UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-06431

MANAGERS TRUST II

(Exact name of registrant as specified in charter)

| | |

| 800 Connecticut Avenue, Norwalk, Connecticut | | 06854 |

| (Address of principal executive offices) | | (Zip code) |

Managers Investment Group LLC

800 Connecticut Avenue, Norwalk, Connecticut 06854

(Name and address of agent for service)

Registrant’s telephone number, including area code: (203) 299-3500

| | |

Date of fiscal year end: | | DECEMBER 31 |

| |

Date of reporting period: | | JANUARY 1, 2004–DECEMBER 31, 2004

(Annual Shareholder Report) |

| Item 1. | REPORTS TO STOCKHOLDERS. |

ANNUAL REPORT

Managers Funds

| • | | Science & Technology Fund |

| • | | Convertible Securities Fund |

December 31, 2004

Table of Contents

Nothing contained herein is to be considered an offer, sale, or solicitation of an offer to buy shares of The Managers Funds. Such offering is made only by Prospectus, which includes details as to offering price and other material information.

Letter to Shareholders

Dear Fellow Shareholder:

The U.S. economy grew steadily this past year, providing a generally healthy backdrop for the financial markets. In addition, inflation remained moderately positive despite a sharp rise in energy prices that could have put pressure on all prices or stalled growth completely. The latest evidence is that the economy was growing at an annualized rate of 4% through the third quarter. Importantly, consumer spending did not show the deterioration that many had predicted. Rather, the consumer showed impressive resilience in the face of higher costs for energy and select other necessities. Also, nonresidential fixed investment continued to rebound. Capital spending had declined between 10% and 15% annually during the heart of the 2001 recession, but increased at a comparable pace in recent quarters. This spending also translated into improving balance sheets and earnings for a good number of companies. Meanwhile, energy and other raw material prices eased in late 2004. While long-term interest rates moderated over the course of the year, short-term rates rose, due primarily to the five one-quarter-point (0.25%) interest rate hikes instituted by the Federal Open Market Committee (FOMC) during the period.

Despite the generally positive economic backdrop, the equity markets were mired in somewhat of a trading range throughout most of 2004, but jumped out of it immediately following the November presidential election. Small capitalization stocks again outpaced large cap stocks and value style benchmarks performed significantly better than growth benchmarks. This was driven by strong gains in the energy and materials sectors while traditional growth sectors such as technology and healthcare struggled for most of the year. Developed and emerging foreign markets also posted healthy gains, enhanced for U.S. investors by a weakening U.S. dollar. The surprise for many investors was the strength of longer term bonds. Despite the steady rise of short-term rates as a result of the FOMC tightening program, long-term rates were steady to lower for the year.

We are pleased to report that the funds within the Managers Funds family performed well within expectations for the year. It was also a very active year from an organizational perspective. Notably, the Managers family of funds celebrated its 20th anniversary in June as Managers Capital Appreciation, Managers Special Equity and Managers Bond Funds eclipsed their 20th year since inception.

In addition to taking over the management and administration of several funds formerly managed by Conseco Funds Group, we were, at year end, in the process of seeking shareholder approval to integrate the Fremont family of mutual funds within our group. (We received shareholder approval in mid-January.) These funds also utilize a subadvisor structure. We believe that a key advantage to shareholders of both fund families will be a broader array of asset classes, investment styles and “intelligence diversification” available within one group of funds.

Beginning in May we instituted expense caps on several of our funds which effectively lowered their respective costs to shareholders. These include Managers Value, now capped at 1.19% per year, Managers Capital Appreciation, now capped at 1.29% per year, Managers International Equity, now capped at 1.55% per year, Managers Emerging Markets Equity, now capped at 1.79% per year, and Managers Global Bond, now capped at 1.19% per year. In a similar effort to reduce costs, we have commenced operation of a new share class of Managers Special Equity (I Class) which, by virtue of a high minimum investment ($250,000), will be of lower cost than the original share class.

Finally, throughout the latter half of the year, Managers made preparations to partner with several of our AMG Affiliates to create Managers Investment Group, which we formed on January 1, 2005. The new organization has expanded resources and a broad variety of investment management services.

As always, we post any news or other pertinent information about the funds as soon as applicable on our Web site at www.managersinvest.com. Should you have any questions about any of our funds or this report, please feel free to contact us at 1-800-835-3879, or visit the Web site. We thank you for your investment in The Managers Funds.

Sincerely,

| | | | |

| | |

| | | |  |

Peter M. Lebovitz | | | | Thomas G. Hoffman, CFA |

President The Managers Funds | | | | Chief Investment Officer Managers Investment Group LLC |

1

The Managers Funds Performance (unaudited)

All periods ended December 31, 2004

| | | | | | | | | | | | | | | | | | |

| | | | | | | Average Annual Total Returns (1)

| | | |

| | | | | | | 1 | | | 3 | | | 5 | | | Since | | | Inception |

| | | | | | | Year

| | | Years

| | | Years

| | | Inception

| | | Date

|

Managers Funds: | | | | | | | | | | | | | | | | | | |

Equity Funds: | | | | | | | | | | | | | | | | | | |

Large-Lap(2) | | -Class A | | No Load | | 10.63 | % | | 0.30 | % | | — | | | (8.64 | )% | | Jul-00 |

| | | -Class A | | With Load | | 4.23 | % | | (1.65 | )% | | — | | | (9.84 | )% | | Jul-00 |

| | | -Class B | | No Load | | 9.98 | % | | (0.26 | )% | | — | | | (9.14 | )% | | Jul-00 |

| | | -Class B | | With Load | | 4.98 | % | | (1.26 | )% | | — | | | (9.54 | )% | | Jul-00 |

| | | -Class C | | No Load | | 9.97 | % | | (0.25 | )% | | — | | | (9.11 | )% | | Jul-00 |

| | | -Class C | | With Load | | 7.87 | % | | (0.61 | )% | | — | | | (9.31 | )% | | Jul-00 |

| | | -Class Y | | No Load | | 11.13 | % | | 0.70 | % | | — | | | (8.25 | )% | | Jul-00 |

20 Fund(2) | | -Class A | | No Load | | (5.11 | )% | | (5.29 | )% | | (19.95 | )% | | (4.62 | )% | | Jan-98 |

| | | -Class A | | With Load | | (10.50 | )% | | (7.12 | )% | | (20.89 | )% | | (5.43 | )% | | Jan-98 |

| | | -Class B | | No Load | | (5.50 | )% | | (5.76 | )% | | (20.33 | )% | | (6.77 | )% | | Feb-98 |

| | | -Class B | | With Load | | (10.23 | )% | | (6.71 | )% | | (20.57 | )% | | (6.77 | )% | | Feb-98 |

| | | -Class C | | No Load | | (5.48 | )% | | (5.79 | )% | | (20.32 | )% | | (7.50 | )% | | Mar-98 |

| | | -Class C | | With Load | | (7.30 | )% | | (6.10 | )% | | (20.49 | )% | | (7.64 | )% | | Mar-98 |

| | | -Class Y | | No Load | | (4.69 | )% | | (4.85 | )% | | (19.53 | )% | | (7.42 | )% | | Apr-98 |

Science & Technology(2) | | -Class A | | No Load | | 2.83 | % | | (10.33 | )% | | — | | | (28.81 | )% | | Jul-00 |

| | | -Class A | | With Load | | (3.56 | )% | | (12.05 | )% | | — | | | (29.74 | )% | | Jul-00 |

| | | -Class B | | No Load | | 2.39 | % | | (10.59 | )% | | — | | | (29.11 | )% | | Jul-00 |

| | | -Class B | | With Load | | (3.09 | )% | | (11.49 | )% | | — | | | (29.42 | )% | | Jul-00 |

| | | -Class C | | No Load | | 1.90 | % | | (10.55 | )% | | — | | | (29.03 | )% | | Jul-00 |

| | | -Class C | | With Load | | (0.05 | )% | | (10.85 | )% | | — | | | (29.19 | )% | | Jul-00 |

| | | -Class Y | | No Load | | 2.76 | % | | (9.71 | )% | | — | | | (28.38 | )% | | Jul-00 |

Mid-Cap(2) | | -Class A | | No Load | | 16.80 | % | | 11.28 | % | | 5.20 | % | | 14.13 | % | | Jan-97 |

| | | -Class A | | With Load | | 10.10 | % | | 9.09 | % | | 3.96 | % | | 13.29 | % | | Jan-97 |

| | | -Class B | | No Load | | 16.13 | % | | 10.72 | % | | 4.69 | % | | 12.49 | % | | Jan-97 |

| | | -Class B | | With Load | | 11.13 | % | | 9.89 | % | | 4.45 | % | | 12.49 | % | | Jan-97 |

| | | -Class C | | No Load | | 16.12 | % | | 10.70 | % | | 4.72 | % | | 11.45 | % | | Feb-98 |

| | | -Class C | | With Load | | 13.98 | % | | 10.32 | % | | 4.51 | % | | 11.29 | % | | Feb-98 |

| | | -Class Y | | No Load | | 17.37 | % | | 11.81 | % | | 5.74 | % | | 14.72 | % | | Jan-97 |

Hybrid Funds: | | | | | | | | | | | | | | | | | | |

Balanced(2) | | -Class A | | No Load | | 9.45 | % | | 5.87 | % | | 3.57 | % | | 9.29 | % | | Jan-97 |

| | | -Class A | | With Load | | 3.12 | % | | 3.79 | % | | 2.36 | % | | 8.48 | % | | Jan-97 |

| | | -Class B | | No Load | | 8.88 | % | | 5.39 | % | | 3.11 | % | | 7.09 | % | | Feb-98 |

| | | -Class B | | With Load | | 3.88 | % | | 4.88 | % | | 2.81 | % | | 7.09 | % | | Feb-98 |

| | | -Class C | | No Load | | 8.88 | % | | 5.36 | % | | 3.09 | % | | 7.00 | % | | Feb-98 |

| | | -Class C | | With Load | | 6.85 | % | | 5.01 | % | | 2.88 | % | | 6.85 | % | | Feb-98 |

| | | -Class Y | | No Load | | 10.04 | % | | 6.41 | % | | 4.11 | % | | 9.84 | % | | Jan-97 |

2

The Managers Funds Performance (continued)

