UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number 811-06351

Green Century Funds

114 State Street

Suite 200

Boston, MA 02109

(Address of principal executive offices)

Green Century Capital Management, Inc.

114 State Street

Suite 200

Boston, MA 02109

(Name and address of agent for service)

Registrant’s telephone number, including area code: (617) 482-0800

Date of fiscal year end: July 31

Date of reporting period: January 31, 2010

| Item 1. | Reports to Stockholders |

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

| | |

| | SEMI-ANNUAL REPORT Green Century Balanced Fund Green Century Equity Fund January 31, 2010 |

| |

| An investment for your future.® | | 114 State Street, Boston, Massachusetts 02109 |

For information on the Green Century Funds®, call 1-800-93-GREEN. For information on how to open an account and account services, call 1-800-221-5519 8:00 am to 6:00 pm Eastern Time, Monday through Friday. For share price and account information, call 1-800-221-5519, twenty-four hours a day.

Dear Green Century Funds Shareholder:

Many mainstream Wall Street investment firms solely focus on a profitable bottom line for themselves; independent, triple bottom line firms like Green Century Capital Management (Green Century) focus on what our investors care about: building a sustainable economy while seeking competitive financial returns.

Green Century forges a new path in the financial sector to provide investors a means to use the power of their investment dollars to encourage environmentally responsible corporate behavior, since business as usual will not create the green future we seek. Here are some of the ways Green Century is different from the mainstream Wall Street firms:

| | • | | Green Century was founded in 1991 by a partnership of non-profit environmental advocacy organizations. Our firm remains 100% owned by these groups and any profits generated on the fees we earn for managing the Green Century Funds belong to our non-profit founders. Instead of being constantly pressured to reach quarterly earnings targets, we have a long-term focus on staying true to our green mission. Bailouts are the closest Wall Street firms can claim to being non-profits. |

| | • | | We are a small, nimble firm that has the freedom to invest in environmentally sound companies. The Green Century Funds do not invest in companies in every sector as many other mutual funds do. In fact, the Green Century Balanced Fund does not invest in any fossil fuel production or manufacturing companies because we support the transition to a less carbon intensive economy. |

| | • | | A critical component of our green investing strategy is being an active shareholder and encouraging companies to be responsible corporate citizens. Unlike many large mutual fund companies, we do not always agree with management’s decisions. As investors, we have the right and the responsibility to hold companies accountable for their environmental performance. Environmentally-destructive practices and policies are not just bad for the planet—they can also create significant risks and disadvantages for companies. |

Shareholder Advocacy Update As of this spring, Green Century is on track to have a record-setting year for our shareholder advocacy program. We have filed over 20 shareholder resolutions asking companies to take action on a range of critical environmental issues including disclosing the impacts of Canadian tar sands oil extraction, adopting sustainable seafood procurement policies and practices, reducing the amount of water used by electric utilities, and increasing transparency around corporate political spending.

This year Green Century launched a new high-profile shareholder campaign that encourages increased transparency and reducing the environmental risks associated with fossil fuel development. The new campaign seeks to ensure that development of natural gas is done in a way that does not have unintended and harmful consequences for the environment and human health. The shareholder proposals ask companies to increase transparency regarding the environmental impact of their operations and encourage companies to mitigate risks by switching to less toxic fracturing fluids and adopting best practices for drilling and managing wastes.

Green Century is committed to fostering a more sustainable economy through our robust advocacy efforts. We thank you for your continued investment in the Green Century Funds as we all work toward a healthier, more sustainable world.

If you have any questions, please do not hesitate to contact us at 1-800-93-GREEN or visit us on-line at: www.GreenCentury.com.

Respectfully,

Green Century Capital Management

THE GREEN CENTURY BALANCED FUND

The Green Century Balanced Fund seeks capital growth and income from a diversified portfolio of stocks and bonds that meet Green Century’s standards for corporate environmental performance. The portfolio managers of the Balanced Fund aim to invest in companies that are in the business of solving environmental problems or that are committed to reducing their environmental impact.

| | | | | | | | | | |

| | | AVERAGE ANNUAL RETURN* Total expense ratio: 1.38% | | Six Months | | One Year | | Five Years | | Ten Years |

| December 31, 2009 | | Green Century Balanced Fund | | 14.20% | | 22.44% | | 0.64% | | 0.53% |

| | | Lipper Balanced Fund Index2 | | 16.42% | | 23.35% | | 2.63% | | 2.79% |

| January 31, 2010 | | Green Century Balanced Fund | | 5.41% | | 23.63% | | 0.91% | | -0.54% |

| | | Lipper Balanced Fund Index2 | | 7.95% | | 27.13% | | 2.55% | | 2.88% |

* The performance data quoted represents past performance and is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information as of the most recent month-end, call 1-800-93-GREEN. Performance includes the reinvestment of income dividends and capital gain distributions. Performance shown does not reflect the deduction of taxes that a shareholder might pay on Fund distributions or the redemption of Fund shares.

During the six month periods ended December 31, 2009 and January 31, 2010, the Balanced Fund performance lagged the Lipper Balanced Fund Index, though both the Fund and that Index were up significantly. For the six months ended January 31, 2010, the Fund returned 5.41%, while the Lipper Balanced Fund Index returned 7.95%.

As the economy stabilized, stocks in the industrial, technology, and consumer discretionary sectors did particularly well. While the Balanced Fund does not hold any fossil-fuel energy company stocks, the Fund’s holdings of smaller companies’ stocks in solar and wind energy lagged the market in concert with oil and gas stocks. The Balanced Fund’s bond holdings participated in the overall recovery, with the prices of intermediate maturity corporate bonds increasing as the prospects for economic recovery strengthened.

The Fund’s equity holdings which positively contributed to its performance during the six months ended January 31, 2010 included: Cree1, General Mills1, Apple1, and J.M. Smucker Co.1, while poor performers included Advance Auto Parts1, Sims Metal Management1, First Solar1, and Owens-Illinois1.

The Balanced Fund’s portfolio managers believe the Fund is positioned to benefit from the moderate economic growth expected in

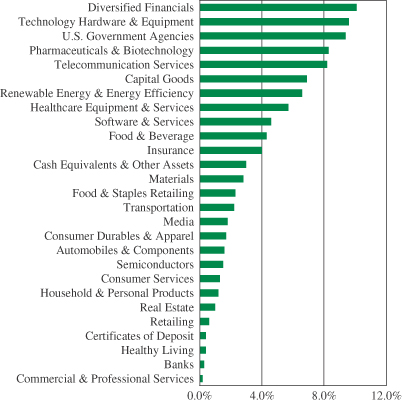

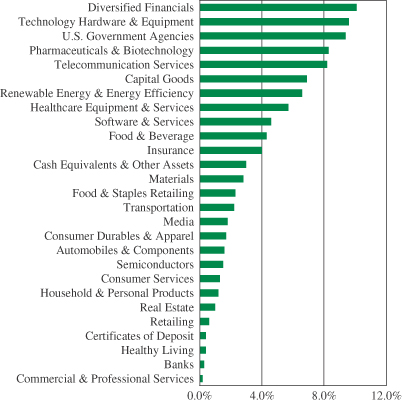

GREEN CENTURY BALANCED FUND

INVESTMENTS BY INDUSTRY

2

2010. The Fund’s equity holdings are weighted toward steady growth companies with higher domestic sales exposure and the Fund’s bond holdings are weighted toward short to intermediate maturity and high quality bonds.

The Green Century Balanced Fund invests in the stocks and bonds of environmentally responsible corporations of various sizes, including small, medium, and large companies. The value of the stocks held in the Balanced Fund will fluctuate in response to factors that may affect a single issuer, industry, or sector of the economy or may affect the market as a whole. Bonds are subject to a variety of risks including interest rate, credit, and inflation risk.

THE GREEN CENTURY EQUITY FUND

The Green Century Equity Fund invests essentially all of its assets in the stocks which make up the FTSE KLD 400 Social Index (the “Index”), comprised of 400 primarily large capitalization U.S. companies selected based on a comprehensive range of social and environmental sustainability criteria. The Equity Fund seeks to provide shareholders with a long-term total return that matches that of the Index.

| | | | | | | | | | |

| | | AVERAGE ANNUAL RETURN* Total expense ratio: 0.95% | | Six Months | | One Year | | Five Years | | Ten Years |

| December 31, 2009 | | Green Century Equity Fund | | 24.11% | | 30.37% | | –0.33% | | –2.45% |

| | | S&P 500® Index3 | | 22.59% | | 26.46% | | 0.42% | | –0.95% |

| January 31, 2010 | | Green Century Equity Fund | | 10.56% | | 37.29% | | –0.43% | | –2.25% |

| | | S&P 500® Index3 | | 9.87% | | 33.14% | | 0.18% | | –0.80% |

* The performance data quoted represents past performance and is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information as of the most recent month-end, call 1-800-93-GREEN. Performance includes the reinvestment of income dividends and capital gain distributions. Performance shown does not reflect the deduction of taxes that a shareholder might pay on Fund distributions or the redemption of Fund shares.

The Green Century Equity Fund outperformed the S&P 500® Index for the six-month and one year periods ended December 31, 2009 and January 31, 2010. For the six month period ended January 31, 2010, the Equity Fund’s return was 10.56%, while the S&P 500® Index was up 9.87%.

The U.S. economy returned to positive growth in the third quarter of 2009 and expanded again during the fourth quarter. The Federal Reserve kept interest rates at historically low levels in an ongoing attempt to stimulate growth. Economic data releases were mixed for the six months ended January 31, 2010, with improvements in some indicators such as manufacturing indices but ongoing high unemployment and relatively low consumer confidence. The U.S. stock market rose during the period led by improvements in the financial and consumer discretionary sectors.

3

The performance of the Equity Fund was helped, relative to the S&P 500®, in part due to an underweight in energy, diversified financials, electric utilities and diversified telecommunications. The Equity Fund did not own companies such as MEMC Electronic Materials1, Iron Mountain1, and Owens-Illinois1 which were down significantly for the six months ended January 31, 2010. The fund benefited from being overweight to software and commercial banks during the period due predominantly to owning Microsoft1 and Wells Fargo1, respectively.

Conversely, the Equity Fund was overweight in communications equipment stocks which were among the worst performers on a relative basis. Qualcomm1 and Cisco Systems1 performed poorly as companies continued with cost-cutting strategies and delayed spending in response to the recession. The Fund was also hurt by being underweighted in aerospace and defense and not owning companies such as Boeing1 and United Technologies1. These companies performed better than the overall market during the period as the government announced increased defense spending over the next few years.

