UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-06312

The Lazard Funds, Inc.

(Exact name of registrant as specified in charter)

30 Rockefeller Plaza

New York, New York 10112

(Address of principal executive offices) (Zip code)

Mark R. Anderson, Esq.

Lazard Asset Management LLC

30 Rockefeller Plaza

New York, New York 10112

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212) 632-6000

Date of fiscal year end: 12/31

Date of reporting period: 6/30/24

ITEM 1. REPORTS TO STOCKHOLDERS.

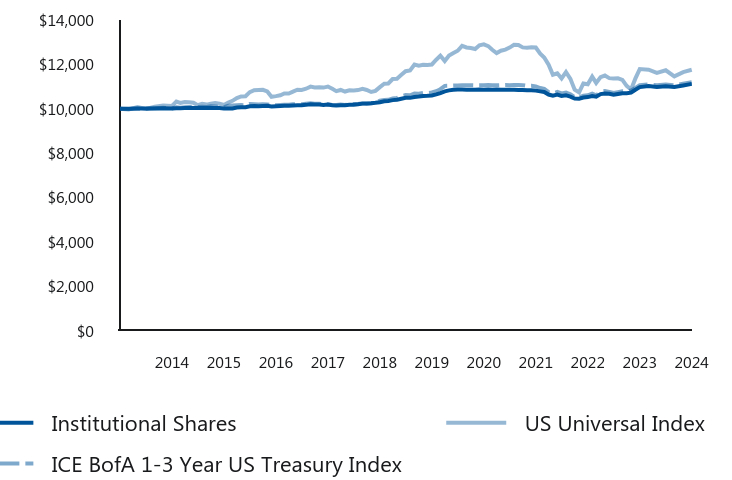

Lazard Enhanced Opportunities Portfolio

LEOIX: Institutional Shares

Semi-Annual Shareholder Report - June 30, 2024

This semi-annual shareholder report contains important information about the Lazard Enhanced Opportunities Portfolio for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Portfolio at www.lazardassetmanagement.com/us/en_us/funds/list/mutual-funds/42#TSR. You can also request this information by contacting us at Contact.US@Lazard.com or (800) 823-6300.

What were the Portfolio costs for the last six months?

(based on a $10,000 investment and annualized for periods of less than one year)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional Shares | $201 | 3.93% |

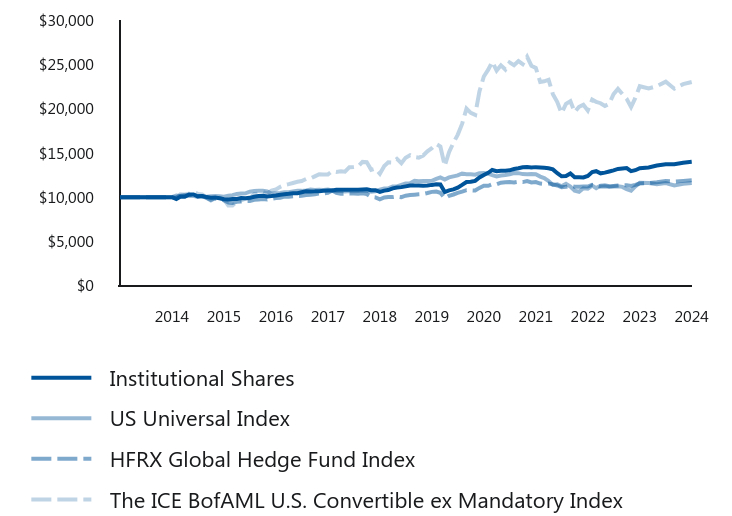

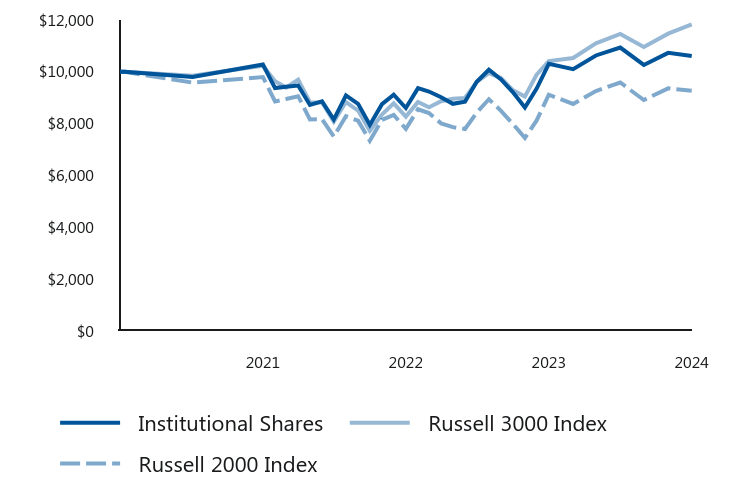

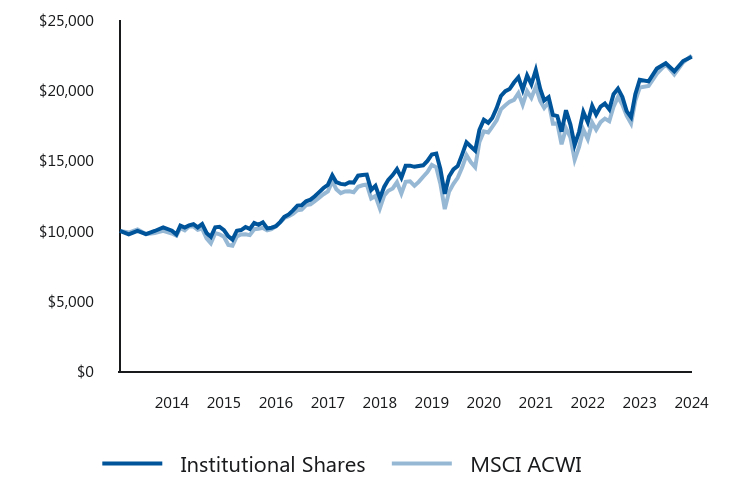

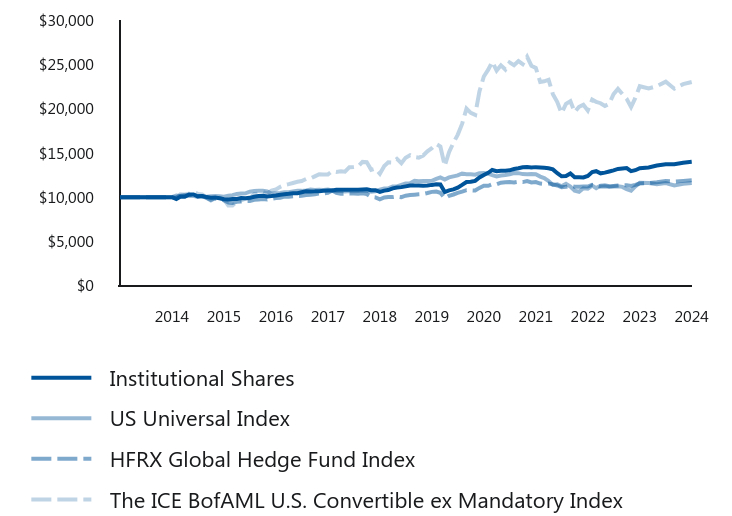

Total Return Based on $10,000 Investment

| Institutional Shares | US Universal Index | HFRX Global Hedge Fund Index | The ICE BofAML U.S. Convertible ex Mandatory Index |

|---|

| 2014 | $10,000 | $10,000 | $10,000 | $10,000 |

| 2014 | $10,000 | $10,000 | $10,000 | $10,000 |

| 2015 | $9,800 | $10,190 | $9,971 | $9,892 |

| 2015 | $10,040 | $10,131 | $10,172 | $10,319 |

| 2015 | $10,040 | $10,173 | $10,206 | $10,297 |

| 2015 | $10,300 | $10,161 | $10,227 | $10,380 |

| 2015 | $10,310 | $10,143 | $10,254 | $10,610 |

| 2015 | $10,090 | $10,030 | $10,127 | $10,372 |

| 2015 | $10,130 | $10,088 | $10,124 | $10,299 |

| 2015 | $10,010 | $10,059 | $9,900 | $9,929 |

| 2015 | $9,930 | $10,098 | $9,695 | $9,625 |

| 2015 | $9,970 | $10,130 | $9,837 | $9,979 |

| 2015 | $9,880 | $10,093 | $9,766 | $9,936 |

| 2015 | $9,768 | $10,043 | $9,652 | $9,725 |

| 2016 | $9,746 | $10,154 | $9,385 | $9,062 |

| 2016 | $9,790 | $10,226 | $9,355 | $9,064 |

| 2016 | $9,801 | $10,351 | $9,471 | $9,476 |

| 2016 | $9,910 | $10,422 | $9,510 | $9,630 |

| 2016 | $9,877 | $10,430 | $9,554 | $9,826 |

| 2016 | $9,921 | $10,614 | $9,573 | $9,858 |

| 2016 | $10,042 | $10,701 | $9,712 | $10,332 |

| 2016 | $10,130 | $10,713 | $9,727 | $10,423 |

| 2016 | $10,152 | $10,715 | $9,781 | $10,588 |

| 2016 | $10,086 | $10,644 | $9,725 | $10,429 |

| 2016 | $10,119 | $10,405 | $9,810 | $10,727 |

| 2016 | $10,185 | $10,436 | $9,895 | $10,865 |

| 2017 | $10,274 | $10,472 | $9,944 | $11,171 |

| 2017 | $10,319 | $10,553 | $10,056 | $11,377 |

| 2017 | $10,374 | $10,550 | $10,059 | $11,475 |

| 2017 | $10,441 | $10,637 | $10,102 | $11,603 |

| 2017 | $10,452 | $10,719 | $10,126 | $11,732 |

| 2017 | $10,553 | $10,710 | $10,148 | $11,817 |

| 2017 | $10,664 | $10,764 | $10,242 | $12,051 |

| 2017 | $10,646 | $10,856 | $10,272 | $12,109 |

| 2017 | $10,657 | $10,818 | $10,334 | $12,344 |

| 2017 | $10,680 | $10,831 | $10,405 | $12,583 |

| 2017 | $10,714 | $10,815 | $10,412 | $12,569 |

| 2017 | $10,750 | $10,863 | $10,488 | $12,570 |

| 2018 | $10,762 | $10,758 | $10,744 | $12,940 |

| 2018 | $10,825 | $10,656 | $10,484 | $12,855 |

| 2018 | $10,837 | $10,710 | $10,381 | $12,923 |

| 2018 | $10,837 | $10,638 | $10,391 | $12,877 |

| 2018 | $10,837 | $10,696 | $10,418 | $13,384 |

| 2018 | $10,837 | $10,681 | $10,399 | $13,400 |

| 2018 | $10,837 | $10,703 | $10,383 | $13,464 |

| 2018 | $10,866 | $10,756 | $10,430 | $13,976 |

| 2018 | $10,891 | $10,710 | $10,358 | $13,938 |

| 2018 | $10,779 | $10,620 | $10,036 | $13,092 |

| 2018 | $10,791 | $10,668 | $9,974 | $13,237 |

| 2018 | $10,596 | $10,835 | $9,751 | $12,651 |

| 2019 | $10,737 | $10,984 | $9,959 | $13,525 |

| 2019 | $10,800 | $10,996 | $10,022 | $13,946 |

| 2019 | $10,992 | $11,195 | $10,005 | $13,913 |

| 2019 | $11,081 | $11,210 | $10,070 | $14,315 |

| 2019 | $11,132 | $11,382 | $10,001 | $13,825 |

| 2019 | $11,221 | $11,543 | $10,162 | $14,459 |

| 2019 | $11,310 | $11,578 | $10,241 | $14,742 |

| 2019 | $11,308 | $11,840 | $10,280 | $14,524 |

| 2019 | $11,320 | $11,788 | $10,326 | $14,456 |

| 2019 | $11,282 | $11,826 | $10,358 | $14,701 |

| 2019 | $11,308 | $11,824 | $10,465 | $15,182 |

| 2019 | $11,385 | $11,842 | $10,597 | $15,534 |

| 2020 | $11,449 | $12,054 | $10,641 | $16,003 |

| 2020 | $11,436 | $12,235 | $10,488 | $15,720 |

| 2020 | $10,574 | $11,996 | $9,871 | $13,527 |

| 2020 | $10,767 | $12,236 | $10,155 | $15,071 |

| 2020 | $10,870 | $12,350 | $10,301 | $16,148 |

| 2020 | $11,076 | $12,453 | $10,482 | $17,035 |

| 2020 | $11,385 | $12,672 | $10,624 | $18,270 |

| 2020 | $11,711 | $12,599 | $10,787 | $20,004 |

| 2020 | $11,737 | $12,576 | $10,769 | $19,523 |

| 2020 | $11,841 | $12,531 | $10,745 | $19,289 |

| 2020 | $12,217 | $12,695 | $11,048 | $21,923 |

| 2020 | $12,509 | $12,739 | $11,298 | $23,624 |

| 2021 | $12,742 | $12,659 | $11,279 | $24,388 |

| 2021 | $13,072 | $12,495 | $11,450 | $25,286 |

| 2021 | $12,934 | $12,350 | $11,444 | $24,295 |

| 2021 | $12,975 | $12,454 | $11,630 | $24,884 |

| 2021 | $12,989 | $12,501 | $11,675 | $24,408 |

| 2021 | $13,030 | $12,592 | $11,719 | $25,212 |

| 2021 | $13,181 | $12,719 | $11,667 | $24,902 |

| 2021 | $13,257 | $12,710 | $11,747 | $25,363 |

| 2021 | $13,368 | $12,602 | $11,702 | $25,013 |

| 2021 | $13,396 | $12,591 | $11,807 | $25,848 |

| 2021 | $13,341 | $12,607 | $11,655 | $24,840 |

| 2021 | $13,390 | $12,598 | $11,710 | $24,597 |

| 2022 | $13,361 | $12,322 | $11,538 | $23,005 |

| 2022 | $13,318 | $12,154 | $11,496 | $23,074 |

| 2022 | $13,261 | $11,828 | $11,551 | $23,256 |

| 2022 | $13,132 | $11,387 | $11,447 | $21,631 |

| 2022 | $12,703 | $11,449 | $11,323 | $20,737 |

| 2022 | $12,360 | $11,221 | $11,119 | $19,479 |

| 2022 | $12,388 | $11,503 | $11,179 | $20,538 |

| 2022 | $12,676 | $11,204 | $11,285 | $20,828 |

| 2022 | $12,250 | $10,721 | $11,176 | $19,607 |

| 2022 | $12,235 | $10,603 | $11,185 | $20,198 |

| 2022 | $12,220 | $10,999 | $11,201 | $20,438 |

| 2022 | $12,400 | $10,961 | $11,195 | $19,780 |

| 2023 | $12,834 | $11,301 | $11,382 | $21,004 |

| 2023 | $12,930 | $11,024 | $11,328 | $20,762 |

| 2023 | $12,689 | $11,282 | $11,194 | $20,606 |

| 2023 | $12,770 | $11,351 | $11,232 | $20,287 |

| 2023 | $12,898 | $11,233 | $11,180 | $20,553 |

| 2023 | $13,027 | $11,216 | $11,265 | $21,632 |

| 2023 | $13,187 | $11,227 | $11,323 | $22,225 |

| 2023 | $13,235 | $11,160 | $11,361 | $21,649 |

| 2023 | $13,284 | $10,893 | $11,349 | $21,104 |

| 2023 | $12,930 | $10,730 | $11,256 | $20,181 |

| 2023 | $13,043 | $11,213 | $11,384 | $21,211 |

| 2023 | $13,271 | $11,638 | $11,542 | $22,526 |

| 2024 | $13,353 | $11,610 | $11,579 | $22,274 |

| 2024 | $13,565 | $11,471 | $11,685 | $22,533 |

| 2024 | $13,712 | $11,584 | $11,832 | $23,041 |

| 2024 | $13,728 | $11,313 | $11,768 | $22,243 |

| 2024 | $13,891 | $11,500 | $11,839 | $22,755 |

| 2024 | $13,989 | $11,606 | $11,909 | $23,004 |

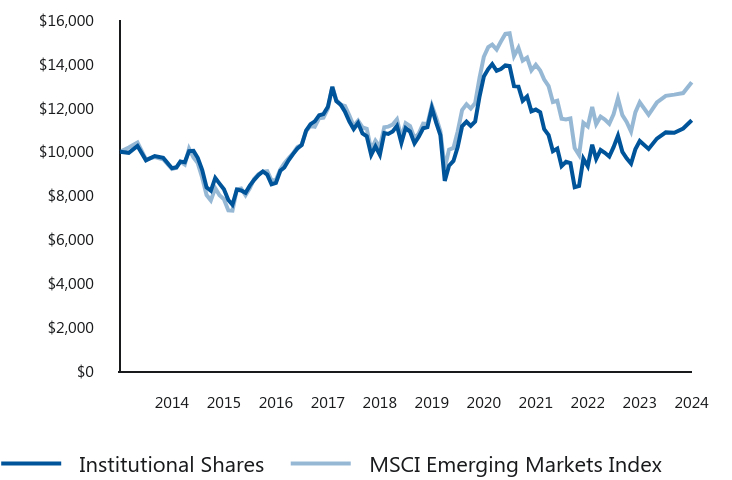

Average Annual Total Returns (%)

| 1 Year | 5 Years | Since Inception 12/31/14 |

|---|

| Institutional Shares | 7.39% | 4.51% | 3.60% |

| US Universal Index | 3.47% | 0.11% | 1.58% |

| HFRX Global Hedge Fund Index | 5.42% | 3.19% | 1.86% |

| The ICE BofAML U.S. Convertible ex Mandatory Index | 6.37% | 9.73% | 9.17% |

The performance quoted represents past performance. Past performance does not guarantee future results. The current performance may be lower or higher than the performance data quoted. The performance graph and table do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares. Effective as of May 1, 2024, the US Universal Index replaced the ICE BofA US Convertible ex Mandatory Index (USD Hedged) as the Portfolio’s broad-based securities market index. The US Universal Index was selected in connection with certain regulatory requirements to provide a broad measure of market performance.

| Total Net Assets | $39,477,092 |

| # of Portfolio Holdings | 164 |

| Portfolio Turnover Rate | 192% |

| Total Advisory Fees Paid (Net of Waivers/Reimbursements) | $100,291 |

Top 10 Holdings (% of Net Assets)

| U.S. Treasury Bills 0.000% due 10/22/24 | 15.2% |

| U.S. Treasury Bills 0.000% due 10/15/24 | 12.8% |

| U.S. Treasury Bills 0.000% due 09/24/24 | 5.7% |

| Eagle Bulk Shipping, Inc. 5.000% due 08/01/24 | 5.6% |

| U.S. Treasury Bills 0.000% due 10/01/24 | 5.2% |

| U.S. Treasury Bills 0.000% due 08/27/24 | 3.9% |

| Pegasystems, Inc. 0.750% due 03/01/25 | 3.5% |

| Guidewire Software, Inc. 1.250% due 03/15/25 | 3.3% |

| Natera, Inc. 2.250% due 05/01/27 | 3.3% |

| Transocean, Inc. 4.625% due 09/30/29 | 2.9% |

Top 10 Sectors (% of Net Assets)

| U.S. Treasury Securities | 45.2% |

| Information Technology | 33.7% |

| Health Care | 26.1% |

| Industrials | 14.5% |

| Consumer Discretionary | 14.3% |

| Financials | 12.1% |

| Communication Services | 11.4% |

| Cash, Cash Equivalents and Repurchase Agreements | 7.6% |

| Energy | 4.7% |

| Materials | 3.7% |

If you wish to view additional information about the Portfolio including, but not limited to, the

prospectus, financial statements, holdings and proxy voting information please visit: https://www.lazardassetmanagement.com/us/en_us/funds/list/mutual-funds/42#documents.

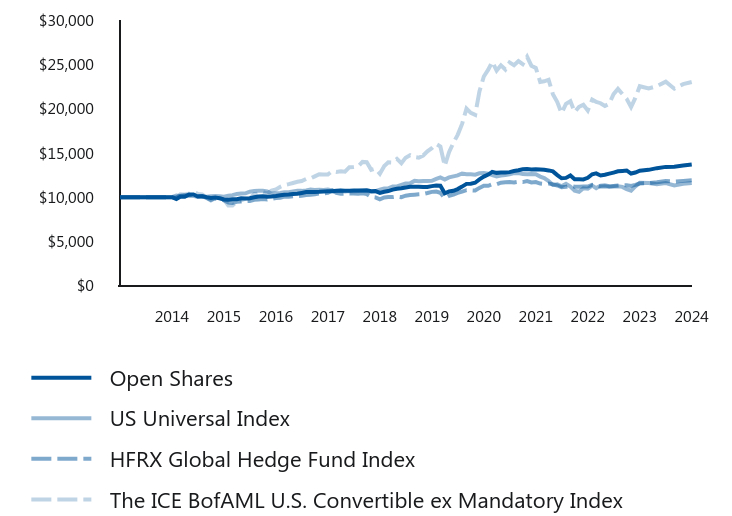

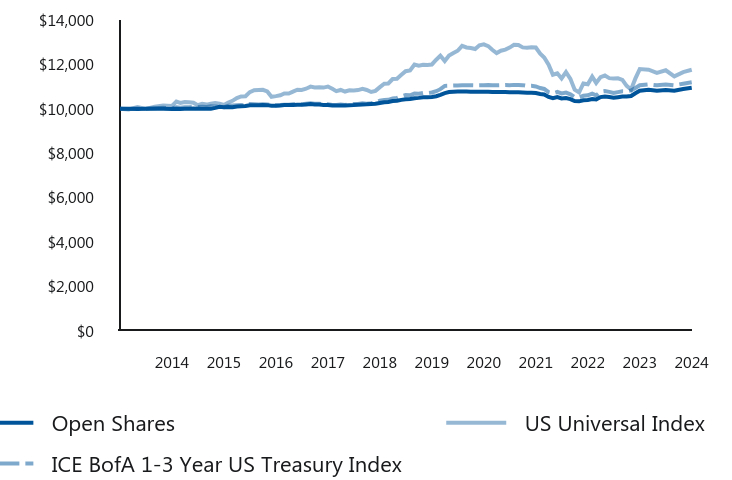

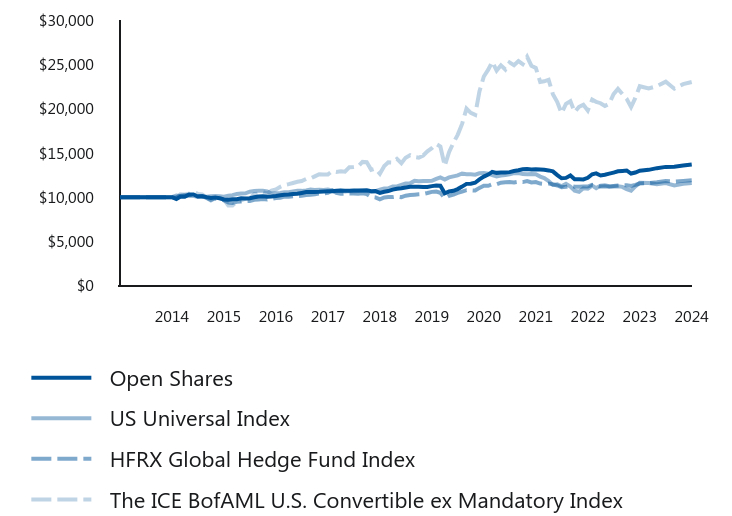

Lazard Enhanced Opportunities Portfolio

Semi-Annual Shareholder Report - June 30, 2024

This semi-annual shareholder report contains important information about the Lazard Enhanced Opportunities Portfolio for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Portfolio at www.lazardassetmanagement.com/us/en_us/funds/list/mutual-funds/42#TSR. You can also request this information by contacting us at Contact.US@Lazard.com or (800) 823-6300.

What were the Portfolio costs for the last six months?

