futures, included long positions in German, Dutch, Italian, U.K. and Hong Kong stocks and short positions in Swiss, Canadian, Japanese and U.S. stocks. Within fixed income, we maintained long futures positions in German bunds and Japanese and Australian government bonds, as well as short futures positions in U.K., Canadian and U.S. government bonds. The currency component of the tactical asset allocation included long positions in the U.S. dollar and Norwegian krone and short exposures to the British pound and euro, which we achieved through the use of currency forwards.

Equity

For the overall portfolio, the equity portion contributed to relative performance. An overweighted allocation to European stocks was a large contributor within equity as European markets rallied strongly largely because of a potentially improving fiscal outlook and positive developments in the European debt crisis. Stock selection within Europe also contributed to relative performance, led by holdings in Switzerland, the Netherlands and France. Although equities contributed to relative performance overall, certain equity holdings detracted. For example, stock selection in Asia hurt relative performance as some stocks, such as Hong Kong-based manufacturer Li & Fung and Chinese utility Trina Solar, which is not part of the MSCI ACWI, declined during the period.

Fixed Income

For the overall portfolio, our fixed income holdings also contributed to relative performance, with the bulk arising from security selection in Asia and Europe. We used bond futures to establish a long position in Japanese government bonds and a short position in U.K. government bonds, each of which contributed to relative performance. Despite the positive effect of security selection, our underweighted allocation to European fixed income detracted from relative performance as bond markets in several European countries included in the Citigroup WGBI rallied. Germany was a notable laggard, and our overweighted allocation to bunds detracted from performance.

Currencies

Overall, our currency positions detracted from performance relative to the blended benchmark. As the euro appreciated 5.19% against the U.S. dollar during the period, our short euro position, achieved via currency forward contracts, was a key detractor from relative performance.3 The British pound and Canadian dollar also strengthened against the U.S. dollar, leading our short positions in these currencies to detract from relative performance. Somewhat

