UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| Investment Company Act file number | 811-06325 |

| | |

| | BNY Mellon Midcap Index Fund, Inc. | |

| | (Exact name of Registrant as specified in charter) | |

| | | |

| | c/o BNY Mellon Investment Adviser, Inc. 240 Greenwich Street New York, New York 10286 | |

| | (Address of principal executive offices) (Zip code) | |

| | | |

| | Deirdre Cunnane, Esq. 240 Greenwich Street New York, New York 10286 | |

| | (Name and address of agent for service) | |

| |

| Registrant's telephone number, including area code: | (212) 922-6400 |

| | |

Date of fiscal year end: | 10/31 | |

| Date of reporting period: | 10/31/2021 | |

| | | | | | | |

FORM N-CSR

Item 1. Reports to Stockholders.

BNY Mellon Midcap Index Fund, Inc.

| |

ANNUAL REPORT October 31, 2021 |

| |

Save time. Save paper. View your next shareholder report online as soon as it’s available. Log into www.im.bnymellon.com and sign up for eCommunications. It’s simple and only takes a few minutes. |

| |

The views expressed in this report reflect those of the portfolio manager(s) only through the end of the period covered and do not necessarily represent the views of BNY Mellon Investment Adviser, Inc. or any other person in the BNY Mellon Investment Adviser, Inc. organization. Any such views are subject to change at any time based upon market or other conditions and BNY Mellon Investment Adviser, Inc. disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund in the BNY Mellon Family of Funds are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund in the BNY Mellon Family of Funds. |

| |

Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value |

Contents

T H E F U N D

F O R M O R E I N F O R M AT I O N

Back Cover

DISCUSSION OF FUND PERFORMANCE (Unaudited)

For the period from November 1, 2020 through October 31, 2021, as provided by David France, CFA, Todd Frysinger, CFA, Vlasta Sheremeta, CFA, Michael Stoll, and Marlene Walker Smith, Portfolio Managers

Market and Fund Performance Overview

For the 12-month period ended October 31, 2021, BNY Mellon Midcap Index Fund, Inc.’s Investor shares produced a total return of 48.22%, and its Class I shares returned 48.61%.1 In comparison, the S&P MidCap 400® Index (the “Index”), the fund’s benchmark, produced a total return of 48.90% for the same period.2,3

Mid-cap equities rose during the reporting period, supported by government stimulus programs, accommodative central bank policies, strong corporate earnings and improving investor sentiment as vaccines for the COVID-19 pandemic rolled out. The difference in returns between the fund and the Index resulted primarily from transaction costs and operating expenses that are not reflected in Index results.

The Fund’s Investment Approach

The fund seeks to match the performance of the Index. To pursue its goal, the fund generally is fully invested in stocks included in the Index and in futures whose performance is tied to the Index. The fund generally invests in all 400 stocks in the Index, in proportion to their weighting in the Index.

The Index is an unmanaged index of 400 common stocks of medium-sized companies. S&P weights each company’s stock in the Index by its market capitalization (i.e., the share price times the number of shares outstanding), adjusted by the number of available float shares (i.e., those shares available to public investors). Companies included in the Index generally have market capitalizations ranging between approximately $3.2 billion and $9.8 billion, to the extent consistent with market conditions.

Stocks Gain on Economic Growth and Government Stimulus

Investor sentiment turned optimistic in November 2020 with the resolution in the U.S. presidential election and progress toward a COVID-19 vaccine. Vaccine approvals and passage of the latest in a series of pandemic-related U.S. fiscal stimulus packages in December helped to support the stock market rally into the new year. A strong risk-on rally ensued, particularly in areas of the market that had been hard hit by the pandemic, such as travel and leisure names.

2

In 2021, equity strength rotated out of technology and growth stocks benefiting from the pandemic into COVID-19-sensitive sectors of the market, which had previously lagged, as well as cyclical and value-oriented areas of the market on the theory that these sectors were offering more attractive valuations and would benefit most from economic reopening. The Index continued to gain ground despite increasing inflationary pressures, weakening consumer confidence, disappointing employment numbers, and the spread of the Delta variant of the virus. Stocks dipped in September as U.S. economic growth showed evidence of slowing, and the U.S. Federal Reserve (the “Fed”) raised its inflation estimates while stating its intention to begin tapering its quantitative easing program in November. However, equities rebounded in October as a majority of companies reported better-than-expected earnings. By the end of the period, the Index had once more reached new record territory. For the period as a whole, mid-cap stocks tended to outperform their large-cap counterparts.

Energy and Financials Lead the Market

Oil and gas prices soared during the period in response to increasing demand from economic reopenings and pandemic-related supply bottlenecks. Most energy stocks benefited, with the sector leading the Index higher. Within financials, the next-best performing sector, banking profitability was supported by the steepening yield curve, rising interest rates, high levels of capital market trading and volatility, and increasing numbers of mergers and acquisitions. Information technology, the largest sector in the Index, also outperformed as a wide range of technology-based products and services were increasingly integrated into corporate and daily life.

The weakest-performing sectors in the Index included utilities and consumer staples. Utilities were hurt by rising energy costs, which many were unable to pass along to consumers due to regulatory constraints. Climate change-related extreme weather events in some areas, such as Texas, further undermined utility company profitability. Consumer staples companies faced increasing costs as supply-chain disruptions and rising inflationary pressures drove prices for agricultural products and industrial materials higher.

Replicating the Performance of the Index

In seeking to match the performance of the Index, we do not actively manage investments in response to macroeconomic trends. We note, however, that equity markets are likely to face a number of headwinds in the coming months, making the exceptionally strong returns of the current reporting period less likely to be repeated in the near future. Increasing inflationary pressures, driven by strong demand and supply-chain disruptions, have increased the possibility that the Fed may soon taper its asset-buying program and eventually begin to raise interest rates, removing some support for equity markets and signaling a phase of slower economic

3

DISCUSSION OF FUND PERFORMANCE (Unaudited) (continued)

growth. Mid-cap stocks have historically been more vulnerable to economic slowdowns than larger-cap issues. At the same time, we see no indications of an end to the current growth cycle as global economies continue to reopen in the wake of the pandemic, potentially setting the stage for further market appreciation. As always, we continue to monitor factors that affect the fund’s investments.

November 15, 2021

¹ DUE TO RECENT MARKET VOLATILITY, CURRENT PERFORMANCE MAY BE DIFFERENT THAN THE FIGURES SHOWN. Investors should note that the fund’s short-term performance is highly unusual, in part due to unusually favorable market conditions, and is unlikely to be repeated or consistently achieved in the future. Total return includes reinvestment of dividends and any capital gains paid. The fund’s return reflects the absorption of certain fund expenses by BNY Mellon Investment Adviser, Inc. pursuant to an agreement. Had these expenses not been absorbed, returns would have been lower. Past performance is no guarantee of future results. Share price and investment return fluctuate such that upon redemption, fund shares may be worth more or less than their original cost.

² Source: Lipper Inc. — The S&P MidCap 400® Index provides investors with a benchmark for midsized companies. The Index measures the performance of midsized companies, reflecting the distinctive risk and return characteristics of this market segment. Investors cannot invest directly in any index.

3 “Standard & Poor’s®,” “S&P®,” and “S&P MidCap 400®” are registered trademarks of Standard & Poor’s Financial Services LLC and have been licensed for use on behalf of the fund. The fund is not sponsored, endorsed, managed, advised, sold or promoted by Standard & Poor’s and its affiliates, and Standard & Poor’s and its affiliates make no representation regarding the advisability of investing in the fund.

Equities are subject generally to market, market sector, market liquidity, issuer and investment style risks, among other factors, to varying degrees, all of which are more fully described in the fund’s prospectus.

The fund uses an indexing strategy. It does not attempt to manage market volatility, use defensive strategies or reduce the effects of any long-term periods of poor stock performance.

Recent market risks include pandemic risks related to COVID-19. The effects of COVID-19 have contributed to increased volatility in global markets and will likely affect certain countries, companies, industries and market sectors more dramatically than others. To the extent the fund may overweight its investments in certain countries, companies, industries or market sectors, such positions will increase the fund’s exposure to risk of loss from adverse developments affecting those countries, companies, industries or sectors.

The prices of mid-cap company stocks tend to be more volatile than the prices of large company stocks, mainly because these companies have less established and more volatile earnings histories. They also tend to be less liquid than larger company stocks.

The fund may, but is not required, to use derivative instruments. A small investment in derivatives could have a potentially large impact on the fund’s performance. The use of derivatives involves risks different from, or possibly greater than, the risks associated with investing directly in the underlying assets.

4

FUND PERFORMANCE (Unaudited)

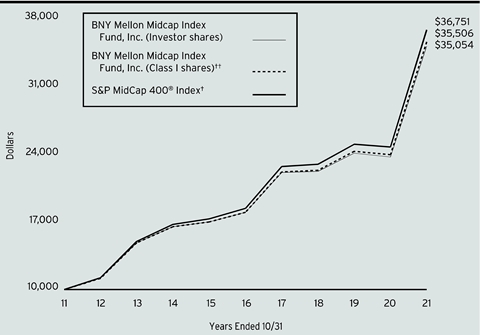

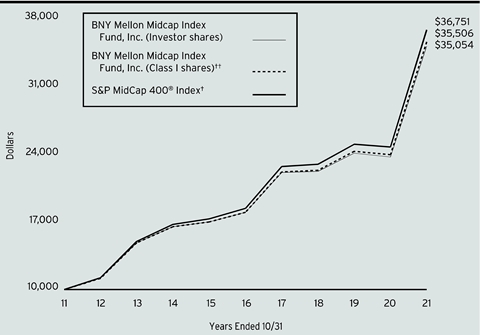

Comparison of change in value of a $10,000 investment in Investor shares and Class I shares of BNY Mellon Midcap Index Fund, Inc. with a hypothetical investment of $10,000 in the S&P MidCap 400® Index (the “Index”).

