SECURITIES AND EXCHANGE COMMISSION

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number

(Exact name of registrant as specified in charter)

610 Market Street

Philadelphia, PA 19106

Registrant's telephone number, including area code:

Date of reporting period:

Item 1. Report to Stockholders.

(a) The registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows:

Delaware Global Listed Real Assets Fund

Annual shareholder report | October 31, 2024

This annual shareholder report contains important information about Delaware Global Listed Real Assets Fund (Fund) for the period of November 1, 2023, to October 31, 2024. You can find additional information about the Fund at

delawarefunds.com/literature.

You can also request this information by contacting us at

800 523-1918

, weekdays from

8:30am to 6:00pm ET.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund's costs for the last 12 months ?

(Based on a hypothetical $10,000 investment)

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class A | $ 131 | 1.23 % |

Management's discussion of

Fund performance

Delaware Global Listed Real

Asset

s Fund (Class A) re

turne

d 13.49% (excluding sales charge) for the 12 months ended

October 31, 2024.

During the same period, the MSCI ACWI (All Country World Index) Index (net) and MSCI ACWI Index (gross), the Fund's broad-based securities market indices, returned 32.79% and 33.40%, respectively, while the Bloomberg Global Inflation-Linked Total Return Index Value Hedged USD, the Fund's narrowly based securities market index, returned 7.68%.

Top contributors to performance:

Equities and credit-sensitive fixed income g

eneral

ly rallied over the fiscal year against a backdrop of slowing inflation and the start of rate cuts by the US Federal Reserve (Fed) and other central banks globally.

Real asset equities and real asset credit generally drove outperformance relative to inflation-linked bonds as the momentum behind artificial intelligence (AI) and US technology stocks helped propel risk assets forward.

Relative to the Fund's narrowly based index:

Overweight

to re

al asset equities including infrastructure, natural resources, and real estate

Overweight to real asset credit

Underweight to inflation-linked fixed income

Top detractors from performance:

The Fund’s allocations to commodities and cash underperformed the Fund’s narrowly based index.

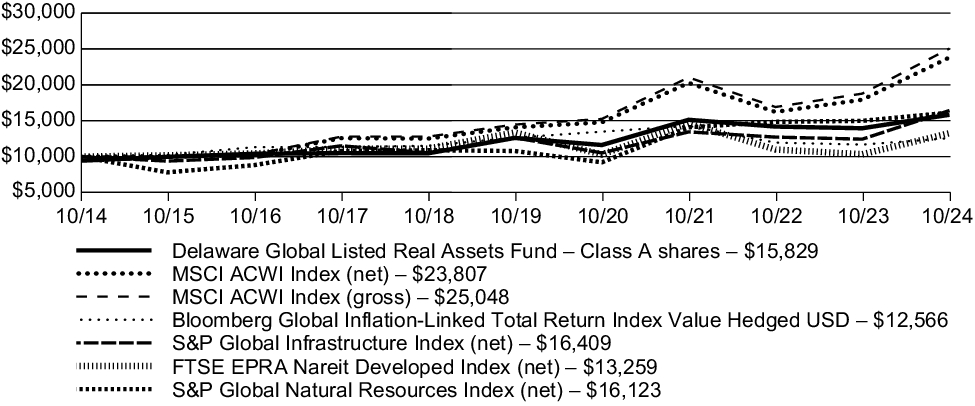

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Class. It also assumes a $10,000 initial investment at the beginning of the first full fiscal year in multiple

broad-based

securities market indices

and

multiple

narrowly

based

securities

market

indices for the same period and the deduction of the maximum applicable sales charge for Class A shares. The Fund changed its investment strategy as of

August 19, 2019

.

Growth of $10,000 investment

For the period October 31, 2014, through October 31, 2024

Average annual total returns (as of October 31, 2024 ) | 1 year | 5 year | 10 year |

| Delaware Global Listed Real Assets Fund (Class A) – including sales charge | 6.98 | % | 3.43 | % | 4.70 | % |

| Delaware Global Listed Real Assets Fund (Class A) – excluding sales charge | 13.49 | % | 4.67 | % | 5.32 | % |

| MSCI ACWI Index (net) | 32.79 | % | 11.08 | % | 9.06 | % |

| MSCI ACWI Index (gross) | 33.40 | % | 11.61 | % | 9.62 | % |

| Bloomberg Global Inflation-Linked Total Return Index Value Hedged USD | 7.68 | % | -0.11 | % | 2.31 | % |

| S&P Global Infrastructure Index (net) | 32.01 | % | 5.38 | % | 5.08 | % |

| FTSE EPRA Nareit Developed Index (net) | 28.46 | % | -0.15 | % | 2.86 | % |

| S&P Global Natural Resources Index (net) | 7.61 | % | 8.39 | % | 4.89 | % |

Keep in mind that the

Fund's

past performance is not a good predictor of how the

Fund

will perform in the future.

Visit delawarefunds.com/performance

for the most recent performance information. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance results reflect any expense caps in effect during these periods. All results shown assume reinvestment of distributions.

In connection with new regulatory requirements, effective the date of this report, the Fund changed its broad-based securities market benchmark index to the MSCI ACWI Index. Although the MSCI ACWI Index can be considered broadly representative of the overall securities market applicable to the Fund, the Fund will continue to show the performance of the Bloomberg Global Inflation-Linked Total Return Index Value Hedged USD for comparative purposes because Delaware Management Company, the Fund's manager, believes it is more representative of the Fund's investment universe.

Fund

statistics

(as of October 31, 2024)

| Fund net assets | $ 117,448,584 |

| Total number of portfolio holdings | 247 |

| Total advisory fees paid | $ 682,489 |

| Portfolio turnover rate | 73 % |

Fund

holdings

(as of October 31, 2024)

The tables below show the investment makeup of the Fund, with each category representing a percentage of the total net assets of the Fund.

| Common Stocks | 62.62 % |

| US Treasury Obligations | 12.12 % |

| Sovereign Bonds | 8.73 % |

| Corporate Bonds | 8.62 % |

| Short-Term Investments | 2.88 % |

| Exchange-Traded Fund | 2.78 % |

| Loan Agreements | 1.14 % |

| Non-Agency Commercial Mortgage-Backed Securities | 0.67 % |

| Closed-Ended Trust | 0.49 % |

| Equinix | 1.96 % |

| Welltower | 1.94 % |

| Shell | 1.22 % |

| Cellnex Telecom | 1.18 % |

| CF Industries Holdings | 1.07 % |

| Anglo American | 1.02 % |

| Athens International Airport | 1.01 % |

| Xcel Energy | 0.99 % |

| Enbridge | 0.96 % |

| Atlas Arteria | 0.96 % |

Effective February 27, 2024, the Fund introduced a revised fee waiver for Class A shares of 0.98% (excluding certain items, such as distribution and service (12b-1) fees).

This is a summary of certain changes to the Fund since the beginning of the reporting period. For more complete information, you may review the Fund's next prospectus, which we expect to be available by March 1, 2025, at

delawarefunds.com/literature

or upon request at 800 523-1918, weekdays from 8:30am to 6:00pm ET.

Availability of a

dditio

nal information

You can find additional information about the Fund, such as the prospectus, financial information, holdings, and proxy voting information, at delawarefunds.com/literature. You can also request this information by contacting us at

800 523-1918

, weekdays from 8:30am to 6:00pm ET, or by contacting your financial intermediary.

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports, and other communication to shareholders with the same residential address, provided they have the same last name or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain shareholder

s

of the Fund. If you would like to receive individual mailings, please call

800 523-1918

or contact your financial intermediary. Your instructions will typically be effective within 30 days after we receive them from you or your financial intermediary. If you choose, you may receive these documents through electronic delivery.

For more information, please scan the QR code at left to navigate to additional hosted material at delawarefunds.com/literature.

Delaware Global Listed Real Assets Fund

Annual shareholder report | October 31, 2024

This

annual shareholder report

contains important information about Delaware Global Listed Real Assets Fund (Fund) for the period of November 1, 2023, to October 31, 2024. You can find additional information about the Fund at

delawarefunds.com/literature.

You can also request this information by contacting us at

800 523-1918

, weekdays from

8:30am to 6:00pm ET.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund's costs for the last 12 months ?

(Based on a hypothetical $10,000 investment)

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class C | $ 210 | 1.98 % |

Management's discussion of

Fund performance

Delaware Global Listed Real Assets Fund (Class C) returned 12.57% (excluding sales charge) for the 12

months

ended

October 31, 2024.

During the same period, the MSCI ACWI (All Country World Index) Index (net) and MSCI ACWI Index (gross), the Fund's broad-based securities market indices, returned 32.79% and 33.40%, respectively, while the Bloomberg Global Inflation-Linked Total Return Index Value Hedged USD, the Fund's narrowly based securities market index, returned 7.68%.

Top contributors to performance:

Equities and credit-sensitive fixed income generally rallied over the fiscal year against a backdrop of slowing inflation and the start of rate cuts by the US Federal Reserve (Fed) and other central banks globally.

Real asset equities and real asset credit generally drove outperformance relative to inflation-linked bonds as the momentum behind artificial intelligence (AI) and US technology stocks helped propel risk assets forward.

Relative to the Fund's narrowly based index:

Overweight to real asset equities including infrastructure, natural resources, and real estate

Overweight to real asset credit

Underweight to inflation-linked fixed income

Top detractors from performance:

The Fund’s allocations to commodities and cash underperformed the Fund’s narrowly based index.