3. Source: IDC/Exshare.

Semiannual Report | 7

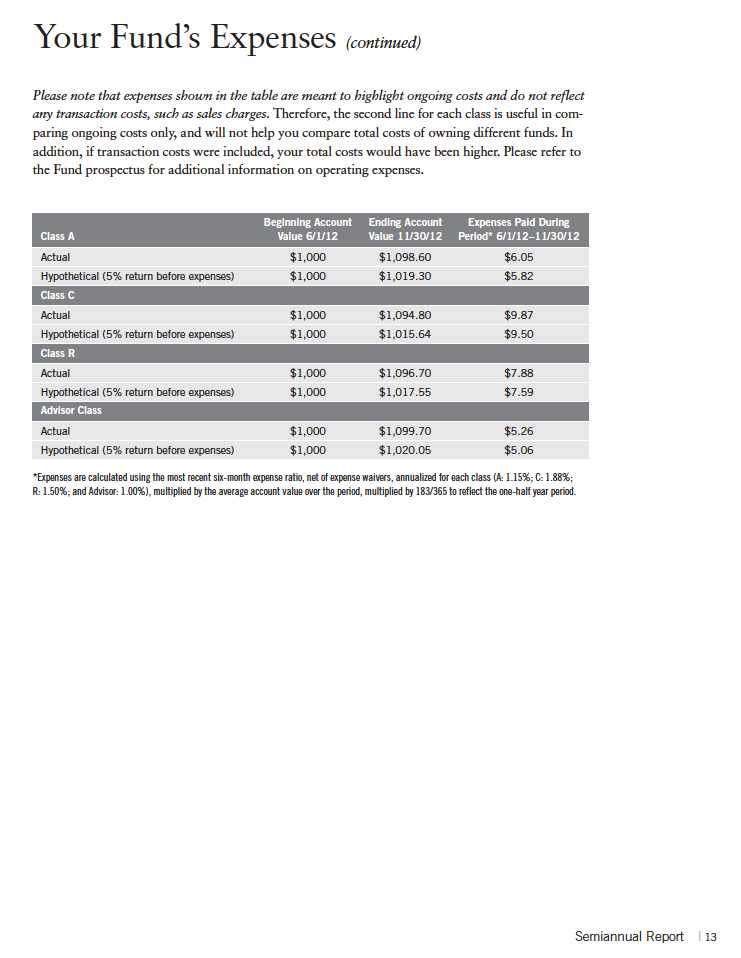

Your Fund s Expenses

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

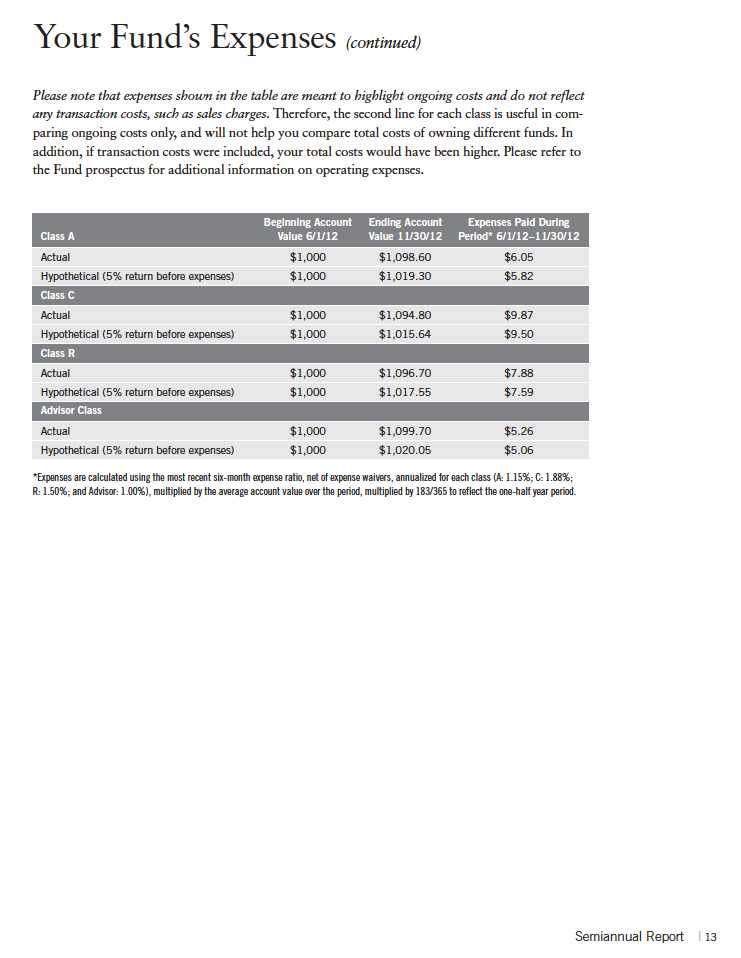

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The Ending Account Value is derived from the Fund s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading Expenses Paid During Period. |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical Ending Account Value is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund s actual return. The figure under the heading Expenses Paid During Period shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

12 | Semiannual Report

Franklin Templeton International Trust

Notes to Financial Statements (unaudited)

