3

RisKs AND contrOL

3.1 Risk Factors

The Group conducts its activities in an ever-changing environment and is exposed to risks that, if they were to occur, could have a material adverse effect on its business, financial condition, including its operating income and cash flow, reputation or outlook.

The Group employs a continuous process of identifying and analyzing risks in order to determine those that could prevent it from achieving its objectives. This chapter presents the significant risks to which the Group believes it is exposed as of the date of this Registration Document. However, as of such date, the Group may not be aware of, or may be underestimating the potential consequences of, other risks that could, or other risks may not have been considered by the Group as being likely to have a material adverse impact on the Group, its business, financial condition, including its operating income and cash flow, reputation or outlook.

The main internal control and risk management procedures, in particular those relating to the preparation and processing of accounting and financial information, are described in point 3.3 of this chapter.

3.1.1 Risks related to market environment and other financial risks

The financial performance of TOTAL is sensitive to a number of market environment related factors, the most significant being hydrocarbon prices, refining margins and exchange rates.

Generally, a decline in hydrocarbon prices has a negative effect on the Group’s results due to a decrease in revenues from oil and gas production. Conversely, a rise in hydrocarbon prices increases the Group’s results.

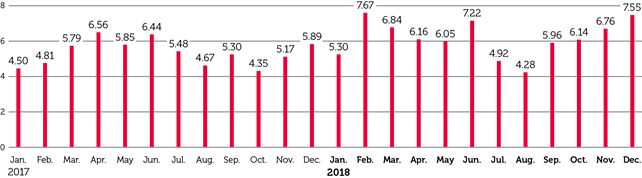

In 2018, at first, oil prices increased to reach their highest point in October above $80 per barrel, supported by supply tensions and geopolitics. Prices then decreased to below $60 per barrel by the end of the year, mainly driven by record production in the United States. In December, OPEC and Russia announced a production cut to mitigate the price drop. The oil and natural gas markets remain highly volatile.

For the fiscal year 2019, according to the scenarios retained below, the Group estimates that an increase of $10 per barrel in the average liquids price would increase annual adjusted net operating income (1) by approximately $2.7 billion and annual cash flow from operations by approximately $3.2 billion. Conversely, a decrease of $10 per barrel in the average liquids price would decrease annual adjusted net operating income by approximately $2.7 billion and annual cash flow from operations by approximately $3.2 billion.

The impact of changes in crude oil and gas prices on downstream operations depends upon the speed at which the prices of finished products adjust to reflect these changes. The Group estimates that a decrease in its European Refining Margin Indicator ("ERMI") of $10 per ton would decrease annual adjusted net operating income by approximately $0.5 billion and annual cash flow from operations by approximately $0.6 billion. Conversely, an increase in its ERMI of $10 per ton would increase annual adjusted net operating income by approximately $0.5 billion and annual cash flow from operations by approximately $0.6 billion.

All of the Group’s activities are, for various reasons and to varying degrees, sensitive to fluctuations in the dollar/euro exchange rate. The Group estimates that a decrease of $0.10 per euro (strengthening of the dollar versus the euro) would increase annual adjusted net operating income by approximately $0.1 billion and have a limited impact on annual cash flow from operations. Conversely, an increase of $0.10 per euro (weakening of the dollar versus the euro) would decrease adjusted net operating income by approximately $0.1 billion and have a limited impact on annual cash flow from operations.

Sensitivities 2019 (a) | Scenario retained | Change | Estimated impact on adjusted net operating income | Estimated impact on cash flow from operations |

Dollar | 1.2 $/€ | +/-0.1 $ per € | -/+0.1 B$ | ~ 0 B$ |

Average liquids price | 60 $/b (b) | +/-10 $/b | +/-2.7 B$ | +/-3.2 B$ |

European Refining Margin Indicator (ERMI) | 35 $/t | +/-10 $/t | +/-0.5 B$ | +/-0.6 B$ |

(a) Sensitivities revised once per year upon publication of the previous year’s fourth quarter results. Indicated sensitivities are approximate and based upon TOTAL’s current view of its 2019 portfolio. Results may differ significantly from the estimates implied by the application of these sensitivities. The impact of the $/€ sensitivity on adjusted net operating income is attributable essentially to Refining & Chemicals.

(b) Brent environment at 60 $/b.

In addition to the adverse effect on the Group’s revenues, margins and profitability, a prolonged period of low oil and natural gas prices could lead the Group to review its projects and the evaluation of its assets and oil and natural gas reserves.

Prices for oil and natural gas may fluctuate widely due to many factors over which TOTAL has no control. These factors include:

-variations in global and regional supply of and demand for energy;

-global and regional economic and political developments in natural resource-producing regions, particularly in the Middle East, Africa and South America, as well as in Russia;

-the ability of the OPEC and other producing nations to influence global production levels and prices;

-prices of unconventional energies as well as evolving approaches for developing oil sands and shale oil, which may affect the Group’s realized prices, notably under its long-term gas sales contracts and asset valuations, particularly in North America;

-cost and availability of new technologies;

-regulations and governmental actions;

-global economic and financial market conditions;

(1) Adjusted results are defined as income at replacement cost, excluding special items and the impact of fair value changes.

-the security situation in certain regions, the magnitude of international terrorist threats, wars or other conflicts;

-changes in demographics, notably population growth rates, and consumer preferences; and

-adverse weather conditions that can disrupt supplies or interrupt operations of the Group’s facilities.

Prolonged periods of low oil and natural gas prices may reduce the economic viability of projects in production or in development and reduce the Group’s liquidity, thereby decreasing its ability to finance capital expenditures and/or causing it to cancel or postpone investment projects.

If TOTAL were unable to finance its investment projects, the Group’s opportunities for future revenues and profitability growth would be reduced, which could materially negatively impact the Group’s financial condition, including its operating income and cash flow.

Prolonged periods of low oil and natural gas prices may reduce the Group’s reported reserves and cause the Group to revise the price assumptions upon which asset impairment tests are based, which could have a significant adverse effect on the Group’s results in the period in which it occurs. For additional information on impairments recognized on the Group’s assets, refer to Note 3 to the Consolidated Financial Statements (point 8.7 of chapter 8).

Conversely, in a high oil and gas price environment, the Group can experience significant increases in cost and government take, and, under some production-sharing contracts, the Group’s production rights could be reduced. Higher prices can also reduce demand for the Group’s products.

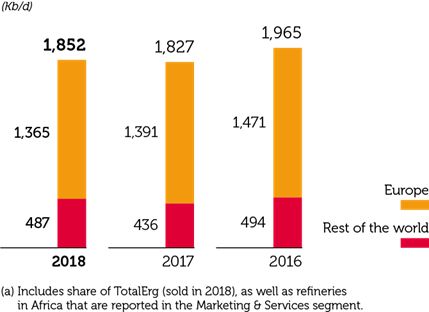

The Group’s results from its Refining & Chemicals and Marketing & Services segments are primarily dependent upon the supply and demand for petroleum products and the associated margins on sales of these products, with the impact of changes in oil and gas prices on results on these segments being dependent upon the speed at which the prices of petroleum products adjust to reflect movements in oil and gas prices. In 2018, the positive effects of higher oil and gas prices on the Group’s results have been greater than the decrease of the results of the Refining & Chemicals segment. The Group’s refining margins remain highly volatile.

The activities of Trading & Shipping (oil, gas and power trading and shipping activities) are particularly sensitive to market risk and more specifically to price risk as a consequence of the volatility of oil and gas prices, to liquidity risk (inability to buy or sell cargoes at market prices) and to counterparty risk (when a counterparty does not fulfill its contractual obligations). The Group uses various energy derivative instruments and freight-rate instruments to reduce its exposure to price fluctuations of crude oil, petroleum products, natural gas, power and freight-rates. Although TOTAL believes it has established appropriate risk management procedures, large market fluctuations may adversely affect the Group’s activities and financial condition, including its operating income and cash flow.

[REDACTED SECTION: CERTAIN TEXT HAS BEEN REDACTED.]

TOTAL is exposed to other financial risks related to its financing and cash management activities.

The Group is exposed to changes in interest rates and foreign exchange rates. Even though the Group generally seeks to minimize the currency exposure of each entity with regards to its functional currency (primarily the dollar, the euro, the pound sterling and the Norwegian krone), the Group’s financial condition, including its operating income and cash flow, could be impacted by a significant change in the value of these currencies.

