UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | |

Investment Company Act file number | | 811-06310 |

Legg Mason Partners Variable Income Trust

|

| (Exact name of registrant as specified in charter) |

| | |

| 125 Broad Street, New York, NY | | 10004 |

| (Address of principal executive offices) | | (Zip code) |

Robert I. Frenkel, Esq.

Legg Mason & Co., LLC

300 First Stamford Place, 4th Floor

Stamford, CT 06902

|

| (Name and address of agent for service) |

Registrant’s telephone number, including area code: (800) 451-2010

Date of fiscal year end: October 31

Date of reporting period: April 30, 2007

| ITEM 1. | REPORT TO STOCKHOLDERS. |

The Semi-Annual Report to Stockholders is filed herewith.

SEMI-ANNUAL

REPORT

APRIL 30, 2007

Legg Mason Partners

Variable High Income Portfolio

INVESTMENT PRODUCTS: NOT FDIC INSURED Ÿ NO BANK GUARANTEE Ÿ MAY LOSE VALUE

Legg Mason Partners Variable High Income Portfolio

Semi-Annual Report • April 30, 2007

What’s

Inside

Portfolio Objective

The Portfolio’s primary objective is high current income. It’s secondary objective is capital appreciation.

Letter from the Chairman

R. JAY GERKEN, CFA

Chairman, President and Chief Executive Officer

Dear Shareholder,

The U.S. economy showed signs of weakening during the six-month reporting period. U.S. gross domestic product (“GDP”)i expanded 2.5% in the fourth quarter of 2006. Based on the preliminary estimate from the U.S. Commerce Department, GDP growth was a tepid 0.6% in the first quarter of 2007. While consumer spending remained fairly solid, ongoing troubles in the housing market continued to negatively impact the economy. In addition, corporate spending was mixed during the reporting period.

After increasing the federal funds rateii to 5.25% in June 2006—its 17th consecutive rate hike—the Federal Reserve Board (“Fed”)iii held rates steady at its last seven meetings. In its statement accompanying the May 2007 meeting, the Fed stated, “Economic growth slowed in the first part of this year and the adjustment in the housing sector is ongoing. Nevertheless, the economy seems likely to expand at a moderate pace over coming quarters. Core inflation remains somewhat elevated. Although inflation pressures seem likely to moderate over time, the high level of resource utilization has the potential to sustain those pressures.”

During the reporting period, short- and long-term Treasury yields experienced periods of volatility. Initially, yields fluctuated given mixed economic data and shifting expectations regarding the Fed’s future monetary policy. Yields then fell sharply at the end of February 2007, as economic data weakened and the stock market experienced its largest one-day decline in more than five years. Overall, during the six months ended April 30, 2007, two-year Treasury yields fell from 4.71% to 4.60%. Over the same period, 10-year Treasury yields moved from 4.61% to 4.63%. Looking at the six-month period as a whole, the overall bond market, as measured by the Lehman Brothers U.S. Aggregate Indexiv, returned 2.64%.

The high yield bond market generated solid results over the six-month period ended April 30, 2007. During that time, the

Legg Mason Partners Variable High Income Portfolio I

Citigroup High Yield Market Indexv returned 6.88%. With interest rates relatively low, demand for higher yielding bonds remained strong. The high yield market was further aided by strong corporate profits and low default rates.

Despite periods of weakness, emerging markets debt generated a positive return, as the JPMorgan Emerging Markets Bond Index Global (“EMBI Global”)vi gained 5.29% during the six-month reporting period. Strong investor demand, an expanding global economy and solid domestic spending supported many emerging market countries.

Performance Review

For the six months ended April 30, 2007, Legg Mason Partners Variable High Income Portfolio1 returned 7.25%. In comparison, the Portfolio’s unmanaged benchmark, the Citigroup High Yield Market Index, returned 6.88% and its Lipper Variable High Current Yield Funds Category Average2, increased 6.55% over the same time frame.

| | |

| Performance Snapshot as of April 30, 2007 (unaudited) |

| |

| | | Six Months |

| | |

Variable High Income Portfolio1 | | 7.25% |

| |

Citigroup High Yield Market Index | | 6.88% |

| |

Lipper Variable High Current Yield Funds Category Average2 | | 6.55% |

| |

| The performance shown represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above. Principal value and investment returns will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost. Performance figures reflect current reimbursements and/or fee waivers, which may be reduced or terminated at any time. Absent these reimbursements or waivers, performance would have been lower. |

| The 30-Day SEC Yield for the period ending April 30, 2007 was 7.43%. Current expense reimbursements and/or fee waivers are voluntary and may be reduced or terminated at any time. Absent these reimbursements and/or fee waivers, the yield would have remained unchanged. The 30-Day SEC Yield is the average annualized net investment income per share for the 30-day period indicated and is subject to change. |

| Portfolio returns assume the reinvestment of all distributions, including returns of capital, if any, at net asset value and the deduction of all Portfolio expenses. |

| |

| Total Annual Operating Expenses |

| As of the Portfolio’s most current prospectus dated April 30, 2007, the gross total annual operating expense was 0.66%. |

1 | | The Portfolio is an underlying investment option of various variable annuity and variable life insurance products. The Portfolio’s performance returns do not reflect the deduction of initial sales charges and expenses imposed in connection with investing in variable annuity or variable life insurance contracts, such as administrative fees, account charges, and surrender charges, which, if reflected, would reduce the performance of the Portfolio. Past performance is no guarantee of future results. |

2 | | Lipper, Inc. is a major independent mutual-fund tracking organization. Returns are based on the six-month period ended April 30, 2007, including the reinvestment of all distributions, including returns of capital, if any, calculated among the 107 funds in the Portfolio’s Lipper category. |

II Legg Mason Partners Variable High Income Portfolio

Special Shareholder Notices

With a goal of moving the mutual funds formerly advised by Citigroup Asset Management (“CAM”) to a more cohesive and rational operating platform, Legg Mason, Inc. recommended a number of governance- and investment-related proposals to streamline and restructure the funds. The Board of Directors/Trustees of the affected funds have carefully considered and approved these proposals and, where required, have obtained shareholder approval. As such, the following changes became effective during the month of April 2007:

| | • | | Funds Redomiciled and Single Form of Organization Adopted: The legacy CAM funds have been redomiciled to a single jurisdiction and a single form of corporate structure has been introduced. Equity funds have been grouped for organizational and governance purposes with other funds in the fund complex that are predominantly equity funds, and fixed-income funds have been grouped with other funds that are predominantly fixed-income funds. Additionally, the funds have adopted a single form of organization as a Maryland business trust, with all funds operating under uniform charter documents. |

| | • | | New Boards Elected: New Boards have been elected for the legacy CAM funds. The 10 Boards previously overseeing the funds have been realigned and consolidated into two Boards, with the remaining Boards each overseeing a distinct asset class or product type: equity or fixed income. |

| | • | | Revised Fundamental Investment Policies Instituted: A uniform set of fundamental investment policies has been instituted for most funds, to the extent appropriate. Please note, however, that each fund will continue to be managed in accordance with its prospectus and statement of additional information, as well as any policies or guidelines that may have been established by the fund’s Board or investment manager. |

Effective close of business on April 27, 2007, Western Asset Management Company Limited (“Western Asset Limited”) became an additional subadviser to the Portfolio,

Legg Mason Partners Variable High Income Portfolio III

under an additional sub-advisory agreement between Western Asset Management Company (“Western Asset”) and Western Asset Limited. Western Asset and Western Asset Limited are wholly-owned subsidiaries of Legg Mason, Inc. Western Asset and Western Asset Limited provide the day-to-day portfolio management of the Portfolio as the Portfolio’s subadviser and sub-subadviser, respectively. Western Asset Limited provides certain advisory services to the Fund relating to currency transactions and investments in non-U.S. dollar denominated securities. Western Asset Limited has offices at 10 Exchange Place, London, England. Western Asset Limited acts as an investment adviser to institutional accounts, such as corporate pension plans, mutual funds, and endowment funds.

Effective April 30, 2007, the Portfolio was managed by a team of portfolio managers, sector specialists and other investment professionals led by S. Kenneth Leech, Steven A. Walsh and Michael C. Buchanan. Effective May 17, 2007, Detlev S. Schlichter and Keith J. Gardner were added as portfolio managers of the Portfolio.

Information About Your Portfolio

As you may be aware, several issues in the mutual fund industry have come under the scrutiny of federal and state regulators. Affiliates of the Portfolio’s manager have, in recent years, received requests for information from various government regulators regarding market timing, late trading, fees, and other mutual fund issues in connection with various investigations. The regulators appear to be examining, among other things, the Portfolio’s response to market timing and shareholder exchange activity, including compliance with prospectus disclosure related to these subjects. The Portfolio has been informed that the Manager and its affiliates are not in a position to predict the outcome of these requests and investigations.

Important information concerning the Portfolio and its Manager with regard to recent regulatory developments that may affect the Portfolio is contained in the Notes to Financial Statements included in this report.

IV Legg Mason Partners Variable High Income Portfolio

As always, thank you for your continued confidence in our stewardship of your assets. We look forward to helping you meet your financial goals.

Sincerely,

R. Jay Gerken, CFA

Chairman, President and Chief Executive Officer

June 4, 2007

The information provided is not intended to be a forecast of future events, a guarantee of future results or investment advice. Views expressed may differ from those of the firm as a whole.

RISKS: Keep in mind, high-yield bonds are rated below investment grade and carry more risk than higher rated securities. Also, the Portfolio is subject to fluctuations in share price as interest rates rise and fall and is subject to certain risks of overseas investing, including currency fluctuations, differing securities regulations and periods of illiquidity, which could result in significant market fluctuations. These risks are magnified in emerging markets. As interest rates rise, bond prices fall, reducing the value of the Portfolio’s share price. The Portfolio may use derivatives, such as options and futures, which can be illiquid, may disproportionately increase losses, and have a potentially large impact on performance. Please see the Portfolio’s prospectus for more information on these and other risks.

