UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-06336

Franklin Templeton International Trust

(Exact name of registrant as specified in charter)

One Franklin Parkway, San Mateo, CA 94403-1906

(Address of principal executive offices) (Zip code)

Craig S. Tyle, One Franklin Parkway, San Mateo, CA 94403-1906

(Name and address of agent for service)

Registrant's telephone number, including area code: 650 312-2000

Date of fiscal year end: 5/31

Date of reporting period: 11/30/14

Item 1. Reports to Stockholders.

| |

| Contents | |

| |

| Shareholder Letter | 1 |

| Semiannual Report | |

| Franklin Global Allocation Fund | 3 |

| Performance Summary | 8 |

| Your Fund’s Expenses | 11 |

| Consolidated Financial Highlights | |

| and Consolidated Statement | |

| of Investments | 13 |

| Consolidated Financial Statements | 35 |

| Notes to | |

| Consolidated Financial Statements | 39 |

| Shareholder Information | 53 |

| 1

Semiannual Report

Franklin Global Allocation Fund

(formerly, Franklin Templeton Global Allocation Fund)

This semiannual report for Franklin Global Allocation Fund covers the period ended November 30, 2014.

Your Fund’s Goal and Main Investments

The Fund seeks total return. Under normal market conditions, the Fund strategically invests in a diversified core portfolio of equity and fixed income investments, and tactically adjusts the Fund’s exposure to certain asset classes, regions, currencies and sectors independent of the investment processes of the core portfolio’s investment strategies.

Performance Overview

The Fund’s Class A shares had a -0.97% cumulative total return for the six months under review. In comparison, the Fund’s benchmark had a -1.10% total return.1 The benchmark is a combination of MSCI All Country World Index (ACWI),2 which measures stock performance in developed and emerging markets; Citigroup World Government Bond Index (WGBI),2 which measures performance of investment-grade world government bonds; Bloomberg Commodity Index,2,3 which measures performance of exchange-traded futures contracts on physical commodities; and Payden & Rygel (P&R) 90 Day U.S. Treasury Bill (T-Bill) Index,4 a proxy for short-term investments and other net assets. You can find more of the Fund’s performance data in the Performance Summary beginning on page 8.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. Please visit franklintempleton.com or call (800) 342-5236 for most recent month-end performance.

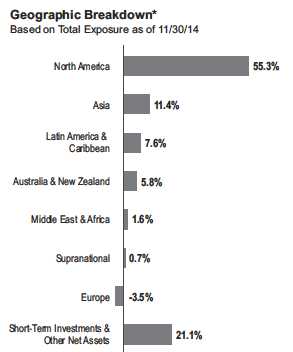

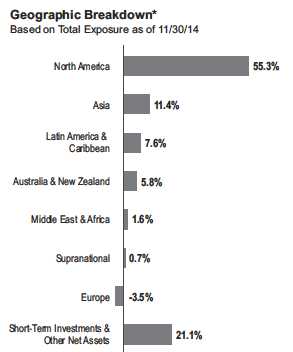

*The figures shown reflect derivatives held in the portfolio. See footnote 5.

Economic and Market Overview

The global economy grew moderately during the six months under review as many developed markets continued to recover and many emerging markets continued to expand. U.S. economic growth trends were generally encouraging during the period. Economic activity improved in the third quarter of 2014, resulting largely from increased consumer spending, business investments, federal defense spending and a narrower trade deficit. The U.S. Federal Reserve Board (Fed) ended its

1. The Fund’s blended benchmark is currently weighted 50% for the MSCI ACWI, 35% for the Citigroup WGBI, 5% for the Bloomberg Commodity Index and 10% for

the P&R 90 Day U.S. T-Bill Index, rebalanced monthly. For the period from 5/31/14 through 11/30/14, the MSCI ACWI had a +2.13% total return, the Citigroup WGBI

had a -3.82% total return, the Bloomberg Commodity Index had a -15.60% total return, and the P&R 90 Day U.S. T-Bill Index had a +0.02% total return.

2. Source: Morningstar.

3. Prior to 7/1/14, the index was known as Dow Jones-UBS Commodity Index.

4. Source: Payden & Rygel.

The indexes are unmanaged and include reinvestment of any income or distributions. One cannot invest directly in an index, and an index is not representative of the

Fund’s portfolio.

5. Breakdown figures are intended to illustrate the Fund’s estimated exposure to various asset classes, countries, currencies, sectors, or other categories as a percentage

of the Fund’s total exposure, and reflect both direct and indirect (long and short) exposures through the Fund’s use of derivatives, such as swaps, forwards, futures and

options. The use of derivative instruments may allow tactical adjustments to be made quickly and efficiently, and the historical data provided may differ significantly from the

Fund’s current allocations.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Consolidated Statement of Investments (SOI).

The Consolidated SOI begins on page 17.

franklintempleton.com Semiannual Report | 3

FRANKLIN GLOBAL ALLOCATION FUND

asset purchase program in October, after gradually reducing its purchases during the six-month period, based on its view that underlying economic strength could support ongoing progress in labor market conditions. The Fed reaffirmed it would maintain its near-zero interest rate policy for a “considerable time” and stated its actions to normalize monetary policy remained dependent on economic performance.

Outside the U.S., the U.K. economy grew relatively well, supported by the services and manufacturing sectors. U.K. gross domestic product (GDP) continued to expand in the third quarter. In the eurozone, economic growth remained subdued as concerns persisted about the potential negative impacts to growth from the crisis in Ukraine and tension in the Middle East. In June, the European Central Bank (ECB) reduced its main interest rate and for the first time set a negative deposit rate; the ECB reduced both rates again in September. The ECB broadened its monetary easing stance by implementing an asset purchase program to prevent deflation and stimulate the economy.

In Japan, second- and third-quarter GDP contractions indicated the economy was in a recession. However, private consumption and exports improved in the third quarter. In October, the Bank of Japan expanded its stimulus measures amid weak domestic demand following a sales tax hike and as substantially lower crude oil prices exerted further downward pressure on inflation. In November, Prime Minister Shinzo Abe called an early parliamentary election and postponed a second sales tax increase scheduled for October 2015, as he sought to expand the mandate for his economic policies.

In several emerging markets, economic growth moderated in the third quarter. However, Brazil exited recession as government spending prior to presidential elections drove third-quarter GDP growth. Emerging market equities, as measured by the MSCI Emerging Markets Index, ended the six-month period relatively flat, amid headwinds such as soft domestic demand and weak exports in several countries, as well as concerns about the timing of U.S. interest rate increases and geopolitical tensions in certain regions. Many emerging market currencies depreciated against the U.S. dollar, leading central banks in several countries to raise interest rates in an effort to curb inflation and support their currencies. Several other central banks lowered interest rates to promote economic growth.

After implementing monetary stimulus measures to support specific sectors, China’s central bank increased its efforts to bolster the economy by cutting its benchmark interest rates for the first time since July 2012.

As measured by the MSCI World Index, stocks in global developed markets advanced overall during the six-month period amid a generally accommodative monetary policy environment, continued strength in corporate earnings and signs of an economic recovery. Global government and corporate bonds performed well in local currency terms as interest rates in many developed market countries remained at historical lows. However, the U.S. dollar’s appreciation against most currencies led these bonds to post losses in U.S. dollar terms. Commodity prices overall ended lower for the period, as measured by the Bloomberg Commodity Index, driven by steep declines in crude oil prices resulting from weak global demand growth and strong world supply. Gold prices declined amid benign global inflation and a strong U.S. dollar.

Investment Strategy

We manage the Fund using a multi-manager approach. While we are responsible for the Fund’s overall investments, we consult with various other investment managers within Franklin Templeton Investments (subadvisors) who independently manage separate portions of the Fund’s core equity and fixed income portfolio in accordance with the following strategies: all-cap U.S. growth equity, non-U.S. growth equity, deep value equity, non-U.S. value equity, emerging markets equity, global fixed income and global low duration fixed income. The allocations to each strategy may change from time to time and are subject to periodic rebalancing as market values of the portfolio’s securities change or at our discretion.

Under normal market conditions, the Fund’s baseline allocation between broad asset classes is 50% global equity (U.S./international/emerging), 35% global fixed income (U.S./international/emerging), 5% commodity-linked

4 | Semiannual Report franklintempleton.com

FRANKLIN GLOBAL ALLOCATION FUND

instruments, and 10% cash and derivative instruments. We manage the Fund’s allocation to commodities, as well as the Fund’s tactical allocation portion, and rebalance the Fund’s portfolio to maintain the baseline strategic allocation to various asset classes and investment strategies. We may change the baseline strategic allocation from time to time.

For purposes of its investment goal, the Fund regularly enters into various transactions involving derivative instruments. For the Fund’s tactical asset allocation, we primarily use stock index futures, government bond futures, equity total return swaps, and currency forwards and futures contracts. We make tactical investment decisions based on quantitative research and a systematic investment strategy driven by bottom-up fundamentals analysis, top-down macroeconomic analysis and short-term sentiment indicators. The tactical allocation portion of the Fund is intended to adjust the Fund’s equity, fixed income, commodity, country/regional and currency exposures. Although we do not attempt to time the entire market’s direction, we keep the flexibility to shift the Fund’s net exposure (the value of securities held long less the value of securities held short) depending on which market opportunities look more attractive.6 The Fund may, from time to time, have a net short position in certain asset classes, regions, currencies and sectors.

What is a futures contract?

A futures contract, or a future, is an agreement between the Fund and a counterparty made through a U.S. or foreign futures exchange to buy or sell an asset at a specific price on a future date.

What is a currency forward contract?

A currency forward contract, or a currency forward, is an agreement between the Fund and a counterparty to buy or sell a foreign currency at a specific exchange rate on a future date.

What is a swap agreement?

A swap agreement, such as an equity total return swap, is a contract between the Fund and a counterparty to exchange on a future date the returns, or differentials in rates of return, that would have been earned or realized if a notional amount were invested in specific instruments.