In addition, as TOTAL mostly turns to financial markets for its external financing, its financial condition and operations could be materially impacted if access to those markets were to become more difficult.

For further information on financial risks, refer to Notes 15 and 16 to the Consolidated Financial Statements (point 8.7 of chapter 8).

3.1.2 Industrial and environmental risks and risks related to climate issues

TOTAL is exposed to risks related to the safety and security of its operations.

The Group’s activities involve a wide range of operational risks, such as explosions, fires, accidents, equipment failures, leakage of toxic products, emissions or discharges into the air, water or soil, that can potentially cause death or injury, or impact natural resources and ecosystems.

The industrial event that could have the most significant impact is a major industrial accident, e.g., blow out, explosion, fire, leakage of highly toxic products or massive leakage, resulting in death or injury and/or accidental pollution on a large-scale or at an environmentally sensitive site.

Acts of terrorism or malicious acts against employees, plants, sites, pipelines and transportation or computer systems of the Group’s or its contractors could also disrupt the Group’s business activities and could cause harm or damage to people, property and the environment and could have a material adverse effect on the Group’s financial condition.

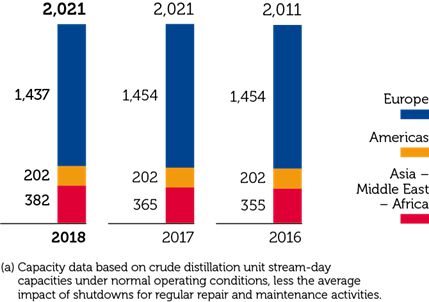

Certain activities of the Group face additional specific risks. TOTAL’s Exploration & Production activities are exposed to risks related to the physical characteristics of oil and gas fields, particularly during drilling operations, which can cause blow outs, explosions, fires or other damage, in particular to the environment, and lead to a disruption of the Group’s operations or reduce its production. In addition to the risks of explosions and fires, the activities of the Gas, Renewables & Power (1), Refining & Chemicals and Marketing & Services business segments entail risks related to the overall life cycle of the products manufactured, as well as the materials used. With regard to transportation, the likelihood of an operational accident depends not only on the hazardous nature of the products transported, but also on the volumes involved and the sensitivity of the regions through which they are transported (quality of infrastructure, population density, environment).

(1) Integrated Gas, Renewables & Power, as from January 1, 2019 (refer to point 2.2 of chapter 2).

Total’s workforce and the public are exposed to risks inherent to the Group’s operations, which could lead to legal proceedings against the Group’s entities and legal representatives, notably in cases of death, injury and property and environmental damage. Such proceedings could also damage the Group’s reputation. In addition, like most industrial groups, TOTAL is concerned by declarations of occupational illnesses.

To manage the operational risks to which it is exposed, the Group has adopted a preventive and remedial approach by putting in place centralized HSE (health, safety and environment) and security management systems that seek to take all necessary measures to reduce the related risks (refer to points 5.4 and 5.5 of chapter 5). In addition, the Group maintains third-party liability insurance coverage for all its subsidiaries. TOTAL also has insurance to protect against the risk of damage to Group property and/or business interruption at its main refining and petrochemical sites. TOTAL’s insurance and risk management policies are described in point 3.4 of this chapter. However, the Group is not insured against all potential risks. In certain cases, such as a major environmental disaster, TOTAL’s liability may exceed the maximum coverage provided by its third-party liability insurance. The Group cannot guarantee that it will not suffer any uninsured loss and there can be no guarantee, particularly in the event of a major environmental disaster or industrial accident, that such loss would not have a material adverse effect on the Group’s financial condition, including its operating income and cash flow, and its reputation.

Crisis management systems are necessary to effectively respond to emergencies, avoid potential disruptions to the Group’s business and operations and minimize impacts on third parties or the environment.

The Group has crisis management plans in place to deal with emergencies (refer to point 5.5 of chapter 5). However, these plans cannot exclude the risk that the Group’s business and operations may be severely disrupted in a crisis situation or ensure the absence of impacts on third parties or the environment. TOTAL has also implemented business continuity plans to continue or resume operations following a shutdown or incident. An inability for the Group to resume its activities in a timely manner could prolong the impact of any disruption and thus could have a material adverse effect on its financial condition, including its operating income and cash flow.

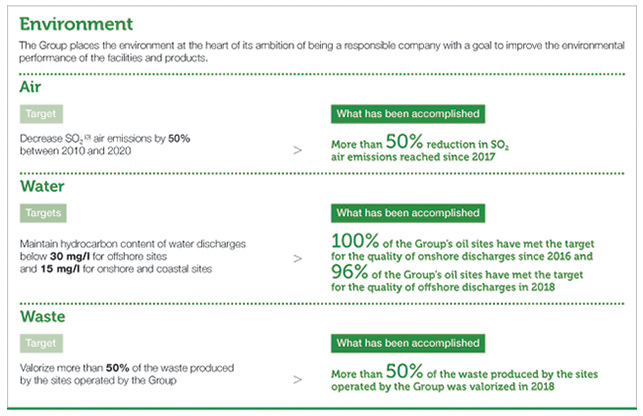

TOTAL is subject to increasingly stringent environmental, health and safety laws and regulations in numerous countries and may incur material related compliance costs.

The Group’s activities are subject to numerous laws and regulations pertaining to the environment, health and safety. In most countries where the Group operates, particularly in Europe and the United States, sites and products are subject to increasingly stringent laws governing the protection of the environment (water, air, soil, noise, protection of nature, waste management and impact assessments, etc.), health (occupational safety and chemical product risk, etc.) and the safety of personnel and residents. Product quality and consumer protection are also subject to increasingly strict regulations. The Group’s entities ensure that their products meet applicable specifications and abide by all applicable consumer protection laws. Failure to do so could lead to personal injury, property damage, environmental harm and loss of customers, which could negatively impact the Group’s financial condition, including its operating income and cash flow, and its reputation.

TOTAL incurs and will continue to incur substantial expenditures to comply with increasingly complex laws and regulations aimed at protecting health, safety and the environment. Such expenditures could have a material adverse effect on the Group’s financial condition.

The introduction of new laws and regulations could compel the Group to curtail, modify or cease certain operations or implement temporary shutdowns of sites, which could diminish productivity and have a material adverse impact on its financial condition.

Moreover, pursuant to applicable regulations, most of the Group’s activities will require, at site closure, decommissioning followed by environmental remediation after operations are discontinued. Costs related to such activities may materially exceed the Group’s provisions and adversely impact its operating incomes. With regard to the definitive shutdown of activities, the Group’s environmental contingencies and asset retirement obligations are addressed in the "Asset retirement obligations" and "Provisions for environmental contingencies" sections of the Group’s consolidated balance sheet (refer to Note 12 to the Consolidated Financial Statements, point 8.7 of chapter 8). Future expenditures related to asset retirement obligations are accounted for in accordance with the accounting principles described in the same Note.

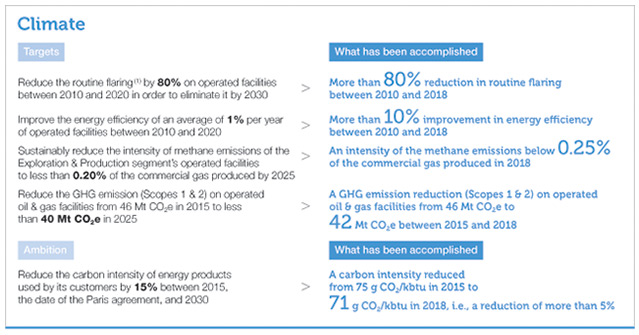

Laws and regulations related to climate change as well as growing concern of stakeholders may adversely affect the Group’s business and financial condition.

Firstly, there is a risk incurred by rapidly changing modes of energy production in favor of a lower-carbon energy mix that allows for a more limited share of fossil fuel. This could impact the Group’s business model, profitability, financial situation and shareholder value.

The growing concern of certain stakeholders with regards to climate change could also have an impact on certain external financing of the Group’s projects or influence certain investors involved in the oil and gas sector.

