UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| Investment Company Act file number: | 811-06322 |

| | |

| Exact name of registrant as specified in charter: | Delaware Pooled® Trust |

| | |

| Address of principal executive offices: | 2005 Market Street |

| | Philadelphia, PA 19103 |

| | |

| Name and address of agent for service: | David F. Connor, Esq. |

| | 2005 Market Street |

| | Philadelphia, PA 19103 |

| | |

| Registrant’s telephone number, including area code: | (800) 523-1918 |

| | |

| Date of fiscal year end: | October 31 |

| | |

| Date of reporting period: | October 31, 2010 |

Item 1. Reports to Stockholders

| Annual report 2010 |

| |

| October 31, 2010 |

| | | |

| | | |

| U.S. equities | | International equities |

| The Large-Cap Value Equity Portfolio | | The International Equity Portfolio |

| The Select 20 Portfolio | | The Labor Select International Equity Portfolio |

| The Large-Cap Growth Equity Portfolio | | The Emerging Markets Portfolio |

| The Focus Smid-Cap Growth Equity Portfolio | | The Emerging Markets Portfolio II |

| The Real Estate Investment Trust Portfolio II | | The Global Real Estate Securities Portfolio |

| The Delaware Macquarie Real Estate Portfolio | | |

| | | International fixed income |

| U.S. fixed income | | The Global Fixed Income Portfolio |

| The Core Focus Fixed Income Portfolio | | The International Fixed Income Portfolio |

| The High-Yield Bond Portfolio | | |

| The Core Plus Fixed Income Portfolio | | |

| Contents | | |

| | | |

| Portfolio objectives | | 2 |

| The Large-Cap Value Equity Portfolio | | 4 |

| The Select 20 Portfolio | | 8 |

| The Large-Cap Growth Equity Portfolio | | 12 |

| The Focus Smid-Cap Growth Equity Portfolio | | 16 |

| The Real Estate Investment Trust Portfolio II | | 20 |

| The Core Focus Fixed Income Portfolio | | 25 |

| The High-Yield Bond Portfolio | | 28 |

| The Core Plus Fixed Income Portfolio | | 32 |

| The International Equity Portfolio | | 36 |

| The Labor Select International Equity Portfolio | | 40 |

| The Emerging Markets Portfolio | | 44 |

| The Global Real Estate Securities Portfolio | | 48 |

| The Global Fixed Income Portfolio | | 52 |

| The International Fixed Income Portfolio | | 56 |

| Disclosure of Portfolio expenses | | 60 |

| Sector allocations, security types, country allocations, | | |

| and top 10 holdings | | 62 |

| Financial statements | | 74 |

| Financial highlights | | 129 |

| Notes to financial statements | | 146 |

| Report of independent registered | | |

| public accounting firm | | 171 |

| Other Portfolio information | | 172 |

| Board of trustees/directors and officers addendum | | 182 |

Delaware Pooled® Trust

Delaware Pooled Trust, based in Philadelphia, is a registered investment company that offers no-load, open-end equity and fixed income mutual funds to institutional and high net worth individual investors. Delaware Management Company, a series of Delaware Management Business Trust, serves as investment advisor for the Portfolios. Mondrian Investment Partners Limited serves as investment sub-advisor for International Equity,* Labor Select International Equity, Emerging Markets,* Global Fixed Income,* and International Fixed Income Portfolios.* The Delaware Macquarie Real Estate Portfolio is closed to new investors. The Delaware Macquarie Real Estate Portfolio and The Emerging Markets Portfolio II each have fewer than six months of audited financial statements and accordingly, there is no portfolio management review section for those Portfolios. Shareholder services

Delaware Investments provides its Delaware Pooled Trust shareholders with annual and semiannual reports, monthly account reports, and other communications. A dedicated shareholder services staff is available to assist with account questions and provide net asset values of the Delaware Pooled Trust Portfolios weekdays from 9 a.m. to 5 p.m. Eastern time. Shareholders may call 800 231-8002 or write to: Client Services, Delaware Pooled Trust, 2005 Market Street, Philadelphia, PA 19103.

|

The performance quoted in this report represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 800 231-8002 or visiting www.delawareinvestments.com/institutional/performance. Carefully consider the Portfolios’ investment objectives, risk factors, charges, and expenses before investing. This and other important information can be found in the Portfolios’ prospectus, which may be obtained by calling 800 231-8002. Investors should read the prospectus carefully before investing. Performance includes reinvestment of all distributions.

Funds are not FDIC insured and are not guaranteed. It is possible to lose the principal amount invested. Mutual fund advisory services are provided by Delaware Management Company, a series of Delaware Management Business Trust (DMBT), which is a registered investment advisor. Delaware Investments is the marketing name of Delaware Management Holdings, Inc. (DMHI) and its subsidiaries. |

| *Closed to new investors. | |

| ©2010 Delaware Management Holdings, Inc. | 2010 Annual report • Delaware Pooled Trust |

| All third-party trademarks cited are the property of their respective owners. | |

1

Portfolio objectives

The Large-Cap Value Equity Portfolio seeks long-term capital appreciation. The Portfolio invests primarily in securities of large-capitalization companies that we believe have long-term capital appreciation potential. The Portfolio currently defines large-capitalization stocks as those with market capitalizations of $5 billion or greater at the time of purchase. Typically, we seek to select securities that we believe are undervalued in relation to their intrinsic value as indicated by multiple factors.

The Select 20 Portfolio seeks long-term capital appreciation. The Portfolio seeks to achieve its objective by investing in a portfolio of twenty (20) securities, primarily common stocks of companies that we believe have long-term capital appreciation potential and are expected to grow faster than the U.S. economy.

The Large-Cap Growth Equity Portfolio seeks capital appreciation. The Portfolio invests primarily in common stocks of growth-oriented companies that we believe have long-term capital appreciation potential and expect to grow faster than the U.S. economy. For purposes of the Portfolio, we generally consider large-capitalization companies to be those that, at the time of purchase, have total market capitalizations within the range of market capitalizations of companies in the Russell 1000® Growth Index.

The Focus Smid-Cap Growth Equity Portfolio seeks long-term capital appreciation. The Portfolio invests primarily in common stocks of growth-oriented companies that we believe have long-term capital appreciation potential and expect to grow faster than the U.S. economy. For purposes of the Portfolio, we will generally consider companies that, at the time of purchase, have total market capitalizations within the range of market capitalizations of companies in the Russell 2500™ Growth Index.

The Real Estate Investment Trust Portfolio II seeks maximum long-term total return, with capital appreciation as a secondary objective. The Portfolio invests primarily in securities of companies principally engaged in the real estate industry.

The Core Focus Fixed Income Portfolio seeks maximum long-term total return, consistent with reasonable risk. The Portfolio will invest primarily in a diversified portfolio of investment grade, fixed income obligations, including securities issued or guaranteed by the U.S. government, its agencies or instrumentalities (U.S. government securities), mortgage-backed securities, asset-backed securities, corporate bonds, and other fixed income securities.

The High-Yield Bond Portfolio seeks high total return. The Portfolio will primarily invest its assets at the time of purchase in: (1) corporate bonds rated BB or lower by Standard & Poor’s (S&P) or similarly rated by another nationally recognized statistical rating organization (NRSRO); (2) securities issued or guaranteed by the U.S. government, its agencies or instrumentalities; or (3) commercial paper of companies rated A-1 or A-2 by S&P, rated P-1 or P-2 by Moody’s Investors Service, Inc., or unrated but considered to be of comparable quality.

The Core Plus Fixed Income Portfolio seeks maximum long-term total return, consistent with reasonable risk. The Portfolio allocates its investments principally among three sectors of the fixed income securities markets: U.S. investment grade sector, U.S. high yield sector, and international sector.

The International Equity Portfolio seeks maximum long-term total return. The Portfolio invests primarily in equity securities of companies that are organized, have a majority of their assets, or derive most of their operating income outside the United States, and that, in our opinion, are undervalued at the time of purchase based on our fundamental analysis. Investments will be made mainly in marketable securities of companies in developed countries. The International Equity Portfolio is presently closed to new investors.

