UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, For Use of the Commission Only (as permitted by 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant To §240.14a-12 |

ARROWHEAD RESEARCH CORPORATION

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of filing fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing party: |

| (4) | Date filed: |

ARROWHEAD RESEARCH CORPORATION

225 SOUTH LAKE AVENUE, SUITE 1050

PASADENA, CALIFORNIA 91101

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON TUESDAY, MARCH 3, 2015

TO THE STOCKHOLDERS OF ARROWHEAD RESEARCH CORPORATION:

NOTICE IS HEREBY GIVEN that the 2015 Annual Meeting of Stockholders of Arrowhead Research Corporation, a Delaware corporation (the “Company”), will be held on Tuesday, March 3, 2015, at 10:00 a.m., local time, at the Sheraton Pasadena, 303 E. Cordova Street, Pasadena, California 91101, for the following purposes:

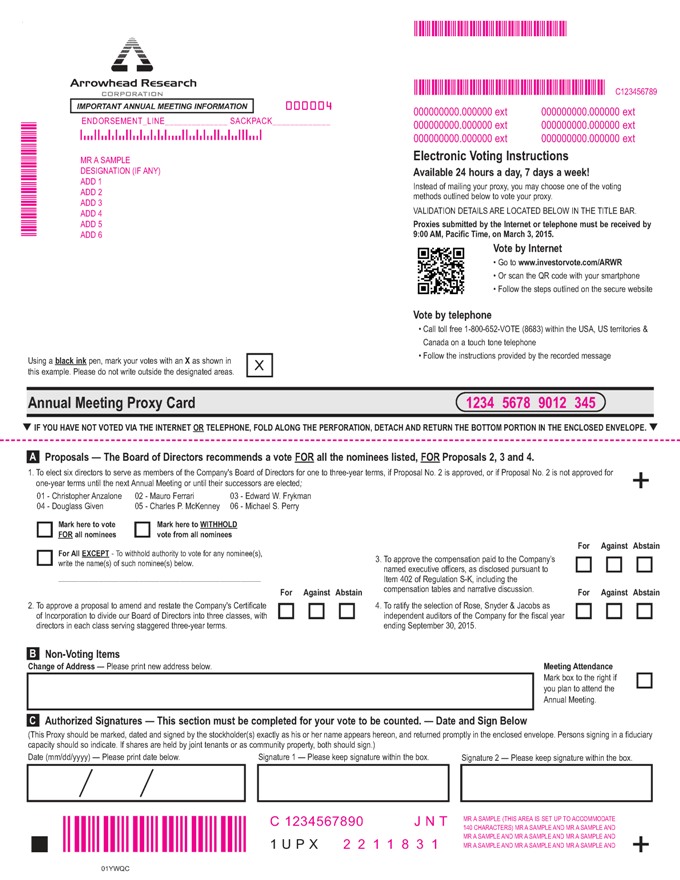

| 1. | To elect six directors to serve as members of the Company’s Board of Directors for one to three-year terms, if Proposal No. 2 is approved, or, if Proposal No. 2 is not approved, for one-year terms until the next Annual Meeting or until their successors are elected; |

| 2. | To approve a proposal to amend and restate the Company’s Certificate of Incorporation to divide our Board of Directors into three classes, with directors in each class serving staggered three-year terms; |

| 3. | To conduct an advisory (non-binding) vote on executive compensation; and |

| 4. | To ratify the selection of Rose, Snyder & Jacobs, LLP as independent auditors of the Company for the fiscal year ending September 30, 2015; |

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice. Proposal No. 1 relates solely to the election of the six directors nominated by the Board of Directors and does not include any other matters relating to the election of directors, including, without limitation, the election of directors nominated by any stockholder of the Company.

Only stockholders of record at the close of business on January 9, 2015 are entitled to notice of and to vote at the Annual Meeting.

All stockholders of record are cordially invited to attend the Annual Meeting in person. However, to ensure your representation at the meeting, you are urged to vote via the Internet or telephone as instructed in the Notice Regarding the Internet Availability of Proxy Materials, or to mark, sign, date and return the proxy card as promptly as possible in the postage-prepaid envelope enclosed for that purpose. Any stockholder of record attending the Annual Meeting may vote in person even if such stockholder has previously returned a proxy. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the meeting, you must obtain a proxy issued in your name from that record holder.

| /s/ Jane Davidson |

| Jane Davidson |

| Secretary |

| Pasadena, California |

| January 27, 2015 |

Your vote is important, whether or not you expect to attend the Annual Meeting of Stockholders. Stockholders of record are urged to vote via the Internet or telephone as instructed, or if you are voting by mail, to mark, sign and date and promptly return the proxy in the stamped return envelope provided. Voting promptly will help avoid the additional expense of further solicitation to assure a quorum at the meeting.

Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the meeting, you must obtain a proxy issued in your name from that record holder.

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting To Be Held on Tuesday, March 3, 2015

You may access the following proxy materials atwww.edocumentview.com/ARWR

Notice of the 2015 Annual Meeting of Stockholders;

Company’s 2015 Proxy Statement;

Company’s Annual Report on Form 10-K for the year ended September 30, 2014; and

Form of Proxy Card

ARROWHEAD RESEARCH CORPORATION

225 South Lake Avenue, Suite 1050

Pasadena, California 91101

(626) 304-3400

PROXY STATEMENT FOR ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON TUESDAY, MARCH 3, 2015

GENERAL INFORMATION CONCERNING SOLICITATION AND VOTING

The enclosed Proxy is solicited on behalf of Arrowhead Research Corporation (the “Company” or “Arrowhead”) for use at the 2015 Annual Meeting of Stockholders (the “Annual Meeting”) to be held on Tuesday, March 3, 2015 at 10:00 a.m., local time, and at any adjournment(s) thereof, for the purposes set forth herein and in the accompanying Notice of Annual Meeting of Stockholders (the “Notice”). The Annual Meeting will be held at the Sheraton Pasadena, 303 E. Cordova Street, Pasadena, CA 91101.

The Company anticipates that these proxy solicitation materials will first be mailed on or about January 27, 2015 to all stockholders entitled to vote at the Annual Meeting.

Record Date

Only holders of record of our voting stock at the close of business on January 9, 2015 (the “Record Date”) are entitled to notice of the Annual Meeting and to vote at the Annual Meeting. On that date, the Company had outstanding (i) 54,733,264 shares of common stock (“Common Stock”), (ii) 2,300 shares of Series B Convertible Preferred Stock (the “Series B Preferred Stock”) and (iii) 16,000 shares of Series C Convertible Preferred Stock (the “Series C Preferred Stock”, together the “Preferred Stock”). Holders of the Preferred Stock are entitled to vote with the holders of Common Stock on an as-converted basis, subject to the applicable limitations on their rights to convert the Preferred Stock into Common Stock. As of the Record Date, and without regard to conversion limits that may serve to reduce the number of shares eligible to vote at the annual meeting, the Preferred Stock was entitled to vote up to 3,987,206 equivalent shares of Common Stock. The Common Stock and that portion of the Preferred Stock that is entitled to vote at the Annual Meeting is sometimes referred to herein as the “Voting Stock.”

Revocability of Proxies

Any proxy given by a stockholder of record pursuant to this solicitation may be revoked by the person giving it at any time before its use by delivering to the Secretary of the Company, at or before the taking of the vote at the Annual Meeting, a written notice of revocation or a duly executed proxy bearing a later date or by attending the Annual Meeting and voting in person. Stockholders may also revoke their proxy by entering a new vote over the Internet or by telephone.

