UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811-06351

Green Century Funds

114 State Street

Suite 200

Boston, MA 02109

(Address of principal executive offices)

Green Century Capital Management, Inc.

114 State Street

Suite 200

Boston, MA 02109

(Name and address of agent for service)

Registrant’s telephone number, including area code: (617) 482-0800

Date of fiscal year end: July 31

Date of reporting period: July 31, 2022

Item 1. Reports to Stockholders

| | (a) | The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). |

| | |

| | ANNUAL REPORT Green Century Balanced Fund Green Century Equity Fund Green Century MSCI International Index Fund July 31, 2022 |

| |

| An investment for your future.® | | 114 State Street, Boston, Massachusetts 02109 |

For information on the Green Century Funds®, call 1-800-93-GREEN. For information on how to open an account and account services, call 1-800-221-5519 8:00 am to 6:00 pm Eastern Time, Monday through Friday. For share price and account information, visit www.greencentury.com.

Dear Shareholder,

More than 30 years ago, the group of environmental and public health nonprofits that founded Green Centuryo decided to help people save for their future without compromising their values. It was a simple concept, but one that was only being used by a handful of pioneers in the socially and environmentally responsible investing space. Since then, Green Century has grown into a leader in the environmentally and socially responsible investing field with more than $1B in Assets Under Management, providing mutual funds for individuals and institutions to keep their money out of the most irresponsible industries.

As we finish celebrating our 30th year of providing individuals a way to align their investments with their values, I wanted to share some Green Century milestones we have been able to accomplish with your support. Green Century has followed a three-pronged approach of values-based investing, shareholder advocacy, and non-profit ownership that work together in a way that lets you align your investments with your values and helps protect the planet at the same time.

Thank you for your investments and support over the last three decades. As we look back, here are a few of our noteworthy accomplishments

Investment Strategy:

| | • | | In 1992, we created the Green Century Equity Fund and the Green Century Balanced Fund as no-load funds to make them more accessible to everyday investors in an era when funds with “loads” or purchase fees were common. |

| | • | | In 2009, the Green Century Balanced Fund published the first known carbon footprint report for a U.S. mutual fund, setting the stage for the current focus on how the companies in a portfolio measure and manage their greenhouse gas emissions. |

| | • | | In 2014, Green Century became the first family of fossil fuel free mutual funds that are environmentally friendly and diversified. |

| | • | | In 2016, the Green Century MSCI International Fund was launched and became the first environmentally friendly and diversified fossil fuel free international mutual index fund in the U.S. |

| | • | | In 2022, Green Century joined the Tobacco Free Pledge to encourage other asset owners to stop investing in companies that produce tobacco products responsible for preventable loss of life and environmental damage. |

Shareholder Advocacy:

Throughout the years, Green Century has led an award-winning shareholder advocacy program that has helped persuade hundreds of companies to make changes to their environmental policies and practices. Some of our achievements include:

| | • | | Securing an agreement in 2006 with Whole Foods1 to stop selling polycarbonate baby bottles and children’s sippy cups containing the toxic chemical bisphenol A, more commonly known as BPA |

| | • | | Winning an Outstanding Achievement award in 2014 for our work that has protected Indonesian tropical forests and endangered species such as the orangutan. |

| | • | | Convincing Amazon1 to commit to carbon neutrality for half of its package delivery by 2030 in a new “Shipment Zero” program |

| | • | | Securing an agreement with Royal Caribbean1 to address the growing problem of food waste in 2019 |

| | • | | Filing the highest number of shareholder proposals on environmental issues in 2021 and winning the most majority proxy votes, including one at Costco1, of any firm in the U.S. in 2022. |

Non-profit Ownership:

Green Century was founded by environmental and public health organizations. Because of this unique ownership structure, Green Century’s profits belong to our non-profit owners who can use the funds for their critical work. The achievements of these nine Public Interest Research Groups (PIRGs) that work at the state and national level include:

| | • | | The Stop the Overuse of Antibiotics Campaign helped California and Maryland pass laws banning the routine use of medically important antibiotics on farms operating within those states. The campaign organizes medical professionals to help decision-makers understand the grave public health consequences of antibiotic resistance |

| | • | | The No Bees, No Food Campaign is working to restore bee populations to healthy levels and save our food supply by working to ban the sale of bee-killing pesticides for our homes, parks, and gardens in 21 states around the country. |

| | • | | The Beyond Plastic Campaign helped convince Maine, Maryland, Vermont, and Oregon to ban polystyrene foam, a non recyclable product made from fossil fuels that takes hundreds of years to fully degrade. |

Thank you for investing in the Green Century Funds.

Sincerely,

Leslie Samuelrich, President

Green Century Funds

° Green Century Capital Management, Inc. (Green Century) is the investment advisor to the Green Century Funds (The Funds).

2

Green Century on the Web

E-News. For more regular updates on the Green Century Funds and on our advocacy efforts, please consider signing up for our e-newsletter. Call 1-800-934-7336, visit www.greencentury.com, or email info@greencentury.com.

Online Access. Information on your account is available on our website at www.greencentury.com. From the home page, click on Access My Account. Shareholders may also perform online transactions on the site. While there, please consider registering for e-delivery of your statements and other Fund documents.

Twitter. Green Century is on Twitter. Follow us at Twitter.com/Green_Century for a sustainable investor’s perspective on critical issues.

The Green Century Funds’ proxy voting guidelines and a record of the Funds’ proxy votes for the year ended June 30, 2022 are available without charge, upon request, (i) at www.greencentury.com, (ii) by calling 1-800-934-7336, (iii) by sending an e-mail to info@greencentury.com, and (iv) on the Securities and Exchange Commission’s website at www.sec.gov.

The Green Century Funds file their complete schedule of portfolio holdings with the SEC for the first and third quarters of the year on Form N-PORT, Part F. The Green Century Funds’ Forms N-PORT, Part F are available on the EDGAR database on the SEC’s website at www.sec.gov. Copies may be obtained upon payment of a duplicating fee, by writing the SEC’s Public Reference Section, Washington DC 20549-0102 or by electronic request at the following e-mail address: publicinfo@sec.gov. The information on Form N-PORT, Part F may also be obtained by calling us at 1-800-934-7336, or by e-mailing a request to info@greencentury.com

3

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

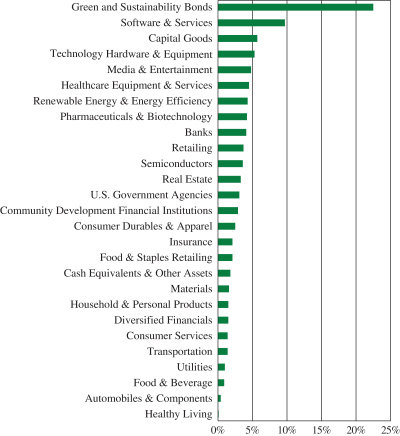

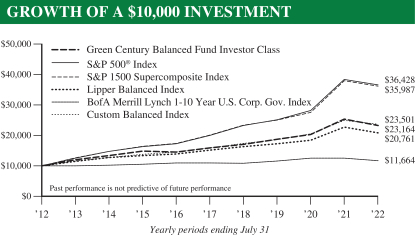

GREEN CENTURY BALANCED FUND

Investment Objective The Green Century Balanced Fund seeks capital growth and income from a diversified portfolio of stocks and bonds that meet Green Century’s standards for corporate environmental responsibility.

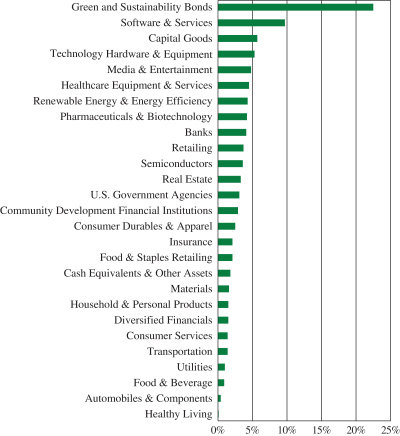

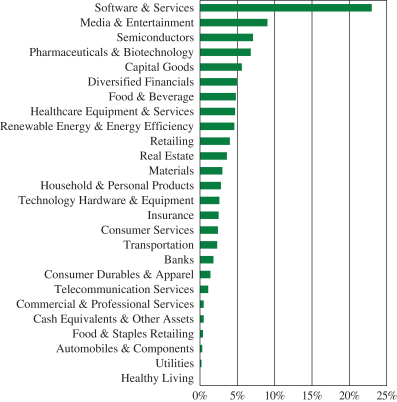

Portfolio Orientation As of the fiscal year ended July 31, 2022 the Green Century Balanced Fund (the Balanced Fund or the Fund) was diversified in a number of ways. Equity holdings represented 64.5% and

bonds constituted 33.7% of the Fund’s net asset value. The Fund had 1.8% invested in cash, cash equivalents, and other assets, less liabilities. The portfolio managers view equities as the primary source of potential long-term growth, while emphasizing the importance of diversification in seeking to lower volatility. The Fund’s equity holdings were diversified across 71 equity holdings at fiscal year-end, none of which represented more than 4.4% of total net assets. Generally, larger, more established companies constitute larger positions in the Fund’s portfolio than smaller companies. The portfolio managers seek to mitigate risk by investing primarily in companies they believe have demonstrated records of profitability, above-average growth prospects, and reasonable valuations.

As of July 31st , the stocks held by the Balanced Fund were also diversified by sector, with (as a percent of total net assets) Technology (19.1%), Health Care (8.7%), and Consumer Discretionary (8.0%) as the largest sectors.

In line with its environmental mandate, the Fund had exposure to what Green Century considers environmental leaders in a number of industries

GREEN CENTURY BALANCED FUND

INVESTMENT BY INDUSTRY (unaudited)

4

including Healthy Living, Capital Goods, and Transportation. Green Century’s environmental screens prohibit traditional energy and utility companies from being owned, while the Fund has broad exposure to information technology, health care, financial, consumer, and industrial companies.

In addition to its equity exposure to environmental leaders, the Fund invests in designated Green Bonds and designated Social Impact Bonds. The issuers of Green Bonds have indicated that the proceeds from the bonds will be used for environmentally positive goals such as greenhouse gas reduction, climate adaptation, and climate change mitigation. Issuers of designated Social Impact Bonds have indicated that the proceeds from the bonds will be used for projects supporting such issues as poverty alleviation, low-income housing, fair trade, and community development. As of July 31st, 26.3% of the total portfolio and 78.1% of the market value of the bonds held in the Fund were designated Green / Sustainable or Social Impact Bonds.

