Item 1. Reports to Stockholders

Macquarie Institutional Portfolios (registered as Delaware Pooled® Trust)

| | |

US equities | | |

Macquarie Large Cap Value Portfolio | | |

| |

US fixed income | | |

Macquarie Core Plus Bond Portfolio | | |

Macquarie High Yield Bond Portfolio | | |

| |

International equities | | |

Macquarie Emerging Markets Portfolio | | |

Macquarie Emerging Markets Portfolio II | | |

Macquarie Labor Select International Equity Portfolio | | |

October 31, 2018

This page intentionally left blank.

Macquarie Institutional Portfolios

Macquarie Institutional Portfolios (registered as Delaware Pooled® Trust) are designed exclusively for institutional investors and high net worth individuals.

Delaware Management Company, a series of Macquarie Investment Management Business Trust (MIMBT), serves as investment advisor for the Portfolios. Mondrian Investment Partners Limited serves as investment sub-advisor for Macquarie Emerging Markets Portfolio* and Macquarie Labor Select International Equity Portfolio.

The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 800 231-8002 or visiting macquarie.com/investment-management/institutional. Carefully consider the Portfolios’ investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Portfolios’ prospectus which may be obtained by visiting macquarie.com/investment-management/institutional or calling 800 231-8002. Investors should read the prospectus carefully before investing. Performance includes reinvestment of all distributions.

The Portfolios are not FDIC insured and are not guaranteed. It is possible to lose the principal amount invested. Mutual fund advisory services are provided by Delaware Management Company, a series of MIMBT, which is a registered investment advisor.

The Portfolios are distributed by Delaware Distributors, L.P. (DDLP), an affiliate of MIMBT, Macquarie Management Holdings, Inc., and Macquarie Group Limited. Macquarie Investment Management (MIM) is the marketing name for certain companies comprising the asset management division of Macquarie Group Limited and its subsidiaries and affiliates worldwide. Institutional investment management is provided by Macquarie Investment Management Advisers (MIMA), a series of MIMBT. MIMBT is a US registered investment advisor, and may not be able to provide investment advisory services to certain clients in certain jurisdictions.

Other than Macquarie Bank Limited (MBL), none of the entities noted are authorized deposit-taking institutions for the purposes of the Banking Act 1959 (Commonwealth of Australia). The obligations of these entities do not represent deposits or other liabilities of MBL. MBL does not guarantee or otherwise provide assurance in respect of the obligations of these entities, unless noted otherwise. The Portfolios are governed by US laws and regulations.

*Closed to new investors.

©2018 Macquarie Management Holdings, Inc.

All third-party marks cited are the property of their respective owners.

1

Portfolio objectives and strategies

Macquarie Large Cap Value Portfolio seeks long-term capital appreciation. The Portfolio invests primarily in securities of large-capitalization companies that we believe have long-term capital appreciation potential. The Portfolio currently defines large-capitalization stocks as those with market capitalizations of $5 billion or greater at the time of purchase. Typically, we seek to select securities that we believe are undervalued in relation to their intrinsic value as indicated by multiple factors.

Macquarie Core Plus Bond Portfolio seeks maximum long-term total return, consistent with reasonable risk. The Portfolio allocates its investments principally among three sectors of the fixed income securities markets: US investment grade sector, US high yield sector, and international sector.

Macquarie High Yield Bond Portfolio seeks high total return. The Portfolio will primarily invest its assets at the time of purchase in: (1) corporate bonds rated BB or lower by Standard & Poor’s (S&P) or similarly rated by another nationally recognized statistical rating organization; (2) securities issued or guaranteed by the US government, its agencies, or instrumentalities; or (3) commercial paper of companies rated A-1 or A-2 by S&P, rated P-1 or P-2 by Moody’s Investors Service, Inc. (Moody’s), or unrated but considered to be of comparable quality.

Macquarie Emerging Markets Portfolio seeks long-term capital appreciation. The Portfolio generally invests in equity securities of companies that are organized in, have a majority of their assets in, or derive a majority of their operating income from emerging countries. Macquarie Emerging Markets Portfolio is presently closed to new investors.

Macquarie Emerging Markets Portfolio II seeks long-term capital appreciation. The Portfolio invests primarily in a broad range of equity securities of companies located in emerging market countries. The Portfolio may invest in companies of any size. The portfolio manager believes that although market price and intrinsic business value are positively correlated in the long run, short-term divergences can emerge. The Portfolio seeks to take advantage of these divergences through a fundamental, bottom-up approach. The Portfolio invests in securities of companies with sustainable franchises when they are trading at a discount to the portfolio manager’s intrinsic value estimate for that security.

Macquarie Labor Select International Equity Portfolio seeks maximum long-term total return. The Portfolio invests primarily in equity securities of companies that are organized, have a majority of their assets, or derive most of their operating income outside of the United States, and that, in the opinion of Mondrian Investment Partners Limited (“Mondrian”), the Portfolio’s sub-advisor, are undervalued at the time of purchase based on the rigorous fundamental analysis that the sub-advisor employs. In addition to following these quantitative guidelines, Mondrian will select securities of issuers that present certain characteristics that are compatible or operate in accordance with certain investment policies or restrictions followed by organized labor.

Carefully consider the Portfolios’ investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Portfolios’ prospectus, which may be obtained by visiting macquarie.com/investment-management/institutional or calling 800 231-8002. Investors should read the applicable prospectus carefully before investing.

Macquarie Institutional Portfolios are designed exclusively for institutional investors and high net worth individuals.

International investments entail risks not ordinarily associated with US investments including fluctuation in currency values, differences in accounting principles, or economic or political instability in other nations. Investing in emerging markets can be riskier than investing in established foreign markets due to increased volatility and lower trading volume.

The Portfolios’ share prices and yields will fluctuate in response to movements in stock prices.

Fixed income securities and bond funds can lose value, and investors can lose principal, as interest rates rise. They also may be affected by economic conditions that hinder an issuer’s ability to make interest and principal payments on its debt.

2

The Portfolios may also be subject to prepayment risk, the risk that the principal of a bond that is held by a portfolio will be prepaid prior to maturity, at the time when interest rates are lower than what the bond was paying. A portfolio may then have to reinvest that money at a lower interest rate.

Securities in the lowest of the rating categories considered to be investment grade (that is, Baa or BBB) have some speculative characteristics.

High yielding, non-investment-grade bonds (junk bonds) involve higher risk than investment grade bonds.

The high yield secondary market is particularly susceptible to liquidity problems when institutional investors, such as mutual funds and certain other financial institutions, temporarily stop buying bonds for regulatory, financial, or other reasons. In addition, a less liquid secondary market makes it more difficult for the Portfolio to obtain precise valuations of the high yield securities in its portfolio.

If and when a Portfolio invests in forward foreign currency contracts or uses other investments to hedge against currency risks, the Portfolio will be subject to special risks, including counterparty risk.

The Portfolios may invest in derivatives, which may involve additional expenses and are subject to risk, including the risk that an underlying security or securities index moves in the opposite direction from what the portfolio manager anticipated. A derivative transaction depends upon the counterparties’ ability to fulfill their contractual obligations.

Interest payments on inflation-indexed debt securities will vary as the principal and/or interest is adjusted for inflation.

3

Portfolio management review

Macquarie Institutional Portfolios — Macquarie Large Cap Value Portfolio

October 31, 2018

For the fiscal year ended Oct. 31, 2018, Macquarie Large Cap Value Portfolio gained +9.00% at net asset value (NAV) with all distributions reinvested. This result was ahead of the Portfolio’s benchmark, the Russell 1000® Value Index, which returned +3.03% for the same period. Complete annualized performance for Macquarie Large Cap Value Portfolio is shown on the table on page 6.

US stock prices moved higher during the Portfolio’s fiscal year, accompanied by an increase in volatility. There were three corrective phases in the broad-market S&P 500® Index, between -7% and -10% each, during the period. While it’s difficult, in our view, to pinpoint the reasons — perhaps volatility had simply been too low for too long — several developments appeared to put investors on edge, including rising interest rates, a more restrictive global-trade environment, concerns about rising deficits and debt, waning Federal Reserve stimulus, and the potential for higher inflation.

