UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-06324

Exact name of registrant as specified in charter:

Delaware Group® Global & International Funds

Address of principal executive offices:

2005 Market Street

Philadelphia, PA 19103

Name and address of agent for service:

David F. Connor, Esq.

2005 Market Street

Philadelphia, PA 19103

Registrant’s telephone number, including area code: (800) 523-1918

Date of fiscal year end: November 30

Date of reporting period: November 30, 2009

Item 1. Reports to Stockholders

Annual report Delaware International Value Equity Fund Delaware Emerging Markets Fund Delaware Global Value Fund November 30, 2009 International equity mutual funds |

This annual report is for the information of Delaware International Value Equity Fund, Delaware Emerging Markets Fund, and Delaware Global Value Fund shareholders, but it may be used with prospective investors when preceded or accompanied by a current prospectus for Delaware International Value Equity Fund, Delaware Emerging Markets Fund, and Delaware Global Value Fund. The figures in the annual report for Delaware International Value Equity Fund, Delaware Emerging Markets Fund, and Delaware Global Value Fund represent past results, which are not a guarantee of future results. The return and principal value of an investment in the Fund will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. You should consider the investment objectives, risks, charges, and expenses of the Fund carefully before investing. The Delaware International Value Equity Fund, Delaware Emerging Markets Fund, and Delaware Global Value Fund prospectus contains this and other important information about the Fund. Prospectuses for all open-end funds in the Delaware Investments® Family of Funds are available from your financial advisor, online at www.delawareinvestments.com, or by phone at 800 523-1918. Please read the prospectus carefully before you invest or send money. |

You can obtain shareholder reports and prospectuses online instead of in the mail.

Visit www.delawareinvestments.com/edelivery. |

Experience Delaware Investments

Delaware Investments is committed to the pursuit of consistently superior asset management and unparalleled client service. We believe in our investment processes, which seek to deliver consistent results, and in convenient services that help add value for our clients.

If you are interested in learning more about creating an investment plan, contact your financial advisor.

You can learn more about Delaware Investments or obtain a prospectus for Delaware International Funds at www.delawareinvestments.com.

| Manage your investments online |

- 24-hour access to your account information

- Obtain share prices

- Check your account balance and recent transactions

- Request statements or literature

- Make purchases and redemptions

|

On January 4, 2010, Delaware Management Holdings, Inc. and its subsidiaries (collectively known by the marketing name of Delaware Investments) were sold by a subsidiary of Lincoln National Corporation to Macquarie Group Limited, a global provider of banking, financial, advisory, investment and funds management services. Please see your Fund’s prospectus and any supplements thereto for more complete information.

Investments in Delaware International Value Equity Fund, Delaware Emerging Markets Fund, and Delaware Global Value Fund are not and will not be deposits with or liabilities of Macquarie Bank Limited ABN 46 008 583 542 and its holding companies, including subsidiaries or related companies, and are subject to investment risk, including possible delays in repayment and loss of income and capital invested. No Macquarie Group company guarantees or will guarantee the performance of the Funds, the repayment of capital from the Funds, or any particular rate of return.

| Table of contents | |

| Portfolio management review | 1 |

| Performance summaries | 12 |

| Disclosure of Fund expenses | 22 |

| Country and sector allocations | 27 |

| Statements of net assets | 33 |

| Statements of operations | 54 |

| Statements of changes in net assets | 56 |

| Financial highlights | 62 |

| Notes to financial statements | 90 |

| Report of independent registered | |

| public accounting firm | 107 |

| Other Fund information | 108 |

| Board of trustees/directors and | |

| officers addendum | 116 |

| About the organization | 122 |

Views expressed herein are current as of November 30, 2009, and are subject to change.

Funds are not FDIC insured and are not guaranteed. It is possible to lose the principal amount invested.

Mutual fund advisory services provided by Delaware Management Company, a series of Delaware Management Business Trust, which is a registered investment advisor. Delaware Investments is the marketing name of Delaware Management Holdings, Inc. and its subsidiaries. Macquarie Group refers to Macquarie Group Limited and its subsidiaries and affiliates worldwide.

© 2010 Delaware Management Holdings, Inc.

All third-party trademarks cited are the property of their respective owners.

| Portfolio management review |

| Delaware International Value Equity Fund | Dec. 8, 2009 |

| Performance review (for the period ended Nov. 30, 2009) |

| Delaware International Value Equity Fund (Class A shares) | 1-year return | | +44.76% |

| MSCI EAFE Index (net) (benchmark) | 1-year return | | +37.72% |

| MSCI EAFE Index (gross) | 1-year return | | +38.43% |

Past performance does not guarantee future results.

For complete, annualized performance for Delaware International Value Equity Fund, please see the table on page 12.

The performance of Class A shares excludes the applicable sales charge and reflects the reinvestment of all distributions.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index. |

When the Fund’s fiscal year began in December 2008, global financial markets were already in the midst of a protracted downturn. Investors have experienced weak economic cycles and significant market declines before, but this situation, accompanied by a global credit crisis, was worse than anything many had seen in decades:

- With diminished confidence in the capital markets, and uncertainty about their own futures, financial institutions seemed largely unwilling to lend to corporations and individuals.

- A difficult global stock market environment became a dismal one, leading to some very prominent business casualties.

- In December 2008, the environment was still shaped by effects from the most notable of these casualties, including the September 2008 bankruptcy of Wall Street investment bank Lehman Brothers, and the bailout of U.S. insurance giant American International Group (AIG), which received tens of billions of dollars in guaranteed federal loans.

Both the global economy and investor sentiment in general seemed to reach low points during the winter months, eventually setting the stage for the start of a recovery. Given the crisis atmosphere and investors’ tremendous risk aversion, international equities were trading at relatively cheap prices by early March 2009. Additionally, dramatic steps had been taken by the central banks and fiscal authorities around the world (including the U.S. Treasury Department) to boost global economic growth. It took some time before it seemed that investors’ outlooks were gradually improving, but in the weeks following March 9, 2009 stock prices started to rise. It became apparent during subsequent months that the economy’s decline was easing and possibly even starting to reverse.

Over time, investors seemed to conclude that the worst-case scenario of a market collapse was unlikely, despite continued economic weakness. Stock market performance was very strong in the second quarter of 2009 with the subsequent “snap-back” rally led overwhelmingly by the market’s most volatile stocks, as buyers took advantage of their extremely low valuations. In fact, many of the best performers during this time were, in our view, highly speculative companies with weak business fundamentals, many of which were hit the hardest in the market decline.

By the third calendar quarter of 2009 and continuing into the fourth quarter, the stock market rally became broader, as the deepest stock-price discounts vanished. By autumn, investors appeared to favor individual companies with more solid business

1

Portfolio management review

Delaware International Value Equity Fund

fundamentals and the prospect of sustainable earnings growth many of which had more reasonable valuations. We felt that this was a promising development for the Fund, as these are the types of stocks we regularly favor for the portfolio.

Fund performance

For the fiscal year, Delaware International Value Equity Fund returned +44.76% at net asset value and +36.41% at maximum offer price (both figures are for Class A shares with all distributions reinvested). The Fund’s benchmark index, the MSCI EAFE Index, returned +37.72% for the same period. For the Fund’s complete, annualized performance information, please see the table on page 12. Strong stock selection was the primary driver of the Fund’s relative outperformance for the fiscal year.

A beneficial defensive stance

Some months before the start of the Fund’s fiscal year, we positioned the portfolio relatively defensively. While, like most investors, we failed to anticipate the depths of the market’s collapse, we did conclude that economic conditions were rapidly deteriorating. This led us to take a number of proactive steps:

- We substantially reduced the Fund’s allocation to the more highly economically sensitive financial stocks, moving from an underweighted exposure relative to our MSCI EAFE benchmark to an even more underweighted one.

- We increasingly avoided companies with significant debt levels, which we believed would suffer if capital became less readily available.

- When we did invest in these and other cyclical (more economically sensitive) sectors, we favored individual securities that we believed offered less volatility and other relatively conservative characteristics.

Given the gathering economic risks, we felt this defensive approach was prudent. In retrospect, it turned out to be very helpful for performance in the very challenging market environment of December 2008 through the first quarter of 2009 — a span in which the Fund significantly outpaced its benchmark. Although being defensively positioned was not generally helpful during the fiscal year’s second quarter, when riskier securities fared the best, it drove strong relative performance for the fiscal first half overall.