Moreover, regulations may change and require the Group to reduce, change or cease certain operations, and subject it to additional obligations with regards to the compliance of its facilities. This could have a negative effect on its activities and its financial situation, including operating income and cash flow. Regulations designed to gradually limit fossil fuel use may, depending on the GHG emission limits and time horizons set, negatively and significantly affect the development of projects, as well as the economic value of certain of the Group’s assets. In Europe, for example, the Group’s industrial facilities are part of the CO2 emissions quotas market (EU-ETS), and the financial risk incurred by purchasing these quotas on the market could increase due to the reform of the system that was approved in 2018. This emission quotas market is in its third phase. The Group estimates that about 25% of emissions subjected to EU-ETS are not covered by free quotas in the period 2013-2020 (phase 3) and to 30% or more from 2021 to 2030 (phase 4). At the end of 2018, the price of these quotas was about €20/t, and the Group expects this price to be higher than €30/t in phase 4.

Internal studies conducted by TOTAL have shown that a long-term CO2 price of $40/t (1) applied worldwide would have a negative impact of around 5% on the discounted present value of the Group’s assets (upstream and downstream). [REDACTED SECTION: CERTAIN TEXT HAS BEEN REDACTED.]

(1) As from 2021 or the current price in a given country.

Finally, the Company and several of its subsidiaries have received claims issued by public entities in certain countries in view of financing the protective measures to be implemented in order to limit the consequences of climate change. The Group is subject to the risk of judicial actions in this area.

The physical effects of climate change may adversely affect the Group’s business.

TOTAL’s businesses operate in various regions, where the potential physical impacts of climate change, including changes in weather patterns, are highly uncertain and may adversely impact the Group’s operating income.

Climate change potentially has multiple effects that could harm the Group’s operations. The increasing scarcity of water resources may negatively affect the Group’s operations in some regions of the world, high sea levels may harm certain coastal activities, and the multiplication of extreme weather events may damage offshore and onshore facilities. These climate risk factors are continually assessed in the risk management and prevention plans.

The Group believes that it is impossible to guarantee that the contingencies or liabilities related to the matters mentioned in this point 3.1.2 would not have a material adverse impact on its business, financial condition, including its operating income and cash flow, reputation, prospects or shareholder value, if such risks were to occur.

3.1.3 Risks related to critical IT systems security

Disruption to or breaches of TOTAL’s critical IT services or information security systems could adversely affect the Group’s activities.

The Group’s activities depend heavily on the reliability and security of its information technology (IT) systems. The Group’s IT systems, some of which are managed by third parties, are susceptible to being compromised, damaged, disrupted or shutdown due to failures during the process of upgrading or replacing software, databases or components, power or network outages, hardware failures, cyber-attacks (viruses, computer intrusions), user errors or natural disasters. The cyber threat is constantly evolving. Attacks are becoming more sophisticated with regularly renewed techniques while the digital transformation amplifies exposure to these cyber threats. The adoption of new technologies, such as the Internet of things (IoT) or the migration to the cloud, as well as the evolution of architectures for increasingly interconnected systems, are all areas where cyber security is a very important issue. The Group and its service providers may not be able to prevent third parties from breaking into the Group’s IT systems, disrupting business operations or communications infrastructure through denial-of-service attacks, or gaining access to confidential or sensitive information held in the system. The Group, like many companies, has been and expects to continue to be the target of attempted cybersecurity attacks. While the Group has not experienced any such attack that has had a material impact on its business, the Group cannot guarantee that its security measures will be sufficient to prevent a material disruption, breach or compromise in the future.

As a result, the Group’s activities and assets could sustain serious damage, services to clients could be interrupted, material intellectual property could be divulged and, in some cases, personal injury, property damage, environmental harm and regulatory violations could occur, potentially having a material adverse effect on the Group’s financial condition, including its operating income and cash flow.

3.1.4 Risks related to the development of major projects and reserves

The Group’s production growth and profitability depend on the delivery of its major development projects.

Growth of production and profitability of the Group rely heavily on the successful execution of its major development projects that are increasingly complex and capital-intensive. These major projects may face a number of difficulties, including, in particular, those related to:

-economic or political risks, including threats specific to a certain country or region, such as terrorism, social unrest or other conflicts (refer to point 3.1.6 of this chapter);

-negotiations with partners, governments, local communities, suppliers, customers and other third parties;

-obtaining project financing;

-controlling capital and operating costs;

-earning an adequate return in a low oil and/or gas price environment;

-respecting project schedules; and

-the timely issuance or renewal of permits and licenses by public agencies.

Poor delivery of any major project that underpins production or production growth could adversely affect the Group’s financial condition, including its operating income and cash flow.

The Group’s long-term profitability depends on cost-effective discovery, acquisition and development of economically viable new reserves; if the Group is unsuccessful, its financial condition, including its operating income and cash flow, could be materially affected.

A large portion of the Group’s revenues and operating results are derived from the sale of oil and gas that the Group extracts from underground reserves developed as part of its Exploration & Production activities. The development of oil and gas fields, the construction of facilities and the drilling of production or injection wells is capital intensive and requires advanced technology. Due to constantly changing market conditions and environmental challenges, cost projections can be uncertain. For Exploration & Production activities to continue to be profitable, the Group needs to replace its reserves with new proved reserves (likely to be developed and produced in an economically viable manner).

In addition, a number of factors may undermine TOTAL’s ability to discover, acquire and develop new reserves, which are inherently uncertain, including:

-the geological nature of oil and gas fields, notably unexpected drilling conditions, including pressure or unexpected heterogeneities in geological formations;

-the risk of dry holes or failure to find expected commercial quantities of hydrocarbons;

-equipment failures, fires, blow-outs or accidents;

-shortages or delays in the availability or delivery of appropriate equipment;

-the Group’s inability to develop or implement new technologies that enable access to previously inaccessible fields;

-the Group’s inability to anticipate market changes in a timely manner;

-adverse weather conditions;

-the inability of the Group’s partners to execute or finance projects in which the Group holds an interest or to meet their contractual obligations;

-the inability of service companies to deliver contracted services on time and on budget;

-compliance with both anticipated and unanticipated governmental requirements, including U.S. and EU regulations that may give a competitive advantage to companies not subject to such regulations;

-economic or political risks, including threats specific to a certain country or region, such as terrorism, social unrest or other conflicts (refer to point 3.1.6 of this chapter);

-competition from oil and gas companies for the acquisition and development of assets and licenses (refer to point 3.1.7 of this chapter);

-increased taxes and royalties, including retroactive claims and changes in regulations and tax reassessments; and

-disputes related to property titles.

These factors could lead to cost overruns and/or could impair the Group’s ability to complete a development project or make production economical. Some of these factors may also affect the Group’s projects and facilities further down the oil and gas chain.

If TOTAL fails to develop new reserves cost-effectively and in sufficient quantities, the Group’s financial condition, including its operating income and cash flow, could be materially affected.

The Group’s oil and gas reserves data are estimates only and subsequent upward or downward adjustments are possible. If actual production from such reserves proves to be lower than current estimates indicate, the Group’s financial condition, including its operating income and cash flow, could be impacted.

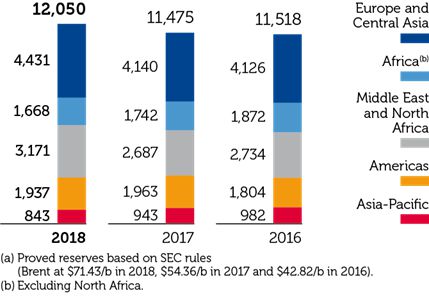

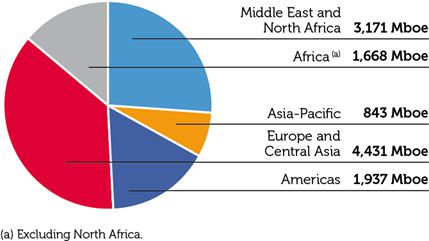

The Group’s proved reserves figures are estimates prepared in accordance with SEC rules. Proved reserves are those reserves which, by analysis of geoscience and engineering data, can be estimated with reasonable certainty to be economically recoverable - from a given date forward, from known reservoirs and under existing economic conditions, operating methods and government regulations - prior to the time at which contracts providing the right to operate expire, unless evidence indicates that renewal is reasonably certain, regardless of whether deterministic or probabilistic methods are used for the estimation. Reserves are estimated by teams of qualified, experienced and trained geoscientists and petroleum, gas and project engineers, who rigorously review and analyze in detail all available geoscience and engineering data (for example, seismic data, electrical logs, cores, fluids, pressures, flow rates and facilities parameters). This process involves making subjective judgments, including with respect to the estimate of hydrocarbons initially in place, initial production rates and recovery efficiency, based on available geological, technical and economic data. Consequently, estimates of reserves are not exact measurements and are subject to revision.

