UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number | 811-06325 | |||||

|

| |||||

| BNY Mellon Midcap Index Fund, Inc. |

| ||||

| (Exact name of Registrant as specified in charter) |

| ||||

|

|

| ||||

|

c/o BNY Mellon Investment Adviser, Inc. 240 Greenwich Street New York, New York 10286 |

| ||||

| (Address of principal executive offices) (Zip code) |

| ||||

|

|

| ||||

| Bennett A. MacDougall, Esq. 240 Greenwich Street New York, New York 10286 |

| ||||

| (Name and address of agent for service) |

| ||||

| ||||||

Registrant's telephone number, including area code: | (212) 922-6400 | |||||

|

| |||||

Date of fiscal year end:

| 10/31 |

| ||||

Date of reporting period: | 10/31/19

|

| ||||

FORM N-CSR

Item 1. Reports to Stockholders.

BNY Mellon Midcap Index Fund, Inc.

ANNUAL REPORT October 31, 2019 |

|

Save time. Save paper. View your next shareholder report online as soon as it’s available. Log into www.bnymellonim.com/us and sign up for eCommunications. It’s simple and only takes a few minutes. |

The views expressed in this report reflect those of the portfolio manager(s) only through the end of the period covered and do not necessarily represent the views of BNY Mellon Investment Adviser, Inc. or any other person in the BNY Mellon Investment Adviser, Inc. organization. Any such views are subject to change at any time based upon market or other conditions and BNY Mellon Investment Adviser, Inc. disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund in the BNY Mellon Family of Funds are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund in the BNY Mellon Family of Funds. |

Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value |

Contents

THE FUND

| |

BNY Mellon Investment Adviser, Inc. | |

With Those of Other Funds | |

in Affiliated Issuers | |

Public Accounting Firm | |

FOR MORE INFORMATION

Back Cover

| The Fund |

A LETTER FROM THE PRESIDENT OF BNY MELLON INVESTMENT ADVISER, INC.

Dear Shareholder:

We are pleased to present this annual report for BNY Mellon Midcap Index Fund, Inc. (formerly, Dreyfus Midcap Index Fund, Inc.), covering the 12-month period from November 1, 2018 through October 31, 2019. For information about how the fund performed during the reporting period, as well as general market perspectives, we provide a Discussion of Fund Performance on the pages that follow.

Equity markets weakened in the fourth quarter of 2018, as concerns about rising interest rates, trade tensions and slowing global growth provided downward pressure on returns. In December 2018, stocks experienced a sharp sell-off, as it appeared that the U.S. Federal Reserve (the “Fed”) would maintain its hawkish stance on monetary policy. In January 2019, a pivot in stance from the Fed helped stimulate a rebound across equity markets that continued into the second quarter. Escalating trade tensions disrupted equity markets again in May. The dip was short-lived, as markets rose once again in June and July of 2019, when a trade deal appeared more likely, and the pace of U.S. economic growth remained steady. Nevertheless, concerns continued to emerge over slowing global growth, resulting in bouts of market volatility in August 2019. Stocks rebounded in September and continued an upward path through most of October 2019, supported in part by central bank policy and consistent consumer spending.

In fixed-income markets, a risk-off mentality prevailed to start the period, fueled in part by equity market volatility. A flight to quality supported price increases for U.S. Treasuries, which continued through the end of 2018, leading to a flattening yield curve. After the Fed’s supportive statements in January 2019, other developed-market central banks followed suit and reiterated their abilities to bolster flagging growth by continuing accommodative policies. This further buoyed fixed-income instrument prices. The Fed cut rates in July, September and October of 2019, for a total 75-basis-point reduction in the federal funds rate during the 12 months. Concerns about the pace of global economic growth also fueled demand for fixed-income instruments during much of the reporting period, resulting in positive bond market returns.

We believe that over the near term, the outlook for the U.S. remains positive, but we will monitor relevant data for any signs of a change. As always, we encourage you to discuss the risks and opportunities in today’s investment environment with your financial advisor.

Thank you for your continued confidence and support.

Sincerely,

Renee LaRoche-Morris

President

BNY Mellon Investment Adviser, Inc.

November 15, 2019

2

DISCUSSION OF FUND PERFORMANCE(Unaudited)

For the period from November 1, 2018 through October 31, 2019, as provided by Thomas J. Durante, CFA, Karen Q. Wong, CFA and Richard A. Brown, CFA, portfolio managers

Market and Fund Performance Overview

For the 12-month period ended October 31, 2019, BNY Mellon Midcap Index Fund, Inc.’s (formerly, Dreyfus Midcap Index Fund, Inc.) Class I shares produced a total return of 8.76%, and its Investor shares returned 8.48%.1 In comparison, the S&P MidCap 400® Index (the “Index”), the fund’s benchmark, produced a total return of 9.02% for the same period.2,3

Mid-cap stocks advanced during the reporting period, supported by a sound U.S. economic environment and supportive central bank policy. The difference in returns between the fund and the Index during the reporting period was primarily the result of transaction costs and operating expenses that are not reflected in the Index’s results.

The Fund’s Investment Approach

The fund seeks to match the performance of the Index. To pursue its goal, the fund generally is fully invested in stocks included in the Index and in futures whose performance is tied to the Index. The fund generally invests in all 400 stocks in the Index in proportion to their weighting in the Index.

The Index is an unmanaged index of 400 common stocks of medium-sized companies. S&P weights each company’s stock in the Index by its market capitalization (i.e., the share price times the number of shares outstanding), adjusted by the number of available float shares (i.e., those shares available to public investors). Companies included in the Index generally have market capitalizations ranging between approximately $1.6 billion and $6.8 billion, to the extent consistent with market conditions.

Markets Pivot on Central Bank and Trade Activity

During the fourth quarter of 2018, many equity markets felt pressure from slowing global growth, escalating trade issues between the U.S. and China, Brexit difficulties and additional geopolitical issues elsewhere in Europe and the emerging markets. Renewed articulation of hawkish narratives by U.S. Federal Reserve (“Fed”) officials alarmed investors and stoked volatility. In December 2018, equities reached new lows for the year, as economic and political news continued to unnerve investors. Investors also feared the European Central Bank (ECB) would proceed with its plan to conclude stimulus measures in January, despite moderating growth rates.

January 2019 marked a turnaround in the markets. Talk of a potential trade deal between the U.S. and China helped fuel investor optimism, as equity prices recovered. The ECB announced it would provide additional stimulus to support the eurozone economy. China also announced plans to stoke its slowing economic growth rate. At its first meeting of the year, the Fed emphasized its focus on data as a primary driver for rate-hike decisions, and its

3

DISCUSSION OF FUND PERFORMANCE(Unaudited) (continued)

ability to suspend additional rate increases when the data is not supportive. These sentiments reassured investors of central bankers’ commitments to support flagging growth. The rebound continued throughout the month of January, and equity markets maintained an upward trajectory through April 2019. However, renewed trade tensions between the U.S. and China in May caused stocks to pull back once again. The dip was short-lived, as markets rose once again in June. At the end of July and again in September and October, the Fed cut the federal funds rate each time by 25 basis points. Supported by rate cuts and moderate economic growth, equity markets went on to post solid gains during the last several months of the period despite occasional pockets of volatility.

In this environment, mid-cap stocks produced lower returns than their large-cap counterparts but outperformed small-cap equities.

Information Technology Stocks Lead the Market

The information technology sector led the Index’s various market segments during the reporting period. The semiconductor and semiconductor equipment industry led the sector, propelled upwards by strong demand for memory chips by mobile device manufacturers. Electronic equipment and instruments companies also performed well, benefiting from increased IT spending and strategic acquisitions within the industry. Margins are also improving due to increased artificial intelligence capabilities. Software was also among the top-performing industries. In the industrials sector, machinery propelled the sector upwards. Road and rail shippers have also benefited from increased shipping demand and have been able to increase their prices as a result. In the financials sector, insurance companies were the best performers. Insurers have benefited from reduced expenses and better forecasting technology. Many capital markets companies also posted strong returns, particularly wealth managers and companies that make software used by wealth managers. Real estate was also among the top-performing sectors. The low interest-rate environment makes the dividend payments of real estate investment trusts (REITs) attractive. In particular, medical complex and assisted living facility REITs have performed well due to high use rates of the properties.

Conversely, the energy sector trailed the broader market during the period. Oil prices were volatile during the period, hurting companies involved with shale oil. New techniques, such as fracking, and new well-drilling technologies have made it difficult for companies owning wells that use outdated methods to remain competitive without increasing their expenses. Drillers currently have little pricing power, and large debt service payments are eating into earnings. The health care sector also suffered, due in part to the health care providers and services industry, which is feeling the pinch of higher labor and benefit costs. A handful of biotechnology companies suffered during the period due to patent expiration and generic drugs taking away market share. Elsewhere in the market, personal products companies provided a headwind to returns for the consumer staples sector.

Replicating the Performance of the Index

Although we do not actively manage the fund’s investments in response to macroeconomic trends, it is worth noting that while the U.S. economic picture continues to be supported by

4

a strong labor market and sound corporate balance sheets, trade frictions and other geopolitical issues may have the potential to impact the markets. As always, we continue to monitor factors which affect the fund’s investments.

November 15, 2019

1 Total return includes reinvestment of dividends and any capital gains paid. Past performance is no guarantee of future results. Share price and investment return fluctuate such that upon redemption, fund shares may be worth more or less than their original cost.

