Item 1. Reports to Stockholders

| | |

| Annual report | | |

| |

| October 31, 2016 | | |

| |

| U.S. equities | | |

The Large-Cap Value Equity Portfolio | | |

| |

| U.S. fixed income | | |

The High-Yield Bond Portfolio | | |

The Core Plus Fixed Income Portfolio | | |

| |

| International equities | | |

The Labor Select International Equity Portfolio | | |

The Emerging Markets Portfolio | | |

The Emerging Markets Portfolio II | | |

| | |

| | |

This page intentionally left blank.

Delaware Pooled® Trust

Delaware Pooled Trust, based in Philadelphia, is a registered investment company that offers no-load, open-end equity and fixed income mutual funds to institutional and high net worth individual investors.

Delaware Management Company, a series of Delaware Management Business Trust (DMBT), serves as investment advisor for the Portfolios. Mondrian Investment Partners Limited serves as investment sub-advisor for The Labor Select International Equity Portfolio and The Emerging Markets Portfolio.*

The performance quoted in this report represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 800 231-8002 or visiting delawareinvestments.com/dpt/performance. Carefully consider the Portfolios’ investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Portfolios’ prospectus which may be obtained by visiting delawareinvestments.com/dpt/literature or calling 800 231-8002. Investors should read the prospectus carefully before investing. Performance includes reinvestment of all distributions.

The portfolios are not FDIC insured and are not guaranteed. It is possible to lose the principal amount invested. Mutual fund advisory services are provided by Delaware Management Company, a series of DMBT, which is a registered investment advisor.

Delaware Investments, a member of Macquarie Group, refers to Delaware Management Holdings, Inc. and its subsidiaries, including the Portfolios’ distributor, Delaware Distributors, L.P. Macquarie Group refers to Macquarie Group Limited and its subsidiaries and affiliates worldwide.

Neither Delaware Investments nor its affiliates referred to in this document are authorized deposit-taking institutions for the purposes of the Banking Act 1959 (Commonwealth of Australia). The obligations of these entities do not represent deposits or other liabilities of Macquarie Bank Limited (MBL), a subsidiary of Macquarie Group Limited and an affiliate of Delaware Investments. MBL does not guarantee or otherwise provide assurance in respect of the obligations of these entities, unless noted otherwise. The Portfolios are governed by U.S laws and regulations.

*Closed to new investors.

©2016 Delaware Management Holdings, Inc.

All third-party marks cited are the property of their respective owners.

Portfolio objectives and strategies

The Large-Cap Value Equity Portfolio seeks long-term capital appreciation. The Portfolio invests primarily in securities of large-capitalization companies that we believe have long-term capital appreciation potential. The Portfolio currently defines large-capitalization stocks as those with market capitalizations of $5 billion or greater at the time of purchase. Typically, we seek to select securities that we believe are undervalued in relation to their intrinsic value as indicated by multiple factors.

The High-Yield Bond Portfolio seeks high total return. The Portfolio will primarily invest its assets at the time of purchase in: (1) corporate bonds rated BB or lower by Standard & Poor’s (S&P) or similarly rated by another nationally recognized statistical rating organization; (2) securities issued or guaranteed by the U.S. government, its agencies, or instrumentalities; or (3) commercial paper of companies rated A-1 or A-2 by S&P, rated P-1 or P-2 by Moody’s Investors Service, Inc. (Moody’s), or unrated but considered to be of comparable quality.

The Core Plus Fixed Income Portfolio seeks maximum long-term total return, consistent with reasonable risk. The Portfolio allocates its investments principally among three sectors of the fixed income securities markets: U.S. investment grade sector, U.S. high yield sector, and international sector.

The Labor Select International Equity Portfolio seeks maximum long-term total return. The Portfolio invests primarily in equity securities of companies that are organized, have a majority of their assets, or derive most of their operating income outside of the United States, and that, in the opinion of Mondrian Investment Partners Limited (“Mondrian”), the Portfolio’s sub-advisor, are undervalued at the time of purchase based on the rigorous fundamental analysis that the sub-advisor employs. In addition to following these quantitative guidelines, Mondrian will select securities of issuers that present certain characteristics that are compatible or operate in accordance with certain investment policies or restrictions followed by organized labor.

The Emerging Markets Portfolio seeks long-term capital appreciation. The Portfolio generally invests in equity securities of companies that are organized in, have a majority of their assets in, or derive a majority of their operating income from emerging countries. The Emerging Markets Portfolio is presently closed to new investors.

The Emerging Markets Portfolio II seeks long-term capital appreciation. The Portfolio invests primarily in a broad range of equity securities of companies located in emerging market countries. The Portfolio may invest in companies of any size. The portfolio manager believes that although market price and intrinsic business value are positively correlated in the long run, short-term divergences can emerge. The Portfolio seeks to take advantage of these divergences through a fundamental, bottom-up approach. The Portfolio invests in securities of companies with sustainable franchises when they are trading at a discount to the portfolio manager’s intrinsic value estimate for that security.

Carefully consider the Portfolios’ investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Portfolios’ prospectus which may be obtained by visiting delawareinvestments.com/dpt/literature or calling 800 231-8002. Investors should read the applicable prospectus carefully before investing.

The Portfolios of Delaware Pooled ® Trust (DPT) are designed exclusively for institutional investors and high net worth individuals.

International investments entail risks not ordinarily associated with U.S. investments including fluctuation in currency values, differences in accounting principles, or economic or political instability in other nations. Investing in emerging markets can be riskier than investing in established foreign markets due to increased volatility and lower trading volume.

The Portfolios’ share prices and yields will fluctuate in response to movements in stock prices.

Fixed income securities and bond funds can lose value, and investors can lose principal, as interest rates rise. They also may be affected by economic conditions that hinder an issuer ’s ability to make interest and principal payments on its debt.

The Portfolios may also be subject to prepayment risk, the risk that the principal of a fixed income security that is held by the Portfolios may be prepaid prior to maturity, potentially forcing the Portfolios to reinvest that money at a lower interest rate.

2

Securities in the lowest of the rating categories considered to be investment grade (that is, Baa or BBB) have some speculative characteristics.

High yielding, non-investment-grade bonds (junk bonds) involve higher risk than investment grade bonds.

The high yield secondary market is particularly susceptible to liquidity problems when institutional investors, such as mutual funds and certain other financial institutions, temporarily stop buying bonds for regulatory, financial, or other reasons. In addition, a less liquid secondary market makes it more difficult for a Portfolio to obtain precise valuations of the high yield securities in its portfolio.

3

Portfolio management review

Delaware Pooled® Trust — The Large-Cap Value Equity Portfolio

October 31, 2016

For the fiscal year ended Oct. 31, 2016, Delaware Pooled Trust — The Large-Cap Value Equity Portfolio added +7.15% at net asset value (NAV) with all distributions reinvested. This result outpaced the Portfolio’s benchmark, the Russell 1000® Value Index, which returned +6.37% during the same period. Complete annualized performance for The Large-Cap Value Equity Portfolio is shown on the table on page 5.

The economy in the United States continued its slow but steady growth throughout the fiscal year. The country’s gross domestic product (GDP) — a measure of national economic output — expanded at an average pace of 1.5% for the four quarters leading up to September 2016. Against this sluggish backdrop, the U.S. Federal Reserve increased interest rates by 0.25 percentage points in December 2015, but opted not to follow up with additional rate hikes for the remainder of the fiscal year. (Source: Bloomberg.)

Throughout the fiscal period, stock prices were highly volatile, as investors faced questions about the Fed’s pace of rate changes, sluggish corporate profits, the Brexit vote in the United Kingdom, and uncertainty surrounding the U.S. presidential election, among other concerns. Nevertheless, the equity market finished the Portfolio’s fiscal year in positive territory, largely on the strength of a rally between February and July 2016.

A significant underweight and security selection in the financials sector, especially an investment in insurance broker Marsh & McLennan Companies, helped the Portfolio’s performance the most.

Stock picking in the industrials category also contributed to performance, especially the Portfolio’s investments in Waste Management (the country’s largest solid-waste disposal business) and defense contractor Northrop Grumman. Waste Management has been able to maintain pricing power while simultaneously improving collection volumes — a situation that has allowed the company to produce favorable revenue and earnings growth. Northrop Grumman benefited from its ability to produce better-than-expected revenue growth, especially in its aerospace business. Investments in biopharmaceuticals manufacturer Baxalta and clinical laboratory-services provider Quest Diagnostics helped the Portfolio in the healthcare sector. Baxalta’s shares performed well on news of the company’s potential acquisition by Ireland-based Shire, a transaction ultimately announced in January 2016. We sold the Portfolio’s position in Baxalta when the transaction closed in June, as our own internal investment guidelines require us to invest exclusively in U.S. companies. Shares of Quest Diagnostics gained during the fiscal year, as investors became steadily more optimistic about the longer-term prospects of this medical-testing company. Some of the Portfolio’s healthcare investments did not meet our expectations. Express Scripts, a pharmacy benefits manager (PBM), found itself in a protracted contract dispute with Anthem, its largest

The views expressed are current as of the date of this report and subject to change.

customer. Despite its short-term difficulties, we see good upside potential with Express Scripts over the longer term. A related detractor was CVS Health, which combines a chain of retail pharmacies with a PBM division. Although CVS encountered some financial challenges during the fiscal period owing to lower levels of drug price inflation and higher expenses, we believe it is well positioned for the long term.

