UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-06292

______________________________________________

UBS Investment Trust

(Exact name of registrant as specified in charter)

1285 Avenue of the Americas, New York, New York 10019-6028

(Address of principal executive offices) (Zip code)

Keith A. Weller, Esq. UBS Asset Management One North Wacker Drive Chicago, IL 60606 |

| (Name and address of agent for service) |

| |

| Copy to: |

Stephen H. Bier, Esq. Dechert LLP 1095 Avenue of the Americas New York, NY 10036-6797 |

Registrant’s telephone number, including area code: 212-821 3000

Date of fiscal year end: August 31

Date of reporting period: August 31, 2021

Item 1. Reports to Stockholders.

| (a) | Copy of the report transmitted to shareholders: |

UBS U.S. Allocation Fund

Annual Report | August 31, 2021

October 6, 2021

Dear shareholder,

We present you with the annual report for UBS U.S. Allocation Fund (the "Fund") for the 12 months ended August 31, 2021.

Performance

Over the 12 months ended August 31, 2021, the Fund's Class A shares returned 22.37%% before deducting the maximum sales charge and returned 15.63% after deducting the maximum sales charge. During the same period, the Fund's primary benchmark, the S&P 500 Index,1 which tracks large cap US equities, returned 31.17%. Since the Fund invests in both stocks and bonds, we believe it is appropriate to also compare its performance to the UBS U.S. Allocation Fund Benchmark (the Fund's secondary benchmark),2 which returned 21.22% during the period. (Returns for all share classes over various time periods and descriptions of the indices are shown in "Performance at a glance" on page 6; please note that the returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.)

Market commentary

The US economy rebounded sharply following the dramatic downturn due to the COVID-19 pandemic. Looking back, with large parts of the economy locked down, second quarter 2020 US annualized gross domestic product ("GDP") was -31.4% compared with the first quarter of 2020. This was the largest quarterly contraction on record. With the economy reopening, third quarter GDP growth was 33.4%, the largest quarterly increase ever. GDP growth in the US was then 4.3% and 6.3% during the fourth quarter of 2020 and the first quarter of 2021, respectively. Finally, second quarter 2021 annualized GDP growth was 6.7%.

The US Federal Reserve Board (the "Fed") maintained its highly accommodative monetary policy during the reporting period. Throughout the 12 months ended August 31, 2021, the Fed maintained the federal funds rate in a record-low range between 0.00% and 0.25%. The Fed also continued to purchase Treasury and mortgage securities, as well as individual corporate bonds. While inflation sharply increased, at its June 2021 meeting the Fed stated, "Progress on vaccinations has reduced the spread of COVID-19 in the United States... Inflation has risen, largely reflecting transitory factors." However, Fed officials pushed forward the time table for raising rates and now projects that it would institute two interest rate increases by the end of 2023, versus in 2024. Finally, in July 2021, Fed Chair Jerome Powell said the central bank may start tapering its monthly asset purchases in 2021.

The global equity market produced very strong results during the reporting period. Supporting the market were the continued COVID-19 vaccine rollout, aggressive monetary and fiscal policy and improving corporate profits. While there were periods of weakness, they were short lived, and investor demand for equities was robust overall. For the

UBS U.S. Allocation Fund

Investment Objective:

Total return, consisting of long-term capital appreciation and current income

Portfolio Managers:

Nicole Goldberger

Evan Brown

UBS Asset Management (Americas) Inc.

Commencement:

Class A—May 10, 1993

Class P (formerly Class Y)—May 10, 1993

Dividend payments:

Annually, if any

1 The S&P 500 Index is an unmanaged, weighted index composed of 500 widely held common stocks varying in composition and is not available for direct investment. Investors should note that indices do not reflect the deduction of fees and expenses.

2 The UBS U.S. Allocation Fund Benchmark is an unmanaged benchmark compiled by the Advisor, constructed as follows: from July 22, 1992 (the Fund's inception) until February 29, 2004: 100% S&P 500 Index; from March 1, 2004 until May 31, 2005: 65% Russell 3000 Index, 30% Blomberg Barclays US Aggregate Index and 5% BofA Merrill Lynch US High Yield Cash Pay Index; and from June 1, 2005 until present: 65% Russell 3000 Index, 30% Bloomberg Barclays US Aggregate Index and 5% BofA Merrill Lynch US High Yield Cash Pay Constrained Index. Investors should note that indices do not reflect the deduction of fees and expenses.

1

12-months ended August 31, 2021, the S&P 500 Index3 gained 31.17% and reached several new all-time highs. Outside the US, international developed equities, as measured by the MSCI EAFE Index (net),4 returned 26.12% during the reporting period, while emerging markets equities, as measured by the MSCI Emerging Markets Index (net),5 gained 21.12%.

The overall global fixed income market generated weak results over the reporting period. Developed market central banks maintained their highly accommodative monetary policies to support their economies. While inflation moved higher, the US Fed characterized the increase as being transitory. Regardless, with global growth improving and inflation rising, both short- and long-term US Treasury yields moved higher (bond yields and prices move in the opposite direction). For the 12 month reporting period as a whole, the yield on the US 10-year Treasury rose from 0.72% to 1.30%. The overall US bond market, as measured by the Bloomberg Barclays US Aggregate Index,6 returned -0.08% during the 12-months ended August 31, 2021. Returns of riskier fixed income securities were positive. High yield bonds, as measured by the ICE BofAML US High Yield Cash Pay Constrained Index,7 returned 10.12%. Elsewhere, emerging markets debt, as measured by the J.P. Morgan Emerging Markets Bond Index Global (EMBI Global),8 gained 4.20% during the reporting period.

Portfolio commentary

What worked

• Overall, security selection and asset allocation decisions contributed to performance during the reporting period. The US value equity core portion of the Fund was the most additive for returns.

• In the US value equity core portion of the Fund, performance was mainly driven by positive stock selection. The portfolio benefited from the market rotation in favor of value and small- cap stocks as a result of the expected post-pandemic economic normalization and rising bond yields. An overweight preference for the information technology and health care sectors were the most beneficial on a relative basis, followed by consumer staples and industrials. On an individual stock basis, the largest contributors included:

– AGCO's share price rose as the company posted strong second quarter 2021 results that beat expectations on both the top and bottom lines. In addition, strong end market demand more than offset supply chain and material cost challenges.

3 The S&P 500 Index is an unmanaged, weighted index composed of 500 widely held common stocks varying in composition and is not available for direct investment. Investors should note that indices do not reflect the deduction of fees and expenses.

4 The MSCI EAFE Index (net) is an index of stocks designed to measure the investment returns of developed economies outside of North America. Net total return indices reinvest dividends after the deduction of withholding taxes, using a tax rate applicable to non-resident institutional investors who do not benefit from double taxation treaties. The index is constructed and managed with a view to being fully investable from the perspective of international institutional investors. Investors should note that indices do not reflect the deduction of fees and expenses.

5 The MSCI Emerging Markets Index (net) is a market capitalization-weighted index composed of different emerging market countries in Europe, Latin America, and the Pacific Basin. Net total return indices reinvest dividends after the deduction of withholding taxes, using a tax rate applicable to non-resident institutional investors who do not benefit from double taxation treaties. The index is constructed and managed with a view to being fully investable from the perspective of international institutional investors. Investors should note that indices do not reflect the deduction of fees and expenses.

6 The Bloomberg Barclays US Aggregate Index is an unmanaged broad based index designed to measure the US dollar-denominated, investment-grade, taxable bond market. The index includes bonds from the Treasury, government-related, corporate, mortgage-backed, asset-backed and commercial mortgage-backed sectors. Investors should note that indices do not reflect the deduction of fees and expenses.

7 The ICE BofAML US High Yield Cash Pay Constrained Index is an unmanaged index of publicly placed, non-convertible, coupon-bearing US dollar denominated, below investment grade corporate debt with a term to maturity of at least one year. The index is market capitalization weighted, so that larger bond issuers have a greater effect on the index's return. However, the representation of any single bond issuer is restricted to a maximum of 2% of the total index. Investors should note that indices do not reflect the deduction of fees and expenses.

8 The J.P. Morgan Emerging Markets Bond Index Global (EMBI Global) is an unmanaged index which is designed to track total returns for US dollar denominated debt instruments issued by emerging market sovereign and quasi-sovereign entities: Brady bonds, loans and Eurobonds. Investors should note that indices do not reflect the deduction of fees and expenses.

2

– Wells Fargo's stock price fared well, and its shares were boosted by economic recovery.

– Bunge's shares performed well, benefiting from the agriculture boom. The company's first quarter 2021 adjusted earnings more than tripled from a year ago.

• In the US growth equity portion of the Fund, within sector allocation, an overweight to communication services and an underweight in consumer staples contributed the most to relative performance. Stock selection within health care and communication services were most positive. Several holdings were additive to performance on a relative basis including:

– HubSpot outperformed as the company experienced a large acceleration in new customer acquisitions as small- and mid-sized businesses have embraced digital transformation. The company also reported strong quarterly earnings results.

– Alphabet's shares outperformed amid robust results secured by strength in Cloud, advertising recovery, and YouTube viewership growth. We continue to favor its shares given improving cloud execution, secular YouTube tailwinds via connected TV penetration, and recovery in key advertising markets such as travel.

– United Rentals contributed to performance due to upward earnings revisions. We continue to see improving utilization rates, decent fleet absorption and signs of health in used equipment markets. We believe these factors should drive favorable pricing and incremental margins for the equipment rental industry.

• Overall, asset allocation was positive for relative performance during the reporting period.9

– We began the period slightly underweight equities and overweight fixed income versus the UBS U.S. Allocation Fund Benchmark.

– We ended the period slightly overweight equities and underweight fixed income versus the UBS U.S. Allocation Fund Benchmark. For comparison purposes, neutral Index weights for the Fund are 65.0% equities and 35.0% fixed income.

– We tactically adjusted the portfolio during the reporting period given the changing economic and market environment due to the COVID-19 pandemic. We moved to an overweight in equities by increasing exposure to US small-cap stocks over US large-cap stocks, as investors shifted focus away from large-cap stocks towards smaller-firms with improving profit margins. Furthermore, we increased our cyclical exposure and emphasized the reopening trend during the pandemic.

– Overall, asset allocation decisions were positive over the reporting period. Within equities, an overweight contributed to relative returns, as risk assets experienced a tremendous rebound, reversing much of the damage caused by the initial COVID-19 induced selloff in 2020. Within fixed income, an underweight to US government securities contributed to relative returns.

• Relative to the secondary benchmark, the use of fixed income and equity derivatives (futures, options, and swaps) contributed to the Fund's results. These derivative instruments, which were utilized to manage the Fund's fixed income and equity exposure, were contributors to performance.

9 Allocations include derivative expsoure.

3

What didn't work

• In the US value equity portion of the Fund, the largest detractors stemmed from energy and consumer discretionary sectors. On an individual stock basis, the largest detractors included:

– Dollar Tree cut its full-year profit forecast as the discount retailer joined rival Dollar General Corp in flagging that surging supply chain costs were squeezing its margins. We continue to hold this stock.

