SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12 |

ESB Financial Corporation

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | (1) | Amount previously paid: |

| | (2) | Form, schedule or registration statement no.: |

[ESB Financial Corporation Letterhead]

March 18, 2005

Dear Stockholder:

You are cordially invited to attend the annual meeting of stockholders of ESB Financial Corporation. The meeting will be held at the Connoquenessing Country Club located at 1512 Mercer Road, Ellwood City, Pennsylvania, on Wednesday, April 20, 2005, at 4:00 p.m., local time. The matters to be considered by stockholders at the annual meeting are described in detail in the accompanying materials.

The board of directors of ESB Financial Corporation has determined that the matters to be considered at the annual meeting are in the best interests of the Company and its shareholders. For the reasons set forth in the proxy statement, the board unanimously recommends that you vote “FOR” each matter to be considered.

It is very important that you be represented at the annual meeting regardless of the number of shares you own or whether you are able to attend the meeting in person. Let me urge you to mark, sign and date your proxy card today and return it in the envelope provided, even if you plan to attend the annual meeting. This will not prevent you from voting in person, but will ensure that your vote is counted if you are unable to attend.

Your continued support of and interest in ESB Financial Corporation is appreciated.

|

Sincerely, |

|

| /s/ CHARLOTTE A. ZUSCHLAG |

| Charlotte A. Zuschlag |

| President and Chief Executive Officer |

ESB FINANCIAL CORPORATION

600 Lawrence Avenue

Ellwood City, Pennsylvania 16117

(724) 758-5584

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON APRIL 20, 2005

NOTICE IS HEREBY GIVEN that an Annual Meeting of Stockholders of ESB Financial Corporation (the “Company”) will be held at the Connoquenessing Country Club located at 1512 Mercer Road, Ellwood City, Pennsylvania, on Wednesday, April 20, 2005, at 4:00 p.m., local time, for the following purposes, all of which are more completely set forth in the accompanying proxy statement:

| | (1) | To elect two directors for a three-year term and until their successors are elected and qualified; |

| | (2) | To approve the ESB Financial Corporation 2005 Stock Incentive Plan; |

| | (3) | To ratify the appointment of S.R. Snodgrass, A.C. as the Company’s independent registered public accounting firm for the year ending December 31, 2005; and |

| | (4) | To transact such other business as may properly come before the meeting or any adjournment thereof. Except with respect to procedural matters incident to the conduct of the annual meeting, management is not aware of any other matters which could come before the annual meeting. |

The board of directors has fixed March 4, 2005 as the voting record date for the determination of stockholders entitled to notice of and to vote at the annual meeting. Only those stockholders of record as of the close of business on that date will be entitled to vote at the annual meeting or at any such adjournment.

|

BY ORDER OF THE BOARD OF DIRECTORS |

|

| /s/ FRANK D. MARTZ |

| Frank D. Martz |

| Group Senior Vice President of |

| Operations and Secretary |

March 18, 2005

Ellwood City, Pennsylvania

YOU ARE CORDIALLY INVITED TO ATTEND THE ANNUAL MEETING. IT IS IMPORTANT THAT YOUR SHARES BE REPRESENTED REGARDLESS OF THE NUMBER YOU OWN. EVEN IF YOU PLAN TO BE PRESENT, YOU ARE URGED TO COMPLETE, SIGN, DATE AND RETURN THE ENCLOSED PROXY PROMPTLY IN THE ENVELOPE PROVIDED. IF YOU ATTEND THIS MEETING, YOU MAY VOTE EITHER IN PERSON OR BY YOUR PROXY. ANY PROXY GIVEN MAY BE REVOKED BY YOU IN WRITING OR IN PERSON AT ANY TIME PRIOR TO THE EXERCISE THEREOF.

ESB FINANCIAL CORPORATION

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

APRIL 20, 2005

General

This proxy statement is being furnished to the holders of common stock, $0.01 par value per share, of ESB Financial Corporation (the “Company”), the savings and loan holding company of ESB Bank (including all predecessors thereto, the “Bank”), in connection with the solicitation of proxies by the board of directors of the Company for use at its annual meeting of stockholders to be held at the Connoquenessing Country Club located at 1512 Mercer Road, Ellwood City, Pennsylvania, on Wednesday, April 20, 2005, at 4:00 p.m., local time, and at any adjournment thereof, for the purposes set forth in the notice of annual meeting of stockholders. This proxy statement is first being mailed to stockholders on or about March 18, 2005.

Voting Rights

Only stockholders of record at the close of business on March 4, 2005 (the “record date”) will be entitled to notice of and to vote at the annual meeting. At such date, there were 13,537,345 shares of common stock issued and outstanding and the Company had no other class of equity securities outstanding.

Each share of common stock is entitled to one vote at the annual meeting on all matters properly presented at the meeting. The presence in person or by proxy of at least a majority of the issued and outstanding shares of common stock entitled to vote is necessary to constitute a quorum at the annual meeting. Directors are elected by a plurality of the votes cast with a quorum present. The affirmative vote of a majority of the total votes cast at the annual meeting is required for approval of the proposals to approve the Company’s 2005 Stock Incentive Plan (“Incentive Plan”) and to ratify the appointment of the Company’s independent registered public accounting firm.

Under rules applicable to broker-dealers, the election of directors and the proposal to ratify the auditors are considered “discretionary” items upon which brokerage firms may vote in their discretion on behalf of their client if such clients have not furnished voting instructions. The proposal to approve the Incentive Plan is a “non-discretionary” item for which brokerage firms may not vote without instructions from clients and, thus, there may be broker “non-votes” at the meeting. Abstentions and broker “non-votes” will be counted for purposes of determining the presence of a quorum at the annual meeting. However, because of the required votes, abstentions and broker “non-votes” will have no effect on the voting for the election of directors or the proposals to approve the Incentive Plan and to ratify the appointment of the Company’s independent registered public accounting firm.

Proxies

Shares of common stock represented by properly executed proxies, if such proxies are received in time and not revoked, will be voted in accordance with the instructions indicated on the proxies. If no contrary instructions are given, each proxy received will be voted (i) FOR the nominees for director described herein; (ii) FOR approval of the 2005 Stock Incentive Plan; (iii) FOR ratification of S.R. Snodgrass, A.C. as the Company’s independent registered public accounting firm for the year ending December 31, 2005; and (iv) upon the transaction of such other business as may properly come before the meeting, in accordance with the best judgment of the persons appointed as proxies. Any stockholder giving a proxy has the power to revoke it at any time before it is exercised by (i) filing with the Secretary of the Company written notice thereof (Frank D. Martz, Group Senior Vice President of Operations and Secretary, ESB Financial Corporation, 600 Lawrence Avenue, Ellwood City, Pennsylvania 16117); (ii) submitting a duly-executed proxy bearing a later date; or (iii) appearing at the annual meeting and giving the Secretary notice of his or her intention to vote

in person. Proxies solicited hereby may be exercised only at the annual meeting and any adjournment thereof and will not be used for any other meeting.