In energy, the Portfolio benefited most by its investment in oil and gas services company Halliburton, which we believe is well positioned to capitalize on a potential rebound in demand for its services. In contrast, the Portfolio’s position in Marathon Oil detracted from results, as declining oil prices hurt the energy exploration and production firm for much of the fiscal year. No matter what is happening in the market and economy, our approach remains the same — we try to look past short-term concerns about companies and focus on their long-term potential. Throughout the fiscal period, we maintained the Portfolio’s generally defensive positioning and continued to emphasize what we believe are reasonably valued, higher-quality stocks. In our opinion, this approach was well suited to the current environment of sluggish economic growth and uncertainty on the part of investors, especially leading up to the November U.S. presidential election.

Valuations strike us as high across the market. As it has become more difficult to find stocks that are undervalued on an absolute basis, our investment focus has shifted to stocks that we believe provide good relative value — that is, better value than other available alternatives in the Portfolio’s investment universe, in our opinion.

During the fiscal year, we made modest changes to the Portfolio, selling only two holdings — Baxalta and Johnson Controls, both of which were acquired by offshore firms. With the proceeds of the Baxalta sale, we established a new position in Abbott Laboratories, a medical-products company that we liked for what we viewed as its strong competitive position and attractive relative valuation.

At fiscal year end, we were researching our options for a new consumer discretionary position to replace the Portfolio’s previous position in Johnson Controls. We also had equity research projects underway in the information technology sector, a sector in which we believed were finding decent relative value, and in real estate investment trusts (REITs). In late August REITs became the 11th sector in the S&P 500® Index, and one in which we have been exploring opportunities because of our investment process mandate to have exposure to all S&P 500 Index economic sectors.

We continue to emphasize what we view as higher-quality, attractively valued stocks with the potential to offer a good risk-reward trade-off for our shareholders. We remain grateful for our shareholders’ confidence.

Performance summary

Delaware Pooled® Trust — The Large-Cap Value Equity Portfolio

The performance data quoted represent past performance; past performance does not guarantee future results. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Please obtain the performance data for the most recent month end by calling 800 231-8002 or visiting our website at delawareinvestments.com/dpt/performance.

Carefully consider the Portfolio’s investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Portfolio’s prospectus which may be obtained by visiting delawareinvestments.com/dpt/literature or calling 800 231-8002. Investors should read the prospectus carefully before investing.

| | | | | | | | | | | | | | | | | | | | |

| Portfolio and benchmark performance | | | | | | | | | | | | | | | | | | | | |

| Average annual total returns | | | | | | | | | | | | | | | | | | | | |

| Periods ended Oct. 31, 2016 | | 1 year | | | 3 years | | | 5 years | | | 10 years | | | Lifetime | |

| | | | | |

| | | | | | | | | | | | | | | | | | | | |

The Large-Cap Value Equity Portfolio | | | +7.15% | | | | +8.71% | | | | +14.38% | | | | +6.81% | | | | +9.84% | |

Russell 1000 Value Index | | | +6.37% | | | | +7.59% | | | | +13.31% | | | | +5.35% | | | | +9.80% | |

| | |

| |

| Portfolio profile | | |

| Oct. 31, 2016 | | |

| | |

Total net assets | | Number of holdings |

$217.1 million | | 32 |

| | |

Inception date | | |

Feb. 3, 1992 | | |

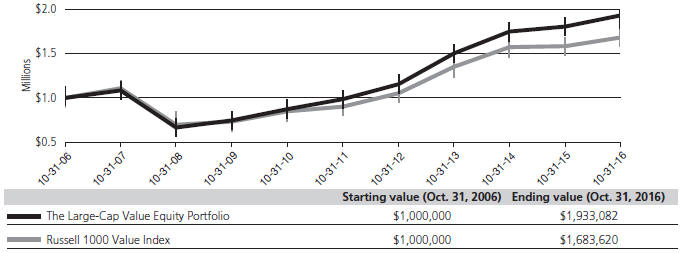

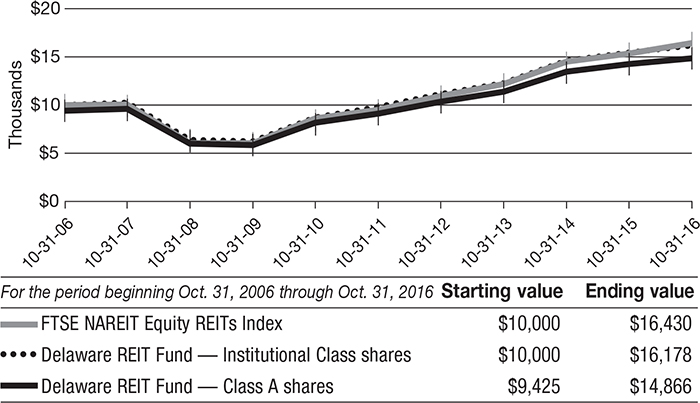

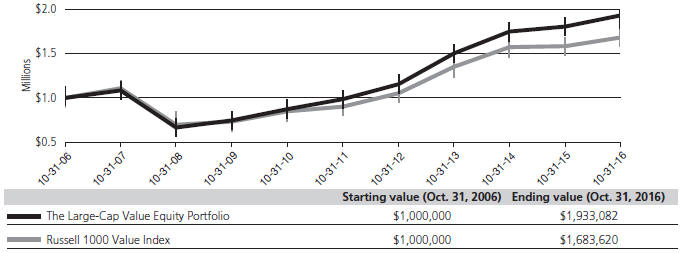

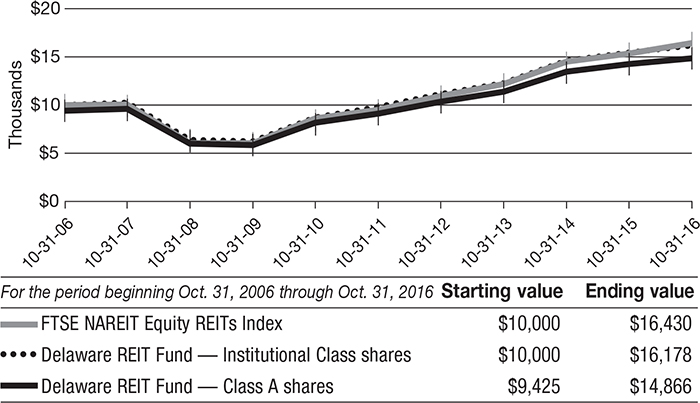

Growth of $1,000,000

The performance graph assumes $1 million invested on Oct. 31, 2006, and includes reinvestment of all distributions. The performance graph does not reflect the deduction of taxes the shareholder would pay on Portfolio distributions or redemptions of Portfolio shares.

Total return assumes reinvestment of dividends and capital gains, but does not reflect reductions for taxes. Returns and share values will fluctuate so that shares, when redeemed, may be worth more or less than their original cost.

Performance summary

Delaware Pooled® Trust — The Large-Cap Value Equity Portfolio

The most recent prospectus disclosed the Portfolio’s total operating expenses as 0.65%. Management has contractually agreed to reimburse certain expenses and/or waive its management fees from Nov. 1, 2015, through Oct. 31, 2016,* in order to prevent total annual Portfolio operating expenses (with certain exclusions) from exceeding, in an aggregate amount, 0.70% of the Portfolio’s average daily net assets, as described in the most recent prospectus.

Expense limitations were in effect during the period shown. Performance would have been lower had the expense limitations not been in effect.

The Russell 1000 Value Index measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000 companies with lower price-to-book ratios and lower forecasted growth values.

The S&P 500 Index, mentioned on page 4, measures the performance of 500 mostly large-cap stocks weighted by market value, and is often used to represent performance of the U.S. stock market.

Russell Investment Group is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. Russell® is a trademark of Russell Investment Group.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

Investing involves risk, including the possible loss of principal.

Past performance is not a guarantee of future results.

* The contractual waiver period is from Feb. 27, 2015 through Feb. 28, 2017.

6

Portfolio management review

Delaware Pooled® Trust — The High-Yield Bond Portfolio

October 31, 2016

For the fiscal year ended Oct. 31, 2016, Delaware Pooled Trust — The High-Yield Bond Portfolio returned +6.63% at net asset value (NAV) with all distributions reinvested. For the same period, the Portfolio’s benchmark, the BofA Merrill Lynch U.S. High Yield Constrained Index, returned +10.18%. Complete annualized performance for The High-Yield Bond Portfolio is shown in the table on page 9.