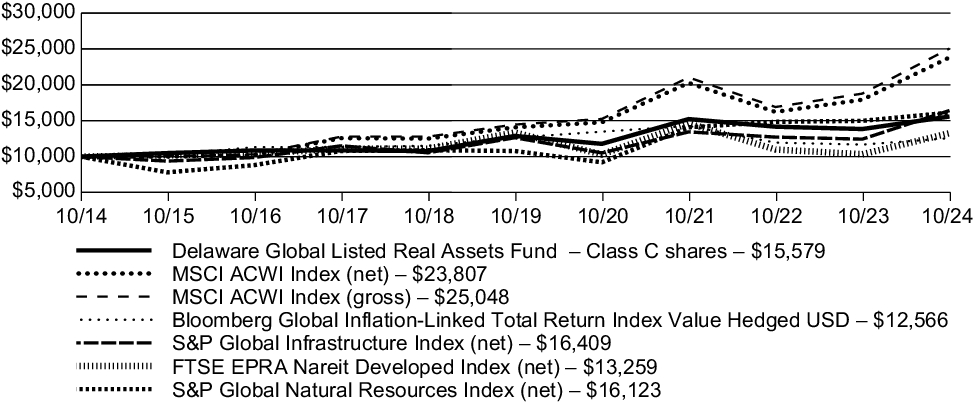

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Class. It also assumes a $10,000 initial investment at the beginning of the first full fiscal year in multiple

broad-based

securities market indices

and

multiple

narrowly

based

securities

market

indices for the same period. The Fund changed its investment strategy as of

August 19, 2019

.

Growth of $10,000 investment

For the period October 31, 2014, through October 31, 2024

Average annual total returns (as of October 31, 2024 ) | 1 year | 5 year | 10 year |

| Delaware Global Listed Real Assets Fund (Class C) – including sales charge | 11.57 | % | 3.88 | % | 4.53 | % |

| Delaware Global Listed Real Assets Fund (Class C) – excluding sales charge | 12.57 | % | 3.88 | % | 4.53 | % |

| MSCI ACWI Index (net) | 32.79 | % | 11.08 | % | 9.06 | % |

| MSCI ACWI Index (gross) | 33.40 | % | 11.61 | % | 9.62 | % |

| Bloomberg Global Inflation-Linked Total Return Index Value Hedged USD | 7.68 | % | -0.11 | % | 2.31 | % |

| S&P Global Infrastructure Index (net) | 32.01 | % | 5.38 | % | 5.08 | % |

| FTSE EPRA Nareit Developed Index (net) | 28.46 | % | -0.15 | % | 2.86 | % |

| S&P Global Natural Resources Index (net) | 7.61 | % | 8.39 | % | 4.89 | % |

Keep in mind that the

Fund's

past performance is not a good predictor of how the

Fund

will perform in the future.

Visit delawarefunds.com/performance

for the most recent performance information. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance results reflect any expense caps in effect during these periods. All results shown assume reinvestment of distributions.

In connection with new regulatory requirements, effective the date of this

report

, the Fund changed its broad-based securities market benchmark index to the MSCI ACWI Index. Although the MSCI ACWI Index can be considered broadly representative of the overall securities market applicable to the Fund, the Fund will continue to show the performance of the Bloomberg Global Inflation-Linked Total Return Index Value Hedged USD for comparative purposes because Delaware Management Company, the Fund's manager, believes it is more representative of the Fund's investment universe.

Fund

statistics

(as of October 31, 2024)

| Fund net assets | $ 117,448,584 |

| Total number of portfolio holdings | 247 |

| Total advisory fees paid | $ 682,489 |

| Portfolio turnover rate | 73 % |

Fund

holdings

(as of October 31, 2024)

The tables below show the investment makeup of the Fund, with each category representing a percentage of the total net assets of the Fund.

| Common Stocks | 62.62 % |

| US Treasury Obligations | 12.12 % |

| Sovereign Bonds | 8.73 % |

| Corporate Bonds | 8.62 % |

| Short-Term Investments | 2.88 % |

| Exchange-Traded Fund | 2.78 % |

| Loan Agreements | 1.14 % |

| Non-Agency Commercial Mortgage-Backed Securities | 0.67 % |

| Closed-Ended Trust | 0.49 % |

| Equinix | 1.96 % |

| Welltower | 1.94 % |

| Shell | 1.22 % |

| Cellnex Telecom | 1.18 % |

| CF Industries Holdings | 1.07 % |

| Anglo American | 1.02 % |

| Athens International Airport | 1.01 % |

| Xcel Energy | 0.99 % |

| Enbridge | 0.96 % |

| Atlas Arteria | 0.96 % |

Effective February 27, 2024, the Fund introduced a revised fee waiver for Class C shares of 0.98% (excluding certain items, such as distribution and service (12b-1) fees).

This is a summary of certain changes to the Fund since the beginning of the reporting period. For more complete information, you may review the Fund's next prospectus, which we expect to be available by March 1, 2025, at

delawarefunds.com/literature

or upon request at 800 523-1918, weekdays from 8:30am to 6:00pm ET.

Availability of additional information

You can find additional information about the Fund, such as the prospectus, financial information,

holdings

, and proxy voting information, at delawarefunds.com/literature. You can also request this information by contacting us at

800 523-1918

, weekdays from 8:30am to 6:00pm ET, or by contacting your financial intermediary.

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports, and other communication to shareholders with the same residential address, provided they have the same last name or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain shareholders of the Fund. If you would like to receive individual mailings, please call

800 523-1918

or contact your financial intermediary. Your instructions will typically be effective within 30 days after we receive them from you or your financial intermediary. If you choose, you may receive these documents through electronic delivery.

For more information, please scan the QR code at left to navigate to additional hosted material at delawarefunds.com/literature.

Delaware Global Listed Real Assets Fund

Annual shareholder report | October 31, 2024

This annual shareholder report contains important information about Delaware Global Listed Real Assets Fund (Fund) for the period of November 1, 2023, to October 31, 2024. You can find additional information about the Fund at

delawarefunds.com/literature.

You can also request this information by contacting us at

800 523-1918

, weekdays from

8:30am to 6:00pm ET.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund's costs for the last 12 months ?

(Based on a hypothetical $10,000 investment)

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class R | $ 158 | 1.48 % |

Management's discussion of

Fund performance

Delaware Global Listed Real Assets Fund (Class R)

returned

13.12% (excluding sales charge) for the 12 months ended

October 31, 2024.

During the same period, the MSCI ACWI (All Country World Index) Index (net) and MSCI ACWI Index (gross), the Fund's broad-based securities market indices, returned 32.79% and 33.40%, respectively, while the Bloomberg Global Inflation-Linked Total Return Index Value Hedged USD, the Fund's narrowly based securities market index, returned 7.68%.

Top contributors to performance:

Equities and credit-sensitive fixed income generally rallied over the fiscal year against a backdrop of slowing inflation and the start of rate cuts by the US Federal Reserve (Fed) and other central banks globally.

Real asset equities and real asset credit generally drove outperformance relative to inflation-linked bonds as the momentum behind artificial intelligence (AI) and US technology stocks helped propel risk assets forward.

Relative to the Fund's narrowly based index:

Overweight to real asset equities including infrastructure, natural resources, and real estate

Overweight to real asset credit

Underweight to inflation-linked fixed income

Top detractors from performance:

The Fund’s allocations to commodities and cash underperformed the Fund’s narrowly based index.

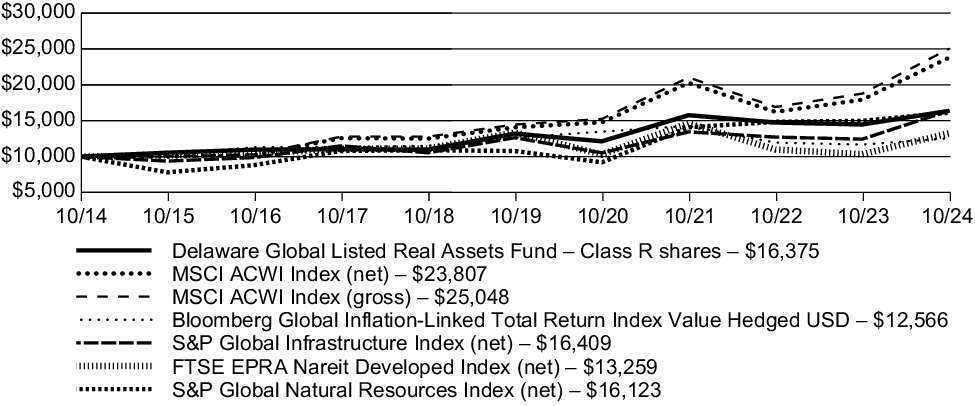

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Class. It also assumes a $10,000 initial investment at the beginning of the first full fiscal year in multiple

broad-based

securities market indices

and

multiple

narrowly

based

securities

market

indices

for the same period. The Fund changed its investment strategy as of

August 19, 2019

.

Growth of $10,000 investment

For the period October 31, 2014, through October 31, 2024

Average annual total returns (as of October 31, 2024 ) | 1 year | 5 year | 10 year |

| Delaware Global Listed Real Assets Fund (Class R) – including sales charge | 13.12 | % | 4.40 | % | 5.05 | % |

| Delaware Global Listed Real Assets Fund (Class R) – excluding sales charge | 13.12 | % | 4.40 | % | 5.05 | % |

| MSCI ACWI Index (net) | 32.79 | % | 11.08 | % | 9.06 | % |

| MSCI ACWI Index (gross) | 33.40 | % | 11.61 | % | 9.62 | % |

| Bloomberg Global Inflation-Linked Total Return Index Value Hedged USD | 7.68 | % | -0.11 | % | 2.31 | % |

| S&P Global Infrastructure Index (net) | 32.01 | % | 5.38 | % | 5.08 | % |

| FTSE EPRA Nareit Developed Index (net) | 28.46 | % | -0.15 | % | 2.86 | % |

| S&P Global Natural Resources Index (net) | 7.61 | % | 8.39 | % | 4.89 | % |

Keep in mind that the

Fund's

past performance is not a good predictor of how the

Fund

will perform in the future.

