0000872825ck0000872825:C000167115Member2020-12-012021-11-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | | | | | | | | | | | | | | | | | | | |

| Investment Company Act file number | 811-06247 |

| |

| AMERICAN CENTURY WORLD MUTUAL FUNDS, INC. |

| (Exact name of registrant as specified in charter) |

| |

| 4500 MAIN STREET, KANSAS CITY, MISSOURI | 64111 |

| (Address of principal executive offices) | (Zip Code) |

| |

JOHN PAK

4500 MAIN STREET, KANSAS CITY, MISSOURI 64111 |

| (Name and address of agent for service) |

| |

| Registrant’s telephone number, including area code: | 816-531-5575 |

| |

| Date of fiscal year end: | 11-30 |

| |

| Date of reporting period: | 11-30-2024 |

ITEM 1. REPORTS TO STOCKHOLDERS.

(a)

ANNUAL SHAREHOLDER REPORT

Emerging Markets Fund

| | | | | |

Investor Class (TWMIX) | November 30, 2024 |

This annual shareholder report contains important information about Emerging Markets Fund for the period of December 1, 2023 to November 30, 2024. You can find additional information about the fund at americancentury.com/docs. You can also request this information by contacting us at 1-800-345-2021. This report describes changes to the fund that occurred during the reporting period.

| | | | | | | | |

What were the fund costs for the last year? (based on a hypothetical $10,000 investment) |

|

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Investor Class | $137 | 1.27% |

|

| | | | | |

| What were the key factors that affected the fund’s performance? |

Emerging Markets Fund Investor Class returned 15.29% for the reporting period ended November 30, 2024. |

| The fund seeks capital growth. The commentary below refers to the fund's performance relative to the MSCI Emerging Markets Index. |

| • | Consumer discretionary contributed to relative performance with contributions from MakeMyTrip, an India-based travel company, and Zomato, an India-based food delivery and restaurant reservation company. Trip.com Group, a China-based travel company, benefited results as well. The fund's underweight position in the materials sector also boosted performance. |

| • | Other individual contributors included aircraft company Embraer and semiconductor business Taiwan Semiconductor Manufacturing Co. |

| • | The communication services and energy sectors were the leading detractors from relative performance. NetEase, a China-based internet technology business, and PRIO, an oil and natural gas company, dragged on results. |

| • | Other notable detractors included Samsung Electronics and Hapvida Participacoes e Investimentos, the Brazil-based health care company. Kweichow Moutai, a China-based liquor producer, and Banco BTG Pactual, a financial company based in Brazil, also hurt results. |

| | |

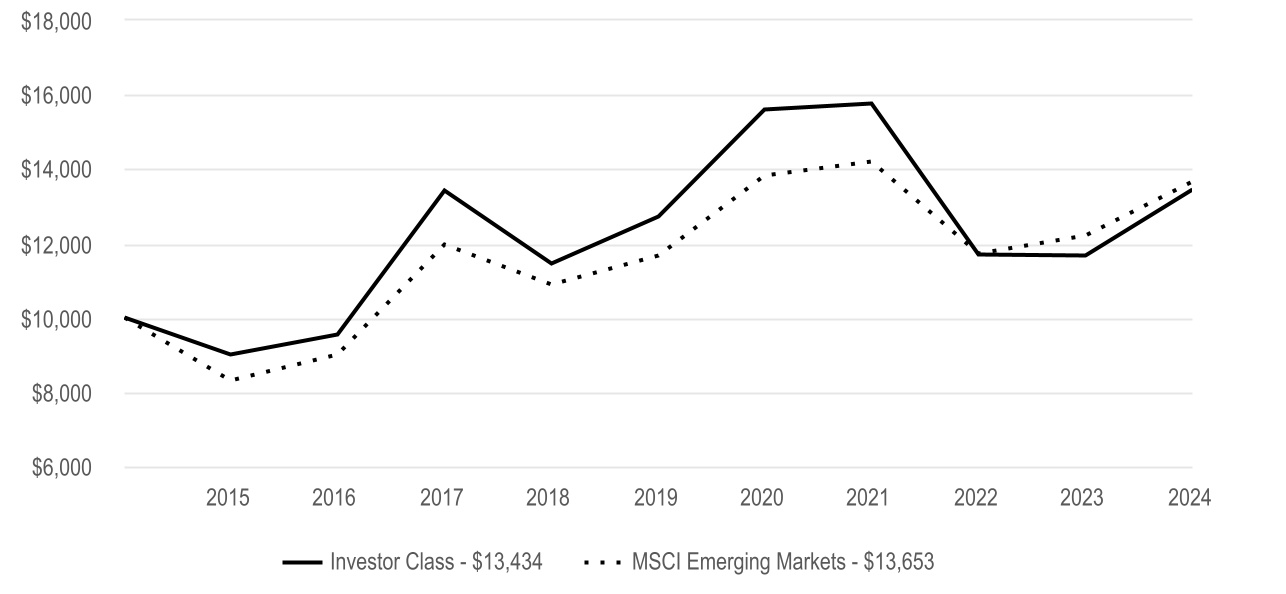

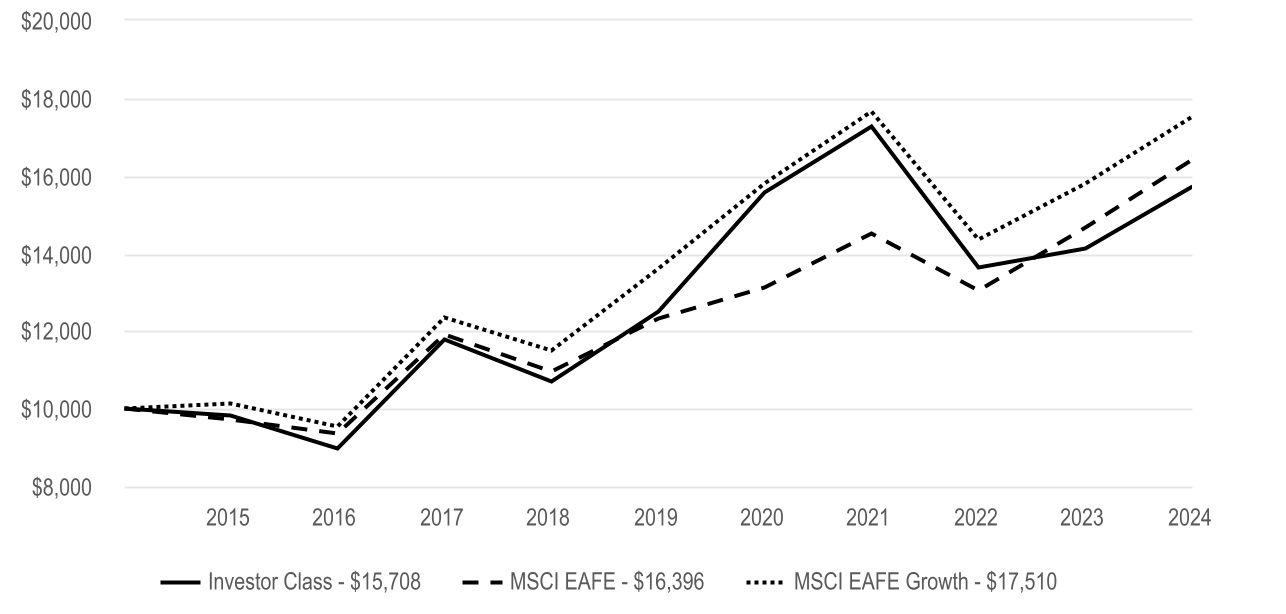

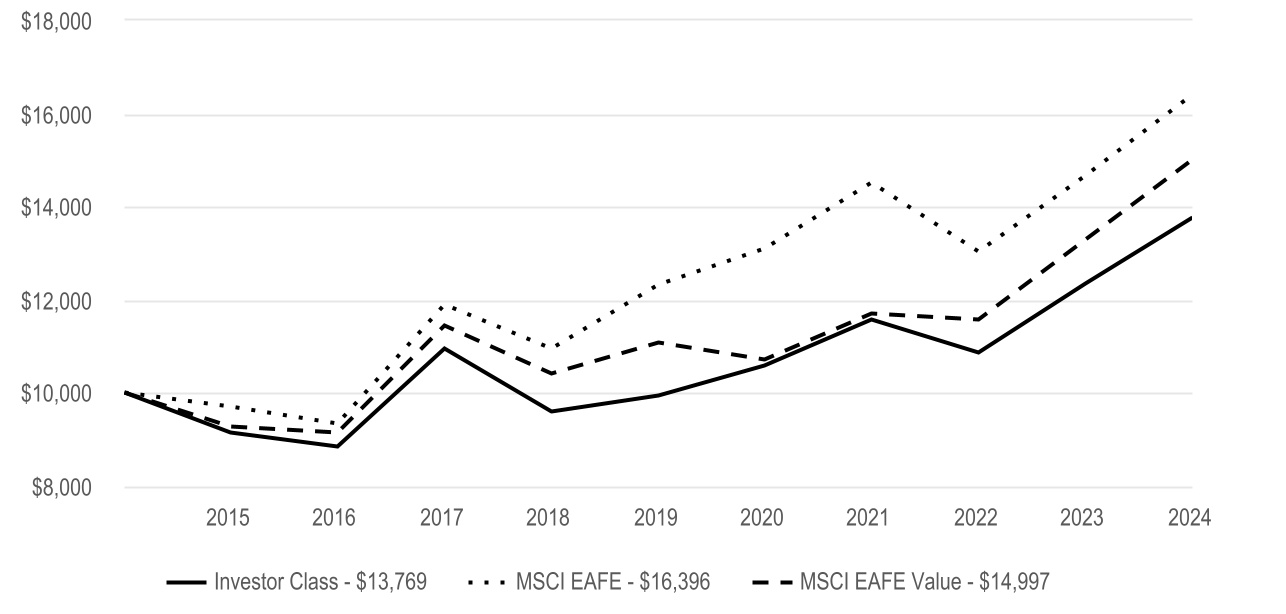

Cumulative Performance (based on an initial $10,000 investment) |

| November 30, 2014 through November 30, 2024 |

|

| | | | | | | | | | | | | | |

Average Annual Total Returns | |

| 1 Year | 5 Year | 10 Year | | | |

| Investor Class | 15.29% | 1.12% | 3.00% | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| MSCI Emerging Markets | 11.86% | 3.20% | 3.16% | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | |

|

The opinions expressed are those of American Century Investments and are no guarantee of the future performance of any American Century Investments fund. This information is for educational purposes only and is not intended as investment advice. Data reflects past performance, assumes reinvestment of dividends and capital gains and is no guarantee of future results. Current performance may be higher or lower than data shown. Investment return and principal value will fluctuate and redemption value may be more or less than original cost, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Total returns for periods less than one year are not annualized. Visit americancentury.com for more recent performance information.

|

| | | | | |

Fund Statistics | |

| Net Assets | $1,785,280,256 |

| Management Fees (dollars paid during the reporting period) | $12,707,240 |

| Portfolio Turnover Rate | 29 | % |

| Total Number of Portfolio Holdings | 78 |

| |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Types of Investments in Portfolio (as a % of net assets) | | | | | | | | | | | | Top Five Countries (as a % of net assets) | | | | |

| Common Stocks | 99.5% | | | | | | | | | | | | | | | | | China | 27% | | | | | | |

| Short-Term Investments | 1.2% | | | | | | | | | | | | | | | | | India | 19% | | | | | | |

| Other Assets and Liabilities | (0.7)% | | | | | | | | | | | | | | | | | Taiwan | 19% | | | | | | |

| | | | | | | | | | | | | | | | | | | South Korea | 8% | | | | | | |

| | | | | | | | | | | | | | | | | | | Brazil | 6% | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| Fund Changes |

|

|

| Beginning October 2024, the total eligible investments required to qualify for a waiver of the annual account maintenance fee changed from $10,000 to $25,000. Such fee will also be waived for any accounts for which the shareholder has elected to receive electronic delivery of all fund/account documents. |

|

|

|

|

| | |

| For additional information about the fund, including its Prospectus, Statement of Additional Information, financial statements, holdings and proxy voting information, scan the QR code or visit americancentury.com/docs. |

| | |

|

| ©2025 American Century Proprietary Holdings, Inc. All rights reserved. |

A-25086885

ANNUAL SHAREHOLDER REPORT

Emerging Markets Fund

| | | | | |

I Class (AMKIX) | November 30, 2024 |

This annual shareholder report contains important information about Emerging Markets Fund for the period of December 1, 2023 to November 30, 2024. You can find additional information about the fund at americancentury.com/docs. You can also request this information by contacting us at 1-800-345-2021.

| | | | | | | | |

What were the fund costs for the last year? (based on a hypothetical $10,000 investment) |

|

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| I Class | $115 | 1.07% |

|

| | | | | |

| What were the key factors that affected the fund’s performance? |

Emerging Markets Fund I Class returned 15.60% for the reporting period ended November 30, 2024. |

| The fund seeks capital growth. The commentary below refers to the fund's performance relative to the MSCI Emerging Markets Index. |

| • | Consumer discretionary contributed to relative performance with contributions from MakeMyTrip, an India-based travel company, and Zomato, an India-based food delivery and restaurant reservation company. Trip.com Group, a China-based travel company, benefited results as well. The fund's underweight position in the materials sector also boosted performance. |

| • | Other individual contributors included aircraft company Embraer and semiconductor business Taiwan Semiconductor Manufacturing Co. |

| • | The communication services and energy sectors were the leading detractors from relative performance. NetEase, a China-based internet technology business, and PRIO, an oil and natural gas company, dragged on results. |

| • | Other notable detractors included Samsung Electronics and Hapvida Participacoes e Investimentos, the Brazil-based health care company. Kweichow Moutai, a China-based liquor producer, and Banco BTG Pactual, a financial company based in Brazil, also hurt results. |

| | |

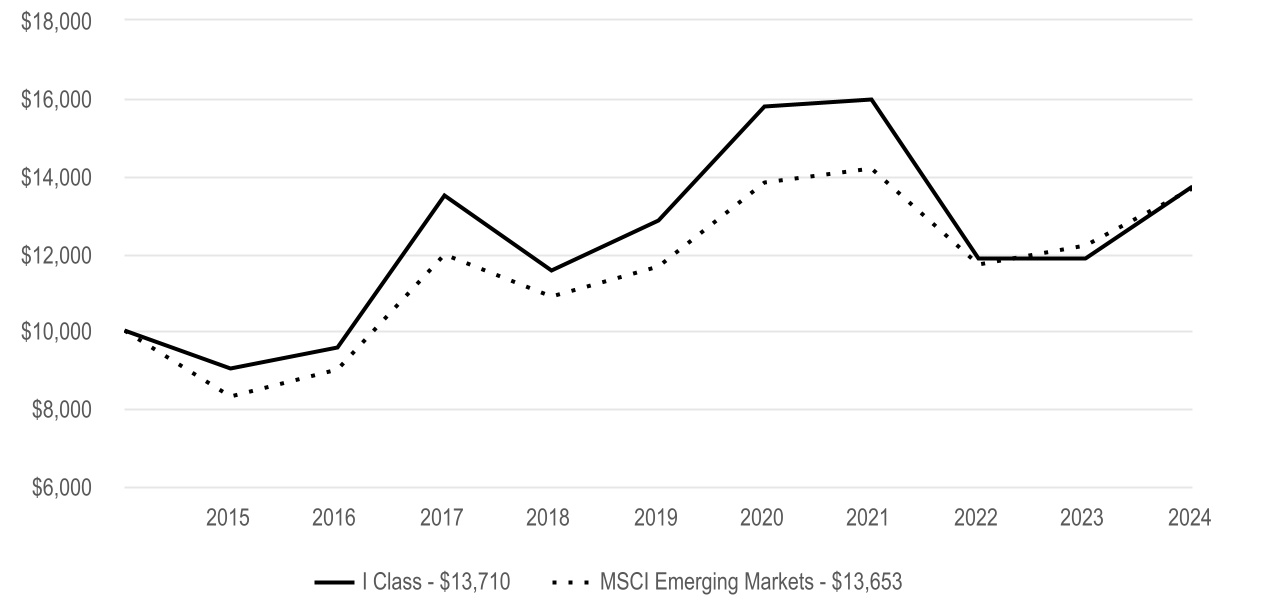

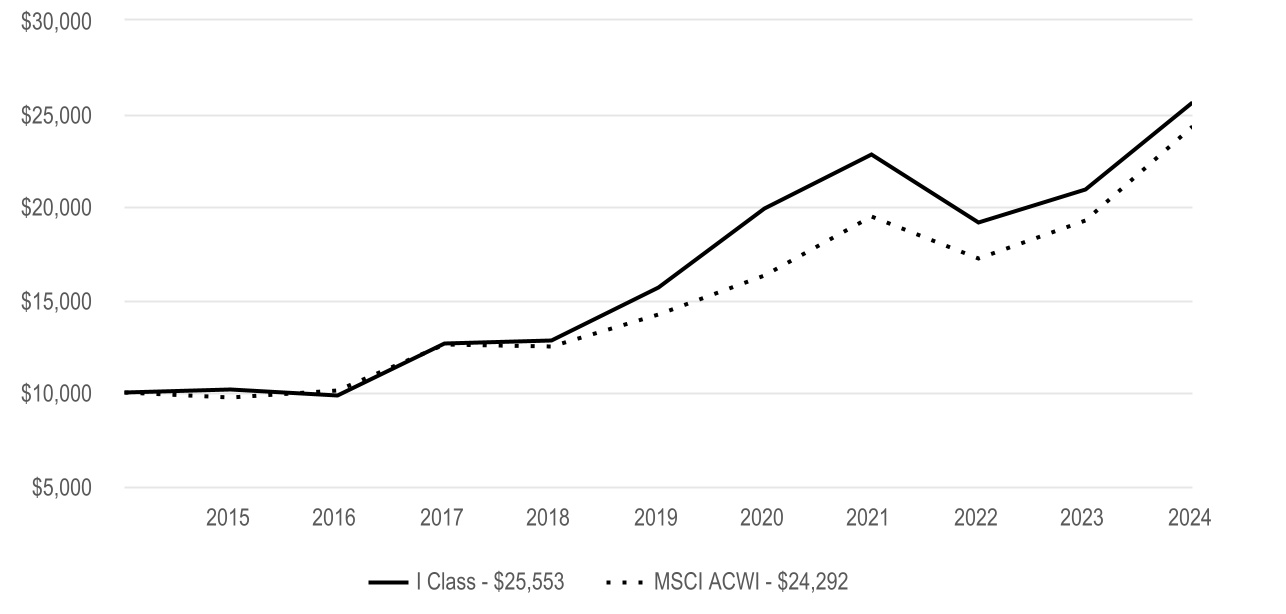

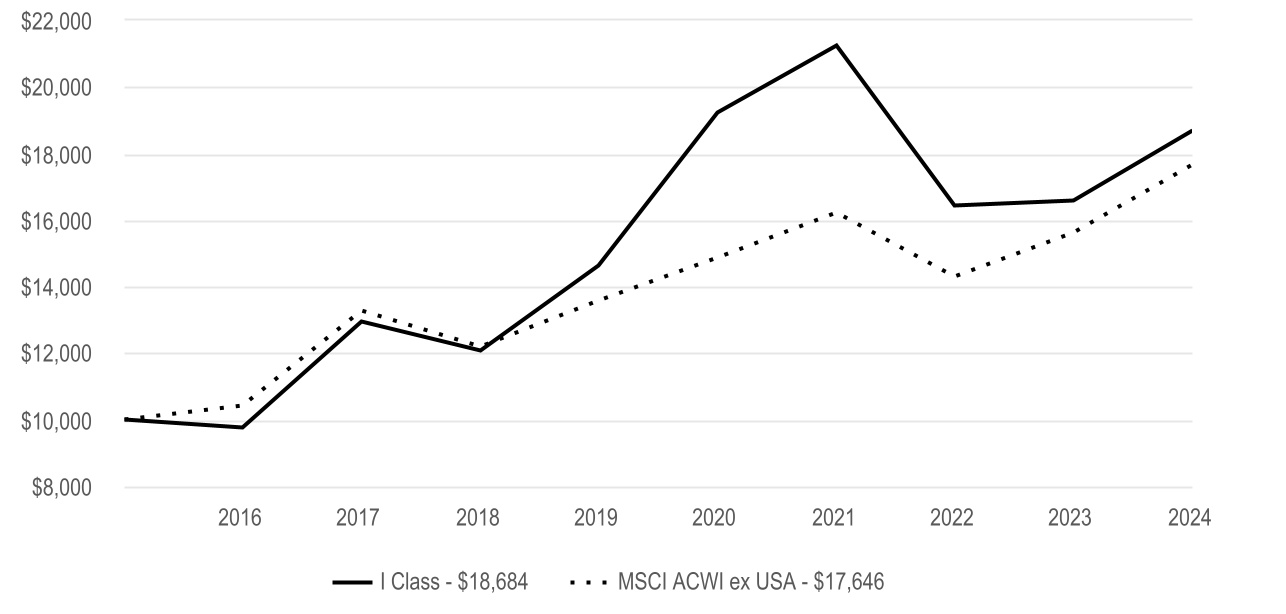

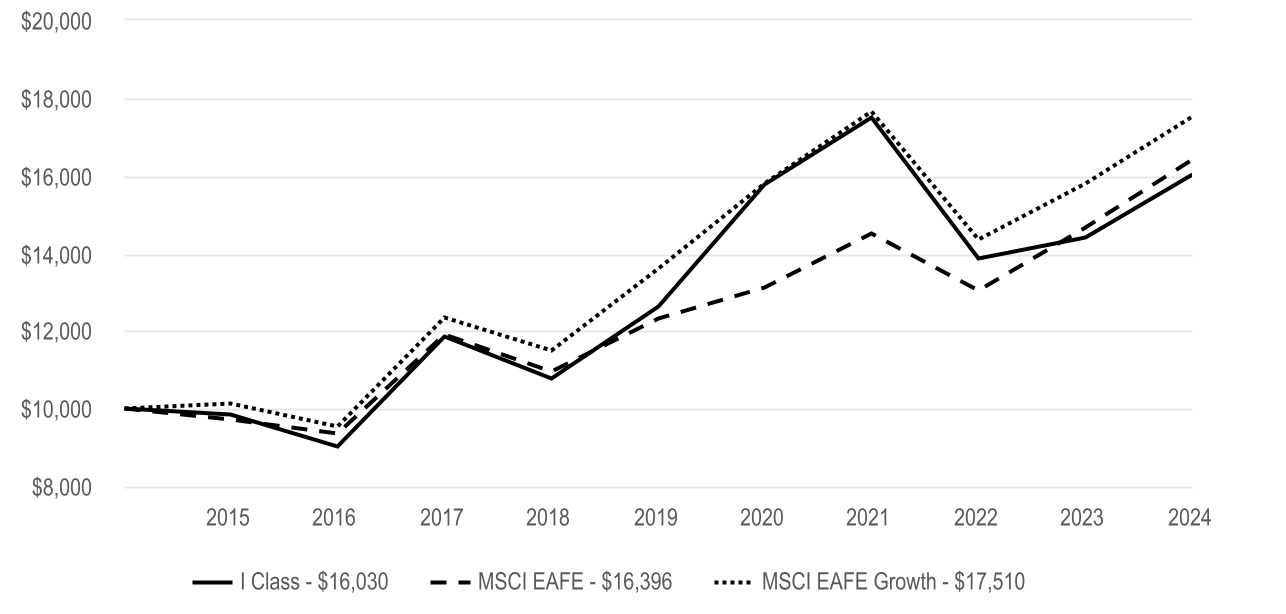

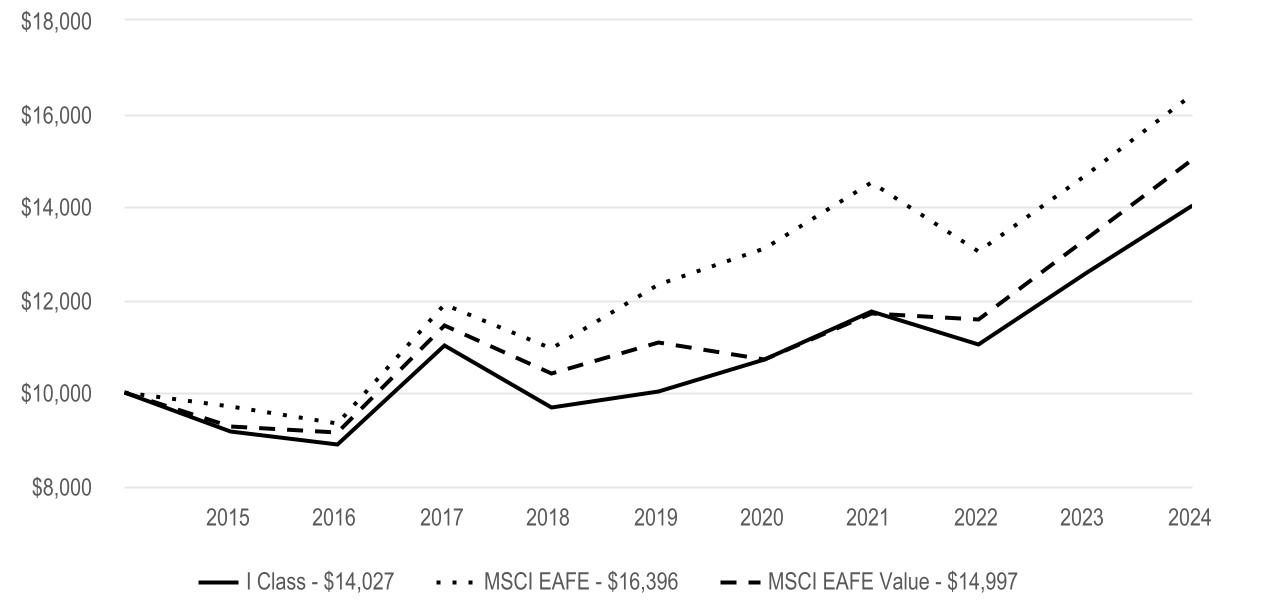

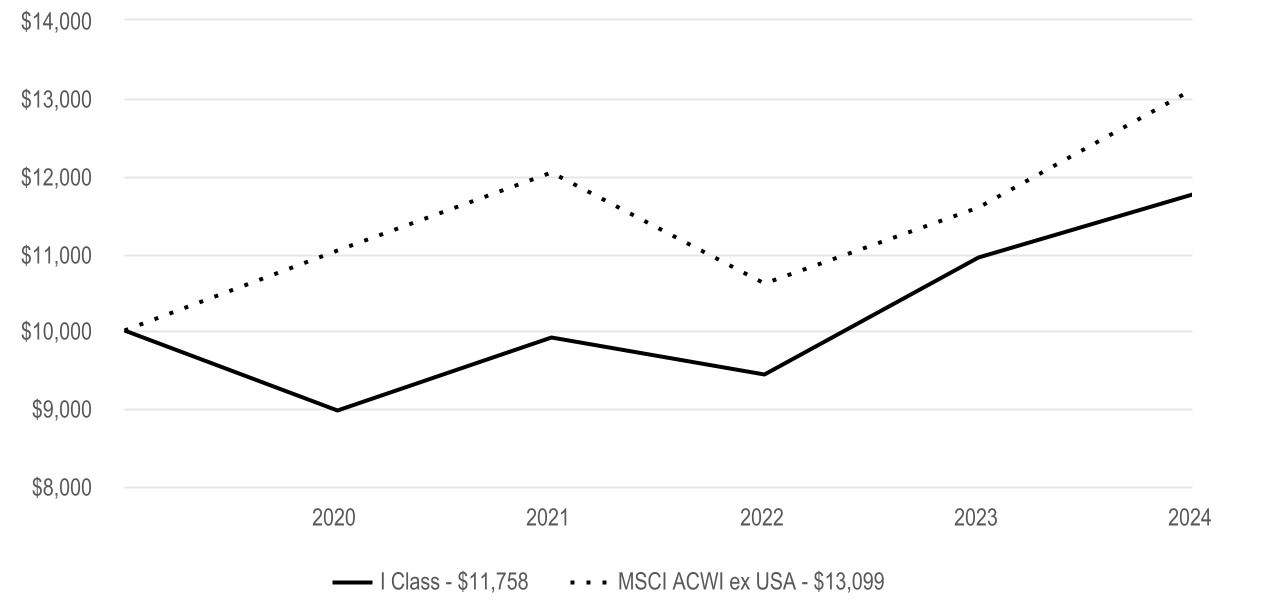

Cumulative Performance (based on an initial $10,000 investment) |

| November 30, 2014 through November 30, 2024 |

|

| | | | | | | | | | | | | | |

Average Annual Total Returns | |

| 1 Year | 5 Year | 10 Year | | | |

| I Class | 15.60% | 1.32% | 3.21% | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| MSCI Emerging Markets | 11.86% | 3.20% | 3.16% | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | |

|

The opinions expressed are those of American Century Investments and are no guarantee of the future performance of any American Century Investments fund. This information is for educational purposes only and is not intended as investment advice. Data reflects past performance, assumes reinvestment of dividends and capital gains and is no guarantee of future results. Current performance may be higher or lower than data shown. Investment return and principal value will fluctuate and redemption value may be more or less than original cost, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Total returns for periods less than one year are not annualized. Visit americancentury.com for more recent performance information.

