UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark one)

|

| |

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the fiscal year ended December 31, 2017 |

OR

|

| |

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the transition period from: ____________________ to ____________________ |

Commission File No. 1-13219

OCWEN FINANCIAL CORPORATION

(Exact name of registrant as specified in its charter)

|

| | |

| Florida | | 65-0039856 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

1661 Worthington Road, Suite 100 West Palm Beach, Florida | | 33409 |

| (Address of principal executive office) | | (Zip Code) |

(561) 682-8000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

| Common Stock, $.01 par value | | New York Stock Exchange (NYSE) |

| (Title of each class) | | (Name of each exchange on which registered) |

Securities registered pursuant to Section 12 (g) of the Act: Not applicable.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

|

| | | | | | |

| | Large Accelerated filer | o | | | Accelerated filer | x |

| | Non-accelerated filer | o | (Do not check if a smaller reporting company) | | Smaller reporting company | o |

| | | | | | Emerging growth company | o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act) Yes o No x

Aggregate market value of the voting and non-voting common equity of the registrant held by nonaffiliates as of June 30, 2017: $331,954,234

Number of shares of common stock outstanding as of February 23, 2018: 133,359,058 shares

DOCUMENTS INCORPORATED BY REFERENCE: Portions of our definitive Proxy Statement with respect to our Annual Meeting of Shareholders, which is currently scheduled to be held on May 23, 2018, are incorporated by reference into Part III, Items 10 - 14.

OCWEN FINANCIAL CORPORATION

2017 FORM 10-K ANNUAL REPORT

TABLE OF CONTENTS

FORWARD-LOOKING STATEMENTS

This Annual Report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical fact included in this report, including, without limitation, statements regarding our financial position, business strategy and other plans and objectives for our future operations, are forward-looking statements.

These statements include declarations regarding our management’s beliefs and current expectations. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “could”, “intend,” “consider,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict” or “continue” or the negative of such terms or other comparable terminology. Forward-looking statements by their nature address matters that are, to different degrees, uncertain. Our business has been undergoing substantial change, which has magnified such uncertainties. Readers should bear these factors in mind when considering forward-looking statements and should not place undue reliance on such statements. Forward-looking statements involve a number of assumptions, risks and uncertainties that could cause actual results to differ materially from those suggested by such statements. In the past, actual results have differed from those suggested by forward looking statements and this may happen again. Important factors that could cause actual results to differ include, but are not limited to, the risks discussed in “Risk Factors” and the following:

| |

| • | uncertainty related to claims, litigation, cease and desist orders and investigations brought by government agencies and private parties regarding our servicing, foreclosure, modification, origination and other practices, including uncertainty related to past, present or future investigations, litigation, cease and desist orders and settlements with state regulators, the Consumer Financial Protection Bureau (CFPB), State Attorneys General, the Securities and Exchange Commission (SEC), the Department of Justice or the Department of Housing and Urban Development (HUD) and actions brought under the False Claims Act by private parties on behalf of the United States of America regarding incentive and other payments made by governmental entities; |

| |

| • | adverse effects on our business because of regulatory investigations, litigation, cease and desist orders or settlements; |

| |

| • | reactions to the announcement of such investigations, litigation, cease and desist orders or settlements by key counterparties, including lenders, the Federal National Mortgage Association (Fannie Mae), the Federal Home Loan Mortgage Corporation (Freddie Mac) and the Government National Mortgage Association (Ginnie Mae); |

| |

| • | our ability to reach settlements with regulatory agencies on appropriate terms and to comply with the terms of our settlements with regulatory agencies; |

| |

| • | increased regulatory scrutiny and media attention; |

| |

| • | any adverse developments in existing legal proceedings or the initiation of new legal proceedings; |

| |

| • | our ability to effectively manage our regulatory and contractual compliance obligations; |

| |

| • | our ability to comply with our servicing agreements, including our ability to comply with our agreements with, and the requirements of, Fannie Mae, Freddie Mac and Ginnie Mae and maintain our seller/servicer and other statuses with them; |

| |

| • | the adequacy of our financial resources, including our sources of liquidity and ability to sell, fund and recover advances, repay borrowings and comply with our debt agreements, including the financial and other covenants contained in them; |

| |

| • | our ability to invest excess liquidity at adequate risk-adjusted returns; |

| |

| • | limits on our ability to repurchase our own stock as a result of regulatory settlements and other conditions; |

| |

| • | our servicer and credit ratings as well as other actions from various rating agencies, including the impact of prior or future downgrades of our servicer and credit ratings; |

| |

| • | failure of our information technology and other security measures or breach of our privacy protections, including any failure to protect customers’ data; |

| |

| • | volatility in our stock price; |

| |

| • | the characteristics of our servicing portfolio, including prepayment speeds along with delinquency and advance rates; |

| |

| • | our ability to contain and reduce our operating costs; |

| |

| • | our ability to successfully modify delinquent loans, manage foreclosures and sell foreclosed properties; |

| |

| • | uncertainty related to legislation, regulations, regulatory agency actions, regulatory examinations, government programs and policies, industry initiatives and evolving best servicing practices; |

| |

| • | our dependence on New Residential Investment Corp. (NRZ) for a substantial portion of our advance funding for non-agency mortgage servicing rights; |

| |

| • | our ability to complete the proposed acquisition of PHH Corporation (PHH), to successfully integrate its business, and to realize the strategic objectives and other benefits of the acquisition at the time anticipated or at all, including our ability to integrate, maintain and enhance PHH’s servicing, subservicing and other business relationships; |

| |

| • | our ability to timely transfer mortgage servicing rights under our agreements with NRZ and our ability to maintain our long-term relationship with NRZ under these new arrangements and after the acquisition of PHH, our ability to maintain a subservicing relationship with NRZ; |

| |

| • | the loss of the services of our senior managers; |

| |

| • | uncertainty related to general economic and market conditions, delinquency rates, home prices and disposition timelines on foreclosed properties; |

| |

| • | uncertainty related to the actions of loan owners and guarantors, including mortgage-backed securities investors, Ginnie Mae, trustees and government sponsored entities (GSEs), regarding loan put-backs, penalties and legal actions; |

| |

| • | uncertainty related to the GSEs substantially curtailing or ceasing to purchase our conforming loan originations or the Federal Housing Administration (FHA) of HUD or Department of Veterans Affairs (VA) ceasing to provide insurance; |

| |

| • | uncertainty related to the processes for judicial and non-judicial foreclosure proceedings, including potential additional costs or delays or moratoria in the future or claims pertaining to past practices; |

| |

| • | our ability to adequately manage and maintain real estate owned (REO) properties and vacant properties collateralizing loans that we service; |

| |

| • | uncertainty related to our ability to continue to collect certain expedited payment or convenience fees and potential liability for charging such fees; |

| |

| • | our reserves, valuations, provisions and anticipated realization on assets; |

| |

| • | uncertainty related to the ability of third-party obligors and financing sources to fund servicing advances on a timely basis on loans serviced by us; |

| |

| • | uncertainty related to the ability of our technology vendors to adequately maintain and support our systems, including our servicing systems, loan originations and financial reporting systems; |

| |

| • | our ability to realize anticipated future gains from future draws on existing loans in our reverse mortgage portfolio; |

| |

| • | our ability to effectively manage our exposure to interest rate changes and foreign exchange fluctuations; |

| |

| • | uncertainty related to our ability to adapt and grow our business; |

| |

| • | our ability to meet capital requirements established by, or agreed with, regulators or counterparties; |

| |

| • | our ability to protect and maintain our technology systems and our ability to adapt such systems for future operating environments; and |

| |

| • | uncertainty related to the political or economic stability of foreign countries in which we have operations. |

Further information on the risks specific to our business is detailed within this report, including under “Risk Factors.” Forward-looking statements speak only as of the date they were made and we disclaim any obligation to update or revise forward-looking statements whether because of new information, future events or otherwise.