Beneficial Ownership

The following table sets forth information as to the common stock beneficially owned, as of March 4, 2005, by (i) the only persons or entities, including any “group” as that term is used in Section 13(d)(3) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), who or which was known to the Company to be the beneficial owner of more than 5% of the issued and outstanding common stock, (ii) each director and director nominee of the Company, (iii) certain named executive officers of the Company, and (iv) all directors and executive officers of the Company as a group.

| | | | | | |

Name and Address of Beneficial Owner

| | Amount and Nature of Beneficial

Ownership as of March 4, 2005(1)

| | | Percent

of Common Stock

| |

ESB Financial Corporation Employee Stock Ownership Plan Trust 600 Lawrence Avenue Ellwood City, Pennsylvania 16117 | | 1,699,573 | (2) | | 12.6 | % |

| | |

Directors and nominees: | | | | | | |

| | |

Charles Delman Lloyd L. Kildoo Mario J. Manna William B. Salsgiver Herbert S. Skuba James P. Wetzel, Jr. Charlotte A. Zuschlag | | 57,016

276,714

76,094

361,381

164,889

113,499

470,809 | (3)

(4)

(5)

(6)

(7)

(8)

(9) | | *

2.0

*

2.7

1.2

*

3.4 |

|

| | |

Named Executive Officers: | | | | | | |

| | |

Thomas F. Angotti Charles P. Evanoski Frank D. Martz Todd F. Palkovich | | 121,561

120,631

192,446

106,462 | (10)

(11)

(12)

(13) | | *

*

1.4

* |

|

| | |

Directors and executive officers

of the Company as a group (13 persons) | | 2,136,520 | (14) | | 15.2 | |

| * | Amounts to less than 1.0% of the issued and outstanding common stock. |

| (1) | Pursuant to rules promulgated by the Securities and Exchange Commission (the “SEC”) under the Exchange Act, a person or entity is considered to beneficially own shares of common stock if the person or entity has or shares (i) voting power, which includes the power to vote or to direct the voting of the shares, or (ii) investment power, which includes the power to dispose or direct the disposition of the shares. Unless otherwise indicated, a person has sole voting power and sole investment power with respect to the indicated shares. Under applicable regulations, a person is deemed to have beneficial ownership of any shares of common stock which may be acquired within 60 days of the record date pursuant to the exercise of outstanding stock options. Shares of common stock which are subject to stock options are deemed to be outstanding for the purpose of computing the percentage of outstanding common stock owned by such person or group but not deemed outstanding for the purpose of computing the percentage of common stock owned by any other person or group. |

2

| (2) | The ESB Financial Corporation Employee Stock Ownership Plan Trust (“Trust”) was established pursuant to the ESB Financial Corporation Employee Stock Ownership Plan (“ESOP”) by an agreement between the Company and Messrs. Salsgiver, Kildoo, Skuba and Manna who act as trustees of the ESOP. As of the record date, 503,929 shares held in the Trust were unallocated, and 1,165,644 shares held in the Trust had been allocated to the accounts of participating employees. Under the terms of the ESOP, the trustees will generally vote all allocated shares held in the ESOP in accordance with the instructions of the participating employees, and allocated shares for which employees do not give instructions will generally be voted in the same ratio on any matter as to those shares for which instructions are given. Unallocated shares held in the ESOP will be voted by the ESOP trustees in accordance with their fiduciary duties as trustees. |

| (3) | Includes 27,405 shares owned by Mr. Delman’s wife, 1,629 shares held in Mr. Delman’s IRA and 27,982 shares which may be acquired by Mr. Delman upon the exercise of stock options exercisable within 60 days of the record date. |

| (4) | Includes 54,789 shares held by Mr. Kildoo’s wife, 125,426 shares owned jointly with Mr. Kildoo’s wife, with whom voting and dispositive power is shared and 18,100 shares which may be acquired by Mr. Kildoo upon the exercise of stock options exercisable within 60 days of the record date. |

| (5) | Includes 16,225 shares held by Mr. Manna’s wife, 7,180 shares held in Mr. Manna’s IRA, 4,898 shares held in Mr. Manna’s wife’s IRA and 25,548 shares which may be acquired by Mr. Manna upon the exercise of stock options exercisable within 60 days of the record date. |

| (6) | Includes 219,316 shares owned jointly with Mr. Salsgiver’s wife, with whom voting and dispositive power is shared, 13,881 shares owned jointly by Mr. Salsgiver’s wife and mother-in-law, 18,721 shares which may be acquired by Mr. Salsgiver upon the exercise of stock options exercisable within 60 days of the record date and 30,323 shares held in trust for which he is trustee. |

| (7) | Includes 38,176 shares held by Mr. Skuba’s wife, 56,088 shares owned jointly with Mr. Skuba’s wife, with whom voting and dispositive power is shared, 7,566 shares held in Mr. Skuba’s IRA and 21,782 shares which may be acquired by Mr. Skuba upon the exercise of stock options exercisable within 60 days of the record date. Does not include 110,927 shares owned by the Ellwood City Hospital, of which Mr. Skuba serves as President and Chief Executive Officer and as to which beneficial ownership is disclaimed. |

| (8) | Includes 11,835 shares held by Mr. Wetzel’s wife, 1,802 shares held by Mr. Wetzel’s son and 20,597 shares held in the Peoples Home Savings Bank Employee Stock Ownership Plan for the account of Mr. Wetzel. The share amounts for Mr. Wetzel may be adjusted based on the allocation procedures in connection with the exchange of common stock of the Company for common stock of PHSB Financial Corporation pursuant to the acquisition of PHSB by the Company in February 2005. |

| (9) | Includes 2,447 shares held in trust for Ms. Zuschlag’s niece and four nephews, for which she is custodian, 449 shares held in trust for Ms. Zuschlag’s two godsons, for which she is custodian, 7,470 shares held in Ms. Zuschlag’s IRA, 173,182 shares which may be acquired by Ms. Zuschlag upon the exercise of stock options exercisable within 60 days of the record date, 55,126 shares held by the ESOP for the account of Ms. Zuschlag, 5,804 shares held in a management recognition plan (“MRP”) which may be voted by Ms. Zuschlag pending vesting and distribution, and 3,847 shares held by the Company’s profit sharing plan account for Ms. Zuschlag. Does not include 27,113 shares held by a trust established by the Company to fund certain benefits to be paid to Ms. Zuschlag pursuant to an excess benefit plan. Ms. Zuschlag does not possess voting or investment power with respect to such shares. See “Executive Compensation - Excess Benefit Plan.” |

| (10) | Includes 1,620 shares owned jointly with Mr. Angotti’s wife, with whom voting and dispositive power is shared, 4,756 shares held by Mr. Angotti’s wife, 70,796 shares which may be acquired by Mr. Angotti upon the exercise of stock options exercisable within 60 days of the record date, 17,204 shares held by the ESOP for the account of Mr. Angotti, 2,038 shares held in a MRP which may be voted by Mr. Angotti pending vesting and distribution, and 8,847 shares held by the profit sharing plan account for Mr. Angotti. |

3

| (11) | Includes 59,978 shares which may be acquired by Mr. Evanoski upon the exercise of stock options exercisable within 60 days of the record date, 27,284 shares held by the ESOP for the account of Mr. Evanoski, 2,038 shares held in a MRP which may be voted by Mr. Evanoski pending vesting and distribution, and 2,858 shares held by the profit sharing plan account for Mr. Evanoski. |

| (12) | Includes 91,299 shares owned jointly with Mr. Martz’s wife, with whom voting and dispositive power is shared, 46,197 shares which may be acquired by Mr. Martz upon the exercise of stock options exercisable within 60 days of the record date, 6,961 shares which may be acquired by Mr. Martz’s wife upon the exercise of stock options exercisable within 60 days of the record date, 31,639 shares held by the ESOP for the account of Mr. Martz, 10,603 shares held by the ESOP for the account of Mr. Martz’s wife, 2,038 shares held in a MRP which may be voted by Mr. Martz pending vesting and distribution, 25 shares held in a MRP which may be voted by Mr. Martz’s wife pending vesting and distribution, 2,858 shares held by the profit sharing plan account for Mr. Martz and 826 shares held by the profit sharing plan account for Mr. Martz’s wife. |

| (13) | Includes 4,933 shares held in Mr. Palkovich’s IRA, 16,583 shares held jointly with Mr. Palkovich’s wife, 39,275 shares which may be acquired by Mr. Palkovich upon the exercise of stock options exercisable within 60 days of the record date, 30,829 shares held by the ESOP for the account of Mr. Palkovich, 2,038 shares held in a MRP which may be voted by Mr. Palkovich pending vesting and distribution, and 2,846 shares held by the profit sharing plan account for Mr. Palkovich. |

| (14) | Includes 515,156 shares which may be acquired by all directors and officers of the Company as a group upon the exercise of stock options exercisable within 60 days of the record date. Also includes 182,220, 13,956 and 23,136 shares which are held by the ESOP, the profit sharing plan and the MRP, respectively, which have been allocated to the accounts of participating officers and, consequently, will be voted at the annual meeting by direction of such participating officers. Does not include 27,113 shares held by a trust established by the Company to fund certain benefits to be paid to the President and Chief Executive Officer of the Company. See “Executive Compensation - Excess Benefit Plan.” |

4

ELECTION OF DIRECTORS

The articles of incorporation and bylaws of the Company provide that the board of directors shall be divided into three classes as nearly equal in number as possible, and that the members of each class shall be elected for terms of three years and until their successors are elected and qualified, with one of the three classes of directors to be elected each year. The number of directors currently authorized by the Company’s bylaws is seven.

