UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-06351

Green Century Funds

114 State Street

Suite 200

Boston, MA 02109

(Address of principal executive offices)

Green Century Capital Management, Inc.

114 State Street

Suite 200

Boston, MA 02109

(Name and address of agent for service)

Registrant’s telephone number, including area code: (617) 482-0800

Date of fiscal year end: July 31

Date of reporting period: July 31, 2012

| Item 1. | Reports to Stockholders |

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1)

| ANNUAL REPORT Green Century Balanced Fund Green Century Equity Fund July 31, 2012 |

An investment for your future.®114 State Street, Boston, Massachusetts 02109

For information on the Green Century Funds®, call 1-800-93-GREEN. For information on how to open an account and account services, call 1-800-221-5519 8:00 am to 6:00 pm Eastern Time, Monday through Friday. For share price and account information, call 1-800-221-5519, twenty-four hours a day.

Dear Green Century Funds Shareholder:

Over twenty-one years ago, a partnership of non-profit environmental advocacy organizations founded our family of no-load environmentally responsible mutual funds to serve investors who care about a clean, healthy planet. The Funds’ administrator, Green Century Capital Management, Inc. (Green Century), has sustained consistent goals over the past two decades:

| • | Investing in sustainable leaders and rejecting laggards. We search for companies leading the way toward a more sustainable future, while avoiding those which hold us back. We believe a company doesn’t necessarily need to make solar panels to contribute to a green future; we also invest in companies that meet our rigorous sustainability standards in various industries. |

| • | Acting on your values. We use the clout of your investment dollars to encourage companies to be more environmentally responsible, advocating for improved corporate environmental practices and a greener future. |

| • | Supporting advocacy. By investing with the Green Century Funds, you support the advocacy groups that founded and own Green Century. These organizations have a long history of winning battles to clean up our environment, improve public health and protect consumer rights. |

Managing the Green Century Equity Fund and the Green Century Balanced Fund to seek competitive returns is our core business. For a detailed discussion of the Funds’ portfolios, investment strategies and performance please see our Management Discussion on the following pages.

Also key to our mission is our work to enhance shareholder value and build a sustainable economy by advocating that corporations act more responsibly. Green Century believes that sustainable business practices should be built on policies that serve the environment and the broader public good, not just short-term business goals. While attention to environmental issues is critical, effective corporate governance and accountability within a company are also necessary to ensure legitimate corporate sustainability. In this important presidential election year, that also means holding corporations accountable for their political contributions. This year, we are building on our long track record of successful advocacy campaigns by working to protect shareholder value from reckless corporate political spending.

Stop the spending. Over two years have passed since the Supreme Court’s Citizens United decision reversed the long standing prohibition on the use of corporate treasury funds for political purposes – and the floodgates are open. In this election year, the implications of such spending on our democracy are inescapable. At the same time, there is growing concern that such funds, which can be funneled to SuperPACS, trade associations and other organizations for political use, often without proper oversight or board and shareholder knowledge, could create a risk to shareholder value.

Over the past few years, Green Century has filed two dozen shareholder proposals urging companies to increase transparency and ensure proper management of their political contributions and lobby

expenditures. We believe shareholders have the right and responsibility to understand how their dollars are being spent in efforts that influence both elections and public policy. This year, we raised the stakes.

Target1, 3M1, and Bank of America1 are prime examples of companies whose political contributions may not be in the best interest of shareholders. In 2010, Target made a $150,000 contribution to MN Forward, a group supporting a gubernatorial candidate in Minnesota whose views were contradictory to Target’s corporate policies. Following the donation, the company experienced boycotts, public backlash and degradation of employee morale. 3M continued to support the same candidate even after the uproar. At Bank of America, shareholders are concerned that continued political spending could expose the company’s already-battered brand to further risk, given its sizable “political footprint.” Each company has experienced firsthand the impact that controversial contributions can have on the company’s reputation and workforce morale, demonstrating that such spending can result in significant business risk.

As a result, Green Century and Trillium Asset Management (Trillium), the subadviser to the Green Century Balanced Fund, partnered to break new ground this spring by being the first institutional investors to challenge companies to refrain entirely from political spending. Green Century filed the proposal at Target, and Trillium filed it at Bank of America and 3M.

Green Century continues to create significant impact and positive change for our investors, finding innovative strategies that tackle the most relevant issues that threaten the planet as well as shareholder value – and, in this case, democracy.

Proxy voting for the environment. Green Century not only files shareholder resolutions at public companies to bring about positive change for the environment, we also vote the proxy ballots of the nearly 500 companies held by the Funds. Our votes consistently support resolutions related to protecting the environment. Green Century does so not only to act on the values of the Funds’ investors, but because managing environmental risks is a critical component of our strategy to seek long-term total returns.

A report recently released by Ceres – a network of investors, companies and public interest groups dedicated to expanding sustainable business practices – details the poor proxy voting records of the largest mutual fund companies on the issue of climate change. Of the 44 largest U.S. fund companies, market leaders Fidelity, Vanguard and American Funds ranked 40th, 42nd and dead last, respectively, on their support for resolutions on climate change in 2011. Green Century Capital Management voted in favor of 100% of resolutions that call for increased climate impact disclosure and better climate change management in the 2011 proxy season, and is on track to do so again in 2012.

Thank you for your investment in the Green Century Funds.

Respectfully,

Green Century Capital Management

2

Green Century on the Web

E-News. For more regular updates on the Green Century Funds and on our advocacy efforts, please consider signing up for our e-newsletter. Visit: www.greencentury.com/news/signup, email info@greencentury.com or call 1-800-93-GREEN.

Online Access. Information on your account is available on our website at www.greencentury.com. From the home page, click on Access My Account. Shareholders may also perform online transactions on the site. While there, please consider registering for e-delivery of your statements and other fund documents.

Twitter. As of this summer, Green Century is now on Twitter. Follow us at Twitter.com/Green__Century for a sustainable investor’s perspective on critical issues.

The Green Century Funds’ proxy voting guidelines and a record of the Funds’ proxy votes for the year ended June 30, 2012 are available without charge, upon request, (i) at www.greencentury.com, (ii) by calling 1-800-93-GREEN, (iii) by sending an e-mail to info@greencentury.com, and (iv) on the Securities and Exchange Commission’s website at www.sec.gov.

The Green Century Funds file their complete schedule of portfolio holdings with the SEC for the first and third quarters of the year on Form N-Q. The Green Century Funds’ Forms N-Q are available on the EDGAR database on the SEC’s website at www.sec.gov. These Forms may also be reviewed and copied at the SEC’s Public Reference Room in Washington D.C. Information about the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330. The information on Form N-Q may also be obtained by calling 1-800-93-GREEN, or by e-mailing a request to info@greencentury.com.

3

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (unaudited)

GREEN CENTURY BALANCED FUND

Investment Objective The Green Century Balanced Fund seeks capital growth and income from a diversified portfolio of stocks and bonds that meet Green Century’s standards for corporate environmental responsibility.

Portfolio Orientation As of the fiscal year ended July 31, 2012, the Green Century Balanced Fund (the Balanced Fund or the Fund) was diversified in a number of ways. Equity holdings represented 68.7% and bonds constituted 28.8% of the Fund’s net asset value. The Fund also held 0.1% of its net assets in community investment certificates of deposit and had 2.4% invested in cash, cash equivalents and other assets less liabilities. The portfolio managers view equities as the primary source of potential long-term growth, while emphasizing the importance of diversification in seeking to lower volatility. The Fund’s equity holdings were diversified across 60 equity holdings at fiscal year-end, none of which represented more than 3.0% of total net assets. Generally, larger, less-volatile companies constituted larger positions in the Fund’s portfolio than smaller companies. The portfolio managers seek to mitigate risk by investing primarily in companies they believe have demonstrated records of profitability, above-average growth prospects and reasonable valuations.

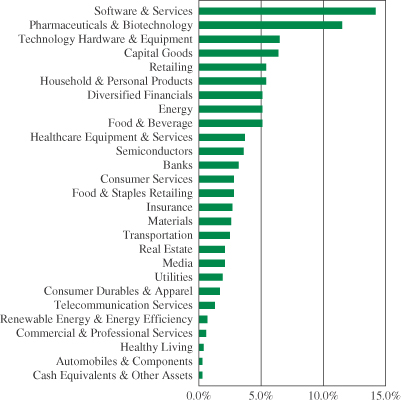

The stocks held by the Balanced Fund were also diversified by industry, including (as a percent of total net assets) Technology Hardware and Equipment (7.8%), Software and Services (7.1%), Capital Goods (6.5%), Renewable Energy and Energy Efficiency (3.4%), and 20 additional industry groupings. In line with its environmental mandate, the Fund had exposure to what Green Century considers environmental leaders in a number of industries beyond the companies in the Renewable Energy and Energy Efficiency sector. Green Century’s environmental screens keep the

GREEN CENTURY BALANCED FUND

INVESTMENT BY INDUSTRY (unaudited)

4

Fund out of traditional energy and utility companies, while the Fund has broad exposure to information technology, health care, financial, consumer and industrial companies.

Higher quality, intermediate maturity bonds can lower volatility and provide a stable source of income. At fiscal year-end, the Balanced Fund held 28 bonds diversified across corporate and government agency issuers. In an effort to dampen volatility, the weighted average maturity (4.4 years) and duration (4.0 years) remained in the intermediate range. The weighted average yield to maturity was 1.3%. All current fixed income holdings are investment grade.

Economic Environment The primary risks facing the markets today are political, from Europe to China to the U.S. “fiscal cliff.” In spite of these risks, the Fund’s portfolio managers believe that the underlying U.S. economic conditions are stronger than they were a year ago. U.S. economic growth has been continued at between 1.5% and 2.5% for the past year, weathering last year’s switch from overall government stimulus to government austerity as state and local governments cut back their spending. Consumer confidence, while very sensitive to headline political and economic news, has been trending upward since early 2009. After a prolonged slump, the U.S. housing market is beginning to pick up, with new construction rising slightly and the inventory of unsold homes declining. In contrast to conditions in the U.S., the Fund’s portfolio managers see a significant slowing in the pace of growth in Europe and in China. The European slowdown results from European Union-imposed austerity measures in Greece, Italy, Spain, Ireland, and Portugal; Chinese economic growth has slowed to just over 7.5% per year in response to deliberate Chinese government policy. The portfolio managers believe that due to the very well known risks in the market, risk-aversion in the market is very high. As a result, yields on high-quality bonds are very low and stock prices are fairly cheap, and the portfolio managers are currently emphasizing stocks over bonds.

