UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-06292

UBS Investment Trust

(Exact name of registrant as specified in charter)

51 West 52nd Street, New York, New York 10019-6114

(Address of principal executive offices) (Zip code)

Mark F. Kemper, Esq.

UBS Global Asset Management

51 West 52nd Street

New York, NY 10019-6114

(Name and address of agent for service)

Copy to:

Jack W. Murphy, Esq.

Dechert LLP

1775 I Street, N.W.

Washington, DC 20006-2401

Registrant’s telephone number, including area code: 212-882 5000

Date of fiscal year end: August 31

Date of reporting period: August 31, 2008

Item 1. Reports to Stockholders.

UBS U.S. Allocation Fund

Annual Report

August 31, 2008

UBS U.S. Allocation Fund

October 15, 2008

Dear shareholder,

We present you with the annual report for UBS U.S. Allocation Fund (the “Fund”) for the 12 months ended August 31, 2008.

Performance

Throughout the reporting period, both the US equity and fixed income markets experienced a high degree of volatility. Among numerous market challenges, fluctuating oil prices, inflationary pressures and falling corporate profits caused the equity markets to perform poorly during the reporting period, hurting the Fund’s returns. In fixed income, concerns over the US real estate market impacted mortgage- and asset-backed securities significantly, which weighed upon the Fund’s relative performance. | | | | UBS U.S. Allocation Fund

Investment goal:

Total return, consisting of

long-term capital appreciation

and current income

Portfolio Managers:

Portfolio Management

Team, including

Edwin M. Denson, PhD.

UBS Global Asset

Management (Americas) Inc.

Commencement:

Class A—May 10, 1993

Class B—January 30, 1996

Class C—July 22, 1992

Class Y—May 10, 1993

Dividend payments:

Annually, if any | | |

Against this backdrop, over the 12 months ended August 31, 2008, the Fund’s Class A shares declined 9.02% before deducting the maximum sales charge; after deducting the maximum sales charge, the Fund’s Class A shares declined 14.02%. During the same period, our proprietary index, the UBS U.S. Allocation Fund Index* declined 4.97%, and the Fund’s benchmark, the S&P 500 Index, fell 11.14%.

(Returns for all share classes over various time periods are shown in “Performance at a glance” on page 8; please note that the returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.)

| * | The UBS U.S. Allocation Fund Index is an unmanaged index compiled by the advisor, constructed as follows: from July 22, 1992 (the Fund’s inception) until February 29, 2004: 100% S&P 500 Index; from March 1, 2004 until May 31, 2005: 65% Russell 3000 Index, 30% Lehman Brothers US Aggregate Index, 5% Merrill Lynch US High Yield Cash Pay Index; and from June 1, 2005 until present: 65% Russell 3000 Index, 30% Lehman Brothers US Aggregate Index, 5% Merrill Lynch US High Yield Cash Pay Constrained Index. Investors should note that indices do not reflect fees and expenses. |

1

UBS U.S. Allocation Fund

| An interview with Lead Portfolio Manager Edwin M. Denson |

| Q. | | Can you describe the economic environment during the reporting period? |

| A. | | The US economy delivered mixed results during the 12-month reporting period. The US Department of Commerce reported that third quarter 2007 US gross domestic product (“GDP”) growth was a strong 4.8%. The economy then contracted during the last three months of the year, as fourth quarter 2007 GDP was – 0.2%. A variety of factors caused the economy to stumble, including the faltering housing market and tepid consumer and business spending. |

| | | |

| | | While there were fears that the US economy was headed for a recession—defined as two consecutive quarters of negative growth—GDP grew a surprising 0.9% during the first quarter of 2008. The Commerce Department’s estimate for second quarter GDP growth was 2.8%. This strong showing was, in part, due to rising exports, buoyed by the declining dollar, which made US goods more attractive overseas. In addition, consumer spending improved in recent months, helped by the government’s tax rebate program. |

| | | |

| Q. | | How did the Federal Reserve Board (the “Fed”) react in this economic environment? |

| A. | | The Fed has been extremely aggressive in attempting to stabilize the markets and keep the US economy from falling into a recession. As the problems and fallout from subprime mortgages escalated, the Fed moved into action by pumping substantial amounts of liquidity into the financial system in an effort to facilitate normal market operations. For example, in March 2008, the Fed established a new lending program allowing certain brokerage firms to take loans from its discount window. During the same month, it also helped orchestrate the purchase of Bear Stearns by JPMorgan Chase. |

| | | |

| | | Following the conclusion of the reporting period, the Fed made available billions of dollars to investment firms in an attempt to settle the markets following Lehman Brothers’ bankruptcy. It also announced an $85 billion loan to insurance giant AIG in exchange for an 80% ownership interest. The US Treasury Department was actively involved as well, taking control of mortgage finance companies Fannie Mae and Freddie Mac. |

| | | |

| | | During the reporting period, the Federal Reserve Board lowered the federal funds rate seven times between September 2007 and April 2008 in an attempt to stimulate the US economy and address other concerns. (The Federal Funds rate, or “fed funds” rate, is the rate that banks charge one another for funds they borrow on an overnight basis.) |

2

UBS U.S. Allocation Fund

| | | The final reduction brought the rate to 2.00%—its lowest level since 2004. Following the conclusion of the reporting period, the Fed again reduced the rate, citing a reduction of inflationary pressures and slowing economic activity. The most recent cut lowered the rate to 1.5%. |

| | | |

| Q. | | How did the equity and fixed income markets perform during the reporting period? |

| A. | | After initially rising in October 2007, the US stock market, as represented by the S&P 500 Index, declined during each of the next five months. The market then rallied briefly in April and May before plunging 8.43% in June 2008. This marked its worst monthly performance since September 2002 and its worst month of June since the Great Depression in 1930. The market ended the 12-month period largely treading water in July and August. All told, the S&P 500 Index fell 11.14% during the reporting period, and was down nearly 20% since its peak in October 2007. |

| | | |

| | | Turning to the US bond market, Treasury yields moved in response to mixed signals regarding the economy, rising inflation and expectations regarding future Fed monetary policy. Treasury yields ultimately moved lower, given the Fed’s numerous interest rate cuts and increased investor risk aversion triggered by the escalating troubles in the housing market. In the 12 months ended August 31, 2008, the overall US bond market, as measured by the Lehman Brothers US Aggregate Index, returned 5.86%.(1) |

| | | |

| Q. | | How was the Fund allocated at the end of the reporting period? |

| A. | | As of August 31, 2008, the Fund was overweight to equities and high yield debt, and underweight US bonds in relation to the target allocation of the UBS US Allocation Fund Index. This reflects a significant increase in the Fund’s allocation to equities and a decrease to bonds over the course of the 12-month period. |

| | | |

| | | During the reporting period, the sell-off in the equity markets caused the asset class to become undervalued, in our view. In response, we increased the Fund’s equity allocation. Given several flights to quality, high yield bond spreads widened over the period, making them more attractive, in our view. (Spread is the difference between the yield paid |

|

| (1) | The Lehman Brothers US Aggregate Index covers the USD-denominated, investment-grade, fixed-rate, taxable bond market of SEC-registered securities. The index includes bonds from the Treasury, Government-Related, Corporate, MBS (agency fixed-rate and hybrid ARM passthroughs), ABS and CMBS sectors. US Agency Hybrid Adjustable Rate Mortgage (ARM) securities were added to the US Aggregate Index on April 1, 2007. |

3

UBS U.S. Allocation Fund

| | | on US Treasury bonds and higher risk securities.) As such, we increased our exposure to these securities as well. |

| | | |

| | | While US investment grade bond prices fluctuated during the reporting period, we maintained our underweight to this area, as we found other areas of the market (such as equities and high yield bonds) to be more attractively valued based on our forward-looking risk and return expectations. Overall, our asset allocation strategies detracted from results during the reporting period, due to the weak performance of US equities and, to a lesser extent, high yield bonds. |

| | | |

| Q. | | Which equity strategies performed well during the reporting period, and which areas produced disappointing results? |

| A. | | Overall, the Fund’s equity holdings detracted from performance during the reporting period, with an underweight to energy stocks, a significant contributor to underperformance. The Fund’s underweight to the energy sector stems largely from an underweight to energy reserves and exploration/production companies. We believe many of these companies will see their margins reduced as crude oil prices fall and costs associated with new projects coming on line continue to rise. In our opinion, investors pricing these stocks based on recent margin levels are likely to be disappointed when these stock prices underperform. |

| | | |

| | | While the Fund maintained an underweight to the energy sector, it was overweight oil services companies, benefiting performance. We expect, over time, that their business models will be less dependent on crude oil prices than they had been in years past. Historically, lower crude oil prices dramatically reduced the number of profitable projects that oil services companies could provide infrastructure to globally. Today, we believe projects will continue to be profitable, resulting in continued demand for oil services, even if crude prices decline. Also benefiting Fund performance were electric utilities and railroads, in addition to liquid natural gas terminals and pipelines. |

| | | |

| | | The Fund’s overweight to banks detracted from performance. Given the price volatility seen in financial stocks during the reporting period, it is clear that investors, and in some cases the companies themselves, are having a difficult time evaluating the impact of the credit deterioration and subprime mortgage fallout on their respective businesses. We believe that while the environment for financials will continue to be challenging over the near term, conditions will improve over time, and that many of the companies within the sector are worth far more than the prices investors are paying today. |

4

UBS U.S. Allocation Fund

| Q. | | How did you manage the Fund’s fixed income exposure during the reporting period? |

| A. | | Early in the reporting period, we lengthened the Fund’s duration to a neutral position relative to the benchmark as we felt prices had moved to what we considered to be fair value. (Duration measures a portfolio’s sensitivity to changes in interest rates.) At the end of November 2007, we moved to a modest underweight duration relative to the benchmark as disarray in the credit markets caused longer-term interest rates to approach historically low levels. In our view, these events priced in an unduly dire economic outlook. As interest rates moved sharply higher in May and early June 2008, they moved closer to our estimate of fair value, and we added duration to the Fund, again moving to a neutral position. Overall, our duration positioning had a positive impact on performance. |

| | | |

| | | We viewed the periods of market volatility and their subsequent pricing dislocations as opportunities to adjust the Fund’s portfolio. During the reporting period, we increased the Fund’s exposure to certain Treasury Inflation-Protected Securities (TIPS) that offered what we believed to be relatively attractive yields, benefiting performance. |

| | | |

| | | However, this was not enough to offset the negative impact of the Fund’s holdings in mortgage- and asset-backed securities, which hurt the Fund’s performance significantly during the reporting period. In both cases, these securities were impacted by the fallout in the subprime mortgage market and heightened investor risk aversion. |

| | | |

| | | Finally, we maintained a relatively conservative stance in the Fund’s high yield component. However, the Fund’s exposure to the sector hurt performance on an absolute basis when high yield bonds underperformed during the reporting period. |

| | | |

| Q. | | What is your outlook for the economy? |

| A. | | While the extraordinary actions by the Fed and other government initiatives to add liquidity and restore confidence have provided some relief to the credit-related issues plaguing the markets, we expect volatility to remain high. As the credit crunch largely continues, and the effects of the still-slowing housing market are felt, the outlook for the US economy remains uncertain. We think it is likely, however, that the focus will shift from concerns over credit to a broader economic uneasiness. |

| | | |

| | | Looking ahead, we plan to monitor the state of the financial markets, inflation and the overall strength of the economy closely, as well as other factors that we believe are likely to influence the Fed’s future decisions on interest rates. |

5

UBS U.S. Allocation Fund

We thank you for your continued support and welcome any comments or questions you may have. For additional information on the UBS family of funds,** please contact your financial advisor or visit us at www.ubs.com/globalam-us.

