UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811-06351

Green Century Funds

114 State Street

Suite 200

Boston, MA 02109

(Address of principal executive offices)

Green Century Capital Management, Inc.

114 State Street

Suite 200

Boston, MA 02109

(Name and address of agent for service)

Registrant’s telephone number, including area code: (617) 482-0800

Date of fiscal year end: July 31

Date of reporting period: July 31, 2023

Item 1. Reports to Stockholders

| | (a) | The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). |

| | |

| | ANNUAL REPORT Green Century Balanced Fund Green Century Equity Fund Green Century MSCI International Index Fund July 31, 2023 |

| |

| An investment for your future.® | | 114 State Street, Boston, Massachusetts 02109 |

For information on the Green Century Funds®, call 1-800-93-GREEN. For information on how to open an account and account services, call 1-800-221-5519 8:00 am to 6:00 pm Eastern Time, Monday through Friday. For share price and account information, visit www.greencentury.com.

Dear Green Century Funds Shareholder:

Thank you for putting your trust in the Green Century Funds°. We’re honored to provide opportunities for you to invest in alignment with your environmental values and help make an impact as you save for the future.

The last year has seen sustainable investing come into the mainstream in new ways. Families have taken steps to invest with their values in unprecedented numbers. Institutions and businesses have added sustainable investing options to their retirement plans. The media, including the Wall Street Journal, which rarely reported on sustainable investing a decade ago, now publishes articles on the topic weekly.

This increased interest grew the Green Century Funds to over $1B and has sparked mainstream investment firms to launch products to meet this increased demand.

The wildfires, extreme heat, and flooding of the summer brought the reality of climate risk home to investment advisors, and more are starting to consider it in their decisions. This positive step means that the financial sector is elevating climate change as a key factor in their investment decisions, which can help companies address this challenge.

The call to move money out of fossil fuel companies has been a significant force in helping to grow and shape this field. Starting just over 10 years ago, the fossil fuel divestment movement has convinced institutions, ranging from Harvard University to the New York Pension Fund, to change their investments. So far, nearly 1,500 organizations with assets of more than $39.2 trillion have committed to divest from fossil fuels and this adoption has helped elevate the attention on fossil fuel companies, raised the cost of capital needed for new fossil fuel projects, and signaled interest to investors to support clean energy projects.

This success has sparked a pushback by the fossil fuel industry. We believe the recent attack on sustainable investing, being called ESG (Environmental, Social and Governance) in the media, is a thinly veiled attempt by the fossil fuel industry and its supporters to weaken the move away from the oil and gas industry. A 2022 investigative report by InfluenceMap suggests fossil fuel companies have been the major driver in the fight against sustainable finance. While the campaign has not resonated with many Americans, it could potentially restrict some investment options for government entities in Texas and Florida and how they invest. Green Century is collaborating with other investors to oppose these limitations.

In conversations with our current and prospective investors, I have observed that the fossil fuel industry’s efforts have strengthened people’s determination to choose a cleaner future. Green Century is proud to support tens of thousands of individuals from across the country who want clean air, clean water, wildlife, open spaces, and a livable climate.

In the last year, Green Century worked with 60 companies and helped persuade 20 of them to adopt new environmental policies. We scored a significant victory when we successfully helped persuade Costco1, the third largest retailer in the world, to shrink its greenhouse gas emissions. The company will set targets to reduce carbon pollution from growing or producing the products they sell, which account for 98% of the company’s emissions. To help protect wildlife from plastic waste, we also got ODP Corporation1, which operates Office Depot and OfficeMax, to adopt a policy to reduce the total amount of packaging of its private label products and e-commerce shipping. Apple1 announced it will allow consumers to repair their iPhone 14, MacBook Pro, and other products, keeping electronic waste out of our landfills. Green Century started a campaign with Apple in 2021 to adopt this policy.

Green Century supported our non-profit owners with financial resources to lead programs to source 100% renewable energy in states, aid in protecting wildlife from plastic pollution, and help keep life-saving medicines effective. Green Century’s ownership provides a unique way for investors to make an impact. There is no other mutual fund company that is exclusively owned by environmental and public health organizations.

To learn more about Green Century’s work, I encourage you to join our Enews list orSign up on our website at www.greencentury.com.

* An investment strategy that incorporates environmental, social and governance criteria may result in lower or higher returns than an investment strategy that does not include such criteria.

Thank you for saving for your future with Green Century. Together, we are building a greener future.

Sincerely,

Leslie Samuelrich

President, Green Century Funds

° Green Century Capital Management, Inc. (Green Century) is the investment advisor to the Green Century Funds (the Funds).

The Green Century Funds are a family of fossil fuel-free, environmentally responsible mutual funds. Green Century Capital Management hosts an award-winning and in-house shareholder advocacy program and is the only mutual fund company in the U.S. wholly owned by environmental and public health nonprofit organizations.

You should carefully consider the Fund’s investment objectives, risks, charges, and expenses before investing. To obtain a Prospectus that contains this and other information about the Funds please visit www.greencentury.com, email info@greencentury.com, or call 1-800-934-7336. Please read the Prospectus carefully before investing.

2

Stocks will fluctuate in response to factors that may affect a single company, industry, sector, country, region or the market as a whole and may perform worse than the market. Foreign securities are subject to additional risks such as currency fluctuations, regional economic and political conditions, differences in accounting methods, and other unique risks compared to investing in securities of U.S. issuers. Bonds are subject to a variety of risks including interest rate, credit, and inflation risk. A sustainable investment strategy which incorporates environmental, social and governance criteria may result in lower or higher returns than an investment strategy that does not include such criteria.

This information has been prepared from sources believed reliable. The views expressed are as the date of this writing and are those of the Advisor to the Funds.

The Green Century Funds are distributed by UMB Distribution Services, LLC. 235 W Galena Street, Milwaukee, WI 53212. 8/23. UMB and Green Century are not affiliated.

Green Century on the Web

E-News. For more regular updates on the Green Century Funds and on our advocacy efforts, please consider signing up for our e-newsletter. Call 1-800-934-7336, visit www.greencentury.com, or email info@greencentury.com.

Online Access. Information on your account is available on our website at www.greencentury.com. From the home page, click on Access My Account. Shareholders may also perform online transactions on the site. While there, please consider registering for e-delivery of your statements and other Fund documents.

Twitter. Green Century is on Twitter. Follow us at Twitter.com/Green_Century for a sustainable investor’s perspective on critical issues.

The Green Century Funds’ proxy voting guidelines and a record of the Funds’ proxy votes for the year ended June 30, 2023 are available without charge, upon request, (i) at www.greencentury.com, (ii) by calling 1-800-934-7336, (iii) by sending an e-mail to info@greencentury.com, and (iv) on the Securities and Exchange Commission’s website at www.sec.gov.

The Green Century Funds file their complete schedule of portfolio holdings with the SEC for the first and third quarters of the year on Form N-PORT, Part F. The Green Century Funds’ Forms N-PORT, Part F are available on the EDGAR database on the SEC’s website at www.sec.gov. Copies may be obtained upon payment of a duplicating fee, by writing the SEC’s Public Reference Section, Washington DC 20549-0102 or by electronic request at the following e-mail address: publicinfo@sec.gov. The information on Form N-PORT, Part F may also be obtained by calling us at 1-800-934-7336, or by e-mailing a request to info@greencentury.com

3

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

GREEN CENTURY BALANCED FUND

Investment Objective The Green Century Balanced Fund seeks capital growth and income from a diversified portfolio of stocks and bonds that meet Green Century’s standards for corporate environmental responsibility.

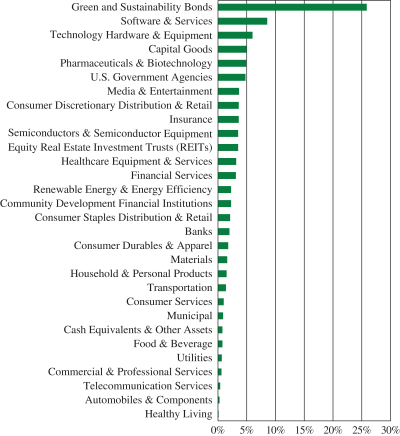

Portfolio Orientation As of the fiscal year ended July 31, the Green Century Balanced Fund (the Balanced Fund or the Fund) was diversified in a number of ways. Equity holdings represented 61.6% and bonds

constituted 37.6% of the Fund’s net asset value. The Fund had 0.8% invested in cash, cash equivalents, and other assets, less liabilities. The portfolio managers view equities as the primary source of potential long-term growth, while emphasizing the importance of diversification in seeking to lower volatility. The Fund’s equity holdings were diversified across 72 equity holdings at fiscal year-end, none of which represented more than 5.10% of total net assets. Generally, larger, more established companies constitute larger positions in the Fund’s portfolio than smaller companies. The portfolio managers seek to mitigate risk by investing primarily in companies they believe have demonstrated records of profitability, above-average growth prospects, and reasonable valuations.

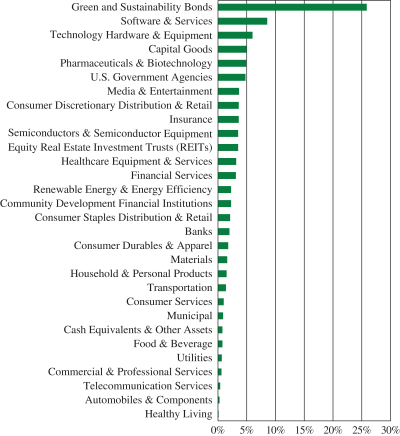

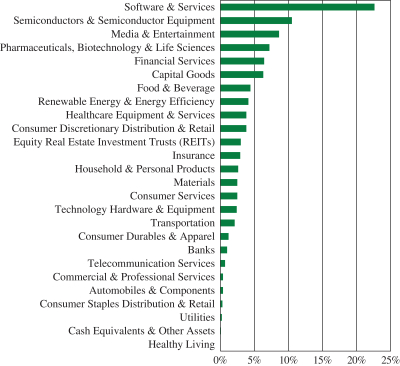

As of July 31, the stocks held by the Balanced Fund were also diversified by sector, with (as a percent of total net assets) Technology (18%), Health Care (9.7%), and Financial Services (7.2%) as the largest sectors.

