United States

Securities and Exchange Commission

Washington, D.C. 20549

Form N-CSR

Certified Shareholder Report of Registered Management Investment Companies

811-6447

(Investment Company Act File Number)

Federated Fixed Income Securities, Inc.

_______________________________________________________________

(Exact Name of Registrant as Specified in Charter)

Federated Investors Funds

4000 Ericsson Drive

Warrendale, Pennsylvania 15086-7561

(Address of Principal Executive Offices)

(412) 288-1900

(Registrant's Telephone Number)

John W. McGonigle, Esquire

Federated Investors Tower

1001 Liberty Avenue

Pittsburgh, Pennsylvania 15222-3779

(Name and Address of Agent for Service)

(Notices should be sent to the Agent for Service)

Date of Fiscal Year End: 11/30/13

Date of Reporting Period: 11/30/13

Item 1. Reports to Stockholders

Annual Shareholder Report

November 30, 2013

| Share Class | Ticker |

| A | STIAX |

| B | SINBX |

| C | SINCX |

| F | STFSX |

| Institutional | STISX |

Federated Strategic Income Fund

Fund Established 1994

A Portfolio of Federated Fixed Income Securities, Inc.

Dear Valued Shareholder,

I am pleased to present the Annual Shareholder Report for your fund covering the period from December 1, 2012 through November 30, 2013. This report includes Management's Discussion of Fund Performance, a complete listing of your fund's holdings, performance information and financial statements along with other important fund information.

In addition, our website, FederatedInvestors.com, offers easy access to Federated resources that include timely fund updates, economic and market insights from our investment strategists, and financial planning tools. We invite you to register to take full advantage of its capabilities.

Thank you for investing with Federated. I hope you find this information useful and look forward to keeping you informed.

Sincerely,

J. Christopher Donahue, President

Not FDIC Insured • May Lose Value • No Bank Guarantee

CONTENTS

| 1 |

| 9 |

| 10 |

| 17 |

| 22 |

| 24 |

| 26 |

| 27 |

| 42 |

| 43 |

| 45 |

| 46 |

| 52 |

| 57 |

| 57 |

Management's Discussion of Fund Performance (unaudited)

The total return of Federated Strategic Income Fund (the “Fund”), based on net asset value for the 12-month reporting period ending November 30, 2013, was 0.66% for Class A Shares, -0.20% for Class B Shares, -0.09% for Class C Shares, 0.66% for Class F Shares and 0.81% for Institutional Shares. The total return of the Fund's blended benchmark which is comprised of 25% Barclays Emerging Markets Bond Index/40% Barclays U.S. Corporate High Yield 2% Issuer Capped Index/25% Barclays Mortgage-Backed Securities Index/10% JPMorgan Non-Dollar Index (“Blended Index”)1 was 1.71% for the same period.2 The total return of the Lipper Multi-Sector Income Funds Average (LMSIFA),3 a peer group average for the Fund, was 2.38% for the same period. The Fund's and the Lipper Average's total returns for the most recently completed fiscal year reflected actual cash flows, transaction costs and other expenses which were not reflected in the total return of the Blended Index.

During the 12-month reporting period, the most significant factors affecting the Fund's performance relative to the Blended Index were: (1) the allocation of assets among fixed income sectors; (2) the selection of securities within each of the Fund's sectors; and (3) the impact of derivatives4 utilized in anticipation of interest changes and to hedge the exposure to various fixed income asset classes.

The following discussion will focus on the performance of the Fund's Institutional Shares. The 0.81% total return for the Institutional Shares for the 12-month reporting period consisted of 4.20% income and 3.39% depreciation in the net asset value of the shares. During the reporting period, the Fund underperformed the Blended Index and the LMSIFA.

MARKET OVERVIEW

The rise in interest rates on U.S. Government securities was the dominant theme that impacted the Fund's asset classes during the reporting period. For example, in the United States, the yield on the 10-year U.S. government bond increased from 1.62% on November 30, 2012 to 2.75% on November 30, 2013. The major asset classes the Fund invests in were impacted differently by this rise in interest rates.5

The domestic noninvestment-grade6 market benefited from strong corporate credit fundamentals, an expanding U.S. economy and low default rates during the reporting period. These factors allowed the market to offset rising interest rates in the U.S. Treasury market and generate attractive returns. For example, the yield spread between high-yield bonds7 and U.S. Treasury securities with comparable maturities as measured by the Credit Suisse High Yield Bond Index,8 began the reporting period at 583 bps and ended the reporting period at 462 bps. The portion of the Blended Index related to high-yield bonds returned 8.55% during the reporting period.

Annual Shareholder Report

The domestic investment-grade market was more directly impacted by the increase in U.S. government interest rates. The domestic investment-grade sector is more sensitive to changes in interest rates and, being relatively high quality, did not benefit as much from credit spread tightening to offset the rise in interest rates. The portion of the Blended Index related to the domestic investment-grade market returned -0.81% during the reporting period.

The international markets9 were the worst performing sectors during the 12-month reporting period. In emerging markets, rising interest rates coupled with increasing current account issues in certain countries negatively impacted results. The portion of the Blended Index related to emerging markets returned -3.46% during the reporting period. In the developed market section of the international portion of the Fund, rising interest rates and currency depreciation of the Japanese Yen were the biggest factors negatively impacting returns. The portion of the Blended Index related to developed markets returned -5.33% during the reporting period.

SECTOR ALLOCATION

The Fund's overweight to the domestic noninvestment-grade sector positively impacted returns during the 12-month reporting period as did the Fund's underweight to the domestic investment-grade sector and the international developed sector. The Fund's overweight to the emerging markets negatively impacted Fund performance.

SECURITY SELECTION

Security selection in the domestic investment-grade sector and the emerging market sector negatively impacted Fund performance, during the reporting period.

IMPACT OF DERIVATIVES

Derivatives were used throughout the reporting period to implement the Fund's duration10 strategy. For the reporting period as a whole, this had a modest positive effect on Fund performance. Early in the reporting period, derivatives were used to reduce the exposure to the domestic noninvestment-grade market which had a negative impact on Fund performance. Late in the period, currency forwards were used to take advantage of short-term opportunities in the currency markets, which positively affected Fund performance.

Annual Shareholder Report

| 1 | Please see the footnotes to the line graphs under “Fund Performance and Growth of a $10,000 Investment” below for the definition of, and more information about, the Blended Index. At the end of the reporting period, the Fund's Adviser elected to remove the JPMorgan Non-Dollar Index from the Blended Index and increase the Barclays Mortgage-Backed Securities Index from 25% to 35%. |

| 2 | The Fund's broad-based securities market index is the Barclays U.S. Aggregate Bond Index (BAB). Please see the footnotes to the line graphs under “Fund Performance and Growth of a $10,000 Investment” below for the definition of, and more information about, the BAB. The BAB's return for the 12-month reporting period was -1.61%. The Blended Index is being used for comparison purposes because, although it is not the Fund's broad-based securities market index, the Fund's Adviser believes it more closely reflects the market sectors in which the Fund invests. |

| 3 | Please see the footnotes to the line graphs under “Fund Performance and Growth of a $10,000 Investment” below for the definition of, and more information about, the LMSIFA. |

| 4 | The Fund's use of derivative instruments involves risks different from, or possibly greater than, the risks associated with investing directly in securities and other traditional instruments. |

| 5 | Bond prices are sensitive to changes in interest rates, and a rise in interest rates can cause a decline in their prices. |

| 6 | Investment-grade securities are securities that are rated at least “BBB- (minus)” or unrated securities of a comparable quality. Noninvestment-grade securities are securities that are not rated at least “BBB- (minus)” or unrated securities of a comparable quality. Credit ratings are an indication of the risk that a security will default. They do not protect a security from credit risk. Lower-rated bonds typically offer higher yields to help compensate investors for the increased risk associated with them. Among these risks are lower credit-worthiness, greater price volatility, more risk to principal and income than with higher-rated securities and increased possibilities of default. |

| 7 | High-yield, lower-rated securities generally entail greater market, credit and liquidity risks than investment-grade securities and may include higher volatility and higher risk of default. |

| 8 | Credit Suisse High Yield Bond Index serves as a benchmark to evaluate the performance of low-quality bonds. Low-quality is defined as those bonds in the range from “BB” to “CCC” and defaults. The index is unmanaged, and it is not possible to invest directly in an index. |

| 9 | International investing involves special risks including currency risk, increased volatility of foreign securities, political risks and differences in auditing and other financial standards. Prices of emerging markets securities can be significantly more volatile than the prices of securities in developed countries. |

| 10 | Duration is a measure of a security's price sensitivity to changes in interest rates. Securities with longer durations are more sensitive to changes in interest rates than securities of shorter durations. |

Annual Shareholder Report

FUND PERFORMANCE AND GROWTH OF A $10,000 INVESTMENT

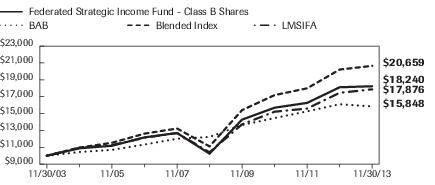

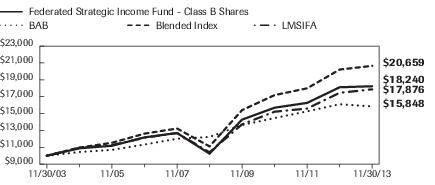

The Average Annual Total Return table below shows returns for each class averaged over the stated periods. The graphs below illustrate the hypothetical investment of $10,0001 in the Federated Strategic Income Fund from November 30, 2003 to November 30, 2013, compared to the Barclays U.S. Aggregate Bond Index (BAB),2 the Fund's broad-based securities market index, a blend of indexes comprised of 25% Barclays Emerging Market Bond Index (BEMB)/40% Barclays U.S. Corporate High Yield 2% Issuer Capped Index (BHY2%ICI)/35% Barclays Mortgage-Backed Securities Index (BMB)3 and the Lipper Multi-Sector Income Funds Average (LMSIFA).4

Average Annual Total Returns for the Period Ended 11/30/2013

(returns reflect all applicable sales charges and contingent deferred sales charges as specified below in footnote #1)

| Share Class | 1 Year | 5 Years | 10 Years |

| Class A Shares | -3.91% | 11.67% | 6.36% |

| Class B Shares | -5.52% | 11.60% | 6.19% |

| Class C Shares | -1.06% | 11.85% | 6.04% |

| Class F Shares | -1.35% | 12.48% | 6.73% |

| Institutional Shares | 0.81% | 12.95% | 6.95% |

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. For current to the most recent month-end performance and after-tax returns, visit FederatedInvestors.com or call 1-800-341-7400. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Mutual funds are not obligations of or guaranteed by any bank and are not federally insured.

