UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| Investment Company Act file number: | | 811-06322

|

| Exact name of registrant as specified in charter: | | Delaware Pooled® Trust

|

| Address of principal executive offices: | | 610 Market Street |

| | Philadelphia, PA 19106

|

| Name and address of agent for service: | | David F. Connor, Esq. |

| | 610 Market Street |

| | Philadelphia, PA 19106

|

| Registrant’s telephone number, including area code: | | (800) 523-1918

|

| Date of fiscal year end: | | October 31

|

| Date of reporting period: | | October 31, 2021 |

Item 1. Reports to Stockholders

Table of Contents

|  |

| | |

| Annual report |

Macquarie Institutional Portfolios (registered as Delaware Pooled® Trust)

Macquarie Emerging Markets Portfolio |

Macquarie Emerging Markets Portfolio II |

Macquarie Labor Select International Equity Portfolio |

October 31, 2021

Table of Contents

Table of contents

Macquarie Institutional Portfolios

Macquarie Institutional Portfolios (registered as Delaware Pooled® Trust) are designed exclusively for institutional investors and high net worth individuals. Delaware Management Company, a series of Macquarie Investment Management Business Trust (MIMBT), serves as investment advisor for the Portfolios. Mondrian Investment Partners Limited serves as investment sub-advisor for Macquarie Emerging Markets Portfolio* and Macquarie Labor Select International Equity Portfolio.

The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 800 231-8002 or visiting macquarieim.com/mipliterature. Carefully consider the Portfolios’ investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Portfolios’ prospectus which may be obtained by visiting macquarieim.com/mipliterature or calling 800 231-8002. Investors should read the prospectus carefully before investing. Performance includes reinvestment of all distributions.

The Portfolios are not FDIC insured and are not guaranteed. It is possible to lose the principal amount invested. Mutual fund advisory services are provided by Delaware Management Company, a series of MIMBT, which is a registered investment advisor.

Macquarie Institutional Portfolios are designed exclusively for US institutional investors and high net worth individuals. Macquarie Institutional Portfolios are distributed in the United States by Delaware Distributors, L.P., an affiliate of MIMBT, Macquarie Management Holdings, Inc., and Macquarie Group Limited. Non-US investors cannot invest in Macquarie Institutional Portfolios. Macquarie Investment Management (MIM) is the marketing name for certain companies comprising the asset management division of Macquarie Group Limited and its subsidiaries and affiliates worldwide. Institutional investment management is provided by Macquarie Investment Management Advisers (MIMA), a series of Macquarie Investment Management Business Trust (MIMBT). MIMBT is a US registered investment advisor, and may not be able to provide investment advisory services to certain clients in certain jurisdictions.

Other than Macquarie Bank Limited (MBL), none of the entities noted are authorized deposit-taking institutions for the purposes of the Banking Act 1959 (Commonwealth of Australia). The obligations of these entities do not represent deposits or other liabilities of MBL. MBL does not guarantee or otherwise provide assurance in respect of the obligations of these entities, unless noted otherwise.

The Portfolios are governed by US laws and regulations.

*Closed to new investors.

©2021 Macquarie Management Holdings, Inc.

All third-party marks cited are the property of their respective owners.

Table of Contents

Portfolio management review (Unaudited)

Macquarie Institutional Portfolios — Macquarie Emerging Markets Portfolio

October 31, 2021

Investment objective

The Portfolio seeks long-term capital appreciation.

Macquarie Emerging Markets Portfolio gained 14.29% at net asset value (NAV) with all distributions reinvested for the fiscal year ended October 31, 2021. The Portfolio’s benchmark, the MSCI Emerging Markets Index, rose 17.33% (gross) and 16.96% (net) for the same period. Complete annualized performance for Macquarie Emerging Markets Portfolio is shown in the table on page 5.

This fiscal period presented emerging market investors with two widely dissimilar environments: China – and virtually everywhere else. China ended the period down 9%. In contrast, emerging markets excluding China were up 37%.

During the 12-month period, China’s markets were increasingly constrained by investor unease over both regulatory controls and the overall health of the Chinese economy. Initially, these markets were held back as authorities sought to more heavily regulate companies to help meet the government’s common prosperity goals, particularly in the consumer Internet and education sectors. This was compounded later in the fiscal period when one of China’s leading property companies, Evergrande, faced severe bond payment difficulties. Since property is a large portion of the Chinese economy – roughly 25% of gross domestic product (GDP) – investors worried about the potential for systemic risk.

Elsewhere, emerging markets benefited from the resurgence of economic activities and investor confidence following the easing of pandemic shutdowns. The Europe, Middle East, and Africa (EMEA) region gained 67%; Russia, the largest European market, was up 82%, profiting from oil’s ascendancy. Taiwan, South Korea, and India, the three largest emerging markets after China, gained 42%, 24%, and 50%, respectively.

The Portfolio’s underperformance relative to the benchmark was largely due to our top-down country positioning. The Portfolio’s overweight position in China – we held roughly 40% in Chinese stocks compared with the benchmark, which held approximately 35% – cost the Portfolio about 110 basis points for the 12-month period (one basis point is a hundredth of a percentage point). In addition, the global upsurge in energy prices buoyed Middle Eastern economies Saudi Arabia (+56%), the United Arab Emirates (+53%), Kuwait (+33%), and Qatar (+23%). Lack of exposure to Middle Eastern economies cost the Portfolio approximately 120 basis points in relative performance.

Where we added the most value to the Portfolio was in our stock selection, mostly in China, but also in Taiwan and South Korea. Our positioning in Asian companies added about 200 basis points.

Many sectors in emerging markets flourished during the fiscal year, including energy (+55%), materials (+44%), financials (+34%), information technology (IT) (+34%), and industrials (+29%). Consumer discretionary stocks fell 15%, real estate lost close to 11%, and communication services was down 1%. The leading sector for the Portfolio was IT, where we were overweight compared to the benchmark. This contributed approximately 160 basis points to relative performance. The sector that hurt the Portfolio’s performance the most was materials, where a slight underweight, along with exposure to the underperforming pulp and paper industry and gold stocks, hurt relative returns.

The strongest-performing stock for the Portfolio was Russian oil and gas conglomerate PJSC Lukoil Oil Co., which rose 107%, capitalizing on global energy demand.

Taiwanese stock ASE Technology Holding Co., which gained 63% for the Portfolio, was another strong contributor to performance. ASE is a leading packager and tester of chips. It benefited from heavy demand for semiconductors globally. ASE was one of several successful holdings that confirmed our overweight investment strategy in both the Taiwan market and the IT sector.

Despite China’s decline for the 12-month period, during the first half of the fiscal year the Chinese market was relatively robust, and we added value to the Portfolio through taking significant profits before the stock selloff occurred. China Merchants Bank Co. Ltd. was a case in point – we reduced the Portfolio’s position and took profits as we did with Baidu Inc., CSPC Pharmaceutical Group Ltd., and others. China Merchants, an outperformer in the strong financials sector, gained 66% for the Portfolio during the fiscal period.

The three holdings that most hurt the Portfolio’s performance were also Chinese stocks. Alibaba Group Holding Ltd. was down 45%; Ping An Insurance Group Co. of China Ltd. declined 28%; and Autohome Inc. was down 67% for the 12-month period.

Ping An, one of China’s largest life insurers, lost ground on concerns about the property sector and its negative effect on financials stocks. We believe the long-term investment case for Ping An remains solid, however. At period end, it traded below our worst-case valuations and offered a dividend yield of almost 5%.

Ecommerce platform Alibaba suffered from negative sentiment toward consumer discretionary stocks, as well as the confluence of negative effects on Chinese markets mentioned earlier.

Autohome’s decline was the Portfolio’s largest loss for the 12-month period. The leading online car portal in China, Autohome suffered from a host of factors. In addition to general worries over Chinese markets, the stock was punished by the chip shortage that held back auto manufacturers. These constraints in producing cars also led to

1

Table of Contents

Portfolio management review (Unaudited)

Macquarie Institutional Portfolios — Macquarie Emerging Markets Portfolio

reduced advertising spending. Another factor related to advertising spend: increasing competition. There has been an increase in competitive intensity in this industry. At period end, we viewed the stock as undervalued but still desirable, with roughly half of Autohome’s market cap in cash, the company still profitable, and its long-term business prospects attractive, in our view.

We added to all three underperforming Chinese companies in recent months, believing there’s a significant opportunity for these stocks to rally from here. We followed the same approach with other Chinese holdings that traded at unexpected lows and whose risks had been priced in. Our view is that, with regulatory changes, one must examine each company’s unique vulnerabilities and strengths to see the potential effects. In our opinion, many of the Chinese companies in the Portfolio that were sold down heavily in response to regulatory actions are more resilient than investors give them credit for. Likewise, we believe there will be a strong, growing Chinese market over the next five years.

The Portfolio utilized foreign currency exchange contracts to facilitate the purchase and sale of equities traded on international exchanges. The effect of these contracts on performance was immaterial.

2 The views expressed are current as of the date of this report and are subject to change.

Table of Contents

Portfolio management review (Unaudited)

Macquarie Institutional Portfolios — Macquarie Emerging Markets Portfolio II

October 31, 2021

Investment objective

The Portfolio seeks long-term capital appreciation.