|

| | | | | |

Fund Statistics | |

| Net Assets | $1,785,280,256 |

| Management Fees (dollars paid during the reporting period) | $12,707,240 |

| Portfolio Turnover Rate | 29 | % |

| Total Number of Portfolio Holdings | 78 |

| |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Types of Investments in Portfolio (as a % of net assets) | | | | | | | | | | | | Top Five Countries (as a % of net assets) | | | | |

| Common Stocks | 99.5% | | | | | | | | | | | | | | | | | China | 27% | | | | | | |

| Short-Term Investments | 1.2% | | | | | | | | | | | | | | | | | India | 19% | | | | | | |

| Other Assets and Liabilities | (0.7)% | | | | | | | | | | | | | | | | | Taiwan | 19% | | | | | | |

| | | | | | | | | | | | | | | | | | | South Korea | 8% | | | | | | |

| | | | | | | | | | | | | | | | | | | Brazil | 6% | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| For additional information about the fund, including its Prospectus, Statement of Additional Information, financial statements, holdings and proxy voting information, scan the QR code or visit americancentury.com/docs. |

| | |

|

| ©2025 American Century Proprietary Holdings, Inc. All rights reserved. |

A-25086877

ANNUAL SHAREHOLDER REPORT

Emerging Markets Fund

| | | | | |

Y Class (AEYMX) | November 30, 2024 |

This annual shareholder report contains important information about Emerging Markets Fund for the period of December 1, 2023 to November 30, 2024. You can find additional information about the fund at americancentury.com/docs. You can also request this information by contacting us at 1-800-345-2021.

| | | | | | | | |

What were the fund costs for the last year? (based on a hypothetical $10,000 investment) |

|

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Y Class | $99 | 0.92% |

|

| | | | | |

| What were the key factors that affected the fund’s performance? |

Emerging Markets Fund Y Class returned 15.72% for the reporting period ended November 30, 2024. |

| The fund seeks capital growth. The commentary below refers to the fund's performance relative to the MSCI Emerging Markets Index. |

| • | Consumer discretionary contributed to relative performance with contributions from MakeMyTrip, an India-based travel company, and Zomato, an India-based food delivery and restaurant reservation company. Trip.com Group, a China-based travel company, benefited results as well. The fund's underweight position in the materials sector also boosted performance. |

| • | Other individual contributors included aircraft company Embraer and semiconductor business Taiwan Semiconductor Manufacturing Co. |

| • | The communication services and energy sectors were the leading detractors from relative performance. NetEase, a China-based internet technology business, and PRIO, an oil and natural gas company, dragged on results. |

| • | Other notable detractors included Samsung Electronics and Hapvida Participacoes e Investimentos, the Brazil-based health care company. Kweichow Moutai, a China-based liquor producer, and Banco BTG Pactual, a financial company based in Brazil, also hurt results. |

| | |

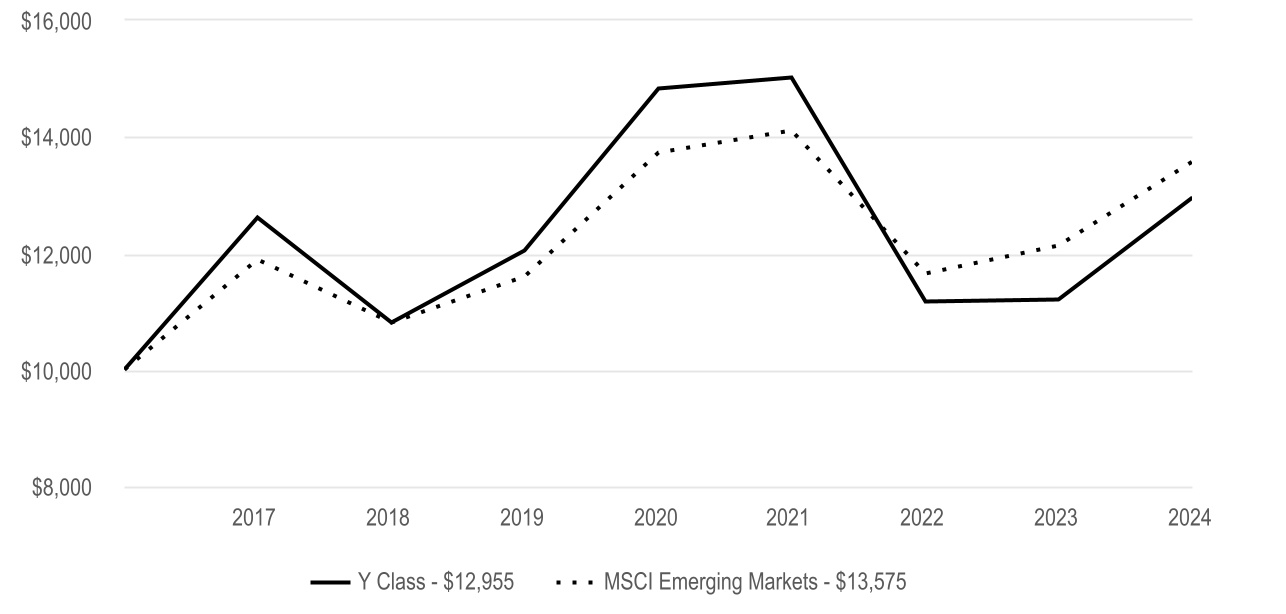

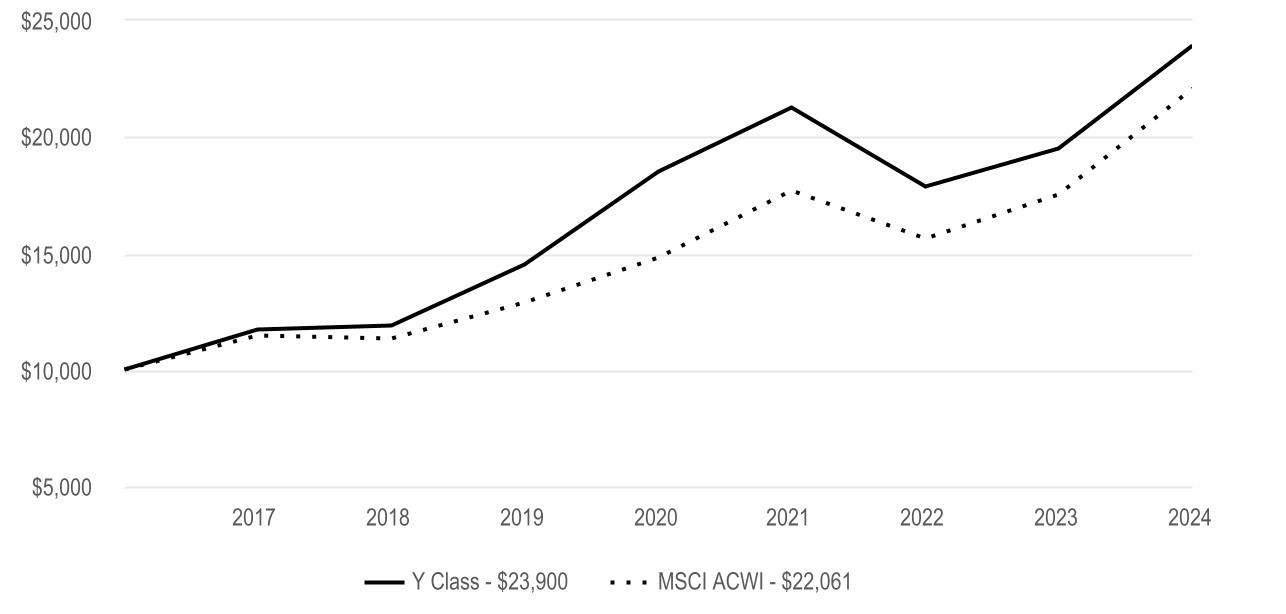

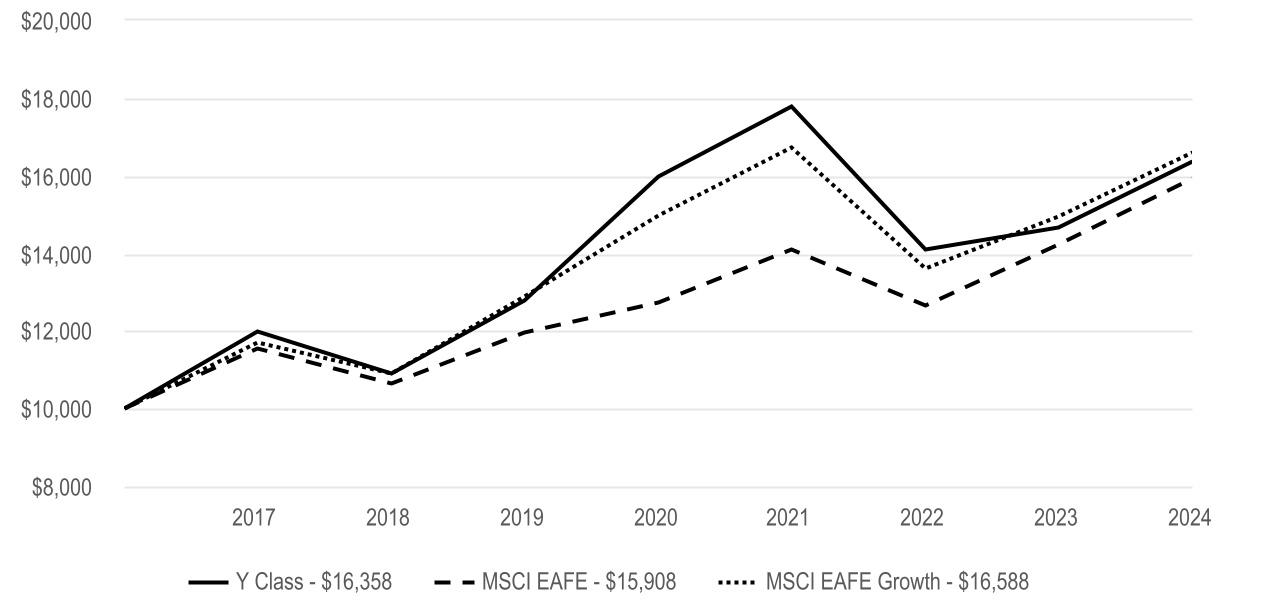

Cumulative Performance (based on an initial $10,000 investment) |

| April 10, 2017 through November 30, 2024 |

|

| | | | | | | | | | | | | | | | |

Average Annual Total Returns | |

| 1 Year | 5 Year | | Since Inception | Inception Date | |

| Y Class | 15.72% | 1.46% | | 3.44% | 4/10/17 | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| MSCI Emerging Markets | 11.86% | 3.20% | | 4.08% | — | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | |

|

The opinions expressed are those of American Century Investments and are no guarantee of the future performance of any American Century Investments fund. This information is for educational purposes only and is not intended as investment advice. Data reflects past performance, assumes reinvestment of dividends and capital gains and is no guarantee of future results. Current performance may be higher or lower than data shown. Investment return and principal value will fluctuate and redemption value may be more or less than original cost, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Total returns for periods less than one year are not annualized. Visit americancentury.com for more recent performance information.

|

| | | | | |

Fund Statistics | |

| Net Assets | $1,785,280,256 |

| Management Fees (dollars paid during the reporting period) | $12,707,240 |

| Portfolio Turnover Rate | 29 | % |

| Total Number of Portfolio Holdings | 78 |

| |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Types of Investments in Portfolio (as a % of net assets) | | | | | | | | | | | | Top Five Countries (as a % of net assets) | | | | |

| Common Stocks | 99.5% | | | | | | | | | | | | | | | | | China | 27% | | | | | | |

| Short-Term Investments | 1.2% | | | | | | | | | | | | | | | | | India | 19% | | | | | | |

| Other Assets and Liabilities | (0.7)% | | | | | | | | | | | | | | | | | Taiwan | 19% | | | | | | |

| | | | | | | | | | | | | | | | | | | South Korea | 8% | | | | | | |

| | | | | | | | | | | | | | | | | | | Brazil | 6% | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| For additional information about the fund, including its Prospectus, Statement of Additional Information, financial statements, holdings and proxy voting information, scan the QR code or visit americancentury.com/docs. |

| | |

|

| ©2025 American Century Proprietary Holdings, Inc. All rights reserved. |

A-2509A885

ANNUAL SHAREHOLDER REPORT

Emerging Markets Fund

| | | | | |

A Class (AEMMX) | November 30, 2024 |

This annual shareholder report contains important information about Emerging Markets Fund for the period of December 1, 2023 to November 30, 2024. You can find additional information about the fund at americancentury.com/docs. You can also request this information by contacting us at 1-800-345-2021.

| | | | | | | | |

What were the fund costs for the last year? (based on a hypothetical $10,000 investment) |

|

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| A Class | $163 | 1.52% |

|

| | | | | |

| What were the key factors that affected the fund’s performance? |

Emerging Markets Fund A Class returned 15.06% for the reporting period ended November 30, 2024. |

| The fund seeks capital growth. The commentary below refers to the fund's performance relative to the MSCI Emerging Markets Index. |

| • | Consumer discretionary contributed to relative performance with contributions from MakeMyTrip, an India-based travel company, and Zomato, an India-based food delivery and restaurant reservation company. Trip.com Group, a China-based travel company, benefited results as well. The fund's underweight position in the materials sector also boosted performance. |

| • | Other individual contributors included aircraft company Embraer and semiconductor business Taiwan Semiconductor Manufacturing Co. |

| • | The communication services and energy sectors were the leading detractors from relative performance. NetEase, a China-based internet technology business, and PRIO, an oil and natural gas company, dragged on results. |

| • | Other notable detractors included Samsung Electronics and Hapvida Participacoes e Investimentos, the Brazil-based health care company. Kweichow Moutai, a China-based liquor producer, and Banco BTG Pactual, a financial company based in Brazil, also hurt results. |

