contracts, and expenses are translated at the rates of exchange prevailing on the respective dates of such transactions. Net realized and unrealized foreign currency exchange gains or losses related to investment securities are a component of net realized gain (loss) on investment transactions and change in net unrealized appreciation (depreciation) on investments, respectively.

Repurchase Agreements — The fund may enter into repurchase agreements with institutions that ACIM has determined are creditworthy pursuant to criteria adopted by the Board of Directors. The fund requires that the collateral, represented by securities, received in a repurchase transaction be transferred to the custodian in a manner sufficient to enable the fund to obtain those securities in the event of a default under the repurchase agreement. ACIM monitors, on a daily basis, the securities transferred to ensure the value, including accrued interest, of the securities under each repurchase agreement is equal to or greater than amounts owed to the fund under each repurchase agreement.

Joint Trading Account — Pursuant to an Exemptive Order issued by the Securities and Exchange Commission, the fund, along with certain other funds in the American Century Investments family of funds, may transfer uninvested cash balances into a joint trading account. These balances are invested in one or more repurchase agreements that are collateralized by U.S. Treasury or Agency obligations.

Segregated Assets — In accordance with the 1940 Act, the fund segregates assets on its books and records to cover certain types of investment securities and other financial instruments. ACIM monitors, on a daily basis, the securities segregated to ensure the fund designates a sufficient amount of liquid assets, marked-to-market daily. The fund may also receive assets or be required to pledge assets at the custodian bank or with a broker for collateral requirements.

Income Tax Status — It is the fund’s policy to distribute substantially all net investment income and net realized gains to shareholders and to otherwise qualify as a regulated investment company under provisions of the Internal Revenue Code. Accordingly, no provision has been made for income taxes. The fund files U.S. federal, state, local and non-U.S. tax returns as applicable. The fund's tax returns are subject to examination by the relevant taxing authority until expiration of the applicable statute of limitations, which is generally three years from the date of filing but can be longer in certain jurisdictions. At this time, management believes there are no uncertain tax positions which, based on their technical merit, would not be sustained upon examination and for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

Multiple Class — All shares of the fund represent an equal pro rata interest in the net assets of the class to which such shares belong, and have identical voting, dividend, liquidation and other rights and the same terms and conditions, except for class specific expenses and exclusive rights to vote on matters affecting only individual classes. Income, non-class specific expenses, and realized and unrealized capital gains and losses of the fund are allocated to each class of shares based on their relative net assets.

Distributions to Shareholders — Distributions from net investment income and net realized gains, if any, are generally declared and paid annually. The fund may make distributions on a more frequent basis to comply with the distribution requirements of the Internal Revenue Code, in all events in a manner consistent with provisions of the 1940 Act.

Indemnifications — Under the corporation’s organizational documents, its officers and directors are indemnified against certain liabilities arising out of the performance of their duties to the fund. In addition, in the normal course of business, the fund enters into contracts that provide general indemnifications. The maximum exposure under these arrangements is unknown as this would involve future claims that may be made against a fund. The risk of material loss from such claims is considered by management to be remote.

Securities Lending — Securities are lent to qualified financial institutions and brokers. State Street Bank & Trust Co. serves as securities lending agent to the fund pursuant to a Securities Lending Agreement. The lending of securities exposes the fund to risks such as: the borrowers may fail to return the loaned securities, the borrowers may not be able to provide additional collateral, the fund may experience delays in recovery of the loaned securities or delays in access to collateral, or the fund may experience losses related to the investment collateral. To minimize certain risks, loan counterparties pledge collateral in the form of cash and/or securities. The lending agent has agreed to indemnify the fund in the case of default of any securities borrowed. Cash collateral received is invested in the State Street Navigator Securities Lending Government Money Market Portfolio, a money market mutual fund registered under the 1940 Act. The loans may also be secured by U.S. government securities in an amount at least equal to the market value of the securities loaned, plus accrued interest and dividends, determined on a daily basis and adjusted accordingly. By lending securities, the fund seeks to increase its net investment income through the receipt of interest and fees. Such income is reflected separately within the Statement of Operations. The value of loaned securities and related collateral outstanding at period end, if any, are shown on a gross basis within the Schedule of Investments and Statement of Assets and Liabilities.