The Labor Select International Equity Portfolio seeks maximum long-term total return. The Portfolio invests primarily in equity securities of companies that are organized, have a majority of their assets, or derive most of their operating income outside of the United States, and that, in our opinion, are undervalued at the time of purchase based on the rigorous fundamental analysis that we employ. In addition to following these quantitative guidelines, we will select securities of issuers that present certain characteristics that are compatible or operate in accordance with certain investment policies or restrictions followed by organized labor.

The Emerging Markets Portfolio seeks long-term capital appreciation. The Portfolio, an international fund, generally invests in equity securities of companies that are organized in, have a majority of their assets in, or derive a majority of their operating income from emerging countries. The Emerging Markets Portfolio is presently closed to new investors.

The Emerging Markets Portfolio II seeks long-term capital appreciation. The Portfolio invests primarily in equity securities of issuers from emerging or developing foreign countries. Under normal market conditions, at least 80% of the Portfolio’s total assets will be invested in equity securities of issuers from countries whose economies are considered to be emerging. The Portfolio’s investment manager considers an “emerging country” to be any country that is: (1) generally recognized to be an emerging or developing country by the international financial community, including the World Bank and the International Finance Corporation; (2) classified by the United Nations as developing; or (3) included in the International Finance Corporation Free Ind ex or the Morgan Stanley Capital International Emerging Markets Index.

2010 Annual report • Delaware Pooled Trust

2

The Global Real Estate Securities Portfolio seeks maximum long-term total return through a combination of current income and capital appreciation. Under normal circumstances, the Portfolio will invest at least 80% of its net assets in securities issued by U.S. and non-U.S. companies in the real estate and real estate–related sectors. The Portfolio may invest in companies across all market capitalizations and may invest its assets in securities of companies located in emerging market countries. Under normal circumstances, the Portfolio will invest at least 40% of its total assets in securities of non-U.S. issuers.

The Delaware Macquarie Real Estate Portfolio seeks maximum long-term total return, through a combination of current income and capital appreciation. The Portfolio invests primarily in securities of companies principally engaged in the real estate industry. The Delaware Macquarie Real Estate Portfolio is presently closed to new investors.

The Global Fixed Income Portfolio seeks current income consistent with the preservation of principal. The Portfolio invests primarily in fixed income securities that may also provide the potential for capital appreciation. The Portfolio is a global fund that invests in issuers located throughout the world. The Global Fixed Income Portfolio is presently closed to new investors.

The International Fixed Income Portfolio seeks current income consistent with the preservation of principal. The Portfolio invests primarily in fixed income securities that may also provide the potential for capital appreciation. The Portfolio is an international fund that invests primarily in issuers that are organized, have a majority of their assets, or derive most of their operating income outside of the United States. The International Fixed Income Portfolio is presently closed to new investors.

Carefully consider the Portfolios’ investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in Portfolios’ prospectus and, if available, their summary prospectus, which may be obtained by visiting www.delawareinvestments.com or calling 800 231-8002. Investors should read the prospectus and, if available, the summary prospectus carefully before investing.

The Portfolios of Delaware Pooled® Trust (DPT) are designed exclusively for institutional investors and high net worth individuals.

International investments entail risks not ordinarily associated with U.S. investments including fluctuation in currency values, differences in accounting principles, or economic or political instability in other nations. Investing in emerging markets can be riskier than investing in established foreign markets due to increased volatility and lower trading volume.

Narrowly focused investments may exhibit higher volatility than investments in multiple industry sectors.

REIT investments are subject to many of the risks associated with direct real estate ownership, including changes in economic conditions, credit risk, and interest rate fluctuations.

A REIT fund’s tax status as a regulated investment company could be jeopardized if it holds real estate directly, as a result of defaults, or receives rental income from real estate holdings.

The Portfolios’ share prices and yields will fluctuate in response to movements in stock prices.

Fixed income securities and bond funds can lose value, and investors can lose principal, as interest rates rise. They also may be affected by economic conditions that hinder an issuer’s ability to make interest and principal payments on its debt.

The Portfolios may also be subject to prepayment risk, the risk that the principal of a fixed income security that is held by the Portfolios may be prepaid prior to maturity, potentially forcing the Portfolios to reinvest that money at a lower interest rate.

Securities in the lowest of the rating categories considered to be investment grade (that is, Baa or BBB) have some speculative characteristics.

High yielding, noninvestment grade bonds (junk bonds) involve higher risk than investment grade bonds.

The high yield secondary market is particularly susceptible to liquidity problems when institutional investors, such as mutual funds and certain other financial institutions, temporarily stop buying bonds for regulatory, financial, or other reasons. In addition, a less liquid secondary market makes it more difficult for a Portfolio to obtain precise valuations of the high yield securities in its portfolio.

Because the Portfolios expect to hold a concentrated portfolio of a limited number of securities, the Portfolios’ risk is increased because each investment has a greater effect on the Portfolios’ overall performance.

The Real Estate Investment Trust II, The Global Real Estate Securities, The Delaware Macquarie Real Estate, The Select 20, The Global Fixed Income, and The International Fixed Income Portfolios are considered “nondiversified” as defined in the Investment Company Act of 1940. “Nondiversified” Portfolios may allocate more of their net assets to investments in single securities than “diversified” Portfolios. Resulting adverse effects may subject these Portfolios to greater risks and volatility.

2010 Annual report • Delaware Pooled Trust

3

Portfolio management review

Delaware Pooled® Trust — The Large-Cap Value Equity Portfolio

October 31, 2010

For the fiscal year ended Oct. 31, 2010, Delaware Pooled Trust — The Large-Cap Value Equity Portfolio returned +16.80% at net asset value (NAV) with all distributions reinvested. The Portfolio outperformed its benchmark, the Russell 1000® Value Index, which returned +15.71% during the same time frame. Complete annualized performance for The Large-Cap Value Equity Portfolio is shown in the table on page 6.

Although U.S. stock prices finished the annual fiscal period ended Oct. 31, 2010, on an upswing and achieved solid gains overall, these results masked the stock market’s fluctuating performance during that time span.

As the reporting period began, many equity investors remained optimistic about the U.S. economic recovery. Stock prices, which began a long rally back in March 2009, continued to climb through late April 2010 when investor sentiment abruptly reversed course due to several factors, including:

- Worries about the financial health of certain European governments, especially Greece

- The uncertain economic effects of the Gulf of Mexico oil spill

- New economic data showing a more vulnerable U.S. economy

Against this backdrop, stocks turned in sluggish results through the rest of the spring and summer of 2010. However, a strong rebound in early fall propelled equity values upward during the last three months of the Portfolio’s fiscal year.

In this environment, the Portfolio enjoyed good results in absolute terms, as well as relative to its benchmark, the Russell 1000 Value Index. From a sector perspective, the biggest source of outperformance came from strategic allocations within the underperforming energy and financials sectors. Among energy stocks, the Portfolio was helped by having less exposure than the benchmark to this lagging group, while a few well-chosen energy stocks actually boosted returns. In financials, the main source of our outperformance compared with the benchmark index was the Portfolio’s significant underweighting in this group, which, despite generating a positive return of about 6% overall, was the index’s weakest-performing sector during the fiscal year.

One of the top individual contributors to the Portfolio’s performance was chemical company E.I. du Pont de Nemours (DuPont), which enjoyed favorable returns. DuPont, a broadly diversified business with global scope, benefited from continued strength in pricing and healthy demand for its industrial products.

Another noteworthy contributor to the Portfolio’s performance was Xerox, a manufacturer of printers and copiers and a provider of document-oriented products and services. The company’s business fundamentals were somewhat weaker than the stocks we typically invest in, but this was helpful during the market’s rally in the first half of the fiscal period, when lower-quality companies gained considerably from the improvement in investor sentiment.