The Equity Fund, like other mutual funds invested primarily in stocks, carries the risk of investing in the stock market. The large companies in which the Equity Fund is invested may perform worse than the stocks market as a whole. The Equity Fund will not shift concentration from one industry to another or from stocks to bonds or cash, in order to defend against a falling stock market.

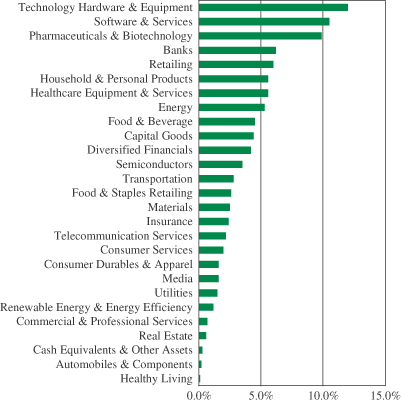

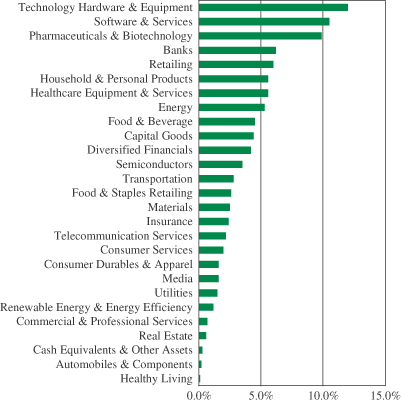

GREEN CENTURY EQUITY FUND

INVESTMENTS BY INDUSTRY

4

The Green Century Funds’ proxy voting guidelines and a record of the Funds’ proxy votes for the year ended June 30, 2009 are available without charge, upon request, (i) at www.greencentury.com, (ii) by calling 1-800-93-GREEN, (iii) sending an e-mail to info@greencentury.com, and (iv) on the Securities and Exchange Commission’s website at www.sec.gov.

The Green Century Funds file their complete schedule of portfolio holdings with the SEC for the first and third quarters of the year on Form N-Q. The Green Century Funds’ Forms N-Q are available on the EDGAR database on the SEC’s website at www.sec.gov. These Forms may also be reviewed and copied at the SEC’s Public Reference Room in Washington D.C. Information about the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330. The information on Form N-Q may also be obtained by calling 1-800-93-GREEN, or by e-mailing a request to info@greencentury.com.

1 As of January 31, 2010, the following companies comprised the listed percentages of each of the Green Century Funds:

| | | | |

| Portfolio Holding | | GREEN CENTURY

BALANCED FUND | | GREEN CENTURY

EQUITY FUND |

Cree | | 1.33% | | 0.12% |

General Mills | | 2.39% | | 0.46% |

Apple | | 1.43% | | 0.00% |

J.M. Smucker Co. | | 1.56% | | 0.14% |

Advance Auto Parts | | 0.63% | | 0.00% |

Sims Metal Management | | 0.57% | | 0.00% |

First Solar | | 0.45% | | 0.14% |

Owens-Illinois | | 0.39% | | 0.00% |

MEMC Electronic Materials | | 0.00% | | 0.00% |

Iron Mountain | | 0.00% | | 0.00% |

Microsoft | | 1.23% | | 5.02% |

Wells Fargo | | 0.00% | | 2.90% |

Qualcomm | | 0.00% | | 1.30% |

Cisco Systems | | 0.84% | | 2.60% |

Boeing | | 0.00% | | 0.00% |

United Technologies | | 0.00% | | 0.00% |

Portfolio composition will change due to ongoing management of the Funds. Please refer to the Green Century Funds website for current information regarding the Funds’ portfolio holdings. These holdings are subject to risk as described in the Funds’ prospectus. References to specific investments should not be construed as a recommendation of the securities by the Funds, their administrator, or their distributor.

2 Lipper Analytical Services, Inc. (“Lipper”) is a respected mutual fund reporting service. The Lipper Balanced Fund Index includes the 30 largest funds whose primary objective is to conserve principal by maintaining at all times a balanced portfolio of both stocks and bonds. Typically the stock/bond ratio ranges around 60%/40%.

3 The S&P 500® Index is an unmanaged index of 500 selected common stocks, most of which are listed on the New York Stock Exchange. The S&P 500® Index is heavily weighted toward stocks with large market capitalization and represents approximately two-thirds of the total market value of all domestic stocks. It is not possible to invest directly in the S&P 500® Index.

This material must be preceded or accompanied by a current prospectus.

Distributor: UMB Distribution Services, LLC, 3/10

5

GREEN CENTURY FUNDS EXPENSE EXAMPLE

For the six months ended January 31, 2010

As a shareholder of the Green Century Funds (the “Funds”), you incur two types of costs: (1) transaction costs, including redemption fees on certain redemptions; and (2) ongoing costs, including management fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from August 1, 2009 to January 31, 2010 (the “period”).

Actual Expenses. The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 equals 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account during the period.

Hypothetical Example for Comparison Purposes. The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the actual return of either of the Funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees on shares held for 60 days or less. Therefore, the second line of the table is useful in comparing the ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs could have been higher.

| | | | | | | | | |

| | | BEGINNING

ACCOUNT VALUE

AUGUST 1, 2009 | | ENDING

ACCOUNT VALUE

JANUARY 31, 2010 | | EXPENSES

PAID DURING

THE PERIOD1 |

Balanced Fund | | | | | | | | | |

Actual Expenses | | $ | 1,000.00 | | $ | 1,054.10 | | $ | 7.15 |

Hypothetical Example, assuming a 5% return before expenses | | | 1,000.00 | | | 1,018.04 | | | 7.02 |

| | | |

Equity Fund | | | | | | | | | |

Actual Expenses | | | 1,000.00 | | | 1,105.60 | | | 5.04 |

Hypothetical Example, assuming a 5% return before expenses | | | 1,000.00 | | | 1,020.21 | | | 4.84 |

1 Expenses are equal to the Funds’ annualized expense ratios (1.38% for the Balanced Fund and .95% for the Equity Fund), multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

6

| | |

GREEN CENTURY BALANCED FUND PORTFOLIO OF INVESTMENTS January 31, 2010 (unaudited) | | |

| | | | | |

COMMON STOCKS — 64.1% | | | | | |

| | | SHARES | | VALUE |

| | | | | |

Technology Hardware & Equipment — 7.6% |

Apple, Inc. (a) | | 3,761 | | $ | 722,563 |

Cisco Systems, Inc. (a) | | 18,940 | | | 425,582 |

EMC Corporation (a) | | 15,000 | | | 250,050 |

Hewlett-Packard Company | | 19,000 | | | 894,330 |

International Business Machines Corporation | | 10,700 | | | 1,309,573 |

NETGEAR, Inc. (a) | | 11,362 | | | 234,512 |

| | | | | |

| | | | | 3,836,610 |

| | | | | |

Capital Goods — 6.9% |

3M Company | | 10,795 | | | 868,890 |

ABB Ltd. American Depositary Receipt (a)(b) | | 8,940 | | | 161,188 |

Emerson Electric Company | | 8,844 | | | 367,380 |

Gardner Denver, Inc. | | 8,400 | | | 334,740 |

Illinois Tool Works, Inc. | | 11,990 | | | 522,644 |

Koninklijke Philips Electronics N.V. American Depositary Receipt (b) | | 5,650 | | | 170,856 |

Middleby Corporation (a) | | 3,000 | | | 135,180 |

Pentair, Inc. | | 8,917 | | | 272,325 |

Quanta Services, Inc. (a) | | 9,600 | | | 174,912 |

W.W. Grainger, Inc. | | 4,900 | | | 486,472 |

| | | | | |

| | | | | 3,494,587 |

| | | | | |

Renewable Energy & Energy Efficiency — 5.6% |

American Superconductor Corporation (a) | | 4,500 | | | 171,090 |

Ballard Power Systems, Inc. (a) | | 70,958 | | | 158,946 |

Cree, Inc. (a) | | 12,000 | | | 670,920 |

First Solar, Inc. (a) | | 2,015 | | | 228,299 |

GT Solar International, Inc. (a) | | 18,000 | | | 103,500 |

International Rectifier Corporation (a) | | 21,000 | | | 378,840 |

Itron, Inc. (a) | | 3,720 | | | 228,929 |

Johnson Controls, Inc. | | 5,957 | | | 165,783 |

OM Group, Inc. (a) | | 8,600 | | | 280,532 |

Ormat Technologies, Inc. | | 7,800 | | | 268,476 |

Suntech Power Holdings Company Ltd. American Depository Receipt (a)(b) | | 11,947 | | | 161,404 |

| | | | | |

| | | | | 2,816,719 |

| | | | | |

| | | | | |

| | | SHARES | | VALUE |

| | | | | |

Pharmaceuticals & Biotechnology — 5.0% |

Amgen, Inc. (a) | | 6,317 | | $ | 369,418 |

GlaxoSmithKline plc American Depositary Receipt (b) | | 9,578 | | | 373,638 |

Johnson & Johnson | | 13,640 | | | 857,410 |

Teva Pharmaceutical Industries Ltd. American Depositary Receipt (b) | | 11,485 | | | 651,429 |