PART I

When we use the terms “Ocwen,” “OCN,” “we,” “us” and “our,” we are referring to Ocwen Financial Corporation and its consolidated subsidiaries.

OVERVIEW

We are a financial services company that services and originates loans. Our goal is to be a world-class servicing and lending company that delivers service excellence to our customers and servicing clients and strong returns to our shareholders. To achieve this goal, our focus is on executing against the following objectives:

| |

| • | Deliver Excellent Service - Build on a strong track record of success as a leader in the servicing industry in foreclosure prevention and loss mitigation that helps families stay in their homes and improves financial outcomes for mortgage loan investors. We continue to invest in new process and technology enhancements, including a significant, multi-year investment to replace our current servicing platform with LoanSphere MSP®, an industry-leading system provided by Black Knight Financial Services. We believe this investment will improve the way we work, help simplify internal processes, and allow our teams to provide better service to our servicing customers and clients. |

| |

| • | Continuous Cost Improvement - Improve our cost structure as part of an organization-wide initiative to return Ocwen to profitability. In addition, we take our commitments to enhancing the customer experience, maintaining a strong risk and compliance infrastructure and delivering strong loss mitigation results very seriously and, accordingly, we continue to make appropriate investments in those important areas even as we continue to optimize our cost structure through productivity improvements and other initiatives. In addition, part of our cost improvement objective includes resolving our legacy litigation and regulatory matters. |

| |

| • | Our Culture - Actively foster a strong and positive culture of compliance, risk management, ethical behavior and service excellence. Our success ultimately depends on the strength of our relationships with our customers, our servicing clients, our regulators and other key counterparties. We strongly believe ourselves to be partners in the homeownership process and are committed to helping our customers in every permissible way, all within an appropriate risk and compliance environment. |

As previously announced, we have entered into an Agreement and Plan of Merger, dated as of February 27, 2018 (the Merger Agreement), with PHH Corporation, a Maryland corporation (PHH), and POMS Corp, a Maryland corporation and a wholly owned subsidiary of Ocwen (Merger Sub). PHH is a leading non-bank servicer with established servicing and origination recapture capabilities. Pursuant to the Merger Agreement, Merger Sub will merge with and into PHH (the Merger), with PHH surviving, and PHH will become a wholly owned subsidiary of Ocwen. The consideration to be paid in the Merger will be $360.0 million in cash. As of December 31, 2017, PHH had approximately $1.8 billion in total assets. The transaction is expected to close in the second half of 2018, subject to approval by PHH’s stockholders, regulatory approvals and other closing conditions.

For more information on the terms and conditions of the Merger, see “- Pending Acquisition of PHH” below. For more information on the risks relating to the Merger, see “Item 1A. Risk Factors - Risks Relating to Our Pending Acquisition of PHH.”

We are headquartered in West Palm Beach, Florida with offices located throughout the United States (U.S.) and in the United States Virgin Islands (USVI) and operations in India and the Philippines. Ocwen Financial Corporation is a Florida corporation organized in February 1988. With our predecessors, we have been servicing residential mortgage loans since 1988. We have been originating forward mortgage loans since 2012 and reverse mortgage loans since 2013. In 2015, we began originating short-term loans to independent used car dealers but exited that business in early 2018 to focus on our core businesses of servicing and lending.

BUSINESS LINES

Servicing and Lending are our primary lines of business. Our other business activities that are currently individually insignificant are included in the Corporate Items and Other segment.

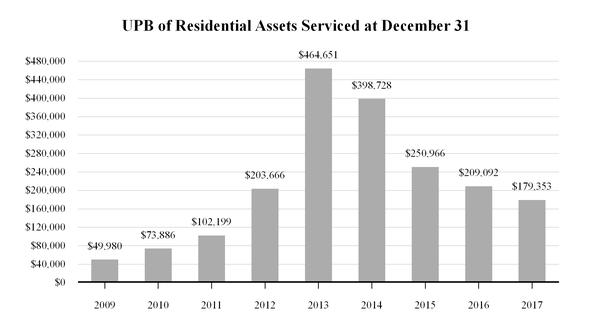

Servicing

Our Servicing business is primarily comprised of our core residential mortgage servicing business and currently accounts for most of our total revenues. Our servicing clients include some of the largest financial institutions in the U.S., including the Federal National Mortgage Association (Fannie Mae) and the Federal Home Loan Mortgage Corporation (Freddie Mac) (each, an Agency or, collectively, the GSEs), the Government National Mortgage Association (Ginnie Mae), New Residential Investment Corp. (NRZ) and non-Agency residential mortgage-backed securities (RMBS) trusts. As of December 31, 2017, our residential servicing portfolio consisted of 1,221,695 loans with an unpaid principal balance (UPB) of $179.4 billion.

Servicing involves the collection of principal and interest payments from borrowers, the administration of tax and insurance escrow accounts, the collection of insurance claims, the management of loans that are delinquent or in foreclosure or bankruptcy, including making servicing advances, evaluating loans for modification and other loss mitigation activities and, if necessary, foreclosure referrals and the sale of the underlying mortgaged property following foreclosure REO on behalf of mortgage loan investors or other servicers. Master servicing involves the collection of payments from servicers and the distribution of funds to investors in mortgage and asset-backed securities and whole loan packages. We earn contractual monthly servicing fees (which are typically payable as a percentage of UPB) pursuant to servicing agreements as well as other ancillary fees relating to our servicing activities such as late fees and REO referral commissions.

We own mortgage servicing rights (MSRs) outright, where we receive all the servicing economics, and we subservice on behalf of other institutions that own the MSRs or Rights to MSRs, in which case we earn a fee for performing the subservicing activities. Special servicing is a component form of subservicing where we generally manage only delinquent loans on behalf of a loan owner. The owners of MSRs or Rights to MSRs may choose to retain Ocwen as a subservicer instead of servicing the MSRs themselves for a variety of reasons, including the lack of a servicing platform or the necessary capacity or expertise to service some or all of their MSRs. We typically earn subservicing and special servicing fees either as a percentage of UPB or on a per loan basis.

Servicing advances are an important component of our business and are amounts that we, as servicer, are required to advance to, or on behalf of, our servicing clients if we do not receive such amounts from borrowers. These amounts include principal and interest payments, property taxes and insurance premiums and amounts to maintain, repair and market real estate properties on behalf of our servicing clients. Most of our advances have the highest reimbursement priority such that we are entitled to repayment of the advances from the loan or property liquidation proceeds before most other claims on these proceeds. The costs incurred in meeting advancing obligations consist principally of the interest expense incurred in financing the advance receivables and the costs of arranging such financing.

Reducing delinquencies is important to our business because it enables us to recover advances and recognize additional ancillary income, such as late fees, which we do not recognize on delinquent loans until they are brought current. Performing loans also require less work and thus are generally less costly to service. While increasing borrower participation in loan modification programs is a critical component of our ability to reduce delinquencies, the persistence of those modifications to remain current is also an important factor.

Our Servicing business grew rapidly via portfolio and business acquisitions during the period 2010 through 2013. Our growth ceased primarily because of significant regulatory actions against us that have effectively prohibited any significant acquisitions of servicing since early 2014. In addition, during 2015 we sold MSRs with a UPB of $87.6 billion as we implemented a strategy to sell a portion of our Agency MSRs to refocus our business on non-Agency servicing, reduce our exposure to interest rate movements, monetize unrealized value and generate liquidity. These and other smaller asset sales combined with normal portfolio runoff as mortgages are repaid and paid off have resulted in a 61.4% decline in our servicing portfolio as compared to December 31, 2013.

Our servicing segment has had pre-tax net income in four of the five years in the period ending December 31, 2017. While we have been successful in reducing the size and costs of our servicing operations in line with declines in our residential servicing portfolio, we would benefit from economies of scale if we were able to increase the size of our servicing portfolio. If we are successful in removing regulatory restrictions limiting the growth of our servicing portfolio, we would acquire MSRs if we view the purchase price and other terms to be attractive.

Lending

In 2017, our Lending business originated or purchased forward and reverse mortgage loans with a UPB of $2.5 billion and $1.0 billion, respectively. These loans were acquired through three primary channels: directly with mortgage customers (retail), through correspondent lender relationships (correspondent) and through broker relationships (wholesale). Per-loan margins vary by channel, with correspondent typically being the lowest margin and retail the highest. We exited the forward lending correspondent and wholesale/broker channels in the second and fourth quarters of 2017, respectively, and our forward lending business is now primarily focused on portfolio recapture (i.e., refinancing loans in our servicing portfolio).

Our forward mortgage loans are conventional (conforming to the underwriting standards of the GSEs, collectively Agency loans) and government-insured (insured by the Federal Housing Administration (FHA) or Department of Veterans Affairs (VA)). After origination, we generally package and sell the loans in the secondary mortgage market, through GSE and Ginnie Mae guaranteed securitizations and whole loan transactions. We typically retain the associated MSRs on securitizations, providing the Servicing business with a source of new MSRs to replenish our servicing portfolio and partially offset the impact of amortization and prepayments. Whole loan transactions are generally completed on a servicing released basis.

We also originate and purchase Home Equity Conversion Mortgages (HECM or reverse mortgage loans), which are generally insured by the FHA, through our Liberty Home Equity Solutions, Inc. (Liberty) operations. Loans originated under this program are generally guaranteed by the FHA, which provides investors with protection against risk of borrower default. The reverse mortgage channel provides both current period and future period gain on sale revenue from new originations because of subsequent tail draws taken by the borrower. While we focus on current period reported earnings, we also utilize our market experience to invest in future asset value when returns are at attractive levels. These future cash flows are not guaranteed but viewed as probable given our historic asset quality and slow prepayment speeds.

Retail Lending. We originate forward and reverse mortgage loans directly with borrowers through our retail lending business. Our forward lending business benefits from our significant servicing portfolio by offering refinance options to qualified borrowers seeking to lower their mortgage payments. Depending on borrower eligibility, we refinance eligible customers into conforming or government-insured products. We also are increasing our ability to originate retail loans to non-Ocwen servicing customers through various marketing channels and a centralized call center. Through lead campaigns and direct marketing, the retail channel seeks to convert leads into in a cost-efficient manner. We are focused on increasing recapture rates on our existing servicing portfolio to grow this business.

Wholesale Lending. We originate reverse mortgage loans through a network of approved brokers. Brokers are subject to a formal approval and monitoring process. We underwrite all loans originated through this channel consistent with the underwriting standards required by the ultimate investor prior to funding.

Correspondent Lending. Our reverse correspondent lending operation purchases mortgage loans that have been originated by a network of approved third-party lenders.

All the lenders participating in our correspondent lending program are approved by senior lending and compliance management. We also employ an ongoing monitoring and renewal process for participating lenders that includes an evaluation of the performance of the loans they have sold to us. We perform a variety of pre- and post-funding review procedures to ensure that the loans we purchase conform to our requirements and to the requirements of the investors to whom we sell loans.

We provide customary origination representations and warranties to investors in connection with our loan sales and securitization activities. We receive customary origination representations and warranties from our network of approved originators relating to loans we purchase through our correspondent lending channel. We recognize the fair value of the liability for our representations and warranties at the time of sale. In the event we cannot remedy a breach of a representation or warranty, we may be required to repurchase the loan or provide an indemnification payment to the investor. To the extent that we have recourse against a third-party originator, we may recover part or all of any loss we incur.

Automotive Capital Services

Automotive Capital Services, Inc. (ACS) is a business we began in 2015 that provided short-term inventory-secured loans to independent used car dealers to finance their inventory. In October 2017, we announced we were exploring strategic options for ACS, and in January 2018 we decided to exit this business. We are currently providing some transition-related support to existing customers, and we expect to have exited the business by the end of the second quarter of 2018, although we will retain, and continue to attempt to collect on, defaulted loans.

The results of operations for each of our reportable operating segments (Servicing, Lending and Corporate Items and Other) are included in the individual business operations sections of Management’s Discussion and Analysis of Financial Condition and Results of Operations. Financial information related to reportable operating segments is provided in Note 21 — Business Segment Reporting.

REGULATION

Our business is subject to extensive oversight and regulation by federal, state and local governmental authorities, including the CFPB, HUD and various state agencies that license and conduct examinations of our loan servicing, origination and collection activities. In addition, we operate under a number of regulatory settlements that subject us to ongoing reporting and other obligations. From time to time, we also receive requests (including requests in the form of subpoenas and civil investigative demands) from federal, state and local agencies for records, documents and information relating to the policies, procedures and practices of our loan servicing, origination and collection activities. The GSEs and their conservator, the Federal Housing Finance Authority (FHFA), Ginnie Mae, the United States Treasury Department, various investors, non-Agency securitization trustees and others also subject us to periodic reviews and audits.

In the current regulatory environment, we have faced and expect to continue to face heightened regulatory and public scrutiny as an organization as well as stricter and more comprehensive regulation of the entire mortgage sector. We continue to work diligently to assess and understand the implications of the regulatory environment in which we operate and to meet the requirements of this constantly changing environment. We devote substantial resources to regulatory compliance, while, at the same time, striving to meet the needs and expectations of our customers, clients and other stakeholders. Our failure to comply with applicable federal, state and local laws, regulations and licensing requirements could lead to any of the following:

| |

| • | loss of our licenses and approvals to engage in our servicing and lending businesses; |

| |

| • | governmental investigations and enforcement actions; |

| |

| • | administrative fines and penalties and litigation; |

| |

| • | civil and criminal liability, including class action lawsuits and actions to recover incentive and other payments made by governmental entities; |

| |

| • | breaches of covenants and representations under our servicing, debt or other agreements; |

| |

| • | damage to our reputation; |

| |

| • | inability to raise capital; or |

| |

| • | inability to execute on our business strategy. |

In addition to amounts paid to resolve regulatory matters, we could incur costs to comply with the terms of such resolutions, including the costs of third-party firms to monitor our compliance with such resolutions. We have recognized $177.5 million in such third-party monitoring costs from January 1, 2014 through December 31, 2017 relating to the 2013

Ocwen National Mortgage Settlement, our 2014 settlement with the New York Department of Financial Services (NY DFS) and our 2015 settlement with the California Department of Business Oversight (CA DBO).

We must comply with a large number of federal, state and local consumer protection laws including, among others, the Dodd-Frank Wall Street Reform and Consumer Protection Act (the Dodd-Frank Act), the Gramm-Leach-Bliley Act, the Fair Debt Collection Practices Act, the Real Estate Settlement Procedures Act (RESPA), the Truth in Lending Act (TILA), the Fair Credit Reporting Act, the Servicemembers Civil Relief Act, the Homeowners Protection Act, the Federal Trade Commission Act, the Telephone Consumer Protection Act, the Equal Credit Opportunity Act, as well as individual state laws pertaining to licensing, general mortgage origination and servicing practices and foreclosure, and federal and local bankruptcy rules. These statutes apply to many facets of our business, including loan origination, default servicing and collections, use of credit reports, safeguarding of non-public personally identifiable information about our customers, foreclosure and claims handling, investment of and interest payments on escrow balances and escrow payment features, and mandate certain disclosures and notices to borrowers. These requirements can and do change as statutes and regulations are enacted, promulgated, amended, interpreted and enforced.

Since the financial crisis that began in 2007, the trend among federal, state and local lawmakers and regulators has been toward increasing laws, regulations and investigative proceedings with regard to residential mortgage lenders and servicers. Over the past few years, state and federal lawmakers and regulators have adopted a variety of new or expanded laws and regulations and recommended practices, including the Dodd-Frank Act, which created the CFPB as a new federal entity responsible for regulating consumer financial services. Since its formation, the CFPB has taken a very active role in the mortgage industry, and its rule-making and regulatory agenda relating to loan servicing and origination continues to evolve. Individual states have also been active, as have other regulatory organizations such as the Multistate Mortgage Committee (MMC), a multistate coalition of various mortgage banking regulators. We also believe there has been a shift among certain regulators towards a broader view of the scope of regulatory oversight responsibilities with respect to mortgage lenders and servicers. In addition to their traditional focus on licensing and examination matters, certain regulators have begun to make observations, recommendations or demands with respect to areas such as corporate governance, safety and soundness and risk and compliance management.

The CFPB and state regulators have also increasingly focused on the use and adequacy of technology in the mortgage servicing industry. In 2016, the CFPB issued a special edition supervision report that stressed the need for mortgage servicers to assess and make necessary improvements to their information technology systems to ensure compliance with the CFPB’s mortgage servicing requirements. The NY DFS also issued Cybersecurity Requirements for Financial Services Companies, which took effect in 2017, and which required banks, insurance companies, and other financial services institutions regulated by the NY DFS to establish and maintain a cybersecurity program designed to protect consumers and ensure the safety and soundness of New York State’s financial services industry.

New regulatory and legislative measures, or changes in enforcement practices, including those related to the technology we use, could, either individually or in the aggregate, require significant changes to our business practices, impose additional costs on us, limit our product offerings, limit our ability to efficiently pursue business opportunities, negatively impact asset values or reduce our revenues.

We are subject to a number of ongoing federal and state regulatory examinations, consent orders, inquiries, subpoenas, civil investigative demands, requests for information and other actions, which could result in further adverse regulatory action against us.

To the extent that an examination, audit or other regulatory engagement identifies an alleged failure by us to comply with applicable laws, regulations or licensing requirements, or if allegations are made that we have failed to comply with applicable laws, regulations or licensing requirements or the commitments we have made in connection with our regulatory settlements (whether such allegations are made through administrative actions such as cease and desist orders, through legal proceedings or otherwise) or if other regulatory actions of a similar or different nature are taken in the future against us, this could lead to (i) administrative fines and penalties and litigation, (ii) loss of our licenses and approvals to engage in our servicing and lending businesses, (iii) governmental investigations and enforcement actions, (iv) civil and criminal liability, including class action lawsuits and actions to recover incentive and other payments made by governmental entities, (v) breaches of covenants and representations under our servicing, debt or other agreements, (vi) damage to our reputation, (vii) inability to raise capital or otherwise fund our operations and (viii) inability to execute on our business strategy. Any of these occurrences could increase our operating expenses and reduce our revenues, hamper our ability to grow or otherwise materially and adversely affect our business, reputation, financial condition, liquidity and results of operations.

Finally, there are a number of foreign laws and regulations that are applicable to our operations outside of the U.S., including laws and regulations that govern licensing, employment, safety, taxes and insurance and laws and regulations that govern the creation, continuation and the winding up of companies as well as the relationships between shareholders, our corporate entities, the public and the government in these countries. Non-compliance with these laws and regulations could

result in adverse actions against us, including (i) restrictions on our operations in these counties, (ii) fines, penalties or sanctions or (iii) reputational damage.

CFPB

On April 20, 2017, the CFPB filed a lawsuit in the federal district court for the Southern District of Florida against Ocwen, Ocwen Mortgage Servicing. Inc. (OMS) and Ocwen Loan Servicing, LLC (OLS) alleging violations of federal consumer financial laws relating to our servicing business dating back to 2014. The CFPB’s claims include allegations regarding (1) the adequacy of Ocwen’s servicing system and integrity of Ocwen’s mortgage servicing data, (2) Ocwen’s foreclosure practices and (3) various purported servicer errors with respect to borrower escrow accounts, hazard insurance policies, timely cancellation of private mortgage insurance, handling of customer complaints, and marketing of optional products. The CFPB alleges violations of unfair, deceptive acts or abusive practices, as well as violations of specific laws or regulations. The CFPB does not claim specific monetary damages, although it does seek consumer relief, disgorgement of allegedly improper gains, and civil money penalties. We believe we have factual and legal defenses to the CFPB’s allegations and are vigorously defending ourselves.

Prior to the CFPB instituting legal proceedings, we had been engaged with the CFPB in efforts to resolve the matter. We have recorded $12.5 million as of December 31, 2017 as a result of these discussions. If we are successful in defending ourselves against the CFPB, it is possible that our losses could be less than $12.5 million. It is also possible that we could incur losses that materially exceed the amount accrued, and the resolution of the matters raised by the CFPB could have a material adverse impact on our business, reputation, financial condition, liquidity and results of operations. We cannot currently estimate the amount, if any, of reasonably possible loss above amounts previously accrued.

State Licensing, State Attorneys General and Other Matters

Our licensed entities are required to renew their licenses, typically on an annual basis, and to do so they must satisfy the license renewal requirements of each jurisdiction, which generally include financial requirements such as providing audited financial statements or satisfying minimum net worth requirements and non-financial requirements such as satisfactorily completing examinations as to the licensee’s compliance with applicable laws and regulations. Failure to satisfy any of the requirements to which our licensed entities are subject could result in a variety of regulatory actions ranging from a fine, a directive requiring a certain step to be taken, a suspension or ultimately a revocation of a license, any of which could have a material adverse impact on our results of operations and financial condition. In addition, we receive information requests and other inquiries, both formal and informal in nature, from our state regulators as part of their general regulatory oversight of our servicing and lending businesses. We also regularly engage with state attorneys general and the CFPB and, on occasion, we engage with other federal agencies, including the Department of Justice and various inspectors general on various matters, including responding to information requests and other inquiries. Many of our regulatory engagements arise from a complaint that the entity is investigating, although some are formal investigations or proceedings. The GSEs and their conservator, FHFA, HUD, FHA, VA, Ginnie Mae, the United States Treasury Department, and others also subject us to periodic reviews and audits. We have in the past resolved, and may in the future resolve, matters via consent orders or payment of monetary amounts to settle issues identified in connection with examinations or regulatory or other oversight activities, and such resolutions could have material and adverse effects on our business, reputation, operations, results of operations and financial condition.

On April 20, 2017 and shortly thereafter, mortgage and banking regulatory agencies from 30 states and the District of Columbia took regulatory actions against OLS and certain other Ocwen companies that alleged deficiencies in our compliance with laws and regulations relating to our servicing and lending activities. In general, the regulatory actions took the form of “cease and desist orders,” and we use that term to refer to all the orders for ease of reference; for ease of reference, we also include the District of Columbia as a state when we reference states below. All the cease and desist orders were applicable to OLS, but additional Ocwen entities were named in some orders, including Ocwen Financial Corporation, OMS, Homeward and Liberty. Following the issuance of the orders, we reached agreements with certain regulatory agencies to obtain delays in the enforcement of certain terms or exceptions to certain terms contained in the cease and desist orders. Additionally, we revised our operations based on the terms of the orders while we sought to negotiate resolutions.

We have entered into agreements with 28 states plus the District of Columbia to resolve these regulatory actions. These agreements generally contain the following key terms (the Multi-State Common Settlement Terms):

| |

| • | Ocwen will not acquire any new residential mortgage servicing rights until April 30, 2018. |

| |

| • | Ocwen will develop a plan of action and milestones regarding its transition from the servicing system we currently use, REALServicing®, to an alternate servicing system and, with certain exceptions, will not board any new loans onto the REALServicing system. |

| |

| • | If Ocwen chooses to merge with or acquire an unaffiliated company or its assets to effectuate a transfer of loans from the REALServicing system, Ocwen must give the applicable regulatory agency prior notice to the signing of any final agreement and the opportunity to object (which prior notice requirement is independent of, and in addition to, applicable state law notice and consent requirements relating to change of control transactions). If no objection is |

received, the provisions of the first bullet point above shall not prohibit the transaction, or limit the transfer of loans from the REALServicing system onto the merged or acquired company’s alternate servicing system. If an unaffiliated company merges with or acquires Ocwen or Ocwen’s assets, the provisions of the first bullet point above shall not prohibit the transaction, or limit the transfer of loans from the REALServicing system onto the merging or acquiring company’s alternate servicing system.

| |

| • | Ocwen will engage a third-party auditor to perform an analysis with respect to our compliance with certain federal and state laws relating to escrow by testing approximately 9,000 loan files relating to residential real property in various states, and Ocwen must develop corrective action plans for any errors that are identified by the third-party auditor. |

| |

| • | Ocwen will develop and submit for review a plan to enhance our consumer complaint handling processes. |

| |

| • | Ocwen will provide financial condition reporting on a confidential basis as part of each state’s supervisory framework through September 2020. |

In addition to the terms described above, Ocwen entered into settlements with certain states on different or additional terms, which include making certain additional communications with and for borrowers, and certain review and reporting obligations. In addition, Ocwen agreed with the Connecticut regulatory agency to pay certain amounts only in the event we fail to comply with certain requirements under our agreement with Connecticut. In its agreement with the Maryland regulatory agency, Ocwen agreed to complete an independent management assessment and enterprise risk assessment, to certain other review and reporting requirements, and to a prohibition, with certain de minimis exceptions, on repurchases of our stock until December 7, 2018. Ocwen also agreed to make certain payments to Maryland, to provide remediation to certain borrowers in the form of cash payments or credits and to pay certain amounts only in the event we fail to comply with certain requirements under our agreement with Maryland. We will also incur costs complying with the terms of these settlements, including in connection with the escrow analysis and transition to a new servicing system. In addition, in the event errors were to be uncovered during the escrow analysis, we could incur costs remedying such errors or other actions could be taken against us by regulators or others.

We continue to seek timely resolutions with the remaining two state regulatory agencies, one of which took action in conjunction with its state Attorney General, as discussed below. If Ocwen is successful in reaching such resolutions, they may contain some or all of the Multi-State Common Settlement Terms and may also contain additional terms, including potentially monetary fines or penalties or additional restrictions on our business. There can be no assurance that Ocwen will be able to reach resolutions with the remaining regulatory agencies. It is possible that the outcome of the remaining regulatory actions, whether through negotiated settlements or other resolutions, could be materially adverse to our business, reputation, financial condition, liquidity and results of operations. We cannot currently estimate the amount, if any, of reasonably possible loss related to these matters.

Certain of the state regulators’ cease and desist orders reference a confidential supervisory memorandum of understanding (MOU) that we entered into with the Multistate Mortgage Committee (MMC), a multistate coalition of various mortgage banking regulators, and six states relating to a servicing examination from 2013 to 2015. The MOU contained various provisions relating to servicing practices and safety and soundness aspects of the regulatory review, as a step toward closing the 2013 - 2015 examination. There were no monetary or other penalties under the MOU. Ocwen responded to the MOU items, and continues to provide certain reports and other information pursuant to the MOU.

In April 2017, and concurrent with the issuance of the cease and desist orders and the filing of the CFPB lawsuit discussed above, two state attorneys general took actions against us relating to our servicing practices. The Florida Attorney General, together with the Florida Office of Financial Regulation, filed a lawsuit in the federal district court for the Southern District of Florida against Ocwen, OMS and OLS alleging violations of federal and state consumer financial laws relating to our servicing business. These claims are similar to the claims made by the CFPB. The Florida lawsuit seeks injunctive and equitable relief, costs, and civil money penalties in excess of $10,000 per confirmed violation of the applicable statute. As previously disclosed, the Massachusetts Attorney General had sent us a civil investigative demand requesting information relating to various aspects of our servicing practices, including lender-placed insurance and property preservation fees. Subsequently, the Massachusetts Attorney General filed a lawsuit against OLS in the Superior Court for the Commonwealth of Massachusetts alleging violations of state consumer financial laws relating to our servicing business, including with respect to our activities relating to lender-placed insurance and property preservation fees. The Massachusetts Attorney General’s lawsuit seeks injunctive and equitable relief, costs, and civil money penalties of $5,000 per confirmed violation of the applicable statute. While we endeavor to negotiate appropriate resolutions in these two matters, we are vigorously defending ourselves, as we believe we have valid defenses to the claims made in both lawsuits. The outcome of these two lawsuits, whether through negotiated settlements, court rulings or otherwise, could potentially involve monetary fines or penalties or additional restrictions on our business and could be materially adverse to our business, reputation, financial condition, liquidity and results of operations. We cannot currently estimate the amount, if any, of reasonably possible loss related to these matters.

On occasion, we engage with agencies of the federal government on various matters. For example, OLS received a letter from the Department of Justice, Civil Rights Division, notifying OLS that the Department of Justice had initiated a general

investigation into OLS’s policies and procedures to determine whether violations of the Servicemembers Civil Relief Act by OLS might exist. The letter stated that at this point, the investigation is preliminary in nature and the Department of Justice has not made any determination as to whether OLS violated the act. In addition, Ocwen was named as a defendant in a HUD administrative complaint filed by a non-profit organization alleging discrimination in the manner in which the company maintains REO properties in minority communities. In February 2018, this matter was administratively closed; and similar claims were filed in federal court. We believe these claims are without merit and intend to vigorously defend ourselves.

In April 2017, Ocwen received a subpoena from the Office of Inspector General of HUD requesting the production of documentation related to lender-placed insurance arrangements with a mortgage insurer and the amounts paid for such insurance. We understand that other servicers in the industry have received similar subpoenas. In May 2016, Ocwen received a subpoena from the Office of Inspector General of HUD requesting the production of documentation related to HECM loans originated by Liberty. We understand that other lenders in the industry have received similar subpoenas. In May 2017, Ocwen received a subpoena from the Office of the Special Inspector General for the Troubled Asset Relief Program (SIGTARP) requesting the production of documents related to Ocwen’s participation from 2009 to the present in the Treasury Department’s Making Home Affordable Program and its Home Affordable Modification Program (HAMP). We have been providing documents and information in response to these subpoenas.

In July 2017, we received a letter from Ginnie Mae in which Ginnie Mae informed us that the state regulators’ cease and desist orders discussed above create a material change in Ocwen’s business status under Chapter 3 of the Ginnie Mae MBS Guide, and Ginnie Mae has accordingly declared an event of default under Guaranty Agreements between Ocwen and Ginnie Mae. In the letter, Ginnie Mae notified Ocwen that it will forbear from immediately exercising any rights relating to this matter for a period of 90 days from the date of the letter. During such forbearance period, Ginnie Mae has asked Ocwen to provide certain information regarding the cease and desist orders and certain information regarding Ocwen’s business plan, financial results and operations. Ginnie Mae stated that it reserves the right to make additional requests of Ocwen and to restrict or terminate Ocwen’s participation in the Ginnie Mae mortgage-backed securities program. Based on our conversations with Ginnie Mae, we understand that Ginnie Mae views this as a violation with a prescribed remedy and that the purpose of the notice is to provide for a period of resolution. We have provided and intend to continue to provide information to Ginnie Mae as we seek to resolve its concerns, including with respect to our efforts to settle the state regulatory and operational matters outlined by Ginnie Mae. Ginnie Mae has indicated to us that resolution of the state regulators’ cease and desist orders would substantially address its concerns and that there may be other alternatives to address them as well. Based on our progress in resolving the matters raised by Ginnie Mae, Ginnie Mae has twice extended the forbearance period for an additional 90 days. The present forbearance period extends through April 29, 2018. We continue to operate as a Ginnie Mae issuer in all respects and continue to participate in Ginnie Mae issuing of mortgage-backed securities and home equity conversion loan pools in the ordinary course.

Adverse actions by Ginnie Mae could materially and adversely impact our business, reputation, financial condition, liquidity and results of operations, including if Ginnie Mae were to terminate us as an issuer or servicer of Ginnie Mae securities or otherwise take action indicating that such a termination was planned. For example, such actions could make financing our business more difficult, including by making future financing more expensive or if a lender were to allege a default under our debt agreements, which could trigger cross-defaults under all our other material debt agreements.

New York Department of Financial Services

In December 2014, we entered into a consent order (the 2014 NY Consent Order) with the NY DFS as a result of an investigation relating to Ocwen’s servicing of residential mortgages. The 2014 NY Consent Order contained monetary and non-monetary provisions including the appointment of a third-party operations monitor (NY Operations Monitor) to monitor various aspects of our operations and restrictions on our ability to acquire MSRs that effectively prohibit any such future acquisitions until we have satisfied certain specified conditions. We were also required to pay all reasonable and necessary costs of the NY Operations Monitor, and those costs were substantial.

On March 27, 2017, we entered into a consent order (the 2017 NY Consent Order) with the NY DFS that provided for (1) the termination of the engagement of the NY Operations Monitor on April 14, 2017, (2) a regulatory examination of our servicing business, following which the NY DFS would make a determination on whether the restrictions on our ability to acquire MSRs contained in the 2014 NY Consent Order should be eased and (3) certain reporting and other obligations, including in connection with matters identified in a final report by the NY Operations Monitor. In addition, the 2017 NY Consent Order provides that if the NY DFS concludes that we have materially failed to comply with our obligations under the order or otherwise finds that our servicing operations are materially deficient, the NY DFS may, among other things, and, in addition to its general authority to take regulatory action against us, require us to retain an independent consultant to review and issue recommendations on our servicing operations.

The NY Operations Monitor delivered its final report in April 2017 when its engagement terminated. The final report contained certain recommended operational enhancements to which we have responded. Under the 2017 NY Consent Order, we

are required to update the NY DFS quarterly on our implementation of the enhancements that we and the NY DFS agreed should be made. We made what we believe to be our final required report to the NY DFS in December 2017. Our updates to date show that all agreed upon enhancements are being implemented.

California Department of Business Oversight

In January 2015, OLS entered into a consent order (the 2015 CA Consent Order) with the CA DBO relating to our alleged failure to produce certain information and documents during a routine licensing examination. The order contained monetary and non-monetary provisions, including the appointment of an independent third-party auditor (the CA Auditor) to assess OLS’ compliance with laws and regulations impacting California borrowers and a prohibition on acquiring any additional MSRs for loans secured in California. We were also required to pay all reasonable and necessary costs of the CA Auditor, and those costs were substantial.

On February 17, 2017, OLS and two other subsidiaries, Ocwen Business Solutions, Inc. (OBS) and Ocwen Financial Solutions Private Limited (OFSPL), reached an agreement, in three consent orders (collectively, the 2017 CA Consent Order), with the CA DBO that terminated the 2015 CA Consent Order and resolved open matters between the CA DBO and OLS, OBS and OFSPL, including certain matters relating to OLS’ servicing practices and the licensed activities of OBS and OFSPL. The 2017 CA Consent Order does not involve any admission of wrongdoing by OLS, OBS or OFSPL. Additionally, we have certain reporting and other obligations under the 2017 CA Consent Order. We believe that we have completed those obligations of the 2017 CA Consent Order that have already come due, and we have so notified the CA DBO. If the CA DBO were to allege that we failed to comply with these obligations or otherwise were in breach of applicable laws, regulations or licensing requirements, it could take regulatory action against us.

Ocwen 2013 National Mortgage Settlement

In December 2013, we entered into a settlement with the CFPB and various state attorneys general and other state agencies that regulate the mortgage servicing industry relating to various allegations regarding deficient mortgage servicing practices (the Ocwen National Mortgage Settlement). The settlement contained monetary and non-monetary provisions, including quarterly testing on various metrics relating to servicing standards agreed under the Ocwen National Mortgage Settlement.

In September 2017, Ocwen reached an agreement in principle with the Monitoring Committee established under the Ocwen National Mortgage Settlement relating to a previously disclosed potential violation of one of the tested metrics during the first quarter of 2017. To resolve the matter and without agreeing with the Monitoring Committee’s allegations, Ocwen agreed to pay $1.0 million and to provide notices to certain borrowers with active lender placed insurance policies. On September 26, 2017, the court overseeing the Ocwen National Mortgage Settlement issued an order approving the agreement in principle. The parties reached this agreement in principle following the filing of the final report of the Office of Mortgage Settlement Oversight under the Ocwen National Mortgage Settlement. With this final report, the Office of Mortgage Settlement Oversight has concluded all monitoring and testing activities under the Ocwen National Mortgage Settlement.

