UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-06318

MORGAN STANLEY PATHWAY FUNDS

(Exact name of registrant as specified in charter)

2000 Westchester Avenue

Purchase, NY 10577

(Address of principal executive offices)(Zip code)

CT Corp

155 Federal Street Suite 700

Boston, MA 02110

(Name and address of agent for service)

Registrant’s telephone number, including area code: (888) 454-3965

Date of fiscal year end: August 31

Date of reporting period: August 31, 2023

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking rules.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under clearance requirements of 44 U.S.C. § 3507.

ITEM 1. REPORT TO STOCKHOLDERS

The following is a copy of the Registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “1940 Act”) (17 CFR 270.30e-1).

Morgan Stanley

Pathway Funds

Annual Report

| » | August 31, 2023 |

| • | Large Cap Equity Fund |

| • | Small-Mid Cap Equity Fund |

| • | International Equity Fund |

| • | Emerging Markets Equity Fund |

| • | Core Fixed Income Fund |

| • | High Yield Fund |

| • | International Fixed Income Fund |

| • | Municipal Bond Fund |

| • | Inflation-Linked Fixed Income Fund |

| • | Ultra-Short Term Fixed Income Fund |

| • | Alternative Strategies Fund |

INVESTMENT PRODUCTS: NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE

| I | ||||

MORGAN STANLEY PATHWAY FUNDS PERFORMANCE SUMMARY | ||||

| 1 | ||||

| 4 | ||||

| 7 | ||||

| 10 | ||||

| 13 | ||||

| 15 | ||||

| 17 | ||||

| 19 | ||||

| 21 | ||||

| 23 | ||||

| 25 | ||||

| 31 | ||||

| 33 | ||||

| 302 | ||||

| 304 | ||||

| 306 | ||||

| 310 | ||||

| 311 | ||||

| 322 | ||||

| 361 | ||||

BOARD APPROVALOF MANAGEMENT AGREEMENTAND INVESTMENT ADVISORY AGREEMENTS | 362 | |||

| 367 | ||||

| 373 | ||||

DEAR SHAREHOLDER,

Global equity market returns were positive during the twelve-month period ending August 31, 2023. U.S. markets as measured by the S&P 500® Index i gained 15.94%, while developed international markets represented by the MSCI EAFE® Index (Net) viii gained 17.92% and emerging markets as measured by the MSCI Emerging Markets Index (Net) xi gained 1.25%.

During the trailing 12 months ending August 31, 2023, U.S. growth stocks outperformed U.S. value. The U.S. large-cap Russell 1000® Growth Index iii gained 21.94% compared to the Russell 1000® Value Index iv which gained 8.59%. The U.S. small-cap Russell 2000® Growth Index vi gained 6.78% compared to a gain of 2.17% for the Russell 2000® Value Index vii. In developed international markets the MSCI EAFE® Growth Index ix gained 15.22% compared to a gain of 20.74% for the MSCI EAFE® Value Index x. Within emerging markets, the MSCI Emerging Markets Growth Index (Net) xii declined -2.35% compared to a gain of 5.22% for the MSCI Emerging Markets Value Index (Net) xiii.

Within the United States, nine out of the eleven S&P 500® Index i sectors posted positive results. The returns were as follows: Information Technology (+33.33%), Communication Services (+25.76%), Industrials (+18.61%), Energy (+15.10%), Materials (+12.39%), Consumer Discretionary (+11.26%), Health Care (+8.59%), Financials (+6.40%), Consumer Staples (+3.46%), Real Estate (-8.09%) and Utilities (-12.65%).

Fixed income markets produced mixed returns during the same twelve-month period. Broad investment grade indices such as the Bloomberg U.S. Aggregate BondTM Index xv declined -1.19% and the Bloomberg Global Aggregate Bond Index xvi declined -0.09%. U.S. high yield as measured by the Bloomberg U.S. Corporate High Yield Bond Index xvii gained 7.16%.

Morgan Stanley & Co. economists expect U.S. real GDP to grow 2.0% in 2023 and 1.1% in 2024. The forecast for global real GDP growth is 2.9% in 2023 and 2.7% in 2024.

Morgan Stanley Pathway Funds

(Returns are for the fiscal one-year period ending August 31, 2023)

The Large Cap Equity Fund gained 14.71% compared to a gain of 15.40% for Russell 1000® Index ii. The return of the Lipper Large-Cap Core Funds Average xxii gained 15.15%.

The Small-Mid Cap Equity Fund gained 6.47% compared to a gain of 6.64% for Russell 2500® Index v. The return of the Lipper Small-Cap Core Funds Average xxiii gained 7.65%.

The International Equity Fund gained 21.72% compared to a gain of 17.92% for the MSCI EAFE® Index (Net) viii. The return of the Lipper International Large-Cap Core Funds Average xxiv gained 16.39%.

The Emerging Markets Equity Fund gained 4.64% compared to a gain 1.25% for the MSCI Emerging Markets Index (Net) xi. The return of the Lipper Emerging Markets Funds Average xxv gained 4.99%.

The Core Fixed Income Fund declined -1.60% compared to a decline of -1.19% for the Bloomberg U.S. Aggregate BondTM Index xv. The return of the Lipper Core Bond Funds Average xxvi declined -1.09%.

The High Yield Fund gained 6.71% compared to a gain of 7.16% for the Bloomberg U.S. Corporate High Yield Bond Index xvii. The return of the Lipper High Yield Funds Average xxvii gained 6.25%.

The International Fixed Income Fund declined -0.15% compared to a decline of -0.34% for the FTSE Non-USD World Government Bond Index (USD) Hedged xx. The return of the Lipper International Income Funds Average xxviii gained 2.04%.

I

The Municipal Bond Fund gained 1.35% compared to a gain of 1.70% for the Bloomberg U.S. Municipal BondTM Index xix. The return of the Lipper General & Insured Municipal Debt Funds Average xxix gained 1.16%.

The Inflation-Linked Fixed Income Fund declined -4.51% compared to a decline of -3.68% for the Bloomberg U.S. Treasury Inflation Protected Securities (TIPS) Index xviii. The return of the Lipper Inflation Protected Bond Funds Average xxx declined -2.99%.

The Ultra-Short Term Fixed Income Fund gained 4.95% compared to a gain of 4.44% for the FTSE 3-Month U.S. Treasury Bill Index xiv. The return of the Lipper Ultra-Short Obligations Funds Average xxxi gained 4.37%.

The Alternative Strategies Fund gained 2.14% compared to a gain 0.67% for the HFRX Global Hedge Fund Index xxi. The return of the Lipper Alternative Multi-Strategy Funds Average xxxii gained 3.00%.

Additional information regarding the investment managers of the Morgan Stanley Pathway Funds and commentary specific to each individual Sub-adviser is available in the Annual Report following this Shareholder Letter.

We thank you for your continued confidence in Morgan Stanley Wealth Management and support as shareholders of the Morgan Stanley Pathway Funds.

Sincerely,

Paul Ricciardelli

Chief Executive Officer

II

Although the statements of fact and data contained herein have been obtained from, and are based upon, sources the firm believes reliable, we do not guarantee their accuracy, and any such information may be incomplete or condensed. All opinions included in this report constitute the firm’s judgment as of the date herein, and are subject to change without notice. This material is for informational purposes only, and is not intended as an offer or solicitation with respect to the purchase or sale of any security. This report may contain forward-looking statements, and there can be no guarantee that they will come to pass. The index returns shown are preliminary and subject to change. Past performance is not a guarantee of future results.

Risk Considerations

Equity securities may fluctuate in response to news on companies, industries, market conditions, and general economic environment.

Investing in foreign markets entails risks not typically associated with domestic markets, such as currency fluctuations and controls, restrictions on foreign investments, less governmental supervision and regulation, and the potential for political instability. These risks may be magnified in countries with emerging markets and frontier markets, since these countries may have relatively unstable governments and less established markets and economies.

Investing in small- to medium-sized companies entails special risks, such as limited product lines, markets, and financial resources, and greater volatility than securities of larger, more established companies.

The value of fixed income securities will fluctuate and, upon a sale, may be worth more or less than their original cost or maturity value. Bonds are subject to interest rate risk, call risk, reinvestment risk, liquidity risk, and credit risk of the issuer.

High yield bonds (bonds rated below investment grade) may have speculative characteristics and present significant risks beyond those of other securities, including greater credit risk, price volatility, and limited liquidity in the secondary market. High yield bonds should comprise only a limited portion of a balanced portfolio.

Yields are subject to change with economic conditions. Yield is only one factor that should be considered when making an investment decision.

Asset allocation and diversification do not assure a profit or protect against loss in declining financial markets.

The indices are unmanaged. An investor cannot invest directly in an index. They are shown for illustrative purposes only and do not represent the performance of any specific investment.

Because of their narrow focus, sector investments tend to be more volatile than investments that diversify across many sectors and companies.