Waters Corporation (a) | | 5,000 | | | 284,900 |

| | | | | |

| | | | | 2,536,795 |

| | | | | |

Diversified Financials — 4.8% |

American Express Company | | 5,755 | | | 216,733 |

Bank of America Corporation | | 31,870 | | | 483,787 |

Charles Schwab Corporation (The) | | 16,000 | | | 292,640 |

Goldman Sachs Group, Inc. (The) | | 3,300 | | | 490,776 |

JPMorgan Chase & Company | | 18,177 | | | 707,812 |

Stifel Financial Corporation (a) | | 4,700 | | | 245,810 |

| | | | | |

| | | | | 2,437,558 |

| | | | | |

Food & Beverage — 4.3% |

Diamond Foods, Inc. | | 5,121 | | | 183,946 |

General Mills, Inc. | | 16,900 | | | 1,205,139 |

J. M. Smucker Company (The) | | 13,105 | | | 787,218 |

| | | | | |

| | | | | 2,176,303 |

| | | | | |

Insurance — 4.0% |

Aflac, Inc. | | 4,500 | | | 217,935 |

Chubb Corporation | | 11,345 | | | 567,250 |

HCC Insurance Holdings, Inc. | | 14,000 | | | 379,400 |

Horace Mann Educators Corporation | | 17,000 | | | 203,830 |

Progressive Corporation (The) | | 23,500 | | | 389,630 |

W. R. Berkley Corporation | | 10,300 | | | 250,599 |

| | | | | |

| | | | | 2,008,644 |

| | | | | |

Healthcare Equipment & Services — 3.9% |

Baxter International, Inc. | | 8,600 | | | 495,274 |

Becton, Dickinson and Company | | 3,300 | | | 248,721 |

Gen-Probe, Inc. (a) | | 4,998 | | | 214,564 |

Hologic, Inc. (a) | | 14,950 | | | 225,297 |

Medtronic, Inc. | | 12,250 | | | 525,402 |

UnitedHealth Group, Inc. | | 7,530 | | | 248,490 |

| | | | | |

| | | | | 1,957,748 |

| | | | | |

Software & Services — 3.6% |

Google, Inc., Class A (a) | | 907 | | | 480,184 |

Microsoft Corporation | | 21,950 | | | 618,551 |

7

| | |

GREEN CENTURY BALANCED FUND PORTFOLIO OF INVESTMENTS January 31, 2010 (unaudited) | | continued |

| | | | | |

| | | SHARES | | VALUE |

| | | | | |

Software & Services — (continued) |

Oracle Corporation | | 30,798 | | $ | 710,202 |

| | | | | |

| | | | | 1,808,937 |

| | | | | |

Materials — 2.8% |

Air Products & Chemicals, Inc. | | 4,300 | | | 326,628 |

Ecolab, Inc. | | 14,043 | | | 616,488 |

Owens-Illinois, Inc. (a) | | 7,200 | | | 195,984 |

Sims Metal Management Ltd. American Depositary Receipt (b) | | 15,200 | | | 285,760 |

| | | | | |

| | | | | 1,424,860 |

| | | | | |

Telecommunication Services — 2.8% |

AT&T, Inc. | | 30,475 | | | 772,846 |

Telefonica S.A. American Depositary Receipt (b) | | 8,562 | | | 613,039 |

| | | | | |

| | | | | 1,385,885 |

| | | | | |

Food & Staples Retailing — 2.3% |

Costco Wholesale Corporation | | 10,840 | | | 622,541 |

Sysco Corporation | | 18,635 | | | 521,594 |

| | | | | |

| | | | | 1,144,135 |

| | | | | |

Media — 1.8% |

John Wiley & Sons, Inc., Class A | | 14,225 | | | 593,894 |

McGraw-Hill Companies, Inc. (The) | | 8,969 | | | 317,951 |

| | | | | |

| | | | | 911,845 |

| | | | | |

Semiconductors — 1.5% |

Intel Corporation | | 38,330 | | | 743,602 |

| | | | | |

Consumer Durables & Apparel — 1.4% |

Deckers Outdoor Corporation (a) | | 2,012 | | | 197,518 |

Jarden Corporation | | 9,854 | | | 300,350 |

Timberland Company (The), Class A (a) | | 11,000 | | | 189,200 |

| | | | | |

| | | | | 687,068 |

| | | | | |

Consumer Services — 1.3% |

Chipotle Mexican Grill, Inc. (a) | | 2,083 | | | 200,926 |

Panera Bread Company, Class A (a) | | 2,556 | | | 182,550 |

Starbucks Corporation (a) | | 11,147 | | | 242,893 |

| | | | | |

| | | | | 626,369 |

| | | | | |

Transportation — 1.2% |

Canadian Pacific Railway Ltd. | | 4,000 | | | 188,000 |

Expeditors International of Washington, Inc. | | 2,578 | | | 87,910 |

| | | | | | |

| | | SHARES | | VALUE |

| | | | | | |

Transportation — (continued) |

United Parcel Service, Inc., Class B | | | 6,064 | | $ | 350,317 |

| | | | | | |

| | | | | | 626,227 |

| | | | | | |

Household & Personal Products — 1.2% |

Church & Dwight Company, Inc. | | | 9,875 | | | 595,364 |

| | | | | | |

Retailing — 0.6% |

Advance Auto Parts, Inc. | | | 8,100 | | | 319,545 |

| | | | | | |

Automobiles & Components — 0.6% |

Toyota Motor Corporation American Depositary Receipt (b) | | | 4,083 | | | 314,391 |

| | | | | | |

Healthy Living — 0.4% |

United Natural Foods, Inc. (a) | | | 8,000 | | | 216,880 |

| | | | | | |

Banks — 0.3% |

Royal Bank of Canada | | | 3,236 | | | 158,758 |

| | | | | | |

Commercial & Professional Services — 0.2% |

Interface, Inc., Class A | | | 11,600 | | | 94,076 |

| | | | | | |

Total Common Stocks (Cost $29,943,967) | | | | | | 32,322,906 |

| | | | | | |

CORPORATE BONDS & NOTES — 23.1% |

| | | PRINCIPAL

AMOUNT | | VALUE |

Telecommunication Services — 5.4% |

| AT&T Corporation | | | | | | |

7.30%, due 11/15/11 (c) | | $ | 1,000,000 | | | 1,106,060 |

| BellSouth Corporation | | | | | | |

4.75%, due 11/15/12 | | | 500,000 | | | 536,117 |

| France Telecom S.A. | | | | | | |

7.75%, due 3/1/11 (b)(c) | | | 500,000 | | | 535,999 |

| Verizon Communications, Inc. | | | | | | |

5.25%, due 4/15/13 | | | 500,000 | | | 546,953 |

| | | | | | |

| | | | | | 2,725,129 |

| | | | | | |

Diversified Financials — 5.3% |

| Goldman Sachs Group, Inc. (The) | | | | | | |

6.60%, due 1/15/12 | | | 500,000 | | | 545,202 |

JPMorgan Chase & Company | | | | | | |

4.60%, due 1/17/11 | | | 500,000 | | | 517,791 |

JPMorgan Chase & Company | | | | | | |

4.50%, due 1/15/12 | | | 500,000 | | | 525,285 |

8

| | |

GREEN CENTURY BALANCED FUND PORTFOLIO OF INVESTMENTS January 31, 2010 (unaudited) | | continued |

| | | | | | |

| | | PRINCIPAL

AMOUNT | | VALUE |

| | | | | | |

Diversified Financials — (continued) |

SLM Corporation | | | | | | |

4.00%, due 7/25/14 (d) | | $ | 1,235,000 | | $ | 1,060,828 |

| | | | | | |

| | | | | | 2,649,106 |

| | | | | | |

Pharmaceuticals & Biotechnology — 3.3% |

Abbott Laboratories | | | | | | |

5.60%, due 11/30/17 | | | 500,000 | | | 554,937 |

Amgen, Inc. | | | | | | |

4.85%, due 11/18/14 | | | 500,000 | | | 543,188 |

Wyeth | | | | | | |

5.50%, due 3/15/13 (c) | | | 500,000 | | | 552,339 |

| | | | | | |

| | | | | | 1,650,464 |

| | | | | | |

Technology Hardware & Equipment — 2.0% |

Xerox Corporation | | | | | | |

7.625%, due 6/15/13 | | | 1,000,000 | | | 1,023,637 |

| | | | | | |

Healthcare Equipment & Services — 1.8% |

Aetna, Inc. | | | | | | |

5.75%, due 6/15/11 | | | 595,000 | | | 626,964 |

UnitedHealth Group, Inc. | | | | | | |

4.875%, due 4/1/13 | | | 250,000 | | | 268,087 |

| | | | | | |

| | | | | | 895,051 |

| | | | | | |

Renewable Energy & Energy Efficiency — 1.0% |

| Johnson Controls, Inc. | | | | | | |

5.50%, due 1/15/16 | | | 500,000 | | | 522,272 |

| | | | | | |

Software & Services — 1.0% |

| Oracle Corporation | | | | | | |

5.00%, due 1/15/11 | | | 500,000 | | | 519,018 |

| | | | | | |

Real Estate — 1.0% |

| Simon Property Group LP | | | | | | |

4.875%, due 8/15/10 | | | 500,000 | | | 509,318 |

| | | | | | |

Automobiles & Components — 1.0% |

| Toyota Motor Credit Corporation | | | | | | |

5.50%, due 7/25/17 (b)(c) | | | 500,000 | | | 506,537 |

| | | | | | |

Transportation — 1.0% |

| Ryder System, Inc. | | | | | | |

4.625%, due 4/1/10 | | | 500,000 | | | 501,368 |

| | | | | | |

| | | | | | |

| | | PRINCIPAL

AMOUNT | | VALUE |

| | | | | | |

Consumer Durables & Apparel — 0.3% |

| Newell Rubbermaid, Inc. | | | | | | |

4.00%, due 5/1/10 | | $ | 141,000 | | $ | 141,813 |

| | | | | | |

Total Corporate Bonds & Notes

(Cost $11,343,392) | | | | | | 11,643,713 |

| | | | | | |

U.S. GOVERNMENT AGENCIES — 9.4% |

| Fannie Mae Pool | | | | | | |

5.50%, due 3/1/12 | | | 68,935 | | | 71,049 |

| Federal Farm Credit Bank | | | | | | |

4.50%, due 10/25/11 | | | 500,000 | | | 530,830 |

| Federal Farm Credit Bank | | | | | | |

3.40%, due 4/22/16 | | | 500,000 | | | 496,331 |

| Federal Home Loan Bank | | | | | | |

3.125%, due 12/13/13 | | | 550,000 | | | 568,082 |

| Federal Home Loan Bank | | | | | | |

5.625%, due 6/13/16 | | | 1,000,000 | | | 1,048,854 |

| Federal Home Loan Bank | | | | | | |

3.875%, due 12/14/18 | | | 550,000 | | | 553,702 |

Federal Home Loan Mortgage Corporation | | | | | | |

2.00%, due 11/15/14 (c) | | | 500,000 | | | 507,225 |

Federal Home Loan Mortgage Corporation | | | | | | |

3.75%, due 3/27/19 | | | 500,000 | | | 496,955 |

Federal National Mortgage Association | | | | | | |

3.00%, due 4/15/15 | | | 500,000 | | | 501,007 |

| | | | | | |

Total U.S. Government Agencies (Cost $4,695,590) | | | | | | 4,774,035 |

| | | | | | |

CERTIFICATES OF DEPOSIT — 0.4% |

Self Help Credit Union Environmental Certificate of Deposit | | | | | | |

3.40%, due 8/8/10 | | | 95,000 | | | 95,025 |

Shorebank Pacific Time Deposit Receipt | | | | | | |

3.75%, due 8/8/11 | | | 95,000 | | | 95,000 |

| | | | | | |

Total Certificates Of Deposit

(Cost $190,025) | | | | | | 190,025 |

| | | | | | |

9

| | |

GREEN CENTURY BALANCED FUND PORTFOLIO OF INVESTMENTS January 31, 2010 (unaudited) | | concluded |

| | | |

SHORT-TERM OBLIGATION — 2.8% | | | |

| | | VALUE |

| | | |

Repurchase Agreement—

State Street Bank & Trust Repurchase Agreement, 0.01%, dated 01/29/10, due 02/01/10, proceeds $1,416,204 (collateralized by Federal Home Loan Bank, 4.375%, due 09/17/2010, value $1,447,546)

