UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-06292

UBS Investment Trust

______________________________________________________________________________

(Exact name of registrant as specified in charter)

787 Seventh Avenue, New York, New York 10019

______________________________________________________________________________

(Address of principal executive offices) (Zip code)

Keith A. Weller, Esq.

UBS Asset Management

One North Wacker Drive

Chicago, IL 60606

(Name and address of agent for service)

Copy to:

Stephen H. Bier, Esq.

Dechert LLP

1095 Avenue of the Americas

New York, NY 10036-6797

Registrant’s telephone number, including area code: 888-793-8637

Date of fiscal year end: August 31

Date of reporting period: August 31, 2024

Item 1. Reports to Stockholders.

(a) Copy of the report transmitted to shareholders:

TABLE OF CONTENTS

Annual Shareholder Report

August 31, 2024

This annual shareholder report contains important information about UBS U.S. Allocation Fund for the period of September 1, 2023 to August 31, 2024. You can find additional information about the Fund at http://www.ubs.com/port-info . You can also request this information by contacting us at 1-800-647-1568.

What were the Fund costs for the last year?

Annual Fund Operating Expenses

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $112 | 1.03% |

How did the Fund perform last year and what affected its performance?

Portfolio performance summary

What worked:

- Tactical asset allocation contributed positively to relative performance.

- Overweight stocks vs. bonds was a positive contributor to performance.

- An overweight to US large cap was the main contributor to performance. Within US large cap, an overweight to US Communication Services and an overweight to US Information Technology contributed the most.

- Within Fixed Income, overweights in securitized fixed income contributed to performance.

What didn’t work:

- Security selection detracted from relative performance. Negative impact from US Large Cap Value and the US Securitized Bond strategies outweighed positive contribution from the US High Yield Fixed Income, US Large Cap Growth, and the US Large Cap Sector Rotation Strategies.

- From a tactical allocation perspective, underweights to US 10 year treasuries and an overweight to US Health Care detracted the most from relative performance.

We used derivatives extensively for capital management, risk management, and expressing asset allocation views. We utilized various futures which include equity regional, equity style, fixed income regional in both government and corporate credit. Futures were sometimes used to manage overall regional exposure while increasing exposure to actively managed sleeves of the portfolio. We also utilized futures to gain exposure to asset classes when limited by our max allocation to external ETFs by SEC rules.

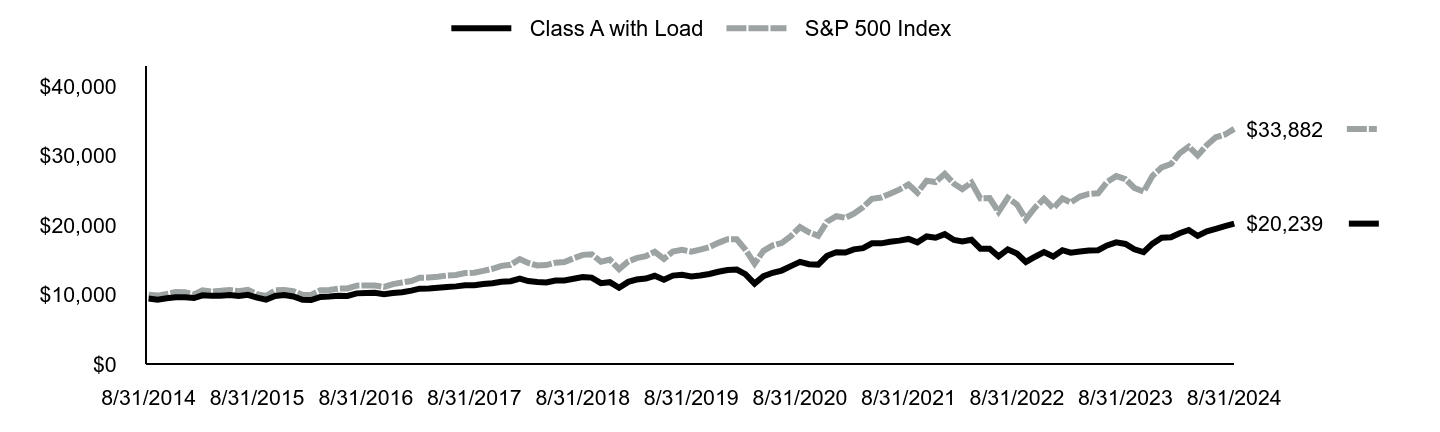

| Class A with Load | S&P 500 Index |

|---|

| 8/31/2014 | $9,450 | $10,000 |

| 9/30/2014 | $9,272 | $9,860 |

| 10/31/2014 | $9,464 | $10,101 |

| 11/30/2014 | $9,623 | $10,372 |

| 12/31/2014 | $9,630 | $10,346 |

| 1/31/2015 | $9,502 | $10,036 |

| 2/28/2015 | $9,899 | $10,612 |

| 3/31/2015 | $9,844 | $10,444 |

| 4/30/2015 | $9,837 | $10,545 |

| 5/31/2015 | $9,927 | $10,680 |

| 6/30/2015 | $9,804 | $10,474 |

| 7/31/2015 | $9,972 | $10,693 |

| 8/31/2015 | $9,557 | $10,048 |

| 9/30/2015 | $9,269 | $9,799 |

| 10/31/2015 | $9,816 | $10,626 |

| 11/30/2015 | $9,927 | $10,657 |

| 12/31/2015 | $9,725 | $10,489 |

| 1/31/2016 | $9,262 | $9,969 |

| 2/29/2016 | $9,219 | $9,955 |

| 3/31/2016 | $9,668 | $10,631 |

| 4/30/2016 | $9,730 | $10,672 |

| 5/31/2016 | $9,837 | $10,864 |

| 6/30/2016 | $9,818 | $10,892 |

| 7/31/2016 | $10,181 | $11,293 |

| 8/31/2016 | $10,229 | $11,309 |

| 9/30/2016 | $10,269 | $11,311 |

| 10/31/2016 | $10,070 | $11,105 |

| 11/30/2016 | $10,229 | $11,516 |

| 12/31/2016 | $10,332 | $11,744 |

| 1/31/2017 | $10,577 | $11,967 |

| 2/28/2017 | $10,861 | $12,442 |

| 3/31/2017 | $10,892 | $12,456 |

| 4/30/2017 | $10,997 | $12,584 |

| 5/31/2017 | $11,112 | $12,761 |

| 6/30/2017 | $11,188 | $12,841 |

| 7/31/2017 | $11,334 | $13,105 |

| 8/31/2017 | $11,357 | $13,145 |

| 9/30/2017 | $11,520 | $13,416 |

| 10/31/2017 | $11,632 | $13,729 |

| 11/30/2017 | $11,851 | $14,150 |

| 12/31/2017 | $11,927 | $14,308 |

| 1/31/2018 | $12,298 | $15,127 |

| 2/28/2018 | $11,956 | $14,569 |

| 3/31/2018 | $11,822 | $14,199 |

| 4/30/2018 | $11,763 | $14,254 |

| 5/31/2018 | $12,037 | $14,597 |

| 6/30/2018 | $12,049 | $14,687 |

| 7/31/2018 | $12,286 | $15,233 |

| 8/31/2018 | $12,520 | $15,730 |

| 9/30/2018 | $12,454 | $15,819 |

| 10/31/2018 | $11,658 | $14,738 |

| 11/30/2018 | $11,795 | $15,038 |

| 12/31/2018 | $10,985 | $13,680 |

| 1/31/2019 | $11,836 | $14,777 |

| 2/28/2019 | $12,180 | $15,251 |

| 3/31/2019 | $12,314 | $15,547 |

| 4/30/2019 | $12,715 | $16,177 |

| 5/31/2019 | $12,147 | $15,149 |

| 6/30/2019 | $12,737 | $16,217 |

| 7/31/2019 | $12,851 | $16,450 |

| 8/31/2019 | $12,625 | $16,189 |

| 9/30/2019 | $12,753 | $16,492 |

| 10/31/2019 | $12,971 | $16,849 |

| 11/30/2019 | $13,291 | $17,461 |

| 12/31/2019 | $13,558 | $17,988 |

| 1/31/2020 | $13,616 | $17,981 |

| 2/29/2020 | $12,954 | $16,501 |

| 3/31/2020 | $11,587 | $14,463 |

| 4/30/2020 | $12,659 | $16,317 |

| 5/31/2020 | $13,149 | $17,094 |

| 6/30/2020 | $13,469 | $17,434 |

| 7/31/2020 | $14,109 | $18,417 |

| 8/31/2020 | $14,727 | $19,740 |

| 9/30/2020 | $14,387 | $18,990 |

| 10/31/2020 | $14,329 | $18,485 |

| 11/30/2020 | $15,592 | $20,509 |

| 12/31/2020 | $16,121 | $21,297 |

| 1/31/2021 | $16,065 | $21,082 |

| 2/28/2021 | $16,527 | $21,664 |

| 3/31/2021 | $16,691 | $22,612 |

| 4/30/2021 | $17,389 | $23,819 |

| 5/31/2021 | $17,389 | $23,986 |

| 6/30/2021 | $17,621 | $24,546 |

| 7/31/2021 | $17,785 | $25,129 |

| 8/31/2021 | $18,021 | $25,893 |

| 9/30/2021 | $17,538 | $24,688 |

| 10/31/2021 | $18,390 | $26,418 |

| 11/30/2021 | $18,194 | $26,235 |

| 12/31/2021 | $18,712 | $27,411 |

| 1/31/2022 | $17,882 | $25,992 |

| 2/28/2022 | $17,668 | $25,214 |

| 3/31/2022 | $17,899 | $26,150 |

| 4/30/2022 | $16,613 | $23,870 |

| 5/31/2022 | $16,623 | $23,914 |

| 6/30/2022 | $15,522 | $21,940 |

| 7/31/2022 | $16,521 | $23,963 |

| 8/31/2022 | $15,915 | $22,986 |

| 9/30/2022 | $14,706 | $20,869 |

| 10/31/2022 | $15,463 | $22,558 |

| 11/30/2022 | $16,122 | $23,819 |

| 12/31/2022 | $15,496 | $22,446 |

| 1/31/2023 | $16,406 | $23,857 |

| 2/28/2023 | $16,039 | $23,275 |

| 3/31/2023 | $16,205 | $24,129 |

| 4/30/2023 | $16,352 | $24,506 |

| 5/31/2023 | $16,394 | $24,612 |

| 6/30/2023 | $17,084 | $26,239 |

| 7/31/2023 | $17,538 | $27,082 |

| 8/31/2023 | $17,303 | $26,650 |

| 9/30/2023 | $16,540 | $25,380 |

| 10/31/2023 | $16,113 | $24,846 |

| 11/30/2023 | $17,342 | $27,115 |

| 12/31/2023 | $18,192 | $28,347 |

| 1/31/2024 | $18,266 | $28,824 |

| 2/29/2024 | $18,848 | $30,363 |

| 3/31/2024 | $19,309 | $31,339 |

| 4/30/2024 | $18,465 | $30,059 |

| 5/31/2024 | $19,130 | $31,550 |

| 6/30/2024 | $19,481 | $32,682 |

| 7/31/2024 | $19,864 | $33,080 |

| 8/31/2024 | $20,239 | $33,882 |

Average Annual Total Returns (%)

| 1 Year | 5 Years | 10 Years |

|---|

| Class A | 16.97% | 9.90% | 7.91% |

| Class A with Load | 10.55% | 8.66% | 7.30% |

| S&P 500 Index | 27.14% | 15.92% | 12.98% |

Performance data represents past performance, which does not guarantee future results.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or a redemption of Fund shares.

| FUND STATISTICS | |

|---|

| Total Net Assets | $229,345,180 |

| # of Portfolio Holdings | 1,053 |

| Portfolio Turnover Rate | 58% |

| Total Advisory Fees Paid (includes Administration Fees) | $1,092,819 |

What is the Fund’s investment objective?