A variety of factors that are beyond the Group’s control could cause such estimates to be adjusted downward in the future, or cause the Group’s actual production to be lower than its currently reported proved reserves indicate. Such factors include:

-a prolonged period of low prices of oil or gas, making reserves no longer economically viable to exploit and therefore not classifiable as proved;

-an increase in the price of oil or gas, which may reduce the reserves to which the Group is entitled under production sharing and risked service contracts and other contractual terms;

-changes in tax rules and other regulations that make reserves no longer economically viable to exploit, or disputes related to property titles; and

-the actual production performance of the Group’s deposits.

The Group’s reserves estimates may therefore require substantial downward revisions should its subjective judgments prove not to have been conservative enough based on the available geoscience and engineering data, or the Group’s assumptions regarding factors or variables that are beyond its control prove to be incorrect over time. Any downward adjustment could indicate lower future production amounts, which could adversely affect the Group’s financial condition, including its operating income and cash flow.

3.1.5 Risks related to equity affiliates and management of assets operated by third parties

Many of the Group’s projects are conducted by equity affiliates or are operated by third parties. For these projects, the Group’s degree of control, as well as its ability to identify and manage risks, may be reduced.

A significant number of the Group’s projects are conducted by equity affiliates (1) or operated by third parties. In cases where the Group’s company is not the operator, such company may have limited influence over, and control of, the behavior, performance and costs of the partnership, its ability to manage risks may be limited and it may, nevertheless, be prosecuted by regulators or claimants in the event of an incident.

Additionally, the partners of the Group may not be able to meet their financial or other obligations to the projects, which may threaten the viability of a given project. These partners may also not have the financial capacity to fully indemnify the Group or third parties in the event of an incident.

With respect to joint-ventures, contractual terms generally provide that the operator, whether an entity of the Group or a third party, assumes full liability for damages caused by its gross negligence or willful misconduct.

(1) For additional information, refer to Note 8 to the Consolidated Financial Statements (point 8.7 of chapter 8).

In the absence of the operator’s gross negligence or willful misconduct, other liabilities are generally borne by the joint-venture and the cost thereof is assumed by the partners of the joint-venture in proportion to their respective ownership interests.

With respect to third-party providers of goods and services, the amount and nature of the liability assumed by the third party depends on the context and may be limited by contract. Contracts may also contain obligations to indemnify TOTAL or for TOTAL to indemnify partners or third parties.

3.1.6 Risks related to political or economic factors

TOTAL has significant production and reserves located in politically, economically and socially unstable areas, where the risk that the Group’s operations may be materially affected is relatively high.

A significant portion of TOTAL’s oil and gas production and reserves is located in countries that are not part of the Organisation for Economic Co-operation and Development (OECD). In recent years, a number of these countries have experienced varying degrees of one or more of the following: economic or political instability, civil war, violent conflict, social unrest, actions of terrorist groups and the application of international economic sanctions. Any of these conditions alone or in combination could disrupt the Group’s operations in any of these regions, causing substantial declines in production or revisions to reserves estimates.

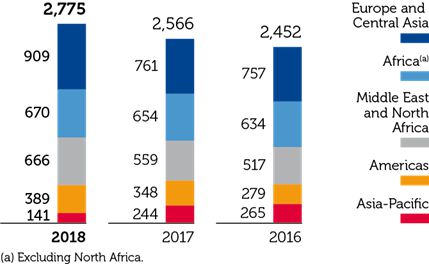

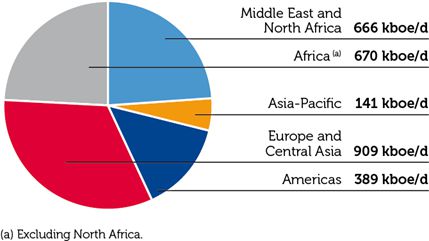

In Africa (excluding North Africa), which represented 24% of the Group’s 2018 combined liquids and gas production, certain of the countries in which the Group has production have recently suffered from some of these conditions, including Nigeria, which is one of the main contributing countries to the Group’s production of hydrocarbons (refer to point 2.1.9 of chapter 2).

The Middle East and North Africa zone, which represented 24% of the Group’s 2018 combined liquids and gas production, has in recent years suffered increased political instability in connection with violent conflict and social unrest, particularly in Libya and Syria, where the European Union (EU) and the U.S. have enacted economic sanctions prohibiting TOTAL from producing oil and gas since 2011. In Yemen, the deterioration of security conditions in the vicinity of the Balhaf site caused the company Yemen LNG, in which the Group holds a stake of 39.62%, to stop its commercial production and export of LNG and to declare force majeure to its various stakeholders in 2015. The plant has been put in preservation mode. In Iran, TOTAL signed in July 2017 a 20-year contract with the National Iranian Oil Company (NIOC) relating to the development and production of phase 11 (SP11) of the giant South Pars gas field. Following the withdrawal of the United States from the Joint Comprehensive Plan of Action on May 8, 2018, TOTAL withdrew from this project and finalized its withdrawal on October 29, 2018, prior to the re-imposition of US secondary sanctions on the oil industry as of November 5, 2018. TOTAL was the operator and had a 50.1% interest alongside the Chinese state-owned company CNPC (30%) and Petropars (19.9%); a wholly-owned subsidiary of NIOC. TOTAL ceased all operational activity in Iran before November 4, 2018.

In South America, which represented 6% of the Group’s 2018 combined liquids and gas production, certain of the countries in which TOTAL has production have recently suffered from political or economic instability, including Argentina, Brazil and Venezuela.

Since July 2014, international economic sanctions have been adopted against certain Russian individuals and entities, including various entities operating in the financial, energy and defense sectors. As of December 31, 2018, TOTAL held 21% of its proved reserves in Russia, from which the Group had 14% of its combined oil and gas production in 2018.

For additional information concerning international economic sanctions applicable notably to Cuba, Iran, Russia, Syria and Venezuela, refer to point 3.1.9.1 of this chapter.

Furthermore, in addition to current production, TOTAL is also exploring for and developing, or is participating in the exploration and/or development of, new reserves in other regions of the world that are historically characterized by political, social or economic instability.

The occurrence and magnitude of incidents related to economic, social or political instability are unpredictable. It is possible that they could have a material adverse impact on the Group’s production and operations in the future and/or cause certain investors to reduce their holdings of TOTAL’s securities.

TOTAL, like other major international energy companies, has a geographically diverse portfolio of reserves and operational sites, which allows it to conduct its business and financial affairs so as to reduce its exposure to political and economic risks. However, there can be no assurance that such events will not have negative consequences on the Group.

Intervention by host country authorities can adversely affect the Group’s activities and its operating incomes.

TOTAL has significant exploration and production activities, and in some cases refining, marketing or chemicals operations, in countries whose governmental and regulatory framework is subject to unexpected change and where the enforcement of contractual rights is uncertain. The legal framework of TOTAL’s exploration and production activities, established through concessions, licenses, permits and contracts granted by or entered into with a government entity, a state-owned company or private owners, is subject to risks of renegotiation that, in certain cases, can reduce or challenge the protections offered by the initial legal framework and/or the economic benefit to TOTAL.

In addition, the Group’s exploration and production activities in such countries are often undertaken in conjunction with state-owned entities, for example as part of a joint-venture in which the state has a significant degree of control. In recent years, in various regions globally, TOTAL has observed governments and state-owned enterprises impose more stringent conditions on companies pursuing exploration and production activities in their respective countries, increasing the costs and uncertainties of the Group’s business operations. TOTAL expects this trend to continue.

Potential increasing intervention by governments in such countries can take a wide variety of forms, including:

-the award or denial of exploration and production interests;

-the imposition of specific drilling obligations;

-price and/or production quota controls and export limits;

-nationalization or expropriation of assets;

-unilateral cancellation or modification of license or contract rights;

-increases in taxes and royalties, including retroactive claims and changes in regulations and tax reassessments;

-the renegotiation of contracts;

-the imposition of increased local content requirements;

-payment delays; and

-currency exchange restrictions or currency devaluation.

If a host government were to intervene in one of these forms in a country where TOTAL has substantial operations, including exploration, the Group could incur material costs or the Group’s production or asset value could decrease, which could potentially have a material adverse effect on its financial condition, including its operating income and cash flow.

For example, the Nigerian government has been contemplating new legislation to govern the petroleum industry which, if passed into law, could have an impact on the existing and future activities of the Group in that country through increased taxes and/or operating costs and could affect financial returns from projects in that country.

3.1.7 Risks related to competition and lack of innovation

The Group operates in a highly competitive environment. Its competitiveness could be adversely impacted if the Group’s level of innovation lagged behind its competitors.

TOTAL’s main competitors are comprised of national (companies directly or indirectly controlled by a state) and international oil companies. The evolution of the energy sector has opened the door to new competitors and increased market price volatility.

TOTAL is subject to competition in the acquisition of assets and licenses for the exploration and production of oil and natural gas as well as for the sale of manufactured products based on crude and refined oil. In the gas sector, major producers increasingly compete in the downstream value chain with established distribution companies. Increased competitive pressure could have a significant negative effect on the prices, margins and market shares of the Group’s companies.

The pursuit of unconventional gas development, particularly in the United States, has contributed to falling hydrocarbon market prices and a marked difference between spot and long-term contract prices. The competitiveness of long-term contracts indexed to oil prices could be affected if this discrepancy persists and if it should prove difficult to invoke price revision clauses.

The Group’s activities are carried out in a constantly changing environment with new products and technologies continuously emerging. The Group may not be able to anticipate these changes, identify and integrate technological developments in order to maintain its competitiveness, maintain a high level of performance and operational excellence, and best meet the needs and demands of its customers. The Group’s innovation policy requires significant investment, notably in R&D, of which the expected impact cannot be guaranteed.

In the field of R&D, the multiplication of research partnerships, in particular in related technical fields, may make it difficult for the Group to track technical information exchanged with research partners and monitor related contractual restrictions (e.g., confidentiality, limited use). New and increasingly complex digital technologies as well as the multiplication of partnerships are all likely to increase contamination risks, which could, as a result, limit TOTAL’s ability to exploit innovations.

3.1.8 Ethical misconduct and non-compliance risks

Ethical misconduct or non-compliance of the Group or its employees with applicable laws could expose TOTAL to criminal and civil penalties and be damaging to TOTAL’s reputation and shareholder value.

The Group’s Code of Conduct, which applies to all of its employees, defines TOTAL’s commitment to ethical standards, business integrity, human rights and compliance with applicable legal requirements. TOTAL maintains a "zero tolerance" principle for fraud of any kind, particularly bribery, corruption and influence peddling. Non-compliance with laws and regulations as well as ethical or human rights misconduct by TOTAL, its employees or a third-party acting on its behalf could expose TOTAL and/or its employees to investigations, criminal and civil sanctions and to additional penalties (such as debarment from public procurement). Further measures could, depending on applicable legislation (notably, the U.S. Foreign Corrupt Practices Act, the UK Bribery Act, the French law n° 2016-1691 dated December 9, 2016 relating to transparency, the fight against corruption and modernization of the economy or the Regulation (EU) 2016/679 with regard to the protection of personal data), be imposed by competent authorities, such as the review and reinforcement of the compliance program under the supervision of an independent third party. Any of the above could be damaging to the financial condition, shareholder value or reputation of the Group.

Generally, entities of the Group could potentially be subject to administrative, judicial or arbitration proceedings that could have a material adverse impact on the Group’s financial condition and reputation (refer to point 3.2 of this chapter).

3.1.9 Countries targeted by economic sanctions

TOTAL has activities in certain countries targeted by economic sanctions. If the Group’s activities are not conducted in accordance with applicable laws and regulations, TOTAL could face penalties.

Economic sanctions or other restrictive measures could target countries, such as Cuba, Iran, and Syria and/or target actors or economic sectors, such as in Russia or in Venezuela.

U.S. and European restrictions relevant to the Group and certain disclosure concerning the Group’s limited activities or presence in certain targeted countries are outlined in points 3.1.9.1 and 3.1.9.2, respectively.

3.1.9.1 U.S. and European legal restrictions

TOTAL closely monitors applicable international economic sanctions regimes, including those adopted by the United States and the European Union ("EU") (collectively, "Sanctions Regimes"), changes to such regimes and possible impacts on the Group’s activities. TOTAL takes steps to ensure compliance with applicable Sanctions Regimes and believes that its current activities in targeted countries do not infringe the applicable Sanctions Regimes. However, the Group cannot assure that current or future regulations related to Sanctions Regimes will not have a negative impact on its business, financial condition or reputation. A violation by the Group of applicable Sanctions Regimes could result in criminal, civil and/or material financial penalties.

A) Restrictions against Cuba

U.S. sanctions against Cuba prohibit any person subject to the jurisdiction of the United States (1) from engaging, directly or indirectly, in any activities or dealings related to Cuba, without government authorization. Therefore, the use of the U.S. dollar is prohibited for almost all transactions related to Cuba. Furthermore, it is prohibited to export and reexport to Cuba all goods subject to the Export Administration Regulations (2) without a license and with exceptions (for example, certain medical equipment), as well as to import all goods of Cuban origin into the United States. Cuba is not subject to European economic sanctions.

TOTAL has had an interest in a liquefied petroleum gas (LPG) cylinder filing plant in Cuba since 1997 and continues the development of its activities regarding lubricants, fluids and greases in Cuba.

B) Restrictions against Iran

Several countries and international organizations, including the United States and the EU, maintain Sanctions Regimes of varying degrees targeting Iran.

On July 14, 2015, the EU, China, France, Russia, the United Kingdom, the United States and Germany reached an agreement with Iran, known as the Joint Comprehensive Plan of Action (the "JCPOA"), regarding limits on Iran’s nuclear activities and relief under certain U.S., EU and UN economic sanctions regarding Iran. On January 16, 2016, the International Atomic Energy Agency ("IAEA") confirmed that Iran had met its initial nuclear compliance commitments under the JCPOA. Therefore, as from that date, UN economic sanctions, most U.S. secondary sanctions (i.e., those covering non-U.S. persons (3) and for activities outside U.S. jurisdiction) and most EU economic sanctions were suspended (4).

Following the withdrawal of the United States from the JCPOA in May 2018, U.S. secondary sanctions concerning the oil industry were re-imposed as of November 5, 2018.

In July 2017, TOTAL signed a contract for a period of 20 years with the National Iranian Oil Company ("NIOC") relating to the development and production of phase 11 (SP11) (5) of the giant South Pars gas field. Following the withdrawal of the United States from the JCPOA, TOTAL withdrew from this project and finalized its withdrawal on October 29, 2018, prior to the re-imposition of U.S. secondary sanctions on the oil industry as of November 5, 2018. TOTAL ceased all operational activity in Iran before November 4, 2018.

Furthermore, certain U.S. states have adopted regulations with respect to Iran requiring, in certain conditions, state pension funds and other state-owned institutional investors to divest securities in any company that has or had business operations in Iran and state public contracts not to be awarded to such companies. Certain U.S. state regulators have adopted similar initiatives relating to investments by insurance companies. TOTAL believes the impact of these regulations to be limited due to the Group’s decision to withdraw from Iran. Nevertheless, TOTAL continues to closely monitor these measures, which are generally still in effect following the withdrawal of the United States from the JCPOA.

With respect to the Group’s activities conducted under the sanctions framework that was in place prior to the entry into force of the JCPOA, the U.S. Department of State made a determination on September 30, 2010 that certain historical activities would not be deemed sanctionable and that, so long as TOTAL acted in accordance with its commitments related to this determination, it would not be regarded as a company of concern for its past Iran-related activities. TOTAL’s historical activities in Iran have been conducted in compliance with these Sanctions Regimes. Since 2011, TOTAL has had no production in Iran.

Refer to point 3.1.9.2 below for information concerning Section 13(r) of the Securities Exchange Act of 1934, as amended, pertaining to activities of the Group related to Iran.

C) Restrictions against Russia

Since July 2014, various Sanctions Regimes have been adopted against Russia, including prohibitions to deal with certain Russian individuals and entities or restrictions on financings, as well as restrictions on investments and exports to Russia.

The economic sanctions adopted by the EU since 2014 do not materially affect TOTAL’s activities in Russia. TOTAL has been formally authorized by the French government, which is the competent authority for granting authorization under the EU sanctions regime, to continue all its activities in Russia on the Kharyaga and Termokarstovoye fields and the Yamal LNG and the Arctic 2 LNG projects.