(based on a $10,000 investment and annualized for periods of less than one year)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Open Shares | $214 | 4.19% |

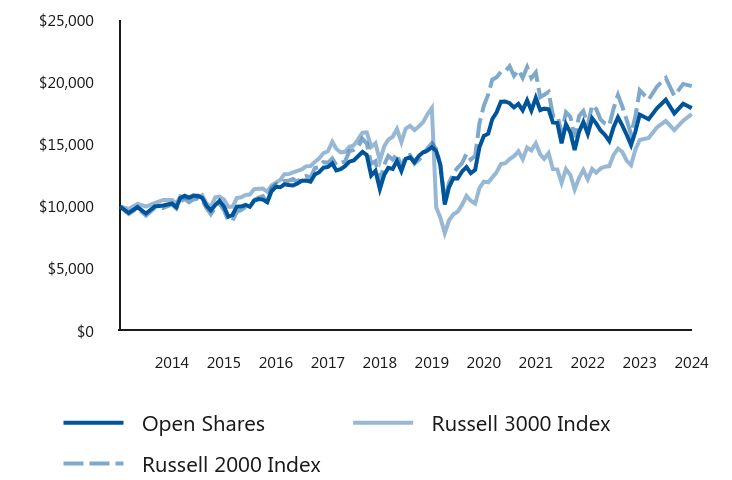

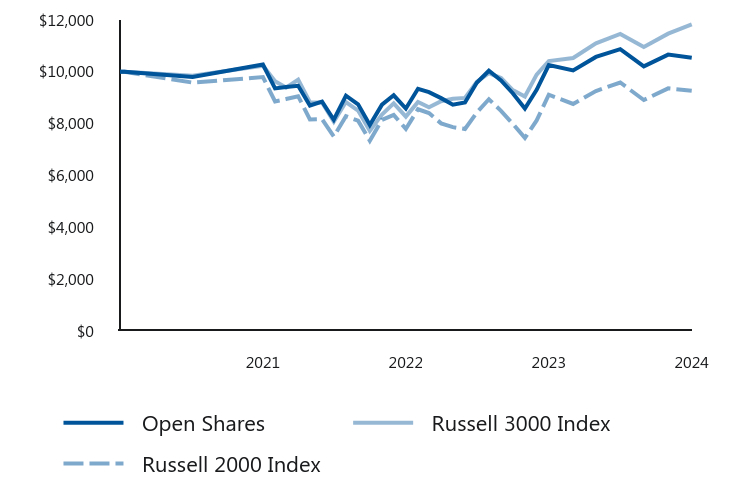

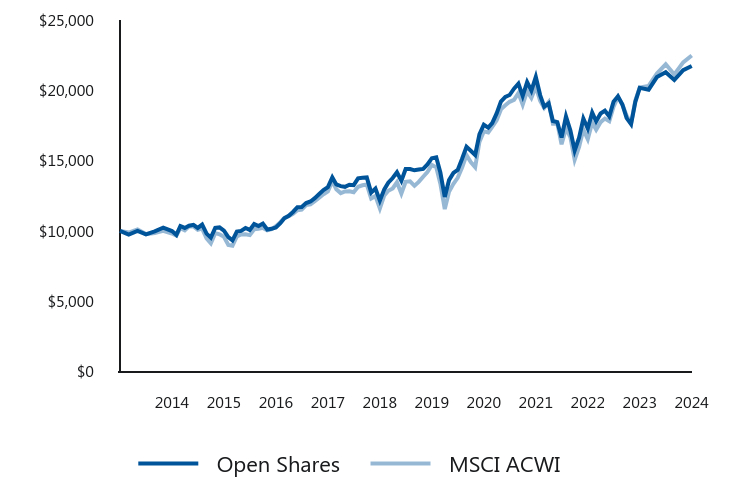

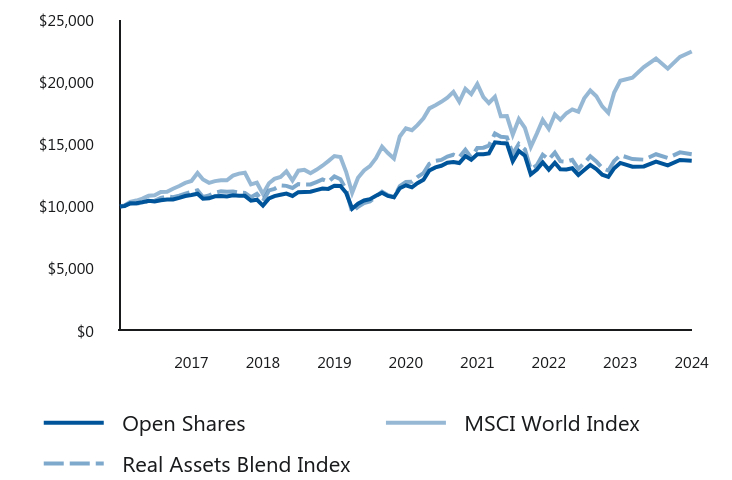

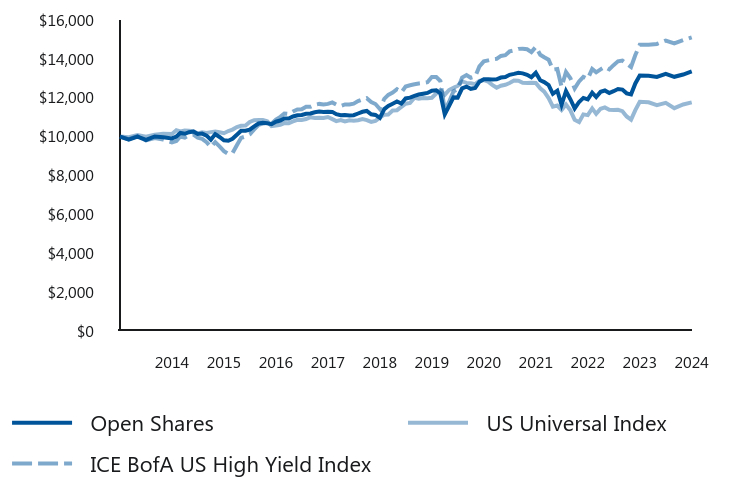

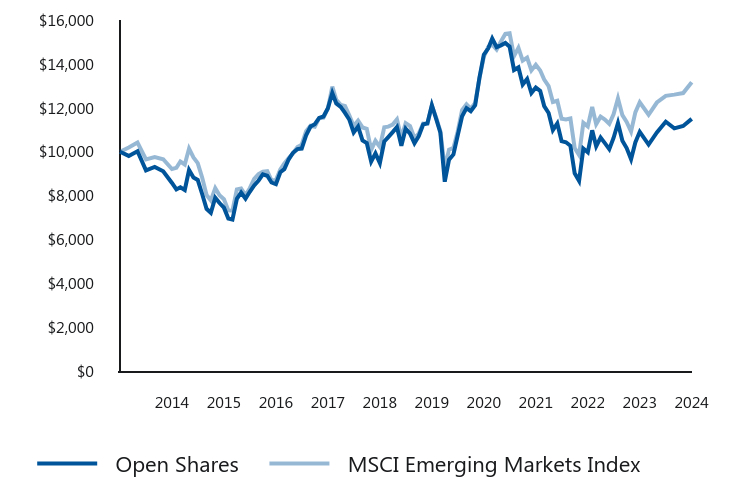

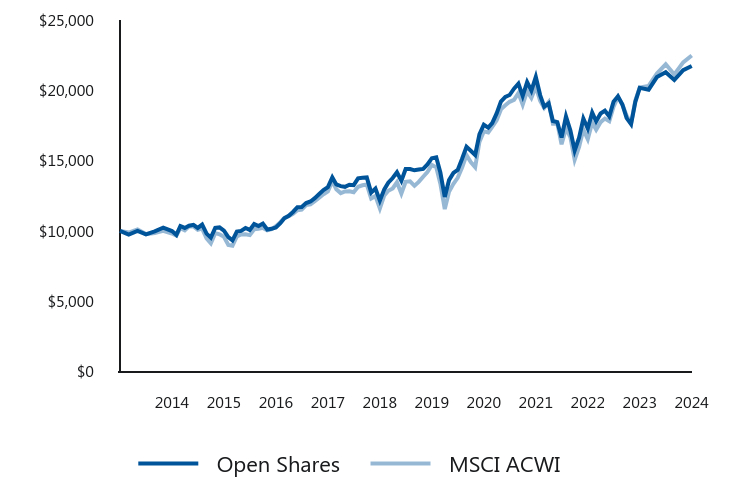

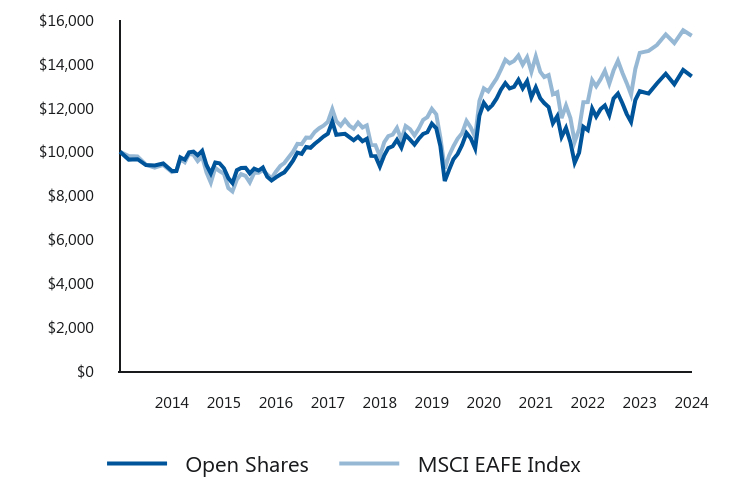

Total Return Based on $10,000 Investment

| Open Shares | US Universal Index | HFRX Global Hedge Fund Index | The ICE BofAML U.S. Convertible ex Mandatory Index |

|---|

| 2014 | $10,000 | $10,000 | $10,000 | $10,000 |

| 2014 | $10,000 | $10,000 | $10,000 | $10,000 |

| 2015 | $9,800 | $10,190 | $9,971 | $9,892 |

| 2015 | $10,040 | $10,131 | $10,172 | $10,319 |

| 2015 | $10,040 | $10,173 | $10,206 | $10,297 |

| 2015 | $10,290 | $10,161 | $10,227 | $10,380 |

| 2015 | $10,300 | $10,143 | $10,254 | $10,610 |

| 2015 | $10,080 | $10,030 | $10,127 | $10,372 |

| 2015 | $10,110 | $10,088 | $10,124 | $10,299 |

| 2015 | $10,000 | $10,059 | $9,900 | $9,929 |

| 2015 | $9,910 | $10,098 | $9,695 | $9,625 |

| 2015 | $9,950 | $10,130 | $9,837 | $9,979 |

| 2015 | $9,870 | $10,093 | $9,766 | $9,936 |

| 2015 | $9,743 | $10,043 | $9,652 | $9,725 |

| 2016 | $9,710 | $10,154 | $9,385 | $9,062 |

| 2016 | $9,754 | $10,226 | $9,355 | $9,064 |

| 2016 | $9,764 | $10,351 | $9,471 | $9,476 |

| 2016 | $9,874 | $10,422 | $9,510 | $9,630 |

| 2016 | $9,841 | $10,430 | $9,554 | $9,826 |

| 2016 | $9,885 | $10,614 | $9,573 | $9,858 |

| 2016 | $9,995 | $10,701 | $9,712 | $10,332 |

| 2016 | $10,082 | $10,713 | $9,727 | $10,423 |

| 2016 | $10,104 | $10,715 | $9,781 | $10,588 |

| 2016 | $10,038 | $10,644 | $9,725 | $10,429 |

| 2016 | $10,071 | $10,405 | $9,810 | $10,727 |

| 2016 | $10,134 | $10,436 | $9,895 | $10,865 |

| 2017 | $10,223 | $10,472 | $9,944 | $11,171 |

| 2017 | $10,267 | $10,553 | $10,056 | $11,377 |

| 2017 | $10,312 | $10,550 | $10,059 | $11,475 |

| 2017 | $10,367 | $10,637 | $10,102 | $11,603 |

| 2017 | $10,378 | $10,719 | $10,126 | $11,732 |

| 2017 | $10,478 | $10,710 | $10,148 | $11,817 |

| 2017 | $10,589 | $10,764 | $10,242 | $12,051 |

| 2017 | $10,570 | $10,856 | $10,272 | $12,109 |

| 2017 | $10,582 | $10,818 | $10,334 | $12,344 |

| 2017 | $10,604 | $10,831 | $10,405 | $12,583 |

| 2017 | $10,638 | $10,815 | $10,412 | $12,569 |

| 2017 | $10,669 | $10,863 | $10,488 | $12,570 |

| 2018 | $10,669 | $10,758 | $10,744 | $12,940 |

| 2018 | $10,730 | $10,656 | $10,484 | $12,855 |

| 2018 | $10,743 | $10,710 | $10,381 | $12,923 |

| 2018 | $10,730 | $10,638 | $10,391 | $12,877 |

| 2018 | $10,730 | $10,696 | $10,418 | $13,384 |

| 2018 | $10,743 | $10,681 | $10,399 | $13,400 |

| 2018 | $10,743 | $10,703 | $10,383 | $13,464 |

| 2018 | $10,759 | $10,756 | $10,430 | $13,976 |

| 2018 | $10,784 | $10,710 | $10,358 | $13,938 |

| 2018 | $10,672 | $10,620 | $10,036 | $13,092 |

| 2018 | $10,685 | $10,668 | $9,974 | $13,237 |

| 2018 | $10,489 | $10,835 | $9,751 | $12,651 |

| 2019 | $10,616 | $10,984 | $9,959 | $13,525 |

| 2019 | $10,691 | $10,996 | $10,022 | $13,946 |

| 2019 | $10,855 | $11,195 | $10,005 | $13,913 |

| 2019 | $10,956 | $11,210 | $10,070 | $14,315 |

| 2019 | $11,007 | $11,382 | $10,001 | $13,825 |

| 2019 | $11,095 | $11,543 | $10,162 | $14,459 |

| 2019 | $11,171 | $11,578 | $10,241 | $14,742 |

| 2019 | $11,168 | $11,840 | $10,280 | $14,524 |

| 2019 | $11,168 | $11,788 | $10,326 | $14,456 |

| 2019 | $11,143 | $11,826 | $10,358 | $14,701 |

| 2019 | $11,155 | $11,824 | $10,465 | $15,182 |

| 2019 | $11,245 | $11,842 | $10,597 | $15,534 |

| 2020 | $11,308 | $12,054 | $10,641 | $16,003 |

| 2020 | $11,296 | $12,235 | $10,488 | $15,720 |

| 2020 | $10,441 | $11,996 | $9,871 | $13,527 |

| 2020 | $10,633 | $12,236 | $10,155 | $15,071 |

| 2020 | $10,722 | $12,350 | $10,301 | $16,148 |

| 2020 | $10,913 | $12,453 | $10,482 | $17,035 |

| 2020 | $11,194 | $12,672 | $10,624 | $18,270 |

| 2020 | $11,500 | $12,599 | $10,787 | $20,004 |

| 2020 | $11,526 | $12,576 | $10,769 | $19,523 |

| 2020 | $11,628 | $12,531 | $10,745 | $19,289 |

| 2020 | $12,000 | $12,695 | $11,048 | $21,923 |

| 2020 | $12,323 | $12,739 | $11,298 | $23,624 |

| 2021 | $12,553 | $12,659 | $11,279 | $24,388 |

| 2021 | $12,864 | $12,495 | $11,450 | $25,286 |

| 2021 | $12,743 | $12,350 | $11,444 | $24,295 |

| 2021 | $12,783 | $12,454 | $11,630 | $24,884 |

| 2021 | $12,783 | $12,501 | $11,675 | $24,408 |

| 2021 | $12,824 | $12,592 | $11,719 | $25,212 |

| 2021 | $12,959 | $12,719 | $11,667 | $24,902 |

| 2021 | $13,033 | $12,710 | $11,747 | $25,363 |

| 2021 | $13,143 | $12,602 | $11,702 | $25,013 |

| 2021 | $13,171 | $12,591 | $11,807 | $25,848 |

| 2021 | $13,129 | $12,607 | $11,655 | $24,840 |

| 2021 | $13,159 | $12,598 | $11,710 | $24,597 |

| 2022 | $13,131 | $12,322 | $11,538 | $23,005 |

| 2022 | $13,089 | $12,154 | $11,496 | $23,074 |

| 2022 | $13,019 | $11,828 | $11,551 | $23,256 |

| 2022 | $12,907 | $11,387 | $11,447 | $21,631 |

| 2022 | $12,485 | $11,449 | $11,323 | $20,737 |

| 2022 | $12,134 | $11,221 | $11,119 | $19,479 |

| 2022 | $12,176 | $11,503 | $11,179 | $20,538 |

| 2022 | $12,445 | $11,204 | $11,285 | $20,828 |

| 2022 | $12,027 | $10,721 | $11,176 | $19,607 |

| 2022 | $12,012 | $10,603 | $11,185 | $20,198 |

| 2022 | $11,997 | $10,999 | $11,201 | $20,438 |

| 2022 | $12,179 | $10,961 | $11,195 | $19,780 |

| 2023 | $12,588 | $11,301 | $11,382 | $21,004 |

| 2023 | $12,682 | $11,024 | $11,328 | $20,762 |

| 2023 | $12,447 | $11,282 | $11,194 | $20,606 |

| 2023 | $12,525 | $11,351 | $11,232 | $20,287 |

| 2023 | $12,651 | $11,233 | $11,180 | $20,553 |

| 2023 | $12,777 | $11,216 | $11,265 | $21,632 |

| 2023 | $12,918 | $11,227 | $11,323 | $22,225 |

| 2023 | $12,965 | $11,160 | $11,361 | $21,649 |

| 2023 | $13,012 | $10,893 | $11,349 | $21,104 |

| 2023 | $12,667 | $10,730 | $11,256 | $20,181 |

| 2023 | $12,777 | $11,213 | $11,384 | $21,211 |

| 2023 | $12,987 | $11,638 | $11,542 | $22,526 |

| 2024 | $13,083 | $11,610 | $11,579 | $22,274 |

| 2024 | $13,274 | $11,471 | $11,685 | $22,533 |

| 2024 | $13,417 | $11,584 | $11,832 | $23,041 |

| 2024 | $13,433 | $11,313 | $11,768 | $22,243 |

| 2024 | $13,577 | $11,500 | $11,839 | $22,755 |

| 2024 | $13,688 | $11,606 | $11,909 | $23,004 |

Average Annual Total Returns (%)

| 1 Year | 5 Years | Since Inception 12/31/14 |

|---|

| Open Shares | 7.14% | 4.29% | 3.36% |

| US Universal Index | 3.47% | 0.11% | 1.58% |

| HFRX Global Hedge Fund Index | 5.42% | 3.19% | 1.86% |

| The ICE BofAML U.S. Convertible ex Mandatory Index | 6.37% | 9.73% | 9.17% |

The performance quoted represents past performance. Past performance does not guarantee future results. The current performance may be lower or higher than the performance data quoted. The performance graph and table do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares. Effective as of May 1, 2024, the US Universal Index replaced the ICE BofA US Convertible ex Mandatory Index (USD Hedged) as the Portfolio’s broad-based securities market index. The US Universal Index was selected in connection with certain regulatory requirements to provide a broad measure of market performance.

| Total Net Assets | $39,477,092 |

| # of Portfolio Holdings | 164 |

| Portfolio Turnover Rate | 192% |

| Total Advisory Fees Paid (Net of Waivers/Reimbursements) | $100,291 |

Top 10 Holdings (% of Net Assets)

| U.S. Treasury Bills 0.000% due 10/22/24 | 15.2% |

| U.S. Treasury Bills 0.000% due 10/15/24 | 12.8% |

| U.S. Treasury Bills 0.000% due 09/24/24 | 5.7% |

| Eagle Bulk Shipping, Inc. 5.000% due 08/01/24 | 5.6% |

| U.S. Treasury Bills 0.000% due 10/01/24 | 5.2% |

| U.S. Treasury Bills 0.000% due 08/27/24 | 3.9% |

| Pegasystems, Inc. 0.750% due 03/01/25 | 3.5% |

| Guidewire Software, Inc. 1.250% due 03/15/25 | 3.3% |

| Natera, Inc. 2.250% due 05/01/27 | 3.3% |

| Transocean, Inc. 4.625% due 09/30/29 | 2.9% |

Top 10 Sectors (% of Net Assets)

| U.S. Treasury Securities | 45.2% |

| Information Technology | 33.7% |

| Health Care | 26.1% |

| Industrials | 14.5% |

| Consumer Discretionary | 14.3% |

| Financials | 12.1% |

| Communication Services | 11.4% |

| Cash, Cash Equivalents and Repurchase Agreements | 7.6% |

| Energy | 4.7% |

| Materials | 3.7% |

If you wish to view additional information about the Portfolio including, but not limited to, the

prospectus, financial statements, holdings and proxy voting information please visit: https://www.lazardassetmanagement.com/us/en_us/funds/list/mutual-funds/42#documents.

