QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registranto |

Filed by a Party other than the Registranto |

Check the appropriate box: |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to §240.14a-12

|

Scott's Liquid Gold-Inc. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| ý | | No fee required |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

| o | | Fee paid previously with preliminary materials. |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | | Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

SCOTT'S LIQUID GOLD-INC.

4880 Havana Street

Denver, Colorado 80239

NOTICE OF ANNUAL MEETING OF

SHAREHOLDERS

To Be Held May 20, 2003

TO OUR SHAREHOLDERS:

The Annual Meeting of Shareholders of Scott's Liquid Gold-Inc., a Colorado corporation (the "Company"), will be held at 9:00 a.m., Mountain Time, on Tuesday, May 20, 2003 at the Company's offices, 4880 Havana Street, Denver, Colorado for the purpose of considering and acting upon the following:

- (1)

- The election of six directors;

- (2)

- Such other matters as may properly come before the meeting or any adjournment thereof.

Only shareholders of record at the close of business on March 31, 2003 are entitled to notice of and to vote at the meeting.

BY ORDER OF THE BOARD OF DIRECTORS

Dennis P. Passantino

Corporate Secretary

Denver, Colorado

April 17, 2003

THE FORM OF PROXY IS ENCLOSED. TO ASSURE THAT YOUR SHARES WILL BE VOTED AT THE MEETING, PLEASE COMPLETE AND SIGN THE ENCLOSED PROXY AND RETURN IT PROMPTLY IN THE ENCLOSED, POSTAGE PREPAID, ADDRESSED ENVELOPE. NO ADDITIONAL POSTAGE IS REQUIRED IF MAILED IN THE UNITED STATES. THE GIVING OF A PROXY WILL NOT AFFECT YOUR RIGHT TO VOTE IN PERSON IF YOU ATTEND THE MEETING.

SCOTT'S LIQUID GOLD-INC.

4880 Havana Street

Denver, Colorado 80239

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

To Be Held May 20, 2003

The enclosed Proxy is solicited by and on behalf of the Board of Directors of Scott's Liquid Gold-Inc., a Colorado corporation (the "Company"), for use at the Company's Annual Meeting of Shareholders to be held at 9:00 a.m., Mountain Time, on Tuesday, May 20, 2003 at the Company's offices, 4880 Havana Street, Denver, Colorado, or any adjournment thereof. This Proxy Statement and the accompanying form of Proxy are first being mailed or given to the shareholders of the Company on or about April 17, 2003.

Any shareholder signing and mailing the enclosed Proxy may revoke it at any time before it is voted by giving written notice of the revocation to the Company's Corporate Secretary, by voting in person at the meeting or by filing at the meeting a later executed proxy.

VOTING SECURITIES AND PRINCIPAL SHAREHOLDERS

All voting rights are vested exclusively in the holders of the Company's $0.10 par value common stock. Each share of the Company's common stock is entitled to one vote. Cumulative voting in the election of directors is not permitted. Holders of a majority of shares entitled to vote at the meeting, when present in person or by proxy, constitute a quorum. On March 31, 2003, the record date for shareholders entitled to vote at the meeting, the Company had 10,153,058 shares of its $0.10 par value common stock issued and outstanding.

When a quorum is present, in the election of directors, those six nominees having the highest number of votes cast in favor of their election will be elected to the Company's Board of Directors. Consequently, any shares not voted (whether by abstention, broker non-vote or otherwise) have no impact in the election of directors except to the extent the failure to vote for an individual results in another individual receiving a larger number of votes.

The following persons are the only persons known to the Company who on March 31, 2003, owned beneficially more than 5% of the Company's common stock, its only class of outstanding voting securities:

Name and Address of

Beneficial Owner

| | Amount and Nature of

Beneficial Ownership

| | Percent

of Class

| |

|---|

Mark E. Goldstein

4880 Havana Street

Denver, Colorado 80239 | | 2,646,965 | (1)(2) | 25.8 | % |

Scott's Liquid Gold-Inc.

Employee Stock

Ownership Plan

4880 Havana Street

Denver, Colorado 80239 |

|

921,841 |

(3) |

9.1 |

% |

- (1)

- Includes 2,126,473 shares held by the Goldstein Family Partnership, Ltd., a limited partnership of which the general partner is the Goldstein Family Corporation and whose limited partners include Mark E. Goldstein, his children, a sister, and certain other relatives. Mr. Goldstein is the sole director and sole executive officer of the Goldstein Family Corporation, and he owns 80% of the outstanding stock of the Goldstein Family Corporation in his individual name and owns as a

trustee 20% of the outstanding stock of the Goldstein Family Corporation. Mr. Goldstein has the sole voting and disposition powers with respect to these shares of the Company owned by the Goldstein Family Partnership, Ltd. Also includes 120,500 shares underlying stock options granted by the Company and exercisable within 60 days, and 76,002 shares held by Mr. Goldstein's minor children. Includes 4,600 shares held jointly by Mr. Goldstein and his wife, and does not include 25,890 shares of the Company's common stock owned by Mr. Goldstein's spouse, as to which Mr. Goldstein disclaims any beneficial ownership.

- (2)

- Does not include 97,346 shares held by the Company's Employee Stock Ownership Plan attributable to Mr. Goldstein's vested interest in the Plan as of December 31, 2002.

- (3)

- The five-person committee administering the Employee Stock Ownership Plan directs the voting of shares held under such Plan. The Company's four executive officers are members of this five-person committee.

SECURITY OWNERSHIP OF MANAGEMENT

The following table shows as of March 31, 2003, the shares of the Company's common stock beneficially owned by each director and executive officer of the Company and the shares beneficially owned by all of the directors and executive officers as a group:

Name of Beneficial Owner

| | Amount and Nature of

Beneficial Ownership(1)

| | Percent

of Class

| |

|---|

| Mark E. Goldstein | | 2,646,965 | (2)(3)(4) | 25.8 | % |

| Jeffrey R. Hinkle | | 228,878 | (3)(4)(5) | 2.2 | % |

| Jeffry B. Johnson | | 127,000 | (3)(4)(6) | 1.2 | % |

| Dennis P. Passantino | | 120,000 | (3)(4) | 1.2 | % |

| Carl A. Bellini | | 105,000 | (3) | 1.0 | % |

| Dennis H. Field | | 173,500 | (3) | 1.7 | % |

| All Directors and executive officers as a Group (six persons) | | 3,401,343 | (3)(4) | 31.3 | % |

- (1)

- Beneficial owners listed have sole voting and disposition power with respect to the shares shown unless otherwise indicated.