2 Source: Lipper Inc. — The S&P MidCap 400® Index provides investors with a benchmark for midsized companies. The index measures the performance of midsized companies, reflecting the distinctive risk and return characteristics of this market segment. Investors cannot invest directly in any index.

3 “Standard & Poor’s®,” “S&P®,” and “S&P MidCap 400®” are registered trademarks of Standard & Poor’s Financial Services LLC and have been licensed for use on behalf of the fund. The fund is not sponsored, endorsed, managed, advised, sold or promoted by Standard & Poor’s and its affiliates, and Standard & Poor’s and its affiliates make no representation regarding the advisability of investing in the fund.

Equities are subject generally to market, market sector, market liquidity, issuer and investment style risks, among other factors, to varying degrees, all of which are more fully described in the fund’s prospectus.

The prices of mid-cap company stocks tend to be more volatile than the prices of large company stocks, mainly because these companies have less established and more volatile earnings histories. They also tend to be less liquid than larger company stocks.

The fund may, but is not required to, use derivative instruments, such as options, futures, options on futures, forward contracts and other credit derivatives. A small investment in derivatives could have a potentially large impact on the fund’s performance. The use of derivatives involves risks different from, or possibly greater than, the risks associated with investing directly in the underlying assets.

5

FUND PERFORMANCE(Unaudited)

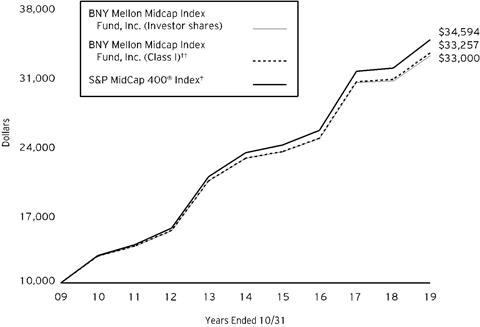

Comparison of change in value of a $10,000 investment in Investor shares and Class I shares of BNY Mellon Midcap Index Fund, Inc. with a hypothetical investment of $10,000 in the S&P MidCap 400® Index (the “Index”)

† Source: Lipper Inc.

†† The total return figures presented for Class I shares of the fund reflect the performance of the fund’s Investor shares for the period prior to 8/31/16 (the inception date for Class I shares).

Past performance is not predictive of future performance.

The above graph compares a hypothetical investment of $10,000 made in each of the Investor and Class I shares of BNY Mellon Midcap Index Fund, Inc. on 10/31/09 to a hypothetical investment of $10,000 made in the Index on that date. All dividends and capital gain distributions are reinvested.

The fund’s performance shown in the line graph above takes into account all applicable fees and expenses. The Index provides investors with a benchmark for mid-sized companies. The Index measures the performance of mid-sized companies, reflecting the distinctive risk and return characteristics of this market segment. Unlike a mutual fund, the Index is not subject to charges, fees and other expenses. Investors cannot invest directly in any index. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

6

Average Annual Total Returns as of 10/31/19 | |||||

| Inception | 1 Year | 5 Years | 10 Years | |

Investor Shares | 6/19/1991 | 8.48% | 7.86% | 12.68% | |

Class I | 8/31/2016 | 8.76% | 8.03%† | 12.77%† | |

S&P MidCap 400® Index | 9.02% | 8.37% | 13.21% | ||

† The total return performance figures presented for Class I shares of the fund reflect the performance of the fund’s Investor shares for the period prior to 8/31/16 (the inception date for Class I shares).

The performance data quoted represents past performance, which is no guarantee of future results. Share price and investment return fluctuate and an investor’s shares may be worth more or less than original cost upon redemption. Current performance may be lower or higher than the performance quoted. Go to www.bnymellonim.com/us for the fund’s most recent month-end returns.

The fund’s performance shown in the graph and table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

7

UNDERSTANDING YOUR FUND’S EXPENSES(Unaudited)

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You also may pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial adviser.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in BNY Mellon Midcap Index Fund, Inc. from May 1, 2019 to October 31, 2019. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

Expenses and Value of a $1,000 Investment |

| |||

Assume actual returns for the six months ended October 31, 2019 |

| |||

|

|

|

|

|

|

| Investor Shares | Class I |

|

Expense paid per $1,000† | $2.52 | $1.26 |

| |

Ending value (after expenses) | $998.50 | $1,000.00 |

| |

COMPARING YOUR FUND’S EXPENSES

WITH THOSE OF OTHER FUNDS(Unaudited)

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (“SEC”) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

Expenses and Value of a $1,000 Investment |

| |||

Assuming a hypothetical 5% annualized return for the six months ended October 31, 2019 |

| |||

|

|

|

|

|

|

| Investor Shares | Class I |

|

Expense paid per $1,000† | $2.55 | $1.28 |

| |

Ending value (after expenses) | $1,022.68 | $1,023.95 |

| |

†Expenses are equal to the fund’s annualized expense ratio of .50% for Investor Shares and .25% for Class I, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). | ||||

8

STATEMENT OF INVESTMENTS

October 31, 2019

Description | Shares | Value ($) | |||||

Common Stocks - 99.7% | |||||||

Automobiles & Components - 1.3% | |||||||

Adient | 136,912 | a | 2,901,165 | ||||

Dana | 227,397 | a | 3,690,653 | ||||

Delphi Technologies | 139,494 | 1,703,222 | |||||

Gentex | 398,239 | 11,170,604 | |||||

The Goodyear Tire & Rubber Company | 363,691 | 5,771,776 | |||||

Thor Industries | 85,235 | a | 5,391,966 | ||||

Visteon | 43,766 | a,b | 4,071,113 | ||||

34,700,499 | |||||||

Banks - 7.6% | |||||||

Associated Banc-Corp | 253,866 | 5,105,245 | |||||

BancorpSouth Bank | 146,795 | 4,502,203 | |||||

Bank of Hawaii | 63,514 | a | 5,545,407 | ||||

Bank OZK | 188,986 | 5,302,947 | |||||

Cathay General Bancorp | 118,645 | 4,220,203 | |||||

Commerce Bancshares | 154,331 | a | 9,932,743 | ||||

Cullen/Frost Bankers | 89,910 | a | 8,099,093 | ||||

East West Bancorp | 227,498 | 9,764,214 | |||||

F.N.B. | 507,861 | 6,124,804 | |||||

First Financial Bankshares | 212,380 | a | 7,068,006 | ||||

First Horizon National | 488,640 | 7,803,581 | |||||

Fulton Financial | 260,212 | a | 4,439,217 | ||||

Hancock Whitney | 140,563 | 5,481,957 | |||||

Home BancShares | 245,087 | 4,529,208 | |||||

International Bancshares | 87,457 | 3,582,239 | |||||

LendingTree | 11,992 | a,b | 4,315,321 | ||||

New York Community Bancorp | 730,312 | 8,508,135 | |||||

PacWest Bancorp | 184,949 | 6,841,264 | |||||

Pinnacle Financial Partners | 113,126 | 6,654,071 | |||||

Prosperity Bancshares | 146,187 | a | 10,089,827 | ||||

Signature Bank | 85,598 | 10,127,955 | |||||

Sterling Bancorp | 321,485 | 6,317,180 | |||||

Synovus Financial | 241,556 | 8,181,502 | |||||

TCF Financial | 240,032 | 9,502,867 | |||||

Texas Capital Bancshares | 78,640 | b | 4,251,278 | ||||

Trustmark | 102,975 | a | 3,534,102 | ||||

UMB Financial | 67,583 | a | 4,410,467 | ||||

Umpqua Holdings | 349,037 | 5,521,765 | |||||

United Bankshares | 159,360 | a | 6,301,094 | ||||

Valley National Bancorp | 525,318 | a | 6,083,182 | ||||

Washington Federal | 124,230 | 4,529,426 | |||||

Webster Financial | 144,017 | 6,351,150 | |||||

9

STATEMENT OF INVESTMENTS (continued)