In contrast, the Portfolio’s unfavorable positioning in the consumer staples and consumer discretionary sectors was a source of underperformance. In addition to some disappointing stock selection in both groups, the Portfolio was underweighted in the outperforming consumer discretionary sector and significantly overexposed to consumer staples stocks, which trailed the benchmark index.

One of the Portfolio’s weakest performers during the fiscal year came from consumer staples: CVS Caremark, a drug-store chain and pharmacy-benefits manager. One of the company’s chief competitors, Walgreens, threatened to terminate its relationship and stop accepting prescriptions

The views expressed are current as of the date of this report and are subject to change.

2010 Annual report • Delaware Pooled Trust

4

managed by CVS subsidiary Caremark; although the disagreement was eventually settled, CVS’s stock never fully recovered. We continue to hold CVS in the Portfolio because we believe it is attractively valued and should benefit from an eventual pickup in prescription drug use.

In the healthcare sector, Quest Diagnostics was another disappointing stock within the Portfolio. Among Quest’s laboratory testing services is pre-employment testing — a business that slowed down for the company in concert with the decelerating job market. Against this backdrop, Quest forecasted slower-than-anticipated revenues for its 2010 fiscal year. We still have a positive outlook for Quest and therefore continue to hold the stock in our Portfolio. In our view, the company has strong cash flow and should benefit from higher testing volumes due to an aging population in the United States.

We continued to adhere to our bottom-up stock selection process during the reporting period, meaning we chose to invest in stocks one at a time, based on our assessment of their individual characteristics. We continued to favor stocks with consistent earnings and relatively healthy balance sheets — the types of stocks that, since the market’s April 2010 peak, have generally enjoyed better performance than their lower-quality counterparts.

While changes to the Portfolio were relatively modest during the reporting period, we did sell a handful of stocks when we felt they had reached or come close to our target price, and we replaced them with securities that we felt offered significantly better value potential.

For example, within the consumer discretionary sector, we sold our position in toy manufacturer Mattel because the company had achieved our objectives over the past several years. We felt it now offered more downside risk than upside potential, and we used the proceeds of our sale to add a position in cable television provider Comcast, whose shares we felt were extremely inexpensive relative to their long-term performance prospects.

Similarly, we sold the Portfolio’s stake in food-products business H.J. Heinz, which was originally purchased when the company was seeking to turn around its declining business. As Heinz gradually improved its profit margins and earnings, the stock performed well, leading us to exchange our position for a company we felt offered better long-term value: Williams Companies, a natural gas exploration and production firm that we felt was well priced and stood to benefit from long-term trends favoring demand for natural gas.

At period end, we continued to focus on, in our view, financially secure, attractively valued companies, which we saw as well positioned to withstand the potential risks in the economic environment. Accordingly, we were significantly overweighted relative to the benchmark index in defensive sectors such as healthcare while de-emphasizing more economically sensitive groups. These included financial stocks, whose future earnings power we see as diminished, and consumer discretionary holdings, which we believe could be challenged by high unemployment and sluggish consumer spending trends.

2010 Annual report • Delaware Pooled Trust

5

Performance summary

Delaware Pooled® Trust — The Large-Cap Value Equity Portfolio

The performance data quoted represent past performance; past performance does not guarantee future results. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Please obtain the performance data for the most recent month end by calling 800 231-8002 or visiting our Web site at www.delawareinvestments.com.

Carefully consider the Portfolio’s investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Portfolio’s prospectus and, if available, its summary prospectus, which may be obtained by visiting www.delawareinvestments.com or calling 800 231-8002. Investors should read the prospectus and, if available, the summary prospectus carefully before investing.

| Portfolio performance | | | | | | | | | | |

| Average annual total returns | | | | | | | | | | |

| Periods ended Oct. 31, 2010 | | 1 year | | 3 years | | 5 years | | 10 years | | Lifetime |

| | | +16.80% | | -6.95% | | +1.40% | | +2.79% | | +8.50% |

| Portfolio profile |

| Oct. 31, 2010 |

| |

| Total net assets |

| $6.6 million |

| |

| Number of holdings |

| 34 |

| Inception date |

| Feb. 3, 1992 |

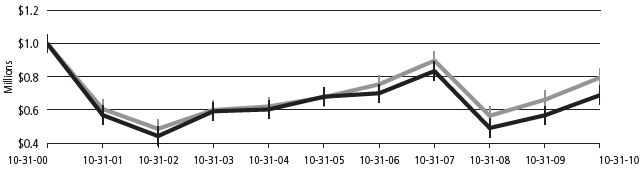

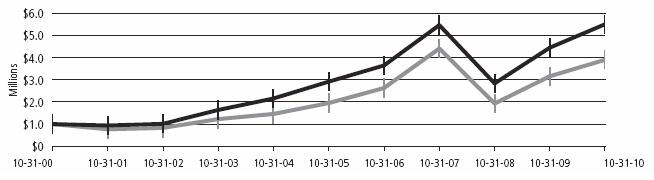

Growth of $1,000,000

| | | | Starting value (Oct. 31, 2000) | | Ending value (Oct. 31, 2010) |

| The Large-Cap Value Equity Portfolio | | $1,000,000 | | $1,316,578 |

| Russell 1000® Value Index | | $1,000,000 | | $1,298,137 |

2010 Annual report • Delaware Pooled Trust

6

The performance graph assumes $1 million invested on Oct. 31, 2000, and includes reinvestment of all distributions. The performance graph does not reflect the deduction of taxes the shareholder would pay on Portfolio distributions or redemptions of Portfolio shares.

Total return assumes reinvestment of dividends and capital gains, but does not reflect reductions for taxes. Returns and share values will fluctuate so that shares, when redeemed, may be worth more or less than their original cost.

The most recent prospectus designated the Portfolio’s total operating expenses as 0.98%. Management has contractually agreed to reimburse certain expenses and/or waive its management fees from Feb. 28, 2010, through Feb. 28, 2011, in order to prevent total annual Portfolio operating expenses from exceeding, in an aggregate amount, 0.70% of the Portfolio’s average daily net assets, as described in the most recent prospectus.

Expense limitations were in effect during the period shown. Performance would have been lower had the expense limitations not been in effect.

The Russell 1000 Value Index measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000 companies with lower price-to-book ratios and lower forecasted growth values.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

Past performance is not a guarantee of future results.

2010 Annual report • Delaware Pooled Trust

7

Portfolio management review

Delaware Pooled® Trust — The Select 20 Portfolio

October 31, 2010

For its fiscal year ended Oct. 31, 2010, Delaware Pooled Trust — The Select 20 Portfolio returned +21.29% at net asset value (NAV) with all distributions reinvested, surpassing the +20.48% return of the benchmark Russell 3000® Growth Index. Complete annualized performance for The Select 20 Portfolio is shown in the table on page 10.

At the start of the Portfolio’s fiscal year, the economy seemed to have put recession in the rearview mirror, but troubling and often contradictory signs remained. Analysts welcomed favorable corporate earnings but worried about real revenue growth; mergers and acquisitions and share buybacks seemed to be back in vogue but corporations still had plenty of “cash-on-the-sidelines”; the Federal Reserve stayed creative with nontraditional stimuli but high unemployment continued to limit consumer activity, and analysts wondered if the recovery was artificial. Despite the uncertainties, investor sentiment was generally quite favorable, which gave equities a boost.

In reality, 12 short months later, very little has changed. The economy experienced a solid growth rate in the fourth quarter 2009, though it has slowed in the months that followed as a weak labor market maintained a tight grip on consumer activity. Corporate earnings have been well received by many investors but analysts hoped to see more signs of revenue growth. At the end of the fiscal year, an estimated $1 trillion remained in cash on balance sheets.

The Fed kept interest rates low for an “extended period,” while debating another bond-buying plan to stimulate growth (source: Bloomberg). China surpassed Japan as the world’s second-largest economy and reined in stimuli to prevent its economy from overheating. Meanwhile, Europe struggled with a sovereign debt crisis that brought controversial government austerity plans and citizen protests.