Manager’s Discussion

For the six-month period ended November 30, 2014, the Fund’s multi-asset portfolio’s Class A shares performed better than its blended benchmark. An overweighted allocation to global equities contributed, as did relative value positioning among specific countries. An underweighted allocation to sovereign developed fixed income markets also added value, as did selection across those markets. Currency positions overall, through the use of currency forwards, contributed significantly to relative performance. An underweighting in commodities, which declined during the period, also helped relative results.

Baseline Strategic Allocation

At period-end, the Fund’s largest asset class exposure was to global equities, which was consistent with the significant structural weight of these assets within our baseline strategic allocation. Regionally, the largest equity weightings were in North America and Europe, with the U.S., the U.K. and Germany making up the largest country exposures. The U.S. finished the period as the largest country overweighting relative to the blended benchmark’s equity portion, followed by Hong Kong and Germany. Conversely, the largest underweightings were in Australia, Taiwan and Canada. Within the fixed income allocation, the largest regional allocation at period-end was to Europe. At the country level, the largest fixed income exposures were to Italy, Australia and Canada. Relative to the blended benchmark’s fixed income portion, the largest country overweightings were in Italy and Australia, followed by South Korea, which is not part of the Citigroup WGBI. The largest fixed income underweightings were in Germany, the U.S. and Japan.

6. A long position may involve the purchase of a security, commodity or currency, or the use of derivatives, with the expectation that the asset or underlying asset will

subsequently rise in value. A short position may involve the sale of a borrowed security, commodity or currency, or the use of derivatives, with the expectation that the

asset or underlying asset will subsequently fall in value.

See franklintempletondatasources.com for additional data provider information.

franklintempleton.com Semiannual Report | 5

FRANKLIN GLOBAL ALLOCATION FUND

| | |

| Portfolio Breakdown* | | |

| 11/30/14 | | |

| | % of Total | |

| | Exposure | |

| |

| Stocks, Equity Index Futures & Total Return Swaps | 63.1 | % |

| Banks | 5.4 | % |

| Energy | 5.3 | % |

| Pharmaceuticals, Biotechnology & Life Sciences | 5.3 | % |

| Software & Services | 5.0 | % |

| Capital Goods | 4.1 | % |

| Materials | 4.0 | % |

| Technology Hardware & Equipment | 2.6 | % |

| Health Care Equipment & Services | 2.4 | % |

| Diversified Financials | 2.1 | % |

| Equity Index Futures | 7.4 | % |

| Total Return Swaps | 1.9 | % |

| Other | 17.6 | % |

| |

| Bonds, Interest Rate Futures & Interest Rate Swaps | 24.4 | % |

| Foreign Government & Agency Securities | 22.2 | % |

| U.S. Government & Agency Securities | 7.5 | % |

| Corporate Bonds | 7.1 | % |

| Interest Rate Swaps | -2.0 | % |

| Interest Rate Futures – Foreign Government | -5.1 | % |

| Interest Rate Futures – U.S. Government | -5.3 | % |

| |

| Commodities | 5.0 | % |

| Exchange Traded Notes | 5.0 | % |

| |

| Money Market Funds & Other Net Assets | 7.5 | % |

*The figures shown reflect derivatives held in the portfolio. See footnote 5 on

page 3.

Tactical Asset Allocation

At period-end, the portfolio’s tactical asset allocation included allocations to developed and emerging market equities and developed market fixed income, in addition to currency positions. Equity allocations, through the use of index futures, included long positions in German, Spanish, Japanese, Hong Kong and U.S. stocks, as well as short positions in Australian, U.K., and Dutch stocks. Within fixed income, the Fund maintained, through the use of futures contracts, net long positions in Italian, Canadian and Australian government bonds, as well as net short positions in U.S. Treasuries, German Bunds and U.K. gilts. The currency component of the tactical asset allocation included net long positions in the U.S. dollar, British pound, Norwegian krone and Australian dollar and net short exposures to the Japanese yen, British pound, Swiss franc and euro, achieved through currency forwards.

Equity

For the overall portfolio, the Fund’s overweighting in equities relative to its blended benchmark added value. However, results from certain country selections limited gains. An overweighting in European markets was a major detractor, including overweighted allocations to Germany, Italy and the U.K. Security selection in Germany helped offset some of the negative effects of an overweighting in the region. In Asia, security selection more than offset the small negative effect of an overweighting, particularly in South Korea, which weakened over the period. The Fund’s positioning in Japanese stocks contributed to relative results. In North America, stock selection in the U.S. hurt relative performance, as did stock selection in Canada, particularly in energy stocks.

Fixed Income

For the overall portfolio, an underweighted allocation to sovereign developed market fixed income generally supported relative performance, as bond market returns were generally negative across the countries included in the Citigroup WGBI. Selection across fixed income markets generally contributed to relative performance. Avoidance of Japanese government bonds aided relative returns. Additionally, a preference for Italian bonds over German Bunds helped relative results, as the yield spread between these bonds narrowed over the period. In contrast, overweighted positions in several emerging markets, including South Korea, Poland and Mexico, detracted from relative performance.

Currencies

Overall, currency positions were major contributors to the Fund’s performance relative to the blended benchmark. The euro and Japanese yen depreciated against the U.S. dollar during the period, leading net short positions in these currencies, achieved through currency forward contracts, to enhance relative performance. The Swiss franc and Swedish krona also weakened against the U.S. dollar, and net short positions in these currencies aided relative performance. Somewhat offsetting these gains were long positions in the British pound, established in the latter half of the period, and the Norwegian krone.

6 | Semiannual Report franklintempleton.com

FRANKLIN GLOBAL ALLOCATION FUND

Thank you for your continued participation in Franklin Global Allocation Fund. We look forward to serving your future investment needs.

The foregoing information reflects our analysis, opinions and portfolio holdings as of November 30, 2014, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

franklintempleton.com

Semiannual Report | 7

FRANKLIN GLOBAL ALLOCATION FUND

Performance Summary as of November 30, 2014

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

| | | |

| Net Asset Value | | | |

| Share Class (Symbol) | 11/30/14 | 5/31/14 | Change |

| A (FGAAX) | $11.27 | $11.38 | -$0.11 |

| C (n/a) | $11.13 | $11.27 | -$0.14 |

| R (n/a) | $11.22 | $11.35 | -$0.13 |

| Advisor (FGAZX) | $11.31 | $11.41 | -$0.10 |

8 | Semiannual Report franklintempleton.com

FRANKLIN GLOBAL ALLOCATION FUND

PERFORMANCE SUMMARY

Performance as of 11/30/141

Cumulative total return excludes sales charges. Average annual total returns and value of $10,000 investment include maximum sales charges. Class A: 5.75% maximum initial sales charge; Class C: 1% contingent deferred sales charge in first year only;

Class R/Advisor Class: no sales charges.

| | | | | | | | | | | | | | | |

| | | | | | | | | Value of | | Average Annual | | | | | |

| | | Cumulative | | | Average Annual | | $ | 10,000 | | Total Return | | Total Annual Operating Expenses6 | |

| Share Class | | Total Return2 | | | Total Return3 | | | Investment4 | | (12/31/14 | )5 | (with waiver) | | (without waiver) | |

| A | | | | | | | | | | | | 1.31 | % | 2.04 | % |

| 6-Month | | -0.97 | % | | -6.63 | % | $ | 9,337 | | | | | | | |

| 1-Year | + | 2.82 | % | | -3.12 | % | $ | 9,688 | | -6.78 | % | | | | |

| 3-Year | + | 21.00 | % | + | 4.47 | % | $ | 11,402 | + | 4.11 | % | | | | |

| Since Inception (9/1/11) | + | 18.58 | % | + | 3.49 | % | $ | 11,176 | + | 2.70 | % | | | | |

| C | | | | | | | | | | | | 2.01 | % | 2.74 | % |

| 6-Month | | -1.24 | % | | -2.23 | % | $ | 9,777 | | | | | | | |

| 1-Year | + | 2.18 | % | + | 1.18 | % | $ | 10,118 | | -2.72 | % | | | | |

| 3-Year | + | 18.38 | % | + | 5.79 | % | $ | 11,838 | + | 5.46 | % | | | | |

| Since Inception (9/1/11) | + | 15.78 | % | + | 4.62 | % | $ | 11,578 | + | 3.76 | % | | | | |

| R | | | | | | | | | | | | 1.51 | % | 2.24 | % |

| 6-Month | | -1.15 | % | | -1.15 | % | $ | 9,885 | | | | | | | |

| 1-Year | + | 2.53 | % | + | 2.53 | % | $ | 10,253 | | -1.29 | % | | | | |

| 3-Year | + | 19.83 | % | + | 6.21 | % | $ | 11,983 | + | 5.89 | % | | | | |

| Since Inception (9/1/11) | + | 17.31 | % | + | 5.04 | % | $ | 11,731 | + | 4.22 | % | | | | |

| Advisor | | | | | | | | | | | | 1.01 | % | 1.74 | % |

| 6-Month | | -0.88 | % | | -0.88 | % | $ | 9,912 | | | | | | | |

| 1-Year | + | 3.08 | % | + | 3.08 | % | $ | 10,308 | | -0.86 | % | | | | |

| 3-Year | + | 21.67 | % | + | 6.76 | % | $ | 12,167 | + | 6.41 | % | | | | |

| Since Inception (9/1/11) | + | 19.24 | % | + | 5.57 | % | $ | 11,924 | + | 4.73 | % | | | | |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

franklintempleton.com Semiannual Report | 9

FRANKLIN GLOBAL ALLOCATION FUND

PERFORMANCE SUMMARY

All investments involve risks, including possible loss of principal. Generally, investors should be comfortable with fluctuation in the value of their investments, especially over the short term. The market values of securities owned by the Fund will go up or down, sometimes rapidly or unpredictably, due to factors affecting individual issuers, securities markets generally or sectors within the securities markets. Bond prices generally move in the opposite direction of interest rates. Thus, as prices of bonds in the Fund adjust to a rise in interest rates, the Fund’s share price may decline. Changes in the financial strength of a bond issuer or in a bond’s credit rating may affect its value. Foreign investing carries additional risks such as currency and market volatility and political or social instability, risks that are heightened in less developed or emerging market countries. Derivatives, including currency management strategies, involve costs and can create economic leverage in the portfolio, which may result in significant volatility and cause the Fund to participate in losses (as well as gains) in an amount that significantly exceeds the Fund’s initial investment. The Fund may not achieve the anticipated benefits, and may realize losses when a counterparty fails to perform as promised. Because the Fund allocates assets to a variety of investment strategies involving certain risks, it is subject to those same risks. These and other risks are described more fully in the Fund’s prospectus. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results.