The United States adopted various economic sanctions, some of which target PAO Novatek (6) ("Novatek"), and the entities in which Novatek (individually or with other similarly targeted persons or entities) owns an interest of at least 50%, including OAO Yamal LNG (7) ("Yamal LNG"),Terneftegas (8) and OOO Arctic 2 LNG (9). These sanctions prohibit, in particular, U.S. persons from all transactions in, providing financing for, and other dealings in debt issued by these entities after July 16, 2014 of longer than 90 days maturity (reduced to 60 days as from the end of November 2017). The use of the U.S. dollar is therefore prohibited for these types of financings, including Yamal LNG. The Yamal LNG project’s financing was finalized in successive steps in 2016 in compliance with applicable regulations. The financing of the Arctic LNG 2 project is under discussion.

In addition, the U.S. Department of Commerce has imposed restrictions on exports and reexports of certain goods to Russia under the regulation related to the U.S. export control with respect to certain oil projects, which do not materially impact TOTAL’s current activities in Russia.

In August 2017, the United States adopted the Countering America’s Adversaries Through Sanctions Act ("CAATSA"). This law provides for, in particular, the possibility to impose secondary sanctions against a non-U.S. person who (i) invests in certain types of crude oil projects; (ii) carries out a significant transaction with a sanctioned Russian individual or entity; (iii) carries out a significant transaction with an individual/entity party to or acting on behalf of Russian economic intelligence or defense sectors; (iv) carries out a direct and significant investment (beyond certain amounts), which contributes to the development of Russian export pipelines or (v) sells, leases or provides goods, services, technologies or information that could directly and in a significant manner facilitate the maintenance or expansion of the construction, modernization or repair of energy export pipelines by Russia. This law also, on the one hand, reduced the maturity periods of debts restricting the financing of certain entities and, on the other hand, extended, as from January 29, 2018, the prohibition applicable to certain entities to export goods and services outside of Russia in support of exploration or production projects of oil in deep water, beyond the Arctic offshore, or concerning shale formations (shale oil).

On April 6, 2018, the American Department of Treasury’s Office of Foreign Assets Control (OFAC) for the first time designated and registered certain Russian oligarchs and political figures, as well as several entities owned by them, on the list of Specially Designated Nationals and Blocked Persons List. Non-U.S. persons may now be sanctioned under secondary sanctions for having carried out significant transactions with the designated persons.

TOTAL continues its activities in Russia in compliance with applicable sanctions regimes.

(1) Cuban Assets Control Regulations (CACR), 31 CFR Part. 515.

(2) Export Administration Regulations (EAR) § 734.3.

(3) "U.S. person" means any U.S. citizen and permanent resident alien wherever he/she is in the world, entity organized under the laws of the United States or any jurisdiction within the United States, including foreign branches, or any person or entity located in the United States.

(4) Certain U.S. and EU human rights-related and terrorism-related sanctions remain in force.

(5) TOTAL was an operator of the SP11 project and held 50.1% alongside the national Chinese company China National Petroleum Corporation ("CNPC") (30%) and Petropars (19.9%), a 100% owned subsidiary of NIOC.

(6) A Russian company listed on the Moscow and London stock exchanges and in which the Group held an interest of 19.4% as of December 31, 2018.

(7) A company jointly owned by PAO Novatek, Total E&P Yamal (20.02%), China National Oil and Gas Exploration Development Corporation - CNODC, a subsidiary of CNPC and Silk Road Fund.

(8) A company jointly owned by PAO Novatek and Total Termokarstovoye BV (49%).

(9) A company wholly-owned owned by PAO Novatek as of December 31, 2018.

As of December 31, 2018, TOTAL held 21% of its proved reserves in Russia, where the Group had 14% of its combined oil and gas production in 2018.

D) Restrictions against Syria

The EU adopted measures in 2011 regarding trade with and investment in Syria that are applicable to European persons and to entities constituted under the laws of an EU Member State, including, notably, a prohibition on the purchase, import or transportation from Syria of crude oil and petroleum products. The United States also has adopted comprehensive measures that broadly prohibit trade and investment in and with Syria. Since 2011, the Group ceased its activities that contributed to oil and gas production in Syria and has not purchased hydrocarbons from Syria since that time (refer to point 3.1.9.2).

E) Restrictions against Venezuela

Since 2014, different Sanctions Regimes were adopted relating to Venezuela, including prohibitions to deal with certain Venezuelan individuals and entities, as well as restrictions on financings.

In August 2017, the United States adopted economic sanctions relating to the Government of Venezuela as well as certain state-owned or controlled entities (collectively, the "Government of Venezuela"), including Petroleos de Venezuela, S.A. ("PdVSA") as well as entities in which PdVSA (individually or with other similarly targeted persons or entities collectively) owns an interest of at least 50% (which includes Petrocedeño S.A., a company in which the Group held an interest of 30.32% as of December 31, 2018). These sanctions prohibit all U.S. persons (1) from transacting in, providing financing for or otherwise dealing in debt issued by PdVSA as from August 25, 2017 of longer than 90 days maturity. The use of the U.S. dollar is therefore prohibited for these types of financings, including with Petrocedeño S.A.

Since November 13, 2017, Venezuela has also been subject to European sanctions, which mainly provide for the freezing of assets of certain individuals and entities, a military embargo as well as restrictions on the exportation of certain goods.

In May 2018, the United States adopted a new round of sanctions against the Government of Venezuela, prohibiting all U.S. persons from transacting in (i) the purchase of debts owed to the Government of Venezuelan and (ii) the sale, transfer, assignment, or pledging as collateral by the Government of Venezuelan of any equity interest in any entity in which the Government of Venezuela has a 50% or greater ownership interest.

On January 28, 2019, pursuant to Executive Order 13850, American Department of Treasury’s Office of Foreign Assets Control (OFAC) designated and registered PdVSA on the list of Specially Designated Nationals and Blocked Persons List, as well as any entities in which PdVSA owns an interest of at least 50%, including Petrocedeño S.A.

To date, TOTAL has organised the management of its interest to ensure compliance with applicable sanctions.

3.1.9.2 Information concerning certain limited activities in Iran and Syria

Information concerning TOTAL’s activities related to Iran that took place in 2018 provided in this section is disclosed according to Section 13(r) of the Securities Exchange Act of 1934, as amended ("U.S. Exchange Act").

In addition, information for 2018 is provided concerning the payments made by Group affiliates to, or additional cash flow that operations of Group affiliates generate for, the government of any country identified by the United States as a state sponsor of terrorism (currently, Iran, North Korea, Syria and Sudan) (2) or any entity controlled by those governments.

TOTAL believes that these activities are not sanctionable, including for activities previously disclosed. For more information on certain U.S. and EU restrictions relevant to TOTAL in these jurisdictions, refer to point 3.1.9.1 of this chapter.

A) Iran

The Group’s operational activities related to Iran were stopped in 2018 following the withdrawal of the United States from the JCPOA in May 2018 and prior to the re-imposition of U.S. secondary sanctions on the oil industry as of November 5, 2018.

Statements in this section concerning affiliates intending or expecting to continue activities described below are subject to such activities continuing to be permissible under applicable international economic sanctions regimes.

a) Exploration & Production

Following the suspension of certain international economic sanctions against Iran on January 16, 2016, the Group commenced various business development activities in Iran. Total E&P South Pars S.A.S. ("TEPSP") (a wholly-owned affiliate), CNPC International Ltd. ("CNPCI") (a wholly-owned affiliate of China National Petroleum Company) and Petropars Ltd. ("Petropars") (a wholly-owned affiliate of NIOC) signed a 20-year risked service contract in July 2017, (the "Risked Service Contract") for the development and production of phase 11 of the South Pars gas field ("SP11").TEPSP (50.1%) was the operator and a partner of the project alongside CNPCI (30%) and Petropars (19.9%). These companies entered into a joint operating agreement in July 2017 (the "JOA") concerning, among other things, the governance of their obligations under the Risked Service Contract and the designation of TEPSP as the project’s operator.

In 2018, TEPSP continued conducting petroleum operations on behalf of the above-mentioned consortium in accordance with the terms and conditions of the Risked Service Contract and the JOA. In particular, TEPSP: (i) held several meetings with the Iranian authorities, NIOC and other Iranian state owned/controlled entities; (ii) launched tenders for award of service contracts for the purposes of the SP11 project; (iii) negotiated various agreements (such as service and/or supply agreements and bank service agreements); and (iv) performed other activities under the Risked Service Contract and the JOA.