At the annual meeting, stockholders of the Company will be asked to elect two directors for a three-year term and until their successors are elected and qualified. The two nominees for election as directors were selected by the nominating committee of the board of directors. There are no arrangements or understandings between the persons named and any other person pursuant to which such person was selected as a nominee for election as a director at the annual meeting, and no director or nominee for director is related to any other director or executive officer of the Company by blood, marriage or adoption.

James P. Wetzel, Jr. was elected to the board in February 2005 upon completion of the acquisition of PHSB Financial Corporation. Pursuant to the merger agreement for the acquisition of PHSB, the Company agreed to elect James P. Wetzel, Jr. to the board of directors of the Company, with an initial term that expires at the 2006 annual meeting of stockholders, and at such time to nominate Mr. Wetzel for election as a director for an additional three year term, subject to Mr. Wetzels’ compliance with the Company’s applicable director requirements and the fiduciary duties of the board of directors.

If any person named as nominee should be unable or unwilling to stand for election at the time of the annual meeting, the proxies will nominate and vote for any replacement nominee or nominees recommended by the board of directors of the Company. At this time, the board of directors knows of no reason why any of the nominees may not be able to serve as a director if elected.

Article 7.F of the Company’s articles of incorporation governs nominations for election to the board of directors and requires all nominations for election to the board of directors, other than those made by or at the direction of the board, to be made pursuant to timely notice in writing to the Secretary of the Company, as set forth in the articles of incorporation. To be timely, with respect to an election to be held at an annual meeting of stockholders, a stockholders’ notice must be delivered to, or mailed and received at, the principal executive offices of the Company, not later than 60 days prior to the anniversary date of the immediately preceding annual meeting of stockholders. Each written notice of a stockholder nomination must set forth certain information specified in the articles of incorporation. The presiding officer of the meeting may refuse to acknowledge the nomination of any person not made in compliance with the procedures set forth in the articles of incorporation.

Information with Respect to Nominees for Director and Continuing Directors

The following tables present information concerning each nominee for director and each director whose term continues and reflects his/her tenure as a director of the Company and his/her principal occupation during the past five years.

All of the members of the board of directors, except Ms. Zuschlag and Mr. Wetzel, are independent as defined in the rules of the Nasdaq Stock Market.

5

Nominees for Director for a Three-Year Term Expiring in 2008

| | | | | | |

Name

| | Age

| | Position with the Company and

Principal Occupation During the Past Five Years

| | Director

Since(1)

|

Herbert S. Skuba | | 66 | | Vice Chairman of the Board of the Company and ESB Bank; Director, President and Chief Executive Officer of Ellwood City Hospital, Ellwood City, Pennsylvania. | | 1988 |

| | | |

Charles Delman | | 79 | | Director; retired; former Chairman, President and Chief Executive Officer of ESB Bancorp, Inc. from June 1989 to March 1994 and President of Economy Savings Bank, PaSA from 1971 to December 1992. | | 1994 |

The Board of Directors Recommends a Vote For Election of the Above Nominees for Director.

Members of the Board of Directors Continuing in Office

Directors With Terms Expiring in 2006

| | | | | | |

Name

| | Age

| | Position with the Company and

Principal Occupation During the Past Five Years

| | Director

Since(1)

|

Charlotte A. Zuschlag | | 53 | | Director; President and Chief Executive Officer of the Company since February 1991 and of ESB Bank since June 1989. | | 1988 |

| | | |

William B. Salsgiver | | 71 | | Chairman of the Board of the Company and ESB Bank; a principal of the property development and residential construction firm, Perry Homes, Zelienople, Pennsylvania. | | 1987 |

| | | |

James P. Wetzel, Jr. | | 60 | | Director; former President and Chief Executive Officer of PHSB Financial Corporation from December 2001, and President of Peoples Home Saving Bank from 1986, until their acquisition by the Company in February 2005. | | 2005 |

Directors With Terms Expiring in 2007

| | | | | | |

Name

| | Age

| | Position with the Company and

Principal Occupation During the Past Five Years

| | Director

Since(1)

|

Lloyd L. Kildoo | | 65 | | Director; Owner and Funeral Director of Glenn-Kildoo Funeral Homes of Zelienople and Cranberry Township, Pennsylvania. | | 1986 |

| | | |

Mario J. Manna | | 69 | | Director; Retired tax collector, Borough of Coraopolis, Pennsylvania | | 2001 |

| (1) | Includes service with ESB Bank prior to the Bank’s conversion to the holding company form. |

6

Executive Officers Who Are Not Directors

The following table sets forth certain information with respect to the executive officers of the Company who are not also directors of the Company. All executive officers of the Company are elected annually by the board of directors and shall serve at the discretion of the board.

| | | | |

Name

| | Age

| | Position with the Company and

Principal Occupation During the Past Five Years

|

Frank D. Martz | | 49 | | Group Senior Vice President of Operations of the Company since January 2000 and Secretary of the Company since February 1991; Group Senior Vice President of Operations of ESB Bank since January 2000 and Secretary of ESB Bank since November 1989; Senior Vice President of Operations of the Company and ESB Bank from April 1993 through December 1999. |

| | |

Charles P. Evanoski | | 46 | | Group Senior Vice President of the Company and ESB Bank since January 2000 and Chief Financial Officer of the Company and ESB Bank since April 1993; Senior Vice President of the Company and ESB Bank from April 1993 through December 1999. |

| | |

Todd F. Palkovich | | 50 | | Group Senior Vice President of Lending of the Company and ESB Bank since January 2000; Senior Vice President of Lending of the Company and ESB Bank from April 1993 through December 1999. |

| | |

Thomas F. Angotti | | 57 | | Group Senior Vice President of Administration of the Company since February 2000; President and Chief Executive Officer of SHS Bancorp, Inc. from September 1997 through February 2000; President and Chief Executive Officer of Spring Hill Savings Bank from April 1997 through May 2000; President of Spring Hill Savings Bank from September 1989 through April 1997. |

| | |

Bonita L. Wadding | | 35 | | Senior Vice President and Controller of the Company since November 2003; Vice President and Controller of ESB Bank since September 2000; Assistant Vice President and Financial Analyst of ESB Bank since April 1997. |

| | |

Richard E. Canonge | | 42 | | Senior Vice President and Treasurer of the Company and ESB Bank since February 2005; formerly served as Vice President and Chief Financial Officer of PHSB Financial Corporation from December 2001, and of Peoples Home Savings Bank from 1990, until their acquisition by the Company in February 2005. |

Directors’ Compensation

As of December 31, 2004, except as described below, all non-employee directors of the Company receive $850 per month (except for Mr. Salsgiver who receives $1,360 per month as Chairman of the Board and Mr. Skuba who receives $1,105 per month as Vice Chairman of the Board) and are not compensated for attendance at committee meetings (except for members of the audit committee who receive $325 per meeting and Mr. Kildoo who receives $520 per meeting as Chairman of the audit committee). Full-time employee directors of the Company do not receive any fees for board or committee meetings. During 2004, total compensation paid to directors of the Company amounted to $70,686 in the aggregate. See also “Executive Compensation-Directors’ Retirement Plan.”

