SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12 |

ESB Financial Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

March 19, 2004

Dear Stockholder:

You are cordially invited to attend the annual meeting of stockholders of ESB Financial Corporation. The meeting will be held at the Connoquenessing Country Club located at 1512 Mercer Road, Ellwood City, Pennsylvania, on Wednesday, April 21, 2004, at 4:00 p.m., Eastern Time. The matters to be considered by stockholders at the annual meeting are described in detail in the accompanying materials.

The board of directors of ESB Financial Corporation has determined that the matters to be considered at the annual meeting are in the best interests of the Company and its shareholders. For the reasons set forth in the proxy statement, the board unanimously recommends that you vote “FOR” each matter to be considered.

It is very important that you be represented at the annual meeting regardless of the number of shares you own or whether you are able to attend the meeting in person. Let me urge you to mark, sign and date your proxy card today and return it in the envelope provided, even if you plan to attend the annual meeting. This will not prevent you from voting in person, but will ensure that your vote is counted if you are unable to attend.

Your continued support of and interest in ESB Financial Corporation is appreciated.

Sincerely,

Charlotte A. Zuschlag

President and Chief Executive Officer

ESB FINANCIAL CORPORATION

600 Lawrence Avenue

Ellwood City, Pennsylvania 16117

(724) 758-5584

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON APRIL 21, 2004

NOTICE IS HEREBY GIVEN that an Annual Meeting of Stockholders of ESB Financial Corporation (the “Company”) will be held at the Connoquenessing Country Club located at 1512 Mercer Road, Ellwood City, Pennsylvania, on Wednesday, April 21, 2004, at 4:00 p.m., Eastern Time, for the following purposes, all of which are more completely set forth in the accompanying proxy statement:

| | (1) | To elect two directors for a three-year term and until their successors are elected and qualified; |

| | (2) | To ratify the appointment of Ernst & Young LLP as the Company’s independent auditors for the year ending December 31, 2004; and |

| | (3) | To transact such other business as may properly come before the meeting or any adjournment thereof. Except with respect to procedural matters incident to the conduct of the annual meeting, management is not aware of any other matters which could come before the annual meeting. |

The board of directors has fixed March 5, 2004 as the voting record date for the determination of stockholders entitled to notice of and to vote at the annual meeting. Only those stockholders of record as of the close of business on that date will be entitled to vote at the annual meeting or at any such adjournment.

BY ORDER OF THE BOARD OF DIRECTORS

Frank D. Martz

Group Senior Vice President of

Operations and Secretary

March 19, 2004

Ellwood City, Pennsylvania

YOU ARE CORDIALLY INVITED TO ATTEND THE ANNUAL MEETING. IT IS IMPORTANT THAT YOUR SHARES BE REPRESENTED REGARDLESS OF THE NUMBER YOU OWN. EVEN IF YOU PLAN TO BE PRESENT, YOU ARE URGED TO COMPLETE, SIGN, DATE AND RETURN THE ENCLOSED PROXY PROMPTLY IN THE ENVELOPE PROVIDED. IF YOU ATTEND THIS MEETING, YOU MAY VOTE EITHER IN PERSON OR BY YOUR PROXY. ANY PROXY GIVEN MAY BE REVOKED BY YOU IN WRITING OR IN PERSON AT ANY TIME PRIOR TO THE EXERCISE THEREOF.

ESB FINANCIAL CORPORATION

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

APRIL 21, 2004

General

This proxy statement is being furnished to the holders of common stock, $0.01 par value per share, of ESB Financial Corporation (the “Company”), the savings and loan holding company of ESB Bank (including all predecessors thereto, “ESB Bank” or the “Bank”), in connection with the solicitation of proxies by the board of directors of the Company for use at its annual meeting of stockholders to be held at the Connoquenessing Country Club located at 1512 Mercer Road, Ellwood City, Pennsylvania, on Wednesday, April 21, 2004, at 4:00 p.m., Eastern Time, and at any adjournment thereof, for the purposes set forth in the notice of annual meeting of stockholders. This proxy statement is first being mailed to stockholders on or about March 19, 2004.

Voting Rights

Only stockholders of record at the close of business on March 5, 2004 (the “record date”) will be entitled to notice of and to vote at the annual meeting. At such date, there were 10,823,448 shares of common stock issued and outstanding and the Company had no other class of equity securities outstanding.

Each share of common stock is entitled to one vote at the annual meeting on all matters properly presented at the meeting. The presence in person or by proxy of at least a majority of the issued and outstanding shares of common stock entitled to vote is necessary to constitute a quorum at the annual meeting. Directors are elected by a plurality of the votes cast with a quorum present. The affirmative vote of a majority of the total votes cast at the annual meeting is required for approval of the proposal to ratify the appointment of the Company’s independent auditors.

Abstentions will be counted for purposes of determining the presence of a quorum at the annual meeting. Because of the required votes, abstentions will have no effect on the voting for the election of directors or the proposal to ratify the appointment of the Company’s independent auditors. Under rules applicable to broker-dealers, all of the proposals for consideration at the annual meeting are considered “discretionary” items upon which brokerage firms may vote in their discretion on behalf of their client if such clients have not furnished voting instructions. Thus, there are no proposals to be considered at the annual meeting which are considered “non-discretionary” and for which there will be “broker non-votes.”

Proxies

Shares of common stock represented by properly executed proxies, if such proxies are received in time and not revoked, will be voted in accordance with the instructions indicated on the proxies. If no contrary instructions are given, each proxy received will be voted (i) FOR the nominees for director described herein; (ii) FOR ratification of Ernst & Young LLP as the Company’s independent auditors for the year ending December 31, 2004; and (iii) upon the transaction of such other business as may properly come before the meeting, in accordance with the best judgment of the persons appointed as proxies. Any stockholder giving a proxy has the power to revoke it at any time before it is exercised by (i) filing with the Secretary of the Company written notice thereof (Frank D. Martz, Group Senior Vice President of Operations and Secretary, ESB Financial Corporation, 600 Lawrence Avenue, Ellwood City, Pennsylvania 16117); (ii) submitting a duly-executed proxy bearing a later date; or (iii) appearing at the annual meeting and giving the Secretary notice of his or her intention to vote in person. Proxies solicited hereby may be exercised only at the annual meeting and any adjournment thereof and will not be used for any other meeting.

Beneficial Ownership

The following table sets forth information as to the common stock beneficially owned, as of March 5, 2004, by (i) the only persons or entities, including any “group” as that term is used in Section 13(d)(3) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), who or which was known to the Company to be the beneficial owner of more than 5% of the issued and outstanding common stock, (ii) each director and director nominee of the Company, (iii) certain named executive officers of the Company, and (iv) all directors and executive officers of the Company as a group.

| | | | | | |

Name and Address of Beneficial Owner

| | Amount and Nature of Beneficial

Ownership as of March 5, 2004(1)

| | | Percent of Common Stock

| |

ESB Financial Corporation Employee Stock Ownership Plan Trust 600 Lawrence Avenue Ellwood City, Pennsylvania 16117 | | 1,706,049 | (2) | | 15.8 | % |

| | |

Directors and nominees: | | | | | | |

George William Blank, Jr. Charles Delman Lloyd L. Kildoo Mario J. Manna William B. Salsgiver Herbert S. Skuba Charlotte A. Zuschlag | | 43,557

60,894

273,714

73,094

353,864

160,389

459,075 | (3)

(4)

(5)

(6)

(7)

(8)

(9) | | *

*

2.5

*

3.3

1.5

4.2 |

|

| | |

Named Executive Officers: Thomas F. Angotti Charles P. Evanoski Robert C. Hilliard Frank D. Martz Todd F. Palkovich | | 115,674

112,065

142,715

185,716

97,899 | (10)

(11)

(12)

(13)