For the twelve months ended June 30, 2012, consumer prices increased by 1.7%. Excluding food and energy, consumer price inflation was at a 2.2% rate, while producer price inflation (PPI) was running at 2.6% in the twelve months through June 30, 2012. Including food and energy prices, the 12-month PPI rose 0.7% through June. The GDP deflator, the broadest index of prices, is 1.6% above its year-ago level despite the level of monetary stimulus in the economy.

Investment Strategy and Performance Green Century believes that environmental responsibility may enhance corporate profitability, which in turn may produce competitive returns. Environmentally sound companies may enjoy higher profitability through lower costs and participation in growth sectors of the market. In addition, this investment strategy seeks to avoid companies at risk due to exposure to environmental liabilities.

The Balanced Fund holds a number of stocks which the portfolio managers believe have attractive environmental and financial characteristics. Holdings include Polypore1 (microporous membranes used for hybrid/electric car batteries and in energy storage), First Solar1 (photo-voltaic solar power systems) and OM Group1 (advanced battery technologies). The Fund’s exposure to clean technology and energy efficiency companies includes relatively small, diversified positions in seven companies.

The Fund continues to hold 2.7% of the portfolio in Green Bonds issued by the International Bank for Reconstruction & Development1 and the International Finance Corporation1 , whose proceeds are used by

5

the World Bank to finance projects in developing countries which immediately contribute to carbon reduction. As interest rates fell during the year, corporate and Federal Agency issuers called existing holdings of higher interest rate bonds. These bonds were replaced with lower interest rate bonds.

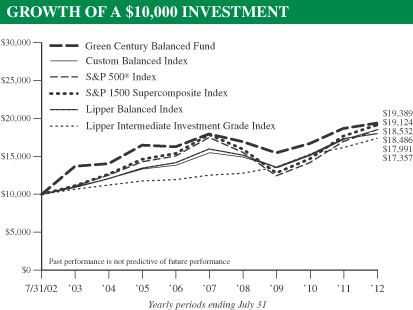

During a year when equity markets were highly variable and largely flat, the Balanced Fund’s returns were slightly better than the Lipper Balanced Fund Index2. The Fund’s return for the year ended July 31, 2012 was 3.81%, just slightly over the Lipper Balanced Fund Index competitor group which had a return of 3.79% for the same period.* The Fund’s return for the year ended July 31, 2012 underperformed the Custom Balanced Index, an index comprised of the S&P 1500 Index (60% weighting) and of the BofA Merrill Lynch 1-10 Year US Corporate and Government Index3 (40% weighting).*

Green Century Balanced Fund Total expense ratio: 1.48% | AVERAGE ANNUAL RETURN* | |||||||||||||||||

| One Year | Three Years | Five Years | Ten Years | |||||||||||||||

June 30, 2012 | Green Century Balanced Fund | 2.16% | 10.13% | 1.10% | 5.46% | |||||||||||||

Lipper Balanced Fund Index2 | 1.77% | 11.54% | 1.81% | 5.37% | ||||||||||||||

Custom Balanced Index3 | 5.43% | 12.70% | 3.11% | 5.77% | ||||||||||||||

July 31, 2012 | Green Century Balanced Fund | 3.81% | 7.88% | 1.55% | 6.84% | |||||||||||||

Lipper Balanced Fund Index2 | 3.79% | 9.83% | 2.40% | 6.05% | ||||||||||||||

Custom Balanced Index3 | 7.42% | 11.24% | 3.67% | 6.37% | ||||||||||||||

* The performance data quoted represents past performance and is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain Fund prices and performance information as of the most recent month-end, call 1-800-93-GREEN. Performance includes the reinvestment of income dividends and capital gain distributions. Performance shown does not reflect the deduction of taxes that a shareholder might pay on Fund distributions or the redemption of Fund shares. A redemption fee of 2.00% may be imposed on redemptions or exchanges of shares you have owned for 60 days or less. Please see the prospectus for more information.

A comparison of the Fund’s equity holdings to the S&P 1500 Supercomposite Index (the S&P 1500)3, which like the Fund includes stocks across a range of capitalizations, provides some insight into relative performance; for the fiscal year ended July 31, 2012, the stocks held by the Balanced Fund underperformed those included in the S&P 1500, 5.43% vs. 8.27%. A performance attribution analysis provided by the Fund’s portfolio manager indicates that the underperformance of the Fund’s equities relative to the S&P 1500 is primarily due to the Fund’s stock selection, particularly in Information Technology and in Health Care. For the past twelve months, the Fund’s zero investment in fossil-fuel based energy stocks helped the portfolio, as energy stocks were the worst performing sector in the S&P 1500 for the period. Stock selection in the Industrials, Financial Services, and Consumer Discretionary sectors boosted the Fund’s performance relative to the S&P 1500.

The companies held in the portfolio that contributed most toward the Fund’s equity performance relative to the S&P 1500 included MasterCard1, Whole Foods Market1, Jarden1, Lincoln Electric Holdings1, and W. W. Grainger1. Companies the Fund held that detracted most from performance relative to the S&P 1500 included Polypore International1, Minerals Technologies1, First Solar1, Hartford Financial Services1, and Green Mountain Coffee Roasters1.

The fixed income portion of the portfolio continued to be managed with the goal of seeking to reduce risk and generating income for the Fund. Gross of fees, the fixed income portion of the Fund’s portfolio returned 4.94%,

6

lagging the Lipper Intermediate Investment Grade Bond Index2 return of 7.67%. Overall, lower credit quality bonds and longer maturity bonds did better over the year; the returns of the fixed income portfolio were negatively impacted by the Fund’s high credit quality and intermediate maturity portfolio.

The Fund’s portfolio managers do not anticipate any significant changes in investment strategy for the Fund, believing that the investment environment may be favorable to the Fund’s core holdings in what the portfolio managers consider high-quality, environmentally responsible companies with strong growth prospects and reasonable valuations.

The Balanced Fund consistently includes stocks and bonds of what Green Century believes to be environmentally responsible corporations of various sizes, including small, medium, and large companies. The value of the stocks held in the Balanced Fund will fluctuate in response to factors that may affect the single issuer, industry, or sector of the economy or may affect the market as a whole. Bonds are subject to a variety of risks including interest rate, credit, and inflation risk.

The S&P 500® Index and the S&P Supercomposite 1500 Index (the S&P 1500 Index) are unmanaged indexes of 500 and 1500 stocks, respectively. The Custom Balanced Index is comprised of a 60% weighting in the S&P 1500 Index and a 40% weighting in the BofA Merrill Lynch 1-10 Year US Corporate & Government Index (the BofA Merrill Lynch Index). The BofA Merrill Lynch Index tracks the performance of U.S. dollar-denominated investment grade government and corporate public debt issued in the U.S. domestic bond market with at least 1 year and less than 10 years remaining maturity, including U.S. treasury, U.S. agency, foreign government, supranational and corporate securities. Similar to the Balanced Fund, the performance of the S&P 500®, the S&P 1500 Index, the Custom Balanced Index and the BofA Merrill Lynch Index reflect the reinvestment of dividends and distributions. Unlike the Fund, however, the performance of the S&P 500®, the S&P 1500 Index, the Custom Balanced Index and the BofA Merrill Lynch Index does not include management and other operating expenses. It is not possible to invest directly in an index.

The Lipper Balanced Fund Index includes the 30 largest funds whose primary objective is to conserve principal by maintaining at all times a balanced portfolio of both stocks and bonds. Typically the stock/bond ratio ranges around 60%/40%. The Lipper Intermediate Investment Grade Bond Index includes the 30 largest funds whose primary objective is to invest in investment-grade debt (rated in the top four classifications) with dollar weighted average maturities of five to ten years. It is not possible to invest directly in an index.

7

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (unaudited) GREEN CENTURY EQUITY FUND

Investment Objective The Green Century Equity Fund (the Equity Fund or the Fund) seeks long-term total return which matches the performance of an index comprised of the stocks of approximately 400 companies selected based on environmental, social and governance criteria.

Portfolio Orientation The Equity Fund seeks to achieve its investment objective by investing substantially all its investable assets in the stocks which make up the MSCI KLD 400 Social Index (the Index), formerly named the Domini 400 Social Index, comprised primarily of large-cap U.S. companies. Like other index funds, the Equity Fund is not actively managed in the traditional investment sense, but rather seeks to be nearly fully invested at all times in a broad and diverse portfolio of stocks which meet certain environmental, social and governance criteria. The Equity Fund, like many other mutual funds invested primarily in stocks, carries the risk of investing in the stock market. The large companies in which the Equity Fund is invested may perform worse than the stock market as a whole.

In evaluating whether a company meets the criteria for inclusion in the Index, a company’s dedication to sustainability is analyzed across five key categories: environment; community and society; employees and supply chain; customers; and governance and ethics. Green Century believes that certain industries impose unique and onerous risks and/or costs on society. Companies involved in these industries are evaluated based on their level of involvement as well as the impact of that involvement on society. Therefore, companies that derive significant revenues from the manufacture of tobacco products or alcoholic beverages; derive significant revenues from the operation of gambling enterprises; or have a significant direct ownership share in, operate or design nuclear power plants are not eligible for the Index. Major military contractors and firearms manufacturers are also ineligible.

GREEN CENTURY EQUITY FUND

INVESTMENT BY INDUSTRY (unaudited)

8

Investment Strategy and Performance Green Century believes that enterprises which exhibit a social awareness may be better prepared to meet future societal needs for goods and services and may be less likely to incur certain legal liabilities that may be assessed when a product or service is determined to be harmful. Green Century also believes that such investments may, over the long term, provide investors with a return that is competitive with enterprises that do not exhibit such social and environmental awareness.

