- IONS Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Ionis Pharmaceuticals (IONS) DEF 14ADefinitive proxy

Filed: 11 Apr 18, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant o

Check the appropriate box:

| o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material Pursuant to §240.14a-12 |

Ionis Pharmaceuticals, Inc. |

(Name of Registrant as Specified In Its Charter) |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box): | ||

☒ | No fee required. | |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

(1) | Title of each class of securities to which transaction applies: | |

(2) | Aggregate number of securities to which transaction applies: | |

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

(4) | Proposed maximum aggregate value of transaction: | |

(5) | Total fee paid: | |

o | Fee paid previously with preliminary materials. | |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

(1) | Amount Previously Paid: | |

(2) | Form, Schedule or Registration Statement No.: | |

(3) | Filing Party: | |

(4) | Date Filed: | |

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number

IONIS PHARMACEUTICALS, INC.

2855 Gazelle Court

Carlsbad, CA 92010

NOTICE OF 2018 ANNUAL MEETING OF STOCKHOLDERS

Dear Stockholders,

I am pleased to invite you to Ionis Pharmaceuticals, Inc.’s 2018 Annual Meeting of Stockholders. We will host the meeting at our offices in Carlsbad, California on Wednesday, May 23, 2018, at 2:00 p.m. Pacific Time. This booklet includes the agenda for this year’s Annual Meeting and the Proxy Statement. We will cover the formal items on the agenda during the Annual Meeting. Following the formal Annual Meeting, we will review the major developments of the past year and our plans for 2018, and answer your questions. The Proxy Statement explains the matters we will discuss in the meeting and provides additional information about us.

Your vote is very important. Whether or not you plan to attend the meeting, please be sure to vote your shares as soon as possible to ensure your representation at the meeting. We are distributing our proxy materials under a Securities and Exchange Commission rule that allows us to furnish proxy materials to our stockholders over the Internet rather than in paper form. We believe this method of distribution reduces our environmental impact and costs without hindering our stockholders’ timely access to such important material. As a result, if you are a stockholder of record (that is, if your stock is registered with us in your own name) you will receive a Notice Regarding the Availability of Proxy Materials in the mail, which contains instructions on how to access our proxy materials and vote electronically through the Internet or to request printed proxy materials so you may vote by telephone or mail.

If your shares are registered in the name of a broker or other nominee, that nominee will forward the Notice Regarding the Availability of Proxy Materials to you and you can direct that nominee to vote your shares. Alternatively, if your nominee participates in a program provided through Broadridge Financial Solutions, Inc. that allows you to vote by telephone or through the Internet, your nominee will send you a voting form with telephone and Internet voting instructions.

If you plan to attend the meeting and prefer to vote in person, you may still do so even if you have already returned your proxy.

PLEASE NOTE, HOWEVER, THAT IF A BROKER, BANK OR OTHER NOMINEE HOLDS YOUR SHARES OF RECORD AND YOU WISH TO VOTE AT THE MEETING, YOU MUST OBTAIN A PROXY ISSUED IN YOUR NAME FROM THE BROKER, BANK OR OTHER NOMINEE.

In this document, unless the context requires otherwise, the words “Ionis,” “Company,” “we,” “our” and “us” refer only to Ionis Pharmaceuticals, Inc. and its subsidiaries and not to any other person or entity.

We look forward to seeing you at the meeting.

Sincerely,

Patrick R. O’Neil

Corporate Secretary

IONIS PHARMACEUTICALS, INC.

2855 Gazelle Court

Carlsbad, CA 92010

NOTICE OF 2018 ANNUAL MEETING OF STOCKHOLDERS

Date: | Wednesday, May 23, 2018 |

Time: | 2:00 p.m., Pacific Time |

Place: | Ionis Pharmaceuticals, Inc. 2855 Gazelle Court Carlsbad, CA 92010 |

Dear Stockholders,

At our 2018 Annual Meeting of Stockholders, we will ask you to:

• | Proposal 1: | elect Frederick T. Muto and Breaux B. Castleman to serve as Directors for a three-year term; |

• | Proposal 2: | make an advisory vote on executive compensation; and |

• | Proposal 3: | ratify the Audit Committee’s selection of Ernst & Young LLP as independent auditors for our 2018 fiscal year. |

• | Transact any other business that may be properly presented at the Annual Meeting. | |

The foregoing items of business are more fully described in the enclosed Proxy Statement. If you were an Ionis stockholder of record at the close of business on March 26, 2018 you may vote at the Annual Meeting.

By order of the Board of Directors,

Patrick R. O’Neil

Corporate Secretary

Carlsbad, California

April 6, 2018

ALL STOCKHOLDERS ARE CORDIALLY INVITED TO ATTEND THE MEETING IN PERSON. WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING, PLEASE VOTE BY TELEPHONE OR INTERNET BY FOLLOWING THE INSTRUCTIONS INCLUDED IN THIS PROXY STATEMENT AND YOUR NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS OR PROXY CARD. ALTERNATIVELY, YOU MAY REQUEST A WRITTEN PROXY STATEMENT, AND COMPLETE, DATE, SIGN AND RETURN YOUR PROXY AS PROMPTLY AS POSSIBLE TO ENSURE YOUR REPRESENTATION AT THE MEETING. IF YOU RECEIVE YOUR PROXY MATERIALS BY MAIL, WE WILL INCLUDE A RETURN ENVELOPE (WHICH IS POSTAGE PREPAID IF MAILED IN THE UNITED STATES) FOR THAT PURPOSE. EVEN IF YOU HAVE GIVEN YOUR PROXY, YOU MAY STILL VOTE IN PERSON IF YOU ATTEND THE MEETING. PLEASE NOTE, HOWEVER, THAT IF YOUR SHARES ARE HELD OF RECORD BY A BROKER, BANK OR OTHER NOMINEE AND YOU WISH TO VOTE AT THE MEETING, YOU MUST OBTAIN FROM THE BROKER, BANK OR OTHER NOMINEE A PROXY ISSUED IN YOUR NAME.

IONIS PHARMACEUTICALS, INC.

2855 Gazelle Court

Carlsbad, CA 92010

PROXY STATEMENT

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING

Why did I receive a Notice Regarding the Availability of Proxy Materials on the Internet?

Ionis’ Board of Directors (the “Board”) is soliciting your proxy to vote at the 2018 Annual Meeting of Stockholders, including at any adjournments or postponements of the meeting. We are distributing our Notice of Annual Meeting and Proxy Materials (the “Notice”) by mail using the Notice and Access procedures established by the United States Securities and Exchange Commission (the “SEC”). The Notice is important because it contains a control number and instructions that will allow you to access our proxy materials and vote electronically through the Internet or to request printed proxy materials so you may vote by telephone or mail. Your vote is very important. Whether or not you plan to attend the meeting, please be sure to vote your shares as soon as possible to ensure your representation at the meeting. All stockholders will have the ability to access the proxy materials on the website referred to in the Notice or request to receive a printed set of the proxy materials. You can find instructions on how to access the proxy materials over the Internet or to request a printed copy in the Notice.

We intend to mail the Notice on or before April 13, 2018 to all stockholders of record entitled to vote at the Annual Meeting.

Will I receive any other proxy materials by mail?

We may choose to send you a proxy card, along with a second Notice, on or after April 23, 2018.

Where and when is the Annual Meeting and how do I attend?

We will hold the meeting on Wednesday, May 23, 2018, at 2:00 p.m. Pacific Time at our offices located at 2855 Gazelle Court, Carlsbad, California 92010. You may find directions to the Annual Meeting at www.ionispharma.com.1 We discuss information on how to vote in person at the Annual Meeting below.

If you cannot attend, please note that we will make a webcast of the presentation that follows the Annual Meeting available on the day of the meeting and for a limited time following the meeting at www.ionispharma.com.1

If you plan to attend the meeting and prefer to vote in person, you may still do so even if you have already returned your proxy.

Who can vote at the Annual Meeting?

Only stockholders of record at the close of business on March 26, 2018 may vote at the Annual Meeting. On this record date, there were 125,441,857 shares of common stock outstanding and entitled to vote.