All periods ended December 31, 2004

| | | | | | | | | | | | | | | | | | |

| | | | | | | Average Annual Total Returns (1)

| | | |

| | | | | | | 1 | | | 3 | | | 5 | | | Since | | | Inception |

| | | | | | | Year

| | | Years

| | | Years

| | | Inception

| | | Date

|

Managers Funds: | | | | | | | | | | | | | | | | | | |

Income Funds: | | | | | | | | | | | | | | | | | | |

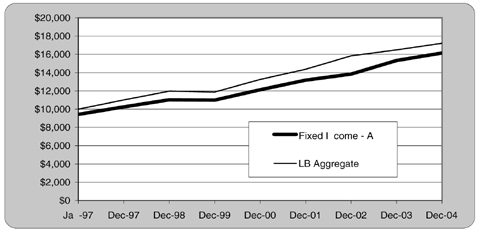

Fixed Income(2) | | -Class A | | No Load | | 5.44 | % | | 7.04 | % | | 8.01 | % | | 6.96 | % | | Jan-97 |

| | | -Class A | | With Load | | 0.13 | % | | 5.24 | % | | 6.90 | % | | 6.28 | % | | Jan-97 |

| | | -Class B | | No Load | | 4.90 | % | | 6.51 | % | | 7.48 | % | | 6.14 | % | | Mar-98 |

| | | -Class B | | With Load | | (0.10 | )% | | 5.62 | % | | 7.18 | % | | 6.14 | % | | Mar-98 |

| | | -Class C | | No Load | | 4.85 | % | | 6.52 | % | | 7.49 | % | | 6.33 | % | | Mar-98 |

| | | -Class C | | With Load | | 2.78 | % | | 6.17 | % | | 7.27 | % | | 6.18 | % | | Mar-98 |

| | | -Class Y | | No Load | | 5.99 | % | | 7.61 | % | | 8.59 | % | | 7.57 | % | | Jan-97 |

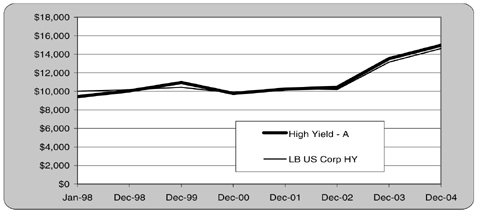

High Yield(2) | | -Class A | | No Load | | 10.62 | % | | 13.49 | % | | 6.45 | % | | 6.83 | % | | Jan-98 |

| | | -Class A | | With Load | | 4.22 | % | | 11.29 | % | | 5.20 | % | | 5.93 | % | | Jan-98 |

| | | -Class B | | No Load | | 10.07 | % | | 12.96 | % | | 5.89 | % | | 5.69 | % | | Feb-98 |

| | | -Class B | | With Load | | 5.07 | % | | 12.17 | % | | 5.62 | % | | 5.69 | % | | Feb-98 |

| | | -Class C | | No Load | | 10.08 | % | | 12.97 | % | | 5.92 | % | | 5.68 | % | | Feb-98 |

| | | -Class C | | With Load | | 8.05 | % | | 12.58 | % | | 5.71 | % | | 5.52 | % | | Feb-98 |

| | | -Class Y | | No Load | | 11.26 | % | | 14.16 | % | | 7.05 | % | | 6.74 | % | | Mar-98 |

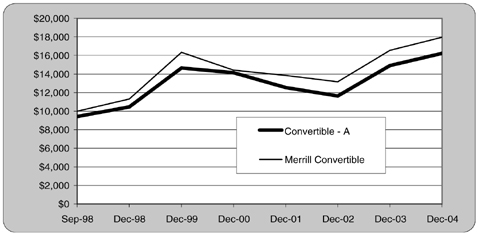

Convertible Securities(2) | | -Class A | | No Load | | 8.89 | % | | 8.98 | % | | 2.07 | % | | 9.09 | % | | Sep-98 |

| | | -Class A | | With Load | | 2.61 | % | | 6.84 | % | | 0.87 | % | | 8.06 | % | | Sep-98 |

| | | -Class B | | No Load | | 8.39 | % | | 8.48 | % | | 1.56 | % | | 8.54 | % | | Sep-98 |

| | | -Class B | | With Load | | 3.39 | % | | 7.62 | % | | 1.29 | % | | 8.54 | % | | Sep-98 |

| | | -Class C | | No Load | | 8.36 | % | | 8.44 | % | | 1.56 | % | | 8.56 | % | | Sep-98 |

| | | -Class C | | With Load | | 6.25 | % | | 8.06 | % | | 1.36 | % | | 8.39 | % | | Sep-98 |

| | | -Class Y | | No Load | | 9.39 | % | | 9.53 | % | | 2.57 | % | | 9.64 | % | | Sep-98 |

Performance differences among the share classes are due to differences in sales charge structures and class expenses. Returns shown reflect maximum sales charge of 5.75% on Class A (5.00% maximum for Managers Fixed Income Fund), 1% on Class C as well as the applicable contingent deferred sales charge (CDSC) on both Class B and C shares. The Class B shares’ CDSC declines annually between years 1 through 6 according to the following schedule: 5, 4, 3, 3, 2, 1%. No sales charge is assessed after year six. Class C shares held for less than one year are subject to a 1% CDSC.

The Fund share classes differ with regard to sales charges and Fund expenses. In choosing a Fund and class(es), investors should consider the amount they plan to invest, their investment objectives, the Fund’s investment objectives, risks, charges and expenses carefully before investing, and how long they intend to keep their money invested in the Fund and class(es). Each Fund’s prospectus contains information concerning the Fund’s investment objective, risk, charges and expenses and other information. Additional risks are associated with investing in high yield bonds, and such securities may be considered speculative.

There are also risks associated with investing in small-cap companies, such as increased volatility, and bonds, such as rising interest rates. More specifically, the value of debt instruments held in bond funds declines when interest rates rise and longer-term bonds are more vulnerable to interest rate risk. To obtain a prospectus, please call (800) 835-3879 or visit our website at www.managersinvest.com. Please read the Prospectus carefully before you invest in a Fund or send money. Investors should discuss their goals and choices with a registered financial professional in order to determine which share class is appropriate for them. Distributed by Managers Distributors, Inc., member NASD.

| (1) | Total return equals income yield plus share price change and assumes reinvestment of all dividends and capital gain distributions. Returns are net of fees and may reflect offsets of Fund expenses as described in the Prospectus. No adjustment has been made for taxes payable by shareholders on their reinvested dividends and capital gain distributions. Returns for periods greater than one year are annualized. |

The performance data shown represents past performance, which is not a guarantee of future results. (From time to time the Funds’ advisor has waived fees or reimbursed expenses, which may have resulted in higher returns.) Current performance may be higher or lower than the performance data quoted. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. For performance information through the most recent month end please call (800) 835-3879 or visit our web site at www.managersinvest.com.

| (2) | Formerly part of the Conseco Funds Group. |

3

About Your Fund’s Expenses

We believe it is important for you to understand the impact of costs on your investment. All mutual funds have operating expenses. As a shareholder of the Fund, you incur ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports (like this one), among others. Operating expenses, which are deducted from the Fund’s gross income, directly reduce the investment return of the Fund.

A fund’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in the Fund, so you can compare these costs with those of other mutual funds. The examples are based on an investment in the Fund of $1,000 made at the beginning of the most recent fiscal period and held for the entire period.

The table below illustrates your Fund’s costs in two ways:

Actual Fund return: This helps you to estimate the actual expenses that you paid over the period. The “Ending Account Value” shown is derived from the Fund’s actual return, and the fourth column shows the dollar amount that would have been paid by an investor who started with $1,000 in the Fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for the Fund under the heading “Expenses Paid During Period.”

Hypothetical 5% annual return: This helps you compare the Fund’s costs with those of other mutual funds because the Securities and Exchange Commission requires all mutual funds to calculate expenses based on a 5% annual return less expenses. It assumes that the Fund had a return of 5% per year and that the expense ratio is unchanged. You can assess the Fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

| | | | | | | | | | | | |

Six Months Ended December 31, 2004

| | Expense

Ratio

| | | Beginning

Account

Value

6/30/2004

| | Ending

Account

Value

12/31/2004

| | Expenses

Paid During Period*

|

Managers Science & Technology Fund Class A | | | | | | | | | | | | |

Based on Actual Fund Return | | 1.75 | % | | $ | 1,000 | | $ | 1,048 | | $ | 9.03 |

Based on Hypothetical 5% Annual Return | | 1.75 | % | | $ | 1,000 | | $ | 1,016 | | $ | 8.89 |

Managers Science & Technology Fund Class B | | | | | | | | | | | | |

Based on Actual Fund Return | | 2.25 | % | | $ | 1,000 | | $ | 1,044 | | $ | 11.59 |

Based on Hypothetical 5% Annual Return | | 2.25 | % | | $ | 1,000 | | $ | 1,014 | | $ | 11.42 |

Managers Science & Technology Fund Class C | | | | | | | | | | | | |

Based on Actual Fund Return | | 2.25 | % | | $ | 1,000 | | $ | 1,049 | | $ | 11.62 |

Based on Hypothetical 5% Annual Return | | 2.25 | % | | $ | 1,000 | | $ | 1,014 | | $ | 11.42 |

Managers Science & Technology Fund Class Y | | | | | | | | | | | | |

Based on Actual Fund Return | | 1.25 | % | | $ | 1,000 | | $ | 1,052 | | $ | 6.46 |

Based on Hypothetical 5% Annual Return | | 1.25 | % | | $ | 1,000 | | $ | 1,019 | | $ | 6.36 |

| | |

|

| |

|

| |

|

| |

|

|

Managers 20 Fund Class A | | | | | | | | | | | | |

Based on Actual Fund Return | | 1.75 | % | | $ | 1,000 | | $ | 981 | | $ | 8.74 |

Based on Hypothetical 5% Annual Return | | 1.75 | % | | $ | 1,000 | | $ | 1,016 | | $ | 8.89 |

Managers 20 Fund Class B | | | | | | | | | | | | |

Based on Actual Fund Return | | 2.25 | % | | $ | 1,000 | | $ | 978 | | $ | 11.22 |