Voting and Solicitation

Each share of the Company’s Voting Stock is entitled to one vote on all matters presented at the Annual Meeting. Stockholders do not have the right to cumulate their votes in the election of directors. Shares of Voting Stock represented by properly executed proxies will, unless such proxies have been previously revoked, be voted in accordance with the instructions indicated thereon. In the absence of specific instructions to the contrary, properly executed proxies will be voted FOR all matters submitted to a vote of stockholders at the Annual Meeting pursuant to this proxy statement. No business other than that set forth in the accompanying Notice of Annual Meeting of Stockholders is expected to come before the Annual Meeting. Should any other matter requiring a vote of stockholders properly arise, the persons named in the enclosed form of proxy will vote such proxy in accordance with the recommendation of the Board of Directors (the “Board”).

1

If you will not be able to attend the Annual Meeting to vote in person, you may vote your shares via the Internet or by telephone or by mail as set forth in the Notice.

In addition to proxy solicitation by a proxy solicitor engaged by the Company, if any, proxies may be solicited by certain of the directors, officers and employees of the Company, without additional compensation. The Company will bear the costs of solicitation. In addition, the Company expects to reimburse brokerage firms and other persons representing beneficial owners of shares for their expenses in forwarding solicitation materials to such beneficial owners.

If your shares are held in street name, the voting instruction form sent to you by your broker, bank or other nominee should indicate whether the institution has a process for beneficial holders to provide voting instructions over the Internet or by telephone. A number of banks and brokerage firms participate in a program that also permits stockholders whose shares are held in street name to direct their vote over the Internet or by telephone. If your bank or brokerage firm gives you this opportunity, the voting instructions from the bank or brokerage firm that accompany this proxy statement will tell you how to use the Internet or telephone to direct the vote of shares held in your account. If your voting instruction form does not include Internet or telephone information, please complete and return the voting instruction form in the self-addressed, postage-paid envelope provided by your broker. Stockholders who vote by proxy over the Internet or by telephone need not return a proxy card or voting instruction form by mail.

Quorum; Abstentions; Broker Non-Votes

The required quorum for the transaction of business at the Annual Meeting is a majority of the votes eligible to be cast by holders of shares of Voting Stock issued and outstanding on the Record Date. Shares that are voted “FOR,” “AGAINST” or “ABSTAIN” on a matter are treated as being present at the meeting for purposes of establishing a quorum with respect to such matter. For certain proposals, brokers may not have discretionary authority to vote on a particular matter if they have not received specific instructions from the beneficial owner of the shares (“broker non-votes”). Shares subject to a broker non-vote will be counted as present for the purpose of determining the presence or absence of a quorum for the transaction of business at the Annual Meeting; the effect of abstentions and broker non-votes on the proposals presented herein is discussed below.

With regard to the election of directors, votes may be cast in favor of a director nominee or withheld. Because directors are elected by plurality, abstentions from voting and broker non-votes will be entirely excluded from the vote and will have no effect on its outcome. If a quorum is present at the meeting, the nominees receiving the greatest number of votes, up to six directors, will be elected.

Because Proposal No. 2 must be approved by a majority of the outstanding capital stock, abstentions and broker non-votes will have the same effect as a vote against that proposal. Because Proposal Nos. 3 and 4 must be approved by the affirmative vote of a majority of the shares of Voting Stock entitled to vote thereon and present in person or by proxy at the Annual Meeting (the “Required Vote”), abstentions will be counted in tabulations of the votes cast on each such proposal and will have the same effect as a vote against the proposal, whereas broker non-votes will be excluded from the vote and will have no effect on its outcome.

Deadline for Receipt of Stockholder Proposals

Any stockholder who meets the requirements of the proxy rules under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), who intends to present a proposal at the Company’s 2016 Annual Meeting of Stockholders must ensure that the proposal is received by the Corporate Secretary at Arrowhead Research Corporation, 225 South Lake Avenue, Suite 1050, Pasadena, CA 91101, not later than September 29, 2015, in order to be considered for inclusion in our proxy materials for that meeting; provided, however, that if the Company’s 2016 Annual Meeting of Stockholders is held before February 2, 2016 or after April 2, 2016, you must provide specified information to us a reasonable time before we begin to print and send our proxy statement for our 2016 Annual Meeting. Proposals received after the specified dates may be excluded from the Company’s proxy statement.

Additionally, our Bylaws provide for notice procedures to recommend a person for nomination as a director or to propose business to be considered by stockholders at a meeting. To be considered timely under these provisions, the stockholder’s notice must be received by the Corporate Secretary at our principal executive offices at the address set forth above between 90 and 120 days prior to the one-year anniversary of the date of the 2015 Annual Meeting;

2

provided, however, that if the 2016 Annual Meeting date is advanced by more than 30 days before or delayed by more than 60 days after the anniversary date of the 2015 Annual Meeting, then stockholders must provide notice within time periods specified in our Bylaws. Our Bylaws also specify requirements as to the form and content of a stockholder’s notice.

PROPOSAL ONE

ELECTION OF DIRECTORS

The Board has nominated the following six persons as directors to serve until the 2016 Annual Meeting and until their successors have been duly elected. Each of the nominees is currently a director of Arrowhead. Except as set forth in the biographical information below, none of the nominees is related by blood, marriage or adoption to any other nominee or any executive officer of the Company. The six nominees receiving the greatest numbers of votes at the Annual Meeting will be elected to the six director positions. Unless otherwise instructed, the proxy holders will vote the proxies received by them for the six nominees named below. If any nominee is unable or declines to serve as director at the time of the Annual Meeting, the proxies will be voted for any nominee who is designated by our present Board to fill the vacancy. The table below sets forth, with respect to each nominee for election, his age and current position with Arrowhead, and, if Proposal No. 2 is approved by the Company’s stockholders, the class which each nominee shall serve under if elected and the expiration of the term of such director.

Nominees for Election as Directors. The Board unanimously adopted a resolution proposing that the Company adopt an Amended and Restated Certificate of Incorporation (the “A&R Certificate of Incorporation”) and Amended and Restated Bylaws (the “A&R Bylaws”) that classify the Board into three separate classes, as nearly equal in number as possible, with one class being elected each year to serve a staggered three-year term. The classification of the board and the adoption of the A&R Certificate of Incorporation is conditioned on obtaining stockholder approval as discussed herein under “Proposal Two — Approval of a Classified Board of Directors.” Stockholder approval is not required for the adoption of the A&R Bylaws.

Subject to the approval of the A&R Certificate of Incorporation, the terms of office of the Class I, Class II and Class III directors will expire in 2016, 2017 and 2018, respectively.

OUR BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” EACH OF THE NOMINEES LISTED BELOW.

Name | Age | Position with Arrowhead | Classification (Term Expiration) | |||

Charles P. McKenney* | 76 | Director | Class I (2016) | |||

Mauro Ferrari** | 55 | Director | Class I (2016) | |||

Christopher Anzalone | 45 | Chief Executive Officer, President & Director | Class II (2017) | |||

Michael S. Perry* | 55 | Director | Class II (2017) | |||

Douglass Given | 62 | Director and Chairman of the Board | Class III (2018) | |||

Edward W. Frykman* | 78 | Director | Class III (2018) | |||

| * | Member of the Audit Committee, Compensation Committee and Nomination Committee. |

| ** | Member of the Compensation Committee and Nomination Committee |

If the A&R Certificate of Incorporation is not approved, each nominee, if elected at the Annual Meeting, will serve as a director until the earlier of the 2016 Annual Meeting of the Company’s stockholders or until his successor is duly elected and qualified.

3

Dr. Christopher Anzalone has been President, Chief Executive Officer and Director of the Company since December 1, 2007. In 2005, Dr. Anzalone formed and served as CEO of the Benet Group LLC, a private equity firm focused on creating and building new nano-biotechnology companies from university-generated science. Prior to his tenure at the Benet Group, from 1999 until 2003, he was a partner at the Washington, DC-based private equity firm Galway Partners, LLC, where he was responsible for sourcing, structuring, and building new business ventures. Dr. Anzalone holds a Ph.D. in Biology from UCLA and a B.A. in Government from Lawrence University. We believe Dr. Anzalone’s qualifications to serve on the Board include his deep understanding of the business through his role as Chief Executive Officer; in addition, Dr. Anzalone has extensive experience in biotechnology, nanotechnology, company-building and venture capital.

Dr. Mauro Ferrariwas appointed to the Arrowhead Board of Directors in 2010. Dr. Ferrari is the President and CEO of The Houston Methodist Hospital Research Institute (TMHRI), Executive Vice President of Houston Methodist Hospital, and Senior Associate Dean of Weill Cornell Medical College in New York. He is also the President of The Alliance for NanoHealth. Dr. Ferrari is an internationally recognized expert in nanomedicine and biomedical nanotechnology. Prior to assuming leadership of TMHRI, Dr. Ferrari was Professor and Chairman of The Department of NanoMedicine and Biomedical Engineering at The University of Texas Health Science Center at Houston, Professor of Experimental Therapeutics at the MD Anderson Cancer Center, Adjunct Professor of Bioengineering at Rice University, and Adjunct Professor of Biomedical Engineering at the University of Texas in Austin. His previous academic appointments include tenured professorships at UC Berkeley and The Ohio State University.

From 2003 to 2005, Dr. Ferrari served as Special Expert on Nanotechnology and Eminent Scholar at The National Cancer Institute, where he led in the development of NCI’s program in Nanotechnology, which remains the largest program in NanoMedicine in the world. Dr. Ferrari has been serving as the Editor-in-Chief for “Biomedical Microdevices: BioMEMS and Biomedical Nanotechnology” since 1997. We believe Dr. Ferrari’s qualifications to serve on the Board include his extensive training and experience in the fields of nanotechnology, biotechnology and biomedical applications. Dr. Ferrari has significant technical training, several academic appointments, over 300 published articles, over 30 issued patents, and is the recipient of most prestigious academic awards in nanomedicine and drug delivery technology. Additionally, Dr. Ferrari has extensive experience in developmental stage organizations having founded several startup companies.

Edward W. Frykman has been a director of the Company since January 2004. Mr. Frykman was an Account Executive with Crowell, Weedon & Co., a position he held from 1992 until 2008 when he retired. Before his service at Crowell, Weedon & Co., Mr. Frykman served as Senior Vice President of L.H. Friend & Co. Both Crowell Weedon & Co. and L.H. Friend & Co. are investment brokerage firms located in Southern California. In addition, Mr. Frykman was a Senior Account Executive with Shearson Lehman Hutton, where he served as the Manager of the Los Angeles Regional Retail Office of E. F. Hutton & Co. Mr. Frykman is also a director of Acacia Research Corporation, a publicly-held corporation based in Newport Beach, California. We believe Mr. Frykman’s qualifications to serve on the Board include his long tenure as a member of the Board which enabled Mr. Frykman to gain a deep understanding of the company’s operations, strategy and finances. Mr. Frykman also has extensive experience in the fields of finance and public company oversight.

Dr. Douglass Givenhas been a director of the company since November 2010. Dr. Given is the founder and managing partner of G5 Partners LLC and an Advisor to Bay City Capital LLC, a San Francisco based Life Sciences Venture Capital firm. He joined Bay City in 2000, served as a General Partner and Investment Partner from 2004-2014, and participated in more than 50 investments. He has co-founded 14 startup companies. He formerly held positions as Corporate Senior Vice President and Chief Technology Officer at Mallinckrodt, Vice President at Schering Plough, Vice President at Monsanto/GD Searle and Medical Advisor at Lilly. He has been a Director at 8 public and 8 private companies and is currently Chairman at Arrowhead, Vivaldi Biosciences Inc and Medical eXellence Inc. He has held positions as CEO at Progenitor Inc, Mercator Genetics Inc, NeoRx Corp, VIA Pharmaceuticals Inc, and Vivaldi Biosciences Inc. Dr. Given has been a member of the University of Chicago Medical Center and Pritzker School of Medicine Visiting Committee since 1995 and served as its Chair from 2007-2013.

4

Additional University of Chicago activities include the Center for Global Health External Advisory Board and Investment Committee for the Innovation Fund. He is a member of the Johns Hopkins Bloomberg School of Public Health Advisory Board and its Development Committee and Innovation and Commercialization Committee. He is a member of the Harvard School of Public Health International Advisory Council and the Stanford Medicine Community Council. He received his MD & PhD from the University of Chicago and MBA from the Wharton School, University of Pennsylvania. Dr. Given was a Clinical and Research Fellow in Internal Medicine and Infectious Diseases at Massachusetts General Hospital and Harvard Medical School. We believe Dr. Given’s qualifications to serve on the Board include his extensive experience as a physician scientist, in finance and business transactions, particularly investments in the life sciences industry as well as directorship roles in biopharmaceutical companies. Dr. Given also has significant leadership roles, including CTO and Senior Vice President, at several large pharmaceutical companies. Dr. Douglass Given is a brother of Dr. Bruce Given, our chief operating officer.

Charles P. McKenney has been a director of the Company since April 2004. Mr. McKenney is retired from a government affairs law practice in Pasadena, California that he maintained from 1989 until 2014, representing businesses and organizations in their relations with state and local government regarding their obligations under state and local land use and trade practices laws. From 1973 through 1989, he served as Attorney for Corporate Government Affairs for Sears, Roebuck and Co., helping organize and carry out Sears’s western state and local government relations programs. Mr. McKenney has served two terms on the Pasadena, California City Council as well as on several city boards and committees, including three city Charter Reform Task Forces. We believe Mr. McKenney’s qualifications to serve on the Board include his long tenure as a member of the Board resulting in a deep understanding of the Company’s operations, strategy and finances. Mr. McKenney also has extensive experience providing strategic legal and advisory services to developmental stage organizations.

Dr. Michael S. Perry joined Arrowhead’s Board of Directors in December 2011. Dr. Perry is currently Chief Scientific Officer, Global Cell and Gene Therapy at Novartis Pharma. Prior to his appointment at Novartis, Dr. Perry was a Venture Partner with Bay City Capital LLP from 2005 until November 2012 and President and Chief Medical Officer of Poniard Pharmaceuticals from 2010 to November 2012. He also currently serves as a member of the board of directors of AmpliPhi Biosciences Corporation and Avita Medical. He was Chief Development Officer at VIA Pharmaceuticals, Inc., a publicly held drug development company, from April 2005 until May 2009. Prior thereto, he served as Chairman and Chief Executive Officer of Extropy Pharmaceuticals, Inc., a privately held pediatric specialty pharmaceutical company, from June 2003 to April 2005. From 2002 to 2003, Dr. Perry served as President and Chief Executive Officer of Pharsight Corporation, a publicly held software and consulting services firm. From 2000 to 2002, Dr. Perry served as Global Head of Research and Development for Baxter BioScience. From 1997 to 2000, Dr. Perry was President and Chief Executive Officer of both SyStemix Inc. and Genetic Therapy Inc., two wholly owned subsidiaries of Novartis Corp. and from 1994 to 1997, he was Vice President of Regulatory Affairs for Novartis Pharma (previously Sandoz Pharmaceuticals). Prior to 1994, Dr. Perry held various management positions with Syntex Corporation, Schering-Plough Corporation and BioResearch Laboratories, Inc. Dr. Perry holds a Doctor of Veterinary Medicine, a Ph.D. in Biomedical Pharmacology and a B.Sc. in Physics from the University of Guelph, Ontario, Canada. He is a graduate of the International Management Program at Harvard Business School. We believe Dr. Perry’s qualifications to serve on the board include his medical expertise and his extensive experience in preclinical and clinical drug development, including executive level leadership roles in several publicly held biotech companies.

Corporate Governance Policies and Practices

The following is a summary of our corporate governance policies and practices:

| • | The positions of Chairman of the Board and Chief Executive Officer are separated, which allows our Chief Executive Officer to focus on our day-to-day business, while allowing the Chairman of the Board to lead the Board in its fundamental role of providing advice to and oversight of management. While our Bylaws do not require that our Chairman and Chief Executive Officer positions be separate, our Board believes that having separate positions is the appropriate leadership structure for us at this time and demonstrates our commitment to good corporate governance. |

5

| • | A majority of the members of the Board are independent directors, as defined by the NASDAQ Marketplace Rules. The Board has determined that all of the Company’s directors are independent, except Dr. Anzalone, due to his employment relationship with the Company, and Dr. Given, who is the brother of Bruce Given, the Company’s Chief Operating Officer. Non-employee directors do not receive consulting or other fees from the Company, other than Board and Committee compensation. |

| • | The Board has overall responsibility for the oversight of the Company’s risk management process, which is designed to support the achievement of organizational objectives, including strategic objectives, to improve long-term organizational performance and enhance stockholder value. Risk management includes not only understanding company-specific risks and the steps management implements to manage those risks, but also what level of risk is acceptable and appropriate for the Company. Management is responsible for establishing our business strategy, identifying and assessing the related risks and implementing appropriate risk management practices. The Board regularly reviews our business strategy and management’s assessment of the related risk, and discusses with management the appropriate level of risk for the Company. |

| • | All of the Company’s employees, officers and directors are subject to the Company’s Code of Business Conduct and Ethics Policy, which is available on the Company’s website at www.arrowheadresearch.com. The ethics policy meets the requirements of the NASDAQ Marketplace Rules, as well as the code of ethics requirements of the SEC. |

| • | The Audit, Compensation and Nomination Committees consist entirely of independent directors. |

| • | The independent directors meet separately in executive session on a regular basis to discuss matters relating to the Company and the Board, without members of the management team present. |

| • | The Board reviews at least annually the Company’s business initiatives, capital projects and budget matters. |

| • | The Audit Committee reviews and approves all related-party transactions or, if the size and nature of the transaction warrants, a special committee of non-related Board members is formed to negotiate and approve the transaction. |

Stockholder Communications with Directors

Stockholders who wish to communicate with the Board or any individual director can write to: Jane Davidson, Corporate Secretary, Arrowhead Research Corporation, 225 South Lake Avenue, Suite 1050, Pasadena, CA 91101. Your letter should indicate that you are an Arrowhead stockholder. Depending on the subject matter, management will:

| • | Forward the communication to the director or directors to whom it is addressed; |

| • | Forward the communication to the Chairman of the Board, if addressed to the board of directors; or |

| • | If not addressed to any director or directors, attempt to handle the inquiry directly (for example, requests for information or stock-related matters). |

Board Meetings and Committees

The Board held a total of seven meetings during the fiscal year ended September 30, 2014. The Board has three standing committees: an Audit Committee, a Compensation Committee, and a Nomination Committee.

The functions of the Audit Committee are to select independent public accountants, to review the scope and results of the year-end audit with management and the independent auditors, to review the Company’s accounting principles and its system of internal accounting controls, to review the Company’s annual and quarterly reports before filing with the Securities and Exchange Commission, and to review any related-party transactions. The Audit Committee met four times during fiscal 2014. The current members of the Audit Committee are Edward W. Frykman, Chairman, Charles P. McKenney, and Michael S. Perry. The Board has determined that all members of the Audit Committee are independent directors under the Rules of the SEC and the listing standards of the NASDAQ Marketplace Rules and are financially literate. The Board has determined that Mr. Frykman is an “audit committee financial expert” in accordance with the applicable regulations. The Audit Committee Charter is available on the Company’s website at www.arrowheadresearch.com.

6

The functions of the Compensation Committee are to review the goals and achievements of the Company and the Chief Executive Officer for the prior year and approve the goals of the Company and the Chief Executive Officer for the next year, to review and approve salaries, bonuses and other benefits payable to the Company’s executive officers and to administer the Company’s 2004 Equity Incentive Plan and 2013 Incentive Plan. The Compensation Committee is specifically responsible for determining the compensation of the Chief Executive Officer and the other executive officers. The Compensation Committee reviews compensation recommendations made by the Chief Executive Officer for other senior executives of the Company at least annually; the Chief Executive Officer is not present during discussions or deliberations regarding his compensation. The Compensation Committee engaged a consultant to provide advice and guidance with regard to compensation for our named executive officers for fiscal 2014. The Compensation Committee met three times during fiscal 2014. The current members of the Compensation Committee are Michael S. Perry, Chairman, Edward Frykman, Charles P. McKenney, and Mauro Ferrari. The Board has determined that all members of the Compensation Committee are independent directors under the listing rules of the NASDAQ Marketplace Rules. The Compensation Committee’s charter is available on the Company’s website at www.arrowheadresearch.com. The Committee has not delegated any of its responsibilities or authorities granted under its charter.

The Nomination Committee is responsible for proposing a slate of directors for election by the stockholders at each Annual Stockholders Meeting and for proposing candidates to fill any vacancies. The Nomination Committee met once during fiscal 2014. The current members of the Nomination Committee are Michael S. Perry, Chairman, Edward Frykman, Charles P. McKenney and Mauro Ferrari. The Nomination Committee’s charter is available on the Company’s website at www.arrowheadresearch.com. The Nomination Committee manages the process for evaluating current Board members at the time they are considered for re-nomination. After considering the appropriate skills and characteristics required on the Board, the current makeup of the Board, the results of the evaluations, and the wishes of the Board members to be re-nominated, the Nomination Committee recommends to the Board whether those individuals should be re-nominated.

On at least an annual basis, the Nomination Committee reviews with the Board whether it believes the Board would benefit from adding new members and, if so, the appropriate skills and characteristics required for any new members. If the Board determines that a new member would be beneficial, the Nomination Committee solicits and receives recommendations for candidates and manages the process for evaluating candidates. All potential candidates, regardless of their source, are reviewed under the same process. The Nomination Committee (or its chairman) screens the available information about the potential candidate(s). Based on the results of the initial screening, interviews with viable candidates are scheduled with Nomination Committee members, other members of the Board and senior members of management. Upon completion of these interviews and other due diligence, the Nomination Committee may recommend to the Board the election or nomination of a candidate.

Candidates for independent Board member positions have historically been identified through recommendations from directors or others associated with the Company. Arrowhead stockholders may also recommend candidates by sending the candidate’s name and resume to the Nomination Committee pursuant to the procedures, set forth above, for communication with the Board. As described above, our Bylaws also provide for separate notice procedures to recommend a person for nomination as a director to be considered by stockholders at a meeting, including requirements as to the timing, form and content of a stockholder’s notice.

The Nomination Committee has no predefined minimum criteria for selecting Board nominees, although it believes that all independent directors should share qualities such as independence, business experience at the corporate level, relevant non-competitive experience, and strong communication and analytical skills. In any given search, the Nomination Committee may also define particular characteristics for candidates to balance the overall skills and characteristics of the Board and the needs of the Company. However, during any search, the Nomination Committee reserves the right to modify its stated search criteria for exceptional candidates. While the Board does not have a policy with regard to consideration of diversity for selecting candidates, the Nomination Committee may consider diversity, including diversity with respect to experience, skill set, age, areas of expertise and professional background, as well as race, gender, national origin and any other criteria deemed appropriate by the Nomination Committee.

No incumbent director attended fewer than 75% of the aggregate of (i) the total number of meetings of the Board held during fiscal 2014, and (ii) the total number of meetings held by all committees of the Board during fiscal 2014 on which such person served.

7

In addition, the majority of the directors attended the 2014 Annual Meeting of Stockholders. It is the Company’s policy to encourage, but not require, that all directors attend our annual stockholder meetings.

FISCAL 2014 DIRECTOR COMPENSATION

Director Compensation

Directors who are also employees of the Company receive no separate compensation from the Company for their service as members of the Board. Effective in the second quarter of fiscal 2014, our non-employee chairman of the board receives a cash retainer of $70,000 per year; other non-employee directors receive a cash retainer of $45,000 per year, paid quarterly. In 2014, non-employee directors received a grant of 15,000 restricted stock units which vest on the one year anniversary of the date of grant. The Non-employee Chairman received an additional grant of 5,000 restricted stock units. Dr. Given received an additional $80,000 in board fees for his service on a special short term Corporate Development Committee from February to December 2014. Prior to the increase in board fees effective in the second quarter of fiscal 2014, non-employee directors received a cash retainer of $37,500 per year, paid quarterly. Dr. Given received an additional payment of $1,250 quarterly for his service as Chairman. Based on the policies of his current employer, Dr. Ferrari currently declines to accept cash or equity compensation. Dr. Ferrari may elect to receive compensation in the future. The following table sets forth the total compensation paid to our non-employee directors in fiscal 2014. Dr. Anzalone’s compensation is set forth below in the Summary Compensation Table.

Name | Fee Earned or Paid in Cash ($) | Stock Awards ($) (1) (2) (3) | Total ($) | |||||||||

Douglass Given | $ | 143,125 | $ | 290,800 | $ | 433,925 | ||||||

Edward Frykman | $ | 43,125 | $ | 218,100 | $ | 261,225 | ||||||

Charles McKenney | $ | 43,125 | $ | 218,100 | $ | 261,225 | ||||||

Michael S. Perry | $ | 43,125 | $ | 218,100 | $ | 261,225 | ||||||

Mauro Ferrari | $ | — | $ | — | $ | — | ||||||

| (1) | Each non-employee director received a grant of 15,000 restricted stock units (“RSUs”). Dr. Given received an additional grant of 5,000 units for his service as Chairman of the Board. Dr. Ferrari has declined to accept compensation at this time due to his obligations to his employer. |

| (2) | This column represents the total grant date fair value, computed in accordance with ASC 718, of restricted stock units granted during fiscal year 2014, based on the number of RSUs granted multiplied by the grant date fair value of $14.54, which is equal to the closing price of our Common Stock on the grant date. |

| (3) | RSUs to non-employee directors vest one year from date of grant. |

Vote Required; Recommendation of the Board

The six nominees receiving the greatest numbers of votes at the meeting, assuming a quorum is present, will be elected to the six director positions to serve until their terms expire or until their successors have been duly elected and qualified. Because directors are elected by plurality, abstentions from voting and broker non-votes will be entirely excluded from the vote and will have no effect on its outcome.

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” EACH OF THE NOMINEES

FOR DIRECTOR IN PROPOSAL ONE.

PROPOSAL TWO

APPROVAL OF A CLASSIFIED BOARD OF DIRECTORS

The Board has unanimously adopted a resolution proposing an A&R Certificate of Incorporation adding a new Article NINTH that classifies the Board into three classes with staggered terms of office, incorporating all prior amendments to the Company’s Certificate of Incorporation, and making certain non-substantive conforming

8

changes. The Board has also unanimously adopted a resolution adopting, subject to stockholder approval of the A&R Certificate of Incorporation, the A&R Bylaws which will amend Section 2.2 of the Bylaws to create a classified Board as provided for in the proposed A&R Certificate of Incorporation. If Proposal No. 2 is adopted by the stockholders, the A&R Bylaws will replace the Company’s current Bylaws. Because bylaw amendments can be adopted by board action alone, a separate stockholder vote is not being sought on the proposed bylaw amendments that would be made concurrent with the adoption of the A&R Certificate of Incorporation.

As of January 9, 2015, the Board consists of a single class of six directors. All of the Company’s directors are elected at each Annual Meeting of Stockholders, unless a vacancy occurs during the year (which could be created through expanding the size of the Board, for example) and the Nomination Committee finds a candidate to fill the vacancy. In such a case, the Nomination Committee would present the candidate to the Board of Directors for approval and appointment. The candidate would serve until he or she is elected by the Stockholders at the next Annual Meeting. If approved, the A&R Certificate of Incorporation would classify the Board into three separate classes, as nearly equal in number as possible, with one class being elected each year to serve a staggered three-year term. However, for the initial terms immediately following the division of the Board into three classes, directors would be assigned terms of one, two or three years, as described below.

The directors initially elected in Class I (Charles McKenney and Mauro Ferrari) would serve until the 2016 Annual Meeting of Stockholders, or until their respective successors have been elected and have qualified, or until their earlier death, resignation, retirement or removal. The directors initially elected in Class II (Michael S. Perry and Christopher Anzalone) would serve until the 2017 Annual Meeting of Stockholders, or until their respective successors have been elected and have qualified, or until their earlier death, resignation, retirement or removal. The directors initially elected in Class III (Douglass Given and Edward Frykman) would serve until the 2018 Annual Meeting of Stockholders, or until their respective successors have been elected and have qualified, or until their earlier death, resignation, retirement or removal.

If Proposal No. 2 is approved, beginning with the election of directors to be held at the 2016 Annual Meeting of Stockholders, the class of directors to be elected in such year would be elected for a three-year term, and at each successive annual meeting, the class of directors to be elected in such year would be elected for a three-year term so that the term of office of one class of directors shall expire in each year.

If the stockholders approve Proposal No. 2 at the Annual Meeting, Article NINTH of the A&R Certificate of Incorporation will read as set forth below:

The Board shall be classified, with respect to the time for which the directors severally hold office, into three classes, as nearly equal in number as possible, the first class, designated “Class I,” to hold office initially for a term expiring at the annual meeting of stockholders to be held in 2016, the second class, designated “Class II,” to hold office initially for a term expiring at the annual meeting of stockholders to be held in 2017, and the third class, designated “Class III,” to hold office initially for a term expiring at the annual meeting of stockholders to be held in 2018, with members of each class to hold office until their successors are elected and qualified or until their earlier death, resignation, retirement or removal. At each annual meeting of the stockholders of the Corporation, the successors to the class of directors whose term expires at that meeting shall be elected to hold office for a term expiring at the annual meeting of stockholders held in the third year following the year of their election. If the number of directors which constitutes the whole Board is changed, any increase or decrease shall be apportioned among the classes so as to maintain the number of directors in each class as nearly equally as possible, and any additional director of any class elected to fill a vacancy resulting from an increase in such class shall hold office for a term that coincides with the remaining term of that class, but in no event shall a decrease in such number of directors shorten the term of any incumbent director. Any director chosen to fill a vacancy not resulting from an increase in the number of directors shall hold office until the next election of the class for which such director has been chosen, and until that director’s successor has been elected and has qualified or until such director’s earlier death, resignation, retirement or removal.

In addition to making the change set forth above, the A&R Certificate of Incorporation will incorporate all prior amendments to the Company’s Certificate of Incorporation and will contain certain non-substantive conforming changes. The complete text of the proposed A&R Certificate of Incorporation is attached hereto as Exhibit A.

9

Background

The classified board amendment is designed to assure continuity and stability in the Board’s leadership and policies by ensuring that at any given time a majority of the directors will have prior experience with the Company and, therefore, will be familiar with its business and operations. The Company has not experienced continuity problems in the past and the Board wishes to ensure that the Board’s past continuity will continue. The Board believes that the stability in the Board of Directors’ leadership and policies in the past has helped to promote the creation of long-term stockholder value. The Board also believes that the classified board amendment will assist the Board in protecting the interests of the Company’s stockholders in the event of an unsolicited offer for the Company by encouraging any potential acquirer to negotiate directly with the Board.

To preserve the classified board structure, the A&R Certificate of Incorporation also provides that a director elected by the Board of Directors to fill a vacancy holds office until the next election of the class for which such director has been chosen, and until that director’s successor has been elected and qualified or until his or her earlier death, resignation, retirement or removal. Delaware law provides that, if a corporation has a classified board, unless the corporation’s Certificate of Incorporation specifically provides otherwise, the directors may only be removed by the stockholders for cause. The A&R Certificate of Incorporation would not provide for removal of directors other than for cause. Therefore, if Proposal No. 2 is approved, stockholders would be able to remove directors of the Company for cause, but not in other circumstances. Presently, all of the directors of the Company are elected annually and all of the directors may be removed, with or without cause, by a majority of the voting power of the Company.

Unless a director is removed or resigns, three annual elections would be needed to replace all of the directors on the classified Board. The classified board amendment may, therefore, discourage an individual or entity from acquiring a significant position in the Company’s stock with the intention of obtaining immediate control of the Board. If this Proposal No. 2 is approved, these provisions will be applicable to each annual election of directors, including the elections following any change of control of the Company.

The Company is not aware of any present or threatened third-party plans to gain control of the Company, and the classified board amendment is not being recommended in response to any such plan or threat. Rather, the Board is recommending the classified board amendment as part of its periodic review of the Company’s key governance mechanisms and to assist in assuring fair and equitable treatment for all of the Company’s stockholders in hostile takeover situations. The Board has no present intention of soliciting a stockholder vote on any other proposals relating to a possible takeover of the Company.

The classified board amendment may increase the amount of time required for a takeover bidder to obtain control of the Company without the cooperation of the Board, even if the takeover bidder were to acquire a majority of the voting power of the Company’s outstanding Common Stock. Without the ability to obtain immediate control of the Board, a takeover bidder will not be able to take action to remove other impediments to its acquisition of the Company. Thus, the classified board amendment could discourage certain takeover attempts, perhaps including some takeovers that stockholders may feel would be in their best interests. Further, the classified board amendment will make it more difficult for stockholders to change the majority composition of the Board, even if the stockholders believe such a change would be desirable. Because of the additional time required to change the control of the Board, the classified board amendment could be viewed as tending to perpetuate present management.

Although this proposal could make it more difficult for a hostile bidder to acquire control over the Company, the Board of Directors believes that by forcing potential bidders to negotiate with the Board for a change of control transaction, the Board will be better able to maximize stockholder value in any change of control transaction.

Vote Required; Recommendation of the Board

Proposal No. 2 must be approved by the affirmative vote of a majority of the shares of Voting Stock entitled to vote thereon. For this purpose, abstentions and broker non-votes will be counted as a vote against the proposal.

10

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” PROPOSAL TWO.

PROPOSAL THREE

ADVISORY VOTE ON EXECUTIVE COMPENSATION

The compensation paid to our NEO’s is described below in the Compensation Discussion and Analysis on pages11 through 19 of this proxy statement for the fiscal year ended September 30, 2014. The Board of Directors is asking stockholders to cast a non-binding, advisory vote FOR the following resolution:

“RESOLVED, that the compensation paid to the Company’s named executive officers, as disclosed pursuant to Item 402 of Regulation S-K, as set forth in the compensation tables and narrative discussion, is hereby APPROVED.”

Although the vote we are asking you to cast is non-binding, the Compensation Committee and the Board value the views of our stockholders and will consider the outcome of the vote when determining future compensation arrangements for our named executive officers.

Vote Required; Recommendation of the Board

Proposal No. 3 must be approved by the Required Vote, assuming a quorum is present. For this purpose, abstentions will be counted as a vote against the proposal, while broker non-votes will have no effect on the outcome of the vote.

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” PROPOSAL THREE.

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

The following compensation discussion and analysis describes the material elements of compensation received for fiscal 2014 by each of the executive officers identified below in the Summary Compensation Table, who are referred to collectively as our “named executive officers.” Our named executive officers with respect to the fiscal year that ended on September 30, 2014 were Christopher Anzalone, President and Chief Executive Officer; Bruce Given, Chief Operating Officer, Kenneth Myszkowski, Chief Financial Officer, David Lewis, Chief Scientific Officer and Peter Leone, Vice President, Program Management and Strategy. Although the Company’s fiscal year ends September 30 of each year, the Company’s compensation is based on a calendar year. The tables and information presented in this Compensation and Analysis and the Executive Compensation tables that follow generally refers to compensation earned in the fiscal year. Thus, salaries are reported for the twelve months ending September 30, 2014. Bonuses reflect amounts earned for the period ending December 31, 2013 and paid in early 2014.

Compensation Philosophy and Objectives

Our philosophy in setting compensation policies for executive officers has two fundamental objectives: (1) to attract, motivate and retain a highly skilled team of executives and (2) to align our executives’ interests with those of our stockholders by rewarding short-term and long-term performance and aligning compensation to increases in stockholder value. The Compensation Committee believes that executive compensation should be directly linked both to continuous improvements in corporate performance (“pay for performance”) and the achievement of specific objectives that are expected to increase stockholder value. In furtherance of this goal, the Compensation Committee has established the following guidelines as a foundation for compensation decisions:

| • | provide a competitive total compensation package that enables the Company to attract and retain highly qualified executives with the skills and experience required for the achievement of business goals; |

11

| • | promote the achievement of key strategic and financial performance measures by linking short-term and long-term compensation to the achievement of measurable goals; |

| • | reward significant achievements outside of predetermined goals; |

| • | recognize that pharmaceutical research, development and commercialization require sustained and focused effort over many years, and involve a high degree of risk and therefore balance incentives for annual and long-term compensation; |

| • | employ outside compensation expertise and market data from industry peers to assure that the Company’s compensation practices are consistent with industry practice and meet the Company’s goals for its compensation program; |

| • | consider the Company’s cash resources and cost of capital to balance cash and equity compensation; and |

| • | align executives’ incentives with the creation of stockholder value. |

The executive compensation program consists of three key elements: base salary, performance bonus and equity-based compensation. The Compensation Committee believes that cash compensation in the form of base salary and performance bonuses provides our executives with short-term rewards for success in operations, and that long-term compensation through the award of stock options and restricted stock units aligns the objectives of management with those of our stockholders with respect to long-term performance and success.

The Compensation Committee also focuses on the Company’s financial and working capital condition when making compensation decisions and approving performance objectives. Because the Company has sought to preserve cash and currently does not operate at a profit, overall compensation is weighted more heavily toward equity-based compensation. Thus, a significant portion of each executive’s compensation is at risk, and dependent on the increase in the value of the company’s stock and the satisfaction of other performance criteria. The Compensation Committee will continue to periodically reassess the appropriate weighting of cash and equity compensation as the Company development programs mature.

In reviewing the compensation structure for fiscal 2014, the Compensation Committee also considered how the Company’s compensation policies may affect the Company’s risk profile and whether compensation policies and practices may encourage undue risk-taking by employees. More specifically, the Compensation Committee considered the general design philosophy of the Company’s policies for employees whose conduct would be most affected by incentives established by compensation policies. In considering these issues, the Compensation Committee concluded that the use of performance-based bonuses and long-term equity awards did not appear to create undue risks for the Company or encourage excessive risk-taking behavior on the part of named executive officers.

With respect to bonus awards for our executive officers, the amount of an individual’s award depends principally on overall Company performance, as determined by the Compensation Committee, which reduces the ability and incentive for an individual to take undue risks in an effort to increase the amount of his or her bonus award. The Company’s performance goals are reviewed regularly by the Compensation Committee and the Board of Directors and are considered to be generally of the nature that would not encourage or reward excessive risk taking. Additionally, the Board has the ability to intervene in instances where actions by the Company vis-à-vis Company performance goal attainment would be considered unduly risky to prevent or penalize such actions.

With respect to equity awards, these awards typically vest over a period of two to four years, meaning that long-term value creation, contrasted with short-term gain, presents the best opportunity for employees to profit from these awards. The Company has not historically issued equity awards with specific performance based vesting conditions in addition to or in lieu of time-based vesting conditions, imposed claw-back provisions or holding periods for vested awards, although the Compensation Committee considers from time to time whether such mechanisms might be appropriate in the future as the Company’s development programs progress.

Procedures and Policies

The Compensation Committee reviews executive compensation annually. The Compensation Committee draws on a number of resources to assist in the evaluation of the various components of the Company’s executive compensation program including, but not limited to, advice of an independent compensation consultant, and information provided in the public filings of industry peers and industry data compiled yearly by Radford in its Global Life Sciences Survey, which represents a nationally-based assessment of executive compensation widely

12

used within the pharmaceutical and biotechnology industry sectors. While we do not position compensation levels based upon a specific or target level relative to a peer group or other companies, pay practices at other companies are an important factor that the Compensation Committee considers in assessing the reasonableness of compensation and ensuring that our compensation practices are competitive in the marketplace.

Roles in Determining Compensation

Compensation Committee

The Board has delegated to the Compensation Committee the responsibility to ensure that total compensation paid to our executive officers, including named executive officers, is consistent with our compensation policy and objectives. The Compensation Committee’s charter is available on the Company’s website at www.arrowheadresearch.com. The Compensation Committee oversees and approves all compensation arrangements and actions for our executive officers and other key employees, including the named executive officers. While the Compensation Committee draws on a number of resources, including input from the Chief Executive Officer and independent compensation consultants, to make decisions regarding the Company’s executive compensation program, ultimate decision-making authority rests with the Compensation Committee. The Compensation Committee retains discretion over base salary, annual incentive bonus, equity compensation and other compensation considerations for our named executive officers. The Compensation Committee relies upon the judgment of its members in making compensation decisions, after reviewing the performance of the Company and evaluating an executive’s performance during the year against Company goals, operational performance, and business responsibilities. In addition, the Compensation Committee incorporates judgment in the assessment process to respond to and adjust for the evolving business environment.

During 2014, Dr. Perry served as Chairman of the Compensation Committee, and Mr. Frykman, Mr. McKenney and Dr. Ferrari served as members. The Company’s Board of Directors has determined that all of the Compensation Committee members are “independent” directors for all required legal purposes, including pursuant to Nasdaq’s definition of independence. The members have extensive experience in executive management, as well as compensation practices and policies.

Compensation Consultant

The Compensation Committee has retained the services of an external compensation consultant, StreeterWyatt LLC (“StreeterWyatt”). The mandate of StreeterWyatt is to assist the Compensation Committee in its review of executive and director compensation practices, including the competitiveness of pay levels, executive compensation design, benchmarking with the Company’s peers in the industry and other technical considerations. The Compensation Committee has evaluated StreeterWyatt’s performance, considered alternative compensation consultants and has the final authority to engage and terminate the StreeterWyatt’s services. The decision to engage StreeterWyatt was not made or recommended by the Company’s management. The Compensation Committee, after a review of the factors set forth in Section 10C-1 of the Securities Exchange Act of 1934, has determined that the work performed by StreeterWyatt in 2014 does not present any conflicts of interest.

In October 2013, the Compensation Committee first retained the services of StreeterWyatt to advise the committee on the Company’s overall compensation practices, including the following: (i) establishment of a peer group of companies to use in compensation analysis (ii) assessment of compensation levels and mix of compensation elements for the Company’s executive officers and vice presidents, (iii) executive compensation and governance trends based on peer group practices and market trends, (iv) development of company-wide cash and equity grant ranges based on the Company’s job classification structure, and (v) adoption of an equity incentive plan as a successor to the Company’s 2004 Stock Incentive Plan.

In September 2014, the Compensation Committee again retained the services of StreeterWyatt in order to (i) assess compensation levels and mix of elements for the Company’s executive officers and other key employees, (ii) review the peer group companies selected in 2013 and recommend any changes, and (iii) advise the committee on executive compensation and governance trends based on peer group trends and market practices.

Chief Executive Officer

The Chief Executive Officer attends Compensation Committee meetings and works with the Compensation Committee Chairman and StreeterWyatt to develop compensation recommendations for the executive officers (excluding the Chief Executive Officer), based upon individual experience and breadth of knowledge, internal

13

considerations, individual performance during the fiscal year and other factors deemed relevant by the Compensation Committee. The recommendations are then submitted to the Compensation Committee for review and consideration. The Compensation Committee works directly with StreeterWyatt to determine compensation actions for the Chief Executive Officer; the Chief Executive Officer does not participate in Compensation Committee discussions relating to his compensation.

As part of the review process, the Chief Executive Officer makes recommendations to the Compensation Committee with respect to the compensation levels for individual executives other than himself based on the performance evaluation conducted by each executive’s manager. The Compensation Committee reviews this information and adjusts or approves the recommendations as appropriate. In addition, for each named executive officer, the Compensation Committee considers the Company’s performance against annual and longer term objectives, market data regarding executive compensation at comparable companies and realized and realizable values under previous equity awards.

In the case of the Chief Executive Officer, the Compensation Committee evaluates his performance against the Company’s annual goals and longer term objectives pre-established by the Board of Directors, together with market data regarding executive compensation at comparable companies and realized and realizable values under previous equity awards.

Comparative Analysis

The Compensation Committee engaged StreeterWyatt to conduct a benchmarking study reporting on compensation levels and practices, including equity, relative to industry peers. The findings were presented to the Committee by StreeterWyatt in December 2013 and StreeterWyatt provided a competitive assessment of the Company’s executive compensation program as compared to the market data for base salaries, target total cash compensation and equity compensation. As a general rule, the Compensation Committee considered NEO compensation relative to the peer group median, however, various other factors were taken into account in determining compensation and the Compensation Committee does not target compensation at any specific level relative to the peer group. Such factors include past performance and scope of the NEO’s actual role relative to the normal scope associated with that particular job among the peer group companies. In consideration of these factors, the market data and StreeterWyatt’s assessment of the Company’s executive compensation programs, as well as the Company’s performance in fiscal 2013, adjustments to compensation were made in the first calendar quarter of 2014, as described below in the discussion on base salary.

Because the biotechnology industry is a dynamic industry, the comparator group used by the Compensation Committee to measure the competitive positioning of our compensation packages is periodically updated to ensure that companies continue to meet the established criteria. Accordingly, a group of peer companies for purposes of measuring the competitive positioning of the 2014 compensation package for the named executive officers was selected for primary comparison, as well as a secondary group of peer companies for referencing additional information. For example, using a secondary peer group provided input on more positions and for certain positions provided more robust data than the primary peer group alone. The selection of the primary peer group was based on an analysis performed by StreeterWyatt in late 2013. Peer companies were selected at that time primarily using the following criteria: publicly-held pre-commercial U.S. biotechnology companies, and companies with 50 – 500 employees. In general, the Company also selected peer companies with market capitalization values between 50% and 200% of the Company’s market capitalization at the time of final peer selection in late 2013. While there are companies that fall outside this guideline range, the primary peer group was selected in such a manner that the Company’s market capitalization was very near the median for all peer companies. Consideration was also given to the frequency or infrequency with which a company was identified as a peer with other peer companies. Specifically, the selected comparable companies were as follows:

Primary peer group members:

| Alnylam Pharmaceuticals, Inc. | Geron Corporation | Osiris Therapeutics, Inc. | ||

| Anacor Pharmaceuticals, Inc. | Infinity Pharmaceuticals, Inc. | Regulus Therapeutics Inc. | ||

| ArQule Inc. | Neurocrine Biosciences Inc. | Rigel Pharmaceuticals, Inc. | ||

| BioCryst Pharmaceuticals, Inc. | Omeros Corporation | Sangamo Biosciences Inc. | ||

| CytRx Corporation | Organovo Holdings, Inc. | Sarepta Therapeutics, Inc. | ||

| Dynavax Technologies Corporation | Orexigen Therapeutics, Inc. | Targacept, Inc. | ||

| Xenoport, Inc. |

14

Secondary peer group members:

| Achillion Pharmaceuticals, Inc. | Dyax Corp. | Progenics Pharmaceuticals, Inc. | ||

| Ariad Pharmaceuticals Inc. | Idenix Pharmaceuticals Inc. | Peregrine Pharmaceuticals, Inc. | ||

| Arena Pharmaceuticals, Inc. | Immumedix Inc. | Raptor Pharmaceuticals Corp. | ||

| Cadence Pharmaceuticals Inc. | Insmed Incorporated | Synta Pharmaceuticals Corp. | ||

| Cerus Corporation | InterMune, Inc. | Threshold Pharmaceuticals Inc. | ||

| Corcept Therapeutics Incorporated | Keryx Biopharmaceuticals Inc. | Vanda Pharmaceuticals, Inc | ||

| Cytokinetics, Incorporated | Lexicon Pharmaceuticals, Inc. | XOMA Corporation | ||

| Zogenix, Inc. |

Elements of Compensation

In fiscal 2014, our executive compensation program consisted of the following forms of compensation, each of which are described below in greater detail:

| • | Base Salary |

| • | Annual Bonus Incentive |

| • | Equity Compensation |

| • | Employee Benefit Program |

| • | Termination Benefits |

Base Salary

Our Compensation Committee aims to set executives’ base salaries at market competitive levels with salaries of executives with similar roles at other publicly traded biotech companies. The Compensation Committee believes it is important to provide reasonable, market-based fixed compensation to our executive officers working in a highly volatile and competitive industry, while balancing the needs to retain and recruit talented executives, achieve corporate goals, and conserve cash and equity. In determining appropriate base salary levels for a given executive officer, the Compensation Committee considers the following factors (with no specific weighting applied to any individual factor):

| • | individual performance of the executive, as well as our overall Company performance, during the prior year; |

| • | level of responsibility, including breadth, scope and complexity of the position; |

| • | level of experience and expertise of the executive; |

| • | internal review of the executive’s compensation relative to other executives to ensure internal equity; and |

| • | executive officer compensation levels at other similar companies. |

Salaries for executive officers are determined on an individual basis at the time of hire and are set to be competitive with market rates in our industry (meaning within the range of salaries observed among the peer group companies and survey data, although current circumstances are considered in each individual case. Adjustments to base salary are considered annually in light of each executive officer’s individual performance, the Company’s

15

performance and market rate compensation levels, as well as changes in job responsibilities or promotion. The Chief Executive Officer assists the Compensation Committee in its annual review of the base salaries of other executive officers and key employees based on the foregoing criteria.

Changes in Base Salaries for 2014

The compensation study prepared by StreeterWyatt and presented in December 2013 provided an assessment of the Company’s compensation practices as compared to industry peers. Base salary levels for the Company’s executives, in the aggregate, were determined to be within the range of salaries provided to similarly placed executives and consistent with the Company’s compensation philosophy. Merit increases and any market-based adjustments awarded to executives for calendar 2014 are consistent with the findings and recommendations of StreeterWyatt regarding market based increases observable from peer and survey data.

The base salaries for calendar 2014 and 2013 were as follows:

Name | 2014 Base Salary | 2013 Base Salary | Percent Increase | |||||||||

Christopher Anzalone | $ | 553,000 | $ | 512,500 | 7.9 | % | ||||||

Bruce Given | $ | 388,000 | $ | 369,000 | 5.1 | % | ||||||

Kenneth Myszkowski | $ | 296,000 | $ | 281,875 | 5.0 | % | ||||||

David L. Lewis | $ | 240,000 | $ | 195,000 | 23.1 | % | ||||||

Peter Leone | $ | 235,000 | $ | 210,000 | 11.9 | % | ||||||

Dr. Lewis’ base salary increase was based on his increased level of responsibility and a promotion to Chief Scientific Officer. Mr. Leone’s increase was based on an increase in his scope of responsibility.

Bonus Incentive

The Company provides executive officers with performance-based cash bonuses, which are designed to reward executives for overall corporate performance as well as individual performance. Executive officers are evaluated for bonus eligibility generally on an annual basis. Through a collaborative planning process involving the Board of Directors and executive management, corporate goals are established early in the calendar year and are regularly evaluated for appropriateness by the Board of Directors.

Bonuses were paid in February 2014 for performance in calendar 2013. The target bonus amount for the Chief Executive Officer was established by the Compensation Committee early in the calendar year. For 2013, the maximum bonus for the Chief Executive Officer was 200% of his respective target and the minimum bonus, or threshold, was zero. The bonus amounts for the other named executive officers were set by the Compensation Committee in collaboration with the Chief Executive Officer in February 2014 based on each executive’s accountability, scope of responsibilities and potential impact on the Company’s performance. Accordingly, due to higher levels of control and accountability for the Company’s overall performance, a higher percentage of each named executive officer’s total cash compensation is dependent on a performance-based cash bonus.

In determining the amount of the bonus for each named executive officer, the Compensation Committee evaluated the corporate goals that had been established during the beginning of the calendar year (set forth below) as well as other corporate and individual achievements and performance throughout the year. For calendar year 2013, the Compensation Committee determined that the Company had achieved or exceeded all the corporate goals, except entering into a new partnership.

In 2013, corporate goals included:

| • | Commencing clinical studies for ARC-520; |

| • | Ending 2013 with sufficient cash for 2014 operations (as determined by the Compensation Committee); |

| • | Progressing a new clinical candidate to GLP toxicology testing readiness; |

| • | Enter into a partnership with meaningful upfront payment; |

| • | Stock price exceeds an appropriate index return, and |

| • | Obtain new analyst coverage. |

16

Corporate achievements in calendar 2013 included:

| • | Completion of planned enrollment of a Phase 1 clinical trial of ARC-520 in healthy volunteers and submission of an application for a Certificate of Clinical Trial to the Hong Kong Department of Health to begin a Phase 2a clinical trial of ARC-520 in chronic HBV patients; |

| • | Closed a $60 million financing from a syndicate of high-quality biotech investors. |

| • | Presented data at the AASLD Liver Meeting on the ARC-520 chimpanzee study indicating possible immune de-repression as hepatitis B s-antigen levels were reduced; |

| • | Presented Phase 1 data at HepDART 2013 showing that ARC-520 was generally safe and well-tolerated at all six dose levels studied; |

| • | Advanced ARC-AAT as the Company’s next clinical candidate; |

| • | Stock price of the Company’s common stock increased from $2.10 on January 2, 2013 to $10.85 on December 31, 2013; and |

| • | Several analysts initiated coverage of the Company in 2013. |

The target bonuses, if applicable, and actual bonuses, as a percentage of base salary, for the named executive officers for calendar year 2013 are set forth in the following table:

Name | Title | Target Bonus for 2014 (% of Base Salary) (1) | Actual Award (% of Base Salary) | Amount of Bonus | ||||||||||

Christopher Anzalone | President & Chief Executive Officer | 50 | % | 95 | % | $ | 486,000 | |||||||

Bruce Given | Chief Operating Officer | N/A | 60 | % | $ | 221,000 | ||||||||

Kenneth Myszkowski | Chief Financial Officer | N/A | 40 | % | $ | 113,000 | ||||||||

David L. Lewis | Chief Scientific Officer | N/A | 40 | % | $ | 86,000 | ||||||||

Peter Leone | Vice President, Program Management & Strategy | N/A | 15 | % | $ | 32,000 | ||||||||

| (1) | A target bonus was determined for the Chief Executive Officer only at the beginning of the calendar year. Bonuses for all other named executive officers were determined by the Compensation Committee and the Chief Executive Officer in February 2014. |

Bonuses based on corporate and individual performance during calendar year 2014 are expected to be evaluated by the Compensation Committee in the second fiscal quarter of 2015.

Equity Compensation

Overview

Stock Options and Restricted Stock. As an additional component of our compensation program, executive officers are eligible to receive equity compensation in the form of stock options, restricted stock, and restricted stock units. We believe that periodic equity awards serve as useful performance recognition mechanisms with respect to all employees, as most awards are subject to time-based vesting provisions. Our typical equity awards to executive officers (including the named executive officers) have a term of 10 years and vest and become exercisable over a period of four years, with monthly vesting.