A rebound in commodity prices and the U.S. Federal Reserve’s assurances of continued monetary accommodation sparked a rally in high yield bond prices over the last three quarters of the Portfolio’s fiscal year ended Oct. 31, 2016. However, conditions were anything but accommodative in the first quarter of the fiscal year, as a steep fall in commodity prices — especially oil — magnified the effect of the Fed’s first interest rate hike since the global financial crisis. As such, the high yield market took on bipolar characteristics, with negative returns from November 2015 through January 2016 and solidly positive returns from February through October 2016. As a result, credit spreads finished inside their historical averages and nearly 1% tighter than where they were at the start of the fiscal year.

Importantly, the recovery in oil prices that began in February 2016 — coupled with a global search for yield — reopened capital markets to energy companies. This backdrop allowed many distressed businesses to extend maturity profiles by accessing both debt and equity markets, despite an oil price environment that, in our view, was not supportive of business models and balance sheets. Given the weak pricing environment, defaults among high yield energy companies climbed to the low double digits, versus low single digits for the rest of the high yield sector. Nevertheless, it was the meaningful recovery in oil prices that allowed the energy sector to return 12.3% for the fiscal year.

More broadly, domestic high yield bonds benefited from a global search for income. Almost three-quarters of developed-market debt now trades at a negative yield, and global central banks gave no indication that a new monetary tightening cycle was close at hand. In that environment, most industry groups performed relatively well, with gaming, consumer products, chemicals, and technology all outperforming the BofA Merrill Lynch U.S. High Yield Constrained Index. Excluding the still-depressed commodity group, high yield bonds generally finished the fiscal year at prices that we believe to be slightly overvalued given their underlying fundamentals. Any mild overvaluation, however, is likely to be expected given the continued low level of global interest rates.

Shifting currents within the high yield market created significant managerial challenges for the Portfolio. As the fiscal year began, we trimmed exposure to the energy sector; at one point, the Portfolio’s allocation to the group fell to just 3% of assets. Though we subsequently increased the Portfolio’s energy holdings, we finished the period about 3 percentage points below the sector’s 13%

weighting in the benchmark index. With the short- to medium-term outlook for energy prices likely to remain cloudy, we took what we considered to be a cautious approach, preferring companies that we view as having favorable cost structures, manageable free cash flows, diversified assets, geographic exposure, and the ability to withstand a $40-a-barrel oil price for a long time.

Elsewhere, we added marginally to the Portfolio’s metals and mining allocation as the recovery in commodity prices gained traction. We also added so-called “fallen angels,” whose credit ratings had dropped below investment grade after the plunge in oil prices. Finally, we increased the Portfolio’s weighting to holdings that fit our up-in-quality criteria.

Among individual holdings, the Portfolio’s overweight position in Builders FirstSource contributed to relative performance. The company owns and operates 55 distribution centers and manufacturing facilities for building materials throughout the United States. While Builders FirstSource benefited from a healthy environment for residential home construction, the company also exhibited many of the characteristics we prefer in a high yield credit, including strong free cash flow, a U.S.-centric clientele, and a plan for shedding debt. The Portfolio’s position in Builders FirstSource — which grew to about 0.80% of assets by the end of the fiscal year — contributed 0.10 percentage points to the Portfolio’s total return during the fiscal year.

AK Steel, which operates steelmaking plants in Ohio, Kentucky, Indiana, Michigan, and Pennsylvania, also contributed to the Portfolio’s results. After several difficult years — during which the Portfolio continued to hold the bonds — the company recovered strongly in 2016 following several favorable trade rulings that seemed to boost the price of its key commodity. AK Steel also benefited from continued strength in the U.S. auto industry.

Another basic materials company, Australia-based FMG Resources, contributed to the Portfolio’s performance. FMG Resources gained from a recovery in iron ore prices, positive free cash flow, a reduction in debt, and a favorable cost structure. As a result, we added to the Portfolio’s position in FMG Resources during the fiscal year.

Most of the Portfolio’s underperforming positions suffered from weak free cash flows and overleveraged balance sheets, exacerbated by a difficult business environment. Among the primary detractors from relative performance was Immucor, whose products are designed to support immune system health. Given the near-term challenges posed by, in our view, an overlevered balance sheet, we reduced the Portfolio’s holdings with an emphasis on the secured part of the company’s capital structure.

The global networking company Intelsat also detracted from relative performance. Intelsat operates a fleet of nearly 50 satellites, but the company suffered from liquidity issues that called into serious

Portfolio management review

Delaware Pooled® Trust — The High-Yield Bond Portfolio

question its ability to refund maturing bonds at par. Consequently, we exited the Portfolio’s position during the fiscal period.

The Portfolio’s Neiman Marcus bonds likewise reduced returns. The luxury products retailer suffered a 5% drop in same-store sales despite generally robust consumer spending. Revenues from the Dallas-based company’s eight Texas stores were particularly hurt by the decline in oil prices. Neiman Marcus announced stronger earnings toward the end of the fiscal year, however, and the Portfolio retains a decreased position.

We believe the Portfolio may be positioned to benefit from a bottom-up, bond-by-bond approach that, if accurate, would play to our

strength as fundamental credit analysts. However, given the resilience of the U.S. economy (compared to much of the developed world) we continue to favor companies with a domestic focus. As noted earlier, the Portfolio continues to be overweight businesses that we view as having healthy free cash flows, a disciplined strategy of capital allocation, and a commitment to deleveraging. We are generally satisfied with the Portfolio’s current yield profile, though we may look to add income to the portfolio if opportunities present themselves.

The views expressed are current as of the date of this report and subject to change.

8

Performance summary

Delaware Pooled® Trust — The High-Yield Bond Portfolio

The performance data quoted represent past performance; past performance does not guarantee future results. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Please obtain the performance data for the most recent month end by calling 800 231-8002 or visiting our website at delawareinvestments.com/dpt/performance.

Carefully consider the Portfolio’s investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Portfolio’s prospectus which may be obtained by visiting delawareinvestments.com/dpt/literature or calling 800 231-8002. Investors should read the prospectus carefully before investing.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Portfolio and benchmark performance | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Average annual total returns | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Periods ended Oct. 31, 2016 | | 1 year | | | | | | 3 years | | | | | | 5 years | | | | | | 10 years | | | | | | Lifetime | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

The High-Yield Bond Portfolio | | | +6.63% | | | | | | | | +2.72% | | | | | | | | +6.62% | | | | | | | | +7.38% | | | | | | | | +7.65% | |

| BofA Merrill Lynch U.S. High Yield Constrained Index | | | +10.18% | | | | | | | | +4.54% | | | | | | | | +7.07% | | | | | | | | +7.56% | | | | | | | | +7.00% | |

| | |

| |

| Portfolio profile | | |

| Oct. 31, 2016 | | |

| | |

Total net assets | | Number of holdings |

$242.3 million | | 231 |

| | |

Inception date | | |

Dec. 2, 1996 | | |

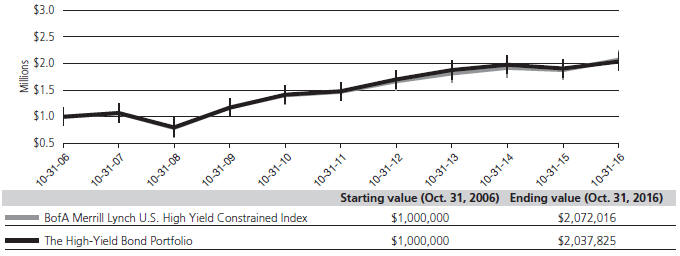

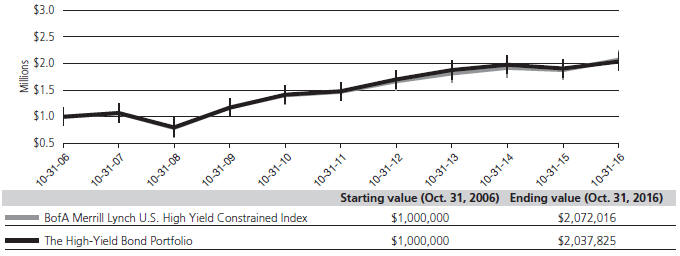

Growth of $1,000,000

The performance graph assumes $1 million invested on Oct. 31, 2006, and includes reinvestment of all distributions. The performance graph does not reflect the deduction of taxes the shareholder would pay on Portfolio distributions or redemptions of Portfolio shares.

Total return assumes reinvestment of dividends and capital gains, but does not reflect reductions for taxes. Returns and share values will fluctuate so that shares, when redeemed, may be worth more or less than their original cost.