Higher quality, intermediate maturity bonds can typically lower volatility and provide a stable source of income. At fiscal year end, the Balanced Fund held 55 bonds diversified across corporate and government agency issuers. In an effort to dampen volatility, the weighted average maturity (4.98 years) and modified duration (4.15 years) remain in the intermediate-range. The weighted average yield to maturity was 1.08%. All fixed income holdings were investment grade at time of purchase and remain investment grade at July 31, 2022.

Economic Environment. Equity markets witnessed considerable volatility over the last 12-months, with a major pullback in valuation as marked by P/E (Price/Earnings) contraction. During the period, investors grappled with conflicting economic data and signals about the direction of global bank tightening in the face of persistent inflation increases. The portfolio managers now anticipate that a recession is increasingly likely at the end of 2022 or the beginning of 2023. Normally, fiscal and monetary policy tightening act with a significant lag, only leading to declines in demand after 12-18 months. However, the Fed’s interest rate increases in this cycle have been very aggressive. Further, the Fed’s rate hikes are following, rather than leading, other global central bank rate increases, likely shortening that time frame. Leading indicators, such as consumer and business sentiment and surveys of new orders from manufacturers, are falling, predicting declines in economic activity. Immediate, co-incident economic indicators do not yet show declines. The portfolio managers see some slight softening in the labor market, but so far businesses continue to add jobs, and layoffs have only ticked up slightly. Yet, inflation measures continue to be stubbornly high, creating consumer discomfort, and non-food, non-energy consumer spending is softening.

While the portfolio managers now anticipate a recession, and also do not see the obvious economic and financial imbalances that preceded either the Great Financial Crisis or the dot.com collapse, they are concerned about growing labor market inconsistencies, including rapid readjustments in pay scales and changes in labor market participation. In addition, the slow underlying growth of the economy, and the low neutral rate of interest, limit the Fed’s scope for policy, raising the possibility that the Fed may need to push the economy into a deep and persistent recession before inflationary forces recede. This is not the base case, but such a recession would entail a much more tumultuous market. While, a mild recession, both bond and equity markets already show distress, with a significant amount of economic decline already priced in. The S&P 500 dropped more than 20% from its high on January 3, beginning a bear market. Equity market declines have resulted from declines in valuation, or price-to-earnings (P/E) compression in response to higher interest rates. As economic activity slows, the portfolio managers expect

5

that corporate earnings will decline. They have already seen some early signs of this, with retailers such as Target and Wal-Mart reporting unexpectedly soft consumer spending for more discretionary items. Wider credit spreads, especially for below-investment grade debt, will constrain spending by more leveraged companies. There has already been significant compression in valuation; declines in corporate earnings from here will have a muted effect because the valuation multiples are already reduced.

Deliberately slowing economic growth may ease supply chain disruptions, but it can be a painful remedy. While the Fed intends to slow growth without causing a recession, it has limited control; consumers and businesses make their own decisions about spending and investing based on the information that they have. That information now includes the knowledge that the Fed is determined to raise interest rates to a restrictive level, and that the Fed views the risks to economic growth as skewed to the downside. With rapidly declining consumer and business confidence, there is expectation both consumers and businesses will curtail spending; this will likely translate into reduced corporate earnings, and could reasonably initiate another downturn for equity markets. However, neither a recession nor a bear market means the end of the world, and the underlying strength of the economy means that recovery will happen when the Fed stops raising rates.The portfolio managers also note that recovery from bear markets is usually sudden and sharp, so that attempts to time the market are usually unsuccessful. While they have become more cautious, they believe that they are adequately positioned for more risk-off markets. As always, they will be carefully monitoring economic data and our positioning as these higher interest rates begin to affect economic activity. In a slowing growth environment, the expectation is that focusing on quality, lower-leverage, profitable companies with steadier earnings and revenues will be protective. The portfolio managers continue to avoid positioning for extremes and acknowledge that an environment of high uncertainty means an increased likelihood of rapid rotation, as market participants grasp at informational straws. In such a period, thoughtful analysis of company management, strategies, and prospects assumes added importance.

They remain committed to a long-term focus and investment in high-quality and sustainability centered companies seeking to meet the challenges of this year of recovery and transition, and beyond. In addition, they are seeking out companies that acknowledge the ongoing climate crisis and which are setting their own targets for greenhouse gas reduction. In such challenging and difficult times as these, companies will be increasingly distinguished by the quality and integrity of their management, and by management’s attention to evolving social and environmental considerations. This is all the more true as regulatory frameworks continue to be dismantled. The growing environmental, social, and policy challenges facing the world make it increasingly imperative that we, as shareholders, engage our companies in creating the transition to a lower-carbon economy and recognizing the human rights and dignity of their workers. We expect our companies to act with integrity and purpose, and to take leading roles in creating alternative mechanisms, through legislation or internal policies, to protect the needs and concerns of their employees, communities, and planet.

Investment Strategy and Performance. The portfolio managers believe that strong environmental, social, and governance practices may enhance corporate profitability and reduce certain types of risks. The Fund specifically avoid risks associated with exposure to fossil fuels. Companies with strong balance sheets, strategic leadership in their products and markets, and strong environmental, social, and governance policies will have the financial flexibility and leadership wisdom to navigate choppy and volatile economic conditions.

6

The Balanced Fund holds a number of stocks that the portfolio managers believe have attractive environmental, social, and financial characteristics. New holdings over the reporting period include Levi Strauss1, Paycom Software1, Sunrun1, West Pharmaceuticals1, and Wolfspeed1.

At July 31, 2022, the Fund held over $104 million in Green / Sustainability or Social Impact Bonds and Notes. Some holdings include notes issued by Johnson Controls Intl1, NXPI1, and National Community Renaissance Cal1, and POAH1.

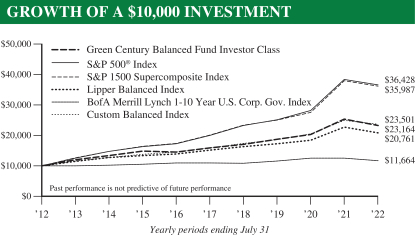

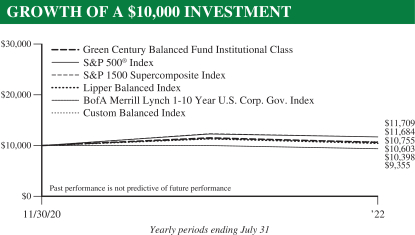

For the year ending July 31, 2022, the Balanced Fund’s Institutional Share Class returns were –7.72%, versus –5.10% return for its Custom Balanced Index,2 an index comprised of the S&P 1500 Index3 (60% weighting) and of the BofA Merrill Lynch 1-10 Year US Corporate and Government Index4 (40% weighting).* The Lipper Balanced Index5 returned –8.08% for the same twelve-month period.

The lack of exposure to traditional energy was a primary reason for underperformance in the period, as well as the Fund’s overweight to equities.

The Fund’s high-quality fixed income exposure performed relatively in-line with the benchmark as intentioned, with slight underperformance in the period. The Fund’s portfolio managers do not anticipate any significant changes in investment strategy for the Fund, believing that the investment environment may be favorable to the Fund’s core holdings in what the portfolio managers consider high-quality, environmentally responsible companies with strong growth prospects and reasonable valuations.

| | | | | | | | | | | | | | | | | | |

Green Century Balanced Fund Total expense ratio: 1.46% for Individual Share Class and 1.16% for

Institutional Share Class | | CUMULATIVE

RETURN* | | | AVERAGE ANNUAL RETURN* | |

| | Latest

Quarter | | | One Year | | | Five Years | | | Ten Years | |

| June 30, 2022 | | Green Century Balanced Fund — Individual Share Class | | | –12.43% | | | | –12.11% | | | | 6.69% | | | | 7.95% | |

| | Green Century Balanced Fund — Institutional Share Class** | | | –12.39% | | | | –11.88% | | | | 6.79% | | | | 8.00% | |

| | | Custom Balanced Index | | | –10.65% | | | | –9.25% | | | | 7.28% | | | | 8.39% | |

| July 31, 2022 | | Green Century Balanced Fund — Individual Share Class | | | 0.73% | | | | –7.97% | | | | 7.98% | | | | 8.76% | |

| | Green Century Balanced Fund — Institutional Share Class** | | | 0.82% | | | | –7.72% | | | | 8.09% | | | | 8.82% | |

| | | Custom Balanced Index | | | 0.87% | | | | –5.10% | | | | 8.29% | | | | 8.92% | |

* The performance data quoted represents past performance and is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain Fund prices and performance information as of the most recent month-end, call 1-800-93-GREEN/1-800-934-7336. Performance includes the reinvestment of income dividends and capital gain distributions. Performance shown does not reflect the deduction of taxes that a shareholder might pay on Fund distributions or the redemption of Fund shares. A redemption fee of 2.00% may be imposed on redemptions or exchanges of shares you have owned for 60 days or less. Please see the prospectus for more information.

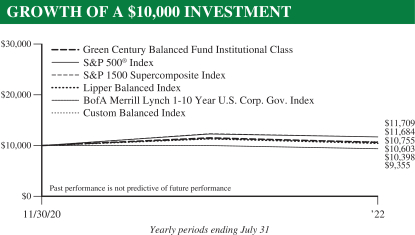

**Institutional Shares were offered as of November 28, 2020. The Institutional Share Class performance prior to November 28, 2020 reflects the performance of the Fund’s Individual Investor Class.

7

The Balanced Fund consistently includes stocks and bonds of what Green Century believes to be environmentally responsible corporations of various sizes, including small, medium, and large companies. The value of the stocks held in the Balanced Fund will fluctuate in response to factors that may affect the single issuer, industry, or sector of the economy or may affect the market as a whole. Bonds are subject to a variety of risks including interest rate, credit, and inflation risk. The Funds’ environmental criteria limit the investments available to the Funds compared to mutual funds that do not use environmental criteria.

