UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-06292

______________________________________________

UBS Investment Trust

______________________________________________________________________________

(Exact name of registrant as specified in charter)

51 West 52nd Street, New York, New York 10019-6114

______________________________________________________________________________

(Address of principal executive offices) (Zip code)

Mark F. Kemper, Esq.

UBS Global Asset Management

51 West 52nd Street

New York, NY 10019-6114 |

| (Name and address of agent for service) |

| |

| Copy to: |

Jack W. Murphy, Esq.

Dechert LLP

1775 I Street, N.W.

Washington, DC 20006-2401 |

Registrant’s telephone number, including area code: 212-882 5000

Date of fiscal year end: August 31

Date of reporting period: August 31, 2007

Item 1. Reports to Stockholders.

UBS U.S. Allocation Fund

Annual Report

August 31, 2007

UBS U.S. Allocation Fund

October 15, 2007

Dear shareholder,

We present you with the annual report for UBS U.S. Allocation Fund (the “Fund”) for the 12 months ended August 31, 2007.

PerformanceOver the 12 months ended August 31, 2007, the Fund’s Class A shares returned 11.04% before deducting the maximum sales charge; after deducting the maximum sales charge, the Fund’s Class A shares returned 4.95%. During the same period, the U.S. Allocation Fund Index* (the “Index”) returned 11.62%, and the S&P 500 Index returned 15.13%. (Returns for all share classes over various time periods are shown in “Performance at a glance” on page 9; please note that the returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.) | | |

UBS U.S. Allocation Fund | |

| | | | |

| | | Investment goal: | |

| | | Total return, consisting of long-term capital appreciation and current income | |

| | | | |

| | | Portfolio Managers: | |

| | | Portfolio Management Team,

including Brian D. Singer, CFA

UBS Global Asset

Management (Americas) Inc. | |

| | | | |

| | | Commencement: | |

| | | Class A—May 10, 1993 | |

| | | Class B—January 30, 1996 | |

| | | Class C—July 22, 1992 | |

| | | Class Y—May 10, 1993 | |

| | | | |

| | | Dividend payments: | |

| | | Annually, if any

| |

| | | | | |

| An interview with Lead Portfolio Manager Brian D. Singer |

| Q. | How would you describe the economic environment during the reporting period? |

| A. | US economic growth was mixed during the fiscal year. Gross domestic product—or “GDP,” which represents the market value of all final goods and services produced within a country in a given period of time—grew 1.1% and 2.1% in the third and fourth quarters of 2006, respectively. However, the economy weakened meaningfully during the first quarter of 2007, coming in at a modest 0.6%—the slowest rate of growth in |

| | |

| * | An unmanaged index compiled by the advisor, constructed as follows: from July 22, 1992 (the Fund’s inception) until February 29, 2004: 100% S&P 500 Index; from March 1, 2004 until May 31, 2005: 65% Russell 3000 Index, 30% Lehman Brothers US Aggregate Bond Index, 5% Merrill Lynch US High Yield Cash Pay Index; and from June 1, 2005 until present: 65% Russell 3000 Index, 30% Lehman Brothers US Aggregate Bond Index, 5% Merrill Lynch US High Yield Cash Pay Constrained Index. |

1

UBS U.S. Allocation Fund

| | the US since the fourth quarter of 2002. The slowdown was attributed to a variety of factors, including the cooling of the housing market and relatively tepid business spending.

As the fiscal year drew to a close, improving manufacturing activity and strong exports provided a boost to the economy, and the final number for second quarter GDP was 3.8%. Despite this uptick, the economic growth outlook for the remainder of 2007 is less robust, in our view. The combination of financial market volatility with tight credit conditions, ongoing housing market troubles, and concerns over subprime mortgage lending—the practice of making loans to borrowers who do not qualify for the best market interest rates because of their deficient credit history—is likely to impact both consumer and business spending. |

| | |

| Q. | How did the Federal Reserve Board (the “Fed”) react to the economic environment and the issues in the subprime mortgage market? |

| A. | Fed Chairman Ben Bernanke initially indicated that the issues related to the subprime mortgage market would probably not impact the overall economy. During Mr. Bernanke’s remarks to Congress in late March 2007, he stated that subprime defaults were “likely to be contained.” However, as the fallout from subprime mortgages escalated, the Fed became more concerned about these issues. On July 18, 2007, the Fed Chairman told Congress that “rising delinquencies and foreclosures are creating personal, economic and social distress for many homeowners and communities—problems that likely will get worse before they get better.”

As credit concerns mounted, the Fed provided greater amounts of liquidity to the market in order to facilitate normal market operations. In mid-August, the Fed lowered the discount rate—the rate the Fed uses for loans it makes directly to banks—from 6.25% to 5.75%. After the reporting period ended on August 31, 2007, the Fed continued to take action by reducing the federal funds rate from 5.25% to 4.75%. (The federal funds rate, or “fed funds” rate, is the rate that banks charge one another for funds they borrow on an overnight basis.) This was the first reduction in the federal funds rate since June 2003.

In its statement accompanying the September meeting, the Fed stated, “Economic growth was moderate during the first half of the year, but the tightening of credit conditions has the potential to intensify the housing correction and to restrain economic growth more generally. Today’s action is intended to help forestall some of the adverse effects on the broader economy that might otherwise arise from the disruptions in financial markets and to promote moderate growth over time.” |

2

UBS U.S. Allocation Fund

| Q. | How did the stock market perform during the reporting period? |

| A. | While the US stock market experienced periods of extreme volatility during the reporting period, it generated strong results overall, returning 15.13% as measured by the S&P 500 Index. With the exception of February 2007, the market generated positive results in each of the first eight months of the reporting period. Stocks then weakened significantly in June and July, due in part to the escalating negative news related to the US subprime mortgage market and fears that this would spill over into the broader corporate debt and loan markets.

In addition, investor concerns arose that the robust merger and acquisition environment, which had been supporting the market in recent years, would be impacted by the credit crunch. After falling from a peak in July, stock prices then rallied in August as the Fed lowered the discount rate and investors anticipated that the Fed’s next step would be to reduce the federal funds rate. |

| | |

| Q. | Did the bond market generate positive results as well during the reporting period? |

| A. | After advancing modestly during the first half of the reporting period, Treasury yields moved sharply higher during the second quarter of 2007. This was due, in part, to inflationary fears, a solid job market and expectations that the Fed would not be cutting short-term rates in the near future. Toward the end of the fiscal year, the turmoil in the subprime mortgage market triggered a massive flight to quality. This caused both short- and long-term Treasury yields to move sharply lower (which pushed fixed income prices higher) in July and August. In contrast, most other segments of the fixed income market experienced rapid spread widening and falling prices. (Spread represents the difference between the yield paid on US Treasury bonds and higher-risk securities.) During the reporting period, the overall US bond market, as measured by the Lehman Brothers US Aggregate Bond Index, returned 5.26%. |

| | |

| Q. | How was the Portfolio allocated at the end of the reporting period? |

| A. | As of August 31, 2007, the Fund’s net assets were allocated as follows: approximately 69% was invested in US equities; 23% was invested in investment grade US bonds; 5% was in high yield securities, and 3% was invested in cash equivalents. |

| | |

| | In comparison, at the time of the semiannual report, on February 28, 2007, the Fund’s net assets were allocated as follows: 66% was invested in US stocks; 30% was invested in investment grade US bonds; 2% was invested in high yield securities, and 2% was invested in cash equivalents. |

3

UBS U.S. Allocation Fund

| | We kept the allocation steady during the first part of the reporting period, but made several adjustments to the Fund’s allocation during the second half of the reporting period. In February 2007, we took advantage of the selloff in the bond market by increasing the Fund’s exposure to bonds while maintaining our allocation to high yield securities. This shift was done in concert with reducing our position in cash equivalents. We had been holding cash for some time (instead of holding the full benchmark exposure to US bonds), as we perceived bonds to be inferior to cash from a risk/return perspective. However, in our opinion, the selloff in bonds increased the attractiveness of the fixed income asset class relative to cash, warranting a change in strategy.

In July, following 2007’s second flight to quality in the bond market, high yield spreads widened sharply. As a result of this widening, high yield debt valuations moved from being overvalued to within our fair value range. In response, we increased the Fund’s high yield allocation to a position of 5%, in line with the Fund’s benchmark. To do so, we reduced the Fund’s allocation to investment grade bonds. |

| | |

| Q. | Which portions of the Fund performed well during the period and which areas produced disappointing results? |

| A. | During the fiscal year, we continued to rely on our bottom-up research process to guide sector allocation and stock selection for the Fund. For the period as a whole, our sector positioning enhanced relative results, while our security selection had a slight negative impact on performance.

In the equity component of the Fund, we held overweight positions in pharmaceuticals, banks and autos, and underweights in energy and materials. Later in the fiscal year, we also moved to an underweight position in capital goods stocks.

The Fund’s overweight to banks negatively impacted performance, as the financial sector, in general, underperformed during the period. Investors’ focus on subprime lending issues and levered debt weighed heavily on stock prices. An underweight to oil refining also detracted from performance, as that sector delivered strong returns during the reporting period. However, we continue to find this area unattractive, as we believe that current oil prices are not sustainable. |

| | |

| | In terms of the Fund’s fixed income exposure, we remained moderately defensive in terms of duration for most of the period. (Duration is a measure of a security’s sensitivity to changes in interest rates.) Specifically, our underweight duration exposure in the five- to 10-year part of the yield curve expressed our view that we expected yields in this area to rise |

4

UBS U.S. Allocation Fund

| | relative to the short end of the curve. Late in the period, we extended the Fund’s duration to assume a neutral position relative to the benchmark, the U.S. Allocation Fund Index. This reflected our belief that market sentiment and pricing had moved within our fair value estimates. (A yield curve illustrates the yields of all bonds of the same quality with maturities ranging from the shortest to the longest available.) Our defensive approach hindered returns at the beginning of the reporting period, though yields recovered in June and July of 2007. Overall, our duration strategy produced flat results during the reporting period.