| | |

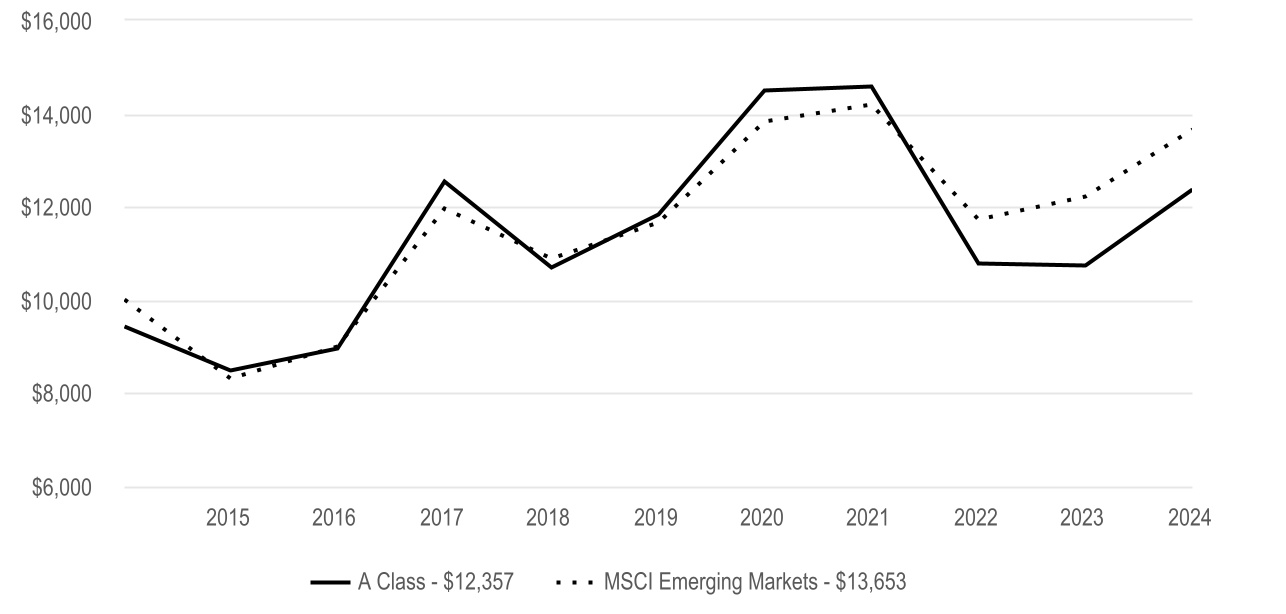

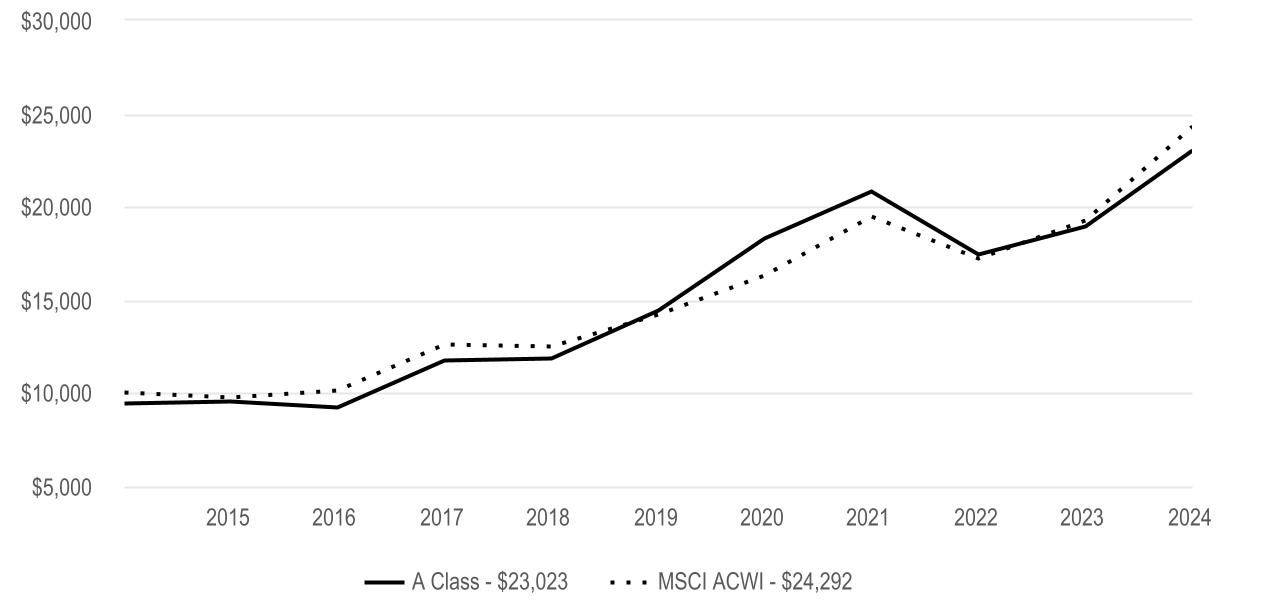

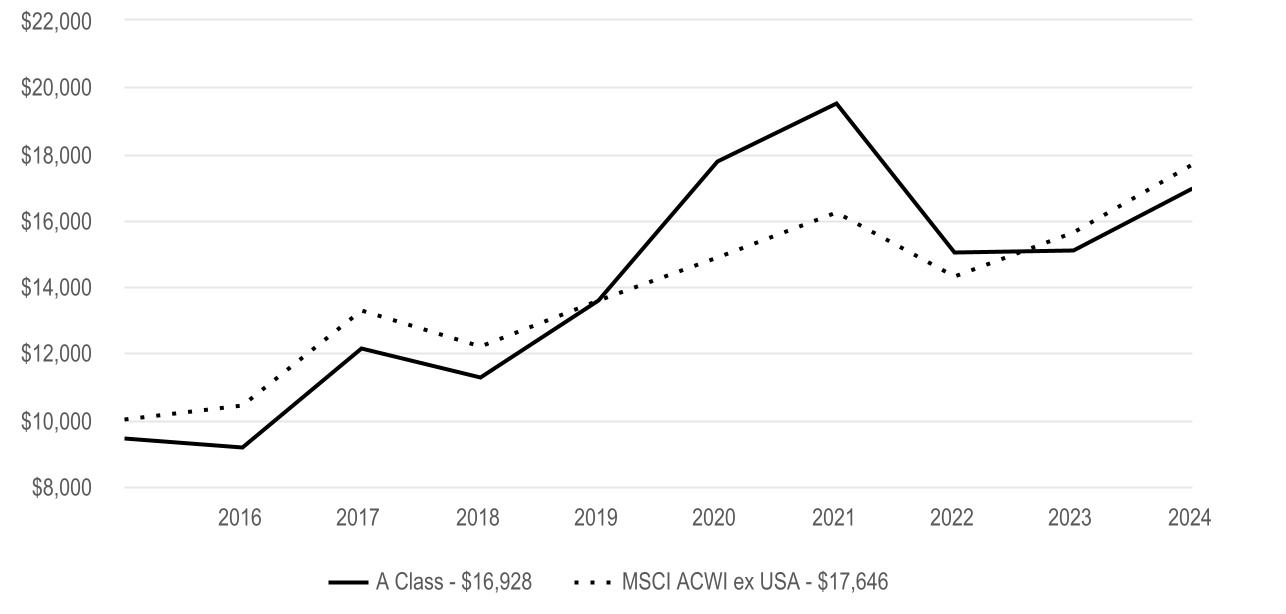

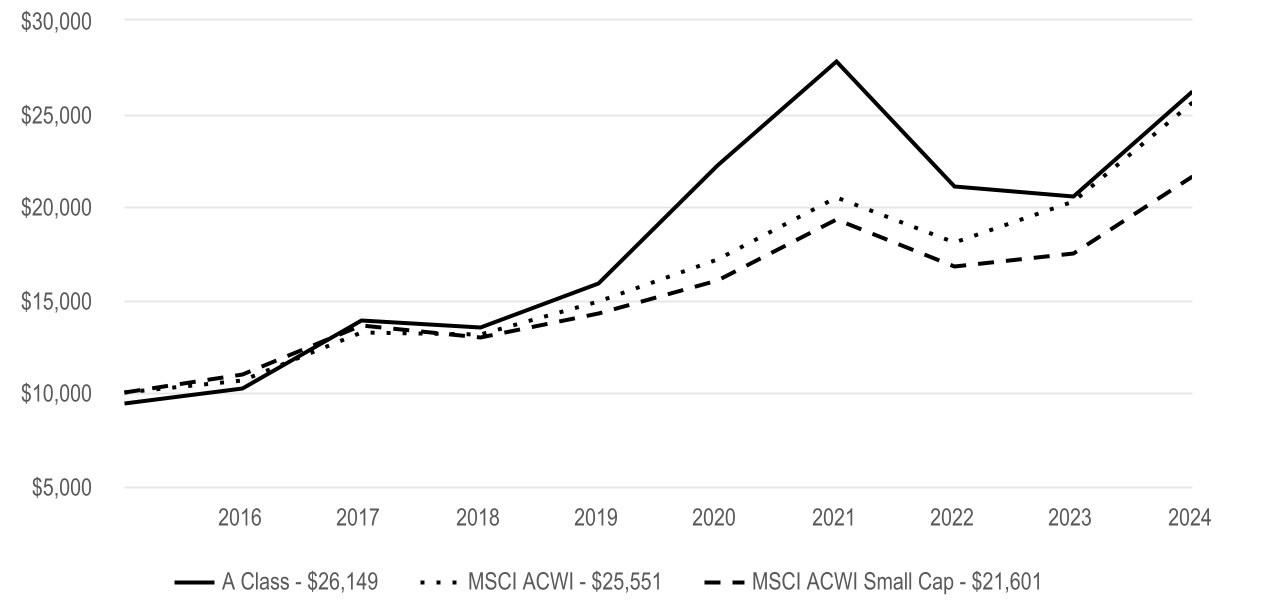

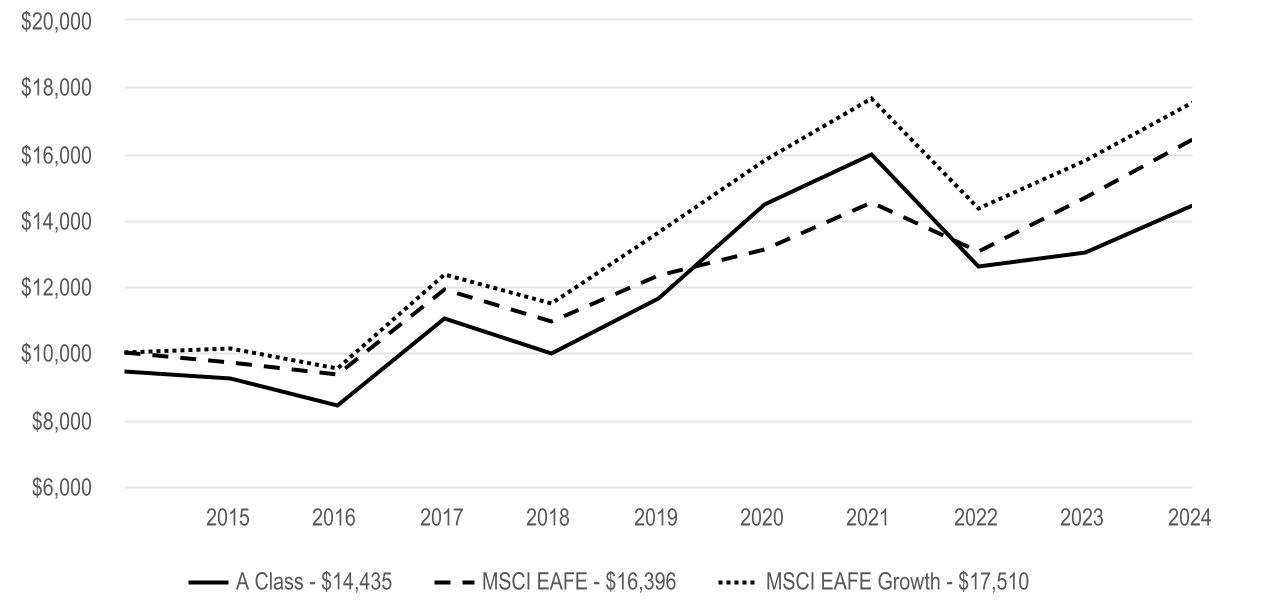

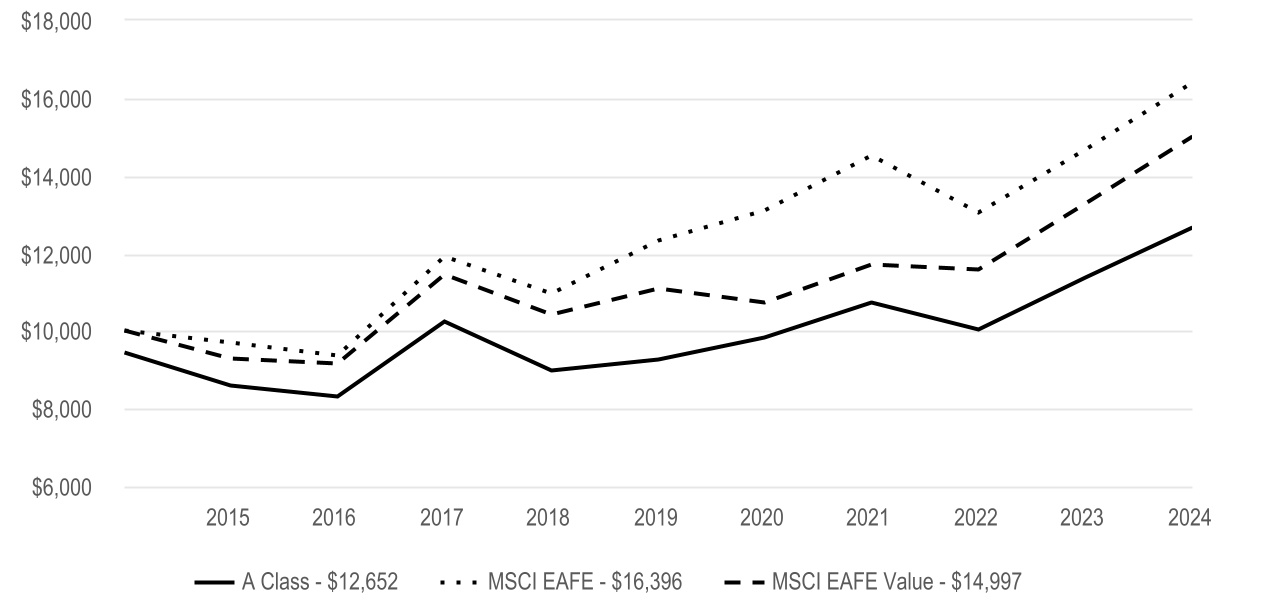

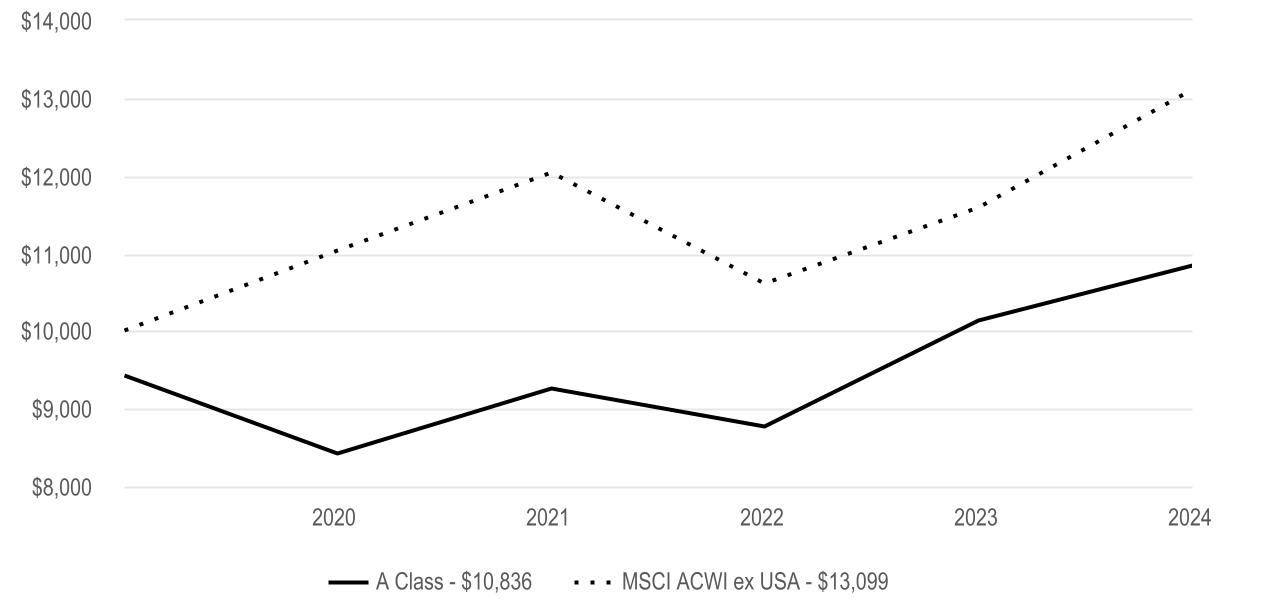

Cumulative Performance (based on an initial $10,000 investment) |

| November 30, 2014 through November 30, 2024 |

| The initial investment is adjusted to reflect the maximum initial sales charge. |

| | | | | | | | | | | | | | |

Average Annual Total Returns | |

| 1 Year | 5 Year | 10 Year | | | |

| A Class | 15.06% | 0.88% | 2.75% | | | |

| A Class - with sales charge | 8.44% | -0.31% | 2.14% | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| MSCI Emerging Markets | 11.86% | 3.20% | 3.16% | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | | | | | | | | | | | | |

|

| A Class shares have a 5.75% maximum initial sales charge and may be subject to a maximum contingent deferred sales charge of 1.00%. |

|

|

|

|

|

|

|

|

|

| | |

|

The opinions expressed are those of American Century Investments and are no guarantee of the future performance of any American Century Investments fund. This information is for educational purposes only and is not intended as investment advice. Data reflects past performance, assumes reinvestment of dividends and capital gains and is no guarantee of future results. Current performance may be higher or lower than data shown. Investment return and principal value will fluctuate and redemption value may be more or less than original cost, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Total returns for periods less than one year are not annualized. Visit americancentury.com for more recent performance information.

|

| | | | | |

Fund Statistics | |

| Net Assets | $1,785,280,256 |

| Management Fees (dollars paid during the reporting period) | $12,707,240 |

| Portfolio Turnover Rate | 29 | % |

| Total Number of Portfolio Holdings | 78 |

| |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Types of Investments in Portfolio (as a % of net assets) | | | | | | | | | | | | Top Five Countries (as a % of net assets) | | | | |

| Common Stocks | 99.5% | | | | | | | | | | | | | | | | | China | 27% | | | | | | |

| Short-Term Investments | 1.2% | | | | | | | | | | | | | | | | | India | 19% | | | | | | |

| Other Assets and Liabilities | (0.7)% | | | | | | | | | | | | | | | | | Taiwan | 19% | | | | | | |

| | | | | | | | | | | | | | | | | | | South Korea | 8% | | | | | | |

| | | | | | | | | | | | | | | | | | | Brazil | 6% | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| For additional information about the fund, including its Prospectus, Statement of Additional Information, financial statements, holdings and proxy voting information, scan the QR code or visit americancentury.com/docs. |

| | |

|

| ©2025 American Century Proprietary Holdings, Inc. All rights reserved. |

A-25086851

ANNUAL SHAREHOLDER REPORT

Emerging Markets Fund

| | | | | |

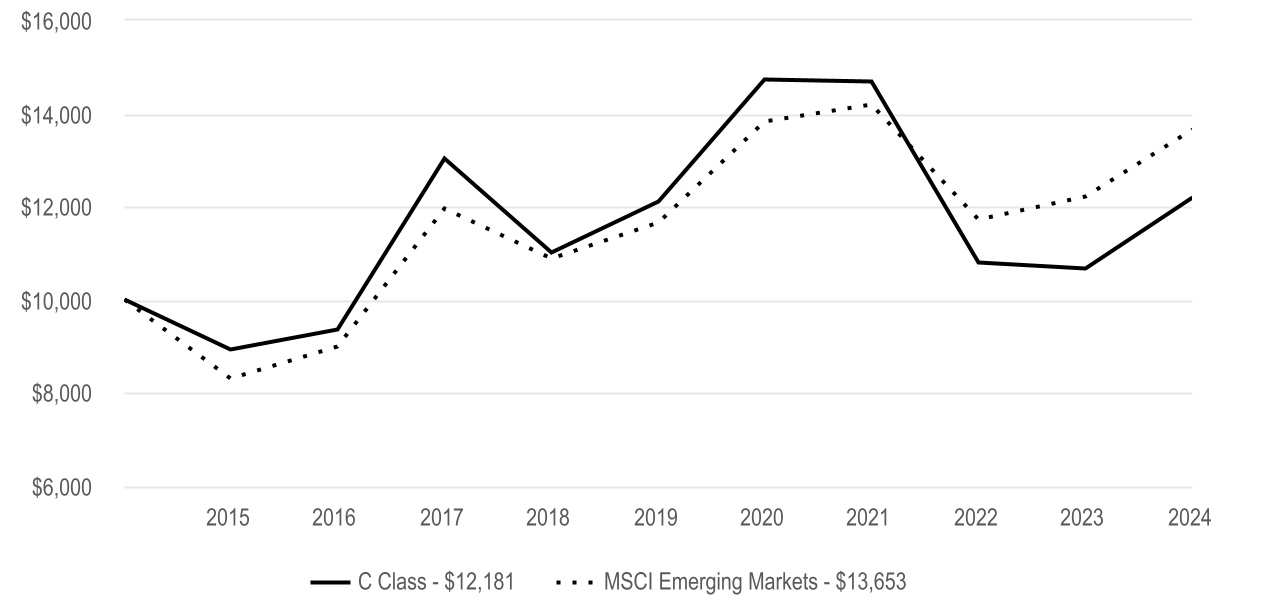

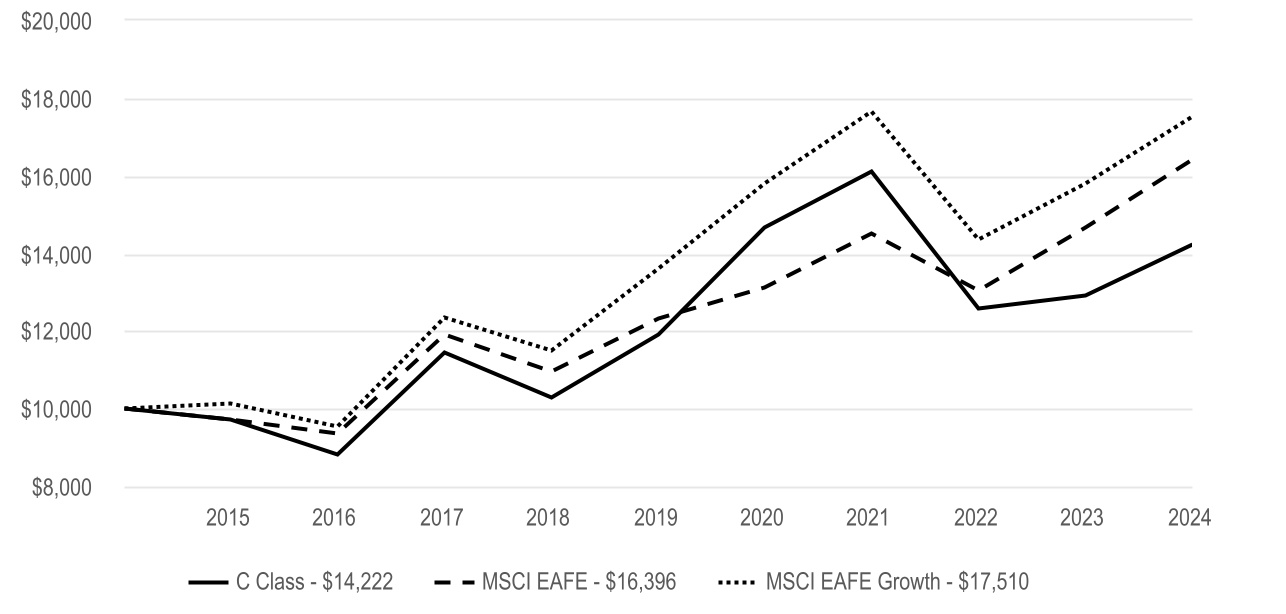

C Class (ACECX) | November 30, 2024 |

This annual shareholder report contains important information about Emerging Markets Fund for the period of December 1, 2023 to November 30, 2024. You can find additional information about the fund at americancentury.com/docs. You can also request this information by contacting us at 1-800-345-2021.

| | | | | | | | |

What were the fund costs for the last year? (based on a hypothetical $10,000 investment) |

|

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| C Class | $243 | 2.27% |

|

| | | | | |

| What were the key factors that affected the fund’s performance? |

Emerging Markets Fund C Class returned 14.25% for the reporting period ended November 30, 2024. |

| The fund seeks capital growth. The commentary below refers to the fund's performance relative to the MSCI Emerging Markets Index. |

| • | Consumer discretionary contributed to relative performance with contributions from MakeMyTrip, an India-based travel company, and Zomato, an India-based food delivery and restaurant reservation company. Trip.com Group, a China-based travel company, benefited results as well. The fund's underweight position in the materials sector also boosted performance. |

| • | Other individual contributors included aircraft company Embraer and semiconductor business Taiwan Semiconductor Manufacturing Co. |

| • | The communication services and energy sectors were the leading detractors from relative performance. NetEase, a China-based internet technology business, and PRIO, an oil and natural gas company, dragged on results. |

| • | Other notable detractors included Samsung Electronics and Hapvida Participacoes e Investimentos, the Brazil-based health care company. Kweichow Moutai, a China-based liquor producer, and Banco BTG Pactual, a financial company based in Brazil, also hurt results. |

| | |

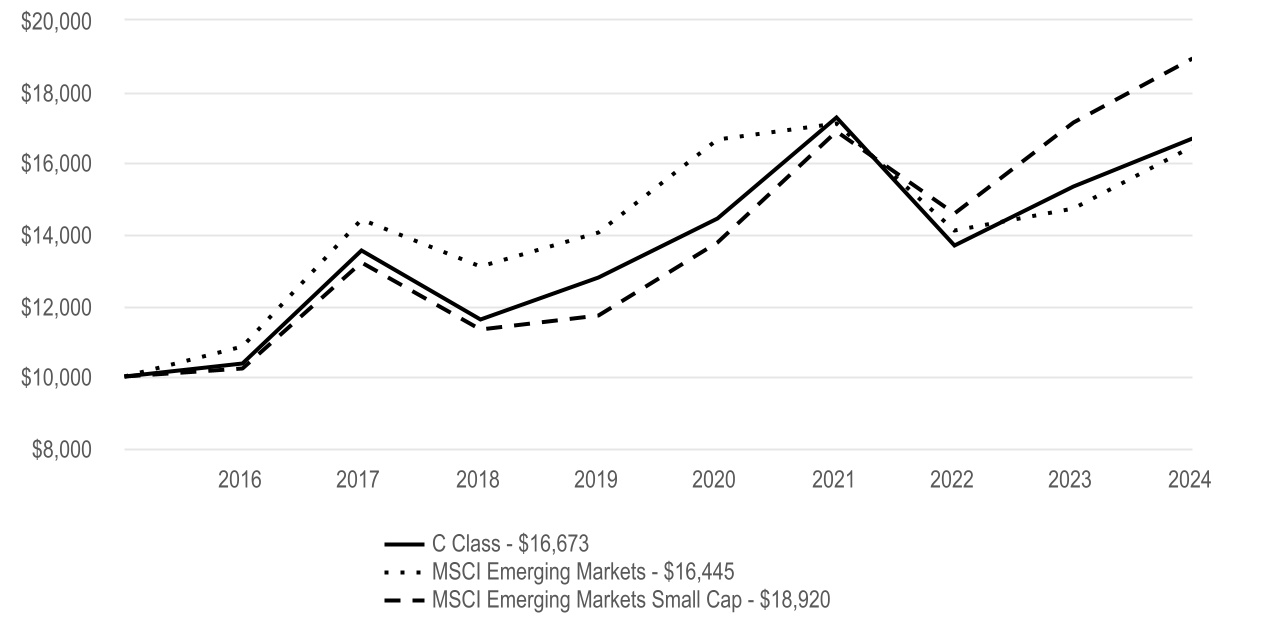

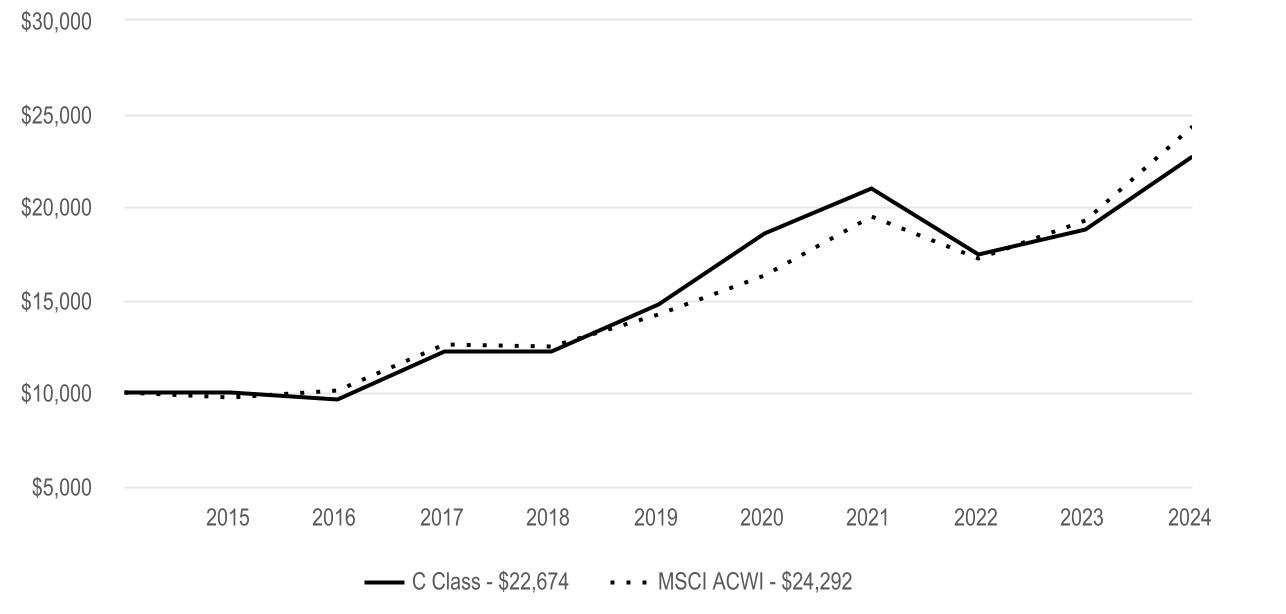

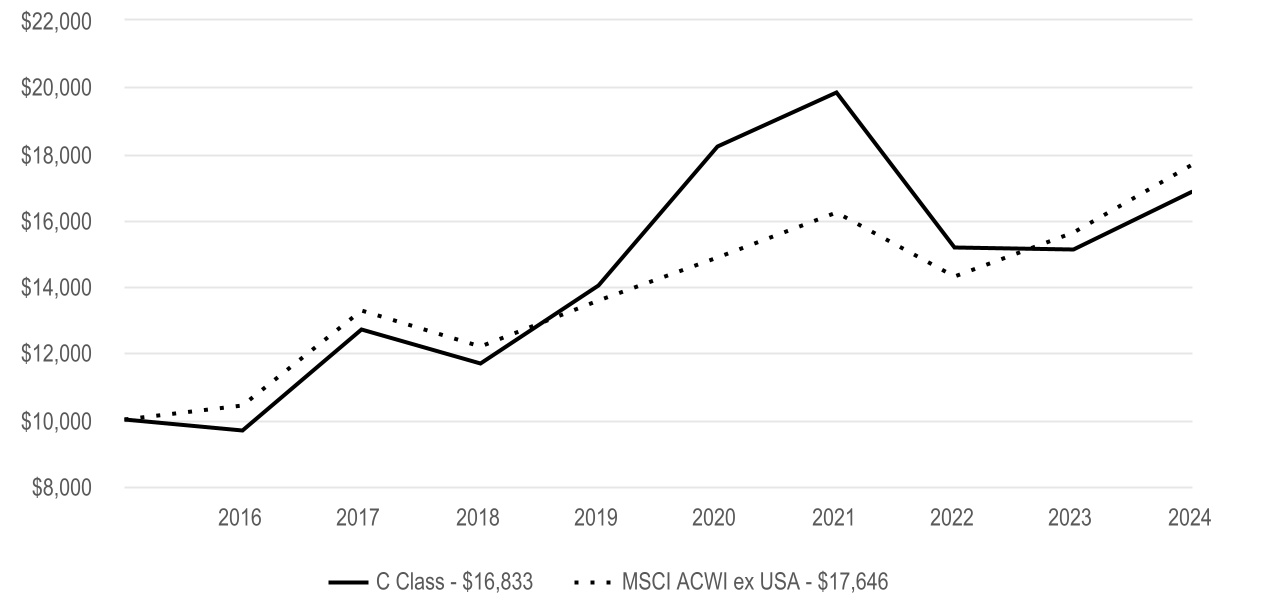

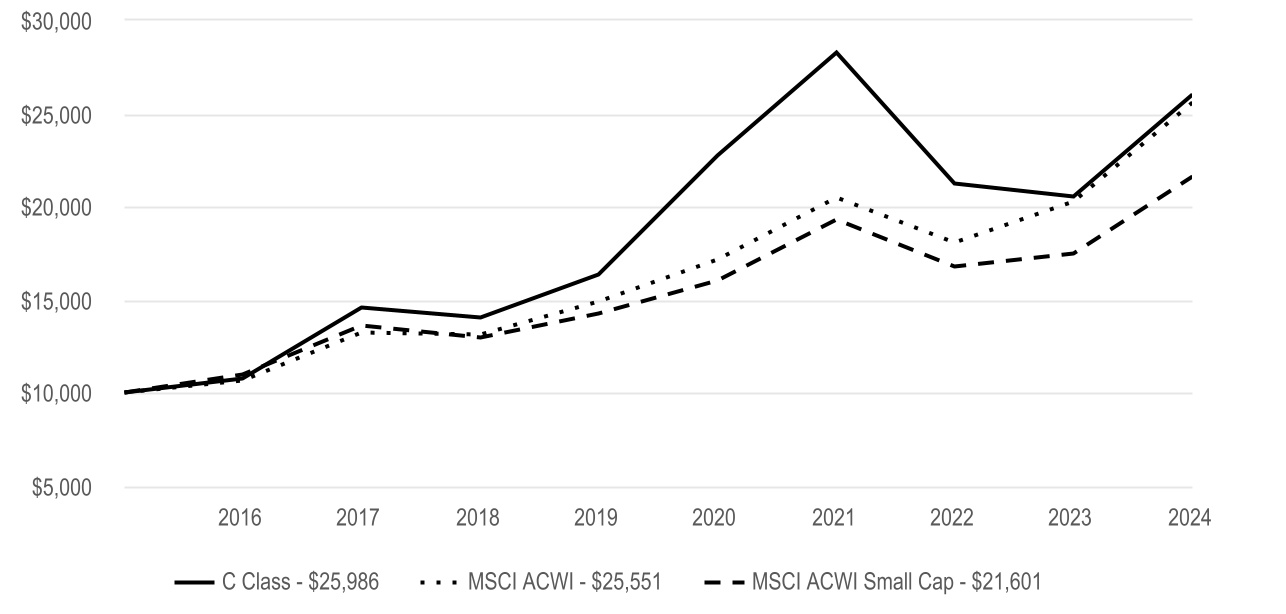

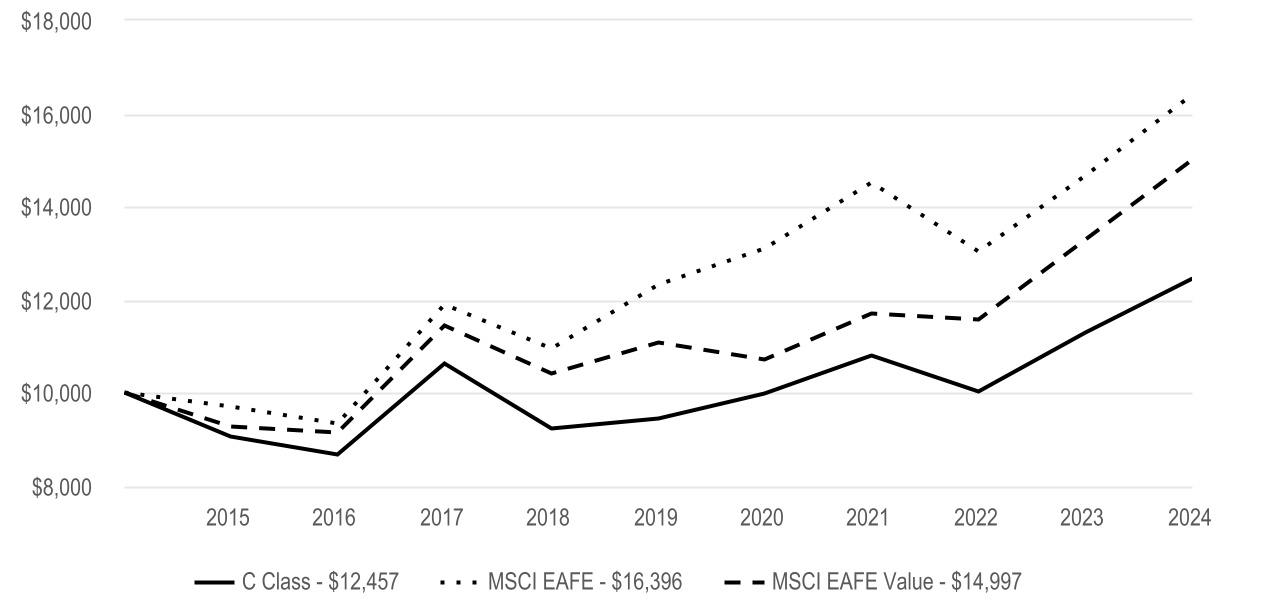

Cumulative Performance (based on an initial $10,000 investment) |

| November 30, 2014 through November 30, 2024 |

|

| | | | | | | | | | | | | | |

Average Annual Total Returns | |

| 1 Year | 5 Year | 10 Year | | | |

| C Class | 14.25% | 0.11% | 1.99% | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| MSCI Emerging Markets | 11.86% | 3.20% | 3.16% | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | | | | | | | | | | | | |

|

|

|

|

|

| C Class shares will automatically convert to A Class shares after being held for approximately eight years. C Class average annual returns do not reflect this conversion. |

|

|

|

|

|

| | |

|

The opinions expressed are those of American Century Investments and are no guarantee of the future performance of any American Century Investments fund. This information is for educational purposes only and is not intended as investment advice. Data reflects past performance, assumes reinvestment of dividends and capital gains and is no guarantee of future results. Current performance may be higher or lower than data shown. Investment return and principal value will fluctuate and redemption value may be more or less than original cost, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Total returns for periods less than one year are not annualized. Visit americancentury.com for more recent performance information.