Stocks held

The Fund’s relative performance benefited from its underweighting to Japanese stocks, which trailed the market’s performance during the past year.

Relative performance was strong in a number of sectors, including consumer staples, consumer discretionary, and information technology. In consumer staples, Parmalat, an Italian food and dairy company, continued its impressive rebound from a serious accounting fraud scandal of several years ago. Diversified German retailer Metro also contributed to Fund performance, as diminishing concerns about the global economy helped the stock.

In the consumer discretionary sector, Hong Kong-based Techtronic Industries was a standout. This maker of power tools, vacuum cleaners and other household appliances had fallen during the downturn because investors were concerned about the company’s ability to refinance its debt. After thorough research we became satisfied that Techtronic’s financial condition was better than the market believed — a conclusion, it seems, that the market subsequently came to share, as the stock price appreciated favorably.

2

Other strong performers for the Fund in the consumer discretionary sector included German automaker BMW and French retail and luxury goods company PPR, both of which rose off of previously depressed valuations.

South Korea’s Samsung Electronics led the way for the Fund in the technology sector. This maker of electronic products lost significant value because of investors’ concerns about a diminished market for semiconductors and personal computers — two market segments to which the company was significantly exposed. As those markets showed signs of recovery, so did Samsung, which realized healthy gains. We sold our shares for a profit after the stock reached our target price.

Weakness in financials, telecommunications

Although the Fund was helped overall by our decision to be underweighted in the financials sector, we owned a handful of weak-performing individual holdings that hampered results. One of these was Mitsubishi UFJ Financial Group, a large Japanese diversified financial company. In our view, this company’s underperformance stemmed from persistent weakness in the Japanese economy, rather than any fundamental business problem. Also lagging was Dutch bank ING Groep, which we sold early in 2009, due to concerns regarding its balance sheet risk.

The telecommunication services sector was the other negative area — both because of unfavorable stock selection and the Fund’s overexposure to this sector, which failed to gain as much as the overall market. Two noteworthy detractors in this group were France Telecom and Chunghwa Telecom, the leading communications service providers in France and Taiwan, respectively. Both stocks’ returns lagged the benchmark, as investors apparently preferred companies that offered more growth potential during the market’s climb.

Portfolio shifts

We maintained the portfolio’s defensive stance through roughly the end of the second quarter of 2009. During the third quarter, we preserved our basic defensive positioning of the Fund’s holdings but sought to adapt to changing conditions. For example, as evidence mounted that the market’s progress might be sustainable and that the economy was slowly improving, we felt more comfortable adding to the Fund’s beta — its risk exposure relative to the benchmark. For example, we added to our position in Lafarge, a French producer of building materials. We became increasingly positive about LaFarge, as we felt that a healthier credit market and improving economy had expanded the company’s financial prospects. At period end, the Fund’s beta was similar to that of the MSCI EAFE Index.

As the period came to a close, we were encouraged that investors once again were favoring stocks with what we believe are solid business fundamentals, sustainable earnings and reasonable valuations. We believe this constitutes a more normalized investment environment than the speculative atmosphere of the second quarter, when it seemed that the riskier and more volatile the stock, the better it was performing. By the end of November 2009, the market appeared to be assessing stocks on a company-by-company basis, and because of our regular emphasis on careful individual stock research, we felt this was a favorable backdrop for our style of value investing.

3

| Portfolio management review |

| Delaware Emerging Markets Fund | Dec. 8, 2009 |

| Performance review (for the period ended Nov. 30, 2009) |

| Delaware Emerging Markets Fund (Class A shares) | 1-year return | | +79.84% |

| MSCI Emerging Markets Index (net) (benchmark) | 1-year return | | +85.12% |

| MSCI Emerging Markets Index (gross) | 1-year return | | +85.68% |

Past performance does not guarantee future results.

For complete, annualized performance for Delaware Emerging Markets Fund, please see the table on page 15.

The performance of Class A shares excludes the applicable sales charge and reflects the reinvestment of all distributions.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index. |

For the fiscal year, Delaware Emerging Markets Fund advanced by 79.84% at net asset value and by 69.41% at maximum offer price (both figures are for Class A shares with all distributions reinvested). The Fund’s benchmark index, the MSCI Emerging Markets Index, advanced by 85.12% for the same period. For the Fund’s complete, annualized performance information, please see the table on page 15.

Market overview

The first few months of 2009 proved challenging for emerging market equities as risk aversion mounted throughout global financial markets. In hindsight, March was the market bottom; emerging markets equities staged a significant rally, finishing up more than 85% for the Fund’s fiscal year and outperforming established international markets, as measured by the MSCI EAFE Index — by more than 45% during the period.

Regional market perspective

The fiscal year saw some unusual returns. Indonesia was the strongest performing market in our investment universe, rising over 166% for the fiscal year. Elsewhere in Asia, positive investor sentiment after favorable election results in mid-May helped send the Indian market up over 114% for the period. China was up more than 75%, though it ended the Fund’s fiscal year trailing the broader MSCI Emerging Asia Index. (All country returns based on MSCI country indices).

In Latin America, Brazilian stocks posted significant gains. One of the last countries to be hit by the global downturn, Brazil experienced one of the most impressive rallies in our investment universe, gaining more than 125% during the period. With such an advance, Brazil ended the period as the strongest performer among major emerging markets.

Markets in the Europe, Middle East, and Africa (EMEA) region posted strong gains. Russia and Hungry were the best-performing markets in the region, up over 80% in the period. Turkey and South Africa advanced by more than 70%.

Market rally

Since it bottomed in early March 2009, the MSCI Emerging Markets Index climbed over 100% through the end of the Fund’s fiscal period.

In addition to reduced risk aversion, several other factors contributed to the rally in emerging markets this year. For instance, a moderately weak U.S. dollar has provided a backdrop for rapidly expanding liquidity, which in turn has contributed to increased credit availability in emerging markets. We believe that a weaker U.S. dollar has been a key contributor to the relative outperformance of emerging markets this year. Additionally,

4

important stimulus measures enacted in several major emerging countries has contributed to improved liquidity and credit conditions locally. Finally, increasing commodity prices, in part due to the weaker U.S. dollar, has also provided a strong underpinning for the rally.

Many of the same performance trends that began in March for emerging market companies continued late into the fiscal period. These included the general outperformance of financially leveraged companies over those with stronger balance sheets; cyclical companies strongly outperforming noncyclicals; and small-capitalization companies lending larger-capitalization companies.

Within the Fund

Prior to discussing specific performance drivers, we would like to highlight that our country and sector allocations are primarily the result of our bottom-up stock selection process.

That said, Fund positioning on a country basis in India, as well as our holdings in South Korea, China, and Brazil notably detracted from fund performance, while holdings in Indonesia and Russia contributed positively to performance throughout the period.

With the Indian market up over 114% for the period, our underweight in India was a significant detractor from Fund performance. This underweight has primarily been the result of the high valuations we saw for many Indian stocks. Additionally, Fund holding in participation notes in two Indian companies was a large detractor from performance in the period. These participation notes were underwritten by Lehman Brothers, and used as a tool to gain access to the Indian market prior to our approval as a qualified investor by Indian regulatory authorities when originally purchased. With the 2008 bankruptcy of Lehman, we have had to substantially write down these participation notes to cents on the dollar. We do not expect any further material impact from the participation notes.

Our holdings in South Korea also detracted from performance. Despite the fact that the Korean market outperformed the benchmark index during the period, our overweight in this market is primarily the result of large positions in several defensive names in the Korean telecom and utilities sectors. Both telecom and utilities have underperformed throughout the market rally as investors shifted away from traditionally defensive sectors. Examples of such positions include SK Telecom and KT Corporation, both telecom players, as well as Korea Electric Power (KEPCO), an integrated utility company. We continue to see these shares trading at discounts to our intrinsic value estimates.

Our holdings in China also detracted from performance. The most significant detractor from performance was our position in China Unicom, a Chinese mobile carrier. Competitive intensity increased after the mobile sector went through restructuring last year, putting pressure on the shares of the resulting three mobile carriers. We took the opportunity to average down our position in China Unicom and purchased shares of China Mobile at what we believe were attractive prices. China Mobile was a top contributor to Fund performance for the period. We continue to see upside in the shares of both companies, as we believe investor concern over competitive pressure is overdone.