The S&P 500® Index6 and the S&P Supercomposite 1500 Index (the S&P 1500 Index) are unmanaged indexes of 500 and 1500 stocks, respectively. The Custom Balanced Index is comprised of a 60% weighting in the S&P 1500 Index and a 40% weighting in the BofA Merrill Lynch 1-10 Year US Corporate & Government Index (the BofA Merrill Lynch Index). The BofA Merrill Lynch Index tracks the performance of U.S. dollar-denominated investment grade government and corporate public debt issued in the U.S. domestic bond market with at least 1 year and less than 10 years remaining maturity, including U.S. Treasury, U.S. Agency, foreign government, supranational and corporate securities. Similar to the Balanced Fund, the performance of the S&P 500® Index, the S&P 1500 Index, the Custom Balanced Index and the BofA Merrill Lynch Index reflect reinvestment of dividends and distributions. Unlike the Fund, however, the performance of the S&P 500® Index, the S&P 1500 Index, the Custom Balanced Index and the BofA Merrill Lynch Index does not include management and other operating expenses. It is not possible to invest directly in an index.

8

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

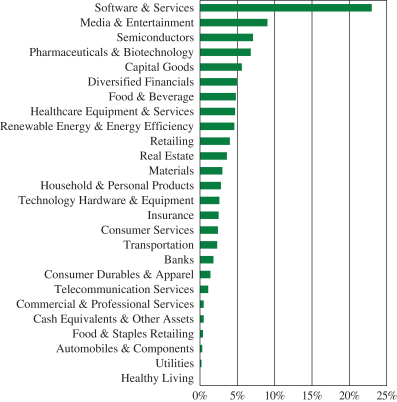

GREEN CENTURY EQUITY FUND

Investment Objective The Green Century Equity Fund (the Equity Fund or the Fund) seeks to achieve long-term total return that matches the performance of an index comprised of the stocks of companies selected based on environmental, social and governance criteria.

Portfolio Orientation The Fund seeks to achieve its objective by investing in the stocks which make up the MSCI KLD 400 Social ex Fossil Fuels Index7 (the KLD400 ex Fossil Fuels Index or the Index), a custom index calculated by MSCI, Inc. The KLD400 ex Fossil Fuels Index is comprised of the common stocks of the approximately 400 companies in the MSCI KLD 400 Social Index (the KLD400 Index), minus the stocks of the companies that explore for, extract, produce, manufacture, or refine coal, oil or gas that are included in the KLD400 Index. The Index also does not include companies that produce or transmit electricity derived from fossil fuels, transmit natural gas, or own carbon reserves.

The KLD400 Index, formerly named the Domini 400 Social Index, is the longest-running socially responsible index. Like other index funds, the Equity Fund is not actively managed in the traditional investment sense, but rather seeks to be nearly fully invested at all times in a broad and diverse portfolio of stocks which meet certain environmental, social and governance (ESG) criteria. The Equity Fund, like many other mutual funds invested primarily in stocks, carries the risk of investing in the stock market. The large companies in which the Equity Fund is invested may perform worse than the stock market as a whole. The Fund’s environmental criteria limit the investments available to the Fund compared to mutual funds that do not use environmental criteria.

The Fund invests in the stocks of companies selected for inclusion in the Index based on a thorough review of environmental, social, and governance factors and includes

GREEN CENTURY EQUITY FUND

INVESTMENT BY INDUSTRY (unaudited)

9

those companies believed to have the best overall sustainability records. Green Century believes that certain industries impose unique and onerous risks and/or costs on society. Companies involved in these industries are evaluated based on their level of involvement as well as the impact of that involvement on society. Therefore, companies that derive significant revenues from the manufacture of tobacco products, alcoholic beverages, genetically modified organisms (GMOs), or the operation of gambling enterprises; or have a significant direct ownership share in, operate or design nuclear power plants are not eligible for the Index. Major military contractors and firearms manufacturers are also ineligible. The Index excludes all companies that explore for, extract, produce, manufacture, or refine coal, oil or gas. The Index also does not include companies that produce or transmit electricity derived from fossil fuels, transmit natural gas, or own carbon reserves.

Investment Strategy and Performance Green Century believes that companies that minimize their negative social and environmental impact and follow governance standards could enjoy competitive advantages and be less likely to incur certain legal liabilities that may be assessed when a product or service is determined to be harmful. Green Century also believes that such investments may, over the long term, provide investors with a return that is competitive with enterprises that do not exhibit such social and environmental awareness.

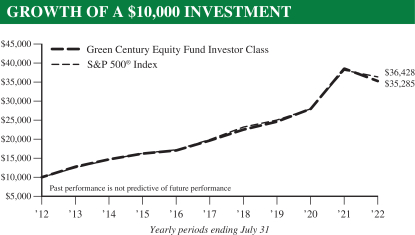

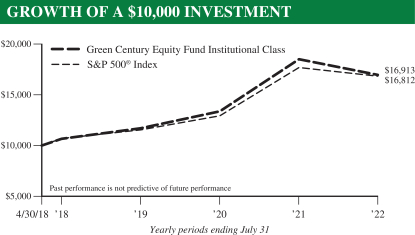

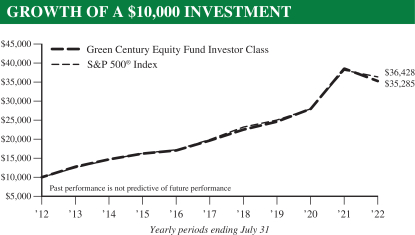

The Equity Fund’s total return for the latest quarter ended July 31, 2022 was –0.63% for the individual share class and –0.58% for the institutional share class, underperforming the S&P 500® Index that returned 0.39% for the same period. Additional results for various time periods are below:*

| | | | | | | | | | | | | | | | | | |

Green Century Equity Fund Total expense ratio: 1.25% for Individual Share Class and 0.95% for

Institutional Share Class | | CUMULATIVE

RETURN* | | | AVERAGE ANNUAL RETURN* | |

| | Latest

Quarter | | | One Year | | | Five Years | | | Ten Years | |

| June 30, 2022 | | Green Century Equity Index Fund — Individual Share Class | | | –17.02% | | | | –13.35% | | | | 11.09% | | | | 12.58% | |

| | Green Century Equity Fund — Institutional Share Class | | | –16.95% | | | | –13.09% | | | | 11.36% | | | | 12.72% | |

| | | S&P 500® Index | | | –16.10% | | | | –10.62% | | | | 11.31% | | | | 12.96% | |

| July 31, 2022 | | Green Century Equity Index Fund — Individual Share Class | | | –0.63% | | | | –8.64% | | | | 12.44% | | | | 13.44% | |

| | Green Century Equity Fund — Institutional Share Class | | | –0.58% | | | | –8.38% | | | | 12.72% | | | | 13.58% | |

| | | S&P 500® Index | | | 0.39% | | | | –4.64% | | | | 12.83% | | | | 13.80% | |

* The performance data quoted represents past performance and is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain Fund prices and performance information as of the most recent month-end, call 1-800-93-GREEN/1-800-934-7336. Performance includes the reinvestment of income dividends and capital gains distributions. Performance shown does not reflect the deduction of taxes that a shareholder might pay on Fund distributions or the redemption of Fund shares. A redemption fee of 2.00% may be imposed on redemptions or exchanges of shares you have owned for 60 days or less. Please see the prospectus for more information. As of April 1, 2014, the Equity Fund invests in the common stocks which make up the MSCI KLD 400 Social ex Fossil Fuels Index; prior to April 1, 2014, the Fund invested in the common stocks which made up the MSCI KLD 400 Social Index. Institutional shares were offered as of April 30, 2018. The Institutional Share Class performance for periods prior to April 30, 2018 reflects the performance of the Fund’s Individual Investor Class.

10

For the year ended July 31, 2022, the Equity Fund Institutional and Investor share classes returned –8.38% and –8.64%, respectively, underperforming the S&P 500 Index which returned –4.64%. As the MSCI KLD 400 Social ex Fossil Fuels Index does not include all of the stocks in the S&P 500® Index and includes some stocks not included in the S&P 500® Index, the performance of the Fund can be expected to differ from the performance of the broader benchmark.

The strongest performing sectors in the Equity Fund were Consumer Staples, Utilities, and Health Care which returned 7.58%, –1.05% and –1.89%, respectively. The worst performing sectors were Communication Services and Information Technology, which returned –17.86% and –11.89%, respectively, for the year. Within the

S&P 500 Index, Energy, Utilities and Consumer Staples were the strongest performing sectors, gaining 67.44%, 15.55%, and 7.43%, respectively. The worst performing sectors were Communication Services and Consumer Discretionary, which returned –28.98% and –10.29%, respectively, for the year.

U.S. equities performed exceptionally well and finished 2021 near all-time highs. For the third consecutive year, U.S. equities posted double-digit gains. U.S. equities were flat in the third quarter of 2021 due to concerns on peak growth, inflation, and unwinding stimulus building a wall of worry in September. U.S. equities finished the fourth quarter strong. Investors focused on solid consumer spending and employment data, while digesting stubbornly high inflation figures. The first quarter of 2022 saw the S&P 500 realize its first quarterly decline since the beginning of 2020. Continued high inflation compounded by Russia’s invasion of Ukraine led to a pullback in investor risk appetite. Headwinds for global

The S&P 500® Index is an unmanaged index of 500 stocks. Similar to the Equity Fund, the S&P 500® Index’s performance reflects reinvestment of dividends and distributions. Unlike the Fund, however, the S&P 500® Index’s performance does not include management and other operating expenses. It is not possible to invest directly in an index.

11

financial markets continued in the second quarter of 2022, with negative returns in most major asset classes outside of cash. US equities outperformed non-US developed equities as measured by the S&P 500 and MSCI World Ex USA indices8, with 1 year returns of –4.64% and –13.20% respectively.

12

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

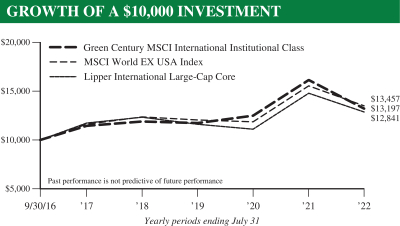

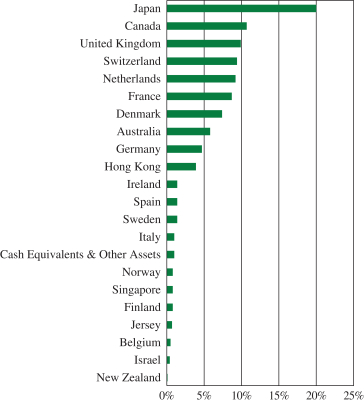

GREEN CENTURY MSCI INTERNATIONAL INDEX FUND

Investment Objective The Green Century MSCI International Index Fund (the International Fund or the Fund) seeks to achieve long-term total return that matches the performance of an index comprised of the stocks of foreign companies selected based on environmental, social and governance criteria.