Class C: These shares have higher annual fees and expenses than Class A shares.

Class R: Shares are available to certain eligible investors as described in the prospectus. These shares have higher annual fees and expenses than Class A shares.

Advisor Class: Shares are available to certain eligible investors as described in the prospectus.

1. The Fund has an expense reduction contractually guaranteed through at least 9/30/15, a fee waiver related to the management fee paid by a subsidiary and a fee waiver

associated with its investments in a Franklin Templeton money fund, contractually guaranteed through at least its current fiscal year-end. Fund investment results reflect the

expense reduction and fee waivers, to the extent applicable; without these reductions, the results would have been lower.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated. Six-month return has not been annualized.

4. These figures represent the value of a hypothetical $10,000 investment in the Fund over the periods indicated.

5. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

6. Figures are as stated in the Fund’s current prospectus. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to

become higher than the figures shown.

10 | Semiannual Report franklintempleton.com

FRANKLIN GLOBAL ALLOCATION FUND

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribu- tion and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

franklintempleton.com Semiannual Report | 11

FRANKLIN GLOBAL ALLOCATION FUND

YOUR FUND’S EXPENSES

| | | | | | |

| | | Beginning Account | | Ending Account | | Expenses Paid During |

| Share Class | | Value 6/1/14 | | Value 11/30/14 | | Period* 6/1/14–11/30/14 |

| A | | | | | | |

| Actual | $ | 1,000 | $ | 990.30 | $ | 6.39 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,018.65 | $ | 6.48 |

| C | | | | | | |

| Actual | $ | 1,000 | $ | 987.60 | $ | 9.77 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,015.24 | $ | 9.90 |

| R | | | | | | |

| Actual | $ | 1,000 | $ | 988.50 | $ | 7.48 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,017.55 | $ | 7.59 |

| Advisor | | | | | | |

| Actual | $ | 1,000 | $ | 991.20 | $ | 4.99 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,020.05 | $ | 5.06 |

*Expenses are calculated using the most recent six-month expense ratio, net of expense waivers, annualized for each class (A: 1.28%;

C: 1.96%; R: 1.50%; and Advisor: 1.00%), multiplied by the average account value over the period, multiplied by 183/365 to reflect the

one-half year period.

12 | Semiannual Report franklintempleton.com

FRANKLIN TEMPLETON INTERNATIONAL TRUST

Consolidated Financial Highlights

Franklin Global Allocation Fund

| | | | | | | | | | | | |

| | | Six Months Ended | | | | | | | | | | |

| | | November 30, 2014 | | | | | | Year Ended May 31, | |

| | | (unaudited) | | | 2014 | | | 2013 | | | 2012 | a |

| Class A | | | | | | | | | | | | |

| Per share operating performance | | | | | | | | | | | | |

| (for a share outstanding throughout the period) | | | | | | | | | | | | |

| Net asset value, beginning of period | $ | 11.38 | | $ | 10.78 | | $ | 9.53 | | $ | 10.00 | |

| Income from investment operationsb: | | | | | | | | | | | | |

| Net investment incomec | | 0.03 | | | 0.10 | d | | 0.08 | | | 0.06 | |

| Net realized and unrealized gains (losses) | | (0.14 | ) | | 0.79 | | | 1.36 | | | (0.47 | ) |

| Total from investment operations | | (0.11 | ) | | 0.89 | | | 1.44 | | | (0.41 | ) |

| Less distributions from net investment income and net foreign | | | | | | | | | | | | |

| currency gains | | — | | | (0.29 | ) | | (0.19 | ) | | (0.06 | ) |

| Net asset value, end of period | $ | 11.27 | | $ | 11.38 | | $ | 10.78 | | $ | 9.53 | |

| |

| Total returne | | (0.97 | )% | | 8.35 | % | | 15.22 | % | | (4.09 | )% |

| |

| Ratios to average net assetsf | | | | | | | | | | | | |

| Expenses before waiver and payments by affiliates | | 2.03 | % | | 1.89 | % | | 2.10 | % | | 2.85 | % |

| Expenses net of waiver and payments by affiliates | | 1.28 | %g | | 1.20 | %g | | 1.16 | % | | 1.08 | % |

| Net investment income | | 0.51 | % | | 0.92 | %d | | 0.76 | % | | 0.79 | % |

| |

| Supplemental data | | | | | | | | | | | | |

| Net assets, end of period (000’s) | $ | 20,328 | | $ | 23,509 | | $ | 23,472 | | $ | 18,055 | |

| Portfolio turnover rate | | 25.46 | % | | 39.58 | % | | 47.73 | % | | 15.34 | % |

aFor the period September 1, 2011 (commencement of operations) to May 31, 2012.

bThe amount shown for a share outstanding throughout the period may not correlate with the Consolidated Statement of Operations for the period due to the timing of sales

and repurchases of the Fund shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

cBased on average daily shares outstanding.

dNet investment income per share includes approximately $0.03 per share received in the form of a special dividend paid in connection with certain Fund holdings.

Excluding this amount, the ratio of net investment income to average net assets would have been 0.68%.

eTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable, and is not annualized for periods less than one year.

fRatios are annualized for periods less than one year.

gBenefit of expense reduction rounds to less than 0.01%.

franklintempleton.com The accompanying notes are an integral part of these consolidated financial statements. | Semiannual Report | 13

FRANKLIN TEMPLETON INTERNATIONAL TRUST

CONSOLIDATED FINANCIAL HIGHLIGHTS

| | | | | | | | | | | | |

| Franklin Global Allocation Fund (continued) | | | | | | | | | | | | |

| | | Six Months Ended | | | | | | | | | | |

| | | November 30, 2014 | | | | | | Year Ended May 31, | |

| | | (unaudited) | | | 2014 | | | 2013 | | | 2012 | a |

| Class C | | | | | | | | | | | | |

| Per share operating performance | | | | | | | | | | | | |

| (for a share outstanding throughout the period) | | | | | | | | | | | | |

| Net asset value, beginning of period | $ | 11.27 | | $ | 10.72 | | $ | 9.49 | | $ | 10.00 | |

| Income from investment operationsb: | | | | | | | | | | | | |

| Net investment income (loss)c | | (0.01 | ) | | 0.02 | d | | —e | | | —e | |

| Net realized and unrealized gains (losses) | | (0.13 | ) | | 0.78 | | | 1.36 | | | (0.48 | ) |

| Total from investment operations | | (0.14 | ) | | 0.80 | | | 1.36 | | | (0.48 | ) |

| Less distributions from net investment income and net foreign | | | | | | | | | | | | |

| currency gains | | — | | | (0.25 | ) | | (0.13 | ) | | (0.03 | ) |

| Net asset value, end of period | $ | 11.13 | | $ | 11.27 | | $ | 10.72 | | $ | 9.49 | |

| |

| Total returnf | | (1.24 | )% | | 7.62 | % | | 14.40 | % | | (4.77 | )% |

| |

| Ratios to average net assetsg | | | | | | | | | | | | |

| Expenses before waiver and payments by affiliates | | 2.71 | % | | 2.62 | % | | 2.86 | % | | 3.69 | % |

| Expenses net of waiver and payments by affiliates | | 1.96 | %h | | 1.93 | %h | | 1.92 | % | | 1.92 | % |

| Net investment income (loss) | | (0.17 | )% | | 0.19 | %d | | —%i | | | (0.05 | )% |

| |

| Supplemental data | | | | | | | | | | | | |

| Net assets, end of period (000’s) | $ | 5,557 | | $ | 5,557 | | $ | 6,315 | | $ | 3,639 | |

| Portfolio turnover rate | | 25.46 | % | | 39.58 | % | | 47.73 | % | | 15.34 | % |

aFor the period September 1, 2011 (commencement of operations) to May 31, 2012.

bThe amount shown for a share outstanding throughout the period may not correlate with the Consolidated Statement of Operations for the period due to the timing of sales

and repurchases of the Fund shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

cBased on average daily shares outstanding.

dNet investment income per share includes approximately $0.03 per share received in the form of a special dividend paid in connection with certain Fund holdings.

Excluding this amount, the ratio of net investment income to average net assets would have been (0.05)%.

eAmount rounds to less than $0.01 per share.

fTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable, and is not annualized for periods less than one year.

gRatios are annualized for periods less than one year.

hBenefit of expense reduction rounds to less than 0.01%.

iRounds to less than 0.01%.