Within Brazil, our overweight in several names that outperformed the market, such as Petrobras, Vale, and Fibria Celulose

5

Portfolio management review

Delaware Emerging Markets Fund

contributed to Fund performance. However, Eletrobras Participacoes, Brazil’s largest utility, returned 48% in the period, significantly underperforming the broader Brazilian market. As one of our most substantial overweights in the Fund, Eletrobras was one of the largest detractors from relative Fund performance for the period despite the gain by the stock. In addition to the general underperformance of more traditionally defensive sectors such as utilities through the market rally, Eletrobras also suffered from poor investor sentiment that resulted from concern over corporate governance practices. Nevertheless, we continued to believe that the company’s asset base is undervalued and view the shares as attractive on a risk-reward basis. We believe our patience has begun to produce results, as we have seen constructive news concerning restructuring that we think could potentially benefit Eletrobras — at both the company level and in politics.

Our holdings in Indonesia and Russia contributed to Fund performance for the fiscal year. Gudang Garam, an Indonesian tobacco producer, returned over 400% in the period. Our investment thesis was predicated on the belief that that the market had been significantly undervaluing the company’s franchise and turnaround potential. The company has recently restructured its distribution system, improving its competitiveness in the process. In addition, British American Tobacco purchased its fourth largest competitor at a premium valuation in June, suggesting to investors a potentially much higher private market valuation for Gudang Garam.

In Russia, our holding in Sberbank contributed to performance during the period. We believe the market unduly punished the stock as investors moved away from riskier assets, such as Russian equities in general , at the beginning of the fiscal year. We added to our holding as we believed the market was not recognizing Sberbank’s position as the de facto flight-to-safety bank in Russia.

Investment opportunities

We added several new names to the Fund in the period. In South Korea, a new investment was made in Lotte Chilsung Beverage. As the country’s largest beverage manufacturer, the company operates in a mature but stable market. We saw the company trading at a large discount to its core business and non-core assets, including its stakes in two other Lotte businesses and its land holdings.

We also initiated new holdings in South Africa, including Vodacom Group, a provider of mobile telecommunications services in sub-Saharan Africa. The company is a spin-off from state-controlled Telkom South Africa and we believe its business has better growth potential than Telkom’s traditional land-line telephone business. In our opinion, shares were trading at a discount to intrinsic value and we continued to add to our position throughout the period.

6

Outlook

We reiterate our standing conviction in the long-term fundamentals of emerging markets. We believe continued growth over time should be led by several key factors, including: rising domestic consumption; strong national balance sheets; greater political transparency; rising global trade; and accommodative monetary and fiscal policy. These factors serve to create an environment in which developing countries can develop their competitive advantages and achieve sustainable economic development. We believe that, for investors committed to emerging market over the long term, attractive investment opportunities can arise out of this process.

As always, we look to remain disciplined in making investment decisions for the Fund. Our process remains focused on seeking to maintain an attractive balance between risk and reward, as we continue to invest in companies we believe are trading at discounts to our own estimated intrinsic value.

7

| Portfolio management review |

| Delaware Global Value Fund | Dec. 8, 2009 |

| Performance review (for the period ended Nov. 30, 2009) | | | |

| Delaware Global Value Fund (Class A shares) | 1-year return | | +42.14% |

| MSCI World Index (net) (benchmark) | 1-year return | | +31.79% |

Past performance does not guarantee future results.

For complete, annualized performance for Delaware Global Value Fund please see the table on page 18.

The performance of Class A shares excludes the applicable sales charge and reflects the reinvestment of all distributions.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index. |

When the Fund’s fiscal year began in December 2008, global financial markets were already in the midst of a protracted downturn. Investors have experienced weak economic cycles and significant market declines before, but this situation, accompanied by a global credit crisis, was worse than anything many had seen in decades:

- With diminished confidence in the capital markets, and uncertainty about their own futures, financial institutions, seemed largely unwilling to lend to corporations and individuals.

- A difficult global stock market environment became a dismal one, leading to some very prominent business casualties.

- In December 2008, the environment was still shaped by effects from the most notable of these casualties, including the September 2008 bankruptcy of Wall Street investment bank Lehman Brothers, and the bailout of U.S. insurance giant American International Group (AIG), which received tens of billions of dollars in guaranteed federal loans.

Both the U.S. economy and investor sentiment in general seemed to reach low points during the winter months, eventually setting the stage for the start of a recovery. Given the crisis atmosphere and investors’ tremendous risk aversion, global equities were trading at relatively cheap prices by early March 2009. Additionally, dramatic steps had been taken by the central banks and fiscal authorities around the world, (including the U.S. Treasury Department), to boost global economic growth. It took some time before it seemed that investors’ outlooks were gradually improving, but in the weeks following March 9, 2009 stock prices started to rise. It became apparent during subsequent months that the economy’s decline was easing and possibly even starting to reverse.

Over time, investors seemed to conclude that the worst-case scenario of a market collapse was unlikely, despite continued economic weakness. Stock market performance was very strong in the second quarter of 2009 with the subsequent “snap-back” rally led overwhelmingly by the market’s most volatile stocks, as buyers took advantage of their extremely low valuations. In fact, many of the best performers during this time were, in our view, highly speculative companies with weak business fundamentals, many of which were hit the hardest in the market decline.

By the third calendar quarter of 2009 and continuing into the fourth quarter, the stock market rally became broader, as the deepest stock-price discounts vanished. By autumn, investors appeared to favor individual companies with more solid business fundamentals and the prospect of sustainable earnings growth, many of which had more reasonable valuations. We felt that this was a promising development for the Fund, as these are the types of stocks we regularly favor for the portfolio.

8

Fund performance

For the fiscal year, Delaware Global Value Fund returned +42.14% at net asset value and +33.86% at maximum offer price (both figures are for Class A shares with all distributions reinvested). The Fund’s benchmark index, the MSCI World Index, returned +31.79% for the same period. For the Fund’s complete, annualized performance information, please see the table on page 18. Strong stock selection was the primary driver of the Fund’s relative outperformance for the fiscal year.

A beneficial defensive stance

Some months before the start of the Fund’s fiscal year, we positioned the portfolio relatively defensively. While, like most investors, we failed to anticipate the depths of the market’s collapse, we did conclude that economic conditions were rapidly deteriorating. This led us to take a number of proactive steps:

- We substantially reduced the Fund’s allocation to the more economically sensitive financial stocks, moving from an underweighted exposure relative to our MSCI World Index benchmark to an even more underweighted one.

- We increasingly avoided companies with significant debt levels, which we believed would suffer if capital became less readily available.

- When we did invest in these and other cyclical (more economically sensitive) sectors, we favored individual securities that we believed offered low volatility and other relatively conservative characteristics.

Given the gathering economic risks, we felt this defensive approach was prudent. In retrospect, it turned out to be very helpful for performance in the challenging market environment of December 2008 through the first quarter of 2009. Although being defensively positioned was not generally helpful during the fiscal year’s second quarter, when riskier securities fared the best, it drove strong relative performance for the fiscal first half overall.

Global allocation

The allocation between U.S. and non-U.S. stocks in Delaware Global Value Fund is overwhelmingly a function of our bottom-up stock selection process. We look for the same attributes in domestic and international holdings — that is, good valuations combined with strong fundamentals, a competitive position, and encouraging prospects for operating performance relative to a company’s own history and the overall global market. We seek to identify stock valuations that are discounted to the overall market.

We do not make explicit top-down allocation decisions based on factors such as U.S. dollar expectations versus non-U.S. currencies, or prospects for U.S. economic growth versus other parts of the world. Although we do incorporate a close examination of individual companies’ exposures to those factors as part of our bottom-up stock research, such considerations are not part of an overall policy decision that drives stock selection.

The Fund’s exposure to U.S. equities throughout the period was significantly underweight in comparison to that portion of the MSCI World Index. For the overall fiscal

9

Portfolio management review

Delaware Global Value Fund

period, we were approximately 10 percentage points below the index weighting in U.S. stocks, at about 38% versus 48% for the index. This ratio shifted somewhat during the course of the year, but the overall underweighting to the U.S. was generally a contributor to relative performance.