Annual Shareholder Report

Growth of a $10,000 INVESTMENT–CLASS A SHARES

Growth of $10,000 as of November 30, 2013

| Federated Strategic Income Fund - | Class A Shares | BAB | Blended Index | LMSIFA |

| 11/30/2003 | 9,550 | 10,000 | 10,000 | 10,000 |

| 11/30/2004 | 10,481 | 10,444 | 10,968 | 10,934 |

| 11/30/2005 | 10,853 | 10,695 | 11,536 | 11,257 |

| 11/30/2006 | 11,905 | 11,330 | 12,621 | 12,139 |

| 11/30/2007 | 12,511 | 12,015 | 13,228 | 12,687 |

| 11/30/2008 | 10,180 | 12,224 | 11,110 | 10,408 |

| 11/30/2009 | 14,284 | 13,646 | 15,406 | 13,726 |

| 11/30/2010 | 15,799 | 14,468 | 17,190 | 15,222 |

| 11/30/2011 | 16,514 | 15,266 | 17,996 | 15,597 |

| 11/30/2012 | 18,398 | 16,107 | 20,221 | 17,461 |

| 11/30/2013 | 18,519 | 15,848 | 20,659 | 17,876 |

41 graphic description end -->

| ■ | Total returns shown include the maximum sales charge of 4.50% ($10,000 investment minus $450 sales charge = $9,550). |

Growth of a $10,000 INVESTMENT–CLASS b SHARES

Growth of $10,000 as of November 30, 2013

| Federated Strategic Income Fund - | Class B Shares | BAB | Blended Index | LMSIFA |

| 11/30/2003 | 10,000 | 10,000 | 10,000 | 10,000 |

| 11/30/2004 | 10,880 | 10,444 | 10,968 | 10,934 |

| 11/30/2005 | 11,182 | 10,695 | 11,536 | 11,257 |

| 11/30/2006 | 12,174 | 11,330 | 12,621 | 12,139 |

| 11/30/2007 | 12,698 | 12,015 | 13,228 | 12,687 |

| 11/30/2008 | 10,251 | 12,224 | 11,110 | 10,408 |

| 11/30/2009 | 14,281 | 13,646 | 15,406 | 13,726 |

| 11/30/2010 | 15,696 | 14,468 | 17,190 | 15,222 |

| 11/30/2011 | 16,266 | 15,266 | 17,996 | 15,597 |

| 11/30/2012 | 18,121 | 16,107 | 20,221 | 17,461 |

| 11/30/2013 | 18,240 | 15,848 | 20,659 | 17,876 |

41 graphic description end -->

| ■ | Total returns shown include the maximum contingent deferred sales charge of 5.50%, as applicable. |

Annual Shareholder Report

Growth of a $10,000 INVESTMENT–CLASS C SHARES

Growth of $10,000 as of November 30, 2013

| Federated Strategic Income Fund - | Class C Shares | BAB | Blended Index | LMSIFA |

| 11/30/2003 | 10,000 | 10,000 | 10,000 | 10,000 |

| 11/30/2004 | 10,894 | 10,444 | 10,968 | 10,934 |

| 11/30/2005 | 11,196 | 10,695 | 11,536 | 11,257 |

| 11/30/2006 | 12,176 | 11,330 | 12,621 | 12,139 |

| 11/30/2007 | 12,715 | 12,015 | 13,228 | 12,687 |

| 11/30/2008 | 10,269 | 12,224 | 11,110 | 10,408 |

| 11/30/2009 | 14,287 | 13,646 | 15,406 | 13,726 |

| 11/30/2010 | 15,703 | 14,468 | 17,190 | 15,222 |

| 11/30/2011 | 16,273 | 15,266 | 17,996 | 15,597 |

| 11/30/2012 | 17,996 | 16,107 | 20,221 | 17,461 |

| 11/30/2013 | 17,979 | 15,848 | 20,659 | 17,876 |

41 graphic description end -->

| ■ | Total returns shown include the contingent deferred sales charge of 1.00%, as applicable. |

Growth of a $10,000 INVESTMENT–CLASS F SHARES

Growth of $10,000 as of November 30, 2013

| Federated Strategic Income Fund - | Class F Shares | BAB | Blended Index | LMSIFA |

| 11/30/2003 | 9,900 | 10,000 | 10,000 | 10,000 |

| 11/30/2004 | 10,855 | 10,444 | 10,968 | 10,934 |

| 11/30/2005 | 11,242 | 10,695 | 11,536 | 11,257 |

| 11/30/2006 | 12,335 | 11,330 | 12,621 | 12,139 |

| 11/30/2007 | 12,967 | 12,015 | 13,228 | 12,687 |

| 11/30/2008 | 10,543 | 12,224 | 11,110 | 10,408 |

| 11/30/2009 | 14,795 | 13,646 | 15,406 | 13,726 |

| 11/30/2010 | 16,372 | 14,468 | 17,190 | 15,222 |

| 11/30/2011 | 17,116 | 15,266 | 17,996 | 15,597 |

| 11/30/2012 | 19,057 | 16,107 | 20,221 | 17,461 |

| 11/30/2013 | 19,183 | 15,848 | 20,659 | 17,876 |

41 graphic description end -->

| ■ | Total returns shown include the maximum sales charge of 1.00% ($10,000 investment minus $100 = $9,900) and a contingent deferred sales charge of 1.00%, as applicable. |

Annual Shareholder Report

Growth of a $10,000 INVESTMENT–INSTITUTIONAL SHARES5

Growth of $10,000 as of November 30, 2013

| Federated Strategic Income Fund - | Institutional Shares | BAB | Blended Index | LMSIFA |

| 11/30/2003 | 10,000 | 10,000 | 10,000 | 10,000 |

| 11/30/2004 | 10,975 | 10,444 | 10,968 | 10,934 |

| 11/30/2005 | 11,364 | 10,695 | 11,536 | 11,257 |

| 11/30/2006 | 12,466 | 11,330 | 12,621 | 12,139 |

| 11/30/2007 | 13,101 | 12,015 | 13,228 | 12,687 |

| 11/30/2008 | 10,651 | 12,224 | 11,110 | 10,408 |

| 11/30/2009 | 14,976 | 13,646 | 15,406 | 13,726 |

| 11/30/2010 | 16,611 | 14,468 | 17,190 | 15,222 |

| 11/30/2011 | 17,408 | 15,266 | 17,996 | 15,597 |

| 11/30/2012 | 19,427 | 16,107 | 20,221 | 17,461 |

| 11/30/2013 | 19,584 | 15,848 | 20,659 | 17,876 |

41 graphic description end -->

| 1 | Represents a hypothetical investment of $10,000 in the Fund after deducting the applicable sales charges: for Class A Shares, the maximum sales charge of 4.50% ($10,000 investment minus $450 sales charge = $9,550); for Class B Shares, the maximum contingent deferred sales charge is 5.50% on any redemption less than one year from the purchase date; for Class C Shares, a 1.00% contingent deferred sales charge would be applied to any redemption less than one year from the purchase date; for Class F Shares, the maximum sales charge of 1.00% ($10,000 investment minus $100 sales charge = $9,900) and a contingent deferred sales charge of 1.00% would be applied on any redemption less than four years from the purchase date. The Fund's performance assumes the reinvestment of all dividends and distributions. The BAB, the Blended Index and the LMSIFA have been adjusted to reflect the reinvestment of dividends on securities in the indexes and average. |

| 2 | The BAB is a broad-based benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid ARM pass-throughs), asset-backed securities and commercial mortgage-backed securities. The index is not adjusted to reflect sales loads, expenses or other fees that the Securities and Exchange Commission (SEC) requires to be reflected in the Fund's performance. The index is unmanaged and, unlike the Fund, is not affected by cash flows. It is not possible to invest directly in an index. |

| 3 | At the end of the reporting period, the Fund's Adviser elected to remove the JPMorgan Non-Dollar Index from the Blended Index and increase the Barclays Mortgage-Backed Securities Index from 25% to 35%. The BEMB tracks total returns for external-currency-denominated debt instruments of the emerging markets. The BHY2%ICI is an issuer-constrained version of the Barclays U.S. Corporate High-Yield Index that measures the market of USD-denominated, noninvestment grade, fixed-rate, taxable corporate bonds. The index follows the same rules as the uncapped index but limits the exposure of each issuer to 2% of the total market value and redistributes any excess market value index-wide on a pro-rata basis. The BMB covers agency mortgage-backed pass-through securities (both fixed-rate and hybrid ARM) issued by Ginnie Mae (GNMA), Fannie Mae (FNMA) and Freddie Mac (FHLMC). The indexes are not adjusted to reflect sales loads, expenses or other fees that the SEC requires to be reflected in the Fund's performance. The indexes are unmanaged and, unlike the Fund, are not affected by cash flows. It is not possible to invest directly in an index. |