– Take-Two Interactive's shares lowered as delays in introductions pressured the outlook of the company. We continue to hold this stock.

– Mondelez, a multinational confectionery, food, holding and beverage and snack food company detracted from performance given headwinds in the snack producer business. We continue to hold this stock.

• In the US growth equity portion of the Fund, both sector allocation and stock selection detracted from performance. An overweight to consumer discretionary and small cash position were headwinds for relative results. Security selection within consumer discretionary and information technology sectors detracted from performance. On an individual stock basis, the largest detractors included:

– Splunk is an American software company. The company delivered modest upside to fourth quarter results and its cloud-based annual reoccurring revenue continues to grow very strongly as its business transitions. However, its guidance was subdued as Splunk continues to see headwinds from the macroeconomic conditions in its traditional on-premise business. We sold our position during the reporting period.

– Salesforce detracted from results. Although they are experiencing good sales momentum with strong customer interest in key digital transformation areas, its shares were weighed down by the announcement that the company would acquire Slack. This came as a surprise as Salesforce's Chief Executive Officer previously cited the rich valuation environment and organic growth priority. We continue to hold this stock.

– Coupa was a headwind for performance, as the company issued conservative guidance for the full year amid integration of Llamasoft, a direct purchasing software company. We sold our position during the reporting period.

4

We thank you for your continued support and welcome any comments or questions you may have. For additional information on the UBS family of funds,* please contact your financial advisor or visit us at www.ubs.com/am-us.

Sincerely,

| |

| |

Igor Lasun

President

UBS U.S. Allocation Fund

Managing Director

UBS Asset Management

(Americas) Inc. | | Nicole Goldberger

Portfolio Manager

UBS U.S. Allocation Fund

Managing Director

UBS Asset Management

(Americas) Inc. | |

Evan Brown

Portfolio Manager

UBS U.S. Allocation Fund

Managing Director

UBS Asset Management

(Americas) Inc.

This letter is intended to assist shareholders in understanding how the Fund performed during the 12 months ended August 31, 2021. The views and opinions in the letter were current as of October 6, 2021. They are not guarantees of future performance or investment results and should not be taken as investment advice. Investment decisions reflect a variety of factors, and we reserve the right to change our views about individual securities, sectors and markets at any time. As a result, the views expressed should not be relied upon as a forecast of the Fund's future investment intent. We encourage you to consult your financial advisor regarding your personal investment program.

* Mutual funds are sold by prospectus only. You should read it carefully and consider a fund's investment objectives, risks, charges, expenses and other important information contained in the prospectus before investing. The prospectus contains this and other information about the fund. Prospectuses for most of our funds can be obtained from your Financial Advisor, by calling UBS Funds at 800-647 1568 or by visiting our website at www.ubs.com/am-us.

5

Performance at a glance (unaudited)

Average annual total returns for periods ended 08/31/2021 | | 1 year | | 5 years | | 10 years | |

Before deducting maximum sales charge | |

Class A1 | | | 22.37 | % | | | 11.99 | % | | | 11.00 | % | |

Class P2 | | | 22.69 | | | | 12.29 | | | | 11.31 | | |

After deducting maximum sales charge | |

Class A1 | | | 15.63 | | | | 10.73 | | | | 10.38 | | |

S&P 500 Index3 | | | 31.17 | | | | 18.02 | | | | 16.34 | | |

UBS U.S. Allocation Fund Benchmark4 | | | 21.22 | | | | 13.04 | | | | 11.92 | | |

Most recent calendar quarter-end returns (unaudited)

Average annual total returns for periods ended 09/30/2021 | | 1 year | | 5 years | | 10 years | |

Before deducting maximum sales charge | |

Class A1 | | | 21.90 | % | | | 11.30 | % | | | 11.33 | % | |

Class P2 | | | 22.22 | | | | 11.60 | | | | 11.64 | | |

After deducting maximum sales charge | |

Class A1 | | | 15.19 | | | | 10.04 | | | | 10.70 | | |

The annualized gross and net expense ratios, respectively, for each class of shares as in the December 29, 2020 prospectuses, were as follows: Class A—1.01% and 1.01%; and Class P—0.74% and 0.74%.

Net expenses reflect fee waivers and/or expense reimbursements, if any, pursuant to an agreement that is in effect to cap the expenses. The Fund and UBS Asset Management (Americas) Inc. have entered into a written agreement, separate from UBS AM's investment advisory agreement with the Fund, whereby UBS AM has agreed to permanently reduce its management fees based on the Fund's average daily net assets to the following rates: $0 to $250 million: 0.50%; in excess of $250 million up to $500 million: 0.45%; in excess of $500 million up to $2 billion: 0.40%; over $2 billion: 0.35%. Effective December 29, 2020, UBS AM has contractually undertaken to waive fees/reimburse a portion of the Fund's expenses, when necessary, so that the ordinary total annual operating expenses of each class through December 31, 2021 (excluding dividend expense, borrowing costs and interest expense relating to short sales, and expenses attributable to investments in other investment companies, interest, taxes, brokerage commissions and extraordinary expenses, if any) would not exceed 1.15% for Class A and 0.90% for Class P.

1 Maximum sales charge for Class A shares is 5.5%. Class A shares bear ongoing 12b-1 service fees.

2 Class P shares do not bear initial or contingent deferred sales charges or ongoing 12b-1 service and distribution fees, but Class P shares held through advisory programs may be subject to a program fee, which, if included, would have reduced performance.

3 The S&P 500 Index is an unmanaged, weighted index comprising 500 widely held common stocks varying in composition and is not available for direct investment. Investors should note that indices do not reflect the deduction of fees and expenses.

4 The UBS U.S. Allocation Fund Benchmark is an unmanaged benchmark compiled by the Advisor, constructed as follows: from June 1, 2005 until present: 65% Russell 3000 Index, 30% Bloomberg Barclays US Aggregate Bond Index, and 5% ICE BofAML US High Yield Cash Pay Constrained Index. Investors should note that indices do not reflect the deduction of fees and expenses.

Past performance does not predict future performance, and the performance information provided does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The return and principal value of an investment will fluctuate, so that an investor's shares, when redeemed, may be worth more or less than their original cost. Performance results assume reinvestment of all dividends and capital gain distributions at net asset value on the ex-dividend dates. Current performance may be higher or lower than the performance data quoted. For month-end performance figures, please visit http://www.ubs.com/us-mutualfundperformance.

6

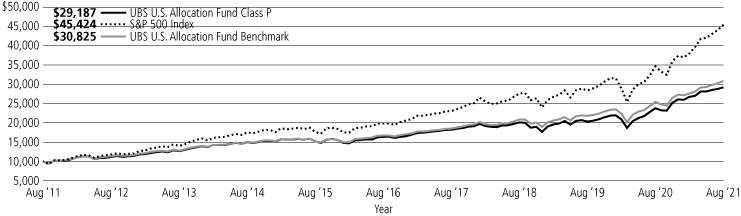

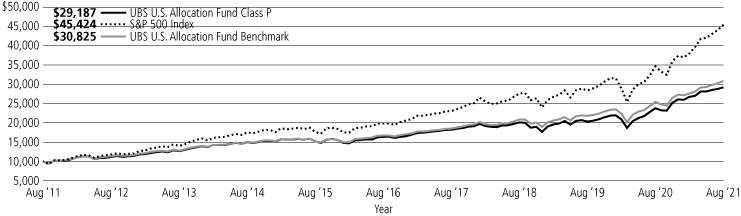

Illustration of an assumed investment of $10,000 in Class P shares of the Fund (unaudited)

The following graph depicts the performance of UBS U.S. Allocation Fund Class P shares versus the S&P 500 Index and the UBS U.S. Allocation Fund Benchmark over the 10 years ended August 31, 2021. The performance of the other class will vary based upon the different class specific expenses and sales charges. The performance provided does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is no guarantee of future results. Share price and returns will vary with market conditions; investors may realize a gain or loss upon redemption. It is important to note that the Fund is a professionally managed portfolio while the Indices are not available for investment and are unmanaged. The comparison is shown for illustration purposes only.

UBS U.S. Allocation Fund Class P

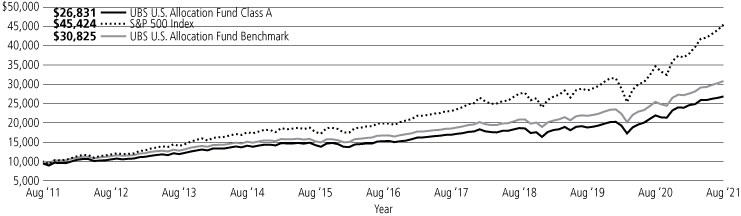

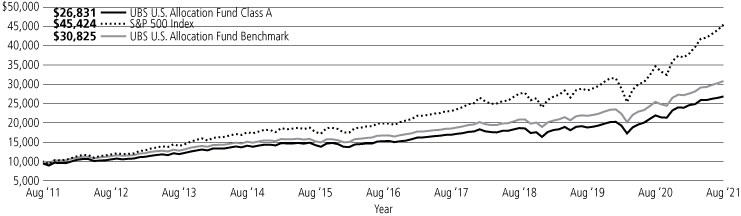

Illustration of an assumed investment of $10,000 in Class A shares of the Fund (unaudited)

The following graph depicts the performance of UBS U.S. Allocation Fund Class A shares versus the S&P 500 Index and the UBS U.S. Allocation Fund Benchmark over the 10 years ended August 31, 2021. The performance of the other class will vary based upon the different class specific expenses and sales charges. The performance provided does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is no guarantee of future results. Share price and returns will vary with market conditions; investors may realize a gain or loss upon redemption. It is important to note that the Fund is a professionally managed portfolio while the Indices are not available for investment and are unmanaged. The comparison is shown for illustration purposes only.

UBS U.S. Allocation Fund Class A

7

Understanding your Fund's expenses (unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transactional costs (as applicable), including sales charges (loads); and (2) ongoing costs, including management fees; service and/or distribution (12b-1) fees (if applicable); and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example below is based on an investment of $1,000 invested at the beginning of the period and held for the entire period, March 1, 2021 to August 31, 2021.

Actual expenses (unaudited)

The first line for each class of shares in the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over a period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line for each class of shares under the heading entitled "Expenses paid during period" to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes (unaudited)

The second line for each class of shares in the table below provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratios for each class of shares and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return for each class of shares. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing Fund costs only and do not reflect any transactional costs (as applicable), such as sales charges (loads). Therefore, the second line in the table for each class of shares is useful in comparing ongoing Fund costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | Beginning

account value

March 1, 2021 | | Ending

account value

August 31, 2021 | | Expenses paid

during period1

03/01/21 to 08/31/21 | | Expense

ratio during

the period | |

Class A | | Actual | | $ | 1,000.00 | | | $ | 1,090.40 | | | $ | 4.95 | | | | 0.94 | % | |

| | | Hypothetical (5% annual return before expenses) | | | 1,000.00 | | | | 1,020.47 | | | | 4.79 | | | | 0.94 | | |

Class P | | Actual | | | 1,000.00 | | | | 1,091.80 | | | | 3.48 | | | | 0.66 | | |

| | | Hypothetical (5% annual return before expenses) | | | 1,000.00 | | | | 1,021.88 | | | | 3.36 | | | | 0.66 | | |

1 Expenses are equal to the Fund's annualized net expense ratio, multiplied by the average account value over the period, multiplied by 184 divided by 365 (to reflect the one-half year period).