Through it all, investors generally remained quite positive and equities even gained momentum in the final two months of the fiscal year. Of course, some speed bumps occurred along the way, including a 1,000-point move in the Dow Jones Industrial Average in a matter of minutes one day in May 2010; and a devastating oil spill in the Gulf of Mexico threatened to hinder growth throughout several regions and economic sectors. Yet by fiscal year-end, despite the ongoing uncertainties, the major equity U.S. indices had produced double-digit returns.

Throughout the Portfolio’s fiscal year, we remained consistent in our investment philosophy and management. We sought what, in our view, were high-quality companies that we believed had solid cash flows and strong competitive positions, and that we believe are run by experienced management teams capable of guiding their operations through good times and bad.

Apple was the Portfolio’s top contributor during the Portfolio’s fiscal year. The company has bucked virtually every macroeconomic and consumer spending trend with its unique product offerings. The four key product lines (Mac desktops and laptops, iPod, iPhone, and now the iPad) have proven highly popular and, in our view, the iPhone and iPad are fitting perfectly into the huge secular growth area of wireless proliferation. Of note, Apple is very much a niche company globally and we believe still has tremendous growth potential in fast-growing markets outside of the United States.

Online travel company priceline.com was another contributor during the fiscal year. Its “name your own price” business strategy has proven even more successful lately as it fulfills the consumer’s hearty appetite for value in these economic times. Additionally, priceline.com’s European hotel-booking subsidiary is ranked number one in market share in this high-margin, fast-growing business sector (source: Bloomberg).

The views expressed are current as of the date of this report and are subject to change.

2010 Annual report • Delaware Pooled Trust

8

Medco Health Solutions dropped during the fiscal year and was among the largest detractors to the Portfolio. The pharmaceutical-benefits manager creates outsourced prescription drug programs and other services for companies and their employees. Its business model fits the cost-cutting mood of corporate America and underscores the true benefits of outsourcing. During the June 2010 quarter, management reported disappointing results and guidance, yet we still believe in the company’s fundamentals.

Symantec was another disappointment during the period. We had been encouraged by management’s commitment to grow its core software security business internally, but noted a shift in philosophy when it acquired a security and certification company. We became concerned that management had changed its strategic direction to growth through acquisition, and therefore, we sold our position during the period. As a general rule, we prefer internal growth through business reinvestment over acquisition strategies.

Looking ahead, we still see legacy effects of the 2008 financial debacle and economic downturn that may hinder growth in the future. We do not anticipate a post-recessionary boom and expect a flat-to-moderate growth cycle with ongoing shifts in investor sentiment. While macroeconomic factors cannot be avoided these days, we are not taking on more cyclical risk based on forecasts and trends. As bottom-up stock pickers, we understand that fundamentals still matter and we will seek companies that we believe have secular growth characteristics, superior business models, and strong competitive positions that may lead to performance in a variety of market environments.

2010 Annual report • Delaware Pooled Trust

9

Performance summary

Delaware Pooled® Trust — The Select 20 Portfolio

The performance data quoted represent past performance; past performance does not guarantee future results. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Please obtain the performance data for the most recent month end by calling 800 231-8002 or visiting our Web site at www.delawareinvestments.com.

Carefully consider the Portfolio’s investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Portfolio’s prospectus and, if available, its summary prospectus, which may be obtained by visiting www.delawareinvestments.com or calling 800 231-8002. Investors should read the prospectus and, if available, the summary prospectus carefully before investing.

| Portfolio performance | | | | | | | | | | |

| Average annual total returns | | | | | | | | | | |

| Periods ended Oct. 31, 2010 | | 1 year | | 3 years | | 5 years | | 10 years | | Lifetime |

| | | +21.29% | | -4.14% | | +1.60% | | -3.64% | | -3.16% |

| Portfolio profile |

| Oct. 31, 2010 |

| |

| Total net assets |

| $11.5 million |

| |

| Number of holdings |

| 20 |

| Inception date |

| March 31, 2000 |

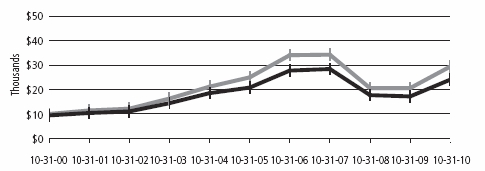

Growth of $1,000,000

| | | | Starting value (Oct. 31, 2000) | | Ending value (Oct. 31, 2010) |

| Russell 3000 Growth Index | | $1,000,000 | | $796,654 |

| The Select 20 Portfolio | | $1,000,000 | | $690,054 |

2010 Annual report • Delaware Pooled Trust

10

The performance graph assumes $1 million invested on Oct. 31, 2000, and includes reinvestment of all distributions. The performance graph does not reflect the deduction of taxes the shareholder would pay on Portfolio distributions or redemptions of Portfolio shares.

Total return assumes reinvestment of dividends and capital gains, but does not reflect reductions for taxes. Returns and share values will fluctuate so that shares, when redeemed, may be worth more or less than their original cost.

The most recent prospectus designated the Portfolio’s total operating expenses as 1.18%. Management has contractually agreed to reimburse certain expenses and/or waive its management fees from Feb. 28, 2010, through Feb. 28, 2011, in order to prevent total annual Portfolio operating expenses from exceeding, in an aggregate amount, 0.89% of the Portfolio’s average daily net assets, as described in the most recent prospectus.

Expense limitations were in effect during the period shown. Performance would have been lower had the expense limitations not been in effect.

The Russell 3000 Growth Index measures the performance of the broad growth segment of the U.S. equity universe. It includes those Russell 3000 companies with higher price-to-book ratios and higher forecasted growth values.

The Dow Jones Industrial Average is an often-quoted market indicator that comprises 30 widely held blue-chip stocks.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

Past performance is not a guarantee of future results.

“Nondiversified” Portfolios may allocate more of their net assets to investments in single securities than “diversified” Portfolios. Resulting adverse effects may subject these Portfolios to greater risks and volatility.

Because the Portfolio expects to hold a concentrated portfolio of a limited number of securities, the Portfolio’s risk is increased because each investment has a greater effect on the Portfolio’s overall performance.

Investments in small and/or medium-sized companies typically exhibit greater risk and higher volatility than larger, more established companies.

Instances of high double-digit returns are unusual, cannot be sustained, and were primarily achieved during favorable market conditions.

2010 Annual report • Delaware Pooled Trust

11

Portfolio management review

Delaware Pooled® Trust — The Large-Cap Growth Equity Portfolio

October 31, 2010

Delaware Pooled Trust — The Large-Cap Growth Equity Portfolio returned +21.35% at net asset value (NAV) with all distributions reinvested for the fiscal year ended Oct. 31, 2010. The Portfolio’s benchmark, the Russell 1000 Growth Index, returned +19.65% for the same period. Complete annualized performance for The Large-Cap Growth Equity Portfolio is shown in the table on page 14.

During the first half of the Portfolio’s fiscal year, the market generally appeared to gain steam as investor sentiment rose in anticipation of improving economic fundamentals. In early 2010, positive housing and industrial-production data emerged, helping to support the market’s upward trend. Investor optimism quickly waned in late April 2010, however, as the sovereign debt crisis in Europe sparked a broad market selloff. This news, combined with decelerating economic growth in China and weak U.S. economic data, contributed to a sharp drop in investor sentiment. (Source: Bloomberg.)

During the latter half of the Portfolio’s fiscal year, the market was characterized by several sharp swings, investor pessimism, and lingering macroeconomic concerns. Despite moves away from the market’s bottom in 2008, economic fundamentals still did not show any meaningful improvement. Cyclical stocks, such as those in the energy and industrial sectors as well as those tied to commodity prices, generally performed well during the fiscal year.

