TEMPLETON

FOREIGN SMALLER COMPANIES FUND

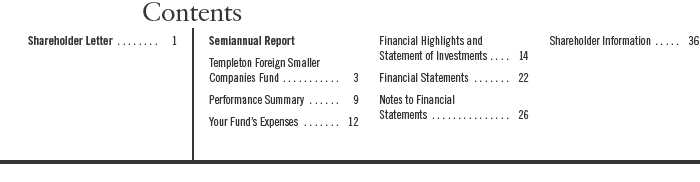

Semiannual Report

Templeton Foreign Smaller Companies Fund

Your Fund’s Goal and Main Investments: Templeton Foreign Smaller Companies Fund seeks to provide long-term capital growth. Under normal market conditions, the Fund invests at least 80% of its net assets in investments of smaller companies located outside the U.S., including

emerging markets.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. Please visit franklintempleton.com or call (800) 342-5236 for most recent month-end performance.

This semiannual report for Templeton Foreign Smaller Companies Fund covers the period ended April 30, 2011.

Performance Overview

For the six months under review, Templeton Foreign Smaller Companies Fund – Class A delivered a cumulative total return of +13.07%. The Fund under-performed international small capitalization stocks in developed and emerging

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI). The SOI begins on page 18.

Semiannual Report | 3

markets as measured by its new benchmark, the Morgan Stanley Capital International (MSCI) All Country (AC) World Ex USA Small Cap Index, which produced a +14.66% total return for the same period.1 In comparison, the Fund performed comparably to the +12.95% total return of its old benchmark, the MSCI Europe, Australasia, Far East (EAFE) Index, which tracks stock performance in global developed markets excluding the U.S. and Canada. The MSCI AC World Ex USA Small Cap Index replaced the MSCI EAFE Index because we believe it better represents the Fund’s portfolio composition. Please note that index performance information is provided for reference and we do not attempt to track an index but rather undertake investments on the basis of fundamental research. You can find the Fund’s long-term performance data in the Performance Summary beginning on page 9.

Economic and Market Overview

Global financial markets generally remained firm during the six months under review as economic and corporate earnings improvements offset European debt worries, escalating geopolitical turmoil in Middle East/North Africa (MENA) and a devastating natural disaster in Japan. Stock markets also benefited from the developed world’s continued policy support. The U.S. led the way as the Federal Reserve Board (Fed) ushered in another round of quantitative easing and the Obama administration extended Bush-era tax cuts at the beginning of the period. In Europe, where fiscal deficits continued to plague some nations, Ireland and Portugal were forced to accept bailouts and the European Central Bank (ECB) approved the creation of a 750 billion euro rescue facility to address future sovereign funding shortfalls. The ECB’s extraordinary interventions indicated its commitment to preserving monetary union stability, but the decision to raise interest rates toward the end of the period also signaled its vigilance on price stability, the bank’s primary mandate. The ECB’s rate hike was notable for its divergence from the U.S. Fed’s loose monetary policy, while in other parts of the world, particularly emerging markets, policymakers’ actions against inflation broadly continued. At least 21 countries raised official interest rates during the period to forestall asset bubbles and growing inflationary pressures.

Rising commodity prices fueled global inflationary pressures — oil surpassed $100 per barrel for the first time since 2008 and agricultural commodities reached record-high prices. Geopolitical instability helped exacerbate price pressures when civil conflict in MENA at the beginning of 2011 threatened

1. Source: © 2011 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. The indexes are unmanaged and include reinvested dividends. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

4 | Semiannual Report

global oil supplies. Growing concerns about the creditworthiness of some advanced economies eroded confidence in certain currencies, pressuring the dollar and sending precious metals’ prices to new highs. Finally, genuine global economic growth and demand increases also helped support commodity prices. For the most part, global economic trends remained positive, led by emerging markets, where demand growth continued to surge despite restrictive monetary policy. Growth was less consistent in the developed world, where austerity programs in parts of Europe and persistent weaknesses in U.S. labor and housing markets hampered an ongoing recovery. Nonetheless, a generally favorable economic backdrop combined with a corporate profit cycle that could potentially be one of the strongest in market history helped global stock markets reach new post-crisis highs during the six months under review.

Investment Strategy

We take a bottom-up, value-oriented, long-term approach to investing. We focus our analysis on the market price of a company’s securities relative to our evaluation of the company’s long-term earnings, asset value and cash flow potential. We also consider a company’s price/earnings ratio, profit margins and liquidation value. We are patient investors and may hold a security for several years as we wait for the market to recognize a company’s true worth.

Manager’s Discussion

Most of the Fund’s holdings increased in value during the period under review, led by Canaccord Financial, Barco and Emeco Holdings. Shares of Canaccord Financial, a small independent Canadian brokerage firm, performed well as the company announced quarterly earnings results well above market expectations. Looking at the longer term, we believe Canaccord’s strong relationships with Canadian small capitalization equity issues and institutional clients could help boost its market share business if financial market conditions further improve. In our assessment, Canaccord management has done a good job in streamlining the company for the current business environment.

Based in Belgium, Barco is a leading imaging technology firm. Recent sales figures reflected the impact of rapid growth in digital cinema technology, a trend that encouraged the company to overcome previous capacity constraints and production bottlenecks to service the booming global demand in its industry.

Emeco is the leading supplier of heavy earthmoving equipment rentals to the Australian mining industry. The company’s focus is on coal and gold extraction, with a growing presence in iron ore. Its share price rose strongly during the period as the company’s fiscal second-half earnings results were buoyed by

Semiannual Report | 5

Hotels, Restaurants & Leisure, Spain

rising demand and its recent exit from underperforming U.S. and European operations, while Australian mining industry sentiment revived with the demise of a planned mineral tax.

It is important to recognize the effect of currency movements on the Fund’s performance. In general, if the value of the U.S. dollar goes up compared with a foreign currency, an investment traded in that foreign currency will go down in value because it will be worth fewer U.S. dollars. This can have a negative effect on Fund performance. Conversely, when the U.S. dollar weakens in relation to a foreign currency, an investment traded in that foreign currency will increase in value, which can contribute to Fund performance. For the six months ended April 30, 2011, the U.S. dollar declined in value relative to most currencies. As a result, the Fund’s performance was positively affected by the portfolio’s predominant investment in securities with non-U.S. currency exposure. However, one cannot expect the same result in future periods.

In contrast, some holdings disappointed during the six-month reporting period, including Downer EDI; Descente Limited; and Alapis Holding Industrial and Commercial.

Downer EDI provides engineering and infrastructure management services to the public and private rail, road, power, telecommunications and mining sectors in Australia, New Zealand and Asia. The share price declined due to concerns regarding the future level of mining capital expenditure in Australia following recent tax changes. Over the longer term, we believe the company remains poised to benefit from favorable industry trends within its underlying businesses that could enable it to generate attractive earnings growth.

Based in Osaka, Japan, Descente is a leading sports apparel manufacturer and wholesaler. During the period, Descente revised down its sales and profit forecasts, exacerbating existing pressures on the stock stemming from a generally weak overall market for consumer-related sporting goods and concerns about the ramifications of geopolitical tensions between Japan and China. Looking at the longer term, however, we considered that Descente’s business is cash generative and the company has a solid balance sheet, according to our analysis. The company owns well-known brands and, although its domestic market is mature, we believe expansion overseas and continued success in international markets could provide future growth.