In 2018, TEPSP completed the technical studies, which were started in November 2016, in accordance with the technical services agreement (the "TSA") between NIOC and TEPSP, acting on behalf of the consortium.

(1) "U.S. person" means any U.S. citizen and permanent resident alien wherever he/she is in the world, entity organized under the laws of the United States or any jurisdiction within the United States, including foreign branches, or any person or entity located in the United States.

(2) In North Korea, other than fees related to trademarks and designs paid in 2018, TOTAL is not present. In this country. In Sudan, other than the payment of fees related to trademarks, the Group is not aware of any of its activities in 2018 having resulted in payments to, or additional cash flow for, the government of that country.

However, as a result of the withdrawal of the U.S. from the JCPOA in May 2018, TOTAL ceased all of its activities related to the SP11 project and finalized its withdrawal from the SP11 project on October 29, 2018, at which time it transferred its participating interest and operatorship of the project to CNPCI.

The MOU entered into between TOTAL and NIOC in January 2016 to assess potential developments in Iran (including South Azadegan) was amended to include North Azadegan and to extend its duration. NIOC provided TOTAL in 2017 with technical data on the Azadegan oil field so that it could assess potential development of this field. Representatives of TOTAL held technical meetings in 2017 with representatives of NIOC and its affiliated companies and carried out a technical review of the Azadegan (South & North) oil field as well as the Iran LNG Project (a project contemplating a 10 Mt/y LNG production facility at Tombak Port on Iran’s Persian Gulf coast), the results of which were partially disclosed to NIOC and relevant affiliated companies. In addition, TOTAL signed an MOU in 2017 with an international company to evaluate jointly the Azadegan oil field opportunity with NIOC. This international company decided in February 2018 to withdraw from this technical cooperation and a MOU termination agreement was formally executed with TOTAL on May 16, 2018. Technical studies were pursued by TOTAL until March 2018 on the Azadegan area with regular contacts with NIOC. All work and contacts with NIOC on this subject ceased at the end of March 2018.

During 2018, in connection with the activities under the aforementioned Risked Service Contract and MOUs, and to discuss other new opportunities, representatives of TOTAL attended meetings with the Iranian oil and gas ministry and several Iranian companies with ties to the government of Iran. In connection with travel to Iran in 2018 by certain employees of the Group, TOTAL made payments to Iranian authorities for visas, airport services, exit fees and similar travel-related charges. In addition, representatives of TOTAL had meetings in France with the Iranian ambassador.

Neither revenues nor profits were recognized from any of the aforementioned activities under the aforementioned Risked Service Contract and MOUs in 2018.

Maersk Oil studied two potential projects with NIOC, prior to the acquisition of Maersk Oil by TOTAL in March 2018. These studies ceased after a meeting with NIOC representatives in May 2018.

The Tehran branch office of TEPSP, opened in 2017 for the purposes of the SP11 project, ceased all operational activities prior to November 1, 2018 and will be closed and de-registered in 2019. Since November 2018, Total Iran BV maintains a local representative office in Tehran with a few employees, solely for non-operational functions. Concerning payments to Iranian entities in 2018, Total Iran BV and Elf Petroleum Iran collectively made payments of approximately IRR 31.7 billion (approximately $300,000 (1)) to the Iranian administration for taxes and social security contributions concerning the personnel of the aforementioned representative office and residual obligations related to various prior risked service contracts. In 2019, similar types of payments are to be made in connection with maintaining the representative office in Tehran, albeit in lower amounts. None of these payments has been or is expected to be executed in U.S. dollars.

Furthermore, Total E&P UK Limited ("TEP UK"), a wholly-owned affiliate, holds a 1% interest in a joint venture for the Bruce field in the United Kingdom with Serica Energy (UK) Limited ("Serica") (98%, operator) and BP Exploration Operating Company Limited ("BP") (1%), following the completion of the sale of 42.25% of TEP UK’s interests in the Bruce field on November 30, 2018 pursuant to a sale and purchase agreement dated August 2, 2018 between TEP UK and Serica. Upon the closing of the transaction on November 30, 2018, all other prior joint venture partners also sold their interests in the Bruce field to Serica (BP sold 36% retaining a 1% interest; BHP Billiton Petroleum Great Britain Limited ("BHP") sold their full 16% interest and Marubeni Oil & Gas (U.K.) Limited (("Marubeni") sold their full 3.75%).

The Bruce field joint venture is party to an agreement (the "Bruce Rhum Agreement") governing certain transportation, processing and operation services provided to another joint venture at the Rhum field in the UK, co-owned by Serica (50%, operator) and the Iranian Oil Company UK Ltd ("IOC"), a subsidiary of NIOC (50%). Under the terms of the Bruce Rhum Agreement, the Rhum field owners pay a proportion of the operating costs of the Bruce field facilities calculated on a gas throughput basis. IOC’s share of costs incurred under the Bruce Rhum Agreement have been paid to TEP UK in 2018 by Naftiran Intertrade Company Limited ("NICO"), the trading branch of the National Iranian Oil Company ("NIOC"). NIOC is the parent company of IOC and an Iranian government owned corporation. In 2018, based upon TEP UK’s 1% interest in the Bruce field and income from the net cash flow sharing arrangement with Serica, gross revenue to TEP UK from IOC’s share of the Rhum field resulting from the Bruce Rhum Agreement was approximately £8 million. This sum was used to offset operating costs on the Bruce field and as such, generated no net profit to TEP UK. This arrangement is expected to continue in 2019.

In 2018, TEP UK acted as agent for BHP and Marubeni, which faced difficulty securing banking arrangements allowing them to accept payments from IOC, and, thus, received payments from IOC in relation to BHP and Marubeni’s share of income from the Bruce Rhum Agreement under the terms of an agency agreement entered into in June 2018 between BHP, Marubeni and TEP UK (the "Agency Agreement"). Payments made from IOC to BHP and Marubeni in 2018 related to the periods prior to the completion of their divestment to Serica in November 2018. Total payment received on behalf of BHP and Marubeni by TEP UK under this arrangement in 2018 was approximately £7 million. This amount relates to income due to BHP and Marubeni under the Bruce Rhum Agreement for 2017 and 2018. TEP UK transferred all income received under the Agency Agreement to BHP and Marubeni and provided the service on a no profit, no loss basis. The Agency Agreement is expected to be terminated upon receipt of all payments relating to the period up to November 30, 2018.

Prior to the re-imposition of U.S. secondary sanctions on the oil industry as of November 5, 2018, TEP UK liaised directly with IOC concerning its interest in the Bruce Rhum Agreement and it received payments directly for services provided to IOC under the Bruce Rhum Agreement. In October 2018, the U.S. Treasury Department’s Office of Foreign Asset Control ("OFAC") granted a new conditional license to BP and Serica authorizing the provision of services to the Rhum field, following the reinstatement of U.S. secondary sanctions. The principal condition of the OFAC license is that the Iranian government’s shareholding in IOC is transferred into a trust in order that Iran may not derive any benefit from the Rhum field or exercise any control while the U.S. secondary sanctions are in place. A Jersey based trust has been put in place with the trustee holding IOC’s shares in the Rhum field. IOC’s interest is now managed by a new independent management company established by the trust and referred to as the "Rhum Management Company" ("RMC") and where necessary TEP UK liaises, and expects to continue doing so in 2019, with RMC in relation to the Bruce Rhum Agreement.

TEP UK is also party to an agreement with Serica whereby TEP UK uses reasonable endeavors to evacuate Rhum NGL from the St Fergus Terminal (the "Rhum NGL Agreement"). TEP UK provides this service - subject to Serica having title to all of the Rhum NGL to be evacuated and Serica having a valid license from OFAC for the activity - on a cost basis, but for which TEP UK charges a monthly handling fee that generates an income of approximately £35,000 per annum relating to IOC’s 50% stake in the Rhum field. After costs, TEP UK realizes little profit from this arrangement.TEP UK expects to continue this activity in 2019.

(1) Converted using the average exchange rate for fiscal year 2018, as published by Bloomberg.

Following the acquisition of Maersk Oil in 2018, the undeveloped Yeoman discovery is now wholly owned by the Group, under license P2158 granted to Maersk Oil North Sea UK Limited, recently renamed Total E&P North Sea UK Limited ("TEPNSUK"). Yeoman is situated adjacent to the Pardis discovery in which IOC held an interest, which it sold in October 2018. Prior to this divestment, non-legally binding technical and commercial discussions had taken place between TEPNSUK, IOC and the UK Government’s Oil and Gas Authority during the first half of 2018 regarding a potential joint development of Yeoman and Pardis but no contractual arrangements were implemented in connection with such discussions. Also prior to this divestement, other discussions had taken place between TEPNSUK and IOC on an informal basis regarding a potential farm-in to Pardis by Maersk Oil.