Priceline.com was the top contributor to the Portfolio’s overall return during the fiscal year. The company’s strong earning reports during the period supported our view that the company’s core North American business and rapidly growing European hotel-booking business were largely unaffected by sovereign crisis concerns. Despite general investor concerns surrounding global economic and fiscal headwinds, we believe investors may be underestimating what we view as the powerful cash economics of the company’s business, and we continue to hold the stock.

Novo Nordisk was another contributor to the Portfolio’s overall performance. The company experienced continued success in rolling out its latest diabetes drug, Victoza, which was approved by the U.S. Food and Drug Administration in January 2010. We think the initial stages of the product launch look promising in terms of market share growth, and we believe it could enhance the company’s position as one of the leading global franchises in diabetes treatment.

VeriSign also had a positive effect on overall return. Many investors seemed encouraged by the company’s increased focus on its domain-name listing business, which we believe is its primary driver of shareholder value. As part of that increased focus, the company sold a security business late in the fiscal year to a competitor — a transaction that was generally well received by the market.

Medco Health Solutions was one of the Portfolio’s largest detractors for the fiscal year. Investor concerns about the sustainability of the company’s generic drug cycle and whether there was sufficient growth in other product areas hurt the stock’s overall performance. Nonetheless, the company is developing other products and offerings that we believe may increase customer retention and bolster the company’s value proposition for new business opportunities. We believe the stock’s performance was likely the result of an overreaction by investors and therefore we continue to hold the stock.

Walgreens also lagged during the Portfolio’s fiscal year. The company engaged in a very public and confrontational negotiation with CVS Caremark, one of its partners in drug distribution and a competitor to Walgreens in drug retailing. While the negotiation was eventually settled in June 2010, the details of their business relationship are unknown. While the incident was unfortunate and hurt the stock temporarily in the last few months of the fiscal year, we believe it doesn’t materially impair the long-term value of Walgreens’ business model or competitive position.

The views expressed are current as of the date of this report and are subject to change.

2010 Annual report • Delaware Pooled Trust

12

Symantec also hurt the Portfolio’s overall performance. The stock suffered, in our view, because weak macroeconomic conditions created an environment of dampened spending growth in enterprise storage management and security. We sold the position because management seemed to lessen its focus on its core business, software security and storage, in favor of business acquisition.

Although the U.S. equity market posted a positive return during the last three months of the Portfolio’s fiscal year, significant month-to-month volatility demonstrates to us that many investors are still uncertain about the future growth prospects of the global economy. While fundamentals may still be trending in a slightly positive direction (from a very low base during the global financial crisis in 2008–2009), we don’t believe we are entering into a typical post-recessionary boom cycle. Rather, we believe the lingering effects of the credit crisis could lead to moderate growth, at best, and are likely to continue to result in often-conflicting economic data points and a variety of company fundamental outcomes dependent on the quality of a company’s business model, competitive position, and management.

Regardless of the economic outcome, we remain consistent in our long-term investment philosophy: We want to own what we believe to be strong secular-growth companies with solid business models and competitive positions that we believe can grow market share and deliver shareholder value in a variety of market environments.

2010 Annual report • Delaware Pooled Trust

13

Performance summary

Delaware Pooled® Trust — The Large-Cap Growth Equity Portfolio

The performance data quoted represent past performance; past performance does not guarantee future results. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Please obtain the performance data for the most recent month end by calling 800 231-8002 or visiting our Web site at www.delawareinvestments.com.

Carefully consider the Portfolio’s investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Portfolio’s prospectus and, if available, its summary prospectus, which may be obtained by visiting www.delawareinvestments.com or calling 800 231-8002. Investors should read the prospectus and, if available, the summary prospectus carefully before investing.

| Portfolio performance | | | | | | |

| Average annual total returns | | | | | | |

| Periods ended Oct. 31, 2010 | | 1 year | | 3 years | | Lifetime |

| | | +21.35% | | -5.01% | | +1.28% |

| Portfolio profile |

| Oct. 31, 2010 |

| |

| Total net assets |

| $244.1 million |

| |

| Number of holdings |

| 29 |

| |

| Inception date |

| Nov. 1, 2005 |

Growth of $1,000,000

| | | | Starting value (Nov. 1, 2005) | | Ending value (Oct. 31, 2010) |

| Russell 1000® Growth Index | | $1,000,000 | | $1,176,721 |

| The Large-Cap Growth Equity Portfolio | | $1,000,000 | | $1,065,754 |

2010 Annual report • Delaware Pooled Trust

14

The performance graph assumes $1 million invested on Nov. 1, 2005, and includes reinvestment of all distributions. The performance graph does not reflect the deduction of taxes the shareholder would pay on Portfolio distributions or redemptions of Portfolio shares.

Total return assumes reinvestment of dividends and capital gains, but does not reflect reductions for taxes. Returns and share values will fluctuate so that shares, when redeemed, may be worth more or less than their original cost.

The most recent prospectus designated the Portfolio’s total operating expenses as 0.66%. Management has contractually agreed to reimburse certain expenses and/or waive its management fees from Feb. 28, 2010, through Feb. 28, 2011, in order to prevent total annual Portfolio operating expenses from exceeding, in an aggregate amount, 0.65% of the Portfolio’s average daily net assets, as described in the most recent prospectus.

Expense limitations were in effect during the period shown. Performance would have been lower had the expense limitations not been in effect.

The Russell 1000 Growth Index measures the performance of the large-cap growth segment of the U.S. equity universe. It includes those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

Past performance is not a guarantee of future results.

Because the Portfolio expects to hold a concentrated portfolio of a limited number of securities, the Portfolio’s risk is increased because each investment has a greater effect on the Portfolio’s overall performance.

Instances of high double-digit returns are unusual, cannot be sustained, and were primarily achieved during favorable market conditions.

2010 Annual report • Delaware Pooled Trust

15

Portfolio management review

Delaware Pooled® Trust — The Focus Smid-Cap Growth Equity Portfolio

October 31, 2010

For its fiscal year ended Oct. 31, 2010, Delaware Pooled Trust — The Focus Smid-Cap Growth Equity Portfolio returned +41.10% at net asset value with all distributions reinvested, far surpassing the +28.75% return of the benchmark Russell 2500 Growth Index. Complete annualized performance for The Focus Smid-Cap Growth Equity Portfolio is shown in the table on page 18.

At the start of the Portfolio’s fiscal year, the economy seemed to have put recession in the rearview mirror, but troubling and often contradictory signs remained. Analysts welcomed favorable corporate earnings but worried about real revenue growth; mergers and acquisitions and share buybacks seemed to be back in vogue but corporations still had plenty of “cash-on-the-sidelines”; the Federal Reserve stayed creative with nontraditional stimuli but high unemployment continued to limit consumer activity, and analysts wondered if the recovery was artificial. Despite the uncertainties, investor sentiment was generally quite favorable, enough to give equities a boost.

In reality, 12 short months later, very little has changed. The economy experienced a solid growth rate in the fourth quarter of 2009 (GDP +5%), though it slowed in the months that followed as a weak labor market maintained a tight grip on consumer activity. Corporate earnings have been well received by many investors but analysts hoped to see more signs of revenue growth. At the end of the fiscal year, an estimated $1 trillion remained in cash on balance sheets.

The Fed kept interest rates low for an “extended period,” while debating another bond-buying plan to stimulate growth (source: Bloomberg). China surpassed Japan as the world’s second-largest economy and reined in stimuli to prevent its economy from overheating. Meanwhile, Europe struggled with a sovereign debt crisis that brought controversial government austerity plans and citizen protests.

Through it all, investors generally remained quite positive and equities even gained momentum in the final two months of the fiscal year. Of course, some speed bumps occurred along the way, including a 1,000-point move in the Dow Jones Industrial Average in a matter of minutes one day in May 2010; and a devastating oil spill in the Gulf of Mexico threatened to hinder growth throughout several regions and economic sectors. Yet by fiscal year-end, despite the ongoing uncertainties, the major equity indices had produced double-digit returns.