Growth investing does not guarantee a profit or eliminate risk. The stocks of these companies can have relatively high valuations. Because of these high valuations, an investment in a growth stock can be more risky than an investment in a company with more modest growth expectations.

Value investing does not guarantee a profit or eliminate risk. Not all companies whose stocks are considered to be value stocks are able to turn their business around or successfully employ corrective strategies which would result in stock prices that do not rise as initially expected.

III

Performance of the Morgan Stanley Pathway Funds For the Year Ended August 31, 2023†* | ||||

| Large Cap Equity Fund | 14.71 | % | ||

Russell 1000® Index (ii) | 15.40 | % | ||

| Small-Mid Cap Equity Fund | 6.47 | % | ||

Russell 2500® Index (v) | 6.64 | % | ||

| International Equity Fund | 21.72 | % | ||

MSCI EAFE® Index (Net) (viii) | 17.92 | % | ||

| Emerging Markets Equity Fund | 4.64 | % | ||

MSCI Emerging Markets Index (Net) (xi) | 1.25 | % | ||

| Core Fixed Income Fund | -1.60 | % | ||

Bloomberg U.S. Aggregate BondTM Index (xv) | -1.19 | % | ||

| High Yield Fund | 6.71 | % | ||

Bloomberg U.S. Corporate High Yield Bond Index (xvii) | 7.16 | % | ||

| International Fixed Income Fund | -0.15 | % | ||

FTSE Non-USD World Government Bond Index (USD) Hedged (xx) | -0.34 | % | ||

| Municipal Bond Fund | 1.35 | % | ||

Bloomberg U.S. Municipal BondTM Index (xix) | 1.70 | % | ||

| Inflation-Linked Fixed Income Fund | -4.51 | % | ||

Bloomberg U.S. Treasury Inflation Protected Securities (TIPS) Index (xviii) | -3.68 | % | ||

| Ultra-Short Term Fixed Income Fund | 4.95 | % | ||

FTSE 3-Month U.S. Treasury Bill Index (xiv) | 4.44 | % | ||

| Alternative Strategies Fund | 2.14 | % | ||

HFRX Global Hedge Fund Index (xxi) | 0.67 | % | ||

See pages 26 through 30 for all footnotes.

IV

| ABOUTTHE SUB-ADVISERS |

• ClearBridge Investments, LLC (“ClearBridge”) |

| ClearBridge is a wholly-owned subsidiary of Legg Mason, Inc., a financial services holding company. The Portfolio Managers for the ClearBridge Large Cap Growth strategy utilize a fundamental, bottom-up research approach that emphasizes company analysis, management and stock selection. ClearBridge invests in large capitalization companies that it believes are dominant in their industries due to product, distribution or service strength. ClearBridge emphasizes individual security selection while diversifying the Fund’s investments across industries, which may help to reduce risk. ClearBridge attempts to identify established large capitalization companies with the highest growth potential, then analyze each company in detail, ranking its management, strategy and competitive market position. The Portfolio Managers pursue a collaborative approach in which both they and the research analysts propose companies with attractive business models and good long-term growth prospects for further review. The team is particularly valuation conscious, gravitating toward “controversy”, or companies that are temporarily inefficiently priced. |

• Columbia Management Investment Advisers, LLC (“Columbia”) |

| Columbia uses a combination of fundamental and quantitative analysis with risk management, including cross-correlation analysis, in identifying investment opportunities and constructing it’s portion of the Fund’s portfolio. In selecting investments, Columbia considers, among other factors: |

| · overall economic and market conditions; and |

| · the financial condition and management of a company, including its competitive position, the quality of its balance sheet and earnings, its future prospects, and the potential for growth and stock price appreciation. |

| Columbia may sell a security when the security’s price reaches a target set by Columbia; if Columbia believes that there is deterioration in the issuer’s financial circumstances or fundamental prospects; if other investments are more attractive; or for other reasons. |

As of August 31, 2023 the Sub-advisers for Morgan Stanley Pathway Large Cap Equity Fund (“Fund”) were BlackRock Financial Management, Inc. (“BlackRock”), Columbia Management Investment Advisers, LLC (“Columbia”), Lazard Asset Management, LLC (“Lazard”), Great Lakes Advisors, LLC (“Great Lakes”) and ClearBridge Investments, LLC (“ClearBridge”).

For the fiscal year ending August 31, 2023, the Fund returned 14.71% compared to 15.40% for Russell 1000® Index ii. The Fund’s positioning within industrials and utilities had the largest positive impact on relative performance, while the positioning within consumer staples and real estate had the largest negative impact. The top contributors included NVIDIA, Microsoft and Broadcom, while the top detractors included Crown Castle, PayPal Holdings and Estee Lauder Companies.

The Fund’s dividend yield was 1.43%, less than the benchmark’s 1.49% dividend yield. The Fund’s one year forward price to earnings ratio (P/E) was 20.7, slightly greater than the benchmark which was 20.1. The estimated earnings per share growth over the next 3-5 years was 14.0%, slightly higher than the benchmark’s 13.9% growth rate. The top 10 positions accounted for 19% of the Fund’s holdings.

During the fiscal one-year period, BlackRock performed in-line with the Russell 1000® Index ii, which matched its passive mandate to track the index.

The portion of the Fund managed by Lazard underperformed their benchmark during the fiscal one-year period. Their positioning was strongest within financials and weakest within information technology. The top contributors were Alphabet, Analog Devices and Verisk Analytics, while the top detractors were Crown Castle, Omnicell and Adobe. As of August 31, 2023, Lazard’s top ten positions represented 62% of their portfolio.

The portion of the Fund managed by ClearBridge outperformed their benchmark during the fiscal one-year period. Their positioning was strongest within information technology and weakest within financials. The top contributors were NVIDIA, Microsoft and Netflix, while the top detractors were PayPal Holdings, Atlassian and Advance Auto Parts. As of August 31, 2023, ClearBridge’s top ten positions represented 48% of their portfolio.

1

• BlackRock Financial Management, Inc. (“BlackRock”) |

| BlackRock employs a “passive” management approach, attempting to invest in a portfolio of assets whose performance is expected to match approximately the performance of the Russell 1000® Index. The Fund will be substantially invested in securities in the Russell 1000® Index, and will invest, under normal circumstances, at least 80% of its assets in securities or other financial instruments that are components of or have economic characteristics similar to the securities included in the Russell 1000® Index. |

• Lazard Asset Management, LLC (“Lazard”) |

| Lazard, an indirect, wholly-owned subsidiary of Lazard Ltd., is known for its global perspective on investing and years of experience with global, regional and domestic portfolios. With more than 300 investment personnel worldwide, Lazard offers investors of all types an array of equity, fixed income, and alternative investment solutions from its network of local offices in ten different countries. Its team-based approach to portfolio management helps Lazard to deliver robust and consistent performance over time, and strong client relationships allow them to understand how to employ their capabilities to its clients’ advantage. Lazard manages an all cap, concentrated strategy designed to leverage the best collection of ideas from the U.S. Equity team. It is benchmark-agnostic, seeking to outperform any broad-based market index (i.e., S&P 500® Index, Russell 1000® Index, Russell 3000® Index) by investing in companies that compound earnings and capital and by taking advantage of valuation anomalies. |

• Great Lakes Advisors, LLC (“Great Lakes”) |

| Great Lakes is a value strategy in which the team believes that a bottom-up focused portfolio targeting stocks with attractive valuations and improving fundamentals, coupled with a disciplined use of risk controls, has the potential to deliver consistent outperformance as well as protection in down markets with lower volatility than the benchmark. |

The portion of the Fund managed by Columbia outperformed their benchmark during the fiscal one-year period. Their positioning was strongest within consumer discretionary and weakest within consumer staples. The top contributors were NVIDIA, Eli Lilly and Exact Sciences, while the top detractors were Estee Lauder, Bloom Energy and CrowdStrike Holdings. As of August 31, 2023, Columbia’s top ten positions represented 42% of their portfolio.

Great Lakes began managing their portion of the portfolio on July 17, 2023 and since inception through August 31, 2023 outperformed their benchmark. Their positioning was strongest within industrials and weakest within financials. The top contributors were Eli Lilly, Exxon Mobil and Quanta Services, while the top detractors were JP Morgan Chase, PayPal Holdings and Bank of America. As of August 31, 2023, Great Lakes’ top ten positions represented 23% of their portfolio.