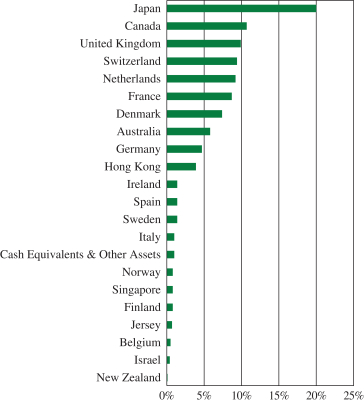

Portfolio Orientation The Fund seeks to achieve its objective by investing in the stocks included in the MSCI World ex USA SRI ex Fossil Fuels Index9 (the Index), a custom index calculated by MSCI, Inc. The Index is comprised of the common stocks of the approximately 240 companies in the MSCI World ex USA SRI Index, minus the stocks of the companies that explore for, extract, process, refine or distribute coal, oil or gas. The Index also does not include companies that produce or transmit electricity derived from fossil fuels, transmit natural gas, or own carbon reserves.

The International Fund is the only responsible, diversified fossil fuel free international index fund available in the U.S. The Fund is also broadly diversified and responsibly screened. Like other index funds, the International Fund is not actively managed in the traditional investment sense, but rather seeks to be nearly fully invested at all times in a broad and diverse portfolio of stocks which meet certain environmental, social and governance (ESG) criteria.

The Fund invests in the stocks of companies selected for inclusion in the Index based on a thorough review of environmental, social, and governance factors and includes those companies believed to have the best overall sustainability records. Green Century believes that certain industries impose unique and onerous risks and/or costs on society. Companies involved in these industries are evaluated based on their level of involvement as well as the impact of that involvement on society. Therefore, companies that

GREEN CENTURY MSCI INTERNATIONAL INDEX FUND

INVESTMENT BY COUNTRY (unaudited)

13

derive significant revenues from the manufacture of tobacco products, alcoholic beverages, genetically modified organisms (GMOs), or the operation of gambling enterprises; or have a significant direct ownership share in, operate or design nuclear power plants are not eligible for the Index. Major military contractors and firearms manufacturers are also ineligible. The Index excludes all companies that explore for, extract, produce, manufacture, or refine coal, oil or gas. The Index also does not include companies that produce or transmit electricity derived from fossil fuels, transmit natural gas, or own carbon reserves.

Investment Strategy and Performance Green Century believes that companies that minimize their negative social and environmental impact and follow governance standards could enjoy competitive advantages and be less likely to incur certain legal liabilities that may be assessed when a product or service is determined to be harmful. Green Century also believes that such investments may, over the long term, provide investors with a return that is competitive with enterprises that do not exhibit such social and environmental awareness.

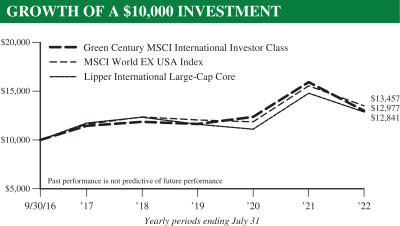

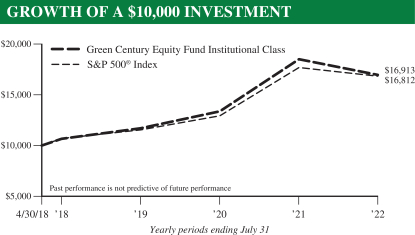

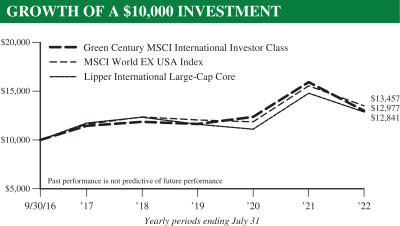

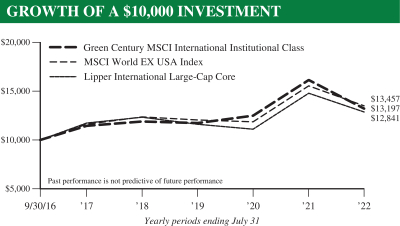

Both share classes of the International Fund underperformed its benchmark for the latest quarter ended July 31, 2022. The Fund’s total return was –3.52% for the individual share class and –3.46% for the institutional share class for this period, while the MSCI World ex USA Index returned –4.12% for the same period. Additional results for various time periods are below:*

| | | | | | | | | | | | | | | | | | |

Green Century MSCI International Fund Total expense ratio: 1.28% for Individual Share Class and 0.98% for

Institutional Share Class | | CUMULATIVE

RETURN* | | | AVERAGE ANNUAL RETURN* | |

| | Inception Date: September 30, 2016 | |

| | Latest

Quarter | | | One Year | | | Five Years | | | Since

Inception | |

| June 30, 2022 | | Green Century MSCI International Index Fund — Individual Share Class | | | –15.57% | | | | –21.24% | | | | 2.12% | | | | 3.65% | |

| | Green Century MSCI International Index Fund — Institutional Share Class | | | –15.54% | | | | –21.07% | | | | 2.40% | | | | 3.93% | |

| | MSCI World ex USA Index | | | –14.66% | | | | –16.76% | | | | 2.66% | | | | 4.42% | |

| July 31, 2022 | | Green Century MSCI International Index Fund — Individual Share Class | | | –3.52% | | | | –18.36% | | | | 2.59% | | | | 4.57% | |

| | Green Century MSCI International Index Fund — Institutional Share Class | | | –3.46% | | | | –18.05% | | | | 2.91% | | | | 4.87% | |

| | MSCI World ex USA Index | | | –4.12% | | | | –13.20% | | | | 3.06% | | | | 5.22% | |

* The performance data quoted represents past performance and is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain Fund prices and performance information as of the most recent month-end, call 1-800-93-GREEN/1-800-934-7336. Performance includes the reinvestment of income dividends and capital gains distributions. Performance shown does not reflect the deduction of taxes that a shareholder might pay on Fund distributions or the redemption of Fund shares. A redemption fee of 2.00% may be imposed on redemptions or exchanges of shares you have owned for 60 days or less. Please see the prospectus for more information.

14

The Institutional and Investor share classes of the Green Century MSCI International Index Fund, which closely tracks the MSCI World ex USA SRI ex Fossil Fuels Index, returned –18.05% and –18.36%, respectively, for the one year period ended July 31, 2022, while the MSCI World ex USA Index (Index), returned –13.20% during the same period.

The difference in performance of the International Fund relative to the Index was largely due to differences in sector allocation and stock selection criteria between the International Fund and the Index.

The strongest performing sectors in the International Fund were Communication Services, Health Care, and Financials which returned –3.83%, –7.41% and –10.58%, respectively. The worst performing sectors were Information Technology and Materials, which returned –36.71% and –26.01%, respectively, for the year. Within the MSCI World ex USA Index, Energy, Utilities, and Financials were the strongest performing sectors, returning 33.25%, –7.45%, and –7.90%, respectively. The worst performing sectors were Information Technology and Consumer Discretionary which returned –29.21% and –21.52%, respectively, for the year.

U.S. equities performed exceptionally well and finished 2021 near all-time highs. For the third consecutive year, U.S. equities posted double-digit gains. U.S. equities were flat in the third quarter of 2021 due to concerns on peak growth, inflation, and unwinding stimulus building a wall of worry in September. U.S. equities finished the fourth quarter strong. Investors focused on solid consumer

The MSCI World ex USA Index is a custom index calculated by MSCI Inc. The MSCI World ex USA Index includes large and mid-cap stocks across 22 of 23 Developed Markets (DM) countries and excludes the United States. With 1,023 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country. The MSCI World ex USA Index is a free float-adjusted market capitalization index. Unlike the Fund, the MSCI World ex USA Index’s performance does not include management and other operating expenses. It is not possible to invest directly in an index.

15

spending and employment data, while digesting stubbornly high inflation figures. The first quarter of 2022 saw the S&P 500 realize its first quarterly decline since the beginning of 2020. Continued high inflation compounded by Russia’s invasion of Ukraine led to a pullback in investor risk appetite. Headwinds for global financial markets continued in the second quarter of 2022, with negative returns in most major asset classes outside of cash. US equities outperformed non-US developed equities as measured by the S&P 500 and MSCI World Ex USA indices, with 1 year returns of –4.64% and –13.20% respectively.

1 As of July 31, 2022, the following companies comprised the listed percentages of each of the Green Century Funds:

| | | | | | | | | | | | |

| Portfolio Holdings | | GREEN

CENTURY

BALANCED

FUND | | | GREEN

CENTURY

EQUITY

FUND | | | GREEN

CENTURY

INTERNATIONAL

INDEX FUND | |

Whole Foods | | | 0.13 | % | | | 0.00 | % | | | 0.00 | % |

Amazon | | | 0.00 | % | | | 0.00 | % | | | 0.00 | % |

Royal Caribbean | | | 0.00 | % | | | 0.05 | % | | | 0.00 | % |

Costco | | | 1.43 | % | | | 0.00 | % | | | 0.00 | % |

Levi Strauss | | | 0.62 | % | | | 0.00 | % | | | 0.00 | % |

Paycom Software | | | 0.58 | % | | | 0.09 | % | | | 0.00 | % |

Sunrun | | | 0.94 | % | | | 0.00 | % | | | 0.00 | % |

West Pharmaceuticals | | | 0.41 | % | | | 0.14 | % | | | 0.00 | % |

Wolfspeed | | | 0.60 | % | | | 0.00 | % | | | 0.00 | % |

| | | | | | | | | | | | |

| Portfolio Holdings | | GREEN

CENTURY

BALANCED

FUND | | | GREEN

CENTURY

EQUITY

FUND | | | GREEN

CENTURY

INTERNATIONAL

INDEX FUND | |

Johnson Controls International | | | 0.43 | % | | | 0.21 | % | | | 0.00 | % |

NXPI | | | 1.15 | % | | | 0.00 | % | | | 0.00 | % |

National Community Renaissance | | | 0.88 | % | | | 0.00 | % | | | 0.00 | % |

Preservation of Affordable Housing Inc (POAH) | | | 0.76 | % | | | 0.00 | % | | | 0.00 | % |

Portfolio composition will change due to ongoing management of the Funds. Please refer to the Green Century Funds website for current information regarding the Funds’ portfolio holdings. Note that some of the holdings discussed above may not have been held by any Fund during the fiscal year ended July 31, 2022, or may have been held by a Fund for a portion of the fiscal year, or may have been held by a Fund for the entire fiscal year. These holdings are subject to risk as described in the Funds’ prospectus. References to specific investments should not be construed as a recommendation of the securities by the Funds, their administrator, or their distributor.