Franklin Templeton Global Allocation Fund

1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

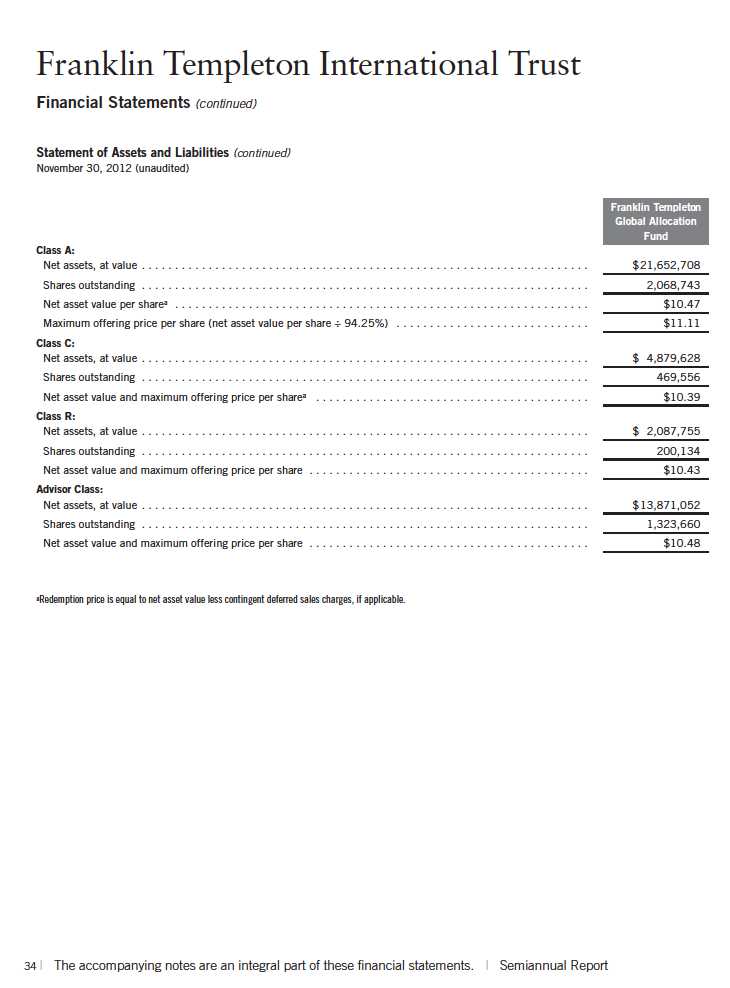

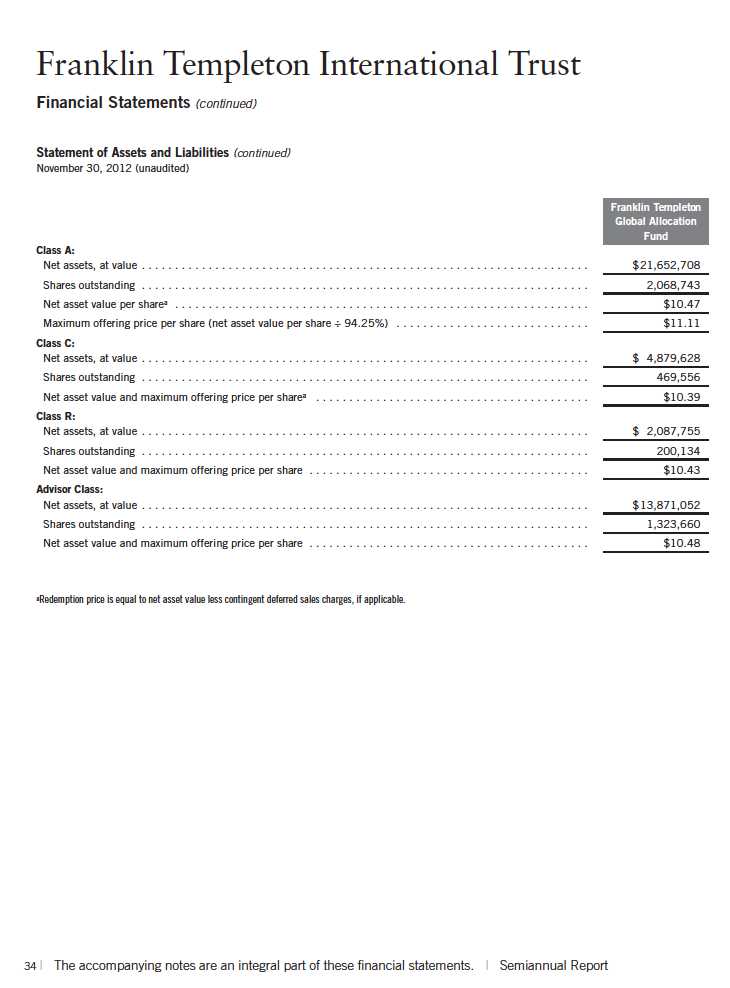

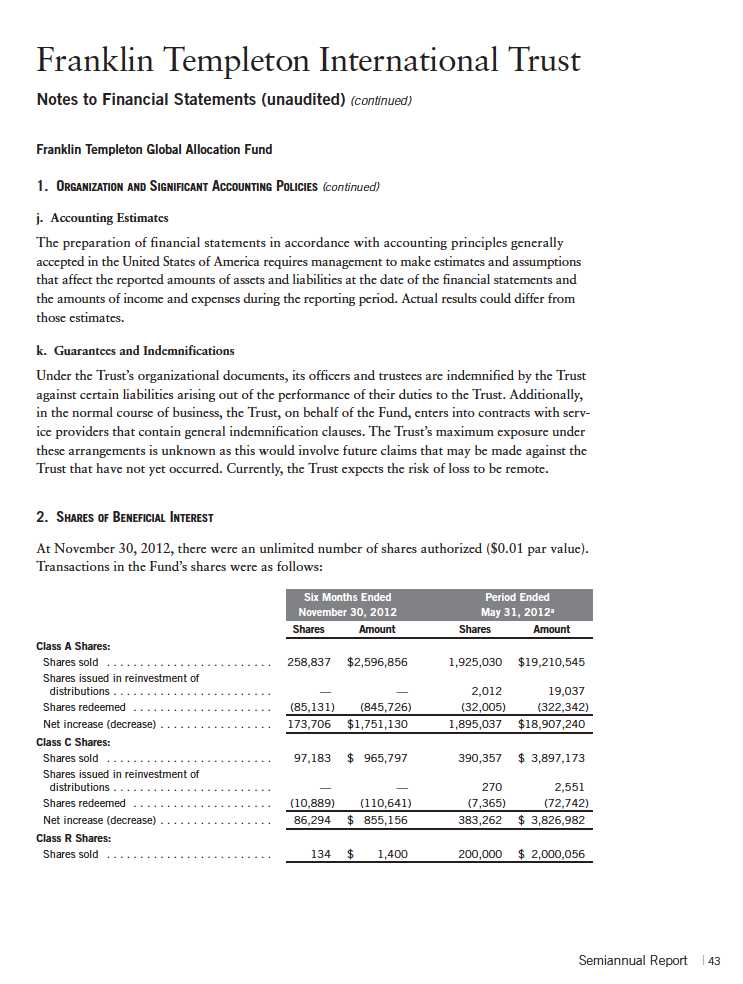

Franklin Templeton International Trust (Trust) is registered under the Investment Company Act of 1940, as amended, (1940 Act) as an open-end investment company, consisting of four separate funds. The Franklin Templeton Global Allocation Fund (Fund) is included in this report. The financial statements of the remaining funds in the Trust are presented separately. The Fund offers four classes of shares: Class A, Class C, Class R, and Advisor Class. Each class of shares differs by its initial sales load, contingent deferred sales charges, distribution fees, voting rights on matters affecting a single class and its exchange privilege.

The following summarizes the Fund s significant accounting policies.

a. Financial Instrument Valuation

The Fund s investments in financial instruments are carried at fair value daily. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants on the measurement date. Under procedures approved by the Trust s Board of Trustees (the Board), the Fund s administrator, investment manager and other affiliates have formed the Valuation and Liquidity Oversight Committee (VLOC). The VLOC provides administration and oversight of the Fund s valuation policies and procedures, which are approved annually by the Board. Among other things, these procedures allow the Fund to utilize independent pricing services, quotations from securities and financial instrument dealers, and other market sources to determine fair value.

Equity securities, exchange traded notes, and derivative financial instruments (derivatives) listed on an exchange or on the NASDAQ National Market System are valued at the last quoted sale price or the official closing price of the day, respectively. Foreign equity securities are valued as of the close of trading on the foreign stock exchange on which the security is primarily traded, or the NYSE, whichever is earlier. The value is then converted into its U.S. dollar equivalent at the foreign exchange rate in effect at the close of the NYSE on the day that the