7

In connection with the acquisition of PHSB Financial Corporation, the Company entered into a consulting and noncompetition agreement with James P. Wetzel, Jr., who became a director of the Company in February 2005 upon completion of the merger. Mr. Wetzel agreed to provide consulting services to the Company and to not compete against the Company or its subsidiaries or affiliates for a period of three years following completion of the merger. In exchange, the Company agreed to pay Mr. Wetzel $180,000 per year, payable monthly, and to provide Mr. Wetzel with the continued use of the automobile previously owned by Peoples Home Savings Bank, with the Company to pay all insurance and repair costs on the automobile.

Code of Ethics for Directors, Executive Officers and Financial Professionals

The board of directors of the Company has adopted a code of ethics for the Company’s directors, executive officers, including the chief executive officer and the chief financial officer, and financial professionals. Our directors and officers are expected to adhere at all times to this code of ethics. We have posted this code of ethics on our website atwww.esbbank.com.

The Company will disclose on its website at www.esbbank.com, to the extent and in the manner permitted by Item 5.05 of Form 8-K, the nature of any amendment to this code of ethics (other than technical, administrative, or other non-substantive amendments), our approval of any material departure from a provision of this code of ethics, and our failure to take action within a reasonable period of time regarding any material departure from a provision of this code of ethics that has been made known to any of our executive officers.

Directors Attendance at Annual Meetings

Although we do not have a formal policy regarding attendance by members of the board of directors at annual meetings of stockholders, we expect that our directors will attend, absent a valid reason for not doing so. In 2004, all of our directors attended our annual meeting of stockholders.

The Board of Directors and Its Committees

Regular meetings of the board of directors of the Company are held on a monthly basis and special meetings of the board of directors of the Company are held from time-to-time as needed.

There were 13 meetings of the board of directors of the Company held during 2004. No director attended fewer than 75% of both the aggregate total number of meetings of the board of directors held during 2004 and the total number of meetings held by all committees of the board on which the director served during such year.

The board of directors of the Company has established various standing committees of the board, including executive, compensation, audit and nominating and corporate governance committees. The Company and its subsidiaries have other committees comprised of officers and directors of the Company and such subsidiaries which meet for specific purposes.

The executive committee of the Company is authorized to exercise the powers of the board of directors between regular meetings of the board. Currently, Messrs. Skuba, Salsgiver and Delman and Ms. Zuschlag (Chairperson) serve as members of this committee. During 2004, the executive committee met three times.

The compensation committee of the Company makes recommendations regarding officer salaries to the board of directors. Currently, Messrs. Salsgiver (Chairman), Kildoo and Manna serve as members of this committee. During 2004, the compensation committee met two times.

The Company established a nominating and corporate governance committee in May 2003 to evaluate and make recommendations to the board of directors for the election of directors. As of December 31, 2004, the members of this committee were Messrs. Salsgiver (Chairman), Kildoo and Manna. Each of these persons is independent within the meaning of the rules of the Nasdaq Stock Market. The nominating and corporate governance committee operates pursuant to a written charter, which can be viewed on our website atwww.esbbank.com. During 2004, the nominating and corporate governance committee met two times.

8

The nominating and corporate governance committee considers candidates for director suggested by its members and other directors, as well as management and stockholders. The nominating and corporate governance committee also may solicit prospective nominees identified by it. A stockholder who desires to recommend a prospective nominee for the board should notify the Company’s Secretary or any member of the nominating and corporate governance committee in writing with whatever supporting material the shareholder considers appropriate. The nominating and corporate governance committee also considers whether to nominate any person nominated pursuant to the provision of the Company’s articles of incorporation relating to stockholder nominations, which is described under “Election of Directors.” The nominating and corporate governance committee has the authority and ability to retain a search firm to identify or evaluate potential nominees if it so desires.

The charter of the nominating and corporate governance committee sets forth certain criteria the committee may consider when recommending individuals for nomination as director including: (a) ensuring that the board of directors, as a whole, is diverse and consists of individuals with various and relevant career experience, relevant technical skills, industry knowledge and experience, financial expertise (including expertise that could qualify a director as a “financial expert,” as that term is defined by the rules of the SEC), local or community ties and (b) minimum individual qualifications, including strength of character, mature judgment, familiarity with our business and industry, independence of thought and an ability to work collegially. The committee also may consider the extent to which the candidate would fill a present need on the board of directors.

Once the nominating and corporate governance committee has identified a prospective nominee, the committee makes an initial determination as to whether to conduct a full evaluation of the candidate. This initial determination is based on whatever information is provided to the committee with the recommendation of the prospective candidate, as well as the committee’s own knowledge of the prospective candidate, which may be supplemented by inquiries to the person making the recommendation or others.

The audit committee reviews the Company’s records and affairs to determine its financial condition, reviews the Company’s systems of internal control with management and the independent registered public accounting firm, and monitors the Company’s adherence in accounting and financial reporting to generally accepted accounting principles. Currently, Messrs. Kildoo (Chairman), Delman, Skuba and Manna serve as members of this committee. The audit committee met eight times during 2004. The members are independent as defined in the listing standards of the Nasdaq Stock Market.

The board of directors has determined that Mr. Delman, a member of the audit committee, meets the requirements recently adopted by the SEC for qualification as an audit committee financial expert. An audit committee financial expert is defined as a person who has the following attributes: (i) an understanding of generally accepted accounting principles and financial statements; (ii) the ability to assess the general application of such principles in connection with the accounting for estimates, accruals and reserves; (iii) experience preparing, auditing, analyzing or evaluating financial statements that present a breadth and level of complexity or accounting issues that are generally comparable to the breadth and complexity of issues that can reasonably be expected to be raised by the registrant’s financial statements, or experience actively supervising one or more persons engaged in such activities; (iv) an understanding of internal controls and procedures for financial reporting; and (v) an understanding of audit committee functions.

The identification of a person as an audit committee financial expert does not impose on such person any duties, obligations or liability that are greater than those that are imposed on such person as a member of the audit committee and the board of directors in the absence of such identification. Moreover, the identification of a person as an audit committee financial expert for purposes of the regulations of the SEC does not affect the duties, obligations or liability of any other member of the audit committee or the board of directors. Finally, a person who is determined to be an audit committee financial expert will not be deemed an “expert” for purposes of Section 11 of the Securities Act of 1933.

The board of directors has adopted an audit committee charter, a copy of which is available on the Company’s website atwww.esbbank.com.

9

Report of the Audit Committee

The audit committee has reviewed and discussed the audited financial statements with management. The audit committee has discussed with the independent registered public accounting firm the matters required to be discussed by Statement on Auditing Standards No. 61 “Communication with Audit Committees,” as may be modified or supplemented. The audit committee has received the written disclosures and the letter from the independent registered public accounting firm required by Independence Standards Board Standard No. 1, as may be modified or supplemented, and has discussed with the independent registered public accounting firm, the independent registered public accounting firm’s independence. Based on the review and discussions referred to above in this report, the audit committee recommended to the board of directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2004 for filing with the SEC.

Lloyd L. Kildoo, Chairman

Charles Delman

Herbert S. Skuba

Mario J. Manna

10

EXECUTIVE COMPENSATION

Summary

The following table sets forth a summary of certain information concerning the compensation awarded to or paid by the Company or its subsidiaries for services rendered in all capacities during the last three fiscal years to the President and Chief Executive Officer and the four other highest compensated executive officers of the Company.