|

| | | | | |

Fund Statistics | |

| Net Assets | $1,785,280,256 |

| Management Fees (dollars paid during the reporting period) | $12,707,240 |

| Portfolio Turnover Rate | 29 | % |

| Total Number of Portfolio Holdings | 78 |

| |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Types of Investments in Portfolio (as a % of net assets) | | | | | | | | | | | | Top Five Countries (as a % of net assets) | | | | |

| Common Stocks | 99.5% | | | | | | | | | | | | | | | | | China | 27% | | | | | | |

| Short-Term Investments | 1.2% | | | | | | | | | | | | | | | | | India | 19% | | | | | | |

| Other Assets and Liabilities | (0.7)% | | | | | | | | | | | | | | | | | Taiwan | 19% | | | | | | |

| | | | | | | | | | | | | | | | | | | South Korea | 8% | | | | | | |

| | | | | | | | | | | | | | | | | | | Brazil | 6% | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| For additional information about the fund, including its Prospectus, Statement of Additional Information, financial statements, holdings and proxy voting information, scan the QR code or visit americancentury.com/docs. |

| | |

|

| ©2025 American Century Proprietary Holdings, Inc. All rights reserved. |

A-25086679

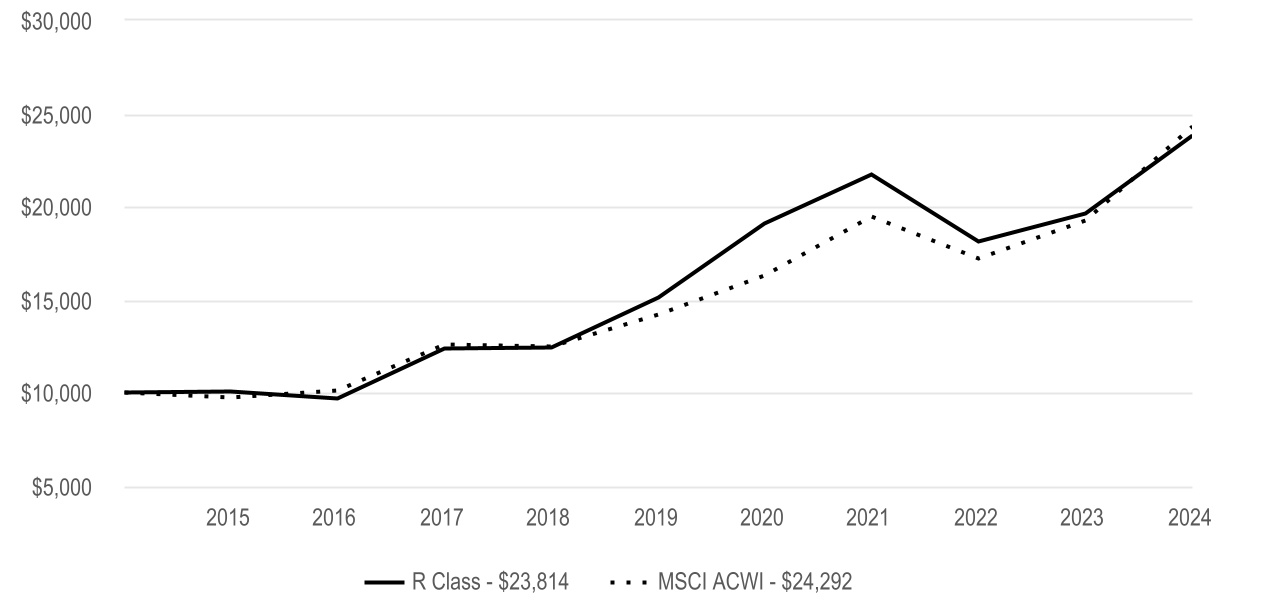

ANNUAL SHAREHOLDER REPORT

Emerging Markets Fund

| | | | | |

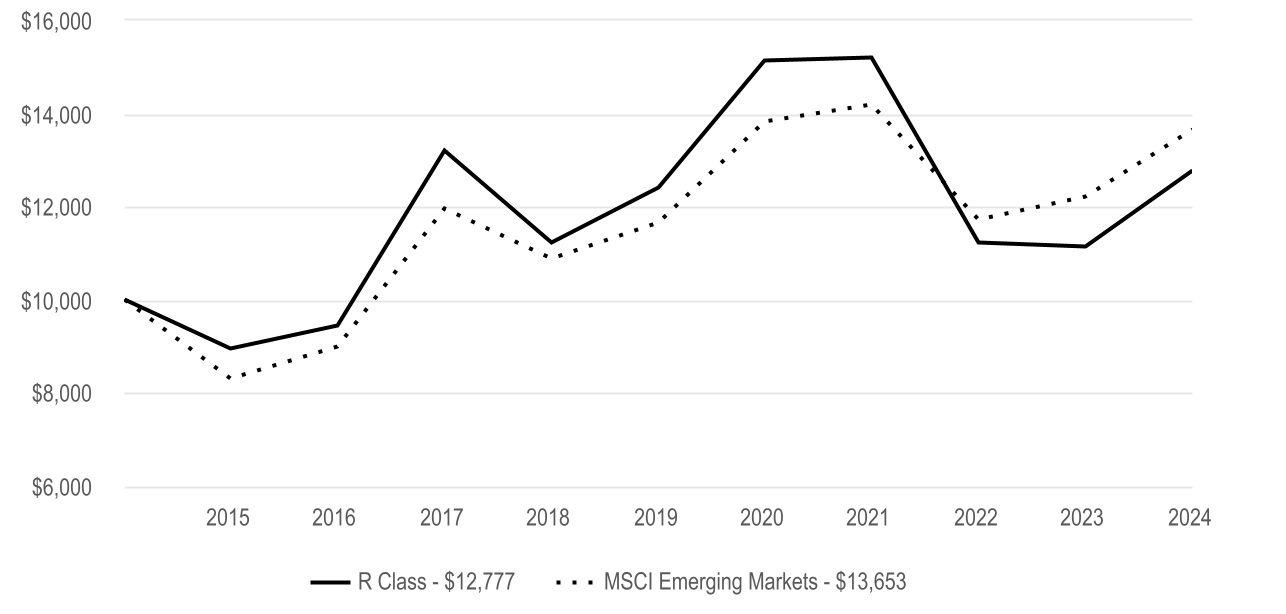

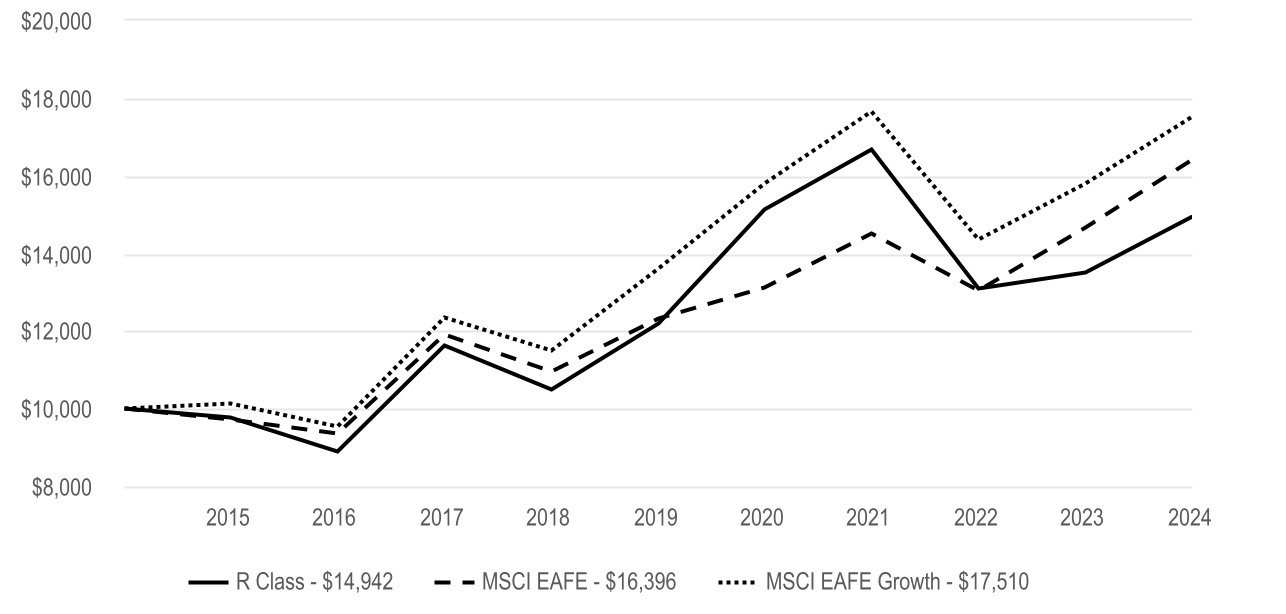

R Class (AEMRX) | November 30, 2024 |

This annual shareholder report contains important information about Emerging Markets Fund for the period of December 1, 2023 to November 30, 2024. You can find additional information about the fund at americancentury.com/docs. You can also request this information by contacting us at 1-800-345-2021.

| | | | | | | | |

What were the fund costs for the last year? (based on a hypothetical $10,000 investment) |

|

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| R Class | $190 | 1.77% |

|

| | | | | |

| What were the key factors that affected the fund’s performance? |

Emerging Markets Fund R Class returned 14.71% for the reporting period ended November 30, 2024. |

| The fund seeks capital growth. The commentary below refers to the fund's performance relative to the MSCI Emerging Markets Index. |

| • | Consumer discretionary contributed to relative performance with contributions from MakeMyTrip, an India-based travel company, and Zomato, an India-based food delivery and restaurant reservation company. Trip.com Group, a China-based travel company, benefited results as well. The fund's underweight position in the materials sector also boosted performance. |

| • | Other individual contributors included aircraft company Embraer and semiconductor business Taiwan Semiconductor Manufacturing Co. |

| • | The communication services and energy sectors were the leading detractors from relative performance. NetEase, a China-based internet technology business, and PRIO, an oil and natural gas company, dragged on results. |

| • | Other notable detractors included Samsung Electronics and Hapvida Participacoes e Investimentos, the Brazil-based health care company. Kweichow Moutai, a China-based liquor producer, and Banco BTG Pactual, a financial company based in Brazil, also hurt results. |

| | |

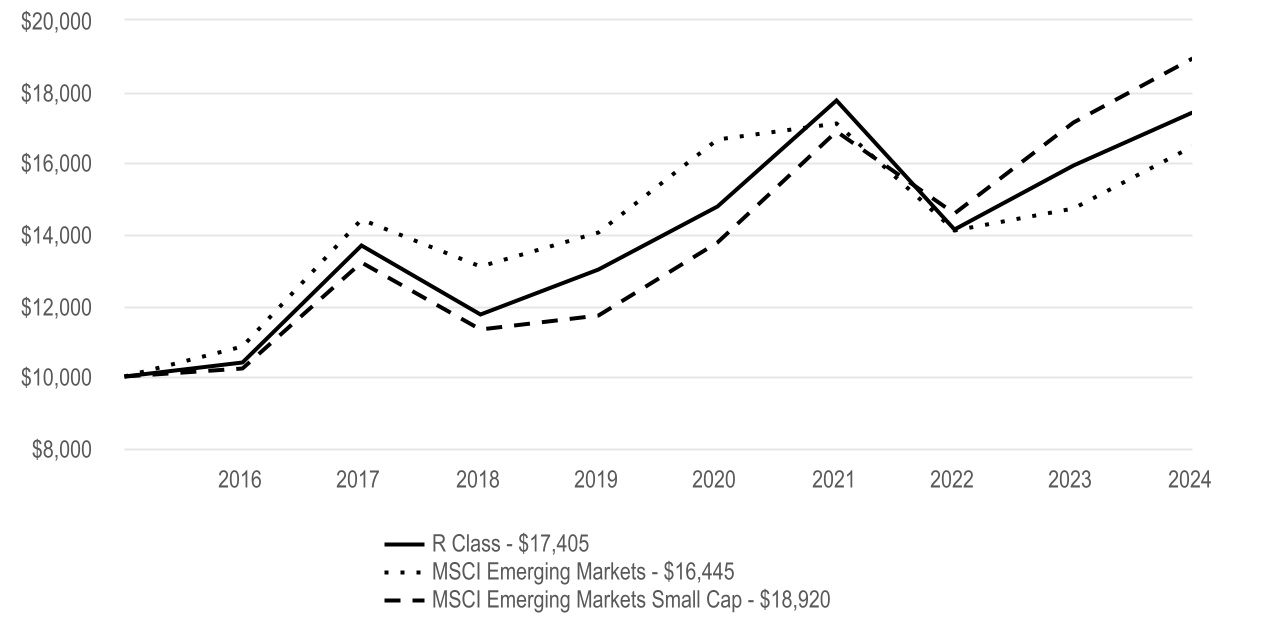

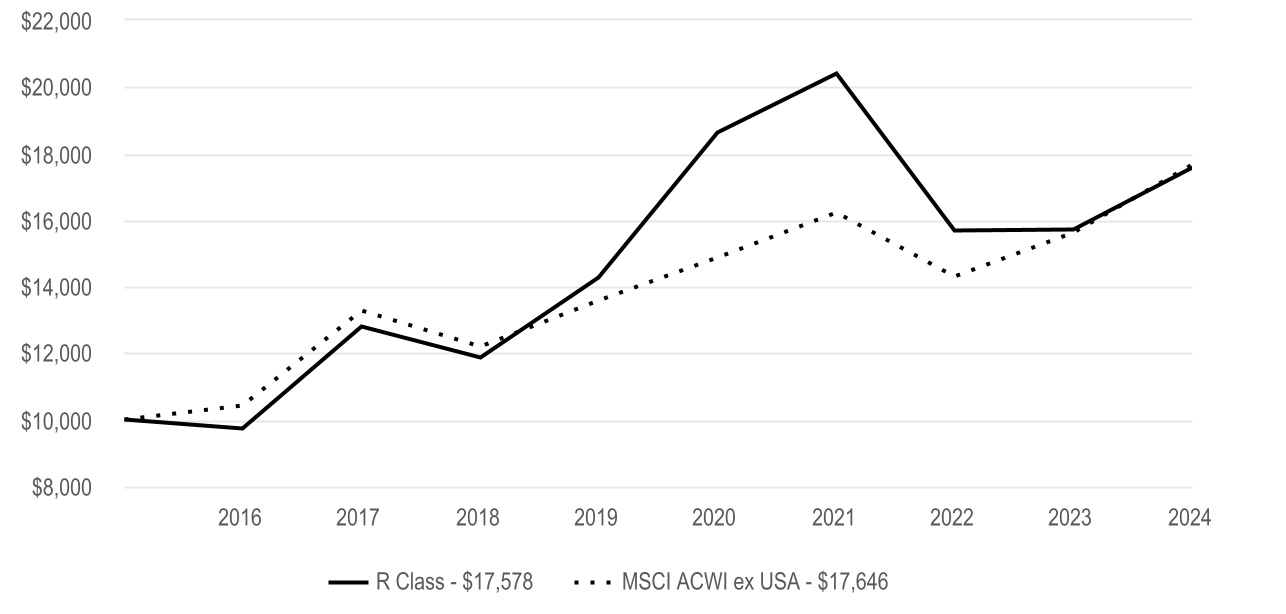

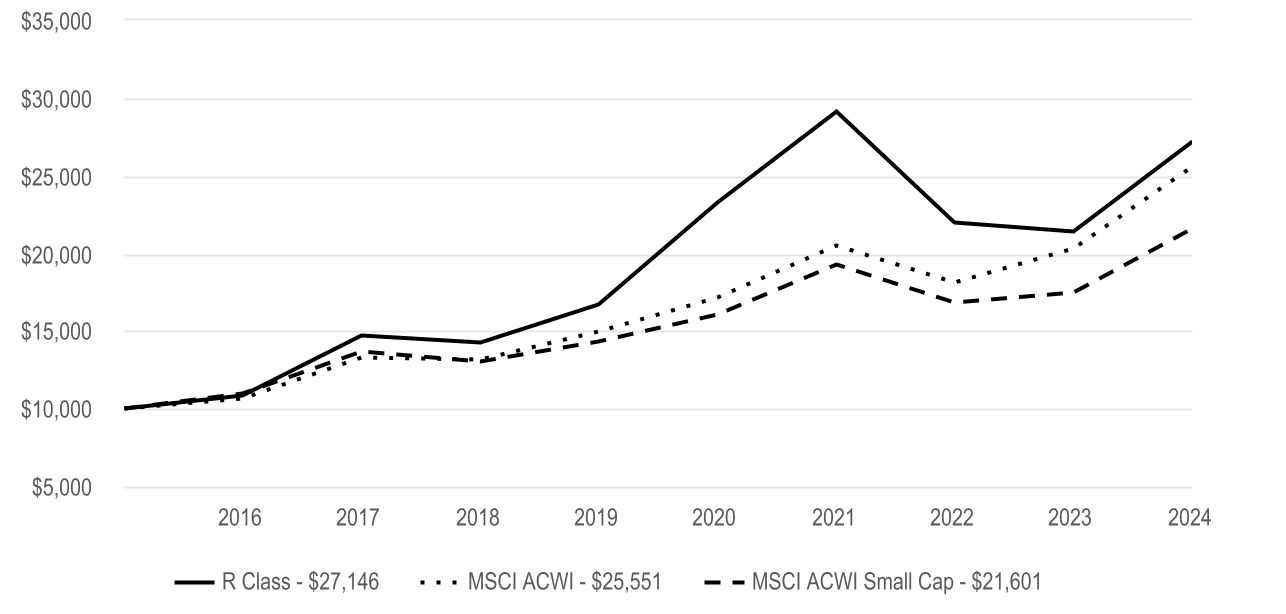

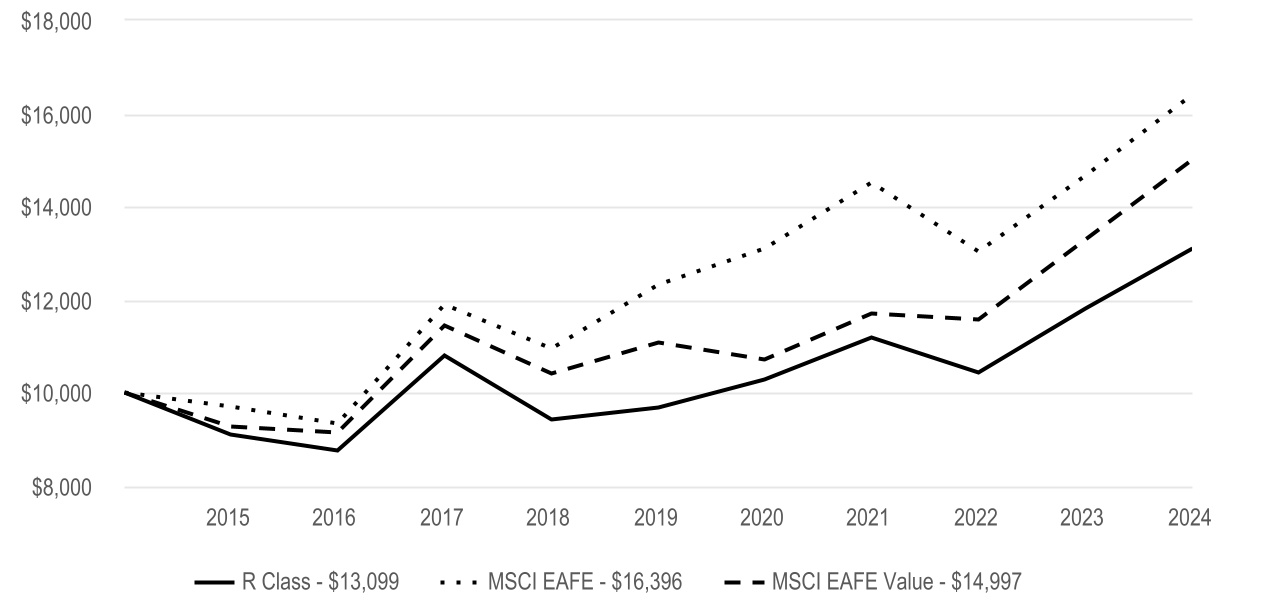

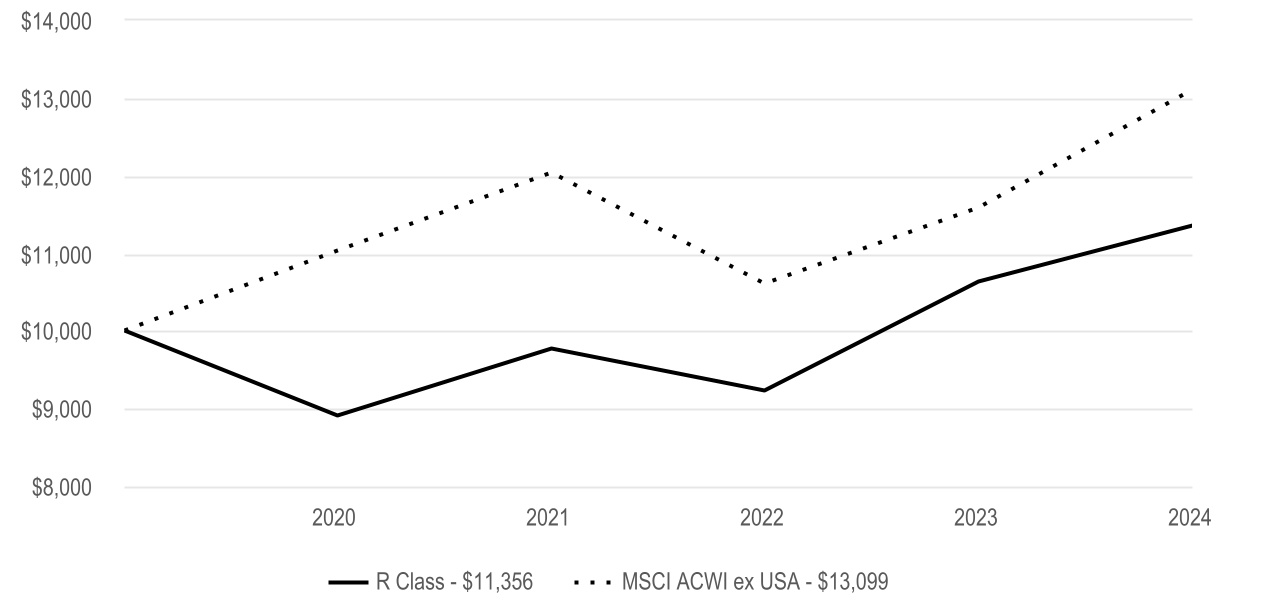

Cumulative Performance (based on an initial $10,000 investment) |

| November 30, 2014 through November 30, 2024 |

|

| | | | | | | | | | | | | | |

Average Annual Total Returns | |

| 1 Year | 5 Year | 10 Year | | | |

| R Class | 14.71% | 0.61% | 2.48% | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| MSCI Emerging Markets | 11.86% | 3.20% | 3.16% | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | |

|

The opinions expressed are those of American Century Investments and are no guarantee of the future performance of any American Century Investments fund. This information is for educational purposes only and is not intended as investment advice. Data reflects past performance, assumes reinvestment of dividends and capital gains and is no guarantee of future results. Current performance may be higher or lower than data shown. Investment return and principal value will fluctuate and redemption value may be more or less than original cost, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Total returns for periods less than one year are not annualized. Visit americancentury.com for more recent performance information.

