UNITEDSTATES

SECURITIESANDEXCHANGECOMMISSION

Washington,D.C.20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-06349

Name of Fund: BlackRock Latin America Fund, Inc.

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock

Latin America Fund, Inc., 40 East 52nd Street, New York, NY 10022

Registrant’s telephone number, including area code: (800) 441-7762

Date of fiscal year end: 10/31/2010

Date of reporting period: 10/31/2010

Item 1 – Report to Stockholders

Annual Report

BlackRock Global Emerging Markets Fund, Inc.

BlackRock Latin America Fund, Inc.

BlackRock International Fund of BlackRock Series, Inc.

October 31, 2010

Not FDIC Insured • No Bank Guarantee • May Lose Value

| |

| Table of Contents | |

| | Page |

| Dear Shareholder | 3 |

| Annual Report: | |

| Fund Summaries | 4 |

| About Fund Performance | 10 |

| Disclosure of Expenses | 10 |

| Derivative Financial Instruments | 10 |

| Financial Statements: | |

| Schedules of Investments | 11 |

| Statements of Assets and Liabilities | 16 |

| Statements of Operations | 17 |

| Statements of Changes in Net Assets | 18 |

| Financial Highlights | 19 |

| Notes to Financial Statements | 25 |

| Report of Independent Registered Public Accounting Firm | 33 |

| Important Tax Information | 34 |

| Master Portfolio Information | 35 |

| Master Portfolio Financial Statements: | |

| Schedule of Investments | 36 |

| Statement of Assets and Liabilities | 38 |

| Statement of Operations | 39 |

| Statements of Changes in Net Assets | 40 |

| Master Portfolio Financial Highlights | 40 |

| Master Portfolio Notes to Financial Statements | 41 |

| Master Report of Independent Registered Public Accounting Firm | 44 |

| Disclosure of Investment Advisory Agreements and Sub-Advisory Agreements | 45 |

| Officers and Directors | 49 |

| Additional Information | 52 |

| Mutual Fund Family | 54 |

2 ANNUAL REPORT

OCTOBER 31, 2010

Dear Shareholder

The global economic recovery that began in 2009 has continued on its choppy course this year, delivering mixed but slowly improving economic data and

gradual if uneven improvement of investor sentiment. The risks of a double-dip recession continue to recede, but the economy remains mired in a slow-

growth environment. In the United States, the National Bureau of Economic Research declared that the “Great Recession” ended in June 2009. Spanning

December 2007 to June 2009, this marked the longest reported recession since the Great Depression. Structural problems of ongoing deleveraging and

weak spending among businesses and households weigh heavily on the pace of economic growth. The unemployment rate remains stubbornly high in the

face of sluggish job gains in the private sector. The US dollar, along with other developed market currencies, has experienced devaluation resulting from

aggressively easy monetary and fiscal policies. Given these long-standing conditions, the Federal Reserve Board has announced that additional policy

action will be taken to combat deflation and unemployment and promote economic growth.

The high levels of volatility experienced in global equity markets throughout 2009 continued into 2010 as mixed economic data and lingering credit issues

caused stocks to trade in both directions, but by the end of the first quarter, most markets had managed to post gains. The second quarter, in contrast,

brought higher levels of volatility and a “flight to quality” as investor sentiment was dominated by fears of a double-dip recession. Global equity markets

saw negative quarterly returns — and for many markets, the first significant downturn since the bull market began in March 2009. In the third quarter, eco-

nomic data turned less negative and strong corporate earnings reports became increasingly consistent. These factors, along with attractive valuations and

expectations for additional quantitative easing, drove equity markets higher, with most markets recapturing their second quarter losses. Stocks continued

their rally into the beginning of the fourth quarter, closing out the 12-month period in positive territory. International equities posted gains on both a six-

and 12-month basis. In the United States, both large and small cap equities posted robust gains for the 12-month period, while on a six-month basis,

large cap stocks remained relatively flat and small caps turned slightly negative.

In fixed income markets, yields fluctuated but declined significantly over the past 12 months amid heightened uncertainty. Weak economic data, lingering

credit problems and, near the end of the period, the expectation of additional quantitative easing drove interest rates lower and bond prices higher.

Treasuries rallied over the period, modestly outperforming the credit spread sectors of the market. Corporate credit spreads benefited from the low interest

rate environment and high yield fixed income became increasingly attractive due to declining default rates and better-than-expected results on European

bank stress tests. Tax-exempt municipal bonds performed well over the 12-month period, driven primarily by technical factors including favorable supply-

and-demand dynamics.

Cash investments, as represented by the 3-month Treasury bill, returned only a fraction over 0% for the 12-month period as short-term interest rates

remained low. Yields on money market securities remain near all-time lows.

| | |

| Against this backdrop, the major market averages posted the following returns: | | |

| Total Returns as of October 31, 2010 | 6-month | 12-month |

| US large cap equities (S&P 500 Index) | 0.74% | 16.52% |

| US small cap equities (Russell 2000 Index) | (1.24) | 26.58 |

| International equities (MSCI Europe, Australasia, Far East Index) | 5.74 | 8.36 |

| 3-month Treasury bill (BofA Merrill Lynch 3-Month Treasury Bill Index) | 0.08 | 0.12 |

| US Treasury securities (BofA Merrill Lynch 10-Year US Treasury Index) | 10.63 | 10.03 |

| US investment grade bonds (Barclays Capital US Aggregate Bond Index) | 5.33 | 8.01 |

| Tax-exempt municipal bonds (Barclays Capital Municipal Bond Index) | 3.95 | 7.78 |

| US high yield bonds (Barclays Capital US Corporate High Yield 2% Issuer Capped Index) | 6.73 | 19.10 |

Past performance is no guarantee of future results. Index performance shown for illustrative purposes only. You cannot invest directly in an index.

As global economic conditions continue to improve, investors across the world continue to face uncertainty about the future of economic growth. Through

periods of uncertainty, as ever, BlackRock’s full resources are dedicated to the management of our clients’ assets. For additional market perspective and

investment insight, visit www.blackrock.com/shareholdermagazine, where you’ll find the most recent issue of our award-winning Shareholder® magazine, as

well as its quarterly companion newsletter, Shareholder Perspectives. As always, we thank you for entrusting BlackRock with your investments, and we look

forward to your continued partnership in the months and years ahead.

THIS PAGE NOT PART OF YOUR FUND REPORT

3

Fund Summary as of October 31, 2010

BlackRock Global Emerging Markets Fund, Inc.

Portfolio Management Commentary

How did the Fund perform?

• The Fund generated positive results for the 12-month period ended

October 31, 2010, but underperformed its benchmark, the MSCI Emerging

Markets Index.

What factors influenced performance?

• The Fund’s underperformance relative to its benchmark was not attri-

butable to any particular factor. Notable individual securities that did not

perform as expected include Russian oil & gas producer OAO Gazprom,

which lagged the general market rally due to unresolved concerns around

the company’s plans to discontinue engaging in long-term contracts to

deliver gas supplies and begin trading in the spot market. Macau-based

casino operator Melco Crown Entertainment Ltd. fell on concerns that a

proposed government review of the country’s gaming industry would have a

negative impact on the company’s revenues; however, we expect Melco to

benefit from the region’s economic recovery and, as such, have retained

the position. Indian mobile telecommunications operator Reliance

Communications Ltd. also lost ground after the company cut its call

charges aggressively in connection with an ongoing tariff war with competi-

tors. Other Indian stocks that underperformed include construction compa-

nies Punj Lloyd Ltd. and Unitech Ltd., both of which reported disappointing

earnings in the fourth quarter of 2009.

• Indian stocks that contributed positively to performance include tobacco

company ITC Ltd. and, in financials, Axis Bank, which benefited from strong

loan growth, increasing profits and lower-than-expected default activity.

Brazilian consumer stock Lojas Renner SA also made a notable positive

impact on performance.

Describe recent portfolio activity.

• During the 12-month period, we increased the Fund’s exposure to Latin

America. In particular, we significantly increased exposure to Mexico with

the purchase of mobile telecommunications operator America Movil, SA de

CV, following its merger with Telmex. We believe the merger was fundamen-

tally misunderstood by the market and that the post-merger company will

have significant strengths versus its competitors as an integrated player. In

Brazil, we added to holdings in Itau Unibanco Holdings SA, which continues

to benefit from strong loan growth. Among Brazilian oil companies, we

established a new position in OGX Petroleo e Gas Participacoes SA, which

offers significant potential from its drilling program in the Campos and

Santos basins, and we reduced our position in Petrobras.

• Outside of Latin America, we exited our position in Russian oil company

Rosneft and added to Chinese oil & gas company CNOOC Ltd. Also in

China, we made new investments in companies benefiting from growth in

consumer demand, including the dominant mobile telecommunications

operator, China Mobile Ltd. We also added to holdings of Taiwanese

electronics manufacturer HON HAI Precision Industry Co., Ltd.

Describe Fund positioning at period end.

• At period end, the Fund was overweight relative to its benchmark in

consumer-related sectors and underweight in materials. From a geographic

perspective, the Fund was overweight in India, Brazil and Turkey and under-

weight in China, Korea and Taiwan. We remain cautious about China as we

are concerned about economic deceleration resulting from the govern-

ment’s policy on the property market.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions.

