UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-06373

Sit Mutual Funds, Inc.

(Exact name of registrant as specified in charter)

3300 IDS Center

80 South Eighth Street

Minneapolis, MN 55402

(Address of principal executive offices)

Paul E. Rasmussen, VP Treasurer

Sit Mutual Funds, Inc.

3300 IDS Center

80 South Eighth Street

Minneapolis, MN 55402

(Name and address of agent for service)

Copy to:

Mike Radmer, Esq.

Dorsey & Whitney

Suite 1500

50 South Sixth Street

Minneapolis, MN 55402-1498

Registrant’s telephone number, including area code: (612) 332-3223

Date of fiscal year end: June 30, 2012

Date of reporting period: June 30, 2012

| Item 1: | Reports to Stockholders |

Sit Mutual Funds

STOCK FUNDS ANNUAL REPORT

TABLE OF CONTENTS

This document must be preceded or accompanied by a Prospectus.

CHAIRMAN’S LETTER

August 6, 2012

Dear Fellow Shareholders:

After a relatively strong start to 2012, U.S. economic data has turned decidedly mixed in recent months, perhaps characterizing the “two steps forward, one step back” nature of this subpar economic recovery. Job growth, for example, has decelerated over the past three months after some encouraging readings to begin the year, although it is clear the mild winter may have pulled forward some hiring. Manufacturing, which has been a key pillar of strength throughout the recovery, has taken a sharp step back recently, as measured by the June ISM Purchasing Managers Index (PMI), which posted its first contractionary reading in almost three years. On the other hand, housing appears to be slowly on the mend and consumer spending, by most measures, has remained resilient, undoubtedly boosted by the significant drop in energy costs (both oil and natural gas) over the past several months. Bottom line, while we have only modestly reduced our U.S. growth forecasts for the remainder of the year, external factors have potential to have a direct impact on both business and consumer sentiment. Increasing economic stress overseas, fears over the upcoming U.S. budget “fiscal cliff ” and a looming reopening of the debt ceiling debate are among the key issues that add uncertainty to forecasts in the months ahead.

There is no question that events transpiring outside the U.S. are major “wild cards,” when considering the outlook over the next several quarters. The economic situation in Europe continues to be dismal and the region may very well be in recession currently. Our best “guess” is that the rate of economic growth will hit a bottom sometime later this year, but, given the many factors involved—austerity measures, political changes, a fragile banking system and a slowdown in emerging markets—uncertainty is likely to linger well into next year. Outside of Europe, China represents the other major “swing factor” for the remainder of 2012. Economic growth has slowed significantly in recent months, and policy measures designed to ease monetary conditions have not been effective to this point. While we expect China to successfully engineer a soft landing, external factors present the biggest downside risk to the country’s economic growth. Again, the central risk is Europe, with some signs of slowing in the U.S. potentially adding to export weakness. It should be noted that the European region is China’s largest trading partner, and any deepening in the current recessionary conditions will have a direct negative impact on the Chinese economy.

Equity Strategy

Stocks posted mixed results over the past year, as economic and political turmoil drove significant volatility on a quarter to quarter basis.

Without question, the state of the global economy, combined with political dysfunction, is weighing on investor sentiment at the present time. Amid all the gloom and uncertainty, however, we believe it is worth considering several positive factors that should support higher equity prices over time. First, valuations for stocks appear quite reasonable. For example, the P/E ratio (on projected 2012 earnings) for stocks within the S&P 500 Index is approximately 13x,

which appears very attractive relative to history and the current low level of interest rates and inflation. Second, corporations are flush with cash—nearly $2.3 trillion rests on corporate balance sheets -and companies are generating record levels of free cash flow. This should support higher dividends and share repurchases in the year ahead. And finally, in terms of the economy, the long decline in housing appears to have run its course in most markets, perhaps boosting consumer sentiment in the months ahead.

To be sure, there are “macro” challenges that will likely persist over the next several quarters, but we believe there are elements of our portfolio strategy that can serve to combat an environment of slow growth and continued market volatility. First and foremost, we believe a focus on companies with strong financial characteristics (low debt levels, strong free cash flow generation) will result in outperforming the overall market, as “organic” growth becomes somewhat more challenging. Financially strong companies have the potential to create incremental value for shareholders by repurchasing stock, increasing dividends or making accretive acquisitions. Second, we believe diversification is important during a period of economic and market volatility. For example, balancing the portfolio with “pro-cyclical” sectors (i.e., producer manufacturing, technology) and “noncyclical” sectors (i.e., consumer staples, health care) should serve to reduce portfolio volatility amid fluctuations in investors’ views on the direction of the economy.

Outside the United States, we continue to be underweighted in Europe, favoring the United Kingdom and non-euro area countries that are experiencing stronger relative growth and are less impacted by the financial crisis on the continent. In Asia ex-Japan, we like basic material and consumer-related stocks. Consumer-related stocks should benefit from continued increased spending, while basic material stocks should gain from continued development in the region. In Japan, investments consist of export-oriented companies and entities with domestic consumption exposure. Similar to the developing economies in Asia, Latin America will also benefit from growing consumer consumption and the continued global demand for raw materials.

Although equity markets will likely remain quite volatile over the next several quarters, our research staff remains committed to indentifying investment opportunities that will serve our shareholders well over the long-term.

With best wishes,

Roger J. Sit

Chairman, President, CEO and Global CIO

2

[This page intentionally left blank.]

3

Sit Balanced Fund

OBJECTIVE & STRATEGY

The Sit Balanced Fund’s dual objectives are to seek long-term growth of capital consistent with the preservation of principal and to provide regular income. It pursues its objectives by investing in a diversified portfolio of stocks and bonds. The Fund may emphasize either equity securities or fixed-income securities, or hold equal amounts of each, dependent upon the Adviser’s analysis of market, financial and economic conditions.

The Fund’s permissible investment allocation is: 35-65% in equity securities and 35-65% in fixed-income securities. At all times at least 25% of the fixed-income assets will be invested in fixed-income senior securities.

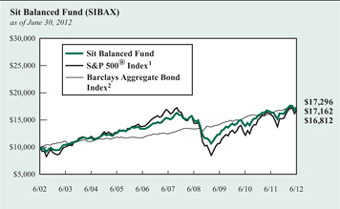

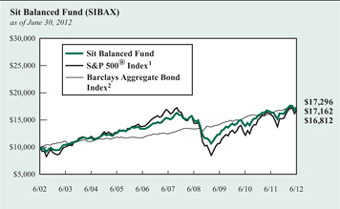

The Sit Balanced Fund’s twelve-month return was +4.61%.The S&P 500® Index return was +5.45% over the period, while the Barclays Aggregate Bond Index advanced +7.47%.

Stocks edged higher over the past twelve months, shaking off the ongoing and interrelated problems of too much debt (at both the government and consumer levels), fragile real estate markets, and high unemployment rates. Tepid growth in the U.S. and slowing economic conditions outside the U.S. (particularly in China and Europe) will clearly pose challenges to continued corporate earnings growth in the months ahead. From our perspective, however, the good news is that high-quality growth companies are inexpensive and earnings expectations are beginning to reflect a slower economic growth backdrop. We continue to emphasize the electronic technology sector within the Fund, but we also see opportunities in other heavily-weighted sectors, including producer manufacturing, health technology and consumer non-durables. Regardless of the sector, we continue to emphasize “quality,” favoring companies with strong balance sheets, predictable earnings growth and consistent cash flow generation. In terms of performance over the past year, the equity portion of the Fund lagged the S&P 500® Index return primarily due to underperformance in the energy and technology-related sectors, partially offset by solid performance within the retail trade sector.

Increasing economic stress overseas, fears over the upcoming U.S. “fiscal cliff ” and a looming reopening of the debt ceiling debate have all combined to encourage the Federal Reserve to remain highly accommodative. As a result, interest rates for many fixed income sectors fell further over the past twelve months, most notably for U.S. Treasuries as global investors flocked to U.S. government securities as a “safe haven.” U.S. Treasury rates remain exceptionally low and, therefore, we remain underweighted in this sector. Conversely, we believe high-quality corporate bonds, closed-end funds and mortgages continue to provide investors with attractive risk-adjusted return potential. The fixed income portion of the Fund essentially matched the return of the Barclays Aggregate Bond Index over the past twelve months. The Fund was positioned

HYPOTHETICAL GROWTH OF $10.000

The chart above illustrates the total value of a hypothetical $10,000 investment in the Fund over the past 10 years (or for the life of the Fund if shorter) as compared to the performance of the S&P 500® Index and the Barclays Capital Aggregate Bond Index. Past performance does not guarantee future results. Returns include the reinvestment of distributions. The chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| 1 | S&P 500® Index is an unmanaged capitalization-weighted index that measures the performance of 500 widely held common stocks of large-cap companies. It is not possible to invest directly in an index. This is the primary index for the equity portion of the Fund. |

| 2 | Barclays Capital Aggregate Bond Index is an unmanaged market value-weighted index which measures the performance of investment grade debt securities with maturities of at least one year. This is the primary index for the fixed income portion of the Fund. |

defensively against a rise in interest rates, but rates declined during the year, resulting in underperformance from a price perspective. This was basically offset by the Fund’s income advantage.

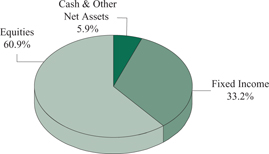

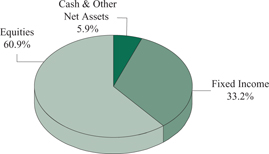

As of June 30th, the asset allocation of the Fund was 61% equities, 33% fixed income, and 6% cash and other net assets.

Roger J. Sit

Bryce A. Doty

John M. Bernstein

Portfolio Managers

| | |

| 4 | | SIT MUTUAL FUNDS ANNUAL REPORT |

COMPARATIVE RATES OF RETURNS

as of June 30, 2012

| | | | | | | | | | | | |

| | | Sit

Balanced

Fund | | | S&P 500®

Index 1 | | | Barclays

Aggregate

Bond

Index 2 | |

One Year | | | 4.61 | % | | | 5.45 | % | | | 7.47 | % |

Five Year | | | 2.36 | | | | 0.22 | | | | 6.79 | |

Ten Year | | | 5.55 | | | | 5.33 | | | | 5.63 | |

Since Inception

(12/31/93) | | | 6.34 | | | | 8.01 | | | | 6.23 | |

Performance figures are historical and do not guarantee future results. Investment returns and principal value will vary, and you may have a gain or loss when you sell shares. Current performance may be lower or higher than the performance data quoted. Contact the Fund for performance data current to the most recent month-end. Returns include changes in share price as well as reinvestment of all dividends and capital gains. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Management fees and administrative expenses are included in the Fund’s performance. Returns for periods greater than one year are compounded average annual rates of return.

| 1 | S&P 500® Index is an unmanaged capitalization-weighted index that measures the performance of 500 widely held common stocks of large-cap companies. It is not possible to invest directly in an index. |

| 2 | Barclays Capital Aggregate Bond Index is an unmanaged market value-weighted index which measures the performance of investment grade debt securities with maturities of at least one year. |

PORTFOLIO SUMMARY

| | | | |

Net Asset Value 6/30/12: | | $ | 16.97 Per Share | |

Net Asset Value 6/30/11: | | $ | 16.47 Per Share | |

Total Net Assets: | | $ | 11.8 Million | |

TOP HOLDINGS

Top Equity Holdings:

| | 3. | International Business Machines Corp. |

| | 4. | Occidental Petroleum Corp. |

Top Fixed Income Holdings:

| | 1. | U.S. Treasury Strips, 3.09%, 8/15/20 |

| | 2. | Government National Mortgage Association, 2005-74 HA, 7.50%, 9/16/35 |

| | 3. | Continental Airlines 2009-1 Pass Thru Certs., 9.00%, 7/8/16 |

| | 4. | Procter & Gamble ESOP, 9.36%, 1/1/21 |

| | 5. | Freddie Mac REMIC, 7.50%, 6/15/30 |

Based on total net assets as of June 30, 2012. Subject to change.