The Fund seeks total return, consisting of long-term capital appreciation and current income.

Top 5 Equity Holdings (%)

| Apple, Inc. | 4.2% |

| Microsoft Corp. | 4.0 |

| NVIDIA Corp. | 3.8 |

| Alphabet, Inc., Class A | 2.3 |

| Amazon.com, Inc. | 2.2 |

Top 5 Holdings (other than equities) (%)

| Invesco S&P 500 Equal Weight ETF | 2.0% |

| Uniform Mortgage-Backed Security, TBA , 2.000% | 1.7 |

| Uniform Mortgage-Backed Security, TBA , 4.500% | 1.3 |

| iShares Core S&P Mid-Cap ETF | 1.2 |

| Uniform Mortgage-Backed Security, TBA , 5.000% | 1.2 |

If you wish to view additional information about the Fund, including but not limited to financial statements or holdings, please visit http://www.ubs.com/port-info .

Annual Shareholder Report

August 31, 2024

This annual shareholder report contains important information about UBS U.S. Allocation Fund for the period of September 1, 2023 to August 31, 2024. You can find additional information about the Fund at http://www.ubs.com/port-info . You can also request this information by contacting us at 1-800-647-1568.

What were the Fund costs for the last year?

Annual Fund Operating Expenses

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class P | $83 | 0.76% |

How did the Fund perform last year and what affected its performance?

Portfolio performance summary

What worked:

- Tactical asset allocation contributed positively to relative performance.

- Overweight stocks vs. bonds was a positive contributor to performance.

- An overweight to US large cap was the main contributor to performance. Within US large cap, an overweight to US Communication Services and an overweight to US Information Technology contributed the most.

- Within Fixed Income, overweights in securitized fixed income contributed to performance.

What didn’t work:

- Security selection detracted from relative performance. Negative impact from US Large Cap Value and the US Securitized Bond strategies outweighed positive contribution from the US High Yield Fixed Income, US Large Cap Growth, and the US Large Cap Sector Rotation Strategies.

- From a tactical allocation perspective, underweights to US 10 year treasuries and an overweight to US Health Care detracted the most from relative performance.

We used derivatives extensively for capital management, risk management, and expressing asset allocation views. We utilized various futures which include equity regional, equity style, fixed income regional in both government and corporate credit. Futures were sometimes used to manage overall regional exposure while increasing exposure to actively managed sleeves of the portfolio. We also utilized futures to gain exposure to asset classes when limited by our max allocation to external ETFs by SEC rules.

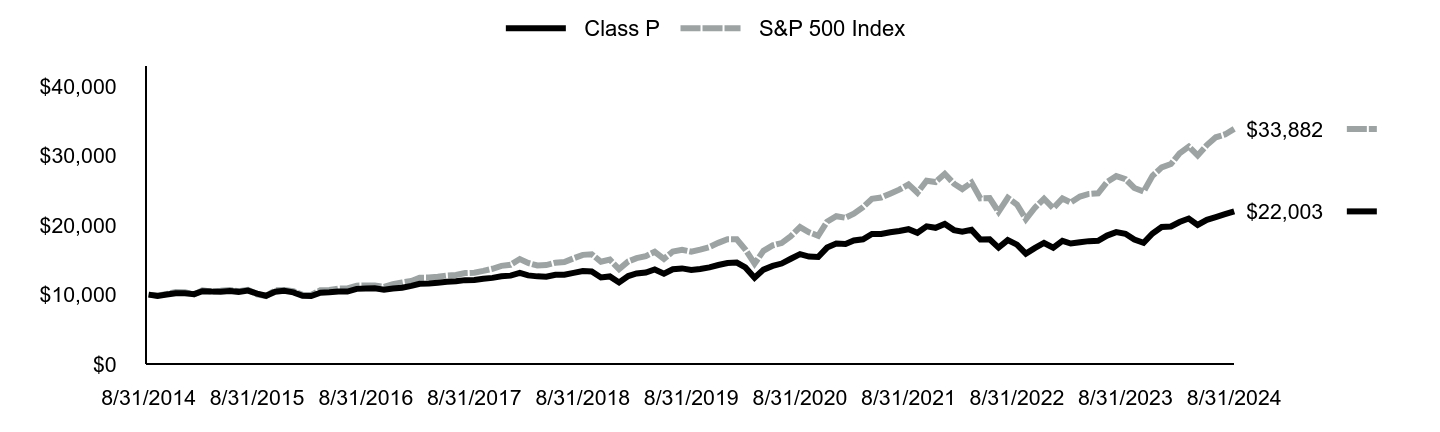

| Class P | S&P 500 Index |

|---|

| 8/31/2014 | $10,000 | $10,000 |

| 9/30/2014 | $9,815 | $9,860 |

| 10/31/2014 | $10,020 | $10,101 |

| 11/30/2014 | $10,190 | $10,372 |

| 12/31/2014 | $10,200 | $10,346 |

| 1/31/2015 | $10,066 | $10,036 |

| 2/28/2015 | $10,488 | $10,612 |

| 3/31/2015 | $10,433 | $10,444 |

| 4/30/2015 | $10,428 | $10,545 |

| 5/31/2015 | $10,527 | $10,680 |

| 6/30/2015 | $10,398 | $10,474 |

| 7/31/2015 | $10,580 | $10,693 |

| 8/31/2015 | $10,140 | $10,048 |

| 9/30/2015 | $9,835 | $9,799 |

| 10/31/2015 | $10,421 | $10,626 |

| 11/30/2015 | $10,540 | $10,657 |

| 12/31/2015 | $10,326 | $10,489 |

| 1/31/2016 | $9,837 | $9,969 |

| 2/29/2016 | $9,795 | $9,955 |

| 3/31/2016 | $10,277 | $10,631 |

| 4/30/2016 | $10,344 | $10,672 |

| 5/31/2016 | $10,458 | $10,864 |

| 6/30/2016 | $10,441 | $10,892 |

| 7/31/2016 | $10,830 | $11,293 |

| 8/31/2016 | $10,882 | $11,309 |

| 9/30/2016 | $10,927 | $11,311 |

| 10/31/2016 | $10,719 | $11,105 |

| 11/30/2016 | $10,890 | $11,516 |

| 12/31/2016 | $11,001 | $11,744 |

| 1/31/2017 | $11,266 | $11,967 |

| 2/28/2017 | $11,571 | $12,442 |

| 3/31/2017 | $11,606 | $12,456 |

| 4/30/2017 | $11,723 | $12,584 |

| 5/31/2017 | $11,846 | $12,761 |

| 6/30/2017 | $11,931 | $12,841 |

| 7/31/2017 | $12,088 | $13,105 |

| 8/31/2017 | $12,118 | $13,145 |

| 9/30/2017 | $12,293 | $13,416 |

| 10/31/2017 | $12,413 | $13,729 |

| 11/30/2017 | $12,653 | $14,150 |

| 12/31/2017 | $12,737 | $14,308 |

| 1/31/2018 | $13,135 | $15,127 |

| 2/28/2018 | $12,771 | $14,569 |

| 3/31/2018 | $12,632 | $14,199 |

| 4/30/2018 | $12,571 | $14,254 |

| 5/31/2018 | $12,866 | $14,597 |

| 6/30/2018 | $12,881 | $14,687 |

| 7/31/2018 | $13,137 | $15,233 |

| 8/31/2018 | $13,393 | $15,730 |

| 9/30/2018 | $13,324 | $15,819 |

| 10/31/2018 | $12,476 | $14,738 |

| 11/30/2018 | $12,625 | $15,038 |

| 12/31/2018 | $11,762 | $13,680 |

| 1/31/2019 | $12,676 | $14,777 |

| 2/28/2019 | $13,046 | $15,251 |

| 3/31/2019 | $13,192 | $15,547 |

| 4/30/2019 | $13,622 | $16,177 |

| 5/31/2019 | $13,020 | $15,149 |

| 6/30/2019 | $13,653 | $16,217 |

| 7/31/2019 | $13,779 | $16,450 |

| 8/31/2019 | $13,539 | $16,189 |

| 9/30/2019 | $13,682 | $16,492 |

| 10/31/2019 | $13,920 | $16,849 |

| 11/30/2019 | $14,264 | $17,461 |

| 12/31/2019 | $14,555 | $17,988 |

| 1/31/2020 | $14,619 | $17,981 |

| 2/29/2020 | $13,913 | $16,501 |

| 3/31/2020 | $12,446 | $14,463 |

| 4/30/2020 | $13,603 | $16,317 |

| 5/31/2020 | $14,133 | $17,094 |

| 6/30/2020 | $14,479 | $17,434 |

| 7/31/2020 | $15,170 | $18,417 |

| 8/31/2020 | $15,838 | $19,740 |

| 9/30/2020 | $15,478 | $18,990 |

| 10/31/2020 | $15,416 | $18,485 |

| 11/30/2020 | $16,778 | $20,509 |

| 12/31/2020 | $17,355 | $21,297 |

| 1/31/2021 | $17,299 | $21,082 |

| 2/28/2021 | $17,798 | $21,664 |

| 3/31/2021 | $17,977 | $22,612 |

| 4/30/2021 | $18,734 | $23,819 |

| 5/31/2021 | $18,740 | $23,986 |

| 6/30/2021 | $18,992 | $24,546 |

| 7/31/2021 | $19,174 | $25,129 |

| 8/31/2021 | $19,431 | $25,893 |

| 9/30/2021 | $18,916 | $24,688 |

| 10/31/2021 | $19,840 | $26,418 |

| 11/30/2021 | $19,632 | $26,235 |

| 12/31/2021 | $20,195 | $27,411 |

| 1/31/2022 | $19,303 | $25,992 |

| 2/28/2022 | $19,074 | $25,214 |

| 3/31/2022 | $19,332 | $26,150 |

| 4/30/2022 | $17,946 | $23,870 |

| 5/31/2022 | $17,961 | $23,914 |

| 6/30/2022 | $16,777 | $21,940 |

| 7/31/2022 | $17,857 | $23,963 |

| 8/31/2022 | $17,208 | $22,986 |

| 9/30/2022 | $15,903 | $20,869 |

| 10/31/2022 | $16,729 | $22,558 |

| 11/30/2022 | $17,441 | $23,819 |

| 12/31/2022 | $16,769 | $22,446 |

| 1/31/2023 | $17,758 | $23,857 |

| 2/28/2023 | $17,361 | $23,275 |

| 3/31/2023 | $17,547 | $24,129 |

| 4/30/2023 | $17,709 | $24,506 |

| 5/31/2023 | $17,762 | $24,612 |

| 6/30/2023 | $18,512 | $26,239 |

| 7/31/2023 | $19,007 | $27,082 |

| 8/31/2023 | $18,760 | $26,650 |

| 9/30/2023 | $17,937 | $25,380 |

| 10/31/2023 | $17,478 | $24,846 |

| 11/30/2023 | $18,808 | $27,115 |

| 12/31/2023 | $19,741 | $28,347 |

| 1/31/2024 | $19,823 | $28,824 |

| 2/29/2024 | $20,462 | $30,363 |

| 3/31/2024 | $20,964 | $31,339 |

| 4/30/2024 | $20,054 | $30,059 |

| 5/31/2024 | $20,779 | $31,550 |

| 6/30/2024 | $21,166 | $32,682 |

| 7/31/2024 | $21,587 | $33,080 |

| 8/31/2024 | $22,003 | $33,882 |

Average Annual Total Returns (%)

| 1 Year | 5 Years | 10 Years |

|---|

| Class P | 17.29% | 10.20% | 8.21% |

| S&P 500 Index | 27.14% | 15.92% | 12.98% |

Performance data represents past performance, which does not guarantee future results.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or a redemption of Fund shares.

| FUND STATISTICS | |

|---|

| Total Net Assets | $229,345,180 |

| # of Portfolio Holdings | 1,053 |

| Portfolio Turnover Rate | 58% |

| Total Advisory Fees Paid (includes Administration Fees) | $1,092,819 |

What is the Fund’s investment objective?