Sincerely,

Kai R. Sotorp

President

UBS U.S. Allocation Fund

Head—Americas

UBS Global Asset Management (Americas) Inc.

Edwin M. Denson, PhD.

Lead Portfolio Manager

UBS U.S. Allocation Fund

Head of Asset Allocation

UBS Global Asset Management (Americas) Inc.

This letter is intended to assist shareholders in understanding how the Fund performed during the 12 months ended August 31, 2008. The views and opinions in the letter were current as of October 15, 2008. They are not guarantees of performance or investment results and should not be taken as investment advice. Investment decisions reflect a variety of factors, and we reserve the right to change our views about individual securities, sectors and markets at any time. As a result, the views expressed should not be relied upon as a forecast of the Fund’s future investment intent. We encourage you to consult your financial advisor regarding your personal investment program.

| ** | Mutual funds are sold by prospectus only. You should read it carefully and consider a fund’s investment objectives, risks, charges, expenses and other important information contained in the prospectus before investing. Prospectuses for most of our funds can be obtained from your Financial Advisor, by calling UBS Funds at 800-647 1568 or by visiting our Web site at www.ubs.com/globalam-us. |

6

UBS U.S. Allocation Fund

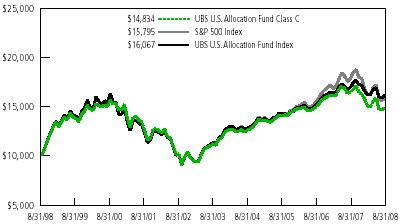

| Comparison of change in value of a $10,000 investment in the Class C shares of the UBS U.S. Allocation Fund, the S&P 500 Index(1) and the U.S. Allocation Fund Index(2) from August 31, 1998 through August 31, 2008 (unaudited) |

The graph depicts the performance of UBS U.S. Allocation Fund Class C shares versus the S&P 500 Index and the UBS U.S. Allocation Fund Index over the 10 years ended August 31, 2008. The performance of the other share classes will vary from the performance of the class shown based on the difference in sales charges and fees paid by shareholders investing in different share classes. Past performance does not predict future performance and the performance provided does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Performance results assume reinvestment of all dividend and capital gain distributions at net asset value on the ex-dividend dates. It is important to note that the Fund is a professionally managed portfolio, while the Indices are not available for investment and are unmanaged. The comparison is shown for illustrative purposes only.

| (1) | The S&P 500 Index is an unmanaged, weighted index comprising 500 widely held common stocks varying in composition and is not available for direct investment. Investors should note that indices do not reflect fees and expenses. | | |

| | | | |

| (2) | The UBS U.S. Allocation Fund Index is an unmanaged index compiled by the advisor, constructed as follows: from July 22, 1992 (the Fund’s inception) until February 29, 2004: 100% S&P 500 Index; from March 1, 2004 until May 31, 2005: 65% Russell 3000 Index, 30% Lehman Brothers US Aggregate Index, 5% Merrill Lynch US High Yield Cash Pay Index; and from June 1, 2005 until present: 65% Russell 3000 Index, 30% Lehman Brothers US Aggregate Index, 5% Merrill Lynch US High Yield Cash Pay Constrained Index. Investors should note that indices do not reflect fees and expenses. | | |

7

UBS U.S. Allocation Fund

| Performance at a glance (unaudited) |

| |

| Average annual total returns for periods ended 08/31/08 |

| | | | | | 1 year | | | 5 years | | | 10 years |

|

| | | Class A(1) | | | –9.02 | % | | | 6.63 | % | | | 4.80 | % |

| | |

|

| Before deducting maximum sales charge | | Class B(2) | | | –9.96 | % | | | 5.74 | % | | | 4.33 | % |

| | |

|

| | | Class C(3) | | | –9.70 | % | | | 5.84 | % | | | 4.02 | % |

| | |

|

| | | Class Y(4) | | | –8.69 | % | | | 7.00 | % | | | 5.15 | % |

|

| | | Class A(1) | | | –14.02 | % | | | 5.43 | % | | | 4.21 | % |

| | |

|

| After deducting maximum sales charge | | Class B(2) | | | –14.41 | % | | | 5.42 | % | | | 4.33 | % |

| | |

|

| | | Class C(3) | | | –10.58 | % | | | 5.84 | % | | | 4.02 | % |

|

| S&P 500 Index(5) | | | | | –11.14 | % | | | 6.92 | % | | | 4.68 | % |

|

| UBS U.S. Allocation Fund Index(6) | | | | | –4.97 | % | | | 7.29 | % | | | 4.86 | % |

|

| Lipper Flexible Portfolio Funds median(7) | | | | | –4.27 | % | | | 7.19 | % | | | 6.34 | % |

|

| For most recent quarter-end performance, please refer to the “Average annual total return” table on page 9. |

| |

| (1) | | Maximum sales charge for Class A shares is 5.5%. Class A shares bear ongoing 12b-1 service fees. |

| |

| (2) | | Maximum contingent deferred sales charge for Class B shares is 5% imposed on redemptions and is reduced to 0% after a maximum of six years. Class B shares bear ongoing 12b-1 service and distribution fees. |

| |

| (3) | | Maximum contingent deferred sales charge for Class C shares is 1% imposed on redemptions and is reduced to 0% after one year. Class C shares bear ongoing 12b-1 service and distribution fees. |

| |

| (4) | | The Fund offers Class Y shares to a limited group of eligible investors, including certain qualifying retirement plans. Class Y shares do not bear initial or contingent deferred sales charges or ongoing 12b-1 service and distribution fees.

If an investor sells or exchanges shares less than 90 days after purchase, a redemption fee of 1.00% of the amount sold or exchanged will be deducted at the time of the transaction, except as noted otherwise in the prospectus. |

| |

| (5) | | The S&P 500 Index is an unmanaged, weighted index comprising 500 widely held common stocks varying in composition and is not available for direct investment. Investors should note that indices do not reflect fees and expenses. |

| |

| (6) | | The UBS U.S. Allocation Fund Index is an unmanaged index compiled by the advisor, constructed as follows: from July 22, 1992 (the Fund’s inception) until February 29, 2004: 100% S&P 500 Index; from March 1, 2004 until May 31, 2005: 65% Russell 3000 Index, 30% Lehman Brothers US Aggregate Index, 5% Merrill Lynch US High Yield Cash Pay Index; and from June 1, 2005 until present: 65% Russell 3000 Index, 30% Lehman Brothers US Aggregate Index, 5% Merrill Lynch US High Yield Cash Pay Constrained Index. Investors should note that indices do not reflect fees and expenses. |

| |

| (7) | | Lipper peer group data calculated by Lipper Inc; used with permission. The Lipper median is the return of the fund that places in the middle of a Lipper peer group. |

Past performance does not predict future performance, and the performance information provided does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance results assume reinvestment of all dividends and capital gain distributions at net asset value on the ex-dividend dates. Current performance may be higher or lower than the performance data quoted. For month-end performance figures, please visit http://www.ubs.com.

8

UBS U.S. Allocation Fund

| Performance at a glance (unaudited) (concluded) |

| |

| Average annual total returns for periods ended 09/30/08 |

| | | | | | 1 year | | | 5 years | | | 10 years |

|

| | | Class A(1) | | | –18.80 | % | | | 4.85 | % | | | 3.17 | % |

| | |

|

| Before deducting maximum sales charge | | Class B(2) | | | –19.72 | % | | | 3.97 | % | | | 2.70 | % |

| | |

|

| | | Class C(3) | | | –19.45 | % | | | 4.06 | % | | | 2.40 | % |

| | |

|

| | | Class Y(4) | | | –18.55 | % | | | 5.21 | % | | | 3.51 | % |

|

| | | Class A(1) | | | –23.27 | % | | | 3.67 | % | | | 2.59 | % |

| | |

|

| After deducting maximum sales charge | | Class B(2) | | | –23.69 | % | | | 3.63 | % | | | 2.70 | % |

| | |

|

| | | Class C(3) | | | –20.24 | % | | | 4.06 | % | | | 2.40 | % |

|

| (1) | | Maximum sales charge for Class A shares is 5.5%. Class A shares bear ongoing 12b-1 service fees. |

| |

| (2) | | Maximum contingent deferred sales charge for Class B shares is 5% imposed on redemptions and is reduced to 0% after a maximum of six years. Class B shares bear ongoing 12b-1 service and distribution fees. |

| |

| (3) | | Maximum contingent deferred sales charge for Class C shares is 1% imposed on redemptions and is reduced to 0% after one year. Class C shares bear ongoing 12b-1 service and distribution fees. |

| |

| (4) | | The Fund offers Class Y shares to a limited group of eligible investors, including certain qualifying retirement plans. Class Y shares do not bear initial or contingent deferred sales charges or ongoing 12b-1 service and distribution fees. |

| |

| | | If an investor sells or exchanges shares less than 90 days after purchase, a redemption fee of 1.00% of the amount sold or exchanged will be deducted at the time of the transaction, except as noted otherwise in the prospectus. |

Past performance does not predict future performance, and the performance information provided does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance results assume reinvestment of all dividends and capital gain distributions at net asset value on the ex-dividend dates. Current performance may be higher or lower than the performance data quoted. For month-end performance figures, please visit http://www.ubs.com.