Throughout the year, we remained consistent in our investment philosophy and management. We sought high-quality companies that we believed had solid cash flows and strong competitive positions and that we believe are run by experienced management teams capable of guiding their operations through good times and bad.

Netflix was the best performer within the Portfolio during the period. The company has long been the market leader in mail-order DVD distribution and was continuing to grow its dominant share even before rival Blockbuster’s recent bankruptcy filing. More significantly, Netflix has looked to the future and is transitioning to a new online offering as a complement to its traditional DVD-by-mail service. The company has developed an effective model for online distribution through key partnerships with gaming console companies and other consumer electronics manufacturers. Customer retention has been a key to success as current subscribers can also access the new, efficient distribution method.

Online travel company priceline.com was among the Portfolio’s top contributors during the fiscal year. Its “name your own price” business strategy has proven even more successful lately as it fulfills the consumer’s hearty appetite for value in these economic times. Additionally, priceline.com’s European hotel-booking subsidiary is ranked number one in market share in this high margin, fast-growing business sector (source: Bloomberg). We sold the stock during the Portfolio’s fiscal year because

The views expressed are current as of the date of this report and are subject to change.

2010 Annual report • Delaware Pooled Trust

16

its market capitalization increased above our threshold of $10 billion. We are still believers in the company’s story and own the stock in our other strategies that allow for larger-market-cap stock holdings.

The Portfolio also suffered some setbacks from holdings that underperformed. Strayer Education was the Portfolio’s worst performer on both an absolute and relative basis. The for-profit educational institute has struggled with the rest of the industry as consumer groups have raised concerns about lending practices and the government contemplates enhanced scrutiny and regulations. Many of its students qualify for government loans and some analysts fear that high default rates from non-credit-worthy borrowers may lead to another subprime-like debacle. The possibility of new regulations has led to greater uncertainty over the entire for-profit education industry and related companies have been hurt. We do not believe the government will stand in the way of individua ls accessing education. As long-term investors, we feel that Strayer should be a survivor and industry leader as reforms are implemented.

OptionsXpress was another poor performer on a relative basis, even though the stock actually increased during the period. The online brokerage company focuses on options trading for retail (individual) investors. Despite the surge in U.S. equities, retail activity has been slow as individuals often seek the safe haven of fixed income and cash equivalents (as opposed to options and other derivatives) during uncertain times. Fewer transactions means lower trading revenues. Still, we like the company’s cash metrics and long-term fundamentals and are willing to maintain our relatively small position in the near future.

Looking ahead, we still see legacy effects of the 2008 financial debacle and economic downturn that may hinder growth in the future. We do not anticipate a post-recessionary boom and expect a flat-to-moderate growth cycle with ongoing shifts in investor sentiment. While macroeconomic factors cannot be avoided these days, we are not taking on more cyclical risk based on forecasts and trends. As bottom-up stock pickers, we understand that fundamentals still matter and we will seek companies that we believe have secular growth characteristics, superior business models, and strong competitive positions that may lead to performance in a variety of market environments.

2010 Annual report • Delaware Pooled Trust

17

Performance summary

Delaware Pooled® Trust — The Focus Smid-Cap Growth Equity Portfolio

The performance data quoted represent past performance; past performance does not guarantee future results. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Please obtain the performance data for the most recent month end by calling 800 231-8002 or visiting our Web site at www.delawareinvestments.com.

Carefully consider the Portfolio’s investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Portfolio’s prospectus and, if available, its summary prospectus, which may be obtained by visiting www.delawareinvestments.com or calling 800 231-8002. Investors should read the prospectus and, if available, the summary prospectus carefully before investing.

| Portfolio performance | | | | | | | | |

| Average annual total returns | | | | | | | | |

| Periods ended Oct. 31, 2010 | | 1 year | | 3 years | | 5 years | | Lifetime |

| | | +41.10% | | +5.66% | | +8.24% | | +7.54% |

| | | | | | | | | |

| Portfolio profile | | | | | | | | |

| Oct. 31, 2010 | | | | | | | | |

| Total net assets |

| $4.6 million |

| |

| Number of holdings |

| 30 |

| Inception date |

| Dec. 1, 2003 |

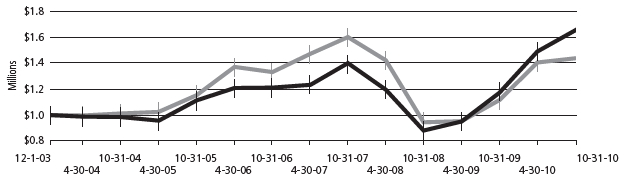

Growth of $1,000,000

| | | | Starting value (Dec. 1, 2003) | | Ending value (Oct. 31, 2010) |

| The Focus Smid-Cap Growth Equity Portfolio | | $1,000,000 | | $1,653,319 |

| Russell 2500 Growth Index | | $1,000,000 | | $1,438,164 |

2010 Annual report • Delaware Pooled Trust

18

The performance graph assumes $1 million invested on Dec. 1, 2003, and includes reinvestment of all distributions. The performance graph does not reflect the deduction of taxes the shareholder would pay on Portfolio distributions or redemptions of Portfolio shares.

Total return assumes reinvestment of dividends and capital gains, but does not reflect reductions for taxes. Returns and share values will fluctuate so that shares, when redeemed, may be worth more or less than their original cost.

The most recent prospectus designated the Portfolio’s total operating expenses as 1.48%. Management has contractually agreed to waive all or a portion of its management fees from Feb. 28, 2010, through Feb. 28, 2011, in order to prevent total annual Portfolio operating expenses from exceeding 0.92% of the Portfolio’s average daily net assets, as described in the most recent prospectus.

Expense limitations were in effect during the period shown. Performance would have been lower had the expense limitations not been in effect.

The Russell 2500 Growth Index measures the performance of the small- to mid-cap growth segment of the U.S. equity universe. It includes those Russell 2500 companies with higher price-to-book ratios and higher forecasted growth values.

The Dow Jones Industrial Average is an often-quoted market indicator that comprises 30 widely held blue-chip stocks.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

Past performance is not a guarantee of future results.

Investments in small and/or medium-sized companies typically exhibit greater risk and higher volatility than larger, more established companies.

Instances of high double-digit returns are unusual, cannot be sustained, and were primarily achieved during favorable market conditions.

Because the Portfolio expects to hold a concentrated portfolio of a limited number of securities, the Portfolio’s risk is increased because each investment has a greater effect on the Portfolio’s overall performance.

2010 Annual report • Delaware Pooled Trust

19

Portfolio management review

Delaware Pooled® Trust — The Real Estate Investment Trust Portfolio II

October 31, 2010

For its fiscal year ended Oct. 31, 2010, Delaware Pooled Trust — The Real Estate Investment Trust Portfolio II gained 39.51% (at net asset value, with all distributions reinvested). In comparison, the Portfolio’s benchmark, the FTSE NAREIT Equity REITs Index, rose 42.81% during the same time span. Complete annualized performance for The Real Estate Investment Trust Portfolio II is shown in the table on page 22.

Investors in U.S. real estate securities enjoyed strong results during the Portfolio’s fiscal year, despite a significant downturn between late April and August 2010, when concerns about European government debt levels and the potential for a U.S. economic slowdown were most pronounced.

In our view, one of the leading factors boosting stock prices of real estate investment trusts (REITs) was the healthy availability of credit. Precisely the opposite conditions were present during the credit crisis of late 2007 through early 2009, when REIT performance suffered because lenders were unwilling to finance companies that held too much debt.

Throughout the Portfolio’s fiscal year, we sought ways to position the Portfolio to take advantage of promising opportunities, given prevailing market conditions. In the early part of the Portfolio’s fiscal year, for example, REIT values were accelerating along with optimism about economic growth and the availability of credit. We added to the Portfolio’s investments in a handful of companies that we felt would benefit significantly in such an environment, while de-emphasizing those we felt would not fare as well.