The Fund seeks total return, consisting of long-term capital appreciation and current income.

Top 5 Equity Holdings (%)

| Apple, Inc. | 4.2% |

| Microsoft Corp. | 4.0 |

| NVIDIA Corp. | 3.8 |

| Alphabet, Inc., Class A | 2.3 |

| Amazon.com, Inc. | 2.2 |

Top 5 Holdings (other than equities) (%)

| Invesco S&P 500 Equal Weight ETF | 2.0% |

| Uniform Mortgage-Backed Security, TBA , 2.000% | 1.7 |

| Uniform Mortgage-Backed Security, TBA , 4.500% | 1.3 |

| iShares Core S&P Mid-Cap ETF | 1.2 |

| Uniform Mortgage-Backed Security, TBA , 5.000% | 1.2 |

If you wish to view additional information about the Fund, including but not limited to financial statements or holdings, please visit http://www.ubs.com/port-info .

| (b) | Copy of each notice transmitted to shareholders in reliance on Rule 30e-3 under the Investment Company Act of 1940, as amended (the "1940 Act"), that contains disclosures specified by paragraph (c)(3) of that rule: Not applicable to the registrant. |

Item 2. Code of Ethics.

The registrant has adopted a code of ethics that applies to its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions pursuant to Section 406 of the Sarbanes-Oxley Act of 2002. (The registrant has designated the code of ethics adopted pursuant to Sarbanes-Oxley as a “Code of Conduct” to lessen the risk of confusion with its separate code of ethics adopted pursuant to Rule 17j-1 under the 1940 Act.).

Item 3. Audit Committee Financial Expert.

The registrant’s Board has determined that the following person serving on the registrant’s Audit Committee is an “audit committee financial expert” as defined in item 3 of Form N-CSR: Virginia G. Breen. Ms. Breen is independent as defined in item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

For the fiscal years ended August 31, 2024 and August 31, 2023, the aggregate Ernst & Young LLP (E&Y) audit fees for professional services rendered to the registrant were approximately $73,107 and $73,107, respectively.

Fees included in the audit fees category are those associated with the annual audits of financial statements and services that are normally provided in connection with statutory and regulatory filings.

In each of the fiscal years ended August 31, 2024 and August 31, 2023, the aggregate audit-related fees billed by EY for services rendered to the registrant that are reasonably related to the performance of the audits of the financial statements, but not reported as audit fees, were approximately $3,056 and $2,910, respectively.

Fees included in the audit-related fees category are those associated with the reading and providing of comments on the 2024 and 2023 semiannual financial statements.

There were no audit-related fees required to be approved pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X during the fiscal years indicated above.

In each of the fiscal years ended August 31, 2024 and August 31, 2023, the aggregate tax fees billed by EY for professional services rendered to the registrant were approximately $14,665 and $13,020, respectively.

Fees included in the tax fees category comprise all services performed by professional staff in the independent accountant’s tax division except those services related to the audits. This category comprises fees for review of tax compliance, tax return preparation and excise tax calculations and assistance with identification of passive foreign investment companies (PFICs).

There were no tax fees required to be approved pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X during the fiscal years indicated above.

In each of the fiscal years ended August 31, 2024 and August 31, 2023, there were no fees billed by EY for products and services, other than the services reported in Item 4(a)-(c) above, rendered to the registrant.

Fees included in the all other fees category would consist of services related to internal control reviews, strategy and other consulting, financial information systems design and implementation, consulting on other information systems, and other tax services unrelated to the registrant.

There were no “all other fees” required to be approved pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X during the fiscal years indicated above.

| (e) | (1) Audit Committee Pre-Approval Policies and Procedures: |

The registrant’s Audit Committee (“audit committee”) has adopted an “Audit Committee Charter (Amended and Restated as of September 14, 2016)” (the “charter”). The charter contains the audit committee’s pre-approval policies and procedures. Reproduced below is an excerpt from the charter regarding pre-approval policies and procedures:

The [audit] Committee shall:

…

| 2. | Pre-approve (a) all audit and permissible non-audit services1 to be provided to the Fund and (b) all permissible non-audit services to be provided by the Fund’s independent auditors to UBS AM and any Covered Service Providers, if the engagement relates directly to the operations and financial reporting of the Fund. In carrying out this responsibility, the Committee shall seek periodically from UBS AM and from the independent auditors a list of such audit and permissible non-audit services that can be expected to be rendered to the Fund, UBS AM or any Covered Service Providers by the Fund’s independent auditors, and an estimate of the fees sought to be paid in connection with such services. The Committee has delegated its responsibility to pre-approve any such audit and permissible non-audit services not exceeding $100,000 (excluding reasonable out-of-pocket expenses) on an annual basis to the Chairperson. All such pre-approvals will be reported to the full Committee on a quarterly basis at the Committee’s next regularly scheduled meeting after the pre-approval. The Committee may not delegate to management its responsibility to pre-approve services to be performed by the independent auditor. Requests or applications to provide services that require specific pre-approval by the Committee or the Chairperson will be submitted by both the Fund’s independent auditors and the Fund’s Treasurer or other designated Fund officer and must include a joint statement as to whether, in their view, the request or application is consistent with SEC rules on auditor independence. From year to year, the Committee shall report to the Board whether this system of pre-approval has been effective and efficient or whether this Charter should be amended to allow for pre-approval pursuant to such policies and procedures as the Committee shall approve, including the delegation of some or all of the Committee’s pre-approval responsibilities to other persons (other than UBS AM or the Fund’s officers). |

1 The Committee will not approve non-audit services that the Committee believes may taint the independence of the auditors. Currently, permissible non-audit services include any professional services (including tax services) that are not prohibited services as described below, provided to the Fund by the independent auditors, other than those provided to the Fund in connection with an audit or a review of the financial statements of the Fund. Permissible non-audit services may not include: (i) bookkeeping or other services related to the accounting records or financial statements of the Fund; (ii) financial information systems design and implementation; (iii) appraisal or valuation services, fairness opinions or contribution-in-kind reports; (iv) actuarial services; (v) internal audit outsourcing services; (vi) management functions or human resources; (vii) broker or dealer, investment adviser or investment banking services; (viii) legal services and expert services unrelated to the audit; and (ix) any other service the Public Company Accounting Oversight Board determines, by regulation, is impermissible.

Pre-approval by the Committee of any permissible non-audit services is not required so long as: (i) the aggregate amount of all such permissible non-audit services provided to the Fund, UBS AM and any service providers controlling, controlled by or under common control with UBS AM that provide ongoing services to the Fund (“Covered Service Providers”) constitutes not more than 5% of the total amount of revenues paid to the independent auditors (during the fiscal year in which the permissible non-audit services are provided) by (a) the Fund, (b) its investment adviser and (c) any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the Fund during the fiscal year in which the services are provided that would have to be approved by the Committee; (ii) the permissible non-audit services were not recognized by the Fund at the time of the engagement to be non-audit services; and (iii) such services are promptly brought to the attention of the Committee and approved by the Committee (or its delegate(s)) prior to the completion of the audit.

(e) (2) Services approved pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X:

Audit-Related Fees:

There were no amounts that were approved by the audit committee pursuant to the de minimis exception for the fiscal years ended August 31, 2024 and August 31, 2023 on behalf of the registrant.

There were no amounts that were required to be approved by the audit committee pursuant to the de minimis exception for the fiscal years ended August 31, 2024 and August 31, 2023 on behalf of the registrant’s service providers that relate directly to the operations and financial reporting of the registrant.

Tax Fees:

There were no amounts that were approved by the audit committee pursuant to the de minimis exception for the fiscal years ended August 31, 2024 and August 31, 2023 on behalf of the registrant.

There were no amounts that were required to be approved by the audit committee pursuant to the de minimis exception for the fiscal years ended August 31, 2024 and August 31, 2023 on behalf of the registrant’s service providers that relate directly to the operations and financial reporting of the registrant.

All Other Fees:

There were no amounts that were approved by the audit committee pursuant to the de minimis exception for the fiscal years ended August 31, 2024 and August 31, 2023 on behalf of the registrant.

There were no amounts that were required to be approved by the audit committee pursuant to the de minimis exception for the fiscal years ended August 31, 2024 and August 31, 2023 on behalf of the registrant’s service providers that relate directly to the operations and financial reporting of the registrant.

| (f) | For the fiscal year ended August 31, 2023, if greater than 50%, specify the percentage of hours spent on the audit of the registrant’s financial statements for the most recent fiscal year that were attributed to work performed by persons who are not full-time, permanent employees of E&Y. According to E&Y, such amount was below 50%; therefore, disclosure item not applicable for this filing. |

| (g) | For the fiscal years ended August 31, 2024 and August 31, 2023, the aggregate fees billed by EY of $576,355 and $1,645,887, respectively, for non-audit services rendered on behalf of the registrant (“covered”), its investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser) and any entity controlling, controlled by, or under common control with the adviser (“non-covered”) that provides ongoing services to the registrant for each of the last two fiscal years of the registrant is shown in the table below: |

| | | 2024 | | | 2023 | |

| | Covered Services | | $ | 17,721 | | | $ | 15,930 | |

| | Non-Covered Services | | $ | 558,634 | | | $ | 1,629,957 | |

| (h) | The registrant’s audit committee was not required to consider whether the provision of non-audit services that were rendered to the registrant’s investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant that were not pre-approved pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X is compatible with maintaining the principal accountant’s independence. |

| (i) | Not applicable to the registrant. |

| (j) | Not applicable to the registrant. |

Item 5. Audit Committee of Listed Registrants.

Not applicable to the registrant.

Item 6. Investments.

| (a) | Included as part of the report to shareholders filed under Item 1 of this form. |

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

(a) Copy of the most recent financial statements:

UBS U.S. Allocation Fund

Annual Financial Statements | August 31, 2024

UBS U.S. Allocation Fund

Portfolio of investments—August 31, 2024

| | | Number of

shares | | Value | |

Common stocks—62.3% | |

Aerospace & defense—1.4% | |

Axon Enterprise, Inc.* | | | 53 | | | $ | 19,343 | | |

Boeing Co.* | | | 411 | | | | 71,407 | | |

General Dynamics Corp. | | | 166 | | | | 49,694 | | |

General Electric Co. | | | 4,029 | | | | 703,544 | | |

Howmet Aerospace, Inc. | | | 283 | | | | 27,355 | | |

Huntington Ingalls Industries, Inc. | | | 41 | | | | 11,594 | | |

L3Harris Technologies, Inc. | | | 138 | | | | 32,661 | | |

Lockheed Martin Corp. | | | 152 | | | | 86,351 | | |

Northrop Grumman Corp. | | | 2,330 | | | | 1,219,079 | | |

RTX Corp. | | | 930 | | | | 114,706 | | |

Textron, Inc. | | | 118 | | | | 10,762 | | |

TransDigm Group, Inc. | | | 625 | | | | 858,256 | | |

| | | | | | 3,204,752 | | |

Air freight & logistics—0.1% | |

CH Robinson Worldwide, Inc. | | | 90 | | | | 9,316 | | |

Expeditors International of Washington, Inc. | | | 98 | | | | 12,094 | | |

FedEx Corp. | | | 166 | | | | 49,596 | | |

United Parcel Service, Inc., Class B | | | 519 | | | | 66,717 | | |

| | | | | | 137,723 | | |

Automobile components—0.3% | |

Aptiv PLC* | | | 8,606 | | | | 615,587 | | |

BorgWarner, Inc. | | | 246 | | | | 8,381 | | |

| | | | | | 623,968 | | |

Automobiles—0.5% | |

Ford Motor Co. | | | 3,299 | | | | 36,916 | | |

General Motors Co. | | | 966 | | | | 48,087 | | |

Tesla, Inc.* | | | 4,805 | | | | 1,028,799 | | |

| | | | | | 1,113,802 | | |

Banks—1.8% | |

Bank of America Corp. | | | 7,192 | | | | 293,074 | | |

Citigroup, Inc. | | | 2,006 | | | | 125,656 | | |

Citizens Financial Group, Inc. | | | 520 | | | | 22,386 | | |

Fifth Third Bancorp | | | 703 | | | | 30,011 | | |

Huntington Bancshares, Inc. | | | 1,533 | | | | 22,949 | | |

JPMorgan Chase & Co. | | | 3,028 | | | | 680,695 | | |

KeyCorp | | | 1,000 | | | | 17,060 | | |

M&T Bank Corp. | | | 184 | | | | 31,668 | | |

PNC Financial Services Group, Inc. | | | 433 | | | | 80,144 | | |

Regions Financial Corp. | | | 863 | | | | 20,212 | | |

Truist Financial Corp. | | | 1,409 | | | | 62,644 | | |

U.S. Bancorp | | | 1,658 | | | | 78,307 | | |

Wells Fargo & Co. | | | 44,071 | | | | 2,576,831 | | |

| | | | | | 4,041,637 | | |

Beverages—0.4% | |

Brown-Forman Corp., Class B | | | 92 | | | | 4,194 | | |

Coca-Cola Co. | | | 1,913 | | | | 138,635 | | |

Constellation Brands, Inc., Class A | | | 2,657 | | | | 639,567 | | |

Keurig Dr. Pepper, Inc. | | | 530 | | | | 19,403 | | |

Molson Coors Beverage Co., Class B | | | 42 | | | | 2,267 | | |

Monster Beverage Corp.* | | | 364 | | | | 17,155 | | |

| | | Number of

shares | | Value | |

Common stocks—(continued) | |

Beverages—(concluded) | |

PepsiCo, Inc. | | | 671 | | | $ | 116,003 | | |

| | | | | | 937,224 | | |

Biotechnology—0.4% | |

AbbVie, Inc. | | | 1,731 | | | | 339,813 | | |

ABIOMED, Inc.*,1 | | | 76 | | | | 133 | | |

Amgen, Inc. | | | 531 | | | | 177,264 | | |

Biogen, Inc.* | | | 140 | | | | 28,666 | | |

Gilead Sciences, Inc. | | | 1,199 | | | | 94,721 | | |

Incyte Corp.* | | | 172 | | | | 11,294 | | |

Moderna, Inc.* | | | 331 | | | | 25,619 | | |

Regeneron Pharmaceuticals, Inc.* | | | 103 | | | | 122,023 | | |

Vertex Pharmaceuticals, Inc.* | | | 254 | | | | 125,956 | | |

| | | | | | 925,489 | | |

Broadline retail—2.2% | |

Amazon.com, Inc.* | | | 28,595 | | | | 5,104,207 | | |

eBay, Inc. | | | 420 | | | | 24,822 | | |

Etsy, Inc.* | | | 117 | | | | 6,446 | | |

| | | | | | 5,135,475 | | |

Building products—0.4% | |

A.O. Smith Corp. | | | 72 | | | | 6,028 | | |

Allegion PLC | | | 75 | | | | 10,413 | | |

Builders FirstSource, Inc.* | | | 79 | | | | 13,746 | | |

Carrier Global Corp. | | | 572 | | | | 41,630 | | |

Hayward Holdings, Inc.* | | | 51,134 | | | | 758,829 | | |

Johnson Controls International PLC | | | 457 | | | | 33,292 | | |

Masco Corp. | | | 116 | | | | 9,229 | | |

Trane Technologies PLC | | | 162 | | | | 58,589 | | |

| | | | | | 931,756 | | |

Capital markets—2.2% | |

Ameriprise Financial, Inc. | | | 2,689 | | | | 1,208,544 | | |

Bank of New York Mellon Corp. | | | 779 | | | | 53,143 | | |

BlackRock, Inc. | | | 1,641 | | | | 1,479,870 | | |

Blackstone, Inc. | | | 772 | | | | 109,902 | | |

Cboe Global Markets, Inc. | | | 106 | | | | 21,772 | | |

Charles Schwab Corp. | | | 1,549 | | | | 100,840 | | |

CME Group, Inc. | | | 365 | | | | 78,745 | | |

FactSet Research Systems, Inc. | | | 47 | | | | 19,874 | | |

Franklin Resources, Inc. | | | 399 | | | | 8,076 | | |

Goldman Sachs Group, Inc. | | | 345 | | | | 176,036 | | |

Intercontinental Exchange, Inc. | | | 608 | | | | 98,222 | | |

Invesco Ltd. | | | 599 | | | | 10,237 | | |

KKR & Co., Inc. | | | 702 | | | | 86,887 | | |

MarketAxess Holdings, Inc. | | | 48 | | | | 11,635 | | |

Moody's Corp. | | | 167 | | | | 81,453 | | |

Morgan Stanley | | | 1,309 | | | | 135,626 | | |

MSCI, Inc. | | | 87 | | | | 50,511 | | |

Nasdaq, Inc. | | | 377 | | | | 27,174 | | |

Northern Trust Corp. | | | 221 | | | | 20,157 | | |

Raymond James Financial, Inc. | | | 191 | | | | 22,838 | | |

S&P Global, Inc. | | | 2,177 | | | | 1,117,324 | | |

State Street Corp. | | | 303 | | | | 26,391 | | |

1

UBS U.S. Allocation Fund

Portfolio of investments—August 31, 2024

| | | Number of

shares | | Value | |

Common stocks—(continued) | |

Capital markets—(concluded) | |

T. Rowe Price Group, Inc. | | | 271 | | | $ | 28,737 | | |

| | | | | | 4,973,994 | | |

Chemicals—0.3% | |

CF Industries Holdings, Inc. | | | 7,681 | | | | 638,214 | | |

Commercial services & supplies—0.1% | |

Cintas Corp. | | | 61 | | | | 49,112 | | |

Copart, Inc.* | | | 585 | | | | 30,982 | | |

Republic Services, Inc. | | | 146 | | | | 30,399 | | |

Rollins, Inc. | | | 196 | | | | 9,835 | | |

Veralto Corp. | | | 150 | | | | 16,865 | | |

Waste Management, Inc. | | | 259 | | | | 54,918 | | |

| | | | | | 192,111 | | |

Communications equipment—0.2% | |

Arista Networks, Inc.* | | | 255 | | | | 90,112 | | |

Cisco Systems, Inc. | | | 4,158 | | | | 210,145 | | |

F5, Inc.* | | | 57 | | | | 11,580 | | |

Juniper Networks, Inc. | | | 359 | | | | 13,958 | | |

Motorola Solutions, Inc. | | | 176 | | | | 77,799 | | |

| | | | | | 403,594 | | |

Construction & engineering—0.0%† | |

Quanta Services, Inc. | | | 115 | | | | 31,640 | | |

Construction materials—0.3% | |

Vulcan Materials Co. | | | 2,612 | | | | 640,489 | | |

Consumer finance—0.1% | |

American Express Co. | | | 600 | | | | 155,190 | | |

Capital One Financial Corp. | | | 406 | | | | 59,654 | | |

Discover Financial Services | | | 259 | | | | 35,926 | | |

Synchrony Financial | | | 452 | | | | 22,717 | | |

| | | | | | 273,487 | | |

Consumer staples distribution & retail—1.0% | |

Costco Wholesale Corp. | | | 213 | | | | 190,077 | | |

Dollar General Corp. | | | 112 | | | | 9,293 | | |

Dollar Tree, Inc.* | | | 109 | | | | 9,209 | | |

Kroger Co. | | | 339 | | | | 18,038 | | |

Sysco Corp. | | | 194 | | | | 15,126 | | |

Target Corp. | | | 228 | | | | 35,025 | | |

Walgreens Boots Alliance, Inc. | | | 254 | | | | 2,350 | | |

Walmart, Inc. | | | 26,957 | | | | 2,081,889 | | |

| | | | | | 2,361,007 | | |

Distributors—0.0%† | |

Genuine Parts Co. | | | 130 | | | | 18,624 | | |

LKQ Corp. | | | 176 | | | | 7,320 | | |

Pool Corp. | | | 45 | | | | 15,823 | | |

| | | | | | 41,767 | | |

Diversified telecommunication services—0.2% | |

AT&T, Inc. | | | 8,854 | | | | 176,195 | | |

Verizon Communications, Inc. | | | 5,152 | | | | 215,250 | | |

| | | | | | 391,445 | | |

| | | Number of

shares | | Value | |

Common stocks—(continued) | |

Electric utilities—1.5% | |

Alliant Energy Corp. | | | 468 | | | $ | 27,270 | | |

American Electric Power Co., Inc. | | | 951 | | | | 95,366 | | |

Constellation Energy Corp. | | | 581 | | | | 114,283 | | |

Duke Energy Corp. | | | 1,362 | | | | 155,200 | | |

Edison International | | | 674 | | | | 58,658 | | |

Entergy Corp. | | | 399 | | | | 48,155 | | |

Evergy, Inc. | | | 405 | | | | 23,952 | | |

Eversource Energy | | | 624 | | | | 42,139 | | |

Exelon Corp. | | | 1,804 | | | | 68,714 | | |

FirstEnergy Corp. | | | 910 | | | | 39,967 | | |

NextEra Energy, Inc. | | | 29,989 | | | | 2,414,415 | | |

NRG Energy, Inc. | | | 393 | | | | 33,409 | | |

PG&E Corp. | | | 3,910 | | | | 77,027 | | |

Pinnacle West Capital Corp. | | | 223 | | | | 19,517 | | |

PPL Corp. | | | 1,306 | | | | 41,675 | | |

Southern Co. | | | 1,930 | | | | 166,752 | | |

Xcel Energy, Inc. | | | 983 | | | | 60,189 | | |

| | | | | | 3,486,688 | | |

Electrical equipment—0.9% | |

AMETEK, Inc. | | | 163 | | | | 27,881 | | |

Eaton Corp. PLC | | | 283 | | | | 86,861 | | |

Emerson Electric Co. | | | 401 | | | | 42,261 | | |

GE Vernova, Inc.* | | | 3,448 | | | | 693,048 | | |

Generac Holdings, Inc.* | | | 32 | | | | 5,009 | | |

Hubbell, Inc. | | | 44 | | | | 17,597 | | |

Regal Rexnord Corp. | | | 7,023 | | | | 1,178,530 | | |

Rockwell Automation, Inc. | | | 91 | | | | 24,755 | | |

| | | | | | 2,075,942 | | |

Electronic equipment, instruments & components—0.7% | |

Amphenol Corp., Class A | | | 1,229 | | | | 82,896 | | |

CDW Corp. | | | 134 | | | | 30,236 | | |

Corning, Inc. | | | 790 | | | | 33,062 | | |

Jabil, Inc. | | | 100 | | | | 10,928 | | |

Keysight Technologies, Inc.* | | | 8,289 | | | | 1,277,501 | | |

TE Connectivity Ltd. | | | 304 | | | | 46,694 | | |

Teledyne Technologies, Inc.* | | | 53 | | | | 22,938 | | |

Trimble, Inc.* | | | 242 | | | | 13,719 | | |

Zebra Technologies Corp., Class A* | | | 56 | | | | 19,341 | | |

| | | | | | 1,537,315 | | |

Energy equipment & services—0.2% | |

Baker Hughes Co. | | | 969 | | | | 34,079 | | |

Halliburton Co. | | | 788 | | | | 24,499 | | |

Schlumberger NV | | | 8,323 | | | | 366,129 | | |

| | | | | | 424,707 | | |

Entertainment—2.0% | |

Electronic Arts, Inc. | | | 294 | | | | 44,635 | | |

Liberty Media Corp.-Liberty Formula One,

Class C* | | | 7,600 | | | | 593,180 | | |

Live Nation Entertainment, Inc.* | | | 6,609 | | | | 645,501 | | |

Netflix, Inc.* | | | 531 | | | | 372,417 | | |

Take-Two Interactive Software, Inc.* | | | 10,843 | | | | 1,753,421 | | |

Walt Disney Co. | | | 11,468 | | | | 1,036,478 | | |

2

UBS U.S. Allocation Fund

Portfolio of investments—August 31, 2024

| | | Number of

shares | | Value | |

Common stocks—(continued) | |

Entertainment—(concluded) | |

Warner Bros Discovery, Inc.* | | | 2,683 | | | $ | 21,035 | | |

| | | | | | 4,466,667 | | |

Financial services—4.1% | |

Apollo Global Management, Inc. | | | 7,880 | | | | 911,952 | | |

Berkshire Hathaway, Inc., Class B* | | | 7,617 | | | | 3,625,083 | | |

Corpay, Inc.* | | | 80 | | | | 25,244 | | |

Fidelity National Information Services, Inc. | | | 23,836 | | | | 1,965,278 | | |