9

UBS U.S. Allocation Fund

Understanding your Fund’s expenses (unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transactional costs (as applicable), including sales charges (loads); and (2) ongoing costs, including management fees; service and/or distribution (12b-1) fees (if applicable); and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example below is based on an investment of $1,000 invested at the beginning of the period and held for the entire period, March 1, 2008 to August 31, 2008.

Actual expenses

The first line for each class of shares in the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over a period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line for each class of shares under the heading entitled “Expenses paid during period” to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The second line for each class of shares in the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratios for each class of shares and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return for each class of shares. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing Fund costs only and do not reflect any transactional costs (as applicable), such as sales charges (loads). Therefore, the second line in the table for each class of shares is useful in comparing ongoing Fund costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

10

UBS U.S. Allocation Fund

Understanding your Fund’s expenses (unaudited) (concluded)

| | | | | | | | | Expenses paid | | Expense |

| | | | | Beginning | | Ending | | during period(1) | | ratio |

| | | | | account value | | account value | | 03/01/08 to | | during the |

| | | | | March 1, 2008 | | August 31, 2008 | | 08/31/08 | | period |

|

| Class A | | Actual | | $1,000.00 | | | $990.10 | | | $4.65 | | | 0.93 | % |

|

| | | Hypothetical

(5% annual return

before expenses) | | 1,000.00 | | | 1,020.46 | | | 4.72 | | | 0.93 | % |

|

| Class B | | Actual | | 1,000.00 | | | 985.10 | | | 9.43 | | | 1.89 | % |

|

| | | Hypothetical

(5% annual return

before expenses) | | 1,000.00 | | | 1,015.63 | | | 9.58 | | | 1.89 | % |

|

| Class C | | Actual | | 1,000.00 | | | 986.00 | | | 8.59 | | | 1.72 | % |

|

| | | Hypothetical

(5% annual return

before expenses) | | 1,000.00 | | | 1,016.49 | | | 8.72 | | | 1.72 | % |

|

| Class Y | | Actual | | 1,000.00 | | | 991.50 | | | 3.00 | | | 0.60 | % |

|

| | | Hypothetical

(5% annual return

before expenses) | | 1,000.00 | | | 1,022.12 | | | 3.05 | | | 0.60 | % |

|

| (1) | | Expenses are equal to the Fund’s annualized net expense ratios, multiplied by the average account value over the period, multiplied by 184 divided by 366 (to reflect the one-half year period). |

11

UBS U.S. Allocation Fund

Portfolio statistics (unaudited)

| Characteristics | | 08/31/08 | | | | 02/29/08 | | | | 08/31/07 |

|

| Net assets (mm) | | $ | 546.7 | | | | $ | 621.9 | | | | | $ | 745.0 | |

|

| Number of securities | | | 483 | | | | | | 562 | | | | | | 490 | |

|

| | | | | | | | | | | | | | | | | |

| Portfolio composition(1) | | 08/31/08 | | | | 02/29/08 | | | | 08/31/07 |

|

| Stocks | | | 73.6% | | | | | | 65.3% | | | | | | 69.4% | |

|

| Bonds | | | 22.4 | | | | | | 30.6 | | | | | | 27.6 | |

|

| Futures, options and swap contracts | | | (0.3) | | | | | | (0.2) | | | | | | 0.0(2) | |

|

| Cash equivalents and other assets less liabilities | | | 4.3 | | | | | | 4.3 | | | | | | 3.0 | |

|

| Total | | 100.0% | | | | | 100.0% | | | | | 100.0% | |

|

| | | | | | | | | | | | | | | | | |

| Top five equity sectors(1) | | 08/31/08 | | | | 02/29/08 | | | | 08/31/07 |

|

| Health care | | 12.6% | | | | Health care | 12.1% | | | | Financials | 14.8% | |

|

| | | | | | | | | | | | | | Consumer | | | |

| Financials | | 12.2 | | | | Financials | 11.5 | | | | discretionary | 11.7 | |

|

| Information | | | | | | | | | | | | | Information | | | |

| technology | | 12.1 | | | | Industrials | 10.1 | | | | technology | 11.3 | |

|

| | | | | | | | Consumer | | | | | | | | | |

| Consumer discretionary | | 10.8 | | | | discretionary | 10.0 | | | | Health care | 10.3 | |

|

| | | | | | | | Information | | | | | | | | | |

| Industrials | | 10.7 | | | | technology | 8.5 | | | | Industrials | 8.6 | |

|

| Total | | 58.4% | | | | | 52.2% | | | | | 56.7% | |

|

| | | | | | | | | | | | | | | | | |

| Top ten equity securities(1) | | 08/31/08 | | | | 02/29/08 | | | | 08/31/07 |

|

| Intel Corp. | | 2.2% | | | | General Electric Co. | 1.8% | | | | Citigroup, Inc. | 2.5% | |

|

| Wyeth | | 1.8 | | | | Intel Corp. | 1.7 | | | | Wells Fargo & Co. | 2.3 | |

|

| Wells Fargo & Co. | | 1.8 | | | | Wyeth | 1.6 | | | | Intel Corp. | 2.0 | |

|

| General Electric Co. | | 1.7 | | | | Wells Fargo & Co. | 1.6 | | | | Exelon Corp. | 1.9 | |

|

| Halliburton Co. | | 1.5 | | | | Allergan, Inc. | 1.6 | | | | Microsoft Corp. | 1.9 | |

|

| Comcast Corp., Class A | | 1.5 | | | | Citigroup, Inc. | 1.5 | | | | Morgan Stanley | 1.8 | |

|

| Citigroup, Inc. | | 1.4 | | | | Exelon Corp. | 1.5 | | | | General Electric Co. | 1.8 | |

|

| | | | | | | | Burlington Northern | | | | | | Illinois Tool | | | |

| Baker Hughes, Inc. | | 1.4 | | | | Santa Fe Corp. | 1.4 | | | | Works, Inc. | 1.5 | |

|

| Microsoft Corp. | | 1.4 | | | | Morgan Stanley | 1.3 | | | | Wyeth | 1.4 | |

|

| Genzyme Corp. | | 1.4 | | | | Johnson & Johnson | 1.2 | | | | Sprint Nextel Corp. | 1.4 | |

|

| Total | | 16.1% | | | | 15.2% | | | | 18.5% |

|

| (1) | | Weightings represent percentages of the Fund’s net assets as of the dates indicated. |

| (2) | | Weighting represents less than 0.05% of the Fund’s net assets as of the dates indicated. |

12

UBS U.S. Allocation Fund

Portfolio statistics (unaudited) (continued)

| Long-term fixed income | | | | | | | | | | |

| sector allocation(1) | | | 08/31/08 | | 02/29/08 | | 08/31/07 |

|

| Mortgage & agency debt securities | | | 9.5 | % | | 12.7 | % | | 13.7 | % |

|

| Corporate bonds | | | 6.7 | | | 8.5 | | | 7.3 | |

|

| US government obligations | | | 4.2 | | | 4.8 | | | 2.7 | |

|

| Commercial mortgage-backed securities | | | 1.6 | | | 3.4 | | | 3.0 | |

|

| Asset-backed securities | | | 0.3 | | | 1.1 | | | 0.9 | |

|

| Collateralized debt obligation | | | 0.1 | | | 0.1 | | | — | |

|

| International government obligations | | | — | | | — | | | 0.0 | (2) |

|

| Total | | | 22.4 | % | | 30.6 | % | | 27.6 | % |

|

| (1) | | Weightings represent percentages of the Fund’s net assets as of the dates indicated. |

| (2) | | Weighting represents less than 0.05% of the Fund’s net assets as of the dates indicated. |

13

UBS U.S. Allocation Fund

Portfolio statistics (unaudited) (concluded)

| Top ten fixed | | | | | | | | | | | | | | | |

| income securities(1) | | | 08/31/08 | | | | | 02/29/08 | | | | 08/31/07 |

|

| | | | | | | US Treasury Notes, | | | | | | US Treasury Bonds, | | | |

| FNMA Certificates | | | | | | 4.250% | | | | | | 6.250% | | | |

| TBA, 5.500% TBA | | | 1.2 | % | | due 09/30/12 | | | 1.3 | % | | due 08/15/23 | | 0.9 | % |

|

| US Treasury Inflation | | | | | | US Treasury Notes, | | | | | | FHLMC Certificates, | | | |

| Index Notes, 2.000% | | | | | | 4.625% due | | | | | | 5.500% | | | |

| due 01/15/16 | | | 1.0 | | | 02/15/17 | | | 0.9 | | | due 08/23/17 | | 0.9 | |

|

| US Treasury | | | | | | US Treasury Bonds, | | | | | | FHLMC Certificates, | | | |

| Notes, 4.625% | | | | | | 6.250% due | | | | | | 5.600% | | | |

| due 02/15/17 | | | 0.9 | | | 08/15/23 | | | 0.9 | | | due 10/17/13 | | 0.8 | |

|

| FNMA Certificates | | | | | | FNMA Certificates, | | | | | | US Treasury Bonds, | | | |

| TBA, 6.000% | | | | | | 6.500% | | | | | | 4.750% | | | |

| TBA | | | 0.6 | | | due 01/01/36 | | | 0.8 | | | due 02/15/37 | | 0.7 | |

|

| US Treasury Inflation | | | | | | US Treasury Notes, | | | | | | FNMA Certificates, | | | |

| Index Notes, 2.375% | | | | | | 3.250% due | | | | | | 6.500% | | | |

| due 04/15/11 | | | 0.6 | | | 12/31/09 | | | 0.6 | | | due 01/01/36 | | 0.7 | |

|

| FHLMC Certificates, | | | | | | US Treasury Inflation | | | | | | US Treasury Notes, | | | |

| 5.500% | | | | | | Index Notes, 2.375% | | | | | | 5.125% | | | |

| due 05/01/37 | | | 0.6 | | | due 04/15/11 | | | 0.6 | | | due 05/15/16 | | 0.6 | |