Stocks held

The Fund’s relative performance benefited from its significant underweighting in Japanese stocks, which trailed the market’s performance during the past year.

Relative performance for the Fund was positive in all but one of the industry sectors — including consumer staples, consumer discretionary, and information technology. In consumer staples, Parmalat, an Italian food and dairy company, continued its impressive rebound from a serious accounting fraud scandal of several years ago. Diversified German retailer Metro also performed well, as diminishing concerns about the global economy helped the stock.

In the consumer discretionary sector, strong performers included German automaker BMW and French retail and luxury goods company PPR, both of which rose off of previously depressed valuations.

South Korea’s Samsung Electronics led the way for the Fund in the information technology sector. This manufacturer of electronic products lost significant value because of investors’ concerns about a diminished market for semiconductors and personal computers — two market segments to which the company was significantly exposed. As those markets showed signs of recovery, so did Samsung, which realized healthy gains. We sold our shares after the stock reached our target price.

Weakness in technology

Technology was the Fund’s sole underperforming sector. The tech industry was still experiencing a significant cyclical downturn in August when we established a position in computer manufacturer Dell. A combination of industry-specific factors and broader macroeconomic issues severely impacted the volumes that we saw in Dell’s and other computer manufacturers’ operating performance. What gave us the confidence to invest in Dell even before the cycle turned was the company’s solid balance sheet — especially in terms of its cash position — and what we felt was a solid level of profitability.

Xerox, a U.S. technology holding, was a notable detractor for the Fund. The company clearly had cyclical exposure that was in line with its industry, but we believe it lacked the same kind of competitively distinctive position that would later prompt us to buy into Dell. We felt there were better opportunities elsewhere and sold our Xerox position in April.

Two noteworthy detractors in telecom were France Telecom and Chunghwa Telecom, the leading communications service providers in France and Taiwan, respectively. Both stocks’ returns lagged the benchmark, as investors apparently preferred companies that offered more growth potential during the market’s climb.

10

Portfolio shifts

We maintained the portfolio’s defensive stance through roughly the end of the second quarter of 2009. During the third quarter, we preserved our basic defensive positioning of the Fund’s holdings but sought to adapt to changing conditions. For example, as evidence mounted that the market’s progress might be sustainable and that the economy was slowly improving, we felt more comfortable adding to the Fund’s beta — its risk exposure relative to the benchmark. For example, we added to our position in Lafarge, a French producer of building materials. We became increasingly positive about Lafarge, as we felt that a healthier credit market and improving economy had expanded the company’s financial prospects.

The largest shift among domestic sectors was in financials. We started the year without any holdings of financial companies in the U.S. market; by the end of the period we held four financial stocks. Among these, American Express was by far the largest contributor to Fund performance. At the date of its initial purchase in June 2009, the stock was beaten down due to a combination of exposure to credit risk in its asset portfolio and the prospect of deleveraging by American consumers. We felt that these risks were adequately discounted in the stock price, while the company’s solid brand value, the high credit quality of its customers, and its more stable business model offered substantial room for revaluation.

As the period came to a close, we were encouraged that investors once again were favoring stocks that we believe have solid business fundamentals, sustainable earnings and reasonable valuations. We believe this constituted a more normalized investment environment than the speculative atmosphere of the 2009’s second quarter, when it often seemed that the riskier and more volatile the stock, the better it was performing. By the end of November 2009, the market appeared to be assessing stocks on a company-by-company basis, and because of our regular emphasis on careful individual stock research, we felt this was a favorable backdrop for our style of value investing.

11

| Performance summaries |

| Delaware International Value Equity Fund | Nov. 30, 2009 |

The performance data quoted represent past performance; past performance does not guarantee future results. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Please obtain the performance data for the most recent month end by calling 800 523-1918 or visiting our Web site at www.delawareinvestments.com/performance. Current performance may be lower or higher than the performance data quoted.

You should consider the investment objectives, risks, charges, and expenses of the Fund carefully before investing. The Delaware International Value Equity Fund prospectus contains this and other important information about the Fund. Please request a prospectus through your financial advisor by calling 800 523-1918 or visiting our Web site at www.delawareinvestments.com. Read the prospectus carefully before you invest or send money.

| Fund performance | Average annual total returns from Nov. 30, 1999, through Nov. 30, 2009 |

| 1 year | | 5 years | | 10 years | | Lifetime |

| Class A (Est. Oct. 31, 1991) |

| Excluding sales charge | | +44.76% | | | | +2.94% | | | | +4.45 | % | | | | +6.70% | |

| Including sales charge | | +36.41% | | | | +1.72% | | | | +3.83 | % | | | | +6.35% | |

| Class B (Est. Sept. 6, 1994) |

| Excluding sales charge | | +43.65% | | | | +2.20% | | | | +3.85 | % | | | | +5.29% | |

| Including sales charge | | +39.65% | | | | +1.92% | | | | +3.85 | % | | | | +5.29% | |

| Class C (Est. Nov. 29, 1995) |

| Excluding sales charge | | +43.71% | | | | +2.23% | | | | +3.72 | % | | | | +5.38% | |

| Including sales charge | | +42.71% | | | | +2.23% | | | | +3.72 | % | | | | +5.38% | |

| Class R (Est. June 2, 2003) |

| Excluding sales charge | | +44.55% | | | | +2.74% | | | | n/a | | | | | +7.94% | |

| Including sales charge | | +44.55% | | | | +2.74% | | | | n/a | | | | | +7.94% | |

| Institutional Class (Est. Nov. 9, 1992) |

| Excluding sales charge | | +45.13% | | | | +3.24% | | | | +4.75 | % | | | | +6.99% | |

| Including sales charge | | +45.13% | | | | +3.24% | | | | +4.75 | % | | | | +6.99% | |

Returns reflect the reinvestment of all distributions and any applicable sales charges as noted in the following paragraphs.

Performance for Class B and C shares, excluding sales charges, assumes either that contingent deferred sales charges did not apply or that the investment was not redeemed.

Expense limitations were in effect for all classes during the periods shown in the Fund performance chart and in the Performance of a $10,000 Investment chart. The current expenses for each class are listed on the “Fund expenses” chart. (Note that all charts and graphs referred to in the “Performance summary” section of this report are found on pages 12 through 14.) Performance would have been lower had the expense limitation not been in effect.

The Fund offers Class A, B, C, R, and Institutional Class shares.

12

Class A shares are sold with a maximum front-end sales charge of up to 5.75%, and have an annual distribution and service fee of up to 0.30% of average daily net assets.

Class B shares may only be purchased through dividend reinvestment and certain permitted exchanges as described in the prospectus. Please see the prospectus for additional information on Class B purchase and sales charges. Class B shares have a contingent deferred sales charge that declines from 4.00% to zero depending on the period of time the shares are held.

Class B shares will automatically convert to Class A shares on a quarterly basis approximately eight years after purchase. They are also subject to an annual distribution and service fee of up to 1.00% of average daily net assets.

Ten-year and lifetime performance figures for Class B shares reflect conversion to Class A shares after eight years.

Class C shares are sold with a contingent deferred sales charge of 1.00% if redeemed during the first 12 months. They are also subject to an annual distribution and service fee of 1.00% of average daily net assets.

Class R shares are available only for certain retirement plan products. They are sold without a sales charge and have an annual distribution and service fee of up to 0.60% of average daily net assets, which has been limited contractually to 0.50% through March 31, 2010.

Institutional Class shares are available without sales or asset-based distribution charges only to certain eligible institutional accounts.

International investments are subject to risks not ordinarily associated with U.S. investments including capital loss from unfavorable fluctuation in currency values, differences in generally accepted accounting principles, or economic or political instability in other nations.

Instances of high double-digit returns are unusual, cannot be sustained, and were achieved primarily during favorable market conditions.