Greece-based Alapis, together with its subsidiaries, engages in the manufacturing and distribution of pharmaceuticals and parapharmaceutical products, veterinary pharmaceuticals, cosmetics, detergents and organic products. During the period, Alapis shares fell sharply in value due to worries about the impact of the Greek government’s recent efforts to cut health care costs and potential

6 | Semiannual Report

problems for the company’s debt refinancing. However, Alapis sells low-cost drugs, and in our view the government’s austerity measures could therefore fuel demand for Alapis’ products rather than curtail it. We also believe the market could eventually recognize the company’s fundamental strength and raise its valuation.

Thank you for your continued participation in Templeton Foreign Smaller Companies Fund. We look forward to serving your future investment needs.

Harlan B. Hodes, CPA

Cindy L. Sweeting, CFA

Portfolio Management Team

Templeton Foreign Smaller Companies Fund

CFA® is a trademark owned by CFA Institute.

The foregoing information reflects our analysis, opinions and portfolio holdings as of April 30, 2011, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

Semiannual Report | 7

Martin Cobb assumed portfolio manager responsibilities for the Fund in February 2011. He joined Franklin Templeton in 2003 and manages several global equity portfolios. His research responsibilities are U.S. banks and financials, as well as the U. K. and the Republic of Ireland.

Prior to joining Franklin Templeton Investments, Mr. Cobb was an investment manager with SVM Asset Management in Edinburgh, where he specialized in U.K. equities. Prior to this position, he worked for First State Investments where, as senior portfolio manager, U.K. equities, he managed their flagship U.K. equities fund as well as several global portfolios for institutional and retail clients. He began his career in investment management with Baillie Gifford as an equities analyst, after which he assumed responsibility for the management of several institutional client portfolios.

Cindy L. Sweeting assumed portfolio manager responsibilities for the Fund in February 2011. She is also executive vice president of Templeton Investment Counsel, LLC, and director of portfolio management for the Templeton Global Equity Group. She has portfolio management responsibility for other retail funds and institutional separate account relationships with global and international mandates.

Ms. Sweeting has 28 years of experience in the investment industry. She joined Franklin Templeton Investments in Templeton’s Nassau office in 1997, and has served as director of research for the Templeton Global Equity Group, as well as president of Templeton Global Advisers Limited. Prior to joining Templeton, she was the senior vice president of investments with McDermott International Investments Co., Inc., in Nassau. At McDermott, she was responsible for the investment department, which encompassed portfolio management and pension administration.

8 | Semiannual Report

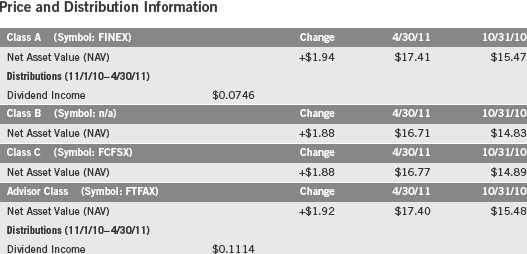

Performance Summary as of 4/30/11

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

Semiannual Report | 9

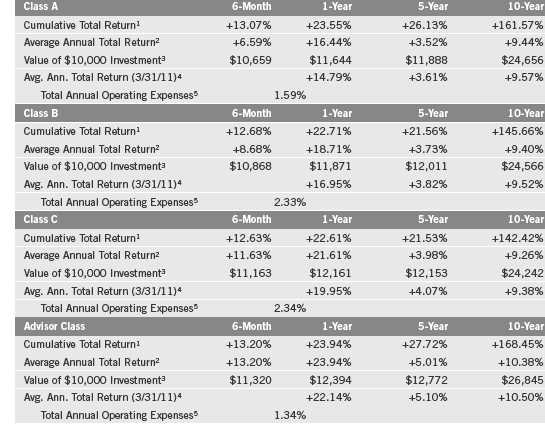

Performance Summary (continued)

Performance

Cumulative total return excludes sales charges. Average annual total returns and value of $10,000 investment include maximum sales charges. Class A: 5.75% maximum initial sales charge; Class B: contingent deferred sales charge (CDSC) declining from 4% to 1% over six years, and eliminated thereafter; Class C: 1% CDSC in first year only; Advisor Class: no sales charges.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

10 | Semiannual Report

Performance Summary (continued)

Endnotes

Special risks are associated with foreign investing, including currency fluctuations, economic instability and political developments. Investments in emerging markets involve heightened risks related to the same factors, in addition to those associated with these markets’ smaller size and lesser liquidity. In addition, smaller company stocks have historically exhibited greater price volatility than large-company stocks, particularly over the short term. The manager applies various techniques and analyses in making investment decisions for the Fund, but there can be no guarantee that these decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

Class B: Class C: | These shares have higher annual fees and expenses than Class A shares. Prior to 1/1/04, these shares were offered with an initial sales charge; thus actual total returns would have differed. These shares have higher annual fees and expenses than Class A shares. |

Advisor Class: | Shares are available to certain eligible investors as described in the prospectus. |

1. Cumulative total return represents the change in value of an investment over the periods indicated.

2. Average annual total return represents the average annual change in value of an investment over the periods indicated. Six-month return has not been annualized.

3. These figures represent the value of a hypothetical $10,000 investment in the Fund over the periods indicated.

4. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

5. Figures are as stated in the Fund’s prospectus current as of the date of this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

Semiannual Report | 11

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. | |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

12 | Semiannual Report

Your Fund’s Expenses (continued)

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

*Expenses are calculated using the most recent six-month expense ratio, annualized for each class (A: 1.49%; B: 2.23%; C: 2.24%; and Advisor: 1.24%), multiplied by the average account value over the period, multiplied by 181/365 to reflect the one-half year period.

Semiannual Report | 13

Franklin Templeton International Trust

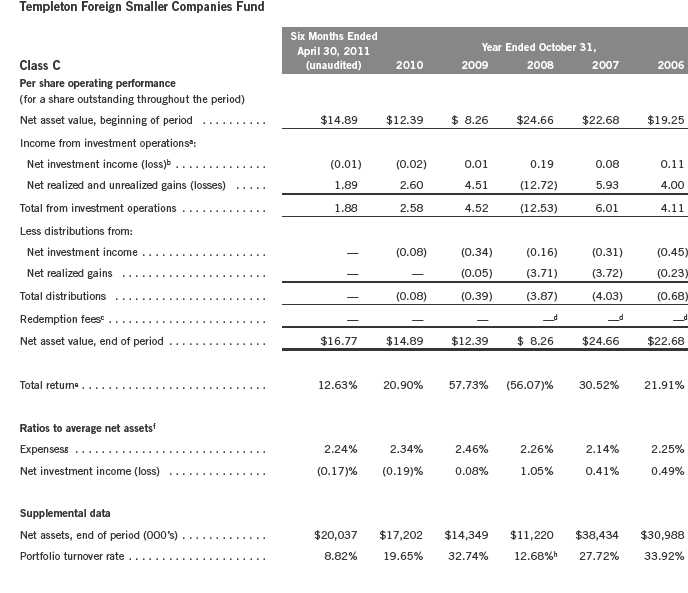

Financial Highlights

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of

the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund.

bBased on average daily shares outstanding.

cEffective September 1, 2008, the redemption fee was eliminated.

dAmount rounds to less than $0.01 per share.

eTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable, and is not annualized for periods less than one year.

fRatios are annualized for periods less than one year.

gBenefit of expense reduction rounds to less than 0.01%.

hExcludes the value of portfolio securities delivered as a result of a redemption in-kind.