FUND DIVERSIFICATION

Based on total net assets as of June 30, 2012. Subject to change.

SCHEDULE OF INVESTMENTS

June 30, 2012

Sit Balanced Fund

| | | | | | |

Quantity | | Name of Issuer | | Fair Value ($) | |

Common Stocks - 60.9% | | | | |

Communications - 1.8% | | | | |

2,200 | | Rogers Communications, Inc. | | | 79,662 | |

3,075 | | Verizon Communications, Inc. | | | 136,653 | |

| | | | | | |

| | | | | 216,315 | |

| | | | | | |

Consumer Durables - 0.6% | | | | |

200 | | Fossil, Inc. * | | | 15,308 | |

900 | | Tupperware Brands Corp. | | | 49,284 | |

| | | | | | |

| | | | | 64,592 | |

| | | | | | |

Consumer Non-Durables - 6.2% | | | | |

700 | | Coach, Inc. | | | 40,936 | |

2,100 | | Coca-Cola Co. | | | 164,199 | |

1,325 | | General Mills, Inc. | | | 51,066 | |

800 | | NIKE, Inc. | | | 70,224 | |

2,000 | | PepsiCo, Inc. | | | 141,320 | |

1,800 | | Philip Morris International, Inc. | | | 157,068 | |

1,800 | | Procter & Gamble Co. | | | 110,250 | |

| | | | | | |

| | | | | 735,063 | |

| | | | | | |

Consumer Services - 1.9% | | | | |

1,600 | | McDonald’s Corp. | | | 141,648 | |

650 | | Visa, Inc. | | | 80,360 | |

| | | | | | |

| | | | | 222,008 | |

| | | | | | |

Electronic Technology - 9.8% | | | | |

550 | | Apple, Inc. * | | | 321,200 | |

6,100 | | Applied Materials, Inc. | | | 69,906 | |

4,700 | | Atmel Corp. * | | | 31,490 | |

1,850 | | Broadcom Corp. * | | | 62,530 | |

2,750 | | Ciena Corp. * | | | 45,018 | |

1,400 | | EMC Corp. * | | | 35,882 | |

5,000 | | Intel Corp. | | | 133,250 | |

1,185 | | International Business Machines Corp. | | | 231,762 | |

2,900 | | Qualcomm, Inc. | | | 161,472 | |

2,025 | | VeriFone Systems, Inc. * | | | 67,007 | |

| | | | | | |

| | | | | 1,159,517 | |

| | | | | | |

Energy Minerals - 4.6% | | | | |

800 | | Apache Corp. | | | 70,312 | |

2,200 | | Chevron Corp. | | | 232,100 | |

1,550 | | Marathon Petroleum Corp. | | | 69,626 | |

2,025 | | Occidental Petroleum Corp. | | | 173,684 | |

| | | | | | |

| | | | | 545,722 | |

| | | | | | |

Finance - 5.6% | | | | |

850 | | ACE, Ltd. | | | 63,010 | |

1,025 | | Ameriprise Financial, Inc. | | | 53,566 | |

875 | | Franklin Resources, Inc. | | | 97,116 | |

455 | | Goldman Sachs Group, Inc. | | | 43,616 | |

2,800 | | JPMorgan Chase & Co. | | | 100,044 | |

2,000 | | Marsh & McLennan Cos., Inc. | | | 64,460 | |

500 | | PartnerRe, Ltd. | | | 37,835 | |

| | | | | | |

Quantity | | Name of Issuer | | Fair Value ($) | |

800 | | Prudential Financial, Inc. | | | 38,744 | |

1,200 | | US Bancorp | | | 38,592 | |

3,700 | | Wells Fargo & Co. | | | 123,731 | |

| | | | | | |

| | | | | 660,714 | |

| | | | | | |

Health Services - 1.3% | | | | |

1,005 | | Express Scripts Holding Co. * | | | 56,109 | |

600 | | McKesson Corp. | | | 56,250 | |

650 | | UnitedHealth Group, Inc. | | | 38,025 | |

| | | | | | |

| | | | | 150,384 | |

| | | | | | |

Health Technology - 5.4% | | | | |

850 | | Allergan, Inc. | | | 78,684 | |

700 | | Baxter International, Inc. | | | 37,205 | |

1,375 | | Celgene Corp. * | | | 88,220 | |

1,400 | | Gilead Sciences, Inc. * | | | 71,792 | |

160 | | Intuitive Surgical, Inc. * | | | 88,606 | |

300 | | Johnson & Johnson | | | 20,268 | |

2,800 | | Pfizer, Inc. | | | 64,400 | |

2,000 | | St. Jude Medical, Inc. | | | 79,820 | |

1,200 | | Stryker Corp. | | | 66,120 | |

900 | | Thermo Fisher Scientific, Inc. | | | 46,719 | |

| | | | | | |

| | | | | 641,834 | |

| | | | | | |

Industrial Services - 1.1% | | | | |

1,425 | | Schlumberger, Ltd. | | | 92,497 | |

1,200 | | Seadrill, Ltd. | | | 42,624 | |

| | | | | | |

| | | | | 135,121 | |

| | | | | | |

Non-Energy Minerals - 0.5% | | | | |

650 | | Allegheny Technologies, Inc. | | | 20,728 | |

1,000 | | Freeport-McMoRan Copper & Gold, Inc. | | | 34,070 | |

| | | | | | |

| | | | | 54,798 | |

| | | | | | |

Process Industries - 1.7% | | | | |

1,650 | | Ecolab, Inc. | | | 113,074 | |

700 | | EI du Pont de Nemours & Co. | | | 35,399 | |

475 | | Praxair, Inc. | | | 51,647 | |

| | | | | | |

| | | | | 200,120 | |

| | | | | | |

Producer Manufacturing - 5.8% | | | | |

775 | | 3M Co. | | | 69,440 | |

525 | | Caterpillar, Inc. | | | 44,578 | |

1,675 | | Danaher Corp. | | | 87,234 | |

1,100 | | Deere & Co. | | | 88,957 | |

1,625 | | Emerson Electric Co. | | | 75,692 | |

525 | | Flowserve Corp. | | | 60,244 | |

3,400 | | General Electric Co. | | | 70,856 | |

950 | | Honeywell International, Inc. | | | 53,048 | |

325 | | Precision Castparts Corp. | | | 53,459 | |

1,100 | | United Technologies Corp. | | | 83,083 | |

| | | | | | |

| | | | | 686,591 | |

| | | | | | |

See accompanying notes to financial statements.

| | |

| 6 | | SIT MUTUAL FUNDS ANNUAL REPORT |

| | | | | | |

Quantity/

Principal

Amount ($) | | Name of Issuer | | Fair Value ($) | |

Retail Trade - 5.4% | | | | |

| 325 | | Amazon.com, Inc. * | | | 74,214 | |

| 400 | | Bed Bath & Beyond, Inc. * | | | 24,720 | |

| 550 | | Costco Wholesale Corp. | | | 52,250 | |

| 425 | | CVS Caremark Corp. | | | 19,860 | |

| 1,900 | | Dick’s Sporting Goods, Inc. | | | 91,200 | |

| 1,425 | | Home Depot, Inc. | | | 75,511 | |

| 2,100 | | Target Corp. | | | 122,199 | |

| 2,600 | | TJX Cos., Inc. | | | 111,618 | |

| 950 | | Wal-Mart Stores, Inc. | | | 66,234 | |

| | | | | | |

| | | | | 637,806 | |

| | | | | | |

Technology Services - 6.8% | | | | |

| 1,625 | | Accenture, PLC | | | 97,646 | |

| 900 | | Cognizant Technology Solutions Corp. * | | | 54,000 | |

| 255 | | Google, Inc. * | | | 147,918 | |

| 1,400 | | Informatica Corp. * | | | 59,304 | |

| 1,800 | | Microsoft Corp. | | | 55,062 | |

| 4,600 | | Oracle Corp. | | | 136,620 | |

| 140 | | priceline.com, Inc. * | | | 93,033 | |

| 325 | | Salesforce.com, Inc. * | | | 44,934 | |

| 825 | | Teradata Corp. * | | | 59,408 | |

| 650 | | VMware, Inc. * | | | 59,176 | |

| | | | | | |

| | | | | 807,101 | |

| | | | | | |

Transportation - 1.6% | | | | |

| 1,100 | | Expeditors International of Washington, Inc. | | | 42,625 | |

| 800 | | Union Pacific Corp. | | | 95,448 | |

| 625 | | United Parcel Service, Inc. | | | 49,225 | |

| | | | | | |

| | | | | 187,298 | |

| | | | | | |

Utilities - 0.8% | | | | |

| 600 | | Kinder Morgan, Inc. | | | 19,332 | |

| 1,800 | | Wisconsin Energy Corp. | | | 71,226 | |

| | | | | | |

| | | | | 90,558 | |

| | | | | | |

Total Common Stocks

(cost: $5,500,403) | | | 7,195,542 | |

| | | | | | |

Bonds - 32.9% | | | | |

Asset-Backed Securities - 4.2% | | | | |

| 27,930 | | Bayview Financial Acquisition Trust, 2006-D 1A2, 5.66%, 12/28/36 | | | 28,679 | |

| 92,760 | | Centex Home Equity, 2004-D AF4, 4.68%, 6/25/32 | | | 94,455 | |

| | Citifinancial Mortgage Securities, Inc.: | | | | |

| 29,407 | | 2004-1 AF3, 3.77%, 4/25/34 | | | 28,757 | |

| 72,284 | | 2003-1 AF5, 4.78%, 1/25/33 | | | 71,239 | |

| 46,534 | | Conseco Finance, 2001-D M1, 1.59%, 11/15/32 1 | | | 40,493 | |

| 47,973 | | First Franklin Mtge. Loan Asset-Backed Certs., 2005-FF2 M2, 0.68%, 3/25/35 1 | | | 45,198 | |

| 33,276 | | New Century Home Equity Loan Trust, 2005-A A4W, 5.04%, 8/25/35 | | | 30,107 | |

| | | | | | |

Principal

Amount ($) | | Name of Issuer | | Fair Value ($) | |

| 5,831 | | Origen Manufactured Housing, 2002-A A3, 6.17%, 5/15/32 1 | | | 5,981 | |

| 75,000 | | RAAC Series, 2005-SP2 1M1, 0.77%, 5/25/44 1 | | | 63,663 | |

| 50,000 | | Residential Asset Mortgage Products, Inc., 2005-RZ3 A3, 0.65%, 9/25/35 | | | 43,475 | |