Fiserv, Inc.* | | | 631 | | | | 110,173 | | |

Global Payments, Inc. | | | 259 | | | | 28,752 | | |

Jack Henry & Associates, Inc. | | | 99 | | | | 17,130 | | |

Mastercard, Inc., Class A | | | 4,631 | | | | 2,238,347 | | |

PayPal Holdings, Inc.* | | | 1,107 | | | | 80,180 | | |

Visa, Inc., Class A | | | 1,661 | | | | 459,050 | | |

| | | | | | 9,461,189 | | |

Food products—1.1% | |

Archer-Daniels-Midland Co. | | | 275 | | | | 16,772 | | |

Bunge Global SA | | | 9,423 | | | | 955,304 | | |

Campbell Soup Co. | | | 113 | | | | 5,618 | | |

Conagra Brands, Inc. | | | 190 | | | | 5,928 | | |

General Mills, Inc. | | | 296 | | | | 21,398 | | |

Hershey Co. | | | 52 | | | | 10,039 | | |

Hormel Foods Corp. | | | 210 | | | | 6,836 | | |

J.M. Smucker Co. | | | 65 | | | | 7,454 | | |

Kellanova | | | 109 | | | | 8,786 | | |

Kraft Heinz Co. | | | 426 | | | | 15,093 | | |

Lamb Weston Holdings, Inc. | | | 37 | | | | 2,291 | | |

McCormick & Co., Inc. | | | 118 | | | | 9,444 | | |

Mondelez International, Inc., Class A | | | 21,070 | | | | 1,513,037 | | |

Tyson Foods, Inc., Class A | | | 129 | | | | 8,296 | | |

| | | | | | 2,586,296 | | |

Gas utilities—0.0%† | |

Atmos Energy Corp. | | | 293 | | | | 38,307 | | |

Ground transportation—0.6% | |

CSX Corp. | | | 1,320 | | | | 45,236 | | |

JB Hunt Transport Services, Inc. | | | 63 | | | | 10,912 | | |

Lyft, Inc., Class A* | | | 50,257 | | | | 586,499 | | |

Norfolk Southern Corp. | | | 169 | | | | 43,291 | | |

Old Dominion Freight Line, Inc. | | | 132 | | | | 25,449 | | |

Uber Technologies, Inc.* | | | 7,975 | | | | 583,212 | | |

Union Pacific Corp. | | | 418 | | | | 107,046 | | |

| | | | | | 1,401,645 | | |

Health care equipment & supplies—0.8% | |

Abbott Laboratories | | | 1,738 | | | | 196,863 | | |

Align Technology, Inc.* | | | 65 | | | | 15,419 | | |

Baxter International, Inc. | | | 526 | | | | 19,957 | | |

Becton Dickinson & Co. | | | 283 | | | | 68,602 | | |

Boston Scientific Corp.* | | | 1,436 | | | | 117,451 | | |

Cooper Cos., Inc.* | | | 6,909 | | | | 730,489 | | |

Dexcom, Inc.* | | | 395 | | | | 27,389 | | |

Edwards Lifesciences Corp.* | | | 604 | | | | 42,256 | | |

GE HealthCare Technologies, Inc. | | | 417 | | | | 35,370 | | |

Hologic, Inc.* | | | 239 | | | | 19,416 | | |

| | | Number of

shares | | Value | |

Common stocks—(continued) | |

Health care equipment & supplies—(concluded) | |

IDEXX Laboratories, Inc.* | | | 76 | | | $ | 36,581 | | |

Insulet Corp.* | | | 63 | | | | 12,775 | | |

Intuitive Surgical, Inc.* | | | 348 | | | | 171,435 | | |

Medtronic PLC | | | 1,340 | | | | 118,697 | | |

ResMed, Inc. | | | 139 | | | | 34,058 | | |

Solventum Corp.* | | | 140 | | | | 8,975 | | |

STERIS PLC | | | 89 | | | | 21,458 | | |

Stryker Corp. | | | 333 | | | | 120,020 | | |

Teleflex, Inc. | | | 43 | | | | 10,542 | | |

Zimmer Biomet Holdings, Inc. | | | 193 | | | | 22,284 | | |

| | | | | | 1,830,037 | | |

Health care providers & services—1.7% | |

Cardinal Health, Inc. | | | 240 | | | | 27,053 | | |

Cencora, Inc. | | | 163 | | | | 39,050 | | |

Centene Corp.* | | | 520 | | | | 40,992 | | |

Cigna Group | | | 278 | | | | 100,583 | | |

CVS Health Corp. | | | 1,255 | | | | 71,836 | | |

DaVita, Inc.* | | | 40 | | | | 6,037 | | |

Elevance Health, Inc. | | | 225 | | | | 125,300 | | |

HCA Healthcare, Inc. | | | 190 | | | | 75,162 | | |

Henry Schein, Inc.* | | | 104 | | | | 7,337 | | |

Humana, Inc. | | | 117 | | | | 41,473 | | |

Labcorp Holdings, Inc. | | | 78 | | | | 17,931 | | |

McKesson Corp. | | | 125 | | | | 70,135 | | |

Molina Healthcare, Inc.* | | | 56 | | | | 19,588 | | |

Quest Diagnostics, Inc. | | | 120 | | | | 18,836 | | |

UnitedHealth Group, Inc. | | | 5,433 | | | | 3,206,557 | | |

Universal Health Services, Inc., Class B | | | 49 | | | | 11,661 | | |

| | | | | | 3,879,531 | | |

Health care REITs—0.1% | |

Alexandria Real Estate Equities, Inc. | | | 241 | | | | 28,816 | | |

Healthpeak Properties, Inc. | | | 1,202 | | | | 26,781 | | |

Ventas, Inc. | | | 669 | | | | 41,552 | | |

Welltower, Inc. | | | 977 | | | | 117,904 | | |

| | | | | | 215,053 | | |

Hotel & resort REITs—0.0%† | |

Host Hotels & Resorts, Inc. | | | 1,194 | | | | 21,134 | | |

Hotels, restaurants & leisure—1.6% | |

Airbnb, Inc., Class A* | | | 589 | | | | 69,096 | | |

Booking Holdings, Inc. | | | 30 | | | | 117,277 | | |

Caesars Entertainment, Inc.* | | | 217 | | | | 8,168 | | |

Carnival Corp.* | | | 885 | | | | 14,603 | | |

Chipotle Mexican Grill, Inc.* | | | 15,320 | | | | 859,146 | | |

Darden Restaurants, Inc. | | | 110 | | | | 17,396 | | |

Domino's Pizza, Inc. | | | 33 | | | | 13,669 | | |

Expedia Group, Inc.* | | | 105 | | | | 14,604 | | |

Hilton Worldwide Holdings, Inc. | | | 227 | | | | 49,858 | | |

Hyatt Hotels Corp., Class A3 | | | 3,218 | | | | 488,879 | | |

Las Vegas Sands Corp. | | | 15,092 | | | | 588,437 | | |

Marriott International, Inc., Class A | | | 217 | | | | 50,928 | | |

McDonald's Corp. | | | 631 | | | | 182,144 | | |

MGM Resorts International* | | | 273 | | | | 10,262 | | |

3

UBS U.S. Allocation Fund

Portfolio of investments—August 31, 2024

| | | Number of

shares | | Value | |

Common stocks—(continued) | |

Hotels, restaurants & leisure—(concluded) | |

Norwegian Cruise Line Holdings Ltd.* | | | 360 | | | $ | 6,440 | | |

Royal Caribbean Cruises Ltd.* | | | 212 | | | | 34,899 | | |

Starbucks Corp. | | | 11,321 | | | | 1,070,627 | | |

Wynn Resorts Ltd. | | | 75 | | | | 5,766 | | |

Yum! Brands, Inc. | | | 254 | | | | 34,270 | | |

| | | | | | 3,636,469 | | |

Household durables—0.1% | |

DR Horton, Inc. | | | 251 | | | | 47,379 | | |

Garmin Ltd. | | | 149 | | | | 27,310 | | |

Lennar Corp., Class A | | | 203 | | | | 36,958 | | |

Mohawk Industries, Inc.* | | | 38 | | | | 5,895 | | |

NVR, Inc.* | | | 3 | | | | 27,518 | | |

PulteGroup, Inc. | | | 182 | | | | 23,960 | | |

| | | | | | 169,020 | | |

Household products—0.1% | |

Church & Dwight Co., Inc. | | | 90 | | | | 9,169 | | |

Clorox Co. | | | 60 | | | | 9,499 | | |

Colgate-Palmolive Co. | | | 393 | | | | 41,854 | | |

Kimberly-Clark Corp. | | | 142 | | | | 20,542 | | |

Procter & Gamble Co. | | | 1,156 | | | | 198,300 | | |

| | | | | | 279,364 | | |

Independent power and renewable electricity producers—0.2% | |

AES Corp. | | | 22,111 | | | | 378,762 | | |

Vistra Corp. | | | 596 | | | | 50,916 | | |

| | | | | | 429,678 | | |

Industrial conglomerates—0.1% | |

3M Co. | | | 399 | | | | 53,741 | | |

Honeywell International, Inc. | | | 458 | | | | 95,223 | | |

| | | | | | 148,964 | | |

Industrial REITs—0.6% | |

Prologis, Inc. | | | 10,438 | | | | 1,334,185 | | |

Insurance—1.4% | |

Aflac, Inc. | | | 530 | | | | 58,491 | | |

Allstate Corp. | | | 5,988 | | | | 1,131,373 | | |

American International Group, Inc. | | | 689 | | | | 53,087 | | |

Aon PLC, Class A | | | 233 | | | | 80,087 | | |

Arch Capital Group Ltd.* | | | 415 | | | | 46,932 | | |

Arthur J Gallagher & Co. | | | 219 | | | | 64,073 | | |

Assurant, Inc. | | | 67 | | | | 13,155 | | |

Brown & Brown, Inc. | | | 236 | | | | 24,811 | | |

Chubb Ltd. | | | 431 | | | | 122,481 | | |

Cincinnati Financial Corp. | | | 164 | | | | 22,473 | | |

Everest Group Ltd. | | | 49 | | | | 19,220 | | |

Globe Life, Inc. | | | 121 | | | | 12,711 | | |

Hartford Financial Services Group, Inc. | | | 278 | | | | 32,276 | | |

Loews Corp. | | | 238 | | | | 19,502 | | |

Marsh & McLennan Cos., Inc. | | | 4,516 | | | | 1,027,435 | | |

MetLife, Inc. | | | 591 | | | | 45,791 | | |

Principal Financial Group, Inc. | | | 232 | | | | 18,889 | | |

Progressive Corp. | | | 622 | | | | 156,868 | | |

Prudential Financial, Inc. | | | 393 | | | | 47,616 | | |

| | | Number of

shares | | Value | |

Common stocks—(continued) | |

Insurance—(concluded) | |

Travelers Cos., Inc. | | | 241 | | | $ | 54,965 | | |

W.R. Berkley Corp. | | | 314 | | | | 18,746 | | |

Willis Towers Watson PLC | | | 117 | | | | 34,177 | | |

| | | | | | 3,105,159 | | |

Interactive media & services—4.6% | |

Alphabet, Inc., Class A | | | 32,913 | | | | 5,377,326 | | |

Alphabet, Inc., Class C | | | 6,011 | | | | 992,476 | | |

IAC, Inc.* | | | 15,875 | | | | 837,883 | | |