Visit delawarefunds.com/performance

for the most recent performance information. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance results reflect any expense caps in effect during these periods. All results shown assume reinvestment of distributions.

In connection with new regulatory requirements, effective the date of this report, the Fund changed its broad-based securities market benchmark index to the MSCI ACWI Index. Although the MSCI ACWI Index can be considered broadly representative of the overall securities market applicable to the Fund, the Fund will continue to show the performance of the Bloomberg Global Inflation-Linked Total Return Index Value Hedged USD for comparative purposes because Delaware Management Company, the Fund's manager, believes it is more representative of the Fund's investment universe.

Fund

statistics

(as of October 31, 2024)

| Fund net assets | $ 117,448,584 |

| Total number of portfolio holdings | 247 |

| Total advisory fees paid | $ 682,489 |

| Portfolio turnover rate | 73 % |

Fund

holdings

(as of October 31, 2024)

The tables below show the investment makeup of the Fund, with each category representing a percentage of the total net assets of the Fund.

| Common Stocks | 62.62 % |

| US Treasury Obligations | 12.12 % |

| Sovereign Bonds | 8.73 % |

| Corporate Bonds | 8.62 % |

| Short-Term Investments | 2.88 % |

| Exchange-Traded Fund | 2.78 % |

| Loan Agreements | 1.14 % |

| Non-Agency Commercial Mortgage-Backed Securities | 0.67 % |

| Closed-Ended Trust | 0.49 % |

| Equinix | 1.96 % |

| Welltower | 1.94 % |

| Shell | 1.22 % |

| Cellnex Telecom | 1.18 % |

| CF Industries Holdings | 1.07 % |

| Anglo American | 1.02 % |

| Athens International Airport | 1.01 % |

| Xcel Energy | 0.99 % |

| Enbridge | 0.96 % |

| Atlas Arteria | 0.96 % |

Effective February 27, 2024, the Fund introduced a revised fee waiver for Class R

shares

of 0.98% (excluding certain items, such as distribution and service (12b-1) fees).

This is a summary of certain changes to the Fund since the beginning of the reporting period. For more complete information, you may review the Fund's next prospectus, which we expect to be available by March 1, 2025, at

delawarefunds.com/literature

or upon request at 800 523-1918, weekdays from 8:30am to 6:00pm ET.

Availability of additional information

You can find additional information about the Fund, such as the prospectus, financial information, holdings, and proxy voting information, at delawarefunds.com/literature. You can also request this information by contacting us at

800 523-1918

, weekdays from 8:30am to 6:00pm ET, or by contacting your financial intermediary.

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports, and other communication to shareholders with the same residential address, provided they have the same last name or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain shareholder

s

of the Fund. If you would like to receive individual mailings, please call

800 523-1918

or contact your financial intermediary. Your instructions will typically be effective within 30 days after we receive them from you or your financial intermediary. If you choose, you may receive these documents through electronic delivery.

For more information, please scan the QR code at left to navigate to additional hosted material at delawarefunds.com/literature.

Delaware Global Listed Real Assets Fund

Institutional Class

: DPRSX

Annual shareholder report | October 31, 2024

This annual shareholder report contains important information about Delaware Global Listed Real Assets Fund (Fund) for the period of November 1, 2023, to October 31, 2024. You can find additional information about the Fund at

delawarefunds.com/literature.

You can also request this information by contacting us at

800 523-1918

, weekdays from

8:30am to 6:00pm ET.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund's costs for the last 12 months ?

(Based on a hypothetical $10,000 investment)

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Institutional Class | $ 105 | 0.98 % |

Management's discussion of

Fund performance

Delaware Global Listed Real Assets Fund (Institutional Class)

returned

13.74% (excluding sales charge) for the 12 months ended

October 31, 2024.

During the same period, the MSCI ACWI (All Country World Index) Index (net) and MSCI ACWI Index (gross), the Fund's broad-based securities market indices, returned 32.79% and

33.40

%, respectively, while the Bloomberg Global Inflation-Linked Total Return Index Value Hedged USD, the Fund's narrowly based securities market index, returned 7.68%.

Top contributors to performance:

Equities and credit-sensitive fixed income generally rallied over the fiscal year against a backdrop of slowing inflation and the start of rate cuts by the US Federal Reserve (Fed) and other central banks globally.

Real asset equities and real asset credit generally drove outperformance relative to inflation-linked bonds as the momentum behind artificial intelligence (AI) and US technology stocks helped propel risk assets forward.

Relative to the Fund's narrowly based index:

Overweight to real asset equities including infrastructure, natural resources, and real estate

Overweight to real asset credit

Underweight to inflation-linked fixed income

Top detractors from performance:

The Fund’s allocations to commodities and cash underperformed the Fund’s narrowly based index.

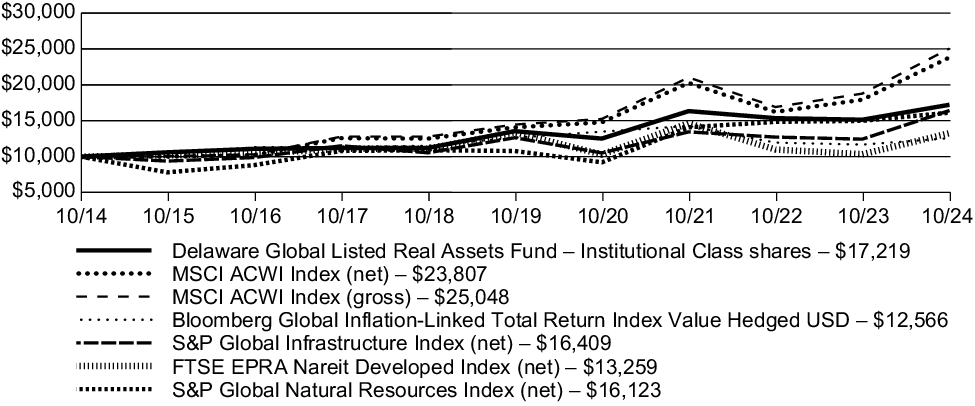

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Class. It also assumes a $

10,000

initial investment at the beginning of the first full fiscal year in multiple

broad-based

securities market indices

and

multiple

narrowly

based

securities

market

indices for the same period. The Fund changed its investment strategy as of

August 19, 2019

.

Growth of $10,000 investment

For the period October 31, 2014, through October 31, 2024

Average annual total returns (as of October 31, 2024 ) | 1 year | 5 year | 10 year |

| Delaware Global Listed Real Assets Fund (Institutional Class) – including sales charge | 13.74 | % | 4.92 | % | 5.59 | % |

| Delaware Global Listed Real Assets Fund (Institutional Class) – excluding sales charge | 13.74 | % | 4.92 | % | 5.59 | % |

| MSCI ACWI Index (net) | 32.79 | % | 11.08 | % | 9.06 | % |

| MSCI ACWI Index (gross) | 33.40 | % | 11.61 | % | 9.62 | % |

| Bloomberg Global Inflation-Linked Total Return Index Value Hedged USD | 7.68 | % | -0.11 | % | 2.31 | % |

| S&P Global Infrastructure Index (net) | 32.01 | % | 5.38 | % | 5.08 | % |

| FTSE EPRA Nareit Developed Index (net) | 28.46 | % | -0.15 | % | 2.86 | % |

| S&P Global Natural Resources Index (net) | 7.61 | % | 8.39 | % | 4.89 | % |

Keep in mind that the

Fund's

past performance is not a good predictor of how the

Fund

will perform in the future.

Visit delawarefunds.com/performance

for the most recent performance information. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance results reflect any expense caps in effect during these periods. All results shown assume reinvestment of distributions.

In connection with new regulatory requirements, effective the date of this report, the Fund changed its broad-based securities market benchmark index to the MSCI ACWI Index. Although the MSCI ACWI Index can be considered broadly representative of the overall securities market applicable to the Fund, the Fund will continue to show the performance of the Bloomberg Global Inflation-Linked Total Return Index Value Hedged USD for comparative purposes because Delaware Management Company, the Fund's manager, believes it is more representative of the Fund's investment universe.

Fund

statistics

(as of October 31, 2024)

| Fund net assets | $ 117,448,584 |

| Total number of portfolio holdings | 247 |

| Total advisory fees paid | $ 682,489 |

| Portfolio turnover rate | 73 % |

Fund

holdings

(as of October 31, 2024)

The tables below show the investment makeup of the Fund, with each category representing a percentage of the total net assets of the Fund.

| Common Stocks | 62.62 % |

| US Treasury Obligations | 12.12 % |

| Sovereign Bonds | 8.73 % |

| Corporate Bonds | 8.62 % |

| Short-Term Investments | 2.88 % |

| Exchange-Traded Fund | 2.78 % |

| Loan Agreements | 1.14 % |

| Non-Agency Commercial Mortgage-Backed Securities | 0.67 % |

| Closed-Ended Trust | 0.49 % |

| Equinix | 1.96 % |

| Welltower | 1.94 % |

| Shell | 1.22 % |

| Cellnex Telecom | 1.18 % |

| CF Industries Holdings | 1.07 % |

| Anglo American | 1.02 % |

| Athens International Airport | 1.01 % |

| Xcel Energy | 0.99 % |

| Enbridge | 0.96 % |

| Atlas Arteria | 0.96 % |

Effective February 27, 2024, the Fund introduced a revised fee waiver for Institutional Class shares of 0.98% (excluding certain items, such as distribution and service (12b-1) fees).

This is a summary of certain changes to the Fund since the beginning of the reporting period. For more complete information, you may review the Fund's next prospectus, which we expect to be available by March 1, 2025, at

delawarefunds.com/literature

or upon request at 800 523-1918, weekdays from 8:30am to 6:00pm ET.

Availability of additional information

You can find additional information about the Fund, such as the prospectus, financial information, holdings, and proxy voting information, at delawarefunds.com/literature. You can also request this information by contacting us at

800 523-1918

, weekdays from 8:30am to 6:00pm ET, or by contacting your financial intermediary.

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports, and other communication to shareholders with the same residential address, provided they have the same last name or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain shareholder

s

of the Fund. If you would

like

to

receive individual mailings, please call

800 523-1918

or contact your financial intermediary. Your instructions will typically be effective within 30 days after we receive them from you or your financial intermediary. If you choose, you may receive these documents through electronic delivery.

For more information, please scan the QR code at left to navigate to additional hosted material at delawarefunds.com/literature.

Delaware Global Listed Real Assets Fund

Annual shareholder report | October 31, 2024

This annual shareholder report contains important information about Delaware Global Listed Real Assets Fund (Fund) for the period of November 1, 2023, to October 31, 2024. You can find additional information about the Fund at

delawarefunds.com/literature.

You can also request this information by contacting us at

800 523-1918

, weekdays from

8:30am to 6:00pm ET.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund's costs for the last 12 months ?

(Based on a hypothetical $10,000 investment)

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class R6 | $ 95 | 0.89 % |

Management's discussion of

Fund

performance

Delaware Global Listed Real Assets Fund (Class R6) returned 13.82% (excluding sales charge) for the 12 months ended

October 31, 2024.

During the same period, the MSCI ACWI (All Country World Index) Index (net) and MSCI ACWI Index (gross), the Fund's broad-based securities market indices, returned 32.79% and 33.40%, respectively, while the Bloomberg Global Inflation-Linked Total Return Index Value Hedged USD, the Fund's narrowly based securities market index, returned 7.68%.

Top contributors to performance:

Equities and credit-sensitive fixed income generally rallied over the fiscal year against a backdrop of slowing inflation and the start of rate cuts by the US Federal Reserve (Fed) and other central banks globally.

Real asset equities and real asset credit generally drove outperformance relative to inflation-linked bonds as the momentum behind artificial intelligence (AI) and US technology stocks helped propel risk assets forward.

Relative to the Fund's narrowly based index:

Overweight to real asset equities including infrastructure, natural resources, and real estate

Overweight to real asset credit

Underweight to inflation-linked fixed income

Top detractors from performance:

The Fund’s allocations to commodities and cash underperformed the Fund’s narrowly based index.

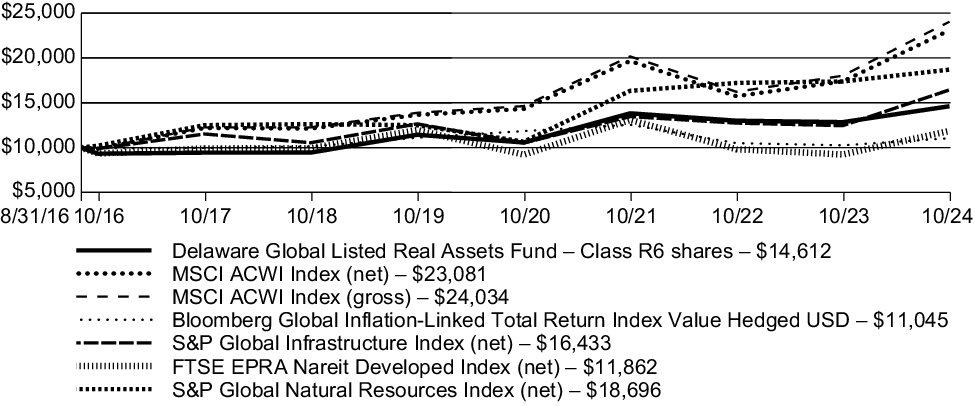

The following graph compares the initial and subsequent account values at the end of each of the most recently completed fiscal years (or period) of the Class for the life of the Class. It also assumes a $10,000 initial investment at the Class's inception date in multiple

broad-based

securities market indices

and

multiple

narrowly

based

securities

market

indices for the same period. The Fund changed its investment strategy as of

August 19, 2019

.

Growth of $10,000 investment

For the period August 31, 2016 (Class R6's inception), through October 31, 2024

Average annual total returns (as of October 31, 2024 ) | 1 year | 5 year | Since inception

(8/31/16)

|

| Delaware Global Listed Real Assets Fund (Class R6) – including sales charge | 13.82 | % | 5.03 | % | 4.75 | % |

| Delaware Global Listed Real Assets Fund (Class R6) – excluding sales charge | 13.82 | % | 5.03 | % | 4.75 | % |

| MSCI ACWI Index (net) | 32.79 | % | 11.08 | % | 10.79 | % |

| MSCI ACWI Index (gross) | 33.40 | % | 11.61 | % | 11.34 | % |

| Bloomberg Global Inflation-Linked Total Return Index Value Hedged USD | 7.68 | % | -0.11 | % | 1.22 | % |

| S&P Global Infrastructure Index (net) | 32.01 | % | 5.38 | % | 6.27 | % |

| FTSE EPRA Nareit Developed Index (net) | 28.46 | % | -0.15 | % | 2.11 | % |

| S&P Global Natural Resources Index (net) | 7.61 | % | 8.39 | % | 7.96 | % |

Keep in mind that the

Fund's

past performance is not a good predictor of how the

Fund

will perform in the future.

Visit delawarefunds.com/performance

for the most recent performance information. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance results reflect any expense caps in effect during these periods. All results shown assume reinvestment of distributions.

In connection with new regulatory requirements, effective the date of this report, the Fund changed its broad-based securities market benchmark index to the MSCI ACWI Index. Although the MSCI ACWI Index can be considered broadly representative of the overall securities market applicable to the Fund, the Fund will continue to show the performance of the Bloomberg Global Inflation-Linked Total Return Index Value Hedged USD for comparative purposes because Delaware Management Company, the Fund's manager, believes it is more representative of the Fund's investment universe.

Fund

statistics

(as of October 31, 2024)

| Fund net assets | $ 117,448,584 |

| Total number of portfolio holdings | 247 |

| Total advisory fees paid | $ 682,489 |

| Portfolio turnover rate | 73 % |

Fund

holdings

(as of October 31, 2024)

The tables below show the investment makeup of the Fund, with each category representing a percentage of the total net assets of the Fund.

| Common Stocks | 62.62 % |

| US Treasury Obligations | 12.12 % |

| Sovereign Bonds | 8.73 % |

| Corporate Bonds | 8.62 % |

| Short-Term Investments | 2.88 % |

| Exchange-Traded Fund | 2.78 % |

| Loan Agreements | 1.14 % |

| Non-Agency Commercial Mortgage-Backed Securities | 0.67 % |

| Closed-Ended Trust | 0.49 % |

| Equinix | 1.96 % |

| Welltower | 1.94 % |

| Shell | 1.22 % |

| Cellnex Telecom | 1.18 % |

| CF Industries Holdings | 1.07 % |

| Anglo American | 1.02 % |

| Athens International Airport | 1.01 % |

| Xcel Energy | 0.99 % |

| Enbridge | 0.96 % |

| Atlas Arteria | 0.96 % |

Effective February 27, 2024, the Fund introduced a revised fee waiver for Class R6 shares of

0.88

% (excluding certain items, such as distribution and service (12b-1) fees).

This is a summary of certain changes to the Fund since the beginning of the reporting period. For more complete information, you may review the Fund's next prospectus, which we expect to be available by March 1, 2025, at

delawarefunds.com/literature

or upon request at 800 523-1918, weekdays from 8:30am to 6:00pm ET.

Availability of additional information

You can find additional information about the Fund, such as the prospectus, financial information, holdings, and proxy voting information, at delawarefunds.com/literature. You can also request this information by contacting us at

, weekdays from 8:30am to 6:00pm ET, or by contacting your financial intermediary.

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports, and other communication to shareholders with the same residential address, provided they have the same last name or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain shareholder

s

of the Fund. If you would like to receive individual mailings, please call

800 523-1918

or contact your financial intermediary. Your instructions will typically be effective within 30 days after we receive them from you or your financial intermediary. If you choose, you may receive these documents through electronic delivery.

For more information, please scan the QR code at left to navigate to additional hosted material at delawarefunds.com/literature.

Item 2. Code of Ethics.

| | (a) | The registrant has adopted a code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party. A copy of the registrant’s Code of Business Ethics has been posted on the Macquarie Funds Internet Web site at www.macquarie.com/mam. Any amendments to the Code of Business Ethics, and information on any waiver from its provisions granted by the registrant, will also be posted on this Web site within five business days of such amendment or waiver and will remain on the Web site for at least 12 months. |

Item 3. Audit Committee Financial Expert.

The registrant’s Board of Trustees has determined that certain members of the registrant’s Audit Committee are audit committee financial experts, as defined below. For purposes of this item, an “audit committee financial expert” is a person who has the following attributes:

a. An understanding of generally accepted accounting principles and financial statements;

b. The ability to assess the general application of such principles in connection with the accounting for estimates, accruals, and reserves;

c. Experience preparing, auditing, analyzing, or evaluating financial statements that present a breadth and level of complexity of accounting issues that are generally comparable to the breadth and complexity of issues that can reasonably be expected to be raised by the registrant’s financial statements, or experience actively supervising one or more persons engaged in such activities;

d. An understanding of internal controls and procedures for financial reporting; and

e. An understanding of audit committee functions.

An “audit committee financial expert” shall have acquired such attributes through:

a. Education and experience as a principal financial officer, principal accounting officer, controller, public accountant, or auditor or experience in one or more positions that involve the performance of similar functions;

b. Experience actively supervising a principal financial officer, principal accounting officer, controller, public accountant, auditor, or person performing similar functions;

c. Experience overseeing or assessing the performance of companies or public accountants with respect to the preparation, auditing, or evaluation of financial statements; or

d. Other relevant experience.