The following table reflects a breakdown of transactions accounted for as secured borrowings, the gross obligation by the type of collateral pledged, and the remaining contractual maturity of those transactions as of November 30, 2022.

| | | | | | | | | | | | | | | | | |

| Remaining Contractual Maturity of Agreements |

| Overnight and Continuous | <30 days | Between 30 & 90 days | >90 days | Total |

Securities Lending Transactions(1) | | | | |

| Common Stocks | $ | 33,975,400 | | — | | — | | — | | $ | 33,975,400 | |

| Gross amount of recognized liabilities for securities lending transactions | $ | 33,975,400 | |

(1)Amount represents the payable for cash collateral received for securities on loan. This will generally be in the Overnight and Continuous column as the securities are typically callable on demand.

3. Fees and Transactions with Related Parties

Certain officers and directors of the corporation are also officers and/or directors of American Century Companies, Inc. (ACC). The corporation’s investment advisor, ACIM, the corporation's distributor, American Century Investment Services, Inc. (ACIS), and the corporation’s transfer agent, American Century Services, LLC, are wholly owned, directly or indirectly, by ACC. Various funds issued by American Century Asset Allocation Portfolios, Inc. own, in aggregate, 17% of the shares of the fund.

Management Fees — The corporation has entered into a management agreement with ACIM, under which ACIM provides the fund with investment advisory and management services in exchange for a single, unified management fee (the fee) per class. The agreement provides that ACIM will pay all expenses of managing and operating the fund, except brokerage expenses, taxes, interest, fees and expenses of the independent directors (including legal counsel fees), extraordinary expenses, and expenses incurred in connection with the provision of shareholder services and distribution services under a plan adopted pursuant to Rule 12b-1 under the 1940 Act. The fee is computed and accrued daily based on each class's daily net assets and paid monthly in arrears. The difference in the fee among the classes is a result of their separate arrangements for non-Rule 12b-1 shareholder services. It is not the result of any difference in advisory or custodial fees or other expenses related to the management of the fund’s assets, which do not vary by class. The investment advisor agreed to waive the G Class's management fee in its entirety. The investment advisor expects this waiver to remain in effect permanently and cannot terminate it without the approval of the Board of Directors.

The annual management fee for each class is as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investor Class | I Class | Y Class | A Class | C Class | R Class | R5 Class | R6 Class | G Class(1) |

| 1.25% | 1.05% | 0.90% | 1.25% | 1.25% | 1.25% | 1.05% | 0.90% | 0.00% |

(1)Annual management fee before waiver was 0.90%.

Distribution and Service Fees — The Board of Directors has adopted a separate Master Distribution and Individual Shareholder Services Plan for each of the A Class, C Class and R Class (collectively the plans), pursuant to Rule 12b-1 of the 1940 Act. The plans provide that the A Class will pay ACIS an annual distribution and service fee of 0.25%. The plans provide that the C Class will pay ACIS an annual distribution and service fee of 1.00%, of which 0.25% is paid for individual shareholder services and 0.75% is paid for distribution services. The plans provide that the R Class will pay ACIS an annual distribution and service fee of 0.50%. The fees are computed and accrued daily based on each class’s daily net assets and paid monthly in arrears. The fees are used to pay financial intermediaries for distribution and individual shareholder services. Fees incurred under the plans during the period ended November 30, 2022 are detailed in the Statement of Operations.

Directors' Fees and Expenses — The Board of Directors is responsible for overseeing the investment advisor’s management and operations of the fund. The directors receive detailed information about the fund and its investment advisor regularly throughout the year, and meet at least quarterly with management of the investment advisor to review reports about fund operations. The fund’s officers do not receive compensation from the fund.

Interfund Transactions — The fund may enter into security transactions with other American Century Investments funds and other client accounts of the investment advisor, in accordance with the 1940 Act rules and procedures adopted by the Board of Directors. The rules and procedures require, among other things, that these transactions be effected at the independent current market price of the security. During the period, the interfund sales were $4,187,035 and there were no interfund purchases. The effect of interfund transactions on the Statement of Operations was $3,414,121 in net realized gain (loss) on investment transactions.

4. Investment Transactions

Purchases and sales of investment securities, excluding short-term investments, for the period ended November 30, 2022 were $1,642,960,239 and $1,553,214,297, respectively.