Early in the Portfolio’s fiscal year, Congressional Republicans passed their tax bill, which was signed into law in late December 2017. The market’s reaction was generally positive as investors appeared to discount a boost in corporate earnings resulting from a lower tax rate. The Federal Open Market Committee (FOMC) implemented four quarter-point rate increases during the period, three of which occurred under its new chair, Jerome Powell. These increases lifted the federal funds rate target range to between 2.00% and 2.25%. The economy appeared to be on solid footing throughout the fiscal year as evidenced by higher real gross domestic product (GDP – a measure of goods and services a nation produces) growth, robust consumer sentiment, very low unemployment, a surge in corporate earnings, and rising business investment.

Stock selection and an overweight allocation in the healthcare sector made strong contributions to relative performance. Pharmacy benefit manager Express Scripts Holding Co. led performance in the sector and in the Portfolio. Investors have generally reacted positively to the pending acquisition of Express Scripts by Cigna Corp., which seeks to expand its customer base, provide a wider array of services, and position itself to further deliver on cost containment.

Another healthcare stock, pharmaceutical and medical-products distributor Cardinal Health Inc., was a notable detractor. Several developments have pressured the company’s shares including weak performance in its Cordis medical-device unit, higher-than-expected deflation in generic drug pricing, and investors’ concerns about increasing competition in the pharmaceutical supply chain.

Stock selection in the energy and information technology sectors also contributed to performance during the fiscal year. The Portfolio’s position in exploration and production company ConocoPhillips led the way. The company continues to benefit from prior moves it made to strengthen its finances and improve efficiency. ConocoPhillips has focused its production in several US shale basins and has seen

improvement in revenues and earnings as oil prices have risen and break-even costs have come down.

In information technology, the Portfolio benefited most from a position in CA Inc., a provider of IT management software and solutions. In July, the company agreed to be acquired by semiconductor developer Broadcom in an all-cash deal worth $18.9 billion — a premium to CA’s share price at that time. The deal closed shortly after the end of the Portfolio’s fiscal year.

Halliburton Co., a provider of energy services, was a significant detractor from the Portfolio’s performance. As the largest provider of pressure-pumping services in the United States, the company’s stock has been hurt by ongoing constraints on takeaway capacity in the Permian Basin, as well as by slowing activity in another shale basin. Near term, we think the company’s margins will likely remain under pressure as Halliburton absorbs higher costs.

Stock selection in the materials sector hurt relative performance the most. The Portfolio’s one holding in the sector, diversified chemical manufacturer DowDuPont Inc., was weakest among all Portfolio holdings for the fiscal year. The company has faced higher cost pressures, mostly from rising input prices, as well as foreign-exchange headwinds. Since approximately two-thirds of DowDuPont’s revenue comes from outside the US, we believe rising trade tensions and potential tariffs have likely weighed on its shares as well.

During the fiscal year, there was one full position sale and purchase in the Portfolio. We exited the Portfolio’s position in integrated oil company Chevron Corp., reducing our target weight in the energy sector to 12%. A longtime Portfolio holding that had been a solid performer, Chevron’s shares were near their all-time high reached in 2014 before the oil market correction, and within 10% of our price target. We used the proceeds of this sale to purchase American International Group Inc. (AIG), a leading global multiline insurer that we found attractively valued. AIG has significantly changed since it nearly went bankrupt during the global financial crisis. More recently, AIG has faced new challenges owing to poor underwriting in its core property and casualty business. This led to significant reserve charges and turnover in senior and mid-level management. Consequently, financial and share-price performance was weak relative to peers. Valuation looked attractive to us and a new, highly regarded management team took steps to improve balance-sheet strength and underwriting discipline. In our view, AIG offers attractive upside potential if it can deliver on its business turnaround. The purchase raised the Portfolio’s target weight in the financial sector to 15%.

Throughout the fiscal year, we maintained our value-oriented approach to managing the Portfolio. In all market conditions, we try to look past the market’s short-term concerns about companies and focus on their long-term revenue, earnings, and cash-flow potential.

4

Although high valuations have tempered our performance expectations for the US equity market, our long-term outlook for

stocks — especially those value-oriented, higher-quality stocks that we seek to emphasize in the Portfolio — remains positive.

The views expressed are current as of the date of this report and are subject to change.

5

Performance summary

Macquarie Institutional Portfolios — Macquarie Large Cap Value Portfolio

The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 800 231-8002 or visiting macquarie.com/investment-management/mip.

Carefully consider the Portfolio’s investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Portfolio’s prospectus and, if available, its summary prospectus, which may be obtained by visiting macquarie.com/investment-management/mip or calling 800 231-8002. Investors should read the prospectus and, if available, the summary prospectus carefully before investing.

Portfolio and benchmark performance

Average annual total returns

| | | | | | | | | | |

Periods ended Oct. 31, 2018 | | 1 year | | 3 years | | 5 years | | 10 years | | Lifetime |

Macquarie Large Cap Value Portfolio | | +9.00% | | +9.95% | | +9.77% | | +13.64% | | +9.96% |

Russell 1000 Value Index | | +3.03% | | +8.88% | | +8.61% | | +11.30% | | +9.83% |

Portfolio profile

Oct. 31, 2018

| | | | | | |

Total net assets | | Number of holdings | | | | |

$106.8 million | | 33 | | | | |

Inception date | | | | | | |

Feb. 3, 1992 | | | | | | |

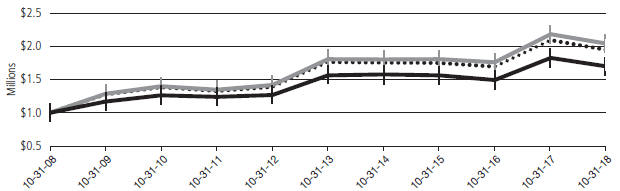

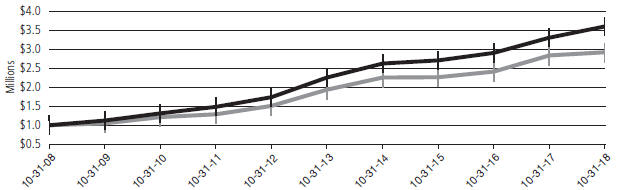

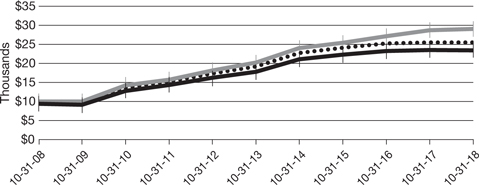

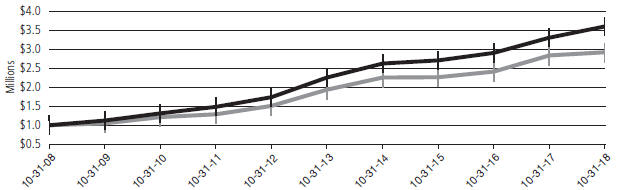

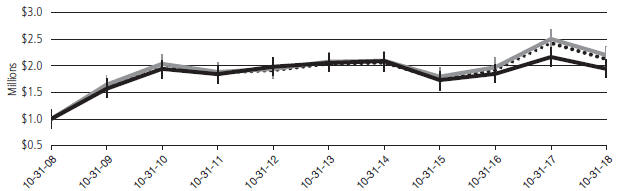

Growth of $1,000,000

| | | | | | |

| | | | Starting value (Oct. 31, 2008) | | Ending value (Oct. 31, 2018) |

| | | |

| | Macquarie Large Cap Value Portfolio | | $1,000,000 | | $3,593,140 |

| | | |

| | Russell 1000 Value Index | | $1,000,000 | | $2,916,960 |

The performance graph assumes $1 million invested on Oct. 31, 2008, and includes reinvestment of all distributions. The performance graph does not reflect the deduction of taxes the shareholder would pay on Portfolio distributions or redemptions of Portfolio shares.

Total return assumes reinvestment of dividends and capital gains, but does not reflect reductions for taxes. Returns and share values will fluctuate so that shares, when redeemed, may be worth more or less than their original cost.

6

The most recent prospectus disclosed the Portfolio’s total operating expenses as 0.66%. Management has contractually agreed to reimburse certain expenses and/or waive its management fees from Nov. 1, 2017 through Oct. 31, 2018,* in order to prevent total annual Portfolio operating expenses (with certain exclusions) from exceeding, in an aggregate amount, 0.70% of the Portfolio’s average daily net assets, as described in the most recent prospectus.

Expense limitations were in effect during the period shown. Performance would have been lower had the expense limitations not been in effect.

The Russell 1000 Value Index measures the performance of the large-cap value segment of the US equity universe. It includes those Russell 1000 companies with lower price-to-book ratios and lower forecasted growth values.