14 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

Franklin Templeton International Trust

Financial Highlights (continued)

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of

the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund.

bBased on average daily shares outstanding.

cEffective September 1, 2008, the redemption fee was eliminated.

dAmount rounds to less than $0.01 per share.

eTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable, and is not annualized for periods less than one year.

fRatios are annualized for periods less than one year.

gBenefit of expense reduction rounds to less than 0.01%.

hExcludes the value of portfolio securities delivered as a result of a redemption in-kind.

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 15

Franklin Templeton International Trust

Financial Highlights (continued)

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of

the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund.

bBased on average daily shares outstanding.

cEffective September 1, 2008, the redemption fee was eliminated.

dAmount rounds to less than $0.01 per share.

eTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable, and is not annualized for periods less than one year.

fRatios are annualized for periods less than one year.

gBenefit of expense reduction rounds to less than 0.01%.

hExcludes the value of portfolio securities delivered as a result of a redemption in-kind.

16 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

Franklin Templeton International Trust

Financial Highlights (continued)

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of

the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund.

bBased on average daily shares outstanding.

cEffective September 1, 2008, the redemption fee was eliminated.

dAmount rounds to less than $0.01 per share.

eTotal return is not annualized for periods less than one year.

fRatios are annualized for periods less than one year.

gBenefit of expense reduction rounds to less than 0.01%.

hExcludes the value of portfolio securities delivered as a result of a redemption in-kind.

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 17

Franklin Templeton International Trust

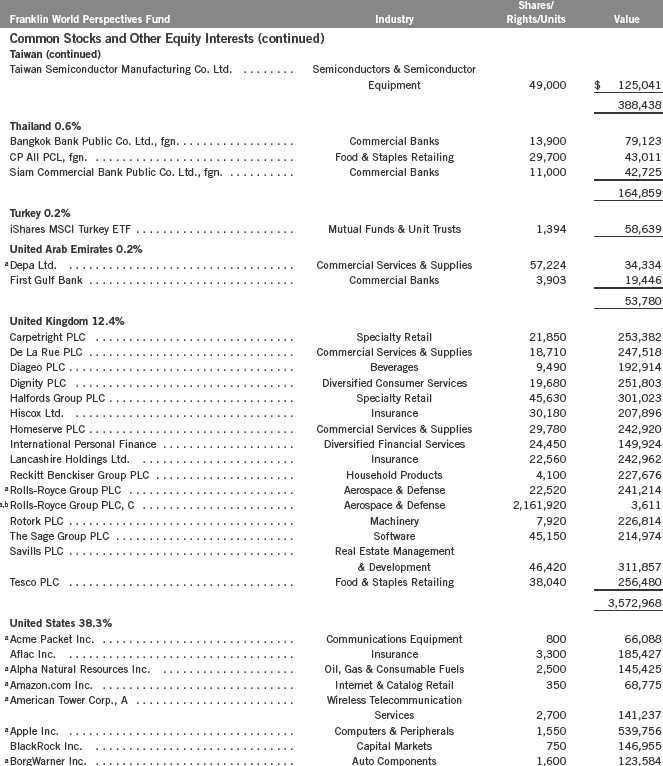

Statement of Investments, April 30, 2011 (unaudited)

18 | Semiannual Report

Franklin Templeton International Trust

Statement of Investments, April 30, 2011 (unaudited) (continued)

Franklin Templeton International Trust

Statement of Investments, April 30, 2011 (unaudited) (continued)

20 | Semiannual Report

Franklin Templeton International Trust

Statement of Investments, April 30, 2011 (unaudited) (continued)

See Abbreviations on page 35.

aNon-income producing.

bSecurity was purchased pursuant to Rule 144A under the Securities Act of 1933 and may be sold in transactions exempt from registration only to qualified institutional buyers or in

a public offering registered under the Securities Act of 1933. This security has been deemed liquid under guidelines approved by the Trust’s Board of Trustees. At April 30, 2011, the

value of this security was $2,772,300, representing 1.14% of net assets.

cA portion of the security purchased on a delayed delivery basis. See Note 1(c).

dSecurity has been deemed illiquid because it may not be able to be sold within seven days.

eThe security is traded on a discount basis with no stated coupon rate.

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 21

Franklin Templeton International Trust

Financial Statements

Statement of Assets and Liabilities

April 30, 2011 (unaudited)

22 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

Franklin Templeton International Trust

Financial Statements (continued)

Statement of Assets and Liabilities (continued)

April 30, 2011 (unaudited)

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 23

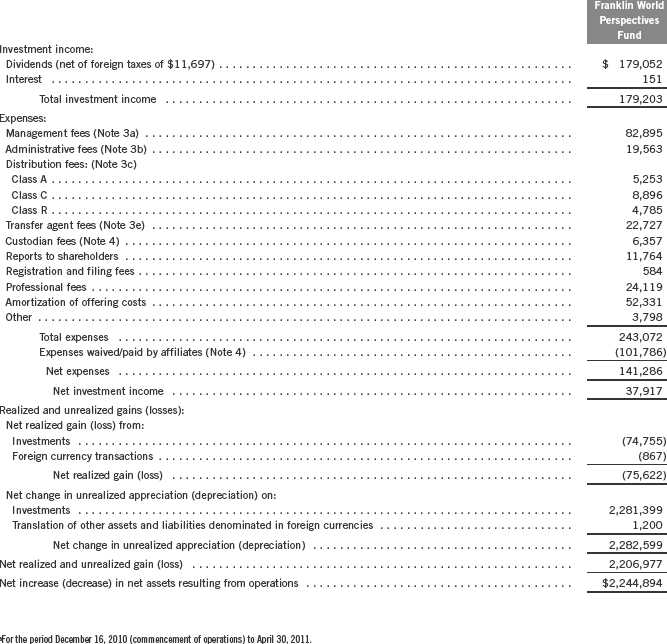

Franklin Templeton International Trust

Financial Statements (continued)

Statement of Operations

for the six months ended April 30, 2011 (unaudited)

24 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

Franklin Templeton International Trust

Financial Statements (continued)

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 25

Franklin Templeton International Trust

Notes to Financial Statements (unaudited)

Templeton Foreign Smaller Companies Fund

1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

Franklin Templeton International Trust (Trust) is registered under the Investment Company Act of 1940, as amended, (1940 Act) as an open-end investment company, consisting of three separate funds. The Templeton Foreign Smaller Companies Fund (Fund) is included in this report. The financial statements of the remaining funds in the Trust are presented separately. The Fund offers four classes of shares: Class A, Class B, Class C, and Advisor Class. Each class of shares differs by its initial sales load, contingent deferred sales charges, distribution fees, voting rights on matters affecting a single class and its exchange privilege.

The following summarizes the Fund’s significant accounting policies.

a. Financial Instrument Valuation

The Fund’s investments in securities and other financial instruments are carried at fair value daily. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants on the measurement date. Under procedures approved by the Trust’s Board of Trustees, the Fund may utilize independent pricing services, quotations from securities and financial instrument dealers, and other market sources to determine fair value.

Equity securities listed on an exchange or on the NASDAQ National Market System are valued at the last quoted sale price or the official closing price of the day, respectively. Foreign equity securities are valued as of the close of trading on the foreign stock exchange on which the security is primarily traded, or the NYSE, whichever is earlier. The value is then converted into its U.S. dollar equivalent at the foreign exchange rate in effect at the close of the NYSE on the day that the value of the security is determined. Over-the-counter securities are valued within the range of the most recent quoted bid and ask prices. Securities that trade in multiple markets or on multiple exchanges are valued according to the broadest and most representative market. Certain equity securities are valued based upon fundamental characteristics or relationships to similar securities.