Annual Shareholder Report

| 4 | Lipper figures represent the average of the total returns reported by all mutual funds designated by Lipper, Inc. as falling into the respective category and is not adjusted to reflect any sales charges. These total returns are reported net of expenses and other fees that the SEC requires to be reflected in a mutual fund's performance. |

| 5 | The Fund's Institutional Shares commenced operations on January 28, 2008. The Fund offers four other classes of shares: Class A Shares, Class B Shares, Class C Shares and Class F Shares. For the period prior to the commencement of operations of the Institutional Shares, the performance information shown is for the Fund's Class A Shares. In relation to the Institutional Shares, the performance of the Class A Shares has not been adjusted to reflect the expenses of the Institutional Shares, since the Institutional Shares have a lower expense ratio than the expense ratio of the Class A Shares. The performance of the Class A Shares has been adjusted to reflect the absence of sales charges and to remove any voluntary waiver of Fund expenses related to the Class A Shares that may have occurred during the period prior to the commencement of operations of the Institutional Shares. |

Annual Shareholder Report

Portfolio of Investments Summary Table (unaudited)

At November 30, 2013, the Fund's portfolio composition1 was as follows:

| Security Type | Percentage of

Total Net Assets2 |

| Corporate Debt Securities | 64.4% |

| Foreign Government Securities | 17.9% |

| Mortgage-Backed Securities3 | 6.8% |

| Collateralized Mortgage Obligations | 4.1% |

| Trade Finance Agreements | 1.9% |

| Commercial Mortgage-Backed Securities | 0.4% |

| U.S. Treasury Securities | 0.2% |

| Asset-Backed Securities4 | 0.0% |

| Floating Rate Loans4 | 0.0% |

| Derivative Contracts4,5 | 0.0% |

| Other Security Types6 | 0.2% |

| Cash Equivalents7 | 3.9% |

| Other Assets and Liabilities—Net8 | 0.2% |

| TOTAL | 100.0% |

| 1 | See the Fund's Prospectus and Statement of Additional Information for a description of these security types. |

| 2 | As of the date specified above, the Fund owned shares of one or more affiliated investment companies. For purposes of this table, the affiliated investment company (other than an affiliated money market mutual fund) is not treated as a single portfolio security, but rather the Fund is treated as owning a pro rata portion of each security and each other asset and liability owned by the affiliated investment company. Accordingly, the percentages of total net assets shown in the table will differ from those presented on the Portfolio of Investments. |

| 3 | For purposes of this table, Mortgage-Backed Securities include mortgage-backed securities guaranteed by Government Sponsored Entities. |

| 4 | Represents less than 0.1%. |

| 5 | Based upon net unrealized appreciation (depreciation) or value of the derivative contracts as applicable. Derivative contracts may consist of futures, forwards, options and swaps. The impact of a derivative contract on the Fund's performance may be larger than its unrealized appreciation (depreciation) or value may indicate. In many cases, the notional value or amount of a derivative contract may provide a better indication of the contract's significance to the portfolio. More complete information regarding the Fund's direct investments in derivative contracts, including unrealized appreciation (depreciation), value, and notional values or amounts of such contracts, can be found in the table at the end of the Portfolio of Investments included in this Report. |

| 6 | Other Security Types consist of common stock, warrants and preferred stock. |

| 7 | Cash Equivalents include any investments in money market mutual funds and/or overnight repurchase agreements. |

| 8 | Assets, other than investments in securities and derivative contracts, less liabilities. See Statement of Assets and Liabilities. |

Annual Shareholder Report

Portfolio of Investments

November 30, 2013

Principal

Amount,

Foreign Par

Amount

or Shares | | | Value in

U.S. Dollars |

| | | CORPORATE BONDS—0.3% | |

| | | Basic Industry - Chemicals—0.1% | |

| $1,250,000 | 1 | Reliance Industries Ltd., Bond, Series 144A, 8.250%, 01/15/2027 | $1,505,630 |

| | | Basic Industry - Paper—0.0% | |

| 250,000 | 3,4,5 | Pope & Talbot, Inc., 8.375%, 12/01/2099 | 0 |

| 202,000 | | Westvaco Corp., Sr. Deb., 7.500%, 06/15/2027 | 213,333 |

| | | TOTAL | 213,333 |

| | | Financial Institutional - Banking—0.1% | |

| 1,003,962 | 1,2,5 | Regional Diversified Fun, Series 144A, 9.250%, 3/15/2030 | 659,101 |

| | | Financial Institution - Finance Noncaptive—0.1% | |

| 500,000 | | Susa Partnership LP, Sr. Unsecd. Note, 8.200%, 6/01/2017 | 597,182 |

| | | Financial Institution - Insurance - Life—0.0% | |

| 500,000 | 1 | Union Central Life Ins Co, Note, Series 144A, 8.200%, 11/01/2026 | 560,785 |

| | | TOTAL CORPORATE BONDS

(IDENTIFIED COST $3,664,124) | 3,536,031 |

| | | FOREIGN GOVERNMENTS/AGENCIES—7.3% | |

| | | AUSTRALIAN DOLLAR—0.1% | |

| | | Sovereign—0.1% | |

| 1,552,000 | | Australia, Government of, Series 17, 5.500%, 3/01/2017 | 1,511,171 |

| | | British Pound—1.0% | |

| | | Sovereign—1.0% | |

| 2,500,000 | | U.K. Treasury, 4.750%, 03/07/2020 | 4,761,371 |

| 2,330,000 | | UK Treasury Bill, Unsecd. Deb., 0.330%, 1/06/2014 | 3,812,334 |

| 2,200,000 | | United Kingdom, Government of, 0.320%, 1/20/2014 | 3,599,092 |

| | | TOTAL BRITISH POUND | 12,172,797 |

| | | Canadian Dollar—0.2% | |

| | | Sovereign—0.2% | |

| 400,000 | | Canada, Government of, 4.000%, 06/01/2017 | 410,364 |

| 1,970,000 | | Canada, Government of, Bond, 4.000%, 06/01/2016 | 1,985,321 |

| 800,000 | | Canada, Government of, 4.500%, 06/01/2015 | 792,046 |

| | | TOTAL CANADIAN DOLLAR | 3,187,731 |

| | | DANISH KRONE—0.2% | |

| | | Sovereign—0.2% | |

| 13,030,000 | | Denmark, Government of, 4.000%, 11/15/2015 | 2,556,021 |

Annual Shareholder Report

Principal

Amount,

Foreign Par

Amount

or Shares | | | Value in

U.S. Dollars |

| | | FOREIGN GOVERNMENTS/AGENCIES—continued | |

| | | Euro—3.0% | |

| | | Sovereign—3.0% | |

| 3,600,000 | | Bonos Y Oblig Del Estado, 3.250%, 4/30/2016 | $5,073,528 |

| 3,500,000 | | Bonos Y Oblig Del Estado, 3.300%, 07/30/2016 | 4,937,808 |

| 3,600,000 | | Bonos Y Oblig Del Estado, Bond, 3.150%, 01/31/2016 | 5,056,147 |

| 1,550,000 | | Bundesrepublic Deutschla, 2.250%, 9/04/2021 | 2,255,768 |

| 1,640,000 | | Buoni Poliennali Del Tes, 2.750%, 11/15/2016 | 2,292,996 |

| 1,000,000 | | Buoni Poliennali Del Tes, 2.750%, 12/01/2015 | 1,398,739 |

| 2,155,000 | | Buoni Poliennali Del Tes, 3.750%, 4/15/2016 | 3,087,705 |

| 3,500,000 | | Buoni Poliennali Del Tes, Bond, 3.750%, 08/01/2015 | 4,959,318 |

| 3,400,000 | | Buoni Poliennali Del Tes, Bond, 4.250%, 2/01/2015 | 4,803,656 |

| 1,340,000 | | Germany, Government of, Series 2003, 4.250%, 1/04/2014 | 1,827,125 |

| 1,000,000 | | Spain, Government of, 3.000%, 04/30/2015 | 1,393,957 |

| | | TOTAL EURO | 37,086,747 |

| | | Japanese Yen—2.6% | |

| | | Sovereign—2.6% | |

| 137,000,000 | | Japan, Government of, Series 276, 1.600%, 12/20/2015 | 1,378,776 |

| 200,000,000 | | Japan, Government of, Series 327, 0.100%, 4/15/2015 | 1,953,007 |

| 440,000,000 | | Japan, Government of, Series 360, 0.080%, 4/21/2014 | 4,295,092 |

| 490,000,000 | | Japan, Government of, Sr. Unsecd. Note, Series 298, 1.300%, 12/20/2018 | 5,047,792 |

| 475,000,000 | | Japan, Government of, Sr. Unsecd. Note, Series 299, 1.300%, 3/20/2019 | 4,901,796 |

| 772,000,000 | | Japan, Government of, Sr. Unsecd. Note, Series 316, 0.100%, 5/15/2014 | 7,537,976 |

| 399,000,000 | | Japan-262 (10 Year Issue), Series 262, 1.900%, 06/20/2014 | 3,934,726 |