The S&P 500 Index, mentioned on page 4, measures the performance of 500 mostly large-cap stocks weighted by market value, and is often used to represent performance of the US stock market.

Frank Russell Company (“Russell”) is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. Russell® is a trademark of the Frank Russell Company.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

Investing involves risk, including the possible loss of principal.

Past performance is not a guarantee of future results.

* The aggregate contractual waiver period covering this report is from Feb. 28, 2017 through Feb. 28, 2019.

7

Portfolio management review

Macquarie Institutional Portfolios — Macquarie Core Plus Bond Portfolio

October 31, 2018

For the fiscal year ended Oct. 31, 2018, Macquarie Core Plus Bond Portfolio returned -2.29% at net asset value (NAV) with all distributions reinvested. The Portfolio’s benchmark, the Bloomberg Barclays US Aggregate Index, returned -2.05% for the same period. Complete annualized performance for Macquarie Core Plus Bond Portfolio is shown in the table on page 10.

As the Portfolio’s fiscal year began, the US Federal Reserve announced it would begin tapering reinvestment of its large-scale asset purchases and let its balance sheet gradually shrink, effectively ending the monetary-policy stimulus that had been in place over the past decade. Additionally, the Fed’s short-term interest rate hikes continued, causing the yield curve to flatten as short-term yields rose faster than longer-term yields.

At the same time that the Fed began withdrawing monetary stimulus, business received a boost in confidence and profits from government deregulation and the accommodative fiscal policy that resulted from passage of the tax reform bill in December 2017.

In spring 2018, trade tensions flared with the Trump administration’s implementation of tariffs on steel and aluminum. China responded in kind, leading many investors to fear a potential trade war. Closer to home, the administration’s threat to withdraw from the North American Free Trade Agreement (NAFTA) led to a reworking of that agreement with Mexico and Canada, though it has not yet been ratified.

During the fiscal period, the pace of US economic growth diverged from that of other economies. As the US economy rebounded, thanks in part to the federal tax cuts and deregulation, Europe began to encounter new issues and emerging markets felt pressure on their US dollar-denominated debt as the dollar strengthened. The London interbank offered rate (LIBOR) rose in the second quarter of 2018 in part because of US tax reform and the repatriation of overseas assets by some US-based firms. The US-China trade war intensified, and Italy’s political uncertainty weighed on financial markets as well. Driven by these factors and concerns about rising interest rates, US stock volatility increased in the spring and summer.

Among emerging markets, Turkey and Argentina were particularly concerning. Turkey’s president threatened the independence of the country’s central bank, and the weakening condition of the country’s fiscal accounts raised investors’ anxiety. Argentina’s inflation rose significantly, and the country’s fiscal account deteriorated.

Emerging markets exposure detracted from Portfolio performance as currencies deteriorated and yield premiums widened, causing debt securities issued by emerging market countries to underperform. Argentina and Turkey had a large negative impact among emerging market bonds, as US dollar-denominated and local sovereign bonds detracted along with some bank issues in both countries. Similarly, a

small exposure to developed market local currency bonds hurt performance because of the stronger US dollar.

Investment grade financial bonds, which averaged about 10% of the Portfolio, were adversely affected by increases in the federal funds rate and LIBOR. Meanwhile, yield spreads rose on bank securities, particularly in the first quarter of 2018. More generally, investment grade and high yield bonds posed a challenge as credit spreads widened through the period. Within high yield, American Tire Distributors Inc. detracted from returns after two major customers, tire manufacturers Goodyear and Bridgestone, stopped using the company as a distributor. We exited the Portfolio’s position in American Tire during the fiscal year.

In retrospect, we underestimated both the extent to which economic growth divergence between the US and other economies would lead to significant monetary policy divergence and the challenges posed by a stronger US dollar. In response, we reduced risk by decreasing the Portfolio’s exposure to emerging market local currency bonds and, to a certain extent, emerging market US dollar-denominated bonds. We also gradually reduced the Portfolio’s exposure to investment grade corporate bonds and traditional high yield bonds, redeploying assets in US Treasury securities.

Entering the fourth calendar quarter of 2018, we began to unwind an investment in collateralized mortgage obligations (CMOs) that we had held in the Portfolio for a few years but felt was no longer attractive in a more volatile environment. We used these assets to add slightly to the Portfolio’s high-quality asset-backed securities (ABS), and we plan to purchase fixed-rate agency mortgage-backed securities (MBS).

On the positive side, the Portfolio’s performance relative to its benchmark was helped to some extent by exposure to sectors that benefited from rising rates. Premium agency mortgage-backed coupons performed well. Similarly, exposure to high-quality collateralized loan obligations (CLOs) contributed to performance as they reset, capturing higher yields. Exposure to bank loans was also positive, as the credit environment was somewhat benign and coupons reset quarterly.

Fannie Mae and Freddie Mac 4.5% pass-through bonds performed well along with bonds issued by financial firms Royal Bank of Scotland Group PLC, Credit Suisse Group AG, and aircraft leasing firm AerCap Global Aviation Trust, as finance spreads widened, creating expanded profit opportunities. Elsewhere, Energy Transfer Partners LP, a master limited partnership that owns and operates a large diversified portfolio of US energy assets, had strong performance and added to returns.

Along with adding high-quality securities, including ABS and Treasury securities, we used derivatives to help manage risk exposure. Because we expect more volatility as the Fed continues to increase rates,

8

we’ve added additional derivative protection. Further, we believe 2019 could see monetary policy divergence between the Fed and other major central banks come back in line if the Fed pauses its rate hikes and dials back its monetary tightening pressure.

At various volatile periods during the fiscal year we used derivatives, specifically credit default swaps, to reduce credit exposure and to hedge the Portfolio’s small exposure to convertible bonds. The use of credit default swaps had an immaterial effect on the Portfolio’s returns during the fiscal period.

We also used forward currency hedges to add liquidity and to reduce local currency exposure in developed and emerging markets. Because the Portfolio’s natural duration (interest rate sensitivity) was reduced through exposure to less interest rate sensitive areas such as CLOs and bank loans, we used interest rate futures to add interest rate exposure. However, our bias was to be short, by up to a year, of the benchmark’s interest rate sensitivity measure. The short position contributed modestly to the Portfolio’s returns as interest rates rose during the fiscal year.

The views expressed are current as of the date of this report and are subject to change.

9

Performance summary

Macquarie Institutional Portfolios — Macquarie Core Plus Bond Portfolio

The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 800 231-8002 or visiting macquarie.com/investment-management/mip.

Carefully consider the Portfolio’s investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Portfolio’s prospectus and, if available, its summary prospectus, which may be obtained by visiting macquarie.com/investment-management/mip or calling 800 231-8002. Investors should read the prospectus and, if available, the summary prospectus carefully before investing.

| | | | | | | | | | |

Portfolio and benchmark performance |

Average annual total returns |

Periods ended Oct. 31, 2018 | | 1 year | | 3 years | | 5 years | | 10 years | | Lifetime |

Macquarie Core Plus Bond Portfolio | | –2.29% | | +1.28% | | +2.02% | | +5.75% | | +5.13% |

Bloomberg Barclays US Aggregate Index | | –2.05% | | –1.04% | | +1.83% | | +3.94% | | +4.03% |

Portfolio profile

Oct. 31, 2018

| | | | |

Total net assets | | Number of holdings | | |

$220 million | | 970 | | |

Inception date | | | | |

June 28, 2002 | | | | |

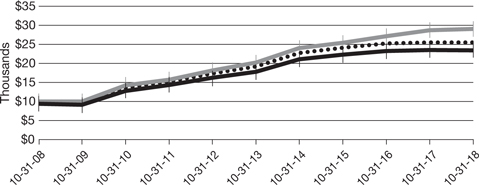

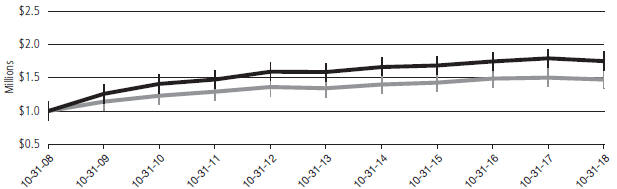

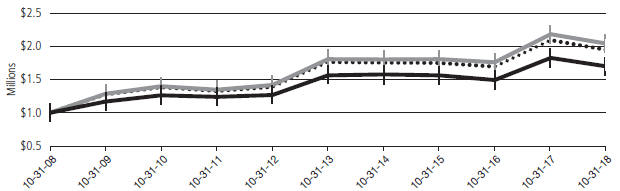

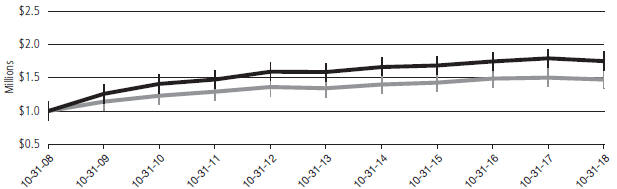

Growth of $1,000,000

| | | | | | |

| | | | Starting value (Oct. 31, 2008) | | Ending value (Oct. 31, 2018) |

| | | |

| | Macquarie Core Plus Bond Portfolio | | $1,000,000 | | $1,749,149 |

| | | |

| | Bloomberg Barclays US Aggregate Index | | $1,000,000 | | $1,471,502 |

The performance graph assumes $1 million invested on Oct. 31, 2008 and includes reinvestment of all distributions. The performance graph does not reflect the deduction of taxes the shareholder would pay on Portfolio distributions or redemptions of Portfolio shares.