Based on Hypothetical 5% Annual Return | | 2.25 | % | | $ | 1,000 | | $ | 1,014 | | $ | 11.42 |

Managers 20 Fund Class C | | | | | | | | | | | | |

Based on Actual Fund Return | | 2.25 | % | | $ | 1,000 | | $ | 979 | | $ | 11.22 |

Based on Hypothetical 5% Annual Return | | 2.25 | % | | $ | 1,000 | | $ | 1,014 | | $ | 11.42 |

Managers 20 Fund Class Y | | | | | | | | | | | | |

Based on Actual Fund Return | | 1.25 | % | | $ | 1,000 | | $ | 981 | | $ | 6.24 |

Based on Hypothetical 5% Annual Return | | 1.25 | % | | $ | 1,000 | | $ | 1,019 | | $ | 6.36 |

| | |

|

| |

|

| |

|

| |

|

|

4

About Your Fund’s Expenses (continued)

| | | | | | | | | | | | |

Six Months Ended December 31, 2004

| | Expense

Ratio

| | | Beginning

Account

Value

6/30/2004

| | Ending

Account

Value

12/31/2004

| | Expenses

Paid

During

Period*

|

Managers Mid-Cap Fund Class A | | | | | | | | | | | | |

Based on Actual Fund Return | | 1.50 | % | | $ | 1,000 | | $ | 1,107 | | $ | 7.97 |

Based on Hypothetical 5% Annual Return | | 1.50 | % | | $ | 1,000 | | $ | 1,018 | | $ | 7.63 |

Managers Mid-Cap Fund Class B | | | | | | | | | | | | |

Based on Actual Fund Return | | 2.00 | % | | $ | 1,000 | | $ | 1,105 | | $ | 10.61 |

Based on Hypothetical 5% Annual Return | | 2.00 | % | | $ | 1,000 | | $ | 1,015 | | $ | 10.16 |

Managers Mid-Cap Fund Class C | | | | | | | | | | | | |

Based on Actual Fund Return | | 2.00 | % | | $ | 1,000 | | $ | 1,105 | | $ | 10.61 |

Based on Hypothetical 5% Annual Return | | 2.00 | % | | $ | 1,000 | | $ | 1,015 | | $ | 10.16 |

Managers Mid-Cap Fund Class Y | | | | | | | | | | | | |

Based on Actual Fund Return | | 1.00 | % | | $ | 1,000 | | $ | 1,109 | | $ | 5.32 |

Based on Hypothetical 5% Annual Return | | 1.00 | % | | $ | 1,000 | | $ | 1,020 | | $ | 5.09 |

| | |

|

| |

|

| |

|

| |

|

|

Managers Large-Cap Fund Class A | | | | | | | | | | | | |

Based on Actual Fund Return | | 1.50 | % | | $ | 1,000 | | $ | 1,079 | | $ | 7.86 |

Based on Hypothetical 5% Annual Return | | 1.50 | % | | $ | 1,000 | | $ | 1,018 | | $ | 7.63 |

Managers Large-Cap Fund Class B | | | | | | | | | | | | |

Based on Actual Fund Return | | 2.00 | % | | $ | 1,000 | | $ | 1,076 | | $ | 10.47 |

Based on Hypothetical 5% Annual Return | | 2.00 | % | | $ | 1,000 | | $ | 1,015 | | $ | 10.16 |

Managers Large-Cap Fund Class C | | | | | | | | | | | | |

Based on Actual Fund Return | | 2.00 | % | | $ | 1,000 | | $ | 1,076 | | $ | 10.47 |

Based on Hypothetical 5% Annual Return | | 2.00 | % | | $ | 1,000 | | $ | 1,015 | | $ | 10.16 |

Managers Large-Cap Fund Class Y | | | | | | | | | | | | |

Based on Actual Fund Return | | 1.00 | % | | $ | 1,000 | | $ | 1,081 | | $ | 5.25 |

Based on Hypothetical 5% Annual Return | | 1.00 | % | | $ | 1,000 | | $ | 1,020 | | $ | 5.09 |

| | |

|

| |

|

| |

|

| |

|

|

Managers Balanced Fund Class A | | | | | | | | | | | | |

Based on Actual Fund Return | | 1.50 | % | | $ | 1,000 | | $ | 1,066 | | $ | 7.81 |

Based on Hypothetical 5% Annual Return | | 1.50 | % | | $ | 1,000 | | $ | 1,018 | | $ | 7.63 |

Managers Balanced Fund Class B | | | | | | | | | | | | |

Based on Actual Fund Return | | 2.00 | % | | $ | 1,000 | | $ | 1,064 | | $ | 10.40 |

Based on Hypothetical 5% Annual Return | | 2.00 | % | | $ | 1,000 | | $ | 1,015 | | $ | 10.16 |

Managers Balanced Fund Class C | | | | | | | | | | | | |

Based on Actual Fund Return | | 2.00 | % | | $ | 1,000 | | $ | 1,064 | | $ | 10.41 |

Based on Hypothetical 5% Annual Return | | 2.00 | % | | $ | 1,000 | | $ | 1,015 | | $ | 10.16 |

Managers Balanced Fund Class Y | | | | | | | | | | | | |

Based on Actual Fund Return | | 1.00 | % | | $ | 1,000 | | $ | 1,069 | | $ | 5.22 |

Based on Hypothetical 5% Annual Return | | 1.00 | % | | $ | 1,000 | | $ | 1,020 | | $ | 5.09 |

| | |

|

| |

|

| |

|

| |

|

|

5

About Your Fund’s Expenses (continued)

| | | | | | | | | | | | |

Six Months Ended December 31, 2004

| | Expense

Ratio

| | | Beginning

Account

Value

6/30/2004

| | Ending

Account

Value

12/31/2004

| | Expenses

Paid During

Period*

|

Managers Convertible Fund Class A | | | | | | | | | | | | |

Based on Actual Fund Return | | 1.55 | % | | $ | 1,000 | | $ | 1,072 | | $ | 8.09 |

Based on Hypothetical 5% Annual Return | | 1.55 | % | | $ | 1,000 | | $ | 1,017 | | $ | 7.88 |

Managers Convertible Fund Class B | | | | | | | | | | | | |

Based on Actual Fund Return | | 2.05 | % | | $ | 1,000 | | $ | 1,069 | | $ | 10.69 |

Based on Hypothetical 5% Annual Return | | 2.05 | % | | $ | 1,000 | | $ | 1,015 | | $ | 10.41 |

Managers Convertible Fund Class C | | | | | | | | | | | | |

Based on Actual Fund Return | | 2.05 | % | | $ | 1,000 | | $ | 1,069 | | $ | 10.69 |

Based on Hypothetical 5% Annual Return | | 2.05 | % | | $ | 1,000 | | $ | 1,015 | | $ | 10.41 |

Managers Convertible Fund Class Y | | | | | | | | | | | | |

Based on Actual Fund Return | | 1.05 | % | | $ | 1,000 | | $ | 1,074 | | $ | 5.49 |

Based on Hypothetical 5% Annual Return | | 1.05 | % | | $ | 1,000 | | $ | 1,020 | | $ | 5.35 |

| | |

|

| |

|

| |

|

| |

|

|

Managers High Yield Fund Class A | | | | | | | | | | | | |

Based on Actual Fund Return | | 1.40 | % | | $ | 1,000 | | $ | 1,090 | | $ | 7,37 |

Based on Hypothetical 5% Annual Return | | 1.40 | % | | $ | 1,000 | | $ | 1,018 | | $ | 7.12 |

Managers High Yield Fund Class B | | | | | | | | | | | | |

Based on Actual Fund Return | | 1.90 | % | | $ | 1,000 | | $ | 1,088 | | $ | 10.00 |

Based on Hypothetical 5% Annual Return | | 1.90 | % | | $ | 1,000 | | $ | 1,016 | | $ | 9.65 |

Managers High Yield Fund Class C | | | | | | | | | | | | |

Based on Actual Fund Return | | 1.90 | % | | $ | 1,000 | | $ | 1,088 | | $ | 10.00 |

Based on Hypothetical 5% Annual Return | | 1.90 | % | | $ | 1,000 | | $ | 1,016 | | $ | 9.65 |

Managers High Yield Fund Class Y | | | | | | | | | | | | |

Based on Actual Fund Return | | 0.90 | % | | $ | 1,000 | | $ | 1,093 | | $ | 4.75 |

Based on Hypothetical 5% Annual Return | | 0.90 | % | | $ | 1,000 | | $ | 1,021 | | $ | 4.58 |

| | |

|

| |

|

| |

|

| |

|

|

Managers Fixed Income Fund Class A | | | | | | | | | | | | |

Based on Actual Fund Return | | 0.99 | % | | $ | 1,000 | | $ | 1,056 | | $ | 5.13 |

Based on Hypothetical 5% Annual Return | | 0.99 | % | | $ | 1,000 | | $ | 1,020 | | $ | 5.04 |

Managers Fixed Income Fund Class B | | | | | | | | | | | | |

Based on Actual Fund Return | | 1.49 | % | | $ | 1,000 | | $ | 1,052 | | $ | 7.71 |

Based on Hypothetical 5% Annual Return | | 1.49 | % | | $ | 1,000 | | $ | 1,018 | | $ | 7.58 |

Managers Fixed Income Fund Class C | | | | | | | | | | | | |

Based on Actual Fund Return | | 1.49 | % | | $ | 1,000 | | $ | 1,053 | | $ | 7.71 |

Based on Hypothetical 5% Annual Return | | 1.49 | % | | $ | 1,000 | | $ | 1,018 | | $ | 7.58 |

Managers Fixed Income Fund Class Y | | | | | | | | | | | | |

Based on Actual Fund Return | | 0.49 | % | | $ | 1,000 | | $ | 1,058 | | $ | 2.54 |

Based on Hypothetical 5% Annual Return | | 0.49 | % | | $ | 1,000 | | $ | 1,023 | | $ | 2.50 |

| * | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value-over the period, multiplied by the number of days in the most recent fiscal half-year, then divided by 365. |

You can find more information about the Fund’s expenses, including annual expense ratios for past fiscal periods, in the Financial Statements section of this report. For additional information on operating expenses and other shareholder costs, please refer to the Fund’s prospectus

6

Managers Science & Technology

Managers Science and Technology Fund (“Science & Tech”) is a stock fund seeking long-term capital appreciation through a non-diversified portfolio of equity securities of companies that the Fund’s subadvisor believes are positioned to take advantage of scientific or technological advances to power earnings growth. Managers currently utilizes a single independent subadvisor, a team led by Douglas S. MacKay of Oak Associates, ltd. (“Oak”), to manage the portfolio. Oak has managed the portfolio since December 2000.