value of the security is determined. Over-the-counter (OTC) securities are valued within the range of the most recent quoted bid and ask prices. Securities that trade in multiple markets or on multiple exchanges are valued according to the broadest and most representative market. Certain equity securities are valued based upon fundamental characteristics or relationships to similar securities. Investments in open-end mutual funds are valued at the closing net asset value.

Debt securities generally trade in the OTC market rather than on a securities exchange. The Fund s pricing services use multiple valuation techniques to determine fair value. In instances where sufficient market activity exists, the pricing services may utilize a market-based approach through which quotes from market makers are used to determine fair value. In instances where sufficient market activity may not exist or is limited, the pricing services also utilize proprietary valuation models which may consider market characteristics such as benchmark yield curves,

Semiannual Report | 37

Franklin Templeton International Trust

Notes to Financial Statements (unaudited) (continued)

Franklin Templeton Global Allocation Fund

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) |

| a. | Financial Instrument Valuation (continued) |

credit spreads, estimated default rates, anticipated market interest rate volatility, coupon rates, anticipated timing of principal repayments, underlying collateral, and other unique security features in order to estimate the relevant cash flows, which are then discounted to calculate the fair value. Securities denominated in a foreign currency are converted into their U.S. dollar equivalent at the foreign exchange rate in effect at the close of the NYSE on the date that the values of the foreign debt securities are determined.

Certain derivatives trade in the OTC market. The Fund s pricing services use various techniques including industry standard option pricing models and proprietary discounted cash flow models to determine the fair value of those instruments. The Fund s net benefit or obligation under the derivative contract, as measured by the fair market value of the contract, is included in net assets.