8

Portfolio statistics and industry diversification—(unaudited)1

As a percentage of net assets as of August 31, 2021

Top ten equity holdings | | | |

JPMorgan BetaBuilders MSCI US REIT ETF | | | 4.2 | % | |

Microsoft Corp. | | | 2.6 | | |

Apple, Inc. | | | 2.4 | | |

Alphabet, Inc., Class A | | | 2.3 | | |

Amazon.com, Inc. | | | 2.1 | | |

iShares Core S&P Mid-Cap ETF | | | 2.0 | | |

AbbVie, Inc. | | | 1.9 | | |

Health Care Select Sector SPDR Fund | | | 1.5 | | |

Salesforce.com, Inc. | | | 1.3 | | |

Energy Select Sector SPDR Fund | | | 1.2 | | |

Total | | | 21.5 | % | |

Top ten fixed income holdings | | | |

UMBS TBA, 3.000% | | | 0.9 | % | |

Federal National Mortgage Association, 2.000% due 03/01/51 | | | 0.7 | | |

U.S. Treasury Notes, 0.375% due 11/30/25 | | | 0.7 | | |

UMBS TBA, 2.000% | | | 0.7 | | |

U.S. Treasury Inflation Index Notes (TIPS), 0.125% due 07/15/30 | | | 0.5 | | |

U.S. Treasury Notes, 0.250% due 05/15/24 | | | 0.5 | | |

U.S. Treasury Notes, 1.500% due 03/31/23 | | | 0.5 | | |

Federal National Mortgage Association, 2.500% due 08/01/51 | | | 0.4 | | |

U.S. Treasury Bonds, 1.375% due 11/15/40 | | | 0.4 | | |

Santander Retail Auto Lease Trust, 1.100% due 06/20/25 | | | 0.4 | | |

Total | | | 5.7 | % | |

Top five issuer breakdown by country or territory of origin | | | |

United States | | | 98.8 | % | |

Canada | | | 0.4 | | |

United Kingdom | | | 0.4 | | |

Mexico | | | 0.2 | | |

Sweden | | | 0.2 | | |

Total | | | 100.0 | % | |

† Amount is less than 0.05% or (0.05%).

1 The portfolio is actively managed and its composition will vary over time.

9

Portfolio statistics and industry diversification—(unaudited)1 (concluded)

As a percentage of net assets as of August 31, 2021

Asset allocation | | | |

Common stocks | | | 49.7 | % | |

Corporate bonds | | | 12.9 | | |

Exchange traded funds | | | 8.9 | | |

U.S. Treasury obligations | | | 5.9 | | |

Mortgage-backed securities | | | 4.9 | | |

U.S. government agency obligations | | | 4.4 | | |

Asset-backed securities | | | 4.1 | | |

Municipal bonds | | | 0.8 | | |

Non-U.S. government agency obligations | | | 0.7 | | |

Options and swaptions purchased | | | 0.0 | † | |

Preferred stocks | | | 0.0 | † | |

Futures and swaps | | | 13.2 | | |

Cash equivalents and other assets less liabilities | | | (5.5 | ) | |

Total | | | 100.0 | % | |

† Amount is less than 0.05% or (0.05%).