2

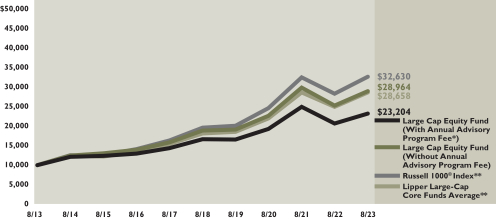

The following graph depicts the performance of the Russell 1000® Indexii vs. the Lipper Large-Cap Core Funds Averagexxii

HISTORICAL PERFORMANCE FOR THE TEN-YEAR PERIOD ENDED AUGUST 31, 2023 LARGE CAP EQUITY FUND Comparison of $10,000 Investment in the Fund with the Russell 1000® Index |

The performance shown above and below represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above and below. Performance figures may reflect voluntary fee waivers and/or expense reimbursements. In the absence of voluntary fee waivers and/or expense reimbursements, the total return would have been lower. Principal value and investment returns will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance data current to the most recent month-end, please visit our website at www.morganstanley.com/wealth-investmentsolutions/cgcm.

The graph above and returns shown below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

LARGE CAP EQUITY FUND Average Annual Total Returns for the Period Ended August 31, 2023† | |||||||||||||||||||||||

| Without Annual Advisory Program Fee | With Annual Advisory Program Fee* | Russell 1000® Index** | Lipper Large-Cap Core Funds Average** | ||||||||||||||||||||

| Since Inception 11/18/1991 | 8.71 | % | 6.70 | % | 10.21 | % | 9.77 | % | |||||||||||||||

| 10 years | 11.22 | 8.51 | 12.55 | 11.66 | |||||||||||||||||||

| 5 years | 9.01 | 6.53 | 10.77 | 10.15 | |||||||||||||||||||

| 3 years | 8.53 | 6.20 | 9.93 | 9.31 | |||||||||||||||||||

| 1 year | 14.71 | 12.44 | 15.40 | 15.15 | |||||||||||||||||||

See pages 26 through 30 for all footnotes.

3

| ABOUTTHE SUB-ADVISERS |

• Neuberger Berman Investment Advisers LLC (“Neuberger”) |

| Neuberger employs in-depth research to identify out-of-favor small cap companies selling at a significant discount to intrinsic value, where there is a dynamic plan or event that is expected to both enhance value and narrow the price/value gap. Neuberger’s analysts seek to invest when there is a true disconnect between reality and market perception — something that occurs regularly in particular types of companies. For example, we believe the market tends to demonstrate inefficiency in pricing companies with complex corporate structures since many investors will not take the time to understand them. Neuberger’s valuation approach resembles the due diligence effort that Neuberger’s a private equity firm might employ to evaluate the purchase of an entire company. Neuberger’s analysts also focus on investing in businesses where management has a significant ownership stake as, in our view, such companies tend to be more aligned with shareholders’ interests. |

• Westfield Capital Management Company, L.P. (“Westfield”) |

| Westfield favors investing in earnings growth stocks given a conviction that stock prices follow earnings progress and that they offer the best opportunity for superior real rates of return. Reasonably priced stocks of companies with high foreseen earnings potential are best identified through in-depth, fundamental research. It is Westfield’s belief that the small capitalization portion of the market is under-researched, and therefore less efficient, than the large capitalization sector. |

• BlackRock Financial Management, Inc. (“BlackRock”) |

| BlackRock employs a “passive” management approach, attempting to invest in a portfolio of assets whose performance is expected to match approximately the performance of the Russell 2500® Index. The Fund will be substantially invested in securities in the Russell 2500® Index, and will invest, under normal circumstances, at least 80% of its assets in securities or other financial instruments that are components of or have economic characteristics similar to the securities included in the Russell 2500® Index. |

As of August 31, 2023, the Sub-advisers for the Morgan Stanley Pathway Small-Mid Cap Equity (“Fund) were BlackRock Financial Management, Inc. (“BlackRock”), Aristotle Capital Boston, LLC (“Aristotle”), D.F. Dent & Company, Inc. (“DF Dent”), Neuberger Berman Investment Advisers LLC (“Neuberger”), Nuance Investments, LLC (“Nuance”) and Westfield Capital Management Company, L.P. (“Westfield”).

For the fiscal year ending August 31, 2023, the Fund returned 6.47% compared to 6.64% for Russell 2500® Index v. The Fund’s positioning within health care and energy had the largest positive impact on relative performance, while the positioning within consumer discretionary and industrials had the largest negative impact. The top contributors included Rambus, MACOM Technology Solutions and Saia, while the top detractors included Signature Bank, Cable One and Advanced Drainage Systems.

The Fund’s dividend yield was 1.30%, less than the benchmark’s 1.55% yield. The Fund’s forward P/E was 16.5, higher than the benchmark which was 14.8. The estimated earnings per share growth over the next 3-5 years was 11.7%, higher than the benchmark’s 10.8% growth rate. The top 10 positions accounted for 6% of the Fund’s holdings.

During the fiscal one-year period, BlackRock performed in-line with the Russell 2500® Index v, which matched its passive mandate to track the index.

The portion of the Fund managed by Neuberger outperformed their benchmark during the fiscal one-year period. Their positioning was strongest in health care and weakest in industrials. The top contributors were Rambus, International Game Technology and MACOM Technology Solutions, while the top detractors were Unisys, Comerica and Verint Systems. As of August 31, 2023, Neuberger’s top ten positions represented 26% of their portfolio.

The portion of the Fund managed by Westfield outperformed their benchmark during the fiscal one-year period. Their positioning was strongest in industrials and consumer discretionary. The top contributors were Saia, Prometheus Biosciences and Samsara, while the top detractors were Advanced Drainage Systems, Fate Therapeutics and Chart Industries. As of August 31, 2023, Westfield’s top ten positions represented 25% of their portfolio.

The portion of the Fund managed by Aristotle underperformed their benchmark during the fiscal one-year period. Their positioning was strongest in energy and weakest in financials. The top contributors were Oceaneering International, MACOM Technology Solutions and Huron Consulting, while the top detractors were Signature Bank, Catalent and Wolverine World Wide. As of August 31, 2023, Aristotle’s top ten positions represented 20% of their portfolio.

4

• D.F. Dent & Company, Inc (“DF Dent”) |

| DF Dent employs a bottom-up, fundamental process that seeks companies that are consistent growers, have strong management and are unrecognized and under-researched. The strategy looks for companies with above-average EPS growth expectations, high returns on investment, sustainable free cash flow growth, a competitive advantage and attractive relative valuations. |

• Nuance Investments, LLC (“Nuance”) |

| Nuance seeks to invest in companies with leading and sustainable market share positions and above-average financial strength that are trading at discounts to Nuance’s calculation of intrinsic value. Through analysis of companies’ financial statements, management strategy, and competitive positioning, Nuance attempts to provide excess returns over time. |

• Aristotle Capital Boston, LLC (“Aristotle”) |

| Aristotle seeks to deliver a diversified, high quality portfolio that can deliver attractive risk-adjusted results primarily driven by stock selection. They focus on companies they believe have low expectations, can create shareholder value, and have high potential for improved growth and profitability. |

The portion of the Fund managed by DF Dent trailed their benchmark during the fiscal one-year period. Positioning was strongest in health care and weakest in consumer discretionary. The top contributors were TransDigm Group, Intuitive Surgical and Old Dominion Freight Line, while the top detractors were Cable One, WNS (Holdings) Limited and Endava. As of August 31, 2023, DF Dent’s top ten positions represented 39% of their portfolio.

The portion of the fund managed by Nuance outperformed their benchmark during the fiscal one-year period. Positioning was strongest in health care and weakest in industrials. The top contributors were Dentsply Sirona, Universal Health Services and Smith & Nephew, while the top detractors were Baxter International, Healthcare Realty Trust and Northern Trust. As of August 31, 2023, Nuance’s top ten positions represented 44% of their portfolio.

5

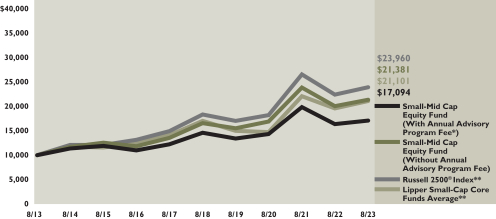

The following graph depicts performance of the Russell 2500® Indexv vs. the Lipper Small-Cap Core Funds Averagexxiii

HISTORICAL PERFORMANCE FOR THE TEN-YEAR PERIOD ENDED AUGUST 31, 2023 SMALL-MID CAP EQUITY FUND Comparison of $10,000 Investment in the Fund with the Russell 2500® Index |

The performance shown above and below represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above and below. Performance figures may reflect voluntary fee waivers and/or expense reimbursements. In the absence of voluntary fee waivers and/or expense reimbursements, the total return would have been lower. Principal value and investment returns will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance data current to the most recent month-end, please visit our website at www.morganstanley.com/wealth-investmentsolutions/cgcm.