For the fiscal year ended October 31, 2021, Macquarie Emerging Markets Portfolio II gained 16.50% at net asset value (NAV) with all distributions reinvested. This result lagged the Portfolio’s benchmark, the MSCI Emerging Markets Index, which advanced 17.33% (gross) and 16.96% (net) for the same period. Complete annualized performance for Macquarie Emerging Markets Portfolio II is shown in the table on page 8.

The MSCI Emerging Markets Index rose during the fiscal year ended October 31, 2021, but significantly lagged developed markets. Early in the 12-month period, markets rallied on the progress of COVID-19 vaccines, US dollar weakness, and fund inflows. The rally stalled, however, as investors wrestled with a host of issues including the pace of economic recovery, hints of earlier-than-expected interest rate hikes by the US Federal Reserve, supply chain disruptions, and COVID-19 variants. During the second half of the fiscal year, inflationary pressures globally appeared to ratchet up, prompting several central banks to tighten monetary policy. In addition, equities in China corrected sharply as policy makers announced measures to regulate business activities more tightly in sectors such as online gaming and for-profit education. Concerns about debt defaults in the property-development sector and weaker-than-expected macroeconomic data further weighed on investor sentiment. Among regions, Europe, the Middle East, and Africa (EMEA) outperformed significantly, while Asia lagged. Among sectors, energy, materials, technology, and financials outperformed, while consumer discretionary, real estate, and communication services lagged.

The technology sector contributed the most to the Portfolio’s relative performance due to favorable asset allocation and stock selection. End-demand for technology products appeared resilient, supporting the outlook for leading semiconductor companies. The energy sector also contributed to performance as companies producing oil and gas benefited from rising energy prices.

On the negative side, the financials and materials sectors detracted the most from relative performance. The Portfolio, compared to the benchmark, was underweight these sectors, both of which outperformed significantly as global economies began to recover from COVID-related slowdowns.

Among individual stocks, SK Telecom Co. Ltd. and MediaTek Inc. contributed the most to the Portfolio’s relative performance. Shares of SK Telecom in South Korea outperformed as the company announced plans to separate its telecommunications and non-telecommunications assets into two companies. Shares of MediaTek in Taiwan also outperformed, supported by strong demand for its 5G smartphone chips.

In contrast, Americanas S.A. (formerly B2W Companhia Digital) and JD.com detracted the most from the Portfolio’s relative performance. Shares of Americanas in Brazil underperformed as the company’s gross merchandise value (GMV) growth rate lagged peers, while investments in digital marketing and other growth initiatives weighed on margins. We believe that Brazilian ecommerce remains an attractive secular growth opportunity and that Americanas’ business strategy and assets position the company to benefit from this growth. Shares of JD.com in China underperformed as Chinese regulators raised concerns about anti-competitive business practices in the ecommerce sector. In our opinion, the ecommerce sector in China is very competitive and JD.com’s logistics infrastructure positions the company to gain market share. The Portfolio continued to hold both Americanas and JD.com at the end of the fiscal year.

We think that market volatility may persist in the near-term due to ongoing concerns about global supply chain challenges, rising interest rates, and geopolitical tension. Nonetheless, over the long term, we continue to expect some trends to persist including: greater technology adoption; industry consolidation; increasing consumer preference for high-quality, healthy, and premium products; accommodative monetary policy; and improvements in corporate governance. Our strategy remains centered on identifying individual companies that we believe possess sustainable franchises and favorable long-term growth prospects, and that trade at significant discounts to their intrinsic value. We are particularly focused on companies that we think could benefit from long-term changes in how people in emerging markets live and work.

Among countries, we currently hold overweight positions in South Korea, Russia, India, and Taiwan. Conversely, we are currently underweight China, South Africa, Saudi Arabia, and Southeast Asia. Sectors we currently favor include technology, energy, communication services, and consumer staples. The Portfolio is most underweight financials and materials.

The Portfolio utilized foreign currency exchange contracts to facilitate the purchase and sale of equities traded on international exchanges. The effect of these contracts on performance was immaterial.

The views expressed are current as of the date of this report and are subject to change. 3

Table of Contents

Portfolio management review (Unaudited)

Macquarie Institutional Portfolios — Macquarie Labor Select International Equity Portfolio

October 31, 2021

Investment objective

The Portfolio seeks maximum long-term total return.

For the fiscal year ended October 31, 2021, Macquarie Labor Select International Equity Portfolio advanced +37.68% at net asset value (NAV) and outperformed the Portfolio’s benchmark, the MSCI EAFE Index, which returned +34.80% (gross) and +34.18% (net). Complete annualized performance for Macquarie Labor Select International Equity Portfolio is shown in the table on page 10.

During the 12-month period ended October 31, 2021, international equity markets continued to rebound strongly from the sharp pandemic-induced decline in early 2020. Despite widespread shutdowns and ongoing geopolitical tensions, equities were supported by improving corporate earnings, continued economic stimulus, and the approval and distribution of multiple COVID vaccines, which enabled many economies to substantially re-open in 2021. Economically sensitive sectors outperformed, led by energy and financials, which were buoyed by an uptick in economic activity from the initial trough in the first half of 2020. The Portfolio, driven by robust stock selection, generated strong absolute returns that exceeded index returns.

The value segment of the MSCI EAFE Index returned 38% (net) and significantly outperformed the growth segment of the MSCI EAFE Index, which gained 30% (net), partially reversing some of the value-growth divergence that was seen in the months following the COVID-19 outbreak. In previous similar selloffs, markets have subsequently rewarded valuations once the focus returned to underlying fundamentals. This started to materialize during the fiscal year. However, valuation dispersions remain at historically extreme levels, providing what we view as attractive opportunities for patient stock-pickers who are focused on fundamental value.

Country allocation to the Netherlands and Hong Kong held back the Portfolio’s relative returns. The positive effect of its underweight position in the relatively weak Australian equity market was more than offset by its overweight position in the relatively weak Hong Kong market and its underweight position in the strong Dutch equity market. The Dutch market benefited from its high weighting to the strong information technology sector. The Hong Kong market generated the lowest returns for the Portfolio, as the region suffered from the Chinese government’s increasing regulatory crackdowns and fears of contagion from concerns over fallout from the Evergrande debt crisis.

In Europe, strong stock selection in the UK and Spain aided relative returns. After adding to the Portfolio’s positions during 2020, Banco Santander S.A. (+103.2%) and Lloyds Banking Group PLC (+95.2%) were bolstered by rising bond yields and a rebound in economic activity, which supported a fall in impairments. In the Asia-Pacific region, strong stock selection in Japan was driven by Fujifilm Holdings Corp. (+53.6%), the diversified imaging company, as it continued to benefit from its increased focus on healthcare. The market rewarded increased disclosures about, and investment in, its high-growth, high-margin biopharmaceutical manufacturing business.

The Portfolio’s weakest-performing stock during the fiscal year was the Japanese pharmaceutical company Takeda Pharmaceutical Co. Ltd. (-5.9%), which was down on higher-than-expected research and development (R&D) spending and on suspended trials of its narcolepsy drug. Returns from Hong Kong-based pork company WH Group Ltd. (+2.4%) and Japanese electronic equipment company Kyocera Corp. (+8.8%) were also relatively weak during the fiscal year. Plummeting pork prices in China alongside recent management issues held back WH Group. Kyocera, which was a defensive holding in the initial COVID selloff, lagged the strong market rebound with fiscal year 2021 guidance disappointing on higher-than-expected upfront investment. The company did, however, revise its dividend back up (to the fiscal year 2019 level) and reduce the number of its divisions to try to facilitate more dynamic decision making. In our opinion, there remains significant scope to unlock value through improved capital or operational efficiency and we continue to engage with the company on this. We continue to hold all three stocks in the Portfolio.

Overweight positions in the weak communication services and utilities sectors broadly offset the Portfolio’s overweight position in the strong energy sector and its underweight position in the relatively weak consumer staples sector. Energy was the standout performer, rising 80%, as gas prices rose sharply, and oil prices rallied back up to 2018 levels due to growing demand from COVID re-openings and continued crude oil supply discipline from OPEC+. Stock selection within sectors, led by strong stock selection in financials and communication services, added to the Portfolio’s relative returns.

The Portfolio’s underweight position in the strong Australian dollar and its overweight position in the weak Japanese yen more than offset the positive effect of its overweight position in the strong British pound. The British pound gained strength after a Brexit deal was eventually reached in December 2020.

The Portfolio utilized foreign currency exchange contracts to facilitate the purchase and sale of equities traded on international exchanges. The effect of these contracts on performance was immaterial.

4 The views expressed are current as of the date of this report and are subject to change.

Table of Contents

Performance summary (Unaudited)

Macquarie Institutional Portfolios — Macquarie Emerging Markets Portfolio

The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 800 231-8002 or visiting macquarieim.com/mipliterature.