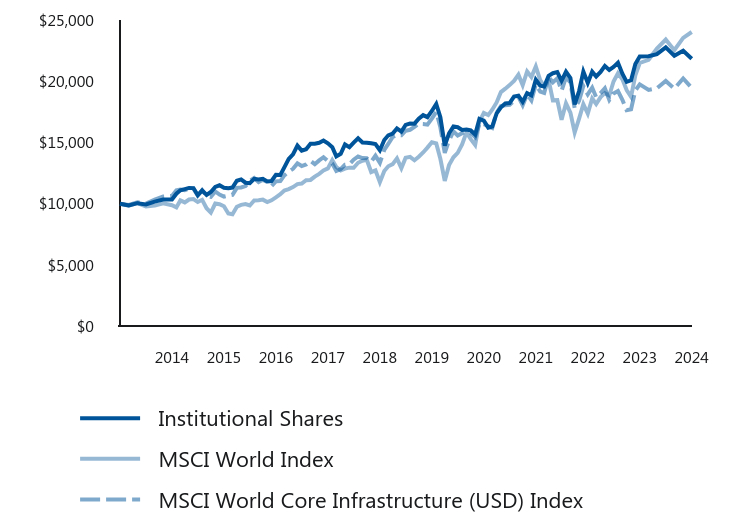

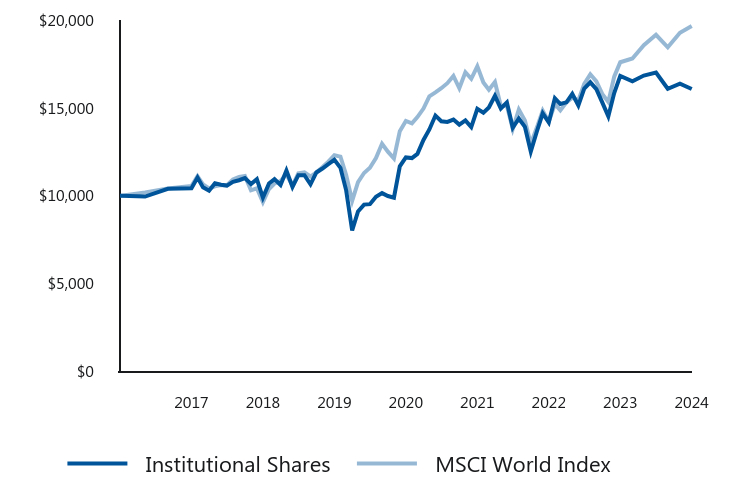

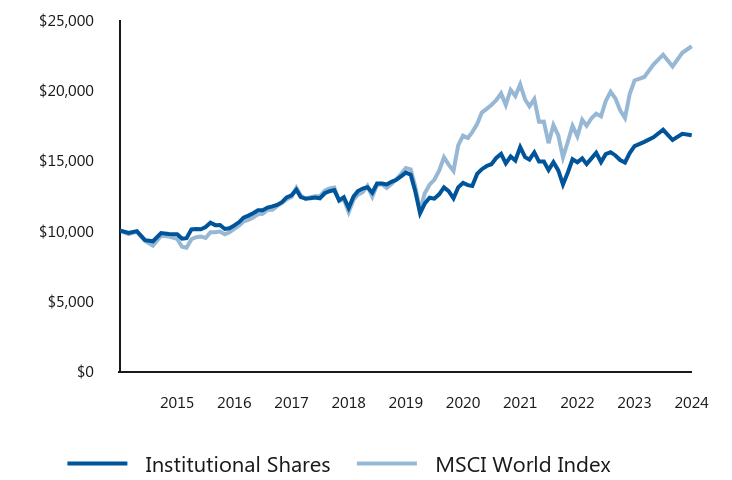

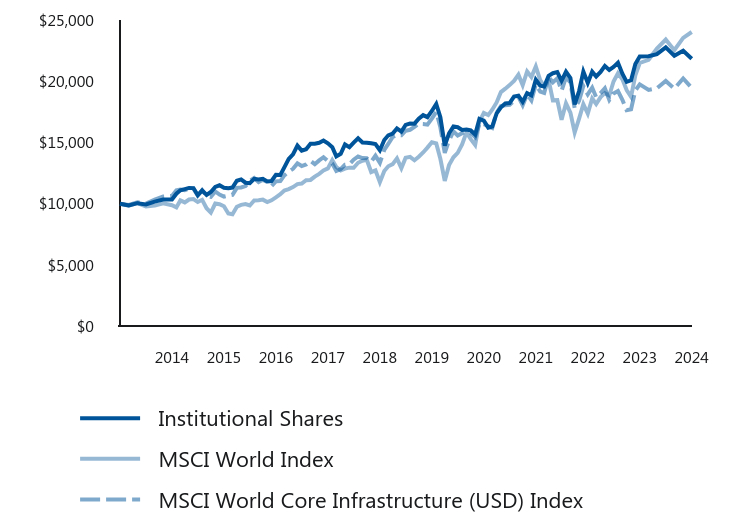

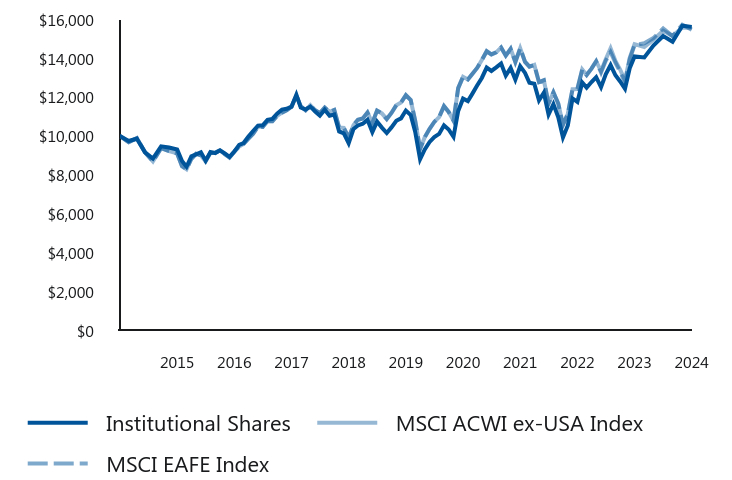

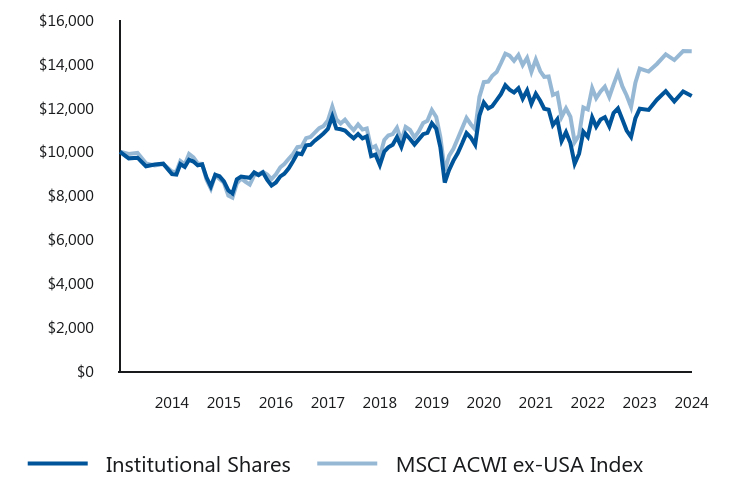

Lazard Global Listed Infrastructure Portfolio

GLIFX: Institutional Shares

Semi-Annual Shareholder Report - June 30, 2024

This semi-annual shareholder report contains important information about the Lazard Global Listed Infrastructure Portfolio for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Portfolio at www.lazardassetmanagement.com/us/en_us/funds/list/mutual-funds/42#TSR. You can also request this information by contacting us at Contact.US@Lazard.com or (800) 823-6300.

What were the Portfolio costs for the last six months?

(based on a $10,000 investment and annualized for periods of less than one year)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional Shares | $48 | 0.96% |

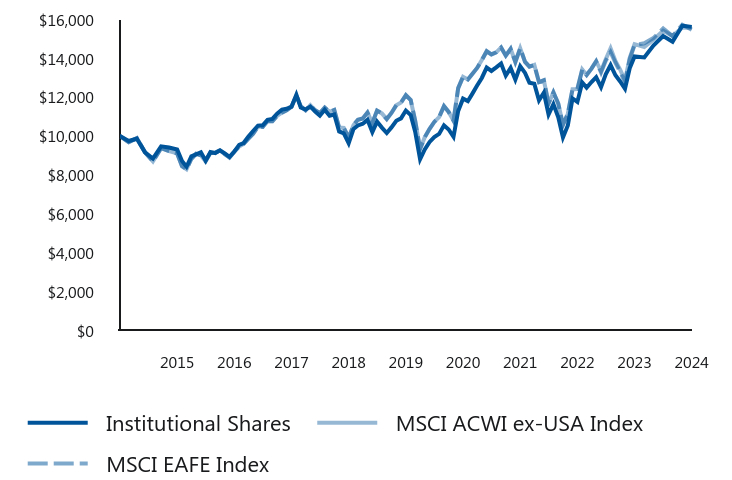

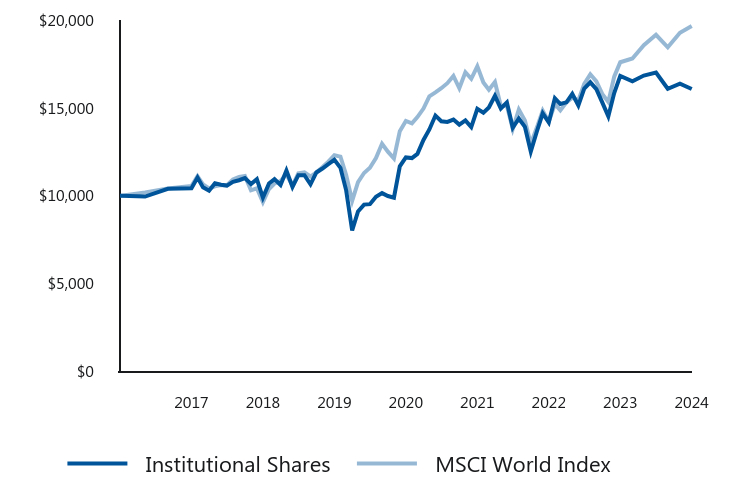

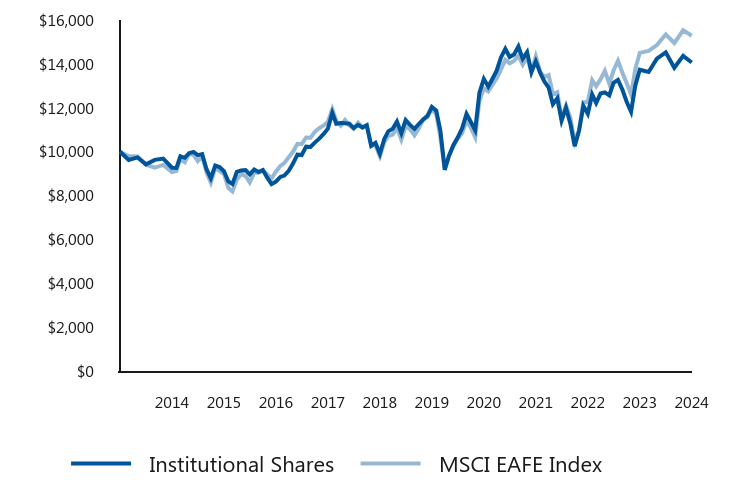

Total Return Based on $10,000 Investment

| Institutional Shares | MSCI World Index | MSCI World Core Infrastructure (USD) Index |

|---|

| 2014 | $10,000 | $10,000 | $10,000 |

| 2014 | $9,865 | $9,840 | $9,911 |

| 2014 | $10,049 | $10,056 | $10,119 |

| 2014 | $9,941 | $9,784 | $10,026 |

| 2014 | $10,180 | $9,848 | $10,346 |

| 2014 | $10,350 | $10,044 | $10,587 |

| 2014 | $10,346 | $9,883 | $10,645 |

| 2015 | $10,821 | $9,704 | $11,097 |

| 2015 | $11,100 | $10,273 | $11,169 |

| 2015 | $11,198 | $10,111 | $11,115 |

| 2015 | $11,296 | $10,349 | $11,223 |

| 2015 | $11,281 | $10,384 | $11,226 |

| 2015 | $10,695 | $10,142 | $10,674 |

| 2015 | $11,092 | $10,324 | $11,112 |

| 2015 | $10,729 | $9,640 | $10,634 |

| 2015 | $10,965 | $9,285 | $10,565 |

| 2015 | $11,377 | $10,020 | $11,010 |

| 2015 | $11,511 | $9,970 | $10,746 |

| 2015 | $11,309 | $9,794 | $10,580 |

| 2016 | $11,275 | $9,209 | $10,667 |

| 2016 | $11,325 | $9,140 | $10,727 |

| 2016 | $11,882 | $9,761 | $11,301 |

| 2016 | $11,992 | $9,915 | $11,331 |

| 2016 | $11,721 | $9,971 | $11,448 |

| 2016 | $11,690 | $9,859 | $11,873 |

| 2016 | $12,031 | $10,275 | $12,100 |

| 2016 | $11,979 | $10,283 | $11,771 |

| 2016 | $12,039 | $10,338 | $11,956 |

| 2016 | $11,825 | $10,137 | $11,790 |

| 2016 | $11,860 | $10,283 | $11,447 |

| 2016 | $12,360 | $10,529 | $11,832 |

| 2017 | $12,352 | $10,783 | $11,855 |

| 2017 | $12,971 | $11,082 | $12,315 |

| 2017 | $13,661 | $11,200 | $12,622 |

| 2017 | $14,028 | $11,366 | $12,856 |

| 2017 | $14,744 | $11,607 | $13,296 |

| 2017 | $14,342 | $11,651 | $13,081 |

| 2017 | $14,456 | $11,929 | $13,206 |

| 2017 | $14,907 | $11,946 | $13,499 |

| 2017 | $14,907 | $12,214 | $13,233 |

| 2017 | $14,978 | $12,445 | $13,544 |

| 2017 | $15,166 | $12,715 | $13,800 |

| 2017 | $14,932 | $12,886 | $13,480 |

| 2018 | $14,614 | $13,567 | $13,274 |

| 2018 | $13,868 | $13,005 | $12,673 |

| 2018 | $14,083 | $12,721 | $12,828 |

| 2018 | $14,840 | $12,868 | $13,188 |

| 2018 | $14,616 | $12,949 | $13,224 |

| 2018 | $14,990 | $12,942 | $13,597 |

| 2018 | $15,347 | $13,346 | $13,859 |

| 2018 | $15,008 | $13,512 | $13,734 |

| 2018 | $14,987 | $13,587 | $13,716 |

| 2018 | $14,939 | $12,590 | $13,426 |

| 2018 | $14,880 | $12,734 | $13,926 |

| 2018 | $14,374 | $11,766 | $13,337 |

| 2019 | $15,204 | $12,681 | $14,410 |

| 2019 | $15,587 | $13,063 | $14,882 |

| 2019 | $15,736 | $13,234 | $15,457 |

| 2019 | $16,153 | $13,704 | $15,610 |

| 2019 | $15,896 | $12,913 | $15,589 |

| 2019 | $16,440 | $13,764 | $15,962 |

| 2019 | $16,548 | $13,833 | $16,040 |

| 2019 | $16,542 | $13,549 | $16,282 |

| 2019 | $16,938 | $13,838 | $16,528 |

| 2019 | $17,236 | $14,189 | $16,510 |

| 2019 | $17,070 | $14,585 | $16,457 |

| 2019 | $17,573 | $15,023 | $16,955 |

| 2020 | $18,152 | $14,931 | $17,502 |

| 2020 | $17,072 | $13,670 | $16,238 |

| 2020 | $14,749 | $11,861 | $14,160 |

| 2020 | $15,754 | $13,156 | $15,162 |

| 2020 | $16,319 | $13,792 | $15,908 |

| 2020 | $16,248 | $14,157 | $15,570 |

| 2020 | $16,031 | $14,834 | $15,762 |

| 2020 | $16,053 | $15,825 | $15,867 |

| 2020 | $15,985 | $15,279 | $15,790 |

| 2020 | $15,652 | $14,810 | $15,445 |

| 2020 | $16,924 | $16,704 | $16,579 |

| 2020 | $16,787 | $17,412 | $16,495 |

| 2021 | $16,214 | $17,240 | $16,336 |

| 2021 | $16,306 | $17,681 | $16,183 |

| 2021 | $17,383 | $18,270 | $17,435 |

| 2021 | $17,876 | $19,120 | $17,982 |

| 2021 | $18,186 | $19,395 | $18,036 |

| 2021 | $18,225 | $19,684 | $18,078 |

| 2021 | $18,754 | $20,036 | $18,417 |

| 2021 | $18,823 | $20,535 | $18,736 |

| 2021 | $18,318 | $19,683 | $18,045 |

| 2021 | $19,031 | $20,797 | $18,925 |

| 2021 | $18,855 | $20,341 | $18,443 |

| 2021 | $20,123 | $21,210 | $19,743 |

| 2022 | $19,635 | $20,088 | $19,163 |

| 2022 | $19,574 | $19,580 | $19,047 |

| 2022 | $20,448 | $20,116 | $20,362 |

| 2022 | $20,658 | $18,445 | $19,912 |

| 2022 | $20,744 | $18,459 | $20,249 |

| 2022 | $20,040 | $16,861 | $19,216 |

| 2022 | $20,775 | $18,200 | $20,343 |

| 2022 | $20,270 | $17,439 | $19,891 |

| 2022 | $18,111 | $15,817 | $17,784 |

| 2022 | $19,204 | $16,953 | $18,411 |

| 2022 | $20,791 | $18,131 | $19,614 |

| 2022 | $19,862 | $17,360 | $18,928 |

| 2023 | $20,785 | $18,589 | $19,477 |

| 2023 | $20,394 | $18,143 | $18,706 |

| 2023 | $20,759 | $18,704 | $19,039 |

| 2023 | $21,252 | $19,031 | $19,424 |

| 2023 | $20,928 | $18,841 | $18,479 |

| 2023 | $21,169 | $19,981 | $19,004 |

| 2023 | $21,510 | $20,652 | $19,201 |

| 2023 | $20,616 | $20,159 | $18,491 |

| 2023 | $19,949 | $19,290 | $17,639 |

| 2023 | $20,077 | $18,730 | $17,715 |

| 2023 | $21,412 | $20,487 | $19,239 |

| 2023 | $22,025 | $21,493 | $19,745 |

| 2024 | $22,040 | $21,751 | $19,296 |

| 2024 | $22,213 | $22,673 | $19,428 |

| 2024 | $22,761 | $23,401 | $20,021 |

| 2024 | $22,078 | $22,533 | $19,397 |

| 2024 | $22,485 | $23,540 | $20,231 |

| 2024 | $21,837 | $24,021 | $19,458 |

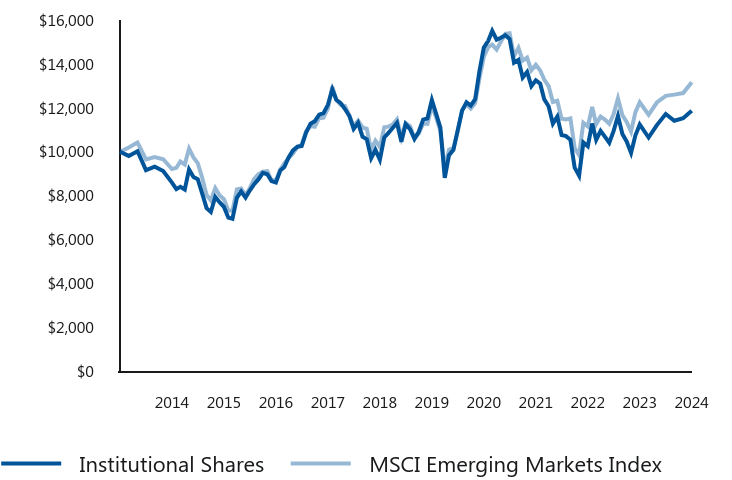

Average Annual Total Returns (%)

| 1 Year | 5 Years | 10 Years |

|---|

| Institutional Shares | 3.15% | 5.84% | 8.12% |

| MSCI World Index | 20.19% | 11.78% | 9.16% |

| MSCI World Core Infrastructure (USD) Index | 4.82% | 4.53% | 6.88% |

The performance quoted represents past performance. Past performance does not guarantee future results. The current performance may be lower or higher than the performance data quoted. The performance graph and table do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

| Total Net Assets | $8,375,700,563 |

| # of Portfolio Holdings | 27 |

| Portfolio Turnover Rate | 21% |

| Total Advisory Fees Paid (Net of Waivers/Reimbursements) | $39,107,640 |

Top 10 Holdings (% of Net Assets)

| National Grid PLC | 9.2% |

| Ferrovial SE | 8.6% |

| Snam SpA | 5.0% |

| Exelon Corp. | 4.9% |

| CSX Corp. | 4.9% |

| Norfolk Southern Corp. | 4.8% |

| American Electric Power Co., Inc. | 4.8% |

| Terna - Rete Elettrica Nazionale | 4.7% |

| Vinci SA | 4.7% |

| Severn Trent PLC | 4.6% |

Top Sectors (% of Net Assets)

| Utilities | 55.4% |

| Industrials | 32.8% |

| Cash, Cash Equivalents and Repurchase Agreements | 9.3% |

| Communication Services | 1.9% |

If you wish to view additional information about the Portfolio including, but not limited to, the

prospectus, financial statements, holdings and proxy voting information please visit: https://www.lazardassetmanagement.com/us/en_us/funds/list/mutual-funds/42#documents.

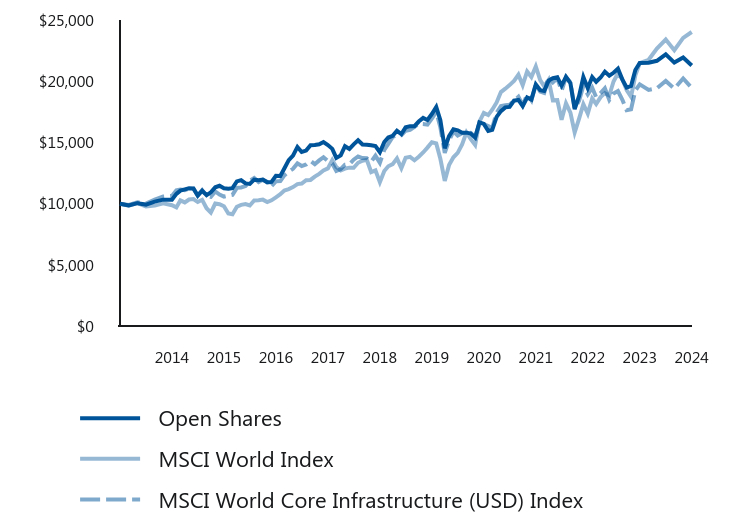

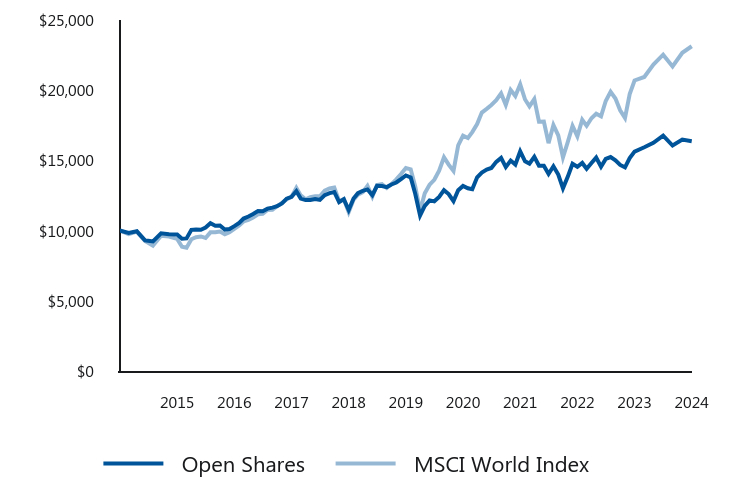

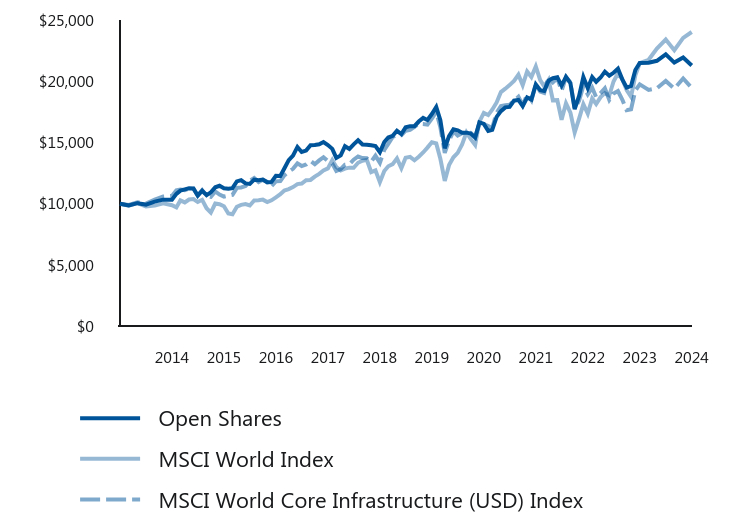

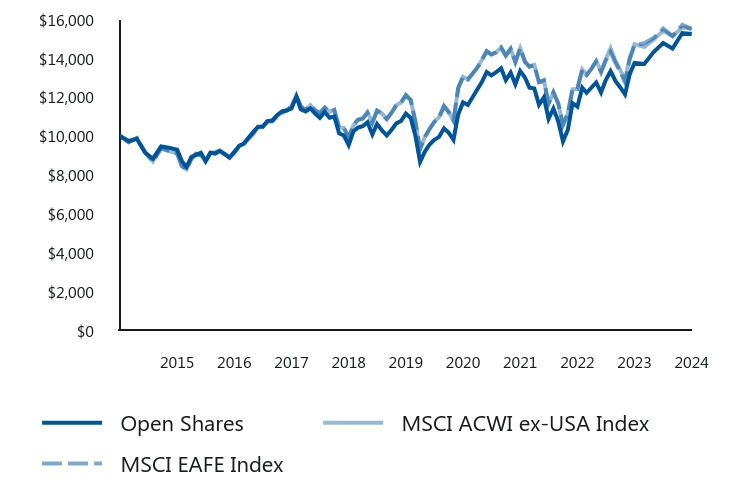

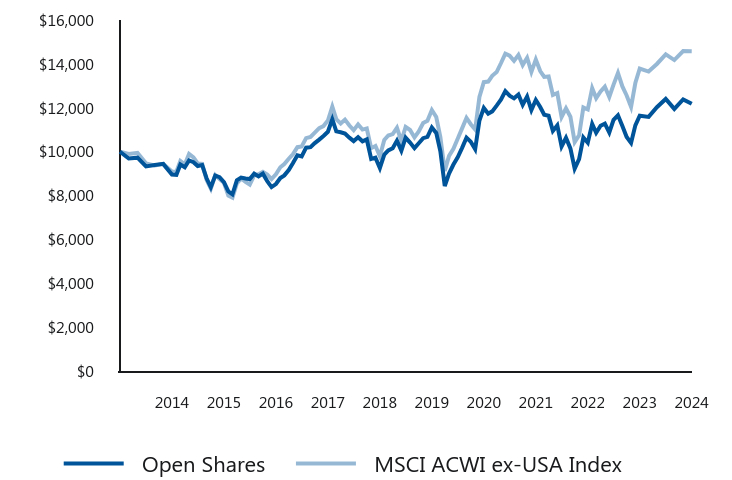

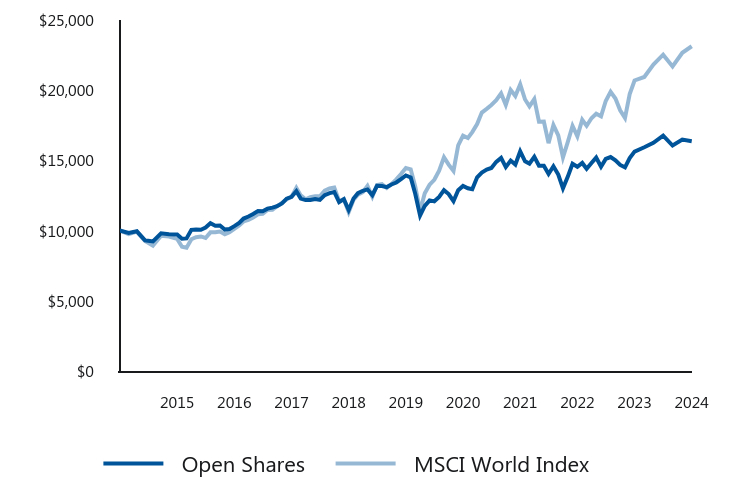

Lazard Global Listed Infrastructure Portfolio

Semi-Annual Shareholder Report - June 30, 2024

This semi-annual shareholder report contains important information about the Lazard Global Listed Infrastructure Portfolio for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Portfolio at www.lazardassetmanagement.com/us/en_us/funds/list/mutual-funds/42#TSR. You can also request this information by contacting us at Contact.US@Lazard.com or (800) 823-6300.

