UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| Investment Company Act file number: | | 811-06322 |

| | | |

| Exact name of registrant as specified in charter: | | Delaware Pooled® Trust |

| | | |

| Address of principal executive offices: | | 2005 Market Street |

| | | Philadelphia, PA 19103 |

| | | |

| Name and address of agent for service: | | David F. Connor, Esq. |

| | | 2005 Market Street |

| | | Philadelphia, PA 19103 |

| | | |

| Registrant’s telephone number, including area code: | | (800) 523-1918 |

| | | |

| Date of fiscal year end: | | October 31 |

| | | |

| Date of reporting period: | | October 31, 2011 |

Item 1. Reports to Stockholders

| Annual report 2011 |

| |

| October 31, 2011 |

| | | |

| | | |

| U.S. equities | | International equities |

| The Large-Cap Value Equity Portfolio | | The International Equity Portfolio |

| The Select 20 Portfolio | | The Labor Select International Equity Portfolio |

| The Large-Cap Growth Equity Portfolio | | The Emerging Markets Portfolio |

| The Focus Smid-Cap Growth Equity Portfolio | | The Emerging Markets Portfolio II |

| The Real Estate Investment Trust Portfolio II | | The Global Real Estate Securities Portfolio |

| | | |

| U.S. fixed income | | International fixed income |

| The Core Focus Fixed Income Portfolio | | The Global Fixed Income Portfolio |

| The High-Yield Bond Portfolio | | |

| The Core Plus Fixed Income Portfolio | | |

Contents

| Portfolio objectives | 2 |

| The Large-Cap Value Equity Portfolio | 4 |

| The Select 20 Portfolio | 8 |

| The Large-Cap Growth Equity Portfolio | 12 |

| The Focus Smid-Cap Growth Equity Portfolio | 16 |

| The Real Estate Investment Trust Portfolio II | 20 |

| The Core Focus Fixed Income Portfolio | 24 |

| The High-Yield Bond Portfolio | 28 |

| The Core Plus Fixed Income Portfolio | 32 |

| The International Equity Portfolio | 36 |

| The Labor Select International Equity Portfolio | 40 |

| The Emerging Markets Portfolio | 44 |

| The Emerging Markets Portfolio II | 48 |

| The Global Real Estate Securities Portfolio | 52 |

| The Global Fixed Income Portfolio | 56 |

| Disclosure of Portfolio expenses | 60 |

| Security type, sector allocations, country allocations, | |

| and top 10 equity holdings | 62 |

| Statements of net assets | 74 |

| Statements of operations | 117 |

| Statements of changes in net assets | 121 |

| Financial highlights | 126 |

| Notes to financial statements | 141 |

| Report of independent registered | |

| public accounting firm | 167 |

| Other Portfolio information | 168 |

| Board of trustees/directors and officers addendum | 180 |

Delaware Pooled® Trust

Delaware Pooled Trust, based in Philadelphia, is a registered investment company that offers no-load, open-end equity and fixed income mutual funds to institutional and high net worth individual investors.

Delaware Management Company, a series of Delaware Management Business Trust, serves as investment advisor for the available investment Portfolios. Mondrian Investment Partners Limited serves as investment sub-advisor for The International Equity,* Labor Select International Equity, Emerging Markets,* and Global Fixed Income* Portfolios.

Shareholder services

Delaware Investments provides its Delaware Pooled Trust shareholders with annual and semiannual reports, monthly account reports, and other communications.

A dedicated shareholder services staff is available to assist with account questions and provide net asset values of the Delaware Pooled Trust Portfolios weekdays from 9 a.m. to 5 p.m. Eastern time. Shareholders may call 800 231-8002 or write to: Client Services, Delaware Pooled Trust, 2005 Market Street, Philadelphia, PA 19103.

The performance quoted in this report represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 800 231-8002 or visiting www.delawareinvestments.com/institutional/performance. Carefully consider the Portfolios’ investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Portfolios’ prospectus and, if available, their summary prospectuses, which may be obtained by visiting www.delawareinvestments.com or calling 800 231-8002. Investors should read the prospectus and, if available, the summary prospectus carefully before investing. Performance includes reinvestment of all distributions.

Funds are not FDIC insured and are not guaranteed. It is possible to lose the principal amount invested. Mutual fund advisory services are provided by Delaware Management Company, a series of Delaware Management Business Trust (DMBT), which is a registered investment advisor. Delaware Investments is the marketing name of Delaware Management Holdings, Inc. (DMHI) and its subsidiaries.

| *Closed to new investors. | |

| ©2011 Delaware Management Holdings, Inc. | 2011 Annual report · Delaware Pooled Trust |

| All third-party trademarks cited are the property of their respective owners. | |

1

Portfolio objectives

The Large-Cap Value Equity Portfolio seeks long-term capital appreciation. The Portfolio invests primarily in securities of large-capitalization companies that we believe have long-term capital appreciation potential. The Portfolio currently defines large-capitalization stocks as those with market capitalizations of $5 billion or greater at the time of purchase. Typically, we seek to select securities that we believe are undervalued in relation to their intrinsic value as indicated by multiple factors.

The Select 20 Portfolio seeks long-term capital appreciation. The Portfolio seeks to achieve its objective by investing in a portfolio of twenty (20) securities, primarily common stocks of companies that we believe have long-term capital appreciation potential and are expected to grow faster than the U.S. economy.

The Large-Cap Growth Equity Portfolio seeks capital appreciation. The Portfolio invests primarily in common stocks of growth-oriented companies that we believe have long-term capital appreciation potential and expect to grow faster than the U.S. economy. For purposes of the Portfolio, we generally consider large-capitalization companies to be those that, at the time of purchase, have total market capitalizations within the range of market capitalizations of companies in the Russell 1000® Growth Index.

The Focus Smid-Cap Growth Equity Portfolio seeks long-term capital appreciation. The Portfolio invests primarily in common stocks of growth-oriented companies that we believe have long-term capital appreciation potential and expect to grow faster than the U.S. economy. For purposes of the Portfolio, we will generally consider companies that, at the time of purchase, have total market capitalizations within the range of market capitalizations of companies in the Russell 2500™ Growth Index.

The Real Estate Investment Trust Portfolio II seeks maximum long-term total return, with capital appreciation as a secondary objective. The Portfolio invests primarily in securities of companies principally engaged in the real estate industry.

The Core Focus Fixed Income Portfolio seeks maximum long-term total return, consistent with reasonable risk. The Portfolio will invest primarily in a diversified portfolio of investment grade, fixed income obligations, including securities issued or guaranteed by the U.S. government, its agencies or instrumentalities (U.S. government securities), mortgage-backed securities, asset-backed securities, corporate bonds, and other fixed income securities.

The High-Yield Bond Portfolio seeks high total return. The Portfolio will primarily invest its assets at the time of purchase in: (1) corporate bonds rated BB or lower by Standard & Poor’s (S&P) or similarly rated by another nationally recognized statistical rating organization; (2) securities issued or guaranteed by the U.S. government, its agencies or instrumentalities; or (3) commercial paper of companies rated A-1 or A-2 by S&P, rated P-1 or P-2 by Moody’s Investors Service, Inc., or unrated but considered to be of comparable quality.

The Core Plus Fixed Income Portfolio seeks maximum long-term total return, consistent with reasonable risk. The Portfolio allocates its investments principally among three sectors of the fixed income securities markets: U.S. investment grade sector, U.S. high yield sector, and international sector.

The International Equity Portfolio seeks maximum long-term total return. The Portfolio invests primarily in equity securities of companies that are organized, have a majority of their assets, or derive most of their operating income outside the United States, and that, in our opinion, are undervalued at the time of purchase based on our fundamental analysis. Investments will be made mainly in marketable securities of companies in developed countries. The International Equity Portfolio is presently closed to new investors.

The Labor Select International Equity Portfolio seeks maximum long-term total return. The Portfolio invests primarily in equity securities of companies that are organized, have a majority of their assets, or derive most of their operating income outside of the United States, and that, in our opinion, are undervalued at the time of purchase based on the rigorous fundamental analysis that we employ. In addition to following these quantitative guidelines, we will select securities of issuers that present certain characteristics that are compatible or operate in accordance with certain investment policies or restrictions followed by organized labor.

2011 Annual report · Delaware Pooled Trust

2

The Emerging Markets Portfolio seeks long-term capital appreciation. The Portfolio, an international fund, generally invests in equity securities of companies that are organized in, have a majority of their assets in, or derive a majority of their operating income from emerging countries. The Emerging Markets Portfolio is presently closed to new investors.