The Fund has procedures to determine the fair value of financial instruments for which market prices are not reliable or readily available. Under these procedures, the VLOC convenes on a regular basis to review such financial instruments and considers a number of factors, including significant unobservable valuation inputs, when arriving at fair value. The VLOC primarily employs a market-based approach which may use related or comparable assets or liabilities, recent transactions, market multiples, book values, and other relevant information for the investment to determine the fair value of the investment. An income-based valuation approach may also be used in which the anticipated future cash flows of the investment are discounted to calculate fair value. Discounts may also be applied due to the nature or duration of any restrictions on the disposition of the investments. Due to the inherent uncertainty of valuations of such investments, the fair values may differ significantly from the values that would have been used had an active market existed. The VLOC employs various methods for calibrating these valuation approaches including a regular review of key inputs and assumptions, transactional back-testing or disposition analysis, and reviews of any related market activity.

Trading in securities on foreign securities stock exchanges and OTC markets may be completed before the daily close of business on the NYSE. Occasionally, events occur between the time at which trading in a foreign security is completed and the close of the NYSE that might call into question the reliability of the value of a portfolio security held by the Fund. As a result, differences may arise between the value of the Fund s portfolio securities as determined at the foreign market close and the latest indications of value at the close of the NYSE. In order to minimize the potential for these differences, the VLOC monitors price movements following the close of trading in foreign stock markets through a series of country specific market proxies (such as baskets of American Depositary Receipts, futures contracts and exchange traded funds). These price movements are measured against established trigger thresholds for each specific market proxy

38 | Semiannual Report

Franklin Templeton International Trust

Notes to Financial Statements (unaudited) (continued)

Franklin Templeton Global Allocation Fund

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) |

| a. | Financial Instrument Valuation (continued) |

to assist in determining if an event has occurred that may call into question the reliability of the values of the foreign securities held by the Fund. If such an event occurs, the securities may be valued using fair value procedures, which may include the use of independent pricing services.

b. Foreign Currency Translation

Portfolio securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars based on the exchange rate of such currencies against U.S. dollars on the date of valuation. The Fund may enter into foreign currency exchange contracts to facilitate transactions denominated in a foreign currency. Purchases and sales of securities, income and expense items denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date. Portfolio securities and assets and liabilities denominated in foreign currencies contain risks that those currencies will decline in value relative to the U.S. dollar. Occasionally, events may impact the availability or reliability of foreign exchange rates used to convert the U.S. dollar equivalent value. If such an event occurs, the foreign exchange rate will be valued at fair value using procedures established and approved by the Board.

The Fund does not separately report the effect of changes in foreign exchange rates from changes in market prices on securities held. Such changes are included in net realized and unrealized gain or loss from investments on the Statement of Operations.

Realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on securities transactions and the difference between the recorded amounts of dividends, interest, and foreign withholding taxes and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in foreign exchange rates on foreign denominated assets and liabilities other than investments in securities held at the end of the reporting period.

c. Derivative Financial Instruments

The Fund invested in derivatives in order to manage risk or gain exposure to various other investments or markets. Derivatives are financial contracts based on an underlying or notional amount, require no initial investment or an initial net investment that is smaller than would normally be required to have a similar response to changes in market factors, and require or permit net settlement. Derivatives contain various risks including the potential inability of the counter-party to fulfill their obligations under the terms of the contract, the potential for an illiquid secondary market, and/or the potential for market movements which expose the Fund to gains or losses in excess of the amounts shown on the Statement of Assets and Liabilities. Realized gain and loss and unrealized appreciation and depreciation on these contracts for the period are included in the Statement of Operations.

Semiannual Report | 39

Franklin Templeton International Trust

Notes to Financial Statements (unaudited) (continued)

Franklin Templeton Global Allocation Fund

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) |

| c. | Derivative Financial Instruments (continued) |

The Fund s investments in OTC derivatives are subject to the terms of International Swaps and Derivatives Association Master Agreements and other related agreements between the Fund and certain derivative counterparties. These agreements contain various provisions, including but not limited to collateral requirements, events of default, requirements for the Fund to maintain certain net asset levels and/or limit the decline in net assets over various periods of time. Should the Fund fail to meet any of these provisions, the derivative counterparty has the right to terminate the derivative contract and require immediate payment by the Fund for those OTC derivatives with that particular counterparty that are in a net unrealized loss position.

At November 30, 2012, the Fund had OTC derivatives in a net unrealized loss position for such contracts of $81,470.