(Cost $1,416,203) | | $ | 1,416,203 |

| | | |

TOTAL INVESTMENTS (e) — 99.8% | | | |

(Cost $47,589,177) | | | 50,346,882 |

Other Assets Less Liabilities — 0.2% | | | 87,636 |

| | | |

NET ASSETS — 100.0% | | $ | 50,434,518 |

| | | |

| (a) | Non-income producing security. |

| (b) | Securities whose values are determined or significantly influenced by trading in markets other than the United States or Canada. |

| (c) | Step rate bond. Rate shown is currently in effect at January 31, 2010. |

| (d) | Floating rate bond. Rate shown is currently in effect at January 31, 2010. |

| (e) | The cost of investments for federal income tax purposes is $47,592,431 resulting in gross unrealized appreciation and depreciation of $5,264,304 and $2,509,853 respectively, or net unrealized appreciation of $2,754,451. |

See Notes to Financial Statements

10

| | |

GREEN CENTURY EQUITY FUND PORTFOLIO OF INVESTMENTS January 31, 2010 (unaudited) | | |

| | | | | |

COMMON STOCKS — 99.7% |

| | | SHARES | | VALUE |

| | | | | |

Technology Hardware & Equipment — 12.0% |

3Com Corporation (a) | | 3,600 | | $ | 26,820 |

Adaptec, Inc. (a) | | 800 | | | 2,432 |

ADC Telecommunications, Inc. (a) | | 1,000 | | | 5,310 |

Arrow Electronics, Inc. (a) | | 1,050 | | | 27,583 |

Cisco Systems, Inc. (a) | | 53,257 | | | 1,196,685 |

Corning, Inc. | | 14,358 | | | 259,593 |

Dell, Inc. (a) | | 18,095 | | | 233,425 |

Echelon Corporation (a) | | 282 | | | 2,394 |

EMC Corporation (a) | | 18,969 | | | 316,213 |

Hewlett-Packard Company | | 21,937 | | | 1,032,575 |

Imation Corporation (a) | | 300 | | | 2,682 |

International Business Machines Corporation | | 12,151 | | | 1,487,161 |

Lexmark International, Inc. (a) | | 700 | | | 18,053 |

Molex, Inc. | | 733 | | | 14,777 |

NetApp, Inc. (a) | | 3,137 | | | 91,381 |

Palm, Inc. (a) | | 1,576 | | | 16,375 |

Plantronics, Inc. | | 400 | | | 10,568 |

Polycom, Inc. (a) | | 800 | | | 17,944 |

QUALCOMM, Inc. | | 15,274 | | | 598,588 |

Seagate Technology | | 4,740 | | | 79,300 |

Tellabs, Inc. (a) | | 4,074 | | | 26,196 |

Xerox Corporation | | 8,368 | | | 72,969 |

| | | | | |

| | | | | 5,539,024 |

| | | | | |

Software & Services — 10.5% |

Adobe Systems, Inc. (a) | | 4,795 | | | 154,878 |

Advent Software, Inc. (a) | | 294 | | | 11,099 |

Autodesk, Inc. (a) | | 2,050 | | | 48,769 |

Automatic Data Processing, Inc. | | 4,592 | | | 187,308 |

BMC Software, Inc. (a) | | 1,700 | | | 65,688 |

Compuware Corporation (a) | | 2,208 | | | 16,759 |

Convergys Corporation (a) | | 1,100 | | | 11,770 |

eBay, Inc. (a) | | 11,860 | | | 273,017 |

Electronic Arts, Inc. (a) | | 3,008 | | | 48,970 |

Factset Research Systems, Inc. | | 344 | | | 21,672 |

Google, Inc., Class A (a) | | 2,168 | | | 1,147,783 |

Microsoft Corporation | | 82,101 | | | 2,313,606 |

Novell, Inc. (a) | | 3,000 | | | 13,410 |

Paychex, Inc. | | 3,391 | | | 98,305 |

Red Hat, Inc. (a) | | 1,340 | | | 36,475 |

Salesforce.com, Inc. (a) | | 857 | | | 54,462 |

Symantec Corporation (a) | | 7,489 | | | 126,939 |

Yahoo!, Inc. (a) | | 12,799 | | | 192,113 |

| | | | | |

| | | | | 4,823,023 |

| | | | | |

| | | | | |

| | | SHARES | | VALUE |

| | | | | |

Pharmaceuticals & Biotechnology — 9.9% |

Affymetrix, Inc. (a) | | 500 | | $ | 2,640 |

Allergan, Inc. | | 2,877 | | | 165,427 |

Amgen, Inc. (a) | | 9,437 | | | 551,876 |

Amylin Pharmaceuticals, Inc. (a) | | 1,421 | | | 25,550 |

Biogen Idec, Inc. (a) | | 2,712 | | | 145,743 |

Cubist Pharmaceuticals, Inc. (a) | | 439 | | | 8,995 |

Dionex Corporation (a) | | 150 | | | 10,477 |

Endo Pharmaceuticals Holdings, Inc. (a) | | 1,020 | | | 20,512 |

Genzyme Corporation (a) | | 2,452 | | | 133,045 |

Gilead Sciences, Inc. (a) | | 8,315 | | | 401,365 |

Illumina, Inc. (a) | | 1,124 | | | 41,239 |

Johnson & Johnson | | 25,623 | | | 1,610,662 |

Life Technologies Corporation (a) | | 1,632 | | | 81,127 |

Merck & Company, Inc. | | 28,020 | | | 1,069,804 |

Millipore Corporation (a) | | 500 | | | 34,485 |

Techne Corporation | | 350 | | | 22,967 |

Thermo Fisher Scientific, Inc. (a) | | 3,771 | | | 174,032 |

Waters Corporation (a) | | 900 | | | 51,282 |

| | | | | |

| | | | | 4,551,228 |

| | | | | |

Banks — 6.2% |

Bank of Hawaii Corporation | | 431 | | | 19,602 |

BB&T Corporation | | 6,429 | | | 179,176 |

Cathay General Bancorp | | 400 | | | 3,832 |

Comerica, Inc. | | 1,362 | | | 47,003 |

Fifth Third Bancorp | | 7,066 | | | 87,901 |

First Horizon National Corporation (a) | | 1,998 | | | 25,874 |

Heartland Financial USA, Inc. | | 100 | | | 1,395 |

Hudson City Bancorp, Inc. | | 4,912 | | | 65,182 |

Keycorp | | 8,118 | | | 58,287 |

M&T Bank Corporation | | 1,095 | | | 80,756 |

NewAlliance Bancshares, Inc. | | 1,000 | | | 11,640 |

People’s United Financial, Inc. | | 2,960 | | | 47,863 |

PNC Financial Services Group, Inc. | | 4,217 | | | 233,748 |

Popular, Inc. | | 6,963 | | | 14,970 |

Regions Financial Corporation | | 11,430 | | | 72,581 |

SunTrust Banks, Inc. | | 4,502 | | | 109,534 |

Synovus Financial Corporation | | 4,580 | | | 12,641 |

U.S. Bancorp | | 17,533 | | | 439,728 |

Umpqua Holdings Corporation | | 988 | | | 12,212 |

Wells Fargo & Company | | 47,007 | | | 1,336,409 |

| | | | | |

| | | | | 2,860,334 |

| | | | | |

11

| | |

GREEN CENTURY EQUITY FUND PORTFOLIO OF INVESTMENTS January 31, 2010 (unaudited) | | continued |