|

| | | | | |

Fund Statistics | |

| Net Assets | $1,785,280,256 |

| Management Fees (dollars paid during the reporting period) | $12,707,240 |

| Portfolio Turnover Rate | 29 | % |

| Total Number of Portfolio Holdings | 78 |

| |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Types of Investments in Portfolio (as a % of net assets) | | | | | | | | | | | | Top Five Countries (as a % of net assets) | | | | |

| Common Stocks | 99.5% | | | | | | | | | | | | | | | | | China | 27% | | | | | | |

| Short-Term Investments | 1.2% | | | | | | | | | | | | | | | | | India | 19% | | | | | | |

| Other Assets and Liabilities | (0.7)% | | | | | | | | | | | | | | | | | Taiwan | 19% | | | | | | |

| | | | | | | | | | | | | | | | | | | South Korea | 8% | | | | | | |

| | | | | | | | | | | | | | | | | | | Brazil | 6% | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| For additional information about the fund, including its Prospectus, Statement of Additional Information, financial statements, holdings and proxy voting information, scan the QR code or visit americancentury.com/docs. |

| | |

|

| ©2025 American Century Proprietary Holdings, Inc. All rights reserved. |

A-25086489

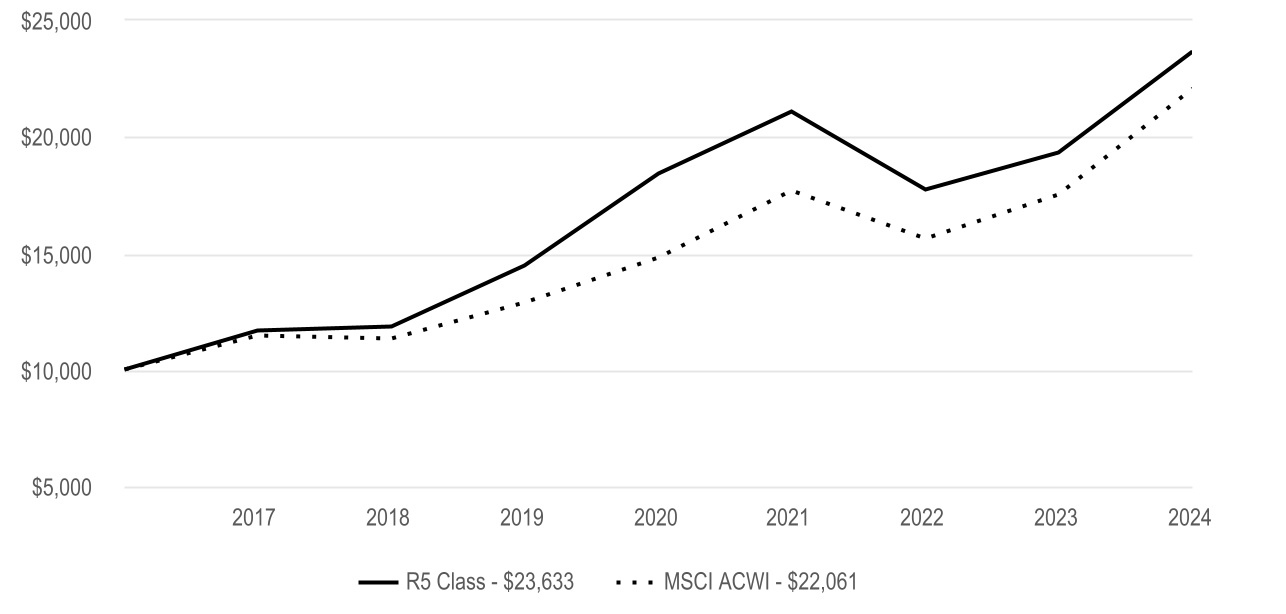

ANNUAL SHAREHOLDER REPORT

Emerging Markets Fund

| | | | | |

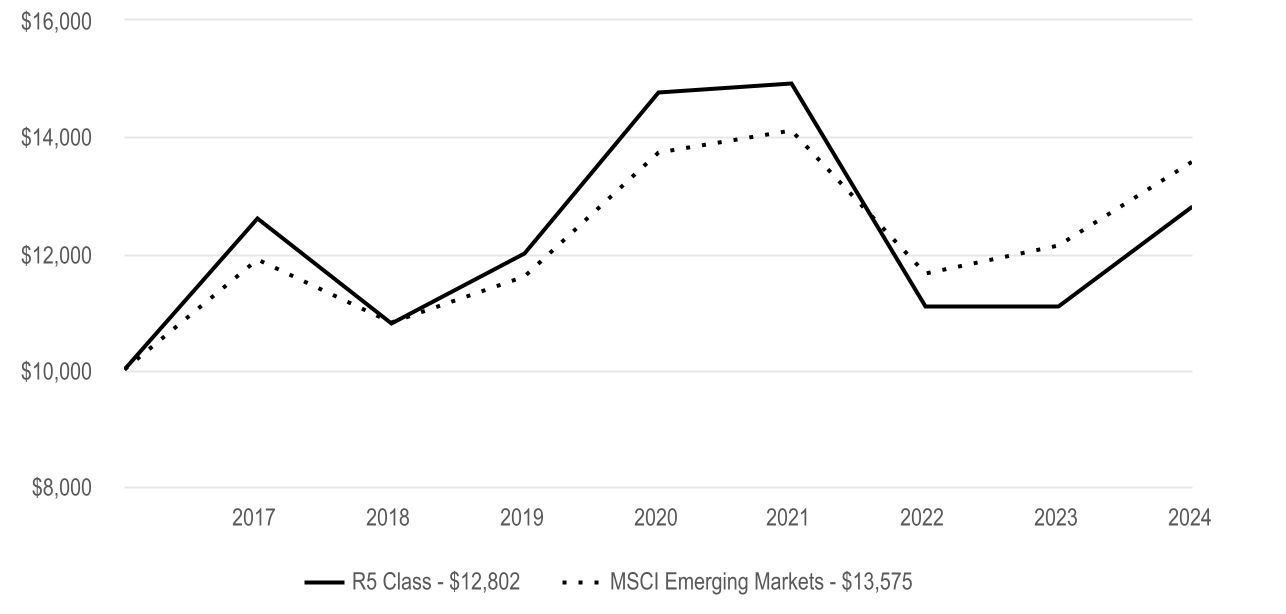

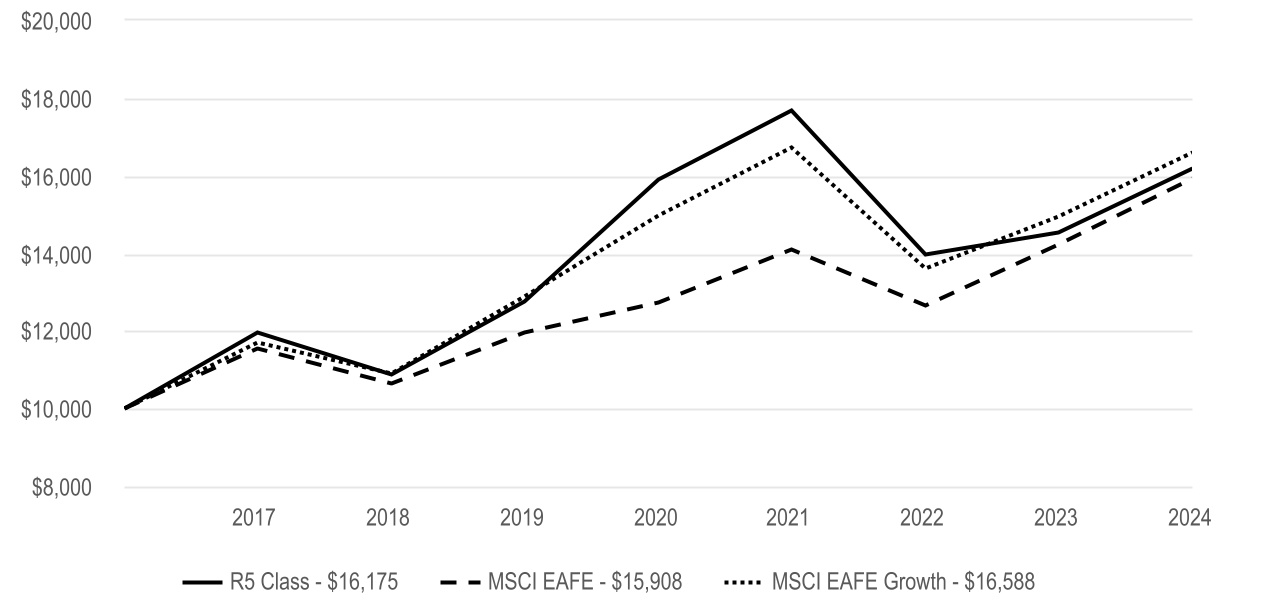

R5 Class (AEGMX) | November 30, 2024 |

This annual shareholder report contains important information about Emerging Markets Fund for the period of December 1, 2023 to November 30, 2024. You can find additional information about the fund at americancentury.com/docs. You can also request this information by contacting us at 1-800-345-2021.

| | | | | | | | |

What were the fund costs for the last year? (based on a hypothetical $10,000 investment) |

|

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| R5 Class | $115 | 1.07% |

|

| | | | | |

| What were the key factors that affected the fund’s performance? |

Emerging Markets Fund R5 Class returned 15.48% for the reporting period ended November 30, 2024. |

| The fund seeks capital growth. The commentary below refers to the fund's performance relative to the MSCI Emerging Markets Index. |

| • | Consumer discretionary contributed to relative performance with contributions from MakeMyTrip, an India-based travel company, and Zomato, an India-based food delivery and restaurant reservation company. Trip.com Group, a China-based travel company, benefited results as well. The fund's underweight position in the materials sector also boosted performance. |

| • | Other individual contributors included aircraft company Embraer and semiconductor business Taiwan Semiconductor Manufacturing Co. |

| • | The communication services and energy sectors were the leading detractors from relative performance. NetEase, a China-based internet technology business, and PRIO, an oil and natural gas company, dragged on results. |

| • | Other notable detractors included Samsung Electronics and Hapvida Participacoes e Investimentos, the Brazil-based health care company. Kweichow Moutai, a China-based liquor producer, and Banco BTG Pactual, a financial company based in Brazil, also hurt results. |

| | |

Cumulative Performance (based on an initial $10,000 investment) |

| April 10, 2017 through November 30, 2024 |

|

| | | | | | | | | | | | | | | | |

Average Annual Total Returns | |

| 1 Year | 5 Year | | Since Inception | Inception Date | |

| R5 Class | 15.48% | 1.30% | | 3.28% | 4/10/17 | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| MSCI Emerging Markets | 11.86% | 3.20% | | 4.08% | — | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | |

|

The opinions expressed are those of American Century Investments and are no guarantee of the future performance of any American Century Investments fund. This information is for educational purposes only and is not intended as investment advice. Data reflects past performance, assumes reinvestment of dividends and capital gains and is no guarantee of future results. Current performance may be higher or lower than data shown. Investment return and principal value will fluctuate and redemption value may be more or less than original cost, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Total returns for periods less than one year are not annualized. Visit americancentury.com for more recent performance information.

|

| | | | | |

Fund Statistics | |

| Net Assets | $1,785,280,256 |

| Management Fees (dollars paid during the reporting period) | $12,707,240 |

| Portfolio Turnover Rate | 29 | % |

| Total Number of Portfolio Holdings | 78 |

| |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Types of Investments in Portfolio (as a % of net assets) | | | | | | | | | | | | Top Five Countries (as a % of net assets) | | | | |

| Common Stocks | 99.5% | | | | | | | | | | | | | | | | | China | 27% | | | | | | |

| Short-Term Investments | 1.2% | | | | | | | | | | | | | | | | | India | 19% | | | | | | |

| Other Assets and Liabilities | (0.7)% | | | | | | | | | | | | | | | | | Taiwan | 19% | | | | | | |

| | | | | | | | | | | | | | | | | | | South Korea | 8% | | | | | | |

| | | | | | | | | | | | | | | | | | | Brazil | 6% | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| For additional information about the fund, including its Prospectus, Statement of Additional Information, financial statements, holdings and proxy voting information, scan the QR code or visit americancentury.com/docs. |

| | |

|

| ©2025 American Century Proprietary Holdings, Inc. All rights reserved. |

A-2509A802

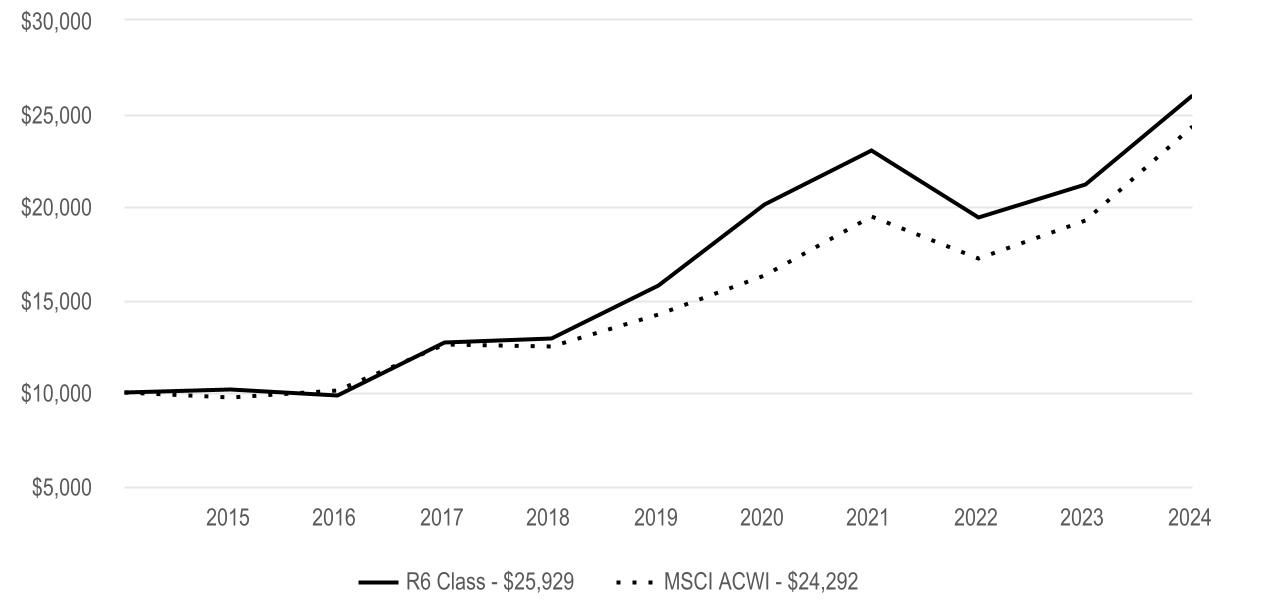

ANNUAL SHAREHOLDER REPORT

Emerging Markets Fund

| | | | | |

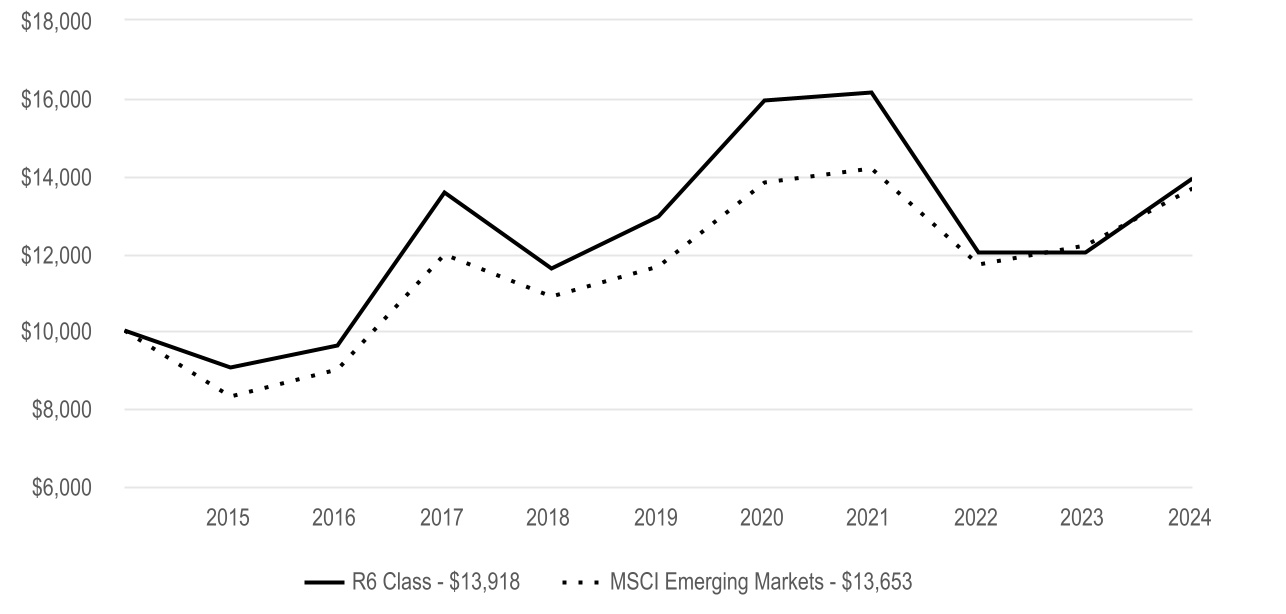

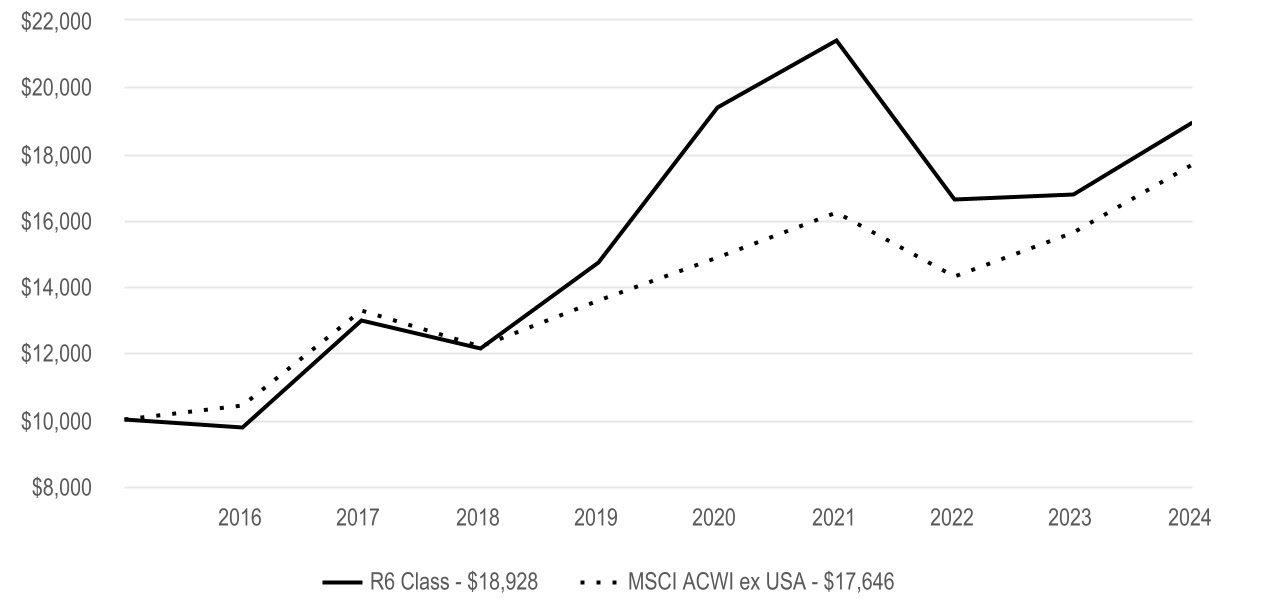

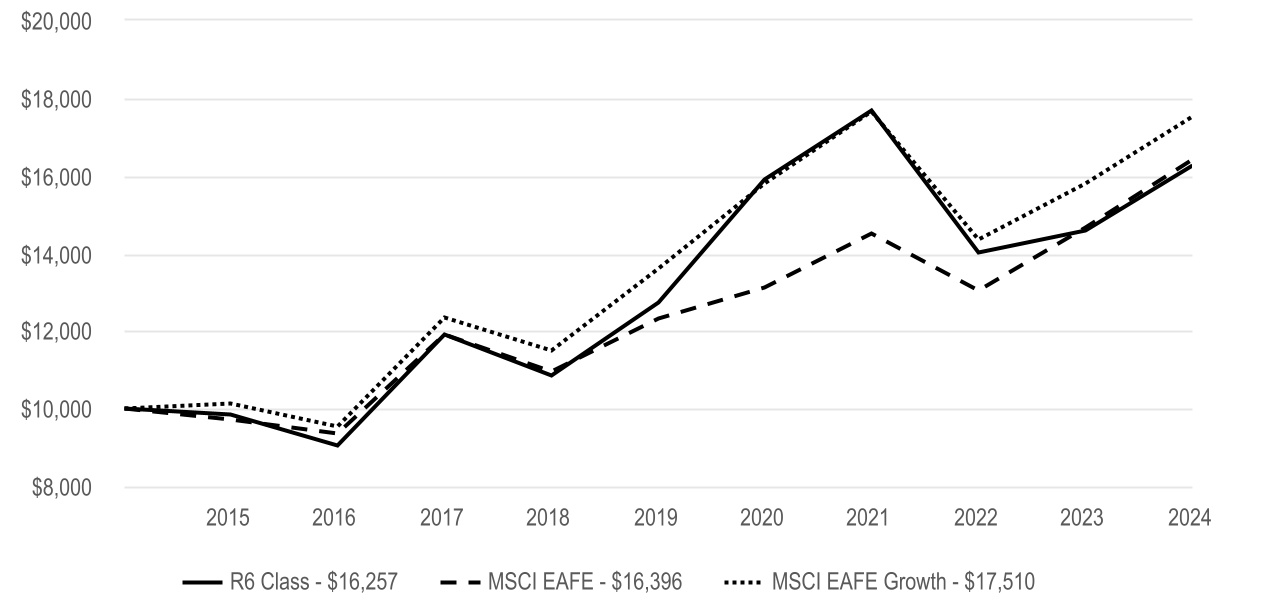

| R6 Class (AEDMX) | November 30, 2024 |

This annual shareholder report contains important information about Emerging Markets Fund for the period of December 1, 2023 to November 30, 2024. You can find additional information about the fund at americancentury.com/docs. You can also request this information by contacting us at 1-800-345-2021.

| | | | | | | | |

What were the fund costs for the last year? (based on a hypothetical $10,000 investment) |

|

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| R6 Class | $99 | 0.92% |

|

| | | | | |

| What were the key factors that affected the fund’s performance? |

Emerging Markets Fund R6 Class returned 15.75% for the reporting period ended November 30, 2024. |

| The fund seeks capital growth. The commentary below refers to the fund's performance relative to the MSCI Emerging Markets Index. |

| • | Consumer discretionary contributed to relative performance with contributions from MakeMyTrip, an India-based travel company, and Zomato, an India-based food delivery and restaurant reservation company. Trip.com Group, a China-based travel company, benefited results as well. The fund's underweight position in the materials sector also boosted performance. |

| • | Other individual contributors included aircraft company Embraer and semiconductor business Taiwan Semiconductor Manufacturing Co. |

| • | The communication services and energy sectors were the leading detractors from relative performance. NetEase, a China-based internet technology business, and PRIO, an oil and natural gas company, dragged on results. |

| • | Other notable detractors included Samsung Electronics and Hapvida Participacoes e Investimentos, the Brazil-based health care company. Kweichow Moutai, a China-based liquor producer, and Banco BTG Pactual, a financial company based in Brazil, also hurt results. |