All index performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index.

i | | Gross domestic product (“GDP”) is the market value of all final goods and services produced within a country in a given period of time. |

ii | | The federal funds rate is the interest rate that banks with excess reserves at a Federal Reserve district bank charge other banks that need overnight loans. |

iii | | The Federal Reserve Board (“Fed”) is responsible for the formulation of policies designed to promote economic growth, full employment, stable prices, and a sustainable pattern of international trade and payments. |

iv | | The Lehman Brothers U.S. Aggregate Index is a broad-based bond index comprised of government, corporate, mortgage and asset-backed issues, rated investment grade or higher, and having at least one year to maturity. |

v | | The Citigroup High Yield Market Index is a broad-based unmanaged index of high yield securities. |

vi | | The JPMorgan Emerging Markets Bond Index Global (“EMBI Global”) tracks total returns for U.S. dollar denominated debt instruments issued by emerging market sovereign and quasi-sovereign entities: Brady bonds, loans, Eurobonds, and local market instruments. Countries covered are Algeria, Argentina, Brazil, Bulgaria, Chile, China, Colombia, Cote d’Ivoire, Croatia, Ecuador, Greece, Hungary, Lebanon, Malaysia, Mexico, Morocco, Nigeria, Panama, Peru, the Philippines, Poland, Russia, South Africa, South Korea, Thailand, Turkey and Venezuela. |

Legg Mason Partners Variable High Income Portfolio V

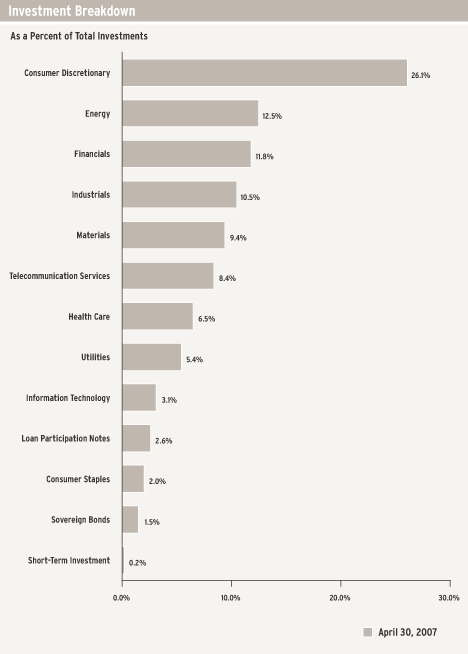

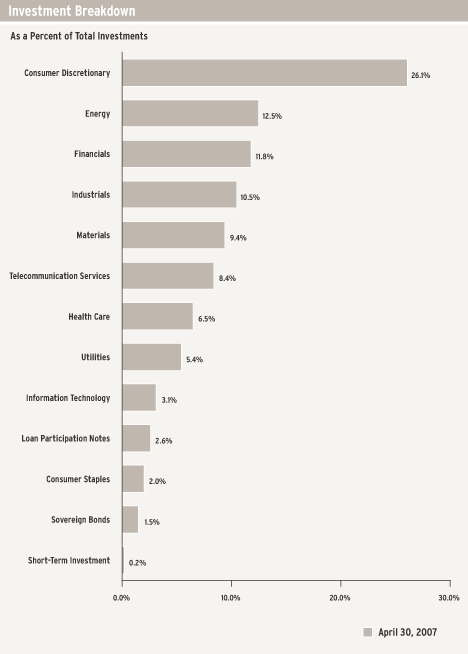

Fund at a Glance (unaudited)

Legg Mason Partners Variable High Income Portfolio 2007 Semi-Annual Report 1

Fund Expenses (unaudited)

Example

As a shareholder of the Fund, you may incur two types of costs: (1) transaction costs and (2) ongoing costs, including management fees; distribution and/or service (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

This example is based on an investment of $1,000 invested on November 1, 2006 and held for the six months ended April 30, 2007.

Actual Expenses

The table below titled “Based on Actual Total Return” provides information about actual account values and actual expenses. You may use the information provided in this table, together with the amount you invested, to estimate the expenses that you paid over the period. To estimate the expenses you paid on your account, divide your ending account value by $1,000 (for example, an $8,600 ending account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During the Period”.

| | | | | | | | |

| Based on Actual Total Return(1) |

| | | | |

Actual Total

Return(2) | | Beginning

Account

Value | | Ending

Account

Value | | Annualized

Expense

Ratio(3) | | Expenses Paid During the Period(4) |

| 7.25% | | 1,000.00 | | $1,072.50 | | 0.65% | | $3.34 |

| | | | | | | | |

(1) | | For the six months ended April 30, 2007. |

(2) | | Assumes reinvestment of all distributions, including returns of capital, if any, at net asset value. Total return is not annualized, as it may not be representative of the total return for the year. Total returns do not reflect expenses associated with the separate account such as administrative fees, account charges and surrender charges which, if reflected, would reduce the total returns. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. |

(3) | | The expense ratio does not include the non-recurring restructuring and/or reorganization fees. |

(4) | | Expenses (net of fee waivers and/or expense reimbursements) are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year, then divided by 365. |

2 Legg Mason Partners Variable High Income Portfolio 2007 Semi-Annual Report

Fund Expenses (unaudited) (continued)

Hypothetical Example for Comparison Purposes

The table below titled “Based on Hypothetical Total Return” provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio and an assumed rate of return of 5.00% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use the information provided in this table to compare the ongoing costs of investing in the Fund and other funds. To do so, compare the 5.00% hypothetical example relating to the Fund with the 5.00% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table below are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

| | | | | | | | |

| Based on Hypothetical Total Return(1) |

| | | | |

Hypothetical

Annualized

Total Return | | Beginning

Account

Value | | Ending

Account

Value | | Annualized

Expense

Ratio(2) | | Expenses Paid During the Period(3) |

| 5.00% | | 1,000.00 | | 1,021.57 | | 0.65% | | $3.26 |

| | | | | | | | |

(1) | | For the six months ended April 30, 2007. |

(2) | | The expense ratio does not include the non-recurring restructuring and/or reorganization fees. |

(3) | | Expenses (net of fee waivers and/or expense reimbursements) are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year, then divided by 365. |

Legg Mason Partners Variable High Income Portfolio 2007 Semi-Annual Report 3

Schedule of Investments (April 30, 2007) (unaudited)

LEGG MASON PARTNERS VARIABLE HIGH INCOME PORTFOLIO

| | | | | | | | | |

| | | |

Face

Amount | | Rating‡ | | Security | | Value | |

| | | | | | | | | |

| | CORPORATE BONDS & NOTES — 92.7% | | | | |

| | Aerospace & Defense — 1.9% | | | | |

| $ | 810,000 | | B+ | | Alliant Techsystems Inc., Senior Subordinated Notes,

6.750% due 4/1/16 | | $ | 822,150 | |

| | | | | DRS Technologies Inc., Senior Subordinated Notes: | | | | |

| | 395,000 | | B+ | | 6.625% due 2/1/16 | | | 400,925 | |

| | 970,000 | | B | | 7.625% due 2/1/18 | | | 1,020,925 | |

| | | | | Hawker Beechcraft Acquisition Co.: | | | | |

| | | | | Senior Notes: | | | | |

| | 340,000 | | B- | | 8.500% due 4/1/15 (a) | | | 359,550 | |

| | 540,000 | | B- | | 8.875% due 4/1/15 (a)(b) | | | 569,700 | |

| | 680,000 | | B- | | Senior Subordinated Notes, 9.750% due 4/1/17 (a) | | | 731,000 | |

| | | | | L-3 Communications Corp., Senior Subordinated Notes: | | | | |

| | 1,015,000 | | BB+ | | 7.625% due 6/15/12 | | | 1,056,868 | |

| | 45,000 | | BB+ | | 5.875% due 1/15/15 | | | 44,044 | |

| | | |

| | | | | Total Aerospace & Defense | | | 5,005,162 | |

| | | |

| | Airlines — 1.2% | | | | | | |

| | | | | Continental Airlines Inc.: | | | | |

| | 595,000 | | CCC+ | | Notes, 8.750% due 12/1/11 | | | 590,537 | |

| | | | | Pass-Through Certificates: | | | | |

| | 108,086 | | B+ | | Series 2000-2, Class C, 8.312% due 4/2/11 | | | 111,937 | |

| | 400,000 | | B+ | | Series C, 7.339% due 4/19/14 | | | 403,956 | |

| | | | | United Airlines Inc., Pass-Through Certificates: | | | | |

| | 437,290 | | B | | Series 2000-1, Class B, 8.030% due 7/1/11 | | | 492,224 | |

| | 888,598 | | B | | Series 2000-2, Class B, 7.811% due 10/1/09 | | | 1,015,779 | |

| | | | | Series 2001-1: | | | | |

| | 160,000 | | B+ | | Class B, 6.932% due 9/1/11 | | | 184,900 | |

| | 365,000 | | CCC- | | Class C, 6.831% due 9/1/08 | | | 415,416 | |

| | | |

| | | | | Total Airlines | | | 3,214,749 | |

| | | |

| | Auto Components — 1.0% | | | | |

| | 940,000 | | CCC+ | | Keystone Automotive Operations Inc., Senior Subordinated Notes, 9.750% due 11/1/13 | | | 897,700 | |

| | 1,815,000 | | CCC+ | | Visteon Corp., Senior Notes, 8.250% due 8/1/10 | | | 1,860,375 | |

| | | |

| | | | | Total Auto Components | | | 2,758,075 | |

| | | |

| | Automobiles — 2.9% | | | | |

| | | | | Ford Motor Co.: | | | | |

| | 405,000 | | CCC+ | | Debentures, 8.875% due 1/15/22 | | | 359,438 | |

| | 4,170,000 | | CCC+ | | Notes, 7.450% due 7/16/31 | | | 3,320,362 | |

| | | | | General Motors Corp.: | | | | |

| | 680,000 | | B- | | Notes, 7.200% due 1/15/11 | | | 651,100 | |

| | | | | Senior Debentures: | | | | |

| | 750,000 | | B- | | 8.250% due 7/15/23 | | | 682,500 | |

| | 3,155,000 | | B- | | 8.375% due 7/15/33 | | | 2,867,106 | |

| | | |

| | | | | Total Automobiles | | | 7,880,506 | |

| | | |

See Notes to Financial Statements.

4 Legg Mason Partners Variable High Income Portfolio 2007 Semi-Annual Report

Schedule of Investments (April 30, 2007) (unaudited) (continued)

| | | | | | | | | |

| | | |

Face

Amount | | Rating‡ | | Security | | Value | |

| | | | | | | | | |

| | Building Products — 1.7% | | | | |

| | | | | Ainsworth Lumber Co., Ltd.: | | | | |

| $ | 345,000 | | CCC+ | | 7.250% due 10/1/12 | | $ | 254,869 | |

| | 150,000 | | CCC+ | | Senior Notes, 6.750% due 3/15/14 | | | 106,688 | |

| | | | | Associated Materials Inc.: | | | | |

| | 1,090,000 | | CCC | | Senior Discount Notes, step bond to yield 13.693% due 3/1/14 | | | 822,950 | |

| | 805,000 | | CCC | | Senior Subordinated Notes, 9.750% due 4/15/12 | | | 843,237 | |

| | 765,000 | | CCC+ | | Nortek Inc., Senior Subordinated Notes, 8.500% due 9/1/14 | | | 759,262 | |

| | 2,450,000 | | CCC+ | | NTK Holdings Inc., Senior Discount Notes, step bond to yield