Match Group, Inc.* | | | 278 | | | | 10,344 | | |

Meta Platforms, Inc., Class A | | | 6,493 | | | | 3,384,866 | | |

| | | | | | 10,602,895 | | |

IT services—0.2% | |

Accenture PLC, Class A | | | 644 | | | | 220,216 | | |

Akamai Technologies, Inc.* | | | 149 | | | | 15,174 | | |

Cognizant Technology Solutions Corp., Class A | | | 543 | | | | 42,229 | | |

EPAM Systems, Inc.* | | | 72 | | | | 14,455 | | |

Gartner, Inc.* | | | 80 | | | | 39,357 | | |

GoDaddy, Inc., Class A* | | | 153 | | | | 25,614 | | |

International Business Machines Corp. | | | 940 | | | | 190,002 | | |

VeriSign, Inc.* | | | 78 | | | | 14,344 | | |

| | | | | | 561,391 | | |

Leisure products—0.3% | |

Brunswick Corp. | | | 9,163 | | | | 724,335 | | |

Hasbro, Inc. | | | 116 | | | | 7,907 | | |

| | | | | | 732,242 | | |

Life sciences tools & services—1.3% | |

Agilent Technologies, Inc. | | | 290 | | | | 41,447 | | |

Bio-Rad Laboratories, Inc., Class A* | | | 5,434 | | | | 1,832,997 | | |

Bio-Techne Corp. | | | 142 | | | | 10,507 | | |

Charles River Laboratories International, Inc.* | | | 41 | | | | 8,108 | | |

Danaher Corp. | | | 654 | | | | 176,129 | | |

IQVIA Holdings, Inc.* | | | 2,498 | | | | 628,372 | | |

Mettler-Toledo International, Inc.* | | | 18 | | | | 25,903 | | |

Revvity, Inc. | | | 114 | | | | 13,970 | | |

Thermo Fisher Scientific, Inc. | | | 377 | | | | 231,881 | | |

Waters Corp.* | | | 58 | | | | 20,088 | | |

West Pharmaceutical Services, Inc. | | | 67 | | | | 21,013 | | |

| | | | | | 3,010,415 | | |

Machinery—1.3% | |

Caterpillar, Inc. | | | 348 | | | | 123,923 | | |

Cummins, Inc. | | | 103 | | | | 32,224 | | |

Deere & Co. | | | 189 | | | | 72,905 | | |

Dover Corp. | | | 92 | | | | 17,115 | | |

Fortive Corp. | | | 256 | | | | 19,046 | | |

IDEX Corp. | | | 61 | | | | 12,595 | | |

Illinois Tool Works, Inc. | | | 195 | | | | 49,370 | | |

Ingersoll Rand, Inc. | | | 27,259 | | | | 2,492,836 | | |

Nordson Corp. | | | 42 | | | | 10,776 | | |

Otis Worldwide Corp. | | | 247 | | | | 23,388 | | |

PACCAR, Inc. | | | 367 | | | | 35,298 | | |

4

UBS U.S. Allocation Fund

Portfolio of investments—August 31, 2024

| | | Number of

shares | | Value | |

Common stocks—(continued) | |

Machinery—(concluded) | |

Parker-Hannifin Corp. | | | 97 | | | $ | 58,219 | | |

Pentair PLC | | | 77 | | | | 6,829 | | |

Snap-on, Inc. | | | 38 | | | | 10,782 | | |

Stanley Black & Decker, Inc. | | | 133 | | | | 13,614 | | |

Westinghouse Air Brake Technologies Corp. | | | 130 | | | | 22,044 | | |

Xylem, Inc. | | | 142 | | | | 19,529 | | |

| | | | | | 3,020,493 | | |

Media—0.1% | |

Charter Communications, Inc., Class A* | | | 115 | | | | 39,967 | | |

Comcast Corp., Class A | | | 4,829 | | | | 191,083 | | |

Fox Corp., Class A | | | 277 | | | | 11,459 | | |

Fox Corp., Class B | | | 189 | | | | 7,263 | | |

Interpublic Group of Cos., Inc. | | | 429 | | | | 13,990 | | |

News Corp., Class A | | | 398 | | | | 11,275 | | |

News Corp., Class B | | | 99 | | | | 2,914 | | |

Omnicom Group, Inc. | | | 248 | | | | 24,907 | | |

Paramount Global, Class B | | | 493 | | | | 5,162 | | |

| | | | | | 308,020 | | |

Multi-utilities—0.2% | |

Ameren Corp. | | | 498 | | | | 41,090 | | |

CenterPoint Energy, Inc. | | | 1,229 | | | | 33,552 | | |

CMS Energy Corp. | | | 534 | | | | 36,237 | | |

Consolidated Edison, Inc. | | | 592 | | | | 60,123 | | |

Dominion Energy, Inc. | | | 1,523 | | | | 85,136 | | |

DTE Energy Co. | | | 387 | | | | 48,383 | | |

NiSource, Inc. | | | 846 | | | | 27,969 | | |

Public Service Enterprise Group, Inc. | | | 844 | | | | 68,153 | | |

Sempra | | | 1,144 | | | | 94,014 | | |

WEC Energy Group, Inc. | | | 556 | | | | 51,724 | | |

| | | | | | 546,381 | | |

Office REITs—0.0%† | |

BXP, Inc. | | | 226 | | | | 17,000 | | |

Oil, gas & consumable fuels—2.7% | |

APA Corp. | | | 26,104 | | | | 743,703 | | |

Chevron Corp. | | | 1,677 | | | | 248,112 | | |

ConocoPhillips | | | 1,164 | | | | 132,452 | | |

Coterra Energy, Inc. | | | 648 | | | | 15,766 | | |

Devon Energy Corp. | | | 24,424 | | | | 1,093,707 | | |

Diamondback Energy, Inc. | | | 175 | | | | 34,144 | | |

EOG Resources, Inc. | | | 550 | | | | 70,851 | | |

EQT Corp. | | | 567 | | | | 19,000 | | |

Exxon Mobil Corp. | | | 7,772 | | | | 916,630 | | |

Hess Corp. | | | 273 | | | | 37,690 | | |

Kinder Morgan, Inc. | | | 1,832 | | | | 39,516 | | |

Marathon Oil Corp. | | | 603 | | | | 17,276 | | |

Marathon Petroleum Corp. | | | 356 | | | | 63,055 | | |

Occidental Petroleum Corp. | | | 628 | | | | 35,783 | | |

ONEOK, Inc. | | | 576 | | | | 53,199 | | |

Phillips 66 | | | 401 | | | | 56,264 | | |

Targa Resources Corp. | | | 212 | | | | 31,143 | | |

Valero Energy Corp. | | | 331 | | | | 48,568 | | |

| | | Number of

shares | | Value | |

Common stocks—(continued) | |

Oil, gas & consumable fuels—(concluded) | |

Williams Cos., Inc. | | | 54,467 | | | $ | 2,492,955 | | |

| | | | | | 6,149,814 | | |

Passenger airlines—0.0%† | |

American Airlines Group, Inc.* | | | 301 | | | | 3,197 | | |

Delta Air Lines, Inc. | | | 448 | | | | 19,035 | | |

Southwest Airlines Co.3 | | | 342 | | | | 9,891 | | |

United Airlines Holdings, Inc.* | | | 238 | | | | 10,481 | | |

| | | | | | 42,604 | | |

Personal care products—0.0%† | |

Estee Lauder Cos., Inc., Class A | | | 112 | | | | 10,266 | | |

Kenvue, Inc. | | | 939 | | | | 20,611 | | |

| | | | | | 30,877 | | |

Pharmaceuticals—2.4% | |

Bristol-Myers Squibb Co. | | | 38,120 | | | | 1,904,094 | | |

Catalent, Inc.* | | | 182 | | | | 11,095 | | |

Eli Lilly & Co. | | | 2,723 | | | | 2,614,134 | | |

Johnson & Johnson | | | 2,369 | | | | 392,922 | | |

Merck & Co., Inc. | | | 2,475 | | | | 293,164 | | |

Pfizer, Inc. | | | 5,483 | | | | 159,062 | | |

Viatris, Inc. | | | 1,179 | | | | 14,242 | | |

Zoetis, Inc. | | | 446 | | | | 81,837 | | |

| | | | | | 5,470,550 | | |

Professional services—0.1% | |

Automatic Data Processing, Inc. | | | 292 | | | | 80,566 | | |

Broadridge Financial Solutions, Inc. | | | 95 | | | | 20,222 | | |

Dayforce, Inc.*,3 | | | 93 | | | | 5,317 | | |

Equifax, Inc. | | | 94 | | | | 28,870 | | |

Jacobs Solutions, Inc. | | | 82 | | | | 12,372 | | |

Leidos Holdings, Inc. | | | 101 | | | | 16,009 | | |

Paychex, Inc. | | | 224 | | | | 29,389 | | |

Paycom Software, Inc. | | | 37 | | | | 6,023 | | |

Verisk Analytics, Inc. | | | 108 | | | | 29,464 | | |

| | | | | | 228,232 | | |

Real estate management & development—0.1% | |

CBRE Group, Inc., Class A* | | | 485 | | | | 55,843 | | |

CoStar Group, Inc.* | | | 645 | | | | 49,858 | | |

| | | | | | 105,701 | | |

Residential REITs—0.1% | |

AvalonBay Communities, Inc. | | | 211 | | | | 47,629 | | |

Camden Property Trust | | | 156 | | | | 19,531 | | |

Equity Residential | | | 572 | | | | 42,832 | | |

Essex Property Trust, Inc. | | | 89 | | | | 26,859 | | |

Invitation Homes, Inc. | | | 967 | | | | 35,624 | | |

Mid-America Apartment Communities, Inc. | | | 170 | | | | 27,603 | | |

UDR, Inc. | | | 512 | | | | 22,789 | | |

| | | | | | 222,867 | | |

5

UBS U.S. Allocation Fund

Portfolio of investments—August 31, 2024

| | | Number of

shares | | Value | |

Common stocks—(continued) | |

Retail REITs—0.1% | |

Federal Realty Investment Trust | | | 109 | | | $ | 12,535 | | |

Kimco Realty Corp. | | | 1,133 | | | | 26,354 | | |

Realty Income Corp. | | | 1,388 | | | | 86,209 | | |

Regency Centers Corp. | | | 260 | | | | 18,899 | | |

Simon Property Group, Inc. | | | 518 | | | | 86,687 | | |

| | | | | | 230,684 | | |

Semiconductors & semiconductor equipment—6.8% | |

Advanced Micro Devices, Inc.* | | | 5,324 | | | | 790,933 | | |

Analog Devices, Inc. | | | 503 | | | | 118,124 | | |

Applied Materials, Inc. | | | 860 | | | | 169,644 | | |

Broadcom, Inc. | | | 17,171 | | | | 2,795,782 | | |

Enphase Energy, Inc.* | | | 127 | | | | 15,372 | | |

First Solar, Inc.* | | | 107 | | | | 24,329 | | |

Intel Corp. | | | 27,922 | | | | 615,401 | | |

KLA Corp. | | | 141 | | | | 115,540 | | |

Lam Research Corp. | | | 137 | | | | 112,478 | | |

Marvell Technology, Inc. | | | 7,407 | | | | 564,710 | | |

Microchip Technology, Inc. | | | 592 | | | | 48,639 | | |

Micron Technology, Inc. | | | 10,062 | | | | 968,367 | | |