Separately, Ocwen is finalizing an agreement regarding a 2016 letter agreement it entered with certain state signatories to the Ocwen National Mortgage Settlement (the State Government Parties). Per the terms of the 2016 letter agreement, the parties agreed to certain timelines by which Ocwen would implement corrective action plans and return to metric testing. Such timelines were not established previously in the Ocwen National Mortgage Settlement. The State Government Parties alleged that Ocwen had failed to meet certain of these timeframes, and asserted that Ocwen was subject to monetary penalties pursuant to the terms of the letter agreement. Although Ocwen denies these allegations, to resolve the dispute, Ocwen is finalizing an agreement that will include a payment to the State Government Parties. Such payment is not expected to be material to Ocwen’s overall financial condition. If the agreement is not finalized, Ocwen intends to vigorously defend itself against these allegations.

PENDING ACQUISITION OF PHH

On February 27, 2018, we entered into the Merger Agreement with PHH, and the Merger Sub, a wholly owned subsidiary of Ocwen. PHH is a leading non-bank servicer with established servicing and origination recapture capabilities. Pursuant to the Merger Agreement, Merger Sub will merge with and into PHH with PHH surviving. As a result of the Merger, PHH will become a wholly owned subsidiary of Ocwen.

Under the terms and subject to the conditions of the Merger Agreement, at the effective time of the Merger, each outstanding share of PHH common stock, par value $0.01 per share, will be converted into the right to receive $11.00 in cash.

Upon the closing of Merger, Ocwen will also assume (at the subsidiary level) additional debt in the form of PHH’s outstanding senior unsecured notes. The aggregate principal amount of these notes is approximately $119 million, representing approximately $97 million of PHH’s 7.375% Senior Notes Due 2019 and approximately $22.0 million of PHH’s 6.375% Senior Notes Due 2021.

PHH and Ocwen have made customary representations, warranties and covenants in the Merger Agreement, including, among other things, covenants relating to (1) the conduct of PHH’s business during the interim period between the execution of the Merger Agreement and the consummation of the Merger, (2) the use of reasonable best efforts to obtain governmental and regulatory approvals, (3) the facilitation of PHH’s stockholders’ consideration of, and voting upon, the adoption of the Merger Agreement and certain related matters, (4) the recommendation by the board of directors of PHH (the PHH Board) in favor of the adoption by its stockholders of the Merger Agreement and certain related matters and (5) non-solicitation obligations relating to alternative business combination transactions. In particular, prior to a change in recommendation by the PHH Board that is adverse to the Merger or otherwise qualifies as a Company Adverse Recommendation Change (as defined in the Merger Agreement), Ocwen will have the right, following notice from PHH that it intends to make such change of recommendation, to propose revisions to the Merger Agreement and the PHH Board must negotiate in good faith and consider such revised terms prior to making a determination to change its recommendation. As described below, if PHH makes such a change in recommendation, it may be required to pay a termination fee to Ocwen.

Completion of the Merger is subject to certain customary conditions, including, among others, (1) approval by the requisite vote of PHH’s stockholders, (2) receipt of all required regulatory approvals, in each case without the imposition of a Burdensome Condition (as defined in the Merger Agreement), and (3) the absence of any governmental order or law prohibiting the consummation of the Merger. The obligation of each party to consummate the Merger is also conditioned upon (1) the accuracy of the representations and warranties of the other party, subject to specified materiality standards, and (2) performance in all material respects by the other party of its obligations under the Merger Agreement. In addition, the obligation of Ocwen to consummate the Merger is subject to PHH’s satisfaction of a minimum unrestricted cash threshold and a minimum net worth threshold (in each case, to be measured as of an agreed date prior to the Merger) and PHH’s consummation (subject to limited exceptions) of certain of its previously announced asset sale transactions and PHH’s exit from its private label solutions business.

The Merger Agreement contains certain termination rights for both Ocwen and PHH, including, subject to specified exceptions, if, among other things, (1) the Merger is not consummated by September 27, 2018 (or, in certain circumstances, December 27, 2018), (2) a governmental authority has issued a final and non-appealable order, or a law is issued, prohibiting the Merger, (3) the PHH stockholders’ approval of the Merger Agreement is not obtained or (4) there has been a breach by the other party that is not cured and is such that the closing conditions cannot be satisfied. Ocwen may also terminate the Merger Agreement if, prior to the approval of the Merger Agreement by PHH’s stockholders, the PHH Board withdraws or adversely modifies its recommendation, recommends to its stockholders an acquisition proposal other than the Merger, or otherwise makes a Company Adverse Recommendation Change, as defined in the Merger Agreement.

The Merger Agreement also provides that, upon termination under specified circumstances, PHH will be required to pay to Ocwen a termination fee of $12.6 million. PHH would be required to pay such termination fee if, prior to receipt of the PHH stockholders’ approval, (1) the PHH Board withdraws or adversely modifies its recommendation of approval of the Merger, (2) PHH materially breaches its obligations under the non-solicitation provisions of the Merger Agreement in a manner adverse to Ocwen or (3) PHH enters into an alternative acquisition agreement. In addition, the termination fee would be payable if (1) an alternative acquisition proposal is made prior to PHH’s stockholders meeting, (2) the Merger Agreement is thereafter terminated under one of certain specified provisions and (3) within 12 months of such termination, PHH enters into a definitive agreement for an alternative acquisition (assuming such transaction is subsequently consummated) or consummates an alternative acquisition transaction.

COMPETITION

The financial services markets in which we operate are highly competitive. We compete with large and small financial services companies, including bank and non-bank entities, in the servicing and lending markets. Large banks such as Wells Fargo, JPMorgan Chase, Bank of America and Citibank are generally the largest participants in these markets, although we also compete against other large non-bank servicers such as Nationstar Mortgage LLC and Walter Investment Management.

In the servicing industry, we compete based on price, quality and counterparty risk. Potential counterparties also (1) assess our regulatory compliance track record and examine our systems and processes for maintaining and demonstrating regulatory compliance, and (2) consider our third-party servicer ratings. Certain of our competitors, especially large banks, may have substantially lower costs of capital and greater financial resources, which makes it challenging to compete. We believe that our competitive strengths flow from our ability to control and drive down delinquencies using proprietary processes and our lower cost to service non-performing, non-Agency loans. Notwithstanding these strengths, we have suffered reputational damage as a result of our regulatory settlements and the associated scrutiny of our business. We believe this has weakened our competitive position against both our bank and non-bank servicing competitors. In addition, multiple consent orders effectively prohibit us from competing in the market for bulk servicing acquisitions at this time.

In the lending industry, we face intense competition in most areas, including product offerings, rates, fees and customer service. Some of our competitors, including the larger banks, have substantially lower costs of capital and strong retail

presence, which makes it challenging to compete. In addition, with the proliferation of smartphones and technological changes enabling improved payment systems and cheaper data storage, newer market participants, often called “disruptors,” are reinventing aspects of the financial industry and capturing profit pools previously enjoyed by existing market participants. As a result, the lending industry could become even more competitive if new market participants are successful in capturing market share from existing market participants such as ourselves. We believe our competitive strengths flow from our existing role as a mortgage servicer, which provides us with an existing customer relationship to capture refinance volume from our servicing portfolio and from our customer service.

The reverse lending market faces many of the same competitive pressures as the forward market with additional pressure coming from a negative consumer impression of the product as a result of unfavorable press coverage in prior periods. In addition, the reverse market is significantly smaller than the forward market with a higher market share concentration among the top five Ginnie Mae HMBS issuers. These higher concentration levels can, at times, lead to significant price competition. We believe our competitive advantage flows from our long tenure in the industry (Liberty began operations in 2004), our strategic partnerships and our use of technology to produce higher levels of productivity to drive down per-loan costs.

THIRD-PARTY SERVICER RATINGS

Like other servicers, we are the subject of mortgage servicer ratings or rankings (collectively, ratings) issued and revised from time to time by rating agencies including Moody’s Investors Service, Inc. (Moody’s), Standard & Poor’s Ratings Services (S&P) and Fitch Ratings, Inc. (Fitch). Favorable ratings from these agencies are important to the conduct of our loan servicing and lending businesses.

The following table summarizes our key ratings by these rating agencies:

|

| | | | | |

| | Moody’s | | S&P | | Fitch |

| Residential Prime Servicer | SQ3- | | Average | | RPS3- |

| Residential Subprime Servicer | SQ3- | | Average | | RPS3- |

| Residential Special Servicer | SQ3- | | Average | | RSS3- |

| Residential Second/Subordinate Lien Servicer | SQ3- | | Average | | RPS3- |

| Residential Home Equity Servicer | — | | — | | RPS3- |

| Residential Alt-A Servicer | — | | — | | RPS3- |

| Master Servicing | SQ3 | | Average | | RMS3- |

| Ratings Outlook | N/A | | Stable | | Negative |

| | | | | | |

| Date of last action | April 24, 2017 | | August 9, 2016 | | April 25, 2017 |

In addition to servicer ratings, each of the rating agencies will from time to time assign an outlook (or a ratings watch such as Moody’s review status) to the rating status of a mortgage servicer. A negative outlook is generally used to indicate that a rating “may be lowered,” while a positive outlook is generally used to indicate a rating “may be raised.” S&P’s servicer ratings outlook for Ocwen is stable in general and its outlook for master servicing is positive. Fitch changed the servicer ratings outlook to Negative from Stable on April 25, 2017. Moody’s placed the servicer ratings on Watch for Downgrade on April 24, 2017. The Morningstar ratings were withdrawn on August 8, 2017 at the request of Ocwen.

Failure to maintain minimum servicer ratings could adversely affect our ability to sell or fund servicing advances going forward, could affect the terms and availability of debt financing facilities that we may seek in the future, and could impair our ability to consummate future servicing transactions or adversely affect our dealings with lenders, other contractual counterparties, and regulators, including our ability to maintain our status as an approved servicer by Fannie Mae and Freddie Mac. The servicer rating requirements of Fannie Mae do not necessarily require or imply immediate action, as Fannie Mae has discretion with respect to whether we are in compliance with their requirements and what actions it deems appropriate under the circumstances if we fall below their desired servicer ratings.

See Item 1A. Risk Factors - Risks Relating to Our Business for further discussion of the adverse effects that a failure to maintain minimum servicer ratings could have on our business, financing activities, financial condition or results of operations.

NEW RESIDENTIAL INVESTMENT CORP. RELATIONSHIP

In 2012 and 2013, we sold Rights to MSRs with respect to certain non-Agency MSRs and the related servicing advances to Home Loan Servicing Solutions, Ltd. (HLSS), an indirect wholly-owned subsidiary of NRZ. While certain underlying economics of the MSRs were transferred, legal title was retained by Ocwen, causing the Rights to MSRs transactions to be accounted for as secured financings. We continue to recognize the MSRs and related financing liability on our consolidated

balance sheet as well as the full amount of servicing revenue and changes in the fair value of the MSRs and related financing liability in our consolidated statements of operations.

On July 23, 2017 and January 18, 2018, we entered into a series of agreements with NRZ that collectively modify, supplement and supersede the arrangements among the parties as set forth in (i) the Master Servicing Rights Purchase Agreement dated as of October 1, 2012, as amended, and (ii) certain Sale Supplements, as amended (collectively, the Existing Rights to MSRs Agreements). The July 23, 2017 agreements, as amended, include a Master Agreement, Transfer Agreement and Subservicing Agreement (collectively, the 2017 Agreements) pursuant to which the parties agreed, among other things, to undertake certain actions to facilitate the transfer of the MSRs underlying the Rights to MSRs to NRZ and under which Ocwen will subservice mortgage loans underlying the MSRs for an initial term of five years (the Initial Term). While we continue the process of obtaining the third-party consents necessary to transfer the MSRs to NRZ, on January 18, 2018, the parties entered into new agreements regarding the Rights to MSRs that remained subject to the Existing Rights to MSRs Agreements (including a Servicing Addendum) and amended the Transfer Agreement (collectively, New RMSR Agreements) to accelerate the implementation of certain parts of our arrangement in order to achieve the intent of the 2017 Agreements sooner. Ocwen will continue to service the related mortgage loans until the necessary third-party consents are obtained in order to transfer the applicable MSRs in accordance with the New RMSR Agreements. Upon receiving the required consents and transferring the MSRs, Ocwen will subservice the mortgage loans underlying the MSRs pursuant to the 2017 Agreements.

The 2017 Agreements and New RMSR Agreements provide for the conversion of the economics of the Existing Rights to MSRs Agreements into a more traditional subservicing arrangement and involve upfront payments to Ocwen. Prior to execution of the New RMSR Agreements, we received these payments upon obtaining the required third-party consents and the transfer of the MSRs. Upon execution of the New RMSR Agreements, we received the balance of these upfront payments. These upfront payments generally represent the net present value of the difference between the future revenue stream Ocwen would have received under the Existing Rights to MSRs Agreements and the future revenue Ocwen expects to receive under the 2017 Agreements. On September 1, 2017, pursuant to the 2017 Agreements, Ocwen successfully transferred MSRs with UPB of $15.9 billion to NRZ and received a lump-sum payment of $54.6 million. On January 18, 2018, Ocwen received a lump-sum payment of $279.6 million in accordance with the terms of the New RMSR Agreements.

In the event the required third-party consents are not obtained with respect to any dates specified in, and in accordance with the process set forth in, the New RMSR Agreements, such MSRs will either: (i) remain subject to the New RMSR Agreements at the option of NRZ, (ii) be acquired by Ocwen at a price determined in accordance with the terms of the New RMSR Agreements, or (iii) be sold to a third party in accordance with the terms of the New RMSR Agreements.

At any time during the Initial Term, NRZ may terminate the Subservicing Agreement and Servicing Addendum for convenience, subject to Ocwen’s right to receive a termination fee and proper notice. Following the Initial Term, NRZ may extend the term of the Subservicing Agreement and Servicing Addendum for additional three-month periods by providing proper notice. Following the Initial Term, the Subservicing Agreement and Servicing Addendum can be cancelled by Ocwen on an annual basis. NRZ and Ocwen have the ability to terminate the Subservicing Agreement and Servicing Addendum for cause if certain specified conditions occur.

Under the terms of the Subservicing Agreement and Servicing Addendum, in addition to a base servicing fee, Ocwen will continue to receive ancillary income, which primarily includes late fees, loan modification fees and Speedpay® fees. NRZ will receive all float earnings and deferred servicing fees related to delinquent borrower payments, as well as be entitled to receive all REO-related income including REO referral commissions.

Prior to January 18, 2018, MSRs as to which necessary transfer consents had not yet been obtained continued to be subject to the terms of the agreements entered into in 2012 and 2013. Under the 2012 and 2013 agreements, the servicing fees payable under the servicing agreements underlying the Rights to MSRs were apportioned between NRZ and us. NRZ retained a fee based on the UPB of the loans serviced, and OLS received certain fees, including a performance fee based on servicing fees paid less an amount calculated based on the amount of servicing advances and the cost of financing those advances.