- (2)

- For information regarding Mr. Goldstein's beneficial ownership of shares, see footnote 1 under the table in "Voting Securities and Principal Shareholders."

- (3)

- For each named person, includes the following number of shares underlying stock options granted by the Company: 120,500 for Mr. Goldstein; 129,000 for Mr. Hinkle; 100,000 for Mr. Johnson; 100,000 for Mr. Passantino; 105,000 for Mr. Bellini; and 170,000 for Mr. Field.

- (4)

- Does not include shares owned by the Company's Employee Stock Ownership Plan under which, at December 31, 2002, Mark E. Goldstein had a vested interest in 97,346 shares, Jeffrey R. Hinkle had a vested interest in 56,960 shares, Jeffry B. Johnson had a vested interest in 54,406 shares, and Dennis P. Passantino had a vested interest in 41,198 shares.

- (5)

- Of Mr. Hinkle's shares, 64,100 are held jointly by Mr. Hinkle and his wife.

- (6)

- Of Mr. Johnson's shares, 22,000 are held jointly by Mr. Johnson and his wife.

There has been no change in control of the Company since the beginning of the last fiscal year, and there are no arrangements known to the Company, including any pledge of securities of the Company, the operation of which may at a subsequent date result in a change in control of the Company.

2

ELECTION OF DIRECTORS AND MANAGEMENT INFORMATION

Nominees

The Company's Board of Directors consists currently of six directors. Unless authority to vote is withheld, the persons named in the enclosed form of proxy will vote the shares represented by such proxy for the election of the six nominees for director named below. If, at the time of the Meeting, any of these nominees shall have become unavailable for any reason to serve as a director, the persons entitled to vote the proxy will vote for such substitute nominee or nominees, if any, as they determine in their discretion. If elected, the nominees for director will hold office until the next annual meeting of shareholders or until their successors are elected and qualified. The nominees for director, each of whom has consented to serve if elected, are as follows:

Name of Nominee and

Position in the Company

| | Age

| | Director

Since

| | Principal Occupation for

Last Five Years

|

|---|

Mark E. Goldstein

(Chairman of the Board, President and Chief Executive Officer) | | 47 | | 1983 | | Chairman of the Board of the Company since February 22, 2000, President and Chief Executive Officer of the Company since August, 1990. From 1982 to 1990, Vice President-Marketing of Company. Employed by the Company since 1978. |

Jeffrey R. Hinkle

(Vice President–Marketing) |

|

49 |

|

2000 |

|

Vice President–Marketing of the Company since February 2000. Vice President of Marketing for the Company's subsidiaries from November 1992 to 2000. Employed by the Company since 1981. |

Jeffry B. Johnson

(Treasurer and Chief Financial Officer) |

|

57 |

|

2000 |

|

Treasurer and Chief Financial Officer of the Company since November 2000. From 1981 to 2000, Controller of Company. Employed by the Company since 1976. |

Dennis P. Passantino

(Vice President–Operations and Corporate Secretary) |

|

47 |

|

2002 |

|

Vice President–Operations and Corporate Secretary since November 2002. From 1991 to 2002, Operations Manager. Employed by the Company since 1981. |

Carl A. Bellini |

|

69 |

|

2000 |

|

Management Consultant since 1997. From 1987 to 1997, Executive Vice President and Chief Operating Officer of Revco D.S., Inc. (a large drug store chain). |

Dennis H. Field |

|

70 |

|

1991 |

|

Management Consultant since 1990. From 1984 to 1990, Executive Vice President/General Manager, Faberge USA, Inc. (mass market health and beauty aids). |

All of the foregoing persons are currently directors of the Company. Their positions on standing committees of the Board of Directors are shown below under "Directors' Meetings and Committees".

3

The Company's only executive officers are those who are described in the foregoing table. The officers of the Company are elected annually at the first meeting of the Company's Board of Directors held after each annual meeting of shareholders and serve at the pleasure of the Board of Directors.

There are no family relationships among the executive officers or directors of the Company. There are no arrangements or understandings pursuant to which any of these persons were elected as an executive officer or director.

Directors' Meetings and Committees

During the year ended December 31, 2002, the Company had seven directors meetings plus eight actions by unanimous written consent. The Company's Board of Directors has both a Compensation Committee and an Audit Committee. The Company does not have a nominating committee.

The primary responsibilities of the Compensation Committee include development of an executive compensation philosophy for the Company; origination of all executive compensation proposals; review of the appropriate mix of variable versus fixed compensation; and review of all transactions between the Company and any executive officer or director, whether or not involving compensation. The Committee consists of two outside directors of the Company and, in addition, the President of the Company. Current members of the Compensation Committee are Dennis H. Field (Chairperson), Carl A. Bellini, and Mark E. Goldstein (with Mr. Goldstein having no vote). The Compensation Committee met one time during 2002.

The Audit Committee has as its primary responsibilities the selection of an independent public accountant to audit the annual financial statements of the Company, the review of internal and external audit functions, the review of the systems of internal accounting controls, and the review of financial information which is provided to the shareholders and others. The Audit Committee consists of two outside directors. The current members of the Audit Committee are Carl A. Bellini (Chairperson) and Dennis H. Field. The Audit Committee met eight times during 2002, plus had one action by unanimous written consent.

Compensation Committee Interlocks and Insider Participation

Mr. Dennis Field serves on both the Compensation Committee and the Audit Committee. From 1978 to 1982, Mr. Field was President and Chief Operating Officer of Aquafilter Corporation, a wholly owned subsidiary of the Company which manufactured cigarette filters. After leaving Aquafilter Corporation, Mr. Field had virtually no contact with the Company from the date of his resignation to 1991 when he was asked to join the Company's Board. Prior to 1991, he was Executive Vice President/General Manager, U.S. Division, of Faberge. Mr. Field has a distinguished career with significant consumer product companies.

4

Executive Compensation

The following Summary Compensation Table shows the annual and other compensation of the chief executive officer and all other executive officers of the Company at December 31, 2002, for services in all capacities provided to the Company and its subsidiaries for the past three years.