(14) | | 1.1

1.0

1.3

1.7

* |

|

| | |

Directors and executive officers of the Company as a group (13 persons) | | 2,093,290 | (15) | | 18.3 | |

| * | Amounts to less than 1.0% of the issued and outstanding common stock. |

| (1) | Pursuant to rules promulgated by the Securities and Exchange Commission (the “SEC”) under the Exchange Act, a person or entity is considered to beneficially own shares of common stock if the person or entity has or shares (i) voting power, which includes the power to vote or to direct the voting of the shares, or (ii) investment power, which includes the power to dispose or direct the disposition of the shares. Unless otherwise indicated, a person has sole voting power and sole investment power with respect to the indicated shares. Under applicable regulations, a person is deemed to have beneficial ownership of any shares of common stock which may be acquired within 60 days of the record date pursuant to the exercise of outstanding stock options. Shares of common stock which are subject to stock options are deemed to be outstanding for the purpose of computing the percentage of outstanding common stock owned by such person or group but not deemed outstanding for the purpose of computing the percentage of common stock owned by any other person or group. |

| (2) | The ESB Financial Corporation Employee Stock Ownership Plan Trust (“Trust”) was established pursuant to the ESB Financial Corporation Employee Stock Ownership Plan (“ESOP”) by an agreement between the Company and Messrs. Salsgiver, Blank, Skuba and Manna who act as trustees of the ESOP. As of the record date, 602,679 shares held in the Trust were unallocated, and 1,103,370 shares held in the Trust had been allocated to the accounts of participating employees. Under the terms of the ESOP, the trustees will generally vote all allocated |

2

shares held in the ESOP in accordance with the instructions of the participating employees, and allocated shares for which employees do not give instructions will generally be voted in the same ratio on any matter as to those shares for which instructions are given. Unallocated shares held in the ESOP will be voted by the ESOP trustees in accordance with their fiduciary duties as trustees.

| (3) | Includes 9,644 shares owned jointly with Mr. Blank’s wife, with whom voting and dispositive power is shared, 10,096 shares held in Mr. Blank’s IRA, 4,992 shares held in Mr. Blank’s Keogh Account and 10,920 shares which may be acquired by Mr. Blank upon the exercise of stock options exercisable within 60 days of the record date. |

| (4) | Includes 27,405 shares owned by Mr. Delman’s wife, 1,629 shares held in Mr. Delman’s IRA and 31,860 shares which may be acquired by Mr. Delman upon the exercise of stock options exercisable within 60 days of the record date. |

| (5) | Includes 54,789 shares held by Mr. Kildoo’s wife, 125,426 shares owned jointly with Mr. Kildoo’s wife, with whom voting and dispositive power is shared and 15,100 shares which may be acquired by Mr. Kildoo upon the exercise of stock options exercisable within 60 days of the record date. |

| (6) | Includes 16,225 shares held by Mr. Manna’s wife, 7,180 shares held in Mr. Manna’s IRA, 4,898 shares held in Mr. Manna’s wife’s IRA and 23,097 shares which may be acquired by Mr. Manna upon the exercise of stock options exercisable within 60 days of the record date. |

| (7) | Includes 219,316 shares owned jointly with Mr. Salsgiver’s wife, with whom voting and dispositive power is shared, 13,881 shares owned jointly by Mr. Salsgiver’s wife and mother-in-law, 20,041 shares which may be acquired by Mr. Salsgiver upon the exercise of stock options exercisable within 60 days of the record date and 25,273 shares held in trust for which he is trustee. |

| (8) | Includes 38,176 shares held by Mr. Skuba’s wife, 56,088 shares owned jointly with Mr. Skuba’s wife, with whom voting and dispositive power is shared, 6,066 shares held in Mr. Skuba’s IRA and 26,400 shares which may be acquired by Mr. Skuba upon the exercise of stock options exercisable within 60 days of the record date. Does not include 100,656 shares owned by the Ellwood City Hospital, of which Mr. Skuba serves as President and Chief Executive Officer and as to which beneficial ownership is disclaimed. |

| (9) | Includes 2,377 shares held in trust for Ms. Zuschlag’s niece and four nephews, for which she is custodian, 436 shares held in trust for Ms. Zuschlag’s two godsons, for which she is custodian, 7,320 shares held in Ms. Zuschlag’s IRA, 169,678 shares which may be acquired by Ms. Zuschlag upon the exercise of stock options exercisable within 60 days of the record date, 51,712 shares held by the ESOP for the account of Ms. Zuschlag, 4,608 shares held in a management recognition plan (“MRP”) which may be voted by Ms. Zuschlag pending vesting and distribution, and 3,181 shares held by the Company’s profit sharing plan account for Ms. Zuschlag. Does not include 23,390 shares held by a trust established by the Company to fund certain benefits to be paid to Ms. Zuschlag pursuant to an excess benefit plan. Ms. Zuschlag does not possess voting or investment power with respect to such shares. See “Executive Compensation—Excess Benefit Plan.” |

| (10) | Includes 1,620 shares owned jointly with Mr. Angotti’s wife, with whom voting and dispositive power is shared, 4,756 shares held by Mr. Angotti’s wife, 76,796 shares which may be acquired by Mr. Angotti upon the exercise of stock options exercisable within 60 days of the record date, 15,190 shares held by the ESOP for the account of Mr. Angotti, 576 shares held in a MRP which may be voted by Mr. Angotti pending vesting and distribution, and 8,222 shares held by the profit sharing plan account for Mr. Angotti. |

| (11) | Includes 60,576 shares which may be acquired by Mr. Evanoski upon the exercise of stock options exercisable within 60 days of the record date, 25,210 shares held by the ESOP for the account of Mr. Evanoski, 576 shares held in a MRP which may be voted by Mr. Evanoski pending vesting and distribution, and 2,366 shares held by the profit sharing plan account for Mr. Evanoski. |

3

| (12) | Includes 14,588 shares held by Mr. Hilliard’s wife, 2,701 shares held in trust for Mr. Hilliard’s son for which Mr. Hilliard’s wife is custodian, 55,978 shares which may be acquired by Mr. Hilliard upon the exercise of stock options exercisable within 60 days of the record date, 51,309 shares held by the ESOP for the account of Mr. Hilliard, 576 shares held in a MRP which may be voted by Mr. Hilliard pending vesting and distribution, and 2,097 shares held by the profit sharing plan account for Mr. Hilliard. Does not include 5,404 shares held by Mr. Hilliard’s mother-in-law for which Mr. Hilliard has power-of-attorney and as to which beneficial ownership is disclaimed. |

| (13) | Includes 86,156 shares owned jointly with Mr. Martz’s wife, with whom voting and dispositive power is shared, 49,095 shares which may be acquired by Mr. Martz upon the exercise of stock options exercisable within 60 days of the record date, 7,359 shares which may be acquired by Mr. Martz’s wife upon the exercise of stock options exercisable within 60 days of the record date, 29,559 shares held by the ESOP for the account of Mr. Martz, 9,911 shares held by the ESOP for the account of Mr. Martz’s wife, 576 shares held in a MRP which may be voted by Mr. Martz pending vesting and distribution, 2,366 shares held by the profit sharing plan account for Mr. Martz and 694 shares held by the profit sharing plan account for Mr. Martz’s wife. |

| (14) | Includes 4,933 shares held in Mr. Palkovich’s IRA, 16,045 shares held jointly with Mr. Palkovich’s wife, 35,275 shares which may be acquired by Mr. Palkovich upon the exercise of stock options exercisable within 60 days of the record date, 28,746 shares held by the ESOP for the account of Mr. Palkovich, 576 shares held in a MRP which may be voted by Mr. Palkovich pending vesting and distribution, and 2,366 shares held by the profit sharing plan account for Mr. Palkovich. |

| (15) | Includes 587,159 shares which may be acquired by all directors and officers of the Company as a group upon the exercise of stock options exercisable within 60 days of the record date. Also includes 219,933, 22,130 and 7,488 shares which are held by the ESOP, the profit sharing plan and the MRP, respectively, which have been allocated to the accounts of participating officers and, consequently, will be voted at the annual meeting by direction of such participating officers. Does not include 23,390 shares held by a trust established by the Company to fund certain benefits to be paid to the President and Chief Executive Officer of the Company. See “Executive Compensation—Excess Benefit Plan.” |

4

ELECTION OF DIRECTORS

The articles of incorporation and bylaws of the Company provide that the board of directors shall be divided into three classes as nearly equal in number as possible, and that the members of each class shall be elected for terms of three years and until their successors are elected and qualified, with one of the three classes of directors to be elected each year. The number of directors currently authorized by the Company’s bylaws is six.