Debt securities generally trade in the over-the-counter market rather than on a securities exchange. The Fund’s pricing services use multiple valuation techniques to determine fair value. In instances where sufficient market activity exists, the pricing services may utilize a market-based approach through which quotes from market makers are used to determine fair value. In instances where sufficient market activity may not exist or is limited, the pricing services also utilize proprietary valuation models which may consider market characteristics such as benchmark yield curves, option-adjusted spreads, credit spreads, estimated default rates, coupon rates, anticipated timing of principal repayments, underlying collateral, and other unique security features in order to estimate the relevant cash flows, which are then discounted to calculate the fair value. Securities denominated in a foreign currency are converted into their U.S. dollar equivalent at the foreign

26 | Semiannual Report

Franklin Templeton International Trust

Notes to Financial Statements (unaudited) (continued)

Templeton Foreign Smaller Companies Fund

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) |

| a. | Financial Instrument Valuation (continued) |

exchange rate in effect at the close of the NYSE on the date that the values of the foreign debt securities are determined.

The Fund has procedures to determine the fair value of securities and other financial instruments for which market prices are not readily available or which may not be reliably priced. Under these procedures, the Fund primarily employs a market-based approach which may use related or comparable assets or liabilities, recent transactions, market multiples, book values, and other relevant information for the investment to determine the fair value of the investment. The Fund may also use an income-based valuation approach in which the anticipated future cash flows of the investment are discounted to calculate fair value. Discounts may also be applied due to the nature or duration of any restrictions on the disposition of the investments. Due to the inherent uncertainty of valuations of such investments, the fair values may differ significantly from the values that would have been used had an active market existed.

Trading in securities on foreign securities stock exchanges and over-the-counter markets may be completed before the daily close of business on the NYSE. Occasionally, events occur between the time at which trading in a foreign security is completed and the close of the NYSE that might call into question the reliability of the value of a portfolio security held by the Fund. As a result, differences may arise between the value of the Fund’s portfolio securities as determined at the foreign market close and the latest indications of value at the close of the NYSE. In order to minimize the potential for these differences, the investment manager monitors price movements following the close of trading in foreign stock markets through a series of country specific market proxies (such as baskets of American Depository Receipts, futures contracts and exchange traded funds). These price movements are measured against established trigger thresholds for each specific market proxy to assist in determining if an event has occurred that may call into question the reliability of the values of the foreign securities held by the Fund. If such an event occurs, the securities may be valued using fair value procedures, which may include the use of independent pricing services.

b. Foreign Currency Translation

Portfolio securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars based on the exchange rate of such currencies against U.S. dollars on the date of valuation. The Fund may enter into foreign currency exchange contracts to facilitate transactions denominated in a foreign currency. Purchases and sales of securities, income and expense items denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date. Portfolio securities and assets and liabilities denominated in foreign currencies contain risks that those currencies will decline in value relative to the U.S. dollar. Occasionally, events may impact the availability or reliability of foreign exchange rates

Semiannual Report | 27

Franklin Templeton International Trust

Notes to Financial Statements (unaudited) (continued)

Templeton Foreign Smaller Companies Fund

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) |

| b. | Foreign Currency Translation (continued) |

used to convert the U.S. dollar equivalent value. If such an event occurs, the foreign exchange rate will be valued at fair value using procedures established and approved by the Trust’s Board of Trustees.

The Fund does not separately report the effect of changes in foreign exchange rates from changes in market prices on securities held. Such changes are included in net realized and unrealized gain or loss from investments on the Statement of Operations.

Realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on securities transactions and the difference between the recorded amounts of dividends, interest, and foreign withholding taxes and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in foreign exchange rates on foreign denominated assets and liabilities other than investments in securities held at the end of the reporting period.

c. Securities Purchased on a Delayed Delivery Basis

The Fund purchases securities on a delayed delivery basis, with payment and delivery scheduled for a future date. These transactions are subject to market fluctuations and are subject to the risk that the value at delivery may be more or less than the trade date purchase price. Although the Fund will generally purchase these securities with the intention of holding the securities, it may sell the securities before the settlement date. Sufficient assets have been segregated for these securities.

d. Income Taxes

It is the Fund’s policy to qualify as a regulated investment company under the Internal Revenue Code. The Fund intends to distribute to shareholders substantially all of its taxable income and net realized gains to relieve it from federal income and excise taxes. As a result, no provision for U.S. federal income taxes is required. The Fund files U.S. income tax returns as well as tax returns in certain other jurisdictions. The Fund records a provision for taxes in its financial statements including penalties and interest, if any, for a tax position taken on a tax return (or expected to be taken) when it fails to meet the more likely than not (a greater than 50% probability) threshold and based on the technical merits, the tax position may not be sustained upon examination by the tax authorities. As of April 30, 2011, and for all open tax years, the Fund has determined that no provision for income tax is required in the Fund’s financial statements. Open tax years are those that remain subject to examination and are based on each tax jurisdiction statute of limitation.

28 | Semiannual Report

Franklin Templeton International Trust

Notes to Financial Statements (unaudited) (continued)

Templeton Foreign Smaller Companies Fund

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) |

| d. | Income Taxes (continued) |

The Fund may be subject to foreign taxation related to income received, capital gains on the sale of securities and certain foreign currency transactions in the foreign jurisdictions in which it invests. Foreign taxes, if any, are recorded based on the tax regulations and rates that exist in the foreign markets in which the Fund invests. When a capital gain tax is determined to apply the Fund records an estimated deferred tax liability for unrealized gains on these securities in an amount that would be payable if the securities were disposed of on the valuation date.

e. Security Transactions, Investment Income, Expenses and Distributions

Security transactions are accounted for on trade date. Realized gains and losses on security transactions are determined on a specific identification basis. Interest income and estimated expenses are accrued daily. Amortization of premium and accretion of discount on debt securities are included in interest income. Dividend income is recorded on the ex-dividend date except that certain dividends from foreign securities are recognized as soon as the Fund is notified of the ex-dividend date. Distributions to shareholders are recorded on the ex-dividend date and are determined according to income tax regulations (tax basis). Distributable earnings determined on a tax basis may differ from earnings recorded in accordance with accounting principles generally accepted in the United States of America. These differences may be permanent or temporary. Permanent differences are reclassified among capital accounts to reflect their tax character. These reclassifications have no impact on net assets or the results of operations. Temporary differences are not reclassified, as they may reverse in subsequent periods.

Common expenses incurred by the Trust are allocated among the funds based on the ratio of net assets of each fund to the combined net assets of the Trust. Fund specific expenses are charged directly to the fund that incurred the expense.

Realized and unrealized gains and losses and net investment income, not including class specific expenses, are allocated daily to each class of shares based upon the relative proportion of net assets of each class. Differences in per share distributions, by class, are generally due to differences in class specific expenses.

f. Accounting Estimates

The preparation of financial statements in accordance with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

Semiannual Report | 29

Franklin Templeton International Trust

Notes to Financial Statements (unaudited) (continued)

Templeton Foreign Smaller Companies Fund

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) |

| g. | Guarantees and Indemnifications |

Under the Trust’s organizational documents, its officers and trustees are indemnified by the Trust against certain liabilities arising out of the performance of their duties to the Trust. Additionally, in the normal course of business, the Trust, on behalf of the Fund, enters into contracts with service providers that contain general indemnification clauses. The Trust’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Trust that have not yet occurred. Currently, the Trust expects the risk of loss to be remote.