In the Fund’s high yield component, we continued to take a conservative stance by underweighting it relative to the benchmark for the reporting period through June, as we felt the sector was overvalued. Overall, this stance had a negative impact on performance during the fiscal year. This is due to the fact that the high yield asset class outperformed as investors, seeking higher returns, flocked to relatively riskier asset classes at times during the reporting period. However, as discussed, we moved to a more neutral high yield position late in the period as the asset class became more fairly valued, according to our models. |

| | |

| Q. | Did the Fund have any exposure to subprime mortgages during the reporting period? |

| A. | While we avoided direct investments in subprime securities, the Fund’s performance was hurt by disappointing returns from its investment in the Alt-A market. Alt-A loans are designed for people with good credit, who want to borrow without verifying their income. In the wake of the deterioration of the subprime market, the Alt-A market came under scrutiny as concerns were raised about the creditworthiness of borrowers and the standards of the lenders of these securities.

Even higher-quality home equity asset-backed securities (bonds that are based on underlying pools of assets) were affected as investors—surprised by the number and magnitude of defaults in the subprime mortgage market—grew increasingly concerned. In many instances, we think that prices reflected unduly pessimistic default assumptions, investor uncertainty and poor liquidity. Given the divergence between fundamentals and market pricing, we anticipate significant investment opportunities in this sector as the year progresses. |

| | |

| Q. | What is your outlook for the economy and the Fund over the coming months? |

| A. | We believe that the problems in the US housing market are likely to have some impact on the future growth potential of the economy. That said, we believe the effects will take several quarters to filter through |

5

UBS U.S. Allocation Fund

| | to the global economy. In our view, they are not likely to be enough to end the current economic growth cycle on their own.

At the time of this writing, we believe the US equity market is priced slightly below fair value. This is largely in response to the decline in investor risk appetite, and is the result of turmoil in the credit markets spilling over into the equity markets.

In this environment, we see opportunities in areas where prices have fallen below our fundamental value estimates. We view the recent volatility and spread widening in the bond market as a return to normal pricing, as bond prices had reached very expensive levels. In fact, in our opinion, investment grade and high yield credit are fast approaching fair value. We believe our current asset allocation to be appropriate considering ongoing economic expansion in the US and the strength of realized earnings growth. |

| | | | |

| | Adding growth equity investments to UBS U.S. Allocation Fund | |

| | We regularly review our product offerings, in an effort to ensure they continue to meet our shareholders’ evolving needs. After careful analysis, this focus has led us to determine that investing a portion of UBS U.S. Allocation Fund’s assets to growth equities has the potential to provide our shareholders with returns at more attractive risk levels. | |

| | | | |

| | Managing risk and accessing an additional source of returns via a diverse strategy | |

| | By introducing US growth equities into the Fund, the portfolio management team seeks to provide shareholders with: | |

| | • | An investment that has the potential to reduce the risk of underperforming in markets that do not favor value stocks, by diversifying through a distinct growth equity investment process; and | |

| | • | Access to the security selection skill of an experienced growth equity investment team. | |

| | | | |

| | Investing in growth equities | |

| | The Fund will seek to invest directly in individual large capitalization US growth equities. This will be accomplished gradually, based on market conditions and the Fund’s allocation to value stocks. In general, we expect to have about 15% of the total US equity component of the Fund invested in growth equities. | |

| | | | |

| | For more information, please refer to the Funds’ prospectus, or contact your Financial Advisor. | |

| | | | |

6

UBS U.S. Allocation Fund

We thank you for your continued support and welcome any comments or questions you may have. For additional information on the UBS family of funds*, please contact your financial advisor, or visit us at www.ubs.com/globalam-us.

| Sincerely, |

|

| Kai R. Sotorp |

| President |

| UBS U.S. Allocation Fund |

| Head of the Americas |

| UBS Global Asset Management (Americas) Inc. |

|

| Brian D. Singer, CFA |

| Lead Portfolio Manager |

| UBS U.S. Allocation Fund |

| Americas Chief Investment Officer |

| UBS Global Asset Management (Americas) Inc. |

This letter is intended to assist shareholders in understanding how the Fund performed during the fiscal year ended August 31, 2007. The views and opinions in the letter were current as of October 15, 2007. They are not guarantees of performance or investment results and should not be taken as investment advice. Investment decisions reflect a variety of factors, and we reserve the right to change our views about individual securities, sectors and markets at any time. As a result, the views expressed should not be relied upon as a forecast of the Fund’s future investment intent. We encourage you to consult your financial advisor regarding your personal investment program.

| * | Mutual funds are sold by prospectus only. You should read it carefully and consider a fund’s investment objectives, risks, charges, expenses and other important information contained in the prospectus before investing. Prospectuses for most of our funds can be obtained from your Financial Advisor, by calling UBS Funds at 800-647 1568 or by visiting our Web site at www.ubs.com/globalam-us. |

7

UBS U.S. Allocation Fund

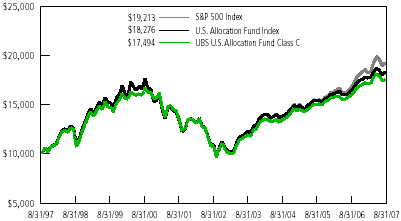

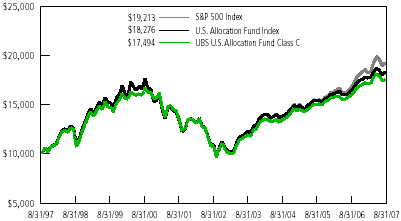

Comparison of change in value of a $10,000 investment in the Class C shares of the UBS U.S. Allocation Fund, the S&P 500 Index(1) and U.S. Allocation Fund Index(2) from August 31, 1997 through August 31, 2007 (unaudited)

The graph depicts the performance of UBS U.S. Allocation Fund Class C shares versus the S&P 500 Index and UBS U.S. Allocation Fund Index over the 10 years ended August 31, 2007. The performance of the other share classes will vary from the performance of the class shown based on the difference in sales charges and fees paid by shareholders investing in different share classes. Past performance does not predict future performance and the performance provided does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Performance results assume reinvestment of all dividend and capital gain distributions at net asset value on ex-dividend dates. It is important to note that the Fund is a professionally managed portfolio, while the Indexes are not available for investment and are unmanaged. The comparison is shown for illustrative purposes only.

| (1) | The S&P 500 Index is an unmanaged, weighted index comprising 500 widely held common stocks varying in composition and is not available for direct investment. |

| | |

| (2) | An unmanaged index compiled by the advisor, constructed as follows: from July 22, 1992 (the Fund’s inception) until February 29, 2004: 100% S&P 500 Index; from March 1, 2004 until May 31, 2005: 65% Russell 3000 Index, 30% Lehman Brothers US Aggregate Bond Index, and 5% Merrill Lynch US High Yield Cash Pay Index; and from June 1, 2005 until present: 65% Russell 3000 Index, 30% Lehman Brothers US Aggregate Bond Index, and 5% Merrill Lynch US High Yield Cash Pay Constrained Index. |

8

UBS U.S. Allocation Fund

Performance at a glance (unaudited)

Average annual total returns for periods ended 08/31/07

| | | | | | 1 year | | | 5 years | | | 10 years |

|

| | | Class A(1) | | | 11.04 | % | | | 10.96 | % | | | 6.55 | % |

| | |

|

| Before deducting maximum sales charge | | Class B(2) | | | 10.16 | | | | 10.10 | | | | 6.06 | |

| | |

|

| | | Class C(3) | | | 10.23 | | | | 10.14 | | | | 5.75 | |

| | |

|

| | | Class Y(4) | | | 11.42 | | | | 11.34 | | | | 6.89 | |

|

| | | Class A(1) | | | 4.95 | | | | 9.71 | | | | 5.95 | |

| | |

|

| After deducting maximum sales charge | | Class B(2) | | | 5.16 | | | | 9.83 | | | | 6.06 | |

| | |

|

| | | Class C(3) | | | 9.23 | | | | 10.14 | | | | 5.75 | |

|

| S&P 500 Index(5) | | | | | 15.13 | | | | 12.00 | | | | 6.75 | |

|

| U.S. Allocation Fund Index(6) | | | | | 11.62 | | | | 10.89 | | | | 6.22 | |

|

| Lipper Flexible Portfolio Funds median(7) | | | | | 12.14 | | | | 11.34 | | | | 6.80 | |

|

For most recent quarter-end performance, please refer to the “Average annual total return” table on page 10.

| (1) | | Maximum sales charge for Class A shares is 5.5%. Class A shares bear ongoing 12b-1 service fees. |

| |

| (2) | | Maximum contingent deferred sales charge for Class B shares is 5% imposed on redemptions and is reduced to 0% after a maximum of six years. Class B shares bear ongoing 12b-1 service and distribution fees. |

| |

| (3) | | Maximum contingent deferred sales charge for Class C shares is 1% imposed on redemptions and is reduced to 0% after one year. Class C shares bear ongoing 12b-1 service and distribution fees. |

| |

| (4) | | The Fund offers Class Y shares to a limited group of eligible investors, including certain qualifying retirement plans. Class Y shares do not bear initial or contingent deferred sales charges or ongoing 12b-1 service and distribution fees.

If an investor sells or exchanges shares less than 90 days after purchase, a redemption fee of 1.00% of the amount sold or exchanged will be deducted at the time of the transaction, except as noted otherwise in the prospectus. |

| |

| (5) | | The S&P 500 Index is an unmanaged, weighted index comprising 500 widely held common stocks varying in composition and is not available for direct investment. |

| |

| (6) | | An unmanaged index compiled by the advisor, constructed as follows: from July 22, 1992 (the Fund’s inception) until February 29, 2004: 100% S&P 500 Index; from March 1, 2004 until May 31, 2005: 65% Russell 3000 Index, 30% Lehman Brothers US Aggregate Bond Index, 5% Merrill Lynch US High Yield Cash Pay Index and from June 1, 2005 until present: 65% Russell 3000 Index, 30% Lehman Brothers US Aggregate Bond Index, 5% Merrill Lynch US High Yield Cash Pay Constrained Index. |

| |

| (7) | | Lipper peer group data calculated by Lipper Inc; used with permission. The Lipper median is the return of the fund that places in the middle of a Lipper peer group. |

Past performance does not predict future performance, and the performance information provided does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance results assume reinvestment of all dividends and capital gain distributions at net asset value on the ex-dividend dates. Current performance may be higher or lower than the performance data quoted. For month-end performance figures, please visit http://www.ubs.com.