At the annual meeting, stockholders of the Company will be asked to elect two directors for a three-year term and until their successors are elected and qualified. The two nominees for election as directors were selected by the nominating committee of the board of directors. There are no arrangements or understandings between the persons named and any other person pursuant to which such person was selected as a nominee for election as a director at the annual meeting, and no director or nominee for director is related to any other director or executive officer of the Company by blood, marriage or adoption.

If any person named as nominee should be unable or unwilling to stand for election at the time of the annual meeting, the proxies will nominate and vote for any replacement nominee or nominees recommended by the board of directors of the Company. At this time, the board of directors knows of no reason why any of the nominees may not be able to serve as a director if elected.

Article 7.F of the Company’s articles of incorporation governs nominations for election to the board of directors and requires all nominations for election to the board of directors, other than those made by or at the direction of the board, to be made pursuant to timely notice in writing to the Secretary of the Company, as set forth in the articles of incorporation. To be timely, with respect to an election to be held at an annual meeting of stockholders, a stockholders’ notice must be delivered to, or mailed and received at, the principal executive offices of the Company, not later than 60 days prior to the anniversary date of the immediately preceding annual meeting of stockholders. Each written notice of a stockholder nomination must set forth certain information specified in the articles of incorporation. The presiding officer of the meeting may refuse to acknowledge the nomination of any person not made in compliance with the procedures set forth in the articles of incorporation.

Information with Respect to Nominees for Director and Continuing Directors

The following tables present information concerning each nominee for director and each director whose term continues and reflects his/her tenure as a director of the Company and his/her principal occupation during the past five years.

All of the members of the board of directors, except Ms. Zuschlag who is an employee of the Company, are independent as defined in the rules of the Nasdaq Stock Market.

Nominees for Director for a Three-Year Term Expiring in 2007

| | | | | | |

Name

| | Age

| | Position with the Company and Principal Occupation During the Past Five Years

| | Director Since(1)

|

Lloyd L. Kildoo | | 64 | | Director; Owner and Funeral Director of Glenn-Kildoo Funeral Homes of Zelienople and Cranberry Township, Pennsylvania. | | 1986 |

| | | |

Mario J. Manna | | 68 | | Director; Retired tax collector, Borough of Coraopolis, Pennsylvania | | 2001 |

The Board of Directors Recommends a Vote For Election of the Above Nominees for Director.

5

Members of the Board of Directors Continuing in Office

Directors With Terms Expiring in 2005

| | | | | | |

Name

| | Age

| | Position with the Company and Principal Occupation During the Past Five Years

| | Director Since(1)

|

Herbert S. Skuba | | 65 | | Vice Chairman of the Board of the Company and ESB Bank; Director, President and Chief Executive Officer of Ellwood City Hospital, Ellwood City, Pennsylvania. | | 1988 |

| | | |

Charles Delman | | 78 | | Director; retired; former Chairman, President and Chief Executive Officer of ESB Bancorp, Inc. from June 1989 to March 1994 and President of Economy Savings Bank, PaSA from 1971 to December 1992. | | 1994 |

Directors With Terms Expiring in 2006

| | | | | | |

Name

| | Age

| | Position with the Company and Principal Occupation During the Past Five Years

| | Director Since(1)

|

Charlotte A. Zuschlag | | 52 | | Director; President and Chief Executive Officer of the Company since February 1991 and of ESB Bank since June 1989. | | 1988 |

| | | |

William B. Salsgiver | | 70 | | Chairman of the Board of the Company and ESB Bank; a principal of the property development and residential construction firm, Perry Homes, Zelienople, Pennsylvania. | | 1987 |

| (1) | Includes service with ESB Bank prior to the Bank’s conversion to the holding company form. |

6

Executive Officers Who Are Not Directors

The following table sets forth certain information with respect to the executive officers of the Company who are not also directors of the Company. All executive officers of the Company are elected annually by the board of directors and shall serve at the discretion of the board.

| | | | |

Name

| | Age

| | Position with the Company and Principal Occupation During the Past Five Years

|

Frank D. Martz | | 48 | | Group Senior Vice President of Operations of the Company since January 2000 and Secretary of the Company since February 1991; Group Senior Vice President of Operations of ESB Bank since January 2000 and Secretary of ESB Bank since November 1989; Senior Vice President of Operations of the Company and ESB Bank from April 1993 through December 1999. |

| | |

Charles P. Evanoski | | 45 | | Group Senior Vice President of the Company and ESB Bank since January 2000 and Chief Financial Officer of the Company and ESB Bank since April 1993; Senior Vice President of the Company and ESB Bank from April 1993 through December 1999. |

| | |

Todd F. Palkovich | | 49 | | Group Senior Vice President of Lending of the Company and ESB Bank since January 2000; Senior Vice President of Lending of the Company and ESB Bank from April 1993 through December 1999. |

| | |

Robert C. Hilliard | | 54 | | Group Senior Vice President of Internal Audit, Compliance and Loan Review of the Company and ESB Bank since January 2000; Senior Vice President of Internal Audit, Compliance and Loan Review of the Company and ESB Bank from March 1995 through December 1999. Mr. Hilliard is a certified public accountant. |

| | |

Thomas F. Angotti | | 56 | | Group Senior Vice President of Administration of the Company since February 2000; President and Chief Executive Officer of SHS Bancorp, Inc. from September 1997 through February 2000; President and Chief Executive Officer of Spring Hill Savings Bank from April 1997 through May 2000; President of Spring Hill Savings Bank from September 1989 through April 1997. |

| | |

Bonita L. Wadding | | 34 | | Senior Vice President and Controller of the Company since November 2003. Vice President and Controller of ESB Bank since September 2000. Assistant Vice President and Financial Analyst of ESB Bank since April 1997. |

Directors’ Compensation

As of December 31, 2003, except as described below, all non-employee directors of the Company receive $794 per month (except for Mr. Salsgiver who receives $1,270 per month as Chairman of the Board and Mr. Skuba who receives $1,032 per month as Vice Chairman of the Board) and are not compensated for attendance at committee meetings (except for members of the audit committee who receive $250 per meeting and Mr. Kildoo who receives $400 per meeting as Chairman of the audit committee). Full-time employee directors of the Company do not receive any fees for board or committee meetings. During 2003, total compensation paid to directors of the Company amounted to $75,421 in the aggregate. See also “Executive Compensation-Directors’ Retirement Plan.”

7

Directors Attendance at Annual Meetings

Although we do not have a formal policy regarding attendance by members of the board of directors at annual meetings of stockholders, we expect that our directors will attend, absent a valid reason for not doing so. In 2003, all of our directors attended our annual meeting of stockholders.

The Board of Directors and Its Committees

Regular meetings of the board of directors of the Company are held on a monthly basis and special meetings of the board of directors of the Company are held from time-to-time as needed.

There were 13 meetings of the board of directors of the Company held during 2003. No director attended fewer than 75% of both the aggregate total number of meetings of the board of directors held during 2003 and the total number of meetings held by all committees of the board on which the director served during such year.

The board of directors of the Company has established various standing committees of the board, including executive, compensation, audit and nominating and corporate governance committees. The Company and its subsidiaries have other committees comprised of officers and directors of the Company and such subsidiaries which meet for specific purposes.

The executive committee of the Company is authorized to exercise the powers of the board of directors between regular meetings of the board. Currently, Messrs. Skuba, Salsgiver and Delman and Ms. Zuschlag (Chairperson) serve as members of this committee. During 2003, the executive committee did not meet.

The compensation committee of the Company makes recommendations regarding officer salaries to the board of directors. Currently, Messrs. Salsgiver (Chairman), Kildoo and Manna serve as members of this committee. During 2003, the compensation committee met once.