5. Capital Share Transactions

Transactions in shares of the fund were as follows:

| | | | | | | | | | | | | | |

| Year ended November 30, 2022(1) | Year ended

November 30, 2021 |

| Shares | Amount | Shares | Amount |

| Investor Class/Shares Authorized | 1,100,000,000 | | | 1,100,000,000 | | |

| Sold | 6,048,510 | | $ | 73,081,025 | | 10,257,205 | | $ | 154,967,241 | |

| Issued in reinvestment of distributions | 379,470 | | 4,322,163 | | 222,670 | | 3,290,668 | |

| Redeemed | (10,249,865) | | (115,441,774) | | (12,682,038) | | (189,334,522) | |

| (3,821,885) | | (38,038,586) | | (2,202,163) | | (31,076,613) | |

| I Class/Shares Authorized | 1,520,000,000 | | | 1,520,000,000 | | |

| Sold | 38,584,764 | | 446,185,226 | | 37,994,838 | | 585,982,225 | |

| Issued in reinvestment of distributions | 1,181,788 | | 13,791,471 | | 763,688 | | 11,554,604 | |

| Redeemed | (77,797,712) | | (853,066,174) | | (30,097,172) | | (462,700,286) | |

| (38,031,160) | | (393,089,477) | | 8,661,354 | | 134,836,543 | |

| Y Class/Shares Authorized | 30,000,000 | | | 30,000,000 | | |

| Sold | 3,903,441 | | 46,950,678 | | 1,671,573 | | 25,772,225 | |

| Issued in reinvestment of distributions | 43,474 | | 508,209 | | 19,691 | | 298,311 | |

| Redeemed | (3,077,023) | | (32,540,149) | | (1,043,781) | | (16,151,806) | |

| 869,892 | | 14,918,738 | | 647,483 | | 9,918,730 | |

| A Class/Shares Authorized | 100,000,000 | | | 100,000,000 | | |

| Sold | 2,304,400 | | 24,907,653 | | 2,330,248 | | 33,680,130 | |

| Issued in reinvestment of distributions | 27,169 | | 298,592 | | 12,777 | | 182,204 | |

| Redeemed | (4,177,258) | | (44,494,688) | | (1,919,955) | | (27,758,871) | |

| (1,845,689) | | (19,288,443) | | 423,070 | | 6,103,463 | |

| C Class/Shares Authorized | 45,000,000 | | | 45,000,000 | | |

| Sold | 100,840 | | 933,394 | | 372,548 | | 4,958,377 | |

| Redeemed | (726,732) | | (6,922,219) | | (509,367) | | (6,661,355) | |

| (625,892) | | (5,988,825) | | (136,819) | | (1,702,978) | |

| R Class/Shares Authorized | 25,000,000 | | | 30,000,000 | | |

| Sold | 206,455 | | 2,241,994 | | 316,845 | | 4,636,023 | |

| Issued in reinvestment of distributions | 2,832 | | 31,290 | | — | | — | |

| Redeemed | (165,026) | | (1,819,630) | | (302,174) | | (4,388,338) | |

| 44,261 | | 453,654 | | 14,671 | | 247,685 | |

| R5 Class/Shares Authorized | 25,000,000 | | | 30,000,000 | | |

| Sold | 297,124 | | 3,359,435 | | 685,046 | | 10,352,533 | |

| Issued in reinvestment of distributions | 10,433 | | 121,852 | | 1,934 | | 29,285 | |

| Redeemed | (134,705) | | (1,575,297) | | (95,988) | | (1,453,583) | |

| 172,852 | | 1,905,990 | | 590,992 | | 8,928,235 | |

| R6 Class/Shares Authorized | 450,000,000 | | | 450,000,000 | | |

| Sold | 22,145,809 | | 254,818,438 | | 32,070,850 | | 490,325,641 | |

| Issued in reinvestment of distributions | 821,931 | | 9,591,938 | | 399,613 | | 6,042,152 | |

| Redeemed | (16,919,603) | | (189,415,923) | | (12,638,202) | | (193,104,977) | |

| 6,048,137 | | 74,994,453 | | 19,832,261 | | 303,262,816 | |

| G Class/Shares Authorized | 510,000,000 | | | N/A | |

| Sold | 7,000,209 | | 70,836,355 | | | |

| Issued in connection with reorganization (Note 9) | 69,959,409 | | 781,612,283 | | | |

| Issued in reinvestment of distributions | 2 | | 24 | | | |

| Redeemed | (6,581,141) | | (67,393,318) | | | |

| 70,378,479 | | 785,055,344 | | | |

| Net increase (decrease) | 33,188,995 | | $ | 420,922,848 | | 27,830,849 | | $ | 430,517,881 | |

(1)April 1, 2022 (commencement of sale) through November 30, 2022 for the G Class.