9

UBS U.S. Allocation Fund

Performance at a glance (unaudited) (concluded)

Average annual total returns for periods ended 09/30/07

| | | | | | 1 year | | | 5 years | | | 10 years |

|

| | | Class A(1) | | | 10.65 | % | | | 13.98 | % | | | 6.18 | % |

| | |

|

| Before deducting maximum sales charge | | Class B(2) | | | 9.87 | % | | | 13.10 | % | | | 5.69 | % |

| | |

|

| | | Class C(3) | | | 9.85 | % | | | 13.13 | % | | | 5.39 | % |

| | |

|

| | | Class Y(4) | | | 11.06 | % | | | 14.37 | % | | | 6.53 | % |

|

| | | Class A(1) | | | 4.57 | % | | | 12.69 | % | | | 5.58 | % |

| | |

|

| After deducting maximum sales charge | | Class B(2) | | | 4.87 | % | | | 12.85 | % | | | 5.69 | % |

| | |

|

| | | Class C(3) | | | 8.85 | % | | | 13.13 | % | | | 5.39 | % |

|

| (1) | | Maximum sales charge for Class A shares is 5.5%. Class A shares bear ongoing 12b-1 service fees. |

| | | |

| (2) | | Maximum contingent deferred sales charge for Class B shares is 5% imposed on redemptions and is reduced to 0% after a maximum of six years. Class B shares bear ongoing 12b-1 service and distribution fees. |

| | | |

| (3) | | Maximum contingent deferred sales charge for Class C shares is 1% imposed on redemptions and is reduced to 0% after one year. Class C shares bear ongoing 12b-1 service and distribution fees. |

| | | |

| (4) | | The Fund offers Class Y shares to a limited group of eligible investors, including certain qualifying retirement plans. Class Y shares do not bear initial or contingent deferred sales charges or ongoing 12b-1 service and distribution fees. |

| | | |

| | | If an investor sells or exchanges shares less than 90 days after purchase, a redemption fee of 1.00% of the amount sold or exchanged will be deducted at the time of the transaction, except as noted otherwise in the prospectus. |

Past performance does not predict future performance, and the performance information provided does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance results assume reinvestment of all dividends and capital gain distributions at net asset value on the ex-dividend dates. Current performance may be higher or lower than the performance data quoted. For month-end performance figures, please visit http://www.ubs.com.

10

UBS U.S. Allocation Fund

Understanding your Fund’s expenses (unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transactional costs (as applicable), including sales charges (loads); and (2) ongoing costs, including management fees; service and/or distribution (12b-1) fees (if applicable); and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example below is based on an investment of $1,000 invested at the beginning of the period and held for the entire period, March 1, 2007 to August 31, 2007.

Actual expenses

The first line for each class of shares in the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over a period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line for each class of shares under the heading entitled “Expenses paid during period” to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The second line for each class of shares in the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratios for each class of shares and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return for each class of shares. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing Fund costs only and do not reflect any transactional costs (as applicable), such as sales charges (loads). Therefore, the second line in the table for each class of shares is useful in comparing ongoing Fund costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

11

UBS U.S. Allocation Fund

Understanding your Fund’s expenses (unaudited) (concluded)

| | | | | Beginning | | Ending | | Expenses paid |

| | | | | account value | | account value | | during period(1) |

| | | | | March 1, 2007 | | August 31, 2007 | | 03/01/07 to 08/31/07 |

|

| Class A | | Actual | | $ | 1,000.00 | | | $ | 1,027.20 | | | $ | 4.65 | |

|

| | | Hypothetical (5% annual return before expenses) | | | 1,000.00 | | | | 1,020.62 | | | | 4.63 | |

|

| Class B | | Actual | | | 1,000.00 | | | | 1,023.40 | | | | 8.62 | |

|

| | | Hypothetical (5% annual return before expenses) | | | 1,000.00 | | | | 1,016.69 | | | | 8.59 | |

|

| Class C | | Actual | | | 1,000.00 | | | | 1,023.50 | | | | 8.42 | |

|

| | | Hypothetical (5% annual return before expenses) | | | 1,000.00 | | | | 1,016.89 | | | | 8.39 | |

|

| Class Y | | Actual | | | 1,000.00 | | | | 1,028.70 | | | | 2.86 | |

|

| | | Hypothetical (5% annual return before expenses) | | | 1,000.00 | | | | 1,022.38 | | | | 2.85 | |

|

| (1) | | Expenses are equal to the Fund’s annualized net expense ratios: Class A: 0.91%, Class B: 1.69%, Class C: 1.65% and Class Y: 0.56%, multiplied by the average account value over the period, multiplied by 184 divided by 365 (to reflect the one-half year period). |

12

UBS U.S. Allocation Fund

Portfolio statistics (unaudited)

| Characteristics | | 08/31/07 | | | | 02/28/07 | | | | 08/31/06 |

|

| Net assets (mm) | | $ | 745.0 | | | | | $ | 863.8 | | | | | $ | 892.6 | |

|

| Number of securities | | | 490 | | | | | | 491 | | | | | | 491 | |

|

| | | | | | | | | | | | | | | | | |

| Portfolio composition* | | 08/31/07 | | | | 02/28/07 | | | | 08/31/06 |

|

| Stocks | | | 69.4 | % | | | | | 65.6 | % | | | | | 66.1 | % |

|

| Bonds | | | 27.6 | | | | | | 31.8 | | | | | | 31.8 | |

|

| Swap contracts | | | 0.0 | ** | | | | | N/A | | | | | | N/A | |

|

| Cash equivalents and other | | | | | | | | | | | | | | | | |

| assets less liabilities | | | 3.0 | | | | | | 2.6 | | | | | | 2.1 | |

|

| | | | 100.0 | % | | | | | 100.0 | % | | | | | 100.0 | % |

|

| | | | | | | | | | | | | | | | | |

| Top five equity sectors* | | 08/31/07 | | | | 02/28/07 | | | | 08/31/06 |

|

| Financials | | | 14.8 | % | | Financials | | | 16.7 | % | | Financials | | | 17.2 | % |

|

| Consumer | | | | | | Consumer | | | | | | | | | | |

| discretionary | | | 11.7 | | | discretionary | | | 11.1 | | | Health care | | | 11.9 | |

|

| Information | | | | | | | | | | | | Information | | | | |

| technology | | | 11.3 | | | Health care | | | 9.6 | | | technology | | | 9.2 | |

|

| | | | | | | Information | | | | | | Consumer | | | | |

| Health care | | | 10.3 | | | technology | | | 8.7 | | | discretionary | | | 9.1 | |

|

| Industrials | | | 8.6 | | | Industrials | | | 7.2 | | | Industrials | | | 6.5 | |

|

| Total | | | 56.7 | % | | | | | 53.3 | % | | | | | 53.9 | % |

|

| | | | | | | | | | | | | | | | | |

| Top ten equity securities* | | 08/31/07 | | | | 02/28/07 | | | | 08/31/06 |

|

| Citigroup | | | 2.5 | % | | Citigroup | | | 2.6 | % | | Citigroup | | | 2.9 | % |

|

| Wells Fargo | | | 2.3 | | | Morgan Stanley | | | 2.4 | | | Microsoft | | | 2.4 | |

|

| Intel Corp. | | | 2.0 | | | Microsoft | | | 2.1 | | | Morgan Stanley | | | 2.3 | |

|

| Exelon | | | 1.9 | | | Wells Fargo | | | 2.1 | | | Wyeth | | | 2.1 | |

|

| Microsoft | | | 1.9 | | | Exelon | | | 1.8 | | | Wells Fargo | | | 2.1 | |

|

| Morgan Stanley | | | 1.8 | | | Mellon Financial Corp. | | | 1.4 | | | Exelon | | | 1.8 | |

|

| General Electric | | | 1.8 | | | Johnson Controls, Inc. | | | 1.4 | | | Allergan | | | 1.6 | |

|

| | | | | | | American | | | | | | UnitedHealth | | | | |

| Illinois Tool Works | | | 1.5 | | | International Group | | | 1.4 | | | Group | | | 1.6 | |

|

| | | | | | | | | | | | | American | | | | |

| Wyeth | | | 1.4 | | | Allergan | | | 1.4 | | | International Group | | | 1.5 | |

|

| Sprint Nextel Corp. | | | 1.4 | | | Wyeth | | | 1.4 | | | Johnson & Johnson | | | 1.5 | |

|

| Total | | | 18.5 | % | | | | | 18.0 | % | | | | | 19.8 | % |

|

| * | | Weightings represent percentages of net assets. | | |

| ** | | Amount represents less than 0.05%. | | |

13

UBS U.S. Allocation Fund

Portfolio statistics (unaudited) (continued)

| Fixed income sector allocation* | | | 08/31/07 | | | 02/28/07 | | | 08/31/06 |

|

| Mortgage & agency debt securities | | | 13.7 | % | | | 12.7 | % | | | 13.1 | % |

|

| Corporate bonds | | | 7.3 | | | | 7.8 | | | | 7.4 | |

|

| Commercial mortgage-backed securities | | | 3.0 | | | | 2.5 | | | | 3.3 | |

|

| US government obligations | | | 2.7 | | | | 7.1 | | | | 5.9 | |

|

| Asset-backed securities | | | 0.9 | | | | 1.5 | | | | 2.1 | |

|

| International government obligations | | | 0.0 | † | | | 0.2 | | | | 0.0 | † |

|

| Total | | | 27.6 | % | | | 31.8 | % | | | 31.8 | % |

|

| * | | Weightings represent percentages of net assets. |

| | | |

| † | | Weightings represent less than 0.05% of the Fund’s net assets as of the date indicated. |