SUMMARY COMPENSATION TABLE

| |

| | Annual Compensation

| | Long Term Compensation

|

|---|

| |

| | Salary

| | Bonus

| | Other Annual

Compensation

| | Securities

Underlying Options

| | All Other

Compensation

|

|---|

Name and Principal Position

| | Year

| | $

| | $(1)

| | $

| | (#)

| | ($)(2)

|

|---|

Mark E. Goldstein

Chairman of the Board, President and Chief Executive Officer | | 2002

2001

2000 | | $

$

$ | 350,000

350,000

350,000 | | —

—

— | | $

$

| 32,519

29,328

101,580 | | —

—

50,000 | | $

$

$ | 1,172

1,117

4,242 |

Carolyn J. Anderson(5)

Executive Vice President, Chief Operating Officer, Corporate Secretary until September, 2002 |

|

2002

2001

2000 |

|

$

$

$ |

200,000

300,000

300,000 |

|

—

—

— |

|

$

$

$ |

8,924

76,214

30,341 |

|

—

—

50,000 |

|

$

$

$ |

100,000

1,117

4,242 |

Jeffrey R. Hinkle(3)

Vice President–Marketing |

|

2002

2001

2000 |

|

$

$

$ |

200,000

200,000

200,000 |

|

—

— |

|

$

$

$ |

10,066

12,148

96,755 |

|

—

—

50,000 |

|

$

$

$ |

1,172

1,117

4,242 |

Jeffry B. Johnson(3)

Treasurer and Chief Financial Officer |

|

2002 2001 2000 |

|

$ |

190,000 $190,000 $147,600 |

|

—

— |

|

$

$

$ |

7,872

87,429

7,087 |

|

—

50,000 |

|

$

$

$ |

1,134

1,117

3,841 |

Dennis P. Passantino(4)

Vice President–Operations and Corporate Secretary |

|

2002 |

|

$ |

183,750 |

|

— |

|

$ |

3,280 |

|

10,000 |

|

$ |

1,122 |

Note: There were no restricted stock awards or long term incentive payouts during the last three fiscal years. In 2000, options to purchase 50,000 shares of the Company's common stock were awarded to each of the Company's then executive officers at an average price of $.70 a share. No options were granted to the executive officers during 2001 and during 2002, except for Mr. Passantino who was granted in 2002 an option to purchase 10,000 shares of the Company's common stock at a price of $0.57 a share prior to Mr. Passantino becoming an officer.

- (1)

- The Company has adopted a bonus plan for its executive officers for the year 2003. The plan provides that an amount will be distributed to the Company's executive officers equal to 10% of the annual before tax profit exceeding $1 million, excluding items that are infrequent, unusual, or extraordinary. Such amount, if any, for 2003 will be divided among the Company's executive officers as follows: President, 31%, Vice President-Marketing, 25%, Treasurer, 22%, and Vice President–Operations, 22%. In no event is a bonus paid unless pre-tax profits, excluding the above-mentioned items, exceed $1,000,000 for the fiscal year, nor is any bonus paid on the first $1,000,000 of pre-tax earnings, excluding the above mentioned items. The Company had a similar plan in 2002, 2001, and 2000.

- (2)

- All Other Compensation for each of the executive officers (except Ms. Anderson for the 2002 year) consists of Company contributions under an Employee Stock Ownership Plan and Trust Agreement ("ESOP") which provides that the Company may contribute annually to the ESOP

5

cash or common stock in an amount not to exceed 25% of all participants' total compensation (the maximum amount currently deductible under tax laws). The Board of Directors determines whether any contributions will be made for the year. Benefits are allocated to all eligible employees according to a formula based on compensation, except that any income earned on assets of the Trust is allocated to ESOP participants based upon the value that each participant's account bears to the total value of Trust assets.

- (3)

- Mr. Hinkle and Mr. Johnson became executive officers of the Company in 2000.

- (4)

- Mr. Passantino became an executive officer of the Company in November, 2002.

- (5)

- Ms. Anderson resigned as an officer and director of the Company in September of 2002. Ms. Anderson's salary through August 30, 2002 is shown under the column "Salary." Payments made after August 30, 2002 to Ms. Anderson, which was the effective date of her resignation, are shown under the column "All Other Compensation" and were made pursuant to a separation agreement. Under this separation agreement, Ms. Anderson received during the last four months of 2002 a continuation of her monthly salary (based on an annual salary of $300,000) and will receive severance payments of $175,000 during 2003, $125,000 during 2004, and $50,000 during 2005. The Company's obligations to make these severance payments cease in the event of Ms. Anderson's death. The Company also pays the premiums for a basic health plan for Ms. Anderson and any costs incurred under the Company's executive officers' health plan until Ms. Anderson is eligible for Medicare (currently August, 2003); after such eligibility, the Company will pay the premium costs up to $5,000 per year of supplemental Medicare coverage for Ms. Anderson through December 31, 2007. Ms. Anderson provided a general release to the Company, waived any right to unused vacation, sick leave or personal leave, and entered into a noncompetition covenant through December 31, 2005.

The dollar amount of Other Annual Compensation changes from year to year because of fluctuations in the costs of benefits and their timing. Other Annual Compensation in the table above for 2000 through 2002 is comprised of the following:

| | Mark E. Goldstein

| | Carolyn J. Anderson

|

|---|

| | 2000

| | 2001

| | 2002

| | 2000

| | 2001

| | 2002

|

|---|

| Automobile purchase(1) | | $ | 36,733 | | $ | — | | $ | — | | $ | — | | $ | 25,000 | | $ | — |

Income taxes on automobile purchase(1) |

|

|

35,012 |

|

|

— |

|

|

— |

|

|

— |

|

|

23,244 |

|

|

— |

Other automobile expenses |

|

|

2,204 |

|

|

1,333 |

|

|

2,848 |

|

|

707 |

|

|

1,939 |

|

|

1,197 |

Memberships |

|

|

14,170 |

|

|

13,565 |

|

|

15,121 |

|

|

3,673 |

|

|

— |

|

|

— |

Life insurance |

|

|

2,328 |

|

|

2,412 |

|

|

2,412 |

|

|

8,069 |

|

|

8,069 |

|

|

739 |

Income taxes on life insurance |

|

|

2,142 |

|

|

2,175 |

|

|

2,131 |

|

|

7,423 |

|

|

7,277 |

|

|

— |

Medical plan(2) |

|

|

2,015 |

|

|

2,889 |

|

|

3,075 |

|

|

— |

|

|

238 |

|

|

1,545 |

Disability plan(3) |

|

|

4,672 |

|

|

4,672 |

|

|

4,672 |

|

|

8,165 |

|

|

8,165 |

|

|

5,443 |

Other |

|

|

2,304 |

|

|

2,282 |

|

|

2,260 |

|

|

2,304 |

|

|

2,282 |

|

|

— |

| | |

| |

| |

| |

| |

| |

|

Total other compensation |

|

$ |

101,580 |

|

$ |

29,328 |

|

$ |

32,519 |

|

$ |

30,341 |

|

$ |

76,214 |

|

$ |

8,924 |

| | |

| |

| |

| |

| |

| |

|

6

| | Jeffrey R. Hinkle

| | Jeffry B. Johnson

|

|---|

| | 2000

| | 2001

| | 2002

| | 2000

| | 2001

| | 2002

|

|---|

| Automobile purchase(1) | | $ | 44,016 | | $ | — | | $ | — | | $ | 1,100 | | $ | 40,534 | | $ | — |

Income taxes on automobile purchase(1) |

|

|

41,952 |

|

|

— |

|

|

— |

|

|

1,012 |

|

|

37,687 |

|

|

— |

Other automobile expenses |

|

|

461 |

|

|

789 |

|

|

1,130 |

|

|

2,625 |

|

|

2,099 |

|

|

843 |

Memberships |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

Life insurance |

|

|

1,344 |

|

|

1,344 |

|

|

1,344 |

|

|

1,146 |

|

|

1,592 |

|

|

2,427 |

Income taxes on life insurance |

|

|

1,236 |

|

|

1,213 |

|

|

1,026 |

|

|

1,054 |

|

|

1,436 |

|

|

1,850 |

Medical plan(2) |

|

|

3,113 |

|

|

3,642 |

|

|

1,406 |

|

|

150 |

|

|

3,279 |

|

|

1,950 |

Disability plan(3) |

|

|

4,633 |

|

|

5,160 |

|

|

5,160 |

|

|

— |

|

|

802 |

|

|

802 |

Other |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

| | |

| |

| |

| |

| |

| |

|

Total other compensation |

|

$ |

96,755 |

|

$ |

12,148 |

|

$ |

10,066 |

|

$ |

7,087 |

|

$ |

87,683 |

|

$ |

7,872 |

| | |

| |

| |

| |

| |

| |

|

| | Dennis P. Passantino

| |

| |

| |

|

|---|

| |

| |

| | 2002

| |

| |

| |

|

|---|

| Automobile purchase(1) | | | | | | $ | 900 | | | | | | |

Income taxes on automobile purchase(1) |

|

|

|

|

|

|

686 |

|

|

|

|

|

|

Other automobile expenses |

|

|

|

|

|

|

— |

|

|

|

|

|

|

Memberships |

|

|

|

|

|

|

— |

|

|

|

|

|

|

Life insurance |

|

|

|

|

|

|

887 |

|

|

|

|

|

|

Income taxes on life insurance |

|

|

|

|

|

|

676 |

|

|

|

|

|

|

Medical plan(2) |

|

|

|

|

|

|

131 |

|

|

|

|

|

|

Disability plan(3) |

|

|

|

|

|

|

— |

|

|

|

|

|

|

Other |

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total other compensation |

|

|

|

|

|

$ |

3,280 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- (1)

- Every three to five years, the Company provides funds needed, plus an amount to pay resulting income taxes, to each executive officer for the purchase of an automobile. In the case of Mr. Johnson, the amounts shown for 2000 represent the lease value, and income taxes on that value, for his use in 2000 of a vehicle owned by the Company. In the case of Mr. Passantino, the amount shown for 2002 represents the lease value, and income tax on that value, for his use in 2002 of a vehicle leased by the Company.

- (2)

- In addition to group life, health, hospitalization and medical reimbursement plans which generally are available to all employees, the Company has adopted a plan which provides for additional medical coverage of not more than $50,000 per year to each of the Company's executive officers. The plan further provides that, for a period of five years following an executive officer's voluntary retirement, or involuntary retirement in the event of a change in control of the Company, the Company will, at no cost to the executive or his or her surviving dependents, cover the executive and/or such dependents under the Company Health Plan and shall also provide, at no cost to the executive, for the payment of additional medical coverage of up to $50,000 a year.

- (3)

- The Company maintains a Key Executive Disability Plan. The purpose of this Plan is to provide the executive with his or her regular salary during periods of long-term disability in excess of 90 days to age 70, or to date of death, whichever first occurs. The benefits available under this

7

Plan will cease upon termination of employment as an executive officer of the Company other than during a period of disability. The Plan is partially funded by disability insurance maintained by the Company under which the Company is the beneficiary. The table sets forth the premiums paid by the Company for this disability insurance.

Option Grants in Last Fiscal Year

No options were granted to the Company's executive officers during the 2002 year, except for Mr. Passantino as described in the following table:

| | Individual Grants

| | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term

|

|---|

Name

| | Number of

Securities

Underlying

(#)(2)

| | % of Total Options

Granted to

Employees in

Fiscal Year

| | Exercise or Base

Price

($/Share)

| | Expiration

Date

| | 5%($)(1)

| | 10%($)(1)

|

|---|

| Dennis P. Passantino | | 10,000 | | 20 | % | 0.50 | | April 30, 2007 | | $ | 1,400 | | $ | 3,100 |

- (1)

- Assumes 5% and 10% growth per year based upon May 1, 2002 price of $0.50/share.

- (2)

- The options shown in the table above were issued under the Company's 1998 Stock Option Plan. Under that Plan, no option may be exercised more than ten years after it is granted. If the option grant is for an incentive stock option, the exercise price must be at least 100% of the fair market value of the Company's stock on the date of grant. The exercise price for a nonqualified stock option must be no less than 85% of the fair market value of the Company's stock on the date of grant. If the grantee owns more than 10% of the Company's outstanding stock, then these limitations for an incentive stock option are five years from the date of grant and 110% of the fair market value. No incentive option may be granted to any person in any year to purchase shares having an aggregate fair market value greater than $100,000 at the date of the option grant. Payment for shares purchased upon the exercise of any option must be made in cash.

Outstanding Options

No options were exercised by any of the Company's executive officers during 2002. The following table summarizes information with respect to the value of each person's unexercised stock options at December 31, 2002.

Fiscal Year End Option Values

| | Number of Securities

Underlying Unexercised

Options at Year End

| | In-the-Money

Value of Unexercised

Options at Year End(1)

|

|---|

Name

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| Mark E. Goldstein | | 120,500 | | 0 | | 0 | | 0 |

| Carolyn J. Anderson | | 0 | | 0 | | 0 | | 0 |

| Jeffrey R. Hinkle | | 129,000 | | 0 | | 0 | | 0 |

| Jeffry B. Johnson | | 58,000 | | 0 | | 0 | | 0 |

| Dennis P. Passantino | | 23,000 | | 0 | | 0 | | 0 |

- (1)

- The in-the-money value of unexercised options is equal to the excess of the per share market price of the Company's stock at December 31, 2002 over the per share exercise price multiplied by the number of unexercised options. However, the per share exercise price was higher than the market price of the Company's stock at year end

8

COMPENSATION COMMITTEE REPORT

Background

The Compensation Committee of the Board of Directors is currently comprised of the Company's two outside directors and the Company's President (who serves as a non-voting member of the Committee). The responsibilities of the Compensation Committee include the origination of all executive compensation proposals.

In making decisions regarding executive compensation, the Compensation Committee considers a number of factors. The Compensation Committee has also determined that an outside consultant on compensation matters should be used once every three years.

Organization Philosophy

The Committee believes that the Company's organization and the specific responsibilities of its executive officers are an essential part of analyzing compensation levels. The first important point concerning the management of the Company is that each executive subscribes to a team concept of executive management, and operates in accordance with this concept. Although each of the executive officers has his or her specific areas of responsibility and each is able to and often does make independent decisions, the executive officers operate as a collaborative team, and very few, if any, significant decisions are made without input from the group as a whole.

Second, each executive officer is responsible for a number of distinct areas and tasks. Each performs many tasks traditionally associated with "middle management" in other companies in addition to their respective duties of top level or executive management. As a result, the Company has very little "middle management" and operates as a fairly lean organization.

Mark E. Goldstein became President and Chief Executive Officer of the Company in 1990 and Chairman of the Board in February, 2000. Mark E. Goldstein has the responsibilities associated with these positions at a public company. He is also actively involved in the sales and marketing efforts of the Company and its development of new products. For example, Mark Goldstein is the primary contact with the Company's largest account, Wal-Mart Stores, Inc.; and he, together with Jeffrey R. Hinkle, directs the Company's advertising and promotional efforts. Mr. Goldstein also directs the Company's research and development and quality control activities. He ultimately is responsible for the day-to-day operations of the Company, although he relies on the Company's other executive officers for advice and counsel.

Jeffrey R. Hinkle has been employed by the Company for 21 years. He joined the Company as a regional sales manager in 1981, held various sales positions at the Company's subsidiaries, including Vice President-Marketing of subsidiaries, and became Vice President-Marketing of the Company in February, 2000. Mr. Hinkle is responsible for the Company's sales force, marketing and, together with Mr. Goldstein, the Company's advertising and promotional efforts.

Jeffry B. Johnson was elected as the Company's Treasurer and Chief Financial Officer in November, 2000. Mr. Johnson has served the Company for 26 years. He joined the Company as internal auditor in 1976, was promoted to Controller in 1981, and to Chief Accounting Officer on October 1, 2000. Mr. Johnson performs all of the functions of Treasurer and Chief Financial Officer, including negotiations and maintenance of relationships with creditors. He also supervises back office functions relating to accounting, personnel, benefits and, together with Mr. Goldstein, data processing and computer operations.

Dennis P. Passantino was elected as an executive officer in November, 2002. He is the Vice President-Operations and Corporate Secretary. Mr. Passantino has served the Company for 21 years.

9

He joined the Company as Materials Manager in 1981, was promoted to Operations Manager in 1991. Mr. Passantino has a direct responsibility for operations of the Company's plant and facilities.

Carolyn J. Anderson was Executive Vice President, Chief Operating Officer and Corporate Secretary of the Company until September, 2002 when she resigned from all her positions at the Company. Ms. Anderson had previously been employed by the Company for 31 years.

Factors and Policies

In determining its recommendations on executive compensation, the Committee considered the management organization as described above and the following factors, among others:

- (a)

- Services performed and time devoted to the Company by the executive;

- (b)

- Amounts paid to executives in comparable companies;

- (c)

- The size and complexities of the business;

- (d)

- Successes achieved by the executive;

- (e)

- The executive's abilities;

- (f)

- Volume of business during the executive's tenure;

- (g)

- Corporate earnings and profits;

- (h)

- Comparison of salary to distributions to stockholders;

- (i)

- Prevailing economic conditions;

- (j)

- Compensation paid to other employees of the corporation; and

- (k)

- The amount previously paid to the executive.

The Company and the Compensation Committee have viewed the base salary as an important part of the compensation for the Company's executive officers as well as other employees. The Company's 2002 executive bonus plan provided for a bonus pool based on 10% of pre-tax profits (excluding items that are infrequent, unusual or extraordinary) for a year in excess of $1 million. Any bonus amount payable under the plan would have been divided among the executive officers. The Company had substantially the same plan in prior years and has implemented substantially the same plan for the year 2003. The Compensation Committee believes that this bonus plan is an important part of the incentives for the Company's executive officers and recognizes directly many of the factors considered important by the Compensation Committee as stated above.

The Company provides certain other benefits and perquisites to the executive officers. The Committee believes that the types of benefits offered to Company executives and the value of these benefits are similar to benefit packages provided by other companies. A number of the benefits are provided by the Company not only to the executive officers but also to other Company employees. The Company believes that these benefits are appropriate for their positions, to compensate them consistent with market levels and to facilitate performance of their jobs in a more efficient and effective manner.

Application of Factors

Utilizing these factors and policies, the Compensation Committee in February, 2002 recommended that the base salaries of the Company's executive officers remain the same in 2002 as in 2001 and that the components of other compensation provided to the Company's executive officers also remain the same in 2002 as in 2001. These recommendations were adopted by the Company's Board of Directors.

10

In making its recommendations for the compensation of executives in 2002, the Compensation Committee noted, among other things, that: (1) the executive officers devote considerable time to the Company, often more than full time; (2) the Company's philosophy as to its employees in general is that good employees, who are paid well and stay with the Company, contribute significantly to the successes of the Company's businesses; (3) with respect to base salaries, the base salaries of Mr. Goldstein and Ms. Anderson prior to 1995 had not changed since October 30, 1988, and then, was part of an aggregate increase for the then four executive officers of 13.5%; (4) Mr. Hinkle's base salary has remained unchanged since November, 1997; (5) Mr. Johnson's base salary was last changed when he became Chief Executive Officer in October, 2000; (6) the Company's bonus plan emphasizes performance and successes achieved by executives; (7) the levels of the bonus plan and other components of compensation have been in effect for a number of years; and (8) the existing base salaries, if continued, and any bonus in 2002 are expected to be tax deductible, without being subject to a limitation on the deductibility of certain compensation in excess of $1 million under the Internal Revenue Code.

The Committee believed that the roles of the Company's officers continue to be difficult because of decreasing sales of the Company's skin care products and competitive and market factors. The competition for all of its products continues to be intense, both in terms of seeking retail shelf space and pricing. The Company's management has been faced with a slowing economy and the bankruptcy of K-Mart, which was the largest bankruptcy of a retailer in the United States.

The Committee also noted in February, 2002, a number of items relating to the performance of the executive officers in 2001, including, among other things, the following:

- •

- The Company introduced Montagne Jeunesse products in the United States;

- •

- A new advertisement for Scott's Liquid Gold for Wood was developed and used;

- •

- The introduction of the Company's diabetic skin care product continued;

- •

- The Company introduced "RubOut" for bruises;

- •

- Sales were made to the Dollar General Stores;

- •

- The Company introduced certain new products in 2001 in an effort to increase sales and has considered a number of other possible products;

- •

- The management took steps to control the inventory of the Company and reduced the number of items of Alpha Hydrox products with alpha hydroxy acid carried on retail shelves;

- •

- The Company reduced the number of employees, which was approximately 160 employees about 11/2 years ago to approximately 100 employees;

- •

- Other cost containment measures had been taken and continued.

Since 1992, the Compensation Committee has engaged a consultant on compensation matters every three years. The Hay Group was most recently engaged in 2000 and issued a report in February, 2001. The report concluded that:

- •

- In the aggregate the Company's executive compensation levels were within 10% of the median of a peer group used for the report and just over 10% above the median of a general industry group in terms of total direct compensation.

- •

- The base salary and the total cash compensation for the four executive officers in the aggregate were each between the median and the 75th percentile for the peer group; their aggregate base salary was above the 90th percentile for the general industry group; and their total cash compensation in the aggregate was between the 75th and 90th percentile for the general industry group.

11

The comparison groups were a peer group comprised of perfumes, cosmetics, and other toilet preparation companies and selected specialty chemical companies with an average annual revenue of $39.25 million and a general industry group comprised of companies from a broad range of industries. The report stated that the Company's executive compensation places a greater emphasis on base salary than the comparison groups.

In conclusion, the Compensation Committee believes that the levels of compensation for the Company's executive officers have been fair and appropriate.

COMPENSATION COMMITTEE

Carl A. Bellini

Dennis H. Field

Mark E. Goldstein

12

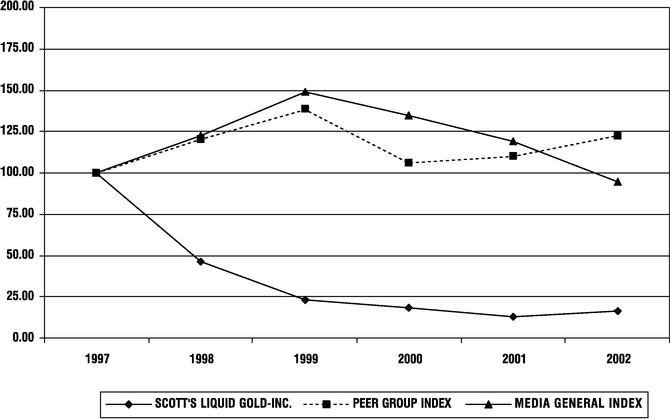

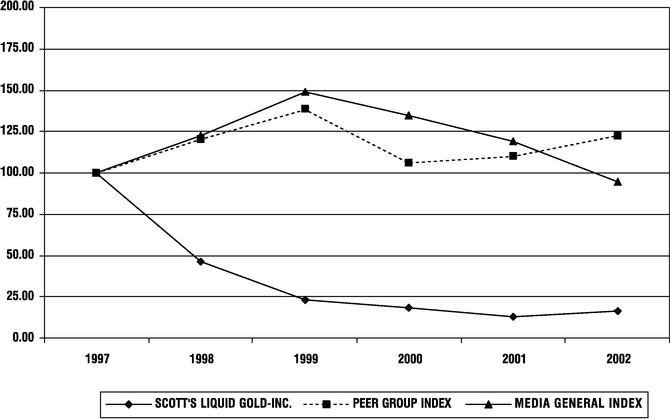

Stock Performance Graph

There follows a graph, constructed for the Company, comparing the cumulative total shareholder return of Scott's Liquid Gold-Inc. common stock to the Media General Composite Index (see below), and to a selected peer group.

Fiscal year ended December 31

Assumes $100 invested on January 1, 1998

in the Company, the Peer Group,

The Media General Composite Index

and assumes the reinvestment of any dividends

Note: The foregoing graph was prepared for the Company by Media General Financial Services of Richmond, Virginia. The peer group selected by the Company consists of companies which use the standard industrial classification of specialty cleaning and sanitation and which are publicly held, and other publicly held companies which are partially or entirely engaged in the cosmetics business. The Company believes that, within its industry classes, the assembly of a peer group is difficult because the Company competes with other companies that are significantly larger than Scott's Liquid Gold-Inc., including two major companies which are not publicly traded.

The following companies comprise the peer group: Avon Products, Inc., CCA Industries, Inc., Chattem, Inc., Clorox Co., Del Laboratories, Inc., and Procter & Gamble Co. The Media General Composite Index is based on the market value of all common stocks listed on the NYSE, AMEX and Nasdaq National Market, and SmallCap. The index is adjusted for all stock splits and dividends.

13

Compensation of Directors

Four directors are full-time executive officers of the Company and receive no additional compensation for service as a director. Carl A. Bellini, and Dennis H. Field are non-employee directors. The Company pays $2,500 per month to each non-employee director for his services as director.

On January 15, 1993, the Company's Board of Directors adopted the Company's 1993 Stock Option Plan for Outside Directors (the "Plan"), which was approved by the Company's shareholders on May 5, 1993. The Plan provides for the granting of options to directors who are not employees of the Company. The purpose of the Plan is to further the growth and development of the Company by providing an incentive to outside directors of the Company, by increasing their involvement in the business and affairs of the Company, by helping the Company to attract and retain well qualified directors and/or by rewarding directors for their past dedication to the Company. The Plan became effective on January 15, 1993 and expired January 15, 2003.