Description | Shares | Value ($) | |||||

Common Stocks - 99.7% (continued) | |||||||

Banks - 7.6% (continued) | |||||||

Wintrust Financial | 88,658 | 5,658,154 | |||||

208,679,807 | |||||||

Capital Goods - 10.7% | |||||||

Acuity Brands | 62,373 | 7,783,527 | |||||

AECOM | 246,492 | b | 9,862,145 | ||||

AGCO | 99,073 | 7,597,908 | |||||

Axon Enterprise | 92,615 | b | 4,735,405 | ||||

Carlisle | 88,519 | 13,478,788 | |||||

Colfax | 132,149 | a,b | 4,440,206 | ||||

Crane | 79,651 | 6,094,895 | |||||

Curtiss-Wright | 66,776 | 9,031,454 | |||||

Donaldson | 199,284 | 10,510,238 | |||||

Dycom Industries | 49,389 | b | 2,251,645 | ||||

EMCOR Group | 87,708 | 7,692,869 | |||||

EnerSys | 66,470 | 4,444,184 | |||||

Fluor | 220,742 | 3,556,154 | |||||

GATX | 55,839 | a | 4,441,992 | ||||

Graco | 260,676 | 11,782,555 | |||||

Granite Construction | 74,751 | a | 1,759,639 | ||||

Hubbell | 85,039 | 12,050,026 | |||||

ITT | 137,484 | 8,173,424 | |||||

Kennametal | 131,456 | 4,068,563 | |||||

Lennox International | 55,080 | a | 13,624,589 | ||||

Lincoln Electric Holdings | 96,696 | 8,661,061 | |||||

MasTec | 94,482 | a,b | 5,946,697 | ||||

Mercury Systems | 84,724 | b | 6,240,770 | ||||

MSC Industrial Direct, Cl. A | 71,270 | 5,217,677 | |||||

Nordson | 80,043 | 12,551,543 | |||||

NOW | 169,262 | a,b | 1,784,021 | ||||

nVent Electric | 243,490 | 5,614,879 | |||||

Oshkosh | 107,071 | 9,141,722 | |||||

Owens Corning | 170,007 | 10,418,029 | |||||

Regal Beloit | 65,690 | 4,864,345 | |||||

Resideo Technologies | 192,682 | b | 1,836,259 | ||||

Teledyne Technologies | 56,835 | b | 18,732,816 | ||||

Terex | 100,850 | 2,778,418 | |||||

The Timken Company | 107,056 | 5,245,744 | |||||

The Toro Company | 166,568 | 12,847,390 | |||||

Trex | 91,304 | a,b | 8,024,709 | ||||

Trinity Industries | 163,364 | a | 3,231,340 | ||||

Valmont Industries | 33,867 | 4,646,214 | |||||

Watsco | 51,051 | 9,000,291 | |||||

10

Description | Shares | Value ($) | |||||

Common Stocks - 99.7% (continued) | |||||||

Capital Goods - 10.7% (continued) | |||||||

Woodward | 87,922 | 9,377,761 | |||||

293,541,892 | |||||||

Commercial & Professional Services - 2.9% | |||||||

ASGN | 82,692 | b | 5,258,384 | ||||

Clean Harbors | 80,306 | b | 6,622,033 | ||||

Deluxe | 67,164 | 3,481,110 | |||||

FTI Consulting | 57,268 | b | 6,234,767 | ||||

Healthcare Services Group | 116,926 | a | 2,848,317 | ||||

Herman Miller | 92,346 | 4,294,089 | |||||

HNI | 68,601 | 2,606,838 | |||||

Insperity | 59,734 | 6,309,702 | |||||

KAR Auction Services | 207,966 | a | 5,170,035 | ||||

Manpowergroup | 93,576 | 8,507,930 | |||||

MSA Safety | 56,391 | 6,770,867 | |||||

Stericycle | 140,999 | a,b | 8,121,542 | ||||

Tetra Tech | 85,495 | 7,478,248 | |||||

The Brink's Company | 78,152 | 6,639,794 | |||||

80,343,656 | |||||||

Consumer Durables & Apparel - 2.7% | |||||||

Brunswick | 134,121 | 7,811,207 | |||||

Carter's | 69,999 | a | 7,016,700 | ||||

Deckers Outdoor | 45,180 | b | 6,908,022 | ||||

Helen of Troy | 39,256 | a,b | 5,878,979 | ||||

KB Home | 135,817 | 4,847,309 | |||||

Mattel | 540,361 | a,b | 6,451,910 | ||||

Polaris | 89,773 | 8,856,106 | |||||

Skechers USA, Cl. A | 209,075 | b | 7,813,133 | ||||

Tempur Sealy International | 71,972 | b | 6,545,853 | ||||

Toll Brothers | 202,288 | 8,044,994 | |||||

TRI Pointe Group | 226,106 | b | 3,558,908 | ||||

73,733,121 | |||||||

Consumer Services - 5.0% | |||||||

Adtalem Global Education | 86,024 | b | 2,561,795 | ||||

Boyd Gaming | 126,520 | a | 3,447,670 | ||||

Brinker International | 60,357 | 2,682,869 | |||||

Caesars Entertainment | 872,511 | b | 10,714,435 | ||||

Churchill Downs | 55,693 | 7,239,533 | |||||

Cracker Barrel Old Country Store | 37,570 | a | 5,842,135 | ||||

Domino's Pizza | 64,422 | a | 17,498,304 | ||||

Dunkin' Brands Group | 129,281 | 10,164,072 | |||||

Eldorado Resorts | 103,829 | a,b | 4,648,424 | ||||

Graham Holdings, Cl. B | 6,872 | 4,327,024 | |||||

Jack in the Box | 41,026 | a | 3,447,005 | ||||

11

STATEMENT OF INVESTMENTS (continued)

Description | Shares | Value ($) | |||||

Common Stocks - 99.7% (continued) | |||||||

Consumer Services - 5.0% (continued) | |||||||

Marriott Vacations Worldwide | 60,597 | 6,661,428 | |||||

Papa John's International | 34,865 | a | 2,041,346 | ||||

Penn National Gaming | 170,141 | b | 3,626,555 | ||||

Scientific Games | 86,342 | a,b | 2,071,345 | ||||

Service Corp. International | 284,968 | 12,960,345 | |||||

Six Flags Entertainment | 120,657 | 5,090,519 | |||||

Texas Roadhouse | 102,471 | 5,789,612 | |||||

The Cheesecake Factory | 65,288 | a | 2,728,386 | ||||

The Wendy's Company | 291,920 | 6,182,866 | |||||

WW International | 70,049 | b | 2,442,609 | ||||

Wyndham Destinations | 144,364 | 6,699,933 | |||||

Wyndham Hotels & Resorts | 150,829 | 8,140,241 | |||||

137,008,451 | |||||||

Diversified Financials - 3.3% | |||||||

Eaton Vance | 176,770 | 8,060,712 | |||||

Evercore, Cl. A | 62,488 | 4,601,616 | |||||

FactSet Research Systems | 59,784 | a | 15,156,440 | ||||

Federated Investors, Cl. B | 150,359 | a | 4,802,466 | ||||

FirstCash | 64,163 | 5,414,716 | |||||

Green Dot, Cl. A | 76,456 | b | 2,204,991 | ||||

Interactive Brokers Group, Cl. A | 119,559 | a | 5,687,422 | ||||

Janus Henderson Group | 249,427 | a | 5,769,247 | ||||

Jefferies Financial Group | 391,993 | a | 7,318,509 | ||||

Legg Mason | 128,143 | 4,774,608 | |||||

Navient | 318,182 | 4,381,366 | |||||

SEI Investments | 198,410 | 11,888,727 | |||||

SLM | 667,390 | 5,632,772 | |||||

Stifel Financial | 108,982 | 6,100,812 | |||||

91,794,404 | |||||||

Energy - 2.1% | |||||||

Antero Midstream | 403,856 | a | 2,600,833 | ||||

Apergy | 122,355 | b | 3,079,675 | ||||

Chesapeake Energy | 1,737,056 | a,b | 2,327,655 | ||||

CNX Resources | 293,709 | a,b | 2,475,967 | ||||

Core Laboratories | 70,100 | 3,087,204 | |||||

EQT | 399,622 | a | 4,291,940 | ||||

Equitrans Midstream | 322,265 | a | 4,485,929 | ||||

Matador Resources | 163,280 | a,b | 2,271,225 | ||||

Murphy Oil | 241,261 | a | 4,977,214 | ||||

Oasis Petroleum | 433,490 | b | 1,131,409 | ||||

Oceaneering International | 158,339 | b | 2,242,080 | ||||

Patterson-UTI Energy | 317,301 | a | 2,639,944 | ||||

PBF Energy, Cl. A | 161,568 | 5,215,415 | |||||

12

Description | Shares | Value ($) | |||||

Common Stocks - 99.7% (continued) | |||||||

Energy - 2.1% (continued) | |||||||

Southwestern Energy | 855,426 | a,b | 1,753,623 | ||||

Transocean | 877,953 | a,b | 4,170,277 | ||||

World Fuel Services | 102,480 | 4,280,590 | |||||

WPX Energy | 652,973 | b | 6,516,671 | ||||

57,547,651 | |||||||

Food & Staples Retailing - .5% | |||||||

Casey's General Stores | 57,437 | a | 9,810,814 | ||||

Sprouts Farmers Market | 186,889 | b | 3,627,515 | ||||

13,438,329 | |||||||

Food, Beverage & Tobacco - 1.9% | |||||||

Flowers Foods | 298,867 | a | 6,491,391 | ||||

Ingredion | 104,267 | 8,237,093 | |||||

Lancaster Colony | 31,311 | 4,357,865 | |||||

Pilgrim's Pride | 81,827 | b | 2,484,268 | ||||

Post Holdings | 105,722 | b | 10,878,794 | ||||

Sanderson Farms | 30,780 | a | 4,765,052 | ||||

The Boston Beer Company, Cl. A | 14,005 | a,b | 5,244,312 | ||||

The Hain Celestial Group | 126,536 | a,b | 2,991,311 | ||||

Tootsie Roll Industries | 26,653 | a | 913,665 | ||||

TreeHouse Foods | 87,860 | a,b | 4,746,197 | ||||

51,109,948 | |||||||

Health Care Equipment & Services - 6.3% | |||||||

Acadia Healthcare | 138,497 | a,b | 4,153,525 | ||||

Allscripts Healthcare Solutions | 263,354 | a,b | 2,881,093 | ||||

Amedisys | 49,495 | b | 6,361,097 | ||||

Avanos Medical | 76,486 | a,b | 3,368,443 | ||||

Cantel Medical | 57,480 | a | 4,189,717 | ||||

Chemed | 24,884 | 9,802,056 | |||||

Covetrus | 154,292 | a,b | 1,529,805 | ||||

Encompass Health | 154,218 | 9,873,036 | |||||

Globus Medical, Cl. A | 119,863 | b | 6,277,225 | ||||

Haemonetics | 79,414 | b | 9,587,652 | ||||

HealthEquity | 111,090 | b | 6,308,801 | ||||

Hill-Rom Holdings | 104,417 | 10,931,416 | |||||

ICU Medical | 29,300 | b | 4,735,173 | ||||

Integra LifeSciences Holdings | 111,021 | b | 6,445,879 | ||||

LivaNova | 75,658 | b | 5,351,290 | ||||

Masimo | 76,670 | b | 11,177,719 | ||||

MEDNAX | 131,868 | b | 2,895,821 | ||||

Molina Healthcare | 97,987 | b | 11,527,191 | ||||

NuVasive | 81,351 | b | 5,738,500 | ||||

Patterson | 133,450 | a | 2,285,999 | ||||

Penumbra | 49,980 | a,b | 7,795,381 | ||||

13

STATEMENT OF INVESTMENTS (continued)