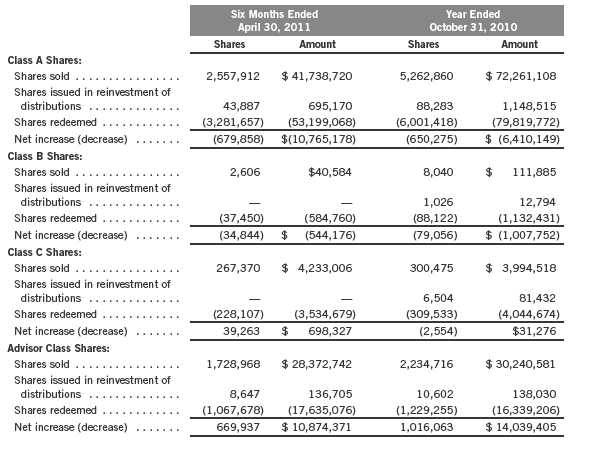

2. SHARES OF BENEFICIAL INTEREST

At April 30, 2011, there were an unlimited number of shares authorized (without par value).

Transactions in the Fund’s shares were as follows:

30 | Semiannual Report

Franklin Templeton International Trust

Notes to Financial Statements (unaudited) (continued)

Templeton Foreign Smaller Companies Fund

3. TRANSACTIONS WITH AFFILIATES

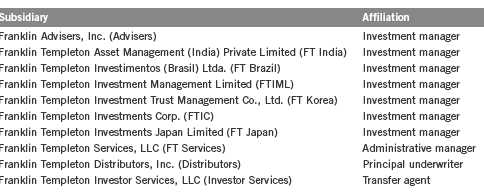

Franklin Resources, Inc. is the holding company for various subsidiaries that together are referred to as Franklin Templeton Investments. Certain officers and trustees of the Trust are also officers and/or directors of the following subsidiaries:

a. Management Fees

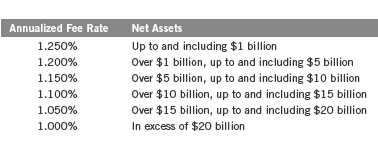

The Fund pays an investment management fee to FTIC based on the average daily net assets of the Fund as follows:

Under a subadvisory agreement, TIC, an affiliate of FTIC, provides subadvisory services to the Fund. The subadvisory fee is paid by FTIC based on the average daily net assets, and is not an additional expense of the Fund.

b. Administrative Fees

Under an agreement with FTIC, FT Services provides administrative services to the Fund. The fee is paid by FTIC based on average daily net assets, and is not an additional expense of the Fund.

c. Distribution Fees

The Trust’s Board of Trustees has adopted distribution plans for each share class, with the exception of Advisor Class shares, pursuant to Rule 12b-1 under the 1940 Act. Under the Fund’s Class A reimbursement distribution plan, the Fund reimburses Distributors for costs incurred in connection with the servicing, sale and distribution of the Fund’s shares up to the maximum annual plan rate. Under the Class A reimbursement distribution plan, costs exceeding the maximum for the current plan year cannot be reimbursed in subsequent periods.

Semiannual Report | 31

Franklin Templeton International Trust

Notes to Financial Statements (unaudited) (continued)

Templeton Foreign Smaller Companies Fund

3. TRANSACTIONS WITH AFFILIATES (continued) c. Distribution Fees (continued)

In addition, under the Fund’s Class B and C compensation distribution plans, the Fund pays Distributors for costs incurred in connection with the servicing, sale and distribution of the Fund’s shares up to the maximum annual plan rate for each class.

The maximum annual plan rates, based on the average daily net assets, for each class, are as follows:

d. Sales Charges/Underwriting Agreements

Distributors has advised the Fund of the following commission transactions related to the sales and redemptions of the Fund’s shares for the period:

e. Transfer Agent Fees

For the period ended April 30, 2011, the Fund paid transfer agent fees of $203,857, of which $116,573 was retained by Investor Services.

4. EXPENSE OFFSET ARRANGEMENT

The Fund has entered into an arrangement with its custodian whereby credits realized as a result of uninvested cash balances are used to reduce a portion of the Fund’s custodian expenses. During the period ended April 30, 2011, the custodian fees were reduced as noted in the Statement of Operations.

5. INCOME TAXES

For tax purposes, capital losses may be carried over to offset future capital gains, if any. At October 31, 2010, the Fund had tax basis capital losses of $31,789,260 expiring in 2017. During the year ended October 31, 2010, the Fund utilized $1,639,678 of capital loss carryforwards.

32 | Semiannual Report

Franklin Templeton International Trust

Notes to Financial Statements (unaudited) (continued)

Templeton Foreign Smaller Companies Fund

5. INCOME TAXES (continued)

At April 30, 2011, the cost of investments, net unrealized appreciation (depreciation) for income tax purposes were as follows:

Net investment income (loss) differs for financial statement and tax purposes primarily due to differing treatments of foreign currency transactions and passive foreign investment company shares, non-deductible expenses and regulatory settlements.

Net realized gains (losses) differ for financial statement and tax purposes primarily due to differing treatments of wash sales and foreign currency transactions.

6. INVESTMENT TRANSACTIONS

Purchases and sales of investments (excluding short term securities) for the period ended April 30, 2011, aggregated $21,732,271 and $18,397,140, respectively.

7. CONCENTRATION OF RISK

Investing in foreign securities may include certain risks and considerations not typically associated with investing in U.S. securities, such as fluctuating currency values and changing local and regional economic, political and social conditions, which may result in greater market volatility. In addition, certain foreign securities may not be as liquid as U.S. securities.

8. CREDIT FACILITY

The Fund, together with other U.S. registered and foreign investment funds (collectively, Borrowers), managed by Franklin Templeton Investments, are borrowers in a joint syndicated senior unsecured credit facility totaling $750 million (Global Credit Facility) which matures on January 20, 2012. This Global Credit Facility provides a source of funds to the Borrowers for temporary and emergency purposes, including the ability to meet future unanticipated or unusually large redemption requests.

Under the terms of the Global Credit Facility, the Fund shall, in addition to interest charged on any borrowings made by the Fund and other costs incurred by the Fund, pay its share of fees and expenses incurred in connection with the implementation and maintenance of the Global

Semiannual Report | 33

Franklin Templeton International Trust

Notes to Financial Statements (unaudited) (continued)

Templeton Foreign Smaller Companies Fund

8. CREDIT FACILITY (continued)

Credit Facility, based upon its relative share of the aggregate net assets of all of the Borrowers, including an annual commitment fee of 0.08% based upon the unused portion of the Global Credit Facility, which is reflected in other expenses on the Statement of Operations. During the period ended April 30, 2011, the Fund did not use the Global Credit Facility.

9. FAIR VALUE MEASUREMENTS

The Fund follows a fair value hierarchy that distinguishes between market data obtained from independent sources (observable inputs) and the Fund’s own market assumptions (unobservable inputs). These inputs are used in determining the value of the Fund’s investments and are summarized in the following fair value hierarchy:

- Level 1 – quoted prices in active markets for identical securities

- Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speed, credit risk, etc.)

- Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments)

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities.

For movements between the levels within the fair value hierarchy, the Fund has adopted a policy of recognizing the transfers as of the date of the underlying event which caused the movement.

The following is a summary of the inputs used as of April 30, 2011, in valuing the Fund’s assets and liabilities carried at fair value:

34 | Semiannual Report

Franklin Templeton International Trust

Notes to Financial Statements (unaudited) (continued)

Templeton Foreign Smaller Companies Fund

10. SUBSEQUENT EVENTS

The Fund has evaluated subsequent events through the issuance of the financial statements and determined that no events have occurred that require disclosure.