14 | Semiannual Report | The accompanying notes are an integral part of these consolidated financial statements. franklintempleton.com

FRANKLIN TEMPLETON INTERNATIONAL TRUST

CONSOLIDATED FINANCIAL HIGHLIGHTS

| | | | | | | | | | | | |

| Franklin Global Allocation Fund (continued) | | | | | | | | | | | | |

| | | Six Months Ended | | | | | | | | | | |

| | | November 30, 2014 | | | | | | Year Ended May 31, | |

| | | (unaudited) | | | 2014 | | | 2013 | | | 2012 | a |

| Class R | | | | | | | | | | | | |

| Per share operating performance | | | | | | | | | | | | |

| (for a share outstanding throughout the period) | | | | | | | | | | | | |

| Net asset value, beginning of period | $ | 11.35 | | $ | 10.76 | | $ | 9.51 | | $ | 10.00 | |

| Income from investment operationsb: | | | | | | | | | | | | |

| Net investment incomec | | 0.02 | | | 0.07 | d | | 0.04 | | | 0.02 | |

| Net realized and unrealized gains (losses) | | (0.15 | ) | | 0.79 | | | 1.37 | | | (0.47 | ) |

| Total from investment operations | | (0.13 | ) | | 0.86 | | | 1.41 | | | (0.45 | ) |

| Less distributions from net investment income and net foreign | | | | | | | | | | | | |

| currency gains | | — | | | (0.27 | ) | | (0.16 | ) | | (0.04 | ) |

| Net asset value, end of period | $ | 11.22 | | $ | 11.35 | | $ | 10.76 | | $ | 9.51 | |

| |

| Total returne | | (1.15 | )% | | 8.16 | % | | 14.84 | % | | (4.45 | )% |

| |

| Ratios to average net assetsf | | | | | | | | | | | | |

| Expenses before waiver and payments by affiliates | | 2.25 | % | | 2.19 | % | | 2.44 | % | | 3.27 | % |

| Expenses net of waiver and payments by affiliates | | 1.50 | %g | | 1.50 | %g | | 1.50 | % | | 1.50 | % |

| Net investment income | | 0.29 | % | | 0.62 | %d | | 0.42 | % | | 0.37 | % |

| |

| Supplemental data | | | | | | | | | | | | |

| Net assets, end of period (000’s) | $ | 2,273 | | $ | 2,297 | | $ | 2,155 | | $ | 1,903 | |

| Portfolio turnover rate | | 25.46 | % | | 39.58 | % | | 47.73 | % | | 15.34 | % |

aFor the period September 1, 2011 (commencement of operations) to May 31, 2012.

bThe amount shown for a share outstanding throughout the period may not correlate with the Consolidated Statement of Operations for the period due to the timing of sales

and repurchases of the Fund shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

cBased on average daily shares outstanding.

dNet investment income per share includes approximately $0.03 per share received in the form of a special dividend paid in connection with certain Fund holdings.

Excluding this amount, the ratio of net investment income to average net assets would have been 0.38%.

eTotal return is not annualized for periods less than one year.

fRatios are annualized for periods less than one year.

gBenefit of expense reduction rounds to less than 0.01%.

franklintempleton.com The accompanying notes are an integral part of these consolidated financial statements. | Semiannual Report | 15

FRANKLIN TEMPLETON INTERNATIONAL TRUST

CONSOLIDATED FINANCIAL HIGHLIGHTS

| | | | | | | | | | | | |

| Franklin Global Allocation Fund (continued) | | | | | | | | | | | | |

| | | Six Months Ended | | | | | | | | | | |

| | | November 30, 2014 | | | | | | Year Ended May 31, | |

| | | (unaudited) | | | 2014 | | | 2013 | | | 2012 | a |

| Advisor Class | | | | | | | | | | | | |

| Per share operating performance | | | | | | | | | | | | |

| (for a share outstanding throughout the period) | | | | | | | | | | | | |

| Net asset value, beginning of period | $ | 11.41 | | $ | 10.79 | | $ | 9.53 | | $ | 10.00 | |

| Income from investment operationsb: | | | | | | | | | | | | |

| Net investment incomec | | 0.04 | | | 0.12 | d | | 0.09 | | | 0.06 | |

| Net realized and unrealized gains (losses) | | (0.14 | ) | | 0.80 | | | 1.38 | | | (0.47 | ) |

| Total from investment operations | | (0.10 | ) | | 0.92 | | | 1.47 | | | (0.41 | ) |

| Less distributions from net investment income and net foreign | | | | | | | | | | | | |

| currency gains | | — | | | (0.30 | ) | | (0.21 | ) | | (0.06 | ) |

| Net asset value, end of period | $ | 11.31 | | $ | 11.41 | | $ | 10.79 | | $ | 9.53 | |

| |

| Total returne | | (0.88 | )% | | 8.62 | % | | 15.47 | % | | (4.09 | )% |

| |

| Ratios to average net assetsf | | | | | | | | | | | | |

| Expenses before waiver and payments by affiliates | | 1.75 | % | | 1.69 | % | | 1.94 | % | | 2.77 | % |

| Expenses net of waiver and payments by affiliates | | 1.00 | %g | | 1.00 | %g | | 1.00 | % | | 1.00 | % |

| Net investment income | | 0.79 | % | | 1.12 | %d | | 0.92 | % | | 0.87 | % |

| |

| Supplemental data | | | | | | | | | | | | |

| Net assets, end of period (000’s) | $ | 11,627 | | $ | 12,441 | | $ | 14,511 | | $ | 12,654 | |

| Portfolio turnover rate | | 25.46 | % | | 39.58 | % | | 47.73 | % | | 15.34 | % |

aFor the period September 1, 2011 (commencement of operations) to May 31, 2012.

bThe amount shown for a share outstanding throughout the period may not correlate with the Consolidated Statement of Operations for the period due to the timing of sales

and repurchases of the Fund shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

cBased on average daily shares outstanding.

dNet investment income per share includes approximately $0.03 per share received in the form of a special dividend paid in connection with certain Fund holdings.

Excluding this amount, the ratio of net investment income to average net assets would have been 0.88%.

eTotal return is not annualized for periods less than one year.

fRatios are annualized for periods less than one year.

gBenefit of expense reduction rounds to less than 0.01%.

16 | Semiannual Report | The accompanying notes are an integral part of these consolidated financial statements. franklintempleton.com

FRANKLIN TEMPLETON INTERNATIONAL TRUST

| | | | |

| Consolidated Statement of Investments, November 30, 2014 (unaudited) | | | |

| |

| Franklin Global Allocation Fund | | | | |

| | | Shares/ | | |

| | Country | Warrants | | Value |

| Common Stocks and Other Equity Interests 51.2% | | | | |

| Automobiles & Components 1.7% | | | | |

| BorgWarner Inc. | United States | 990 | $ | 55,995 |

| Brilliance China Automotive Holdings Ltd. | China | 114,000 | | 194,339 |

| Cie Generale des Etablissements Michelin, B | France | 500 | | 46,015 |

| General Motors Co. | United States | 2,175 | | 72,710 |

| Guangzhou Automobile Group Co. Ltd., H | China | 54,000 | | 51,041 |

| Hyundai Mobis Co. Ltd. | South Korea | 206 | | 45,712 |

| Hyundai Motor Co. | South Korea | 157 | | 25,248 |

| Nissan Motor Co. Ltd. | Japan | 7,300 | | 68,178 |

| aTesla Motors Inc. | United States | 140 | | 34,233 |

| Toyota Motor Corp. | Japan | 1,100 | | 67,785 |

| | | | | 661,256 |

| Banks 5.0% | | | | |

| Bangkok Bank PCL, fgn. | Thailand | 3,400 | | 20,900 |

| Bank Danamon Indonesia Tbk PT | Indonesia | 244,500 | | 84,145 |

| Bank of Nova Scotia | Canada | 1,400 | | 86,329 |

| Barclays PLC | United Kingdom | 9,910 | | 37,998 |

| BNP Paribas SA | France | 1,780 | | 114,216 |

| China Merchants Bank Co. Ltd., H | China | 72,201 | | 149,525 |

| CIT Group Inc. | United States | 778 | | 37,966 |

| Citigroup Inc. | United States | 1,184 | | 63,900 |

| Citizens Financial Group Inc. | United States | 659 | | 16,231 |

| Columbia Banking System Inc. | United States | 512 | | 14,065 |

| Hana Financial Group Inc. | South Korea | 3,220 | | 97,777 |

| HSBC Holdings PLC | United Kingdom | 5,600 | | 55,793 |

| aING Groep NV, IDR | Netherlands | 5,580 | | 81,804 |

| Itau Unibanco Holding SA, ADR | Brazil | 6,776 | | 102,047 |

| JPMorgan Chase & Co. | United States | 1,251 | | 75,260 |

| KB Financial Group Inc. | South Korea | 3,158 | | 110,364 |

| PNC Financial Services Group Inc. | United States | 1,216 | | 106,364 |

| Siam Commercial Bank PCL, fgn. | Thailand | 5,700 | | 34,085 |

| aSignature Bank | United States | 680 | | 82,464 |

| Societe Generale SA | France | 706 | | 35,048 |

| Standard Chartered PLC | United Kingdom | 2,290 | | 33,564 |

| SunTrust Banks Inc. | United States | 1,066 | | 41,883 |

| aSVB Financial Group | United States | 570 | | 59,935 |

| UniCredit SpA | Italy | 10,369 | | 76,716 |

| United Bank Ltd. | Pakistan | 101,700 | | 177,326 |

| United Overseas Bank Ltd. | Singapore | 7,500 | | 138,111 |

| Wells Fargo & Co. | United States | 738 | | 40,206 |

| | | | | 1,974,022 |

| Capital Goods 3.9% | | | | |

| AMETEK Inc. | United States | 710 | | 36,182 |

| aB/E Aerospace Inc. | United States | 508 | | 39,558 |

| BAE Systems PLC | United Kingdom | 6,480 | | 48,760 |

| The Boeing Co. | United States | 470 | | 63,149 |

| Carillion PLC | United Kingdom | 6,740 | | 36,643 |

| Caterpillar Inc. | United States | 344 | | 34,606 |

| CNH Industrial NV | United Kingdom | 1,280 | | 10,028 |

franklintempleton.com Semiannual Report | 17

FRANKLIN TEMPLETON INTERNATIONAL TRUST

CONSOLIDATED STATEMENT OF INVESTMENTS (UNAUDITED)

| | | | |

| Franklin Global Allocation Fund (continued) | | | | |

| | | Shares/ | | |

| | Country | Warrants | | Value |

| Common Stocks and Other Equity Interests (continued) | | | | |

| Capital Goods (continued) | | | | |

| CNH Industrial NV (Qualifying Common Shares) | United Kingdom | 1,929 | $ | 15,112 |