Performance summary

Delaware Pooled® Trust — The High-Yield Bond Portfolio

The most recent prospectus disclosed the Portfolio’s total operating expenses as 0.56%. Management has contractually agreed to reimburse certain expenses and/or waive its management fees from Nov. 1, 2015, through Oct. 31, 2016,* in order to prevent total annual Portfolio operating expenses (with certain exceptions) from exceeding, in an aggregate amount, 0.59% of the Portfolio’s average daily net assets, as described in the most recent prospectus.

Expense limitations were in effect during the period shown. Performance would have been lower had the expense limitations not been in effect.

The BofA Merrill Lynch U.S. High Yield Constrained Index tracks the performance of U.S. dollar-denominated high yield corporate debt publicly issued in the U.S. domestic market, but caps individual issuer exposure at 2% of the benchmark. Qualifying securities must have, among other things, a below-investment-grade rating (based on an average of Moody’s, Standard & Poor’s, and Fitch), an investment grade issuing country (based on an average of Moody’s, Standard & Poor’s, and Fitch foreign currency long-term sovereign debt ratings), and maturities of one year or more.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

Investing involves risk, including the possible loss of principal.

Past performance is not a guarantee of future results.

Fixed income securities and bond funds can lose value, and investors can lose principal, as interest rates rise. They also may be affected by economic conditions that hinder an issuer’s ability to make interest and principal payments on its debt.

The Portfolio may also be subject to prepayment risk, the risk that the principal of a fixed income security that is held by the Portfolio may be prepaid prior to maturity, potentially forcing the Portfolio to reinvest that money at a lower interest rate.

The Portfolio may be invested in foreign corporate bonds, which have special risks not ordinarily associated with domestic investments, such as currency fluctuations, economic and political change, and different accounting standards.

High yielding, noninvestment grade bonds (junk bonds) involve higher risk than investment grade bonds.

The high yield secondary market is particularly susceptible to liquidity problems when institutional investors, such as mutual funds and certain other financial institutions, temporarily stop buying bonds for regulatory, financial, or other reasons. In addition, a less liquid secondary market makes it more difficult for the Portfolio to obtain precise valuations of the high yield securities in its portfolio.

The Portfolio may experience portfolio turnover in excess of 100%, which could result in higher transaction costs and tax liability.

Per Standard & Poor’s credit rating agency, bonds rated below AAA, including A, are more susceptible to the adverse effects of changes in circumstances and economic conditions than those in higher-rated categories, but the obligor’s capacity to meet its financial commitment on the obligation is still strong. Bonds rated BBB exhibit adequate protection parameters, although adverse economic conditions or changing circumstances are more likely to lead to a weakened capacity of the obligor to meet its financial commitments. Bonds rated BB, B, and CCC are regarded as having significant speculative characteristics with BB indicating the least degree of speculation.

Investing in emerging markets can be riskier than investing in established foreign markets due to increased volatility and lower trading volume.

* The contractual waiver period is from Feb. 27, 2015 through Feb. 28, 2017.

10

Portfolio management review

Delaware Pooled® Trust — The Core Plus Fixed Income Portfolio

October 31, 2016

For the fiscal year ended Oct. 31, 2016, Delaware Pooled Trust — The Core Plus Fixed Income Portfolio returned +3.63% at net asset value (NAV) with all distributions reinvested. The Portfolio’s benchmark, the Bloomberg Barclays U.S. Aggregate Index, formerly known as the Barclays U.S. Aggregate Index, returned +4.37% for the same period. Complete annualized performance for The Core Plus Fixed Income Portfolio is shown in the table on page 13.

The Portfolio’s fiscal year began with slow global growth and somewhat challenged earnings for companies in the United States. Commodity prices, particularly oil, were in a prolonged slump, and the U.S. dollar rallied. In December 2015, the U.S. Federal Reserve raised the federal funds rate for the first time in nine years, signaling a shift to tighter monetary policy.

Market volatility picked up significantly in January and February 2016 as financial conditions deteriorated in an already slow-growth environment, prompting action by central banks. The European Central Bank injected more stimulus by expanding its quantitative easing program and beginning the purchase of corporate bonds, a significant development. At the same time, the Fed announced that it would go slowly on additional rate hikes, an important dovish signal. The Bank of Japan also added more monetary stimulus. These concerted central bank actions caused a market reversal: Oil prices rose and energy securities rallied, particularly in fixed income. Additionally, yield spreads began to decline significantly.

The summer began with Brexit, the United Kingdom’s vote to leave the European Union. Although the result was shocking, its effect was tempered as the Bank of England quickly injected more liquidity into the U.K. financial markets, seemingly easing investor anxiety. The Portfolio’s fiscal year ended with a high degree of uncertainty in the run-up to the U.S. presidential election.

The Portfolio’s performance was hurt by a defensive position in a rapidly changing market that benefited from central bank stimulus in the winter. Underweights relative to the benchmark index in both the energy and metals-and-mining sectors were primary detractors as the two sectors rallied in the winter and spring.

The Portfolio had responded to deteriorating market conditions and rising risks before the fiscal year began by moving Portfolio assets from the corporate sector — including investment grade bonds — to more defensive agency mortgage-backed securities (MBS). We also increased the Portfolio’s exposure to Treasurys, attempting to take some risk off the table as risk premiums widened early in the fiscal period. This limited gains in the Portfolio, as it missed the strong rally that resulted from central bank stimuli in February and March. As the markets rebounded, we added back corporate exposure, but we did so conservatively.

We looked for bonds issued by companies that we viewed as having good balance sheet management and resilient product lineups that

could withstand what we saw as a continued slow-growth, earnings-and-revenue-challenged environment. This included relatively defensive energy investments, as we focused on companies with less exposure to petroleum price volatility.

Among these were some midstream holdings — pipeline companies — that had been sensitive to oil prices in 2015. Although some of these companies had been downgraded, in our view they were generally in better financial shape, with less leverage, than oil service companies that had made heavy capital expenditures in an effort to capture the significant buildup in shale and offshore platform exploration. After oil prices stabilized, these companies began to look more attractive to us. In an environment of lower oil prices, the market gave them the latitude to be somewhat more flexible in their capital-market activities. Holdings included independent energy producers with more stable balance sheets, such as ConocoPhillips, Anadarko Petroleum, and Noble Energy. Elsewhere in the energy sector, we couldn’t keep up with credit markets and energy markets that were significantly rallying, which led to most of the underperformance.

Also detracting were bonds issued by Sprint Communications in the telecommunications sector, Community Health Systems within healthcare, and high yield bonds issued by Dynegy, an electricity provider utility, and QEP Resources, an independent natural gas and oil exploration firm.

Exposure to asset-backed securities (ABS) and collateralized loan obligations (CLOs) detracted somewhat from the Portfolio’s performance as they missed the full benefit of the bond rally earlier this year. The Portfolio’s returns also were held back somewhat by a lack of exposure to the robust high yield bond market.

On the positive side, the Portfolio benefited from its exposure to finance companies — money-center banks, regional banks, and foreign banks, including large Swiss banks, and major U.K. mortgage providers. The Portfolio also benefited from corporate bonds issued by food and beverage and communications firms related to mergers and acquisitions.

Performance was boosted by an overweight to commercial mortgage-backed securities (CMBS), particularly more defensive investments, including Freddie Mac multifamily securitizations. Individual contributors also included bonds issued by Fannie Mae and Bank of America, and by 30-year interest rate swaps. The Portfolio’s overweight to utilities was beneficial, compounded by outperformance versus the Portfolio’s benchmark, the Bloomberg Barclays U.S. Aggregate Index. Additionally, the Portfolio gained overall from its allocation to emerging market bonds, which rallied and are not included in the benchmark index.

Throughout the Portfolio’s fiscal year, corporate fundamentals declined as companies became more levered, balance sheets

Portfolio management review

Delaware Pooled® Trust — The Core Plus Fixed Income Portfolio

weakened somewhat, and earnings growth receded. However, there was a slight uptick in earnings in the third quarter of 2016, partly due to the weakening U.S. dollar. During the previous fiscal year, the U.S. dollar had rallied, placing a financial strain on U.S. firms with overseas earnings.

The Portfolio’s use of derivatives had no material effect on its performance. We used derivatives for a variety of hedging purposes. We employed them either to increase or decrease interest rate sensitivity, to make adjustments in yield curve exposure, or to try to capture the effect of collapsing swap rates, and we recently used credit default swap indices to dial back credit risk. We also used currency futures to reduce currency exposure when it seemed warranted.

The election of Donald Trump shortly after the end of the fiscal period underscores the uncertainties and global risks associated with a series of anti-establishment election results, beginning with the U.K. Brexit vote in June, and that could continue next year with national elections in Italy, France, and Germany. The Portfolio is positioned for a possible change in the interest rate environment, with exposure to risk reduced through interest rate futures. In our view, uncertainty regarding trade pacts and potential renewed strengthening of the U.S. dollar could negatively impact emerging market bonds.