What were the Portfolio costs for the last six months?

(based on a $10,000 investment and annualized for periods of less than one year)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Open Shares | $60 | 1.21% |

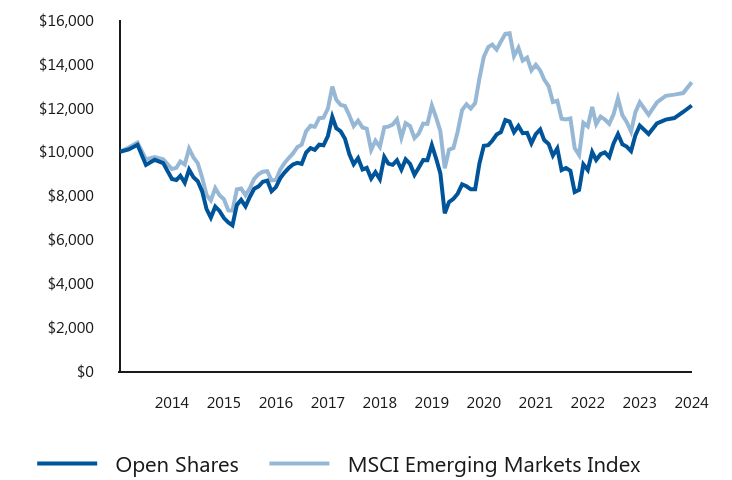

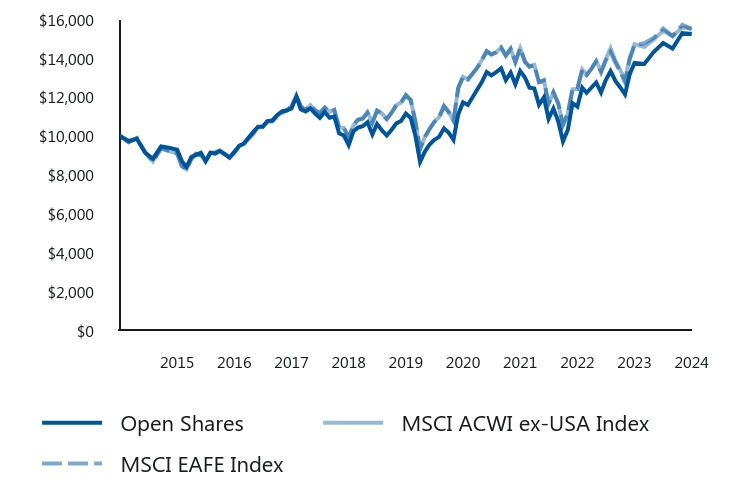

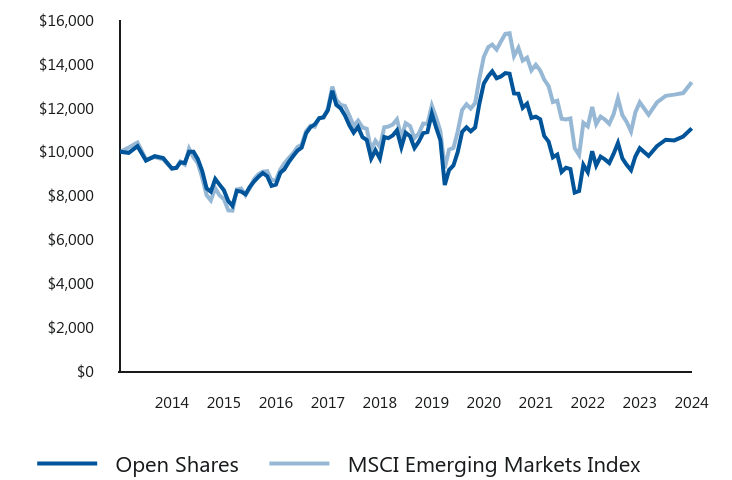

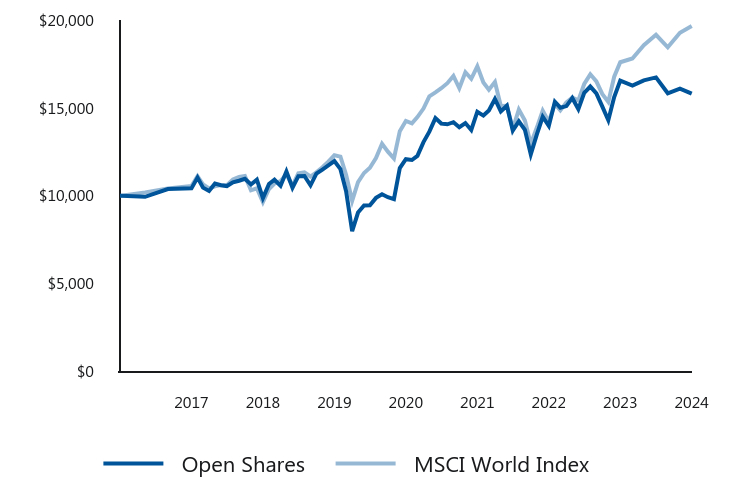

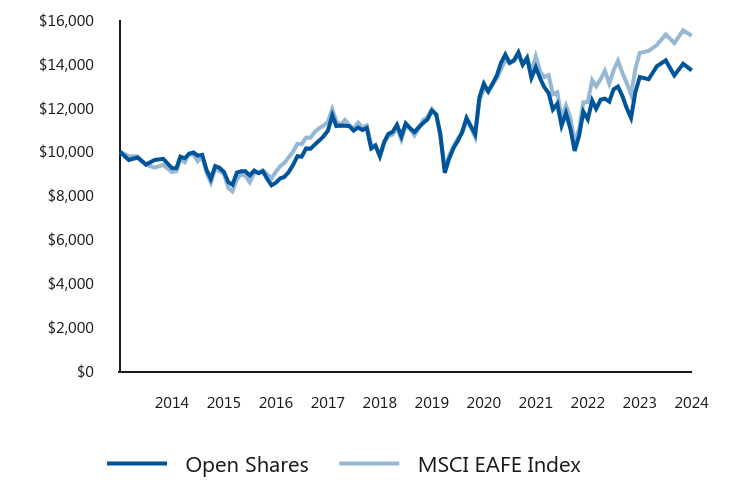

Total Return Based on $10,000 Investment

| Open Shares | MSCI World Index | MSCI World Core Infrastructure (USD) Index |

|---|

| 2014 | $10,000 | $10,000 | $10,000 |

| 2014 | $9,865 | $9,840 | $9,911 |

| 2014 | $10,049 | $10,056 | $10,119 |

| 2014 | $9,934 | $9,784 | $10,026 |

| 2014 | $10,173 | $9,848 | $10,346 |

| 2014 | $10,336 | $10,044 | $10,587 |

| 2014 | $10,332 | $9,883 | $10,645 |

| 2015 | $10,806 | $9,704 | $11,097 |

| 2015 | $11,076 | $10,273 | $11,169 |

| 2015 | $11,181 | $10,111 | $11,115 |

| 2015 | $11,271 | $10,349 | $11,223 |

| 2015 | $11,256 | $10,384 | $11,226 |

| 2015 | $10,664 | $10,142 | $10,674 |

| 2015 | $11,067 | $10,324 | $11,112 |

| 2015 | $10,698 | $9,640 | $10,634 |

| 2015 | $10,934 | $9,285 | $10,565 |

| 2015 | $11,343 | $10,020 | $11,010 |

| 2015 | $11,469 | $9,970 | $10,746 |

| 2015 | $11,268 | $9,794 | $10,580 |

| 2016 | $11,234 | $9,209 | $10,667 |

| 2016 | $11,276 | $9,140 | $10,727 |

| 2016 | $11,822 | $9,761 | $11,301 |

| 2016 | $11,931 | $9,915 | $11,331 |

| 2016 | $11,662 | $9,971 | $11,448 |

| 2016 | $11,624 | $9,859 | $11,873 |

| 2016 | $11,970 | $10,275 | $12,100 |

| 2016 | $11,919 | $10,283 | $11,771 |

| 2016 | $11,971 | $10,338 | $11,956 |

| 2016 | $11,751 | $10,137 | $11,790 |

| 2016 | $11,785 | $10,283 | $11,447 |

| 2016 | $12,283 | $10,529 | $11,832 |

| 2017 | $12,274 | $10,783 | $11,855 |

| 2017 | $12,879 | $11,082 | $12,315 |

| 2017 | $13,564 | $11,200 | $12,622 |

| 2017 | $13,928 | $11,366 | $12,856 |

| 2017 | $14,638 | $11,607 | $13,296 |

| 2017 | $14,231 | $11,651 | $13,081 |

| 2017 | $14,344 | $11,929 | $13,206 |

| 2017 | $14,782 | $11,946 | $13,499 |

| 2017 | $14,791 | $12,214 | $13,233 |

| 2017 | $14,853 | $12,445 | $13,544 |

| 2017 | $15,039 | $12,715 | $13,800 |

| 2017 | $14,797 | $12,886 | $13,480 |

| 2018 | $14,483 | $13,567 | $13,274 |

| 2018 | $13,743 | $13,005 | $12,673 |

| 2018 | $13,947 | $12,721 | $12,828 |

| 2018 | $14,697 | $12,868 | $13,188 |

| 2018 | $14,475 | $12,949 | $13,224 |

| 2018 | $14,846 | $12,942 | $13,597 |

| 2018 | $15,189 | $13,346 | $13,859 |

| 2018 | $14,844 | $13,512 | $13,734 |

| 2018 | $14,824 | $13,587 | $13,716 |

| 2018 | $14,776 | $12,590 | $13,426 |

| 2018 | $14,709 | $12,734 | $13,926 |

| 2018 | $14,208 | $11,766 | $13,337 |

| 2019 | $15,028 | $12,681 | $14,410 |

| 2019 | $15,406 | $13,063 | $14,882 |

| 2019 | $15,544 | $13,234 | $15,457 |

| 2019 | $15,956 | $13,704 | $15,610 |

| 2019 | $15,692 | $12,913 | $15,589 |

| 2019 | $16,240 | $13,764 | $15,962 |

| 2019 | $16,336 | $13,833 | $16,040 |

| 2019 | $16,330 | $13,549 | $16,282 |

| 2019 | $16,710 | $13,838 | $16,528 |

| 2019 | $17,004 | $14,189 | $16,510 |

| 2019 | $16,841 | $14,585 | $16,457 |

| 2019 | $17,326 | $15,023 | $16,955 |

| 2020 | $17,896 | $14,931 | $17,502 |

| 2020 | $16,821 | $13,670 | $16,238 |

| 2020 | $14,531 | $11,861 | $14,160 |

| 2020 | $15,521 | $13,156 | $15,162 |

| 2020 | $16,076 | $13,792 | $15,908 |

| 2020 | $15,996 | $14,157 | $15,570 |

| 2020 | $15,793 | $14,834 | $15,762 |

| 2020 | $15,804 | $15,825 | $15,867 |

| 2020 | $15,727 | $15,279 | $15,790 |

| 2020 | $15,400 | $14,810 | $15,445 |

| 2020 | $16,650 | $16,704 | $16,579 |

| 2020 | $16,515 | $17,412 | $16,495 |

| 2021 | $15,941 | $17,240 | $16,336 |

| 2021 | $16,031 | $17,681 | $16,183 |

| 2021 | $17,091 | $18,270 | $17,435 |

| 2021 | $17,564 | $19,120 | $17,982 |

| 2021 | $17,868 | $19,395 | $18,036 |

| 2021 | $17,908 | $19,684 | $18,078 |

| 2021 | $18,415 | $20,036 | $18,417 |

| 2021 | $18,483 | $20,535 | $18,736 |

| 2021 | $17,977 | $19,683 | $18,045 |

| 2021 | $18,676 | $20,797 | $18,925 |

| 2021 | $18,504 | $20,341 | $18,443 |

| 2021 | $19,746 | $21,210 | $19,743 |

| 2022 | $19,267 | $20,088 | $19,163 |

| 2022 | $19,208 | $19,580 | $19,047 |

| 2022 | $20,052 | $20,116 | $20,362 |

| 2022 | $20,246 | $18,445 | $19,912 |

| 2022 | $20,330 | $18,459 | $20,249 |

| 2022 | $19,640 | $16,861 | $19,216 |

| 2022 | $20,359 | $18,200 | $20,343 |

| 2022 | $19,853 | $17,439 | $19,891 |

| 2022 | $17,726 | $15,817 | $17,784 |

| 2022 | $18,808 | $16,953 | $18,411 |

| 2022 | $20,349 | $18,131 | $19,614 |

| 2022 | $19,439 | $17,360 | $18,928 |

| 2023 | $20,342 | $18,589 | $19,477 |

| 2023 | $19,959 | $18,143 | $18,706 |

| 2023 | $20,303 | $18,704 | $19,039 |

| 2023 | $20,785 | $19,031 | $19,424 |

| 2023 | $20,455 | $18,841 | $18,479 |

| 2023 | $20,691 | $19,981 | $19,004 |

| 2023 | $21,024 | $20,652 | $19,201 |

| 2023 | $20,137 | $20,159 | $18,491 |

| 2023 | $19,486 | $19,290 | $17,639 |

| 2023 | $19,611 | $18,730 | $17,715 |

| 2023 | $20,915 | $20,487 | $19,239 |

| 2023 | $21,499 | $21,493 | $19,745 |

| 2024 | $21,513 | $21,751 | $19,296 |

| 2024 | $21,668 | $22,673 | $19,428 |

| 2024 | $22,203 | $23,401 | $20,021 |

| 2024 | $21,523 | $22,533 | $19,397 |

| 2024 | $21,934 | $23,540 | $20,231 |

| 2024 | $21,288 | $24,021 | $19,458 |

Average Annual Total Returns (%)

| 1 Year | 5 Years | 10 Years |

|---|

| Open Shares | 2.89% | 5.56% | 7.85% |

| MSCI World Index | 20.19% | 11.78% | 9.16% |

| MSCI World Core Infrastructure (USD) Index | 4.82% | 4.53% | 6.88% |

The performance quoted represents past performance. Past performance does not guarantee future results. The current performance may be lower or higher than the performance data quoted. The performance graph and table do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

| Total Net Assets | $8,375,700,563 |

| # of Portfolio Holdings | 27 |

| Portfolio Turnover Rate | 21% |

| Total Advisory Fees Paid (Net of Waivers/Reimbursements) | $39,107,640 |

Top 10 Holdings (% of Net Assets)

| National Grid PLC | 9.2% |

| Ferrovial SE | 8.6% |

| Snam SpA | 5.0% |

| Exelon Corp. | 4.9% |

| CSX Corp. | 4.9% |

| Norfolk Southern Corp. | 4.8% |

| American Electric Power Co., Inc. | 4.8% |

| Terna - Rete Elettrica Nazionale | 4.7% |

| Vinci SA | 4.7% |

| Severn Trent PLC | 4.6% |

Top Sectors (% of Net Assets)

| Utilities | 55.4% |

| Industrials | 32.8% |

| Cash, Cash Equivalents and Repurchase Agreements | 9.3% |

| Communication Services | 1.9% |

If you wish to view additional information about the Portfolio including, but not limited to, the

prospectus, financial statements, holdings and proxy voting information please visit: https://www.lazardassetmanagement.com/us/en_us/funds/list/mutual-funds/42#documents.

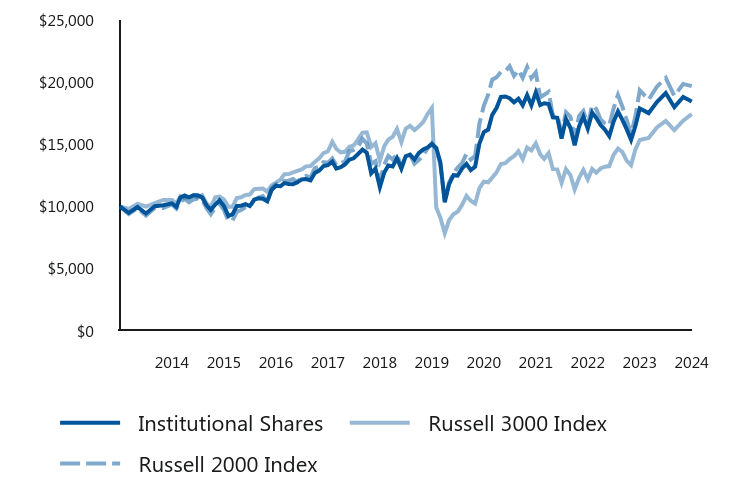

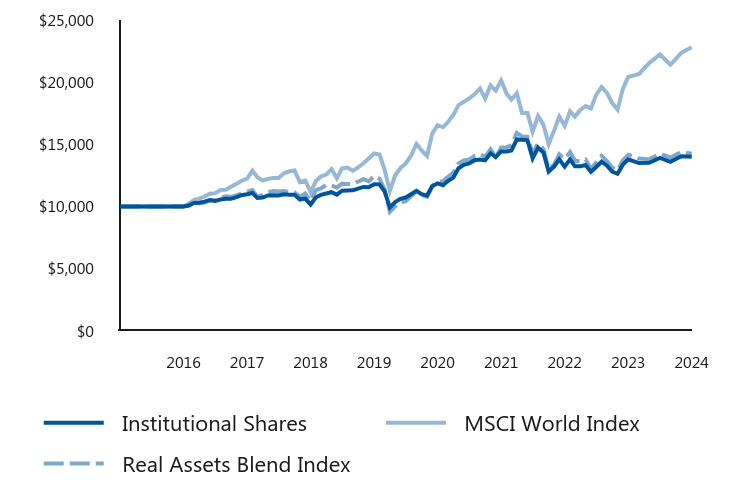

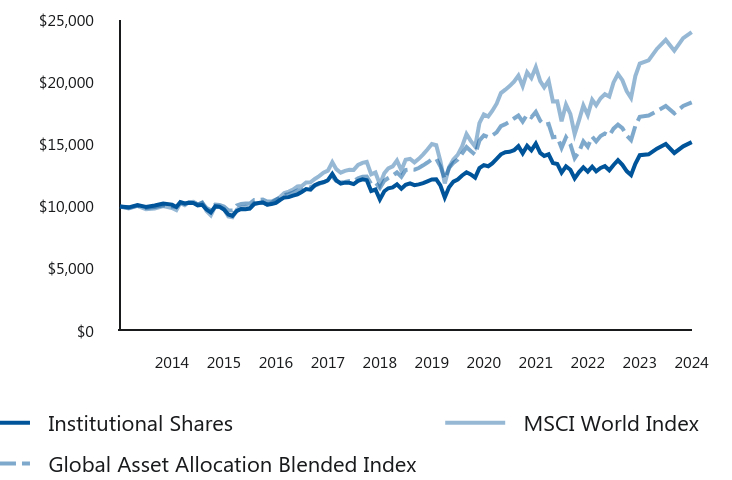

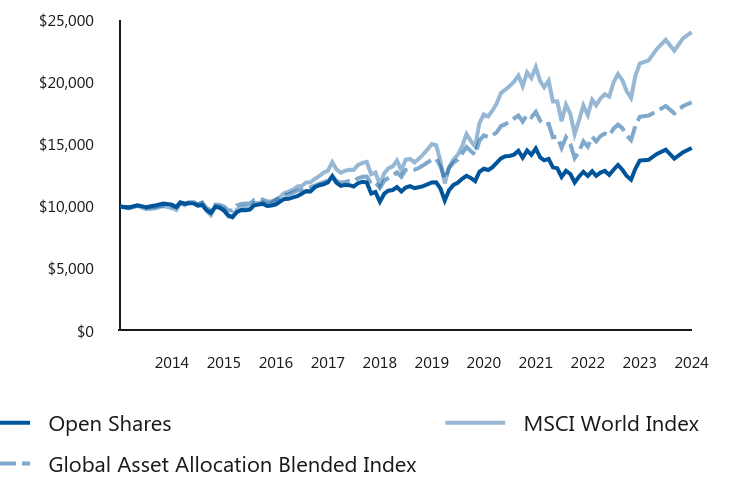

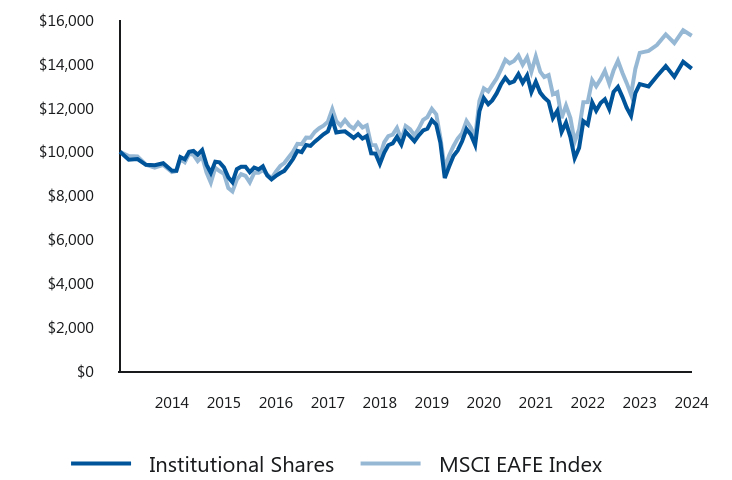

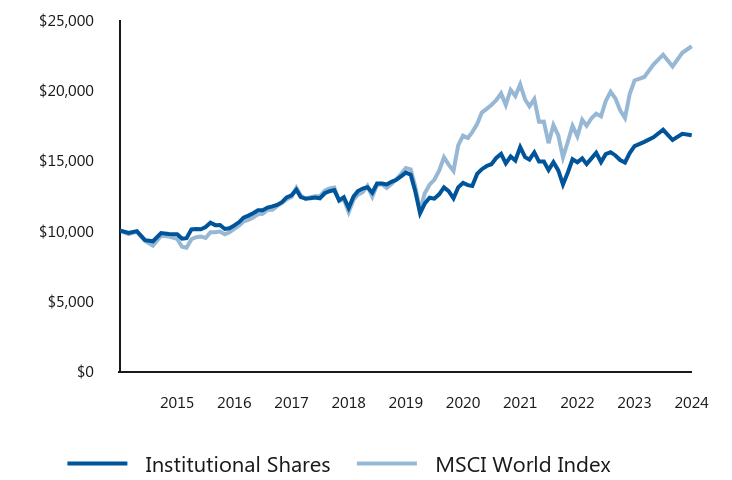

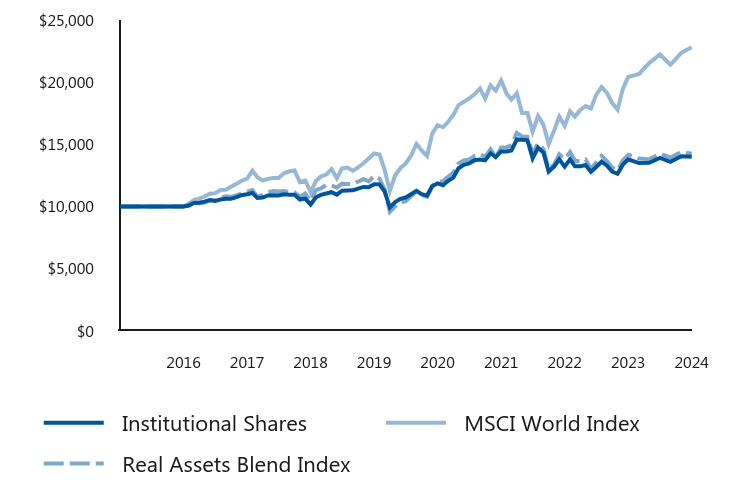

Lazard Opportunistic Strategies Portfolio

LCAIX: Institutional Shares

Semi-Annual Shareholder Report - June 30, 2024

This semi-annual shareholder report contains important information about the Lazard Opportunistic Strategies Portfolio for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Portfolio at www.lazardassetmanagement.com/us/en_us/funds/list/mutual-funds/42#TSR. You can also request this information by contacting us at Contact.US@Lazard.com or (800) 823-6300.