The registrant’s Board of Trustees has also determined that each member of the registrant’s Audit Committee is independent. In order to be “independent” for purposes of this item, the Audit Committee member may not, other than in his or her capacity as a member of the Board of Trustees or any committee thereof, (i) accept directly or indirectly any consulting, advisory or other compensatory fee from the issuer; or (ii) be an “interested person” of the registrant as defined in Section 2(a)(19) of the Investment Company Act of 1940.

The names of the audit committee financial experts on the registrant’s Audit Committee are set forth below:

Ann Borowiec

H. Jeffrey Dobbs

Frances Sevilla-Sacasa, Chair

Christianna Wood

Item 4. Principal Accountant Fees and Services.

Audit Fees

| | (a) | The aggregate fees billed for each of the last two fiscal years for professional services rendered by the principal accountant for the audit of the registrant’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years are $46,000 for 2024 and $30,931 for 2023. |

Audit-Related Fees

| | (b) | The aggregate fees billed in each of the last two fiscal years for assurance and related services by the principal accountant that are reasonably related to the performance of the audit of the registrant’s financial statements and are not reported under paragraph (a) of this Item are $1,374,878 for 2024 and $1,362,878 for 2023. These audit-related services were as follows: year end audit procedures; group reporting and subsidiary statutory audits. |

Tax Fees

| | (c) | The aggregate fees billed in each of the last two fiscal years for professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning are $5,171 for 2024 and $17,401 for 2023. These tax-related services were as follows: review of income tax returns and review of annual excise distribution calculations. |

All Other Fees

| | (d) | The aggregate fees billed in each of the last two fiscal years for products and services provided by the principal accountant, other than the services reported in paragraphs (a) through (c) of this Item are $0 for 2024 and $0 for 2023. |

| | (e)(1) | The registrant’s Audit Committee has established pre-approval policies and procedures as permitted by Rule 2-01(c)(7)(i)(B) of Regulation S-X (the “Pre-Approval Policy”) with respect to services provided by the registrant’s independent auditors. Pursuant to the Pre-Approval Policy, the Audit Committee has pre-approved the services set forth in the table below with respect to the registrant up to the specified fee limits. Certain fee limits are based on aggregate fees to the registrant and other registrants within the Macquarie Funds. |

| | |

Service | | Range of Fees |

| Audit Services | | |

| |

| Statutory audits or financial audits for new Funds | | up to $50,000 per Fund |

| |

| Services associated with SEC registration statements (e.g., Form N-1A, Form N-14, etc.), periodic reports and other documents filed with the SEC or other documents issued in connection with securities offerings (e.g., comfort letters for closed-end Fund offerings, consents), and assistance in responding to SEC comment letters | | up to $10,000 per Fund |

| |

| Consultations by Fund management as to the accounting or disclosure treatment of transactions or events and/or the actual or potential impact of final or proposed rules, standards or interpretations by the SEC, FASB, or other regulatory or standard-setting bodies (Note: Under SEC rules, some consultations may be considered “audit-related services” rather than “audit services”) | | up to $25,000 in the aggregate |

| |

| Audit-Related Services | | |

| |

| Consultations by Fund management as to the accounting or disclosure treatment of transactions or events and /or the actual or potential impact of final or proposed rules, standards or interpretations by the SEC, FASB, or other regulatory or standard-setting bodies (Note: Under SEC rules, some consultations may be considered “audit services” rather than “audit-related services”) | | up to $25,000 in the aggregate |

| |

| Tax Services | | |

| |

| U.S. federal, state and local and international tax planning and advice (e.g., consulting on statutory, regulatory or administrative developments, evaluation of Funds’ tax compliance function, etc.) | | up to $25,000 in the aggregate |

| |

| U.S. federal, state and local tax compliance (e.g., excise distribution reviews, etc.) | | up to $5,000 per Fund |

| |

| Review of federal, state, local and international income, franchise and other tax returns | | up to $5,000 per Fund |

Under the Pre-Approval Policy, the Audit Committee has also pre-approved the services set forth in the table below with respect to the registrant’s investment adviser and other entities controlling, controlled by or under common control with the investment adviser that provide ongoing services to the registrant (the “Control Affiliates”) up to the specified fee limit. This fee limit is based on aggregate fees to the investment adviser and its Control Affiliates.

| | |

Service | | Range of Fees |

| Non-Audit Services | | |

| |

| Services associated with periodic reports and other documents filed with the SEC and assistance in responding to SEC comment letters | | up to $10,000 in the aggregate |

The Pre-Approval Policy requires the registrant’s independent auditors to report to the Audit Committee at each of its regular meetings regarding all services initiated since the last such report was rendered, including those services authorized by the Pre-Approval Policy.

| | (e)(2) | The percentage of services described in each of paragraphs (b) through (d) of this Item that were approved by the audit committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X are as follows: |

(b) 0%

(c) 0%

(d) 0%

| | (g) | The aggregate non-audit fees billed by the registrant’s accountant for services rendered to the registrant, and rendered to the registrant’s investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the registrant for each of the last two fiscal years of the registrant was $9,688,403 for 2024 and $24,428,000 for 2023. |

| | (h) | The audit committee of the registrant’s board of trustees has considered whether the provision of non-audit services that were rendered to the registrant’s investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant that were not pre-approved pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X is compatible with maintaining the principal accountant’s independence. |

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

| (a) | Schedule of Investments in securities of unaffiliated issuers as of the close of the reporting period is included as part of the Financial Statements filed under Item 7 of this form. |

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

| | (a) | An open-end management investment company registered on Form N-1A [17 CFR 239.15A and 17 CFR 274.11A] must file its most recent annual or semi-annual financial statements required, and for the periods specified, by Regulation S-X. |

The annual financial statements are attached herewith.

| | (b) | An open-end management investment company registered on Form N-1A [17 CFR 239.15A and 17 CFR 274.11A] must file the information required by Item 13 of Form N-1A. |

The Financial Highlights are attached herewith.

Multi-asset mutual fund

Delaware Global Listed Real Assets Fund

Financial statements and other information

For the year ended October 31, 2024

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

Form N-PORT and proxy voting information

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (SEC) for the first and third quarters of each fiscal year on Form N-PORT. The Fund’s Form N-PORT, as well as a description of the policies and procedures that the Fund uses to determine how to vote proxies (if any) relating to portfolio securities, is available without charge (i) upon request, by calling 800 523-1918; and (ii) on the SEC’s website at sec.gov. In addition, a description of the policies and procedures that the Fund uses to determine how to vote proxies (if any) relating to portfolio securities and the Schedule of Investments included in the Fund’s most recent Form N-PORT are available without charge on the Fund’s website at delawarefunds.com/literature.

Information (if any) regarding how the Fund voted proxies relating to portfolio securities during the most recently disclosed 12-month period ended June 30 is available without charge (i) through the Fund’s website at delawarefunds.com/proxy; and (ii) on the SEC’s website at sec.gov.

Schedule of investments

| Delaware Global Listed Real Assets Fund | October 31, 2024 |

| | | Principal

amount° | Value (US $) |

| Corporate Bonds — 8.62% |

| Basic Industry — 1.01% |

| Alcoa Nederland Holding 144A 5.50% 12/15/27 # | | 365,000 | $ 362,646 |

| Cleveland-Cliffs 144A 7.00% 3/15/32 # | | 215,000 | 215,512 |

| FMG Resources August 2006 | | | |

| 144A 5.875% 4/15/30 # | | 75,000 | 74,707 |

| 144A 6.125% 4/15/32 # | | 200,000 | 200,852 |

| Novelis | | | |

| 144A 3.875% 8/15/31 # | | 175,000 | 153,838 |

| 144A 4.75% 1/30/30 # | | 100,000 | 93,764 |

|

|

| Vibrantz Technologies 144A 9.00% 2/15/30 # | | 85,000 | 79,712 |

| | 1,181,031 |

| Brokerage — 0.06% |

| HAT Holdings I 144A 3.75% 9/15/30 # | | 75,000 | 65,697 |

| | 65,697 |

| Capital Goods — 1.11% |

| Ball 3.125% 9/15/31 | | 290,000 | 250,870 |

| Bombardier | | | |

| 144A 7.25% 7/1/31 # | | 195,000 | 201,709 |

| 144A 8.75% 11/15/30 # | | 120,000 | 130,172 |

|

|

| Clean Harbors 144A 5.125% 7/15/29 # | | 130,000 | 126,601 |

| GFL Environmental 144A 5.125% 12/15/26 # | | 110,000 | 109,000 |

| Sealed Air | | | |

| 144A 4.00% 12/1/27 # | | 120,000 | 114,965 |

| 144A 5.00% 4/15/29 # | | 135,000 | 130,521 |

|

|

| Terex 144A 6.25% 10/15/32 # | | 245,000 | 244,058 |

| | 1,307,896 |

| Communications — 1.93% |

| CCO Holdings 144A 5.375% 6/1/29 # | | 240,000 | 229,292 |

| CMG Media 144A 8.875% 12/15/27 # | | 145,000 | 105,306 |

| CSC Holdings 144A 4.50% 11/15/31 # | | 200,000 | 146,827 |

| Cumulus Media New Holdings 144A 8.00% 7/1/29 # | | 41,000 | 16,908 |

| Frontier Communications Holdings 144A 5.875% 10/15/27 # | | 203,000 | 202,699 |

| Gray Television 144A 5.375% 11/15/31 # | | 265,000 | 160,101 |

| Lamar Media 3.75% 2/15/28 | | 120,000 | 114,189 |

| LCPR Senior Secured Financing DAC 144A 6.75% 10/15/27 # | | 194,000 | 182,023 |