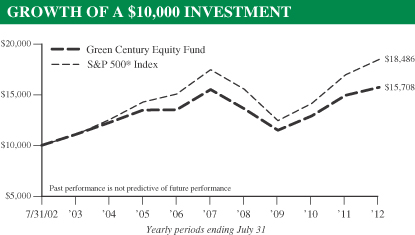

The Equity Fund’s total return for its fiscal year ended July 31, 2012 was 5.14%, while the S&P 500® Index3 returned 9.13% for the same period. Additional results for various time periods are below*:

Green Century Equity Fund Total expense ratio: 1.25% | AVERAGE ANNUAL RETURN* | |||||||||||||||||

| One Year | Three Years | Five Years | Ten Years | |||||||||||||||

June 30, 2012 | Green Century Equity Fund | 2.03% | 13.74% | -0.46% | 3.73% | |||||||||||||

S&P 500® Index3 | 5.45% | 16.40% | 0.22% | 5.33% | ||||||||||||||

July 31, 2012 | Green Century Equity Fund | 5.14% | 11.01% | 0.26% | 4.62% | |||||||||||||

S&P 500® Index3 | 9.13% | 14.13% | 1.13% | 6.34% | ||||||||||||||

* The performance data quoted represents past performance and is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain Fund prices and performance information as of the most recent month-end, call 1-800-93-GREEN. Performance includes the reinvestment of income dividends and capital gains distributions. Performance shown does not reflect the deduction of taxes that a shareholder might pay on Fund distributions or the redemption of Fund shares. A redemption fee of 2.00% may be imposed on redemptions or exchanges of shares you have owned for 60 days or less. Please see the prospectus for more information.

The Equity Fund performed well, relative to the S&P 500® Index, in part due to its underweighting of energy, financial and materials companies which performed poorly. The Equity Fund also benefited from being overweight in sectors that performed better than the S&P 500® Index including healthcare, information technology, and consumer staples.

The performance of Equity Fund was hurt relative to the S&P 500® Index due to underweighting of the telecommunications and utilities sectors which posted strong positive returns. Sector allocation differences in consumer discretionary and industrials did not have a material impact on the Fund’s performance relative to the S&P 500® Index.

The strongest performing sectors in the Equity Fund were healthcare, utilities, and consumer discretionary, returning 18.11%, 13.89%, and 12.37%, respectively. Only energy and telecommunication services

The S&P 500® Index is an unmanaged index of 500 stocks. Similar to the Equity Fund, the S&P 500® Index’s performance reflects reinvestment of dividends and distributions. Unlike the Fund, however, the S&P 500® Index’s performance does not include management and other operating expenses.

9

exhibited negative returns, losing -19.10% and -3.93%, respectively. Within the S&P 500® Index, telecommunication services, consumer staples, and utilities were the strongest performing sectors, gaining 28.61%, 20.03%, and 18.95%, respectively. Only energy and materials lost value over the period, returning -4.97% and -4.87%, respectively.

1 As of July 31, 2012, the following companies comprised the listed percentages of each of the Green Century Funds:

| Portfolio Holdings | GREEN CENTURY BALANCED FUND | GREEN CENTURY EQUITY FUND | ||||||

Target Corporation | 0.00 | % | 0.70 | % | ||||

3M Company | 0.00 | % | 1.09 | % | ||||

Bank of America | 0.00 | % | 0.00 | % | ||||

Polypore International, Inc. | 0.47 | % | 0.00 | % | ||||

First Solar, Inc. | 0.06 | % | 0.02 | % | ||||

OM Group, Inc. | 0.30 | % | 0.00 | % | ||||

International Bank for Reconstruction & Development | 0.90 | % | 0.00 | % | ||||

International Finance Corporation | 1.76 | % | 0.00 | % | ||||

MasterCard, Inc. | 2.56 | % | 0.00 | % | ||||

| Portfolio Holdings | GREEN CENTURY BALANCED FUND | GREEN CENTURY EQUITY FUND | ||||||

Whole Foods Market, Inc. | 1.55 | % | 0.29 | % | ||||

Jarden Corporation | 1.51 | % | 0.00 | % | ||||

Lincoln Electric Holdings, Inc. | 1.99 | % | 0.06 | % | ||||

W.W. Grainger, Inc. | 0.00 | % | 0.22 | % | ||||

Minerals Technologies, Inc. | 2.08 | % | 0.02 | % | ||||

Hartford Financial Services Group, Inc. | 1.26 | % | 0.12 | % | ||||

Green Mountain Coffee Roasters, Inc. | 0.00 | % | 0.04 | % | ||||

Portfolio composition will change due to ongoing management of the Funds. Please refer to the Green Century Funds website for current information regarding the Funds’ portfolio holdings. Note that some of the holdings discussed above may not have been held by either Fund during the fiscal year ended July 31, 2012, or may have been held by a Fund for a portion of the fiscal year or may have been held by a Fund for the entire fiscal year. These holdings are subject to risk as described in the Funds’ prospectus. References to specific investments should not be construed as a recommendation of the securities by the Funds, their administrator, or their distributor.

2 Lipper Analytical Services, Inc. (“Lipper”) is a respected mutual fund reporting service. The Lipper Balanced Fund Index includes the 30 largest funds whose primary objective is to conserve principal by maintaining at all times a balanced portfolio of both stocks and bonds. Typically the stock/bond ratio ranges around 60%/40%. The Lipper Intermediate Investment Grade Bond Index includes the 30 largest funds whose primary objective is to invest in investment-grade debt (rated in the top four classifications) with dollar weighted average maturities of five to ten years.

3 The S&P 500® Index is an unmanaged index of 500 selected common stocks, most of which are listed on the New York Stock Exchange. The S&P 500® Index is heavily weighted toward stocks with large market capitalization and represents approximately two-thirds of the total market value of all domestic stocks. The S&P Supercomposite 1500 Index is an unmanaged broad-based capitalization-weighted index comprising 1500 stocks of large-cap, mid-cap, and small-cap U.S. companies. The Custom Balanced Index is comprised of a 60% weighting in the S&P 1500 Index and a 40% weighting in the BofA Merrill Lynch 1-10 Year US Corporate & Government Index (the BofA Merrill Lynch Index). The BofA Merrill Lynch Index tracks the performance of U.S. dollar-denominated investment grade government and corporate public debt issued in the U.S. domestic bond market with at least 1 year and less than 10 years remaining maturity, including U.S. treasury, U.S. agency, foreign government, supranational and corporate securities. It is not possible to invest directly in the S&P 500® Index, the S&P Supercomposite 1500 Index, the Custom Balanced Index or the BofA Merrill Lynch Index.

This material must be preceded or accompanied by a current prospectus.

Distributor: UMB Distribution Services, LLC 9/12

The Green Century Equity Fund (the “Fund”) is not sponsored, endorsed, or promoted by MSCI, its affiliates, information providers or any other third party involved in, or related to, compiling, computing or creating the MSCI indices (the “MSCI Parties”), and the MSCI Parties bear no liability with respect to the Fund or any index on which the Fund is based. The MSCI Parties are not sponsors of the Fund and are not affiliated with the Fund in any way. The Statement of Additional Information contains a more detailed description of the limited relationship the MSCI Parties have with Green Century Capital Management and the Fund.

10

GREEN CENTURY FUNDS EXPENSE EXAMPLE

For the six months ended July 31, 2012 (unaudited)

As a shareholder of the Green Century Funds (the “Funds”), you incur two types of costs: (1) transaction costs, including redemption fees on certain redemptions; and (2) ongoing costs, including management fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from February 1, 2012 to July 31, 2012 (the “period”).

Actual Expenses The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 equals 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account during the period.

Hypothetical Example for Comparison Purposes The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the actual return of either of the Funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees on shares held for 60 days or less. Therefore, the second line of the table is useful in comparing the ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs could have been higher.

| BEGINNING ACCOUNT VALUE FEBRUARY 1, 2012 | ENDING ACCOUNT VALUE JULY 31, 2012 | EXPENSES PAID DURING THE PERIOD1 | ||||||||||

Balanced Fund | ||||||||||||

Actual Expenses | $ | 1,000.00 | $ | 1,028.60 | $ | 7.50 | ||||||

Hypothetical Example, assuming a 5% return before expenses | 1,000.00 | 1,017.61 | 7.46 | |||||||||

Equity Fund | ||||||||||||

Actual Expenses | 1,000.00 | 1,026.80 | 6.29 | |||||||||

Hypothetical Example, assuming a 5% return before expenses | 1,000.00 | 1,018.80 | 6.26 | |||||||||

1 Expenses are equal to the Funds’ annualized expense ratios (1.48% for the Balanced Fund and 1.25% for the Equity Fund), multiplied by the average account value over the period, multiplied by 182/366 (to reflect the one-half year period).

11

GREEN CENTURY BALANCED FUND PORTFOLIO OF INVESTMENTS

July 31, 2012

| COMMON STOCKS — 68.7% | ||||||||

| SHARES | VALUE | |||||||

Technology Hardware & Equipment — 7.8% |

| |||||||

Apple, Inc. (a) | 2,756 | $ | 1,683,255 | |||||

Cisco Systems, Inc. | 58,541 | 933,729 | ||||||

EMC Corporation (a) | 30,575 | 801,371 | ||||||

QUALCOMM, Inc. | 19,258 | 1,149,317 | ||||||

| 4,567,672 | ||||||||

Software & Services — 7.1% |

| |||||||

International Business Machines Corporation | 7,059 | 1,383,423 | ||||||

MasterCard, Inc., Class A | 3,452 | 1,507,040 | ||||||

Microsoft Corporation | 19,093 | 562,671 | ||||||

Oracle Corporation | 24,382 | 736,336 | ||||||

| 4,189,470 | ||||||||

Capital Goods — 6.5% |

| |||||||

Cummins, Inc. | 2,289 | 219,515 | ||||||

Lincoln Electric Holdings, Inc. | 29,276 | 1,167,527 | ||||||

Middleby Corporation (The) (a) | 3,961 | 387,861 | ||||||

Pentair, Inc. | 5,917 | 259,342 | ||||||

Valmont Industries, Inc. | 7,727 | 957,221 | ||||||

Wabtec Corporation | 10,757 | 851,739 | ||||||

| 3,843,205 | ||||||||

Insurance — 4.5% |

| |||||||

Aflac, Inc. | 7,037 | 308,080 | ||||||

Chubb Corporation | 11,421 | 830,193 | ||||||

Hartford Financial Services Group, Inc. (The) | 45,076 | 741,500 | ||||||

Horace Mann Educators Corporation | 23,734 | 413,921 | ||||||

Lincoln National Corporation | 9,136 | 183,177 | ||||||

W. R. Berkley Corporation | 5,221 | 191,245 | ||||||

| 2,668,116 | ||||||||

Pharmaceuticals & Biotechnology — 4.5% |

| |||||||

Amgen, Inc. | 8,124 | 671,042 | ||||||

GlaxoSmithKline PLC American Depositary Receipt (b) | 28,246 | 1,299,316 | ||||||