In line with its environmental mandate, the Fund had exposure to what Green Century considers environmental leaders in a number of

GREEN CENTURY BALANCED FUND

INVESTMENT BY INDUSTRY (unaudited)

4

industries including Healthy Living, Capital Goods, and Transportation. Green Century’s environmental screens prohibit traditional energy and utility companies from being owned, while the Fund has broad exposure to information technology, health care, financial, consumer, and industrial companies.

In addition to its equity exposure to environmental leaders, the Fund invests in designated Green Bonds and designated Social Impact Bonds. The issuers of Green Bonds have indicated that the proceeds from the bonds will be used for environmentally positive goals such as greenhouse gas reduction, climate adaptation, and climate change mitigation. Issuers of designated Social Impact Bonds have indicated that the proceeds from the bonds will be used for projects supporting such issues as poverty alleviation, low-income housing, fair trade, and community development. As of July 31st, 29.9% of the total portfolio and 79.5% of the market value of the bonds held in the Fund were designated Green / Sustainable or Social Impact Bonds.

Higher quality, intermediate maturity bonds can typically lower volatility and provide a stable source of income. At fiscal year end, the Balanced Fund held 52 bonds diversified across corporate and government agency issuers. In an effort to dampen volatility, the weighted average maturity (5.02 years) and modified duration (4.30 years) remain in the intermediate range. The weighted average yield to maturity was 4.99%. All fixed income holdings were investment grade at time of purchase and remain investment grade at July 31, 2023.

Economic Environment.

Equity markets witnessed considerable volatility over the last 12-months, hitting a low in October and then bouncing back sharply during the first half of 2023. While the U.S. economy has thus far been resilient, the portfolio managers note that icebergs lurk mostly underwater. They continue to see many risks, with a wide dispersion of potential outcomes. They anticipate deteriorating profits, rising unemployment, more volatile asset markets, and recession risks rising across the developed world as already tightened monetary policy takes hold. Company managements are guiding earnings outlooks lower, while also indicating that lower income consumers are showing signs of stress. Unemployment remains at very low levels, but both new unemployment claims and continuing unemployment claims have begun to rise, and the Job Openings and Labor Turnover Survey (JOLTS) shows job openings are down 18% since March of 2022, a signal that typically precedes a recession. Once recessions begin, the unemployment rate typically jumps sharply. The Institute for Supply Management (ISM) Purchasing Managers Index Manufacturing series show that Manufacturing Employment, New Orders, and Prices Paid are all in contractionary territory. The ISM Services Indexes are still in expansionary territory indicating that spending on services is supporting the economy. Commercial real estate, particularly for downtown office buildings, will likely come under increasing stress as office leases negotiated before the start of Covid come up for renewal in the next few years; companies have been negotiating for better amenities and smaller space, leaving even Class A space vulnerable if it is of an older vintage.

Further support for the portfolio manager’s view that recession is near comes from The Conference Board’s surveys of year-over-year leading and coincident economic indicators, which are now at or below the levels consistent with every U.S. recession since 1970. Recent U.S. equity returns were generated by a very narrow market, focused on mega capitalization Information Technology, Consumer Discretionary, and Communications Services companies that arguably would benefit from enhanced generative Artificial Intelligence (AI). The portfolio managers continue to favor stocks over bonds as a strategic allocation. They

5

acknowledge that bonds can provide a diversification benefit to portfolio construction. They also recognize that stocks may have considerable additional risk over the immediate horizon. Nonetheless, the rapid recoveries of equity markets at the end of bear markets suggests caution in reducing equity holdings, and the earnings growth capabilities of stocks are expected to ultimately support their valuation in both inflationary and deflationary environments. They prefer to position for equity market downside by adjusting portfolio composition to reflect our cautious stance rather than moving below an appropriate strategic allocation.

Overall, the portfolio managers believe that the fund’s domestically oriented equity strategies have been making active portfolio construction decisions to be appropriately positioned for a more risk-off equity market. In these strategies, for either a slowing growth or a recessionary environment, they expect that a focus on quality, lower-leverage, profitable companies with steadier earnings and revenues will be protective of portfolio value. They continue to avoid positioning for extremes and acknowledge that a likely recession, combined with high uncertainty about the exact course of that recession, means an increased likelihood of rapid rotation, particularly as investors lean heavily on small changes in weekly and monthly data releases. In such an environment, thoughtful analysis of company management, strategies, and prospects assumes added importance. The portfolio managers remain committed to our long-term focus and investment in high-quality and sustainability-centered companies seeking to meet the challenges of this year of recovery and transition, and beyond. They continue to seek out companies that acknowledge the ongoing climate crisis and which are setting their own targets for greenhouse reduction. This is becoming ever more important; June 2023 was the hottest June on record, with average temperatures more than 2.5 degrees Fahrenheit over June temperatures in the late 1800s.

Investment Strategy and Performance. The portfolio managers believe that strong environmental, social, and governance practices may enhance corporate profitability and reduce certain types of risks. The Fund specifically avoids risks associated with exposure to fossil fuels. Companies with strong balance sheets, strategic leadership in their products and markets, and strong environmental, social, and governance policies will have the financial flexibility and leadership wisdom to navigate choppy and volatile economic conditions.

The Balanced Fund holds a number of stocks that the portfolio managers believe have attractive environmental, social, and financial characteristics. New holdings over the reporting period include Verisk Analytics Inc.1, Gilead Sciences Inc.1, Progressive Corp. Ohio1, ServiceNow, Inc.1 and Equinix Inc.1

On July 31, 2023, the Fund held over $118.0 million in Green / Sustainability or Social Impact Bonds and Notes. Some holdings include notes issued by Euro Invt. Bank1, IBRD1, Mastercard1 and SalesForce1.

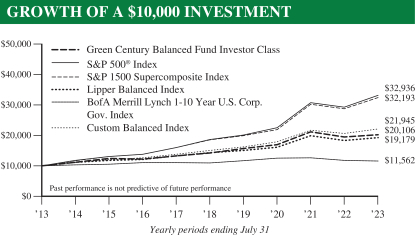

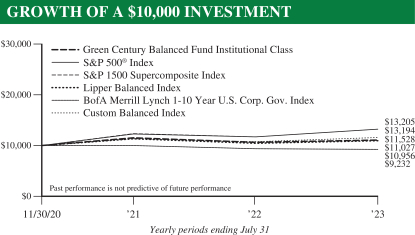

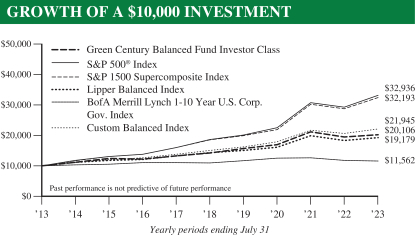

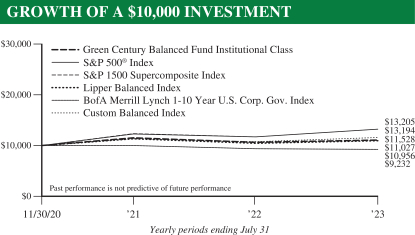

For the year ending July 31, 2023, the Balanced Fund’s returns were 4.01%, versus 7.19% return for its Custom Balanced Index,2 an index comprised of the S&P 1500 Index3 (60% weighting) and of the BofA Merrill Lynch 1-10 Year US Corporate and Government Index4 (40% weighting).* The Lipper Balanced Index5 returned 5.37% for the same twelve-month period.

Stock selection and a smaller cap bias were the primary reasons for underperformance in the period, as a narrow market propelled a handful of larger cap names to lofty valuations.

6

The Fund’s high-quality fixed income exposure performed relatively in-line with the benchmark as intentioned, with slight underperformance in the period. The Fund’s portfolio managers do not anticipate any significant changes in investment strategy for the Fund, believing that the investment environment may be favorable to the Fund’s core holdings in what the portfolio managers consider high-quality, environmentally responsible companies with strong growth prospects and reasonable valuations.

| | | | | | | | | | | | | | | | | | |

Green Century Balanced Fund Total expense ratio: 1.46% for Individual Share Class and 1.16% for

Institutional Share Class | | CUMULATIVE

RETURN* | | | AVERAGE ANNUAL RETURN* | |

| | Latest

Quarter | | | One Year | | | Five Years | | | Ten Years | |

| June 30, 2023 | | Green Century Balanced Fund — Individual Share Class | | | 2.87% | | | | 9.07% | | | | 7.35% | | | | 7.48% | |

| | Green Century Balanced Fund — Institutional Share Class** | | | 2.95% | | | | 9.43% | | | | 7.52% | | | | 7.56% | |

| | | Custom Balanced Index | | | 4.70% | | | | 11.47% | | | | 7.89% | | | | 8.30% | |

| July 31, 2023 | | Green Century Balanced Fund — Individual Share Class | | | 4.10% | | | | 3.67% | | | | 7.24% | | | | 7.23% | |

| | Green Century Balanced Fund — Institutional Share Class** | | | 4.18% | | | | 4.01% | | | | 7.41% | | | | 7.32% | |

| | | Custom Balanced Index | | | 5.80% | | | | 7.19% | | | | 7.88% | | | | 8.18% | |

* The performance data quoted represents past performance and is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain Fund prices and performance information as of the most recent month-end, call 1-800-93-GREEN/1-800-934-7336. Performance includes the reinvestment of income dividends and capital gain distributions. Performance shown does not reflect the deduction of taxes that a shareholder might pay on Fund distributions or the redemption of Fund shares. A redemption fee of 2.00% may be imposed on redemptions or exchanges of shares you have owned for 60 days or less. Please see the prospectus for more information.

**Institutional Shares were offered as of November 28, 2020. The Institutional Share Class performance prior to November 28, 2020 reflects the performance of the Fund’s Individual Investor Class.

7

The Lipper Balanced Fund Index includes the 30 largest funds whose primary objective is to conserve principal by maintaining at all times a balanced portfolio of both stocks and bonds. Typically the stock/bond ratio ranges around 60%/40%.