The graph above and returns shown below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

SMALL-MID CAP EQUITY FUND Average Annual Total Returns for the Period Ended August 31, 2023† | |||||||||||||||||||||||

| Without Annual Advisory Program Fee | With Annual Advisory Program Fee* | Russell 2500® Index** | Lipper Small-Cap Core Funds Average** | ||||||||||||||||||||

| Since Inception 11/18/1991 | 8.83 | % | 6.82 | % | 10.36 | % | 10.17 | % | |||||||||||||||

| 10 years | 7.90 | 5.27 | 9.13 | 7.96 | |||||||||||||||||||

| 5 years | 5.21 | 2.81 | 5.43 | 4.42 | |||||||||||||||||||

| 3 years | 8.12 | 5.80 | 9.52 | 12.63 | |||||||||||||||||||

| 1 year | 6.47 | 4.36 | 6.64 | 7.65 | |||||||||||||||||||

See pages 26 through 30 for all footnotes.

6

| ABOUTTHE SUB-ADVISERS |

• Victory Capital Management, Inc. (“Victory Capital”) |

| Victory Capital’s investment franchise, Trivalent Investments, employs a bottom-up investment approach that emphasizes individual stock selection. The investment process uses a combination of quantitative and traditional qualitative, fundamental analysis to identify stocks with low relative price multiples and positive trends in earnings forecasts. The stock selection process is designed to produce a diversified portfolio that, relative to the S&P Developed ex-U.S. Small Cap Index, tends to have a below average price-to-earnings ratio and an above average earnings growth trend. |

• Causeway Capital Management LLC (“Causeway”) |

| Causeway’s international developed market investment philosophy is based on a long-term value strategy and the investment team applies an active, bottom-up, research-intensive approach towards stock selection. Causeway’s investment approach seeks to identify under-priced stocks of high quality companies believed to be exhibiting superior financial strength as compared to peers. In addition to fundamental analysis, quantitative research is considered an integral part of the process and is used for screenings of investment candidates as well as risk management. Portfolio managers work as a team to make investment decisions and are supported by the firm’s dedicated fundamental and quantitative research analysts. Analysts and portfolio managers are assigned global industryspecific research responsibilities. Fundamental research is further organized into six research clusters: financials/materials, consumer, industrial/ manufacturing, energy, technology and health care. Causeway’s unconstrained, international established market value equity approach invests in a variety of market capitalization ranges, but primarily in large- and midcapitalization non-U.S. developed market companies. Causeway can also invest in smallcap issues and less developed emerging markets. Value-driven security characteristics may include low price/earnings ratio, low price/ book ratio, low price/cash flow ratio and high dividend yield, but may also include outof- favor companies that may have high rates of growth of earnings. Sector and regional weights are byproducts of the investment process. |

As of August 31, 2023, the Sub-advisers for the Morgan Stanley Pathway International Equity Fund (“Fund”) were BlackRock Financial Management Inc. (“BlackRock”), Causeway Capital Management, LLC (“Causeway”), Schroders Investment Management North America, Inc. (“Schroders”), Victory Capital Management, Inc. (“Victory Capital”) and Walter Scott & Partners Limited (“Walter Scott”).

For the fiscal year ending August 31, 2023, the Fund returned 21.72% compared to 17.92% for the MSCI EAFE® Index (Net) viii. The Fund’s positioning within financials and consumer discretionary had the largest positive impact on relative performance, while the positioning within energy and utilities had the largest negative impact. The top contributors included Rolls-Royce, UniCredit and SAP SE, while the top detractors included Misumi Group, Roche Holding and CSL Limited.

The Fund’s dividend yield was 2.84% compared to the benchmark of 3.18%. On a valuation basis, the Fund’s forward P/E was 13.91, higher than the benchmark which was 13.22. The estimated earnings per share growth over the next 3-5 years was 10.86%, compared to the benchmark of 8.84%. The top ten positions accounted for 14% of the Fund’s holdings.

During the fiscal one-year period ending August 31, 2023, BlackRock performed in-line with the MSCI EAFE® Index (Net) viii, which matched its passive mandate to track the index.

The portion of the Fund managed by Causeway outperformed their benchmark during the fiscal one-year period. Their positioning was strongest in financials and weakest in consumer staples. The top positions contributing to performance included Rolls-Royce Holdings, UniCredit and SAP SE, while the top detractors included British American Tobacco, Reckitt Benckiser Group and Roche Holding. As of August 31, 2023, Causeway’s top ten positions represented 32% of their portfolio.

The portion of the Fund managed by Schroders trailed their benchmark during the fiscal one-year period. Overall positioning was strongest in energy and weakest in industrials. The top positions contributing to performance were Equinor ASA, Shell PLC and BOC Hong Kong (Holdings) Ltd., while the top detractors included Zalando SE, Sony Group and Siemens AG. As of August 31, 2023, Schroders’ top ten positions represented 24% of their portfolio.

The portion of the Fund managed by Victory Capital outperformed their benchmark during the fiscal one-year period. Overall positioning was strongest in real estate and weakest in energy. The top positions contributing to performance included Gerresheimer, Celestica and Bank of Ireland Group, while the top detractors included Vermilion Energy, Harbour Energy and Nuvei Corp. As of August 31, 2023, Victory’s top ten positions represented 10% of their portfolio.

7

• BlackRock Financial Management, Inc. (“BlackRock”) |

| BlackRock Financial Management, Inc. employs a “passive” management approach, attempting to invest in a portfolio of assets whose performance is expected to match approximately the performance of the MSCI EAFE® Index (Net). The Fund will be substantially invested in securities in the MSCI EAFE® Index (Net), and will invest, under normal circumstances, at least 80% of its assets in securities or other financial instruments that are components of or have economic characteristics similar to the securities included in the MSCI EAFE® Index (Net). |

• Schroders Investment Management North America, Inc. (“Schroders”) |

| Schroders uses a bottom-up growth oriented approach towards stock selection and employs a fundamental, research driven process to identify quality growth companies with attractive medium-term growth and valuation, quality management and financial position, and a sustainable competitive advantage. Schroders “best ideas” portfolio blends both core and opportunistic holdings. |

• Walter Scott & Partners Limited (“Walter Scott”) |

| Walter Scott is considered growth-oriented strategy focusing on long-term high-quality growth companies. The root of the process lies with the team’s ability to identify companies capable of sustaining what it believes are exceptional rates of internal and external wealth generation through intensive fundamental research. Portfolio shape is a result of stock selection in high-conviction businesses with a long-term time horizon. |

The portion of the Fund managed by Walter Scott trailed their benchmark during the fiscal one-year period. Overall positioning was strongest in consumer staples and weakest in industrials. The top positions contributing to performance included Novo Nordisk, SAP SE and Industria de Diseno Textil S.A., while the top detractors included Misumi Group, Novozymes A/S and Sysmex. As of August 31, 2023, Walter Scott’s top ten positions represented 28% of their portfolio.

8

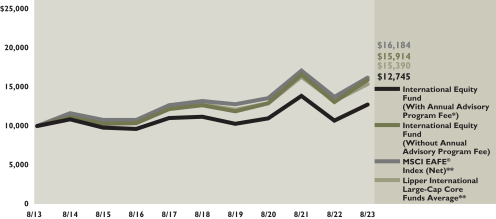

The following graph depicts the performance of MSCI EAFE® Index (Net)viii vs. the Lipper International Large-Cap Core Funds Averagexxiv

HISTORICAL PERFORMANCE FOR THE TEN-YEAR PERIOD ENDED AUGUST 31, 2023 INTERNATIONAL EQUITY FUND Comparison of $10,000 Investment in the Fund with the Morgan Stanley Capital International Europe, Australasia, |

The performance shown above and below represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above and below. Performance figures may reflect voluntary fee waivers and/or expense reimbursements. In the absence of voluntary fee waivers and/or expense reimbursements, the total return would have been lower. Principal value and investment returns will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance data current to the most recent month-end, please visit our website at www.morganstanley.com/wealth-investmentsolutions/cgcm.

The graph above and returns shown below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

INTERNATIONAL EQUITY FUND Average Annual Total Returns for the Period Ended August 31, 2023† | |||||||||||||||||||||||

| Without Annual Advisory Program Fee | With Annual Advisory Program Fee* | MSCI EAFE® Index (Net)** | Lipper International Large-Cap Core Funds Average** | ||||||||||||||||||||

| Since Inception 11/18/1991 | 5.29 | % | 3.35 | % | 5.34 | % | 6.57 | % | |||||||||||||||

| 10 years | 4.76 | 2.20 | 4.93 | 4.32 | |||||||||||||||||||

| 5 years | 4.66 | 2.28 | 4.14 | 4.05 | |||||||||||||||||||

| 3 years | 7.26 | 4.96 | 6.05 | 5.50 | |||||||||||||||||||

| 1 year | 21.72 | 19.31 | 17.92 | 16.39 | |||||||||||||||||||

See pages 26 through 30 for all footnotes.