ABBREVIATIONS

Selected Portfolio

FHLB - Federal Home Loan Bank

Semiannual Report | 35

Franklin Templeton International Trust

Shareholder Information

Templeton Foreign Smaller Companies Fund

Board Review of Investment Management Agreement

At a meeting held April 19, 2011, the Board of Trustees (Board), including a majority of non-interested or independent Trustees, approved renewal of the investment management agreement for each of the Funds within the Trust, including Templeton Foreign Smaller Companies Fund (Fund(s)). In reaching this decision, the Board took into account information furnished throughout the year at regular Board meetings, as well as information prepared specifically in connection with the annual renewal review process. Information furnished and discussed throughout the year included investment performance reports and related financial information for each Fund, as well as periodic reports on expenses, shareholder services, legal, compliance, pricing, brokerage commissions and execution and other services provided by the Investment Manager (Manager) and its affiliates. Information furnished specifically in connection with the renewal process included a report for each Fund prepared by Lipper, Inc. (Lipper), an independent organization, as well as additional material, including a Fund profitability analysis prepared by management. The Lipper reports compared each Fund’s investment performance and expenses with those of other mutual funds deemed comparable to the Fund as selected by Lipper. The Fund profitability analysis report discussed the profitability to Franklin Templeton Investments from its overall U.S. fund operations, as well as on an individual fund-by-fund basis. Additional material accompanying such profitability analysis included information on a fund-by-fund basis listing portfolio managers and other accounts they manage, as well as information on management fees charged by the Manager and its affiliates to U.S. mutual funds and other accounts, including management’s explanation of differences where relevant. Such material also included a memorandum prepared by management describing project initiatives and capital investments relating to the services provided to the Funds by the Franklin Templeton Investments organization, as well as a memorandum relating to economies of scale and a comparative analysis concerning transfer agent fees charged each Fund.

In considering such materials, the independent Trustees received assistance and advice from and met separately with independent counsel. While the investment management agreements for all Funds were considered at the same Board meeting, the Board dealt with each Fund separately. In approving continuance of the investment management agreement for each Fund, the Board, including a majority of independent Trustees, determined that the existing management fee structure was fair and reasonable and that continuance of the investment management agreement was in the best interests of each Fund and its shareholders. While attention was given to all information furnished, the following discusses some primary factors relevant to the Board’s decision.

NATURE, EXTENT AND QUALITY OF SERVICE. The Board was satisfied with the nature and quality of the overall services provided by the Manager and its affiliates to the Fund and its shareholders. In addition to investment performance and expenses discussed later, the Board’s

36 | Semiannual Report

Franklin Templeton International Trust

Shareholder Information (continued)

Templeton Foreign Smaller Companies Fund

Board Review of Investment Management Agreement (continued)

opinion was based, in part, upon periodic reports furnished it showing that the investment policies and restrictions for the Fund were consistently complied with as well as other reports periodically furnished the Board covering matters such as the compliance of portfolio managers and other management personnel with the code of ethics adopted throughout the Franklin Templeton fund complex, the adherence to fair value pricing procedures established by the Board, and the accuracy of net asset value calculations. The Board also noted the extent of benefits provided Fund shareholders from being part of the Franklin Templeton family of funds, including the right to exchange investments between the same class of funds without a sales charge, the ability to reinvest Fund dividends into other funds and the right to combine holdings in other funds to obtain a reduced sales charge. Favorable consideration was given to management’s continuous efforts and expenditures in establishing back-up systems and recovery procedures to function in the event of a natural disaster, it being noted that such systems and procedures had functioned smoothly during the Florida hurricanes and blackouts experienced in previous years. Among other factors taken into account by the Board were the Manager’s best execution trading policies, including a favorable report by an independent portfolio trading analytical firm. Consideration was also given to the experience of the Fund’s portfolio management team, the number of accounts managed and general method of compensation. In this latter respect, the Board noted that a primary factor in management’s determination of a portfolio manager’s bonus compensation was the relative investment performance of the funds he or she managed and that a portion of such bonus was required to be invested in a predesignated list of funds within such person’s fund management area so as to be aligned with the interests of shareholders. The Board also took into account the quality of transfer agent and shareholder services provided Fund shareholders by an affiliate of the Manager and the continuous enhancements to the Franklin Templeton website. Particular attention was given to management’s conservative approach and diligent risk management procedures, including continuous monitoring of counterparty credit risk and attention given to derivatives and other complex instruments. The Board also took into account, among other things, management’s efforts in establishing a global credit facility for the benefit of the Fund and other accounts managed by Franklin Templeton Investments to provide a source of cash for temporary and emergency purposes or to meet unusual redemption requests as well as the strong financial position of the Manager’s parent company and its commitment to the mutual fund business as evidenced by its subsidization of money market funds.

INVESTMENT PERFORMANCE. The Board placed significant emphasis on the investment performance of the Fund in view of its importance to shareholders. While consideration was given to performance reports and discussions with portfolio managers at Board meetings throughout the year, particular attention in assessing performance was given to the Lipper reports furnished for the agreement renewal. The Lipper reports prepared for the Fund showed the investment performance

Semiannual Report | 37

Franklin Templeton International Trust

Shareholder Information (continued)

Templeton Foreign Smaller Companies Fund

Board Review of Investment Management Agreement (continued)

of its Class A shares in comparison to a performance universe selected by Lipper. The performance universe for the Fund consisted of the Fund and all retail and institutional international small/mid-cap value funds as selected by Lipper. Comparative performance within such universe was shown for the one-year period ended January 31, 2011, and the previous 10 years ended that date. The Lipper report showed the Fund’s total return for the one-year period to be in the second-highest quintile of such performance universe, and on an annualized basis to also be in the second-highest quintile of such universe for each of the previous three-and five-year periods, and the middle quin-tile of such universe for the previous 10-year period. The Board was satisfied with the Fund’s comparative investment performance as set forth in the Lipper report.

COMPARATIVE EXPENSES. Consideration was given to a comparative analysis of the management fee and total expense ratio of the Fund compared with those of a group of other funds selected by Lipper as constituting its appropriate Lipper expense group. Lipper expense data is based upon information taken from each fund’s most recent annual report, which reflects historical asset levels that may be quite different from those currently existing, particularly in a period of market volatility. While recognizing such inherent limitation and the fact that expense ratios generally increase as assets decline and decrease as assets grow, the Board believed the independent analysis conducted by Lipper to be an appropriate measure of comparative expenses. In reviewing comparative costs, Lipper provides information on each Fund’s contractual investment management fee in comparison with the investment management fee that would have been charged by other funds within its Lipper expense group assuming they were similar in size to the Fund, as well as the actual total expense ratio of the Fund in comparison with those of its Lipper expense group. The Lipper contractual investment management fee analysis includes administrative charges as being part of the investment management fee, and actual total expenses, for comparative consistency, are shown by Lipper for Fund Class A shares. The results of such Lipper comparisons showed both the contractual investment management fee rate and actual total expense ratio of the Fund to be in the middle quintile of its Lipper expense group. The Board found the comparative investment management fee and total expense ratio of this Fund as shown in the Lipper report to be acceptable.