| Nexstar Media 144A 5.625% 7/15/27 # | | 143,000 | 140,648 |

| Outfront Media Capital 144A 4.625% 3/15/30 # | | 165,000 | 153,611 |

| Sable International Finance 144A 7.125% 10/15/32 # | | 250,000 | 251,484 |

| Sirius XM Radio 144A 5.50% 7/1/29 # | | 210,000 | 203,870 |

Schedule of investments

Delaware Global Listed Real Assets Fund

| | | Principal

amount° | Value (US $) |

| Corporate Bonds (continued) |

| Communications (continued) |

| Virgin Media Secured Finance 144A 5.50% 5/15/29 # | | 200,000 | $ 189,311 |

| Vmed O2 UK Financing I 144A 4.25% 1/31/31 # | | 200,000 | 172,739 |

| | 2,269,008 |

| Consumer Cyclical — 1.65% |

| Caesars Entertainment 144A 7.00% 2/15/30 # | | 315,000 | 323,139 |

| Carnival | | | |

| 144A 5.75% 3/1/27 # | | 75,000 | 75,272 |

| 144A 6.00% 5/1/29 # | | 185,000 | 185,429 |

| 144A 7.625% 3/1/26 # | | 125,000 | 125,952 |

|

|

| Goodyear Tire & Rubber 5.25% 7/15/31 | | 145,000 | 127,585 |

| Hilton Domestic Operating | | | |

| 144A 4.00% 5/1/31 # | | 205,000 | 186,886 |

| 4.875% 1/15/30 | | 135,000 | 130,900 |

|

|

| Murphy Oil USA 144A 3.75% 2/15/31 # | | 221,000 | 196,622 |

| Royal Caribbean Cruises 144A 5.50% 4/1/28 # | | 335,000 | 335,188 |

| Wyndham Hotels & Resorts 144A 4.375% 8/15/28 # | | 265,000 | 252,415 |

| | 1,939,388 |

| Consumer Non-Cyclical — 0.36% |

| CHS 144A 5.25% 5/15/30 # | | 213,000 | 186,054 |

| Tenet Healthcare | | | |

| 4.25% 6/1/29 | | 139,000 | 131,602 |

| 6.875% 11/15/31 | | 100,000 | 107,335 |

| | 424,991 |

| Electric — 1.19% |

| California Buyer 144A 6.375% 2/15/32 # | | 300,000 | 298,114 |

| Calpine | | | |

| 144A 5.00% 2/1/31 # | | 25,000 | 23,620 |

| 144A 5.125% 3/15/28 # | | 240,000 | 234,782 |

|

|

| Lightning Power 144A 7.25% 8/15/32 # | | 235,000 | 244,683 |

| NRG Energy 144A 3.625% 2/15/31 # | | 125,000 | 110,791 |

| TerraForm Power Operating 144A 4.75% 1/15/30 # | | 213,000 | 198,950 |

| Vistra Operations | | | |

| 144A 5.00% 7/31/27 # | | 50,000 | 49,374 |

| 144A 5.50% 9/1/26 # | | 50,000 | 49,880 |

| 144A 5.625% 2/15/27 # | | 190,000 | 189,629 |

| | 1,399,823 |

| Energy — 0.79% |

| CNX Resources 144A 6.00% 1/15/29 # | | 185,000 | 183,566 |

| Genesis Energy 8.25% 1/15/29 | | 205,000 | 209,538 |

| | | Principal

amount° | Value (US $) |

| Corporate Bonds (continued) |

| Energy (continued) |

| Hilcorp Energy I 144A 6.00% 4/15/30 # | | 75,000 | $ 71,600 |

| Nabors Industries 144A 9.125% 1/31/30 # | | 145,000 | 149,876 |

| NGL Energy Operating 144A 8.375% 2/15/32 # | | 185,000 | 186,566 |

| NuStar Logistics | | | |

| 6.00% 6/1/26 | | 65,000 | 65,097 |

| 6.375% 10/1/30 | | 60,000 | 60,728 |

| | 926,971 |

| Technology — 0.33% |

| Iron Mountain 144A 4.50% 2/15/31 # | | 275,000 | 255,582 |

| Seagate HDD Cayman 5.75% 12/1/34 | | 135,000 | 133,197 |

| | 388,779 |

| Transportation — 0.19% |

| Air Canada 144A 3.875% 8/15/26 # | | 175,000 | 169,434 |

| Delta Air Lines 7.375% 1/15/26 | | 47,000 | 48,187 |

| | 217,621 |

| Total Corporate Bonds (cost $10,401,243) | 10,121,205 |

|

|

|

| Non-Agency Commercial Mortgage-Backed Securities — 0.67% |

Cantor Commercial Real Estate Lending

Series 2019-CF1 B 4.178% 5/15/52 • | | 200,000 | 172,686 |

Morgan Stanley Capital I Trust

Series 2016-BNK2 B 3.485% 11/15/49 | | 740,000 | 608,113 |

| Total Non-Agency Commercial Mortgage-Backed Securities (cost $979,666) | 780,799 |

|

|

|

| Loan Agreements — 1.14% |

| Communications — 0.36% |

| Charter Communications Operating Tranche B2 6.343% (SOFR03M + 1.75%) 2/1/27 • | | 251,548 | 251,539 |

| Lamar Media Tranche B 6.285% (SOFR01M + 1.60%) 2/5/27 • | | 169,139 | 168,928 |

| | 420,467 |

| Electric — 0.73% |

| Calpine | | | |

| 6.685% (SOFR01M + 2.00%) 12/16/27 • | USD | 58,105 | 58,178 |

| 6.685% (SOFR01M + 2.00%) 1/31/31 • | USD | 311,675 | 311,242 |

|

|

| Calpine Construction Finance Company 6.685% (SOFR01M + 2.00%) 7/31/30 • | | 121,711 | 121,199 |

Schedule of investments

Delaware Global Listed Real Assets Fund

| | | Principal

amount° | Value (US $) |

|

| Loan Agreements (continued) |

| Electric (continued) |

|

| Hamilton Projects Acquiror 1st Lien 8.435% (SOFR01M + 3.75%) 5/31/31 • | | 199,500 | $ 200,711 |

| Vistra Operations 6.685% (SOFR01M + 2.00%) 12/20/30 • | | 161,793 | 162,115 |

| | 853,445 |

| Finance Companies — 0.05% |

| Setanta Aircraft Leasing DAC Tranche B 6.354% (SOFR03M + 1.75%) 11/6/28 • | | 62,500 | 62,845 |