11.237% due 3/1/14 | | | 1,849,750 | |

| | | |

| | | | | Total Building Products | | | 4,636,756 | |

| | | |

| | Capital Markets — 0.4% | | | | |

| | | | | E*TRADE Financial Corp., Senior Notes: | | | | |

| | 525,000 | | BB- | | 7.375% due 9/15/13 | | | 550,594 | |

| | 375,000 | | BB- | | 7.875% due 12/1/15 | | | 406,406 | |

| | | |

| | | | | Total Capital Markets | | | 957,000 | |

| | | |

| | Chemicals — 2.8% | | | | |

| | 1,150,000 | | BB- | | Equistar Chemicals LP, Senior Notes, 10.625% due 5/1/11 | | | 1,219,000 | |

| | 1,370,000 | | B | | Georgia Gulf Corp., Senior Notes, 9.500% due 10/15/14 (a) | | | 1,376,850 | |

| | 625,000 | | B | | Huntsman International LLC, Senior Subordinated Notes,

7.875% due 11/13/14 (a) | | | 656,250 | |

| | | | | Lyondell Chemical Co.: | | | | |

| | | | | Senior Notes: | | | | |

| | 365,000 | | B+ | | 8.000% due 9/15/14 | | | 384,162 | |

| | 305,000 | | B+ | | 8.250% due 9/15/16 | | | 327,875 | |

| | | | | Senior Secured Notes: | | | | |

| | 605,000 | | BB | | 11.125% due 7/15/12 | | | 647,350 | |

| | 50,000 | | BB | | 10.500% due 6/1/13 | | | 55,063 | |

| | 760,000 | | BBB- | | Methanex Corp., Senior Notes, 8.750% due 8/15/12 | | | 843,600 | |

| | 195,000 | | B- | | Momentive Performance Materials Inc., Senior Notes,

9.750% due 12/1/14 (a) | | | 207,188 | |

| | 1,420,000 | | B | | Montell Finance Co. BV, Debentures, 8.100% due 3/15/27 (a) | | | 1,412,900 | |

| | 325,000 | | BB+ | | Westlake Chemical Corp., Senior Notes, 6.625% due 1/15/16 | | | 317,687 | |

| | | |

| | | | | Total Chemicals | | | 7,447,925 | |

| | | |

| | Commercial Banks — 0.3% | | | | |

| | 250,000 | | B+ | | ATF Capital BV, Senior Notes, 9.250% due 2/21/14 (a) | | | 247,500 | |

| | 470,000 | | BB | | TuranAlem Finance BV, Bonds, 8.250% due 1/22/37 (a) | | | 473,525 | |

| | | |

| | | | | Total Commercial Banks | | | 721,025 | |

| | | |

| | Commercial Services & Supplies — 2.3% | | | | |

| | 1,180,000 | | CCC+ | | Allied Security Escrow Corp., Senior Subordinated Notes,

11.375% due 7/15/11 | | | 1,203,600 | |

| | 565,000 | | BB | | Allied Waste North America Inc., Senior Notes, 6.875% due 6/1/17 | | | 575,594 | |

| | | | | Aramark Corp., Senior Notes: | | | | |

| | 700,000 | | B- | | 8.500% due 2/1/15 (a) | | | 735,875 | |

| | 170,000 | | B- | | 8.860% due 2/1/15 (a)(c) | | | 175,525 | |

See Notes to Financial Statements.

Legg Mason Partners Variable High Income Portfolio 2007 Semi-Annual Report 5

Schedule of Investments (April 30, 2007) (unaudited) (continued)

| | | | | | | | | |

| | | |

Face

Amount | | Rating‡ | | Security | | Value | |

| | | | | | | | | |

| | Commercial Services & Supplies — 2.3% (continued) | | | | |

| $ | 225,000 | | B | | Ashtead Holdings PLC, Secured Notes, 8.625% due 8/1/15 (a) | | $ | 236,250 | |

| | 1,190,000 | | B | | DynCorp International LLC/DIV Capital Corporation, Senior Subordinated Notes, Series B, 9.500% due 2/15/13 | | | 1,285,200 | |

| | 900,000 | | B | | Interface Inc., Senior Notes, 10.375% due 2/1/10 | | | 999,000 | |

| | 790,000 | | B- | | Rental Services Corp., Senior Bonds, 9.500% due 12/1/14 (a) | | | 843,325 | |

| | | |

| | | | | Total Commercial Services & Supplies | | | 6,054,369 | |

| | | |

| | Communications Equipment — 0.4% | | | | |

| | 1,105,000 | | B+ | | Lucent Technologies Inc., Debentures, 6.450% due 3/15/29 | | | 1,011,075 | |

| | | |

| | Consumer Finance — 4.3% | | | | |

| | | | | Ford Motor Credit Co.: | | | | |

| | | | | Notes: | | | | |

| | 775,000 | | B | | 7.875% due 6/15/10 | | | 779,647 | |

| | 350,000 | | B | | 9.806% due 4/15/12 (c) | | | 374,446 | |

| | 610,000 | | B | | 7.000% due 10/1/13 | | | 577,539 | |

| | | | | Senior Notes: | | | | |

| | 542,000 | | B | | 10.605% due 6/15/11 (c) | | | 584,636 | |

| | 1,120,000 | | B | | 9.875% due 8/10/11 | | | 1,193,679 | |

| | 500,000 | | B | | 8.105% due 1/13/12 (c) | | | 493,633 | |

| | 610,000 | | B | | 8.000% due 12/15/16 | | | 597,547 | |

| | | | | General Motors Acceptance Corp.: | | | | |

| | 4,065,000 | | BB+ | | Bonds, 8.000% due 11/1/31 | | | 4,375,249 | |

| | 2,480,000 | | BB+ | | Notes, 6.875% due 8/28/12 | | | 2,480,987 | |

| | | |

| | | | | Total Consumer Finance | | | 11,457,363 | |

| | | |

| | Containers & Packaging — 1.7% | | | | |

| | 1,305,000 | | CCC+ | | Graham Packaging Co. Inc., Senior Subordinated Notes, 9.875% due 10/15/14 | | | 1,357,200 | |

| | 960,000 | | B- | | Graphic Packaging International Corp., Senior Subordinated Notes, 9.500% due 8/15/13 | | | 1,032,000 | |

| | 725,000 | | B | | Plastipak Holdings Inc., Senior Notes, 8.500% due 12/15/15 (a) | | | 779,375 | |

| | 600,000 | | NR | | Radnor Holdings Corp., Senior Notes, 11.000% due 3/15/10 (d) | | | 5,250 | |

| | 92,000 | | B | | Smurfit Kappa Funding, Senior Notes, 9.625% due 10/1/12 | | | 97,290 | |

| | 645,000 | | CCC+ | | Smurfit-Stone Container Corp., Senior Notes, 8.000% due 3/15/17 (a) | | | 645,000 | |

| | 675,000 | | CCC+ | | Smurfit-Stone Container Enterprises Inc., Senior Notes, 8.375% due 7/1/12 | | | 689,344 | |

| | | |

| | | | | Total Containers & Packaging | | | 4,605,459 | |

| | | |

| | Diversified Consumer Services — 1.0% | | | | |

| | | | | Education Management LLC/Education Management Finance Corp.: | | | | |

| | 495,000 | | CCC+ | | Senior Notes, 8.750% due 6/1/14 | | | 525,938 | |

| | 1,015,000 | | CCC+ | | Senior Subordinated Notes, 10.250% due 6/1/16 | | | 1,113,962 | |

| | | | | Service Corp. International: | | | | |

| | 500,000 | | BB- | | Debentures, 7.875% due 2/1/13 | | | 517,500 | |

| | | | | Senior Notes: | | | | |

| | 25,000 | | BB- | | 7.625% due 10/1/18 | | | 26,594 | |

| | 385,000 | | BB- | | 7.500% due 4/1/27 (a) | | | 386,925 | |

| | | |

| | | | | Total Diversified Consumer Services | | | 2,570,919 | |

| | | |

See Notes to Financial Statements.

6 Legg Mason Partners Variable High Income Portfolio 2007 Semi-Annual Report

Schedule of Investments (April 30, 2007) (unaudited) (continued)

| | | | | | | | | | |

| | | |

Face

Amount | | | Rating‡ | | Security | | Value | |

| | | | | | | | | | |

| | Diversified Financial Services — 3.3% | | | | |

| $ | 410,000 | | | B- | | Ameripath Intermediate Holdings Inc., Senior Unsecured Notes, 10.650% due 2/15/14 (a)(c) | | $ | 413,075 | |

| | 910,000 | | | B | | Basell AF SCA, Senior Secured Subordinated Second Priority Notes, 8.375% due 8/15/15 (a) | | | 950,950 | |

| | 650,000 | | | CCC+ | | CCM Merger Inc., Notes, 8.000% due 8/1/13 (a) | | | 661,375 | |

| | 790,000 | | | B+ | | Idearc Inc., Senior Notes, 8.000% due 11/15/16 (a) | | | 827,525 | |

| | 1,463,000 | | | NR | | JPMorgan Chase London, zero coupon bond to yield 9.312% due 11/8/07 (a) | | | 1,398,350 | |

| | 680,000 | | | CCC | | Milacron Escrow Corp., Senior Secured Notes, 11.500% due 5/15/11 | | | 677,450 | |

| | 680,000 | | | B- | | PGS Solutions Inc., Senior Subordinated Notes, 9.625% due 2/15/15 (a) | | | 694,294 | |

| | 615,000 | | | B | | Smurfit Kappa Funding PLC, Senior Subordinated Notes, 7.750% due 4/1/15 | | | 633,450 | |

| | 296,000 | | | B- | | UCAR Finance Inc., Senior Notes, 10.250% due 2/15/12 | | | 313,020 | |

| | 550,000 | | | B- | | UGS Corp., Senior Subordinated Notes, 10.000% due 6/1/12 | | | 602,250 | |

| | 1,715,000 | | | CCC+ | | Vanguard Health Holdings Co. II LLC, Senior Subordinated Notes, 9.000% due 10/1/14 | | | 1,785,744 | |

| | | |

| | | | | | Total Diversified Financial Services | | | 8,957,483 | |

| | | |

| | Diversified Telecommunication Services — 7.0% | | | | |

| | 1,265,000 | | | B- | | Cincinnati Bell Inc., Senior Notes, 7.000% due 2/15/15 | | | 1,274,487 | |

| | 180,000 | | | BB- | | Cincinnati Bell Telephone Co., Senior Debentures, 6.300% due 12/1/28 | | | 169,200 | |

| | | | | | Citizens Communications Co.: | | | | |

| | 25,000 | | | BB+ | | Senior Bonds, 7.125% due 3/15/19 (a) | | | 25,313 | |

| | 1,115,000 | | | BB+ | | Senior Notes, 7.875% due 1/15/27 (a) | | | 1,165,175 | |

| | 695,000 | | | NR | | GT Group Telecom Inc., Senior Discount Notes,

13.250% due 2/1/10 (d)(e)(f) | | | 0 | |

| | 1,370,000 | | | CCC | | Hawaiian Telcom Communications Inc., Senior Subordinated Notes, Series B, 12.500% due 5/1/15 | | | 1,548,100 | |

| | | | | | Intelsat Bermuda Ltd.: | | | | |

| | 950,000 | | | B+ | | 9.250% due 6/15/16 | | | 1,049,750 | |

| | | | | | Senior Notes: | | | | |

| | 65,000 | | | B | | 8.872% due 1/15/15 (c) | | | 66,788 | |

| | 2,050,000 | | | B | | 11.250% due 6/15/16 | | | 2,349,812 | |

| | | | | | Intelsat Corp.: | | | | |

| | 120,000 | | | B | | 9.000% due 6/15/16 | | | 132,150 | |

| | 361,000 | | | B | | Senior Notes, 9.000% due 8/15/14 | | | 391,685 | |

| | | | | | Level 3 Financing Inc., Senior Notes: | | | | |

| | 310,000 | | | CCC+ | | 9.250% due 11/1/14 (a) | | | 323,563 | |

| | 940,000 | | | CCC+ | | 9.150% due 2/15/15 (a)(c) | | | 956,450 | |

| | 385,000 | | | CCC+ | | 8.750% due 2/15/17 (a) | | | 393,662 | |

| | 630,000 | | | B- | | Nordic Telephone Co. Holdings, Senior Secured Notes,

8.875% due 5/1/16 (a) | | | 680,400 | |

See Notes to Financial Statements.