Total return assumes reinvestment of dividends and capital gains but does not reflect reductions for taxes. Returns and share values will fluctuate so that shares, when redeemed, may be worth more or less than their original cost.

10

The most recent prospectus disclosed the Portfolio’s total operating expenses as 0.60%. Management has contractually agreed to reimburse certain expenses and/or waive its management fees from Nov. 1, 2017 through Oct. 31, 2018,* in order to prevent total annual Portfolio operating expenses (with certain exclusions) from exceeding, in an aggregate amount, 0.45% of the Portfolio’s average daily net assets, as described in the most recent prospectus.

Expense limitations were in effect during the period shown. Performance would have been lower had the expense limitations not been in effect.

The Bloomberg Barclays US Aggregate Index measures the performance of publicly issued investment grade (Baa3/BBB- or better) corporate, US government, mortgage- and asset-backed securities with at least one year to maturity and at least $250 million par amount outstanding.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

Investing involves risk, including the possible loss of principal.

Past performance is not a guarantee of future results.

Fixed income securities and bond funds can lose value, and investors can lose principal, as interest rates rise. They also may be affected by economic conditions that hinder an issuer’s ability to make interest and principal payments on its debt.

The Portfolio may also be subject to prepayment risk, the risk that the principal of a bond that is held by the Portfolio will be prepaid prior to maturity, at the time when interest rates are lower than what the bond was paying. The Portfolio may then have to reinvest that money at a lower interest rate.

Interest payments on inflation-indexed debt securities will vary as the principal and/or interest is adjusted for inflation.

High yielding, non-investment-grade bonds (junk bonds) involve higher risk than investment grade bonds. The high yield secondary market is particularly susceptible to liquidity problems when institutional investors, such as mutual funds and certain other financial institutions, temporarily stop buying bonds for regulatory, financial, or other reasons. In addition, a less liquid secondary market makes it more difficult for the Portfolio to obtain precise valuations of the high yield securities in its portfolio.

International investments entail risks not ordinarily associated with US investments including fluctuation in currency values, differences in accounting principles, or economic or political instability in other nations.

Investing in emerging markets can be riskier than investing in established foreign markets due to increased volatility and lower trading volume.

Because the Portfolio may invest in bank loans and other direct indebtedness, it is subject to the risk that the Portfolio will not receive payment of principal, interest, and other amounts due in connection with these investments, which primarily depend on the financial condition of the borrower and the lending institution.

The Portfolio may invest in derivatives, which may involve additional expenses and are subject to risk, including the risk that an underlying security or securities index moves in the opposite direction from what the portfolio manager anticipated. A derivatives transaction depends upon the counterparties’ ability to fulfill their contractual obligations.

If and when the Portfolio invests in forward foreign currency contracts or uses other investments to hedge against currency risks, the Portfolio will be subject to special risks, including counterparty risk.

The Portfolio may experience portfolio turnover in excess of 100%, which could result in higher transaction costs and tax liability.

*The aggregate contractual waiver period covering this report is from Feb. 28, 2017 through Feb. 28, 2019.

Performance summary

Macquarie Institutional Portfolios — Macquarie Core Plus Bond Portfolio

This document may mention bond ratings published by nationally recognized statistical rating organizations (NRSROs) Standard & Poor’s, Moody’s Investors Service, and Fitch, Inc. For securities rated by an NRSRO other than S&P, the rating is converted to the equivalent S&P credit rating. Bonds rated AAA are rated as having the highest quality and are generally considered to have the lowest degree of investment risk. Bonds rated AA are considered to be of high quality, but with a slightly higher degree of risk than bonds rated AAA. Bonds rated A are considered to have many favorable investment qualities, though they are somewhat more susceptible to adverse economic conditions. Bonds rated BBB are believed to be of medium-grade quality and generally riskier over the long term. Bonds rated BB, B, and CCC are regarded as having significant speculative characteristics, with BB indicating the least degree of speculation of the three.

Investments in mortgage-backed securities (MBS) may involve risks. MBS represent an ownership interest in a pool of mortgage loans. The individual mortgage loans are packaged or “pooled” together for sale to investors. These mortgage loans may have either fixed or adjustable interest rates.

Investments in collateralized loan obligations (CLOs) may involve risks. CLOs are securities backed by a pool of debt, often low-rated corporate loans. Investors receive scheduled debt payments from the underlying loans but assume most of the risk in the event that borrowers default.

Investments in collateralized mortgage obligations (CMOs) may involve risks. CMOs are debt securities issued by US government agencies or by financial institutions and other mortgage lenders, which are collateralized by a pool of mortgages held under an indenture. Prepayment of mortgages may shorten the stated maturity of the obligations and can result in a loss of premium, if any has been paid.

12

Portfolio management review

Macquarie Institutional Portfolios — Macquarie High Yield Bond Portfolio

October 31, 2018

For the fiscal year ended Oct. 31, 2018, Macquarie High Yield Bond Portfolio returned -0.77% at net asset value (NAV) with all distributions reinvested. For the same period, the Portfolio’s benchmark, the ICE BofAML US High Yield Constrained Index, returned +0.86%. Complete annualized performance for Macquarie High Yield Bond Portfolio is shown in the table on page 15.

High yield bonds posted modest gains during the Portfolio’s fiscal year ended Oct. 31, 2018, as the sector’s income component offset the effects of rising interest rates across the fixed income yield curve. There were, however, divergent forces working at the credit and sector levels. Lower-rated bonds briefly lost value in late 2017 amid concerns that the tax bill (then debated in Congress) would limit the deductibility of interest. When that fear subsided, CCC-rated bonds subsequently outperformed, especially as sharply rising Treasury yields in early 2018 caused investors to reduce exposure to longer-duration, higher-rated bonds. Over the Portfolio’s fiscal year, credit spreads widened slightly, while default rates remained low by historical standards.

Industries’ initial reactions to the Trump administration’s trade policy drove sector returns. Companies that make steel benefited from the imposition of tariffs on metal imports from Canada, Mexico, and the European Union, with the price of steel rising by more than one-third over the first six months of 2018. Conversely, rising raw material prices curtailed second-quarter earnings of companies that use steel — a group that includes homebuilders, automobiles, manufacturers, and a wide array of basic industries.

A steep rise in transportation costs also sliced into the bottom lines of energy-intensive industries.

Overall, however, US corporations operated in one of the most favorable earnings environments in several decades, with lower tax rates, reduced regulation, and increased consumer and government spending augmenting a late-cycle economic expansion. Unit labor costs remained notably restrained despite an unemployment rate below 4% and the fastest pace of economic growth since 2014.

From a valuation perspective, high yield spreads finished the Portfolio’s fiscal year at the lower end of historical ranges, the result of the strong fundamental backdrop discussed above and solid technical conditions. Light new-issue supply activity was a large contributor to the solid technical picture, as cash received from interest payments and principal repayments outweighed both the retail outflows from the market and the reduced volume of new-issue supply brought to market during the fiscal period.

During the fiscal year, the Portfolio’s positioning in the automotive, pharmaceuticals, support services, and chemicals sectors detracted from the Portfolio’s performance. In contrast, the Portfolio’s positioning in the software services, health facilities, insurance

brokerage, and wireline telecommunications sectors contributed to performance.

Source: Bloomberg.