| | |

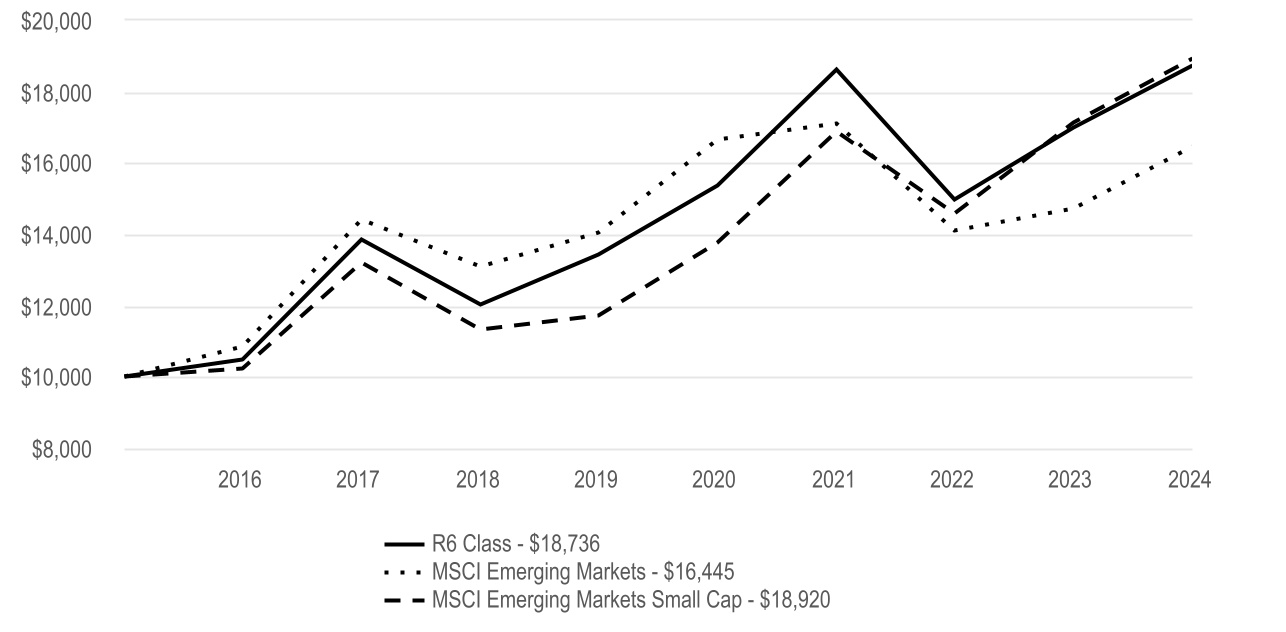

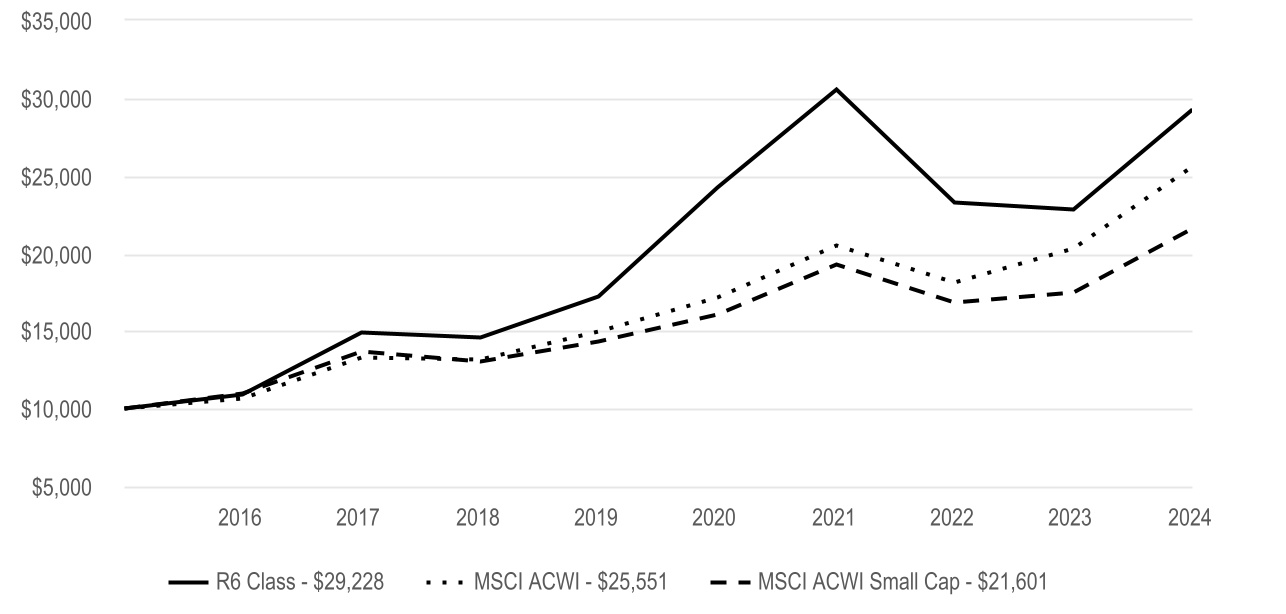

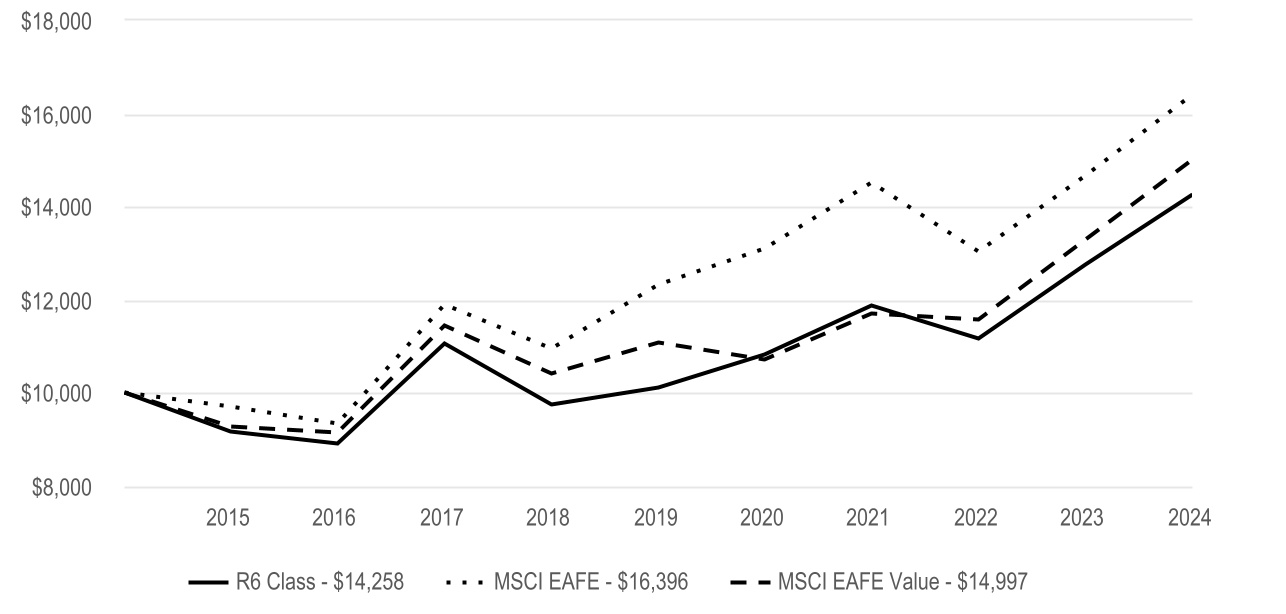

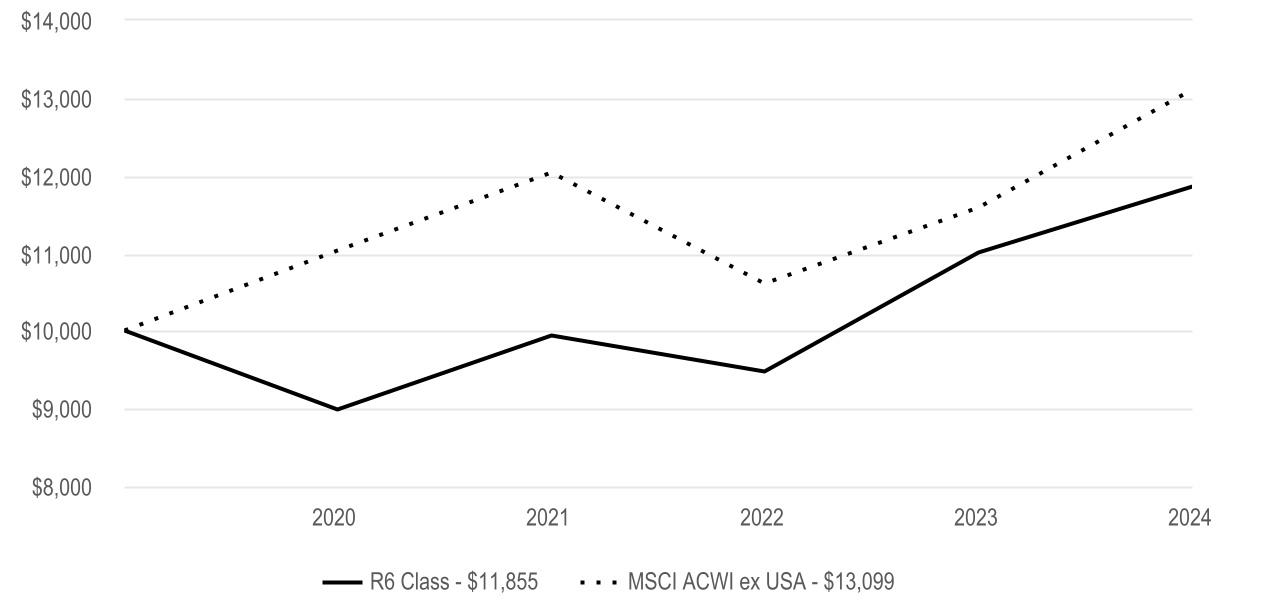

Cumulative Performance (based on an initial $10,000 investment) |

| November 30, 2014 through November 30, 2024 |

|

| | | | | | | | | | | | | | |

Average Annual Total Returns | |

| 1 Year | 5 Year | 10 Year | | | |

| R6 Class | 15.75% | 1.47% | 3.36% | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| MSCI Emerging Markets | 11.86% | 3.20% | 3.16% | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | |

|

The opinions expressed are those of American Century Investments and are no guarantee of the future performance of any American Century Investments fund. This information is for educational purposes only and is not intended as investment advice. Data reflects past performance, assumes reinvestment of dividends and capital gains and is no guarantee of future results. Current performance may be higher or lower than data shown. Investment return and principal value will fluctuate and redemption value may be more or less than original cost, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Total returns for periods less than one year are not annualized. Visit americancentury.com for more recent performance information.

|

| | | | | |

Fund Statistics | |

| Net Assets | $1,785,280,256 |

| Management Fees (dollars paid during the reporting period) | $12,707,240 |

| Portfolio Turnover Rate | 29 | % |

| Total Number of Portfolio Holdings | 78 |

| |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Types of Investments in Portfolio (as a % of net assets) | | | | | | | | | | | | Top Five Countries (as a % of net assets) | | | | |

| Common Stocks | 99.5% | | | | | | | | | | | | | | | | | China | 27% | | | | | | |

| Short-Term Investments | 1.2% | | | | | | | | | | | | | | | | | India | 19% | | | | | | |

| Other Assets and Liabilities | (0.7)% | | | | | | | | | | | | | | | | | Taiwan | 19% | | | | | | |

| | | | | | | | | | | | | | | | | | | South Korea | 8% | | | | | | |

| | | | | | | | | | | | | | | | | | | Brazil | 6% | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| For additional information about the fund, including its Prospectus, Statement of Additional Information, financial statements, holdings and proxy voting information, scan the QR code or visit americancentury.com/docs. |

| | |

|

| ©2025 American Century Proprietary Holdings, Inc. All rights reserved. |

A-25086422

ANNUAL SHAREHOLDER REPORT

Emerging Markets Fund

| | | | | |

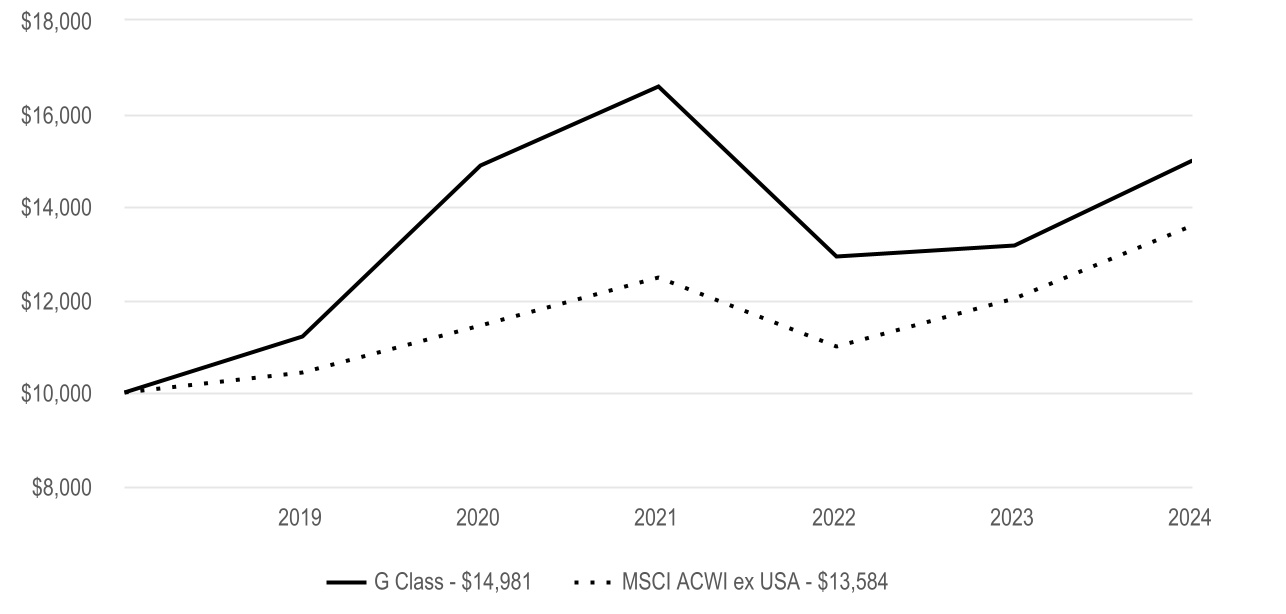

G Class (ACADX) | November 30, 2024 |

This annual shareholder report contains important information about Emerging Markets Fund for the period of December 1, 2023 to November 30, 2024. You can find additional information about the fund at americancentury.com/docs. You can also request this information by contacting us at 1-800-345-2021.

| | | | | | | | |

What were the fund costs for the last year? (based on a hypothetical $10,000 investment) |

|

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| G Class | $2 | 0.02% |

|

| | | | | |

| What were the key factors that affected the fund’s performance? |

Emerging Markets Fund G Class returned 16.79% for the reporting period ended November 30, 2024. |

| The fund seeks capital growth. The commentary below refers to the fund's performance relative to the MSCI Emerging Markets Index. |

| • | Consumer discretionary contributed to relative performance with contributions from MakeMyTrip, an India-based travel company, and Zomato, an India-based food delivery and restaurant reservation company. Trip.com Group, a China-based travel company, benefited results as well. The fund's underweight position in the materials sector also boosted performance. |

| • | Other individual contributors included aircraft company Embraer and semiconductor business Taiwan Semiconductor Manufacturing Co. |

| • | The communication services and energy sectors were the leading detractors from relative performance. NetEase, a China-based internet technology business, and PRIO, an oil and natural gas company, dragged on results. |

| • | Other notable detractors included Samsung Electronics and Hapvida Participacoes e Investimentos, the Brazil-based health care company. Kweichow Moutai, a China-based liquor producer, and Banco BTG Pactual, a financial company based in Brazil, also hurt results. |

| | |

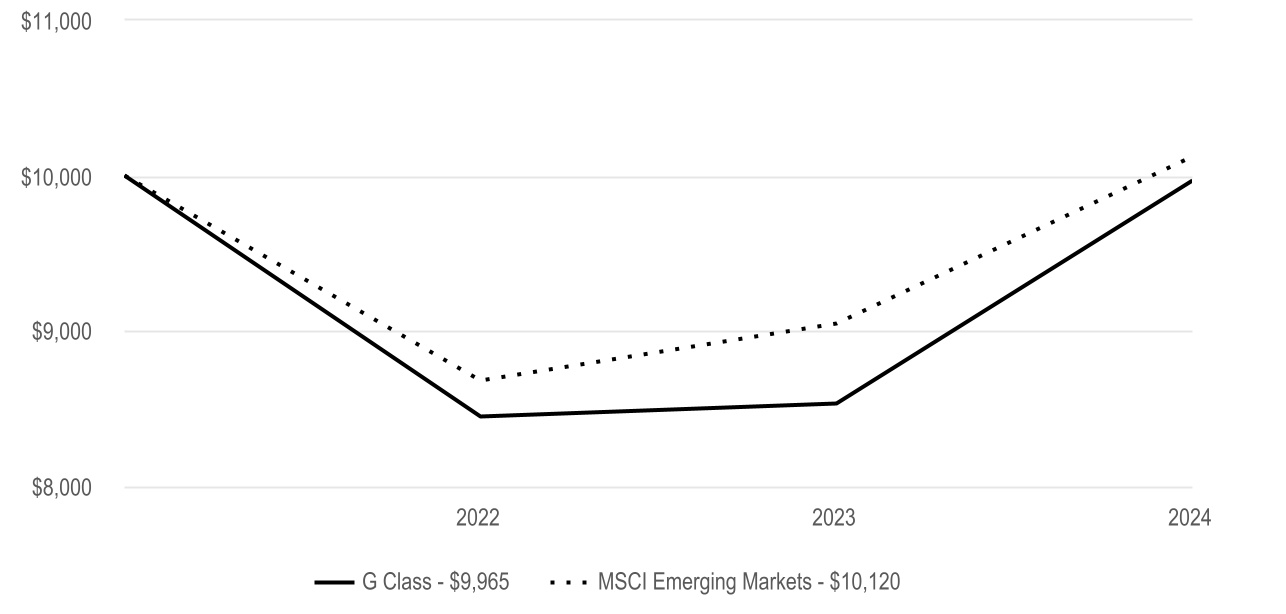

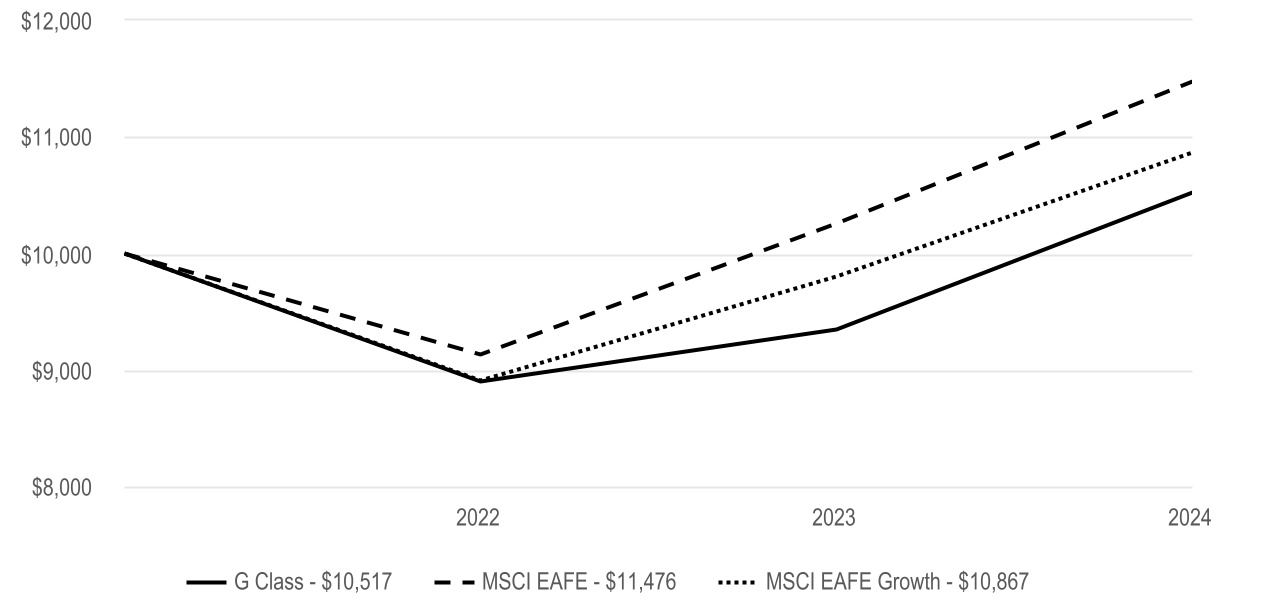

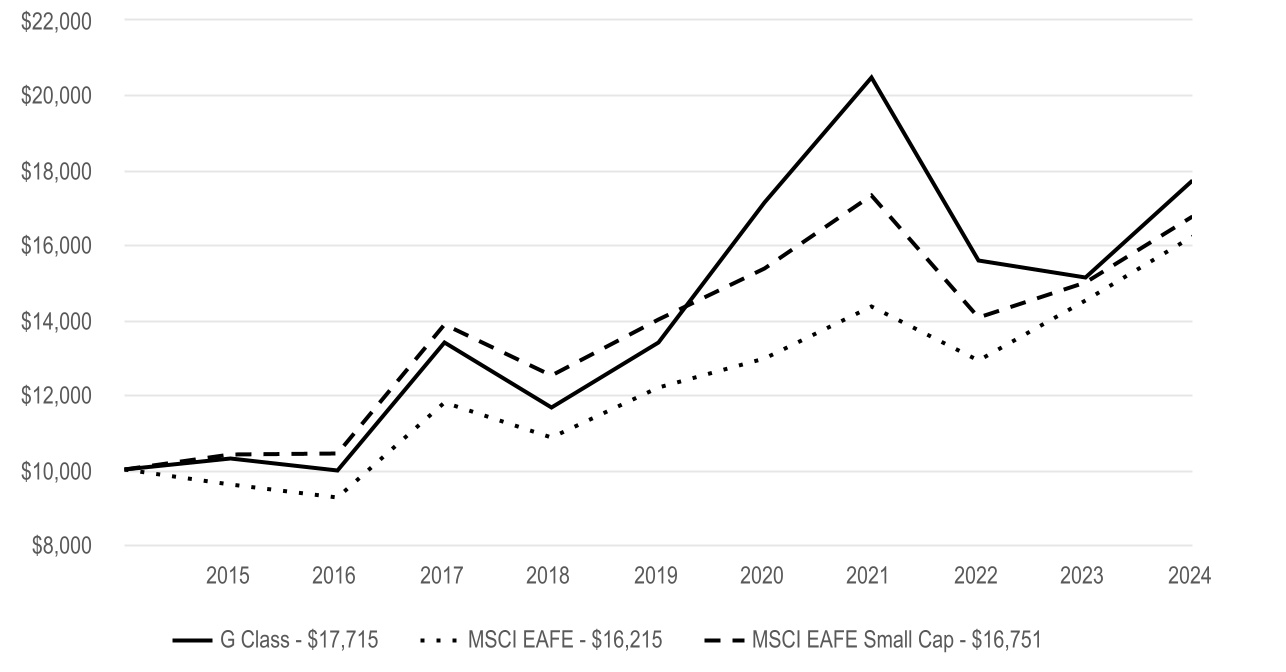

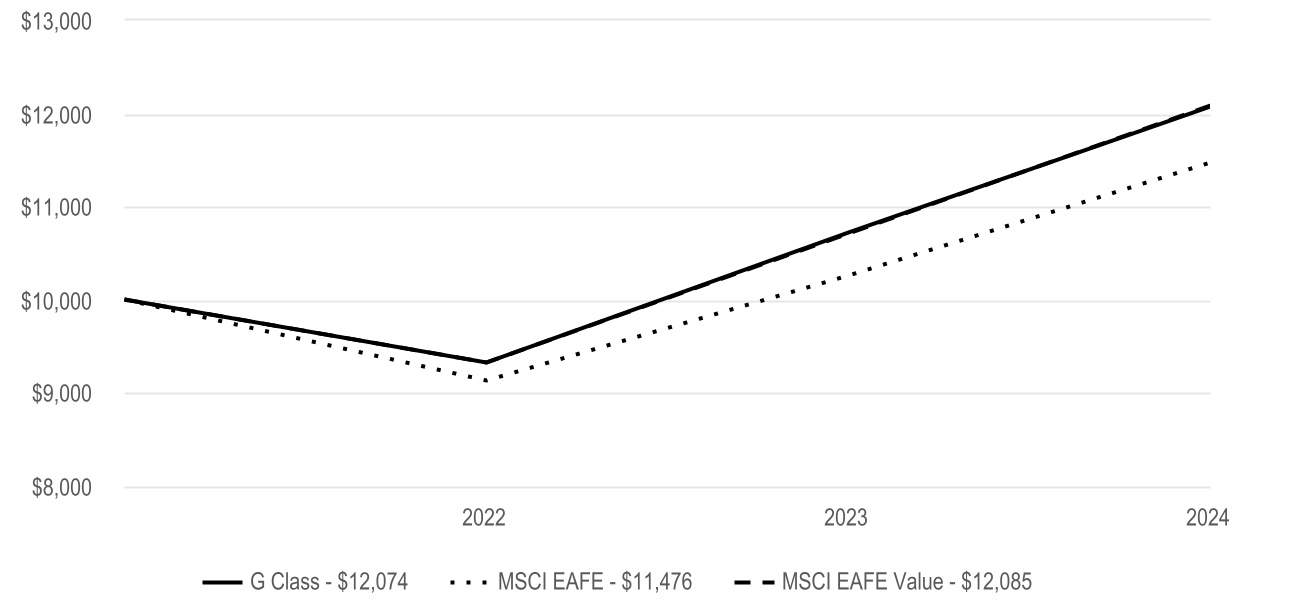

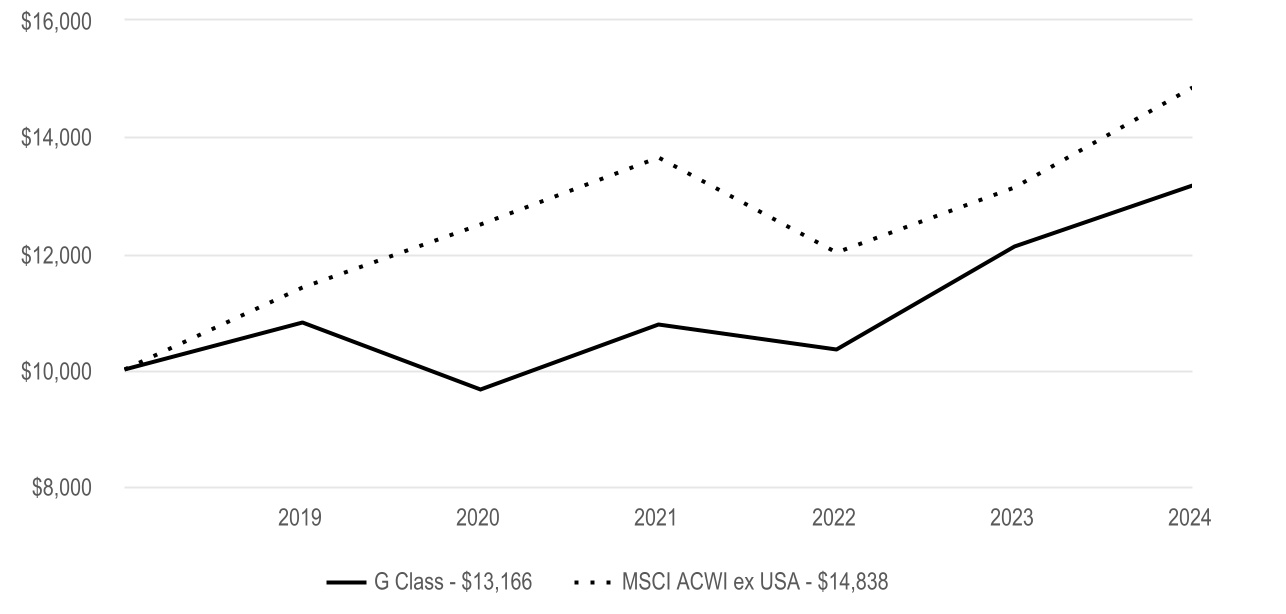

Cumulative Performance (based on an initial $10,000 investment) |

| April 1, 2022 through November 30, 2024 |

|

| | | | | | | | | | | | | | |

Average Annual Total Returns | |

| 1 Year | | | Since Inception | Inception Date | |

| G Class | 16.79% | | | -0.13% | 4/1/22 | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| MSCI Emerging Markets | 11.86% | | | 0.45% | — | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | |

|

The opinions expressed are those of American Century Investments and are no guarantee of the future performance of any American Century Investments fund. This information is for educational purposes only and is not intended as investment advice. Data reflects past performance, assumes reinvestment of dividends and capital gains and is no guarantee of future results. Current performance may be higher or lower than data shown. Investment return and principal value will fluctuate and redemption value may be more or less than original cost, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Total returns for periods less than one year are not annualized. Visit americancentury.com for more recent performance information.