What were the Portfolio costs for the last six months?

(based on a $10,000 investment and annualized for periods of less than one year)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional Shares | $53 | 1.02% |

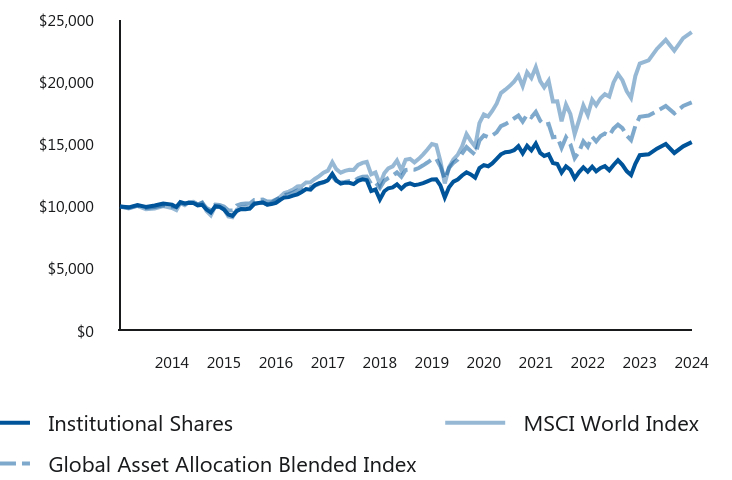

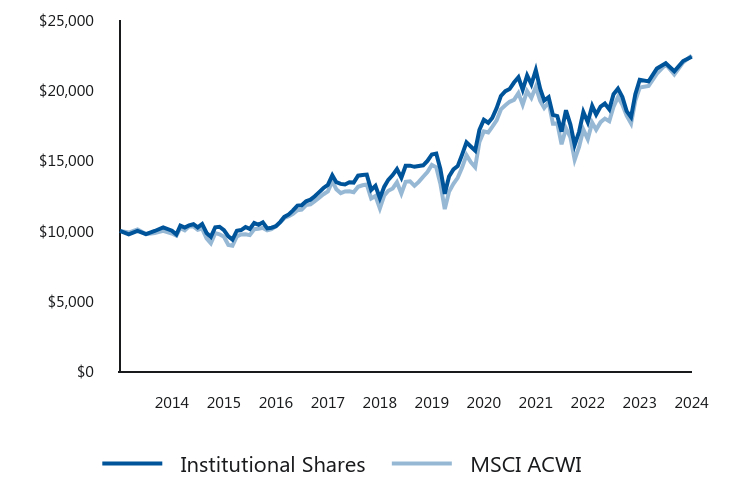

| Institutional Shares | MSCI World Index | Global Asset Allocation Blended Index |

|---|

| 2014 | $10,000 | $10,000 | $10,000 |

| 2014 | $9,934 | $9,840 | $9,894 |

| 2014 | $10,114 | $10,056 | $10,068 |

| 2014 | $9,962 | $9,784 | $9,877 |

| 2014 | $10,085 | $9,848 | $9,954 |

| 2014 | $10,247 | $10,044 | $10,102 |

| 2014 | $10,152 | $9,883 | $10,008 |

| 2015 | $9,960 | $9,704 | $9,983 |

| 2015 | $10,355 | $10,273 | $10,291 |

| 2015 | $10,243 | $10,111 | $10,211 |

| 2015 | $10,294 | $10,349 | $10,340 |

| 2015 | $10,284 | $10,384 | $10,352 |

| 2015 | $10,091 | $10,142 | $10,161 |

| 2015 | $10,142 | $10,324 | $10,298 |

| 2015 | $9,752 | $9,640 | $9,882 |

| 2015 | $9,517 | $9,285 | $9,696 |

| 2015 | $10,008 | $10,020 | $10,158 |

| 2015 | $9,988 | $9,970 | $10,116 |

| 2015 | $9,766 | $9,794 | $9,994 |

| 2016 | $9,359 | $9,209 | $9,690 |

| 2016 | $9,244 | $9,140 | $9,676 |

| 2016 | $9,641 | $9,761 | $10,094 |

| 2016 | $9,808 | $9,915 | $10,205 |

| 2016 | $9,787 | $9,971 | $10,240 |

| 2016 | $9,839 | $9,859 | $10,243 |

| 2016 | $10,194 | $10,275 | $10,529 |

| 2016 | $10,277 | $10,283 | $10,530 |

| 2016 | $10,319 | $10,338 | $10,561 |

| 2016 | $10,152 | $10,137 | $10,406 |

| 2016 | $10,194 | $10,283 | $10,396 |

| 2016 | $10,289 | $10,529 | $10,553 |

| 2017 | $10,544 | $10,783 | $10,714 |

| 2017 | $10,734 | $11,082 | $10,922 |

| 2017 | $10,756 | $11,200 | $10,991 |

| 2017 | $10,872 | $11,366 | $11,123 |

| 2017 | $10,978 | $11,607 | $11,299 |

| 2017 | $11,169 | $11,651 | $11,320 |

| 2017 | $11,403 | $11,929 | $11,503 |

| 2017 | $11,360 | $11,946 | $11,553 |

| 2017 | $11,710 | $12,214 | $11,687 |

| 2017 | $11,880 | $12,445 | $11,822 |

| 2017 | $11,954 | $12,715 | $11,971 |

| 2017 | $12,114 | $12,886 | $12,091 |

| 2018 | $12,628 | $13,567 | $12,419 |

| 2018 | $12,103 | $13,005 | $12,057 |

| 2018 | $11,840 | $12,721 | $11,928 |

| 2018 | $11,920 | $12,868 | $11,974 |

| 2018 | $11,908 | $12,949 | $12,054 |

| 2018 | $11,806 | $12,942 | $12,044 |

| 2018 | $12,068 | $13,346 | $12,271 |

| 2018 | $12,191 | $13,512 | $12,393 |

| 2018 | $12,121 | $13,587 | $12,405 |

| 2018 | $11,249 | $12,590 | $11,819 |

| 2018 | $11,365 | $12,734 | $11,927 |

| 2018 | $10,573 | $11,766 | $11,488 |

| 2019 | $11,226 | $12,681 | $12,073 |

| 2019 | $11,468 | $13,063 | $12,294 |

| 2019 | $11,541 | $13,234 | $12,483 |

| 2019 | $11,783 | $13,704 | $12,750 |

| 2019 | $11,432 | $12,913 | $12,391 |

| 2019 | $11,747 | $13,764 | $12,937 |

| 2019 | $11,867 | $13,833 | $12,987 |

| 2019 | $11,722 | $13,549 | $12,962 |

| 2019 | $11,783 | $13,838 | $13,097 |

| 2019 | $11,880 | $14,189 | $13,313 |

| 2019 | $12,025 | $14,585 | $13,536 |

| 2019 | $12,175 | $15,023 | $13,781 |

| 2020 | $12,188 | $14,931 | $13,836 |

| 2020 | $11,707 | $13,670 | $13,243 |

| 2020 | $10,720 | $11,861 | $12,214 |

| 2020 | $11,546 | $13,156 | $13,101 |

| 2020 | $12,003 | $13,792 | $13,516 |

| 2020 | $12,175 | $14,157 | $13,773 |

| 2020 | $12,496 | $14,834 | $14,251 |

| 2020 | $12,755 | $15,825 | $14,784 |

| 2020 | $12,582 | $15,279 | $14,462 |

| 2020 | $12,323 | $14,810 | $14,170 |

| 2020 | $13,089 | $16,704 | $15,302 |

| 2020 | $13,329 | $17,412 | $15,713 |

| 2021 | $13,241 | $17,240 | $15,574 |

| 2021 | $13,467 | $17,681 | $15,723 |

| 2021 | $13,833 | $18,270 | $15,965 |

| 2021 | $14,198 | $19,120 | $16,461 |

| 2021 | $14,374 | $19,395 | $16,626 |

| 2021 | $14,400 | $19,684 | $16,823 |

| 2021 | $14,526 | $20,036 | $17,079 |

| 2021 | $14,853 | $20,535 | $17,321 |

| 2021 | $14,274 | $19,683 | $16,826 |

| 2021 | $14,878 | $20,797 | $17,396 |

| 2021 | $14,513 | $20,341 | $17,182 |

| 2021 | $15,056 | $21,210 | $17,610 |

| 2022 | $14,306 | $20,088 | $16,899 |

| 2022 | $14,069 | $19,580 | $16,569 |

| 2022 | $14,201 | $20,116 | $16,647 |

| 2022 | $13,504 | $18,445 | $15,565 |

| 2022 | $13,425 | $18,459 | $15,613 |

| 2022 | $12,728 | $16,861 | $14,718 |

| 2022 | $13,228 | $18,200 | $15,563 |

| 2022 | $12,957 | $17,439 | $14,995 |

| 2022 | $12,270 | $15,817 | $13,892 |

| 2022 | $12,768 | $16,953 | $14,419 |

| 2022 | $13,145 | $18,131 | $15,242 |

| 2022 | $12,807 | $17,360 | $14,811 |

| 2023 | $13,202 | $18,589 | $15,622 |

| 2023 | $12,835 | $18,143 | $15,236 |

| 2023 | $13,107 | $18,704 | $15,674 |

| 2023 | $13,243 | $19,031 | $15,876 |

| 2023 | $12,916 | $18,841 | $15,712 |

| 2023 | $13,338 | $19,981 | $16,262 |

| 2023 | $13,733 | $20,652 | $16,585 |

| 2023 | $13,352 | $20,159 | $16,303 |

| 2023 | $12,848 | $19,290 | $15,715 |

| 2023 | $12,535 | $18,730 | $15,342 |

| 2023 | $13,434 | $20,487 | $16,481 |

| 2023 | $14,125 | $21,493 | $17,219 |

| 2024 | $14,195 | $21,751 | $17,324 |

| 2024 | $14,658 | $22,673 | $17,671 |

| 2024 | $15,023 | $23,401 | $18,083 |

| 2024 | $14,307 | $22,533 | $17,498 |

| 2024 | $14,840 | $23,540 | $18,084 |

| 2024 | $15,177 | $24,021 | $18,373 |

Average Annual Total Returns (%)

| 1 Year | 5 Years | 10 Years |

|---|

| Institutional Shares | 13.79% | 5.26% | 4.26% |

| MSCI World Index | 20.19% | 11.78% | 9.16% |

| Global Asset Allocation Blended Index | 12.98% | 7.27% | 6.27% |

The performance quoted represents past performance. Past performance does not guarantee future results. The current performance may be lower or higher than the performance data quoted. The performance graph and table do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

| Total Net Assets | $35,316,607 |

| # of Portfolio Holdings | 15 |

| Portfolio Turnover Rate | 36% |

| Total Advisory Fees Paid (Net of Waivers/Reimbursements) | $70,298 |

Top 10 Holdings (% of Net Assets)

| Vanguard S&P 500 ETF | 12.5% |

| Vanguard S&P 500 Growth ETF | 10.8% |

| iShares Currency Hedged MSCI Japan ETF | 10.4% |

| Vanguard Long-Term Treasury ETF | 10.2% |

| Vanguard S&P 500 Value ETF | 9.8% |

| SPDR EURO STOXX 50 ETF | 9.1% |

| Invesco QQQ Trust | 6.6% |

| Vanguard Mega Cap ETF | 5.7% |

| iShares Expanded Tech-Software Sector ETF | 5.5% |

| iShares Russell 2000 ETF | 5.5% |

Top Sectors (% of Net Assets)

| Equity Funds | 70.1% |

| Fixed-Income Funds | 22.5% |

| Cash, Cash Equivalents and Repurchase Agreements | 5.4% |

| Commodity | 1.9% |

If you wish to view additional information about the Portfolio including, but not limited to, the

prospectus, financial statements, holdings and proxy voting information please visit: https://www.lazardassetmanagement.com/us/en_us/funds/list/mutual-funds/42#documents.

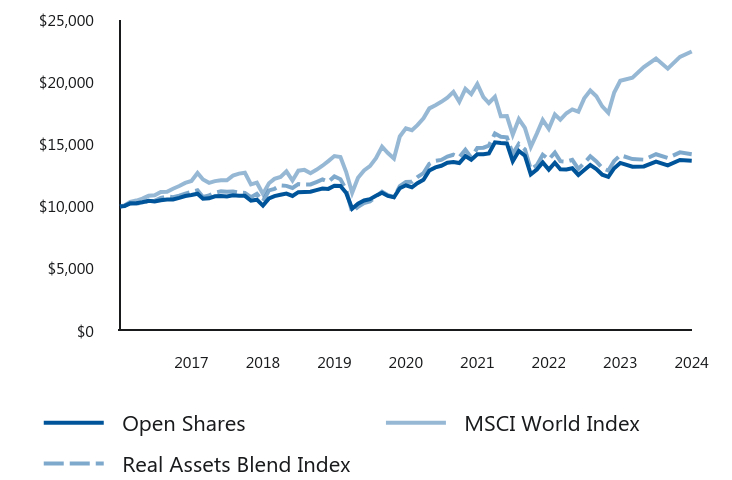

Lazard Opportunistic Strategies Portfolio

Semi-Annual Shareholder Report - June 30, 2024

This semi-annual shareholder report contains important information about the Lazard Opportunistic Strategies Portfolio for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Portfolio at www.lazardassetmanagement.com/us/en_us/funds/list/mutual-funds/42#TSR. You can also request this information by contacting us at Contact.US@Lazard.com or (800) 823-6300.

What were the Portfolio costs for the last six months?

(based on a $10,000 investment and annualized for periods of less than one year)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Open Shares | $65 | 1.27% |

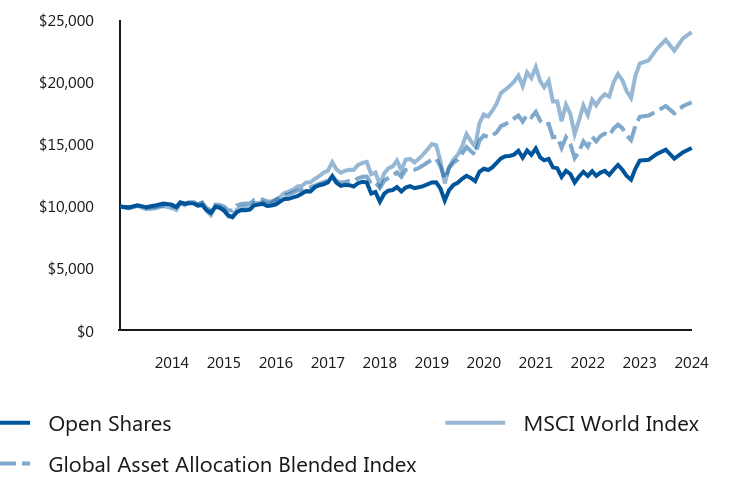

| Open Shares | MSCI World Index | Global Asset Allocation Blended Index |

|---|

| 2014 | $10,000 | $10,000 | $10,000 |

| 2014 | $9,933 | $9,840 | $9,894 |

| 2014 | $10,105 | $10,056 | $10,068 |

| 2014 | $9,952 | $9,784 | $9,877 |

| 2014 | $10,076 | $9,848 | $9,954 |

| 2014 | $10,238 | $10,044 | $10,102 |

| 2014 | $10,142 | $9,883 | $10,008 |

| 2015 | $9,950 | $9,704 | $9,983 |

| 2015 | $10,335 | $10,273 | $10,291 |

| 2015 | $10,223 | $10,111 | $10,211 |

| 2015 | $10,264 | $10,349 | $10,340 |

| 2015 | $10,254 | $10,384 | $10,352 |

| 2015 | $10,062 | $10,142 | $10,161 |

| 2015 | $10,112 | $10,324 | $10,298 |

| 2015 | $9,723 | $9,640 | $9,882 |

| 2015 | $9,487 | $9,285 | $9,696 |

| 2015 | $9,979 | $10,020 | $10,158 |

| 2015 | $9,907 | $9,970 | $10,116 |

| 2015 | $9,675 | $9,794 | $9,994 |

| 2016 | $9,280 | $9,209 | $9,690 |

| 2016 | $9,155 | $9,140 | $9,676 |

| 2016 | $9,550 | $9,761 | $10,094 |

| 2016 | $9,716 | $9,915 | $10,205 |

| 2016 | $9,696 | $9,971 | $10,240 |

| 2016 | $9,748 | $9,859 | $10,243 |

| 2016 | $10,091 | $10,275 | $10,529 |

| 2016 | $10,163 | $10,283 | $10,530 |

| 2016 | $10,215 | $10,338 | $10,561 |

| 2016 | $10,039 | $10,137 | $10,406 |

| 2016 | $10,080 | $10,283 | $10,396 |

| 2016 | $10,166 | $10,529 | $10,553 |

| 2017 | $10,419 | $10,783 | $10,714 |

| 2017 | $10,609 | $11,082 | $10,922 |

| 2017 | $10,620 | $11,200 | $10,991 |

| 2017 | $10,735 | $11,366 | $11,123 |

| 2017 | $10,841 | $11,607 | $11,299 |

| 2017 | $11,020 | $11,651 | $11,320 |

| 2017 | $11,252 | $11,929 | $11,503 |

| 2017 | $11,209 | $11,946 | $11,553 |

| 2017 | $11,547 | $12,214 | $11,687 |

| 2017 | $11,715 | $12,445 | $11,822 |

| 2017 | $11,789 | $12,715 | $11,971 |

| 2017 | $11,943 | $12,886 | $12,091 |

| 2018 | $12,441 | $13,567 | $12,419 |

| 2018 | $11,921 | $13,005 | $12,057 |

| 2018 | $11,660 | $12,721 | $11,928 |

| 2018 | $11,739 | $12,868 | $11,974 |

| 2018 | $11,717 | $12,949 | $12,054 |

| 2018 | $11,615 | $12,942 | $12,044 |

| 2018 | $11,875 | $13,346 | $12,271 |

| 2018 | $11,985 | $13,512 | $12,393 |

| 2018 | $11,928 | $13,587 | $12,405 |

| 2018 | $11,052 | $12,590 | $11,819 |

| 2018 | $11,167 | $12,734 | $11,927 |

| 2018 | $10,385 | $11,766 | $11,488 |

| 2019 | $11,030 | $12,681 | $12,073 |

| 2019 | $11,270 | $13,063 | $12,294 |

| 2019 | $11,329 | $13,234 | $12,483 |

| 2019 | $11,568 | $13,704 | $12,750 |

| 2019 | $11,210 | $12,913 | $12,391 |

| 2019 | $11,532 | $13,764 | $12,937 |

| 2019 | $11,640 | $13,833 | $12,987 |

| 2019 | $11,485 | $13,549 | $12,962 |

| 2019 | $11,556 | $13,838 | $13,097 |

| 2019 | $11,640 | $14,189 | $13,313 |

| 2019 | $11,783 | $14,585 | $13,536 |

| 2019 | $11,933 | $15,023 | $13,781 |

| 2020 | $11,946 | $14,931 | $13,836 |

| 2020 | $11,459 | $13,670 | $13,243 |

| 2020 | $10,487 | $11,861 | $12,214 |

| 2020 | $11,301 | $13,156 | $13,101 |

| 2020 | $11,739 | $13,792 | $13,516 |

| 2020 | $11,909 | $14,157 | $13,773 |

| 2020 | $12,225 | $14,834 | $14,251 |

| 2020 | $12,468 | $15,825 | $14,784 |

| 2020 | $12,298 | $15,279 | $14,462 |

| 2020 | $12,042 | $14,810 | $14,170 |

| 2020 | $12,796 | $16,704 | $15,302 |

| 2020 | $13,037 | $17,412 | $15,713 |

| 2021 | $12,938 | $17,240 | $15,574 |

| 2021 | $13,148 | $17,681 | $15,723 |

| 2021 | $13,507 | $18,270 | $15,965 |

| 2021 | $13,866 | $19,120 | $16,461 |

| 2021 | $14,040 | $19,395 | $16,626 |

| 2021 | $14,065 | $19,684 | $16,823 |

| 2021 | $14,176 | $20,036 | $17,079 |

| 2021 | $14,486 | $20,535 | $17,321 |

| 2021 | $13,928 | $19,683 | $16,826 |

| 2021 | $14,510 | $20,797 | $17,396 |

| 2021 | $14,151 | $20,341 | $17,182 |

| 2021 | $14,673 | $21,210 | $17,610 |

| 2022 | $13,951 | $20,088 | $16,899 |

| 2022 | $13,718 | $19,580 | $16,569 |

| 2022 | $13,834 | $20,116 | $16,647 |

| 2022 | $13,151 | $18,445 | $15,565 |

| 2022 | $13,074 | $18,459 | $15,613 |

| 2022 | $12,390 | $16,861 | $14,718 |

| 2022 | $12,880 | $18,200 | $15,563 |

| 2022 | $12,615 | $17,439 | $14,995 |

| 2022 | $11,941 | $15,817 | $13,892 |

| 2022 | $12,416 | $16,953 | $14,419 |

| 2022 | $12,786 | $18,131 | $15,242 |

| 2022 | $12,463 | $17,360 | $14,811 |

| 2023 | $12,836 | $18,589 | $15,622 |

| 2023 | $12,477 | $18,143 | $15,236 |

| 2023 | $12,730 | $18,704 | $15,674 |

| 2023 | $12,863 | $19,031 | $15,876 |

| 2023 | $12,543 | $18,841 | $15,712 |

| 2023 | $12,956 | $19,981 | $16,262 |

| 2023 | $13,342 | $20,652 | $16,585 |

| 2023 | $12,956 | $20,159 | $16,303 |

| 2023 | $12,463 | $19,290 | $15,715 |

| 2023 | $12,157 | $18,730 | $15,342 |

| 2023 | $13,036 | $20,487 | $16,481 |

| 2023 | $13,691 | $21,493 | $17,219 |

| 2024 | $13,760 | $21,751 | $17,324 |

| 2024 | $14,225 | $22,673 | $17,671 |

| 2024 | $14,567 | $23,401 | $18,083 |

| 2024 | $13,855 | $22,533 | $17,498 |

| 2024 | $14,376 | $23,540 | $18,084 |

| 2024 | $14,704 | $24,021 | $18,373 |

Average Annual Total Returns (%)

| 1 Year | 5 Years | 10 Years |

|---|

| Open Shares | 13.49% | 4.98% | 3.93% |

| MSCI World Index | 20.19% | 11.78% | 9.16% |

| Global Asset Allocation Blended Index | 12.98% | 7.27% | 6.27% |

The performance quoted represents past performance. Past performance does not guarantee future results. The current performance may be lower or higher than the performance data quoted. The performance graph and table do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

| Total Net Assets | $35,316,607 |

| # of Portfolio Holdings | 15 |

| Portfolio Turnover Rate | 36% |

| Total Advisory Fees Paid (Net of Waivers/Reimbursements) | $70,298 |

Top 10 Holdings (% of Net Assets)

| Vanguard S&P 500 ETF | 12.5% |

| Vanguard S&P 500 Growth ETF | 10.8% |

| iShares Currency Hedged MSCI Japan ETF | 10.4% |

| Vanguard Long-Term Treasury ETF | 10.2% |

| Vanguard S&P 500 Value ETF | 9.8% |

| SPDR EURO STOXX 50 ETF | 9.1% |

| Invesco QQQ Trust | 6.6% |

| Vanguard Mega Cap ETF | 5.7% |

| iShares Expanded Tech-Software Sector ETF | 5.5% |

| iShares Russell 2000 ETF | 5.5% |

Top Sectors (% of Net Assets)

| Equity Funds | 70.1% |

| Fixed-Income Funds | 22.5% |

| Cash, Cash Equivalents and Repurchase Agreements | 5.4% |

| Commodity | 1.9% |

If you wish to view additional information about the Portfolio including, but not limited to, the

prospectus, financial statements, holdings and proxy voting information please visit: https://www.lazardassetmanagement.com/us/en_us/funds/list/mutual-funds/42#documents.