Description | Shares | Value ($) | |||||

Common Stocks - 99.7% (continued) | |||||||

Health Care Equipment & Services - 6.3% (continued) | |||||||

STERIS | 132,333 | 18,734,383 | |||||

Tenet Healthcare | 155,407 | a,b | 3,938,013 | ||||

West Pharmaceutical Services | 115,221 | 16,573,389 | |||||

172,462,604 | |||||||

Household & Personal Products - .4% | |||||||

Edgewell Personal Care | 85,459 | b | 2,991,065 | ||||

Energizer Holdings | 101,076 | a | 4,294,719 | ||||

Nu Skin Enterprises, Cl. A | 86,889 | 3,873,512 | |||||

11,159,296 | |||||||

Insurance - 5.6% | |||||||

Alleghany | 22,553 | b | 17,552,774 | ||||

American Financial Group | 115,714 | 12,038,885 | |||||

Brighthouse Financial | 174,649 | b | 6,594,746 | ||||

Brown & Brown | 364,916 | 13,750,035 | |||||

CNO Financial Group | 244,296 | 3,823,232 | |||||

First American Financial | 175,221 | 10,825,153 | |||||

Genworth Financial, Cl. A | 787,435 | b | 3,370,222 | ||||

Kemper | 97,915 | 7,038,130 | |||||

Mercury General | 42,759 | 2,054,998 | |||||

Old Republic International | 445,455 | 9,951,465 | |||||

Primerica | 65,502 | 8,265,042 | |||||

Reinsurance Group of America | 98,056 | 15,931,158 | |||||

RenaissanceRe Holdings | 69,013 | 12,917,853 | |||||

Selective Insurance Group | 88,977 | 6,150,090 | |||||

The Hanover Insurance Group | 61,979 | 8,163,254 | |||||

WR Berkley | 226,145 | a | 15,807,535 | ||||

154,234,572 | |||||||

Materials - 6.1% | |||||||

Allegheny Technologies | 201,013 | a,b | 4,223,283 | ||||

AptarGroup | 100,182 | 11,836,503 | |||||

Ashland Global Holdings | 94,935 | 7,345,121 | |||||

Cabot | 90,362 | 3,938,880 | |||||

Carpenter Technology | 74,528 | a | 3,653,363 | ||||

Commercial Metals | 187,388 | a | 3,622,210 | ||||

Compass Minerals International | 53,017 | a | 2,994,400 | ||||

Domtar | 99,534 | 3,622,042 | |||||

Eagle Materials | 65,925 | 6,021,590 | |||||

Greif, Cl. A | 40,648 | a | 1,592,182 | ||||

Ingevity | 65,465 | b | 5,512,808 | ||||

Louisiana-Pacific | 195,099 | 5,702,744 | |||||

Minerals Technologies | 56,156 | 2,776,914 | |||||

NewMarket | 11,723 | 5,691,399 | |||||

Olin | 256,864 | 4,710,886 | |||||

14

Description | Shares | Value ($) | |||||

Common Stocks - 99.7% (continued) | |||||||

Materials - 6.1% (continued) | |||||||

Owens-Illinois | 247,867 | 2,106,870 | |||||

PolyOne | 120,373 | 3,857,955 | |||||

Reliance Steel & Aluminum | 104,262 | 12,098,562 | |||||

Royal Gold | 102,448 | a | 11,826,597 | ||||

RPM International | 202,827 | 14,690,760 | |||||

Sensient Technologies | 66,164 | a | 4,139,220 | ||||

Silgan Holdings | 121,737 | 3,745,847 | |||||

Sonoco Products | 156,423 | a | 9,025,607 | ||||

Steel Dynamics | 343,528 | 10,429,510 | |||||

The Chemours Company | 259,014 | a | 4,250,420 | ||||

The Scotts Miracle-Gro Company | 61,620 | 6,186,032 | |||||

United States Steel | 267,050 | a | 3,073,746 | ||||

Valvoline | 294,067 | 6,275,390 | |||||

Worthington Industries | 58,082 | 2,137,998 | |||||

167,088,839 | |||||||

Media & Entertainment - 2.2% | |||||||

AMC Networks, Cl. A | 69,114 | a,b | 3,009,915 | ||||

Cable One | 7,863 | 10,421,384 | |||||

Cinemark Holdings | 166,722 | a | 6,102,025 | ||||

John Wiley & Sons, Cl. A | 68,897 | 3,174,085 | |||||

Live Nation Entertainment | 217,409 | a,b | 15,327,334 | ||||

Meredith | 63,553 | 2,395,948 | |||||

TEGNA | 338,680 | a | 5,090,360 | ||||

The New York Times Company, Cl. A | 225,829 | a | 6,978,116 | ||||

World Wrestling Entertainment, Cl. A | 73,286 | a | 4,106,947 | ||||

Yelp | 101,087 | a,b | 3,488,512 | ||||

60,094,626 | |||||||

Pharmaceuticals Biotechnology & Life Sciences - 3.2% | |||||||

Bio-Rad Laboratories, Cl. A | 33,179 | b | 11,002,820 | ||||

Bio-Techne | 59,459 | 12,377,580 | |||||

Catalent | 228,153 | b | 11,099,643 | ||||

Charles River Laboratories International | 76,280 | b | 9,914,874 | ||||

Exelixis | 473,180 | b | 7,310,631 | ||||

Ligand Pharmaceuticals | 29,778 | a,b | 3,240,144 | ||||

Nektar Therapeutics | 266,286 | a,b | 4,560,148 | ||||

PRA Health Sciences | 98,412 | b | 9,615,837 | ||||

Prestige Consumer Healthcare | 78,721 | a,b | 2,791,447 | ||||

Repligen | 68,937 | b | 5,479,802 | ||||

Syneos Health | 97,625 | a,b | 4,895,894 | ||||

United Therapeutics | 68,578 | a,b | 6,161,048 | ||||

88,449,868 | |||||||

Real Estate - 11.5% | |||||||

Alexander & Baldwin | 109,308 | c | 2,569,831 | ||||

15

STATEMENT OF INVESTMENTS (continued)