Novartis A.G. American Depositary Receipt (b) | 3,193 | 187,174 | ||||||

Novo Nordisk A/S American Depositary Receipt (b) | 3,188 | 492,674 | ||||||

| 2,650,206 | ||||||||

Healthcare Equipment & Services — 4.5% |

| |||||||

Baxter International, Inc. | 19,756 | $ | 1,155,924 | |||||

Cerner Corporation (a) | 5,557 | 410,773 | ||||||

UnitedHealth Group, Inc. | 20,998 | 1,072,788 | ||||||

| 2,639,485 | ||||||||

Diversified Financials — 3.6% |

| |||||||

American Express Company | 23,324 | 1,346,028 | ||||||

JPMorgan Chase & Company | 21,789 | 784,404 | ||||||

| 2,130,432 | ||||||||

Renewable Energy & Energy Efficiency — 3.4% |

| |||||||

First Solar, Inc. (a) | 2,187 | 33,986 | ||||||

International Rectifier Corporation (a) | 21,000 | 357,840 | ||||||

OM Group, Inc. (a) | 11,345 | 178,117 | ||||||

Ormat Technologies, Inc. | 47,693 | 858,474 | ||||||

Polypore International, Inc. (a) | 7,507 | 278,960 | ||||||

Quanta Services, Inc. (a) | 9,600 | 220,704 | ||||||

STR Holdings, Inc. (a) | 12,957 | 43,276 | ||||||

Suntech Power Holdings Company Ltd. American Depositary Receipt (a)(b) | 32,793 | 37,056 | ||||||

| 2,008,413 | ||||||||

Telecommunication Services — 3.4% |

| |||||||

BT Group PLC American Depositary Receipt (b) | 30,137 | 1,026,466 | ||||||

Vodafone Group PLC American Depositary Receipt (b) | 33,086 | 951,223 | ||||||

| 1,977,689 | ||||||||

Banks — 2.8% |

| |||||||

East West Bancorp, Inc. | 16,683 | 363,689 | ||||||

Wells Fargo & Company | 37,960 | 1,283,428 | ||||||

| 1,647,117 | ||||||||

Healthy Living — 2.7% |

| |||||||

United Natural Foods, Inc. (a) | 12,285 | 667,076 | ||||||

Whole Foods Market, Inc. | 9,949 | 913,119 | ||||||

| 1,580,195 | ||||||||

Food & Staples Retailing — 2.6% |

| |||||||

Costco Wholesale Corporation | 15,934 | 1,532,532 | ||||||

12

GREEN CENTURY BALANCED FUND PORTFOLIO OF INVESTMENTS

July 31, 2012continued

| SHARES | VALUE | |||||||

Materials — 2.6% |

| |||||||

Minerals Technologies, Inc. | 19,130 | $ | 1,223,172 | |||||

Owens-Illinois, Inc. (a) | 15,273 | 281,787 | ||||||

| 1,504,959 | ||||||||

Transportation — 2.4% |

| |||||||

Canadian Pacific Railway Ltd. | 4,814 | 390,656 | ||||||

United Parcel Service, Inc., Class B | 13,799 | 1,043,342 | ||||||

| 1,433,998 | ||||||||

Media — 2.4% |

| |||||||

Discovery Communications, Inc., Class A (a) | 27,255 | 1,379,921 | ||||||

Consumer Services — 1.9% |

| |||||||

Starbucks Corporation | 9,640 | 436,499 | ||||||

Starwood Hotels & Resorts Worldwide, Inc. | 12,068 | 653,482 | ||||||

| 1,089,981 | ||||||||

Consumer Durables & Apparel — 1.5% |

| |||||||

Jarden Corporation | 19,702 | 890,530 | ||||||

Real Estate — 1.4% | ||||||||

LaSalle Hotel Properties | 9,790 | 257,085 | ||||||

Prologis, Inc. | 18,082 | 584,591 | ||||||

| 841,676 | ||||||||

Household & Personal Products — 1.2% |

| |||||||

Church & Dwight Company, Inc. | 8,662 | 499,018 | ||||||

Colgate-Palmolive Company | 1,981 | 212,680 | ||||||

| 711,698 | ||||||||

Semiconductors — 0.9% |

| |||||||

Intel Corporation | 19,835 | 509,759 | ||||||

Retailing — 0.7% |

| |||||||

Nordstrom, Inc. | 7,322 | 396,413 | ||||||

Automobiles & Components — 0.3% |

| |||||||

Toyota Motor Corporation American Depositary Receipt (b) | 2,650 | 202,752 | ||||||

Food & Beverage — 0.0% |

| |||||||

General Mills, Inc. | 300 | 11,610 | ||||||

Total Common Stocks | 40,407,829 | |||||||

| CORPORATE BONDS & NOTES — 19.4% | ||||||||

| PRINCIPAL AMOUNT | VALUE | |||||||

Diversified Financials — 6.2% |

| |||||||

Bank of New York Mellon Corporation (The) | $ | 500,000 | $ | 533,928 | ||||

Citigroup, Inc. | 500,000 | 521,498 | ||||||

Deutsche Bank A.G. | 500,000 | 519,618 | ||||||

HSBC Bank USA N.A. | 500,000 | 566,339 | ||||||

JPMorgan Chase & Company 5.125%, due 9/15/14 | 500,000 | 537,136 | ||||||

Morgan Stanley | 500,000 | 495,645 | ||||||

UBS A.G. | 500,000 | 496,936 | ||||||

| 3,671,100 | ||||||||

Renewable Energy & Energy Efficiency — 3.6% |

| |||||||

International Bank for Reconstruction & Development | 500,000 | 527,751 | ||||||

International Finance Corporation | 1,000,000 | 1,033,105 | ||||||

Johnson Controls, Inc. | 500,000 | 568,005 | ||||||

| 2,128,861 | ||||||||

Pharmaceuticals & Biotechnology — 2.9% |

| |||||||

Abbott Laboratories | 500,000 | 613,959 | ||||||

Amgen, Inc. | 500,000 | 543,689 | ||||||

Wyeth | 500,000 | 516,186 | ||||||

| 1,673,834 | ||||||||

Software & Services — 2.7% |

| |||||||

International Business Machines Corporation | 500,000 | 521,214 | ||||||

Microsoft Corporation | 500,000 | 519,678 | ||||||

13

GREEN CENTURY BALANCED FUND PORTFOLIO OF INVESTMENTS

July 31, 2012concluded

| PRINCIPAL AMOUNT | VALUE | |||||||

Software & Services — (continued) |

| |||||||

Oracle Corporation | $ | 500,000 | $ | 531,440 | ||||

| 1,572,332 | ||||||||

Technology Hardware & Equipment — 1.8% |

| |||||||

Dell, Inc. | 500,000 | 519,262 | ||||||

Hewlett-Packard Company | 500,000 | 529,747 | ||||||

| 1,049,009 | ||||||||

Telecommunication Services — 1.8% |

| |||||||

AT&T, Inc. | 500,000 | 527,197 | ||||||

Verizon Communications, Inc. | 500,000 | 516,758 | ||||||

| 1,043,955 | ||||||||

Healthcare Equipment & Services — 0.4% |

| |||||||

UnitedHealth Group, Inc. | 250,000 | 257,185 | ||||||

Total Corporate Bonds & Notes | 11,396,276 | |||||||

U.S. GOVERNMENT AGENCIES — 9.4% |

| |||||||

Federal Farm Credit Bank | 500,000 | 589,637 | ||||||

Federal Home Loan Bank | 550,000 | 571,601 | ||||||

Federal Home Loan Bank | 1,000,000 | 1,158,820 | ||||||

Federal Home Loan Bank | 550,000 | 640,444 | ||||||

Federal Home Loan Bank | 1,000,000 | 1,000,007 | ||||||

Federal Home Loan Bank | 1,000,000 | 988,933 | ||||||

Federal Home Loan Mortgage Corporation | 500,000 | 582,423 | ||||||

Total U.S. Government Agencies |

| 5,531,865 | ||||||

CERTIFICATES OF DEPOSIT — 0.1% |

| |||||||

Self Help Credit Union Environmental Certificate of Deposit | $ | 95,000 | $ | 95,000 | ||||

Total Certificates Of Deposit |

| 95,000 | ||||||

| SHORT-TERM OBLIGATION — 2.1% | ||||||||

Repurchase Agreement — | 1,220,160 | |||||||

TOTAL INVESTMENTS (d) — 99.7% |

| |||||||

(Cost $51,733,270) | 58,651,130 | |||||||

Other Assets Less Liabilities — 0.3% |

| 146,997 | ||||||

NET ASSETS — 100.0% | $ | 58,798,127 | ||||||

| (a) | Non-income producing security. |

| (b) | Securities whose values are determined or significantly influenced by trading in markets other than the United States or Canada. |

| (c) | Step rate bond. Rate shown is currently in effect at July 31, 2012. |

| (d) | The cost of investments for federal income tax purposes is $51,733,270 resulting in gross unrealized appreciation and depreciation of $8,385,460 and $1,467,600 respectively, or net unrealized appreciation of $6,917,860. |

