Item 1. Reports to Stockholders

| | |

Annual report 2014 | | |

| |

October 31, 2014 | | |

| |

U.S. equities | | U.S. fixed income |

The Large-Cap Value Equity Portfolio | | The High-Yield Bond Portfolio |

The Select 20 Portfolio | | The Core Plus Fixed Income Portfolio |

The Large-Cap Growth Equity Portfolio | | |

The Focus Smid-Cap Growth Equity Portfolio | | |

| | International equities |

| | The International Equity Portfolio |

| | The Labor Select International Equity Portfolio |

| | The Emerging Markets Portfolio |

| | The Emerging Markets Portfolio II |

This page intentionally left blank.

Delaware Pooled® Trust

Delaware Pooled Trust, based in Philadelphia, is a registered investment company that offers no-load, open-end equity and fixed income mutual funds to institutional and high net worth individual investors.

Delaware Management Company, a series of Delaware Management Business Trust, serves as investment advisor for the Portfolios. Mondrian Investment Partners Limited serves as investment sub-advisor for The International Equity Portfolio,* The Labor Select International Equity Portfolio, and The Emerging Markets* Portfolio. Jackson Square Partners, LLC, serves as investment sub-advisor for The Select 20 Portfolio, The Large-Cap Growth Equity Portfolio, and The Focus-Smid Cap Growth Equity Portfolio.

The performance quoted in this report represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 800 231-8002 or visiting delawareinvestments.com/institutional/performance. Carefully consider the Portfolios’ investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Portfolios’ prospectus and, if available, its summary prospectus, which may be obtained by visiting delawareinvestments.com or calling 800 231-8002. Investors should read the prospectus and, if available, the summary prospectus carefully before investing. Performance includes reinvestment of all distributions.

Portfolios are not FDIC insured and are not guaranteed. It is possible to lose the principal amount invested. Mutual fund advisory services are provided by Delaware Management Company, a series of Delaware Management Business Trust (DMBT), which is a registered investment advisor. Delaware Investments is the marketing name of Delaware Management Holdings, Inc. (DMHI) and its subsidiaries.

Investments in the Portfolios are not and will not be deposits with or liabilities of Macquarie Bank Limited ABN 46 008 583 542 and its holding companies, including their subsidiaries or related companies (Macquarie Group), and are subject to investment risk, including possible delays in repayment and loss of income and capital invested. No Macquarie Group company guarantees or will guarantee the performance of the Portfolios, the repayment of capital from the Portfolios, or any particular rate of return.

*Closed to new investors.

©2014 Delaware Management Holdings, Inc.

All third-party marks cited are the property of their respective owners.

Portfolio objectives and strategies

The Large-Cap Value Equity Portfolio seeks long-term capital appreciation. The Portfolio invests primarily in securities of large-capitalization companies that we believe have long-term capital appreciation potential. The Portfolio currently defines large-capitalization stocks as those with market capitalizations of $5 billion or greater at the time of purchase. Typically, we seek to select securities that we believe are undervalued in relation to their intrinsic value as indicated by multiple factors.

The Select 20 Portfolio seeks long-term capital appreciation. The Portfolio seeks to achieve its objective by investing in a portfolio of twenty (20) securities, primarily common stocks of companies that the Portfolio’s sub-advisor, Jackson Square Partners, LLC believes have long-term capital appreciation potential and are expected to grow faster than the U.S. economy.

The Large-Cap Growth Equity Portfolio seeks capital appreciation. The Portfolio invests primarily in common stocks of growth-oriented companies that the Portfolio’s sub-advisor, Jackson Square Partners, LLC (“JSP”), believes have long-term capital appreciation potential and expects to grow faster than the U.S. economy. For purposes of the Portfolio, JSP generally considers large-capitalization companies to be those that, at the time of purchase, have total market capitalizations within the range of market capitalizations of companies in the Russell 1000® Growth Index.

The Focus Smid-Cap Growth Equity Portfolio seeks long-term capital appreciation. The Portfolio invests primarily in common stocks of growth-oriented companies that the Portfolio’s sub-advisor, Jackson Square Partners, LLC believes have long-term capital appreciation potential and expects to grow faster than the U.S. economy. For purposes of this Portfolio, small-market capitalization companies are those companies whose market capitalization is similar to the market capitalization of companies in the Russell 2000® Growth Index, and mid-market capitalization companies are those companies whose market capitalization is similar to the market capitalization of companies in the Russell Midcap® Growth Index. The two indices listed above are for purposes of determining range and not for targeting portfolio management.

The High-Yield Bond Portfolio seeks high total return. The Portfolio will primarily invest its assets at the time of purchase in: (1) corporate bonds rated BB or lower by Standard & Poor’s (S&P) or similarly rated by another nationally recognized statistical rating organization; (2) securities issued or guaranteed by the U.S. government, its agencies, or instrumentalities; or (3) commercial paper of companies rated A-1 or A-2 by S&P, rated P-1 or P-2 by Moody’s Investors Service, Inc. (Moody’s), or unrated but considered to be of comparable quality.

The Core Plus Fixed Income Portfolio seeks maximum long-term total return, consistent with reasonable risk. The Portfolio allocates its investments principally among three sectors of the fixed income securities markets: U.S. investment grade sector, U.S. high yield sector, and international sector.

The International Equity Portfolio seeks maximum long-term total return. The Portfolio invests primarily in equity securities of companies that are organized, have a majority of their assets, or derive most of their operating income outside the United States, and that, in the opinion of Mondrian Investment Partners Limited, the Portfolio’s sub-advisor, are undervalued at the time of purchase based on the sub-advisor’s fundamental analysis. Investments will be made mainly in marketable securities of companies in developed countries. The International Equity Portfolio is presently closed to new investors.

The Labor Select International Equity Portfolio seeks maximum long-term total return. The Portfolio invests primarily in equity securities of companies that are organized, have a majority of their assets, or derive most of their operating income outside of the United States, and that, in the opinion of Mondrian Investment Partners Limited (“Mondrian”), the Portfolio’s sub-advisor, are undervalued at the time of purchase based on the rigorous fundamental analysis that the sub-advisor employs. In addition to following these quantitative guidelines, Mondrian will select securities of issuers that present certain characteristics that are compatible or operate in accordance with certain investment policies or restrictions followed by organized labor.

The Emerging Markets Portfolio seeks long-term capital appreciation. The Portfolio generally invests in equity securities of companies that are organized in, have a majority of their assets in, or derive a majority of their operating income from emerging countries. The Emerging Markets Portfolio is presently closed to new investors.

The Emerging Markets Portfolio II seeks long-term capital appreciation. The Portfolio invests primarily in a broad range of equity securities of companies located in emerging market countries. The Portfolio may invest in companies of any size. The portfolio manager believes that although market price and intrinsic business value are positively correlated in the long run, short-term divergences can emerge. The Portfolio seeks to take advantage of these divergences through a fundamental, bottom-up approach. The Portfolio invests in securities of companies with sustainable franchises when they are trading at a discount to the portfolio manager’s intrinsic value estimate for that security.

2

Carefully consider the Portfolios’ investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Portfolios’ prospectus and, if available, its summary prospectus, which may be obtained by visiting delawareinvestments.com or calling 800 231-8002. Investors should read the applicable prospectus and, if available, the applicable summary prospectus carefully before investing.

The Portfolios of Delaware Pooled ® Trust (DPT) are designed exclusively for institutional investors and high net worth individuals.

International investments entail risks not ordinarily associated with U.S. investments including fluctuation in currency values, differences in accounting principles, or economic or political instability in other nations. Investing in emerging markets can be riskier than investing in established foreign markets due to increased volatility and lower trading volume.

Narrowly focused investments may exhibit higher volatility than investments in multiple industry sectors.

The Portfolios’ share prices and yields will fluctuate in response to movements in stock prices.

Fixed income securities and bond funds can lose value, and investors can lose principal, as interest rates rise. They also may be affected by economic conditions that hinder an issuer ’s ability to make interest and principal payments on its debt.

The Portfolios may also be subject to prepayment risk, the risk that the principal of a fixed income security that is held by the Portfolios may be prepaid prior to maturity, potentially forcing the Portfolios to reinvest that money at a lower interest rate.

Securities in the lowest of the rating categories considered to be investment grade (that is, Baa or BBB) have some speculative characteristics.

High yielding, noninvestment grade bonds (junk bonds) involve higher risk than investment grade bonds.

The high yield secondary market is particularly susceptible to liquidity problems when institutional investors, such as mutual funds and certain other financial institutions, temporarily stop buying bonds for regulatory, financial, or other reasons. In addition, a less liquid secondary market makes it more difficult for a Portfolio to obtain precise valuations of the high yield securities in its portfolio.