The Balanced Fund consistently includes stocks and bonds of what Green Century believes to be environmentally responsible corporations of various sizes, including small, medium, and large companies. The value of the stocks held in the Balanced Fund will fluctuate in response to factors that may affect the single issuer, industry, or sector of the economy or may affect the market as a whole. Bonds are subject to a variety of risks including interest rate, credit, and inflation risk. The Funds’ environmental criteria limit the investments available to the Funds compared to mutual funds that do not use environmental criteria.

The S&P 500® Index6 and the S&P Supercomposite 1500 Index (the S&P 1500 Index) are unmanaged indexes of 500 and 1500 stocks, respectively. The Custom Balanced Index is comprised of a 60% weighting in the S&P 1500 Index and a 40% weighting in the BofA Merrill Lynch 1-10 Year US Corporate & Government Index (the BofA Merrill Lynch Index). The BofA Merrill Lynch Index tracks the performance of U.S. dollar-denominated investment grade government and corporate public debt issued in the U.S. domestic bond market with at least 1 year and less than 10 years remaining maturity, including U.S. Treasury, U.S. Agency, foreign government, supranational and corporate securities. Similar to the Balanced Fund, the performance of the S&P 500® Index, the S&P 1500 Index, the Custom Balanced Index and the BofA Merrill Lynch Index reflect reinvestment of dividends and distributions. Unlike the Fund, however, the performance of the S&P 500® Index, the S&P 1500 Index, the Custom Balanced Index and the BofA Merrill Lynch Index does not include management and other operating expenses. It is not possible to invest directly in an index.

8

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

GREEN CENTURY EQUITY FUND

Investment Objective The Green Century Equity Fund (the Equity Fund or the Fund) seeks to achieve long-term total return that matches the performance of an index comprised of the stocks of companies selected based on environmental, social and governance criteria.

Portfolio Orientation The Fund seeks to achieve its objective by investing in the stocks which make up the MSCI KLD 400 Social ex Fossil Fuels Index7 (the KLD400 ex Fossil Fuels Index or the Index), a custom index calculated by MSCI, Inc. The KLD400 ex Fossil Fuels Index is comprised of the common stocks of the approximately 400 companies in the MSCI KLD 400 Social Index (the KLD400 Index)7, minus the stocks of the companies that explore for, extract, produce, manufacture, or refine coal, oil or gas that are included in the KLD400 Index. The Index also does not include companies that produce or transmit electricity derived from fossil fuels, transmit natural gas, or own carbon reserves.

The KLD400 Index, formerly named the Domini 400 Social Index, is the longest-running socially responsible index. Like other index funds, the Equity Fund is not actively managed in the traditional investment sense, but rather seeks to be nearly fully invested at all times in a broad and diverse portfolio of stocks which meet certain environmental, social and governance (ESG) criteria. The Equity Fund, like many other mutual funds invested primarily in stocks, carries the risk of investing in the stock market. The large companies in which the Equity Fund is invested may perform worse than the stock market as a whole. The Fund’s environmental criteria limit the investments available to the Fund compared to mutual funds that do not use environmental criteria.

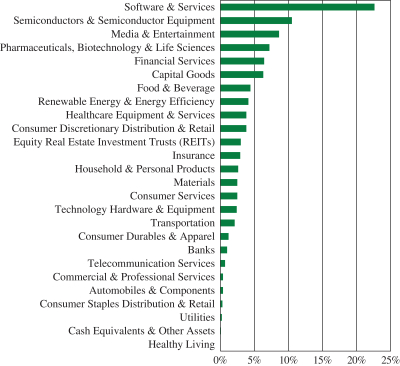

The Fund invests in the stocks of companies selected for inclusion in the Index based on a thorough review of environmental, social, and governance factors and includes

GREEN CENTURY EQUITY FUND

INVESTMENT BY INDUSTRY (unaudited)

9

those companies believed to have the best overall sustainability records. Green Century believes that certain industries impose unique and onerous risks and/or costs on society. Companies involved in these industries are evaluated based on their level of involvement as well as the impact of that involvement on society. Therefore, companies that derive significant revenues from the manufacture of tobacco products, alcoholic beverages, genetically modified organisms (GMOs), or the operation of gambling enterprises; or have a significant direct ownership share in, operate or design nuclear power plants are not eligible for the Index. Major military contractors and firearms manufacturers are also ineligible. The Index excludes all companies that explore for, extract, produce, manufacture, or refine coal, oil or gas. The Index also does not include companies that produce or transmit electricity derived from fossil fuels, transmit natural gas, or own carbon reserves.

Investment Strategy and Performance Green Century believes that companies that minimize their negative social and environmental impact and follow governance standards could enjoy competitive advantages and be less likely to incur certain legal liabilities that may be assessed when a product or service is determined to be harmful. Green Century also believes that such investments may, over the long term, provide investors with a return that is competitive with enterprises that do not exhibit such social and environmental awareness.

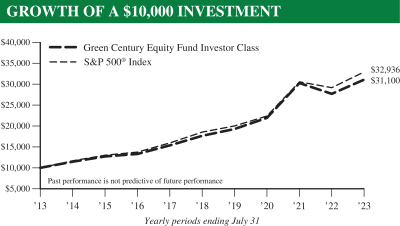

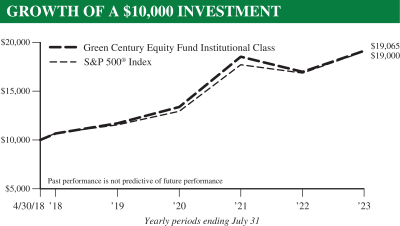

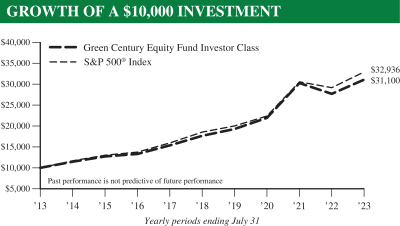

The Equity Fund’s total return for the latest quarter ended July 31, 2023 was 11.47% for the individual share class and 11.55% for the institutional share class, outperforming the S&P 500® Index that returned 10.51% for the same period. Additional results for various time periods are below:*

| | | | | | | | | | | | | | | | | | |

Green Century Equity Fund Total expense ratio: 1.25% for Individual Share Class and 0.95% for

Institutional Share Class | | CUMULATIVE

RETURN* | | | AVERAGE ANNUAL RETURN* | |

| | Latest

Quarter | | | One Year | | | Five Years | | | Ten Years | |

| June 30, 2023 | | Green Century Equity Index Fund – Individual Share Class | | | 8.25% | | | | 17.95% | | | | 12.00% | | | | 12.10% | |

| | Green Century Equity Fund – Institutional Share Class | | | 8.33% | | | | 18.29% | | | | 12.33% | | | | 12.27% | |

| | | S&P 500® Index | | | 8.74% | | | | 19.59% | | | | 12.31% | | | | 12.86% | |

| July 31, 2023 | | Green Century Equity Index Fund – Individual Share Class | | | 11.47% | | | | 12.37% | | | | 12.01% | | | | 12.02% | |

| | Green Century Equity Fund – Institutional Share Class | | | 11.55% | | | | 12.72% | | | | 12.35% | | | | 12.19% | |

| | | S&P 500® Index | | | 10.51% | | | | 13.02% | | | | 12.20% | | | | 12.66% | |

* The performance data quoted represents past performance and is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain Fund prices and performance information as of the most recent month-end, call 1-800-93-GREEN/1-800-934-7336. Performance includes the reinvestment of income dividends and capital gains distributions. Performance shown does not reflect the deduction of taxes that a shareholder might pay on Fund distributions or the redemption of Fund shares. A redemption fee of 2.00% may be imposed on redemptions or exchanges of shares you have owned for 60 days or less. Please see the prospectus for more information. As of April 1, 2014, the Equity Fund invests in the common stocks which make up the MSCI KLD 400 Social ex Fossil Fuels Index; prior to April 1, 2014, the Fund invested in the common stocks which made up the MSCI KLD 400 Social Index. Institutional shares were offered as of April 30, 2018. The Institutional Share Class performance for periods prior to April 30, 2018 reflects the performance of the Fund’s Individual Investor Class.

10

For the year ended July 31, 2023, the Equity Fund Institutional and Investor share classes returned 12.72% and 12.37%, respectively, compared to the S&P 500 Index which returned 13.02%. As the MSCI KLD 400 Social ex Fossil Fuels Index does not include all of the stocks in the S&P 500® Index and includes some stocks not included in the S&P 500® Index, the performance of the Fund can be expected to differ from the performance of the broader benchmark.

The strongest performing sectors in the Equity Fund were Information Technology, Industrials, and Materials which returned 32.44%, 20.06% and 10.02%, respectively. The worst performing sectors were Utilities and Real Estate, which returned -7.36% and -6.27%, respectively, for the year. Within the S&P 500

Index, Information Technology, Industrials, and Energy were the strongest performing sectors, gaining 28.09%, 16.63%, and 16.25%, respectively. The worst performing sectors were Real Estate and Utilities, which returned -9.81% and -6.44%, respectively, for the year.

US equities underperformed non-US developed equities for the reporting period, as measured by the S&P 500 and MSCI World Ex US indices8, with 1 year returns of 13.02% and 15.47% respectively. U.S. Equities declined during a volatile third quarter of 2022. After stocks rallied to start the quarter, investor risk appetite turned sharply lower following higher than expected inflation data. The U.S. Federal Reserve continued to aggressively hike short term interest rates. Global markets finished the 4th quarter higher, with investor sentiment buoyed by easing inflationary pressures. Declining inflation levels allowed the U.S. Federal Reserve and European Central Bank to slow the pace of interest rate increases. Despite additional central bank tightening and a string of bank

The S&P 500® Index is an unmanaged index of 500 stocks. Similar to the Equity Fund, the S&P 500® Index’s performance reflects reinvestment of dividends and distributions. Unlike the Fund, however, the S&P 500® Index’s performance does not include management and other operating expenses. It is not possible to invest directly in an index.

11

failures, global equity markets posted mid-single-digit gains in the first quarter of 2023. As the quarter progressed, investors’ focus gradually drifted from a more optimistic view on the path of inflation in January to concerns about further monetary tightening in February through early March. Financial markets performed well in the second quarter with the U.S. helping propel global equities to a mid-single-digit gain. Declining inflation and a resilient economic growth backdrop bolstered U.S. equity markets in addition to robust returns in a narrow set of mega cap tech stocks helped by optimism with respect to artificial intelligence.