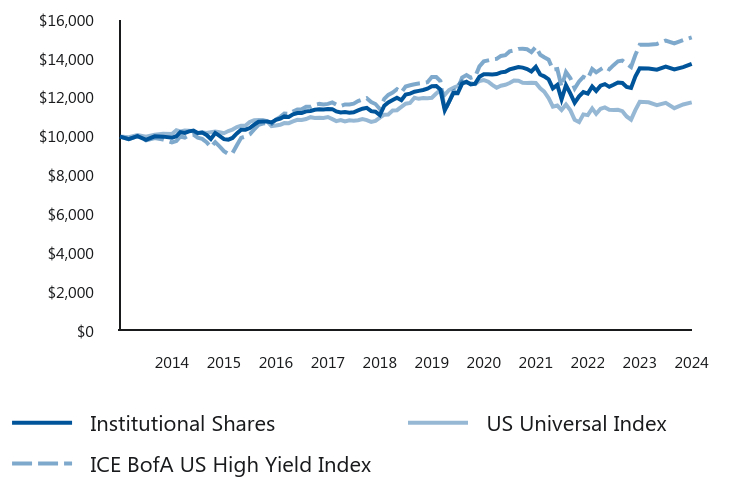

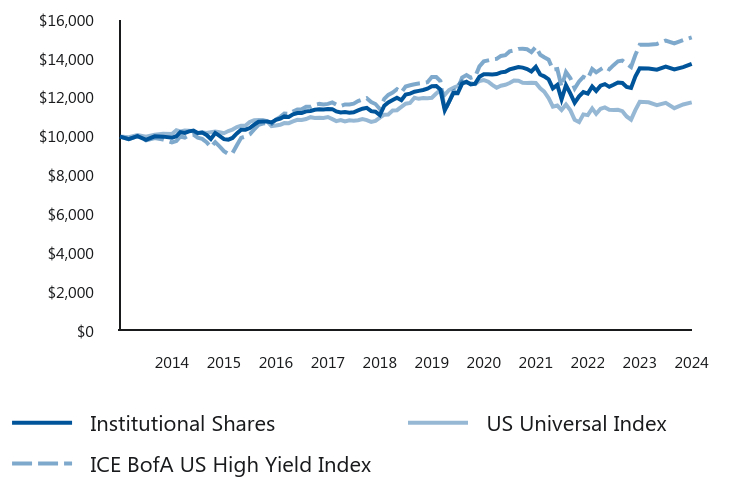

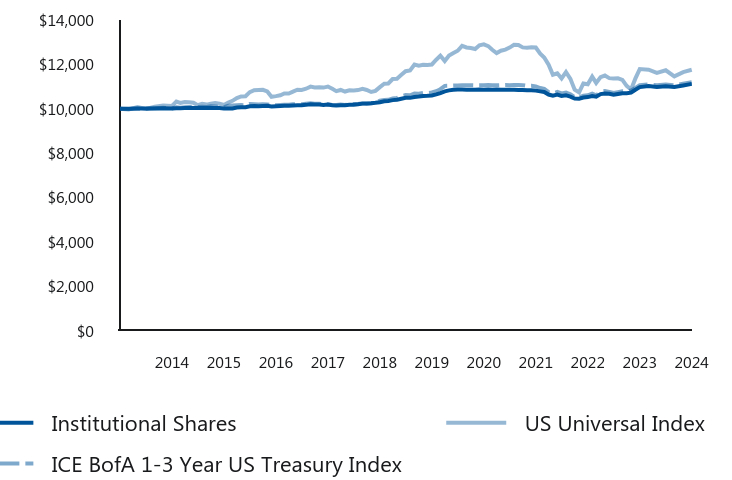

Lazard US Convertibles Portfolio

CONIX: Institutional Shares

Semi-Annual Shareholder Report - June 30, 2024

This semi-annual shareholder report contains important information about the Lazard US Convertibles Portfolio for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Portfolio at www.lazardassetmanagement.com/us/en_us/funds/list/mutual-funds/42#TSR. You can also request this information by contacting us at Contact.US@Lazard.com or (800) 823-6300.

What were the Portfolio costs for the last six months?

(based on a $10,000 investment and annualized for periods of less than one year)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional Shares | $37 | 0.75% |

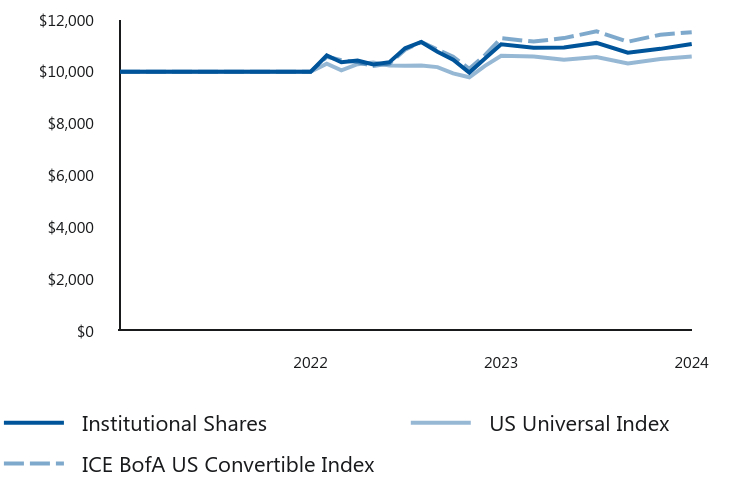

| Institutional Shares | US Universal Index | ICE BofA US Convertible Index |

|---|

| 2022 | $10,000 | $10,000 | $10,000 |

| 2022 | $10,000 | $10,000 | $10,000 |

| 2023 | $10,630 | $10,310 | $10,580 |

| 2023 | $10,370 | $10,057 | $10,444 |

| 2023 | $10,433 | $10,293 | $10,375 |

| 2023 | $10,282 | $10,356 | $10,230 |

| 2023 | $10,373 | $10,248 | $10,320 |

| 2023 | $10,909 | $10,232 | $10,855 |

| 2023 | $11,151 | $10,243 | $11,151 |

| 2023 | $10,778 | $10,181 | $10,863 |

| 2023 | $10,466 | $9,938 | $10,580 |

| 2023 | $9,970 | $9,789 | $10,115 |

| 2023 | $10,516 | $10,229 | $10,642 |

| 2023 | $11,062 | $10,617 | $11,298 |

| 2024 | $10,927 | $10,592 | $11,167 |

| 2024 | $10,938 | $10,465 | $11,301 |

| 2024 | $11,116 | $10,568 | $11,563 |

| 2024 | $10,740 | $10,321 | $11,161 |

| 2024 | $10,886 | $10,492 | $11,433 |

| 2024 | $11,077 | $10,588 | $11,527 |

Average Annual Total Returns (%)

| 1 Year | Since Inception 12/30/22 |

|---|

| Institutional Shares | 1.54% | 7.05% |

| US Universal Index | 3.47% | 3.88% |

| ICE BofA US Convertible Index | 6.19% | 9.94% |

The performance quoted represents past performance. Past performance does not guarantee future results. The current performance may be lower or higher than the performance data quoted. The performance graph and table do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares. Effective as of May 1, 2024, the US Universal Index replaced the ICE BofA US Convertible Index as the Portfolio’s broad-based securities market index. The US Universal Index was selected in connection with certain regulatory requirements to provide a broad measure of market performance.

| Total Net Assets | $12,372,110 |

| # of Portfolio Holdings | 81 |

| Portfolio Turnover Rate | 18% |

| Total Advisory Fees Paid (Net of Waivers/Reimbursements) | $0 |

Top 10 Holdings (% of Net Assets)

| Palo Alto Networks, Inc. 0.375% due 06/01/25 | 3.1% |

| Bank of America Corp., Series L | 2.8% |

| Uber Technologies, Inc. 0.000% due 12/15/25 | 2.6% |

| Royal Caribbean Cruises Ltd. 6.000% due 08/15/25 | 2.4% |

| Live Nation Entertainment, Inc. 2.000% due 02/15/25 | 2.2% |

| Halozyme Therapeutics, Inc. 0.250% due 03/01/27 | 2.2% |

| Dexcom, Inc. 0.250% due 11/15/25 | 2.1% |

| ON Semiconductor Corp. 0.500% due 03/01/29 | 2.1% |

| Cloudflare, Inc. 0.000% due 08/15/26 | 2.0% |

| Ford Motor Co. 0.000% due 03/15/26 | 1.9% |

Top 10 Sectors (% of Net Assets)

| Information Technology | 28.7% |

| Health Care | 14.8% |

| Consumer Discretionary | 13.2% |

| Communication Services | 12.0% |

| Financials | 9.0% |

| Industrials | 7.9% |

| Utilities | 6.9% |

| Cash, Cash Equivalents and Repurchase Agreements | 3.5% |

| Real Estate | 2.1% |

| Materials | 1.0% |

If you wish to view additional information about the Portfolio including, but not limited to, the

prospectus, financial statements, holdings and proxy voting information please visit: https://www.lazardassetmanagement.com/us/en_us/funds/list/mutual-funds/42#documents.

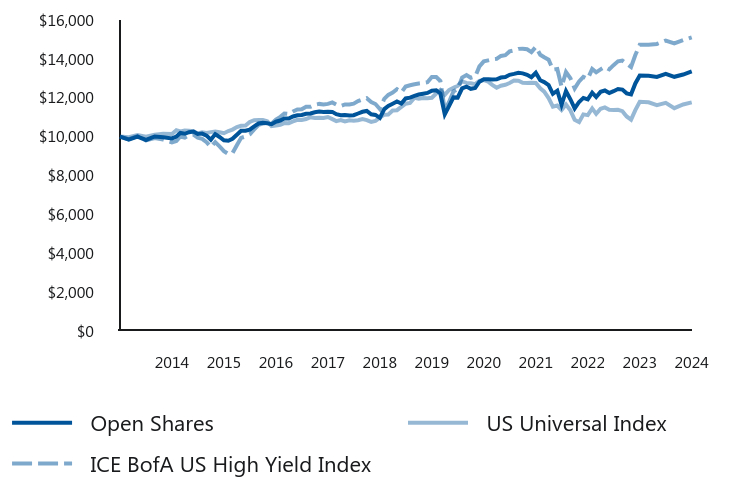

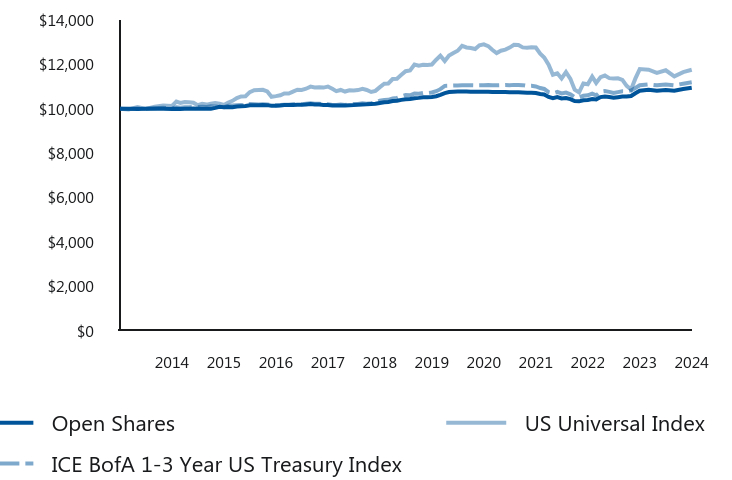

Lazard US Convertibles Portfolio

Semi-Annual Shareholder Report - June 30, 2024

This semi-annual shareholder report contains important information about the Lazard US Convertibles Portfolio for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Portfolio at www.lazardassetmanagement.com/us/en_us/funds/list/mutual-funds/42#TSR. You can also request this information by contacting us at Contact.US@Lazard.com or (800) 823-6300.

What were the Portfolio costs for the last six months?

(based on a $10,000 investment and annualized for periods of less than one year)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Open Shares | $50 | 1.00% |

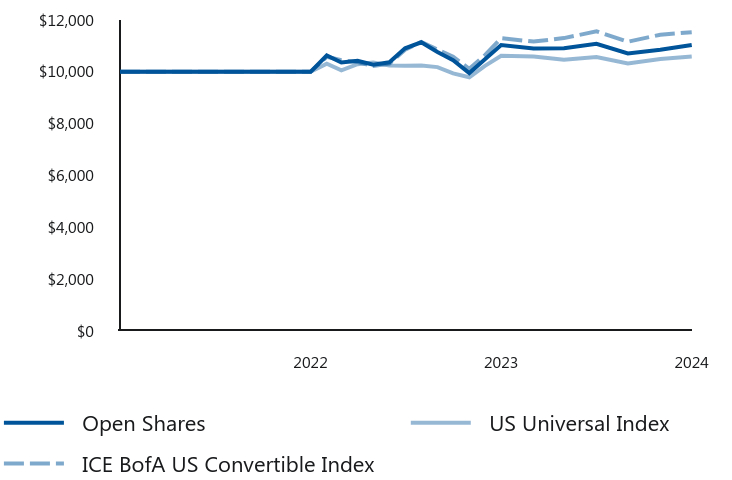

| Open Shares | US Universal Index | ICE BofA US Convertible Index |

|---|

| 2022 | $10,000 | $10,000 | $10,000 |

| 2022 | $10,000 | $10,000 | $10,000 |

| 2023 | $10,630 | $10,310 | $10,580 |

| 2023 | $10,360 | $10,057 | $10,444 |

| 2023 | $10,427 | $10,293 | $10,375 |

| 2023 | $10,276 | $10,356 | $10,230 |

| 2023 | $10,367 | $10,248 | $10,320 |

| 2023 | $10,906 | $10,232 | $10,855 |

| 2023 | $11,138 | $10,243 | $11,151 |

| 2023 | $10,765 | $10,181 | $10,863 |

| 2023 | $10,447 | $9,938 | $10,580 |

| 2023 | $9,952 | $9,789 | $10,115 |

| 2023 | $10,487 | $10,229 | $10,642 |

| 2023 | $11,035 | $10,617 | $11,298 |

| 2024 | $10,900 | $10,592 | $11,167 |

| 2024 | $10,910 | $10,465 | $11,301 |

| 2024 | $11,081 | $10,568 | $11,563 |

| 2024 | $10,706 | $10,321 | $11,161 |

| 2024 | $10,852 | $10,492 | $11,433 |

| 2024 | $11,035 | $10,588 | $11,527 |

Average Annual Total Returns (%)

| 1 Year | Since Inception 12/30/22 |

|---|

| Open Shares | 1.18% | 6.78% |

| US Universal Index | 3.47% | 3.88% |

| ICE BofA US Convertible Index | 6.19% | 9.94% |

The performance quoted represents past performance. Past performance does not guarantee future results. The current performance may be lower or higher than the performance data quoted. The performance graph and table do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares. Effective as of May 1, 2024, the US Universal Index replaced the ICE BofA US Convertible Index as the Portfolio’s broad-based securities market index. The US Universal Index was selected in connection with certain regulatory requirements to provide a broad measure of market performance.

| Total Net Assets | $12,372,110 |

| # of Portfolio Holdings | 81 |

| Portfolio Turnover Rate | 18% |

| Total Advisory Fees Paid (Net of Waivers/Reimbursements) | $0 |

Top 10 Holdings (% of Net Assets)

| Palo Alto Networks, Inc. 0.375% due 06/01/25 | 3.1% |

| Bank of America Corp., Series L | 2.8% |

| Uber Technologies, Inc. 0.000% due 12/15/25 | 2.6% |

| Royal Caribbean Cruises Ltd. 6.000% due 08/15/25 | 2.4% |

| Live Nation Entertainment, Inc. 2.000% due 02/15/25 | 2.2% |

| Halozyme Therapeutics, Inc. 0.250% due 03/01/27 | 2.2% |

| Dexcom, Inc. 0.250% due 11/15/25 | 2.1% |

| ON Semiconductor Corp. 0.500% due 03/01/29 | 2.1% |

| Cloudflare, Inc. 0.000% due 08/15/26 | 2.0% |

| Ford Motor Co. 0.000% due 03/15/26 | 1.9% |

Top 10 Sectors (% of Net Assets)

| Information Technology | 28.7% |

| Health Care | 14.8% |

| Consumer Discretionary | 13.2% |

| Communication Services | 12.0% |

| Financials | 9.0% |

| Industrials | 7.9% |

| Utilities | 6.9% |

| Cash, Cash Equivalents and Repurchase Agreements | 3.5% |

| Real Estate | 2.1% |

| Materials | 1.0% |

If you wish to view additional information about the Portfolio including, but not limited to, the

prospectus, financial statements, holdings and proxy voting information please visit: https://www.lazardassetmanagement.com/us/en_us/funds/list/mutual-funds/42#documents.

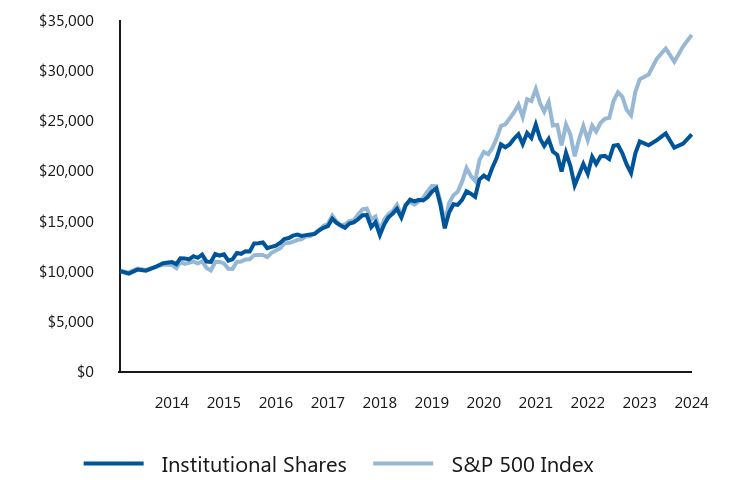

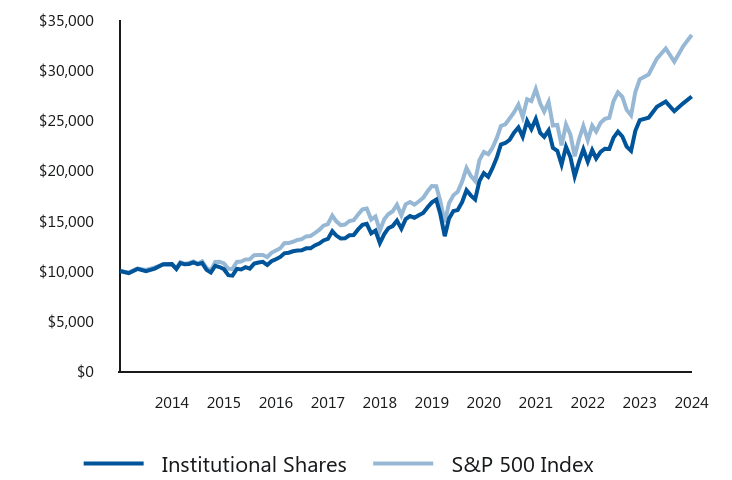

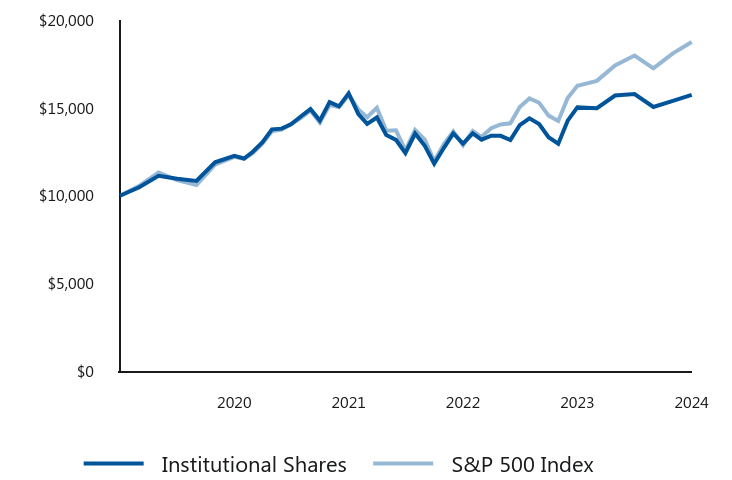

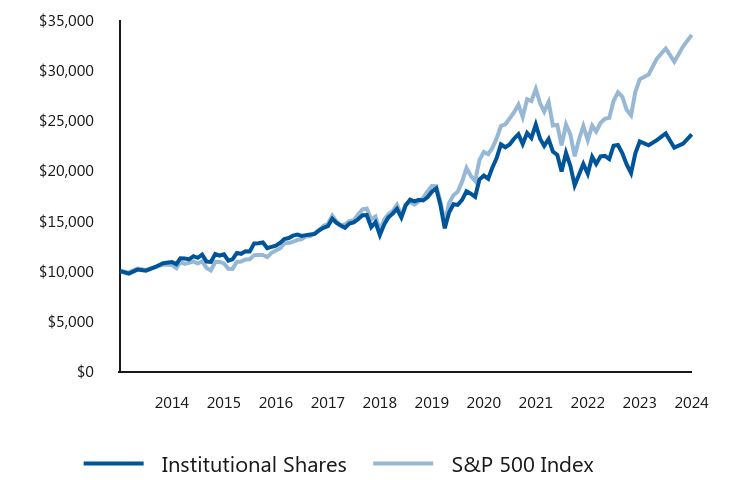

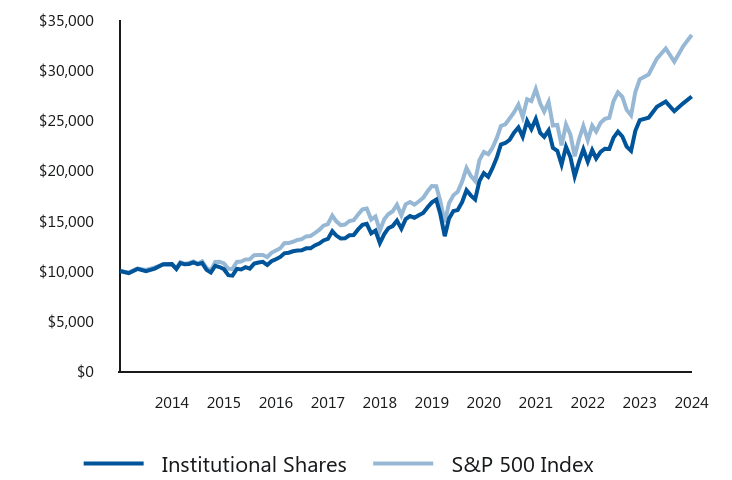

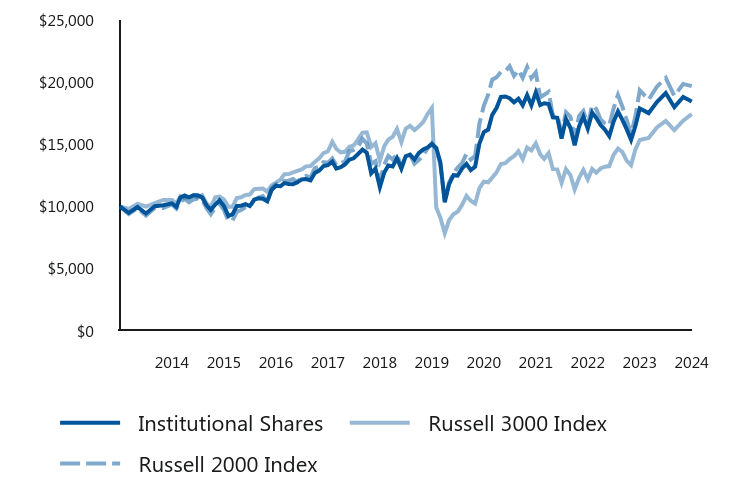

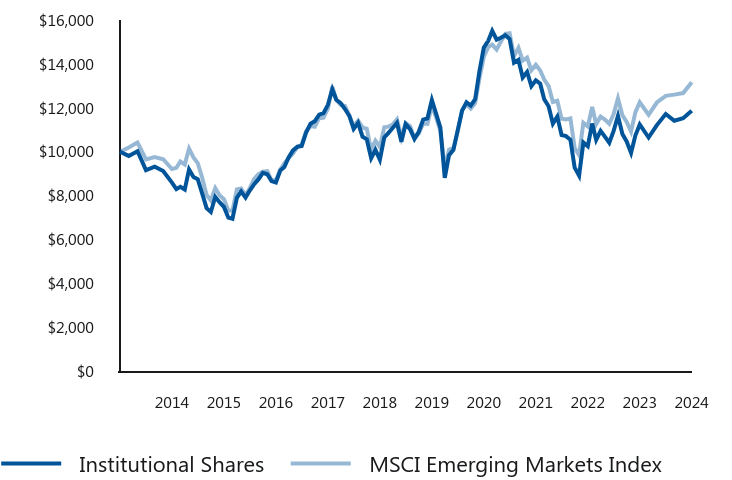

Lazard US Equity Concentrated Portfolio

LEVIX: Institutional Shares

Semi-Annual Shareholder Report - June 30, 2024

This semi-annual shareholder report contains important information about the Lazard US Equity Concentrated Portfolio for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Portfolio at www.lazardassetmanagement.com/us/en_us/funds/list/mutual-funds/42#TSR. You can also request this information by contacting us at Contact.US@Lazard.com or (800) 823-6300.