| Compagnie de Saint-Gobain | France | 870 | | 39,995 |

| Daewoo International Corp. | South Korea | 834 | | 25,625 |

| GEA Group AG | Germany | 2,700 | | 129,130 |

| aHD Supply Holdings Inc. | United States | 2,174 | | 63,220 |

| Honeywell International Inc. | United States | 660 | | 65,386 |

| Huntington Ingalls Industries Inc. | United States | 544 | | 59,280 |

| ITOCHU Corp. | Japan | 5,300 | | 60,997 |

| aKloeckner & Co. SE | Germany | 1,770 | | 20,964 |

| aMeyer Burger Technology AG | Switzerland | 2,010 | | 15,922 |

| MTU Aero Engines AG | Germany | 1,250 | | 111,492 |

| Noble Group Ltd. | Hong Kong | 135,000 | | 126,889 |

| Pall Corp. | United States | 660 | | 63,433 |

| Precision Castparts Corp. | United States | 330 | | 78,507 |

| Rockwell Automation Inc. | United States | 110 | | 12,695 |

| Roper Industries Inc. | United States | 470 | | 74,175 |

| SembCorp Marine Ltd. | Singapore | 25,000 | | 60,040 |

| Siemens AG | Germany | 350 | | 41,449 |

| Sinopec Engineering Group Co. Ltd. | China | 31,000 | | 27,183 |

| aUnited Rentals Inc. | United States | 640 | | 72,518 |

| Weir Group PLC | United Kingdom | 4,300 | | 126,169 |

| | | | | 1,559,107 |

| Commercial & Professional Services 1.2% | | | | |

| Experian PLC | United Kingdom | 8,200 | | 129,919 |

| aIHS Inc., A | United States | 620 | | 75,925 |

| aRecruit Holdings Co. Ltd. | Japan | 1,700 | | 55,860 |

| Serco Group PLC | United Kingdom | 2,230 | | 6,114 |

| SGS SA | Switzerland | 60 | | 129,847 |

| aStericycle Inc. | United States | 630 | | 81,220 |

| | | | | 478,885 |

| Consumer Durables & Apparel 1.2% | | | | |

| Burberry Group PLC | United Kingdom | 4,900 | | 126,454 |

| Ekornes ASA | Norway | 4,350 | | 53,188 |

| Grendene SA | Brazil | 3,700 | | 24,875 |

| Luxottica Group SpA | Italy | 2,000 | | 107,027 |

| aMichael Kors Holdings Ltd. | United States | 410 | | 31,451 |

| NIKE Inc., B | United States | 600 | | 59,574 |

| aTRI Pointe Homes Inc. | United States | 2,320 | | 35,403 |

| aUnder Armour Inc., A | United States | 760 | | 55,092 |

| | | | | 493,064 |

| Consumer Services 0.9% | | | | |

| aChipotle Mexican Grill Inc. | United States | 70 | | 46,454 |

| aChuy’s Holdings Inc. | United States | 1,230 | | 26,334 |

| Starbucks Corp. | United States | 520 | | 42,229 |

| aTAL Education Group, ADR | China | 3,300 | | 101,376 |

| Whitbread PLC | United Kingdom | 1,600 | | 114,789 |

| Wynn Resorts Ltd. | United States | 230 | | 41,080 |

| | | | | 372,262 |

18 | Semiannual Report franklintempleton.com

| | | | |

| | FRANKLIN TEMPLETON INTERNATIONAL TRUST |

| | CONSOLIDATED STATEMENT OF INVESTMENTS (UNAUDITED) |

| |

| |

| |

| |

| Franklin Global Allocation Fund (continued) | | | | |

| | | Shares/ | | |

| | Country | Warrants | | Value |

| Common Stocks and Other Equity Interests (continued) | | | |

| Diversified Financials 2.0% | | | | |

| Aberdeen Asset Management PLC | United Kingdom | 24,490 | $ | 172,328 |

| aAlly Financial Inc. | United States | 1,200 | | 28,536 |

| Azimut Holding SpA | Italy | 5,700 | | 131,233 |

| BM&F BOVESPA SA | Brazil | 7,200 | | 29,576 |

| Credit Suisse Group AG | Switzerland | 3,735 | | 99,858 |

| Deutsche Boerse AG | Germany | 2,040 | | 149,153 |

| GAM Holding Ltd. | Switzerland | 930 | | 16,467 |

| Intercontinental Exchange Inc. | United States | 210 | | 47,458 |

| KIWOOM Securities Co. Ltd. | South Korea | 335 | | 15,048 |

| Korea Investment Holdings Co. Ltd. | South Korea | 642 | | 33,106 |

| MLP AG | Germany | 3,060 | | 14,852 |

| T. Rowe Price Group Inc. | United States | 760 | | 63,437 |

| | | | | 801,052 |

| Energy 4.9% | | | | |

| Anadarko Petroleum Corp. | United States | 202 | | 15,988 |

| Apache Corp. | United States | 1,001 | | 64,154 |

| Baker Hughes Inc. | United States | 1,006 | | 57,342 |

| BG Group PLC | United Kingdom | 1,918 | | 27,005 |

| BP PLC | United Kingdom | 12,004 | | 78,892 |

| Cenovus Energy Inc. | Canada | 2,300 | | 51,641 |

| CNOOC Ltd. | China | 55,000 | | 80,427 |

| CONSOL Energy Inc. | United States | 891 | | 34,865 |

| Dragon Oil PLC | Turkmenistan | 2,110 | | 16,517 |

| Eni SpA | Italy | 2,567 | | 51,338 |

| Ensco PLC, A | United States | 217 | | 7,335 |

| Ensign Energy Services Inc. | Canada | 5,100 | | 48,533 |

| Gazprom OAO, ADR | Russia | 23,800 | | 139,111 |

| Inner Mongolia Yitai Coal Co. Ltd., B | China | 58,200 | | 87,533 |

| Kunlun Energy Co. Ltd. | China | 14,000 | | 15,128 |

| bLUKOIL Holdings, ADR (London Stock Exchange) | Russia | 2,278 | | 106,018 |

| Marathon Oil Corp. | United States | 2,064 | | 59,691 |

| Murphy Oil Corp. | United States | 584 | | 28,277 |

| Noble Corp. PLC | United States | 2,160 | | 38,858 |

| Oceaneering International Inc. | United States | 890 | | 55,812 |

| Paragon Offshore PLC | United States | 390 | | 1,416 |

| PetroChina Co. Ltd., H | China | 78,000 | | 84,489 |

| Petrofac Ltd. | United Kingdom | 2,920 | | 37,678 |

| aRice Energy Inc. | United States | 1,230 | | 30,627 |

| Royal Dutch Shell PLC, A | United Kingdom | 2,371 | | 79,212 |

| Royal Dutch Shell PLC, B | United Kingdom | 1,560 | | 54,239 |

| Saipem SpA | Italy | 1,537 | | 22,016 |

| aSBM Offshore NV | Netherlands | 3,941 | | 53,264 |

| Schlumberger Ltd. | United States | 660 | | 56,727 |

| Suncor Energy Inc. | Canada | 2,000 | | 63,168 |

| Talisman Energy Inc. (CAD Traded) | Canada | 6,911 | | 32,944 |

| Talisman Energy Inc. (USD Traded) | Canada | 3,096 | | 14,582 |

| Technip SA | France | 920 | | 59,880 |

| cTMK OAO, GDR, Reg S | Russia | 12,200 | | 61,610 |

| Total SA, B | France | 1,640 | | 91,824 |

franklintempleton.com

Semiannual Report | 19

FRANKLIN TEMPLETON INTERNATIONAL TRUST

CONSOLIDATED STATEMENT OF INVESTMENTS (UNAUDITED)