MANAGEMENT PROFITABILITY. The Board also considered the level of profits realized by the Manager and its affiliates in connection with the operation of the Fund. In this respect, the Board reviewed the Fund profitability analysis that addresses the overall profitability of Franklin Templeton’s U.S. fund business, as well as its profits in providing management and other services to each of the individual funds during the 12-month period ended September 30, 2010, being the most recent fiscal year-end for Franklin Resources, Inc., the Manager’s parent. In reviewing the analysis, attention was given to the methodology followed in allocating costs to the Fund, it being recognized that allocation methodologies are inherently subjective and various allocation methodologies may each be reasonable while producing different results. In this respect, the Board noted

38 | Semiannual Report

Franklin Templeton International Trust

Shareholder Information (continued)

Templeton Foreign Smaller Companies Fund

Board Review of Investment Management Agreement (continued)

that, while being continuously refined and reflecting changes in the Manager’s own cost accounting, the allocation methodology was consistent with that followed in profitability report presentations for the Fund made in prior years and that the Fund’s independent registered public accounting firm had been engaged by the Manager to review the reasonableness of the allocation methodologies solely for use by the Fund’s Board in reference to the profitability analysis. In reviewing and discussing such analysis, management discussed with the Board its belief that costs incurred in establishing the infrastructure necessary for the type of mutual fund operations conducted by the Manager and its affiliates may not be fully reflected in the expenses allocated to the Fund in determining its profitability, as well as the fact that the level of profits, to a certain extent, reflected operational cost savings and efficiencies initiated by management. The Board also took into account management’s expenditures in improving shareholder services provided the Fund, as well as the need to meet additional regulatory and compliance requirements resulting from the Sarbanes-Oxley Act and recent SEC and other regulatory requirements. In addition, the Board considered a third-party study comparing the profitability of the Manager’s parent on an overall basis to other publicly held managers broken down to show profitability from management operations exclusive of distribution expenses, as well as profitability including distribution expenses. The Board also considered the extent to which the Manager and its affiliates might derive ancillary benefits from fund operations, including revenues generated from transfer agent services and potential benefits resulting from allocation of fund brokerage and the use of commission dollars to pay for research. Based upon its consideration of all these factors, the Board determined that the level of profits realized by the Manager and its affiliates from providing services to the Fund was not excessive in view of the nature, quality and extent of services provided.

ECONOMIES OF SCALE. The Board also considered whether economies of scale are realized by the Manager as the Fund grows larger and the extent to which this is reflected in the level of management fees charged. While recognizing that any precise determination is inherently subjective, the Board noted that based upon the Fund profitability analysis, it appears that as some funds get larger, at some point economies of scale do result in the Manager realizing a larger profit margin on management services provided such a fund. The Board also noted that economies of scale are shared with the Fund and its shareholders through management fee breakpoints so that as a fund grows in size, its effective management fee rate declines. The fee schedule under the investment management agreement for the Fund provides an initial fee of 1% on the first $100 million of net assets; 0.90% on the next $150 million; 0.80% on the next $250 million; and 0.75% on net assets in excess of $500 million. The Fund’s assets were approximately $226 million at December 31, 2010. The Board believed that to the extent economies of scale may be realized by the Manager and its affiliates, the schedule of fees under the investment management agreement for such Fund provides for a sharing of benefits with the Fund and its shareholders.

Semiannual Report | 39

Franklin Templeton International Trust

Shareholder Information (continued)

Templeton Foreign Smaller Companies Fund

Proxy Voting Policies and Procedures

The Fund’s investment manager has established Proxy Voting Policies and Procedures (Policies) that the Fund uses to determine how to vote proxies relating to portfolio securities. Shareholders may view the Fund’s complete Policies online at franklintempleton.com. Alternatively, shareholders may request copies of the Policies free of charge by calling the Proxy Group collect at (954) 527-7678 or by sending a written request to: Franklin Templeton Companies, LLC, 300 S.E. 2nd Street, Fort Lauderdale, FL 33301, Attention: Proxy Group. Copies of the Fund’s proxy voting records are also made available online at franklintempleton.com and posted on the U.S. Securities and Exchange Commission’s website at sec.gov and reflect the most recent 12-month period ended June 30.

Quarterly Statement of Investments

The Fund files a complete statement of investments with the U.S. Securities and Exchange Commission for the first and third quarters for each fiscal year on Form N-Q. Shareholders may view the filed Form N-Q by visiting the Commission’s website at sec.gov. The filed form may also be viewed and copied at the Commission’s Public Reference Room in Washington, DC. Information regarding the operations of the Public Reference Room may be obtained by calling (800) SEC-0330.

40 | Semiannual Report

INTERNATIONAL

FRANKLIN INDIA GROWTH FUND

Semiannual Report

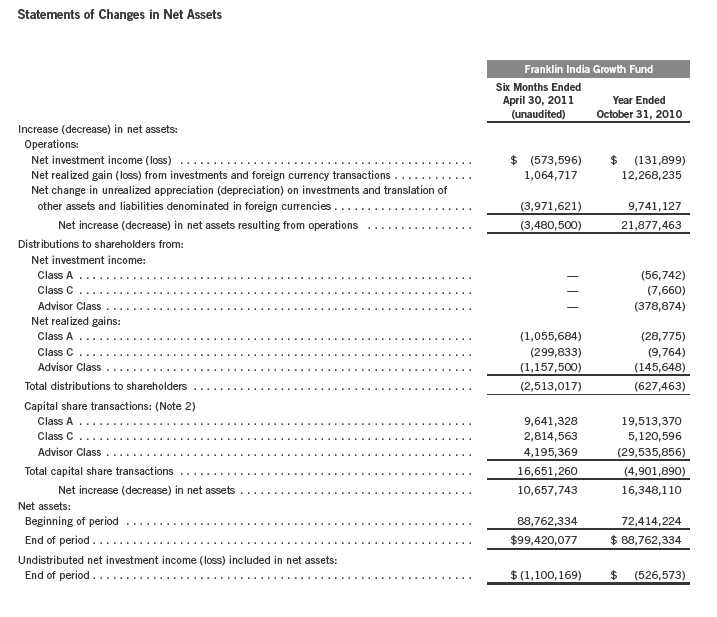

Franklin India Growth Fund

Your Fund’s Goal and Main Investments: Franklin India Growth Fund seeks long-term capital appreciation by investing under normal market conditions at least 80% of its net assets in securities of “Indian companies,” which are defined as those organized under the laws of, with a principal office in, or for which the principal trading market for their securities is in India, that derive 50% or more of total revenue or profit from goods or services produced or sales made in India, or that have 50% or

more of their assets in India.1

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. Please visit franklintempleton.com or call (800) 342-5236 for most recent month-end performance.

This semiannual report for Franklin India Growth Fund covers the period ended April 30, 2011.

Performance Overview

For the six months under review, Franklin India Growth Fund – Class A had a -2.32% cumulative total return. The Fund performed better than the -5.56% total return of its benchmark, the Morgan Stanley Capital International (MSCI) India Index, which is designed to measure stock market performance in India.2 You can find more of the Fund’s performance data in the Performance Summary beginning on page 7.

Economic and Market Overview

During the six months under review, the Indian economy continued to exhibit strength, with gross domestic product growing 7.8% year-over-year in the first quarter of 2011, according to the country’s Central Statistical Organisation. However, this growth rate was soft compared to the previous four quarters due to a deceleration in industrial activity. For India’s 2011 fiscal year (ended March 31, 2011), the Central Statistical Organisation estimated economic growth of 8.5% over fiscal year 2010.

1. The Fund currently invests indirectly in Indian companies through FT (Mauritius) Offshore Investments Limited, a wholly owned, collective investment vehicle registered in the Republic of Mauritius.

2. Source: MSCI, Inc. The index is unmanaged and includes reinvested dividends. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI). The SOI begins on page 27.