6. Fair Value Measurements

The fund’s investments valuation process is based on several considerations and may use multiple inputs to determine the fair value of the investments held by the fund. In conformity with accounting principles generally accepted in the United States of America, the inputs used to determine a valuation are classified into three broad levels.

•Level 1 valuation inputs consist of unadjusted quoted prices in an active market for identical investments.

•Level 2 valuation inputs consist of direct or indirect observable market data (including quoted prices for comparable investments, evaluations of subsequent market events, interest rates, prepayment speeds, credit risk, etc.). These inputs also consist of quoted prices for identical investments initially expressed in local currencies that are adjusted through translation into U.S. dollars.

•Level 3 valuation inputs consist of unobservable data (including a fund’s own assumptions).

The level classification is based on the lowest level input that is significant to the fair valuation measurement. The valuation inputs are not necessarily an indication of the risks associated with investing in these securities or other financial instruments.

The following is a summary of the level classifications as of period end. The Schedule of Investments provides additional information on the fund's portfolio holdings.

| | | | | | | | | | | |

| Level 1 | Level 2 | Level 3 |

| Assets | | | |

| Investment Securities | | | |

| Common Stocks | | | |

| Brazil | $ | 46,738,726 | | $ | 160,278,260 | | — | |

| China | 111,222,441 | | 717,013,879 | | — | |

| India | 85,620,038 | | 226,504,037 | | — | |

| Mexico | 35,710,443 | | 102,460,397 | | — | |

| Peru | 27,236,392 | | — | | — | |

| Russia | 46 | | 2 | | — | |

| United States | 22,464,668 | | — | | — | |

| Other Countries | — | | 1,211,547,444 | | — | |

| Short-Term Investments | 33,975,400 | | 151,107 | | — | |

| $ | 362,968,154 | | $ | 2,417,955,126 | | — | |

7. Risk Factors

The value of the fund’s shares will go up and down, sometimes rapidly or unpredictably, based on the performance of the securities owned by the fund and other factors generally affecting the securities market. Market risks, including political, regulatory, economic and social developments, can affect the value of the fund’s investments. Natural disasters, public health emergencies, war, terrorism and other unforeseeable events may lead to increased market volatility and may have adverse long-term effects on world economies and markets generally.

There are certain risks involved in investing in foreign securities. These risks include those resulting from political events (such as civil unrest, national elections and imposition of exchange controls), social and economic events (such as labor strikes and rising inflation), and natural disasters. Securities of foreign issuers may be less liquid and more volatile. Investing in emerging markets or a significant portion of assets in one country or region may accentuate these risks.

8. Federal Tax Information

On December 21, 2022, the fund declared and paid the following per-share distributions from net investment

income to shareholders of record on December 20, 2022:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investor Class | I Class | Y Class | A Class | C Class | R Class | R5 Class | R6 Class | G Class |

| $0.2144 | $0.2280 | $0.2383 | $0.1973 | $0.1461 | $0.1803 | $0.2280 | $0.2383 | $0.2997 |

The tax character of distributions paid during the years ended November 30, 2022 and November 30, 2021 were as follows:

| | | | | | | | |

| 2022 | 2021 |

| Distributions Paid From | | |

| Ordinary income | $ | 30,570,266 | | $ | 22,717,358 | |

| Long-term capital gains | — | | — | |

The book-basis character of distributions made during the year from net investment income or net realized gains may differ from their ultimate characterization for federal income tax purposes. These differences reflect the differing character of certain income items and net realized gains and losses for financial statement and tax purposes, and may result in reclassification among certain capital accounts on the financial statements.