Description | Shares | Value ($) | |||||

Common Stocks - 99.7% (continued) | |||||||

Real Estate - 11.5% (continued) | |||||||

American Campus Communities | 214,752 | c | 10,733,305 | ||||

Brixmor Property Group | 465,439 | c | 10,248,967 | ||||

Camden Property Trust | 151,302 | c | 17,304,410 | ||||

CoreCivic | 187,745 | c | 2,864,989 | ||||

CoreSite Realty | 57,696 | c | 6,779,280 | ||||

Corporate Office Properties Trust | 175,096 | c | 5,189,845 | ||||

Cousins Properties | 230,169 | c | 9,236,682 | ||||

CyrusOne | 176,924 | c | 12,611,143 | ||||

Douglas Emmett | 257,173 | c | 11,140,734 | ||||

EastGroup Properties | 58,510 | c | 7,837,414 | ||||

EPR Properties | 119,579 | c | 9,302,050 | ||||

First Industrial Realty Trust | 197,700 | c | 8,325,147 | ||||

Healthcare Realty Trust | 202,125 | c | 7,027,886 | ||||

Highwoods Properties | 162,208 | c | 7,591,334 | ||||

JBG SMITH Properties | 184,934 | a,c | 7,445,443 | ||||

Jones Lang LaSalle | 80,540 | 11,800,721 | |||||

Kilroy Realty | 146,212 | c | 12,271,573 | ||||

Lamar Advertising, Cl. A | 134,302 | c | 10,745,503 | ||||

Liberty Property Trust | 246,450 | c | 14,557,801 | ||||

Life Storage | 72,952 | c | 7,945,932 | ||||

Mack-Cali Realty | 143,781 | c | 3,079,789 | ||||

Medical Properties Trust | 696,796 | c | 14,444,581 | ||||

National Retail Properties | 265,860 | c | 15,661,813 | ||||

Omega Healthcare Investors | 338,211 | a,c | 14,894,812 | ||||

Park Hotels & Resorts | 375,475 | c | 8,729,794 | ||||

Pebblebrook Hotel Trust | 204,314 | a,c | 5,252,913 | ||||

Potlatchdeltic | 105,151 | c | 4,465,763 | ||||

PS Business Parks | 31,319 | c | 5,654,645 | ||||

Rayonier | 202,651 | c | 5,467,524 | ||||

Sabra Health Care REIT | 296,390 | c | 7,291,194 | ||||

Senior Housing Properties Trust | 371,936 | c | 3,691,465 | ||||

Service Properties Trust | 256,969 | a,c | 6,501,316 | ||||

Spirit Realty Capital | 139,768 | c | 6,966,037 | ||||

Tanger Factory Outlet Centers | 149,672 | a,c | 2,412,713 | ||||

Taubman Centers | 95,742 | a,c | 3,425,649 | ||||

The GEO Group | 192,966 | c | 2,936,943 | ||||

Uniti Group | 290,231 | a,c | 2,008,399 | ||||

Urban Edge Properties | 180,485 | c | 3,810,038 | ||||

Weingarten Realty Investors | 190,737 | c | 6,052,085 | ||||

316,277,463 | |||||||

Retailing - 3.4% | |||||||

Aaron's | 105,611 | 7,913,433 | |||||

American Eagle Outfitters | 248,751 | a | 3,825,790 | ||||

16

Description | Shares | Value ($) | |||||

Common Stocks - 99.7% (continued) | |||||||

Retailing - 3.4% (continued) | |||||||

AutoNation | 91,022 | b | 4,628,469 | ||||

Bed Bath & Beyond | 200,181 | a | 2,742,480 | ||||

Dick's Sporting Goods | 103,172 | a | 4,016,486 | ||||

Dillard's, Cl. A | 16,899 | a | 1,165,693 | ||||

Etsy | 188,164 | b | 8,371,416 | ||||

Five Below | 87,048 | b | 10,890,575 | ||||

Foot Locker | 171,846 | a | 7,477,019 | ||||

Grubhub | 142,798 | a,b | 4,863,700 | ||||

Murphy USA | 47,459 | b | 5,596,840 | ||||

Ollie's Bargain Outlet Holdings | 84,839 | a,b | 5,419,515 | ||||

Pool | 62,380 | 12,937,612 | |||||

Sally Beauty Holdings | 189,960 | a,b | 2,944,380 | ||||

Urban Outfitters | 108,747 | b | 3,121,039 | ||||

Williams-Sonoma | 122,278 | a | 8,166,948 | ||||

94,081,395 | |||||||

Semiconductors & Semiconductor Equipment - 3.8% | |||||||

Cirrus Logic | 90,937 | b | 6,180,079 | ||||

Cree | 168,224 | a,b | 8,029,332 | ||||

Cypress Semiconductor | 576,709 | 13,420,018 | |||||

First Solar | 118,616 | a,b | 6,143,123 | ||||

MKS Instruments | 85,120 | 9,211,686 | |||||

Monolithic Power Systems | 62,772 | 9,410,778 | |||||

Semtech | 104,080 | b | 5,251,877 | ||||

Silicon Laboratories | 67,755 | b | 7,198,291 | ||||

SolarEdge Technologies | 73,211 | b | 6,220,007 | ||||

Synaptics | 51,700 | a,b | 2,177,087 | ||||

Teradyne | 265,775 | 16,270,745 | |||||

Universal Display | 66,264 | 13,264,728 | |||||

102,777,751 | |||||||

Software & Services - 5.7% | |||||||

ACI Worldwide | 180,682 | b | 5,671,608 | ||||

Blackbaud | 76,904 | a | 6,456,091 | ||||

CACI International, Cl. A | 38,893 | b | 8,702,309 | ||||

CDK Global | 189,444 | 9,574,500 | |||||

Commvault Systems | 64,075 | b | 3,182,605 | ||||

CoreLogic | 125,273 | b | 5,072,304 | ||||

Fair Isaac | 45,172 | b | 13,734,095 | ||||

j2 Global | 73,490 | a | 6,978,610 | ||||

KBR | 221,383 | 6,234,145 | |||||

Liveramp Holdings | 105,923 | b | 4,140,530 | ||||

LogMeIn | 77,285 | 5,076,079 | |||||

Manhattan Associates | 100,567 | b | 7,537,497 | ||||

MAXIMUS | 99,757 | 7,655,352 | |||||

17

STATEMENT OF INVESTMENTS (continued)

Description | Shares | Value ($) | |||||

Common Stocks - 99.7% (continued) | |||||||

Software & Services - 5.7% (continued) | |||||||

Perspecta | 216,032 | 5,733,489 | |||||

PTC | 161,974 | a,b | 10,837,680 | ||||

Sabre | 427,793 | 10,044,580 | |||||

Science Applications International | 76,884 | a | 6,352,156 | ||||

Teradata | 178,733 | a,b | 5,349,479 | ||||

Tyler Technologies | 60,266 | b | 16,182,626 | ||||

WEX | 67,625 | b | 12,793,297 | ||||

157,309,032 | |||||||

Technology Hardware & Equipment - 5.7% | |||||||

Arrow Electronics | 130,124 | b | 10,316,231 | ||||

Avnet | 162,399 | 6,424,504 | |||||

Belden | 60,453 | 3,100,030 | |||||

Ciena | 238,961 | b | 8,870,232 | ||||

Cognex | 266,790 | 13,737,017 | |||||

Coherent | 37,526 | a,b | 5,588,372 | ||||

II-VI | 135,165 | a,b | 4,480,720 | ||||

InterDigital | 50,242 | 2,694,478 | |||||

Jabil | 217,641 | 8,013,542 | |||||

Littelfuse | 38,437 | 6,748,384 | |||||

Lumentum Holdings | 120,151 | a,b | 7,528,662 | ||||

National Instruments | 183,834 | 7,608,889 | |||||

NCR | 194,729 | a,b | 5,688,034 | ||||

NETSCOUT Systems | 104,612 | a,b | 2,533,703 | ||||

Plantronics | 52,006 | a | 2,050,077 | ||||

SYNNEX | 63,956 | 7,530,179 | |||||

Tech Data | 55,734 | b | 6,771,681 | ||||

Trimble | 393,471 | b | 15,675,885 | ||||

Viasat | 90,025 | a,b | 6,197,321 | ||||

Vishay Intertechnology | 207,051 | 4,172,078 | |||||

Zebra Technologies, Cl. A | 84,555 | b | 20,113,098 | ||||

155,843,117 | |||||||

Telecommunication Services - .1% | |||||||

Telephone & Data Systems | 149,843 | 3,909,404 | |||||

Transportation - 2.9% | |||||||

Avis Budget Group | 92,158 | b | 2,738,014 | ||||

Genesee & Wyoming, Cl. A | 88,476 | b | 9,823,490 | ||||

JetBlue Airways | 463,902 | b | 8,953,309 | ||||

Kirby | 91,928 | a,b | 7,277,020 | ||||

Knight-Swift Transportation Holdings | 192,246 | a | 7,009,289 | ||||

Landstar System | 62,047 | 7,020,618 | |||||

Old Dominion Freight Line | 100,125 | a | 18,230,760 | ||||

Ryder System | 83,383 | 4,054,915 | |||||

Werner Enterprises | 69,668 | a | 2,542,882 | ||||

18

Description | Shares | Value ($) | |||||

Common Stocks - 99.7% (continued) | |||||||

Transportation - 2.9% (continued) | |||||||

XPO Logistics | 144,020 | a,b | 11,003,128 | ||||

78,653,425 | |||||||

Utilities - 4.8% | |||||||

ALLETE | 80,747 | 6,949,087 | |||||

Aqua America | 337,204 | a | 15,285,457 | ||||

Black Hills | 93,507 | 7,371,157 | |||||

Hawaiian Electric Industries | 170,342 | a | 7,690,941 | ||||

IDACORP | 78,748 | 8,474,860 | |||||

MDU Resources Group | 313,841 | 9,066,866 | |||||

National Fuel Gas | 134,989 | a | 6,116,352 | ||||

New Jersey Resources | 142,039 | 6,192,900 | |||||

NorthWestern | 79,746 | 5,783,180 | |||||

OGE Energy | 312,826 | 13,470,288 | |||||

ONE Gas | 82,464 | 7,655,958 | |||||

PNM Resources | 124,475 | 6,491,371 | |||||

Southwest Gas Holdings | 84,971 | 7,417,968 | |||||

Spire | 79,419 | 6,675,961 | |||||

UGI | 326,591 | 15,568,593 | |||||

130,210,939 | |||||||

Total Common Stocks(cost $1,843,630,533) | 2,734,450,089 | ||||||

Principal Amount ($) | |||||||

Short-Term Investments - .0% | |||||||

U.S. Treasury Bills - .0% | |||||||

1.95%, 12/12/19 | 695,000 | d,e | 693,821 | ||||

1-Day | Shares | ||||||

Investment Companies - .4% | |||||||

Registered Investment Companies - .4% | |||||||

Dreyfus Institutional Preferred Government Plus Money Market Fund | 1.79 | 11,652,384 | f | 11,652,384 | |||

19

STATEMENT OF INVESTMENTS (continued)

Description | 1-Day | Shares | Value ($) | ||||

Investment of Cash Collateral for Securities Loaned - 1.5% | |||||||

Registered Investment Companies - 1.5% | |||||||

Dreyfus Institutional Preferred Government Plus Money Market Fund | 1.79 | 40,453,746 | f | 40,453,746 | |||

Total Investments(cost $1,896,430,144) | 101.6% | 2,787,250,040 | |||||

Liabilities, Less Cash and Receivables | (1.6%) | (43,864,802) | |||||

Net Assets | 100.0% | 2,743,385,238 | |||||

REIT—Real Estate Investment Trust

a Security, or portion thereof, on loan. At October 31, 2019, the value of the fund’s securities on loan was $513,973,737 and the value of the collateral was $529,218,633, consisting of cash collateral of $40,453,746 and U.S. Government & Agency securities valued at $488,764,887.

b Non-income producing security.

c Investment in real estate investment trust within the United States.

d Held by a counterparty for open exchange traded derivative contracts.

e Security is a discount security. Income is recognized through the accretion of discount.

f Investment in affiliated issuer. The investment objective of this investment company is publicly available and can be found within the investment company’s prospectus.