14

UBS U.S. Allocation Fund

Portfolio statistics (unaudited) (concluded)

| Top ten fixed | | | | | | | | | | | | | | | | | |

| income securities* | | | 08/31/07 | | | | | 02/28/07 | | | | | 08/31/06 |

|

| US Treasury | | | | | | US Treasury | | | | | | US Treasury | | | | | |

| Bonds, 6.250% | | | | | | Notes, 3.500% | | | | | | Notes, 3.875% | | | | | |

| due 08/15/23 | | | 0.9 | % | | due 05/31/07 | | | 1.5 | % | | due 02/15/13 | | | | 0.9 | % |

|

| FHLMC | | | | | | US Treasury | | | | | | US Treasury | | | | | |

| Certificates, 5.500% | | | | | | Notes, 5.125% | | | | | | Bonds, 8.500% | | | | | |

| due 08/23/17 | | | 0.9 | | | due 05/15/16 | | | 1.2 | | | due 02/15/20 | | | | 0.9 | |

|

| FHLMC | | | | | | US Treasury | | | | | | US Treasury | | | | | |

| Certificates, 5.600% | | | | | | Notes, 4.875% | | | | | | Bonds, 8.875% | | | | | |

| due 10/17/13 | | | 0.8 | | | due 08/13/08 | | | 1.0 | | | due 05/15/17 | | | | 0.8 | |

|

| | | | | | | US Treasury | | | | | | | | | | | |

| US Treasury | | | | | | Inflation Index | | | | | | US Treasury | | | | | |

| Bonds, 4.750% | | | | | | Notes, 2.000% | | | | | | Bonds, 8.875% | | | | | |

| due 02/15/37 | | | 0.7 | | | due 01/15/16 | | | 0.8 | | | due 02/15/19 | | | | 0.8 | |

|

| FNMA | | | | | | FNMA | | | | | | FNMA | | | | | |

| Certificates, 6.500% | | | | | | Certificates, 5.500% | | | | | | Certificates, 5.500% | | | | | |

| due 01/01/36 | | | 0.7 | | | due 11/01/17 | | | 0.7 | | | due 11/01/17 | | | | 0.8 | |

|

| US Treasury | | | | | | FHLMC | | | | | | US Treasury | | | | | |

| Notes, 5.125% | | | | | | Certificates, 5.600% | | | | | | Notes, 4.875% | | | | | |

| due 05/15/16 | | | 0.6 | | | due 10/17/13 | | | 0.7 | | | due 05/31/08 | | | | 0.7 | |

|

| JP Morgan | | | | | | | | | | | | | | | | | |

| Chase Commercial | | | | | | | | | | | | | | | | | |

| Mortgage | | | | | | US Treasury | | | | | | FNMA | | | | | |

| Securities, 5.345% | | | | | | Bonds, 4.500% | | | | | | Certificates, 4.625% | | | | | |

| due 12/15/44 | | | 0.6 | | | due 02/15/36 | | | 0.6 | | | due 06/01/10 | | | | 0.7 | |

|

| FNMA | | | | | | FNMA | | | | | | FNMA | | | | | |

| Certificates, 5.200% | | | | | | Certificates, 5.500% | | | | | | REMIC, 6.000% | | | | | |

| due 11/08/10 | | | 0.5 | | | due 09/01/17 | | | 0.6 | | | due 01/25/32 | | | | 0.7 | |

|

| Greenwich | | | | | | Asset | | | | | | | | | | | |

| Capital Commercial | | | | | | Securitization | | | | | | Ford Motor | | | | | |

| Funding Corp., 5.962% | | | | | | Corp., 7.384% | | | | | | Credit Co., 5.800% | | | | | |

| due 03/18/49 | | | 0.4 | | | due 08/13/29 | | | 0.6 | | | due 01/12/09 | | | | 0.6 | |

|

| | | | | | | US Treasury | | | | | | | | | | | |

| FNMA | | | | | | Inflation Index | | | | | | FNMA | | | | | |

| Certificates, 5.000% | | | | | | Notes, 2.000% | | | | | | Certificates, 5.500% | | | | | |

| due 02/01/19 | | | 0.4 | | | due 07/15/14 | | | 0.5 | | | due 09/01/17 | | | | 0.6 | |

|

| Total | | | 6.5 | % | | | | | 8.2 | % | | | | | | 7.5 | % |

|

| * | | Weightings represent percentages of net assets. | | |

15

UBS U.S. Allocation Fund

Portfolio of investments—August 31, 2007

Common stocks—69.35%

| Security description | | | Shares | | | | Value |

|

| Aerospace & defense—0.11% |

| Hexcel Corp.(1),* | | | 21,000 | | | | $457,590 |

|

| LMI Aerospace, Inc.* | | | 15,700 | | | | 358,902 |

|

| | | | | | | | 816,492 |

|

| Air freight & couriers—1.20% |

| ABX Air, Inc.* | | | 33,000 | | | | 226,380 |

|

| Dynamex, Inc.(1),* | | | 8,200 | | | | 205,984 |

|

| FedEx Corp. | | | 77,800 | | | | 8,533,104 |

|

| | | | | | | | 8,965,468 |

|

| Auto components—2.21% |

| BorgWarner, Inc.(1) | | | 74,800 | | | | 6,320,600 |

|

| Johnson Controls, Inc. | | | 89,500 | | | | 10,122,450 |

|

| | | | | | | | 16,443,050 |

|

| Automobiles—0.35% |

| Harley-Davidson, Inc.(1) | | | 48,000 | | | | 2,581,920 |

|

| Banks—5.84% |

| Bank of New York Mellon Corp. | | | 253,400 | | | | 10,244,962 |

|

| Banner Corp. | | | 5,900 | | | | 190,098 |

|

| City National Corp. | | | 32,000 | | | | 2,284,480 |

|

| CoBiz Financial, Inc. | | | 9,499 | | | | 173,452 |

|

| Colonial BancGroup, Inc. | | | 14,700 | | | | 311,934 |

|

| Columbia Banking System, Inc. | | | 400 | | | | 12,204 |

|

| Cullen/Frost Bankers, Inc.(1) | | | 7,800 | | | | 402,324 |

|

| Fifth Third Bancorp(1) | | | 201,838 | | | | 7,203,598 |

|

| PNC Financial Services Group | | | 73,400 | | | | 5,165,158 |

|

| Preferred Bank | | | 3,900 | | | | 160,446 |

|

| PrivateBancorp, Inc.(1) | | | 9,342 | | | | 312,770 |

|

| Sterling Financial Corp. | | | 9,400 | | | | 239,418 |

|

| Wells Fargo & Co.(1) | | | 459,200 | | | | 16,779,168 |

|

| | | | | | | | 43,480,012 |

|

| Security description | | | Shares | | | | Value |

|

| Beverages—1.03% |

| Anheuser-Busch Cos., Inc. | | | 70,900 | | | | $3,502,460 |

|

| Constellation Brands, Inc., Class A(1),* | | | 171,700 | | | | 4,151,706 |

|

| | | | | | | | 7,654,166 |

|

| Biotechnology—1.64% |

| Amgen, Inc.* | | | 31,700 | | | | 1,588,487 |

|

| Genzyme Corp.* | | | 130,300 | | | | 8,132,023 |

|

| Millennium Pharmaceuticals, Inc.(1),* | | | 247,500 | | | | 2,512,125 |

|

| | | | | | | | 12,232,635 |

|

| Building products—1.28% |

| Masco Corp. | | | 327,400 | | | | 8,518,948 |

|

| NCI Building Systems, Inc.* | | | 9,100 | | | | 422,149 |

|

| Watsco, Inc.(1) | | | 11,700 | | | | 563,004 |

|

| | | | | | | | 9,504,101 |

|

| Chemicals—0.07% |

| Cytec Industries, Inc.(1) | | | 8,100 | | | | 537,840 |

|

| Commercial services & supplies—0.22% |

| Angelica Corp. | | | 5,800 | | | | 118,088 |

|

| Coinstar, Inc.(1),* | | | 8,400 | | | | 274,512 |

|

| Dice Holdings, Inc.* | | | 2,000 | | | | 19,360 |

|

| Dollar Financial Corp.* | | | 15,500 | | | | 371,690 |

|

| FTD Group, Inc. | | | 12,000 | | | | 213,240 |

|

| LECG Corp.* | | | 12,400 | | | | 190,216 |

|

| PeopleSupport, Inc.(1),* | | | 20,400 | | | | 256,632 |

|

| Valassis Communications, Inc.* | | | 19,200 | | | | 175,104 |

|

| | | | | | | | 1,618,842 |

|

| Communications equipment—0.14% |

| Black Box Corp. | | | 1,400 | | | | 57,330 |

|

| F5 Networks, Inc.* | | | 8,200 | | | | 286,754 |

|

| Harris Corp. | | | 5,700 | | | | 346,731 |

|

16

UBS U.S. Allocation Fund

Portfolio of investments—August 31, 2007

Common stocks—(continued)