| | | | | |

| | | SHARES | | VALUE |

| | | | | |

Retailing — 6.0% |

Amazon.com, Inc. (a) | | 3,059 | | $ | 383,629 |

AutoZone, Inc. (a) | | 346 | | | 53,640 |

Bed Bath & Beyond, Inc. (a) | | 2,434 | | | 94,196 |

Best Buy Company, Inc. | | 3,894 | | | 142,715 |

Carmax, Inc. (a) | | 1,876 | | | 38,702 |

Charming Shoppes, Inc. (a) | | 800 | | | 4,648 |

Family Dollar Stores, Inc. | | 1,265 | | | 39,063 |

Foot Locker, Inc. | | 1,300 | | | 14,677 |

Gap, Inc. (The) | | 4,868 | | | 92,881 |

Genuine Parts Company | | 1,491 | | | 56,181 |

Home Depot, Inc. | | 15,502 | | | 434,211 |

J.C. Penney Company, Inc. | | 2,134 | | | 52,987 |

Kohl’s Corporation (a) | | 2,741 | | | 138,064 |

Limited Brands, Inc. | | 3,078 | | | 58,544 |

Lowe’s Companies, Inc. | | 13,514 | | | 292,578 |

Men’s Wearhouse, Inc. (The) | | 500 | | | 10,075 |

Netflix, Inc. (a) | | 526 | | | 32,744 |

Nordstrom, Inc. | | 2,057 | | | 71,049 |

Office Depot, Inc. (a) | | 2,500 | | | 14,200 |

Pep Boys — Manny, Moe & Jack (The) | | 300 | | | 2,505 |

RadioShack Corporation | | 1,200 | | | 23,424 |

Staples, Inc. | | 6,755 | | | 158,472 |

Target Corporation | | 6,970 | | | 357,352 |

Tiffany & Company | | 1,073 | | | 43,575 |

TJX Companies, Inc. | | 3,965 | | | 150,710 |

| | | | | |

| | | | | 2,760,822 |

| | | | | |

Household & Personal Products — 5.6% |

Alberto-Culver Company | | 992 | | | 28,163 |

Avon Products, Inc. | | 3,991 | | | 120,289 |

Church & Dwight Company, Inc. | | 634 | | | 38,224 |

Clorox Company | | 1,290 | | | 76,329 |

Colgate-Palmolive Company | | 4,584 | | | 366,858 |

Estee Lauder Companies, Inc. (The), Class A | | 1,099 | | | 57,719 |

Kimberly-Clark Corporation | | 3,837 | | | 227,879 |

Nu Skin Enterprises, Inc., Class A | | 500 | | | 11,620 |

Procter & Gamble Company | | 27,065 | | | 1,665,851 |

WD-40 Company | | 103 | | | 3,169 |

| | | | | |

| | | | | 2,596,101 |

| | | | | |

Healthcare Equipment & Services — 5.6% |

Baxter International, Inc. | | 5,583 | | | 321,525 |

Beckman Coulter, Inc. | | 636 | | | 41,575 |

| | | | | |

| | | SHARES | | VALUE |

| | | | | |

Healthcare Equipment & Services — (continued) |

Becton, Dickinson and Company | | 2,165 | | $ | 163,176 |

Cerner Corporation (a) | | 770 | | | 58,251 |

CIGNA Corporation | | 2,533 | | | 85,539 |

Cross Country Healthcare, Inc. (a) | | 200 | | | 1,812 |

Edwards Lifesciences Corporation (a) | | 500 | | | 44,810 |

Gen-Probe, Inc. (a) | | 491 | | | 21,079 |

Health Management Associates, Inc., Class A (a) | | 2,200 | | | 14,608 |

Henry Schein, Inc. (a) | | 880 | | | 47,564 |

Hill-Rom Holdings, Inc. | | 600 | | | 14,022 |

Hospira, Inc. (a) | | 1,509 | | | 76,416 |

Humana, Inc. (a) | | 1,493 | | | 72,590 |

Idexx Laboratories, Inc. (a) | | 538 | | | 28,240 |

IMS Health, Inc. | | 1,600 | | | 34,624 |

Intuitive Surgical, Inc. (a) | | 354 | | | 116,133 |

Invacare Corporation | | 300 | | | 7,512 |

McKesson Corporation | | 2,434 | | | 143,168 |

Medtronic, Inc. | | 10,227 | | | 438,636 |

Molina Healthcare, Inc. (a) | | 100 | | | 2,225 |

Patterson Companies, Inc. (a) | | 1,155 | | | 32,987 |

Quest Diagnostics, Inc. | | 1,690 | | | 94,082 |

St. Jude Medical, Inc. (a) | | 3,088 | | | 116,510 |

Stryker Corporation | | 2,779 | | | 144,286 |

Varian Medical Systems, Inc. (a) | | 1,205 | | | 60,599 |

WellPoint, Inc. (a) | | 4,235 | | | 269,854 |

Zimmer Holdings, Inc. (a) | | 2,007 | | | 113,034 |

| | | | | |

| | | | | 2,564,857 |

| | | | | |

Energy — 5.3% |

Apache Corporation | | 3,069 | | | 303,125 |

Cameron International Corporation (a) | | 2,205 | | | 83,040 |

Chesapeake Energy Corporation | | 6,000 | | | 148,680 |

Clean Energy Fuels Corporation (a) | | 200 | | | 3,348 |

Devon Energy Corporation | | 4,105 | | | 274,665 |

Diamond Offshore Drilling, Inc. | | 655 | | | 59,952 |

EOG Resources, Inc. | | 2,328 | | | 210,498 |

Helmerich & Payne, Inc. | | 953 | | | 39,864 |

Hess Corporation | | 2,997 | | | 173,197 |

National Oilwell Varco, Inc. | | 3,906 | | | 159,755 |

Newfield Exploration Company (a) | | 1,226 | | | 60,000 |

Noble Energy, Inc. | | 1,620 | | | 119,783 |

Pioneer Natural Resources Company | | 1,100 | | | 48,378 |

12

| | |

GREEN CENTURY EQUITY FUND PORTFOLIO OF INVESTMENTS January 31, 2010 (unaudited) | | continued |

| | | | | |

| | | SHARES | | VALUE |

| | | | | |

Energy — (continued) |

Quicksilver Resources, Inc. (a) | | 609 | | $ | 8,094 |

Smith International, Inc. | | 2,376 | | | 72,040 |

Southwestern Energy Company (a) | | 3,210 | | | 137,645 |

Spectra Energy Corporation | | 6,024 | | | 128,010 |

Ultra Petroleum Corporation (a) | | 1,339 | | | 61,514 |

Williams Companies, Inc. | | 5,375 | | | 112,015 |

XTO Energy, Inc. | | 5,356 | | | 238,717 |

| | | | | |

| | | | | 2,442,320 |

| | | | | |

Food & Beverage — 4.5% |

Campbell Soup Company | | 2,374 | | | 78,603 |

Darling International, Inc. (a) | | 552 | | | 4,300 |

Dean Foods Company (a) | | 1,664 | | | 29,336 |

Flowers Foods, Inc. | | 953 | | | 23,148 |

General Mills, Inc. | | 2,972 | | | 211,933 |

Green Mountain Coffee Roasters, Inc. (a) | | 385 | | | 32,656 |

H.J. Heinz Company | | 2,951 | | | 128,752 |

Hershey Company (The) | | 1,446 | | | 52,678 |

J. M. Smucker Company (The) | | 1,039 | | | 62,413 |

Kellogg Company | | 2,655 | | | 144,485 |

Kraft Foods, Inc., Class A | | 13,647 | | | 377,476 |

McCormick & Company, Inc. | | 1,150 | | | 41,745 |

PepsiCo, Inc. | | 14,388 | | | 857,813 |

Tootsie Roll Industries, Inc. | | 218 | | | 5,675 |

| | | | | |

| | | | | 2,051,013 |

| | | | | |

Capital Goods — 4.4% |

3M Company | | 6,525 | | | 525,197 |

A.O. Smith Corporation | | 252 | | | 10,730 |

AMETEK, Inc. | | 1,067 | | | 38,881 |

Apogee Enterprises, Inc. | | 300 | | | 4,128 |

Baldor Electric Company | | 400 | | | 9,872 |

Brady Corporation, Class A | | 450 | | | 12,717 |

CLARCOR, Inc. | | 450 | | | 14,571 |

Cooper Industries Ltd., Class A | | 1,552 | | | 66,581 |

Cummins, Inc. | | 1,794 | | | 81,017 |

Deere & Company | | 3,832 | | | 191,408 |

Donaldson Company, Inc. | | 712 | | | 27,227 |

EMCOR Group, Inc. (a) | | 600 | | | 14,436 |

Emerson Electric Company | | 6,976 | | | 289,783 |

Fastenal Company | | 1,426 | | | 59,151 |

Gardner Denver, Inc. | | 464 | | | 18,490 |

General Cable Corporation (a) | | 450 | | | 13,095 |

Graco, Inc. | | 554 | | | 14,786 |

| | | | | |

| | | SHARES | | VALUE |

| | | | | |

Capital Goods — (continued) |

Granite Construction, Inc. | | 429 | | $ | 13,248 |

Hubbell, Inc., Class B | | 500 | | | 21,530 |

Illinois Tool Works, Inc. | | 4,529 | | | 197,419 |

Kadant, Inc. (a) | | 100 | | | 1,522 |

Lincoln Electric Holdings, Inc. | | 421 | | | 20,557 |

Masco Corporation | | 3,300 | | | 44,748 |

Nordson Corporation | | 263 | | | 14,870 |

Owens Corning (a) | | 991 | | | 25,498 |

Pall Corporation | | 1,050 | | | 36,194 |

Quanta Services, Inc. (a) | | 1,811 | | | 32,996 |

Rockwell Automation, Inc. | | 1,294 | | | 62,423 |

Simpson Manufacturing Company, Inc. | | 300 | | | 7,398 |

Spirit Aerosystems Holdings, Inc. (a) | | 900 | | | 19,305 |

SPX Corporation | | 490 | | | 26,676 |

Tennant Company | | 150 | | | 3,590 |

Thomas & Betts Corporation (a) | | 521 | | | 17,589 |

Timken Company | | 948 | | | 21,245 |

W.W. Grainger, Inc. | | 693 | | | 68,801 |

Westinghouse Air Brake Technologies Corporation | | 429 | | | 16,444 |

| | | | | |

| | | | | 2,044,123 |

| | | | | |

Diversified Financials — 4.2% |

American Express Company | | 10,901 | | | 410,532 |

Bank of New York Mellon Corporation (The) | | 11,054 | | | 321,561 |

BlackRock, Inc. | | 187 | | | 39,984 |

Capital One Financial Corporation | | 4,069 | | | 149,983 |

Charles Schwab Corporation (The) | | 10,551 | | | 192,978 |

CME Group, Inc. | | 618 | | | 177,255 |

Franklin Resources, Inc. | | 1,606 | | | 159,042 |

Medallion Financial Corporation | | 100 | | | 803 |

Northern Trust Corporation | | 2,265 | | | 114,428 |

NYSE Euronext | | 2,456 | | | 57,495 |

PHH Corporation (a) | | 500 | | | 8,720 |

State Street Corporation | | 4,521 | | | 193,860 |

T. Rowe Price Group, Inc. | | 2,398 | | | 118,989 |

TradeStation Group, Inc. (a) | | 200 | | | 1,414 |

| | | | | |

| | | | | 1,947,044 |

| | | | | |

Semiconductors — 3.5% |

Advanced Micro Devices, Inc. (a) | | 6,183 | | | 46,125 |

Analog Devices, Inc. | | 2,587 | | | 69,746 |

13

| | |

GREEN CENTURY EQUITY FUND PORTFOLIO OF INVESTMENTS January 31, 2010 (unaudited) | | continued |