Certain Portfolios expect to hold a concentrated portfolio of a limited number of securities; those Portfolios’ risk is increased because each investment has a greater effect on that Portfolio’s overall performance.

The Select 20 Portfolio is considered “nondiversified” as defined in the Investment Company Act of 1940. “Nondiversified” Portfolios may allocate more of their net assets to investments in single securities than “diversified” Portfolios. Resulting adverse effects may subject this Portfolio to greater risks and volatility.

Portfolio management review

Delaware Pooled® Trust — The Large-Cap Value Equity Portfolio

October 31, 2014

For the fiscal year ended Oct. 31, 2014, Delaware Pooled Trust — The Large-Cap Value Equity Portfolio returned +16.19% at net asset value (NAV) with all distributions reinvested. This result modestly trailed the Portfolio’s benchmark, the Russell 1000® Value Index, which gained +16.46% during the period. Complete annualized performance for The Large-Cap Value Equity Portfolio is shown in the table on page 5.

It was a relatively strong 12-month period for stocks, despite a pickup in market volatility late in the fiscal year. Corporate earnings growth remained positive, if slower than in the years immediately following the global financial crisis. Meanwhile, the U.S. economy continued its slow but steady expansion, as did the country’s employment picture. As of the end of October 2014, the national jobless rate was 5.8% — the lowest level since July 2008 — and down from 7.2% a year earlier. (Source: U.S. Commerce Department.)

Late in the fiscal year, the U.S. Federal Reserve wrapped up its quantitative-easing economic stimulus program, though it reiterated plans to maintain its benchmark short-term interest rate near zero for some time longer. This commitment helped boost stock prices, even in the face of various global challenges, including renewed concerns about the European economy, serious geopolitical risks in Russia and the Middle East, and a sharp decline in the price of oil that weighed heavily on energy stocks.

Detractors from the Portfolio’s performance included securities in the healthcare, telecommunications, and energy sectors. Security selection in the healthcare sector was a source of weakness. In this sector, the Portfolio’s position in drugmaker Pfizer failed to gain much ground (returning 1% during the Portfolio’s fiscal year). Various factors weighed on Pfizer’s shares, including a series of revenue declines and a failed effort to acquire U.K.-based competitor AstraZeneca. Despite the underperformance, we continued to hold Pfizer in the Portfolio at fiscal year end and maintained a positive long-term outlook for the company.

The telecommunication services sector was another source of underperformance. Here, AT&T was the weakest individual performer, advancing just 1%. The company’s new discounted pricing plan has succeeded in reducing customer turnover but has also put pressure on revenues. Nevertheless, we still consider AT&T to be an undervalued stock with a strong balance sheet and believe it may be well positioned to benefit from various growth opportunities.

Within the struggling energy group, Occidental Petroleum was another source of underperformance. The company’s shares declined approximately -5% during the Portfolio’s fiscal year, due somewhat to more limited exposure to North American shale drilling than some of the company’s competitors. We continue to hold the stock because we believe it is undervalued and the company has what we view as attractive assets in California and Texas.

On the positive side, stock selection was strong in the industrials sector. Two defense contractors, Northrop Grumman and Raytheon, were strong performers for the Portfolio, gaining 31% and 29%, respectively, during the Portfolio’s fiscal year. In our opinion, both companies have been successful in cutting costs, managing through an environment of declining defense spending, and taking such shareholder-friendly steps as buying back shares and increasing dividends.

The information technology sector also added value, especially a position in Broadcom, which makes semiconductors for communications applications. Broadcom’s shares rose sharply in June after the company announced plans to abandon its unprofitable cellular baseband business. The move boosted the company’s earnings and cash flow and set the stage for a 59% stock-price increase during the Portfolio’s fiscal year. At the end of the period, we continued to view Broadcom as a high-quality company with a strong balance sheet and favorable competitive position in many growing business segments.

We made relatively few changes to the Portfolio during the fiscal year. In financials, we sold a longtime stake in property casualty insurance company Travelers in March 2014, after the stock reached our price target. We used the proceeds to establish a new position in financial holding company BB&T. Meanwhile, within technology, we sold communications equipment maker Motorola Solutions, which similarly reached our target price, and, as of the end of the fiscal year, we were evaluating suitable alternatives for a replacement position.

At fiscal year end, we have aimed to position the Portfolio somewhat defensively, with a significant overweighting in the healthcare sector and modest overweightings in consumer staples and telecommunication services. We believe a generally defensive portfolio stance is prudent, given that the stock market now strikes us as fully valued. The one exception to the Portfolio’s defensive allocation is a relative overweighting in the energy sector. In this sector, we are taking a long-term view to see the potential for a reversal in the trends that have pushed down commodity prices. We are watching this segment of the market closely, however, and will not hesitate to re-evaluate the Portfolio’s positioning if recent pricing trends appear longer-lasting, in our view.

Regardless of market conditions, our approach remains consistent. We will continue to look for good businesses that may be available for purchase at what we view as compelling valuations because of temporary fundamental challenges and negative investor sentiment. We will continue to adhere to our process of searching for what we believe to be favorable relative values in the marketplace.

|

The views expressed are current as of the date of this report and subject to change. |

Performance summary

Delaware Pooled® Trust — The Large-Cap Value Equity Portfolio

The performance data quoted represent past performance; past performance does not guarantee future results. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Please obtain the performance data for the most recent month end by calling 800 231-8002 or visiting our website at delawareinvestments.com.

Carefully consider the Portfolio’s investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Portfolio’s prospectus and, if available, its summary prospectus, which may be obtained by visiting delawareinvestments.com or calling 800 231-8002. Investors should read the prospectus and, if available, the summary prospectus carefully before investing.

Portfolio and benchmark performance

| | | | | | | | | | |

Average annual total returns Periods ended Oct. 31, 2014 | | 1 year | | 3 years | | 5 years | | 10 years | | Lifetime |

The Large-Cap Value Equity Portfolio | | +16.19% | | +20.97% | | +18.50% | | +8.73% | | +10.26% |

Russell 1000 Value Index | | +16.46% | | +20.42% | | +16.49% | | +7.90% | | +10.30% |

Portfolio profile

Oct. 31, 2014

| | |

| Total net assets | | Number of holdings |

$139.8 million | | 32 |

Feb. 3, 1992

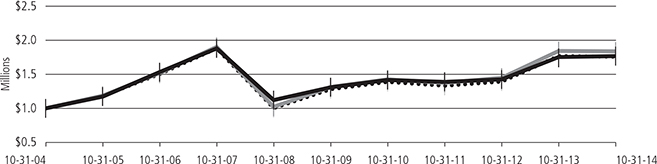

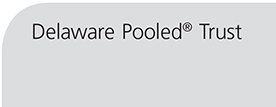

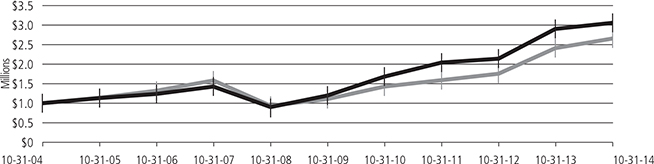

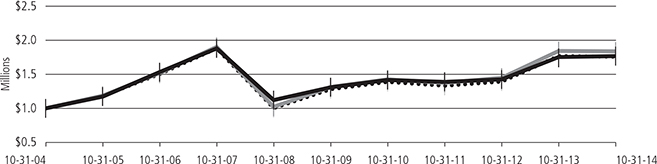

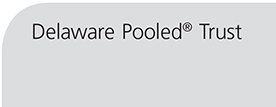

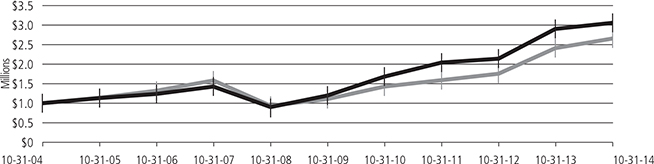

Growth of $1,000,000

| | | | |

| | | Starting value (Oct. 31, 2004) | | Ending value (Oct. 31, 2014) |

| | |

The Large-Cap Value Equity Portfolio The Large-Cap Value Equity Portfolio

| | $1,000,000 | | $2,309,306 |

| | |

Russell 1000 Value Index Russell 1000 Value Index

| | $1,000,000 | | $2,139,168 |

The performance graph assumes $1 million invested on Oct. 31, 2004, and includes reinvestment of all distributions. The performance graph does not reflect the deduction of taxes the shareholder would pay on Portfolio distributions or redemptions of Portfolio shares.

Total return assumes reinvestment of dividends and capital gains, but does not reflect reductions for taxes. Returns and share values will fluctuate so that shares, when redeemed, may be worth more or less than their original cost.