9

| ABOUTTHE SUB-ADVISERS |

• Van Eck Associates Corporation (“VanEck”) |

| VanEck is privately held global asset management firm founded in 1955. VanEck’s mission is to develop and offer investors forward-looking, intelligently designed investment strategies that strengthen a long-term portfolio. VanEck’s Emerging Markets Equity Strategy (“Strategy”) seeks long-term competitive risk-adjusted returns through investments that demonstrate structural growth at a reasonable price. The Strategy seeks to uncover structural growth opportunities wherever they exist within emerging markets, and employs a fundamentally driven stock selection and research process with the flexibility to invest across the market capitalization spectrum. |

• BlackRock Financial Management, Inc. (“BlackRock”) |

| BlackRock employs a “passive” management approach, attempting to invest in a portfolio of assets whose performance is expected to match approximately the performance of the MSCI Emerging Markets Index (Net). The Fund will be substantially invested in securities in the MSCI Emerging Markets Index (Net), and will invest, under normal circumstances, at least 80% of its assets in securities or other financial instruments that are components of or have economic characteristics similar to the securities included in the MSCI Emerging Markets Index (Net). |

• Lazard Asset Management LLC (“Lazard”) |

| Lazard, an indirect, wholly-owned subsidiary of Lazard Ltd., is known for its global perspective on investing and years of experience with global, regional and domestic portfolios. With more than 300 investment personnel worldwide, Lazard offers investors of all types an array of equity, fixed income, and alternative investment solutions from its network of local offices in ten different countries. Its team-based approach to portfolio management helps Lazard to deliver robust and consistent performance over time, and strong client relationships allow them to understand how to employ their capabilities to its clients’ advantage. |

As of August 31, 2023, the Sub-advisers for the Morgan Stanley Pathway Emerging Markets Equity Fund (“Fund”) were BlackRock Financial Management, Inc. (“BlackRock”), Van Eck Associates Corporation (“VanEck”), Lazard Asset Management LLC (“Lazard”) and Martin Currie Inc. (“Martin Currie”).

For the fiscal year ending August 31, 2023, the Fund returned 4.64% compared to 1.25% for the MSCI Emerging Markets Index (Net) xi. The Fund’s positioning within financials and information technology had the largest positive impact on relative performance, while the positioning within communication services and energy and the largest negative impact. The top contributors included Samsung Electronics, OTP Bank Nyrt and SK Hynix, while the top detractors included Meituan, JD.com and Wuxi Biologics.

The Fund’s holdings offered a dividend yield of 3.05%, slightly higher than the MSCI Emerging Market’s Index (Net) xii yield of 3.02%. On a valuation basis, the Fund’s forward P/E was 11.6 compared to the benchmark which was 11.8. The estimated earnings per share growth over the next 3-5 years was 14.95%, less than the benchmark of 15.93%. The top ten positions accounted for 22% of the Fund’s holdings.

For the fiscal year ending August 31, 2023, BlackRock performed in-line with the MSCI Emerging Markets Index (Net) xi, which matched its passive mandate to track the index.

The portion of the Fund managed by VanEck outperformed their benchmark during the fiscal one-year period. Overall positioning was strongest in financials and weakest in information technology. The top positions contributing to performance included Bank of Georgia Group, MercadoLibre and MLP Saglik Hizmetleri, while the top detractors include Hoyuan Green Energy, Wuxi Biologics and Transaction Capital. As of August 31, 2023, VanEck’s top ten positions represented 37% of their portfolio.

The portion of the Fund managed by Lazard outperformed their benchmark during the fiscal one-year period. Overall positioning was strongest in information technology and weakest in real estate. The top positions contributing to performance included OTP Bank Nyrt, Quanta Computer and Galp Energia, while the top detractors included China Vanke, UPL Limited and Anhui Conch Cement Company. As of August 31, 2023, Lazard’s top ten positions represented 25% of their portfolio.

10

| Lazard manages a relative value strategy (“Value Strategy”) and invests primarily in equity securities, principally common stocks, of non-U.S. companies whose principal activities are located in emerging or developing market countries. In the Value Strategy, assets are invested in companies that are believed to be undervalued based on their earnings, cash flow or asset values. Lazard’s approach consists of an analytical framework, accounting validation, fundamental analysis and portfolio construction parameters and its selection process focuses on growth and considers the sustainability of growth and the tradeoff between valuation and growth. |

• Martin Currie Inc. (“Martin Currie”) |

Martin Currie is a core active strategy that strives to identify mispriced businesses through fundamental research. Martin Currie seeks high-quality companies with strong growth opportunities while employing a disciplined approach to valuation. The strategy has a long-term investment horizon focusing on stock selection that drives its sector/country allocations. |

The portion of the Fund managed by Martin Currie outperformed their benchmark during the fiscal one-year period. Overall positioning was strongest in materials and weakest in consumer discretionary. The top positions contributing to performance included Samsung Electronics, Taiwan Semiconductor and SK Hynix, while the top detractors included Meituan, JD.com and EPAM Systems. As of August 31, 2023, Martin Currie’s top ten positions represented 45% of their portfolio.

11

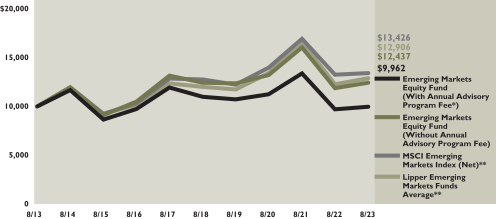

The following graph depicts the performance of MSCI Emerging Markets Index (Net)xi vs. the Lipper Emerging Markets Funds Averagexxv

HISTORICAL PERFORMANCE FOR THE TEN-YEAR PERIOD ENDED AUGUST 31, 2023 EMERGING MARKETS EQUITY FUND Comparison of $10,000 Investment in the Fund with the MSCI Emerging Markets Index (Net) |

The performance shown above and below represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above and below. Performance figures may reflect voluntary fee waivers and/or expense reimbursements. In the absence of voluntary fee waivers and/or expense reimbursements, the total return would have been lower. Principal value and investment returns will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance data current to the most recent month-end, please visit our website at www.morganstanley.com/wealth-investmentsolutions/cgcm.

The graph above and returns shown below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

EMERGING MARKETS EQUITY FUND Average Annual Total Returns for the Period Ended August 31, 2023† | |||||||||||||||||||||||

| Without Annual Advisory Program Fee | With Annual Advisory Program Fee* | MSCI Emerging Markets Index (Net)** | Lipper Emerging Markets Funds Average** | ||||||||||||||||||||

| Since Inception 4/20/1994 | 3.90 | % | 1.95 | % | 5.15 | % | 5.23 | % | |||||||||||||||

| 10 years | 2.21 | -0.28 | 2.99 | 2.53 | |||||||||||||||||||

| 5 years | 0.00 | -2.28 | 0.98 | 1.20 | |||||||||||||||||||

| 3 years | -2.04 | -4.14 | -1.39 | -1.63 | |||||||||||||||||||

| 1 year | 4.64 | 2.57 | 1.25 | 4.99 | |||||||||||||||||||

See pages 26 through 30 for all footnotes.

12

| ABOUT THE SUB-ADVISERS |

• Metropolitan West Asset Management LLC (“MetWest”) |

| MetWest seeks to achieve consistent outperformance through the measured and diversified application of five fixed income management strategies, including: (i) duration management; (ii) yield curve positioning; (iii) sector allocation; (iv) security selection; and (v) opportunistic execution. Predicated on a long-term economic outlook, MetWest employs a value-oriented approach to managing fixed income that recognizes the periodic inefficient nature of over-the-counter markets and the mean-reverting characteristics of the investable universe. |

• Western Asset Management Company (“Western”) |

| Western combines traditional analysis with innovative technology applied to all sectors of the market. Western believes inefficiencies exist in the fixed-income market and attempts to add incremental value by exploiting these inefficiencies across all eligible market sectors. The key areas of focus are: (i) sector and subsector allocation; (ii) issue selection; (iii) duration; and (iv) term structure. |

• BlackRock Financial Management, Inc. (“BlackRock”) |

| BlackRock’s Customized Core strategy employs a fundamental, diversified, relative value approach that seeks alpha by strategically allocating among three alpha sources — macro strategies, sector allocation and security selection — based on best and highest information ratio ideas, and aims to provide superior long-term performance relative to the benchmark index by creating a diversified portfolio of investment grade securities. A disciplined and risk-budgeted risk management framework which consists of determining interest rate risk, yield curve risk, cash flow risk, credit risk and liquidity risk of all securities. |

As of August 31, 2023, the Sub-advisers for the Morgan Stanley Pathway Core Fixed Income Fund (“Fund”) were Metropolitan West Asset Management LLC (“MetWest”), Western Asset Management Company (“Western”) and BlackRock Financial Management, Inc. (“BlackRock”).

For the fiscal year ending August 31, 2023, the Fund returned -1.60% compared to its benchmark, the Bloomberg U.S. Aggregate BondTM Index xv which returned -1.19%.