The Emerging Markets Portfolio II seeks long-term capital appreciation. The Portfolio invests primarily in equity securities of issuers from emerging or developing foreign countries. Under normal market conditions, at least 80% of the Portfolio’s total assets will be invested in equity securities of issuers from countries whose economies are considered to be emerging. The Portfolio’s investment manager considers an “emerging country” to be any country that is: (1) generally recognized to be an emerging or developing country by the international financial community, including the World Bank and the International Finance Corporation; (2) classified by the United Nations as developing; or (3) included in the International Finance Corporation Free Index or the MSCI Emerging Markets Index.

The Global Real Estate Securities Portfolio seeks maximum long-term total return through a combination of current income and capital appreciation. Under normal circumstances, the Portfolio will invest at least 80% of its net assets in securities issued by U.S. and non-U.S. companies in the real estate and real estate–related sectors. The Portfolio may invest in companies across all market capitalizations and may invest its assets in securities of companies located in emerging market countries. Under normal circumstances, the Portfolio will invest at least 40% of its total assets in securities of non-U.S. issuers.

The Global Fixed Income Portfolio seeks current income consistent with the preservation of principal. The Portfolio invests primarily in fixed income securities that may also provide the potential for capital appreciation. The Portfolio is a global fund that invests in issuers located throughout the world. The Global Fixed Income Portfolio is presently closed to new investors.

Carefully consider the Portfolios’ investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Portfolios’ prospectus and, if available, their summary prospectuses, which may be obtained by visiting www.delawareinvestments.com or calling 800 231-8002. Investors should read the prospectus and, if available, the summary prospectus carefully before investing.

The Portfolios of Delaware Pooled® Trust (DPT) are designed exclusively for institutional investors and high net worth individuals.

International investments entail risks not ordinarily associated with U.S. investments including fluctuation in currency values, differences in accounting principles, or economic or political instability in other nations. Investing in emerging markets can be riskier than investing in established foreign markets due to increased volatility and lower trading volume.

Narrowly focused investments may exhibit higher volatility than investments in multiple industry sectors.

REIT investments are subject to many of the risks associated with direct real estate ownership, including changes in economic conditions, credit risk, and interest rate fluctuations.

A REIT fund’s tax status as a regulated investment company could be jeopardized if it holds real estate directly, as a result of defaults, or receives rental income from real estate holdings.

The Portfolios’ share prices and yields will fluctuate in response to movements in stock prices.

Fixed income securities and bond funds can lose value, and investors can lose principal, as interest rates rise. They also may be affected by economic conditions that hinder an issuer’s ability to make interest and principal payments on its debt.

The Portfolios may also be subject to prepayment risk, the risk that the principal of a fixed income security that is held by the Portfolios may be prepaid prior to maturity, potentially forcing the Portfolios to reinvest that money at a lower interest rate.

Securities in the lowest of the rating categories considered to be investment grade (that is, Baa or BBB) have some speculative characteristics.

High yielding, noninvestment grade bonds (junk bonds) involve higher risk than investment grade bonds.

The high yield secondary market is particularly susceptible to liquidity problems when institutional investors, such as mutual funds and certain other financial institutions, temporarily stop buying bonds for regulatory, financial, or other reasons. In addition, a less liquid secondary market makes it more difficult for a Portfolio to obtain precise valuations of the high yield securities in its portfolio.

Because the Portfolios expect to hold a concentrated portfolio of a limited number of securities, the Portfolios’ risk is increased because each investment has a greater effect on the Portfolios’ overall performance.

The Portfolios will be affected primarily by changes in stock prices.

The Real Estate Investment Trust II, The Global Real Estate Securities, The Select 20, and The Global Fixed Income Portfolios are considered “nondiversified” as defined in the Investment Company Act of 1940. “Nondiversified” Portfolios may allocate more of their net assets to investments in single securities than “diversified” Portfolios. Resulting adverse effects may subject these Portfolios to greater risks and volatility.

2011 Annual report · Delaware Pooled Trust

3

Portfolio management review

Delaware Pooled® Trust — The Large-Cap Value Equity Portfolio

October 31, 2011

For the fiscal year ended Oct. 31, 2011, Delaware Pooled Trust — The Large-Cap Value Equity Portfolio returned +12.98% at net asset value (NAV) with all distributions reinvested. The Portfolio outperformed its benchmark, the Russell 1000® Value Index, which returned +6.16% during the same period. Complete annualized performance for The Large-Cap Value Equity Portfolio is shown in the table on page 6.

In the first half of the Portfolio’s fiscal year, stock prices generally climbed as corporate earnings remained healthy and investors anticipated a continued slow-but-steady economic recovery. Market conditions abruptly soured in late July 2011, however, as several unresolved issues took center stage:

- Concerns mounted about rising debt levels in Greece, Italy, and other financially challenged countries in the euro zone.

- A political battle in Washington, D.C., surrounding the lifting of the U.S. federal debt ceiling triggered new worries about the United States’ ability to manage its fiscal situation.

- Similar concerns caused credit rating agency Standard & Poor’s to downgrade the sovereign credit rating of the United States from the highest level of AAA to AA+.

- These events took place against a backdrop of sustained high unemployment and increasing signs of global economic weakness.

While August and September 2011 saw dramatic price swings in both directions, October witnessed sharp gains in the stock market, as many investors became more optimistic that European policy makers could resolve the region’s debt crisis, while economic growth in the U.S. appeared to be more resilient than many had feared.

In this environment, the Portfolio outpaced the benchmark largely due to successful sector allocation decisions and strong stock picking. In sector terms, our decision to underweight financial stocks proved quite helpful, given financials’ status as the worst-performing group in the benchmark index during the fiscal year. A modest relative overweighting in energy (the market’s top-performing sector) also had a meaningful positive effect on relative results, as did a small cash position during periods when the market was in a steep decline.

From the standpoint of stock selection, several holdings in the energy sector were notable contributors to performance during the fiscal year. National Oilwell Varco, a maker of components for oil drilling rigs, benefited from a resurgence in demand that caused the stock’s price to increase sharply. We sold the stock after it reached our price target. Another significant outperformer in the energy sector was oil exploration and production company Marathon Oil. Security selection in the information technology sector was another source of strength, led by Motorola Solutions. Motorola Solutions generated steady financial performance amid difficult economic conditions.

Among performance detractors, the weakest relative performer was document-management company Xerox. The company’s shares fared poorly as many investors were concerned about the effects of reduced government and healthcare spending on Xerox’s services business. Also, despite the Portfolio’s favorable results overall from the struggling financial sector, several individual holdings in this group were disappointing performers. Insurance company Allstate, for example, had a challenging year, given a large number of severe storms that increased payouts to policyholders. Another noteworthy detractor in the financials sector was Bank of New York Mellon, which had difficulty growing fee income in the current market environment.

The views expressed are current as of the date of this report and are subject to change.

2011 Annual report · Delaware Pooled Trust

4

At the end of the fiscal year, we maintained the Portfolio’s defensive positioning, as we continue to anticipate slow economic growth for some time. We believe that conditions justify a conservative approach until we see sustainable improvement.

Given this backdrop, we maintained the Portfolio’s underweighting relative to the benchmark index within traditionally economically sensitive sectors such as financials and consumer discretionary, while remaining relatively overweight in more defensive groups, including healthcare and consumer staples. One potential exception is the information technology sector. Despite this sector’s economic sensitivity, we were overweight at the end of the fiscal year because we identified a number of companies displaying strong balance sheets, good cash flows, and other characteristics that we routinely favor for investment. Stocks of these companies were available for purchase at what we saw as undeservedly low prices.

As of the end of the Portfolio’s fiscal year, valuations across the market struck us as generally higher than they should be, given the sluggish economic situation. While circumstances can change quickly, we expect to maintain our less-cyclical positioning until we see more lasting improvements in market and economic conditions.

2011 Annual report · Delaware Pooled Trust

5

Performance summary

Delaware Pooled® Trust — The Large-Cap Value Equity Portfolio

The performance data quoted represent past performance; past performance does not guarantee future results. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Please obtain the performance data for the most recent month end by calling 800 231-8002 or visiting our website at www.delawareinvestments.com.