The most recent prospectus disclosed the Portfolio’s total operating expenses as 0.72%. Management has contractually agreed to reimburse certain expenses and/or waive its management fees from Nov. 1, 2013, through Oct. 31, 2014,* in order to prevent total annual Portfolio

Performance summary

Delaware Pooled® Trust — The Large-Cap Value Equity Portfolio

operating expenses (with certain exclusions) from exceeding, in an aggregate amount, 0.70% of the Portfolio’s average daily net assets, as described in the most recent prospectus.

Expense limitations were in effect during the period shown. Performance would have been lower had the expense limitations not been in effect.

The Russell 1000 Value Index measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000 companies with lower price-to-book ratios and lower forecasted growth values.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

Investing involves risk, including the possible loss of principal.

Past performance is not a guarantee of future results.

* The contractual waiver period is from Feb. 28, 2013 through Feb. 27, 2015.

6

Portfolio management review

Delaware Pooled® Trust — The Select 20 Portfolio

October 31, 2014

For the fiscal year ended Oct. 31, 2014, Delaware Pooled Trust — The Select 20 Portfolio returned +15.92% at net asset value (NAV) with all distributions reinvested, underperforming its benchmark, the Russell 3000® Growth Index, which returned +16.39% for the same period. Complete annualized performance for The Select 20 Portfolio is shown in the table on page 8.

Despite several economic hurdles, U.S. stocks posted strong gains for the fiscal year ended Oct. 31, 2014. The S&P 500® Index gained a solid 17.27% during the period, recovering handily from several severe market dips, most notably in early February and mid-October 2014. Large-cap equities performed particularly well during the period, as indicated by the 16.78% gain in the Russell 1000® Index. Outside the United States, market conditions remained volatile for much of the fiscal year as evidenced by the MSCI EAFE Index decline of 0.60%. (Source: FactSet.) The tension between Russia and Ukraine, conflicts in the Middle East, and concerns about the Islamic State of Iraq and Syria (ISIS) increased anxiety for investors throughout the world.

In December 2013, the U.S. Federal Reserve, under the leadership of newly appointed Chairwoman Janet Yellen, announced it would begin reducing its $85-billion-per-month quantitative-easing (QE3) strategy, with the goal of ending it by late 2014. The Fed reduced its purchase of U.S. Treasurys by $10 billion on several occasions and eventually completed its purchase program in late October. The Fed indicated, however, that it would revisit the bond buyback strategy if the economy were to worsen.

Economic growth gained momentum during the last six months of the Portfolio’s fiscal year after a series of severe storms dampened consumer spending and housing activity for much of the winter. Consumer confidence rose during this period as job openings expanded somewhat and unemployment claims dropped. Consumer spending, capital purchases, and spending by local governments all added to gross domestic product, which grew 4.6% in the second quarter of 2014 and then another 3.5% in the third quarter (according to the U.S. Commerce Department’s advance estimate).

Allergan contributed to performance during the period. The stock experienced a strong rise in price following an acquisition offer from Canada-based Valeant Pharmaceuticals International. While Allergan rejected the acquisition, Valeant continued to aggressively pursue an acquisition of Allergan. We continue to hold the company and our discussions are focused on what we believe to be fair value for

Allergan under several different scenarios. While much attention has been focused on the potential acquisition, we continue to believe the company operates at a high level driven both by its core ophthalmology franchise and the growing use of Botox in both cosmetic and other medical indications.

VeriFone Systems likewise contributed to performance during the period. Management’s execution in driving the company’s international expansion as well as realizing synergies from recent strategic initiatives enabled the company to recover from a period of fundamental difficulty. Going forward, we believe the company could see some upside as the industry moves toward more secure payment methods. Several high-profile credit card “hacking” incidents could potentially result in VeriFone’s customers upgrading to point-of-sale terminals with tighter security standards and capabilities.

NeuStar detracted from performance during the period. The company experienced weakness as the approval process — allowing the company to remain the sole database provider of cell phone numbers and other related information for the North American wireless carrier industry — was in negotiations and had come increasingly into question. While we felt NeuStar may have ultimately gotten the renewal, at least in most of its current form, there were growing concerns. While we continue to believe the company has attractive business-model characteristics and an attractive cash-flow-based valuation, we decided to exit the Portfolio’s position during the period due to the company’s higher risk profile.

j2 Global was also a detractor from performance during the period. The stock declined early in the period as the company reported earnings results that missed consensus expectations. We felt the stock’s decline was likely an overreaction and that the company could continue to add incremental value for shareholders, in our opinion, by making many small, strategic, and financially sound acquisitions. While the stock has since recovered, it ended the period relatively flat during an overall strong up market.

Regardless of the economic outcome, we remain consistent in our long-term investment philosophy: We want to own what we view as strong secular-growth companies with solid business models and competitive positions that we believe can grow market share and have the potential to deliver shareholder value in a variety of market environments.

The views expressed are current as of the date of this report and subject to change.

Performance summary

Delaware Pooled® Trust — The Select 20 Portfolio

The performance data quoted represent past performance; past performance does not guarantee future results. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Please obtain the performance data for the most recent month end by calling 800 231-8002 or visiting our website at delawareinvestments.com.

Carefully consider the Portfolio’s investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Portfolio’s prospectus and, if available, its summary prospectus, which may be obtained by visiting delawareinvestments.com or calling 800 231-8002. Investors should read the prospectus and, if available, the summary prospectus carefully before investing.

Portfolio and benchmark performance

| | | | | | | | | | |

Average annual total returns Periods ended Oct. 31, 2014 | | 1 year | | 3 years | | 5 years | | 10 years | | Lifetime |

The Select 20 Portfolio | | +15.92% | | +17.95% | | +18.06% | | +8.72% | | +2.06% |

Russell 3000 Growth Index | | +16.39% | | +19.23% | | +17.52% | | +9.09% | | +1.79% |

Portfolio profile

Oct. 31, 2014

| | |

| Total net assets | | Number of holdings |

$90.4 million | | 22 |

March 31, 2000

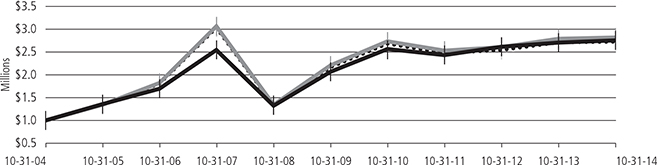

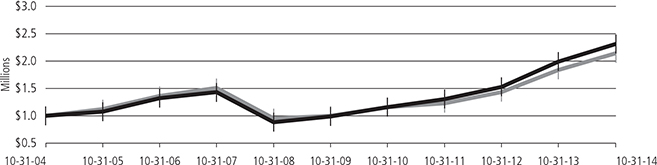

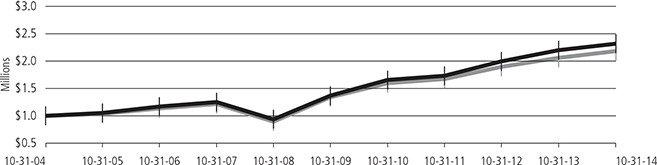

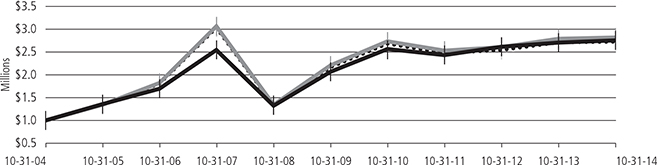

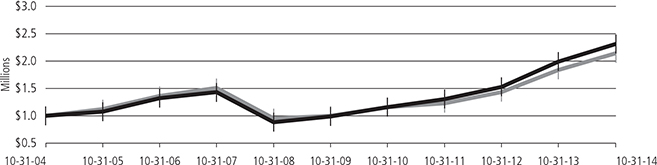

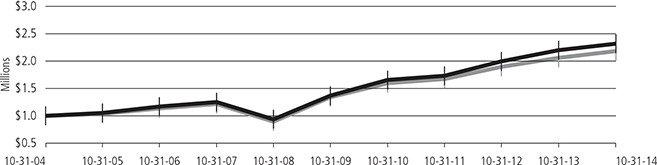

Growth of $1,000,000

| | | | |

| | | Starting value (Oct. 31, 2004) | | Ending value (Oct. 31, 2014) |

| | |

Russell 3000 Growth Index Russell 3000 Growth Index

| | $1,000,000 | | $2,386,373 |

| | |

The Select 20 Portfolio The Select 20 Portfolio

| | $1,000,000 | | $2,307,121 |

The performance graph assumes $1 million invested on Oct. 31, 2004, and includes reinvestment of all distributions. The performance graph does not reflect the deduction of taxes the shareholder would pay on Portfolio distributions or redemptions of Portfolio shares.