Legg Mason Partners Variable High Income Portfolio 2007 Semi-Annual Report 7

Schedule of Investments (April 30, 2007) (unaudited) (continued)

| | | | | | | | | | |

| | | |

Face

Amount | | | Rating‡ | | Security | | Value | |

| | | | | | | | | | |

| | Diversified Telecommunication Services — 7.0% (continued) | | | | |

| | | | | | NTL Cable PLC, Senior Notes: | | | | |

| $ | 135,000 | | | B- | | 8.750% due 4/15/14 | | $ | 142,425 | |

| | 1,220,000 | | | B- | | 9.125% due 8/15/16 | | | 1,308,450 | |

| | | | | | Qwest Communications International Inc., Senior Notes: | | | | |

| | 180,000 | | | B+ | | 7.500% due 2/15/14 | | | 186,750 | |

| | 935,000 | | | B+ | | Series B, 7.500% due 2/15/14 | | | 970,062 | |

| | | | | | Qwest Corp.: | | | | |

| | 890,000 | | | BB+ | | Notes, 8.875% due 3/15/12 | | | 987,900 | |

| | 1,350,000 | | | BB+ | | Senior Notes, 7.500% due 10/1/14 | | | 1,434,375 | |

| | 100,000 | | | CCC+ | | Umbrella Acquisition Inc., Senior Notes, 9.750% due 3/15/15 (a)(b) | | | 100,875 | |

| | 1,310,000 | | | B- | | Wind Acquisition Finance SA, Senior Bond, 10.750% due 12/1/15 (a) | | | 1,519,600 | |

| | 1,560,000 | | | BB- | | Windstream Corp., Senior Notes, 8.625% due 8/1/16 | | | 1,719,900 | |

| | | |

| | | | | | Total Diversified Telecommunication Services | | | 18,896,872 | |

| | | |

| | Electric Utilities — 0.7% | | | | |

| | 375,660 | | | BB | | Midwest Generation LLC, Pass-Through Certificates, Series B,

8.560% due 1/2/16 | | | 414,400 | |

| | 1,165,000 | | | B | | Orion Power Holdings Inc., Senior Notes, 12.000% due 5/1/10 | | | 1,351,400 | |

| | | |

| | | | | | Total Electric Utilities | | | 1,765,800 | |

| | | |

| | Electronic Equipment & Instruments — 0.3% | | | | |

| | | | | | NXP BV/NXP Funding LLC: | | | | |

| | 250,000 | | | B+ | | Senior Notes, 9.500% due 10/15/15 (a) | | | 263,750 | |

| | 630,000 | | | BB+ | | Senior Secured Bonds, 7.875% due 10/15/14 (a) | | | 658,350 | |

| | | |

| | | | | | Total Electronic Equipment & Instruments | | | 922,100 | |

| | | |

| | Energy Equipment & Services — 2.7% | | | | |

| | 995,000 | | | A- | | ANR Pipeline Co., Debentures, 9.625% due 11/1/21 | | | 1,352,157 | |

| | 970,000 | | | B | | Complete Production Services Inc., Senior Notes,

8.000% due 12/15/16 (a) | | | 1,007,588 | |

| | 286,000 | | | B | | Dresser-Rand Group Inc., Senior Subordinated Notes,

7.375% due 11/1/14 | | | 293,150 | |

| | 460,000 | | | CCC+ | | Geokinetics Inc., Senior Secured Notes, 11.855% due 12/15/12 (a)(c) | | | 477,250 | |

| | 240,000 | | | B | | GulfMark Offshore Inc., Senior Subordinated Notes,

7.750% due 7/15/14 | | | 246,600 | |

| | 1,000,000 | | | B | | Hanover Compressor Co., Senior Subordinated Notes,

8.625% due 12/15/10 | | | 1,047,500 | |

| | 320,000 | | | BB- | | Pride International Inc., Senior Notes, 7.375% due 7/15/14 | | | 330,000 | |

| | 130,000 | | | BB | | Southern Natural Gas Co., Senior Notes, 8.000% due 3/1/32 | | | 157,182 | |

| | 1,780,000 | | | BB | | Tennessee Gas Pipeline Co., Bonds, 8.375% due 6/15/32 | | | 2,231,924 | |

| | | |

| | | | | | Total Energy Equipment & Services | | | 7,143,351 | |

| | | |

| | Food & Staples Retailing — 0.5% | | | | |

| | 1,125,000 | | | BB+ | | Delhaize America Inc., Debentures, 9.000% due 4/15/31 | | | 1,376,213 | |

| | | |

See Notes to Financial Statements.

8 Legg Mason Partners Variable High Income Portfolio 2007 Semi-Annual Report

Schedule of Investments (April 30, 2007) (unaudited) (continued)

| | | | | | | | | | |

| | | |

Face

Amount | | | Rating‡ | | Security | | Value | |

| | | | | | | | | | |

| | Food Products — 0.5% | | | | |

| | | | | | Dole Food Co. Inc., Senior Notes: | | | | |

| $ | 1,200,000 | | | B- | | 7.250% due 6/15/10 | | $ | 1,183,500 | |

| | 44,000 | | | B- | | 8.875% due 3/15/11 | | | 44,770 | |

| | | |

| | | | | | Total Food Products | | | 1,228,270 | |

| | | |

| | Gas Utilities — 0.5% | | | | |

| | 1,470,000 | | | B- | | Suburban Propane Partners LP/Suburban Energy Finance Corp., Senior Notes, 6.875% due 12/15/13 | | | 1,473,675 | |

| | | |

| | Health Care Equipment & Supplies — 0.1% | | | | |

| | 330,000 | | | B | | Advanced Medical Optics Inc., Senior Subordinated Notes,

7.500% due 5/1/17 (a) | | | 341,550 | |

| | | |

| | Health Care Providers & Services — 5.7% | | | | |

| | 1,150,000 | | | B- | | AmeriPath Inc., Senior Subordinated Notes, 10.500% due 4/1/13 | | | 1,257,812 | |

| | | | | | DaVita Inc.: | | | | |

| | 670,000 | | | B | | Senior Notes, 6.625% due 3/15/13 | | | 675,863 | |

| | 1,005,000 | | | B | | Senior Subordinated Notes, 7.250% due 3/15/15 | | | 1,032,637 | |

| | | | | | HCA Inc.: | | | | |

| | 215,000 | | | B- | | Debentures, 7.500% due 11/15/95 | | | 177,945 | |

| | 2,925,000 | | | B- | | Notes, 6.375% due 1/15/15 | | | 2,555,719 | |

| | 220,000 | | | B- | | Senior Notes, 6.500% due 2/15/16 | | | 192,775 | |

| | | | | | Senior Secured Notes: | | | | |

| | 810,000 | | | BB- | | 9.250% due 11/15/16 (a) | | | 884,925 | |

| | 720,000 | | | BB- | | 9.625% due 11/15/16 (a)(b) | | | 787,500 | |

| | 1,875,000 | | | CCC+ | | IASIS Healthcare LLC/IASIS Capital Corp., Senior Subordinated Notes, 8.750% due 6/15/14 | | | 1,952,344 | |

| | 583,000 | | | B- | | Psychiatric Solutions Inc., Senior Subordinated Notes,

10.625% due 6/15/13 | | | 641,300 | |

| | | | | | Tenet Healthcare Corp., Senior Notes: | | | | |

| | 650,000 | | | CCC+ | | 7.375% due 2/1/13 | | | 614,250 | |

| | 2,560,000 | | | CCC+ | | 9.875% due 7/1/14 | | | 2,636,800 | |

| | 1,425,000 | | | B+ | | Triad Hospitals Inc., Senior Subordinated Notes, 7.000% due 11/15/13 | | | 1,496,250 | |

| | 290,000 | | | B- | | US Oncology Holdings Inc., Senior Notes, 9.797% due 3/15/12 (a)(b) | | | 295,075 | |

| | | |

| | | | | | Total Health Care Providers & Services | | | 15,201,195 | |

| | | |

| | Hotels, Restaurants & Leisure — 6.1% | | | | |

| | 1,300,000 | | | B+ | | Boyd Gaming Corp., Senior Subordinated Notes, 6.750% due 4/15/14 | | | 1,304,875 | |

| | 870,000 | | | CCC | | Buffets Inc., Senior Notes, 12.500% due 11/1/14 | | | 917,850 | |

| | 1,400,000 | | | B+ | | Caesars Entertainment Inc., Senior Subordinated Notes,

8.125% due 5/15/11 | | | 1,491,000 | |

| | 585,000 | | | B- | | Denny’s Holdings Inc., Senior Notes, 10.000% due 10/1/12 | | | 627,413 | |

| | 420,000 | | | CCC+ | | El Pollo Loco Inc., Senior Notes, 11.750% due 11/15/13 | | | 458,850 | |

| | 1,300,000 | | | B- | | Herbst Gaming Inc., Senior Subordinated Notes, 8.125% due 6/1/12 | | | 1,319,500 | |

| | 1,345,000 | | | B- | | Inn of the Mountain Gods Resort & Casino, Senior Notes,

12.000% due 11/15/10 | | | 1,471,094 | |

| | 1,375,000 | | | B | | Isle of Capri Casinos Inc., Senior Subordinated Notes,

7.000% due 3/1/14 | | | 1,361,250 | |

See Notes to Financial Statements.