Monolithic Power Systems, Inc. | | | 48 | | | | 44,865 | | |

NVIDIA Corp. | | | 72,632 | | | | 8,670,082 | | |

NXP Semiconductors NV | | | 256 | | | | 65,628 | | |

ON Semiconductor Corp.* | | | 456 | | | | 35,509 | | |

Qorvo, Inc.* | | | 104 | | | | 12,052 | | |

QUALCOMM, Inc. | | | 1,171 | | | | 205,276 | | |

Skyworks Solutions, Inc. | | | 146 | | | | 16,000 | | |

Teradyne, Inc. | | | 162 | | | | 22,150 | | |

Texas Instruments, Inc. | | | 941 | | | | 201,694 | | |

| | | | | | 15,612,575 | | |

Software—6.4% | |

Adobe, Inc.* | | | 461 | | | | 264,803 | | |

ANSYS, Inc.* | | | 87 | | | | 27,964 | | |

Autodesk, Inc.* | | | 214 | | | | 55,298 | | |

Cadence Design Systems, Inc.* | | | 271 | | | | 72,880 | | |

Crowdstrike Holdings, Inc., Class A* | | | 2,236 | | | | 619,998 | | |

Dynatrace, Inc.* | | | 15,865 | | | | 803,086 | | |

Fair Isaac Corp.* | | | 24 | | | | 41,526 | | |

Fortinet, Inc.* | | | 652 | | | | 50,015 | | |

Gen Digital, Inc. | | | 625 | | | | 16,538 | | |

HubSpot, Inc.* | | | 1,439 | | | | 718,162 | | |

Intuit, Inc. | | | 285 | | | | 179,624 | | |

Microsoft Corp. | | | 22,146 | | | | 9,237,982 | | |

Oracle Corp. | | | 8,534 | | | | 1,205,769 | | |

Palo Alto Networks, Inc.* | | | 338 | | | | 122,599 | | |

PTC, Inc.* | | | 119 | | | | 21,312 | | |

Roper Technologies, Inc. | | | 109 | | | | 60,431 | | |

Salesforce, Inc. | | | 1,017 | | | | 257,199 | | |

ServiceNow, Inc.* | | | 209 | | | | 178,695 | | |

Synopsys, Inc.* | | | 159 | | | | 82,613 | | |

Tyler Technologies, Inc.* | | | 42 | | | | 24,691 | | |

Zoom Video Communications, Inc., Class A* | | | 9,454 | | | | 653,082 | | |

| | | | | | 14,694,267 | | |

| | | Number of

shares | | Value | |

Common stocks—(continued) | |

Specialized REITs—0.3% | |

American Tower Corp. | | | 765 | | | $ | 171,406 | | |

Crown Castle, Inc. | | | 717 | | | | 80,318 | | |

Digital Realty Trust, Inc. | | | 527 | | | | 79,899 | | |

Equinix, Inc. | | | 151 | | | | 125,988 | | |

Extra Space Storage, Inc. | | | 337 | | | | 59,649 | | |

Iron Mountain, Inc. | | | 473 | | | | 53,572 | | |

Public Storage | | | 253 | | | | 86,961 | | |

SBA Communications Corp. | | | 172 | | | | 38,986 | | |

VICI Properties, Inc. | | | 1,753 | | | | 58,690 | | |

Weyerhaeuser Co. | | | 1,231 | | | | 37,533 | | |

| | | | | | 793,002 | | |

Specialty retail—0.3% | |

AutoZone, Inc.* | | | 16 | | | | 50,904 | | |

Bath & Body Works, Inc. | | | 221 | | | | 6,798 | | |

Best Buy Co., Inc. | | | 177 | | | | 17,771 | | |

CarMax, Inc.* | | | 134 | | | | 11,330 | | |

Home Depot, Inc. | | | 868 | | | | 319,858 | | |

Lowe's Cos., Inc. | | | 494 | | | | 122,759 | | |

O'Reilly Automotive, Inc.* | | | 53 | | | | 59,888 | | |

Ross Stores, Inc. | | | 286 | | | | 43,074 | | |

TJX Cos., Inc. | | | 957 | | | | 112,227 | | |

Tractor Supply Co. | | | 105 | | | | 28,093 | | |

Ulta Beauty, Inc.* | | | 43 | | | | 15,172 | | |

| | | | | | 787,874 | | |

Technology hardware, storage & peripherals—4.3% | |

Apple, Inc. | | | 42,107 | | | | 9,642,503 | | |

Hewlett Packard Enterprise Co. | | | 1,291 | | | | 25,007 | | |

HP, Inc. | | | 828 | | | | 29,957 | | |

NetApp, Inc. | | | 222 | | | | 26,800 | | |

Seagate Technology Holdings PLC | | | 204 | | | | 20,308 | | |

Super Micro Computer, Inc.*,3 | | | 55 | | | | 24,073 | | |

Western Digital Corp.* | | | 320 | | | | 20,989 | | |

| | | | | | 9,789,637 | | |

Textiles, apparel & luxury goods—0.4% | |

Deckers Outdoor Corp.* | | | 25 | | | | 23,982 | | |

Lululemon Athletica, Inc.* | | | 94 | | | | 24,390 | | |

NIKE, Inc., Class B | | | 9,609 | | | | 800,622 | | |

Ralph Lauren Corp. | | | 50 | | | | 8,563 | | |

Tapestry, Inc. | | | 196 | | | | 8,030 | | |

| | | | | | 865,587 | | |

Tobacco—0.1% | |

Altria Group, Inc. | | | 831 | | | | 44,683 | | |

Philip Morris International, Inc. | | | 763 | | | | 94,070 | | |

| | | | | | 138,753 | | |

Trading companies & distributors—0.0%† | |

Fastenal Co. | | | 356 | | | | 24,308 | | |

United Rentals, Inc. | | | 51 | | | | 37,804 | | |

WW Grainger, Inc. | | | 35 | | | | 34,472 | | |

| | | | | | 96,584 | | |

6

UBS U.S. Allocation Fund

Portfolio of investments—August 31, 2024

| | | Number of

shares | | Value | |

Common stocks—(concluded) | |

Water utilities—0.0%† | |

American Water Works Co., Inc. | | | 362 | | | $ | 51,809 | | |

Wireless telecommunication services—0.5% | |

T-Mobile U.S., Inc. | | | 6,263 | | | | 1,244,583 | | |

Total common stocks

(cost—$111,722,905) | | | 142,881,761 | | |

Preferred stocks—0.0%† | |

Financial services—0.0%† | |

SquareTwo Financial Corp.*,1,2

(cost—$0) | | | 35,000 | | | | 0 | | |

Exchange traded funds—3.3% | |

Invesco S&P 500 Equal Weight ETF | | | 26,621 | | | | 4,681,835 | | |

iShares Core S&P Mid-Cap ETF | | | 46,294 | | | | 2,865,136 | | |

Total exchange traded funds

(cost—$6,897,090) | | | 7,546,971 | | |

| | | Face

amount | | | |

Asset-backed securities—6.4% | |

AmeriCredit Automobile Receivables Trust,

Series 2020-2, Class C,

1.480%, due 02/18/26 | | $ | 61,322 | | | | 61,119 | | |

Series 2022-1, Class A3,

2.450%, due 11/18/26 | | | 266,466 | | | | 263,857 | | |

ARES XLVIII CLO Ltd.,

Series 2018-48A, Class C,

3 mo. USD Term SOFR + 2.062%

7.344%, due 07/20/304,5 | | | 725,000 | | | | 726,541 | | |

BMW Vehicle Lease Trust,

Series 2024-1, Class A3,

4.980%, due 03/25/27 | | | 200,000 | | | | 201,087 | | |

Capital One Multi-Asset Execution Trust,

Series 2005-B3, Class B3,

3 mo. USD Term SOFR + 0.812%

6.113%, due 05/15/285 | | | 350,000 | | | | 349,585 | | |

CCG Receivables Trust,

Series 2024-1, Class A2,

4.990%, due 03/15/324 | | | 475,000 | | | | 475,550 | | |

Dell Equipment Finance Trust,

Series 2024-1, Class D,

6.120%, due 09/23/304 | | | 150,000 | | | | 153,378 | | |

Series 2023-3, Class D,

6.750%, due 10/22/294 | | | 650,000 | | | | 669,675 | | |

DLLMT LLC,

Series 2024-1A, Class A3,

4.840%, due 08/21/284 | | | 475,000 | | | | 476,207 | | |

Drive Auto Receivables Trust,

Series 2021-1, Class D,

1.450%, due 01/16/29 | | | 352,597 | | | | 345,490 | | |

Series 2024-1, Class A3,

5.350%, due 02/15/28 | | | 200,000 | | | | 200,758 | | |

DT Auto Owner Trust,

Series 2021-1A, Class D,

1.160%, due 11/16/264 | | | 295,731 | | | | 290,491 | | |

| | | Face

amount | | Value | |

Asset-backed securities—(continued) | |

Enterprise Fleet Financing LLC,

Series 2023-2, Class A2,

5.560%, due 04/22/304 | | $ | 544,191 | | | $ | 547,460 | | |

Series 2024-2, Class A2,

5.740%, due 12/20/264 | | | 150,000 | | | | 151,396 | | |

Exeter Automobile Receivables Trust,

Series 2024-4A, Class C,

5.480%, due 08/15/30 | | | 150,000 | | | | 151,522 | | |

Series 2024-3A, Class B,

5.570%, due 09/15/28 | | | 475,000 | | | | 481,042 | | |

Series 2023-4A, Class A2,

6.070%, due 12/15/25 | | | 35,917 | | | | 35,919 | | |

GM Financial Automobile Leasing Trust,

Series 2023-1, Class B,

5.510%, due 01/20/27 | | | 475,000 | | | | 477,423 | | |

HPEFS Equipment Trust,

Series 2022-1A, Class B,

1.790%, due 05/21/294 | | | 220,819 | | | | 220,357 | | |

Series 2024-1A, Class D,

5.820%, due 11/20/314 | | | 500,000 | | | | 509,123 | | |

Series 2024-2A, Class D,

5.820%, due 04/20/324 | | | 475,000 | | | | 484,996 | | |

Hyundai Auto Lease Securitization Trust,

Series 2024-B, Class B,

5.560%, due 08/15/284 | | | 475,000 | | | | 483,247 | | |

Hyundai Auto Receivables Trust,

Series 2024-A, Class C,

5.270%, due 07/15/31 | | | 475,000 | | | | 484,632 | | |

OneMain Financial Issuance Trust,

Series 2021-1A, Class A1,

1.550%, due 06/16/364 | | | 600,000 | | | | 558,252 | | |

Series 2020-2A, Class A,

1.750%, due 09/14/354 | | | 600,000 | | | | 570,912 | | |

Series 2020-2A, Class B,

2.210%, due 09/14/354 | | | 300,000 | | | | 278,766 | | |

Santander Drive Auto Receivables Trust,

Series 2020-4, Class D,

1.480%, due 01/15/27 | | | 82,999 | | | | 82,297 | | |

Series 2022-5, Class C,

4.740%, due 10/16/28 | | | 475,000 | | | | 473,125 | | |

Series 2024-4, Class C,

4.950%, due 04/15/30 | | | 300,000 | | | | 300,341 | | |

Series 2023-2, Class A3,

5.210%, due 07/15/27 | | | 437,251 | | | | 436,949 | | |

Series 2023-3, Class A3,