Portfolio Summary (Unaudited)† | Value (%) |

Financials | 16.6 |

Industrials | 16.5 |

Information Technology | 15.2 |

Consumer Discretionary | 12.4 |

Real Estate | 11.5 |

Health Care | 9.5 |

Materials | 6.1 |

Utilities | 4.7 |

Consumer Staples | 2.8 |

Communication Services | 2.3 |

Energy | 2.1 |

Investment Companies | 1.9 |

Government | .0 |

101.6 |

† Based on net assets.

See notes to financial statements.

20

STATEMENT OF INVESTMENTS IN AFFILIATED ISSUERS

Investment Companies | Value | Purchases ($) | Sales ($) | Value | Net | Dividends/ |

Registered Investment | ||||||

Dreyfus Institutional Preferred Government Plus Money Market Fund | 1,153,431 | 671,022,047 | 660,523,094 | 11,652,384 | .4 | 492,650 |

Investment of Cash | ||||||

Dreyfus Institutional Preferred Government Money Market Fund, Institutional Shares | 73,609,257 | 84,092,731 | 157,701,988 | - | - | - |

Dreyfus Institutional Preferred Government Plus Money Market Fund | - | 368,429,065 | 327,975,319 | 40,453,746 | 1.5 | - |

Total | 74,762,688 | 1,123,543,843 | 1,146,200,401 | 52,106,130 | 1.9 | 492,650 |

† Effective January 2, 2019, cash collateral for securities lending was transferred from Dreyfus Institutional Preferred Government Money Market Fund, Institutional Shares to Dreyfus Institutional Preferred Government Plus Money Market Fund.

See notes to financial statements.

21

STATEMENT OF FUTURES

October 31, 2019

Description | Number of | Expiration | Notional | Value ($) | Unrealized Appreciation ($) | |

Futures Long | ||||||

Standard & Poor's Midcap 400 E-mini | 57 | 12/19 | 10,934,598 | 11,143,500 | 208,902 | |

Gross Unrealized Appreciation | 208,902 | |||||

See notes to financial statements.

22

STATEMENT OF ASSETS AND LIABILITIES

October 31, 2019

|

|

|

|

|

|

|

|

|

| Cost |

| Value |

|

Assets ($): |

|

|

|

| ||

Investments in securities—See Statement of Investments |

|

|

| |||

Unaffiliated issuers | 1,844,324,014 |

| 2,735,143,910 |

| ||

Affiliated issuers |

| 52,106,130 |

| 52,106,130 |

| |

Dividends, interest and securities lending income receivable |

| 1,761,455 |

| |||

Receivable for shares of Common Stock subscribed |

| 1,709,665 |

| |||

|

|

|

|

| 2,790,721,160 |

|

Liabilities ($): |

|

|

|

| ||

Due to BNY Mellon Investment Adviser, Inc. and affiliates—Note 3(b) |

| 934,826 |

| |||

Liability for securities on loan—Note 1(b) |

| 40,453,746 |

| |||

Payable for shares of Common Stock redeemed |

| 3,137,897 |

| |||

Payable for investment securities purchased |

| 2,689,198 |

| |||

Payable for futures variation margin—Note 4 |

| 105,512 |

| |||

Directors fees and expenses payable |

| 14,743 |

| |||

|

|

|

|

| 47,335,922 |

|

Net Assets ($) |

|

| 2,743,385,238 |

| ||

Composition of Net Assets ($): |

|

|

|

| ||

Paid-in capital |

|

|

|

| 1,609,137,814 |

|

Total distributable earnings (loss) |

|

|

|

| 1,134,247,424 |

|

Net Assets ($) |

|

| 2,743,385,238 |

| ||

Net Asset Value Per Share | Investor Shares | Class I |

|

Net Assets ($) | 1,940,533,393 | 802,851,845 |

|

Shares Outstanding | 56,852,557 | 23,564,992 |

|

Net Asset Value Per Share ($) | 34.13 | 34.07 |

|

|

|

|

|

See notes to financial statements. |

|

|

|

23

STATEMENT OF OPERATIONS

Year Ended October 31, 2019

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investment Income ($): |

|

|

|

| ||

Income: |

|

|

|

| ||

Cash dividends (net of $24,692 foreign taxes withheld at source): |

| |||||

Unaffiliated issuers |

|

| 48,013,523 |

| ||

Affiliated issuers |

|

| 492,650 |

| ||

Income from securities lending—Note 1(b) |

|

| 1,038,254 |

| ||

Interest |

|

| 36,541 |

| ||

Total Income |

|

| 49,580,968 |

| ||

Expenses: |

|

|

|

| ||

Management fee—Note 3(a) |

|

| 7,298,762 |

| ||

Shareholder servicing costs—Note 3(b) |

|

| 5,154,485 |

| ||

Directors’ fees—Note 3(a,c) |

|

| 280,582 |

| ||

Loan commitment fees—Note 2 |

|

| 67,410 |

| ||

Interest expense—Note 2 |

|

| 8,728 |

| ||

Total Expenses |

|

| 12,809,967 |

| ||

Less—Directors’ fees reimbursed by |

|

| (280,582) |

| ||

Net Expenses |

|

| 12,529,385 |

| ||

Investment Income—Net |

|

| 37,051,583 |

| ||

Realized and Unrealized Gain (Loss) on Investments—Note 4 ($): |

|

| ||||

Net realized gain (loss) on investments | 244,673,519 |

| ||||

Net realized gain (loss) on futures | 2,550,374 |

| ||||

Net Realized Gain (Loss) |

|

| 247,223,893 |

| ||

Net change in unrealized appreciation (depreciation) on investments | (73,085,646) |

| ||||

Net change in unrealized appreciation (depreciation) on futures | 467,666 |

| ||||

Net Change in Unrealized Appreciation (Depreciation) |

|

| (72,617,980) |

| ||

Net Realized and Unrealized Gain (Loss) on Investments |

|

| 174,605,913 |

| ||

Net Increase in Net Assets Resulting from Operations |

| 211,657,496 |

| |||

|

|

|

|

|

|

|

See notes to financial statements. | ||||||

24

STATEMENT OF CHANGES IN NET ASSETS

|

|

|

| Year Ended October 31, | |||||

|

|

|

| 2019 |

| 2018 |

| ||

Operations ($): |

|

|

|

|

|

|

|

| |

Investment income—net |

|

| 37,051,583 |

|

|

| 42,541,015 |

| |

Net realized gain (loss) on investments |

| 247,223,893 |

|

|

| 313,844,577 |

| ||

Net change in unrealized appreciation |

| (72,617,980) |

|

|

| (309,613,052) |

| ||

Net Increase (Decrease) in Net Assets | 211,657,496 |

|

|

| 46,772,540 |

| |||

Distributions ($): |

| ||||||||

Distributions to shareholders: |

|

|

|

|

|

|

|

| |

Investor Shares |

|

| (244,574,349) |

|

|

| (227,034,189) |

| |

Class I |

|

| (108,705,932) |

|

|

| (90,220,636) |

| |

Total Distributions |

|

| (353,280,281) |

|

|

| (317,254,825) |

| |

Capital Stock Transactions ($): |

| ||||||||

Net proceeds from shares sold: |

|

|

|

|

|

|

|

| |

Investor Shares |

|

| 256,644,043 |

|

|

| 472,594,320 |

| |

Class I |

|

| 177,856,734 |

|

|

| 281,173,080 |

| |

Distributions reinvested: |

|

|

|

|

|

|

|

| |

Investor Shares |

|

| 239,293,099 |

|

|

| 223,247,292 |

| |

Class I |

|

| 54,360,648 |

|

|

| 37,285,087 |

| |

Cost of shares redeemed: |

|

|

|

|

|

|

|

| |

Investor Shares |

|

| (662,985,612) |

|

|

| (1,037,910,361) |

| |

Class I |

|

| (483,237,429) |

|

|

| (138,523,724) |

| |

Increase (Decrease) in Net Assets | (418,068,517) |

|

|

| (162,134,306) |

| |||

Total Increase (Decrease) in Net Assets | (559,691,302) |

|

|

| (432,616,591) |

| |||

Net Assets ($): |

| ||||||||

Beginning of Period |

|

| 3,303,076,540 |

|

|

| 3,735,693,131 |

| |

End of Period |

|

| 2,743,385,238 |

|

|

| 3,303,076,540 |

| |

Capital Share Transactions (Shares): |

| ||||||||

Investor Sharesa |

|

|

|

|

|

|

|

| |

Shares sold |

|

| 7,777,767 |

|

|

| 12,438,710 |

| |

Shares issued for distributions reinvested |

|

| 8,423,823 |

|

|

| 5,983,133 |

| |

Shares redeemed |

|

| (20,116,492) |

|

|

| (27,124,448) |

| |

Net Increase (Decrease) in Shares Outstanding | (3,914,902) |

|

|

| (8,702,605) |

| |||

Class Ia |

|

|

|

|

|

|

|

| |

Shares sold |

|

| 5,505,556 |

|

|

| 7,311,830 |

| |

Shares issued for distributions reinvested |

|

| 1,921,187 |

|

|

| 1,001,929 |

| |

Shares redeemed |

|

| (14,807,228) |

|

|

| (3,633,568) |

| |

Net Increase (Decrease) in Shares Outstanding | (7,380,485) |

|

|

| 4,680,191 |

| |||

|

|

|

|

|

|

|

|

|

|

aDuring the period ended October 31, 2019, 27,964 Class I shares representing $957,373 were automatically converted for 27,900 Investor shares and during the period ended October 31, 2018, 33,938 Class I shares representing $1,336,368 were automatically converted for 33,929 Investor shares.

| |||||||||

See notes to financial statements. | |||||||||

25

FINANCIAL HIGHLIGHTS

The following tables describe the performance for each share class for the fiscal periods indicated. All information (except portfolio turnover rate) reflects financial results for a single fund share. Total return shows how much your investment in the fund would have increased (or decreased) during each period, assuming you had reinvested all dividends and distributions. These figures have been derived from the fund’s financial statements.