Summary Compensation Table

| | | | | | | | | | | | | | | | | | | |

| | | | | Annual Compensation

| | Long Term Compensation Awards

| | |

Name and Principal Position

| | Year

| | Salary

| | Bonus

| | Other Annual Compensation(1)

| | Stock Grants (2)

| | Securities

Underlying Options(3)

| | All Other Compensation(4)

|

Charlotte A. Zuschlag President and Chief Executive Officer | | 2004

2003

2002 | | $

| 328,962

327,200

312,800 | | $

| 118,000

86,380

102,800 | | $

| —

—

— | | $

| 51,240

—

— | | 15,000

15,000

18,000 | | $

| 52,390

59,878

49,014 |

| | | | | | | |

Charles P. Evanoski Group Senior Vice President and Chief Financial Officer | | 2004

2003

2002 | | $

| 128,462

125,192

120,385 | | $

| 32,000

22,000

26,400 | | $

| —

—

— | | $

| 25,620

—

— | | 4,000

4,000

4,800 | | $

| 33,950

38,252

31,396 |

| | | | | | | |

Frank D. Martz Group Senior Vice President of Operations and Secretary | | 2004

2003

2002 | | $

| 128,462

125,192

120,385 | | $

| 32,000

22,000

26,400 | | $

| —

—

— | | $

| 25,620

—

— | | 4,000

4,000

4,800 | | $

| 33,950

38,252

31,396 |

| | | | | | | |

Todd F. Palkovich Group Senior Vice President of Lending | | 2004

2003

2002 | | $

| 128,462

125,192

120,385 | | $

| 32,000

22,000

26,400 | | $

| —

—

— | | $

| 25,620

—

— | | 4,000

4,000

4,800 | | $

| 33,950

38,252

31,396 |

| | | | | | | |

Thomas F. Angotti Group Senior Vice President of Administration | | 2004

2003

2002 | | $

| 123,112

114,677

110,346 | | $

| 32,000

20,150

24,200 | | $

| —

—

— | | $

| 25,620

—

— | | 4,000

4,000

4,800 | | $

| 32,583

35,039

28,833 |

| (1) | Does not include amounts attributable to miscellaneous benefits received by the named executive officer, including the payment of club membership dues and the use and maintenance of an automobile. In the opinion of management of the Company, the costs to the Company of providing such benefits to the named executive officer during the year ended December 31, 2004 did not exceed the lesser of $50,000 or 10% of the total of annual salary and bonus reported for such individual. |

| (2) | Represents the grant of 4,000, 2,000, 2,000, 2,000 and 2,000 shares of restricted common stock to Ms. Zuschlag and Messrs. Evanoski, Martz, Palkovich and Angotti, respectively, in 2004 pursuant to the MRP, which were deemed to have had the indicated value at the date of grant, and which had a fair market value at December 31, 2004 of $57,800, $28,900, $28,900, $28,900 and $28,900, respectively. The awards vest over seven years; 12.5% immediately and 12.5% each year from the date of grant. Dividends paid on the restricted common stock are paid to the recipient. |

| (3) | Represents grants of stock options under the Company’s stock option plans. The awards have been adjusted for subsequent stock splits and stock dividends. |

| (4) | During the year ended December 31, 2003, consists of amounts allocated, accrued or paid by the Company on behalf of Ms. Zuschlag and Messrs. Evanoski, Martz, Palkovich and Angotti pursuant to the profit sharing plan of $7,175, $5,616, $5,616, $5,616 and $5,429, respectively, and estimated allocations under the ESOP of $45,215, $28,334, $28,334, $28,334 and $27,154, respectively. |

11

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires the Company’s officers and directors, and persons who own more than 10% of the Company’s common stock to file reports of ownership and changes in ownership with the SEC. Officers, directors and 10% stockholders are required by regulation to furnish the Company with copies of all Section 16(a) forms they file. The Company knows of no person, other than the Company’s ESOP, who owns 10% or more of the Company’s common stock.

Based solely on review of the copies of such forms furnished to the Company, the Company believes that all applicable Section 16(a) filing requirements were satisfied by its officers and directors during 2004.

Stock Options

The following table sets forth certain information concerning individual grants of stock options pursuant to the Company’s stock option plans to the named executive officers during the year ended December 31, 2004.

| | | | | | | | | | | | | | | | |

Individual Grants

| | Potential Realizable

Value at Assumed Annual Rates of Stock Price

Appreciation for Option Term(4)

|

Name

| | Options

Granted(1)

| | % of Total

Options

Granted to

Employees(2)

| | | Exercise

Price(3)

| | Expiration

Date

| | 5%

| | 10%

|

Charlotte A. Zuschlag | | 15,000 | | 22.9 | % | | $ | 14.50 | | 11/15/14 | | $ | 134,700 | | $ | 340,350 |

Charles P. Evanoski | | 4,000 | | 6.1 | | | | 14.50 | | 11/15/14 | | | 35,920 | | | 90,760 |

Frank D. Martz | | 4,000 | | 6.1 | | | | 14.50 | | 11/15/14 | | | 35,920 | | | 90,760 |

Todd F. Palkovich | | 4,000 | | 6.1 | | | | 14.50 | | 11/15/14 | | | 35,920 | | | 90,760 |

Thomas F. Angotti | | 4,000 | | 6.1 | | | | 14.50 | | 11/15/14 | | | 35,920 | | | 90,760 |

| (1) | The options vested immediately and are exercisable on the date of grant. |

| (2) | Percentage of options to purchase common stock granted to all employees during 2004. |

| (3) | The exercise price was based on the market price of the common stock on the date of grant. |

| (4) | Assumes compounded rates of return for the remaining life of the options and future stock prices of $23.48 and $37.19 at compounded rates of return of 5% and 10%, respectively. |

12

The following table sets forth certain information concerning exercises of stock options by the named executive officers during the year ended December 31, 2004 and options held at December 31, 2004.

Aggregated Option Exercises in Last Fiscal Year and Year End Option Values

| | | | | | | | | | | | | | |

Name

| | Shares Acquired

on Exercise(1)

| | Value Realized

| | Number of Unexercised Options at Year End(1)

| | Value of Unexercised Options at Year End(2)

|

| | | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

Charlotte A. Zuschlag | | 11,496 | | $ | 98,636 | | 173,182 | | — | | $ | 993,779 | | — |

Charles P. Evanoski | | 4,598 | | | 35,956 | | 59,978 | | — | | | 375,156 | | — |

Frank D. Martz | | 6,898 | | | 56,012 | | 46,197 | | — | | | 257,279 | | — |

Todd F. Palkovich | | 25,301 | | | 256,751 | | 39,275 | | — | | | 197,946 | | — |

Thomas F. Angotti | | 5,000 | | | 54,350 | | 75,796 | | — | | | 627,477 | | — |

| (1) | As adjusted for subsequent stock splits and stock dividends. |

| (2) | Based on a per share market price of $14.45 at December 31, 2004. |

The following information sets forth certain information for all equity compensation plans and individual compensation agreements (whether with employees or non-employees, such as directors) in effect as of December 31, 2004.

Equity Compensation Plan Information

| | | | | | | |

Plan Category

| | Number of securities to be

issued upon exercise of

outstanding options,

warrants and rights (1)(2)

| | Weighted-average exercise

price of outstanding

options, warrants and

rights (1)(2)

| | Number of securities

remaining available

for future issuance

under equity

compensations plans

(excluding securities

reflected in the first

column)(2)

|

Equity compensation plans approved by security holders | | 882,082 | | $ | 9.32 | | 92,362 |

Equity compensation plans not approved by security holders | | — | | | — | | — |

| | |

| |

|

| |

|

Total | | 882,082 | | $ | 9.32 | | 92,362 |

| | |

| |

|

| |

|

| (1) | Includes outstanding options granted under the 1990 Stock Option Plan and the 1992 Stock Incentive Plan, which were approved by security holders and have expired. No additional options may be granted under these plans. |

| (2) | The table does not include information for equity compensation plans assumed by the Company in connection with acquisitions of the companies which originally established those plans. As of December 31, 2004, a total of 63,936 shares of common stock were issuable with a weighted-average exercise price of $4.02 upon exercise of outstanding options and 30,374 shares of restricted stock were outstanding which had not yet vested under those assumed plans. No additional options and 11,187 shares of restricted stock may be granted under the assumed plans. |

Employment and Change of Control Agreements

ESB Bank has entered into an employment agreement with Ms. Zuschlag pursuant to which ESB Bank agreed to employ her as President and Chief Executive Officer for a term of three years with a current base salary of $350,100. Such salary may be increased at the discretion of the Board of Directors of ESB Bank but may not be decreased during the term of the agreement without the prior written consent of Ms. Zuschlag. On an annual basis, the board of directors of ESB Bank considers whether to renew the employment agreement for an additional year. The employment agreement