The Fund entered into exchange traded futures contracts primarily to manage and/or gain exposure to interest rate, certain foreign currencies, credit, and equity price risk. A futures contract is an agreement between the Fund and a counterparty to buy or sell an asset for a specified price on a future date. Required initial margin deposits of cash or securities are pledged by the Fund. Subsequent payments, known as variation margin, are made or received by the Fund, depending on fluctuations in the value of the asset underlying the futures contract. Such variation margin is accounted for as unrealized appreciation or depreciation until the contract is closed, at which time the gains or losses are realized.

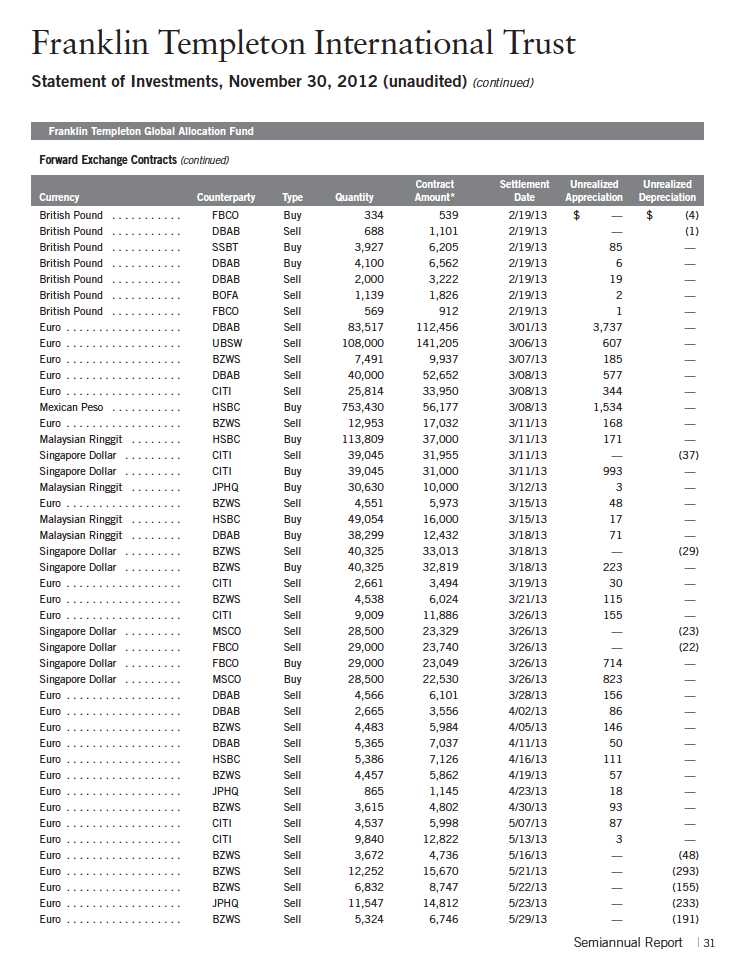

The Fund entered into OTC forward exchange contracts primarily to manage and/or gain exposure to certain foreign currencies. A forward exchange contract is an agreement between the Fund and a counterparty to buy or sell a foreign currency for a specific exchange rate on a future date. Pursuant to the terms of the forward exchange contracts, cash or securities may be required to be deposited as collateral. Unrestricted cash may be invested according to the Fund s investment objectives.

The Fund purchased or wrote exchange traded and/or OTC option contracts primarily to manage and/or gain exposure to equity price risk. An option is a contract entitling the holder to purchase or sell a specific amount of shares or units of an asset or notional amount of a swap (swaption), at a specified price. Options purchased are recorded as an asset while options written are recorded as a liability. Upon exercise of an option, the acquisition cost or sales proceeds of the underlying investment is adjusted by any premium received or paid. Upon expiration of an option, any premium received or paid is recorded as a realized gain or loss. Upon closing an option other than through expiration or exercise, the difference between the premium and the cost to close the position is recorded as a realized gain or loss. Pursuant to the terms of the written option contract, cash or securities may be required to be deposited as collateral.