Year Ended October 31, | ||||||||||

Investor Shares | 2019 | 2018 | 2017 | 2016a | 2015 | |||||

Per Share Data ($): | ||||||||||

Net asset value, | 36.02 | 39.03 | 35.17 | 37.70 | 39.13 | |||||

Investment Operations: | ||||||||||

Investment income—netb | .40 | .42 | .32 | .42 | .39 | |||||

Net realized and unrealized | 1.82 | (.11) | 7.30 | 1.45 | .81 | |||||

Total from Investment Operations | 2.22 | .31 | 7.62 | 1.87 | 1.20 | |||||

Distributions: | ||||||||||

Dividends from investment | (.44) | (.35) | (.38) | (.43) | (.40) | |||||

Dividends from net realized | (3.67) | (2.97) | (3.38) | (3.97) | (2.23) | |||||

Total Distributions | (4.11) | (3.32) | (3.76) | (4.40) | (2.63) | |||||

Net asset value, end of period | 34.13 | 36.02 | 39.03 | 35.17 | 37.70 | |||||

Total Return (%) | 8.48 | .52 | 22.89 | 5.79 | 2.98 | |||||

Ratios/Supplemental Data (%): | ||||||||||

Ratio of total expenses | .51 | .51 | .51 | .51 | .51 | |||||

Ratio of net expenses | .50 | .50 | .50 | .50 | .50 | |||||

Ratio of net investment income | 1.19 | 1.09 | .88 | 1.23 | 1.00 | |||||

Portfolio Turnover Rate | 15.37 | 15.73 | 24.48 | 21.68 | 19.45 | |||||

Net Assets, end of period ($ x 1,000) | 1,940,533 | 2,189,027 | 2,711,092 | 3,191,813 | 3,303,416 | |||||

a On August 31, 2016, the fund redesignated existing shares as Investor shares.

b Based on average shares outstanding.

See notes to financial statements.

26

Year Ended October 31, | ||||||||

Class I Shares | 2019 | 2018 | 2017 | 2016a | ||||

Per Share Data ($): | ||||||||

Net asset value, beginning of period | 36.00 | 39.01 | 35.18 | 36.39 | ||||

Investment Operations: | ||||||||

Investment income—netb | .48 | .50 | .42 | .02 | ||||

Net realized and unrealized | 1.81 | (.08) | 7.28 | (1.23) | ||||

Total from Investment Operations | 2.29 | .42 | 7.70 | (1.21) | ||||

Distributions: | ||||||||

Dividends from investment | (.55) | (.46) | (.49) | − | ||||

Dividends from net realized | (3.67) | (2.97) | (3.38) | − | ||||

Total Distributions | (4.22) | (3.43) | (3.87) | − | ||||

Net asset value, end of period | 34.07 | 36.00 | 39.01 | 35.18 | ||||

Total Return (%) | 8.76 | .79 | 23.17 | (3.33)c | ||||

Ratios/Supplemental Data (%): | ||||||||

Ratio of total expenses | .26 | .26 | .26 | .26d | ||||

Ratio of net expenses | .25 | .25 | .25 | .25d | ||||

Ratio of net investment income | 1.46 | 1.31 | 1.10 | .70d | ||||

Portfolio Turnover Rate | 15.37 | 15.73 | 24.48 | 21.68 | ||||

Net Assets, end of period ($ x 1,000) | 802,852 | 1,114,049 | 1,024,602 | 5,867 | ||||

a From August 31, 2016 (commencement of initial offering) to October 31, 2016.

b Based on average shares outstanding.

c Not annualized.

d Annualized.

See notes to financial statements.

27

NOTES TO FINANCIAL STATEMENTS

NOTE 1—Significant Accounting Policies:

BNY Mellon Midcap Index Fund, Inc. (the “fund”), which is registered under the Investment Company Act of 1940, as amended (the “Act”), is a non-diversified open-end management investment company. The fund’s investment objective is to seek to match the performance of the S&P’sMidCap 400® Index. BNY Mellon Investment Adviser, Inc. (the “Adviser”), a wholly-owned subsidiary of The Bank of New York Mellon Corporation (“BNY Mellon”), serves as the fund’s investment adviser.

Effective June 3, 2019, the fund changed its name from Dreyfus Midcap Index Fund, Inc. to BNY Mellon Midcap Index Fund, Inc. In addition, The Dreyfus Corporation, the fund’s investment adviser, changed its name to “BNY Mellon Investment Adviser, Inc.”, MBSC Securities Corporation, the fund’s distributor, changed its name to “BNY Mellon Securities Corporation” and Dreyfus Transfer, Inc., the fund’s transfer agent, changed its name to “BNY Mellon Transfer, Inc.”

BNY Mellon Securities Corporation (the “Distributor”), a wholly-owned subsidiary of the Adviser, is the distributor of the fund’s shares, which are sold without a sales charge. The fund is authorized to issue 300 million shares of $.001 par value Common Stock. The fund currently has authorized two classes of shares: Investor shares (200 million shares authorized) and Class I (100 million shares authorized). Investor shares are sold primarily to retail investors through financial intermediaries and bear Shareholder Services Plan fees. Class I shares are sold at net asset value per share generally to institutional investors. Other differences between the classes include the services offered to and the expenses borne by each class, and certain voting rights. Income, expenses (other than expenses attributable to a specific class), and realized and unrealized gains or losses on investments are allocated to each class of shares based on its relative net assets.

The Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) is the exclusive reference of authoritative U.S. generally accepted accounting principles (“GAAP”) recognized by the FASB to be applied by nongovernmental entities. Rules and interpretive releases of the Securities and Exchange Commission (“SEC”) under authority of federal laws are also sources of authoritative GAAP for SEC registrants. The fund is an investment company and applies the accounting and reporting guidance of the FASB ASC Topic 946 Financial Services-Investment Companies. The fund’s financial statements are prepared in accordance with GAAP, which may require the use of management

28

estimates and assumptions. Actual results could differ from those estimates.

The fundenters into contracts that contain a variety of indemnifications. The fund’s maximum exposure under these arrangements is unknown. The fund does not anticipate recognizing any loss related to these arrangements.

(a) Portfolio valuation: The fair value of a financial instrument is the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (i.e., the exit price). GAAP establishes a fair value hierarchy that prioritizes the inputs of valuation techniques used to measure fair value. This hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements).

Additionally, GAAP provides guidance on determining whether the volume and activity in a market has decreased significantly and whether such a decrease in activity results in transactions that are not orderly. GAAP requires enhanced disclosures around valuation inputs and techniques used during annual and interim periods.

Various inputs are used in determining the value of the fund’s investments relating to fair value measurements. These inputs are summarized in the three broad levels listed below:

Level 1—unadjusted quoted prices in active markets for identical investments.

Level 2—other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.).

Level 3—significant unobservable inputs (including the fund’s own assumptions in determining the fair value of investments).

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. Valuation techniques used to value the fund’s investments are as follows:

Investments in equity securities are valued at the last sales price on the securities exchange or national securities market on which such securities are primarily traded. Securities listed on the National Market System for which market quotations are available are valued at the official closing

29

NOTES TO FINANCIAL STATEMENTS(continued)

price or, if there is no official closing price that day, at the last sales price. For open short positions, asked prices are used for valuation purposes. Bid price is used when no asked price is available. Registered investment companies that are not traded on an exchange are valued at their net asset value. All of the preceding securities are generally categorized within Level 1 of the fair value hierarchy.

Securities not listed on an exchange or the national securities market, or securities for which there were no transactions, are valued at the average of the most recent bid and asked prices. U.S. Treasury Bills are valued at the mean price between quoted bid prices and asked prices by an independent pricing service (the “Service”) approved by the fund’s Board of Directors (the “Board”). These securities are generally categorized within Level 2 of the fair value hierarchy.

The Service is engaged under the general oversight of the Board.

Fair valuing of securities may be determined with the assistance of a pricing service using calculations based on indices of domestic securities and other appropriate indicators, such as prices of relevant American Depository Receipts and futures. Utilizing these techniques may result in transfers between Level 1 and Level 2 of the fair value hierarchy.