The views expressed are current as of the date of this report and subject to change.

12

Performance summary

Delaware Pooled® Trust — The Core Plus Fixed Income Portfolio

The performance data quoted represent past performance; past performance does not guarantee future results. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Please obtain the performance data for the most recent month end by calling 800 231-8002 or visiting our website at delawareinvestments.com/dpt/performance.

Carefully consider the Portfolio’s investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Portfolio’s prospectus which may be obtained by visiting delawareinvestments.com/dpt/literature or calling 800 231-8002. Investors should read the prospectus carefully before investing.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Portfolio and benchmark performance | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Average annual total returns | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Periods ended Oct. 31, 2016 | | 1 year | | | | | | 3 years | | | | | | 5 years | | | | | | 10 years | | | | | | Lifetime | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

The Core Plus Fixed Income Portfolio | | | +3.63% | | | | | | | | +3.30% | | | | | | | | +3.43% | | | | | | | | +5.57% | | | | | | | | +5.84% | |

Bloomberg Barclays U.S. Aggregate Index* | | | +4.37% | | | | | | | | +3.48% | | | | | | | | +2.90% | | | | | | | | +4.64% | | | | | | | | +4.73% | |

*Formerly known as the Barclays U.S. Aggregate Index. | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| |

| Portfolio profile | | |

| Oct. 31, 2016 | | |

| | |

Total net assets | | Number of holdings |

$133.2 million | | 744 |

| | |

Inception date | | |

June 28, 2002 | | |

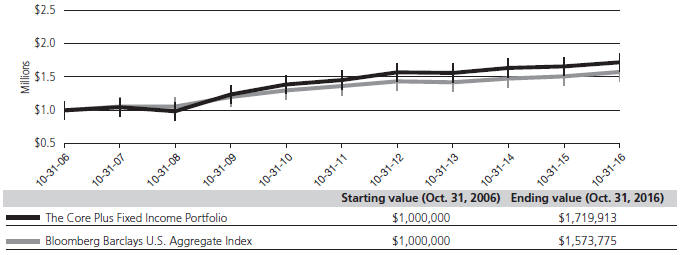

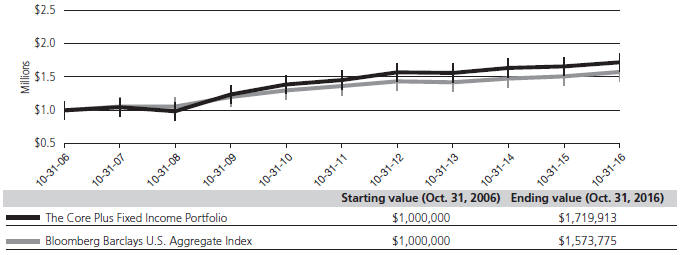

Growth of $1,000,000

The performance graph assumes $1 million invested on Oct. 31, 2006, and includes reinvestment of all distributions. The performance graph does not reflect the deduction of taxes the shareholder would pay on Portfolio distributions or redemptions of Portfolio shares.

Total return assumes reinvestment of dividends and capital gains, but does not reflect reductions for taxes. Returns and share values will fluctuate so that shares, when redeemed, may be worth more or less than their original cost.

Performance summary

Delaware Pooled® Trust — The Core Plus Fixed Income Portfolio

The most recent prospectus disclosed the Portfolio’s total operating expenses as 0.60%. Management has contractually agreed to reimburse certain expenses and/or waive its management fees from Nov. 1, 2015, through Oct. 31, 2016,* in order to prevent total annual Portfolio operating expenses (with certain exclusions) from exceeding, in an aggregate amount, 0.45% of the Portfolio’s average daily net assets, as described in the most recent prospectus.

Expense limitations were in effect during the period shown. Performance would have been lower had the expense limitations not been in effect.

The Bloomberg Barclays U.S. Aggregate Index (formerly known as the Barclays U.S. Aggregate Index) measures the performance of publicly issued investment grade (Baa3/BBB- or better) corporate, U.S. government, mortgage- and asset-backed securities with at least one year to maturity and at least $250 million par amount outstanding.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

Investing involves risk, including the possible loss of principal.

Past performance is not a guarantee of future results.

Fixed income securities and bond funds can lose value, and investors can lose principal, as interest rates rise. They also may be affected by economic conditions that hinder an issuer’s ability to make interest and principal payments on its debt.

The Portfolio may also be subject to prepayment risk, the risk that the principal of a fixed income security that is held by the Portfolio may be prepaid prior to maturity, potentially forcing the Portfolio to reinvest that money at a lower interest rate.

Interest payments on inflation-indexed debt securities will vary as the principal and/or interest is adjusted for inflation.

High yielding, non-investment grade bonds (junk bonds) involve higher risk than investment grade bonds. The high yield secondary market is particularly susceptible to liquidity problems when institutional investors, such as mutual funds and certain other financial institutions, temporarily stop buying bonds for regulatory, financial, or other reasons. In addition, a less liquid secondary market makes it more difficult for the Portfolio to obtain precise valuations of the high yield securities in its portfolio.

International investments entail risks not ordinarily associated with U.S. investments including fluctuation in currency values, differences in accounting principles, or economic or political instability in other nations. Investing in emerging markets can be riskier than investing in established foreign markets due to increased volatility and lower trading volume.

Because the Portfolio may invest in bank loans and other direct indebtedness, it is subject to the risk that the Portfolio will not receive payment of principal, interest, and other amounts due in connection with these investments, which primarily depend on the financial condition of the borrower and the lending institution.

The Portfolio may experience portfolio turnover in excess of 100%, which could result in higher transaction costs and tax liability.

Per Standard & Poor’s credit rating agency, bonds rated below AAA, including A, are more susceptible to the adverse effects of changes in circumstances and economic conditions than those in higher-rated categories, but the obligor’s capacity to meet its financial commitment on the obligation is still strong. Bonds rated BBB exhibit adequate protection parameters, although adverse economic conditions or changing circumstances are more likely to lead to a weakened capacity of the obligor to meet its financial commitments. Bonds rated BB, B, and CCC are regarded as having significant speculative characteristics with BB indicating the least degree of speculation.

Investments in mortgage-backed securities (MBS) may involve risks. MBS represent an ownership interest in a pool of mortgage loans. The individual mortgage loans are packaged or “pooled” together for sale to investors. These mortgage loans may have either fixed or adjustable interest rates.

Investments in collateralized loan obligations (CLOs) may involve risks. CLOs are securities backed by a pool of debt, often low-rated corporate loans. Investors receive scheduled debt payments from the underlying loans but assume most of the risk in the event that borrowers default.

*The contractual waiver period is from Feb. 27, 2015 through Feb. 28, 2017.

14

Portfolio management review

Delaware Pooled® Trust — The Labor Select International Equity Portfolio

October 31, 2016

For the fiscal year ended Oct. 31, 2016, Delaware Pooled Trust — The Labor Select International Equity Portfolio returned -4.24% at net asset value (NAV) with all distributions reinvested. The Portfolio’s benchmark, the MSCI EAFE Index, returned -2.74% (gross) and -3.23% (net) for the same period. Complete annualized performance for The Labor Select International Equity Portfolio is shown in the table on page 17.

Over the course of the 12-month fiscal period, central bank policies and investor sentiment toward the United Kingdom’s Brexit referendum seemed to strongly affect the markets in the Portfolio’s asset class. Returns in Europe lagged those in the Asia Pacific region. The performance of local currencies relative to the U.S. dollar varied widely. In fact, the Portfolio’s underperformance relative to its benchmark index was entirely due to currency movements, though currency effects held back U.S. dollar returns for the benchmark index as well.

After a partial recovery in non-commodity-linked sectors in late 2015, markets again weakened in early 2016, driven by further Chinese renminbi devaluation and the Bank of Japan’s (BOJ’s) surprise decision to introduce negative interest rates. The unexpected results of the June 2016 Brexit referendum triggered a fall in international equities. Euro-zone markets and the financial sector registered the most significant losses, as many investors worried about potential economic and political repercussions. By the close of the fiscal period, supportive central banks and increasing expectations for additional stimulus appeared to help international equities shrug off Brexit concerns. The third quarter of 2016 saw particularly strong gains, led by cyclically sensitive sectors.

Among the larger European markets, the Dutch market registered the most modest decline, down just 0.2% in U.S. dollar terms. Next in terms of limited losses was the export-oriented German market (-2.9%), which was helped by improved Chinese and euro-zone data. Other major European markets, including France (-5.0%), Spain (-9.1%), the U.K. (-10.2%), and Italy (-23.2%), experienced greater declines. In the case of the U.K., strong local returns were not enough to offset the British pound’s depreciation. Brexit particularly hit stocks in the financial and consumer discretionary sectors; however, the large number of internationally diversified companies in the U.K. portion of the benchmark index mitigated its effect on the broader U.K. equity market.