† Source: Lipper Inc.

†† The total return figures presented for Class I shares of the fund reflect the performance of the fund’s Investor shares for the period prior to 8/31/16 (the inception date for Class I shares).

Past performance is not predictive of future performance.

The above graph compares a hypothetical investment of $10,000 made in each of the Investor shares and Class I shares of BNY Mellon Midcap Index Fund, Inc. on 10/31/11 to a hypothetical investment of $10,000 made in the Index on that date. All dividends and capital gain distributions are reinvested.

The fund’s performance shown in the line graph above takes into account all applicable fees and expenses. The Index provides investors with a benchmark for mid-sized companies. The Index measures the performance of mid-sized companies, reflecting the distinctive risk and return characteristics of this market segment. Unlike a mutual fund, the Index is not subject to charges, fees and other expenses. Investors cannot invest directly in any index. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

5

FUND PERFORMANCE (Unaudited) (continued)

| | | | | | |

Average Annual Total Returns as of 10/31/2021 | |

| Inception

Date | 1 Year | 5 Years | 10 Years |

Investor Shares | 6/19/1991 | 48.22% | 14.33% | 13.36% |

Class I | 8/31/2016 | 48.61% | 14.61%† | 13.51%† |

S&P MidCap 400® Index | | 48.90% | 14.89% | 13.90% |

† The total return performance figures presented for Class I shares of the fund reflect the performance of the fund’s Investor shares for the period prior to 8/31/16 (the inception date for Class I shares).

The performance data quoted represents past performance, which is no guarantee of future results. Share price and investment return fluctuate and an investor’s shares may be worth more or less than original cost upon redemption. Current performance may be lower or higher than the performance quoted. Go to www.im.bnymellon.com for the fund’s most recent month-end returns.

The fund’s performance shown in the graph and table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

6

UNDERSTANDING YOUR FUND’S EXPENSES (Unaudited)

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You also may pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial adviser.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in BNY Mellon Midcap Index Fund, Inc. from May 1, 2021 to October 31, 2021. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| | | | | |

Expenses and Value of a $1,000 Investment | |

Assume actual returns for the six months ended October 31, 2021 | |

| | | | |

| | Investor Shares | Class I | |

Expenses paid per $1,000† | $2.56 | $1.28 | |

Ending value (after expenses) | $1,029.00 | $1,030.40 | |

COMPARING YOUR FUND’S EXPENSES

WITH THOSE OF OTHER FUNDS (Unaudited)

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (“SEC”) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| | | | | |

Expenses and Value of a $1,000 Investment | |

Assuming a hypothetical 5% annualized return for the six months ended October 31, 2021 | |

| | | | |

| | Investor Shares | Class I | |

Expenses paid per $1,000† | $2.55 | $1.28 | |

Ending value (after expenses) | $1,022.68 | $1,023.95 | |

† | Expenses are equal to the fund’s annualized expense ratio of .50% for Investor Shares and .25% for Class I, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