| | 62,845 |

| Total Loan Agreements (cost $1,334,147) | 1,336,757 |

|

|

|

| Sovereign BondsΔ — 8.73% |

| Australia — 0.21% |

| Australia Government Bond | | | |

| 2.50% 9/20/30 ■ | AUD | 254,114 | 250,993 |

| | 250,993 |

| Canada — 0.47% |

| Canadian Government Real Return Bonds | | | |

| 0.25% 12/1/54 | CAD | 71,823 | 36,432 |

| 1.50% 12/1/44 | CAD | 86,778 | 61,451 |

| 4.00% 12/1/31 | CAD | 532,945 | 449,976 |

| | 547,859 |

| France — 1.70% |

| French Republic Government Bonds OAT | | | |

| 144A 0.10% 3/1/26 # | EUR | 197,318 | 212,483 |

| 144A 0.10% 3/1/29 # | EUR | 608,596 | 639,714 |

| 144A 0.10% 3/1/36 # | EUR | 145,083 | 139,552 |

| 144A 0.10% 7/25/38 # | EUR | 386,424 | 362,468 |

| 144A 0.10% 7/25/47 # | EUR | 123,680 | 105,023 |

| 144A 0.10% 7/25/53 # | EUR | 59,132 | 47,887 |

| 144A 3.15% 7/25/32 # | EUR | 389,104 | 493,003 |

| | 2,000,130 |

| Germany — 0.40% |

| Deutsche Bundesrepublik Inflation Linked Bonds | | | |

| 0.10% 4/15/46 ■ | EUR | 174,288 | 172,854 |

| 0.50% 4/15/30 ■ | EUR | 266,852 | 290,524 |

| | 463,378 |

| | | Principal

amount° | Value (US $) |

|

| Sovereign Bonds (continued) |

| Italy — 1.14% |

| Italy Buoni Poliennali Del Tesoro | | | |

| 144A 0.10% 5/15/33 # | EUR | 642,709 | $ 613,405 |

| 144A 0.15% 5/15/51 # | EUR | 65,208 | 45,727 |

| 144A 1.30% 5/15/28 # | EUR | 403,718 | 440,673 |

| 144A 2.55% 9/15/41 # | EUR | 206,612 | 240,446 |

| | 1,340,251 |

| Japan — 0.35% |

| Japanese Government CPI Linked Bond | | | |

| 0.10% 3/10/29 | JPY | 60,199,150 | 413,532 |

| | 413,532 |

| Spain — 0.39% |

| Spain Government Inflation Linked Bonds | | | |

| 144A 1.00% 11/30/30 # | EUR | 269,128 | 293,832 |

| 144A 2.05% 11/30/39 # | EUR | 135,789 | 159,214 |

| | 453,046 |

| United Kingdom — 4.07% |

| United Kingdom Inflation-Linked Gilt | | | |

| 0.125% 3/22/29 ■ | GBP | 747,548 | 946,788 |

| 0.125% 3/22/51 ■ | GBP | 506,811 | 454,783 |

| 0.125% 11/22/56 ■ | GBP | 214,319 | 182,741 |

| 0.125% 3/22/68 ■ | GBP | 232,971 | 181,219 |

| 0.125% 3/22/73 ■ | GBP | 45,778 | 37,186 |

| 0.375% 3/22/62 ■ | GBP | 157,396 | 142,699 |

| 0.50% 3/22/50 ■ | GBP | 405,249 | 411,232 |

| 0.625% 3/22/40 ■ | GBP | 580,919 | 685,008 |

| 0.625% 11/22/42 ■ | GBP | 291,786 | 334,876 |

| 0.625% 3/22/45 ■ | GBP | 377,537 | 414,881 |

| 1.25% 11/22/32 ■ | GBP | 314,064 | 422,915 |

| 2.00% 1/26/35 ■ | GBP | 179,000 | 562,815 |

| | 4,777,143 |

| Total Sovereign Bonds (cost $10,817,482) | 10,246,332 |

|

|

|

| US Treasury Obligations — 12.12% |

US Treasury Floating Rate Note

4.724% (USBMMY3M + 0.18%) 7/31/26 • | | 1,455,600 | 1,455,060 |

| US Treasury Inflation Indexed Bonds | | | |

| 0.25% 2/15/50 | | 409,694 | 256,462 |

| 0.75% 2/15/42 | | 474,646 | 381,612 |

| 1.00% 2/15/49 | | 525,420 | 407,686 |

Schedule of investments

Delaware Global Listed Real Assets Fund

| | | Principal

amount° | Value (US $) |

|

| US Treasury Obligations (continued) |

| US Treasury Inflation Indexed Bonds | | | |

| 1.50% 2/15/53 | | 216,991 | $ 186,414 |

| 2.125% 2/15/40 | | 162,249 | 163,192 |

| 3.875% 4/15/29 | | 2,497,030 | 2,708,800 |

| US Treasury Inflation Indexed Notes | | | |

| 0.125% 4/15/25 | | 4,350,830 | 4,291,108 |

| 0.375% 1/15/27 | | 2,064,628 | 1,997,577 |

| 1.375% 7/15/33 | | 2,498,611 | 2,391,578 |

| Total US Treasury Obligations (cost $14,257,053) | 14,239,489 |

| | | Number of

shares | |

| Closed-Ended Trust — 0.49% |

| Sprott Physical Uranium Trust † | 31,349 | 578,415 |

| Total Closed-Ended Trust (cost $499,949) | 578,415 |

|

|

|

| Common Stocks — 62.62% |

| Consumer Staples — 0.34% |

| Bunge Global | 4,685 | 393,634 |

| | 393,634 |

| Energy — 7.28% |

| ARC Resources | 27,954 | 462,972 |

| Chord Energy | 4,759 | 595,351 |

| Enbridge | 27,969 | 1,129,728 |

| Expand Energy | 7,090 | 600,665 |

| Granite Ridge Resources | 19,796 | 117,390 |

| Kimbell Royalty Partners | 47,130 | 756,437 |

| Parex Resources | 25,485 | 236,665 |

| Permian Resources | 48,672 | 663,399 |

| Schlumberger | 23,258 | 931,948 |

| Shell | 43,054 | 1,437,458 |

| Tourmaline Oil | 11,028 | 508,412 |

| Unit | 13,260 | 412,452 |

| Valaris † | 4,448 | 225,069 |

| Valero Energy | 3,643 | 472,716 |

| | 8,550,662 |

| Industrials — 7.46% |

| Arcosa | 5,133 | 480,654 |

| Athens International Airport | 138,902 | 1,186,062 |

| Atlas Arteria | 351,031 | 1,123,730 |

| | | Number of

shares | Value (US $) |

|

| Common Stocks (continued) |

| Industrials (continued) |

| Catena | 3,495 | $ 160,205 |

| CCR | 515,742 | 1,089,313 |

| Enav 144A # | 259,935 | 1,101,278 |

| Net Power † | 13,464 | 121,445 |

| Sacyr | 320,039 | 1,065,738 |

| Sunrun † | 18,252 | 263,741 |

| Transurban Group | 127,912 | 1,066,012 |

| Vinci | 9,843 | 1,102,620 |

| | 8,760,798 |

| Information Technology — 1.86% |

| Cellnex Telecom 144A # | 37,837 | 1,389,593 |

| First Solar † | 1,235 | 240,183 |

| Helios Towers † | 85,910 | 117,866 |

| NEXTDC † | 40,689 | 434,643 |

| | 2,182,285 |

| Materials — 11.46% |

| Air Products and Chemicals | 1,007 | 312,704 |

| Alcoa | 22,693 | 909,762 |

| Anglo American | 38,571 | 1,195,717 |

| Canfor † | 19,279 | 229,988 |

| CF Industries Holdings | 15,229 | 1,252,281 |

| Corteva | 9,424 | 574,110 |

| CRH | 11,096 | 1,057,814 |

| Endeavour Mining | 31,984 | 717,211 |

| ERO Copper † | 35,390 | 649,925 |

| Hudbay Minerals | 97,282 | 870,674 |

| International Paper | 13,529 | 751,401 |

| Lifezone Metals † | 21,300 | 136,746 |

| Louisiana-Pacific | 3,970 | 392,633 |

| Metallus † | 23,027 | 324,450 |

| MP Materials † | 31,256 | 562,295 |

| Newmont | 9,718 | 441,586 |

| Nutrien | 15,271 | 728,121 |

| Steel Dynamics | 1,872 | 244,296 |

| Sylvamo | 5,191 | 441,339 |

| Titan Cement International | 6,718 | 238,523 |

| West Fraser Timber | 4,510 | 407,320 |

| Wheaton Precious Metals | 15,460 | 1,020,515 |

| | 13,459,411 |

Schedule of investments

Delaware Global Listed Real Assets Fund

| | | Number of

shares | Value (US $) |

|

| Common Stocks (continued) |

| Real Estate — 0.91% |

| Crown Castle | 9,962 | $ 1,070,815 |

| | 1,070,815 |

| Real Estate Operating Companies/Developer — 0.84% |

| Lendlease | 34,745 | 153,945 |

| Mitsubishi Estate | 32,600 | 482,090 |

| Sumitomo Realty & Development | 11,600 | 344,099 |

| | 980,134 |

| REIT Diversified — 3.02% |

| CapitaLand Investment | 78,900 | 166,683 |

| Charter Hall Group | 29,580 | 291,890 |

| DigitalBridge Group | 20,742 | 325,442 |

| Fastighets Balder Class B † | 12,865 | 100,084 |

| Inmobiliaria Colonial Socimi | 16,791 | 101,770 |

| Land Securities Group | 15,316 | 118,955 |

| Lifestyle Communities | 11,229 | 63,295 |

| LondonMetric Property | 79,280 | 198,176 |

| Nomura Real Estate Master Fund | 347 | 327,573 |

| Shaftesbury Capital | 36,902 | 64,760 |

| Stockland | 68,275 | 230,880 |

| Sun Hung Kai Properties | 39,956 | 432,642 |

| VICI Properties | 35,301 | 1,121,160 |

| | 3,543,310 |

| REIT Healthcare — 3.07% |

| Alexandria Real Estate Equities | 6,065 | 676,551 |

| American Healthcare REIT | 19,758 | 525,563 |

| Parkway Life Real Estate Investment Trust | 44,000 | 125,493 |

| Welltower | 16,881 | 2,276,909 |

| | 3,604,516 |

| REIT Industrial — 2.56% |

| First Industrial Realty Trust | 8,399 | 440,863 |

| Goodman Group | 36,738 | 877,285 |

| Nippon Prologis REIT | 217 | 349,128 |

| Prologis | 9,288 | 1,048,987 |

| Segro | 12,499 | 126,644 |

| Warehouses De Pauw CVA | 7,001 | 166,615 |

| | 3,009,522 |

| REIT Information Technology — 3.09% |

| American Tower | 1,029 | 219,733 |

| Digital Realty Trust | 4,547 | 810,412 |

| | | Number of

shares | Value (US $) |

|

| Common Stocks (continued) |

| REIT Information Technology (continued) |

| Equinix | 2,536 | $ 2,302,891 |

| Keppel REIT | 171,200 | 294,886 |

| | 3,627,922 |

| REIT Lodging — 0.46% |

| Hoshino Resorts REIT | 82 | 124,477 |

| Hyatt Hotels Class A | 473 | 68,798 |

| Ryman Hospitality Properties | 1,569 | 167,961 |

| Sunstone Hotel Investors | 18,254 | 184,183 |

| | 545,419 |

| REIT Mall — 0.35% |

| Simon Property Group | 2,441 | 412,822 |

| | 412,822 |

| REIT Manufactured Housing — 0.41% |

| Sun Communities | 3,648 | 484,017 |

| | 484,017 |

| REIT Multifamily — 2.64% |

| Advance Residence Investment | 94 | 188,895 |

| AvalonBay Communities | 3,755 | 832,146 |

| Equity Residential | 9,341 | 657,326 |

| Essex Property Trust | 1,806 | 512,651 |

| InterRent Real Estate Investment Trust | 14,543 | 118,969 |

| LEG Immobilien | 3,893 | 367,762 |

| UNITE Group | 19,978 | 225,992 |

| Vonovia | 6,026 | 197,567 |

| | 3,101,308 |

| REIT Office — 1.11% |

| Derwent London | 2,544 | 71,840 |

| Gecina | 1,357 | 145,020 |

| Kilroy Realty | 9,638 | 387,640 |

| Merlin Properties Socimi | 31,548 | 352,022 |

| Nippon Building Fund | 298 | 255,950 |

| Wihlborgs Fastigheter | 8,645 | 90,875 |

| | 1,303,347 |

| REIT Retail — 0.48% |

| Frasers Centrepoint Trust | 130,620 | 220,396 |

| Link REIT | 74,633 | 347,747 |

| | 568,143 |

Schedule of investments

Delaware Global Listed Real Assets Fund

| | | Number of