Carefully consider the Portfolio’s investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Portfolio’s prospectus and, if available, its summary prospectus, which may be obtained by visiting www.delawareinvestments.com or calling 800 231-8002. Investors should read the prospectus and, if available, the summary prospectus carefully before investing.

| Portfolio performance | | | | | | | | | | |

| Average annual total returns | | | | | | | | | | |

| Periods ended Oct. 31, 2011 | | 1 year | | 3 years | | 5 years | | 10 years | | Lifetime |

| | +12.98% | | +13.95% | | -0.25% | | +4.85% | | +8.72% |

| Portfolio profile |

| Oct. 31, 2011 |

| |

| Total net assets |

| $6.6 million |

| |

| Number of holdings |

| 37 |

| |

| Inception date |

| Feb. 3, 1992 |

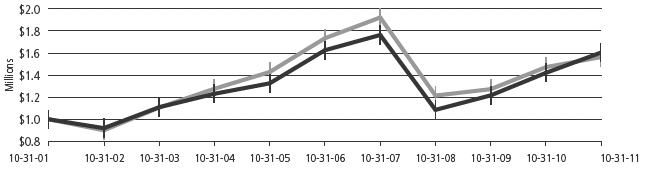

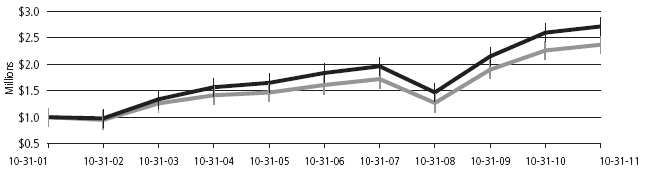

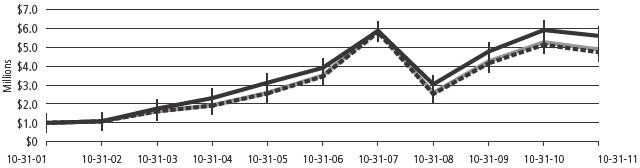

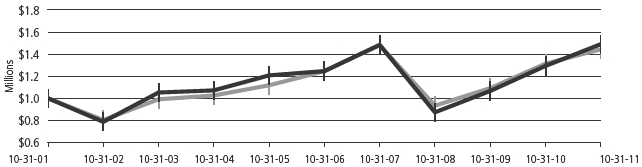

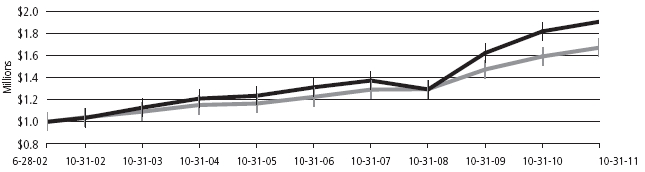

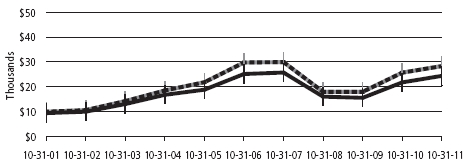

Growth of $1,000,000

| | | | Starting value (Oct. 31, 2001) | | Ending value (Oct. 31, 2011) |

| | The Large-Cap Value Equity Portfolio | | $1,000,000 | | $1,605,466 |

| | Russell 1000 Value Index | | $1,000,000 | | $1,563,565 |

2011 Annual report · Delaware Pooled Trust

6

The performance graph assumes $1 million invested on Oct. 31, 2001, and includes reinvestment of all distributions. The performance graph does not reflect the deduction of taxes the shareholder would pay on Portfolio distributions or redemptions of Portfolio shares.

Total return assumes reinvestment of dividends and capital gains, but does not reflect reductions for taxes. Returns and share values will fluctuate so that shares, when redeemed, may be worth more or less than their original cost.

The most recent prospectus designated the Portfolio’s total operating expenses as 1.02%. Management has contractually agreed to reimburse certain expenses and/or waive its management fees from Feb. 28, 2011, through Feb. 28, 2012, in order to prevent total annual Portfolio operating expenses from exceeding, in an aggregate amount, 0.70% of the Portfolio’s average daily net assets, as described in the most recent prospectus.

Expense limitations were in effect during the period shown. Performance would have been lower had the expense limitations not been in effect.

The Russell 1000 Value Index measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000 companies with lower price-to-book ratios and lower forecasted growth values.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

Past performance is not a guarantee of future results.

2011 Annual report · Delaware Pooled Trust

7

Portfolio management review

Delaware Pooled® Trust — The Select 20 Portfolio

October 31, 2011

During the first several months of the Portfolio’s fiscal year ended Oct. 31, 2011, investors generally adopted an optimistic tone, seemingly focusing on several positive macroeconomic developments, including: the injection of additional stimulus by the Federal Reserve, a bipartisan deal to extend the Bush-era tax cuts (which also included stimulus measures), and still slowly improving economic conditions in the United States. (Data: Bloomberg.)

Starting in the spring and summer months of 2011, however, investors began responding to a pause in economic growth, as well as broad euro zone fears related primarily to the increasing risk of a Greek debt restructuring and possible default. Major equity indices reflected the increased level of uncertainty, generally declining through most of May and much of June.

For the most part, this trend continued through the final months of the Portfolio’s fiscal year, as market activity largely centered on the daily news coming out of the euro zone, which was predominantly negative. For example, the Greek government teetered on the edge of default as it awaited approval on an additional expanded bailout package. Additionally, many investors kept a close eye on activity in Spain and Italy, as both countries — each a major euro-zone economy — attempted to enact austerity measures aimed at staving off a potential default. These events, combined with a slowing economic environment across Europe, the United States, and even many emerging economies, took a significant toll on investors. The S&P 500® Index, for example, experienced a steep decline through July 2011 and into early August before recovering part of those losses.

Within this environment, Delaware Pooled Trust — The Select 20 Portfolio returned +15.23% at net asset value (NAV) with all distributions reinvested for the fiscal year ended Oct. 31, 2011. The Portfolio’s benchmark, the Russell 3000® Growth Index, returned +9.92% for the same period. Complete annualized performance for The Select 20 Portfolio is shown in the table on page 10. As is customary with this Portfolio, returns were generated largely from our stock selection decisions as opposed to sector allocation choices.

MasterCard was one of the Portfolio’s top contributors — we continued to hold the stock even through talks of credit/debit card transaction fee reductions as part of the financial overhaul legislation. We believed banks would be affected far more than credit card companies whose related fees were much smaller. We opportunistically added to the Portfolio’s position when investors punished the stock because of the anticipated reform. When the Fed announced final recommendations that were more favorable than initially feared, investors were able to focus on strong company fundamentals and the growing global trend of consumers shifting from paper to plastic.

Priceline.com was another solid contributor and its “name your own price” model seemed to fit in well with today’s value-conscious consumer. While priceline.com’s business model is attractive, the more interesting story, in our view, is the company’s higher-margin European business that matches travelers with the smaller independent hotels that are more prevalent than large chains abroad. This segment has represented the real growth of priceline.com and the company will seek to match its success in other fragmented hotel markets, such as those in Asia.

Crown Castle International, which operates and leases wireless towers throughout the U.S., detracted from the Portfolio’s performance when it posted negative returns due to investor fears that potential industry consolidations would slow plans for infrastructure spending. While a proposed merger now faces antitrust issues, Crown Castle has continued to report solid earnings from enhanced wireless demand and investors generally seem to be regaining confidence.

The Portfolio’s position in Strayer Education, a private educational institute, also hurt overall performance. The institute has struggled with declining revenue from shrinking enrollment. The entire

The views expressed are current as of the date of this report and are subject to change.

2011 Annual report · Delaware Pooled Trust

8

for-profit education industry has suffered for several quarters largely due to enhanced government scrutiny and stricter regulations concerning recruiting, enrollment, and financial assistance. The “gainful employment” rules placed aid restrictions on programs that insufficiently prepare students for finding well-paying jobs, a tough feat in this challenging economic environment. Strayer is an industry leader that we believe will survive and even benefit, as competitors fail and the labor market ultimately improves.

Regardless of the economy, we remain consistent in our long-term investment philosophy: We want to own what we view as strong secular-growth companies. We seek companies with solid business models and competitive positions that we believe can grow market share, and which have the potential to deliver shareholder value in a variety of market environments.

2011 Annual report · Delaware Pooled Trust

9

Performance summary

Delaware Pooled® Trust — The Select 20 Portfolio

The performance data quoted represent past performance; past performance does not guarantee future results. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Please obtain the performance data for the most recent month end by calling 800 231-8002 or visiting our website at www.delawareinvestments.com.