The portion of the Fund managed by MetWest trailed the benchmark during the fiscal one-year period. Detractors to performance included duration and curve position, which entered the year longer than the Index before extending in a disciplined fashion alongside the significant increase in Treasury yields. An overweight to agency mortgage-backed securities (MBS) was also negative as the sector was impacted by the swift rise in Treasury rates and volatility, resulting in it being one of the few fixed income sectors to trail comparable Treasuries over the trailing twelve-month period. The impact from asset-backed securities (ABS) issues was positive given sustained investor demand for short duration, floating rate profile types in a period marked by heightened rate volatility, with the portfolio’s collateralized loan obligations (CLO) and student loan holdings the greatest contributors. The overweight to corporate credit also boosted relative returns, as the sector outpaced duration-adjusted Treasuries.

The portion of the Fund managed BlackRock trailed the benchmark during the fiscal one-year period. The main detractor to performance was duration positioning. Contributors included yield curve positioning, agency mortgages positioning, investment grade credit positioning and selection. The strategy was predominantly overweight in the belly and front-end of the yield curve, although specific positions were adjusted in response to market signals. The portfolio maintained a cautious yet opportunistic stance, adapting to high volatility in the rates market.

The portion of the Fund managed by Western outperformed the benchmark during the fiscal one-year period. Emerging market debt was the largest contributor to performance as exposures to local rates as well as USD-denominated emerging market bonds contributed. Corporate bond exposure in aggregate (including both investment-grade and high-yield credit) also significantly contributed to performance. Structured product positions, in aggregate (including non-agency residential mortgage-backed securities (RMBS), commercial mortgage-backed securities (CMBS) and ABS), contributed to performance, mainly due to favorable subsector and issue selection as spreads generally widened for the structured product sectors. Tactical exposure to Agency MBS also contributed as spreads widened earlier in the reporting period before tightening since 2Q23. In terms of detractors, duration positioning was the main detractor from performance. An overweight to duration detracted as yields significantly increased during the 12-month period. Developed non-U.S. positions also detracted as most currency positions depreciated versus a strengthening U.S. Dollar. Finally, yield curve positioning modestly contributed to performance given a consistent overweight to the long end of the curve.

13

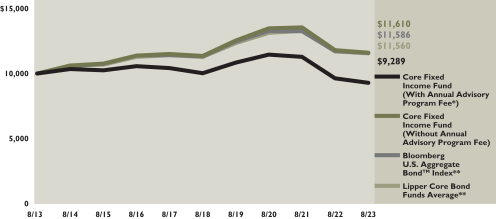

The following graph depicts the performance of Bloomberg U.S. Aggregate BondTM Indexxv vs. the Lipper Core Bond Funds Averagexxvi

HISTORICAL PERFORMANCE FOR THE TEN-YEAR PERIOD ENDED AUGUST 31, 2023 CORE FIXED INCOME FUND Comparison of $10,000 Investment in the Fund with the Bloomberg U.S. Aggregate BondTM Index |

The performance shown above and below represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above and below. Performance figures may reflect voluntary fee waivers and/or expense reimbursements. In the absence of voluntary fee waivers and/or expense reimbursements, the total return would have been lower. Principal value and investment returns will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance data current to the most recent month-end, please visit our website at www.morganstanley.com/wealth-investmentsolutions/cgcm.

The graph above and returns shown below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

CORE FIXED INCOME FUND Average Annual Total Returns for the Period Ended August 31, 2023† | |||||||||||||||||||||||

| Without Annual Advisory Program Fee | With Annual Advisory Program Fee* | Bloomberg U.S. Aggregate BondTM Index** | Lipper Core Bond Funds Average** | ||||||||||||||||||||

| Since Inception 11/18/1991 | 4.45 | % | 2.52 | % | 4.69 | % | 4.58 | % | |||||||||||||||

| 10 years | 1.50 | -0.97 | 1.48 | 1.45 | |||||||||||||||||||

| 5 years | 0.46 | -1.83 | 0.49 | 0.51 | |||||||||||||||||||

| 3 years | -4.81 | -6.85 | -4.41 | -4.13 | |||||||||||||||||||

| 1 year | -1.60 | -3.55 | -1.19 | -1.09 | |||||||||||||||||||

See pages 26 through 30 for all footnotes.

14

| ABOUT THE SUB-ADVISERS |

• Western Asset Management Company (“Western”) |

| Western combines traditional analysis with innovative technology applied to all sectors of the market. Western believes inefficiencies exist in the fixed-income market and attempts to add incremental value by exploiting these inefficiencies across all eligible market sectors. The key areas of focus are: (i) sector and subsector allocation; (ii) issue selection; (iii) duration; and (iv) term structure. |

• PineBridge Investments LLC (“PineBridge”) |

| PineBridge is a strategy seeking total return through a combination of high current income and capital appreciation. The strategy focuses on security selection to drive excess return and is generally overweight the higher quality segment of the high yield market. |

As of August 31, 2023, the Sub-advisers for the Morgan Stanley Pathway High Yield Fund (“Fund”) were Western Asset Management Company (“Western”) and PineBridge Investments LLC (“PineBridge”).

For the fiscal year ending August 31, 2023, the Fund returned 6.71% compared to its benchmark, the Bloomberg U.S. Corporate High Yield Bond Index xvii which returned 7.16%.

The portion of the Fund managed by Western trailed the benchmark during the fiscal one-year period. The following portfolio positioning impacted performance for the period: rating positioning was largely neutral to relative performance during the period. Industry allocations was positive to relative performance largely due to an underweight to communications and an overweight to transportation. Issue selection was a net the detractor to relative performance as issue selection within banking and consumer non-cyclical detracted from relative performance however issue selection within communications and consumer cyclical helped offset some of the drag.

The portion of the Fund managed by PineBridge outperformed the benchmark during the fiscal one-year period. Security selection was the primary driver out relative outperformance over the trailing twelve-month period. Selection within energy, capital goods, consumer cyclical, technology and Real Estate Investment Trusts (REITs) were the most notable contributors. Within sectors, an underweight allocation to the communications sector and overweight allocations to the energy and finance companies sectors contributed to performance. Sector selection overall was a marginal detractor from performance during the period. Security selection within financial institution credits also detracted from performance. In addition, an underweight allocation to the consumer cyclical sector also detracted from performance

15

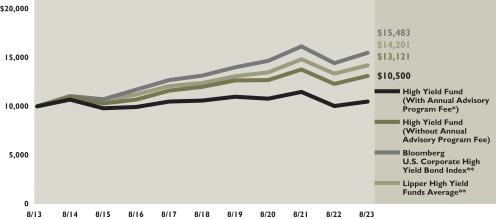

The following graph depicts the performance of the Bloomberg U.S. Corporate High Yield Bond Indexxvii vs. the Lipper High Yield Funds Averagexxvii

HISTORICAL PERFORMANCE FOR THE TEN-YEAR PERIOD ENDED AUGUST 31, 2023 HIGH YIELD FUND Comparison of $10,000 Investment in the Fund with the Bloomberg U.S. Corporate High Yield Bond Index |

The performance shown above and below represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above and below. Performance figures may reflect voluntary fee waivers and/or expense reimbursements. In the absence of voluntary fee waivers and/or expense reimbursements, the total return would have been lower. Principal value and investment returns will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance data current to the most recent month-end, please visit our website at www.morganstanley.com/wealth-investmentsolutions/cgcm.

The graph above and returns shown below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

HIGH YIELD FUND Average Annual Total Returns for the Period Ended August 31, 2023† | |||||||||||||||||||||||

| Without Annual Advisory Program Fee | With Annual Advisory Program Fee* | Bloomberg U.S. Corporate High Yield Bond Index** | Lipper High Yield Funds Average** | ||||||||||||||||||||

| Since Inception 7/13/1998 | 4.00 | % | 1.98 | % | 5.92 | % | 4.88 | % | |||||||||||||||

| 10 years | 2.75 | 0.25 | 4.47 | 3.61 | |||||||||||||||||||

| 5 years | 1.78 | -0.54 | 3.32 | 2.76 | |||||||||||||||||||

| 3 years | 1.08 | -1.08 | 1.81 | 1.71 | |||||||||||||||||||

| 1 year | 6.71 | 4.60 | 7.16 | 6.25 | |||||||||||||||||||

See pages 26 through 30 for all footnotes.

16

International Fixed Income Fund

| ABOUTTHE SUB-ADVISER |

• Pacific Investment Management Company LLC (“PIMCO”) |

| PIMCO is a leading global investment management firm, with offices in 11 countries throughout North America, Europe and Asia. Founded in 1971, PIMCO offers a wide range of innovative solutions to help millions of investors worldwide meet their needs. Our goal is to provide attractive returns while maintaining a strong culture of risk management and long-term discipline. PIMCO’s investment philosophy revolves around the principle of diversification. PIMCO believes that no single risk should dominate returns. PIMCO seeks to add value through the use of “top-down” strategies such as our exposure to interest rates, or duration, changing volatility, yield curve positioning and sector rotation. PIMCO also employs “bottom-up” strategies involving analysis and selection of specific securities. |

As of August 31, 2023, the Sub-adviser for the Morgan Stanley Pathway International Fixed Income Fund (“Fund”) was Pacific Investment Management Company LLC (“PIMCO”).