The Fund’s expense ratios, as described in the most recent prospectus, are disclosed in the following “Fund expense ratios” table. Delaware Investments has agreed to (1) voluntarily waive all or a portion of its investment advisory fees and/or reimburse certain expenses (excluding certain expenses) to prevent total annual fund operating expenses from exceeding 1.35% of the Fund’s average daily net assets from Sept. 11, 2009, until the voluntary cap is discontinued; and (2) contractually limit the Class R shares distribution and service fees from April 1, 2009, through March 31, 2010, to 0.50%. Please see the most recent prospectus for additional information on these fee waivers and/or reimbursements.

| Fund expense ratios | Class A | | Class B | | Class C | | Class R | | Institutional Class |

| Total annual operating expense | 1.49% | | 2.19% | | 2.19% | | 1.79% | | 1.19% |

| (without fee waivers) | | | | | | | | | |

| Net expense ratio | 1.49% | | 2.19% | | 2.19% | | 1.69% | | 1.19% |

| (including fee waivers, if any)* | | | | | | | | | |

| Type of waiver | Voluntary | | Voluntary | | Voluntary | | Contractual | | Voluntary |

| | | | | | | and voluntary | | |

13

Performance summaries

Delaware International Value Equity Fund

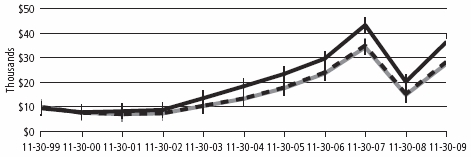

Performance of a $10,000 investment

Average annual total returns from Nov. 30, 1999, through Nov. 30, 2009

| For period beginning Nov. 30, 1999, through Nov. 30, 2009 | Starting value | | Ending value |

| | Delaware International Value Equity Fund — | | | |

| | | Class A Shares | $9,425 | | $14,560 |

| | MSCI EAFE Index (gross) | $10,000 | | $12,557 |

| | MSCI EAFE Index (net) | $10,000 | | $12,071 |

The chart assumes $10,000 invested in the Fund on Nov. 30, 1999, and includes the effect of a 5.75% front-end sales charge and the reinvestment of all distributions. Please note additional details on these fees in the “Performance summary” section of this report, which includes pages 12 through 14.

The chart also assumes $10,000 invested in the MSCI EAFE Index as of Nov. 30, 1999.

The MSCI EAFE Index measures equity market performance across developed market countries in Europe, Australasia, and the Far East. Index “net” return approximates the minimum possible dividend reinvestment, after deduction of withholding tax at the highest possible rate. Index “gross” return reflects the maximum possible dividend reinvestment.

An index is unmanaged and does not reflect the costs of operating a mutual fund, such as the costs of buying, selling, and holding securities. You cannot invest directly in an index. Past performance is not a guarantee of future results.

The “Fund performance” table and the “Performance of a $10,000 investment” graph do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares. Performance of other Fund classes will vary due to different charges and expenses.

| | Nasdaq symbols | | CUSIPs | |

| Class A | | | DEGIX | | | 245914106 | |

| Class B | | | DEIEX | | | 245914700 | |

| Class C | | | DEGCX | | | 245914858 | |

| Class R | | | DIVRX | | | 245914577 | |

| Institutional Class | | | DEQIX | | | 245914403 | |

14

| Delaware Emerging Markets Fund | Nov. 30, 2009 |

The performance data quoted represent past performance; past performance does not guarantee future results. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Please obtain the performance data for the most recent month end by calling 800 523-1918 or visiting our Web site at www.delawareinvestments.com/performance. Current performance may be lower or higher than the performance data quoted.

You should consider the investment objectives, risks, charges, and expenses of the Fund carefully before investing. The Delaware Emerging Markets Fund prospectus contains this and other important information about the Fund. Please request a prospectus through your financial advisor by calling 800 523-1918 or visiting our Web site at www.delawareinvestments.com. Read the prospectus carefully before you invest or send money.

| Fund performance | Average annual total returns from Nov. 30, 1999, through Nov. 30, 2009 |

| 1 year | | 5 years | | 10 years | | Lifetime |

| Class A (Est. June 10, 1996) |

| Excluding sales charge | | +79.84 | % | | | | +14.63 | % | | | | +14.48 | % | | | | +9.48% | |

| Including sales charge | | +69.41 | % | | | | +13.28 | % | | | | +13.80 | % | | | | +9.00% | |

| Class B (Est. June 10, 1996) |

| Excluding sales charge | | +78.59 | % | | | | +13.78 | % | | | | +13.80 | % | | | | +9.01% | |

| Including sales charge | | +74.59 | % | | | | +13.55 | % | | | | +13.80 | % | | | | +9.01% | |

| Class C (Est. June 10, 1996) |

| Excluding sales charge | | +78.68 | % | | | | +13.79 | % | | | | +13.64 | % | | | | +8.69% | |

| Including sales charge | | +77.68 | % | | | | +13.79 | % | | | | +13.64 | % | | | | +8.69% | |

| Class R (Est. Aug. 31, 2009) |

| Excluding sales charge | | n/a | | | | | n/a | | | | | n/a | | | | | +12.93% | |

| Including sales charge | | n/a | | | | | n/a | | | | | n/a | | | | | +12.93% | |

| Institutional Class (Est. June 10, 1996) |

| Excluding sales charge | | +80.39 | % | | | | +14.91 | % | | | | +14.77 | % | | | | +9.78% | |

| Including sales charge | | +80.39 | % | | | | +14.91 | % | | | | +14.77 | % | | | | +9.78% | |

Returns reflect the reinvestment of all distributions and any applicable sales charges as noted in the following paragraphs.

Performance for Class B and C shares, excluding sales charges, assumes either that contingent deferred sales charges did not apply or that the investment was not redeemed.

Expense limitations were in effect for all classes during the periods shown in the Fund performance chart and in the Performance of a $10,000 Investment chart. The current expenses for each class are listed on the “Fund expenses” chart. (Note that all charts and graphs referred to in the “Performance summary” section of this report are found on pages 15 through 17.) Performance would have been lower had the expense limitation not been in effect.

The Fund offers Class A, B, C, R, and Institutional Class shares.

15

Performance summaries

Delaware Emerging Markets Fund

Class A shares are sold with a maximum front-end sales charge of up to 5.75%, and have an annual distribution and service fee of up to 0.30% of average daily net assets. This fee has been contractually limited to 0.25% of average daily net assets from April 1, 2009, through March 31, 2010.

Class B shares may only be purchased through dividend reinvestment and certain permitted exchanges as described in the prospectus. Please see the prospectus for additional information on Class B purchase and sales charges. Class B shares have a contingent deferred sales charge that declines from 4.00% to zero depending on the period of time the shares are held.

Class B shares will automatically convert to Class A shares on a quarterly basis approximately eight years after purchase. They are also subject to an annual distribution and service fee of up to 1.00% of average daily net assets.

Ten-year and lifetime performance figures for Class B shares reflect conversion to Class A shares after eight years.

Class C shares are sold with a contingent deferred sales charge of 1.00% if redeemed during the first 12 months. They are also subject to an annual distribution and service fee of 1.00% of average daily net assets.

Class R shares are available only for certain retirement plan products. They are sold without a sales charge and have an annual distribution and service fee of up to 0.60% of average daily net assets, which has been limited contractually to 0.50% from April 1, 2009, through March 31, 2010.

Institutional Class shares are available without sales or asset-based distribution charges only to certain eligible institutional accounts.

International investments entail risks not ordinarily associated with U.S. investments including fluctuation in currency values, differences in accounting principles, or economic or political instability in other nations. Investing in emerging markets can be riskier than investing in established foreign markets due to increased volatility and lower trading volume.

Instances of high double-digit returns are unusual, cannot be sustained, and were achieved primarily during favorable market conditions.