The Company established a nominating and corporate governance committee in May 2003 to evaluate and make recommendations to the board of directors for the election of directors. As of December 31, 2003, the members of this committee were Messrs. Salsgiver (Chairman), Delman and Skuba. Each of these persons is independent within the meaning of the rules of the Nasdaq Stock Market. The nominating and corporate governance committee operates pursuant to a written charter, which can be viewed on our website atwww.esbbank.com. During 2003, the nominating and corporate governance committee did not meet, but met once in early 2004 in connection with nominations for director for the upcoming annual meeting.

The nominating and corporate governance committee considers candidates for director suggested by its members and other directors, as well as management and stockholders. The nominating and corporate governance committee also may solicit prospective nominees identified by it. A stockholder who desires to recommend a prospective nominee for the board should notify the Company’s Secretary or any member of the nominating and corporate governance committee in writing with whatever supporting material the shareholder considers appropriate. The nominating and corporate governance committee also considers whether to nominate any person nominated pursuant to the provision of the Company’s articles of incorporation relating to stockholder nominations, which is described under “Election of Directors.” The nominating and corporate governance committee has the authority and ability to retain a search firm to identify or evaluate potential nominees if it so desires.

The charter of the nominating and corporate governance committee sets forth certain criteria the committee may consider when recommending individuals for nomination as director including: (a) ensuring that the board of directors, as a whole, is diverse and consists of individuals with various and relevant career experience, relevant technical skills, industry knowledge and experience, financial expertise (including expertise that could qualify a director as a “financial expert,” as that term is defined by the rules of the SEC), local or community ties and (b) minimum individual qualifications, including strength of character, mature judgment, familiarity with our business and industry, independence of thought and an ability to work collegially. The committee also may consider the extent to which the candidate would fill a present need on the board of directors.

8

Once the nominating and corporate governance committee has identified a prospective nominee, the committee makes an initial determination as to whether to conduct a full evaluation of the candidate. This initial determination is based on whatever information is provided to the committee with the recommendation of the prospective candidate, as well as the committee’s own knowledge of the prospective candidate, which may be supplemented by inquiries to the person making the recommendation or others.

The audit committee reviews the Company’s records and affairs to determine its financial condition, reviews the Company’s systems of internal control with management and the independent auditors, and monitors the Company’s adherence in accounting and financial reporting to generally accepted accounting principles. Currently, Messrs. Kildoo (Chairman), Delman, Skuba and Manna serve as members of this committee. The audit committee met six times during 2003. The members are independent as defined in the listing standards of the Nasdaq Stock Market.

The board of directors has determined that Mr. Delman, a member of the audit committee, meets the requirements recently adopted by the SEC for qualification as an audit committee financial expert. An audit committee financial expert is defined as a person who has the following attributes: (i) an understanding of generally accepted accounting principles and financial statements; (ii) the ability to assess the general application of such principles in connection with the accounting for estimates, accruals and reserves; (iii) experience preparing, auditing, analyzing or evaluating financial statements that present a breadth and level of complexity or accounting issues that are generally comparable to the breadth and complexity of issues that can reasonably be expected to be raised by the registrant’s financial statements, or experience actively supervising one or more persons engaged in such activities; (iv) an understanding of internal controls and procedures for financial reporting; and (v) an understanding of audit committee functions.

The identification of a person as an audit committee financial expert does not impose on such person any duties, obligations or liability that are greater than those that are imposed on such person as a member of the audit committee and the board of directors in the absence of such identification. Moreover, the identification of a person as an audit committee financial expert for purposes of the regulations of the SEC does not affect the duties, obligations or liability of any other member of the audit committee or the board of directors. Finally, a person who is determined to be an audit committee financial expert will not be deemed an “expert” for purposes of Section 11 of the Securities Act of 1933.

The board of directors adopted an updated audit committee charter in November 2003, a copy of which is attached to this proxy statement as Appendix A.

Relationship with Independent Auditors

The audit committee of the board of directors appointed Ernst & Young LLP as the independent auditors to audit the Company’s financial statements for the year ending December 31, 2004. The audit committee considered the compatibility of the non-audit services provided to the Company by Ernst & Young in 2003 described below on the independence of Ernst & Young from the Company in evaluating whether to appoint Ernst & Young to perform the audit of the Company’s financial statements for the year ending December 31, 2004.

The following table sets forth the aggregate fees paid by us to Ernst & Young for professional services rendered by Ernst & Young in connection with the audit of the Company’s consolidated financial statements for 2003 and 2002, as well as the fees paid by us to Ernst & Young for audit-related services, tax services and all other services rendered by Ernst & Young to us during 2003 and 2002.

| | | | | | |

| | | Year Ended December 31,

|

| | | 2003

| | 2002

|

Audit fees (1) | | $ | 227,819 | | $ | 138,250 |

Audit-related fees (2) | | | 38,125 | | | 31,275 |

Tax fees (3) | | | 57,050 | | | 79,400 |

All other fees | | | — | | | — |

| | |

|

| |

|

|

Total | | $ | 322,994 | | $ | 248,925 |

| | |

|

| |

|

|

9

| (1) | Audit fees consist of fees incurred in connection with the audit of our annual financial statements, reporting on management’s assertion regarding the effectiveness of internal controls in accordance with FDICIA, the review of the interim financial statements included in our quarterly reports filed with the SEC and the issuance of consents and assistance with, and review of, documents filed with the SEC. |

| (2) | Audit-related fees consist of fees incurred in connection with audits of the financial statements of certain of the Company’s employee benefit plans, agreed upon procedures for reviewing student loans preformed under the Federal Family Educational Loan Program and procedures performed relating to the Uniform Attestation Program. |

| (3) | Tax fees consist of fees incurred in connection with tax planning, tax compliance and tax consulting services. |

The audit committee selects the Company’s independent auditors and pre-approves all audit services to be provided by it to the Company. The audit committee also reviews and pre-approves all audit-related, tax and all other services rendered by our independent auditors in accordance with the audit committee’s charter and policy on pre-approval of audit-related, tax and other services. In its review of these services and related fees and terms, the audit committee considers, among other things, the possible effect of the performance of such services on the independence of our independent auditors. Pursuant to its policy, the audit committee pre-approves certain audit-related services and certain tax services which are specifically described by the audit committee on an annual basis and separately approves other individual engagements as necessary. The pre-approval requirements do not apply to certain services if: (i) the aggregate amount of such services provided to the Company constitutes not more than five percent of the total amount of revenues paid by the Company to its independent auditor during the year in which the services are provided; (ii) such services were not recognized by the Company at the time of the engagement to be other services; and (iii) such services are promptly brought to the attention of the committee and approved by the committee or by one or more members of the committee to whom authority to grant such approvals has been delegated by the committee prior to the completion of the audit. The committee may delegate to one or more designated members of the committee the authority to grant required pre-approvals. The decisions of any member to whom authority is delegated to pre-approve an activity shall be presented to the full committee at its next scheduled meeting.

Since May 6, 2003, the effective date of SEC rules stating that an auditor is not independent of an audit client if the services it provides to the client are not appropriately approved, each new engagement of Ernst & Young was approved in advance by the audit committee, and none of those engagements made use of thede minimis exception to pre-approval contained in the SEC’s rules.

Report of the Audit Committee

The audit committee has reviewed and discussed the audited financial statements with management. The audit committee has discussed with the independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61 “Communication with Audit Committees,” as may be modified or supplemented. The audit committee has received the written disclosures and the letter from the independent auditors required by Independence Standards Board Standard No. 1, as may be modified or supplemented, and has discussed with the independent auditor, the independent auditor’s independence. Based on the review and discussions referred to above in this report, the audit committee recommended to the board of directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2003 for filing with the SEC.

Lloyd L. Kildoo, Chairman

Charles Delman

Herbert S. Skuba

Mario J. Manna

10

EXECUTIVE COMPENSATION

Summary

The following table sets forth a summary of certain information concerning the compensation awarded to or paid by the Company or its subsidiaries for services rendered in all capacities during the last three fiscal years to the President and Chief Executive Officer and the five other highest compensated executive officers of the Company.