Stockholder of Record: Shares Registered in Your Name

If on March 26, 2018 your shares were registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, then you are a stockholder of record. As a stockholder of record, you may vote in person at the meeting or vote by proxy over the telephone, by mail, or the Internet as instructed under the section below titled “How do I vote?” Whether or not you plan to attend the meeting, we urge you to fill out and return the proxy card or vote over the telephone or Internet to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If on March 26, 2018 you did not own shares in your name, but rather in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in “street name” and that organization is forwarding the Notice to you. The organization holding your account is the stockholder of

| 1 | Any information that is included on or linked to our website is not part of this Proxy Statement or any registration statement or report that incorporates this Proxy Statement by reference. |

1

record for purposes of voting at the Annual Meeting. As a beneficial owner, you may direct your broker or other agent regarding how to vote the shares in your account. If your shares are registered in the name of a broker or other nominee, your nominee may be participating in a program provided through Broadridge Financial Solutions, Inc. (“Broadridge”) that also allows you to vote by telephone or through the Internet. If so, the voting form your nominee sends you will provide telephone and Internet instructions. You are also invited to attend the Annual Meeting in person.

PLEASE NOTE, HOWEVER, THAT IF A BROKER, BANK OR OTHER NOMINEE HOLDS YOUR SHARES OF RECORD AND YOU WISH TO VOTE AT THE MEETING, YOU MUST OBTAIN A PROXY ISSUED IN YOUR NAME FROM THE BROKER, BANK OR OTHER NOMINEE.

What am I voting on?

There are three matters scheduled for a vote:

• | Proposal 1: | elect Frederick T. Muto and Breaux B. Castleman to serve as Directors for a three-year term; |

• | Proposal 2: | make an advisory vote on executive compensation; and |

• | Proposal 3: | ratify the Audit Committee’s selection of Ernst & Young LLP as independent auditors for our 2018 fiscal year. |

What if another matter is properly brought before the meeting?

The Board knows of no other matters that will be presented for consideration at the Annual Meeting. If any other matters are properly brought before the meeting, the persons named in the accompanying proxy intend to vote on those matters in accordance with their best judgment.

How do I vote?

You may vote in one of the following ways:

| • | vote through the Internet by following the instructions included with your Notice or proxy card; |

| • | vote by telephone by following the instructions included with your proxy card if you have received proxy materials electronically or by mail; |

| • | vote by mail by completing, signing, dating and returning your proxy card in the postage paid envelope provided; or |

| • | vote in person by attending the Annual Meeting. |

The procedures for voting are fairly simple:

For Shares Registered in Your Name:

If you are a stockholder of record, you may go to www.proxyvote.com to vote your shares through the Internet up until 11:59 P.M. Eastern Time on May 22, 2018. The votes represented by your proxy will be displayed on the computer screen and you will be prompted to submit or revise your votes as desired.

To vote your shares by telephone, you must first request that we send proxy materials to you by following the instructions included in your Notice. Once you have received your proxy materials, you may vote using a touch-tone telephone by calling 1-800-690-6903 up until 11:59 P.M. Eastern Time on May 22, 2018 and following the recorded instructions. Please have your proxy card available at the time you vote.

To vote using the proxy card, simply complete, sign and date the proxy card that may be delivered to you and return it promptly in the envelope provided. If you return your signed proxy card to us before the Annual Meeting, we will vote your shares as you direct.

For Shares Registered in the Name of a Broker or Bank:

If your broker or bank holds your shares in “street name,” you will need to obtain a proxy form from the institution that holds your shares and follow the instructions included on that form regarding how to instruct your broker to vote your shares. If you do not give instructions to your broker, your broker can vote your shares with

2

respect to “discretionary” items, but not with respect to “non-discretionary” items. Discretionary items are proposals considered routine under the rules of the New York Stock Exchange (NYSE) on which a broker may vote shares held in street name in the absence of your voting instructions. While Ionis is listed with the Nasdaq Stock Market (Nasdaq), NYSE rules affect how brokers licensed by the NYSE can vote in a director election of any company, including companies listed with Nasdaq. The proposal to ratify Ernst & Young LLP as independent auditors is a discretionary item. Proposals 1 and 2 regarding (1) the election of Directors, and (2) approval, on an advisory basis, of our executive compensation, are non-discretionary items. If you do not give your broker instructions for a non-discretionary item, the inspector of elections will treat your shares as broker non-votes.

A number of brokers and banks are participating in a program provided by Broadridge which allows proxies to vote shares by means of the telephone and Internet. If your shares are held in an account with a broker or bank participating in the Broadridge program, you may vote your shares by telephone or through the Internet by having the voting form in hand and calling the number or going to the website indicated on the form and following the instructions.

What if I return a proxy card or otherwise vote but do not make specific choices?

If you return a signed and dated proxy card or otherwise vote without marking voting selections, one of the individuals named on your proxy card will vote your shares as follows:

| • | “For” the election of the nominees for Director named in the Proxy Statement; |

| • | “For” the approval, on an advisory basis, of executive compensation; and |

| • | “For” the ratification of the Audit Committee’s selection of Ernst & Young LLP as independent auditors for our 2018 fiscal year. |

If any other matter is properly presented at the meeting, one of the individuals named on your proxy card will vote your shares using his or her best judgment.

Who is paying for this proxy solicitation?

Our Board is soliciting your proxy to vote at the Annual Meeting. We will bear the entire cost of soliciting proxies, including preparing, assembling, making available on the Internet and printing and mailing this Proxy Statement, the proxy card and any additional information furnished to stockholders. We will furnish copies of solicitation materials to banks, brokerage houses, fiduciaries and custodians holding our common stock in “street name” on behalf of beneficial owners of such shares. We may reimburse persons representing beneficial owners of our common stock for their costs of forwarding solicitation materials to such beneficial owners. Our Directors, officers or other employees may supplement original solicitation of proxies by telephone, electronic mail or personal solicitation. We will not pay our Directors, officers or employees any additional compensation for soliciting proxies. However, please be aware that you must bear any costs associated with your Internet service, such as usage charges from Internet access providers or telephone companies.

What does it mean if I receive more than one Notice?

If you receive more than one Notice or proxy card, your shares are registered in more than one name or are registered in different accounts. Please complete, sign, date and return each separate proxy card or vote by telephone or through the Internet by following the instructions included with each Notice or proxy card to properly vote your shares.

Can I change my vote after submitting my proxy?

Yes. Once you have submitted your proxy by mail, Internet or telephone, you may revoke it at any time before we exercise it at the Annual Meeting. You may revoke your proxy by any one of the following four ways:

| • | you may mail another proxy marked with a later date; |

| • | you may revoke it through the Internet; |

| • | you may notify our corporate secretary in writing sent to 2855 Gazelle Court, Carlsbad, California 92010 that you wish to revoke your proxy before the Annual Meeting takes place; or |

| • | you may vote in person at the Annual Meeting. Attendance at the meeting will not, by itself, revoke a proxy. |

3

When are stockholder proposals due for next year’s Annual Meeting?

If you have a proposal that you would like us to include in our Proxy Statement and form of proxy for, or to present at the 2019 Annual Meeting of Stockholders, you must send the proposal to us by no later than December 14, 2018. Stockholders wishing to submit proposals or Director nominations that are not to be included in such Proxy Statement and form of proxy must do so no later than the close of business on January 23, 2019. Stockholders should also review our bylaws, which contain additional requirements with respect to advance notice of stockholder proposals and Director nominations.

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present at the meeting if at least a majority of the outstanding shares are represented in person or by proxy. We will count your shares towards the quorum only if you submit a valid proxy vote or vote at the meeting. We will count abstentions and broker non-votes towards the quorum requirement.

If there is no quorum, the holders of a majority of shares present at the meeting in person or represented by proxy may adjourn the meeting to another date.

How are votes counted?

Each share of our common stock you own entitles you to one vote. Your Notice and proxy card indicates the number of shares of our common stock you owned at the close of business on March 26, 2018. The inspector of elections will count votes for the meeting, and will separately count “For” and “Against” votes, abstentions, and broker non-votes. With respect to Proposal 1, the election of Directors, stockholders do not affirmatively vote “Against” nominees. Instead, if you do not want to elect a particular nominee, you should choose to “Withhold” a vote in favor of the applicable nominee for Director and the inspector of elections will count each “Withhold” for each nominee. Abstentions will have no effect on Proposal 1. Abstentions will count towards the vote total for Proposals 2 and 3, and in each case, will have the same effect as “Against” votes. Broker non-votes have no effect and the inspector of elections will not count them towards the vote total for any proposal.

What are “broker non-votes”?

Broker non-votes occur when a beneficial owner of shares held in “street name” does not give instructions to the broker or nominee holding the shares as to how to vote on matters deemed “non-routine.” If your broker holds your shares in “street name,” and you do not give instructions to your broker, your broker can vote your shares with respect to “discretionary” items, but not with respect to “non-discretionary” items. The proposal to ratify Ernst & Young LLP as independent auditors is a discretionary item. Proposals 1 and 2 regarding (a) the election of Directors, and (b) approval, on an advisory basis, of our executive compensation, are non-discretionary items. If you do not give your broker instructions for a non-discretionary item, the inspector of elections will treat your unvoted shares as broker non-votes.

How many votes are needed to approve each proposal?

| • | Proposal 1: For the election of Directors in an uncontested election, a Director nominee must receive a majority of the votes cast in person or by proxy in the election such that the number of shares voted “For” the nominee must exceed 50% of the votes cast with respect to that Director. Only “For” and “Withhold” votes will affect the outcome. Abstentions and broker non-votes will have no effect. |

| • | Proposal 2: We will consider the advisory approval of the compensation of our executive officers to be approved if it receives “For” votes from the holders of a majority of shares either present in person or represented by proxy and entitled to vote on the matter. If you “Abstain” from voting, it will have the same effect as an “Against” vote. Broker non-votes will have no effect. |

| • | Proposal 3: To be approved, the ratification of the selection of Ernst & Young LLP as our independent auditors for our 2018 fiscal year must receive “For” votes from the holders of a majority of shares present in person or by proxy and entitled to vote on the matter. If you “Abstain” from voting, it will have the same effect as an “Against” vote. |

4

How can I find out the results of the voting at the Annual Meeting?

We will announce preliminary voting results at the Annual Meeting. In addition, we will publish final voting results in a current report on Form 8-K that we expect to file within four business days after the Annual Meeting. If final voting results are not available to us in time to file as part of a Form 8-K within four business days after the Annual Meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after we know the final results, file an additional Form 8-K to publish final results.

How can I elect to receive materials for future Annual Meetings electronically?

We are pleased to offer to our stockholders the benefits and convenience of electronic delivery of Annual Meeting materials, including:

| • | delivering the Proxy Statement, Annual Report on Form 10-K, and related materials by email to our stockholders; |

| • | stockholder voting online; |

| • | helping the environment by decreasing the use of paper documents; |

| • | reducing the amount of bulky documents stockholders receive; and |

| • | reducing our printing and mailing costs associated with more traditional delivery methods. |

We encourage you to conserve natural resources and to reduce printing and mailing costs by signing up for electronic delivery of our stockholder communications after you place your current vote at www.proxyvote.com.

5

PROPOSAL 1

ELECTION OF DIRECTORS

Information about our Board

The Board is divided into three classes. Presently, the Board has eight members with two classes consisting of three Directors each and one class consisting of two Directors. Each class serves a three-year term and we hold elections each year at the Annual Meeting to elect the Directors whose terms are expiring.

In addition, the Board may elect a new Director to fill any vacant spot, including a vacancy caused by an increase in the size of the Board. However, the Board believes it is important for our stockholders to ratify any member of the Board whom the Board appoints. As a result, whenever the Board appoints a new member, the Board will submit such new member’s directorship for ratification at the next regularly scheduled Annual Meeting of Stockholders.

The Board represents the interests of our stockholders by overseeing the Chief Executive Officer and other members of senior management in our operation. The Board’s goal is to optimize long-term value by providing guidance and strategic oversight to Ionis’ management on our stockholders’ behalf.

Information about the 2018 Elections

The Board has nominated two individuals for election at the Annual Meeting. Each of the nominees currently serves as one of our Directors. Mr. Muto and Mr. Castleman have each served as a Director since March 2001 and June 2013, respectively. Mr. Muto and Mr. Castleman have been re-elected by our stockholders each successive term. If re-elected, Mr. Muto and Mr. Castleman will serve until the 2021 Annual Meeting or, in each case, until his successor is elected and has qualified, or until his earlier death, resignation or removal.

Our bylaws provide a majority vote standard for the election of directors in uncontested elections. In an uncontested election, the majority vote standard means that to be elected, a Director nominee must receive a majority of the votes cast in the election such that the number of shares voted “For” the nominee must exceed 50% of the votes cast with respect to that Director. The number of votes cast with respect to a Director’s election excludes abstentions and broker non-votes. In contested elections where the number of nominees exceeds the number of Directors to be elected, the vote standard will be a plurality of the shares present in person or by proxy and entitled to vote.

If a nominee who already serves as a Director is not elected, and no successor is elected, the Director will offer to tender his resignation to the Board. The Nominating, Governance and Review Committee will make a recommendation to the Board on whether to accept or reject the resignation, or whether to take other action. The Board will act on the Nominating, Governance and Review Committee’s recommendation and publicly disclose its decision and the rationale behind it within 90 days from the date of the certification of the election results. The Director who tenders his or her resignation will not participate in the recommendation of the Nominating, Governance and Review Committee or in the Board’s decision. If a nominee’s failure to be elected at the Annual Meeting results in a vacancy on the Board, then the Board can fill the vacancy.

The Nominating, Governance and Review Committee delivered its report to the Board on March 23, 2018. Following that report, the Board determined it would be in the best interests of Ionis and its stockholders to nominate Mr. Muto and Mr. Castleman to be elected as Directors at the Annual Meeting. We provide below a short biography for each nominee. Mr. Muto and Mr. Castleman have agreed to serve if elected, and we have no reason to believe that they cannot serve. However, if they cannot serve, we may vote your proxy for another nominee proposed by the Board, or the Board may reduce the number of authorized Directors.

6

Biographies of the Nominees for Election for a Three-Year Term Expiring at the 2021 Annual Meeting

Frederick T. Muto, age 642, has served as a Director of Ionis since March 2001. Mr. Muto joined the law firm of Cooley LLP, outside counsel to Ionis, in 1980, became a partner in 1986 and Senior Counsel in 2018. He is a founding partner of Cooley LLP’s San Diego office and was Chair of the firm’s Business Department for a number of years.

The Board believes Mr. Muto is uniquely suited to serve on the Board primarily because, with over 37 years of experience at one of the country’s leading law firms focused on life sciences and technology companies, he provides us important advice regarding our strategic transactions, corporate governance and compensation matters.

Breaux B. Castleman, age 77, has served as a Director of Ionis since June 2013. Since August 2001, Mr. Castleman has been president and chief executive officer of Syntiro Healthcare Services, Inc., a healthcare investment company, which sold its operations as a service provider of integrated care management and disease management. Mr. Castleman was a director of USMD Holdings, Inc., a physician-led integrated healthcare system, from September 2009 until October 2016 and was a director of MELA Sciences, Inc., a medical device company, from 2003 until 2011.

The Board believes that Mr. Castleman is uniquely suited to serve on the Board and the Audit Committee because he has significant experience in strategic planning and financial structuring matters for Fortune 1000 companies and has financial advisory expertise in the life sciences industry.

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE ELECTION OF THE ABOVE NOMINEES.

Biographies of the Directors Whose Terms Expire at the 2019 Annual Meeting

Stanley T. Crooke, M.D., Ph.D., age 72, is a founder of Ionis and has been Chief Executive Officer and a Director since January 1989. He was elected Chairman of the Board in February 1991. Prior to founding Ionis, from 1980 until January 1989, Dr. Crooke worked for SmithKline Beckman Corporation, a pharmaceutical company, where his titles included President of Research and Development of SmithKline and French Laboratories. Dr. Crooke serves on the board of directors of Akcea Therapeutics, Inc., a biopharmaceutical company.

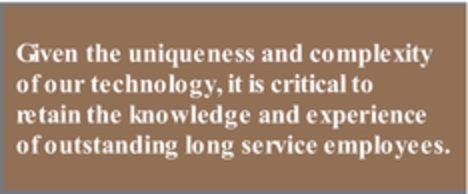

The Board believes Dr. Crooke is uniquely suited to serve on the Board primarily because, as the Chief Executive Officer and founder of Ionis, he has dedicated nearly 31 years to discovering and developing antisense, our technology platform. He is the named inventor on some of the key patents in the field of RNA-targeted therapeutics, and has nearly 40 years of drug discovery and development experience.

Joseph Klein, III, age 56, has served as a Director of Ionis since December 2005. Mr. Klein is currently Managing Director of Gauss Capital Advisors, LLC, a financial consulting and investment advisory firm focused on biopharmaceuticals, which he founded in March 1998. From September 2003 to December 2008, Mr. Klein also served as a Venture Partner of Red Abbey Venture Partners, L.P., a life science private equity fund. From September 2001 to September 2002, Mr. Klein was a Venture Partner of MPM Capital, a healthcare venture capital firm. From June 1999 to September 2000 when it merged with WebMD Corporation, Mr. Klein served as Vice President, Strategy, for Medical Manager Corporation, a leading developer of physician office management information systems. For over nine years from 1989 to 1998, Mr. Klein was a health care investment analyst at T. Rowe Price Associates, Inc., where he was the founding portfolio manager of the T. Rowe Price Health Sciences Fund, Inc. Mr. Klein serves on the board of directors of The Prospector Funds, Inc., an SEC Registered Investment Company that manages two no-load mutual funds. Mr. Klein also serves on the boards of private and non-profit entities.

The Board believes that Mr. Klein is uniquely suited to serve on the Board and the Audit Committee because he is a Chartered Financial Analyst and has extensive public company, venture investment, board, and financial advisory expertise in the life sciences industry, including previously serving as Chairman of the Audit Committee at several public biopharmaceutical companies.

| 2 | All ages of our Directors provided under this Proposal 1 are as of March 1, 2018. |

7

Joseph Loscalzo, age 66, is Hersey Professor of the Theory and Practice of Medicine at Harvard Medical School, Chairman of the Department of Medicine, and Physician-in-Chief at Brigham and Women’s Hospital. Dr. Loscalzo received his A.B. degree, summa cum laude, his Ph.D. in biochemistry, and his M.D. from the University of Pennsylvania. His clinical training was completed at Brigham and Women’s Hospital and Harvard Medical School, where he served as Resident and Chief Resident in medicine and Fellow in cardiovascular medicine. Post-training, Dr. Loscalzo joined the Harvard faculty and staff at Brigham and Women’s Hospital in 1984. He rose to the rank of Associate Professor of Medicine, Chief of Cardiology at the West Roxbury Veterans Administration Medical Center, and Director of the Center for Research in Thrombolysis at Brigham and Women’s Hospital. He joined the faculty of Boston University in 1994, first as Chief of Cardiology and, in 1997, Wade Professor and Chair of Medicine, Professor of Biochemistry, and Director of the Whitaker Cardiovascular Institute. He returned to Harvard and Brigham and Women’s Hospital in 2005. He currently serves on the board of directors of Leap Therapeutics, Inc., a publicly held biopharmaceutical company.

The Board believes Dr. Loscalzo is uniquely suited to serve on the Board primarily because of his extensive scientific expertise, including 27 years of research in the areas of vascular biology, thrombosis, and atherosclerosis, and practical knowledge as a practicing physician. Dr. Loscalzo’s expertise and role as a leading cardiologist is particularly valuable as we advance and grow our cardiovascular franchise.

Biographies of the Directors Whose Terms Expire at the 2020 Annual Meeting

Spencer R. Berthelsen, M.D., age 65, has served as a Director of Ionis since May 2002. Since 1980, he has practiced Internal Medicine with the Kelsey Seybold Clinic, a 400 physician medical group based in the Texas Medical Center in Houston. Dr. Berthelsen has served in various senior leadership positions at Kelsey Seybold, including Chairman of the Department of Internal Medicine, Medical Director and Managing Director. He served as Chairman of their Board of Directors from October 2001 through April 2016. He has served as a Clinical Professor of Medicine at Baylor College of Medicine and the University of Texas Health Science Center of Houston. Dr. Berthelsen served on the board of the Texas Academy of Internal Medicine in the past and the Caremark National Pharmacy and Therapeutics Committee from 1999 through 2005.

The Board believes Dr. Berthelsen is uniquely suited to serve on the Board because of his experience advising a large multi-specialty group practice and 37 years of experience as a practicing physician.

B. Lynne Parshall, age 63, has served as a Director of Ionis since September 2000 and as a Senior Strategic Advisor to Ionis since January 2018. Previously she served as our Chief Operating Officer from December 2007 through December 2017 and as our Chief Financial Officer from June 1994 through December 2012. She also served as our Corporate Secretary through 2014, and has served with the Company in various executive roles since November 1991. Prior to joining Ionis, Ms. Parshall practiced law at Cooley LLP, outside counsel to Ionis, where she was a partner from 1986 to 1991. Ms. Parshall is a member of the American and California bar associations. Ms. Parshall serves on the board of directors of Cytokinetcs Inc. and Akcea Therapeutics, Inc., both biopharmaceutical companies. Within the last five years, Ms. Parshall formerly served as a Director of Regulus Therapeutics, Inc.

The Board believes Ms. Parshall is uniquely suited to serve on the Board primarily because, as the former Chief Operating Officer and former executive of the Company for over 25 years, she has valuable Company-specific experience and expertise. In addition, Ms. Parshall has over 31 years of experience structuring and negotiating strategic licensing and financing transactions in the life sciences field.

Joseph H. Wender, age 73, has served as a Director of Ionis since January 1994. Mr. Wender began with Goldman, Sachs & Co. in 1971 and became a General Partner of that firm in 1982, where he headed the Financial Institutions Group for over a decade. Since January 2008, he has been a Senior Consultant to Goldman Sachs & Co. He is also an Independent Trustee of the Schwab Family of Funds and Director of Grandpoint Capital, a bank holding company. Mr. Wender also is co-CEO and minority partner, with his wife, of Colgin Cellars. Since March 2014, Mr. Wender has been a director, and is currently lead director, of Outfront Media, lessors of advertising space on out-of-home advertising structures.

The Board believes Mr. Wender is uniquely suited to serve on the Board primarily because, with over 46 years of experience as an investment banker with Goldman, Sachs & Co., he provides Ionis important advice regarding our financial reporting, corporate finance matters, strategic transactions, and compensation matters. Mr. Wender is also highly qualified to serve on the Audit Committee.

8

INFORMATION REGARDING THE BOARD AND CORPORATE GOVERNANCE

Independence of the Board

As required under Nasdaq listing standards, a majority of the members of a listed company’s board of directors must qualify as “independent,” as evaluated by our Nominating, Governance and Review Committee and affirmed by our Board. Our Nominating, Governance and Review Committee consults with our legal counsel to ensure that the Committee’s determinations are consistent with all relevant securities and other laws and regulations regarding the definition of “independent,” including those set forth in the applicable Nasdaq listing standards and applicable SEC rules and regulations, as in effect from time to time.

Consistent with these considerations, after review of all relevant transactions or relationships between each Director, or any of his or her family members, and Ionis, its senior management and its independent auditors, the Board affirmatively has determined that all of our Directors are independent Directors within the meaning of the applicable Nasdaq listing standards and SEC rules and regulations, except for Dr. Crooke and Ms. Parshall, our Chief Executive Officer and former Chief Operating Officer, respectively. In making this determination, the Board found that none of these Directors has a material or other disqualifying relationship with us. With respect to Mr. Muto who is a partner of Cooley LLP, our outside legal counsel, he is independent for purposes other than serving on the Audit Committee or Compensation Committee, each of which he is not a member.

Information Regarding the Board and its Committees

Leadership Structure

Our Chief Executive Officer is the Chairman of the Board. The Board believes that Ionis’ CEO is best suited to serve as Chairman because he has served as CEO since Ionis was formed 29 years ago and he is the Director most familiar with our science, business and industry. Because of that experience, he is the Director most capable of effectively identifying strategic priorities and leading the discussion and execution of strategy. Our independent Directors bring experience, oversight and expertise from outside Ionis and our industry, while the CEO brings Company-specific experience and expertise. The Board believes the combined role of Chairman and CEO promotes strategy development and execution, and facilitates information flow between management and the Board, which are essential to effective governance.

One of the key responsibilities of the Board is to develop strategic direction and hold management accountable for executing the established strategy. As part of each Board meeting, our independent Directors meet in an executive session without the presence of our employee Director. We do not have a single “lead independent director.” Instead, the Chairpersons of the Audit Committee, the Compensation Committee, and the Nominating, Governance and Review Committee preside over the executive sessions on a rotating basis. This rotating approach provides diversity to the process, thereby ensuring healthy discussion since the same individual does not continuously lead each executive session. In addition, Dr. Loscalzo and Mr. Muto, who are both independent Board members, are members of the Agenda Committee, which sets the agenda for each Board meeting. The Board believes the combined role of Chairman and CEO, together with the executive sessions and agenda setting described above, is in the best interest of stockholders because it provides the appropriate balance between developing strategy and independently overseeing management.

Risk Oversight

Our Board administers its risk oversight function directly and through both its Audit Committee and its Nominating, Governance and Review Committee. The Audit Committee oversees management of financial risks and related party transactions. The Nominating, Governance and Review Committee manages risks associated with the independence of the Board and potential conflicts of interests at the Board level, and periodically reviews our policies and procedures and makes recommendations when appropriate. We provide a complete description of each of these committees and its respective roles and responsibilities on pages 11 through 15 of this Proxy Statement. While each of these committees is responsible for evaluating certain risks and overseeing how we manage risk, these committees regularly inform the entire Board about such risks through committee reports.

9

In addition to the formal compliance program, the Board, the Audit Committee and the Nominating, Governance and Review Committee encourage management to promote a corporate culture that understands risk management and incorporates it into the overall corporate strategy and day-to-day business operations. Our risk management structure also includes an ongoing effort to assess and analyze the most likely areas of future risk for Ionis. As a result, the Board, the Audit Committee, the Nominating, Governance and Review Committee and the Scientific/Medical Committee periodically ask our executives to discuss the most likely sources of material future risks and how we are addressing any significant potential vulnerability.

Board Committees

The Board has five committees: an Audit Committee, a Compensation Committee, a Nominating, Governance and Review Committee, an Agenda Committee and a Scientific/Medical Committee. Below is a description of each committee of our Board. Each of the committees has authority to engage legal counsel or other experts or consultants as it deems appropriate to carry out its responsibilities. The Board has determined that each member of our Audit Committee, Compensation Committee, and Nominating, Governance and Review Committee:

| • | meets the applicable rules and regulations regarding “independence,” including, but not limited to, Rule 5605(a)(2) of the Nasdaq listing standards and applicable SEC rules and regulations; |

| • | is not an officer or employee of Ionis; and |

| • | is free of any relationship that would interfere with his individual exercise of independent judgment with regard to Ionis. |

Meetings and Attendance; Committee Members

The Board met five times in 2017. During 2017, each Director attended 75% or more of the aggregate number of meetings of the Board and the committees on which such Director served. We encourage each member of the Board to attend the Annual Meeting of Stockholders.

The table below provides membership and meeting information for fiscal 2017 for each of the Board committees and identifies our current Board and committee members.

Name | Audit | Compensation | Nominating, Governance and Review | Agenda | Science/ Medical | Attended 2017 Annual Meeting |

Dr. Spencer R. Berthelsen | — | X* | X* | — | X | X |

Mr. Breaux B. Castleman | X | — | — | — | — | X |

Dr. Stanley T. Crooke | — | — | — | X* | X* | X |

Mr. Joseph Klein, III | X | — | — | — | — | X |

Dr. Joseph Loscalzo | — | — | X | X | X | X |

Mr. Frederick T. Muto(1) | — | — | — | X | — | X |

Ms. B. Lynne Parshall | — | — | — | X | — | X |

Mr. Joseph H. Wender | X* | X | X | — | — | — |

Total meetings in fiscal year 2017 | 6 | 4(2) | 2 | 4 | 1 |

| * | Committee Chairperson |

| (1) | Mr. Muto serves as an advisor, in a non-voting capacity, to the Nominating, Governance and Review Committee, and to the Compensation Committee. |

| (2) | The Compensation Committee also acted by written consent 11 times. Our Compensation Committee typically acts by unanimous written consent each month to confirm stock options and RSUs granted in connection with new hires and promotions. |

10

The Audit Committee of the Board oversees our corporate accounting and financial reporting process, including audits of our financial statements. For this purpose, the Audit Committee performs several functions.

The Audit Committee:

| • | reviews the annual and quarterly financial statements and oversees the annual and quarterly financial reporting processes, including sessions with the auditors in which Ionis’ employees and management are not present; |

| • | selects and hires our independent auditors; |

| • | oversees the independence of our independent auditors; |

| • | evaluates our independent auditors’ performance; and |

| • | has the authority to hire its own outside consultants and advisors, if necessary. |

In addition to the responsibilities listed above, the Audit Committee has the following functions:

| • | reviewing our annual budget with management and, if acceptable, recommending the budget to the Board for approval; |

| • | setting and approving changes to our investment policy; |

| • | receiving and considering our independent auditors’ comments as to the audit of the financial statements and internal controls, adequacy of staff and management performance and procedures in connection with internal controls; |

| • | reviewing and, if appropriate, approving related party transactions; |

| • | establishing and enforcing procedures for the receipt, retention and treatment of complaints regarding accounting or auditing improprieties; and |

| • | pre-approving all audit and non-audit services provided by our independent auditors that are not prohibited by law. |

Our Audit Committee charter requires that each member must be independent. We consider the members to be independent as long as they:

| • | do not accept any consulting, advisory or other compensatory fee from us, except in connection with their service as a Director; |

| • | are not an affiliate of Ionis or one of its subsidiaries; and |

| • | meet all of the other Nasdaq independence requirements. |

In addition, all Audit Committee members must be financially literate and at least one member must be a “financial expert,” as defined by SEC regulations. Our Board has determined that the Audit Committee’s financial expert is Mr. Wender based on, among other things, his over 46 years of experience as an investment banker and consultant with Goldman, Sachs & Co. We provide the Audit Committee with the funding it needs to perform its duties.

In 2017, the Audit Committee met six times. The Board has adopted a written Audit Committee charter, which you can find on our corporate website at www.ionispharma.com.3 Each member meets the membership criteria set forth in the Audit Committee charter and as stated above.

Compensation Committee

The primary function of the Compensation Committee of the Board is to review, modify (as needed) and approve our overall compensation strategy and policies and approve the compensation and other terms of employment of our executive officers, including our Chief Executive Officer. We include a full list of the Compensation Committee’s responsibilities as part of the Compensation Discussion and Analysis (“CD&A”) set

| 3 | Any information that is included on or linked to our website is not part of this Proxy Statement or any registration statement or report that incorporates this Proxy Statement by reference. |

11

forth on pages 24 through 45 of this Proxy Statement. The charter of the Compensation Committee grants the Compensation Committee full access to all of our books, records, facilities and personnel, and authority to obtain, at our expense, advice and assistance from internal and external legal, accounting or other advisors and consultants and other external resources that the Compensation Committee considers necessary or appropriate in the performance of its duties. In particular, the Compensation Committee has the sole authority to retain independent compensation consultants to help the Compensation Committee evaluate executive and Director compensation, including the authority to approve the consultants’ reasonable fees and other retention terms.

We also have a Non-Management Stock Option Committee that, as delegated by the Compensation Committee, may award stock options and RSUs to employees who are below director level in accordance with guidelines adopted by the Compensation Committee. The Non-Management Stock Option Committee has one member, Dr. Crooke.

The Compensation Committee met four times in 2017 and acted by unanimous written consent 11 times. The Board has adopted a written Compensation Committee charter, which you can find on our corporate website at www.ionispharma.com.4

The Compensation Committee reviews with management Ionis’ CD&A to consider whether to recommend that we include the CD&A in our Proxy Statements and other filings.

Compensation Committee Interlocks and Insider Participation

As noted above, during the fiscal year ended December 31, 2017, our Compensation Committee was composed of Dr. Berthelsen and Mr. Wender. None of the members of the Compensation Committee has ever been an employee or officer of Ionis. None of our executive officers serves as a member of the board of directors or compensation committee of any other entity that has one or more executive officers serving as a member of our Board or Compensation Committee.

Nominating, Governance and Review Committee

The Nominating, Governance and Review Committee of the Board is responsible for:

| • | interviewing, evaluating, nominating and recommending individuals for membership on our Board, and considering proposed changes to the Board for approval; |

| • | managing risks associated with the independence of the Board and potential conflicts of interests at the Board level, and periodically reviewing our policies and procedures and making recommendations when appropriate; and |

| • | performing such other functions as may be necessary or convenient for the efficient discharge of the foregoing. |

The Nominating, Governance and Review Committee met two times during 2017. You can find our Nominating, Governance and Review Committee charter on our corporate website at www.ionispharma.com.5

Director Nominations - Quality Standards

The Nominating, Governance and Review Committee believes that candidates for Director should have certain minimum qualifications. As a result, the Board adopted membership standards and believes that the Board members should meet the minimum membership requirements listed below.

The minimum membership requirements are as follows:

| • | members must be able to read and understand basic financial statements; |

| • | members must demonstrate high personal integrity and ethics; |

| • | members cannot serve as a director on the board of more than five other publicly traded companies; |

| 4 | Any information that is included on or linked to our website is not part of this Proxy Statement or any registration statement or report that incorporates this Proxy Statement by reference. |

| 5 | Any information that is included on or linked to our website is not part of this Proxy Statement or any registration statement or report that incorporates this Proxy Statement by reference. |

12

| • | members cannot serve more than ten consecutive terms on the Board, except that Stanley T. Crooke, a founder of the Company, may serve for no more than 15 consecutive terms; and |

| • | members cannot run for re-election or serve on the Board once they have reached the age of 80. |

In addition to these minimum standards, the Nominating, Governance and Review Committee will consider such factors as:

| • | possessing relevant expertise to offer advice and guidance to management; |

| • | having sufficient time to devote to Ionis’ affairs; |

| • | demonstrating excellence in his or her field; |

| • | having sound business judgment; and |

| • | being committed to vigorously representing the long-term interests of our stockholders. |

Director Nominations - Diversity Discussion

In considering Director nominations, the Nominating, Governance and Review Committee considers the total mix of competencies represented on the Board as a whole, as well as the competencies each member, or nominee brings to the Board. In general, our Board members’ experience falls into three large categories: (1) investment banking, financial accounting and corporate governance experience; (2) medical and scientific expertise; and (3) employee versus non-employee Directors. By selecting individuals who have investment banking, financial accounting and corporate governance backgrounds, we gain valuable experience that ensures we are managing our financial resources appropriately, reporting our financial results fairly and accurately, and generally running our business consistent with current good corporate practices. As a cutting edge drug discovery and development company, we also greatly benefit from Board members who themselves are scientists and medical doctors. This way we can set and adjust our strategy and objectives based on the results we generate from our research and development efforts. In different ways, these first two categories allow us to effectively manage our cash and make prudent investments in our technology to achieve the greatest likelihood of success. We try to evenly balance the Board members across these first two categories.

Regarding the third category, a mix of employee and non-employee Directors offers different perspectives for the Board to consider when making decisions. Employee Directors can provide the Board valuable insight regarding our day-to-day operations, which can help the Board make important management and compensation decisions. Non-employee Directors can compare the opportunities and challenges presented to Ionis against the facts and circumstances these Directors are experiencing outside Ionis. We have a significantly higher number of non-employee Directors vs. employee Directors. Finally, we do not discriminate against nominees on the basis of gender, race, religion, national origin, sexual orientation, disability or any other basis prohibited by applicable law.

Director Nominations - Process

The Nominating, Governance and Review Committee will consider Director candidates our stockholders recommend. The Nominating, Governance and Review Committee does not intend to alter the manner in which it evaluates candidates, including the minimum criteria set forth above, based on whether or not a stockholder recommended the candidate.

The Nominating, Governance and Review Committee reviews new candidates for Director in the context of the Board’s composition, our operating requirements and our stockholders’ long-term interests. In conducting this assessment, the Nominating, Governance and Review Committee considers diversity, maturity, skills, the minimum membership requirements discussed above, and such other factors as it deems appropriate given the current needs of the Board and Ionis, to maintain a balance of knowledge, experience and capability. The Nominating, Governance and Review Committee then uses its network of contacts to compile a list of potential candidates, but may also engage, if it deems appropriate, a paid professional search firm. The Nominating, Governance and Review Committee conducts any appropriate and necessary inquiries into the backgrounds and qualifications of possible candidates after considering the function and needs of the Board. In the case of

13

incumbent Directors whose terms of office are set to expire, the Nominating, Governance and Review Committee reviews such Directors’ overall service to Ionis during their term, including the number of meetings attended, level of participation, quality of performance, and any other relationships and transactions that might impair such Directors’ independence.

The Nominating, Governance and Review Committee meets to discuss and consider the candidates’ qualifications and determines whether each candidate is independent based upon applicable Nasdaq listing standards, SEC rules and regulations, and the advice of counsel, if necessary. Finally, the Nominating, Governance and Review Committee then selects a nominee for recommendation to the Board by majority vote.

Stockholder Recommendations for Directors

Stockholders who wish to recommend individuals for consideration by the Nominating, Governance and Review Committee to become nominees for election to the Board may do so by delivering a written recommendation to Ionis’ corporate secretary at the following address: 2855 Gazelle Court, Carlsbad, CA 92010. Submissions must include:

| • | the name, age, business address and residence address of the nominee; |

| • | the principal occupation or employment of the nominee; |

| • | the stock ownership in Ionis of the nominee; |

| • | the stock ownership in Ionis of the stockholder making the nomination, including any trading in derivative securities that may disguise ownership occurring within the last 12 months; |

| • | the information relating to the nominee that is required to be disclosed in solicitations of proxies under applicable securities laws; |

| • | the nominee’s written consent to being named in the Proxy Statement as a nominee and to serving as a Director if elected; |

| • | other information as we may reasonably require to determine the eligibility of the proposed nominee to serve as an independent Director or that could be material to a reasonable stockholder’s understanding of the independence of the proposed nominee; and |

| • | any voting commitments the nominee has to third parties. |

In addition, the nominee will need to complete a written questionnaire regarding the background and qualifications of the nominee, and the background of any other person or entity on whose behalf the nomination is being made. The nominee must also agree to comply with all of our applicable publicly disclosed corporate governance, conflict of interest, confidentiality and stock ownership and trading policies and guidelines. The description of the requirements for Director nomination set forth above is qualified in its entirety by reference to our full and complete bylaws, which is an exhibit to our Current Report on Form 8-K filed with the SEC on December 18, 2015, a copy of which is available by contacting our corporate secretary. To date, the Board has not received or rejected a timely Director nominee for election at the upcoming stockholder meeting from a stockholder or stockholders holding more than 5% of our voting stock.

Agenda Committee

The primary function of the Agenda Committee of the Board is to determine the matters to be considered by the Board at each of its meetings and prepare an agenda accordingly. The Agenda Committee discussed in advance and set the agenda for each Board meeting held in 2017.

Science/Medical Committee

The primary functions of the Science/Medical Committee of the Board are to focus on the key scientific and development issues facing our technology and drugs in development, and help set our strategy in such areas. The Science/Medical Committee met once in 2017.