Most Asia Pacific markets in the benchmark index generated strong returns for the fiscal period in U.S. dollar terms. Australia, supported by a recovery in commodity prices, generated the highest return among major markets, up 12.6%. The materials sector, in fact, generated the highest returns over the fiscal period. Improved expectations for Chinese growth supported the Hong Kong market, which gained 8.5%. The Japanese market rose 3.2%, as yen appreciation more than offset local market declines. Conversely, the

markets in Singapore fell 3.8% when growth estimates were again revised downward.

As stated previously, currency effects were responsible for the Portfolio’s relative performance. Most prominently, the British pound ended the fiscal period 21% weaker. This was largely seen as a response to Brexit. The Portfolio’s overweight position in the pound hurt its relative performance while its underweight position in the strong Japanese yen also detracted from performance. The yen was up 14.8% for the fiscal period, as many investors sought safe havens, and the BOJ, after moving to negative interest rates in January 2016, refrained from further increasing the scale of its quantitative easing.

In contrast, our country, sector, and stock selection all outperformed the Portfolio’s benchmark index. In terms of country allocation results, the positive effect of the Portfolio’s underweight position in Japan and its overweight position in the U.K. more than offset the negative effects of an underweight position in Australia. In local currency terms, Japan was down 10.1%, while the U.K. and Australia were up 13.5% and 5.5%, respectively.

Returns from holdings in Switzerland, Japan, and the U.K. drove the Portfolio’s strong relative stock selection. An underweight position in financials (by 7.4 percentage points) and an overweight position in the energy sector (by 4.5 percentage points) drove the Portfolio’s relative outperformance at the sector level. Strong stock selection within sectors also added to relative returns, led by the Portfolio’s stocks in the utilities and consumer staples sectors.

In terms of individual holdings, among the Portfolio’s biggest disappointments was its position in U.K. retail bank Lloyds Banking Group. The stock fell more than 35% over the 12-month period, primarily due to concerns regarding the outlook for the U.K. economy and housing market following the Brexit result. We acquired the position in Lloyds Banking Group when we bought into the share price weakness, starting in late 2015. We also held Pearson, a U.K. media and education company, in the Portfolio during the fiscal period. The stock decreased more than 25% due to continued weakness in the U.S. higher education market. Finally, Sanofi, the French healthcare company, declined more than 20% as a result of continued competition and pricing pressure on diabetes drug Lantus® in the United States. We continue to hold all three stocks in the Portfolio and, in fact, we added to the positions during the fiscal period as we believe that the market reaction to the events described above was excessive.

Stocks that delivered strong positive returns for the Portfolio included Syngenta, the Swiss agrichemicals company, which rose more than 20%, aided by ChemChina’s bid to acquire it. The Portfolio’s position in Japanese brewer Kirin Holdings also gained more than 20%. Kirin Holdings’ strong financial results indicated to us that its strategy to regain share in the Japanese market was succeeding. Tokyo

Portfolio management review

Delaware Pooled® Trust — The Labor Select International Equity Portfolio

Electron, the Japanese manufacturer of semiconductor production equipment, increased more than 50% during the fiscal year. The company benefited from a strong order environment, improving margins and shareholder returns, and rising semiconductor capital expenditure in China.

The highlights of the Portfolio’s investment strategy during the period include a strong value stock orientation, overweight positions in selected European markets, an overweight position in the telecommunications and energy sectors, and underweight positions in the financials, materials, and industrial sectors.

The views expressed are current as of the date of this report and subject to change.

16

Performance summary

Delaware Pooled® Trust — The Labor Select International Equity Portfolio

The performance data quoted represent past performance; past performance does not guarantee future results. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Please obtain the performance data for the most recent month end by calling 800 231-8002 or visiting our website at delawareinvestments.com/dpt/performance.

Carefully consider the Portfolio’s investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Portfolio’s prospectus which may be obtained by visiting delawareinvestments.com/dpt/literature or calling 800 231-8002. Investors should read the prospectus carefully before investing.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Portfolio and benchmark performance | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Average annual total returns | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Periods ended Oct. 31, 2016 | | 1 year | | | | | | 3 years | | | | | | 5 years | | | | | | 10 years | | | | | | Lifetime | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

The Labor Select International Equity Portfolio | | | –4.24% | | | | | | | | –1.47% | | | | | | | | +3.81% | | | | | | | | +0.88% | | | | | | | | +6.66% | |

MSCI EAFE Index (gross) | | | –2.74% | | | | | | | | –0.86% | | | | | | | | +5.48% | | | | | | | | +1.70% | | | | | | | | +4.82% | |

MSCI EAFE Index (net) | | | –3.23% | | | | | | | | –1.31% | | | | | | | | +4.99% | | | | | | | | +1.22% | | | | | | | | +4.40% | |

| | |

| |

| Portfolio profile | | |

| Oct. 31, 2016 | | |

| | |

Total net assets | | Number of holdings |

$394.8 million | | 50 |

| | |

Inception date | | |

Dec. 19, 1995 | | |

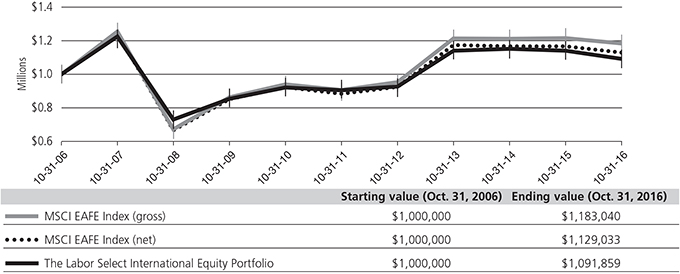

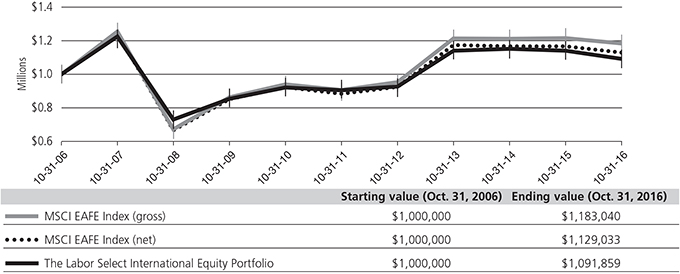

Growth of $1,000,000

The performance graph assumes $1 million invested on Oct. 31, 2006, and includes reinvestment of all distributions. The performance graph does not reflect the deduction of taxes the shareholder would pay on Portfolio distributions or redemptions of Portfolio shares.

Total return assumes reinvestment of dividends and capital gains, but does not reflect reductions for taxes. Returns and share values will fluctuate so that shares, when redeemed, may be worth more or less than their original cost.

Performance summary

Delaware Pooled® Trust — The Labor Select International Equity Portfolio

The most recent prospectus disclosed the Portfolio’s total operating expenses as 0.87%.

The MSCI EAFE (Europe, Australasia, Far East) Index is a free float-adjusted market capitalization weighted index designed to measure equity market performance of developed markets, excluding the United States and Canada. Index “gross” return approximates the maximum possible dividend reinvestment. Index “net” return approximates the minimum possible dividend reinvestment, after deduction of withholding tax at the highest possible rate.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

Investing involves risk, including the possible loss of principal.

Past performance is not a guarantee of future results.

International investments entail risks not ordinarily associated with U.S. investments including fluctuation in currency values, differences in accounting principles, or economic or political instability in other nations.

Investing in emerging markets can be riskier than investing in established foreign markets due to increased volatility and lower trading volume.

If and when the Portfolio invests in forward foreign currency contracts or uses other investments to hedge against currency risks, the Portfolio will be subject to special risks, including counterparty risk.

From time to time, the Portfolio may invest up to 30% of its net assets in securities of issuers in the commercial banking industry; to the extent that the Portfolio invests 30% of its net assets in such securities, it may be slightly more sensitive to movement in the commercial banking industry.

18

Portfolio management review

Delaware Pooled® Trust — The Emerging Markets Portfolio

October 31, 2016

Delaware Pooled Trust — The Emerging Markets Portfolio returned +6.75% at net asset value (NAV) with all distributions reinvested for the fiscal year ended Oct. 31, 2016. The Portfolio’s benchmark, the MSCI Emerging Markets Index, returned +9.67% (gross) and +9.27% (net). Complete annualized performance for The Emerging Markets Portfolio is shown in the table on page 21.

Emerging markets outperformed developed markets for the Portfolio’s fiscal year — a long time coming. In our view, three key drivers of this asset class’s positive performance stood out. The first was the rally in commodity markets that began in January 2016. Most of the stronger-performing markets for the fiscal year all had some direct link to commodities. These included commodity exporter Peru, up 31%. Indonesia, a big coal producer, was up 32%. Commodity-rich Russia was up 19%, followed by Chile, up 14%.