See Notes to Financial Statements

14

GREEN CENTURY EQUITY FUND PORTFOLIO OF INVESTMENTS

July 31, 2012

| COMMON STOCKS — 99.7% | ||||||||

| SHARES | VALUE | |||||||

Software & Services — 14.2% | ||||||||

Adobe Systems, Inc. (a) | 4,547 | $ | 140,411 | |||||

Advent Software, Inc. (a) | 291 | 6,623 | ||||||

Autodesk, Inc. (a) | 2,080 | 70,554 | ||||||

Automatic Data Processing, Inc. | 4,573 | 258,603 | ||||||

BMC Software, Inc. (a) | 1,506 | 59,638 | ||||||

Compuware Corporation (a) | 1,998 | 18,402 | ||||||

Convergys Corporation | 1,076 | 15,860 | ||||||

eBay, Inc. (a) | 10,718 | 474,807 | ||||||

Electronic Arts, Inc. (a) | 3,049 | 33,600 | ||||||

FactSet Research Systems, Inc. | 396 | 36,812 | ||||||

Google, Inc., Class A (a) | 2,389 | 1,512,165 | ||||||

International Business Machines Corporation | 10,188 | 1,996,644 | ||||||

Microsoft Corporation | 69,936 | 2,061,014 | ||||||

Monster Worldwide, Inc. (a) | 1,150 | 8,338 | ||||||

Red Hat, Inc. (a) | 1,778 | 95,408 | ||||||

Salesforce.com, Inc. (a) | 1,208 | 150,227 | ||||||

Symantec Corporation (a) | 6,716 | 105,777 | ||||||

Yahoo!, Inc. (a) | 10,768 | 170,565 | ||||||

| 7,215,448 | ||||||||

Pharmaceuticals & Biotechnology — 11.5% |

| |||||||

Abbott Laboratories | 14,542 | 964,280 | ||||||

Affymetrix, Inc. (a) | 546 | 2,288 | ||||||

Agilent Technologies, Inc. | 3,199 | 122,490 | ||||||

Amylin Pharmaceuticals, Inc. (a) | 1,410 | 43,414 | ||||||

Biogen Idec, Inc. (a) | 2,105 | 306,972 | ||||||

Bristol-Myers Squibb Company | 15,673 | 557,959 | ||||||

Cubist Pharmaceuticals, Inc. (a) | 572 | 24,630 | ||||||

Endo Health Solutions, Inc. (a) | 1,077 | 32,019 | ||||||

Gilead Sciences, Inc. (a) | 7,020 | 381,397 | ||||||

Hospira, Inc. (a) | 1,525 | 52,994 | ||||||

Illumina, Inc. (a) | 1,121 | 46,488 | ||||||

Johnson & Johnson | 25,446 | 1,761,372 | ||||||

Life Technologies Corporation (a) | 1,639 | 71,919 | ||||||

Merck & Company, Inc. | 28,179 | 1,244,666 | ||||||

Techne Corporation | 326 | 22,520 | ||||||

Thermo Fisher Scientific, Inc. | 3,369 | 187,552 | ||||||

Waters Corporation (a) | 820 | 63,534 | ||||||

| 5,886,494 | ||||||||

Technology Hardware & Equipment — 6.5% |

| |||||||

Cisco Systems, Inc. | 49,898 | 795,873 | ||||||

Corning, Inc. | 14,207 | 162,102 | ||||||

Technology Hardware & Equipment — (continued) |

| |||||||

Dell, Inc. (a) | 14,258 | $ | 169,385 | |||||

Echelon Corporation (a) | 282 | 908 | ||||||

EMC Corporation (a) | 19,016 | 498,409 | ||||||

Hewlett-Packard Company | 18,309 | 333,956 | ||||||

Imation Corporation (a) | 300 | 1,671 | ||||||

Lexmark International, Inc. | 661 | 11,561 | ||||||

Molex, Inc. | 613 | 15,399 | ||||||

Motorola Solutions, Inc. | 2,541 | 122,832 | ||||||

Plantronics, Inc. | 397 | 13,030 | ||||||

Polycom, Inc. (a) | 1,597 | 13,958 | ||||||

QUALCOMM, Inc. | 15,674 | 935,424 | ||||||

Seagate Technology PLC | 3,716 | 111,554 | ||||||

Silicon Graphics International Corporation (a) | 280 | 1,862 | ||||||

Super Micro Computer, Inc. (a) | 281 | 3,487 | ||||||

Tellabs, Inc. | 3,253 | 10,703 | ||||||

Xerox Corporation | 12,638 | 87,581 | ||||||

| 3,289,695 | ||||||||

Capital Goods — 6.4% | ||||||||

3M Company | 6,103 | 556,777 | ||||||

A.O. Smith Corporation | 360 | 17,791 | ||||||

AMETEK, Inc. | 2,220 | 68,820 | ||||||

Apogee Enterprises, Inc. | 264 | 4,274 | ||||||

Brady Corporation, Class A | 457 | 12,124 | ||||||

CLARCOR, Inc. | 462 | 22,338 | ||||||

Cooper Industries PLC | 1,458 | 104,801 | ||||||

Cummins, Inc. | 1,708 | 163,797 | ||||||

Deere & Company | 3,570 | 274,247 | ||||||

Donaldson Company, Inc. | 1,297 | 44,267 | ||||||

Dover Corporation | 1,691 | 92,109 | ||||||

Eaton Corporation | 2,933 | 128,583 | ||||||

EMCOR Group, Inc. | 611 | 16,088 | ||||||

Emerson Electric Company | 6,815 | 325,552 | ||||||

Fastenal Company | 2,581 | 111,293 | ||||||

Gardner Denver, Inc. | 463 | 26,382 | ||||||

General Cable Corporation (a) | 451 | 11,785 | ||||||

Graco, Inc. | 553 | 25,372 | ||||||

Granite Construction, Inc. | 330 | 8,547 | ||||||

Hubbell, Inc., Class B | 479 | 39,412 | ||||||

Illinois Tool Works, Inc. | 4,088 | 222,142 | ||||||

Ingersoll-Rand PLC | 2,805 | 118,960 | ||||||

Kadant, Inc. (a) | 100 | 2,071 | ||||||

Lincoln Electric Holdings, Inc. | 733 | 29,232 | ||||||

Lindsay Corporation | 123 | 8,721 | ||||||

Masco Corporation | 3,291 | 39,591 | ||||||

15

GREEN CENTURY EQUITY FUND PORTFOLIO OF INVESTMENTS

July 31, 2012continued

| SHARES | VALUE | |||||||

Capital Goods — (continued) | ||||||||

Middleby Corporation (The) (a) | 172 | $ | 16,842 | |||||

Nordson Corporation | 506 | 25,937 | ||||||

Owens Corning (a) | 1,062 | 28,525 | ||||||

Pall Corporation | 1,059 | 56,561 | ||||||

Pentair, Inc. | 908 | 39,798 | ||||||

Rockwell Automation, Inc. | 1,311 | 88,309 | ||||||

Roper Industries, Inc. | 890 | 88,510 | ||||||

Simpson Manufacturing Company, Inc. | 357 | 8,654 | ||||||

Snap-On, Inc. | 537 | 36,398 | ||||||

Spirit Aerosystems Holdings, Inc. (a) | 1,093 | 25,685 | ||||||

Stanley Black & Decker, Inc. | 1,483 | 99,198 | ||||||

Tennant Company | 155 | 6,459 | ||||||

Timken Company | 761 | 27,548 | ||||||

W.W. Grainger, Inc. | 548 | 112,247 | ||||||

WABCO Holdings, Inc. (a) | 594 | 32,622 | ||||||

Wabtec Corporation | 440 | 34,839 | ||||||

Xylem, Inc. | 1,711 | 41,030 | ||||||

| 3,244,238 | ||||||||

Retailing — 5.4% | ||||||||

AutoZone, Inc. (a) | 323 | 121,199 | ||||||

Bed Bath & Beyond, Inc. (a) | 2,220 | 135,309 | ||||||

Best Buy Company, Inc. | 2,736 | 49,494 | ||||||

Buckle, Inc. (The) | 250 | 9,668 | ||||||

Carmax, Inc. (a) | 2,090 | 58,165 | ||||||

Collective Brands, Inc. (a) | 565 | 12,159 | ||||||

Foot Locker, Inc. | 1,404 | 46,360 | ||||||

Gap, Inc. (The) | 2,923 | 86,199 | ||||||

Genuine Parts Company | 1,434 | 91,819 | ||||||

Home Depot, Inc. | 14,273 | 744,765 | ||||||

J.C. Penney Company, Inc. | 1,481 | 33,337 | ||||||

Kohl’s Corporation | 2,217 | 110,229 | ||||||

Lowe’s Companies, Inc. | 11,521 | 292,288 | ||||||

Men’s Wearhouse, Inc. (The) | 448 | 12,208 | ||||||

Netflix, Inc. (a) | 485 | 27,572 | ||||||

Nordstrom, Inc. | 1,528 | 82,726 | ||||||

Office Depot, Inc. (a) | 2,500 | 4,450 | ||||||

OfficeMax, Inc. (a) | 746 | 3,350 | ||||||

Pep Boys-Manny, Moe & Jack (The) | 500 | 4,535 | ||||||

RadioShack Corporation | 836 | 2,433 | ||||||

Staples, Inc. | 6,393 | 81,447 | ||||||

Target Corporation | 5,900 | 357,835 | ||||||

Retailing — (continued) | ||||||||

Tiffany & Company | 1,169 | $ | 64,213 | |||||

TJX Companies, Inc. | 7,015 | 310,624 | ||||||

| 2,742,384 | ||||||||

Household & Personal Products — 5.4% |

| |||||||

Avon Products, Inc. | 3,964 | 61,402 | ||||||

Clorox Company | 1,136 | 82,599 | ||||||

Colgate-Palmolive Company | 4,436 | 476,249 | ||||||

Estee Lauder Companies, Inc. (The), Class A | 2,220 | 116,284 | ||||||

Kimberly-Clark Corporation | 3,652 | 317,395 | ||||||

Nu Skin Enterprises, Inc., Class A | 522 | 26,627 | ||||||

Procter & Gamble Company | 25,496 | 1,645,512 | ||||||

WD-40 Company | 128 | 6,150 | ||||||

| 2,732,218 | ||||||||

Diversified Financials — 5.1% | ||||||||

American Express Company | 9,717 | 560,768 | ||||||

Bank of New York Mellon Corporation (The) | 11,221 | 238,783 | ||||||

BlackRock, Inc. | 1,230 | 209,420 | ||||||

Capital One Financial Corporation | 4,638 | 262,001 | ||||||

Charles Schwab Corporation (The) | 9,938 | 125,517 | ||||||

CME Group, Inc. | 2,905 | 151,379 | ||||||

Discover Financial Services | 4,876 | 175,341 | ||||||

Eaton Vance Corporation | 1,066 | 28,281 | ||||||

Franklin Resources, Inc. | 1,414 | 162,539 | ||||||

IntercontinentalExchange, Inc. (a) | 668 | 87,655 | ||||||

Invesco Ltd. | 4,102 | 90,777 | ||||||

Legg Mason, Inc. | 1,164 | 28,541 | ||||||

Northern Trust Corporation | 2,045 | 92,843 | ||||||

NYSE Euronext | 2,379 | 60,617 | ||||||