Beginning in the spring of 2010, as the sovereign debt crisis unfolded in Greece and threatened to distress the global economy, we gradually positioned the Portfolio more defensively by focusing on stocks with solid balance sheets and attractive performance prospects, as we felt these types of holdings would be less dependent on a recovering economy.

Although this defensive positioning was helpful while market conditions worsened, in retrospect the Portfolio would have been better served had we adopted a more aggressive posture in the fiscal year’s final few months. When market conditions turned upward in August 2010, we did not pivot quickly enough to capture the full upside potential.

The apartment sector was a source of positive results for the Portfolio during the fiscal year. The Portfolio’s performance was supported by good stock selection as well as an overweight position relative to the benchmark index in this sector, as apartment companies benefited from their relatively short lease durations and therefore were quick to recover when credit conditions improved.

The Portfolio’s top contributor in the apartment sector was Apartment Investment & Management Company, whose shares rose significantly to more than 90% during the fiscal year, partly due to the company’s success in improving its balance sheet. Other helpful performers in the Portfolio included Equity Residential, the country’s largest apartment owner and a beneficiary of the broad trends favoring apartment companies.

An emphasis on the strong-performing regional malls sector was also helpful, with a number of companies in this group profiting from the gradual improvement in consumer spending. Among the Portfolio’s leading relative contributors in this sector were Macerich and CBL. Both of these stocks were hampered by concerns about their debt levels during the credit crisis but succeeded in fixing their balance sheets.

The Portfolio’s underweight position in the troubled industrials group, especially being underexposed to ProLogis, was another positive factor. This stock, which had a fairly meaningful weighting within the benchmark index, advanced during the fiscal year but significantly lagged the benchmark’s impressive results.

The views expressed are current as of the date of this report and are subject to change.

2010 Annual report • Delaware Pooled Trust

20

In contrast, security selection within the healthcare sector was a source of underperformance, as this relatively defensive group failed to keep pace with the benchmark. We opted to limit our exposure to medical-office-property company Health Care REIT in favor of Healthcare Realty Trust, a stock we felt offered better prospects. Unfortunately, this approach did not work out well during the fiscal year. As of this writing, we continue to feel that the company’s shares are appropriate investments for the Portfolio, and we continue to hold them.

The Portfolio’s relative underweighting within the lodging sector was a modest impediment as the sector outpaced the benchmark overall. A position in Chesapeake Lodging Trust was a noteworthy disappointment, while a position in Gaylord Entertainment, a hospitality and entertainment company, did relatively well. Gaylord was added to the Portfolio after its stock price dropped as a result of concerns about the financial effect of flooding in Memphis, home to one of its largest properties. When the damage proved less severe than many investors had expected, the stock recovered. As the Portfolio& #8217;s fiscal year progressed, Chesapeake and Gaylord became candidates for removal from the Portfolio, and both positions were completely liquidated by the end of the period.

At the end of the Portfolio’s fiscal year, we maintained a slight relative overweight in apartment and mall companies, while remaining underweight in lodging, office, healthcare, and industrial REITs. In our view, REIT prices have become fairly high, and we feel it is not prudent to remain aggressively positioned, in light of a potential shift in the market environment. For example, rising Treasury yields could increase the cost of financing and lead to some headwinds for real estate stocks. We continue to watch market conditions closely and believe we are poised to make the Portfolio holdings somewhat more defensive if the market backdrop weakens.

2010 Annual report • Delaware Pooled Trust

21

Performance summary

Delaware Pooled® Trust — The Real Estate Investment Trust Portfolio II

The performance data quoted represent past performance; past performance does not guarantee future results. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Please obtain the performance data for the most recent month end by calling 800 231-8002 or visiting our Web site at www.delawareinvestments.com.

Carefully consider the Portfolio’s investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Portfolio’s prospectus and, if available, its summary prospectus, which may be obtained by visiting www.delawareinvestments.com or calling 800 231-8002. Investors should read the prospectus and, if available, the summary prospectus carefully before investing.

| Portfolio performance | | | | | | | | | |

| Average annual total returns | | | | | | | | | |

| Periods ended Oct. 31, 2010 | 1 year | | 3 years | | 5 years | | 10 years | | Lifetime |

| | +39.51% | | -5.20% | | +3.22% | | +10.15% | | +8.37% |

| Portfolio profile |

| Oct. 31, 2010 |

| |

| Total net assets |

| $2.8 million |

| |

| Number of holdings |

| 55 |

| Inception date |

| Nov. 4, 1997 |

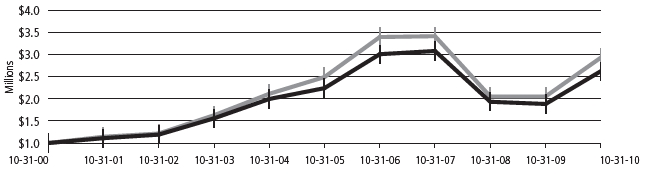

Growth of $1,000,000

| | | | Starting value (Oct. 31, 2000) | | Ending value (Oct. 31, 2010) |

| FTSE NAREIT Equity REITs Index | | $1,000,000 | | $2,936,925 |

| The Real Estate Investment Trust Portfolio II | | $1,000,000 | | $2,629,910 |

2010 Annual report • Delaware Pooled Trust

22

The performance graph assumes $1 million invested on Oct. 31, 2000, and includes reinvestment of all distributions. The performance graph does not reflect the deduction of taxes the shareholder would pay on Portfolio distributions or redemptions of Portfolio shares.

Total return assumes reinvestment of dividends and capital gains, but does not reflect reductions for taxes. Returns and share values will fluctuate so that shares, when redeemed, may be worth more or less than their original cost.

The most recent prospectus designated the Portfolio’s total operating expenses as 1.53%. Management has contractually agreed to reimburse certain expenses and/or waive its management fees from Feb. 28, 2010, through Feb. 28, 2011, in order to prevent total annual Portfolio operating expenses from exceeding, in an aggregate amount, 0.95% of the Portfolio’s average daily net assets, as described in the most recent prospectus.

Expense limitations were in effect during the period shown. Performance would have been lower had the expense limitations not been in effect.

The FTSE NAREIT Equity REITs Index measures the performance of all publicly traded equity real estate investment trusts traded on U.S. exchanges.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

Past performance is not a guarantee of future results.

“Nondiversified” Portfolios may allocate more of their net assets to investments in single securities than “diversified” Portfolios. Resulting adverse effects may subject these Portfolios to greater risks and volatility.

Narrowly focused investments may exhibit higher volatility than investments in multiple industry sectors.

REIT investments are subject to many of the risks associated with direct real estate ownership, including changes in economic conditions, credit risk, and interest rate fluctuations. A REIT fund’s tax status as a regulated investment company could be jeopardized if it holds real estate directly, as a result of defaults, or receives rental income from real estate holdings.

Instances of high double-digit returns are unusual, cannot be sustained, and were primarily achieved during favorable market conditions.

2010 Annual report • Delaware Pooled Trust

23

Portfolio management review

Delaware Pooled® Trust — The Core Focus Fixed Income Portfolio

October 31, 2010

When the Portfolio’s fiscal year began, financial markets were bolstered by a broad-based sense of optimism about the economy:

- On the heels of the U.S. economy’s first quarterly expansion in more than a year, gross domestic product growth in the fourth quarter of 2009 showed continued improvements, even strength. Annualized GDP expansion of 5.0% during those three months represented the fastest quarterly growth for the U.S. economy since early 2006. (Source: U.S. Commerce Department.)

As the fiscal year progressed, however, indications began to mount that the U.S. economic environment was slowing once again. For example:

- Unemployment in the United States remained stubbornly high. The jobless rate hovered between 9.5% and 10% through the entire fiscal year.

- The rate of expansion in GDP decreased rather rapidly during the first half of 2010. This trend led some economists to worry about the potential for a “double-dip” recession.

- The European debt crisis, which began in the spring of 2010, threatened to spread beyond Greece and ensnare other vulnerable economies across the developed world.

- The U.S. housing market, weighed down by significant foreclosure activity and declining sales, continued to struggle.

Source: Bloomberg

Despite these considerable economic headwinds, the fiscal year was largely a favorable time for the fixed income market as accommodative monetary policy from the Federal Reserve combined with still considerable value within many areas of the corporate bond market and a strong demand for yield in light of low interest rates all bode well for fixed income investors.

Against this backdrop, Delaware Pooled Trust — The Core Focus Fixed Income Portfolio returned +8.46% at net asset value (NAV) with all distributions reinvested for the fiscal year ended Oct. 31, 2010. The Portfolio’s benchmark, the Barclays Capital U.S. Aggregate Index, returned +8.01% for the same time period. Complete annualized performance for The Core Focus Fixed Income Portfolio is shown in the table on page 26.

The Portfolio’s continued overweight in investment grade corporate bonds, an emphasis on BBB and A-rated issues, and security selection in general, each aided relative returns during the fiscal year. Among investment grade U.S. corporate bonds, we concluded that the BBB and A-rated area generally offered the best risk-reward trade-off and emphasized Portfolio positions in those categories. It’s important to note, however, that these bonds, which are considered medium-grade, experienced down periods during the year when investors made efforts to move toward higher-quality bonds.

The Portfolio generally remained underweight in government-backed or agency mortgage-backed securities (MBS), as we believed that these securities remained expensive for much of the fiscal year. This positioning benefited Portfolio performance, as these areas underperformed the benchmark during the fiscal year.

Detractors from the Portfolio’s relative performance came from overweights in asset-backed securities and commercial mortgage-backed securities (particularly during the latter parts of the period). This happened despite the Portfolio’s bias toward higher-quality commercial mortgage-backed securities.

We believe the coming months will likely be characterized by much economic uncertainty, as periods of improving growth can be quickly followed by slowdowns and investors continue to demonstrate a pattern of rapidly changing attitudes toward risk. Within this difficult environment, we believe that our focus on in-depth security research, applied across a well-diversified global range of investment opportunities, may put the Portfolio in a position to accommodate the ongoing tests that will likely face the U.S. economy during the next several years. Building a Portfolio that combines our best research ideas with a modestly defensive bias seems most appropriate to us at this time.

The views expressed are current as of the date of this report and are subject to change.

2010 Annual report • Delaware Pooled Trust

��

25

Performance summary

Delaware Pooled® Trust — The Core Focus Fixed Income Portfolio

The performance data quoted represent past performance; past performance does not guarantee future results. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Please obtain the performance data for the most recent month end by calling 800 231-8002 or visiting our Web site at www.delawareinvestments.com.

Carefully consider the Portfolio’s investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Portfolio’s prospectus and, if available, its summary prospectus, which may be obtained by visiting www.delawareinvestments.com or calling 800 231-8002. Investors should read the prospectus and, if available, the summary prospectus carefully before investing.

| Portfolio performance | | | | | | | | |

| Average annual total returns | | | | | | | | |

| Periods ended Oct. 31, 2010 | | 1 year | | 3 years | | 5 years | | Lifetime |

| | | +8.46% | | +6.95% | | +6.12% | | +5.69% |

| Portfolio profile |

| Oct. 31, 2010 |

| |

| Total net assets |

| $19.2 million |

| Inception date |

| June 30, 2004 |

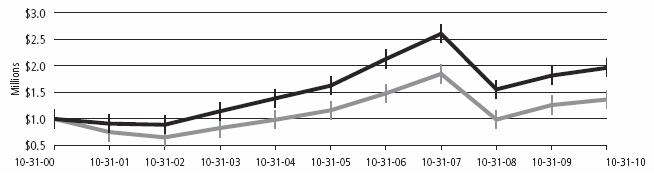

Growth of $1,000,000

| | | | | Starting value (June 30, 2004) | | Ending value (Oct. 31, 2010) |

| | Barclays Capital U.S. Aggregate Index | | $1,000,000 | | $1,438,083 |

| | The Core Focus Fixed Income Portfolio | | $1,000,000 | | $1,419,899 |

2010 Annual report • Delaware Pooled Trust

26

The performance graph assumes $1 million invested on June 30, 2004, and includes reinvestment of all distributions. The performance graph does not reflect the deduction of taxes the shareholder would pay on Portfolio distributions or redemptions of Portfolio shares.

Total return assumes reinvestment of dividends and capital gains, but does not reflect reductions for taxes. Returns and share values will fluctuate so that shares, when redeemed, may be worth more or less than their original cost.

The most recent prospectus designated the Portfolio’s total operating expenses for shares as 0.71%. Management has contractually agreed to reimburse certain expenses and/or waive its management fees from Feb. 28, 2010, through Feb. 28, 2011, in order to prevent total annual Portfolio operating expenses from exceeding, in an aggregate amount, 0.43% of the Portfolio’s average daily net assets, as described in the most recent prospectus.

Expense limitations were in effect during the period shown. Performance would have been lower had the expense limitation not been in effect.

The Barclays Capital U.S. Aggregate Index measures the performance of more than 8,000 publicly issued investment grade (Baa3/BBB- or better) corporate, U.S. government, mortgage- and asset-backed securities with at least one year to maturity and at least $250 million par amount outstanding.

Index performance returns do not reflect any management fees, transaction costs or expenses. Indices are unmanaged and one cannot invest directly in an index.

Past performance is not a guarantee of future results.

The letter ratings are provided by S&P and describe the creditworthiness of the underlying bonds in the portfolio and generally range from AAA (highest quality) to CCC (lowest; highly speculative).

Securities in the lowest of the rating categories considered to be investment grade (that is, Baa or BBB) have some speculative characteristics.

Fixed income securities and bond funds can lose value, and investors can lose principal, as interest rates rise. They also may be affected by economic conditions that hinder an issuer’s ability to make interest and principal payments on its debt.

The Portfolio may also be subject to prepayment risk, the risk that the principal of a fixed income security that is held by the Portfolio may be prepaid prior to maturity, potentially forcing the Portfolio to reinvest that money at a lower interest rate.

The Portfolio may be invested in foreign corporate bonds, which have special risks not ordinarily associated with domestic investments, such as currency fluctuations, economic and political change, and different accounting standards. The Portfolio may invest in derivatives, which may involve additional expenses and are subject to risk, including the risk that an underlying security or securities index moves in the opposite direction from what the portfolio manager anticipated. A derivative transaction depends upon the counterparties’ ability to fulfill their contractual obligations.

Diversification may not protect against market risk.

The Portfolio may experience portfolio turnover in excess of 100%, which could result in higher transaction costs and tax liability.

2010 Annual report • Delaware Pooled Trust

27

Portfolio management review

Delaware Pooled® Trust — The High-Yield Bond Portfolio

October 31, 2010

Delaware Pooled Trust — The High-Yield Bond Portfolio returned +20.85% with all distributions reinvested for the fiscal year ended Oct. 31, 2010. For the same period, the BofA Merrill Lynch U.S. High Yield Constrained Index returned +19.08%. Complete annualized performance for The High-Yield Bond Portfolio is shown in the table on page 30.

As the Portfolio’s fiscal year began, the U.S. economy was still in the process of recovering from the worst recession since the 1930s. While high yield bonds usually underperform Treasurys during economic downturns, the near-panic conditions that infected markets during the global financial crisis had caused credit spreads (the yield differential between government and corporate bonds of similar maturities) to widen to virtually unprecedented levels (it’s important to remember that as yields rise, prices decline). Spreads eventually moderated as financial conditions improved, sparking strong rallies in the high yield sector. Favorable sentiment toward fixed income was also aided by the sovereign debt crisis in the euro zone, attempts by the Chinese government to cool its overheated property sector, and by fears of a double-dip recession in major industrialized economies. Those factors implied an extended period of low interest rates while virtually eliminating inflation as an immediate threat. (Source: Moody’s.)