7

STATEMENT OF INVESTMENTS

October 31, 2021

| | | | | | | | |

| |

Description | | | | Shares | | Value ($) | |

Common Stocks - 100.3% | | | | | |

Automobiles & Components - 2.2% | | | | | |

Adient | | | | 94,038 | a | 3,913,862 | |

Dana | | | | 143,913 | | 3,193,429 | |

Fox Factory Holding | | | | 42,076 | a | 6,772,132 | |

Gentex | | | | 238,921 | | 8,455,414 | |

Harley-Davidson | | | | 152,735 | | 5,573,300 | |

Lear | | | | 59,403 | | 10,208,406 | |

The Goodyear Tire & Rubber Company | | | | 280,695 | a | 5,366,888 | |

Thor Industries | | | | 55,340 | | 5,642,466 | |

Visteon | | | | 27,697 | a | 3,134,746 | |

| | | | | 52,260,643 | |

Banks - 7.9% | | | | | |

Associated Banc-Corp | | | | 153,935 | | 3,429,672 | |

Bank of Hawaii | | | | 40,713 | | 3,440,249 | |

Bank OZK | | | | 121,708 | | 5,436,696 | |

Cadence Bank | | | | 190,887 | | 5,539,541 | |

Cathay General Bancorp | | | | 77,408 | | 3,265,844 | |

CIT Group | | | | 99,037 | | 4,905,303 | |

Commerce Bancshares | | | | 106,263 | | 7,492,604 | |

Cullen/Frost Bankers | | | | 56,624 | | 7,332,808 | |

East West Bancorp | | | | 141,114 | | 11,215,741 | |

Essent Group | | | | 111,056 | | 5,330,688 | |

F.N.B. | | | | 318,847 | | 3,714,568 | |

First Financial Bankshares | | | | 128,032 | | 6,493,783 | |

First Horizon | | | | 549,360 | | 9,322,639 | |

Fulton Financial | | | | 164,498 | | 2,648,418 | |

Glacier Bancorp | | | | 107,250 | | 5,929,852 | |

Hancock Whitney | | | | 86,702 | | 4,290,015 | |

Home BancShares | | | | 150,619 | | 3,578,707 | |

International Bancshares | | | | 53,759 | | 2,279,382 | |

MGIC Investment | | | | 338,955 | | 5,477,513 | |

New York Community Bancorp | | | | 464,729 | | 5,776,581 | |

PacWest Bancorp | | | | 117,100 | | 5,558,737 | |

Pinnacle Financial Partners | | | | 76,082 | | 7,347,239 | |

Prosperity Bancshares | | | | 92,883 | | 6,995,019 | |

Signature Bank | | | | 60,345 | | 17,971,948 | |

Sterling Bancorp | | | | 191,226 | | 4,866,702 | |

Synovus Financial | | | | 146,371 | | 6,819,425 | |

Texas Capital Bancshares | | | | 50,082 | a | 3,034,969 | |

UMB Financial | | | | 42,677 | | 4,217,341 | |

Umpqua Holdings | | | | 219,802 | | 4,494,951 | |

United Bankshares | | | | 128,187 | | 4,741,637 | |

8

| | | | | | | | |

| |

Description | | | | Shares | | Value ($) | |

Common Stocks - 100.3% (continued) | | | | | |

Banks - 7.9% (continued) | | | | | |

Valley National Bancorp | | | | 406,227 | | 5,386,570 | |

Washington Federal | | | | 68,641 | | 2,427,146 | |

Webster Financial | | | | 90,487 | | 5,063,653 | |

Wintrust Financial | | | | 56,612 | | 5,010,162 | |

| | | | | 190,836,103 | |

Capital Goods - 12.7% | | | | | |

Acuity Brands | | | | 35,685 | | 7,330,770 | |

AECOM | | | | 144,072 | a | 9,850,203 | |

AGCO | | | | 61,806 | | 7,553,311 | |

Axon Enterprise | | | | 65,323 | a | 11,755,527 | |

Builders FirstSource | | | | 206,093 | a | 12,009,039 | |

Carlisle | | | | 51,840 | | 11,556,173 | |

Colfax | | | | 128,661 | a | 6,641,481 | |

Crane | | | | 49,771 | | 5,140,349 | |

Curtiss-Wright | | | | 40,582 | | 5,181,510 | |

Donaldson | | | | 125,545 | | 7,533,955 | |

Dycom Industries | | | | 30,411 | a | 2,415,242 | |

EMCOR Group | | | | 53,722 | | 6,526,686 | |

EnerSys | | | | 42,098 | | 3,369,524 | |

Flowserve | | | | 129,256 | | 4,345,587 | |

Fluor | | | | 142,087 | a | 2,762,171 | |

GATX | | | | 35,163 | | 3,335,211 | |

Graco | | | | 168,841 | | 12,693,466 | |

Hexcel | | | | 83,759 | a | 4,752,486 | |

Hubbell | | | | 54,072 | | 10,780,335 | |

ITT | | | | 86,078 | | 8,097,357 | |

Kennametal | | | | 83,349 | | 3,313,123 | |

Lennox International | | | | 34,002 | | 10,176,119 | |

Lincoln Electric Holdings | | | | 59,377 | | 8,455,285 | |

MasTec | | | | 57,396 | a | 5,115,705 | |

Mercury Systems | | | | 56,528 | a | 2,913,453 | |

MSC Industrial Direct, Cl. A | | | | 46,579 | | 3,915,897 | |

Nordson | | | | 53,779 | | 13,671,160 | |

nVent Electric | | | | 167,945 | | 5,953,650 | |

Oshkosh | | | | 68,613 | | 7,341,591 | |

Owens Corning | | | | 103,134 | | 9,633,747 | |

Regal Rexnord | | | | 67,462 | | 10,276,486 | |

Simpson Manufacturing | | | | 43,382 | | 4,602,396 | |

Sunrun | | | | 204,787 | a | 11,812,114 | |

Terex | | | | 70,368 | | 3,152,486 | |

The Middleby | | | | 55,306 | a | 10,090,027 | |

The Timken Company | | | | 69,091 | | 4,902,006 | |

The Toro Company | | | | 106,464 | | 10,164,118 | |

9

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | |

| |

Description | | | | Shares | | Value ($) | |

Common Stocks - 100.3% (continued) | | | | | |

Capital Goods - 12.7% (continued) | | | | | |

Trex | | | | 114,706 | a | 12,204,718 | |

Trinity Industries | | | | 81,769 | | 2,293,620 | |

Univar Solutions | | | | 169,505 | a | 4,335,938 | |

Valmont Industries | | | | 21,188 | | 5,063,084 | |

Watsco | | | | 32,972 | | 9,548,032 | |

Woodward | | | | 63,197 | | 7,138,101 | |

| | | | | 309,703,239 | |

Commercial & Professional Services - 3.4% | | | | | |

ASGN | | | | 52,864 | a | 6,325,706 | |

CACI International, Cl. A | | | | 23,535 | a | 6,769,607 | |

Clean Harbors | | | | 50,001 | a | 5,627,113 | |

FTI Consulting | | | | 34,232 | a | 4,926,669 | |

IAA | | | | 134,761 | a | 8,038,494 | |

Insperity | | | | 35,604 | | 4,450,500 | |

KAR Auction Services | | | | 120,356 | a | 1,765,623 | |

KBR | | | | 140,661 | | 5,969,653 | |

ManpowerGroup | | | | 54,195 | | 5,237,947 | |

MillerKnoll | | | | 73,684 | | 2,867,781 | |

MSA Safety | | | | 36,411 | | 5,571,975 | |

Science Applications International | | | | 57,526 | | 5,164,684 | |

Stericycle | | | | 91,796 | a | 6,142,988 | |

Tetra Tech | | | | 54,066 | | 9,497,234 | |

The Brink's Company | | | | 49,651 | | 3,419,961 | |

| | | | | 81,775,935 | |

Consumer Durables & Apparel - 4.8% | | | | | |

Brunswick | | | | 77,481 | | 7,212,706 | |

Callaway Golf | | | | 117,948 | a | 3,190,493 | |

Capri Holdings | | | | 151,069 | a | 8,042,914 | |

Carter's | | | | 43,650 | | 4,300,398 | |

Columbia Sportswear | | | | 35,137 | | 3,648,626 | |

Crocs | | | | 62,383 | a | 10,071,735 | |

Deckers Outdoor | | | | 27,507 | a | 10,873,792 | |

Helen of Troy | | | | 23,923 | a | 5,381,479 | |

KB Home | | | | 89,135 | | 3,578,770 | |

Mattel | | | | 348,769 | a | 7,606,652 | |

Polaris | | | | 56,932 | | 6,544,333 | |

Skechers USA, CI. A | | | | 133,958 | a | 6,190,199 | |

Taylor Morrison Home | | | | 124,120 | a | 3,789,384 | |

Tempur Sealy International | | | | 195,347 | | 8,687,081 | |

Toll Brothers | | | | 115,215 | | 6,932,487 | |

TopBuild | | | | 32,919 | a | 8,459,195 | |

Tri Pointe Homes | | | | 114,917 | a | 2,779,842 | |

10

| | | | | | | | |

| |

Description | | | | Shares | | Value ($) | |

Common Stocks - 100.3% (continued) | | | | | |

Consumer Durables & Apparel - 4.8% (continued) | | | | | |

YETI Holdings | | | | 86,900 | a | 8,544,877 | |

| | | | | 115,834,963 | |

Consumer Services - 3.9% | | | | | |

Boyd Gaming | | | | 81,528 | a | 5,199,856 | |

Choice Hotels International | | | | 32,977 | | 4,637,226 | |

Churchill Downs | | | | 34,666 | | 7,973,180 | |

Cracker Barrel Old Country Store | | | | 23,666 | | 3,151,601 | |

Graham Holdings, Cl. B | | | | 4,020 | | 2,355,117 | |

Grand Canyon Education | | | | 44,804 | a | 3,570,879 | |

H&R Block | | | | 176,598 | | 4,074,116 | |

Jack in the Box | | | | 21,885 | | 2,165,521 | |

Marriott Vacations Worldwide | | | | 42,688 | | 6,711,407 | |

Papa John's International | | | | 32,258 | | 4,002,573 | |

Scientific Games | | | | 95,675 | a | 7,658,784 | |

Service Corp. International | | | | 166,636 | | 11,412,900 | |

Six Flags Entertainment | | | | 76,565 | a | 3,149,118 | |

Texas Roadhouse | | | | 69,346 | | 6,158,618 | |

The Wendy's Company | | | | 178,726 | | 3,985,590 | |

Travel + Leisure | | | | 86,182 | | 4,683,130 | |

Wingstop | | | | 29,708 | | 5,123,739 | |

Wyndham Hotels & Resorts | | | | 93,500 | | 7,897,945 | |

| | | | | 93,911,300 | |

Diversified Financials - 3.5% | | | | | |

Affiliated Managers Group | | | | 41,180 | | 6,913,298 | |

Evercore, Cl. A | | | | 39,387 | | 5,980,522 | |

FactSet Research Systems | | | | 37,591 | | 16,686,269 | |

Federated Hermes | | | | 96,163 | | 3,203,190 | |

FirstCash | | | | 40,354 | | 3,570,118 | |

Interactive Brokers Group, Cl. A | | | | 86,754 | | 6,146,521 | |

Janus Henderson Group | | | | 171,269 | | 7,964,008 | |

Jefferies Financial Group | | | | 197,579 | | 8,495,897 | |