Carefully consider the Portfolio’s investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Portfolio’s prospectus and, if available, its summary prospectus, which may be obtained by visiting macquarieim.com/mipliterature or calling 800 231-8002. Investors should read the prospectus and, if available, the summary prospectus carefully before investing.

| Portfolio and benchmark performance | | Average annual total returns through October 31, 2021 |

| | 1 year | | 5 year | | 10 year | | Lifetime |

| Macquarie Emerging Markets Portfolio | | +14.29 | % | | +6.06 | % | | +3.04 | % | | | +6.98 | % | |

| MSCI Emerging Markets Index (net) | | +16.96 | % | | +9.39 | % | | +4.88 | % | | | +6.19 | %* | |

| MSCI Emerging Markets Index (gross) | | +17.33 | % | | +9.79 | % | | +5.25 | % | | | +6.49 | %* | |

| * | The benchmark lifetime return is calculated using the last business day in the month of the Portfolio’s inception date. |

Portfolio profile

October 31, 2021

| Total net assets | | Number of holdings |

| $69.3 million | | 46 |

| | | |

| Inception date | | |

| April 16, 1997 | | |

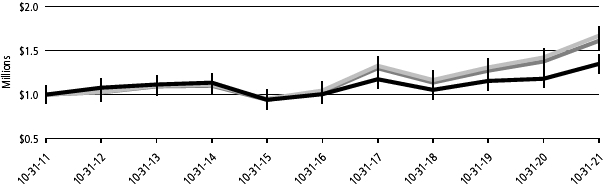

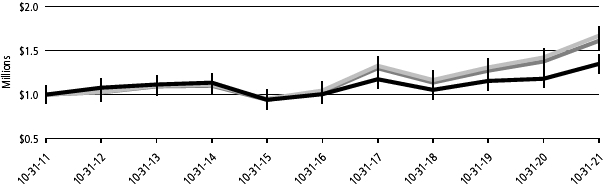

Growth of $1,000,000

| For period beginning October 31, 2011 through October 31, 2021 | | Starting value | | Ending value |

| MSCI Emerging Markets Index (gross) | | | $ | 1,000,000 | | | | $ | 1,667,908 | |

| MSCI Emerging Markets Index (net) | | | $ | 1,000,000 | | | | $ | 1,609,939 | |

| Macquarie Emerging Markets Portfolio | | | $ | 1,000,000 | | | | $ | 1,348,546 | |

The performance graph assumes $1 million invested on October 31, 2011 and includes reinvestment of all distributions. The performance graph does not reflect the deduction of taxes the shareholder would pay on Portfolio distributions or redemptions of Portfolio shares.

(continues) 5

Table of Contents

Performance summary (Unaudited)

Macquarie Institutional Portfolios — Macquarie Emerging Markets Portfolio

Total return assumes reinvestment of dividends and capital gains but does not reflect reductions for taxes. Returns and share values will fluctuate so that shares, when redeemed, may be worth more or less than their original cost.

The most recent prospectus disclosed the Portfolio’s total operating expenses as 1.28%. Management has contractually agreed to reimburse certain expenses and/or waive its management fees from February 26, 2021 through March 1, 2022,* in order to prevent total annual Portfolio operating expenses (with certain exclusions) from exceeding, in an aggregate amount, 1.26% of the Portfolio’s average daily net assets, as described in the most recent prospectus.

The purchase reimbursement fees (0.40%) and redemption reimbursement fees (0.45%) are paid to the Portfolio. These fees are designed to reflect an approximation of the brokerage and other transaction costs associated with the investment of an investor’s purchase amount or the disposition of assets to meet redemptions, and to limit the extent to which the Portfolio (and, indirectly, the Portfolio’s existing shareholders) would have to bear such costs. In lieu of the reimbursement fees, investors in Macquarie Emerging Markets Portfolio may be permitted to utilize alternative purchase and redemption methods designed to accomplish the same economic effect as the reimbursement fees. Reimbursement fees applicable to purchases and redemptions of shares of the Portfolio are not reflected in the “Growth of $1,000,000” graph.

Expense limitations were in effect during the period shown. Performance would have been lower had the expense limitations not been in effect.

The MSCI Emerging Markets Index represents large- and mid-cap stocks across emerging market countries worldwide. The index covers approximately 85% of the free float-adjusted market capitalization in each country. Index “net” return approximates the minimum possible dividend reinvestment, after deduction of withholding tax at the highest possible rate. Index “gross” return approximates the maximum possible dividend reinvestment.

Gross domestic product, mentioned on page 1, is a measure of all goods and services produced by a nation in a year. It is a measure of economic activity.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

Investing involves risk, including the possible loss of principal.

Past performance is not a guarantee of future results.

International investments entail risks including fluctuation in currency values, differences in accounting principles, or economic or political instability. Investing in emerging markets can be riskier than investing in established foreign markets due to increased volatility, lower trading volume, and higher risk of market closures. In many emerging markets, there is substantially less publicly available information and the available information may be incomplete or misleading. Legal claims are generally more difficult to pursue.

If and when the Portfolio invests in forward foreign currency contracts or uses other investments to hedge against currency risks, the Portfolio will be subject to special risks, including counterparty risk.

Fixed income securities and bond funds can lose value, and investors can lose principal as interest rates rise. They also may be affected by economic conditions that hinder an issuer’s ability to make interest and principal payments on its debt. This includes prepayment risk, the risk that the principal of a bond that is held by a portfolio will be prepaid prior to maturity at the time when interest rates are lower than what the bond was paying. A portfolio may then have to reinvest that money at a lower interest rate.

High yielding, non-investment-grade bonds (junk bonds) involve higher risk than investment grade bonds. The high yield secondary market is particularly susceptible to liquidity problems when institutional investors, such as mutual funds and certain other financial institutions, temporarily stop buying bonds for regulatory, financial, or other reasons. In addition, a less liquid secondary market makes it more difficult for to obtain precise valuations of the high yield securities.

The Portfolio may invest in derivatives, which may involve additional expenses and are subject to risk, including the risk that an underlying security or securities index moves in the opposite direction from what the portfolio manager anticipated. A derivatives transaction depends upon the counterparties’ ability to fulfil their contractual obligations.

6

Table of Contents

To the extent the Portfolio focuses its investments in a particular country or geographic region, it may be more susceptible to economic, political, regulatory, or other events or conditions affecting issuers and countries within that country or geographic region. As a result, the Portfolio may be subject to greater price volatility and risk of loss than a portfolio holding more geographically diverse investments.

The Portfolio may be subject to the risk that securities cannot be readily sold within seven calendar days at approximately the price at which it has valued them.

The Portfolio is subject to the risk that the value of securities in a particular industry or sector (such as financials) will decline because of changing expectations for the performance of that industry or sector.

The disruptions caused by natural disasters, pandemics, or similar events could prevent the Portfolio from executing advantageous investment decisions in a timely manner and could negatively impact the Portfolio’s ability to achieve its investment objective and the value of the Portfolio’s investments.

The Portfolio is presently closed to new investors.

____________________

| * | The aggregate contractual waiver period covering this report is from February 28, 2020 through March 1, 2022. |

(continues) 7

Table of Contents

Performance summary (Unaudited)

Macquarie Institutional Portfolios — Macquarie Emerging Markets Portfolio II

The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 800 231-8002 or visiting macquarieim.com/mipliterature.

Carefully consider the Portfolio’s investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Portfolio’s prospectus and, if available, its summary prospectus, which may be obtained by visiting macquarieim.com/mipliterature or calling 800 231-8002. Investors should read the prospectus and, if available, the summary prospectus carefully before investing.

| Portfolio and benchmark performance | | Average annual total returns through October 31, 2021 |

| | 1 year | | 5 year | | 10 year | | Lifetime |

| Macquarie Emerging Markets Portfolio II | | +16.50% | | +13.34% | | +7.52% | | +6.74% |

| MSCI Emerging Markets Index (net) | | +16.96% | | +9.39% | | +4.88% | | +5.35%* |

| MSCI Emerging Markets Index (gross) | | +17.33% | | +9.79% | | +5.25% | | +5.71%* |

| * | The benchmark lifetime return is calculated using the last business day in the month of the Portfolio’s inception date. |

| Portfolio profile | | |

| October 31, 2021 | | |

| | | |

| Total net assets | | Number of holdings |

| $22.3 million | | 87 |

| | | |

| Inception date | | |

| June 23, 2010 | | |

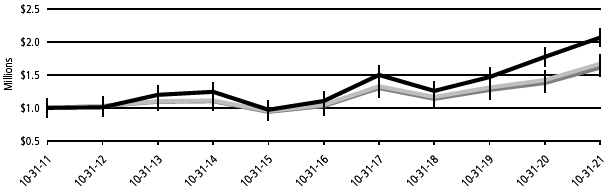

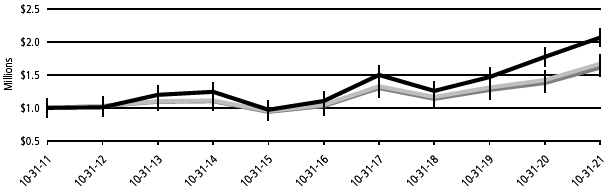

Growth of $1,000,000

For period beginning October 31, 2011 through October 31, 2021 Starting value Ending value | | Starting value | | Ending value |

| Macquarie Emerging Markets Portfolio II | | $1,000,000 | | $2,064,170 |

| MSCI Emerging Markets Index (gross) | | $1,000,000 | | $1,667,908 |

| MSCI Emerging Markets Index (net) | | $1,000,000 | | $1,609,939 |

The performance graph assumes $1 million invested on October 31, 2011 and includes reinvestment of all distributions. The performance graph does not reflect the deduction of taxes the shareholder would pay on Portfolio distributions or redemptions of Portfolio shares.