American Tire Distributors Inc. detracted from the Portfolio’s relative performance during the fiscal year. The company suffered a negative credit event when Goodyear and Bridgestone — its two largest customers, representing about one-quarter of annual revenue — formed a joint venture to in-source distribution of their manufactured tires. Bonds issued by American Tire Distributors traded down sharply on the news, and we subsequently sold the Portfolio’s position because of the company’s deteriorating long-term outlook.

Alta Mesa Holdings LP, an oil and natural gas exploration and production company, also detracted from performance. The company’s weaker-than-expected third-quarter earnings results, combined with a precipitous 11% drop in oil prices in October, resulted in weakness in the company’s equity and bond prices. We remain positive on the longer-term fundamentals of the company and maintain our position in the bonds.

Finally, Tronox Inc., a titanium dioxide producer, detracted from returns for the year. In 2017, the company announced the acquisition of Cristal USA Inc. with the intention of selling certain Cristal assets in order to both alleviate any antitrust concerns surrounding the transaction and enhance the combined company’s credit profile moving forward. In August 2018, the Federal Trade Commission (FTC) filed an injunction to block the acquisition. As a result, Tronox’s bonds sold off, detracting from overall Portfolio performance. It is our view that the transactions will ultimately be completed, and we maintain the Portfolio’s position in the bonds.

A bank loan issued to Applied Systems Inc., a provider of software to the property and casualty insurance market, was the Portfolio’s strongest contributor. Applied Systems reported positive earnings during the fiscal year. In our view, the company has used its favorable free-cash-flow profile and stable margins to reduce outstanding debt while continuing to build upon an already-dominant market share within its industry.

Tenet Healthcare Corp., a US-based owner and operator of hospitals and related healthcare facilities, also contributed to performance for the year. Investors’ outlook for hospitals improved throughout the year as the likelihood of a repeal of the Affordable Care Act diminished. Additionally, Tenet’s strong earnings, supported by a cost-savings plan and deleveraging of its balance sheet, led to strong performance for the company’s bond complex. We maintain the Portfolio’s position in Tenet’s bonds.

Finally, a position in Surgery Center Holdings Inc. contributed to the Portfolio’s returns for the year. The hospital services company brought in a new management team early in the year and implemented operational efficiency plans to enhance revenues and

Portfolio management review

Macquarie Institutional Portfolios — Macquarie High Yield Bond Portfolio

improve operating margins. The improving operating trends throughout the year resulted in solid bond performance. We currently maintain the Portfolio’s position in the company’s bonds.

Although the economic backdrop for high yield bonds remains generally supportive, we are cognizant of various risk factors, including the continuation of the Federal Reserve’s monetary tightening cycle, stretched valuations, volatility in domestic equity markets, and the unforeseen consequences of an escalating trade war on the global economy. With those risks in mind, we moved the Portfolio’s duration component to neutral and, with regard to credit quality, maintain an overweight allocation to what we view as our highest conviction names. At the sector level, we have reduced exposure to sectors, such as builders, building materials, and

packaging. Meanwhile, we have retained an overweight allocation to banking and insurance brokers.

Given the strength of domestic economic activity, we believe that the US credit cycle has further to run, thus potentially lending support to lower-tier credits. Conversely, the likely rise in benchmark and market interest rates could pressure longer-duration, higher-quality issues. As such, we think achieving a proper balance between credit and duration risk remains the primary challenge in managing the Portfolio. In this environment, credit selection could remain paramount, in which case we believe our bottom-up (bond by bond) approach to managing and constructing high yield portfolios may prove advantageous.

The views expressed are current as of the date of this report and are subject to change.

14

Performance summary

Macquarie Institutional Portfolios — Macquarie High Yield Bond Portfolio

The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 800 231-8002 or visiting macquarie.com/investment-management/mip.

Carefully consider the Portfolio’s investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Portfolio’s prospectus and, if available, its summary prospectus, which may be obtained by visiting macquarie.com/investment-management/mip or calling 800 231-8002. Investors should read the prospectus and, if available, the summary prospectus carefully before investing.

Portfolio and benchmark performance

Average annual total returns

| | | | | | | | | | | | | | | | | | | | |

Periods ended Oct. 31, 2018 | | | 1 year | | | | 3 years | | | | 5 years | | | | 10 years | | | | Lifetime | |

Macquarie High Yield Bond Portfolio | | | –0.77% | | | | +4.83% | | | | +3.21% | | | | +10.65% | | | | +7.30% | |

ICE BofAML US High Yield Constrained Index* | | | +0.86% | | | | +6.65% | | | | +4.69% | | | | +11.20% | | | | +6.81% | |

*Formerly known as the BofA Merrill Lynch US High Yield Constrained Index.

Portfolio profile

Oct. 31, 2018

| | | | |

Total net assets | | Number of holdings | | |

$77.7 million | | 157 | | |

| | | | |

Inception date | | | | |

Dec. 2, 1996 | | | | |

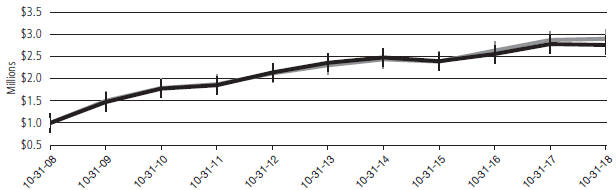

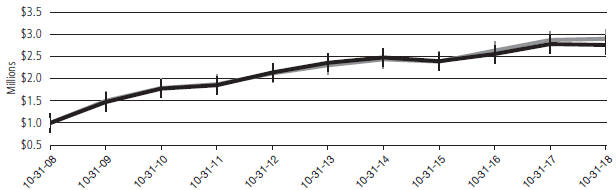

Growth of $1,000,000

| | | | | | |

| | | | Starting value (Oct. 31, 2008) | | Ending value (Oct. 31, 2018) |

| | | |

| | ICE BofAML US High Yield Constrained Index | | $1,000,000 | | $2,890,470 |

| | | |

| | Macquarie High Yield Bond Portfolio | | $1,000,000 | | $2,752,196 |

The performance graph assumes $1 million invested on Oct. 31, 2008, and includes reinvestment of all distributions. The performance graph does not reflect the deduction of taxes the shareholder would pay on Portfolio distributions or redemptions of Portfolio shares.

Total return assumes reinvestment of dividends and capital gains, but does not reflect reductions for taxes. Returns and share values will fluctuate so that shares, when redeemed, may be worth more or less than their original cost.

Performance summary

Macquarie Institutional Portfolios — Macquarie High Yield Bond Portfolio

The most recent prospectus disclosed the Portfolio’s total operating expenses as 0.58%. Management has contractually agreed to reimburse certain expenses and/or waive its management fees from Nov. 1, 2017 through Oct. 31, 2018,* in order to prevent total annual Portfolio operating expenses (with certain exceptions) from exceeding, in an aggregate amount, 0.59% of the Portfolio’s average daily net assets, as described in the most recent prospectus.

Expense limitations were in effect during the period shown. Performance would have been lower had the expense limitations not been in effect.

The ICE BofAML US High Yield Constrained Index (formerly known as the BofA Merrill Lynch US High Yield Constrained Index) tracks the performance of US dollar-denominated high yield corporate debt publicly issued in the US domestic market, but caps individual issuer exposure at 2% of the benchmark. Qualifying securities must have, among other things, a below-investment-grade rating (based on an average of Moody’s, Standard & Poor’s, and Fitch), an investment grade issuing country (based on an average of Moody’s, Standard & Poor’s, and Fitch foreign currency long-term sovereign debt ratings), and maturities of one year or more.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

Investing involves risk, including the possible loss of principal.

Past performance is not a guarantee of future results.

Fixed income securities and bond funds can lose value, and investors can lose principal, as interest rates rise. They also may be affected by economic conditions that hinder an issuer’s ability to make interest and principal payments on its debt.

The Portfolio may also be subject to prepayment risk, the risk that the principal of a bond that is held by the Portfolio will be prepaid prior to maturity, at the time when interest rates are lower than what the bond was paying. The Portfolio may then have to reinvest that money at a lower interest rate.

The Portfolio may be invested in foreign corporate bonds, which have special risks not ordinarily associated with domestic investments, such as currency fluctuations, economic and political change, and different accounting standards.

High yielding, non-investment-grade bonds (junk bonds) involve higher risk than investment grade bonds. The high yield secondary market is particularly susceptible to liquidity problems when institutional investors, such as mutual funds and certain other financial institutions, temporarily stop buying bonds for regulatory, financial, or other reasons. In addition, a less liquid secondary market makes it more difficult for the Portfolio to obtain precise valuations of the high yield securities in its portfolio.