| | | | |

| Franklin Global Allocation Fund (continued) | | | | |

| | | Shares/ | | |

| | Country | Warrants | | Value |

| Common Stocks and Other Equity Interests (continued) | | | | |

| Energy (continued) | | | | |

| Transocean Ltd. | United States | 1,160 | $ | 24,372 |

| Trican Well Service Ltd. | Canada | 5,100 | | 34,526 |

| WorleyParsons Ltd. | Australia | 9,800 | | 92,771 |

| | | | | 1,959,810 |

| Food & Staples Retailing 1.0% | | | | |

| CVS Health Corp. | United States | 585 | | 53,446 |

| Dairy Farm International Holdings Ltd. | Hong Kong | 8,100 | | 74,682 |

| The Kroger Co. | United States | 1,417 | | 84,793 |

| Metro AG | Germany | 882 | | 29,977 |

| Tesco PLC | United Kingdom | 27,030 | | 78,824 |

| Walgreen Co. | United States | 847 | | 58,113 |

| Whole Foods Market Inc. | United States | 350 | | 17,160 |

| | | | | 396,995 |

| Food, Beverage & Tobacco 1.6% | | | | |

| Altria Group Inc. | United States | 1,407 | | 70,716 |

| British American Tobacco PLC | United Kingdom | 1,582 | | 93,888 |

| Coca-Cola Enterprises Inc. | United States | 185 | | 8,129 |

| Imperial Tobacco Group PLC | United Kingdom | 1,231 | | 56,990 |

| Lorillard Inc. | United States | 1,305 | | 82,398 |

| Mead Johnson Nutrition Co., A | United States | 360 | | 37,382 |

| aMonster Beverage Corp. | United States | 570 | | 63,926 |

| PepsiCo Inc. | United States | 665 | | 66,566 |

| Philip Morris International Inc. | United States | 353 | | 30,686 |

| Unilever PLC | United Kingdom | 2,381 | | 100,772 |

| Univanich Palm Oil PCL, fgn. | Thailand | 41,100 | | 12,758 |

| | | | | 624,211 |

| Health Care Equipment & Services 2.4% | | | | |

| aCerner Corp. | United States | 780 | | 50,232 |

| Cigna Corp. | United States | 643 | | 66,158 |

| Cochlear Ltd. | Australia | 1,500 | | 88,812 |

| Elekta AB, B | Sweden | 13,500 | | 137,593 |

| Envision Healthcare Holdings Inc. | United States | 400 | | 14,144 |

| Getinge AB, B | Sweden | 1,467 | | 33,956 |

| GN Store Nord AS | Denmark | 5,600 | | 119,655 |

| aInsulet Corp. | United States | 1,000 | | 46,590 |

| McKesson Corp. | United States | 420 | | 88,519 |

| Medtronic Inc. | United States | 2,398 | | 177,140 |

| Shanghai Pharmaceuticals Holding Co. Ltd., H | China | 15,600 | | 37,336 |

| Sinopharm Group Co. | China | 5,600 | | 20,869 |

| Stryker Corp. | United States | 672 | | 62,436 |

| | | | | 943,440 |

| Household & Personal Products 0.4% | | | | |

| Avon Products Inc. | United States | 3,457 | | 33,810 |

| Reckitt Benckiser Group PLC | United Kingdom | 1,300 | | 106,848 |

| | | | | 140,658 |

20 | Semiannual Report

franklintempleton.com

| | | | |

| | FRANKLIN TEMPLETON INTERNATIONAL TRUST |

| | CONSOLIDATED STATEMENT OF INVESTMENTS (UNAUDITED) |

| |

| |

| |

| |

| Franklin Global Allocation Fund (continued) | | | | |

| | | Shares/ | | |

| | Country | Warrants | | Value |

| Common Stocks and Other Equity Interests (continued) | | | |

| Insurance 1.6% | | | | |

| ACE Ltd. | United States | 685 | $ | 78,323 |

| Aegon NV | Netherlands | 8,393 | | 65,940 |

| aAlleghany Corp. | United States | 133 | | 60,720 |

| The Allstate Corp. | United States | 789 | | 53,770 |

| American International Group Inc. | United States | 1,793 | | 98,257 |

| Aviva PLC | United Kingdom | 5,710 | | 45,368 |

| AXA SA | France | 2,680 | | 64,754 |

| China Life Insurance Co. Ltd., H | China | 9,000 | | 31,161 |

| MetLife Inc. | United States | 1,020 | | 56,722 |

| Muenchener Rueckversicherungs-Gesellschaft AG | Germany | 180 | | 37,107 |

| Swiss Re AG | Switzerland | 280 | | 23,948 |

| Zurich Insurance Group AG | Switzerland | 113 | | 35,430 |

| | | | | 651,500 |

| Materials 3.5% | | | | |

| Akzo Nobel NV | Netherlands | 390 | | 26,966 |

| Anglo American PLC | United Kingdom | 1,071 | | 22,136 |

| Arab Potash Co. PLC | Jordan | 2,244 | | 63,196 |

| Compania de Minas Buenaventura SA, ADR | Peru | 4,520 | | 41,810 |

| CRH PLC | Ireland | 1,860 | | 43,981 |

| Cytec Industries Inc. | United States | 1,750 | | 84,175 |

| Ecolab Inc. | United States | 1,120 | | 122,024 |

| Freeport-McMoRan Inc., B | United States | 2,102 | | 56,439 |

| HudBay Minerals Inc. | Canada | 5,200 | | 39,206 |

| aImpala Platinum Holdings Ltd. | South Africa | 11,650 | | 84,816 |

| International Paper Co. | United States | 1,365 | | 73,464 |

| Kumba Iron Ore Ltd. | South Africa | 1,486 | | 34,561 |

| MeadWestvaco Corp. | United States | 1,219 | | 54,611 |

| Mining and Metallurgical Co. Norilsk Nickel OJSC, ADR | Russia | 1,285 | | 22,822 |

| POSCO | South Korea | 242 | | 65,767 |

| Praxair Inc. | United States | 380 | | 48,784 |

| Sika AG | Switzerland | 28 | | 106,636 |

| Symrise AG | Germany | 1,500 | | 89,725 |

| Syngenta AG | Switzerland | 430 | | 141,723 |

| aThyssenKrupp AG | Germany | 1,486 | | 39,345 |

| Umicore SA | Belgium | 3,300 | | 134,294 |

| | | | | 1,396,481 |

| Media 1.8% | | | | |

| CBS Corp., B | United States | 1,176 | | 64,539 |

| aCharter Communications Inc., A | United States | 350 | | 59,395 |

| Comcast Corp., Special A | United States | 323 | | 18,350 |

| ITV PLC | United Kingdom | 31,000 | | 103,856 |

| Reed Elsevier PLC | United Kingdom | 4,105 | | 71,459 |

| aSirius XM Holdings Inc. | United States | 9,500 | | 34,485 |

| Time Warner Cable Inc. | United States | 625 | | 93,300 |

| Time Warner Inc. | United States | 1,123 | | 95,590 |

| Twenty-First Century Fox Inc., B | United States | 3,006 | | 106,292 |

| The Walt Disney Co. | United States | 810 | | 74,933 |

| | | | | 722,199 |

franklintempleton.com

Semiannual Report | 21

FRANKLIN TEMPLETON INTERNATIONAL TRUST

CONSOLIDATED STATEMENT OF INVESTMENTS (UNAUDITED)

| | | | |

| Franklin Global Allocation Fund (continued) | | | | |

| | | Shares/ | | |

| | Country | Warrants | | Value |

| Common Stocks and Other Equity Interests (continued) | | | | |

| Pharmaceuticals, Biotechnology & Life Sciences 5.1% | | | | |

| aActavis PLC | United States | 590 | $ | 159,660 |

| aAlkermes PLC | United States | 2,000 | | 110,040 |

| Bayer AG | Germany | 350 | | 52,683 |

| aBiogen Idec Inc. | United States | 300 | | 92,307 |

| Bristol-Myers Squibb Co. | United States | 1,330 | | 78,537 |

| aCelgene Corp. | United States | 1,180 | | 134,154 |

| CSL Ltd. | Australia | 1,400 | | 98,409 |

| Eli Lilly & Co. | United States | 851 | | 57,970 |

| Gerresheimer AG | Germany | 440 | | 24,332 |

| aGilead Sciences Inc. | United States | 710 | | 71,227 |

| GlaxoSmithKline PLC | United Kingdom | 2,710 | | 62,943 |

| aHospira Inc. | United States | 913 | | 54,451 |

| aIllumina Inc. | United States | 490 | | 93,536 |

| aJazz Pharmaceuticals PLC | United States | 270 | | 47,814 |

| Lonza Group AG | Switzerland | 240 | | 28,231 |

| Merck & Co. Inc. | United States | 2,629 | | 158,792 |

| aMorphoSys AG | Germany | 200 | | 19,705 |

| Perrigo Co. PLC | United States | 510 | | 81,697 |

| aQIAGEN NV | Netherlands | 1,870 | | 44,717 |

| aQuintiles Transnational Holdings Inc. | United States | 710 | | 41,052 |

| aRegeneron Pharmaceuticals Inc. | United States | 111 | | 46,188 |

| Roche Holding AG | Switzerland | 690 | | 206,768 |

| Sanofi | France | 590 | | 57,169 |

| Teva Pharmaceutical Industries Ltd., ADR | Israel | 3,228 | | 183,932 |

| UCB SA | Belgium | 300 | | 23,551 |

| | | | | 2,029,865 |

| Real Estate 0.5% | | | | |

| American Tower Corp. | United States | 940 | | 98,709 |

| Land and Houses PCL, fgn. | Thailand | 282,800 | | 86,062 |

| aLand and Houses PCL, fgn., wts., 5/05/17 | Thailand | 56,560 | | 10,844 |

| | | | | 195,615 |

| Retailing 1.8% | | | | |

| Advance Auto Parts Inc. | United States | 220 | | 32,358 |

| aAmazon.com Inc. | United States | 260 | | 88,046 |

| Dollarama Inc. | Canada | 2,000 | | 93,729 |

| Kingfisher PLC | United Kingdom | 10,800 | | 52,702 |

| Kohl’s Corp. | United States | 439 | | 26,173 |

| aLKQ Corp. | United States | 1,890 | | 54,905 |

| Marks & Spencer Group PLC | United Kingdom | 8,010 | | 61,199 |

| aThe Priceline Group Inc. | United States | 90 | | 104,417 |

| Springland International Holdings Ltd. | China | 37,700 | | 14,390 |

| Start Today Co. Ltd. | Japan | 5,000 | | 107,970 |

| Tractor Supply Co. | United States | 750 | | 57,698 |

| Truworths International Ltd. | South Africa | 683 | | 4,900 |

| | | | | 698,487 |

| Semiconductors & Semiconductor Equipment 1.2% | | | | |

| Applied Materials Inc. | United States | 2,650 | | 63,732 |

| ARM Holdings PLC | United Kingdom | 7,500 | | 107,274 |

| ASML Holding NV | Netherlands | 600 | | 63,417 |

22 | Semiannual Report franklintempleton.com

FRANKLIN TEMPLETON INTERNATIONAL TRUST

CONSOLIDATED STATEMENT OF INVESTMENTS (UNAUDITED)