As of period end, the federal tax cost of investments and the components of distributable earnings on a tax-basis were as follows:

| | | | | |

| Federal tax cost of investments | $ | 2,712,532,550 | |

| Gross tax appreciation of investments | $ | 443,344,592 | |

| Gross tax depreciation of investments | (374,953,862) | |

| Net tax appreciation (depreciation) of investments | 68,390,730 | |

Net tax appreciation (depreciation) on translation of assets and liabilities in

foreign currencies | (3,284,862) | |

| Net tax appreciation (depreciation) | $ | 65,105,868 | |

| Undistributed ordinary income | $ | 64,771,831 | |

| Accumulated short-term capital losses | $ | (559,991,097) | |

The difference between book-basis and tax-basis unrealized appreciation (depreciation) is attributable primarily to the realization to ordinary income for tax purposes of unrealized gains on investments in passive foreign investment companies.

Accumulated capital losses represent net capital loss carryovers that may be used to offset future realized capital gains for federal income tax purposes. The capital loss carryovers may be carried forward for an unlimited period. Future capital loss carryover utilization in any given year may be subject to Internal Revenue Code limitations.

9. Reorganization

On December 2, 2021, the Board of Directors approved an agreement and plan of reorganization (the reorganization), whereby the net assets of NT Emerging Markets Fund, one fund in a series issued by the corporation, were transferred to Emerging Markets Fund in exchange for shares of Emerging Markets Fund. The purpose of the transaction was to combine two funds with substantially similar investment objectives and strategies. The financial statements and performance history of Emerging Markets Fund survived after the reorganization. The reorganization was effective at the close of the NYSE on April 22, 2022.

The reorganization was accomplished by a tax-free exchange of shares. On April 22, 2022, NT Emerging Markets Fund exchanged its shares for shares of Emerging Markets Fund as follows:

| | | | | | | | | | | |

| Original Fund/Class | Shares Exchanged | New Fund/Class | Shares Received |

| NT Emerging Markets Fund – G Class | 75,795,014 | | Emerging Markets

Fund – G Class | 69,959,409 | |

The net assets of NT Emerging Markets Fund and Emerging Markets Fund immediately before the reorganization were $781,612,283 and $2,574,757,849, respectively. NT Emerging Markets Fund's unrealized appreciation of $(21,227,170) was combined with that of Emerging Markets Fund. Immediately after the reorganization, the combined net assets were $3,356,370,132.

Assuming the reorganization had been completed on December 1, 2021, the beginning of the annual reporting period, the pro forma results of operations for the period ended November 30, 2022 are as follows:

| | | | | |

| Net investment income (loss) | $ | 40,561,064 | |

| Net realized and unrealized gain (loss) | (1,115,140,186) | |

| Net increase (decrease) in net assets resulting from operations | $ | (1,074,579,122) | |

Because the combined investment portfolios have been managed as a single integrated portfolio since the reorganization was completed, it is not practicable to separate the amounts of revenue and earnings of NT Emerging Markets Fund that have been included in the fund’s Statement of Operations since April 22, 2022.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For a Share Outstanding Throughout the Years Ended November 30 (except as noted) | | | | |

| Per-Share Data | | Ratios and Supplemental Data | | |

| | Income From Investment Operations: | Distributions From: | | | Ratio to Average Net Assets of: | | |

| Net Asset

Value,

Beginning

of Period | Net Investment Income (Loss)(1) | Net

Realized

and

Unrealized

Gain (Loss) | Total From

Investment

Operations | Net

Investment

Income | Net

Realized

Gains | Total

Distributions | Net Asset

Value,

End

of Period | Total Return(2) | Operating

Expenses | Operating

Expenses

(before

expense

waiver) | Net

Investment

Income

(Loss) | Net

Investment

Income

(Loss)