Legg Mason Partners Variable High Income Portfolio 2007 Semi-Annual Report 9

Schedule of Investments (April 30, 2007) (unaudited) (continued)

| | | | | | | | | | |

| | | |

Face

Amount | | | Rating‡ | | Security | | Value | |

| | | | | | | | | | |

| | Hotels, Restaurants & Leisure — 6.1% (continued) | | | | |

| $ | 1,150,000 | | | B | | Las Vegas Sands Corp., Senior Notes, 6.375% due 2/15/15 | | $ | 1,125,562 | |

| | 260,000 | | | B+ | | Mandalay Resort Group, Senior Subordinated Debentures,

7.625% due 7/15/13 | | | 261,300 | |

| | | | | | MGM MIRAGE Inc., Senior Notes: | | | | |

| | 685,000 | | | BB | | 6.750% due 9/1/12 | | | 689,281 | |

| | 1,175,000 | | | BB | | 7.625% due 1/15/17 | | | 1,204,375 | |

| | 485,000 | | | B | | Mohegan Tribal Gaming Authority, Senior Subordinated Notes, 6.875% due 2/15/15 | | | 488,638 | |

| | 440,000 | | | B- | | OSI Restaurant Partners Inc., Senior Notes, 9.625% due 5/15/15 (a) | | | 454,850 | |

| | 115,000 | | | B+ | | River Rock Entertainment Authority, Senior Notes,

9.750% due 11/1/11 | | | 122,331 | |

| | 690,000 | | | CCC | | Sbarro Inc., Senior Notes, 10.375% due 2/1/15 (a) | | | 726,225 | |

| | | | | | Snoqualmie Entertainment Authority, Senior Secured Notes: | | | | |

| | 280,000 | | | B | | 9.150% due 2/1/14 (a)(c) | | | 287,350 | |

| | 220,000 | | | B | | 9.125% due 2/1/15 (a) | | | 228,800 | |

| | | | | | Station Casinos Inc.: | | | | |

| | | | | | Senior Notes: | | | | |

| | 120,000 | | | B+ | | 6.000% due 4/1/12 | | | 118,200 | |

| | 1,005,000 | | | B+ | | 7.750% due 8/15/16 | | | 1,050,225 | |

| | | | | | Senior Subordinated Notes: | | | | |

| | 210,000 | | | B | | 6.875% due 3/1/16 | | | 198,450 | |

| | 75,000 | | | B | | 6.625% due 3/15/18 | | | 69,000 | |

| | 275,000 | | | B+ | | Turning Stone Casino Resort Enterprise, Senior Notes,

9.125% due 12/15/10 (a) | | | 281,875 | |

| | | |

| | | | | | Total Hotels, Restaurants & Leisure | | | 16,258,294 | |

| | | |

| | Household Durables — 2.2% | | | | |

| | 105,000 | | | BB+ | | American Greetings Corp., Senior Notes, 7.375% due 6/1/16 | | | 108,938 | |

| | 985,000 | | | B- | | Jarden Corp., Senior Subordinated Notes, 7.500% due 5/1/17 | | | 1,013,319 | |

| | | | | | K Hovnanian Enterprises Inc., Senior Notes: | | | | |

| | 1,300,000 | | | BB | | 7.500% due 5/15/16 | | | 1,254,500 | |

| | 495,000 | | | BB | | 8.625% due 1/15/17 | | | 499,950 | |

| | 755,000 | | | B- | | Norcraft Cos. LP/Norcraft Finance Corp., Senior Subordinated Notes, 9.000% due 11/1/11 | | | 790,862 | |

| | 1,065,000 | | | B- | | Norcraft Holdings LP/Norcraft Capital Corp., Senior Discount Notes, step bond to yield 10.276% due 9/1/12 | | | 974,475 | |

| | 1,200,000 | | | B | | Sealy Mattress Co., Senior Subordinated Notes, 8.250% due 6/15/14 | | | 1,269,000 | |

| | | |

| | | | | | Total Household Durables | | | 5,911,044 | |

| | | |

| | Household Products — 0.7% | | | | |

| | 20,000 | | | CCC+ | | American Achievement Corp., Senior Subordinated Notes,

8.250% due 4/1/12 | | | 20,450 | |

| | | | | | Nutro Products Inc.: | | | | |

| | 150,000 | | | CCC | | Senior Notes, 9.370% due 10/15/13 (a)(c) | | | 154,125 | |

| | 980,000 | | | CCC | | Senior Subordinated Notes, 10.750% due 4/15/14 (a) | | | 1,043,700 | |

| | 555,000 | | | B- | | Visant Holding Corp., Senior Notes, 8.750% due 12/1/13 | | | 586,913 | |

| | | |

| | | | | | Total Household Products | | | 1,805,188 | |

| | | |

See Notes to Financial Statements.

10 Legg Mason Partners Variable High Income Portfolio 2007 Semi-Annual Report

Schedule of Investments (April 30, 2007) (unaudited) (continued)

| | | | | | | | | | |

| | | |

Face

Amount | | | Rating‡ | | Security | | Value | |

| | | | | | | | | | |

| | Independent Power Producers & Energy Traders — 3.9% | | | | |

| $ | 305,000 | | | B+ | | AES China Generating Co., Ltd., Class A, 8.250% due 6/26/10 | | $ | 304,796 | |

| | | | | | AES Corp.: | | | | |

| | | | | | Senior Notes: | | | | |

| | 1,470,000 | | | B | | 9.500% due 6/1/09 (g) | | | 1,576,575 | |

| | 1,095,000 | | | B | | 7.750% due 3/1/14 | | | 1,163,437 | |

| | 240,000 | | | BB- | | Senior Secured Notes, 9.000% due 5/15/15 (a) | | | 258,000 | |

| | 1,060,000 | | | B- | | Dynegy Holdings Inc., Senior Debentures, 7.625% due 10/15/26 | | | 1,045,425 | |

| | | | | | Edison Mission Energy, Senior Notes: | | | | |

| | 160,000 | | | BB- | | 7.500% due 6/15/13 | | | 167,200 | |

| | 880,000 | | | BB- | | 7.750% due 6/15/16 | | | 930,600 | |

| | 241,523 | | | BB | | Mirant Mid Atlantic LLC, Pass-Through Certificates, Series B,

9.125% due 6/30/17 | | | 281,525 | |

| | 1,065,000 | | | B- | | Mirant North America LLC, Senior Notes, 7.375% due 12/31/13 | | | 1,131,562 | |

| | | | | | NRG Energy Inc., Senior Notes: | | | | |

| | 525,000 | | | B- | | 7.250% due 2/1/14 | | | 544,688 | |

| | 2,665,000 | | | B- | | 7.375% due 2/1/16 | | | 2,774,931 | |

| | 40,000 | | | B- | | 7.375% due 1/15/17 | | | 41,550 | |

| | | | | | TXU Corp., Senior Notes: | | | | |

| | 260,000 | | | BB- | | Series Q, 6.500% due 11/15/24 | | | 226,308 | |

| | 60,000 | | | BB- | | Series R, 6.550% due 11/15/34 | | | 51,888 | |

| | | |

| | | | | | Total Independent Power Producers & Energy Traders | | | 10,498,485 | |

| | | |

| | Insurance — 0.8% | | | | |

| | | | | | Crum & Forster Holdings Corp., Senior Notes: | | | | |

| | 1,570,000 | | | BB | | 10.375% due 6/15/13 | | | 1,730,109 | |

| | 300,000 | | | BB | | 7.750% due 5/1/17 (a) | | | 303,000 | |

| | | |

| | | | | | Total Insurance | | | 2,033,109 | |

| | | |

| | Internet & Catalog Retail — 0.5% | | | | |

| | 1,264,000 | | | B- | | FTD Inc., Senior Subordinated Notes, 7.750% due 2/15/14 | | | 1,276,640 | |

| | | |

| | IT Services — 0.8% | | | | |

| | | | | | SunGard Data Systems Inc.: | | | | |

| | 750,000 | | | B- | | Senior Notes, 9.125% due 8/15/13 | | | 808,125 | |

| | 1,120,000 | | | B- | | Senior Subordinated Notes, 10.250% due 8/15/15 | | | 1,237,600 | |

| | | |

| | | | | | Total IT Services | | | 2,045,725 | |

| | | |

| | Leisure Equipment & Products — 0.4% | | | | |

| | 1,030,000 | | | B | | WMG Acquisition Corp., Senior Subordinated Notes,

7.375% due 4/15/14 | | | 993,950 | |

| | | |

| | Machinery — 0.7% | | | | |

| | 360,000 | | | BB- | | American Railcar Industries Inc., Senior Unsecured Notes,

7.500% due 3/1/14 (a) | | | 374,850 | |

| | 935,000 | | | B | | Mueller Group Inc., Senior Subordinated Notes, 10.000% due 5/1/12 | | | 1,014,475 | |

| | 550,000 | | | B | | Mueller Holdings Inc., Senior Discount Notes, step bond to yield 10.786% due 4/15/14 | | | 517,000 | |

| | | |

| | | | | | Total Machinery | | | 1,906,325 | |

| | | |

See Notes to Financial Statements.

Legg Mason Partners Variable High Income Portfolio 2007 Semi-Annual Report 11

Schedule of Investments (April 30, 2007) (unaudited) (continued)

| | | | | | | | | | |

| | | |

Face

Amount | | | Rating‡ | | Security | | Value | |

| | | | | | | | | | |

| | Media — 9.0% | | | | |

| | | | | | Affinion Group Inc.: | | | | |

| $ | 1,325,000 | | | B- | | Senior Notes, 10.125% due 10/15/13 | | $ | 1,450,875 | |

| | 385,000 | | | B- | | Senior Subordinated Notes, 11.500% due 10/15/15 | | | 425,425 | |

| | 1,830,000 | | | CCC+ | | AMC Entertainment Inc., Senior Subordinated Notes,

11.000% due 2/1/16 | | | 2,109,075 | |

| | 2,266,000 | | | CCC | | CCH I Holdings LLC/CCH I Holdings Capital Corp., Senior Notes, 11.750% due 5/15/14 | | | 2,266,000 | |

| | 1,713,000 | | | CCC | | CCH I LLC/CCH Capital Corp., Senior Secured Notes,

11.000% due 10/1/15 | | | 1,828,627 | |

| | | | | | CCH II LLC/CCH II Capital Corp., Senior Notes: | | | | |

| | 1,340,000 | | | CCC | | 10.250% due 9/15/10 | | | 1,433,800 | |

| | 686,000 | | | CCC(h) | | 10.250% due 10/1/13 | | | 757,172 | |

| | 380,000 | | | CCC | | Charter Communications Holdings LLC, Senior Discount Notes, 12.125% due 1/15/12 | | | 394,250 | |

| | 355,000 | | | CCC | | Charter Communications Holdings LLC/Charter Communications Holdings Capital Corp., Senior Discount Notes,

11.750% due 5/15/11 | | | 367,425 | |

| | 400,000 | | | BB- | | Chukchansi Economic Development Authority, Senior Notes,

8.000% due 11/15/13 (a) | | | 416,500 | |

| | 860,000 | | | CCC | | CMP Susquehanna Corp., Senior Subordinated Notes,

9.875% due 5/15/14 (a) | | | 881,500 | |

| | | | | | CSC Holdings Inc.: | | | | |

| | | | | | Senior Debentures: | | | | |

| | 470,000 | | | B+ | | 7.625% due 7/15/18 | | | 481,750 | |

| | 40,000 | | | B+ | | Series B, 8.125% due 8/15/09 | | | 41,800 | |

| | | | | | Senior Notes: | | | | |

| | | | | | Series B: | | | | |

| | 360,000 | | | B+ | | 8.125% due 7/15/09 | | | 376,200 | |

| | 560,000 | | | B+ | | 7.625% due 4/1/11 | | | 580,300 | |

| | 740,000 | | | B+ | | Series WI, 6.750% due 4/15/12 | | | 742,775 | |

| | 504,000 | | | B | | Dex Media East LLC/Dex Media East Finance Co., Senior Notes, 12.125% due 11/15/12 | | | 550,620 | |

| | 1,001,000 | | | B | | Dex Media West LLC/Dex Media Finance Co., Senior Subordinated Notes, Series B, 9.875% due 8/15/13 | | | 1,094,844 | |

| | | | | | EchoStar DBS Corp., Senior Notes: | | | | |

| | 1,850,000 | | | BB- | | 6.625% due 10/1/14 | | | 1,882,375 | |

| | 615,000 | | | BB- | | 7.125% due 2/1/16 | | | 643,444 | |

| | 235,000 | | | CCC- | | ION Media Networks Inc., Senior Secured Notes,

11.606% due 1/15/13 (a)(c) | | | 245,575 | |

| | 580,000 | | | B | | Lamar Media Corp., Senior Subordinated Notes, 6.625% due 8/15/15 | | | 578,550 | |

| | 870,000 | | | B | | Primedia Inc., Senior Notes, 8.875% due 5/15/11 | | | 898,275 | |

| | | | | | R.H. Donnelley Corp., Senior Discount Notes: | | | | |

| | 300,000 | | | B | | Series A-1, 6.875% due 1/15/13 | | | 298,875 | |

| | 550,000 | | | B | | Series A-2, 6.875% due 1/15/13 | | | 547,938 | |

| | 175,000 | | | B | | R.H. Donnelley Finance Corp. I, Senior Subordinated Notes,

10.875% due 12/15/12 (a) | | | 190,313 | |

See Notes to Financial Statements.