The Portfolio may experience portfolio turnover in excess of 100%, which could result in higher transaction costs and tax liability.

This document may mention bond ratings published by nationally recognized statistical rating organizations (NRSROs) Standard & Poor’s, Moody’s Investors Service, and Fitch, Inc. For securities rated by an NRSRO other than S&P, the rating is converted to the equivalent S&P credit rating. Bonds rated AAA are rated as having the highest quality and are generally considered to have the lowest degree of investment risk. Bonds rated AA are considered to be of high quality, but with a slightly higher degree of risk than bonds rated AAA. Bonds rated A are considered to have many favorable investment qualities, though they are somewhat more susceptible to adverse economic conditions. Bonds rated BBB are believed to be of medium-grade quality and generally riskier over the long term. Bonds rated BB, B, and CCC are regarded as having significant speculative characteristics, with BB indicating the least degree of speculation of the three.

International investments entail risks not ordinarily associated with US investments including fluctuation in currency values, differences in accounting principles, or economic or political instability in other nations. Investing in emerging markets can be riskier than investing in established foreign markets due to increased volatility and lower trading volume.

*The aggregate contractual waiver period covering this report is from Feb. 28, 2017 through Feb. 28, 2019.

16

Portfolio management review

Macquarie Institutional Portfolios — Macquarie Emerging Markets Portfolio

October 31, 2018

For the fiscal year ended Oct. 31, 2018, Macquarie Emerging Markets Portfolio returned -10.28% at net asset value (NAV) with all distributions reinvested, outperforming its benchmark, the MSCI Emerging Markets Index. The index returned -12.19% (gross) and -12.52% (net) for the same period. Complete annualized performance for Macquarie Emerging Markets Portfolio is shown in the table on page 19.

Weakness in emerging markets — a dramatic reversal from the previous fiscal year’s robust performance — was largely due to three key factors:

First, US-China trade protectionism and imposed tariffs weighed heavily on these markets. China saw a decline of 16.7% for the 12-month period as the trade and tariff wars seemed to dampen investor confidence in Chinese economic growth and spread across the asset class.

A second factor was the reversal of the dominant Chinese Internet-related companies that had seen significant growth in recent years. Tencent (-24%), Alibaba (-23%), and Baidu (-22%) make up a large part of the benchmark index and clearly dragged down the index’s performance. South African-listed Naspers (-28%), which owns a big stake in Tencent, also declined sharply during the Portfolio’s fiscal year.

Third, concerns over rising US interest rates weighed on stocks in all markets, particularly emerging markets. Finally, some fairly consequential elections in Brazil, Malaysia, Mexico, Turkey, and South Africa affected emerging markets. Results in these elections weighed on investor sentiment and contributed to market volatility.

Value style investing, as measured by the MSCI Emerging Markets Value Index, outperformed growth style investing, as measured by the MSCI Emerging Markets Growth Index, by a significant margin (-8.3% versus -16.7%, respectively). This after a long period in which growth had outperformed. This outcome clearly benefited the Portfolio’s positioning, as value stocks, particularly within the energy sector, performed well. Overall, the recovery in oil prices helped energy stocks. The energy sector gained 14.5%. The strongest-performing emerging markets, in fact, all have a strong commodity focus. Brazil was up 5% and Russia rose 10.7%. Qatar also gained during the period. Countries with strong technology-linked markets, notably China and South Korea (-20%), fared poorly during the fiscal year.

The Portfolio’s outperformance largely can be attributed to the Portfolio’s positioning from a country perspective. We were overweight in commodity-linked areas including Brazil, Russia, and the Middle East, and underweight in China, South Korea, and South Africa. From a sector perspective, we benefited more from our stock selection within sectors than our allocation to specific sectors. The one exception was the Portfolio’s overall information technology (IT)

positioning: Both the Portfolio’s IT underweight and our stock selection within IT were significant positives in terms of relative performance. On the negative side, the Portfolio was underweighted in the energy sector, whose upsurge hurt both relative and absolute performance. In addition, the Portfolio’s overweight in Turkey also hurt performance.

Turning to specific stocks, all of the Portfolio’s energy-related holdings performed well. Two Middle Eastern banks held in the Portfolio, with their obvious linkage to the energy markets, were standouts during the fiscal year. Qatar National Bank QPSC was up 61% and First Abu Dhabi Bank PJSC was up 44%. Within Russia, LUKOIL PJSC was up 34%, and Gazprom PJSC rose by 12%.

The strongest-performing stock in the Portfolio over the 12-month period was Brazilian pulp and paper company Suzano Papel e Celulose S.A., which rose 82%. Suzano has done well for several reasons. Pulp prices have been quite strong. In addition, as an exporter, Suzano benefited from a weakening Brazilian real. What was possibly most relevant though was its announced takeover of Brazilian pulp and paper company Fibria, as this merger is projected to potentially yield significant benefits.

The Portfolio’s holdings in Turkey, particularly Turkish banks, hurt performance during the 12-month period. Turkey’s rising political tensions with the United States and weak currency, along with investors’ increasing concerns over its economic policies, all dragged its market down. The Portfolio’s two Turkish banks, Turkiye Halk Bankasi AS and Turkiye Garanti Bankasi AS, fell 60% and 54%, respectively. Given the deeply discounted valuation of these banks and the Turkish lira, we continue to hold these positions in the Portfolio.

Two holdings in India also saw significant declines. Vedanta Ltd.,a diversified mining company, was down more than 40%. Although materials in general did well for the fiscal period, deterioration in prices in some of Vedanta’s key platforms, such as zinc, punished the stock. We increased the Portfolio’s position in Vedanta on this weakness, as we believe it has strong and well-supported long-term fundamentals. Indiabulls Housing Finance Ltd. was down 37%. Indiabulls’ weakness occurred mostly toward the end of the 12-month period, driven by concerns about liquidity in the Indian market and its ability to access financing. Currency weakness compounded the drop in price. We added to the Portfolio’s position in Indiabulls during the fiscal period, believing that concerns over tight liquidity may be exaggerated.

Another disappointing holding for the Portfolio during the fiscal year was China-headquartered WH Group Ltd., which declined 36%. The company comprises about half US-based Smithfield, and half a Chinese pork company. WH Group was in the firing zone of the trade wars, and its stock was weakened by pork prices and domestic

Portfolio management review

Macquarie Institutional Portfolios — Macquarie Emerging Markets Portfolio

Chinese concerns. We added to the Portfolio’s holding considerably during the fiscal period, believing that the selloff was overdone. About 80% of WH Group’s profits come from packaged meats, a highly stable business where profits grew for the fiscal year.

Asia was the weakest region during the fiscal year and we took advantage of that weakness to increase the Portfolio’s overall weighting in the region. In particular, we added to holdings in both China and South Korea. The Portfolio ended the fiscal period still underweight in China — but that underweight narrowed — and with a slight overweight in South Korea. In adding to holdings in China, we identified situations where we believed either that a stock was sold down in excess of the impact of the trade war, as with WH Group, or that a company still had attractive business prospects regardless of protectionist posturing.

For much of 2017, volatility in this asset class had diminished to unprecedentedly low levels. Because we had expected volatility to increase, it was not a huge surprise to us to see a return to more historical norms over the past fiscal year. Our strong value orientation continued to lead us to invest in companies with more defensive attributes that have the potential to make them less vulnerable to volatility-inducing trade wars, political uncertainties, and domestic economic changes. Our objective is a portfolio that seeks to protect capital and outperform in volatile markets, and we were gratified to see the Portfolio outperform its benchmark for the fiscal period.

The Portfolio utilized foreign currency exchange contracts to facilitate the purchase and sale of equities traded on international exchanges. The effect of these contracts on performance was immaterial.

The views expressed are current as of the date of this report and are subject to change.

18

Performance summary

Macquarie Institutional Portfolios — Macquarie Emerging Markets Portfolio

The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 800 231-8002 or visiting macquarie.com/investment-management/mip.

Carefully consider the Portfolio’s investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Portfolio’s prospectus and, if available, its summary prospectus, which may be obtained by visiting macquarie.com/investment-management/mip or calling 800 231-8002. Investors should read the prospectus and, if available, the summary prospectus carefully before investing.