| 335,000,000 | | Japan-309, Sr. Unsecd. Note, Series 309, 1.100%, 06/20/2020 | 3,435,718 |

| | | TOTAL JAPANESE YEN | 32,484,883 |

| | | SINGAPORE DOLLAR—0.1% | |

| | | Sovereign—0.1% | |

| 1,230,000 | | Singapore, Government of, 0.250%, 02/01/2015 | 979,013 |

| | | SWEDISH KRONA—0.1% | |

| | | Sovereign—0.1% | |

| 7,500,000 | | Sweden, Government of, Series 1050, 3.000%, 7/12/2016 | 1,200,368 |

| | | TOTAL FOREIGN GOVERNMENTS/AGENCIES

(IDENTIFIED COST $95,202,837) | 91,178,731 |

Annual Shareholder Report

Principal

Amount,

Foreign Par

Amount

or Shares | | | Value in

U.S. Dollars |

| | | COMMERCIAL MORTGAGE-BACKED SECURITY—0.2% | |

| | | Agency Commercial Mortgage-Backed Security—0.2% | |

| $2,000,000 | 1,2 | FREMF Mortgage Trust 2013-K25, B, 3.742%, 11/25/2045

(IDENTIFIED COST $2,008,306) | $1,838,881 |

| | | COLLATERALIZED MORTGAGE OBLIGATIONS—2.4% | |

| | | Non-Agency Mortgage—0.0% | |

| 1,366 | 1 | SMFC Trust Asset-Backed Certificates, 1997-A B1-4, 2.711%, 1/28/2027 | 1,250 |

| | | Commercial Mortgage—2.4% | |

| 1,600,000 | | Citigroup Commercial Mortgage Trust 2013-GC11 B, 3.732%, 4/10/2046 | 1,534,045 |

| 2,500,000 | | Commercial Mortgage Pass-Through Certificates 2012-CR1 AM, 3.912%, 5/15/2045 | 2,533,970 |

| 3,900,000 | | Commercial Mortgage Pass-Through Certificates 2012-CR1 B, 4.612%, 5/15/2045 | 4,025,081 |

| 1,000,000 | | Commercial Mortgage Pass-Through Certificates 2012-LC4 B, 4.934%, 12/10/2044 | 1,065,144 |

| 2,000,000 | | Commercial Mortgage Pass-Through Certificates 2012-LC4, 4.063%, 12/10/2044 | 2,058,278 |

| 2,100,000 | | Commercial Mortgage Trust 2013-LC6 AM, 3.282%, 1/10/2046 | 2,002,164 |

| 4,000,000 | | Commercial Mortgage Trust 2013-LC6 B, 3.739%, 1/10/2046 | 3,859,400 |

| 2,500,000 | | GS Mortgage Securities Corp. II 2012-GCJ7 AS, 4.085%, 5/10/2045 | 2,568,877 |

| 4,000,000 | | GS Mortgage Securities Corp. II 2012-GCJ7 B, 4.740%, 5/10/2045 | 4,187,885 |

| 2,000,000 | 1,2 | JPMorgan Chase Commercial Mortgage Securities 2011-C3A B, 5.013%, 2/15/2046 | 2,162,209 |

| 1,000,000 | | Morgan Stanley Capital I 2012-C4 AS, 3.773%, 3/15/2045 | 1,007,423 |

| 2,250,000 | 1,2 | UBS-Barclays Commercial Mortgage Trust 2013-C6 B, 3.875%, 4/10/2046 | 2,183,933 |

| 1,000,000 | | WF-RBS Commercial Mortgage Trust 2012-C6 B, 4.697%, 4/15/2045 | 1,044,908 |

| | | TOTAL | 30,233,317 |

| | | TOTAL COLLATERALIZED MORTGAGE OBLIGATIONS

(IDENTIFIED COST $29,433,694) | 30,234,567 |

| | | COMMON STOCK—0.0% | |

| | | Automobiles—0.0% | |

| 785 | 3 | Motors Liquidation Co.

(IDENTIFIED COST $11,409) | 36,816 |

| | | PREFERRED STOCK—0.0% | |

| | | Financial Institution - Brokerage—0.0% | |

| 40,000 | 3,4,5 | Lehman Brothers Holdings, Pfd., Series D, 5.670%

(IDENTIFIED COST $3,400) | 400 |

Annual Shareholder Report

Principal

Amount,

Foreign Par

Amount

or Shares | | | Value in

U.S. Dollars |

| | | INVESTMENT COMPANIES—89.0%6 | |

| 10,282,081 | | Emerging Markets Fixed Income Core Fund | $341,328,021 |

| 11,534,765 | | Federated Mortgage Core Portfolio | 113,156,049 |

| 6,553,357 | 7 | Federated Prime Value Obligations Fund, Institutional Shares, 0.07% | 6,553,357 |

| 2,753,784 | | Federated Project and Trade Finance Core Fund | 26,821,859 |

| 92,613,629 | | High Yield Bond Portfolio | 618,659,039 |

| | | TOTAL INVESTMENT COMPANIES

(IDENTIFIED COST $1,089,668,208) | 1,106,518,325 |

| | | TOTAL INVESTMENTS—99.2%

(IDENTIFIED COST $1,219,991,978)8 | 1,233,343,751 |

| | | OTHER ASSETS AND LIABILITIES - NET—0.8%9 | 10,385,195 |

| | | TOTAL NET ASSETS—100% | $1,243,728,946 |

| |

At November 30, 2013, the Fund had the following outstanding futures contracts:

| Description | Number of

Contracts | Notional

Value | Expiration

Date | Unrealized

Appreciation |

| 3United States Treasury Notes (CBT) 10-Year Long Futures | 574 | $71,965,250 | March 2014 | $196,031 |

At November 30, 2013, the Fund had the following outstanding foreign exchange contracts:

| Settlement Date | Foreign Currency

Units to

Deliver/Receive | In

Exchange

For | Unrealized

Appreciation

(Depreciation) |

| Contracts Purchased: |

| 12/5/2013 | 1,134,462 Australian Dollar | 1,114,461 Canadian Dollar | $(15,804) |

| 12/5/2013 | 2,647,077 Australian Dollar | 2,628,547 Canadian Dollar | $(63,367) |

| 12/5/2013 | 1,571,769 Canadian Dollar | 1,801,000 New Zealand Dollar | $14,759 |

| 12/5/2013 | 3,245,000 Euro | 445,356,780 Japanese Yen | $60,126 |

| 12/5/2013 | 2,349,000 Euro | 3,803,501 New Zealand Dollar | $97,206 |

| 12/5/2013 | 2,250,000 Euro | 20,072,475 Swedish Krona | $(4,917) |

| 12/5/2013 | 216,289,265 Japanese Yen | 2,615,000 New Zealand Dollar | $(15,416) |

| 12/5/2013 | 225,366,680 Japanese Yen | 2,695,000 New Zealand Dollar | $8,136 |

| 12/5/2013 | 146,532,500 Japanese Yen | $1,482,522 | $(51,865) |

| 12/5/2013 | 146,532,500 Japanese Yen | $1,491,577 | $(60,919) |

| 12/5/2013 | 17,600,000 Swedish Krona | $2,631,815 | $52,612 |

| 12/12/2013 | 1,500,000 Canadian Dollar | $1,434,838 | $(22,894) |

| 12/12/2013 | 6,000,000 Euro | $7,996,176 | $154,789 |

| 12/12/2013 | 591,600,000 Japanese Yen | $5,985,643 | $(209,254) |

Annual Shareholder Report

| Settlement Date | Foreign Currency

Units to

Deliver/Receive | In

Exchange

For | Unrealized

Appreciation

(Depreciation) |

| Contracts Purchased (continued): |

| 12/12/2013 | 595,980,000 Japanese Yen | $6,000,785 | $(181,630) |

| 12/12/2013 | 1,500,000 Pound Sterling | $2,412,182 | $42,862 |

| 12/12/2013 | 22,800,000 Swedish Krona | $3,490,108 | $(13,083) |

| 12/24/2013 | 211,700 Euro | $282,223 | $5,368 |

| 12/24/2013 | 445,300 Euro | $595,113 | $9,821 |

| 12/24/2013 | 1,971,000 Euro | $2,666,318 | $11,259 |

| 12/24/2013 | 3,139,000 Euro | $4,198,067 | $66,222 |

| 1/17/2014 | 3,245,000 Euro | 452,677,500 Japanese Yen | $(12,765) |

| Contracts Sold: |

| 12/5/2013 | 3,781,538 Australian Dollar | 3,739,752 Canadian Dollar | $76,105 |

| 12/5/2013 | 1,573,462 Canadian Dollar | 1,801,000 New Zealand Dollar | $(16,353) |

| 12/5/2013 | 3,245,000 Euro | 445,729,995 Japanese Yen | $(56,483) |

| 12/5/2013 | 1,174,500 Euro | 1,907,423 New Zealand Dollar | $(43,989) |

| 12/5/2013 | 1,174,500 Euro | 1,913,672 New Zealand Dollar | $(38,906) |

| 12/5/2013 | 2,250,000 Euro | 20,097,675 Swedish Krona | $8,761 |

| 12/5/2013 | 96,000,135 Japanese Yen | 1,155,000 New Zealand Dollar | $2,230 |

| 12/5/2013 | 128,448,320 Japanese Yen | 1,540,000 New Zealand Dollar | $(1,401) |

| 12/5/2013 | 216,210,815 Japanese Yen | 2,615,000 New Zealand Dollar | $16,182 |