Total return assumes reinvestment of dividends and capital gains, but does not reflect reductions for taxes. Returns and share values will fluctuate so that shares, when redeemed, may be worth more or less than their original cost.

The most recent prospectus disclosed the Portfolio’s total operating expenses as 0.85%. Management has contractually agreed to reimburse certain expenses and/or waive its management fees from Nov. 1, 2013, through Oct. 31, 2014,* in order to prevent total annual Portfolio

8

operating expenses (with certain exceptions) from exceeding, in an aggregate amount, 0.89% of the Portfolio’s average daily net assets, as described in the most recent prospectus.

Expense limitations were in effect during the period shown. Performance would have been lower had the expense limitations not been in effect.

The Russell 3000 Growth Index measures the performance of the broad growth segment of the U.S. equity universe. It includes those Russell 3000 companies with higher price-to-book ratios and higher forecasted growth values.

The Russell 1000 Index measures the performance of the large-cap segment of the U.S. equity universe.

The S&P 500 Index measures the performance of 500 mostly large-cap stocks weighted by market value, and is often used to represent performance of the U.S. stock market.

The MSCI EAFE Index measures equity market performance across developed market countries in Europe, Australasia, and the Far East. Index “net” return approximates the minimum possible dividend reinvestment, after deduction of withholding tax at the highest possible rate.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

Investing involves risk, including the possible loss of principal.

Past performance is not a guarantee of future results.

Because the Portfolio expects to hold a concentrated portfolio of a limited number of securities, the Portfolio’s risk is increased because each investment has a greater effect on the Portfolio’s overall performance.

Investments in small and/or medium-sized companies typically exhibit greater risk and higher volatility than larger, more established companies.

“Nondiversified” Portfolios may allocate more of their net assets to investments in single securities than “diversified” Portfolios. Resulting adverse effects may subject these Portfolios to greater risks and volatility.

On Feb. 28, 2008, the Portfolio changed its investment strategy to limit its investments to no less than 15 securities and no more than 25 securities. The performance prior to Feb. 28, 2008 is that of the Portfolio’s predecessor, The All-Cap Growth Equity Portfolio.

* The contractual waiver period is from Feb. 28, 2013 through Feb. 27, 2015.

Portfolio management review

Delaware Pooled® Trust — The Large-Cap Growth Equity Portfolio

October 31, 2014

For the fiscal year ended Oct. 31, 2014, Delaware Pooled Trust — The Large-Cap Growth Equity Portfolio returned +17.10% at net asset value (NAV) with all distributions reinvested. The Portfolio slightly underperformed its benchmark, the Russell 1000® Growth Index, which returned +17.11% for the same period. Complete annualized performance for The Large-Cap Growth Equity Portfolio is shown in the table on page 11.

Despite several economic hurdles, U.S. stocks posted strong gains for the fiscal year ended Oct. 31, 2014. The S&P 500® Index gained a solid 17.27% during the period, recovering handily from several severe market dips, most notably in early February and mid-October 2014. Large-cap equities performed particularly well during the period, as indicated by the 16.78% gain in the Russell 1000® Index. Outside the United States, market conditions remained volatile for much of the fiscal year as evidenced by the MSCI EAFE Index decline of 0.60%. (Source: FactSet.) The tension between Russia and Ukraine, conflicts in the Middle East, and concerns about the Islamic State of Iraq and Syria (ISIS) increased anxiety for investors throughout the world.

In December 2013, the U.S. Federal Reserve, under the leadership of newly appointed Chairwoman Janet Yellen, announced it would begin reducing its $85-billion-per-month quantitative-easing (QE3) strategy, with the goal of ending it by late 2014. The Fed reduced its purchase of U.S. Treasurys by $10 billion on several occasions and eventually completed its purchase program in late October. The Fed indicated, however, that it would revisit the bond buyback strategy if the economy were to worsen.

Economic growth gained momentum during the last six months of the Portfolio’s fiscal year after a series of severe storms dampened consumer spending and housing activity for much of the winter. Consumer confidence rose during this period as job openings expanded somewhat and unemployment claims dropped. Consumer spending, capital purchases, and spending by local governments all added to gross domestic product, which grew 4.6% in the second quarter of 2014 and then another 3.5% in the third quarter (according to the U.S. Commerce Department’s advance estimate).

Allergan contributed to performance during the period. The stock experienced a strong rise in price following an acquisition offer from Canada-based Valeant Pharmaceuticals International. While Allergan rejected the acquisition, Valeant continued to aggressively pursue an acquisition of Allergan. We continue to hold the company and our discussions are focused on what we believe to be fair value for Allergan under several different scenarios. While much attention has been focused on the potential acquisition, we continue to believe the company operates at a high level driven both by its core

ophthalmology franchise and the growing use of Botox in both cosmetic and other medical indications.

Celgene likewise contributed to performance during the period as the company experienced several positive events throughout the year. The company made significant progress toward regulatory approval for expanded use of one of its drugs within the United Kingdom. It also achieved positive clinical advancements for a new drug to treat Crohn’s disease. Overall, Celgene, in our opinion, continues to be a leader in the treatment of blood cancers with a growing pipeline of breast, lung, and pancreatic cancer treatments. We believe the company continues to benefit from large growth prospects driven by additional indications for its drugs, by increased use of existing drugs, and by international growth opportunities.

Apple was a detractor from performance during the period due to the Portfolio’s lack of significant exposure to this strong-performing company. We sold the company due to growing concerns related to its future growth trajectory, margin compression, and product innovation, among others. We still believe Apple is not merely a hardware company, but rather a platform solution where customers tend to be sticky and buy into the “halo” effect of the Apple ecosystem. Therefore, we believe that the sustainability of Apple’s franchise will be stronger for a longer period of time and that the company deserves a higher valuation than the typical technology hardware company. However, as the risk-reward profile of this company had changed, we no longer felt the stock was as attractive relative to our other holdings in the portfolio and decided to exit the Portfolio’s position.

Syngenta detracted from performance during the period. In our experience, investors have shown increasing concern about future product development, margin compression, lack of progress in cost savings, industry lawsuits, and certain regulatory issues — most notably in China. We continue to believe that companies like Syngenta should benefit from the growing secular demand for their services, which can help increase crop yield and overall food quality. However, given Syngenta’s higher risk-reward trade-off as well as current headwinds that we think are unlikely to subside in the near-to-intermediate term, we decided to exit the Portfolio’s position during the period and allocate to more attractive opportunities.

Regardless of the economic outcome, we remain consistent in our long-term investment philosophy: We want to own what we view as strong secular-growth companies with solid business models and competitive positions that we believe can grow market share and have the potential to deliver shareholder value in a variety of market environments.

|

|

| The views expressed are current as of the date of this report and subject to change. |

Performance summary

Delaware Pooled® Trust — The Large-Cap Growth Equity Portfolio

The performance data quoted represent past performance; past performance does not guarantee future results. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Please obtain the performance data for the most recent month end by calling 800 231-8002 or visiting our website at delawareinvestments.com.

Carefully consider the Portfolio’s investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Portfolio’s prospectus and, if available, its summary prospectus, which may be obtained by visiting delawareinvestments.com or calling 800 231-8002. Investors should read the prospectus and, if available, the summary prospectus carefully before investing.

Portfolio and benchmark performance

| | | | | | | | | | |

Average annual total returns Periods ended Oct. 31, 2014 | | 1 year | | 3 years | | 5 years | | Lifetime | | |

The Large-Cap Growth Equity Portfolio | | +17.10% | | +20.34% | | +18.70% | | +8.42% | | |