1 The portfolio is actively managed and its composition will vary over time.

10

UBS U.S. Allocation Fund

Portfolio of investments—August 31, 2021

| | | Number of

shares | | Value | |

Common stocks—49.7% | |

Aerospace & defense—0.3% | |

TransDigm Group, Inc.* | | | 1,180 | | | $ | 716,815 | | |

Air freight & logistics—0.3% | |

FedEx Corp. | | | 2,971 | | | | 789,365 | | |

Airlines—0.7% | |

Southwest Airlines Co.* | | | 40,218 | | | | 2,002,052 | | |

Auto components—0.5% | |

Aptiv PLC* | | | 8,835 | | | | 1,344,599 | | |

Automobiles—0.9% | |

Ford Motor Co.* | | | 105,875 | | | | 1,379,551 | | |

Tesla, Inc.* | | | 1,692 | | | | 1,244,838 | | |

| | | | | | 2,624,389 | | |

Banks—1.4% | |

Bank OZK | | | 31,980 | | | | 1,356,911 | | |

Wells Fargo & Co. | | | 58,678 | | | | 2,681,585 | | |

| | | | | | 4,038,496 | | |

Biotechnology—2.3% | |

AbbVie, Inc. | | | 44,281 | | | | 5,348,259 | | |

BioMarin Pharmaceutical, Inc.* | | | 13,328 | | | | 1,122,351 | | |

| | | | | | 6,470,610 | | |

Capital markets—1.1% | |

Ameriprise Financial, Inc. | | | 8,365 | | | | 2,282,892 | | |

Charles Schwab Corp. | | | 11,908 | | | | 867,498 | | |

| | | | | | 3,150,390 | | |

Chemicals—1.1% | |

CF Industries Holdings, Inc. | | | 31,199 | | | | 1,417,058 | | |

Westlake Chemical Corp. | | | 20,525 | | | | 1,792,859 | | |

| | | | | | 3,209,917 | | |

Commercial services & supplies—0.5% | |

Stericycle, Inc.* | | | 20,067 | | | | 1,396,663 | | |

Communications equipment—0.5% | |

Ciena Corp.* | | | 22,231 | | | | 1,270,057 | | |

Consumer finance—0.5% | |

Synchrony Financial | | | 29,506 | | | | 1,467,923 | | |

Diversified financial services—0.5% | |

Voya Financial, Inc. | | | 22,679 | | | | 1,473,681 | | |

Electric utilities—0.9% | |

NextEra Energy, Inc. | | | 28,414 | | | | 2,386,492 | | |

Electrical equipment—0.2% | |

Shoals Technologies Group, Inc., Class A* | | | 15,313 | | | | 498,744 | | |

Entertainment—1.0% | |

Netflix, Inc.* | | | 2,411 | | | | 1,372,317 | | |

Take-Two Interactive Software, Inc.* | | | 9,505 | | | | 1,532,396 | | |

| | | | | | 2,904,713 | | |

Equity real estate investment trusts—0.8% | |

Prologis, Inc. | | | 17,100 | | | | 2,302,686 | | |

| | | Number of

shares | | Value | |

Common stocks—(continued) | |

Food products—1.9% | |

Bunge Ltd. | | | 31,582 | | | $ | 2,391,073 | | |

Mondelez International, Inc., Class A | | | 38,295 | | | | 2,376,971 | | |

Oatly Group AB, ADR* | | | 33,300 | | | | 606,726 | | |

| | | | | | 5,374,770 | | |

Health care equipment & supplies—1.3% | |

Cooper Cos., Inc. | | | 1,761 | | | | 793,701 | | |

DexCom, Inc.* | | | 2,634 | | | | 1,394,492 | | |

Edwards Lifesciences Corp.* | | | 12,818 | | | | 1,502,013 | | |

| | | | | | 3,690,206 | | |

Health care providers & services—1.1% | |

Laboratory Corp. of America Holdings* | | | 7,107 | | | | 2,156,122 | | |

UnitedHealth Group, Inc. | | | 2,537 | | | | 1,056,077 | | |

| | | | | | 3,212,199 | | |

Hotels, restaurants & leisure—1.7% | |

Airbnb, Inc., Class A* | | | 284 | | | | 44,017 | | |

Booking Holdings, Inc.* | | | 730 | | | | 1,678,759 | | |

McDonald's Corp. | | | 6,790 | | | | 1,612,354 | | |

Starbucks Corp. | | | 11,335 | | | | 1,331,749 | | |

| | | | | | 4,666,879 | | |

Insurance—1.0% | |

Allstate Corp. | | | 10,039 | | | | 1,358,076 | | |

Marsh & McLennan Cos., Inc. | | | 8,508 | | | | 1,337,458 | | |

| | | | | | 2,695,534 | | |

Interactive media & services—3.5% | |

Alphabet, Inc., Class A* | | | 2,233 | | | | 6,462,190 | | |

Facebook, Inc., Class A* | | | 4,184 | | | | 1,587,326 | | |

IAC/InterActiveCorp* | | | 3,850 | | | | 508,393 | | |

Match Group, Inc.* | | | 7,044 | | | | 968,127 | | |

Vimeo, Inc.* | | | 8,806 | | | | 335,685 | | |

| | | | | | 9,861,721 | | |

Internet & direct marketing retail—2.2% | |

Amazon.com, Inc.* | | | 1,676 | | | | 5,817,044 | | |

Coupang, Inc.* | | | 6,735 | | | | 201,781 | | |

| | | | | | 6,018,825 | | |

IT services—2.4% | |

Akamai Technologies, Inc.* | | | 22,149 | | | | 2,508,374 | | |

Fidelity National Information Services, Inc. | | | 7,283 | | | | 930,549 | | |

Visa, Inc., Class A | | | 13,832 | | | | 3,168,911 | | |

| | | | | | 6,607,834 | | |

Life sciences tools & services—1.5% | |

10X Genomics, Inc., Class A* | | | 2,497 | | | | 439,272 | | |

Bio-Rad Laboratories, Inc., Class A* | | | 3,317 | | | | 2,669,588 | | |

IQVIA Holdings, Inc.* | | | 4,576 | | | | 1,188,525 | | |

| | | | | | 4,297,385 | | |

Machinery—1.8% | |

AGCO Corp. | | | 15,992 | | | | 2,200,819 | | |

Ingersoll Rand, Inc.* | | | 51,324 | | | | 2,721,199 | | |

| | | | | | 4,922,018 | | |

11

UBS U.S. Allocation Fund

Portfolio of investments—August 31, 2021

| | | Number of

shares | | Value | |

Common stocks—(concluded) | |

Media—1.1% | |

Comcast Corp., Class A | | | 51,351 | | | $ | 3,115,979 | | |

Multiline retail—1.1% | |

Dollar General Corp. | | | 5,222 | | | | 1,164,036 | | |

Dollar Tree, Inc.* | | | 21,792 | | | | 1,973,048 | | |

| | | | | | 3,137,084 | | |

Oil, gas & consumable fuels—1.5% | |

APA Corp. | | | 54,271 | | | | 1,057,199 | | |

ConocoPhillips | | | 10,376 | | | | 576,179 | | |

Hess Corp. | | | 3,132 | | | | 215,325 | | |

Williams Cos., Inc. | | | 100,166 | | | | 2,473,099 | | |

| | | | | | 4,321,802 | | |

Pharmaceuticals—0.3% | |

Eli Lilly & Co. | | | 3,383 | | | | 873,795 | | |

Road & rail—0.3% | |

Union Pacific Corp. | | | 3,667 | | | | 795,152 | | |

Semiconductors & semiconductor equipment—2.7% | |

Advanced Micro Devices, Inc.* | | | 12,201 | | | | 1,350,895 | | |

Applied Materials, Inc. | | | 8,473 | | | | 1,144,956 | | |

Marvell Technology, Inc. | | | 15,683 | | | | 959,643 | | |

Micron Technology, Inc.* | | | 22,189 | | | | 1,635,329 | | |

NVIDIA Corp. | | | 4,532 | | | | 1,014,488 | | |

Qorvo, Inc.* | | | 4,523 | | | | 850,460 | | |

Universal Display Corp. | | | 2,656 | | | | 554,015 | | |

| | | | | | 7,509,786 | | |

Software—7.5% | |

Autodesk, Inc.* | | | 6,042 | | | | 1,873,564 | | |

HubSpot, Inc.* | | | 2,351 | | | | 1,609,189 | | |

Microsoft Corp. | | | 24,449 | | | | 7,380,664 | | |

Salesforce.com, Inc.* | | | 13,683 | | | | 3,629,689 | | |

ServiceNow, Inc.* | | | 3,290 | | | | 2,117,575 | | |

Trade Desk, Inc., Class A* | | | 11,652 | | | | 932,743 | | |

VMware, Inc., Class A* | | | 11,302 | | | | 1,682,529 | | |

Zscaler, Inc.* | | | 5,905 | | | | 1,643,598 | | |

| | | | | | 20,869,551 | | |

Technology hardware, storage & peripherals—2.9% | |

Apple, Inc. | | | 44,506 | | | | 6,757,346 | | |

Western Digital Corp.* | | | 20,422 | | | | 1,290,670 | | |

| | | | | | 8,048,016 | | |

Trading companies & distributors—0.4% | |

United Rentals, Inc.* | | | 2,957 | | | | 1,042,786 | | |

Total common stocks

(cost—$94,652,401) | | | 139,108,914 | | |

Preferred stocks—0.0%† | |

Financial services—0.0%† | |

Squaretwo Financial Corp.1,2

(cost—$0) | | | 35,000 | | | | 0 | | |

Exchange traded funds—8.9% | |

Energy Select Sector SPDR Fund3 | | | 66,441 | | | | 3,215,744 | | |

Health Care Select Sector SPDR Fund | | | 31,520 | | | | 4,261,819 | | |

iShares Core S&P Mid-Cap ETF | | | 20,491 | | | | 5,636,459 | | |

JPMorgan BetaBuilders MSCI US REIT ETF | | | 114,921 | | | | 11,767,911 | | |

Total exchange traded funds

(cost—$24,452,520) | | | 24,881,933 | | |

| | | Face

amount | | Value | |

Asset-backed securities—4.1% | |

AmeriCredit Automobile Receivables Trust,

Series 2020-2, Class B,

0.970%, due 02/18/26 | | $ | 350,000 | | | $ | 352,643 | | |

Capital One Multi-Asset Execution Trust,

Series 2005-B3, Class B3,

3 mo. USD LIBOR + 0.550%,

0.676%, due 05/15/284 | | | 350,000 | | | | 347,435 | | |

CCG Receivables Trust,

Series 2020-1, Class C,

1.840%, due 12/14/275 | | | 275,000 | | | | 279,029 | | |

Drive Auto Receivables Trust,

Series 2017-1, Class D,

3.840%, due 03/15/23 | | | 6,041 | | | | 6,053 | | |

Series 2018-4, Class D,

4.090%, due 01/15/26 | | | 224,878 | | | | 230,267 | | |

DT Auto Owner Trust,

Series 2021-1A, Class C,

0.840%, due 10/15/265 | | | 325,000 | | | | 325,426 | | |

Series 2021-1A, Class D,

1.160%, due 11/16/265 | | | 325,000 | | | | 324,925 | | |

Ford Credit Auto Owner Trust,

Series 2018-1, Class A,

3.190%, due 07/15/315 | | | 560,000 | | | | 603,524 | | |

Series 2020-1, Class A,

2.040%, due 08/15/315 | | | 450,000 | | | | 468,589 | | |

Golden Credit Card Trust,

Series 2021-1A, Class C,

1.740%, due 08/15/281,5 | | | 450,000 | | | | 449,900 | | |

HPEFS Equipment Trust,

Series 2021-1A, Class D,

1.030%, due 03/20/315 | | | 675,000 | | | | 674,660 | | |

Series 2021-2A, Class D,

1.290%, due 03/20/295 | | | 425,000 | | | | 424,865 | | |

Invitation Homes Trust,

Series 2018-SFR1, Class C,

1 mo. USD LIBOR + 1.250%,

1.343%, due 03/17/374,5 | | | 149,978 | | | | 150,178 | | |

New Residential Advance Receivables Trust

Advance Receivables Backed Notes,

Series 2020-APT1, Class AT1,

1.035%, due 12/16/525 | | | 175,000 | | | | 175,055 | | |

NRZ Advance Receivables Trust,

Series 2020-T3, Class AT3,

1.317%, due 10/15/525 | | | 90,000 | | | | 90,075 | | |

Ocwen Master Advance Receivables Trust,

Series 2020-T1, Class AT1,

1.278%, due 08/15/525 | | | 325,000 | | | | 324,697 | | |

OneMain Direct Auto Receivables Trust,

Series 2019-1A, Class A,

3.630%, due 09/14/275 | | | 550,000 | | | | 592,559 | | |

OneMain Financial Issuance Trust,

Series 2020-2A, Class A,

1.750%, due 09/14/355 | | | 150,000 | | | | 153,758 | | |

Series 2020-2A, Class B,

2.210%, due 09/14/355 | | | 300,000 | | | | 308,257 | | |

Series 2021-1A, Class A1,

1.550%, due 06/16/365 | | | 600,000 | | | | 604,949 | | |

12

UBS U.S. Allocation Fund

Portfolio of investments—August 31, 2021

| | | Face

amount | | Value | |

Asset-backed securities—(concluded) | |

Santander Consumer Auto Receivables Trust,

Series 2020-BA, Class B,

0.770%, due 12/15/255 | | $ | 475,000 | | | $ | 477,278 | | |

Santander Drive Auto Receivables Trust,

Series 2020-2, Class B,

0.960%, due 11/15/24 | | | 350,000 | | | | 351,269 | | |

Series 2021-1, Class D,

1.130%, due 11/16/26 | | | 750,000 | | | | 753,793 | | |

Santander Retail Auto Lease Trust,

Series 2021-B, Class C,

1.100%, due 06/20/255 | | | 1,150,000 | | | | 1,153,259 | | |

Sofi Consumer Loan Program Trust,

Series 2018-1, Class B,

3.650%, due 02/25/275 | | | 90,352 | | | | 91,364 | | |

Series 2018-2, Class B,

3.790%, due 04/26/275 | | | 70,696 | | | | 71,205 | | |

Series 2018-3, Class B,

4.020%, due 08/25/275 | | | 115,219 | | | | 116,422 | | |

Tesla Auto Lease Trust,

Series 2020-A, Class B,

1.180%, due 01/22/245 | | | 150,000 | | | | 151,523 | | |

Series 2020-A, Class D,

2.330%, due 02/20/245 | | | 150,000 | | | | 153,717 | | |

Series 2021-A, Class A4,

0.660%, due 03/20/255 | | | 700,000 | | | | 702,066 | | |

Series 2021-A, Class D,

1.340%, due 03/20/255 | | | 575,000 | | | | 577,790 | | |

Total asset-backed securities

(cost—$11,339,500) | | | 11,486,530 | | |

Corporate bonds—12.9% | |

Advertising—0.0%† | |

Lamar Media Corp.

4.875%, due 01/15/29 | | | 5,000 | | | | 5,319 | | |

Aerospace & defense—0.1% | |

Bombardier, Inc.

7.500%, due 12/01/245 | | | 29,000 | | | | 30,227 | | |

7.500%, due 03/15/255 | | | 25,000 | | | | 25,682 | | |

Raytheon Technologies Corp.

4.125%, due 11/16/28 | | | 150,000 | | | | 172,563 | | |

Spirit AeroSystems, Inc.

7.500%, due 04/15/255 | | | 20,000 | | | | 21,175 | | |

TransDigm, Inc.

4.625%, due 01/15/295 | | | 65,000 | | | | 64,187 | | |

6.375%, due 06/15/26 | | | 25,000 | | | | 25,958 | | |

| | | | | | 339,792 | | |

Agriculture—0.1% | |

Philip Morris International, Inc.

2.900%, due 11/15/21 | | | 180,000 | | | | 180,966 | | |

Reynolds American, Inc.

5.700%, due 08/15/35 | | | 70,000 | | | | 85,579 | | |

| | | | | | 266,545 | | |

| | | Face

amount | | Value | |

Corporate bonds—(continued) | |

Airlines—0.0%† | |

American Airlines Group, Inc.

5.000%, due 06/01/225 | | $ | 75,000 | | | $ | 75,656 | | |

American Airlines, Inc./AAdvantage Loyalty IP Ltd.

5.500%, due 04/20/265 | | | 30,000 | | | | 31,620 | | |

United Airlines, Inc.

4.375%, due 04/15/265 | | | 3,000 | | | | 3,112 | | |

4.625%, due 04/15/295 | | | 15,000 | | | | 15,563 | | |

| | | | | | 125,951 | | |

Apparel—0.0%† | |

Hanesbrands, Inc.

5.375%, due 05/15/255 | | | 25,000 | | | | 26,256 | | |

William Carter Co.

5.500%, due 05/15/255 | | | 30,000 | | | | 31,500 | | |

5.625%, due 03/15/275 | | | 10,000 | | | | 10,450 | | |

| | | | | | 68,206 | | |

Auto manufacturers—0.2% | |

Allison Transmission, Inc.

5.875%, due 06/01/295 | | | 50,000 | | | | 55,000 | | |

Ford Motor Co.

7.450%, due 07/16/31 | | | 40,000 | | | | 52,636 | | |

8.500%, due 04/21/23 | | | 30,000 | | | | 33,169 | | |

9.000%, due 04/22/25 | | | 100,000 | | | | 122,170 | | |

General Motors Co.

6.600%, due 04/01/36 | | | 200,000 | | | | 273,524 | | |

General Motors Financial Co., Inc.

5.200%, due 03/20/23 | | | 30,000 | | | | 32,036 | | |

PM General Purchaser LLC

9.500%, due 10/01/285 | | | 42,000 | | | | 45,671 | | |

| | | | | | 614,206 | | |

Auto parts & equipment—0.1% | |

Clarios Global LP

6.750%, due 05/15/255 | | | 4,000 | | | | 4,235 | | |

Clarios Global LP/Clarios U.S. Finance Co.