Second, the information technology (IT) sector has continued to find favor with investors. During the Portfolio’s fiscal year, this sector as a whole rose approximately 20% for the emerging market asset class, principally due to performance gains of Internet-related businesses. This was led by the three largest Chinese Internet stocks — Tencent, Alibaba, and Baidu. Additionally, Taiwan’s outperformance for the period (+18%), for example, was related to its economy’s strong emphasis on IT-related industries.

Finally, Brazil was up 71% for the fiscal year, riding the wave of a huge reversal in investor sentiment along with a strong recovery of its currency, which rose approximately 25%. Brazil benefited from the new government put into place this year. President Dilma Rousseff was impeached during the fiscal year, and investors seemed hopeful that the necessary reforms would commence. As a commodity producer, Brazil was also helped by the upswing in commodity prices.

Conversely, many of the smallest European markets turned in the weakest performances, including Greece (-42%), Poland (-12%), and the Czech Republic (-5%). Turkey was down 6%. Of the major emerging markets, the weakest was Mexico (-5%), despite its strength as an oil exporter. Mexico’s currency, which depreciated 12.1%, was undermined by uncertainties over the outcome of the U.S. presidential election. In terms of sectors, most of the underperformers were industries that historically have been considered defensive, including telecommunications, the consumer sectors, healthcare, utilities, and real estate. The exception, of course, were commodities, which significantly outperformed.

The Portfolio’s underperformance with respect to its benchmark index was largely due to the Portfolio’s underweighting and more defensive positioning in Brazil, as well as the Portfolio’s underweight to the commodities sector, particularly materials. Avoiding growth-oriented IT stocks that we viewed as overvalued also detracted from the Portfolio’s performance. The most notable example was our lack of a position in Chinese Internet company Tencent, which gained 40% for the fiscal period. Tencent takes up more than 3.5% of the benchmark

index; not holding this company cost the Portfolio about 80 basis points in relative performance.

In terms of contributors, our stock selection in India, stock selection and positioning in Korea, and avoidance of exposure to poorly performing European countries including Greece, Poland, and the Czech Republic, all helped the Portfolio’s performance. India was up just 4% for the fiscal period, but the Portfolio’s holdings in oil and gas explorer Cairn India (+44%) and housing finance company Indiabulls Housing Finance (+15%), were strong outperformers. Korea slightly underperformed the Portfolio’s benchmark index; the Portfolio’s underweight there aided performance, as did the Portfolio’s large positions in Samsung Electronics (+19%) and Hyundai Mobis (+14%). Stock selection in the healthcare sector also added value for the Portfolio.

We can’t neglect to mention China, given that it takes up more than 25% of the benchmark index. China’s unremarkable performance numbers for the fiscal period (+1.5%) masked the disparities between the big gains posted by many Internet-related companies and the less attractive returns that were often seen in other Chinese sectors.

In terms of individual detractors, several consumer-related Chinese stocks were among the Portfolio’s biggest disappointments. These companies struggled under the competitive pressures that resulted from China’s lower-growth environment: shoe manufacturer Belle International Holdings (-38%), snack foods producer Want Want China Holdings (-27%), and consumer products company Hengan International Group (-26%). We continue to hold all three names; we reduced Hengan International Group and Want Want China Holdings in light of concerns regarding margin sustainability, and we added to Belle International Holdings, due to the company’s deep value proposition that we believe still exists.

Another Chinese holding that detracted from the Portfolio’s performance was utility company China Resources Power Holdings. The company declined 25%, as it was negatively affected by rising coal prices, which saw some recovery in China toward the second half of the fiscal period. And finally, Philippines-based telecommunications company PLDT produced weak numbers, declining 33%. Competitive pressure in the Philippines dragged on the company’s profitability and top line growth. We added to China Resources Power Holdings during the Portfolio’s fiscal year given the particularly cheap multiples and progressive dividend policy. The company’s stock starts on a dividend yield of almost 7%. We are currently reviewing PLDT, which we still held in the Portfolio as of the end of the fiscal year.

Contributors to performance included the Portfolio’s large holding in Taiwan Semiconductor Manufacturing. The company rose 42% during the fiscal year. WH Group — a Chinese stock that we began buying late in 2015 — contributed to the Portfolio’s

Portfolio management review

Delaware Pooled® Trust — The Emerging Markets Portfolio

performance. WH Group is the largest pork-producing company in the world. The company’s free cash flow generation has been relatively strong and it has paid down a lot of debt, while also increasing dividends. The Portfolio’s position in WH Group rose 53% by the end of the fiscal period.

Although we didn’t fully participate in the Brazilian rally, the Portfolio held several strong performers there. These included credit card processing company Cielo, up 29%, and brewer Ambev, up 20%. CCR, the toll road operator, rose 74%.

At fiscal year end, the Portfolio was defensively positioned, being underweight the more cyclical sectors such as materials and information technology, while being overweight more stable areas

such as consumer, telecommunications, and utility. We remain underweight China, with no exposure to the high growth Internet companies such as Tencent and Alibaba, and overweight selective areas such as India, Malaysia, the Middle East, and Mexico. We continue to tilt the Portfolio more toward what we view as value names that have underperformed, especially where fundamentals have not deteriorated anywhere near what the price moves would suggest. We remain disciplined in our approach with a commitment to finding what we see as undervalued companies using the dividend discount model approach. We remain confident that after an underwhelming period for the product, there is potential for our value names to be more in favor.

The views expressed are current as of the date of this report and subject to change.

20

Performance summary

Delaware Pooled® Trust — The Emerging Markets Portfolio

The performance data quoted represent past performance; past performance does not guarantee future results. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Please obtain the performance data for the most recent month end by calling 800 231-8002 or visiting our website at delawareinvestments.com/dpt/performance.

Carefully consider the Portfolio’s investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Portfolio’s prospectus which may be obtained by visiting delawareinvestments.com/dpt/literature or calling 800 231-8002. Investors should read the prospectus carefully before investing.

Portfolio and benchmark performance

| | | | | | | | | | |

| Average annual total returns | | | | | | | | | | |

| Periods ended Oct. 31, 2016 | | 1 year | | 3 years | | 5 years | | 10 years | | Lifetime |

| | | | | |

| | | | | | | | | | |

The Emerging Markets Portfolio | | +6.75% | | –3.39% | | +0.09% | | +3.71% | | +7.22% |

MSCI Emerging Markets Index (gross) | | +9.67% | | –1.70% | | +0.90% | | +3.82% | | +5.65% |

MSCI Emerging Markets Index (net) | | +9.27% | | –2.05% | | +0.55% | | +3.49% | | +5.37% |

| | |

| |

| Portfolio profile | | |

| Oct. 31, 2016 | | |

| | |

Total net assets | | Number of holdings |

$133.8 million | | 88 |

| | |

Inception date | | |

April 16, 1997 | | |

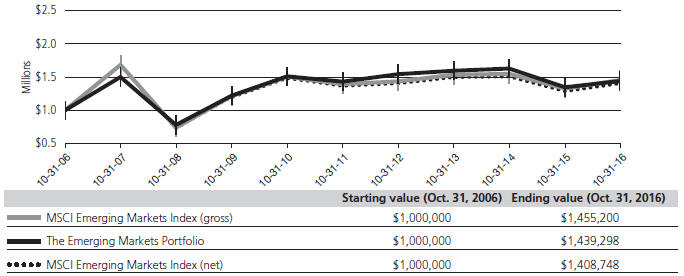

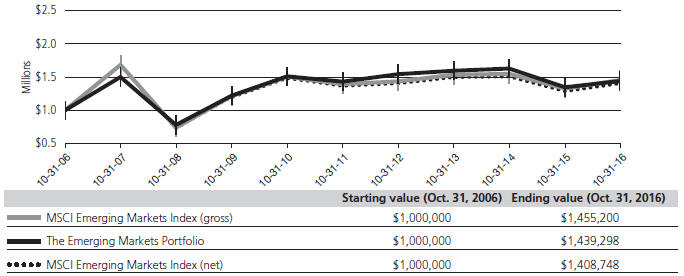

Growth of $1,000,000

The performance graph assumes $1 million invested on Oct. 31, 2006, and includes reinvestment of all distributions. The performance graph does not reflect the deduction of taxes the shareholder would pay on Portfolio distributions or redemptions of Portfolio shares.

Total return assumes reinvestment of dividends and capital gains, but does not reflect reductions for taxes. Returns and share values will fluctuate so that shares, when redeemed, may be worth more or less than their original cost.