| | | | |

| Franklin Global Allocation Fund (continued) | | | | |

| | | Shares/ | | |

| | Country | Warrants | | Value |

| Common Stocks and Other Equity Interests (continued) | | | | |

| Semiconductors & Semiconductor Equipment (continued) | | | | |

| aCavium Inc. | United States | 1,200 | $ | 67,920 |

| aGCL-Poly Energy Holdings Ltd. | Hong Kong | 241,700 | | 65,452 |

| Microchip Technology Inc. | United States | 1,500 | | 67,725 |

| aTrina Solar Ltd., ADR | China | 5,561 | | 55,777 |

| | | | | 491,297 |

| Software & Services 4.9% | | | | |

| Alibaba Group Holding Ltd., ADR | China | 320 | | 35,725 |

| aANSYS Inc. | United States | 330 | | 27,562 |

| CA Inc. | United States | 1,052 | | 32,770 |

| Capcom Co. Ltd. | Japan | 1,800 | | 26,767 |

| aCheck Point Software Technologies Ltd. | Israel | 1,300 | | 100,503 |

| aCognizant Technology Solutions Corp., A | United States | 1,110 | | 59,929 |

| aCoStar Group Inc. | United States | 270 | | 45,970 |

| Dassault Systemes SA | France | 1,600 | | 104,677 |

| aElectronic Arts Inc. | United States | 1,230 | | 54,034 |

| aFacebook Inc., A | United States | 1,420 | | 110,334 |

| aFleetCor Technologies Inc. | United States | 350 | | 53,162 |

| aGoogle Inc., A | United States | 360 | | 197,669 |

| Infosys Ltd., ADR | India | 700 | | 48,888 |

| aLinkedIn Corp., A | United States | 100 | | 22,627 |

| MasterCard Inc., A | United States | 1,890 | | 164,978 |

| MercadoLibre Inc. | Argentina | 650 | | 91,611 |

| Microsoft Corp. | United States | 3,466 | | 165,709 |

| aMobileye NV | United States | 330 | | 14,546 |

| aNetSuite Inc. | United States | 530 | | 56,048 |

| The Sage Group PLC | United Kingdom | 22,000 | | 140,079 |

| aSalesforce.com Inc. | United States | 1,350 | | 80,824 |

| Symantec Corp. | United States | 3,576 | | 93,298 |

| Visa Inc., A | United States | 540 | | 139,423 |

| Xerox Corp. | United States | 5,695 | | 79,502 |

| | | | | 1,946,635 |

| Technology Hardware & Equipment 2.5% | | | | |

| Apple Inc. | United States | 3,095 | | 368,088 |

| CANON Inc. | Japan | 500 | | 16,014 |

| Cisco Systems Inc. | United States | 2,872 | | 79,382 |

| Digital China Holdings Ltd. | China | 18,000 | | 16,759 |

| aFlextronics International Ltd. | Singapore | 1,510 | | 16,746 |

| Hewlett-Packard Co. | United States | 1,238 | | 48,356 |

| Kingboard Chemical Holdings Ltd. | Hong Kong | 20,700 | | 38,705 |

| QUALCOMM Inc. | United States | 760 | | 55,404 |

| Samsung Electronics Co. Ltd. | South Korea | 192 | | 221,996 |

| SanDisk Corp. | United States | 430 | | 44,488 |

| YASKAWA Electric Corp. | Japan | 7,500 | | 97,312 |

| | | | | 1,003,250 |

| Telecommunication Services 0.9% | | | | |

| China Mobile Ltd. | China | 4,000 | | 49,259 |

| China Telecom Corp. Ltd., H | China | 102,000 | | 61,556 |

| Koninklijke KPN NV | Netherlands | 9,940 | | 33,029 |

| Mobile TeleSystems, ADR | Russia | 593 | | 7,247 |

franklintempleton.com Semiannual Report | 23

FRANKLIN TEMPLETON INTERNATIONAL TRUST

CONSOLIDATED STATEMENT OF INVESTMENTS (UNAUDITED)

| | | | | |

| Franklin Global Allocation Fund (continued) | | | | | |

| | | Shares/ | | | |

| | Country | Warrants | | | Value |

| Common Stocks and Other Equity Interests (continued) | | | | | |

| Telecommunication Services (continued) | | | | | |

| Telefonica SA | Spain | 3,037 | | $ | 48,681 |

| Telenor ASA | Norway | 2,020 | | | 42,533 |

| Vodafone Group PLC | United Kingdom | 27,467 | | | 100,504 |

| | | | | | 342,809 |

| Transportation 1.1% | | | | | |

| A.P. Moeller-Maersk AS, B | Denmark | 33 | | | 68,856 |

| Deutsche Lufthansa AG | Germany | 2,190 | | | 39,124 |

| DSV AS, B | Denmark | 4,800 | | | 150,391 |

| aHub Group Inc., A | United States | 1,340 | | | 50,411 |

| Kansas City Southern | United States | 290 | | | 34,492 |

| Union Pacific Corp. | United States | 760 | | | 88,745 |

| | | | | | 432,019 |

| Utilities 0.1% | | | | | |

| NRG Energy Inc. | United States | 1,551 | | | 48,484 |

| Total Common Stocks and Other Equity Interests | | | | | |

| (Cost $16,555,789) | | | | | 20,363,403 |

| Preferred Stocks 0.9% | | | | | |

| Automobiles & Components 0.1% | | | | | |

| Volkswagen AG, pfd. | Germany | 146 | | | 33,650 |

| Banks 0.3% | | | | | |

| Banco Bradesco SA, ADR, pfd. | Brazil | 6,900 | | | 106,812 |

| Energy 0.2% | | | | | |

| Petroleo Brasileiro SA, ADR, pfd. | Brazil | 8,603 | | | 87,837 |

| Materials 0.3% | | | | | |

| Vale SA, ADR, pfd., A | Brazil | 16,750 | | | 130,147 |

| Total Preferred Stocks (Cost $604,686) | | | | | 358,446 |

| |

| | | Principal | | | |

| | | Amount* | | | |

| Corporate Bonds 6.4% | | | | | |

| Automobiles & Components 0.6% | | | | | |

| dBMW Finance NV, senior note, FRN, 0.37%, 9/05/16 | Germany | 130,000 | EUR | | 162,072 |

| BMW US Capital LLC, senior note, 1.25%, 7/20/16 | Germany | 65,000 | EUR | | 82,219 |

| | | | | | 244,291 |

| Banks 2.2% | | | | | |

| cAbbey National Treasury Services PLC, senior note, Reg S, 2.00%, | | | | | |

| 1/14/19 | United Kingdom | 100,000 | EUR | | 130,740 |

| Bank of Montreal, senior note, 1.45%, 4/09/18 | Canada | 100,000 | | | 99,447 |

| HSBC USA Inc., senior note, 2.375%, 2/13/15 | United States | 120,000 | | | 120,473 |

| Royal Bank of Canada, senior note, 1.20%, 1/23/17 | Canada | 65,000 | | | 65,260 |

| c,dSociete Generale SA, senior note, Reg S, FRN, 0.431%, 4/17/15 | France | 100,000 | EUR | | 124,590 |

| Toyota Motor Credit Corp., senior note, | | | | | |

| 2.10%, 1/17/19 | Japan | 65,000 | | | 65,711 |

| cReg S, 1.25%, 8/01/17 | Japan | 125,000 | EUR | | 159,636 |

| c,dVolkswagen Bank GmbH, senior note, Reg S, FRN, 0.481%, 5/09/16 | Germany | 100,000 | EUR | | 124,885 |

| | | | | | 890,742 |

24 | Semiannual Report franklintempleton.com

FRANKLIN TEMPLETON INTERNATIONAL TRUST

CONSOLIDATED STATEMENT OF INVESTMENTS (UNAUDITED)

| | | | | |

| Franklin Global Allocation Fund (continued) | | | | | |

| | | Principal | | | |

| | Country | Amount* | | | Value |

| Corporate Bonds (continued) | | | | | |

| Capital Goods 0.2% | | | | | |

| John Deere Capital Corp., 0.70%, 9/04/15 | United States | 90,000 | $ | | 90,285 |

| Diversified Financials 0.3% | | | | | |

| Caterpillar International Finance Ltd., senior note, 1.375%, 5/18/15 | United States | 100,000 | EUR | 125,146 |

| Energy 0.5% | | | | | |

| Chevron Corp., senior note, 0.889%, 6/24/16 | United States | 150,000 | | | 150,886 |

| eNGPL PipeCo LLC, | | | | | |

| secured note, 144A, 7.119%, 12/15/17 | United States | 6,000 | | | 6,240 |

| senior secured note, 144A, 9.625%, 6/01/19 | United States | 25,000 | | | 26,938 |

| | | | | | 184,064 |

| Food & Staples Retailing 0.4% | | | | | |

| Costco Wholesale Corp., senior note, 1.125%, 12/15/17 | United States | 150,000 | | | 149,729 |

| Food, Beverage & Tobacco 0.8% | | | | | |

| Anheuser-Busch InBev Finance, senior note, 0.80%, 1/15/16 | Belgium | 150,000 | | | 150,504 |

| cAnheuser-Busch InBev NV, senior note, Reg S, 1.25%, 3/24/17 | Belgium | 130,000 | EUR | 165,169 |

| | | | | | 315,673 |

| Materials 0.0%† | | | | | |

| eWalter Energy Inc., | | | | | |

| first lien, 144A, 9.50%, 10/15/19 | United States | 15,000 | | | 12,825 |

| fsecond lien, 144A, PIK, 11.50%, 4/01/20 | United States | 6,000 | | | 2,625 |

| | | | | | 15,450 |

| Media 0.4% | | | | | |

| iHeartCommunications Inc., senior secured note, first lien, 9.00%, | | | | | |

| 12/15/19 | United States | 65,000 | | | 64,106 |

| The Walt Disney Co., senior note, 1.10%, 12/01/17 | United States | 110,000 | | | 109,820 |

| | | | | | 173,926 |

| Pharmaceuticals, Biotechnology & Life Sciences 0.2% | | | | | |

| Johnson & Johnson, senior note, 1.65%, 12/05/18 | United States | 65,000 | | | 65,834 |

| Software & Services 0.1% | | | | | |

| First Data Corp., | | | | | |

| senior bond, 12.625%, 1/15/21 | United States | 8,000 | | | 9,540 |

| senior note, 11.75%, 8/15/21 | United States | 12,000 | | | 13,950 |

| e,fFirst Data Holdings Inc., 144A, PIK, 14.50%, 9/24/19 | United States | 6,658 | | | 6,867 |

| | | | | | 30,357 |

| Technology Hardware & Equipment 0.3% | | | | | |

| eAvaya Inc., | | | | | |

| senior note, 144A, 10.50%, 3/01/21 | United States | 42,000 | | | 36,855 |

| senior secured note, 144A, 7.00%, 4/01/19 | United States | 17,000 | | | 16,702 |

