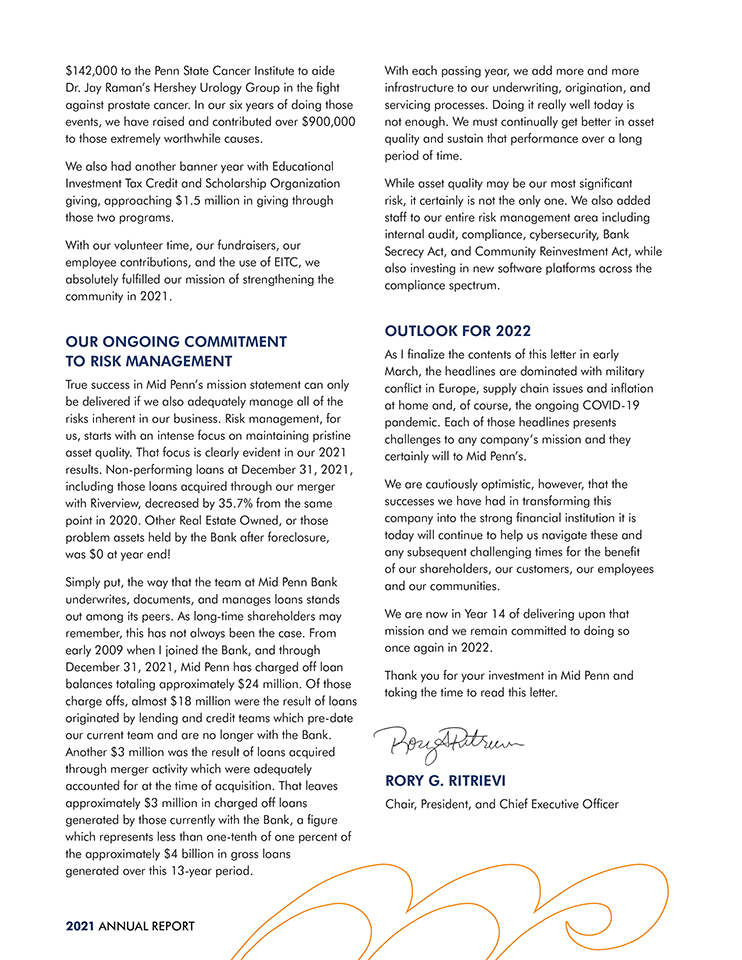

$142,000 to the Penn State Cancer Institute to aide Dr. Jay Raman’s Hershey Urology Group in the fight against prostate cancer. In our six years of doing those events, we have raised and contributed over $900,000 to those extremely worthwhile causes. We also had another banner year with Educational Investment Tax Credit and Scholarship Organization giving, approaching $1.5 million in giving through those two programs. With our volunteer time, our fundraisers, our employee contributions, and the use of EITC, we absolutely fulfilled our mission of strengthening the community in 2021. OUR ONGOING COMMITMENT TO RISK MANAGEMENT True success in Mid Penn’s mission statement can only be delivered if we also adequately manage all of the risks inherent in our business. Risk management, for us, starts with an intense focus on maintaining pristine asset quality. That focus is clearly evident in our 2021 results. Non-performing loans at December 31, 2021, including those loans acquired through our merger with Riverview, decreased by 35.7% from the same point in 2020. Other Real Estate Owned, or those problem assets held by the Bank after foreclosure, was $0 at year end! Simply put, the way that the team at Mid Penn Bank underwrites, documents, and manages loans stands out among its peers. As long-time shareholders may remember, this has not always been the case. From early 2009 when I joined the Bank, and through December 31, 2021, Mid Penn has charged off loan balances totaling approximately $24 million. Of those charge offs, almost $18 million were the result of loans originated by lending and credit teams which pre-date our current team and are no longer with the Bank. Another $3 million was the result of loans acquired through merger activity which were adequately accounted for at the time of acquisition. That leaves approximately $3 million in charged off loans generated by those currently with the Bank, a figure which represents less than one-tenth of one percent of the approximately $4 billion in gross loans generated over this 13-year period. With each passing year, we add more and more infrastructure to our underwriting, origination, and servicing processes. Doing it really well today is not enough. We must continually get better in asset quality and sustain that performance over a long period of time. While asset quality may be our most significant risk, it certainly is not the only one. We also added staff to our entire risk management area including internal audit, compliance, cybersecurity, Bank Secrecy Act, and Community Reinvestment Act, while also investing in new software platforms across the compliance spectrum. OUTLOOK FOR 2022 As I finalize the contents of this letter in early March, the headlines are dominated with military conflict in Europe, supply chain issues and inflation at home and, of course, the ongoing COVID-19 pandemic. Each of those headlines presents challenges to any company’s mission and they certainly will to Mid Penn’s. We are cautiously optimistic, however, that the successes we have had in transforming this company into the strong financial institution it is today will continue to help us navigate these and any subsequent challenging times for the benefit of our shareholders, our customers, our employees and our communities. We are now in Year 14 of delivering upon that mission and we remain committed to doing so once again in 2022. Thank you for your investment in Mid Penn and taking the time to read this letter. RORY G. RITRIEVI Chair, President, and Chief Executive Officer 2021 ANNUAL REPORT