Summary Compensation Table

| | | | | | | | | | | | | | | | | | | |

Name and Principal Position

| | Year

| | Annual Compensation

| | Long Term

Compensation

| | All Other Compensation(4)

|

| | | Salary

| | Bonus

| | Other Annual Compensation(1)

| | Awards

| |

| | | | | | Stock Grants(2)

| | Securities

Underlying Options(3)

| |

Charlotte A. Zuschlag President and Chief Executive Officer | | 2003

2002

2001 | | $

| 327,200

312,800

299,231 | | $

| 86,380

102,800

90,000 | | $

| —

—

— | | $

| —

—

90,160 | | 15,000

18,000

21,598 | | $

| 54,610

49,014

30,702 |

| | | | | | | |

Charles P. Evanoski Group Senior Vice President and Chief Financial Officer | | 2003

2002

2001 | | $

| 125,192

120,385

113,908 | | $

| 22,000

26,400

22,680 | | $

| —

—

— | | $

| —

—

11,270 | | 4,000

4,800

4,752 | | $

| 36,000

31,396

21,694 |

| | | | | | | |

Frank D. Martz Group Senior Vice President of Operations and Secretary | | 2003

2002

2001 | | $

| 125,192

120,385

113,908 | | $

| 22,000

26,400

22,680 | | $

| —

—

— | | $

| —

—

11,270 | | 4,000

4,800

4,752 | | $

| 36,000

31,396

21,694 |

| | | | | | | |

Todd F. Palkovich Group Senior Vice President of Lending | | 2003

2002

2001 | | $

| 125,192

120,385

113,908 | | $

| 22,000

26,400

22,680 | | $

| —

—

— | | $

| —

—

11,270 | | 4,000

4,800

4,752 | | $

| 36,000

31,396

21,694 |

| | | | | | | |

Robert C. Hilliard Group Senior Vice President of Internal Audit, Compliance and Loan Review | | 2003

2002

2001 | | $

| 114,677

110,346

104,462 | | $

| 20,150

24,200

20,800 | | $

| —

—

— | | $

| —

—

11,270 | | 4,000

4,800

4,752 | | $

| 33,064

27,986

19,922 |

| | | | | | | |

Thomas F. Angotti Group Senior Vice President of Administration | | 2003

2002

2001 | | $

| 114,677

110,346

104,462 | | $

| 20,150

24,200

20,800 | | $

| —

—

— | | $

| —

—

11,270 | | 4,000

4,800

4,752 | | $

| 33,064

28,833

19,922 |

| (1) | Does not include amounts attributable to miscellaneous benefits received by the named executive officer, including the payment of club membership dues and the use and maintenance of an automobile. In the opinion of management of the Company, the costs to the Company of providing such benefits to the named executive officer during the year ended December 31, 2003 did not exceed the lesser of $50,000 or 10% of the total of annual salary and bonus reported for such individual. |

| (2) | Represents the grant of 11,520, 1,440, 1,440, 1,440, 1,440 and 1,440 shares of restricted common stock (as adjusted for subsequent stock splits), to Ms. Zuschlag and Messrs. Evanoski, Martz, Palkovich, Hilliard and Angotti, respectively, in 2001 pursuant to the MRP, which were deemed to have had the indicated value at the date of grant, and which had a fair market value at December 31, 2003 of $185,472, $23,184, $23,184, $23,184, |

11

$23,184 and $23,184, respectively. The awards vest over four years; 20% immediately and 20% each year from the date of grant. Dividends paid on the restricted common stock are paid to the recipient.

| (3) | Represents grants of stock options under the Company’s stock option plans. The awards have been adjusted for subsequent stock splits and stock dividends. |

| (4) | During the year ended December 31, 2003, consists of amounts allocated, accrued or paid by the Company on behalf of Ms. Zuschlag and Messrs. Evanoski, Martz, Palkovich, Hilliard and Angotti pursuant to the profit sharing plan of $7,000, $5,152, $5,152, $5,152, $4,719 and $4,719, respectively, and estimated allocations under the ESOP of $47,610, $30,848, $30,848, $30,848, $28,345 and $28,345, respectively. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires the Company’s officers and directors, and persons who own more than 10% of the Company’s common stock to file reports of ownership and changes in ownership with the SEC. Officers, directors and 10% stockholders are required by regulation to furnish the Company with copies of all Section 16(a) forms they file. The Company knows of no person, other than the Company’s ESOP, who owns 10% or more of the Company’s common stock.

Based solely on review of the copies of such forms furnished to the Company, the Company believes that all applicable Section 16(a) filing requirements were satisfied by its officers and directors during 2003.

Stock Options

The following table sets forth certain information concerning individual grants of stock options pursuant to the Company’s stock option plans to the named executive officers during the year ended December 31, 2003.

| | | | | | | | | | | | | | | | |

Individual Grants

| | Potential Realizable

Value at Assumed

Annual Rates of Stock Price

Appreciation for Option Term(4)

|

Name

| | Options

Granted(1)

| | % of Total

Options

Granted to

Employees(2)

| | | Exercise

Price(3)

| | Expiration

Date

| | 5%

| | 10%

|

Charlotte A. Zuschlag | | 15,000 | | 22.5 | % | | $ | 15.35 | | 11/17/13 | | $ | 142,650 | | $ | 360,450 |

Charles P. Evanoski | | 4,000 | | 6.0 | | | | 15.35 | | 11/17/13 | | | 38,040 | | | 96,120 |

Frank D. Martz | | 4,000 | | 6.0 | | | | 15.35 | | 11/17/13 | | | 38,040 | | | 96,120 |

Todd F. Palkovich | | 4,000 | | 6.0 | | | | 15.35 | | 11/17/13 | | | 38,040 | | | 96,120 |

Robert C. Hilliard | | 4,000 | | 6.0 | | | | 15.35 | | 11/17/13 | | | 38,040 | | | 96,120 |

Thomas F. Angotti | | 4,000 | | 6.0 | | | | 15.35 | | 11/17/13 | | | 38,040 | | | 96,120 |

| (1) | The options vested immediately and are exercisable on the date of grant. |

| (2) | Percentage of options to purchase common stock granted to all employees during 2003. |

| (3) | The exercise price was based on the market price of the common stock on the date of grant. |

| (4) | Assumes compounded rates of return for the remaining life of the options and future stock prices of $24.86 and $39.38 at compounded rates of return of 5% and 10%, respectively. |

12

The following table sets forth certain information concerning exercises of stock options by the named executive officers during the year ended December 31, 2003 and options held at December 31, 2003.

AGGREGATED OPTION EXERCISES IN LAST FISCAL YEAR

AND YEAR END OPTION VALUES

| | | | | | | | | | | | | | | |

Name

| | Shares Acquired on Exercise(1)

| | Value Realized

| | Number of Unexercised Options at Year End(1)

| | Value of Unexercised Options at Year End(2)

|

| | | | | | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

Charlotte A. Zuschlag | | 5,875 | | $ | 66,681 | | 169,678 | | — | | $ | 1,361,068 | | $ | — |