Performance summary

Delaware Pooled® Trust — The Emerging Markets Portfolio

The most recent prospectus disclosed the Portfolio’s total operating expenses as 1.19%. The purchase reimbursement fee (0.55%) and redemption reimbursement fee (0.55%) are paid to the Portfolio. These fees are designed to reflect an approximation of the brokerage and other transaction costs associated with the investment of an investor’s purchase amount or the disposition of assets to meet redemptions, and to limit the extent to which the Portfolio (and, indirectly, the Portfolio’s existing shareholders) would have to bear such costs. In lieu of the reimbursement fees, investors in The Emerging Markets Portfolio may be permitted to utilize alternative purchase and redemption methods designed to accomplish the same economic effect as the reimbursement fees. Reimbursement fees applicable to purchases and redemptions of shares of the Portfolio are not reflected in the “Growth of $1,000,000” graph.

Expense limitations were in effect during the period shown. Performance would have been lower had the expense limitations not been in effect.

The MSCI Emerging Markets Index measures equity market performance across emerging market countries worldwide. Index “gross” return approximates the maximum possible dividend reinvestment. Index “net” return approximates the minimum possible dividend reinvestment, after deduction of withholding tax at the highest possible rate.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

Investing involves risk, including the possible loss of principal.

Past performance is not a guarantee of future results.

International investments entail risks not ordinarily associated with U.S. investments including fluctuation in currency values, differences in accounting principles, or economic or political instability in other nations.

Investing in emerging markets can be riskier than investing in established foreign markets due to increased volatility and lower trading volume.

If and when the Portfolio invests in forward foreign currency contracts or uses other investments to hedge against currency risks, the Portfolio will be subject to special risks, including counterparty risk.

Fixed income securities and bond funds can lose value, and investors can lose principal, as interest rates rise. They also may be affected by economic conditions that hinder an issuer’s ability to make interest and principal payments on its debt.

The Portfolio may also be subject to prepayment risk, the risk that the principal of a fixed income security that is held by the Portfolio may be prepaid prior to maturity, potentially forcing the Portfolio to reinvest that money at a lower interest rate.

High yielding, non-investment-grade bonds (junk bonds) involve higher risk than investment grade bonds.

The Portfolio is presently closed to new investors.

22

Portfolio management review

Delaware Pooled® Trust — The Emerging Markets Portfolio II

October 31, 2016

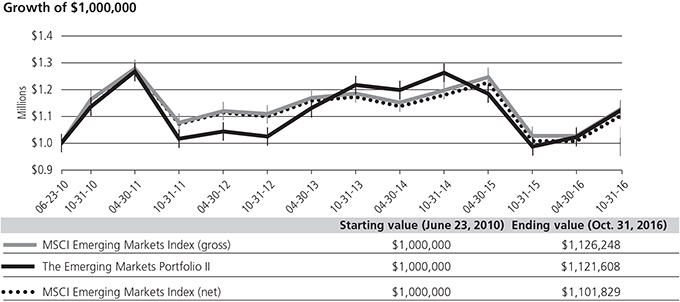

For the fiscal year ended Oct. 31, 2016, Delaware Pooled Trust — The Emerging Markets Portfolio II returned +13.62% at net asset value (NAV) with all distributions reinvested. This result outpaced the Portfolio’s benchmark, the MSCI Emerging Markets Index, which returned +9.67% (gross) and +9.27% (net) for the same period. Complete annualized performance for The Emerging Markets Portfolio II is shown in the table on page 24.

Emerging market equities rose sharply during the Portfolio’s fiscal year. Positive drivers of performance included the impeachment of Brazil’s president Dilma Rousseff, a continued rebound in commodity prices, and expectations that the U.S. Federal Reserve will increase interest rates at a more moderate pace.

Among countries, the Portfolio’s overweight positioning in Brazil contributed the most to relative performance. Shares of Petrobras rose as the company executed on its plan to reduce debt through asset sales. Hypermarcas and Itau Unibanco Holding also outperformed, buoyed by some signs of stabilization in the economy.

SINA was the largest contributor to performance in China. SINA operates an online portal and owns a majority stake in Weibo, a leading Internet social media platform. Shares of Weibo rose as the company appeared to show progress in generating advertising revenue on its platform — this in turn boosted SINA’s valuation. In addition, SINA distributed a small portion of its Weibo holdings to shareholders, which investors seemed to view favorably from a corporate governance perspective.

The Portfolio’s positions in Sohu.com and Baidu detracted from this outperformance. Shares of Sohu.com declined after the company indicated weakness in its gaming and brand advertising businesses. We believe that Sohu’s search business remains a key growth driver and that the stock is significantly undervalued. Shares of Baidu also underperformed following the government’s investigation into healthcare-related advertising on Baidu’s search results. The company subsequently lowered its second quarter guidance as it began working to address these concerns.

On the negative side, the Portfolio’s overweight in Turkey was unfavorable when the failed coup attempt against President Erdogan prompted a broad selloff in equities and currency depreciation. Shares of Akbank, a bellwether for the economy, declined during the fiscal year. In our view, Akbank is a particularly well run private bank, and we believe one of the best capitalized and most conservatively provisioned in Turkey. We believe profit growth should improve substantially — regulatory headwinds will likely subside and the bank should be in a position to benefit from secular growth and to take market share as the sector becomes more capital constrained.

Shares of Anadolu Efes Biracilik Ve Malt Sanayii fell due to negative sentiment and lira weakness related to the failed coup attempt. However, in our opinion, its beer business continues to have strong pricing power in Turkey, potential growth opportunity, and likely participation in consolidation in the Russian market. Furthermore, we believe its soft drink business has a strong position in Turkey, Central Asia, Southeast Asia, and the Middle East, as well as strong secular growth opportunities.

Shares of mobile operator Turkcell Iletisim Hizmetleri also underperformed due to intense competition and rising capital spending. Turkcell is the leading mobile telecommunications operator in Turkey, as well as a provider of fiber broadband access. There are high barriers to entry in this sector, and increasing competitive rationality and strong data demand should lead to double-digit revenue growth for the company. Elsewhere, the Portfolio’s underweight positioning in Indonesia was unfavorable in terms of asset allocation.

The financials sector added the most to the Portfolio’s relative performance due to positive stock selection. The Portfolio’s positions in Itau Unibanco Holding and Banco Santander Brasil and the Portfolio’s underweight positioning in Chinese financials were the main contributors to performance.

In contrast, the consumer staples sector detracted the most from performance. Shares of Lotte Chilsung Beverage in Korea were pressured by an ongoing investigation into alleged misuse of funds by Lotte Group’s senior management. We will continue to monitor these developments, but we do not believe that they materially alter the underlying businesses. Shares of Uni-President China Holdings also detracted from the Portfolio’s performance as industry growth remained lackluster in both noodles and beverages. Uni-President China remains a leader in instant noodles and beverages in China and we believe that the company has competitive brands and should continue to gain market share.

Despite a challenging macroeconomic backdrop, we believe there are pockets of opportunities for long-term stock appreciation driven by structural demographic shifts, technology adoption, implementation of government policy, improvement in corporate governance, and industry consolidation. Our investment approach remains centered on identifying individual companies that we believe possess sustainable franchises and favorable long-term growth prospects and that trade at significant discounts to their intrinsic value. We are particularly focused on companies that we think should benefit from long-term changes in how people in emerging markets live and work. Sectors we currently favor include technology and telecommunication.

|

| The views expressed are current as of the date of this report and subject to change. |

23

Performance summary

Delaware Pooled® Trust — The Emerging Markets Portfolio II

The performance data quoted represent past performance; past performance does not guarantee future results. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Please obtain the performance data for the most recent month end by calling 800 231-8002 or visiting our website at delawareinvestments.com/dpt/performance.

Carefully consider the Portfolio’s investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Portfolio’s prospectus which may be obtained by visiting delawareinvestments.com/dpt/literature or calling 800 231-8002. Investors should read the prospectus carefully before investing.

| | | | | | | | | | | | | | | | |

| Portfolio and benchmark performance | | | | | | | | | | | | | | | | |

| Average annual total returns | | | | | | | | | | | | | | | | |

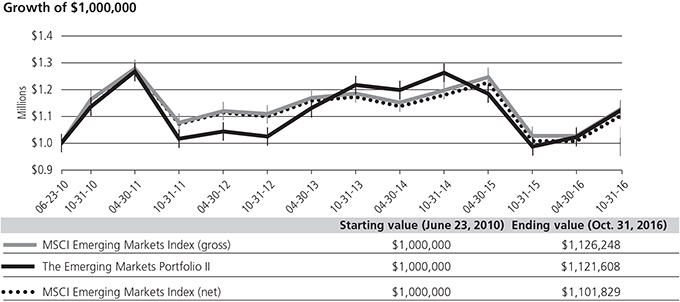

| Periods ended Oct. 31, 2016 | | 1 year | | | 3 years | | | 5 years | | | Lifetime | |

| | | | |

| | | | | | | | | | | | | | | | |

The Emerging Markets Portfolio II | | | +13.62% | | | | –2.68% | | | | +1.99% | | | | +1.82% | |