2 The Custom Balanced Index is comprised of a 60% weighting in the S&P 1500 Index and a 40% weighting in the BofA Merrill Lynch 1-10 Year US Corporate & Government Index (the BofA Merrill Lynch Index). It is not possible to invest directly in the Custom Balanced Index.

3 The S&P Supercomposite 1500 Index is an unmanaged broad-based capitalization-weighted index comprising 1500 stocks of large-cap, mid-cap, and small-cap U.S. companies. It is not possible to invest directly in the S&P Supercomposite 1500 Index.

4 The BofA Merrill Lynch Index tracks the performance of U.S. dollar-denominated investment grade government and corporate public debt issued in the U.S. domestic bond market with at least 1 year and less than 10 years remaining maturity, including U.S. treasury, U.S. agency, foreign government, supranational and corporate securities. It is not possible to invest directly in the BofA Merrill Lynch Index.

5 The Lipper Balanced Fund Index includes the 30 largest funds whose primary objective is to conserve principal by maintaining at all times a balanced portfolio of both stocks and bonds. Typically the stock/bond ratio ranges around 60%/40%. It is not possible to invest directly in the Lipper Balanced Fund Index.

6 The S&P 500® Index is an unmanaged index of 500 selected common stocks, most of which are listed on the New York Stock Exchange. The S&P 500® Index is heavily weighted toward stocks with large market capitalization and represents approximately two-thirds of the total market value of all domestic stocks. It is not possible to invest directly in the S&P 500® Index.

7 The MSCI KLD 400 Social ex Fossil Fuels Index (the KLD400 ex Fossil Fuels Index) is a custom index calculated by MSCI Inc. The KLD400 ex Fossil Fuels Index is comprised of the common stocks of the approximately 400 companies in the MSCI KLD 400 Social Index (the KLD400 Index), minus the stocks of the companies that explore for, extract, produce, manufacture, or refine coal, oil or gas or produce or transmit electricity derived from fossil fuels or transmit natural gas or have carbon reserves that are included in the KLD400 Index. The KLD400 Index is a free float-adjusted market capitalization index designed to provide exposure to U.S. companies that have positive ESG characteristics and consists of approximately 400 companies selected from the MSCI USA Investable Market Index. It is not possible to invest directly in an index.

8 The MSCI World ex USA Index is a custom index calculated by MSCI Inc. The MSCI World ex USA Index includes large and mid-cap stocks across 22 of 23 Developed Markets countries and excludes the United States. With 1,023 constituents, the index covers

16

approximately 85% of the free float-adjusted market capitalization in each country. The MSCI World ex USA Index is a free float-adjusted market capitalization index. It is not possible to invest directly in the MSCI World ex USA Index.

9 The World ex USA SRI ex Fossil Fuels Index is a custom index calculated by MSCI Inc. The World ex USA SRI ex Fossil Fuels Index is comprised of the common stocks of the companies in the MSCI World ex USA SRI Index (the World ex USA SRI Index), minus the stocks of the companies that explore for, extract, produce, manufacture or refine coal, oil or gas or produce or transmit electricity derived from fossil fuels or transmit natural gas or have carbon reserves that are included in the World ex USA SRI (Socially Responsible Investment) Index. The World ex USA SRI Index includes large and mid-cap stocks from approximately 22 Developed Markets countries (excluding the U.S.). The World ex USA SRI Index is a capitalization weighted index that provides exposure to companies with what MSCI calculates to have outstanding ESG ratings and excludes companies whose products have negative social or environmental impacts. It is not possible to invest directly in an index.

Stocks will fluctuate in response to factors that may affect a single company, industry, sector, country, region or the market as a whole and may perform worse than the market. Foreign securities are subject to additional risks such as currency fluctuations, regional economic and political conditions, differences in accounting methods, and other unique risks compared to investing in securities of U.S. issuers. Bonds are subject to a variety of risks including interest rate, credit, and inflation risk. A sustainable investment strategy which incorporates environmental, social and governance criteria may result in lower or higher returns than an investment strategy that does not include such criteria.

This material must be preceded or accompanied by a current prospectus.

Distributor: UMB Distribution Services, LLC 9/22

Neither the Green Century Equity Fund nor the Green Century MSCI International Index Fund (each a “Fund” and together the “Funds”) is sponsored, endorsed, or promoted by MSCI, its affiliates, information providers or any other third party involved in, or related to, compiling, computing or creating the MSCI indices (the “MSCI Parties”), and the MSCI Parties bear no liability with respect to a Fund or any index on which a Fund is based. The MSCI Parties are not sponsors of either of the Funds and are not affiliated with the Funds in any way. The Statement of Additional Information contains a more detailed description of the limited relationship the MSCI Parties have with Green Century Capital Management and the Funds.

17

GREEN CENTURY FUNDS EXPENSE EXAMPLE

For the six months ended July 31, 2022 (unaudited)

As a shareholder of the Green Century Funds (the “Funds”), you incur two types of costs: (1) transaction costs, including redemption fees on certain redemptions; and (2) ongoing costs, including management fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from February 1, 2022 to July 31, 2022 (the “period”).

Actual Expenses The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 equals 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account during the period.

Hypothetical Example for Comparison Purposes The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the actual return of either of the Funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5%hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees on shares held for 60 days or less. Therefore, the second line of the table is useful in comparing the ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs could have been higher.

| | | | | | | | | | | | |

| | | BEGINNING

ACCOUNT VALUE

FEBRUARY 1, 2022 | | | ENDING

ACCOUNT VALUE

JULY 31, 2022 | | | EXPENSES

PAID DURING

THE PERIOD1 | |

Balanced Fund | | | | | | | | | | | | |

Actual Expenses — Individual Investor Class | | $ | 1,000.00 | | | $ | 926.00 | | | $ | 6.98 | |

Actual Expenses — Institutional Class | | | 1,000.00 | | | | 927.30 | | | | 5.55 | |

Hypothetical Example, assuming a 5% return before expenses —Individual Investor Class | | | 1,000.00 | | | | 1,017.75 | | | | 7.31 | |

Hypothetical Example, assuming a 5% return before expenses — Institutional Class | | | 1,000.00 | | | | 1,019.24 | | | | 5.81 | |

18

| | | | | | | | | | | | |

| | | BEGINNING

ACCOUNT VALUE

FEBRUARY 1, 2022 | | | ENDING

ACCOUNT VALUE

JULY 31, 2022 | | | EXPENSES

PAID DURING

THE PERIOD1 | |

Equity Fund | | | | | | | | | | | | |

Actual Expenses — Individual Investor Class | | $ | 1,000.00 | | | $ | 895.40 | | | $ | 5.87 | |

Actual Expenses — Institutional Class | | | 1,000.00 | | | | 896.70 | | | | 4.47 | |

Hypothetical Example, assuming a 5% return before expenses —Individual Investor Class | | | 1,000.00 | | | | 1,018.80 | | | | 6.26 | |

Hypothetical Example, assuming a 5% return before expenses —Institutional Class | | | 1,000.00 | | | | 1,020.29 | | | | 4.76 | |

| | | |

| | | BEGINNING

ACCOUNT VALUE

FEBRUARY 1, 2022 | | | ENDING

ACCOUNT VALUE

JULY 31, 2022 | | | EXPENSES

PAID DURING

THE PERIOD1 | |

MSCI International Index Fund | | | | | | | | | | | | |

Actual Expenses — Individual Investor Class | | $ | 1,000.00 | | | $ | 855.40 | | | $ | 5.89 | |

Actual Expenses — Institutional Class | | | 1,000.00 | | | | 856.50 | | | | 4.51 | |

Hypothetical Example, assuming a 5% return before expenses —Individual Investor Class | | | 1,000.00 | | | | 1,018.65 | | | | 6.41 | |

Hypothetical Example, assuming a 5% return before expenses —Institutional Class | | | 1,000.00 | | | | 1,020.14 | | | | 4.91 | |

1 Expenses are equal to the Funds’ annualized expense ratios (1.46% for the Balanced Fund Individual Investor Class, 1.16% for the Balanced Fund Institutional Class, 1.25% for the Equity Fund Individual Investor Class, 0.95% for the Equity Fund Institutional Class, 1.28% for the International Index Fund Individual Investor Class and 0.98% for the International Index Fund Institutional Class), multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period).