| Security description | | | Shares | | | | Value |

|

| Communications equipment—(concluded) |

| OpNext, Inc.* | | | 11,100 | | | | $133,311 |

|

| Powerwave Technologies, Inc.* | | | 34,400 | | | | 235,640 |

|

| | | | | | | | 1,059,766 |

|

| Computers & peripherals—0.71% |

| Dell, Inc.(1),* | | | 186,100 | | | | 5,257,325 |

|

| Construction & engineering—0.02% |

| Sterling Construction Co., Inc.* | | | 7,600 | | | | 168,112 |

|

| Distributors—0.13% |

| Beacon Roofing Supply, Inc.(1),* | | | 38,200 | | | | 445,030 |

|

| WESCO International, Inc.* | | | 10,500 | | | | 499,695 |

|

| | | | | | | | 944,725 |

|

| Diversified financials—6.98% |

| Apollo Investment Corp. | | | 24,100 | | | | 526,344 |

|

| Asset Acceptance Capital Corp. | | | 6,989 | | | | 79,046 |

|

| Citigroup, Inc.(1) | | | 397,586 | | | | 18,638,832 |

|

| Discover Financial Services* | | | 126,925 | | | | 2,937,044 |

|

| Federal Home Loan Mortgage Corp.(1) | | | 85,100 | | | | 5,243,011 |

|

| J.P. Morgan Chase & Co. | | | 193,400 | | | | 8,610,168 |

|

| Lazard Ltd., Class A | | | 15,300 | | | | 613,377 |

|

| Morgan Stanley | | | 220,950 | | | | 13,780,651 |

|

| National Financial Partners Corp. | | | 6,100 | | | | 298,229 |

|

| optionsXpress Holdings, Inc. | | | 7,500 | | | | 176,400 |

|

| PennantPark Investment Corp.(1) | | | 37,800 | | | | 490,644 |

|

| Walter Industries, Inc. | | | 24,064 | | | | 608,338 |

|

| | | | | | | | 52,002,084 |

|

| Security description | | | | | Shares | | Value |

|

| Diversified telecommunication services—2.42% |

| AT&T, Inc. | | | | | 182,300 | | $7,268,301 |

|

| NeuStar, Inc., Class A* | | | | | 14,100 | | 445,842 |

|

| Sprint Nextel Corp.(1) | | | | | 545,094 | | 10,313,179 |

|

| | | | | | | | 18,027,322 |

|

| Electric utilities—2.91% |

| American Electric Power Co., Inc. | | | | | 101,100 | | 4,496,928 |

|

| Exelon Corp.(1) | | | | | 205,000 | | 14,487,350 |

|

| Northeast Utilities | | | | | 16,600 | | 458,990 |

|

| Pepco Holdings, Inc. | | | | | 79,000 | | 2,202,520 |

|

| | | | | | | | 21,645,788 |

|

| Electrical equipment—0.13% |

| A.O. Smith Corp. | | | | | 5,300 | | 255,460 |

|

| Airvana, Inc.(1),* | | | | | 17,700 | | 109,032 |

|

| Franklin Electric Co., Inc.(1) | | | | | 6,955 | | 287,102 |

|

| General Cable Corp.* | | | | | 5,800 | | 337,444 |

|

| | | | | | | | 989,038 |

|

| Electronic equipment & instruments—0.12% |

| Newport Corp.* | | | | | 24,200 | | 334,202 |

|

| Regal-Beloit Corp. | | | | | 11,600 | | 585,916 |

|

| | | | | | | | 920,118 |

|

| Energy equipment & services—2.02% |

| ENSCO International, Inc. | | | | | 66,400 | | 3,600,208 |

|

| GlobalSantaFe Corp. | | | | | 67,600 | | 4,771,884 |

|

| Halliburton Co. | | | | | 169,300 | | 5,856,087 |

|

| Oil States International, Inc.* | | | | | 9,000 | | 379,800 |

|

| TETRA Technologies, Inc.* | | | | | 20,600 | | 411,794 |

|

| | | | | | | | 15,019,773 |

|

| Food & drug retailing—0.84% |

| Sysco Corp. | | | | | 188,000 | | 6,275,440 |

|

17

UBS U.S. Allocation Fund

Portfolio of investments—August 31, 2007

Common stocks—(continued)

| Security description | | | Shares | | | | Value |

|

| Food products—0.01% |

| Maui Land & Pineapple Co., Inc.* | | | 2,377 | | | | $69,052 |

|

| Gas utilities—1.01% |

| NiSource, Inc.(1) | | | 120,600 | | | | 2,272,104 |

|

| Sempra Energy | | | 95,900 | | | | 5,277,377 |

|

| | | | | | | | 7,549,481 |

|

| Health care equipment & supplies—0.93% |

| Abaxis, Inc.* | | | 9,400 | | | | 182,736 |

|

| Advanced Medical Optics, Inc.(1),* | | | 10,700 | | | | 307,518 |

|

| ICU Medical, Inc.* | | | 9,678 | | | | 365,925 |

|

| Medical Action Industries, Inc.* | | | 8,600 | | | | 195,134 |

|

| Medtronic, Inc. | | | 97,200 | | | | 5,136,048 |

|

| Mentor Corp. | | | 3,400 | | | | 151,606 |

|

| Palomar Medical Technologies, Inc.(1),* | | | 8,847 | | | | 278,681 |

|

| Syneron Medical Ltd.(1),* | | | 12,400 | | | | 280,488 |

|

| | | | | | | | 6,898,136 |

|

| Health care providers & services—1.00% |

| LifePoint Hospitals, Inc.* | | | 8,500 | | | | 238,850 |

|

| Pharmaceutical Product Development, Inc. (PPD) | | | 47,400 | | | | 1,660,422 |

|

| United Health Group, Inc. | | | 110,600 | | | | 5,531,106 |

|

| | | | | | | | 7,430,378 |

|

| Hotels, restaurants & leisure—1.05% |

| Carnival Corp. | | | 165,300 | | | | 7,536,027 |

|

| Vail Resorts, Inc.* | | | 4,800 | | | | 274,464 |

|

| | | | | | | | 7,810,491 |

|

| Household durables—0.71% |

| Fortune Brands, Inc. | | | 56,900 | | | | 4,727,821 |

|

| Interface, Inc., Class A | | | 8,400 | | | | 151,536 |

|

| Syntax-Brillian Corp.(1),* | | | 43,900 | | | | 285,350 |

|

| Security description | | | Shares | | | | Value |

|

| Household durables—(concluded) |

| Tempur-Pedic International, Inc. | | | 5,600 | | | | $161,840 |

|

| | | | | | | | 5,326,547 |

|

| Industrial conglomerates—1.76% |

| General Electric Co. | | | 336,500 | | | | 13,079,755 |

|

| Insurance—1.83% |

| AFLAC, Inc.(1) | | | 61,200 | | | | 3,262,572 |

|

| Allstate Corp. | | | 79,200 | | | | 4,336,200 |

|

| CastlePoint Holdings Ltd. | | | 28,900 | | | | 327,148 |

|

| Hartford Financial Services Group, Inc. | | | 54,700 | | | | 4,863,377 |

|

| Primus Guaranty, Ltd.(1),* | | | 45,400 | | | | 431,754 |

|

| Tower Group, Inc.(1) | | | 15,200 | | | | 381,672 |

|

| | | | | | | | 13,602,723 |

|

| Internet & catalog retail—0.84% |

| Amazon.com, Inc.* | | | 78,800 | | | | 6,296,908 |

|

| Internet software & services—1.26% |

| Art Technology Group, Inc.* | | | 94,000 | | | | 292,340 |

|

| Google, Inc., Class A* | | | 6,100 | | | | 3,143,025 |

|

| Limelight Networks, Inc.(1),* | | | 5,300 | | | | 43,619 |

|

| Openwave Systems, Inc.(1) | | | 16,700 | | | | 75,484 |

|

| RightNow Technologies, Inc.* | | | 19,600 | | | | 287,140 |

|

| Sourcefire, Inc.(1),* | | | 600 | | | | 5,748 |

|

| TheStreet.com, Inc.(1) | | | 21,100 | | | | 215,642 |

|

| Tumbleweed Communications Corp.* | | | 64,000 | | | | 142,720 |

|

| ValueClick, Inc.* | | | 18,600 | | | | 372,744 |

|

| Websense, Inc.* | | | 21,000 | | | | 431,970 |

|

| Yahoo!, Inc.* | | | 193,900 | | | | 4,407,347 |

|

| | | | | | | | 9,417,779 |

|

| IT consulting & services—0.12% |

| CACI International, Inc., Class A* | | | 8,900 | | | | 454,078 |

|

| Glu Mobile, Inc.(1),* | | | 9,900 | | | | 82,566 |

|

18

UBS U.S. Allocation Fund

Portfolio of investments—August 31, 2007

Common stocks—(continued)

| Security description | | | Shares | | | | Value |

|

| IT consulting & services—(concluded) |

| SRA International, Inc., Class A* | | | 13,400 | | | | $378,014 |

|

| | | | | | | | 914,658 |

|

| Machinery—2.36% |

| Chart Industries, Inc.* | | | 8,900 | | | | 240,211 |

|

| Graco, Inc. | | | 8,700 | | | | 351,567 |

|

| Illinois Tool Works, Inc.(1) | | | 189,300 | | | | 11,011,581 |

|

| Insteel Industries, Inc.(1) | | | 15,300 | | | | 289,170 |

|

| Nordson Corp. | | | 9,600 | | | | 482,016 |

|

| PACCAR, Inc. | | | 61,200 | | | | 5,235,660 |

|

| | | | | | | | 17,610,205 |

|

| Media—2.85% |

| BigBand Networks(1),* | | | 6,200 | | | | 62,620 |

|

| Cinemark Holdings, Inc.* | | | 6,000 | | | | 107,880 |

|

| News Corp., Class A | | | 231,900 | | | | 4,691,337 |

|

| Omnicom Group, Inc. | | | 114,300 | | | | 5,821,299 |

|

| R.H. Donnelley Corp.* | | | 66,385 | | | | 3,905,430 |

|

| The McGraw-Hill Cos., Inc.(1) | | | 50,000 | | | | 2,523,000 |

|

| Viacom Inc., Class B* | | | 105,100 | | | | 4,147,246 |

|

| | | | | | | | 21,258,812 |

|

| Metals & mining—0.56% |

| Alpha Natural Resources, Inc.* | | | 16,000 | | | | 308,960 |

|

| Foundation Coal Holdings, Inc. | | | 12,400 | | | | 420,608 |

|

| Peabody Energy Corp.(1) | | | 69,500 | | | | 2,954,445 |

|

| Quanex Corp.(1) | | | 11,700 | | | | 506,727 |

|

| | | | | | | | 4,190,740 |

|

| Multi-line retail—1.61% |

| Costco Wholesale Corp. | | | 125,400 | | | | 7,743,450 |

|

| Target Corp. | | | 64,600 | | | | 4,259,078 |

|

| | | | | | | | 12,002,528 |

|

| Oil & gas—1.71% |

| Chevron Corp.(1) | | | 40,900 | | | | 3,589,384 |

|

| EOG Resources, Inc.(1) | | | 60,800 | | | | 4,095,488 |

|

| Security description | | | Shares | | | | Value |

|

| Oil & gas—(concluded) |

| Equitable Resources, Inc. | | | 8,300 | | | | $408,277 |

|

| Exxon Mobil Corp. | | | 54,400 | | | | 4,663,712 |

|

| | | | | | | | 12,756,861 |

|

| Pharmaceuticals—6.71% |

| Allergan, Inc. | | | 164,400 | | | | 9,865,644 |

|

| Animal Health International, Inc.* | | | 14,189 | | | | 161,045 |

|

| Bristol-Myers Squibb Co. | | | 140,800 | | | | 4,104,320 |

|

| Cephalon, Inc.* | | | 28,300 | | | | 2,123,915 |

|

| Johnson & Johnson | | | 100,664 | | | | 6,220,029 |

|

| Medco Health Solutions, Inc.* | | | 58,500 | | | | 4,998,825 |

|

| Merck & Co., Inc. | | | 178,500 | | | | 8,955,345 |

|

| Schering-Plough Corp. | | | 100,100 | | | | 3,005,002 |

|

| Wyeth | | | 228,100 | | | | 10,561,030 |

|

| | | | | | | | 49,995,155 |

|

| Real estate—0.11% |

| FelCor Lodging Trust, Inc. | | | 29,700 | | | | 651,618 |

|

| MFA Mortgage Investments, Inc. | | | 24,300 | | | | 188,325 |

|

| | | | | | | | 839,943 |

|

| Road & rail—1.44% |

| Burlington Northern Santa Fe Corp. | | | 118,900 | | | | 9,648,735 |

|

| Genesee & Wyoming, Inc., Class A* | | | 13,350 | | | | 365,523 |

|

| Kansas City Southern* | | | 15,600 | | | | 474,084 |

|

| Pacer International, Inc.(1) | | | 12,100 | | | | 261,602 |

|

| | | | | | | | 10,749,944 |

|

| Semiconductor equipment & products—4.43% |

| Analog Devices, Inc. | | | 244,300 | | | | 9,009,784 |

|

| AuthenTec, Inc.* | | | 8,800 | | | | 93,984 |

|

| Intel Corp.(1) | | | 565,500 | | | | 14,561,625 |

|

19

UBS U.S. Allocation Fund

Portfolio of investments—August 31, 2007

Common stocks—(concluded)