|

| | | | | | | | | | | | | JP Morgan Chase | | | |

| US Treasury Bonds, | | | | | | FHLMC Certificates, | | | | | | Commercial Mortgage | | | |

| 5.375% | | | | | | 5.500% | | | | | | Securities, 5.345% | | | |

| due 02/15/31 | | | 0.5 | | | due 05/01/37 | | | 0.5 | | | due 12/15/44 | | 0.6 | |

|

| US Treasury Bonds, | | | | | | FNMA Certificates, | | | | | | FNMA Certificates, | | | |

| 4.750% | | | | | | 5.000% | | | | | | 5.200% | | | |

| due 02/15/37 | | | 0.5 | | | due 02/01/19 | | | 0.5 | | | due 11/08/10 | | 0.5 | |

|

| FNMA REMIC, | | | | | | | | | | | | Greenwich Capital | | | |

| Series 2004-W1, | | | | | | FHLMC Certificates, | | | | | | Commercial Funding | | | |

| Class 3A, 5.855% | | | | | | 5.600% | | | | | | Corp., 5.962% | | | |

| due 01/25/43 | | | 0.5 | | | due 10/17/13 | | | 0.5 | | | due 03/18/49 | | 0.4 | |

|

| GNMA Certificates II, | | | | | | Lehman XS Trust, | | | | | | FNMA Certificates, | | | |

| 6.000% | | | | | | 6.000% | | | | | | 5.500% | | | |

| due 02/20/34 | | | 0.4 | | | due 12/25/35 | | | 0.5 | | | due 02/01/19 | | 0.4 | |

|

| Total | | | 6.8 | % | | | | | 7.1 | % | | | | 6.5 | % |

|

| (1) | | Weightings represent percentages of the Fund’s net assets as of the dates indicated. |

14

UBS U.S. Allocation Fund

Portfolio of investments—August 31, 2008

Common stocks—73.59%

| Security description | | Shares | | | Value |

|

| Aerospace & defense—0.78% | | | | | |

| BE Aerospace, Inc.* | | 6,800 | | | $162,860 |

|

| General Dynamics Corp. | | 9,200 | | | 849,160 |

|

| Hexcel Corp.* | | 19,100 | | | 396,898 |

|

| LMI Aerospace, Inc.* | | 10,000 | | | 235,900 |

|

| Precision Castparts Corp. | | 10,700 | | | 1,104,882 |

|

| United Technologies Corp. | | 23,000 | | | 1,508,570 |

|

| | | | | | 4,258,270 |

|

| Air freight & couriers—1.69% | | | | | |

| Dynamex, Inc.* | | 10,500 | | | 309,540 |

|

| FedEx Corp. | | 79,900 | | | 6,617,318 |

|

| Ryder System, Inc. | | 35,600 | | | 2,296,912 |

|

| | | | | | 9,223,770 |

|

| Airlines—0.27% | | | | | |

| Southwest Airlines Co. | | 98,600 | | | 1,501,678 |

|

| Auto components—1.74% | | | | | |

| BorgWarner, Inc. | | 108,400 | | | 4,482,340 |

|

| Johnson Controls, Inc. | | 162,500 | | | 5,024,500 |

|

| | | | | | 9,506,840 |

|

| Banks—4.42% | | | | | |

| City National Corp. | | 30,600 | | | 1,514,394 |

|

| Cullen/Frost Bankers, Inc. | | 2,800 | | | 155,904 |

|

| East West Bancorp, Inc.(1) | | 15,200 | | | 189,544 |

|

| Fifth Third Bancorp | | 316,338 | | | 4,991,814 |

|

| South Financial Group, Inc. | | 33,700 | | | 229,160 |

|

| SunTrust Banks, Inc. | | 85,700 | | | 3,589,973 |

|

| SVB Financial Group* | | 6,700 | | | 375,535 |

|

| The Bank of New York Mellon Corp. | | 88,500 | | | 3,062,985 |

|

| United Bankshares, Inc.(1) | | 5,300 | | | 136,475 |

|

| Wells Fargo & Co. | | 323,300 | | | 9,786,291 |

|

| WSFS Financial Corp. | | 3,000 | | | 160,410 |

|

| | | | | | 24,192,485 |

|

| Security description | | Shares | | | Value |

|

| Beverages—0.65% | | | | | |

| Constellation Brands, Inc., Class A* | | 124,400 | | $ | 2,626,084 |

|

| PepsiCo, Inc. | | 13,900 | | | 951,872 |

|

| | | | | | 3,577,956 |

|

| Biotechnology—1.35% | | | | | |

| Genzyme Corp.* | | 94,400 | | | 7,391,520 |

|

| Building products—0.91% | | | | | |

| Masco Corp. | | 260,400 | | | 4,963,224 |

|

| Chemicals—0.66% | | | | | |

| Cytec Industries, Inc. | | 10,800 | | | 548,640 |

|

| Monsanto Co. | | 6,500 | | | 742,625 |

|

| Potash Corp. of Saskatchewan, Inc. | | 3,200 | | | 555,520 |

|

| Praxair, Inc. | | 17,900 | | | 1,608,136 |

|

| Spartech Corp. | | 16,100 | | | 169,533 |

|

| | | | | | 3,624,454 |

|

| Commercial services & supplies—0.91% | | | | | |

| Coinstar, Inc.* | | 20,800 | | | 684,736 |

|

| Dice Holdings, Inc.* | | 1,800 | | | 16,002 |

|

| Dollar Financial Corp.(1),* | | 20,400 | | | 372,912 |

|

| Factset Research Systems, Inc.(1) | | 4,600 | | | 288,466 |

|

| LECG Corp.* | | 14,100 | | | 114,915 |

|

| MasterCard, Inc., Class A | | 12,800 | | | 3,104,640 |

|

| Mobile Mini, Inc.(1),* | | 17,200 | | | 367,736 |

|

| | | | | | 4,949,407 |

|

| Communications equipment—1.33% | | | | | |

| Cisco Systems, Inc.* | | 76,000 | | | 1,827,800 |

|

| F5 Networks, Inc.(1),* | | 9,300 | | | 317,223 |

|

| Harris Corp. | | 6,500 | | | 340,340 |

|

| NICE Systems Ltd., ADR(1),* | | 6,800 | | | 208,284 |

|

| OpNext, Inc.* | | 12,600 | | | 79,884 |

|

| Powerwave Technologies, Inc.(1),* | | 83,400 | | | 421,170 |

|

| QUALCOMM, Inc. | | 52,300 | | | 2,753,595 |

|

15

UBS U.S. Allocation Fund

Portfolio of investments—August 31, 2008

Common stocks—(continued)

| Security description | | Shares | | | Value |

|

| Communications equipment—(concluded) | | | | | |

| Research In Motion Ltd. (RIM)* | | 10,900 | | | $1,325,440 |

|

| | | | | | 7,273,736 |

|

| Computers & peripherals—2.09% | | | | | |

| Apple, Inc.* | | 10,700 | | | 1,813,971 |

|

| Dell, Inc.* | | 135,200 | | | 2,937,896 |

|

| Hewlett-Packard Co. | | 51,800 | | | 2,430,456 |

|

| NetApp, Inc.* | | 156,600 | | | 3,990,168 |

|

| Stratasys, Inc.(1),* | | 16,600 | | | 276,556 |

|

| | | | | | 11,449,047 |

|

| Construction & engineering—0.04% | | | | | |

| Sterling Construction Co., Inc.* | | 12,445 | | | 229,610 |

|

| Distributors—0.09% | | | | | |

| Beacon Roofing Supply, Inc.(1),* | | 29,900 | | | 486,772 |

|

| Diversified financials—5.10% | | | | | |

| American Express Co. | | 20,500 | | | 813,440 |

|

| BlackRock, Inc. | | 1,600 | | | 347,600 |

|

| Citigroup, Inc. | | 413,786 | | | 7,857,796 |

|

| Discover Financial Services | | 204,525 | | | 3,364,436 |

|

| Goldman Sachs Group, Inc. | | 3,300 | | | 541,101 |

|

| Morgan Stanley | | 152,250 | | | 6,216,368 |

|

| National Financial | | | | | |

|

| Partners Corp. | | 18,200 | | | 367,094 |

|

| optionsXpress Holdings, Inc.(1) | | 5,800 | | | 133,806 |

|

| PennantPark Investment Corp.(1) | | 49,100 | | | 392,309 |

|

| Principal Financial Group, Inc. | | 93,200 | | | 4,267,628 |

|

| State Street Corp. | | 5,700 | | | 385,719 |

|

| T. Rowe Price Group, Inc. | | 11,500 | | | 682,640 |

|

| Visa, Inc., Class A | | 33,200 | | | 2,519,880 |

|

| | | | | | 27,889,817 |

|

| Security description | | Shares | | | Value |

|

| Diversified telecommunication services—2.16% | |

| AT&T, Inc. | | 151,600 | | | $4,849,684 |

|

| Cbeyond, Inc.(1),* | | 9,300 | | | 157,449 |

|

| NeuStar, Inc., Class A* | | 18,600 | | | 446,586 |

|

| Sprint Nextel Corp. | | 731,194 | | | 6,376,012 |

|

| | | | | | 11,829,731 |

|

| Electric utilities—1.58% | | | | | |

| American Electric Power Co., Inc. | | 73,200 | | | 2,857,728 |

|

| Exelon Corp. | | 56,800 | | | 4,314,528 |

|

| Pepco Holdings, Inc. | | 57,200 | | | 1,450,020 |

|

| | | | | | 8,622,276 |

|

| Electrical equipment—0.06% | | | | | |

| General Cable Corp.* | | 6,700 | | | 329,774 |

|

| Electronic equipment & instruments—0.14% | | | |

| Daktronics, Inc. | | 22,200 | | | 389,166 |

|

| Regal-Beloit Corp. | | 8,200 | | | 384,990 |

|

| | | | | | 774,156 |

|

| Energy equipment & services—3.77% | | | | | |

| Baker Hughes, Inc. | | 95,300 | | | 7,624,953 |

|

| Cameron International Corp.* | | 12,100 | | | 563,739 |

|

| GulfMark Offshore, Inc.* | | 4,700 | | | 235,470 |

|

| Halliburton Co. | | 192,800 | | | 8,471,632 |

|

| Oil States International, Inc.* | | 10,300 | | | 572,989 |

|

| Schlumberger Ltd. | | 15,100 | | | 1,422,722 |

|

| TETRA Technologies, Inc.* | | 31,700 | | | 701,838 |

|

| Weatherford International Ltd.* | | 26,200 | | | 1,010,796 |

|

| | | | | | 20,604,139 |

|

| Food & drug retailing—0.86% | | | | | |

| PetMed Express, Inc.(1),* | | 24,100 | | | 343,184 |

|

| Sysco Corp. | | 136,200 | | | 4,335,246 |

|

| | | | | | 4,678,430 |

|

16

UBS U.S. Allocation Fund

Portfolio of investments—August 31, 2008

Common stocks—(continued)