| | | | | |

| | | SHARES | | VALUE |

| | | | | |

Semiconductors — (continued) |

Entegris, Inc. (a) | | 800 | | $ | 2,912 |

Intel Corporation | | 51,128 | | | 991,883 |

Lam Research Corporation (a) | | 1,075 | | | 35,486 |

LSI Corporation (a) | | 5,700 | | | 28,443 |

Micron Technology, Inc. (a) | | 8,041 | | | 70,118 |

National Semiconductor Corporation | | 2,219 | | | 29,424 |

Novellus Systems, Inc. (a) | | 900 | | | 18,810 |

Texas Instruments, Inc. | | 11,655 | | | 262,237 |

Xilinx, Inc. | | 2,423 | | | 57,134 |

| | | | | |

| | | | | 1,612,318 |

| | | | | |

Transportation — 2.8% |

AMR Corporation (a) | | 3,445 | | | 23,839 |

Arkansas Best Corporation | | 200 | | | 4,508 |

C.H. Robinson Worldwide, Inc. | | 1,517 | | | 85,908 |

Continental Airlines, Inc., Class B (a) | | 1,223 | | | 22,491 |

CSX Corporation | | 3,583 | | | 153,567 |

Expeditors International of Washington, Inc. | | 1,965 | | | 67,007 |

FedEx Corporation | | 2,875 | | | 225,256 |

Genesee & Wyoming, Inc., Class A (a) | | 330 | | | 9,725 |

J.B. Hunt Transport Services, Inc. | | 907 | | | 27,809 |

JetBlue Airways Corporation (a) | | 2,453 | | | 12,118 |

Kansas City Southern (a) | | 774 | | | 22,988 |

Norfolk Southern Corporation | | 3,354 | | | 157,839 |

Ryder System, Inc. | | 500 | | | 18,200 |

Southwest Airlines Company | | 6,912 | | | 78,313 |

United Parcel Service, Inc., Class B | | 6,511 | | | 376,140 |

| | | | | |

| | | | | 1,285,708 |

| | | | | |

Food & Staples Retailing — 2.6% |

Costco Wholesale Corporation | | 3,989 | | | 229,089 |

CVS Caremark Corporation | | 13,033 | | | 421,878 |

Safeway, Inc. | | 3,755 | | | 84,300 |

Sysco Corporation | | 5,386 | | | 150,754 |

Walgreen Company | | 9,144 | | | 329,641 |

| | | | | |

| | | | | 1,215,662 |

| | | | | |

Materials — 2.5% |

Air Products & Chemicals, Inc. | | 1,971 | | | 149,717 |

Airgas, Inc. | | 577 | | | 24,384 |

Alcoa, Inc. | | 9,096 | | | 115,792 |

| | | | | |

| | | SHARES | | VALUE |

| | | | | |

Materials — (continued) |

Bemis Company, Inc. | | 892 | | $ | 25,030 |

Calgon Carbon Corporation (a) | | 400 | | | 5,356 |

Domtar Corporation (a) | | 408 | | | 19,817 |

Ecolab, Inc. | | 2,202 | | | 96,668 |

H.B. Fuller Company | | 400 | | | 8,008 |

Horsehead Holding Corporation (a) | | 313 | | | 3,067 |

Lubrizol Corporation | | 610 | | | 44,951 |

MeadWestvaco Corporation | | 1,550 | | | 37,308 |

Minerals Technologies, Inc. | | 150 | | | 7,170 |

Nalco Holding Company | | 1,300 | | | 30,654 |

Nucor Corporation | | 2,874 | | | 117,259 |

Praxair, Inc. | | 2,828 | | | 213,005 |

Rock-Tenn Company, Class A | | 291 | | | 12,423 |

Schnitzer Steel Industries, Inc., Class A | | 192 | | | 7,776 |

Sealed Air Corporation | | 1,400 | | | 27,776 |

Sigma-Aldrich Corporation | | 1,129 | | | 54,023 |

Sonoco Products Company | | 901 | | | 25,012 |

Valspar Corporation | | 900 | | | 23,832 |

Wausau Paper Corporation (a) | | 442 | | | 3,898 |

Weyerhaeuser Company | | 1,976 | | | 78,842 |

Worthington Industries, Inc. | | 889 | | | 12,864 |

| | | | | |

| | | | | 1,144,632 |

| | | | | |

Insurance — 2.4% | | | | | |

Aflac, Inc. | | 4,269 | | | 206,748 |

Chubb Corporation | | 3,156 | | | 157,800 |

Cincinnati Financial Corporation | | 1,470 | | | 38,793 |

Erie Indemnity Company | | 429 | | | 16,731 |

Hartford Financial Services Group, Inc. | | 3,497 | | | 83,893 |

Lincoln National Corporation | | 2,787 | | | 68,504 |

Phoenix Companies, Inc. (The) (a) | | 1,000 | | | 2,350 |

Principal Financial Group, Inc. | | 2,781 | | | 64,102 |

Progressive Corporation (The) | | 6,353 | | | 105,333 |

StanCorp Financial Group, Inc. | | 420 | | | 18,052 |

Travelers Companies, Inc. (The) | | 5,048 | | | 255,782 |

Unum Group | | 3,115 | | | 60,961 |

Wesco Financial Corporation | | 10 | | | 3,530 |

| | | | | |

| | | | | 1,082,579 |

| | | | | |

Telecommunication Services — 2.2% | | | |

Frontier Communications Corporation | | 2,900 | | | 22,069 |

Leap Wireless International, Inc. (a) | | 482 | | | 6,358 |

MetroPCS Communications, Inc. (a) | | 2,678 | | | 15,077 |

14

| | |

GREEN CENTURY EQUITY FUND PORTFOLIO OF INVESTMENTS January 31, 2010 (unaudited) | | continued |

| | | | | |

| | | SHARES | | VALUE |

| | | | | |

Telecommunication Services — (continued) |

Qwest Communications International, Inc. | | 15,161 | | $ | 63,828 |

Sprint Nextel Corporation (a) | | 27,633 | | | 90,636 |

Verizon Communications, Inc. | | 26,199 | | | 770,775 |

Windstream Corporation | | 3,762 | | | 38,786 |

| | | | | |

| | | | | 1,007,529 |

| | | | | |

Consumer Services — 2.0% | | | | | |

Capella Education Company (a) | | 128 | | | 9,393 |

Choice Hotels International, Inc. | | 638 | | | 20,250 |

Darden Restaurants, Inc. | | 1,371 | | | 50,672 |

DeVry, Inc. | | 674 | | | 41,154 |

McDonald’s Corporation | | 9,972 | | | 622,552 |

Peet’s Coffee & Tea, Inc. (a) | | 122 | | | 3,989 |

Starbucks Corporation (a) | | 6,826 | | | 148,739 |

| | | | | |

| | | | | 896,749 |

| | | | | |

Consumer Durables & Apparel — 1.6% |

Black & Decker Corporation | | 543 | | | 35,110 |

Coach, Inc. | | 2,984 | | | 104,082 |

Deckers Outdoor Corporation (a) | | 100 | | | 9,817 |

Eastman Kodak Company (a) | | 2,434 | | | 14,726 |

Harman International Industries, Inc. | | 627 | | | 22,290 |

KB Home | | 941 | | | 14,378 |

Leggett & Platt, Inc. | | 1,400 | | | 25,564 |

Liz Claiborne, Inc. (a) | | 900 | | | 4,383 |

Mattel, Inc. | | 3,362 | | | 66,299 |

NIKE, Inc., Class B | | 2,696 | | | 171,870 |

Phillips-Van Heusen Corporation | | 500 | | | 19,645 |

Pulte Homes, Inc. (a) | | 3,535 | | | 37,188 |

Snap-On, Inc. | | 500 | | | 20,440 |

Stanley Works (The) | | 686 | | | 35,158 |

Timberland Company (The), Class A (a) | | 400 | | | 6,880 |

Tupperware Brands Corporation | | 600 | | | 25,476 |

Under Armour, Inc., Class A (a) | | 250 | | | 6,350 |

VF Corporation | | 1,031 | | | 74,263 |

Whirlpool Corporation | | 679 | | | 51,047 |

| | | | | |

| | | | | 744,966 |

| | | | | |

Media — 1.6% | | | | | |

Discovery Communications, Inc., Class A (a) | | 1,203 | | | 35,681 |

John Wiley & Sons, Inc., Class A | | 436 | | | 18,203 |

| | | | | |

| | | SHARES | | VALUE |

| | | | | |

Media — (continued) | | | | | |

New York Times Company (The), Class A (a) | | 1,313 | | $ | 16,964 |

Omnicom Group, Inc. | | 2,898 | | | 102,299 |

Scholastic Corporation | | 200 | | | 5,980 |

Virgin Media, Inc. | | 3,157 | | | 44,798 |

Walt Disney Company (The) | | 17,152 | | | 506,842 |

Washington Post Company (The), Class B | | 25 | | | 10,865 |

| | | | | |

| | | | | 741,632 |

| | | | | |

Utilities — 1.5% | | | | | |

AGL Resources, Inc. | | 700 | | | 24,703 |

Alliant Energy Corporation | | 1,000 | | | 31,200 |

Atmos Energy Corporation | | 800 | | | 22,096 |

Avista Corporation | | 500 | | | 10,190 |

Cleco Corporation | | 500 | | | 12,960 |

Consolidated Edison, Inc. | | 2,566 | | | 112,237 |

Energen Corporation | | 649 | | | 28,524 |

EQT Corporation | | 1,112 | | | 48,950 |

IDACORP, Inc. | | 400 | | | 12,540 |

MGE Energy, Inc. | | 201 | | | 6,719 |

National Fuel Gas Company | | 750 | | | 35,190 |

New Jersey Resources Corporation | | 400 | | | 14,596 |

Nicor, Inc. | | 400 | | | 16,208 |

NiSource, Inc. | | 2,500 | | | 35,625 |

Northeast Utilities | | 1,619 | | | 40,993 |

Northwest Natural Gas Company | | 243 | | | 10,539 |

NSTAR | | 978 | | | 33,585 |

OGE Energy Corporation | | 964 | | | 34,916 |

Pepco Holdings, Inc. | | 1,954 | | | 32,085 |

Piedmont Natural Gas Company, Inc. | | 630 | | | 16,172 |

Portland General Electric Company | | 815 | | | 15,892 |

Questar Corporation | | 1,559 | | | 64,667 |

UGI Corporation | | 974 | | | 23,873 |

WGL Holdings, Inc. | | 450 | | | 14,278 |

| | | | | |

| | | | | 698,738 |

| | | | | |

Renewable Energy & Energy Efficiency — 1.2% |

American Superconductor Corporation (a) | | 372 | | | 14,143 |

Applied Materials, Inc. | | 12,433 | | | 151,434 |

Calpine Corporation (a) | | 2,973 | | | 32,554 |

Cree, Inc. (a) | | 985 | | | 55,071 |

Energy Conversion Devices, Inc. (a) | | 450 | | | 4,100 |

15

| | |

GREEN CENTURY EQUITY FUND PORTFOLIO OF INVESTMENTS January 31, 2010 (unaudited) | | concluded |