12

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

GREEN CENTURY MSCI INTERNATIONAL INDEX FUND

Investment Objective The Green Century MSCI International Index Fund (the International Fund or the Fund) seeks to achieve long-term total return that matches the performance of an index comprised of the stocks of foreign companies selected based on environmental, social and governance criteria.

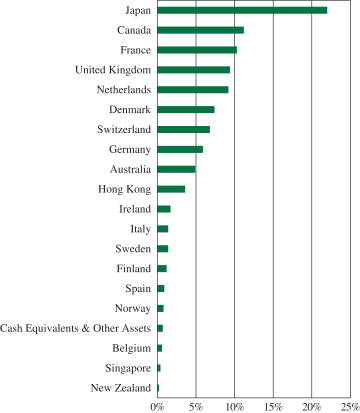

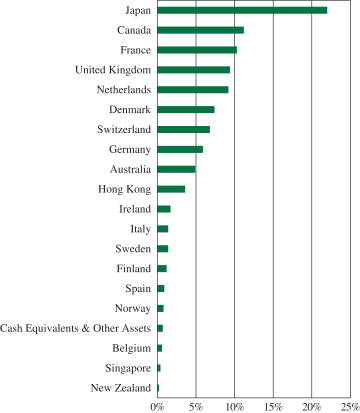

Portfolio Orientation The Fund seeks to achieve its objective by investing in the stocks included in the MSCI World ex USA SRI ex Fossil Fuels Index9 (the Index), a custom index calculated by MSCI, Inc. The Index is comprised of the common stocks of the approximately 240 companies in the MSCI World ex USA SRI Index, minus the stocks of the companies that explore for, extract, process, refine or distribute coal, oil or gas. The Index also does not include companies that produce or transmit electricity derived from fossil fuels, transmit natural gas, or own carbon reserves.

The International Fund is the only responsible, diversified fossil fuel free international index fund available in the U.S. The Fund is also broadly diversified and responsibly screened. Like other index funds, the International Fund is not actively managed in the traditional investment sense, but rather seeks to be nearly fully invested at all times in a broad and diverse portfolio of stocks which meet certain environmental, social and governance (ESG) criteria.

The Fund invests in the stocks of companies selected for inclusion in the Index based on a thorough review of environmental, social, and governance factors and includes those companies believed to have the best overall sustainability records. Green Century believes that certain industries impose unique and onerous risks and/or costs on society. Companies involved in these industries are evaluated based on their level of involvement as well as the impact of that involvement on

GREEN CENTURY MSCI INTERNATIONAL INDEX FUND

INVESTMENT BY COUNTRY (unaudited)

13

society. Therefore, companies that derive significant revenues from the manufacture of tobacco products, alcoholic beverages, genetically modified organisms (GMOs), or the operation of gambling enterprises; or have a significant direct ownership share in, operate or design nuclear power plants are not eligible for the Index. Major military contractors and firearms manufacturers are also ineligible. The Index excludes all companies that explore for, extract, produce, manufacture, or refine coal, oil or gas. The Index also does not include companies that produce or transmit electricity derived from fossil fuels, transmit natural gas, or own carbon reserves.

Investment Strategy and Performance Green Century believes that companies that minimize their negative social and environmental impact and follow governance standards could enjoy competitive advantages and be less likely to incur certain legal liabilities that may be assessed when a product or service is determined to be harmful. Green Century also believes that such investments may, over the long term, provide investors with a return that is competitive with enterprises that do not exhibit such social and environmental awareness.

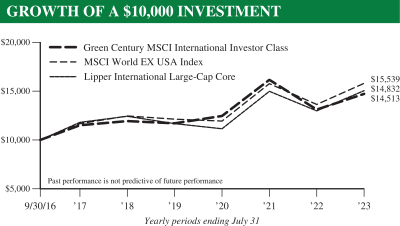

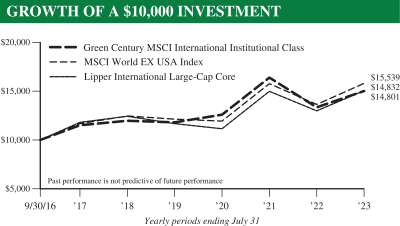

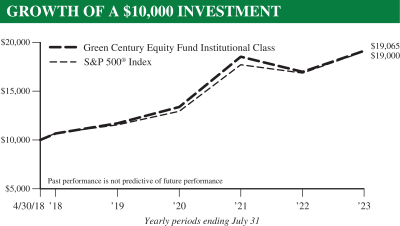

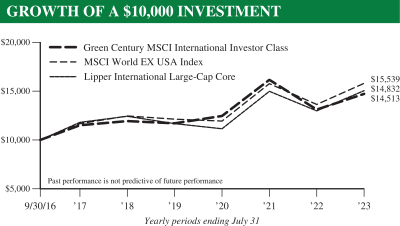

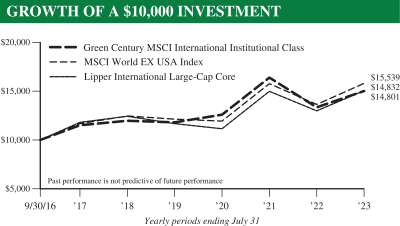

Both share classes of the International Fund underperformed its benchmark for the latest quarter ended July 31, 2023. The Fund’s total return was 1.73% for the individual share class and 1.86% for the institutional share class for this period, while the MSCI World ex USA Index returned 3.43% for the same period. Additional results for various time periods are below:*

| | | | | | | | | | | | | | | | | | |

Green Century MSCI International Fund Total expense ratio: 1.28% for Individual Share Class and 0.98% for

Institutional Share Class | | CUMULATIVE

RETURN* | | | AVERAGE ANNUAL RETURN* | |

| | Inception Date: September 30, 2016 | |

| | Latest

Quarter | | | One Year | | | Five Years | | | Since

Inception | |

| June 30, 2023 | | Green Century MSCI International Index Fund — Individual Share Class | | | 2.55% | | | | 15.87% | | | | 4.32% | | | | 5.37% | |

| | Green Century MSCI International Index Fund — Institutional Share Class | | | 2.61% | | | | 16.23% | | | | 4.62% | | | | 5.67% | |

| | MSCI World ex USA Index | | | 3.03% | | | | 17.41% | | | | 4.58% | | | | 6.25% | |

| July 31, 2023 | | Green Century MSCI International Index Fund — Individual Share Class | | | 1.73% | | | | 11.83% | | | | 4.17% | | | | 5.60% | |

| | Green Century MSCI International Index Fund — Institutional Share Class | | | 1.86% | | | | 12.15% | | | | 4.49% | | | | 5.91% | |

| | MSCI World ex USA Index | | | 3.43% | | | | 15.47% | | | | 4.74% | | | | 6.66% | |

* The performance data quoted represents past performance and is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain Fund prices and performance information as of the most recent month-end, call 1-800-93-GREEN/1-800-934-7336. Performance includes the reinvestment of income dividends and capital gains distributions. Performance shown does not reflect the deduction of taxes that a shareholder might pay on Fund distributions or the redemption of Fund shares. A redemption fee of 2.00% may be imposed on redemptions or exchanges of shares you have owned for 60 days or less. Please see the prospectus for more information.

14

The Institutional and Investor share classes of the Green Century MSCI International Index Fund (International Fund), which closely tracks the MSCI World ex USA SRI ex Fossil Fuels Index, returned 12.15% and 11.83%, respectively, for the one year period ended July 31, 2023, while the MSCI World ex USA Index (Index), returned 15.47% during the same period. The difference in performance of the International Fund relative to the Index was largely due to differences in sector allocation and stock selection criteria between the International Fund and the Index.

The strongest performing sectors in the International Fund were Information Technology, Consumer Discretionary and Financials which returned 35.88%, 20.22% and 15.50%, respectively. The worst performing sectors were Real Estate and Communication Services, which returned -0.85% and 0.77%, respectively, for the year. Within the MSCI World ex USA Index, Consumer Discretionary, Information Technology, and Industrials were the strongest performing sectors, gaining 25.12%, 24.87%, and 21.45%, respectively. The worst performing sectors were Real Estate and Communication Services which returned -6.49% and 3.34%, respectively, for the year.

US equities underperformed non-US developed equities for the reporting period, as measured by the S&P 500 and MSCI World Ex US indices, with 1 year returns of 13.02% and 15.47% respectively. U.S. Equities declined during a volatile third quarter of 2022. After stocks rallied to start the quarter, investor risk appetite turned sharply lower following higher than expected inflation data. The U.S. Federal Reserve continued to aggressively hike short term interest rates. Global markets finished the 4th quarter higher, with investor

The MSCI World ex USA Index is a custom index calculated by MSCI Inc. The MSCI World ex USA Index includes large and mid-cap stocks across 22 of 23 Developed Markets (DM) countries and excludes the United States. With 1,023 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country. The MSCI World ex USA Index is a free float-adjusted market capitalization index. Unlike the Fund, the MSCI World ex USA Index’s performance does not include management and other operating expenses. It is not possible to invest directly in an index.

15

sentiment buoyed by easing inflationary pressures. Declining inflation levels allowed the U.S. Federal Reserve and European Central Bank to slow the pace of interest rate increases. Despite additional central bank tightening and a string of bank failures, global equity markets posted mid-single-digit gains in the first quarter of 2023. As the quarter progressed, investors’ focus gradually drifted from a more optimistic view on the path of inflation in January to concerns about further monetary tightening in February through early March. Financial markets performed well in the second quarter with the U.S. helping propel global equities to a mid-single-digit gain. Declining inflation and a resilient economic growth backdrop bolstered U.S. equity markets in addition to robust returns in a narrow set of mega cap tech stocks helped by optimism with respect to artificial intelligence.