A maximum of 400,000 shares of the Company's common stock were available for issuance upon the exercise of options granted under the Plan. The number of shares subject to outstanding options, and the exercise price per share of such options are subject to adjustment on account of stock dividends, stock splits, mergers, consolidations, recapitalizations, combinations or exchanges of stock, or other similar circumstances.

The Plan is administered by the Board of Directors or a committee appointed by and serving at the pleasure of the Board of Directors, consisting of no fewer than two directors. The Plan is currently administered by the Board of Directors. At March 31 2003, options to purchase 175,000 shares of the Company's common stock were outstanding under the Plan. Except for the exercise of options for 100,000 shares by a director, who resigned from the Board during 1999, no options had been exercised at or prior to March 31, 2003.

The non-employee directors are also eligible to receive grants of options under the 1998 Stock Option Plan. Other eligible persons under the 1998 Plan are all full-time employees of the Company, and the Plan has been used primarily to provide options to full-time employees. No options have been issued to non-employee directors under the 1998 Plan except for three options for a total of 75,000 shares granted to non-employee directors in December, 2000, of which 25,000 shares have expired, and one option for a total of 50,000 shares to a non-employee director in February 2002. A maximum of 1,100,000 shares of common stock are available for issuance upon the exercise of options granted under the 1998 Plan. Options may be granted under the 1998 plan through November 8, 2008. The option price for non-qualified stock options granted under the 1998 Plan, which are the only type available to non-employee directors, must not be less than 85% of the fair market value as of the date of grant of the shares subject to the option. In other respects, the 1998 Plan is similar to the terms of the 1993 Stock Option Plan described above.

On February 19, 2002, each of the two non-employee directors received options under the 1993 and 1998 Plans with an exercise price of $0.57 per share, which was the fair market value on the date of grant, and an expiration date of February 18, 2007. Mr. Bellini's option was for 50,000 shares, and the option granted to Mr. Field, replacing options that expired on February 14, 2001, was for 100,000 shares. These options are fully vested.

14

The following table summarizes information with respect to the value of each non-employee director's unexercised stock options at December 31, 2002:

| | Year End Option Values

|

|---|

| | Number of Securities Underlying

Unexercised Options at Year End

| | In-the-Money Value of Unexercised

Options at Year End(1)

|

|---|

Name

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| Carl A. Bellini | | 105,000 | | 0 | | 0 | | 0 |

| Dennis H. Field | | 170,000 | | 0 | | 0 | | 0 |

- (1)

- The in-the-money value of unexercised options is equal to the excess of the per share market price of the Company's stock at December 31, 2002 over the per share exercise price multiplied by the number of unexercised options. However, the per share exercise price was higher than the market price of the Company's stock at year end.

TRANSACTIONS WITH MANAGEMENT

The Company has indemnification agreements with each of its directors and executive officers. These agreements provide for indemnification and advancement of expenses to the full extent permitted by law in connection with any proceeding in which the person is made a party because the person is a director or officer of the Company. They also state certain procedures, presumptions and terms relevant to indemnification and advancement of expenses.

SECTION 16 REPORTS

Section 16(a) of the Securities Exchange Act of 1934 requires directors, executive officers and beneficial owners of more than 10% of the outstanding shares of the Company to file with the Securities and Exchange Commission reports regarding changes in their beneficial ownership of shares in the Company. To the Company's knowledge, there was full compliance with all Section 16(a) filing requirements applicable to those persons for 2002.

COMPANY ACCOUNTANTS

KPMG LLP were selected by the Board of Directors as the Company's independent auditors for the fiscal year ended December 31, 2003. This firm has been the Company's independent auditors for each of the Company's fiscal years since the year ended December 31, 2002. A representative of KPMG LLP is expected to be present at the Annual Meeting of Shareholders and to have the opportunity to make a statement if he so desires. Such representative also is expected to be available to respond to appropriate questions at that time.

On July 16, 2002, at the recommendation of the Company's Audit Committee, the Company's Board of Directors dismissed Arthur Andersen LLP as the Company's independent public accountant and engaged KPMG LLP to serve as the Company's independent public accountant for the year ending December 31, 2002.

Arthur Andersen LLP's reports on the Company's consolidated financial statements for the past two years ended December 31, 2000 and December 31, 2001, did not contain an adverse opinion or a disclaimer of opinion, and were not qualified or modified as to uncertainty, audit scope or accounting principles.

During the Company's two fiscal years ended December 31, 2000 and December 31, 2001 and the period from January 1, 2002 to July 16, 2002, there were no disagreements with Arthur Andersen LLP on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which, if not resolved to the satisfaction of Arthur Andersen LLP, would have caused them

15

to make reference to the subject matter of the disagreement in connection with their reports. In addition, during the above period, there were no reportable events as defined in Item 304(a)(1)(v) of SEC Regulation S-K.

Although the Company requested a letter from Arthur Andersen LLP stating its agreement with such statements and although the Company has used reasonable efforts to obtain such letter, the Company has not been able to obtain the letter.

During the Company's two fiscal years ended December 31, 2000 and December 31, 2001 and the period from January 1, 2002 to the date of engaging KPMG LLP as stated above, the Company did not consult with KPMG LLP with respect to the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company's consolidated financial statements, or any other matters or reportable events described in Items 304(a)(2)(i) and (ii) of SEC Regulation S-K.

REPORT OF AUDIT COMMITTEE

April 14, 2003

To the Board of Directors of Scott's Liquid Gold-Inc.:

We have reviewed and discussed with management the Company's audited financial statements. We have discussed with KPMG LLP, its independent auditors, the matters required to be discussed by Statement on Auditing Standards No. 61,Communication with Audit Committees, as amended, by the Auditing Standards Board of the American Institute of Certified Public Accountants. We have received and reviewed the written disclosures and the letter from the independent auditors required by Independence Standard No. 1,Independence Discussions with Audit Committees, as amended, by the Independence Standards Board, and have discussed with the auditors the auditors' independence.

Based on the reviews and discussions referred to above, we recommend to the Board of Directors that the audited financial statements referred to above be included in the Company's Annual Report on Form 10-K for the year ended December 31, 2002 and filed with the Securities and Exchange Commission.

The Audit Committee is composed of the two directors named below, all of whom are independent directors as defined in Rule 4200(a)(14) of the Nasdaq Stock Market listing standards.

The Board has adopted a written charter for the Audit Committee.

Submitted by the members of the Audit Committee of the Board of Directors.

Carl A. Bellini, Chairman

Dennis H. Field

DISCLOSURE OF AUDITOR FEES

The following is a description of the fees billed to the Company by KPMG LLP during the year ended December 31, 2002:

- •

- Audit Fees—Audit fees paid and/or billed to the Company by KPMG LLP in connection with KPMG LLP's review and audit of the Company's annual financial statement for the year ended December 31, 2002 and KPMG LLP's review of the Company's interim financial statements included in the Company's Quarterly Reports on Form 10-Q for the second and third quarters of the year ended December 31, 2002 totaled approximately $209,400.

16

- •

- Financial Information Systems Design and Implementation Fees—The Company did not engage KPMG LLP to provide advice to the Company regarding financial information systems design and implementation during the year ended December 31, 2002.

- •

- All other fees—Fees billed to the Company by KPMG LLP during the year ended December 31, 2002 for all other non-audit services rendered to the Company (which consisted of tax services) totaled approximately $10,000.

SHAREHOLDER PROPOSALS

Shareholder proposals for inclusion in the Company's proxy materials relating to the next annual meeting of shareholders must be received by the Company on or before December 20, 2003. Also, persons named in the proxy solicited by the Board of Directors of the Company for its year 2004 annual meeting of shareholders may exercise discretionary authority on any proposal presented by a shareholder of the Company at that meeting if the Company has not received notice of the proposal by March 3, 2004.

2002 ANNUAL REPORT ON FORM 10-K

Shareholders who wish to obtain, without charge, a copy of the Company's Form 10-K report for the year ended December 31, 2002 in the form filed with the Securities and Exchange Commission should address a written request to Dennis P. Passantino, Corporate Secretary, Scott's Liquid Gold-Inc., 4880 Havana Street, Denver, Colorado 80239. The Company's annual report to shareholders consists of such Form 10-K and accompanies this proxy statement.

SOLICITATION OF PROXIES

The Company will pay the cost of soliciting proxies in the accompanying form. In addition to solicitation by mail, proxies may be solicited by officers and other regular employees of the Company by telephone, telegraph or by personal interview for which employees will not receive additional compensation. Arrangements also may be made with brokerage houses and other custodians, nominees and fiduciaries to forward solicitation materials to beneficial owners of the shares held of record by such persons, and the Company may reimburse such persons for reasonable out-of pocket expenses incurred by them in so doing.

OTHER BUSINESS

As of the date of this Proxy Statement, Management was not aware that any business not described above would be presented for consideration at the meeting. If any other business properly comes before the meeting, it is intended that the shares represented by proxies will be voted in respect thereto in accordance with the judgment of the persons voting them.

The above Notice and Proxy Statement are sent by order of the Board of Directors.

| | Dennis P. Passantino

Corporate Secretary |

Denver, Colorado

April 17, 2003

17

| PROXY | | SCOTT'S LIQUID GOLD-INC. | | PROXY |

| | | Proxy Solicited by the Board of Directors for the Annual Meeting of Shareholders

To be held May 20, 2003

| | |

The undersigned hereby appoints Mark E. Goldstein, Jeffrey R. Hinkle, Jeffry B. Johnson and Dennis P. Passantino, and each of them, proxies of the undersigned, with full power of substitution, to vote all shares of common stock of Scott's Liquid Gold-Inc., which the undersigned is entitled to vote, at the Annual Meeting of Shareholders to be held on May 20, 2003, at 9:00 a.m. and at any and all adjournments thereof for the following purposes:

(1) |

|

Election of Directors: |

|

FOR all nominees listed below

(except as marked to the contrary below) / / |

|

WITHHOLD AUTHORITY

to vote for all nominees listed below / / |

| Mark E. Goldstein | | Jeffrey R. Hinkle | | Jeffry B. Johnson | | Dennis P. Passantino | | Carl A. Bellini | | Dennis H. Field |

(INSTRUCTION: TO WITHHOLD AUTHORITY TO VOTE FOR ANY INDIVIDUAL NOMINEE, WRITE THE NOMINEE'S NAME ON THE LINE IMMEDIATELY BELOW.)

(2) In their discretion, the Proxies are authorized to vote upon such other business as properly may come before the meeting.

(back of card)

THIS PROXY WHEN PROPERLY EXECUTED WILL BE VOTED IN THE MANNER DIRECTED HEREIN BY THE UNDERSIGNED SHAREHOLDER(S). IF NO DIRECTION IS INDICATED, THE SHARES REPRESENTED BY THIS PROXY WILL BE VOTED AT THE MEETING "FOR" ELECTION OF THE NOMINEES FOR DIRECTOR AS SELECTED BY THE BOARD OF DIRECTORS.

The undersigned hereby acknowledges receipt of the Notice of Annual Meeting of Shareholders and the Proxy Statement furnished therewith. The undersigned hereby revokes any proxies given prior to the date reflected below.

| | Dated | | | , 2003 |

| | | |

| |

|

|

|

SIGNATURE(S) OF SHAREHOLDER(S) |

| | Please complete, date and sign exactly as your name appears hereon. If shares are held jointly, each holder should sign. When signing as attorney, executor, administrator, trustee, guardian or corporate official, please add your title. |

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS. PLEASE SIGN AND RETURN THIS PROXY IN THE ENCLOSED ENVELOPE. THE GIVING OF A PROXY WILL NOT AFFECT YOUR RIGHT TO VOTE IN PERSON IF YOU ATTEND THE MEETING.

QuickLinks

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS To Be Held May 20, 2003SCOTT'S LIQUID GOLD-INC. 4880 Havana Street Denver, Colorado 80239PROXY STATEMENTANNUAL MEETING OF SHAREHOLDERS To Be Held May 20, 2003VOTING SECURITIES AND PRINCIPAL SHAREHOLDERSSECURITY OWNERSHIP OF MANAGEMENTELECTION OF DIRECTORS AND MANAGEMENT INFORMATIONSUMMARY COMPENSATION TABLECOMPENSATION COMMITTEE REPORTTRANSACTIONS WITH MANAGEMENTSECTION 16 REPORTSCOMPANY ACCOUNTANTSREPORT OF AUDIT COMMITTEEDISCLOSURE OF AUDITOR FEESSHAREHOLDER PROPOSALS2002 ANNUAL REPORT ON FORM 10-KSOLICITATION OF PROXIESOTHER BUSINESS