| Hewlett-Packard Co., senior note, 2.35%, 3/15/15 | United States | 50,000 | | | 50,222 |

| | | | | | 103,779 |

| Utilities 0.4% | | | | | |

| cSnam SpA, senior note, Reg S, 2.375%, 6/30/17 | Italy | 125,000 | EUR | 162,690 |

| Total Corporate Bonds (Cost $2,651,818) | | | | | 2,551,966 |

franklintempleton.com Semiannual Report | 25

FRANKLIN TEMPLETON INTERNATIONAL TRUST

CONSOLIDATED STATEMENT OF INVESTMENTS (UNAUDITED)

| | | | | |

| Franklin Global Allocation Fund (continued) | | | | | |

| | | Principal | | | |

| | Country | Amount* | | | Value |

| d,gSenior Floating Rate Interests 0.1% | | | | | |

| Retailing 0.0%† | | | | | |

| hToys R US-Delaware Inc., | | | | | |

| Filo Term Loan, 8.75%, 10/24/19 | United States | 2,000 | | $ | 1,961 |

| Term Loan B4, 9.75%, 4/24/20 | United States | 14,700 | | | 13,582 |

| | | | | | 15,543 |

| Technology Hardware & Equipment 0.1% | | | | | |

| Avaya Inc., | | | | | |

| Tranche B-3 Term Loan, 4.654%, 10/26/17 | United States | 20,647 | | | 20,105 |

| Tranche B6 Term Loan, 6.50%, 3/31/18 | United States | 4,913 | | | 4,903 |

| | | | | | 25,008 |

| Total Senior Floating Rate Interests (Cost $39,446) | | | | | 40,551 |

| |

| | | Units | | | |

| |

| iExchange Traded Notes (Cost $2,213,147) 4.9% | | | | | |

| Energy 4.9% | | | | | |

| a,j,kiPATH Dow Jones-UBS Commodity Index Total Return ETN, 6/12/36 | United States | 59,600 | | | 1,944,152 |

| |

| | | Principal | | | |

| | | Amount* | | | |

| |

| Foreign Government and Agency Securities 17.5% | | | | | |

| Deutsche Bahn Finance BV, senior note, 4.00%, 1/16/17 | Germany | 100,000 | EUR | | 134,543 |

| France Treasury Note, 2.25%, 2/25/16 | France | 65,000 | EUR | | 83,141 |

| eGovernment of Austria, senior note, 144A, 1.15%, 10/19/18 | Austria | 60,000 | EUR | | 77,842 |

| Government of Canada, | | | | | |

| 2.00%, 12/01/14 | Canada | 48,000 | CAD | | 41,988 |

| 1.00%, 2/01/15 | Canada | 132,000 | CAD | | 115,461 |

| 1.25%, 9/01/18 | Canada | 130,000 | CAD | | 113,879 |

| eGovernment of Finland, 144A, 1.125%, 9/15/18 | Finland | 60,000 | EUR | | 77,693 |

| Government of France, | | | | | |

| 3.25%, 4/25/16 | France | 125,000 | EUR | | 162,625 |

| 1.00%, 5/25/19 | France | 60,000 | EUR | | 77,329 |

| esenior note, 144A, 1.375%, 1/29/18 | France | 152,000 | | | 153,284 |

| Government of Germany, 0.50%, 4/12/19 | Germany | 60,000 | EUR | | 76,079 |

| Government of Hungary, | | | | | |

| 5.50%, 12/22/16 | Hungary | 350,000 | HUF | | 1,526 |

| 4.125%, 2/19/18 | Hungary | 50,000 | | | 52,131 |

| 4.00%, 4/25/18 | Hungary | 1,060,000 | HUF | | 4,503 |

| 5.375%, 2/21/23 | Hungary | 80,000 | | | 87,560 |

| A, 6.75%, 11/24/17 | Hungary | 5,540,000 | HUF | | 25,344 |

| A, 7.00%, 6/24/22 | Hungary | 9,950,000 | HUF | | 50,185 |

| A, 6.00%, 11/24/23 | Hungary | 5,760,000 | HUF | | 28,071 |

| B, 6.75%, 2/24/17 | Hungary | 3,260,000 | HUF | | 14,611 |

| B, 5.50%, 6/24/25 | Hungary | 29,850,000 | HUF | | 142,200 |

| senior note, 6.25%, 1/29/20 | Hungary | 32,000 | | | 36,270 |

| senior note, 6.375%, 3/29/21 | Hungary | 6,000 | | | 6,926 |

| csenior note, Reg S, 4.375%, 7/04/17 | Hungary | 95,000 | EUR | | 127,310 |

| csenior note, Reg S, 5.75%, 6/11/18 | Hungary | 10,000 | EUR | | 14,215 |

| Government of Ireland, | | | | | |

| 5.90%, 10/18/19 | Ireland | 26,000 | EUR | | 40,945 |

| 4.50%, 4/18/20 | Ireland | 40,000 | EUR | | 60,149 |

26 | Semiannual Report franklintempleton.com

FRANKLIN TEMPLETON INTERNATIONAL TRUST

CONSOLIDATED STATEMENT OF INVESTMENTS (UNAUDITED)

| | | | |

| Franklin Global Allocation Fund (continued) | | | | |

| | | Principal | | |

| | Country | Amount* | | Value |

| Foreign Government and Agency Securities (continued) | | | | |

| Government of Ireland, (continued) | | | | |

| 5.00%, 10/18/20 | Ireland | 123,000 | EUR $ | 192,004 |

| senior bond, 5.40%, 3/13/25 | Ireland | 131,670 | EUR | 223,449 |

| Government of Malaysia, | | | | |

| 3.741%, 2/27/15 | Malaysia | 120,000 | MYR | 35,520 |

| 3.835%, 8/12/15 | Malaysia | 70,000 | MYR | 20,765 |

| 4.72%, 9/30/15 | Malaysia | 507,000 | MYR | 151,523 |

| 3.197%, 10/15/15 | Malaysia | 40,000 | MYR | 11,806 |

| Government of Mexico, | | | | |

| 9.50%, 12/18/14 | Mexico | 23,700 | l MXN | 170,898 |

| 6.00%, 6/18/15 | Mexico | 6,620 | l MXN | 48,315 |

| 8.00%, 12/17/15 | Mexico | 12,570 | l MXN | 94,809 |

| 6.25%, 6/16/16 | Mexico | 290 | l MXN | 2,172 |

| Government of the Netherlands, | | | | |

| e144A, Strip, 4/15/16 | Netherlands | 120,000 | EUR | 149,354 |

| cReg S, 1.25%, 1/15/19 | Netherlands | 60,000 | EUR | 78,219 |

| Government of Poland, | | | | |

| 5.50%, 4/25/15 | Poland | 235,000 | PLN | 70,909 |

| 6.25%, 10/24/15 | Poland | 6,000 | PLN | 1,854 |

| 5.00%, 4/25/16 | Poland | 335,000 | PLN | 104,014 |

| 4.75%, 10/25/16 | Poland | 1,185,000 | PLN | 371,898 |

| 4.75%, 4/25/17 | Poland | 10,000 | PLN | 3,180 |

| Strip, 7/25/15 | Poland | 491,000 | PLN | 144,418 |

| Strip, 1/25/16 | Poland | 555,000 | PLN | 161,729 |

| Government of Portugal, | | | | |

| e144A, 5.125%, 10/15/24 | Portugal | 80,000 | | 83,976 |

| cReg S, 3.875%, 2/15/30 | Portugal | 90,000 | EUR | 114,638 |

| csenior bond, Reg S, 4.95%, 10/25/23 | Portugal | 500 | EUR | 727 |

| csenior note, Reg S, 5.65%, 2/15/24 | Portugal | 1,200 | EUR | 1,827 |

| eGovernment of Slovenia, senior note, 144A, 5.85%, 5/10/23 | Slovenia | 200,000 | | 229,529 |

| eGovernment of Ukraine, 144A, 7.75%, 9/23/20 | Ukraine | 280,000 | | 216,367 |

| Inter-American Development Bank, 0.875%, 11/15/16 | Supranationalm | 65,000 | | 65,383 |

| International Bank for Reconstruction and Development, 0.75%, | | | | |

| 12/15/16 | Supranationalm | 135,000 | | 135,468 |

| Korea Monetary Stabilization Bond, | | | | |

| senior bond, 2.47%, 4/02/15 | South Korea | 38,900,000 | KRW | 35,003 |

| senior bond, 2.80%, 8/02/15 | South Korea | 181,710,000 | KRW | 164,107 |

| senior note, 2.84%, 12/02/14 | South Korea | 14,730,000 | KRW | 13,233 |

| senior note, 2.74%, 2/02/15 | South Korea | 40,790,000 | KRW | 36,691 |

| senior note, 2.76%, 6/02/15 | South Korea | 50,000,000 | KRW | 45,091 |

| senior note, 2.90%, 12/02/15 | South Korea | 225,900,000 | KRW | 204,749 |

| senior note, 2.80%, 4/02/16 | South Korea | 34,800,000 | KRW | 31,583 |

| senior note, 2.79%, 6/02/16 | South Korea | 90,700,000 | KRW | 82,399 |

| senior note, 2.46%, 8/02/16 | South Korea | 31,600,000 | KRW | 28,587 |

| senior note, 2.22%, 10/02/16 | South Korea | 8,700,000 | KRW | 7,841 |

| Korea Treasury Bond, senior note, | | | | |

| 3.25%, 12/10/14 | South Korea | 92,800,000 | KRW | 83,390 |

| 3.25%, 6/10/15 | South Korea | 80,160,000 | KRW | 72,475 |

| 2.75%, 12/10/15 | South Korea | 216,120,000 | KRW | 195,604 |

| 2.75%, 6/10/16 | South Korea | 80,900,000 | KRW | 73,473 |