8

Table of Contents

Total return assumes reinvestment of dividends and capital gains, but does not reflect reductions for taxes. Returns and share values will fluctuate so that shares, when redeemed, may be worth more or less than their original cost.

The most recent prospectus disclosed the Portfolio’s total operating expenses as 1.37%. Management has contractually agreed to reimburse certain expenses and/or waive its management fees from February 26, 2021 through March 1, 2022,* in order to prevent total annual Portfolio operating expenses (with certain exclusions) from exceeding, in an aggregate amount, 1.20% of the Portfolio’s average daily net assets, as described in the most recent prospectus.

Expense limitations were in effect during the period shown. Performance would have been lower had the expense limitations not been in effect.

The MSCI Emerging Markets Index represents large- and mid-cap stocks across emerging market countries worldwide. The index covers approximately 85% of the free float-adjusted market capitalization in each country. Index “net” return approximates the minimum possible dividend reinvestment, after deduction of withholding tax at the highest possible rate. Index “gross” return approximates the maximum possible dividend reinvestment.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

Investing involves risk, including the possible loss of principal.

Past performance is not a guarantee of future results.

Investing in small and/or medium-sized companies typically exhibit greater risk and higher volatility than larger, more established companies.

International investments entail risks including fluctuation in currency values, differences in accounting principles, or economic or political instability. Investing in emerging markets can be riskier than investing in established foreign markets due to increased volatility, lower trading volume, and higher risk of market closures. In many emerging markets, there is substantially less publicly available information, and the available information may be incomplete or misleading. Legal claims are generally more difficult to pursue.

If and when the Portfolio invests in forward foreign currency contracts or uses other investments to hedge against currency risks, the Portfolio will be subject to special risks, including counterparty risk.

To the extent the Portfolio focuses its investments in a particular country or geographic region, it may be more susceptible to economic, political, regulatory, or other events or conditions affecting issuers and countries within that country or geographic region. As a result, the Portfolio may be subject to greater price volatility and risk of loss than a portfolio holding more geographically diverse investments.

The Portfolio may be subject to the risk that securities cannot be readily sold within seven calendar days at approximately the price at which it has valued them.

The Portfolio is subject to the risk that the value of securities in a particular industry or sector (such as financials) will decline because of changing expectations for the performance of that industry or sector.

The disruptions caused by natural disasters, pandemics, or similar events could prevent the Portfolio from executing advantageous investment decisions in a timely manner and could negatively impact the Portfolio’s ability to achieve its investment objective and the value of the Portfolio’s investments.

____________________

| * | The aggregate contractual waiver period covering this report is from February 28, 2020 through March 1, 2022. |

(continues) 9

Table of Contents

Performance summary (Unaudited)

Macquarie Institutional Portfolios — Macquarie Labor Select International Equity Portfolio

The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 800 231-8002 or visiting macquarieim.com/mipliterature.

Carefully consider the Portfolio’s investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Portfolio’s prospectus and, if available, its summary prospectus, which may be obtained by visiting macquarieim.com/mipliterature or calling 800 231-8002. Investors should read the prospectus and, if available, the summary prospectus carefully before investing.

| Portfolio and benchmark performance | | Average annual total returns through October 31, 2021 |

| | 1 year | | 5 year | | 10 year | | Lifetime |

| Macquarie Labor Select International Equity Portfolio | | +37.68% | | +6.50% | | +5.15% | | +6.63% |

| MSCI EAFE Index (net) | | +34.18% | | +9.79% | | +7.37% | | +5.28%* |

| MSCI EAFE Index (gross) | | +34.80% | | +10.32% | | +7.87% | | +5.71%* |

| * | The benchmark lifetime return is calculated using the last business day in the month of the Portfolio’s inception date. |

| Portfolio profile | | |

| October 31, 2021 | | |

| | | |

| Total net assets | | Number of holdings |

| $174.1 million | | 46 |

| | | |

| Inception date | | |

| December 19, 1995 | | |

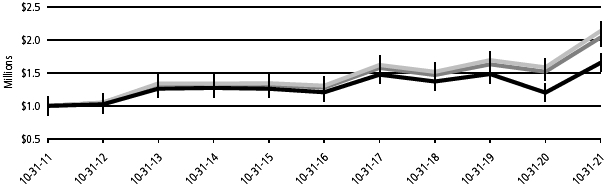

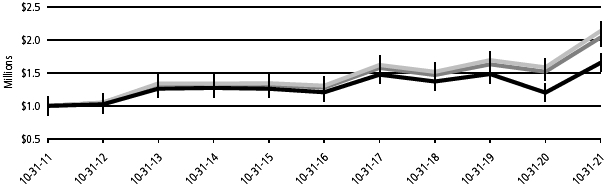

Growth of $1,000,000

| For period beginning October 31, 2011 through October 31, 2021 | | Starting value | | Ending value |

| MSCI EAFE Index (gross) | | $1,000,000 | | $2,133,238 |

| MSCI EAFE Index (net) | | $1,000,000 | | $2,035,718 |

| Macquarie Labor Select International Equity Portfolio | | $1,000,000 | | $1,652,226 |

The performance graph assumes $1 million invested on October 31, 2011 and includes reinvestment of all distributions. The performance graph does not reflect the deduction of taxes the shareholder would pay on Portfolio distributions or redemptions of Portfolio shares.

10

Table of Contents

Total return assumes reinvestment of dividends and capital gains, but does not reflect reductions for taxes. Returns and share values will fluctuate so that shares, when redeemed, may be worth more or less than their original cost.

The most recent prospectus disclosed the Portfolio’s total operating expenses as 0.86%.

The MSCI EAFE (Europe, Australasia, Far East) Index represents large- and mid-cap stocks across 21 developed markets, excluding the United States and Canada. The index covers approximately 85% of the free float-adjusted market capitalization in each country. Index “net” return approximates the minimum possible dividend reinvestment, after deduction of withholding tax at the highest possible rate. Index “gross” return approximates the maximum possible dividend reinvestment.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

Investing involves risk, including the possible loss of principal.

Past performance is not a guarantee of future results.

International investments entail risks including fluctuation in currency values, differences in accounting principles, or economic or political instability. Investing in emerging markets can be riskier than investing in established foreign markets due to increased volatility, lower trading volume, and higher risk of market closures. In many emerging markets, there is substantially less publicly available information, and the available information may be incomplete or misleading. Legal claims are generally more difficult to pursue.

If and when the Portfolio invests in forward foreign currency contracts or uses other investments to hedge against currency risks, the Portfolio will be subject to special risks, including counterparty risk.

From time to time, the Portfolio may invest up to 30% of its net assets in securities of issuers in the commercial banking industry; to the extent that the Portfolio invests 30% of its net assets in such securities, it may be slightly more sensitive to movement in the commercial banking industry.

To the extent the Portfolio focuses its investments in a particular country or geographic region, it may be more susceptible to economic, political, regulatory, or other events or conditions affecting issuers and countries within that country or geographic region. As a result, the Portfolio may be subject to greater price volatility and risk of loss than a portfolio holding more geographically diverse investments.

The Portfolio may be subject to the risk that securities cannot be readily sold within seven calendar days at approximately the price at which it has valued them.

The Portfolio is subject to the risk that the value of securities in a particular industry or sector (such as financials) will decline because of changing expectations for the performance of that industry or sector.

The disruptions caused by natural disasters, pandemics, or similar events could prevent the Portfolio from executing advantageous investment decisions in a timely manner and could negatively impact the Portfolio’s ability to achieve its investment objective and the value of the Portfolio’s investments.

(continues) 11

Table of Contents

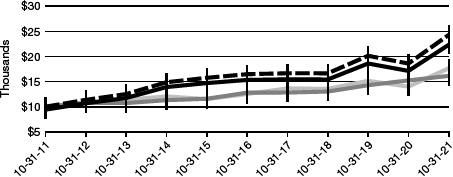

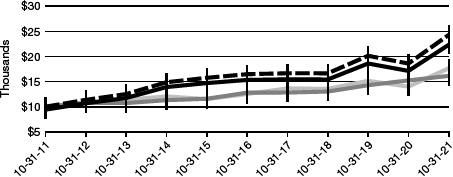

Disclosure of Portfolio expenses

For the six-month period from May 1, 2021 to October 31, 2021 (Unaudited)

As a shareholder of a Portfolio, you incur two types of costs: (1) transaction costs, including reimbursement fees on Macquarie Emerging Markets Portfolio; and (2) ongoing costs, including management fees and other Portfolio expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in a Portfolio and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire six-month period from May 1, 2021 to October 31, 2021.