| 12/5/2013 | 293,065,000 Japanese Yen | $2,999,918 | $138,604 |

| 12/5/2013 | 8,797,760 Swedish Krona | $1,320,177 | $(21,694) |

| 12/5/2013 | 8,802,240 Swedish Krona | $1,321,065 | $(21,490) |

| 12/12/2013 | 1,500,000 Canadian Dollar | $1,430,866 | $18,922 |

| 12/12/2013 | 1,000 Euro | $1,350 | $(9) |

| 12/12/2013 | 5,999,000 Euro | $8,090,730 | $(58,876) |

| 12/12/2013 | 591,600,000 Japanese Yen | $5,911,710 | $135,322 |

| 12/12/2013 | 595,980,000 Japanese Yen | $6,048,900 | $229,745 |

| 12/12/2013 | 1,500,000 Pound Sterling | $2,411,549 | $(43,495) |

| 12/12/2013 | 22,800,000 Swedish Krona | $3,452,660 | $(24,365) |

| 12/24/2013 | 365,000 Euro | $490,396 | $(5,452) |

| 12/24/2013 | 5,402,000 Euro | $7,220,259 | $(118,285) |

| 1/17/2014 | 3,245,000 Euro | 449,984,150 Japanese Yen | $(13,540) |

| NET UNREALIZED APPRECIATION ON FOREIGN EXCHANGE CONTRACTS | $32,779 |

Net Unrealized Appreciation on Futures Contracts and Foreign Exchange Contracts is included in “Other Assets and Liabilities—Net.”

| 1 | Denotes a restricted security that either: (a) cannot be offered for public sale without first being registered, or being able to take advantage of an exemption from registration, under the Securities Act of 1933; or (b) is subject to a contractual restriction on public sales. At November 30, 2013, these restricted securities amounted to $8,911,789, which represented 0.7% of total net assets. |

Annual Shareholder Report

| 2 | Denotes a restricted security that may be resold without restriction to “qualified institutional buyers” as defined in Rule 144A under the Securities Act of 1933 and that the Fund has determined to be liquid under criteria established by the Fund's Board of Directors (the “Directors”). At November 30, 2013, these liquid restricted securities amounted to $6,844,124, which represented 0.6% of total net assets. |

| 3 | Non-income-producing security. |

| 4 | Issuer in default. |

| 5 | Market quotations and price evaluations are not available. Fair value determined in accordance with procedures established by and under the general supervision of the Directors. |

| 6 | Affiliated holdings. |

| 7 | 7-day net yield. |

| 8 | The cost of investments for federal tax purposes amounts to $1,262,120,148. |

| 9 | Assets, other than investments in securities, less liabilities. See Statement of Assets and Liabilities. |

Note: The categories of investments are shown as a percentage of total net assets at November 30, 2013.

Various inputs are used in determining the value of the Fund's investments. These inputs are summarized in the three broad levels listed below:

Level 1—quoted prices in active markets for identical securities, including investment companies with daily net asset values, if applicable.

Level 2—other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.). Also includes securities valued at amortized cost.

Level 3—significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments).

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities.

Annual Shareholder Report

The following is a summary of the inputs used, as of November 30, 2013, in valuing the Fund's assets carried at fair value:

| Valuation Inputs |

| | Level 1—

Quoted

Prices and

Investments in

Certain

Investment

Companies | Level 2—

Other

Significant

Observable

Inputs | Level 3—

Significant

Unobservable

Inputs | Total |

| Debt Securities: | | | | |

| U.S. Corporate Bonds | $— | $2,876,930 | $659,101 | $3,536,031 |

| Foreign Governments/Agencies | — | 91,178,731 | — | 91,178,731 |

| Commercial Mortgage-Backed Security | — | 1,838,881 | — | 1,838,881 |

| Collateralized Mortgage Obligations | — | 30,234,5671 | — | 30,234,567 |

| Equity Securities: | | | | |

| Common Stock | | | | |

| Domestic | 36,816 | — | — | 36,816 |

| Preferred Stock | | | | |

| Domestic | — | — | 4002 | 400 |

| Investment Companies3 | 1,079,696,466 | 26,821,859 | — | 1,106,518,325 |

| TOTAL SECURITIES | $1,079,733,282 | $152,950,968 | $659,501 | $1,233,343,751 |

OTHER FINANCIAL

INSTRUMENTS4 | $196,031 | $32,779 | $— | $228,810 |

| 1 | Includes $1,659 of a collateralized mortgage obligation security transferred from Level 3 to Level 2 because observable market data was obtained for this security. This transfer represents the value of the security at the beginning of the period. |

| 2 | Shares were exchanged in conjunction with a corporate action for shares of another security whose fair value is determined using valuation techniques utilizing unobservable market data due to observable market data being unavailable. |

| 3 | Emerging Markets Fixed Income Core Fund, Federated Mortgage Core Portfolio, High Yield Bond Portfolio and Federated Project and Trade Finance Core Fund are affiliated holdings offered only to registered investment companies and other accredited investors. |

| 4 | Other financial instruments include futures contracts and foreign exchange contracts. |

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report

Financial Highlights–Class A Shares

(For a Share Outstanding Throughout Each Period)

| Year Ended November 30 | 2013 | 2012 | 2011 | 2010 | 2009 |

| Net Asset Value, Beginning of Period | $9.47 | $8.96 | $9.10 | $8.75 | $6.72 |

| Income From Investment Operations: | | | | | |

| Net investment income | 0.411 | 0.471 | 0.531 | 0.561 | 0.541 |

| Net realized and unrealized gain (loss) on investments, futures contracts, swap contracts and foreign currency transactions | (0.35) | 0.53 | (0.12) | 0.34 | 2.06 |

| TOTAL FROM INVESTMENT OPERATIONS | 0.06 | 1.00 | 0.41 | 0.90 | 2.60 |

| Less Distributions: | | | | | |

| Distributions from net investment income | (0.37) | (0.49) | (0.55) | (0.55) | (0.57) |

| Net Asset Value, End of Period | $9.16 | $9.47 | $8.96 | $9.10 | $8.75 |

| Total Return2 | 0.66% | 11.40% | 4.52% | 10.61% | 40.31% |

| Ratios to Average Net Assets: | | | | | |

| Net expenses | 1.26% | 1.26% | 1.26% | 1.26% | 1.27% |

| Net investment income | 4.42% | 5.10% | 5.77% | 6.31% | 6.92% |

| Expense waiver/reimbursement3 | 0.07% | 0.06% | 0.07% | 0.08% | 0.10% |

| Supplemental Data: | | | | | |

| Net assets, end of period (000 omitted) | $635,469 | $813,104 | $668,477 | $632,690 | $582,883 |

| Portfolio turnover | 13% | 7% | 34% | 25% | 27% |

| 1 | Per share numbers have been calculated using the average shares method. |

| 2 | Based on net asset value, which does not reflect the sales charge, redemption fee or contingent deferred sales charge, if applicable. |

| 3 | This expense decrease is reflected in both the net expense and the net investment income ratios shown above. |

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report

Financial Highlights–Class B Shares

(For a Share Outstanding Throughout Each Period)

| Year Ended November 30 | 2013 | 2012 | 2011 | 2010 | 2009 |

| Net Asset Value, Beginning of Period | $9.46 | $8.95 | $9.10 | $8.74 | $6.71 |

| Income From Investment Operations: | | | | | |

| Net investment income | 0.341 | 0.401 | 0.461 | 0.491 | 0.481 |

| Net realized and unrealized gain (loss) on investments, futures contracts, swap contracts and foreign currency transactions | (0.36) | 0.53 | (0.13) | 0.35 | 2.06 |

| TOTAL FROM INVESTMENT OPERATIONS | (0.02) | 0.93 | 0.33 | 0.84 | 2.54 |

| Less Distributions: | | | | | |

| Distributions from net investment income | (0.30) | (0.42) | (0.48) | (0.48) | (0.51) |

| Net Asset Value, End of Period | $9.14 | $9.46 | $8.95 | $9.10 | $8.74 |

| Total Return2 | (0.20)% | 10.58% | 3.63% | 9.91% | 39.31% |

| Ratios to Average Net Assets: | | | | | |

| Net expenses | 2.01% | 2.01% | 2.01% | 2.01% | 2.02% |

| Net investment income | 3.67% | 4.36% | 5.03% | 5.55% | 6.23% |

| Expense waiver/reimbursement3 | 0.07% | 0.06% | 0.07% | 0.08% | 0.10% |

| Supplemental Data: | | | | | |

| Net assets, end of period (000 omitted) | $103,142 | $126,636 | $123,676 | $161,508 | $185,180 |

| Portfolio turnover | 13% | 7% | 34% | 25% | 27% |

| 1 | Per share numbers have been calculated using the average shares method. |

| 2 | Based on net asset value, which does not reflect the sales charge, redemption fee or contingent deferred sales charge, if applicable. |

| 3 | This expense decrease is reflected in both the net expense and the net investment income ratios shown above. |