Charles P. Evanoski | | — | | | — | | 60,576 | | — | | | 511,831 | | | — |

Frank D. Martz | | 6,879 | | | 57,101 | | 49,095 | | — | | | 392,008 | | | — |

Todd F. Palkovich | | — | | | — | | 60,576 | | — | | | 511,831 | | | — |

Robert C. Hilliard | | — | | | — | | 55,978 | | — | | | 463,920 | | | — |

Thomas F. Angotti | | — | | | — | | 76,796 | | — | | | 802,590 | | | — |

| (1) | As adjusted for subsequent stock splits and stock dividends. |

| (2) | Based on a per share market price of $16.10 at December 31, 2003. |

Employment and Change of Control Agreements

ESB Bank has entered into an employment agreement with Ms. Zuschlag pursuant to which ESB Bank agreed to employ her as President and Chief Executive Officer for a term of three years with a current base salary of $327,200. Such salary may be increased at the discretion of the Board of Directors of ESB Bank but may not be decreased during the term of the agreement without the prior written consent of Ms. Zuschlag. On an annual basis, the board of directors of ESB Bank considers whether to renew the employment agreement for an additional year. The employment agreement is terminable with or without cause by ESB Bank. The employment agreement provides that in the event of a wrongful termination of employment (including a voluntary termination by Ms. Zuschlag as a result of ESB Bank’s material breach of the agreement or for “good reason” following a change in control of the Company, including a change in her position, salary or duties without her consent), Ms. Zuschlag would be entitled to (1) an amount of cash severance which is equal to three times her average annual compensation over the last five years, (2) continued participation in certain employee benefit plans of the Company, including medical and dental plans, for thirty-six months or shorter period upon her full-time employment by another employer; and (3) if Ms.Zuschlag is still receiving medical and dental coverage after the end of the thirty-six month period referred to in clause (2), then she would be entitled to continued medical and dental coverage until the earlier of Ms. Zuschlag’s death or the date Ms. Zuschlag receives medical and dental coverage from a subsequent employer substantially similar to the coverage provided by the Company, provided however, Ms. Zuschlag shall pay the employee share of the costs of such coverage provided pursuant to this clause (3) to the same extent as if she were still an employee. The employment agreement with ESB Bank provides that in the event any of the payments to be made thereunder or otherwise upon termination of employment are deemed to constitute “parachute payments” within the meaning of Section 280G of the Code, then such payments and benefits received thereunder shall be reduced, in the manner determined by Ms. Zuschlag, by the minimum amount necessary to result in no portion of the payments and benefits being non-deductible by ESB Bank for federal income tax purposes. Parachute payments generally are payments in excess of three times the base amount, which is defined to mean the recipient’s average annual compensation from the employer includable in the recipient’s gross income during the most recent five taxable years ending before the date on which a change in control of the employer occurred. Recipients of parachute payments are subject to a 20% excise tax on the amount by which such payments exceed the base amount, in addition to regular income taxes, and payments in excess of the base amount are not deductible by the employer as compensation expense for federal income tax purposes.

13

The Company has also entered into an employment agreement with Ms. Zuschlag to serve on terms substantially similar to the agreement entered into with ESB Bank, except as provided below. Ms. Zuschlag’s compensation, benefits and expenses are paid by the Company and ESB Bank in the same proportion as the time and services actually expended by her on behalf of each company. However, the agreement with the Company provides that severance payments payable to Ms. Zuschlag by the Company shall (1) include the amount by which the severance benefits payable by ESB Bank are reduced by Section 280G of the Code, and (2) not be subject to reduction in the event of a change in control as are the amounts payable by ESB Bank. As a result, the severance benefits payable by the Company may constitute “parachute payments” under Section 280G of the Code. In addition, the agreement with the Company provides that the Company shall reimburse Ms. Zuschlag for any resulting excise taxes payable by her, plus such additional amount as may be necessary to compensate her for the payment of state and federal income, excise and other employment-related taxes on the additional payments.

The Company and ESB Bank entered into change of control agreements with Messrs. Evanoski, Martz, Palkovich, Hilliard and Angotti in order to assist them in maintaining a stable and competent management base. The agreements provide for a three-year term, and subject to satisfactory performance reviews, among other things, shall extend on each anniversary date for an additional year so that the remaining term will be three years, unless either the Boards of Directors of the employers or the executive provides contrary written notice to the other not less than 30 days in advance of such anniversary date. The agreements are automatically extended for an additional one year upon a change in control, as defined. The agreements provide for payments in the event that certain adverse actions are taken with respect to the executive’s employment subsequent to a change in control in an amount equal to 2.99 times the respective executive’s annual compensation, as defined.

Excess Benefit Plan

The Company has adopted an excess benefit plan for the purpose of permitting Ms. Zuschlag, and any other employees of the Company who may be designated pursuant to the plan, to receive certain benefits that Ms. Zuschlag and any other employees of the Company otherwise would be eligible to receive under the Company’s retirement and profit sharing plan and ESOP but for the limitations set forth in Sections 401(a)(17), 402(g) and 415 of the Internal Revenue Code of 1986, as amended (the “Code”). Pursuant to the excess benefit plan, during any plan year the Company shall make matching contributions on behalf of the participant in an amount equal to the amount of matching contributions that would have been made by the Company on behalf of the participant but for limitations in the Code, less the actual amount of matching contributions actually made by the Company on behalf of the participant. Finally, the excess benefit plan generally provides that during any plan year a participant shall receive a supplemental ESOP allocation in an amount equal to the amount which would have been allocated to the participant but for limitations in the Code, less the amount actually allocated to the participant pursuant to the ESOP. The supplemental benefits to be received by a participant pursuant to the excess benefit plan shall be credited to an account maintained pursuant to the plan within 180 days after the end of each plan year. In connection with its adoption of the excess benefit plan, the Company adopted a trust which currently holds 23,390 shares of common stock to fund its obligation to Ms. Zuschlag under the excess benefit plan.

Supplemental Executive Retirement Plan

The Company has adopted a Supplemental Executive Benefit Plan (“SERP”) in order to provide supplemental retirement and death benefits for certain key employees of the Company. Under the SERP, participants shall receive an annual retirement benefit following retirement at age 65 equal to 25% of the participant’s final average pay multiplied by a target retirement benefit percentage. Final average pay is based upon the participant’s last three year’s compensation and the target benefit percentage is equal to the fraction resulting from the participant’s years of credited service divided by 20. Benefits under the plan are payable in ten equal annual payments and a lesser benefit is payable upon early retirement at age 55 with at least ten years of service. If a participant dies prior to retirement, the participant’s estate will receive a lump sum payment equal to the net present value of future benefit payments under the plan. At December 31, 2003, Ms. Zuschlag and Messrs. Evanoski, Martz, Palkovich, Hilliard and Angotti had 16, 21, 25, 13, 26 and 17 years of credited service under the SERP, respectively.

14

Directors’ Retirement Plan

The Company and the Bank have adopted the ESB Financial Corporation Directors’ Retirement Plan and entered into director retirement agreements with each director of the Company and the Bank. The plan provides that any retiring director with a minimum of five or more years of service with the Company or the Bank and a minimum of 10 total years of service, including years of service with any bank acquired by the Company or the Bank, that remains in continuous service as a board member until age 75 will be entitled to receive an annual retirement benefit equal to his or her director’s fees earned during the last full calendar year prior to his or her retirement date, multiplied by a ratio, ranging from 25% to 50%, based on the director’s total years of service. The maximum ratio of 50% of fees requires 20 or more years of service and the minimum ratio of 25% of fees requires 10 years of service. Retirement benefits may also be payable under the plan if a director retires from service as a director prior to attaining age 75. One director is currently receiving monthly benefits under the plan.

Compensation Committee

Executive compensation is determined by the compensation committee of the board of directors. The report of the compensation committee with respect to compensation for the Chief Executive Officer and all other executive officers is set forth below, as defined.

The compensation committee of the board of directors has furnished the following report on executive compensation:

The executive compensation program is administered by the compensation committee of the board of directors, which is composed of the individuals listed below this report, none of whom is a full-time employee director of the Company. The committee makes recommendations regarding officer salaries to the board of directors.

The committee determines the level of salary increases, if any, to take effect on December 1 after reviewing various published surveys of compensation paid to executives performing similar duties for financial institutions and their holding companies, with a particular focus on the level of compensation paid by comparable institutions in ESB Bank’s market. Also, it is the policy of the committee to determine the salary components of executive compensation upon the basis of corporate performance. The performance factors which the committee considers are profitability, capital levels, and performance relative to such industry standards as problem asset levels, loan production, regulatory compliance, and asset-liability management. The committee also considers whether or not the overall value of the Company has improved from year to year.

The Company’s executive compensation program is designed to:

| | · | Align the interests of executives with the interests of the stockholders by providing performance based awards in cash and stock; and |

| | · | Allow the Company to compete for and retain executives critical to the Company’s success by providing an opportunity for compensation that is comparable to the levels offered by other companies in our market. |

Stock options were granted to executive officers of the Company during fiscal 2002. Ms. Zuschlag received options to purchase 18,000 shares of common stock and Messrs. Evanoski, Martz, Palkovich, Hilliard and Angotti received options to purchase 4,800, 4,800, 4,800, 4,800 and 4,800 shares of common stock, respectively (adjusted for a subsequent six-for-five stock split). Stock options were granted to executive officers of the Company during fiscal 2003. Ms. Zuschlag received options to purchase 15,000 shares of common stock and Messrs. Evanoski, Martz, Palkovich, Hilliard and Angotti received options to purchase 4,000, 4,000, 4,000, 4,000 and 4,000 shares of common stock, respectively.