| | | | | |

| | | SHARES | | VALUE |

| | | | | |

Renewable Energy & Energy Efficiency — (continued) |

First Solar, Inc. (a) | | 575 | | $ | 65,147 |

ITC Holdings Corporation | | 443 | | | 23,798 |

Itron, Inc. (a) | | 411 | | | 25,293 |

Johnson Controls, Inc. | | 6,183 | | | 172,073 |

Ormat Technologies, Inc. | | 164 | | | 5,645 |

SunPower Corporation, Class A (a) | | 538 | | | 10,970 |

Zoltek Companies, Inc. (a) | | 250 | | | 2,088 |

| | | | | |

| | | | | 562,316 |

| | | | | |

Commercial & Professional Services — 0.7% |

Avery Dennison Corporation | | 1,016 | | | 33,030 |

Deluxe Corporation | | 450 | | | 8,375 |

Herman Miller, Inc. | | 500 | | | 8,445 |

HNI Corporation | | 400 | | | 10,008 |

Interface, Inc., Class A | | 400 | | | 3,244 |

Kelly Services, Inc. (a) | | 200 | | | 2,624 |

Knoll, Inc. | | 420 | | | 4,729 |

Manpower, Inc. | | 723 | | | 37,444 |

Monster Worldwide, Inc. (a) | | 1,150 | | | 17,929 |

Pitney Bowes, Inc. | | 2,040 | | | 42,677 |

R.R. Donnelley & Sons Company | | 1,850 | | | 36,667 |

Robert Half International, Inc. | | 1,400 | | | 37,688 |

Steelcase, Inc. | | 500 | | | 3,540 |

Stericycle, Inc. (a) | | 766 | | | 40,544 |

Team, Inc. (a) | | 100 | | | 1,784 |

Tetra Tech, Inc. (a) | | 552 | | | 12,497 |

| | | | | |

| | | | | 301,225 |

| | | | | |

Real Estate — 0.6% | | | | | |

AMB Property Corporation | | 1,295 | | | 31,080 |

Boston Properties, Inc. | | 1,285 | | | 83,358 |

CB Richard Ellis Group, Inc., Class A (a) | | 2,574 | | | 31,660 |

Forest City Enterprises, Inc., Class A (a) | | 1,339 | | | 15,144 |

Jones Lang LaSalle, Inc. | | 323 | | | 18,414 |

Liberty Property Trust | | 1,110 | | | 33,744 |

ProLogis | | 4,234 | | | 53,348 |

Regency Centers Corporation | | 809 | | | 27,094 |

| | | | | |

| | | | | 293,842 |

| | | | | |

| | | | | | |

| | | SHARES | | VALUE | |

| | | | | | |

Automobiles & Components — 0.2% | |

BorgWarner, Inc. (a) | | 1,150 | | $ | 40,354 | |

Harley-Davidson, Inc. | | 2,166 | | | 49,255 | |

Modine Manufacturing Company (a) | | 200 | | | 1,902 | |

WABCO Holdings, Inc. | | 564 | | | 14,579 | |

| | | | | | |

| | | | | 106,090 | |

| | | | | | |

Healthy Living — 0.1% | | | | |

Hain Celestial Group, Inc. (The) (a) | | 350 | | | 5,596 | |

United Natural Foods, Inc. (a) | | 400 | | | 10,844 | |

Whole Foods Market, Inc. (a) | | 1,250 | | | 34,025 | |

| | | | | | |

| | | | | 50,465 | |

| | | | | | |

Total Securities

(Cost $48,006,495) | | | | | 45,924,340 | |

| | | | | | |

SHORT-TERM OBLIGATION — 0.5% | |

Repurchase Agreement—

State Street Bank & Trust

Repurchase Agreement,

0.01%, dated 01/29/10,

due 02/01/10, proceeds $241,528

(collateralized by Federal Home

Loan Bank, 4.375%, due 09/17/2010, value $249,936)

(Cost $241,528) | | | | | 241,528 | |

| | | | | | |

TOTAL INVESTMENTS (b) — 100.2% | |

(Cost $48,248,023) | | | | | 46,165,868 | |

Liabilities Less Other Assets — (0.2)% | | | | | (90,088 | ) |

| | | | | | |

NET ASSETS — 100.0% | | | | $ | 46,075,780 | |

| | | | | | |

| (a) | Non-income producing security. |

| (b) | The cost of investments for federal income tax purposes is $49,656,706 resulting in gross unrealized appreciation and depreciation of $3,723,541 and $7,214,379 respectively, or net unrealized depreciation of $3,490,838. |

See Notes to Financial Statements

16

GREEN CENTURY FUNDS STATEMENTS OF ASSETS AND LIABILITIES

January 31, 2010

(unaudited)

| | | | | | | | |

| | | BALANCED FUND | | | EQUITY FUND | |

ASSETS: | | | | | | | | |

Investments, at value (cost $47,589,177 and $48,248,023 respectively) | | $ | 50,346,882 | | | $ | 46,165,868 | |

Receivables for: | | | | | | | | |

Capital stock sold | | | 1,852 | | | | 4,522 | |

Interest | | | 147,494 | | | | — | |

Dividends | | | 33,929 | | | | 46,826 | |

| | | | | | | | |

Total assets | | | 50,530,157 | | | | 46,217,216 | |

| | | | | | | | |

LIABILITIES: | | | | | | | | |

Payable for securities purchased | | | — | | | | 94,420 | |

Payable for capital stock repurchased | | | 34,896 | | | | 9,498 | |

Accrued expenses | | | 60,743 | | | | 37,518 | |

| | | | | | | | |

Total liabilities | | | 95,639 | | | | 141,436 | |

| | | | | | | | |

NET ASSETS | | $ | 50,434,518 | | | $ | 46,075,780 | |

| | | | | | | | |

NET ASSETS CONSIST OF: | | | | | | | | |

Paid-in capital | | $ | 66,184,749 | | | $ | 55,171,178 | |

Undistributed net investment income | | | 34,198 | | | | 13,855 | |

Accumulated net realized losses on investments | | | (18,542,115 | ) | | | (7,027,098 | ) |

Net unrealized appreciation (depreciation) on investments | | | 2,757,686 | | | | (2,082,155 | ) |

| | | | | | | | |

NET ASSETS | | $ | 50,434,518 | | | $ | 46,075,780 | |

| | | | | | | | |

SHARES OUTSTANDING | | | 3,263,054 | | | | 2,673,910 | |

| | | | | | | | |

NET ASSET VALUE, REDEMPTION PRICE AND OFFERING PRICE PER SHARE | | $ | 15.46 | | | $ | 17.23 | |

| | | | | | | | |

GREEN CENTURY FUNDS STATEMENTS OF OPERATIONS

For the six-months ended January 31, 2010

(unaudited)

| | | | | | | | |

| | | BALANCED FUND | | | EQUITY FUND | |

INVESTMENT INCOME: | | | | | | | | |

Interest income | | $ | 377,175 | | | $ | 12 | |

Dividend and other income (net of $4,735 and $71 foreign withholding taxes, respectively) | | | 243,658 | | | | 421,210 | |

| | | | | | | | |

Total investment income | | | 620,833 | | | | 421,222 | |

| | | | | | | | |

EXPENSES: | | | | | | | | |

Administrative services fee | | | 184,178 | | | | 162,318 | |

Investment advisory fee | | | 163,970 | | | | 57,961 | |

| | | | | | | | |

Total expenses | | | 348,148 | | | | 220,279 | |

| | | | | | | | |

NET INVESTMENT INCOME | | | 272,685 | | | | 200,943 | |

| | | | | | | | |

NET REALIZED AND UNREALIZED GAINS (LOSSES): | | | | | | | | |

Net realized losses on investments: | | | (924,821 | ) | | | (859,128 | ) |

Change in net unrealized appreciation on investments: | | | 3,225,408 | | | | 5,140,787 | |

| | | | | | | | |

NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS | | | 2,300,587 | | | | 4,281,659 | |

| | | | | | | | |

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 2,573,272 | | | $ | 4,482,602 | |

| | | | | | | | |

See Notes to Financial Statements

17

GREEN CENTURY FUNDS STATEMENTS OF CHANGES IN NET ASSETS

| | | | | | | | | | | | | | | | |

| | | BALANCED FUND | | | EQUITY FUND | |

| | | FOR THE

SIX MONTHS ENDED

JANUARY 31, 2010

(UNAUDITED) | | | FOR THE

YEAR ENDED

JULY 31, 2009

(AUDITED) | | | FOR THE

SIX MONTHS ENDED

JANUARY 31, 2010

(UNAUDITED) | | | FOR THE

YEAR ENDED

JULY 31, 2009

(AUDITED) | |

INCREASE (DECREASE) IN NET ASSETS: | | | | | | | | | | | | | | | | |

| From operations: | | | | | | | | | | | | | | | | |

Net investment income | | $ | 272,685 | | | $ | 864,319 | | | $ | 200,943 | | | $ | 522,974 | |

Net realized losses on investments | | | (924,821 | ) | | | (5,067,782 | ) | | | (859,128 | ) | | | (5,948,753 | ) |

Change in net unrealized appreciation (depreciation) on Investments | | | 3,225,408 | | | | (416,403 | ) | | | 5,140,787 | | | | (2,464,633 | ) |

| | | | | | | | | | | | | | | | |

Net increase (decrease) in net assets resulting from operations | | | 2,573,272 | | | | (4,619,866 | ) | | | 4,482,602 | | | | (7,890,412 | ) |

| | | | | | | | | | | | | | | | |

| Dividends and distributions to shareholders: | | | | | | | | | | | | | | | | |

From net investment income | | | (293,473 | ) | | | (871,482 | ) | | | (204,589 | ) | | | (552,199 | ) |

From net realized gains | | | — | | | | — | | | | — | | | | (11,945 | ) |

| | | | | | | | | | | | | | | | |

Total dividends and distributions | | | (293,473 | ) | | | (871,482 | ) | | | (204,589 | ) | | | (564,144 | ) |

| | | | | | | | | | | | | | | | |

| Capital share transactions: | | | | | | | | | | | | | | | | |

Proceeds from sales of shares | | | 1,741,831 | | | | 4,227,112 | | | | 4,257,407 | | | | 6,772,566 | |

Reinvestment of dividends and distributions | | | 287,026 | | | | 849,276 | | | | 201,951 | | | | 558,869 | |

Payments for shares redeemed | | | (1,978,662 | ) | | | (4,183,887 | ) | | | (3,320,258 | ) | | | (8,340,909 | ) |

| | | | | | | | | | | | | | | | |

Net increase (decrease) in net assets resulting from capital share transactions | | | 50,195 | | | | 892,501 | | | | 1,139,100 | | | | (1,009,474 | ) |

| | | | | | | | | | | | | | | | |

Total increase (decrease) in net assets | | | 2,329,994 | | | | (4,598,847 | ) | | | 5,417,113 | | | | (9,464,030 | ) |

NET ASSETS: | | | | | | | | | | | | | | | | |

Beginning of period | | | 48,104,524 | | | | 52,703,371 | | | | 40,658,667 | | | | 50,122,697 | |

| | | | | | | | | | | | | | | | |

End of period | | $ | 50,434,518 | | | $ | 48,104,524 | | | $ | 46,075,780 | | | $ | 40,658,667 | |

| | | | | | | | | | | | | | | | |

Undistributed net investment income | | | 34,198 | | | | 54,986 | | | | 13,855 | | | | 17,501 | |

See Notes to Financial Statements

18

GREEN CENTURY BALANCED FUND FINANCIAL HIGHLIGHTS

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | SIX MONTHS ENDED

JANUARY 31, 2010 | | | FOR THE YEARS ENDED JULY 31, | |

| | | (UNAUDITED) | | | 2009 | | | 2008 | | | 2007 | | | 2006 | | | 2005 | |

Net Asset Value, beginning of period | | $ | 14.75 | | | $ | 16.52 | | | $ | 17.78 | | | $ | 16.29 | | | $ | 16.52 | | | $ | 14.11 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Income from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.08 | | | | 0.27 | | | | 0.28 | | | | 0.22 | | | | 0.03 | | | | 0.05 | |