For the fiscal year ending August 31, 2023, the Fund returned -0.15% compared to its benchmark, the FTSE Non-USD World Government Bond Index (USD) Hedged xx which returned -0.34%.

Interest rate strategies added to performance. Tactical short exposure to U.S. duration added to performance as the Fed continued its rate hiking cycle. Outside of the U.S., select exposure to Italian interest rates and underweight exposure to Japanese duration contributed to performance. An underweight to Chinese duration detracted from performance as the People’s Bank of China cut key lending rates in response to an economic slowdown. Spread strategies overall added to performance. Overweight exposure to financial investment grade corporate credit contributed to performance while select exposure to high yield financials detracted from performance as financial spreads generally widened over the period. Lastly, overall currency strategies detracted from performance particularly long exposure to Japanese Yen as it depreciated against the U.S. Dollar over the period.

17

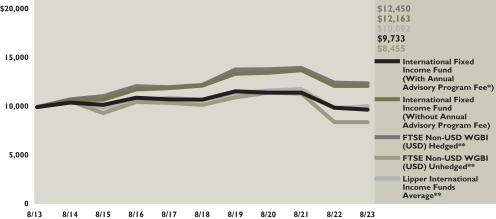

The following graph depicts the performance of the FTSE Non- USD World Government Bond Index (USD) Hedgedxx vs. the FTSE Non-USD World Government Bond Index (USD) Unhedgedxx and the Lipper International Income Funds Averagexxviii

HISTORICAL PERFORMANCE FOR THE TEN-YEAR PERIOD ENDED AUGUST 31, 2023 INTERNATIONAL FIXED INCOME FUND Comparison of $10,000 Investment in the Fund with the FTSE Non-USD World Government Bond Index (USD) Hedged, |

The performance shown above and below represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above and below. Performance figures may reflect voluntary fee waivers and/or expense reimbursements. In the absence of voluntary fee waivers and/or expense reimbursements, the total return would have been lower. Principal value and investment returns will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance data current to the most recent month-end, please visit our website at www.morganstanley.com/wealth-investmentsolutions/cgcm.

The graph above and returns shown below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

INTERNATIONAL FIXED INCOME FUND Average Annual Total Returns for the Period Ended August 31, 2023† | ||||||||||||||||||||||||||||

| Without Annual Advisory Program Fee | With Annual Advisory Program Fee* | FTSE Non-USD WGBI (USD) Hedged** | FTSE Non-USD WGBI (USD) Unhedged** | Lipper International Income Funds Average** | ||||||||||||||||||||||||

| Since Inception 11/18/1991 | 4.80 | % | 2.86 | % | 5.03 | % | 3.67 | % | 4.19 | % | ||||||||||||||||||

| 10 years | 1.98 | -0.51 | 2.22 | -1.66 | -0.07 | |||||||||||||||||||||||

| 5 years | -0.06 | -2.33 | 0.30 | -3.76 | -1.06 | |||||||||||||||||||||||

| 3 years | -3.46 | -5.53 | -3.56 | -9.67 | -4.70 | |||||||||||||||||||||||

| 1 year | -0.15 | -2.13 | -0.34 | -0.02 | 2.04 | |||||||||||||||||||||||

See pages 26 through 30 for all footnotes.

18

| ABOUTTHE SUB-ADVISER |

• BlackRock Financial Management, Inc. (“BlackRock”) |

| BlackRock seeks to build a high quality municipal bond portfolio that offers an attractive level of tax free income and capital preservation while providing stability and consistency throughout full market cycles. By way of comprehensive sector analysis, a rigorous credit review and sophisticated risk management technology, BlackRock’s seasoned portfolio managers strive to capture market inefficiencies. |

As of August 31, 2023, the Sub-adviser for the Morgan Stanley Pathway Municipal Bond Fund (“Fund”) was BlackRock Financial Management, Inc. (“BlackRock”).

For the fiscal year ending August 31, 2023, the Fund returned 1.35% compared to its benchmark, the Bloomberg U.S. Municipal BondTM Index xix which returned 1.70%.

Contributors to relative performance included security selection within school districts, an overweight to corporate-backed municipals, and an underweight to AAA bonds. Detractors included duration management, exposures to the education sector, security selection within tobacco and healthcare and an overweight to maturities dated 25+ years.

19

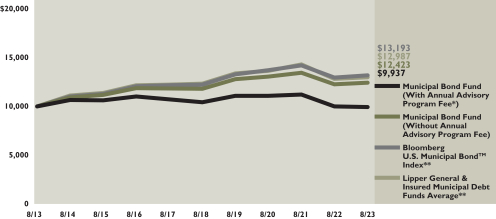

The following graph depicts the performance of the Bloomberg U.S. Municipal BondTM Indexxix vs. the Lipper General & Insured Municipal Debt Funds Averagexxix

HISTORICAL PERFORMANCE FOR THE TEN-YEAR PERIOD ENDED AUGUST 31, 2023 MUNICIPAL BOND FUND Comparison of $10,000 Investment in the Fund with the Bloomberg U.S. Municipal BondTM Index |

The performance shown above and below represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above and below. Performance figures may reflect voluntary fee waivers and/or expense reimbursements. In the absence of voluntary fee waivers and/or expense reimbursements, the total return would have been lower. Principal value and investment returns will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance data current to the most recent month-end, please visit our website at www.morganstanley.com/wealth-investmentsolutions/cgcm.

The graph above and returns shown below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

MUNICIPAL BOND FUND Average Annual Total Returns for the Period Ended August 31, 2023† | |||||||||||||||||||||||

| Without Annual Advisory Program Fee | With Annual Advisory Program Fee* | Bloomberg U.S. Municipal BondTM Index** | Lipper General & Insured Municipal Debt Funds Average** | ||||||||||||||||||||

| Since Inception 11/18/1991 | 4.02 | % | 2.10 | % | 4.77 | % | 4.32 | % | |||||||||||||||

| 10 years | 2.19 | -0.30 | 2.81 | 2.61 | |||||||||||||||||||

| 5 years | 1.01 | -1.28 | 1.52 | 0.99 | |||||||||||||||||||

| 3 years | -1.64 | -3.75 | -1.32 | -1.65 | |||||||||||||||||||

| 1 year | 1.35 | -0.66 | 1.70 | 1.16 | |||||||||||||||||||

See pages 26 through 30 for all footnotes.

20

Inflation-Linked Fixed Income Fund

| ABOUTTHE SUB-ADVISER |

• Pacific Investment Management Company LLC (“PIMCO”) |

| PIMCO is a leading global investment management firm, with offices in 11 countries throughout North America, Europe and Asia. Founded in 1971, PIMCO offers a wide range of innovative solutions to help millions of investors worldwide meet their needs. Our goal is to provide attractive returns while maintaining a strong culture of risk management and long-term discipline. PIMCO’s investment philosophy revolves around the principle of diversification. PIMCO believes that no single risk should dominate returns. PIMCO seeks to add value through the use of “top-down” strategies such as our exposure to interest rates, or duration, changing volatility, yield curve positioning and sector rotation. PIMCO also employs “bottom-up” strategies involving analysis and selection of specific securities. |

As of August 31, 2023, the Sub-adviser for the Morgan Stanley Pathway Inflation-Linked Fixed Income Fund (“Fund”) was Pacific Investment Management Company LLC (“PIMCO”).

For the fiscal year ending August 31, 2023, the Fund returned -4.51% compared to its benchmark, the Bloomberg U.S. Treasury Inflation Protected Securities (TIPS) Index xviii which returned -3.68%.

Interest rate strategies contributed to performance. U.S. and Eurozone curve positioning contributed to performance over the period as yields generally rose over the period. Japanese curve positioning detracted from performance as Japanese yields rose over the period particularly further out on the curve. Breakeven inflation positions overall contributed to performance. Security selection within Eurozone and U.K. breakevens contributed to performance. Modest overweight position during the period in U.S. breakeven inflation contributed to performance. Spread sector strategies were generally neutral to performance. Tactical exposure to agency MBS modestly contributed to performance while legacy RMBS exposure detracted from performance over the period.

21

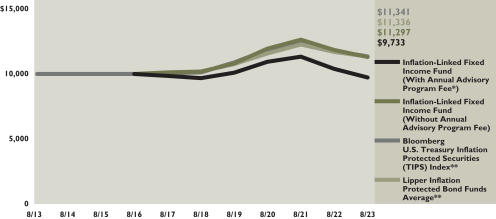

The following graph depicts the performance of the Bloomberg U.S. Treasury Inflation Protected Securities (TIPS) Indexxviii vs. the Lipper Inflation Protected Bond Funds Averagexxx

HISTORICAL PERFORMANCE FOR THE TEN-YEAR PERIOD ENDED AUGUST 31, 2023 INFLATION-LINKED FIXED INCOME FUND^ Comparison of $10,000 Investment in the Fund with the Bloomberg U.S. Treasury Inflation Protected Securities (TIPS) |

| ^ | Since inception March 9, 2016. |

The performance shown above and below represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above and below. Performance figures may reflect voluntary fee waivers and/or expense reimbursements. In the absence of voluntary fee waivers and/or expense reimbursements, the total return would have been lower. Principal value and investment returns will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance data current to the most recent month-end, please visit our website at www.morganstanley.com/wealth-investmentsolutions/cgcm.