Carefully consider the Portfolio’s investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Portfolio’s prospectus and, if available, its summary prospectus, which may be obtained by visiting www.delawareinvestments.com or calling 800 231-8002. Investors should read the prospectus and, if available, the summary prospectus carefully before investing.

| Portfolio performance | | | | | | | | | | |

| Average annual total returns | | | | | | | | | | |

| Periods ended Oct. 31, 2011 | | 1 year | | 3 years | | 5 years | | 10 years | | Lifetime |

| | +15.23% | | +19.96% | | +3.86% | | +4.07% | | -1.69% |

| Portfolio profile |

| Oct. 31, 2011 |

| |

| Total net assets |

| $46 million |

| |

| Number of holdings |

| 24 |

| Inception date |

| March 31, 2000 |

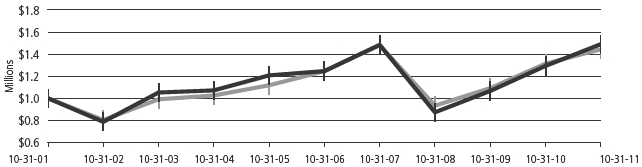

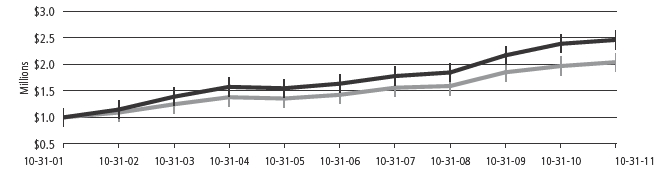

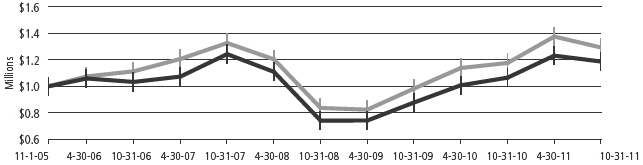

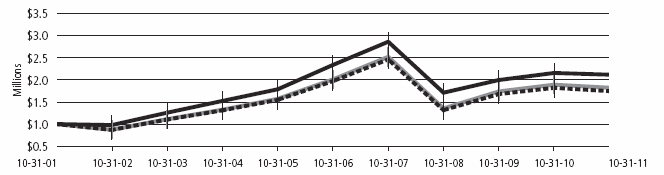

Growth of $1,000,000

| | | | Starting value (Oct. 31, 2001) | | Ending value (Oct. 31, 2011) |

| The Select 20 Portfolio | | $1,000,000 | | $1,490,079 |

| Russell 3000 Growth Index | | $1,000,000 | | $1,443,524 |

2011 Annual report · Delaware Pooled Trust

10

The performance graph assumes $1 million invested on Oct. 31, 2001, and includes reinvestment of all distributions. The performance graph does not reflect the deduction of taxes the shareholder would pay on Portfolio distributions or redemptions of Portfolio shares.

Total return assumes reinvestment of dividends and capital gains, but does not reflect reductions for taxes. Returns and share values will fluctuate so that shares, when redeemed, may be worth more or less than their original cost.

The most recent prospectus designated the Portfolio’s total operating expenses as 1.24%. Management has contractually agreed to reimburse certain expenses and/or waive its management fees from Feb. 28, 2011, through Feb. 28, 2012, in order to prevent total annual Portfolio operating expenses from exceeding, in an aggregate amount, 0.89% of the Portfolio’s average daily net assets, as described in the most recent prospectus.

Expense limitations were in effect during the period shown. Performance would have been lower had the expense limitations not been in effect.

The Russell 3000 Growth Index measures the performance of the broad growth segment of the U.S. equity universe. It includes those Russell 3000 companies with higher price-to-book ratios and higher forecasted growth values.

The S&P 500 Index, mentioned on page 8, measures the performance of 500 mostly large-cap stocks weighted by market value, and is often used to represent performance of the U.S. stock market.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

Past performance is not a guarantee of future results.

Because the Portfolio expects to hold a concentrated portfolio of a limited number of securities, the Portfolio's risk is increased because each investment has a greater effect on the Portfolio's overall performance.

Investments in small and/or medium-sized companies typically exhibit greater risk and higher volatility than larger, more established companies.

“Nondiversified” Portfolios may allocate more of their net assets to investments in single securities than “diversified” Portfolios. Resulting adverse effects may subject these Portfolios to greater risks and volatility.

On February 28, 2008, the Portfolio changed its investment strategy to limit its investments to no less than 15 securities and no more than 25 securities. The performance prior to February 28, 2008 is that of the Portfolio’s predecessor, The All-Cap Growth Equity Portfolio.

2011 Annual report · Delaware Pooled Trust

11

Portfolio management review

Delaware Pooled® Trust — The Large-Cap Growth Equity Portfolio

October 31, 2011

During the first several months of the Portfolio’s fiscal year ended Oct. 31, 2011, investors generally adopted an optimistic tone, seemingly focusing on several positive macroeconomic developments, including: the injection of additional stimulus by the Federal Reserve, a bipartisan deal to extend the Bush-era tax cuts (which also included stimulus measures), and still slowly improving economic conditions in the United States. (Data: Bloomberg.)

Starting in the spring and summer months of 2011, however, investors began responding to a pause in economic growth, as well as broad euro zone fears related primarily to the increasing risk of a Greek debt restructuring and possible default. Major equity indices reflected the increased level of uncertainty, generally declining through most of May and much of June.

For the most part, this trend continued through the final months of the Portfolio’s fiscal year, as market activity largely centered on the daily news coming out of the euro zone, which was predominantly negative. For example, the Greek government teetered on the edge of default as it awaited approval on an additional expanded bailout package. Additionally, many investors kept a close eye on activity in Spain and Italy, as both countries — each a major euro-zone economy — attempted to enact austerity measures aimed at staving off a potential default. These events, combined with a slowing economic environment across Europe, the United States, and even many emerging economies, took a significant toll on investors. The S&P 500® Index, for example, experienced a steep decline through July 2011 and into early August before recovering part of those losses.

Within this environment, Delaware Pooled Trust — The Large-Cap Growth Equity Portfolio returned +11.43% at net asset value (NAV) with all distributions reinvested for the fiscal year ended Oct. 31, 2011. The Portfolio’s benchmark, the Russell 1000® Growth Index, returned +9.92% for the same period. Complete annualized performance for The Large-Cap Growth Equity Portfolio is shown in the table on page 14. As is customary with this Portfolio, returns were generated largely from our stock selection decisions as opposed to sector allocation choices.

MasterCard was one of the Portfolio’s top contributors — we continued to hold the stock even through talks of credit/debit card transaction fee reductions as part of the financial overhaul legislation. We believed banks would be affected far more than credit card companies whose related fees were much smaller. We opportunistically added to the Portfolio’s position when investors seemed to punish the stock because of the anticipated reform. When the Fed announced final recommendations that were more favorable than initially feared, investors were able to focus on strong company fundamentals and the growing global trend of consumers shifting from paper to plastic.

Priceline.com was another solid contributor and its “name your own price” model seemed to fit in well with today’s value-conscious consumer. While priceline.com’s business model is attractive, the more interesting story, in our view, is the company’s higher-margin European business that matches travelers with the smaller independent hotels that are more prevalent than large chains abroad. This segment has represented the real growth of priceline.com and the company will seek to match its success in other fragmented hotel markets, such as those in Asia.

Staples, the nation’s largest office supply retailer, was a notable detractor for the fiscal year. During the Portfolio’s fiscal year, many investors grew concerned about the growth prospects for the office supply space as a whole, as Staples missed earnings and revenue forecasts in the weaker economy. While consumers and businesses have generally remained quite cost-conscious, Staples has gained market share at home and abroad and we believe the company looks primed to benefit from a future recovery.

The views expressed are current as of the date of this report and are subject to change.

2011 Annual report · Delaware Pooled Trust

12

Crown Castle International, which operates and leases wireless towers throughout the U.S., detracted from the Portfolio’s performance when it posted negative returns due to investor fears that potential industry consolidations would slow plans for infrastructure spending. While a proposed merger now faces antitrust issues, Crown Castle has continued to report solid earnings from enhanced wireless demand and investors generally seem to be regaining confidence.

Regardless of the economy, we remain consistent in our long-term investment philosophy: We want to own what we view as strong secular-growth companies. We seek companies with solid business models and competitive positions that we believe can grow market share, and which have the potential to deliver shareholder value in a variety of market environments.

2011 Annual report · Delaware Pooled Trust

13

Performance summary

Delaware Pooled® Trust — The Large-Cap Growth Equity Portfolio

The performance data quoted represent past performance; past performance does not guarantee future results. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Please obtain the performance data for the most recent month end by calling 800 231-8002 or visiting our website at www.delawareinvestments.com.