Portfolio and benchmark performance

Average annual total returns

| | | | | | | | | | | | | | | | | | | | |

Periods ended Oct. 31, 2018 | | | 1 year | | | | 3 years | | | | 5 years | | | | 10 years | | | | Lifetime | |

Macquarie Emerging Markets Portfolio | | | –10.28% | | | | +3.83% | | | | –1.11% | | | | +6.86% | | | | +6.76% | |

MSCI Emerging Markets Index (net) | | | –12.52% | | | | +6.52% | | | | +0.78% | | | | +7.84% | | | | +5.35% | |

MSCI Emerging Markets Index (gross) | | | –12.19% | | | | +6.92% | | | | +1.15% | | | | +8.20% | | | | +5.64% | |

Portfolio profile

Oct. 31, 2018

| | | | |

| Total net assets | | Number of holdings | | |

| $79.5 million | | 59 | | |

| | | | |

| Inception date | | | | |

| April 16, 1997 | | | | |

Growth of $1,000,000

| | | | |

| | Starting value (Oct. 31, 2008) | | Ending value (Oct. 31, 2018) |

| | |

MSCI Emerging Markets Index (gross) MSCI Emerging Markets Index (gross)

| | $1,000,000 | | $2,200,231 |

| | |

MSCI Emerging Markets Index (net) MSCI Emerging Markets Index (net)

| | $1,000,000 | | $2,127,101 |

| | | |

Macquarie Emerging Markets Portfolio Macquarie Emerging Markets Portfolio

| | $1,000,000 | | $1,941,500 |

The performance graph assumes $1 million invested on Oct. 31, 2008, and includes reinvestment of all distributions. The performance graph does not reflect the deduction of taxes the shareholder would pay on Portfolio distributions or redemptions of Portfolio shares.

Total return assumes reinvestment of dividends and capital gains, but does not reflect reductions for taxes. Returns and share values will fluctuate so that shares, when redeemed, may be worth more or less than their original cost.

Performance summary

Macquarie Institutional Portfolios — Macquarie Emerging Markets Portfolio

The most recent prospectus disclosed the Portfolio’s total operating expenses as 1.22%. The purchase reimbursement fee (0.40%) and redemption reimbursement fee (0.45%) are paid to the Portfolio. These fees are designed to reflect an approximation of the brokerage and other transaction costs associated with the investment of an investor’s purchase amount or the disposition of assets to meet redemptions, and to limit the extent to which the Portfolio (and, indirectly, the Portfolio’s existing shareholders) would have to bear such costs. In lieu of the reimbursement fees, investors in Macquarie Emerging Markets Portfolio may be permitted to utilize alternative purchase and redemption methods designed to accomplish the same economic effect as the reimbursement fees. Reimbursement fees applicable to purchases and redemptions of shares of the Portfolio are not reflected in the “Growth of $1,000,000” graph.

Expense limitations were in effect during the period shown. Performance would have been lower had the expense limitations not been in effect.

The MSCI Emerging Markets Index measures equity market performance across emerging market countries worldwide. Index “gross” return approximates the maximum possible dividend reinvestment. Index “net” return approximates the minimum possible dividend reinvestment, after deduction of withholding tax at the highest possible rate.

The MSCI Emerging Markets Growth Index, mentioned on page 17, includes large- and mid-cap securities exhibiting overall growth style characteristics across 24 emerging market countries. The growth investment style characteristics for index construction are defined using five variables: long-term forward earnings per share (EPS) growth rate, short-term forward EPS growth rate, current internal growth rate, long-term historical EPS growth trend, and long-term historical sales per share growth trend.

The MSCI Emerging Markets Value Index, mentioned on page 17, includes large- and mid-cap securities exhibiting overall value style characteristics across 24 emerging market countries. The value investment style characteristics for index construction are defined using three variables: book value to price, 12-month forward earnings to price, and dividend yield.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

Investing involves risk, including the possible loss of principal.

Past performance is not a guarantee of future results.

International investments entail risks not ordinarily associated with US investments including fluctuation in currency values, differences in accounting principles, or economic or political instability in other nations. Investing in emerging markets can be riskier than investing in established foreign markets due to increased volatility and lower trading volume.

If and when the Portfolio invests in forward foreign currency contracts or uses other investments to hedge against currency risks, the Portfolio will be subject to special risks, including counterparty risk.

Fixed income securities and bond funds can lose value, and investors can lose principal, as interest rates rise. They also may be affected by economic conditions that hinder an issuer’s ability to make interest and principal payments on its debt.

The Portfolio may also be subject to prepayment risk, the risk that the principal of a bond that is held by the Portfolio will be prepaid prior to maturity, at the time when interest rates are lower than what the bond was paying. The Portfolio may then have to reinvest that money at a lower interest rate.

High yielding, non-investment-grade bonds (junk bonds) involve higher risk than investment grade bonds.

The Portfolio is presently closed to new investors.

20

Portfolio management review

Macquarie Institutional Portfolios — Macquarie Emerging Markets Portfolio II

October 31, 2018

For the fiscal year ended Oct. 31, 2018, Macquarie Emerging Markets Portfolio II returned -16.13% at net asset value (NAV) with all distributions reinvested. This result lagged the Portfolio’s benchmark, the MSCI Emerging Markets Index, which returned -12.19% (gross) and -12.52% (net) for the same period. Complete annualized performance for Macquarie Emerging Markets Portfolio II is shown in the table on page 23.

The MSCI Emerging Markets Index fell during the 12-month period ended Oct. 31, 2018. Concerns related to US interest rate tightening and a rising US dollar led to depreciation in emerging market currencies and rate hikes in some countries. This, in turn, raised concerns about economic growth and higher inflation. Additionally, persistent rhetoric about tariffs and trade ratcheted up, especially between the United States and China. Country-specific concerns were also present, particularly related to Turkey, South Africa, and China. Investors also focused on the elections in Brazil and Mexico. Sector performance varied widely. Energy delivered the strongest performance on the back of oil prices. In contrast, the technology sector declined due to concerns about both the peaking of the semiconductor cycle and the Chinese Internet sector.

Among countries, the Portfolio’s holdings in Brazil contributed the most to relative performance during the fiscal year, due to the Portfolio’s overweight allocation. Shares of B2W Cia Digital gained on optimism about the shift in its sales strategy. We continue to believe that the company appears well positioned for structural growth in Brazil’s ecommerce industry, which is still in its early stages of development. Shares of Petroleo Brasileiro S.A. (Petrobras) also performed well during the fiscal year, as the company showed progress on both divestiture and operations. Shares of Itau Unibanco Holding S.A. outperformed due to expectations for accelerating growth in Brazil. This outperformance was somewhat mitigated by the Portfolio’s position in BRF S.A., whose shares were hit hard due to news that it is under investigation for forging records. This will likely impact short-term results; however, we believe that BRF’s brand and operations appear largely intact and, in our view, are likely to recover.

In Russia, rising energy prices drove performance of LUKOIL PJSC, Rosneft Oil Co. PJSC, and Gazprom PJSC. Shares of Yandex NV also performed well after reporting strong earnings results and guidance earlier in 2018, particularly in its fast-growing taxi business. Finally, the Portfolio’s lack of a position in Magnit PJSC was positive in terms of asset allocation.

In South Korea, shares of telecommunications operator SK Telecom Co. Ltd. rose during the Portfolio’s fiscal year, supported by a stable operating environment and inexpensive valuations. We remain optimistic about the company’s long-term growth opportunities in 5G wireless networking.

Elsewhere, in India, favorable stock selection contributed to the Portfolio’s relative performance as shares of Reliance Industries Ltd. outperformed. The company reported strong financial results driven by both its refining and petrochemicals business, in addition to its telecommunications business. Furthermore, Reliance Industries has increasingly focused on strengthening its media and retail businesses. Finally, the Portfolio’s underweight positioning in South Africa contributed to relative performance as currency depreciation weighed on the equity market during the fiscal year.

On the negative side, the Portfolio’s holdings in China detracted the most from relative performance during the fiscal year due to unfavorable stock selection and unfavorable asset allocation. Concern about slower economic growth, exacerbated by rising trade tensions, weighed on advertising-driven stocks such as SINA Corp. China and Weibo Corp. and consumer staples stocks such as Tsingtao Brewery Co. Ltd. In addition, tightening government regulations in the gaming sector adversely affected sentiment for stocks such as Sohu.com Ltd. Shares of JD.com Inc. declined during the fiscal year following allegations of misconduct by the chairman and CEO. Despite these concerns, we retain our optimistic view about long-term consumption growth and Internet engagement in China, and we continue to view these companies as well positioned to potentially capture value from these trends. The Portfolio’s position in Uni-President China Holdings Ltd. was a bright spot, however, as business fundamentals in both instant noodles and beverages seemed to stabilize. The company continued to benefit as consumption-upgrades trended higher.