6.250%, due 05/15/265 | | | 4,000 | | | | 4,215 | | |

Dana Financing Luxembourg SARL

5.750%, due 04/15/255 | | | 30,000 | | | | 30,937 | | |

Dana, Inc.

4.250%, due 09/01/30 | | | 20,000 | | | | 20,796 | | |

5.625%, due 06/15/28 | | | 10,000 | | | | 10,749 | | |

Meritor, Inc.

4.500%, due 12/15/285 | | | 5,000 | | | | 5,100 | | |

6.250%, due 06/01/255 | | | 40,000 | | | | 42,547 | | |

Tenneco, Inc.

5.000%, due 07/15/26 | | | 35,000 | | | | 34,973 | | |

5.125%, due 04/15/295 | | | 30,000 | | | | 31,122 | | |

7.875%, due 01/15/295 | | | 5,000 | | | | 5,625 | | |

| | | | | | 190,299 | | |

13

UBS U.S. Allocation Fund

Portfolio of investments—August 31, 2021

| | | Face

amount | | Value | |

Corporate bonds—(continued) | |

Banks—2.3% | |

Bank of America Corp.

4.200%, due 08/26/24 | | $ | 120,000 | | | $ | 131,526 | | |

5.700%, due 01/24/22 | | | 550,000 | | | | 561,923 | | |

6.110%, due 01/29/37 | | | 350,000 | | | | 481,691 | | |

(Series Z),

(fixed, converts to FRN on 10/23/24),

6.500%, due 10/23/246 | | | 25,000 | | | | 28,188 | | |

Bank of New York Mellon Corp.

1.600%, due 04/24/25 | | | 150,000 | | | | 154,208 | | |

Barclays PLC

4.337%, due 01/10/28 | | | 305,000 | | | | 343,777 | | |

Citigroup, Inc.

(fixed, converts to FRN on 03/20/29),

3.980%, due 03/20/30 | | | 150,000 | | | | 170,332 | | |

5.500%, due 09/13/25 | | | 300,000 | | | | 348,615 | | |

(fixed, converts to FRN on 01/30/23),

5.950%, due 01/30/236 | | | 30,000 | | | | 31,583 | | |

6.675%, due 09/13/43 | | | 125,000 | | | | 194,753 | | |

Goldman Sachs Group, Inc.

3 mo. USD LIBOR + 1.600%,

1.735%, due 11/29/234 | | | 600,000 | | | | 617,468 | | |

5.150%, due 05/22/45 | | | 160,000 | | | | 214,666 | | |

5.750%, due 01/24/22 | | | 200,000 | | | | 204,362 | | |

HSBC Holdings PLC

6.500%, due 09/15/37 | | | 200,000 | | | | 279,933 | | |

JPMorgan Chase & Co.

3.875%, due 09/10/24 | | | 550,000 | | | | 598,701 | | |

(fixed, converts to FRN on 07/24/47),

4.032%, due 07/24/48 | | | 150,000 | | | | 179,156 | | |

(Series R),

(fixed, converts to FRN on 08/01/23),

6.000%, due 08/01/236 | | | 50,000 | | | | 53,063 | | |

Kreditanstalt fuer Wiederaufbau

1.928%, due 04/18/367 | | | 105,000 | | | | 81,882 | | |

Lloyds Banking Group PLC

4.582%, due 12/10/25 | | | 200,000 | | | | 225,292 | | |

Morgan Stanley

4.300%, due 01/27/45 | | | 150,000 | | | | 186,746 | | |

4.350%, due 09/08/26 | | | 365,000 | | | | 414,707 | | |

4.875%, due 11/01/22 | | | 720,000 | | | | 756,893 | | |

Wells Fargo & Co.

(fixed, converts to FRN on 06/17/26),

3.196%, due 06/17/27 | | | 95,000 | | | | 102,877 | | |

| | | | | | 6,362,342 | | |

Beverages—0.1% | |

Anheuser-Busch Cos. LLC/Anheuser-Busch

InBev Worldwide, Inc.

4.700%, due 02/01/36 | | | 75,000 | | | | 92,459 | | |

4.900%, due 02/01/46 | | | 30,000 | | | | 38,278 | | |

Primo Water Holdings, Inc.

4.375%, due 04/30/295 | | | 50,000 | | | | 50,476 | | |

| | | | | | 181,213 | | |

| | | Face

amount | | Value | |

Corporate bonds—(continued) | |

Biotechnology—0.1% | |

Biogen, Inc.

3.250%, due 02/15/515 | | $ | 56,000 | | | $ | 56,391 | | |

Gilead Sciences, Inc.

2.950%, due 03/01/27 | | | 200,000 | | | | 216,047 | | |

4.750%, due 03/01/46 | | | 50,000 | | | | 64,324 | | |

| | | | | | 336,762 | | |

Building materials—0.2% | |

Builders FirstSource, Inc.

4.250%, due 02/01/325 | | | 10,000 | | | | 10,272 | | |

5.000%, due 03/01/305 | | | 25,000 | | | | 26,750 | | |

6.750%, due 06/01/275 | | | 4,000 | | | | 4,270 | | |

Cornerstone Building Brands, Inc.

6.125%, due 01/15/295 | | | 42,000 | | | | 44,900 | | |

Griffon Corp.

5.750%, due 03/01/28 | | | 20,000 | | | | 21,224 | | |

Masco Corp.

4.500%, due 05/15/47 | | | 100,000 | | | | 122,040 | | |

Patrick Industries, Inc.

4.750%, due 05/01/295 | | | 25,000 | | | | 25,562 | | |

7.500%, due 10/15/275 | | | 35,000 | | | | 37,975 | | |

SRM Escrow Issuer LLC

6.000%, due 11/01/285 | | | 64,000 | | | | 67,840 | | |

Standard Industries, Inc.

4.375%, due 07/15/305 | | | 10,000 | | | | 10,273 | | |

Summit Materials LLC/Summit

Materials Finance Corp.

5.250%, due 01/15/295 | | | 2,000 | | | | 2,118 | | |

6.500%, due 03/15/275 | | | 25,000 | | | | 26,250 | | |

U.S. Concrete, Inc.

5.125%, due 03/01/295 | | | 30,000 | | | | 32,788 | | |

| | | | | | 432,262 | | |

Chemicals—0.3% | |

Ashland LLC

3.375%, due 09/01/315 | | | 30,000 | | | | 30,833 | | |

Chemours Co.

4.625%, due 11/15/295 | | | 40,000 | | | | 39,721 | | |

DuPont de Nemours, Inc.

4.725%, due 11/15/28 | | | 100,000 | | | | 119,139 | | |

LYB International Finance II BV

3.500%, due 03/02/27 | | | 150,000 | | | | 165,023 | | |

NOVA Chemicals Corp.

4.250%, due 05/15/295 | | | 20,000 | | | | 20,100 | | |

5.250%, due 06/01/275 | | | 75,000 | | | | 80,132 | | |

Nutrien Ltd.

4.200%, due 04/01/29 | | | 100,000 | | | | 115,261 | | |

Tronox, Inc.

4.625%, due 03/15/295 | | | 75,000 | | | | 76,046 | | |

WR Grace & Co-Conn

4.875%, due 06/15/275 | | | 25,000 | | | | 25,938 | | |

5.625%, due 10/01/245 | | | 50,000 | | | | 54,750 | | |

| | | | | | 726,943 | | |

14

UBS U.S. Allocation Fund

Portfolio of investments—August 31, 2021

| | | Face

amount | | Value | |

Corporate bonds—(continued) | |

Coal—0.0%† | |

SunCoke Energy, Inc.

4.875%, due 06/30/295 | | $ | 33,000 | | | $ | 33,424 | | |

Commercial services—0.3% | |

Allied Universal Holdco LLC/Allied

Universal Finance Corp.

9.750%, due 07/15/275 | | | 25,000 | | | | 27,344 | | |

ASGN, Inc.

4.625%, due 05/15/285 | | | 59,000 | | | | 61,597 | | |

Avis Budget Car Rental LLC/Avis

Budget Finance, Inc.

5.375%, due 03/01/295 | | | 10,000 | | | | 10,500 | | |

5.750%, due 07/15/275 | | | 77,000 | | | | 80,369 | | |

Carriage Services, Inc.

4.250%, due 05/15/295 | | | 35,000 | | | | 35,055 | | |

Garda World Security Corp.

6.000%, due 06/01/295 | | | 20,000 | | | | 19,322 | | |

9.500%, due 11/01/275 | | | 98,000 | | | | 106,721 | | |

Gartner, Inc.

3.625%, due 06/15/295 | | | 15,000 | | | | 15,439 | | |

4.500%, due 07/01/285 | | | 10,000 | | | | 10,587 | | |

Herc Holdings, Inc.

5.500%, due 07/15/275 | | | 68,000 | | | | 71,685 | | |

Legends Hospitality Holding Co. LLC/Legends

Hospitality Co-Issuer, Inc.

5.000%, due 02/01/265 | | | 25,000 | | | | 25,750 | | |

MoneyGram International, Inc.

5.375%, due 08/01/265 | | | 75,000 | | | | 76,500 | | |

NESCO Holdings II, Inc.

5.500%, due 04/15/295 | | | 40,000 | | | | 41,492 | | |

Nielsen Finance LLC/Nielsen Finance Co.

5.625%, due 10/01/285 | | | 30,000 | | | | 31,537 | | |

Prime Security Services Borrower LLC/Prime

Finance, Inc.

3.375%, due 08/31/275 | | | 5,000 | | | | 4,825 | | |

Rent-A-Center, Inc.

6.375%, due 02/15/295 | | | 30,000 | | | | 32,325 | | |

Service Corp. International

5.125%, due 06/01/29 | | | 35,000 | | | | 38,166 | | |

Square, Inc.

3.500%, due 06/01/315 | | | 35,000 | | | | 36,400 | | |

United Rentals North America, Inc.

4.875%, due 01/15/28 | | | 38,000 | | | | 40,280 | | |

WW International, Inc.

4.500%, due 04/15/295 | | | 55,000 | | | | 54,381 | | |

Yale University,

(Series 2020),

1.482%, due 04/15/30 | | | 100,000 | | | | 99,164 | | |

| | | | | | 919,439 | | |

Computers—0.2% | |

Ahead DB Holdings LLC

6.625%, due 05/01/285 | | | 25,000 | | | | 25,437 | | |

Apple, Inc.

3.850%, due 05/04/43 | | | 210,000 | | | | 250,475 | | |

| | | Face

amount | | Value | |

Corporate bonds—(continued) | |

Computers—(concluded) | |

Banff Merger Sub, Inc.

9.750%, due 09/01/265 | | $ | 25,000 | | | $ | 26,219 | | |

Booz Allen Hamilton, Inc.

3.875%, due 09/01/285 | | | 10,000 | | | | 10,308 | | |

4.000%, due 07/01/295 | | | 35,000 | | | | 36,269 | | |

International Business Machines Corp.

5.875%, due 11/29/32 | | | 175,000 | | | | 238,235 | | |

KBR, Inc.

4.750%, due 09/30/285 | | | 10,000 | | | | 10,150 | | |

Science Applications International Corp.

4.875%, due 04/01/285 | | | 10,000 | | | | 10,444 | | |

Western Digital Corp.

4.750%, due 02/15/26 | | | 50,000 | | | | 55,875 | | |

| | | | | | 663,412 | | |

Distribution & wholesale—0.0%† | |

American Builders & Contractors

Supply Co., Inc.

3.875%, due 11/15/295 | | | 20,000 | | | | 19,875 | | |

4.000%, due 01/15/285 | | | 10,000 | | | | 10,329 | | |

Avient Corp.

5.750%, due 05/15/255 | | | 20,000 | | | | 21,110 | | |

IAA, Inc.

5.500%, due 06/15/275 | | | 35,000 | | | | 36,531 | | |

| | | | | | 87,845 | | |

Diversified financial services—0.5% | |

Ally Financial, Inc.

4.125%, due 02/13/22 | | | 100,000 | | | | 101,663 | | |

Capital One Bank USA N.A.

3.375%, due 02/15/23 | | | 70,000 | | | | 72,958 | | |

Capital One Financial Corp.

3.750%, due 07/28/26 | | | 200,000 | | | | 221,291 | | |

Curo Group Holdings Corp.

7.500%, due 08/01/285 | | | 40,000 | | | | 39,897 | | |

GE Capital Funding LLC

3.450%, due 05/15/25 | | | 200,000 | | | | 216,827 | | |

GE Capital International Funding Co.

Unlimited Co.

4.418%, due 11/15/35 | | | 200,000 | | | | 242,762 | | |

Nationstar Mortgage Holdings, Inc.

5.125%, due 12/15/305 | | | 10,000 | | | | 10,251 | | |

6.000%, due 01/15/275 | | | 30,000 | | | | 31,612 | | |

OneMain Finance Corp.

3.875%, due 09/15/28 | | | 35,000 | | | | 35,131 | | |

5.375%, due 11/15/29 | | | 10,000 | | | | 10,925 | | |

5.625%, due 03/15/23 | | | 35,000 | | | | 36,969 | | |

6.125%, due 03/15/24 | | | 30,000 | | | | 32,250 | | |

7.125%, due 03/15/26 | | | 100,000 | | | | 116,875 | | |

8.875%, due 06/01/25 | | | 15,000 | | | | 16,451 | | |

Quicken Loans LLC/Quicken Loans

Co-Issuer, Inc.

3.625%, due 03/01/295 | | | 45,000 | | | | 45,956 | | |

Visa, Inc.

2.000%, due 08/15/50 | | | 50,000 | | | | 44,515 | | |

| | | | | | 1,276,333 | | |

15

UBS U.S. Allocation Fund

Portfolio of investments—August 31, 2021

| | | Face

amount | | Value | |

Corporate bonds—(continued) | |

Electric—0.9% | |

Alabama Power Co.

6.000%, due 03/01/39 | | $ | 30,000 | | | $ | 42,591 | | |

Berkshire Hathaway Energy Co.

3.750%, due 11/15/23 | | | 80,000 | | | | 85,285 | | |

4.450%, due 01/15/49 | | | 200,000 | | | | 252,066 | | |

Calpine Corp.

4.625%, due 02/01/295 | | | 25,000 | | | | 25,081 | | |

5.000%, due 02/01/315 | | | 30,000 | | | | 30,525 | | |

5.125%, due 03/15/285 | | | 30,000 | | | | 30,525 | | |

Clearway Energy Operating LLC

4.750%, due 03/15/285 | | | 25,000 | | | | 26,467 | | |

Dominion Energy, Inc.

3.900%, due 10/01/25 | | | 150,000 | | | | 165,111 | | |

DTE Electric Co.

3.950%, due 03/01/49 | | | 100,000 | | | | 121,309 | | |

Duke Energy Ohio, Inc.

4.300%, due 02/01/49 | | | 150,000 | | | | 188,895 | | |

Exelon Corp.

3.400%, due 04/15/26 | | | 170,000 | | | | 185,472 | | |

4.450%, due 04/15/46 | | | 200,000 | | | | 246,970 | | |

FirstEnergy Corp.,

(Series C),

5.350%, due 07/15/478 | | | 30,000 | | | | 37,548 | | |

Florida Power & Light Co.

5.950%, due 02/01/38 | | | 45,000 | | | | 65,207 | | |

Leeward Renewable Energy Operations LLC

4.250%, due 07/01/295 | | | 35,000 | | | | 35,716 | | |

National Rural Utilities Cooperative

Finance Corp.

3.900%, due 11/01/28 | | | 100,000 | | | | 114,162 | | |

Northern States Power Co.

2.600%, due 05/15/23 | | | 50,000 | | | | 51,358 | | |

NRG Energy, Inc.

3.625%, due 02/15/315 | | | 25,000 | | | | 25,437 | | |

5.250%, due 06/15/295 | | | 10,000 | | | | 10,857 | | |

Oncor Electric Delivery Co. LLC

3.750%, due 04/01/45 | | | 40,000 | | | | 46,613 | | |

Pike Corp.

5.500%, due 09/01/285 | | | 30,000 | | | | 30,487 | | |

Southern California Edison Co.

3.650%, due 02/01/50 | | | 175,000 | | | | 178,334 | | |

Southern Power Co.

5.250%, due 07/15/43 | | | 160,000 | | | | 203,031 | | |

Virginia Electric and Power Co.

4.600%, due 12/01/48 | | | 100,000 | | | | 132,173 | | |

Vistra Operations Co. LLC

5.000%, due 07/31/275 | | | 65,000 | | | | 67,444 | | |

| | | | | | 2,398,664 | | |

Electrical components & equipment—0.0%† | |

Energizer Holdings, Inc.

4.375%, due 03/31/295 | | | 20,000 | | | | 20,057 | | |

4.750%, due 06/15/285 | | | 25,000 | | | | 25,688 | | |

| | | | | | 45,745 | | |

| | | Face

amount | | Value | |

Corporate bonds—(continued) | |

Electronics—0.0%† | |

Sensata Technologies BV

4.000%, due 04/15/295 | | $ | 10,000 | | | $ | 10,351 | | |

Energy-Alternate Sources—0.0%† | |

Renewable Energy Group, Inc.

5.875%, due 06/01/285 | | | 32,000 | | | | 33,136 | | |

TerraForm Power Operating LLC

4.750%, due 01/15/305 | | | 35,000 | | | | 36,835 | | |

| | | | | | 69,971 | | |

Engineering & construction—0.1% | |

AECOM

5.125%, due 03/15/27 | | | 30,000 | | | | 33,509 | | |

Arcosa, Inc.

4.375%, due 04/15/295 | | | 30,000 | | | | 30,888 | | |

Dycom Industries, Inc.

4.500%, due 04/15/295 | | | 40,000 | | | | 41,100 | | |

Great Lakes Dredge & Dock Corp.

5.250%, due 06/01/295 | | | 40,000 | | | | 41,300 | | |

MasTec, Inc.

4.500%, due 08/15/285 | | | 10,000 | | | | 10,525 | | |

New Enterprise Stone & Lime Co., Inc.

6.250%, due 03/15/265 | | | 35,000 | | | | 35,962 | | |

9.750%, due 07/15/285 | | | 47,000 | | | | 52,052 | | |

Weekley Homes LLC/Weekley Finance Corp.

4.875%, due 09/15/285 | | | 30,000 | | | | 31,088 | | |

| | | | | | 276,424 | | |

Entertainment—0.2% | |

Affinity Gaming

6.875%, due 12/15/275 | | | 58,000 | | | | 61,613 | | |

Caesars Entertainment, Inc.

6.250%, due 07/01/255 | | | 65,000 | | | | 68,702 | | |

8.125%, due 07/01/275 | | | 118,000 | | | | 130,425 | | |

CCM Merger, Inc.

6.375%, due 05/01/265 | | | 29,000 | | | | 30,595 | | |

Cinemark USA, Inc.

5.250%, due 07/15/285 | | | 25,000 | | | | 23,750 | | |

5.875%, due 03/15/265 | | | 30,000 | | | | 29,850 | | |

Jacobs Entertainment, Inc.

7.875%, due 02/01/245 | | | 50,000 | | | | 52,250 | | |

Scientific Games International, Inc.

8.250%, due 03/15/265 | | | 25,000 | | | | 26,591 | | |

8.625%, due 07/01/255 | | | 30,000 | | | | 32,388 | | |

Speedway Motorsports LLC/Speedway

Funding II, Inc.

4.875%, due 11/01/275 | | | 35,000 | | | | 35,874 | | |

WMG Acquisition Corp.

3.000%, due 02/15/315 | | | 35,000 | | | | 34,475 | | |

| | | | | | 526,513 | | |

Environmental control—0.1% | |

Clean Harbors, Inc.

4.875%, due 07/15/275 | | | 15,000 | | | | 15,705 | | |

5.125%, due 07/15/295 | | | 25,000 | | | | 27,437 | | |

Covanta Holding Corp.

5.000%, due 09/01/30 | | | 20,000 | | | | 20,500 | | |

16

UBS U.S. Allocation Fund

Portfolio of investments—August 31, 2021

| | | Face

amount | | Value | |

Corporate bonds—(continued) | |

Environmental control—(concluded) | |

GFL Environmental, Inc.

4.000%, due 08/01/285 | | $ | 10,000 | | | $ | 9,925 | | |

4.375%, due 08/15/295 | | | 35,000 | | | | 35,175 | | |

4.750%, due 06/15/295 | | | 20,000 | | | | 20,550 | | |

Harsco Corp.

5.750%, due 07/31/275 | | | 15,000 | | | | 15,562 | | |

Madison IAQ LLC

5.875%, due 06/30/295 | | | 20,000 | | | | 20,475 | | |

Stericycle, Inc.

3.875%, due 01/15/295 | | | 15,000 | | | | 15,266 | | |

| | | | | | 180,595 | | |

Food—0.3% | |

Albertsons Cos., Inc./Safeway, Inc./New

Albertsons LP/Albertsons LLC

3.500%, due 03/15/295 | | | 5,000 | | | | 5,050 | | |

4.875%, due 02/15/305 | | | 30,000 | | | | 32,737 | | |

5.875%, due 02/15/285 | | | 15,000 | | | | 16,088 | | |

Chobani LLC/Chobani Finance Corp., Inc.

4.625%, due 11/15/285 | | | 10,000 | | | | 10,390 | | |

7.500%, due 04/15/255 | | | 55,000 | | | | 57,464 | | |

JBS USA LUX SA/JBS USA Food Co./JBS

USA Finance, Inc.

5.500%, due 01/15/305 | | | 25,000 | | | | 28,214 | | |

Kraft Heinz Foods Co.

4.250%, due 03/01/31 | | | 25,000 | | | | 28,858 | | |

5.000%, due 07/15/35 | | | 35,000 | | | | 43,398 | | |

5.200%, due 07/15/45 | | | 35,000 | | | | 44,913 | | |

6.875%, due 01/26/39 | | | 25,000 | | | | 37,353 | | |

Kroger Co.