PHH Corporation (a) | 489 | 7,927 | ||||||

State Street Corporation | 4,549 | 183,689 | ||||||

T. Rowe Price Group, Inc. | 2,328 | 141,426 | ||||||

| 2,607,504 | ||||||||

Energy — 5.1% | ||||||||

Apache Corporation | 3,575 | 307,879 | ||||||

Cameron International Corporation (a) | 2,267 | 113,962 | ||||||

Chesapeake Energy Corporation | 6,096 | 114,727 | ||||||

Clean Energy Fuels Corporation (a) | 634 | 8,946 | ||||||

Continental Resources, Inc. (a) | 419 | 26,812 | ||||||

Denbury Resources, Inc. (a) | 3,595 | 54,357 | ||||||

Devon Energy Corporation | 3,584 | 211,886 | ||||||

16

GREEN CENTURY EQUITY FUND PORTFOLIO OF INVESTMENTS

July 31, 2012continued

| SHARES | VALUE | |||||||

Energy — (continued) | ||||||||

Energen Corporation | 668 | $ | 34,208 | |||||

EOG Resources, Inc. | 2,511 | 246,103 | ||||||

EQT Corporation | 1,375 | 77,550 | ||||||

FMC Technologies, Inc. (a) | 2,200 | 99,264 | ||||||

Hess Corporation | 2,816 | 132,803 | ||||||

National Oilwell Varco, Inc. | 3,941 | 284,934 | ||||||

Newfield Exploration Company (a) | 1,240 | 37,857 | ||||||

Noble Corporation (a) | 2,319 | 85,803 | ||||||

Noble Energy, Inc. | 1,628 | 142,336 | ||||||

OYO Geospace Corporation (a) | 55 | 5,213 | ||||||

Pioneer Natural Resources Company | 1,078 | 95,543 | ||||||

QEP Resources, Inc. | 1,631 | 48,979 | ||||||

Quicksilver Resources, Inc. (a) | 895 | 4,045 | ||||||

Range Resources Corporation | 1,488 | 93,149 | ||||||

Southwestern Energy Company (a) | 3,212 | 106,799 | ||||||

Spectra Energy Corporation | 5,983 | 183,618 | ||||||

Ultra Petroleum Corporation (a) | 1,398 | 33,217 | ||||||

Whiting Petroleum Corporation (a) | 1,076 | 43,470 | ||||||

| 2,593,460 | ||||||||

Food & Beverage — 5.1% | ||||||||

Campbell Soup Company | 1,759 | 58,241 | ||||||

Coca-Cola Enterprises, Inc. | 2,789 | 81,774 | ||||||

Darling International, Inc. (a) | 1,082 | 17,875 | ||||||

Dean Foods Company (a) | 1,706 | 21,103 | ||||||

Flowers Foods, Inc. | 1,136 | 24,276 | ||||||

General Mills, Inc. | 5,990 | 231,813 | ||||||

Green Mountain Coffee Roasters, Inc. (a) | 1,212 | 22,131 | ||||||

H.J. Heinz Company | 2,987 | 164,912 | ||||||

Hillshire Brands Company | 1,088 | 27,864 | ||||||

J. M. Smucker Company (The) | 1,043 | 80,103 | ||||||

Kellogg Company | 2,299 | 109,662 | ||||||

Kraft Foods, Inc., Class A | 15,578 | 618,602 | ||||||

McCormick & Company, Inc. | 1,109 | 67,516 | ||||||

PepsiCo, Inc. | 14,543 | 1,057,712 | ||||||

Tootsie Roll Industries, Inc. | 180 | 4,406 | ||||||

| 2,587,990 | ||||||||

Healthcare Equipment & Services — 3.7% |

| |||||||

Baxter International, Inc. | 5,203 | 304,428 | ||||||

Becton, Dickinson and Company | 1,934 | 146,423 | ||||||

Cerner Corporation (a) | 1,327 | 98,092 | ||||||

CIGNA Corporation | 2,699 | 108,716 | ||||||

Healthcare Equipment & Services — (continued) |

| |||||||

Edwards Lifesciences Corporation (a) | 1,058 | $ | 107,070 | |||||

Gen-Probe, Inc. (a) | 416 | 34,399 | ||||||

Health Management Associates, Inc., Class A (a) | 2,312 | 15,213 | ||||||

Henry Schein, Inc. (a) | 828 | 61,943 | ||||||

Hill-Rom Holdings, Inc. | 563 | 14,722 | ||||||

Humana, Inc. | 1,510 | 93,016 | ||||||

Idexx Laboratories, Inc. (a) | 507 | 44,702 | ||||||

Invacare Corporation | 265 | 3,734 | ||||||

Medtronic, Inc. | 9,787 | 385,804 | ||||||

Molina Healthcare, Inc. (a) | 262 | 6,395 | ||||||

Patterson Companies, Inc. | 805 | 27,451 | ||||||

Quest Diagnostics, Inc. | 1,459 | 85,249 | ||||||

St. Jude Medical, Inc. | 2,937 | 109,726 | ||||||

Varian Medical Systems, Inc. (a) | 1,037 | 56,599 | ||||||

WellPoint, Inc. | 3,122 | 166,371 | ||||||

| 1,870,053 | ||||||||

Semiconductors — 3.6% | ||||||||

Advanced Micro Devices, Inc. (a) | 5,483 | 22,261 | ||||||

Analog Devices, Inc. | 2,741 | 107,118 | ||||||

Applied Materials, Inc. | 11,882 | 129,395 | ||||||

Entegris, Inc. (a) | 1,275 | 10,264 | ||||||

Intel Corporation | 46,289 | 1,189,627 | ||||||

Lam Research Corporation (a) | 1,841 | 63,349 | ||||||

LSI Corporation (a) | 5,209 | 35,942 | ||||||

Texas Instruments, Inc. | 10,636 | 289,725 | ||||||

| 1,847,681 | ||||||||

Banks — 3.2% | ||||||||

Bank of Hawaii Corporation | 424 | 19,805 | ||||||

BB&T Corporation | 6,525 | 204,689 | ||||||

Cathay General Bancorp | 695 | 11,252 | ||||||

Comerica, Inc. | 1,822 | 55,043 | ||||||

First Horizon National Corporation | 2,332 | 19,192 | ||||||

Heartland Financial USA, Inc. | 100 | 2,613 | ||||||

Hudson City Bancorp, Inc. | 4,348 | 27,610 | ||||||

International Bancshares Corporation | 518 | 9,495 | ||||||

KeyCorp | 8,767 | 69,961 | ||||||

M&T Bank Corporation | 1,047 | 89,874 | ||||||

New York Community Bancorp, Inc. | 4,034 | 52,361 | ||||||

Old National Bancorp | 849 | 10,392 | ||||||

People’s United Financial, Inc. | 3,309 | 37,921 | ||||||

17

GREEN CENTURY EQUITY FUND PORTFOLIO OF INVESTMENTS

July 31, 2012continued

| SHARES | VALUE | |||||||

Banks — (continued) | ||||||||

PNC Financial Services Group, Inc. | 4,916 | $ | 290,536 | |||||

Popular, Inc. (a) | 938 | 14,136 | ||||||

Regions Financial Corporation | 12,967 | 90,250 | ||||||

Synovus Financial Corporation | 6,838 | 12,992 | ||||||

U.S. Bancorp | 17,680 | 592,280 | ||||||

Umpqua Holdings Corporation | 1,018 | 12,705 | ||||||

| 1,623,107 | ||||||||

Consumer Services — 2.8% | ||||||||

Capella Education Company (a) | 128 | 3,395 | ||||||

Chipotle Mexican Grill, Inc. (a) | 288 | 84,191 | ||||||

Choice Hotels International, Inc. | 264 | 10,581 | ||||||

Darden Restaurants, Inc. | 1,183 | 60,546 | ||||||

DeVry, Inc. | 547 | 10,738 | ||||||

Jack in the Box, Inc. (a) | 384 | 10,364 | ||||||

Marriott International, Inc., Class A | 2,460 | 89,593 | ||||||

McDonald’s Corporation | 9,429 | 842,575 | ||||||

Peet’s Coffee & Tea, Inc. (a) | 122 | 9,199 | ||||||

Starbucks Corporation | 6,982 | 316,145 | ||||||

Vail Resorts, Inc. | 329 | 16,331 | ||||||

| 1,453,658 | ||||||||

Food & Staples Retailing — 2.8% | ||||||||

Costco Wholesale Corporation | 4,029 | 387,509 | ||||||

CVS Caremark Corporation | 12,092 | 547,163 | ||||||

Safeway, Inc. | 2,458 | 38,222 | ||||||

Sysco Corporation | 5,468 | 160,705 | ||||||

Walgreen Company | 8,112 | 294,952 | ||||||

| 1,428,551 | ||||||||

Insurance — 2.7% | ||||||||

ACE Ltd. | 3,137 | 230,569 | ||||||

Aflac, Inc. | 4,369 | 191,275 | ||||||

Chubb Corporation | 2,530 | 183,906 | ||||||

Cincinnati Financial Corporation | 1,416 | 53,581 | ||||||

Erie Indemnity Company | 265 | 18,892 | ||||||

Hartford Financial Services Group, Inc. (The) | 3,846 | 63,267 | ||||||

Marsh & McLennan Companies, Inc. | 5,001 | 166,083 | ||||||

PartnerRe Ltd. | 599 | 43,392 | ||||||

Phoenix Companies, Inc. (The) (a) | 1,000 | 1,630 | ||||||

Principal Financial Group, Inc. | 2,771 | 70,910 | ||||||

Progressive Corporation (The) | 5,344 | 105,490 | ||||||

Insurance — (continued) | ||||||||

StanCorp Financial Group, Inc. | 410 | $ | 12,202 | |||||

Travelers Companies, Inc. (The) | 3,656 | 229,048 | ||||||

| 1,370,245 | ||||||||

Materials — 2.6% | ||||||||

Air Products & Chemicals, Inc. | 1,975 | 158,849 | ||||||

Alcoa, Inc. | 9,810 | 83,091 | ||||||

Ball Corporation | 1,359 | 56,480 | ||||||

Bemis Company, Inc. | 935 | 28,751 | ||||||

Calgon Carbon Corporation (a) | 517 | 7,155 | ||||||

Compass Minerals International, Inc. | 306 | 22,136 | ||||||

Domtar Corporation | 335 | 24,743 | ||||||

Ecolab, Inc. | 2,714 | 177,631 | ||||||

H.B. Fuller Company | 451 | 13,178 | ||||||

Horsehead Holding Corporation (a) | 429 | 3,874 | ||||||

International Flavors & Fragrances, Inc. | 745 | 41,526 | ||||||

MeadWestvaco Corporation | 1,569 | 44,560 | ||||||

Minerals Technologies, Inc. | 170 | 10,870 | ||||||

Nucor Corporation | 2,917 | 114,347 | ||||||

Praxair, Inc. | 2,776 | 288,038 | ||||||

Rock-Tenn Company, Class A | 651 | 37,901 | ||||||