Navient | | | | 166,227 | | 3,274,672 | |

PROG Holdings | | | | 65,823 | | 2,662,540 | |

SEI Investments | | | | 107,157 | | 6,755,177 | |

SLM | | | | 303,590 | | 5,570,876 | |

Stifel Financial | | | | 104,757 | | 7,633,643 | |

| | | | | 84,856,731 | |

Energy - 2.2% | | | | | |

Antero Midstream | | | | 326,213 | | 3,470,906 | |

ChampionX | | | | 200,275 | a | 5,253,213 | |

CNX Resources | | | | 215,742 | a | 3,151,991 | |

DT Midstream | | | | 96,724 | | 4,638,883 | |

EQT | | | | 299,600 | a | 5,965,036 | |

11

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | |

| |

Description | | | | Shares | | Value ($) | |

Common Stocks - 100.3% (continued) | | | | | |

Energy - 2.2% (continued) | | | | | |

Equitrans Midstream | | | | 403,264 | | 4,157,652 | |

HollyFrontier | | | | 149,317 | | 5,046,915 | |

Murphy Oil | | | | 144,886 | | 4,032,177 | |

NOV | | | | 378,609 | a | 5,308,098 | |

Targa Resources | | | | 227,442 | | 12,434,254 | |

| | | | | 53,459,125 | |

Food & Staples Retailing - 1.1% | | | | | |

BJ's Wholesale Club Holdings | | | | 137,095 | a | 8,011,832 | |

Casey's General Stores | | | | 37,009 | | 7,088,704 | |

Grocery Outlet Holding | | | | 86,128 | a | 1,911,180 | |

Performance Food Group | | | | 152,675 | a | 6,905,490 | |

Sprouts Farmers Market | | | | 115,328 | a | 2,553,362 | |

| | | | | 26,470,568 | |

Food, Beverage & Tobacco - 2.0% | | | | | |

Darling Ingredients | | | | 161,203 | a | 13,624,878 | |

Flowers Foods | | | | 197,518 | | 4,888,570 | |

Ingredion | | | | 66,961 | | 6,376,696 | |

Lancaster Colony | | | | 19,957 | | 3,392,690 | |

Pilgrim's Pride | | | | 49,768 | a | 1,401,467 | |

Post Holdings | | | | 58,576 | a | 5,944,292 | |

Sanderson Farms | | | | 21,030 | | 3,984,134 | |

The Boston Beer Company, Cl. A | | | | 9,399 | a | 4,628,820 | |

The Hain Celestial Group | | | | 84,084 | a | 3,772,849 | |

Tootsie Roll Industries | | | | 16,788 | | 531,340 | |

| | | | | 48,545,736 | |

Health Care Equipment & Services - 6.7% | | | | | |

Acadia Healthcare | | | | 89,187 | a | 5,529,594 | |

Amedisys | | | | 32,393 | a | 5,485,431 | |

Chemed | | | | 15,724 | | 7,582,899 | |

Encompass Health | | | | 99,469 | | 6,322,250 | |

Envista Holdings | | | | 160,146 | a | 6,261,709 | |

Globus Medical, Cl. A | | | | 77,758 | a | 6,000,585 | |

Haemonetics | | | | 50,499 | a | 3,469,786 | |

HealthEquity | | | | 82,778 | a | 5,478,248 | |

Hill-Rom Holdings | | | | 65,442 | | 10,136,966 | |

ICU Medical | | | | 19,777 | a | 4,630,389 | |

Integra LifeSciences Holdings | | | | 72,177 | a | 4,796,883 | |

LHC Group | | | | 31,624 | a | 4,256,274 | |

LivaNova | | | | 52,662 | a | 4,040,229 | |

Masimo | | | | 50,392 | a | 14,288,148 | |

Molina Healthcare | | | | 58,113 | a | 17,185,176 | |

Neogen | | | | 106,600 | a | 4,510,246 | |

NuVasive | | | | 51,513 | a | 2,748,734 | |

12

| | | | | | | | |

| |

Description | | | | Shares | | Value ($) | |

Common Stocks - 100.3% (continued) | | | | | |

Health Care Equipment & Services - 6.7% (continued) | | | | | |

Option Care Health | | | | 137,219 | a | 3,750,195 | |

Patterson Companies | | | | 85,923 | | 2,685,953 | |

Penumbra | | | | 34,387 | a | 9,509,725 | |

Progyny | | | | 68,195 | a | 4,189,219 | |

Quidel | | | | 37,598 | a | 4,991,886 | |

R1 RCM | | | | 132,497 | a | 2,875,185 | |

STAAR Surgical | | | | 47,455 | a | 5,621,519 | |

Tandem Diabetes Care | | | | 61,686 | a | 8,409,652 | |

Tenet Healthcare | | | | 107,013 | a | 7,668,552 | |

| | | | | 162,425,433 | |

Household & Personal Products - .3% | | | | | |

Coty, Cl. A | | | | 323,706 | a | 2,745,027 | |

Energizer Holdings | | | | 63,319 | | 2,309,244 | |

Nu Skin Enterprises, Cl. A | | | | 49,475 | | 1,986,421 | |

| | | | | 7,040,692 | |

Insurance - 3.7% | | | | | |

Alleghany | | | | 13,870 | a | 9,034,641 | |

American Financial Group | | | | 66,102 | | 8,992,516 | |

Brighthouse Financial | | | | 82,422 | a | 4,140,057 | |

CNO Financial Group | | | | 126,549 | | 3,054,893 | |

First American Financial | | | | 109,890 | | 8,037,355 | |

Kemper | | | | 59,292 | | 3,763,856 | |

Kinsale Capital Group | | | | 21,387 | | 4,002,577 | |

Mercury General | | | | 26,129 | | 1,423,769 | |

Old Republic International | | | | 284,199 | | 7,340,860 | |

Primerica | | | | 39,442 | | 6,635,722 | |

Reinsurance Group of America | | | | 67,986 | | 8,027,787 | |

RenaissanceRe Holdings | | | | 47,080 | | 6,675,944 | |

RLI | | | | 39,723 | | 4,302,398 | |

Selective Insurance Group | | | | 60,022 | | 4,703,924 | |

The Hanover Insurance Group | | | | 35,422 | | 4,463,172 | |

Unum Group | | | | 198,066 | | 5,044,741 | |

| | | | | 89,644,212 | |

Materials - 6.0% | | | | | |

AptarGroup | | | | 65,949 | | 7,965,320 | |

Ashland Global Holdings | | | | 56,069 | | 5,383,185 | |

Avient | | | | 91,151 | | 4,911,216 | |

Cabot | | | | 56,541 | | 3,016,462 | |

Cleveland-Cliffs | | | | 454,808 | a | 10,965,421 | |

Commercial Metals | | | | 119,519 | | 3,846,121 | |

Compass Minerals International | | | | 33,629 | | 2,206,062 | |

Eagle Materials | | | | 41,587 | | 6,169,847 | |

Greif, Cl. A | | | | 26,696 | | 1,726,697 | |

13

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | |

| |

Description | | | | Shares | | Value ($) | |

Common Stocks - 100.3% (continued) | | | | | |

Materials - 6.0% (continued) | | | | | |

Ingevity | | | | 39,125 | a | 3,048,229 | |

Louisiana-Pacific | | | | 95,151 | | 5,607,248 | |

Minerals Technologies | | | | 33,452 | | 2,373,085 | |

NewMarket | | | | 7,183 | | 2,442,292 | |

Olin | | | | 143,493 | | 8,176,231 | |

Reliance Steel & Aluminum | | | | 63,486 | | 9,279,114 | |

Royal Gold | | | | 65,563 | | 6,492,048 | |

RPM International | | | | 129,061 | | 11,254,119 | |

Sensient Technologies | | | | 41,795 | | 3,995,602 | |

Silgan Holdings | | | | 84,472 | | 3,395,774 | |

Sonoco Products | | | | 97,626 | | 5,657,427 | |

Steel Dynamics | | | | 192,866 | | 12,744,585 | |

The Chemours Company | | | | 163,880 | | 4,591,918 | |

The Scotts Miracle-Gro Company | | | | 40,704 | | 6,042,916 | |

U.S. Steel | | | | 269,934 | | 7,123,558 | |

Valvoline | | | | 179,524 | | 6,096,635 | |

Worthington Industries | | | | 33,447 | | 1,816,841 | |

| | | | | 146,327,953 | |

Media & Entertainment - 1.6% | | | | | |

Cable One | | | | 4,951 | | 8,472,201 | |

John Wiley & Sons, Cl. A | | | | 43,327 | | 2,347,024 | |

TEGNA | | | | 220,741 | | 4,339,768 | |

The New York Times Company, Cl. A | | | | 166,106 | | 9,067,727 | |

TripAdvisor | | | | 98,204 | a | 3,237,786 | |

World Wrestling Entertainment, Cl. A | | | | 45,484 | | 2,778,618 | |

Yelp | | | | 69,823 | a | 2,697,262 | |

Ziff Davis | | | | 47,867 | a | 6,139,900 | |

| | | | | 39,080,286 | |

Pharmaceuticals Biotechnology & Life Sciences - 3.6% | | | | | |

Arrowhead Pharmaceuticals | | | | 104,191 | a | 6,649,470 | |

Emergent BioSolutions | | | | 48,170 | a | 2,296,264 | |

Exelixis | | | | 314,880 | a | 6,773,069 | |

Halozyme Therapeutics | | | | 141,296 | a | 5,379,139 | |

Jazz Pharmaceuticals | | | | 60,783 | a | 8,086,570 | |

Medpace Holdings | | | | 28,442 | a | 6,443,535 | |

Nektar Therapeutics | | | | 183,275 | a | 2,778,449 | |

Neurocrine Biosciences | | | | 94,101 | a | 9,919,186 | |

Perrigo | | | | 129,846 | | 5,862,547 | |

Repligen | | | | 50,864 | a | 14,775,992 | |

Syneos Health | | | | 103,488 | a | 9,659,570 | |

United Therapeutics | | | | 44,890 | a | 8,563,216 | |

| | | | | 87,187,007 | |

14

| | | | | | | | |

| |

Description | | | | Shares | | Value ($) | |

Common Stocks - 100.3% (continued) | | | | | |

Real Estate - 10.0% | | | | | |

American Campus Communities | | | | 138,202 | b | 7,424,211 | |

Apartment Income REIT | | | | 156,930 | b | 8,413,017 | |

Brixmor Property Group | | | | 296,833 | b | 6,957,766 | |

Camden Property Trust | | | | 100,072 | b | 16,321,743 | |

CoreSite Realty | | | | 43,904 | b | 6,254,564 | |

Corporate Office Properties Trust | | | | 112,003 | b | 3,037,521 | |

Cousins Properties | | | | 148,557 | b | 5,884,343 | |

CyrusOne | | | | 123,316 | b | 10,114,378 | |

Douglas Emmett | | | | 174,232 | b | 5,693,902 | |

EastGroup Properties | | | | 40,150 | b | 7,940,867 | |

EPR Properties | | | | 74,143 | b | 3,722,720 | |

First Industrial Realty Trust | | | | 129,073 | b | 7,515,921 | |

Healthcare Realty Trust | | | | 144,660 | b | 4,782,460 | |

Highwoods Properties | | | | 104,062 | b | 4,666,140 | |