2.800%, due 08/01/22 | | | 100,000 | | | | 102,084 | | |

3.850%, due 08/01/23 | | | 160,000 | | | | 169,145 | | |

3.875%, due 10/15/46 | | | 100,000 | | | | 112,236 | | |

Performance Food Group, Inc.

4.250%, due 08/01/295 | | | 30,000 | | | | 30,102 | | |

5.500%, due 10/15/275 | | | 10,000 | | | | 10,413 | | |

Post Holdings, Inc.

4.625%, due 04/15/305 | | | 50,000 | | | | 51,053 | | |

5.500%, due 12/15/295 | | | 5,000 | | | | 5,356 | | |

Simmons Foods, Inc./Simmons Prepared Foods,

Inc./Simmons Pet Food, Inc./Simmons Feed

4.625%, due 03/01/295 | | | 30,000 | | | | 30,529 | | |

United Natural Foods, Inc.

6.750%, due 10/15/285 | | | 30,000 | | | | 32,400 | | |

| | | | | | 847,783 | | |

Forest Products & Paper—0.0%† | |

Clearwater Paper Corp.

4.750%, due 08/15/285 | | | 30,000 | | | | 30,801 | | |

Healthcare-products—0.1% | |

Abbott Laboratories

3.750%, due 11/30/26 | | | 62,000 | | | | 70,126 | | |

4.900%, due 11/30/46 | | | 50,000 | | | | 69,491 | | |

Avantor Funding, Inc.

4.625%, due 07/15/285 | | | 60,000 | | | | 63,444 | | |

| | | Face

amount | | Value | |

Corporate bonds—(continued) | |

Healthcare-products—(concluded) | |

Medtronic, Inc.

4.375%, due 03/15/35 | | $ | 97,000 | | | $ | 121,766 | | |

Zimmer Biomet Holdings, Inc.

4.250%, due 08/15/35 | | | 50,000 | | | | 55,613 | | |

| | | | | | 380,440 | | |

Healthcare-services—0.4% | |

Acadia Healthcare Co., Inc.

5.000%, due 04/15/295 | | | 30,000 | | | | 31,350 | | |

Centene Corp.

2.500%, due 03/01/31 | | | 35,000 | | | | 34,910 | | |

3.000%, due 10/15/30 | | | 60,000 | | | | 62,188 | | |

4.625%, due 12/15/29 | | | 95,000 | | | | 104,205 | | |

Charles River Laboratories International, Inc.

4.250%, due 05/01/285 | | | 10,000 | | | | 10,474 | | |

CHS/Community Health Systems, Inc.

5.625%, due 03/15/275 | | | 45,000 | | | | 47,475 | | |

6.875%, due 04/15/295 | | | 60,000 | | | | 62,325 | | |

8.000%, due 03/15/265 | | | 40,000 | | | | 42,818 | | |

DaVita, Inc.

4.625%, due 06/01/305 | | | 25,000 | | | | 26,129 | | |

Encompass Health Corp.

4.500%, due 02/01/28 | | | 60,000 | | | | 62,850 | | |

HCA, Inc.

5.375%, due 02/01/25 | | | 120,000 | | | | 135,150 | | |

Legacy LifePoint Health LLC

4.375%, due 02/15/275 | | | 60,000 | | | | 59,850 | | |

MEDNAX, Inc.

6.250%, due 01/15/275 | | | 20,000 | | | | 21,075 | | |

Select Medical Corp.

6.250%, due 08/15/265 | | | 25,000 | | | | 26,438 | | |

Syneos Health, Inc.

3.625%, due 01/15/295 | | | 10,000 | | | | 9,947 | | |

Tenet Healthcare Corp.

4.625%, due 07/15/24 | | | 35,000 | | | | 35,481 | | |

4.625%, due 06/15/285 | | | 10,000 | | | | 10,350 | | |

4.875%, due 01/01/265 | | | 35,000 | | | | 36,306 | | |

5.125%, due 11/01/275 | | | 35,000 | | | | 36,837 | | |

6.125%, due 10/01/285 | | | 60,000 | | | | 63,339 | | |

UnitedHealth Group, Inc.

4.625%, due 07/15/35 | | | 40,000 | | | | 50,865 | | |

| | | | | | 970,362 | | |

Home builders—0.1% | |

Forestar Group, Inc.

3.850%, due 05/15/265 | | | 30,000 | | | | 30,263 | | |

Installed Building Products, Inc.

5.750%, due 02/01/285 | | | 10,000 | | | | 10,525 | | |

KB Home

6.875%, due 06/15/27 | | | 35,000 | | | | 41,825 | | |

Mattamy Group Corp.

5.250%, due 12/15/275 | | | 19,000 | | | | 19,808 | | |

Picasso Finance Sub, Inc.

6.125%, due 06/15/255 | | | 22,000 | | | | 23,265 | | |

Shea Homes LP/Shea Homes Funding Corp.

4.750%, due 02/15/285 | | | 13,000 | | | | 13,588 | | |

17

UBS U.S. Allocation Fund

Portfolio of investments—August 31, 2021

| | | Face

amount | | Value | |

Corporate bonds—(continued) | |

Home builders—(concluded) | |

Tri Pointe Homes, Inc.

5.700%, due 06/15/28 | | $ | 27,000 | | | $ | 30,079 | | |

Williams Scotsman International, Inc.

4.625%, due 08/15/285 | | | 50,000 | | | | 51,875 | | |

| | | | | | 221,228 | | |

Housewares—0.0%† | |

Newell Brands, Inc.

6.000%, due 04/01/468 | | | 25,000 | | | | 32,500 | | |

Insurance—0.5% | |

Allstate Corp.

3.280%, due 12/15/26 | | | 200,000 | | | | 221,112 | | |

3.850%, due 08/10/49 | | | 50,000 | | | | 60,501 | | |

American International Group, Inc.

2.500%, due 06/30/25 | | | 75,000 | | | | 78,865 | | |

Aon PLC

4.750%, due 05/15/45 | | | 50,000 | | | | 64,294 | | |

Berkshire Hathaway Finance Corp.

3.000%, due 05/15/22 | | | 150,000 | | | | 152,987 | | |

4.250%, due 01/15/49 | | | 100,000 | | | | 125,645 | | |

HUB International Ltd.

7.000%, due 05/01/265 | | | 50,000 | | | | 51,730 | | |

Lincoln National Corp.

4.000%, due 09/01/23 | | | 150,000 | | | | 160,402 | | |

MetLife, Inc.

4.125%, due 08/13/42 | | | 130,000 | | | | 157,345 | | |

Prudential Financial, Inc.

6.625%, due 06/21/40 | | | 110,000 | | | | 167,564 | | |

Teachers Insurance & Annuity

Association of America

4.270%, due 05/15/475 | | | 50,000 | | | | 61,621 | | |

| | | | | | 1,302,066 | | |

Internet—0.2% | |

Alibaba Group Holding Ltd.

2.125%, due 02/09/31 | | | 200,000 | | | | 196,768 | | |

Amazon.com, Inc.

2.500%, due 06/03/50 | | | 150,000 | | | | 143,998 | | |

Arches Buyer, Inc.

4.250%, due 06/01/285 | | | 20,000 | | | | 20,325 | | |

6.125%, due 12/01/285 | | | 25,000 | | | | 25,803 | | |

Netflix, Inc.

5.375%, due 11/15/295 | | | 50,000 | | | | 61,491 | | |

5.875%, due 02/15/25 | | | 15,000 | | | | 17,213 | | |

Northwest Fiber LLC/Northwest Fiber

Finance Sub, Inc.

6.000%, due 02/15/285 | | | 30,000 | | | | 29,850 | | |

Uber Technologies, Inc.

4.500%, due 08/15/295 | | | 20,000 | | | | 19,682 | | |

7.500%, due 09/15/275 | | | 20,000 | | | | 21,800 | | |

| | | | | | 536,930 | | |

Investment companies—0.0%† | |

Compass Group Diversified Holdings LLC

5.250%, due 04/15/295 | | | 25,000 | | | | 26,170 | | |

| | | Face

amount | | Value | |

Corporate bonds—(continued) | |

Iron & steel—0.0%† | |

Big River Steel LLC/BRS Finance Corp.

6.625%, due 01/31/295 | | $ | 4,000 | | | $ | 4,350 | | |

Cleveland-Cliffs, Inc.

4.625%, due 03/01/295 | | | 10,000 | | | | 10,525 | | |

4.875%, due 03/01/315 | | | 10,000 | | | | 10,750 | | |

Commercial Metals Co.

3.875%, due 02/15/31 | | | 20,000 | | | | 20,469 | | |

TMS International Corp.

6.250%, due 04/15/295 | | | 30,000 | | | | 31,446 | | |

| | | | | | 77,540 | | |

Leisure Time—0.1% | |

Carnival Corp.

4.000%, due 08/01/285 | | | 20,000 | | | | 20,104 | | |

5.750%, due 03/01/275 | | | 40,000 | | | | 40,893 | | |

7.625%, due 03/01/265 | | | 50,000 | | | | 53,130 | | |

11.500%, due 04/01/235 | | | 9,000 | | | | 10,105 | | |

NCL Corp. Ltd.

5.875%, due 03/15/265 | | | 25,000 | | | | 25,063 | | |

Pinnacle Bidco PLC

6.375%, due 02/15/259 | | GBP | 100,000 | | | | 140,413 | | |

Royal Caribbean Cruises Ltd.

5.500%, due 08/31/265 | | | 20,000 | | | | 20,275 | | |

7.500%, due 10/15/27 | | | 25,000 | | | | 29,026 | | |

9.125%, due 06/15/235 | | | 25,000 | | | | 27,250 | | |

VOC Escrow Ltd.

5.000%, due 02/15/285 | | | 20,000 | | | | 19,700 | | |

| | | | | | 385,959 | | |

Lodging—0.0%† | |

Boyd Gaming Corp.

4.750%, due 12/01/27 | | | 35,000 | | | | 36,094 | | |

Hilton Grand Vacations Borrower Escrow

LLC/Hilton Grand Vacations Borrower ESC

4.875%, due 07/01/315 | | | 10,000 | | | | 9,912 | | |

5.000%, due 06/01/295 | | | 20,000 | | | | 20,250 | | |

| | | | | | 66,256 | | |

Machinery-construction & mining—0.0%† | |

BWX Technologies, Inc.

4.125%, due 06/30/285 | | | 10,000 | | | | 10,275 | | |

Terex Corp.

5.000%, due 05/15/295 | | | 20,000 | | | | 21,025 | | |

| | | | | | 31,300 | | |

Machinery-diversified—0.0%† | |

GrafTech Finance, Inc.

4.625%, due 12/15/285 | | | 25,000 | | | | 25,500 | | |

Mueller Water Products, Inc.