19

| | |

GREEN CENTURY BALANCED FUND PORTFOLIO OF INVESTMENTS July 31, 2022 | | |

| | | | | | | | |

COMMON STOCKS — 64.5% | |

| | | SHARES | | | VALUE | |

Software & Services — 8.0% | | | | | | | | |

Adobe, Inc. (a) | | | 6,480 | | | $ | 2,657,578 | |

Autodesk, Inc. (a) | | | 11,965 | | | | 2,588,269 | |

Mastercard, Inc., Class A | | | 20,267 | | | | 7,170,262 | |

Microsoft Corporation | | | 53,091 | | | | 14,904,767 | |

Paycom Software, Inc. (a) | | | 7,024 | | | | 2,321,362 | |

PayPal Holdings, Inc. (a) | | | 25,725 | | | | 2,225,984 | |

| | | | | | | | |

| | | | | | | 31,868,222 | |

| | | | | | | | |

Technology Hardware & Equipment — 5.3% | |

Apple, Inc | | | 108,052 | | | | 17,559,531 | |

Palo Alto Networks, Inc. (a) | | | 6,983 | | | | 3,485,215 | |

| | | | | | | | |

| | | | | | | 21,044,746 | |

| | | | | | | | |

Capital Goods — 4.8% | | | | | | | | |

Deere & Company | | | 8,719 | | | | 2,992,187 | |

Eaton Corporation PLC | | | 21,989 | | | | 3,262,948 | |

Illinois Tool Works, Inc. | | | 11,220 | | | | 2,331,067 | |

Rockwell Automation, Inc. | | | 8,926 | | | | 2,278,629 | |

Trane Technologies PLC | | | 20,961 | | | | 3,081,057 | |

Westinghouse Air Brake Technologies Corporation | | | 33,630 | | | | 3,143,396 | |

Xylem, Inc. | | | 21,084 | | | | 1,940,361 | |

| | | | | | | | |

| | | | | | | 19,029,645 | |

| | | | | | | | |

Healthcare Equipment & Services — 4.5% | | | | | |

Baxter International, Inc. | | | 28,987 | | | | 1,700,378 | |

CVS Health Corp | | | 31,621 | | | | 3,025,497 | |

Elevance Health, Inc. | | | 14,251 | | | | 6,799,152 | |

Medtronic PLC | | | 22,868 | | | | 2,115,747 | |

Stryker Corporation | | | 12,760 | | | | 2,740,210 | |

West Pharmaceutical Services, Inc. | | | 4,741 | | | | 1,628,818 | |

| | | | | | | | |

| | | | | | | 18,009,802 | |

| | | | | | | | |

Renewable Energy & Energy Efficiency — 4.3% | |

First Solar, Inc. (a) | | | 38,872 | | | | 3,854,936 | |

Hannon Armstrong Sustainable Infrastructure Capital, Inc. REIT | | | 88,127 | | | | 3,180,503 | |

Ormat Technologies, Inc. | | | 19,664 | | | | 1,701,723 | |

SolarEdge Technologies, Inc. (a) | | | 13,202 | | | | 4,754,436 | |

Sunrun, Inc. (a) | | | 114,058 | | | | 3,728,556 | |

| | | | | | | | |

| | | | | | | 17,220,154 | |

| | | | | | | | |

Pharmaceuticals & Biotechnology — 4.2% | |

AstraZeneca PLC ADR (b) | | | 69,516 | | | | 4,604,045 | |

IQVIA Holdings, Inc. (a) | | | 15,895 | | | | 3,819,092 | |

Merck & Company, Inc. | | | 27,300 | | | | 2,438,982 | |

| | | | | | | | |

| | | SHARES | | | VALUE | |

Pharmaceuticals & Biotechnology — (continued) | |

Roche Holding AG ADR (b) | | | 55,382 | | | $ | 2,296,691 | |

Thermo Fisher Scientific, Inc. | | | 5,889 | | | | 3,524,036 | |

| | | | | | | | |

| | | | | | | 16,682,846 | |

| | | | | | | | |

Banks — 4.1% | |

East West Bancorp, Inc. | | | 43,189 | | | | 3,100,106 | |

First Republic Bank | | | 23,150 | | | | 3,766,736 | |

KeyCorp | | | 161,925 | | | | 2,963,228 | |

PNC Financial Services Group, Inc. (The) | | | 22,699 | | | | 3,766,672 | |

SVB Financial Group (a) | | | 6,707 | | | | 2,706,610 | |

| | | | | | | | |

| | | | | | | 16,303,352 | |

| | | | | | | | |

Media & Entertainment — 4.0% | | | | | | | | |

Alphabet, Inc., Class A (a) | | | 105,940 | | | | 12,322,941 | |

Walt Disney Company (The) (a) | | | 32,150 | | | | 3,411,115 | |

| | | | | | | | |

| | | | | | | 15,734,056 | |

| | | | | | | | |

Retailing — 3.7% | | | | | | | | |

Home Depot, Inc. (The) | | | 11,443 | | | | 3,443,656 | |

Target Corporation | | | 26,209 | | | | 4,282,027 | |

TJX Companies, Inc. (The) | | | 69,602 | | | | 4,256,858 | |

Tractor Supply Company | | | 14,712 | | | | 2,817,054 | |

| | | | | | | | |

| | | | | | | 14,799,595 | |

| | | | | | | | |

Semiconductors — 3.6% | | | | | | | | |

Analog Devices, Inc. | | | 19,593 | | | | 3,369,212 | |

ASML Holding NV (b) | | | 5,655 | | | | 3,248,458 | |

NVIDIA Corporation | | | 30,001 | | | | 5,449,082 | |

Wolfspeed, Inc. (a) | | | 28,718 | | | | 2,392,210 | |

| | | | | | | | |

| | | | | | | 14,458,962 | |

| | | | | | | | |

Consumer Durables & Apparel — 2.5% | | | | | |

Levi Strauss & Company, Class A | | | 129,446 | | | | 2,449,118 | |

Lululemon Athletica, Inc. (a) | | | 7,754 | | | | 2,407,695 | |

NIKE, Inc., Class B | | | 26,195 | | | | 3,010,329 | |

VF Corporation | | | 44,341 | | | | 1,981,156 | |

| | | | | | | | |

| | | | | | | 9,848,298 | |

| | | | | | | | |

Real Estate — 2.4% | | | | | |

American Tower Corporation REIT | | | 10,311 | | | | 2,792,528 | |

AvalonBay Communities, Inc. REIT | | | 10,785 | | | | 2,307,343 | |

Jones Lang LaSalle, Inc. (a) | | | 9,787 | | | | 1,866,087 | |

Prologis, Inc. REIT | | | 18,865 | | | | 2,500,745 | |

| | | | | | | | |

| | | | | | | 9,466,703 | |

| | | | | | | | |

20

| | |

GREEN CENTURY BALANCED FUND PORTFOLIO OF INVESTMENTS July 31, 2022 | | continued |

| | | | | | | | |

| | | SHARES | | | VALUE | |

Food & Staples Retailing — 2.1% | | | | | |

Costco Wholesale Corporation | | | 10,528 | | | $ | 5,698,806 | |

Sysco Corporation | | | 30,845 | | | | 2,618,741 | |

| | | | | | | | |

| | | | | | | 8,317,547 | |

| | | | | | | | |

Insurance — 1.8% | | | | | |

Aflac, Inc. | | | 56,782 | | | | 3,253,609 | |

Travelers Companies, Inc. (The) | | | 25,349 | | | | 4,022,886 | |

| | | | | | | | |

| | | | | | | 7,276,495 | |

| | | | | | | | |

Materials — 1.6% | | | | | |

Ball Corporation | | | 28,637 | | | | 2,102,529 | |

Ingevity Corporation (a) | | | 30,562 | | | | 2,050,710 | |

International Flavors & Fragrances, Inc. | | | 17,903 | | | | 2,220,867 | |

| | | | | | | | |

| | | | | | | 6,374,106 | |

| | | | | | | | |

Household & Personal Products — 1.5% | | | | | |

Procter & Gamble Company (The) | | | 17,374 | | | | 2,413,422 | |

Unilever PLC ADR (b) | | | 74,953 | | | | 3,647,213 | |

| | | | | | | | |

| | | | | | | 6,060,635 | |

| | | | | | | | |

Consumer Services — 1.4% | | | | | |

Bright Horizons Family Solutions, Inc. (a) | | | 25,343 | | | | 2,373,879 | |

Starbucks Corporation | | | 39,204 | | | | 3,323,715 | |

| | | | | | | | |

| | | | | | | 5,697,594 | |

| | | | | | | | |

Transportation — 1.4% | | | | | |

J.B. Hunt Transport Services, Inc. | | | 15,948 | | | | 2,922,790 | |

United Parcel Service, Inc., Class B | | | 14,085 | | | | 2,745,026 | |

| | | | | | | | |

| | | | | | | 5,667,816 | |

| | | | | | | | |

Utilities — 1.0% | | | | | |

American Water Works Company, Inc. | | | 24,572 | | | | 3,819,472 | |

| | | | | | | | |

Diversified Financials — 1.0% | | | | | |

LPL Financial Holdings, Inc. | | | 18,194 | | | | 3,819,284 | |

| | | | | | | | |

Food & Beverage — 0.9% | | | | | |

McCormick & Company, Inc. | | | 39,734 | | | | 3,470,765 | |

| | | | | | | | |

Automobiles & Components — 0.4% | | | | | |

Aptiv PLC (a) | | | 15,823 | | | | 1,659,674 | |

| | | | | | | | |

Total Common Stocks

(Cost $150,638,309) | | | | | | | 256,629,769 | |

| | | | | | | | |

| | | | | | | | |

| | | PRINCIPAL

AMOUNT | | | VALUE | |

|

BONDS & NOTES — 33.7% | |

Green and Sustainability Bonds — 22.5% | |

Apple, Inc.

2.85%, due 2/23/23 (c) | | $ | 3,000,000 | | | $ | 2,996,736 | |

Apple, Inc.

3.00%, due 6/20/27 (c) | | | 2,000,000 | | | | 1,998,484 | |

Asian Development Bank

2.125%, due 3/19/25 (b) | | | 1,000,000 | | | | 980,569 | |

Asian Development Bank

3.125%, due 9/26/28 (b) | | | 4,000,000 | | | | 4,061,312 | |

Bank of America Corporation

2.456% (3-Month USD Libor+87 basis points), due 10/22/25 (c) | | | 4,000,000 | | | | 3,845,836 | |

Bank of Nova Scotia (The)

2.375%, due 1/18/23 | | | 1,845,000 | | | | 1,840,596 | |

BlueHub Loan Fund, Inc.

2.89%, due 1/1/27 | | | 2,000,000 | | | | 1,795,510 | |

Boston Properties LP

4.50%, due 12/1/28 (c) | | | 5,000,000 | | | | 4,984,680 | |

Bridge Housing Corporation

3.25%, due 7/15/30 (c) | | | 4,500,000 | | | | 4,110,102 | |

Century Housing Corporation

0.60%, due 2/15/24 | | | 2,500,000 | | | | 2,389,750 | |

Citigroup, Inc.