shares | Value (US $) |

|

| Common Stocks (continued) |

| REIT Self-Storage — 0.98% |

| Big Yellow Group | 13,024 | $ 202,869 |

| Public Storage | 2,891 | 951,312 |

| | 1,154,181 |

| REIT Shopping Center — 1.48% |

| Acadia Realty Trust | 7,365 | 180,369 |

| Agree Realty | 11,172 | 829,521 |

| Kite Realty Group Trust | 16,028 | 411,439 |

| Tanger | 9,629 | 319,971 |

| | 1,741,300 |

| REIT Single Tenant — 0.22% |

| Realty Income | 4,268 | 253,391 |

| | 253,391 |

| REIT Specialty — 0.99% |

| CBRE Group Class A † | 1,142 | 149,568 |

| Corp Inmobiliaria Vesta ADR | 5,674 | 147,864 |

| Essential Properties Realty Trust | 6,677 | 211,594 |

| Invitation Homes | 20,870 | 655,527 |

| | 1,164,553 |

| Utilities — 11.61% |

| APA Group | 121,323 | 555,508 |

| EDP Renovaveis | 80,237 | 1,087,501 |

| Enel | 142,484 | 1,080,610 |

| Essential Utilities | 28,420 | 1,097,012 |

| National Grid | 88,578 | 1,112,199 |

| Orsted 144A #, † | 17,909 | 1,054,064 |

| Pennon Group | 150,016 | 1,053,271 |

| Severn Trent | 32,964 | 1,090,521 |

| Snam | 228,326 | 1,096,857 |

| Spruce Power Holding † | 35,005 | 88,212 |

| SSE | 43,420 | 986,649 |

| Terna - Rete Elettrica Nazionale | 127,567 | 1,104,951 |

| United Utilities Group | 81,329 | 1,073,335 |

| Xcel Energy | 17,344 | 1,158,753 |

| | 13,639,443 |

| Total Common Stocks (cost $69,889,750) | 73,550,933 |

|

|

| | | Number of

shares | Value (US $) |

|

|

| Exchange-Traded Fund — 2.78% |

| abrdn Bloomberg All Commodity Strategy K-1 Free ETF | 162,005 | $ 3,267,641 |

| Total Exchange-Traded Fund (cost $3,310,565) | 3,267,641 |

|

|

|

| Short-Term Investments — 2.88% |

| Money Market Mutual Funds — 2.88% |

| BlackRock Liquidity FedFund – Institutional Shares (seven-day effective yield 4.76%) | | 845,667 | 845,667 |

| Fidelity Investments Money Market Government Portfolio – Class I (seven-day effective yield 4.70%) | | 845,667 | 845,667 |

| Goldman Sachs Financial Square Government Fund – Institutional Shares (seven-day effective yield 4.81%) | | 845,667 | 845,667 |

| Morgan Stanley Institutional Liquidity Funds Government Portfolio – Institutional Class (seven-day effective yield 4.78%) | | 845,667 | 845,667 |

| Total Short-Term Investments (cost $3,382,668) | 3,382,668 |

Total Value of Securities—100.05%

(cost $114,872,523) | | | $117,504,239 |

| ° | Principal amount shown is stated in USD unless noted that the security is denominated in another currency. |

| # | Security exempt from registration under Rule 144A of the Securities Act of 1933, as amended. At October 31, 2024, the aggregate value of Rule 144A securities was $16,080,339, which represents 13.69% of the Fund’s net assets. See Note 11 in “Notes to financial statements.” |

| • | Variable rate investment. Rates reset periodically. Rate shown reflects the rate in effect at October 31, 2024. For securities based on a published reference rate and spread, the reference rate and spread are indicated in their descriptions. The reference rate descriptions (i.e. SOFR01M, SOFR03M, etc.) used in this report are identical for different securities, but the underlying reference rates may differ due to the timing of the reset period. Certain variable rate securities are not based on a published reference rate and spread but are determined by the issuer or agent and are based on current market conditions, or for mortgage-backed securities, are impacted by the individual mortgages which are paying off over time. These securities do not indicate a reference rate and spread in their descriptions. |

| Δ | Securities have been classified by country of risk. |

| ■ | Regulation S security. Security is offered and sold outside of the United States; therefore, it is exempt from registration with the SEC under Rules 903 and 904 of the Securities Act of 1933. |

| † | Non-income producing security. |

Schedule of investments

Delaware Global Listed Real Assets Fund

The following forward foreign currency exchange contracts were outstanding at October 31, 2024:1

| Forward Foreign Currency Exchange Contracts | | | | |

| Counterparty | | Currency to

Receive (Deliver) | | In Exchange For | | Settlement

Date | | Unrealized

Appreciation |

| CITI | | CAD | (727,429) | | USD | 534,102 | | 11/22/24 | | $11,289 |

| CITI | | EUR | (29,800) | | USD | 33,390 | | 11/22/24 | | 946 |

| JPMCB | | AUD | (267,309) | | USD | 179,511 | | 11/22/24 | | 3,552 |

| JPMCB | | CAD | (54,800) | | USD | 39,803 | | 11/22/24 | | 417 |

| JPMCB | | EUR | (3,952,142) | | USD | 4,378,286 | | 11/22/24 | | 75,410 |

| JPMCB | | GBP | (3,661,826) | | USD | 4,752,242 | | 11/22/24 | | 30,651 |

| JPMCB | | JPY | (61,924,975) | | USD | 428,969 | | 11/22/24 | | 20,253 |

| TD | | GBP | (153,400) | | USD | 199,882 | | 11/22/24 | | 2,087 |

| Total Forward Foreign Currency Exchange Contracts | | $144,605 |

The use of forward foreign currency exchange contracts involves elements of market risk and risks in excess of the amounts disclosed in the financial statements. The forward foreign currency exchange contracts presented above represent the Fund’s total exposure in such contracts, whereas only the net unrealized appreciation (depreciation) is reflected in the Fund’s net assets.

| 1 | See Note 8 in “Notes to financial statements.” |

| Summary of abbreviations: |

| ADR – American Depositary Receipt |

| CITI – Citigroup |

| CPI – Consumer Price Index |

| CVA – Certified Dutch Certificate |

| DAC – Designated Activity Company |

| ETF – Exchange-Traded Fund |

| JPMCB – JPMorgan Chase Bank |

| OAT – Obligations Assimilables du Trésor |

| REIT – Real Estate Investment Trust |

| SOFR01M – Secured Overnight Financing Rate 1 Month |

| SOFR03M – Secured Overnight Financing Rate 3 Month |

| TD – TD Bank |

| USBMMY3M – US Treasury 3 Month Bill Money Market Yield |

| Summary of currencies: |

| AUD – Australian Dollar |

| CAD – Canadian Dollar |

| EUR – European Monetary Unit |

| GBP – British Pound Sterling |

| Summary of currencies: (continued) |

| JPY – Japanese Yen |

| USD – US Dollar |

See accompanying notes, which are an integral part of the financial statements.

Statement of assets and liabilities

| Delaware Global Listed Real Assets Fund | October 31, 2024 |

| Assets: | |

| Investments, at value* | $117,504,239 |

| Cash | 310,311 |

| Dividends and interest receivable | 251,998 |

| Receivable for fund shares sold | 205,666 |

| Unrealized appreciation on forward foreign currency exchange contracts | 144,605 |

| Prepaid expenses | 45,406 |

| Foreign tax reclaims receivable | 28,085 |

| Receivable for securities sold | 1,416 |

| Other assets | 863 |

| Total Assets | 118,492,589 |

| Liabilities: | |

| Due to custodian | 765 |

| Payable for securities purchased | 454,252 |

| Payable for fund shares redeemed | 293,689 |

| Cash collateral due to brokers | 110,000 |

| Investment management fees payable to affiliates | 93,164 |

| Other accrued expenses | 83,343 |

| Distribution fees payable to affiliates | 8,792 |

| Total Liabilities | 1,044,005 |

| Total Net Assets | $117,448,584 |

|

| Net Assets Consist of: | |

| Paid-in capital | $120,534,747 |

| Total distributable earnings (loss) | (3,086,163) |

| Total Net Assets | $117,448,584 |

|

| Net Asset Value | |

|

| Class A: | |

| Net assets | $34,093,912 |

| Shares of beneficial interest outstanding, unlimited authorization, no par | 2,769,091 |

| Net asset value per share | $12.31 |

| Sales charge | 5.75% |

| Offering price per share, equal to net asset value per share / (1 - sales charge) | $13.06 |

|

| Class C: | |

| Net assets | $357,153 |

| Shares of beneficial interest outstanding, unlimited authorization, no par | 29,035 |

| Net asset value per share | $12.30 |

|

| Class R: | |

| Net assets | $2,343,715 |

| Shares of beneficial interest outstanding, unlimited authorization, no par | 190,654 |

| Net asset value per share | $12.29 |

|

| Institutional Class: | |

| Net assets | $73,985,140 |

| Shares of beneficial interest outstanding, unlimited authorization, no par | 5,969,561 |

| Net asset value per share | $12.39 |

|

| Class R6: | |

| Net assets | $6,668,664 |

| Shares of beneficial interest outstanding, unlimited authorization, no par | 539,456 |

| Net asset value per share | $12.36 |

*Investments, at cost | $114,872,523 |

See accompanying notes, which are an integral part of the financial statements.

Statement of operations

| Delaware Global Listed Real Assets Fund | Year ended October 31, 2024 |

| Investment Income: | |

| Dividends | $2,479,997 |

| Interest | 1,813,270 |

| Foreign tax withheld | (114,864) |

| | 4,178,403 |

|

| Expenses: | |

| Management fees | 836,958 |

| Distribution expenses — Class A | 89,729 |

| Distribution expenses — Class C | 5,166 |

| Distribution expenses — Class R | 12,789 |

| Dividend disbursing and transfer agent fees and expenses | 85,797 |

| Registration fees | 83,702 |

| Accounting and administration expenses | 58,377 |

| Audit and tax fees | 50,314 |

| Reports and statements to shareholders expenses | 50,035 |