Carefully consider the Portfolio’s investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Portfolio’s prospectus and, if available, its summary prospectus, which may be obtained by visiting www.delawareinvestments.com or calling 800 231-8002. Investors should read the prospectus and, if available, the summary prospectus carefully before investing.

| Portfolio performance | | | | | | | | |

| Average annual total returns | | | | | | | | |

| Periods ended Oct. 31, 2011 | | 1 year | | 3 years | | 5 years | | Lifetime |

| | +11.43% | | +17.02% | | +2.82% | | +2.91% |

| Portfolio profile |

| Oct. 31, 2011 |

| |

| Total net assets |

| $170.5 million |

| |

| Number of holdings |

| 32 |

| Inception date |

| Nov. 1, 2005 |

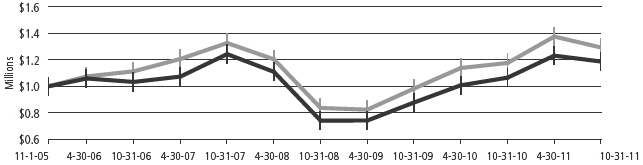

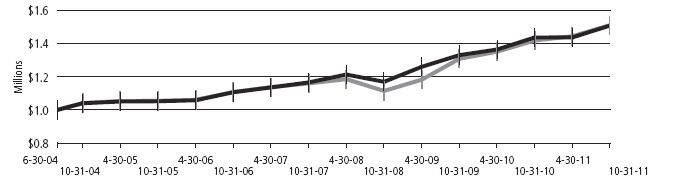

Growth of $1,000,000

| | | | Starting value (Nov. 1, 2005) | | Ending value (Oct. 31, 2011) |

| Russell 1000 Growth Index | | $1,000,000 | | $1,293,445 |

| The Large-Cap Growth Equity Portfolio | | $1,000,000 | | $1,187,578 |

2011 Annual report · Delaware Pooled Trust

14

The performance graph assumes $1 million invested on Nov. 1, 2005, and includes reinvestment of all distributions. The performance graph does not reflect the deduction of taxes the shareholder would pay on Portfolio distributions or redemptions of Portfolio shares.

Total return assumes reinvestment of dividends and capital gains, but does not reflect reductions for taxes. Returns and share values will fluctuate so that shares, when redeemed, may be worth more or less than their original cost.

The most recent prospectus designated the Portfolio’s total operating expenses as 0.65%. Management has contractually agreed to reimburse certain expenses and/or waive its management fees from Feb. 28, 2011, through Feb. 28, 2012, in order to prevent total annual Portfolio operating expenses from exceeding, in an aggregate amount, 0.65% of the Portfolio’s average daily net assets, as described in the most recent prospectus.

Expense limitations were in effect during the period shown. Performance would have been lower had the expense limitations not been in effect.

The Russell 1000 Growth Index measures the performance of the large-cap growth segment of the U.S. equity universe. It includes those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values.

The S&P 500 Index, mentioned on page 12, measures the performance of 500 mostly large-cap stocks weighted by market value, and is often used to represent performance of the U.S. stock market.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

Past performance is not a guarantee of future results.

Because the Portfolio expects to hold a concentrated portfolio of a limited number of securities, the Portfolio’s risk is increased because each investment has a greater effect on the Portfolio’s overall performance.

2011 Annual report · Delaware Pooled Trust

15

Portfolio management review

Delaware Pooled® Trust — The Focus Smid-Cap Growth Equity Portfolio

October 31, 2011

During the first several months of the Portfolio’s fiscal year ended Oct. 31, 2011, investors generally adopted an optimistic tone, seemingly focusing on several positive macroeconomic developments, including: the injection of additional stimulus by the Federal Reserve, a bipartisan deal to extend the Bush-era tax cuts (which also included stimulus measures), and still slowly improving economic conditions in the United States. (Data: Bloomberg.)

Starting in the spring and summer months of 2011, however, investors began responding to a pause in economic growth, as well as broad euro zone fears related primarily to the increasing risk of a Greek debt restructuring and possible default. Major equity indices reflected the increased level of uncertainty, generally declining through most of May and much of June.

For the most part, this trend continued through the final months of the Portfolio’s fiscal year, as market activity largely centered on the daily news coming out of the euro zone, which was predominantly negative. For example, the Greek government teetered on the edge of default as it awaited approval on an additional expanded bailout package. Additionally, many investors kept a close eye on activity in Spain and Italy, as both countries — each a major euro-zone economy — attempted to enact austerity measures aimed at staving off a potential default. These events, combined with a slowing economic environment across Europe, the United States, and even many emerging economies, took a significant toll on investors. The S&P 500® Index, for example, experienced a steep decline through July 2011 and into early August before recovering part of those losses.

Within this environment, Delaware Pooled Trust — The Focus Smid-Cap Growth Equity Portfolio returned +21.44% at net asset value (NAV) with all distributions reinvested for the fiscal year ended Oct. 31, 2011. The Portfolio’s benchmark, the Russell 2500™ Growth Index, returned +11.91% for the same period. Complete annualized performance for The Focus Smid-Cap Growth Equity Portfolio is shown in the table on page 18.

Weight Watchers International is the leading global provider of weight-management products and services. While the company continues to derive solid income from its traditional member meetings, it has expanded its market toward an increasing amount of internet and royalty revenue streams, which result in higher company margins. As a result, earnings have grown incrementally through its expanding subscriber base. Weight Watchers was the largest contributor to Portfolio performance during the fiscal year.

Peet’s Coffee & Tea is a specialty coffee roaster that markets its products through retail, restaurants, and company-owned stores. Though coffee prices have risen for the past few years, the gourmet segment of the market seems to be in solid growth mode. The company’s successful direct distribution model has resulted in special displays and premium product placements in chain stores and discount retailers that carry its brands. This positioning represents a significant advantage for gourmet coffee brands like Peet’s, which are generally priced more expensively than other offerings in the same aisles. Earnings remained solid throughout the fiscal year and we added to the Portfolio’s position as growth prospects looked strong for the long term.

The Portfolio was not without its detractors. The Portfolio’s position in Strayer Education, a private educational institute, hurt overall performance. The institute has struggled with declining revenue from shrinking enrollment. The entire for-profit education industry has suffered for several quarters largely due to enhanced government scrutiny and stricter regulations concerning recruiting, enrollment, and financial assistance. The “gainful employment” rules placed aid restrictions on programs that insufficiently prepare

The views expressed are current as of the date of this report and are subject to change.

2011 Annual report · Delaware Pooled Trust

16

students for finding well-paying jobs, a tough feat in this challenging economic environment. Strayer is an industry leader that we believe will survive and even benefit, as competitors fail and the labor market ultimately improves.

SBA Communications, which operates and leases wireless towers throughout the U.S., also posted negative returns due to investor fears that potential industry consolidations would slow down plans for infrastructure spending. While a proposed merger now faces antitrust issues, SBA Communications has continued to report solid earnings from enhanced wireless demand and investors generally seem to be regaining confidence.

Regardless of the economy, we remain consistent in our long-term investment philosophy: We want to own what we view as strong secular-growth companies. We seek companies with solid business models and competitive positions that we believe can grow market share, and which have the potential to deliver shareholder value in a variety of market environments.

2011 Annual report · Delaware Pooled Trust

17

Performance summary

Delaware Pooled® Trust — The Focus Smid-Cap Growth Equity Portfolio

The performance data quoted represent past performance; past performance does not guarantee future results. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Please obtain the performance data for the most recent month end by calling 800 231-8002 or visiting our website at www.delawareinvestments.com.

Carefully consider the Portfolio’s investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Portfolio’s prospectus and, if available, its summary prospectus, which may be obtained by visiting www.delawareinvestments.com or calling 800 231-8002. Investors should read the prospectus and, if available, the summary prospectus carefully before investing.

| Portfolio performance | | | | | | | | |

| Average annual total returns | | | | | | | | |

| Periods ended Oct. 31, 2011 | | 1 year | | 3 years | | 5 years | | Lifetime |

| | +21.44% | | +31.62% | | +10.65% | | +9.20% |

| Portfolio profile |

| Oct. 31, 2011 |

| |

| Total net assets |

| $16.7 million |

| |

| Number of holdings |

| 29 |

| Inception date |

| Dec. 1, 2003 |

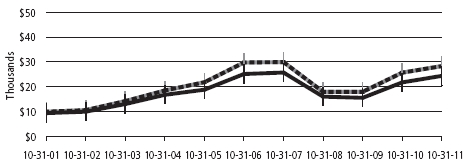

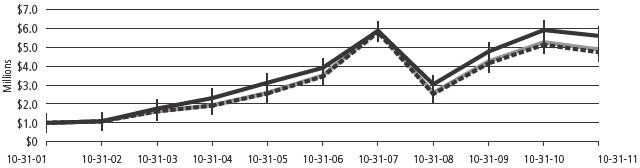

Growth of $1,000,000

| | | | Starting value (Dec. 1, 2003) | | Ending value (Oct. 31, 2011) |

| The Focus Smid-Cap Growth Equity Portfolio | | $1,000,000 | | $2,007,863 |

| Russell 2500 Growth Index | | $1,000,000 | | $1,609,480 |

2011 Annual report · Delaware Pooled Trust

18

The performance graph assumes $1 million invested on Dec. 1, 2003, and includes reinvestment of all distributions. The performance graph does not reflect the deduction of taxes the shareholder would pay on Portfolio distributions or redemptions of Portfolio shares.