12 Legg Mason Partners Variable High Income Portfolio 2007 Semi-Annual Report

Schedule of Investments (April 30, 2007) (unaudited) (continued)

| | | | | | | | | | |

| | | |

Face

Amount | | | Rating‡ | | Security | | Value | |

| | | | | | | | | | |

| | Media — 9.0% (continued) | | | | |

| $ | 400,000 | | | B | | R.H. Donnelley Inc., Senior Subordinated Notes,

10.875% due 12/15/12 | | $ | 435,000 | |

| | | | | | Rainbow National Services LLC: | | | | |

| | 530,000 | | | B+ | | Senior Notes, 8.750% due 9/1/12 (a) | | | 568,425 | |

| | 620,000 | | | B+ | | Senior Subordinated Debentures, 10.375% due 9/1/14 (a) | | | 701,375 | |

| | | | | | XM Satellite Radio Inc., Senior Notes: | | | | |

| | 290,000 | | | CCC | | 9.860% due 5/1/13 (c) | | | 287,100 | |

| | 575,000 | | | CCC | | 9.750% due 5/1/14 | | | 579,312 | |

| | | |

| | | | | | Total Media | | | 24,055,495 | |

| | | |

| | Metals & Mining — 2.7% | | | | |

| | 3,155,000 | | | BB | | Freeport-McMoRan Copper & Gold Inc., Senior Notes,

8.375% due 4/1/17 | | | 3,458,669 | |

| | 840,000 | | | CCC+ | | Metals USA Holdings Corp., Senior Notes,

11.356% due 1/15/12 (a)(b)(c) | | | 835,800 | |

| | 1,465,000 | | | B- | | Metals USA Inc., Senior Secured Notes, 11.125% due 12/1/15 | | | 1,633,475 | |

| | 695,000 | | | B | | Novelis Inc., Senior Notes, 7.250% due 2/15/15 | | | 735,831 | |

| | 560,000 | | | B- | | Tube City IMS Corp., Senior Subordinated Notes, 9.750% due 2/1/15 (a) | | | 593,600 | |

| | | |

| | | | | | Total Metals & Mining | | | 7,257,375 | |

| | | |

| | Multiline Retail — 0.7% | | | | |

| | | | | | Neiman Marcus Group Inc.: | | | | |

| | 1,280,000 | | | B- | | Senior Notes, 9.000% due 10/15/15 (b) | | | 1,417,600 | |

| | 540,000 | | | B- | | Senior Subordinated Notes, 10.375% due 10/15/15 | | | 609,525 | |

| | | |

| | | | | | Total Multiline Retail | | | 2,027,125 | |

| | | |

| | Oil, Gas & Consumable Fuels — 9.4% | | | | |

| | 1,360,000 | | | CCC+ | | Belden & Blake Corp., Secured Notes, 8.750% due 7/15/12 | | | 1,407,600 | |

| | | | | | Chesapeake Energy Corp., Senior Notes: | | | | |

| | 2,325,000 | | | BB | | 6.375% due 6/15/15 | | | 2,339,531 | |

| | 235,000 | | | BB | | 6.500% due 8/15/17 | | | 235,000 | |

| | 295,000 | | | B+ | | Compagnie Generale de Geophysique SA, Senior Notes,

7.500% due 5/15/15 | | | 311,225 | |

| | 800,000 | | | NR | | Corral Finans AB, 6.855% due 4/15/10 (a)(b) | | | 815,000 | |

| | | | | | El Paso Corp., Medium-Term Notes: | | | | |

| | 1,605,000 | | | BB- | | 7.800% due 8/1/31 | | | 1,797,600 | |

| | 1,305,000 | | | BB- | | 7.750% due 1/15/32 | | | 1,461,600 | |

| | 660,000 | | | BB | | Enterprise Products Operating LP, Junior Subordinated Notes,

8.375% due 8/1/66 (c) | | | 732,042 | |

| | 1,450,000 | | | B- | | EXCO Resources Inc., Senior Notes, 7.250% due 1/15/11 | | | 1,460,875 | |

| | 675,000 | | | B | | Inergy LP/Inergy Finance Corp., Senior Notes, 6.875% due 12/15/14 | | | 669,937 | |

| | 795,000 | | | CCC+ | | International Coal Group Inc., Senior Notes, 10.250% due 7/15/14 | | | 815,869 | |

| | | | | | Mariner Energy Inc., Senior Notes: | | | | |

| | 495,000 | | | B- | | 7.500% due 4/15/13 | | | 493,763 | |

| | 230,000 | | | B- | | 8.000% due 5/15/17 | | | 232,588 | |

| | 400,000 | | | BB | | OMI Corp., Senior Notes, 7.625% due 12/1/13 | | | 410,000 | |

See Notes to Financial Statements.

Legg Mason Partners Variable High Income Portfolio 2007 Semi-Annual Report 13

Schedule of Investments (April 30, 2007) (unaudited) (continued)

| | | | | | | | | | |

| | | |

Face

Amount | | | Rating‡ | | Security | | Value | |

| | | | | | | | | | |

| | Oil, Gas & Consumable Fuels — 9.4% (continued) | | | | |

| $ | 610,000 | | | BB | | OPTI Canada Inc., Senior Secured Notes, 8.250% due 12/15/14 (a) | | $ | 648,125 | |

| | 500,000 | | | B- | | Petrohawk Energy Corp., Senior Notes, 9.125% due 7/15/13 | | | 538,125 | |

| | | | | | Petroplus Finance Ltd.: | | | | |

| | 310,000 | | | BB- | | 6.750% due 5/1/14 (a) | | | 313,100 | |

| | 490,000 | | | BB- | | 7.000% due 5/1/17 (a) | | | 496,738 | |

| | | | | | Pogo Producing Co., Senior Subordinated Notes: | | | | |

| | 10,000 | | | B+ | | 7.875% due 5/1/13 | | | 10,175 | |

| | 1,220,000 | | | B+ | | 6.875% due 10/1/17 | | | 1,201,700 | |

| | 195,000 | | | B+ | | Series B, 8.250% due 4/15/11 | | | 199,388 | |

| | 1,485,000 | | | B+ | | SemGroup LP, Senior Notes, 8.750% due 11/15/15 (a) | | | 1,540,687 | |

| | 55,000 | | | BB- | | SESI LLC, Senior Notes, 6.875% due 6/1/14 | | | 56,100 | |

| | 1,450,000 | | | B- | | Stone Energy Corp., Senior Subordinated Notes, 6.750% due 12/15/14 | | | 1,363,000 | |

| | 455,000 | | | NR | | Vintage Petroleum Inc., Senior Notes, 8.250% due 5/1/12 | | | 473,236 | |

| | 460,000 | | | B | | Whiting Petroleum Corp., Senior Subordinated Notes,

7.000% due 2/1/14 | | | 449,650 | |

| | | | | | Williams Cos. Inc.: | | | | |

| | | | | | Notes: | | | | |

| | 865,000 | | | BB | | 7.875% due 9/1/21 | | | 962,312 | |

| | 2,650,000 | | | BB | | 8.750% due 3/15/32 | | | 3,097,187 | |

| | 600,000 | | | BB | | Senior Notes, 7.625% due 7/15/19 | | | 657,000 | |

| | | |

| | | | | | Total Oil, Gas & Consumable Fuels | | | 25,189,153 | |

| | | |

| | Paper & Forest Products — 1.9% | | | | |

| | 800,000 | | | B+ | | Abitibi-Consolidated Co. of Canada, 6.000% due 6/20/13 | | | 696,000 | |

| | | | | | Abitibi-Consolidated Inc.: | | | | |

| | 210,000 | | | B+ | | 7.400% due 4/1/18 | | | 179,550 | |

| | 385,000 | | | B+ | | Senior Notes, 8.375% due 4/1/15 | | | 361,900 | |

| | 1,400,000 | | | B | | Appleton Papers Inc., Senior Subordinated Notes, Series B,

9.750% due 6/15/14 | | | 1,457,750 | |

| | | | | | NewPage Corp.: | | | | |

| | 790,000 | | | B- | | Senior Secured Notes, 11.610% due 5/1/12 (c) | | | 879,862 | |

| | 795,000 | | | CCC+ | | Senior Subordinated Notes, 12.000% due 5/1/13 | | | 887,419 | |

| | 640,000 | | | CCC+ | | Verso Paper Holdings LLC, Senior Subordinated Notes,

11.375% due 8/1/16 (a) | | | 688,000 | |

| | | |

| | | | | | Total Paper & Forest Products | | | 5,150,481 | |

| | | |

| | Pharmaceuticals — 0.6% | | | | |

| | 1,530,000 | | | CCC | | Leiner Health Products Inc., Senior Subordinated Notes,

11.000% due 6/1/12 | | | 1,510,875 | |

| | | |

| | Real Estate Investment Trusts (REITs) — 1.0% | | | | |

| | 40,000 | | | BB- | | Forest City Enterprises Inc., Senior Notes, 7.625% due 6/1/15 | | | 41,200 | |

| | | | | | Host Marriott LP, Senior Notes: | | | | |

| | 625,000 | | | BB | | 7.125% due 11/1/13 | | | 646,875 | |

| | 625,000 | | | BB | | Series O, 6.375% due 3/15/15 | | | 630,468 | |

| | 430,000 | | | B | | Kimball Hill Inc., Senior Subordinated Notes, 10.500% due 12/15/12 | | | 421,400 | |

| | | | | | Ventas Realty LP/Ventas Capital Corp., Senior Notes: | | | | |

| | 140,000 | | | BB+ | | 7.125% due 6/1/15 | | | 146,300 | |

See Notes to Financial Statements.