Russell 1000 Growth Index | | +17.11% | | +19.30% | | +17.43% | | +9.08% | | |

Portfolio profile

Oct. 31, 2014

| | |

| Total net assets | | Number of holdings |

$277.3 million | | 30 |

Nov. 1, 2005

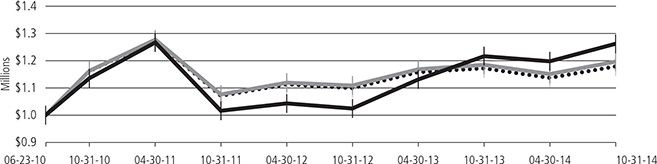

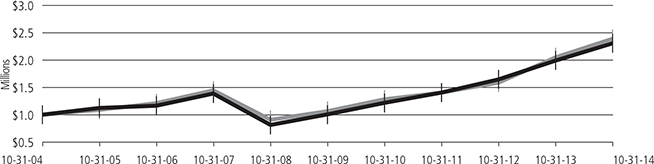

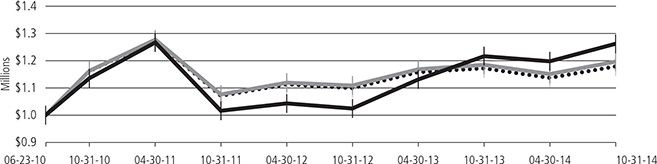

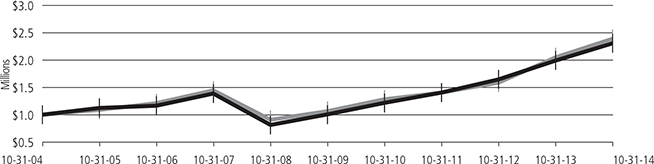

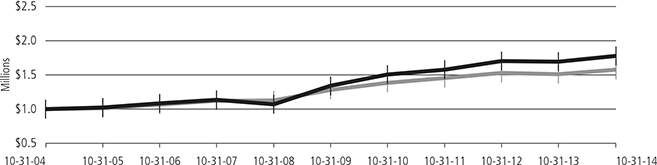

Growth of $1,000,000

| | | | |

| | | Starting value (Nov. 1, 2005) | | Ending value (Oct. 31, 2014) |

| | |

Russell 1000 Growth Index Russell 1000 Growth Index

| | $1,000,000 | | $2,196,171 |

| | |

The Large-Cap Growth Equity Portfolio The Large-Cap Growth Equity Portfolio

| | $1,000,000 | | $2,069,749 |

The performance graph assumes $1 million invested on Nov. 1, 2005, and includes reinvestment of all distributions. The performance graph does not reflect the deduction of taxes the shareholder would pay on Portfolio distributions or redemptions of Portfolio shares.

Total return assumes reinvestment of dividends and capital gains, but does not reflect reductions for taxes. Returns and share values will fluctuate so that shares, when redeemed, may be worth more or less than their original cost.

The most recent prospectus disclosed the Portfolio’s total operating expenses as 0.65%. Management has contractually agreed to reimburse certain expenses and/or waive its management fees from Nov. 1, 2013, through Oct. 31, 2014,* in order to prevent total annual Portfolio

Performance summary

Delaware Pooled® Trust — The Large-Cap Growth Equity Portfolio

operating expenses (with certain exceptions) from exceeding, in an aggregate amount, 0.65% of the Portfolio’s average daily net assets, as described in the most recent prospectus.

Expense limitations were in effect during the period shown. Performance would have been lower had the expense limitations not been in effect.

The Russell 1000 Growth Index measures the performance of the large-cap growth segment of the U.S. equity universe. It includes those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values.

The S&P 500 Index measures the performance of 500 mostly large-cap stocks weighted by market value, and is often used to represent performance of the U.S. stock market.

The Russell 1000 Index measures the performance of the large-cap segment of the U.S. equity universe.

The MSCI EAFE Index measures equity market performance across developed market countries in Europe, Australasia, and the Far East. Index “net” return approximates the minimum possible dividend reinvestment, after deduction of withholding tax at the highest possible rate.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

Investing involves risk, including the possible loss of principal.

Past performance is not a guarantee of future results.

Because the Portfolio expects to hold a concentrated portfolio of a limited number of securities, the Portfolio’s risk is increased because each investment has a greater effect on the Portfolio’s overall performance.

*The contractual waiver period is from Feb. 28, 2013 through Feb. 27, 2015.

12

Portfolio management review

Delaware Pooled® Trust — The Focus Smid-Cap Growth Equity Portfolio

October 31, 2014

For the fiscal year ended Oct. 31, 2014, Delaware Pooled Trust — The Focus Smid-Cap Growth Equity Portfolio returned +5.51% at net asset value (NAV) with all distributions reinvested. The Portfolio underperformed its benchmark, the Russell 2500™ Growth Index, which returned +10.24% for the same period. Complete annualized performance for The Focus Smid-Cap Growth Equity Portfolio is shown in the table on page 14.

Despite several economic hurdles, U.S. stocks posted strong gains for the fiscal year ended Oct. 31, 2014. The S&P 500® Index gained a solid 17.27% during the period, recovering handily from a number of market dips, most notably in early February and mid October 2014. Large-cap equities performed particularly well during the period, as indicated by the 16.78% gain in the Russell 1000® Index. Outside the United States, market conditions remained volatile for much of the fiscal year as evidenced by the MSCI EAFE Index decline of 0.60%. (Source: FactSet.) The tension between Russia and Ukraine, conflicts in the Middle East, and concerns about the Islamic State of Iraq and Syria (ISIS) increased anxiety for investors throughout the world.

In December 2013, the U.S. Federal Reserve, under the leadership of newly appointed Chairwoman Janet Yellen, announced it would begin reducing its $85-billion-per-month quantitative-easing (QE3) strategy, with the goal of ending it by late 2014. The Fed reduced its purchase of U.S. Treasurys by $10 billion on several occasions and eventually completed its purchase program in late October. The Fed indicated, however, that it would revisit the bond buyback strategy if the economy were to worsen.

Economic growth gained momentum during the last six months of the Portfolio’s fiscal year after a series of severe storms dampened consumer spending and housing activity for much of the winter. Consumer confidence rose during this period as job openings expanded somewhat and unemployment claims dropped. Consumer spending, capital purchases, and spending by local governments all added to gross domestic product, which grew 4.6% in the second quarter of 2014 and then another 3.5% in the third quarter (according to the U.S. Commerce Department’s advance estimate).

VeriFone Systems contributed to performance during the period. Management’s execution in driving the company’s international expansion as well as realizing synergies from recent strategic initiatives enabled the company to recover from a period of fundamental difficulty. Going forward, we believe the company could see some upside as the industry moves toward more secure payment methods. Several high-profile credit card “hacking” incidents could

result in VeriFone’s customers upgrading to point-of-sale terminals with tighter security standards and capabilities.

Heartland Payment Systems likewise contributed to performance during the period. The stock rose as the company further strengthened its business through recent acquisitions and strategic partnerships. The company recently announced it would acquire TouchNet Information Systems, a payment-processing company that serves higher-education institutions. The acquisition makes Heartland Payment Systems the largest provider of payment-processing services to the higher-education market and further diversifies the company’s business. We feel these recent efforts should be accretive to shareholder value over the long term. We continue to believe the company is well positioned to benefit from the secular global trend of payment transactions moving from paper currency to electronic transactions.

Core Laboratories was a detractor from performance during the period. The stock declined as investors grew increasingly concerned about utilization of Core Laboratories services by North American clients in the near term. We are willing to live with a certain degree of cyclicality in the energy industry given that this company’s solutions to site analysis are valuable throughout the cycle. In our view, this is a well-owned stock with little historical controversy and volatility. Therefore, we believe that investors may be overreacting to potentially transitory weakness in commodity prices, which we believe is contributing to a reasonable conservative assessment of industry conditions by company management.

NeuStar detracted from performance during the period. The company experienced weakness as the approval process — allowing the company to remain the sole database provider of cell phone numbers and other related information for the North American wireless carrier industry — was in negotiations and had come increasingly into question. While we felt NeuStar may have ultimately gotten the renewal, at least in most of its current form, there were growing concerns. While we continue to believe the company has attractive business-model characteristics and an attractive cash-flow-based valuation, we decided to exit the Portfolio’s position during the period due to the company’s higher risk profile.

Regardless of the economic outcome, we remain consistent in our long-term investment philosophy: We want to own what we view as strong secular-growth companies with solid business models and competitive positions that we believe can grow market share and have the potential to deliver shareholder value in a variety of market environments.

|

|

| The views expressed are current as of the date of this report and subject to change. |

Performance summary

Delaware Pooled® Trust — The Focus Smid-Cap Growth Equity Portfolio

The performance data quoted represent past performance; past performance does not guarantee future results. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Please obtain the performance data for the most recent month end by calling 800 231-8002 or visiting our website at delawareinvestments.com.

Carefully consider the Portfolio’s investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Portfolio’s prospectus and, if available, its summary prospectus, which may be obtained by visiting delawareinvestments.com or calling 800 231-8002. Investors should read the prospectus and, if available, the summary prospectus carefully before investing.