40 | Semiannual Report

Franklin Templeton International Trust

Notes to Financial Statements (unaudited) (continued)

Franklin Templeton Global Allocation Fund

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) |

| c. | Derivative Financial Instruments (continued) |

See Notes 6 and 9 regarding investment transactions and other derivative information, respectively.

d. Restricted Cash

At November 30, 2012, the Fund held restricted cash in connection with investments in certain derivative securities. Restricted cash is held in a segregated account with the Fund s custodian and is reflected in the Statement of Assets and Liabilities.

e. Exchange Traded Notes

The Fund purchases exchange traded notes. Exchange traded notes are senior, unsecured, unsub-ordinated debt securities issued by an underwriting bank. Exchange traded notes are designed to provide investors access to the returns of various market benchmarks and intended to replicate the economic effects that would apply had the Fund directly purchased the underlying referenced asset or basket of assets. The risks of exchange traded notes include the credit risk of the issuer and the potential inability of the Fund to dispose of the exchange traded note in the normal course of business.

f. Investment in GAF Holdings Corp. (GAF Subsidiary)

The Fund invests in certain financial instruments through its investment in the GAF Subsidiary. The GAF Subsidiary is a Cayman Islands exempted liability company, is a wholly-owned subsidiary of the Fund, and is able to invest in certain financial instruments and/or commodity-linked derivative investments consistent with the investment objective of the Fund. The financial statements include the accounts of the Fund and the GAF Subsidiary.

g. Income and Deferred Taxes

It is the Fund s policy to qualify as a regulated investment company under the Internal Revenue Code. The Fund intends to distribute to shareholders substantially all of its taxable income and net realized gains to relieve it from federal income and excise taxes. As a result, no provision for U.S. federal income taxes is required.

The Fund may be subject to foreign taxation related to income received, capital gains on the sale of securities and certain foreign currency transactions in the foreign jurisdictions in which it invests. Foreign taxes, if any, are recorded based on the tax regulations and rates that exist in the foreign markets in which the Fund invests. When a capital gain tax is determined to apply the Fund records an estimated deferred tax liability in an amount that would be payable if the securities were disposed of on the valuation date.

The Fund recognizes the tax benefits of uncertain tax positions only when the position is more likely than not to be sustained upon examination by the tax authorities based on the technical

Semiannual Report | 41

Franklin Templeton International Trust

Notes to Financial Statements (unaudited) (continued)

Franklin Templeton Global Allocation Fund

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) |

| g. | Income and Deferred Taxes (continued) |

merits of the tax position. As of November 30, 2012 and for all open tax years, the Fund has determined that no liability for unrecognized tax benefits is required in the Fund s financial statements related to uncertain tax positions taken on a tax return (or expected to be taken on future tax returns). Open tax years are those that remain subject to examination and are based on each tax jurisdiction statute of limitation.

h. Security Transactions, Investment Income, Expenses and Distributions

Security transactions are accounted for on trade date. Realized gains and losses on security transactions are determined on a specific identification basis. Interest income and estimated expenses are accrued daily. Amortization of premium and accretion of discount on debt securities are included in interest income. Dividend income is recorded on the ex-dividend date except that certain dividends from foreign securities are recognized as soon as the Fund is notified of the ex-dividend date. Distributions to shareholders are recorded on the ex-dividend date and are determined according to income tax regulations (tax basis). Distributable earnings determined on a tax basis may differ from earnings recorded in accordance with accounting principles generally accepted in the United States of America. These differences may be permanent or temporary. Permanent differences are reclassified among capital accounts to reflect their tax character. These reclassifications have no impact on net assets or the results of operations. Temporary differences are not reclassified, as they may reverse in subsequent periods.

Common expenses incurred by the Trust are allocated among the funds based on the ratio of net assets of each fund to the combined net assets of the Trust. Fund specific expenses are charged directly to the fund that incurred the expense.

Realized and unrealized gains and losses and net investment income, not including class specific expenses, are allocated daily to each class of shares based upon the relative proportion of net assets of each class. Differences in per share distributions, by class, are generally due to differences in class specific expenses.

Inflation-indexed bonds are adjusted for inflation through periodic increases or decreases in the security s interest accruals, face amount, or principal redemption value, by amounts corresponding to the rate of inflation as measured by an index. Any increase or decrease in the face amount or principal redemption value will be included as interest income on the Statement of Operations.

i. Offering Costs

Offering costs are amortized on a straight line basis over twelve months.

42 | Semiannual Report

Franklin Templeton International Trust

Notes to Financial Statements (unaudited) (continued)

Franklin Templeton Global Allocation Fund

10. CREDIT FACILITY

The Fund, together with other U.S. registered and foreign investment funds (collectively, Borrowers), managed by Franklin Templeton Investments, are borrowers in a joint syndicated senior unsecured credit facility totaling $1.5 billion (Global Credit Facility) which matures on January 18, 2013. This Global Credit Facility provides a source of funds to the Borrowers for temporary and emergency purposes, including the ability to meet future unanticipated or unusually large redemption requests.