14 Legg Mason Partners Variable High Income Portfolio 2007 Semi-Annual Report

Schedule of Investments (April 30, 2007) (unaudited) (continued)

| | | | | | | | | | |

| | | |

Face

Amount | | | Rating‡ | | Security | | Value | |

| | | | | | | | | | |

| | Real Estate Investment Trusts (REITs) — 1.0% (continued) | | | | |

| $ | 315,000 | | | BB+ | | 6.500% due 6/1/16 | | $ | 320,119 | |

| | 575,000 | | | BB+ | | 6.750% due 4/1/17 | | | 592,250 | |

| | | |

| | | | | | Total Real Estate Investment Trusts (REITs) | | | 2,798,612 | |

| | | |

| | Real Estate Management & Development — 1.0% | | | | |

| | 560,000 | | | B- | | Ashton Woods USA LLC/Ashton Woods Finance Co., Senior Subordinated Notes, 9.500% due 10/1/15 | | | 541,100 | |

| | | | | | Realogy Corp., Senior Notes: | | | | |

| | 670,000 | | | B- | | 10.500% due 4/15/14 (a) | | | 672,513 | |

| | 1,440,000 | | | B- | | 12.375% due 4/15/15 (a) | | | 1,443,600 | |

| | | |

| | | | | | Total Real Estate Management & Development | | | 2,657,213 | |

| | | |

| | Road & Rail — 1.8% | | | | |

| | | | | | Grupo Transportacion Ferroviaria Mexicana SA de CV, Senior Notes: | | | | |

| | 1,230,000 | | | B- | | 9.375% due 5/1/12 | | | 1,334,550 | |

| | 50,000 | | | B- | | 12.500% due 6/15/12 | | | 53,650 | |

| | | | | | Hertz Corp.: | | | | |

| | 400,000 | | | B | | Senior Notes, 8.875% due 1/1/14 | | | 433,000 | |

| | 1,730,000 | | | B | | Senior Subordinated Notes, 10.500% due 1/1/16 | | | 1,980,850 | |

| | 433,000 | | | CCC+ | | Horizon Lines LLC/Horizon Lines Holding Co., Senior Notes,

9.000% due 11/1/12 | | | 457,897 | |

| | 270,000 | | | B- | | Kansas City Southern de Mexico, Senior Notes, 7.625% due 12/1/13 (a) | | | 275,400 | |

| | 240,000 | | | B- | | Kansas City Southern Railway, Senior Notes, 7.500% due 6/15/09 | | | 246,600 | |

| | | |

| | | | | | Total Road & Rail | | | 4,781,947 | |

| | | |

| | Semiconductors & Semiconductor Equipment — 0.3% | | | | |

| | 940,000 | | | B | | Freescale Semiconductor Inc., Senior Notes, 8.875% due 12/15/14 (a) | | | 945,875 | |

| | | |

| | Software — 0.7% | | | | |

| | 970,000 | | | CCC+ | | Activant Solutions Inc., Senior Subordinated Notes,

9.500% due 5/1/16 | | | 965,150 | |

| | 992,684 | | | B- | | UGS Capital Corp. II, Senior Notes, 10.348% due 6/1/11 (a)(b)(c) | | | 1,027,428 | |

| | | |

| | | | | | Total Software | | | 1,992,578 | |

| | | |

| | Specialty Retail — 0.5% | | | | |

| | 165,000 | | | BB+ | | AutoNation Inc., Senior Notes, 7.000% due 4/15/14 | | | 166,650 | |

| | 635,000 | | | CCC+ | | Blockbuster Inc., Senior Subordinated Notes, 9.000% due 9/1/12 | | | 650,875 | |

| | 185,000 | | | CCC+ | | Eye Care Centers of America, Senior Subordinated Notes, 10.750% due 2/15/15 | | | 207,200 | |

| | 360,000 | | | B | | Linens ‘n Things Inc., Senior Secured Notes, 10.981% due 1/15/14 (c) | | | 340,650 | |

| | | |

| | | | | | Total Specialty Retail | | | 1,365,375 | |

| | | |

| | Textiles, Apparel & Luxury Goods — 1.0% | | | | |

| | | | | | Levi Strauss & Co., Senior Notes: | | | | |

| | 1,340,000 | | | B | | 9.750% due 1/15/15 | | | 1,477,350 | |

| | 90,000 | | | B | | 8.875% due 4/1/16 | | | 97,087 | |

| | 600,000 | | | B | | Oxford Industries Inc., Senior Notes, 8.875% due 6/1/11 | | | 625,500 | |

| | 500,000 | | | CCC+ | | Simmons Co., 7.875% due 1/15/14 | | | 495,417 | |

| | | |

| | | | | | Total Textiles, Apparel & Luxury Goods | | | 2,695,354 | |

| | | |

See Notes to Financial Statements.

Legg Mason Partners Variable High Income Portfolio 2007 Semi-Annual Report 15

Schedule of Investments (April 30, 2007) (unaudited) (continued)

| | | | | | | | | | |

| | | |

Face

Amount | | | Rating‡ | | Security | | Value | |

| | | | | | | | | | |

| | Thrifts & Mortgage Finance — 0.4% | | | | |

| $ | 1,075,000 | | | CCC- | | Ocwen Capital Trust I, Capital Securities, 10.875% due 8/1/27 | | $ | 1,134,125 | |

| | | |

| | Tobacco — 0.3% | | | | |

| | | | | | Alliance One International Inc., Senior Notes: | | | | |

| | 470,000 | | | B | | 8.500% due 5/15/12 (a) | | | 487,625 | |

| | 255,000 | | | B | | 11.000% due 5/15/12 | | | 284,325 | |

| | | |

| | | | | | Total Tobacco | | | 771,950 | |

| | | |

| | Trading Companies & Distributors — 1.0% | | | | |

| | 565,000 | | | B | | Ashtead Capital Inc., Notes, 9.000% due 8/15/16 (a) | | | 610,200 | |

| | 475,000 | | | B+ | | H&E Equipment Services Inc., Senior Notes, 8.375% due 7/15/16 | | | 517,750 | |

| | 1,145,000 | | | CCC+ | | Penhall International Corp., Senior Secured Notes,

12.000% due 8/1/14 (a) | | | 1,259,500 | |

| | 205,000 | | | B- | | TransDigm Inc., Senior Subordinated Notes, 7.750% due 7/15/14 (a) | | | 213,713 | |

| | | |

| | | | | | Total Trading Companies & Distributors | | | 2,601,163 | |

| | | |

| | Wireless Telecommunication Services — 1.1% | | | | |

| | | | | | Rural Cellular Corp.: | | | | |

| | 455,000 | | | CCC | | Senior Notes, 9.875% due 2/1/10 | | | 483,437 | |

| | 535,000 | | | B | | Senior Secured Notes, 8.250% due 3/15/12 | | | 567,100 | |

| | 1,810,000 | | | B | | True Move Co., Ltd., 10.750% due 12/16/13 (a) | | | 1,909,550 | |

| | | |

| | | | | | Total Wireless Telecommunication Services | | | 2,960,087 | |

| | | |

| | | | | | TOTAL CORPORATE BONDS & NOTES (Cost — $237,898,541) | | | 248,250,435 | |

| | | |

| | ASSET-BACKED SECURITIES — 0.2% | | | | |

| | Diversified Financial Services — 0.0% | | | | |

| | 1,402,534 | | | D | | Airplanes Pass-Through Trust, Subordinated Notes, Series D,

10.875% due 3/15/19 (d)(e)(f) | | | 0 | |

| | | |

| | Electric — 0.2% | | | | |

| | 370,232 | | | BB | | Mirant Mid-Atlantic LLC, Series C, 10.060% due 12/30/28 | | | 462,096 | |

| | | |

| | | | | | TOTAL ASSET-BACKED SECURITIES

(Cost — $2,023,905) | | | 462,096 | |

| | | |

| | CONVERTIBLE NOTE — 0.1% | | | | |

| | Automobiles — 0.1% | | | | |

| | 290,000 | | | CCC+ | | Ford Motor Co., Senior Notes, 4.250% due 12/15/36

(Cost — $290,000) | | | 327,700 | |

| | | |

| | LOAN PARTICIPATIONS — 2.5% | | | | |

| | United States — 2.5% | | | | |

| | 750,000 | | | | | Iap Worldwide Service second Lien, Term Loan,

15.188% due 6/30/12 (c) | | | 749,531 | |

| | 500,000 | | | | | Penhall International Corp., Term Loan, 12.824% due 4/1/12 (c) | | | 492,500 | |

| | 2,000,000 | | | | | SandRidge Energy, Term Loan, 8.975% due 4/1/15 (c) | | | 2,065,000 | |

| | 3,000,000 | | | | | UPC Broadband Holding B.V. Term Loan, 7.640% due 3/15/13 (Toronto Dominion) (c) | | | 3,006,427 | |

See Notes to Financial Statements.

16 Legg Mason Partners Variable High Income Portfolio 2007 Semi-Annual Report

Schedule of Investments (April 30, 2007) (unaudited) (continued)

| | | | | | | | | | |

| | | |

Face

Amount | | | Rating‡ | | Security | | Value | |

| | | | | | | | | | |

| | United States — 2.5% (continued) | | | | |

| $ | 500,000 | | | | | Verso Paper Holdings Term Loan, 11.570% due 2/1/12 (c) | | $ | 502,188 | |

| | | |

| | | | | | TOTAL LOAN PARTICIPATIONS

(Cost — $6,694,467) | | | 6,815,646 | |

| | | |

| | SOVEREIGN BONDS — 1.5% | | | | |

| | Brazil — 0.5% | | | | |

| | | | | | Federative Republic of Brazil: | | | | |

| | 760,000 | | | BB | | 11.000% due 8/17/40 | | | 1,031,890 | |

| | 260,000 | | | BB | | Collective Action Securities, Notes, 8.000% due 1/15/18 | | | 295,295 | |

| | | |

| | | | | | Total Brazil | | | 1,327,185 | |

| | | |

| | Russia — 1.0% | | | | |

| | 2,348,200 | | | BBB+ | | Russian Federation, 7.500% due 3/31/30 (a) | | | 2,669,604 | |

| | | |

| | | | | | TOTAL SOVEREIGN BONDS

(Cost — $3,831,877) | | | 3,996,789 | |

| | | |

| | | |

| Shares | | | | | | | | |

| | COMMON STOCKS — 0.0% | | | | |

| | CONSUMER DISCRETIONARY — 0.0% | | | | |

| | Household Durables — 0.0% | | | | |

| | 2,453,154 | | | | | Home Interiors & Gifts Inc. (e)(f)* | | | 24,532 | |

| | | |

| | CONSUMER STAPLES — 0.0% | | | | |

| | Food Products — 0.0% | | | | |

| | 23,465 | | | | | Aurora Foods Inc. (e)(f)* | | | 0 | |

| | | |

| | TELECOMMUNICATION SERVICES — 0.0% | | | | |

| | Diversified Telecommunication Services — 0.0% | | | | |

| | 870 | | | | | McLeodUSA Inc., Class A Shares (e)(f)* | | | 0 | |

| | | |

| | Wireless Telecommunication Services — 0.0% | | | | |

| | 1 | | | | | Crown Castle International Corp. * | | | 34 | |

| | | |

| | | | | | TOTAL TELECOMMUNICATION SERVICES | | | 34 | |

| | | |

| | | | | | TOTAL COMMON STOCKS (Cost — $1,098,307) | | | 24,566 | |

| | | |

| | CONVERTIBLE PREFERRED STOCKS — 0.2% | | | | |

| | ENERGY — 0.2% | | | | |

| | Oil, Gas & Consumable Fuels — 0.2% | | | | |

| | 1,616 | | | | | Chesapeake Energy Corp., Convertible, 6.250%

(Cost — $406,004) | | | 456,318 | |

| | | |

| | PREFERRED STOCKS — 0.3% | | | | |

| | CONSUMER DISCRETIONARY — 0.3% | | | | |

| | Media — 0.3% | | | | |

| | 101 | | | | | ION Media Networks Inc., 0.000% (b)

(Cost — $745,100) | | | 781,803 | |

| | | |

See Notes to Financial Statements.