Hudson Pacific Properties | | | | 151,194 | b | 3,893,246 | |

JBG SMITH Properties | | | | 115,020 | b | 3,319,477 | |

Jones Lang LaSalle | | | | 50,434 | a | 13,023,572 | |

Kilroy Realty | | | | 104,767 | b | 7,059,200 | |

Kite Realty Group Trust | | | | 212,640 | b | 4,316,592 | |

Lamar Advertising, Cl. A | | | | 86,271 | b | 9,765,877 | |

Life Storage | | | | 78,269 | b | 10,473,175 | |

Medical Properties Trust | | | | 592,512 | b | 12,638,281 | |

National Retail Properties | | | | 175,563 | b | 7,963,538 | |

National Storage Affiliates Trust | | | | 80,921 | b | 5,054,326 | |

Omega Healthcare Investors | | | | 237,342 | b | 6,968,361 | |

Park Hotels & Resorts | | | | 234,562 | a,b | 4,346,434 | |

Pebblebrook Hotel Trust | | | | 130,015 | b | 2,920,137 | |

Physicians Realty Trust | | | | 215,536 | b | 4,097,339 | |

Potlatchdeltic | | | | 66,879 | b | 3,495,765 | |

PS Business Parks | | | | 20,051 | b | 3,563,063 | |

Rayonier | | | | 140,516 | b | 5,245,462 | |

Rexford Industrial Realty | | | | 137,712 | b | 9,254,246 | |

Sabra Health Care REIT | | | | 217,741 | b | 3,081,035 | |

SL Green Realty | | | | 66,638 | b | 4,669,325 | |

Spirit Realty Capital | | | | 118,254 | b | 5,786,168 | |

STORE Capital | | | | 244,480 | b | 8,392,998 | |

The Macerich Company | | | | 213,151 | b | 3,855,902 | |

Urban Edge Properties | | | | 111,661 | b | 1,957,417 | |

| | | | | 243,870,489 | |

Retailing - 4.2% | | | | | |

American Eagle Outfitters | | | | 152,343 | | 3,616,623 | |

AutoNation | | | | 43,621 | a | 5,283,376 | |

Dick's Sporting Goods | | | | 65,519 | | 8,138,115 | |

15

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | |

| |

Description | | | | Shares | | Value ($) | |

Common Stocks - 100.3% (continued) | | | | | |

Retailing - 4.2% (continued) | | | | | |

Five Below | | | | 55,680 | a | 10,985,664 | |

Foot Locker | | | | 89,344 | | 4,259,028 | |

GameStop, Cl. A | | | | 61,878 | a | 11,355,232 | |

Kohl's | | | | 156,188 | | 7,579,804 | |

Lithia Motors | | | | 30,079 | | 9,601,818 | |

Murphy USA | | | | 23,577 | | 3,841,872 | |

Nordstrom | | | | 110,427 | a | 3,172,568 | |

Ollie's Bargain Outlet Holdings | | | | 60,194 | a | 4,072,726 | |

RH | | | | 16,941 | a | 11,174,792 | |

Urban Outfitters | | | | 66,550 | a | 2,124,942 | |

Victoria's Secret & Co. | | | | 74,469 | a | 3,758,450 | |

Williams-Sonoma | | | | 74,732 | | 13,879,974 | |

| | | | | 102,844,984 | |

Semiconductors & Semiconductor Equipment - 4.6% | | | | | |

Amkor Technology | | | | 101,196 | | 2,218,216 | |

Brooks Automation | | | | 74,277 | | 8,649,557 | |

Cirrus Logic | | | | 57,513 | a | 4,647,626 | |

CMC Materials | | | | 29,155 | | 3,742,627 | |

First Solar | | | | 98,320 | a | 11,758,089 | |

Lattice Semiconductor | | | | 136,384 | a | 9,470,505 | |

MKS Instruments | | | | 55,443 | | 8,319,222 | |

Semtech | | | | 64,850 | a | 5,514,195 | |

Silicon Laboratories | | | | 40,579 | a | 7,659,692 | |

SolarEdge Technologies | | | | 52,009 | a | 18,446,552 | |

SunPower | | | | 83,713 | a | 2,817,780 | |

Synaptics | | | | 35,179 | a | 6,844,778 | |

Universal Display | | | | 43,079 | | 7,892,073 | |

Wolfspeed | | | | 114,820 | a | 13,791,030 | |

| | | | | 111,771,942 | |

Software & Services - 5.7% | | | | | |

ACI Worldwide | | | | 116,413 | a | 3,571,551 | |

Alliance Data Systems | | | | 49,699 | | 4,236,840 | |

Aspen Technology | | | | 67,533 | a | 10,581,746 | |

Blackbaud | | | | 41,619 | a | 2,955,365 | |

CDK Global | | | | 121,643 | | 5,293,903 | |

Cerence | | | | 37,978 | a | 3,992,627 | |

Commvault Systems | | | | 45,759 | a | 2,814,179 | |

Concentrix | | | | 42,807 | | 7,605,948 | |

Digital Turbine | | | | 86,899 | a | 7,478,528 | |

Envestnet | | | | 54,427 | a | 4,544,654 | |

Fair Isaac | | | | 28,232 | a | 11,241,982 | |

Genpact | | | | 172,700 | | 8,522,745 | |

Liveramp Holdings | | | | 67,297 | a | 3,601,062 | |

16

| | | | | | | | |

| |

Description | | | | Shares | | Value ($) | |

Common Stocks - 100.3% (continued) | | | | | |

Software & Services - 5.7% (continued) | | | | | |

Manhattan Associates | | | | 63,045 | a | 11,445,189 | |

MAXIMUS | | | | 61,403 | | 5,192,852 | |

Mimecast | | | | 60,446 | a | 4,560,046 | |

NCR | | | | 131,270 | a | 5,190,416 | |

Paylocity Holding | | | | 39,098 | a | 11,930,364 | |

Qualys | | | | 33,199 | a | 4,132,612 | |

Sabre | | | | 322,097 | a | 3,343,367 | |

SailPoint Technologies Holdings | | | | 93,227 | a | 4,473,031 | |

Teradata | | | | 108,351 | a | 6,128,333 | |

WEX | | | | 44,791 | a | 6,705,213 | |

| | | | | 139,542,553 | |

Technology Hardware & Equipment - 4.1% | | | | | |

Arrow Electronics | | | | 71,813 | a | 8,312,355 | |

Avnet | | | | 98,616 | | 3,758,256 | |

Belden | | | | 44,362 | | 2,671,036 | |

Ciena | | | | 154,744 | a | 8,401,052 | |

Cognex | | | | 175,812 | | 15,399,373 | |

Coherent | | | | 24,518 | a | 6,237,379 | |

II-VI | | | | 104,799 | a | 6,341,387 | |

Jabil | | | | 144,968 | | 8,692,281 | |

Littelfuse | | | | 24,606 | | 7,247,697 | |

Lumentum Holdings | | | | 75,850 | a | 6,263,693 | |

National Instruments | | | | 132,843 | | 5,641,842 | |

NETSCOUT Systems | | | | 73,975 | a | 2,001,764 | |

SYNNEX | | | | 41,483 | | 4,355,715 | |

Viasat | | | | 72,705 | a | 4,339,761 | |

Vishay Intertechnology | | | | 131,215 | | 2,521,952 | |

Vontier | | | | 168,779 | | 5,709,794 | |

Xerox Holdings | | | | 135,980 | | 2,420,444 | |

| | | | | 100,315,781 | |

Telecommunication Services - .3% | | | | | |

Iridium Communications | | | | 130,964 | a | 5,310,590 | |

Telephone & Data Systems | | | | 98,291 | | 1,841,973 | |

| | | | | 7,152,563 | |

Transportation - 2.7% | | | | | |

Avis Budget Group | | | | 47,212 | a | 8,182,312 | |

GXO Logistics | | | | 98,556 | a | 8,751,773 | |

JetBlue Airways | | | | 317,658 | a | 4,456,742 | |

Kirby | | | | 59,538 | a | 3,120,387 | |

Knight-Swift Transportation Holdings | | | | 165,793 | | 9,398,805 | |

Landstar System | | | | 38,248 | | 6,724,381 | |

Ryder System | | | | 53,692 | | 4,561,135 | |

Saia | | | | 26,319 | a | 8,228,372 | |

17

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | |

| |

Description | | | | Shares | | Value ($) | |

Common Stocks - 100.3% (continued) | | | | | |

Transportation - 2.7% (continued) | | | | | |

Werner Enterprises | | | | 62,226 | | 2,820,082 | |

XPO Logistics | | | | 98,557 | a | 8,456,191 | |

| | | | | 64,700,180 | |

Utilities - 3.1% | | | | | |

ALLETE | | | | 52,116 | | 3,207,219 | |

Black Hills | | | | 62,944 | | 4,178,223 | |

Essential Utilities | | | | 222,376 | | 10,467,238 | |

Hawaiian Electric Industries | | | | 109,148 | | 4,427,043 | |

IDACORP | | | | 50,137 | | 5,230,292 | |

MDU Resources Group | | | | 201,036 | | 6,177,836 | |

National Fuel Gas | | | | 91,074 | | 5,230,380 | |

New Jersey Resources | | | | 95,554 | | 3,612,897 | |

NorthWestern | | | | 51,073 | | 2,904,011 | |

OGE Energy | | | | 200,073 | | 6,816,487 | |

ONE Gas | | | | 53,011 | | 3,567,640 | |

PNM Resources | | | | 85,688 | | 4,262,978 | |

Southwest Gas Holdings | | | | 58,887 | | 4,077,925 | |

Spire | | | | 51,184 | | 3,212,308 | |

UGI | | | | 209,112 | | 9,077,552 | |

| | | | | 76,450,029 | |

Total Common Stocks (cost $1,351,532,525) | | | | 2,436,008,447 | |

| | | 1-Day

Yield (%) | | | | | |

Investment Companies - .7% | | | | | |

Registered Investment Companies - .7% | | | | | |

Dreyfus Institutional Preferred Government Plus Money Market Fund, Institutional Shares

(cost $17,970,510) | | 0.06 | | 17,970,510 | c | 17,970,510 | |

Total Investments (cost $1,369,503,035) | | 101.0% | | 2,453,978,957 | |

Liabilities, Less Cash and Receivables | | (1.0%) | | (24,525,856) | |

Net Assets | | 100.0% | | 2,429,453,101 | |

REIT—Real Estate Investment Trust

a Non-income producing security.

b Investment in real estate investment trust within the United States.

c Investment in affiliated issuer. The investment objective of this investment company is publicly available and can be found within the investment company’s prospectus.

18

| | |

Portfolio Summary (Unaudited) † | Value (%) |

Industrials | 18.8 |

Financials | 15.0 |

Consumer Discretionary | 15.0 |

Information Technology | 14.5 |

Health Care | 10.3 |

Real Estate | 10.0 |

Materials | 6.0 |

Consumer Staples | 3.4 |

Utilities | 3.2 |

Energy | 2.2 |

Communication Services | 1.9 |

Investment Companies | .7 |

| | 101.0 |

† Based on net assets.

See notes to financial statements.