1 As of July 31, 2023, the following companies comprised the listed percentages of each of the Green Century Funds:

| | | | | | | | | | | | |

| Portfolio Holdings | | Green

Century

Balanced

Fund | | | Green

Century

Equity

Fund | | | Green

Century

International

Index Fund | |

Costco | | | 1.50 | % | | | 0.00 | % | | | 0.00 | % |

ODP Corporation | | | 0.00 | % | | | 0.01 | % | | | 0.00 | % |

Apple | | | 6.25 | % | | | 0.00 | % | | | 0.00 | % |

Verisk Analytics Inc. | | | 0.63 | % | | | 0.00 | % | | | 0.00 | % |

Gilead Sciences Inc. | | | 0.55 | % | | | 0.46 | % | | | 0.00 | % |

Progressive Corp. | | | 0.48 | % | | | 0.36 | % | | | 0.00 | % |

ServicesNow Inc. | | | 0.76 | % | | | 0.58 | % | | | 0.00 | % |

| | | | | | | | | | | | |

| Portfolio Holdings | | Green

Century

Balanced

Fund | | | Green

Century

Equity

Fund | | | Green

Century

International

Index Fund | |

Equinix Inc. | | | 0.53 | % | | | 0.37 | % | | | 0.00 | % |

Euro Invt. Bank | | | 1.84 | % | | | 0.00 | % | | | 0.00 | % |

IBRD | | | 1.48 | % | | | 0.00 | % | | | 0.00 | % |

Mastercard | | | 3.02 | % | | | 1.63 | % | | | 0.00 | % |

SalesForce | | | 1.31 | % | | | 1.10 | % | | | 0.00 | % |

Portfolio composition will change due to ongoing management of the Funds. Please refer to the Green Century Funds website for current information regarding the Funds’ portfolio holdings. Note that some of the holdings discussed above may not have been held by any Fund during the fiscal year ended July 31, 2023, or may have been held by a Fund for a portion of the fiscal year, or may have been held by a Fund for the entire fiscal year. These holdings are subject to risk as described in the Funds’ prospectus. References to specific investments should not be construed as a recommendation of the securities by the Funds, their administrator, or their distributor.

2 The Custom Balanced Index is comprised of a 60% weighting in the S&P 1500 Index and a 40% weighting in the BofA Merrill Lynch 1-10 Year US Corporate & Government Index (the BofA Merrill Lynch Index). It is not possible to invest directly in the Custom Balanced Index.

3 The S&P Supercomposite 1500 Index is an unmanaged broad-based capitalization-weighted index comprising 1500 stocks of large-cap, mid-cap, and small-cap U.S. companies. It is not possible to invest directly in the S&P Supercomposite 1500 Index.

4 The BofA Merrill Lynch Index tracks the performance of U.S. dollar-denominated investment grade government and corporate public debt issued in the U.S. domestic bond market with at least 1 year and less than 10 years remaining maturity, including U.S. treasury, U.S. agency, foreign government, supranational and corporate securities. It is not possible to invest directly in the BofA Merrill Lynch Index.

5 The Lipper Balanced Fund Index includes the 30 largest funds whose primary objective is to conserve principal by maintaining at all times a balanced portfolio of both stocks and bonds. Typically the stock/bond ratio ranges around 60%/40%. It is not possible to invest directly in the Lipper Balanced Fund Index.

6 The S&P 500® Index is an unmanaged index of 500 selected common stocks, most of which are listed on the New York Stock Exchange. The S&P 500® Index is heavily weighted toward stocks with large market capitalization and represents approximately two-thirds of the total market value of all domestic stocks. It is not possible to invest directly in the S&P 500® Index.

7 The MSCI KLD 400 Social ex Fossil Fuels Index (the KLD400 ex Fossil Fuels Index) is a custom index calculated by MSCI Inc. The KLD400 ex Fossil Fuels Index is comprised of the common stocks of the approximately 400 companies in the MSCI KLD 400 Social Index (the KLD400 Index), minus the stocks of the companies that explore for, extract, produce, manufacture, or refine coal, oil or gas or produce or transmit electricity derived from fossil fuels or transmit natural gas or have carbon reserves that are included in the KLD400 Index. The KLD400 Index is a free float-adjusted market capitalization index designed to provide exposure to U.S. companies that have positive ESG characteristics and consists of approximately 400 companies selected from the MSCI USA Investable Market Index. It is not possible to invest directly in an index.

16

8 The MSCI World ex USA Index is a custom index calculated by MSCI Inc. The MSCI World ex USA Index includes large and mid-cap stocks across 22 of 23 Developed Markets countries and excludes the United States. With 1,023 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country. The MSCI World ex USA Index is a free float-adjusted market capitalization index. It is not possible to invest directly in the MSCI World ex USA Index.

9 The World ex USA SRI ex Fossil Fuels Index is a custom index calculated by MSCI Inc. The World ex USA SRI ex Fossil Fuels Index is comprised of the common stocks of the companies in the MSCI World ex USA SRI Index (the World ex USA SRI Index), minus the stocks of the companies that explore for, extract, produce, manufacture or refine coal, oil or gas or produce or transmit electricity derived from fossil fuels or transmit natural gas or have carbon reserves that are included in the World ex USA SRI (Socially Responsible Investment) Index. The World ex USA SRI Index includes large and mid-cap stocks from approximately 22 Developed Markets countries (excluding the U.S.). The World ex USA SRI Index is a capitalization weighted index that provides exposure to companies with what MSCI calculates to have outstanding ESG ratings and excludes companies whose products have negative social or environmental impacts. It is not possible to invest directly in an index.

Stocks will fluctuate in response to factors that may affect a single company, industry, sector, country, region or the market as a whole and may perform worse than the market. Foreign securities are subject to additional risks such as currency fluctuations, regional economic and political conditions, differences in accounting methods, and other unique risks compared to investing in securities of U.S. issuers. Bonds are subject to a variety of risks including interest rate, credit, and inflation risk. A sustainable investment strategy which incorporates environmental, social and governance criteria may result in lower or higher returns than an investment strategy that does not include such criteria.

This material must be preceded or accompanied by a current prospectus.

Distributor: UMB Distribution Services, LLC 9/23

Neither the Green Century Equity Fund nor the Green Century MSCI International Index Fund (each a “Fund” and together the “Funds”) is sponsored, endorsed, or promoted by MSCI, its affiliates, information providers or any other third party involved in, or related to, compiling, computing or creating the MSCI indices (the “MSCI Parties”), and the MSCI Parties bear no liability with respect to a Fund or any index on which a Fund is based. The MSCI Parties are not sponsors of either of the Funds and are not affiliated with the Funds in any way. The Statement of Additional Information contains a more detailed description of the limited relationship the MSCI Parties have with Green Century Capital Management and the Funds.

17

GREEN CENTURY FUNDS EXPENSE EXAMPLE

For the six months ended July 31, 2023 (unaudited)

As a shareholder of the Green Century Funds (the “Funds”), you incur two types of costs: (1) transaction costs, including redemption fees on certain redemptions; and (2) ongoing costs, including management fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from February 1, 2023 to July 31, 2023 (the “period”).

Actual Expenses The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 equals 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account during the period.

Hypothetical Example for Comparison Purposes The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the actual return of either of the Funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees on shares held for 60 days or less. Therefore, the second line of the table is useful in comparing the ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs could have been higher.

| | | | | | | | | | | | |

| | | BEGINNING

ACCOUNT VALUE

FEBRUARY 1, 2023 | | | ENDING

ACCOUNT VALUE

JULY 31, 2023 | | | EXPENSES

PAID DURING

THE PERIOD1 | |

Balanced Fund | | | | | | | | | | | | |

Actual Expenses — Individual Investor Class | | $ | 1,000.00 | | | $ | 1,036.20 | | | $ | 7.38 | |

Actual Expenses — Institutional Class | | | 1,000.00 | | | | 1,037.90 | | | | 5.87 | |

Hypothetical Example, assuming a 5% return before expenses —Individual Investor Class | | | 1,000.00 | | | | 1,017.75 | | | | 7.32 | |

Hypothetical Example, assuming a 5% return before expenses —Institutional Class | | | 1,000.00 | | | | 1,019.24 | | | | 5.82 | |

18

| | | | | | | | | | | | |

| | | BEGINNING

ACCOUNT VALUE

FEBRUARY 1, 2023 | | | ENDING

ACCOUNT VALUE

JULY 31, 2023 | | | EXPENSES

PAID DURING

THE PERIOD1 | |

Equity Fund | | | | | | | | | | | | |

Actual Expenses — Individual Investor Class | | $ | 1,000.00 | | | $ | 1,141.70 | | | $ | 6.64 | |

Actual Expenses — Institutional Class | | | 1,000.00 | | | | 1,143.30 | | | | 5.05 | |

Hypothetical Example, assuming a 5% return before expenses —Individual Investor Class | | | 1,000.00 | | | | 1,018.80 | | | | 6.26 | |

Hypothetical Example, assuming a 5% return before expenses —Institutional Class | | | 1,000.00 | | | | 1,020.29 | | | | 4.76 | |

| | | |

| | | BEGINNING

ACCOUNT VALUE

FEBRUARY 1, 2023 | | | ENDING

ACCOUNT VALUE

JULY 31, 2023 | | | EXPENSES

PAID DURING

THE PERIOD1 | |

MSCI International Index Fund | | | | | | | | | | | | |

Actual Expenses — Individual Investor Class | | $ | 1,000.00 | | | $ | 1,045.50 | | | $ | 6.49 | |

Actual Expenses — Institutional Class | | | 1,000.00 | | | | 1,047.00 | | | | 4.97 | |

Hypothetical Example, assuming a 5% return before expenses —Individual Investor Class | | | 1,000.00 | | | | 1,018.65 | | | | 6.41 | |

Hypothetical Example, assuming a 5% return before expenses —Institutional Class | | | 1,000.00 | | | | 1,020.14 | | | | 4.91 | |

1 Expenses are equal to the Funds’ annualized expense ratios (1.46% for the Balanced Fund Individual Investor Class, 1.16% for the Balanced Fund Institutional Class, 1.25% for the Equity Fund Individual Investor Class, 0.95% for the Equity Fund Institutional Class, 1.28% for the MSCI International Index Fund Individual Investor Class and 0.98% for the MSCI International Index Fund Institutional Class), multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period).