13

is terminable with or without cause by ESB Bank. The employment agreement provides that in the event of a wrongful termination of employment (including a voluntary termination by Ms. Zuschlag as a result of ESB Bank’s material breach of the agreement or for “good reason” following a change in control of the Company, including a change in her position, salary or duties without her consent), Ms. Zuschlag would be entitled to (1) an amount of cash severance which is equal to three times her average annual compensation over the last five years, (2) continued participation in certain employee benefit plans of the Company, including medical and dental plans, for thirty-six months or shorter period upon her full-time employment by another employer; and (3) if Ms.Zuschlag is still receiving medical and dental coverage after the end of the thirty-six month period referred to in clause (2), then she would be entitled to continued medical and dental coverage until the earlier of Ms. Zuschlag’s death or the date Ms. Zuschlag receives medical and dental coverage from a subsequent employer substantially similar to the coverage provided by the Company, provided however, Ms. Zuschlag shall pay the employee share of the costs of such coverage provided pursuant to this clause (3) to the same extent as if she were still an employee. The employment agreement with ESB Bank provides that in the event any of the payments to be made thereunder or otherwise upon termination of employment are deemed to constitute “parachute payments” within the meaning of Section 280G of the Code, then such payments and benefits received thereunder shall be reduced, in the manner determined by Ms. Zuschlag, by the minimum amount necessary to result in no portion of the payments and benefits being non-deductible by ESB Bank for federal income tax purposes. Parachute payments generally are payments in excess of three times the base amount, which is defined to mean the recipient’s average annual compensation from the employer includable in the recipient’s gross income during the most recent five taxable years ending before the date on which a change in control of the employer occurred. Recipients of parachute payments are subject to a 20% excise tax on the amount by which such payments exceed the base amount, in addition to regular income taxes, and payments in excess of the base amount are not deductible by the employer as compensation expense for federal income tax purposes.

The Company has also entered into an employment agreement with Ms. Zuschlag to serve on terms substantially similar to the agreement entered into with ESB Bank, except as provided below. Ms. Zuschlag’s compensation, benefits and expenses are paid by the Company and ESB Bank in the same proportion as the time and services actually expended by her on behalf of each company. However, the agreement with the Company provides that severance payments payable to Ms. Zuschlag by the Company shall (1) include the amount by which the severance benefits payable by ESB Bank are reduced by Section 280G of the Code, and (2) not be subject to reduction in the event of a change in control as are the amounts payable by ESB Bank. As a result, the severance benefits payable by the Company may constitute “parachute payments” under Section 280G of the Code. In addition, the agreement with the Company provides that the Company shall reimburse Ms. Zuschlag for any resulting excise taxes payable by her, plus such additional amount as may be necessary to compensate her for the payment of state and federal income, excise and other employment-related taxes on the additional payments.

The Company and ESB Bank entered into change of control agreements with Messrs. Evanoski, Martz, Palkovich and Angotti in order to assist them in maintaining a stable and competent management base. The agreements provide for a three-year term, and subject to satisfactory performance reviews, among other things, shall extend on each anniversary date for an additional year so that the remaining term will be three years, unless either the Boards of Directors of the employers or the executive provides contrary written notice to the other not less than 30 days in advance of such anniversary date. The agreements are automatically extended for an additional one year upon a change in control, as defined. The agreements provide for payments in the event that certain adverse actions are taken with respect to the executive’s employment subsequent to a change in control in an amount equal to 2.99 times the respective executive’s annual compensation, as defined.

Excess Benefit Plan

The Company has adopted an excess benefit plan for the purpose of permitting Ms. Zuschlag, and any other employees of the Company who may be designated pursuant to the plan, to receive certain benefits that Ms. Zuschlag and any other employees of the Company otherwise would be eligible to receive under the Company’s retirement and profit sharing plan and ESOP but for the limitations set forth in Sections 401(a)(17), 402(g) and 415 of the Internal Revenue Code of 1986, as amended (the “Code”). Pursuant to the excess benefit plan, during any plan year the Company shall make matching contributions on behalf of the participant in an amount equal to the amount of matching contributions that would have been made by the Company on behalf of the participant but for limitations in the Code, less the actual amount of matching contributions actually made by the Company on behalf of the participant. Finally, the excess benefit plan generally provides that during any plan year a participant shall receive a supplemental ESOP allocation in an amount

14

equal to the amount which would have been allocated to the participant but for limitations in the Code, less the amount actually allocated to the participant pursuant to the ESOP. The supplemental benefits to be received by a participant pursuant to the excess benefit plan shall be credited to an account maintained pursuant to the plan within 180 days after the end of each plan year. In connection with its adoption of the excess benefit plan, the Company adopted a trust which currently holds 27,113 shares of common stock to fund its obligation to Ms. Zuschlag under the excess benefit plan.

Supplemental Executive Retirement Plan

The Company has adopted a Supplemental Executive Benefit Plan (“SERP”) in order to provide supplemental retirement and death benefits for certain key employees of the Company. Under the SERP, participants shall receive an annual retirement benefit following retirement at age 65 equal to 25% of the participant’s final average pay multiplied by a target retirement benefit percentage. Final average pay is based upon the participant’s last three year’s compensation and the target benefit percentage is equal to the fraction resulting from the participant’s years of credited service divided by 20. Benefits under the plan are payable in ten equal annual payments and a lesser benefit is payable upon early retirement at age 55 with at least ten years of service. If a participant dies prior to retirement, the participant’s estate will receive a lump sum payment equal to the net present value of future benefit payments under the plan. At December 31, 2004, Ms. Zuschlag and Messrs. Evanoski, Martz, Palkovich and Angotti had 17, 22, 26, 14 and 18 years of credited service under the SERP, respectively.

Directors’ Retirement Plan

The Company and the Bank have adopted the ESB Financial Corporation Directors’ Retirement Plan and entered into director retirement agreements with each director of the Company and the Bank. The plan provides that any retiring director with a minimum of five or more years of service with the Company or the Bank and a minimum of 10 total years of service, including years of service with any bank acquired by the Company or the Bank, that remains in continuous service as a board member until age 75 will be entitled to receive an annual retirement benefit equal to his or her director’s fees earned during the last full calendar year prior to his or her retirement date, multiplied by a ratio, ranging from 25% to 50%, based on the director’s total years of service. The maximum ratio of 50% of fees requires 20 or more years of service and the minimum ratio of 25% of fees requires 10 years of service. Retirement benefits may also be payable under the plan if a director retires from service as a director prior to attaining age 75. During 2004, Messrs. Smith and Blank received benefits of $14,256 and $9,504, respectively, under the plan.

Compensation Committee

Executive compensation is determined by the compensation committee of the board of directors. The report of the compensation committee with respect to compensation for the Chief Executive Officer and all other executive officers is set forth below, as defined.

The compensation committee of the board of directors has furnished the following report on executive compensation:

The executive compensation program is administered by the compensation committee of the board of directors, which is composed of the individuals listed below this report, none of whom is a full-time employee director of the Company. The committee makes recommendations regarding officer salaries to the board of directors.

The committee determines the level of salary increases, if any, to take effect on December 1 after reviewing various published surveys of compensation paid to executives performing similar duties for financial institutions and their holding companies, with a particular focus on the level of compensation paid by comparable institutions in ESB Bank’s market. Also, it is the policy of the committee to determine the salary components of executive compensation upon the basis of corporate performance. The performance factors which the committee considers are profitability, capital levels, and performance relative to such industry standards as problem asset levels, loan production, regulatory compliance, and asset-liability management. The committee also considers whether or not the overall value of the Company has improved from year to year.

15

The Company’s executive compensation program is designed to:

| | • | | Align the interests of executives with the interests of the stockholders by providing performance based awards in cash and stock; and |

| | • | | Allow the Company to compete for and retain executives critical to the Company’s success by providing an opportunity for compensation that is comparable to the levels offered by other companies in our market. |

Stock options were granted to executive officers of the Company during fiscal 2003 and 2004. In each year, Ms. Zuschlag received options to purchase 15,000 shares of common stock and Messrs. Evanoski, Martz, Palkovich and Angotti each received options to purchase 4,000 shares of common stock.

Bonuses were paid to the executive officers of the Company during fiscal 2003 and 2004. Ms. Zuschlag was paid $86,380 during fiscal 2003 and Messrs. Evanoski, Martz, Palkovich and Angotti were paid a bonus of $22,000, $22,000, $22,000 and $20,150, respectively. In 2004, Zuschlag was paid $118,000 and Messrs Evanoski, Martz, Palkovich and Angotti were paid a bonus of $32,000, $32,000, $32,000 and $32,000, respectively.

Ms. Zuschlag’s compensation increased from $327,200 for fiscal 2003 to $328,962 for fiscal 2004. Messrs. Evanoski, Martz and Palkovich’s compensation increased from $125,192 for fiscal 2003 to $128,462 for fiscal 2004 and Mr. Angotti’s compensation increased from $114,677 for fiscal 2003 to $123,112 for fiscal 2004.

The committee reviewed and considered various published compensation surveys, the executive officers scope of responsibilities relating to ESB Financial Corporation’s continuing growth as well as the aforementioned factors, the committee recommended to the board of directors that Ms. Zuschlag’s annual base salary be increased to $350,100 and that Messrs. Evanoski, Martz, Palkovich and Angotti’s base salary be increased to $140,000, effective December 1, 2004.

|

The Compensation Committee |

|

William B. Salsgiver (Chairman) |

Lloyd L. Kildoo |

Mario J. Manna |

16

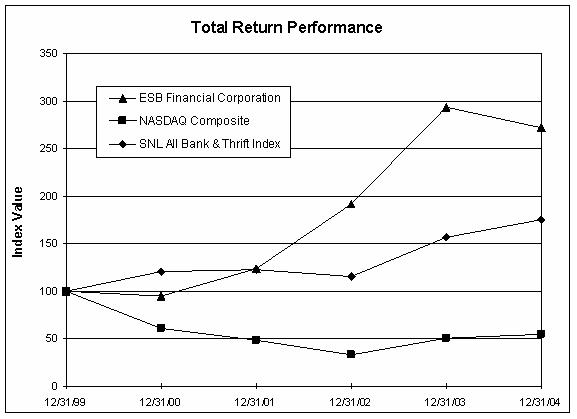

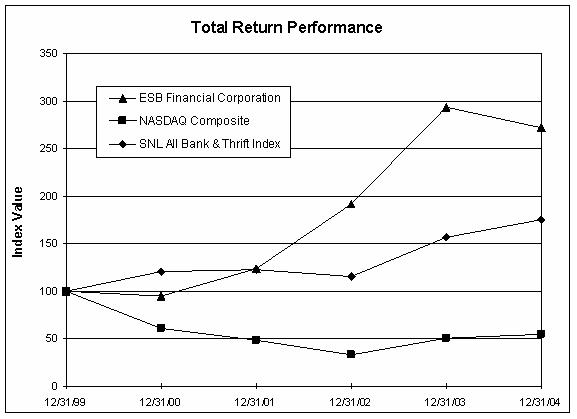

Performance Graph

The following graph compares the yearly cumulative total return on the common stock over a five-year measurement period with the yearly cumulative total return on the stocks included in (i) the NASDAQ-Total US companies and (ii) the SNL Securities All Banks and Thrifts Index. All of these cumulative returns are computed assuming the reinvestment of dividends at the frequency with which dividends were paid during the applicable year.

ESB Financial Corporation

| | | | | | | | | | | | |

| | | Period Ending

|

Index

| | 12/31/99

| | 12/31/00

| | 12/31/01

| | 12/31/02

| | 12/31/03

| | 12/31/04

|

ESB Financial Corporation | | 100.00 | | 94.44 | | 123.87 | | 191.84 | | 293.68 | | 271.42 |

NASDAQ Composite | | 100.00 | | 60.82 | | 48.16 | | 33.11 | | 49.93 | | 54.49 |

SNL All Bank & Thrift Index | | 100.00 | | 120.80 | | 122.59 | | 115.19 | | 156.16 | | 174.88 |

| | |

| Source : SNL Financial LC, Charlottesville, VA | | (434) 977-1600 |

| © 2005 | | |

17

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

In accordance with applicable federal laws and regulations, ESB Bank offers mortgage loans to its directors, officers and full-time employees for the financing of their primary residences as well as various consumer loans. These loans are generally made on substantially the same terms as those prevailing at the time for comparable transactions with non-affiliated persons. It is the belief of management that these loans neither involve more than the normal risk of collectibility nor present other unfavorable features.

Section 22(h) of the Federal Reserve Act generally provides that any credit extended by a savings institution to its executive officers, directors and, to the extent otherwise permitted, principal stockholder(s), or any related interest of the foregoing, must (i) be on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions by the savings association with non-affiliated parties; (ii) be pursuant to underwriting standards that are no less stringent than those applicable to comparable transactions with non-affiliated parties; (iii) not involve more than the normal risk of repayment or present other unfavorable features; and (iv) not exceed, in the aggregate, the institution’s unimpaired capital and surplus, as defined.

As of December 31, 2004, two of the directors and executive officers of the Company, or their affiliates, had aggregate loan balances in excess of $60,000, which amounted to $739,000 in the aggregate. All such loans were made by ESB Bank in the ordinary course of business and were not made with favorable terms nor did they involve more than the normal risk of collectibility.

In connection with the acquisition of PHSB Financial Corporation, the Company entered into a consulting and noncompetition agreement with James P. Wetzel, Jr., who became a director of the Company in February 2005 upon completion of the merger. See “Election of Directors – Directors’ Compensation.”

PROPOSAL TO ADOPT THE 2005 STOCK INCENTIVE PLAN

General

The board of directors has adopted the 2005 Stock Incentive Plan which is designed to attract and retain qualified personnel in key positions, provide officers and key employees with a proprietary interest in the Company as an incentive to contribute to the success of the Company and reward key employees for outstanding performance. The Incentive Plan is also designed to attract and retain qualified directors for the Company. The Incentive Plan provides for the grant of incentive stock options intended to comply with the requirements of Section 422 of the Code (“incentive stock options”), non-incentive or compensatory stock options, stock appreciation rights and share awards of restricted stock, which may be based upon performance goals (collectively “Awards”). Awards will be available for grant to officers, key employees and directors of the Company and any subsidiaries, except that non-employee directors will be eligible to receive only awards of non-incentive stock options under the plan.

Description of the Incentive Plan

The following description of the Incentive Plan is a summary of its terms and is qualified in its entirety by reference to the Incentive Plan, a copy of which is attached to this proxy statement as Appendix A.

Administration.The Incentive Plan will be administered and interpreted by a committee of the board of directors that is comprised solely of two or more non-employee directors.

Stock Options. Under the Incentive Plan, the board of directors or the committee will determine which officers, key employees and non-employee directors will be granted options, whether such options will be incentive or compensatory options (in the case of options granted to employees), the number of shares subject to each option, the exercise price of each option, whether such options may be exercised by delivering other shares of common stock and when such options become exercisable. The per share exercise price of an incentive stock option shall at least equal to the fair market value of a share of common stock on the date the option is granted, and the per share exercise price of a

18

compensatory stock option shall at least equal the greater of par value or the fair market value of a share of common stock on the date the option is granted.

All options granted to participants under the Incentive Plan shall become vested and exercisable at the rate, and subject to such limitations, as specified by the board of directors or the committee at the time of grant. Notwithstanding the foregoing, no vesting shall occur on or after a participant’s employment or service with the Company is terminated for any reason other than his death, disability or retirement. Unless the committee or board of directors shall specifically state otherwise at the time an option is granted, all options granted to participants shall become vested and exercisable in full on the date an optionee terminates his employment or service with the Company or a subsidiary company because of his death, disability or retirement. In addition, all stock options will become vested and exercisable in full upon a change in control of the Company, as defined in the Incentive Plan.