1.678% (SOFR Rate+166.7 basis points), due 5/15/24 (c) | | | 5,000,000 | | | | 4,921,925 | |

City & County of San Francisco CA Community Facilities District No. 2014-1

2.75%, due 9/1/23 | | | 650,000 | | | | 644,628 | |

City of San Francisco CA Public Utilities Commission Water Revenue

2.806%, due 11/1/23 | | | 2,000,000 | | | | 1,988,728 | |

European Investment Bank

2.50%, due 10/15/24 (b) | | | 2,000,000 | | | | 1,981,092 | |

European Investment Bank

2.125%, due 4/13/26 (b) | | | 500,000 | | | | 486,720 | |

International Bank for Reconstruction & Development

2.125%, due 3/3/25 (b) | | | 2,000,000 | | | | 1,964,174 | |

International Finance Corporation

2.125%, due 4/7/26 (b) | | | 500,000 | | | | 486,879 | |

21

| | |

GREEN CENTURY BALANCED FUND PORTFOLIO OF INVESTMENTS July 31, 2022 | | continued |

| | | | | | | | |

| | | PRINCIPAL

AMOUNT | | | VALUE | |

Green and Sustainability Bonds — (continued) | |

Johnson Controls International plc / Tyco Fire & Security Finance SCA

1.75%, due 9/15/30 (b)(c) | | $ | 2,000,000 | | | $ | 1,691,280 | |

National Australia Bank Ltd.

3.625%, due 6/20/23 (b) | | | 2,000,000 | | | | 2,008,810 | |

Nederlandse Waterschapsbank NV

2.375%, due 3/24/26 (b)(d) | | | 1,000,000 | | | | 978,810 | |

New Jersey Infrastructure Bank

3.00%, due 9/1/31 | | | 2,500,000 | | | | 2,354,558 | |

NXP BV / NXP Funding LLC / NXP USA, Inc.

5.00%, due 1/15/33 (b)(c) | | | 4,500,000 | | | | 4,592,524 | |

PNC Financial Services Group, Inc. (The)

2.20%, due 11/1/24 (c) | | | 5,000,000 | | | | 4,869,310 | |

Preservation Of Affordable Housing, Inc.

4.479%, due 12/1/32 (c) | | | 3,000,000 | | | | 3,008,880 | |

Prologis LP

1.25%, due 10/15/30 (c) | | | 4,500,000 | | | | 3,716,491 | |

Regency Centers LP

3.75%, due 6/15/24 (c) | | | 2,000,000 | | | | 1,988,120 | |

San Francisco Bay Area Rapid Transit District

2.622%, due 8/1/29 | | | 2,000,000 | | | | 1,896,832 | |

Starbucks Corporation

2.45%, due 6/15/26 (c) | | | 4,500,000 | | | | 4,354,542 | |

United States International Development Finance Corporation

3.28%, due 9/15/29 | | | 599,311 | | | | 595,958 | |

United States International Development Finance Corporation

3.33%, due 5/15/33 | | | 197,413 | | | | 195,554 | |

United States International Development Finance Corporation

3.43%, due 6/1/33 | | | 199,394 | | | | 197,100 | |

United States International Development Finance Corporation

3.05%, due 6/15/35 | | | 1,270,950 | | | | 1,229,597 | |

| | | | | | | | |

| | | PRINCIPAL

AMOUNT | | | VALUE | |

Green and Sustainability Bonds — (continued) | |

United States International Development Finance Corporation

2.58%, due 7/15/38 | | $ | 2,882,115 | | | $ | 2,674,516 | |

Verizon Communications, Inc.

3.875%, due 2/8/29 (c) | | | 3,500,000 | | | | 3,497,399 | |

Visa, Inc.

0.75%, due 8/15/27 (c) | | | 5,000,000 | | | | 4,457,535 | |

Xylem, Inc.

2.25%, due 1/30/31 (c) | | | 4,500,000 | | | | 3,880,116 | |

| | | | | | | | |

| | | | | | | 89,665,653 | |

| | | | | | | | |

U.S. Government Agencies — 3.1% | |

Federal Farm Credit Banks Funding Corporation

2.26%, due 11/13/24 | | | 500,000 | | | | 493,424 | |

Federal Farm Credit Banks Funding Corporation

1.82%, due 12/18/25 | | | 3,000,000 | | | | 2,903,049 | |

Federal Farm Credit Banks Funding Corporation

2.80%, due 11/12/27 | | | 3,000,000 | | | | 3,001,107 | |

Federal Home Loan Banks

1.875%, due 12/9/22 | | | 3,000,000 | | | | 2,989,869 | |

Federal Home Loan Banks

0.75%, due 12/14/23 (c) | | | 3,000,000 | | | | 2,917,998 | |

| | | | | | | | |

| | | | | | | 12,305,447 | |

| | | | | | | | |

Community Development Financial Institutions — 2.9% | |

Capital Impact Partners

2.60%, due 12/15/22 | | | 2,000,000 | | | | 1,976,306 | |

Capital Impact Partners

1.00%, due 9/15/25 (c) | | | 1,500,000 | | | | 1,372,837 | |

Enterprise Community Loan Fund, Inc.

4.152%, due 11/1/28 (c) | | | 3,000,000 | | | | 2,932,836 | |

Local Initiatives Support Corporation

1.00%, due 11/15/25 | | | 2,000,000 | | | | 1,840,372 | |

Local Initiatives Support Corporation

3.782%, due 3/1/27 (c) | | | 2,000,000 | | | | 1,980,692 | |

Reinvestment Fund, Inc. (The)

3.78%, due 2/15/26 | | | 1,400,000 | | | | 1,377,550 | |

| | | | | | | | |

| | | | | | | 11,480,593 | |

| | | | | | | | |

22

| | |

GREEN CENTURY BALANCED FUND PORTFOLIO OF INVESTMENTS July 31, 2022 | | concluded |

| | | | | | | | |

| | | PRINCIPAL

AMOUNT | | | VALUE | |

Software & Services — 1.7% | |

Adobe, Inc.

3.25%, due 2/1/25 (c) | | $ | 3,500,000 | | | $ | 3,516,065 | |

Salesforce, Inc.

3.70%, due 4/11/28 (c) | | | 3,000,000 | | | | 3,074,532 | |

| | | | | | | | |

| | | | | | | 6,590,597 | |

| | | | | | | | |

Real Estate — 0.9% | | | | | | | | |

National Community Renaissance of California

3.27%, due 12/1/32 (c) | | | 4,000,000 | | | | 3,509,432 | |

| | | | | | | | |

Capital Goods — 0.9% | | | | | | | | |

Trane Technologies Luxembourg Finance SA

3.80%, due 3/21/29 (c) | | | 3,500,000 | | | | 3,385,994 | |

| | | | | | | | |

Media & Entertainment — 0.8% | |

Alphabet, Inc.

1.998%, due 8/15/26 (c) | | | 3,500,000 | | | | 3,377,294 | |

| | | | | | | | |

Diversified Financials — 0.5% | | | | | | | | |

State Street Corporation

3.10%, due 5/15/23 | | | 2,000,000 | | | | 2,004,066 | |

| | | | | | | | |

Insurance — 0.3% | | | | | | | | |

Travelers Property Casualty Corporation

7.75%, due 4/15/26 | | | 1,000,000 | | | | 1,145,891 | |

| | | | | | | | |

Healthy Living — 0.1% | | | | | | | | |

Whole Foods Market, Inc.

5.20%, due 12/3/25 (c)(d) | | | 500,000 | | | | 532,234 | |

| | | | | | | | |

Total Bonds & Notes

(Cost $141,261,894) | | | | | | | 133,997,201 | |

| | | | | | | | |

| | | | | | | | |

|

SHORT-TERM INVESTMENTS — 1.6% | |

| | | | | | VALUE | |

UMB Money Market Fiduciary Account, 0.01% (e)

(Cost $6,629,153) | | | | | | $ | 6,629,153 | |

| | | | | | | | |

Total Short-term Investments

(Cost $6,629,153) | | | | | | | 6,629,153 | |

| | | | | | | | |

TOTAL INVESTMENTS (f) — 99.8% | |

(Cost $298,529,356) | | | | | | | 397,256,123 | |

Other Assets Less Liabilities — 0.2% | | | | | | | 666,092 | |

| | | | | | | | |

NET ASSETS — 100.0% | | | | | | $ | 397,922,215 | |

| | | | | | | | |

PLC – Public Limited Company

REIT – Real Estate Investment Trusts

ADR – American Depository Receipt

LP – Limited Partnership

LLC – Limited Liability Company

| (a) | Non-income producing security. |

| (b) | Securities whose value are determined or significantly influenced by trading in markets other than the United States or Canada. |

| (d) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration to qualified institutional buyers. The total value of these securities is $1,511,044. |

| (e) | The rate quoted is the annualized seven-day yield of the fund at the period end. |

| (f) | The cost of investments for federal income tax purposes is $298,192,787 resulting in gross unrealized appreciation and depreciation of $113,359,366 and $14,296,030 respectively, or net unrealized appreciation of $99,063,336. |

See Notes to Financial Statements

23

| | |

GREEN CENTURY EQUITY FUND PORTFOLIO OF INVESTMENTS July 31, 2022 | | |

| | | | | | | | |

COMMON STOCKS — 99.5% | | | | | | | | |

| | | SHARES | | | VALUE | |

Software & Services — 23.0% | | | | | | | | |

Accenture PLC, Class A (a) | | | 17,727 | | | $ | 5,429,071 | |

Adobe, Inc. (b) | | | 13,232 | | | | 5,426,708 | |

ANSYS, Inc. (b) | | | 2,434 | | | | 679,062 | |

Autodesk, Inc. (b) | | | 6,196 | | | | 1,340,319 | |

Automatic Data Processing, Inc. | | | 11,786 | | | | 2,841,840 | |

Cadence Design Systems, Inc. (b). | | | 7,776 | | | | 1,446,958 | |

Citrix Systems, Inc. | | | 3,504 | | | | 355,340 | |

Cognizant Technology Solutions Corporation, Class A | | | 14,783 | | | | 1,004,653 | |