| Security description | | | Shares | | | | Value |

|

| Semiconductor equipment & products—(concluded) |

| Linear Technology Corp.(1) | | | 111,300 | | | | $3,783,087 |

|

| ON Semiconductor Corp.(1),* | | | 34,500 | | | | 404,340 |

|

| SiRF Technology Holdings, Inc.* | | | 10,500 | | | | 177,030 |

|

| Xilinx, Inc.(1) | | | 194,300 | | | | 4,968,251 |

|

| | | | | | | | 32,998,101 |

|

| Software—4.55% |

| BEA Systems, Inc.* | | | 247,300 | | | | 3,017,060 |

|

| Citrix Systems, Inc.(1),* | | | 116,500 | | | | 4,234,775 |

|

| Innerworkings, Inc.(1),* | | | 15,400 | | | | 217,294 |

|

| Intuit, Inc.* | | | 118,900 | | | | 3,247,159 |

|

| Microsoft Corp. | | | 484,200 | | | | 13,911,066 |

|

| Nuance Communications, Inc.* | | | 11,700 | | | | 219,960 |

|

| Quest Software, Inc.* | | | 9,900 | | | | 144,144 |

|

| Red Hat, Inc.(1),* | | | 71,000 | | | | 1,380,950 |

|

| Secure Computing Corp.* | | | 18,700 | | | | 167,926 |

|

| Smith Micro Software, Inc.(1),* | | | 20,600 | | | | 339,694 |

|

| Symantec Corp.* | | | 354,173 | | | | 6,661,994 |

|

| VASCO Data Security International, Inc.* | | | 10,400 | | | | 325,728 |

|

| | | | | | | | 33,867,750 |

|

| Security description | | | Shares | | | | Value |

|

| Specialty retail—1.55% |

| AnnTaylor Stores Corp.* | | | 6,800 | | | | $213,112 |

|

| Casual Male Retail Group, Inc.(1),* | | | 39,100 | | | | 394,910 |

|

| Chico’s FAS, Inc.* | | | 127,300 | | | | 2,034,254 |

|

| Conn’s, Inc.(1),* | | | 11,800 | | | | 259,600 |

|

| Home Depot, Inc. | | | 184,400 | | | | 7,064,364 |

|

| Interline Brands, Inc.(1),* | | | 22,000 | | | | 533,280 |

|

| Movado Group, Inc.(1) | | | 10,256 | | | | 302,552 |

|

| Regis Corp. | | | 12,600 | | | | 415,926 |

|

| Rush Enterprises, Inc., Class A* | | | 2,600 | | | | 65,936 |

|

| Susser Holdings Corp.* | | | 16,800 | | | | 281,736 |

|

| | | | | | | | 11,565,670 |

|

| Textiles & apparel—0.37% |

| Coach, Inc.(1),* | | | 55,900 | | | | 2,489,227 |

|

| True Religion Apparel, Inc.(1),* | | | 15,900 | | | | 266,802 |

|

| | | | | | | | 2,756,029 |

|

| Venture capital—0.16% |

| The Blackstone Group LP(1),* | | | 51,041 | | | | 1,180,578 |

|

| Water utilities—0.05% |

| Mueller Water Products, Inc., Class B | | | 32,073 | | | | 351,199 |

|

| Total common stocks | | | | | | | |

| (cost—$450,488,374) | | | | | | | 516,663,440 |

|

20

UBS U.S. Allocation Fund

Portfolio of investments—August 31, 2007

| | | | Face | | | | |

| | | | amount | | | | Value |

|

US government obligations—2.74% | | | | | | | |

| US Treasury Bonds, | | | | | | | |

4.750%, due 02/15/37(1) | | | $5,575,000 | | | | $5,499,214 |

|

6.250%, due 08/15/23 | | | 6,035,000 | | | | 6,955,808 |

|

6.250%, due 05/15/30 | | | 345,000 | | | | 410,577 |

|

6.625%, due 02/15/27 | | | 280,000 | | | | 340,878 |

|

| US Treasury Notes, | | | | | | | |

4.500%, due 03/31/09 | | | 1,545,000 | | | | 1,552,121 |

|

4.500%, due 03/31/12 | | | 980,000 | | | | 989,494 |

|

5.125%, due 05/15/16(1) | | | 4,500,000 | | | | 4,692,654 |

|

| Total US government obligations (cost—$19,913,554) | | | | | | | 20,440,746 |

|

Mortgage & agency debt securities—13.71% | | | | | | | |

| Adjustable Rate Mortgage Trust, Series 2006-1, Class 5A1, | | | | | | | |

6.090%, due 03/25/36 | | | 2,245,966 | | | | 2,258,829 |

|

| Banc of America Funding Corp., | | | | | | | |

Series 2006-H, Class B1, | | | | | | | |

6.101%, due 09/20/46(2) | | | 2,393,529 | | | | 2,403,095 |

|

Series 2007-C, Class XB1, | | | | | | | |

5.730%, due 05/20/36(2) | | | 2,398,741 | | | | 2,315,140 |

|

| Bear Stearns Adjustable Rate Mortgage Trust, | | | | | | | |

Series 2005-1, Class 4A1, | | | | | | | |

5.355%, due 03/25/35 | | | 1,028,836 | | | | 999,257 |

|

Series 2007-3, Class 2A1, | | | | | | | |

5.643%, due 05/25/47 | | | 2,759,905 | | | | 2,759,972 |

|

| Bear Stearns Alternative-A Trust, Series 2006-4, Class 3B2, | | | | | | | |

6.297%, due 07/25/36(2) | | | 998,480 | | | | 940,287 |

|

| Countrywide Alternative Loan Trust, Series 2005-J2, Class 2A1, | | | | | | | |

7.500%, due 12/15/34 | | | 917,729 | | | | 922,755 |

|

| Credit Suisse First Boston Mortgage Securities Corp., | | | | | | | |

Series 2005-10, Class 10A3, | | | | | | | |

6.000%, due 11/25/35 | | | 1,954,149 | | | | 1,963,818 |

|

Series 2005-11, Class 1A1, | | | | | | | |

6.500%, due 12/25/35 | | | 1,657,053 | | | | 1,670,000 |

|

| Federal Home Loan Bank Certificates, | | | | | | | |

5.375%, due 05/18/16 | | | 635,000 | | | | 648,315 |

|

5.500%, due 08/13/14 | | | 1,095,000 | | | | 1,130,139 |

|

| Federal Home Loan Mortgage Corporation Certificates, | | | | | | | |

4.500%, due 12/01/34 | | | 2,238,139 | | | | 2,074,470 |

|

4.625%, due 02/21/08 | | | 2,960,000 | | | | 2,950,928 |

|

| | | | | | | | |

|

| | | | | | | | 21 |

UBS U.S. Allocation Fund

Portfolio of investments—August 31, 2007

| | | | Face | | | | |

| | | | amount | | | | Value |

|

Mortgage & agency debt securities—(continued) | | | | | | | |

5.500%, due 08/23/17 | | | $6,155,000 | | | | $6,345,066 |

|

5.500%, due 01/01/18 | | | 29,938 | | | | 29,857 |

|

5.500%, due 04/01/18 | | | 26,199 | | | | 26,125 |

|

5.500%, due 04/01/37 | | | 1,451,797 | | | | 1,417,922 |

|

5.500%, due 05/01/37 | | | 3,234,324 | | | | 3,158,857 |

|

5.600%, due 10/17/13 | | | 6,080,000 | | | | 6,112,808 |

|

5.750%, due 06/27/16 | | | 1,750,000 | | | | 1,809,343 |

|

6.000%, due 12/01/17 | | | 24,519 | | | | 24,820 |

|

6.000%, due 03/01/32 | | | 5,669 | | | | 5,714 |

|

6.500%, due 08/01/28 | | | 1,316,503 | | | | 1,348,280 |

|

6.500%, due 02/01/29 | | | 21,153 | | | | 21,701 |

|

6.500%, due 04/01/29 | | | 18,323 | | | | 18,750 |

|

| Federal Home Loan Mortgage Corporation Certificates ARM, | | | | | | | |

5.229%, due 05/01/37 | | | 2,325,685 | | | | 2,306,358 |

|

5.388%, due 03/01/37 | | | 2,325,562 | | | | 2,315,564 |

|

| Federal National Mortgage Association Certificates, | | | | | | | |

4.250%, due 08/15/10 | | | 710,000 | | | | 700,710 |

|

5.000%, due 02/01/19 | | | 3,347,202 | | | | 3,280,844 |

|

5.200%, due 11/08/10 | | | 3,525,000 | | | | 3,526,956 |

|

5.500%, due 01/23/12 | | | 930,000 | | | | 932,506 |

|

5.500%, due 07/01/33 | | | 1,784,296 | | | | 1,747,673 |

|

5.500%, due 01/01/34 | | | 2,295,237 | | | | 2,248,127 |

|

6.000%, due 03/01/29 | | | 13,166 | | | | 13,254 |

|

6.000%, due 06/01/33 | | | 12,016 | | | | 12,081 |

|

6.070%, due 05/12/16 | | | 1,945,000 | | | | 1,958,969 |

|

6.250%, due 02/01/11 | | | 2,930,000 | | | | 3,068,525 |

|

6.500%, due 03/01/17 | | | 56,578 | | | | 57,745 |

|

6.500%, due 01/01/36 | | | 4,855,972 | | | | 4,972,973 |

|

7.000%, due 08/01/32 | | | 1,126,648 | | | | 1,167,826 |

|

7.500%, due 05/01/31 | | | 7,945 | | | | 8,324 |

|

7.500%, due 02/01/33 | | | 16,784 | | | | 17,576 |

|

| FHLMC REMIC, | | | | | | | |

Series 2148, Class ZA, | | | | | | | |

6.000%, due 04/15/29 | | | 46,776 | | | | 47,162 |

|

Series 2426, Class GH, | | | | | | | |

6.000%, due 08/15/30 | | | 10,435 | | | | 10,479 |

|

| | | | | | | | |

|

| 22 | | | | | | | |

UBS U.S. Allocation Fund

Portfolio of investments—August 31, 2007

| | | | Face | | | | |

| | | | amount | | | | Value |

|

Mortgage & agency debt securities—(continued) | | | | | | | |

Series 2430, Class UC, | | | | | | | |

6.000%, due 09/15/16 | | | $777,698 | | | | $786,507 |

|

Series T-42, Class A5, | | | | | | | |