What were the Portfolio costs for the last six months?

(based on a $10,000 investment and annualized for periods of less than one year)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional Shares | $47 | 0.94% |

| Institutional Shares | S&P 500 Index |

|---|

| 2014 | $10,000 | $10,000 |

| 2014 | $9,745 | $9,862 |

| 2014 | $10,146 | $10,256 |

| 2014 | $10,033 | $10,113 |

| 2014 | $10,379 | $10,360 |

| 2014 | $10,778 | $10,638 |

| 2014 | $10,901 | $10,611 |

| 2015 | $10,682 | $10,292 |

| 2015 | $11,275 | $10,884 |

| 2015 | $11,251 | $10,712 |

| 2015 | $11,153 | $10,815 |

| 2015 | $11,478 | $10,955 |

| 2015 | $11,316 | $10,742 |

| 2015 | $11,633 | $10,968 |

| 2015 | $10,942 | $10,306 |

| 2015 | $10,909 | $10,052 |

| 2015 | $11,690 | $10,900 |

| 2015 | $11,543 | $10,933 |

| 2015 | $11,665 | $10,760 |

| 2016 | $11,024 | $10,226 |

| 2016 | $11,158 | $10,213 |

| 2016 | $11,808 | $10,905 |

| 2016 | $11,715 | $10,948 |

| 2016 | $11,968 | $11,145 |

| 2016 | $11,943 | $11,174 |

| 2016 | $12,753 | $11,586 |

| 2016 | $12,775 | $11,603 |

| 2016 | $12,843 | $11,605 |

| 2016 | $12,284 | $11,394 |

| 2016 | $12,403 | $11,815 |

| 2016 | $12,525 | $12,049 |

| 2017 | $12,816 | $12,278 |

| 2017 | $13,179 | $12,766 |

| 2017 | $13,285 | $12,781 |

| 2017 | $13,524 | $12,913 |

| 2017 | $13,621 | $13,095 |

| 2017 | $13,489 | $13,176 |

| 2017 | $13,577 | $13,447 |

| 2017 | $13,639 | $13,488 |

| 2017 | $13,701 | $13,766 |

| 2017 | $14,055 | $14,087 |

| 2017 | $14,311 | $14,520 |

| 2017 | $14,465 | $14,681 |

| 2018 | $15,212 | $15,522 |

| 2018 | $14,824 | $14,949 |

| 2018 | $14,522 | $14,570 |

| 2018 | $14,305 | $14,625 |

| 2018 | $14,720 | $14,978 |

| 2018 | $14,843 | $15,070 |

| 2018 | $15,155 | $15,630 |

| 2018 | $15,562 | $16,140 |

| 2018 | $15,572 | $16,232 |

| 2018 | $14,366 | $15,122 |

| 2018 | $14,868 | $15,430 |

| 2018 | $13,587 | $14,037 |

| 2019 | $14,652 | $15,162 |

| 2019 | $15,316 | $15,649 |

| 2019 | $15,717 | $15,953 |

| 2019 | $16,191 | $16,599 |

| 2019 | $15,327 | $15,544 |

| 2019 | $16,528 | $16,639 |

| 2019 | $17,098 | $16,879 |

| 2019 | $16,929 | $16,612 |

| 2019 | $17,087 | $16,923 |

| 2019 | $17,024 | $17,290 |

| 2019 | $17,340 | $17,918 |

| 2019 | $17,897 | $18,459 |

| 2020 | $18,227 | $18,452 |

| 2020 | $16,611 | $16,933 |

| 2020 | $14,252 | $14,841 |

| 2020 | $15,814 | $16,744 |

| 2020 | $16,654 | $17,541 |

| 2020 | $16,580 | $17,890 |

| 2020 | $17,090 | $18,899 |

| 2020 | $17,951 | $20,258 |

| 2020 | $17,706 | $19,488 |

| 2020 | $17,387 | $18,970 |

| 2020 | $19,109 | $21,047 |

| 2020 | $19,505 | $21,855 |

| 2021 | $19,191 | $21,635 |

| 2021 | $20,272 | $22,231 |

| 2021 | $21,245 | $23,205 |

| 2021 | $22,606 | $24,443 |

| 2021 | $22,325 | $24,614 |

| 2021 | $22,595 | $25,188 |

| 2021 | $23,179 | $25,787 |

| 2021 | $23,615 | $26,571 |

| 2021 | $22,643 | $25,335 |

| 2021 | $23,747 | $27,111 |

| 2021 | $23,255 | $26,924 |

| 2021 | $24,581 | $28,130 |

| 2022 | $23,146 | $26,676 |

| 2022 | $22,459 | $25,877 |

| 2022 | $23,146 | $26,838 |

| 2022 | $21,898 | $24,498 |

| 2022 | $21,561 | $24,543 |

| 2022 | $19,902 | $22,518 |

| 2022 | $21,773 | $24,594 |

| 2022 | $20,467 | $23,591 |

| 2022 | $18,534 | $21,419 |

| 2022 | $19,602 | $23,153 |

| 2022 | $20,671 | $24,447 |

| 2022 | $19,692 | $23,039 |

| 2023 | $21,372 | $24,485 |

| 2023 | $20,658 | $23,888 |

| 2023 | $21,425 | $24,765 |

| 2023 | $21,465 | $25,151 |

| 2023 | $21,147 | $25,259 |

| 2023 | $22,484 | $26,929 |

| 2023 | $22,550 | $27,794 |

| 2023 | $21,718 | $27,351 |

| 2023 | $20,619 | $26,047 |

| 2023 | $19,757 | $25,500 |

| 2023 | $21,718 | $27,828 |

| 2023 | $22,902 | $29,091 |

| 2024 | $22,527 | $29,580 |

| 2024 | $23,036 | $31,159 |

| 2024 | $23,707 | $32,163 |

| 2024 | $22,285 | $30,851 |

| 2024 | $22,688 | $32,381 |

| 2024 | $23,599 | $33,521 |

Average Annual Total Returns (%)

| 1 Year | 5 Years | 10 Years |

|---|

| Institutional Shares | 4.96% | 7.38% | 8.97% |

| S&P 500 Index | 24.56% | 15.05% | 12.86% |

The performance quoted represents past performance. Past performance does not guarantee future results. The current performance may be lower or higher than the performance data quoted. The performance graph and table do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

| Total Net Assets | $94,783,316 |

| # of Portfolio Holdings | 21 |

| Portfolio Turnover Rate | 67% |

| Total Advisory Fees Paid (Net of Waivers/Reimbursements) | $434,879 |

Top 10 Holdings (% of Net Assets)

| Marvell Technology, Inc. | 11.8% |

| Amazon.com, Inc. | 8.6% |

| Broadcom, Inc. | 6.2% |

| Crown Castle, Inc. | 6.2% |

| Oracle Corp. | 5.6% |

| UnitedHealth Group, Inc. | 5.0% |

| Intercontinental Exchange, Inc. | 4.7% |

| S&P Global, Inc. | 4.7% |

| Lululemon Athletica, Inc. | 4.7% |

| Waste Management, Inc. | 4.6% |

Top Sectors (% of Net Assets)

| Information Technology | 26.5% |

| Financials | 18.2% |

| Consumer Discretionary | 17.3% |

| Industrials | 11.5% |

| Real Estate | 10.3% |

| Health Care | 9.5% |

| Communication Services | 4.2% |

| Cash, Cash Equivalents and Repurchase Agreements | 0.2% |

If you wish to view additional information about the Portfolio including, but not limited to, the

prospectus, financial statements, holdings and proxy voting information please visit: https://www.lazardassetmanagement.com/us/en_us/funds/list/mutual-funds/42#documents.

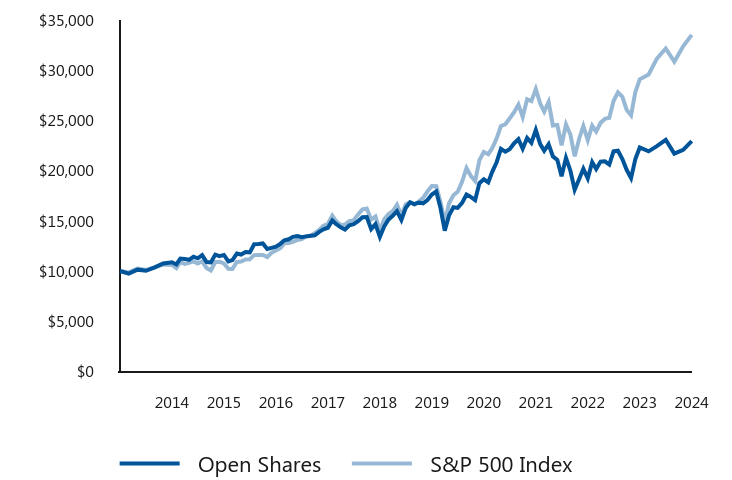

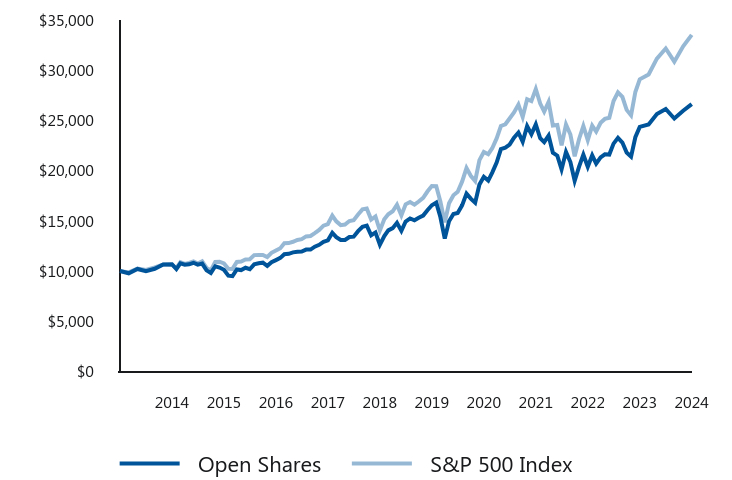

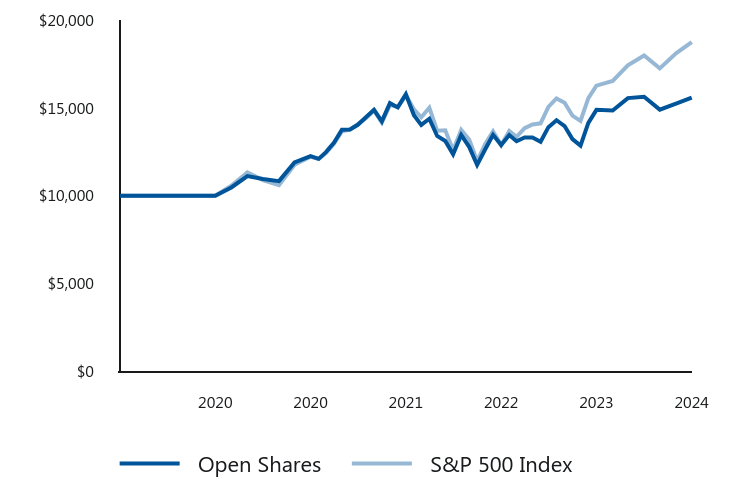

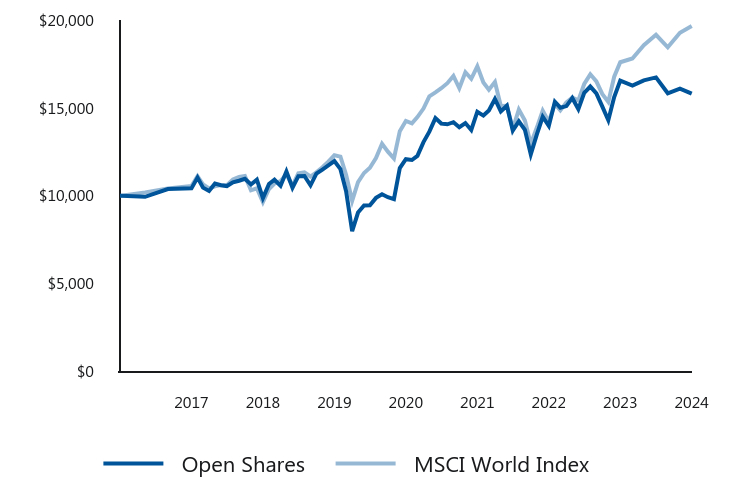

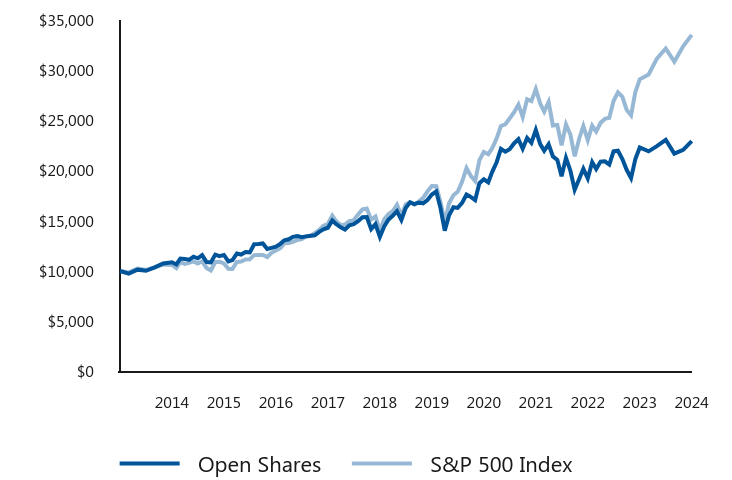

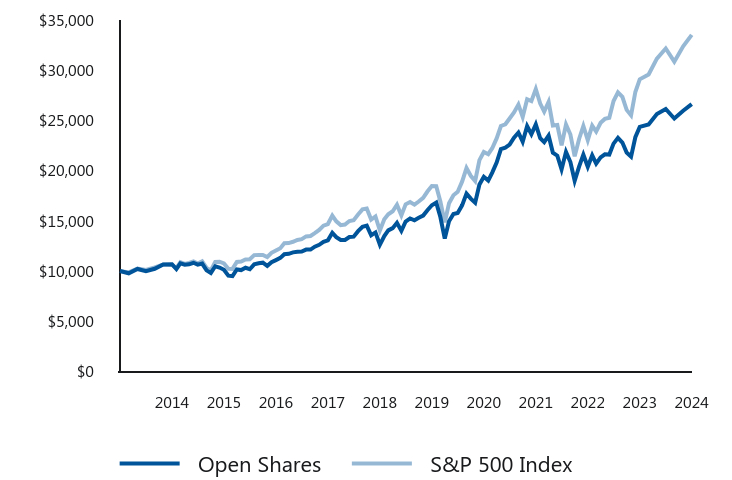

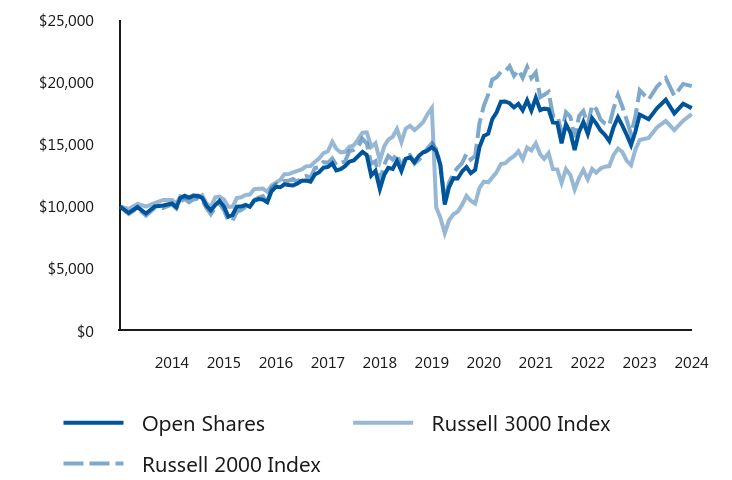

Lazard US Equity Concentrated Portfolio

Semi-Annual Shareholder Report - June 30, 2024

This semi-annual shareholder report contains important information about the Lazard US Equity Concentrated Portfolio for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Portfolio at www.lazardassetmanagement.com/us/en_us/funds/list/mutual-funds/42#TSR. You can also request this information by contacting us at Contact.US@Lazard.com or (800) 823-6300.

What were the Portfolio costs for the last six months?

(based on a $10,000 investment and annualized for periods of less than one year)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Open Shares | $60 | 1.19% |

| Open Shares | S&P 500 Index |

|---|

| 2014 | $10,000 | $10,000 |

| 2014 | $9,739 | $9,862 |

| 2014 | $10,137 | $10,256 |

| 2014 | $10,025 | $10,113 |

| 2014 | $10,362 | $10,360 |

| 2014 | $10,752 | $10,638 |

| 2014 | $10,876 | $10,611 |

| 2015 | $10,651 | $10,292 |

| 2015 | $11,239 | $10,884 |

| 2015 | $11,207 | $10,712 |

| 2015 | $11,118 | $10,815 |

| 2015 | $11,432 | $10,955 |

| 2015 | $11,263 | $10,742 |

| 2015 | $11,585 | $10,968 |

| 2015 | $10,892 | $10,306 |

| 2015 | $10,860 | $10,052 |

| 2015 | $11,634 | $10,900 |

| 2015 | $11,481 | $10,933 |

| 2015 | $11,602 | $10,760 |

| 2016 | $10,961 | $10,226 |

| 2016 | $11,094 | $10,213 |

| 2016 | $11,736 | $10,905 |

| 2016 | $11,644 | $10,948 |

| 2016 | $11,894 | $11,145 |

| 2016 | $11,861 | $11,174 |

| 2016 | $12,661 | $11,586 |

| 2016 | $12,683 | $11,603 |

| 2016 | $12,742 | $11,605 |

| 2016 | $12,198 | $11,394 |

| 2016 | $12,307 | $11,815 |

| 2016 | $12,421 | $12,049 |

| 2017 | $12,709 | $12,278 |

| 2017 | $13,066 | $12,766 |

| 2017 | $13,162 | $12,781 |

| 2017 | $13,406 | $12,913 |

| 2017 | $13,494 | $13,095 |

| 2017 | $13,363 | $13,176 |

| 2017 | $13,450 | $13,447 |

| 2017 | $13,511 | $13,488 |

| 2017 | $13,563 | $13,766 |

| 2017 | $13,903 | $14,087 |

| 2017 | $14,156 | $14,520 |

| 2017 | $14,311 | $14,681 |

| 2018 | $15,035 | $15,522 |

| 2018 | $14,664 | $14,949 |

| 2018 | $14,349 | $14,570 |

| 2018 | $14,135 | $14,625 |

| 2018 | $14,543 | $14,978 |

| 2018 | $14,664 | $15,070 |

| 2018 | $14,970 | $15,630 |

| 2018 | $15,361 | $16,140 |

| 2018 | $15,380 | $16,232 |

| 2018 | $14,177 | $15,122 |

| 2018 | $14,669 | $15,430 |

| 2018 | $13,402 | $14,037 |

| 2019 | $14,454 | $15,162 |

| 2019 | $15,094 | $15,649 |

| 2019 | $15,496 | $15,953 |

| 2019 | $15,961 | $16,599 |

| 2019 | $15,094 | $15,544 |

| 2019 | $16,280 | $16,639 |

| 2019 | $16,838 | $16,879 |

| 2019 | $16,672 | $16,612 |

| 2019 | $16,827 | $16,923 |

| 2019 | $16,745 | $17,290 |

| 2019 | $17,065 | $17,918 |

| 2019 | $17,613 | $18,459 |

| 2020 | $17,924 | $18,452 |

| 2020 | $16,337 | $16,933 |

| 2020 | $14,014 | $14,841 |

| 2020 | $15,538 | $16,744 |

| 2020 | $16,358 | $17,541 |

| 2020 | $16,285 | $17,890 |

| 2020 | $16,783 | $18,899 |

| 2020 | $17,623 | $20,258 |

| 2020 | $17,385 | $19,488 |

| 2020 | $17,063 | $18,970 |

| 2020 | $18,754 | $21,047 |

| 2020 | $19,132 | $21,855 |

| 2021 | $18,827 | $21,635 |

| 2021 | $19,879 | $22,231 |

| 2021 | $20,836 | $23,205 |

| 2021 | $22,161 | $24,443 |

| 2021 | $21,877 | $24,614 |

| 2021 | $22,130 | $25,188 |

| 2021 | $22,708 | $25,787 |

| 2021 | $23,123 | $26,571 |

| 2021 | $22,176 | $25,335 |

| 2021 | $23,250 | $27,111 |

| 2021 | $22,761 | $26,924 |

| 2021 | $24,053 | $28,130 |

| 2022 | $22,637 | $26,676 |

| 2022 | $21,972 | $25,877 |

| 2022 | $22,625 | $26,838 |

| 2022 | $21,415 | $24,498 |

| 2022 | $21,077 | $24,543 |

| 2022 | $19,443 | $22,518 |

| 2022 | $21,270 | $24,594 |

| 2022 | $19,992 | $23,591 |

| 2022 | $18,093 | $21,419 |

| 2022 | $19,141 | $23,153 |

| 2022 | $20,177 | $24,447 |

| 2022 | $19,224 | $23,039 |

| 2023 | $20,849 | $24,485 |

| 2023 | $20,158 | $23,888 |

| 2023 | $20,900 | $24,765 |

| 2023 | $20,926 | $25,151 |

| 2023 | $20,606 | $25,259 |

| 2023 | $21,911 | $26,929 |

| 2023 | $21,974 | $27,794 |

| 2023 | $21,158 | $27,351 |

| 2023 | $20,082 | $26,047 |

| 2023 | $19,250 | $25,500 |

| 2023 | $21,143 | $27,828 |

| 2023 | $22,304 | $29,091 |

| 2024 | $21,920 | $29,580 |

| 2024 | $22,432 | $31,159 |

| 2024 | $23,072 | $32,163 |

| 2024 | $21,689 | $30,851 |

| 2024 | $22,073 | $32,381 |

| 2024 | $22,944 | $33,521 |

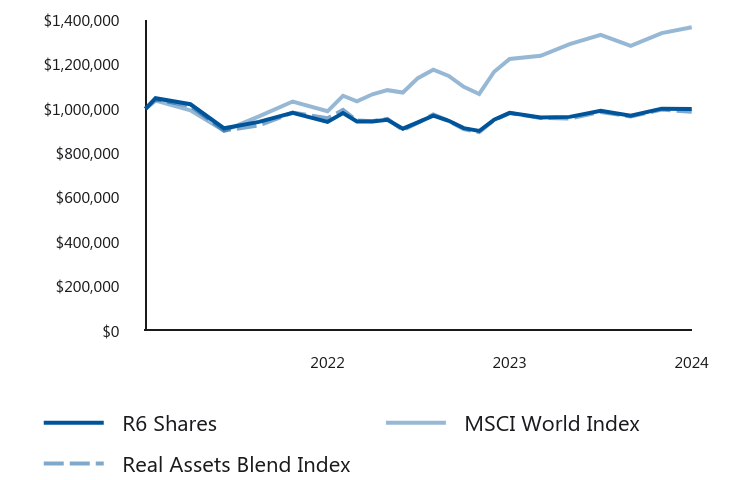

Average Annual Total Returns (%)

| 1 Year | 5 Years | 10 Years |

|---|

| Open Shares | 4.72% | 7.10% | 8.66% |

| S&P 500 Index | 24.56% | 15.05% | 12.86% |

The performance quoted represents past performance. Past performance does not guarantee future results. The current performance may be lower or higher than the performance data quoted. The performance graph and table do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

| Total Net Assets | $94,783,316 |

| # of Portfolio Holdings | 21 |

| Portfolio Turnover Rate | 67% |

| Total Advisory Fees Paid (Net of Waivers/Reimbursements) | $434,879 |

Top 10 Holdings (% of Net Assets)

| Marvell Technology, Inc. | 11.8% |

| Amazon.com, Inc. | 8.6% |

| Broadcom, Inc. | 6.2% |

| Crown Castle, Inc. | 6.2% |

| Oracle Corp. | 5.6% |

| UnitedHealth Group, Inc. | 5.0% |

| Intercontinental Exchange, Inc. | 4.7% |

| S&P Global, Inc. | 4.7% |

| Lululemon Athletica, Inc. | 4.7% |

| Waste Management, Inc. | 4.6% |

Top Sectors (% of Net Assets)

| Information Technology | 26.5% |

| Financials | 18.2% |

| Consumer Discretionary | 17.3% |

| Industrials | 11.5% |

| Real Estate | 10.3% |

| Health Care | 9.5% |

| Communication Services | 4.2% |

| Cash, Cash Equivalents and Repurchase Agreements | 0.2% |

If you wish to view additional information about the Portfolio including, but not limited to, the

prospectus, financial statements, holdings and proxy voting information please visit: https://www.lazardassetmanagement.com/us/en_us/funds/list/mutual-funds/42#documents.