Fortinet, Inc. (b) | | | 19,255 | | | | 1,148,561 | |

International Business Machines Corporation | | | 25,262 | | | | 3,304,017 | |

Intuit, Inc. | | | 7,559 | | | | 3,448,189 | |

Mastercard, Inc., Class A | | | 24,472 | | | | 8,657,949 | |

Microsoft Corporation | | | 199,759 | | | | 56,080,342 | |

NortonLifeLock, Inc | | | 16,249 | | | | 398,588 | |

Okta, Inc., Class A (b) | | | 4,143 | | | | 407,878 | |

Oracle Corporation | | | 44,900 | | | | 3,495,016 | |

Paycom Software, Inc. (b) | | | 1,426 | | | | 471,279 | |

PayPal Holdings, Inc. (b) | | | 31,106 | | | | 2,691,602 | |

salesforce, Inc. (b) | | | 27,657 | | | | 5,089,441 | |

ServiceNow, Inc. (b) | | | 5,618 | | | | 2,509,336 | |

Splunk, Inc. (b) | | | 4,431 | | | | 460,425 | |

Teradata Corporation (b) | | | 2,946 | | | | 112,802 | |

Visa, Inc., Class A | | | 46,507 | | | | 9,864,600 | |

VMware, Inc., Class A | | | 5,846 | | | | 679,305 | |

Western Union Company (The) | | | 11,037 | | | | 187,850 | |

Workday, Inc., Class A (b) | | | 5,471 | | | | 848,552 | |

ZoomInfo Technologies, Inc. (b) | | | 7,315 | | | | 277,165 | |

| | | | | | | | |

| | | | | | | 118,656,848 | |

| | | | | | | | |

Media & Entertainment — 9.0% | | | | | | | | |

Alphabet, Inc., Class A (b) | | | 168,700 | | | | 19,623,184 | |

Alphabet, Inc., Class C (b) | | | 159,420 | | | | 18,594,749 | |

Electronic Arts, Inc. | | | 7,922 | | | | 1,039,604 | |

John Wiley & Sons, Inc., Class A . | | | 1,232 | | | | 64,335 | |

Liberty Global PLC, Series A (a)(b) | | | 4,367 | | | | 95,026 | |

Liberty Global PLC, Series C (a)(b) | | | 8,909 | | | | 203,927 | |

New York Times Company (The), Class A | | | 4,670 | | | | 149,207 | |

Omnicom Group, Inc. | | | 5,831 | | | | 407,237 | |

Scholastic Corporation | | | 806 | | | | 37,938 | |

Walt Disney Company (The) (b) | | | 51,119 | | | | 5,423,726 | |

Warner Bros Discovery, Inc. (b) | | | 62,162 | | | | 932,430 | |

| | | | | | | | |

| | | | | | | 46,571,363 | |

| | | | | | | | |

| | | | | | | | |

| | | SHARES | | | VALUE | |

Semiconductors — 7.1% | | | | | | | | |

Advanced Micro Devices, Inc. (b) | | | 45,880 | | | $ | 4,334,284 | |

Analog Devices, Inc. | | | 14,693 | | | | 2,526,608 | |

Applied Materials, Inc. | | | 24,827 | | | | 2,631,165 | |

Intel Corporation | | | 114,346 | | | | 4,151,903 | |

Lam Research Corporation | | | 3,923 | | | | 1,963,501 | |

Microchip Technology, Inc. | | | 15,671 | | | | 1,079,105 | |

NVIDIA Corporation | | | 70,127 | | | | 12,737,167 | |

NXP Semiconductors NV (a) | | | 7,391 | | | | 1,359,057 | |

ON Semiconductor Corporation (b) | | | 12,055 | | | | 805,033 | |

Skyworks Solutions, Inc. | | | 4,580 | | | | 498,670 | |

Texas Instruments, Inc. | | | 25,876 | | | | 4,628,958 | |

| | | | | | | | |

| | | | | | | 36,715,451 | |

| | | | | | | | |

Pharmaceuticals & Biotechnology — 6.8% | |

AbbVie, Inc. | | | 49,615 | | | | 7,120,249 | |

Agilent Technologies, Inc. | | | 8,466 | | | | 1,135,291 | |

Amgen, Inc. | | | 15,614 | | | | 3,863,997 | |

Biogen, Inc. (b) | | | 4,102 | | | | 882,176 | |

BioMarin Pharmaceutical, Inc. (b) | | | 5,136 | | | | 441,953 | |

Bio-Techne Corporation | | | 1,096 | | | | 422,267 | |

Bristol-Myers Squibb Company | | | 61,207 | | | | 4,515,852 | |

Gilead Sciences, Inc. | | | 35,252 | | | | 2,106,307 | |

Illumina, Inc. (b) | | | 4,383 | | | | 949,708 | |

IQVIA Holdings, Inc. (b) | | | 5,379 | | | | 1,292,412 | |

Jazz Pharmaceuticals PLC (a)(b) | | | 1,719 | | | | 268,267 | |

Merck & Company, Inc. | | | 70,877 | | | | 6,332,151 | |

Mettler-Toledo International, Inc. (b) | | | 637 | | | | 859,778 | |

Vertex Pharmaceuticals, Inc. (b) | | | 7,141 | | | | 2,002,408 | |

Waters Corporation (b) | | | 1,690 | | | | 615,211 | |

Zoetis, Inc. | | | 13,269 | | | | 2,422,256 | |

| | | | | | | | |

| | | | | | | 35,230,283 | |

| | | | | | | | |

Capital Goods — 5.6% | | | | | | | | |

3M Company | | | 16,055 | | | | 2,299,718 | |

A.O. Smith Corporation | | | 3,644 | | | | 230,556 | |

AGCO Corporation | | | 1,768 | | | | 192,571 | |

Air Lease Corporation, Class A | | | 3,044 | | | | 112,963 | |

Allegion PLC (a) | | | 2,462 | | | | 260,233 | |

Applied Industrial Technologies, Inc. | | | 1,075 | | | | 108,134 | |

Builders FirstSource, Inc. (b) | | | 5,345 | | | | 363,460 | |

Carrier Global Corporation | | | 24,127 | | | | 977,867 | |

Caterpillar, Inc. | | | 15,055 | | | | 2,984,654 | |

Cummins, Inc. | | | 4,019 | | | | 889,445 | |

24

| | |

GREEN CENTURY EQUITY FUND PORTFOLIO OF INVESTMENTS July 31, 2022 | | continued |

| | | | | | | | |

| | | SHARES | | | VALUE | |

Capital Goods — (continued) | | | | | | | | |

Deere & Company | | | 8,190 | | | $ | 2,810,644 | |

Dover Corporation | | | 4,022 | | | | 537,661 | |

Eaton Corporation PLC | | | 11,222 | | | | 1,665,233 | |

EMCOR Group, Inc. | | | 1,462 | | | | 170,133 | |

Fastenal Company | | | 16,238 | | | | 833,984 | |

Flowserve Corporation | | | 3,670 | | | | 124,193 | |

Fortive Corporation | | | 9,507 | | | | 612,726 | |

Fortune Brands Home & Security, Inc. | | | 3,743 | | | | 260,812 | |

Graco, Inc. | | | 4,763 | | | | 319,883 | |

Granite Construction, Inc. | | | 1,318 | | | | 39,408 | |

IDEX Corporation | | | 2,130 | | | | 444,637 | |

Illinois Tool Works, Inc. | | | 8,802 | | | | 1,828,703 | |

Lennox International, Inc. | | | 924 | | | | 221,326 | |

Lincoln Electric Holdings, Inc. | | | 1,548 | | | | 218,949 | |

Masco Corporation | | | 6,694 | | | | 370,714 | |

MDU Resources Group, Inc. | | | 5,730 | | | | 163,706 | |

Meritor, Inc. (b) | | | 1,877 | | | | 68,360 | |

Middleby Corporation (The) (b) | | | 1,473 | | | | 213,128 | |

Owens Corning | | | 2,778 | | | | 257,632 | |

PACCAR, Inc. | | | 9,702 | | | | 887,927 | |

Parker-Hannifin Corporation | | | 3,622 | | | | 1,047,084 | |

Quanta Services, Inc. | | | 4,009 | | | | 556,169 | |

Rockwell Automation, Inc. | | | 3,245 | | | | 828,384 | |

Roper Technologies, Inc. | | | 2,963 | | | | 1,293,853 | |

Sensata Technologies Holding NV | | | 4,396 | | | | 195,490 | |

Snap-on, Inc. | | | 1,491 | | | | 334,059 | |

Spirit AeroSystems Holdings, Inc., Class A | | | 2,932 | | | | 96,228 | |

Stanley Black & Decker, Inc. | | | 4,558 | | | | 443,630 | |

Tennant Company | | | 501 | | | | 33,582 | |

Timken Company (The) | | | 1,903 | | | | 124,418 | |

Trane Technologies PLC (a) | | | 6,518 | | | | 958,081 | |

United Rentals, Inc. (b) | | | 2,027 | | | | 654,052 | |

W.W. Grainger, Inc. | | | 1,283 | | | | 697,349 | |

Westinghouse Air Brake Technologies Corporation | | | 4,912 | | | | 459,125 | |

Xylem, Inc. | | | 5,019 | | | | 461,899 | |

| | | | | | | | |

| | | | | | | 28,652,763 | |

| | | | | | | | |

Diversified Financials — 5.0% | | | | | | | | |

Ally Financial, Inc. | | | 9,298 | | | | 307,485 | |

American Express Company | | | 18,137 | | | | 2,793,461 | |

Ameriprise Financial, Inc. | | | 3,093 | | | | 834,863 | |

Bank of New York Mellon Corporation (The) | | | 21,336 | | | | 927,263 | |

| | | | | | | | |

| | | SHARES | | | VALUE | |

Diversified Financials — (continued) | |

BlackRock, Inc. | | | 4,273 | | | $ | 2,859,406 | |

Charles Schwab Corporation (The) | | | 40,725 | | | | 2,812,061 | |

CME Group, Inc. | | | 10,106 | | | | 2,015,945 | |

Equitable Holdings, Inc. | | | 10,867 | | | | 308,949 | |

FactSet Research Systems, Inc. | | | 1,059 | | | | 455,031 | |

Franklin Resources, Inc. | | | 8,373 | | | | 229,839 | |

Intercontinental Exchange, Inc. | | | 15,810 | | | | 1,612,462 | |

Invesco Ltd. | | | 9,639 | | | | 170,996 | |

Moody’s Corporation | | | 4,693 | | | | 1,456,003 | |

Morgan Stanley | | | 37,538 | | | | 3,164,453 | |

Northern Trust Corporation | | | 5,514 | | | | 550,187 | |

S&P Global, Inc. | | | 9,950 | | | | 3,750,453 | |

State Street Corporation | | | 10,219 | | | | 725,958 | |