Under the terms of the Global Credit Facility, the Fund shall, in addition to interest charged on any borrowings made by the Fund and other costs incurred by the Fund, pay its share of fees and expenses incurred in connection with the implementation and maintenance of the Global Credit Facility, based upon its relative share of the aggregate net assets of all of the Borrowers, including an annual commitment fee of 0.08% based upon the unused portion of the Global Credit Facility, which is reflected in other expenses on the Statement of Operations. During the period ended November 30, 2012, the Fund did not use the Global Credit Facility.

11. FAIR VALUE MEASUREMENTS

The Fund follows a fair value hierarchy that distinguishes between market data obtained from independent sources (observable inputs) and the Fund s own market assumptions (unobservable inputs). These inputs are used in determining the value of the Fund s financial instruments and are summarized in the following fair value hierarchy:

- Level 1 quoted prices in active markets for identical financial instruments

- Level 2 other significant observable inputs (including quoted prices for similar financial instruments, interest rates, prepayment speed, credit risk, etc.)

- Level 3 significant unobservable inputs (including the Fund s own assumptions in determining the fair value of financial instruments)

The inputs or methodology used for valuing financial instruments are not an indication of the risk associated with investing in those financial instruments.

For movements between the levels within the fair value hierarchy, the Fund has adopted a policy of recognizing the transfers as of the date of the underlying event which caused the movement.

Semiannual Report | 49

Franklin Templeton International Trust

Notes to Financial Statements (unaudited) (continued)

| | | | | | |

| Franklin Templeton Global Allocation Fund | | | |

| |

| ABBREVIATIONS | | | | |

| |

| |

| Counterparty | Currency | Selected Portfolio |

| |

| BOFA | - | Bankof America Corp. | AUD | - Australian Dollar | ADR | - American Depositary Receipt |

| BZWS | - | Barclays Bank PLC | CAD | -CanadianDollar | ETN | - Exchange Traded Note |

| CITI | - | Citigroup, Inc. | CHF | - Swiss Franc | GDR | - Global Depositary Receipt |

| DBAB | - | Deutsche Bank AG | EUR | - Euro | | |

| FBCO | - | Credit Suisse Group AG | GBP | - British Pound | | |

| HSBC | - | HSBC Bank USA, NA. | HUF | -HungarianForint | | |

| JPHQ | - | JP Morgan Chase & Co. | IDR | -IndonesianRupiah | | |

| MSCO | - | Morgan Stanley | ILS | - New Israeli Shekel | | |

| RBS | - | The Royal Bank of Scotland | KRW | - South Korean Won | | |

| | | Group PLC | MXN | - Mexican Peso | | |

| SCFX | - | Standard Chartered Bank | MYR | - Malaysian Ringgit | | |

| SSBT | - | State Street Bank Corp. | NOK | - Norwegian Krone | | |

| UBSW | - | UBS AG | PLN | - Polish Zloty | | |

| | | | SEK | - Swedish Krona | | |

| | | | SGD | -SingaporeDollar | | |

Semiannual Report | 51

Franklin Templeton International Trust

Shareholder Information

Franklin Templeton Global Allocation Fund

Proxy Voting Policies and Procedures

The Fund s investment manager has established Proxy Voting Policies and Procedures (Policies) that the Fund uses to determine how to vote proxies relating to portfolio securities. Shareholders may view the Fund s complete Policies online at franklintempleton.com. Alternatively, shareholders may request copies of the Policies free of charge by calling the Proxy Group collect at (954) 527-7678 or by sending a written request to: Franklin Templeton Companies, LLC, 300 S.E. 2nd Street, Fort Lauderdale, FL 33301, Attention: Proxy Group. Copies of the Fund s proxy voting records are also made available online at franklintempleton.com and posted on the U.S. Securities and Exchange Commission s website at sec.gov and reflect the most recent 12-month period ended June 30.

Quarterly Statement of Investments

The Fund files a complete statement of investments with the U.S. Securities and Exchange Commission for the first and third quarters for each fiscal year on Form N-Q. Shareholders may view the filed Form N-Q by visiting the Commission s website at sec.gov. The filed form may also be viewed and copied at the Commission s Public Reference Room in Washington, DC. Information regarding the operations of the Public Reference Room may be obtained by calling (800) SEC-0330.

52 | Semiannual Report