14

Stockholder Communications with the Board

We make every effort to ensure that our Board or individual Directors, as applicable, hear our stockholders’ views, and provide appropriate responses to stockholders in a timely manner. Stockholders who wish to communicate with the Board, or individual Directors, may do so by sending written communications addressed to Ionis’ corporate secretary at 2855 Gazelle Court, Carlsbad, CA 92010. If you wish to communicate with the independent Directors about your concerns or issues, you may address correspondence to a particular Director or to the independent Directors generally. If you do not name a particular Director, depending on the subject matter, we will forward the letter to the Chair of the Audit, Compensation, or Nominating, Governance and Review Committee. One or more of our employees designated by the Board will review these communications and will determine whether to present the materials to the Board. The purpose of this screening is to allow the Board to avoid having to consider irrelevant or inappropriate communications, such as advertisements, commercial solicitations and hostile communications. In accordance with our Code of Ethics and Business Conduct policy, all communications that relate to questionable accounting or auditing matters involving Ionis will be promptly and directly forwarded to the Audit Committee. Other than the processes described above, our Board has not adopted a formal written process for stockholder communications with the Board. We believe our Board’s responsiveness to stockholder communications has been excellent.

Code of Ethics and Business Conduct

We have adopted a Code of Ethics and Business Conduct that applies to all officers, Directors and employees. We have posted our Code of Ethics and Business Conduct on our website. If we make any substantive amendments to the Code of Ethics and Business Conduct or grant any waiver from a provision of the Code of Ethics and Business Conduct to any executive officer or Director, we will promptly disclose the nature of the amendment or waiver on our website at www.ionispharma.com.6

Corporate Governance Guidelines

The Board has adopted corporate governance guidelines to ensure that the Board will have the necessary authority and practices in place to review and evaluate our business operations as needed and to make decisions that are independent of our management. The guidelines are also intended to align our Directors’ and management’s interests with those of our stockholders. The corporate governance guidelines set forth the practices the Board intends to follow with respect to board composition and selection, board meetings and involvement of senior management, Chief Executive Officer performance evaluation, succession planning for Board committees and compensation, “clawbacks” of executive compensation, and share retention guidelines for our executive officers and Directors. The Board adopted the corporate governance guidelines to, among other things, reflect changes to the Nasdaq listing standards and SEC rules adopted to implement provisions of the Sarbanes-Oxley Act of 2002. You may view our corporate governance guidelines, as well as the charters for the Audit, Compensation and Nominating, Governance and Review committees at www.ionispharma.com.7

| 6 | Any information that is included on or linked to our website is not part of this Proxy Statement or any registration statement or report that incorporates this Proxy Statement by reference. |

| 7 | Any information that is included on or linked to our website is not part of this Proxy Statement or any registration statement or report that incorporates this Proxy Statement by reference. |

15

PROPOSAL 2

ADVISORY VOTE ON EXECUTIVE COMPENSATION

The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, called the “Dodd-Frank Act,” entitles Ionis’ stockholders to vote to approve, on an advisory (nonbinding) basis, the compensation of our Chief Executive Officer, Chief Financial Officer and our three other most highly compensated executive officers (at December 31, 2017), called our “named executive officers” as disclosed in this Proxy Statement in accordance with the SEC’s rules.

We are asking our stockholders to indicate their support for our named executive officer compensation as described in this Proxy Statement. This Proposal 2, commonly known as a ��say on pay” proposal, gives our stockholders the opportunity to express their views on the compensation paid to our named executive officers. This vote is not intended to address any specific item of compensation, but rather the overall compensation of our named executive officers and the philosophy, policies and practices described in this Proxy Statement. Accordingly, we are asking our stockholders to vote “FOR” the following resolution at the Annual Meeting:

“RESOLVED, that Ionis’ stockholders approve, on an advisory basis, the compensation of the named executive officers, as disclosed in this Proxy Statement for the 2018 Annual Meeting of Stockholders pursuant to the compensation disclosure rules of the Securities and Exchange Commission.”

We recommend you carefully review the EXECUTIVE COMPENSATION section of this Proxy Statement located on pages 24 through 45. Below is a high-level summary of some of our compensation practices. This summary is qualified by the detailed disclosure contained in the EXECUTIVE COMPENSATION section of this Proxy Statement.

16

The table below summarizes some of our executive compensation practices, both the practices we implement because we believe they are consistent with our vision and long-term stockholder value (see “What We Do” below), and those that we choose not to implement as we believe they are counter to our vision and long-term stockholder value (see “What We Don’t Do” below):

What We Do | What We Don’t Do | ||

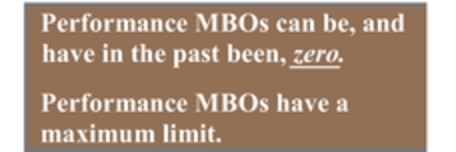

✔ | Demand more of every employee: more commitment, more knowledge, more intensity, more innovation, more productivity | ✘ | Do not guarantee a cash bonus – cash bonuses can, and have been, zero |

✔ | Reward productivity and performance | ✘ | Do not provide perquisites for any employees |

✔ | Recognize the value of long-term employees and low turnover | ✘ | Do not provide “gross-up” payments, other than for relocation |

✔ | Use a balanced mix of fixed and variable cash incentives and long-term equity incentives | ✘ | Do not allow pledging, shorting or hedging against our stock |

✔ | Evaluate compensation compared to the 50th percentile of our peer group | ✘ | Do not reprice or “cash-out” stock options without stockholder approval |

✔ | Design our compensation philosophy and objectives to mitigate unnecessary or imprudent business risk taking | ||

✔ | Set explicit and demanding objectives at the beginning of each year from which we measure performance for the year | ||

✔ | Place a maximum limit on Performance MBOs | ||

✔ | Set a strict budget for equity awards and salary increases | ||

✔ | Set the size of equity awards based on individual and company performance | ||

✔ | Require minimum vesting periods for equity awards | ||

✔ | Maintain equity holding periods that require our named executive officers and non-employee Board members to hold shares received from their RSUs until they meet certain ownership thresholds or no longer serve the Company | ||

✔ | Maintain equity holding periods that require our employees to hold ESPP shares for a minimum of six months | ||

✔ | Require our executive officers and VPs to trade Ionis’ stock through Rule 10b5-1 trading plans | ||

✔ | Use a “double trigger” for cash payments for change of control | ||

✔ | Use an executive “claw-back” policy | ||

✔ | Use an independent compensation consultant engaged by the Compensation Committee | ||

17

CEO Compensation vs. Total Return

(Over Five Years)

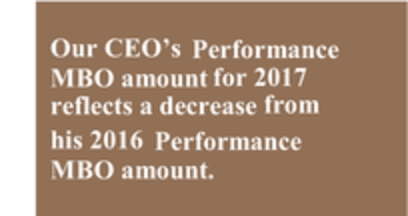

The graph below shows the relationship of our CEO’s compensation ($ in thousands) as calculated pursuant to SEC rules compared to the total return (TSR) on $100 invested on December 31, 2013 in our common stock through December 31, 2017. While stock price is only one of the measures of performance we use to set executive compensation, including for our CEO, over the past five-year period, our CEO’s compensation has generally aligned with our stock performance. Over this period, TSR has generally increased and has outperformed the Nasdaq Biotechnology Index, as reported in our 2017 Annual Report on Form 10-K. For 2016, however, Ionis’ one-year TSR was negative. Our CEO’s compensation for that period increased, largely due to an increase in the Company Performance Factor for the Performance MBO for 2016. Due to Ionis’ significant strategic and financial achievements during 2016, including exceeding many corporate objectives and accomplishing numerous unplanned achievements, the Compensation Committee felt that the increased Company Performance Factor was appropriate. Notably:

| • | Ionis had a goal and measure related to SPINRAZA of filing and acceptance of the NDA and MAA for SPINRAZA with Biogen paying us the license fee to exercise its option to take a license to SPINRAZA. We not only achieved the stated goal, Ionis and Biogen achieved FDA approval of SPINRAZA for the treatment of SMA in pediatric and adult patients. Achieving this approval so quickly (approximately three months from filing) for the broad patient population was an extraordinary achievement and greatly exceeded expectations for 2016, especially since NDA approvals for an orphan drug can typically take between 9-12 months from acceptance of the filing to approval, if at all. SPINRAZA’s approval and the commercial revenue associated with SPINRAZA was a reflection of the evolution of our business and our progress towards sustained profitability. |

| • | In 2016, Ionis and Akcea formed a strategic collaboration with Novartis to develop and commercialize AKCEA-APO(a)-LRx and AKCEA-APOCIII-LRx, valued at over $1 billion plus potential product royalties, including $225 million in near term payments. |

| • | Ionis finished 2016 with pro forma operating income of $25.8 million, where when setting goals for 2016, it had projected a pro forma operating loss in the low $60 million range, representing an improvement of more than 140%. |

| • | Ionis generated $347 million of revenue in 2016, compared to its guidance of $240 million, representing an improvement of 45%. |

| • | Ionis ended 2016 with $665 million in cash, exceeding year end cash guidance by $65 million. |

18

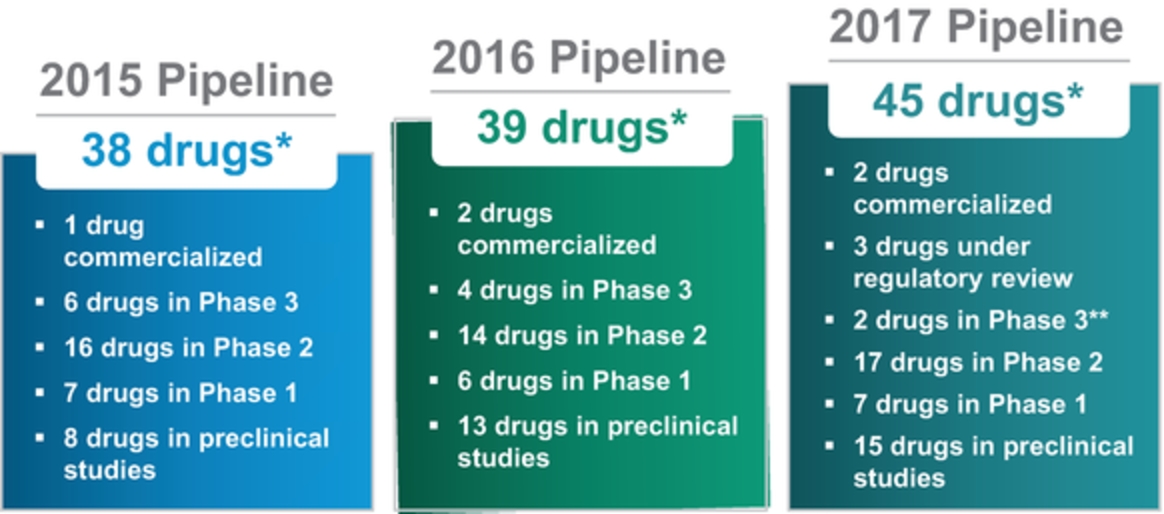

Indeed, the many achievements of the Company in 2016 laid the foundation for a significant growth in revenue and operating income in 2017, as shown by the graphs on page 34. Ionis ended 2017 in a very strong financial position, with 2017 revenues exceeding $500 million, a more than 45% increase from 2016, and Ionis’ sixth consecutive year of revenue growth. For the second year in a row, Ionis was profitable, with pro forma operating profit in 2017 of more than $110 million, a more than 150% increase from 2016. Consistent with this strong record of performance, our stock price increased over the year; however, the Compensation Committee exercised its discretion to decrease the Corporate Performance Factor for 2017, as well as the Individual Performance Factor for our CEO and COO for 2017. As shown in the graph below, our CEO’s compensation aligned with TSR for 2017.8

The affirmative vote of a majority of the holders of shares present or represented by proxy at the Annual Meeting and entitled to vote on the matter is required to adopt the resolution. If you indicate on your proxy to “Abstain” from voting, it will have the same effect as a vote “Against” this Proposal 2. Brokers do not have discretion to vote uninstructed shares with respect to this Proposal 2. Accordingly, if brokers do not receive voting instructions from beneficial owners of the shares, they cannot vote the shares. Therefore, broker non-votes will not affect the outcome of the voting on this Proposal 2.

The “say on pay” vote is advisory, and therefore is not binding on Ionis, the Compensation Committee or the Board. However, Ionis’ management, the Board and the Compensation Committee value the opinions of the stockholders. As such, if there is any significant vote against the named executive officers’ compensation as disclosed in this Proxy Statement, the Board will consider the stockholders’ concerns and the Board and Compensation Committee will evaluate whether any actions are necessary to address those concerns.

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” APPROVAL OF PROPOSAL 2.

| 8 | This graph is not “soliciting material,” is not deemed “filed” with the SEC, is not subject to the liabilities of Section 18 of the Exchange Act and is not to be incorporated by reference in any of our filings under the Securities Act of 1933, as amended (the “Securities Act”) or the Exchange Act, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing. |

19

PROPOSAL 3

RATIFICATION OF SELECTION OF INDEPENDENT AUDITORS

The Audit Committee has selected Ernst & Young LLP as our independent registered public accounting firm for our 2018 fiscal year, and has requested management to ask for stockholder ratification at the Annual Meeting. Ernst & Young LLP has audited our financial statements since we were founded in 1989. Representatives of Ernst & Young LLP will be at the Annual Meeting to answer any questions and make a statement should they desire to do so.

Although our bylaws do not require stockholders to ratify our independent registered public accounting firm, the Audit Committee would like our stockholders’ opinion as a matter of good corporate practice. If the stockholders do not ratify the selection of Ernst & Young LLP, the Audit Committee will reconsider whether to keep the firm. However, even if the stockholders ratify the selection, the Audit Committee may choose to appoint a different independent accounting firm at any time during the year if it believes that a change would be in the best interests of our stockholders and Ionis.

The affirmative vote of the holders of a majority of the shares present in person or represented by proxy at the Annual Meeting and entitled to vote on the matter will be required to ratify the selection of Ernst & Young LLP. If you indicate on your proxy to “Abstain” from voting, it will have the same effect as an “Against” vote for this Proposal 3.

As of December 31, 2017, none of our finance or accounting employees had been employed by Ernst & Young LLP during the past five years.

Independent Auditors’ Fees

The Audit Committee has adopted a policy and procedure for the pre-approval of audit and permissible non-audit services rendered by our independent registered public accounting firm, Ernst & Young LLP. The policy generally pre-approves specific services in the defined categories of audit services, audit-related services, and tax services up to pre-determined amounts. The Audit Committee may pre-approve services as part of its approval of the scope of the engagement of the independent auditor or on an individual explicit case-by-case basis before the Audit Committee engages the independent registered public accounting firm to provide each service. The Audit Committee pre-approved all of the fees described below.

Audit Fees

For the fiscal years ended December 31, 2017 and 2016, Ernst & Young LLP billed us approximately $800,000 and $700,000 for each year, respectively, primarily related to the integrated audit of our financial statements and reviews of our interim financial statements. In addition, Ernst & Young LLP billed us approximately $400,000 and approximately $100,000 in 2017 and 2016, respectively, related to corporate transactions, of which approximately $100,000 was billed to Akcea Therapeutics, Inc. (“Akcea”), our affiliate, in 2017. Additionally, for the fiscal year ended December 31, 2017, Ernst & Young LLP billed us approximately $600,000 related to the audit of the financial statements of Akcea, including professional services rendered in connection with Akcea’s initial public offering of approximately $350,000.

Audit Related Fees

For the fiscal years ended December 31, 2017 and 2016, there were no audit related fees billed by Ernst & Young LLP.

Tax Fees

For the fiscal year ended December 31, 2017, Ernst & Young LLP billed us approximately $400,000 for professional services on tax projects, including services related to Akcea’s initial public offering, international tax planning and state and local tax consulting projects, of which approximately $200,000 was billed to Akcea. For the fiscal year ended December 31, 2016, Ernst & Young LLP billed us approximately $200,000 for professional services rendered for international tax planning for Akcea and state and local tax consulting projects.

All Other Fees