7.500%, due 02/25/42 | | | 2,049,039 | | | | 2,134,017 |

|

| First Horizon Mortgage Pass-Through Trust, | | | | | | | |

Series 2004-FL1, Class 1A1, | | | | | | | |

5.775%, due 02/25/35(2) | | | 190,961 | | | | 184,951 |

|

Series 2007-AR2, Class 1A1, | | | | | | | |

5.863%, due 06/25/37(2) | | | 1,962,057 | | | | 1,930,174 |

|

| FNMA REMIC, Series 2004-W1, Class 3A, | | | | | | | |

6.414%, due 01/25/43(2) | | | 3,137,632 | | | | 3,143,354 |

|

| Government National Mortgage Association Certificates, | | | | | | | |

6.500%, due 10/15/24 | | | 1,840,516 | | | | 1,881,324 |

|

6.500%, due 10/15/28 | | | 12,895 | | | | 13,198 |

|

6.500%, due 04/15/31 | | | 824,275 | | | | 843,143 |

|

7.000%, due 04/15/26 | | | 7,314 | | | | 7,637 |

|

| Government National Mortgage Association Certificates II, | | | | | | | |

6.000%, due 11/20/28 | | | 5,577 | | | | 5,622 |

|

6.000%, due 02/20/29 | | | 12,332 | | | | 12,427 |

|

6.000%, due 02/20/34 | | | 2,783,529 | | | | 2,794,554 |

|

| JP Morgan Alternative Loan Trust, Series 2006-S1, Class 1A19, | | | | | | | |

6.500%, due 03/25/36 | | | 2,309,731 | | | | 2,337,033 |

|

| Lehman XS Trust, Series 2005-8, Class 2A3, | | | | | | | |

6.000%, due 12/25/35(3) | | | 3,250,000 | | | | 3,071,447 |

|

| MLCC Mortgage Investors, Inc., Series 2006-2, Class 4A, | | | | | | | |

5.807%, due 05/25/36(2) | | | 1,161,257 | | | | 1,158,547 |

|

| Residential Asset Securitization Trust, Series 2006-A2, Class A11, | | | | | | | |

6.000%, due 05/25/36 | | | 3,000,000 | | | | 2,929,066 |

|

| Washington Mutual Mortgage Pass-Through Certificates, | | | | | | | |

Series 2007-HY1, Class 1A1 | | | | | | | |

5.717%, due 02/25/37(2) | | | 1,267,081 | | | | 1,258,027 |

|

Series 2007-HY7, Class LB1, | | | | | | | |

5.878%, due 07/25/37(2) | | | 1,174,730 | | | | 1,164,865 |

|

Series 2002-AR17, Class 1A, | | | | | | | |

6.205%, due 11/25/42(2) | | | 1,287,038 | | | | 1,292,157 |

|

| Wells Fargo Mortgage Backed Securities Trust, | | | | | | | |

Series 2007-11, Class B1, | | | | | | | |

6.000%, due 08/25/37(4) | | | 2,398,864 | | | | 2,221,892 |

|

| | | | | | | | |

|

| | | | | | | | 23 |

UBS U.S. Allocation Fund

Portfolio of investments—August 31, 2007

| | | | Face | | | | |

| | | | amount | | | | Value |

|

Mortgage & agency debt securities—(concluded) | | | | | | | |

Series 2007-AR4, Class A1, | | | | | | | |

6.032%, due 08/25/37(2) | | | $1,250,000 | | | | $1,243,945 |

|

| Total mortgage & agency debt securities (cost—$102,854,943) | | | | | | | 102,163,787 |

|

Commercial mortgage-backed securities—2.97% | | | | | | | |

| Banc of America Commercial Mortgage, Inc., | | | | | | | |

Series 2006-2, Class B, | | | | | | | |

5.965%, due 05/10/45(2) | | | 250,000 | | | | 237,905 |

|

Series 2007-3, Class C, | | | | | | | |

5.838%, due 06/10/49(2) | | | 325,000 | | | | 302,674 |

|

| Bear Stearns Commercial Mortgage Securities, | | | | | | | |

Series 2007-PW16, Class C, | | | | | | | |

5.902%, due 06/11/40(2),(5) | | | 200,000 | | | | 188,359 |

|

| Citigroup Commercial Mortgage Trust, | | | | | | | |

Series 2006-C5, Class A4, | | | | | | | |

5.431%, due 10/15/49 | | | 1,050,000 | | | | 1,031,214 |

|

Series 2007-C6, Class A4, | | | | | | | |

5.889%, due 12/10/49(2) | | | 1,600,000 | | | | 1,604,627 |

|

| Citigroup/Deutsche Bank Commercial Mortgage Trust, | | | | | | | |

Series 2007-CD4, Class B, | | | | | | | |

5.447%, due 12/11/49(2) | | | 325,000 | | | | 299,424 |

|

| Credit Suisse Mortgage Capital Certificates, | | | | | | | |

Series 2007-C4, Class C, | | | | | | | |

5.811%, due 09/15/39 | | | 225,000 | | | | 213,867 |

|

| First Union Lehman-Brothers Commercial Mortgage, | | | | | | | |

Series 1997-C2, Class A3, | | | | | | | |

6.650%, due 11/18/29 | | | 139,632 | | | | 139,221 |

|

| GE Capital Commercial Mortgage Corp., | | | | | | | |

Series 2006-C1, Class A4, | | | | | | | |

5.518%, due 03/10/44(2) | | | 1,350,000 | | | | 1,331,544 |

|

| Greenwich Capital Commercial Funding Corp., | | | | | | | |

Series 2006-RR1, Class A1, | | | | | | | |

5.962%, due 03/18/49(2),(5) | | | 3,500,000 | | | | 3,350,156 |

|

| GS Mortgage Securities Corp. II, | | | | | | | |

Series 2006-CC1, Class A, | | | | | | | |

5.520%, due 03/21/46(2),(5) | | | 3,494,490 | | | | 3,268,920 |

|

Series 2006-RR2, Class A1, | | | | | | | |

5.811%, due 06/23/46(2),(5) | | | 3,125,000 | | | | 2,942,969 |

|

| | | | | | | | |

|

| 24 | | | | | | | |

UBS U.S. Allocation Fund

Portfolio of investments—August 31, 2007

| | | | Face | | | | |

| | | | amount | | | | Value |

|

Commercial mortgage-backed securities—(concluded) | | | | | | | |

| JP Morgan Chase Commercial Mortgage Securities Corp., | | | | | | | |

Series 2005-LDP5, Class A4, | | | | | | | |

5.345%, due 12/15/44(2) | | | $4,700,000 | | | | $4,607,589 |

|

Series 2006-LDP8, Class A4, | | | | | | | |

5.399%, due 05/15/45 | | | 1,350,000 | | | | 1,323,453 |

|

Series 2007-LDPX, Class B, | | | | | | | |

5.582%, due 01/15/49(2),(5) | | | 175,000 | | | | 161,719 |

|

| JP Morgan Commercial Mortgage Finance Corp., | | | | | | | |

Series 1998-C6, Class A3, | | | | | | | |

6.613%, due 01/15/30 | | | 181,645 | | | | 181,179 |

|

| Merrill Lynch Mortgage Trust, Series 2007-C1, Class B, | | | | | | | |

6.022%, due 06/12/50(2) | | | 325,000 | | | | 307,536 |

|

| Morgan Stanley Capital I, | | | | | | | |

Series 2007-IQ13, Class B, | | | | | | | |

5.517%, due 03/15/44(2),(5) | | | 375,000 | | | | 344,556 |

|

Series 2007-IQ15, Class B, | | | | | | | |

6.078%, due 06/11/49(2),(5) | | | 325,000 | | | | 309,169 |

|

| Total commercial mortgage-backed securities (cost—$22,453,555) | | | | | | | 22,146,081 |

|

Asset-backed securities—0.90% | | | | | | | |

| Conseco Finance Securitizations Corp., | | | | | | | |

Series 2000-5, Class A5, | | | | | | | |

7.700%, due 02/01/32 | | | 1,279,106 | | | | 1,280,144 |

|

| Countrywide Asset-Backed Certificates, | | | | | | | |

Series 2004-SD1, Class A1, | | | | | | | |

5.845%, due 06/25/33(2),(5) | | | 8,379 | | | | 8,207 |

|

| Fieldstone Mortgage Investment Corp., Series 2006-S1, Class A, | | | | | | | |

5.725%, due 01/25/37(2),(5) | | | 583,657 | | | | 559,764 |

|

| GSAMP Trust, Series 2006-S5, Class A2, | | | | | | | |

5.658%, due 12/12/36(3),(6) | | | 300,000 | | | | 129,000 |

|

| Home Equity Mortgage Trust, | | | | | | | |

Series 2006-4, Class A1, | | | | | | | |

5.671%, due 11/25/36(3) | | | 231,504 | | | | 211,793 |

|

Series 2006-4, Class A2, | | | | | | | |

5.730%, due 11/25/36(3) | | | 2,000,000 | | | | 1,567,579 |

|

Series 2006-5, Class A1, | | | | | | | |

5.500%, due 01/25/37(3) | | | 192,075 | | | | 184,695 |

|

Series 2006-6, Class 2A1, | | | | | | | |

5.605%, due 03/25/37(2) | | | 232,705 | | | | 212,588 |

|

| | | | | | | | |

|

| | | | | | | | 25 |

UBS U.S. Allocation Fund

Portfolio of investments—August 31, 2007

| | | | Face | | | | |

| | | | amount | | | | Value |

|

Asset-backed securities—(concluded) | | | | | | | |

| Long Beach Mortgage Loan Trust, Series 2006-A, Class A2, | | | | | | | |

5.548%, due 05/25/36(3) | | | $250,000 | | | | $153,535 |

|

| Merrill Lynch First Franklin Mortgage Loan, | | | | | | | |

Series 2007-A, Class A1, | | | | | | | |

6.919%, due 09/25/27(2) | | | 250,000 | | | | 249,705 |

|

| Merrill Lynch Mortgage Investors Trust, Series 2006-SL1, Class A, | | | | | | | |