Actual Expenses

The first section of the tables shown, “Actual Portfolio return,” provides information about actual account values and actual expenses. You may use the information in this table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second section of the tables shown, “Hypothetical 5% return,” provides information about hypothetical account values and hypothetical expenses based on a Portfolio’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in each Portfolio and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the second section of each table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher. Certain of the Portfolios’ actual expenses shown in the table reflect fee waivers in effect and assume reinvestment of all dividends and distributions.

In each case, “Expenses Paid During Period” are equal to the relevant Portfolio’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

Macquarie Emerging Markets Portfolio

Expense analysis of an investment of $1,000

| | | | | | | | | Expenses |

| | | | | | | | | Paid |

| | Beginning | | Ending | | | | During |

| | Account | | Account | | Annualized | | Period |

| | Value | | Value | | Expense | | 5/1/21 to |

| | 5/1/21 | | 10/31/21 | | Ratio | | 10/31/21 |

| Actual Portfolio return† | | | | | | | | | |

| Portfolio Class | | $1,000.00 | | $ | 923.50 | | 1.24% | | $6.01 |

| Hypothetical 5% return (5% return before expenses) | | | | | | | | | |

| Portfolio Class | | $1,000.00 | | $ | 1,018.95 | | 1.24% | | $6.31 |

Macquarie Emerging Markets Portfolio II

Expense analysis of an investment of $1,000

| | | | | | | | | Expenses |

| | | | | | | | | Paid |

| | Beginning | | Ending | | | | During |

| | Account | | Account | | Annualized | | Period |

| | Value | | Value | | Expense | | 5/1/21 to |

| | 5/1/21 | | 10/31/21 | | Ratio | | 10/31/21 |

| Actual Portfolio return† | | | | | | | | | |

| Portfolio Class | | $1,000.00 | | $ | 933.90 | | 1.20% | | $5.85 |

| Hypothetical 5% return (5% return before expenses) | | | | | | | | | |

| Portfolio Class | | $1,000.00 | | $ | 1,019.16 | | 1.20% | | $6.11 |

Macquarie Labor Select International Equity Portfolio

Expense analysis of an investment of $1,000

| | | | | | | | Expenses |

| | | | | | | | Paid |

| | Beginning | | Ending | | | | During |

| | Account | | Account | | Annualized | | Period |

| | Value | | Value | | Expense | | 5/1/21 to |

| | 5/1/21 | | 10/31/21 | | Ratio | | 10/31/21 |

| Actual Portfolio return† | | | | | | | | |

| Portfolio Class | | $1,000.00 | | $1,037.20 | | 0.91% | | $4.67 |

| Hypothetical 5% return (5% return before expenses) | | | | | | | | |

| Portfolio Class | | $1,000.00 | | $1,020.62 | | 0.91% | | $4.63 |

| † | Because actual returns reflect only the most recent six-month period, the returns shown may differ significantly from fiscal year returns. |

In addition to the Portfolios’ expenses reflected above, each Portfolio also indirectly bears its portion of the fees and expenses of the investment companies (Underlying Funds) in which it invests. The tables above do not reflect the expenses of the Underlying Funds.

12

Table of Contents

Security type / country and sector allocations

Macquarie Institutional Portfolios — Macquarie Emerging Markets Portfolio

As of October 31, 2021 (Unaudited)

Sector designations may be different from the sector designations presented in other Portfolio materials. The sector designations may represent the investment manager’s or sub-advisor’s internal sector classifications, which may result in the sector designations for one Portfolio being different from another Portfolio’s sector designations.

| | Percentage |

| Security type / country | | of net assets |

| Common Stock by Country | | 95.35 | % |

| Austria | | 2.35 | % |

| Brazil | | 3.53 | % |

| Canada | | 1.36 | % |

| China | | 38.63 | % |

| Hong Kong | | 1.49 | % |

| India | | 9.38 | % |

| Indonesia | | 2.77 | % |

| Mexico | | 1.26 | % |

| Peru | | 2.55 | % |

| Republic of Korea | | 10.00 | % |

| Russia | | 3.01 | % |

| Taiwan | | 16.93 | % |

| United Kingdom | | 2.09 | % |

| Preferred Stock | | 3.65 | % |

| Short-Term Investments | | 1.25 | % |

| Total Value of Securities | | 100.25 | % |

| Liabilities Net of Receivables and Other | | | |

| Assets | | (0.25 | %) |

| Total Net Assets | | 100.00 | % |

| | Percentage |

| Common stock and preferred stock by sector | | of net assets |

| Communication Services | | 11.92 | % |

| Consumer Discretionary | | 10.62 | % |

| Consumer Staples | | 6.53 | % |

| Energy | | 5.33 | % |

| Financials | | 24.77 | % |

| Healthcare | | 4.59 | % |

| Information Technology* | | 27.14 | % |

| Materials | | 8.10 | % |

| Total | | 99.00 | % |

| * | To monitor compliance with the Portfolio’s concentration guidelines as described in the Portfolio’s Prospectus and Statement of Additional Information, the Information Technology sector (as disclosed herein for financial reporting purposes) is subdivided into a variety of “industries” (in accordance with the requirements of the Investment Company Act of 1940, as amended). The Information Technology sector consisted of Computers, Electrical Component and Equipment, Electronics, Energy-Alternate Sources, Semiconductors, and Software. As of October 31, 2021, such amounts, as a percentage of total net assets were 1.05%, 1.88%, 3.62%, 1.70%, 17.46%, and 1.43%, respectively. The percentage in any such single industry will comply with the Portfolio’s concentration policy even if the percentage in the Information Technology sector for financial reporting purposes may exceed 25%. |

13

Table of Contents

Security type / country and sector allocations

Macquarie Institutional Portfolios — Macquarie Emerging Markets Portfolio II

As of October 31, 2021 (Unaudited)

Sector designations may be different from the sector designations presented in other Portfolio materials. The sector designations may represent the investment manager’s internal sector classifications, which may result in the sector designations for one Portfolio being different from another Portfolio’s sector designations.

| | Percentage |

| Security type / country | | of net assets |

| Common Stock by Country | | 100.12 | % |

| Argentina | | 0.08 | % |

| Bahrain | | 0.03 | % |

| Brazil | | 4.08 | % |

| Chile | | 0.52 | % |

| China | | 28.83 | % |

| India | | 14.41 | % |

| Indonesia | | 2.51 | % |

| Malaysia | | 0.05 | % |

| Mexico | | 3.43 | % |

| Peru | | 0.30 | % |

| Republic of Korea | | 18.77 | % |

| Russia | | 7.17 | % |

| South Africa | | 0.24 | % |

| Taiwan | | 17.69 | % |

| Turkey | | 0.61 | % |

| United States | | 1.40 | % |

| Preferred Stock | | 0.08 | % |

| Warrants | | 0.00 | % |

| Short-Term Investments | | 0.03 | % |

| Total Value of Securities | | 100.23 | % |

| Liabilities Net of Receivables and Other | | | |

| Assets | | (0.23 | %) |

| Total Net Assets | | 100.00 | % |

| | Percentage |

| Common stock and preferred stock by sector | | of net assets |

| Communication Services | | 16.52 | % |

| Consumer Discretionary | | 12.83 | % |

| Consumer Staples | | 10.70 | % |

| Energy | | 15.11 | % |

| Financials | | 7.30 | % |

| Healthcare | | 0.54 | % |

| Industrials | | 0.18 | % |

| Information Technology* | | 34.22 | % |

| Materials | | 2.30 | % |

| Real Estate | | 0.16 | % |

| Utilities | | 0.34 | % |

| Total | | 100.20 | % |

| * | To monitor compliance with the Portfolio’s concentration guidelines as described in the Portfolio’s Prospectus and Statement of Additional Information, the Information Technology sector (as disclosed herein for financial reporting purposes) is subdivided into variety of “industries” (in accordance with the requirements of the Investment Company Act of 1940, as amended). The Information Technology sector consisted of Computers, Electronics, Electronic Components-Semiconductors, Internet, Retail, Semiconductor Components-Integrated Circuits, and Software. As of October 31, 2021, such amounts, as a percentage of total net assets were 1.22%, 1.86%, 18.87%, 0.59%, 0.01%, 10.23%, and 1.44%, respectively. The percentage in any such single industry will comply with the Portfolio’s concentration policy even if the percentage in the Information Technology sector for financial reporting purposes may exceed 25%. |

14

Table of Contents

Security type / country and sector allocations

Macquarie Institutional Portfolios — Macquarie Labor Select International Equity Portfolio

As of October 31, 2021 (Unaudited)

Sector designations may be different from the sector designations presented in other Portfolio materials. The sector designations may represent the investment manager’s or sub-advisor’s internal sector classifications, which may result in the sector designations for one Portfolio being different from another Portfolio’s sector designations.