19

| | |

GREEN CENTURY BALANCED FUND PORTFOLIO OF INVESTMENTS July 31, 2023 | | |

| | | | | | | | |

COMMON STOCKS — 61.6% | |

| | | SHARES | | | VALUE | |

Software & Services — 7.7% | | | | | | | | |

Adobe, Inc. (a) | | | 6,586 | | | $ | 3,597,076 | |

Autodesk, Inc. (a) | | | 8,896 | | | | 1,885,863 | |

Microsoft Corporation | | | 52,010 | | | | 17,471,199 | |

Paycom Software, Inc. | | | 7,024 | | | | 2,590,170 | |

PayPal Holdings, Inc. (a) | | | 25,725 | | | | 1,950,470 | |

ServiceNow, Inc. (a) | | | 5,144 | | | | 2,998,952 | |

| | | | | | | | |

| | | | | | | 30,493,730 | |

| | | | | | | | |

Technology Hardware & Equipment — 6.0% | |

Apple, Inc. | | | 101,484 | | | | 19,936,532 | |

Palo Alto Networks, Inc. (a) | | | 14,273 | | | | 3,567,679 | |

| | | | | | | | |

| | | | | | | 23,504,211 | |

| | | | | | | | |

Pharmaceuticals & Biotechnology — 4.9% | | | | | |

AstraZeneca PLC ADR (b) | | | 73,287 | | | | 5,254,678 | |

Gilead Sciences, Inc. | | | 28,375 | | | | 2,160,473 | |

IQVIA Holdings, Inc. (a) | | | 13,140 | | | | 2,940,206 | |

Merck & Company, Inc. | | | 27,300 | | | | 2,911,545 | |

Roche Holding AG ADR | | | 67,859 | | | | 2,626,143 | |

Thermo Fisher Scientific, Inc. | | | 5,889 | | | | 3,231,059 | |

| | | | | | | | |

| | | | | | | 19,124,104 | |

| | | | | | | | |

Capital Goods — 4.2% | | | | | | | | |

Deere & Company | | | 5,649 | | | | 2,426,811 | |

Eaton Corporation PLC | | | 15,151 | | | | 3,110,803 | |

Illinois Tool Works, Inc. | | | 7,095 | | | | 1,868,255 | |

Rockwell Automation, Inc. | | | 4,908 | | | | 1,650,511 | |

Trane Technologies PLC | | | 15,557 | | | | 3,102,688 | |

Westinghouse Air Brake Technologies Corporation | | | 21,955 | | | | 2,600,350 | |

Xylem, Inc. | | | 15,837 | | | | 1,785,622 | |

| | | | | | | | |

| | | | | | | 16,545,040 | |

| | | | | | | | |

Consumer Discretionary Distribution & Retail — 3.6% | |

Home Depot, Inc. (The) | | | 11,443 | | | | 3,820,131 | |

Target Corporation | | | 21,254 | | | | 2,900,534 | |

TJX Companies, Inc. (The) | | | 49,595 | | | | 4,291,455 | |

Tractor Supply Company | | | 14,712 | | | | 3,295,341 | |

| | | | | | | | |

| | | | | | | 14,307,461 | |

| | | | | | | | |

Semiconductors & Semiconductor Equipment — 3.5% | |

Analog Devices, Inc. | | | 15,676 | | | | 3,127,832 | |

ASML Holding NV (b) | | | 4,954 | | | | 3,549,095 | |

NVIDIA Corporation | | | 11,327 | | | | 5,292,994 | |

Wolfspeed, Inc. (a) | | | 29,189 | | | | 1,923,555 | |

| | | | | | | | |

| | | | | | | 13,893,476 | |

| | | | | | | | |

| | | | | | | | |

| | | SHARES | | | VALUE | |

Insurance — 3.3% | | | | | | | | |

Aflac, Inc. | | | 28,265 | | | $ | 2,044,690 | |

Elevance Health, Inc. | | | 14,251 | | | | 6,721,199 | |

Progressive Corporation (The) | | | 15,121 | | | | 1,904,944 | |

Travelers Companies, Inc. (The) | | | 13,908 | | | | 2,400,660 | |

| | | | | | | | |

| | | | | | | 13,071,493 | |

| | | | | | | | |

Healthcare Equipment & Services — 3.2% | | | | | |

Alcon, Inc. (b) | | | 35,019 | | | | 2,973,813 | |

CVS Health Corp. | | | 31,621 | | | | 2,361,773 | |

Medtronic PLC | | | 22,868 | | | | 2,006,896 | |

Stryker Corporation | | | 10,759 | | | | 3,049,208 | |

West Pharmaceutical Services, Inc. | | | 5,832 | | | | 2,146,409 | |

| | | | | | | | |

| | | | | | | 12,538,099 | |

| | | | | | | | |

Financial Services — 3.1% | | | | | | | | |

LPL Financial Holdings, Inc. | | | 19,667 | | | | 4,510,823 | |

Mastercard, Inc., Class A | | | 19,728 | | | | 7,778,356 | |

| | | | | | | | |

| | | | | | | 12,289,179 | |

| | | | | | | | |

Media & Entertainment — 2.9% | | | | | | | | |

Alphabet, Inc., Class A (a) | | | 73,686 | | | | 9,779,606 | |

Walt Disney Company (The) (a) | | | 19,009 | | | | 1,689,710 | |

| | | | | | | | |

| | | | | | | 11,469,316 | |

| | | | | | | | |

Equity Real Estate Investment Trusts (REITs) — 2.7% | |

American Tower Corporation REIT | | | 19,574 | | | | 3,725,128 | |

AvalonBay Communities, Inc. REIT | | | 8,963 | | | | 1,690,870 | |

Equinix, Inc. REIT | | | 2,596 | | | | 2,102,552 | |

Jones Lang LaSalle, Inc. (a) | | | 9,787 | | | | 1,630,025 | |

Prologis, Inc. REIT | | | 10,930 | | | | 1,363,517 | |

| | | | | | | | |

| | | | | | | 10,512,092 | |

| | | | | | | | |

Renewable Energy & Energy Efficiency — 2.3% | |

First Solar, Inc. (a) | | | 12,413 | | | | 2,574,456 | |

Ormat Technologies, Inc. | | | 35,154 | | | | 2,858,020 | |

SolarEdge Technologies, Inc. (a) | | | 10,004 | | | | 2,415,566 | |

Sunrun, Inc. (a) | | | 70,485 | | | | 1,337,805 | |

| | | | | | | | |

| | | | | | | 9,185,847 | |

| | | | | | | | |

Consumer Staples Distribution & Retail — 2.1% | |

Costco Wholesale Corporation | | | 10,528 | | | | 5,902,734 | |

Sysco Corporation | | | 30,845 | | | | 2,353,782 | |

| | | | | | | | |

| | | | | | | 8,256,516 | |

| | | | | | | | |

20

| | |

GREEN CENTURY BALANCED FUND PORTFOLIO OF INVESTMENTS July 31, 2023 | | continued |

| | | | | | | | |

| | | SHARES | | | VALUE | |

Banks — 2.0% | | | | | | | | |

East West Bancorp, Inc. | | | 63,372 | | | $ | 3,942,372 | |

PNC Financial Services Group, Inc. (The) | | | 28,515 | | | | 3,903,418 | |

| | | | | | | | |

| | | | | | | 7,845,790 | |

| | | | | | | | |

Consumer Durables & Apparel — 1.8% | |

Levi Strauss & Company, Class A | | | 129,446 | | | | 1,950,751 | |

Lululemon Athletica, Inc. (a) | | | 7,754 | | | | 2,935,122 | |

NIKE, Inc., Class B | | | 21,523 | | | | 2,375,924 | |

| | | | | | | | |

| | | | | | | 7,261,797 | |

| | | | | | | | |

Materials — 1.6% | | | | | | | | |

Ball Corporation | | | 58,571 | | | | 3,437,532 | |

Ingevity Corporation (a) | | | 19,719 | | | | 1,262,411 | |

International Flavors & Fragrances, Inc. | | | 20,248 | | | | 1,713,183 | |

| | | | | | | | |

| | | | | | | 6,413,126 | |

| | | | | | | | |

Household & Personal Products — 1.5% | |

Procter & Gamble Company (The) | | | 17,374 | | | | 2,715,556 | |

Unilever PLC ADR (b) | | | 61,768 | | | | 3,318,795 | |

| | | | | | | | |

| | | | | | | 6,034,351 | |

| | | | | | | | |

Transportation — 1.4% | | | | | | | | |

J.B. Hunt Transport Services, Inc. | | | 13,020 | | | | 2,655,299 | |

United Parcel Service, Inc., Class B | | | 14,085 | | | | 2,635,726 | |

| | | | | | | | |

| | | | | | | 5,291,025 | |

| | | | | | | | |

Consumer Services — 1.0% | | | | | | | | |

Bright Horizons Family Solutions, Inc. (a) | | | 15,357 | | | | 1,490,090 | |

Starbucks Corporation | | | 22,323 | | | | 2,267,347 | |

| | | | | | | | |

| | | | | | | 3,757,437 | |

| | | | | | | | |

Food & Beverage — 0.8% | | | | | | | | |

McCormick & Company, Inc. | | | 33,631 | | | | 3,009,302 | |

| | | | | | | | |

Utilities — 0.7% | | | | | | | | |

American Water Works Company, Inc. | | | 19,443 | | | | 2,866,481 | |

| | | | | | | | |

Commercial & Professional Services — 0.6% | |

Verisk Analytics, Inc. | | | 10,870 | | | | 2,488,578 | |

| | | | | | | | |

Telecommunication Services — 0.4% | |

Verizon Communications, Inc. | | | 49,228 | | | | 1,677,690 | |

| | | | | | | | |

Automobiles & Components — 0.3% | |

Aptiv PLC (a) | | | 10,287 | | | | 1,126,324 | |

| | | | | | | | |

Total Common Stocks

(Cost $130,346,148) | | | | | | | 242,962,465 | |

| | | | | | | | |

| | | | | | | | |

| | | PRINCIPAL

AMOUNT | | | VALUE | |

| | |

BONDS & NOTES — 37.6% | | | | | | | | |

Green and Sustainability Bonds — 25.9% | | | | | |

Apple, Inc.

3.00%, due 6/20/27 (c) | | $ | 5,000,000 | | | $ | 4,739,395 | |

Asian Development Bank

2.125%, due 3/19/25 (b) | | | 1,000,000 | | | | 952,665 | |

Asian Development Bank

3.125%, due 9/26/28 (b) | | | 4,000,000 | | | | 3,781,528 | |

AvalonBay Communities, Inc.