The Fund’s expense ratios, as described in the most recent prospectus, are disclosed in the following “Fund expense ratios” table. Delaware Investments has agreed to (1) voluntarily waive all or a portion of its investment advisory fees and/or reimburse certain expenses (excluding certain expenses) to prevent total annual fund operating expenses from exceeding 1.75% of the Fund’s average daily net assets from April 1, 2009, until the voluntary cap is discontinued; and (2) contractually limit the Class A and Class R shares distribution and service fees from April 1, 2009, through March 31, 2010, to 0.25% and 0.50%, respectively. Please see the most recent prospectus for additional information on these fee waivers and/or reimbursements.

| Fund expense ratios | Class A | | Class B | | Class C | | Class R | | Institutional Class |

| Total annual operating expense | 1.88% | | 2.58% | | 2.58% | | 2.18% | | 1.58% |

| (without fee waivers) | | | | | | | | | |

| Net expense ratio | 1.83% | | 2.58% | | 2.58% | | 2.08% | | 1.58% |

| (including fee waivers, if any)* | | | | | | | | | |

| Type of waiver | Contractual | | Voluntary | | Voluntary | | Contractual | | Voluntary |

| and voluntary | | | | | | and voluntary | | |

16

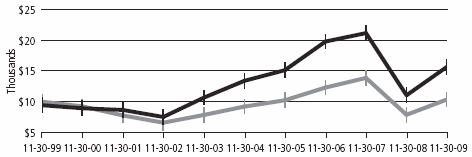

Performance of a $10,000 investment

Average annual total returns from Nov. 30, 1999, through Nov. 30, 2009

| For period beginning Nov. 30, 1999, through Nov. 30, 2009 | Starting value | | Ending value |

| | Delaware Emerging Markets Fund — Class A Shares | $9,425 | | $36,435 |

| | MSCI Emerging Markets Index (gross) | $10,000 | | $28,376 |

| | MSCI Emerging Markets Index (net) | $10,000 | | $27,581 |

The chart assumes $10,000 invested in the Fund on Nov. 30, 1999, and includes the effect of a 5.75% front-end sales charge and the reinvestment of all distributions. Please note additional details on these fees in the “Performance summary” section of this report, which includes pages 15 through 17.

The chart also assumes $10,000 invested in the MSCI Emerging Markets Index as of Nov. 30, 1999. The MSCI Emerging Markets Index measures equity market performance across emerging market countries world-wide. Index “net” return approximates the minimum possible dividend reinvestment, after deduction of withholding tax at the highest possible rate. Index “gross” return reflects the maximum possible dividend reinvestment.

An index is unmanaged and does not reflect the costs of operating a mutual fund, such as the costs of buying, selling, and holding securities. You cannot invest directly in an index. Past performance is not a guarantee of future results.

The “Fund performance” table and the “Performance of a $10,000 investment” graph do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares.

Performance of other Fund classes will vary due to different charges and expenses.

| | Nasdaq symbols | | CUSIPs | |

| Class A | | | DEMAX | | | 245914841 | |

| Class B | | | DEMBX | | | 245914833 | |

| Class C | | | DEMCX | | | 245914825 | |

| Class R | | | DEMRX | | | 245914569 | |

| Institutional Class | | | DEMIX | | | 245914817 | |

17

| Performance summaries |

| Delaware Global Value Fund | Nov. 30, 2009 |

The performance data quoted represent past performance; past performance does not guarantee future results. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Please obtain the performance data current for the most recent month end by calling 800 523-1918 or visiting our Web site at www.delawareinvestments.com/performance. Current performance may be lower or higher than the performance data quoted.

You should consider the investment objectives, risks, charges, and expenses of the Fund carefully before investing. The Delaware Global Value Fund prospectus contains this and other important information about the Fund. Please request a prospectus through your financial advisor or by calling 800 523-1918 or visiting our Web site at www.delawareinvestments.com. Read the prospectus carefully before you invest or send money.

| Fund performance | Average annual total returns through Nov. 30, 2009 |

| 1 year | | 5 years | | 10 years | | Lifetime |

| Class A (Est. Dec. 19, 1997) |

| Excluding sales charge | | +42.14% | | | | +3.21% | | | | +5.23 | % | | | | +6.67% | |

| Including sales charge | | +33.86% | | | | +2.00% | | | | +4.61 | % | | | | +6.14% | |

| Class B (Est. Sept. 28, 2001) |

| Excluding sales charge | | +41.36% | | | | +2.48% | | | | n/a | | | | | +7.69% | |

| Including sales charge | | +37.36% | | | | +2.18% | | | | n/a | | | | | +7.69% | |

| Class C (Est. Sept. 28, 2001) |

| Excluding sales charge | | +41.12% | | | | +2.46% | | | | n/a | | | | | +7.68% | |

| Including sales charge | | +40.12% | | | | +2.46% | | | | n/a | | | | | +7.68% | |

| Institutional Class (Est. Dec. 19, 1997) |

| Excluding sales charge | | +42.46% | | | | +3.48% | | | | +5.45 | % | | | | +6.86% | |

| Including sales charge | | +42.46% | | | | +3.48% | | | | +5.45 | % | | | | +6.86% | |

Class R shares had not commenced operations as of Nov. 30, 2009.

Returns reflect the reinvestment of all distributions and any applicable sales charges as noted in the following paragraphs.

Performance for Class B and C shares, excluding sales charges, assumes either that contingent deferred sales charges did not apply or that the investment was not redeemed.

Expense limitations were in effect for certain classes during the periods shown in the Fund performance chart and in the “Performance of a $10,000 investment” chart. The current expenses for each class are listed on the “Fund expenses” chart. (Note that all charts and graphs referred to in the “Performance summary” section of this report are found on pages 18 through 20.) Performance would have been lower had the expense limitations not been in effect.

The Fund offers Class A, B, C, and Institutional Class shares.

Class A shares are sold with a maximum front-end sales charge of up to 5.75%, and have an annual distribution and service fee of up to 0.30% of average daily net assets. This fee has

18

been contractually limited to 0.25% of average daily net assets through March 31, 2010.

Class B shares may only be purchased through dividend reinvestment and certain permitted exchanges as described in the prospectus. Please see the prospectus for additional information on Class B purchase and sales charges. Class B shares have a contingent deferred sales charge that declines from 4.00% to zero depending on the period of time the shares are held.

Class B shares will automatically convert to Class A shares on a quarterly basis approximately eight years after purchase. They are also subject to an annual distribution and service fee of up to 1.00% of average daily net assets.

Ten-year and lifetime performance figures for Class B shares reflect conversion to Class A shares after approximately eight years.

Class C shares are sold with a contingent deferred sales charge of 1.00% if redeemed during the first 12 months. They are also subject to an annual distribution and service fee of 1.00% of average daily net assets.

Institutional Class shares are available without sales or asset-based distribution charges only to certain eligible institutional accounts. Institutional Class performance prior to Oct. 28, 2002, is based on Class A performance and was adjusted to eliminate the sales charges, but not the asset-based distribution charge of Class A shares.

The “Fund performance” table and the “Performance of a $10,000 investment” graph do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares.

International investments are subject to risks not ordinarily associated with U.S. investments including capital loss from unfavorable fluctuation in currency values, differences in generally accepted accounting principles, or economic or political instability in other nations. Investing in emerging markets can be riskier than investing in established foreign markets due to increased volatility and lower trading volume.

Instances of high double-digit returns are unusual, cannot be sustained, and were achieved primarily during favorable market conditions.

19

Performance summaries

Delaware Global Value Fund

The Fund’s expense ratios, as described in the most recent prospectus, are disclosed in the following ”Fund expense ratios” table. Delaware Investments has agreed to (1) voluntarily waive all or a portion of its investment advisory fees and/or reimburse certain expenses (excluding certain expenses) to prevent total annual fund operating expenses from exceeding 1.30% of the Fund’s average daily net assets from April 1, 2009, until the voluntary cap is discontinued; and (2) contractually limit the Class A distribution and service fees from April 1, 2009, through March 31, 2010, to 0.25% . Please see the most recent prospectus for additional information on these fee waivers and/or reimbursements.

| Fund expense ratios | Class A | | Class B | | Class C | | Class R | | Institutional Class |

| Total annual operating expense | 1.76% | | 2.46% | | 2.46% | | 2.06% | | 1.46% |

| (without fee waivers) | | | | | | | | | |

| Net expenses | 1.71% | | 2.46% | | 2.46% | | 1.96% | | 1.46% |

| (including fee waivers, if any)* | | | | | | | | | |

| Type of waiver | Contractual | | Voluntary | | Voluntary | | Contractual | | Voluntary |

| and voluntary | | | | | | and voluntary | | |

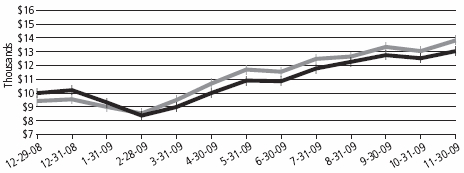

Performance of a $10,000 investment

Average annual total returns from Nov. 30, 1999, through Nov. 30, 2009

| For period beginning Nov. 30, 1999, through Nov. 30, 2009 | Starting value | | Ending value |

| | Delaware Global Value Equity Fund — Class A Shares | $9,425 | | $15,691 |

| | MSCI World Index (net) | $10,000 | | $10,364 |

20

The chart assumes $10,000 invested in the Fund on Nov. 30, 1999, and includes the effect of a 5.75% front-end sales charge and the reinvestment of all distributions. Please note additional details on these fees in the “Performance summary” section of this report, which includes pages 18 through 21.