|

| | | | | |

Fund Statistics | |

| Net Assets | $1,785,280,256 |

| Management Fees (dollars paid during the reporting period) | $12,707,240 |

| Portfolio Turnover Rate | 29 | % |

| Total Number of Portfolio Holdings | 78 |

| |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Types of Investments in Portfolio (as a % of net assets) | | | | | | | | | | | | Top Five Countries (as a % of net assets) | | | | |

| Common Stocks | 99.5% | | | | | | | | | | | | | | | | | China | 27% | | | | | | |

| Short-Term Investments | 1.2% | | | | | | | | | | | | | | | | | India | 19% | | | | | | |

| Other Assets and Liabilities | (0.7)% | | | | | | | | | | | | | | | | | Taiwan | 19% | | | | | | |

| | | | | | | | | | | | | | | | | | | South Korea | 8% | | | | | | |

| | | | | | | | | | | | | | | | | | | Brazil | 6% | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| For additional information about the fund, including its Prospectus, Statement of Additional Information, financial statements, holdings and proxy voting information, scan the QR code or visit americancentury.com/docs. |

| | |

|

| ©2025 American Century Proprietary Holdings, Inc. All rights reserved. |

A-2509A729

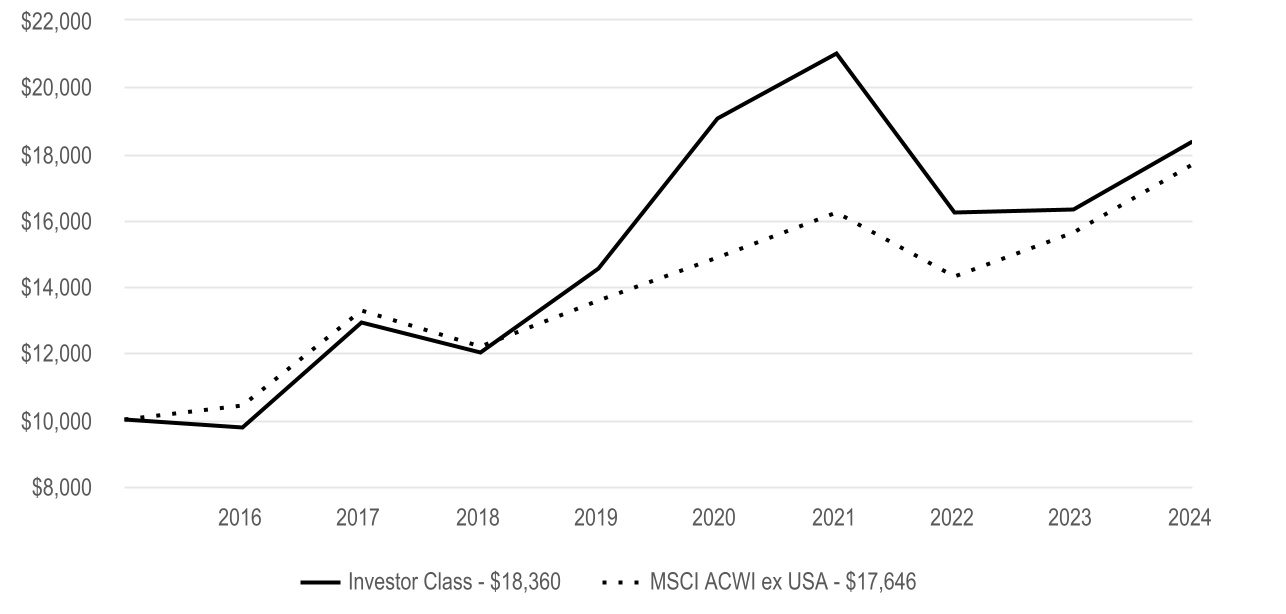

ANNUAL SHAREHOLDER REPORT

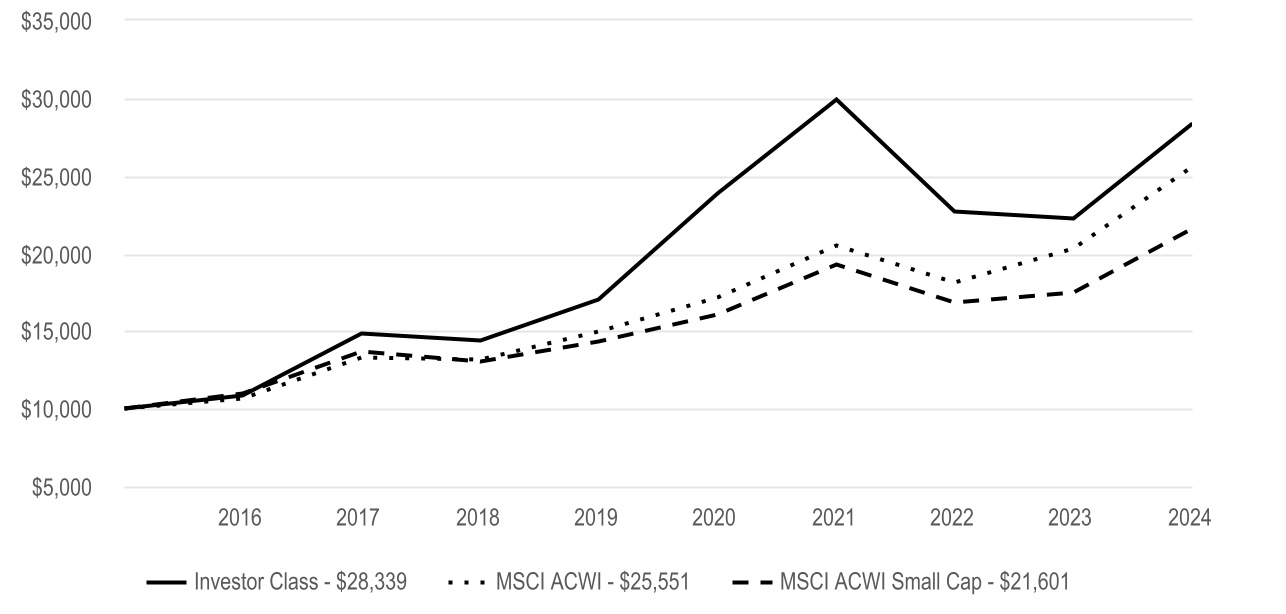

Emerging Markets Small Cap Fund

| | | | | |

Investor Class (AECVX) | November 30, 2024 |

This annual shareholder report contains important information about Emerging Markets Small Cap Fund for the period of December 1, 2023 to November 30, 2024. You can find additional information about the fund at americancentury.com/docs. You can also request this information by contacting us at 1-800-345-2021. This report describes changes to the fund that occurred during the reporting period.

| | | | | | | | |

What were the fund costs for the last year? (based on a hypothetical $10,000 investment) |

|

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Investor Class | $146 | 1.39% |

|

| | | | | |

| What were the key factors that affected the fund’s performance? |

Emerging Markets Small Cap Fund Investor Class returned 9.93% for the reporting period ended November 30, 2024. |

| The fund seeks capital growth. The commentary below refers to the fund's performance compared to the MSCI Emerging Markets Small Cap Index. |

| • | The industrials sector contributed to relative performance. Key holdings included Gamuda, a Malaysia-based engineering and construction company, and BizLink Holding, a company focused on interconnect solutions. Stock selection in financials also contributed to results. |

| • | Notable contributors were MakeMyTrip, an India-based online travel company, and Prestige Estates Projects, an India-based real estate company. India-based PB Fintech, an online platform for insurance and lending products, also helped. |

| • | Communication services and consumer staples hurt relative performance. VTEX, a digital commerce platform, was a notable detractor in interactive media and services. LG H&H, the South Korea-based cosmetics and household goods company, dragged on relative results in personal care products. |

| • | Other notable detractors included Isu Petasys, a South Korea-based maker of printed circuit boards, and Taiwan-based Global Unichip, which specializes in application-specific integrated circuits. A holding in Samsung E&A, a South Korea-based engineering company, also hurt relative results. |

| | |

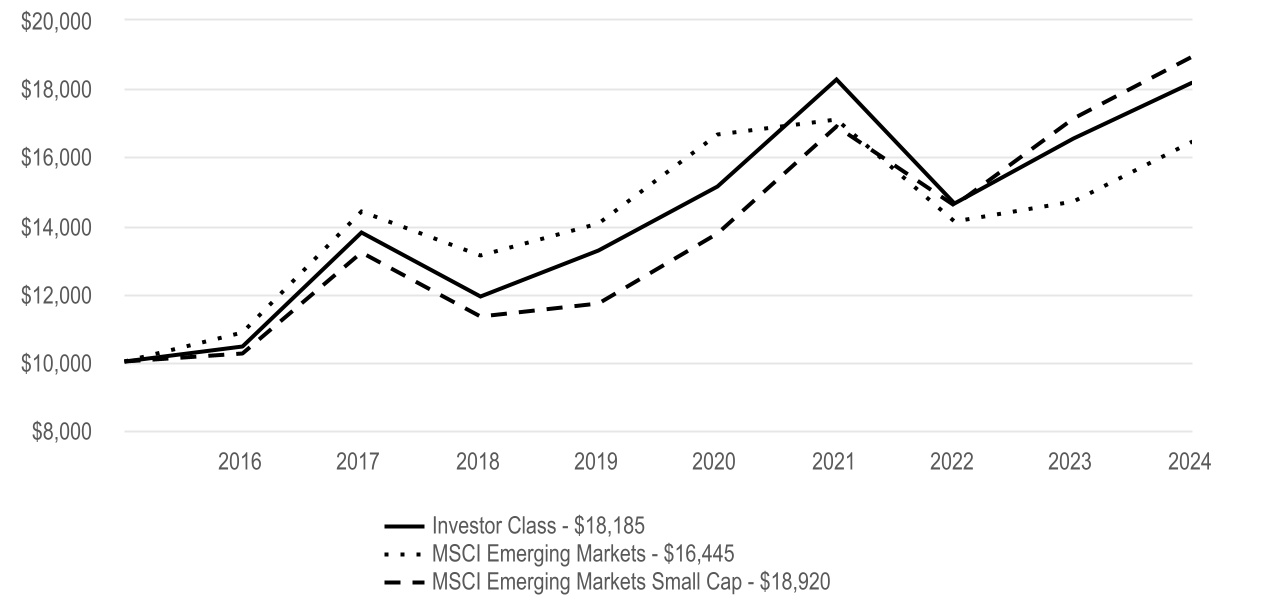

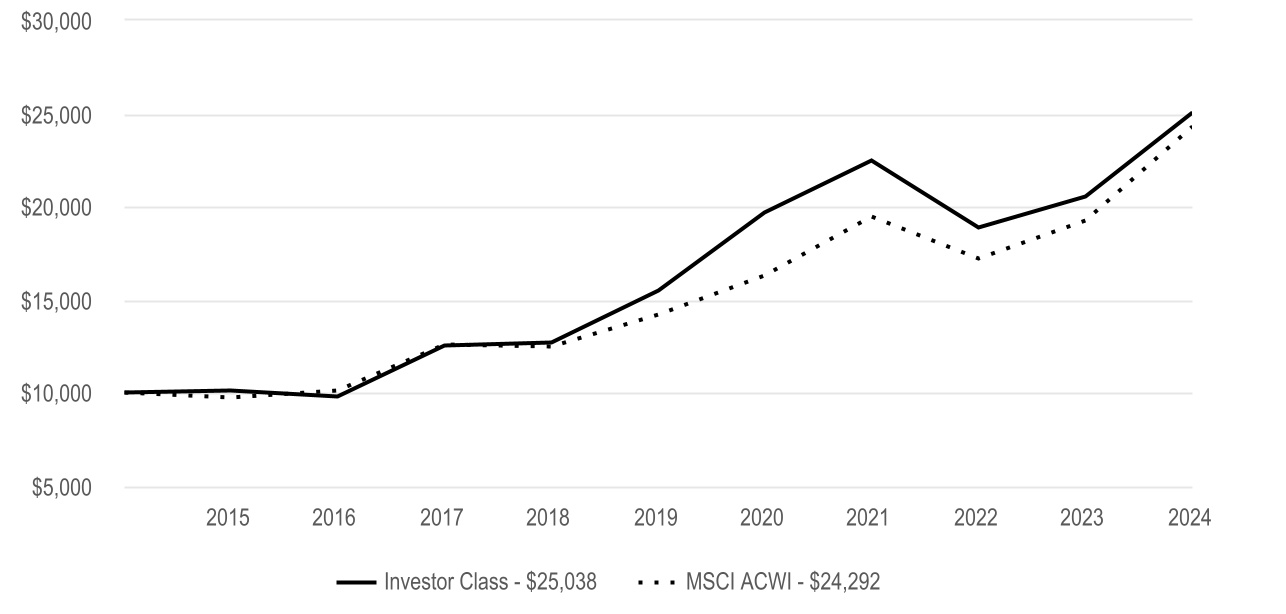

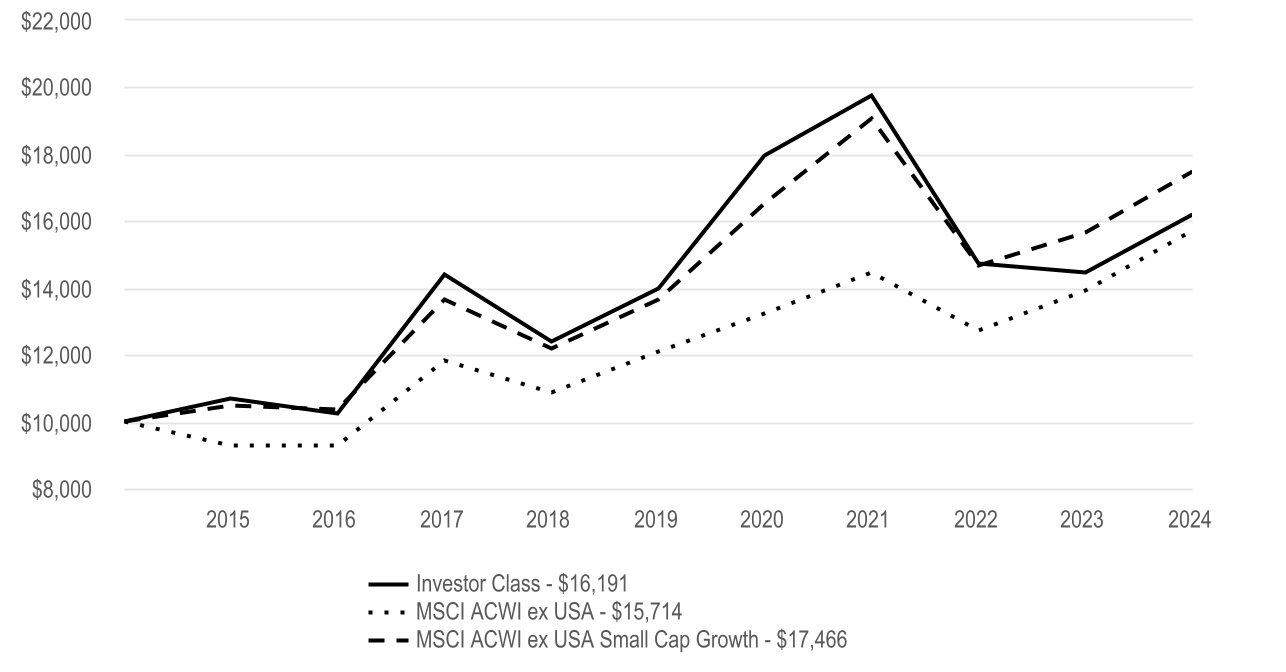

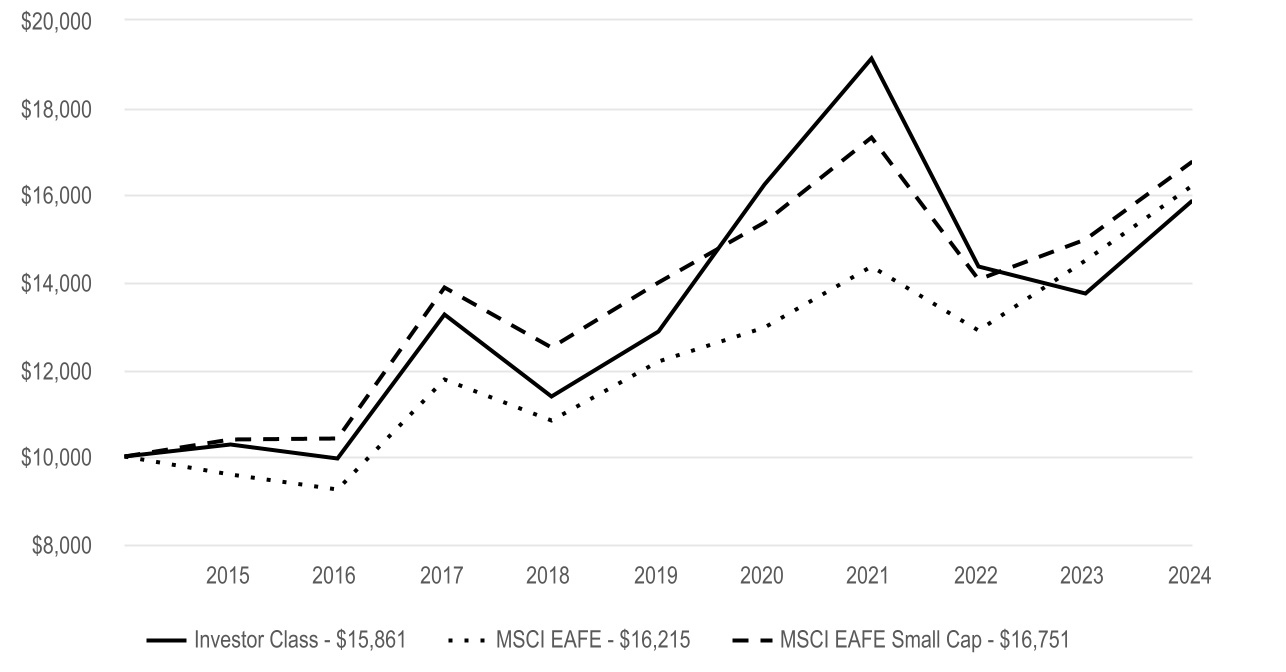

Cumulative Performance (based on an initial $10,000 investment) |

| April 7, 2016 through November 30, 2024 |

|

| | | | | | | | | | | | | | | | |

Average Annual Total Returns | |

| 1 Year | 5 Year | | Since Inception | Inception Date | |

| Investor Class | 9.93% | 6.52% | | 7.15% | 4/7/16 | |

| | | | | | |

| Regulatory Index | | | | | | |

| MSCI Emerging Markets | 11.86% | 3.20% | | 5.92% | — | |

| | | | | | |

| Performance Index | | | | | | |

| MSCI Emerging Markets Small Cap | 10.55% | 10.08% | | 7.65% | — | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | | | | | | | | | | | | |

| The regulatory index is provided as a broad measure of market performance. The performance index is provided because the advisor believes it is more reflective of the fund’s investment strategy. |

|

|

|

|

|

|

|

|

|

|

| | |

|

The opinions expressed are those of American Century Investments and are no guarantee of the future performance of any American Century Investments fund. This information is for educational purposes only and is not intended as investment advice. Data reflects past performance, assumes reinvestment of dividends and capital gains and is no guarantee of future results. Current performance may be higher or lower than data shown. Investment return and principal value will fluctuate and redemption value may be more or less than original cost, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Total returns for periods less than one year are not annualized. Visit americancentury.com for more recent performance information.

|

| | | | | |

Fund Statistics | |

| Net Assets | $22,706,690 |

| Management Fees (dollars paid during the reporting period) | $241,521 |

| Portfolio Turnover Rate | 70 | % |

| Total Number of Portfolio Holdings | 99 |

| |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Types of Investments in Portfolio (as a % of net assets) | | | | | | | | | | | | Top Five Countries (as a % of net assets) | | | | |

| Common Stocks | 95.9% | | | | | | | | | | | | | | | | | India | 27% | | | | | | |

| Exchange-Traded Funds | 0.7% | | | | | | | | | | | | | | | | | Taiwan | 20% | | | | | | |

| Short-Term Investments | 6.2% | | | | | | | | | | | | | | | | | China | 13% | | | | | | |

| Other Assets and Liabilities | (2.8)% | | | | | | | | | | | | | | | | | South Korea | 10% | | | | | | |

| | | | | | | | | | | | | | | | | | | Brazil | 5% | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| Fund Changes |

|

|

| Beginning October 2024, the total eligible investments required to qualify for a waiver of the annual account maintenance fee changed from $10,000 to $25,000. Such fee will also be waived for any accounts for which the shareholder has elected to receive electronic delivery of all fund/account documents. |

|

|

|

|

| | |

| For additional information about the fund, including its Prospectus, Statement of Additional Information, financial statements, holdings and proxy voting information, scan the QR code or visit americancentury.com/docs. |

| | |

|

| ©2025 American Century Proprietary Holdings, Inc. All rights reserved. |

A-25086281

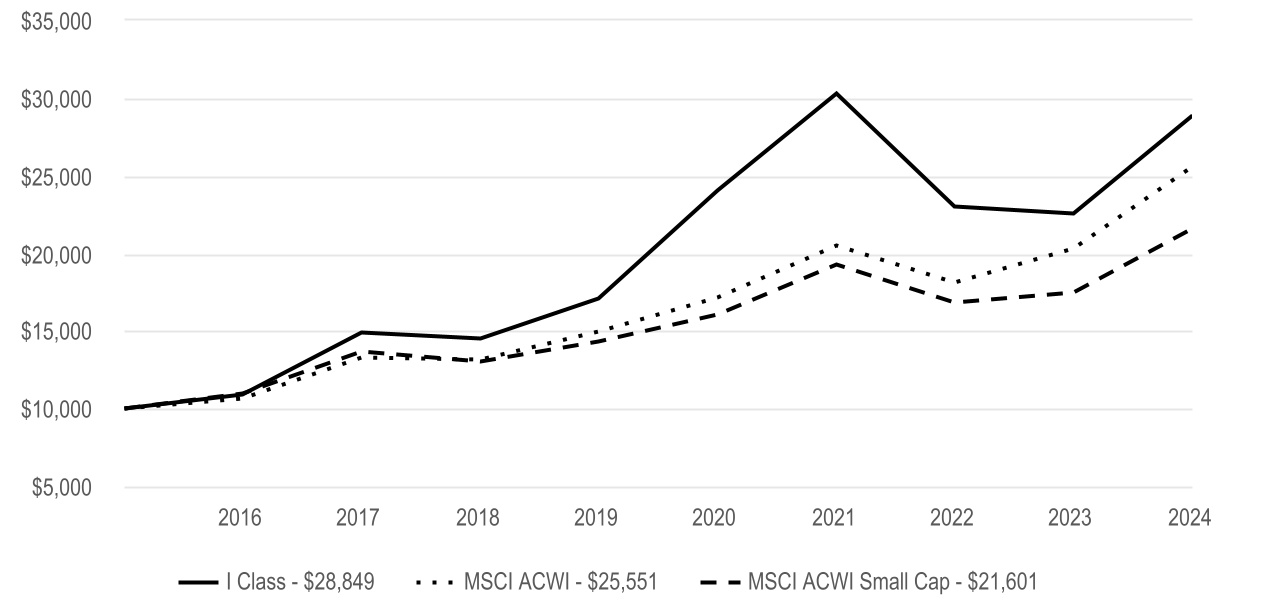

ANNUAL SHAREHOLDER REPORT

Emerging Markets Small Cap Fund

| | | | | |

I Class (AECSX) | November 30, 2024 |

This annual shareholder report contains important information about Emerging Markets Small Cap Fund for the period of December 1, 2023 to November 30, 2024. You can find additional information about the fund at americancentury.com/docs. You can also request this information by contacting us at 1-800-345-2021.

| | | | | | | | |

What were the fund costs for the last year? (based on a hypothetical $10,000 investment) |

|

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| I Class | $125 | 1.19% |

|

| | | | | |

| What were the key factors that affected the fund’s performance? |

Emerging Markets Small Cap Fund I Class returned 10.17% for the reporting period ended November 30, 2024. |

| The fund seeks capital growth. The commentary below refers to the fund's performance compared to the MSCI Emerging Markets Small Cap Index. |

| • | The industrials sector contributed to relative performance. Key holdings included Gamuda, a Malaysia-based engineering and construction company, and BizLink Holding, a company focused on interconnect solutions. Stock selection in financials also contributed to results. |

| • | Notable contributors were MakeMyTrip, an India-based online travel company, and Prestige Estates Projects, an India-based real estate company. India-based PB Fintech, an online platform for insurance and lending products, also helped. |

| • | Communication services and consumer staples hurt relative performance. VTEX, a digital commerce platform, was a notable detractor in interactive media and services. LG H&H, the South Korea-based cosmetics and household goods company, dragged on relative results in personal care products. |

| • | Other notable detractors included Isu Petasys, a South Korea-based maker of printed circuit boards, and Taiwan-based Global Unichip, which specializes in application-specific integrated circuits. A holding in Samsung E&A, a South Korea-based engineering company, also hurt relative results. |

| | |

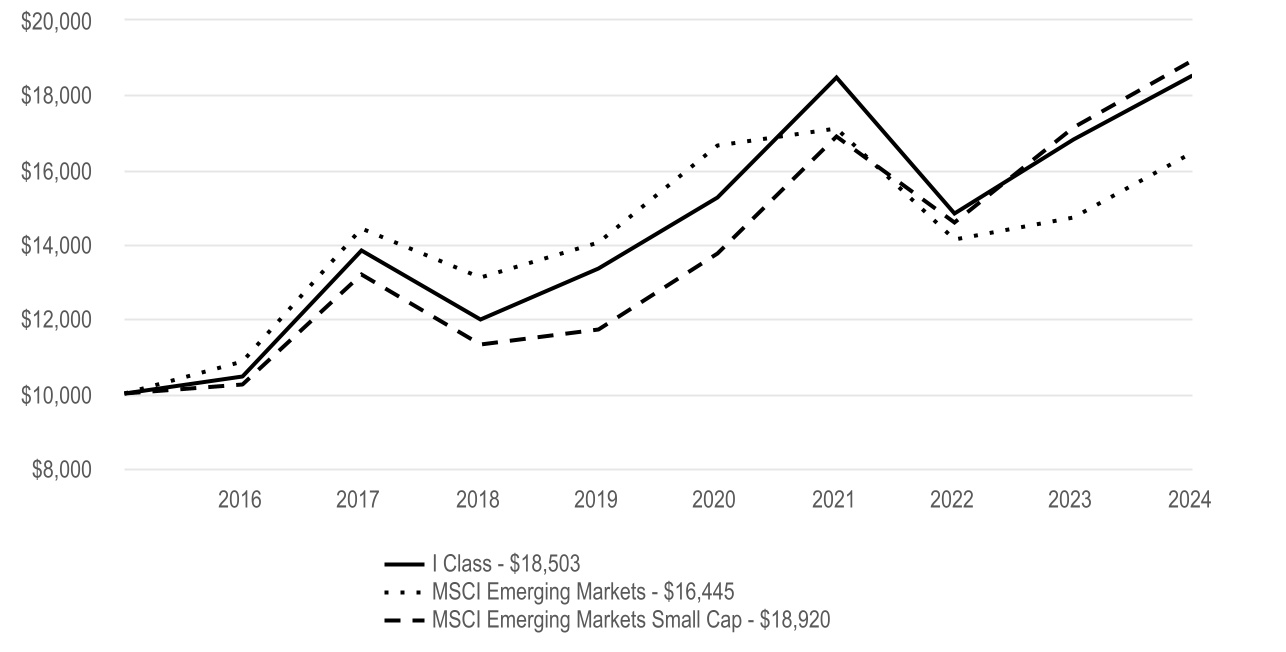

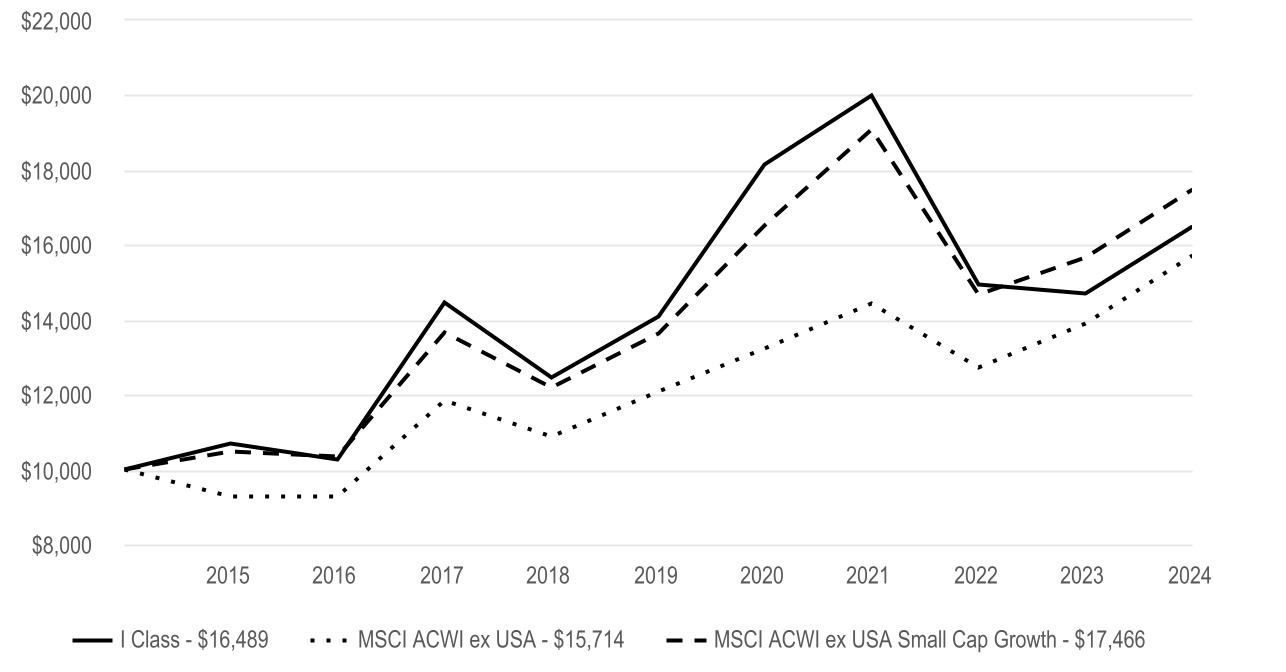

Cumulative Performance (based on an initial $10,000 investment) |

| April 7, 2016 through November 30, 2024 |

|

| | | | | | | | | | | | | | | | |

Average Annual Total Returns | |

| 1 Year | 5 Year | | Since Inception | Inception Date | |

| I Class | 10.17% | 6.74% | | 7.37% | 4/7/16 | |

| | | | | | |

| Regulatory Index | | | | | | |

| MSCI Emerging Markets | 11.86% | 3.20% | | 5.92% | — | |

| | | | | | |

| Performance Index | | | | | | |

| MSCI Emerging Markets Small Cap | 10.55% | 10.08% | | 7.65% | — | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | | | | | | | | | | | | |

| The regulatory index is provided as a broad measure of market performance. The performance index is provided because the advisor believes it is more reflective of the fund’s investment strategy. |

|

|

|

|

|

|

|

|

|

|

| | |

|

The opinions expressed are those of American Century Investments and are no guarantee of the future performance of any American Century Investments fund. This information is for educational purposes only and is not intended as investment advice. Data reflects past performance, assumes reinvestment of dividends and capital gains and is no guarantee of future results. Current performance may be higher or lower than data shown. Investment return and principal value will fluctuate and redemption value may be more or less than original cost, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Total returns for periods less than one year are not annualized. Visit americancentury.com for more recent performance information.