(before

expense

waiver) | Portfolio

Turnover

Rate | Net

Assets,

End of

Period

(in

thousands) |

| Investor Class | | | | | | | | | | | | | |

| 2022 | $13.67 | 0.09 | (3.61) | (3.52) | (0.11) | — | (0.11) | $10.04 | (25.84)% | 1.26% | 1.26% | 0.84% | 0.84% | 52% | $368,506 | |

| 2021 | $13.62 | 0.05 | 0.08 | 0.13 | (0.08) | — | (0.08) | $13.67 | 0.91% | 1.25% | 1.25% | 0.36% | 0.36% | 35% | $554,001 | |

| 2020 | $11.25 | 0.04 | 2.48 | 2.52 | (0.15) | — | (0.15) | $13.62 | 22.79% | 1.26% | 1.26% | 0.33% | 0.33% | 30% | $582,036 | |

| 2019 | $10.19 | 0.17 | 0.94 | 1.11 | (0.05) | — | (0.05) | $11.25 | 10.99% | 1.25% | 1.25% | 1.59% | 1.59% | 39% | $606,668 | |

| 2018 | $12.00 | 0.08 | (1.80) | (1.72) | (0.03) | (0.06) | (0.09) | $10.19 | (14.57)% | 1.18% | 1.29% | 0.71% | 0.60% | 36% | $980,765 | |

| I Class | | | | | | | | | | | | | |

| 2022 | $14.02 | 0.11 | (3.70) | (3.59) | (0.13) | — | (0.13) | $10.30 | (25.69)% | 1.06% | 1.06% | 1.04% | 1.04% | 52% | $828,883 | |

| 2021 | $13.97 | 0.09 | 0.07 | 0.16 | (0.11) | — | (0.11) | $14.02 | 1.09% | 1.05% | 1.05% | 0.56% | 0.56% | 35% | $1,661,545 | |

| 2020 | $11.56 | 0.06 | 2.54 | 2.60 | (0.19) | — | (0.19) | $13.97 | 22.94% | 1.06% | 1.06% | 0.53% | 0.53% | 30% | $1,534,445 | |

| 2019 | $10.46 | 0.20 | 0.97 | 1.17 | (0.07) | — | (0.07) | $11.56 | 11.20% | 1.05% | 1.05% | 1.79% | 1.79% | 39% | $1,325,801 | |

| 2018 | $12.32 | 0.11 | (1.85) | (1.74) | (0.06) | (0.06) | (0.12) | $10.46 | (14.35)% | 0.98% | 1.09% | 0.91% | 0.80% | 36% | $897,336 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For a Share Outstanding Throughout the Years Ended November 30 (except as noted) | | | | |

| Per-Share Data | | Ratios and Supplemental Data | | |

| | Income From Investment Operations: | Distributions From: | | | Ratio to Average Net Assets of: | | |

| Net Asset

Value,

Beginning

of Period | Net Investment Income (Loss)(1) | Net

Realized

and

Unrealized

Gain (Loss) | Total From

Investment

Operations | Net

Investment

Income | Net

Realized

Gains | Total

Distributions | Net Asset

Value,

End

of Period | Total Return(2) | Operating

Expenses | Operating

Expenses

(before

expense

waiver) | Net

Investment

Income

(Loss) | Net

Investment

Income

(Loss)

(before

expense

waiver) | Portfolio

Turnover

Rate | Net

Assets,

End of

Period

(in

thousands) |

| Y Class | | | | | | | | | | | | | |

| 2022 | $14.05 | 0.13 | (3.71) | (3.58) | (0.15) | — | (0.15) | $10.32 | (25.60)% | 0.91% | 0.91% | 1.19% | 1.19% | 52% | $37,909 | |

| 2021 | $14.00 | 0.10 | 0.08 | 0.18 | (0.13) | — | (0.13) | $14.05 | 1.24% | 0.90% | 0.90% | 0.71% | 0.71% | 35% | $39,377 | |

| 2020 | $11.60 | 0.08 | 2.54 | 2.62 | (0.22) | — | (0.22) | $14.00 | 23.09% | 0.91% | 0.91% | 0.68% | 0.68% | 30% | $30,169 | |

| 2019 | $10.49 | 0.26 | 0.94 | 1.20 | (0.09) | — | (0.09) | $11.60 | 11.43% | 0.90% | 0.90% | 1.94% | 1.94% | 39% | $14,638 | |

| 2018 | $12.34 | 0.08 | (1.81) | (1.73) | (0.06) | (0.06) | (0.12) | $10.49 | (14.23)% | 0.83% | 0.94% | 1.06% | 0.95% | 36% | $4,724 | |

| A Class | | | | | | | | | | | | | |

| 2022 | $13.17 | 0.06 | (3.48) | (3.42) | (0.08) | — | (0.08) | $9.67 | (26.03)% | 1.51% | 1.51% | 0.59% | 0.59% | 52% | $51,434 | |