The chart also assumes $10,000 invested in the MSCI World Index as of Nov. 30, 1999. The MSCI World Index is a free float-adjusted market capitalization weighted index designed to measure equity market performance across developed markets world-wide. Index “net” return reflects minimum possible dividend reinvestment, after deduction of withholding tax at the highest possible rate.

An index is unmanaged and does not reflect the costs of operating a mutual fund, such as the costs of buying, selling, and holding securities. You cannot invest directly in an index. Past performance is not a guarantee of future results.

Performance of other Fund classes will vary due to different charges and expenses.

The “Fund performance” chart and the “Performance of a $10,000 investment” graph do not reflect the deduction of taxes the shareholders would pay on Fund distributions or redemptions of Fund shares.

Performance of other Fund classes will vary due to different charges and expenses.

| Stock symbols and CUSIP numbers |

| | Nasdaq symbols | | CUSIPs | |

| Class A | | | DABAX | | | 245914718 | |

| Class B | | | DABBX | | | 245914692 | |

| Class C | | | DABCX | | | 245914684 | |

| Institutional Class | | | DABIX | | | 245914676 | |

21

Disclosure of Fund expenses

For the period June 1, 2009 to November 30, 2009

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution and/or service (12b-1) fees; and other Fund expenses. These following examples are intended to help you understand your ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire period June 1, 2009 to November 30, 2009.

Actual expenses

The first section of the tables shown, “Actual Fund Return,” provides information about actual account values and actual expenses. You may use the information in this section of the table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The second section of the tables shown, “Hypothetical 5% Return,” provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Funds’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second section of each table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher. The Funds’ expenses shown in the tables reflect fee waivers in effect. The expenses shown in each table assume reinvestment of all dividends and distributions.

22

Delaware International Value Equity Fund

Expense analysis of an investment of $1,000

| | Beginning | | Ending | | | | Expenses |

| | Account Value | | Account Value | | Annualized | | Paid During Period |

| | 6/1/09 | | 11/30/09 | | Expense Ratio | | 6/1/09 to 11/30/09* |

| Actual Fund return | | | | | | | | | | | | |

| Class A | | $1,000.00 | | | $1,215.40 | | | 1.59% | | $ | 8.83 | |

| Class B | | 1,000.00 | | | 1,210.10 | | | 2.29% | | | 12.69 | |

| Class C | | 1,000.00 | | | 1,211.70 | | | 2.29% | | | 12.70 | |

| Class R | | 1,000.00 | | | 1,213.70 | | | 1.79% | | | 9.93 | |

| Institutional Class | | 1,000.00 | | | 1,216.80 | | | 1.29% | | | 7.17 | |

| Hypothetical 5% return (5% return before expenses) | | | | | | | |

| Class A | | $1,000.00 | | | $1,017.10 | | | 1.59% | | $ | 8.04 | |

| Class B | | 1,000.00 | | | 1,013.59 | | | 2.29% | | | 11.56 | |

| Class C | | 1,000.00 | | | 1,013.59 | | | 2.29% | | | 11.56 | |

| Class R | | 1,000.00 | | | 1,016.09 | | | 1.79% | | | 9.05 | |

| Institutional Class | | 1,000.00 | | | 1,018.60 | | | 1.29% | | | 6.53 | |

Delaware Emerging Markets Fund

Expense analysis of an investment of $1,000

| | | Beginning | | Ending | | | | Expenses |

| | Account Value | | Account Value | | Annualized | | Paid During Period |

| | 6/1/09 | | 11/30/09** | | Expense Ratio | | 6/1/09 to 11/30/09* |

| Actual Fund return | | | | | | | | | | | | |

| Class A | | $1,000.00 | | | $1,251.70 | | | 1.81% | | $ | 10.22 | |

| Class B | | 1,000.00 | | | 1,247.50 | | | 2.56% | | | 14.42 | |

| Class C | | 1,000.00 | | | 1,247.00 | | | 2.56% | | | 14.42 | |

| Class R** | | 1,000.00 | | | 1,129.30 | | | 2.11% | | | 5.66 | |

| Institutional Class | | 1,000.00 | | | 1,253.10 | | | 1.56% | | | 8.81 | |

| Hypothetical 5% return (5% return before expenses) | | | | | | | |

| Class A | | $1,000.00 | | | $1,015.99 | | | 1.81% | | $ | 9.15 | |

| Class B | | 1,000.00 | | | 1,012.23 | | | 2.56% | | | 12.91 | |

| Class C | | 1,000.00 | | | 1,012.23 | | | 2.56% | | | 12.91 | |

| Class R | | 1,000.00 | | | 1,014.49 | | | 2.11% | | | 10.66 | |

| Institutional Class | | 1,000.00 | | | 1,017.25 | | | 1.56% | | | 7.89 | |

23

Disclosure of Fund expenses

Delaware Global Value Fund

Expense analysis of an investment of $1,000

| | Beginning | | Ending | | | | Expenses |

| | Account Value | | Account Value | | Annualized | | Paid During Period |

| | 6/1/09 | | 11/30/09 | | Expense Ratio | | 6/1/09 to 11/30/09* |

| Actual Fund return | | | | | | | | | | | | |

| Class A | | $1,000.00 | | | $1,242.30 | | | 1.61% | | $ | 9.05 | |

| Class B | | 1,000.00 | | | 1,238.70 | | | 2.36% | | | 13.24 | |

| Class C | | 1,000.00 | | | 1,238.70 | | | 2.36% | | | 13.24 | |

| Institutional Class | | 1,000.00 | | | 1,245.00 | | | 1.36% | | | 7.65 | |

| Hypothetical 5% return (5% return before expenses) | | | | | | | |

| Class A | | $1,000.00 | | | $1,017.00 | | | 1.61% | | $ | 8.14 | |

| Class B | | 1,000.00 | | | 1,013.24 | | | 2.36% | | | 11.91 | |

| Class C | | 1,000.00 | | | 1,013.24 | | | 2.36% | | | 11.91 | |

| Institutional Class | | 1,000.00 | | | 1,018.25 | | | 1.36% | | | 6.88 | |

| * | “Expenses Paid During Period” are equal to the Funds’ annualized expense ratio, multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period). For Delaware Emerging Markets Fund Class R, the “Expenses Paid During Period” for the Actual Fund return are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by 92/365 (to reflect actual since inception). |

| ** | Delaware Emerging Markets Fund Class R shares commenced operations on August 31, 2009. The Ending Account Value for Actual Fund return uses the performance since inception and is not annualized. |

DMC has voluntarily agreed to waive all or a portion of its management fee and reimburse expenses (excluding any 12b-1 plan expenses, taxes, interest, inverse floater program expenses, brokerage fees, short sale and dividend interest expenses, certain insurance costs, and nonroutine expenses or costs including, but not limited to, those relating to reorganizations, litigation, conducting shareholder meetings, and liquidations (collectively, “non-routine expenses”)) in order to prevent total annual fund operating expenses from exceeding, in an aggregate amount, the specified percentages of average daily net assets from September 11, 2009 until such time as the voluntary expense caps are discontinued. These fee waivers and expense reimbursements apply only to expenses paid directly by the Funds, and may be discontinued at any time because they are voluntary. Prior to September 11, 2009, DMC had voluntarily and contractually agreed to waive that portion, if any, of its management fees and reimburse the Funds to the extent necessary to ensure that total annual operating expenses (excluding any 12b-1 plan expenses, taxes, interest, inverse floater program expenses, brokerage fees, certain insurance costs, and nonroutine expenses (as defined above), did not exceed the specified percentages of average daily net assets of the Funds.