|

| | | | | |

Fund Statistics | |

| Net Assets | $22,706,690 |

| Management Fees (dollars paid during the reporting period) | $241,521 |

| Portfolio Turnover Rate | 70 | % |

| Total Number of Portfolio Holdings | 99 |

| |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Types of Investments in Portfolio (as a % of net assets) | | | | | | | | | | | | Top Five Countries (as a % of net assets) | | | | |

| Common Stocks | 95.9% | | | | | | | | | | | | | | | | | India | 27% | | | | | | |

| Exchange-Traded Funds | 0.7% | | | | | | | | | | | | | | | | | Taiwan | 20% | | | | | | |

| Short-Term Investments | 6.2% | | | | | | | | | | | | | | | | | China | 13% | | | | | | |

| Other Assets and Liabilities | (2.8)% | | | | | | | | | | | | | | | | | South Korea | 10% | | | | | | |

| | | | | | | | | | | | | | | | | | | Brazil | 5% | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| For additional information about the fund, including its Prospectus, Statement of Additional Information, financial statements, holdings and proxy voting information, scan the QR code or visit americancentury.com/docs. |

| | |

|

| ©2025 American Century Proprietary Holdings, Inc. All rights reserved. |

A-25086273

ANNUAL SHAREHOLDER REPORT

Emerging Markets Small Cap Fund

| | | | | |

A Class (AECLX) | November 30, 2024 |

This annual shareholder report contains important information about Emerging Markets Small Cap Fund for the period of December 1, 2023 to November 30, 2024. You can find additional information about the fund at americancentury.com/docs. You can also request this information by contacting us at 1-800-345-2021.

| | | | | | | | |

What were the fund costs for the last year? (based on a hypothetical $10,000 investment) |

|

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| A Class | $172 | 1.64% |

|

| | | | | |

| What were the key factors that affected the fund’s performance? |

Emerging Markets Small Cap Fund A Class returned 9.59% for the reporting period ended November 30, 2024. |

| The fund seeks capital growth. The commentary below refers to the fund's performance compared to the MSCI Emerging Markets Small Cap Index. |

| • | The industrials sector contributed to relative performance. Key holdings included Gamuda, a Malaysia-based engineering and construction company, and BizLink Holding, a company focused on interconnect solutions. Stock selection in financials also contributed to results. |

| • | Notable contributors were MakeMyTrip, an India-based online travel company, and Prestige Estates Projects, an India-based real estate company. India-based PB Fintech, an online platform for insurance and lending products, also helped. |

| • | Communication services and consumer staples hurt relative performance. VTEX, a digital commerce platform, was a notable detractor in interactive media and services. LG H&H, the South Korea-based cosmetics and household goods company, dragged on relative results in personal care products. |

| • | Other notable detractors included Isu Petasys, a South Korea-based maker of printed circuit boards, and Taiwan-based Global Unichip, which specializes in application-specific integrated circuits. A holding in Samsung E&A, a South Korea-based engineering company, also hurt relative results. |

| | |

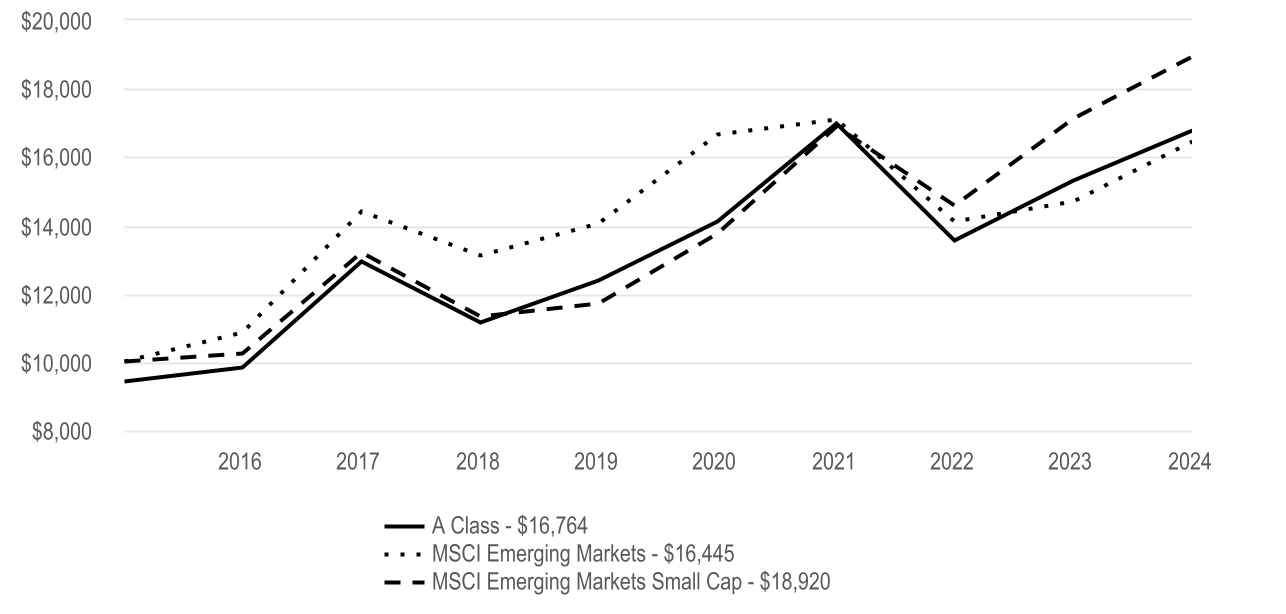

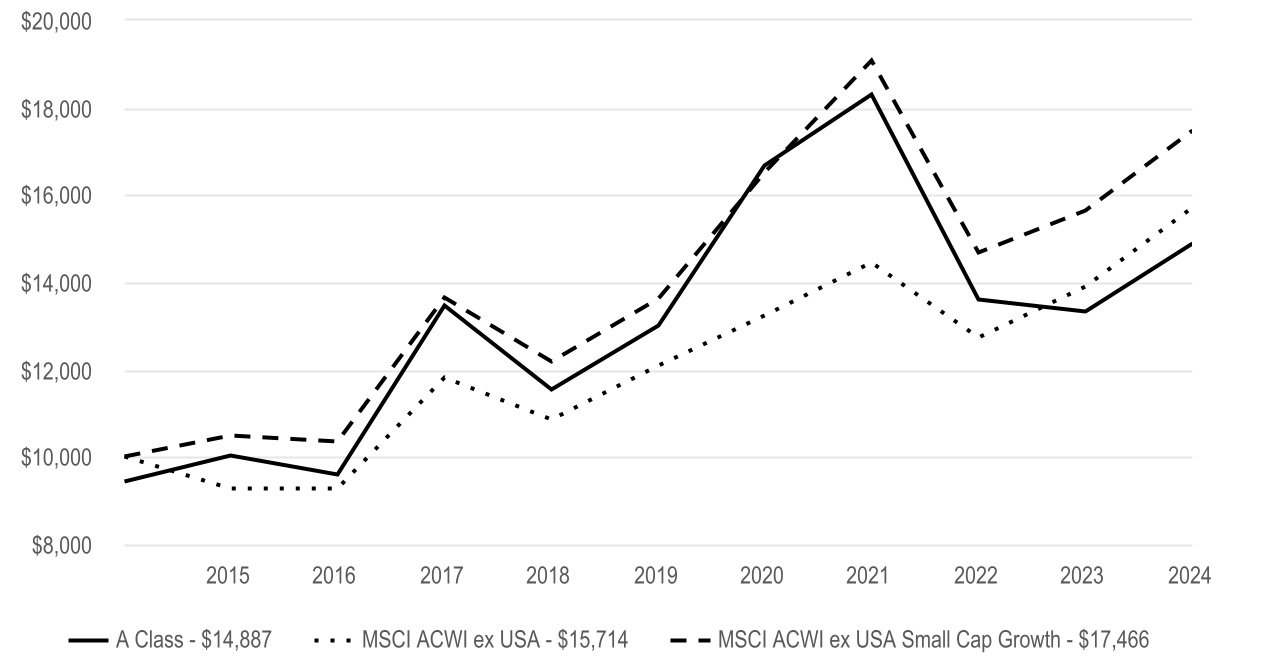

Cumulative Performance (based on an initial $10,000 investment) |

| April 7, 2016 through November 30, 2024 |

| The initial investment is adjusted to reflect the maximum initial sales charge. |

| | | | | | | | | | | | | | | | |

Average Annual Total Returns | |

| 1 Year | 5 Year | | Since Inception | Inception Date | |

| A Class | 9.59% | 6.24% | | 6.88% | 4/7/16 | |

| A Class - with sales charge | 3.29% | 4.99% | | 6.15% | 4/7/16 | |

| Regulatory Index | | | | | | |

| MSCI Emerging Markets | 11.86% | 3.20% | | 5.92% | — | |

| | | | | | |

| Performance Index | | | | | | |

| MSCI Emerging Markets Small Cap | 10.55% | 10.08% | | 7.65% | — | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | | | | | | | | | | | | |

| The regulatory index is provided as a broad measure of market performance. The performance index is provided because the advisor believes it is more reflective of the fund’s investment strategy. |

| A Class shares have a 5.75% maximum initial sales charge and may be subject to a maximum contingent deferred sales charge of 1.00%. |

|

|

|

|

|

|

|

|

|

| | |

|

The opinions expressed are those of American Century Investments and are no guarantee of the future performance of any American Century Investments fund. This information is for educational purposes only and is not intended as investment advice. Data reflects past performance, assumes reinvestment of dividends and capital gains and is no guarantee of future results. Current performance may be higher or lower than data shown. Investment return and principal value will fluctuate and redemption value may be more or less than original cost, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Total returns for periods less than one year are not annualized. Visit americancentury.com for more recent performance information.

|

| | | | | |

Fund Statistics | |

| Net Assets | $22,706,690 |

| Management Fees (dollars paid during the reporting period) | $241,521 |

| Portfolio Turnover Rate | 70 | % |

| Total Number of Portfolio Holdings | 99 |

| |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Types of Investments in Portfolio (as a % of net assets) | | | | | | | | | | | | Top Five Countries (as a % of net assets) | | | | |

| Common Stocks | 95.9% | | | | | | | | | | | | | | | | | India | 27% | | | | | | |

| Exchange-Traded Funds | 0.7% | | | | | | | | | | | | | | | | | Taiwan | 20% | | | | | | |

| Short-Term Investments | 6.2% | | | | | | | | | | | | | | | | | China | 13% | | | | | | |

| Other Assets and Liabilities | (2.8)% | | | | | | | | | | | | | | | | | South Korea | 10% | | | | | | |

| | | | | | | | | | | | | | | | | | | Brazil | 5% | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| For additional information about the fund, including its Prospectus, Statement of Additional Information, financial statements, holdings and proxy voting information, scan the QR code or visit americancentury.com/docs. |

| | |

|

| ©2025 American Century Proprietary Holdings, Inc. All rights reserved. |

A-25086265

ANNUAL SHAREHOLDER REPORT

Emerging Markets Small Cap Fund

| | | | | |

C Class (AECHX) | November 30, 2024 |

This annual shareholder report contains important information about Emerging Markets Small Cap Fund for the period of December 1, 2023 to November 30, 2024. You can find additional information about the fund at americancentury.com/docs. You can also request this information by contacting us at 1-800-345-2021.

| | | | | | | | |

What were the fund costs for the last year? (based on a hypothetical $10,000 investment) |

|

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| C Class | $249 | 2.39% |

|

| | | | | |

| What were the key factors that affected the fund’s performance? |

Emerging Markets Small Cap Fund C Class returned 8.76% for the reporting period ended November 30, 2024. |

| The fund seeks capital growth. The commentary below refers to the fund's performance compared to the MSCI Emerging Markets Small Cap Index. |

| • | The industrials sector contributed to relative performance. Key holdings included Gamuda, a Malaysia-based engineering and construction company, and BizLink Holding, a company focused on interconnect solutions. Stock selection in financials also contributed to results. |

| • | Notable contributors were MakeMyTrip, an India-based online travel company, and Prestige Estates Projects, an India-based real estate company. India-based PB Fintech, an online platform for insurance and lending products, also helped. |

| • | Communication services and consumer staples hurt relative performance. VTEX, a digital commerce platform, was a notable detractor in interactive media and services. LG H&H, the South Korea-based cosmetics and household goods company, dragged on relative results in personal care products. |

| • | Other notable detractors included Isu Petasys, a South Korea-based maker of printed circuit boards, and Taiwan-based Global Unichip, which specializes in application-specific integrated circuits. A holding in Samsung E&A, a South Korea-based engineering company, also hurt relative results. |

| | |

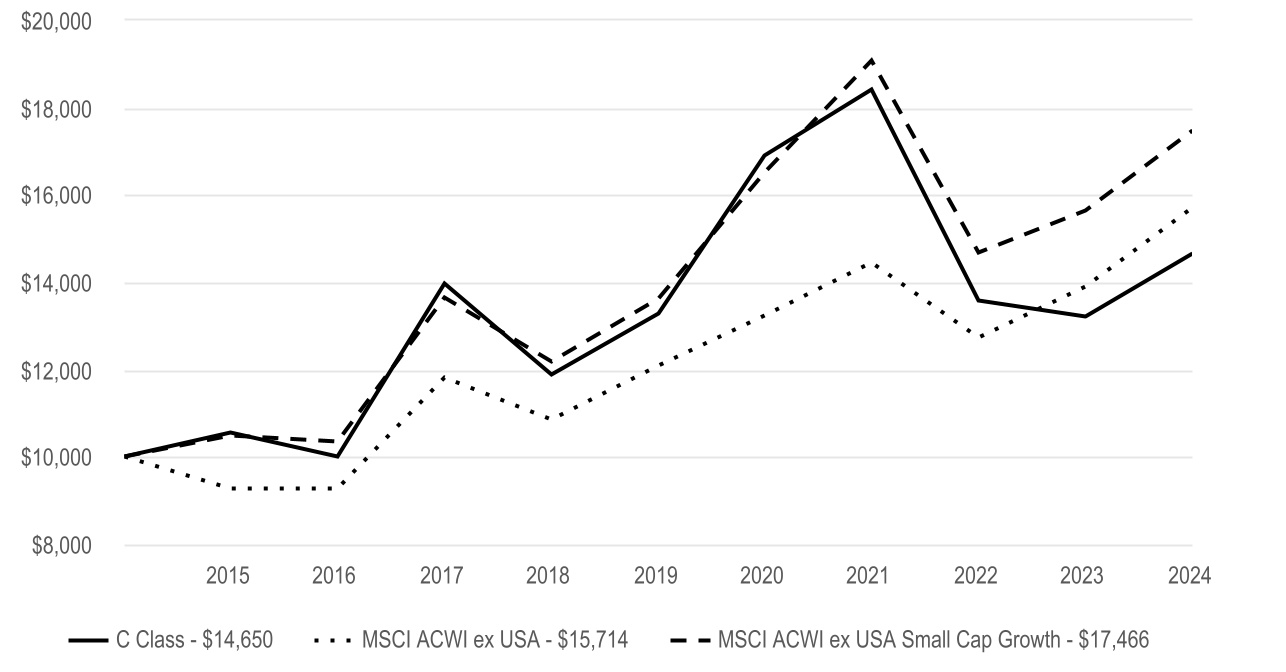

Cumulative Performance (based on an initial $10,000 investment) |

| April 7, 2016 through November 30, 2024 |

|

| | | | | | | | | | | | | | | | |

Average Annual Total Returns | |

| 1 Year | 5 Year | | Since Inception | Inception Date | |

| C Class | 8.76% | 5.46% | | 6.08% | 4/7/16 | |

| | | | | | |

| Regulatory Index | | | | | | |

| MSCI Emerging Markets | 11.86% | 3.20% | | 5.92% | — | |

| | | | | | |

| Performance Index | | | | | | |

| MSCI Emerging Markets Small Cap | 10.55% | 10.08% | | 7.65% | — | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | | | | | | | | | | | | |

| The regulatory index is provided as a broad measure of market performance. The performance index is provided because the advisor believes it is more reflective of the fund’s investment strategy. |

|

|

|

|

| C Class shares will automatically convert to A Class shares after being held for approximately eight years. C Class average annual returns do not reflect this conversion. |

|

|

|

|

|

| | |

|

The opinions expressed are those of American Century Investments and are no guarantee of the future performance of any American Century Investments fund. This information is for educational purposes only and is not intended as investment advice. Data reflects past performance, assumes reinvestment of dividends and capital gains and is no guarantee of future results. Current performance may be higher or lower than data shown. Investment return and principal value will fluctuate and redemption value may be more or less than original cost, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Total returns for periods less than one year are not annualized. Visit americancentury.com for more recent performance information.

|

| | | | | |

Fund Statistics | |

| Net Assets | $22,706,690 |

| Management Fees (dollars paid during the reporting period) | $241,521 |

| Portfolio Turnover Rate | 70 | % |

| Total Number of Portfolio Holdings | 99 |

| |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Types of Investments in Portfolio (as a % of net assets) | | | | | | | | | | | | Top Five Countries (as a % of net assets) | | | | |

| Common Stocks | 95.9% | | | | | | | | | | | | | | | | | India | 27% | | | | | | |

| Exchange-Traded Funds | 0.7% | | | | | | | | | | | | | | | | | Taiwan | 20% | | | | | | |

| Short-Term Investments | 6.2% | | | | | | | | | | | | | | | | | China | 13% | | | | | | |

| Other Assets and Liabilities | (2.8)% | | | | | | | | | | | | | | | | | South Korea | 10% | | | | | | |

| | | | | | | | | | | | | | | | | | | Brazil | 5% | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| For additional information about the fund, including its Prospectus, Statement of Additional Information, financial statements, holdings and proxy voting information, scan the QR code or visit americancentury.com/docs. |

| | |

|

| ©2025 American Century Proprietary Holdings, Inc. All rights reserved. |

A-25086257

ANNUAL SHAREHOLDER REPORT

Emerging Markets Small Cap Fund

| | | | | |

R Class (AECMX) | November 30, 2024 |

This annual shareholder report contains important information about Emerging Markets Small Cap Fund for the period of December 1, 2023 to November 30, 2024. You can find additional information about the fund at americancentury.com/docs. You can also request this information by contacting us at 1-800-345-2021.

| | | | | | | | |

What were the fund costs for the last year? (based on a hypothetical $10,000 investment) |

|

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| R Class | $198 | 1.89% |

|

| | | | | |

| What were the key factors that affected the fund’s performance? |

Emerging Markets Small Cap Fund R Class returned 9.35% for the reporting period ended November 30, 2024. |

| The fund seeks capital growth. The commentary below refers to the fund's performance compared to the MSCI Emerging Markets Small Cap Index. |

| • | The industrials sector contributed to relative performance. Key holdings included Gamuda, a Malaysia-based engineering and construction company, and BizLink Holding, a company focused on interconnect solutions. Stock selection in financials also contributed to results. |

| • | Notable contributors were MakeMyTrip, an India-based online travel company, and Prestige Estates Projects, an India-based real estate company. India-based PB Fintech, an online platform for insurance and lending products, also helped. |

| • | Communication services and consumer staples hurt relative performance. VTEX, a digital commerce platform, was a notable detractor in interactive media and services. LG H&H, the South Korea-based cosmetics and household goods company, dragged on relative results in personal care products. |

| • | Other notable detractors included Isu Petasys, a South Korea-based maker of printed circuit boards, and Taiwan-based Global Unichip, which specializes in application-specific integrated circuits. A holding in Samsung E&A, a South Korea-based engineering company, also hurt relative results. |

| | |

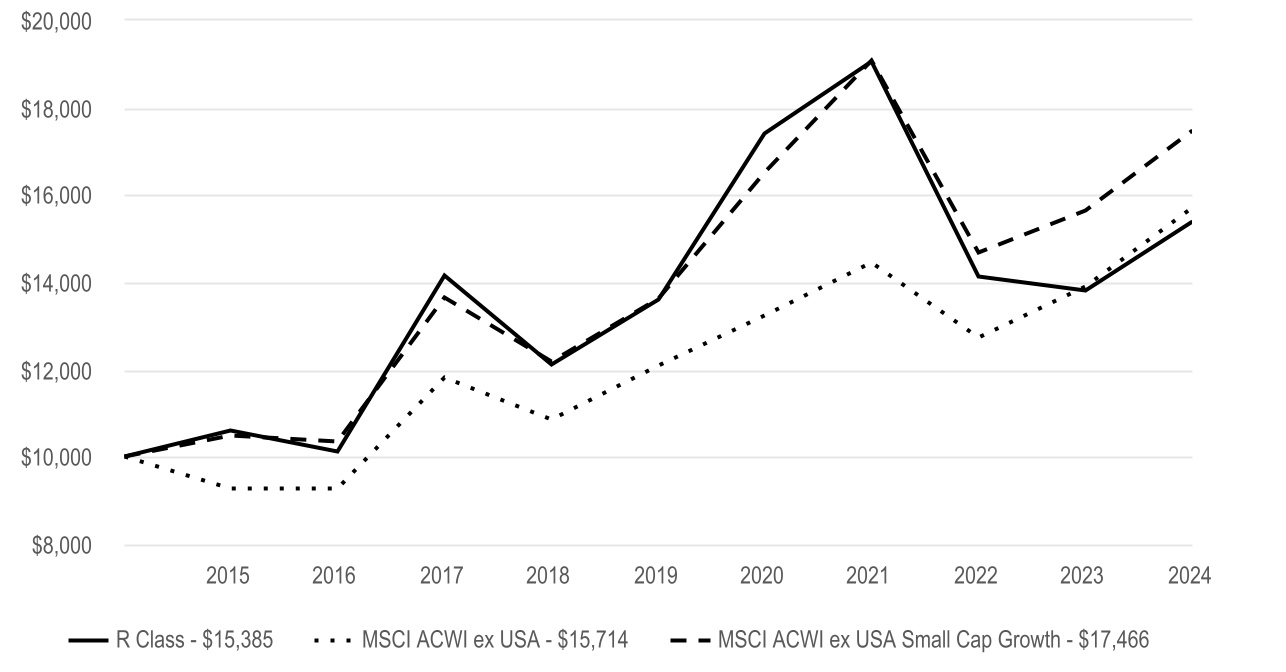

Cumulative Performance (based on an initial $10,000 investment) |

| April 7, 2016 through November 30, 2024 |

|

| | | | | | | | | | | | | | | | |

Average Annual Total Returns | |

| 1 Year | 5 Year | | Since Inception | Inception Date | |

| R Class | 9.35% | 5.99% | | 6.61% | 4/7/16 | |

| | | | | | |

| Regulatory Index | | | | | | |

| MSCI Emerging Markets | 11.86% | 3.20% | | 5.92% | — | |

| | | | | | |

| Performance Index | | | | | | |

| MSCI Emerging Markets Small Cap | 10.55% | 10.08% | | 7.65% | — | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | | | | | | | | | | | | |

| The regulatory index is provided as a broad measure of market performance. The performance index is provided because the advisor believes it is more reflective of the fund’s investment strategy. |

|

|

|

|

|

|

|

|

|

|

| | |

|