| 2021 | $13.13 | 0.01 | 0.07 | 0.08 | (0.04) | — | (0.04) | $13.17 | 0.60% | 1.50% | 1.50% | 0.11% | 0.11% | 35% | $94,363 | |

| 2020 | $10.84 | 0.01 | 2.40 | 2.41 | (0.12) | — | (0.12) | $13.13 | 22.50% | 1.51% | 1.51% | 0.08% | 0.08% | 30% | $88,485 | |

| 2019 | $9.81 | 0.14 | 0.91 | 1.05 | (0.02) | — | (0.02) | $10.84 | 10.71% | 1.50% | 1.50% | 1.34% | 1.34% | 39% | $78,704 | |

| 2018 | $11.57 | 0.05 | (1.75) | (1.70) | — | (0.06) | (0.06) | $9.81 | (14.80)% | 1.43% | 1.54% | 0.46% | 0.35% | 36% | $72,711 | |

| C Class | | | | | | | | | | | | |

| 2022 | $11.87 | (0.02) | (3.14) | (3.16) | — | — | — | $8.71 | (26.56)% | 2.26% | 2.26% | (0.16)% | (0.16)% | 52% | $13,231 | |

| 2021 | $11.88 | (0.08) | 0.07 | (0.01) | — | — | — | $11.87 | (0.17)% | 2.25% | 2.25% | (0.64)% | (0.64)% | 35% | $25,448 | |

| 2020 | $9.82 | (0.07) | 2.17 | 2.10 | (0.04) | — | (0.04) | $11.88 | 21.48% | 2.26% | 2.26% | (0.67)% | (0.67)% | 30% | $27,101 | |

| 2019 | $8.93 | 0.05 | 0.84 | 0.89 | — | — | — | $9.82 | 9.97% | 2.25% | 2.25% | 0.59% | 0.59% | 39% | $30,004 | |

| 2018 | $10.61 | (0.03) | (1.59) | (1.62) | — | (0.06) | (0.06) | $8.93 | (15.39)% | 2.18% | 2.29% | (0.29)% | (0.40)% | 36% | $31,871 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For a Share Outstanding Throughout the Years Ended November 30 (except as noted) | | | | |

| Per-Share Data | | Ratios and Supplemental Data | | |

| | Income From Investment Operations: | Distributions From: | | | Ratio to Average Net Assets of: | | |

| Net Asset

Value,

Beginning

of Period | Net Investment Income (Loss)(1) | Net

Realized

and

Unrealized

Gain (Loss) | Total From

Investment

Operations | Net

Investment

Income | Net

Realized

Gains | Total

Distributions | Net Asset

Value,

End

of Period | Total Return(2) | Operating

Expenses | Operating

Expenses

(before

expense

waiver) | Net

Investment

Income

(Loss) | Net

Investment

Income

(Loss)

(before

expense

waiver) | Portfolio

Turnover

Rate | Net

Assets,

End of

Period

(in

thousands) |

| R Class | | | | | | | | | | | | | |

| 2022 | $13.22 | 0.03 | (3.49) | (3.46) | (0.05) | — | (0.05) | $9.71 | (26.20)% | 1.76% | 1.76% | 0.34% | 0.34% | 52% | $6,075 | |

| 2021 | $13.17 | (0.02) | 0.08 | 0.06 | (0.01) | — | (0.01) | $13.22 | 0.41% | 1.75% | 1.75% | (0.14)% | (0.14)% | 35% | $7,687 | |

| 2020 | $10.88 | (0.02) | 2.40 | 2.38 | (0.09) | — | (0.09) | $13.17 | 22.11% | 1.76% | 1.76% | (0.17)% | (0.17)% | 30% | $7,466 | |

| 2019 | $9.85 | 0.12 | 0.91 | 1.03 | — | — | — | $10.88 | 10.46% | 1.75% | 1.75% | 1.09% | 1.09% | 39% | $6,825 | |

| 2018 | $11.64 | 0.02 | (1.75) | (1.73) | — | (0.06) | (0.06) | $9.85 | (14.97)% | 1.68% | 1.79% | 0.21% | 0.10% | 36% | $5,825 | |