Total return assumes reinvestment of dividends and capital gains, but does not reflect reductions for taxes. Returns and share values will fluctuate so that shares, when redeemed, may be worth more or less than their original cost.

The most recent prospectus designated the Portfolio’s total operating expenses as 1.44%. Management has contractually agreed to reimburse certain expenses and/or waive its management fees from Feb. 28, 2011, through Feb. 28, 2012, in order to prevent total annual Portfolio operating expenses from exceeding, in an aggregate amount, 0.92% of the Portfolio’s average daily net assets, as described in the most recent prospectus.

Expense limitations were in effect during the period shown. Performance would have been lower had the expense limitations not been in effect.

The Russell 2500 Growth Index measures the performance of the small- to mid-cap growth segment of the U.S. equity universe. It includes those Russell 2500 companies with higher price-to-book ratios and higher forecasted growth values.

The S&P 500 Index, mentioned on page 16, measures the performance of 500 mostly large-cap stocks weighted by market value, and is often used to represent performance of the U.S. stock market.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

Past performance is not a guarantee of future results.

Investments in small and/or medium-sized companies typically exhibit greater risk and higher volatility than larger, more established companies.

Because the Portfolio expects to hold a concentrated portfolio of a limited number of securities, the Portfolio’s risk is increased because each investment has a greater effect on the Portfolio’s overall performance.

Instances of high double-digit returns are unusual, cannot be sustained, and were primarily achieved during favorable market conditions.

2011 Annual report · Delaware Pooled Trust

19

Portfolio management review

Delaware Pooled® Trust — The Real Estate Investment Trust Portfolio II

October 31, 2011

For its fiscal year ended Oct. 31, 2011, Delaware Pooled Trust — The Real Estate Investment Trust Portfolio II returned +12.37% at net asset value (NAV) with all distributions reinvested. In comparison, the Portfolio’s benchmark, the FTSE NAREIT Equity REITs Index, advanced by 10.34% during the same period. Complete annualized performance for The Real Estate Investment Trust Portfolio II is shown in the table on page 22.

The Portfolio’s fiscal year was a highly volatile period for U.S. real estate investment trusts (REITs). Early in the fiscal year, REIT prices climbed steadily, posting an upward trend that lasted until early July 2011 as investors embraced the prospect of a moderate economic recovery.

In late July and early August 2011, REIT prices dropped sharply, but they rebounded in subsequent weeks. Over the remaining months of the Portfolio’s fiscal year, big price moves occurred regularly, with the rally in late August followed by a steep drop in September and then another impressive recovery in October.

Despite the up-and-down nature of the market, REITs enjoyed solid gains overall during the Portfolio’s fiscal year, as a favorable supply-demand balance, coupled with readily available financing at attractive prices, provided supportive conditions for property companies.

The Portfolio enjoyed strong results relative to its benchmark, more due to returns of individual securities than through sector allocation.

For much of the fiscal year, we tilted the Portfolio toward high-quality mall, apartment, and self-storage companies, as we believed these businesses were potentially well positioned to take advantage of low interest rates and the pricing power and occupancy rates made possible by tight property supply.

In the mall sector, for example, one of the Portfolio’s top-performing securities for the fiscal year was Simon Property Group, the largest position in both the Portfolio and the benchmark. We believe Simon Property Group is a high-quality company with a good management team and a healthy balance sheet, and its stock was supported by the limited supply of mall space and attractive financing costs.

The Portfolio was also helped by its overweight allocation to the strong-performing apartment sector, as well as security selection within that sector. Another solid contributor to relative returns was Home Properties, which was not one of the apartment sector’s better performers in absolute terms, but we made a timely sale of the security late in the fiscal year. Relative portfolio performance was modestly hampered by an underweight position in AvalonBay Communities, an index constituent that fared relatively well. We reduced the Portfolio’s position in this high-quality apartment company because we believed its shares were somewhat expensive and that better opportunities existed elsewhere.

Public Storage, a leading self-storage company that enjoyed durable pricing power and affordable financing costs, was another notable outperformer for the Portfolio.

The Portfolio’s modest cash position worked against relative returns in an up market (the benchmark does not include a cash stake). Elsewhere, a handful of individual securities provided a modest degree of underperformance. The Portfolio’s weakest individual holding during the fiscal year was Digital Realty Trust, an owner and operator of data-center space. Suburban office company Brandywine Realty Trust and lodging company Marriott International also hampered the Portfolio’s relative results.

The views expressed are current as of the date of this report and are subject to change.

2011 Annual report · Delaware Pooled Trust

20

For the majority of the Portfolio’s fiscal year, we also opted to underweight lodging stocks because of concerns about the health of the economy. This approach generally worked well for the Portfolio, and late in the fiscal year, we selectively took advantage of opportunities to buy high-quality lodging stocks whose low prices failed to reflect what we believed to be their underlying value.

Toward the end of the fiscal year, we moved defensively as the market rallied to trim the Portfolio’s allocation to stocks whose prices had risen beyond what we considered reasonable. At the same time, we also often added to stocks that we believed were fundamentally solid but still attractively valued.

We remain confident about the individual stocks in the Portfolio, but are mindful of the macroeconomic risks facing investors today. We believe the excess levels of debt in Europe (and to a lesser extent, in the United States) bear close scrutiny, and will not hesitate to make changes to the Portfolio as conditions evolve. We continue to assess the market environment day by day in an attempt to position the Portfolio to perform well as the landscape changes. Property companies require affordable and available investment capital in order to thrive, and it is with this in mind that we continue to closely monitor the general health and functioning of the capital markets.

2011 Annual report · Delaware Pooled Trust

21

Performance summary

Delaware Pooled® Trust — The Real Estate Investment Trust Portfolio II

The performance data quoted represent past performance; past performance does not guarantee future results. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Please obtain the performance data for the most recent month end by calling 800 231-8002 or visiting our website at www.delawareinvestments.com.

Carefully consider the Portfolio’s investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Portfolio’s prospectus and, if available, its summary prospectus, which may be obtained by visiting www.delawareinvestments.com or calling 800 231-8002. Investors should read the prospectus and, if available, the summary prospectus carefully before investing.

| Portfolio performance | | | | | | | | | | |

| Average annual total returns | | | | | | | | | | |

| Periods ended Oct. 31, 2011 | | 1 year | | 3 years | | 5 years | | 10 years | | Lifetime |