The Portfolio Managers

Douglas S. MacKay of Oak Associates is a growth manager seeking to maximize returns through investments in the firm’s best ideas in the technology sector. Oak’s investment strategy begins with the overall outlook for the economy. The investment team assesses the overall economic background, including an analysis of fiscal policies, monetary policies, inflation, interest rates, exchange rates, and evolving relationships of economic sectors. The purpose of this macroeconomic analysis is to determine a list of favored technology industries where the most attractive secular growth opportunities reside. These industries are then covered to focus stock specific research.

The investment analysts at Oak research approximately 200 individual issues from the firm’s favored industries. Of these, roughly 100 are closely followed. When researching a potential security, the analysts look at the company growth rate and valuation metrics in absolute terms, relative to the market as a whole, and relative to each security’s historic valuation. The decision to buy a security is based on the investment team’s level of enthusiasm for the company’s management, its products, and the industry in which it operates. While valuation is also an important consideration, they must first be convinced of the company’s fundamental growth prospects and leading position within an industry going forward. MacKay makes the investment decisions, aided by free flowing and open communication among the analysts and other members of the investment team. The end result is a portfolio of fewer than 25 positions in a handful of technology sectors. Given the significant portfolio concentration and the focus on secular, rather than near-term, growth, the Fund is expected to have above-average price volatility.

Selling stocks is critical to Oak’s superior performance and takes place when the strategic stock market outlook changes based on Oak’s macroeconomic analysis or when a better idea with stronger valuation at a better price makes itself available. While MacKay will purchase a security for no more than 6% of the total portfolio at cost, he will let the winners run as long as the fundamentals of the companies are solid.

The Year in Review

For the year 2004, the Managers Science and Technology Fund returned -3.56% (Class A with load) compared with a gain of 10.88% for the S&P 500 Index. Negative performance variance was partially attributed to inclusion of the sales load. Excluding the sales load, the Fund’s return would have been 2.36%. In the U.S., the broad market (using, for example, the Russell 3000, Wilshire 5000, and S&P 500 indices) rose about 12% for the year and, by most measures, it was the first consecutive positive year since 1998-1999.

The equity markets opened the year continuing the rally of 2003 before falling in March amid security concerns following the terrorist attacks in Madrid. The economy took center stage in the middle of the year as the Federal Open Market Committee began to raise the Federal funds rate 0.25%, the first of many such increases. While corporate earnings were strong, the market was soft as a result of concerns about a slowing economy and constrained consumer spending due to rising energy costs. The market began to rally in September only to be slowed down by Merck, which announced the recall of its successful arthritis drug Vioxx.

Throughout most of 2004 the market had been locked into a trading zone, but jumped out immediately after the presidential election. A decisive election boosted markets to their best performance since the fourth quarter of 2003. This end of the year strong performance was led by the IT and consumer sectors. Both sectors had been negative all year and posted strong returns of about 13% in the fourth quarter. As corporate profits continued to grow capital spending increased, helping the IT sector. The consumer was helped by a decrease in energy and materials prices. While price indices rose over all, the fourth quarter saw a decrease in oil prices from a high of over $55 per barrel to about $43 per barrel. This decrease did not stop the energy sector from posting strong returns for the year. Global demand for oil and other materials helped the energy (+31%) and materials (+13%) sectors throughout the year. Industrials (18%) had a strong year despite the poor performance of the airline industry which continues to struggle.

From a style standpoint, the S&P Barra/Value Index outperformed its growth counterpart by over 900 basis points (bps). Low price-to-sales and price-to earnings stocks were the leaders early in the year. The resurgence of the information technology and consumer discretionary sectors in the fourth quarter evened out the distribution as all quintiles performed well.

Since the Fund concentrates on the information technology sector, returns were negative for most of the year, matching the sector. The Fund started the year well, carrying the rally from 2003. However, like the whole sector, the Fund was mostly on the decline until September. IT companies struggled through the second quarter amid rising interest rates. Positive outlooks on capital spending kept the sector flat, however, increased spending did not materialize in the third quarter and technology stocks decreased 10%. From September through the end of the year, the Fund boasted a return of over 18%. IT service company Cognizant Technology Solutions returned 39% for the fourth quarter and was a major contributor. Services were better performers than the semiconductor and electronic equipment industries given the rising price of materials and soft demand for hardware.

7

Managers Science & Technology

The Fund’s lone health care stock, Affymetrix (+19%), a company that places gene coding onto chips for use by researchers in several areas, is an example of the type of technology growth the Fund looks for. The consumer discretionary sector benefited from eBay (+80%) and the team has added Pixar, Harman International and Amazon.com throughout the year.

Looking Forward

Looking forward, the portfolio manager continues to find securities with superb growth opportunities because of new technologies. Companies that own the intellectual property and create the applications that use such technologies are the types of investment opportunities sought out by Oak Associates. Oak’s comments as we progress into 2005:

Looking ahead to 2005, we believe the stock markets will rise by the end of the year, inflation and interest rates will remain low, company earnings will grow and global prosperity will continue. While we think materials, energy, and industrials will continue to perform well as they did in 2004, we expect that the bull market of 2005 will be broader, with more sectors participating, especially technology and selected consumer discretionary, finance, and health care companies. Lower energy prices should provide a nice boost to the economy and corporate earnings in 2005. A weak U.S. dollar will help as well. One big negative is that a major tax incentive to buy capital equipment will expire at the end of this year. However, capital spending tends to be driven by corporate cash flow, which is likely to remain very strong in 2005.

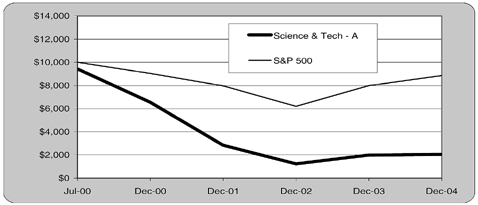

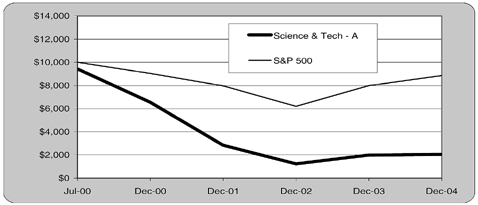

Cumulative Total Return Performance

Science & Tech’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all dividends and distributions were reinvested. The S&P 500 Index is an unmanaged capitalization weighted index of 500 commonly traded stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of those stocks. The Index assumes reinvestment of dividends. This chart compares a hypothetical $10,000 investment made in Science & Technology Fund – Class A Shares on July 3, 2000, to a $10,000 investment made in the S&P 500 for the same time period. The chart is not intended to imply any future performance of the Fund. The graph and chart do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. Total Returns would have been lower had certain expenses not been reduced.

The table below shows the average annual total returns for the Science & Technology Fund - Class A Shares (with load) and the S&P 500 Index since inception through December 31, 2004.

| | | | | | |

Average Annual Total Returns:

| | 1 Year

| | | Since Inception*

| |

Science & Technology – A Shares | | (3.56 | )% | | (29.74 | )% |

S&P 500 | | 10.88 | % | | (2.68 | )% |

| * | Commencement of operations was July 3, 2000. |

The table below displays a full breakdown of the sector allocation of the Fund as well as the top ten positions as of December 31, 2004.

Managers Science & Technology Fund

| | | |

Top Ten Holdings (out of 24 securities)

| | % Fund

| |

Symbol Technologies, Inc. | | 7.2 | % |

eBay, Inc. | | 6.5 | |

NAVTEQ Corp. | | 6.4 | |

Qualcomm, Inc. | | 6.2 | |

Cognizant Technology Solutions Corp. | | 5.9 | |

Amazon.Com, Inc. | | 5.5 | |

Juniper Networks Inc. | | 5.1 | |

EMC Corp. | | 5.0 | |

Symantec Corp. | | 5.0 | |

Electronic Arts, Inc. | | 4.9 | |

| | |

|

|

Top Ten as a Group | | 57.7 | % |

| | |

|

|

| |

Industry Weightings

| | % Fund

| |

| Information Technology | | 73.1 | % |

| Consumer Discretionary | | 19.2 | |

| Industrials | | 4.5 | |

| Health Care | | 3.0 | |

| Other | | 0.2 | |

| | | | |

8

Managers Science & Technology Fund

December 31, 2004

Schedule of Portfolio Investments

| | | | | | | |

Security Description

| | Shares

| | | Value

| |

Common Stocks - 99.8% | | | | | | | |

Consumer Discretionary - 19.2% | | | | | | | |

Amazon.Com, Inc.* | | 2,850 | | | $ | 126,227 | |

eBay, Inc.* | | 1,300 | | | | 151,164 | |

Harman International Industries, Inc. | | 700 | | | | 88,900 | |

Pixar Animation Studios* | | 900 | | | | 77,049 | |

Total Consumer Discretionary | | | | | | 443,340 | |

Health Care - 3.0% | | | | | | | |

Affmetrix, Inc.* | | 1,900 | 2 | | | 69,445 | |

Industrials - 4.5% | | | | | | | |

Apollo Group, Inc., Class A* | | 1,300 | | | | 104,923 | |

Information Technology - 73.1% | | | | | | | |

Applied Materials, Inc. * | | 2,800 | | | | 47,880 | |

Cisco Systems, Inc.* | | 3,850 | | | | 74,305 | |

Cogent Inc.* | | 2,000 | | | | 66,000 | |

Cognex Corp. | | 2,500 | | | | 69,750 | |

Cognizant Technology Solutions Corp.* | | 3,200 | | | | 135,455 | |

Electronic Arts, Inc.* | | 1,850 | | | | 114,108 | |

EMC Corp.* | | 7,800 | | | | 115,986 | |

Formfactor, Inc.* | | 682 | | | | 18,509 | |

Google, Inc.* | | 200 | 2 | | | 38,620 | |

Juniper Networks, Inc.* | | 4,335 | | | | 117,869 | |

Marvell Technology Group Ltd.* | | 2,000 | | | $ | 70,940 | |

Maxim Integrated Products, Inc. | | 2,350 | | | | 99,617 | |

Microsoft Corp. | | 2,200 | | | | 58,762 | |

NAVTEQ Corp.* | | 3,200 | | | | 148,352 | |

Qualcomm, Inc. | | 3,400 | | | | 144,160 | |

Symantec Corp.* | | 4,500 | | | | 115,920 | |

Symbol Technologies, Inc. | | 9,600 | | | | 166,080 | |

Zebra Technologies, Corp.* | | 1,500 | | | | 84,420 | |

Total Information Technology | | | | | | 1,686,733 | |

Total Common Stocks

(cost $1,677,314) | | | | | | 2,304,441 | |

Other Investment Companies – 5.0%1 | | | | | | | |

Bank of New York Institutional Cash Reserves Fund, 2.35%3 | | 112,007 | | | | 112,007 | |

JPMorgan Prime Money Market Fund, Institutional Class Shares, 2.12% | | 3,179 | | | | 3,179 | |

Total Other Investment Companies

(cost $115,186) | | | | | | 115,186 | |

Total Investments – 104.8%

(cost $1,792,500) | | | | | | 2,419,627 | |

Other Assets, less Liabilities – (4.8)% | | | | | | (111,367 | ) |

Net Assets – 100.0% | | | | | $ | 2,308,260 | |

The accompanying notes are an integral part of these financial statements.

9

Managers 20 Fund

Managers 20 Fund (“20”) is a stock fund seeking capital appreciation through a non-diversified portfolio of equity securities of 20 to 25 companies that the Fund’s subadvisor believes offer strong growth potential. Managers currently utilizes a single independent subadvisor, a team led by James D. Oelschlager of Oak Associates, ltd. (“Oak”), to manage the portfolio. Oak has managed the portfolio since December 2000.

The Portfolio Managers

James D. Oelschlager of Oak Associates is a growth manager seeking to maximize returns through investments in the firm’s best ideas. Oak’s investment strategy begins with the overall outlook for the economy. The investment team assesses the overall economic background, including an analysis of fiscal policies, monetary policies, inflation, interest rates, exchange rates, and evolving relationships of economic sectors. The purpose of this macroeconomic analysis is to determine a list of favored industries where the most attractive secular growth opportunities reside. These industries are then covered to focus stock specific research.

The investment analysts at Oak research approximately 200 individual issues from the firm’s favored industries. Of these, roughly 100 are closely followed. When researching a potential security, the analysts look at the company growth rate and valuation metrics in absolute terms, relative to the market as a whole, and relative to each security’s historic valuation. The decision to buy a security is based on the investment team’s level of enthusiasm for the company’s management, its products, and the industry in which it operates. While valuation is also an important consideration, they must first be convinced of the company’s fundamental growth prospects and leading position within an industry going forward. Oelschlager makes the investment decisions, aided by free flowing and open communication among the analysts and other members of the investment team. The end result is a portfolio of 25 or fewer positions in a handful of economic sectors. Given the significant portfolio concentration and the focus on secular, rather than near-term, growth, the Fund is expected to have above-average price volatility.

Selling stocks is critical to Oak’s superior performance and takes place when the strategic stock market outlook changes based on Oak’s macroeconomic analysis or when a better idea with stronger valuation at a better price makes itself available. While Oelschlager will purchase a security for no more than 6% of the total portfolio at cost, he will let the winners run as long as the fundamentals of the companies are solid.

The Year in Review

For the year 2004, the Managers 20 Fund returned -10.50% (Class A with load) compared with a gain of 10.88% for the S&P 500 Index. Negative performance variance was partially attributed to inclusion of the sales load. Excluding the sales load, the Fund’s return would have been -5.11%. In the U.S., the broad market (using, for example, the Russell 3000, Wilshire 5000, and S&P 500 indices) rose about 12% for the year and, by most measures, it was the first consecutive positive year since 1998-1999.

The equity markets opened the year continuing the rally of 2003 before falling in March amid security concerns following the terrorist attacks in Madrid. The economy took center stage in the middle of the year as the Federal Open Market Committee began to raise the Federal funds rate 0.25%, the first of many such increases. While corporate earnings were strong, the market was soft as a result of concerns about a slowing economy and constrained consumer spending due to rising energy costs. The market began to rally in September only to be slowed down by Merck, which announced the recall of its successful arthritis drug Vioxx.

Throughout most of 2004 the market had been locked into a trading zone, but jumped out immediately after the presidential election. A decisive election boosted markets to their best performance since the fourth quarter of 2003. This end of the year rally was led by the IT and consumer sectors. Both sectors had been negative all year and posted strong returns of about 13% in the fourth quarter. As corporate profits continued to grow capital spending increased, helping the IT sector. The consumer was helped by a decrease in energy and materials prices. While price indices rose over all, the fourth quarter saw a decrease in oil prices from a high of over $55 per barrel to about $43 per barrel. This decrease did not stop the energy sector from posting strong returns for the year. Global demand for oil and other materials helped the energy (+31%) and materials (+13%) sectors throughout the year. Industrials (+18%) had a strong year despite the poor performance of the airline industry which continues to struggle.

From a style standpoint, the S&P Barra/Value Index outperformed its growth counterpart by over 900 basis points (bps). Low price-to-sales and price-to earnings stocks were the leaders early in the year. The resurgence of the information technology and consumer discretionary sectors in the fourth quarter evened out the distribution as all quintiles performed well.

Since the Fund concentrates on growth opportunities, the information technology sector is the largest component of the Fund. As technology returns were negative for most of the year, the Fund followed similarly. The Fund started the year well, continuing the rally from 2003. However, like the whole technology sector, the Fund was mostly on the decline until September. In the fourth quarter, the Fund boasted a return of over 11%. IT service company Juniper returned 45% and was one of the top contributors for the year along with eBay (+80%), Dell (+24%) and EMC (+15%), which bounced back from a poor first half of the year.

The Fund started with a healthy position in financials, but the position was trimmed down with the liquidations of AIG and Morgan Stanley after poor performance. The health care sector was hurt by the holding of Pfizer which fell due to concerns over its drug Celebrex having the same health issues as Merck’s Vioxx. The Fund has recently increased its healthcare sector holdings with a purchase in Amgen. This represents a growth opportunity in the biotechnology industry where Amgen is a leader.

10

Managers 20 Fund

Looking Forward

Looking forward, the portfolio manager continues to find securities with superb growth opportunities because of new technologies. Companies that own the intellectual property and create the applications that use such technologies are the types of investment opportunities sought out by Oak Associates. Oak’s comments as we progress into 2005:

Looking ahead to 2005, we believe the stock markets will rise by the end of the year, inflation and interest rates will remain low, company earnings will grow and global prosperity will continue. While we think materials, energy, and industrials will continue to perform well as they did in 2004, we expect that the bull market of 2005 will be broader, with more sectors participating, especially technology and selected consumer discretionary, finance, and health care companies. Lower energy prices should provide a nice boost to the economy and corporate earnings in 2005. A weak U.S. dollar will help as well. One big negative is that a major tax incentive to buy capital equipment will expire at the end of this year. However, capital spending tends to be driven by corporate cash flow, which is likely to remain very strong in 2005.

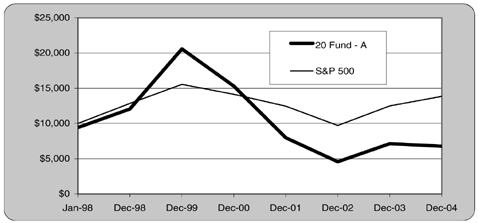

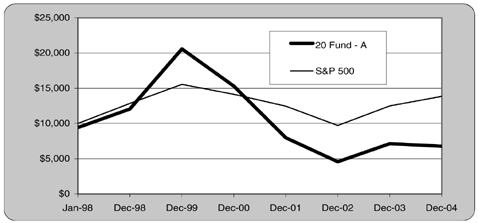

Cumulative Total Return Performance

Managers 20 Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all dividends and distributions were reinvested. The S&P 500 Index is an unmanaged capitalization weighted index of 500 commonly traded stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of those stocks. The Index assumes reinvestment of dividends. This chart compares a hypothetical $10,000 investment made in Managers 20 Fund —Class A Shares on January 2, 1998, to a $10,000 investment made in the S&P 500 for the same time period. The chart is not intended to imply any future performance of the Fund. The graph and chart do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. Total Returns would have been lower had certain expenses not been reduced.

The table below shows the average annual total returns for the 20 Fund - Class A Shares (with load) and the S&P 500 Index since inception through December 31, 2004.

| | | | | | | | | |

Average Annual Total Returns:

| | 1 Year

| | | 5 Years

| | | Since Inception*

| |

20 Fund – A Shares | | (10.50 | )% | | (20.89 | )% | | (5.43 | )% |

S&P 500 | | 10.88 | % | | (2.30 | )% | | 4.77 | % |

| * | Commencement of operations was January 2, 1998. |

The table below displays a full breakdown of the sector allocation of the Fund as well as the top ten positions as of December 31, 2004.

Managers 20 Fund

| | | |

Top Ten Holdings (out of 25 securities)

| | % Fund

| |

eBay, Inc. | | 7.1 | % |

EMC Corp. | | 5.5 | |

Cisco Systems, Inc. | | 5.5 | |

Electronic Arts, Inc. | | 5.2 | |

Schwab (Charles) Corp. | | 4.9 | |

Dell, Inc. | | 4.7 | |

Juniper Networks Inc. | | 4.6 | |

Maxim Integrated Products, Inc. | | 4.5 | |

United Parcel Service, Inc., Class B | | 4.4 | |

Medtronic, Inc. | | 4.2 | |

| | |

|

|

Top Ten as a Group | | 50.6 | % |

| | |

|

|

| |

Industry Weightings

| | % Fund

| |

Information Technology | | 57.6 | % |

Health Care | | 13.9 | |

Financials | | 12.9 | |

Consumer Discretionary | | 9.1 | |

Industrials | | 6.3 | |

Other | | 0.2 | |

11

Managers 20 Fund

December 31, 2004

Schedule of Portfolio Investments

| | | | | | | |

Security Description

| | Shares

| | | Value

| |

Common Stocks - 99.8% | | | | | | | |

Consumer Discretionary - 9.1% | | | | | | | |

eBay, Inc.* | | 23,000 | | | $ | 2,674,440 | |

Harman International Industries, Inc. | | 6,000 | | | | 762,000 | |

Total Consumer Discretionary | | | | | | 3,436,440 | |

| | |

Financial - 12.9% | | | | | | | |

Citigroup, Inc. | | 30,000 2 | | | | 1,445,400 | |

MBNA Corp. | | 55,200 | | | | 1,556,088 | |

Schwab (Charles) Corp. | | 155,000 | | | | 1,853,800 | |

Total Financials | | | | | | 4,855,288 | |

| | |

Health Care - 13.9% | | | | | | | |

Affmetrix, Inc. * | | 22,000 | 2 | | | 804,100 | |

Amgen, Inc.* | | 20,000 | | | | 1,283,000 | |

Medtronic, Inc. | | 32,000 | | | | 1,589,440 | |

Pfizer, Inc. | | 57,000 | | | | 1,532,730 | |

Total Health Care | | | | | | 5,209,270 | |

| | |

Industrials - 6.3% | | | | | | | |

Rockwell Automation, Inc. | | 14,500 | | | | 718,475 | |

United Parcel Service, Inc., Class B | | 19,500 | | | | 1,666,470 | |

Total Industrials | | | | | | 2,384,945 | |

| | |

Information Technology - 57.6% | | | | | | | |

Applied Materials, Inc. * | | 92,500 | | | | 1,581,750 | |

Avid Technology, Inc.* | | 15,000 | 2 | | | 926,250 | |

Cisco Systems, Inc.* | | 107,500 | | | $ | 2,074,750 | |

Cognizant Technology Solutions Corp.* | | 20,500 | | | | 867,765 | |

Dell, Inc.* | | 42,000 | | | | 1,769,880 | |

Electronic Arts, Inc.* | | 31,500 | 2 | | | 1,942,920 | |

EMC Corp.* | | 140,000 | | | | 2,081,800 | |

Juniper Networks, Inc.* | | 63,500 | | | | 1,726,565 | |

Linear Technology Corp. | | 40,200 | | | | 1,558,152 | |

Maxim Integrated Products, Inc. | | 40,000 | | | | 1,695,600 | |

Microsoft Corp. | | 57,000 | | | | 1,522,470 | |

Qualcomm, Inc. | | 37,000 | | | | 1,568,800 | |

Symantec Corp.* | | 56,000 | | | | 1,442,560 | |

Symbol Technologies, Inc. | | 52,200 | | | | 903,060 | |

Total Information Technology | | | | | | 21,662,322 | |

| | |

Total Common Stocks

(cost $41,598,243) | | | | | | 37,548,265 | |

Other Investment Companies – 6.6%1 | | | | | | | |

Bank of New York Institutional Cash Reserves Fund, 2.35%3

(cost $2,493,163) | | 2,493,163 | | | | 2,493,163 | |

| | |

Total Investments – 106.4%

(cost $44,091,406) | | | | | | 40,041,428 | |

Other Assets, less Liabilities – (6.4)% | | | | | | (2,410,835 | ) |

Net Assets - 100.0% | | | | | $ | 37,630,593 | |

The accompanying notes are an integral part of these financial statements.

12

Managers Mid-Cap

Managers Mid-Cap Fund (“Mid-Cap”) is a stock fund seeking long-term capital appreciation through a diversified portfolio of medium capitalization U.S. companies. Managers currently utilizes a single independent subadvisor, a team led by James Miller of Chicago Equity Partners, LLC (“CEP”), to manage the portfolio. CEP has managed the portfolio since December 2000.

The Portfolio Managers

James Miller and the investment team at Chicago Equity Partners believe fundamentals drive stock prices. That is, companies with favorable valuations and earnings expectations will outperform their peers. They utilize a systematic ranking system to identify attractive stocks and construct their portfolios through a disciplined process that minimizes portfolio risks like sector, capitalization and style exposures.

Every day they use their proprietary model to evaluate the expectations, valuation and quality attributes of 3000 stocks. Over time they’ve refined this model, adding and deleting factors as well as changing their weightings, to consistently forecast solid stocks by sector and industry.

CEP’s team of analysts reviews and confirms the model’s daily rankings, paying special attention to any changes in rank. Each analyst follows a specific sector focusing on the timing and nature of earnings releases, legal and regulatory exposures of companies and any other factors the model may not capture. The analysts use an objective, systematic approach to choose the best risk-adjusted stocks within their sector.

Once the analysts have identified stocks with the highest potential to outperform their peers, they construct portfolios that neutralize risk elements that are not consistently rewarded, such as style tilts, industry weightings and market capitalization.

CEP’s analysts review the portfolios daily, meeting at least once per month on a formal basis, to evaluate portfolio holdings, monitor risk, and rebalance as necessary. Once any necessary trades are identified, they implement them using a mix of trading strategies designed to minimize commissions and market impact.

The result of CEP’s disciplined process is a portfolio of 125 to 250 securities that they believe will generate solid excess returns over the S&P Mid Cap 400 at a moderate risk level.

The Year in Review

For the year 2004, the Managers Mid-Cap Fund gained 10.10% (Class A with load) compared with a gain of 16.50% for the S&P Mid Cap 400 Index. Negative performance variance was attributed to inclusion of the sales load. Excluding the sales load, the Fund’s return would have been 16.80%. In the U.S., the broad market (using, for example, the Russell 3000, Wilshire 5000, and S&P 500 indices) rose about 12% for the year and, by most measures, it was the first consecutive positive year since 1998-1999. Mid-cap stocks continued their outperformance of the general market, specifically large-cap stocks. 2004 marks the fifth consecutive year that the S&P Mid Cap 400 Index beat the Russell 3000 and Wilshire 5000 indices.

The equity markets opened the year continuing the rally of 2003 before falling in March amid security concerns following the terrorist attacks in Madrid. The economy took center stage in the middle of the year as the Federal Open Market Committee began to raise the Federal funds rate 0.25%, the first of many such increases. While corporate earnings were strong, the market was soft due to concerns about a slowing economy and constrained consumer spending due to rising fuel costs. The market began to rally in September only to be slowed down by Merck, which announced the recall of its successful arthritis drug Vioxx.

Throughout most of 2004 the market had been locked into a trading zone, but jumped out immediately after the presidential election. A decisive election boosted markets to their best performance since the fourth quarter of 2003. This strong performance in the fourth quarter was led by the information technology and consumer sectors. The IT sector had been negative prior to the election and posted strong returns of about 15% in the fourth quarter. As corporate profits continued to grow capital spending increased, helping the IT sector. The consumer was helped by a decrease in energy and materials prices. While price indices rose over all, the fourth quarter saw a decrease in oil prices from a high of over $55 per barrel to about $43 per barrel. This decrease did not stop the energy sector from posting strong returns for the year. Global demand for oil and other materials helped the energy (+32%) and materials (+30%) sectors post strong returns throughout the year in the mid-cap space. Financials and the consumer discretionary and staples sectors also performed well for the year, posting returns over 19%.

From a style standpoint, the S&P Mid Cap 400 Barra/Value Index outperformed its growth counterpart by almost 500 basis points (bps). Growth stocks, led by technology, finished the year strong, beating value oriented stocks by 50 bps in December.

As the Fund matches sectors with the S&P Mid Cap 400 Index, the return patterns were tied very closely with those of the overall market. Stock selection in the consumer discretionary, information technology and industrials were the largest contributors to the Fund. Homebuilder mortgage banker NVR (+65%) had a strong year, as did several retailers, such as Abercrombie & Fitch (+90%) and American Eagle Outfitters (+187%). While technology performed poorly for the benchmark, CEP achieved high returns from their stock selection. Overweights in Activision (+66%) and Cree (+127%) were among the best performers in the Fund. On the negative end of the spectrum were National Semiconductor and Cypress Semiconductor. The semiconductor industry was among the worst performing industries across all market capitalization ranges. Increasing materials prices and softer demand hurt this and other equipment manufacturers.

Looking Forward

Looking forward, the portfolio manager continues to add value through security selection and immunize the portfolio against sector swings by matching sectors to the benchmark. CEP’s comments as we progress into 2005:

The economy has been growing at roughly a trend real economic growth rate of 3.5%. The fourth quarter GDP number is likely to be in the neighborhood of 3-3.5%, which would represent somewhere between a 3.5-4.0% growth rate year-over-year.

13

Managers Mid-Cap

On the consumer-front, retail sales were a little disappointing over the holiday season, but showed a strong finish, and will likely post a year-over-year showing somewhere in the vicinity of 3.0%. Consumer spending has slowed and is likely to slow further as moderate income growth, in a still less than robust job market, probably won’t be enough to offset rising interest rates and a lack of mortgage equity withdrawals as the housing market slows. The mortgage equity withdrawal has allowed the savings rate to drop to an all-time low and allowed consumers to spend at twice the rate of income growth. (This added at least 1.0% to GDP growth in recent years.) This is unlikely to continue as the Fed seeks to raise interest rates to a neutral level. The consumer is the most interest rate sensitive segment of the economy, and autos and housing are particularly susceptible.

Capital spending would be expected to pick up the slack, but some capital spending has already been pulled forward from the accelerated depreciation of the last tax stimulus act, which is due to expire at the end of this year. The primary determinant of capital spending is cash flow, which has been remarkably strong over the past year, as labor costs have been very contained and profit margins have risen to post-war highs. Year-over-year growth rates in profits have already peaked and are likely to moderate over the coming year. Capital spending is likely to be supported in part by growing exports as the dollar continues to fall, but it is unlikely to offset a waning consumer.

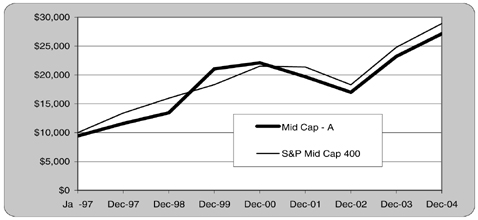

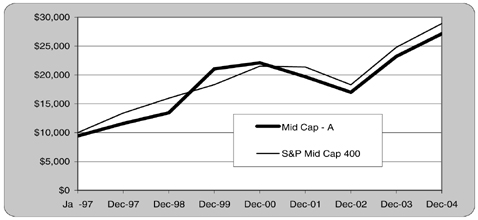

Cumulative Total Return Performance

Mid-Cap’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all dividends and distributions were reinvested. The S&P Mid Cap 400 Index is an unmanaged capitalization weighted index of 400 commonly traded stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of those stocks. The Index assumes reinvestment of dividends. This chart compares a hypothetical $10,000 investment made in Mid-Cap Fund – Class A Shares on January 2, 1997, to a $10,000 investment made in the S&P Mid Cap 400 for the same time period. The chart is not intended to imply any future performance of the Fund. The graph and chart do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. Total Returns would have been lower had certain expenses not been reduced.

The table below shows the average annual total returns for the Mid-Cap Fund - Class A Shares (with load) and the S&P Mid-Cap 400 Index since inception through December 31, 2004.

| | | | | | | | | |

Average Annual Total Returns:

| | 1 Year

| | | 5 Years

| | | Since Inception*

| |

Mid-Cap – A Shares | | 10.10 | % | | 3.96 | % | | 13.29 | % |

S&P Mid-Cap 400 | | 16.50 | % | | 9.54 | % | | 14.19 | % |

| * | Commencement of operations was January 2, 1997. |

The table below displays a full breakdown of the sector allocation of the Fund as well as the top ten positions as of December 31, 2004.

Managers Mid-Cap Fund

| | | |

Top Ten Holdings (out of 99 securities)

| | % Fund

| |

NVR Inc. | | 4.4 | % |

Graco, Inc. | | 2.8 | |

Questar Corp. | | 2.5 | |

Tyson Foods Inc. | | 2.4 | |

Abercrombie & Fitch Co. | | 2.2 | |

Cree, Inc. | | 2.0 | |

American Eagle Outfitters, Inc. | | 1.9 | |

American Financial Group, Inc. | | 1.9 | |

J.B. Hunt Transport Services, Inc. | | 1.9 | |

SEI Investments Co. | | 1.9 | |

| | |

|

|

Top Ten as a Group | | 23.9 | % |

| | |

|

|

| |

Industry Weightings

| | % Fund

| |

Consumer Discretionary | | 22.8 | % |

Financials | | 19.5 | |

Information Technology | | 12.4 | |

Health Care | | 10.5 | |

Industrials | | 10.5 | |

Utilities | | 6.9 | |

Energy | | 6.2 | |

Materials | | 5.1 | |

Consumer Staples | | 4.6 | |

Telecommunication Services | | 0.4 | |

Other | | 1.1 | |

14

Managers Mid-Cap Fund

December 31, 2004

Schedule of Portfolio Investments

| | | | | | |

Security Description

| | Shares

| | | Value

|

Common Stocks - 98.9% | | | | | | |

Consumer Discretionary - 22.8% | | | | | | |

Abercrombie & Fitch Co. | | 48,100 | | | $ | 2,258,295 |

Aeropostale, Inc.* | | 26,700 | | | | 785,781 |

American Eagle Outfitters, Inc. | | 42,300 | | | | 1,992,330 |

American Greetings Corp., Class A | | 46,300 | 2 | | | 1,173,705 |

Autoliv, Inc. | | 20,200 | | | | 975,660 |

Black & Decker Corp. | | 6,400 | 2 | | | 565,312 |

Blyth, Inc. | | 5,400 | | | | 159,624 |

Borg Warner, Inc. | | 8,600 | | | | 465,862 |

Caesars Entertainment, Inc.* | | 29,500 | | | | 594,130 |

CEC Entertainment, Inc.* | | 24,200 | | | | 967,274 |

Chico’s FAS, Inc.* | | 26,500 | 2 | | | 1,206,545 |

Circuit City Stores, Inc. | | 54,600 | | | | 853,944 |

Copart, Inc.* | | 33,100 | | | | 871,192 |

Darden Restaurants, Inc. | | 45,500 | | | | 1,262,170 |

Harte Hanks, Inc. | | 23,100 | | | | 600,138 |

Mandalay Resorts Group | | 7,000 | | | | 493,010 |

NVR, Inc.* | | 5,800 | 2 | | | 4,462,520 |

Pacific Sunwear of California, Inc. * | | 37,800 | | | | 841,428 |

Polaris Industries, Inc. | | 15,900 | | | | 1,081,518 |

Rent-A-Center, Inc.* | | 20,200 | | | | 535,300 |

Timberland Co.* | | 4,700 | | | | 294,549 |

Washington Post Co., The | | 900 | | | | 884,718 |

Total Consumer Discretionary | | | | | | 23,325,005 |

Consumer Staples - 4.6% | | | | | | |

Energizer Holdings, Inc.* | | 17,800 | | | | 884,482 |

PepsiAmericas, Inc. | | 29,200 | | | | 620,208 |

SUPERVALU, Inc. | | 21,700 | | | | 749,084 |

Tyson Foods, Inc., Class A | | 133,800 | | | | 2,461,920 |

Total Consumer Staples | | | | | | 4,715,694 |

Energy - 6.2% | | | | | | |

Diamond Offshore Drilling, Inc. | | 34,700 | 2 | | | 1,389,735 |

Newfield Exploration Co.* | | 25,900 | | | | 1,529,395 |

Pogo Producing Co. | | 18,200 | 2 | | | 882,517 |

Varco International, Inc.* | | 60,900 | | | | 1,775,235 |

Weatherford International, Ltd.* | | 15,500 | | | | 795,150 |

Total Energy | | | | | | 6,372,032 |

Financials - 19.5% | | | | | | |

Allmerica Finance Corp.* | | 26,000 | | | | 853,580 |

American Financial Group, Inc. | | 63,600 | | | | 1,991,315 |

AmeriCredit Corp.* | | 60,800 | | | | 1,486,560 |

Associates Bank Corp. | | 40,050 | | | | 1,330,061 |

Astoria Financial Corp. | | 37,800 | | | | 1,510,866 |

CBL & Associates Properties, Inc. | | 16,200 | | | | 1,236,870 |

Compass Bancshares, Inc. | | 18,300 | | | | 890,661 |

Fidelity National Financial, Inc. | | 11,542 | | | | 527,123 |

Hibernia Corp., Class A | | 50,100 | | | | 1,478,451 |

Independence Community Bank Corp. | | 21,900 | | | | 932,502 |

Indymac Mortgage Holdings, Inc. | | 19,000 | 2 | | | 654,550 |

Janus Capital Group, Inc. | | 58,800 | | | | 988,428 |

Mack-Cali Realty Corp. | | 20,800 | | | | 957,424 |

New Century Financial Corp. | | 11,700 | | | | 747,747 |

Ohio Casualty Corp.* | | 54,000 | 2 | | $ | 1,253,340 |

Protective Life Corp. | | 17,300 | | | | 738,537 |

SEI Investments Co. | | 45,700 | | | | 1,916,201 |

StanCorp Financial Group, Inc. | | 6,200 | | | | 511,500 |

Total Financials | | | | | | 20,005,716 |

Health Care - 10.5% | | | | | | |

Aetna, Inc. | | 7,500 | | | | 935,625 |

Apria Healthcare Group, Inc.* | | 35,300 | | | | 1,163,135 |

Becton, Dickinson & Co. | | 15,500 | | | | 880,400 |

C.R. Bard, Inc. | | 12,400 | | | | 793,352 |

Charles River Laboratories International, Inc.* | | 25,700 | 2 | | | 1,182,457 |

Coventry Health Care, Inc.* | | 22,850 | 2 | | | 1,212,878 |

Cytyc Corp.* | | 41,500 | 2 | | | 1,144,155 |

Humana, Inc.* | | 44,000 | | | | 1,306,360 |

Invitrogen Corp.* | | 9,800 | | | | 657,874 |

Perrigo Co. | | 57,100 | | | | 986,117 |

Renal Care Group, Inc.* | | 14,850 | | | | 534,452 |

Total Health Care | | | | | | 10,796,805 |

Industrials - 10.5% | | | | | | |

Brink’s Co., The | | 23,100 | | | | 912,912 |

Dun & Bradstreet Corp.* | | 16,500 | | | | 984,225 |

Graco, Inc. | | 78,000 | | | | 2,913,300 |

J.B. Hunt Transport Services, Inc. | | 42,800 | | | | 1,919,580 |

Precision Castparts Corp. | | 10,800 | | | | 709,344 |

Republic Services, Inc. | | 28,100 | | | | 942,474 |

Ryder System, Inc. | | 18,600 | | | | 888,522 |

SPX Corp. | | 7,700 | 2 | | | 308,462 |

Thomas & Betts Corp.* | | 24,000 | | | | 738,000 |

Valassis Communications, Inc.* | | 13,400 | | | | 469,134 |

Total Industrials | | | | | | 10,785,953 |

Information Technology - 12.4% | | | | | | |

Activision, Inc.* | | 68,200 | | | | 1,376,276 |

Acxiom Corp. | | 38,400 | 2 | | | 1,009,920 |

Adobe Systems, Inc. | | 12,300 | | | | 771,702 |

Avnet, Inc.* | | 20,700 | | | | 377,568 |

Cree, Inc.* | | 52,200 | 2 | | | 2,092,176 |

Factset Research Systems, Inc. | | 16,500 | | | | 964,260 |

Harris Corp. | | 11,400 | | | | 704,406 |

Imation Corp. | | 15,700 | | | | 499,731 |

Ingram Micro, Inc.* | | 36,900 | | | | 767,520 |

Lam Research Corp.* | | 18,900 | | | | 546,399 |

Macrovision Corp.* | | 30,100 | | | | 774,172 |

Omnivision Technologies, Inc.* | | 34,500 | 2 | | | 633,075 |

Polycom, Inc.* | | 34,600 | | | | 806,872 |

Storage Technology Corp.* | | 28,600 | | | | 904,046 |

Western Digital Corp.* | | 38,300 | | | | 415,172 |

Total Information Technology | | | | | | 12,643,295 |

Materials - 5.1% | | | | | | |

Bemis Co., Inc. | | 23,700 | | | | 689,433 |

Cytec Industries, Inc. | | 25,700 | | | | 1,321,494 |

Georgia Gulf Corp. | | 20,800 | | | | 1,035,840 |

Louisiana-Pacific Corp. | | 60,300 | | | | 1,612,422 |

The accompanying notes are an integral part of these financial statements.

15

Managers Mid-Cap Fund

December 31, 2004

Schedule of Portfolio Investments (continued)

| | | | | | | |

Security Description

| | Shares

| | | Value

| |

Materials (continued) | | | | | | | |

Sigma-Aldrich Corp. | | 8,700 | | | $ | 526,002 | |

Total Materials | | | | | | 5,185,191 | |

Telecommunication Services - 0.4% | | | | | | | |

PTEK Holdings, Inc.* | | 37,200 | | | | 398,412 | |

Utilities - 6.9% | | | | | | | |

Alliant Energy Corp. | | 38,700 | | | | 1,106,820 | |

Energen Corp. | | 27,000 | 2 | | | 1,591,650 | |

Oneok, Inc. | | 65,000 | 2 | | | 1,847,300 | |

Questar Corp. | | 49,800 | | | | 2,537,808 | |

Total Utilities | | | | | | 7,083,578 | |

Total Common Stocks

(cost $82,400,298) | | | | | | 101,311,681 | |

Other Investment Companies – 15.5%1 | | | | | | | |

Bank of New York Institutional Cash Reserves Fund, 2.35%3 | | 14,805,968 | | | $ | 14,805,968 | |

JPMorgan Prime Money Market Fund, Institutional Class Shares, 2.12% | | 1,065,497 | | | | 1,065,497 | |

Total Other Investment Companies

(cost $15,871,465) | | | | | | 15,871,465 | |

Total Investments – 114.4%

(cost $98,271,763) | | | | | | 117,183,146 | |

Other Assets, less Liabilities – (14.4)% | | | | | | (14,740,270 | ) |

Net Assets - 100.0% | | | | | $ | 102,442,876 | |

The accompanying notes are an integral part of these financial statements.

16

Managers Large-Cap

Managers Large-Cap Fund (“Large-Cap”) is a stock fund seeking long-term capital appreciation through a diversified portfolio of large capitalization U.S. companies. Managers currently utilizes a single independent subadvisor, a team led by James Miller of Chicago Equity Partners, LLC (“CEP”), to manage the portfolio. CEP has managed the portfolio since December 2000.

The Portfolio Managers

James Miller and the investment team at Chicago Equity Partners believe fundamentals drive stock prices. That is, companies with favorable valuations and earnings expectations will outperform their peers. They utilize a systematic ranking system to identify attractive stocks and construct their portfolios through a disciplined process that minimizes portfolio risks like sector, capitalization and style exposures.

Every day they use their proprietary model to evaluate the expectations, valuation and quality attributes of 3000 stocks. Over time they’ve refined this model, adding and deleting factors as well as changing their weightings, to consistently forecast solid stocks by sector and industry.

CEP’s team of analysts reviews and confirms the model’s daily rankings, paying special attention to any changes in rank. Each analyst follows a specific sector focusing on the timing and nature of earnings releases, legal and regulatory exposures of companies and any other factors the model may not capture. The analysts use an objective, systematic approach to choose the best risk-adjusted stocks within their sector.

Once the analysts have identified stocks with the highest potential to outperform their peers, they construct portfolios that neutralize risk elements that are not consistently rewarded, such as style tilts, industry weightings and market capitalization.

CEP’s analysts review the portfolios daily, meeting at least once per month on a formal basis, to evaluate portfolio holdings, monitor risk, and rebalance as necessary. Once any necessary trades are identified, they implement them using a mix of trading strategies designed to minimize commissions and market impact.

The result of CEP’s disciplined process is a portfolio of 100 to 200 securities that the investment team believes will generate solid excess returns over the S&P 500 at a moderate risk level.

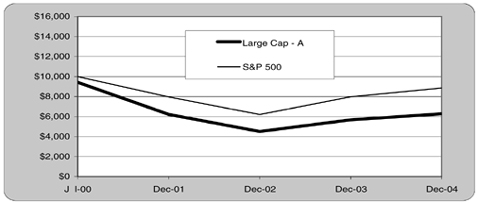

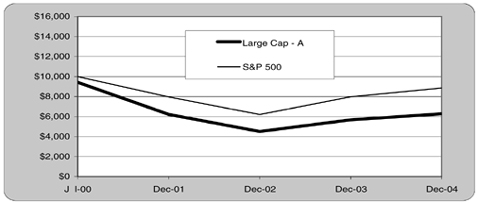

The Year in Review

For the year 2004, the Managers Large-Cap Fund gained 4.23% (Class A with load) compared with a gain of 10.88% for the S&P 500 Index. Negative performance variance was attributed to inclusion of the sales load. Excluding the sales load, the Fund’s return would have been 10.63%. In the U.S., the broad market (using, for example, the Russell 3000, Wilshire 5000, and S&P 500 indices) rose about 12% for the year and, by most measures, it was the first consecutive positive year since 1998-1999.

The equity markets opened the year continuing the rally of 2003 before falling in March amid security concerns following the terrorist attacks in Madrid. The economy took center stage in the middle of the year as the Federal Open Market Committee began to raise the Federal funds rate 0.25%, the first of many such increases. While corporate earnings were strong, the market was soft as a result of concerns about a slowing economy and constrained consumer spending due to rising energy costs. The market began to rally in September only to be slowed down by Merck, which announced the recall of its successful arthritis drug Vioxx.

Throughout most of 2004 the market had been locked into a trading zone, but jumped out immediately after the presidential election. A decisive election boosted markets to their best performance since the fourth quarter of 2003. This strong performance was led by the IT and consumer sectors. Both sectors had been negative all year and posted strong returns of about 13% in the fourth quarter. As corporate profits continued to grow capital spending increased, helping the IT sector. The consumer was helped by a decrease in energy and materials prices. While price indices rose over all, the fourth quarter saw a decrease in oil prices from a high of over $55 per barrel to about $43 per barrel. This decrease did not stop the energy sector from posting strong returns for the year. Global demand for oil and other materials helped the energy (+31%) and materials (+13%) sectors throughout the year. Industrials (18%) had a strong year despite the poor performance of the airline industry which continues to struggle.

From a style standpoint, the S&P Barra/Value Index outperformed its growth counterpart by over 900 basis points (bps). Low price-to-sales and price-to earnings stocks were the leaders early in the year. The resurgence of the information technology and consumer discretionary sectors in the fourth quarter evened out the distribution as all quintiles performed well.

As the Fund matches sectors with the S&P 500 Index, the return patterns were tied very closely with those of the overall market. Stock selection in the consumer staples, financials, industrials and utilities were the largest contributors to the Fund. The utility TXU (+177%), a top holding for the second half of the year, was a strong contributor on higher earnings. Overweights, relative to the benchmark, in Allstate, Bank of America and Wachovia all contributed to the strong returns of the financial sector.

An underweight of the energy sector detracted from performance as it was the top performing sector for the year. Stock selection detracted from the telecommunications and information technology sectors. National Semiconductor (-9%) and Cisco (-20%) hurt the Fund with National Semiconductor being liquidated. The holding of Pfizer and Merck into the fourth quarter was a deterrent to the health care sector, but the Merck position was liquidated prior to year end.

17

Managers Large-Cap

Looking Forward

Looking forward, the portfolio manager continues to add value through security selection and to immunize the portfolio against sector swings by matching sectors to the benchmark. CEP’s comments as we progress into 2005:

The economy has been growing at roughly a trend real economic growth rate of 3.5%. The fourth quarter GDP number is likely to be in the neighborhood of 3-3.5%, which would represent somewhere between a 3.5-4.0% growth rate year-over-year.

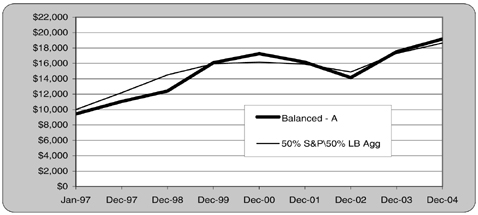

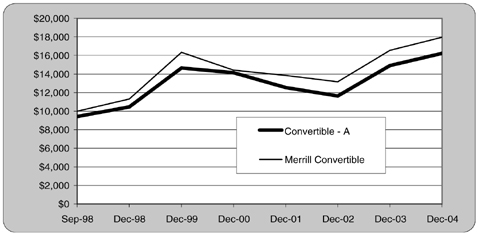

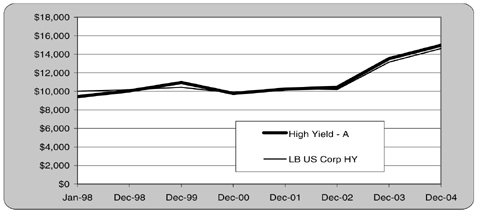

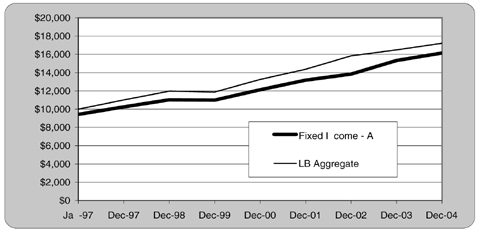

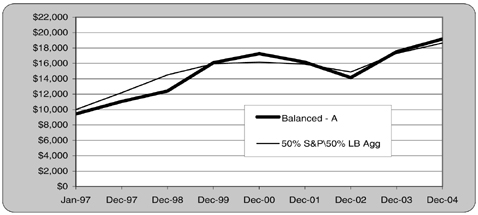

On the consumer front, retail sales were a little disappointing over the holiday season, but showed a strong finish, and will likely post a year over year showing somewhere in the vicinity of 3.0%. Consumer spending has slowed and is likely to slow further as moderate income growth in a still less than robust job market probably won’t be enough to offset rising interest rates and a lack of mortgage equity withdrawals as the housing market slows. The mortgage equity withdrawal has allowed the savings rate to drop to an all-time low and allowed consumers to spend at twice the rate of income growth. (This added at least 1.0% to GDP growth in recent years.) This is unlikely to continue as the Fed seeks to raise interest rates to a neutral level. The consumer is the most interest rate sensitive segment of the economy and autos and housing are particularly susceptible.