Portfolio and benchmark performance

| | | | | | | | | | |

Average annual total returns Periods ended Oct. 31, 2014 | | 1 year | | 3 years | | 5 years | | 10 years | | Lifetime |

The Focus Smid-Cap Growth Equity Portfolio | | +5.51% | | +14.42% | | +20.75% | | +11.83% | | +10.61% |

Russell 2500 Growth Index | | +10.24% | | +18.64% | | +19.20% | | +10.26% | | +9.63% |

Portfolio profile

Oct. 31, 2014

| | |

| Total net assets | | Number of holdings |

$43.3 million | | 26 |

Dec. 1, 2003

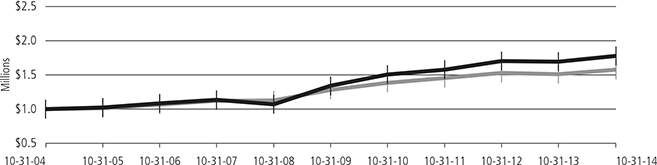

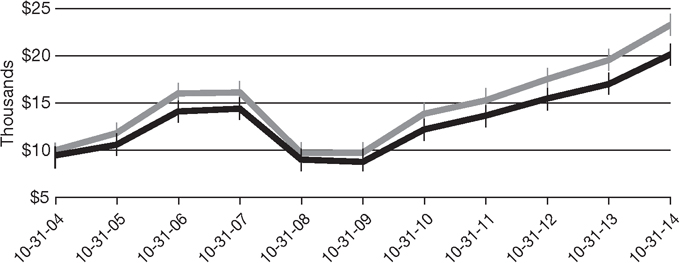

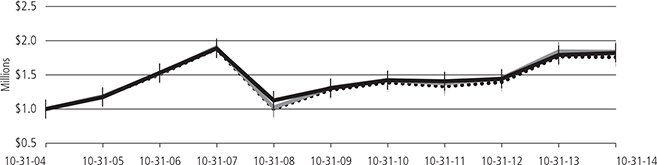

Growth of $1,000,000

| | | | |

| | | Starting value (Oct. 31, 2004) | | Ending value (Oct. 31, 2014) |

| | |

The Focus Smid-Cap Growth Equity Portfolio The Focus Smid-Cap Growth Equity Portfolio

| | $1,000,000 | | $3,058,406 |

| | |

Russell 2500 Growth Index Russell 2500 Growth Index

| | $1,000,000 | | $2,656,668 |

The performance graph assumes $1 million invested on Oct. 31, 2004, and includes reinvestment of all distributions. The performance graph does not reflect the deduction of taxes the shareholder would pay on Portfolio distributions or redemptions of Portfolio shares.

Total return assumes reinvestment of dividends and capital gains, but does not reflect reductions for taxes. Returns and share values will fluctuate so that shares, when redeemed, may be worth more or less than their original cost.

The most recent prospectus disclosed the Portfolio’s total operating expenses as 0.89%. Management has contractually agreed to reimburse certain expenses and/or waive its management fees from Nov. 1, 2013, through Oct. 1, 2014,* in order to prevent total annual Portfolio

14

operating expenses (with certain exceptions) from exceeding, in an aggregate amount, 0.92% of the Portfolio’s average daily net assets, as described in the most recent prospectus.

Expense limitations were in effect during the period shown. Performance would have been lower had the expense limitations not been in effect.

The Russell 2500 Growth Index measures the performance of the small- to mid-cap growth segment of the U.S. equity universe. It includes those Russell 2500 companies with higher price-to-book ratios and higher forecasted growth values.

The S&P 500 Index measures the performance of 500 mostly large-cap stocks weighted by market value, and is often used to represent performance of the U.S. stock market.

The Russell 1000 Index measures the performance of the large-cap segment of the U.S. equity universe.

The MSCI EAFE Index measures equity market performance across developed market countries in Europe, Australasia, and the Far East. Index “net” return approximates the minimum possible dividend reinvestment, after deduction of withholding tax at the highest possible rate.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

Investing involves risk, including the possible loss of principal.

Past performance is not a guarantee of future results.

Investments in small and/or medium-sized companies typically exhibit greater risk and higher volatility than larger, more established companies.

Because the Portfolio expects to hold a concentrated portfolio of a limited number of securities, the Portfolio’s risk is increased because each investment has a greater effect on the Portfolio’s overall performance.

*The contractual waiver period is from Feb. 28, 2013 through Feb. 27, 2015.

Portfolio management review

Delaware Pooled® Trust — The High-Yield Bond Portfolio

October 31, 2014

For the fiscal year ended Oct. 31, 2014, Delaware Pooled Trust — The High-Yield Bond Portfolio returned +5.23% at net asset value (NAV) with all distributions reinvested. For the same period, the Portfolio’s benchmark, the BofA Merrill Lynch U.S. High Yield Constrained Index, returned +5.85%. Complete annualized performance for The High-Yield Bond Portfolio is shown in the table on page 17.

Despite significant fluctuations in the macroeconomic and geopolitical environment, high yield securities remained among the strongest-performing sectors of the domestic bond market during the Portfolio’s fiscal year. However, those fluctuations triggered abrupt changes to investor sentiment that were reflected in heightened volatility across the entire fixed income asset class.

Evidence accumulated early in the Portfolio’s fiscal year that the U.S. economy was picking up steam after years of subpar growth. The U.S. Federal Reserve had pledged to keep benchmark interest rates at virtually zero for “a considerable time,” and the central bank’s third bond-buying program was in full swing. With financial markets awash in liquidity, risk assets of all types became primary beneficiaries. In fact, the lowest-rated credits were the strongest-performing within the high yield sector over the last three months of 2013.

Subsequent events called into question whether a normal recovery was indeed under way. Unusually fierce winter weather across much of the United States caused consumers to pull back and hunker down. Overseas, geopolitical unrest in Ukraine and a lingering economic slowdown in China were cause for concern. Yet, against that troubling backdrop, high yield bonds continued to perform well, with investors drawn to the sector by low default rates, strengthened balance sheets, reasonable spreads, and a clear income advantage over government and investment grade corporate debt. The global search for yield was even strong enough to overcome a burst of new issuance by below-investment-grade companies. However, economic and geopolitical worries caused relative strength within high yield to switch to higher-rated credits.

The positive correlation between performance and credit quality held firm during the final three months of the Portfolio’s fiscal year amid rising nominal yields and expanding credit spreads. Investors became

cautious due to renewed Russia-Ukraine tensions, the rise of the Islamic State of Iraq and Syria (ISIS) in the Middle East, the looming end to Fed bond buying, a secular growth slowdown in China, and tepid economic conditions in Europe. Those negative macroeconomic factors were exacerbated by weak technical conditions, as retail investors redeemed mutual fund shares while the supply of high yield debt expanded sharply.

The Portfolio’s exposure to basic industry and technology issues contributed to relative performance, while energy and utility exposure detracted from performance.

At the individual security level, the Portfolio benefited from its holdings in First Data (transaction processing), Salix Pharmaceuticals (drug manufacturing), Nuveen Investments (investment management), Ally Financial (financial services), and United Rentals (equipment rental). Detracting from relative performance were positions in Hercules Offshore (contract energy drilling), Samson International (energy exploration and production), Arch Coal (coal mining), Halcon Resources (energy exploration and production), and Quiksilver (outdoor sports retailer).

As the fiscal year ended, nearly half of the Portfolio’s assets were invested in B-rated securities, the middle rung on the sub-investment-grade credit ladder. From a sector standpoint, the largest share of Portfolio assets was in energy securities, an allocation representing a slight overweight to the benchmark. Overall, we believe the Portfolio is positioned to anticipate a renewed bout of volatility, given the historical tendency of securities underwriters to book gains before year end amid a seasonal erosion of liquidity. Longer-term, however, we continue to view the current moderate-growth, low-inflation environment as potentially favorable for high yield securities.

With respect to derivatives, we had positions in Treasury futures (representing a little more than 4% of Portfolio assets) to hedge against rate risk, and a position in a credit protection instrument to hedge against spread widening. These positions did not have a material effect on the Portfolio’s performance (that is, greater than 50 basis points).

The views expressed are current as of the date of this report and subject to change.

16

Performance summary

Delaware Pooled® Trust — The High-Yield Bond Portfolio

The performance data quoted represent past performance; past performance does not guarantee future results. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Please obtain the performance data for the most recent month end by calling 800 231-8002 or visiting our website at delawareinvestments.com.

Carefully consider the Portfolio’s investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Portfolio’s prospectus and, if available, its summary prospectus, which may be obtained by visiting delawareinvestments.com or calling 800 231-8002. Investors should read the prospectus and, if available, the summary prospectus carefully before investing.