These views are not intended to be a forecast of future events and are no guarantee of future results.

| |

| Portfolio Information | |

| | Percent of |

| | Long-Term |

| Ten Largest Holdings | Investments |

| Itau Unibanco Holdings SA — ADR | 5% |

| America Movil, SA de CV — ADR | 4 |

| China Mobile Ltd | 4 |

| Vale SA — ADR | 3 |

| HON HAI Precision Industry Co., Ltd. | 3 |

| MTN Group Ltd. | 2 |

| CNOOC Ltd. | 2 |

| Cia de Bebidas das Americas, Preference Shares — ADR | 2 |

| Morgan Stanley Asia Products Ltd. (ITC Ltd.), due 7/03/14 | 2 |

| Samsung Electronics Co. Ltd | 2 |

| |

| | Percent of |

| | Long-Term |

| Geographic Allocation | Investments |

| Brazil | 19% |

| China | 13 |

| South Korea | 10 |

| Taiwan | 7 |

| South Africa | 7 |

| India | 7 |

| Russia | 6 |

| Mexico | 5 |

| Turkey | 5 |

| United States | 5 |

| Peru | 3 |

| Qatar | 2 |

| Indonesia | 2 |

| Thailand | 2 |

| Panama | 1 |

| Cayman Islands | 1 |

| Saudi Arabia | 1 |

| Poland | 1 |

| Israel | 1 |

| Luxembourg | 1 |

| Chile | 1 |

4 ANNUAL REPORT

OCTOBER 31, 2010

BlackRock Global Emerging Markets Fund, Inc.

Total Return Based on a $10,000 Investment

1 Assuming maximum sales charges, transaction costs and other operating expenses, including advisory fees. Institutional Shares do not have

a sales charge.

2 The Fund invests in securities, principally equities, of issuers in countries having smaller capital markets.

3 This unmanaged index measures the total returns of emerging foreign stock markets in Europe, Asia and the Far East.

| | | | | | | |

| Performance Summary for the Period Ended October 31, 2010 | | | | | | |

| | | | | Average Annual Total Returns4 | | |

| | | 1 Year | | 5 Years | | 10 Years |

| | 6-Month | w/o sales | w/sales | w/o sales | w/sales | w/o sales | w/sales |

| | Total Returns | charge | charge | charge | charge | charge | charge |

| Institutional | 10.63% | 21.28% | N/A | 14.14% | N/A | 13.28% | N/A |

| Investor A | 10.49 | 20.93 | 14.58% | 13.80 | 12.58% | 12.98 | 12.37% |

| Investor B | 10.01 | 19.92 | 15.42 | 12.87 | 12.63 | 12.26 | 12.26 |

| Investor C | 10.03 | 19.90 | 18.90 | 12.89 | 12.89 | 12.07 | 12.07 |

| MSCI Emerging Markets Index | 10.16 | 23.89 | N/A | 15.28 | N/A | 14.96 | N/A |

4 Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund

Performance” on page 10 for a detailed description of share classes, including any related sales charges and fees.

N/A — Not applicable as share class and index do not have a sales charge.

| | | | | | | |

| Expense Example | | | | | | | |

| | | Actual | | | Hypothetical6 | | |

| | Beginning | Ending | | Beginning | Ending | | |

| | Account Value | Account Value | Expenses Paid | Account Value | Account Value | Expenses Paid | Annualized |

| | May 1, 2010 | October 31, 2010 | During the Period5 | May 1, 2010 | October 31, 2010 | During the Period5 | Expense Ratio |

| Institutional | $1,000.00 | $1,106.30 | $ 7.01 | $1,000.00 | $1,018.55 | $ 6.72 | 1.32% |

| Investor A | $1,000.00 | $1,104.90 | $ 8.75 | $1,000.00 | $1,016.88 | $ 8.39 | 1.65% |

| Investor B | $1,000.00 | $1,100.10 | $13.07 | $1,000.00 | $1,012.75 | $12.53 | 2.47% |

| Investor C | $1,000.00 | $1,100.30 | $13.34 | $1,000.00 | $1,012.50 | $12.78 | 2.52% |

5 For each share class of the Fund, expenses are equal to the annualized expense ratio for the class, multiplied by the average account value over the period, multiplied by 184/365

(to reflect the one-half year period shown).

6 Hypothetical 5% annual return before expenses is calculated by pro rating the number of days in the most recent fiscal half year divided by 365.

Past performance is not indicative of future results.

ANNUAL REPORT OCTOBER 31, 2010 5

Fund Summary as of October 31, 2010

BlackRock Latin America Fund, Inc.

Portfolio Management Commentary

How did the Fund perform?

• The Fund outperformed its benchmark, the MSCI Emerging Markets Latin

America Index, for the 12-month period ended October 31, 2010.

What factors influenced performance?

• Stock selection within Brazil was the primary contributor to performance

for the period. In particular, an underweight position in oil giant Petroleo

Brasileiro SA and overweight allocations to banks Itau Unibanco Holdings

SA and Banco Bradesco SA helped relative performance. Also benefiting

results was a non-benchmark holding of Canadian-listed Colombian oil

company Pacific Rubiales Energy Corp. Stock selection in Mexico and Chile,

and overweight exposure to Peru and Panama-based Copa Holdings SA,

also had a positive impact on performance.

• Detracting from performance was an underweight exposure to Chile and

Colombia. Both of these markets performed well, despite their unattractive

valuations, due to significant purchasing activity from local pension funds.

Describe recent portfolio activity.

• During the 12-month period, we exited positions in Brazilian steel and pulp

& paper companies, which reduced the Fund’s exposure to Brazil. Our pur-

chase of non-benchmark stock Pacific Rubiales Energy Corp. initiated Fund

exposure to Colombia. We increased exposure to Chile (primarily consumer

exposure) and Peru (through increased mining exposure). The Fund’s expo-

sure to Argentina was reduced when we exited our position in Tenaris.

Describe Fund positioning at period end.

• At period end, the Fund remains positioned to benefit from domestic growth,

especially in Brazil where the Fund’s notable overweights are in the financial

and consumer areas, with particular emphasis on homebuilders. Following

the conclusion of the presidential election in Brazil, its market continues to

trade at attractive multiples relative to other emerging markets. Mexico, on

the other hand, continues to face strong headwinds given that its economy

is highly dependent on economic growth in the United States, which has

been subpar. Mexican stocks are trading at a premium relative to the aver-

age for emerging markets on a relative value basis. Increasing concerns

about security incidents also present challenges for Mexico. Chile continues

to trade at a significant premium relative to most markets in the world.

• We continue to maintain selective positions in the smaller markets of the

Latin American region. Overall, we continue to believe that Latin America

in general, and Brazil specifically, offers a favorable combination of strong

top-down story and attractive bottom-up valuation, resulting in our bullish

view of the region.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions.

These views are not intended to be a forecast of future events and are no guarantee of future results.

| |

| Portfolio Information | |

| | Percent of |

| | Long-Term |

| Ten Largest Holdings | Investments |

| Vale SA — ADR | 9% |

| Itau Unubanco Holdings SA — ADR | 9 |

| Petroleo Brasileiro SA — ADR | 9 |

| America Movil, SA de CV — ADR | 9 |

| Banco Bredesco SA — ADR | 5 |

| Cia de Bebidas das Americas, Preference Shares — ADR | 4 |

| OGX Petroleo e Gas Participacoes SA | 4 |

| Fomento Economico Mexicano, SA de CV — ADR | 3 |

| Itausa-Investimentos Itau SA, Preference Shares | 2 |

| Cia De Minas Buenaventura SA — ADR | 2 |

| |

| | Percent of |

| | Long-Term |

| Geographic Allocation | Investments |

| Brazil | 72% |

| Mexico | 17 |

| Peru | 4 |

| Chile | 3 |

| Colombia | 2 |

| Panama | 1 |

| Argentina | 1 |

6 ANNUAL REPORT

OCTOBER 31, 2010

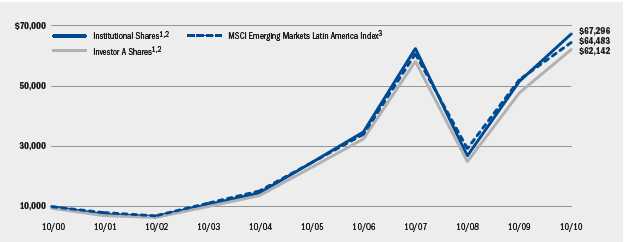

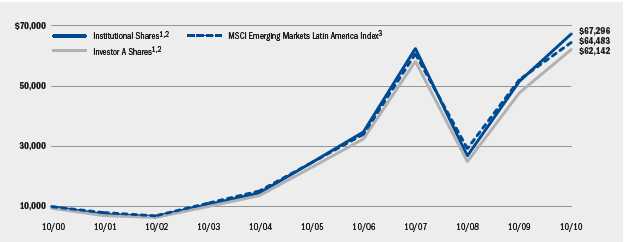

BlackRock Latin America Fund, Inc.

Total Return Based on a $10,000 Investment

1 Assuming maximum sales charges, if any, transaction costs and other operating expenses, including advisory fees. Institutional Shares do not have

a sales charge.

2 The Fund invests primarily in Latin America equity and debt securities.

3 This unmanaged market-capitalization-weighted index by Morgan Stanley Capital International is comprised of a representative sampling of stocks of

large-, medium-, and small-capitalization companies in Argentina, Brazil, Chile and Mexico, which are freely purchasable by foreign investors.

| | | | | | | |

| Performance Summary for the Period Ended October 31, 2010 | | | | | | |

| | | | | Average Annual Total Returns4 | | |

| | | 1 Year | | 5 Years | | 10 Years |

| | 6-Month | w/o sales | w/sales | w/o sales | w/sales | w/o sales | w/sales |

| | Total Returns | charge | charge | charge | charge | charge | charge |

| Institutional | 15.85% | 30.52% | N/A | 22.35% | N/A | 21.00% | N/A |

| Investor A | 15.70 | 30.15 | 23.32% | 22.02 | 20.71% | 20.69 | 20.04% |

| Investor B | 15.23 | 29.06 | 24.56 | 21.01 | 20.82 | 19.93 | 19.93 |

| Investor C | 15.24 | 29.15 | 28.15 | 21.07 | 21.07 | 19.74 | 19.74 |

| MSCI Emerging Markets Latin America Index | 10.34 | 23.75 | N/A | 21.31 | N/A | 20.49 | N/A |

4 Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund

Performance” on page 10 for a detailed description of share classes, including any related sales charges and fees.