| R5 Class | | | | | | | | | | | | | |

| 2022 | $14.04 | 0.11 | (3.71) | (3.60) | (0.13) | — | (0.13) | $10.31 | (25.67)% | 1.06% | 1.06% | 1.04% | 1.04% | 52% | $10,725 | |

| 2021 | $13.98 | 0.06 | 0.11 | 0.17 | (0.11) | — | (0.11) | $14.04 | 1.09% | 1.05% | 1.05% | 0.56% | 0.56% | 35% | $12,172 | |

| 2020 | $11.57 | 0.06 | 2.54 | 2.60 | (0.19) | — | (0.19) | $13.98 | 22.92% | 1.06% | 1.06% | 0.53% | 0.53% | 30% | $3,863 | |

| 2019 | $10.47 | 0.20 | 0.97 | 1.17 | (0.07) | — | (0.07) | $11.57 | 11.19% | 1.05% | 1.05% | 1.79% | 1.79% | 39% | $2,444 | |

| 2018 | $12.32 | 0.12 | (1.86) | (1.74) | (0.05) | (0.06) | (0.11) | $10.47 | (14.33)% | 0.98% | 1.09% | 0.91% | 0.80% | 36% | $4,521 | |

| R6 Class | | | | | | | | | | | | | |

| 2022 | $14.03 | 0.13 | (3.70) | (3.57) | (0.15) | — | (0.15) | $10.31 | (25.56)% | 0.91% | 0.91% | 1.19% | 1.19% | 52% | $687,720 | |

| 2021 | $13.98 | 0.11 | 0.07 | 0.18 | (0.13) | — | (0.13) | $14.03 | 1.24% | 0.90% | 0.90% | 0.71% | 0.71% | 35% | $851,240 | |

| 2020 | $11.58 | 0.08 | 2.54 | 2.62 | (0.22) | — | (0.22) | $13.98 | 23.13% | 0.91% | 0.91% | 0.68% | 0.68% | 30% | $570,868 | |

| 2019 | $10.48 | 0.23 | 0.96 | 1.19 | (0.09) | — | (0.09) | $11.58 | 11.45% | 0.90% | 0.90% | 1.94% | 1.94% | 39% | $405,776 | |

| 2018 | $12.34 | 0.12 | (1.84) | (1.72) | (0.08) | (0.06) | (0.14) | $10.48 | (14.28)% | 0.83% | 0.94% | 1.06% | 0.95% | 36% | $239,031 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For a Share Outstanding Throughout the Years Ended November 30 (except as noted) | | | | |

| Per-Share Data | | Ratios and Supplemental Data | | |

| | Income From Investment Operations: | Distributions From: | | | Ratio to Average Net Assets of: | | |

| Net Asset

Value,

Beginning

of Period | Net Investment Income (Loss)(1) | Net

Realized

and

Unrealized

Gain (Loss) | Total From

Investment

Operations | Net

Investment

Income | Net

Realized

Gains | Total

Distributions | Net Asset

Value,

End

of Period | Total Return(2) | Operating

Expenses | Operating

Expenses

(before

expense

waiver) | Net

Investment

Income

(Loss) | Net

Investment

Income

(Loss)

(before

expense

waiver) | Portfolio

Turnover

Rate | Net

Assets,

End of

Period

(in

thousands) |

| G Class | | | | | | | | | | | | | |

2022(3) | $12.44 | 0.16 | (2.08) | (1.92) | (0.12) | — | (0.12) | $10.40 | (15.56)% | 0.01%(4) | 0.91%(4) | 2.42%(4) | 1.52%(4) | 52%(5) | $731,719 | |

| | |

| Notes to Financial Highlights |

(1)Computed using average shares outstanding throughout the period.

(2)Total returns are calculated based on the net asset value of the last business day and do not reflect applicable sales charges, if any. Total returns for periods less than one year are not annualized.

(3)April 1, 2022 (commencement of sale) through November 30, 2022.

(4)Annualized.

(5)Portfolio turnover is calculated at the fund level. Percentage indicated was calculated for the year ended November 30, 2022.

See Notes to Financial Statements.

| | |

| Report of Independent Registered Public Accounting Firm |

To the Shareholders and the Board of Directors of American Century World Mutual Funds, Inc.:

Opinion on the Financial Statements and Financial Highlights