| Security description | | Shares | | | Value |

|

| Food products—0.14% | | | | | |

| Campbell Soup Co. | | 9,600 | | | $353,376 |

|

| Fresh Del Monte Produce, Inc.* | | 9,000 | | | 208,890 |

|

| Maui Land & Pineapple Co., Inc.* | | 3,977 | | | 106,703 |

|

| Reddy Ice Holdings, Inc.(1) | | 12,500 | | | 105,250 |

|

| | | | | | 774,219 |

|

| Gas utilities—1.12% | | | | | |

| NiSource, Inc. | | 87,400 | | | 1,440,352 |

|

| Sempra Energy | | 69,500 | | | 4,025,440 |

|

| Southwestern Energy Co.* | | 16,500 | | | 633,105 |

|

| | | | | | 6,098,897 |

|

| Health care equipment & supplies—3.68% | | | | | |

| Advanced Medical Optics, Inc.(1),* | | 18,600 | | | 402,318 |

|

| Align Technology, Inc.(1),* | | 23,600 | | | 307,744 |

|

| AngioDynamics, Inc.* | | 17,800 | | | 292,454 |

|

| Baxter International, Inc. | | 21,900 | | | 1,483,944 |

|

| Becton, Dickinson & Co. | | 6,200 | | | 541,756 |

|

| CONMED Corp.(1),* | | 15,600 | | | 498,576 |

|

| Covidien Ltd. | | 56,100 | | | 3,033,327 |

|

| Edwards Lifesciences Corp.* | | 3,700 | | | 219,077 |

|

| Medical Action Industries, Inc.* | | 20,800 | | | 273,936 |

|

| Medtronic, Inc. | | 87,600 | | | 4,782,960 |

|

| Mentor Corp.(1) | | 10,300 | | | 254,204 |

|

| Millipore Corp.* | | 33,400 | | | 2,505,334 |

|

| Orthofix International NV(1),* | | 16,200 | | | 392,688 |

|

| Stryker Corp. | | 20,100 | | | 1,350,519 |

|

| The Cooper Cos., Inc.(1) | | 6,600 | | | 243,078 |

|

| Zimmer Holdings, Inc.* | | 48,600 | | | 3,518,154 |

|

| | | | | | 20,100,069 |

|

| Security description | | Shares | | | Value |

|

| Health care providers & services—1.33% | | | | | |

| DaVita, Inc.* | | 28,900 | | | $1,658,571 |

|

| Express Scripts, Inc.* | | 10,200 | | | 748,782 |

|

| Laboratory Corp. of America Holdings* | | 22,800 | | | 1,667,820 |

|

| Pharmaceutical Product Development, Inc. (PPD) | | 29,358 | | | 1,197,806 |

|

| PSS World Medical, Inc.* | | 25,200 | | | 460,404 |

|

| UnitedHealth Group, Inc. | | 51,000 | | | 1,552,950 |

|

| | | | | | 7,286,333 |

|

| Hotels, restaurants & leisure—2.78% | | | | | |

| Carnival Corp. | | 119,800 | | | 4,439,788 |

|

| International Game Technology | | 38,100 | | | 816,483 |

|

| Life Time Fitness, Inc.(1),* | | 10,400 | | | 367,640 |

|

| Royal Caribbean Cruises Ltd.(1) | | 57,800 | | | 1,571,004 |

|

| Starbucks Corp.* | | 183,800 | | | 2,859,928 |

|

| Starwood Hotels & Resorts Worldwide, Inc. | | 78,100 | | | 2,831,125 |

|

| Wynn Resorts Ltd.(1) | | 24,000 | | | 2,290,080 |

|

| | | | | | 15,176,048 |

|

| Household durables—0.70% | | | | | |

| Fortune Brands, Inc. | | 53,900 | | | 3,170,398 |

|

| Interface, Inc., Class A | | 33,600 | | | 442,512 |

|

| Tempur-Pedic International, Inc.(1) | | 20,900 | | | 236,379 |

|

| | | | | | 3,849,289 |

|

| Household products—0.27% | | | | | |

| Colgate-Palmolive Co. | | 9,400 | | | 714,682 |

|

| Prestige Brands Holdings, Inc.* | | 31,900 | | | 303,050 |

|

| Procter & Gamble Co. | | 6,300 | | | 439,551 |

|

| | | | | | 1,457,283 |

|

| Industrial conglomerates—1.73% | | | | | |

| General Electric Co. | | 335,700 | | | 9,433,170 |

|

17

UBS U.S. Allocation Fund

Portfolio of investments—August 31, 2008

Common stocks—(continued)

| Security description | | Shares | | | Value |

|

| Insurance—2.42% | | | | | |

| ACE Ltd. | | 42,500 | | | $2,235,925 |

|

| AFLAC, Inc. | | 97,900 | | | 5,550,930 |

|

| Hartford Financial Services Group, Inc. | | 53,200 | | | 3,355,856 |

|

| Prudential Financial, Inc. | | 17,100 | | | 1,260,441 |

|

| Tower Group, Inc. | | 20,100 | | | 421,095 |

|

| Validus Holdings Ltd. | | 16,400 | | | 391,304 |

|

| | | | | | 13,215,551 |

|

| Internet & catalog retail—0.33% | | | | | |

| Amazon.com, Inc.* | | 20,200 | | | 1,632,362 |

|

| NutriSystem, Inc. | | 7,500 | | | 149,025 |

|

| | | | | | 1,781,387 |

|

| Internet software & services—0.82% | | | | | |

| Art Technology Group, Inc.* | | 104,100 | | | 426,810 |

|

| Google, Inc., Class A* | | 5,200 | | | 2,409,108 |

|

| Nortel Networks Corp.* | | 24,904 | | | 150,171 |

|

| RightNow Technologies, Inc.* | | 22,300 | | | 334,277 |

|

| TheStreet.com, Inc. | | 46,200 | | | 328,020 |

|

| ValueClick, Inc.* | | 23,800 | | | 306,782 |

|

| Websense, Inc.* | | 24,000 | | | 543,360 |

|

| | | | | | 4,498,528 |

|

| IT consulting & services—0.27% | | | | | |

| Automatic Data Processing, Inc. | | 22,100 | | | 980,798 |

|

| CACI International, Inc., Class A* | | 10,100 | | | 511,565 |

|

| | | | | | 1,492,363 |

|

| Machinery—2.62% | | | | | |

| Chart Industries, Inc.* | | 9,105 | | | 420,469 |

|

| Illinois Tool Works, Inc. | | 137,200 | | | 6,806,492 |

|

| PACCAR, Inc. | | 105,100 | | | 4,525,606 |

|

| Pall Corp. | | 62,700 | | | 2,546,247 |

|

| | | | | | 14,298,814 |

|

| Security description | | Shares | | | Value |

|

| Marine—0.04% | | | | | |

| Hornbeck Offshore Services, Inc.* | | 5,500 | | | $242,330 |

|

| Media—3.67% | | | | | |

| Cinemark Holdings, Inc.(1) | | 29,900 | | | 439,231 |

|

| Comcast Corp., Class A | | 382,500 | | | 8,101,350 |

|

| Interpublic Group of Cos., Inc.* | | 380,600 | | | 3,577,640 |

|

| News Corp., Class A | | 303,100 | | | 4,291,896 |

|

| Omnicom Group, Inc.(1) | | 86,300 | | | 3,658,257 |

|

| | | | | | 20,068,374 |

|

| Metals & mining—0.93% | | | | | |

| Brush Engineered Materials, Inc.* | | 9,300 | | | 272,490 |

|

| CONSOL Energy, Inc. | | 12,700 | | | 859,917 |

|

| Freeport-McMoRan Copper & Gold, Inc. | | 3,900 | | | 348,348 |

|

| Haynes International, Inc.(1),* | | 8,700 | | | 508,602 |

|

| Peabody Energy Corp. | | 49,500 | | | 3,116,025 |

|

| | | | | | 5,105,382 |

|

| Multi-line retail—0.27% | | | | | |

| Target Corp. | | 27,600 | | | 1,463,352 |

|

| Oil & gas—2.96% | | | | | |

| Chesapeake Energy Corp. | | 7,600 | | | 367,840 |

|

| Chevron Corp. | | 55,700 | | | 4,808,024 |

|

| EOG Resources, Inc. | | 24,000 | | | 2,506,080 |

|

| Equitable Resources, Inc. | | 6,700 | | | 334,397 |

|

| Marathon Oil Corp. | | 82,700 | | | 3,727,289 |

|

| Sunoco, Inc. | | 37,600 | | | 1,668,688 |

|

| Tesoro Corp.(1) | | 78,900 | | | 1,463,595 |

|

| Ultra Petroleum Corp.* | | 5,400 | | | 368,010 |

|

| XTO Energy, Inc. | | 18,550 | | | 935,105 |

|

| | | | | | 16,179,028 |

|

18

UBS U.S. Allocation Fund

Portfolio of investments—August 31, 2008

Common stocks—(continued)

| Security description | | Shares | | | Value |

|

| Pharmaceuticals—6.23% | | | | | |

| Abbott Laboratories | | 7,000 | | | $402,010 |

|

| Allergan, Inc. | | 112,800 | | | 6,302,136 |

|

| Cephalon, Inc.* | | 13,700 | | | 1,049,694 |

|

| Johnson & Johnson | | 98,664 | | | 6,948,905 |

|

| Medco Health Solutions, Inc.* | | 106,700 | | | 4,998,895 |

|

| Schering-Plough Corp. | | 231,200 | | | 4,485,280 |

|

| Wyeth | | 227,900 | | | 9,863,512 |

|

| | | | | | 34,050,432 |

|

| Real estate—0.27% | | | | | |

| American Campus Communities, Inc.(1) | | 8,700 | | | 263,784 |

|

| Capstead Mortgage Corp.(1) | | 13,300 | | | 156,142 |

|

| DiamondRock Hospitality Co. | | 24,800 | | | 228,408 |

|

| Digital Realty Trust, Inc. | | 4,600 | | | 211,002 |

|

| Entertainment Properties Trust | | 6,700 | | | 363,609 |

|

| Hatteras Financial Corp. | | 9,900 | | | 245,025 |

|

| | | | | | 1,467,970 |

|

| Road & rail—1.60% | | | | | |

| Burlington Northern Santa Fe Corp. | | 61,100 | | | 6,562,140 |

|

| Kansas City Southern* | | 13,800 | | | 709,734 |

|

| Knight Transportation, Inc.(1) | | 16,600 | | | 296,974 |

|

| Old Dominion Freight Line, Inc.* | | 8,500 | | | 282,795 |

|

| Union Pacific Corp. | | 11,000 | | | 922,900 |

|

| | | | | | 8,774,543 |

|

| Semiconductor equipment & products—4.27% | | | |

| Analog Devices, Inc. | | 177,000 | | | 4,948,920 |

|

| Broadcom Corp., Class A* | | 88,800 | | | 2,136,528 |

|

| Intel Corp. | | 528,200 | | | 12,079,934 |

|

| Security description | | Shares | | | Value |

|

| Semiconductor equipment & products—(concluded) | | |

| ON Semiconductor Corp.* | | 54,100 | | | $512,327 |

|

| Xilinx, Inc. | | 140,700 | | | 3,655,386 |

|

| | | | | | 23,333,095 |

|

| Software—3.23% | | | | | |

| Innerworkings, Inc.(1),* | | 32,800 | | | 389,008 |

|

| Intuit, Inc.* | | 119,900 | | | 3,605,393 |

|

| Microsoft Corp. | | 275,900 | | | 7,529,311 |

|

| Nuance Communications, Inc.(1),* | | 23,600 | | | 372,880 |

|

| Quest Software, Inc.* | | 14,400 | | | 212,976 |

|

| Secure Computing Corp.* | | 28,400 | | | 121,552 |

|

| Smith Micro Software, Inc.(1),* | | 23,300 | | | 176,381 |

|

| Symantec Corp.* | | 123,373 | | | 2,752,452 |

|

| Synchronoss Technologies, Inc.(1),* | | 10,900 | | | 137,994 |

|

| VASCO Data Security International, Inc.* | | 24,400 | | | 337,208 |

|

| VMware, Inc., Class A* | | 51,700 | | | 2,052,490 |

|

| | | | | | 17,687,645 |

|

| Specialty retail—0.84% | | | | | |

| Abercrombie & Fitch Co., Class A | | 12,800 | | | 671,360 |

|

| Casual Male Retail Group, Inc.(1),* | | 49,900 | | | 190,618 |

|

| Hibbett Sports, Inc.(1),* | | 22,800 | | | 544,920 |

|

| Interline Brands, Inc.* | | 30,100 | | | 483,105 |

|

| J. Crew Group, Inc.(1),* | | 29,700 | | | 784,377 |

|

| Movado Group, Inc. | | 18,756 | | | 434,952 |

|

| PetSmart, Inc. | | 11,500 | | | 310,155 |

|

| Rush Enterprises, Inc., Class A* | | 10,500 | | | 138,495 |

|

| Susser Holdings Corp.(1),* | | 9,500 | | | 177,745 |

|

19

UBS U.S. Allocation Fund

Portfolio of investments—August 31, 2008

Common stocks—(continued)

| Security description | | Shares | | | Value |

|

| Specialty retail—(concluded) | | | | | |

| The Sherwin-Williams Co. | | 12,700 | | | $743,585 |

|

| United Rentals, Inc.* | | 6,600 | | | 106,854 |

|

| | | | | | 4,586,166 |

|

| Textiles & apparel—0.39% | | | | | |

| Coach, Inc.* | | 59,400 | | | 1,722,006 |

|

| Steven Madden Ltd.* | | 15,400 | | | 387,310 |

|

| | | | | | 2,109,316 |

|

| Security description | | Shares | | | Value |

|

| Wireless telecommunication services—0.08% |

| American Tower Corp., Class A* | | 10,800 | | | $446,364 |

|

| Total common stocks | | | | | |

| (cost—$416,163,032) | | | | | 402,333,040 |

|

20

UBS U.S. Allocation Fund

Portfolio of investments—August 31, 2008

| | Face | | | |

| Security description | amount | | Value |

|

| US government obligations—4.18% | | | | | |

|

| US Treasury Bonds, | | | | | |

4.750%, due 02/15/37 | $ | 2,775,000 | | | $2,916,353 |

|

5.375%, due 02/15/31 | | 2,600,000 | | | 2,932,719 |

|

8.125%, due 08/15/19 | | 335,000 | | | 453,428 |

|

| US Treasury Inflation Index Notes (TIPS), | | | | | |

2.000%, due 01/15/16 | | 5,516,061 | | | 5,697,489 |

|

2.375%, due 04/15/11 | | 3,008,624 | | | 3,117,217 |

|

| US Treasury Notes, | | | | | |

1.750%, due 03/31/10 | | 2,105,000 | | | 2,089,869 |

|

3.500%, due 05/31/13 | | 690,000 | | | 703,639 |

|

3.875%, due 05/15/18 | | 150,000 | | | 150,879 |

|

4.625%, due 02/15/17(1) | | 4,500,000 | | | 4,809,375 |

|

| Total US government obligations (cost—$22,779,957) | | | | | 22,870,968 |

|

| Mortgage & agency debt securities—9.50% | | | | | |

|

| Banc of America Funding Corp., | | | | | |

Series 2006-H, Class B1, | | | | | |

6.079%, due 09/20/46(2) | | 2,379,118 | | | 401,357 |

|

| Bear Stearns Adjustable Rate Mortgage Trust, | | | | | |

Series 2005-1, Class 4A1, | | | | | |

5.345%, due 03/25/35 | | 958,404 | | | 843,191 |

|

Series 2007-3, Class 2A1, | | | | | |

5.632%, due 05/25/47 | | 2,554,093 | | | 2,160,105 |

|

| Countrywide Alternative Loan Trust, | | | | | |

Series 2005-J2, Class 2A1, | | | | | |

7.500%, due 12/25/34 | | 695,973 | | | 525,677 |

|

| Federal Home Loan Mortgage Corporation Certificates,** | | | | | |

5.500%, due 04/01/18 | | 21,663 | | | 22,040 |

|

5.500%, due 03/01/37 | | 1,934,599 | | | 1,909,270 |

|

5.500%, due 05/01/37 | | 3,051,913 | | | 3,011,956 |

|

6.000%, due 03/01/32 | | 5,080 | | | 5,171 |

|

6.500%, due 08/01/28 | | 1,096,716 | | | 1,137,997 |

|

6.500%, due 04/01/29 | | 15,034 | | | 15,591 |

|

| Federal Home Loan Mortgage Corporation Certificates ARM,** | | | | | |

5.140%, due 05/01/37 | | 2,138,243 | | | 2,141,826 |

|

5.361%, due 03/01/37 | | 1,961,114 | | | 1,979,412 |

|

| Federal Home Loan Mortgage Corporation Certificates TBA,** | | | | | |

5.000%, TBA | | 1,600,000 | | | 1,537,000 |

|

21

UBS U.S. Allocation Fund

Portfolio of investments—August 31, 2008

| | Face | | | |

| Security description | amount | | Value |

|

| Mortgage & agency debt securities—(continued) | | | | | |

|

| Federal National Mortgage Association Certificates,** | | | | | |

3.500%, due 04/28/11 | | $1,945,000 | | | $1,941,828 |

|

3.875%, due 07/12/13 | | 330,000 | | | 328,399 |

|

5.000%, due 10/15/10 | | 1,760,000 | | | 1,764,143 |

|

5.250%, due 08/01/12 | | 195,000 | | | 180,140 |

|

5.500%, due 07/01/33 | | 1,590,638 | | | 1,579,753 |

|

6.000%, due 06/01/33 | | 11,214 | | | 11,426 |

|

6.000%, due 04/01/38 | | 1,083,182 | | | 1,094,726 |

|

6.000%, due 06/01/38 | | 1,066,748 | | | 1,078,116 |

|

6.500%, due 03/01/17 | | 746,323 | | | 776,321 |

|

7.000%, due 08/01/32 | | 981,321 | | | 1,034,154 |

|

7.500%, due 05/01/31 | | 7,281 | | | 7,913 |

|

7.500%, due 02/01/33 | | 13,253 | | | 14,289 |

|

| Federal National Mortgage Association Certificates TBA,** | | | | | |

5.000%, TBA | | 2,225,000 | | | 2,138,781 |

|

5.500%, TBA | | 6,620,000 | | | 6,537,250 |

|

6.000%, TBA | | 3,310,000 | | | 3,342,067 |

|

| FHLMC REMIC, Series T-42, Class A5,** | | | | | |

7.500%, due 02/25/42 | | 1,724,671 | | | 1,859,570 |

|

| First Horizon Mortgage Pass-Through Trust, | | | | | |

Series 2004-FL1, Class 1A1, | | | | | |

2.742%, due 02/25/35(2) | | 151,140 | | | 134,190 |

|

Series 2007-AR2, Class 1A1, | | | | | |

5.850%, due 06/25/37(2) | | 1,678,032 | | | 1,574,791 |

|

| FNMA REMIC,** | | | | | |

Series 2004-W1, Class 3A, | | | | | |

5.855%, due 01/25/43(2) | | 2,554,242 | | | 2,531,864 |

|

| Government National Mortgage Association Certificates, | | | | | |

6.500%, due 10/15/24 | | 1,575,903 | | | 1,629,424 |

|

6.500%, due 10/15/28 | | 11,017 | | | 11,428 |

|

6.500%, due 04/15/31 | | 687,978 | | | 713,127 |

|

7.000%, due 04/15/26 | | 6,736 | | | 7,181 |

|

| Government National Mortgage Association Certificates II, | | | | | |

6.000%, due 11/20/28 | | 4,742 | | | 4,834 |

|

6.000%, due 02/20/29 | | 10,434 | | | 10,633 |

|

6.000%, due 02/20/34 | | 2,304,949 | | | 2,341,172 |

|

| Government National Mortgage Association Certificates TBA, | | | | | |

5.000%, TBA | | 1,100,000 | | | 1,073,532 |

|

22

UBS U.S. Allocation Fund

Portfolio of investments—August 31, 2008

| | Face | | | |

| Security description | amount | | Value |

|

| Mortgage & agency debt securities—(concluded) | | | | | |

|

| Washington Mutual Mortgage Pass-Through Certificates, | | | | | |

Series 2002-AR17, Class 1A, | | | | | |

4.279%, due 11/25/42(2) | | $797,560 | | | $612,377 |

|

Series 2007-HY7, Class LB1, | | | | | |

5.853%, due 07/25/37(2) | | 1,172,998 | | | 308,905 |

|

| Wells Fargo Mortgage Backed Securities Trust, | | | | | |

Series 2007-10, Class 1A1, | | | | | |

6.000%, due 07/25/37 | | 714,794 | | | 578,760 |

|

Series 2007-11, Class B1, | | | | | |

6.000%, due 08/25/37 | | 2,384,438 | | | 1,042,590 |

|

| Total mortgage & agency debt securities (cost—$56,932,339) | | | | | 51,954,277 |

|

| Commercial mortgage-backed securities—1.59% | | | | | |

|

| American Home Mortgage Investment Trust, | | | | | |

2.662%, due 11/25/35(2) | | 251,943 | | | 93,143 |

|

| Bear Stearns Commercial Mortgage Securities, | | | | | |

Series 2006-PW14, Class B, | | | | | |

5.333%, due 12/11/38(3) | | 375,000 | | | 246,097 |

|

| Citigroup Commercial Mortgage Trust, | | | | | |

Series 2006-C5, Class A4, | | | | | |

5.431%, due 10/15/49 | | 1,050,000 | | | 958,983 |

|

| Greenwich Capital Commercial Funding Corp., | | | | | |

Series 2006-RR1, Class A1, | | | | | |

5.961%, due 03/18/49(2),(3) | | 3,500,000 | | | 2,100,000 |

|

| GS Mortgage Securities Corp. II, | | | | | |

Series 2006-CC1, Class A, | | | | | |

5.504%, due 03/21/46(2),(3) | | 3,406,426 | | | 1,873,534 |

|

Series 2006-RR2, Class A1, | | | | | |

5.814%, due 06/23/46(2),(3) | | 3,119,994 | | | 1,871,996 |

|

| JP Morgan Chase Commercial Mortgage Securities Corp., | | | | | |

Series 2006-LDP8, Class A4, | | | | | |

5.399%, due 05/15/45 | | 1,350,000 | | | 1,231,848 |

|

Series 2007-LDPX, Class B, | | | | | |

5.582%, due 05/15/49(2),(3) | | 175,000 | | | 103,881 |

|

| Merrill Lynch/Countrywide Commercial Mortgage Trust, | | | | | |

Series 2006-3, Class B, | | | | | |

5.525%, due 07/12/46(2) | | 275,000 | | | 185,027 |

|

| Total commercial mortgage-backed securities (cost—$13,282,193) | | | | | 8,664,509 |

|

23

UBS U.S. Allocation Fund

Portfolio of investments—August 31, 2008

| | | Face | | | |

| Security description | | amount | | Value |

|

| Asset-backed securities—0.28% | | | | | |

|

| Countrywide Asset-Backed Certificates, | | | | | |

Series 2004-SD1, Class A1, | | | | | |

2.812%, due 06/25/33(2),(3) | | $8,379 | | | $7,293 |

|

| Fieldstone Mortgage Investment Corp., | | | | | |

Series 2006-S1, Class A, | | | | | |

2.692%, due 01/25/37(2),(3) | | 522,647 | | | 73,171 |

|

| GSAMP Trust, Series 2006-S5, Class A2, | | | | | |

5.658%, due 12/12/36(4),(5) | | 296,048 | | | 29,605 |

|

| Home Equity Mortgage Trust, | | | | | |

Series 2006-3, Class A1, | | | | | |

5.472%, due 09/25/36(4) | | 195,961 | | | 63,687 |

|

Series 2006-4, Class A2, | | | | | |

5.730%, due 11/25/36(4) | | 2,000,000 | | | 320,000 |

|

Series 2006-5, Class A1, | | | | | |

5.500%, due 01/25/37(4) | | 523,979 | | | 136,477 |

|

Series 2006-6, Class 2A1, | | | | | |

2.572%, due 03/25/37(2) | | 186,751 | | | 36,370 |

|

| Merrill Lynch First Franklin Mortgage Loan, | | | | | |

Series 2007-A, Class A1, | | | | | |

3.572%, due 09/25/27(2) | | 131,620 | | | 121,644 |

|

| Merrill Lynch Mortgage Investors Trust, | | | | | |

Series 2006-SL1, Class A, | | | | | |

2.652%, due 09/25/36(2) | | 120,474 | | | 48,340 |

|

| Morgan Stanley Mortgage Loan Trust, | | | | | |

Series 2006-14SL, Class A1, | | | | | |

2.632%, due 11/25/36(2) | | 353,430 | | | 106,029 |

|

| Nomura Asset Acceptance Corp., | | | | | |

Series 2006-S4, Class A1, | | | | | |

2.642%, due 08/25/36(2) | | 376,691 | | | 67,804 |

|

| SACO I Trust, | | | | | |

Series 2006-5, Class 2A1, | | | | | |

2.622%, due 05/25/36(2) | | 515,255 | | | 120,393 |

|

| Washington Mutual Master Note Trust, | | | | | |

Series 2007-A5A, Class A5, | | | | | |

3.217%, due 10/15/14(2),(3) | | 450,000 | | | 404,508 |

|

| Total asset-backed securities (cost—$5,515,135) | | | | | 1,535,321 |

|

| Collateralized debt obligation—0.05% | | | | | |

|

| Rutland Rated Investments, CDO, | | | | | |

Series DRYD-1A, Class A6, | | | | | |

6.957%, due 06/20/13(6) (cost—$645,000) | | 645,000 | | | 249,031 |

|

24

UBS U.S. Allocation Fund

Portfolio of investments—August 31, 2008

| | Face | | | |

| Security description | amount | | Value |

|

| Corporate bonds—6.73% | | | | | |

|

| Aerospace & defense—0.12% | | | | | |

| DAE Aviation Holdings | | | | | |

11.250%, due 08/01/15(3) | | $236,000 | | | $227,740 |

|

| Esterline Technologies Corp. | | | | | |

6.625%, due 03/01/17 | | 155,000 | | | 150,350 |

|

| Hawker Beechcraft Acquisition Co. | | | | | |

8.875%, due 04/01/15 | | 250,000 | | | 249,375 |

|

| | | | | | 627,465 |

|

| Agriculture—0.03% | | | | | |

| American Rock Salt Co. LLC | | | | | |

9.500%, due 03/15/14 | | 150,000 | | | 157,500 |

|

| Automobile OEM—0.65% | | | | | |

| Ford Capital BV | | | | | |

9.500%, due 06/01/10 | | 100,000 | | | 83,250 |

|

| Ford Motor Credit Co. | | | | | |

5.800%, due 01/12/09 | | 1,800,000 | | | 1,766,205 |

|

7.375%, due 10/28/09 | | 750,000 | | | 697,068 |

|

| General Motors | | | | | |

7.200%, due 01/15/11(1) | | 300,000 | | | 192,750 |

|

| General Motors Acceptance Corp. | | | | | |

6.875%, due 09/15/11 | | 800,000 | | | 496,432 |

|

7.250%, due 03/02/11 | | 500,000 | | | 333,616 |

|

| | | | | | 3,569,321 |

|

| Banking-non-US—0.12% | | | | | |

| Abbey National PLC | | | | | |

7.950%, due 10/26/29 | | 275,000 | | | 284,771 |

|

| Royal Bank of Scotland Group PLC | | | | | |

7.640%, due 09/29/17(7),(8) | | 200,000 | | | 168,951 |

|

9.118%, due 03/31/10(7) | | 200,000 | | | 200,567 |

|

| | | | | | 654,289 |

|

| Banking-US—0.54% | | | | | |

| Bank of America Corp. | | | | | |

5.420%, due 03/15/17 | | 700,000 | | | 622,224 |

|

| Citigroup, Inc. | | | | | |

6.125%, due 05/15/18 | | 550,000 | | | 514,224 |

|

6.875%, due 03/05/38 | | 265,000 | | | 255,461 |

|

| JP Morgan Chase & Co. | | | | | |

6.400%, due 05/15/38 | | 150,000 | | | 139,320 |

|

25

UBS U.S. Allocation Fund

Portfolio of investments—August 31, 2008

| | Face | | | |

| Security description | amount | | Value |

|

| Corporate bonds—(continued) | | | | | |

|

| Banking-US—(concluded) | | | | | |

| Wachovia Corp. | | | | | |

5.300%, due 10/15/11 | $ | 525,000 | | | $493,084 |

|

| Washington Mutual Bank NV | | | | | |

3.230%, due 05/20/13(2) | | 300,000 | | | 191,351 |

|

| Washington Mutual, Inc. | | | | | |

5.500%, due 01/15/13 | | 585,000 | | | 386,100 |

|

| Washington Mutual Preferred IV | | | | | |

9.750%, due 12/15/17(3),(7),(8) | | 200,000 | | | 90,000 |

|

| Wells Fargo Bank N.A. | | | | | |

5.950%, due 08/26/36 | | 310,000 | | | 278,280 |

|

| | | | | | 2,970,044 |

|

| Broadcast—0.08% | | | | | |

| CMP Susquehanna | | | | | |

9.875%, due 05/15/14 | | 125,000 | | | 78,125 |

|

| Nexstar Finance Holdings LLC, Inc. | | | | | |

11.375%, due 04/01/13(4) | | 207,734 | | | 186,960 |

|

| Nexstar Finance, Inc. | | | | | |

7.000%, due 01/15/14 | | 100,000 | | | 82,000 |

|

| Univision Communications, Inc. | | | | | |

9.750%, due 03/15/15(3) | | 100,000 | | | 71,500 |

|

| | | | | | 418,585 |

|

| Brokerage—0.31% | | | | | |

| Bear Stearns Co., Inc. | | | | | |

7.250%, due 02/01/18 | | 360,000 | | | 373,007 |

|

| Goldman Sachs Group, Inc. | | | | | |

6.150%, due 04/01/18 | | 205,000 | | | 196,096 |

|

6.750%, due 10/01/37 | | 100,000 | | | 87,986 |

|

| Lehman Brothers Holdings*** | | | | | |

7.000%, due 09/27/27 | | 180,000 | | | 160,504 |

|

| Lehman Brothers Holdings MTN*** | | | | | |

6.750%, due 12/28/17 | | 250,000 | | | 224,214 |

|

6.875%, due 05/02/18 | | 130,000 | | | 121,033 |

|

| Merrill Lynch & Co. | | | | | |

5.700%, due 05/02/17 | | 105,000 | | | 88,877 |

|

| Merrill Lynch & Co. MTN | | | | | |

6.875%, due 04/25/18 | | 135,000 | | | 124,336 |

|

26

UBS U.S. Allocation Fund

Portfolio of investments—August 31, 2008

| | Face | | | |

| Security description | amount | | Value |

|

| Corporate bonds—(continued) | | | | | |

|

| Brokerage—(concluded) | | | | | |

| Morgan Stanley MTN | | | | | |

6.625%, due 04/01/18 | $ | 350,000 | | | $325,193 |

|

| | | | | | 1,701,246 |

|

| Building materials—0.14% | | | | | |

| Ahern Rentals, Inc. | | | | | |

9.250%, due 08/15/13 | | 225,000 | | | 145,125 |

|

| Dayton Superior Corp. | | | | | |

13.000%, due 06/15/09 | | 135,000 | | | 110,700 |

|

| Interface, Inc. | | | | | |

10.375%, due 02/01/10 | | 100,000 | | | 105,000 |

|

| US Concrete, Inc. | | | | | |

8.375%, due 04/01/14 | | 450,000 | | | 373,500 |

|

| | | | | | 734,325 |

|

| Business services—0.02% | | | | | |

| Da-Lite Screen Co., Inc. | | | | | |

9.500%, due 05/15/11 | | 125,000 | | | 120,000 |

|

| Cable—0.15% | | | | | |

| Comcast Corp. | | | | | |

6.300%, due 11/15/17 | | 490,000 | | | 486,105 |

|

| Mediacom LLC/Mediacom Capital Corp. | | | | | |

9.500%, due 01/15/13 | | 150,000 | | | 145,125 |

|

| Time Warner Cable, Inc. | | | | | |

6.750%, due 07/01/18 | | 195,000 | | | 196,870 |

|

| | | | | | 828,100 |

|

| Chemicals—0.04% | | | | | |

| Airgas, Inc. | | | | | |

7.125%, due 10/01/18(3) | | 51,000 | | | 51,510 |

|

| Momentive Performance | | | | | |

9.750%, due 12/01/14 | | 50,000 | | | 45,125 |

|

10.125%, due 12/01/14 | | 100,000 | | | 87,500 |

|

| Montell Finance Co. BV | | | | | |

8.100%, due 03/15/27(3) | | 75,000 | | | 38,250 |

|

| | | | | | 222,385 |

|

| Commercial services & supplies—0.15% | | | | | |

| United Rentals N.A., Inc. | | | | | |

6.500%, due 02/15/12 | | 490,000 | | | 437,325 |

|

7.750%, due 11/15/13 | | 100,000 | | | 79,000 |

|

27

UBS U.S. Allocation Fund

Portfolio of investments—August 31, 2008

| | Face | | | |

| Security description | amount | | Value |

|

| Corporate bonds—(continued) | | | | | |

|

| Commercial services & supplies—(concluded) | | | | | |

| Xerox Capital Trust I | | | | | |

8.000%, due 02/01/27 | $ | 300,000 | | $ | 285,647 |

|

| | | | | | 801,972 |

|

| Consumer products—0.05% | | | | | |

| Fortune Brands, Inc. | | | | | |

5.375%, due 01/15/16 | | 305,000 | | | 278,338 |

|

| Containers & packaging—0.13% | | | | | |

| Exopack Holding Corp. | | | | | |

11.250%, due 02/01/14 | | 50,000 | | | 43,875 |

|

| Jefferson Smurfit Corp. | | | | | |

8.250%, due 10/01/12 | | 125,000 | | | 108,750 |

|

| Owens-Illinois, Inc. | | | | | |

7.500%, due 05/15/10 | | 150,000 | | | 153,375 |

|

| Stone Container Finance | | | | | |

7.375%, due 07/15/14 | | 500,000 | | | 402,500 |

|

| | | | | | 708,500 |

|

| Diversified manufacturing—0.09% | | | | | |

| Harland Clarke Holdings | | | | | |

7.554%, due 05/15/15(2) | | 500,000 | | | 352,500 |

|

| SPX Corp. | | | | | |

7.625%, due 12/15/14(3) | | 120,000 | | | 123,300 |

|

| | | | | | 475,800 |

|

| Electric utilities—0.71% | | | | | |

| AES Corp. | | | | | |

8.000%, due 06/01/20(3) | | 375,000 | | | 359,062 |

|

| Dominion Resources, Inc. | | | | | |

5.950%, due 06/15/35 | | 150,000 | | | 136,619 |

|

| DTE Energy Co. | | | | | |

6.350%, due 06/01/16 | | 250,000 | | | 249,004 |

|

| E. ON International Finance BV | | | | | |

5.800%, due 04/30/18(3) | | 175,000 | | | 172,271 |

|

| Edison Mission Energy | | | | | |

7.000%, due 05/15/17 | | 150,000 | | | 143,625 |

|

| Exelon Generation Co. LLC | | | | | |

5.350%, due 01/15/14 | | 395,000 | | | 381,343 |

|

| MidAmerican Energy Holdings | | | | | |

5.950%, due 05/15/37 | | 110,000 | | | 101,923 |

|

28

UBS U.S. Allocation Fund

Portfolio of investments—August 31, 2008

| | Face | | | |

| Security description | amount | | Value |

|

| Corporate bonds—(continued) | | | | | |

|

| Electric utilities—(concluded) | | | | | |

| Mirant Americas Generation LLC | | | | | |

8.300%, due 05/01/11 | $ | 300,000 | | | $306,000 |

|

9.125%, due 05/01/31 | | 175,000 | | | 152,031 |

|

| Mirant N.A. LLC | | | | | |

7.375%, due 12/31/13 | | 100,000 | | | 99,250 |

|

| NRG Energy, Inc. | | | | | |

7.375%, due 02/01/16 | | 150,000 | | | 148,125 |

|

7.375%, due 01/15/17 | | 125,000 | | | 122,188 |

|

| Pacific Gas & Electric Co. | | | | | |

6.050%, due 03/01/34 | | 170,000 | | | 163,227 |

|

| PSEG Power LLC | | | | | |

6.950%, due 06/01/12 | | 350,000 | | | 366,647 |

|

| Reliant Energy, Inc. | | | | | |

6.750%, due 12/15/14 | | 550,000 | | | 554,125 |

|

| Texas Competitive Electric Holdings LLC | | | | | |

10.250%, due 11/01/15(3) | | 450,000 | | | 448,875 |

|

| | | | | | 3,904,315 |

|

| Electronics—0.06% | | | | | |

| NXP BV/NXP Funding LLC | | | | | |

7.875%, due 10/15/14 | | 50,000 | | | 41,000 |

|

9.500%, due 10/15/15 | | 50,000 | | | 33,875 |

|

| Sanmina-SCI Corp. | | | | | |

5.526%, due 06/15/14(2),(3) | | 285,000 | | | 263,625 |

|

| | | | | | 338,500 |

|

| Energy—0.25% | | | | | |

| Anadarko Petroleum Corp. | | | | | |

5.950%, due 09/15/16 | | 100,000 | | | 97,450 |

|

| Atlas Pipeline Partners | | | | | |

8.750%, due 06/15/18(3) | | 50,000 | | | 48,750 |

|

| Canadian Natural Resources | | | | | |

6.750%, due 02/01/39 | | 240,000 | | | 236,084 |

|

| Gulfmark Offshore, Inc. | | | | | |

7.750%, due 07/15/14 | | 100,000 | | | 98,500 |

|

| Helix Energy Solutions | | | | | |

9.500%, due 01/15/16(3) | | 150,000 | | | 149,250 |

|

29

UBS U.S. Allocation Fund

Portfolio of investments—August 31, 2008

| | Face | | | |

| Security description | amount | | Value |

|

| Corporate bonds—(continued) | | | | | |

|

| Energy—(concluded) | | | | | |

| Key Energy Services, Inc. | | | | | |

8.375%, due 12/01/14(3) | | $70,000 | | | $70,525 |

|

| Newfield Exploration Co. | | | | | |

7.125%, due 05/15/18 | | 66,000 | | | 62,205 |

|

| Plains Exploration & Production | | | | | |

7.625%, due 06/01/18 | | 131,000 | | | 123,467 |

|

| Southwestern Energy Co. | | | | | |

7.500%, due 02/01/18(3) | | 50,000 | | | 51,125 |

|

| Transocean, Inc. | | | | | |

6.800%, due 03/15/38 | | 150,000 | | | 149,654 |

|

7.500%, due 04/15/31 | | 85,000 | | | 91,709 |

|

| Whiting Petroleum Corp. | | | | | |

7.250%, due 05/01/12 | | 200,000 | | | 193,000 |

|

| | | | | | 1,371,719 |

|

| Energy-integrated—0.07% | | | | | |

| PPL Energy Supply LLC | | | | | |

6.000%, due 12/15/36 | | 185,000 | | | 153,182 |

|

Series A | | | | | |

6.400%, due 11/01/11 | | 250,000 | | | 252,656 |

|

| | | | | | 405,838 |

|

| Energy-refining & marketing—0.07% | | | | | |

| Petroplus Finance Ltd. | | | | | |

7.000%, due 05/01/17(3) | | 100,000 | | | 88,750 |

|

| Valero Energy Corp. | | | | | |

6.625%, due 06/15/37 | | 175,000 | | | 154,411 |

|

7.500%, due 04/15/32 | | 140,000 | | | 135,189 |

|

| | | | | | 378,350 |

|