Legg Mason Partners Variable High Income Portfolio 2007 Semi-Annual Report 17

Schedule of Investments (April 30, 2007) (unaudited) (continued)

| | | | | | | |

| | |

| Warrants | | Security | | Value | |

| | | | | | | |

| | WARRANTS — 0.0% | | | | |

| | 430 | | Cybernet Internet Services International Inc., Expires 7/1/09 (a)(e)(f)* | | $ | 0 | |

| | 695 | | GT Group Telecom Inc., Class B Shares, Expires 2/1/10 (a)(e)(f)* | | | 0 | |

| | 375 | | IWO Holdings Inc., Expires 1/15/11 (a)(e)(f)* | | | 0 | |

| | 165 | | Jazztel PLC, Expires 5/1/09 (a)(e)(f)* | | | 0 | |

| | 435 | | Merrill Corp., Class B Shares, Expires 11/15/06 (a)(e)(f)* | | | 0 | |

| | | |

| | | TOTAL WARRANTS (Cost — $182,251) | | | 0 | |

| | | |

| | | TOTAL INVESTMENTS BEFORE SHORT-TERM INVESTMENTS (Cost — $253,170,452) | | | 261,115,353 | |

| | | |

| | |

Face

Amount | | | | | |

| | SHORT-TERM INVESTMENT — 0.2% | | | | |

| | Repurchase Agreement — 0.2% | | | | |

| $ | 558,000 | | Nomura Securities International Inc. repurchase agreement dated 4/30/07, 5.170% due 5/1/07; Proceeds at maturity — $558,080; (Fully collateralized by U.S. government agency obligation, 0.000% to 4.650% due 8/1/07 to 5/15/17; Market value — $569,611) (Cost — $558,000) (g) | | | 558,000 | |

| | | |

| | | TOTAL INVESTMENTS — 97.7% (Cost — $253,728,452#) | | | 261,673,353 | |

| | | Other Assets in Excess of Liabilities — 2.3% | | | 6,169,681 | |

| | | |

| | | TOTAL NET ASSETS — 100.0% | | $ | 267,843,034 | |

| | | |

| * | | Non-income producing security. |

| ‡ | | All ratings are by Standard & Poor’s Ratings Service, unless otherwise noted. |

(a) | | Security is exempt from registration under Rule 144A of the Securities Act of 1933. This security may be resold in transactions that are exempt from registration, normally to qualified institutional buyers. This security has been deemed liquid pursuant to guidelines approved by the Board of Trustees, unless otherwise noted. |

(b) | | Payment-in-kind security for which part of the income earned may be paid as additional principal. |

(c) | | Variable rate security. Interest rate disclosed is that which is in effect at April 30, 2007. |

(d) | | Security is currently in default. |

(e) | | Security is valued in good faith at fair value by or under the direction of the Board of Trustees (See Note 1). |

(g) | | All or a portion of this security is segregated for extended settlements. |

(h) | | Rating by Fitch Ratings Service. |

| # | | Aggregate cost for federal income tax purposes is substantially the same. |

See page 19 for definitions of ratings.

See Notes to Financial Statements.

18 Legg Mason Partners Variable High Income Portfolio 2007 Semi-Annual Report

Bond Ratings (unaudited)

The definitions of the applicable rating symbols are set forth below:

Standard & Poor’s Ratings Service (“Standard and Poor’s”) — Ratings from “AA” to “CCC” may be modified by the addition of a plus (+) or minus (–) sign to show relative standings within the major rating categories.

AAA | — Bonds rated “AAA” have the highest rating assigned by Standard & Poor’s. Capacity to pay interest and repay principal is extremely strong. |

AA | — Bonds rated “AA” have a very strong capacity to pay interest and repay principal and differs from the highest rated issue only in a small degree. |

A | — Bonds rated “A” have a strong capacity to pay interest and repay principal although it is somewhat more susceptible to the adverse effects of changes in circumstances and economic conditions than bonds in higher rated categories. |

BBB | — Bonds rated “BBB” are regarded as having an adequate capacity to pay interest and repay principal. Whereas they normally exhibit adequate protection parameters, adverse economic conditions or changing circumstances are more likely to lead to a weakened capacity to pay interest and repay principal for bonds in this category than in higher rated categories. |

BB, B, CCC, CC and C | — Bonds rated “BB”, “B”, “CCC”, “CC” and “C” are regarded, on balance, as predominantly speculative with respect to capacity to pay interest and repay principal in accordance with the terms of the obligation. “BB” represents the lowest degree of speculation and “C” the highest degree of speculation. While such bonds will likely have some quality and protective characteristics, these are outweighed by large uncertainties or major risk exposures to adverse conditions. |

D | — Bonds rated “D” are in default, and payment of interest and/or repayment of principal is in arrears. |

Fitch Ratings Service (“Fitch’’) — Ratings from “AA” to “CCC” may be modified by the additional of a plus (+) or a minus (-) sign to show relative standings with the major ratings categories.

AA | — Bonds rated “AA” are considered to be investment-grade and of very high credit quality. The obligator’s ability to pay interest and/or dividends and repay principal is very strong. |

A | — Bonds rated “A” are considered to have a low expectation of credit risk. The capacity for timely payment of financial commitments is considered to be strong, but may be more vulnerable to changes in economic conditions and circumstances than bonds with higher ratings. |

BBB | — Bonds rated “BBB” currently have a low expectation of credit risk. The capacity for timely payment of financial commitments is considered to be adequate. Adverse changes in economic conditions and circumstances, however, are more likely to impair this capacity. This is the lowest investment grade category assigned by Fitch. |

BB | — Bonds rated “BB” indicate that there is a possibility of credit risk developing, particularly as the result of adverse economic change over time; however, business of financial alternatives may be available to allow financial commitments to be met. |

B | — Bonds rated “B” indicate that significant credit risk is present, but a limited margin of safety remains. Financial Commitments are currently being met; however, capacity for continued payment is contingent upon a sustained, favorable business and economic environment. |

CCC, CC and C | — Bonds rated “CCC”, “CC” and “C” carry the real possibility of defaulting. The capacity to meet financial commitments depends solely on a sustained, favorable business and economic environment. Default of some kind on bonds rated “CC” appears probable, a “C” rating indicates imminent default. |

NR | — Indicates that the bond is not rated by Standard & Poor’s, Moody’s or Fitch. |

Legg Mason Partners Variable High Income Portfolio 2007 Semi-Annual Report 19

Statement of Assets and Liabilities (April 30, 2007) (unaudited)

| | | | |

| ASSETS: | | | | |

Investments, at value (Cost — $253,728,452) | | $ | 261,673,353 | |

Cash | | | 309 | |

Interest receivable | | | 5,729,456 | |

Receivable for securities sold | | | 3,684,564 | |

Prepaid expenses | | | 63,159 | |

| | |

Total Assets | | | 271,150,841 | |

| | |

| LIABILITIES: | | | | |

Payable for securities purchased | | | 2,989,502 | |

Investment management fee payable | | | 131,957 | |

Payable for Fund shares repurchased | | | 117,815 | |

Directors’/Trustees’ fees payable | | | 2,191 | |

Accrued expenses | | | 66,342 | |

| | |

Total Liabilities | | | 3,307,807 | |

| | |

Total Net Assets | | $ | 267,843,034 | |

| | |

| NET ASSETS: | | | | |

Par value (Note 4) | | $ | 353 | |

Paid-in capital in excess of par value | | | 345,557,603 | |

Undistributed net investment income | | | 5,856,792 | |

Accumulated net realized loss on investments | | | (91,516,615 | ) |

Net unrealized appreciation on investments | | | 7,944,901 | |

| | |

Total Net Assets | | $ | 267,843,034 | |

| | |

Shares Outstanding | | | 35,268,089 | |

| | |

Net Asset Value | | | $7.59 | |

| | |

See Notes to Financial Statements.

20 Legg Mason Partners Variable High Income Portfolio 2007 Semi-Annual Report

Statement of Operations (For the six months ended April 30, 2007) (unaudited)

| | | | |

| INVESTMENT INCOME: | | | | |

Interest | | $ | 11,017,134 | |

Dividends | | | 18,309 | |

| | |

Total Investment Income | | | 11,035,443 | |

| | |

| EXPENSES: | | | | |

Investment management fee (Note 2) | | | 811,517 | |

Directors’/Trustees’ fees (Note 9) | | | 31,674 | |

Shareholder reports | | | 26,728 | |

Restructuring fees (Note 9) | | | 18,691 | |

Audit and tax | | | 14,166 | |

Legal fees | | | 9,649 | |

Insurance | | | 3,461 | |

Custody fees | | | 1,714 | |

Transfer agent fees | | | 51 | |

Miscellaneous expenses | | | 2,409 | |

| | |

Total Expenses | | | 920,060 | |

Less: Fee waivers and/or expense reimbursements (Notes 2 and 9) | | | (9,078 | ) |

| | |

Net Expenses | | | 910,982 | |

| | |

Net Investment Income | | | 10,124,461 | |

| | |

| REALIZED AND UNREALIZED GAIN ON INVESTMENTS (NOTES 1 AND 3): | | | | |

Net Realized Gain From Investment Transactions | | | 3,111,361 | |

Change in Net Unrealized Appreciation/Depreciation From Investments | | | 6,038,905 | |

| | |

Net Gain on Investments | | | 9,150,266 | |

| | |

Increase in Net Assets From Operations | | $ | 19,274,727 | |

| | |

See Notes to Financial Statements.

Legg Mason Partners Variable High Income Portfolio 2007 Semi-Annual Report 21

Statements of Changes in Net Assets

| | | | | | | | |

For the six months ended April 30, 2007 (unaudited)

and the year ended October 31, 2006 | | | | | | | | |

| | |

| | | 2007 | | | 2006 | |

| OPERATIONS: | | | | | | | | |

Net investment income | | $ | 10,124,461 | | | $ | 21,211,557 | |

Net realized gain | | | 3,111,361 | | | | 4,068,704 | |

Change in net unrealized appreciation/depreciation | | | 6,038,905 | | | | (484,547 | ) |

| | |

Increase in Net Assets From Operations | | | 19,274,727 | | | | 24,795,714 | |

| | |

| DISTRIBUTIONS TO SHAREHOLDERS FROM (NOTE 1): | | | | | | | | |

Net investment income | | | (21,000,030 | ) | | | (23,000,001 | ) |

| | |

Decrease in Net Assets From Distributions to Shareholders | | | (21,000,030 | ) | | | (23,000,001 | ) |

| | |

| FUND SHARE TRANSACTIONS (NOTE 4): | | | | | | | | |