| | +12.37% | | +15.15% | | -0.39% | | +10.28% | | +8.65% |

| Portfolio profile |

| Oct. 31, 2011 |

| |

| Total net assets |

| $3.1 million |

| |

| Number of holdings |

| 53 |

| Inception date |

| Nov. 4, 1997 |

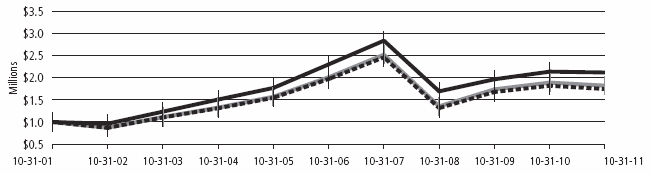

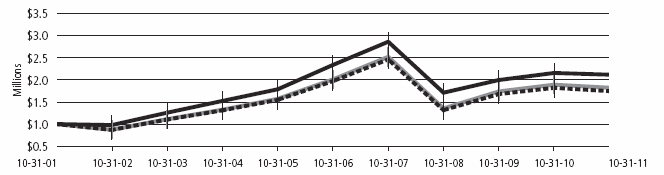

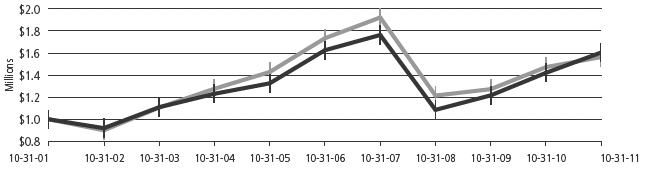

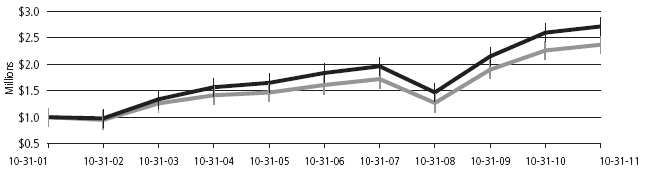

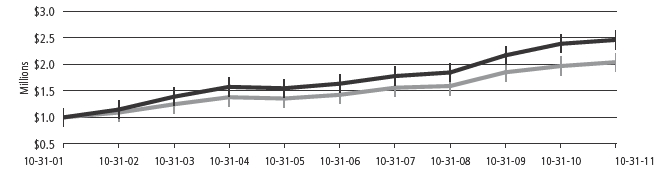

Growth of $1,000,000

| | | | Starting value (Oct. 31, 2001) | | Ending value (Oct. 31, 2011) |

| FTSE NAREIT Equity REITs Index | | $1,000,000 | | $2,835,487 |

| FTSE NAREIT All Equity REITs Index | | $1,000,000 | | $2,831,020 |

| The Real Estate Investment Trust Portfolio II | | $1,000,000 | | $2,660,766 |

2011 Annual report · Delaware Pooled Trust

22

The performance graph assumes $1 million invested on Oct. 31, 2001, and includes reinvestment of all distributions. The performance graph does not reflect the deduction of taxes the shareholder would pay on Portfolio distributions or redemptions of Portfolio shares.

Total return assumes reinvestment of dividends and capital gains, but does not reflect reductions for taxes. Returns and share values will fluctuate so that shares, when redeemed, may be worth more or less than their original cost.

The most recent prospectus designated the Portfolio’s total operating expenses as 1.81%. Management has contractually agreed to reimburse certain expenses and/or waive its management fees from Feb. 28, 2011, through Feb. 28, 2012, in order to prevent total annual Portfolio operating expenses from exceeding, in an aggregate amount, 0.95% of the Portfolio’s average daily net assets, as described in the most recent prospectus.

Expense limitations were in effect during the period shown. Performance would have been lower had the expense limitations not been in effect.

The FTSE NAREIT Equity REITs Index measures the performance of all publicly traded equity real estate investment trusts (REITs) traded on U.S. exchanges, excluding timber REITs. The FTSE NAREIT All Equity REITs Index measures the performance of all publicly traded equity real estate investment trusts traded on U.S. exchanges. Effective Dec. 20, 2010: (1) FTSE changed the composition of the FTSE NAREIT Equity REITs Index to exclude timber REITs; (2) FTSE created the FTSE NAREIT All Equity REITs Index with the components of the former FTSE NAREIT Equity REITs Index, including timber REITs; and (3) the Portfolio changed its benchmark index from the FTSE NAREIT All Equity REITs Index (former FTSE NAREIT Equity REITs Index) to the newly constituted FTSE NAREIT Equity REITs Index. The rationale for the change was that the Portfolio’s portfolio managers believe the new index is more appropriate for the Portfolio’s investment style. The FTSE NAREIT All Equity REITs Index may be excluded from this comparison in the future.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

Past performance is not a guarantee of future results.

“Nondiversified” Portfolios may allocate more of their net assets to investments in single securities than “diversified” Portfolios. Resulting adverse effects may subject Portfolios to greater risks and volatility.

Narrowly focused investments may exhibit higher volatility than investments in multiple industry sectors.

REIT investments are subject to many of the risks associated with direct real estate ownership, including changes in economic conditions, credit risk, and interest rate fluctuations. A REIT fund’s tax status as a regulated investment company could be jeopardized if it holds real estate directly, as a result of defaults, or receives rental income from real estate holdings.

2011 Annual report · Delaware Pooled Trust

23

Portfolio management review

Delaware Pooled® Trust — The Core Focus Fixed Income Portfolio

October 31, 2011

At the beginning of the Portfolio’s fiscal year ended Oct. 31, 2011, financial markets were pressured by continuing credit concerns in the euro zone, tightening policy actions in China, and the political shift signaled by the mid-term U.S. Congressional elections, as well as by mixed reactions and results following the Federal Reserve’s second round of quantitative easing, often called QE2.

As the Portfolio’s fiscal year progressed, headwinds included sharply higher food and energy costs (often related to unrest in the Middle East and North Africa) as well as the earthquake-related nuclear disaster in Japan, which provided a setback to some Japanese multinational corporations and to global growth. These factors were offset by the positive response in risk markets to central bank–created liquidity, including QE2. Late in the fiscal year, the market experienced brief bounces due to perceived progress toward crisis resolution in Europe, but these moments of optimism were generally short-lived.

Despite considerable economic headwinds, the fiscal year was generally favorable to the fixed income market as a whole due to accommodative monetary policy from the Fed, value in many areas of the corporate bond market, and strong demand for yield in light of low interest rates.

Against this backdrop, Delaware Pooled Trust — The Core Focus Fixed Income Portfolio returned +6.49% at net asset value (NAV) with all distributions reinvested for the fiscal year ended Oct. 31, 2011. The Portfolio’s benchmark, the Barclays Capital U.S. Aggregate Index, returned +5.00% for the same period. Complete annualized performance for The Core Focus Fixed Income Portfolio is shown in the table on page 26.

The Portfolio’s relative returns for its fiscal year were aided by a continued overweight in investment grade corporate bonds, including an emphasis on lower-medium- and medium-grade (BBB- and A-rated) issues, as well as the generally positive effects of security selection. Among investment grade U.S. corporate bonds, we believed that bonds rated BBB and A generally offered the best risk-reward trade-off, and thus emphasized Portfolio positions in those categories. These bonds sometimes experienced volatility, but overall aided relative return.

The Portfolio generally remained underweight in government-backed or agency mortgage-backed securities (MBS), as we believed these securities remained expensive for much of the fiscal year. These areas of the market underperformed during this period.

Despite the Portfolio’s bias toward higher-quality commercial mortgage-backed securities (CMBS), its overweight position in this category detracted from its relative return. An overweight allocation in asset-backed securities (ABS) had a similarly negative effect. The negative ramifications of both allocations were particularly notable during the latter parts of the fiscal year.

We have suggested for several years that the nature of the 2008 recession was much different than the typical inventory-cycle type of recession experienced periodically during the last 50-plus years. Unlike other recessions, the 2008 balance-sheet recession was driven by the combination of overly leveraged and indebted parties (both individuals and corporations), as well as a sharp decline in the value of assets those parties held. As we are witnessing today, the effects of a balance sheet recession tend to last considerably longer and may cause any recovery to be less than robust.

The views expressed are current as of the date of this report and are subject to change.

2011 Annual report · Delaware Pooled Trust

24

Unfortunately, the key solution to an inventory-cycle recession — lower short-term rates — has had only a marginal effect on the current recovery. Instead, governments in many of the largest developed nations have turned to deficit spending and increased indebtedness as the short-term solution. While this approach has had positive short-term economic effects at times, the long-term effects of replacing private debt with more debt and leverage at the sovereign level are unclear.

Our current basic belief is that long-lasting solutions in the U.S. must include policy changes that encourage productivity gains. There needs to be a general realization among policy makers and others that we should all live within our means today, in order to build a base for strong economic growth in the future. We believe that the U.S. can only be headed down the true road toward a sustainable recovery and expansion when policy makers stop “papering over” economic problems and begin to move away from near-term solutions or economic issues at hand that month.

Additionally, the effects of a fiscal and credit contraction in the euro zone will likely have profound negative effects on that region’s economics throughout the next few years. We believe these strong economic effects should spill over to the U.S. and emerging markets, and will seek ways to mitigate their potentially harmful effects. Several hedges, including currency exposure for instance, have already been administered in the Portfolio. In the months ahead, we will continue to monitor these events and adjust the Portfolio accordingly.

2011 Annual report · Delaware Pooled Trust

25

Performance summary

Delaware Pooled® Trust — The Core Focus Fixed Income Portfolio

The performance data quoted represent past performance; past performance does not guarantee future results. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Please obtain the performance data for the most recent month end by calling 800 231-8002 or visiting our website at www.delawareinvestments.com.