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report

Financial Highlights–Class C Shares

(For a Share Outstanding Throughout Each Period)

| Year Ended November 30 | 2013 | 2012 | 2011 | 2010 | 2009 |

| Net Asset Value, Beginning of Period | $9.46 | $8.95 | $9.10 | $8.74 | $6.72 |

| Income From Investment Operations: | | | | | |

| Net investment income | 0.341 | 0.401 | 0.461 | 0.501 | 0.481 |

| Net realized and unrealized gain (loss) on investments, futures contracts, swap contracts and foreign currency transactions | (0.35) | 0.53 | (0.13) | 0.34 | 2.05 |

| TOTAL FROM INVESTMENT OPERATIONS | (0.01) | 0.93 | 0.33 | 0.84 | 2.53 |

| Less Distributions: | | | | | |

| Distributions from net investment income | (0.30) | (0.42) | (0.48) | (0.48) | (0.51) |

| Net Asset Value, End of Period | $9.15 | $9.46 | $8.95 | $9.10 | $8.74 |

| Total Return2 | (0.09)% | 10.58% | 3.63% | 9.92% | 39.12% |

| Ratios to Average Net Assets: | | | | | |

| Net expenses | 2.01% | 2.01% | 2.01% | 2.01% | 2.02% |

| Net investment income | 3.67% | 4.35% | 5.02% | 5.57% | 6.15% |

| Expense waiver/reimbursement3 | 0.07% | 0.06% | 0.07% | 0.08% | 0.10% |

| Supplemental Data: | | | | | |

| Net assets, end of period (000 omitted) | $262,115 | $312,701 | $244,083 | $222,727 | $178,659 |

| Portfolio turnover | 13% | 7% | 34% | 25% | 27% |

| 1 | Per share numbers have been calculated using the average shares method. |

| 2 | Based on net asset value, which does not reflect the sales charge, redemption fee or contingent deferred sales charge, if applicable. |

| 3 | This expense decrease is reflected in both the net expense and the net investment income ratios shown above. |

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report

Financial Highlights–Class F Shares

(For a Share Outstanding Throughout Each Period)

| Year Ended November 30 | 2013 | 2012 | 2011 | 2010 | 2009 |

| Net Asset Value, Beginning of Period | $9.42 | $8.92 | $9.06 | $8.71 | $6.69 |

| Income From Investment Operations: | | | | | |

| Net investment income | 0.411 | 0.471 | 0.521 | 0.561 | 0.541 |

| Net realized and unrealized gain (loss) on investments, futures contracts, swap contracts and foreign currency transactions | (0.35) | 0.52 | (0.11) | 0.34 | 2.05 |

| TOTAL FROM INVESTMENT OPERATIONS | 0.06 | 0.99 | 0.41 | 0.90 | 2.59 |

| Less Distributions: | | | | | |

| Distributions from net investment income | (0.37) | (0.49) | (0.55) | (0.55) | (0.57) |

| Net Asset Value, End of Period | $9.11 | $9.42 | $8.92 | $9.06 | $8.71 |

| Total Return2 | 0.66% | 11.34% | 4.54% | 10.66% | 40.33% |

| Ratios to Average Net Assets: | | | | | |

| Net expenses | 1.26% | 1.26% | 1.26% | 1.26% | 1.27% |

| Net investment income | 4.42% | 5.09% | 5.76% | 6.32% | 6.91% |

| Expense waiver/reimbursement3 | 0.07% | 0.06% | 0.07% | 0.13% | 0.15% |

| Supplemental Data: | | | | | |

| Net assets, end of period (000 omitted) | $90,204 | $86,126 | $59,578 | $52,015 | $41,233 |

| Portfolio turnover | 13% | 7% | 34% | 25% | 27% |

| 1 | Per share numbers have been calculated using the average shares method. |

| 2 | Based on net asset value, which does not reflect the sales charge, redemption fee or contingent deferred sales charge, if applicable. |

| 3 | This expense decrease is reflected in both the net expense and the net investment income ratios shown above. |

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report

Financial Highlights–Institutional Shares

(For a Share Outstanding Throughout Each Period)

| Year Ended November 30 | 2013 | 2012 | 2011 | 2010 | 2009 |

| Net Asset Value, Beginning of Period | $9.43 | $8.93 | $9.07 | $8.72 | $6.70 |

| Income From Investment Operations: | | | | | |

| Net investment income | 0.431 | 0.491 | 0.541 | 0.591 | 0.541 |

| Net realized and unrealized gain (loss) on investments, futures contracts, swap contracts and foreign currency transactions | (0.36) | 0.52 | (0.11) | 0.33 | 2.07 |

| TOTAL FROM INVESTMENT OPERATIONS | 0.07 | 1.01 | 0.43 | 0.92 | 2.61 |

| Less Distributions: | | | | | |

| Distributions from net investment income | (0.39) | (0.51) | (0.57) | (0.57) | (0.59) |

| Net Asset Value, End of Period | $9.11 | $9.43 | $8.93 | $9.07 | $8.72 |

| Total Return2 | 0.81% | 11.60% | 4.80% | 10.91% | 40.61% |

| Ratios to Average Net Assets: | | | | | |

| Net expenses | 1.01% | 1.01% | 1.01% | 1.01% | 1.02% |

| Net investment income | 4.66% | 5.33% | 5.97% | 6.63% | 6.78% |

| Expense waiver/reimbursement3 | 0.07% | 0.06% | 0.07% | 0.08% | 0.09% |

| Supplemental Data: | | | | | |

| Net assets, end of period (000 omitted) | $152,799 | $260,363 | $146,274 | $72,035 | $12,839 |

| Portfolio turnover | 13% | 7% | 34% | 25% | 27% |

| 1 | Per share numbers have been calculated using the average shares method. |

| 2 | Based on net asset value. |

| 3 | This expense decrease is reflected in both the net expense and the net investment income ratios shown above. |

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report

Statement of Assets and Liabilities

November 30, 2013

| Assets: | | |

| Total investment in securities, at value including $1,106,518,325 of investment in affiliated holdings (Note 5) (identified cost $1,219,991,978) | | $1,233,343,751 |

| Cash denominated in foreign currencies (identified cost $213,173) | | 213,267 |

| Restricted cash (Note 2) | | 846,650 |

| Income receivable | | 1,037,163 |

| Income receivable from affiliated holdings | | 4,172,359 |

| Receivable for investments sold | | 5,000,000 |

| Receivable for shares sold | | 678,362 |

| Unrealized appreciation on foreign exchange contracts | | 1,586,614 |

| Due from broker | | 1,714,000 |

| TOTAL ASSETS | | 1,248,592,166 |

| Liabilities: | | |

| Payable for shares redeemed | $1,903,676 | |

| Unrealized depreciation on foreign exchange contracts | 1,553,835 | |

| Payable for daily variation margin | 62,781 | |

| Income distribution payable | 505,794 | |

| Payable for transfer agent fee | 217,480 | |

| Payable for Directors'/Trustees' fees (Note 5) | 781 | |

| Payable for distribution services fee (Note 5) | 227,329 | |

| Payable for shareholder services fee (Note 5) | 225,482 | |

| Accrued expenses (Note 5) | 166,062 | |

| TOTAL LIABILITIES | | 4,863,220 |

| Net assets for 136,020,876 shares outstanding | | $1,243,728,946 |

| Net Assets Consist of: | | |

| Paid-in capital | | $1,361,878,608 |

| Net unrealized appreciation of investments, futures contracts and translation of assets and liabilities in foreign currency | | 13,586,639 |

| Accumulated net realized loss on investments, futures contracts, swap contracts and foreign currency transactions | | (133,948,469) |

| Undistributed net investment income | | 2,212,168 |

| TOTAL NET ASSETS | | $1,243,728,946 |

Annual Shareholder Report

Statement of Assets and Liabilities–continued

| Net Asset Value, Offering Price and Redemption Proceeds Per Share | | |

| Class A Shares: | | |

| Net asset value per share ($635,468,902 ÷ 69,408,313 shares outstanding), $0.001 par value, 1,000,000,000 shares authorized | | $9.16 |

| Offering price per share (100/95.50 of $9.16) | | $9.59 |

| Redemption proceeds per share | | $9.16 |

| Class B Shares: | | |

| Net asset value per share ($103,141,771 ÷ 11,278,632 shares outstanding), $0.001 par value, 2,000,000,000 shares authorized | | $9.14 |

| Offering price per share | | $9.14 |

| Redemption proceeds per share (94.50/100 of $9.14) | | $8.64 |

| Class C Shares: | | |

| Net asset value per share ($262,114,985 ÷ 28,656,318 shares outstanding), $0.001 par value, 1,000,000,000 shares authorized | | $9.15 |

| Offering price per share | | $9.15 |

| Redemption proceeds per share (99.00/100 of $9.15) | | $9.06 |

| Class F Shares: | | |

| Net asset value per share ($90,203,954 ÷ 9,906,119 shares outstanding), $0.001 par value, 1,000,000,000 shares authorized | | $9.11 |

| Offering price per share (100/99.00 of $9.11) | | $9.20 |

| Redemption proceeds per share (99.00/100 of $9.11) | | $9.02 |

| Institutional Shares: | | |

| Net asset value per share ($152,799,334 ÷ 16,771,494 shares outstanding), $0.001 par value, 1,000,000,000 shares authorized | | $9.11 |

| Offering price per share | | $9.11 |

| Redemption proceeds per share | | $9.11 |

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report

Statement of Operations

Year Ended November 30, 2013

| Investment Income: | | | |

| Dividends (including $58,927,309 received from affiliated holdings (Note 5) | | | $58,933,274 |

| Investment income allocated from affiliated partnership (Note 5) | | | 22,756,470 |