5.610%, due 10/15/27 | | | 600,000 | | | | 601,365 | | |

Series 2024-3, Class C,

5.640%, due 08/15/30 | | | 475,000 | | | | 485,451 | | |

Series 2023-3, Class A2,

6.080%, due 08/17/26 | | | 217,160 | | | | 217,286 | | |

Series 2023-6, Class A2,

6.080%, due 05/17/27 | | | 259,846 | | | | 260,404 | | |

Series 2023-4, Class A2,

6.180%, due 02/16/27 | | | 395,346 | | | | 396,040 | | |

SCF Equipment Leasing LLC,

Series 2022-2A, Class A3,

6.500%, due 10/21/304 | | | 500,000 | | | | 505,907 | | |

7

UBS U.S. Allocation Fund

Portfolio of investments—August 31, 2024

| | | Face

amount | | Value | |

Asset-backed securities—(concluded) | |

SFS Auto Receivables Securitization Trust,

Series 2024-1A, Class A2,

5.350%, due 06/21/274 | | $ | 402,414 | | | $ | 402,466 | | |

Synchrony Card Funding LLC,

Series 2024-A1, Class A,

5.040%, due 03/15/30 | | | 475,000 | | | | 481,776 | | |

Westlake Automobile Receivables Trust,

Series 2020-3A, Class D,

1.650%, due 02/17/264 | | | 100,537 | | | | 100,371 | | |

World Financial Network Credit Card

Master Note Trust,

Series 2024-B, Class A,

4.620%, due 05/15/31 | | | 250,000 | | | | 250,293 | | |

Total asset-backed securities

(cost—$14,631,726) | | | 14,642,856 | | |

Corporate bonds—13.5% | |

Advertising—0.0%† | |

Clear Channel Outdoor Holdings, Inc.

5.125%, due 08/15/274 | | | 35,000 | | | | 34,192 | | |

7.875%, due 04/01/304 | | | 20,000 | | | | 20,897 | | |

| | | | | | 55,089 | | |

Aerospace & defense—0.1% | |

AAR Escrow Issuer LLC,

6.750%, due 03/15/294 | | | 40,000 | | | | 41,406 | | |

Bombardier, Inc.

7.000%, due 06/01/324 | | | 40,000 | | | | 41,640 | | |

7.250%, due 07/01/314 | | | 10,000 | | | | 10,497 | | |

7.875%, due 04/15/274 | | | 30,000 | | | | 30,102 | | |

8.750%, due 11/15/304 | | | 40,000 | | | | 43,620 | | |

TransDigm, Inc.

6.375%, due 03/01/294 | | | 25,000 | | | | 25,764 | | |

6.625%, due 03/01/324 | | | 28,000 | | | | 29,119 | | |

7.125%, due 12/01/314 | | | 10,000 | | | | 10,560 | | |

| | | | | | 232,708 | | |

Agriculture—0.0%† | |

Reynolds American, Inc.,

5.700%, due 08/15/35 | | | 70,000 | | | | 71,673 | | |

Airlines—0.2% | |

Allegiant Travel Co.,

7.250%, due 08/15/274 | | | 15,000 | | | | 14,241 | | |

American Airlines, Inc.,

7.250%, due 02/15/284 | | | 25,000 | | | | 25,156 | | |

American Airlines, Inc./AAdvantage Loyalty IP Ltd.

5.500%, due 04/20/264 | | | 9,334 | | | | 9,285 | | |

5.750%, due 04/20/294 | | | 15,000 | | | | 14,703 | | |

Delta Air Lines Pass-Through Trust,

Series 2020-1,Class AA

2.000%, due 06/10/28 | | | 83,691 | | | | 77,805 | | |

JetBlue Airways Corp./JetBlue Loyalty LP,

9.875%, due 09/20/314 | | | 25,000 | | | | 24,709 | | |

Mileage Plus Holdings LLC/Mileage Plus

Intellectual Property Assets Ltd.,

6.500%, due 06/20/274 | | | 270,000 | | | | 272,506 | | |

| | | Face

amount | | Value | |

Corporate bonds—(continued) | |

Airlines—(concluded) | |

United Airlines, Inc.

4.375%, due 04/15/264 | | $ | 38,000 | | | $ | 37,083 | | |

4.625%, due 04/15/294 | | | 30,000 | | | | 28,557 | | |

VistaJet Malta Finance PLC/Vista

Management Holding, Inc.,

9.500%, due 06/01/284 | | | 40,000 | | | | 37,407 | | |

| | | | | | 541,452 | | |

Auto manufacturers—0.2% | |

Ford Motor Co.

7.450%, due 07/16/31 | | | 55,000 | | | | 60,526 | | |

9.625%, due 04/22/30 | | | 30,000 | | | | 35,608 | | |

Ford Motor Credit Co. LLC,

4.542%, due 08/01/26 | | | 200,000 | | | | 197,736 | | |

General Motors Co.,

6.600%, due 04/01/36 | | | 200,000 | | | | 216,526 | | |

| | | | | | 510,396 | | |

Auto parts & equipment—0.1% | |

American Axle & Manufacturing, Inc.,

6.500%, due 04/01/27 | | | 25,000 | | | | 25,129 | | |

Dana, Inc.

4.250%, due 09/01/30 | | | 20,000 | | | | 18,012 | | |

5.625%, due 06/15/28 | | | 20,000 | | | | 19,712 | | |

Goodyear Tire & Rubber Co.,

5.250%, due 07/15/31 | | | 86,000 | | | | 78,000 | | |

Phinia, Inc.,

6.750%, due 04/15/294 | | | 30,000 | | | | 30,785 | | |

| | | | | | 171,638 | | |

Banks—2.2% | |

Bank of America Corp.

(fixed, converts to FRN on 03/20/50)

4.083%, due 03/20/515 | | | 75,000 | | | | 63,121 | | |

6.110%, due 01/29/37 | | | 450,000 | | | | 488,796 | | |

Series X,

(fixed, converts to FRN on 09/05/24)

6.250%, due 09/05/245,6 | | | 60,000 | | | | 59,920 | | |

Series Z,

(fixed, converts to FRN on 10/23/24)

6.500%, due 10/23/245,6 | | | 30,000 | | | | 29,981 | | |

Bank of Nova Scotia,

(fixed, converts to FRN on 05/04/32)

4.588%, due 05/04/375 | | | 100,000 | | | | 93,776 | | |

Barclays Bank PLC,

3 mo. EURIBOR + 0.710%

4.429%, due 12/15/245,6,7 | | | 60,000 | | | | 63,339 | | |

Barclays PLC,

(fixed, converts to FRN on 08/09/32)

5.746%, due 08/09/335 | | | 400,000 | | | | 413,659 | | |

Citigroup, Inc.

(fixed, converts to FRN on 03/20/29)

3.980%, due 03/20/305 | | | 175,000 | | | | 169,904 | | |

5.500%, due 09/13/25 | | | 175,000 | | | | 175,893 | | |

6.675%, due 09/13/43 | | | 200,000 | | | | 228,750 | | |

8

UBS U.S. Allocation Fund

Portfolio of investments—August 31, 2024

| | | Face

amount | | Value | |

Corporate bonds—(continued) | |

Banks—(concluded) | |

Deutsche Bank AG,

(fixed, converts to FRN on 01/07/27)

2.552%, due 01/07/285 | | $ | 150,000 | | | $ | 141,845 | | |

Freedom Mortgage Corp.,

12.000%, due 10/01/284 | | | 55,000 | | | | 59,874 | | |

Goldman Sachs Group, Inc.

3.750%, due 02/25/26 | | | 150,000 | | | | 148,284 | | |

5.150%, due 05/22/45 | | | 110,000 | | | | 108,096 | | |

HSBC Holdings PLC,

6.500%, due 09/15/37 | | | 200,000 | | | | 216,382 | | |

JPMorgan Chase & Co.

3.875%, due 09/10/24 | | | 300,000 | | | | 299,887 | | |

(fixed, converts to FRN on 07/24/47)

4.032%, due 07/24/485 | | | 400,000 | | | | 339,515 | | |

Lloyds Banking Group PLC,

4.582%, due 12/10/25 | | | 400,000 | | | | 396,940 | | |

Mitsubishi UFJ Financial Group, Inc.,

3.677%, due 02/22/27 | | | 350,000 | | | | 343,855 | | |

Morgan Stanley

4.300%, due 01/27/45 | | | 200,000 | | | | 179,406 | | |

4.350%, due 09/08/26 | | | 590,000 | | | | 586,888 | | |

(fixed, converts to FRN on 02/07/34)

5.942%, due 02/07/395 | | | 100,000 | | | | 103,218 | | |

Royal Bank of Canada,

2.300%, due 11/03/31 | | | 100,000 | | | | 86,293 | | |

Societe Generale SA,

4.000%, due 01/12/274 | | | 200,000 | | | | 195,476 | | |

Sumitomo Mitsui Financial Group, Inc.,

3.544%, due 01/17/28 | | | 150,000 | | | | 145,290 | | |

| | | | | | 5,138,388 | | |

Beverages—0.1% | |

Anheuser-Busch Cos. LLC/Anheuser-Busch

InBev Worldwide, Inc.

4.700%, due 02/01/36 | | | 75,000 | | | | 74,077 | | |

4.900%, due 02/01/46 | | | 130,000 | | | | 124,811 | | |

| | | | | | 198,888 | | |

Biotechnology—0.2% | |

Amgen, Inc.,

5.250%, due 03/02/33 | | | 150,000 | | | | 154,151 | | |

Gilead Sciences, Inc.

2.950%, due 03/01/27 | | | 200,000 | | | | 193,661 | | |

4.750%, due 03/01/46 | | | 50,000 | | | | 46,323 | | |

| | | | | | 394,135 | | |

Building Materials—0.2% | |

Builders FirstSource, Inc.

4.250%, due 02/01/324 | | | 10,000 | | | | 9,137 | | |

5.000%, due 03/01/304 | | | 30,000 | | | | 29,163 | | |

6.375%, due 06/15/324 | | | 10,000 | | | | 10,299 | | |

Carrier Global Corp.,

6.200%, due 03/15/54 | | | 100,000 | | | | 113,384 | | |

Knife River Corp.,

7.750%, due 05/01/314 | | | 30,000 | | | | 31,761 | | |

Masco Corp.,

4.500%, due 05/15/47 | | | 100,000 | | | | 86,161 | | |

| | | Face

amount | | Value | |

Corporate bonds—(continued) | |

Building Materials—(concluded) | |

Smyrna Ready Mix Concrete LLC

6.000%, due 11/01/284 | | $ | 51,000 | | | $ | 50,897 | | |

8.875%, due 11/15/314 | | | 30,000 | | | | 32,202 | | |

Summit Materials LLC/Summit Materials

Finance Corp.,

5.250%, due 01/15/294 | | | 15,000 | | | | 14,848 | | |

| | | | | | 377,852 | | |

Chemicals—0.4% | |

Celanese U.S. Holdings LLC,

6.379%, due 07/15/32 | | | 150,000 | | | | 158,556 | | |

CF Industries, Inc.,

5.150%, due 03/15/34 | | | 100,000 | | | | 99,708 | | |

Chemours Co.,

4.625%, due 11/15/294 | | | 45,000 | | | | 39,587 | | |

LYB International Finance II BV,

3.500%, due 03/02/27 | | | 150,000 | | | | 146,295 | | |

LYB International Finance III LLC,

3.625%, due 04/01/51 | | | 100,000 | | | | 72,027 | | |

NOVA Chemicals Corp.