| 19,766 | | Residential Asset Securities Corp., 2004 KS2 AI4, 4.18%, 12/25/31 1 | | | 19,385 | |

| 19,949 | | Residential Funding Mortgage Securities II, Inc., 2003-HI2 A6, 4.76%, 7/25/28 | | | 19,485 | |

| | | | | | |

| | | | | 490,917 | |

| | | | | | |

Collateralized Mortgage Obligations - 4.3% | |

| 23,822 | | Fannie Mae Grantor Trust, 2004-T3, 1A3, 7.00%, 2/25/44 | | | 27,738 | |

| | Fannie Mae REMIC: | | | | |

| 67,837 | | 2009-30 AG, 6.50%, 5/25/39 | | | 75,495 | |

| 37,303 | | 2010-108 AP, 7.00%, 9/25/40 | | | 42,159 | |

| | Freddie Mac REMIC: | | | | |

| 45,626 | | 7.00%, 11/15/29 | | | 50,796 | |

| 84,562 | | 7.50%, 6/15/30 | | | 99,662 | |

| 95,799 | | Government National Mortgage Association, 2005-74 HA, 7.50%, 9/16/35 | | | 109,946 | |

| 18,823 | | Irwin Home Equity Corp., 2005-1 M1, 5.42%, 6/25/35 | | | 17,883 | |

| 8,658 | | Master Asset Securitization Trust, 2003-4 CA1, 8.00%, 5/25/18 | | | 9,185 | |

| 59,895 | | Vendee Mortgage Trust, 2008-1 B, 7.99%, 3/15/25 1 | | | 71,998 | |

| | | | | | |

| | | | | 504,862 | |

| | | | | | |

Corporate Bonds - 8.5% | | | | |

| 50,000 | | Berkshire Hathaway Finance Corp., 5.40%, 5/15/18 | | | 59,050 | |

| 50,000 | | Burlington Resources, Inc., 9.13%, 10/1/21 | | | 70,313 | |

| 50,000 | | Chevron Corp., 4.95%, 3/3/19 | | | 60,349 | |

| 25,000 | | Coca-Cola Refreshments USA, Inc., 8.00%, 9/15/22 | | | 34,415 | |

| 25,000 | | Comerica Bank (Subordinated), 8.38%, 7/15/24 | | | 27,094 | |

| 88,475 | | Continental Airlines 2009-1 Pass Thru Certs., 9.00%, 7/8/16 | | | 101,304 | |

| 100,000 | | Genworth Financial, Inc., 7.70%, 6/15/20 | | | 98,656 | |

| 50,000 | | Google, Inc., 3.63%, 5/19/21 | | | 55,373 | |

| 50,000 | | Microsoft Corp., 4.00%, 2/8/21 | | | 57,602 | |

| 70,000 | | Northern States Power Co., 7.13%, 7/1/25 | | | 90,011 | |

| 48,551 | | Northwest Airlines 1999-2 A Pass Thru Tr, 7.58%, 3/1/19 | | | 52,799 | |

See accompanying notes to financial statements.

SCHEDULE OF INVESTMENTS

June 30, 2012

Sit Balanced Fund (Continued)

| | | | | | |

Principal

Amount ($) | | Name of Issuer | | Fair Value ($) | |

| 25,000 | | PartnerRe Finance B LLC, 5.50%, 6/1/20 | | | 26,374 | |

| 75,700 | | Procter & Gamble ESOP, 9.36%, 1/1/21 | | | 100,795 | |

| 50,000 | | South Carolina Electric & Gas Co., 6.50%, 11/1/18 | | | 62,805 | |

| 50,000 | | Statoil ASA, 3.15%, 1/23/22 | | | 52,290 | |

| 50,000 | | USB Capital XIII Trust (Subordinated), 6.63%, 12/15/39 | | | 50,408 | |

| | | | | | |

| | | | | 999,638 | |

| | | | | | |

Federal Home Loan Mortgage Corporation - 3.2% | |

| 79,102 | | 2.50%, 4/1/27 | | | 81,485 | |

| 39,608 | | 2.50%, 4/1/27 | | | 40,801 | |

| 32,144 | | 6.50%, 1/1/14 | | | 32,811 | |

| 46,241 | | 7.00%, 7/1/32 | | | 53,625 | |

| 30,314 | | 7.00%, 5/1/34 | | | 35,621 | |

| 41,259 | | 7.00%, 11/1/37 | | | 47,846 | |

| 18,605 | | 7.00%, 1/1/39 | | | 21,583 | |

| 31,237 | | 7.50%, 11/1/36 | | | 38,156 | |

| 13,099 | | 8.00%, 9/1/15 | | | 14,305 | |

| 15,246 | | 8.38%, 5/17/20 | | | 17,492 | |

| | | | | | |

| | | | | 383,725 | |

| | | | | | |

Federal National Mortgage Association - 5.3% | |

| 41,219 | | 6.50%, 5/1/40 | | | 46,538 | |

| 62,687 | | 6.63%, 11/1/30 | | | 72,599 | |

| 49,523 | | 6.63%, 1/1/31 | | | 57,354 | |

| 29,498 | | 7.00%, 12/1/32 | | | 34,838 | |

| 49,913 | | 7.00%, 3/1/33 | | | 55,868 | |

| 39,684 | | 7.00%, 12/1/36 | | | 46,799 | |

| 27,689 | | 7.00%, 11/1/38 | | | 32,213 | |

| 55,472 | | 7.23%, 12/1/30 | | | 64,515 | |

| 8,302 | | 7.50%, 6/1/32 | | | 10,180 | |

| 28,198 | | 7.50%, 4/1/33 | | | 34,532 | |

| 28,848 | | 7.50%, 11/1/33 | | | 35,235 | |

| 40,829 | | 7.50%, 1/1/34 | | | 49,885 | |

| 13,712 | | 7.50%, 4/1/38 | | | 16,770 | |

| 41,542 | | 8.00%, 2/1/31 | | | 51,462 | |

| 11,913 | | 8.41%, 7/15/26 | | | 12,909 | |

| 7,412 | | 9.50%, 5/1/27 | | | 9,072 | |

| 128 | | 9.75%, 1/15/13 | | | 128 | |

| 22 | | 10.25%, 6/15/13 | | | 22 | |

| | | | | | |

| | | | | 630,919 | |

| | | | | | |

Government National Mortgage Association - 2.5% | |

| 50,237 | | 6.63%, 4/20/31 | | | 59,297 | |

| 29,302 | | 7.00%, 12/15/24 | | | 34,740 | |

| 49,163 | | 7.23%, 12/20/30 | | | 57,437 | |

| 53,026 | | 8.00%, 7/15/24 | | | 63,011 | |

| 73,527 | | 8.38%, 3/15/31 | | | 77,257 | |

| | | | | | |

Principal

Amount ($)/

Quantity | | Name of Issuer | | Fair Value ($) | |

| 1,047 | | 9.50%, 9/20/18 | | | 1,209 | |

| | | | | | |

| | | | | 292,951 | |

| | | | | | |

Taxable Municipal Securities - 1.6% | |

| 100,000 | | Academica Charter Schools, 8.00%, 8/15/24 4 | | | 82,198 | |

| 50,000 | | Coalinga-Huron Joint Unified Sch. Dist. G.O., 5.43%, 8/1/21 | | | 52,380 | |

| 50,000 | | Texas St. Pub. Fin. Auth. Charter Sch. Fin. Rev., 8.75%, 8/15/27 | | | 52,232 | |

| | | | | | |

| | | | | 186,810 | |

| | | | | | |

U.S. Government / Federal Agency Securities - 2.7% | |

| | U.S. Treasury Strips: | | | | |

| 275,000 | | 3.09%, 8/15/20 6 | | | 245,856 | |

| 150,000 | | 4.21%, 2/15/36 6 | | | 78,061 | |

| | | | | | |

| | | | | 323,917 | |

| | | | | | |

Foreign Government Bonds - 0.6% | | | | |

| 50,000 | | Hydro-Quebec, 8.40%, 3/28/25 | | | 77,077 | |

| | | | | | |

Total Bonds

(cost: $3,711,067) | | | 3,890,816 | |

| | | | | | |

Closed-End Mutual Funds - 0.3% | | | | |

| 4,300 | | American Strategic Income Portfolio, Inc. II | | | 37,453 | |

| | | | | | |

Total Closed-End Mutual Funds

(cost: $39,673) | | | 37,453 | |

| | | | | | |

Total Investments in Securities - 94.1%

(cost: $9,251,143) | | | 11,123,811 | |

Other Assets and Liabilities, net - 5.9% | | | 697,663 | |

| | | | | | |

Total Net Assets - 100.0% | | $ | 11,821,474 | |

| | | | | | |

| * | Non-income producing security. |

| 1 | Variable rate security. Rate disclosed is as of June 30, 2012. |

| 4 | 144A Restricted Security. The total value of such security as of June 30, 2012 was $82,198 and represented 0.7% of net assets. This security has been determined to be liquid by the Adviser in accordance with guidelines established by the Board of Directors. |

| 6 | Zero coupon security. Rate disclosed is the effective yield on purchase date. |

Numeric footnotes not disclosed are not applicable to this Schedule of Investments.

ADR — American Depositary Receipt

PLC — Public Limited Company

See accompanying notes to financial statements.

| | |

| 8 | | SIT MUTUAL FUNDS ANNUAL REPORT |

A summary of the levels for the Fund’s investments as of June 30, 2012 is as follows (see Note 2—significant accounting policies in the notes to financial statements):

| | | | | | | | | | | | | | | | |

| | | Investment in Securities | |

| | | Level 1

Quoted

Price ($) | | | Level 2

Other significant

observable inputs ($) | | | Level 3

Significant

unobservable inputs ($) | | | Total ($) | |

Common Stocks ** | | | 7,195,542 | | | | — | | | | — | | | | 7,195,542 | |

Asset-Backed Securities | | | — | | | | 490,917 | | | | — | | | | 490,917 | |

Collateralized Mortgage Obligations | | | — | | | | 504,862 | | | | — | | | | 504,862 | |

Corporate Bonds | | | — | | | | 999,638 | | | | — | | | | 999,638 | |

Federal Home Loan Mortgage Corporation | | | — | | | | 383,725 | | | | — | | | | 383,725 | |

Federal National Mortgage Association | | | — | | | | 630,919 | | | | — | | | | 630,919 | |

Government National Mortgage Association | | | — | | | | 292,951 | | | | — | | | | 292,951 | |

Taxable Municipal Securities | | | — | | | | 186,810 | | | | — | | | | 186,810 | |

U.S. Government / Federal Agency Securities | | | — | | | | 323,917 | | | | — | | | | 323,917 | |

Foreign Government Bonds | | | — | | | | 77,077 | | | | — | | | | 77,077 | |

Closed-End Mutual Funds | | | 37,453 | | | | — | | | | — | | | | 37,453 | |

| | | | | | | | | | | | | | | | |

Total: | | | 7,232,995 | | | | 3,890,816 | | | | — | | | | 11,123,811 | |

| | | | | | | | | | | | | | | | |

| ** | For equity securities categorized in a single level, refer to the Schedule of Investments for further breakdown. |

For the reporting period, there were no transfers between levels 1, 2 and 3.