The graph above and returns shown below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

INFLATION-LINKED FIXED INCOME FUND Average Annual Total Returns for the Period Ended August 31, 2023† | |||||||||||||||||||||||

| Without Annual Advisory Program Fee | With Annual Advisory Program Fee* | Bloomberg U.S. Treasury Inflation Protected Securities (TIPS) Index** | Lipper Inflation Protected Bond Funds Average** | ||||||||||||||||||||

| Since Inception 3/9/2016 | 2.26 | % | -0.14 | % | 2.22 | % | 1.79 | % | |||||||||||||||

| 10 years | N/A | N/A | 2.08 | 1.54 | |||||||||||||||||||

| 5 years | 2.14 | -0.18 | 2.29 | 2.03 | |||||||||||||||||||

| 3 years | -1.81 | -3.92 | -1.49 | -0.86 | |||||||||||||||||||

| 1 year | -4.51 | -6.40 | -3.68 | -2.99 | |||||||||||||||||||

See pages 26 through 30 for all footnotes.

22

Ultra-Short Term Fixed Income Fund

| ABOUTTHE SUB-ADVISER |

• Pacific Investment Management Company LLC (“PIMCO”) |

| PIMCO is a leading global investment management firm, with offices in 11 countries throughout North America, Europe and Asia. Founded in 1971, PIMCO offers a wide range of innovative solutions to help millions of investors worldwide meet their needs. Our goal is to provide attractive returns while maintaining a strong culture of risk management and long-term discipline. PIMCO’s investment philosophy revolves around the principle of diversification. PIMCO believes that no single risk should dominate returns. PIMCO seeks to add value through the use of “top-down” strategies such as our exposure to interest rates, or duration, changing volatility, yield curve positioning and sector rotation. PIMCO also employs “bottom-up” strategies involving analysis and selection of specific securities. |

As of August 31, 2023, the Sub-adviser for the Morgan Stanley Pathway Ultra-Short Term Fixed Income Fund (“Fund”) was Pacific Investment Management Company LLC (“PIMCO”).

For the fiscal year ending August 31, 2023, the Fund returned 4.95% compared to its benchmark, the FTSE 3-Month U.S. Treasury Bill Index xiv which returned 4.44%.

Interest rate strategies contributed to performance. An underweight to U.S. duration, including select short exposure to intermediate rates, contributed to performance as U.S. rates rose over the period. Spread sector strategies generally contributed to performance. Tactical long exposure to financial investment grade corporate credit contributed to performance as spreads tightened over the period. Select exposure to securitized credit particularly commercial MBS and collateralized debt obligations (CDOs)/CLOs contributed to performance. Select exposure to agency MBS detracted from performance as spreads generally tightened over the period. Overall currency strategies were positive for performance. Slight underweight to the U.S. Dollar contributed, while modest tactical exposure to the Australian Dollar detracted from performance.

23

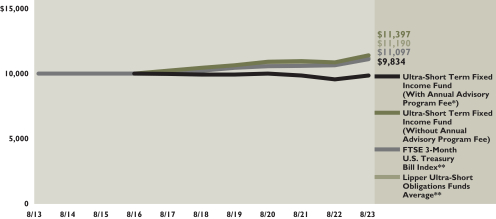

The following graph depicts the performance of the FTSE 3-Month U.S. Treasury Bill Indexxiv vs. the Lipper Ultra-Short Obligations Funds Averagexxxi

HISTORICAL PERFORMANCE FOR THE TEN-YEAR PERIOD ENDED AUGUST 31, 2023 ULTRA-SHORT TERM FIXED INCOME FUND^ Comparison of $10,000 Investment in the Fund with the FTSE 3-Month U.S. Treasury Bill Index |

| ^ | Since inception March 9, 2016. |

The performance shown above and below represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above and below. Performance figures may reflect voluntary fee waivers and/or expense reimbursements. In the absence of voluntary fee waivers and/or expense reimbursements, the total return would have been lower. Principal value and investment returns will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance data current to the most recent month-end, please visit our website at www.morganstanley.com/wealth-investmentsolutions/cgcm.

The graph above and returns shown below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

ULTRA-SHORT TERM FIXED INCOME FUND Average Annual Total Returns for the Period Ended August 31, 2023† | |||||||||||||||||||||||

| Without Annual Advisory Program Fee | With Annual Advisory Program Fee* | FTSE 3-Month U.S. Treasury Bill Index** | Lipper Ultra- Short Obligations Funds Average** | ||||||||||||||||||||

| Since Inception 3/9/2016 | 1.88 | % | -0.50 | % | 1.42 | % | 1.66 | % | |||||||||||||||

| 10 years | N/A | N/A | 1.07 | 1.35 | |||||||||||||||||||

| 5 years | 1.80 | -0.52 | 1.68 | 1.73 | |||||||||||||||||||

| 3 years | 1.52 | -0.66 | 1.63 | 1.38 | |||||||||||||||||||

| 1 year | 4.95 | 2.87 | 4.44 | 4.37 | |||||||||||||||||||

See pages 26 through 30 for all footnotes.

24

| ABOUTTHE MANAGER |

• Consulting Group Advisory Services, LLC |

| Consulting Group Advisory Services, LLC is a business of Morgan Stanley Wealth Management (“MSWM”). MSWM is one of the largest financial services firms in the U.S. with branch offices in all 50 states and the District of Columbia. MSWM’s advisory services are provided by its Consulting Group and Wealth Management Investment Resources business units. |

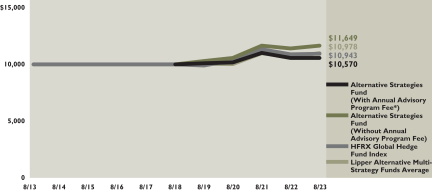

The following graph depicts the performance of the HFRX Global Hedge Fund Indexxxi vs. the Lipper Alternative Multi-Strategy Funds Averagexxxii

During the fiscal one-year period ending August 31, 2023, the Morgan Stanley Pathway Alternative Strategies Fund (“Fund”) returned 2.14% compared to its benchmark, the HFRX Global Hedge Fund Index xxi which returned 0.67%. Contributing to performance were exposures to market neutral, long/short equity, and long/short credit strategies, while detractors included exposures to managed futures, and real assets.

HISTORICAL PERFORMANCE FOR THE TEN-YEAR PERIOD ENDED AUGUST 31, 2023 ALTERNATIVE STRATEGIES FUND^ Comparison of $10,000 Investment in the Fund with the HFRX Global Hedge Fund Index |

| ^ | Since inception February 15, 2018. |

The performance shown above and below represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above and below. Performance figures may reflect voluntary fee waivers and/or expense reimbursements. In the absence of voluntary fee waivers and/or expense reimbursements, the total return would have been lower. Principal value and investment returns will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance data current to the most recent month-end, please visit our website at www.morganstanley.com/wealth-investmentsolutions/cgcm.

The graph above and returns shown below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

ALTERNATIVE STRATEGIES FUND Average Annual Total Returns for the Period Ended August 31, 2023† | |||||||||||||||||||||||

| Without Annual Advisory Program Fee | With Annual Advisory Program Fee* | HFRX Global Hedge Fund Index | Lipper Alternative Multi-Strategy Funds Average | ||||||||||||||||||||

| Since Inception 2/15/2018 | 2.57 | % | 0.22 | % | 1.09 | % | 1.64 | % | |||||||||||||||

| 10 years | N/A | N/A | 1.58 | 2.06 | |||||||||||||||||||

| 5 years | 3.10 | 0.75 | 1.82 | 1.99 | |||||||||||||||||||

| 3 years | 3.33 | 1.11 | 1.81 | 2.87 | |||||||||||||||||||

| 1 year | 2.14 | 0.12 | 0.67 | 3.00 | |||||||||||||||||||

See pages 26 through 30 for all footnotes.

25

| † | All figures represent past performance and are not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemptions of fund shares. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower. To obtain performance data current to the most recent month-end, please visit our website at https://www.morganstanley.com/wealth-investmentsolutions/cgcm/. |

| * | The Funds are available only to investors participating in Morgan Stanley approved advisory programs. These programs charge an annual fee, which may be up to 2.00%. |

| ** | Inception returns of the market indices and Lipper investment category averages are calculated from the end of the inception month. |