5.685%, due 09/25/36(2) | | | 201,615 | | | | 199,926 |

|

| Morgan Stanley Mortgage Loan Trust, Series 2006-14SL, Class A1, | | | | | | | |

5.665%, due 11/25/36(2) | | | 447,041 | | | | 403,725 |

|

| Nomura Asset Acceptance Corp., Series 2006-S4, Class A1, | | | | | | | |

5.675%, due 08/25/36(2) | | | 451,552 | | | | 431,514 |

|

| Rutland Rated Investments, Series DRYD-1A, Class A6F, | | | | | | | |

6.957%, due 06/20/13(5) | | | 645,000 | | | | 561,553 |

|

| SACO I Trust, Series 2006-5, Class 2A1, | | | | | | | |

5.655%, due 05/25/36(2) | | | 616,683 | | | | 553,397 |

|

| Total asset-backed securities (cost—$7,516,220) | | | | | | | 6,707,125 |

|

Corporate bonds—7.27% | | | | | | | |

| | | | | | | | |

Aerospace & defense—0.07% | | | | | | | |

| Esterline Technologies Corp. | | | | | | | |

6.625%, due 03/01/17(5) | | | 155,000 | | | | 149,575 |

|

| Hawker Beechcraft Acquisition Co. | | | | | | | |

8.875%, due 04/01/15(5) | | | 250,000 | | | | 243,750 |

|

| Sequa Corp. | | | | | | | |

9.000%, due 08/01/09 | | | 125,000 | | | | 129,375 |

|

| | | | | | | | 522,700 |

|

Agriculture—0.02% | | | | | | | |

| American Rock Salt Co. LLC | | | | | | | |

9.500%, due 03/15/14 | | | 150,000 | | | | 152,625 |

|

Apparel/textiles—0.03% | | | | | | | |

| Levi Strauss & Co. | | | | | | | |

12.250%, due 12/15/12 | | | 225,000 | | | | 240,188 |

|

Automobile OEM—0.75% | | | | | | | |

| Ford Motor Credit Co. | | | | | | | |

5.800%, due 01/12/09 | | | 3,425,000 | | | | 3,227,282 |

|

7.375%, due 10/28/09 | | | 750,000 | | | | 709,699 |

|

| General Motors | | | | | | | |

7.200%, due 01/15/11(1) | | | 300,000 | | | | 265,500 |

|

| | | | | | | | |

|

| 26 | | | | | | | |

UBS U.S. Allocation Fund

Portfolio of investments—August 31, 2007

| | | | Face | | | | |

| | | | amount | | | | Value |

|

Corporate bonds—(continued) | | | | | | | |

| | | | | | | | |

Automobile OEM—(concluded) | | | | | | | |

| General Motors Acceptance Corp. | | | | | | | |

6.875%, due 09/15/11 | | | $1,055,000 | | | | $940,912 |

|

7.250%, due 03/02/11 | | | 500,000 | | | | 459,351 |

|

| | | | | | | | 5,602,744 |

|

Automotive parts—0.04% | | | | | | | |

| Arvinmeritor | | | | | | | |

8.125%, due 09/15/15(1) | | | 175,000 | | | | 163,625 |

|

| Stanadyne Corp. | | | | | | | |

10.000%, due 08/15/14 | | | 125,000 | | | | 124,375 |

|

| | | | | | | | 288,000 |

|

Banking-non-US—0.10% | | | | | | | |

| Abbey National PLC | | | | | | | |

7.950%, due 10/26/29 | | | 275,000 | | | | 333,677 |

|

| Royal Bank of Scotland Group PLC | | | | | | | |

9.118%, due 03/31/10(7) | | | 350,000 | | | | 382,452 |

|

| | | | | | | | 716,129 |

|

Banking-US—1.07% | | | | | | | |

| Bank of America Corp. | | | | | | | |

5.420%, due 03/15/17 | | | 1,000,000 | | | | 961,484 |

|

| Citigroup, Inc. | | | | | | | |

5.000%, due 09/15/14 | | | 880,000 | | | | 842,585 |

|

5.625%, due 08/27/12 | | | 600,000 | | | | 605,869 |

|

| HSBC Bank USA | | | | | | | |

5.625%, due 08/15/35 | | | 580,000 | | | | 526,700 |

|

| J.P. Morgan Chase & Co. | | | | | | | |

6.750%, due 02/01/11 | | | 1,000,000 | | | | 1,043,011 |

|

| Wachovia Bank N.A. | | | | | | | |

7.800%, due 08/18/10 | | | 775,000 | | | | 837,013 |

|

| Wachovia Corp. | | | | | | | |

5.300%, due 10/15/11 | | | 525,000 | | | | 522,843 |

|

| Washington Mutual, Inc. | | | | | | | |

5.500%, due 01/15/13 | | | 1,335,000 | | | | 1,288,631 |

|

| Wells Fargo Bank N.A. | | | | | | | |

5.950%, due 08/26/36 | | | 655,000 | | | | 640,852 |

|

6.450%, due 02/01/11 | | | 675,000 | | | | 699,914 |

|

| | | | | | | | 7,968,902 |

|

| | | | | | | | |

|

| | | | | | | | 27 |

UBS U.S. Allocation Fund

Portfolio of investments—August 31, 2007

| | | | Face | | | | |

| | | | amount | | | | Value |

|

Corporate bonds—(continued) | | | | | | | |

| | | | | | | | |

Broadcast—0.11% | | | | | | | |

| CMP Susquehanna | | | | | | | |

9.875%, due 05/15/14 | | | $125,000 | | | | $115,625 |

|

| Nexstar Finance Holdings LLC, Inc. | | | | | | | |

11.375%, due 04/01/13(3) | | | 325,000 | | | | 316,875 |

|

| Nexstar Finance, Inc. | | | | | | | |

7.000%, due 01/15/14 | | | 100,000 | | | | 94,500 |

|

| Univision Communications, Inc. | | | | | | | |

7.850%, due 07/15/11 | | | 75,000 | | | | 72,937 |

|

9.750%, due 03/15/15(1),(5) | | | 200,000 | | | | 190,500 |

|

| | | | | | | | 790,437 |

|

Brokerage—0.47% | | | | | | | |

| Bear Stearns Co., Inc. | | | | | | | |

5.350%, due 02/01/12 | | | 240,000 | | | | 230,353 |

|

5.550%, due 01/22/17 | | | 205,000 | | | | 188,740 |

|

| Lehman Brothers Holdings | | | | | | | |

5.250%, due 02/06/12 | | | 535,000 | | | | 519,075 |

|

5.500%, due 04/04/16 | | | 235,000 | | | | 219,759 |

|

6.500%, due 07/19/17 | | | 495,000 | | | | 487,346 |

|

| Merrill Lynch & Co. | | | | | | | |

5.700%, due 05/02/17 | | | 145,000 | | | | 139,608 |

|

6.050%, due 08/15/12 | | | 295,000 | | | | 300,041 |

|

| Morgan Stanley | | | | | | | |

6.750%, due 04/15/11 | | | 1,325,000 | | | | 1,380,920 |

|

| | | | | | | | 3,465,842 |

|

Building materials—0.09% | | | | | | | |

| Ahern Rentals, Inc. | | | | | | | |

9.250%, due 08/15/13 | | | 125,000 | | | | 123,125 |

|

| Ainsworth Lumber | | | | | | | |

7.250%, due 10/01/12 | | | 50,000 | | | | 35,750 |

|

| CRH America, Inc. | | | | | | | |

6.000%, due 09/30/16 | | | 260,000 | | | | 259,448 |

|

| Interface, Inc. | | | | | | | |

10.375%, due 02/01/10 | | | 100,000 | | | | 103,500 |

|

| US Concrete, Inc. | | | | | | | |

8.375%, due 04/01/14 | | | 200,000 | | | | 186,000 |

|

| | | | | | | | 707,823 |

|

| | | | | | | | |

|

| 28 | | | | | | | |

UBS U.S. Allocation Fund

Portfolio of investments—August 31, 2007

| | | | Face | | | | |

| | | | amount | | | | Value |

|

Corporate bonds—(continued) | | | | | | | |

| | | | | | | | |

Business services—0.02% | | | | | | | |

| Da-Lite Screen Co., Inc. | | | | | | | |

9.500%, due 05/15/11 | | | $125,000 | | | | $128,125 |

|

| Sensata Technologies BV | | | | | | | |

8.000%, due 05/01/14 | | | 50,000 | | | | 47,000 |

|

| | | | | | | | 175,125 |

|

Cable—0.19% | | | | | | | |

| Comcast Cable Communications, Inc. | | | | | | | |

6.750%, due 01/30/11 | | | 800,000 | | | | 830,846 |

|

| Comcast Corp. | | | | | | | |

6.300%, due 11/15/17 | | | 160,000 | | | | 161,623 |

|

| Insight Communications, Inc. | | | | | | | |

12.250%, due 02/15/11(3) | | | 150,000 | | | | 154,313 |

|

| Mediacom Broadband LLC | | | | | | | |

9.500%, due 01/15/13 | | | 150,000 | | | | 150,000 |

|

| Quebecor Media | | | | | | | |