Semiannual Report | 3

Persistently high inflation levels, however, led the Reserve Bank of India (RBI) to maintain a tightening monetary policy bias. From the low rates reached during the global financial crisis, the RBI has raised the repo rate, the interest rate at which banks borrow from the RBI, by 200 basis points (100 basis points equal one percentage point) to 6.75% at period-end. Despite the rising rates and input costs, Indian companies managed the reporting period quite well, helped by continued demand for goods and services.

Along with those of other emerging markets, Indian stocks experienced a sell-off by foreign portfolio investors in the early part of 2011. Additionally, concerns about a series of graft allegations at the government and institutional levels weighed on investor sentiment. Small- and mid-capitalization stocks suffered steeper losses than large-capitalization stocks. Real estate and capital goods stocks were the chief decliners, while technology and consumer staples stocks registered gains. Overall, however, net foreign institutional inflows during the period under review totaled $5.4 billion.3

Despite some short-term economic concerns at period-end, India was still poised for longer term growth. A well-balanced growth model combined with a manageable fiscal deficit, a high savings rate and a large young population bode well for the economy. Structural growth drivers such as a rise in income levels and increased government and corporate spending should support higher growth. The government’s continued focus on agricultural and rural sectors could help diversify India’s economic drivers and add to the economy’s ability to navigate through a global slowdown.

Investment Strategy

We are research-driven, fundamental investors pursuing a growth strategy. As bottom-up investors focusing primarily on individual securities, we seek to invest in companies whose current market price, in our opinion, does not reflect future growth prospects. We choose companies that have identifiable drivers of future earnings growth and that present, in our opinion, the best trade-off between earnings growth potential, business and financial risk, and valuation. We rely on a team of analysts to help provide in-depth industry expertise and use both qualitative and quantitative analyses to evaluate companies for distinct and sustainable competitive advantages through leading-edge products, intellectual property, product positioning, unique market niches, brand identity, solid management teams, strong balance sheets, above-average or rising margins, and strong returns on capital invested in the business. In choosing

3. Source: Securities and Exchange Board of India.

4 | Semiannual Report

equity investments, we also consider such factors as the company’s financial strength, management’s expertise, the company’s growth potential within the industry, and the industry’s growth potential.

Manager’s Discussion

Our overall strategy has been to build a diversified portfolio of companies that cover the full market capitalization spectrum and that we think are well positioned to take advantage of Indian economic growth. In particular, we believe companies that could benefit from structural growth drivers such as rising consumer spending and infrastructure investment may provide favorable growth opportunities.

During the period under review, the Fund’s overall telecommunication services and information technology (IT) sectors benefited absolute performance.4 Some stocks in the telecommunication services sector rebounded from lows touched earlier in 2010 resulting from concerns of increasing competitive intensity and regulatory pressures. Bharti Airtel, one of India’s largest telecommunication companies, was among the chief contributors. The firm has maintained its market share through challenging times and, in our view, is well positioned to take advantage of growth opportunities in the Indian market. We think its recent expansion into Africa’s emerging telecommunications market further added to its growth potential. Another sizable holding, Tata Consultancy Services, one of India’s largest IT services companies, also delivered strong performance over the reporting period, aided by recovery in global IT spending.

Our share purchase in Coal India positively contributed to performance. The company, India’s largest coal producer, completed its initial public offering in October 2010. Various drivers, such as rising consumption of coal, large reserves and a monopolistic position in a tight coal market should, in our view, help the company perform well.

In contrast, the Fund’s returns were hampered mainly by our financials and industrials sector holdings.5 Rising inflation and subsequent interest rate increases raised concerns about financials sector profitability, while a slowdown in capital spending hurt performance of industrials sector companies. On an individual stock basis, Reliance Industries was a major detractor from Fund performance. One of India’s biggest conglomerates, the company explores,

4. The telecommunications services sector comprises wireless telecommunication services in the SOI. The IT sector comprises IT services in the SOI.

5. The financials sector comprises commercial banks and diversified financial services in the SOI. The industrials sector comprises construction and engineering, electrical equipment and machinery in the SOI.

Semiannual Report | 5

develops and produces oil and gas, refines petroleum products, produces and markets petrochemical products, produces textiles, and operates retail stores. Uncertainty about the increase in gas production from its key production block in the Krishna-Godavari basin weighed on stock performance during the period under review. Other key detractors included power equipment manufacturing company Crompton Greaves and construction and engineering company Larsen & Toubro. Notwithstanding their recent stock declines, we remained positive on the medium- to long-term performance of these companies and continued to hold these positions at period-end.

Thank you for your continued participation in Franklin India Growth Fund.

We look forward to serving your future investment needs.

Stephen H. Dover, CFA

Purav A. Jhaveri, CFA, FRM

Portfolio Management Team

Franklin India Growth Fund

CFA® is a trademark owned by CFA Institute.

The foregoing information reflects our analysis, opinions and portfolio holdings as of April 30, 2011, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

6 | Semiannual Report

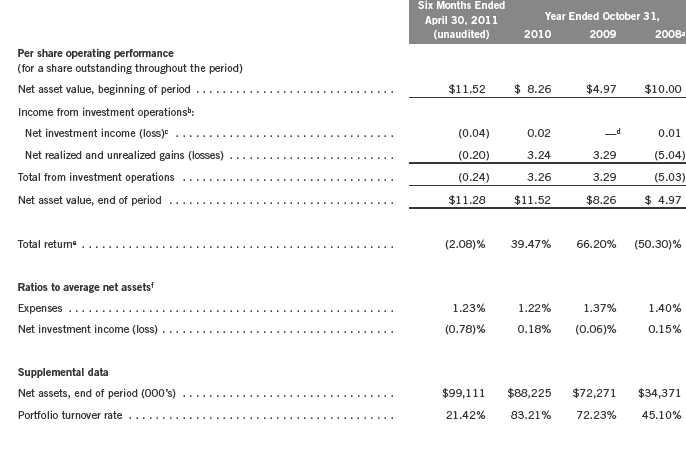

Performance Summary as of 4/30/11

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

Semiannual Report | 7

Performance Summary (continued)

Performance1

Cumulative total return excludes sales charges. Average annual total returns and value of $10,000 investment include maximum sales charges. Class A: 5.75% maximum initial sales charge; Class C: 1% contingent deferred sales charge in first year only; Advisor Class: no sales charges.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

The investment manager and administrator have contractually agreed to waive or assume certain expenses so that the common expenses (including the expenses of FT (Mauritius) Offshore Investments Limited but excluding Rule 12b-1 fees) for each class of the Fund do not exceed 1.40% (other than certain nonroutine expenses) until 2/29/12.

8 | Semiannual Report

Performance Summary (continued)

Endnotes

Special risks are associated with foreign investing, including currency fluctuations, economic instability and political developments. Investments in developing markets involve heightened risks related to the same factors, in addition to risks associated with these companies’ smaller size, lesser liquidity and the potential lack of established legal, political, business and social frameworks to support securities markets in the countries in which they operate. The Fund may also experience greater volatility than a fund that is more broadly diversified geographically. The Fund is designed for the aggressive portion of a well-diversified portfolio. The manager applies various techniques and analyses in making investment decisions for the Fund, but there can be no guarantee that these decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

Class C: Advisor Class: | These shares have higher annual fees and expenses than Class A shares. Shares are available to certain eligible investors as described in the prospectus. |

1. If the manager and administrator had not waived fees, the Fund’s total returns would have been lower. 2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated. Six-month return has not been annualized.

4. These figures represent the value of a hypothetical $10,000 investment in the Fund over the periods indicated.

5. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

6. Figures are as stated in the Fund’s prospectus current as of the date of this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

Semiannual Report | 9

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. | |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds