SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No.__)

| Filed by the Registrant | ☒ |

| Filed by a party other than the Registrant | ☐ |

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under § 240.14a-12 |

Ionis Pharmaceuticals, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☒ | No fee required |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

NOTICE OF 2022 ANNUAL MEETING OF STOCKHOLDERS

AND PROXY STATEMENT

Dear Stockholders,

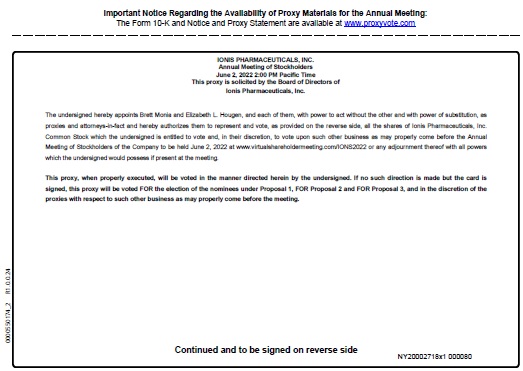

I am pleased to invite you to Ionis Pharmaceuticals, Inc.’s 2022 Annual Meeting of Stockholders to be held on June 2, 2022. The Annual Meeting will be held in a virtual meeting format only, via live webcast on the Internet, with no physical in-person meeting. You can attend and participate in the Annual Meeting online by visiting www.virtualshareholdermeeting.com/IONS2022, where you will be able to listen to the meeting live, submit questions and vote. As always, we encourage you to vote your shares prior to the Annual Meeting.

This document includes the agenda for this year’s Annual Meeting and the Proxy Statement. We will cover the formal items on the agenda during the Annual Meeting. Following the formal Annual Meeting, we will review the major developments of the past year and our plans for 2022 via webcast. You can find information regarding how to join the webcast on our website at ir.ionispharma.com. The Proxy Statement explains the matters we will discuss in the meeting and provides additional information about us.

Your vote is very important. Whether or not you plan to attend the meeting, please be sure to vote your shares as soon as possible to ensure your representation at the meeting. We are distributing our proxy materials under a Securities and Exchange Commission rule that allows us to furnish proxy materials to our stockholders over the Internet rather than in paper form. We believe this method of distribution reduces our environmental impact and costs without hindering our stockholders’ timely access to such important material. As a result, if you are a stockholder of record (that is, if your stock is registered with us in your own name) you will receive a Notice Regarding the Availability of Proxy Materials in the mail, which contains instructions on how to access our proxy materials and vote electronically through the Internet or to request printed proxy materials so you may vote by telephone or mail.

If your shares are registered in the name of a broker or other nominee, that nominee will forward the Notice Regarding the Availability of Proxy Materials to you and you can direct that nominee to vote your shares. Alternatively, if your nominee participates in a program provided through Broadridge Financial Solutions, Inc. that allows you to vote by telephone or through the Internet, your nominee will send you a voting form with telephone and Internet voting instructions.

If you plan to attend the virtual meeting and prefer to vote online, you may still do so even if you have already returned your proxy.

PLEASE NOTE, HOWEVER, THAT IF A BROKER, BANK OR OTHER NOMINEE HOLDS YOUR SHARES OF RECORD AND YOU WISH TO VOTE AT THE MEETING, YOU MUST OBTAIN A PROXY ISSUED IN YOUR NAME FROM THE BROKER, BANK OR OTHER NOMINEE.

In this document, unless the context requires otherwise, the words “Ionis,” “Company,” “we,” “our” and “us” refer only to Ionis Pharmaceuticals, Inc. and its subsidiaries and not to any other person or entity.

Sincerely,

Patrick R. O’Neil |

NOTICE OF 2022 ANNUAL MEETING OF STOCKHOLDERS

| Date: | June 2, 2022 |

| Time: | 2:00 p.m. Pacific Time |

| Place: | Online only: www.virtualshareholdermeeting.com/IONS2022 |

| Record Date: | April 5, 2022. If you were an Ionis stockholder of record at the close of business on April 5, 2022, you may vote at the Annual Meeting. |

| Items of Business: | We are holding the Annual Meeting for the following purposes, as more fully described in the accompanying Proxy Statement: |

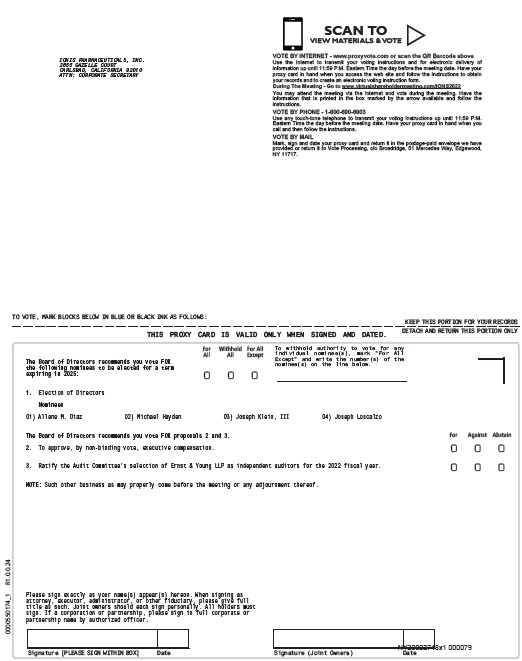

| 1. | To elect our nominees, Allene M. Diaz, Michael Hayden, Joseph Klein, III, and Joseph Loscalzo, to our Board of Directors to serve as Directors for a three-year term; |

| 2. | To make an advisory vote on executive compensation; and |

| 3. | To ratify the Audit Committee’s selection of Ernst & Young LLP as independent auditors for our 2022 fiscal year. |

| 4. | To transact any other business that may be properly presented at the Annual Meeting. |

| Virtual Meeting: | To participate in the Annual Meeting, please visit www.virtualshareholdermeeting.com/IONS2022. You will need the 16-digit control number included on your Notice of Internet Availability of Proxy Materials or your proxy card or voting instruction form that accompanied your proxy materials. Stockholders will be able to vote and submit questions during the Annual Meeting. |

| Voting: | WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING, PLEASE VOTE BY TELEPHONE OR INTERNET BY FOLLOWING THE INSTRUCTIONS INCLUDED IN THIS PROXY STATEMENT AND YOUR NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS OR PROXY CARD. ALTERNATIVELY, YOU MAY REQUEST A WRITTEN PROXY STATEMENT, AND COMPLETE, DATE, SIGN AND RETURN YOUR PROXY AS PROMPTLY AS POSSIBLE TO ENSURE YOUR REPRESENTATION AT THE MEETING. IF YOU RECEIVE YOUR PROXY MATERIALS BY MAIL, WE WILL INCLUDE A RETURN ENVELOPE (WHICH IS POSTAGE PREPAID IF MAILED IN THE UNITED STATES) FOR THAT PURPOSE. EVEN IF YOU HAVE GIVEN YOUR PROXY, YOU MAY STILL VOTE AT THE VIRTUAL MEETING VIA LIVE WEBCAST. PLEASE NOTE, HOWEVER, THAT IF YOUR SHARES ARE HELD OF RECORD BY A BROKER, BANK OR OTHER NOMINEE AND YOU WISH TO VOTE AT THE MEETING, YOU MUST OBTAIN FROM THE BROKER, BANK OR OTHER NOMINEE A PROXY ISSUED IN YOUR NAME. |

By order of the Board of Directors,

Patrick R. O’Neil |

Carlsbad, California

April 20, 2022

ALL STOCKHOLDERS ARE CORDIALLY INVITED TO ATTEND THE VIRTUAL MEETING VIA LIVE WEBCAST.

IONIS PHARMACEUTICALS, INC.

2855 Gazelle Court

Carlsbad, CA 92010

PROXY STATEMENT

FOR THE 2022 ANNUAL MEETING OF STOCKHOLDERS

To Be Held on June 2, 2022

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING

Why did I receive a Notice Regarding the Availability of Proxy Materials on the Internet?

Ionis’ Board of Directors (the “Board”) is soliciting your proxy to vote at the 2022 Annual Meeting of Stockholders, including at any adjournments or postponements of the meeting. We are distributing our Notice of Annual Meeting and Proxy Materials (the “Notice”) by mail using the Notice and Access procedures established by the United States Securities and Exchange Commission (the “SEC”). The Notice is important because it contains a control number and instructions that will allow you to access our proxy materials and vote electronically through the Internet or to request printed proxy materials so you may vote by telephone or mail. Your vote is very important. Whether or not you plan to attend the meeting, please be sure to vote your shares as soon as possible to ensure your representation at the meeting. All stockholders will have the ability to access the proxy materials on the website referred to in the Notice or request to receive a printed set of the proxy materials. You can find instructions on how to access the proxy materials over the Internet or to request a printed copy in the Notice.

We intend to mail the Notice on or before April 22, 2022 to all stockholders of record entitled to vote at the Annual Meeting.

Will I receive any other proxy materials by mail?

We may send you a proxy card, along with a second Notice, on or after May 3, 2022.

Where and when is the Annual Meeting?

The Annual Meeting will be held on Thursday, June 2, 2022, at 2:00 p.m. Pacific Time. The Annual Meeting will be held in a virtual meeting format only, via live webcast on the Internet, with no physical in-person meeting. To participate, vote or submit questions during the Annual Meeting via live webcast, please visit www.virtualshareholdermeeting.com/IONS2022.

If you cannot attend, please note that we will make a webcast of the presentation that follows the Annual Meeting available on the day of the meeting and for a limited time following the meeting at www.ionispharma.com.1

If you plan to attend the virtual meeting and prefer to vote online, you may still do so even if you have already returned your proxy.

How do I attend the Annual Meeting?

We will be hosting the Annual Meeting via live webcast on the Internet. You will not be able to attend the Annual Meeting in person. All stockholders at the close of business on April 5, 2022 can listen to and participate in the Annual Meeting live via the internet at www.virtualshareholdermeeting.com/IONS2022. The webcast will begin at 2:00 p.m. Pacific Time on June 2, 2022. Stockholders may vote and submit questions while connected to the Annual Meeting on the Internet. A summary of the information you need to attend the Annual Meeting online is provided below.

What do I need in order to be able to participate in the Annual Meeting online?

You will need the 16-digit control number included on your proxy card in order to be able to vote your shares or submit questions during the virtual Annual Meeting. Instructions on how to connect and participate in the Annual Meeting via the internet, including how to demonstrate proof of stock ownership, are posted at www.virtualshareholdermeeting.com/IONS2022.

1 Any information that is included on or linked to our website is not part of this Proxy Statement or any registration statement or report that incorporates this Proxy Statement by reference.

![]()

What if I have technical difficulties or trouble accessing the live webcast of the Annual Meeting?

If you encounter any difficulties accessing the live webcast of the Annual Meeting or during the Annual Meeting, please call the telephone number that is listed at www.virtualshareholdermeeting.com/IONS2022 for assistance. If you misplace the 16-digit control number that is required to enter the Annual Meeting webcast and are a stockholder of record, operators providing assistance at this telephone number will be able to provide it to you. However, if you need your 16-digit control number and hold your shares in an account at a brokerage firm, bank, dealer, or other similar organization, you must contact that organization to obtain your 16-digit control number prior to the Annual Meeting.

Who can attend and vote at the Annual Meeting?

Only stockholders at the close of business on April 5, 2022 may attend and vote at the Annual Meeting. On this record date, there were 141,753,122 shares of common stock outstanding and entitled to vote.

Stockholder of Record: Shares Registered in Your Name

If on April 5, 2022 your shares were registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, then you are a stockholder of record. As a stockholder of record, you may vote online at the virtual meeting or vote by proxy over the telephone, by mail, or the Internet as instructed under the section below titled “How do I vote?” Whether or not you plan to attend the meeting, we urge you to fill out and return the proxy card or vote over the telephone or Internet to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If on April 5, 2022 you did not own shares in your name, but rather in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in “street name” and that organization is forwarding the Notice to you. The organization holding your account is the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you may direct your broker or other agent regarding how to vote the shares in your account. If your shares are registered in the name of a broker or other nominee, your nominee may be participating in a program provided through Broadridge Financial Solutions, Inc. (“Broadridge”) that also allows you to vote by telephone or through the Internet. If so, the voting form your nominee sends you will provide telephone and Internet instructions. You are also invited to attend the virtual Annual Meeting via live webcast.

PLEASE NOTE, HOWEVER, THAT IF A BROKER, BANK OR OTHER NOMINEE HOLDS YOUR SHARES OF RECORD AND YOU WISH TO VOTE AT THE MEETING, YOU MUST OBTAIN A PROXY ISSUED IN YOUR NAME FROM THE BROKER, BANK OR OTHER NOMINEE.

What am I voting on?

The following matters are scheduled for a vote:

| 1. | Proposal 1: | elect our nominees, Allene M. Diaz, Michael Hayden, Joseph Klein, III, and Joseph Loscalzo, to our Board of Directors to serve as Directors for a three-year term; |

| 2. | Proposal 2: | make an advisory vote on executive compensation; and |

| 3. | Proposal 3: | ratify the Audit Committee’s selection of Ernst & Young LLP as independent auditors for our 2022 fiscal year. |

What if another matter is properly brought before the meeting?

The Board knows of no other matters that will be presented for consideration at the Annual Meeting. If any other matters are properly brought before the meeting, the persons named in the accompanying proxy intend to vote on those matters in accordance with their best judgment.

How do I vote?

You may vote in one of the following ways:

| 1. | vote through the Internet by following the instructions included with your Notice or proxy card; |

| 2. | vote by telephone by following the instructions included with your proxy card if you have received proxy materials electronically or by mail; |

![]()

| 3. | vote by mail by completing, signing, dating, and returning your proxy card in the postage paid envelope provided; or |

| 4. | vote during the virtual Annual Meeting by following the instructions posted at www.virtualshareholdermeeting.com/IONS2022. |

The procedures for voting are fairly simple:

For Shares Registered in Your Name:

If you are a stockholder of record, you may go to www.proxyvote.com to vote your shares through the Internet up until 11:59 p.m. Eastern Time on June 1, 2022. The votes represented by your proxy will be displayed on the computer screen and you will be prompted to submit or revise your votes as desired.

To vote your shares by telephone, you must first request that we send proxy materials to you by following the instructions included in your Notice. Once you have received your proxy materials, you may vote using a touch-tone telephone by calling 1-800-690-6903 up until 11:59 p.m. Eastern Time on June 1, 2022 and following the recorded instructions. Please have your proxy card available at the time you vote.

To vote using the proxy card, simply complete, sign and date the proxy card that may be delivered to you and return it promptly in the envelope provided. If we receive your signed proxy card before the Annual Meeting, we will vote your shares as you direct.

For Shares Registered in the Name of a Broker or Bank:

If your broker or bank holds your shares in “street name,” you will need to obtain a proxy form from the institution that holds your shares and follow the instructions included on that form regarding how to instruct your broker to vote your shares. If you do not give instructions to your broker, your broker can vote your shares with respect to “discretionary” items, but not with respect to “non-discretionary” items. Discretionary items are proposals considered routine under the rules of the New York Stock Exchange (“NYSE”) on which a broker may vote shares held in street name in the absence of your voting instructions. While Ionis is listed with the Nasdaq Stock Market (“Nasdaq”), NYSE rules affect how brokers licensed by the NYSE can vote in a director election of any company, including companies listed with Nasdaq. The proposal to ratify Ernst & Young LLP as independent auditors is a discretionary item. Proposals 1 and 2 regarding (1) the election of Directors, and (2) approval, on an advisory basis, of our executive compensation, are non-discretionary items. If you do not give your broker instructions for a non-discretionary item your broker cannot vote your shares, which will result in what is commonly referred to as a “broker non-vote.” Broker non-votes will have no effect.

A number of brokers and banks are participating in a program provided by Broadridge that allows proxies to vote shares by means of the telephone and Internet. If your shares are held in an account with a broker or bank participating in the Broadridge program, you may vote your shares by telephone or through the Internet by having the voting form in hand and calling the number or going to the website indicated on the form and following the instructions.

What if I return a proxy card or otherwise vote but do not make specific choices?

If you return a signed and dated proxy card or otherwise vote without marking voting selections, one of the individuals named on your proxy card will vote your shares as follows:

| 1. | “For” the election of the nominees for Director named in the Proxy Statement; |

| 2. | “For” the approval, on an advisory basis, of executive compensation; and |

| 3. | “For” the ratification of the Audit Committee’s selection of Ernst & Young LLP as independent auditors for our 2022 fiscal year. |

If any other matter is properly presented at the meeting, one of the individuals named on your proxy card will vote your shares using his or her best judgment.

Who is paying for this proxy solicitation?

Our Board is soliciting your proxy to vote at the Annual Meeting. We will bear the entire cost of soliciting proxies, including preparing, assembling, making available on the Internet and printing and mailing this Proxy Statement, the proxy card and any additional information furnished to stockholders. We will furnish copies of solicitation materials to banks, brokerage houses, fiduciaries and custodians holding our common stock in “street name” on behalf of beneficial owners of such shares. We may reimburse persons representing beneficial owners of our common stock for their costs of forwarding solicitation materials to such beneficial owners. Our Directors, officers or other employees may supplement original solicitation of proxies by telephone, electronic mail, or personal solicitation. We will not pay our Directors, officers, or employees any additional compensation for soliciting proxies. However, please be aware that you must bear any costs associated with your Internet service, such as usage charges from Internet access providers or telephone companies.

![]()

What does it mean if I receive more than one Notice?

If you receive more than one Notice or proxy card, your shares are registered in more than one name or are registered in different accounts. Please complete, sign, date and return each separate proxy card or vote by telephone or through the Internet by following the instructions included with each Notice or proxy card to properly vote your shares.

Can I change my vote after submitting my proxy?

Yes. Once you have submitted your proxy by mail, Internet, or telephone, you may revoke it at any time before we exercise it at the Annual Meeting. You may revoke your proxy by any one of the following four ways:

| 1. | you may mail another proxy marked with a later date; |

| 2. | you may revoke it through the Internet; |

| 3. | you may notify our corporate secretary in writing sent to 2855 Gazelle Court, Carlsbad, California 92010 that you wish to revoke your proxy before the Annual Meeting takes place; or |

| 4. | you may vote during the virtual Annual Meeting. Attending the meeting will not, by itself, revoke a proxy. |

If your shares are held by your broker, bank, or other agent, you should follow the instructions provided by your broker, bank, or other agent.

When are stockholder proposals due for next year’s Annual Meeting?

If you have a proposal that you would like us to include in our proxy materials for next year’s Annual Meeting of Stockholders, you must send the proposal to us in writing by no later than December 21, 2022 and comply with all applicable requirements of Rule 14a-8 promulgated under the Securities Exchange Act of 1934, as amended (“Rule 14a-8”). Stockholders wishing to submit proposals or Director nominations that are not to be included in such proxy materials for next year’s Annual Meeting of Stockholders pursuant to Rule 14a-8 must do so no later than the close of business on February 2, 2023, as required by our bylaws. Stockholders should also review our bylaws, which contain additional requirements with respect to advance notice of stockholder proposals and Director nominations.

In addition to satisfying the foregoing requirements under our bylaws, to comply with the universal proxy rules (once effective), stockholders who intend to solicit proxies in support of director nominees other than our Board’s nominees must provide notice that sets forth any additional information required by Rule 14a-19 no later than April 3, 2023.

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present at the meeting if at least a majority of the outstanding shares entitled to vote are represented at the meeting or by proxy. We will count your shares towards the quorum only if you submit a valid proxy vote (or one is submitted on your behalf by your broker, bank, or other nominee) or vote at the meeting. We will count abstentions and broker non-votes towards the quorum requirement.

If there is no quorum, the holders of a majority of shares present at the meeting or represented by proxy may adjourn the meeting to another date.

How are votes counted?

Each share of our common stock you own entitles you to one vote. Your Notice and proxy card indicates the number of shares of our common stock you owned at the close of business on April 5, 2022. The inspector of elections will count votes for the meeting and will separately count “For” and “Against” votes, abstentions, and broker non-votes. With respect to Proposal 1, the election of Directors, stockholders do not affirmatively vote “Against” nominees. Instead, if you do not want to elect a particular nominee, you should choose to “Withhold” a vote in favor of the applicable nominee for Director and the inspector of elections will count each “Withhold” for each nominee. Abstentions will have no effect on Proposal 1 or Proposal 3. Abstentions will count towards the vote total for Proposal 2 and will have the same effect as “Against” votes. Broker non-votes have no effect and the inspector of elections will not count them towards the vote total for any proposal.

![]()

What are “broker non-votes”?

Broker non-votes occur when a beneficial owner of shares held in “street name” does not give instructions to the broker or nominee holding the shares as to how to vote on matters deemed “non-routine.” If your broker holds your shares in “street name,” and you do not give instructions to your broker, your broker can vote your shares with respect to “discretionary” items, but not with respect to “non-discretionary” items. The proposal to ratify Ernst & Young LLP as independent auditors is a discretionary item. Proposals 1 and 2 regarding (1) the election of Directors, and (2) approval, on an advisory basis, of our executive compensation, are non-discretionary items.

How many votes are needed to approve each proposal?

| 1. | Proposal 1: For the election of Directors in an uncontested election, a Director nominee must receive a majority of the votes cast in the election such that the number of shares voted “For” the nominee must exceed 50% of the votes cast with respect to that Director. Only “For” and “Withhold” votes will affect the outcome. Abstentions and broker non-votes, if any, will have no effect. |

| 2. | Proposal 2: We will consider the advisory approval of the compensation of our executive officers to be approved if it receives “For” votes from a majority of the holders of shares present or represented by proxy at the Annual Meeting and entitled to vote on the matter. If you “Abstain” from voting, it will have the same effect as an “Against” vote. Broker non-votes, if any, will have no effect. |

| 3. | Proposal 3: To be approved, the ratification of the selection of Ernst & Young LLP as our independent auditors for our 2022 fiscal year must receive “For” votes from a majority of the holders of shares present or represented by proxy at the Annual Meeting and entitled to vote on the matter. Abstentions, if any, will have no effect. Because brokers have discretionary authority to vote on the ratification of the selection of Ernst & Young LLP, we do not expect any broker non-votes in connection with the ratification. |

How can I find out the results of the voting at the Annual Meeting?

We will announce preliminary voting results at the Annual Meeting. In addition, we will publish final voting results in a current report on Form 8-K that we expect to file within four business days after the Annual Meeting. If final voting results are not available to us in time to file as part of a Form 8-K within four business days after the Annual Meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after we know the final results, file an additional Form 8-K to publish final results.

How can I elect to receive materials for future Annual Meetings electronically?

We are pleased to offer to our stockholders the benefits and convenience of electronic delivery of Annual Meeting materials, including:

| 1. | delivering the Proxy Statement, Annual Report on Form 10-K, and related materials by email to our stockholders; |

| 2. | stockholder voting online; |

| 3. | helping the environment by decreasing the use of paper documents; |

| 4. | reducing the number of bulky documents stockholders receive; and |

| 5. | reducing our printing and mailing costs associated with more traditional delivery methods. |

We encourage you to conserve natural resources and to reduce printing and mailing costs by signing up for electronic delivery of our stockholder communications after you place your current vote at www.proxyvote.com.

List of Shareholders

A list of stockholders entitled to vote at the Annual Meeting will be available for examination at our principal executive offices at the address listed above for a period of 10 days prior to the Annual Meeting, and will be available during the virtual Annual Meeting for examination at www.virtualshareholdermeeting.com/IONS2022.

![]()

Environmental, Social and Governance Initiatives

We recognize the importance of Environmental, Social and Governance (“ESG”) initiatives as they relate to our business strategy and risk assessment. During 2020 and 2021, we took steps to formalize our corporate responsibility program. In December 2021, we issued our inaugural corporate responsibility report in which we identified the corporate responsibility initiatives that we believe are most important to our business, some of which are discussed below.

We have a relatively small environmental footprint, so our stewardship programs focus on improving eco-awareness, identifying efficiencies and integrating more sustainable practices into our daily operations. The identification of our ESG initiatives considered investor and other stakeholder interests and is aligned with the requirements of ESG ratings agencies and with leading ESG frameworks, including the Sustainability Accounting Standards Board.

Safety of Clinical Trial Participants

The safety of participants in our clinical trials is very important to us. We have standard operating procedures to govern how we conduct clinical trials. Independent ethics committees and institutional review boards and health authorities review and approve essential clinical trial documents, such as protocols and informed consent forms before they are implemented. During clinical trials, participants are treated by qualified doctors and their staff, who are trained on the administration of our investigational drugs. Our safety data review committees, and, for some studies, independent external Data and Safety Monitoring Boards, monitor safety data across all study participants to identify potential issues or concerns, which are handled in accordance with our study plans. During trials, we evaluate benefit-to-risk assessments, and share annual summary reports and post-approval safety surveillance reports with health authorities.

Drug Safety and Supply Chain Management

We rigorously monitor our products throughout the manufacturing process. Raw materials, components, utilities and products are tested at key stages against pre-defined acceptance criteria using validated or compendial methods. Testing methods are validated in line with international standards to demonstrate consistent and valid results. We use a Quality Management System (“QMS”) to provide governance oversight, control quality and monitor compliance. A Quality Management Review (“QMR”) is performed at least annually to update senior management on the compliance of the QMS against agreed metrics and external vendor performance. Processes are also in place to share learnings from projects and inspections with senior leadership through the QMR.

Access to Medicines

At the core of everything we do is a belief in the potential of our medicines to transform lives. To fulfill this potential, we need to get our medicines to those who need them most. We work closely with patient advocacy organizations and communities around the world to identify and understand the needs of people we serve. Patients are experts in living with their disease, and their perspectives inform our approach to drug development. We recently introduced initiatives to better match the demographics of our clinical trials with the demographics of patient populations, which we believe will improve access and ensure diversity.

Sharing the Benefits of Antisense Technology: The n-Lorem Foundation

The power to develop treatments for patients with extremely rare diseases is a tremendous responsibility that we take seriously. We have donated our time, knowledge, and resources to discover and develop treatments for these diseases. We are closely associated with the n-Lorem Foundation, a charitable organization established by Ionis’ founder and former CEO and Executive Chairman, Stanley T. Crooke. The mission of n-Lorem is to provide personalized antisense treatments to patients with ultra-rare diseases (afflicting fewer than 30 patients worldwide) – for free, for life. Given the rarity of the diseases in question, developing treatments is not commercially viable; however, n-Lorem’s not-for-profit model offers hope to these patients. Ionis supports n-Lorem both financially and with in-kind activities.

Employee Recruitment and Development

We are committed to fair and equitable recruitment of the best and most qualified candidates, and we cast a wide net when searching for talent. We offer internships to promising students to nurture their interest in the biotech and pharmaceutical sectors. Whether we are hiring entry-level, mid-career, or executive level candidates, we look beyond a candidate’s academic qualifications to identify valuable experience and skills. New employees enter a peer mentoring “buddy” program, and we offer comprehensive training and development plans for employees at all levels. Our training and development program supports the development of our employees as they progress through their careers. We also offer integration programs, science classes for non-scientists, a manager’s book club, soft skills training, English language skills, supervisory capabilities, and leadership development programs.

![]()

Diversity, Equity and Inclusion

We strive to create an environment that values different perspectives, where all employees are encouraged to contribute wholeheartedly and reach their full potential. Encouraging diversity has always been part of our corporate culture and we work hard to promote fairness, inclusion and equity. In 2020, we launched Employee Resource Groups (“ERGs”) to promote diversity and inclusion within our organization. The groups are employee-led and focused on a particular dimension of diversity. ERGs give colleagues the opportunity to discuss issues around diversity and inclusion, and are designed to support our business goals, diversify our leadership, build cultural awareness and promote an inclusive and supportive culture. Employee-led ERGs at Ionis include groups focused on:

ERGs give colleagues the opportunity to discuss issues around diversity and inclusion, and are designed to support our business goals, diversify our leadership, build cultural awareness and promote an inclusive and supportive culture. |

| ● | LGBTQIA+; |

| ● | women’s empowerment; |

| ● | diversity, equity and inclusion and social justice; |

| ● | new and expecting parents; |

| ● | mental health; and |

| ● | minority student outreach. |

Employee Health and Safety

We strive to protect the health and safety of all employees, contractors, and visitors, and we aim to provide an injury-free workplace. We have implemented a safety management system that uses risk metrics, monitoring, auditing, and target setting to continuously improve occupational health and work safety. We provide regular safety training to all laboratory and manufacturing employees, and we routinely audit health and safety compliance.

COVID-19

As the COVID-19 outbreak developed in 2020, we were quick to implement a plan to keep our employees and patients safe and minimize disruption to the supply of medicines to our patients and clinical trials. For the safety of our workforce, we asked employees to work from home when possible. We gave essential employees in research and manufacturing the flexibility to determine on-site working hours. Working closely with our employee benefits provider, we rolled out a range of health and wellness programs to help manage the additional stress that many experienced. We also provided extra holiday time, and periodically, we delivered boxes of fresh farm produce to all employees to thank them for their dedication and hard work. We continue to offer our employees health and wellness programs and flexible work arrangements, including remote work options.

Our Employees.

Fairness and transparency guide our culture and our commitment to our employees. Our employees are our core resource. We strive to compensate our employees according to market, internal equity, and performance factors. We work hard to create a rewarding and supportive environment that empowers our employees to thrive. We are proud to have been named one of the Best Places to Work in San Diego in 2020 and one of the Top Biotech Companies in San Diego in 2021 by the San Diego Business Journal. Given the uniqueness and complexity of our technology, it is critical to retain the knowledge and experience of outstanding long service employees. The experience and seniority of our employees is as critical to our future success as it has been to the success we have enjoyed to date. As of December 31, 2021, more than 50 employees, representing nearly 10% of our workforce, had been with us for over 20 years, and six had been with us for over 30 years. Additionally, our average employee turnover rate in 2021 was 16%, while the turnover for life sciences/medical device companies over this period was 19% according to a survey published by Radford – an Aon company. Historically our turnover rate has been even lower and we are encouraged that it is still below the average for life sciences/medical device companies given the current nationwide trend of increased employee turnover.

![]()

We encourage you to view our 2021 Corporate Responsibility Report published on our website for more detailed information regarding our ESG initiatives. Nothing in the report or on our website shall be deemed incorporated by reference into this Proxy Statement.

![]()

PROPOSAL 1

ELECTION OF DIRECTORS

Information about our Board

The Board is divided into three classes. Presently, the Board has ten members with two classes consisting of four Directors each and one class consisting of two Directors. Each class serves a three-year term and we hold elections each year at the Annual Meeting to elect the Directors whose terms are expiring.

In addition, the Board may elect a new Director to fill any vacant spot, including a vacancy caused by an increase in the size of the Board. However, the Board believes it is important for our stockholders to ratify any member of the Board whom the Board appoints. As a result, whenever the Board appoints a new member, the Board will submit such new member’s directorship for ratification or election at the next regularly scheduled Annual Meeting of Stockholders.

The Board represents the interests of our stockholders by overseeing the Chief Executive Officer and other members of senior management in our operations. The Board’s goal is to optimize long-term value by providing guidance and strategic oversight to Ionis’ management on our stockholders’ behalf.

Information about the 2022 Elections

The Board has nominated four individuals for election at the Annual Meeting. Each of the nominees currently serves as one of our Directors. Ms. Diaz, Dr. Hayden, Mr. Klein, and Dr. Loscalzo have each served as a Director for the periods set forth in the table below.

| Name | Commencement of Ionis Directorship |

| Allene M. Diaz | June 2021 |

| Michael Hayden | September 2018 |

| Joseph Klein, III | December 2005 |

| Joseph Loscalzo | February 2014 |

Dr. Hayden, Mr. Klein and Dr. Loscalzo have each been previously re-elected by our stockholders. This is the first time Ms. Diaz is a nominee for election by our stockholders. If re-elected or elected, as applicable, Ms. Diaz, Dr. Hayden, Mr. Klein and Dr. Loscalzo will serve until the 2025 Annual Meeting or, in each case, until his or her successor is elected and has qualified, or until his or her earlier death, resignation or removal.

Our bylaws provide a majority vote standard for the election of directors in uncontested elections. In an uncontested election, the majority vote standard means that to be elected, a Director nominee must receive a majority of the votes cast in the election such that the number of shares voted “For” the nominee must exceed 50% of the votes cast with respect to that Director. The number of votes cast with respect to a Director’s election excludes abstentions and broker non-votes. In contested elections where the number of nominees exceeds the number of Directors to be elected, the vote standard will be a plurality of the shares present or represented by proxy and entitled to vote.

If a nominee who already serves as a Director is not elected, and no successor is elected, the Director will offer to tender his or her resignation to the Board. The Nominating, Governance and Review Committee will make a recommendation to the Board on whether to accept or reject the resignation, or whether to take other action. The Board will act on the Nominating, Governance and Review Committee’s recommendation and publicly disclose its decision and the rationale behind it within 90 days from the date of the certification of the election results. The Director who tenders his or her resignation will not participate in the recommendation of the Nominating, Governance and Review Committee or in the Board’s decision. If a nominee’s failure to be elected at the Annual Meeting results in a vacancy on the Board, then the Board can fill the vacancy.

On March 16, 2022, the Nominating, Governance and Review Committee provided its recommendations to the Board for Director nominees to stand for election at the Annual Meeting. Following such recommendations, the Board determined it would be in the best interests of Ionis and its stockholders to nominate Ms. Diaz, Dr. Hayden, Mr. Klein, and Dr. Loscalzo to be elected as Directors at the Annual Meeting. We provide below a short biography for each nominee. Ms. Diaz, Dr. Hayden, Mr. Klein, and Dr. Loscalzo have agreed to serve if elected, and we have no reason to believe that they cannot serve. However, if they cannot serve, we may vote your proxy for another nominee proposed by the Board, or the Board may reduce the number of authorized Directors.

![]()

Biographies of the Nominees for Election for a Three-Year Term Expiring at the 2025 Annual Meeting

Allene M. Diaz, age 572, has served as a Director of Ionis since June 2021. Since 2020 Ms. Diaz has led AMD Consulting, a new product strategy and portfolio management consulting practice based in Boston, MA. Previously, Ms. Diaz served as Senior Vice President, Research and Development Portfolio Management at GlaxoSmithKline, a global pharmaceutical company based in Brentwood, UK, from September 2019 through June 2020 and as Senior Vice President, Global Commercial Development and Program Strategy at TESARO Inc., a biotechnology company based in Waltham, MA, from May 2015 through August 2019. Prior to that she held a variety of commercial leadership roles in the Merck Serono and EMD Serono divisions of Merck KGaA. Earlier in her career, Ms. Diaz held management, operating, sales, and medical affairs roles at various biopharmaceutical companies, including Pfizer, Parke-Davis, Biogen, and Amylin Pharmaceuticals. She has contributed to the global development, launch or commercialization of multiple transformative products across several therapeutic areas. Ms. Diaz has served on the boards of directors of Mersana Therapeutics since March 2021, Allena Pharmaceuticals since April 2019 and BCLS Acquisition Corporation since October 2020. Ms. Diaz served on the board of directors of Erytech Pharma SA from September 2016 to September 2019.

The Board believes Ms. Diaz is uniquely suited to serve on the Board primarily because of her deep expertise in product development, commercial strategy, market access, and portfolio management.

Michael Hayden, CM, OBC, MB, ChB, Ph.D., FRCP(C), FRSC, age 70, has served as a Director of Ionis since September 2018. Dr. Hayden has been Chief Executive Officer of Prilenia Therapeutics, a private clinical stage biotech company, since September 2018. Dr. Hayden is also a Killam Professor at the University of British Columbia, the highest honor UBC can confer on any faculty member. In addition, he is an accomplished scientist and physician. He was the President of Global R&D and Chief Scientific Officer at Teva Pharmaceuticals from 2012 to 2017. During this time approximately 35 new products were approved in major markets with many for diseases of the central nervous system. In 2015 Teva R&D was recognized as one of the 100 most exciting innovators in the pharmaceutical industry by IDEA Pharma and in 2017 Teva R&D ranked top of the industry for central nervous system development and clinical trial success rate by Pharma Intelligence. Dr. Hayden has founded three biotechnology companies and has been the recipient of numerous prestigious honors and awards, including being inducted into the Canadian Medical Hall of Fame and receiving the July 2012 Diamond Jubilee Medal on behalf of HRH Queen Elisabeth II. He has also received the Canada Gairdner Wightman award. Dr. Hayden was awarded the Order of Canada, the Order of British Columbia, named Canada’s Health Researcher of the Year by Canadian Institutes of Health Research, and received the Prix Galien Award in 2007.

Dr. Hayden served on the board of Aurinia Pharmaceuticals, Inc. until August 2021, and currently serves on the boards of Xenon Pharmaceuticals, 89Bio, AbCellera Biologics and Oxford Biomedica. Although Dr. Hayden serves on these public company boards in addition to that of Ionis, Dr. Hayden attended 75% or more of the aggregate number of meetings of the boards and the committees on which he served during 2021. In addition, we expect that Dr. Hayden will only serve on the boards of a total of four publicly traded companies (including Ionis) starting in June 2022.

The Board believes Dr. Hayden is uniquely suited to serve on the Board because he has significant expertise in pharmaceutical research and development, both in academia and in commercial settings. In addition, Dr. Hayden has made substantial research contributions to advance treatments for brain diseases, which is particularly valuable as we grow our neurologic disease franchise, a key focus of ours. Dr. Hayden also serves as the Chair of our Science/Medical Committee, providing invaluable guidance on the key scientific and development issues facing our technology and medicines in development.

Joseph Klein, III, age 60, has served as a Director of Ionis since December 2005 and is Chairman of the Audit Committee. Mr. Klein is currently Managing Director of Gauss Capital Advisors, LLC, a financial consulting and investment advisory firm focused on biopharmaceuticals, which he founded in March 1998. From September 2003 to December 2008, Mr. Klein also served as a Venture Partner of Red Abbey Venture Partners, L.P., a life science private equity fund. From September 2001 to September 2002, Mr. Klein was a Venture Partner of MPM Capital, a healthcare venture capital firm. From June 1999 to September 2000 when it merged with WebMD Corporation, Mr. Klein served as Vice President, Strategy, for Medical Manager Corporation, a leading developer of physician office management information systems. For over nine years from 1989 to 1998, Mr. Klein was a health care investment analyst at T. Rowe Price Associates, Inc., where he was the founding portfolio manager of the T. Rowe Price Health Sciences Fund. Mr. Klein has served on the boards of directors of The Prospector Funds, Inc., an SEC Registered Investment Company that manages two no-load mutual funds, since September 2007, and Akcea Therapeutics, Inc., from September 2019 until the completion of the Company’s merger with Akcea Therapeutics, Inc. in October 2020 (the “Akcea Merger”). Mr. Klein also serves on the boards of private and non-profit entities.

The Board believes Mr. Klein is uniquely suited to serve on the Board and as Chairman of the Audit Committee because he is a Chartered Financial Analyst and has extensive public company, venture investment, board, and financial advisory expertise in the life sciences industry, including previously serving as Chairman of the Audit Committee at several public biopharmaceutical companies.

Joseph Loscalzo, M.D., Ph.D., age 70, has served as a Director of Ionis since February 2014 and as Chairman of the Board since June 2021. Dr. Loscalzo is Hersey Professor of the Theory and Practice of Medicine at Harvard Medical School and Chairman of the Department of Medicine and Physician-in-Chief at Brigham and Women’s Hospital. Dr. Loscalzo is also a co-founder and member of the Scientific Advisory Board of Scipher Medicine, a private network medicine-based company matching patients with their most effective therapy. Dr. Loscalzo received his A.B. degree, summa cum laude, his Ph.D. in biochemistry, and his M.D. from the University of Pennsylvania. He completed his clinical training at Brigham and Women’s Hospital and Harvard Medical School, where he served as Resident and Chief Resident in medicine and Fellow in cardiovascular medicine. Post-training, Dr. Loscalzo joined the Harvard faculty and staff at Brigham and Women’s Hospital in 1984. He rose to the rank of Associate Professor of Medicine, Chief of Cardiology at the West Roxbury Veterans Administration Medical Center, and Director of the Center for Research in Thrombolysis at Brigham and Women’s Hospital. He joined the faculty of Boston University in 1994, first as Chief of Cardiology and, in 1997, Wade Professor and Chair of Medicine, Professor of Biochemistry, and Director of the Whitaker Cardiovascular Institute. He returned to Harvard and Brigham and Women’s Hospital in 2005. Since January 2016, Dr. Loscalzo has served on the board of directors of Leap Therapeutics, Inc., a public biopharmaceutical company.

2 The ages of all our Directors are as of March 1, 2022.

![]()

The Board believes Dr. Loscalzo is uniquely suited to serve on the Board and as our Chairman primarily because of his extensive scientific expertise, including 31 years of research in the areas of vascular biology, thrombosis, and atherosclerosis, and practical knowledge as a practicing physician. Dr. Loscalzo’s expertise and role as a leading cardiologist is particularly valuable as we advance and grow our cardiovascular franchise.

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE ELECTION OF THE ABOVE NOMINEES.

Biographies of the Directors Whose Terms Expire at the 2023 Annual Meeting

Spencer R. Berthelsen, M.D., age 69, has served as a Director of Ionis since May 2002. Dr. Berthelsen practiced Internal Medicine with the Kelsey Seybold Clinic, a 400-physician medical group based in the Texas Medical Center in Houston, until March 2017. Dr. Berthelsen began at Kelsey Seybold in 1980 and served in various senior leadership positions throughout his nearly four-decade career at the clinic, including Chairman of the Department of Internal Medicine, Medical Director and Managing Director. He also served as Chairman of its board of directors from October 2001 through April 2016. He has served as Clinical Professor of Medicine at both Baylor College of Medicine and The University of Texas Health Science Center. Previously, Dr. Berthelsen served on the boards of the Texas Academy of Internal Medicine and the Caremark National Pharmacy and Therapeutics Committee from 1999 through 2005.

The Board believes Dr. Berthelsen is uniquely suited to serve on the Board because of his experience advising a large multispecialty group practice and almost 40 years of experience as a practicing physician.

Joan E. Herman, age 68, has served as a Director of Ionis since June 2019. Since 2008, Ms. Herman has served as President and Chief Executive Officer of Herman & Associates, a management consulting firm that specializes in advising private equity firms investing in healthcare. She has experience leading healthcare and payor companies, serving in several executive positions at Anthem (formerly WellPoint), including as President and Chief Executive Officer of several different business units. Ms. Herman also served as a Senior Vice President of Phoenix Life Insurance Company. Since January 2013, Ms. Herman has served on the board of directors of Encompass Health (formerly HealthSouth). She previously served on the boards of both Convergys and AARP Services, Inc.

The Board believes Ms. Herman is uniquely suited to serve on the Board because of her experience leading healthcare and payor companies.

B. Lynne Parshall, age 67, has served as a Director of Ionis since September 2000 and as a Senior Strategic Advisor to Ionis since January 2018. Previously she served as our Chief Operating Officer from December 2007 through January 2018 and as our Chief Financial Officer from June 1994 through December 2012. She also served as our Corporate Secretary through 2014 and has served with the Company in various executive roles since November 1991. Prior to joining Ionis, Ms. Parshall practiced law at Cooley LLP, outside counsel to Ionis, where she was a partner from 1986 to 1991. Ms. Parshall is a member of the American and California bar associations. Ms. Parshall has served on the boards of directors of Cytokinetics, Inc., a public biopharmaceutical company, since February 2013, and Akcea Therapeutics, Inc., from January 2015 until the completion of the Akcea Merger.

The Board believes Ms. Parshall is uniquely suited to serve on the Board primarily because, as the former Chief Operating Officer and former executive of the Company for over 26 years, she has valuable Company-specific experience and expertise. In addition, Ms. Parshall has over 35 years of experience structuring and negotiating strategic licensing and financing transactions in the life sciences field.

Joseph H. Wender, age 77, has served as a Director of Ionis since January 1994 and our Independent Lead Director since December 2020. Mr. Wender began with Goldman, Sachs & Co. in 1971 and became a General Partner of that firm in 1982, where he headed the Financial Institutions Group for over a decade. Since January 2022 he has been a Senior Consultant to Goldman Sachs & Co., from January 2019 to December 2021 he was an Advisory Director to Goldman Sachs & Co. and from January 2008 to December 2018 was a Senior Consultant to Goldman Sachs & Co. He is a former Independent Trustee of the Schwab Family of Funds and Director of Grandpoint Capital, a bank holding company. Mr. Wender also is co-CEO and partner of Colgin Cellars. Since March 2014, Mr. Wender has been a Director of Outfront Media, a lessor of advertising space on out-of-home advertising structures, and has served as its Lead Independent Director since 2016.

![]()

The Board believes Mr. Wender is uniquely suited to serve on the Board and as our Independent Lead Director primarily because, with over 50 years of experience as an investment banker with Goldman, Sachs & Co., he provides Ionis important advice regarding our financial reporting, corporate finance, strategic transactions, and compensation matters.

Biographies of the Directors Whose Terms Expire at the 2024 Annual Meeting

Brett P. Monia, Ph.D., age 60, has served as a Director of Ionis since March 2019. Dr. Monia was promoted to Chief Executive Officer in January 2020. From January 2018 to December 2019, Dr. Monia served as our Chief Operating Officer, from January 2012 to January 2018, as our Senior Vice President, Drug Discovery, from February 2009 to January 2012, as our Vice President, Drug Discovery, and from October 2000 to February 2009, as our Vice President, Preclinical Drug Discovery. From October 1989 to October 2000, he held various positions within our Molecular Pharmacology department. Following the Akcea Merger, Dr. Monia became the President of Akcea. Dr. Monia has served on the board of directors of Cognition Therapeutics, Inc., a public clinical stage neuroscience company, since October 2020.

The Board believes Dr. Monia is uniquely suited to serve on the Board primarily because, as an executive officer of the Company since 2012 and a founder of Ionis, he has dedicated more than 32 years to discovering and developing antisense-based drugs. Dr. Monia is the inventor on over 100 issued patents and has directly supervised programs resulting in the clinical development of more than 40 antisense-based drugs across a broad range of therapeutic areas.

Frederick T. Muto, age 68, has served as a Director of Ionis since March 2001. Mr. Muto is now retired, but previously worked at the law firm of Cooley LLP, outside counsel to Ionis, which he joined in 1980. In 1986, Mr. Muto became a partner of Cooley LLP, and in 2018, began serving as senior counsel to Cooley LLP. He is a founder of Cooley LLP’s San Diego office and was chair of the firm’s Business Department for a number of years.

The Board believes Mr. Muto is uniquely suited to serve on the Board primarily because, with over 40 years of experience at one of the country’s leading law firms focused on life sciences and technology companies, he provides us important advice regarding our strategic transactions, corporate governance and compensation matters.

Biographies of Former Directors Who Served in 2021

Breaux B. Castleman, age 81, served as a Director of Ionis from June 2013 to June 2021. Since August 2001, Mr. Castleman has been President and Chief Executive Officer of Syntiro Healthcare Services, Inc., a healthcare investment company, which sold its operations as a service provider of integrated care management and disease management. Since January 2008, Mr. Castleman has been a Senior Advisor of McNally Capital, LLC, a private equity and merchant banking firm focused on investments in private equity, both direct to companies and through private equity partnerships. Mr. Castleman was a director of USMD Holdings, Inc., a physician-led integrated healthcare system, from August 2010 until September 2016.

In accordance with Ionis’ Board membership requirement that prohibits members from running for re-election once they have reached the age of 80, Mr. Castleman did not stand for re-election at the 2021 Annual Meeting. Ionis thanks Mr. Castleman for his eight years of Board service to the Company.

Stanley T. Crooke, M.D., Ph.D., age 76, is a founder of Ionis and was the Executive Chairman of our Board from January 2020 until June 2021. Dr Crooke is also founder, Chairman and Chief Executive Officer of n-Lorem, a nonprofit foundation focused on providing treatments for patients with nano-rare diseases (1 to 30 patients worldwide), which he initiated in January 2020. Dr. Crooke was a Director of the Company beginning in January 1989 and Chairman of the Board from February 1991 until January 2020. He served as our Chief Executive Officer from February 1989 until January 2020. Prior to founding Ionis, from 1980 until January 1989, Dr. Crooke worked for SmithKline Beckman Corporation, a pharmaceutical company, where his titles included President of Research and Development of SmithKline and French Laboratories. Dr. Crooke served on the board of directors of Akcea Therapeutics, Inc. from January 2015 through October 2018.

In June 2021, Dr. Crooke stepped down from the Board and began serving as a Strategic Advisor to the Company, providing strategic advice and continuing to participate in the Company’s scientific activities. Ionis thanks Dr. Crooke for his 32 years of service to the Company as its founder, former Chief Executive Officer and Executive Chairman of the Board.

![]()

Peter N. Reikes, age 61, served as a Director of Ionis from September 2018 until November 2021. Since November 2021, Mr. Reikes has served as Senior Advisor to the U.S. Food and Drug Administration. From July 2021 to November 2021, Mr. Reikes served as Senior Advisor to Stifel, Nicolaus & Company, Inc. and from December 2010 until July 2021 as Vice Chairman in the Investment Banking Division at Stifel. Prior to joining Stifel, he spent 11 years at Cowen and Company, LLC, where he was Vice Chairman and Head of Healthcare Investment Banking, and over 14 years at PaineWebber Incorporated, where he was a Managing Director and Head of Healthcare Investment Banking and began his career in 1985. Over the course of his extensive career in investment banking, Mr. Reikes has completed a wide range of financing and merger and acquisition transactions for companies in the life sciences, medical technology, and healthcare services sectors. Mr. Reikes is also a director of the Heart & Soul Foundation, an organization that supports a range of community service programs in the greater New York City area. Mr. Reikes is a former director of Ricerca Biosciences, LLC, Biocompatibles, Ltd., and the affiliated partnership boards of Alkermes, Inc., Cephalon, Inc., Gensia, Inc., Genzyme Corporation and Repligen Corporation, as well as the Institute for Quality Improvement of the Accreditation Association for Ambulatory Health Care. Mr. Reikes received his B.A. in Economics from the University of California at Los Angeles and his M.B.A. in Finance from The Wharton School at the University of Pennsylvania.

In November 2021, Mr. Reikes resigned as a Director of Ionis because he accepted a position with the U.S. Food and Drug Administration that required him to step off the Company’s Board to avoid a perception of a conflict of interest. The Company thanks Mr. Reikes for his advice and leadership as a member of the Company’s Board and wishes Mr. Reikes success in his new endeavor.

![]()

INFORMATION REGARDING THE BOARD AND CORPORATE GOVERNANCE

Independence of the Board of Directors

As required under Nasdaq listing standards, a majority of the members of a listed company’s board of directors must qualify as “independent,” as evaluated by our Nominating, Governance and Review Committee and affirmatively determined by our Board. Our Nominating, Governance and Review Committee consults with our legal counsel to ensure that the Committee’s determinations are consistent with all relevant securities and other laws and regulations regarding the definition of “independent,” including those set forth in the applicable Nasdaq listing standards and applicable SEC rules and regulations, as in effect from time to time.

Consistent with these considerations, after review of all relevant transactions or relationships between each Director, or any of his or her family members, and Ionis, its senior management and its independent auditors, the Board affirmatively has determined that all of our Directors are independent Directors within the meaning of the applicable Nasdaq listing standards and SEC rules and regulations, except for Ms. Parshall and Dr. Monia, our former Chief Operating Officer, and current Chief Executive Officer, respectively. In making this determination, the Board found that none of these independent Directors has a material or other disqualifying relationship with us. Notably, Mr. Muto has retired from Cooley LLP, Ionis’ outside counsel. Also, although the Company does business with Goldman Sachs & Co. and Brigham and Women’s Hospital, neither Mr. Wender nor Dr. Lozcalzo, respectively, receives any personal compensation directly from revenue received from Ionis.

Information Regarding the Board and its Committees

Leadership Structure

Until January 2020, our Chief Executive Officer was the Chairman of the Board. In January 2020, Dr. Monia assumed the position of Chief Executive Officer and Dr. Crooke transitioned to Executive Chairman of the Board. Following the 2021 Annual Meeting of Stockholders, Dr. Crooke stepped down from the Board and began serving as a Strategic Advisor to the Company, providing strategic advice and continuing to participate in the Company’s scientific activities. In June 2021, Dr. Loscalzo was appointed Chairman of the Board.

In December 2020, the Board appointed Mr. Wender as the Independent Lead Director of the Board. The Board believes that the appointment of an Independent Lead Director and the separated roles of Chairman of the Board and Chief Executive Officer reinforce the independence of the Board in its oversight of the business and affairs of the Company.

Risk Oversight

Our Board administers its risk oversight function directly and through all of its current committees. We provide a complete description of each committee and its respective roles and responsibilities on pages 20 through 24 of this Proxy Statement. While each of these committees is responsible for evaluating certain risks and overseeing how we manage risk, these committees inform the entire Board about such risks through committee reports.

The Audit Committee oversees management of financial risks and related party transactions. In 2019, the Audit Committee authorized the formation of an internal audit function known as “Advisory Services” that reports to the Audit Committee. Advisory Services strives to accomplish its mission of adding value to and improving the Company’s operations through sustaining a systematic, disciplined, and transparent approach to evaluating the effectiveness of governance, risk management, and control processes. The scope of Advisory Services is to determine if the control environment and internal control structure, as designed and represented by Company management, are adequate and functioning in a manner to enable the Company to meet its business objectives and satisfy its responsibilities.

The Nominating, Governance and Review Committee manages risks associated with the independence of the Board and potential conflicts of interests at the Board level, and periodically reviews our policies and procedures and makes recommendations when appropriate. The Compensation Committee reviews risks to the Company related to our executive compensation program and our general compensation philosophies. The Finance Committee evaluates risks to the Company associated with our corporate finance matters. The Science/Medical Committee identifies risks to the Company related to our technology platform. The Compliance Committee is responsible for evaluating risks to the Company in connection with the commercialization of our medicines and good practice guidelines and regulations.

In addition to the formal compliance program, the Board and its committees encourage management to promote a corporate culture that understands risk management and incorporates it into the overall corporate strategy and day-to-day business operations. Our risk management structure also includes an ongoing effort to assess and analyze the most likely areas of future risk for Ionis. As a result, the Board and most of its committees periodically ask our executives to discuss the most likely sources of material future risks and how we are addressing any significant potential vulnerability.

![]()

Board Committees

The Board had six committees as of December 31, 2021: an Audit Committee, a Compensation Committee, a Nominating, Governance and Review Committee, a Science/Medical Committee, a Finance Committee, and a Compliance Committee. On March 26, 2021, the Board dissolved the Agenda Committee and formed the Compliance Committee. Below is a description of each committee of our Board. Each of the committees has authority to engage legal counsel or other experts or consultants as it deems appropriate to carry out its responsibilities. The Board has determined that each member of our Audit Committee, Compensation Committee, and Nominating, Governance and Review Committee:

| ● | meets the applicable rules and regulations regarding “independence,” including, but not limited to, Rule 5605(a)(2) of the Nasdaq listing standards and applicable SEC rules and regulations; |

| ● | is not an officer or employee of Ionis; and |

| ● | is free of any relationship that would interfere with his or her individual exercise of independent judgment with regard to Ionis. |

Meetings and Attendance; Committee Members

The Board met six times in 2021. Each Director serving as of December 31, 2021 attended 75% or more of the aggregate number of meetings of the Board and the committees on which such Director served during 2021. We encourage each member of the Board to attend the Annual Meeting of Stockholders.