See accompanying notes to financial statements.

Sit Dividend Growth Fund—Class I and Class S

OBJECTIVE & STRATEGY

The objective of the Dividend Growth Fund is to provide current income that exceeds the dividend yield of the S&P 500® Index and that grows over a period of years. Secondarily, the Fund seeks long-term capital appreciation.

The Fund seeks to achieve its objectives by investing, under normal market conditions, at least 80% of its net assets in dividend-paying common stocks. The Fund may invest the balance of its assets in preferred stocks, convertible bonds, and U.S. Treasury securities.

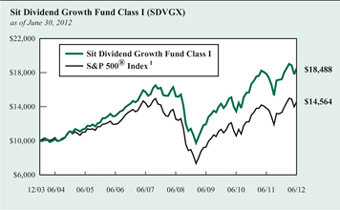

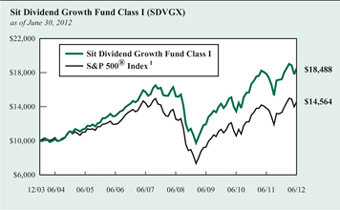

The Sit Dividend Growth Fund Class I posted a +3.76% return over the last twelve months, compared to the +5.45% return for the S&P 500® Index.

U.S. equities posted modest gains over the past twelve months, as corporate profits remained relatively strong despite ongoing turbulence in the global economy. The European sovereign debt crisis has clearly taken center stage, with a moderation in growth in developing economies, particularly China, causing additional concern. It continues to be our view, however, that the global economy will “muddle through” and growth will continue at a moderate pace. Against this backdrop, along with our expectation that market volatility will persist in the coming months, we believe it is prudent to maintain a diversified portfolio with a “high-quality” bias, as measured by historical dividend growth, free cash flow generation, earnings stability, and strong balance sheets. Given the unprecedented strength in corporate balance sheets and the fact that payout ratios (i.e., the portion of corporate earnings paid to shareholders as dividends) are at an all-time low, our strategy has focused on identifying companies with strong financial characteristics and business fundamentals that will allow for increased payouts over time. In this regard, it has been encouraging to see corporations respond to investors’ desire for higher dividends. For example, over the past twelve months, 80 companies within the Fund (out of 90 current holdings) have increased their dividends, with a median increase of +12%.

Relative to the S&P 500® Index, performance over the past year was negatively impacted by stock selection in the electronic technology and health technology sectors, while underweighting the strong-performing consumer services sector also detracted from relative returns. It should be noted that the underweight in shares of Apple (which rose +74% over the period) accounted for the majority of the performance differential of the Fund relative to the S&P 500® Index.

HYPOTHETICAL GROWTH OF $10,000

The chart above illustrates the total value of a hypothetical $10,000 investment in the Fund over the past 10 years (or for the life of the Fund if shorter) as compared to the performance of the S&P 500® Index. Past performance does not guarantee future results. Returns include the reinvestment of distributions. The chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| 1 | S&P 500® Index is an unmanaged capitalization-weighted index that measures the performance of 500 widely held common stocks of large-cap companies. It is not possible to invest directly in an index. This is the Fund’s primary index. |

While we established a position in Apple just prior to the company’s announcement in March to initiate a dividend later this year, it provided only partial offset, given the exceptional performance of the shares throughout the 12-month period.

Our research effort is highly focused on companies that will deliver strong earnings and dividend growth over the longer term.

Roger J. Sit

Kent L. Johnson

Michael J. Stellmacher

Portfolio Managers

| | |

| 10 | | SIT MUTUAL FUNDS ANNUAL REPORT |

COMPARATIVE RATES OF RETURNS

as of June 30, 2012

| | | | | | | | | | | | |

| | | Sit Dividend

Growth Fund | | | S&P 500®

Index 1 | |

| | | Class I | | | Class S | | |

One Year | | | 3.76 | % | | | 3.53 | % | | | 5.45 | % |

Five Year | | | 3.34 | | | | 3.09 | | | | 0.22 | |

Since Inception -

Class I (12/31/03) | | | 7.49 | | | | n/a | | | | 4.52 | |

Since Inception -

Class S (3/31/06) | | | n/a | | | | 5.68 | | | | 2.98 | |

Performance figures are historical and do not guarantee future results. Investment returns and principal value will vary, and you may have a gain or loss when you sell shares. Current performance may be lower or higher than the performance data quoted. Contact the Fund for performance data current to the most recent month-end. Returns include changes in share price as well as reinvestment of all dividends and capital gains. Returns do not reflect the deduction of the 2% redemption fee imposed if shares are redeemed or exchanged within 30 calendar days from their date of purchase. If imposed, the fee would reduce the performance quoted. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Management fees and administrative expenses are included in the Fund’s performance. Returns for periods greater than one year are compounded average annual rates of return.

| 1 | S&P 500® Index is an unmanaged capitalization-weighted index that measures the performance of 500 widely held common stocks of large-cap companies. It is not possible to invest directly in an index. |

PORTFOLIO SUMMARY

| | | | |

Class I: | | | | |

Net Asset Value 6/30/12: | | $ | 14.10 Per Share | |

Net Asset Value 6/30/11: | | $ | 13.91 Per Share | |

Total Net Assets: | | $ | 619.7 Million | |

Class S: | | | | |

Net Asset Value 6/30/12: | | $ | 14.06 Per Share | |

Net Asset Value 6/30/11: | | $ | 13.87 Per Share | |

Total Net Assets: | | $ | 100.9 Million | |

| |

Weighted Average Market Cap: | | $ | 79.4 Billion | |

TOP 10 HOLDINGS

| 2. | International Business Machines Corp. |

| 3. | Verizon Communications, Inc. |

| 4. | Occidental Petroleum Corp. |

Based on total net assets as of June 30, 2012. Subject to change.

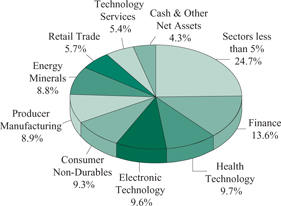

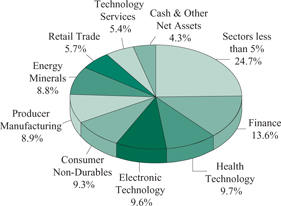

FUND DIVERSIFICATION

Based on total net assets as of June 30, 2012. Subject to change.

SCHEDULE OF INVESTMENTS

June 30, 2012

Sit Dividend Growth Fund

| | | | | | |

Quantity | | Name of Issuer | | Fair Value ($) | |

Common Stocks - 93.9% | |

Communications - 3.5% | |

| 246,900 | | Rogers Communications, Inc. | | | 8,940,249 | |

| 371,300 | | Verizon Communications, Inc. | | | 16,500,572 | |

| | | | | | |

| | | | | 25,440,821 | |

| | | | | | |

Consumer Durables - 3.4% | |

| 160,500 | | Snap-On, Inc. | | | 9,991,125 | |

| 126,400 | | Stanley Black & Decker, Inc. | | | 8,135,104 | |

| 120,200 | | Tupperware Brands Corp. | | | 6,582,152 | |

| | | | | | |

| | | | | 24,708,381 | |

| | | | | | |

Consumer Non-Durables - 9.3% | |

| 68,400 | | Coach, Inc. | | | 4,000,032 | |

| 48,815 | | Colgate-Palmolive Co. | | | 5,081,642 | |

| 67,500 | | Diageo, PLC, ADR | | | 6,957,225 | |

| 216,300 | | General Mills, Inc. | | | 8,336,202 | |

| 59,900 | | NIKE, Inc. | | | 5,258,022 | |

| 200,800 | | PepsiCo, Inc. | | | 14,188,528 | |

| 110,800 | | Philip Morris International, Inc. | | | 9,668,408 | |

| 224,000 | | Procter & Gamble Co. | | | 13,720,000 | |

| | | | | | |

| | | | | 67,210,059 | |

| | | | | | |

Consumer Services - 2.1% | |

| 107,200 | | McDonald’s Corp. | | | 9,490,416 | |

| 275,400 | | Pearson, PLC, ADR | | | 5,466,690 | |

| | | | | | |

| | | | | 14,957,106 | |

| | | | | | |

Electronic Technology - 9.6% | |

| 12,225 | | Apple, Inc. * | | | 7,139,400 | |

| 530,900 | | Applied Materials, Inc. | | | 6,084,114 | |

| 176,000 | | Broadcom Corp. * | | | 5,948,800 | |

| 406,400 | | Intel Corp. | | | 10,830,560 | |

| 96,400 | | International Business Machines Corp. | | | 18,853,912 | |

| 163,300 | | Linear Technology Corp. | | | 5,116,189 | |

| 228,600 | | Qualcomm, Inc. | | | 12,728,448 | |

| 89,000 | | TE Connectivity, Ltd. | | | 2,839,989 | |

| | | | | | |

| | | | | 69,541,412 | |

| | | | | | |

Energy Minerals - 8.8% | |

| 41,000 | | Apache Corp. | | | 3,603,490 | |

| 242,700 | | Chevron Corp. | | | 25,604,850 | |

| 63,450 | | EQT Corp. | | | 3,402,824 | |

| 119,800 | | Marathon Petroleum Corp. | | | 5,381,416 | |

| 180,700 | | Occidental Petroleum Corp. | | | 15,498,639 | |

| 141,150 | | Royal Dutch Shell, PLC, ADR | | | 9,870,620 | |

| | | | | | |

| | | | | 63,361,839 | |

| | | | | | |

Finance - 13.6% | |

| 128,300 | | ACE, Ltd. | | | 9,510,879 | |

| 140,700 | | Ameriprise Financial, Inc. | | | 7,352,982 | |

| 63,600 | | Franklin Resources, Inc. | | | 7,058,964 | |

| 334,600 | | JPMorgan Chase & Co. | | | 11,955,258 | |

| 56,500 | | M&T Bank Corp. | | | 4,665,205 | |

| | | | | | |

Quantity | | Name of Issuer | | Fair Value ($) | |

| 311,500 | | Marsh & McLennan Cos., Inc. | | | 10,039,645 | |

| 117,000 | | PartnerRe, Ltd. | | | 8,853,390 | |

| 327,800 | | PennantPark Investment Corp. | | | 3,392,730 | |

| 41,300 | | Prudential Financial, Inc. | | | 2,000,159 | |

| 107,200 | | Travelers Cos., Inc. | | | 6,843,648 | |

| 259,600 | | US Bancorp | | | 8,348,736 | |

| 267,100 | | Validus Holdings, Ltd. | | | 8,555,213 | |

| 283,400 | | Wells Fargo & Co. | | | 9,476,896 | |

| | | | | | |

| | | | | 98,053,705 | |

| | | | | | |

Health Services - 3.1% | |

| 202,500 | | Cardinal Health, Inc. | | | 8,505,000 | |

| 81,300 | | McKesson Corp. | | | 7,621,875 | |

| 109,800 | | UnitedHealth Group, Inc. | | | 6,423,300 | |

| | | | | | |

| | | | | 22,550,175 | |

| | | | | | |

Health Technology - 9.7% | |

| 60,900 | | Abbott Laboratories | | | 3,926,223 | |

| 160,800 | | Baxter International, Inc. | | | 8,546,520 | |

| 164,600 | | Covidien, PLC | | | 8,806,100 | |

| 177,400 | | Johnson & Johnson | | | 11,985,144 | |

| 241,300 | | Merck & Co., Inc. | | | 10,074,275 | |

| 546,000 | | Pfizer, Inc. | | | 12,558,000 | |

| 158,200 | | St. Jude Medical, Inc. | | | 6,313,762 | |

| 142,900 | | Stryker Corp. | | | 7,873,790 | |

| | | | | | |

| | | | | 70,083,814 | |

| | | | | | |

Industrial Services - 2.3% | |

| 94,200 | | National Oilwell Varco, Inc. | | | 6,070,248 | |

| 89,502 | | Oceaneering International, Inc. | | | 4,283,566 | |

| 167,400 | | Seadrill, Ltd. | | | 5,946,048 | |

| | | | | | |

| | | | | 16,299,862 | |

| | | | | | |

Non-Energy Minerals - 0.7% | |

| 138,800 | | Freeport-McMoRan Copper & Gold, Inc. | | | 4,728,916 | |

| | | | | | |

Process Industries - 1.4% | |

| 198,400 | | EI du Pont de Nemours & Co. | | | 10,033,088 | |

| | | | | | |

Producer Manufacturing - 8.9% | |

| 55,000 | | 3M Co. | | | 4,928,000 | |

| 123,900 | | Autoliv, Inc. | | | 6,772,374 | |

| 59,800 | | Cooper Industries, PLC | | | 4,077,164 | |

| 64,000 | | Deere & Co. | | | 5,175,680 | |

| 187,500 | | Emerson Electric Co. | | | 8,733,750 | |

| 349,100 | | General Electric Co. | | | 7,275,244 | |

| 181,860 | | Honeywell International, Inc. | | | 10,155,062 | |

| 183,000 | | Tyco International, Ltd. | | | 9,671,550 | |

| 96,600 | | United Technologies Corp. | | | 7,296,198 | |

| | | | | | |

| | | | | 64,085,022 | |

| | | | | | |

Retail Trade - 5.7% | |

| 118,700 | | Cato Corp. | | | 3,615,602 | |

| 163,000 | | CVS Caremark Corp. | | | 7,616,990 | |

| 119,900 | | Home Depot, Inc. | | | 6,353,501 | |

See accompanying notes to financial statements.

| | |

| 12 | | SIT MUTUAL FUNDS ANNUAL REPORT |

| | | | | | |

Quantity | | Name of Issuer | | Fair Value ($) | |

| 160,300 | | Target Corp. | | | 9,327,857 | |

| 133,100 | | TJX Cos., Inc. | | | 5,713,983 | |

| 120,500 | | Wal-Mart Stores, Inc. | | | 8,401,260 | |

| | | | | | |

| | | | | 41,029,193 | |

| | | | | | |

Technology Services - 5.4% | |

| 173,000 | | Accenture, PLC | | | 10,395,570 | |

| 98,150 | | Automatic Data Processing, Inc. | | | 5,463,029 | |

| 431,400 | | Microsoft Corp. | | | 13,196,526 | |

| 194,900 | | Oracle Corp. | | | 5,788,530 | |

| 62,800 | | Syntel, Inc. | | | 3,811,960 | |

| | | | | | |

| | | | | 38,655,615 | |

| | | | | | |

Transportation - 2.6% | |

| 73,600 | | Expeditors International of Washington, Inc. | | | 2,852,000 | |

| 188,600 | | Knight Transportation, Inc. | | | 3,015,714 | |

| 59,500 | | Union Pacific Corp. | | | 7,098,945 | |

| 77,900 | | United Parcel Service, Inc. | | | 6,135,404 | |

| | | | | | |

| | | | | 19,102,063 | |

| | | | | | |

Utilities - 3.8% | |

| 288,300 | | Kinder Morgan, Inc. | | | 9,289,026 | |

| 110,400 | | NextEra Energy, Inc. | | | 7,596,624 | |

| 137,600 | | UGI Corp. | | | 4,049,568 | |

| | | | | | |

Quantity | | Name of Issuer | | Fair Value ($) | |

| 158,300 | | Wisconsin Energy Corp. | | | 6,263,931 | |

| | | | | | |

| | | | | 27,199,149 | |

| | | | | | |

Total Common Stocks

(cost: $631,226,186) | | | 677,040,220 | |

| | | | | | |

Closed-End Mutual Funds - 1.8% | |

| 285,500 | | Kayne Anderson MLP Investment Co. | | | 8,784,835 | |

| 154,900 | | Tortoise Energy Capital Corp. | | | 4,030,498 | |

| | | | | | |

Total Closed-End Mutual Funds

(cost: $12,216,697) | | | 12,815,333 | |

| | | | | | |

Total Investments in Securities - 95.7%

(cost: $643,442,883) | | | 689,855,553 | |

Other Assets and Liabilities, net - 4.3% | | | 30,689,226 | |

| | | | | | |

Total Net Assets - 100.0% | | $ | 720,544,779 | |

| | | | | | |

| * | Non-income producing security. |

Numeric footnotes not disclosed are not applicable to this Schedule of Investments.

ADR — American Depositary Receipt

PLC — Public Limited Company

A summary of the levels for the Fund’s investments as of June 30, 2012 is as follows (see Note 2—significant accounting policies in the notes to financial statements):

| | | | | | | | | | | | | | | | |

| | | Investment in Securities | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | | |

| | | Quoted

Price ($) | | | Other significant

observable inputs ($) | | | Significant

unobservable inputs ($) | | | Total ($) | |

Common Stocks ** | | | 677,040,220 | | | | — | | | | — | | | | 677,040,220 | |

Closed-End Mutual Funds | | | 12,815,333 | | | | — | | | | — | | | | 12,815,333 | |

| | | | | | | | | | | | | | | | |

Total: | | | 689,855,553 | | | | — | | | | — | | | | 689,855,553 | |

| | | | | | | | | | | | | | | | |

| ** | For equity securities categorized in a single level, refer to the Schedule of Investments for further breakdown. |

For the reporting period, there were no transfers between levels 1, 2 and 3.

See accompanying notes to financial statements.

Sit Global Dividend Growth Fund - Class I and Class S

OBJECTIVE & STRATEGY

The objective of the Global Dividend Growth Fund is to provide current income that exceeds the dividend yield of a composite index (comprised of 60% S&P 500® Index and 40% MSCI EAFE Index) and that grows over a period of years. Secondarily, the Fund seeks long-term capital appreciation.

The Fund seeks to achieve its objectives by investing, under normal market conditions, at least 80% of its net assets in dividend-paying common stocks issued by U.S. and foreign companies. The Fund may invest the balance of its assets in preferred stocks, convertible bonds, and U.S. Treasury securities.

The Sit Global Dividend Growth Fund Class I slightly outperformed the Composite Index (60% S&P® 500 Index and 40% MSCI EAFE Index) for the last twelve months, falling -2.44% versus a decline of -2.61% for the Index. The markets may have only been modestly down for the last twelve months, but the returns fail to show the volatility that occurred during that time frame. There were several reasons for this volatility. First, equity markets’ concerns continued to escalate in response to the still-unresolved European debt crisis. Second, growth is moderating in the emerging markets, particularly that of Asia and Latin America. Third, growth in most developed nations also showed a modest deceleration in growth. Last, while corporate earnings in general have been relatively strong, expectations are coming down.

Relative to the Composite Index, the financial sector was the top contributing sector, due mostly to the good stock selection on underweighting of the banking and diversified financial industries and good stock selection in the insurance industry. The defensive nature of the holdings in the financial sector materially contributed to performance. Conversely, the less-than-stellar stock selection in the more cyclical industrial sector adversely impacted performance. Additionally, the absence/underweight of Apple Corp. in the Fund resulted in the stock being the largest single detractor to the Fund over the past twelve months. While we purchased a position in Apple just before the company’s announcement to initiate a dividend, it only partially offset the exceptional performance of the shares over the aforementioned timeframe.

Regionally, the euro area meaningfully contributed to the outperformance over the last twelve months. The underweight, good stock selection and currency impact were all positive. The Fund’s overweight position in the UK, along with the defensive nature of the UK holdings, contributed nicely to the relative performance. Asia ex-Japan was the largest detracting region, as most China-related securities lagged the overall market for the past twelve months. The decision to underweight this region only partially offset the negative stock selection.

In general, the Fund holds primarily globally dominant, large cap stocks. The Fund is broadly diversified on both a regional and sector basis and consists of high-quality, dividend-paying stocks. These high quality measures include: historical dividend growth, free cash flow yield, earnings stability, return on invested capital, free cash

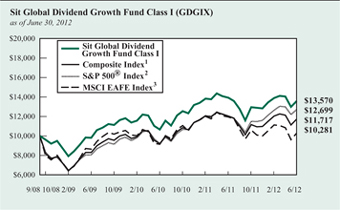

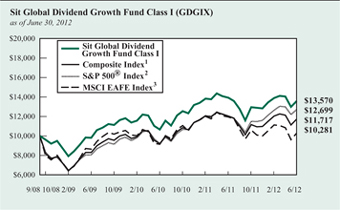

HYPOTHETICAL GROWTH OF $10,000

The chart above illustrates the total value of a hypothetical $10,000 investment in the Fund over the past 10 years (or for the life of the Fund if shorter) as compared to the performance of the Composite Index, S&P 500® Index and MSCI EAFE Index. Past performance does not guarantee future results. Returns include the reinvestment of distributions. The chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| 1 | A composite index comprised of 60% S&P 500® Index and 40% MSCI EAFE Index. This is the Fund’s primary index. |

| 2 | S&P 500® Index is an unmanaged capitalization-weighted index that measures the performance of 500 widely held common stocks of large-cap companies. It is not possible to invest directly in an index. |

| 3 | MSCI EAFE Index (Europe Australasia, Far East) is an unmanaged free float-adjusted market capitalization index that measures the equity market performance of developed markets, excluding the US & Canada. |

flow margins, and debt levels. Importantly, despite this high quality bias, the portfolio is attractively valued compared to the broad market index. We believe the focus on companies with strong operational and financial characteristics will generate solid and predictable earnings along with growing dividends. Over the past twelve months, dividend increases continue with nearly 95% (75 out of 79) of the companies within the Fund increasing their dividends over the period. The average dividend increase was 16.3%. We believe these stocks will continue to reward shareholders over the longer term.

| | |

Roger J. Sit | | Michael J. Stellmacher |

Kent L. Johnson | | Tasha M. Murdoff |

Raymond E. Sit | | |

Portfolio Managers | | |

| | |

| 14 | | SIT MUTUAL FUNDS ANNUAL REPORT |

COMPARATIVE RATES OF RETURNS

as of June 30, 2012

| | | | | | | | | | | | | | | | | | | | |

| | | Sit Global

Dividend

Growth Fund | | | Composite

Index 1 | | | S&P 500®

Index 2 | | | MSCI

EAFE

Index 3 | |

| | | Class I | | | Class S | | | | |

| One Year | | | -2.44 | % | | | -2.60 | % | | | -2.61 | % | | | 5.45 | % | | | -13.83 | % |

| Since Inception (9/30/08) | | | 8.48 | | | | 8.22 | | | | 4.32 | | | | 6.58 | | | | 0.74 | |