Bonuses were paid to the executive officers of the Company during fiscal 2002. Ms. Zuschlag was paid $102,800 during fiscal 2002. Messrs Evanoski, Martz, Palkovich, Hilliard and Angotti were paid a bonus of $26,400, $26,400, $26,400, $24,200 and $24,200, during fiscal 2002. Bonuses were paid to the executive officers of the Company

15

during fiscal 2003. Ms. Zuschlag was paid $86,380 during fiscal 2003. Messrs Evanoski, Martz, Palkovich, Hilliard and Angotti were paid a bonus of $22,000, $22,000, $22,000, $20,150 and $20,150, during fiscal 2003.

Ms. Zuschlag’s compensation increased from $312,800 for fiscal 2002 to $327,200 for fiscal 2003. Messrs. Evanoski, Martz and Palkovich’s compensation increased from $120,385 for fiscal 2002 to $125,192 for fiscal 2003. Messrs. Hilliard and Angotti’s compensation increased from $110,346 for fiscal 2002 to $114,677 for fiscal 2003. At the meeting of the committee that determined executive officers salaries to be effective December 1, 2003, the committee reviewed and considered various published compensation surveys, the executive officers scope of responsibilities relating to ESB Financial Corporation’s continuing growth as well as the aforementioned factors, the committee recommended to the board of directors that Ms. Zuschlag’s annual salary remain at $327,200 and an increase in salary to a level of $127,500 for Messrs. Evanoski, Martz and Palkovich and a level of $116,800 for Messrs. Hilliard and Angotti.

The Compensation Committee

William B. Salsgiver (Chairman)

Lloyd L. Kildoo

Mario J. Manna

16

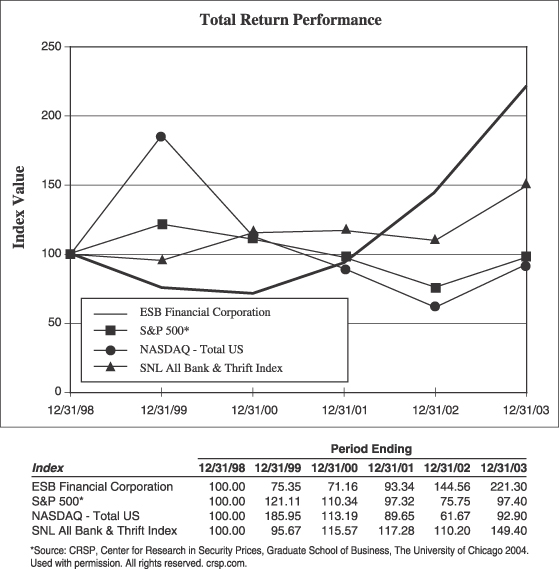

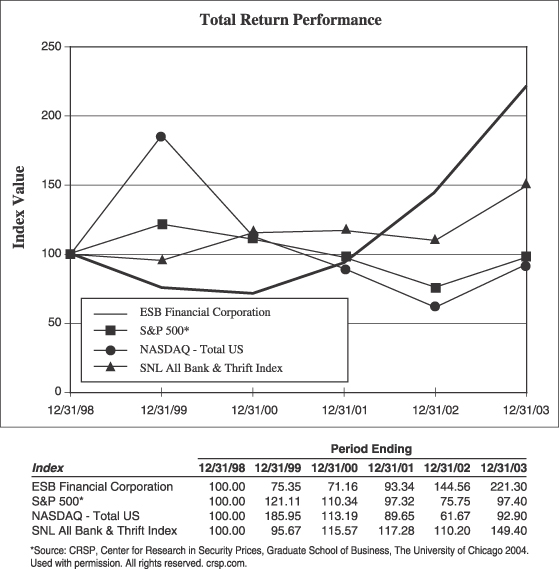

Performance Graph

The following graph compares the yearly cumulative total return on the Common Stock over a five-year measurement period with the yearly cumulative total return on the stocks included in (i) the S&P 500 Total Return Index, (ii) the SNL Securities All Banks and Thrifts Index, and (iii) the NASDAQ-Total US companies. All of these cumulative returns are computed assuming the reinvestment of dividends at the frequency with which dividends were paid during the applicable year.

17

Indebtedness of Management

In accordance with applicable federal laws and regulations, ESB Bank offers mortgage loans to its directors, officers and full-time employees for the financing of their primary residences as well as various consumer loans. These loans are generally made on substantially the same terms as those prevailing at the time for comparable transactions with non-affiliated persons. It is the belief of management that these loans neither involve more than the normal risk of collectibility nor present other unfavorable features.

Section 22(h) of the Federal Reserve Act generally provides that any credit extended by a savings institution to its executive officers, directors and, to the extent otherwise permitted, principal stockholder(s), or any related interest of the foregoing, must (i) be on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions by the savings association with non-affiliated parties; (ii) be pursuant to underwriting standards that are no less stringent than those applicable to comparable transactions with non-affiliated parties; (iii) not involve more than the normal risk of repayment or present other unfavorable features; and (iv) not exceed, in the aggregate, the institution’s unimpaired capital and surplus, as defined.

As of December 31, 2003, three of the directors and executive officers of the Company, or their affiliates, had aggregate loan balances in excess of $60,000, which amounted to $1.2 million in the aggregate. All such loans were made by ESB Bank in the ordinary course of business and were not made with favorable terms nor did they involve more than the normal risk of collectibility.

RATIFICATION OF SELECTION OF INDEPENDENT AUDITORS

General

The audit committee of the board of directors of the Company has appointed Ernst & Young LLP, as independent auditors for the Company for the year ending December 31, 2004. The Board of Directors has directed that the selection of auditors be submitted for ratification by the stockholders at the annual meeting. The Company has been advised by Ernst & Young that neither the firm nor any of its associates has any relationship with the Company or its subsidiaries other than the usual relationship that exists between independent auditors and clients. Ernst & Young will have representatives at the annual meeting who will have an opportunity to make a statement, if they so desire, and will be available to respond to appropriate questions.

The Board of Directors recommends that you vote FOR the ratification of the appointment of Ernst & Young LLP as independent auditors for the year ending December 31, 2004.

OTHER MATTERS

Management is not aware of any business to come before the annual meeting other than those matters described in this proxy statement. However, if any other matters should properly come before the annual meeting, it is intended that the proxies solicited hereby will be voted with respect to those other matters in accordance with the judgment of the persons voting the proxies.

The cost of solicitation of proxies will be borne by the Company. The Company has retained Morrow & Company, a professional proxy solicitation firm, to assist in the solicitation of proxies. The fee arrangement with such firm is $3,000 plus reimbursement for out-of-pocket expenses. The Company will reimburse brokerage firms and other custodians, nominees and fiduciaries for reasonable expenses incurred by them in sending proxy materials to the beneficial owners of the common stock. In addition to solicitations by mail, directors, officers and employees of the Company may solicit proxies personally or by telephone without additional compensation.

18

STOCKHOLDER PROPOSALS AND STOCKHOLDER

COMMUNICATIONS WITH THE BOARD OF DIRECTORS

Any proposal which a stockholder wishes to have included in the proxy solicitation materials to be used in connection with the next annual meeting of stockholders of the Company, must be received at the principal executive offices of the Company, 600 Lawrence Avenue, Ellwood City, Pennsylvania 16117, Attention: Secretary, no later than November 19, 2004. If such proposal is in compliance with all of the requirements of Rule 14a-8 promulgated under the Exchange Act, it will be included in the Company’s proxy statement and set forth on the form of proxy issued for the next annual meeting of stockholders. It is urged that any such proposals be sent by certified mail, return receipt requested.