24

| | Delaware International | | Delaware Emerging | | Delaware Global |

| Value Equity Fund | | Markets Fund | | Value Fund |

| Voluntary operating Expense | | | | | | |

| limitation as a percentage of | | | | | | |

| average net assets effective as of | | | | | | |

| September 11, 2009 | 1.35% | | 1.75% | | | 1.30% |

| April 1, 2009 to September 11, 2009 | | | | | | |

| voluntary operating expense | | | | | | |

| limitation as a percentage of | | | | | | |

| average daily net assets | 1.24% | | 1.61% | | | 1.39% |

| Prior to April 1, 2009 contractual/ | | | | | | |

| voluntary operating expense | | | | | | |

| limitation as a percentage of | | | | | | |

| average daily net assets | 1.10% voluntary | | — | | | 1.20% contractual |

If the current voluntary waivers were in effect for the entire period, the Expense analysis for the Funds would be as follows:

Delaware International Value Equity Fund

Expense analysis of an investment of $1,000

| | Beginning | | Ending | | | | Expenses |

| | Account Value | | Account Value | | Annualized | | Paid During Period |

| | 6/1/09 | | 11/30/09 | | Expense Ratio | | 6/1/09 to 11/30/09* |

| Actual Fund return | | | | | | | | | | | | |

| Class A | | $1,000.00 | | | $1,215.40 | | | 1.65% | | $ | 9.16 | |

| Class B | | 1,000.00 | | | 1,210.10 | | | 2.35% | | | 13.02 | |

| Class C | | 1,000.00 | | | 1,211.70 | | | 2.35% | | | 13.03 | |

| Class R | | 1,000.00 | | | 1,213.70 | | | 1.85% | | | 10.27 | |

| Institutional Class | | 1,000.00 | | | 1,216.80 | | | 1.35% | | | 7.50 | |

| Hypothetical 5% return (5% return before expenses) | | | | | | | |

| Class A | | $1,000.00 | | | $1,016.80 | | | 1.65% | | $ | 8.34 | |

| Class B | | 1,000.00 | | | 1,013.29 | | | 2.35% | | | 11.86 | |

| Class C | | 1,000.00 | | | 1,013.29 | | | 2.35% | | | 11.86 | |

| Class R | | 1,000.00 | | | 1,015.79 | | | 1.85% | | | 9.35 | |

| Institutional Class | | 1,000.00 | | | 1,018.30 | | | 1.35% | | | 6.83 | |

25

Disclosure of Fund expenses

Delaware Emerging Markets Fund

Expense analysis of an investment of $1,000

| | Beginning | | Ending | | | | Expenses |

| | Account Value | | Account Value | | Annualized | | Paid During Period |

| | 6/1/09 | | 11/30/09 | | Expense Ratio | | 6/1/09 to 11/30/09* |

| Actual Fund return | | | | | | | | | | | | |

| Class A | | $1,000.00 | | | $1,251.70 | | | 2.00% | | $ | 11.29 | |

| Class B | | 1,000.00 | | | 1,247.50 | | | 2.75% | | | 15.49 | |

| Class C | | 1,000.00 | | | 1,247.00 | | | 2.75% | | | 15.49 | |

| Class R** | | 1,000.00 | | | 1,129.30 | | | 2.25% | | | 6.04 | |

| Institutional Class | | 1,000.00 | | | 1,253.10 | | | 1.75% | | | 9.88 | |

| Hypothetical 5% return (5% return before expenses) | | | | | | | |

| Class A | | $1,000.00 | | | $1,015.04 | | | 2.00% | | $ | 10.10 | |

| Class B | | 1,000.00 | | | 1,011.28 | | | 2.75% | | | 13.87 | |

| Class C | | 1,000.00 | | | 1,011.28 | | | 2.75% | | | 13.87 | |

| Class R | | 1,000.00 | | | 1,013.79 | | | 2.25% | | | 11.36 | |

| Institutional Class | | 1,000.00 | | | 1,016.29 | | | 1.75% | | | 8.85 | |

Delaware Global Value Fund

Expense analysis of an investment of $1,000

| | Beginning | | Ending | | | | Expenses |

| | Account Value | | Account Value | | Annualized | | Paid During Period |

| | 6/1/09 | | 11/30/09 | | Expense Ratio | | 6/1/09 to 11/30/09* |

| Actual Fund return | | | | | | | | | | | | |

| Class A | | $1,000.00 | | | $1,242.30 | | | 1.55% | | $ | 8.71 | |

| Class B | | 1,000.00 | | | 1,238.70 | | | 2.30% | | | 12.91 | |

| Class C | | 1,000.00 | | | 1,238.70 | | | 2.30% | | | 12.91 | |

| Institutional Class | | 1,000.00 | | | 1,245.00 | | | 1.30% | | | 7.32 | |

| Hypothetical 5% return (5% return before expenses) | | | | | | | |

| Class A | | $1,000.00 | | | $1,017.30 | | | 1.55% | | $ | 7.84 | |

| Class B | | 1,000.00 | | | 1,013.54 | | | 2.30% | | | 11.61 | |

| Class C | | 1,000.00 | | | 1,013.54 | | | 2.30% | | | 11.61 | |

| Institutional Class | | 1,000.00 | | | 1,018.55 | | | 1.30% | | | 6.58 | |

26

| Country and sector allocations | |

| Delaware International Value Equity Fund | As of November 30, 2009 |

Sector designations may be different than the sector designations presented in other Fund materials. The sector designations may represent the investment manager’s internal sector classifications, which may result in the sector designations for one fund being different than another fund’s sector designations.

| Country | Percentage of net assets |

| Common Stock | 100.96 | % |

| Australia | 3.23 | % |

| Brazil | 3.44 | % |

| Canada | 8.56 | % |

| Denmark | 1.54 | % |

| Finland | 1.79 | % |

| France | 18.67 | % |

| Germany | 8.96 | % |

| Hong Kong | 7.40 | % |

| Italy | 6.23 | % |

| Japan | 10.19 | % |

| Luxembourg | 1.08 | % |

| Netherlands | 2.48 | % |

| Singapore | 1.96 | % |

| Spain | 2.26 | % |

| Sweden | 4.52 | % |

| Switzerland | 3.92 | % |

| Taiwan | 1.69 | % |

| United Kingdom | 13.04 | % |

| Securities Lending Collateral | 19.35 | % |

| Total Value of Securities | 120.31 | % |

| Obligation to Return Securities Lending Collateral | (19.81 | %) |

| Liabilities Net of Receivables and Other Assets | (0.50 | %) |

| Total Net Assets | 100.00 | % |

27

Country and sector allocations

Delaware International Value Equity Fund

| Sector | Percentage of net assets |

| Consumer Discretionary | 21.68 | % |

| Consumer Staples | 8.40 | % |

| Energy | 9.14 | % |

| Financials | 12.26 | % |

| Health Care | 7.54 | % |

| Industrials | 18.45 | % |

| Information Technology | 6.05 | % |

| Materials | 8.61 | % |

| Telecommunication Services | 6.70 | % |

| Utilities | 2.13 | % |

| Total | 100.96 | % |

28

| Delaware Emerging Markets Fund | As of November 30, 2009 |

Sector designations may be different than the sector designations presented in other Fund materials. The sector designations may represent the investment manager’s internal sector classifications which may result in the sector designations for one fund being different than another fund’s sector designations.

| Composition of Portfolio | Percentage of net assets |

| Common Stock by Country | 93.33 | % |

| Argentina | 2.54 | % |

| Australia | 0.36 | % |

| Brazil | 12.45 | % |

| Canada | 0.47 | % |

| China | 10.65 | % |

| France | 0.41 | % |

| Hong Kong | 6.41 | % |

| Hungary | 0.41 | % |

| India | 1.69 | % |

| Indonesia | 2.24 | % |

| Israel | 1.26 | % |

| Kazakhstan | 0.04 | % |

| Luxembourg | 0.50 | % |

| Malaysia | 2.23 | % |

| Mexico | 5.12 | % |

| Pakistan | 0.22 | % |

| Peru | 0.85 | % |

| Philippines | 0.52 | % |

| Poland | 1.02 | % |

| Republic of Korea | 12.13 | % |

| Russia | 7.88 | % |

| South Africa | 8.82 | % |