Rockwood Holdings, Inc. | 647 | 28,610 | ||||||

Schnitzer Steel Industries, Inc., Class A | 190 | 5,455 | ||||||

Sealed Air Corporation | 1,694 | 27,443 | ||||||

Sigma-Aldrich Corporation | 1,109 | 76,743 | ||||||

Sonoco Products Company | 930 | 28,188 | ||||||

Valspar Corporation | 817 | 41,013 | ||||||

Wausau Paper Corporation | 442 | 3,753 | ||||||

Worthington Industries, Inc. | 483 | 10,481 | ||||||

| 1,334,816 | ||||||||

Transportation — 2.5% | ||||||||

Arkansas Best Corporation | 237 | 3,245 | ||||||

C.H. Robinson Worldwide, Inc. | 1,504 | 79,486 | ||||||

CSX Corporation | 9,795 | 224,697 | ||||||

Expeditors International of Washington, Inc. | 1,951 | 69,397 | ||||||

Genesee & Wyoming, Inc., Class A (a) | 371 | 23,024 | ||||||

J.B. Hunt Transport Services, Inc. | 860 | 47,317 | ||||||

Kansas City Southern | 1,011 | 73,601 | ||||||

Norfolk Southern Corporation | 3,075 | 227,704 | ||||||

18

GREEN CENTURY EQUITY FUND PORTFOLIO OF INVESTMENTS

July 31, 2012continued

| SHARES | VALUE | |||||||

Transportation — (continued) | ||||||||

Ryder System, Inc. | 477 | $ | 18,813 | |||||

United Parcel Service, Inc., Class B | 6,711 | 507,419 | ||||||

| 1,274,703 | ||||||||

Real Estate — 2.1% | ||||||||

American Tower Corporation, Class A | 3,657 | 264,438 | ||||||

Boston Properties, Inc. | 1,364 | 151,268 | ||||||

CBRE Group, Inc., Class A (a) | 2,883 | 44,917 | ||||||

Corporate Office Properties Trust | 664 | 14,781 | ||||||

Digital Realty Trust, Inc. | 1,135 | 88,609 | ||||||

Forest City Enterprises, Inc., Class A (a) | 1,112 | 15,690 | ||||||

Jones Lang LaSalle, Inc. | 398 | 26,543 | ||||||

Liberty Property Trust | 1,071 | 38,866 | ||||||

Potlatch Corporation | 367 | 12,702 | ||||||

Prologis, Inc. | 4,330 | 139,989 | ||||||

Regency Centers Corporation | 829 | 39,668 | ||||||

Vornado Realty Trust | 1,533 | 128,005 | ||||||

Weyerhaeuser Company | 4,942 | 115,396 | ||||||

| 1,080,872 | ||||||||

Media — 2.1% | ||||||||

Discovery Communications, Inc., Class A (a) | 1,310 | 66,325 | ||||||

Discovery Communications, Inc., Class C (a) | 1,013 | 47,226 | ||||||

John Wiley & Sons, Inc., Class A | 446 | 21,252 | ||||||

Liberty Global, Inc., Class A (a) | 1,270 | 67,031 | ||||||

New York Times Company (The), Class A (a) | 1,224 | 9,486 | ||||||

Scholastic Corporation | 248 | 7,472 | ||||||

Virgin Media, Inc. | 2,434 | 66,643 | ||||||

Walt Disney Company (The) | 15,772 | 775,036 | ||||||

Washington Post Company (The), Class B | 44 | 14,894 | ||||||

| 1,075,365 | ||||||||

Utilities — 1.9% | ||||||||

AGL Resources, Inc. | 1,084 | 43,902 | ||||||

Alliant Energy Corporation | 1,022 | 47,738 | ||||||

Atmos Energy Corporation | 837 | 30,006 | ||||||

Avista Corporation | 562 | 15,556 | ||||||

CenterPoint Energy, Inc. | 3,728 | 78,512 | ||||||

CH Energy Group, Inc. | 128 | 8,324 | ||||||

Cleco Corporation | 553 | 24,199 | ||||||

Utilities — (continued) | ||||||||

Consolidated Edison, Inc. | 2,729 | $ | 176,021 | |||||

IDACORP, Inc. | 456 | 19,243 | ||||||

MDU Resources Group, Inc. | 1,662 | 37,212 | ||||||

MGE Energy, Inc. | 203 | 9,732 | ||||||

National Fuel Gas Company | 643 | 31,468 | ||||||

New Jersey Resources Corporation | 383 | 17,580 | ||||||

NiSource, Inc. | 2,597 | 66,457 | ||||||

Northeast Utilities | 2,887 | 115,134 | ||||||

Northwest Natural Gas Company | 255 | 12,416 | ||||||

OGE Energy Corporation | 900 | 47,799 | ||||||

Pepco Holdings, Inc. | 2,110 | 42,116 | ||||||

Piedmont Natural Gas Company, Inc. | 655 | 20,816 | ||||||

Portland General Electric Company | 689 | 18,761 | ||||||

Questar Corporation | 1,627 | 33,109 | ||||||

UGI Corporation | 1,028 | 31,508 | ||||||

WGL Holdings, Inc. | 472 | 19,092 | ||||||

| 946,701 | ||||||||

Consumer Durables & Apparel — 1.7% |

| |||||||

Columbia Sportswear Company | 122 | 6,172 | ||||||

Deckers Outdoor Corporation (a) | 355 | 14,807 | ||||||

Fifth & Pacific Companies, Inc. (a) | 900 | 9,972 | ||||||

Harman International Industries, Inc. | 656 | 26,470 | ||||||

KB Home | 648 | 5,987 | ||||||

Leggett & Platt, Inc. | 1,272 | 29,485 | ||||||

Mattel, Inc. | 3,121 | 109,766 | ||||||

Meritage Homes Corporation (a) | 355 | 12,460 | ||||||

Mohawk Industries, Inc. (a) | 545 | 36,204 | ||||||

NIKE, Inc., Class B | 3,422 | 319,444 | ||||||

PulteGroup, Inc. (a) | 3,141 | 35,493 | ||||||

PVH Corporation | 632 | 50,200 | ||||||

Tupperware Brands Corporation | 512 | 26,839 | ||||||

Under Armour, Inc., Class A (a) | 714 | 38,870 | ||||||

VF Corporation | 832 | 124,218 | ||||||

Whirlpool Corporation | 703 | 47,495 | ||||||

| 893,882 | ||||||||

Telecommunication Services — 1.3% |

| |||||||

CenturyLink, Inc. | 5,764 | 239,436 | ||||||

Cincinnati Bell, Inc. (a) | 1,716 | 6,607 | ||||||

Crown Castle International Corporation (a) | 2,662 | 164,725 | ||||||

Frontier Communications Corporation | 9,228 | 36,174 | ||||||

19

GREEN CENTURY EQUITY FUND PORTFOLIO OF INVESTMENTS

July 31, 2012concluded

| SHARES | VALUE | |||||||

Telecommunication Services — (continued) |

| |||||||

Leap Wireless International, Inc. (a) | 381 | $ | 2,164 | |||||

SBA Communications Corporation, Class A (a) | 1,069 | 63,135 | ||||||

Sprint Nextel Corporation (a) | 27,582 | 120,257 | ||||||

Windstream Corporation | 5,383 | 53,615 | ||||||

| 686,113 | ||||||||

Renewable Energy & Energy Efficiency — 0.7% |

| |||||||

American Superconductor Corporation (a) | 418 | 1,551 | ||||||

Calpine Corporation (a) | 2,883 | 49,270 | ||||||

Cree, Inc. (a) | 1,011 | 24,213 | ||||||

First Solar, Inc. (a) | 577 | 8,967 | ||||||

Fuel Systems Solutions, Inc. (a) | 142 | 2,516 | ||||||

ITC Holdings Corporation | 471 | 34,943 | ||||||

Itron, Inc. (a) | 372 | 14,497 | ||||||

Johnson Controls, Inc. | 6,363 | 156,848 | ||||||

Ormat Technologies, Inc. | 139 | 2,502 | ||||||

Quanta Services, Inc. (a) | 1,917 | 44,072 | ||||||

SunPower Corporation (a) | 405 | 1,588 | ||||||

Zoltek Companies, Inc. (a) | 250 | 2,085 | ||||||

| 343,052 | ||||||||

Commercial & Professional Services — 0.6% |

| |||||||

Avery Dennison Corporation | 988 | 30,420 | ||||||

Deluxe Corporation | 459 | 12,999 | ||||||

Herman Miller, Inc. | 513 | 9,388 | ||||||

HNI Corporation | 415 | 11,027 | ||||||

IHS, Inc., Class A (a) | 514 | 56,679 | ||||||

Interface, Inc., Class A | 575 | 7,624 | ||||||

Iron Mountain, Inc. | 1,190 | 38,330 | ||||||

Kelly Services, Inc. | 242 | 2,870 | ||||||

Knoll, Inc. | 470 | 6,434 | ||||||

Manpower, Inc. | 739 | 26,294 | ||||||

Pitney Bowes, Inc. | 1,809 | 24,168 | ||||||

R.R. Donnelley & Sons Company | 1,616 | 19,586 | ||||||

Robert Half International, Inc. | 1,254 | 33,871 | ||||||

Steelcase, Inc. | 707 | 6,059 | ||||||

Team, Inc. (a) | 160 | 4,982 | ||||||

Tetra Tech, Inc. (a) | 584 | 15,015 | ||||||

| 305,746 | ||||||||

Healthy Living — 0.4% |

| |||||||

Hain Celestial Group, Inc. (The) (a) | 348 | $ | 19,380 | |||||

United Natural Foods, Inc. (a) | 448 | 24,326 | ||||||

Whole Foods Market, Inc. | 1,624 | 149,051 | ||||||

| 192,757 | ||||||||

Automobiles & Components — 0.3% |

| |||||||

BorgWarner, Inc. (a) | 1,005 | 67,436 | ||||||

Harley-Davidson, Inc. | 2,122 | 91,734 | ||||||

Modine Manufacturing Company (a) | 365 | 2,449 | ||||||

| 161,619 | ||||||||

Total Securities | 50,788,352 | |||||||

| SHORT-TERM OBLIGATION — 0.3% | ||||||||

Repurchase Agreement — | 173,405 | |||||||

TOTAL INVESTMENTS (b) — 100.0% |

| |||||||

(Cost $42,877,926) | 50,961,757 | |||||||

Other Assets Less Liabilities — 0.0% |

| 9,896 | ||||||

NET ASSETS — 100.0% | $ | 50,971,653 | ||||||

| (a) | Non-income producing security. |

| (b) | The cost of investments for federal income tax purposes is $44,257,062 resulting in gross unrealized appreciation and depreciation of $11,273,901 and $4,569,206 respectively, or net unrealized appreciation of $6,704,695. |

