UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-06378

Templeton Developing Markets Trust

(Exact name of registrant as specified in charter)

300 S.E. 2nd Street, Fort Lauderdale, FL 33301-1923

(Address of principal executive offices) (Zip code)

Craig S. Tyle, One Franklin Parkway, San Mateo, CA 94403-1906

(Name and address of agent for service)

Registrant’s telephone number, including area code: (954) 527-7500

Date of fiscal year end: 12/31

Date of reporting period: 06/30/20

| Item 1. | Reports to Stockholders. |

Sign up for electronic delivery at franklintempleton.com/edelivery

Internet Delivery of Fund Reports Unless You Request Paper Copies: Effective January 1, 2021, as permitted by the SEC, paper copies of the Fund’s shareholder reports will no longer be sent by mail, unless you specifically request them from the Fund or your financial intermediary. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. If you have not signed up for electronic delivery, we would encourage you to join fellow shareholders who have. You may elect to receive shareholder reports and other communications electronically from the Fund by calling (800) 632-2301 or by contacting your financial intermediary.

You may elect to continue to receive paper copies of all your future shareholder reports free of charge by contacting your financial intermediary or, if you invest directly with a Fund, calling (800) 632-2301 to let the Fund know of your request. Your election to receive reports in paper will apply to all funds held in your account.

SHAREHOLDER LETTER

Dear Shareholder:

Emerging market countries, like developed countries, have been significantly impacted by the global novel coronavirus (COVID-19) pandemic. Government measures to control the pandemic have included stay-at-home orders and the closing of non-essential businesses, which severely impacted economic activity. With the spread of COVID-19 in certain countries having slowed in recent months, the focus of policymakers and markets has started to shift from the immediate needs of the health crisis toward the economy. In many developed and emerging markets, we are seeing containment, albeit with uneven progress, and many economies are starting to reopen.

The crisis has highlighted the strengths of emerging market countries, whether in terms of their social, governance and health care systems, or the fiscal and corporate reforms they have undertaken over the last two decades. Robust balance sheets across emerging markets have proven to be a source of resilience, and we believe that will continue.

Fiscal and monetary stimulus in emerging markets has been moderate compared to developed markets, in part due to lesser means in certain countries, while others have left room for further action. Policy support has been fairly limited in East Asian markets that have deftly handled the pandemic, such as South Korea and Taiwan, while China has ample ammunition for further spending, to be targeted across both old and new economic infrastructure.

Despite the upheaval the pandemic has caused, we believe key emerging market themes will continue. These include a decreasing reliance on export-oriented industries paired with increased domestic consumer spending, which has made emerging market economies more resilient than in the past. Other themes include improved government and corporate fiscal discipline, such as in South Korea, and accelerated innovation in technology, notably in mobile telecommunication and e-commerce. Specific to the pandemic, social distancing measures have particularly boosted the importance of remote education and telehealth. In our long-term view, emerging markets will continue to be driven

by urbanization, increases in the demand for skilled labor, and the need to sell to new markets. Globalization can coexist with increased localization.

We are committed to our long-term perspective and disciplined investment approach as we conduct a rigorous, fundamental analysis of securities with a regular emphasis on investment risk management.

Historically, patient investors have achieved rewarding results by evaluating their goals, diversifying their assets globally and maintaining a disciplined investment program, all hallmarks of the Templeton investment philosophy. We continue to recommend investors consult their financial advisors and review their portfolios to design a long-term strategy and portfolio allocation that meet their individual needs, goals and risk tolerance.

Templeton Emerging Markets Fund’s semiannual report includes more detail about prevailing conditions and a discussion about investment decisions during the period. Please remember all securities markets fluctuate, as do mutual fund share prices.

We thank you for investing with Franklin Templeton, welcome your questions and comments, and look forward to serving your investment needs in the years ahead.

Sincerely,

|

|

| Manraj S. Sekhon, CFA |

| Chief Investment Officer |

| Franklin Templeton Emerging Markets Equity |

This letter reflects our analysis and opinions as of June 30, 2020, unless otherwise indicated. The information is not a complete analysis of every aspect of any market, country, industry, security or fund. Statements of fact are from sources considered reliable.

CFA® is a trademark owned by CFA Institute.

|

Not FDIC Insured | May Lose Value | No Bank Guarantee |

| | | | |

franklintempleton.com | | Not part of the semiannual report | | 1 |

Contents

|

| Visit franklintempleton.com for fund updates, to access your account, or to find helpful financial planning tools. |

| | | | |

| | | |

2 | | Semiannual Report | | franklintempleton.com |

SEMIANNUAL REPORT

Templeton Developing Markets Trust

This semiannual report for Templeton Developing Markets Trust covers the period ended June 30, 2020.

Your Fund’s Goal and Main Investments

The Fund seeks long-term capital appreciation. Under normal market conditions, the Fund invests at least 80% of its net assets in securities of companies located or operating in “developing market countries,” as defined in the Fund’s prospectus.

Performance Overview

The Fund’s Class A shares posted a -10.06% cumulative total return for the six months under review. In comparison, the MSCI Emerging Markets (EM) Index posted a -9.67% total return, and the Standard & Poor’s®/International Finance Corporation Investable Composite Index posted a -10.20% total return for the same period.1 The indexes measure global emerging market stock performance. Please note, index performance is provided for reference and we do not attempt to track an index but rather undertake investments on the basis of fundamental research. In addition, the Fund’s return reflects the effect of fees and expenses for professional management, while an index does not have such costs. You can find the Fund’s long-term performance data in the Performance Summary beginning on page 7.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

Economic and Market Overview

The novel coronavirus (COVID-19) pandemic and resulting lockdown measures caused many emerging market economies to slow significantly in 2020’s first quarter, as the virus outbreak compounded already weak global economic activity hobbled by U.S.-China trade tensions. In response, many emerging market central banks adopted more

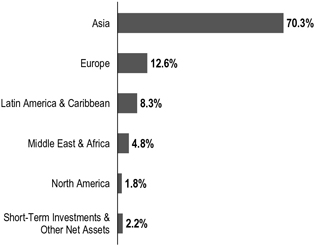

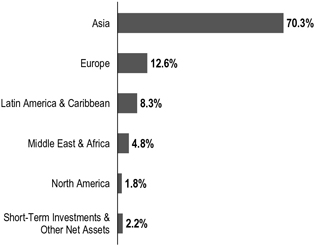

Geographic Composition

Based on Total Net Assets as of 6/30/20

accommodative monetary policies. Emerging market equities fell during the period, though losses were limited by a second-quarter rebound as some countries began reopening their economies.

Regarding individual countries, China’s gross domestic product contracted in 2020’s first quarter for the first time on record, reflecting the significant disruption caused by the pandemic after the government shut down nonessential businesses for nearly two months. Taiwan’s year-on-year growth rate slowed as the country’s export-dependent economy was hit by decreased global demand. South Korea’s year-on-year growth rate moderated due largely to a slowing services sector activity. India’s year-on-year growth rate moderated to its lowest point since the data became available in 2004, with contractions seen in gross fixed capital formation, exports and manufacturing. Russia’s year-on-year growth rate also moderated in the first quarter, while Brazil’s year-on-year growth rate contracted as the services sector and industrial output shrank.

Turning to monetary policies, the People’s Bank of China (PBOC) cut the benchmark loan prime rate once. Taiwan’s central bank lowered its benchmark interest rate for the first

1. Source: Morningstar.

The indexes are unmanaged and include reinvestment of any income or distributions. They do not reflect any fees, expenses or sales charges. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

See www.franklintempletondatasources.com for additional data provider information.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI). The SOI begins on page 15.

| | | | |

franklintempleton.com | | Semiannual Report | | 3 |

TEMPLETON DEVELOPING MARKETS TRUST

time in four years, while South Korea’s central bank cut its benchmark rate twice, ending at an all-time low. India’s central bank also cut its benchmark interest rate twice. The central banks of Russia and Brazil both cut their benchmark rates multiple times to record lows.

In this environment, emerging market stocks, as measured by the MSCI EM Index, posted a -9.67% total return for the six months ended June 30, 2020.1 Chinese equities rose during the period, as investors were reassured by the government’s aggressive actions to contain the pandemic and encouraging second-quarter economic data. Equities in export-oriented Taiwan declined slightly, with losses limited by stimulus measures and low rates of COVID-19 infections. Russian equities fell as a price war with Saudi Arabia led to a collapse in oil prices, which weighed heavily on Russia’s energy export-dependent economy. Brazilian equities fell significantly due largely to the country’s emergence as the epicenter of the pandemic in Latin America as well as the Brazilian real’s depreciation against the U.S. dollar.

Investment Strategy

We employ a fundamental research, value-oriented, long-term investment strategy. We focus on the market price of a company’s securities relative to our evaluation of its long-term earnings, asset value and cash flow potential. This includes an assessment of the potential impacts of material environmental, social and governance factors on the long-term risk and return profile of a company. We also consider a company’s profit and loss outlook, balance sheet strength, cash flow trends and asset value in relation to the current price of the company’s securities. Our analysis considers the company’s position in its sector, the economic framework and political environment.

Manager’s Discussion

Key detractors from absolute performance during the period included ICICI Bank, Banco Bradesco and Itau Unibanco Holding. Banking stocks around the world faced selling pressure, as expectations for a global economic slowdown weakened the outlook for loan growth, net interest margins and asset quality.

ICICI Bank is one of the largest private-sector banks in India. Investors were concerned about the interim impact of economic disruptions caused by COVID-19 on the bank’s loans and margins. Indian financials stocks were broadly hurt by a crisis at a notable private-sector bank, which resulted in a bail-out. Investors also reacted negatively when the Indian central bank extended loan repayment relief while not allowing a one-time restructuring of loans, which sparked

Top 10 Countries

6/30/20

| | |

| | | % of Total

Net Assets |

China | | 30.6% |

South Korea | | 18.9% |

Taiwan | | 11.3% |

Russia | | 8.1% |

Brazil | | 6.8% |

India | | 5.6% |

South Africa | | 4.6% |

U.K. | | 3.1% |

U.S. | | 1.8% |

Thailand | | 1.8% |

fears about bad debts in the banking system. Although ICICI Bank reported a double-digit increase in its March quarter profits, higher-than-expected COVID-19-related costs weighed on profitability. Investors did support the bank’s stake sale of its insurance subsidiaries to raise capital to strengthen its balance sheet, but the bank’s plan to raise money via the issuance of new shares raised concerns of dilution.

Expectations that the Brazilian economy would fall into a recession as a result of COVID-19-related lockdowns weighed on sentiment in leading commercial banks such as Banco Bradesco and Itau Unibanco. Shares in the two banks declined significantly due to market expectations of a decline in asset quality and revenue generation. Both banks reported weak first-quarter corporate results largely due to higher-than-expected costs related to COVID-19 and suspended guidance for 2020. Shares did rebound off their lows as investors used the market correction as a buying opportunity in view of the banks’ sound fundamentals, attractive valuations and dominant market share, which in our view makes them well positioned to recover once the COVID-19 outbreak is contained and domestic economic activity improves.

In contrast, key contributors to absolute performance were Tencent Holdings, Naver and Naspers.

Tencent is one of the largest internet services companies in China. The company provides online gaming, social network, financial technology, cloud and other entertainment related services. Expectations that COVID-19 would have a short-term negative impact on Tencent’s advertising, payments and cloud services as a result of a decline in business activities led shares to reach a period-low in March. Shares subsequently rose, however, on expectations of solid

| | | | |

| | | |

4 | | Semiannual Report | | franklintempleton.com |

TEMPLETON DEVELOPING MARKETS TRUST

Top 10 Holdings

6/30/20

| | |

Company Sector/Industry, Country | | % of Total

Net Assets |

Taiwan Semiconductor Manufacturing Co. Ltd. Semiconductors & Semiconductor Equipment, Taiwan | | 9.2% |

Tencent Holdings Ltd. Interactive Media & Services, China | | 8.3% |

Samsung Electronics Co. Ltd. Technology Hardware, Storage & Peripherals, South Korea | | 8.1% |

Alibaba Group Holding Ltd. Internet & Direct Marketing Retail, China | | 6.8% |

Naver Corp. Interactive Media & Services, South Korea | | 4.6% |

Naspers Ltd. Internet & Direct Marketing Retail, South Africa | | 4.3% |

Unilever PLC Personal Products, U.K. | | 3.1% |

ICICI Bank Ltd. Banks, India | | 2.9% |

Brilliance China Automotive Holdings Ltd. Automobiles, China | | 2.7% |

Yandex NV Interactive Media & Services, Russia | | 2.3% |

growth in the mobile gaming and financial technology businesses. Tencent reported above-consensus first-quarter corporate results, with double-digit revenue and earnings growth driven by an increase in online gaming and better-than-expected performances in its online advertising and financial technology operations. Expectations of continued growth in online gaming and improved monetization of its social application WeChat further supported sentiment in the stock.

Naver is South Korea’s largest search engine and a major e-commerce company. The company also provides services including LINE messenger, the largest messenger app in Japan, image messaging and multimedia mobile application Snow, digital comics platform Naver Webtoon and group social media platform Naver Band. Concerns in March that COVID-19 would negatively impact Naver’s advertising business in the short term weighed on shares, but the company’s earnings rose due to increased online shopping on its platform amid the pandemic. Investors also remained confident of Naver’s penetration into e-commerce and businesses in other areas such as digital content and financial services, which could contribute to its longer-term growth.

Naspers is a global internet and entertainment group and a majority shareholder in Prosus, which holds stakes in major internet companies globally in areas such as online gaming, social media, food delivery, online classifieds and electronic payments. Shares in Naspers benefited from the strong performance of Prosus’ largest underlying investment, Tencent. Naspers reported double-digit revenue and earnings growth for the fiscal year ended March 2020, driven by e-commerce operations and growth at Tencent. While lockdowns across key markets in early 2020 weighed on Naspers’ interests in the classified segment, investors expect market consolidation to help reduce losses and allow companies to focus on monetization as economies reopen. Management’s commitment to reducing Nasper’s share price discount to net asset value was also viewed positively by investors.

We used the market correction as an opportunity to add to our existing high-conviction holdings. In the last six months, the Fund increased its positions in Brazil, South Africa, South Korea and Russia as we continued to identify companies with sustainable earnings power trading at a discount to their intrinsic worth. In terms of sectors, additions were made in financials, communication services and materials. Existing positions were increased in Samsung Life Insurance, one of the largest insurance companies in South Korea, and the aformentioned Itau Unibanco, Banco Bradesco and Prosus.

The Fund reduced its investments in China, the U.S., Macau and Taiwan in favor of what we viewed as more compelling opportunities. Sectors which experienced the largest sales were health care, consumer discretionary and information technology. Key reductions included Cognizant Technology Solutions, a global information technology services company, and Glenmark Pharmaceuticals, a mid-size Indian pharmaceutical company. The Fund liquidated its positions in Chinese commercial bank China Construction Bank, Indian biopharmaceutical company Biocon, and Macau resort and casino operator Sands China.

It is important to recognize the effect of currency movements on the Fund’s performance. In general, if the value of the U.S. dollar goes up compared with a foreign currency, an investment traded in that foreign currency will go down in value because it will be worth fewer U.S. dollars. This can have a negative effect on Fund performance. Conversely, when the U.S. dollar weakens in relation to a foreign currency, an investment traded in that foreign currency will increase in value, which can contribute to Fund performance. For the six months ended June 30, 2020, the U.S. dollar rose in value relative to most currencies. As a result, the Fund’s

| | | | |

franklintempleton.com | | Semiannual Report | | 5 |

TEMPLETON DEVELOPING MARKETS TRUST

performance was negatively affected by the portfolio being predominantly invested in securities with non-U.S. currency exposure.

We thank you for your continued participation in Templeton Developing Markets Trust and look forward to serving your future investment needs.

Chetan Sehgal, CFA

Portfolio Manager

The foregoing information reflects our analysis, opinions and portfolio holdings as of June 30, 2020, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

| | | | |

| | | |

6 | | Semiannual Report | | franklintempleton.com |

TEMPLETON DEVELOPING MARKETS TRUST

Performance Summary as of June 30, 2020

The performance table does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses. Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities.

Performance as of 6/30/201

Cumulative total return excludes sales charges. Average annual total return includes maximum sales charges. Sales charges will vary depending on the size of the investment and the class of share purchased. The maximum is 5.50% and the minimum is 0%. Class A: 5.50% maximum initial sales charge; Advisor Class: no sales charges. For other share classes, visit franklintempleton.com.

| | | | | | | | |

| Share Class | | Cumulative

Total Return2 | | | Average Annual

Total Return3 | |

A4 | | | | | | | | |

6-Month | | | -10.06% | | | | -15.02% | |

1-Year | | | -0.18% | | | | -5.65% | |

5-Year | | | +29.14% | | | | +4.07% | |

10-Year | | | +40.79% | | | | +2.90% | |

| | |

Advisor | | | | | | | | |

6-Month | | | -9.95% | | | | -9.95% | |

1-Year | | | +0.06% | | | | +0.06% | |

5-Year | | | +30.73% | | | | +5.51% | |

10-Year | | | +44.50% | | | | +3.75% | |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

See page 8 for Performance Summary footnotes.

| | | | |

franklintempleton.com | | Semiannual Report | | 7 |

TEMPLETON DEVELOPING MARKETS TRUST

PERFORMANCE SUMMARY

Total Annual Operating Expenses5

| | | | | | | | | | | | |

| Share Class | | With Fee

Waiver | | | | | | Without Fee

Waiver | |

A | | | 1.39% | | | | | | | | 1.53% | |

Advisor | | | 1.14% | | | | | | | | 1.28% | |

Each class of shares is available to certain eligible investors and has different annual fees and expenses, as described in the prospectus.

All investments involve risks, including possible loss of principal. Special risks are associated with foreign investing, including currency fluctuations, economic instability and political developments. Investments in developing markets, of which frontier markets are a subset, involve heightened risks related to the same factors, in addition to those associated with these markets’ smaller size, lesser liquidity and lack of established legal, political, business and social frameworks to support securities markets. Because these frameworks are typically even less developed in frontier markets, as well as various factors including the increased potential for extreme price volatility, illiquidity, trade barriers and exchange controls, the risks associated with developing markets are magnified in frontier markets. The Fund is designed for the aggressive portion of a well-diversified portfolio. Unexpected events and their aftermaths, such as the spread of deadly diseases; natural, environmental or man-made disasters; financial, political or social disruptions; terrorism and war; and other tragedies or catastrophes, can cause investor fear and panic, which can adversely affect the economies of many companies, sectors, nations, regions and the market in general, in ways that cannot necessarily be foreseen. The Fund’s prospectus also includes a description of the main investment risks.

1. The Fund has an expense reduction and a fee waiver associated with any investments it makes in a Franklin Templeton money fund and/or other Franklin Templeton fund, contractually guaranteed through 4/30/21. Fund investment results reflect the expense reduction and fee waiver; without these reductions, the results would have been lower.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated. Return for less than one year, if any, has not been annualized.

4. Prior to 9/10/18, these shares were offered at a higher initial sales charge of 5.75%, thus actual returns (with sales charges) would have differed. Average annual total returns (with sales charges) have been restated to reflect the current maximum initial sales charge of 5.50%.

5. Figures are as stated in the Fund’s current prospectus and may differ from the expense ratios disclosed in the Your Fund’s Expenses and Financial Highlights sections in this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

See www.franklintempletondatasources.com for additional data provider information.

| | | | |

| | | |

8 | | Semiannual Report | | franklintempleton.com |

TEMPLETON DEVELOPING MARKETS TRUST

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs: (1) transaction costs, including sales charges (loads) on Fund purchases and redemptions; and (2) ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses. The table below shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The table below provides information about actual account values and actual expenses in the columns under the heading “Actual.” In these columns the Fund’s actual return, which includes the effect of Fund expenses, is used to calculate the “Ending Account Value” for each class of shares. You can estimate the expenses you paid during the period by following these steps (of course, your account value and expenses will differ from those in this illustration): Divide your account value by $1,000 (if your account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6). Then multiply the result by the number in the row for your class of shares under the headings “Actual” and “Expenses Paid During Period” (if Actual Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50). In this illustration, the actual expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Under the heading “Hypothetical” in the table, information is provided about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. This information may not be used to estimate the actual ending account balance or expenses you paid for the period, but it can help you compare ongoing costs of investing in the Fund with those of other funds. To do so, compare this 5% hypothetical example for the class of shares you hold with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transactional costs. Therefore, information under the heading “Hypothetical” is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transactional costs were included, your total costs would have been higher.

| | | | | | | | | | | | | | | | | | |

| | | | | | | Actual

(actual return after expenses) | | | | Hypothetical (5% annual return before expenses) | | | | |

Share Class | | Beginning

Account

Value 1/1/20 | | | | Ending

Account

Value 6/30/20 | | Expenses

Paid During

Period

1/1/20–6/30/201,2 | | | | Ending

Account

Value 6/30/20 | | Expenses

Paid During

Period

1/1/20–6/30/201,2 | | | | Net Annualized

Expense Ratio2 |

| | | | | | | | | | | | |

| A | | $1,000 | | | | $899.40 | | $ 6.52 | | | | $1,018.00 | | $ 6.92 | | | | 1.38% |

| C | | $1,000 | | | | $896.10 | | $10.04 | | | | $1,014.27 | | $10.67 | | | | 2.13% |

| R | | $1,000 | | | | $898.50 | | $ 7.69 | | | | $1,016.76 | | $ 8.17 | | | | 1.63% |

| R6 | | $1,000 | | | | $901.30 | | $ 4.73 | | | | $1,019.89 | | $ 5.02 | | | | 1.00% |

| Advisor | | $1,000 | | | | $900.50 | | $ 5.34 | | | | $1,019.24 | | $ 5.67 | | | | 1.13% |

1. Expenses are equal to the annualized expense ratio for the six-month period as indicated above—in the far right column—multiplied by the simple average account value over the period indicated, and then multiplied by 182/366 to reflect the one-half year period.

2. Reflects expenses after fee waivers and expense reimbursements. Does not include acquired fund fees and expenses.

| | | | |

franklintempleton.com | | Semiannual Report | | 9 |

TEMPLETON DEVELOPING MARKETS TRUST

Financial Highlights

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six Months Ended June 30, 2020 | | | Year Ended December 31, | |

| | | (unaudited) | | | 2019 | | | 2018 | | | 2017 | | | 2016 | | | 2015 | |

| | | | | | |

Class A | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Per share operating performance (for a share outstanding throughout the period) | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net asset value, beginning of period | | | $21.96 | | | | $18.17 | | | | $21.98 | | | | $15.82 | | | | $13.59 | | | | $17.09 | |

| | | | | | |

Income from investment operationsa: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment incomeb | | | 0.02 | | | | 0.32 | c | | | 0.20 | | | | 0.15 | | | | 0.10 | | | | 0.07 | |

| | | | | | |

Net realized and unrealized gains (losses) | | | (2.23 | ) | | | 4.46 | | | | (3.76 | ) | | | 6.21 | | | | 2.32 | | | | (3.43 | ) |

| | | | | | |

Total from investment operations | | | (2.21 | ) | | | 4.78 | | | | (3.56 | ) | | | 6.36 | | | | 2.42 | | | | (3.36 | ) |

| | | | | | |

Less distributions from: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment income | | | — | | | | (0.76 | ) | | | (0.25 | ) | | | (0.20 | ) | | | (0.19 | ) | | | (0.14 | ) |

| | | | | | |

Net realized gains | | | — | | | | (0.23 | ) | | | — | | | | — | | | | — | | | | — | |

| | | | | | |

Total distributions | | | — | | | | (0.99 | ) | | | (0.25 | ) | | | (0.20 | ) | | | (0.19 | ) | | | (0.14 | ) |

| | | | | | |

Net asset value, end of period | | | $19.75 | | | | $21.96 | | | | $18.17 | | | | $21.98 | | | | $15.82 | | | | $13.59 | |

| | | | | | |

Total returnd | | | (10.06)% | | | | 26.39% | | | | (16.20)% | | | | 40.20% | | | | 17.84% | | | | (19.67)% | |

| | | | | | |

Ratios to average net assetse | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Expenses before waiver and payments by affiliates | | | 1.52% | | | | 1.52% | | | | 1.56% | | | | 1.73% | | | | 1.79% | | | | 1.75% | |

| | | | | | |

Expenses net of waiver and payments by affiliates | | | 1.38% | | | | 1.38% | | | | 1.34% | | | | 1.55% | f | | | 1.58% | | | | 1.68% | |

| | | | | | |

Net investment income | | | 0.23% | | | | 1.57% | c | | | 0.99% | | | | 0.76% | | | | 0.64% | | | | 0.44% | |

| | | | | | |

Supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net assets, end of period (000’s) | | | $901,182 | | | | $1,067,300 | | | | $917,488 | | | | $1,178,838 | | | | $961,888 | | | | $822,399 | |

| | | | | | |

Portfolio turnover rate | | | 8.97% | | | | 17.71% | | | | 9.96% | | | | 8.89% | | | | 27.40% | | | | 67.52% | |

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cNet investment income per share includes approximately $0.09 per share related to income received in the form of special dividends in connection with certain Fund holdings. Excluding this amount, the ratio of net investment income to average net assets would have been 1.15%.

dTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable, and is not annualized for periods less than one year.

eRatios are annualized for periods less than one year.

fBenefit of expense reduction rounds to less than 0.01%.

| | | | |

| | | |

10 | | Semiannual Report | The accompanying notes are an integral part of these financial statements. | | franklintempleton.com |

TEMPLETON DEVELOPING MARKETS TRUST

FINANCIAL HIGHLIGHTS

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six Months Ended June 30, 2020 | | | Year Ended December 31, | |

| | | (unaudited) | | | 2019 | | | 2018 | | | 2017 | | | 2016 | | | 2015 | |

| | | | | | |

Class C | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Per share operating performance (for a share outstanding throughout the period) | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net asset value, beginning of period | | | $21.46 | | | | $17.75 | | | | $21.34 | | | | $15.38 | | | | $13.22 | | | | $16.62 | |

| | | | | | |

Income from investment operationsa: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment income (loss)b | | | (0.05 | ) | | | 0.20 | c | | | 0.08 | | | | — | d | | | (0.02 | ) | | | (0.04 | ) |

| | | | | | |

Net realized and unrealized gains (losses) | | | (2.18 | ) | | | 4.32 | | | | (3.67 | ) | | | 6.01 | | | | 2.26 | | | | (3.33 | ) |

| | | | | | |

Total from investment operations | | | (2.23 | ) | | | 4.52 | | | | (3.59 | ) | | | 6.01 | | | | 2.24 | | | | (3.37 | ) |

| | | | | | |

Less distributions from: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment income | | | — | | | | (0.58 | ) | | | — | | | | (0.05 | ) | | | (0.08 | ) | | | (0.03 | ) |

| | | | | | |

Net realized gains | | | — | | | | (0.23 | ) | | | — | | | | — | | | | — | | | | — | |

| | | | | | |

Total distributions | | | — | | | | (0.81 | ) | | | — | | | | (0.05 | ) | | | (0.08 | ) | | | (0.03 | ) |

| | | | | | |

Net asset value, end of period | | | $19.23 | | | | $21.46 | | | | $17.75 | | | | $21.34 | | | | $15.38 | | | | $13.22 | |

| | | | | | |

Total returne | | | (10.39)% | | | | 25.42% | | | | (16.78)% | | | | 39.19% | | | | 16.90% | | | | (20.28)% | |

| | | | | | |

Ratios to average net assetsf | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Expenses before waiver and payments by affiliates | | | 2.27% | | | | 2.27% | | | | 2.31% | | | | 2.48% | | | | 2.54% | | | | 2.47% | |

| | | | | | |

Expenses net of waiver and payments by affiliates | | | 2.13% | | | | 2.13% | | | | 2.09% | | | | 2.30% | g | | | 2.33% | | | | 2.40% | |

| | | | | | |

Net investment income (loss) | | | (0.52)% | | | | 0.82% | c | | | 0.24% | | | | 0.01% | | | | (0.11)% | | | | (0.28)% | |

| | | | | | |

Supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net assets, end of period (000’s) | | | $43,444 | | | | $56,860 | | | | $63,116 | | | | $172,523 | | | | $141,100 | | | | $117,379 | |

| | | | | | |

Portfolio turnover rate | | | 8.97% | | | | 17.71% | | | | 9.96% | | | | 8.89% | | | | 27.40% | | | | 67.52% | |

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cNet investment income per share includes approximately $0.09 per share related to income received in the form of special dividends in connection with certain Fund holdings. Excluding this amount, the ratio of net investment income to average net assets would have been 0.40%.

dAmount rounds to less than $0.01 per share.

eTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable, and is not annualized for periods less than one year.

fRatios are annualized for periods less than one year.

gBenefit of expense reduction rounds to less than 0.01%.

| | | | |

franklintempleton.com | | The accompanying notes are an integral part of these financial statements. | Semiannual Report | | 11 |

TEMPLETON DEVELOPING MARKETS TRUST

FINANCIAL HIGHLIGHTS

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six Months Ended June 30, 2020 | | | Year Ended December 31, | |

| | | (unaudited) | | | 2019 | | | 2018 | | | 2017 | | | 2016 | | | 2015 | |

| | | | | | |

Class R | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Per share operating performance (for a share outstanding throughout the period) | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net asset value, beginning of period | | | $21.57 | | | | $17.86 | | | | $21.61 | | | | $15.57 | | | | $13.37 | | | | $16.80 | |

| | | | | | |

Income from investment operationsa: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment income (loss)b | | | (0.01 | ) | | | 0.29 | c | | | 0.15 | | | | 0.10 | | | | 0.07 | | | | 0.03 | |

| | | | | | |

Net realized and unrealized gains (losses) | | | (2.18 | ) | | | 4.36 | | | | (3.70 | ) | | | 6.09 | | | | 2.27 | | | | (3.36 | ) |

| | | | | | |

Total from investment operations | | | (2.19 | ) | | | 4.65 | | | | (3.55 | ) | | | 6.19 | | | | 2.34 | | | | (3.33 | ) |

| | | | | | |

Less distributions from: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment income | | | — | | | | (0.71 | ) | | | (0.20 | ) | | | (0.15 | ) | | | (0.14 | ) | | | (0.10 | ) |

| | | | | | |

Net realized gains | | | — | | | | (0.23 | ) | | | — | | | | — | | | | — | | | | — | |

| | | | | | |

Total distributions | | | — | | | | (0.94 | ) | | | (0.20 | ) | | | (0.15 | ) | | | (0.14 | ) | | | (0.10 | ) |

| | | | | | |

Net asset value, end of period | | | $19.38 | | | | $21.57 | | | | $17.86 | | | | $21.61 | | | | $15.57 | | | | $13.37 | |

| | | | | | |

Total returnd | | | (10.15)% | | | | 26.02% | | | | (16.38)% | | | | 39.90% | | | | 17.48% | | | | (19.83)% | |

| | | | | | |

Ratios to average net assetse | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Expenses before waiver and payments by affiliates | | | 1.77% | | | | 1.77% | | | | 1.81% | | | | 1.98% | | | | 2.04% | | | | 1.97% | |

| | | | | | |

Expenses net of waiver and payments by affiliates | | | 1.63% | | | | 1.63% | | | | 1.59% | | | | 1.80% | f | | | 1.83% | | | | 1.90% | |

| | | | | | |

Net investment income (loss) | | | (0.02)% | | | | 1.32% | c | | | 0.74% | | | | 0.51% | | | | 0.39% | | | | 0.22% | |

| | | | | | |

Supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net assets, end of period (000’s) | | | $16,066 | | | | $20,016 | | | | $18,025 | | | | $22,512 | | | | $16,628 | | | | $17,657 | |

| | | | | | |

Portfolio turnover rate | | | 8.97% | | | | 17.71% | | | | 9.96% | | | | 8.89% | | | | 27.40% | | | | 67.52% | |

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cNet investment income per share includes approximately $0.09 per share related to income received in the form of special dividends in connection with certain Fund holdings. Excluding this amount, the ratio of net investment income to average net assets would have been 0.90%.

dTotal return is not annualized for periods less than one year.

eRatios are annualized for periods less than one year.

fBenefit of expense reduction rounds to less than 0.01%.

| | | | |

| | | |

12 | | Semiannual Report | The accompanying notes are an integral part of these financial statements. | | franklintempleton.com |

TEMPLETON DEVELOPING MARKETS TRUST

FINANCIAL HIGHLIGHTS

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six Months Ended June 30, 2020 | | | Year Ended December 31, | |

| | | (unaudited) | | | 2019 | | | 2018 | | | 2017 | | | 2016 | | | 2015 | |

| | | | | | |

Class R6 | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Per share operating performance (for a share outstanding throughout the period) | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net asset value, beginning of period | | | $21.78 | | | | $18.02 | | | | $21.82 | | | | $15.70 | | | | $13.49 | | | | $16.99 | |

| | | | | | |

Income from investment operationsa: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment incomeb | | | 0.08 | | | | 0.39 | c | | | 0.28 | | | | 0.22 | | | | 0.19 | | | | 0.12 | |

| | | | | | |

Net realized and unrealized gains (losses) | | | (2.23 | ) | | | 4.45 | | | | (3.75 | ) | | | 6.19 | | | | 2.28 | | | | (3.40 | ) |

| | | | | | |

Total from investment operations | | | (2.15 | ) | | | 4.84 | | | | (3.47 | ) | | | 6.41 | | | | 2.47 | | | | (3.28 | ) |

| | | | | | |

Less distributions from: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment income | | | — | | | | (0.85 | ) | | | (0.33 | ) | | | (0.29 | ) | | | (0.26 | ) | | | (0.22 | ) |

| | | | | | |

Net realized gains | | | — | | | | (0.23 | ) | | | — | | | | — | | | | — | | | | — | |

| | | | | | |

Total distributions | | | — | | | | (1.08 | ) | | | (0.33 | ) | | | (0.29 | ) | | | (0.26 | ) | | | (0.22 | ) |

| | | | | | |

Net asset value, end of period | | | $19.63 | | | | $21.78 | | | | $18.02 | | | | $21.82 | | | | $15.70 | | | | $13.49 | |

| | | | | | |

Total returnd | | | (9.87)% | | | | 26.89% | | | | (15.90)% | | | | 40.88% | | | | 18.34% | | | | (19.34)% | |

| | | | | | |

Ratios to average net assetse | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Expenses before waiver and payments by affiliates | | | 1.15% | | | | 1.15% | | | | 1.21% | | | | 1.28% | | | | 1.30% | | | | 1.27% | |

| | | | | | |

Expenses net of waiver and payments by affiliates | | | 1.00% | | | | 0.99% | | | | 0.96% | | | | 1.09% | f | | | 1.13% | | | | 1.22% | |

| | | | | | |

Net investment income | | | 0.61% | | | | 1.96% | c | | | 1.37% | | | | 1.22% | | | | 1.09% | | | | 0.90% | |

| | | | | | |

Supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net assets, end of period (000’s) | | | $165,064 | | | | $120,791 | | | | $94,344 | | | | $103,734 | | | | $57,153 | | | | $48,263 | |

| | | | | | |

Portfolio turnover rate | | | 8.97% | | | | 17.71% | | | | 9.96% | | | | 8.89% | | | | 27.40% | | | | 67.52% | |

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cNet investment income per share includes approximately $0.09 per share related to income received in the form of special dividends in connection with certain Fund holdings. Excluding this amount, the ratio of net investment income to average net assets would have been 1.54%.

dTotal return is not annualized for periods less than one year.

eRatios are annualized for periods less than one year.

fBenefit of expense reduction rounds to less than 0.01%.

| | | | |

franklintempleton.com | | The accompanying notes are an integral part of these financial statements. | Semiannual Report | | 13 |

TEMPLETON DEVELOPING MARKETS TRUST

FINANCIAL HIGHLIGHTS

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six Months Ended June 30, 2020 | | | Year Ended December 31, | |

| | | (unaudited) | | | 2019 | | | 2018 | | | 2017 | | | 2016 | | | 2015 | |

| | | | | | |

Advisor Class | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Per share operating performance (for a share outstanding throughout the period) | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net asset value, beginning of period | | | $21.82 | | | | $18.06 | | | | $21.86 | | | | $15.73 | | | | $13.52 | | | | $17.01 | |

| | | | | | |

Income from investment operationsa: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment incomeb | | | 0.04 | | | | 0.37 | c | | | 0.25 | | | | 0.20 | | | | 0.13 | | | | 0.12 | |

| | | | | | |

Net realized and unrealized gains (losses) | | | (2.21 | ) | | | 4.44 | | | | (3.75 | ) | | | 6.18 | | | | 2.31 | | | | (3.43 | ) |

| | | | | | |

Total from investment operations | | | (2.17 | ) | | | 4.81 | | | | (3.50 | ) | | | 6.38 | | | | 2.44 | | | | (3.31 | ) |

| | | | | | |

Less distributions from: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment income | | | — | | | | (0.82 | ) | | | (0.30 | ) | | | (0.25 | ) | | | (0.23 | ) | | | (0.18 | ) |

| | | | | | |

Net realized gains | | | — | | | | (0.23 | ) | | | — | | | | — | | | | — | | | | — | |

| | | | | | |

Total distributions | | | — | | | | (1.05 | ) | | | (0.30 | ) | | | (0.25 | ) | | | (0.23 | ) | | | (0.18 | ) |

| | | | | | |

Net asset value, end of period | | | $19.65 | | | | $21.82 | | | | $18.06 | | | | $21.86 | | | | $15.73 | | | | $13.52 | |

| | | | | | |

Total returnd | | | (9.95)% | | | | 26.67% | | | | (15.99)% | | | | 40.59% | | | | 18.08% | | | | (19.47)% | |

| | | | | | |

Ratios to average net assetse | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Expenses before waiver and payments by affiliates | | | 1.27% | | | | 1.27% | | | | 1.31% | | | | 1.48% | | | | 1.54% | | | | 1.47% | |

| | | | | | |

Expenses net of waiver and payments by affiliates | | | 1.13% | | | | 1.13% | | | | 1.09% | | | | 1.30% | f | | | 1.33% | | | | 1.40% | |

| | | | | | |

Net investment income | | | 0.48% | | | | 1.82% | c | | | 1.24% | | | | 1.01% | | | | 0.89% | | | | 0.72% | |

| | | | | | |

Supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net assets, end of period (000’s) | | | $168,548 | | | | $195,065 | | | | $156,766 | | | | $179,125 | | | | $117,914 | | | | $101,900 | |

| | | | | | |

Portfolio turnover rate | | | 8.97% | | | | 17.71% | | | | 9.96% | | | | 8.89% | | | | 27.40% | | | | 67.52% | |

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cNet investment income per share includes approximately $0.09 per share related to income received in the form of special dividends in connection with certain Fund holdings. Excluding this amount, the ratio of net investment income to average net assets would have been 1.40%.

dTotal return is not annualized for periods less than one year.

eRatios are annualized for periods less than one year.

fBenefit of expense reduction rounds to less than 0.01%.

| | | | |

| | | |

14 | | Semiannual Report | The accompanying notes are an integral part of these financial statements. | | franklintempleton.com |

TEMPLETON DEVELOPING MARKETS TRUST

Statement of Investments, June 30, 2020 (unaudited)

| | | | | | | | | | | | |

| | | Industry | | | Shares | | | Value | |

| | | |

Common Stocks 94.0% | | | | | | | | | | | | |

Brazil 3.0% | | | | | | | | | | | | |

a B2W Cia Digital | | | Internet & Direct Marketing Retail | | | | 330,000 | | | $ | 6,497,664 | |

B3 SA - Brasil Bolsa Balcao | | | Capital Markets | | | | 782,100 | | | | 7,924,862 | |

Lojas Americanas SA | | | Multiline Retail | | | | 1,078,117 | | | | 5,407,639 | |

M Dias Branco SA | | | Food Products | | | | 591,300 | | | | 4,416,696 | |

Totvs SA | | | Software | | | | 240,300 | | | | 1,023,202 | |

Vale SA | | | Metals & Mining | | | | 1,343,400 | | | | 13,817,490 | |

| | | | | | | | | | | | |

| | | |

| | | | | | | | | | | 39,087,553 | |

| | | | | | | | | | | | |

| | | |

Cambodia 0.7% | | | | | | | | | | | | |

NagaCorp Ltd. | | | Hotels, Restaurants & Leisure | | | | 7,580,500 | | | | 8,842,977 | |

| | | | | | | | | | | | |

| | | |

China 30.6% | | | | | | | | | | | | |

a Alibaba Group Holding Ltd., ADR | | | Internet & Direct Marketing Retail | | | | 409,500 | | | | 88,329,150 | |

BAIC Motor Corp. Ltd., H | | | Automobiles | | | | 5,961,900 | | | | 2,609,085 | |

a Baidu Inc., ADR | | | Interactive Media & Services | | | | 112,634 | | | | 13,503,690 | |

Brilliance China Automotive Holdings Ltd. | | | Automobiles | | | | 39,207,200 | | | | 35,485,622 | |

China Merchants Bank Co. Ltd., A | | | Banks | | | | 1,582,900 | | | | 7,587,335 | |

China Merchants Bank Co. Ltd., H | | | Banks | | | | 2,554,800 | | | | 11,839,228 | |

China Mobile Ltd. | | | Wireless Telecommunication Services | | | | 2,583,359 | | | | 17,442,868 | |

China Resources Cement Holdings Ltd. | | | Construction Materials | | | | 11,924,800 | | | | 14,707,034 | |

CNOOC Ltd. | | | Oil, Gas & Consumable Fuels | | | | 11,586,200 | | | | 13,003,424 | |

COSCO SHIPPING Ports Ltd. | | | Transportation Infrastructure | | | | 3,521,105 | | | | 1,899,276 | |

Dairy Farm International Holdings Ltd. | | | Food & Staples Retailing | | | | 270,962 | | | | 1,266,123 | |

Health & Happiness H&H International Holdings Ltd. | | | Food Products | | | | 1,588,500 | | | | 7,220,045 | |

b MGM China Holdings Ltd. | | | Hotels, Restaurants & Leisure | | | | 3,553,000 | | | | 4,617,509 | |

NetEase Inc., ADR | | | Entertainment | | | | 18,341 | | | | 7,875,259 | |

Ping An Bank Co. Ltd., A | | | Banks | | | | 4,068,138 | | | | 7,398,964 | |

Ping An Insurance Group Co. of China Ltd., A | | | Insurance | | | | 1,071,800 | | | | 10,860,895 | |

a Prosus NV | | | Internet & Direct Marketing Retail | | | | 268,847 | | | | 24,989,359 | |

Sunny Optical Technology Group Co. Ltd. | | | Electronic Equipment, Instruments & Components | | | | 800,000 | | | | 12,875,502 | |

Tencent Holdings Ltd. | | | Interactive Media & Services | | | | 1,669,395 | | | | 106,970,582 | |

Uni-President China Holdings Ltd. | | | Food Products | | | | 4,041,500 | | | | 4,042,707 | |

Weifu High-Technology Co. Ltd., B | | | Auto Components | | | | 1,230,263 | | | | 2,099,511 | |

| | | | | | | | | | | | |

| | | |

| | | | | | | | | | | 396,623,168 | |

| | | | | | | | | | | | |

| | | |

Czech Republic 0.3% | | | | | | | | | | | | |

Moneta Money Bank AS | | | Banks | | | | 1,701,603 | | | | 3,852,958 | |

| | | | | | | | | | | | |

| | | |

Hungary 1.1% | | | | | | | | | | | | |

Richter Gedeon Nyrt | | | Pharmaceuticals | | | | 683,469 | | | | 14,174,994 | |

| | | | | | | | | | | | |

| | | |

India 5.6% | | | | | | | | | | | | |

Bajaj Holdings & Investment Ltd. | | | Diversified Financial Services | | | | 294,776 | | | | 9,934,158 | |

Coal India Ltd. | | | Oil, Gas & Consumable Fuels | | | | 2,502,349 | | | | 4,418,124 | |

Glenmark Pharmaceuticals Ltd. | | | Pharmaceuticals | | | | 92,168 | | | | 549,783 | |

ICICI Bank Ltd. | | | Banks | | | | 7,998,181 | | | | 37,268,327 | |

Infosys Ltd. | | | IT Services | | | | 1,687,664 | | | | 16,396,326 | |

Tata Chemicals Ltd. | | | Chemicals | | | | 846,962 | | | | 3,489,214 | |

| | | | | | | | | | | | |

| | | |

| | | | | | | | | | | 72,055,932 | |

| | | | | | | | | | | | |

| | | |

Indonesia 0.9% | | | | | | | | | | | | |

Astra International Tbk PT | | | Automobiles | | | | 33,724,500 | | | | 11,430,898 | |

| | | | | | | | | | | | |

| | | | |

franklintempleton.com | | Semiannual Report | | 15 |

TEMPLETON DEVELOPING MARKETS TRUST

STATEMENT OF INVESTMENTS (UNAUDITED)

| | | | | | | | | | | | |

| | | Industry | | | Shares | | | Value | |

| | |

Common Stocks (continued) | | | | | | | | | |

Kenya 0.2% | | | | | | | | | | | | |

a Equity Group Holdings PLC | | | Banks | | | | 7,076,012 | | | $ | 2,291,154 | |

| | | | | | | | | | | | |

| | | |

Mexico 1.2% | | | | | | | | | | | | |

Banco Santander Mexico SA Institucion de Banca Multiple Grupo Financiero Santander, ADR | | | Banks | | | | 3,726,457 | | | | 13,452,510 | |

Nemak SAB de CV | | | Auto Components | | | | 9,140,436 | | | | 1,913,457 | |

| | | | | | | | | | | | |

| | | |

| | | | | | | | | | | 15,365,967 | |

| | | | | | | | | | | | |

| | | |

Pakistan 0.2% | | | | | | | | | | | | |

Habib Bank Ltd. | | | Banks | | | | 4,890,300 | | | | 2,804,044 | |

| | | | | | | | | | | | |

| | | |

Peru 0.3% | | | | | | | | | | | | |

Intercorp Financial Services Inc. | | | Banks | | | | 123,460 | | | | 3,265,517 | |

| | | | | | | | | | | | |

| | | |

Philippines 0.2% | | | | | | | | | | | | |

BDO Unibank Inc. | | | Banks | | | | 1,411,517 | | | | 2,790,631 | |

| | | | | | | | | | | | |

| | | |

Russia 8.1% | | | | | | | | | | | | |

Gazprom PJSC, ADR | | | Oil, Gas & Consumable Fuels | | | | 1,492,646 | | | | 8,060,181 | |

LUKOIL PJSC, ADR | | | Oil, Gas & Consumable Fuels | | | | 350,812 | | | | 26,077,298 | |

a Mail.Ru Group Ltd., GDR | | | Interactive Media & Services | | | | 496,166 | | | | 11,191,767 | |

a Sberbank of Russia PJSC, ADR | | | Banks | | | | 2,583,758 | | | | 29,371,499 | |

a Yandex NV, A | | | Interactive Media & Services | | | | 590,538 | | | | 29,538,711 | |

| | | | | | | | | | | | |

| | | |

| | | | | | | | | | | 104,239,456 | |

| | | | | | | | | | | | |

| | | |

Singapore 0.1% | | | | | | | | | | | | |

DBS Group Holdings Ltd. | | | Banks | | | | 109,798 | | | | 1,652,170 | |

| | | | | | | | | | | | |

| | | |

South Africa 4.6% | | | | | | | | | | | | |

a Massmart Holdings Ltd. | | | Food & Staples Retailing | | | | 3,651,658 | | | | 4,842,533 | |

Naspers Ltd., N | | | Internet & Direct Marketing Retail | | | | 299,628 | | | | 55,041,614 | |

| | | | | | | | | | | | |

| | | |

| | | | | | | | | | | 59,884,147 | |

| | | | | | | | | | | | |

| | | |

South Korea 18.9% | | | | | | | | | | | | |

Fila Holdings Corp. | | | Textiles, Apparel & Luxury Goods | | | | 276,365 | | | | 8,177,313 | |

Hankook Tire & Technology Co. Ltd. | | | Auto Components | | | | 71,256 | | | | 1,478,679 | |

KT Skylife Co. Ltd. | | | Media | | | | 716,862 | | | | 4,756,834 | |

LG Corp. | | | Industrial Conglomerates | | | | 444,787 | | | | 26,616,456 | |

Naver Corp. | | | Interactive Media & Services | | | | 266,016 | | | | 60,009,278 | |

POSCO | | | Metals & Mining | | | | 76,371 | | | | 11,153,694 | |

Samsung Electronics Co. Ltd. | | | Technology Hardware, Storage & Peripherals | | | | 2,368,146 | | | | 105,112,727 | |

Samsung Life Insurance Co. Ltd. | | | Insurance | | | | 464,972 | | | | 17,528,892 | |

SK Hynix Inc. | | | Semiconductors & Semiconductor Equipment | | | | 139,250 | | | | 9,968,840 | |

| | | | | | | | | | | | |

| | | |

| | | | | | | | | | | 244,802,713 | |

| | | | | | | | | | | | |

| | | |

Taiwan 11.3% | | | | | | | | | | | | |

Catcher Technology Co. Ltd. | | | Technology Hardware, Storage & Peripherals | | | | 492,000 | | | | 3,739,297 | |

CTBC Financial Holding Co. Ltd. | | | Banks | | | | 1,598,800 | | | | 1,111,249 | |

a FIT Hon Teng Ltd. | | | Electronic Equipment, Instruments & Components | | | | 5,356,800 | | | | 2,087,944 | |

Hon Hai Precision Industry Co. Ltd. | | | Electronic Equipment, Instruments & Components | | | | 5,838,392 | | | | 17,192,238 | |

Largan Precision Co. Ltd. | | | Electronic Equipment, Instruments & Components | | | | 22,100 | | | | 3,081,713 | |

Taiwan Semiconductor Manufacturing Co. Ltd. | | | Semiconductors & Semiconductor Equipment | | | | 11,052,000 | | | | 118,372,994 | |

| | | | | | | | | | | | |

| | | |

| | | | | | | | | | | 145,585,435 | |

| | | | | | | | | | | | |

| | | | |

| | | |

16 | | Semiannual Report | | franklintempleton.com |

TEMPLETON DEVELOPING MARKETS TRUST

STATEMENT OF INVESTMENTS (UNAUDITED)

| | | | | | | | | | | | |

| | | Industry | | | Shares | | | Value | |

| | |

Common Stocks (continued) | | | | | | | | | |

Thailand 1.8% | | | | | | | | | | | | |

Kasikornbank PCL, fgn. | | | Banks | | | | 3,395,200 | | | $ | 10,317,844 | |

Kiatnakin Bank PCL, fgn. | | | Banks | | | | 4,178,300 | | | | 5,438,848 | |

Siam Commercial Bank PCL, fgn. | | | Banks | | | | 1,268,000 | | | | 2,991,262 | |

Thai Beverage PCL, fgn. | | | Beverages | | | | 9,206,700 | | | | 4,494,533 | |

| | | | | | | | | | | | |

| | | |

| | | | | | | | | | | 23,242,487 | |

| | | | | | | | | | | | |

| | | |

United Kingdom 3.1% | | | | | | | | | | | | |

Unilever PLC | | | Personal Products | | | | 754,394 | | | | 40,691,170 | |

| | | | | | | | | | | | |

| | | |

United States 1.8% | | | | | | | | | | | | |

Cognizant Technology Solutions Corp., A | | | IT Services | | | | 319,405 | | | | 18,148,592 | |

a IMAX Corp. | | | Entertainment | | | | 497,404 | | | | 5,575,899 | |

| | | | | | | | | | | | |

| | | |

| | | | | | | | | | | 23,724,491 | |

| | | | | | | | | | | | |

| | | |

Total Common Stocks (Cost $922,286,343) | | | | | | | | | | | 1,216,407,862 | |

| | | | | | | | | | | | |

| | | |

Preferred Stocks 3.8% | | | | | | | | | | | | |

Brazil 3.8% | | | | | | | | | | | | |

c Banco Bradesco SA, 13.248%, ADR, pfd. | | | Banks | | | | 5,945,141 | | | | 22,650,987 | |

c Itau Unibanco Holding SA, 10.51%, ADR, pfd. | | | Banks | | | | 5,662,359 | | | | 26,556,464 | |

| | | | | | | | | | | | |

| | | |

Total Preferred Stocks (Cost $52,137,969) | | | | | | | | | | | 49,207,451 | |

| | | | | | | | | | | | |

| | | |

Total Investments before Short Term Investments (Cost $974,424,312) | | | | | | | | | | | 1,265,615,313 | |

| | | | | | | | | | | | |

| | | |

Short Term Investments (Cost $30,229,630) 2.3% | | | | | | | | | | | | |

| | | |

Money Market Funds 2.3% | | | | | | | | | | | | |

| | | |

United States 2.3% | | | | | | | | | | | | |

d,e Institutional Fiduciary Trust Money Market Portfolio, 0.00% | | | | | | | 30,229,630 | | | | 30,229,630 | |

| | | | | | | | | | | | |

| | | |

Total Investments (Cost $1,004,653,942) 100.1% | | | | | | | | | | | 1,295,844,943 | |

| | | |

Other Assets, less Liabilities (0.1)% | | | | | | | | | | | (1,541,410 | ) |

| | | | | | | | | | | | |

| | | |

Net Assets 100.0% | | | | | | | | | | $ | 1,294,303,533 | |

| | | | | | | | | | | | |

See Abbreviations on page 29.

aNon-income producing.

bA portion or all of the security is on loan at June 30, 2020. See Note 1(c).

cVariable rate security. The rate shown represents the yield at period end.

dSee Note 3(f) regarding investments in affiliated management investment companies.

eThe rate shown is the annualized seven-day effective yield at period end.

| | | | |

franklintempleton.com | | The accompanying notes are an integral part of these financial statements. | Semiannual Report | | 17 |

TEMPLETON DEVELOPING MARKETS TRUST

FINANCIAL STATEMENTS

Statement of Assets and Liabilities

June 30, 2020 (unaudited)

| | | | |

Assets: | | | | |

Investments in securities: | | | | |

Cost - Unaffiliated issuers | | $ | 974,424,312 | |

Cost - Non-controlled affiliates (Note 3f) | | | 30,229,630 | |

| | | | |

| |

Value - Unaffiliated issuers+ | | $ | 1,265,615,313 | |

Value - Non-controlled affiliates (Note 3f) | | | 30,229,630 | |

Receivables: | | | | |

Investment securities sold | | | 1,081,479 | |

Capital shares sold | | | 948,119 | |

Dividends | | | 3,846,219 | |

Other assets | | | 1,114 | |

| | | | |

| |

Total assets | | | 1,301,721,874 | |

| | | | |

Liabilities: | | | | |

Payables: | | | | |

Capital shares redeemed | | | 5,744,450 | |

Management fees | | | 942,508 | |

Distribution fees | | | 226,409 | |

Transfer agent fees | | | 175,484 | |

Accrued expenses and other liabilities | | | 329,490 | |

| | | | |

| |

Total liabilities | | | 7,418,341 | |

| | | | |

| |

Net assets, at value | | $ | 1,294,303,533 | |

| | | | |

Net assets consist of: | | | | |

Paid-in capital | | $ | 1,070,734,399 | |

Total distributable earnings (losses) | | | 223,569,134 | |

| | | | |

| |

Net assets, at value | | $ | 1,294,303,533 | |

| | | | |

+Includes securities loaned | | $ | 3,947,970 | |

Class A: | | | | |

Net assets, at value | | $ | 901,181,778 | |

| | | | |

Shares outstanding | | | 45,635,155 | |

| | | | |

Net asset value per sharea | | | $19.75 | |

| | | | |

Maximum offering price per share (net asset value per share ÷ 94.50%) | | | $20.90 | |

| | | | |

Class C: | | | | |

Net assets, at value | | $ | 43,443,506 | |

| | | | |

Shares outstanding | | | 2,259,547 | |

| | | | |

Net asset value and maximum offering price per sharea | | | $19.23 | |

| | | | |

Class R: | | | | |

Net assets, at value | | $ | 16,066,273 | |

| | | | |

Shares outstanding | | | 829,086 | |

| | | | |

Net asset value and maximum offering price per share | | | $19.38 | |

| | | | |

Class R6: | | | | |

Net assets, at value | | $ | 165,064,347 | |

| | | | |

Shares outstanding | �� | | 8,409,446 | |

| | | | |

Net asset value and maximum offering price per share | | | $19.63 | |

| | | | |

Advisor Class: | | | | |

Net assets, at value | | $ | 168,547,629 | |

| | | | |

Shares outstanding | | | 8,576,854 | |

| | | | |

Net asset value and maximum offering price per share | | | $19.65 | |

| | | | |

aRedemption price is equal to net asset value less contingent deferred sales charges, if applicable.

| | | | |

| | | |

18 | | Semiannual Report | The accompanying notes are an integral part of these financial statements. | | franklintempleton.com |

TEMPLETON DEVELOPING MARKETS TRUST

FINANCIAL STATEMENTS

Statement of Operations

for the six months ended June 30, 2020 (unaudited)

| | | | |

Investment income: | | | | |

Dividends:(net of foreign taxes)* | | | | |

Unaffiliated issuers | | $ | 10,126,146 | |

Non-controlled affiliates (Note 3f) | | | 113,228 | |

Interest: | | | | |

Unaffiliated issuers | | | 3,109 | |

Income from securities loaned: | | | | |

Non-controlled affiliates (Note 3f) | | | 67 | |

| | | | |

| |

Total investment income | | | 10,242,550 | |

| | | | |

Expenses: | | | | |

Management fees (Note 3a) | | | 6,667,292 | |

Distribution fees: (Note 3c) | | | | |

Class A | | | 1,125,096 | |

Class C | | | 231,417 | |

Class R | | | 41,180 | |

Transfer agent fees: (Note 3e) | | | | |

Class A | | | 695,291 | |

Class C | | | 35,748 | |

Class R | | | 12,849 | |

Class R6 | | | 26,117 | |

Advisor Class | | | 130,119 | |

Custodian fees (Note 4) | | | 183,622 | |

Reports to shareholders | | | 81,142 | |

Registration and filing fees | | | 69,335 | |

Professional fees | | | 60,062 | |

Trustees’ fees and expenses | | | 95,245 | |

Other | | | 22,972 | |

| | | | |

| |

Total expenses | | | 9,477,487 | |

| |

Expenses waived/paid by affiliates (Note 3f and 3g) | | | (931,169 | ) |

| | | | |

| |

Net expenses | | | 8,546,318 | |

| | | | |

| |

Net investment income | | | 1,696,232 | |

| | | | |

Realized and unrealized gains (losses): | | | | |

Net realized gain (loss) from: | | | | |

Investments:# | | | | |

Unaffiliated issuers | | | (2,823,100 | ) |

Foreign currency transactions | | | (143,870 | ) |

| | | | |

| |

Net realized gain (loss) | | | (2,966,970 | ) |

| | | | |

Net change in unrealized appreciation (depreciation) on: | | | | |

Investments: | | | | |

Unaffiliated issuers | | | (158,683,655 | ) |

Translation of other assets and liabilities denominated in foreign currencies | | | (123,356 | ) |