| Interest | | | 3,126,916 |

| TOTAL INCOME | | | 84,816,660 |

| Expenses: | | | |

| Investment adviser fee (Note 5) | | $12,688,716 | |

| Administrative fee (Note 5) | | 1,164,940 | |

| Custodian fees | | 101,069 | |

| Transfer agent fee | | 1,532,276 | |

| Directors'/Trustees' fees (Note 5) | | 10,808 | |

| Auditing fees | | 27,900 | |

| Legal fees | | 7,333 | |

| Portfolio accounting fees | | 200,436 | |

| Distribution services fee (Note 5) | | 3,131,149 | |

| Shareholder services fee (Note 5) | | 3,154,766 | |

| Account administration fee (Note 2) | | 3,121 | |

| Share registration costs | | 135,027 | |

| Printing and postage | | 170,999 | |

| Insurance premiums (Note 5) | | 7,410 | |

| Taxes | | 117,179 | |

| Miscellaneous (Note 5) | | 10,244 | |

| TOTAL EXPENSES | | $22,463,373 | |

Annual Shareholder Report

Statement of Operations–continued

| Waivers and Reimbursements (Note 5): | | | |

| Waiver/reimbursement of investment adviser fee | $(1,024,010) | | |

| Waiver of distribution services fee | (1,400) | | |

| Reimbursement of shareholder services fee | (1,300) | | |

| TOTAL WAIVERS AND REIMBURSEMENTS | | $(1,026,710) | |

| Net expenses | | | $21,436,663 |

| Net investment income | | | 63,379,997 |

| Realized and Unrealized Gain (Loss) on Investments, Futures Contracts, Swap Contracts and Foreign Currency Transactions: | | | |

| Net realized loss on investments and foreign currency transactions (including realized loss of $45,302,298 on sales of investments in affiliated holdings (Note 5)) | | | (69,146,191) |

| Net realized loss on futures contracts | | | (869,042) |

| Net realized loss on swap contracts | | | (2,254,413) |

| Net realized loss on investments and foreign currency transactions allocated from affiliated partnership (Note 5) | | | (376,799) |

| Realized gain distribution from affiliated investment company shares (Note 5) | | | 4,586,488 |

| Net change in unrealized appreciation of investments and translation of assets and liabilities in foreign currency | | | 5,658,913 |

| Net change in unrealized appreciation of futures contracts | | | (81,239) |

| Net realized and unrealized loss on investments, futures contracts, swap contracts and foreign currency transactions | | | (62,482,283) |

| Change in net assets resulting from operations | | | $897,714 |

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report

Statement of Changes in Net Assets

| Year Ended November 30 | 2013 | 2012 |

| Increase (Decrease) in Net Assets | | |

| Operations: | | |

| Net investment income | $63,379,997 | $70,535,255 |

| Net realized loss on investments including allocation from affiliated partnership, futures contracts, swap contracts and foreign currency transactions | (68,059,957) | (861,181) |

| Net change in unrealized appreciation/depreciation of investments, futures contracts and translation of assets and liabilities in foreign currency | 5,577,674 | 78,826,332 |

| CHANGE IN NET ASSETS RESULTING FROM OPERATIONS | 897,714 | 148,500,406 |

| Distributions to Shareholders: | | |

| Distributions from net investment income | | |

| Class A Shares | (30,523,664) | (38,962,571) |

| Class B Shares | (3,826,557) | (5,612,151) |

| Class C Shares | (9,859,191) | (12,632,733) |

| Class F Shares | (3,657,289) | (3,750,989) |

| Institutional Shares | (9,907,635) | (11,486,171) |

| CHANGE IN NET ASSETS RESULTING FROM DISTRIBUTIONS TO SHAREHOLDERS | (57,774,336) | (72,444,615) |

| Share Transactions: | | |

| Proceeds from sale of shares | 315,688,218 | 512,530,752 |

| Net asset value of shares issued to shareholders in payment of distributions declared | 51,045,204 | 63,271,916 |

| Cost of shares redeemed | (665,057,173) | (295,017,624) |

| CHANGE IN NET ASSETS RESULTING FROM SHARE TRANSACTIONS | (298,323,751) | 280,785,044 |

| Change in net assets | (355,200,373) | 356,840,835 |

| Net Assets: | | |

| Beginning of period | 1,598,929,319 | 1,242,088,484 |

| End of period (including undistributed net investment income of $2,212,168 and $882,848, respectively) | $1,243,728,946 | $1,598,929,319 |

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report

Notes to Financial Statements

November 30, 2013

1. ORGANIZATION

Federated Fixed Income Securities, Inc. (the “Corporation”) is registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company. The Corporation consists of two portfolios. The financial statements included herein are only those of Federated Strategic Income Fund (the “Fund”), a diversified portfolio. The financial statements of the other portfolios are presented separately. The assets of each portfolio are segregated and a shareholder's interest is limited to the portfolio in which shares are held. Each portfolio pays its own expenses. The Fund offers five classes of shares: Class A Shares, Class B Shares, Class C Shares, Class F Shares and Institutional Shares. All shares of the Fund have equal rights with respect to voting, except on class-specific matters. The investment objective of the Fund is to seek a high level of current income.

2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. These policies are in conformity with U.S. generally accepted accounting principles (GAAP).

Investment Valuation

In calculating its net asset value (NAV), the Fund generally values investments as follows:

| ■ | Fixed-income securities acquired with remaining maturities greater than 60 days are fair valued using price evaluations provided by a pricing service approved by the Directors. |

| ■ | Fixed-income securities and repurchase agreements acquired with remaining maturities of 60 days or less are valued at their amortized cost (adjusted for the accretion of any discount or amortization of any premium), unless the issuer's creditworthiness is impaired or other factors indicate that amortized cost is not an accurate estimate of the investment's fair value, in which case it would be valued in the same manner as a longer-term security. |

| ■ | Shares of other mutual funds or non-exchange-traded investment companies are valued based upon their reported NAVs. |

| ■ | Equity securities listed on an exchange or traded through a regulated market system are valued at their last reported sale price or official closing price in their principal exchange or market. |

| ■ | Derivative contracts listed on exchanges are valued at their reported settlement or closing price. |

| ■ | Over-the-counter (OTC) derivative contracts are fair valued using price evaluations provided by a pricing service approved by the Directors. |

| ■ | For securities that are fair valued in accordance with procedures established by and under the general supervision of the Directors, certain factors may be considered such as: the purchase price of the security, information obtained by contacting the issuer, analysis of the issuer's financial statements or other available documents, fundamental analytical data, the nature and duration of restrictions on disposition, the movement of the market in which the security is normally traded and public trading in similar securities of the issuer or comparable issuers. |

If the Fund cannot obtain a price or price evaluation from a pricing service for an investment, the Fund may attempt to value the investment based upon the mean of bid and asked quotations or fair value the investment based on price evaluations, from one or more dealers. If any price, quotation, price evaluation or other pricing source is not readily available when the

Annual Shareholder Report

NAV is calculated, or if the Fund cannot obtain price evaluations from a pricing service or from more than one dealer for an investment within a reasonable period of time as set forth in the Fund's valuation policies and procedures, the Fund uses the fair value of the investment determined in accordance with the procedures described below. There can be no assurance that the Fund could purchase or sell an investment at the price used to calculate the Fund's NAV.

Fair Valuation and Significant Events Procedures

The Directors have appointed a Valuation Committee comprised of officers of the Fund, Federated Investment Management Company (“Adviser”) and certain of the Adviser's affiliated companies to determine fair value of securities and in overseeing the calculation of the NAV. The Directors have also authorized the use of pricing services recommended by the Valuation Committee to provide fair value evaluations of the current value of certain investments for purposes of calculating the NAV. The Valuation Committee employs various methods for reviewing third-party pricing-service evaluations including periodic reviews of third-party pricing services' policies, procedures and valuation methods (including key inputs and assumptions), transactional back-testing, comparisons of evaluations of different pricing services, and review of price challenges by the Adviser based on recent market activity. In the event that market quotations and price evaluations are not available for an investment, the Valuation Committee determines the fair value of the investment in accordance with procedures adopted by the Directors. The Directors periodically review and approve the fair valuations made by the Valuation Committee and any changes made to the procedures.

Factors considered by pricing services in evaluating an investment include the yields or prices of investments of comparable quality, coupon, maturity, call rights and other potential prepayments, terms and type, reported transactions, indications as to values from dealers and general market conditions. Some pricing services provide a single price evaluation reflecting the bid-side of the market for an investment (a “bid” evaluation). Other pricing services offer both bid evaluations and price evaluations indicative of a price between the prices bid and asked for the investment (a “mid” evaluation). The Fund normally uses bid evaluations for U.S. Treasury and Agency securities, mortgage-backed securities and municipal securities. The Fund normally uses mid evaluations for other types of fixed-income securities and OTC derivative contracts. In the event that market quotations and price evaluations are not available for an investment, the fair value of the investment is determined in accordance with procedures adopted by the Directors.

The Directors also have adopted procedures requiring an investment to be priced at its fair value whenever the Adviser determines that a significant event affecting the value of the investment has occurred between the time as of which the price of the investment would otherwise be determined and the time as of which the NAV is computed. An event is considered significant if there is both an affirmative expectation that the investment's value will change in response to the event and a reasonable basis for quantifying the resulting change in value. Examples of significant events that may occur after the close of the principal market on which a security is traded, or after the time of a price evaluation provided by a pricing service or a dealer, include:

| ■ | With respect to securities traded in foreign markets, significant trends in U.S. equity markets or in the trading of foreign securities index futures contracts; |

| ■ | Political or other developments affecting the economy or markets in which an issuer conducts its operations or its securities are traded; and |

Annual Shareholder Report

| ■ | Announcements concerning matters such as acquisitions, recapitalizations, litigation developments, a natural disaster affecting the issuer's operations or regulatory changes or market developments affecting the issuer's industry. |

The Directors have approved the use of a pricing service to determine the fair value of equity securities traded principally in foreign markets when the Adviser determines that there has been a significant trend in the U.S. equity markets or in index futures trading. For other significant events, the Fund may seek to obtain more current quotations or price evaluations from alternative pricing sources. If a reliable alternative pricing source is not available, the Fund will determine the fair value of the investment using another method approved by the Directors.