N/A — Not applicable as share class and index do not have a sales charge.

| | | | | | | |

| Expense Example | | | | | | | |

| | | Actual | | | Hypothetical6 | | |

| | Beginning | Ending | | Beginning | Ending | | |

| | Account Value | Account Value | Expenses Paid | Account Value | Account Value | Expenses Paid | Annualized |

| | May 1, 2010 | October 31, 2010 | During the Period5 | May 1, 2010 | October 31, 2010 | During the Period5 | Expense Ratio |

| Institutional | $1,000.00 | $1,158.50 | $ 6.91 | $1,000.00 | $1,018.80 | $ 6.46 | 1.27% |

| Investor A | $1,000.00 | $1,157.00 | $ 8.37 | $1,000.00 | $1,017.44 | $ 7.83 | 1.54% |

| Investor B | $1,000.00 | $1,152.30 | $12.75 | $1,000.00 | $1,013.35 | $11.93 | 2.35% |

| Investor C | $1,000.00 | $1,152.40 | $12.75 | $1,000.00 | $1,013.35 | $11.93 | 2.35% |

5 For each class of the Fund, expenses are equal to the expense ratio for the class, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the

one-half year period shown).

6 Hypothetical 5% annual return before expenses is calculated by pro rating the number of days in the most recent fiscal half year divided by 365.

Past performance is not indicative of future results.

ANNUAL REPORT OCTOBER 31, 2010 7

Fund Summary as of October 31, 2010

BlackRock International Fund of BlackRock Series, Inc.

Portfolio Management Commentary

How did the Fund perform?

• Effective March 1, 2010, the Fund changed its primary benchmark from

the MSCI EAFE Index to the MSCI All Country World Index ex-US. Fund

management believes the MSCI All Country World Index ex-US is more

representative of the industry standard benchmark for funds with similar

investment strategies.

• For the 12-month period ended October 31, 2010, the Fund, through its

investment in BlackRock Master International Portfolio (the “Portfolio”)

outperformed both the MSCI All Country World Index ex-US and its former

benchmark, the MSCI EAFE Index. The following discussion of relative

performance pertains to the MSCI All Country World Index ex-US.

What factors influenced performance?

• A combination of stock selection and sector allocation contributed positively

to the Fund’s outperformance for the period. The Fund benefited from an

overweight in consumer-related sectors and an underweight in the weak

financials sector.

• With respect to individual stocks, Taiwanese smartphone manufacturer HTC

Corp. was the largest contributor to performance after reporting strong

growth in shipments, which were aided by increasing demand stemming

from the global economic recovery. Furthermore, in the consumer area,

Macau-based casino operator Sands China Ltd. performed well on sharply

increasing casino revenues in the world’s gambling hub. The Swatch Group

Ltd. benefited from positive economic news from Switzerland suggesting that

increasing export activity, supported by the resilient emerging market con-

sumer, was helping the recovery gain traction. Focus Media Holding Ltd. and

German vehicle manufacturer Daimler AG also contributed positively.

• The Portfolio’s position in Greek retail bank EFG Eurobank Ergasis SA

detracted from performance following downgrades to Greece’s sovereign

debt. Exposure to the energy sector also detracted as share prices declined

for companies associated with the oil spill in the Gulf of Mexico, including

holdings of Transocean Ltd., which was directly related to the spill.

Describe recent portfolio activity.

• Recently we have focused on the emerging market consumer, high quality

stocks offering high yields and the recovery in corporate capital expenditure.

Notable purchases include Rogers Communications, Inc., a leading

Canadian wireless and cable company with attractive growth prospects. We

increased the Portfolio’s exposure to Latin America through the purchase of

Telefonica SA, which offers a substantial dividend yield. We also purchased

the South American e-commerce company MercadoLibre Inc., which we

believe is well positioned to benefit from consumer growth in the region.

• Among the stocks we sold during the period, the most notable was Nestle

SA, which was sold on strength. We reduced the Portfolio’s exposure to

European financial stocks through sales of 3i Group Plc, ING Groep NV

CVA and UniCredit SpA.

Describe Portfolio positioning at period end.

• We continue to believe the mix of economic indicators is commensurate

with a period of sustained, but subdued, global growth, rather than a “dou-

ble-dip” recession. We note that many companies currently have huge oper-

ational leverage to support their growth, and weakness in equity markets has

allowed us to buy strong companies, trading below what we regard as fair

value. We continue to favor companies that we believe offer growth at a rea-

sonable price while our focus remains on the resilient and growing emerging

market consumer, particularly in Asia and Latin America, and corporate capi-

tal expenditure, as companies are playing catch-up following the recession,

particularly with respect to their investment in information technology.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions.

These views are not intended to be a forecast of future events and are no guarantee of future results.

8 ANNUAL REPORT

OCTOBER 31, 2010

BlackRock International Fund of BlackRock Series, Inc.

Total Return Based on a $10,000 Investment

1 Assuming maximum sales charges, transaction costs and other operating expenses, including administration fees, if any. Institutional Shares do not have a

sales charge.

2 The Fund invests all of its assets in BlackRock Master International Portfolio of BlackRock Master LLC. The Portfolio invests primarily in a diversified portfolio

of equity securities of companies located outside of the United States.

3 This unmanaged broad-based index measures the total returns of developed foreign stock markets in Europe, Australasia and the Far East.

4 This market capitalization weighted index is designed to provide a broad measure of stock performance throughout the world, with the exception of

US-based companies. The index includes both developed and emerging markets. The Fund now uses this index as its benchmark rather than the

MSCI EAFE Index because Fund management believes it is more representative of the industry standard benchmark for funds with similar strategies.

| | | | | | | |

| Performance Summary for the Period Ended October 31, 2010 | | | | | | |

| | | | | Average Annual Total Returns5 | | |

| | | 1 Year | | 5 Years | | 10 Years |

| | 6-Month | w/o sales | w/sales | w/o sales | w/sales | w/o sales | w/sales |

| | Total Returns | charge | charge | charge | charge | charge | charge |

| Institutional | 13.30% | 17.87% | N/A | 4.48% | N/A | 2.42% | N/A |

| Investor A | 13.24 | 17.66 | 11.48% | 4.17 | 3.05% | 2.13 | 1.58% |

| Investor B | 12.55 | 16.31 | 11.81 | 3.10 | 2.74 | 1.44 | 1.44 |

| Investor C | 12.78 | 16.73 | 15.73 | 3.41 | 3.41 | 1.35 | 1.35 |

| MSCI EAFE Index | 5.74 | 8.36 | N/A | 3.31 | N/A | 3.17 | N/A |

| MSCI All Country World Index ex-US | 6.48 | 12.62 | N/A | 5.74 | N/A | 5.02 | N/A |

5 Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund

Performance” on page 10 for a detailed description of share classes, including any related sales charges and fees.

N/A — Not applicable as share class and index do not have a sales charge.

| | | | | | | |

| Expense Example | | | | | | | |

| | | Actual | | | Hypothetical7 | | |

| | Beginning | Ending | | Beginning | Ending | | |

| | Account Value | Account Value | Expenses Paid | Account Value | Account Value | Expenses Paid | Annualized |

| | May 1, 2010 | October 31, 2010 | During the Period6 | May 1, 2010 | October 31, 2010 | During the Period6 | Expense Ratio |

| Institutional | $1,000.00 | $1,133.00 | $ 9.46 | $1,000.00 | $1,016.33 | $ 8.94 | 1.76% |

| Investor A | $1,000.00 | $1,132.40 | $11.18 | $1,000.00 | $1,014.71 | $10.56 | 2.08% |

| Investor B | $1,000.00 | $1,125.50 | $16.88 | $1,000.00 | $1,009.32 | $15.95 | 3.15% |

| Investor C | $1,000.00 | $1,127.80 | $14.96 | $1,000.00 | $1,011.14 | $14.14 | 2.79% |

6 For each class of the Fund, expenses are equal to the expense ratio for the class, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the

one-half year period shown).

7 Hypothetical 5% annual return before expenses is calculated by pro rating the number of days in the most recent fiscal half year divided by 365.

Past performance is not indicative of future results.

ANNUAL REPORT OCTOBER 31, 2010 9

About Fund Performance

• Institutional Shares are not subject to any sales charge. Institutional

Shares bear no ongoing distribution or service fees and are available only

to eligible investors.

• Investor A Shares incur a maximum initial sales charge (front-end load) of

5.25% and a service fee of 0.25% per year (but no distribution fee).

• Investor B Shares are subject to a maximum contingent deferred sales

charge of 4.50% declining to 0% after six years. In addition, Investor B

Shares are subject to a distribution fee of 0.75% per year and a service

fee of 0.25% per year. These shares automatically convert to Investor A

Shares after approximately eight years. (There is no initial sales charge

for automatic share conversions.) All returns for periods greater than

eight years reflect this conversion. Investor B Shares of the Funds are

only available through exchanges and dividend reinvestments by existing

shareholders or for purchase by certain qualified employee benefit plans.

• Investor C Shares are subject to a distribution fee of 0.75% and a service

fee of 0.25%. In addition, Investor C Shares are subject to a 1% contingent

deferred sales charge if redeemed within one year of purchase.

Performance information reflects past performance and does not guarantee

future results. Current performance may be lower or higher than the per-

formance data quoted. Refer to www.blackrock.com/funds to obtain per-

formance data current to the most recent month-end. Performance results

do not reflect the deduction of taxes that a shareholder would pay on fund

distributions or the redemption of fund shares. The Funds may charge a 2%

redemption fee for sales or exchanges of shares within 30 days of pur-

chase or exchange. Performance data does not reflect this potential fee.

Figures shown in the performance tables on pages 5, 7 and 9 assume

reinvestment of all dividends and capital gain distributions, if any, at net

asset value on the ex-dividend date. Investment return and principal value

of shares will fluctuate so that shares, when redeemed, may be worth more

or less than their original cost. Dividends paid to each class of shares will

vary because of the different levels of service, distribution and transfer

agency fees applicable to each class, which are deducted from the income

available to be paid to shareholders.

Disclosure of Expenses

Shareholders of these Funds may incur the following charges: (a) expenses

related to transactions, including sales charges, redemption fees and

exchange fees; and (b) operating expenses including advisory fees, dis-

tribution fees including 12b-1 fees and other Fund expenses. The expense

examples on pages 5, 7 and 9 (which are based on a hypothetical invest-

ment of $1,000 invested on May 1, 2010 and held through October 31,

2010) are intended to assist shareholders both in calculating expenses

based on an investment in the Funds and in comparing these expenses

with similar costs of investing in other mutual funds.

The tables provide information about actual account values and actual

expenses. In order to estimate the expenses a shareholder paid during the

period covered by this report, shareholders can divide their account value

by $1,000 and then multiply the result by the number corresponding to

their share class under the heading “Expenses Paid During the Period.”

The tables also provide information about hypothetical account values and

hypothetical expenses based on each Fund’s actual expense ratio and an

assumed rate of return of 5% per year before expenses. In order to assist

shareholders in comparing the ongoing expenses of investing in these

Funds and other funds, compare the 5% hypothetical examples with the

5% hypothetical examples that appear in other funds’ shareholder reports.

The expenses shown in the tables are intended to highlight shareholders’

ongoing costs only and do not reflect any transactional expenses, such as

sales charges, redemption fees or exchange fees. Therefore, the hypotheti-

cal examples are useful in comparing ongoing expenses only, and will not

help shareholders determine the relative total expenses of owning different

funds. If these transactional expenses were included, shareholder expenses

would have been higher.

Derivative Financial Instruments

The Funds and Portfolio may invest in various derivative instruments,

including foreign currency exchange contracts and options, as specified

in Note 2 of the Notes to Financial Statements, which constitute forms

of economic leverage. Such instruments are used to obtain exposure to a

market without owning or taking physical custody of securities or to hedge

market, equity and/or foreign currency exchange rate risks. Such derivative

instruments involve risks, including the imperfect correlation between the

value of a derivative instrument and the underlying asset, possible default

of the counterparty to the transaction and illiquidity of the derivative instru-

ment. The Funds’ and Portfolio’s ability to successfully use a derivative

instrument depends on the investment advisor’s ability to accurately

predict pertinent market movements, which cannot be assured. The use

of derivative instruments may result in losses greater than if they had

not been used, may require the Funds and Portfolio to sell or purchase

portfolio securities at inopportune times or at distressed values, may limit

the amount of appreciation the Funds and Portfolio can realize on an

investment or may cause the Funds and Portfolio to hold a security that

they might otherwise sell. The Funds’ and Portfolio’s investments in these

instruments are discussed in detail in the Notes to Financial Statements.

10 ANNUAL REPORT

OCTOBER 31, 2010

Schedule of Investments October 31, 2010

BlackRock Global Emerging Markets Fund, Inc.

(Percentages shown are based on Net Assets)

| | |

| Common Stocks | Shares | Value |

| Brazil — 19.1% | | |

| Cia de Bebidas das Americas, Preference | | |

| Shares — ADR | 52,018 | $ 7,242,986 |

| Cia de Concessoes Rodoviarias | 168,010 | 4,545,351 |

| Cia Energetica de Minas Gerais — ADR | 273,203 | 4,873,942 |

| Cyrela Brazil Realty SA | 355,444 | 4,887,538 |

| Itau Unibanco Holdings SA — ADR | 638,261 | 15,675,690 |

| Lojas Renner SA | 87,243 | 3,461,397 |

| OGX Petroleo e Gas Participacoes SA (a) | 431,000 | 5,634,964 |

| Petroleo Brasileiro SA — ADR | 97,934 | 3,054,561 |

| Vale SA — ADR | 351,990 | 10,112,673 |

| | | 59,489,102 |

| Chile — 0.5% | | |

| Empresa Nacional de Telecomunicaciones SA | 98,000 | 1,558,704 |

| China — 14.3% | | |

| Bank of China Ltd. | 9,772,000 | 5,869,372 |

| CNOOC Ltd. | 3,501,000 | 7,309,101 |

| China Coal Energy Co. | 2,373,000 | 4,126,006 |

| China Mobile Ltd. | 1,108,000 | 11,315,243 |

| Ctrip.com International Ltd. — ADR (a) | 61,563 | 3,205,586 |

| Focus Media Holding Ltd. — ADR (a) | 184,579 | 4,568,330 |

| Melco Crown Entertainment Ltd. — ADR (a) | 693,117 | 4,345,844 |

| Want Want China Holdings Ltd. | 3,890,000 | 3,595,451 |

| | | 44,334,933 |

| Egypt — 0.3% | | |

| Orascom Construction Industries — GDR | 12,285 | 570,325 |

| Orascom Construction Industries | 5,704 | 259,763 |

| | | 830,088 |

| Indonesia — 1.5% | | |

| Bank Rakyat Indonesia Tbk PT | 3,746,000 | 4,795,904 |

| Israel — 1.1% | | |

| Teva Pharmaceutical Industries Ltd. — ADR | 65,405 | 3,394,519 |

| Luxembourg — 0.9% | | |

| Oriflame Cosmetics SA — SDR | 48,744 | 2,762,429 |

| Mexico — 5.2% | | |

| America Movil, SA de CV — ADR | 227,564 | 13,030,315 |

| Fomento Economico Mexicano, SA de CV — ADR | 57,719 | 3,169,350 |

| | | 16,199,665 |

| Panama — 1.2% | | |

| Copa Holdings SA, Class A | 73,947 | 3,751,331 |

| Peru — 2.6% | | |

| Cia de Minas Buenaventura SA — ADR | 92,840 | 4,924,233 |

| Credicorp Ltd. | 24,019 | 3,023,512 |

| | | 7,947,745 |

| Poland — 1.1% | | |

| Bank Pekao SA | 53,872 | 3,516,338 |

| Russia — 5.6% | | |

| Evraz Group SA — GDR (a) | 123,000 | 3,729,360 |

| MMC Norilsk Nickel — ADR | 172,379 | 3,208,024 |

| OAO Gazprom — ADR | 145,829 | 3,186,364 |

| Uralkali — GDR | 125,624 | 3,104,166 |

| VTB Bank OJSC — GDR | 69,009 | 456,839 |

| VimpelCom Ltd. — ADR (a) | 240,281 | 3,683,508 |

| | | 17,368,261 |

| South Africa — 7.1% | | |

| | |

| Common Stocks | Shares | Value |

| African Bank Investments Ltd. | 834,725 | $ 4,278,281 |

| Aveng Ltd. | 500,827 | 3,147,995 |

| Foschini Ltd. | 280,968 | 3,407,937 |

| MTN Group Ltd. | 420,922 | 7,572,361 |

| Tiger Brands Ltd. | 141,727 | 3,799,271 |

| | | 22,205,845 |

| South Korea — 9.5% | | |

| Celltrion, Inc. (a) | 78,008 | 1,728,367 |

| Doosan Infracore Co. Ltd. (a) | 224,880 | 5,564,956 |

| Hyundai Mobis | 21,868 | 5,445,802 |

| LG Chem Ltd. | 14,656 | 4,535,046 |

| NHN Corp. (a) | 19,138 | 3,386,028 |

| Samsung Electronics Co., Ltd. | 9,017 | 5,982,110 |

| Shinhan Financial Group Co., Ltd. | 78,113 | 3,026,114 |

| | | 29,668,423 |

| Taiwan — 7.2% | | |

| Acer, Inc. | 1,147,000 | 3,340,187 |

| Delta Electronics, Inc. | 1,024,000 | 4,230,387 |

| HON HAI Precision Industry Co., Ltd. | 2,022,280 | 7,648,336 |

| Taiwan Semiconductor Manufacturing Co., Ltd. | 2,341,000 | 4,816,165 |

| Taiwan Semiconductor Manufacturing | | |

| Co., Ltd. — ADR | 220,580 | 2,406,528 |

| | | 22,441,603 |

| Thailand — 1.5% | | |

| Banpu PCL | 63,200 | 1,636,270 |

| Kasikornbank PCL | 754,500 | 2,949,884 |

| | | 4,586,154 |

| Turkey — 4.6% | | |

| Koza Altin Isletmeleri AS | 254,801 | 3,015,183 |

| Sekerbank TAS | 1,335,074 | 1,674,027 |

| Turk Hava Yollari (a) | 633,076 | 2,598,669 |

| Turkiye Garanti Bankasi AS | 381,535 | 2,303,126 |

| Yapi ve Kredi Bankasi (a) | 1,284,833 | 4,846,161 |

| | | 14,437,166 |

| Total Common Stocks — 83.3% | | 259,288,210 |

| | Par | |

| Structured Notes | (000) | |

| India — 6.9% | | |

| Deutsche Bank AG: | | |

| (Axis Bank), due 8/17/17 | $ 146 | 4,791,411 |

| (Lanco Infratech Ltd.), due 11/23/16 (a) | 2,522 | 3,591,861 |

| Morgan Stanley Asia Products Ltd. (ITC Ltd.), | | |

| due 7/03/14 | 1,676 | 6,457,940 |

| Morgan Stanley BV (Rolta India Ltd.), due 5/26/14 | 479 | 1,800,439 |

| UBS AG (Glenmark Pharmaceuticals Ltd.), | | |

| due 12/18/12 | 621 | 4,733,778 |

| | | 21,375,429 |

| Qatar — 2.3% | | |

| Deutsche Bank AG (Commercial Bank of Qatar Inc.), | | |

| due 5/26/17 | 142 | 3,249,000 |

| Morgan Stanley BV (Industries Qatar), due 11/30/10 | 120 | 3,793,540 |

| | | 7,042,540 |

| Saudi Arabia — 1.1% | | |

| | | | |

| Portfolio Abbreviations | | | | |

| To simplify the listings of portfolio holdings in | ADR | American Depositary Receipts | KRW | South Korean Won |

| the Schedules of Investments, the names and | BRL | Brazilian Real | MXN | Mexican Peso |

| descriptions of many of the securities have been | CAD | Canadian Dollar | SDR | Swedish Depositary Receipts |

| abbreviated according to the following list: | CLP | Chilean Peso | USD | US Dollar |

| | GDR | Global Depositary Receipts | ZAR | South African Rand |

| See Notes to Financial Statements. | | | | |

ANNUAL REPORT

OCTOBER 31, 2010

11

Schedule of Investments (continued)

BlackRock Global Emerging Markets Fund, Inc.

(Percentages shown are based on Net Assets)

| | |

| | Par | |

| Structured Notes | (000) | Value |

| HSBC Bank Plc: | | |

| (Abdullah Al Othaim Markets), due 9/05/11 | $ 97 | $ 1,830,008 |

| (Co. for Cooperative Insurance), due 9/24/11 (a) | 66 | 1,754,634 |

| | | 3,584,642 |

| United States — 4.5% | | |

| Citigroup Global Markets Holdings, Inc.: | | |

| (United Phosphorus), due 10/24/12 | 709 | 3,166,735 |

| (Yes Bank Ltd.) due 10/24/12 (a) | 385 | 3,098,865 |

| JPMorgan Structured Products BV (Larsen | | |

| & Toubro) due 9/08/14 (a) | 102 | 4,631,820 |

| UBS AG (Unitech Ltd.), due 6/16/11 (a) | 1,639 | 3,201,655 |

| | | 14,099,075 |

| Total Structured Notes — 14.8% | | 46,101,686 |

| Total Long-Term Investments | | |

| (Cost — $242,095,153) — 98.1% | | 305,389,896 |

| Short-Term Securities | Shares | |

| Time Deposits — 0.8% | | |

| United States — 0.8% | | |

| Brown Brothers Harriman & Co., 0.11%, 11/01/2010 | 2,398 | 2,397,891 |

| Money Market Fund — 0.8% | | |

| BlackRock Liquidity Funds, TempFund, Institutional | | |

| Class, 0.21% (b)(c) | 2,579,161 | 2,579,161 |

| Total Short-Term Securities | | |

| (Cost — $4,977,052) — 1.6% | | 4,977,052 |

| Total Investments (Cost — $247,072,205*) — 99.7% | | 310,366,948 |

| Other Assets Less Liabilities — 0.3% | | 1,002,742 |

| Net Assets — 100.0% | | $ 311,369,690 |

* The cost and unrealized appreciation (depreciation) of investments as of

October 31, 2010, as computed for federal income tax purposes, were as follows:

| |

| Aggregate cost | $ 252,829,837 |

| Gross unrealized appreciation | $ 58,794,013 |

| Gross unrealized depreciation | (1,256,902) |

| Net unrealized appreciation | $ 57,537,111 |

(a) Non-income producing security.

(b) Investments in companies considered to be an affiliate of the Fund during the

year, for purposes of Section 2(a)(3) of the Investment Company Act of 1940, as

amended, were as follows:

| | | | |

| | Shares Held at | Shares Held at | |

| | October 31, | Net | October 31, | |

| Affiliate | 2009 | Activity | 2010 | Income |

| BlackRock Liquidity | | | | |

| Funds, TempFund, | | | | |

| Institutional Class | 6,661,505 | (4,082,344) | 2,579,161 | $8,582 |

| (c) Represents the current yield as of report date. | | |

• Foreign currency exchange contracts as of October 31, 2010 were as follows:

| | | | | | | |

| Currency | Currency | | Settlement Unrealized |

| Purchased | | Sold | Counterparty Date | Depreciation |

| USD | 2,694,160 | KRW 3,033,220,342 | Brown | | | |

| | | | | Brothers | | | |

| | | | | Harriman & Co. 11/01/2010 | $(1,437) |

| ZAR | 3,201,072 | USD | 463,225 | JPMorgan | | |

| | | | | Chase | | | |

| | | | | Bank NA | 11/01/2010 | (6,256) |

| CLP 771,509,606 | USD | 1,586,163 | Brown | | | |

| | | | | Brothers | | | |

| | | | | Harriman & Co. 11/02/2010 | (8,917) |

| Total | | | | | | $ (16,610) |

See Notes to Financial Statements.

12 ANNUAL REPORT

OCTOBER 31, 2010

Schedule of Investments (concluded)

BlackRock Global Emerging Markets Fund, Inc.

• Fair Value Measurements — Various inputs are used in determining the fair value of

investments and derivatives, which are as follows:

• Level 1 — price quotations in active markets/exchanges for identical assets

and liabilities

• Level 2 — other observable inputs (including, but not limited to: quoted prices

for similar assets or liabilities in markets that are active, quoted prices for iden-

tical or similar assets or liabilities in markets that are not active, inputs other

than quoted prices that are observable for the assets or liabilities (such as

interest rates, yield curves, volatilities, prepayment speeds, loss severities, credit

risks and default rates) or other market-corroborated inputs)

• Level 3 — unobservable inputs based on the best information available in the

circumstances, to the extent observable inputs are not available (including the

Fund’s own assumptions used in determining the fair value of investments

and derivatives)

The inputs or methodologies used for valuing securities are not necessarily an

indication of the risk associated with investing in those securities. For information

about the Fund’s policy regarding valuation of investments and other significant

accounting policies, please refer to Note 1 of the Notes to Financial Statements.

The following tables summarize the inputs used as of October 31, 2010 in deter-

mining the fair valuation of the Fund’s investments and derivatives:

| | | | |

| Valuation Inputs | Level 1 | Level 2 | Level 3 | Total |

| Assets: | | | | |

| Investments in | | | | |

| Securities: | | | | |

| Common Stocks: | | | | |

| Brazil | $ 59,489,102 | — | — | $ 59,489,102 |

| Chile | 1,558,704 | — | — | 1,558,704 |

| China | 12,119,760 | $ 32,215,173 | — | 44,334,933 |

| Egypt | 570,325 | 259,763 | — | 830,088 |

| Indonesia | — | 4,795,904 | — | 4,795,904 |

| Israel | 3,394,519 | — | — | 3,394,519 |

| Luxembourg | — | 2,762,429 | — | 2,762,429 |

| Mexico | 16,199,665 | — | — | 16,199,665 |

| Panama | 3,751,331 | — | — | 3,751,331 |

| Peru | 7,947,745 | — | — | 7,947,745 |

| Poland | — | 3,516,338 | — | 3,516,338 |

| Russia | 17,368,261 | — | — | 17,368,261 |

| South Africa | — | 22,205,845 | — | 22,205,845 |

| South Korea . | — | 29,668,423 | — | 29,668,423 |

| Taiwan | 2,406,528 | 20,035,075 | — | 22,441,603 |

| Thailand | — | 4,586,154 | — | 4,586,154 |

| Turkey | — | 14,437,166 | — | 14,437,166 |

| Structured Notes: | | | | |

| India | — | — | $ 21,375,429 | 21,375,429 |

| Qatar | — | — | 7,042,540 | 7,042,540 |

| Saudi Arabia . | — | — | 3,584,642 | 3,584,642 |

| United States | — | — | 14,099,075 | 14,099,075 |

| Short-Term | | | | |

| Securities: | | | | |

| Time Deposits | — | 2,397,891 | — | 2,397,891 |

| Money Market | | | | |

| Fund | 2,579,161 | — | — | 2,579,161 |

| Total | $127,385,101 | $136,880,161 | $ 46,101,686 | $310,366,948 |

| | | | | |

| Derivative Financial Instruments1 |

|

| Valuation Inputs | Level 1 | Level 2 | Level 3 | | Total |

| Liabilities: | | | | | |

| Foreign | | | | | |

| currency | | | | | |

| exchange | | | | | |

| contracts | — | $(16,610) | — | | $(16,610) |

1 Derivative financial instruments are foreign currency exchange contracts.

Foreign currency exchange contracts are shown at the unrealized appreciation/

depreciation on the instrument.

The following table is a reconciliation of Level 3 investments for which significant

unobservable inputs were used in determining fair value:

| |

| | Structured |

| | Notes |

| Assets: | |

| Balance, as of October 31, 2009 | $ 18,760,194 |

| Accrued discounts/premiums | — |

| Net realized gain (loss) | 426,583 |

| Net change in unrealized appreciation/depreciation2 | 6,789,812 |

| Purchases | 43,587,833 |

| Sales | (23,462,736) |

| Transfers in3 | — |

| Transfers out3 | — |

| Balance, as of October 31, 2010 | $ 46,101,686 |

2 Included in the related net change in unrealized appreciation/depreciation

in the Statements of Operations. The change in unrealized appreciation/

depreciation on securities still held at October 31, 2010 was $6,540,830.

3 The Fund’s policy is to recognize transfers in and transfers out as of the end of

the period of the event or the change in circumstances that caused the transfer.

See Notes to Financial Statements.

ANNUAL REPORT

OCTOBER 31, 2010

13

Schedule of Investments October 31, 2010

BlackRock Latin America Fund, Inc.

(Percentages shown are based on Net Assets)

| | |

| Common Stocks | Shares | Value |

| Argentina — 0.6% | | |

| Ternium SA — ADR | 170,000 | $ 5,827,600 |

| Brazil — 66.4% | | |

| AES Tiete SA | 179,000 | 2,091,825 |

| AES Tiete SA, Preference Shares | 184,000 | 2,553,902 |

| Anhanguera Educaional Participacoes SA | 545,000 | 10,660,883 |

| BM&F Bovespa SA | 1,860,000 | 15,511,851 |

| BR Malls Participacoes SA | 530,000 | 4,978,004 |

| BR Properties SA | 580,000 | 5,618,185 |

| Banco ABC Brasil SA, Preference Shares | 505,000 | 4,648,150 |

| Banco Bradesco SA — ADR | 2,550,000 | 53,040,000 |

| Banco do Brasil SA | 1,050,000 | 20,329,354 |

| Banco Industrial e Comercial SA, Preference Shares | 555,000 | 5,144,269 |

| Bradespar SA, Preference Shares | 795,000 | 20,105,276 |

| Cia de Bebidas das Americas, Preference | | |

| Shares — ADR | 308,000 | 42,885,920 |

| Cia de Concessoes Rodoviarias | 475,000 | 12,850,673 |

| Cia Energetica de Minas Gerais — ADR (a) | 615,000 | 10,971,600 |

| Cia Energetica de Minas Gerais, Preference Shares | 49,000 | 858,790 |

| Cia Energetica de Sao Paulo, Preference ‘B’ Shares | 610,000 | 9,543,022 |

| Cyrela Brazil Realty SA | 1,390,000 | 19,113,215 |

| Diagnosticos da America SA | 387,000 | 4,700,082 |

| Hypermarcas SA (b) | 860,000 | 14,212,786 |

| Iguatemi Empresa de Shopping Centers SA | 105,000 | 2,455,949 |

| Iochpe-Maxion SA | 555,000 | 8,029,759 |

| Itau Unibanco Holdings SA — ADR | 3,840,000 | 94,310,400 |

| Itau Unibanco Holdings SA — ADR (c) | 500,000 | 12,280,000 |

| Itausa-Investimentos Itau SA, Preference Shares | 2,760,000 | 21,605,364 |

| Light SA | 187,000 | 2,355,784 |

| Localiza Rent A Car SA | 625,000 | 10,347,439 |

| Lojas Renner SA | 50,000 | 1,983,768 |

| MRV Engenharia e Participacoes SA | 220,000 | 2,141,387 |

| Marcopolo SA, Preference Shares | 665,000 | 2,659,531 |

| Metalfrio Solutions SA | 165,000 | 1,211,080 |

| Multiplus SA | 570,000 | 9,554,196 |

| Natura Cosmeticos SA | 2,000 | 57,166 |

| OGX Petroleo e Gas Participacoes SA (b) | 2,782,300 | 36,376,245 |

| PDG Realty SA Empreendimentos e Participacoes | 1,450,000 | 17,951,244 |

| Petroleo Brasileiro SA — ADR | 3,010,000 | 93,881,900 |

| Profarma Distribuidora de Produtos | | |

| Farmaceuticos SA | 362,000 | 3,534,200 |

| Rossi Residencial SA | 274,000 | 2,686,338 |

| Tim Participacoes SA — ADR | 149,000 | 4,806,740 |

| Totvs SA | 57,000 | 5,172,675 |

| Tractebel Energia SA | 357,000 | 5,375,051 |

| Vale SA — ADR | 3,425,000 | 98,400,250 |

| Weg SA | 202,000 | 2,637,417 |

| | | 699,631,670 |

| Chile — 3.5% | | |

| Banco Santander Chile SA — ADR (a) | 132,000 | 12,228,480 |

| Empresa Nacional de Electricidad SA — ADR | 112,000 | 5,976,320 |

| Empresa Nacional de Telecomunicaciones SA | 298,000 | 4,739,732 |

| Empresas La Polar SA | 278,000 | 1,982,856 |

| Lan Airlines SA | 159,000 | 4,939,191 |

| SACI Falabella | 725,000 | 7,262,598 |

| | | 37,129,177 |

| Colombia — 1.6% | | |

| Pacific Rubiales Energy Corp. (b) | 535,000 | 17,053,486 |

| Mexico — 16.9% | | |

| America Movil, SA de CV — ADR | 1,570,000 | 89,898,200 |

| Banco Compartamos SA de CV | 645,500 | 4,547,983 |

| Empresas ICA Sociedad Controladora, SA de CV (b) | 915,000 | 2,412,731 |

| Fomento Economico Mexicano, SA de CV — ADR | 565,000 | 31,024,150 |

| Genomma Lab Internacional SA de CV (b) | 3,520,000 | 7,585,617 |

| Grupo Mexico, SA de CV | 4,310,000 | 14,195,635 |

| | | |

| Common Stocks | | Shares | Value |

| Mexico (concluded) | | | |

| Grupo Televisa, SA — ADR | 780,000 | $ 17,511,000 |

| Wal-Mart de Mexico, SA de CV | 4,070,000 | 11,140,752 |

| | | | 178,316,068 |

| Panama — 1.0% | | | |

| Copa Holdings SA, Class A | 208,000 | 10,551,840 |

| Peru — 4.0% | | | |

| Cia de Minas Buenaventura SA — ADR | 405,000 | 21,481,200 |

| Credicorp Ltd. | | 83,000 | 10,448,040 |

| Southern Copper Corp. | 252,000 | 10,785,600 |

| | | | 42,714,840 |

| Total Common Stocks — 94.0% | | | 991,224,681 |

| | | Par | |

| Corporate Bonds | | (000) | |

| Brazil — 0.1% | | | |

| Lupatech SA, 6.50%, 4/15/18 (d) | BRL | 2,128 | 1,266,510 |

| Total Corporate Bonds — 0.1% | | | 1,266,510 |

| Structured Notes | | | |

| Brazil — 4.2% | | | |

| Deutsche Bank AG (Cyrela Brazil Realty SA), | | | |

| due 6/09/15 | USD | 325 | 4,466,800 |

| Morgan Stanley BV: | | | |

| (Cyrela Brazil Realty SA Empreendimentos e | | | |

| Participacoes), due 4/05/12 | | 400 | 5,552,400 |

| (Hypermarcas SA), due 6/12/11 | | 25 | 416,168 |

| (Itausa — Investimentos Itau SA), due 4/05/12 | 6 | 46,583 |

| (Lojas Renner SA), due 11/17/10 | | 400 | 16,216,080 |

| (Lojas Renner SA), due 3/04/11 | | 50 | 2,030,920 |

| (Lojas Renner SA), due 7/29/11 | | 33 | 1,322,356 |

| (MRV Engenharia e Participacoes SA) | | | |

| due 10/29/12 | | 425 | 4,126,580 |

| (Natura Cosmetico SA), due 7/29/11 | | 95 | 2,744,901 |

| (Natura Cosmeticos SA), due 10/29/12 | | 27 | 761,057 |

| (OGX Petroleo e Gas Participacoes SA), | | | |

| due 4/05/12 | | 162 | 2,118,707 |

| (PDG Realty SA), due 4/05/12 | | 177 | 2,205,526 |

| (Rossi Residencial SA), due 4/05/12 | | 200 | 1,988,540 |

| Total Structured Notes — 4.2% | | | 43,996,618 |

| Total Long-Term Investments | | | |

| (Cost — $654,332,313) — 98.3% | | | 1,036,487,809 |

| Short-Term Securities | | Shares | |

| BlackRock Liquidity Funds, TempFund, | | | |

| Institutional Class, 0.21% (e)(f) | 5,978,803 | $ 5,978,803 |

| | Beneficial | |

| | | Interest | |

| | | (000) | |

| BlackRock Liquidity Series, LLC Money | | | |

| Market Series, 0.39% (e)(f)(g) | USD | 62,122 | 62,121,755 |

| Total Short-Term Securities | | | |

| (Cost — $68,100,558) — 6.5% | | | 68,100,558 |

| Total Investments (Cost — $722,432,871*) — 104.8% | | 1,104,588,367 |

| Liabilities in Excess of Other Assets — (4.8)% | | | (50,534,016) |

| Net Assets — 100.0% | | | $1,054,054,351 |

See Notes to Financial Statements.

14 ANNUAL REPORT

OCTOBER 31, 2010

Schedule of Investments (concluded)

BlackRock Latin America Fund, Inc.

* The cost and unrealized appreciation (depreciation) of investments as of

October 31, 2010, as computed for federal income tax purposes, were as follows:

| |

| Aggregate cost | $ 769,430,741 |

| Gross unrealized appreciation | $ 338,404,175 |

| Gross unrealized depreciation | (3,246,549) |

| Net unrealized appreciation | $ 335,157,626 |

(a) Security, or a portion of security, is on loan.

(b) Non-income producing security.

(c) Security exempt from registration under Rule 144A of the Securities Act of 1933.

These securities may be resold in transactions exempt from registration to qualified

institutional investors.

(d) Convertible security.

(e) Investments in companies considered to be an affiliate of the Fund during the

year, for purposes of Section 2(a)(3) of the Investment Company Act of 1940, as

amended, were as follows:

| | | | | | |

| | Shares/Beneficial | | Shares/Beneficial | |

| | Interest Held at | Net | Interest Held at | |

| Affiliate | October 31, 2009 | Activity | October 31, 2010 | Income |

| BlackRock Liquidity | | | | | |

| Funds, TempFund, | | | | | |

| Institutional Class | 9,596,587 | (3,617,784) 5,978,803 | $ 13,219 |

| BlackRock | | | | | | |

| Liquidity Series, | | | | | |

| LLC Money | | | | | | |

| Market Series | $156,541,250 | $(94,419,495) | $62,121,755 | $ 158,589 |

(f) Represents the current yield as of report date.

(g) Security was purchased with the cash collateral from loaned securities.

• Foreign currency exchange contracts as of October 31, 2010 were as follows:

| | | | | | |

| | | | | | | Unrealized |

| Currency | Currency | | Settlement | Appreciation |

| Purchased | | Sold | Counterparty | Date | (Depreciation) |

| USD | 153,157 | CAD | 158,104 | State Street | | |

| | | | | Global Markets | 11/01/10 | $ (1,862) |

| USD | 275,784 | MXN | 3,441,914 | State Street | | |

| | | | | Global Markets | 11/01/10 | (2,959) |

| USD | 126,050 | CLP | 61,310,912 | Brown Brothers | | |

| | | | | Harriman & Co. | 11/02/10 | 709 |

| Total | | | | | | $ (4,112) |

• Fair Value Measurements — Various inputs are used in determining the fair value of

investments and derivatives, which are as follows:

• Level 1 — price quotations in active markets/exchanges for identical assets

and liabilities

• Level 2 — other observable inputs (including, but not limited to: quoted prices

for similar assets or liabilities in markets that are active, quoted prices for iden-

tical or similar assets or liabilities in markets that are not active, inputs other

than quoted prices that are observable for the assets or liabilities (such as

interest rates, yield curves, volatilities, prepayment speeds, loss severities, credit

risks and default rates) or other market-corroborated inputs)

• Level 3 — unobservable inputs based on the best information available in the

circumstances, to the extent observable inputs are not available (including the

Fund’s own assumptions used in determining the fair value of investments

and derivatives)

The inputs or methodologies used for valuing securities are not necessarily an

indication of the risk associated with investing in those securities. For information

about the Fund’s policy regarding valuation of investments and other significant

accounting policies, please refer to Note 1 of the Notes to Financial Statements.

The following tables summarize the inputs used as of October 31, 2010 in deter-

mining the fair valuation of the Fund’s investments and derivatives:

| | | | | | |

| Valuation Inputs | | Level 1 | Level 2 | | Level 3 | Total |

| Assets: | | | | | | |

| Investments in | | | | | | |

| Securities: | | | | | | |

| Common Stocks: | | | | | | |

| Argentina | $ 5,827,600 | — | | — | $ 5,827,600 |

| Brazil | 699,631,670 | — | | — | 699,631,670 |

| Chile | 37,129,177 | — | | — | 37,129,177 |

| Colombia | 17,053,486 | — | | — | 17,053,486 |

| Mexico | 178,316,068 | — | | — | 178,316,068 |

| Panama | 10,551,840 | — | | — | 10,551,840 |

| Peru | 42,714,840 | — | | — | 42,714,840 |

| Corporate | | | | | | |

| Bonds | | — | — | $ 1,266,510 | 1,266,510 |

| Structured | | | | | | |

| Notes | | — | — | | 43,996,618 | 43,996,618 |

| Short-Term | | | | | | |

| Securities | | 5,978,803 | $62,121,755 | — | 68,100,558 |

| Total | $997,203,484 | $62,121,755 | $45,263,128 | $1,104,588,367 |

| Derivative Financial Instruments1 |

|

| Valuation Inputs | | Level 1 | Level 2 | | Level 3 | Total |

| Assets: | | | | | | |

| Foreign currency | | | | | |

| exchange contracts | — | $ 709 | — | $ 709 |

| Liabilities: | | | | | | |

| Foreign currency | | | | | |

| exchange contracts | — | (4,821) | — | (4,821) |

| Total | | — | $ (4,112) | — | $ (4,112) |

1 Derivative financial instruments are foreign currency exchange contracts.

Foreign currency exchange contracts are shown at the unrealized appreciation/

depreciation on the instrument.

The following table is a reconciliation of Level 3 investments for which significant

unobservable inputs were used in determining fair value:

| | | |

| | Corporate | Structured | |

| | Bonds | Notes | Total |

| Assets: | | | |

| Balance, as of October 31, 2009 | $ 1,753,383 | $ 20,909,528 | $ 22,662,911 |

| Accrued discounts/premiums | — | — | — |

| Net realized gain (loss) | — | 6,239,023 | 6,239,023 |

| Net change in unrealized | | | |

| appreciation/depreciation2 | (209,321) | 3,528,997 | 3,319,676 |

| Purchases | — | 31,464,465 | 31,464,465 |

| Sales | (277,552) | (18,145,395) | (18,422,947) |

| Transfers in3 | — | — | — |

| Transfers out3 | — | — | — |

| Balance, as of October 31, 2010 | $ 1,266,510 | $ 43,996,618 | $ 45,263,128 |

2 Included in the related net change in unrealized appreciation/depreciation in

the Statements of Operations. The change in unrealized appreciation/deprecia-

tion on securities still held at October 31, 2010 was $8,108,613.

3 The Fund’s policy is to recognize transfers in and transfers out as of the end of

the period of the event or the change in circumstances that caused the transfer.

See Notes to Financial Statements.

ANNUAL REPORT

OCTOBER 31, 2010

15

| | | |

| Statements of Assets and Liabilities | | | |

| | BlackRock | BlackRock | |

| | Global Emerging | Latin | BlackRock |

| | Markets | America | International |

| October 31, 2010 | Fund, Inc. | Fund, Inc. | Fund |

| Assets | | | |

| Investments at value — unaffiliated1,2 | $ 307,787,787 | $1,036,487,809 | — |

| Investment at value — Master International Portfolio of BlackRock Master LLC (the “Portfolio”) (cost $55,070,995) | — | — | $ 65,317,863 |

| Investments at value — affiliated3 | 2,579,161 | 68,100,558 | — |

| Unrealized appreciation on foreign currency exchange contracts | — | 709 | — |

| Foreign currency at value4 | 2,569,700 | 453,292 | — |

| Investments sold receivable | 2,695,597 | 18,093,901 | — |

| Capital shares sold receivable | 828,894 | 12,668,076 | 125,279 |

| Dividends receivable | 324,484 | 2,834,111 | — |

| Prepaid expenses | 26,668 | 33,375 | 29,681 |

| Interest receivable | — | 44,130 | — |

| Securities lending income receivable — affiliated | — | 15,503 | — |

| Other assets | 226 | 828 | — |

| Total assets | 316,812,517 | 1,138,732,292 | 65,472,823 |

| Liabilities | | | |

| Collateral on securities loaned, at value | — | 62,121,755 | — |

| Unrealized depreciation on foreign currency exchange contracts | 16,610 | 4,821 | — |

| Investments purchased payable | 4,120,437 | 10,696,522 | — |

| Capital shares redeemed payable | 746,587 | 9,862,657 | 83,520 |

| Investment advisory fees payable | 250,499 | 821,763 | — |

| Deferred foreign capital gain tax | 67,906 | 340,017 | — |

| Distribution fees payable | 62,378 | 305,840 | 27,314 |

| Other affiliates payable | 3,883 | 16,181 | 399 |

| Officer's and Directors' fees payable | 72 | 226 | 9 |

| Administration fees payable | — | — | 12,760 |

| Contributions payable to the Portfolio | — | — | 41,759 |

| Other accrued expenses payable | 172,415 | 475,579 | 93,032 |

| Other liabilities payable | 2,040 | 32,580 | — |

| Total liabilities | 5,442,827 | 84,677,941 | 258,793 |

| Net Assets | $ 311,369,690 | $1,054,054,351 | $ 65,214,030 |

| Net Assets Consist of | | | |

| Paid-in capital | $ 291,691,709 | $ 774,888,939 | $ 90,080,994 |

| Undistributed (accumulated) net investment income (loss) | 728,820 | 858,976 | (181,468) |

| Accumulated net realized loss | (44,249,792) | (103,567,727) | — |

| Net unrealized appreciation/depreciation | 63,198,953 | 381,874,163 | — |

| Accumulated net realized loss allocated from the Portfolio | — | — | (34,932,364) |

| Net unrealized appreciation/depreciation allocated from the Portfolio | — | — | 10,246,868 |

| Net Assets | $ 311,369,690 | $1,054,054,351 | $ 65,214,030 |

| 1 Investments at cost — unaffiliated | $ 244,493,044 | $ 654,332,313 | — |

| 2 Securities loaned at value | — | $ 60,150,176 | — |

| 3 Investments at cost — affiliated | $ 2,579,161 | $ 68,100,558 | — |

| 4 Foreign currency at cost | $ 2,565,394 | $ 505,207 | — |

| Net Asset Value | | | |

| Institutional: | | | |

| Net assets | $ 123,006,574 | $ 200,980,363 | $ 2,645,253 |

| Shares outstanding, 100 million shares authorized | 5,999,481 | 2,667,164 | 205,656 |

| Par value per share | $ 0.10 | $ 0.10 | $ 0.0001 |

| Net asset value | $ 20.50 | $ 75.35 | $ 12.86 |

| Investor A: | | | |

| Net assets | $ 144,975,779 | $ 616,663,759 | $ 37,034,532 |

| Shares outstanding, 100 million shares authorized | 7,320,005 | 8,325,046 | 2,926,117 |

| Par value per share | $ 0.10 | $ 0.10 | $ 0.0001 |

| Net asset value | $ 19.81 | $ 74.07 | $ 12.66 |

| Investor B: | | | |

| Net assets | $ 4,676,611 | $ 18,660,469 | $ 11,898,336 |

| Shares outstanding, 100 million shares authorized | 264,168 | 269,218 | 1,005,069 |

| Par value per share | $ 0.10 | $ 0.10 | $ 0.0001 |

| Net asset value | $ 17.70 | $ 69.31 | $ 11.84 |

| Investor C: | | | |

| Net assets | $ 38,710,726 | $ 217,749,760 | $ 13,635,909 |

| Shares outstanding, 100 million shares authorized | 2,246,910 | 3,206,039 | 1,136,142 |

| Par value per share | $ 0.10 | $ 0.10 | $ 0.0001 |

| Net asset value | $ 17.23 | $ 67.92 | $ 12.00 |

| See Notes to Financial Statements. | | | |

16 ANNUAL REPORT

OCTOBER 31, 2010

| | | |

| Statements of Operations | | | |

| | BlackRock | BlackRock | |

| | Global Emerging | Latin | BlackRock |

| | Markets | America | International |

| Year Ended October 31, 2010 | Fund, Inc. | Fund, Inc. | Fund |

| Investment Income | | | |

| Interest | $ 333 | $ 103,092 | — |

| Dividends | 5,729,503 | 22,934,876 | — |

| Foreign taxes withheld | (498,564) | (1,815,019) | — |

| Dividends — affiliated | 8,582 | 13,219 | — |

| Securities lending — affiliated | — | 158,589 | — |

| Investment income allocated from the Portfolio: | | | |

| Dividends | — | — | $ 1,101,708 |

| Income — affiliated | — | — | 3,121 |

| Foreign taxes withheld | — | — | (100,924) |

| Expenses | — | — | (658,508) |

| Total income | 5,239,854 | 21,394,757 | 345,397 |

| Expenses | | | |

| Investment advisory | 2,534,474 | 8,414,848 | — |

| Service — Investor A | 313,782 | 1,234,845 | 78,963 |

| Service and distribution — Investor B | 46,551 | 179,981 | 157,602 |

| Service and distribution — Investor C | 317,446 | 1,807,260 | 124,824 |

| Transfer agent — Institutional | 98,974 | 171,372 | 9,493 |

| Transfer agent — Investor A | 219,594 | 729,196 | 98,780 |

| Transfer agent — Investor B | 12,094 | 44,372 | 106,818 |

| Transfer agent — Investor C | 84,047 | 343,330 | 35,247 |

| Administration | — | — | 159,676 |

| Custodian | 173,348 | 458,785 | — |

| Professional | 120,245 | 77,795 | 64,523 |

| Accounting services | 99,914 | 255,461 | — |

| Registration | 88,732 | 131,007 | 55,846 |

| Printing | 45,132 | 109,935 | 20,484 |

| Officer and Directors | 10,909 | 22,783 | 33 |

| Miscellaneous | 32,975 | 45,286 | 13,186 |

| Total expenses | 4,198,217 | 14,026,256 | 925,475 |

| Less fees waived by advisor | (3,315) | (5,031) | — |

| Total expenses after fees waived | 4,194,902 | 14,021,225 | 925,475 |

| Net investment income (loss) | 1,044,952 | 7,373,532 | (580,078) |

| Realized and Unrealized Gain (Loss) | | | |

| Net realized gain (loss) from: | | | |

| Investments | 30,105,7511 | 52,842,3272 | — |

| Foreign currency transactions | (438,825) | (1,568,796) | — |

| Investments and foreign currency transactions allocated from the Portfolio | — | — | 6,856,088 |

| | 29,666,926 | 51,273,531 | 6,856,088 |

| Net change in unrealized appreciation/depreciation on: | | | |

| Investments | 20,408,0403 | 155,280,2664 | — |

| Foreign currency transactions | (26,827) | 96,356 | — |

| Investments and foreign currency transactions allocated from the Portfolio | — | — | 2,749,700 |

| | 20,381,213 | 155,376,622 | 2,749,700 |

| Total realized and unrealized gain | 50,048,139 | 206,650,153 | 9,605,788 |

| Net Increase in Net Assets Resulting from Operations | $ 51,093,091 | $ 214,023,685 | $ 9,025,710 |

1 Including $2,040 foreign capital gain tax.

2 Including $32,580 foreign capital gain tax.

3 Net of $67,906 deferred foreign capital gain tax.

4 Net of $340,017 deferred foreign capital gain tax.

See Notes to Financial Statements.

ANNUAL REPORT

OCTOBER 31, 2010

17

| | | | | | | |

| Statements of Changes in Net Assets | | | | | | |

| | BlackRock Global Emerging | BlackRock Latin | BlackRock | |

| | Markets Fund, Inc. | America Fund, Inc. | International Fund |

| | Year Ended October 31, | Year Ended October 31, | Year Ended October 31, |

| Increase (Decrease) in Net Assets: | 2010 | 2009 | 2010 | 2009 | 2010 | | 2009 |

| Operations | | | | | | | |

| Net investment income (loss) | $ 1,044,952 | $ 1,267,163 | $ 7,373,532 | $ 5,021,003 | $ (580,078) | $ 64,482 |

| Net realized gain (loss) | 29,666,926 | (23,216,908) | 51,273,531 | (72,628,541) | 6,856,088 | | (15,605,920) |

| Net change in unrealized appreciation/depreciation | 20,381,213 | 106,105,709 | 155,376,622 | 364,608,806 | 2,749,700 | | 31,035,081 |

| Net increase in net assets resulting from operations | 51,093,091 | 84,155,964 | 214,023,685 | 297,001,268 | 9,025,710 | | 15,493,643 |

| Dividends to Shareholders From | | | | | | | |

| Net investment income: | | | | | | | |

| Institutional | (571,284) | (252,551) | (2,062,764) | — | — | | — |

| Investor A | (495,119) | (232,391) | (7,759,663) | — | — | | — |

| Investor B | — | — | (151,277) | — | — | | — |

| Investor C | (20,174) | — | (1,878,791) | — | — | | — |

| Decrease in net assets resulting from dividends | | | | | | | |

| to shareholders | (1,086,577) | (484,942) | (11,852,495) | — | — | | — |

| Capital Share Transactions | | | | | | | |

| Net increase (decrease) in net assets derived | | | | | | | |

| from capital share transactions | 32,159,861 | 18,024,424 | 92,196,491 | 142,193,743 | (10,726,181) | | (7,735,440) |

| Redemption Fee | | | | | | | |

| Redemption fee | 24,599 | 7,513 | 232,820 | 162,049 | 21,640 | | 15,098 |

| Net Assets | | | | | | | |

| Total increase (decrease) in net assets | 82,190,974 | 101,702,959 | 294,600,501 | 439,357,060 | (1,678,831) | | 7,773,301 |

| Beginning of year | 229,178,716 | 127,475,757 | 759,453,850 | 320,096,790 | 66,892,861 | | 59,119,560 |

| End of year | $ 311,369,690 | $ 229,178,716 | $1,054,054,351 | $ 759,453,850 | $ 65,214,030 | $ 66,892,861 |

| Undistributed (distributions in excess of) net | | | | | | | |

| investment income | $ 728,820 | $ 1,086,964 | $ 858,976 | $ 6,907,334 | $ (181,468) | $ 60,661 |

See Notes to Financial Statements.

18 ANNUAL REPORT

OCTOBER 31, 2010

| | | | | | | |

| Financial Highlights | | | BlackRock Global Emerging Markets Fund, Inc. |

| | | | Period | | | | |

| | | | July 1, 2008 | | | | |

| | Year Ended October 31, | | | Year Ended June 30, | |

| | | | to October 31, | | | | |

| | 2010 | 2009 | 2008 | 2008 | 20071 | | 20061 |

| | | | Institutional | | | |

| Per Share Operating Performance | | | | | | | |

| Net asset value, beginning of period | $ 17.01 | $ 10.17 | $ 22.45 | $ 27.91 | $ 24.14 | $ 17.74 |

| Net investment income2 | 0.13 | 0.14 | 0.07 | 0.12 | 0.09 | | 0.22 |

| Net realized and unrealized gain (loss)3 | 3.47 | 6.75 | (10.34) | 1.28 | 8.37 | | 6.28 |

| Net increase (decrease) from investment operations | 3.60 | 6.89 | (10.27) | 1.40 | 8.46 | | 6.50 |

| Dividends and distributions from: | | | | | | | |

| Net investment income | (0.11) | (0.05) | (0.01) | - | (0.28) | | (0.10) |

| Net realized gain | — | — | (2.00) | (6.86) | (4.41) | | — |

| Total dividends and distributions | (0.11) | (0.05) | (2.01) | (6.86) | (4.69) | | (0.10) |

| Net asset value, end of period | $ 20.50 | $ 17.01 | $ 10.17 | $ 22.45 | $ 27.91 | $ 24.14 |

| Total Investment Return4 | | | | | | | |

| Based on net asset value | 21.28% | 68.14% | (48.15)%5 | 3.84% | 41.99% | | 36.80% |

| Ratios to Average Net Assets | | | | | | | |

| Total expenses | 1.33% | 1.48% | 1.56%6 | 1.40% | 1.44% | | 1.50% |

| Total expenses after fees waived | 1.33% | 1.48% | 1.54%6 | 1.37% | 1.40% | | 1.50% |

| Net investment income | 0.71% | 1.10% | 1.31%6 | 0.45% | 0.36% | | 0.99% |

| Supplemental Data | | | | | | | |

| Net assets, end of period (000) | $ 123,007 | $ 86,173 | $ 42,803 | $ 80,399 | $ 86,385 | $ 73,914 |

| Portfolio turnover | 135% | 191% | 76% | 163% | 140% | | 121% |

| | | | Investor A | | | |

| Per Share Operating Performance | | | | | | | |

| Net asset value, beginning of period | $ 16.45 | $ 9.85 | $ 21.80 | $ 27.27 | $ 23.68 | $ 17.41 |

| Net investment income2 | 0.07 | 0.10 | 0.05 | 0.04 | 0.02 | | 0.17 |

| Net realized and unrealized gain (loss)3 | 3.36 | 6.53 | (10.02) | 1.25 | 8.21 | | 6.16 |

| Net increase (decrease) from investment operations | 3.43 | 6.63 | (9.97) | 1.29 | 8.23 | | 6.33 |

| Dividends and distributions from: | | | | | | | |

| Net investment income | (0.07) | (0.03) | — | — | (0.23) | | (0.06) |

| Net realized gain | — | — | (1.98) | (6.76) | (4.41) | | — |

| Total dividends and distributions | (0.07) | (0.03) | (1.98) | (6.76) | (4.64) | | (0.06) |

| Net asset value, end of period | $ 19.81 | $ 16.45 | $ 9.85 | $ 21.80 | $ 27.27 | $ 23.68 |

| Total Investment Return4 | | | | | | | |

| Based on net asset value | 20.93% | 67.59% | (48.18)%5 | 3.49% | 41.66% | | 36.46% |

| Ratios to Average Net Assets | | | | | | | |

| Total expenses | 1.65% | 1.83% | 1.87%6 | 1.68% | 1.71% | | 1.75% |

| Total expenses after fees waived | 1.65% | 1.83% | 1.85%6 | 1.65% | 1.66% | | 1.75% |

| Net investment income | 0.43% | 0.80% | 0.98%6 | 0.16% | 0.10% | | 0.74% |

| Supplemental Data | | | | | | | |

| Net assets, end of period (000) | $ 144,976 | $ 111,850 | $ 67,614 | $ 145,781 | $ 151,309 | $ 122,331 |

| Portfolio turnover. | 135% | 191% | 76% | 163% | 140% | | 121% |

1 Consolidated Financial Highlights. See Note 1 of the Notes to Financial Statements.

2 Based on average shares outstanding.

3 Includes a redemption fee, which is less than $0.01 per share.

4 Where applicable, total investment returns exclude the effect of any sales charges

and include the reinvestment of dividends and distributions.

5 Aggregate total investment return.

6 Annualized.

See Notes to Financial Statements.

ANNUAL REPORT

OCTOBER 31, 2010

19

| | | | | | | | |