Performance figures are historical and do not guarantee future results. Investment returns and principal value will vary, and you may have a gain or loss when you sell shares. Current performance may be lower or higher than the performance data quoted. Contact the Fund for performance data current to the most recent month-end. Returns include changes in share price as well as reinvestment of all dividends and capital gains. Returns do not reflect the deduction of the 2% redemption fee imposed if shares are redeemed or exchanged within 30 calendar days from their date of purchase. If imposed, the fee would reduce the performance quoted. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Management fees and administrative expenses are included in the Fund’s performance. Returns for periods greater than one year are compounded average annual rates of return.

| 1 | A composite index comprised of 60% S&P 500® Index and 40% MSCI EAFE Index. |

| 2 | S&P 500® Index is an unmanaged capitalization-weighted index that measures the performance of 500 widely held common stocks of large-cap companies. It is not possible to invest directly in an index. |

| 3 | MSCI EAFE Index (Europe Australasia, Far East) is an unmanaged free float-adjusted market capitalization index that measures the equity market performance of developed markets, excluding the US & Canada. |

PORTFOLIO SUMMARY

| | | | |

Class I: | | | | |

Net Asset Value 6/30/12: | | $ | 12.55 Per Share | |

Net Asset Value 6/30/11: | | $ | 13.26 Per Share | |

Total Net Assets: | | $ | 10.4 Million | |

Class S: | | | | |

Net Asset Value 6/30/12: | | $ | 12.54 Per Share | |

Net Asset Value 6/30/11: | | $ | 13.24 Per Share | |

Total Net Assets: | | $ | 2.6 Million | |

| |

Weighted Average Market Cap: | | $ | 81.9 Billion | |

TOP 10 HOLDINGS

| 3. | Royal Dutch Shell, PLC, ADR |

| 4. | Rogers Communications, Inc. |

| 5. | GlaxoSmithKline, PLC, ADR |

| 6. | International Business Machines Corp. |

| 7. | Occidental Petroleum Corp. |

| 10. | Verizon Communications, Inc. |

Based on total net assets as of June 30, 2012. Subject to change.

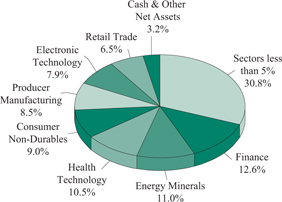

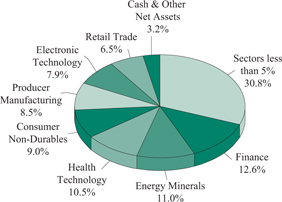

FUND DIVERSIFICATION

Based on total net assets as of June 30, 2012. Subject to change.

SCHEDULE OF INVESTMENTS

June 30, 2012

Sit Global Dividend Growth Fund

| | | | | | |

Quantity | | Name of Issuer | | Fair Value ($) | |

Common Stocks - 95.6% | | | | |

Asia - 5.8% | | | | |

Australia - 3.7% | |

| 3,650 | | BHP Billiton, Ltd., ADR | | | 238,345 | |

| 1,800 | | Rio Tinto, PLC, ADR | | | 86,058 | |

| 1,500 | | Westpac Banking Corp., ADR | | | 163,215 | |

| | | | | | |

| | | | | 487,618 | |

| | | | | | |

China/Hong Kong - 1.2% | |

| 3,475 | | HSBC Holdings, PLC, ADR | | | 153,352 | |

| | | | | | |

Japan - 0.9% | |

| 5,100 | | Komatsu, Ltd. | | | 121,744 | |

| | | | | | |

Europe - 28.3% | |

France - 0.9% | |

| 1,775 | | Schlumberger, Ltd. | | | 115,215 | |

| | | | | | |

Germany - 1.3% | |

| 1,209 | | Muenchener Rueckver | | | 170,595 | |

| | | | | | |

Ireland - 3.0% | |

| 2,700 | | Accenture, PLC | | | 162,243 | |

| 4,250 | | Covidien, PLC | | | 227,375 | |

| | | | | | |

| | | | | 389,618 | |

| | | | | | |

Norway - 1.6% | |

| 6,000 | | Seadrill, Ltd. | | | 213,120 | |

| | | | | | |

Spain - 1.3% | |

| 1,637 | | Inditex SA | | | 169,209 | |

| | | | | | |

Sweden - 0.9% | |

| 2,200 | | Autoliv, Inc. | | | 120,252 | |

| | | | | | |

Switzerland - 5.4% | |

| 1,900 | | ACE, Ltd. | | | 140,847 | |

| 600 | | Kuehne & Nagel International | | | 63,567 | |

| 3,865 | | Nestle SA | | | 230,656 | |

| 142 | | SGS SA | | | 266,246 | |

| | | | | | |

| | | | | 701,316 | |

| | | | | | |

United Kingdom - 13.9% | |

| 2,515 | | British American Tobacco, PLC | | | 127,862 | |

| 7,480 | | Burberry Group, PLC | | | 155,739 | |

| 73,025 | | Centrica, PLC | | | 365,121 | |

| 1,800 | | Diageo, PLC, ADR | | | 185,526 | |

| 6,300 | | GlaxoSmithKline, PLC, ADR | | | 287,091 | |

| 13,600 | | Pearson, PLC, ADR | | | 269,960 | |

| 4,775 | | Royal Dutch Shell, PLC, ADR | | | 333,916 | |

| 16,400 | | Tesco, PLC | | | 79,701 | |

| | | | | | |

| | | | | 1,804,916 | |

| | | | | | |

North America - 61.5% | |

Bermuda - 0.9% | |

| 1,550 | | PartnerRe, Ltd. | | | 117,288 | |

| | | | | | |

Canada - 2.5% | |

| 8,900 | | Rogers Communications, Inc. | | | 322,269 | |

| | | | | | |

| | | | | | |

Quantity | | Name of Issuer | | Fair Value ($) | |

United States - 58.1% | | | | |

| 1,050 | | 3M Co. | | | 94,080 | |

| 265 | | Apple, Inc. * | | | 154,760 | |

| 4,900 | | Applied Materials, Inc. | | | 56,154 | |

| 1,750 | | Automatic Data Processing, Inc. | | | 97,405 | |

| 3,200 | | Baxter International, Inc. | | | 170,080 | |

| 1,800 | | Broadcom Corp. * | | | 60,840 | |

| 3,800 | | Cardinal Health, Inc. | | | 159,600 | |

| 1,775 | | Caterpillar, Inc. | | | 150,715 | |

| 3,300 | | Chevron Corp. | | | 348,150 | |

| 1,900 | | CVS Caremark Corp. | | | 88,787 | |

| 2,100 | | Deere & Co. | | | 169,827 | |

| 3,800 | | EI du Pont de Nemours & Co. | | | 192,166 | |

| 3,600 | | Emerson Electric Co. | | | 167,688 | |

| 950 | | Franklin Resources, Inc. | | | 105,440 | |

| 2,975 | | Freeport-McMoRan Copper & Gold, Inc. | | | 101,358 | |

| 3,250 | | General Mills, Inc. | | | 125,255 | |

| 600 | | Goldman Sachs Group, Inc. | | | 57,516 | |

| 2,500 | | Home Depot, Inc. | | | 132,475 | |

| 2,575 | | Honeywell International, Inc. | | | 143,788 | |

| 7,500 | | Intel Corp. | | | 199,875 | |

| 1,400 | | International Business Machines Corp. | | | 273,812 | |

| 2,750 | | Johnson & Johnson | | | 185,790 | |

| 4,700 | | JPMorgan Chase & Co. | | | 167,931 | |

| 5,350 | | Kinder Morgan, Inc. | | | 172,377 | |

| 2,900 | | Linear Technology Corp. | | | 90,857 | |

| 2,650 | | Marathon Petroleum Corp. | | | 119,038 | |

| 4,100 | | Marsh & McLennan Cos., Inc. | | | 132,143 | |

| 2,450 | | McDonald’s Corp. | | | 216,898 | |

| 3,825 | | Merck & Co., Inc. | | | 159,694 | |

| 6,300 | | Microsoft Corp. | | | 192,717 | |

| 3,175 | | Occidental Petroleum Corp. | | | 272,320 | |

| 2,100 | | Oracle Corp. | | | 62,370 | |

| 2,500 | | PepsiCo, Inc. | | | 176,650 | |

| 10,000 | | Pfizer, Inc. | | | 230,000 | |

| 2,325 | | Philip Morris International, Inc. | | | 202,880 | |

| 2,000 | | Procter & Gamble Co. | | | 122,500 | |

| 3,500 | | Qualcomm, Inc. | | | 194,880 | |

| 2,200 | | Snap-On, Inc. | | | 136,950 | |

| 2,550 | | St. Jude Medical, Inc. | | | 101,770 | |

| 1,575 | | Stanley Black & Decker, Inc. | | | 101,367 | |

| 3,300 | | Target Corp. | | | 192,027 | |

| 3,000 | | TJX Cos., Inc. | | | 128,790 | |

| 1,600 | | Travelers Cos., Inc. | | | 102,144 | |

| 2,250 | | Tupperware Brands Corp. | | | 123,210 | |

| 775 | | Union Pacific Corp. | | | 92,465 | |

| 700 | | United Parcel Service, Inc. | | | 55,132 | |

| 1,900 | | United Technologies Corp. | | | 143,507 | |

| 6,600 | | US Bancorp | | | 212,256 | |

| 5,500 | | Verizon Communications, Inc. | | | 244,420 | |

See accompanying notes to financial statements.

| | |

| 16 | | SIT MUTUAL FUNDS ANNUAL REPORT |

| | | | | | |

Quantity | | Name of Issuer | | Fair Value ($) | |

| 900 | | Wal-Mart Stores, Inc. | | | 62,748 | |

| 3,700 | | Wells Fargo & Co. | | | 123,728 | |

| | | | | | |

| | | | | 7,569,330 | |

| | | | | | |

Total Common Stocks

(cost: $11,565,091) | | | 12,455,842 | |

| | | | | | |

Closed-End Mutual Funds - 1.2% | | | | |

| 2,875 | | Kayne Anderson MLP Investment Co. | | | 88,464 | |

| 2,500 | | Tortoise Energy Capital Corp. | | | 65,050 | |

| | | | | | |

Total Closed-End Mutual Funds

(cost: $132,730) | | | 153,514 | |

| | | | | | |

Total Investments in Securities - 96.8%

(cost: $11,697,821) | | | 12,609,356 | |

Other Assets and Liabilities, net - 3.2% | | | 420,031 | |

| | | | | | |

Total Net Assets - 100.0% | | $ | 13,029,387 | |

| | | | | | |

| * | Non-income producing security. |

Numeric footnotes not disclosed are not applicable to this Schedule of Investments.

ADR — American Depositary Receipt

MLP — Master Limited Partnership

PLC — Public Limited Company

See accompanying notes to financial statements.

SCHEDULE OF INVESTMENTS

June 30, 2012

Sit Global Dividend Growth Fund (Continued)

A summary of the levels for the Fund’s investments as of June 30, 2012 is as follows (see Note 2—significant accounting policies in the notes to financial statements):

| | | | | | | | | | | | | | | | |

| | | Investment in Securities | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | | |

| | | Quoted | | | Other significant | | | Significant | | | | |

| | | Price ($) | | | observable inputs ($) | | | unobservable inputs ($) | | | Total ($) | |

Common Stocks | | | | | | | | | | | | | | | | |

Australia | | | 487,618 | | | | — | | | | — | | | | 487,618 | |

Bermuda | | | 117,288 | | | | — | | | | — | | | | 117,288 | |

Canada | | | 322,269 | | | | — | | | | — | | | | 322,269 | |

China/Hong Kong | | | 153,352 | | | | — | | | | — | | | | 153,352 | |

France | | | 115,215 | | | | — | | | | — | | | | 115,215 | |

Germany | | | — | | | | 170,595 | | | | — | | | | 170,595 | |

Ireland | | | 389,618 | | | | — | | | | — | | | | 389,618 | |

Japan | | | — | | | | 121,744 | | | | — | | | | 121,744 | |

Norway | | | 213,120 | | | | — | | | | — | | | | 213,120 | |

Spain | | | — | | | | 169,209 | | | | — | | | | 169,209 | |

Sweden | | | 120,252 | | | | — | | | | — | | | | 120,252 | |

Switzerland | | | 140,847 | | | | 560,469 | | | | — | | | | 701,316 | |

United Kingdom | | | 1,076,493 | | | | 728,423 | | | | — | | | | 1,804,916 | |

United States | | | 7,569,330 | | | | — | | | | — | | | | 7,569,330 | |

| | | | | | | | | | | | | | | | |

| | | 10,705,402 | | | | 1,750,440 | | | | — | | | | 12,455,842 | |

| | | | | | | | | | | | | | | | |

Closed-End Mutual Funds | | | 153,514 | | | | — | | | | — | | | | 153,514 | |

| | | | | | | | | | | | | | | | |

Total: | | | 10,858,916 | | | | 1,750,440 | | | | — | | | | 12,609,356 | |

| | | | | | | | | | | | | | | | |

The Fund adjusts the closing price of foreign equity securities by applying a systematic process for events occurring after the close of the foreign exchange. At each reporting period, this process is applied for all foreign securities and therefore all foreign securities are classified as level 2. There are no transfers between level 1 and level 2 between reporting periods as a result of applying this process. Level 1 securities of foreign issuers are primarily American Depositary Receipts (ADRs) or Global Depositary Receipts (GDRs). There were no transfers into or out of level 3 during the reporting period.

See accompanying notes to financial statements.

| | |

| 18 | | SIT MUTUAL FUNDS ANNUAL REPORT |

[This page intentionally left blank.]

Sit Large Cap Growth Fund

OBJECTIVE & STRATEGY

The objective of the Large Cap Growth Fund is to maximize long-term capital appreciation. The Fund pursues this objective by investing at least 80% of its net assets in the common stocks of domestic growth companies with capitalizations of $5 billion or more at the time of purchase.

The Sit Large Cap Growth Fund’s one-year return was +4.39%, compared to the +5.76% return for the Russell 1000® Growth Index. The S&P 500® Index return for the period was +5.45%.

Despite economic challenges in many regions of the world, U.S. equities managed to post modest gains over the past twelve months. While the slowdown in China (along with other emerging markets) and further turmoil in Europe have created incremental challenges for the global economy, our expectation is for a continuation of the trend of moderate growth with minimal near-term inflation pressures. Against a backdrop of slowing corporate earnings growth and continued market volatility, we strongly believe that the Fund’s diversification and focus on high-quality growth companies is appropriate. Our specific criteria in this regard include: above-average sales and earnings growth; healthy balance sheets and low debt levels; strong free cash flow generation; and proactive management teams that can navigate through challenging economic conditions. We continue to believe that companies with strong financial characteristics will outperform the overall market, as growth becomes more challenging and investors seek firms that have financial flexibility to repurchase stock, increase dividends or make accretive acquisitions. While the Fund remains well diversified, the heaviest weighted sectors within the Fund include electronic technology, technology services, consumer non-durables, and producer manufacturing.

Relative to the Russell 1000® Growth Index, performance over the past year was negatively impacted by stock selection in the technology services, energy minerals and electronic technology sectors. Cognizant Technology Solutions and salesforce.com were the laggards in the technology services sector, while our positions in Apache and Occidental Petroleum detracted from performance in the energy minerals sector. The electronic technology sector was dragged down by our holdings in Atmel and VeriFone Systems. On the positive side, strong stock selection in retail trade and process industries helped performance over the past twelve months. TJX, Dick’s Sporting Goods, CF Industries and Ecolab were key outperfomers in these sectors.

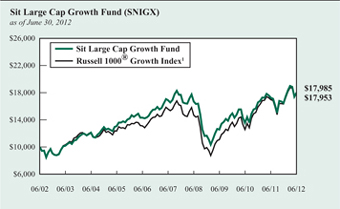

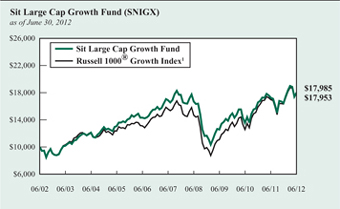

HYPOTHETICAL GROWTH OF $10,000

The chart above illustrates the total value of a hypothetical $10,000 investment in the Fund over the past 10 years (or for the life of the Fund if shorter) as compared to the performance of the Russell 1000® Growth Index. Past performance does not guarantee future results. Returns include the reinvestment of distributions. The chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| 1 | Russell 1000® Growth Index is an unmanaged index that measures the performance of those Russell 1000 Index companies with higher price-to-book ratios and higher forecasted growth values. It is not possible to invest directly in an index. This is the Fund’s primary index. |

Our research effort is highly focused on companies that are attractively valued relative to their long-term projected earnings growth rates. We strongly believe that this focus will reward our shareholders over time.

Roger J. Sit

Ronald D. Sit

Michael J. Stellmacher

Portfolio Managers

| | |

| 20 | | SIT MUTUAL FUNDS ANNUAL REPORT |

COMPARATIVE RATES OF RETURNS

as of June 30, 2012

| | | | | | | | | | | | |

| | | Sit Large

Cap Growth

Fund | | | Russell

1000®

Growth

Index 1 | | | Russell

1000®

Index 2 | |

One Year | | | 4.39 | % | | | 5.76 | % | | | 4.37 | % |

Five Year | | | 1.28 | | | | 2.87 | | | | 0.39 | |

Ten Year | | | 6.05 | | | | 6.03 | | | | 5.72 | |

Since Inception 3 (9/2/82) | | | 9.47 | | | | 10.45 | | | | 11.29 | |

Performance figures are historical and do not guarantee future results. Investment returns and principal value will vary, and you may have a gain or loss when you sell shares. Current performance may be lower or higher than the performance data quoted. Contact the Fund for performance data current to the most recent month-end. Returns include changes in share price as well as reinvestment of all dividends and capital gains. Returns do not reflect the deduction of the 2% redemption fee imposed if shares are redeemed or exchanged within 30 calendar days from their date of purchase. If imposed, the fee would reduce the performance quoted. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Management fees and administrative expenses are included in the Fund’s performance. Returns for periods greater than one year are compounded average annual rates of return.

| 1 | Russell 1000® Growth Index is an unmanaged index that measures the performance of those Russell 1000 Index companies with higher price-to-book ratios and higher forecasted growth values. It is not possible to invest directly in an index. |

| 2 | Russell 1000® Index is an unmanaged index that measures the performance of approximately 1,000 of the largest U.S. companies by market capitalization. |

| 3 | On 6/6/93, the Fund’s investment objective changed to allow for a portfolio of 100% stocks. Prior to that time, the portfolio was required to contain no more than 80% stocks. |

| | | | |

PORTFOLIO SUMMARY | |

Net Asset Value 6/30/12: | | $ | 45.53 Per Share | |

Net Asset Value 6/30/11: | | $ | 43.96 Per Share | |

Total Net Assets: | | $ | 254.3 Million | |

Weighted Average Market Cap: | | $ | 109.3 Billion | |

TOP 10 HOLDINGS

| 2. | International Business Machines Corp. |

| 5. | Occidental Petroleum Corp. |

| 9. | Philip Morris International, Inc. |

Based on total net assets as of June 30, 2012. Subject to change.

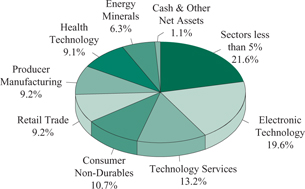

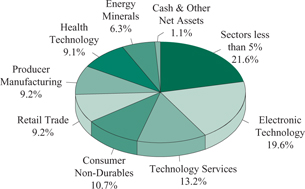

FUND DIVERSIFICATION

Based on total net assets as of June 30, 2012. Subject to change.