Stockholder proposals which are not submitted for inclusion in the Company’s proxy materials pursuant to Rule 14a-8 under the Exchange Act may be brought before an annual meeting pursuant to Article 10.F of the Company’s articles of incorporation, which provides that to be properly brought before an annual meeting, business must be (a) properly brought before the meeting by or at the direction of the board of directors or (b) otherwise properly brought before the meeting by a stockholder. For business to be properly brought before an annual meeting by a stockholder, the stockholder must have given timely notice thereof in writing to the Secretary of the Company. To be timely, a stockholder’s notice must be delivered to, or mailed and received at, the principal executive offices of the Company not less than 60 days prior to the anniversary date of the immediately preceding annual meeting of stockholders of the Company, or not later than February 20, 2005 in connection with the next annual meeting of stockholders of the Company. A stockholder’s notice must set forth, as to each matter the stockholder proposes to bring before an annual meeting, (a) a brief description of the business desired to be brought before the annual meeting and (b) certain other information set forth in the articles of incorporation. No stockholder proposals have been received by the Company in connection with the annual meeting.

The board of directors has adopted a process by which stockholders may communicate directly with members of the board. Stockholders who wish to communicate with the board may do so by sending written communications addressed to the Board of Directors, c/o Frank Martz, Secretary, ESB Financial Corporation, 600 Lawrence Avenue, Ellwood City, Pennsylvania 16117.

ANNUAL REPORTS AND FINANCIAL STATEMENTS

A copy of the Company’s annual report to stockholders for the year ended December 31, 2003 accompanies this proxy statement.

Upon receipt of a written request, the Company will furnish to any stockholder without charge a copy of its Annual Report on Form 10-K filed with the SEC under the Exchange Act for the year ended December 31, 2003. Upon written request, the Company will furnish to any such stockholder a copy of the exhibits to the Annual Report on Form 10-K. Such written requests should be directed to ESB Financial Corporation, 600 Lawrence Avenue, Ellwood City, Pennsylvania 16117, Attention: Secretary. The Annual Report on Form 10-K is not a part of this proxy statement.

19

Appendix A

ESB FINANCIAL CORPORATION

AUDIT COMMITTEE CHARTER

| I. | Audit Committee Purpose |

The Audit Committee (the “Committee”) of ESB Financial Corporation (the “Company”) is appointed by the Board of Directors to assist the Board in fulfilling its oversight responsibilities. The Committee’s primary duties and responsibilities are to:

| | · | Appoint the Company’s independent auditors. |

| | · | Monitor the integrity of the Company’s financial reporting process and systems of internal controls regarding finance, accounting, legal, and regulatory compliance. |

| | · | Monitor the qualifications, independence, and performance of the Company’s independent auditors and internal auditing department. |

| | · | Provide an avenue of communication among the independent auditors, management, the internal auditing department, and the Board of Directors. |

The Committee has the authority to conduct any investigation appropriate to fulfilling its responsibilities, and it has direct access to the independent auditors as well as anyone in the organization. The Committee has the ability to retain, at the Company’s expense, special legal, accounting, or other consultants or experts it deems necessary within the Committee’s scope of responsibilities.

The Committee shall be directly responsible for appointing, determining funding for, and overseeing the independent auditors in accordance with Section 301 of the Sarbanes-Oxley Act of 2002 (“Sarbanes-Oxley”) and Section 10A(m)(2) of the Securities Exchange Act of 1934, as amended (“Exchange Act”).

| II. | Audit Committee Composition and Meetings |

Committee members shall meet the requirements of the Nasdaq Stock Market (the “Nasdaq”). The Committee shall be comprised of three or more directors, as determined by the Board, each of whom shall be independent, as such term is defined in the Rules of the Nasdaq, free from any relationship that would interfere with the exercise of his or her independent judgment. In order to maintain independent judgment, Committee members are prohibited from receiving any consulting, advisory, or other compensatory fee from the Company, other than payment for board or committee service, and Committee members are prohibited from owning 20% or more of the Company’s voting securities. All members of the Committee shall have a basic understanding of finance and accounting and be able to read and understand fundamental financial statements at the time of their appointment, and at least one member of the Committee shall have accounting or related financial management expertise within the meaning of Rules of the Nasdaq.

Committee members shall be appointed by the Board. If a Committee chairman (“Chairman”) is not designated or present, the members of the Committee may designate a Chairman by majority vote of the Committee membership.

The Committee shall meet at least four times annually, or more frequently as circumstances dictate. The Chairman shall approve an agenda in advance of each meeting. The Committee should meet privately in executive session at least annually with management, the director of the internal auditing department, the independent auditors, and as a committee to discuss any matters that the Committee or each of these groups believe should be discussed. The Committee, or at least its Chairman, should communicate with management and the independent auditors no less than quarterly to review the Company’s financial statements and significant findings based upon the auditor’s limited review procedures. The Chairman or another member of the Committee selected thereby should review the Company’s earnings releases with management and the independent auditors prior to their release.

A-1

| III. | Audit Committee Responsibilities and Duties |

Review Procedures

1. Review and reassess the adequacy of this Charter at least annually. Submit the charter to the Board of Directors for approval. Have the charter published at least every three years in accordance with regulations of the Securities and Exchange Commission (the “SEC”).

2. Review the Company’s annual audited financial statements and unaudited interim financial statements including disclosures within “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” prior to filing or distribution. Review should include discussion with management and independent auditors of significant issues regarding accounting principles including critical accounting policies, practices, and judgments.

3. In consultation with management of the Company, the independent auditors, and the internal auditors, consider the integrity of the Company’s financial reporting processes and controls. Discuss significant financial risk exposures, including the effect of regulatory and accounting initiatives, as well as off-balance sheet structures, on the financial statements and the steps management has taken to monitor, control, and report such exposures. Review significant findings prepared by the independent auditors and the internal auditing department together with management’s responses.

4. Review with management and the independent auditors the Company’s quarterly financial results prior to the release of earnings and/or the Company’s quarterly financial statements prior to filing or distribution of the Quarterly Report on Form 10-Q. Discuss any significant changes to the Company’s accounting principles and any items required to be communicated by the independent auditors in accordance with Statement on Auditing Standards (“SAS”) No. 61. The Chairman of the Committee may represent the entire Committee for purposes of this review.

5. Review disclosures made by the Chief Executive Officer and the Chief Financial Officer during the Forms 10-K and 10-Q certification process about significant deficiencies in the design or operation of internal controls or any fraud that involves management or other employees who have a significant role in the Company’s internal controls.

Independent Auditors

6. The Committee shall be directly responsible for the appointment, compensation, oversight of the work, evaluation, and termination of the independent auditors (subject, if applicable, to shareholder ratification). The independent auditors report directly to the Committee and the Committee will be responsible for the resolution of any disagreements between management and the independent auditor regarding financial reporting. The Committee shall also review the independence of the auditors.

7. Audit, audit-related, tax and all other services, which are not prohibited by law, shall be pre-approved by the Committee pursuant to such processes as are determined to be advisable.

However, the pre-approval requirement set forth in the first sentence above, shall not be applicable with respect to the provision for all other services, if:

| | (i) | the aggregate amount of other services provided to the Company constitutes not more than five percent of the total amount of revenues paid by the Company to its independent auditor during the calendar year in which the other services are provided; |

| | (ii) | such services were not recognized by the Company at the time of the engagement to be other services; and |

| | (iii) | such services are promptly brought to the attention of the Committee and approved by the Committee or by one or more members of the Committee to whom authority to grant such approvals has been delegated by the Committee prior to the completion of the audit. |

A-2

Delegation – The Committee may delegate to one or more designated members of the Committee the authority to grant required pre-approvals. The decisions of any member to whom authority is delegated under this paragraph to pre-approve an activity under this subsection shall be presented to the full Committee at its next scheduled meeting.

The pre-approval policies and procedures will be disclosed in the Company’s proxy statements and annual reports in the manner directed by the regulations of the SEC or the Rules of the Nasdaq, as applicable.

8. On an annual basis, review and discuss with the independent auditors all significant relationships they have with the Company that could impair the auditors’ independence. Consider whether the provision of any non-audit services by the independent auditors is compatible with maintaining the auditor’s independence.

9. Review the independent auditors’ audit plan including discussions of audit scope, staffing, locations, reliance upon management, and internal audit and general audit approach.