Lastly, TOTAL S.A. paid approximately €8,000 to Iranian authorities related to various patents (1) in 2018. Similar payments are expected to be made in 2019 for such patents.

b) Other business segments

In 2018, TOTAL S.A. paid fees of approximately €1,500 to Iranian authorities related to the maintenance and protection of trademarks and designs in Iran. Similar payments are expected to be made in 2019.

Trading & Shipping

Following the suspension of applicable EU and U.S. economic sanctions in 2016, the Group commenced the purchase of Iranian hydrocarbons through its wholly-owned affiliate TOTSA TOTAL OIL TRADING SA ("TOTSA"). In 2018, the Group continued its trading activities with Iran via TOTSA, which purchased approximately 18 Mb of Iranian crude oil for nearly €1 billion pursuant to term contracts. It is not possible to estimate the gross revenue and net profit related to these purchases because the totality of this crude oil was used to supply the Group’s refineries. In addition, in 2018, approximately 1 Mb of petroleum products were sold to entities with ties to the government of Iran. These activities generated gross revenue of nearly €43 million and a net profit of approximately €1 million. The Group ceased these activities in June 2018.

Gas, Renewables & Power

Saft Groupe S.A. ("Saft"), a wholly-owned affiliate, in 2018 sold signaling and backup battery systems for metros and railways as well as products for the utilities and oil and gas sectors to companies in Iran, including some having direct or indirect ties with the Iranian government. In 2018, this activity generated gross revenue of approximately €2.5 million and net profit of approximately €0.3 million. Saft ceased this activity in 2018. Saft also attended the Iran Oil Show in 2018, where it discussed business opportunities with Iranian customers, including those with direct or indirect ties with the Iranian government. Saft ceased this activity in 2018.

Total Eren, a company in which Total Eren Holding holds an interest of 68.76% (TOTAL S.A. owns 33.86% of Total Eren Holding), had preliminary discussions during January to March 2018 for possible investments in renewable energy projects in Iran, including meetings with ministries of the Iranian government. These discussions and meetings ceased as of March 2018 and neither revenues nor profits were recognized from this activity in 2018.

Refining & Chemicals

As of May 2018, Hutchinson SA and its affiliates no longer accepted orders from Iranian companies and ceased all activities, in general, with Iran and all Iranian companies prior to August 6, 2018.

Le Joint Français, a wholly-owned affiliate of Hutchinson SA, sold vehicular O-ring seals in 2018 to Iran Khodro, a company in which the government of Iran holds a 20% interest and which is supervised by Iran’s Industrial Management Organization. This activity generated gross revenue of approximately €54,056 and net profit of approximately €8,108.

Paulstra S.N.C., a wholly-owned affiliate of Hutchinson SA, obtained in 2017 an order from Iran Khodro to sell vehicular anti-vibration systems over a 5-year period. This activity did not generate any gross revenue or net profit in 2018 because Paulstra did not delivery any product to Iran Khodro. The order was terminated in 2018. Paulstra S.N.C. also sold oil seals in 2018 to Iran Khodro. This activity generated gross revenue of approximately €1,078,887 and net profit of approximately €161,833.

Catelsa Caceres, a wholly-owned affiliate of Hutchinson Iberia, itself wholly-owned by Hutchinson SA, sold sealing products to Iran Khodro in 2018. This activity generated gross revenue of approximately €1,449 and net profit of approximately €217.

Hutchinson GMBH, a wholly-owned affiliate of Hutchinson SA, sold hoses for automotive vehicles to Iran Khodro in 2018. This activity generated gross revenue for approximately €257,400 and net profit of approximately €38,610. The last shipments from Hutchinson and its affiliates to Iran Khodro were in August 2018 and last payments were made in October 2018.

Hanwha Total Petrochemicals ("HTC"), a joint venture in which Total Holdings UK Limited (a wholly-owned affiliate) holds a 50% interest and Hanwha General Chemicals holds a 50% interest, purchased approximately 17 Mb of condensates from NIOC for approximately KRW 1,310 billion (approximately $1.2 billion) from January to July 2018, then HTC stopped purchasing from NIOC. These condensates are used as raw material for certain of HTC’s steam crackers. HTC also chartered fifteen tankers of condensates with National Iranian Tanker Company (NITC), a subsidiary of NIOC, for approximately KRW 24 billion (approximately $22.3 million). In November 2018, South Korea was granted a significant reduction exemption waiver (the "SRE waiver") allowing it to import Iranian condensate from NIOC for six months. For 2019, based on the SRE waiver, HTC is reviewing the feasibility to resume purchases from NIOC.

Total Research & Technology Feluy ("TRTF", a wholly-owned affiliate), Total Marketing & Services ("TMS", a wholly-owned affiliate), and Total Raffinage Chimie ("TRC") paid in 2018 fees totaling approximately €1,000 to Iranian authorities related to various patents. Similar payments are expected to be made by TRTF and TRC in 2019. TMS abandoned its patent rights in Iran in 2018, thus no payments are expected by TMS in 2019.

Marketing & Services

Until December 2012, at which time it sold its entire interest, the Group held a 50% interest in the lubricants retail company Beh Tam (formerly Beh Total) along with Behran Oil (50%), a company controlled by entities with ties to the government of Iran. As part of the sale of the Group’s interest in Beh Tam, TOTAL S.A. agreed to license the trademark "Total" to Beh Tam for an initial 3-year period (renewed for an additional 3 year period) for the sale by Beh Tam of lubricants to domestic consumers in Iran. Royalty payments for 2014 were received by TOTAL S.A. during the first semester of 2018 in the amount of approximately €730,000. There remain outstanding royalty payments for 2015 through 2017 in favor of TOTAL S.A. This licensing agreement was terminated in 2018. In addition, representatives of Total Oil Asia-Pacific Pte Ltd, a wholly-owned affiliate, visited Behran Oil beginning 2018 regarding the potential purchase of 50% of the share capital of Beh Tam. Discussions on this matter ended following the announcement of the re-imposition of U.S. secondary sanctions on the oil industry.

(1) Section 560.509 of the U.S. Iranian Transactions and Sanctions Regulations provides an authorization for certain transactions in connection with patent, trademark, copyright or other intellectual property protection in the United States or Iran, including payments for such services and payments to persons in Iran directly connected to intellectual property rights, and TOTAL believes that the activities related to the industrial property rights described in this point 3.1.9.2 are consistent with that authorization.

Total Marketing Middle East FZE, a wholly-owned affiliate, sold lubricants to Beh Tam in 2018. The sale in 2018 of approximately 43 t of lubricants and special fluids generated gross revenue of approximately AED 500,000 (approximately $136,000) and net profit of approximately AED 260,000 (approximately $71,000) (1). The company stopped all transactions with this customer as of August 2018.

Total Marketing France ("TMF"), a company wholly-owned by TMS, provided in 2018 fuel payment cards to the Iranian embassy and delegation to UNESCO in France for use in the Group’s service stations. In 2018, these activities generated gross revenue of approximately €32,000 and net profit of approximately €5,000. The company expects to continue this activity in 2019.

TMF also sold jet fuel in 2018 to Iran Air as part of its airplane refueling activities in France. The sale of approximately 260 cubic meters of jet fuel generated gross revenue of approximately €130,000 and net profit of approximately €570. The company stopped all transactions with this customer prior to November 5, 2018.

Total Belgium, a wholly-owned affiliate, provided in 2018 fuel payment cards to the Iranian embassy in Brussels (Belgium) for use in the Group’s service stations. In 2018, these activities generated gross revenue of approximately €11,000 and net profit of approximately €4,000. The company expects to continue this activity in 2019.

B) Syria

Since early December 2011, TOTAL has ceased its activities that contribute to oil and gas production in Syria and maintains a local office solely for non-operational functions. In late 2014, the Group initiated a downsizing of its Damascus office and reduced its staff to a few employees. In 2018, TOTAL paid approximately €84,000 to the Syrian government as contributions for social security in relation to the aforementioned personnel.

In addition, the Group paid fees related to various industrial property rights (patents, trademarks and designs) in 2018.

3.2 Legal and arbitration proceedings