Board Committee Members

The table below provides membership and meeting information for each of the Board committees in 2021.

| Name | Agenda(1) | Audit | Compensation | Nominating, Governance and Review | Compliance(2) | Science/ Medical** | Finance | Attended 2021 Annual Meeting | |||||||

| Dr. Spencer R. Berthelsen | -- | -- | X* | X | -- | X | -- | -- | |||||||

| Breaux B. Castleman(3) | -- | X | -- | -- | -- | -- | -- | -- | |||||||

| Stanley T. Crooke(4) | X* | -- | -- | -- | -- | -- | -- | -- | |||||||

| Ms. Allene M. Diaz(5) | -- | -- | -- | -- | X | -- | -- | X | |||||||

| Dr. Michael Hayden | -- | -- | -- | -- | -- | X* | -- | -- | |||||||

| Ms. Joan E. Herman | -- | X | -- | -- | X | -- | -- | X | |||||||

| Mr. Joseph Klein, III | -- | X* | -- | -- | -- | -- | -- | X | |||||||

| Dr. Joseph Loscalzo | X | -- | -- | X | -- | X | -- | X | |||||||

| Dr. Brett P. Monia | X | -- | -- | -- | -- | -- | -- | X | |||||||

| Mr. Frederick T. Muto | -- | X | X | X | -- | -- | X | -- | |||||||

| Ms. B. Lynne Parshall | X | -- | -- | -- | X* | -- | X | -- | |||||||

| Mr. Peter Reikes(6) | X | -- | -- | -- | -- | -- | X | -- | |||||||

| Mr. Joseph H. Wender | -- | -- | X | X* | -- | -- | X* | -- | |||||||

| Total meetings in fiscal year 2021 | 1 | 8 | 9 | 1 | 3 | 3 | 5 |

* Committee Chairperson

** Dr. Frank Bennett, the Company’s EVP and Chief Scientific Officer, is the executive sponsor of the committee

| (1) | The Agenda Committee was dissolved in March 2021. |

| (2) | The Compliance Committee was formed in March 2021. |

| (3) | Mr. Castleman did not stand for re-election at the 2021 Annual Meeting of Stockholders. |

| (4) | Dr. Crooke resigned from the Board in June 2021. |

| (5) | Ms. Diaz was appointed to the Board in June 2021. |

| (6) | Mr. Reikes resigned from the Board in November 2021. |

![]()

Audit Committee

The Audit Committee of the Board oversees our corporate accounting and financial reporting process, including audits of our financial statements. For this purpose, the Audit Committee performs several functions.

The Audit Committee:

| ● | reviews the annual and quarterly financial statements, including the disclosures contained under the caption “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and oversees the annual and quarterly financial reporting processes, including sessions with the independent auditors and internal auditors in which Ionis’ employees and management are not present; |

| ● | selects and hires our independent auditors; |

| ● | oversees the independence of our independent auditors; |

| ● | evaluates our independent auditors’ performance; and |

| ● | has the authority to hire its own outside consultants and advisors, if necessary. |

In addition to the responsibilities listed above, the Audit Committee has the following functions:

| ● | receiving and considering our independent auditors’ comments as to the audit of the financial statements and internal controls, adequacy of staff and management performance and procedures in connection with internal controls; |

| ● | reviewing and, if appropriate, approving related party transactions; |

| ● | establishing and enforcing procedures for the receipt, retention, and treatment of complaints regarding accounting or auditing improprieties; |

| ● | pre-approving all audit and non-audit services provided by our independent auditors that are not prohibited by law; |

| ● | reviewing and discussing the Company’s cybersecurity risks; and |

| ● | meeting regularly with members of the internal audit/Advisory Services team. |

Our Audit Committee utilizes an Audit Committee calendar to manage and track its key duties and responsibilities throughout each year.

Our Audit Committee charter requires that each member must be independent. We consider the members to be independent as long as they:

| ● | do not accept any consulting, advisory or other compensatory fee from us, except in connection with their service as a Director; |

| ● | are not an affiliate of Ionis or one of its subsidiaries; and |

| ● | meet all of the other Nasdaq independence requirements. |

In addition, all Audit Committee members must be financially literate and at least one member must be a “financial expert,” as defined by SEC regulations. Our Board has determined that the Audit Committee’s financial expert is Mr. Klein based on, among other things, his status as a Chartered Financial Analyst and his extensive public company, venture investment, board, and financial advisory expertise in the life sciences industry, including previously serving as Chairman of the Audit Committee at several public biopharmaceutical companies. We provide the Audit Committee with the funding it needs to perform its duties.

The Audit Committee typically meets twice each quarter: once face-to-face in connection with quarterly Board of Director meetings, and once by teleconference to review quarterly financial results and Form 10-Q or annual financial results and Form 10-K. In 2021, the Audit Committee met eight times. The Board has adopted a written Audit Committee charter, which you can find on our corporate website at www.ionispharma.com.3 Each member meets the membership criteria set forth in the Audit Committee charter and as stated above.

3 Any information that is included on or linked to our website is not part of this Proxy Statement or any registration statement or report that incorporates this Proxy Statement by reference.

![]()

Compensation Committee

The primary function of the Compensation Committee of the Board is to review, modify (as needed) and approve our overall compensation strategy and policies and approve the compensation and other terms of employment of our executive officers, including our Chief Executive Officer. We include a full list of the Compensation Committee’s responsibilities as part of the Compensation Discussion and Analysis (“CD&A”) set forth on pages 33 through 59 of this Proxy Statement. The charter of the Compensation Committee grants the Compensation Committee full access to all of our books, records, facilities and personnel, and authority to obtain, at our expense, advice and assistance from internal and external legal, accounting or other advisors and consultants and other external resources that the Compensation Committee considers necessary or appropriate in the performance of its duties. In particular, the Compensation Committee has the sole authority to retain independent compensation consultants to help the Compensation Committee evaluate executive and Director compensation, including the authority to approve the consultants’ reasonable fees and other retention terms.

We also have a Non-Management Stock Option Committee that, as delegated by the Compensation Committee, may award stock options and RSUs to employees who are below director level in accordance with guidelines adopted by the Compensation Committee. The Non-Management Stock Option Committee has one member, Dr. Monia.

The Compensation Committee met nine times in 2021. The Compensation Committee acted by unanimous written consent (“UWC”) 22 times, which increased in 2021 due to separate UWCs for grants made pursuant to our 2020 Equity Incentive Plan for legacy Akcea employees. The Board has adopted a written Compensation Committee charter, which you can find on our corporate website at www.ionispharma.com.4

The Compensation Committee reviews with management Ionis’ CD&A to consider whether to recommend that we include the CD&A in our Proxy Statements and other filings.

Compensation Committee Interlocks and Insider Participation

As noted above, during the fiscal year ended December 31, 2021, our Compensation Committee was composed of Dr. Berthelsen, Mr. Wender and Mr. Muto. In each case, none of the members of the Compensation Committee has ever been an employee or officer of Ionis. None of our executive officers serves as a member of the board of directors or compensation committee of any other entity that has one or more executive officers serving as a member of our Board or Compensation Committee.

Nominating, Governance and Review Committee

The Nominating, Governance and Review Committee of the Board is responsible for:

| ● | interviewing, evaluating, nominating, and recommending individuals for membership on our Board, and considering proposed changes to the Board for approval; |

| ● | managing risks associated with the independence of the Board and potential conflicts of interests at the Board and executive level, and periodically reviewing our policies and procedures and making recommendations when appropriate; and |

| ● | performing such other functions as may be necessary or convenient for the efficient discharge of the foregoing. |

The Nominating, Governance and Review Committee met one time during 2021. You can find our Nominating, Governance and Review Committee charter on our corporate website at www.ionispharma.com.5

Director Nominations - Approach to Board Composition

The Nominating, Governance and Review Committee believes that candidates for Director should have certain minimum qualifications. As a result, the Board adopted membership standards (that may be revised from time to time) and believes that the Board members should meet the minimum membership requirements listed below.

The minimum membership requirements are as follows:

| ● | members must be able to read and understand basic financial statements; |

4 Any information that is included on or linked to our website is not part of this Proxy Statement or any registration statement or report that incorporates this Proxy Statement by reference.

5 Any information that is included on or linked to our website is not part of this Proxy Statement or any registration statement or report that incorporates this Proxy Statement by reference.

![]()

| ● | members must demonstrate high personal integrity and ethics; |

| ● | members cannot serve as a director on the boards of more than five total publicly traded companies (including Ionis); |

| ● | members cannot serve more than ten consecutive three-year terms on the Board; and |

| ● | members cannot run for re-election to the Board once they have reached the age of 80. |

In addition to these minimum standards, the Nominating, Governance and Review Committee will consider such factors as:

| ● | possessing relevant expertise to offer advice and guidance to management; |

| ● | having sufficient time to devote to Ionis’ affairs; |

| ● | demonstrating excellence in his or her field; |

| ● | having sound business judgment; |

| ● | being committed to vigorously representing the long-term interests of our stockholders; and |

| ● | contributing to the diversity of the Board. |

Director Nominations - Diversity