2.05%, due 1/15/32 (c) | | | 6,000,000 | | | | 4,833,600 | |

Bank of America Corporation

2.456% (3-Month Term SOFR+113.161 basis points), due 10/22/25 (c) | | | 4,000,000 | | | | 3,844,820 | |

Boston Properties LP

4.50%, due 12/1/28 (c) | | | 5,000,000 | | | | 4,636,215 | |

Bridge Housing Corporation

3.25%, due 7/15/30 (c) | | | 4,500,000 | | | | 3,962,209 | |

Century Housing Corporation

0.60%, due 2/15/24 | | | 2,500,000 | | | | 2,435,298 | |

City & County of San Francisco CA Community Facilities District No. 2014-1

2.75%, due 9/1/23 | | | 650,000 | | | | 648,320 | |

City of San Francisco CA Public Utilities Commission Water Revenue

2.806%, due 11/1/23 | | | 2,000,000 | | | | 1,985,904 | |

European Investment Bank

2.50%, due 10/15/24 (b) | | | 2,000,000 | | | | 1,933,780 | |

European Investment Bank

2.125%, due 4/13/26 (b) | | | 500,000 | | | | 468,726 | |

European Investment Bank

3.75%, due 2/14/33 (b) | | | 5,000,000 | | | | 4,867,375 | |

International Bank for Reconstruction & Development

2.125%, due 3/3/25 (b) | | | 2,000,000 | | | | 1,908,372 | |

International Bank for Reconstruction & Development

4.00%, due 7/25/30 (b) | | | 4,000,000 | | | | 3,944,524 | |

International Finance Corporation

2.125%, due 4/7/26 (b) | | | 500,000 | | | | 468,265 | |

Johnson Controls International plc / Tyco Fire & Security Finance SCA

1.75%, due 9/15/30 (b)(c) | | | 5,000,000 | | | | 4,040,725 | |

21

| | |

GREEN CENTURY BALANCED FUND PORTFOLIO OF INVESTMENTS July 31, 2023 | | continued |

| | | | | | | | |

| | | PRINCIPAL

AMOUNT | | | VALUE | |

Green and Sustainability Bonds — (continued) | |

Mastercard, Inc.

1.90%, due 3/15/31 (c) | | $ | 5,000,000 | | | $ | 4,136,995 | |

Nederlandse Waterschapsbank NV

2.375%, due 3/24/26 (b)(d) | | | 3,500,000 | | | | 3,293,101 | |

New Jersey Infrastructure Bank

3.00%, due 9/1/31 | | | 2,500,000 | | | | 2,196,903 | |

NXP BV / NXP Funding LLC / NXP USA, Inc.

5.00%, due 1/15/33 (b)(c) | | | 4,500,000 | | | | 4,325,557 | |

PNC Financial Services Group, Inc. (The)

2.20%, due 11/1/24 (c) | | | 5,000,000 | | | | 4,788,145 | |

Prologis LP

1.25%, due 10/15/30 (c) | | | 4,500,000 | | | | 3,491,239 | |

Regency Centers LP

3.75%, due 6/15/24 (c) | | | 2,000,000 | | | | 1,946,710 | |

Salesforce, Inc.

1.50%, due 7/15/28 (c) | | | 6,000,000 | | | | 5,174,634 | |

San Francisco Bay Area Rapid Transit District

2.622%, due 8/1/29 | | | 2,000,000 | | | | 1,758,274 | |

Starbucks Corporation

2.45%, due 6/15/26 (c) | | | 4,500,000 | | | | 4,209,039 | |

United States International Development Finance Corporation

3.43%, due 6/1/33 | | | 188,332 | | | | 173,948 | |

United States International Development Finance Corporation

3.05%, due 6/15/35 | | | 1,191,300 | | | | 1,061,158 | |

United States International Development Finance Corporation

2.58%, due 7/15/38 | | | 2,772,316 | | | | 2,346,926 | |

Verizon Communications, Inc.

3.875%, due 2/8/29 (c) | | | 5,000,000 | | | | 4,703,460 | |

Visa, Inc.

0.75%, due 8/15/27 (c) | | | 6,000,000 | | | | 5,213,010 | |

Xylem, Inc.

2.25%, due 1/30/31 (c) | | | 4,500,000 | | | | 3,741,385 | |

| | | | | | | | |

| | | | | | | 102,012,205 | |

| | | | | | | | |

| | | | | | | | |

| | | PRINCIPAL

AMOUNT | | | VALUE | |

U.S. Government Agencies — 4.8% | | | | | |

Federal Farm Credit Banks Funding Corporation

2.26%, due 11/13/24 | | $ | 500,000 | | | $ | 481,610 | |

Federal Farm Credit Banks Funding Corporation

1.82%, due 12/18/25 | | | 3,000,000 | | | | 2,792,025 | |

Federal Farm Credit Banks Funding Corporation

2.80%, due 11/12/27 | | | 3,000,000 | | | | 2,804,913 | |

Federal Farm Credit Banks Funding Corporation

3.875%, due 8/15/28 | | | 4,000,000 | | | | 3,922,300 | |

Federal Farm Credit Banks Funding Corporation

1.23%, due 7/29/30 (c) | | | 5,000,000 | | | | 3,959,845 | |

Federal Home Loan Banks

0.75%, due 12/14/23 (c) | | | 3,000,000 | | | | 2,946,468 | |

Federal National Mortgage Association

0.25%, due 11/27/23 | | | 2,000,000 | | | | 1,967,328 | |

| | | | | | | | |

| | | | | | | 18,874,489 | |

| | | | | | | | |

Community Development Financial Institutions — 2.3% | |

Capital Impact Partners

1.00%, due 9/15/25 (c) | | | 1,500,000 | | | | 1,287,025 | |

Enterprise Community Loan Fund, Inc.

4.152%, due 11/1/28 (c) | | | 3,000,000 | | | | 2,764,017 | |

Local Initiatives Support Corporation

1.00%, due 11/15/25 | | | 2,000,000 | | | | 1,742,384 | |

Local Initiatives Support Corporation

3.782%, due 3/1/27 (c) | | | 2,000,000 | | | | 1,913,246 | |

Reinvestment Fund, Inc. (The)

3.78%, due 2/15/26 | | | 1,400,000 | | | | 1,298,584 | |

| | | | | | | | |

| | | | | | | 9,005,256 | |

| | | | | | | | |

Municipal — 0.9% | | | | | | | | |

Commonwealth of Massachusetts

4.11%, due 7/15/31 (c) | | | 3,766,920 | | | | 3,627,868 | |

| | | | | | | | |

Software & Services — 0.9% | | | | | | | | |

Adobe, Inc.

3.25%, due 2/1/25 (c) | | | 3,500,000 | | | | 3,404,866 | |

| | | | | | | | |

22

| | |

GREEN CENTURY BALANCED FUND PORTFOLIO OF INVESTMENTS July 31, 2023 | | concluded |

| | | | | | | | |

| | | PRINCIPAL

AMOUNT | | | VALUE | |

Equity Real Estate Investment Trusts (REITs) — 0.8% | |

National Community Renaissance of California

3.27%, due 12/1/32 (c) | | $ | 4,000,000 | | | $ | 3,315,504 | |

| | | | | | | | |

Capital Goods — 0.8% | | | | | | | | |

Trane Technologies Luxembourg Finance SA

3.80%, due 3/21/29 (c) | | | 3,500,000 | | | | 3,309,884 | |

| | | | | | | | |

Media & Entertainment — 0.8% | |

Alphabet, Inc.

1.998%, due 8/15/26 (c) | | | 3,500,000 | | | | 3,243,849 | |

| | | | | | | | |

Insurance — 0.3% | | | | | | | | |

Travelers Property Casualty Corporation

7.75%, due 4/15/26 | | | 1,000,000 | | | | 1,062,009 | |

| | | | | | | | |

Healthy Living — 0.1% | | | | | | | | |

Whole Foods Market, Inc.

5.20%, due 12/3/25 (c)(d) | | | 500,000 | | | | 498,207 | |

| | | | | | | | |

Total Bonds & Notes

(Cost $159,572,760) | | | | | | | 148,354,137 | |

| | | | | | | | |

| | | | |

|

SHORT-TERM INVESTMENTS — 0.6% |

| | | | | | | | |

| | | | | | VALUE | |

UMB Money Market Fiduciary Account, 0.01% (e)

(Cost $2,359,202) | | | | | | $ | 2,359,202 | |

| | | | | | | | |

Total Short-term Investments

(Cost $2,359,202) | | | | | | | 2,359,202 | |

| | | | | | | | |

TOTAL INVESTMENTS (f) — 99.8% | |

(Cost $292,278,110) | | | | | | | 393,675,804 | |

Other Assets Less Liabilities — 0.2% | | | | | | | 913,515 | |

| | | | | | | | |

NET ASSETS — 100.0% | | | | | | $ | 394,589,319 | |

| | | | | | | | |

ADR – American Depository Receipt

PLC – Public Limited Company

REIT – Real Estate Investment Trusts

LP – Limited Partnership

LLC – Limited Liability Company

| (a) | Non-income producing security. |

| (b) | Securities whose value are determined or significantly influenced by trading in markets other than the United States or Canada. |

| (d) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration to qualified institutional buyers. The total value of these securities is $3,791,308. |

| (e) | The rate quoted is the annualized seven-day yield of the fund at the period end. |

| (f) | The cost of investments for federal income tax purposes is $292,262,573 resulting in gross unrealized appreciation and depreciation of $117,720,139 and $16,306,908 respectively, or net unrealized appreciation of $101,413,231. |

See Notes to Financial Statements

23

| | |

GREEN CENTURY EQUITY FUND PORTFOLIO OF INVESTMENTS July 31, 2023 | | |

| | | | | | | | |

COMMON STOCKS — 99.9% | | | | | | | | |

| | | SHARES | | | VALUE | |

Software & Services — 22.6% | | | | | | | | |

Accenture PLC, Class A (a) | | | 17,152 | | | $ | 5,426,035 | |

Adobe, Inc. (b) | | | 12,460 | | | | 6,805,278 | |

ANSYS, Inc. (b) | | | 2,363 | | | | 808,382 | |

Autodesk, Inc. (b) | | | 5,816 | | | | 1,232,934 | |

Automatic Data Processing, Inc. | | | 11,245 | | | | 2,780,439 | |

Cadence Design Systems, Inc. (b) | | | 7,418 | | | | 1,735,886 | |

Cognizant Technology Solutions Corporation, Class A | | | 13,871 | | | | 915,902 | |

Fidelity National Information Services, Inc. | | | 16,020 | | | | 967,288 | |

Fortinet, Inc. (b) | | | 18,075 | | | | 1,404,789 | |

Gen Digital, Inc. | | | 15,838 | | | | 308,049 | |

International Business Machines Corporation | | | 24,611 | | | | 3,548,414 | |

Intuit, Inc. | | | 7,613 | | | | 3,895,572 | |

Microsoft Corporation | | | 192,088 | | | | 64,526,201 | |

Okta, Inc., Class A (b) | | | 4,237 | | | | 325,656 | |

Oracle Corporation | | | 44,012 | | | | 5,159,527 | |

Paycom Software, Inc. | | | 1,462 | | | | 539,127 | |

PayPal Holdings, Inc. (b) | | | 28,941 | | | | 2,194,307 | |

PTC, Inc. (b) | | | 3,082 | | | | 449,386 | |

Salesforce, Inc. (b) | | | 27,155 | | | | 6,110,147 | |

ServiceNow, Inc. (b) | | | 5,530 | | | | 3,223,990 | |

Splunk, Inc. (b) | | | 4,234 | | | | 458,669 | |

Teradata Corporation (b) | | | 2,826 | | | | 160,658 | |

Visa, Inc., Class A | | | 44,150 | | | | 10,495,780 | |

VMware, Inc., Class A (b) | | | 6,405 | | | | 1,009,620 | |

Western Union Company (The) | | | 10,613 | | | | 129,266 | |

Workday, Inc., Class A (b) | | | 5,534 | | | | 1,312,277 | |

ZoomInfo Technologies, Inc. (b) | | | 7,810 | | | | 199,702 | |

| | | | | | | | |

| | | | | | | 126,123,281 | |

| | | | | | | | |

Semiconductors & Semiconductor Equipment — 10.5% | |

Advanced Micro Devices, Inc. (b) | | | 43,693 | | | | 4,998,479 | |

Analog Devices, Inc. | | | 13,743 | | | | 2,742,141 | |

Applied Materials, Inc. | | | 22,944 | | | | 3,478,081 | |

Intel Corporation | | | 113,244 | | | | 4,050,738 | |

Lam Research Corporation | | | 3,661 | | | | 2,630,392 | |

Microchip Technology, Inc. | | | 14,879 | | | | 1,397,733 | |

NVIDIA Corporation | | | 67,087 | | | | 31,349,084 | |

NXP Semiconductors NV (a) | | | 7,060 | | | | 1,574,239 | |

ON Semiconductor Corporation (b) | | | 11,697 | | | | 1,260,352 | |

Skyworks Solutions, Inc. | | | 4,275 | | | | 488,932 | |

Texas Instruments, Inc. | | | 24,669 | | | | 4,440,420 | |

| | | | | | | | |

| | | | | | | 58,410,591 | |

| | | | | | | | |

| | | | | | | | |

| | | SHARES | | | VALUE | |

Media & Entertainment — 8.6% | | | | | | | | |

Alphabet, Inc., Class A (b) | | | 161,724 | | | $ | 21,464,009 | |

Alphabet, Inc., Class C (b) | | | 145,929 | | | | 19,424,609 | |

Electronic Arts, Inc. | | | 7,451 | | | | 1,015,944 | |

John Wiley & Sons, Inc., Class A . | | | 1,277 | | | | 43,712 | |

Liberty Global PLC, Series A (a)(b) | | | 4,370 | | | | 81,151 | |

Liberty Global PLC, Series C (a)(b) | | | 7,122 | | | | 140,731 | |

New York Times Company (The), Class A | | | 4,076 | | | | 166,138 | |

Omnicom Group, Inc. | | | 5,413 | | | | 458,048 | |

Scholastic Corporation | | | 769 | | | | 33,213 | |

Walt Disney Company (The) (b) | | | 49,557 | | | | 4,405,122 | |

Warner Bros Discovery, Inc. (b) | | | 63,018 | | | | 823,645 | |

| | | | | | | | |

| | | | | | | 48,056,322 | |

| | | | | | | | |

Pharmaceuticals, Biotechnology & Life Sciences — 7.2% | |

AbbVie, Inc. | | | 47,916 | | | | 7,167,275 | |

Agilent Technologies, Inc. | | | 8,011 | | | | 975,499 | |

Amgen, Inc. | | | 14,516 | | | | 3,398,921 | |

Biogen, Inc. (b) | | | 3,918 | | | | 1,058,604 | |

BioMarin Pharmaceutical, Inc. (b) | | | 5,066 | | | | 445,453 | |

Bio-Techne Corporation | | | 4,235 | | | | 353,199 | |

Bristol-Myers Squibb Company | | | 57,078 | | | | 3,549,681 | |

Danaher Corporation | | | 18,814 | | | | 4,798,699 | |

Gilead Sciences, Inc. | | | 33,905 | | | | 2,581,527 | |

Illumina, Inc. (b) | | | 4,310 | | | | 828,167 | |

IQVIA Holdings, Inc. (b) | | | 5,075 | | | | 1,135,582 | |

Jazz Pharmaceuticals PLC (a)(b) | | | 1,733 | | | | 226,018 | |

Merck & Company, Inc. | | | 68,975 | | | | 7,356,184 | |

Mettler-Toledo International, Inc. (b) | | | 597 | | | | 750,710 | |

Vertex Pharmaceuticals, Inc. (b) | | | 7,007 | | | | 2,468,846 | |

Waters Corporation (b) | | | 1,585 | | | | 437,793 | |

Zoetis, Inc. | | | 12,551 | | | | 2,360,718 | |

| | | | | | | | |

| | | | | | | 39,892,876 | |

| | | | | | | | |

Financial Services — 6.4% | | | | | | | | |

Ally Financial, Inc. | | | 7,468 | | | | 228,073 | |

American Express Company | | | 17,178 | | | | 2,901,021 | |

Ameriprise Financial, Inc. | | | 2,857 | | | | 995,522 | |

Bank of New York Mellon Corporation (The) | | | 21,913 | | | | 993,974 | |

BlackRock, Inc. | | | 4,070 | | | | 3,007,119 | |

Charles Schwab Corporation (The) | | | 40,792 | | | | 2,696,351 | |

CME Group, Inc. | | | 9,769 | | | | 1,943,640 | |

Equitable Holdings, Inc. | | | 9,898 | | | | 283,974 | |

FactSet Research Systems, Inc. | | | 1,035 | | | | 450,266 | |

24

| | |

GREEN CENTURY EQUITY FUND PORTFOLIO OF INVESTMENTS July 31, 2023 | | continued |

| | | | | | | | |

| | | SHARES | | | VALUE | |

Financial Services — (continued) | | | | | | | | |

Franklin Resources, Inc. | | | 8,275 | | | $ | 241,961 | |

Intercontinental Exchange, Inc. | | | 15,216 | | | | 1,746,797 | |

Invesco Ltd | | | 9,349 | | | | 157,063 | |

Mastercard, Inc., Class A | | | 23,122 | | | | 9,116,542 | |

Moody’s Corporation | | | 4,482 | | | | 1,581,025 | |

Morgan Stanley | | | 34,014 | | | | 3,114,322 | |

Nasdaq, Inc. | | | 9,391 | | | | 474,152 | |

Northern Trust Corporation | | | 5,582 | | | | 447,230 | |

S&P Global, Inc. | | | 8,917 | | | | 3,517,846 | |

State Street Corporation | | | 9,067 | | | | 656,813 | |

Synchrony Financial | | | 11,480 | | | | 396,519 | |

T. Rowe Price Group, Inc. | | | 6,052 | | | | 745,970 | |

Voya Financial, Inc. | | | 2,739 | | | | 203,398 | |

| | | | | | | | |

| | | | | | | 35,899,578 | |

| | | | | | | | |

Capital Goods — 6.3% | | | | | | | | |

3M Company | | | 14,923 | | | | 1,663,915 | |

A.O. Smith Corporation | | | 3,437 | | | | 249,629 | |

AGCO Corporation | | | 1,763 | | | | 234,655 | |

Air Lease Corporation, Class A | | | 2,900 | | | | 122,786 | |

Allegion PLC (a) | | | 2,423 | | | | 283,152 | |

Applied Industrial Technologies, Inc. | | | 1,062 | | | | 153,979 | |

Builders FirstSource, Inc. (b) | | | 3,734 | | | | 539,302 | |

Carrier Global Corporation | | | 22,651 | | | | 1,348,867 | |

Caterpillar, Inc. | | | 14,019 | | | | 3,717,418 | |

Cummins, Inc. | | | 3,832 | | | | 999,386 | |

Deere & Company | | | 7,644 | | | | 3,283,862 | |

Dover Corporation | | | 3,828 | | | | 558,773 | |

Eaton Corporation PLC | | | 10,800 | | | | 2,217,456 | |

EMCOR Group, Inc. | | | 1,322 | | | | 284,283 | |

Fastenal Company | | | 15,459 | | | | 906,052 | |

Ferguson PLC (a) | | | 5,586 | | | | 902,809 | |

Flowserve Corporation | | | 3,593 | | | | 135,672 | |

Fortive Corporation | | | 9,549 | | | | 748,164 | |

Fortune Brands Innovations, Inc. | | | 3,373 | | | | 239,719 | |

Graco, Inc. | | | 4,610 | | | | 365,711 | |

Granite Construction, Inc. | | | 1,169 | | | | 47,847 | |

IDEX Corporation | | | 2,028 | | | | 457,943 | |

Illinois Tool Works, Inc. | | | 8,287 | | | | 2,182,133 | |

Lennox International, Inc. | | | 859 | | | | 315,631 | |

Lincoln Electric Holdings, Inc. | | | 1,549 | | | | 310,900 | |