Portfolio and benchmark performance

| | | | | | | | | | |

Average annual total returns Periods ended Oct. 31, 2014 | | 1 year | | 3 years | | 5 years | | 10 years | | Lifetime |

The High-Yield Bond Portfolio | | +5.23% | | +10.18% | | +11.06% | | +8.77% | | +8.36% |

BofA Merrill Lynch U.S. High Yield Constrained Index | | +5.85% | | +9.23% | | +10.22% | | +8.12% | | +7.35% |

Portfolio profile

Oct. 31, 2014

| | |

| Total net assets | | Number of holdings |

$143.2 million | | 253 |

Dec. 2, 1996

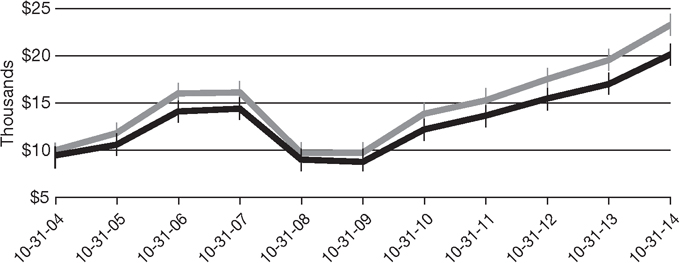

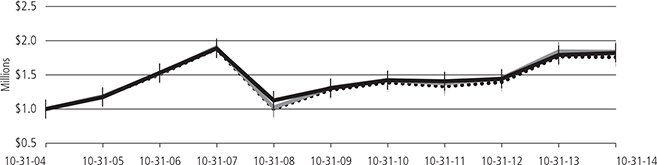

Growth of $1,000,000

| | | | |

| | | Starting value (Oct. 31, 2004) | | Ending value (Oct. 31, 2014) |

| | |

The High-Yield Bond Portfolio The High-Yield Bond Portfolio

| | $1,000,000 | | $2,318,086 |

| | |

BofA Merrill Lynch U.S. High Yield Constrained Index BofA Merrill Lynch U.S. High Yield Constrained Index

| | $1,000,000 | | $2,183,635 |

The performance graph assumes $1 million invested on Oct. 31, 2004, and includes reinvestment of all distributions. The performance graph does not reflect the deduction of taxes the shareholder would pay on Portfolio distributions or redemptions of Portfolio shares.

Total return assumes reinvestment of dividends and capital gains, but does not reflect reductions for taxes. Returns and share values will fluctuate so that shares, when redeemed, may be worth more or less than their original cost.

The most recent prospectus disclosed the Portfolio’s total operating expenses as 0.57%. Management has contractually agreed to reimburse certain expenses and/or waive its management fees from Nov. 1, 2013, through Oct. 31, 2014,* in order to prevent total annual Portfolio

Performance summary

Delaware Pooled® Trust — The High-Yield Bond Portfolio

operating expenses (with certain exceptions) from exceeding, in an aggregate amount, 0.59% of the Portfolio’s average daily net assets, as described in the most recent prospectus.

Expense limitations were in effect during the period shown. Performance would have been lower had the expense limitations not been in effect.

The BofA Merrill Lynch U.S. High Yield Constrained Index tracks the performance of U.S. dollar–denominated high yield corporate debt publicly issued in the U.S. domestic market, but caps individual issuer exposure at 2% of the benchmark.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

Investing involves risk, including the possible loss of principal.

Past performance is not a guarantee of future results.

Fixed income securities and bond funds can lose value, and investors can lose principal, as interest rates rise. They also may be affected by economic conditions that hinder an issuer’s ability to make interest and principal payments on its debt.

The Portfolio may also be subject to prepayment risk, the risk that the principal of a fixed income security that is held by the Portfolio may be prepaid prior to maturity, potentially forcing the Portfolio to reinvest that money at a lower interest rate.

High yielding, noninvestment grade bonds (junk bonds) involve higher risk than investment grade bonds. The high yield secondary market is particularly susceptible to liquidity problems when institutional investors, such as mutual funds and certain other financial institutions, temporarily stop buying bonds for regulatory, financial, or other reasons. In addition, a less liquid secondary market makes it more difficult for the Portfolio to obtain precise valuations of the high yield securities in its portfolio.

International investments entail risks not ordinarily associated with U.S. investments including fluctuations in currency values, differences in accounting principles, or economic or political instability in other nations. Investing in emerging markets can be riskier than investing in established foreign markets due to increased volatility and lower trading volume.

The Portfolio may invest in derivatives, which may involve additional expenses and are subject to risk, including the risk that an underlying security or securities index moves in the opposite direction from what the portfolio manager anticipated. A derivative transaction depends upon the counterparties’ ability to fulfill their contractual obligations.

The Portfolio may experience portfolio turnover in excess of 100%, which could result in higher transaction costs and tax liability.

Bond ratings are determined by a nationally recognized statistical rating organization (NRSRO).

*The contractual waiver period is from Feb. 28, 2013 through Feb. 27, 2015.

18

Portfolio management review

Delaware Pooled® Trust — The Core Plus Fixed Income Portfolio

October 31, 2014

For the fiscal year ended Oct. 31, 2014, Delaware Pooled Trust — The Core Plus Fixed Income Portfolio returned +5.02% at net asset value (NAV) with all distributions reinvested. The Portfolio’s benchmark, the Barclays U.S. Aggregate Index, returned +4.14% for the same period. Complete annualized performance for The Core Plus Fixed Income Portfolio is shown in the table on page 20.

As the Portfolio’s fiscal year began, the domestic economic outlook appeared to brighten after a troubling stretch of subpar growth and elevated unemployment. Improved investor sentiment caused market interest rates to push higher, with the yield on the benchmark 10-year Treasury note finishing 2013 at slightly more than 3%. Additionally, in December 2013, the U.S. Federal Reserve began the long-anticipated process of “tapering” its bond-buying program, with the stated objective of completing the program by the fall of 2014. Against this backdrop of economic optimism, lower-rated debt outperformed while Treasurys and mortgage-backed securities (MBS) lagged.

In the first few months of 2014, the United States experienced what was arguably the most severe winter weather in a generation. As U.S. consumers hunkered down, geopolitical tensions spiked in Ukraine, economic growth decelerated in China, and the euro zone flirted with deflation. These anti-growth factors combined to reverse the previous rise in market interest rates, with longer-duration bonds, BBB-rated corporates, and high yield and emerging market debt the primary beneficiaries.

As evidence accumulated that soft U.S. economic data during the winter months was mostly weather-related, cyclical sectors of the fixed income market rallied, with strength concentrated in high yield bonds and the lower rungs of the investment grade ladder. Meanwhile, the Treasury yield curve flattened, with long-term rates moving lower and short-term rates inching higher in anticipation of an initial Fed tightening in mid-2015.

The fiscal period ended amid a sharply bifurcated global economic environment. Despite uneven progress, the U.S. economy gathered momentum in late summer and early fall. But any upward pressure on yields that might have accompanied accelerating domestic growth was offset by additional unrest in Ukraine, the apparent acceptance of slower secular growth in China, and the continuing inability of European financial institutions to reverse the region’s economic torpor. The resulting flight to safety provided support to longer-duration and higher-quality bonds over the final weeks of the Portfolio’s fiscal year.

Most of the Portfolio’s outperformance for the full fiscal year can be attributed to sector weightings that were in place during the fourth quarter of 2013. At that time, the Portfolio was significantly underweight Treasury debt, a sector that lagged cyclical areas of the

fixed income market amid a surge in economic optimism. The Portfolio was also overweight investment grade and high yield bonds, each of which outperformed the benchmark as spreads tightened during the final months of 2013.

Security selection within the corporate sector contributed to relative performance. Conversely, the Portfolio’s focus on the intermediate portion of the yield curve detracted in late 2013, given that the decline in nominal yields was concentrated in longer-term securities, where the Portfolio maintained an underweight.

Despite the shift in economic backdrop in early 2014, many of the same trends remained in place within the fixed income market, further bolstering the Portfolio’s relative performance. Treasury debt continued to lag, while additional spread tightening underwrote outperformance among investment grade and high yield corporate bonds, as well as emerging market debt. However, the Portfolio’s underweight to government MBS had a negative effect on relative performance during the second half of the fiscal year, when MBS was the strongest-performing sector within the benchmark.

The Portfolio’s overweight allocation to the short-term and floating-rate sectors of the asset-backed securities market detracted as well. During the final three months of the fiscal year, the Portfolio gave back some of its accumulated outperformance to that point as Treasury securities rallied and credit spreads widened amid the global flight to safety.

Among the Portfolio’s derivative positions, we used interest rate futures in an attempt to adjust the Portfolio’s duration (which determines how a bond’s price is affected by interest rate changes). In addition, though we kept the Portfolio’s currency exposure relatively low over the course of the fiscal year, we did employ currency hedging (specifically, foreign currency exchange (FX) forwards) in an attempt to scale back the Portfolio’s foreign exchange risk. The Portfolio also employed credit default swap baskets to help reduce the credit risk associated with the Portfolio’s significant allocation to the below-investment-grade sector. As of the end of the fiscal year, the Portfolio held the following derivatives: a small credit default swap position on emerging market debt, Treasury futures, and a currency hedge on the Brazilian real. None of the Portfolio’s derivative positions during the fiscal year had a material impact on portfolio performance; that is, none affected returns by greater than 50 basis points.