When market quotations or official closing prices are not readily available, or are determined not to accurately reflect fair value, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded (for example, a foreign exchange or market), but before the fund calculates its net asset value, the fund may value these investments at fair value as determined in accordance with the procedures approved by the Board. Certain factors may be considered when fair valuing investments such as: fundamental analytical data, the nature and duration of restrictions on disposition, an evaluation of the forces that influence the market in which the securities are purchased and sold, and public trading in similar securities of the issuer or comparable issuers. These securities are either categorized within Level 2 or 3 of the fair value hierarchy depending on the relevant inputs used.

For restricted securities where observable inputs are limited, assumptions about market activity and risk are used and such securities are generally categorized within Level 3 of the fair value hierarchy.

Futures, which are traded on an exchange, are valued at the last sales price on the securities exchange on which such securities are primarily traded or at the last sales price on the national securities market on each business day and are generally categorized within Level 1 of the fair value hierarchy.

30

The following is a summary of the inputs used as of October 31, 2019in valuing the fund’s investments:

Level 1 - | Level 2 – Other | Level 3 - | Total | |

Assets ($) | ||||

Investments in Securities: † | ||||

Equity Securities— | 2,734,450,089 | - | - | 2,734,450,089 |

Investment | 52,106,130 | - | - | 52,106,130 |

U.S. Treasury | - | 693,821 | - | 693,821 |

Other Financial Instruments: | ||||

Futures†† | 208,902 | - | - | 208,902 |

† See Statement of Investments for additional detailed categorizations, if any.

†† Amount shown represents unrealized appreciation at period end, but only variation margin on exchanged traded and centrally cleared derivatives, if any, are reported in the Statement of Assets and Liabilities.

(b)Securities transactions and investment income: Securities transactions are recorded on a trade date basis. Realized gains and losses from securities transactions are recorded on the identified cost basis. Dividend income is recognized on the ex-dividend date and interest income, including, where applicable, accretion of discount and amortization of premium on investments, is recognized on the accrual basis.

Pursuant to a securities lending agreement with The Bank of New York Mellon, a subsidiary of BNY Mellon and an affiliate of the Adviser, the fund may lend securities to qualified institutions. It is the fund’s policy that, at origination, all loans are secured by collateral of at least 102% of the value of U.S. securities loaned and 105% of the value of foreign securities loaned. Collateral equivalent to at least 100% of the market value of securities on loan is maintained at all times. Collateral is either in the form of cash, which can be invested in certain money market mutual funds managed by the Adviser, or U.S. Government and Agency securities. The fund is entitled to receive all dividends, interest and distributions on securities loaned, in addition to income earned as a result of the lending transaction. Should a borrower fail to return the securities in a timely manner, The Bank of New York Mellon is required to replace the securities for the benefit of the fund or credit the fund with the market value of the unreturned securities and is subrogated to the fund’s rights against the borrower and the collateral. Additionally, the contractual maturity of security lending transactions are on an overnight and continuous basis. During the period ended October 31, 2019, The Bank of

31

NOTES TO FINANCIAL STATEMENTS(continued)

New York Mellon earned $190,465 from the lending of the fund’s portfolio securities, pursuant to the securities lending agreement.

(c) Affiliated issuers: Investments in other investment companies advised by the Adviser are considered “affiliated” under the Act.

(d) Dividends and distributions to shareholders: Dividends and distributions are recorded on the ex-dividend date. Dividends from investment income-net and dividends from net realized capital gains, if any, are normally declared and paid annually, but the fund may make distributions on a more frequent basis to comply with the distribution requirements of the Internal Revenue Code of 1986, as amended (the “Code”). To the extent that net realized capital gains can be offset by capital loss carryovers, it is the policy of the fund not to distribute such gains. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

(e) Federal income taxes: It is the policy of the fund to continue to qualify as a regulated investment company, if such qualification is in the best interests of its shareholders, by complying with the applicable provisions of the Code, and to make distributions of taxable income and net realized capital gain sufficient to relieve it from substantially all federal income and excise taxes.

As of and during the period ended October 31, 2019, the fund did not have any liabilities for any uncertain tax positions. The fund recognizes interest and penalties, if any, related to uncertain tax positions as income tax expense in the Statement of Operations. During the period ended October 31, 2019, the fund did not incur any interest or penalties.

Each tax year in the four-year period ended October 31, 2019 remains subject to examination by the Internal Revenue Service and state taxing authorities.

At October 31, 2019, the components of accumulated earnings on a tax basis were as follows: undistributed ordinary income $27,560,346, undistributed capital gains $240,466,588 and unrealized appreciation $866,220,490.

The tax character of distributions paid to shareholders during the fiscal periods ended October 31, 2019 and October 31, 2018 were as follows: ordinary income $57,653,854 and $46,320,445, and long-term capital gains $295,626,427 and $270,934,380, respectively.

(f) New Accounting Pronouncements: Effective June 1, 2019, the fund adopted Accounting Standards Update 2018-13, Fair Value Measurement (Topic 820): Disclosure Framework—Changes to the Disclosure

32

Requirements for Fair Value Measurement (“ASU 2018-13”). The update provides guidance that eliminates, adds and modifies certain disclosure requirements for fair value measurements. The adoption of ASU 2018-13 had no impact on the operations of the fund for the period ended October 31, 2019.

NOTE 2—Bank Lines of Credit:

The fund participates with other long-term open-end funds managed by the Adviser in a $1.030 billion unsecured credit facility led by Citibank, N.A. (the “Citibank Credit Facility”) and a $300 million unsecured credit facility provided by The Bank of New York Mellon (the “BNYM Credit Facility”), each to be utilized primarily for temporary or emergency purposes, including the financing of redemptions (each, a “Facility”). The Citibank Credit Facility is available in two tranches: (i) Tranche A is in an amount equal to $830 million and is available to all long-term open-ended funds, including the fund, and (ii) Tranche B is in amount equal to $200 million and is available only to BNY Mellon Floating Rate Income Fund, a series of BNY Mellon Investment Funds IV, Inc. In connection therewith, the fund has agreed to pay its pro rata portion of commitment fees for Tranche A of the Citibank Credit Facility and the BNYM Credit Facility. Interest is charged to the fund based on rates determined pursuant to the terms of the respective Facility at the time of borrowing.

The average amount of borrowings outstanding under the Facilities during the period ended October 31, 2019 was approximately $264,930 with a related weighted average annualized interest rate of 3.29%.

NOTE 3—Management Fee and Other Transactions with Affiliates:

(a)Pursuant to a management agreement with the Adviser, the management fee is computed at the annual rate of .25% of the value of the fund’s average daily net assets and is payable monthly. Out of its fee, the Adviser pays all of the expenses of the fund except management fees, Shareholder Services Plan fees, brokerage fees and commissions, taxes, interest expense, commitment fees on borrowings, fees and expenses of the interested Directors (including counsel fees) and extraordinary expenses. In addition, the Adviser required to reduce its fee in an amount equal to the fund’s allocable portion of fees and expenses of the non-interested Directors (including counsel fees). During the period ended October 31, 2019, fees reimbursed by the Adviser amounted to $280,582.

(b)Under the Shareholder Services Plan, Investor shares pay the Distributor at an annual rate of .25% of the value of its average daily net assets for the provision of certain services. The services provided may

33

NOTES TO FINANCIAL STATEMENTS(continued)

include personal services relating to shareholder accounts, such as answering shareholder inquiries regarding the fund and providing reports and other information, and services related to the maintenance of shareholder accounts, such as recordkeeping and sub-accounting services. The Distributor may make payments to Service Agents (securities dealers, financial institutions or other industry professionals) with respect to these services. The Distributor determines the amounts to be paid to Service Agents. During the period ended October 31, 2019,the fund was charged $5,154,485 pursuant to the Shareholder Services Plan.

The components of “Due to BNY Mellon Investment Adviser, Inc. and affiliates” in the Statement of Assets and Liabilities consist of: management fees of $576,850 and Shareholder Services Plan fees of $408,476, which are offset against an expense reimbursement currently in effect in the amount of $50,500.

(c) Each Board member also serves as a Board member of other funds in the BNY Mellon Family of Funds complex. Annual retainer fees and attendance fees are allocated to each fund based on net assets.

NOTE 4—Securities Transactions:

The aggregate amount of purchases and sales of investment securities, excluding short-term securities and futures, during the period ended October 31, 2019, amounted to $446,229,846 and $1,151,844,810, respectively.

Derivatives:A derivative is a financial instrument whose performance is derived from the performance of another asset. Each type of derivative instrument that was held by the fund during the period ended October 31, 2019 is discussed below.

Futures:In the normal course of pursuing its investment objective, the fund is exposed to market risk, including equity price risk,as a result of changes in value of underlying financial instruments. The fund invests in futures in order to manage its exposure to or protect against changes in the market. A futures contract represents a commitment for the future purchase or a sale of an asset at a specified date. Upon entering into such contracts, these investments require initial margin deposits with a counterparty, which consist of cash or cash equivalents. The amount of these deposits is determined by the exchange or Board of Trade on which the contract is traded and is subject to change. Accordingly, variation margin payments are received or made to reflect daily unrealized gains or losses which are recorded in the Statement of Operations. When the contracts are closed, the fund recognizes a realized gain or loss which is reflected in the Statement of Operations. There is minimal counterparty

34

credit risk to the fund with futures since they are exchange traded, and the exchange guarantees the futures against default. Futures open at October 31, 2019 are set forth in the Statement of Futures.

The following summarizes the average market value of derivatives outstanding duringthe period ended October 31, 2019:

|

| Average Market Value ($) |

Equity futures |

| 28,195,495 |

|

|

|