See Notes to Financial Statements

20

GREEN CENTURY FUNDS STATEMENTS OF ASSETS AND LIABILITIES

July 31, 2012

| BALANCED FUND | EQUITY FUND | |||||||

ASSETS: | ||||||||

Investments, at value (cost $51,733,270 and $42,877,926, respectively) | $ | 58,651,130 | $ | 50,961,757 | ||||

Receivables for: | ||||||||

Capital stock sold | 41,197 | 22,344 | ||||||

Interest | 139,864 | — | ||||||

Dividends | 42,925 | 56,278 | ||||||

Total assets | 58,875,116 | 51,040,379 | ||||||

LIABILITIES: | ||||||||

Payable for capital stock repurchased | 3,309 | 15,351 | ||||||

Accrued expenses | 73,680 | 53,375 | ||||||

Total liabilities | 76,989 | 68,726 | ||||||

NET ASSETS | $ | 58,798,127 | $ | 50,971,653 | ||||

NET ASSETS CONSIST OF: | ||||||||

Paid-in capital | $ | 56,424,986 | $ | 50,463,563 | ||||

Undistributed net investment income | — | 7,637 | ||||||

Accumulated net realized losses on investments | (4,544,719 | ) | (7,583,378 | ) | ||||

Net unrealized appreciation on investments | 6,917,860 | 8,083,831 | ||||||

NET ASSETS | $ | 58,798,127 | $ | 50,971,653 | ||||

SHARES OUTSTANDING (UNLIMITED NUMBER OF SHARES AUTHORIZED @ $0.01 PAR VALUE) | 3,255,969 | 2,449,402 | ||||||

NET ASSET VALUE, REDEMPTION PRICE AND OFFERING PRICE PER SHARE | $ | 18.06 | $ | 20.81 | ||||

GREEN CENTURY FUNDS STATEMENTS OF OPERATIONS

For the year ended July 31, 2012

| BALANCED FUND | EQUITY FUND | |||||||

INVESTMENT INCOME: | ||||||||

Interest income | $ | 521,859 | $ | 14 | ||||

Dividend and other income (net of $1,810 and $0 foreign withholding taxes, respectively) | 639,059 | 1,086,947 | ||||||

Total investment income | 1,160,918 | 1,086,961 | ||||||

EXPENSES: | ||||||||

Administrative services fee | 455,722 | 461,350 | ||||||

Investment advisory fee | 371,984 | 128,393 | ||||||

Total expenses | 827,706 | 589,743 | ||||||

NET INVESTMENT INCOME | 333,212 | 497,218 | ||||||

NET REALIZED AND UNREALIZED GAIN (LOSS): | ||||||||

Net realized gain (loss) on investments | 698,443 | (185,192 | ) | |||||

Change in net unrealized appreciation on investments | 1,034,519 | 2,358,110 | ||||||

NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS | 1,732,962 | 2,172,918 | ||||||

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | $ | 2,066,174 | $ | 2,670,136 | ||||

See Notes to Financial Statements

21

GREEN CENTURY FUNDS STATEMENTS OF CHANGES IN NET ASSETS

| BALANCED FUND | EQUITY FUND | |||||||||||||||

| FOR THE YEAR ENDED JULY 31, 2012 | FOR THE YEAR ENDED JULY 31, 2011 | FOR THE YEAR ENDED JULY 31, 2012 | FOR THE YEAR ENDED JULY 31, 2011 | |||||||||||||

INCREASE (DECREASE) IN NET ASSETS: | ||||||||||||||||

From operations: | ||||||||||||||||

Net investment income | $ | 333,212 | $ | 414,043 | $ | 497,218 | $ | 480,986 | ||||||||

Net realized gain (loss) on investments | 698,443 | 2,266,008 | (185,192 | ) | (97,409 | ) | ||||||||||

Change in net unrealized appreciation on Investments | 1,034,519 | 3,571,199 | 2,358,110 | 6,998,388 | ||||||||||||

Net increase in net assets resulting from operations | 2,066,174 | 6,251,250 | 2,670,136 | 7,381,965 | ||||||||||||

Dividends and distributions to shareholders: | ||||||||||||||||

From net investment income | (330,794 | ) | (457,006 | ) | (503,447 | ) | (534,364 | ) | ||||||||

Capital share transactions: | ||||||||||||||||

Proceeds from sales of shares | 4,099,738 | 4,100,652 | 9,871,395 | 5,175,851 | ||||||||||||

Reinvestment of dividends and distributions | 322,341 | 445,182 | 495,535 | 523,786 | ||||||||||||

Payments for shares redeemed | (5,769,152 | ) | (4,690,919 | ) | (14,924,885 | ) | (5,775,084 | ) | ||||||||

Net increase (decrease) in net assets resulting from capital share transactions | (1,347,073 | ) | (145,085 | ) | (4,557,955 | ) | (75,447 | ) | ||||||||

Total increase (decrease) in net assets | 388,307 | 5,649,159 | (2,391,266 | ) | 6,772,154 | |||||||||||

NET ASSETS: | ||||||||||||||||

Beginning of year | 58,409,820 | 52,760,661 | 53,362,919 | 46,590,765 | ||||||||||||

End of year | $ | 58,798,127 | $ | 58,409,820 | $ | 50,971,653 | $ | 53,362,919 | ||||||||

Undistributed net investment income | — | 5,784 | 7,637 | 15,627 | ||||||||||||

See Notes to Financial Statements

22

GREEN CENTURY BALANCED FUND FINANCIAL HIGHLIGHTS

| FOR THE YEARS ENDED JULY 31, | ||||||||||||||||||||

| 2012 | 2011 | 2010 | 2009 | 2008 | ||||||||||||||||

Net Asset Value, beginning of year | $ | 17.50 | $ | 15.76 | $ | 14.75 | $ | 16.52 | $ | 17.78 | ||||||||||

Income from investment operations: | ||||||||||||||||||||

Net investment income | 0.10 | 0.13 | 0.18 | 0.27 | 0.28 | |||||||||||||||

Net realized and unrealized gain (loss) on investments | 0.56 | 1.75 | 1.01 | (1.77 | ) | (1.27 | ) | |||||||||||||

Total increase (decrease) from investment operations | 0.66 | 1.88 | 1.19 | (1.50 | ) | (0.99 | ) | |||||||||||||

Less dividends: | ||||||||||||||||||||

Dividends from net investment income | (0.10 | ) | (0.14 | ) | (0.18 | ) | (0.27 | ) | (0.27 | ) | ||||||||||

Net Asset Value, end of year | $ | 18.06 | $ | 17.50 | $ | 15.76 | $ | 14.75 | $ | 16.52 | ||||||||||

Total return | 3.81 | % | 11.92 | % | 8.07 | % | (8.88 | )% | (5.62 | )% | ||||||||||

Ratios/Supplemental data: | ||||||||||||||||||||

Net assets, end of year (in 000’s) | $ | 58,798 | $ | 58,410 | $ | 52,761 | $ | 48,105 | $ | 52,703 | ||||||||||

Ratio of expenses to average net assets | 1.45 | % | 1.38 | % | 1.38 | % | 1.38 | % | 1.38 | % | ||||||||||

Ratio of net investment income to average net assets | 0.58 | % | 0.72 | % | 1.13 | % | 1.97 | % | 1.50 | % | ||||||||||

Portfolio turnover | 58 | % | 70 | % | 48 | % | 33 | % | 44 | % | ||||||||||

GREEN CENTURY EQUITY FUND FINANCIAL HIGHLIGHTS

| FOR THE YEARS ENDED JULY 31, | ||||||||||||||||||||

| 2012 | 2011 | 2010 | 2009 | 2008 | ||||||||||||||||

Net Asset Value, beginning of year | $ | 19.99 | $ | 17.44 | $ | 15.65 | $ | 18.83 | $ | 22.66 | ||||||||||

Income from investment operations: | ||||||||||||||||||||

Net investment income | 0.19 | 0.18 | 0.17 | 0.21 | 0.18 | |||||||||||||||

Net realized and unrealized gain (loss) on investments | 0.83 | 2.57 | 1.77 | (3.17 | ) | (2.81 | ) | |||||||||||||

Total increase (decrease) from investment operations | 1.02 | 2.75 | 1.94 | (2.96 | ) | (2.63 | ) | |||||||||||||

Less dividends: | ||||||||||||||||||||

Dividends from net investment income | (0.20 | ) | (0.20 | ) | (0.15 | ) | (0.22 | ) | (0.19 | ) | ||||||||||

Distributions from net realized gains | — | — | — | — | (a) | (1.01 | ) | |||||||||||||

Total decrease from dividends | (0.20 | ) | (0.20 | ) | (0.15 | ) | (0.22 | ) | (1.20 | ) | ||||||||||

Net Asset Value, end of year | $ | 20.81 | $ | 19.99 | $ | 17.44 | $ | 15.65 | $ | 18.83 | ||||||||||

Total return | 5.14 | % | 15.77 | % | 12.39 | % | (15.58 | )% | (12.28 | )% | ||||||||||

Ratios/Supplemental data: | ||||||||||||||||||||

Net assets, end of year (in 000’s) | $ | 50,972 | $ | 53,363 | $ | 46,591 | $ | 40,659 | $ | 50,123 | ||||||||||

Ratio of expenses to average net assets | 1.16 | % | 0.95 | % | 0.95 | % | 0.95 | % | 0.95 | % | ||||||||||

Ratio of net investment income to average net assets | 0.97 | % | 0.92 | % | 0.97 | % | 1.38 | % | 0.98 | % | ||||||||||

Portfolio turnover | 14 | % | 13 | % | 13 | % | 23 | % | 6 | % | ||||||||||

| (a) | Amount represents less than 0.005 per share. |

See Notes to Financial Statements

23

GREEN CENTURY FUNDS NOTES TO FINANCIAL STATEMENTS

NOTE 1 — Organization and Significant Accounting Policies

Green Century Funds (the “Trust”) is a Massachusetts business trust which offers two separate series, the Green Century Balanced Fund (the “Balanced Fund”) and the Green Century Equity Fund (the “Equity Fund”), collectively, the “Funds”. The Trust is registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end, diversified management investment company. The Trust accounts separately for the assets, liabilities and operations of each series. The Balanced Fund commenced operations on March 18, 1992 and the Equity Fund commenced operations on September 13, 1995.