19

STATEMENT OF INVESTMENTS IN AFFILIATED ISSUERS

| | | | | | | |

Investment Companies | Value

10/31/20 ($) | Purchases ($)† | Sales ($) | Value

10/31/21 ($) | Net

Assets (%) | Dividends/

Distributions ($) |

Registered Investment Companies; | | | |

Dreyfus Institutional Preferred Government Plus Money Market Fund, Institutional Shares | 6,698,779 | 431,324,782 | (420,053,051) | 17,970,510 | .7 | 9,814 |

Investment of Cash Collateral

for Securities Loaned:†† | | | |

Dreyfus Institutional Preferred Government Plus Money Market Fund, Institutional Shares | 8,924,121 | 8,990,276 | (17,914,397) | - | - | - |

Dreyfus Institutional Preferred Government Plus Money Market Fund, SL Shares | - | 59,066,109 | (59,066,109) | - | - | 136,577††† |

Total | 15,622,900 | 499,381,167 | (497,033,557) | 17,970,510 | .7 | 146,391 |

† Includes reinvested dividends/distributions.

†† Effective November 9, 2020, cash collateral for securities lending was transferred from Dreyfus Institutional Preferred Government Plus Money Market Fund, Institutional Shares to Dreyfus Institutional Preferred Government Plus Money Market Fund, SL Shares.

††† Represents securities lending income earned from reinvestment of cash collateral from loaned securities, net of fees and collateral investment expenses, and other payments to and from borrowers of securities.

See notes to financial statements.

20

STATEMENT OF FUTURES

October 31, 2021

| | | | | | | |

Description | Number of

Contracts | Expiration | Notional

Value ($) | Market

Value ($) | Unrealized Appreciation ($) | |

Futures Long | | |

Standard & Poor's Midcap 400 E-mini | 61 | 12/17/2021 | 16,864,285 | 17,015,340 | 151,055 | |

Gross Unrealized Appreciation | | 151,055 | |

See notes to financial statements.

21

STATEMENT OF ASSETS AND LIABILITIES

October 31, 2021

| | | | | | | |

| | | | | | |

| | | Cost | | Value | |

Assets ($): | | | | |

Investments in securities—See Statement of Investments | | | |

Unaffiliated issuers | 1,351,532,525 | | 2,436,008,447 | |

Affiliated issuers | | 17,970,510 | | 17,970,510 | |

Cash collateral held by broker—Note 4 | | 856,000 | |

Dividends receivable | | 804,326 | |

Receivable for shares of Common Stock subscribed | | 797,223 | |

Receivable for futures variation margin—Note 4 | | 11,136 | |

| | | | | 2,456,447,642 | |

Liabilities ($): | | | | |

Due to BNY Mellon Investment Adviser, Inc. and affiliates—Note 3(b) | | 879,723 | |

Payable for shares of Common Stock redeemed | | 23,569,560 | |

Payable for investment securities purchased | | 2,351,504 | |

Directors’ fees and expenses payable | | 193,754 | |

| | | | | 26,994,541 | |

Net Assets ($) | | | 2,429,453,101 | |

Composition of Net Assets ($): | | | | |

Paid-in capital | | | | | 1,050,848,252 | |

Total distributable earnings (loss) | | | | | 1,378,604,849 | |

Net Assets ($) | | | 2,429,453,101 | |

| | | | |

Net Asset Value Per Share | Investor Shares | Class I | |

Net Assets ($) | 1,806,658,242 | 622,794,859 | |

Shares Outstanding | 44,696,692 | 15,447,868 | |

Net Asset Value Per Share ($) | 40.42 | 40.32 | |

| | | |

See notes to financial statements. | | | |

22

STATEMENT OF OPERATIONS

Year Ended October 31, 2021

| | | | | | | |

| | | | | | |

| | | | | | |

Investment Income ($): | | | | |

Income: | | | | |

Cash dividends: | |

Unaffiliated issuers | | | 31,965,340 | |

Affiliated issuers | | | 9,814 | |

Income from securities lending—Note 1(b) | | | 136,577 | |

Total Income | | | 32,111,731 | |

Expenses: | | | | |

Management fee—Note 3(a) | | | 6,011,628 | |

Shareholder servicing costs—Note 3(b) | | | 4,476,989 | |

Directors’ fees—Note 3(a,c) | | | 256,750 | |

Loan commitment fees—Note 2 | | | 42,314 | |

Interest expense—Note 2 | | | 106 | |

Total Expenses | | | 10,787,787 | |

Less—Directors’ fees reimbursed by

BNY Mellon Investment Adviser, Inc.—Note 3(a) | | | (256,750) | |

Net Expenses | | | 10,531,037 | |

Investment Income—Net | | | 21,580,694 | |

Realized and Unrealized Gain (Loss) on Investments—Note 4 ($): | | |

Net realized gain (loss) on investments | 328,797,119 | |

Net realized gain (loss) on futures | 7,777,487 | |

Net Realized Gain (Loss) | | | 336,574,606 | |

Net change in unrealized appreciation (depreciation) on investments | 547,377,247 | |

Net change in unrealized appreciation (depreciation) on futures | 624,769 | |

Net Change in Unrealized Appreciation (Depreciation) | | | 548,002,016 | |

Net Realized and Unrealized Gain (Loss) on Investments | | | 884,576,622 | |

Net Increase in Net Assets Resulting from Operations | | 906,157,316 | |

| | | | | | |

See notes to financial statements. | | | | | |

23

STATEMENT OF CHANGES IN NET ASSETS

| | | | | | | | | | |

| | | | Year Ended October 31, |

| | | | 2021 | | 2020 | |

Operations ($): | | | | | | | | |

Investment income—net | | | 21,580,694 | | | | 27,217,306 | |

Net realized gain (loss) on investments | | 336,574,606 | | | | 262,938,922 | |

Net change in unrealized appreciation

(depreciation) on investments | | 548,002,016 | | | | (354,403,837) | |

Net Increase (Decrease) in Net Assets

Resulting from Operations | 906,157,316 | | | | (64,247,609) | |

Distributions ($): | |

Distributions to shareholders: | | | | | | | | |

Investor Shares | | | (171,561,929) | | | | (194,638,217) | |

Class I | | | (64,553,175) | | | | (81,299,384) | |

Total Distributions | | | (236,115,104) | | | | (275,937,601) | |

Capital Stock Transactions ($): | |

Net proceeds from shares sold: | | | | | | | | |

Investor Shares | | | 161,921,718 | | | | 176,665,684 | |

Class I | | | 46,167,179 | | | | 140,593,279 | |

Distributions reinvested: | | | | | | | | |

Investor Shares | | | 167,504,997 | | | | 189,969,095 | |

Class I | | | 37,016,417 | | | | 41,048,264 | |

Cost of shares redeemed: | | | | | | | | |

Investor Shares | | | (485,499,143) | | | | (604,536,723) | |

Class I | | | (173,482,413) | | | | (341,157,493) | |

Increase (Decrease) in Net Assets

from Capital Stock Transactions | (246,371,245) | | | | (397,417,894) | |

Total Increase (Decrease) in Net Assets | 423,670,967 | | | | (737,603,104) | |

Net Assets ($): | |

Beginning of Period | | | 2,005,782,134 | | | | 2,743,385,238 | |

End of Period | | | 2,429,453,101 | | | | 2,005,782,134 | |

Capital Share Transactions (Shares): | |

Investor Sharesa | | | | | | | | |

Shares sold | | | 4,350,833 | | | | 6,241,855 | |

Shares issued for distributions reinvested | | | 5,031,691 | | | | 5,842,156 | |

Shares redeemed | | | (13,120,649) | | | | (20,501,751) | |

Net Increase (Decrease) in Shares Outstanding | (3,738,125) | | | | (8,417,740) | |

Class Ia | | | | | | | | |

Shares sold | | | 1,235,853 | | | | 5,239,754 | |

Shares issued for distributions reinvested | | | 1,117,308 | | | | 1,268,434 | |

Shares redeemed | | | (4,765,893) | | | | (12,212,580) | |

Net Increase (Decrease) in Shares Outstanding | (2,412,732) | | | | (5,704,392) | |

| | | | | | | | | |

a | During the period ended October 31, 2021, 5,672 Investor shares representing $219,440 were exchanged for 5,695 Class I shares and during the period ended October 31, 2020, 11,406 Class I shares representing $284,760 were exchanged for 11,365 Investor shares. | |

See notes to financial statements. | | | | | | | | |

24

FINANCIAL HIGHLIGHTS

The following tables describe the performance for each share class for the fiscal periods indicated. All information (except portfolio turnover rate) reflects financial results for a single fund share. Net asset value total return is calculated assuming an initial investment made at the net asset value at the beginning of the period, reinvestment of all dividends and distributions at net asset value during the period, and redemption at net asset value on the last day of the period. Net asset value total return includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset value and returns for shareholder transactions. These figures have been derived from the fund’s financial statements.

| | | | | | | | | | |

| | | | | |

| | |

| | Year Ended October 31, |

Investor Shares | | 2021 | 2020 | 2019 | 2018 | 2017 |

Per Share Data ($): | | | | | | |

Net asset value,

beginning of period | | 30.27 | 34.13 | 36.02 | 39.03 | 35.17 |

Investment Operations: | | | | | | |

Investment income—netb | | .31 | .34 | .40 | .42 | .32 |

Net realized and unrealized

gain (loss) on investments | | 13.50 | (.67) | 1.82 | (.11) | 7.30 |

Total from Investment

Operations | | 13.81 | (.33) | 2.22 | .31 | 7.62 |

Distributions: | | | | | | |

Dividends from investment

income—net | | (.38) | (.43) | (.44) | (.35) | (.38) |

Dividends from net realized

gain on investments | | (3.28) | (3.10) | (3.67) | (2.97) | (3.38) |

Total Distributions | | (3.66) | (3.53) | (4.11) | (3.32) | (3.76) |

Net asset value, end of period | | 40.42 | 30.27 | 34.13 | 36.02 | 39.03 |

Total Return (%) | | 48.22 | (1.66) | 8.48 | .52 | 22.89 |

Ratios/Supplemental Data (%): | | | | | |

Ratio of total expenses

to average net assets | | .51 | .52 | .51 | .51 | .51 |

Ratio of net expenses

to average net assets | | .50 | .50 | .50 | .50 | .50 |

Ratio of net investment income to average net assets | | .83 | 1.13 | 1.19 | 1.09 | .88 |

Portfolio Turnover Rate | | 15.42 | 17.90 | 15.37 | 15.73 | 24.48 |

Net Assets,

end of period ($ x 1,000) | | 1,806,658 | 1,466,328 | 1,940,533 | 2,189,027 | 2,711,092 |

a Based on average shares outstanding.