Carefully consider the Portfolio’s investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Portfolio’s prospectus and, if available, its summary prospectus, which may be obtained by visiting www.delawareinvestments.com or calling 800 231-8002. Investors should read the prospectus and, if available, the summary prospectus carefully before investing.

| Portfolio performance | | | | | | | | |

| Average annual total returns | | | | | | | | |

| Periods ended Oct. 31, 2011 | | 1 year | | 3 years | | 5 years | | Lifetime |

| | +6.49% | | +10.69% | | +6.41% | | +5.80% |

| Portfolio profile |

| Oct. 31, 2011 |

| |

| Total net assets |

| $6.2 million |

| |

| Number of holdings |

| 172 |

| Inception date |

| June 30, 2004 |

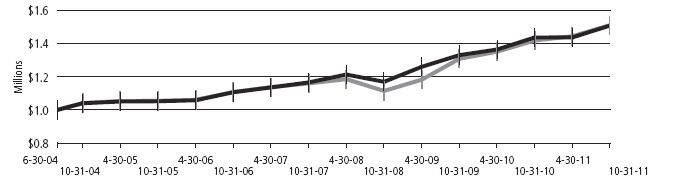

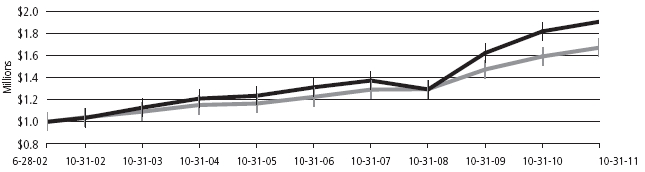

Growth of $1,000,000

| | | | | Starting value (June 30, 2004) | | Ending value (Oct. 31, 2011) |

| | The Core Focus Fixed Income Portfolio | | $1,000,000 | | $1,512,091 |

| | Barclays Capital U.S. Aggregate Index | | $1,000,000 | | $1,510,043 |

2011 Annual report · Delaware Pooled Trust

26

The performance graph assumes $1 million invested on June 30, 2004, and includes reinvestment of all distributions. The performance graph does not reflect the deduction of taxes the shareholder would pay on Portfolio distributions or redemptions of Portfolio shares.

Total return assumes reinvestment of dividends and capital gains, but does not reflect reductions for taxes. Returns and share values will fluctuate so that shares, when redeemed, may be worth more or less than their original cost.

The most recent prospectus designated the Portfolio’s total operating expenses as 0.76%. Management has contractually agreed to reimburse certain expenses and/or waive its management fees from Feb. 28, 2011, through Feb. 28, 2012, in order to prevent total annual Portfolio operating expenses from exceeding, in an aggregate amount, 0.43% of the Portfolio’s average daily net assets, as described in the most recent prospectus.

Expense limitations were in effect during the period shown. Performance would have been lower had the expense limitations not been in effect.

The Barclays Capital U.S. Aggregate Index is a broad composite of more than 8,000 securities that tracks the investment grade domestic bond market.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

Past performance is not a guarantee of future results.

Fixed income securities and bond funds can lose value, and investors can lose principal, as interest rates rise. They also may be affected by economic conditions that hinder an issuer’s ability to make interest and principal payments on its debt.

The Portfolio may also be subject to prepayment risk, the risk that the principal of a fixed income security that is held by the Portfolio may be prepaid prior to maturity, potentially forcing the Portfolio to reinvest that money at a lower interest rate.

The Portfolio may invest in derivatives, which may involve additional expenses and are subject to risk, including the risk that an underlying security or securities index moves in the opposite direction from what the portfolio manager anticipated. A derivative transaction depends upon the counterparties’ ability to fulfill their contractual obligations.

International investments entail risks not ordinarily associated with U.S. investments including fluctuation in currency values, differences in accounting principles, or economic or political instability in other nations. Investing in emerging markets can be riskier than investing in established foreign markets due to increased volatility and lower trading volume.

The Portfolio may be invested in foreign corporate bonds, which have special risks not ordinarily associated with domestic investments, such as currency fluctuations, economic and political change, and different accounting standards.

The Portfolio may experience portfolio turnover in excess of 100%, which could result in higher transaction costs and tax liability.

2011 Annual report · Delaware Pooled Trust

27

Portfolio management review

Delaware Pooled® Trust — The High-Yield Bond Portfolio

October 31, 2011

Delaware Pooled Trust — The High-Yield Bond Portfolio returned +4.52% at net asset value (NAV) with all distributions reinvested for the fiscal year ended Oct. 31, 2011. For the same period, the Portfolio’s benchmark, the BofA Merrill Lynch U.S. High Yield Constrained Index, returned +4.85%. Complete annualized performance for The High-Yield Bond Portfolio is shown in the table on page 30.

The Portfolio’s fiscal year was a tale of two halves. The first half, encompassing the fourth quarter of 2010 and the first quarter of 2011, saw a surprisingly strong high yield bond market in the face of sluggish macroeconomic numbers, persistent sovereign debt concerns in Europe, tighter policy initiatives in China, the earthquake-related nuclear crisis in Japan, and a sharp rise in U.S. Treasury yields. Throughout this period, investor demand for yield gave the market a steady bid for high yield bonds. Demand for lower-rated credits softened during the second half of the fiscal year as the debt difficulties in Europe became protracted and uncertainty over Chinese policy issues lingered.

Bonds regarded as having lower quality generally outperformed higher-quality bonds during the first half of the fiscal year. This trend of lower quality outpacing higher quality on a total return basis was generally true across industries as well. For example, the strongest-performing industries during this period, such as broadcasting, financials, and energy, are usually categorized as lower-credit-quality industries. Automotive, retail, and healthcare were the worst-performing sectors during the Portfolio’s fiscal year, and they are usually categorized as some of the higher-quality sectors in the high yield market.

The downgrading of U.S. government debt by Standard & Poor’s weakened demand in the second half of the fiscal year, with fund flows turning negative in August 2011. We attribute this weakening to an increased level of risk aversion among investors.

Many investors seemed to seek out higher-quality issues during this period, as lower-quality issues substantially underperformed higher-quality issues. Reversing the trend recorded earlier in the fiscal year, the best-performing industries included energy and healthcare (which are usually categorized as higher-credit-quality industries, and are typically more defensive during downturns), while metals and mining, housing, and diversified media were the worst-performing sectors for this period (they are usually categorized as some of the more cyclical sectors in the high yield bond market).

The Portfolio maintained an overweight allocation to lower-credit-quality bonds such as CCC- and B-rated credits for the entire fiscal year. This aided return during the first half of this period, though the emphasis on higher-quality (less distressed) securities within the lower-credit-quality spectrum slightly muted this positive effect. CCC- and B-rated issues hindered performance during the second half of the fiscal year, but the relatively high quality of the issues once again diminished the negative effect.

Over the course of the fiscal year, defaults and distressed-debt exchanges steadily abated as areas of focus and concern in the high yield bond and leveraged loan markets. We believe the decrease in default expectations is attributable to the relative historical strength in demand for new issuance. It should be noted, however, that new issuance toward the end of the fiscal year tapered off considerably, at one point matching the lowest new-issuance volume since the first quarter of 2009.

Our outlook for most of the industries and companies that we follow is still optimistic based on what we view as improving fundamentals, improving liquidity, and still-attractive valuations. Much depends on continued economic improvement and access to new funds for high yield bond issuers. Currently, it appears that financing is only available to companies in the upper tiers of the credit-quality spectrum, due primarily to the volatility and risk aversion caused by the European sovereign debt crisis.

The views expressed are current as of the date of this report and are subject to change.

2011 Annual report · Delaware Pooled Trust

28

While we believe default expectations should stay low, we remain cautious about the global growth picture. The bottom line is that we are currently embracing risk in the Portfolio while remaining cognizant of credit-quality considerations. Currently, we view the most attractive part of the high yield bond market to be in medium- to lower-quality B-rated bonds as well as in higher-quality CCC-rated bonds. We think it is prudent to be selective in the most distressed part of the high yield bond market, represented by CCC-rated bonds. We continue to favor high yield bonds over leveraged loans given what we consider the large valuation gap that currently exists.

2011 Annual report · Delaware Pooled Trust

29

Performance summary

Delaware Pooled® Trust — The High-Yield Bond Portfolio

The performance data quoted represent past performance; past performance does not guarantee future results. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Please obtain the performance data for the most recent month end by calling 800 231-8002 or visiting our website at www.delawareinvestments.com.

Carefully consider the Portfolio’s investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Portfolio’s prospectus and, if available, its summary prospectus, which may be obtained by visiting www.delawareinvestments.com or calling 800 231-8002. Investors should read the prospectus and, if available, the summary prospectus carefully before investing.

| Portfolio performance | | | | | | | | | | |

| Average annual total returns | | | | | | | | | | |