UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-03342

Sit Mid Cap Growth Fund, Inc.

(Exact name of registrant as specified in charter)

3300 IDS Center

80 South Eighth Street

Minneapolis, MN 55402

(Address of principal executive offices)

Paul E. Rasmussen, VP Treasurer

Sit Mutual Funds, Inc.

3300 IDS Center

80 South Eighth Street

Minneapolis, MN 55402

(Name and address of agent for service)

Copy to:

Mike Radmer, Esq.

Dorsey & Whitney

Suite 1500

50 South Sixth Street

Minneapolis, MN 55402-1498

Registrant’s telephone number, including area code:

(612) 334-5888

Date of fiscal year end: | June 30, 2010 |

| |

Date of reporting period: | June 30, 2010 |

Item 1: Reports to Stockholders

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-03343

Sit Large Cap Growth Fund, Inc.

(Exact name of registrant as specified in charter)

3300 IDS Center

80 South Eighth Street

Minneapolis, MN 55402

(Address of principal executive offices)

Paul E. Rasmussen, VP Treasurer

Sit Mutual Funds, Inc.

3300 IDS Center

80 South Eighth Street

Minneapolis, MN 55402

(Name and address of agent for service)

Copy to:

Mike Radmer, Esq.

Dorsey & Whitney

Suite 1500

50 South Sixth Street

Minneapolis, MN 55402-1498

Registrant’s telephone number, including area code:

(612) 334-5888

Date of fiscal year end: | June 30, 2010 |

| |

Date of reporting period: | June 30, 2010 |

Item 1: Reports to Stockholders

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-06373

Sit Mutual Funds, Inc.

(Exact name of registrant as specified in charter)

3300 IDS Center

80 South Eighth Street

Minneapolis, MN 55402

(Address of principal executive offices)

Paul E. Rasmussen, VP Treasurer

Sit Mutual Funds, Inc.

3300 IDS Center

80 South Eighth Street

Minneapolis, MN 55402

(Name and address of agent for service)

Copy to:

Mike Radmer, Esq.

Dorsey & Whitney

Suite 1500

50 South Sixth Street

Minneapolis, MN 55402-1498

Registrant’s telephone number, including area code:

(612) 334-5888

Date of fiscal year end: | June 30, 2010 |

| |

Date of reporting period: | June 30, 2010 |

Item 1: Reports to Stockholders

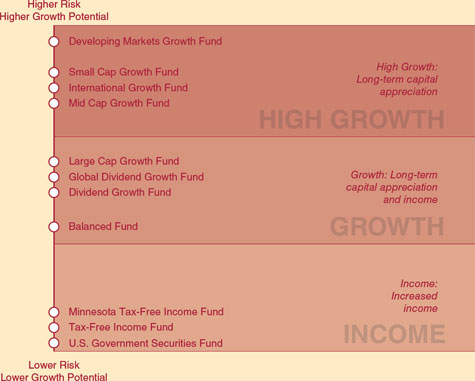

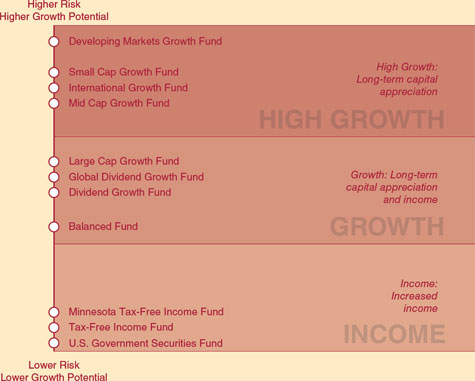

Sit Mutual Funds

Stock Funds

Annual Report

One Year Ended June 30, 2010

A FAMILY OF NO-LOAD FUNDS

Balanced Fund

Dividend Growth Fund

Global Dividend Growth Fund

Large Cap Growth Fund

Mid Cap Growth Fund

International Growth Fund

Small Cap Growth Fund

Developing Markets Growth Fund

|

Sit Mutual Funds |

STOCK FUNDS ANNUAL REPORT |

TABLE OF CONTENTS |

| |

|

|

|

|

Sit Mutual Funds |

One Year Ended June 30, 2010 |

|

Chairman’s Letter |

|

|

Dear Fellow Shareholders:

Equity markets climbed higher over the past year, as economic prospects improved, driven by stimulative fiscal and monetary actions taken by policy makers throughout the world. Although higher stock valuations and further economic challenges may limit significant upside potential, we believe stock prices can climb higher as corporate profits increase.

Following a severe contraction, the U.S. economy (as measured by Gross Domestic Product, or GDP) has now expanded for four consecutive quarters, and further growth is expected over the second half of 2010. Despite revived concerns, on the part of some investors, that the U.S. economy is headed for renewed weakness, we expect the recovery to persist at the same subpar pace we have been forecasting. Consumers continue to reduce debt levels from the highs of 2007, and personal savings rates have moved higher. This retrenchment, combined with the stubbornly slow recovery of labor markets, will likely restrain consumer spending growth to relatively low levels. While job growth has been tepid, wages and work hours have increased since the beginning of the year. This will boost consumer spending over the near-term, but a sustained recovery in the economy will require employers to gain enough confidence to hire additional workers. Our projection for modest consumer spending, which accounts for 70% of GDP, along with a steady uptick in business spending, are key factors underlying our +2.8% GDP forecast for 2010. This represents a below average rebound in growth, compared to other economic recoveries. On a positive note, however, inflation has also remained at very low levels. The core inflation rate, which excludes food and energy sectors, increased just +0.9 percent (year-over-year) in the most recent month. Despite highly accommodative monetary policy, the subdued rate of change in all of these factors – employment, economic growth and inflation – is likely to keep Federal Reserve interest rate increases on hold for quite some time.

Events outside the U.S. weighed on global stock

markets during the most recent quarter. First, concerns over the sustainability of China’s economic recovery emerged as the government stepped up tightening efforts to rein in growth amid rising inflation pressures and a potential “bubble” in real estate. The government’s actions will have an impact on growth during the second half of the year, but we do not expect a “hard landing,” as many segments of the economy (outside of property) will continue to grow. The other major recent events occurred in Europe, as concerns grew over mounting government debt levels in several countries, particularly Greece. Despite initial delays, the European Central Bank resumed its quantitative easing program, including a 750 billion euro program that pledges to buy debt securities in various classes within the region. While sovereign credit concerns are likely to persist for years to come, we believe the risk of a credit/liquidity seizure in the European banking system is no longer a worry for now. However, the impact of austerity measures and decreased confidence will negatively impact already low growth expectations for the region. It is critical, however, that the governments in the region rein in spending at a gradual pace. Given tepid economic growth and fragility of the banking system, severe austerity measures could tip the region into a more severe decline, which could impact the global economy.

Equity Strategy

Although stock prices have responded to better economic conditions over the past year, the correction during the most recent quarter served as a reminder of the many challenges preventing a “new bull market” from emerging in the near term. However, we believe equities are by no means priced for an economic “boom” and patient equity investors will be rewarded over the longer term.

Given the events of recent years, the risks and headwinds facing the equity market are readily apparent to most investors. Debt levels remain too high (for both the government and consumers), higher unemployment appears to

2

| | | | |

| | |

| |

| | |

| | |

|

| |

| | | | |

be structural in nature, real estate markets are weak, and government policy (i.e., taxes, regulations) are adding uncertainty in many sectors of the economy. With these issues constantly dominating the headlines in recent months, investor pessimism towards stocks is understandable. However, while we remain cognizant of the risks, we believe investors must recognize positive factors, as well. First, inflation remains virtually non-existent and interest rates are extraordinarily low. This should motivate investors to take some risk in equities. Second, valuations for stocks are very reasonable, particularly after the recent correction. The P/E ratio for the S&P 500 Index (on projected next 12 month earnings) currently stands at 13, well below the average of 19 experienced over the last 20 years. Third, Corporate America has done a remarkable job boosting productivity and profitability. This should allow for solid earnings increases, even if sales growth is muted this cycle. And finally, corporate debt levels are very low, cash positions are high, and free cash flow is being produced at record levels. Most companies have plenty of capital to invest for growth, make acquisitions, or return capital to shareholders (through either dividends or share repurchases).

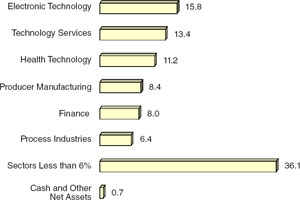

Our investment strategy has not changed materially since this time last year, largely because our economic view of a “subpar” economic recovery has remained intact. In this regard, we believe it is still prudent to remain diversified among sectors, focus on companies that can grow earnings in a slow growth environment, and maintain a “high quality” bias within each Fund. Technology remains a key focus, as cyclical improvements in key segments (e.g., PCs, semiconductors) are converging with secular trends (e.g., wireless communications, smart phones) to create numerous growth opportunities in the sector. We have also recently added to the capital goods sector, as several key end markets, such as commercial aerospace, appear to be in a sustained uptrend. Conversely, health care weightings have been reduced, due to uncertainties related to the impact of

U.S. health care reform as well as the impact of austerity measures, particularly in Europe, which will pressure product pricing. In general, the Funds remain well-diversified, as we expect volatility to increase in the months ahead. Regardless of the sector, we continue to emphasize “quality,” favoring companies with strong balance sheets, predictable earnings growth, and consistent cash flow generation.

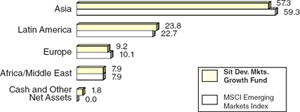

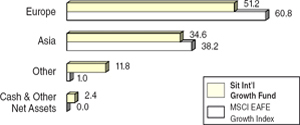

Equity markets outside the U.S. have also corrected in recent months, due to European sovereign debt concerns and the risks of an economic slowdown during the second half of the year, particularly in China. While volatility may remain quite high, we continue to see attractive investment opportunities in emerging markets, particularly in Asia (including China), as long-term economic growth prospects remain bright. In Asia, we continue to underweight Japan, however, due to weak domestic consumption trends and structural issues within the economy. While we continue to see select opportunities in Europe (particularly exporters that can benefit from a weak euro), as valuations are generally attractive, corporate earnings growth will be challenged amid tepid economic growth in the region.

Despite the recent correction, this past year was rewarding for investors, as stocks rebounded from their lows of early 2009. And, while the current investment environment remains very complex and challenging, we continue to believe there are attractive investment opportunities that will serve our shareholders well over the long term.

With best wishes,

Roger J. Sit

Chairman, President, Chief Executive Officer and

Global Chief Investment Officer

3

| | | | |

| Sit Mutual Funds | | | |

| One Year Ended June 30, 2010 | | | |

| | | | |

| Performance Summary and Stock Funds Market Review

| | | |

| | | | |

Global equities rallied over the past year, with almost all of the U.S. indices that we monitor posting +13% or greater gains. Domestic small- and mid- cap stocks outperformed larger issues by a wide margin, as the S&P 500 Index gained +14.43%, the Russell 2000® Index rose +21.48%, and the S&P Mid Cap 400 Index returned +24.93%. Growth stocks underperformed value stocks largely due to the outperforming finance sector that tends to be more heavily weighted within value indices. The growth-value return differential was greatest among smaller stocks. The Russell 2000® Growth Index’s gain of +17.96% over the period compared to the Russell 2000® Value Index’s gain of +25.07%, which represents over a 700 basis point differential. The Russell 1000® Growth Index’s +13.62% gain versus the Russell 1000® Value Index’s +16.92% exhibited a more modest differential.

All sectors that we monitor within the S&P 500 Index posted positive returns over the past year, but there was a wide gap among groups. There was generally a rotation to more “cyclical” sectors within the market, as investors gained confidence that the economy was emerging from recession. Within the S&P 500 Index, sectors that outperformed the overall Index included consumer durables, producer manufacturing, transportation, consumer services and electronic technology. The sectors that underperformed the broader market over the period included energy minerals, technology services, communications, health technology and utilities. These sectors were disproportionately influenced by some very large, “defensive” companies that lagged the overall market during the period, including Exxon Mobil, Exelon, Verizon Communications, Pfizer, AT&T and Wal-Mart.

Improving sentiment that drove domestic stocks higher also helped markets outside the U.S., as the MSCI World Index gained +9.32% on a local currency basis over the past twelve months. Currency movements, however, had an unusually large impact on returns for U.S. investors within the regional components. For example, the MSCI Europe Index gained just +2.70% in U.S dollar terms, which was far below the local return (+13.27%), due to the weak euro. Conversely, while the MSCI Japan Index fell -9.08% on a local currency basis, it represented only -0.98% in U.S. dollar terms due to the relative strength of the yen to the dollar. The MSCI Emerging Market Index, not materially impacted by currency, was the best regional component within the broad index and gained +20.58% in U.S. dollar terms.

| | | | |

SIT EQUITY FUNDS | | 3-Month

Return* | |

Balanced SIBAX | | -7.07 | % | |

S&P 500 Index | | -11.42 | | |

Barclays Capital Aggregate Bond Index | | 3.49 | | |

Dividend Growth Class I SDVGX | | -9.91 | | |

S&P 500 Index | | -11.42 | | |

Dividend Growth Class S SDVSX | | -9.99 | | |

S&P 500 Index | | -11.42 | | |

Global Dividend Growth(1) Class I GDGIX | | -12.73 | | |

Global Dividend Growth(1) Class S GDGSX | | -12.79 | | |

Composite Index(2) | | -12.40 | | |

S&P 500 Index | | -11.42 | | |

MSCI EAFE Index | | -13.97 | | |

Large Cap Growth SNIGX | | -12.64 | | |

Russell 1000® Growth Index(3) | | -11.75 | | |

Mid Cap Growth(4) NBNGX | | -9.68 | | |

Russell Midcap® Growth Index(5) | | -10.20 | | |

International Growth(1) SNGRX | | -14.32 | | |

MSCI EAFE Growth Index(6) | | -12.44 | | |

Small Cap Growth(4) SSMGX | | -7.34 | | |

Russell 2000® Growth Index(7) | | -9.22 | | |

Developing Markets Growth(1) SDMGX | | -12.08 | | |

MSCI Emerging Markets Index(7) | | -9.14 | | |

|

*3- and 6-month returns not annualized.

Performance figures are historical and do not guarantee future results. Investment returns and principal value will vary, and you may have a gain or loss when you sell shares. Average annual total returns include changes in share price as well as reinvestment of all dividends and capital gains.

| |

(1) | International investing has special risks, such as currency exchange fluctuations, high volatility, illiquidity and the possibility of political instability. |

(2) | Composite Index comprised of 60% S&P 500 Index and 40% MSCI EAFE Index. |

(3) | Figures assume an inception date of 9/2/82. |

4

| | |

| AVERAGE ANNUAL RETURNS FOR PERIODS ENDED JUNE 30, 2010 | |

| | | | | | | | | | | | | | | | | | | |

6-Month

Return* | | 1-Year | | 3-Year | | 5-Year | | 10-Year | | Since

Inception | | Inception

Date |

-3.22 | % | | 12.33 | % | | -3.20 | % | | 1.90 | % | | -0.47 | % | | 5.75 | % | | 12/31/93 | |

-6.65 | | | 14.43 | | | -9.81 | | | -0.79 | | | -1.59 | | | 6.92 | | | | |

5.33 | | | 9.50 | | | 7.55 | | | 5.54 | | | 6.47 | | | 6.30 | | | | |

-6.19 | | | 12.71 | | | -5.02 | | | 3.33 | | | — | | | 4.65 | | | 12/31/03 | |

-6.65 | | | 14.43 | | | -9.81 | | | -0.79 | | | — | | | 0.85 | | | | |

-6.35 | | | 12.37 | | | -5.27 | | | — | | | — | | | 0.73 | | | 3/31/06 | |

-6.65 | | | 14.43 | | | -9.81 | | | — | | | — | | | -3.18 | | | | |

-9.79 | | | 8.79 | | | �� | | | — | | | — | | | 3.69 | | | 9/30/08 | |

-9.93 | | | 8.47 | | | — | | | — | | | — | | | 3.45 | | | 9/30/08 | |

-9.28 | | | 11.06 | | | — | | | — | | | — | | | -4.60 | | | | |

-6.65 | | | 14.43 | | | — | | | — | | | — | | | -4.57 | | | | |

-13.23 | | | 5.92 | | | — | | | — | | | — | | | -4.94 | | | | |

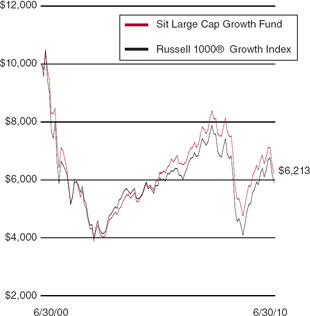

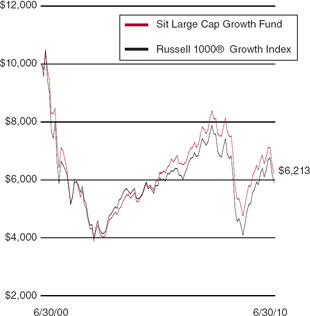

-9.36 | | | 7.80 | | | -7.07 | | | 0.77 | | | -4.65 | | | 9.07 | | | 9/2/82 | |

-7.64 | | | 13.62 | | | -6.91 | | | 0.38 | | | -5.14 | | | 9.82 | | | | |

-2.03 | | | 16.87 | | | -8.42 | | | 1.36 | | | -4.28 | | | 11.25 | | | 9/2/82 | |

-3.31 | | | 21.30 | | | -7.53 | | | 1.37 | | | -1.99 | | | N/A | | | | |

-11.92 | | | 8.10 | | | -13.48 | | | -0.05 | | | -5.98 | | | 2.87 | | | 11/1/91 | |

-10.73 | | | 8.60 | | | -11.70 | | | 1.68 | | | -1.61 | | | 2.82 | | | | |

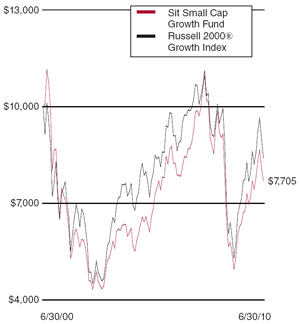

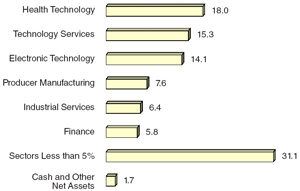

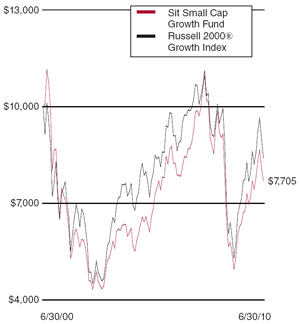

0.16 | | | 20.97 | | | -7.94 | | | 2.46 | | | -2.57 | | | 9.44 | | | 7/1/94 | |

-2.31 | | | 17.96 | | | -7.54 | | | 1.14 | | | -1.72 | | | 5.06 | | | | |

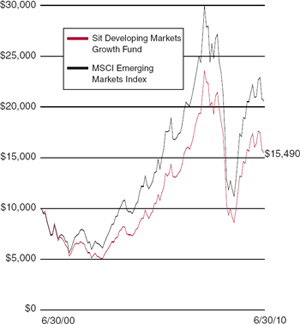

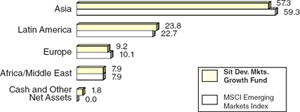

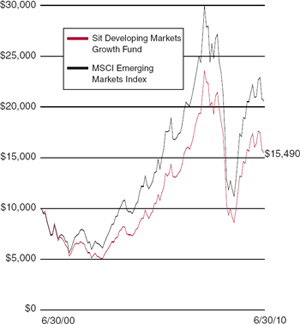

-10.80 | | | 18.05 | | | -6.27 | | | 9.75 | | | 4.47 | | | 4.73 | | | 7/1/94 | |

-7.22 | | | 20.58 | | | -4.67 | | | 10.19 | | | 7.50 | | | 4.14 | | | | |

| |

(4) | Stocks of small- and mid-sized companies may be subject to more abrupt or erratic market movements than stocks of larger, more established companies. |

(5) | Russell Midcap® Growth Index inception 12/31/85. |

(6) | Figures assume an inception date of 10/31/91. |

(7) | Figures assume an inception date of 6/30/94. |

5

| | | | |

| Sit Mutual Funds | | | |

| Total Returns by Calendar Year

| | | |

| | | | |

| |

| SIT EQUITY FUNDS TOTAL RETURN BY CALENDAR YEAR |

| | | | | | | | | | | | | | |

| | | 1999 | | 2000 | | 2001 | | 2002 | |

| Balanced | | 20.15 | % | | -4.80 | % | | -12.99 | % | | -18.59 | % | |

| S&P 500 Index | | 21.04 | | | -9.11 | | | -11.88 | | | -22.10 | | |

| Barclays Capital Aggregate Bond Index | | -0.82 | | | 11.63 | | | 8.44 | | | 10.25 | | |

| | | | | | | | | | | | | | |

| Dividend Growth Class I | | — | | | — | | | — | | | — | | |

| S&P 500 Index | | — | | | — | | | — | | | — | | |

| | | | | | | | | | | | | | |

| Dividend Growth Class S | | — | | | — | | | — | | | — | | |

| S&P 500 Index | | — | | | — | | | — | | | — | | |

| | | | | | | | | | | | | | |

| Global Dividend Growth Class I(1) | | — | | | — | | | — | | | — | | |

| Global Dividend Growth Class S(1) | | — | | | — | | | — | | | — | | |

| Composite Index(3) | | — | | | — | | | — | | | — | | |

| S&P 500 Index | | — | | | — | | | — | | | — | | |

| MSCI EAFE Index | | — | | | — | | | — | | | — | | |

| | | | | | | | | | | | | | |

| Large Cap Growth(4) | | 33.41 | | | -13.84 | | | -27.70 | | | -30.58 | | |

| Russell 1000® Growth Index | | 33.16 | | | -22.43 | | | -20.42 | | | -27.89 | | |

| | | | | | | | | | | | | | |

| Mid Cap Growth(5) (6) | | 70.65 | | | -4.35 | | | -33.39 | | | -34.64 | | |

| Russell Midcap® Growth Index | | 51.29 | | | -11.75 | | | -20.15 | | | -27.41 | | |

| | | | | | | | | | | | | | |

| International Growth(1) | | 50.77 | | | -26.66 | | | -33.26 | | | -29.84 | | |

| MSCI EAFE Growth Index | | 29.46 | | | -24.51 | | | -24.58 | | | -16.02 | | |

| | | | | | | | | | | | | | |

| Small Cap Growth(5) | | 108.63 | | | 6.25 | | | -28.19 | | | -26.22 | | |

| Russell 2000® Growth Index | | 43.10 | | | -22.44 | | | -9.24 | | | -30.27 | | |

| | | | | | | | | | | | | | |

| Developing Markets Growth(1) | | 82.50 | | | -30.18 | | | -12.01 | | | -18.37 | | |

| MSCI Emerging Markets Index | | 63.70 | | | -31.80 | | | -4.91 | | | -7.97 | | |

| |

Performance figures are historical and do not guarantee future results. Investment returns and principal value will vary, and you may have a gain or loss when you sell shares. Average annual returns include reinvestment of all dividends and capital gains. For any returns less than one year, the returns are cumulative. |

(1) | International investing has special risks, such as currency exchange fluctuations, high volatility, illiquidity and the possibility of political instability. |

(2) | Due to the Fund’s inception date of 9/30/08, the 2008 calendar year returns for the Sit Global Dividend Growth Fund and its benchmarks reflect performance since 9/30/08. |

(3) | Composite Index comprised of 60% S&P 500 Index and 40% MSCI EAFE Index. |

6

| | | | | | | | | | | | | | | | | | | | | | | |

|

| 2003 | | | 2004 | | | 2005 | | | 2006 | | | 2007 | | | 2008 | | | 2009 | | YTD 2010 | |

| 19.20 | % | | 9.22 | % | | 7.51 | % | | 7.88 | % | | 10.52 | % | | -26.88 | % | | 23.12 | % | | -3.22 | % |

| 28.68 | | | 10.88 | | | 4.91 | | | 15.80 | | | 5.50 | | | -37.00 | | | 26.47 | | | -6.65 | |

| 4.10 | | | 4.34 | | | 2.43 | | | 4.33 | | | 6.97 | | | 5.24 | | | 5.93 | | | 5.33 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| — | | | 10.91 | | | 9.41 | | | 18.29 | | | 12.89 | | | -29.60 | | | 25.59 | | | -6.19 | |

| — | | | 10.88 | | | 4.91 | | | 15.80 | | | 5.50 | | | -37.00 | | | 26.47 | | | -6.65 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| — | | | — | | | — | | | 11.25 | | | 12.56 | | | -29.77 | | | 25.25 | | | -6.35 | |

| — | | | — | | | — | | | 11.11 | | | 5.50 | | | -37.00 | | | 26.47 | | | -6.65 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| — | | | — | | | — | | | — | | | — | | | -5.25 | (2) | | 24.65 | | | -9.79 | |

| — | | | — | | | — | | | — | | | — | | | -5.31 | (2) | | 24.40 | | | -9.93 | |

| — | | | — | | | — | | | — | | | — | | | -21.11 | (2) | | 28.67 | | | -9.28 | |

| — | | | — | | | — | | | — | | | — | | | -21.94 | (2) | | 26.47 | | | -6.65 | |

| — | | | — | | | — | | | — | | | — | | | -19.95 | (2) | | 31.78 | | | -13.23 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| 26.34 | | | 12.79 | | | 9.59 | | | 9.54 | | | 14.14 | | | -34.10 | | | 28.14 | | | -9.36 | |

| 29.76 | | | 6.30 | | | 5.27 | | | 9.08 | | | 11.81 | | | -38.44 | | | 37.21 | | | -7.64 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| 38.51 | | | 17.02 | | | 15.27 | | | 9.56 | | | 18.87 | | | -45.34 | | | 35.59 | | | -2.03 | |

| 42.71 | | | 15.48 | | | 12.10 | | | 10.65 | | | 11.44 | | | -44.32 | | | 46.29 | | | -3.31 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| 28.70 | | | 12.97 | | | 14.67 | | | 18.19 | | | 16.08 | | | -44.99 | | | 27.65 | | | -11.92 | |

| 31.99 | | | 16.12 | | | 13.28 | | | 22.33 | | | 16.45 | | | -42.70 | | | 29.36 | | | -10.73 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| 34.57 | | | 6.79 | | | 18.52 | | | 7.99 | | | 20.43 | | | -42.96 | | | 33.06 | | | 0.16 | |

| 48.53 | | | 14.31 | | | 4.15 | | | 13.34 | | | 7.05 | | | -38.54 | | | 34.47 | | | -2.31 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| 45.96 | | | 16.54 | | | 33.77 | | | 31.59 | | | 40.72 | | | -55.26 | | | 73.97 | | | -10.80 | |

| 51.59 | | | 22.45 | | | 30.31 | | | 29.18 | | | 36.48 | | | -54.48 | | | 74.50 | | | -7.22 | |

| |

(4) | Pursuant to a Plan of Reorganization on 7/14/00, the Large Cap Growth Fund acquired all of the assets of Regional Growth Fund in exchange for shares of common stock of the Large Cap Growth Fund. |

(5) | Stocks of small- and mid-sized companies may be subject to more abrupt or erratic market movements than stocks of larger, more established companies. |

(6) | Pursuant to a Plan of Reorganization on 10/26/07, the Mid Cap Growth Fund acquired all of the assets of the Science and Technology Growth Fund in exchange for shares of common stock of the Mid Cap Growth Fund. |

7

| | | | |

| Sit Mutual Funds | | | |

| Average Annual Total Returns for Periods Ended December 31, 2009

| | | |

| | | | |

|

The tables on this page and the next page show the Funds’ average annual total returns (before and after taxes) and the change in value of a broad-based market index over various periods ended December 31, 2009. The index information is intended to permit you to compare each Fund’s performance to a broad measure of market performance. The after-tax returns are intended to show the impact of federal income taxes on an investment in a Fund. The highest individual federal marginal income tax rate in effect during the specified period are assumed, and the state and local tax impact is not reflected. |

|

A Fund’s “Return After Taxes on Distributions” shows the effect of taxable distributions (dividends and capital gain distributions), but assumes that you still hold the fund shares at the end of the period and so do not have any taxable gain or loss on your investment in the Fund. |

|

A Fund’s “Return After Taxes on Distributions and Sale of Fund Shares” shows the effect of both taxable distributions and any taxable gain or loss that would be realized if the Fund shares were purchased at the beginning and sold at the end of the specified period. |

|

The Funds’ past performance, before and after taxes, is not an indication of how the Funds will perform in the future. Your actual after-tax returns depend on your own tax situation and may differ from those shown. After-tax returns reflect past tax effects and are not predictive of future tax effects. After-tax returns are not relevant to investors who hold their Fund shares in a tax-deferred account (including a 401(k) or IRA account). Indices reflect no deduction for fees, expenses, or taxes. |

| | | | | | | | |

Sit Balanced Fund | | 1 Year | 5 Years | 10 Years |

| Return Before Taxes | | 23.1 | % | 2.9 | % | 0.1 | % |

| Return After Taxes on Distributions | | 22.2 | % | 2.3 | % | -0.6 | % |

| Return After Taxes on Distributions and Sale of Fund Shares | | 19.2 | % | 2.2 | % | -0.3 | % |

| Barclays Capital Aggregate Bond Index | | 5.9 | % | 5.0 | % | 6.3 | % |

| S&P 500 Index | | 26.5 | % | 0.4 | % | -1.0 | % |

| | | | | | | | |

Sit Dividend Growth Fund - Class I | | 1 Year | 5 Years | Since Inception* |

| Return Before Taxes | | 25.6 | % | 5.3 | % | 6.2 | % |

| Return After Taxes on Distributions | | 25.2 | % | 4.5 | % | 5.5 | % |

| Return After Taxes on Distributions and Sale of Fund Shares | | 21.7 | % | 4.4 | % | 5.2 | % |

| S&P 500 Index | | 26.5 | % | 0.4 | % | 2.1 | % |

*Inception date 12/31/03 | | | | | | | |

| | | | | | | | |

Sit Global Dividend Growth Fund - Class I | | 1 Year | 5 Years | Since Inception* |

| Return Before Taxes | | 24.7 | % | n/a | | 14.2 | % |

| Return After Taxes on Distributions | | 24.3 | % | n/a | | 13.9 | % |

| Return After Taxes on Distributions and Sale of Fund Shares | | 20.9 | % | n/a | | 12.1 | % |

| Composite Index (60% S&P 500 Index, 40% MSCI EAFE Growth Index) | | 28.7 | % | n/a | | 1.2 | % |

| S&P 500 Index | | 26.5 | % | n/a | | -1.0 | % |

| MSCI EAFE Growth Index | | 31.8 | % | n/a | | 4.4 | % |

*Inception date 9/30/08 | | | | | | | |

8

| | | | |

| | |

| |

| | |

| | |

|

| |

| | | | |

| | | | | | | | |

Sit Large Cap Growth Fund | | 1 Year | 5 Years | 10 Years |

| Return Before Taxes | | 28.1 | % | 3.0 | % | -3.3 | % |

| Return After Taxes on Distributions | | 28.0 | % | 2.9 | % | -3.6 | % |

| Return After Taxes on Distributions and Sale of Fund Shares | | 23.9 | % | 2.5 | % | -2.8 | % |

| Russell 1000® Growth Index | | 37.2 | % | 1.6 | % | -4.0 | % |

| | | | | | | | |

Sit Mid Cap Growth Fund | | 1 Year | 5 Years | 10 Years |

| Return Before Taxes | | 35.6 | % | 2.2 | % | -2.8 | % |

| Return After Taxes on Distributions | | 35.6 | % | 2.0 | % | -3.3 | % |

| Return After Taxes on Distributions and Sale of Fund Shares | | 30.3 | % | 1.9 | % | -2.4 | % |

| Russell Mid Cap® Growth Index | | 46.3 | % | 2.4 | % | -0.5 | % |

| | | | | | | | |

Sit International Growth Fund | | 1 Year | 5 Years | 10 Years |

| Return Before Taxes | | 27.7 | % | 2.0 | % | -5.8 | % |

| Return After Taxes on Distributions | | 27.5 | % | 1.9 | % | -5.9 | % |

| Return After Taxes on Distributions and Sale of Fund Shares | | 23.5 | % | 1.7 | % | -4.7 | % |

| MSCI EAFE Growth Index | | 29.4 | % | 3.6 | % | -1.3 | % |

| | | | | | | | |

Sit Small Cap Growth Fund | | 1 Year | 5 Years | 10 Years |

| Return Before Taxes | | 33.1 | % | 3.2 | % | -0.5 | % |

| Return After Taxes on Distributions | | 33.1 | % | 3.2 | % | -0.6 | % |

| Return After Taxes on Distributions and Sale of Fund Shares | | 28.1 | % | 2.7 | % | -0.5 | % |

| Russell 2000® Growth Index | | 34.5 | % | 0.9 | % | -1.4 | % |

| | | | | | | | |

Sit Developing Markets Growth Fund | | 1 Year | 5 Years | 10 Years |

| Return Before Taxes | | 74.0 | % | 14.0 | % | 5.1 | % |

| Return After Taxes on Distributions | | 73.9 | % | 13.8 | % | 5.0 | % |

| Return After Taxes on Distributions and Sale of Fund Shares | | 62.9 | % | 12.3 | % | 4.4 | % |

| MSCI Emerging Markets Index | | 74.5 | % | 12.8 | % | 7.3 | % |

9

| | | | |

| Sit Balanced Fund | | | |

| One Year Ended June 30, 2010 | | | |

| | | | |

| Portfolio Managers: Roger J. Sit, Bryce A. Doty, and John M. Bernstein

| | | |

| | | | |

The Sit Balanced Fund’s one-year return was +12.33%. By comparison, the S&P 500 Index return was +14.43% over the period, while the Barclay’s Capital Aggregate Bond Index gained +9.50%. The Lipper Balanced Fund Index returned +13.33% over the period.

Relatively stable interest rates, a contraction in credit spreads and a rebound in economic growth allowed both bonds and stocks to post solid returns over the past twelve months. Equities moved higher as corporate earnings generally surprised on the upside. But the equity portion of the Fund lagged the S&P 500 Index over the past twelve months, at least partially due to our focus on high quality, less cyclical stocks, which hampered performance in an environment where investors favored high beta, low quality and more cyclical companies. However, we believe we are entering another phase of the recovery, as the sluggish economic environment (and continued low interest rates) will lead investors back to high quality growth stocks that can generate sustained earnings growth. Moreover, the valuations (e.g., P/E ratios) for large cap growth stocks, such as 3M, Intel and Medtronic, are well below historical averages, and we believe solid dividend yields provide further support at current prices. In short, we continue to find many opportunities for long-term equity investors, and our research staff remains highly focused on identifying companies that can deliver consistently strong results over time.

Despite a strengthening economy, interest rates remained relatively low over the past year and virtually all segments of the bond market posted above-average returns. While U.S. Treasuries have recently rallied, once again, on fears that another economic/ credit crisis may be emerging, we believe concerns are overdone. Yields on U.S. Treasuries remain exceptionally low and, therefore, we remain underweighted in the sector. Conversely, we believe high quality corporate bonds, closed end funds and mortgages continue to provide investors with attractive risk-adjusted return potential.

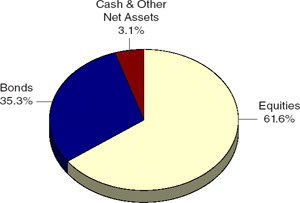

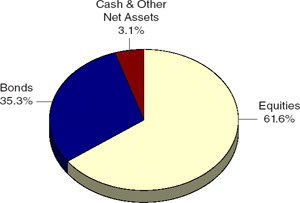

As of June 30th, the asset allocation of the Fund was 62% equities, 35% fixed income, and 3% cash and equivalents. We continue to emphasize high quality securities in each asset class within the Fund, and we appreciate shareholders’ continued interest.

INVESTMENT OBJECTIVE AND STRATEGY |

The Sit Balanced Fund’s dual objectives are to seek long-term growth of capital consistent with the preservation of principal and to provide regular income. It pursues its objectives by investing in a diversified portfolio of stocks and bonds. The Fund may emphasize either equity securities or fixed-income securities, or hold equal amounts of each, dependent upon the Adviser’s analysis of market, financial and economic conditions.

The Fund’s permissible investment allocation is: 35-65% in equity securities and 35-65% in fixed-income securities. At all times at least 25% of the fixed-income assets will be invested in fixed-income senior securities.

| | | |

Net Asset Value 6/30/10: | | $ | 14.18 Per Share |

6/30/09: | | $ | 12.96 Per Share |

| | | |

Total Net Assets: | | $ | 10.5 Million |

PORTFOLIO STRUCTURE

(% OF TOTAL NET ASSETS) |

10

| | | | |

| | |

| |

| | |

| | |

|

| |

| | | | |

| | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS* | |

| | | | | | | | | | |

| | Sit Balanced

Fund | | S&P 500

Index(1) | | Barclays

Capital

Aggregate

Bond Index(2) | |

| | | | | | | | | | |

3 Month** | | -7.07 | % | | -11.42 | % | | 3.49 | % | |

6 Month** | | -3.22 | | | -6.65 | | | 5.33 | | |

1 Year | | 12.33 | | | 14.43 | | | 9.50 | | |

5 Year | | 1.90 | | | -0.79 | | | 5.54 | | |

10 Year | | -0.47 | | | -1.59 | | | 6.47 | | |

Inception | | 5.75 | | | 6.92 | | | 6.30 | | |

(12/31/93) | | | | | | | | | | |

| | | | | | | | | | |

CUMULATIVE TOTAL RETURNS* | |

| | | | | | | | | | |

| | Sit Balanced

Fund | | S&P 500

Index(1) | | Barclays

Capital

Aggregate

Bond Index(2) | |

| | | | | | | | | | |

1 Year | | 12.33 | % | | 14.43 | % | | 9.50 | % | |

5 Year | | 9.86 | | | -3.91 | | | 30.94 | | |

10 Year | | -4.62 | | | -14.79 | | | 87.14 | | |

Inception | | 151.79 | | | 201.83 | | | 174.17 | | |

(12/31/93) | | | | | | | | | | |

*As of 6/30/10.

|

**Not annualized.

| |

| | | | | | | | | | | |

|

Performance figures are historical and do not guarantee future results. Investment returns and principal value will vary, and you may have a gain or loss when you sell shares. Average annual total returns include changes in share price as well as reinvestment of all dividends and capital gains. Management fees and administrative expenses are included in the Fund’s performance.

| |

|

(1) | An unmanaged index which measures the performance of 500 widely held common stocks of large-cap companies. |

(2) | An unmanaged index which measures the performance of approximately 6,000 publicly traded bonds with an approximate average maturity of 10 years. |

The sum of $10,000 invested on 6/30/00 and held until 6/30/10 would have declined to $9,538 in the Fund, $8,521 in the S&P 500 Index or grown to $18,714 in the Barclays Capital Aggregate Bond Index assuming reinvestment of all dividends and capital gains.

| | |

Stocks | 1. | IBM Corp. |

| 2. | Google, Inc. |

| 3. | Mc Donald’s Corp. |

| 4. | Occidental Petroleum Corp. |

| 5. | PepsiCo, Inc. |

Bonds | 1. | U.S. Treasury Strip, 11/15/21 |

| 2. | GNR Series 2005-74 HA, 7.50%, 9/16/35 |

| 3. | American Strategic, Inc. Portfolio II |

| 4. | Wachovia Bank, 6.00%, 11/15/17 |

| 5. | Procter & Gamble ESOP, 9.36%, 1/1/21 |

Total Number of Holdings: 162 |

11

| | | | |

| Sit Balanced Fund | | | |

| | | | |

| Portfolio of Investments - June 30, 2010

| | | |

| | | | |

|

| | | | | |

Quantity/Par($) Name of Issuer | | Fair Value ($)(1) | |

| | | |

Common Stocks (61.6%) (2) | | | |

Communications (1.8%) | | | |

2,300 | | Rogers Communications, Inc. | | 75,348 | |

4,000 | | Verizon Communications, Inc. | | 112,080 | |

| | | | 187,428 | |

Consumer Non-Durables (6.3%) | | | |

2,700 | | Coca-Cola Company | | 135,324 | |

1,300 | | Colgate-Palmolive Co. | | 102,388 | |

1,100 | | General Mills, Inc. | | 39,072 | |

2,400 | | PepsiCo, Inc. | | 146,280 | |

2,750 | | Philip Morris International, Inc. | | 126,060 | |

2,000 | | The Procter & Gamble Co. | | 119,960 | |

| | | | 669,084 | |

Consumer Services (2.4%) | | | |

2,350 | | McDonald’s Corp. | | 154,795 | |

1,400 | | Visa, Inc. | | 99,050 | |

| | | | 253,845 | |

Electronic Technology (11.1%) | | | |

1,400 | | Analog Devices, Inc. | | 39,004 | |

550 | | Apple, Inc. (3) | | 138,342 | |

7,200 | | Applied Materials, Inc. | | 86,544 | |

2,300 | | Broadcom Corp. | | 75,831 | |

3,000 | | Ciena Corp. (3) | | 38,040 | |

6,700 | | Cisco Systems, Inc. (3) | | 142,777 | |

1,800 | | EMC Corp. (3) | | 32,940 | |

6,700 | | Intel Corp. | | 130,315 | |

1,525 | | IBM Corp. | | 188,307 | |

1,100 | | Linear Technology Corp. | | 30,591 | |

2,000 | | Marvell Technology Group (3) | | 31,520 | |

3,700 | | Qualcomm, Inc. | | 121,508 | |

1,100 | | Research In Motion, Ltd. (3) | | 54,186 | |

2,200 | | Seagate Technology (3) | | 28,688 | |

900 | | Veeco Instruments, Inc. (3) | | 30,852 | |

| | | | 1,169,445 | |

Energy Minerals (5.4%) | | | |

400 | | Apache Corp. | | 33,676 | |

1,400 | | EQT Corp. | | 50,596 | |

800 | | Murphy Oil Corp. | | 39,640 | |

1,900 | | Occidental Petroleum Corp. | | 146,585 | |

3,500 | | Southwestern Energy Co. (3) | | 135,240 | |

2,400 | | Suncor Energy, Inc. | | 70,656 | |

2,200 | | Ultra Petroleum Corp. (3) | | 97,350 | |

| | | | 573,743 | |

Finance (7.5%) | | | |

1,200 | | Aflac, Inc. | | 51,204 | |

5,200 | | Bank of America Corp. | | 74,724 | |

2,100 | | Bank of New York Mellon Financial Corp. | | 51,849 | |

225 | | CME Group, Inc. | | 63,349 | |

| | | | | |

Quantity/Par($) Name of Issuer | | Fair Value ($)(1) | |

| | | | | |

700 | | Franklin Resources, Inc. | | 60,333 | |

700 | | Goldman Sachs Group, Inc. | | 91,889 | |

3,000 | | JPMorgan Chase & Co. | | 109,830 | |

200 | | M&T Bank Corp. | | 16,990 | |

300 | | Northern Trust Corp. | | 14,010 | |

500 | | PartnerRe, Ltd. | | 35,070 | |

800 | | Prudential Financial, Inc. | | 42,928 | |

1,000 | | The Travelers Companies, Inc. | | 49,250 | |

1,500 | | U.S. Bancorp | | 33,525 | |

3,900 | | Wells Fargo & Co. | | 99,840 | |

| | | | 794,791 | |

Health Services (0.9%) | | | |

600 | | McKesson Corp. | | 40,296 | |

900 | | Medco Health Solutions, Inc. (3) | | 49,572 | |

| | | | 89,868 | |

Health Technology (6.6%) | | | |

700 | | Abbott Laboratories | | 32,746 | |

600 | | Allergan, Inc. | | 34,956 | |

650 | | Baxter International, Inc. | | 26,416 | |

2,500 | | Celgene Corp. (3) | | 127,050 | |

1,500 | | Genzyme Corp. (3) | | 76,155 | |

2,500 | | Gilead Sciences, Inc. (3) | | 85,700 | |

200 | | Intuitive Surgical, Inc. (3) | | 63,124 | |

1,000 | | Johnson & Johnson | | 59,060 | |

1,100 | | Medtronic, Inc. | | 39,897 | |

700 | | St. Jude Medical, Inc. (3) | | 25,263 | |

1,700 | | Thermo Fisher Scientific, Inc. (3) | | 83,385 | |

750 | | Varian Medical Systems, Inc. (3) | | 39,210 | |

| | | | 692,962 | |

Industrial Services (0.8%) | | | |

1,550 | | Schlumberger, Ltd. | | 85,777 | |

Non-Energy Minerals (0.6%) | | | |

650 | | Allegheny Technologies, Inc. | | 28,724 | |

500 | | Freeport-McMoran, Inc. | | 29,565 | |

| | | | 58,289 | |

Process Industries (1.1%) | | | |

1,500 | | Ecolab, Inc. | | 67,365 | |

700 | | Praxair, Inc. | | 53,193 | |

| | | | 120,558 | |

Producer Manufacturing (5.1%) | | | |

725 | | 3M Co. | | 57,268 | |

2,900 | | ABB, Ltd., A.D.R. | | 50,112 | |

1,300 | | Danaher Corp. | | 48,256 | |

1,400 | | Deere & Co. | | 77,952 | |

1,300 | | Emerson Electric Co. | | 56,797 | |

4,200 | | General Electric Co. | | 60,564 | |

500 | | Goodrich Corp. | | 33,125 | |

500 | | Lockheed Martin Corp. | | 37,250 | |

12

| | | | |

| | |

| |

| | |

| | |

|

| |

| | | | |

|

| | | | | |

Quantity/Par($) Name of Issuer | | Fair Value ($)(1) | |

| | | | | |

400 | | Precision Castparts Corp. | | 41,168 | |

1,100 | | United Technologies Corp. | | 71,401 | |

| | | | 533,893 | |

Retail Trade (4.5%) | | | |

1,450 | | Best Buy Co., Inc. | | 49,097 | |

800 | | Costco Wholesale Corp. | | 43,864 | |

2,550 | | CVS/Caremark Corp. | | 74,766 | |

1,400 | | Home Depot, Inc. | | 39,298 | |

1,400 | | Kohl’s Corp. (3) | | 66,500 | |

2,100 | | Target Corp. | | 103,257 | |

1,975 | | Wal-Mart Stores, Inc. | | 94,938 | |

| | | | 471,720 | |

Technology Services (5.4%) | | | |

2,600 | | Accenture Ltd. | | 100,490 | |

2,000 | | Adobe Systems, Inc. (3) | | 52,860 | |

375 | | Google, Inc. (3) | | 166,856 | |

5,000 | | Microsoft Corp. | | 115,050 | |

6,300 | | Oracle Corp. | | 135,198 | |

| | | | 570,454 | |

Transportation (1.5%) | | | |

1,400 | | Expeditors Intl. of Washington, Inc. | | 48,314 | |

1,100 | | Union Pacific Corp. | | 76,461 | |

625 | | United Parcel Service, Inc. | | 35,556 | |

| | | | 160,331 | |

Utilities (0.6%) | | | |

1,350 | | Calpine Corp. (3) | | 17,172 | |

900 | | Wisconsin Energy Corp. | | 45,666 | |

| | | | 62,838 | |

Total common stocks | | 6,495,026 | |

(cost: $6,169,101) | | | |

| | | | | |

Bonds (32.1%) (2) | | | |

Asset-Backed Securities (3.2%) | | |

100,000 | | Centex Home Equity 2004-D AF4, | | | |

| | 4.68%, 6/25/32 | | 97,435 | |

63,158 | | Chase Funding 2003-6 1A4, | | | |

| | 4.49%, 11/25/34 | | 61,173 | |

| | Countrywide Home Equity: | | | |

44,272 | | 2003-5 AF6, 4.81%, 1/25/34 | | 41,294 | |

46,315 | | 2004-10 AF5B, 5.11%, 2/25/35 | | 43,000 | |

| | Green Tree Financial Corp: | | | |

17,007 | | 1997-1 A6, 7.29%, 3/15/28 | | 18,045 | |

20,173 | | 1997-6 A10, 6.87%, 1/15/29 | | 21,452 | |

| | Origen Mfg. Housing: | | | |

12,398 | | 2001-A A5, 7.08%, 3/15/32 | | 12,506 | |

11,057 | | 2002-A A3, 6.17%, 5/15/23 | | 11,292 | |

31,445 | | Residential Funding 2003-HI2 A6, | | | |

| | 4.76%, 7/25/28 | | 30,591 | |

| | | | 336,788 | |

| | | | | |

Quantity/Par($) Name of Issuer | | Fair Value ($)(1) | |

| | | | | |

Collateralized Mortgage Obligations (4.0%) | | | |

19,520 | | Bank of America Funding Corp. | | | |

| | 2003-2 1A1, 6.50%, 6/25/32 | | 20,355 | |

29,789 | | Federal National Mtg. Association, | | | |

| | 7.00%, 2/25/44 | | 33,498 | |

138,646 | | GNR Series 2005-74 HA, 7.50%, 9/16/35 | | 157,866 | |

218 | | GSR Mortgage Loan Trust 2005-4F 5A2, 6.00%, 5/25/35 | | 208 | |

21,956 | | Master Asset Securitization Trust | | | |

| | 2003-4 CA1, 8.00%, 5/25/18 | | 22,624 | |

41,658 | | Residential Funding Mtg. Securities | | | |

| | 2005-S6 A2, 5.25%, 8/25/35 | | 40,876 | |

44,250 | | Specialty Underwriting & Residential Fin. 2004-AA1 2A2, 5.50%, 10/25/34 | | 42,578 | |

75,270 | | Vendee Mtg. Tr., 2008-1 B, 8.21%, 3/15/25 | | 84,114 | |

17,481 | | Washington Mutual Mtg. Pass-Through 2002-S8, 5.25%, 1/25/18 | | 17,866 | |

| | | | 419,985 | |

Corporate Bonds (6.7%) | | | |

50,000 | | Bank of America Corp, 5.63%, 7/1/20 | | 50,397 | |

25,000 | | Comerica Bank, 8.38%, 7/15/24 | | 27,131 | |

97,979 | | Continental Airlines, 9.00%, 7/8/16 | | 105,327 | |

50,000 | | Delta Air Lines, 6.20%, 7/2/18 | | 50,000 | |

75,000 | | JPM Chase Capital, 6.80%, 10/1/37 | | 74,128 | |

45,000 | | NTC Capital, variable rate, 1/15/27 | | 36,515 | |

25,000 | | PartnerRe Finance, 5.50%, 6/1/20 | | 24,160 | |

85,381 | | Procter & Gamble ESOP, 9.36%, 1/1/21 | | 108,016 | |

50,000 | | Renre NA Hldgs., 5.75%, 3/15/20 | | 49,837 | |

68,920 | | SW Airlines 07-1 Trust, 6.65%, 8/1/22 (5) | | 69,954 | |

100,000 | | Wachovia Bank, 6.00%, 11/15/17 | | 109,130 | |

| | | | 704,595 | |

Federal Home Loan Mortgage Corporation (2.9%) | | | |

62,451 | | 7.00%, 7/1/32 | | 69,474 | |

46,190 | | 7.00%, 5/1/34 | | 51,384 | |

80,195 | | 7.00%, 11/1/37 | | 89,301 | |

42,038 | | 7.50%, 11/1/36 | | 48,037 | |

24,585 | | 8.00%, 9/1/15 | | 26,958 | |

22,206 | | 8.38%, 5/17/20 | | 24,954 | |

| | | | 310,108 | |

Federal National Mortgage Association (5.7%) | | | |

65,881 | | 6.63%, 11/1/30 | | 74,461 | |

51,921 | | 6.63%, 1/1/31 | | 58,683 | |

43,705 | | 7.00%, 12/1/32 | | 49,515 | |

57,981 | | 7.23%, 12/1/30 | | 66,062 | |

12,477 | | 7.50%, 6/1/32 | | 14,251 | |

39,965 | | 7.50%, 4/1/33 | | 44,396 | |

48,071 | | 8.00%, 2/1/31 | | 55,675 | |

14,503 | | 8.47%, 4/15/26 | | 16,831 | |

10,101 | | 9.50%, 5/1/27 | | 11,811 | |

See accompanying notes to portfolios of investments on page 48.

13

| | | | |

| Sit Balanced Fund | | | |

| | | | |

| Portfolio of Investments - June 30, 2010

| | | |

| | | | |

|

| | | | | |

Quantity/Par($) Name of Issuer | | Fair Value ($)(1) | |

| | | | | |

3,031 | | 9.75%, 1/1/13 | | 3,285 | |

2,440 | | 10.25%, 6/15/13 | | 2,647 | |

56,223 | | 7.00%, 12/1/36 | | 63,367 | |

19,562 | | 7.50%, 4/1/38 | | 21,730 | |

41,764 | | 7.50%, 11/1/33 | | 46,394 | |

63,437 | | 7.50%, 1/1/34 | | 70,470 | |

4,769 | | 11.00%, 12/1/12 | | 5,204 | |

| | | | 604,782 | |

Government National Mortgage Association (4.2%) | | | |

93,764 | | 6.20%, 9/15/40 | | 100,005 | |

52,751 | | 6.63%, 4/20/31 | | 58,722 | |

36,913 | | 7.00%, 12/15/24 | | 41,940 | |

57,752 | | 7.23%, 12/20/30 | | 65,047 | |

67,232 | | 8.00%, 7/15/24 | | 73,391 | |

76,396 | | 8.375%, 3/15/31 | | 89,411 | |

404 | | 9.00%, 6/15/11 | | 429 | |

5,386 | | 9.00%, 11/15/16 | | 5,962 | |

753 | | 9.50%, 5/20/16 | | 837 | |

1,269 | | 9.50%, 9/20/18 | | 1,454 | |

167 | | 11.25%, 10/15/11 | | 179 | |

| | | | 437,377 | |

| | | | | |

Taxable Municipal Securities (0.7%) | | | |

100,000 | | Academica School, 8.00%, 8/15/24 | | 72,086 | |

| | | | | |

U.S. Government / Federal Agency Securities (4.7%) | | | |

| | U.S. Treasury Strips, Zero Coupon: | | | |

675,000 | | 4.22% effective yield, 11/15/21 | | 451,176 | |

125,000 | | 4.21% effective yield, 2/15/36 | | 44,431 | |

| | | | 495,607 | |

| | | | | |

Total bonds | | 3,381,328 | |

(cost: $3,282,067) | | | |

| | | | | |

Closed-End Mutual Funds (3.2%) (2) | | | |

6,309 | | American Select Portfolio | | 77,664 | |

5,603 | | American Strategic, Inc. Portfolio | | 74,520 | |

10,600 | | American Strategic, Inc. Portfolio II | | 110,028 | |

8,700 | | American Strategic, Inc. Portfolio III | | 78,735 | |

Total closed-end mutual funds | | 340,947 | |

(cost: $337,663) | | | |

| | | | | |

| | | | | |

Short-Term Securities (3.0%) (2) | | | |

317,961 | | Wells Fargo Adv. Govt. Fund, 0.04% | | 317,961 | |

(cost: $317,961) | | | |

| | | | | |

Total investments in securities | | $ 10,535,262 | |

(cost: $10,106,792) (4) | | | |

See accompanying notes to portfolios of investments on page 48.

14

This page has been left blank intentionally.

15

| | | | |

| Sit Dividend Growth Fund - Class I and Class S | | | |

| One Year Ended June 30, 2010 | | | |

| | | | |

| Portfolio Managers: Roger J. Sit, Kent L. Johnson, and Michael J. Stellmacher

| | | |

| | | | |

The Sit Dividend Growth Fund Class I posted a +12.71% return over the last twelve months, compared to the +14.43% return for the S&P 500 Index.

Stock prices responded to the improvement in economic conditions over the past twelve months. Our analysis has concluded that market gains were fueled, in particular, by a strong rally in lower quality stocks, which tend to have characteristics such as high debt levels, low stock prices and more volatile earnings. While this is a “typical” rally at the beginning of an economic cycle, we continue to caution investors that a classic, strong recovery is not likely given the headwinds of high debt levels, weak real estate markets and a fading impact from stimulus. The good news, however, is that stock valuations are attractive, balance sheets are solid, and corporate earnings have been exceptional. We continue to believe that high quality, dividend-paying companies are attractive in an environment of modest economic growth and low inflation. It is encouraging to note that dividend increases, once again, are on the rise. Over the past twelve months, 58 companies within the Fund (out of 94 current holdings, or 62%) have increased their dividends, with an average increase of +12%.

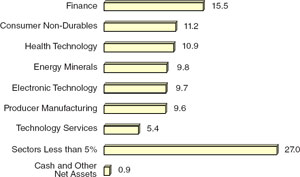

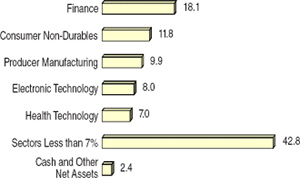

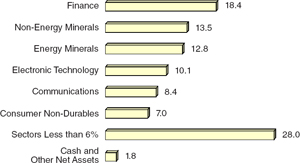

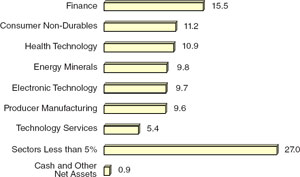

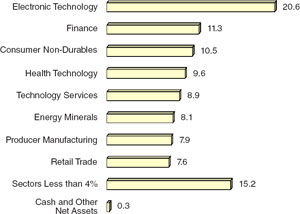

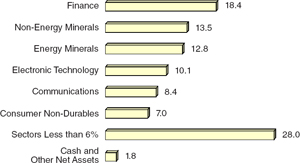

The finance sector remains the heaviest weighting in the Fund, followed by consumer non-durables and health technology. In addition, the Fund’s financial characteristics related to “stability” (e.g., earnings consistency, balance sheet strength) and “quality” (e.g., high return on capital, cash flow generation) are superior to the S&P 500 Index average. We believe these metrics will carry particular importance in an environment of slow corporate earnings growth and somewhat higher market volatility, which we foresee in the months ahead.

The Fund’s twelve-month underperformance was driven by negative stock selection in the electronic technology sector, which was largely driven by the absence of non-dividend paying Apple in the Fund. This is significant because the shares of Apple carry a large weight within the S&P 500 Index and rose over +76% during the period. On the positive side, stock selection was strong in energy minerals, retail trade and consumer durables. The Fund’s most significant contributors to performance included Atlas Energy, Lufkin Industries and Apollo Investment, while the most negative contributors were Total, Qualcomm and Baxter International.

INVESTMENT OBJECTIVE AND STRATEGY |

The objective of the Dividend Growth Fund is to provide current income that exceeds the dividend yield of the S&P 500 Index and that grows over a period of years. Secondarily, the Fund seeks long-term capital appreciation.

The Fund seeks to achieve its objectives by investing, under normal market conditions, at least 80% of its net assets in dividend-paying common stocks. The Fund may invest the balance of its assets in preferred stocks, convertible bonds, and U.S. Treasury securities.

| | | | |

| | Class I | | Class S |

| | | | |

Net Asset Value | | | | |

| | | | |

6/30/10: | | $10.64 Per Share | | $10.61 Per Share |

| | | | |

6/30/09: | | $9.60 Per Share | | $9.58 Per Share |

| | | | |

Total Net Assets | | $39.4 Million | | $24.9 Million |

| | | | |

Weighted Average Market Cap: | | $58.1 Billion |

PORTFOLIO STRUCTURE - BY SECTOR

(% OF TOTAL NET ASSETS) |

16

| | | | |

| | |

| |

| | |

| | |

|

| |

| | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURNS* | |

| | | | | | | | | | | | | | | |

| | | Class

I | | S&P 500

Index(1) | | Class

S | | S&P 500

Index(1) | | |

| | | | | | | | | | | | | | | |

| 3 Month** | | -9.91 | % | | -11.42 | % | | -9.99 | % | | -11.42 | % | | |

| 6 Month** | | -6.19 | | | -6.65 | | | -6.35 | | | -6.65 | | | |

| 1 Year | | 12.71 | | | 14.43 | | | 12.37 | | | 14.43 | | | |

| 3 Year | | -5.02 | | | -9.81 | | | -5.27 | | | -9.81 | | | |

| 5 Year | | 3.33 | | | -0.79 | | | n/a | | | n/a | | | |

| Inception*** | | 4.65 | | | 0.85 | | | 0.73 | | | -3.18 | | | |

| | | | | | | | | | | | | | | |

| CUMULATIVE TOTAL RETURNS* | |

| | | | | | | | | | | | | | | |

| | | Class | | S&P 500 | | Class | | S&P 500 | | |

| | | I | | Index(1) | | S | | Index(1) | | |

| | | | | | | | | | | | | | | |

| 1 Year | | 12.71 | % | | 14.43 | % | | 12.37 | % | | 14.43 | % | | |

| 3 Year | | -14.33 | | | -26.65 | | | -14.99 | | | -26.65 | | | |

| 5 Year | | 17.81 | | | -3.91 | | | n/a | | | n/a | | | |

| Inception*** | | 34.40 | | | 5.68 | | | 3.16 | | | -12.82 | | | |

| | | | | | | | | | | | | | | |

| *As of 6/30/10 | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| **Not annualized. | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| ***Dividend Growth Fund Class I Inception was 12/31/03; Dividend Growth Fund Class S Inception was 3/31/06.

| |

| | |

Performance figures are historical and do not guarantee future results. Investment returns and principal value will vary, and you may have a gain or loss when you sell shares. Average annual total returns include changes in share price as well as reinvestment of all dividends and capital gains. Management fees and administrative expenses are included in the Fund’s performance.

| |

(1) | An unmanaged index which measures the performance of 500 widely held common stocks of large-cap companies. |

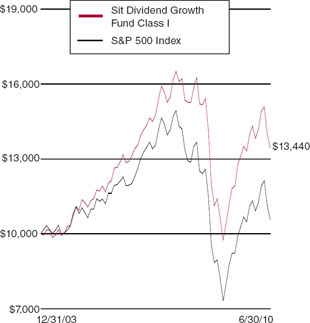

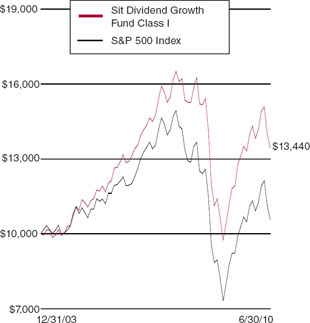

The sum of $10,000 invested at inception (12/31/03) and held until 6/30/10 would have grown to $13,440 in the Fund or $10,568 in the S&P 500 Index assuming reinvestment of all dividends and capital gains.

| | |

| 1. | IBM Corp. |

| 2. | Johnson & Johnson |

| 3. | Chevron Corp. |

| 4. | Verizon Communications, Inc. |

| 5. | J.P. Morgan Chase & Co. |

| 6. | PepsiCo, Inc. |

| 7. | Procter & Gamble Co. |

| 8. | 3M Co. |

| 9. | Intel Corp. |

| 10. | Philip Morris International, Inc. |

| | Total Number of Holdings: 94 |

17

| | | | |

| Sit Dividend Growth Fund | | | |

| | | | |

| Portfolio of Investments - June 30, 2010

| | | |

| | | | |

|

| | | | | |

Quantity | | Name of Issuer | Fair Value ($)(1) | |

| | | | | |

Common Stocks (97.4%) (2) |

Communications (3.7%) |

5,000 | | Millicom Intl. Cellular S.A. | | 405,350 | |

14,800 | | Rogers Communications, Inc. | | 484,848 | |

53,000 | | Verizon Communications, Inc. | | 1,485,060 | |

| | | | 2,375,258 | |

| | | | | |

Consumer Durables (2.1%) |

6,500 | | Polaris Industries, Inc. | | 355,030 | |

17,000 | | Snap-on, Inc. | | 695,470 | |

8,000 | | Tupperware Brands Corp. | | 318,800 | |

| | | | 1,369,300 | |

| | | | | |

Consumer Non-Durables (11.2%) |

10,700 | | Colgate-Palmolive Co. | | 842,732 | |

11,900 | | Diageo p.l.c. | | 746,606 | |

27,100 | | General Mills, Inc. | | 962,592 | |

8,300 | | Lancaster Colony Corp. | | 442,888 | |

5,700 | | NIKE, Inc. | | 385,035 | |

23,000 | | PepsiCo, Inc. | | 1,401,850 | |

23,000 | | Philip Morris International, Inc. | | 1,054,320 | |

22,900 | | Procter & Gamble Co. | | 1,373,542 | |

| | | | 7,209,565 | |

| | | | | |

Consumer Services (2.2%) |

14,700 | | McDonald’s Corp. | | 968,289 | |

33,700 | | Pearson, A.D.R. | | 443,155 | |

| | | | 1,411,444 | |

| | | | | |

Electronic Technology (9.7%) |

53,600 | | Applied Materials, Inc. | | 644,272 | |

11,400 | | Broadcom Corp. | | 375,858 | |

54,800 | | Intel Corp. | | 1,065,860 | |

16,900 | | IBM Corp. | | 2,086,812 | |

21,900 | | Linear Technology Corp. | | 609,039 | |

28,300 | | Qualcomm, Inc. | | 929,372 | |

20,300 | | Tyco Electronics, Ltd. | | 515,214 | |

| | | | 6,226,427 | |

| | | | | |

Quantity | | Name of Issuer | Fair Value ($)(1) | |

| | | | | |

Energy Minerals (9.8%) |

6,000 | | Apache Corp. | | 505,140 | |

23,900 | | Chevron Corp. | | 1,621,854 | |

18,500 | | EQT Corp. | | 668,590 | |

22,800 | | Marathon Oil Corp. | | 708,852 | |

11,300 | | Murphy Oil Corp. | | 559,915 | |

13,100 | | Occidental Petroleum Corp. | | 1,010,665 | |

9,000 | | Sasol, A.D.R. | | 317,430 | |

20,400 | | Total, A.D.R. | | 910,656 | |

| | | | 6,303,102 | |

|

Finance (15.5%) |

12,000 | | ACE, Ltd. | | 617,760 | |

13,100 | | Allied World Assurance Co. Hldgs. | | 594,478 | |

18,000 | | Ameriprise Financial, Inc. | | 650,340 | |

31,500 | | Apollo Investment Corp. | | 293,895 | |

17,300 | | Bank of New York Mellon Corp. | | 427,137 | |

7,360 | | Franklin Resources, Inc. | | 634,358 | |

39,350 | | J.P. Morgan Chase & Co. | | 1,440,603 | |

44,100 | | Northwest Bancshares, Inc. | | 505,827 | |

8,800 | | PartnerRe, Ltd. | | 617,232 | |

35,700 | | PennantPark Investment Corp. | | 340,935 | |

10,200 | | Prudential Financial, Inc. | | 547,332 | |

13,500 | | Royal Bank of Canada | | 645,165 | |

17,900 | | The Travelers Companies, Inc. | | 881,575 | |

34,700 | | U.S. Bancorp | | 775,545 | |

39,800 | | Wells Fargo & Co. | | 1,018,880 | |

| | | | 9,991,062 | |

|

Health Services (2.0%) |

8,400 | | McKesson Corp. | | 564,144 | |

16,150 | | Owens & Minor, Inc. | | 458,337 | |

11,600 | | Pharmaceutical Product Dev., Inc. | | 294,756 | |

| | | | 1,317,237 | |

|

Health Technology (10.9%) |

20,100 | | Abbott Laboratories | | 940,278 | |

19,600 | | Baxter International, Inc. | | 796,544 | |

11,200 | | Becton, Dickinson & Co. | | 757,344 | |

10,350 | | Eli Lilly and Co. | | 346,725 | |

28,600 | | Johnson & Johnson | | 1,689,116 | |

22,400 | | Medtronic, Inc. | | 812,448 | |

26,192 | | Meridian Bioscience, Inc. | | 445,264 | |

12,600 | | Teva Pharmaceutical, A.D.R. | | 655,074 | |

12,000 | | Thermo Fisher Scientific, Inc. (3) | | 588,600 | |

| | | | 7,031,393 | |

18

| | | | |

| | |

| |

| | |

| | |

|

| |

| | | | |

|

| | | | | |

Quantity/Par ($) Name of Issuer | Fair Value ($)(1) | |

| | | | | |

Industrial Services (1.9%) |

18,800 | | Halliburton Co. | | 461,540 | |

13,500 | | National-Oilwell Varco, Inc. | | 446,445 | |

15,400 | | Seadrill, Ltd. | | 281,512 | |

| | | | 1,189,497 | |

|

Non-Energy Minerals (1.4%) |

7,900 | | BHP Billiton, Ltd. | | 489,721 | |

12,520 | | Haynes International, Inc. | | 385,992 | |

| | | | 875,713 | |

| | | | | |

Process Industries (1.9%) |

22,900 | | E. I. du Pont de Nemours and Co. | | 792,111 | |

23,600 | | RPM International, Inc. | | 421,024 | |

| | | | 1,213,135 | |

|

Producer Manufacturing (9.6%) |

15,500 | | 3M Co. | | 1,224,345 | |

29,600 | | ABB, Ltd., A.D.R. | | 511,488 | |

11,100 | | Cooper Industries | | 488,400 | |

15,500 | | Deere & Co. | | 863,040 | |

13,700 | | Emerson Electric Co. | | 598,553 | |

45,300 | | General Electric Co. | | 653,226 | |

10,800 | | Goodrich Corp. | | 715,500 | |

4,100 | | Lockheed Martin Corp. | | 305,450 | |

12,900 | | United Technologies Corp. | | 837,339 | |

| | | | 6,197,341 | |

Retail Trade (4.6%) |

20,047 | | Cato Corp. | | 441,435 | |

17,300 | | Home Depot, Inc. | | 485,611 | |

15,500 | | Target Corp. | | 762,135 | |

7,800 | | TJX Co | | 327,210 | |

19,700 | | Wal-Mart Stores, Inc. | | 946,979 | |

| | | | 2,963,370 | |

Technology Services (5.4%) |

20,000 | | Accenture, Ltd. | | 773,000 | |

11,600 | | Automatic Data Processing, Inc. | | 467,016 | |

42,200 | | Microsoft Corp. | | 971,022 | |

39,700 | | Oracle Corp. | | 851,962 | |

12,222 | | Syntel, Inc. | | 414,937 | |

| | | | 3,477,937 | |

Transportation (2.4%) |

7,000 | | Expeditors Intl. of Washington, Inc. | | 241,570 | |

9,600 | | Union Pacific Corp. | | 667,296 | |

11,050 | | United Parcel Service, Inc. | | 628,634 | |

| | | | 1,537,500 | |

| | | | | |

Quantity | | Name of Issuer | Fair Value ($)(1) | |

| | | | | |

Utilities (3.1%) | |

8,900 | | Enbridge, Inc. | | 414,740 | |

13,700 | | NextEra Energy, Inc. | | 668,012 | |

16,200 | | UGI Corp. | | 412,128 | |

9,700 | | Wisconsin Energy Corp. | | 492,178 | |

| | | | 1,987,058 | |

| | | | | |

Total common stocks | | 62,676,339 | |

(cost: $63,386,354) | | | |

| | | | | |

Closed-End Mutual Funds (1.7%) (2) |

18,950 | | Kayne Anderson MLP Invest. Co. | | 495,922 | |

25,400 | | Tortoise Energy Capital Corp. | | 581,914 | |

| | | | | |

Total closed-end mutual funds | | 1,077,836 | |

(cost: $894,050) | | | |

| | | | | |

Short-Term Securities (0.4%) (2) |

229,863 | | Wells Fargo Adv. Govt. Fund, 0.04% | | 229,863 | |

(cost: $229,863) | | | |

| | | | | |

Total investments in securities | | | |

(cost: $64,510,267) (4) | | $ 63,984,038 | |

See accompanying notes to portfolios of investments on page 48.

19

| | | | |

| Sit Global Dividend Growth Fund - Class I and Class S | | | |

| One Year Ended June 30, 2010 | | | |

| | | | |

| Portfolio Managers: Roger J. Sit, Kent L. Johnson, Raymond E. Sit, Michael J. Stellmacher, Tasha M. Murdoff

| | | |

| | | | |

The Sit Global Dividend Growth Fund Class I posted a +8.79% return over the last twelve months, compared to +11.06% return for the Composite Index (60% S&P 500 Index and 40% MSCI EAFE Index).

On an industry basis, the Fund’s twelve-month underperformance was largely due to negative stock selection in the technology hardware and semiconductor industries, which was largely driven by the absence of Apple in the Fund. This is significant because the shares of Apple carry a large weight within the Composite Index and rose approximately +76% during the period. Additionally, the Fund’s large weight in the underperforming Qualcomm detracted from performance. Stock selection was positive in the energy, capital goods, and diversified financial industries.

On a geographical basis, North America was the largest relative detractor due to both stock selection and allocation. On the positive side, Japan and the UK contributed the most to performance, a result of positive stock selection and allocation effect. In Japan, Aflac was the top contributor, while in the UK it was Pearson and Burberry.

Over the past twelve months, global stock prices responded to improved economic conditions. The market gains were fueled mostly by a strong rally in lower quality stocks, which tend to have characteristics such as high debt levels, low stock prices, and more volatile earnings. While this is a “typical” rally at the beginning of an economic cycle, we continue to caution investors that a classic, strong recovery is not likely given the headwinds of high debt levels, weak real estate markets, austerity measures, and a fading impact from stimulus. However, global stock valuations are attractive, balance sheets are strong, and corporate earnings have been good, although a slowdown in profit growth is likely the remainder of this year. We continue to believe that global, high quality, dividend-paying companies are attractive in an environment of modest economic growth and low inflation. It is encouraging to note that dividend increases are on the rise. Over the past twelve months, 56 companies within the Fund (out of 98 current holdings, or 57%) have increased their dividends.

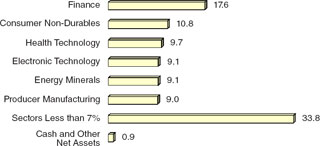

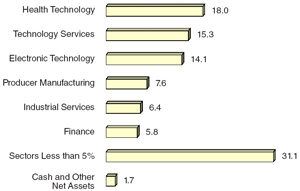

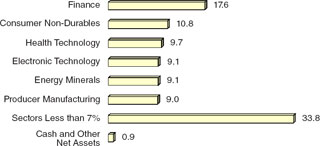

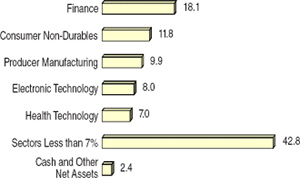

The finance sector remains the heaviest weighting in the Fund (with an emphasis on insurance and bank stocks), followed by consumer non-durables and health technology. Our research effort remains highly focused on companies with strong, experienced management teams, sound balance sheets, and sustainable earnings, and global dividend growth potential.

INVESTMENT OBJECTIVE AND STRATEGY |

The objective of the Global Dividend Growth Fund is to provide current income that exceeds the dividend yield of a composite index (comprised of 60% S&P 500 Index and 40% MSCI EAFE Index) and that grows over a period of years. Secondarily, the Fund seeks long-term capital appreciation.

The Fund seeks to achieve its objectives by investing, under normal market conditions, at least 80% of its net assets in dividend-paying common stocks issued by U.S. and foreign companies. The Fund may invest the balance of its assets in preferred stocks, convertible bonds, and U.S. Treasury securities.

| | | | |

| | Class I | | Class S |

| | | | |

Net Asset Value | | | | |

| | | | |

6/30/10: | | $10.41 Per Share | | $10.40 Per Share |

| | | | |

6/30/09: | | $9.70 Per Share | | $9.70 Per Share |

| | | | |

Total Net Assets | | $2.8 Million | | $0.9 Million |

| | | | |

Weighted Average Market Cap: $64.1 Billion |

PORTFOLIO STRUCTURE - BY SECTOR

(% OF TOTAL NET ASSETS) |

20

| | | | |

| | |

| |

| | |

| | |

|

| |

| | | | |

| | | | | | | | | | | | | |

| |

AVERAGE ANNUAL TOTAL RETURNS* | |

|

| | | | | | | | | | | | | |

| | | 3 Month** | | 6 Month** | | 1 Year | | Since

Inception

(9/30/08) | |

| | | | | | | | | | | | | |

| Class I | | -12.73 | % | | -9.79 | % | | 8.79 | % | 3.69 | % | |

| Class S | | -12.79 | | | -9.93 | | | 8.47 | | 3.45 | | |

| Composite Index(1) | | -12.40 | | | -9.28 | | | 11.06 | | -4.60 | | |

| S&P 500

Index(2) | | -11.42 | | | -6.65 | | | 14.43 | | -4.57 | | |

| MSCI EAFE Index(3) | | -13.97 | | | -13.23 | | | 5.92 | | -4.94 | | |

| | | | | | | | | | | | | |

CUMULATIVE TOTAL RETURNS* | |

| | | | | | | | | | | | | |

| | | 3 Month | | 6 Month | | 1 Year | | Since

Inception

(9/30/08) | |

| | | | | | | | | | | | | |

| Class I | | -12.73 | % | | -9.79 | % | | 8.79 | % | 6.55 | % | |

| Class S | | -12.79 | | | -9.93 | | | 8.47 | | 6.10 | | |

| Composite Index(1) | | -12.40 | | | -9.28 | | | 11.06 | | -7.91 | | |

| S&P 500

Index(2) | | -11.42 | | | -6.65 | | | 14.43 | | -7.85 | | |

| MSCI EAFE Index(3) | | -13.97 | | | -13.23 | | | 5.92 | | -8.47 | | |

| | | | | | | | | | | | | |

| *As of 6/30/10 | | | | | | | | | | |

| | | | | | | | | | | | | |

| **Not annualized. | | | | | | | | | | |

| | | | | | | | | | | | | |

| | |

Performance figures are historical and do not guarantee future results. Investment returns and principal value will vary, and you may have a gain or loss when you sell shares. Average annual total returns include changes in share price as well as reinvestment of all dividends and capital gains. Management fees and administrative expenses are included in the Fund’s performance.

| |

| | |

| |

(1) | (Hypothetical) Composite Index comprised of 60% S&P 500 Index and 40% MSCI EAFE Index. |

(2) | An unmanaged index which measures the performance of 500 widely held common stocks of large-cap companies. |

(3) | A free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. & Canada. The Index currently comprises 21 developed market country indices. |

The sum of $10,000 invested at inception (9/30/08) and held until 6/30/10 would have grown to $10,655 in the Fund or declined to $9,209 in the Composite Index, $9,215 in the S&P 500 Index, or $9,153 in the MSCI EAFE Index assuming reinvestment of all dividends and capital gains.