In Taiwan, MediaTek Inc. underperformed on concern about Chinese smartphone demand. Despite this underperformance, MediaTek has strong technology capabilities in mobile basebands, chipsets, and Wi-Fi. As mobile technology penetrates more deeply into everyday products, we believe there may be attractive structural growth opportunities for MediaTek.

The Portfolio’s overweight allocation to Argentina and Turkey detracted from performance as those currencies came under pressure due to greater reliance on external funding, higher inflation, and rising US interest rates. Despite higher macroeconomic volatility, we believe the Portfolio’s holdings are appropriately positioned to weather economic stress and remain invested. The primary detractors during the fiscal year were IRSA Inversiones y Representaciones S.A. in Argentina and Akbank T.A.S. in Turkey. Among sectors, energy contributed the most to performance due to the Portfolio’s positions in Reliance Industries in India and Lukoil in Russia. The consumer discretionary sector also outperformed during the fiscal year due to the Portfolio’s position in B2W. In contrast, the technology sector detracted most from relative performance due to the Portfolio’s positions in SINA and Sohu.com.

21

Portfolio management review

Macquarie Institutional Portfolios — Macquarie Emerging Markets Portfolio II

Considering the varied macroeconomic backdrop that we see across emerging markets, we believe there are selective opportunities for long-term stock appreciation driven by structural demographic shifts, technology adoption, implementation of government policy, improvement in corporate governance, and industry consolidation. We have found that in markets where price action is heavily macro driven, investors can often misprice individual companies significantly. Our investment approach remains centered on identifying individual companies that we believe possess sustainable franchises and favorable long-term growth prospects and that trade at significant discounts to their intrinsic value. We are particularly

focused on companies that we expect to benefit from long-term changes in how people in emerging markets live and work. Among countries, we currently hold overweight positions in Brazil, Russia, South Korea, and India. Conversely, we are currently underweight South Africa and Taiwan. Sectors we currently favor include technology, telecommunications, and consumer staples. We have an underweight allocation to financials.

The Portfolio utilized foreign currency exchange contracts to facilitate the purchase and sale of equities traded on international exchanges. The effect of these contracts on performance was immaterial.

The views expressed are current as of the date of this report and are subject to change.

22

Performance summary

Macquarie Institutional Portfolios — Macquarie Emerging Markets Portfolio II

The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 800 231-8002 or visiting macquarie.com/investment-management/mip.

Carefully consider the Portfolio’s investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Portfolio’s prospectus and, if available, its summary prospectus, which may be obtained by visiting macquarie.com/investment-management/mip or calling 800 231-8002. Investors should read the prospectus and, if available, the summary prospectus carefully before investing.

Portfolio and benchmark performance

Average annual total returns

| | | | | | | | |

Periods ended Oct. 31, 2018 | | 1 year | | 3 years | | 5 years | | Lifetime |

Macquarie Emerging Markets Portfolio II | | –16.13% | | +8.96% | | +0.97% | | +2.97% |

MSCI Emerging Markets Index (net) | | –12.52% | | +6.52% | | +0.78% | | +2.95% |

MSCI Emerging Markets Index (gross) | | –12.19% | | +6.92% | | +1.15% | | +3.31% |

Portfolio profile

Oct. 31, 2018

| | | | |

| Total net assets | | Number of holdings | | |

| $27.2 million | | 71 | | |

| | | | |

| Inception date | | | | |

| June 23, 2010 | | | | |

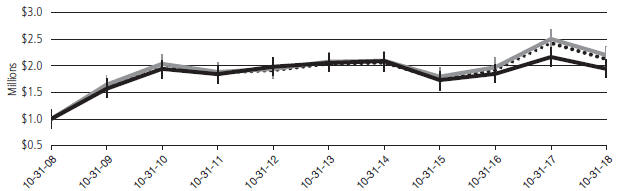

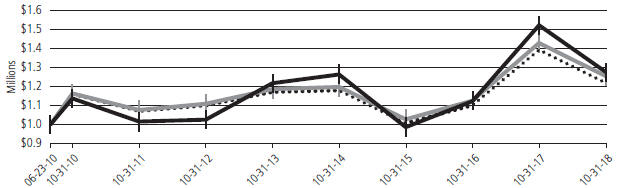

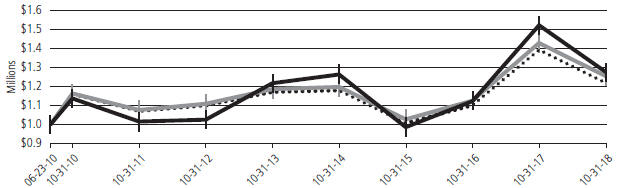

Growth of $1,000,000

| | | | |

| | Starting value (June 23, 2010) | | Ending value (Oct. 31, 2018) |

| | |

Macquarie Emerging Markets Portfolio II Macquarie Emerging Markets Portfolio II

| | $1,000,000 | | $1,276,875 |

| | |

MSCI Emerging Markets Index (gross) MSCI Emerging Markets Index (gross)

| | $1,000,000 | | $1,255,105 |

| | | |

MSCI Emerging Markets Index (net) MSCI Emerging Markets Index (net)

| | $1,000,000 | | $1,218,885 |

The performance graph assumes $1 million invested on June 23, 2010, and includes reinvestment of all distributions. The performance graph does not reflect the deduction of taxes the shareholder would pay on Portfolio distributions or redemptions of Portfolio shares.

Total return assumes reinvestment of dividends and capital gains, but does not reflect reductions for taxes. Returns and share values will fluctuate so that shares, when redeemed, may be worth more or less than their original cost.

23

Performance summary

Macquarie Institutional Portfolios — Macquarie Emerging Markets Portfolio II

The most recent prospectus disclosed the Portfolio’s total operating expenses as 1.32%. Management has contractually agreed to reimburse certain expenses and/or waive its management fees from Nov. 1, 2017 through Oct. 31, 2018,* in order to prevent total annual Portfolio operating expenses (with certain exclusions) from exceeding, in an aggregate amount, 1.20% of the Portfolio’s average daily net assets, as described in the most recent prospectus. Please see the “Financial highlights” section in this report for the most recent expense ratios.

Expense limitations were in effect during the period shown. Performance would have been lower had the expense limitations not been in effect.

The MSCI Emerging Markets Index measures equity market performance across emerging market countries worldwide. Index “gross” return approximates the maximum possible dividend reinvestment. Index “net” return approximates the minimum possible dividend reinvestment, after deduction of withholding tax at the highest possible rate.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

Investing involves risk, including the possible loss of principal.

Past performance is not a guarantee of future results.

International investments entail risks not ordinarily associated with US investments including fluctuation in currency values, differences in accounting principles, or economic or political instability in other nations. Investing in emerging markets can be riskier than investing in established foreign markets due to increased volatility and lower trading volume.

If and when the Portfolio invests in forward foreign currency contracts or uses other investments to hedge against currency risks, the Portfolio will be subject to special risks, including counterparty risk.

*The aggregate contractual waiver period covering this report is from Feb. 28, 2017 through Feb. 28, 2019.

24

Portfolio management review

Macquarie Institutional Portfolios — Macquarie Labor Select International Equity Portfolio

October 31, 2018

For the fiscal year ended Oct. 31, 2018, Macquarie Labor Select International Equity Portfolio returned -7.02% at net asset value (NAV) with all distributions reinvested. The Portfolio’s benchmark, the MSCI EAFE Index, returned -6.85% (net) and -6.39% (gross) for the same period. Complete annualized performance for Macquarie Labor Select International Equity Portfolio is shown in the table on page 27.

International equity markets posted negative returns over the 12-month period ended Oct. 31, 2018 — all due to significant market declines in October.

Markets were generally robust for most of the year, despite intensifying political and economic tensions. However, beginning in February 2018, a sharp, broad selloff saw volatility return. The period was also characterized by a shift in the relative returns of value and growth investment styles, with value stocks leading the market late in the fiscal period after growth had outperformed for several years. The broad MSCI EAFE Index declined 6.9% (net), while the MSCI EAFE Growth Index fell 6.0% (net) and the MSCI EAFE Value Index declined 7.7% (net) — all in US dollar terms. (Sources: MSCI, Bloomberg.)