See notes to financial statements.

25

FINANCIAL HIGHLIGHTS (continued)

| | | | | | | | | |

| | | | | |

| | | | | |

| | Year Ended October 31, |

Class I Shares | | 2021 | 2020 | 2019 | 2018 | 2017 |

Per Share Data ($): | | | | | | |

Net asset value,

beginning of period | | 30.20 | 34.07 | 36.00 | 39.01 | 35.18 |

Investment Operations: | | | | | | |

Investment income—neta | | .40 | .42 | .48 | .50 | .42 |

Net realized and unrealized

gain (loss) on investments | | 13.46 | (.67) | 1.81 | (.08) | 7.28 |

Total from Investment

Operations | | 13.86 | (.25) | 2.29 | .42 | 7.70 |

Distributions: | | | | | | |

Dividends from investment

income—net | | (.46) | (.52) | (.55) | (.46) | (.49) |

Dividends from net realized

gain on investments | | (3.28) | (3.10) | (3.67) | (2.97) | (3.38) |

Total Distributions | | (3.74) | (3.62) | (4.22) | (3.43) | (3.87) |

Net asset value, end of period | | 40.32 | 30.20 | 34.07 | 36.00 | 39.01 |

Total Return (%) | | 48.61 | (1.42) | 8.76 | .79 | 23.17 |

Ratios/Supplemental Data (%): | | | | | |

Ratio of total expenses

to average net assets | | .26 | .27 | .26 | .26 | .26 |

Ratio of net expenses

to average net assets | | .25 | .25 | .25 | .25 | .25 |

Ratio of net investment income

to average net assets | | 1.09 | 1.40 | 1.46 | 1.31 | 1.10 |

Portfolio Turnover Rate | | 15.42 | 17.90 | 15.37 | 15.73 | 24.48 |

Net Assets,

end of period ($ x 1,000) | | 622,795 | 539,454 | 802,852 | 1,114,049 | 1,024,602 |

a Based on average shares outstanding.

See notes to financial statements.

26

NOTES TO FINANCIAL STATEMENTS

NOTE 1—Significant Accounting Policies:

BNY Mellon Midcap Index Fund, Inc. (the “fund”), which is registered under the Investment Company Act of 1940, as amended (the “Act”), is a diversified open-end management investment company. The fund’s investment objective is to seek to match the performance of the S&P’s MidCap 400® Index. BNY Mellon Investment Adviser, Inc. (the “Adviser”), a wholly-owned subsidiary of The Bank of New York Mellon Corporation (“BNY Mellon”), serves as the fund’s investment adviser.

BNY Mellon Securities Corporation (the “Distributor”), a wholly-owned subsidiary of the Adviser, is the distributor of the fund’s shares, which are sold without a sales charge. The fund is authorized to issue 300 million shares of $.001 par value Common Stock. The fund currently has authorized two classes of shares: Investor shares (200 million shares authorized) and Class I (100 million shares authorized). Investor shares are sold primarily to retail investors through financial intermediaries and bear Shareholder Services Plan fees. Class I shares are sold primarily to bank trust departments and other financial service providers (including The Bank of New York Mellon, a subsidiary of BNY Mellon and an affiliate of the Adviser, and its affiliates), acting on behalf of customers having a qualified trust or an investment account or relationship at such institution, and bear no Shareholder Services Plan fees. Other differences between the classes include the services offered to and the expenses borne by each class, and certain voting rights. Income, expenses (other than expenses attributable to a specific class), and realized and unrealized gains or losses on investments are allocated to each class of shares based on its relative net assets.

The Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) is the exclusive reference of authoritative U.S. generally accepted accounting principles (“GAAP”) recognized by the FASB to be applied by nongovernmental entities. Rules and interpretive releases of the SEC under authority of federal laws are also sources of authoritative GAAP for SEC registrants. The fund is an investment company and applies the accounting and reporting guidance of the FASB ASC Topic 946 Financial Services-Investment Companies. The fund’s financial statements are prepared in accordance with GAAP, which may require the use of management estimates and assumptions. Actual results could differ from those estimates.

The fund enters into contracts that contain a variety of indemnifications. The fund’s maximum exposure under these arrangements is unknown. The

27

NOTES TO FINANCIAL STATEMENTS (continued)

fund does not anticipate recognizing any loss related to these arrangements.

(a) Portfolio valuation: The fair value of a financial instrument is the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (i.e., the exit price). GAAP establishes a fair value hierarchy that prioritizes the inputs of valuation techniques used to measure fair value. This hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements).

Additionally, GAAP provides guidance on determining whether the volume and activity in a market has decreased significantly and whether such a decrease in activity results in transactions that are not orderly. GAAP requires enhanced disclosures around valuation inputs and techniques used during annual and interim periods.

Various inputs are used in determining the value of the fund’s investments relating to fair value measurements. These inputs are summarized in the three broad levels listed below:

Level 1—unadjusted quoted prices in active markets for identical investments.

Level 2—other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.).

Level 3—significant unobservable inputs (including the fund’s own assumptions in determining the fair value of investments).

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. Valuation techniques used to value the fund’s investments are as follows:

Investments in equity securities are valued at the last sales price on the securities exchange or national securities market on which such securities are primarily traded. Securities listed on the National Market System for which market quotations are available are valued at the official closing price or, if there is no official closing price that day, at the last sales price. For open short positions, asked prices are used for valuation purposes. Bid price is used when no asked price is available. Registered investment companies that are not traded on an exchange are valued at their net asset

28

value. All of the preceding securities are generally categorized within Level 1 of the fair value hierarchy.

Securities not listed on an exchange or the national securities market, or securities for which there were no transactions, are valued at the average of the most recent bid and asked prices. These securities are generally categorized within Level 2 of the fair value hierarchy.

Fair valuing of securities may be determined with the assistance of a pricing service using calculations based on indices of domestic securities and other appropriate indicators, such as prices of relevant American Depository Receipts and futures. Utilizing these techniques may result in transfers between Level 1 and Level 2 of the fair value hierarchy.

When market quotations or official closing prices are not readily available, or are determined not to accurately reflect fair value, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded (for example, a foreign exchange or market), but before the fund calculates its net asset value, the fund may value these investments at fair value as determined in accordance with the procedures approved by the fund’s Board of Directors (the “Board”). Certain factors may be considered when fair valuing investments such as: fundamental analytical data, the nature and duration of restrictions on disposition, an evaluation of the forces that influence the market in which the securities are purchased and sold, and public trading in similar securities of the issuer or comparable issuers. These securities are either categorized within Level 2 or 3 of the fair value hierarchy depending on the relevant inputs used.

For securities where observable inputs are limited, assumptions about market activity and risk are used and such securities are generally categorized within Level 3 of the fair value hierarchy.

Futures, which are traded on an exchange, are valued at the last sales price on the securities exchange on which such securities are primarily traded or at the last sales price on the national securities market on each business day and are generally categorized within Level 1 of the fair value hierarchy.

The following is a summary of the inputs used as of October 31, 2021 in valuing the fund’s investments:

29

NOTES TO FINANCIAL STATEMENTS (continued)

| | | | | | | |

| | Level 1-Unadjusted Quoted Prices | Level 2- Other Significant Observable Inputs | | Level 3-Significant Unobservable Inputs | Total | |

Assets ($) | | |

Investments In Securities:† | | |

Equity Securities - Common Stocks | 2,436,008,447 | - | | - | 2,436,008,447 | |

Investment Companies | 17,970,510 | - | | - | 17,970,510 | |

Other Financial Instruments: | | |

Futures†† | 151,055 | - | | - | 151,055 | |

† See Statement of Investments for additional detailed categorizations, if any.

†† Amount shown represents unrealized appreciation (depreciation) at period end, but only variation margin on exchanged-traded and centrally cleared derivatives, if any, are reported in the Statement of Assets and Liabilities.

(b) Securities transactions and investment income: Securities transactions are recorded on a trade date basis. Realized gains and losses from securities transactions are recorded on the identified cost basis. Dividend income is recognized on the ex-dividend date and interest income, including, where applicable, accretion of discount and amortization of premium on investments, is recognized on the accrual basis.