| | Percentage |

| Security type / country | | of net assets |

| Common Stock by Country | | | 98.08% | |

| China/Hong Kong | | | 3.34% | |

| Denmark | | | 1.28% | |

| France | | | 8.37% | |

| Germany | | | 4.99% | |

| Italy | | | 7.27% | |

| Japan | | | 29.64% | |

| Singapore | | | 4.09% | |

| Spain | | | 4.74% | |

| Sweden | | | 3.34% | |

| Switzerland | | | 3.33% | |

| United Kingdom | | | 27.69% | |

| Short-Term Investments | | | 0.55% | |

| Total Value of Securities | | | 98.63% | |

| Receivables and Other Assets Net of | | | | |

| Liabilities | | | 1.37% | |

| Total Net Assets | | | 100.00% | |

| | Percentage |

| Common stock by sector | | of net assets |

| Communication Services | | | 8.59% | |

| Consumer Discretionary | | | 13.17% | |

| Consumer Staples | | | 6.70% | |

| Energy | | | 7.16% | |

| Financials | | | 16.43% | |

| Healthcare | | | 13.47% | |

| Industrials | | | 13.07% | |

| Information Technology | | | 6.70% | |

| Materials | | | 2.50% | |

| Utilities | | | 10.29% | |

| Total | | | 98.08% | |

15

Table of Contents

Schedules of investments

Macquarie Institutional Portfolios — Macquarie Emerging Markets Portfolio

October 31, 2021

| | | | | Number of | | | |

| | | | shares | | Value (US $) |

| Common Stock – 95.35%Δ | | | | | |

| Austria – 2.35% | | | | | |

| Mondi | | 65,243 | | $ | 1,629,512 |

| | | | | | | 1,629,512 |

| Brazil – 3.53% | | | | | |

| Hypera | | 203,000 | | | 1,007,842 |

| Itau Unibanco Holding ADR | | 113,137 | | | 460,468 |

| Suzano † | | 102,600 | | | 893,146 |

| XP Class A † | | 2,612 | | | 85,703 |

| | | | | | | 2,447,159 |

| Canada – 1.36% | | | | | |

| Barrick Gold | | 51,390 | | | 944,034 |

| | | | | | | 944,034 |

| China – 38.63% | | | | | |

| Alibaba Group Holding † | | 194,380 | | | 4,072,224 |

| Autohome ADR | | 40,371 | | | 1,588,599 |

| Baidu ADR † | | 16,954 | | | 2,750,617 |

| China Medical System Holdings | | 319,000 | | | 543,659 |

| China Merchants Bank Class H | | 255,000 | | | 2,148,352 |

| CSPC Pharmaceutical Group | | 1,564,960 | | | 1,637,269 |

| Gree Electric Appliances of | | | | | |

| | Zhuhai Class A | | 228,000 | | | 1,305,799 |

| Hengan International Group | | 149,500 | | | 781,078 |

| LONGi Green Energy Technology | | | | | |

| | Class A | | 77,128 | | | 1,177,416 |

| Midea Group Class A | | 172,819 | | | 1,857,197 |

| NetEase | | 69,662 | | | 1,376,139 |

| Ping An Insurance Group Co. of | | | | | |

| | China Class H | | 502,000 | | | 3,606,683 |

| Tencent Holdings | | 41,100 | | | 2,540,852 |

| Tingyi Cayman Islands Holding | | 674,000 | | | 1,261,287 |

| Yum China Holdings | | 2,279 | | | 130,085 |

| | | | | | | 26,777,256 |

| Hong Kong – 1.49% | | | | | |

| WH Group 144A # | | 1,475,820 | | | 1,035,663 |

| | | | | | | 1,035,663 |

| India – 9.38% | | | | | |

| HCL Technologies | | 65,081 | | | 994,059 |

| Housing Development Finance | | 64,349 | | | 2,444,585 |

| Infosys ADR | | 32,695 | | | 728,445 |

| Reliance Industries | | 68,888 | | | 2,333,257 |

| | | | | | | 6,500,346 |

| Indonesia – 2.77% | | | | | |

| Bank Rakyat Indonesia Persero | | 6,402,383 | | | 1,920,602 |

| | | | | | | 1,920,602 |

| Mexico – 1.26% | | | | | |

| Grupo Financiero Banorte | | | | | |

| | Class O | | 138,854 | | | 877,718 |

| | | | | | | 877,718 |

| Peru – 2.55% | | | | | |

| Credicorp | | 13,638 | | | 1,768,303 |

| | | | | | | 1,768,303 |

| Republic of Korea – 10.00% | | | | | |

| LG Chem | | 468 | | | 334,815 |

| Samsung Electronics | | 50,192 | | | 2,998,076 |

| Samsung Fire & Marine | | | | | |

| | Insurance | | 6,018 | | | 1,189,644 |

| Shinhan Financial Group | | 36,554 | | | 1,196,517 |

| SK Hynix | | 13,744 | | | 1,211,443 |

| | | | | | | 6,930,495 |

| Russia – 3.01% | | | | | |

| LUKOIL PJSC ADR (London | | | | | |

| | International Exchange) | | 13,283 | | | 1,354,866 |

| Polymetal International | | 39,324 | | | 729,218 |

| | | | | | | 2,084,084 |

| Taiwan – 16.93% | | | | | |

| Alchip Technologies | | 24,000 | | | 888,937 |

| ASE Technology Holding | | 166,000 | | | 595,746 |

| CTBC Financial Holding | | 1,037,046 | | | 865,184 |

| Delta Electronics | | 148,000 | | | 1,303,918 |

| Hon Hai Precision Industry | | 652,000 | | | 2,508,729 |

| Taiwan Semiconductor | | | | | |

| | Manufacturing | | 262,588 | | | 5,571,207 |

| | | | | | | | 11,733,721 |

| United Kingdom – 2.09% | | | | | |

| Unilever | | 27,114 | | | 1,451,531 |

| | | | | | | 1,451,531 |

| Total Common Stock | | | | | |

| | (cost $58,986,473) | | | | | 66,100,424 |

| | | | | | | | |

| Preferred Stock – 3.65%Δ | | | | | |

| Brazil – 0.87% | | | | | |

| Itausa 2.99% ** | | 329,888 | | | 600,880 |

| | | | | | | 600,880 |

| Republic of Korea – 2.78% | | | | | |

| LG Chem 2.66% ** | | 3,318 | | | 1,088,916 |

| Samsung Electronics 4.56% ** | | 15,351 | | | 840,755 |

| | | | | | 1,929,671 |

| Total Preferred Stock | | | | | |

| (cost $2,679,339) | | | | | 2,530,551 |

16

Table of Contents

| | | | | Number of | | | |

| | | | shares | | Value (US $) |

| Short-Term Investments – 1.25% | | | | | |

| Money Market Mutual Funds – 1.25% | | | | | |

| BlackRock FedFund – | | | | | |

| | Institutional Shares (seven-day | | | | | |

| | effective yield 0.03%) | | 216,066 | | $ | 216,066 |

| Fidelity Investments Money | | | | | |

| | Market Government Portfolio | | | | | |

| | – Class I (seven-day effective | | | | | |

| | yield 0.01%) | | 216,067 | | | 216,067 |

| GS Financial Square Government | | | | | |

| | Fund – Institutional Shares | | | | | |

| | (seven-day effective yield | | | | | |

| | 0.03%) | | 216,067 | | | 216,067 |

| Morgan Stanley Government | | | | | |

| | Portfolio – Institutional Share | | | | | |

| | Class (seven-day effective | | | | | |

| | yield 0.03%) | | 216,067 | | | 216,067 |

| Total Short-Term Investments | | | | | |

| (cost $864,267) | | | | | 864,267 |

| Total Value of | | | | | |

| Securities–100.25% | | | | | |

| (cost $62,530,079) | | | | $ | 69,495,242 |

| Δ | Securities have been classified by country of origin. Aggregate classification by business sector has been presented on page 13 in “Security type / country and sector allocations.” |

| † | Non-income producing security. |

| # | Security exempt from registration under Rule 144A of the Securities Act of 1933, as amended. At October 31, 2021, the aggregate value of Rule 144A securities was $1,035,663, which represents 1.49% of the Portfolio’s net assets. See Note 10 in “Notes to financial statements.” |

| ** | Perpetual security with no stated maturity date. |

Summary of abbreviations:

ADR – American Depositary Receipt

GS – Goldman Sachs

PJSC – Private Joint Stock Company

See accompanying notes, which are an integral part of the financial statements.