Each stock option or portion thereof shall be exercisable at any time on or after it vests and is exercisable until the earlier of ten years after its date of grant or three months after the date on which the employee’s employment terminated (three years after termination of service in the case of non-employee directors), unless extended by the committee or the board of directors to a period not to exceed five years from such termination. Unless stated otherwise at the time an option is granted (i) if an employee terminates his employment with the Company as a result of disability or retirement without having fully exercised his options, the optionee shall have one year following his termination due to disability or retirement to exercise such options, and (ii) if an optionee terminates his employment or service with the Company following a change in control of the Company without having fully exercised his options, the optionee shall have the right to exercise such options during the remainder of the original ten year term of the option. However, failure to exercise incentive stock options within three months after the date on which the optionee’s employment terminates may result in adverse tax consequences to the optionee. If an optionee dies while serving as an employee or a non-employee director or terminates employment or service as a result of disability or retirement and dies without having fully exercised his options, the optionee’s executors, administrators, legatees or distributees of his estate shall have the right to exercise such options during the one year period following his death, provided no option will be exercisable more than ten years from the date it was granted.

Stock options are non-transferable except by will or the laws of descent and distribution. Notwithstanding the foregoing, an optionee who holds non-qualified options may transfer such options to his or her spouse, lineal ascendants, lineal descendants, or to a duly established trust for the benefit of one or more of these individuals. Options so transferred may thereafter be transferred only to the optionee who originally received the grant or to an individual or trust to whom the optionee could have initially transferred the option. Options which are so transferred shall be exercisable by the transferee according to the same terms and conditions as applied to the optionee.

Payment for shares purchased upon the exercise of options may be made (i) in cash or by check, (ii) by delivery of a properly executed exercise notice, together with irrevocable instructions to a broker to sell the shares and then to properly deliver to the Company the amount of sale proceeds to pay the exercise price, all in accordance with applicable laws and regulations, (iii) at the discretion of the board or the committee, by delivering shares of common stock (including shares acquired pursuant to the exercise of an option) equal in fair market value to the purchase price of the shares to be acquired pursuant to the option, (iv) at the discretion of the board or the committee, by withholding some of the shares of common stock which are being purchased upon exercise of an option, or (v) any combination of the foregoing. With respect to subclause (iii) hereof, the shares of common stock delivered to pay the purchase price must have either been (x) purchased in open market transactions or (y) issued by the Company pursuant to a plan thereof, in each case more than six months prior to the exercise date of the option.

Share Awards. Under the Incentive Plan, the board of directors or the committee is authorized to grant share awards, which are a right to receive a distribution of shares of common stock. Shares of common stock granted pursuant to a share award will be in the form of restricted stock which shall vest upon such terms and conditions as established by the committee. The board or the committee will determine which officers and key employees will be granted share awards, the number of shares subject to each share award, whether the share award is contingent upon achievement of certain performance goals and the performance goals, if any, required to be met in connection with a share award. Non-employee directors are not eligible to receive share awards. The number of shares available to be issued as share awards will not exceed 130,000 shares, or 20% of the total number of shares available for issuance under the Incentive Plan.

19

If the employment of a share award recipient is terminated before the share award is completely earned, the recipient will forfeit the right to any shares subject to the share award that has not been earned, except as set forth below. All shares subject to a share award held by a recipient whose employment or service with the Company or a subsidiary company terminates due to death, disability or retirement will be deemed fully earned as of the recipient’s last day of employment or service. In addition, all shares subject to a share award held by a recipient will be deemed to be fully earned as of the effective date of a change of control of the Company.

A recipient of share award will not be entitled to receive any dividends declared on the common stock and will not be entitled to any voting rights with respect to an unvested share award until it vests. Share awards are not transferable by the recipient and shares subject to a share award may only be earned by and paid to the recipient who was notified in writing of such award by the committee.

The committee may determine to make any share award a performance share award by making such award contingent upon the achievement of a performance goal, or any combination of performance goals. Each performance share award will be evidenced by a written agreement setting forth the performance goals applicable to such award. All determinations regarding the achievement of any performance goal will be made by the committee. Each performance share award will be granted and administered to comply with the requirements of Section 162(m) of the Code. Notwithstanding anything to the contrary in the Incentive Plan, a recipient of a performance award shall have no rights as a stockholder until the shares of Common Stock covered by the performance share award are issued to the recipient according to the terms thereof.

Stock Appreciation Rights. Under the Incentive Plan, the board of directors or the committee is authorized to grant rights to optionees (“stock appreciation rights”) under which an optionee may surrender any exercisable incentive stock option or compensatory stock option or part thereof in return for payment by the Company to the optionee of common stock in an amount equal to the excess of the fair market value of the shares of common stock subject to option at the time over the option price of such shares. Stock appreciation rights may be granted concurrently with the stock options to which they relate or at any time thereafter which is prior to the exercise or expiration of such options.

Number of Shares Covered by the Incentive Plan. A total of 650,000 shares of common stock, which is equal to approximately 4.7% of the issued and outstanding common stock, has been reserved for future issuance pursuant to the Incentive Plan. No more than 130,000, or 20%, of the shares reserved under the Incentive Plan may be granted as Share Awards. In the event of a stock split, reverse stock split, subdivision, stock dividend or any other capital adjustment, the number of shares of common stock under the Incentive Plan, the number of shares to which any Award relates and the exercise price per share under any option or stock appreciation right shall be adjusted to reflect such increase or decrease in the total number of shares of common stock outstanding or such capital adjustment.

Amendment and Termination of the Incentive Plan. The board of directors may at any time terminate or amend the Incentive Plan with respect to any shares of common stock as to which Awards have not been granted, subject to any required stockholder approval or any stockholder approval which the board may deem to be advisable. The board of directors may not, without the consent of the holder of an Award, alter or impair any Award previously granted or awarded under the Incentive Plan except as specifically authorized by the plan.

Unless sooner terminated, the Incentive Plan shall continue in effect for a period of ten years from February 15, 2005, the date that the Incentive Plan was adopted by the board of directors. Termination of the Incentive Plan shall not affect any previously granted Awards.

Awards to be Granted. The Company has not made any determination as to the timing or recipients of grants of Awards under the Incentive Plan.

Awards Granted or Available Under Existing Plans.As of December 31, 2004, options covering 946,018 shares of common stock were issued and outstanding under the Company’s existing stock option plans and 92,362 shares remained available for grant under such plans.

Federal Income Tax Consequences. Set forth below is a summary of the federal income tax consequences under the Internal Revenue Code relating to awards which may be granted under the Incentive Plan.

20

Incentive Stock Options.No taxable income is recognized by the optionee upon the grant or exercise of an incentive stock option that meets the requirements of Section 422 of the Code. However, the exercise of an incentive stock option may result in alternative minimum tax liability for the optionee. If no disposition of shares issued to an optionee pursuant to the exercise of an incentive stock option is made by the optionee within two years from the date of grant or within one year after the date of exercise, then upon sale of such shares, any amount realized in excess of the exercise price (the amount paid for the shares) will be taxed to the optionee as a long-term capital gain and any loss sustained will be a long-term capital loss, and no deduction will be allowed to the Company for federal income tax purposes.

If shares of common stock acquired upon the exercise of an incentive stock option are disposed of prior to the expiration of the two-year and one-year holding periods described above (a “disqualifying disposition”), the optionee generally will recognize ordinary income in the year of disposition in an amount equal to the excess (if any) of the fair market value of the shares on the date of exercise (or, if less, the amount realized on an arm’s length sale of such shares) over the exercise price of the underlying options, and the Company will be entitled to deduct such amount. Any gain realized from the shares in excess of the amount taxed as ordinary income will be taxed as capital gain and will not be deductible by the Company.

An incentive stock option will not be eligible for the tax treatment described above if it is exercised more than three months following termination of employment, except in certain cases where the incentive stock option is exercised after the death or permanent and total disability of the optionee. If an incentive stock option is exercised at a time when it no longer qualifies for the tax treatment described above, the option is treated as a nonqualified stock option.