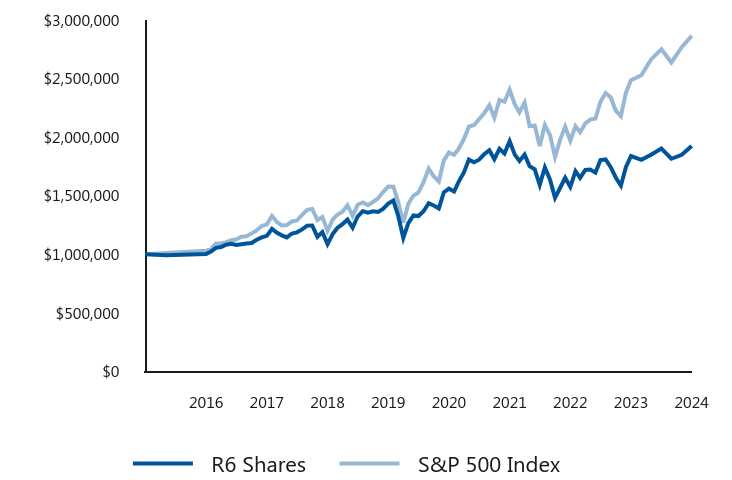

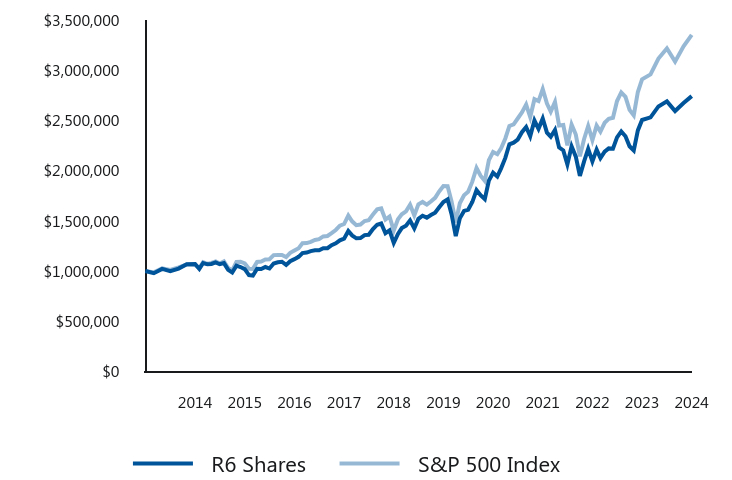

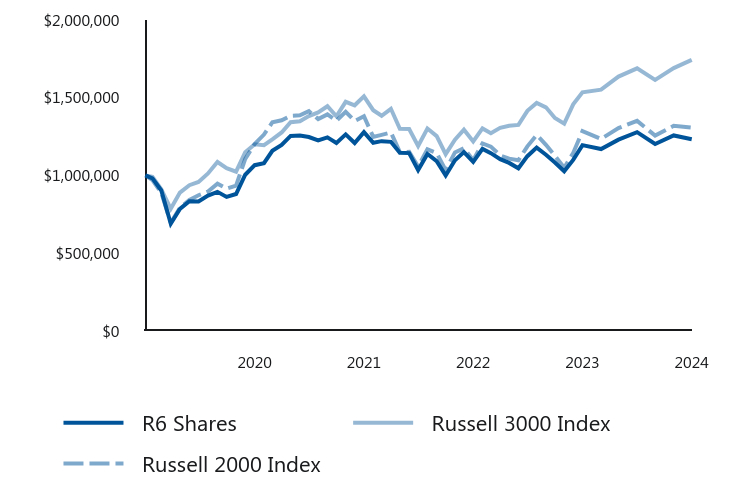

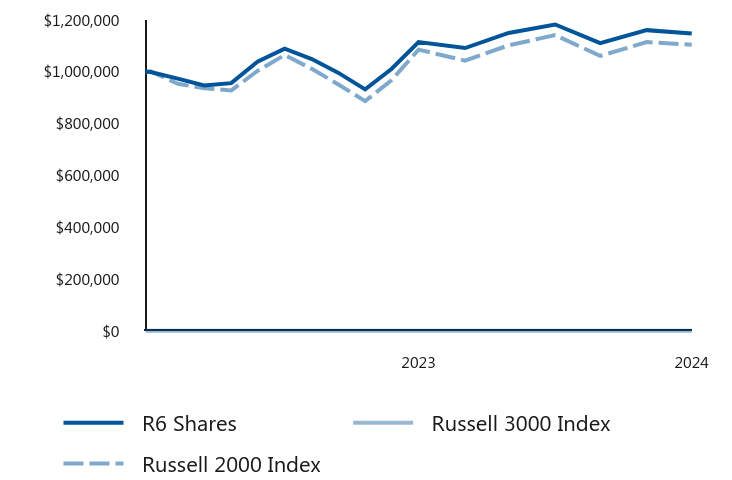

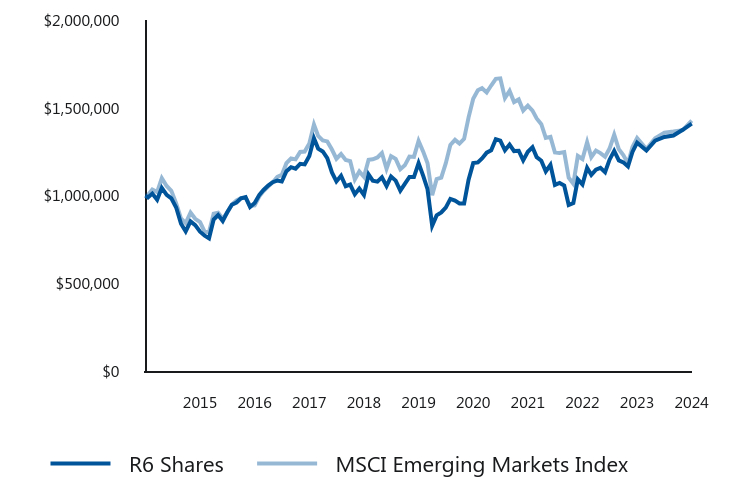

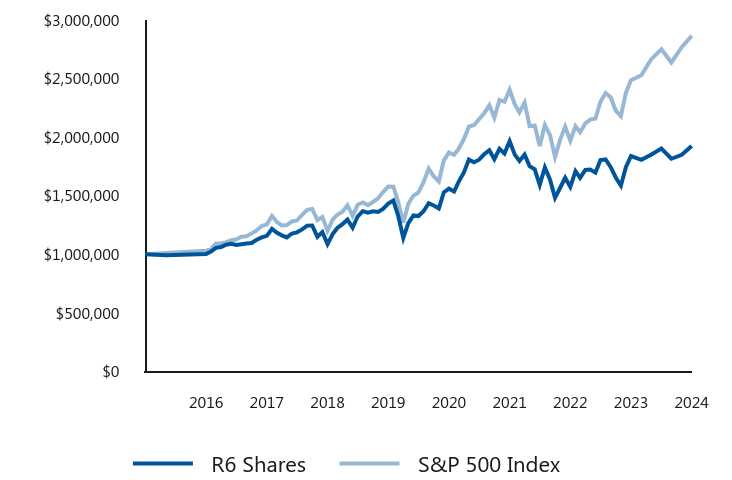

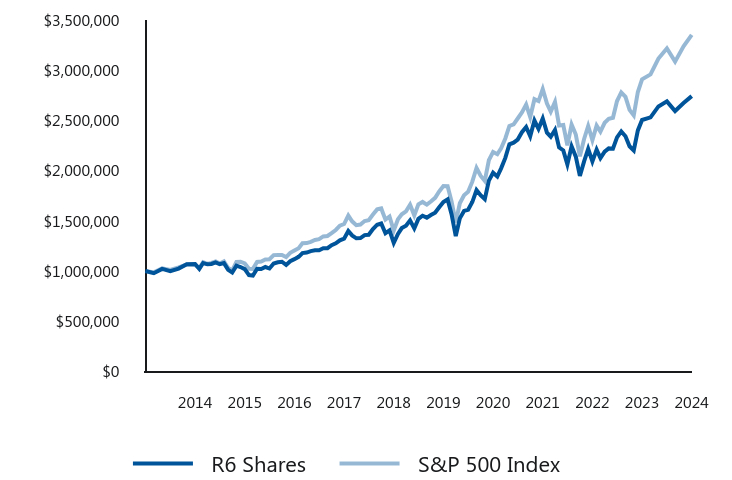

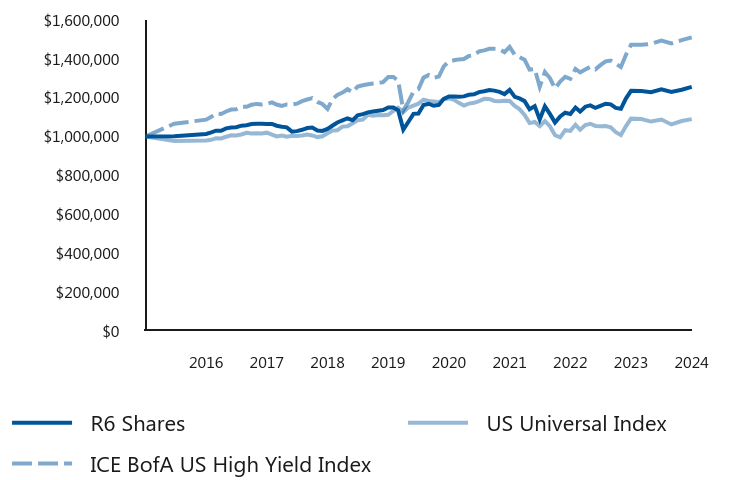

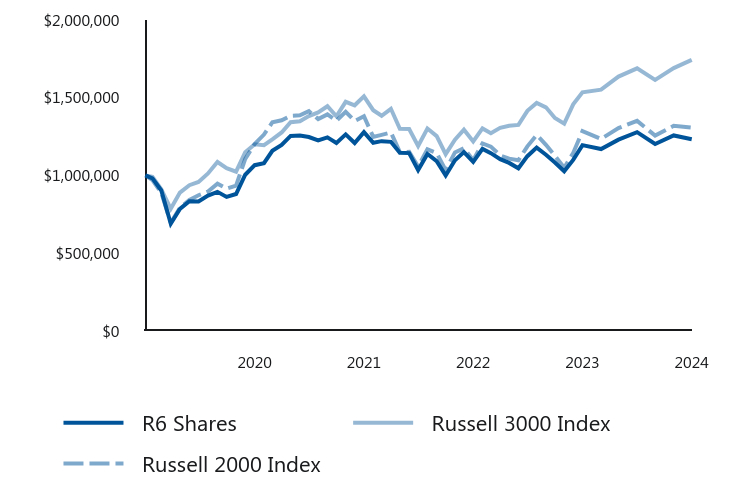

Lazard US Equity Concentrated Portfolio

Semi-Annual Shareholder Report - June 30, 2024

This semi-annual shareholder report contains important information about the Lazard US Equity Concentrated Portfolio for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Portfolio at www.lazardassetmanagement.com/us/en_us/funds/list/mutual-funds/42#TSR. You can also request this information by contacting us at Contact.US@Lazard.com or (800) 823-6300.

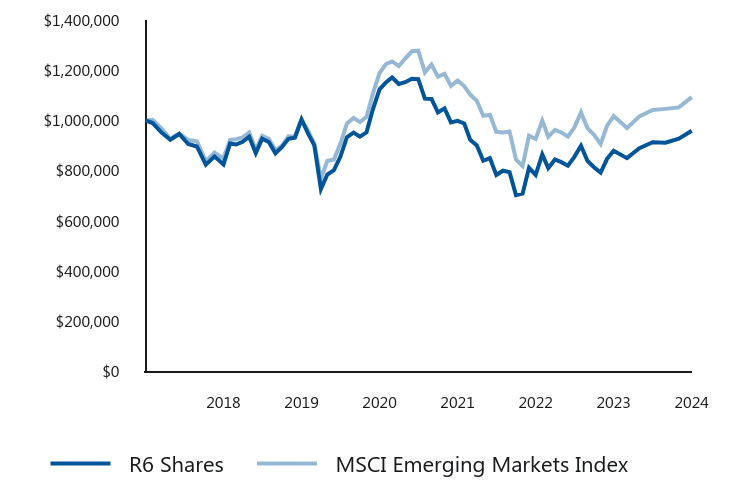

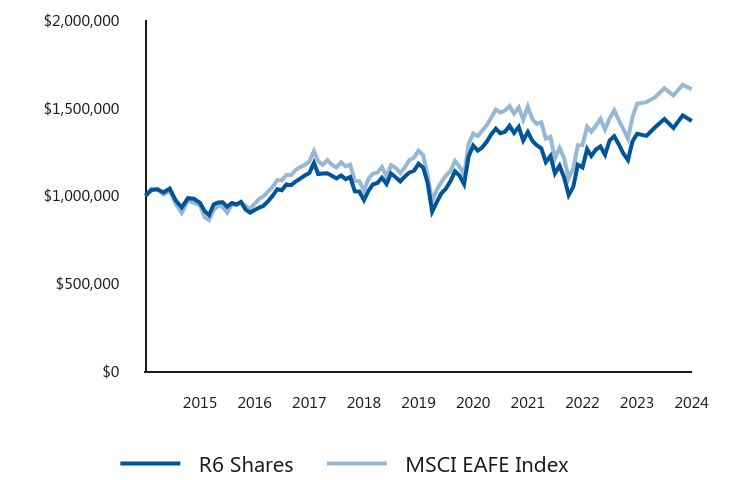

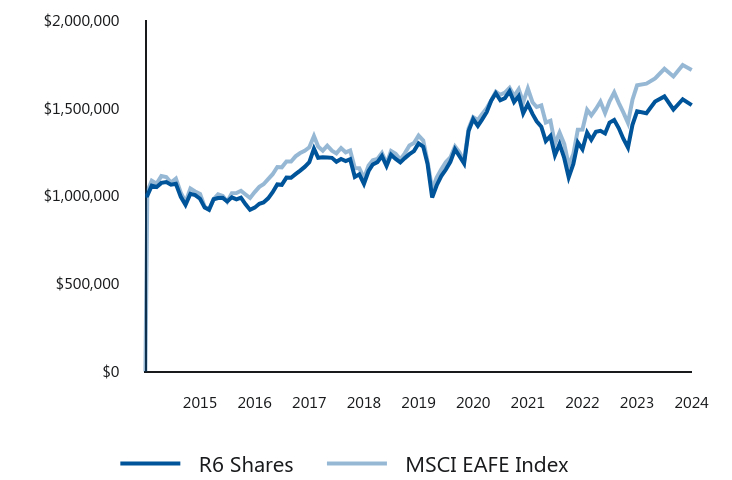

What were the Portfolio costs for the last six months?

(based on a $10,000 investment and annualized for periods of less than one year)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

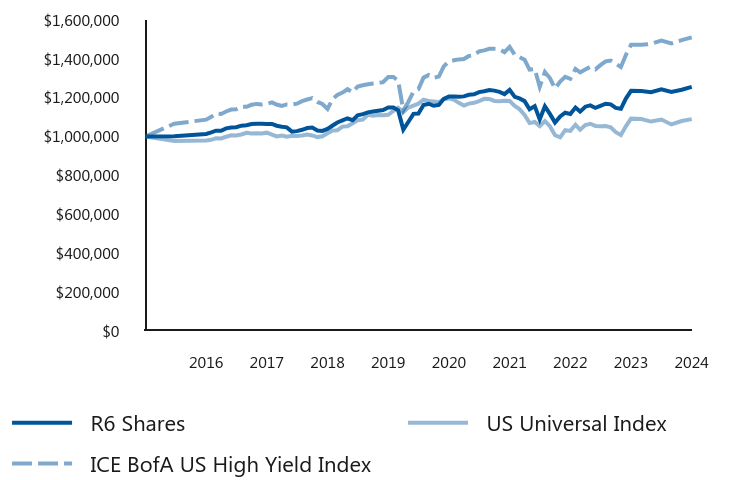

| R6 Shares | $46 | 0.91% |

| R6 Shares | S&P 500 Index |

|---|

| 2016 | $1,000,000 | $1,000,000 |

| 2016 | $992,552 | $1,010,050 |

| 2016 | $1,001,730 | $1,030,049 |

| 2017 | $1,025,042 | $1,049,620 |

| 2017 | $1,054,713 | $1,091,290 |

| 2017 | $1,062,484 | $1,092,599 |

| 2017 | $1,082,264 | $1,103,853 |

| 2017 | $1,089,328 | $1,119,417 |

| 2017 | $1,079,438 | $1,126,358 |

| 2017 | $1,086,502 | $1,149,561 |

| 2017 | $1,091,457 | $1,153,080 |

| 2017 | $1,096,402 | $1,176,833 |

| 2017 | $1,123,953 | $1,204,295 |

| 2017 | $1,144,440 | $1,241,230 |

| 2017 | $1,157,203 | $1,255,032 |

| 2018 | $1,216,798 | $1,326,887 |

| 2018 | $1,185,869 | $1,277,982 |

| 2018 | $1,161,729 | $1,245,505 |

| 2018 | $1,144,378 | $1,250,284 |

| 2018 | $1,177,570 | $1,280,393 |

| 2018 | $1,187,377 | $1,288,274 |

| 2018 | $1,212,271 | $1,336,198 |

| 2018 | $1,244,808 | $1,379,758 |

| 2018 | $1,246,349 | $1,387,622 |

| 2018 | $1,149,290 | $1,292,709 |

| 2018 | $1,189,346 | $1,319,080 |

| 2018 | $1,086,833 | $1,199,967 |

| 2019 | $1,172,635 | $1,296,128 |

| 2019 | $1,224,790 | $1,337,744 |

| 2019 | $1,257,596 | $1,363,739 |

| 2019 | $1,295,451 | $1,418,957 |

| 2019 | $1,225,631 | $1,328,785 |

| 2019 | $1,322,369 | $1,422,432 |

| 2019 | $1,367,794 | $1,442,916 |

| 2019 | $1,354,335 | $1,420,117 |

| 2019 | $1,366,953 | $1,446,674 |

| 2019 | $1,361,064 | $1,478,066 |

| 2019 | $1,387,142 | $1,531,720 |

| 2019 | $1,432,332 | $1,577,978 |

| 2020 | $1,458,621 | $1,577,363 |

| 2020 | $1,328,872 | $1,447,514 |

| 2020 | $1,139,760 | $1,268,732 |

| 2020 | $1,265,269 | $1,431,371 |

| 2020 | $1,331,416 | $1,499,547 |

| 2020 | $1,326,328 | $1,529,388 |

| 2020 | $1,367,033 | $1,615,645 |

| 2020 | $1,435,726 | $1,731,810 |

| 2020 | $1,416,221 | $1,666,001 |

| 2020 | $1,390,780 | $1,621,686 |

| 2020 | $1,528,162 | $1,799,260 |

| 2020 | $1,559,742 | $1,868,352 |

| 2021 | $1,535,600 | $1,849,489 |

| 2021 | $1,620,959 | $1,900,479 |

| 2021 | $1,699,421 | $1,983,713 |

| 2021 | $1,808,059 | $2,089,581 |

| 2021 | $1,785,642 | $2,104,176 |

| 2021 | $1,807,197 | $2,153,203 |

| 2021 | $1,853,757 | $2,204,449 |

| 2021 | $1,888,587 | $2,271,465 |

| 2021 | $1,811,858 | $2,165,842 |

| 2021 | $1,899,922 | $2,317,667 |

| 2021 | $1,859,814 | $2,301,675 |

| 2021 | $1,966,253 | $2,404,790 |

| 2022 | $1,850,826 | $2,280,463 |

| 2022 | $1,797,092 | $2,212,182 |

| 2022 | $1,850,826 | $2,294,320 |

| 2022 | $1,752,314 | $2,094,251 |

| 2022 | $1,724,452 | $2,098,093 |

| 2022 | $1,592,108 | $1,925,000 |

| 2022 | $1,741,368 | $2,102,485 |

| 2022 | $1,637,244 | $2,016,742 |

| 2022 | $1,482,040 | $1,831,003 |

| 2022 | $1,568,264 | $1,979,243 |

| 2022 | $1,653,474 | $2,089,883 |

| 2022 | $1,575,212 | $1,969,506 |

| 2023 | $1,709,206 | $2,093,191 |

| 2023 | $1,652,232 | $2,042,117 |

| 2023 | $1,719,756 | $2,117,062 |

| 2023 | $1,722,922 | $2,150,089 |

| 2023 | $1,696,545 | $2,159,334 |

| 2023 | $1,804,162 | $2,302,066 |

| 2023 | $1,809,437 | $2,376,020 |

| 2023 | $1,743,124 | $2,338,190 |

| 2023 | $1,655,554 | $2,226,710 |

| 2023 | $1,585,734 | $2,179,890 |