At fiscal year end, the Portfolio was positioned for a longer-than-consensus period of ultralow policy rates, economic weakness abroad highlighted by pockets of deflation, and stable or falling market interest rates from already low levels.

|

|

| The views expressed are current as of the date of this report and subject to change. |

Performance summary

Delaware Pooled® Trust — The Core Plus Fixed Income Portfolio

The performance data quoted represent past performance; past performance does not guarantee future results. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Please obtain the performance data for the most recent month end by calling 800 231-8002 or visiting our website at delawareinvestments.com.

Carefully consider the Portfolio’s investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Portfolio’s prospectus and, if available, its summary prospectus, which may be obtained by visiting delawareinvestments.com or calling 800 231-8002. Investors should read the prospectus and, if available, the summary prospectus carefully before investing.

Portfolio and benchmark performance

| | | | | | | | | | |

Average annual total returns Periods ended Oct. 31, 2014 | | 1 year | | 3 years | | 5 years | | 10 years | | Lifetime |

The Core Plus Fixed Income Portfolio | | +5.02% | | +4.08% | | +5.77% | | +5.91% | | +6.40% |

Barclays U.S. Aggregate Index | | +4.14% | | +2.73% | | +4.22% | | +4.64% | | +4.94% |

Portfolio profile

Oct. 31, 2014

| | |

| Total net assets | | Number of holdings |

$77.0 million | | 642 |

June 28, 2002

Growth of $1,000,000

| | | | |

| | | Starting value (Oct. 31, 2004) | | Ending value (Oct. 31, 2014) |

The Core Plus Fixed Income Portfolio The Core Plus Fixed Income Portfolio

| | $1,000,000 | | $1,776,475 |

| | |

Barclays U.S. Aggregate Index Barclays U.S. Aggregate Index

| | $1,000,000 | | $1,573,313 |

The performance graph assumes $1 million invested on Oct. 31, 2004, and includes reinvestment of all distributions. The performance graph does not reflect the deduction of taxes the shareholder would pay on Portfolio distributions or redemptions of Portfolio shares.

Total return assumes reinvestment of dividends and capital gains, but does not reflect reductions for taxes. Returns and share values will fluctuate so that shares, when redeemed, may be worth more or less than their original cost.

The most recent prospectus disclosed the Portfolio’s total operating expenses as 0.70%. Management has contractually agreed to reimburse certain expenses and/or waive its management fees from Nov. 1, 2013, through Oct. 31, 2014,* in order to prevent total annual Portfolio

20

operating expenses (with certain exceptions) from exceeding, in an aggregate amount, 0.45% of the Portfolio’s average daily net assets, as described in the most recent prospectus.

Expense limitations were in effect during the period shown. Performance would have been lower had the expense limitations not been in effect.

The Barclays U.S. Aggregate Index is a broad composite that tracks the investment grade domestic bond market.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

Investing involves risk, including the possible loss of principal.

Past performance is not a guarantee of future results.

Fixed income securities and bond funds can lose value, and investors can lose principal, as interest rates rise. They also may be affected by economic conditions that hinder an issuer’s ability to make interest and principal payments on its debt.

The Portfolio may also be subject to prepayment risk, the risk that the principal of a fixed income security that is held by the Portfolio may be prepaid prior to maturity, potentially forcing the Portfolio to reinvest that money at a lower interest rate.

Interest payments on inflation-indexed debt securities will vary as the principal and/or interest is adjusted for inflation.

International investments entail risks not ordinarily associated with U.S. investments including fluctuation in currency values, differences in accounting principles, or economic or political instability in other nations. Investing in emerging markets can be riskier than investing in established foreign markets due to increased volatility and lower trading volume.

High yielding, noninvestment grade bonds (junk bonds) involve higher risk than investment grade bonds. The high yield secondary market is particularly susceptible to liquidity problems when institutional investors, such as mutual funds and certain other financial institutions, temporarily stop buying bonds for regulatory, financial, or other reasons. In addition, a less liquid secondary market makes it more difficult for the Portfolio to obtain precise valuations of the high yield securities in its portfolio.

Because the Portfolio may invest in bank loans and other direct indebtedness, it is subject to the risk that the Portfolio will not receive payment of principal, interest, and other amounts due in connection with these investments, which primarily depend on the financial condition of the borrower and the lending institution.

The Portfolio may experience portfolio turnover in excess of 100%, which could result in higher transaction costs and tax liability.

Bond ratings are determined by a nationally recognized statistical rating organization (NRSRO).

*The contractual waiver period is from Feb. 28, 2013 through Feb. 27, 2015.

Portfolio management review

Delaware Pooled® Trust — The International Equity Portfolio

October 31, 2014

For the fiscal year ended Oct. 31, 2014, Delaware Pooled Trust — The International Equity Portfolio returned +1.46% at net asset value (NAV) with all distributions reinvested. The Portfolio’s benchmark, the MSCI EAFE Index, returned -0.17% (gross) and -0.60% (net) for the same period. Complete annualized performance for The International Equity Portfolio is shown in the table on page 24.

The Portfolio’s fiscal year was generally a weak period for non-U.S. equities; however, we should note that many companies in the Portfolio’s investment universe did turn in positive performance in local-currency terms. U.S.-based investors saw their returns reduced due to the strength of the dollar relative to other major currencies. Relative to the U.S. dollar, the British pound declined 0.4%, the Australian dollar lost 7.2%, the euro retreated by 7.8%, and the Japanese yen declined 12.5%.

That said, each of the major international equity markets experienced significant macroeconomic and, in many cases, political challenges that constrained investor enthusiasm. In the euro zone, Germany declined 5.5% for the 12-month period ended Oct. 31, 2014, due to lingering uncertainty about the status of its trade relationship with Russia. France was down 6.6%, owing to weak business and consumer confidence. Italy remained in political upheaval, with new Prime Minister Matteo Renzi presenting an ambitious program of structural reforms that may be difficult to implement owing to a fragmented parliamentary majority. The Italian equity market fell 2.7%. In contrast, Spain was up 1.8%, based on a period of political stability and some successful structural and economic reforms.

Outside of the euro zone, the United Kingdom eked out a positive return of 0.1%, though it experienced considerable volatility as the pound declined over fears related to Scotland’s vote for independence. The failure of that referendum in September 2014 helped restore investor confidence.

Asia’s largest developed market, Japan, had a difficult year that included an increase in the consumption tax rate, the implementation of the final “arrow” of Prime Minister Shinzo Abe’s three-part stimulus plan, and a surprise announcement for further monetary policy easing by the Bank of Japan. These events caused considerable volatility, and Japan declined 0.7% for the 12 months ended Oct. 31, 2014.

The Portfolio’s fiscal year was one in which traditionally defensive sectors generated strong returns while cyclically sensitive sectors lagged. The healthcare sector, for example, produced the highest return of 13.1%, driven in part by the prospects for increased merger and acquisition activity, as well as generally resilient earnings. Utilities did well — mainly on the back of declining bond yields — which created relative value for stocks in this sector. Finally, telecoms rose 1.8% based on an improved regulatory outlook and signs of industry consolidation, especially in Europe.

A relatively weak outlook for global economic growth weighed on the more cyclically sensitive sectors. Financials lagged slightly, declining 1.2% despite easier credit conditions and lots of liquidity. The energy sector also fared poorly, down 5.4%. Despite a promise of better capital discipline and cash flow management, these stocks declined as a result of concerns about the oil supply from Russia and the need to impose sanctions over its invasion of Ukraine. The materials sector generated the weakest return, down 7.4%. This result was primarily driven by weak demand for raw materials in emerging markets, especially China.

The following is a brief summary attribution showing how our decisions impacted Portfolio results:

— Country allocations added to relative returns, led by overweight positions in the strong Spanish and Israeli equity markets, which more than offset the impact of underweight exposure to the strong-performing Scandinavian markets.

— The Portfolio’s currency allocation added to relative investment returns, supported by our underweight allocation to the Japanese yen and overweight allocation to the Singaporean dollar.

— Sector allocation and stock selection both contributed strongly to relative returns. The Portfolio benefited from an overweight to the healthcare sector, as well as from stock selection in the utilities, consumer discretionary, and financial sectors. These positions more than offset the effects of poor stock selection in the consumer staples sector.

The Portfolio’s strongest-performing stocks included Teva Pharmaceutical Industries, the Israeli generics manufacturer, which led the way with a 55% return, driven by the success of its main branded drug, Copaxone. Iberdrola, the Spanish utility, rose nearly 20% as concerns about utility regulation dissipated and European bond yields contracted. French telecommunication services provider Orange rose more than 20% on signs that wireless industry consolidations gained support from the government.