Repurchase Agreements

The Fund may invest in repurchase agreements for short-term liquidity purposes. It is the policy of the Fund to require the other party to a repurchase agreement to transfer to the Fund's custodian or sub-custodian eligible securities or cash with a market value (after transaction costs) at least equal to the repurchase price to be paid under the repurchase agreement. The eligible securities are transferred to accounts with the custodian or sub-custodian in which the Fund holds a “securities entitlement” and exercises “control” as those terms are defined in the Uniform Commercial Code. The Fund has established procedures for monitoring the market value of the transferred securities and requiring the transfer of additional eligible securities if necessary to equal at least the repurchase price. These procedures also allow the other party to require securities to be transferred from the account to the extent that their market value exceeds the repurchase price or in exchange for other eligible securities of equivalent market value.

The insolvency of the other party or other failure to repurchase the securities may delay the disposition of the underlying securities or cause the Fund to receive less than the full repurchase price. Under the terms of the repurchase agreement, any amounts received by the Fund in excess of the repurchase price and related transaction costs must be remitted to the other party.

The Fund may enter into repurchase agreements in which eligible securities are transferred into joint trading accounts maintained by the custodian or sub-custodian for investment companies and other clients advised by the Fund's Adviser and its affiliates. The Fund will participate on a pro rata basis with the other investment companies and clients in its share of the securities transferred under such repurchase agreements and in its share of proceeds from any repurchase or other disposition of such securities.

Investment Income, Gains and Losses, Expenses and Distributions

Investment transactions are accounted for on a trade-date basis. Realized gains and losses from investment transactions are recorded on an identified-cost basis. Interest income and expenses are accrued daily. Dividend income and distributions to shareholders are recorded on the ex-dividend date. Foreign dividends are recorded on the ex-dividend date or when the Fund is informed of the ex-dividend date. Distributions of net investment income are declared and paid monthly. Non-cash dividends included in dividend income, if any, are recorded at fair value. The Fund invests in Emerging Markets Fixed Income Core Fund (EMCORE), a portfolio of Federated Core Trust II, L.P., which is a limited partnership established under the laws of the state of Delaware. The Fund records daily its proportionate share of income, expenses, realized and unrealized gains and losses from EMCORE. Investment income, realized and unrealized gains and losses, and certain fund-level expenses are allocated to each class based on relative

Annual Shareholder Report

average daily net assets, except that Class A Shares, Class B Shares, Class C Shares, Class F Shares and Institutional Shares may bear distribution services fees, shareholder services fees and account administration fees unique to those classes. For the year ended November 30, 2013, account administration fees for the Fund were as follows:

| | Account

Administration

Fees Incurred |

| Class A Shares | $1,227 |

| Class C Shares | 1,894 |

| TOTAL | $3,121 |

Dividends are declared separately for each class. No class has preferential dividend rights; differences in per share dividend rates are generally due to differences in separate class expenses.

Premium and Discount Amortization/Paydown Gains and Losses

All premiums and discounts on fixed-income securities, other than mortgage-backed securities, are amortized/accreted using the effective-interest-rate method. Gains and losses realized on principal payment of mortgage-backed securities (paydown gains and losses) are classified as part of investment income.

Federal Taxes

It is the Fund's policy to comply with the Subchapter M provision of the Internal Revenue Code (the “Code”) and to distribute to shareholders each year substantially all of its income. Accordingly, no provision for federal income tax is necessary. As of and during the year ended November 30, 2013, the Fund did not have a liability for any uncertain tax positions. The Fund recognizes interest and penalties, if any, related to tax liabilities as income tax expense in the Statement of Operations. As of November 30, 2013, tax years 2010 through 2013 remain subject to examination by the Fund's major tax jurisdictions, which include the United States of America, the state of Maryland and the Commonwealth of Pennsylvania.

The Fund may be subject to taxes imposed by governments of countries in which it invests. Such taxes are generally based on either income or gains earned or repatriated. The Fund accrues and applies such taxes to net investment income, net realized gains and net unrealized gains as income and/or gains are earned.

Other Taxes

As an open-end management investment company incorporated in the state of Maryland but domiciled in the Commonwealth of Pennsylvania, the Fund is subject to the Pennsylvania Franchise Tax. This franchise tax is assessed annually on the value of the Fund, as represented by average net assets for the tax year.

When-Issued and Delayed-Delivery Transactions

The Fund may engage in when-issued or delayed-delivery transactions. The Fund records when-issued securities on the trade date and maintains security positions such that sufficient liquid assets will be available to make payment for the securities purchased. Securities purchased on a when-issued or delayed-delivery basis are marked to market daily and begin earning interest on the settlement date. Losses may occur on these transactions due to changes in market conditions or the failure of counterparties to perform under the contract.

Annual Shareholder Report

Swap Contracts

Swap contracts involve two parties that agree to exchange the returns (or the differential in rates of return) earned or realized on particular predetermined investments, instruments, indices or other measures. The gross returns to be exchanged or “swapped” between parties are generally calculated with respect to a “notional amount” for a predetermined period of time. The Fund enters into interest rate, total return, credit default, currency and other swap agreements. Risks may arise upon entering into swap agreements from the potential inability of the counterparties to meet the terms of their contract from unanticipated changes in the value of the swap agreement.

The Fund uses credit default swaps to manage exposure to a given issuer or sector by either selling protection to increase exposure, or buying protection to reduce exposure. The “buyer” in a credit default swap is obligated to pay the “seller” a periodic stream of payments over the term of the contract provided that no event of default on an underlying reference obligation has occurred. If an event of default occurs, the seller must pay the buyer the full notional value, or the “par value”, of the reference obligation in exchange for the reference obligation. In connection with these agreements, securities may be identified as collateral in accordance with the terms of the respective swap agreements to provide assets of value and recourse in the event of default or bankruptcy/insolvency. Recovery values are assumed by market makers considering either industry standard recovery rates or entity specific factors and considerations until a credit event occurs. If a credit event has occurred, the recovery value is typically determined by a facilitated auction whereby a minimum number of allowable broker bids, together with a specific valuation method, are used to calculate the settlement value. The Fund's maximum risk of loss from counterparty credit risk, either as the protection buyer or as the protection seller, is the fair value of the contract. This risk is mitigated by having a master netting arrangement between the Fund and the counterparty and by the posting of collateral by the counterparty to the Fund to cover the Fund's exposure to the counterparty.

Upfront payments received or paid by the Fund will be reflected as an asset or liability on the Statement of Assets and Liabilities. Changes in the value of swap contracts are included in “Swaps, at value” on the Statement of Assets and Liabilities, and periodic payments are reported as “Net realized gain (loss) on swap contracts” in the Statement of Operations.

At November 30, 2013, the Fund had no outstanding swap contracts.

The average notional amount of swap contracts held by the Fund throughout the period was $9,230,769. This is based on amounts held as of each month-end throughout the fiscal period.

Futures Contracts

The Fund purchases and sells financial futures contracts to manage cash flows, enhance yield and to potentially reduce transaction costs. Upon entering into a financial futures contract with a broker, the Fund is required to deposit in a segregated account a specified amount of cash or U.S. government securities which is shown as Restricted Cash in the Statement of Assets and Liabilities. Futures contracts are valued daily and unrealized gains or losses are recorded in a “variation margin” account. Daily, the Fund receives from or pays to the broker a specified amount of cash based upon changes in the variation margin account. When a contract is closed, the Fund recognizes a realized gain or loss. Futures contracts have market

Annual Shareholder Report

risks, including the risk that the change in the value of the contract may not correlate with the changes in the value of the underlying securities. There is minimal counterparty risk to the Fund since futures are exchange traded and the exchange's clearinghouse, as counterparty to all exchange traded futures, guarantees the futures against default.

Futures contracts outstanding at period end are listed after the Fund's Portfolio of Investments.

The average notional value of long and short futures contracts held by the Fund throughout the period was $29,462,939 and $18,294,072, respectively. This is based on amounts held as of each month-end throughout the fiscal period.

Foreign Exchange Contracts

The Fund enters into foreign exchange contracts for the delayed delivery of securities or foreign currency exchange transactions. The Fund enters into foreign exchange contracts to protect assets against adverse changes in foreign currency exchange rates or exchange control regulations. Purchased contracts are used to acquire exposure to foreign currencies, whereas, contracts to sell are used to hedge the Fund's securities against currency fluctuations. Risks may arise upon entering into these transactions from the potential inability of counterparties to meet the terms of their commitments and from unanticipated movements in security prices or foreign exchange rates. The foreign exchange contracts are adjusted by the daily exchange rate of the underlying currency and any gains or losses are recorded for financial statement purposes as unrealized until the settlement date.

Foreign exchange contracts are subject to Master Netting Agreements which are agreements between the Fund and its counterparties that provides for the net settlement of all transactions and collateral with the Fund, through a single payment, in the event of default or termination. Amounts presented on the Portfolio of Investments and Statement of Assets and Liabilities are not net settlement amounts but gross. Foreign exchange contracts outstanding at period end, including net unrealized appreciation/depreciation or net settlement amounts, are listed after the Fund's Portfolio of Investments.

Foreign exchange contracts outstanding at period end are listed after the Fund's Portfolio of Investments.