17

Table of Contents

Schedules of investments

Macquarie Institutional Portfolios — Macquarie Emerging Markets Portfolio II

October 31, 2021

| | | | | Number of | | | |

| | | | shares | | Value (US $) |

| Common Stock – 100.12%Δ | | | | | |

| Argentina – 0.08% | | | | | |

| IRSA Inversiones y | | | | | |

| | Representaciones ADR † | | 3,493 | | $ | 16,382 |

| IRSA Propiedades Comerciales | | | | | |

| | ADR | | 579 | | | 1,621 |

| | | | | | | 18,003 |

| Bahrain – 0.03% | | | | | |

| Aluminium Bahrain GDR 144A #, | | | | | |

| | † | | 691 | | | 6,736 |

| | | | | | | 6,736 |

| Brazil – 4.08% | | | | | |

| Americanas † | | 42,195 | | | 222,048 |

| Banco Bradesco ADR | | 28,682 | | | 100,387 |

| Banco Santander Brasil ADR | | 10,741 | | | 65,628 |

| BRF ADR † | | 20,063 | | | 82,860 |

| Getnet Adquirencia e Servicos | | | | | |

| | para Meios de Pagamento | | | | | |

| | ADR † | | 1,343 | | | 2,148 |

| Itau Unibanco Holding ADR | | 26,165 | | | 106,492 |

| Petroleo Brasileiro ADR | | 12,122 | | | 119,038 |

| Rumo † | | 1,573 | | | 4,415 |

| Telefonica Brasil ADR | | 8,845 | | | 71,025 |

| TIM ADR | | 6,138 | | | 60,521 |

| Vale ADR | | 4,239 | | | 53,962 |

| XP Class A † | | 604 | | | 19,820 |

| | | | | | | 908,344 |

| Chile – 0.52% | | | | | |

| Sociedad Quimica y Minera de | | | | | |

| | Chile ADR | | 2,110 | | | 115,818 |

| | | | | | | 115,818 |

| China – 28.83% | | | | | |

| Alibaba Group Holding † | | 4,500 | | | 94,274 |

| Alibaba Group Holding ADR † | | 4,590 | | | 757,075 |

| Anhui Conch Cement Class H | | 27,500 | | | 136,784 |

| Baidu ADR † | | 1,785 | | | 289,598 |

| BeiGene † | | 3,600 | | | 100,775 |

| China Petroleum & Chemical | | | | | |

| | ADR | | 1,715 | | | 83,486 |

| China Petroleum & Chemical | | | | | |

| | Class H | | 32,000 | | | 15,711 |

| DiDi Global ADR † | | 2,500 | | | 20,175 |

| Genor Biopharma Holdings 144A | | | | | |

| | #, † | | 12,500 | | | 16,226 |

| iQIYI ADR † | | 1,615 | | | 13,372 |

| JD.com ADR † | | 14,577 | | | 1,141,088 |

| Joinn Laboratories China Class H | | | | | |

| | 144A # | | 280 | | | 3,624 |

| Kunlun Energy | | 68,000 | | | 62,227 |

| Kweichow Moutai Class A | | 2,500 | | | 713,391 |

| Luzhou Laojiao Class A | | 4,200 | | | 150,265 |

| Ping An Insurance Group Co. of | | | | | |

| | China Class H | | 23,000 | | | 165,246 |

| Prosus † | | 2,283 | | | 201,130 |

| Sohu.com ADR † | | 6,444 | | | 130,555 |

| Tencent Holdings | | 18,200 | | | 1,125,146 |

| Tencent Music Entertainment | | | | | |

| | Group ADR † | | 4 | | | 31 |

| Tianjin Development Holdings | | 62,000 | | | 13,786 |

| Tingyi Cayman Islands Holding | | 58,000 | | | 108,538 |

| Trip.com Group ADR † | | 4,911 | | | 140,258 |

| Tsingtao Brewery Class H | | 24,000 | | | 208,676 |

| Uni-President China Holdings | | 107,000 | | | 91,316 |

| Weibo ADR † | | 1,715 | | | 77,141 |

| Wuliangye Yibin Class A | | 16,300 | | | 551,484 |

| Zhihu ADR † | | 500 | | | 4,130 |

| | | | | | | 6,415,508 |

| India – 14.41% | | | | | |

| HCL Technologies | | 21,000 | | | 320,758 |

| HDFC Bank | | 12,000 | | | 253,658 |

| Reliance Industries GDR 144A # | | 30,737 | | | 2,090,116 |

| Tata Chemicals | | 11,058 | | | 133,106 |

| Tata Consultancy Services | | 6,000 | | | 272,251 |

| Tata Consumer Products | | 12,607 | | | 136,287 |

| | | | | | | 3,206,176 |

| Indonesia – 2.51% | | | | | |

| Astra International | | 337,700 | | | 143,614 |

| Bank Central Asia | | 786,000 | | | 414,706 |

| | | | | | | 558,320 |

| Malaysia – 0.05% | | | | | |

| UEM Sunrise † | | 118,400 | | | 11,294 |

| | | | | | | 11,294 |

| Mexico – 3.43% | | | | | |

| America Movil ADR Class L | | 5,291 | | | 94,074 |

| Banco Santander Mexico ADR | | 16,863 | | | 108,766 |

| Becle | | 49,866 | | | 113,838 |

| Coca-Cola Femsa ADR | | 3,722 | | | 200,058 |

| Grupo Financiero Banorte | | | | | |

| | Class O | | 10,549 | | | 66,682 |

| Grupo Televisa ADR | | 17,723 | | | 179,357 |

| | | | | | | 762,775 |

| Peru – 0.30% | | | | | |

| Cia de Minas Buenaventura ADR | | | | | |

| | † | | 8,287 | | | 65,302 |

| | | | | | | 65,302 |

18

Table of Contents

| | | Number of | | | |

| | | | shares | | Value (US $) |

| Common StockΔ (continued) | | | | | |

| Republic of Korea – 18.77% | | | | | |

| Fila Holdings | | 3,123 | | $ | 99,151 |

| LG Uplus | | 6,905 | | | 84,795 |

| Samsung Electronics | | 24,291 | | | 1,450,953 |

| SK Hynix | | 13,489 | | | 1,188,967 |

| SK Telecom | | 1,780 | | | 462,516 |

| SK Telecom ADR | | 30,689 | | | 889,981 |

| | | | | | 4,176,363 |

| Russia – 7.17% | | | | | |

| Etalon Group GDR 144A # | | 4,800 | | | 7,546 |

| Gazprom PJSC ADR | | 44,140 | | | 432,837 |

| LUKOIL PJSC ADR (London | | | | | |

| International Exchange) | | 2,022 | | | 206,244 |

| Mail.Ru Group GDR † | | 2,072 | | | 42,393 |

| Rosneft Oil PJSC GDR | | 44,435 | | | 395,916 |

| Sberbank of Russia PJSC | | 52,760 | | | 265,007 |

| Yandex Class A † | | 2,962 | | | 245,372 |

| | | | | | 1,595,315 |

| South Africa – 0.24% | | | | | |

| Naspers Class N | | 318 | | | 53,922 |

| | | | | | 53,922 |

| Taiwan – 17.69% | | | | | |

| Hon Hai Precision Industry | | 107,564 | | | 413,879 |

| MediaTek | | 38,000 | | | 1,247,604 |

| Taiwan Semiconductor | | | | | |

| Manufacturing | | 64,000 | | | 1,357,858 |

| Taiwan Semiconductor | | | | | |

| Manufacturing ADR | | 5,831 | | | 662,985 |

| United Microelectronics ADR | | 24,806 | | | 254,757 |

| | | | | | 3,937,083 |

| Turkey – 0.61% | | | | | |

| Akbank TAS | | 100,106 | | | 61,017 |

| Anadolu Efes Biracilik Ve Malt | | | | | |

| Sanayii | | 9,675 | | | 22,341 |

| D-MARKET Elektronik Hizmetler | | | | | |

| ve Ticaret ADR † | | 500 | | | 2,275 |

| Turkcell Iletisim Hizmetleri ADR | | 9,092 | | | 36,095 |

| Turkiye Sise ve Cam Fabrikalari | | 16,275 | | | 14,660 |

| | | | | | 136,388 |

| United States – 1.40% | | | | | |

| Micron Technology | | 4,500 | | | 310,950 |

| | | | | | 310,950 |

| Total Common Stock | | | | | |

| (cost $15,211,052) | | | | | 22,278,297 |

| | | | | | | |

| Preferred Stock – 0.08%Δ | | | | | |

| Russia – 0.08% | | | | | |

| Transneft PJSC 6.18% ** | | 8 | | | 17,163 |

| Total Preferred Stock | | | | | |

| (cost $20,913) | | | | | 17,163 |

| | | | | | |

| Warrants – 0.00%Δ | | | | | |

| Argentina – 0.00% | | | | | |

| IRSA Inversiones y | | | | | |

| Representaciones exercise | | | | | |

| price $0.23, expiration date | | | | | |

| 3/5/26 | | 4,240 | | | 978 |

| Total Warrants | | | | | |

| (cost $0) | | | | | 978 |

| | | | | | |

| Short-Term Investments – 0.03% | | | | | |

| Money Market Mutual Funds – 0.03% | | | | |

| BlackRock FedFund – | | | | | |

| Institutional Shares (seven-day | | | | | |

| effective yield 0.03%) | | 1,860 | | | 1,860 |

| Fidelity Investments Money | | | | | |

| Market Government Portfolio | | | | | |

| – Class I (seven-day effective | | | | | |

| yield 0.01%) | | 1,860 | | | 1,860 |

| GS Financial Square Government | | | | | |

| Fund – Institutional Shares | | | | | |

| (seven-day effective yield | | | | | |

| 0.03%) | | 1,860 | | | 1,860 |

| Morgan Stanley Government | | | | | |

| Portfolio – Institutional Share | | | | | |

| Class (seven-day effective | | | | | |

| yield 0.03%) | | 1,859 | | | 1,859 |

| Total Short-Term Investments | | | | | |

| (cost $7,439) | | | | | 7,439 |

| Total Value of | | | | | |

| Securities–100.23% | | | | | |

| (cost $15,239,404) | | | | $ | 22,303,877 |

| Δ | Securities have been classified by country of origin. Aggregate classification by business sector has been presented on page 14 in “Security type / country and sector allocations.” |

| † | Non-income producing security. |

| # | Security exempt from registration under Rule 144A of the Securities Act of 1933, as amended. At October 31, 2021, the aggregate value of Rule 144A securities was $2,124,248, which represents 9.55% of the Portfolio’s net assets. See Note 10 in “Notes to financial statements.” |

| ** | Perpetual security with no stated maturity date. |

19

Table of Contents

Schedules of investments

Macquarie Institutional Portfolios — Macquarie Emerging Markets Portfolio II

Summary of abbreviations:

ADR – American Depositary Receipt

GDR – Global Depositary Receipt

GS – Goldman Sachs

PJSC – Private Joint Stock Company

See accompanying notes, which are an integral part of the financial statements.