Net realized and unrealized gain (loss) on investments | | | 0.72 | | | | (1.77 | ) | | | (1.27 | ) | | | 1.48 | | | | (0.23 | ) | | | 2.42 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total increase (decrease) from investment operations | | | 0.80 | | | | (1.50 | ) | | | (0.99 | ) | | | 1.70 | | | | (0.20 | ) | | | 2.47 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Less dividends: | | | | | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | (0.09 | ) | | | (0.27 | ) | | | (0.27 | ) | | | (0.21 | ) | | | (0.03 | ) | | | (0.06 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net Asset Value, end of period | | $ | 15.46 | | | $ | 14.75 | | | $ | 16.52 | | | $ | 17.78 | | | $ | 16.29 | | | $ | 16.52 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total return | | | 5.41 | %(a) | | | (8.88 | )% | | | (5.62 | )% | | | 10.40 | % | | | (1.22 | )% | | | 17.41 | % |

| Ratios/Supplemental data: | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (in 000’s) | | $ | 50,435 | | | $ | 48,105 | | | $ | 52,703 | | | $ | 51,754 | | | $ | 50,230 | | | $ | 62,449 | |

Ratio of expenses to average net assets | | | 1.38 | %(b) | | | 1.38 | % | | | 1.38 | % | | | 1.44 | % | | | 2.39 | % | | | 2.38 | % |

Ratio of net investment income to average net assets | | | 1.08 | %(b) | | | 1.97 | % | | | 1.50 | % | | | 1.24 | % | | | 0.15 | % | | | 0.35 | % |

Portfolio turnover | | | 13 | %(a) | | | 33 | % | | | 44 | % | | | 35 | % | | | 110 | % | | | 86 | % |

GREEN CENTURY EQUITY FUND FINANCIAL HIGHLIGHTS

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | SIX MONTHS ENDED

JANUARY 31, 2010 | | | FOR THE YEARS ENDED JULY 31, | |

| | | (UNAUDITED) | | | 2009 | | | 2008 | | | 2007 | | | 2006 | | | 2005 | |

Net Asset Value, beginning of period | | $ | 15.65 | | | $ | 18.83 | | | $ | 22.66 | | | $ | 19.91 | | | $ | 19.91 | | | $ | 18.18 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Income from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.08 | | | | 0.21 | | | | 0.18 | | | | 0.19 | | | | 0.04 | | | | 0.12 | |

Net realized and unrealized gain (loss) on investments | | | 1.58 | | | | (3.17 | ) | | | (2.81 | ) | | | 2.75 | | | | (0.01 | ) | | | 1.72 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total increase (decrease) from investment operations | | | 1.66 | | | | (2.96 | ) | | | (2.63 | ) | | | 2.94 | | | | 0.03 | | | | 1.84 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Less dividends: | | | | | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | (0.08 | ) | | | (0.22 | ) | | | (0.19 | ) | | | (0.19 | ) | | | (0.03 | ) | | | (0.11 | ) |

Distributions from net realized gains | | | — | | | | — | (c) | | | (1.01 | ) | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total decrease from dividends | | | (0.08 | ) | | | (0.22 | ) | | | (1.20 | ) | | | (0.19 | ) | | | (0.03 | ) | | | (0.11 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net Asset Value, end of period | | $ | 17.23 | | | $ | 15.65 | | | $ | 18.83 | | | $ | 22.66 | | | $ | 19.91 | | | $ | 19.91 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total return | | | 10.56 | %(a) | | | (15.58 | )% | | | (12.28 | )% | | | 14.76 | % | | | 0.16 | % | | | 10.10 | % |

| Ratios/Supplemental data: | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (in 000’s) | | $ | 46,076 | | | $ | 40,659 | | | $ | 50,123 | | | $ | 42,232 | | | $ | 32,938 | | | $ | 35,383 | |

Ratio of expenses to average net assets | | | 0.95 | %(b) | | | 0.95 | % | | | 0.95 | % | | | 0.95 | % | | | 1.50 | % | | | 1.50 | % |

Ratio of net investment income to average net assets | | | 0.87 | %(b) | | | 1.38 | % | | | 0.98 | % | | | 0.89 | % | | | 0.20 | % | | | 0.64 | % |

Portfolio turnover | | | 9 | %(a) | | | 23 | % | | | 6 | % | | | 8 | %(d) | | | 12 | %(e) | | | 9 | %(e) |

| (c) | Amount represents less than 0.005 per share. |

| (d) | Represents portfolio turnover for the Equity Fund from November 28, 2006 to July 31, 2007. Porfolio turnover for the Domini Trust from August 1, 2006 to November 27, 2006 was 1%. For further information regarding the withdrawal of the Equity Fund’s investment in the Domini Trust, please see the notes to the financial statements. |

| (e) | Represents portfolio turnover for the Domini Social Equity Trust (“Domini Trust”) for the years ended 2006 and 2005. |

See Notes to Financial Statements

19

GREEN CENTURY FUNDS NOTES TO FINANCIAL STATEMENTS

(unaudited)

NOTE 1 — Organization and Significant Accounting Policies

Green Century Funds (the “Trust”) is a Massachusetts business trust which offers two separate series, the Green Century Balanced Fund (the “Balanced Fund”) and the Green Century Equity Fund (the “Equity Fund”), collectively, the “Funds”. The Trust is registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company. The Trust accounts separately for the assets, liabilities and operations of each series. The Balanced Fund commenced operations on March 18, 1992 and the Equity Fund commenced operations on September 13, 1995.

Through November 27, 2006, the Equity Fund invested substantially all of its assets in the Domini Social Equity Trust (the “Domini Trust”), an open-end, diversified management investment company which had the same investment objective as the Fund. The Equity Fund accounted for its investment in the Domini Trust as a partnership investment and recorded its share of the Domini Trust income, expenses and realized and unrealized gains and losses daily. The value of such investment reflected the Fund’s proportionate interest in the net assets of the Domini Trust (2.57% at November 27, 2006). Effective November 28, 2006, the Equity Fund withdrew its investment from the Domini Trust and directly invested in the securities of the companies included in the FTSE KLD 400 Social Index, formerly the Domini 400 SocialSM Index (the “Index”).

The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

The following is a summary of the Funds’ significant accounting policies:

| | (A) | Investment Valuation: Equity securities listed on national securities exchanges other than NASDAQ are valued at last sale price. If a last sale price is not available, securities listed on national exchanges other than NASDAQ are valued at the mean between the closing bid and closing ask prices. NASDAQ National Market® and SmallCapSM securities are valued at the NASDAQ Official Closing Price (“NOCP”). The NOCP is based on the last traded price if it falls within the concurrent best bid and ask prices and is normalized pursuant to NASDAQ’s published procedures if it falls outside this range. If a NOCP is not available for any such security, the security is valued at the last sale price, or, if there have been no sales that day, at the mean between the closing bid and closing ask prices. Unlisted equity securities are valued at last sale price, or when last sale prices are not available, at the last quoted bid price. Debt securities (other than certificates of deposit and short-term obligations maturing in sixty days or less) are valued on the basis of valuations furnished by a pricing service which takes into account appropriate factors such as institution-size trading in similar groups of securities, yield, quality, coupon rate, maturity, type of issue, and other market data, without exclusive reliance on quoted prices or exchange or over-the-counter prices, since such valuations are believed to reflect more accurately the fair value of the securities. Securities, if any, for which there are no such valuations or quotations available, or for which the market quotation is not reliable, are valued at fair value by management as determined in good faith under guidelines established by the Trustees. Certificates of deposit are valued at cost plus accrued interest. Short-term obligations maturing in sixty days or less are valued at amortized cost, which approximate market value. |

20

| | |

GREEN CENTURY FUNDS NOTES TO FINANCIAL STATEMENTS (unaudited) | | continued |

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below:

Level 1 — quoted prices for active markets for identical securities. An active market for the security is a market in which transactions occur with sufficient frequency and volume to provide pricing information on an ongoing basis. A quoted price in an active market provides the most reliable evidence of fair value.

Level 2 — other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) Quoted prices for identical or similar assets in markets that are not active. Inputs that are derived principally from or corroborated by observable market data. An adjustment to any observable input that is significant to the fair value may render the measurement a Level 3 measurement.

Level 3 — significant unobservable inputs, including the Fund’s own assumptions in determining the fair value of investments.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used to value the Balanced Fund’s net assets as of January 31, 2010:

| | | | | | | | |

| | | LEVEL 1 —

QUOTED PRICES | | LEVEL 2 — OTHER

SIGNIFICANT

OBSERVABLE

INPUTS | | LEVEL 3 —

SIGNIFICANT

UNOBSERVABLE

INPUTS | | TOTAL |

COMMON STOCKS* | | $32,322,906 | | $ — | | $ — | | $32,322,906 |

CORPORATE BONDS & NOTES | | — | | 11,643,713 | | — | | 11,643,713 |

U.S. GOVERNMENT AGENCIES | | — | | 4,774,035 | | — | | 4,774,035 |

CERTIFICATES OF DEPOSIT | | — | | 190,025 | | — | | 190,025 |

SHORT-TERM OBLIGATION | | — | | 1,416,203 | | — | | 1,416,203 |

| | | | | | | | |

TOTAL | | $32,322,906 | | $18,023,976 | | $ — | | $50,346,882 |

| | | | | | | | |

* All sub-categories within common stocks represent level 1 evaluation status.

The following is a summary of the inputs used to value the Equity Fund’s net assets as of January 31, 2010:

| | | | | | | | |

| | | LEVEL 1 —

QUOTED PRICES | | LEVEL 2 — OTHER

SIGNIFICANT

OBSERVABLE

INPUTS | | LEVEL 3 —

SIGNIFICANT

UNOBSERVABLE

INPUTS | | TOTAL |

COMMON STOCKS* | | $45,924,340 | | $ — | | $ — | | $45,924,340 |

SHORT-TERM OBLIGATION | | — | | 241,528 | | — | | 241,528 |

| | | | | | | | |

TOTAL | | $45,924,340 | | $241,528 | | $ — | | $46,165,868 |

| | | | | | | | |

* All sub-categories within common stocks represent level 1 evaluation status.

21

| | |

GREEN CENTURY FUNDS NOTES TO FINANCIAL STATEMENTS (unaudited) | | continued |

In preparing these financial statements, management has evaluated events and transactions for potential recognition or disclosure through the date on which the financial statements were issued.