Pursuant to a securities lending agreement with The Bank of New York Mellon, the fund may lend securities to qualified institutions. It is the fund’s policy that, at origination, all loans are secured by collateral of at least 102% of the value of U.S. securities loaned and 105% of the value of foreign securities loaned. Collateral equivalent to at least 100% of the market value of securities on loan is maintained at all times. Collateral is either in the form of cash, which can be invested in certain money market mutual funds managed by the Adviser, or U.S. Government and Agency securities. The fund is entitled to receive all dividends, interest and distributions on securities loaned, in addition to income earned as a result of the lending transaction. Should a borrower fail to return the securities in a timely manner, The Bank of New York Mellon is required to replace the securities for the benefit of the fund or credit the fund with the market value of the unreturned securities and is subrogated to the fund’s rights against the borrower and the collateral. Additionally, the contractual maturity of security lending transactions are on an overnight and continuous basis. During the period ended October 31, 2021, The Bank of New York Mellon earned $17,843 from the lending of the fund’s portfolio securities, pursuant to the securities lending agreement.

30

(c) Affiliated issuers: Investments in other investment companies advised by the Adviser are considered “affiliated” under the Act.

(d) Risk: Certain events particular to the industries in which the fund’s investments conduct their operations, as well as general economic, political and public health conditions, may have a significant negative impact on the investee’s operations and profitability. In addition, turbulence in financial markets and reduced liquidity in equity, credit and/or fixed income markets may negatively affect many issuers, which could adversely affect the fund. Global economies and financial markets are becoming increasingly interconnected, and conditions and events in one country, region or financial market may adversely impact issuers in a different country, region or financial market. These risks may be magnified if certain events or developments adversely interrupt the global supply chain; in these and other circumstances, such risks might affect companies world-wide. Recent examples include pandemic risks related to COVID-19 and aggressive measures taken world-wide in response by governments, including closing borders, restricting international and domestic travel, and the imposition of prolonged quarantines of large populations, and by businesses, including changes to operations and reducing staff. The effects of COVID-19 have contributed to increased volatility in global markets and will likely affect certain countries, companies, industries and market sectors more dramatically than others. The COVID-19 pandemic has had, and any other outbreak of an infectious disease or other serious public health concern could have, a significant negative impact on economic and market conditions and could trigger a prolonged period of global economic slowdown. To the extent the fund may overweight its investments in certain countries, companies, industries or market sectors, such positions will increase the fund’s exposure to risk of loss from adverse developments affecting those countries, companies, industries or sectors.

(e) Dividends and distributions to shareholders: Dividends and distributions are recorded on the ex-dividend date. Dividends from investment income-net and dividends from net realized capital gains, if any, are normally declared and paid annually, but the fund may make distributions on a more frequent basis to comply with the distribution requirements of the Internal Revenue Code of 1986, as amended (the “Code”). To the extent that net realized capital gains can be offset by capital loss carryovers, it is the policy of the fund not to distribute such gains. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

(f) Federal income taxes: It is the policy of the fund to continue to qualify as a regulated investment company, if such qualification is in the

31

NOTES TO FINANCIAL STATEMENTS (continued)

best interests of its shareholders, by complying with the applicable provisions of the Code, and to make distributions of taxable income and net realized capital gain sufficient to relieve it from substantially all federal income and excise taxes.

As of and during the period ended October 31, 2021, the fund did not have any liabilities for any uncertain tax positions. The fund recognizes interest and penalties, if any, related to uncertain tax positions as income tax expense in the Statement of Operations. During the period ended October 31, 2021, the fund did not incur any interest or penalties.

Each tax year in the four-year period ended October 31, 2021 remains subject to examination by the Internal Revenue Service and state taxing authorities.

At October 31, 2021, the components of accumulated earnings on a tax basis were as follows: undistributed ordinary income $56,775,125, undistributed capital gains $255,758,191 and unrealized appreciation $1,066,071,533.

The tax character of distributions paid to shareholders during the fiscal periods ended October 31, 2021 and October 31, 2020 were as follows: ordinary income $26,861,419 and $35,453,303, and long-term capital gains $209,253,685 and $240,484,298, respectively.

During the period ended October 31, 2021, as a result of permanent book to tax differences, primarily due to the tax treatment for treating a portion of the proceeds from redemptions as a distribution for tax purposes, the fund decreased total distributable earnings (loss) by $36,909,875 and increased paid-in capital by the same amount. Net assets and net asset value per share were not affected by this reclassification.

NOTE 2—Bank Lines of Credit:

The fund participates with other long-term open-end funds managed by the Adviser in a $823.5 million unsecured credit facility led by Citibank, N.A. (the “Citibank Credit Facility”) and a $300 million unsecured credit facility provided by The Bank of New York Mellon (the “BNYM Credit Facility”), each to be utilized primarily for temporary or emergency purposes, including the financing of redemptions (each, a “Facility”). The Citibank Credit Facility is available in two tranches: (i) Tranche A is in an amount equal to $688.5 million and is available to all long-term open-ended funds, including the fund, and (ii) Tranche B is an amount equal to $135 million and is available only to BNY Mellon Floating Rate Income Fund, a series of BNY Mellon Investment Funds IV, Inc. In connection therewith, the fund has agreed to pay its pro rata portion of commitment

32

fees for Tranche A of the Citibank Credit Facility and the BNYM Credit Facility. Interest is charged to the fund based on rates determined pursuant to the terms of the respective Facility at the time of borrowing.

The average amount of borrowings outstanding under the Facilities during the period ended October 31, 2021 was approximately $8,493 with a related weighted average annualized interest rate of 1.25%.

NOTE 3—Management Fee and Other Transactions with Affiliates:

(a) Pursuant to a management agreement with the Adviser, the management fee is computed at the annual rate of .25% of the value of the fund’s average daily net assets and is payable monthly. Out of its fee, the Adviser pays all of the expenses of the fund except management fees, Shareholder Services Plan fees, brokerage fees and commissions, taxes, interest expense, commitment fees on borrowings, fees and expenses of the interested Directors (including counsel fees) and extraordinary expenses. In addition, the Adviser is required to reduce its fee in an amount equal to the fund’s allocable portion of fees and expenses of the non-interested Directors (including counsel fees). During the period ended October 31, 2021, fees reimbursed by the Adviser amounted to $256,750.

(b) Under the Shareholder Services Plan, Investor shares pay the Distributor at an annual rate of .25% of the value of its average daily net assets for the provision of certain services. The services provided may include personal services relating to shareholder accounts, such as answering shareholder inquiries regarding the fund, and services related to the maintenance of shareholder accounts. The Distributor may make payments to Service Agents (securities dealers, financial institutions or other industry professionals) with respect to these services. The Distributor determines the amounts to be paid to Service Agents. During the period ended October 31, 2021, the fund was charged $4,476,989 pursuant to the Shareholder Services Plan.

The fund has an arrangement with the custodian whereby the fund will receive interest income or be charged overdraft fees when cash balances are maintained. For financial reporting purposes, the fund includes this interest income and overdraft fees, if any, as interest income in the Statement of Operations.

The components of “Due to BNY Mellon Investment Adviser, Inc. and affiliates” in the Statement of Assets and Liabilities consist of: management fees of $512,673 and Shareholder Services Plan fees of $382,550, which are offset against an expense reimbursement currently in effect in the amount of $15,500.

33

NOTES TO FINANCIAL STATEMENTS (continued)

(c) Each Board member also serves as a Board member of other funds in the BNY Mellon Family of Funds complex. Annual retainer fees and attendance fees are allocated to each fund based on net assets.

NOTE 4—Securities Transactions:

The aggregate amount of purchases and sales of investment securities, excluding short-term securities and futures, during the period ended October 31, 2021, amounted to $362,744,942 and $786,728,585, respectively.

Derivatives: A derivative is a financial instrument whose performance is derived from the performance of another asset. Each type of derivative instrument that was held by the fund during the period ended October 31, 2021 is discussed below.

Futures: In the normal course of pursuing its investment objective, the fund is exposed to market risk, including equity price risk, as a result of changes in value of underlying financial instruments. The fund invests in futures in order to manage its exposure to or protect against changes in the market. A futures contract represents a commitment for the future purchase or a sale of an asset at a specified date. Upon entering into such contracts, these investments require initial margin deposits with a counterparty, which consist of cash or cash equivalents. The amount of these deposits is determined by the exchange or Board of Trade on which the contract is traded and is subject to change. Accordingly, variation margin payments are received or made to reflect daily unrealized gains or losses which are recorded in the Statement of Operations. When the contracts are closed, the fund recognizes a realized gain or loss which is reflected in the Statement of Operations. There is minimal counterparty credit risk to the fund with futures since they are exchange traded, and the exchange guarantees the futures against default. Futures open at October 31, 2021 are set forth in the Statement of Futures.

The following summarizes the average market value of derivatives outstanding during the period ended October 31, 2021:

| | | |

| | Average Market Value ($) |

Equity futures | | 18,609,791 |

At October 31, 2021, the cost of investments for federal income tax purposes was $1,387,907,424; accordingly, accumulated net unrealized appreciation on investments was $1,066,071,533, consisting of $1,121,825,471 gross unrealized appreciation and $55,753,938 gross unrealized depreciation.

34

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders and the Board of Directors of BNY Mellon Midcap Index Fund, Inc.

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities of BNY Mellon Midcap Index Fund, Inc. (the “Fund”), including the statements of investments, investments in affiliated issuers and futures, as of October 31, 2021, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, the financial highlights for each of the five years in the period then ended and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund at October 31, 2021, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and its financial highlights for each of the five years in the period then ended, in conformity with U.S. generally accepted accounting principles.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.