| | |

| 1. | IBM Corp. |

| 2. | BHP Billiton, A.D.R. |

| 3. | Rio Tinto, A.D.R. |

| 4. | McDonald’s Corp. |

| 5. | Procter & Gamble Co. |

| 6. | Johnson & Johnson |

| 7. | Philip Morris International, Inc. |

| 8. | PepsiCo, Inc. |

| 9. | Verizon Communications, Inc. |

| 10. | Chevron Corp. |

| | Total Number of Holdings: 98

|

21

| | | | |

| Sit Global Dividend Growth Fund | | | |

| | | | |

| Portfolio of Investments - June 30, 2010

| | | |

| | | | |

|

| | | | | |

Quantity | | Name of Issuer | | Fair Value ($)(1) | |

| | | | | |

Common Stocks (96.5%) (2) | | | |

Asia (9.7%) | | | |

Australia (5.3%) | | | |

1,500 | | BHP Billiton, A.D.R. (Non-Energy Minerals) | | 92,985 | |

2,000 | | Rio Tinto, A.D.R. (Non-Energy Minerals) | | 87,200 | |

200 | | Westpac Banking, A.D.R. (Finance) | | 17,716 | |

| | | | 197,901 | |

Hong Kong / China (2.1%) | | | |

1,014 | | HSBC Holdings, p.l.c. (Finance) | | 46,228 | |

5,000 | | Hutchison Whampoa, Ltd. (Producer Manufacturing) | | 30,770 | |

| | | | 76,998 | |

Japan * (2.3%) | | | |

700 | | AFLAC, Inc., A.D.R. (Finance) | | 29,869 | |

1,000 | | Canon, Inc., A.D.R. (Electronic Tech.) | | 37,310 | |

400 | | Oracle Corp. Japan (Tech. Services) | | 19,656 | |

| | | | 86,835 | |

Europe (26.7%) | | | |

France (3.3%) | | | |

925 | | Schlumberger, A.D.R. (Industrial Svcs.) | | 51,190 | |

1,050 | | Total, A.D.R. (Energy Minerals) | | 46,872 | |

1,075 | | Veolia Environment, A.D.R. (Utilities) | | 25,123 | |

| | | | 123,185 | |

Germany (1.8%) | | | |

210 | | Muenchener Rueckver (Finance) | | 26,368 | |

450 | | Siemens AG, A.D.R. (Producer Mfg.) | | 40,289 | |

| | | | 66,657 | |

Ireland (1.1%) | | | |

1,075 | | Accenture (Technology Services) | | 41,549 | |

| | | | | |

Israel (1.0%) | | | |

700 | | Teva Pharmaceutical, A.D.R. (Health Technology) | | 36,393 | |

Italy (1.4%) | | | |

8,800 | | Enel S.P.A. (Utilities) | | 37,261 | |

450 | | Tenaris, A.D.R. (Industrial Services) | | 15,575 | |

| | | | 52,836 | |

Luxembourg (0.4%) | | | |

200 | | Millicom International Cellular S.A. (Communications) | | 16,214 | |

| | | | | |

Netherlands (1.6%) | | | |

1,100 | | Philips Electronics, A.D.R. (Consumer Durables) | | 32,824 | |

1,100 | | TNT NV (Transportation) | | 27,706 | |

| | | | 60,530 | |

| | | | | |

Quantity | | Name of Issuer | | Fair Value ($)(1) | |

| | | | | |

Spain (2.1%) | | | |

1,700 | | Banco Santander, A.D.R. (Finance) | | 17,850 | |

580 | | Inditex (Consumer Durables) | | 33,072 | |

500 | | Telefonica, A.D.R. (Communications) | | 27,765 | |

| | | | 78,687 | |

Sweden (0.8%) | | | |

2,500 | | Ericsson, A.D.R. (Electronic Tech.) | | 27,550 | |

| | | | | |

Switzerland (6.1%) | | | |

2,200 | | ABB, Ltd., A.D.R. (Producer Mfg.) | | 38,016 | |

650 | | ACE, Ltd., A.D.R. (Finance) | | 33,462 | |

1,200 | | Credit Suisse Group, A.D.R. (Finance) | | 44,916 | |

400 | | Kuehne & Nagel Intl. A.G. (Transport.) | | 41,176 | |

1,060 | | Nestle, S.A. (Consumer Non-Durables) | | 51,112 | |

125 | | Roche Holdings, A.G. (Health Tech.) | | 17,205 | |

| | | | 225,887 | |

United Kingdom (7.1%) | | | |

655 | | British American Tobacco p.l.c. (Consumer Non-Durables) | | 20,787 | |

1,700 | | Burberry Group, p.l.c. (Retail Trade) | | 19,199 | |

800 | | Diageo, A.D.R. (Cons. Non-Durables) | | 50,192 | |

1,100 | | GlaxoSmithkline, A.D.R. (Health Tech.) | | 37,411 | |

3,800 | | Pearson, A.D.R. (Consumer Services) | | 49,970 | |

975 | | Royal Dutch Shell, A.D.R. (Energy Minerals) | | 47,073 | |

6,650 | | Tesco, p.l.c. (Retail Trade) | | 37,515 | |

| | | | 262,147 | |

North America (60.1%) | | | |

Bermuda (1.2%) | | | |

525 | | PartnerRe, Ltd. (Finance) | | 36,824 | |

500 | | Seadrill, Ltd. (Industrial Services) | | 9,140 | |

| | | | 45,964 | |

Canada (2.2%) | | | |

1,350 | | Rogers Communications, Inc. (Communications) | | 44,226 | |

775 | | Royal Bank of Canada (Finance) | | 37,037 | |

| | | | 81,263 | |

United States (56.7%) | | | |

|

Communications (1.5%) | | | |

2,050 | | Verizon Communications, Inc. | | 57,441 | |

| | | | | |

Consumer Durables (1.0%) | | | |

900 | | Snap-on, Inc. | | 36,819 | |

22

| | | | |

| | |

| |

| | |

| | |

|

| |

| | | | |

|

| | | | | |

Quantity | | Name of Issuer | | Fair Value ($)(1) | |

| | | | | |

Consumer Non-Durables (7.6%) | | | |

525 | | Colgate-Palmolive Co. | | 41,349 | |

1,400 | | General Mills, Inc. | | 49,728 | |

950 | | PepsiCo, Inc. | | 57,903 | |

1,350 | | Philip Morris International, Inc. | | 61,884 | |

1,150 | | Procter & Gamble Co. | | 68,977 | |

| | | | 279,841 | |

Consumer Services (1.9%) | | | |

1,050 | | McDonald’s Corp. | | 69,164 | |

| | | | | |

Electronic Technology (7.3%) | | | |

2,000 | | Applied Materials, Inc. | | 24,040 | |

2,800 | | Intel Corp. | | 54,460 | |

800 | | IBM Corp. | | 98,784 | |

1,400 | | Linear Technology Corp. | | 38,934 | |

1,700 | | Qualcomm, Inc. | | 55,828 | |

| | | | 272,046 | |

Energy Minerals (6.6%) | | | |

300 | | Apache Corp. | | 25,257 | |

825 | | Chevron Corp. | | 55,984 | |

1,025 | | EQT Corp. | | 37,043 | |

1,400 | | Marathon Oil Corp. | | 43,526 | |

600 | | Murphy Oil Corp. | | 29,730 | |

700 | | Occidental Petroleum Corp. | | 54,005 | |

| | | | 245,545 | |

Finance (7.1%) | | | |

425 | | Franklin Resources, Inc. | | 36,631 | |

200 | | Goldman Sachs Group, Inc. | | 26,254 | |

1,525 | | J.P. Morgan Chase & Co. | | 55,830 | |

475 | | Prudential Financial, Inc. | | 25,489 | |

550 | | The Travelers Companies, Inc. | | 27,088 | |

1,600 | | U.S. Bancorp | | 35,760 | |

2,150 | | Wells Fargo & Co. | | 55,040 | |

| | | | 262,092 | |

Health Services (0.9%) | | | |

500 | | McKesson Corp. | | 33,580 | |

| | | | | |

Health Technology (7.2%) | | | |

800 | | Abbott Laboratories | | 37,424 | |

1,125 | | Baxter International, Inc. | | 45,720 | |

725 | | Becton, Dickinson & Co. | | 49,024 | |

550 | | Eli Lilly and Co. | | 18,425 | |

1,075 | | Johnson & Johnson | | 63,489 | |

| | | | | |

Quantity | | Name of Issuer | | Fair Value ($)(1) | |

| | | | | |

1,000 | | Medtronic, Inc. | | 36,270 | |

325 | | Teleflex, Inc. | | 17,641 | |

| | | | 267,993 | |

Process Industries (0.8%) | | | |

800 | | E. I. du Pont De Nemours and Co. | | 27,672 | |

| | | | | |

Producer Manufacturing (5.2%) | | | |

625 | | 3M Co. | | 49,369 | |

450 | | Caterpillar, Inc. | | 27,031 | |

650 | | Deere & Co. | | 36,192 | |

1,175 | | General Electric Co. | | 16,943 | |

250 | | Lockheed Martin Corp. | | 18,625 | |

700 | | United Technologies Corp. | | 45,437 | |

| | | | 193,597 | |

Retail Trade (4.9%) | | | |

450 | | Best Buy Co., Inc. | | 15,237 | |

600 | | CVS Caremark Corp. | | 17,592 | |

1,200 | | Home Depot, Inc. | | 33,684 | |

925 | | Target Corp. | | 45,482 | |

650 | | TJX Co. | | 27,268 | |

900 | | Wal-Mart Stores, Inc. | | 43,263 | |

| | | | 182,526 | |

Technology Services (3.2%) | | | |

450 | | Automatic Data Processing, Inc. | | 18,117 | |

35 | | Google, Inc. (3) | | 15,573 | |

2,100 | | Microsoft Corp. | | 48,321 | |

1,800 | | Oracle Corp. | | 38,628 | |

| | | | 120,639 | |

Transportation (0.9%) | | | |

450 | | Union Pacific Corp. | | 31,280 | |

| | | | | |

Utilities (0.6%) | | | |

625 | | Exelon Corp. | | 23,731 | |

| | | | | |

Total common stocks for United States | | 2,103,966 | |

| | | | | |

Total common stocks | | 3,584,562 | |

(cost: $3,400,484) | | | |

| | | | | |

| | | | | |

Exchange Traded Funds (1.0%) (2) | | | |

4,000 | | iShares MSCI Japan * | | 36,800 | |

(cost: $36,590) | | | |

See accompanying notes to portfolios of investments on page 48.

23

| | | | |

| Sit Global Dividend Growth Fund | | | |

| | | | |

| Portfolio of Investments - June 30, 2010

| | | |

| | | | |

|

| | | | | | |

Quantity | | Name of Issuer | | Fair Value ($)(1) | |

| | | | | |

Closed-End Mutual Funds (1.6%) (2) | | | |

1,300 | | Tortoise Energy Capital Corp. | | 29,783 | |

1,200 | | Kayne Anderson MLP Invest. Co. | | 31,404 | |

Total closed-end mutual funds | | 61,187 | |

(cost: $45,430) | | | |

| | | | | |

Short Term Securities (0.7%) (2) | | | |

24,615 | | Wells Fargo Adv. Govt. Fund, 0.04% | | 24,615 | |

(cost: $24,615) | | | |

| | | | | |

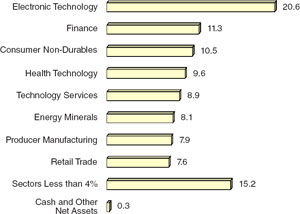

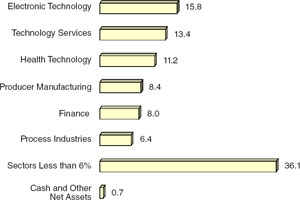

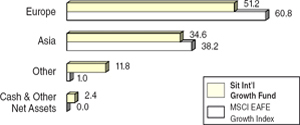

Total investments in securities | | | |