20

Table of Contents

Macquarie Institutional Portfolios — Macquarie Labor Select International Equity Portfolio

October 31, 2021

| | | Number of | | | |

| | | | shares | | Value (US $) |

| Common Stock – 98.08%Δ | | | | | |

| China/Hong Kong – 3.34% | | | | | |

| Jardine Matheson Holdings | | 47,000 | | $ | 2,722,710 |

| WH Group 144A # | | 4,417,507 | | | 3,100,005 |

| | | | | | 5,822,715 |

| Denmark – 1.28% | | | | | |

| ISS † | | 111,582 | | | 2,221,236 |

| | | | | | 2,221,236 |

| France – 8.37% | | | | | |

| Bouygues | | 16,286 | | | 658,931 |

| Cie de Saint-Gobain | | 51,473 | | | 3,543,986 |

| Dassault Aviation | | 19,330 | | | 2,016,680 |

| Sanofi | | 57,696 | | | 5,764,585 |

| Societe Generale | | 77,746 | | | 2,591,528 |

| | | | | | 14,575,710 |

| Germany – 4.99% | | | | | |

| Allianz | | 18,649 | | | 4,336,441 |

| Evonik Industries | | 134,286 | | | 4,349,674 |

| | | | | | 8,686,115 |

| Italy – 7.27% | | | | | |

| Enel | | 683,662 | | | 5,718,707 |

| Eni | | 218,294 | | | 3,130,123 |

| Snam | | 673,787 | | | 3,814,262 |

| | | | | | 12,663,092 |

| Japan – 29.64% | | | | | |

| Coca-Cola Bottlers Japan | | | | | |

| Holdings | | 137,900 | | | 1,892,306 |

| Denso | | 58,000 | | | 4,184,549 |

| FUJIFILM Holdings | | 59,800 | | | 4,617,678 |

| Fujitsu | | 14,300 | | | 2,462,272 |

| Hitachi | | 28,700 | | | 1,650,360 |

| Honda Motor | | 183,200 | | | 5,383,082 |

| Kyocera | | 78,400 | | | 4,577,776 |

| Mitsubishi Electric | | 217,300 | | | 2,907,502 |

| Nippon Telegraph & Telephone | | 165,100 | | | 4,618,020 |

| Otsuka Holdings | | 60,000 | | | 2,365,782 |

| Sekisui Chemical | | 198,400 | | | 3,246,466 |

| Sony Group | | 53,500 | | | 6,167,932 |

| Takeda Pharmaceutical | | 158,000 | | | 4,440,219 |

| Tokio Marine Holdings | | 58,400 | | | 3,073,334 |

| | | | | | 51,587,278 |

| Singapore – 4.09% | | | | | |

| Singapore Telecommunications | | 832,700 | | | 1,543,752 |

| United Overseas Bank | | 280,709 | | | 5,568,384 |

| | | | | | 7,112,136 |

| Spain – 4.74% | | | | | |

| Banco Santander | | 1,573,840 | | | 5,961,130 |

| Red Electrica | | 110,199 | | | 2,294,295 |

| | | | | | 8,255,425 |

| Sweden – 3.34% | | | | | |

| Essity Class B | | 60,254 | | | 1,949,064 |

| Telia | | 981,102 | | | 3,860,776 |

| | | | | | 5,809,840 |

| Switzerland – 3.33% | | | | | |

| Novartis | | 54,907 | | | 4,536,004 |

| Zurich Insurance Group | | 2,850 | | | 1,263,450 |

| | | | | | 5,799,454 |

| United Kingdom – 27.69% | | | | | |

| BP | | 824,935 | | | 3,953,635 |

| CK Hutchison Holdings | | 820,500 | | | 5,520,619 |

| GlaxoSmithKline | | 306,824 | | | 6,334,672 |

| Kingfisher | | 786,493 | | | 3,605,789 |

| Lloyds Banking Group | | 8,446,006 | | | 5,804,820 |

| Royal Dutch Shell Class B | | 233,413 | | | 5,382,520 |

| SSE | | 271,089 | | | 6,097,366 |

| Tesco | | 1,277,906 | | | 4,720,222 |

| Travis Perkins | | 71,503 | | | 1,509,909 |

| Wickes Group | | 118,636 | | | 348,098 |

| WPP | | 340,427 | | | 4,919,813 |

| | | | | | 48,197,463 |

| Total Common Stock | | | | | |

| (cost $152,051,946) | | | | | 170,730,464 |

| |

| Short-Term Investments – 0.55% | | | | | |

| Money Market Mutual Funds – 0.55% | | | | |

| BlackRock FedFund – | | | | | |

| Institutional Shares (seven- | | | | | |

| day effective yield 0.03%) | | 239,378 | | | 239,378 |

| Fidelity Investments Money | | | | | |

| Market Government Portfolio | | | | | |

| – Class I (seven-day effective | | | | | |

| yield 0.01%) | | 239,379 | | | 239,379 |

| GS Financial Square | | | | | |

| Government Fund – | | | | | |

| Institutional Shares (seven- | | | | | |

| day effective yield 0.03%) | | 239,379 | | | 239,379 |

21

Table of Contents

Schedules of investments

Macquarie Institutional Portfolios — Macquarie Labor Select International Equity Portfolio

| | | Number of | | | |

| | | | shares | | Value (US $) |

| Short-Term Investments (continued) | | | |

| Money Market Mutual Funds (continued) | | | |

| Morgan Stanley Government | | | | | |

| Portfolio – Institutional | | | | | |

| Share Class (seven-day | | | | | |

| effective yield 0.03%) | | 239,379 | | $ | 239,379 |

| Total Short-Term Investments | | | | | |

| (cost $957,515) | | | | | 957,515 |

| Total Value of | | | | | |

| Securities–98.63% | | | | | |

| (cost $153,009,461) | | | | $ | 171,687,979 |

| Δ | Securities have been classified by country of origin. Aggregate classification by business sector has been presented on page 15 in “Security type / country and sector allocations.” |

| # | Security exempt from registration under Rule 144A of the Securities Act of 1933, as amended. At October 31, 2021, the aggregate value of Rule 144A securities was $3,100,005, which represents 1.78% of the Portfolio’s net assets. See Note 10 in “Notes to financial statements.” |

| † | Non-income producing security. |

Summary of abbreviations:

GS – Goldman Sachs

See accompanying notes, which are an integral part of the financial statements.

22

Table of Contents

Statements of assets and liabilities

Macquarie Institutional Portfolios

October 31, 2021 (Unaudited)

| | | | | | | | | | | Macquarie |

| | | Macquarie | | Macquarie | | Labor Select |

| | | Emerging | | Emerging | | International |

| | | Markets | | Markets | | Equity |

| | | | Portfolio | | Portfolio II | | Portfolio |

| Assets: | | | | | | | | | | | | |

| Investments, at value* | | $ | 69,495,242 | | | $ | 22,303,877 | | | $ | 171,687,979 | |

| Cash | | | 258 | | | | 57 | | | | 128,068 | |

| Foreign currencies, at valueΔ | | | 4,382 | | | | 14,915 | | | | 380,741 | |

| Dividends and interest receivable | | | 62,960 | | | | 28,226 | | | | 846,822 | |

| Foreign tax reclaims receivable | | | 2,847 | | | | 36 | | | | 1,678,781 | |

| Receivable for securities sold | | | — | | | | — | | | | 29,680 | |

| Total Assets | | | 69,565,689 | | | | 22,347,111 | | | | 174,752,071 | |

| Liabilities: | | | | | | | | | | | | |

| Capital gains tax payable | | | 67,932 | | | | 31,697 | | | | — | |

| Investment management fees payable to affiliates | | | 59,380 | | | | 20,913 | | | | 110,081 | |

| Payable for securities purchased | | | 52,663 | | | | — | | | | 454,695 | |

| Custody fees payable | | | 25,333 | | | | 12,403 | | | | 47,999 | |

| Accounting and administration fees payable to non-affiliates | | | 16,944 | | | | 15,366 | | | | 20,321 | |

| Audit and tax fees payable | | | 5,949 | | | | 5,949 | | | | 5,949 | |

| Payable for fund shares redeemed | | | 5,000 | | | | — | | | | 19,306 | |

| Reports and statements to shareholders expenses payable to non-affiliates | | | 4,765 | | | | 4,181 | | | | 9,481 | |

| Other accrued expenses | | | 4,100 | | | | 3,925 | | | | 9,260 | |

| Accounting and administration expenses payable to affiliates | | | 554 | | | | 409 | | | | 869 | |