4.000%, due 06/15/295 | | | 20,000 | | | | 20,811 | | |

| | | | | | 46,311 | | |

Media—0.7% | |

Audacy Capital Corp.

6.750%, due 03/31/295 | | | 35,000 | | | | 35,325 | | |

Cable One, Inc.

4.000%, due 11/15/305 | | | 30,000 | | | | 30,351 | | |

18

UBS U.S. Allocation Fund

Portfolio of investments—August 31, 2021

| | | Face

amount | | Value | |

Corporate bonds—(continued) | |

Media—(concluded) | |

CCO Holdings LLC/CCO Holdings Capital Corp.

4.250%, due 02/01/315 | | $ | 20,000 | | | $ | 20,525 | | |

4.250%, due 01/15/345 | | | 35,000 | | | | 35,315 | | |

4.500%, due 08/15/305 | | | 5,000 | | | | 5,224 | | |

4.750%, due 03/01/305 | | | 147,000 | | | | 155,538 | | |

5.375%, due 06/01/295 | | | 50,000 | | | | 54,625 | | |

Charter Communications Operating LLC/Charter

Communications Operating Capital

4.200%, due 03/15/28 | | | 150,000 | | | | 169,772 | | |

Comcast Corp.

2.887%, due 11/01/515 | | | 289,000 | | | | 287,632 | | |

3.969%, due 11/01/47 | | | 185,000 | | | | 217,466 | | |

CSC Holdings LLC

5.750%, due 01/15/305 | | | 50,000 | | | | 52,835 | | |

7.500%, due 04/01/285 | | | 25,000 | | | | 27,375 | | |

DIRECTV Holdings LLC/DIRECTV

Financing Co., Inc.

5.875%, due 08/15/275 | | | 2,000 | | | | 2,090 | | |

Fox Corp.

3.050%, due 04/07/25 | | | 25,000 | | | | 26,728 | | |

5.576%, due 01/25/49 | | | 50,000 | | | | 68,779 | | |

Liberty Interactive LLC

8.250%, due 02/01/30 | | | 30,000 | | | | 33,750 | | |

News Corp.

3.875%, due 05/15/295 | | | 30,000 | | | | 30,848 | | |

Nexstar Media, Inc.

4.750%, due 11/01/285 | | | 10,000 | | | | 10,398 | | |

5.625%, due 07/15/275 | | | 35,000 | | | | 37,160 | | |

Radiate Holdco LLC/Radiate Finance, Inc.

4.500%, due 09/15/265 | | | 10,000 | | | | 10,412 | | |

6.500%, due 09/15/285 | | | 50,000 | | | | 51,000 | | |

Scripps Escrow, Inc.

5.875%, due 07/15/275 | | | 30,000 | | | | 30,796 | | |

Sirius XM Radio, Inc.

3.875%, due 09/01/315 | | | 20,000 | | | | 19,914 | | |

4.000%, due 07/15/285 | | | 45,000 | | | | 45,951 | | |

4.125%, due 07/01/305 | | | 20,000 | | | | 20,474 | | |

5.375%, due 07/15/265 | | | 75,000 | | | | 77,016 | | |

5.500%, due 07/01/295 | | | 30,000 | | | | 32,850 | | |

TEGNA, Inc.

4.750%, due 03/15/265 | | | 5,000 | | | | 5,306 | | |

Time Warner Cable LLC

6.550%, due 05/01/37 | | | 25,000 | | | | 34,115 | | |

Time Warner Entertainment Co. LP

8.375%, due 03/15/23 | | | 35,000 | | | | 39,134 | | |

Univision Communications, Inc.

4.500%, due 05/01/295 | | | 35,000 | | | | 35,504 | | |

6.625%, due 06/01/275 | | | 20,000 | | | | 21,656 | | |

Videotron Ltd.

3.625%, due 06/15/295 | | | 20,000 | | | | 20,600 | | |

Walt Disney Co.

2.000%, due 09/01/29 | | | 100,000 | | | | 101,947 | | |

4.950%, due 10/15/45 | | | 70,000 | | | | 94,818 | | |

| | | | | | 1,943,229 | | |

| | | Face

amount | | Value | |

Corporate bonds—(continued) | |

Mining—0.1% | |

Arconic Corp.

6.125%, due 02/15/285 | | $ | 10,000 | | | $ | 10,689 | | |

Freeport-McMoRan, Inc.

4.250%, due 03/01/30 | | | 35,000 | | | | 37,800 | | |

5.400%, due 11/14/34 | | | 25,000 | | | | 31,349 | | |

Hudbay Minerals, Inc.

6.125%, due 04/01/295 | | | 20,000 | | | | 21,500 | | |

Kaiser Aluminum Corp.

4.625%, due 03/01/285 | | | 60,000 | | | | 62,250 | | |

Novelis Corp.

3.250%, due 11/15/265 | | | 10,000 | | | | 10,252 | | |

3.875%, due 08/15/315 | | | 10,000 | | | | 10,091 | | |

Southern Copper Corp.

6.750%, due 04/16/40 | | | 90,000 | | | | 127,800 | | |

| | | | | | 311,731 | | |

Miscellaneous manufacturers—0.1% | |

Amsted Industries, Inc.

4.625%, due 05/15/305 | | | 10,000 | | | | 10,400 | | |

5.625%, due 07/01/275 | | | 15,000 | | | | 15,713 | | |

Eaton Corp.

2.750%, due 11/02/22 | | | 70,000 | | | | 71,977 | | |

Illinois Tool Works, Inc.

2.650%, due 11/15/26 | | | 110,000 | | | | 118,233 | | |

| | | | | | 216,323 | | |

Oil & gas—0.8% | |

Aker BP ASA

3.750%, due 01/15/305 | | | 150,000 | | | | 162,183 | | |

Antero Resources Corp.

5.375%, due 03/01/305 | | | 10,000 | | | | 10,174 | | |

7.625%, due 02/01/295 | | | 50,000 | | | | 55,000 | | |

Apache Corp.

4.875%, due 11/15/27 | | | 25,000 | | | | 27,321 | | |

5.100%, due 09/01/40 | | | 30,000 | | | | 33,375 | | |

Ascent Resources Utica Holdings LLC/ARU

Finance Corp.

5.875%, due 06/30/295 | | | 30,000 | | | | 28,759 | | |

7.000%, due 11/01/265 | | | 30,000 | | | | 30,563 | | |

8.250%, due 12/31/285 | | | 10,000 | | | | 10,574 | | |

BP Capital Markets America, Inc.

3.017%, due 01/16/27 | | | 75,000 | | | | 81,152 | | |

Burlington Resources LLC

7.200%, due 08/15/31 | | | 150,000 | | | | 216,436 | | |

California Resources Corp.

7.125%, due 02/01/265 | | | 59,000 | | | | 61,893 | | |

Comstock Resources, Inc.

5.875%, due 01/15/305 | | | 20,000 | | | | 20,054 | | |

6.750%, due 03/01/295 | | | 30,000 | | | | 31,485 | | |

Ecopetrol SA

5.375%, due 06/26/26 | | | 325,000 | | | | 357,256 | | |

Endeavor Energy Resources LP/EER Finance, Inc.

6.625%, due 07/15/255 | | | 30,000 | | | | 31,814 | | |

EOG Resources, Inc.

3.900%, due 04/01/35 | | | 50,000 | | | | 57,575 | | |

19

UBS U.S. Allocation Fund

Portfolio of investments—August 31, 2021

| | | Face

amount | | Value | |

Corporate bonds—(continued) | |

Oil & gas—(concluded) | |

EQT Corp.

3.625%, due 05/15/315 | | $ | 60,000 | | | $ | 63,432 | | |

7.500%, due 02/01/308 | | | 35,000 | | | | 45,474 | | |

Equinor ASA

4.800%, due 11/08/43 | | | 50,000 | | | | 65,503 | | |

Exxon Mobil Corp.

4.114%, due 03/01/46 | | | 50,000 | | | | 59,802 | | |

Hilcorp Energy I LP/Hilcorp Finance Co.

5.750%, due 02/01/295 | | | 75,000 | | | | 76,125 | | |

Laredo Petroleum, Inc.

7.750%, due 07/31/295 | | | 30,000 | | | | 29,040 | | |

Marathon Petroleum Corp.

4.750%, due 09/15/44 | | | 110,000 | | | | 129,738 | | |

MEG Energy Corp.

5.875%, due 02/01/295 | | | 30,000 | | | | 30,897 | | |

7.125%, due 02/01/275 | | | 55,000 | | | | 57,874 | | |

Murphy Oil Corp.

6.375%, due 07/15/28 | | | 35,000 | | | | 36,838 | | |

6.875%, due 08/15/24 | | | 15,000 | | | | 15,300 | | |

Nabors Industries, Inc.

9.000%, due 02/01/255 | | | 14,000 | | | | 14,000 | | |

Occidental Petroleum Corp.

3.400%, due 04/15/26 | | | 20,000 | | | | 20,550 | | |

5.500%, due 12/01/25 | | | 3,000 | | | | 3,345 | | |

5.550%, due 03/15/26 | | | 37,000 | | | | 41,255 | | |

6.375%, due 09/01/28 | | | 50,000 | | | | 59,313 | | |

6.450%, due 09/15/36 | | | 60,000 | | | | 75,000 | | |

6.625%, due 09/01/30 | | | 15,000 | | | | 18,713 | | |

6.950%, due 07/01/24 | | | 30,000 | | | | 33,793 | | |

8.500%, due 07/15/27 | | | 50,000 | | | | 63,074 | | |

Shell International Finance BV

4.375%, due 05/11/45 | | | 100,000 | | | | 124,526 | | |

Southwestern Energy Co.

5.375%, due 03/15/30 | | | 30,000 | | | | 31,207 | | |

8.375%, due 09/15/28 | | | 10,000 | | | | 11,200 | | |

Sunoco LP/Sunoco Finance Corp.

5.875%, due 03/15/28 | | | 15,000 | | | | 15,844 | | |

| | | | | | 2,337,457 | | |

Oil & gas services—0.0%† | |

Archrock Partners LP/Archrock Partners

Finance Corp.

6.250%, due 04/01/285 | | | 10,000 | | | | 10,188 | | |

6.875%, due 04/01/275 | | | 30,000 | | | | 31,162 | | |

USA Compression Partners LP/USA

Compression Finance Corp.

6.875%, due 04/01/26 | | | 39,000 | | | | 40,523 | | |

6.875%, due 09/01/27 | | | 35,000 | | | | 36,658 | | |

| | | | | | 118,531 | | |

Packaging & containers—0.1% | |

Cascades, Inc./Cascades USA, Inc.

5.375%, due 01/15/285 | | | 10,000 | | | | 10,538 | | |

Graphic Packaging International LLC

3.500%, due 03/15/285 | | | 35,000 | | | | 35,730 | | |

4.750%, due 07/15/275 | | | 15,000 | | | | 16,226 | | |

| | | Face

amount | | Value | |

Corporate bonds—(continued) | |

Packaging & containers—(concluded) | |

OI European Group BV