Change in deferred taxes on unrealized appreciation | | | 2,456,619 | |

| | | | |

| |

Net change in unrealized appreciation (depreciation) | | | (156,350,392 | ) |

| | | | |

| |

Net realized and unrealized gain (loss) | | | (159,317,362 | ) |

| | | | |

| |

Net increase (decrease) in net assets resulting from operations | | $ | (157,621,130 | ) |

| | | | |

| |

*Foreign taxes withheld on dividends | | $ | 1,571,737 | |

#Net of foreign taxes | | $ | 620,180 | |

| | | | |

franklintempleton.com | | The accompanying notes are an integral part of these financial statements. | Semiannual Report | | 19 |

TEMPLETON DEVELOPING MARKETS TRUST

FINANCIAL STATEMENTS

Statements of Changes in Net Assets

| | | | | | | | |

| | |

| | | Six Months Ended

June 30, 2020

(unaudited) | | | Year Ended

December 31, 2019 | |

| | |

Increase (decrease) in net assets: | | | | | | | | |

Operations: | | | | | | | | |

Net investment income | | $ | 1,696,232 | | | $ | 21,614,482 | |

Net realized gain (loss) | | | (2,966,970 | ) | | | 79,478,484 | |

Net change in unrealized appreciation (depreciation) | | | (156,350,392 | ) | | | 216,719,810 | |

| | | | |

Net increase (decrease) in net assets resulting from operations | | | (157,621,130 | ) | | | 317,812,776 | |

| | | | |

Distributions to shareholders: | | | | | | | | |

Class A | | | — | | | | (46,760,052 | ) |

Class C | | | — | | | | (2,077,821 | ) |

Class R | | | — | | | | (847,686 | ) |

Class R6 | | | — | | | | (5,673,314 | ) |

Advisor Class | | | — | | | | (8,880,953 | ) |

| | | | |

| | |

Total distributions to shareholders | | | — | | | | (64,239,826 | ) |

| | | | |

Capital share transactions: (Note 2) | | | | | | | | |

Class A | | | (57,380,426 | ) | | | (36,510,410 | ) |

Class C | | | (7,217,656 | ) | | | (17,789,807 | ) |

Class R | | | (1,782,092 | ) | | | (1,593,568 | ) |

Class R6 | | | 63,596,459 | | | | 6,458,686 | |

Advisor Class | | | (5,324,711 | ) | | | 6,155,524 | |

| | | | |

| | |

Total capital share transactions | | | (8,108,426 | ) | | | (43,279,575 | ) |

| | | | |

Net increase (decrease) in net assets | | | (165,729,556 | ) | | | 210,293,375 | |

Net assets: | | | | | | | | |

Beginning of period | | | 1,460,033,089 | | | | 1,249,739,714 | |

| | | | |

| | |

End of period | | $ | 1,294,303,533 | | | $ | 1,460,033,089 | |

| | | | |

| | | | |

| | | |

20 | | Semiannual Report | The accompanying notes are an integral part of these financial statements. | | franklintempleton.com |

TEMPLETON DEVELOPING MARKETS TRUST

Notes to Financial Statements (unaudited)

1. Organization and Significant Accounting Policies

Templeton Developing Markets Trust (Fund) is registered under the Investment Company Act of 1940 (1940 Act) as an open-end management investment company and applies the specialized accounting and reporting guidance in U.S. Generally Accepted Accounting Principles (U.S. GAAP). The Fund offers five classes of shares: Class A, Class C, Class R, Class R6 and Advisor Class. Class C shares automatically convert to Class A shares after they have been held for 10 years. Each class of shares may differ by its initial sales load, contingent deferred sales charges, voting rights on matters affecting a single class, its exchange privilege and fees due to differing arrangements for distribution and transfer agent fees.

The following summarizes the Fund’s significant accounting policies.

a. Financial Instrument Valuation

The Fund’s investments in financial instruments are carried at fair value daily. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants on the measurement date. The Fund calculates the net asset value (NAV) per share each business day as of 4 p.m. Eastern time or the regularly scheduled close of the New York Stock Exchange (NYSE), whichever is earlier. Under compliance policies and procedures approved by the Fund’s Board of Trustees (the Board), the Fund’s administrator has responsibility for oversight of valuation, including leading the cross-functional Valuation Committee (VC). The Fund may utilize independent pricing services, quotations from securities and financial instrument dealers, and other market sources to determine fair value.

Equity securities listed on an exchange or on the NASDAQ National Market System are valued at the last quoted sale price or the official closing price of the day, respectively. Foreign equity securities are valued as of the close of trading on the foreign stock exchange on which the security is primarily traded, or as of 4 p.m. Eastern time. The value is then converted into its U.S. dollar equivalent at the foreign exchange rate in effect at 4 p.m. Eastern time on the day that the value of the security is determined. Over-the-counter (OTC) securities are valued within the range of the most recent quoted bid and ask prices. Securities that trade in multiple markets or on multiple exchanges are valued

according to the broadest and most representative market. Certain equity securities are valued based upon fundamental characteristics or relationships to similar securities.

Investments in open-end mutual funds are valued at the closing NAV.

The Fund has procedures to determine the fair value of financial instruments for which market prices are not reliable or readily available. Under these procedures, the Fund primarily employs a market-based approach which may use related or comparable assets or liabilities, recent transac-tions, market multiples, book values, and other relevant information for the investment to determine the fair value of the investment. An income-based valuation approach may also be used in which the anticipated future cash flows of the investment are discounted to calculate fair value. Discounts may also be applied due to the nature or duration of any restrictions on the disposition of the investments. Due to the inherent uncertainty of valuations of such investments, the fair values may differ significantly from the values that would have been used had an active market existed.

Trading in securities on foreign securities stock exchanges and OTC markets may be completed before 4 p.m. Eastern time. In addition, trading in certain foreign markets may not take place on every Fund’s business day. Events can occur between the time at which trading in a foreign security is completed and 4 p.m. Eastern time that might call into question the reliability of the value of a portfolio security held by the Fund. As a result, differences may arise between the value of the Fund’s portfolio securities as determined at the foreign market close and the latest indications of value at 4 p.m. Eastern time. In order to minimize the potential for these differences, an independent pricing service may be used to adjust the value of the Fund’s portfolio securities to the latest indications of fair value at 4 p.m. Eastern time. At June 30, 2020, certain securities may have been fair valued using these procedures, in which case the securities were categorized as Level 2 inputs within the fair value hierarchy. See the Fair Value Measurements note for more information.

When the last day of the reporting period is a non-business day, certain foreign markets may be open on those days that the Fund’s NAV is not calculated, which could result in differences between the value of the Fund’s portfolio securities on the last business day and the last calendar day

| | | | |

franklintempleton.com | | Semiannual Report | | 21 |

TEMPLETON DEVELOPING MARKETS TRUST

NOTES TO FINANCIAL STATEMENTS (UNAUDITED)

1. Organization and Significant Accounting Policies (continued)

a. Financial Instrument Valuation (continued)

of the reporting period. Any significant security valuation changes due to an open foreign market are adjusted and reflected by the Fund for financial reporting purposes.

b. Foreign Currency Translation

Portfolio securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars based on the exchange rate of such currencies against U.S. dollars on the date of valuation. The Fund may enter into foreign currency exchange contracts to facilitate transactions denominated in a foreign currency. Purchases and sales of securities, income and expense items denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date. Portfolio securities and assets and liabilities denominated in foreign currencies contain risks that those currencies will decline in value relative to the U.S. dollar. Occasionally, events may impact the availability or reliability of foreign exchange rates used to convert the U.S. dollar equivalent value. If such an event occurs, the foreign exchange rate will be valued at fair value using procedures established and approved by the Board.

The Fund does not separately report the effect of changes in foreign exchange rates from changes in market prices on securities held. Such changes are included in net realized and unrealized gain or loss from investments in the Statement of Operations.

Realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on securities transactions and the difference between the recorded amounts of dividends, interest, and foreign withholding taxes and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in foreign exchange rates on foreign denominated assets and liabilities other than investments in securities held at the end of the reporting period.

c. Securities Lending

The Fund participates in an agency based securities lending program to earn additional income. The Fund receives collateral in the form of cash and/or U.S. Government and