SCHEDULE OF INVESTMENTS

June 30, 2012

Sit Large Cap Growth Fund

| | | | | | |

Quantity | | Name of Issuer | | Fair Value ($) | |

Common Stocks - 98.9% | | | | |

Communications - 1.9% | | | | |

| 53,600 | | Rogers Communications, Inc. | | | 1,940,856 | |

| 66,300 | | Verizon Communications, Inc. | | | 2,946,372 | |

| | | | | | |

| | | | | 4,887,228 | |

| | | | | | |

Consumer Durables - 1.1% | |

| 8,800 | | Fossil, Inc. * | | | 673,552 | |

| 38,900 | | Tupperware Brands Corp. | | | 2,130,164 | |

| | | | | | |

| | | | | 2,803,716 | |

| | | | | | |

Consumer Non-Durables - 10.7% | |

| 29,200 | | Coach, Inc. | | | 1,707,616 | |

| 77,800 | | Coca-Cola Co. | | | 6,083,182 | |

| 58,200 | | General Mills, Inc. | | | 2,243,028 | |

| 31,700 | | NIKE, Inc. | | | 2,782,626 | |

| 74,500 | | PepsiCo, Inc. | | | 5,264,170 | |

| 61,800 | | Philip Morris International, Inc. | | | 5,392,668 | |

| 61,700 | | Procter & Gamble Co. | | | 3,779,125 | |

| | | | | | |

| | | | | 27,252,415 | |

| | | | | | |

Consumer Services - 3.1% | |

| 55,500 | | McDonald’s Corp. | | | 4,913,415 | |

| 23,100 | | Visa, Inc. | | | 2,855,853 | |

| | | | | | |

| | | | | 7,769,268 | |

| | | | | | |

Electronic Technology - 19.6% | |

| 29,300 | | Apple, Inc. * | | | 17,111,200 | |

| 116,500 | | Applied Materials, Inc. | | | 1,335,090 | |

| 168,800 | | Atmel Corp. * | | | 1,130,960 | |

| 90,300 | | Broadcom Corp. * | | | 3,052,140 | |

| 131,500 | | Ciena Corp. * | | | 2,152,655 | |

| 83,500 | | EMC Corp. * | | | 2,140,105 | |

| 84,800 | | Intel Corp. | | | 2,259,920 | |

| 60,600 | | International Business Machines Corp. | | | 11,852,148 | |

| 113,000 | | Qualcomm, Inc. | | | 6,291,840 | |

| 75,300 | | VeriFone Systems, Inc. * | | | 2,491,677 | |

| | | | | | |

| | | | | 49,817,735 | |

| | | | | | |

Energy Minerals - 6.3% | |

| 71,500 | | Chevron Corp. | | | 7,543,250 | |

| 37,500 | | Marathon Petroleum Corp. | | | 1,684,500 | |

| 78,700 | | Occidental Petroleum Corp. | | | 6,750,099 | |

| | | | | | |

| | | | | 15,977,849 | |

| | | | | | |

Finance - 3.8% | |

| 28,100 | | ACE, Ltd. | | | 2,083,053 | |

| 26,700 | | Franklin Resources, Inc. | | | 2,963,433 | |

| 14,700 | | Goldman Sachs Group, Inc. | | | 1,409,142 | |

| 51,600 | | JPMorgan Chase & Co. | | | 1,843,668 | |

| 44,300 | | Marsh & McLennan Cos., Inc. | | | 1,427,789 | |

| | | | | | |

| | | | | 9,727,085 | |

| | | | | | |

| | | | | | |

Quantity | | Name of Issuer | | Fair Value ($) | |

Health Services - 2.1% | | | | |

| 35,819 | | Express Scripts Holding Co. * | | | 1,999,775 | |

| 21,200 | | McKesson Corp. | | | 1,987,500 | |

| 23,800 | | UnitedHealth Group, Inc. | | | 1,392,300 | |

| | | | | | |

| | | | | 5,379,575 | |

| | | | | | |

Health Technology - 9.1% | |

| 31,600 | | Allergan, Inc. | | | 2,925,212 | |

| 26,400 | | Baxter International, Inc. | | | 1,403,160 | |

| 51,600 | | Celgene Corp. * | | | 3,310,656 | |

| 64,700 | | Gilead Sciences, Inc. * | | | 3,317,816 | |

| 5,200 | | Intuitive Surgical, Inc. * | | | 2,879,708 | |

| 103,600 | | Pfizer, Inc. | | | 2,382,800 | |

| 69,600 | | St. Jude Medical, Inc. | | | 2,777,736 | |

| 44,000 | | Stryker Corp. | | | 2,424,400 | |

| 30,000 | | Thermo Fisher Scientific, Inc. | | | 1,557,300 | |

| | | | | | |

| | | | | 22,978,788 | |

| | | | | | |

Industrial Services - 1.6% | |

| 41,600 | | Schlumberger, Ltd. | | | 2,700,256 | |

| 40,200 | | Seadrill, Ltd. | | | 1,427,904 | |

| | | | | | |

| | | | | 4,128,160 | |

| | | | | | |

Non-Energy Minerals - 0.7% | |

| 51,400 | | Freeport-McMoRan Copper & Gold, Inc. | | | 1,751,198 | |

| | | | | | |

Process Industries - 4.6% | |

| 17,600 | | CF Industries Holdings, Inc. | | | 3,409,824 | |

| 57,100 | | Ecolab, Inc. | | | 3,913,063 | |

| 29,900 | | EI du Pont de Nemours & Co. | | | 1,512,043 | |

| 26,000 | | Praxair, Inc. | | | 2,826,980 | |

| | | | | | |

| | | | | 11,661,910 | |

| | | | | | |

Producer Manufacturing - 9.2% | |

| 30,000 | | 3M Co. | | | 2,688,000 | |

| 20,200 | | Caterpillar, Inc. | | | 1,715,182 | |

| 61,000 | | Danaher Corp. | | | 3,176,880 | |

| 43,650 | | Deere & Co. | | | 3,529,976 | |

| 51,400 | | Emerson Electric Co. | | | 2,394,212 | |

| 19,200 | | Flowserve Corp. | | | 2,203,200 | |

| 38,600 | | Honeywell International, Inc. | | | 2,155,424 | |

| 14,400 | | Precision Castparts Corp. | | | 2,368,656 | |

| 41,800 | | United Technologies Corp. | | | 3,157,154 | |

| | | | | | |

| | | | | 23,388,684 | |

| | | | | | |

Retail Trade - 9.2% | |

| 12,800 | | Amazon.com, Inc. * | | | 2,922,880 | |

| 14,400 | | Bed Bath & Beyond, Inc. * | | | 889,920 | |

| 20,200 | | Costco Wholesale Corp. | | | 1,919,000 | |

| 25,900 | | CVS Caremark Corp. | | | 1,210,307 | |

| 76,300 | | Dick’s Sporting Goods, Inc. | | | 3,662,400 | |

| 50,300 | | Home Depot, Inc. | | | 2,665,397 | |

| 69,600 | | Target Corp. | | | 4,050,024 | |

See accompanying notes to financial statements.

| | |

| 22 | | SIT MUTUAL FUNDS ANNUAL REPORT |

| | | | | | |

Quantity | | Name of Issuer | | Fair Value ($) | |

| 84,800 | | TJX Cos., Inc. | | | 3,640,464 | |

| 35,400 | | Wal-Mart Stores, Inc. | | | 2,468,088 | |

| | | | | | |

| | | | | 23,428,480 | |

| | | | | | |

Technology Services - 13.2% | |

| 71,200 | | Accenture, PLC | | | 4,278,408 | |

| 22,500 | | Cognizant Technology Solutions Corp. * | | | 1,350,000 | |

| 13,700 | | Google, Inc. * | | | 7,946,959 | |

| 56,300 | | Informatica Corp. * | | | 2,384,868 | |

| 67,900 | | Microsoft Corp. | | | 2,077,061 | |

| 187,200 | | Oracle Corp. | | | 5,559,840 | |

| 5,300 | | priceline.com, Inc. * | | | 3,521,956 | |

| 12,400 | | Salesforce.com, Inc. * | | | 1,714,424 | |

| 25,937 | | Teradata Corp. * | | | 1,867,723 | |

| 31,500 | | VMware, Inc. * | | | 2,867,760 | |

| | | | | | |

| | | | | 33,568,999 | |

| | | | | | |

Transportation - 1.9% | |

| 24,800 | | Union Pacific Corp. | | | 2,958,888 | |

| 23,600 | | United Parcel Service, Inc. | | | 1,858,736 | |

| | | | | | |

| | | | | 4,817,624 | |

| | | | | | |

| | | | | | |

Quantity | | Name of Issuer | | Fair Value ($) | |

Utilities - 0.8% | | | | |

| 20,600 | | Kinder Morgan, Inc. | | | 663,732 | |

| 33,900 | | Wisconsin Energy Corp. | | | 1,341,423 | |

| | | | | | |

| | | | | 2,005,155 | |

| | | | | | |

Total Common Stocks

(cost: $191,759,350) | | | 251,343,869 | |

| | | | | | |

Total Investments in Securities - 98.9%

(cost: $191,759,350) | | | 251,343,869 | |

Other Assets and Liabilities, net 1.1% | | | 2,912,486 | |

| | | | | | |

Total Net Assets - 100.0% | | $ | 254,256,355 | |

| | | | | | |

| * | Non-income producing security. |

Numeric footnotes not disclosed are not applicable to this Schedule of Investments.

PLC — Public Limited Company

A summary of the levels for the Fund’s investments as of June 30, 2012 is as follows (see Note 2—significant accounting policies in the notes to financial statements):

| | | | | | | | | | | | | | | | |

| | | Investment in Securities | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | | |

| | | Quoted | | | Other significant | | | Significant | | | | |

| | | Price ($) | | | observable inputs ($) | | | unobservable inputs ($) | | | Total ($) | |

Common Stocks ** | | | 251,343,869 | | | | — | | | | — | | | | 251,343,869 | |

| | | | | | | | | | | | | | | | |

Total: | | | 251,343,869 | | | | — | | | | — | | | | 251,343,869 | |

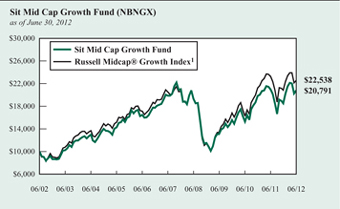

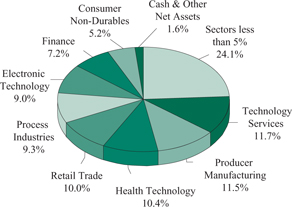

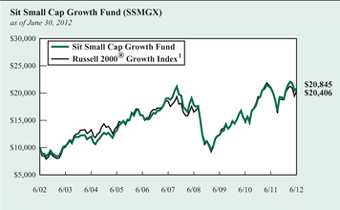

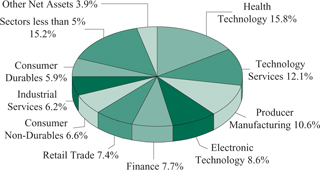

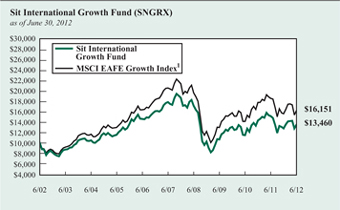

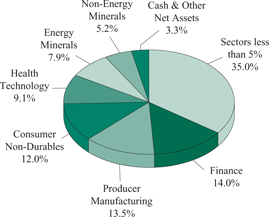

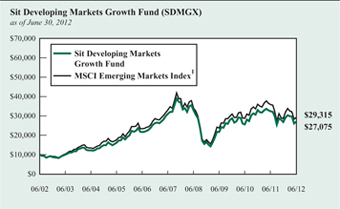

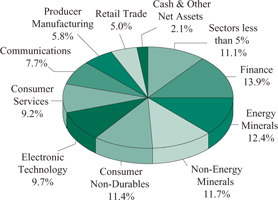

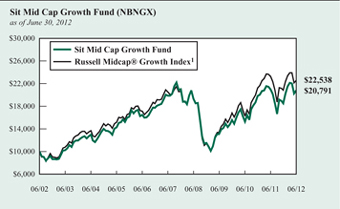

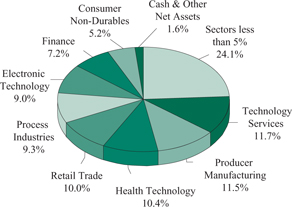

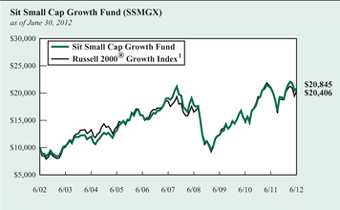

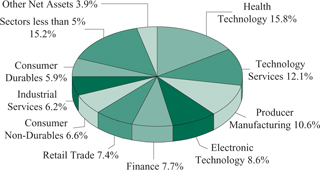

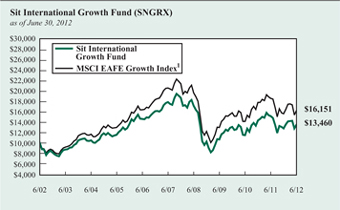

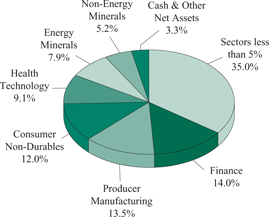

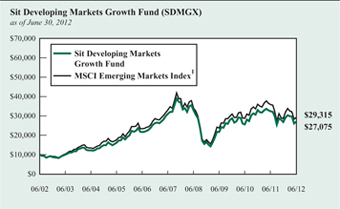

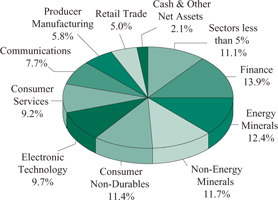

| | | | | | | | | | | | | | | | |